ANNUAL REPORT ON FORM 20-F 2013

UNILEVER N.V. AND UNILEVER PLC

MAKING SUSTAINABLE

LIVING COMMONPLACE

ANNUAL REPORT ON

FORM 20-F2011

Creating a better future every day

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark one)

| (Mark one) | ||

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| OR | ||

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011

OR

| FOR THE FISCAL YEAR ENDED DECEMBER 31, 2013 | ||

| OR | ||

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

OR

| OR | ||

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

Date of event requiring this shell company report

For the transition period fromto to

Commission file number 001-04546

UNILEVER PLC

(Exact name of Registrant as specified in its charter)

ENGLAND

(Jurisdiction of incorporation or organization)

Unilever House, Blackfriars, London, England

(Address of principal executive offices)

T. E. Lovell, Group Secretary

Tel: +44(0)2078225252, Fax: +44(0)20782261082078225464

Unilever House, 100 Victoria Embankment, London EC4Y 0DY, UK

(Name, telephone number, facsimile number and address of Company Contact)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

| American Shares (evidenced by Depositary Receipts) each representing one ordinary share of the nominal amount of 3 1/9p each | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

The total number of outstanding shares of the issuer’s capital stock at the close of the period covered by the annual report was:1,310,156,361 ordinary shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act:

Yesx No¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934:

Yes¨ Nox

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yesx No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes¨ No¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large Accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP¨ | International Financial Reporting Standards as issued by the International Accounting Standards Boardx | Other¨ |

If ‘Other’ has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17¨ Item 18¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act):

Yes¨ Nox

Cautionary statementCAUTIONARY STATEMENT

This document may contain forward-looking statements, including ‘forward-looking statements’ within the meaning of the United States Private Securities Litigation Reform Act of 1995. Words such as ‘will’, ‘aim’, ‘expects’, ‘anticipates’, ‘intends’, ‘looks’, ‘believes’, ‘vision’, or the negative of these terms and other similar expressions of future performance or results, and their negatives, are intended to identify such forward-looking statements. These forward-looking statements are based upon current expectations and assumptions regarding anticipated developments and other factors affecting the Group. They are not historical facts, nor are they guarantees of future performance.

Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause actual results to differ materially from those expressed or implied by these forward-looking statements, including, among others, competitive pricingstatements. Among other risks and activities, economic slowdown, industry consolidation, accessuncertainties, the material or principal factors which cause actual results to credit markets,differ materially are: Unilever’s global brands not meeting consumer preferences; Unilever’s ability to innovate and remain competitive; Unilever’s investment choices in its portfolio management; inability to find sustainable solutions to support long-term growth; customer relationships; the recruitment levels, reputational risks, commodity prices, continued availabilityand retention of talented employees; disruptions in our supply chain; the cost of raw materials prioritisationand commodities; the production of projects, consumption levels, costs, the abilitysafe and high quality products; secure and reliable IT infrastructure; successful execution of acquisitions, divestitures and business transformation projects; economic and political risks and natural disasters; financial risks; failure to maintainmeet high and manage key customer relationshipsethical standards; and supply chain sources, consumer demands, currency values, interest rates, the ability to integrate acquisitions and complete planned divestitures, finalising fair values related to prior acquisitions, the ability to complete planned restructuring activities, physical risks, environmental risks, the ability to manage sustainability,managing regulatory, tax and legal matters and resolve pending matters within current estimates, legislative, fiscal and regulatory developments, political, economic and social conditions in the geographic markets where the Group operates, completion of the Sustainable Development Report 2011 and new or changed priorities of the Boards.matters. Further details of potential risks and uncertainties affecting the Group are described in the Group’s filings with the London Stock Exchange, Euronext Amsterdam and the US Securities and Exchange Commission, including in the Group’s Annual Report on Form 20-F for the year ended 31 December 20112013 and the Annual Report and Accounts 2011.2013. These forward-looking statements speak only as of the date of this document. Except as required by any applicable law or regulation, the Group expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Group’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

ANNUAL REPORT ON FORM 20-F 2013 UNILEVER N.V. AND UNILEVER PLC MAKING SUSTAINABLE LIVING COMMONPLACE | ||

| ||

|

| Item 1 | Identity of Directors, Senior Management and Advisers | 1 | ||||||

| Item 2 | Offer Statistics and Expected Timetable | |||||||

| Item 3 | Key Information | 2 | ||||||

| Item 4 | Information on the Company | 8 | ||||||

| Item 4A | Unresolved Staff Comments | 8 | ||||||

| Item 5 | Operating and Financial Review and Prospects | |||||||

| Item 6 | Directors, Senior Management and Employees | 13 | ||||||

| Item 7 | Major Shareholders and Related Party Transactions | 14 | ||||||

| Item 8 | Financial Information | |||||||

| Item 9 | The Offer and Listing | 15 | ||||||

| Item 10 | Additional Information | |||||||

| Item 11 | Quantitative and Qualitative Disclosures About Market Risk | |||||||

| Item 12 | Description of Securities Other than Equity Securities | |||||||

| Item 13 | Defaults, Dividend Arrearages and Delinquencies | |||||||

| Item 14 | Material Modifications to the Rights of Security Holders and Use of Proceeds | |||||||

| Item 15 | Controls and Procedures | |||||||

| Item 16 | Reserved | |||||||

| Item 17 | Financial Statements | |||||||

| Item 18 | Financial Statements | |||||||

| Item 19 | Exhibits | |||||||

References in this Report on Form 20-F

References set forth below are to certain references in the Group’s Annual Report and Accounts 2013 that include pages incorporated therein, including any page references incorporated in the incorporated material, unless specifically noted otherwise.

The following pages and sections of the Group’s Annual Report and Accounts 2011,2013 and specified information referenced therein, regardless of their inclusion in any cross-reference below, are hereby specifically excluded and are not incorporated by reference into this report on

Form 20-F:

pages 2 to 5;

‘Operational highlights’ on page 6;

pages 4 to 7;

pages 6286 to 89;

pages 111 to 122.

This report on Form 20-F Report and the Group’s Annual Report and Accounts 20112013 (furnished separately on 27 March 20122014 under Form 6-K) contain certain measures that are not defined by generally accepted accounting principles (GAAP) such as IFRS. We believe this information, along with comparable GAAP measurements, is useful to investors because it provides a basis for measuring our operating performance, ability to retire debt and invest in new business opportunities. Our management uses these financial measures, along with the most directly comparable GAAP financial measures, in evaluating our operating performance and value creation. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with GAAP. Non-GAAP financial measures as reported by us may not be comparable with similarly titled amounts reported by other companies. In addition, there are limitations on the usefulness of our reported non-GAAP financial measures.

We report on the following non-GAAP measures:

underlying sales growth;

underlying volume growth;

underlyingcore operating profit and core operating margin (including explanationacquisition and disposal related costs, gain/(loss) on disposal of restructuring, business disposals,group companies, impairments and other one-off items (RDIs)costs (non-core items));

core earnings per share (core EPS);

net debt.

The information set forth under the heading ‘Non-GAAP measures’ on pages 2632 to 2733 of the Group’s Annual Report and Accounts 20112013 furnished separately on 27 March 20122014 under Form 6-K is incorporated by reference. Within these pages further information about the above measures can be found.

The Unilever GroupTHE UNILEVER GROUP

Unilever N.V. (NV) is a public limited company registered in the Netherlands, which has listings of shares and depositary receipts for shares on Euronext Amsterdam and of New York Registry Shares on the New York Stock Exchange. Unilever PLC (PLC) is a public limited company registered in England and Wales which has shares listed on the London Stock Exchange and, as American Depositary Receipts, on the New York Stock Exchange.

The two parent companies, NV and PLC, together with their Groupgroup companies, operate as a single economic entity (the Unilever Group, also referred to as ‘Unilever’ or ‘the Group’). NV and PLC and their Groupgroup companies constitute a single reporting entity for the purposes of presenting consolidated accounts. Accordingly, the accounts of the Unilever Group are presented by both NV and PLC as their respective consolidated accounts.

This document contains references to our website. Information on our website or any other website referenced in this document is not incorporated into this document and should not be considered part of this document. We have included any website as an inactive textual reference only.

ItemITEM 1. Identity of Directors, Senior Management and AdvisersIDENTITY OF DIRECTORS,

SENIOR MANAGEMENT AND ADVISERS

Not applicable.

EXPECTED TIMETABLE

Not applicable.

UnileverAnnual Report on Form 20-F | Form 20-F 1 |

Form 20-FITEM 3. KEY INFORMATION

A. SELECTED FINANCIAL DATA

The schedules below provide the Group’s selected financial data for the five most recent financial years.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

A. Selected financial data

In the schedules below, figures within the income statement and for earnings per share reflect the classification between continuing and discontinued operations which has applied for our reporting during 2007–2011.

| € million | € million | € million | € million | € million | ||||||||||||||||||||||||||||||||||||

| Consolidated income statement | € million 2011 | € million 2010 | € million 2009 | € million 2008 | € million 2007 | 2013 |

| 2012 (Restated) | (a) |

| 2011 (Restated) | (a) |

| 2010 (Restated) | (a) |

| 2009 (Restated) | (a) | ||||||||||||||||||||||

Continuing operations: | ||||||||||||||||||||||||||||||||||||||||

| Turnover | 46,467 | 44,262 | 39,823 | 40,523 | 40,187 | 49,797 | 51,324 | 46,467 | 44,262 | 39,823 | ||||||||||||||||||||||||||||||

| Operating profit | 6,433 | 6,339 | 5,020 | 7,167 | 5,245 | 7,517 | 6,977 | 6,420 | 6,325 | 5,006 | ||||||||||||||||||||||||||||||

Net finance costs | (377 | ) | (394 | ) | (593 | ) | (257 | ) | (252 | ) | (530 | ) | (535 | ) | (543 | ) | (561 | ) | (596 | ) | ||||||||||||||||||||

Income from non-current investments | 189 | 187 | 489 | 219 | 191 | |||||||||||||||||||||||||||||||||||

Share of net profit/(loss) of joint ventures and associates and other income/(loss) from non-current investments | 127 | 91 | 189 | 187 | 489 | |||||||||||||||||||||||||||||||||||

| Profit before taxation | 6,245 | 6,132 | 4,916 | 7,129 | 5,184 | 7,114 | 6,533 | 6,066 | 5,951 | 4,899 | ||||||||||||||||||||||||||||||

Taxation | (1,622 | ) | (1,534 | ) | (1,257 | ) | (1,844 | ) | (1,128 | ) | (1,851 | ) | (1,697 | ) | (1,575 | ) | (1,486 | ) | (1,253 | ) | ||||||||||||||||||||

| Net profit from continuing operations | 4,623 | 4,598 | 3,659 | 5,285 | 4,056 | |||||||||||||||||||||||||||||||||||

Net profit from discontinued operations | – | – | – | – | 80 | |||||||||||||||||||||||||||||||||||

| Net profit | 4,623 | 4,598 | 3,659 | 5,285 | 4,136 | 5,263 | 4,836 | 4,491 | 4,465 | 3,646 | ||||||||||||||||||||||||||||||

Attributable to: | ||||||||||||||||||||||||||||||||||||||||

Non-controlling interests | 371 | 354 | 289 | 258 | 248 | 421 | 468 | 371 | 354 | 289 | ||||||||||||||||||||||||||||||

Shareholders’ equity | 4,252 | 4,244 | 3,370 | 5,027 | 3,888 | 4,842 | 4,368 | 4,120 | 4,111 | 3,357 | ||||||||||||||||||||||||||||||

Combined earnings per share(a) | € 2011 | € 2010 | € 2009 | € 2008 | € 2007 | |||||||||||||||||||||||||||||||||||

Continuing operations: | ||||||||||||||||||||||||||||||||||||||||

| Combined earnings per share(b) | € 2013 | € 2012 | € 2011 | € 2010 | € 2009 | |||||||||||||||||||||||||||||||||||

Basic earnings per share | 1.51 | 1.51 | 1.21 | 1.79 | 1.32 | 1.71 | 1.54 | 1.46 | 1.46 | 1.20 | ||||||||||||||||||||||||||||||

Diluted earnings per share | 1.46 | 1.46 | 1.17 | 1.73 | 1.28 | 1.66 | 1.50 | 1.42 | 1.42 | 1.16 | ||||||||||||||||||||||||||||||

Total operations: | ||||||||||||||||||||||||||||||||||||||||

Basic earnings per share | 1.51 | 1.51 | 1.21 | 1.79 | 1.35 | |||||||||||||||||||||||||||||||||||

Diluted earnings per share | 1.46 | 1.46 | 1.17 | 1.73 | 1.31 | |||||||||||||||||||||||||||||||||||

(a) For the basis of the calculations of combined earnings per share see note 7 on page 83 of the Group’s Annual Report and Accounts 2011 furnished separately on 2 March 2012 under Form 6-K and incorporated here by reference. |

| |||||||||||||||||||||||||||||||||||||||

(a) For an explanation of the restatement see note 1 ‘Accounting information and policies – Recent accounting developments – Adopted by the Group’ on page 95 of the Group’s Annual Report and Accounts 2013 furnished separately on 7 March 2014 under Form 6-K and incorporated here by reference. (b) For the basis of the calculations of combined earnings per share see note 7 ‘Combined earnings per share’ on page 108 of the Group’s Annual Report and Accounts 2013 furnished separately on 7 March 2014 under Form 6-K and incorporated here by reference. | (a) For an explanation of the restatement see note 1 ‘Accounting information and policies – Recent accounting developments – Adopted by the Group’ on page 95 of the Group’s Annual Report and Accounts 2013 furnished separately on 7 March 2014 under Form 6-K and incorporated here by reference. (b) For the basis of the calculations of combined earnings per share see note 7 ‘Combined earnings per share’ on page 108 of the Group’s Annual Report and Accounts 2013 furnished separately on 7 March 2014 under Form 6-K and incorporated here by reference. |

| ||||||||||||||||||||||||||||||||||||||

| € million | € million | € million | € million | € million | ||||||||||||||||||||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||||||||||||||||||||||

Consolidated balance sheet | € million 2011 | € million 2010 | € million 2009 | € million 2008 | € million 2007 | (Restated) | (Restated) | (Restated) | (Restated) | |||||||||||||||||||||||||||||||

Non-current assets | 33,221 | 28,683 | 26,205 | 24,967 | 27,374 | 33,391 | 34,042 | 33,245 | 28,706 | 26,224 | ||||||||||||||||||||||||||||||

Current assets | 14,291 | 12,484 | 10,811 | 11,175 | 9,928 | 12,122 | 12,147 | 14,291 | 12,484 | 10,811 | ||||||||||||||||||||||||||||||

| Total assets | 47,512 | 41,167 | 37,016 | 36,142 | 37,302 | 45,513 | 46,189 | 47,536 | 41,190 | 37,035 | ||||||||||||||||||||||||||||||

Current liabilities | 17,929 | 13,606 | 11,599 | 13,800 | 13,559 | 17,382 | 15,815 | 17,929 | 13,606 | 11,599 | ||||||||||||||||||||||||||||||

Non-current liabilities | 14,662 | 12,483 | 12,881 | 11,970 | 10,924 | 13,316 | 14,425 | 14,489 | 12,322 | 12,728 | ||||||||||||||||||||||||||||||

| Total liabilities | 32,591 | 26,089 | 24,480 | 25,770 | 24,483 | 30,698 | 30,240 | 32,418 | 25,928 | 24,327 | ||||||||||||||||||||||||||||||

Shareholders’ equity | 14,293 | 14,485 | 12,065 | 9,948 | 12,387 | 14,344 | 15,392 | 14,491 | 14,669 | 12,237 | ||||||||||||||||||||||||||||||

Non-controlling interests | 628 | 593 | 471 | 424 | 432 | 471 | 557 | 628 | 593 | 471 | ||||||||||||||||||||||||||||||

| Total equity | 14,921 | 15,078 | 12,536 | 10,372 | 12,819 | 14,815 | 15,949 | 15,119 | 15,262 | 12,708 | ||||||||||||||||||||||||||||||

| Total liabilities and equity | 47,512 | 41,167 | 37,016 | 36,142 | 37,302 | 45,513 | 46,189 | 47,537 | 41,190 | 37,035 | ||||||||||||||||||||||||||||||

| € million | € million | € million | € million | € million | ||||||||||||||||||||||||||||||||||||

| Consolidated cash flow statement | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||||||||||||||||||||||

Net cash flow from operating activities | 6,294 | 6,836 | 5,452 | 5,490 | 5,774 | |||||||||||||||||||||||||||||||||||

Net cash flow from/(used in) investing activities | (1,161 | ) | (755 | ) | (4,467 | ) | (1,164 | ) | (1,263 | ) | ||||||||||||||||||||||||||||||

Net cash flow from/(used in) financing activities | (5,390 | ) | (6,622 | ) | 411 | (4,609 | ) | (4,301 | ) | |||||||||||||||||||||||||||||||

Net increase/(decrease) in cash and cash equivalents | (257 | ) | (541 | ) | 1,396 | (283 | ) | 210 | ||||||||||||||||||||||||||||||||

Cash and cash equivalents at the beginning of the year | 2,217 | 2,978 | 1,966 | 2,397 | 2,360 | |||||||||||||||||||||||||||||||||||

Effect of foreign exchange rates | 84 | (220 | ) | (384 | ) | (148 | ) | (173 | ) | |||||||||||||||||||||||||||||||

Cash and cash equivalents at the end of the year | 2,044 | 2,217 | 2,978 | 1,966 | 2,397 | |||||||||||||||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | |||||||||||||||||||||||||||||||||||||

| Key performance indicators | 2013 | (Restated) | (Restated) | (Restated) | (Restated) | |||||||||||||||||||||||||||||||||||

Underlying sales growth (%)(c) | 4.3 | 6.9 | 6.5 | 4.1 | 3.5 | |||||||||||||||||||||||||||||||||||

Underlying volume growth (%)(c) | 2.5 | 3.4 | 1.6 | 5.8 | 2.3 | |||||||||||||||||||||||||||||||||||

Core operating margin (%)(c) | 14.1 | 13.7 | 13.5 | 13.6 | 12.5 | |||||||||||||||||||||||||||||||||||

Free cash flow (€ million)(c) | 3,856 | 4,333 | 3,075 | 3,365 | 4,072 | |||||||||||||||||||||||||||||||||||

| 2 Form 20-F | UnileverAnnual Report on Form 20-F |

ITEM 3. KEY INFORMATIONForm 20-FCONTINUED

| Consolidated cash flow statement | € million 2011 | € million 2010 | € million 2009 | € million 2008 | € million 2007 | |||||||||||||||

Net cash flow from operating activities | 5,452 | 5,490 | 5,774 | 3,871 | 3,876 | |||||||||||||||

Net cash flow from/(used in) investing activities | (4,467 | ) | (1,164 | ) | (1,263 | ) | 1,415 | (623 | ) | |||||||||||

Net cash flow from/(used in) financing activities | 411 | (4,609 | ) | (4,301 | ) | (3,130 | ) | (3,009 | ) | |||||||||||

| Net increase/(decrease) in cash and cash equivalents | 1,396 | (283 | ) | 210 | 2,156 | 244 | ||||||||||||||

Cash and cash equivalents at the beginning of the year | 1,966 | 2,397 | 2,360 | 901 | 710 | |||||||||||||||

Effect of foreign exchange rates | (384 | ) | (148 | ) | (173 | ) | (697 | ) | (53 | ) | ||||||||||

| Cash and cash equivalents at the end of the year | 2,978 | 1,966 | 2,397 | 2,360 | 901 | |||||||||||||||

Key performance indicators | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

Underlying sales growth (%)(b) | 6.5 | 4.1 | 3.5 | 7.4 | 5.5 | |||||||||||||||

Underlying volume growth (%)(b) | 1.6 | 5.8 | 2.3 | 0.1 | 3.7 | |||||||||||||||

Underlying operating margin (%)(b) | 14.9 | 15.0 | 14.8 | 14.6 | 14.5 | |||||||||||||||

Free cash flow (€ million)(b) | 3,075 | 3,365 | 4,072 | 2,390 | 2,487 | |||||||||||||||

Ratios and other metrics | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

Operating margin (%) | 13.8 | 14.3 | 12.6 | 17.7 | 13.1 | |||||||||||||||

Net profit margin (%)(c) | 9.2 | 9.6 | 8.5 | 12.4 | 9.7 | |||||||||||||||

Net debt (€ million)(b) | 8,781 | 6,668 | 6,357 | 8,012 | 8,335 | |||||||||||||||

Ratio of earnings to fixed charges (times)(d) | 10.0 | 10.7 | 8.8 | 11.7 | 8.3 | |||||||||||||||

|

|

|

Dividend record

The following tables show the dividends declared and dividends paid by NV and PLC for the last five years, expressed in terms of the revised share denominations which became effective from 22 May 2006. Differences between the amounts ultimately received by US holders of NV and PLC shares are the result of changes in exchange rates between the equalisation of the dividends and the date of payment.

Following agreement at the 2009 AGMs and separate meetings of ordinary shareholders, the Equalisation Agreement was modified to facilitate the payment of quarterly dividends from 2010 onwards.

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

Dividends declared for the year | ||||||||||||||||||||

| NV dividends | ||||||||||||||||||||

Dividend per€0.16 | €0.90 | €0.83 | €0.46 | €0.77 | €0.75 | |||||||||||||||

Dividend per€0.16 (US Registry) | US $1.25 | US $1.13 | US $0.67 | US $1.02 | US $1.13 | |||||||||||||||

| PLC dividends | ||||||||||||||||||||

Dividend per 3 1/9p | £0.78 | £0.71 | £0.41 | £0.61 | £0.51 | |||||||||||||||

Dividend per 3 1/9p (US Registry) | US $1.25 | US $1.13 | US $0.67 | US $0.94 | US $1.01 | |||||||||||||||

Dividends paid during the year | ||||||||||||||||||||

| NV dividends | ||||||||||||||||||||

Dividend per€0.16 | €0.88 | €0.82 | €0.78 | €0.76 | €0.72 | |||||||||||||||

Dividend per€0.16 (US Registry) | US $1.24 | US $1.11 | US $1.09 | US $1.11 | US $1.00 | |||||||||||||||

| PLC dividends | ||||||||||||||||||||

Dividend per 3 1/9p | £0.77 | £0.71 | £0.64 | £0.55 | £0.49 | |||||||||||||||

Dividend per 3 1/9p (US Registry) | US $1.24 | US $1.11 | US $1.00 | US $0.99 | US $0.99 | |||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

| Ratios and other metrics | (Restated) | (Restated) | (Restated) | (Restated) | ||||||||||||||||

Operating margin (%) | 15.1 | 13.6 | 13.8 | 14.3 | 12.6 | |||||||||||||||

Net profit margin (%)(d) | 9.7 | 8.5 | 8.9 | 9.3 | 8.4 | |||||||||||||||

Net debt (€ million)(c) | 8,456 | 7,355 | 8,781 | 6,668 | 6,357 | |||||||||||||||

Ratio of earnings to fixed charges (times) | 11.8 | 10.2 | 9.8 | 10.4 | 8.8 | |||||||||||||||

(c) Non–GAAP measures are defined and described on pages 32 and 33 of the Group’s Annual Reports and Accounts 2013 furnished separately on 7 March 2014 under Form 6-K and incorporated here by reference. Reconciliations of non-GAAP measures to relevant GAAP measures are detailed below and should be read in conjunction with pages 32 and 33 of the Group’s Annual Report and Accounts 2013. (d) Net profit margin is expressed as net profit attributable to shareholders’ equity as a percentage of turnover. |

| |||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

| Underlying sales growth (%) | vs 2012 | vs 2011 | vs 2010 | vs 2009 | vs 2008 | |||||||||||||||

Underlying sales growth (%) | 4.3 | 6.9 | 6.5 | 4.1 | 3.5 | |||||||||||||||

Effect of acquisitions (%) | – | 1.8 | 2.7 | 0.3 | 0.6 | |||||||||||||||

Effect of disposals (%) | (1.1 | ) | (0.7 | ) | (1.5 | ) | (0.8 | ) | (3.0 | ) | ||||||||||

Effect of exchange rates (%) | (5.9 | ) | 2.2 | (2.5 | ) | 7.3 | (2.7 | ) | ||||||||||||

Turnover growth (%) | (3.0 | ) | 10.5 | 5.0 | 11.1 | (1.7 | ) | |||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

| Underlying volume growth (%) | vs 2012 | vs 2011 | vs 2010 | vs 2009 | vs 2008 | |||||||||||||||

Underlying volume growth (%) | 2.5 | 3.4 | 1.6 | 5.8 | 2.3 | |||||||||||||||

Effect of price changes (%) | 1.8 | 3.3 | 4.8 | (1.6 | ) | 1.2 | ||||||||||||||

Underlying sales growth (%) | 4.3 | 6.9 | 6.5 | 4.1 | 3.5 | |||||||||||||||

| € million | € million | € million | € million | € million | ||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

| Core operating margin and core operating profit | (Restated) | (Restated) | (Restated) | (Restated) | ||||||||||||||||

Operating profit | 7,517 | 6,977 | 6,420 | 6,325 | 5,006 | |||||||||||||||

Acquisition and disposal related cost | 112 | 190 | 234 | 50 | 11 | |||||||||||||||

(Gain)/loss on disposal of group companies | (733 | ) | (117 | ) | (221 | ) | (468 | ) | (4 | ) | ||||||||||

Impairments and other one-off items | 120 | – | (157 | ) | 110 | (25 | ) | |||||||||||||

Core operating profit | 7,016 | 7,050 | 6,276 | 6,017 | 4,988 | |||||||||||||||

Turnover | 49,797 | 51,324 | 46,467 | 44,262 | 39,823 | |||||||||||||||

Operating margin (%) | 15.1 | 13.6 | 13.8 | 14.3 | 12.6 | |||||||||||||||

Core operating margin (%) | 14.1 | 13.7 | 13.5 | 13.6 | 12.5 | |||||||||||||||

| € million | € million | € million | € million | € million | ||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

| Free cash flow (FCF) to net profit | (Restated) | (Restated) | (Restated) | (Restated) | ||||||||||||||||

Net profit | 5,263 | 4,836 | 4,491 | 4,465 | 3,646 | |||||||||||||||

Taxation | 1,851 | 1,697 | 1,575 | 1,486 | 1,253 | |||||||||||||||

Share of net profit of joint ventures/associates and other income from non-current investments | (127 | ) | (91 | ) | (189 | ) | (187 | ) | (489 | ) | ||||||||||

Net finance costs | 530 | 535 | 543 | 561 | 596 | |||||||||||||||

Depreciation, amortisation and impairment | 1,151 | 1,199 | 1,029 | 993 | 1,032 | |||||||||||||||

Changes in working capital | 200 | 822 | (177 | ) | 169 | 1,701 | ||||||||||||||

Pensions and similar provisions less payments | (383 | ) | (369 | ) | (540 | ) | (458 | ) | (1,014 | ) | ||||||||||

Restructuring and other provisions less payments | 126 | (43 | ) | 9 | 72 | (258 | ) | |||||||||||||

Elimination of (profits)/losses on disposals | (725 | ) | (236 | ) | (215 | ) | (476 | ) | 13 | |||||||||||

Non-cash charge for share-based compensation | 228 | 153 | 105 | 144 | 195 | |||||||||||||||

Other adjustments | (15 | ) | 13 | 8 | 49 | 58 | ||||||||||||||

Cash flow from operating activities | 8,099 | 8,516 | 6,639 | 6,818 | 6,733 | |||||||||||||||

Income tax paid | (1,805 | ) | (1,680 | ) | (1,187 | ) | (1,328 | ) | (959 | ) | ||||||||||

Net capital expenditure | (2,027 | ) | (2,143 | ) | (1,974 | ) | (1,701 | ) | (1,258 | ) | ||||||||||

Net interest and preference dividends paid | (411 | ) | (360 | ) | (403 | ) | (424 | ) | (444 | ) | ||||||||||

Free cash flow | 3,856 | 4,333 | 3,075 | 3,365 | 4,072 | |||||||||||||||

Net cash flow (used in)/from investing activities | (1,161 | ) | (755 | ) | (4,467 | ) | (1,164 | ) | (1,263 | ) | ||||||||||

Net cash flow (used in)/from financing activities | (5,390 | ) | (6,622 | ) | 411 | (4,609 | ) | (4,301 | ) | |||||||||||

UnileverAnnual Report on Form 20-F | Form 20-F 3 |

ITEM 3. KEY INFORMATIONForm 20-FCONTINUED

| € million | € million | € million | € million | € million | ||||||||||||||||

| Net debt to total financial liabilities | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||

Total financial liabilities | (11,501 | ) | (10,221 | ) | (13,718 | ) | (9,534 | ) | (9,971 | ) | ||||||||||

Financial liabilities due within one year | (4,010 | ) | (2,656 | ) | (5,840 | ) | (2,276 | ) | (2,279 | ) | ||||||||||

Financial liabilities due after one year | (7,491 | ) | (7,565 | ) | (7,878 | ) | (7,258 | ) | (7,692 | ) | ||||||||||

Cash and cash equivalents as per balance sheet | 2,285 | 2,465 | 3,484 | 2,316 | 2,642 | |||||||||||||||

Cash and cash equivalents as per cash flow statement | 2,044 | 2,217 | 2,978 | 1,966 | 2,397 | |||||||||||||||

Add bank overdrafts deducted therein | 241 | 248 | 506 | 350 | 245 | |||||||||||||||

Financial assets | 760 | 401 | 1,453 | 550 | 972 | |||||||||||||||

Net debt | (8,456 | ) | (7,355 | ) | (8,781 | ) | (6,668 | ) | (6,357 | ) | ||||||||||

RATIO OF EARNINGS TO FIXED CHARGES (TIMES) For a calculation of our ratio of earnings to fixed charges see Item 19: Exhibits-Calculation of Ratio of Earnings to Fixed Charges.

DIVIDEND RECORD The following tables show the dividends declared and dividends paid by NV and PLC for the last five years, expressed in terms of the revised share denominations which became effective from 22 May 2006. Differences between the amounts ultimately received by US holders of NV and PLC shares are the result of changes in exchange rates between the equalisation of the dividends and the date of payment.

Following agreement at the 2009 AGMs and separate meetings of ordinary shareholders, the Equalisation Agreement was modified to facilitate the payment of quarterly dividends from 2010 onwards.

|

| |||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

Dividends declared for the year | ||||||||||||||||||||

| NV dividends | ||||||||||||||||||||

Dividend per€0.16 | €1.08 | €0.97 | €0.90 | €0.83 | €0.46 | |||||||||||||||

Dividend per€0.16 (US Registry) | US $1.44 | US $1.25 | US $1.25 | US $1.13 | US $0.67 | |||||||||||||||

| PLC dividends | ||||||||||||||||||||

Dividend per 31/9p | £0.91 | £0.79 | £0.78 | £0.71 | £0.41 | |||||||||||||||

Dividend per 31/9p (US Registry) | US $1.44 | US $1.25 | US $1.25 | US $1.13 | US $0.67 | |||||||||||||||

Dividends paid during the year | ||||||||||||||||||||

| NV dividends | ||||||||||||||||||||

Dividend per€0.16 | €1.05 | €0.95 | €0.88 | €0.82 | €0.78 | |||||||||||||||

Dividend per€0.16 (US Registry) | US $1.40 | US $1.23 | US $1.24 | US $1.11 | US $1.09 | |||||||||||||||

| PLC dividends | ||||||||||||||||||||

Dividend per 31/9p | £0.89 | £0.77 | £0.77 | £0.71 | £0.64 | |||||||||||||||

Dividend per 31/9p (US Registry) | US $1.40 | US $1.23 | US $1.24 | US $1.11 | US $1.00 | |||||||||||||||

| 4 Form 20-F | Unilever Annual Report on Form 20-F 2013 |

ITEM 3. KEY INFORMATIONCONTINUED

Exchange ratesEXCHANGE RATES

Unilever reports its financial results and balance sheet position in euros. Other currencies which may significantly impact our financial statements are sterling and US dollars. Average and year-end exchange rates for these two currencies for the last five years are given below.

| 2011 | 2010 | 2009 | 2008 | 2007 | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||||||||||||||||||

Year end | ||||||||||||||||||||||||||||||||||||||||

€1 = US $ | 1.294 | 1.337 | 1.433 | 1.417 | 1.471 | 1.378 | 1.318 | 1.294 | 1.337 | 1.433 | ||||||||||||||||||||||||||||||

€ 1 = £ | 0.839 | 0.862 | 0.888 | 0.977 | 0.734 | 0.833 | 0.816 | 0.839 | 0.862 | 0.888 | ||||||||||||||||||||||||||||||

Average | ||||||||||||||||||||||||||||||||||||||||

€1 = US $ | 1.396 | 1.326 | 1.388 | 1.468 | 1.364 | 1.325 | 1.283 | 1.396 | 1.326 | 1.388 | ||||||||||||||||||||||||||||||

€ 1 = £ | 0.869 | 0.858 | 0.891 | 0.788 | 0.682 | 0.849 | 0.811 | 0.869 | 0.858 | 0.891 | ||||||||||||||||||||||||||||||

On 28 February 20123 March 2014 the exchange rates between euros and US dollars and between euros and sterling as published in the Financial Times in London were as follows:€1 = US $1.340$1.377 and€1 = £0.846.£0.824

Noon Buying Rates in New York for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York were as follows:

| 2011 | 2010 | 2009 | 2008 | 2007 | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||||||||||||||||||

Year end | ||||||||||||||||||||||||||||||||||||||||

€1 = US $ | 1.297 | 1.327 | 1.433 | 1.392 | 1.460 | 1.378 | 1.319 | 1.297 | 1.327 | 1.433 | ||||||||||||||||||||||||||||||

Average | ||||||||||||||||||||||||||||||||||||||||

€1 = US $ | 1.393 | 1.326 | 1.394 | 1.473 | 1.371 | 1.328 | 1.286 | 1.393 | 1.326 | 1.394 | ||||||||||||||||||||||||||||||

High | ||||||||||||||||||||||||||||||||||||||||

€1 = US $ | 1.488 | 1.454 | 1.510 | 1.601 | 1.486 | 1.382 | 1.346 | 1.488 | 1.454 | 1.510 | ||||||||||||||||||||||||||||||

Low | ||||||||||||||||||||||||||||||||||||||||

€1 = US $ | 1.293 | 1.196 | 1.255 | 1.245 | 1.290 | 1.277 | 1.206 | 1.293 | 1.196 | 1.255 | ||||||||||||||||||||||||||||||

High and low exchange rate values for each of the last six months:

| September 2011 | October 2011 | November 2011 | December 2011 | January 2012 | February(a) 2012 | September 2013 | October 2013 | November 2013 | December 2013 | January 2014 | February 2014 | |||||||||||||||||||||||||||||||||||||

High | ||||||||||||||||||||||||||||||||||||||||||||||||

€1 = US $ | 1.428 | 1.417 | 1.380 | 1.349 | 1.319 | 1.345 | 1.354 | 1.381 | 1.361 | 1.382 | 1.368 | 1.381 | ||||||||||||||||||||||||||||||||||||

Low | ||||||||||||||||||||||||||||||||||||||||||||||||

€1 = US $ | 1.345 | 1.328 | 1.324 | 1.293 | 1.268 | 1.307 | 1.312 | 1.349 | 1.336 | 1.355 | 1.350 | 1.351 | ||||||||||||||||||||||||||||||||||||

(a)Through 24 February 2012

Share capitalSHARE CAPITAL

The information set forth under the heading ‘Note 1915A Share capital’ on pages 101 to 102page 116 of the Group’s Annual Report and Accounts 20112013 furnished separately on 27 March 20122014 under Form 6-K is incorporated by reference.

B. Capitalisation and indebtednessCAPITALISATION AND INDEBTEDNESS

Not applicable.

C. Reasons for the offer and use of proceedsREASONS FOR THE OFFER AND USE OF PROCEEDS

Not applicable.

D. Risk factorsRISK FACTORS

Our principal risks, as described on pages 2834 to 3239 of the Group’s Annual Report and Accounts 20112013 furnished separately on 27 March 20122014 under Form 6-K are incorporated by reference. The information set forth under the heading ‘Note 16 Capital and treasuryTreasury risk management’ on pages 93120 to 99125 of the Group’s Annual Report and Accounts 20112013 furnished separately on 27 March 20122014 under Form 6-K is incorporated by reference.

Risk factorsRISK FACTORS

Our business is subject to risks and uncertainties. The risks that we regard as the most relevant to our business are set out below. There may be other risks which are unknown to Unilever or which are currently believed to be immaterial. We have undertaken certain mitigating actions that we believe help us to manage the risks identified below. However, we may not be successful in deploying some or all of these mitigating actions. If the circumstances in these risk factors occur or are not successfully mitigated, our cashflow, operating results, financial position, business and reputation could be materially adversely affected. In addition, risks and uncertainties could cause actual results to vary from those described in this document, or could impact on our ability to meet our targets or be detrimental to our profitability or reputation. This list is not intended to be exhaustive and there may be other risks and uncertainties that are not mentioned below that could impact our future performance or our ability to meet published targets. The risks and uncertainties discussed below should be read in conjunction with the Group’s consolidated financial statements and related notes and the portions of the Strategic Report of the Directorsand Governance section that are incorporated by reference from the Group’s Annual Report and Accounts 20112013 (furnished separately on 27 March 20122014 on Form 6-K) and other information included in or incorporated by reference in this Report on Form 20-F.

Form 20-F

| Form 20-F 5 |

ITEM 3. KEY INFORMATIONCONTINUED

| DESCRIPTION OF RISK | |||||

BRAND PREFERENCE | ||||||

As a branded goods business, Unilever’s success depends on the value and relevance of our brands and products to consumers across the world and on our ability to | Consumer tastes, preferences and behaviours are constantly changing and Unilever’s ability to anticipate and respond to these changes and to continue to differentiate our brands and products is vital to our business. | |||||

We are dependent on creating innovative products that continue to meet the needs of our consumers. If we are unable to innovate effectively, Unilever’s sales or margins could be materially adversely affected.

| ||||||

PORTFOLIO MANAGEMENT | ||||||

| ||||||

|

| |||||

| ||||||

| ||||||

| ||||||

Unilever’s strategic investment choices will | Unilever’s growth and profitability are determined by our portfolio of categories, geographies and channels and how these evolve over time. If Unilever does not make optimal strategic investment decisions then opportunities for growth and improved margin could be missed. | |||||

SUSTAINABILITY | ||||||

| ||||||

The success of our business depends on finding sustainable solutions to support long-term growth. | Unilever’s vision to double the size of our business while reducing our environmental footprint and increasing our positive social impact will require more sustainable ways of doing business. This means reducing our environmental footprint while increasing the positive social benefits of Unilever’s | |||||

CUSTOMER RELATIONSHIPS | ||||||

| ||||||

Successful customer relationships are vital to our business and continued growth. | Maintaining strong relationships with our customers is necessary for our brands to be well presented to our consumers and available for purchase at all times. | |||||

The strength of our customer relationships also affects our ability to obtain pricing and secure favourable trade terms. Unilever may not be able to maintain strong relationships with customers and failure to do so could negatively impact the terms of business with the affected customers and reduce the availability of our products to consumers. | ||||||

TALENT | ||||||

| ||||||

A skilled workforce is essential for the continued success of our business. | Our ability to attract, develop and retain the right number of appropriately qualified people is critical if we are to | |||||

This is especially true in our key emerging markets where there can be a high level of competition for a limited talent pool. The loss of management or other key personnel or the inability to identify, attract and retain qualified personnel could make it difficult to manage the business and could adversely affect operations and financial results. | ||||||

SUPPLY CHAIN | ||||||

| ||||||

Our business depends on | Our supply chain network is exposed to potentially adverse events such as physical disruptions, environmental and industrial accidents or bankruptcy of a key supplier which could impact our ability to deliver orders to our customers. | |||||

| ||||||

The cost of our products can be significantly affected by the cost of the underlying commodities and materials from which they are made. Fluctuations in these costs cannot always be passed on to the consumer through pricing. | ||||||

SAFE AND HIGH QUALITY PRODUCTS | ||||||

The quality and safety of our products are of paramount importance for our brands and our reputation. | The risk that raw materials are accidentally or maliciously contaminated throughout the supply chain or that other product defects occur due to human error, equipment failure or other factors cannot be excluded. | |||||

| ||||||

Unilever’s operations are increasingly dependent on IT systems and the management of information. | We interact electronically with customers, suppliers and consumers in ways which place ever greater emphasis on the need for secure and reliable IT systems and infrastructure and careful management of the information that is in our possession. | |||||

There is also

| ||||||

| 6 Form 20-F | Unilever Annual Report on Form 20-F 2013 |

ITEM 3. KEY INFORMATIONCONTINUED

|

Form 20-F

PRINCIPAL RISK | DESCRIPTION OF RISK | |||||

BUSINESS TRANSFORMATION | ||||||

Successful execution of business transformation projects is key to delivering their intended business benefits and avoiding disruption to | Unilever is continually engaged in major change projects, including acquisitions and disposals and outsourcing, to drive continuous improvement in our business and to strengthen our portfolio and capabilities.

Failure to execute such transactions or change projects successfully, or performance issues with third party outsourced providers on which we are dependent, could result in under-delivery of the expected benefits. Furthermore, disruption may be caused in other parts of the business. | |||||

| ||||||

EXTERNAL ECONOMIC AND POLITICAL RISKS AND NATURAL DISASTERS | ||||||

| ||||||

Unilever operates across the globe and is exposed to a range of external economic and political risks and natural disasters that may affect the execution of our strategy or the running of our operations. | Adverse economic conditions may result in reduced consumer demand for our products, and may affect one or more countries within a region, or may extend globally.

| |||||

Government actions such as fiscal stimulus, changes to taxation and price controls can impact on the growth and profitability of our local operations.

| ||||||

Social and political upheavals and natural disasters can disrupt sales and operations.

| ||||||

In

| ||||||

| ||||||

| ||||||

TREASURY AND PENSIONS | ||||||

Form 20-F

| ||||||

| Unilever is exposed to a variety of external financial | risks in relation to Treasury and Pensions. | Changes to the relative value of currencies can fluctuate widely and could have a significant impact on business results. Further, because Unilever consolidates its financial statements in euros it is subject to exchange risks associated with the translation of the underlying net assets and earnings of its foreign subsidiaries.

We are also subject to the imposition of exchange controls by individual countries which could limit our ability to import materials paid in foreign currency or to remit dividends to the parent company.

Currency rates, along with demand cycles, can also result in significant swings in the prices of the raw materials needed to produce our goods.

Unilever may face liquidity risk, i.e. difficulty in meeting its obligations, associated with its financial liabilities. A material and sustained shortfall in our cash flow could undermine Unilever’s credit rating, impair investor confidence and also restrict Unilever’s ability to raise funds.

We are exposed to market interest rate fluctuations on our floating rate debt. Increases in benchmark interest rates could increase the interest cost of our floating rate debt and increase the cost of future borrowings.

In times of financial market volatility, we are also potentially exposed to

Certain businesses have defined benefit pension plans, most now closed to new employees, which are exposed to movements in interest rates, fluctuating values of underlying investments and increased life expectancy. Changes in any or all of these inputs could potentially increase the cost to Unilever of funding the schemes and therefore have an adverse impact on profitability and cash flow.

| ||||

ETHICAL | ||||||

| ||||||

Acting in an ethical manner, consistent with the expectations of customers, consumers and other stakeholders, is essential for the protection of the reputation of Unilever and its brands. | Unilever’s

| |||||

LEGAL AND REGULATORY | ||||||

| ||||||

Compliance with laws and regulations is an essential part of Unilever’s business operations. | Unilever is subject to local, regional and global laws and regulations in such diverse areas as product safety, product claims, trademarks, copyright, patents, competition, employee health and safety, the environment, corporate governance, listing and disclosure, employment and taxes.

Failure to comply with laws and regulations could expose Unilever to civil and/or criminal actions leading to damages, fines and criminal sanctions against us and/or our employees with possible consequences for our corporate reputation.

Changes to laws and regulations could have a material impact on the cost of doing business. Tax, in particular, is a complex area where laws and their interpretation are changing regularly, leading to the risk of unexpected tax exposure.

| |||||

UnileverAnnual Report on Form 20-F | Form 20-F 7 |

Form 20-F

ItemITEM 4. Information on the CompanyINFORMATION ON THE COMPANY

A. History and development of the CompanyHISTORY AND DEVELOPMENT OF THE COMPANY

The information set forth under the following headings of the Group’s Annual Report and Accounts 20112013 furnished separately on 27 March 20122014 under Form 6-K is incorporated by reference:

‘About Unilever’ on page 42;

‘Our requirementsRequirements and compliance’ on pages 4347 to 45;

‘Note 10 Property, Plant and Equipment’ on pages 111 and 112;

‘Share Capital’ on pages 51 and 52;

Please refer also to ‘Financial Review 2010’2012’ within Item 5A of this report and ‘The Unilever Group’ on page 1 of this report.

B. Business overviewBUSINESS OVERVIEW

The information set forth under the following headings of the Group’s Annual Report and Accounts 20112013 furnished separately on 27 March 20122014 under Form 6-K is incorporated by reference:

‘Note 2 Segment information’ on pages 70 to 71;96 and

‘Better service’Reaching more consumers’ on page 16.18;

Please refer also to ‘Financial Review 2012’ within Item 5A of this report.

Please also refer to ‘The Unilever Group’ on page 1 of this report.

Marketing channelsMARKETING CHANNELS

Unilever’s products are generally sold through our own sales force as well as through independent brokers, agents and distributors to chain, wholesale, co-operative and independent grocery accounts, food service distributors and institutions. Products are physically distributed through a network of distribution centres, satellite warehouses, company-operated and public storage facilities, depots and other facilities.

Raw materialsRAW MATERIALS

Our products use a wide variety of raw and packaging materials which we source internationally, and which may be subject to price volatility. We sawAlthough we have seen rather more stable conditions in key commodity prices rise during the second halfmarkets in 2013 we remain watchful for further periods of 2011 and this looks set to continue into 2012.volatility in 2014.

SeasonalitySEASONALITY

Certain of our businesses, such as ice cream, are subject to significant seasonal fluctuations in sales. However, Unilever operates globally in many different markets and product categories, and no individual element of seasonality is likely to be material to the results of the Group as a whole.

Intellectual propertyINTELLECTUAL PROPERTY

We have a large portfolio of patents and trademarks, and we conduct some of our operations under licences that are based on patents or trademarks owned or controlled by others. We are not dependent on any one patent or group of patents. We use all appropriate efforts to protect our brands and technology.

CompetitionCOMPETITION

As a FMCG (fast moving consumer goods) company, we are competing with a diverse set of competitors. Some of these operate on an international scale like ourselves, while others have a more regional or local focus. Our business model centres on building brands which consumers know, trust, like and buy in conscious preference to competitors’. Our brands command loyalty and affinity and deliver superior performance.

INFORMATION PRESENTED

Unless otherwise stated, share refers to value share. The market data and competitive set classifications are taken from independent industry sources in the markets in which Unilever operates.

IRAN-RELATED REQUIRED DISCLOSURE

Unilever operates in Iran through a non-US subsidiary. In 2013, sales in Iran were significantly less than one percent of Unilever’s worldwide turnover. This non-US subsidiary had€2,426 in gross revenues and€679 in net profits attributable to the sale of home, personal care and food products to local pharmacies controlled by the Government of Iran or affiliated entities in 2013. This non-US subsidiary stopped making these sales in October 2013 and does not intend to resume that business. In addition, we advertised our products on television networks that are owned by the Government of Iran or affiliated entities. Income, payroll and other taxes, duties and fees (including for utilities) were payable to the Government of Iran and affiliated entities in connection with our operations. Our non-US subsidiary maintains bank accounts in Iran to facilitate our business in the country and make any required payments to the Government of Iran and affiliated entities. Our activities in Iran comply in all material respects with applicable laws and regulations, including US and other international trade sanctions, and except as described above, we plan to continue these activities.

C. Organisational structureORGANISATIONAL STRUCTURE

The information set forth under the heading ‘Principal‘Note 26 Principal group companies and non-current investments’ on pages 109134 and 110135 of the Group’s Annual Report and Accounts 20112013 furnished separately on 27 March 20122014 under Form 6-K is incorporated by reference:reference.

Please also refer to ‘The Unilever Group’ on page 1 of this report.

D. Property, plant and equipmentPROPERTY, PLANT AND EQUIPMENT

We have interests in properties in most of the countries where there are Unilever operations. However, none is material in the context of the Group as a whole. The properties are used predominantly to house production and distribution activities and as offices. There is a mixture of leased and owned property throughout the Group. We are not aware of any environmental issues affecting the properties which would have a material impact upon the Group, and there are no material encumbrances on our properties. Any difference between the market value of properties held by the Group and the amount at which they are included in the balance sheet is not significant. We believe our existing facilities are satisfactory for our current business and we currently have no plans to construct new facilities or expand or improve our current facilities in a manner that is material to the Group.

The information set forth under the following headings of the Group’s Annual Report and Accounts 20112013 furnished separately on 27 March 20122014 under Form 6-K is incorporated by reference:

‘Note 10 Property, plant and equipment’ on pages 86111 and 87;112; and

‘Note 26 Principal group companies and non-current investments’ on pages 109134 and 110.

ItemITEM 4A. Unresolved Staff CommentsUNRESOLVED STAFF COMMENTS

Not applicable.

| 8 Form 20-F | Unilever Annual Report on Form 20-F 2013 |

REVIEW AND PROSPECTS A. The information set forth under the following headings of the Group’s Annual Report and Accounts ‘Our key performance indicators’ on page 3; ‘Financial review ‘Currency risk’ on pages 122 to 123; and FINANCIAL REVIEW 2012 The information set forth under the heading ‘Basis of The following discussion summarises the results of the Group during the years In Turnover Operating profit Underlying operating profit Net profit Diluted EPS Turnover (€ million) Operating profit (€ million) Core operating profit Profit before tax (€ million) Net profit (€ million) Diluted earnings per Core earnings per share (€) Turnover at€ Operating profit was€ The cost of financing net borrowings was€ The effective tax rate was Net profit from joint ventures and associates, together with other income from non-current investments, contributed€ Fully diluted earnings per share EXPENSES WHICH MATERIALLY IMPACTED OPERATING PROFIT IN 2012 Absolute turnover grew by€4.9 billion which translated into ItemITEM 5. Operating and Financial Review and ProspectsOPERATING AND FINANCIALOperating resultsOPERATING RESULTS20112013 furnished separately on 27 March 20122014 under Form 6-K is incorporated by reference:28;34;2011’2013’ on pages 2026 to 27; and94.39.8UnileverAnnual Report on Form 20-F 2011Form 20-FFinancial Review 2010Basis of reportingBASIS OF REPORTINGreporting’reporting and critical accounting policies’ on page 2531 of the Group’s Annual Report and Accounts 20112013 furnished separately on 27 March 20122014 under Form 6-K is incorporated by reference.Group results and earnings per shareGROUP RESULTS AND EARNINGS PER SHARE20102012 and 2009.2011. The figures quoted are in euros, at current rates of exchange, being the average rates applying in each period as applicable, unless otherwise stated. Information about exchange rates between the euro, pound sterling and US dollar is given on page 45 of this report.20102012 and 2009,2011, no disposals qualified to be disclosed as discontinued operations for purposes of reporting. € million

2010 € million

2009 %

Change 44,262 39,823 11.1 6,339 5,020 26 6,620 5,888 12 4,598 3,659 26 €1.46 €1.17 25 2012 2011 % change (Restated) (Restated) 51,324 46,467 10.5 % 6,977 6,420 9 %

(€ million) 7,050 6,276 12 % 6,533 6,066 8 % 4,836 4,491 8 %

share (€) 1.50 1.42 6 % 1.53 1.37 12 % 44.351.3 billion increased 11.1%10.5%, with 7.3% due to currency.including a positive impact from foreign exchange of 2.2% and acquisitions net of disposals of 1.1%. Underlying sales growth increased to 4.1%6.9%, driven in particular by an improvement in performance in Western Europe. Underlyingwell balanced between volume growth of 5.8% was partially offset by the full year3.4% and price effectcontributions of negative 1.6%, though3.3%. As in the fourth quarter pricing turned positive on an in-quarter basis.prior year, emerging markets grew strongly, with underlying sales up 11.4% and now representing 55% of total turnover.6.37.0 billion, compared with€5.06.4 billion in 2009, with2011, up 9%. The increase was driven by higher one-off profits arising from the disposal of group companiesgross profit and lower restructuring costs. Underlyingimproved cost discipline. Core operating profit increased bywas€7.1 billion, up 12% tofrom€6.66.3 billion with underlying operating margin increasing by 0.2% to 15.0%.in 2011, reflecting the additional impact of lower one-off credits within non-core items.414390 million,€1558 million lowerless than 2009, asin 2011. The average level of net debt increased by€0.7 billion to€8.9 billion, reflecting the adversefull-year impact of currency was more than offset by lowerfinancing prior year acquisitions such as Alberto Culver. The average net debt. The interest rate was 3.5% on borrowings was 4.4%debt and 2.9% on cash deposits was 1.7%.deposits. The charge for pensions financing cost was a credit of€20 million compared with a net charge of€164145 million, compared to€95 million in 2009.2011.25.5%26.0% compared with 26.2%26.0% in 2009 reflecting the geographic mix of profits and the impact of the Italian frozen foods disposal. The underlying tax rate excluding the effect of restructuring, disposals and impairments was 27.1%.2011.18791 million in 2012, compared to€489189 million in the prior year which benefited from the€327 million gain on disposal of the majority of the equityyear. Assets related to businesses sold in JohnsonDiversey.previous years recorded positive adjustments to fair value in 2011, whilst similar but unrelated assets were impaired in 2012.increased 25%, towere€1.46. This was driven by improved underlying1.50, up 6% from€1.42 in the prior year. Higher operating profit was the key driver with lower restructuring charges, lower pension costs, the favourable impact of foreign exchangeprofits from business disposals and higher profit on business disposalone-off items, partially offset by higher minority interests and pension costs and a provisionlower contribution from non-current investments. Core earnings per share were€1.53, up 12% from€1.37 in respect2011, reflecting the additional impact of the European Commission investigationlower one-off credits within non-core items.consumer detergents. Business disposals include the disposala core operating profit increase of the Italian frozen foods business.€

|

774 million and an operating profit increase ofForm 20-F€

|

| |

Asia Africa CEE

€ million 2010 | € million 2009 | % Change | ||||||||||

Turnover | 17,685 | 14,897 | 18.7 | |||||||||

Operating profit | 2,253 | 1,927 | 16.9 | |||||||||

Underlying operating margin (%) | 13.4 | 13.9 | (0.5 | ) | ||||||||

Underlying sales growth (%) | 7.7 | 7.7 | ||||||||||

Underlying volume growth (%) | 10.2 | 4.1 | ||||||||||

Effect of price changes (%) | (2.2 | ) | 3.4 | |||||||||

Key developments

The relative strength of most major currencies557 million due to cost increases in the region againstfollowing key areas.

Costs of raw and packaging materials and goods purchased for resale increased by€1.7 billion, driven primarily by increased business volume of€1.3 billion and input costs increase of€1.1 billion offset by other items including material cost savings of€0.7 billion during the euro meant thatyear. Additionally, distribution costs increased by€184 million. Despite these increases, due to higher selling prices and benefit from customers buying products with higher margins, gross margin improved by 0.1% to 40.0% at constant exchange rates.

Staff costs increased by€0.9 billion due to salary inflation, particularly in emerging markets, higher pensions charge as a result of one-off credits taken in the prior year and higher bonuses.

Advertising and promotional expenses increased by€694 million as we continue to invest behind our brands.

The impact of exchange rates was significant, contributing 10.1% of the overall turnover growth.

Competitive intensity reached new heights in several key countries in 2010, with increased levels of mostly price-based competition. Against this competitive background, underlying sales growthinput costs and volume growth represent strong and fully competitive performance.

Negative price growth reflects actions taken to ensure that market position were protected against high levels of price based competition.

Underlying operating margin was down by 0.5%, with stable gross margin, but investment in advertising and promotions significantly increased.

Other key developments included the continued successful roll-out of the regional IT platform to a variety of countries.

The Americas

€ million 2010 | € million 2009 | % Change | ||||||||||

Turnover | 14,562 | 12,850 | 13.3 | |||||||||

Operating profit | 2,169 | 1,843 | 17.7 | |||||||||

Underlying operating margin (%) | 16.0 | 16.1 | (0.1 | ) | ||||||||

Underlying sales growth (%) | 4.0 | 4.2 | ||||||||||

Underlying volume growth (%) | 4.8 | 2.5 | ||||||||||

Effect of price changes (%) | (0.7 | ) | 1.6 | |||||||||

Key developments

The relative strength of most major currenciespromotional expenses are discussed further in the region against the euro meant thatour segmental disclosures, which also provide additional details on the impact of exchange rates was significant, contributing 9.0%brands, products and subcategories on driving top line growth.

Out of the overall turnover growth.

Market conditionsincrease of€774 million in North America remained challenging throughoutcore operating profit, the year, with consumer confidence at low levels and competition proving increasingly intense. Latin American markets were generally much stronger, although levelsmajority of competition again increased, particularly in Brazil.

Underlying sales growth of 4.0%it was drivencontributed by strong performance in Latin America supported by encouraging levels of growth in North America. Strong progress in the food categories in Brazil and Mexico, and Personal Care in Argentina contributed to positive volume market share performance.(€365 million) and Refreshments (€235 million).

Underlying price growth was negative reflecting actions taken to ensure market positions were protected against high levelsIMPACT OF COMMODITY COSTS ON GROSS MARGIN

During 2012, the Unilever Group faced cost inflation of over€1.5 billion. The Unilever Group actively mitigates the impact of cost inflation through a combination of price competition.

Underlying operatingincreases and costs savings to protect its margin. Hence, despite cost increases, the Unilever Group was able to improve its gross margin by 0.1 percentage points during 2012. Specifically gross margin was down 0.1% with investmentprotected in advertising and promotions increased from 2009.

A key development in 2010 was the announcement of an agreement to acquire the Alberto Culver business. The transaction was completed in 2011.

Western Europe

€ million 2010 | € million 2009 | % Change | ||||||||||

Turnover | 12,015 | 12,076 | (0.5 | ) | ||||||||

Operating profit | 1,917 | 1,250 | 53.4 | |||||||||

Underlying operating margin (%) | 16.1 | 14.4 | 1.7 | |||||||||

Underlying sales growth (%) | (0.4 | ) | (1.9 | ) | ||||||||

Underlying volume growth (%) | 1.4 | (0.1 | ) | |||||||||

Effect of price changes (%) | (1.8 | ) | (1.8 | ) | ||||||||

Key developments

Competition continued to be intense in most parts3 out of the region throughout 2010.4 categories. In some marketsour Foods category the impact of high vegetable oil prices was not fully recovered as described below. Petrochemicals materially affect our Home Care category, where we have protected our margins. There are no other commodities that have a material impact.

Part of our commodity risk, principally vegetable oils and categories levelspetrochemicals, is hedged using a combination of price promotional activity accelerated towards the end of the year. Against this competitive background, underlying sales growth of negative 0.4% represented robust performance.physical contracts as well as derivatives (futures and options).

Underlying price growth was negative 1.8%, reflecting actions taken to ensure market positions were protected against high levels of price competition.

The major factor behind the significant increase in operating profit was the profit on disposal of the Italian frozen foods business. Underlying operating margin was up sharply by 1.7% reflecting success of cost saving initiatives which reduced indirect costs significantly.

In other developments, the acquisition of the Sara Lee Personal Care business was completed in the fourth quarter. Other smaller bolt-on acquisitions were announced during the year in ice cream.

| UnileverAnnual Report on Form 20-F | Form 20-F 9 |

ITEM 5. OPERATING AND FINANCIAL

REVIEW AND PROSPECTSForm 20-FCONTINUED

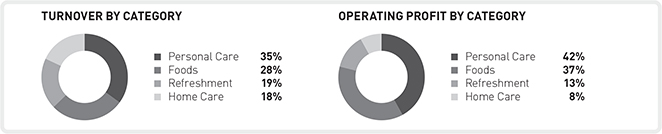

PERSONAL CARE

| € million | € million | % | ||||||||||

| 2012 | 2011 | Change | ||||||||||

| (Restated) | (Restated) | |||||||||||

Turnover | 18,097 | 15,471 | 17.0 | |||||||||

Operating profit | 2,925 | 2,533 | 15.5 | |||||||||

Core operating profit | 3,085 | 2,720 | 13.4 | |||||||||

Core operating margin (%) | 17.0 | 17.6 | (0.6 | ) | ||||||||

Underlying sales growth (%) | 10.0 | 8.2 | ||||||||||

Underlying volume growth (%) | 6.5 | 4.2 | ||||||||||

Effect of price changes (%) | 3.3 | 3.8 | ||||||||||

KEY DEVELOPMENTS

REFRESHMENT

| € million | € million | % | ||||||||||

| 2012 | 2011 | Change | ||||||||||

| (Restated) | (Restated) | |||||||||||

Turnover | 9,726 | 8,804 | 10.5 | |||||||||

Operating profit | 908 | 720 | 26.1 | |||||||||

Core operating profit | 908 | 673 | 34.9 | |||||||||

Core operating margin (%) | 9.3 | 7.7 | 1.6 | |||||||||

Underlying sales growth (%) | 6.3 | 4.9 | ||||||||||

Underlying volume growth (%) | 2.4 | 1.4 | ||||||||||

Effect of price changes (%) | 3.9 | 3.4 | ||||||||||

KEY DEVELOPMENTS

FOODS

| € million | € million | % | ||||||||||

| 2012 | 2011 | Change | ||||||||||

| (Restated) | (Restated) | |||||||||||

Turnover | 14,444 | 13,986 | 3.3 | |||||||||

Operating profit | 2,601 | 2,688 | (3.2 | ) | ||||||||

Core operating profit | 2,528 | 2,444 | 3.4 | |||||||||

Core operating margin (%) | 17.5 | 17.5 | – | |||||||||

Underlying sales growth (%) | 1.8 | 4.9 | ||||||||||

Underlying volume growth (%) | (0.9 | ) | (1.2 | ) | ||||||||

Effect of price changes (%) | 2.7 | 6.2 | ||||||||||

KEY DEVELOPMENTS

HOME CARE

| € million | € million | % | ||||||||||

| 2012 | 2011 | Change | ||||||||||

| (Restated) | (Restated) | |||||||||||

Turnover | 9,057 | 8,206 | 10.4 | |||||||||

Operating profit | 543 | 479 | 13.4 | |||||||||

Core operating profit | 529 | 439 | 20.5 | |||||||||

Core operating margin (%) | 5.8 | 5.4 | 0.4 | |||||||||

Underlying sales growth (%) | 10.3 | 8.1 | ||||||||||

Underlying volume growth (%) | 6.2 | 2.2 | ||||||||||

Effect of price changes (%) | 3.9 | 5.8 | ||||||||||

KEY DEVELOPMENTS

| 10 Form 20-F | Unilever Annual Report on Form 20-F 2013 |

ITEM 5. OPERATING AND FINANCIAL

REVIEW AND PROSPECTSCONTINUED

Non-GAAP measuresNON-GAAP MEASURES

The information set forth under the heading ‘Non-GAAP measures’ on pages 2632 and 2733 of the Group’s Annual Report and Accounts 20112013 furnished separately on 27 March 20122014 under Form 6-K is incorporated by reference.

Underlying sales growthUNDERLYING SALES GROWTH (USG)

The reconciliation of USG to changes in the GAAP measure turnover is as follows:

Total GroupTOTAL GROUP

| 2010 vs 2009 | 2009 vs 2008 | |||||||

Underlying sales growth (%) | 4.1 | 3.5 | ||||||

Effect of acquisitions (%) | 0.3 | 0.6 | ||||||

Effect of disposals (%) | (0.8 | ) | (3.0 | ) | ||||

Effect of exchange rates (%) | 7.3 | (2.7 | ) | |||||

Turnover growth (%) | 11.1 | (1.7 | ) | |||||

Asia Africa CEE

| 2010 vs 2009 | 2009 vs 2008 | |||||||

Underlying sales growth (%) | 7.7 | 7.7 | ||||||

Effect of acquisitions (%) | 0.2 | 0.5 | ||||||

Effect of disposals (%) | (0.1 | ) | (0.9 | ) | ||||

Effect of exchange rates (%) | 10.1 | (4.0 | ) | |||||

Turnover growth (%) | 18.7 | 2.9 | ||||||

The Americas

| 2010 vs 2009 | 2009 vs 2008 | |||||||

Underlying sales growth (%) | 4.0 | 4.2 | ||||||

Effect of acquisitions (%) | 0.3 | 0.7 | ||||||

Effect of disposals (%) | (0.4 | ) | (6.0 | ) | ||||

Effect of exchange rates (%) | 9.0 | (1.2 | ) | |||||

Turnover growth (%) | 13.3 | (2.6 | ) | |||||

Western Europe

| 2010 vs 2009 | 2009 vs 2008 | 2012 vs 2011 | 2011 vs 2010 | |||||||||||||

Underlying sales growth (%) | (0.4 | ) | (1.9 | ) | 6.9 | 6.5 | ||||||||||

Effect of acquisitions (%) | 0.5 | 0.5 | 1.8 | 2.7 | ||||||||||||

Effect of disposals (%) | (2.0 | ) | (2.2 | ) | (0.7 | ) | (1.5 | ) | ||||||||

Effect of exchange rates (%) | 1.4 | (2.5 | ) | 2.2 | (2.5 | ) | ||||||||||

Turnover growth (%) | (0.5 | ) | (6.0 | ) | 10.5 | 5.0 | ||||||||||

| PERSONAL CARE | ||||||||||||||||

2012 vs 2011 | 2011 vs 2010 | |||||||||||||||

Underlying sales growth (%) | 10.0 | 8.2 | ||||||||||||||

Effect of acquisitions (%) | 4.4 | 7.3 | ||||||||||||||

Effect of disposals (%) | (0.5 | ) | (0.2 | ) | ||||||||||||

Effect of exchange rates (%) | 2.3 | (2.9 | ) | |||||||||||||

Turnover growth (%) | 17.0 | 12.4 | ||||||||||||||

| FOODS | ||||||||||||||||

2012 vs 2011 | 2011 vs 2010 | |||||||||||||||

Underlying sales growth (%) | 1.8 | 4.9 | ||||||||||||||

Effect of acquisitions (%) | – | 0.2 | ||||||||||||||

Effect of disposals (%) | (1.5 | ) | (4.3 | ) | ||||||||||||

Effect of exchange rates (%) | 3.0 | (1.9 | ) | |||||||||||||

Turnover growth (%) | 3.3 | (1.3 | ) | |||||||||||||

| REFRESHMENT | ||||||||||||||||

2012 vs 2011 | 2011 vs 2010 | |||||||||||||||

Underlying sales growth (%) | 6.3 | 4.9 | ||||||||||||||

Effect of acquisitions (%) | 0.8 | 0.3 | ||||||||||||||

Effect of disposals (%) | 0.7 | (0.3 | ) | |||||||||||||

Effect of exchange rates (%) | 2.4 | (2.5 | ) | |||||||||||||

Turnover growth (%) | 10.5 | 2.3 | ||||||||||||||

| HOME CARE | ||||||||||||||||

2012 vs 2011 | 2011 vs 2010 | |||||||||||||||

Underlying sales growth (%) | 10.3 | 8.1 | ||||||||||||||

Effect of acquisitions (%) | 0.6 | 1.3 | ||||||||||||||

Effect of disposals (%) | (1.1 | ) | 0.1 | |||||||||||||

Effect of exchange rates (%) | 0.6 | (3.1 | ) | |||||||||||||

Turnover growth (%) | 10.4 | 6.2 | ||||||||||||||

Underlying volume growthUNDERLYING VOLUME GROWTH (UVG)

Underlying Volume Growth or “UVG” is part of USG and means, for the applicable period, the increase in turnover in such period calculated as the sum of (1) the increase in turnover attributable to the volume growth is underlying sales growth after eliminatingof products sold; and (2) the increase in turnover attributable to the composition of products sold during such period. UVG therefore excludes any impact of price changes.to USG due to changes in prices. The relationship between the two measures is set out below:

| 2010 vs 2009 | 2009 vs 2008 | 2012 vs 2011 | 2011 vs 2010 | |||||||||||||

Underlying volume growth (%) | 5.8 | 2.3 | 3.4 | 1.6 | ||||||||||||

Effect of price changes (%) | (1.6 | ) | 1.2 | 3.3 | 4.8 | |||||||||||

Underlying sales growth (%) | 4.1 | 3.5 | 6.9 | 6.5 | ||||||||||||

Underlying operating marginFREE CASH FLOW (FCF)

The reconciliation of underlying operating profit to operating profit is as follows:

| € million 2010 | € million 2009 | |||||||

Operating profit | 6,339 | 5,020 | ||||||

Restructuring costs | 589 | 897 | ||||||

Business disposals | (468 | ) | (4 | ) | ||||

Impairments and other one-off items | 160 | (25 | ) | |||||

Underlying operating profit | 6,620 | 5,888 | ||||||

Turnover | 44,262 | 39,823 | ||||||

Operating margin (%) | 14.3 | 12.6 | ||||||

Underlying operating margin (%) | 15.0 | 14.8 | ||||||

FreeWithin the Unilever Group, free cash flow (FCF)

FCF represents the cash generation from the operation and financing of the business. The movement in FCF measures our progress against the commitment to deliver strong cash flows. FCF is not useddefined as a liquidity measure within Unilever.

FCF includes the cash flow from Group operating activities, less income taxtaxes paid, net capital expenditure,expenditures and net interest payments and preference dividends paid. It does not represent residual cash flows entirely available for discretionary purposes; for example, the repayment of principal amounts borrowed is not deducted from FCF. Free cash flow reflects an additional way of viewing our liquidity that we believe is useful to investors because it represents cash flows that could be used for distribution of dividends, repayment of debt or to fund our strategic initiatives, including acquisitions, if any.

The reconciliation of FCF to net profit is as follows:

| € million 2010 | € million 2009 | € million 2012 (Restated) | € million 2011 (Restated) | |||||||||||||

Net profit | 4,598 | 3,659 | 4,836 | 4,491 | ||||||||||||

Taxation | 1,534 | 1,257 | 1,697 | 1,575 | ||||||||||||

Share of net profit of joint ventures/associates and other income from non-current investments | (187 | ) | (489 | ) | (91 | ) | (189 | ) | ||||||||

Net finance cost | 394 | 593 | 535 | 543 | ||||||||||||

Depreciation, amortisation and impairment | 993 | 1,032 | 1,199 | 1,029 | ||||||||||||

Changes in working capital | 169 | 1,701 | 822 | (177 | ) | |||||||||||

Pensions and similar obligations less payments | (472 | ) | (1,028 | ) | (369 | ) | (540 | ) | ||||||||

Provisions less payments | 72 | (258 | ) | (43 | ) | 9 | ||||||||||

Elimination of (profits)/losses on disposals | (476 | ) | 13 | (236 | ) | (215 | ) | |||||||||

Non-cash charge for share-based compensation | 144 | 195 | 153 | 105 | ||||||||||||

Other adjustments | 49 | 58 | 13 | 8 | ||||||||||||

Cash flow from operating activities | 6,818 | 6,733 | 8,516 | 6,639 | ||||||||||||

Income tax paid | (1,328 | ) | (959 | ) | (1,680 | ) | (1,187 | ) | ||||||||

Net capital expenditure | (1,701 | ) | (1,258 | ) | (2,143 | ) | (1,974 | ) | ||||||||

Net interest and preference dividends paid | (424 | ) | (444 | ) | (360 | ) | (403 | ) | ||||||||

Free cash flow | 3,365 | 4,072 | 4,333 | 3,075 | ||||||||||||

Net cash flow (used in)/from investing activities | (755 | ) | (4,467 | ) | ||||||||||||

Net cash flow (used in)/from financing activities | (6,622 | ) | 411 | |||||||||||||

Net debtCORE OPERATING MARGIN AND CORE OPERATING PROFIT

Core operating profit and core operating margin mean operating profit and operating margin, respectively, before the impact of business disposals, acquisition and disposal related costs, impairments and other one-off items, which we collectively term non-core items, on the grounds that the incidence of these items is uneven between reporting periods.

The reconciliation of core operating profit to operating profit is as follows:

€ million 2012 (Restated) | € million 2011 (Restated) | |||||||

Operating profit | 6,977 | 6,420 | ||||||

Acquisition and disposal related costs | 190 | 234 | ||||||

(Gain)/loss on disposal of group companies | (117 | ) | (221 | ) | ||||

Impairments and other one-off items | – | (157 | ) | |||||

Core operating profit | 7,050 | 6,276 | ||||||

Turnover | 51,324 | 46,467 | ||||||

Operating margin (%) | 13.6 | 13.8 | ||||||

Core operating margin (%) | 13.7 | 13.5 | ||||||

| Unilever Annual Report on Form 20-F 2013 | Form 20-F 11 |

ITEM 5. OPERATING AND FINANCIAL

REVIEW AND PROSPECTSCONTINUED

NET DEBT

The reconciliation of net debt to the GAAP measure total financial liabilities is as follows:

| € million 2010 | € million 2009 | |||||||

Total financial liabilities | (9,534 | ) | (9,971 | ) | ||||

Financial liabilities due within one year | (2,276 | ) | (2,279 | ) | ||||

Financial liabilities due after one year | (7,258 | ) | (7,692 | ) | ||||

Cash and cash equivalents as per balance sheet | 2,316 | 2,642 | ||||||

Cash and cash equivalents as per cash flow statement | 1,966 | 2,397 | ||||||

Bank overdrafts deducted therein | 350 | 245 | ||||||

Financial assets | 550 | 972 | ||||||

Net debt | (6,668 | ) | (6,357 | ) | ||||

| € million 2012 | € million 2011 | |||||||

Total financial liabilities | (10,221 | ) | (13,718 | ) | ||||

Financial liabilities due within one year | (2,656 | ) | (5,840 | ) | ||||