SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark one)

| (Mark one) | ||

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| OR | ||

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

FOR THE FISCAL YEAR ENDED 31 DECEMBER 2011

OR

| FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014 | ||

| OR | ||

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

OR

| OR | ||

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

Date of event requiring this shell company report

For the transition period from to

Commission file number 001-04547

UNILEVER N.V.

(Exact name of Registrant as specified in its charter)

The Netherlands

(Jurisdiction of incorporation or organization)

Weena 455, 3013 AL, Rotterdam, The Netherlands

(Address of principal executive offices)

T.E. Lovell, Group Secretary

Tel: +44(0)2078225252, Fax: +44(0)20782261082078225464

Unilever House, 100 Victoria Embankment, London EC4Y 0DY UK

(Name, telephone number, facsimile number and address of Company Contact)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

| N.V. New York registry shares each representing one ordinary share of nominal amount of | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

The total number of outstanding shares of the issuer’s capital stock at the close of the period covered by the annual report was:1,714,727,700 ordinary shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act:

Yesx No¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934:

Yes¨ Nox

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yesx No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes¨ No¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large Accelerated filerx Accelerated filer¨ Non-accelerated filer¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ¨ | International Financial Reporting Standards as issued by the International Accounting Standards Boardx | Other ¨ |

If ‘Other’ has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17¨ Item 18¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act):

Yes¨ Nox

Cautionary statementCAUTIONARY STATEMENT

This document may contain forward-looking statements, including ‘forward-looking statements’ within the meaning of the United States Private Securities Litigation Reform Act of 1995. Words such as ‘will’, ‘aim’, ‘expects’, ‘anticipates’, ‘intends’, ‘looks’, ‘believes’, ‘vision’, or the negative of these terms and other similar expressions of future performance or results, and their negatives, are intended to identify such forward-looking statements. These forward-looking statements are based upon current expectations and assumptions regarding anticipated developments and other factors affecting the Group. They are not historical facts, nor are they guarantees of future performance.

Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause actual results to differ materially from those expressed or implied by these forward-looking statements, including, among others, competitive pricingstatements. Among other risks and activities, economic slowdown, industry consolidation, accessuncertainties, the material or principal factors which cause actual results to credit markets,differ materially are: Unilever’s global brands not meeting consumer preferences; Unilever’s ability to innovate and remain competitive; Unilever’s investment choices in its portfolio management; inability to find sustainable solutions to support long-term growth; customer relationships; the recruitment levels, reputational risks, commodity prices, continued availabilityand retention of talented employees; disruptions in our supply chain; the cost of raw materials prioritisationand commodities; the production of projects, consumption levels, costs, the abilitysafe and high quality products; secure and reliable IT infrastructure; successful execution of acquisitions, divestitures and business transformation projects; economic and political risks and natural disasters; financial risks; failure to maintainmeet high and manage key customer relationshipsethical standards; and supply chain sources, consumer demands, currency values, interest rates, the ability to integrate acquisitions and complete planned divestitures, finalising fair values related to prior acquisitions, the ability to complete planned restructuring activities, physical risks, environmental risks, the ability to manage sustainability,managing regulatory, tax and legal matters and resolve pending matters within current estimates, legislative, fiscal and regulatory developments, political, economic and social conditions in the geographic markets where the Group operates, completion of the Sustainable Development Report 2011 and new or changed priorities of the Boards.matters. Further details of potential risks and uncertainties affecting the Group are described in the Group’s filings with the London Stock Exchange, Euronext Amsterdam and the US Securities and Exchange Commission, including in the Group’s Annual Report on Form 20-F for the year ended 31 December 20112014 and the Annual Report and Accounts 2011.2014. These forward-looking statements speak only as of the date of this document. Except as required by any applicable law or regulation, the Group expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Group’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

| ||

| ||

|

References in this Report on Form 20-F

References set forth below are to certain references in the Group’s Annual Report and Accounts 2014 that include pages incorporated therein, including any page references incorporated in the incorporated material, unless specifically noted otherwise.

The Group’s Annual Report and Accounts 2014 was furnished separately on 6 March 2015 under Form 6-K. Pages 1 to 40 of the Group’s Annual Report and Accounts 2014 were furnished as Exhibit 1 and pages 41 to 140 of the Group’s Annual Report and Accounts 2014 were furnished as Exhibit 2 to this report on Form 6-K, respectively.

The following pages and sections of the Group’s Annual Report and Accounts 2011,2014 and specified information referenced therein, regardless of their inclusion in any cross-reference below, are hereby specifically excluded and are not incorporated by reference into this report onForm 20-F:

pages 2 to 5;

‘Operational highlights’ on page 6;

pages 2 to 6;

pages 6279 to 83;

pages 111 to 122.

This report on Form 20-F Report and the Group’s Annual Report and Accounts 2011 (furnished separately on 2 March 2012 under Form 6-K)2014 contain certain measures that are not defined by generally accepted accounting principles (GAAP) such as IFRS. We believe this information, along with comparable GAAP measurements, is useful to investors because it provides a basis for measuring our operating performance, ability to retire debt and invest in new business opportunities. Our management uses these financial measures, along with the most directly comparable GAAP financial measures, in evaluating our operating performance and value creation. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with GAAP. Non-GAAP financial measures as reported by us may not be comparable with similarly titled amounts reported by other companies.

In addition, there are limitations on the usefulness of our reported non-GAAP financial measures.

We report on the following non-GAAP measures:

underlying sales growth;

underlying volume growth;

underlyingcore operating profit and core operating margin (including explanation(operating profit and operating margin before the impact of restructuring, business disposals, acquisitions and disposal related costs, impairments and other one-off items (RDIs))items);

core earnings per share (core EPS);

net debt.

The information set forth under the heading ‘Non-GAAP measures’ on pages 26 to 2734 and 35 of the Group’s Annual Report and Accounts 20112014 furnished separately on 26 March 20122015 under Form 6-K is incorporated by reference. Within these pages further information about the above measures can be found.

The Unilever GroupTHE UNILEVER GROUP

Unilever N.V. (NV) is a public limited company registered in the Netherlands, which has listings of shares and depositary receipts for shares on Euronext Amsterdam and of New York Registry Shares on the New York Stock Exchange. Unilever PLC (PLC) is a public limited company registered in England and Wales, which has shares listed on the London Stock Exchange and, as American Depositary Receipts, on the New York Stock Exchange.

The two parent companies, NV and PLC, together with their Groupgroup companies, operate as a single economic entity (the Unilever Group, also referred to as ‘Unilever’ or ‘the Group’the ‘Group’). NV and PLC and their Groupgroup companies constitute a single reporting entity for the purposes of presenting consolidated accounts. Accordingly, the accounts of the Unilever Group are presented by both NV and PLC as their respective consolidated accounts.

This document contains references to our website. Information on our website or any other website referenced in this document is not incorporated into this document and should not be considered part of this document. We have included any website as an inactive textual reference only.

ItemITEM 1. Identity of Directors, Senior Management and AdvisersIDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

|

Form 20-F

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

| UnileverAnnual Report on Form 20-F 2014 | Form 20-F 1 |

Item 2. Offer Statistics and Expected TimetableITEM 3. KEY INFORMATION

Not applicable.A. SELECTED FINANCIAL DATA

The schedules below provide the Group’s selected financial data for the five most recent financial years.

A. Selected financial data

In the schedules below, figures within the income statement and for earnings per share reflect the classification between continuing and discontinued operations which has applied for our reporting during 2007–2011.

| € million | € million | € million | € million | € million | ||||||||||||||||||||||||||||||||||||

| Consolidated income statement | € million 2011 | € million 2010 | € million 2009 | € million 2008 | € million 2007 | 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||||||||||||

Continuing operations: | ||||||||||||||||||||||||||||||||||||||||

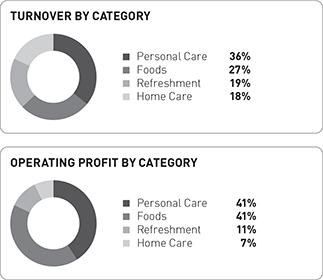

| Turnover | 46,467 | 44,262 | 39,823 | 40,523 | 40,187 | 48,436 | 49,797 | 51,324 | 46,467 | 44,262 | ||||||||||||||||||||||||||||||

| Operating profit | 6,433 | 6,339 | 5,020 | 7,167 | 5,245 | 7,980 | 7,517 | 6,977 | 6,420 | 6,325 | ||||||||||||||||||||||||||||||

Net finance costs | (377 | ) | (394 | ) | (593 | ) | (257 | ) | (252 | )�� | (477 | ) | (530 | ) | (535 | ) | (543 | ) | (561 | ) | ||||||||||||||||||||

Income from non-current investments | 189 | 187 | 489 | 219 | 191 | |||||||||||||||||||||||||||||||||||

Share of net profit/(loss) of joint ventures and associates and other income/(loss) from non-current investments | 143 | 127 | 91 | 189 | 187 | |||||||||||||||||||||||||||||||||||

| Profit before taxation | 6,245 | 6,132 | 4,916 | 7,129 | 5,184 | 7,646 | 7,114 | 6,533 | 6,066 | 5,951 | ||||||||||||||||||||||||||||||

Taxation | (1,622 | ) | (1,534 | ) | (1,257 | ) | (1,844 | ) | (1,128 | ) | (2,131 | ) | (1,851 | ) | (1,697 | ) | (1,575 | ) | (1,486 | ) | ||||||||||||||||||||

| Net profit from continuing operations | 4,623 | 4,598 | 3,659 | 5,285 | 4,056 | |||||||||||||||||||||||||||||||||||

Net profit from discontinued operations | – | – | – | – | 80 | |||||||||||||||||||||||||||||||||||

| Net profit | 4,623 | 4,598 | 3,659 | 5,285 | 4,136 | 5,515 | 5,263 | 4,836 | 4,491 | 4,465 | ||||||||||||||||||||||||||||||

Attributable to: | ||||||||||||||||||||||||||||||||||||||||

Non-controlling interests | 371 | 354 | 289 | 258 | 248 | 344 | 421 | 468 | 371 | 354 | ||||||||||||||||||||||||||||||

Shareholders’ equity | 4,252 | 4,244 | 3,370 | 5,027 | 3,888 | 5,171 | 4,842 | 4,368 | 4,120 | 4,111 | ||||||||||||||||||||||||||||||

Combined earnings per share(a) | € 2011 | € 2010 | € 2009 | € 2008 | € 2007 | € 2014 | € 2013 | € 2012 | € 2011 | € 2010 | ||||||||||||||||||||||||||||||

Continuing operations: | ||||||||||||||||||||||||||||||||||||||||

Basic earnings per share | 1.51 | 1.51 | 1.21 | 1.79 | 1.32 | 1.82 | 1.71 | 1.54 | 1.46 | 1.46 | ||||||||||||||||||||||||||||||

Diluted earnings per share | 1.46 | 1.46 | 1.17 | 1.73 | 1.28 | 1.79 | 1.66 | 1.50 | 1.42 | 1.42 | ||||||||||||||||||||||||||||||

Total operations: | ||||||||||||||||||||||||||||||||||||||||

Basic earnings per share | 1.51 | 1.51 | 1.21 | 1.79 | 1.35 | |||||||||||||||||||||||||||||||||||

Diluted earnings per share | 1.46 | 1.46 | 1.17 | 1.73 | 1.31 | |||||||||||||||||||||||||||||||||||

(a) For the basis of the calculations of combined earnings per share see note 7 on page 83 of the Group’s Annual Report and Accounts 2011 furnished separately on 2 March 2012 under Form 6-K and incorporated here by reference. |

| |||||||||||||||||||||||||||||||||||||||

(a) For the basis of the calculations of combined earnings per share see Note 7 ‘Combined earnings per share’ on page 102 of the Group’s Annual Report and Accounts 2014 furnished separately on 6 March 2015 under Form 6-K and incorporated here by reference. |

(a) For the basis of the calculations of combined earnings per share see Note 7 ‘Combined earnings per share’ on page 102 of the Group’s Annual Report and Accounts 2014 furnished separately on 6 March 2015 under Form 6-K and incorporated here by reference. |

| ||||||||||||||||||||||||||||||||||||||

| € million | € million | € million | € million | € million | ||||||||||||||||||||||||||||||||||||

Consolidated balance sheet | € million 2011 | € million 2010 | € million 2009 | € million 2008 | € million 2007 | 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||||||||||||

Non-current assets | 33,221 | 28,683 | 26,205 | 24,967 | 27,374 | 35,680 | 33,391 | 34,042 | 33,245 | 28,706 | ||||||||||||||||||||||||||||||

Current assets | 14,291 | 12,484 | 10,811 | 11,175 | 9,928 | 12,347 | 12,122 | 12,147 | 14,291 | 12,484 | ||||||||||||||||||||||||||||||

| Total assets | 47,512 | 41,167 | 37,016 | 36,142 | 37,302 | 48,027 | 45,513 | 46,189 | 47,536 | 41,190 | ||||||||||||||||||||||||||||||

Current liabilities | 17,929 | 13,606 | 11,599 | 13,800 | 13,559 | 19,642 | 17,382 | 15,815 | 17,929 | 13,606 | ||||||||||||||||||||||||||||||

Non-current liabilities | 14,662 | 12,483 | 12,881 | 11,970 | 10,924 | 14,122 | 13,316 | 14,425 | 14,489 | 12,322 | ||||||||||||||||||||||||||||||

| Total liabilities | 32,591 | 26,089 | 24,480 | 25,770 | 24,483 | 33,764 | 30,698 | 30,240 | 32,418 | 25,928 | ||||||||||||||||||||||||||||||

Shareholders’ equity | 14,293 | 14,485 | 12,065 | 9,948 | 12,387 | 13,651 | 14,344 | 15,392 | 14,491 | 14,669 | ||||||||||||||||||||||||||||||

Non-controlling interests | 628 | 593 | 471 | 424 | 432 | 612 | 471 | 557 | 628 | 593 | ||||||||||||||||||||||||||||||

| Total equity | 14,921 | 15,078 | 12,536 | 10,372 | 12,819 | 14,263 | 14,815 | 15,949 | 15,119 | 15,262 | ||||||||||||||||||||||||||||||

| Total liabilities and equity | 47,512 | 41,167 | 37,016 | 36,142 | 37,302 | 48,027 | 45,513 | 46,189 | 47,537 | 41,190 | ||||||||||||||||||||||||||||||

| € million | € million | € million | € million | € million | ||||||||||||||||||||||||||||||||||||

| Consolidated cash flow statement | 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||||||||||||||||||||||

Net cash flow from operating activities | 5,543 | 6,294 | 6,836 | 5,452 | 5,490 | |||||||||||||||||||||||||||||||||||

Net cash flow from/(used in) investing activities | (341 | ) | (1,161 | ) | (755 | ) | (4,467 | ) | (1,164 | ) | ||||||||||||||||||||||||||||||

Net cash flow from/(used in) financing activities | (5,190 | ) | (5,390 | ) | (6,622 | ) | 411 | (4,609 | ) | |||||||||||||||||||||||||||||||

Net increase/(decrease) in cash and cash equivalents | 12 | (257 | ) | (541 | ) | 1,396 | (283 | ) | ||||||||||||||||||||||||||||||||

Cash and cash equivalents at the beginning of the year | 2,044 | 2,217 | 2,978 | 1,966 | 2,397 | |||||||||||||||||||||||||||||||||||

Effect of foreign exchange rates | (146 | ) | 84 | (220 | ) | (384 | ) | (148 | ) | |||||||||||||||||||||||||||||||

Cash and cash equivalents at the end of the year | 1,910 | 2,044 | 2,217 | 2,978 | 1,966 | |||||||||||||||||||||||||||||||||||

| Key performance indicators | 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||||||||||||||||||||||

Underlying sales growth (%)(b) | 2.9 | 4.3 | 6.9 | 6.5 | 4.1 | |||||||||||||||||||||||||||||||||||

Underlying volume growth (%)(b) | 1.0 | 2.5 | 3.4 | 1.6 | 5.8 | |||||||||||||||||||||||||||||||||||

Core operating margin (%)(b) | 14.5 | 14.1 | 13.7 | 13.5 | 13.6 | |||||||||||||||||||||||||||||||||||

Free cash flow (€ million)(b) | 3,100 | 3,856 | 4,333 | 3,075 | 3,365 | |||||||||||||||||||||||||||||||||||

| 2 Form 20-F | UnileverAnnual Report on Form 20-F |

ITEM 3. KEY INFORMATIONForm 20-FCONTINUED

| Consolidated cash flow statement | € million 2011 | € million 2010 | € million 2009 | € million 2008 | € million 2007 | |||||||||||||||

Net cash flow from operating activities | 5,452 | 5,490 | 5,774 | 3,871 | 3,876 | |||||||||||||||

Net cash flow from/(used in) investing activities | (4,467 | ) | (1,164 | ) | (1,263 | ) | 1,415 | (623 | ) | |||||||||||

Net cash flow from/(used in) financing activities | 411 | (4,609 | ) | (4,301 | ) | (3,130 | ) | (3,009 | ) | |||||||||||

| Net increase/(decrease) in cash and cash equivalents | 1,396 | (283 | ) | 210 | 2,156 | 244 | ||||||||||||||

Cash and cash equivalents at the beginning of the year | 1,966 | 2,397 | 2,360 | 901 | 710 | |||||||||||||||

Effect of foreign exchange rates | (384 | ) | (148 | ) | (173 | ) | (697 | ) | (53 | ) | ||||||||||

| Cash and cash equivalents at the end of the year | 2,978 | 1,966 | 2,397 | 2,360 | 901 | |||||||||||||||

Key performance indicators | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

Underlying sales growth (%)(b) | 6.5 | 4.1 | 3.5 | 7.4 | 5.5 | |||||||||||||||

Underlying volume growth (%)(b) | 1.6 | 5.8 | 2.3 | 0.1 | 3.7 | |||||||||||||||

Underlying operating margin (%)(b) | 14.9 | 15.0 | 14.8 | 14.6 | 14.5 | |||||||||||||||

Free cash flow (€ million)(b) | 3,075 | 3,365 | 4,072 | 2,390 | 2,487 | |||||||||||||||

Ratios and other metrics | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

Operating margin (%) | 13.8 | 14.3 | 12.6 | 17.7 | 13.1 | |||||||||||||||

Net profit margin (%)(c) | 9.2 | 9.6 | 8.5 | 12.4 | 9.7 | |||||||||||||||

Net debt (€ million)(b) | 8,781 | 6,668 | 6,357 | 8,012 | 8,335 | |||||||||||||||

Ratio of earnings to fixed charges (times)(d) | 10.0 | 10.7 | 8.8 | 11.7 | 8.3 | |||||||||||||||

|

|

|

Dividend record

The following tables show the dividends declared and dividends paid by NV and PLC for the last five years, expressed in terms of the revised share denominations which became effective from 22 May 2006. Differences between the amounts ultimately received by US holders of NV and PLC shares are the result of changes in exchange rates between the equalisation of the dividends and the date of payment.

Following agreement at the 2009 AGMs and separate meetings of ordinary shareholders, the Equalisation Agreement was modified to facilitate the payment of quarterly dividends from 2010 onwards.

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

Dividends declared for the year | ||||||||||||||||||||

| NV dividends | ||||||||||||||||||||

Dividend per€0.16 | €0.90 | €0.83 | €0.46 | €0.77 | €0.75 | |||||||||||||||

Dividend per€0.16 (US Registry) | US $1.25 | US $1.13 | US $0.67 | US $1.02 | US $1.13 | |||||||||||||||

| PLC dividends | ||||||||||||||||||||

Dividend per 3 1/9p | £0.78 | £0.71 | £0.41 | £0.61 | £0.51 | |||||||||||||||

Dividend per 3 1/9p (US Registry) | US $1.25 | US $1.13 | US $0.67 | US $0.94 | US $1.01 | |||||||||||||||

Dividends paid during the year | ||||||||||||||||||||

| NV dividends | ||||||||||||||||||||

Dividend per€0.16 | €0.88 | €0.82 | €0.78 | €0.76 | €0.72 | |||||||||||||||

Dividend per€0.16 (US Registry) | US $1.24 | US $1.11 | US $1.09 | US $1.11 | US $1.00 | |||||||||||||||

| PLC dividends | ||||||||||||||||||||

Dividend per 3 1/9p | £0.77 | £0.71 | £0.64 | £0.55 | £0.49 | |||||||||||||||

Dividend per 3 1/9p (US Registry) | US $1.24 | US $1.11 | US $1.00 | US $0.99 | US $0.99 | |||||||||||||||

| Ratios and other metrics | 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||

Operating margin (%) | 16.5 | 15.1 | 13.6 | 13.8 | 14.3 | |||||||||||||||

Net profit margin (%)(c) | 10.7 | 9.7 | 8.5 | 8.9 | 9.3 | |||||||||||||||

Net debt (€ million)(b) | 9,900 | 8,456 | 7,355 | 8,781 | 6,668 | |||||||||||||||

Ratio of earnings to fixed charges (times)(d) | 12.3 | 11.7 | 10.2 | 9.8 | 10.4 | |||||||||||||||

(b) Non–GAAP measures are defined and described on pages 34 and 35 of the Group’s Annual Report and Accounts 2014 furnished separately on 6 March 2015 under Form 6-K and incorporated here by reference. Reconciliations of non-GAAP measures to relevant GAAP measures are detailed below and should be read in conjunction with pages 34 and 35 of the Group’s Annual Report and Accounts 2014. (c) Net profit margin is expressed as net profit attributable to shareholders’ equity as a percentage of turnover. (d) In the ratio of earnings to fixed charges, earnings consist of net profit from continuing operations excluding net profit or loss of joint ventures and associates increased by fixed charges, income taxes and dividends received from joint ventures and associates. Fixed charges consist of interest payable on debt and a portion of lease costs determined to be representative of interest. This ratio takes no account of interest receivable although Unilever’s treasury operations involve both borrowing and depositing funds. |

| |||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| Underlying sales growth (%) | vs 2013 | vs 2012 | vs 2011 | vs 2010 | vs 2009 | |||||||||||||||

Underlying sales growth (%) | 2.9 | 4.3 | 6.9 | 6.5 | 4.1 | |||||||||||||||

Effect of acquisitions (%) | 0.4 | – | 1.8 | 2.7 | 0.3 | |||||||||||||||

Effect of disposals (%) | (1.3 | ) | (1.1 | ) | (0.7 | ) | (1.5 | ) | (0.8 | ) | ||||||||||

Effect of exchange rates (%) | (4.6 | ) | (5.9 | ) | 2.2 | (2.5 | ) | 7.3 | ||||||||||||

Turnover growth (%) | (2.7 | ) | (3.0 | ) | 10.5 | 5.0 | 11.1 | |||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| Underlying volume growth (%) | vs 2013 | vs 2012 | vs 2011 | vs 2010 | vs 2009 | |||||||||||||||

Underlying volume growth (%) | 1.0 | 2.5 | 3.4 | 1.6 | 5.8 | |||||||||||||||

Effect of price changes (%) | 1.9 | 1.8 | 3.3 | 4.8 | (1.6 | ) | ||||||||||||||

Underlying sales growth (%) | 2.9 | 4.3 | 6.9 | 6.5 | 4.1 | |||||||||||||||

| € million | € million | € million | € million | € million | ||||||||||||||||

| Core operating margin and core operating profit | 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||

Operating profit | 7,980 | 7,517 | 6,977 | 6,420 | 6,325 | |||||||||||||||

Acquisition and disposal related cost | 97 | 112 | 190 | 234 | 50 | |||||||||||||||

(Gain)/loss on disposal of group companies | (1,392 | ) | (733 | ) | (117 | ) | (221 | ) | (468 | ) | ||||||||||

Impairments and other one-off items | 335 | 120 | – | (157 | ) | 110 | ||||||||||||||

Core operating profit | 7,020 | 7,016 | 7,050 | 6,276 | 6,017 | |||||||||||||||

Turnover | 48,436 | 49,797 | 51,324 | 46,467 | 44,262 | |||||||||||||||

Operating margin (%) | 16.5 | 15.1 | 13.6 | 13.8 | 14.3 | |||||||||||||||

Core operating margin (%) | 14.5 | 14.1 | 13.7 | 13.5 | 13.6 | |||||||||||||||

| € million | € million | € million | € million | € million | ||||||||||||||||

| Free cash flow (FCF) to net profit | 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||

Net profit | 5,515 | 5,263 | 4,836 | 4,491 | 4,465 | |||||||||||||||

Taxation | 2,131 | 1,851 | 1,697 | 1,575 | 1,486 | |||||||||||||||

Share of net profit of joint ventures/associates and other income from non-current investments | (143 | ) | (127 | ) | (91 | ) | (189 | ) | (187 | ) | ||||||||||

Net finance costs | 477 | 530 | 535 | 543 | 561 | |||||||||||||||

Depreciation, amortisation and impairment | 1,432 | 1,151 | 1,199 | 1,029 | 993 | |||||||||||||||

Changes in working capital | 8 | 200 | 822 | (177 | ) | 169 | ||||||||||||||

Pensions and similar obligations less payments | (364 | ) | (383 | ) | (369 | ) | (540 | ) | (458 | ) | ||||||||||

Provisions less payments | 32 | 126 | (43 | ) | 9 | 72 | ||||||||||||||

Elimination of (profits)/losses on disposals | (1,460 | ) | (725 | ) | (236 | ) | (215 | ) | (476 | ) | ||||||||||

Non-cash charge for share-based compensation | 188 | 228 | 153 | 105 | 144 | |||||||||||||||

Other adjustments | 38 | (15 | ) | 13 | 8 | 49 | ||||||||||||||

Cash flow from operating activities | 7,854 | 8,099 | 8,516 | 6,639 | 6,818 | |||||||||||||||

Income tax paid | (2,311 | ) | (1,805 | ) | (1,680 | ) | (1,187 | ) | (1,328 | ) | ||||||||||

Net capital expenditure | (2,045 | ) | (2,027 | ) | (2,143 | ) | (1,974 | ) | (1,701 | ) | ||||||||||

Net interest and preference dividends paid | (398 | ) | (411 | ) | (360 | ) | (403 | ) | (424 | ) | ||||||||||

Free cash flow | 3,100 | 3,856 | 4,333 | 3,075 | 3,365 | |||||||||||||||

Net cash flow (used in)/from investing activities | (341 | ) | (1,161 | ) | (755 | ) | (4,467 | ) | (1,164 | ) | ||||||||||

Net cash flow (used in)/from financing activities | (5,190 | ) | (5,390 | ) | (6,622 | ) | 411 | (4,609 | ) | |||||||||||

UnileverAnnual Report on Form 20-F | Form 20-F 3 |

ITEM 3. KEY INFORMATIONForm 20-FCONTINUED

| € million | € million | € million | € million | € million | ||||||||||||||||

| Net debt to total financial liabilities | 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||

Total financial liabilities | (12,722 | ) | (11,501 | ) | (10,221 | ) | (13,718 | ) | (9,534 | ) | ||||||||||

Financial liabilities due within one year | (5,536 | ) | (4,010 | ) | (2,656 | ) | (5,840 | ) | (2,276 | ) | ||||||||||

Financial liabilities due after one year | (7,186 | ) | (7,491 | ) | (7,565 | ) | (7,878 | ) | (7,258 | ) | ||||||||||

Cash and cash equivalents as per balance sheet | 2,151 | 2,285 | 2,465 | 3,484 | 2,316 | |||||||||||||||

Cash and cash equivalents as per cash flow statement | 1,910 | 2,044 | 2,217 | 2,978 | 1,966 | |||||||||||||||

Add bank overdrafts deducted therein | 241 | 241 | 248 | 506 | 350 | |||||||||||||||

Financial assets | 671 | 760 | 401 | 1,453 | 550 | |||||||||||||||

Net debt | (9,900 | ) | (8,456 | ) | (7,355 | ) | (8,781 | ) | (6,668 | ) | ||||||||||

RATIO OF EARNINGS TO FIXED CHARGES (TIMES) For a calculation of our ratio of earnings to fixed charges see Item 19: Exhibits – Calculation of Ratio of Earnings to Fixed Charges.

DIVIDEND RECORD The following tables show the dividends declared and dividends paid by NV and PLC for the last five years, expressed in terms of the revised share denominations which became effective from 22 May 2006. Differences between the amounts ultimately received by US holders of NV and PLC shares are the result of changes in exchange rates between the equalisation of the dividends and the date of payment.

Following agreement at the 2009 Annual General Meetings (AGMs) and separate meetings of ordinary shareholders, the Equalisation Agreement was modified to facilitate the payment of quarterly dividends from 2010 onwards.

|

| |||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

Dividends declared for the year | ||||||||||||||||||||

| NV dividends | ||||||||||||||||||||

Dividend per€0.16 | €1.14 | €1.08 | €0.97 | €0.90 | €0.83 | |||||||||||||||

Dividend per€0.16 (US Registry) | US $1.47 | US $1.44 | US $1.25 | US $1.25 | US $1.13 | |||||||||||||||

| PLC dividends | ||||||||||||||||||||

Dividend per 31/9p | £0.90 | £0.91 | £0.79 | £0.78 | £0.71 | |||||||||||||||

Dividend per 31/9p (US Registry) | US $1.47 | US $1.44 | US $1.25 | US $1.25 | US $1.13 | |||||||||||||||

Dividends paid during the year | ||||||||||||||||||||

| NV dividends | ||||||||||||||||||||

Dividend per€0.16 | €1.12 | €1.05 | €0.95 | €0.88 | €0.82 | |||||||||||||||

Dividend per€0.16 (US Registry) | US $1.51 | US $1.40 | US $1.23 | US $1.24 | US $1.11 | |||||||||||||||

| PLC dividends | ||||||||||||||||||||

Dividend per 31/9p | £0.91 | £0.89 | £0.77 | £0.77 | £0.71 | |||||||||||||||

Dividend per 31/9p (US Registry) | US $1.51 | US $1.40 | US $1.23 | US $1.24 | US $1.11 | |||||||||||||||

| 4 Form 20-F | Unilever Annual Report on Form 20-F 2014 |

ITEM 3. KEY INFORMATIONCONTINUED

Exchange ratesEXCHANGE RATES

Unilever reports its financial results and balance sheet position in euros. Other currencies which may significantly impact our financial statements are sterling and US dollars. Average and year-end exchange rates for these two currencies for the last five years are given below.

| 2011 | 2010 | 2009 | 2008 | 2007 | 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||||||||||||||||||

Year end | ||||||||||||||||||||||||||||||||||||||||

€1 = US $ | 1.294 | 1.337 | 1.433 | 1.417 | 1.471 | 1.215 | 1.378 | 1.318 | 1.294 | 1.337 | ||||||||||||||||||||||||||||||

€ 1 = £ | 0.839 | 0.862 | 0.888 | 0.977 | 0.734 | 0.781 | 0.833 | 0.816 | 0.839 | 0.862 | ||||||||||||||||||||||||||||||

Average | ||||||||||||||||||||||||||||||||||||||||

€1 = US $ | 1.396 | 1.326 | 1.388 | 1.468 | 1.364 | 1.334 | 1.325 | 1.283 | 1.396 | 1.326 | ||||||||||||||||||||||||||||||

€ 1 = £ | 0.869 | 0.858 | 0.891 | 0.788 | 0.682 | 0.807 | 0.849 | 0.811 | 0.869 | 0.858 | ||||||||||||||||||||||||||||||

On 2825 February 20122015 (the latest practicable date for inclusion in this report) the exchange rates between euros and US dollars and between euros and sterling as published in the Financial Times in London were as follows:€1 = US $1.340$1.134 and€1 = £0.846.£0.734.

Noon Buying Rates in New York for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York were as follows:

| 2011 | 2010 | 2009 | 2008 | 2007 | 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||||||||||||||||||

Year end | ||||||||||||||||||||||||||||||||||||||||

€1 = US $ | 1.297 | 1.327 | 1.433 | 1.392 | 1.460 | 1.210 | 1.378 | 1.319 | 1.297 | 1.327 | ||||||||||||||||||||||||||||||

Average | ||||||||||||||||||||||||||||||||||||||||

€1 = US $ | 1.393 | 1.326 | 1.394 | 1.473 | 1.371 | 1.330 | 1.328 | 1.286 | 1.393 | 1.326 | ||||||||||||||||||||||||||||||

High | ||||||||||||||||||||||||||||||||||||||||

€1 = US $ | 1.488 | 1.454 | 1.510 | 1.601 | 1.486 | 1.393 | 1.382 | 1.346 | 1.488 | 1.454 | ||||||||||||||||||||||||||||||

Low | ||||||||||||||||||||||||||||||||||||||||

€1 = US $ | 1.293 | 1.196 | 1.255 | 1.245 | 1.290 | 1.210 | 1.277 | 1.206 | 1.293 | 1.196 | ||||||||||||||||||||||||||||||

High and low exchange rate values for each of the last six months:

| September 2011 | October 2011 | November 2011 | December 2011 | January 2012 | February(a) 2012 | | September 2014 | | | October 2014 | | | November 2014 | | | December 2014 | | | January 2015 | |

| February 2015 | (e)

| |||||||||||||||||||||||||

High | ||||||||||||||||||||||||||||||||||||||||||||||||

€1 = US $ | 1.428 | 1.417 | 1.380 | 1.349 | 1.319 | 1.345 | 1.314 | 1.281 | 1.255 | 1.250 | 1.202 | 1.146 | ||||||||||||||||||||||||||||||||||||

Low | ||||||||||||||||||||||||||||||||||||||||||||||||

€1 = US $ | 1.345 | 1.328 | 1.324 | 1.293 | 1.268 | 1.307 | 1.263 | 1.252 | 1.239 | 1.210 | 1.128 | 1.130 | ||||||||||||||||||||||||||||||||||||

(a)(e)Through 2425 February 20122015.

Share capitalSHARE CAPITAL

The information set forth under the heading ‘Note 1915A Share capital’ on pages 101 to 102page 110 of the Group’s Annual Report and Accounts 20112014 furnished separately on 26 March 20122015 under Form 6-K is incorporated by reference.

B. Capitalisation and indebtednessCAPITALISATION AND INDEBTEDNESS

Not applicable.

C. Reasons for the offer and use of proceedsREASONS FOR THE OFFER AND USE OF PROCEEDS

Not applicable.

D. Risk factorsRISK FACTORS

Our principal risks, as described on pages 28 to 3236 and 37 of the Group’s Annual Report and Accounts 20112014 furnished separately on 26 March 20122015 under Form 6-K, excluding the cross-reference to pages 50 to 53, are incorporated by reference. The information set forth under the heading ‘Note 16 Capital and treasuryTreasury risk management’ on pages 93114 to 99119, ‘Note 17B Credit risk’ on page 121 and ‘Note 18 Financial instruments fair value risk’ on pages 121 to 123 of the Group’s Annual Report and Accounts 20112014 furnished separately on 26 March 20122015 under Form 6-K is incorporated by reference.

Risk factors

Our business is subject to risks and uncertainties. The risks that we regard as the most relevant to our business are set out below.on pages 36 to 37 of the Group’s Annual Report and Accounts 2014 furnished separately on 6 March 2015 under Form 6-K. These are the risks that we see as material to Unilever’s business and performance at this time. There may be other risks that could emerge in the future. We have undertaken certain mitigating actions that we believe help us to manage the risks identified below.identified. However, we may not be successful in deploying some or all of these mitigating actions. If the circumstances in these risk factors occur or are not successfully mitigated, our cashflow,cash flow, operating results, financial position, business and reputation could be materially adversely affected. In addition, risks and uncertainties could cause actual results to vary from those described in this document, or could impact on our ability to meet our targets or be detrimental to our profitability or reputation. ThisThe list is not intended to be exhaustive and there may be other risks and uncertainties that are not mentioned below that could impact our future performance or our ability to meet published targets. The risks and uncertainties discussed below should be read in conjunction with the Group’s consolidated financial statements and related notes and the portions of the Strategic Report of the Directorsand Corporate Governance section that are incorporated by reference from the Group’s Annual Report and Accounts 2011 (furnished2014 furnished separately on 26 March 20122015 on Form 6-K)6-K and other information included in or incorporated by reference in this Reportreport on Form 20-F.

Form 20-F

| ||||

|

| |||

| ||||

| ||||

|

| |||

| ||||

| ||||

| ||||

|

| |||

| ||||

|

| |||

| ||||

|

| |||

| ||||

| ||||

|

| |||

| ||||

| ||||

|

| |||

| ||||

| ||||

| ||||

|

| |||

| ||||

UnileverAnnual Report on Form 20-F | Form 20-F 5 |

Form 20-F

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

Form 20-F

| ||||

| ||||

| ||||

|

| |||

| ||||

| ||||

|

Form 20-F

ItemITEM 4. Information on the CompanyINFORMATION ON THE COMPANY

A. History and development of the CompanyHISTORY AND DEVELOPMENT OF THE COMPANY

The information set forth under the following headings of the Group’s Annual Report and Accounts 20112014 furnished separately on 26 March 20122015 under Form 6-K is incorporated by reference:

‘About Unilever’ on page 41;

‘Our requirements andCorporate governance compliance’ on pages 4346 to 45;

‘Note 10 Property, plant and equipment’ on pages 105 and 106;

‘Shareholder information’ on pages 123 to 126.page 40 (other than ‘Website’).

In 2014 and 2013, the Group did not receive any public takeover offers by third parties in respect of NV or PLC shares or make any public takeover offers in respect of other companies’ shares.

Please refer also to ‘Financial Review 2010’review 2013’ within Item 5A of this report and ‘The Unilever Group’ on page 1 of this report.

B. Business overviewBUSINESS OVERVIEW

The information set forth under the following headings of the Group’s Annual Report and Accounts 20112014 furnished separately on 26 March 20122015 under Form 6-K is incorporated by reference:

‘Note 2 Segment information’ on pages 70 to 71;90 and

‘Better service’Marketing’ on page 16.9;

Please refer also to ‘Financial review 2013’ within Item 5A of this report.

Please also refer to ‘The Unilever Group’ on page 1 of this report.

Marketing channelsMARKETING CHANNELS

Unilever’s products are generally sold through our own sales force as well as through independent brokers, agents and distributors to chain, wholesale, co-operative and independent grocery accounts, food service distributors and institutions. Products are physically distributed through a network of distribution centres, satellite warehouses, company-operated and public storage facilities, depots and other facilities.

Raw materialsRAW MATERIALS

Our products use a wide variety of raw and packaging materials which we source internationally, and which may be subject to price volatility. We sawAlthough we have seen rather more stable conditions in key commodity prices rise during the second halfmarkets in 2014 we remain watchful for further periods of 2011 and this looks set to continue into 2012.volatility in 2015.

SeasonalitySEASONALITY

Certain of our businesses, such as ice cream, are subject to significant seasonal fluctuations in sales. However, Unilever operates globally in many different markets and product categories, and no individual element of seasonality is likely to be material to the results of the Group as a whole.

Intellectual propertyINTELLECTUAL PROPERTY

We have a large portfolio of patents and trademarks, and we conduct some of our operations under licences that are based on patents or trademarks owned or controlled by others. We are not dependent on any one patent or group of patents. We use all appropriate efforts to protect our brands and technology.

CompetitionCOMPETITION

As a FMCG (fastfast moving consumer goods)goods (FMCG) company, we are competing with a diverse set of competitors. Some of these operate on an international scale like ourselves, while others have a more regional or local focus. Our business model centres on building brands which consumers know, trust, like and buy in conscious preference to competitors’. Our brands command loyalty and affinity and deliver superior performance.

INFORMATION PRESENTED

Unless otherwise stated, share refers to value share. The market data and competitive set classifications are taken from independent industry sources in the markets in which Unilever operates.

IRAN-RELATED REQUIRED DISCLOSURE

Unilever operates in Iran through a non-US subsidiary. In 2014, sales in Iran were significantly less than one percent of Unilever’s worldwide turnover. This non-US subsidiary had€627,377 in gross revenues and€164,769 in net profits attributable to the sale of home, personal care and food products to superstores controlled by the Government of Iran or affiliated entities in 2014. In addition, we advertised our products on television networks that are owned by the Government of Iran or affiliated entities. Income, payroll and other taxes, duties and fees (including for utilities) were payable to the Government of Iran and affiliated entities in connection with our operations. Our non-US subsidiary maintains bank accounts in Iran with various banks to facilitate our business in the country and make any required payments to the Government of Iran and affiliated entities. One of the financial institutions used by our non-US subsidiary is Bank Melli, an entity identified on the Specially Designated Nationals and Blocked Persons List maintained by the Office of Foreign Assets Control in the U.S. Department of the Treasury. The account maintained by our non-US subsidiary with Bank Melli was opened in 2014 in order to comply with a requirement that any value added tax collected from customers within Iran is paid to the Iranian tax authorities through an account maintained within Bank Melli. Our activities in Iran comply in all material respects with applicable laws and regulations, including US and other international trade sanctions, and we plan to continue these activities.

C. Organisational structureORGANISATIONAL STRUCTURE

The information set forth under the heading ‘Principal‘Note 27 Principal group companies and non-current investments’ on pages 109129 and 110130 of the Group’s Annual Report and Accounts 20112014 furnished separately on 26 March 20122015 under Form 6-K is incorporated by reference:reference.

Please also refer to ‘The Unilever Group’ on page 1 of this report.

D. Property, plant and equipmentPROPERTY, PLANT AND EQUIPMENT

We have interests in properties in most of the countries where there are Unilever operations. However, none is material in the context of the Group as a whole. The properties are used predominantly to house production and distribution activities and as offices. There is a mixture of leased and owned property throughout the Group. We are not aware of any environmental issues affecting the properties which would have a material impact upon the Group, and there are no material encumbrances on our properties. Any difference between the market value of properties held by the Group and the amount at which they are included in the balance sheet is not significant. We believe our existing facilities are satisfactory for our current business and we currently have no plans to construct new facilities or expand or improve our current facilities in a manner that is material to the Group.

The information set forth under the following headings of the Group’s Annual Report and Accounts 20112014 furnished separately on 26 March 20122015 under Form 6-K is incorporated by reference:

‘Note 10 Property, plant and equipment’ on pages 86105 and 87;106; and

‘Note 27 Principal group companies and non-current investments’ on pages 109129 and 110.130.

| 6 Form 20-F | Unilever Annual Report on Form 20-F 2014 |

ItemITEM 4A. Unresolved Staff CommentsUNRESOLVED STAFF COMMENTS

Not applicable.

ItemITEM 5. Operating and Financial Review and ProspectsOPERATING AND FINANCIAL REVIEW AND PROSPECTS

A. Operating resultsOPERATING RESULTS

The information set forth under the following headings of the Group’s Annual Report and Accounts 20112014 furnished separately on 26 March 20122015 under Form 6-K is incorporated by reference:

‘Outlook’Key financial indicators’ on page 28;

‘Our markets’ on pages 12 and 13;

‘Currency risk’ on pages 116 and 117; and

Please refer also to ‘Outlook’ within Item 5D of this report.

FINANCIAL REVIEW 2013

Form 20-F

Financial Review 2010

Basis of reportingBASIS OF REPORTING

The information set forth under the heading ‘Basis of reporting’‘Consolidated income statement’ on page 2531 of the Group’s Annual Report and Accounts 20112014 furnished separately on 26 March 20122015 under Form 6-K is incorporated by reference.

Group results and earnings per shareGROUP RESULTS AND EARNINGS PER SHARE

The following discussion summarises the results of the Group during the years 20102013 and 2009.2012. The figures quoted are in euros, at current rates of exchange, being the average rates applying in each period as applicable, unless otherwise stated. Information about exchange rates between the euro, pound sterling and US dollar is given on page 45 of this report.

In 20102013 and 2009,2012, no disposals qualified to be disclosed as discontinued operations for purposes of reporting.

| € million 2010 | € million 2009 | % Change | ||||||||||

Turnover | 44,262 | 39,823 | 11.1 | |||||||||

Operating profit | 6,339 | 5,020 | 26 | |||||||||

Underlying operating profit | 6,620 | 5,888 | 12 | |||||||||

Net profit | 4,598 | 3,659 | 26 | |||||||||

Diluted EPS | €1.46 | €1.17 | 25 | |||||||||

| 2013 | 2012 | % change | ||||||||||

Turnover (€ million) | 49,797 | 51,324 | (3.0 | ) | ||||||||

Operating profit (€ million) | 7,517 | 6,977 | 8 | |||||||||

Core operating profit (€ million) | 7,016 | 7,050 | – | |||||||||

Profit before tax (€ million) | 7,114 | 6,533 | 9 | |||||||||

Net profit (€ million) | 5,263 | 4,836 | 9 | |||||||||

Diluted earnings per share (€) | 1.66 | 1.50 | 11 | |||||||||

Core earnings per share (€) | 1.58 | 1.53 | 3 | |||||||||

Turnover at€44.349.8 billion increased 11.1%decreased 3.0%, with 7.3% due to currency.including a negative impact from both foreign exchange, of 5.9%, and acquisitions net of disposals of 1.1%. Underlying sales growth increased to 4.1%was 4.3% (2012: 6.9%), driven in particular by an improvement in performance in Western Europe. Underlyingbalanced between volume growth of 5.8% was partially offset by the full year price effect2.5% (2012: 3.4%) and pricing of negative 1.6%, though1.8% (2012: 3.3%). Emerging markets, now 57% of total turnover, were flat at reported exchange rates, with underlying sales growth of 8.7% versus 11.4% in the fourthprior year. The Group saw a weakening in the market growth of many emerging countries, in particular during the third quarter, pricing turned positive on an in-quarter basis.exacerbated by significant currency devaluation.

Operating profit was€6.37.5 billion, compared with€5.07.0 billion in 2009, with higher one-off profits arising from the disposal2012, up 8%. The increase was mainly driven by non-core items which were a net credit of group companies and lower restructuring costs. Underlying€0.5 billion (2012: net debit€0.1 billion); core operating profit increased by 12% towas flat at€6.6 billion, with underlying operating margin increasing by 0.2% to 15.0%.7.0 billion. The total gain on business disposals, recognised in non-core items, was€0.7 billion.

The cost of financing net borrowings was€414397 million (2012:€15 million lower than 2009, as390 million). The average level of net debt increased following the adverse impactacquisition of currency was more than offset by lower average net debt. Theadditional shares in Hindustan Unilever Limited while interest rate movements were favourable. The average interest rate was 3.3% on borrowings was 4.4%debt and 2.9% on cash deposits was 1.7%.deposits. The charge for pensions financing cost was a credit of€20 million compared with a net charge of€164133 million, compared to€145 million in 2009.2012, both restated for the impact of the revision to the accounting standard IAS 19.

The effective tax rate was 25.5% comparedremained consistent with 26.2% in 2009 reflecting2012 at 26%. Our longer term expectation for the geographic mix of profits and the impact of the Italian frozen foods disposal. The underlying tax rate excluding the effect of restructuring, disposals and impairments was 27.1%remains around 26%.

Net profit from joint ventures and associates, together with other income from non-current investments, contributed€187127 million in 2013, compared to€48991 million in the prior year. The movement is mainly due to the low prior year comparator which benefited fromincluded an impairment of warrants associated with the€327 million gain on disposal disposals of the majority of the equity in JohnsonDiversey.US laundry business.

Fully diluted earnings per share increased 25%, towere€1.46. This was1.66, up 11% from€1.50 in the prior year, driven by improved underlyinghigher operating profit. Core earnings per share were€1.58, up 3% from€1.53 in 2012 after a 7% headwind from currency movements.

EXPENSES WHICH MATERIALLY IMPACTED OPERATING PROFIT IN 2013

Turnover declined by€1.5 billion, due mainly to net exchange rate movements (negative€3.2 billion impact). Despite the drop in absolute turnover, there was a 0.4 percentage point improvement in core operating margin, core operating profit lower restructuring charges, lower pension costs,was almost flat (negative€34 million), and operating profit was up by€540 million with the favourable impact of foreignprofit on disposal of Skippy and Wishbone brands.

Core operating profit improvement in Personal Care (increased by€121 million) was offset by the decline in Foods (down by€151 million). Refreshments and Home Care were broadly flat.

Cost of raw and packaging materials and goods purchased for resale (material costs) decreased by€0.8 billion, driven primarily by the exchange rate depreciation of€1.3 billion, at constant exchange rates it was up by€0.5 billion. At constant rates, the gross total input costs (before savings and including material costs, distribution and supply chain indirects) increase of€1.1 billion was more than offset by price increase of€1.0 billion, and material costs savings of€1.0 billion during the year. Gross margin improved by 1.1 percentage point to 41.6%.

Staff costs were down by€0.1 billion. Salary inflation and higher profit on business disposal partiallyshare based payment costs were more than offset by a provisionthe currency devaluation in respectemerging markets.

Brand and marketing investment increased by€0.5 billion at constant exchange rates as we continued to invest behind our brands. The increase at current exchange rates was€0.1 billion.

The impact of input costs and investment in our brands are discussed further in our segmental disclosures, which also provide additional details of the European Commission investigation into consumer detergents. Business disposals include the disposalimpact of the Italian frozen foods business.brands, products and subcategories on driving top line growth.

|

Form 20-F

ITEM 5. OPERATING AND FINANCIAL

REVIEW AND PROSPECTSCONTINUED

Asia Africa CEEIMPACT OF COMMODITY COSTS ON GROSS MARGIN

€ million 2010 | € million 2009 | % Change | ||||||||||

Turnover | 17,685 | 14,897 | 18.7 | |||||||||

Operating profit | 2,253 | 1,927 | 16.9 | |||||||||

Underlying operating margin (%) | 13.4 | 13.9 | �� | (0.5 | ) | |||||||

Underlying sales growth (%) | 7.7 | 7.7 | ||||||||||

Underlying volume growth (%) | 10.2 | 4.1 | ||||||||||

Effect of price changes (%) | (2.2 | ) | 3.4 | |||||||||

During 2013, the Unilever Group faced cost inflation of overKey developments€

1.1 billion. The relative strength of most major currencies in the region against the euro meant thatUnilever Group actively mitigates the impact of exchange rates was significant, contributing 10.1% of the overall turnover growth.

Competitive intensity reached new heights in several key countries in 2010, with increased levels of mostly price-based competition. Against this competitive background, underlying sales growth and volume growth represent strong and fully competitive performance.

Negative price growth reflects actions taken to ensure that market position were protected against high levelscost inflation through a combination of price based competition.

Underlying operatingincreases and costs savings to protect its margin. Hence, despite cost increases, the Unilever Group was able to improve its gross margin by 1.1 percentage points during 2013 at constant exchange rates. Specifically gross margin was down by 0.5%, withprotected in all four categories. Commodity costs were more stable gross margin, but investment in advertising and promotions significantly increased.than recent years increasing

Other key developments included the continued successful roll-out of the regional IT platform to a variety of countries.

The AmericasPERSONAL CARE

| € million | € million | % | ||||||||||||||||||||||

€ million 2010 | € million 2009 | % Change | 2013 | 2012 | Change | |||||||||||||||||||

Turnover | 14,562 | 12,850 | 13.3 | 18,056 | 18,097 | (0.2 | ) | |||||||||||||||||

Operating profit | 2,169 | 1,843 | 17.7 | 3,078 | 2,925 | 5.2 | ||||||||||||||||||

Underlying operating margin (%) | 16.0 | 16.1 | (0.1 | ) | ||||||||||||||||||||

Core operating profit | 3,206 | 3,085 | 3.9 | |||||||||||||||||||||

Core operating margin (%) | 17.8 | 17.0 | 0.8 | |||||||||||||||||||||

Underlying sales growth (%) | 4.0 | 4.2 | 7.3 | 10.0 | ||||||||||||||||||||

Underlying volume growth (%) | 4.8 | 2.5 | 5.5 | 6.5 | ||||||||||||||||||||

Effect of price changes (%) | (0.7 | ) | 1.6 | 1.7 | 3.3 | |||||||||||||||||||

Key developmentsKEY DEVELOPMENTS

The relative strengthPersonal Care delivered another year of most major currencies in the region against the euro meant that the impact ofstrong underlying growth, although exchange rates was significant, contributing 9.0% of the overallrate movements (6.8%) led to turnover growth.

Market conditions in North America remained challenging throughout the year, with consumer confidence at low levels and competition proving increasingly intense. Latin American markets were generally much stronger, although levels of competition again increased, particularly in Brazil.

being almost unchanged on 2012. Underlying sales growth of 4.0%7.3% was broad-based across all sub-categories; hair care, skin cleansing and skin care, deodorants and oral care growing more than 5%. Underlying volume increased by 5.5%, while the price growth, at 1.7%, was lower than 2012 which had included more commodity cost driven increases. Growth was supported by innovations like Dove Repair Expertise in more than 50 markets, Vaseline Spray & Go moisturisers and the Axe Apollo campaign across more than 70 countries.

REFRESHMENT

| € million | € million | % | ||||||||||

| 2013 | 2012 | Change | ||||||||||

Turnover | 9,369 | 9,726 | (3.7 | ) | ||||||||

Operating profit | 851 | 908 | (6.3 | ) | ||||||||

Core operating profit | 856 | 908 | (5.7 | ) | ||||||||

Core operating margin (%) | 9.1 | 9.3 | (0.2 | ) | ||||||||

Underlying sales growth (%) | 1.1 | 6.3 | ||||||||||

Underlying volume growth (%) | (1.8 | ) | 2.4 | |||||||||

Effect of price changes (%) | 2.9 | 3.9 | ||||||||||

KEY DEVELOPMENTS

Core operating profit at€0.9 billion was€52 million lower than 2012, as a result of a€45 million adverse impact of exchange rates. Underlying pricesales growth was negative reflecting actions taken to ensure market positions were protected against high levels of price competition.

Underlyingadded€10 million. Core operating margin was down 0.1% with investment inlower by 0.2 percentage points as a result of higher advertising and promotions increased from 2009.

A key developmentby around 4% in 2010 was the announcement2013. Our Foods category is impacted by vegetable oil prices and petrochemicals materially affect our Home Care category, where we have protected our margins in both categories. There are no other commodities that have a material impact.

Part of an agreement to acquire the Alberto Culver business. The transaction was completed in 2011.our commodity risk, principally vegetable oils and petrochemicals, is hedged using a combination of physical contracts as well as derivatives (futures and options).

Western EuropeFOODS

| € million | € million | % | ||||||||||||||||||||||

€ million 2010 | € million 2009 | % Change | 2013 | 2012 | Change | |||||||||||||||||||

Turnover | 12,015 | 12,076 | (0.5 | ) | 13,426 | 14,444 | (7.0 | ) | ||||||||||||||||

Operating profit | 1,917 | 1,250 | 53.4 | 3,064 | 2,601 | 17.8 | ||||||||||||||||||

Underlying operating margin (%) | 16.1 | 14.4 | 1.7 | |||||||||||||||||||||

Core operating profit | 2,377 | 2,528 | (6.0 | ) | ||||||||||||||||||||

Core operating margin (%) | 17.7 | 17.5 | 0.2 | |||||||||||||||||||||

Underlying sales growth (%) | (0.4 | ) | (1.9 | ) | 0.3 | 1.8 | ||||||||||||||||||

Underlying volume growth (%) | 1.4 | (0.1 | ) | (0.6 | ) | (0.9 | ) | |||||||||||||||||

Effect of price changes (%) | (1.8 | ) | (1.8 | ) | 0.9 | 2.7 | ||||||||||||||||||

Key developmentsKEY DEVELOPMENTS

Competition continuedFoods turnover declined, by 7.0%, entirely due to be intenseexchange rate movements (3.8%) and business disposals of (3.7%). Underlying sales grew 0.3%, including a positive contribution from price of 0.9%. Underlying volumes were 0.6% lower because of market weakness in most partsspreads. Spreads performance improved in the second half with positive responses to the re-launch of Flora in the region throughout 2010. In someUK and new variants in Europe and the US. Our biggest Foods brands, Knorr and Hellmann’s, both grew well, particularly in emerging markets. Knorr jelly bouillons and baking bags continue to grow rapidly with the addition of new variants. Sales of soups and sauces in the developed markets and categories levels of price promotional activity accelerated towards the end of the year. Against this competitive background, underlying sales growth of negative 0.4% represented robust performance.

Underlying price growth was negative 1.8%, reflecting actions taken to ensure market positions were protected against high levels of price competition.

The major factor behind the significant increase inCore operating profit at€2.4 billion was€151 million lower than the profit on disposalprior year after an€107 million adverse impact from exchange rates and a reduction of the Italian frozen foods business. Underlying€83 million from disposals. Core operating margin was up sharply by 1.7% reflecting0.2 percentage points, adding€31 million to core operating profit. The increase from improved mix and savings was offset by higher advertising and promotions. Operating profit increased due to business disposals.

HOME CARE

| € million | € million | % | ||||||||||

| 2013 | 2012 | Change | ||||||||||

Turnover | 8,946 | 9,057 | (1.2 | ) | ||||||||

Operating profit | 524 | 543 | (3.5 | ) | ||||||||

Core operating profit | 577 | 529 | 9.1 | |||||||||

Core operating margin (%) | 6.4 | 5.8 | 0.6 | |||||||||

Underlying sales growth (%) | 8.0 | 10.3 | ||||||||||

Underlying volume growth (%) | 5.7 | 6.2 | ||||||||||

Effect of price changes (%) | 2.1 | 3.9 | ||||||||||

KEY DEVELOPMENTS

In other developments,Core operating profit at€0.6 billion was broadly unchanged on last year after an adverse€59 million from exchange rates. Underlying sales growth added€42 million. Core operating margin increased by 0.6 percentage points, adding€65 million, with higher gross margins, including the acquisitionbenefit of the Sara Lee Personal Carelow cost business was completed in the fourth quarter. Other smaller bolt-on acquisitions were announced during the year in ice cream.

| UnileverAnnual Report on Form 20-F |

ITEM 5. OPERATING AND FINANCIAL

REVIEW AND PROSPECTSForm 20-FCONTINUED

Non-GAAP measuresNON-GAAP MEASURES

The information set forth under the heading ‘Non-GAAP measures’ on pages 2634 and 2735 of the Group’s Annual Report and Accounts 20112014 furnished separately on 26 March 20122015 under Form 6-K is incorporated by reference.

Underlying sales growthUNDERLYING SALES GROWTH (USG)

The reconciliation of USG to changes in the GAAP measure turnover is as follows:

Total GroupTOTAL GROUP

2013 vs 2012 | 2012 vs 2011 | |||||||

Underlying sales growth (%) | 4.3 | 6.9 | ||||||

Effect of acquisitions (%) | – | 1.8 | ||||||

Effect of disposals (%) | (1.1 | ) | (0.7 | ) | ||||

Effect of exchange rates (%) | (5.9 | ) | 2.2 | |||||

Turnover growth (%)(a) | (3.0 | ) | 10.5 | |||||

| PERSONAL CARE | ||||||||

2013 vs 2012 | 2012 vs 2011 | |||||||

Underlying sales growth (%) | 7.3 | 10.0 | ||||||

Effect of acquisitions (%) | – | 4.4 | ||||||

Effect of disposals (%) | (0.2 | ) | (0.5 | ) | ||||

Effect of exchange rates (%) | (6.8 | ) | 2.3 | |||||

Turnover growth (%)(a) | (0.2 | ) | 17.0 | |||||

| FOODS | ||||||||

2013 vs 2012 | 2012 vs 2011 | |||||||

Underlying sales growth (%) | 0.3 | 1.8 | ||||||

Effect of acquisitions (%) | – | – | ||||||

Effect of disposals (%) | (3.7 | ) | (1.5 | ) | ||||

Effect of exchange rates (%) | (3.8 | ) | 3.0 | |||||

Turnover growth (%)(a) | (7.0 | ) | 3.3 | |||||

| REFRESHMENT | ||||||||

2013 vs 2012 | 2012 vs 2011 | |||||||

Underlying sales growth (%) | 1.1 | 6.3 | ||||||

Effect of acquisitions (%) | 0.1 | 0.8 | ||||||

Effect of disposals (%) | – | 0.7 | ||||||

Effect of exchange rates (%) | (4.7 | ) | 2.4 | |||||

Turnover growth (%)(a) | (3.7 | ) | 10.5 | |||||

| HOME CARE | ||||||||

2013 vs 2012 | 2012 vs 2011 | |||||||

Underlying sales growth (%) | 8.0 | 10.3 | ||||||

Effect of acquisitions (%) | 0.1 | 0.6 | ||||||

Effect of disposals (%) | – | (1.1 | ) | |||||

Effect of exchange rates (%) | (8.6 | ) | 0.6 | |||||

Turnover growth (%)(a) | (1.2 | ) | 10.4 | |||||

| 2010 vs 2009 | 2009 vs 2008 | |||||||

Underlying sales growth (%) | 4.1 | 3.5 | ||||||

Effect of acquisitions (%) | 0.3 | 0.6 | ||||||

Effect of disposals (%) | (0.8 | ) | (3.0 | ) | ||||

Effect of exchange rates (%) | 7.3 | (2.7 | ) | |||||

Turnover growth (%) | 11.1 | (1.7 | ) | |||||

Asia Africa CEE

| 2010 vs 2009 | 2009 vs 2008 | |||||||

Underlying sales growth (%) | 7.7 | 7.7 | ||||||

Effect of acquisitions (%) | 0.2 | 0.5 | ||||||

Effect of disposals (%) | (0.1 | ) | (0.9 | ) | ||||

Effect of exchange rates (%) | 10.1 | (4.0 | ) | |||||

Turnover growth (%) | 18.7 | 2.9 | ||||||

The Americas

| 2010 vs 2009 | 2009 vs 2008 | |||||||

Underlying sales growth (%) | 4.0 | 4.2 | ||||||

Effect of acquisitions (%) | 0.3 | 0.7 | ||||||

Effect of disposals (%) | (0.4 | ) | (6.0 | ) | ||||

Effect of exchange rates (%) | 9.0 | (1.2 | ) | |||||

Turnover growth (%) | 13.3 | (2.6 | ) | |||||

Western Europe

| 2010 vs 2009 | 2009 vs 2008 | |||||||

Underlying sales growth (%) | (0.4 | ) | (1.9 | ) | ||||

Effect of acquisitions (%) | 0.5 | 0.5 | ||||||

Effect of disposals (%) | (2.0 | ) | (2.2 | ) | ||||

Effect of exchange rates (%) | 1.4 | (2.5 | ) | |||||

Turnover growth (%) | (0.5 | ) | (6.0 | ) | ||||

| (a) | Turnover growth is made up of distinct individual growth components namely underlying sales, currency impact, acquisitions and disposals. Turnover growth is arrived at by multiplying these individual components on a compounded basis as there is a currency impact on each of the other components. Accordingly, turnover growth is more than just the sum of the individual components. |

Underlying volume growthUNDERLYING VOLUME GROWTH (UVG)

Underlying Volume Growth or “UVG” is part of USG and means, for the applicable period, the increase in turnover in such period calculated as the sum of (i) the increase in turnover attributable to the volume growth is underlying sales growth after eliminatingof products sold; and (ii) the increase in turnover attributable to the composition of products sold during such period. UVG therefore excludes any impact of price changes. on USG due to changes in prices.

The relationship between the two measures is set out below:

| 2010 vs 2009 | 2009 vs 2008 | |||||||

Underlying volume growth (%) | 5.8 | 2.3 | ||||||

Effect of price changes (%) | (1.6 | ) | 1.2 | |||||

Underlying sales growth (%) | 4.1 | 3.5 | ||||||

2013 vs 2012 | 2012 vs 2011 | |||||||

Underlying volume growth (%) | 2.5 | 3.4 | ||||||

Effect of price changes (%) | 1.8 | 3.3 | ||||||

Underlying sales growth (%) | 4.3 | 6.9 | ||||||

Underlying operating marginFREE CASH FLOW (FCF)

The reconciliation of underlying operating profit to operating profit is as follows:

| € million 2010 | € million 2009 | |||||||

Operating profit | 6,339 | 5,020 | ||||||

Restructuring costs | 589 | 897 | ||||||

Business disposals | (468 | ) | (4 | ) | ||||

Impairments and other one-off items | 160 | (25 | ) | |||||

Underlying operating profit | 6,620 | 5,888 | ||||||

Turnover | 44,262 | 39,823 | ||||||

Operating margin (%) | 14.3 | 12.6 | ||||||

Underlying operating margin (%) | 15.0 | 14.8 | ||||||

FreeWithin the Unilever Group, free cash flow (FCF)

FCF represents the cash generation from the operation and financing of the business. The movement in FCF measures our progress against the commitment to deliver strong cash flows. FCF is not useddefined as a liquidity measure within Unilever.

FCF includes the cash flow from Group operating activities, less income taxtaxes paid, net capital expenditure,expenditures and net interest payments and preference dividends paid. It does not represent residual cash flows entirely available for discretionary purposes; for example, the repayment of principal amounts borrowed is not deducted from FCF. FCF reflects an additional way of viewing our liquidity that we believe is useful to investors because it represents cash flows that could be used for distribution of dividends, repayment of debt or to fund our strategic initiatives, including acquisitions, if any.

The reconciliation of FCF to net profit is as follows:

| € million 2010 | € million 2009 | € million 2013 | € million 2012 | |||||||||||||

Net profit | 4,598 | 3,659 | 5,263 | 4,836 | ||||||||||||

Taxation | 1,534 | 1,257 | 1,851 | 1,697 | ||||||||||||

Share of net profit of joint ventures/associates and other income from non-current investments | (187 | ) | (489 | ) | (127 | ) | (91 | ) | ||||||||

Net finance cost | 394 | 593 | 530 | 535 | ||||||||||||

Depreciation, amortisation and impairment | 993 | 1,032 | 1,151 | 1,199 | ||||||||||||

Changes in working capital | 169 | 1,701 | 200 | 822 | ||||||||||||

Pensions and similar obligations less payments | (472 | ) | (1,028 | ) | (383 | ) | (369 | ) | ||||||||

Provisions less payments | 72 | (258 | ) | 126 | (43 | ) | ||||||||||

Elimination of (profits)/losses on disposals | (476 | ) | 13 | (725 | ) | (236 | ) | |||||||||

Non-cash charge for share-based compensation | 144 | 195 | 228 | 153 | ||||||||||||

Other adjustments | 49 | 58 | (15 | ) | 13 | |||||||||||

Cash flow from operating activities | 6,818 | 6,733 | 8,099 | 8,516 | ||||||||||||

Income tax paid | (1,328 | ) | (959 | ) | (1,805 | ) | (1,680 | ) | ||||||||

Net capital expenditure | (1,701 | ) | (1,258 | ) | (2,027 | ) | (2,143 | ) | ||||||||

Net interest and preference dividends paid | (424 | ) | (444 | ) | (411 | ) | (360 | ) | ||||||||

Free cash flow | 3,365 | 4,072 | 3,856 | 4,333 | ||||||||||||

Net cash flow (used in)/from investing activities | (1,161 | ) | (755 | ) | ||||||||||||

Net cash flow (used in)/from financing activities | (5,390 | ) | (6,622 | ) | ||||||||||||

Net debtCORE OPERATING MARGIN AND CORE OPERATING PROFIT

Core operating profit and core operating margin mean operating profit and operating margin, respectively, before the impact of business disposals, acquisition and disposal related costs, impairments and other one-off items, which we collectively term non-core items, on the grounds that the incidence of these items is uneven between reporting periods.

The reconciliation of net debtcore operating profit to the GAAP measure total financial liabilitiesoperating profit is as follows:

| € million 2010 | € million 2009 | |||||||

Total financial liabilities | (9,534 | ) | (9,971 | ) | ||||

Financial liabilities due within one year | (2,276 | ) | (2,279 | ) | ||||

Financial liabilities due after one year | (7,258 | ) | (7,692 | ) | ||||

Cash and cash equivalents as per balance sheet | 2,316 | 2,642 | ||||||

Cash and cash equivalents as per cash flow statement | 1,966 | 2,397 | ||||||

Bank overdrafts deducted therein | 350 | 245 | ||||||

Financial assets | 550 | 972 | ||||||

Net debt | (6,668 | ) | (6,357 | ) | ||||

€ million 2013 | € million 2012 | |||||||

Operating profit | 7,517 | 6,977 | ||||||

Acquisition and disposal related costs | 112 | 190 | ||||||

(Gain)/loss on disposal of group companies | (733 | ) | (117 | ) | ||||

Impairments and other one-off items | 120 | – | ||||||

Core operating profit | 7,016 | 7,050 | ||||||

Turnover | 49,797 | 51,324 | ||||||

Operating margin | 15.1 | % | 13.6 | % | ||||

Core operating margin | 14.1 | % | 13.7 | % | ||||

UnileverAnnual Report on Form 20-F |

ITEM 5. OPERATING AND FINANCIAL

REVIEW AND PROSPECTSCONTINUED

Form 20-FNET DEBT

The reconciliation of net debt to the GAAP measure of total financial liabilities is as follows:

€ million 2013 | € million 2012 | |||||||

Total financial liabilities | (11,501 | ) | (10,221 | ) | ||||

Current financial liabilities | (4,010 | ) | (2,656 | ) | ||||

Non-current financial liabilities | (7,491 | ) | (7,565 | ) | ||||

Cash and cash equivalents as per balance sheet | 2,285 | 2,465 | ||||||

Cash and cash equivalents as per cash | 2,044 | 2,217 | ||||||

Bank overdrafts deducted therein | 241 | 248 | ||||||

Current financial assets | 760 | 401 | ||||||

Net debt | (8,456 | ) | (7,355 | ) | ||||

ACQUISITIONS AND DISPOSALS

The information set forth under the following headings of the Group’s Annual Report and Accounts 2014 furnished separately on 6 March 2015 under Form 6-K is incorporated by reference:

‘Note 21 Acquisitions and disposals - 2009

On 2 April 2009 we30 July 2012, the Group announced the completion of our purchase of the global TIGI professional hair producta definitive agreement to sell its North American frozen meals business and its supporting advanced education academies. TIGI’s major brands include Bed Head, Catwalk and S-Factor. Turnover of the business worldwide in 2008 was around US $250 million. Theto ConAgra Foods, Inc. for a total cash consideration of US $411.5 million$265 million. The deal was madecompleted on a cash and debt free basis. In addition, further limited payments related19 August 2012.

Further to future growth may be made contingent upon meeting certain thresholds.

On 3 July 2009 we completed the acquisition of Baltimor Holding ZAO’s sauces business in Russia. The acquisition includesDecember 2011, the ketchup, mayonnaise and tomato paste business underGroup acquired the Baltimor, Pomo d’Oro and Vostochniy Gourmand brands – and a production facility at Kolpino, near St Petersburg.

On 24 November 2009 we completed the sale of our interest in JohnsonDiversey. The cash consideration received was US $390 million, which included both the originally announced cash consideration of US $158 million plus the proceedsremaining 18% of the saleoutstanding share capital in Concern Kalina in 2012.

The Group’s capital expenditure is mainly on purchase of the 10.5% senior notes in JohnsonDiversey Holdings, Inc. We retain a 4% interest in JohnsonDiversey in the formproperty, plant and equipment as well as acquisition of warrants.group companies.

B. LIQUIDITY AND CAPITAL RESOURCES

B. Liquidity and capital resources

(i) Information regarding the Group’s liquidity(I) INFORMATION REGARDING THE GROUP’S LIQUIDITY

The information set forth under the following headings of the Group’s Annual Report and Accounts 20112014 furnished separately on 26 March 20122015 under Form 6-K is incorporated by reference:

‘Finance and liquidity’ and ‘Treasury’Balance sheet’ on page 33;

‘MarketNote 16A Management of liquidity risk’ on page 94;

‘Liquidity risk’Note 15 Capital and funding’ on page 95;

‘Capital management’ on page 93;

‘Going concern’ on page 61;

‘Cash flow’ on page 25;

‘Consolidated cash flow statement’ on page 67; and

‘Note 1515C Financial assets and liabilities’ on pages 90112 and 113;

(ii) Information regarding the typePlease refer also to ‘Contractual obligations at 31 December 2014’ on page 11 within Item 5F of this report

FINANCIAL INSTRUMENTS AND RISK

The key financial instruments used the maturity profile of debt, currencyby Unilever are short-term and long-term borrowings, cash and cash equivalents, and certain plain vanilla derivative instruments, principally comprising interest rate structureswaps and foreign exchange contracts. Treasury processes are governed by standards approved by the Unilever Leadership Executive. Unilever manages a variety of market risks, including the effects of changes in foreign exchange rates, interest rates, commodity costs and liquidity.

The information set forth under the heading ‘Note 16 Treasury risk management’ on pages 114 to 119 of the Group’s Annual Report and Accounts 2014 furnished separately on 6 March 2015 under Form 6-K is incorporated by reference.

(II) INFORMATION REGARDING THE TYPE OF FINANCIAL INSTRUMENTS USED, THE MATURITY PROFILE OF DEBT, CURRENCY AND INTEREST RATE STRUCTURE

The information set forth under the following headings of the Group’s Annual Report and Accounts 20112014 furnished separately on 26 March 20122015 under Form 6-K is incorporated by reference:

‘Note 15 Capital and funding’ on pages 109 and 110;

‘Note 17A Financial assets’ on pages 120 and 121;

‘Treasury’Note 18 Financial instruments fair value risk’ on pages 121 to 123; and

(iii) InformationPlease also refer to ‘Information regarding the Group’s material commitments for capital expenditureliquidity’ within Item 5B(I) of this report.

(III) INFORMATION REGARDING THE GROUP’S MATERIAL COMMITMENTS FOR CAPITAL EXPENDITURE

The information set forth under the following headings of the Group’s Annual Report and Accounts 20112014 furnished separately on 26 March 20122015 under Form 6-K is incorporated by reference:

‘Note 20 Commitments and contingent liabilities’ on pages 102 to 103;124 and

‘Note 10 Property, plant and equipment’ on pages 86105 and 87.

C. Research and development, patents and licences, etcRESEARCH AND DEVELOPMENT, PATENTS AND LICENCES, ETC.

The information set forth under the heading ‘Bigger, better, faster innovation’‘Innovation’ on pages 10 to 13page 8 and ‘Note 3 Gross profit and operating costs’ (first table) on page 7292 and ‘Our Value Chain’ on page 9 of the Group’s Annual Report and Accounts 20112014 furnished separately on 26 March 20122015 under Form 6-K is incorporated by reference.

D. Trend informationTREND INFORMATION

Please refer also to Item 3D ‘Risk Factors’factors’ on pages 4 to 7page 5 of this report.

The information set forth under the following headings of the Group’s Annual Report and Accounts 20112014 furnished separately on 26 March 20122015 under Form 6-K is incorporated by reference:

‘Our markets’ on pages 12 and 13; and

OUTLOOK

We expect the economic pressures to continue. Consumer demand in emerging markets is likely to remain subdued for some time to come. There is still little sign of a recovery in Europe and