SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20112013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the transition period fromto

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number 001-12518

BANCO SANTANDER, S.A.

(Exact name of Registrant as specified in its charter)

Kingdom of Spain

(Jurisdiction of incorporation)

Ciudad Grupo Santander

28660 Boadilla del Monte (Madrid), Spain

(address of principal executive offices)

José Antonio Álvarez

Banco Santander, S.A.

Ciudad Grupo Santander

28660 Boadilla del Monte

Madrid, Spain

Tel: +34 91 289 32 80

Fax: +34 91 257 12 82

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered, pursuant to Section 12(b) of the Act

Title of each class | Name of each exchange on which registered | |

American Depositary Shares, each representing the right to receive one Share of Capital Stock of Banco Santander, S.A., par value | New York Stock Exchange | |

Shares of Capital Stock of Banco Santander, S.A., par value | New York Stock Exchange * | |

Guarantee of Non-cumulative Guaranteed Preferred Stock of Santander Finance Preferred, S.A. Unipersonal, Series | New York Stock Exchange ** |

| * | Banco Santander Shares are not listed for trading, but are only listed in connection with the registration of the American Depositary Shares, pursuant to requirements of the New York Stock Exchange. |

| ** | The guarantee is not listed for trading, but is listed only in connection with the registration of the corresponding Non-cumulative Guaranteed Preferred Stock of Santander Finance Preferred, S.A. Unipersonal (a wholly owned subsidiary of Banco Santander, S.A.) |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None.

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act

None.

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

US GAAP ¨International Financial Reporting Standards as issued by the International Accounting Standards Board xOther¨

US GAAP ¨ | International Financial Reporting Standards as issued by the International Accounting Standards Board x | Other¨ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

Indicate the number of outstanding shares of each of the issuer’s classes of capital stock or common stock as of the close

of business covered by the annual report.

9,076,853,400 11,561,067,147 shares

BANCO SANTANDER, S.A.

| Page | ||||||

| 5 | ||||||

| 6 | ||||||

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Accounting Principles

Under Regulation (EC) No. 1606/2002 of the European Parliament and of the Council of July 19, 2002, all companies governed by the law of an EU Member State and whose securities are admitted to trading on a regulated market of any Member State must prepare their consolidated financial statements in conformity with the International Financial Reporting Standards previously adopted by the European Union (“EU-IFRS”). The Bank of Spain Circular 4/2004 of December 22, 2004 on Public and Confidential Financial Reporting Rules and Formats (“Circular 4/2004”) requires Spanish credit institutions to adapt their accounting systems to the principles derived from the adoption by the European Union of International Financial Reporting Standards. Therefore, Grupo Santander (“the Group” or “Santander”) is required to prepare its consolidated financial statements for the year ended December 31, 20112013 in conformity with the EU-IFRS and Bank of Spain’s Circular 4/2004. Differences between EU-IFRS, Bank of Spain’s Circular 4/2004 and International Financial Reporting Standards as issued by the International Accounting Standard Board (IFRS-IASB) are not material. Therefore, we assert that the financial information contained in this annual report on Form 20-F complies with IFRS-IASB.

We have formatted our financial information according to the classification format for banks used in Spain. We have not reclassified the line items to comply with Article 9 of Regulation S-X.S-X (see Note 55 of our consolidated financial statements). Article 9 is a regulation of the US Securities and Exchange Commission that contains formatting requirements for bank holding company financial statements.

Our auditors, Deloitte, S.L., an independent registered public accounting firm, have audited our consolidated financial statements in respect of the three years ended December 31, 2011, 20102013, 2012 and 20092011 in accordance with IFRS-IASB. See page F-1 to our consolidated financial statements for the 2011, 20102013, 2012 and 20092011 report prepared by Deloitte, S.L.

General Information

Our consolidated financial statements are in Euros, which are denoted “euro”, “euros”, “EUR” or “€” throughout this annual report. Also, throughout this annual report, when we refer to:

“dollars”, “US$” or “$”, we mean United States dollars;

“pounds” or “£”, we mean United Kingdom pounds; and

“one billion”, we mean 1,000 million.

When we refer to “average balances” for a particular period, we mean the average of the month-end balances for that period, unless otherwise noted. We do not believe that monthly averages present trends that are materially different from trends that daily averages would show. In calculating our interest income, we include any interest payments we received on non-accruing loans if they were received in the period when due. We have not reflected consolidation adjustments in any financial information about our subsidiaries or other business units.

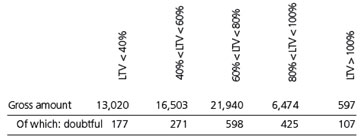

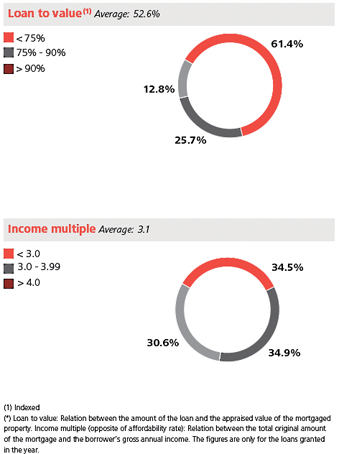

When we refer to “loans”, we mean loans, leases, discounted bills and accounts receivable, unless otherwise noted. The loan to value “LTV” ratios disclosed in this report refer to LTV ratios upon origination unless otherwise noted. Additionally, if a debtloan is approaching a doubtful status, we update the appraisals which are then used to estimate allowances for loan losses.

When we refer to “impaired balances” or “non-performing balances”, we mean impaired or non-performing loans and contingent liabilities (“NPL”), securities and other assets to collect.

When we refer to “allowances for credit losses”, we mean the specific allowances for credit losses, and unless otherwise noted, the collectively assessed allowance for credit losses and any allowances for country-risk. See “Item 4. Information on the Company—B. Business Overview—Classified Assets—Allowances for Credit Losses and Country-Risk Requirements”.

Where a translation of foreign exchange is given for any financial data, we use the exchange rates of the relevant period (as of the end of such period for balance sheet data and the average exchange rate of such period for income statement data) as published by the European Central Bank, unless otherwise noted.

Management makes use of certain financial measures in local currency to help in the assessment of on-going operating performance. These non-GAAP financial measures include the results of operations of our subsidiary banks located outside the eurozone, excluding the impact of foreign exchange. We analyze these banks’ performance on a local currency basis to better measure the comparability of results between periods. Because changes in foreign currency exchange rates have a non-operating impact on the results of operations, we believe that evaluating their performance on a local currency basis provides an additional and meaningful assessment of performance to both management and the company’s investors. For a discussion of the accounting principles used in translation of foreign currency-denominated assets and liabilities to euros, see Note 2(a) of our consolidated financial statements.

4

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains statements that constitute “forward-looking statements” within the meaning of the US Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, information regarding:

exposure to various types of market risks;

management strategy;

capital expenditures;

earnings and other targets; and

asset portfolios.

Forward-looking statements may be identified by words such as “expect,” “project,” “anticipate,” “should,” “intend,” “probability,” “risk,” “VaR,” “RORAC,” “target,” “goal,” “objective,” “estimate,” “future” and similar expressions. We include forward-looking statements in the “Operating and Financial Review and Prospects,” “Information on the Company,” and “Quantitative and Qualitative Disclosures About Market Risk”Risks” sections. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ materially from those in the forward-looking statements.

You should understand that adverse changes in the following important factors, in addition to those discussed in “Key Information—Risk Factors”, “Operating and Financial Review and Prospects,” “Information on the Company” and elsewhere in this annual report, could affect our future results and could cause those results or other outcomes to differ materially from those anticipated in any forward-looking statement:

Economic and Industry Conditions

exposure to various types of market risks, principally including interest rate risk, foreign exchange rate risk and equity price risk;

general economic or industry conditions in Spain, the United Kingdom,U.K., the United States,U.S., other European countries, Brazil, other Latin American countries and the other areas in which we have significant business activities or investments;

a default on, or a ratings downgrade of, the sovereign debt of Spain, and the other countries where we operate;

a worsening of the economic environment in the United Kingdom,U.K., other European countries, Brazil, other Latin American countries, and the United States,U.S., and an increase of the volatility in the capital markets;

a further deterioration of the Spanish economy;

monetary and interest rate policies of the European Central Bank and various central banks;

inflation or deflation;

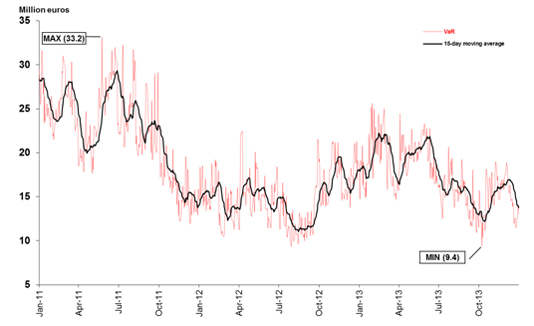

the effects of non-linear market behavior that cannot be captured by linear statistical models, such as the VaR model we use;

changes in competition and pricing environments;

the inability to hedge some risks economically;

the adequacy of loss reserves;

acquisitions or restructurings of businesses that may not perform in accordance with our expectations;

changes in demographics, consumer spending, investment or saving habits; and

changes in competition and pricing environments as a result of the progressive adoption of the internet for conducting financial services and/or other factors.

5

Political and Governmental Factors

political stability in Spain, the United Kingdom, other European countries, Latin America and the US;

changes in Spanish, UK, EU,U.K., E.U., Latin American, USU.S. or other jurisdictions’ laws, regulations or taxes;taxes, including changes in regulatory capital and

increased regulation in light of the global financial crisis.

Transaction and Commercial Factors

damage to our reputation;

our ability to integrate successfully our acquisitions and the challenges inherent in diverting management’s focus and resources from other strategic opportunities and from operational matters while we integrate these acquisitions; and

the outcome of our negotiations with business partners and governments.

Operating Factors

potential losses associated with an increase in the level of substandard loans ornon-performance by counterparties to other types of financial instruments.

technical difficulties and the development and use of new technologies by us and our competitors;

the impact of changes in the composition of our balance sheet on future net interest income.

The forward-looking statements contained in this annual report speak only as of the date of this annual report. We do not undertake to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events.

6

Item 1. Identity of Directors, Senior Management and Advisers

A. Directors and Senior Management

Not applicable.

B. Advisers

Not applicable.

C. AuditorAuditors

Not applicable.

Item 2. Offer Statistics and Expected Timetable

A. Offer Statistics

Not applicable.

B. Method and Expected Timetable

Not applicable.

Selected Consolidated Financial Information

We have selected the following financial information from our consolidated financial statements. You should read this information in connection with, and it is qualified in its entirety by reference to, our consolidated financial statements.

In the F-pages of this annual report on Form 20-F, the audited financial statements for the years 2011, 20102013, 2012 and 20092011 are presented. The audited financial statements for 20082010 and 20072009 are not included in this document, but they can be found in our previous annual reports on Form 20-F.

In August 2013, we filed with the SEC a Form 6-K in which we recasted our audited financial statements included in our annual report on Form 20-F for the fiscal year ended December 31, 2012, as filed with the SEC on April 24, 2013 (the “2012 Form 20-F”) to reflect the change in International Accounting Standard 19 (“IAS 19”). IAS 19 requires that for periods beginning on or after January 1, 2013 actuarial gains and losses be immediately recognized against shareholders’ equity, without the possibility for deferred recognition through the income statement, as it was done in 2012 and prior periods. In addition, that 6-K recasted disclosures in the 2012 Form 20-F to give retroactive effect to the application of IAS 19 and to certain changes to our reporting methods in 2013, including the following:

The impact of the change in IAS 19 as of December 31, 2012, 2011 and 2010 is as follows:

| Millions of euros | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

Deferred tax assets | 1,185 | 694 | 378 | |||||||||

Other assets | (1,213 | ) | (1,211 | ) | (922 | ) | ||||||

|

|

|

|

|

| |||||||

Assets | (28 | ) | (517 | ) | (544 | ) | ||||||

|

|

|

|

|

| |||||||

Deferred tax liabilities | 254 | 208 | 199 | |||||||||

Provisions for pensions and similar obligations | (3,276 | ) | (1,737 | ) | (1,072 | ) | ||||||

|

|

|

|

|

| |||||||

Liabilities | (3,022 | ) | (1,529 | ) | (873 | ) | ||||||

|

|

|

|

|

| |||||||

Valuation adjustment | 2,884 | 1,933 | 1,412 | |||||||||

Non-controlling interests | 262 | 91 | 39 | |||||||||

|

|

|

|

|

| |||||||

Equity | 3,146 | 2,024 | 1,451 | |||||||||

|

|

|

|

|

| |||||||

Provisions (net) | (138 | ) | 26 | (49 | ) | |||||||

Income tax | 43 | (5 | ) | 16 | ||||||||

|

|

|

|

|

| |||||||

Consolidated profit for the year | (95 | ) | 21 | (33 | ) | |||||||

|

|

|

|

|

| |||||||

Of which: | ||||||||||||

Profit attributable to the Parent | (90 | ) | 21 | (31 | ) | |||||||

|

|

|

|

|

| |||||||

Profit attributable to non-controlling interest | (5 | ) | — | (2 | ) | |||||||

|

|

|

|

|

| |||||||

The other adjustments described above did not have a material impact on our financial statements.

The following selected financial information includes the IAS 19 adjustments for 2012, 2011, 2010 and 2009 while the impacts of the envisaged disposal of the Santander UK card business is only included in the 2012, 2011 and 2010 data.

Under IFRS-IASB, revenues and expenses of discontinued businesses (mainly, Santander UK card business that was formerly owned by GE) must be reclassified from each income statement line item to “Profit from discontinued operations”. Revenues and expenses from prior years are also required to be reclassified for comparison purposes to present the same businesses as discontinued operations. This change in presentation does not affect “Consolidated profit for the year” (see Note 37 to our consolidated financial statements). The impact of Santander UK card business reclassification in the balance sheets as of December 31, 2012, 2011 and 2010 is as follows:

| Millions of euros | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

Loans and receivables - Loans and advances to customers | (1,370 | ) | (1,559 | ) | (1,649 | ) | ||||||

Non-current assets held for sale | 1,370 | 1,559 | 1,649 | |||||||||

|

|

|

|

|

| |||||||

Assets | — | — | — | |||||||||

|

|

|

|

|

| |||||||

The income statement for the year ended December 31, 2013 includes the results from Kredyt Bank S.A. after the merger in early 2013 of the subsidiaries in Poland of Banco Santander, S.A. and KBC Bank NV (BZ WBK S.A. and Kredyt Bank S.A.). In addition, the income statement for the year ended December, 31, 2011 reflects the impact of the consolidation of Bank Zachodni WBK, S.A. and the income statement for the year ended December, 31, 2009 reflects the impact of the consolidation of Banco Real, Alliance & Leicester, Bradford & Bingley’s branch network and retail deposits, Sovereign (Santander Bank) and other consumer businesses.

Interest and similar income Interest expense and similar charges Interest income / (charges) Income from equity instruments Income from companies accounted for using the equity method Fee and commission income Fee and commission expense Gains/losses on financial assets and liabilities (net) Exchange differences (net) Other operating income Other operating expenses Total income Administrative expenses Personnel expenses Other general administrative expenses Depreciation and amortization Provisions (net) Impairment losses on financial assets (net) Impairment losses on other assets (net) Gains/(losses) on disposal of assets not classified as non-current assets held for sale Gains/(losses) on non-current assets held for sale not classified as discontinued operations Operating profit/(loss) before tax Income tax Profit from continuing operations Profit/(loss) from discontinued operations (net) Consolidated profit for the year Profit attributable to the Parent Profit attributable to non-controlling interest Per share information: Average number of shares (thousands) (1) Basic earnings per share (euros) Basic earnings per share continuing operation (euros) Diluted earnings per share (euros) Diluted earnings per share continuing operation (euros) Remuneration paid (euros) (2) Remuneration paid (US$) (2) Year ended December 31, 2013 2012 2011 2010 2009 (in millions of euros, except percentages and per share data) 51,447 58,791 60,618 52,637 53,173 (25,512 ) (28,868 ) (30,024 ) (23,672 ) (26,874 ) 25,935 29,923 30,594 28,965 26,299 378 423 394 362 436 500 427 57 17 (1 ) 12,473 12,732 12,640 11,559 10,726 (2,712 ) (2,471 ) (2,232 ) (1,899 ) (1,646 ) 3,234 3,329 2,838 2,166 3,802 160 (189 ) (522 ) 441 444 5,903 6,693 8,050 8,190 7,929 (6,194 ) (6,583 ) (8,029 ) (8,089 ) (7,785 ) 39,677 44,284 43,790 41,712 40,204 (17,452 ) (17,801 ) (17,644 ) (16,073 ) (14,825 ) (10,069 ) (10,306 ) (10,305 ) (9,296 ) (8,451 ) (7,383 ) (7,495 ) (7,339 ) (6,777 ) (6,374 ) (2,391 ) (2,183 ) (2,098 ) (1,937 ) (1,596 ) (2,182 ) (1,478 ) (2,616 ) (1,067 ) (1,747 ) (11,227 ) (18,880 ) (11,794 ) (10,400 ) (11,578 ) (503 ) (508 ) (1,517 ) (286 ) (165 ) 2,152 906 1,846 351 1,565 (422 ) (757 ) (2,109 ) (290 ) (1,225 ) 7,652 3,583 7,858 12,010 10,633 (2,113 ) (590 ) (1,755 ) (2,910 ) (1,222 ) 5,539 2,993 6,103 9,100 9,411 (15 ) 70 15 35 31 5,524 3,063 6,118 9,135 9,442 4,370 2,295 5,330 8,212 8,970 1,154 768 788 923 472 10,836,111 9,766,689 8,892,033 8,686,522 8,554,224 0.40 0.23 0.60 0.94 1.05 0.40 0.22 0.60 0.94 1.04 0.40 0.23 0.60 0.94 1.04 0.40 0.22 0.60 0.94 1.04 0.60 0.60 0.60 0.60 0.60 0.83 0.79 0.78 0.80 0.86

7

| Year ended December 31, | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| (in millions of euros, except percentages and per share data) | ||||||||||||||||||||

Interest and similar income | 60,856 | 52,907 | 53,173 | 55,044 | 45,512 | |||||||||||||||

Interest expense and similar charges | (30,035 | ) | (23,683 | ) | (26,874 | ) | (37,506 | ) | (31,069 | ) | ||||||||||

Interest income / (charges) | 30,821 | 29,224 | 26,299 | 17,538 | 14,443 | |||||||||||||||

Income from equity instruments | 394 | 362 | 436 | 553 | 420 | |||||||||||||||

Income from companies accounted for using the equity method | 57 | 17 | (1 | ) | 792 | 438 | ||||||||||||||

Fee and commission income | 12,749 | 11,681 | 10,726 | 9,741 | 9,290 | |||||||||||||||

Fee and commission expense | (2,277 | ) | (1,946 | ) | (1,646 | ) | (1,475 | ) | (1,422 | ) | ||||||||||

Gains/losses on financial assets and liabilities (net) | 2,838 | 2,164 | 3,802 | 2,892 | 2,306 | |||||||||||||||

Exchange differences (net) | (522 | ) | 441 | 444 | 582 | 649 | ||||||||||||||

Other operating income | 8,050 | 8,195 | 7,929 | 9,436 | 6,740 | |||||||||||||||

Other operating expenses | (8,032 | ) | (8,089 | ) | (7,785 | ) | (9,163 | ) | (6,449 | ) | ||||||||||

Total income | 44,078 | 42,049 | 40,204 | 30,896 | 26,415 | |||||||||||||||

Administrative expenses | (17,781 | ) | (16,255 | ) | (14,825 | ) | (11,666 | ) | (10,777 | ) | ||||||||||

Personnel expenses | (10,326 | ) | (9,329 | ) | (8,451 | ) | (6,813 | ) | (6,435 | ) | ||||||||||

Other general administrative expenses | (7,455 | ) | (6,926 | ) | (6,374 | ) | (4,853 | ) | (4,342 | ) | ||||||||||

Depreciation and amortization | (2,109 | ) | (1,940 | ) | (1,596 | ) | (1,240 | ) | (1,247 | ) | ||||||||||

Provisions (net) | (2,601 | ) | (1,133 | ) | (1,792 | ) | (1,641 | ) | (896 | ) | ||||||||||

Impairment losses on financial assets (net) | (11,868 | ) | (10,443 | ) | (11,578 | ) | (6,283 | ) | (3,430 | ) | ||||||||||

Impairment losses on other assets (net) | (1,517 | ) | (286 | ) | (165 | ) | (1,049 | ) | (1,548 | ) | ||||||||||

Gains/(losses) on disposal of assets not classified as non-current assets held for sale | 1,846 | 350 | 1,565 | 101 | 1,810 | |||||||||||||||

Gains/(losses) on non-current assets held for sale not classified as discontinued operations | (2,109 | ) | (290 | ) | (1,225 | ) | 1,731 | 643 | ||||||||||||

Operating profit/(loss) before tax | 7,939 | 12,052 | 10,588 | 10,849 | 10,970 | |||||||||||||||

Income tax | (1,776 | ) | (2,923 | ) | (1,207 | ) | (1,836 | ) | (2,322 | ) | ||||||||||

Profit from continuing operations | 6,163 | 9,129 | 9,381 | 9,013 | 8,648 | |||||||||||||||

Profit/(loss) from discontinued operations (net) | (24 | ) | (27 | ) | 31 | 319 | 988 | |||||||||||||

Consolidated profit for the year | 6,139 | 9,102 | 9,412 | 9,332 | 9,636 | |||||||||||||||

Profit attributable to the Parent | 5,351 | 8,181 | 8,942 | 8,876 | 9,060 | |||||||||||||||

Profit attributable to non-controlling interest | 788 | 921 | 470 | 456 | 576 | |||||||||||||||

Per share information: | ||||||||||||||||||||

Average number of shares (thousands) (1) | 8,892,033 | 8,686,522 | 8,554,224 | 7,271,470 | 6,801,899 | |||||||||||||||

Basic earnings per share (euros) | 0.60 | 0.94 | 1.05 | 1.22 | 1.33 | |||||||||||||||

Basic earnings per share continuing operation (euros) | 0.60 | 0.94 | 1.04 | 1.18 | 1.20 | |||||||||||||||

Diluted earnings per share (euros) | 0.60 | 0.94 | 1.04 | 1.21 | 1.32 | |||||||||||||||

Diluted earnings per share continuing operation (euros) | 0.60 | 0.94 | 1.04 | 1.17 | 1.19 | |||||||||||||||

Remuneration paid (euros) (2) | 0.60 | 0.60 | 0.60 | 0.63 | 0.61 | |||||||||||||||

Remuneration paid (US$) (2) | 0.78 | 0.80 | 0.86 | 0.88 | 0.89 | |||||||||||||||

8

| Year ended December 31, | Year ended December 31, | |||||||||||||||||||||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||||||||||||||||||

| (in millions of euros, except percentages and per share data) | (in millions of euros, except percentages and per share data) | |||||||||||||||||||||||||||||||||||||||

Total assets | 1,251,526 | 1,217,501 | 1,110,529 | 1,049,632 | 912,915 | 1,115,638 | 1,269,600 | 1,251,009 | 1,216,956 | 1,110,399 | ||||||||||||||||||||||||||||||

Loans and advances to credit institutions (net) (3) | 51,726 | 79,855 | 79,837 | 78,792 | 57,643 | 74,964 | 73,900 | 51,726 | 79,855 | 79,837 | ||||||||||||||||||||||||||||||

Loans and advances to customers (net) (3) | 750,100 | 724,153 | 682,551 | 626,888 | 571,099 | 668,856 | 719,112 | 748,541 | 722,504 | 682,551 | ||||||||||||||||||||||||||||||

Investment securities (net) (4) | 154,015 | 174,258 | 173,990 | 124,673 | 132,035 | 142,234 | 152,066 | 154,015 | 174,258 | 173,990 | ||||||||||||||||||||||||||||||

Investments: Associates and joint venture | 4,155 | 273 | 164 | 1,323 | 15,689 | 5,536 | 4,454 | 4,155 | 273 | 164 | ||||||||||||||||||||||||||||||

Contingent liabilities (net) | 48,042 | 59,795 | 59,256 | 65,323 | 76,217 | |||||||||||||||||||||||||||||||||||

Contingent liabilities | 41,049 | 45,033 | 48,042 | 59,795 | 59,256 | |||||||||||||||||||||||||||||||||||

Liabilities | ||||||||||||||||||||||||||||||||||||||||

Deposits from central banks and credit institutions (5) | 143,138 | 140,112 | 142,091 | 129,877 | 112,897 | 109,397 | 152,966 | 143,138 | 140,112 | 142,091 | ||||||||||||||||||||||||||||||

Customer deposits (5) | 632,533 | 616,376 | 506,975 | 420,229 | 355,407 | 607,837 | 626,639 | 632,533 | 616,376 | 506,975 | ||||||||||||||||||||||||||||||

Debt securities (5) | 197,372 | 192,873 | 211,963 | 236,403 | 233,287 | 175,477 | 205,969 | 197,372 | 192,873 | 211,963 | ||||||||||||||||||||||||||||||

Capitalization | ||||||||||||||||||||||||||||||||||||||||

Guaranteed subordinated debt excluding preferred securities and preferred shares (6) | 6,619 | 10,934 | 13,867 | 15,748 | 16,742 | 4,603 | 5,207 | 6,619 | 10,934 | 13,867 | ||||||||||||||||||||||||||||||

Other subordinated debt | 10,477 | 12,189 | 15,193 | 14,452 | 11,667 | 7,483 | 8,291 | 10,477 | 12,189 | 15,193 | ||||||||||||||||||||||||||||||

Preferred securities (6) | 5,447 | 6,917 | 7,315 | 7,622 | 7,261 | 3,652 | 4,319 | 5,447 | 6,917 | 7,315 | ||||||||||||||||||||||||||||||

Preferred shares (6) | 449 | 435 | 430 | 1,051 | 523 | 401 | 421 | 449 | 435 | 430 | ||||||||||||||||||||||||||||||

Non-controlling interest (including net income of the period) | 6,445 | 5,897 | 5,203 | 2,415 | 2,358 | 9,314 | 9,415 | 6,354 | 5,860 | 5,165 | ||||||||||||||||||||||||||||||

Stockholders’ equity (7) | 76,414 | 75,018 | 68,667 | 57,587 | 55,200 | 70,588 | 71,860 | 74,460 | 73,637 | 67,276 | ||||||||||||||||||||||||||||||

Total capitalization | 105,851 | 111,390 | 110,675 | 98,875 | 93,751 | 96,041 | 99,514 | 103,806 | 109,971 | 109,245 | ||||||||||||||||||||||||||||||

Stockholders’ equity per share (7) | 8.59 | 8.64 | 8.03 | 7.92 | 8.12 | |||||||||||||||||||||||||||||||||||

Stockholders’ equity per average share (7) | 6.51 | 7.36 | 8.37 | 8.48 | 7.86 | |||||||||||||||||||||||||||||||||||

Stockholders’ equity per share at the year-end (7) | 6.23 | 6.96 | 8.36 | 8.84 | 8.18 | |||||||||||||||||||||||||||||||||||

Other managed funds | ||||||||||||||||||||||||||||||||||||||||

Mutual funds | 102,611 | 113,510 | 105,216 | 90,306 | 119,211 | 93,304 | 89,176 | 102,611 | 113,510 | 105,216 | ||||||||||||||||||||||||||||||

Pension funds | 9,645 | 10,965 | 11,310 | 11,128 | 11,952 | 10,879 | 10,076 | 9,645 | 10,965 | 11,310 | ||||||||||||||||||||||||||||||

Managed portfolio | 19,200 | 20,314 | 18,364 | 17,289 | 19,814 | 20,987 | 18,889 | 19,200 | 20,314 | 18,364 | ||||||||||||||||||||||||||||||

Total other managed funds | 131,456 | 144,789 | 134,890 | 118,723 | 150,977 | |||||||||||||||||||||||||||||||||||

Total other managed funds (8) | 125,170 | 118,141 | 131,456 | 144,789 | 134,890 | |||||||||||||||||||||||||||||||||||

Consolidated ratios | ||||||||||||||||||||||||||||||||||||||||

Profitability ratios: | ||||||||||||||||||||||||||||||||||||||||

Net yield (8) | 2.74 | % | 2.68 | % | 2.62 | % | 2.05 | % | 1.80 | % | ||||||||||||||||||||||||||||||

Net yield (9) | 2.31 | % | 2.51 | % | 2.72 | % | 2.66 | % | 2.62 | % | ||||||||||||||||||||||||||||||

Return on average total assets (ROA) | 0.50 | % | 0.76 | % | 0.86 | % | 1.00 | % | 1.10 | % | 0.45 | % | 0.24 | % | 0.50 | % | 0.77 | % | 0.86 | % | ||||||||||||||||||||

Return on average stockholders’ equity (ROE) | 7.14 | % | 11.80 | % | 13.90 | % | 17.07 | % | 21.91 | % | 6.10 | % | 2.91 | % | 7.12 | % | 11.75 | % | 14.37 | % | ||||||||||||||||||||

Capital ratio: | ||||||||||||||||||||||||||||||||||||||||

Average stockholders’ equity to average total assets | 6.10 | % | 5.82 | % | 5.85 | % | 5.55 | % | 4.71 | % | 5.90 | % | 5.65 | % | 5.88 | % | 5.87 | % | 5.68 | % | ||||||||||||||||||||

Ratio of earnings to fixed charges (9) | ||||||||||||||||||||||||||||||||||||||||

Ratio of earnings to fixed charges (10) | ||||||||||||||||||||||||||||||||||||||||

Excluding interest on deposits | 1.63 | % | 2.28 | % | 2.01 | % | 1.57 | % | 1.67 | % | 1.72 | % | 1.27 | % | 1.62 | % | 2.27 | % | 2.02 | % | ||||||||||||||||||||

Including interest on deposits | 1.27 | % | 1.52 | % | 1.40 | % | 1.27 | % | 1.35 | % | 1.30 | % | 1.11 | % | 1.26 | % | 1.52 | % | 1.41 | % | ||||||||||||||||||||

Credit quality data | ||||||||||||||||||||||||||||||||||||||||

Loans and advances to customers | ||||||||||||||||||||||||||||||||||||||||

Allowances for impaired balances including country risk and excluding contingent liabilities as a percentage of total gross loans | 2.46 | % | 2.65 | % | 2.55 | % | 1.95 | % | 1.50 | % | 3.59 | % | 3.41 | % | 2.45 | % | 2.63 | % | 2.55 | % | ||||||||||||||||||||

Impaired balances as a percentage of total gross loans | 4.07 | % | 3.75 | % | 3.43 | % | 2.19 | % | 1.05 | % | ||||||||||||||||||||||||||||||

Allowances for impaired balances as a percentage of impaired balances | 60.52 | % | 70.58 | % | 74.32 | % | 89.08 | % | 143.24 | % | ||||||||||||||||||||||||||||||

Impaired balances as a percentage of total gross loans (11) | 5.81 | % | 4.74 | % | 4.07 | % | 3.76 | % | 3.43 | % | ||||||||||||||||||||||||||||||

Allowances for impaired balances as a percentage of impaired balances (11) | 61.76 | % | 72.01 | % | 60.17 | % | 69.99 | % | 74.32 | % | ||||||||||||||||||||||||||||||

Net loan charge-offs as a percentage of total gross loans | 1.38 | % | 1.31 | % | 1.27 | % | 0.60 | % | 0.46 | % | 1.38 | % | 1.36 | % | 1.39 | % | 1.31 | % | 1.27 | % | ||||||||||||||||||||

Ratios adding contingent liabilities to loans and advances to customers and excluding country risk (*) | ||||||||||||||||||||||||||||||||||||||||

Allowances for impaired balances (**) as a percentage of total loans and contingent liabilities | 2.39 | % | 2.58 | % | 2.44 | % | 1.83 | % | 1.42 | % | 3.48 | % | 3.29 | % | 2.38 | % | 2.56 | % | 2.44 | % | ||||||||||||||||||||

Impaired balances (**) (10) as a percentage of total loans and contingent liabilities | 3.89 | % | 3.55 | % | 3.24 | % | 2.02 | % | 0.94 | % | ||||||||||||||||||||||||||||||

Allowances for impaired balances (**) as a percentage of impaired balances (**) | 61.37 | % | 72.74 | % | 75.33 | % | 90.64 | % | 150.55 | % | ||||||||||||||||||||||||||||||

Impaired balances as a percentage of total loans and contingent liabilities (**) (11) | 5.64 | % | 4.54 | % | 3.90 | % | 3.54 | % | 3.24 | % | ||||||||||||||||||||||||||||||

Allowances for impaired balances as a percentage of impaired balances (**)(11) | 61.65 | % | 72.41 | % | 61.02 | % | 72.17 | % | 75.33 | % | ||||||||||||||||||||||||||||||

Net loan and contingent liabilities charge-offs as a percentage of total loans and contingent liabilities | 1.29 | % | 1.21 | % | 1.17 | % | 0.55 | % | 0.41 | % | 1.29 | % | 1.28 | % | 1.29 | % | 1.21 | % | 1.17 | % | ||||||||||||||||||||

| (*) | We disclose these ratios because our credit risk exposure comprises loans and advances to customers as well as contingent liabilities, all of which are subject to impairment and, therefore, allowances are taken in respect thereof. |

| (**) | Impaired or non-performing loans and contingent liabilities, securities and other assets to collect. |

9

| (1) | Average number of shares has been calculated on the basis of the weighted average number of shares outstanding in the relevant year, net of treasury stock. |

| (2) | The shareholders at the annual shareholders’ meeting held on June 19, 2009 approved a |

| (3) | Equals the sum of the amounts included under the headings “Financial assets held for trading”, “Other financial assets at fair value through profit or loss” and “Loans and receivables” as stated in our consolidated financial statements. |

| (4) | Equals the amounts included as “Debt instruments” and “Equity instruments” under the headings “Financial assets held for trading”, “Other financial assets at fair value through profit or loss”, “Available-for-sale financial assets” and “Loans and receivables” as stated in our consolidated financial statements. |

| (5) | Equals the sum of the amounts included under the headings “Financial liabilities held for trading”, “Other financial liabilities at fair value through profit or loss” and “Financial liabilities at amortized cost” included in Notes 20, 21 and 22 to our consolidated financial statements. |

| (6) | In our consolidated financial statements, preferred securities and preferred shares are included under “Subordinated liabilities”. |

| (7) | Equals the sum of the amounts included at the end of each year as “Own funds” and “Valuation adjustments” as stated in our consolidated financial statements. We have deducted the book value of treasury stock from stockholders’ equity. |

| (8) | At December 31, 2013 we held a 50% ownership interest in Santander Asset Management (SAM) and controlled this company jointly with Warburg Pincus and General Atlantic. Funds under “Other managed funds” are mostly managed by SAM. |

| (9) | Net yield is the total of net interest income (including dividends on equity securities) divided by average earning assets. See “Item 4. Information on the Company—B. Business Overview—Selected Statistical Information—Assets—Earning Assets—Yield Spread”. |

| For the purpose of calculating the ratio of earnings to fixed charges, earnings consist of pre-tax income from continuing operations before adjustment for income or loss from equity investees plus fixed charges. Fixed charges consist of total interest expense (including or excluding interest on deposits as appropriate) and the interest expense portion of rental expense. |

| Impaired loans reflect Bank of Spain classifications. These classifications differ from the classifications applied by U.S. banks in reporting loans as non-accrual, past due, restructured and potential problem loans. See “Item 4. Information on the Company—B. Business Overview—Classified Assets—Bank of |

10

Set forth below is a table showing our allowances for impaired balances broken down by various categories as disclosed and discussed throughout this annual report on Form 20-F:

| IFRS-IASB | ||||||||||||||||||||||||||||||||||||||||

| IFRS-IASB | Year Ended December 31, | |||||||||||||||||||||||||||||||||||||||

| Year Ended December 31, | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | (in millions of euros) | |||||||||||||||||||||||||||||||||||

Allowances refers to: | (in millions of euros) | |||||||||||||||||||||||||||||||||||||||

Allowances for impaired balances (*) (excluding country risk) | 19,661 | 20,748 | 18,497 | 12,863 | 9,302 | 25,681 | 26,112 | 19,531 | 20,553 | 18,497 | ||||||||||||||||||||||||||||||

Allowances for contingent liabilities and commitments (excluding country risk) | (648 | ) | (1,011 | ) | (623 | ) | (622 | ) | (587 | ) | ||||||||||||||||||||||||||||||

Less: Allowances for contingent liabilities and commitments (excluding country risk) | 688 | 614 | 648 | 1,011 | 623 | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Allowances for impaired balances of loans (excluding country risk): | 19,013 | 19,737 | 17,874 | 12,241 | 8,715 | |||||||||||||||||||||||||||||||||||

Allowances referred to country risk and other | 210 | 121 | 192 | 660 | 173 | |||||||||||||||||||||||||||||||||||

Allowances for Balances of Loans (excluding country risk): | 24,993 | 25,497 | 18,883 | 19,541 | 17,874 | |||||||||||||||||||||||||||||||||||

Allowances relating to country risk and other | 154 | 98 | 210 | 121 | 192 | |||||||||||||||||||||||||||||||||||

|

|

|

|

| ||||||||||||||||||||||||||||||||||||

|

|

|

|

| ||||||||||||||||||||||||||||||||||||

Allowances for impaired balances (excluding contingent liabilities) | 19,223 | 19,858 | 18,066 | 12,901 | 8,888 | 25,147 | 25,595 | 19,093 | 19,662 | 18,066 | ||||||||||||||||||||||||||||||

Of which: | ||||||||||||||||||||||||||||||||||||||||

Allowances for Loans and receivables: | 18,988 | 19,739 | 17,899 | 12,720 | 8,796 | 24,959 | 25,467 | 18,858 | 19,544 | 17,899 | ||||||||||||||||||||||||||||||

Allowances for Customers | 18,936 | 19,697 | 17,873 | 12,466 | 8,695 | 24,903 | 25,422 | 18,806 | 19,502 | 17,873 | ||||||||||||||||||||||||||||||

Allowances for Credit institutions and other financial assets | 36 | 17 | 26 | 254 | 101 | 37 | 30 | 36 | 17 | 26 | ||||||||||||||||||||||||||||||

Allowances for Debt Instruments | 16 | 25 | 0 | 0 | 0 | 19 | 15 | 16 | 25 | — | ||||||||||||||||||||||||||||||

Allowances for Debt Instruments available for sale | 235 | 119 | 167 | 181 | 92 | 188 | 129 | 235 | 119 | 167 | ||||||||||||||||||||||||||||||

| (*) | Impaired or non-performing loans and contingent liabilities, securities and other assets to collect. |

Exchange Rates

Fluctuations in the exchange rate between euros and dollars have affected the dollar equivalent of the share prices on Spanish stock exchanges and, as a result, are likely to affect the dollar market price of our American Depositary Shares, or ADSs, in the United States. In addition, dividends paid to the depositary of the ADSs are denominated in euros and fluctuations in the exchange rate affect the dollar conversion by the depositary of dividends paid on the shares to the holders of the ADSs. Fluctuations in the exchange rate of euros against other currencies may also affect the euro value of our non-euro denominated assets, liabilities, earnings and expenses.

The following tables set forth, for the periods and dates indicated, certain information concerning the exchange rate for euros and dollars (expressed in dollars per euro), based on the Noon Buying Rate as announced by the Federal Reserve Bank of New York for the dates and periods indicated.

The New York Federal Reserve Bank announced its decision to discontinue the publication of foreign exchange rates on December 31, 2008. From that date, the exchange rates shown below are those published by the European Central Bank (“ECB”), and are based on the daily consultation procedures between central banks within and outside the European System of Central Banks, which normally takes place at 14:15 p.m. ECBCET time.

| Rate During Period | Rate During Period | |||||||||||||||

| Calendar Period | Period End ($) | Average Rate ($) | Period End ($) | Average Rate ($) | ||||||||||||

2007 | 1.46 | 1.38 | ||||||||||||||

2008 | 1.39 | 1.47 | ||||||||||||||

2009 | 1.44 | 1.39 | 1.44 | 1.39 | ||||||||||||

2010 | 1.34 | 1.33 | 1.34 | 1.33 | ||||||||||||

2011 | 1.29 | 1.39 | 1.29 | 1.39 | ||||||||||||

2012 | 1.32 | 1.28 | ||||||||||||||

2013 | 1.38 | 1.33 | ||||||||||||||

11

| Rate During Period | Rate During Period | |||||||||||||||

| Last six months | High $ | Low $ | High $ | Low $ | ||||||||||||

2011 | ||||||||||||||||

2013 | ||||||||||||||||

October | 1.42 | 1.32 | 1.38 | 1.35 | ||||||||||||

November | 1.38 | 1.32 | 1.36 | 1.34 | ||||||||||||

December | 1.35 | 1.29 | 1.38 | 1.35 | ||||||||||||

2012 | ||||||||||||||||

2014 | ||||||||||||||||

January | 1.32 | 1.27 | 1.37 | 1.35 | ||||||||||||

February | 1.35 | 1.30 | 1.38 | 1.35 | ||||||||||||

March | 1.34 | 1.31 | 1.39 | 1.37 | ||||||||||||

April (through April 26) | 1.33 | 1.30 | ||||||||||||||

April (through April 28) | 1.39 | 1.37 | ||||||||||||||

On April 26, 2012,28, 2014, the exchange rate for euros and dollars (expressed in dollars per euro), as published by the ECB, was $1.32.$1.39.

For a discussion of the accounting principles used in translation of foreign currency-denominated assets and liabilities to euros, see Note 2 (a) ofto our consolidated financial statements.

B. Capitalization and indebtedness.

Not Applicable.

C. Reasons for the offer and use of proceeds.

Not Applicable.

Macro-Economic Risks

Because our loan portfolio is concentrated in Continental Europe, the United Kingdom and Latin America, adverse changes affecting the economies of Continental Europe, the United Kingdom or certain Latin American countries could adversely affect our financial condition.

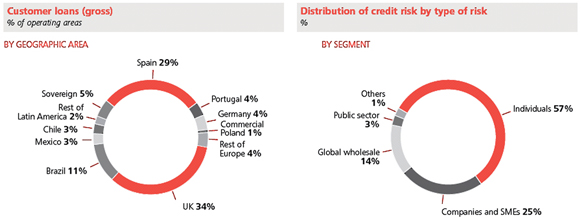

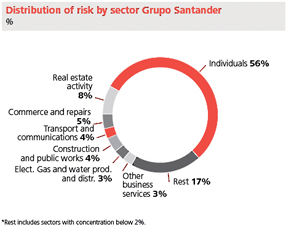

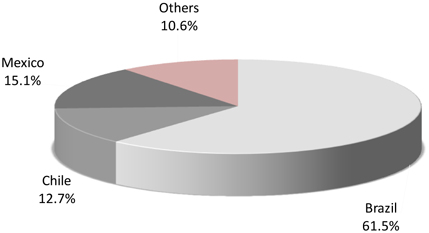

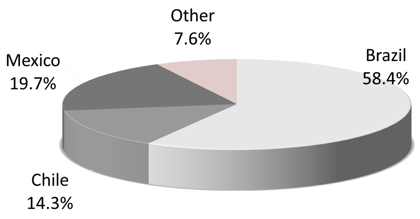

Our loan portfolio is concentrated in Continental Europe (in particular, Spain), the United Kingdom and Latin America. At December 31, 2011,2013, Continental Europe accounted for 42%40% of our total loan portfolio (Spain accounted for 29%24% of our total loan portfolio), while the United Kingdom (where the loan portfolio consists primarily of residential mortgages) and Latin America accounted for 34%35% and 19%20%, respectively. ContinuedAccordingly, the recoverability of these loan portfolios in particular, and our ability to increase the amount of loans outstanding and our results of operations and financial condition in general, are dependent to a significant extent on the level of economic activity in Continental Europe (in particular, Spain), the United Kingdom and Latin America. A return to recessionary economic conditions in the economies of Continental Europe (in particular, Spain), or a return to recessionary conditions in the United Kingdom or the Latin American countries in which we operate, would likely have a significant adverse impact on our loan portfolio and, as a result, on our financial condition, cash flows and results of operations. See “Item 4. Information on the Company—B. Business Overview.”Overview”.

SomeWe are vulnerable to disruptions and volatility in the global financial markets.

In the past six years, financial systems worldwide have experienced difficult credit and liquidity conditions and disruptions leading to less liquidity, greater volatility, general widening of spreads and, in some cases, lack of price transparency on interbank lending rates. Global economic conditions deteriorated significantly between 2007 and 2009, and many of the countries in which we operate fell into recession and some countries have only recently begun to recover and this recovery may not be sustainable. Many major financial institutions, including some of the world’s largest global commercial banks, investment banks, mortgage lenders, mortgage guarantors and insurance companies experienced, and some continue to experience, significant difficulties. Around the world, there have also been runs on deposits at several financial institutions, numerous institutions have sought additional capital or have been assisted by governments, and many lenders and institutional investors have reduced or ceased providing funding to borrowers (including to other financial institutions).

In particular, we face, among others, the following risks related to the economic downturn:

The level of income we derive from certain of our products and services dependsand limit our ability to pursue business opportunities.

Despite recent improvements in certain segments of the global economy, uncertainty remains concerning the future economic environment. There can be no assurance that economic conditions in these segments will continue to improve or that the global economic condition as a whole will improve significantly. Such economic uncertainty could have a negative impact on our business and results of operations. Investors remain cautious and the downgrade of the sovereign debt of France, for example, has induced greater volatility in the capital markets. A slowing or failing of the economic recovery would likely aggravate the adverse effects of these difficult economic and market conditions on us and on others in the financial services industry.

Increased disruption and volatility in the global financial markets could have a material adverse effect on us, including our ability to access capital and liquidity on financial terms acceptable to us, if at all. If capital markets financing ceases to become available, or becomes excessively expensive, we may be forced to raise the rates we pay on deposits to attract more customers and become unable to maintain certain liability maturities. Any such increase in capital markets funding availability or costs or in deposit rates could have a material adverse effect on our interest margins and liquidity.

If all or some of the foregoing risks were to materialize, this could have a material adverse effect on us.

We may suffer adverse effects as a result of the ongoing economic and sovereign debt tensions in the eurozone.

Our results of operations are materially affected by conditions in the capital markets and the economy generally in the eurozone, which, although improving recently, continue to show signs of fragility and volatility and in some cases only sporadic access to capital markets. Interest rate differentials among eurozone countries are affecting government finance and borrowing rates in those economies.

The European Central Bank (the “ECB”) and European Council took actions in 2012 and 2013 to aim to reduce the risk of contagion throughout and beyond the eurozone. These included the creation of the Open Market Transaction facility of the ECB and the decision by eurozone governments to create a banking union. A significant number of financial institutions throughout Europe have substantial exposures to sovereign debt issued by nations that are under financial pressure. Should any of those nations default on their debt, or experience a significant widening of credit spreads, major financial institutions and banking systems throughout Europe could be destabilized, resulting in the further spread of the ongoing economic crisis.

The continued high cost of capital for some European governments has impacted the wholesale markets and there has been a consequent increase in the cost of retail funding, with greater competition in a savings market that is growing slowly by historical standards. In the absence of a permanent resolution of the eurozone crisis, conditions could deteriorate.

We have direct and indirect exposure to financial and economic conditions throughout the eurozone economies. A deterioration of the economic and financial environment could have a material adverse impact on the whole financial sector, creating new challenges in sovereign and corporate lending and resulting in significant disruptions in financial activities at both the market and retail levels. This could materially and adversely affect our operating results, financial position and prospects.

Exposure to sovereign debt could have a material adverse effect on us.

Like many other banks, we invest in debt securities of governments in the geographies in which we operate, including debt securities of the countries that have been most affected by the deterioration in economic conditions, such as Spain, Portugal, Italy and Ireland. Although doubts remain about the solvency of certain countries, the implementation of new regulations by the European Banking Authority may have reduced the risk associated with the sovereign debt of such countries. A failure by any such government to make timely payments under the terms of these securities, or a significant decrease in their market value, could have a material adverse effect on us.

Our growth, asset quality and profitability in Latin America may be adversely affected by volatile macroeconomic and political conditions.

The economies of some of the Latin American countries where we operate experienced significant volatility in recent decades, characterized, in some cases, by slow or regressive growth, declining investment and hyperinflation. This volatility resulted in fluctuations in the levels of deposits and in the relative economic strength of various segments of the economies to which we lend.

Negative and fluctuating economic conditions, such as a changing interest rate environment, impact our profitability by causing lending margins to decrease and leading to decreased demand for higher margin products and services. Negative and fluctuating economic conditions in these Latin American regions could also result in government defaults on public debt. This could affect us in two ways: directly, through portfolio losses, and indirectly, through instabilities that a default in public debt could cause to the banking system as a whole, particularly since commercial banks’ exposure to government debt is high in these Latin American regions.

In addition, our revenues are subject to risk of loss from unfavorable political and diplomatic developments, social instability, and changes in governmental policies, including expropriation, nationalization, international ownership legislation, interest-rate caps and tax policies.

No assurance can be given that our growth, asset quality and profitability will not be affected by volatile macroeconomic and political conditions.

Risks Relating to Our Business

Legal, Regulatory and Compliance Risks

We are exposed to risk of loss from legal and regulatory proceedings.

We face risk of loss from legal and regulatory proceedings, including tax proceedings, that could subject us to monetary judgments, regulatory enforcement actions, fines and penalties. The current regulatory environment in the regions wherejurisdictions in which we operate reflects an increased supervisory focus on enforcement, combined with uncertainty about the evolution of the regulatory regime, and market trends prevailing in those regions. Customer loansmay lead to material operational and deposits, which collectively account for mostcompliance costs.

We are from time to time subject to certain claims and parties to certain legal proceedings incidental to the normal course of our earnings,business, including in connection with conflicts of interest, lending activities, relationships with our employees and other commercial or tax matters. In view of the inherent difficulty of predicting the outcome of legal matters, particularly where the claimants seek very large or indeterminate damages, or where the cases present novel legal theories, involve a large number of parties or are particularly sensitivein the early stages of discovery, we cannot state with confidence what the eventual outcome of these pending matters will be or what the eventual loss, fines or penalties related to economic conditions. In 2011, Continental Europe,each pending matter may be. We believe that we have made adequate reserves related to the costs anticipated to be incurred in connection with these various claims and legal proceedings. However, the amount of these provisions is substantially less than the total amount of the claims asserted against us and in light of the uncertainties involved in such claims and proceedings, there is no assurance that the ultimate resolution of these matters will not significantly exceed the reserves currently accrued by us. As a result, the outcome of a particular matter may be material to our operating results for a particular period, depending upon, among other factors, the size of the loss or liability imposed and our level of income for that period.

We are subject to substantial regulation which could adversely affect our business and operations.

As a financial institution, we are subject to extensive regulation, which materially affects our businesses. For example, we are subject to capital adequacy requirements which, among other things, require us to maintain minimum ratios of regulatory capital to risk-weighted assets. Any failure by us to comply with capital adequacy requirements may result in administrative actions or sanctions which may affect our ability to fulfill our obligations.

Statutes, regulations and policies to which we are subject, in particular those relating to the banking sector and financial institutions, may be changed at any time. For example, in response to the recent financial crisis, regulators world-wide have imposed, and may continue to impose, more stringent capital adequacy requirements, including increasing the minimum regulatory capital requirements imposed on us. Regulators world-wide have also produced a range of proposals for future legislative and regulatory changes which could force us to comply with certain operational restrictions or take steps to raise further capital, or could increase our expenses, or otherwise adversely affect our operating results, financial condition and prospects. The interpretation and the application by regulators of the laws and regulations to which we are subject may also change from time to time. Any legislative or regulatory actions and any required changes to our business operations resulting from such legislation and regulations could result in significant loss of revenue, limit our ability to pursue business opportunities in which we might otherwise consider engaging, affect the value of assets that we hold, require us to increase our prices and therefore reduce demand for our products, impose additional costs on us or otherwise adversely affect our businesses. Accordingly, there can be no assurance that future changes in regulations or in their interpretation or application will not adversely affect us.

Changes in regulations may also cause us to face increased compliance costs and limitations on our ability to pursue certain business opportunities and provide certain products and services. As some of the banking laws and regulations have been recently adopted, the manner in which those laws and related regulations are applied to the operations of financial institutions is still evolving. Moreover, to the extent these recently adopted regulations are implemented inconsistently in the various jurisdictions in which we operate, it may face higher compliance costs. No assurance can be given generally that laws or regulations will be adopted, enforced or interpreted in a manner that will not have a material adverse effect on our business and results of operations.

Extensive legislation affecting the financial services industry has recently been adopted in regions that directly or indirectly affect our business, including Spain, the United Kingdom,States, the European Union, Latin America and Sovereign (US) represented 31%, 12%, 51%other jurisdictions, and 6%, respectively,regulations are in the process of being implemented.

The European Union has created a European Systemic Risk Board to monitor financial stability and has implemented rules with the recommendations to increase capital requirements for certain trading instruments or exposures and to impose compensation limits on certain employees located in affected countries. In addition, the European Union Commission is considering a wide array of other initiatives, including new legislation that will affect derivatives trading, impose surcharges on “globally” systemically important firms and possibly impose new levies on bank balance sheets.

In December 2010, the Basel Committee on Banking Supervision (the “Basel Committee”) reached agreement on comprehensive changes to the capital adequacy framework, known as Basel III. A revised version of Basel III was published in June 2011. Basel III is intended to raise the resilience of the profit attributablebanking sector by increasing both the quality and quantity of the regulatory capital base and enhancing the risk coverage of the capital framework. Among other things, Basel III introduces new eligibility criteria for Common Equity Tier 1, Additional Tier 1 and Tier 2 capital instruments that are intended to raise the quality of regulatory capital, and increases the amount of regulatory capital that institutions are required to hold. Basel III also requires institutions to maintain a capital conservation buffer above the minimum capital ratios in order to avoid certain capital distribution constraints. The capital conservation buffer, to be comprised of Common Equity Tier 1 capital, would result in an effective Common Equity Tier 1 capital requirement of 7 percent of risk-weighted assets. In addition, Basel III directs national regulators to require certain institutions to maintain a counter-cyclical capital buffer during periods of excessive credit growth. Basel III introduces a leverage ratio for institutions as a backstop measure, to be applied from 2018 alongside current risk-based regulatory capital requirements. The changes in Basel III are intended to be phased in gradually between January 2013 and January 2022. The implementation of Basel III in the European Union is being performed through the Capital Requirements Directive IV (“CRD IV”) & Capital Requirements Regulation (“CRR”) legislative package. CRD IV was published in the Official Journal on June 27, 2013 entered into force in July 2013 (being CRR applicable from January 2014), with particular requirements being phased in over a period of time, to be effective by 2019, although requirements relating to certain deductions from Common Equity Tier 1 could be delayed until 2024. CRD IV substantially reflects the Basel III capital and liquidity standards and facilitates the applicable implementation timeframes. However, certain issues continue to remain under discussion and certain details remain to be clarified in further binding technical standards to be issued by the European Banking Authority.

In addition to the Group’s operating areaschanges to the capital adequacy framework published in December 2010 and June 2011 described above, the Basel Committee also published its global quantitative liquidity framework, comprising the Liquidity Coverage Ratio (“LCR”) and Net Stable Funding Ratio (“NSFR”) metrics, with objectives to (1) promote the short-term resilience of banks’ liquidity risk profiles by ensuring they have sufficient high-quality liquid assets to survive a significant stress scenario; and (2) promote resilience over a longer time horizon by creating incentives for banks to fund their activities with more stable sources of funding on an ongoing basis. The LCR has been subsequently revised by the Basel Committee in January 2013 which amended the definition of high-quality liquid assets and agreed a revised timetable for phase-in of the standard from 2015 to 2019, as well as making some technical changes to some of the stress scenario assumptions. As with the Basel Committee’s proposed changes to the capital adequacy framework, the Basel III liquidity standards are being implemented within the European Union through the CRD IV legislative package. In January 2014 the Basel Committee published amendments to the Leverage Ratio and technical revisions to the NSFR ratio, confirming that it remains the intention that the latter ratio, including any future revisions, will become a minimum standard by January 1, 2018. Also, in January 2014, the Basel Committee proposed uniform disclosure standards related to the LCR and issued a new modification to the ratio, which should be adopted by banks from January 1, 2015.

As a Spanish financial institution, the Bank is subject to CRD IV, through which the European Union has implemented the Basel III capital standards and which are in the process of being phased in until January 1, 2019. The CRR is applicable from January 1, 2014 and the CRD IV Directive has already been partially implemented in Spain as of January 1, 2014 by RD-L 14/2013. This Royal Decree-Law has repealed, with effect from January 1, 2014, any Spanish regulatory provisions that may be incompatible with CRR.

In addition to RD-L 14/2013, the Bank of Spain approved on January 31, 2014 its new Circular 2/2014, which derogates its previous Circular 7/2012, and makes certain regulatory determinations contained in CRR pursuant to the delegation contained in RD-L 14/2013, including, relevant rules concerning the applicable transitional regime on capital requirements and the treatment of deductions.

Despite the CRD IV/Basel III framework setting minimum transnational levels of regulatory capital and a measured phase-in, many national authorities have started a race to the top for capital by adopting requirements and interpretation calendars that are more stringent than Basel III’s.

For example, in the last three years the Bank of Spain and the European Banking Authority (the EBA) have imposed new capital requirements in advance of the entering into force of CRD IV. These measures have included Bank of Spain Circular 3/2008 (Circular 3/2008) of May 22, on the calculation and control of minimum capital requirements, which was amended by Bank of Spain Circular 4/2011 (Circular 4/2011) and implements Capital Requirements Directive III in Spain. In addition, some of the requirements of Basel III were already implemented by the Spanish Government in 2011 with Royal Decree-Law 2/2011 (RD-L 2/2011) of February 18 (as amended by Law 9/2012) which established a new minimum requirement in terms of capital on risk-weighted assets (Capital Principal) and required such capital to be greater than 9 per cent from January 1, 2013. RD-L 14/2013 specifically repealed, with effect from January 1, 2014, Title I of Royal Decree-Law 2/2011, which imposed the minimum Capital Principal requirement for credit institutions. Notwithstanding such repeal, as part of the assessment of additional capital requirements that could be required of credit institutions, the Bank of Spain has been given powers to stop or restrict, until December 31, 2014, any distributions of Tier 1 Capital which would have been caught by the minimum Capital Principal requirements stipulated in RD-L 2/2011, provided such distributions, accumulated over the year ended December 31, 2014, exceed in absolute terms the minimum Capital Principal legally required as at December 31, 2013 and further risk non-compliance with additional capital requirements that could be required by the Bank of Spain.

Furthermore, following an evaluation of the capital levels of 71 financial institutions throughout Europe (including the Bank) based on data available as of September 30, 2011, the EBA issued a recommendation on December 8, 2011 pursuant to which, on an exceptional and temporary basis, financial institutions based in the EU should reach a new minimum Core Tier 1 ratio (9 per cent.) by June 30, 2012. This recommendation has been replaced by the EBA recommendation of July 22, 2013 on the preservation of Core Tier 1 capital during the transition to CRD IV. This new recommendation provides for the year. However, manymaintenance of a nominal floor of capital denominated in the relevant reporting currency of Core Tier 1 capital corresponding to the amount of capital needed as at June 30, 2012 to meet the requirements of the economiesabove recommendation of Continental Europe, including SpainDecember 8, 2011. Competent authorities may waive this requirement for institutions which maintain a minimum of 7 per cent of common equity Tier 1 capital under CRD IV rules applied after the transitional period.

In addition, in order to complete the implementation of CRD IV initiated by RD-L 14/2013, the Spanish Ministry of Economy and Portugal, are forecastCompetitiveness has prepared and recently published a draft of a new comprehensive law on the supervision and solvency of financial institutions (the Supervision and Solvency Law), that has been already approved by the Spanish Council of Ministers and is being reviewed in order to have flatbe approved by the Spanish Parliament.

There can be no assurance that the implementation of these new standards will not adversely affect the Bank’s ability to pay dividends or weakening economies in 2012. If therequire it to issue additional securities that qualify as regulatory capital, to liquidate assets, to curtail business environment inor to take any other actions, any of our geographic segments does not improve or worsens, ourwhich may have adverse effects on the Bank’s business, financial condition and results of operations could be materially adversely affected.operations. Furthermore, increased capital requirements may negatively affect the Bank’s return on equity and other financial performance indicators.

Finally, in February 2014 the IMF recommended that the Bank of Spain limit the amount of dividends payable in cash in 2014 by Spanish banking institutions to Our business could be affected if our capital is not managed effectively or if changes limiting our abilitymanage our capital position are adopted.

Effective management of our capital position is important to our ability to operate our business, to continue to grow organically and to pursue our business strategy. However, in response to the recentglobal financial crisis, a number of changes to the regulatory capital framework have been adopted or are beingcontinue to be considered. For example, on December 16, 2010 and January 13, 2011, the Basel Committee on Banking Supervision issued its final guidance on a number of regulatory reforms to the regulatory capital framework in order to strengthen minimum capital requirements, including the phasing out of Innovative Tier 1 Capital instruments with incentives to redeem and implementing a leverage ratio on institutions in addition to current risk-based regulatory requirements. As these and other changes are implemented or future changes are considered or adopted that limit our ability to manage our balance sheet and capital resources effectively or to access funding on commercially acceptable terms, we may experience a material adverse effect on our financial condition and regulatory capital position.

In September 2011, the European Commission (the “Commission”) tabled a proposal for a common system of financial transactions taxes (“FTT”). Despite intense discussions on this proposal there was no unanimity amongst the 27 Member States. Eleven Member States (“participating Member States”) requested enhanced cooperation on a FTT based upon the Commission’s original proposal. The Commission presented a decision to this effect which was adopted by the EU’s Council of Finance Ministers at its committee meeting on January 22, 2013. The proposal of Directive was published on February 14, 2013, under which participating Member States may charge a FTT on all financial transactions where (i) at least one party to the transaction is established in the territory of a participating Member State and a financial institution established in the territory of a participating Member State is a party to the transaction acting either for its own account or for the account of another person, or is acting in the name of a party to the transaction or (ii) a financial institution is a party to a transaction with a financial instrument issued within the territory of a participating Member Estate. We are still assessing the proposals currently under discussion to determine the likely impact on Banco Santander and its affiliates.

The Spanish Government approved on February 3, 2012 the Royal Decree-Law 2/2012 and Law 8/2012, of October 20, 2012, on the clean-up of the financial sector (replacing Royal Decree-Law 18/2012, of May 11, 2012), through which the following actions were performed:

12

The Spanish Government also approved Law 9/2012, of November 14, 2012 which established a new regime on restructuring and resolution of credit institutions and a statutory loss absorbency regime applicable within the framework of restructuring and resolution processes, both based on the legislative proposal for a directive providing for the establishment of an European Union wide framework for the recovery and resolution of credit institutions and investment firms, the first draft of which (and the draft upon which Law 9/2012 was based) was published by the European Commission on June 6, 2012. In June 2012, a number of agreements were reached to reinforce the monetary union, including the definition of a broad roadmap towards a single banking and fiscal union. While support for a banking union in Europe is strong and significant advances have been made in terms of the development of a single-rule book through CRD IV, there is ongoing debate on the extent and pace of integration. On September 13, 2012, the European Parliament approved a proposal for the creation of the Single Supervisory Mechanism, so that 128 of the largest EU banks (including the Bank) will come under the ECB direct oversight from November 2014. The ECB comprehensive assessment includes a supervisory risk assessment, an asset quality review and a stress test to be conducted by national supervisors and the ECB in coordination with the EBA before the ECB becomes the single European bank supervisor in November 2014. The assessment is an important step in preparing the single supervisory mechanism and, more generally, towards bringing about greater transparency of the banks’ balance sheets and consistency of supervisory practices in Europe. The assessment started in November 2013 and will take 12 months to complete, ending in October 2014. The comprehensive assessment consists of three closely interlinked components:Reduced accessReview of the minimum provisioning percentages to be taken into consideration in the estimate of the impairment losses relating to financing granted to the property sector in Spain and to the foreclosed assets and assets received in payment of debt arising from financing granted to that sector, as a result of the impairment of these assets.Increase in the level of minimum capital requirements of Spanish credit institutions on the basis of the assets relating to the property sector in Spain presented on the balance sheet of each entity at December 31, 2012.a supervisory risk assessment – to review, quantitatively and qualitatively, key risks, including liquidity, leverage and funding;an asset quality review (AQR) – to enhance the transparency of bank exposures by reviewing the quality of banks’ assets, including the adequacy of asset and collateral valuation and related provisions;a stress test – to examine the resilience of banks’ balance sheets to stress scenarios.

The assessment will be based on a capital benchmark of 8% Common Equity Tier 1, drawing on the definition of the Capital Requirements Directive IV/Capital Requirements Regulation, including transitional arrangements, for both the AQR and the baseline stress test scenario.

Other open issues include the representation and voting power of non-eurozone countries, the accountability of the ECB to European institutions as part of the Single Supervision Mechanism, the final status of the EBA, the development of a new bank resolution regime and the creation of a common deposit-guarantee scheme. In particular, the Bank Recovery and Resolution Directive (BRRD) and the Deposit Guarantee Schemes Directive were submitted to the European Parliament in June 2013. They have been approved by the European Parliament on April 15, 2014 and approval by the European Council is expected in May 2014 for its official publication. The BRRD is expected to enter into force in 2015, but the bail-in tool will only be operational from 2016. The final regulation on direct recapitalization by the European Stability Mechanism is still pending. European leaders have also supported the reinforcement of the fiscal union but continue negotiating on how to achieve it.

Regulations adopted towards achieving a banking and/or increasesfiscal union in the EU and decisions adopted by the ECB in its future capacity as the Bank’s main supervisory authority may have a material impact on the Bank’s business, financial condition and results of operations.

On January 29, 2014, the European Commission, taking into account the October 2002 report by the High Level Expert Group chaired by Erkki Likannen on the reform of the structure of the EU Banking Sector, proposed new rules to prevent the largest and most complex EU banks with significant trading activities (including us) from engaging in the activity of proprietary trading in financial instruments and commodities. The new proposed regulation would also grant supervisors the power and, in certain instances, the obligation to require the transfer of other high-risk trading activities (such as market-making, complex derivatives and securitization operations) to separate legal trading entities within their group (“subsidiarisation”). Notwithstanding this, banks would have the possibility of not separating activities if they can show to the satisfaction of their supervisor that the risks generated are mitigated by other means. The proposal would also provide rules on the economic, legal, governance, and operational links between the separated trading entity and the rest of the banking group. Furthermore, the proposal is also aimed at increasing transparency of certain transactions in the shadow banking sector.

The European Parliament approved the following dossiers in April 2014 to develop a European Banking Union:

The Single Resolution Fund will be financed with contributions from all banks in the participating Member States. It will be administrated by the Board. The Fund has a target level, to be reached over eight years, of €55 billion and can borrow from the markets by order of the Board. During the transition, the Fund will be divided among national compartments whose resources will be progressively mutualized, starting with 40% of funds in the first year. The Fund and decision-making on its use is regulated by the SRM Regulation, while the transfer of contributions raised nationally towards the Single Fund and the mutualization of the national compartments is set out in an inter-governmental agreement established among the participating Member States.

Regulations adopted on structural measures to improve the resilience of EU credit institutions may have a material impact on the Bank’s business, financial condition and results of operations. These regulations, if adopted, may also cause the Group to invest significant management attention and resources to make any necessary changes.