SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| OR | ||

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the fiscal year ended 31 March | ||

| OR | ||

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| OR | ||

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| Date of event requiring this shell company report | ||

| For the transition period from to | ||

Commission file number: 001-14958

NATIONAL GRID PLC

(Exact name of Registrant as specified in its charter)

England and Wales

(Jurisdiction of incorporation or organization)

1-3 Strand, London WC2N 5EH, England

(Address of principal executive offices)

Helen MahyAlison Kay

011 44 20 7004 3000

Facsimile No. 011 44 20 7004 3004

Group General Counsel and Company Secretary and General Counsel

National Grid plc

1-3 Strand London WC2N 5EH, England

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

Title of each class | Name of each exchange on which registered | |

| Ordinary Shares of 11 17/43 pence each | The New York Stock Exchange* | |

| American Depositary Shares, each representing five | The New York Stock Exchange | |

| Ordinary Shares of 11 17/43 pence each | ||

| 6.625% Guaranteed Notes due 2018 | The New York Stock Exchange | |

| 6.30% Guaranteed Notes due 2016 | The New York Stock Exchange | |

| Preferred Stock ($100 par value-cumulative): | ||

| 3.90% Series | The New York Stock Exchange | |

| 3.60% Series | The New York Stock Exchange |

| * | Not for trading, but only in connection with the registration of American Depositary Shares representing Ordinary Shares pursuant to the requirements of the Securities and Exchange Commission. |

Securities registered or to be registered pursuant to Section 12(g) of the Securities Exchange Act of 1934: None.

Securities for which there is a reporting obligation pursuant to Section 15(d)Section15(d) of the Securities Exchange Act of 1934: None.

The number of outstanding shares of each of the issuer’s classes of capital or common stock as of 31 March 31, 20122014 was

| Ordinary Shares of 11 17/43 pence each |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: Yes þ No ¨o

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No þ

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files): Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer þ | Accelerated filer ¨ | Non-accelerated filer ¨ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ¨ International Financial Reporting Standards as issued by the International Accounting Standards Board þ Other ¨

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

This constitutes the annual report on Form 20-F of National Grid Plcplc (the “Company”) in accordance with the requirements of the US Securities and Exchange Commission (the “SEC”) for the year ended 31 March 20122014 and is dated 125 June 2012.2014. Details of events occurring subsequent to the approval of the annual report on 1618 May 20122014 are summarised in the section titled “Further Information” which forms a part of this Form 20-F . The content of the Group’s website (www.nationalgrid.com/uk) should not be considered to form part of this annual report on Form 20-F.

Form 20-F Cross Reference Table

Item | Form 20-F caption | Location in the document | Page | Form 20-F caption | Location in the document | Page(s) | ||||||||||

1 | Identity of directors, senior management and advisors | Not applicable | – |

Identity of directors, senior management and advisors |

Not applicable | – | ||||||||||

2 | Offer statistics and expected timetable | Not applicable | – |

Offer statistics and expected timetable |

Not applicable | – | ||||||||||

3 | Key Information |

Key Information | ||||||||||||||

3A Selected financial data | “Summary consolidated financial information” | 194-195 | ||||||||||||||

“Financial performance” | 56-63 | |||||||||||||||

“Additional disclosures—Exchange rates” | 189 | 3A Selected financial data | “Additional Information—Summary consolidated financial information” | 186-187 | ||||||||||||

“Strategic Report—Financial review” | 6-9 | |||||||||||||||

“Exchange Rates” | | “Further | | “Financial Statements—Unaudited commentary on consolidated cash flow statement—Net debt” | 91 | |||||||||||

“Additional Information—Other unaudited financial information—Reconciliations of adjusted profit measures” | 182 | |||||||||||||||

3B Capitalization and indebtedness | Not applicable | “Additional Information—Other disclosures—Exchange rates” | 178 | |||||||||||||

| – | “Exchange Rates” | | “Further Information” | | ||||||||||||

3C Reasons for the offer and use of proceeds | Not applicable | 3B Capitalization and indebtedness | Not applicable | – | ||||||||||||

| – | 3C Reasons for the offer and use of proceeds | Not applicable | – | |||||||||||||

3D Risk Factors | “Risk Factors��� | 41-43 | 3D Risk Factors | “Additional Information—Business information in detail—Risk factors” | 167-169 | |||||||||||

4 | Information on the company |

Information on the company | ||||||||||||||

4A History and development of the company | “Delivering our strategy—How do we deliver?—Financial outperformance—Capital investment programme” | 36 | 4A History and development of the company | “Want more information or help?” |

| 192- Back cover |

| |||||||||

“Delivering our strategy—What we delivered this year—Disciplined investment” | 54-55 | “Additional Information—Other disclosures—Key milestones” | 179 | |||||||||||||

Financial position and resources—Summarised balance sheet” | 72-73 | “Strategic Report—Chief Executive’s review” | 4-5 | |||||||||||||

“Additional information—Key milestones” | 185 | �� | “Strategic Report—Our vision and strategy” | 14-15 | ||||||||||||

“Useful Information” | 196 | “Strategic Report—Operating environment” | 12-13 | |||||||||||||

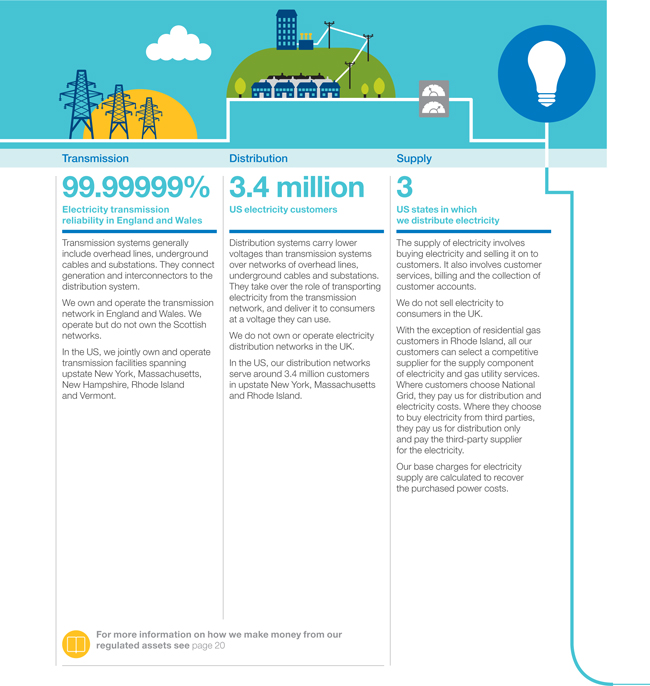

4B Business overview | “Operating across two geographies” | 15 | “Additional Information—Other disclosures—Articles of Association” | 176-177 | ||||||||||||

“Our business model—What we do” | 16-23 | “Financial Statements—Consolidated statement of financial position—Unaudited commentary on consolidated statement of financial position—Property, plant and equipment” | 89 | |||||||||||||

“Our operating environment—Regulatory environment” | 24-29 | “Financial Statements—Consolidated cash flow statement—Unaudited commentary on consolidated cash flow statement—Net capital expenditure” | 91 | |||||||||||||

“Risk factors—Infrastructure security and IT systems—We may suffer a major network failure or interruption, or may not be able to carry out critical non network operations” | 41 | “Additional Information—Other unaudited financial information—Commentary on consolidated financial statements for the year ended 31 March 2013” | 183-185 | |||||||||||||

4C Organizational structure | “Note 36 to the consolidated financial statements—Principal subsidiary undertakings” | 169 | “Financial Statements—Notes to the consolidated financial statements—2. Segmental analysis—(c) Capital expenditure, depreciation and amortisation” | 95 | ||||||||||||

4D Property, plants and equipment | “Operating across two geographies” | 15 | “Strategic Report—How our strategy creates value” | 21 | ||||||||||||

“Delivering our strategy—How do we deliver?—Environmental responsibility” | 34-35 | 4B Business overview | “Additional Information—Business information in detail—Where we operate” | 166 | ||||||||||||

“Financial position and resources—Summarised balance sheet—Property, plant and equipment” | 72 | “Strategic Report—Operating environment” | 12-13 | |||||||||||||

“Additional disclosures—Property, Plant and equipment” | 185 | “Strategic Report—Our vision and strategy”; “—What we do—Electricity”; “—What we do—Gas”; “—How we make money from our regulated assets”; and “—How our strategy creates value” | 14-21 | |||||||||||||

“Note 19 to the consolidated financial statements—Borrowings” | 142 | |||||||||||||||

4A | Unresolved staff comments | “Additional disclosures—Unresolved staff comments” | 185 | |||||||||||||

5 | Operational and financial review and prospects | |||||||||||||||

5A Operating results | “Financial performance” | 56-63 | ||||||||||||||

“Principal operations” | 64-71 | |||||||||||||||

“Financial position and resources—Net debt” | 74-76 | |||||||||||||||

“Note 32 to the consolidated financial | 156 | |||||||||||||||

i

Item | Form 20-F caption | Location in the document | ||||||

| 14 | |||||||

“Strategic Report—Principal operations” | 29-38 | |||||||

“Strategic Report—Non-financial KPIs” | 10-11 | |||||||

“Financial | 93-96 | |||||||

“Additional Information—Business information in detail—Risk factors—Infrastructure and IT systems—We may suffer a major network failure or interruption, or may not be able to carry out critical non network operations due to the failure of technology supporting our business-critical processes”; “—Changes in law or regulation or decisions by governmental bodies or regulators could materially adversely affect us”; and “—Customers and counterparties—Customers and counterparties may not perform their obligations” | 167 168 169 | |||||||

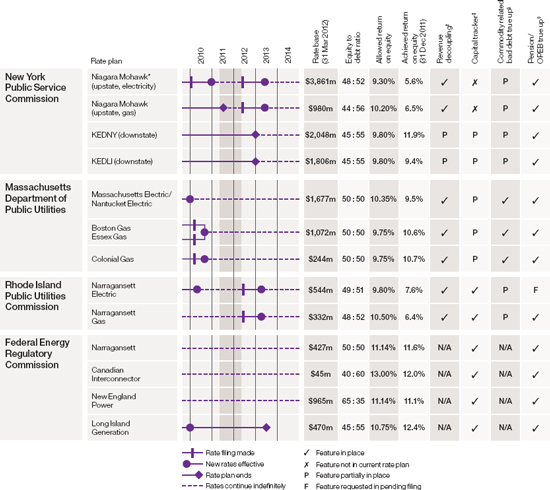

“Additional Information—Business information in detail—UK regulation”; “—US regulation”; and “—Summary of US price controls and rate plans” | 160-165 | |||||||

“Strategic Report—How we make money from our regulated assets” | 20 | |||||||

4C Organizational structure | “Financial Statements—Notes to the consolidated financial statements—32. Subsidiary undertakings, joint ventures and associates—Principal subsidiary undertakings” | 146 | ||||||

4D Property, plants and equipment | “Additional Information—Business information in detail—Where we operate” | 166 | ||||||

“Strategic Report—What we do—Electricity”; “—What we do—Gas”; and “—How we make money from our regulated assets” | 16-20 | |||||||

“Strategic Report—Principal operations” | 29-38 | |||||||

“Strategic Report—Our vision and strategy—Embed sustainability” and “—Drive growth” | 15 | |||||||

“Strategic Report—Operating environment—Changing energy mix”; “—Energy policy”; “—Regulation”; and “—Innovation and technology” | 12-13 | |||||||

“Financial Statements—Consolidated statement of financial position—Unaudited commentary on consolidated statement of financial position—Property, plant and equipment” | 89 | |||||||

“Additional Information—Other disclosures—Property, plant and equipment” | 179 | |||||||

“Financial Statements—Notes to the consolidated financial statements—11. Property, plant and equipment” | 111-112 | |||||||

“Financial Statements—Notes to the consolidated financial statements—19. Borrowings” | 119-121 | |||||||

4A | Unresolved staff comments | “Additional Information—Other disclosures—Unresolved SEC staff comments” | 181 | |||||

ii

Item | Form 20-F caption | Location in the document | Page(s) | |||||

5 | Operating and financial review and prospects | |||||||

5A Operating results | “ | 6-9 | ||||||

“Strategic Report—Operating environment” | ||||||||

“Additional Information—Business information in detail—UK regulation”; “—US regulation”; and “—Summary of US price controls and rate plans” | 160-165 | |||||||

“Strategic Report—Principal operations” | 29-38 | |||||||

“Financial Statements—Consolidated income statement—Unaudited commentary on the consolidated income statement” | 85 | |||||||

“Financial Statements—Notes to the consolidated financial statements—2. Segmental analysis—Unaudited commentary on the results of our principal operations by segment” | 96 | |||||||

“Additional Information—Other unaudited financial information” | 182-185 | |||||||

“Financial Statements—Notes to the consolidated financial statements—30. Financial risk management—(d) Currency risk” | 140-141 | |||||||

5B Liquidity and capital resources | “Strategic Report—Financial | |||||||

“ | ||||||||

| ||||||||

“Financial | ||||||||

“Additional Information—Business information in detail—Risk factors—Financing and liquidity—An inability to access capital markets at commercially acceptable interest rates could affect how we maintain and grow our business” | 169 | |||||||

“Financial Statements—Notes to the consolidated financial statements—2. Segmental analysis—Unaudited commentary on the results of our principal operations by segment” | 96 | |||||||

“Financial Statements—Notes to the consolidated financial statements—26. Net debt” | 130-131 | |||||||

“Financial Statements—Notes to the consolidated financial statements—19. Borrowings” | 119-121 | |||||||

“Financial Statements—Notes to the consolidated financial statements—15. Derivative financial instruments” | 114-116 | |||||||

“Additional Information—Business information in detail—Federal Energy Regulatory Commission—Short-term borrowing extension” | 164 | |||||||

“Additional Information—Directors’ Report disclosures—Material interests in shares” | ||||||||

“Material | | “Further Information” | | |||||

| ||||||||

5C Research and development, patents and licenses, etc. | “Additional | |||||||

5D Trend information | “Strategic Report—Financial | |||||||

“Strategic Report—Principal operations” | ||||||||

“Strategic Report—Operating environment” | 12-13 | |||||||

5E Off-balance sheet arrangements | “Financial |

iii

Item | Form 20-F caption | Location in the document | Page(s) | |||||

5F Tabular disclosure of contractual obligations | “ | |||||||

5G Safe Harbor | “Important notice” | |||||||

“Want more information or help?—Cautionary | Back cover | |||||||

6 | Directors, senior management and employees | |||||||

6A Directors and senior management | “ | |||||||

“Additional Information—Directors’ Report disclosures—Board biographies” | 171-173 | |||||||

6B Compensation | “Corporate Governance—Remuneration Report” | |||||||

“ | ||||||||

“ | ||||||||

“ | ||||||||

“Share | | “Further Information” | | |||||

6C Board practices | “Corporate Governance— | |||||||

“ | ||||||||

“Corporate Governance—Audit Committee”; “—Finance Committee”; “—Safety, Environment and Health Committee”; “—Nominations Committee”; “—Executive Committee”; and “—Management committees” | 49-57 | |||||||

“Corporate Governance—Remuneration Report—Annual statement from the Remuneration Committee chairman” | 58-59 | |||||||

“Corporate Governance—Remuneration Report—Future policy table—Executive Directors” | 60-63 | |||||||

“Corporate Governance—Remuneration Report—Future policy table—Non-executive Directors (NEDs)” | 63 | |||||||

“Corporate Governance—Remuneration Report—Service contracts and policy on payment for loss of office” and “—Dates of Directors’ service

| ||||||||

6D Employees | “ | |||||||

“Additional Information—Other disclosures—Employees” | ||||||||

6E Share ownership | “Corporate Governance—Remuneration Report—Shareholding requirement” and “—Differences in remuneration policy for all employees” | 64 | ||||||

“Corporate Governance—Remuneration Report—Statement of Directors’ shareholdings and share interests (audited information)” | 70-71 | |||||||

iiiv

Item | Form 20-F caption | Location in the document | ||||||

| “Corporate Governance—Remuneration Report— | |||||||

“Additional Information—Other disclosures—The All-employee Share Plans” | 181 | |||||||

“ | | Information” | ||||||

7 | Major shareholders and related party transactions | |||||||

7A Major shareholders | “Additional Information—Directors’ Report disclosures—Material interests in shares” | |||||||

“Material interests in shares” | “Further Information” | |||||||

7B Related party transactions | “ | |||||||

7C Interests of experts and counsel | Not applicable | – | ||||||

8 | Financial information | |||||||

8A Consolidated statements and other financial information | ||||||||

“Financial Statements—Report of Independent Registered Public Accounting | ||||||||

“ | ||||||||

“ | ||||||||

“ | ||||||||

“Financial Statements—Notes to the consolidated financial | 92-131 | |||||||

“Financial Statements—Notes to the consolidated financial statements – supplementary information” | ||||||||

“Strategic Report—Chairman’s statement” | 2-3 | |||||||

8B Significant changes | “Subsequent Events” | | “Further | | ||||

9 | The offer and listing | |||||||

9A Offer and listing details | “Additional Information—Other disclosures—The offer and listing—Price history” | |||||||

“Price | | “Further | | |||||

“ | ||||||||

“Exchange Rates” | | “Further | | |||||

9B | Not applicable | |||||||

9C Markets | “ | |||||||

9D Selling shareholders | Not applicable | – | ||||||

9E Dilution | Not applicable | – | ||||||

9F Expenses of the issue | Not applicable | – | ||||||

10 | Additional information | |||||||

10A Share capital | Not applicable | – | ||||||

10B Memorandum and articles of association | “Additional Information—Other disclosures— | |||||||

|

| |||||||

|

| |||||||

|

| |||||||

|

| |||||||

|

| |||||||

|

| |||||||

|

| |||||||

|

| |||||||

|

| |||||||

| ||||||||

iii

Item | Form 20-F caption | Location in the document | Page | |||||

Financial risk” | ||||||||

“Note 33 to the consolidated financial statements—Commodity risk” | 162-164 | |||||||

“Financial position and resources” | 72-77 | |||||||

11B Qualitative information about market risk | “Note 31 to the consolidated financial statements—Supplementary information on derivative financial instruments” | 155-156 | ||||||

“Note 32 to the consolidated financial statements—Financial risk” | 157-162 | |||||||

“Note 33 to the consolidated financial statements—Commodity risk” | 162-164 | |||||||

“Financial position and resources”

| 72-77 | |||||||

12 | Description of securities other than equity securities | |||||||

12A Debt securities | Not applicable | – | ||||||

12B Warrants and rights | Not applicable | – | ||||||

12C Other securities | Not applicable | – | ||||||

12D American depositary shares | “Additional disclosures—Description of securities other than equity securities depositary fees and charges” | 189 | ||||||

“Definitions and glossary of terms”

| 190 | |||||||

13 | Defaults, dividend arrearages and delinquencies | Not applicable | – | |||||

14 | Material modifications to the rights of security holders and use of proceeds | Not applicable | – | |||||

15 | Controls and procedures | “Internal control over financial reporting” | 47 | |||||

16 | 16A Audit committee financial expert | “Corporate Governance—Audit Committee—Experience” | 88 | |||||

16B Code of ethics | “Additional disclosures—Code of Ethics” | 184 | ||||||

16C Principal accountant fees and services | “Corporate Governance—Audit Committee—External Audit” | 89 | ||||||

“Note 2 to the consolidated financial statements—(e) Auditors’ remuneration” | 128 | |||||||

16D Exemptions from the listing standards for audit committees | Not applicable | – | ||||||

16E Purchases of equity securities by the issuer and affiliated purchasers | Not applicable | – | ||||||

16F Change in registrant’s certifying accountant | Not applicable | – | ||||||

16G Corporate governance | “Additional disclosures—Corporate governance practices: differences from New York Stock Exchange (NYSE) listing standards” | 184 | ||||||

16H Mine safety disclosure | Not applicable | – | ||||||

17 | Financial statements | Not applicable | – | |||||

18 | Financial statements | “Accounting policies” | 112-118 | |||||

“Adoption of new accounting standards” | 119 | |||||||

Consolidated primary statements” | 120-124 | |||||||

“Notes to the consolidated financial statements” | 125-150 | |||||||

“Notes to the consolidated financial statements—supplementary information” | 151-176 | |||||||

“Report of Independent Registered Public Accounting Firm” | 111 | |||||||

19 | Exhibits | Filed with the SEC | – |

iv

Business Review

An energy networks business focused on generating shareholder value through both dividends and asset/equity growth by investing in essential assets under predominantly regulated market conditions to service long-term, sustainable, consumer led demands.

|

|

| ||||||||

| ||||||||

| ||||||||

|

| |||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

|

|  |

www.nationalgrid.com

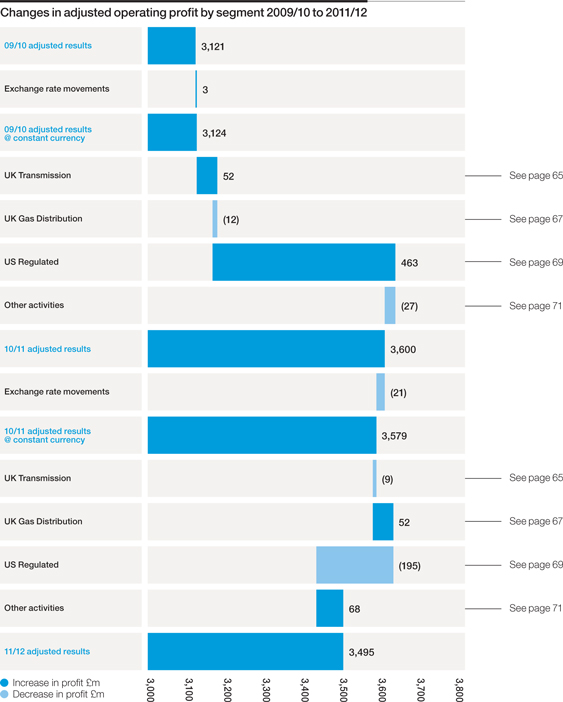

£3,495m-3%

Adjusted operating profit†2010/11: £3,600m

+8% excluding the impact of timing and major storms

51.3p+1%

Adjusted earnings per share† 2010/11: 50.9p (i)

$14.5bn+1%

US rate base 2010/11: $14.3bn

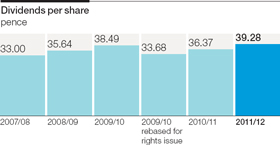

39.28p+8%

Ordinary dividends 2010/11: 36.37p

£3,539m-6%

Operating profit 2010/11: £3,745m

+5% excluding the impact of timing and major storms

57.1p-9%

Earnings per share 2010/11: 62.9p (i)

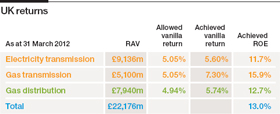

£22.2bn+7%

UK regulatory asset value 2010/11: £20.8bn

10.9%

Group return on equity‡ 2010/11: 10.8%

Our financial results are reported in sterling. The average exchange rate, as detailed on page 57, was $1.60 to £1 in 2011/12 compared with the average rate of $1.57 to £1 in 2010/11. Except as otherwise noted, the figures in this Report are stated in sterling or US dollars. All references to dollars or $ are to the US currency.

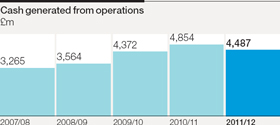

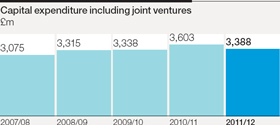

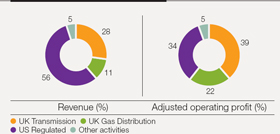

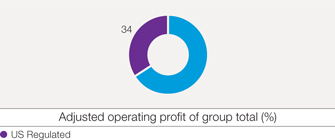

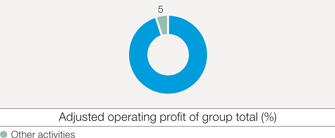

Business analysis 2011/12

Geographical analysis 2011/12

Annual Report and Accounts 2011/12National Grid plc01

Business Review

National Grid is an international electricity and gas company based in the UK and northeastern US. We play a vital role in connecting millions of people safely, reliably and efficiently to the energy they use.

Directors’ Report

The Directors’ Report, prepared in accordance with the requirements of the Companies Act 2006 and the UK Listing Authority’s Listing, and Disclosure and Transparency rules, comprising pages 8 to 107 and 184 to 189 was approved by the Board and signed on its behalf by:

Helen Mahy

Company Secretary & General Counsel

16 May 2012

The location within the main body of the Annual Report of the specific requirements of the Directors’ Report can be found in the checklist on page 81.

Segmental reporting

The performance of our principal businesses is reported by segment, reflecting the management responsibilities and economic characteristics of each activity.

Throughout this report, the following colours are used to indicate references to a particular segment:

Activities which do not fall within these segments are reported separately and are identified as:

Discussion relating to the Company as a whole is identified as:

If you require a full search facility, please go to the pdf of the Annual Report and Accounts 2011/12 in the investor relations section of our website and use a word search.

Important notice

This document contains certain statements that are neither reported financial results nor other historical information. These statements are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. For a description of factors that could affect future results, reference should be made to the full cautionary statement on the back cover of this document and to the risk factors section on pages 41 to 43.

www.nationalgrid.com

IFC to 79

Corporate Governance

80 to 107

Financial Statements

108 to 183

| ||

Additional Information

184 to 198

|

Annual Report and Accounts 2011/12National Grid plc03

Business Review

Sir Peter Gershon, Chairman

Results

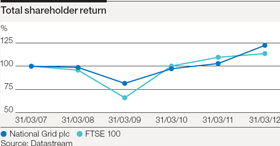

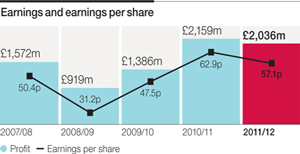

I am pleased to announce a good set of results for 2011/12. Adjusted earnings per share increased by 1% to 51.3 pence per share, compared to 50.9(i) pence per share in 2010/11. This increase is particularly pleasing in light of the significant timing differences and major storm costs incurred this year.

Dividend policy

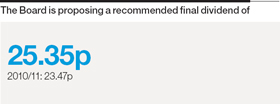

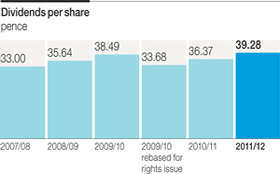

The Board is proposing a final dividend of 25.35 pence per share making a total of 39.28 pence per share for the 2011/12 financial year. This represents an increase of 8% from last year.

Our dividend is an important part of our returns to shareholders along with growth in the value of the asset base attributable to equity holders. This year is the last of our current dividend policy, which has been in place since January 2008. The Board has agreed a new one year dividend policy under which we plan to increase the dividend by 4% in nominal terms over the proposed dividend of 39.28 pence for 2011/12. This policy reflects the outcome from the one year TPCR4 rollover review and forecast inflation of around 3% for the same period. It will apply to the interim dividend to be paid in January 2013 and the final dividend to be paid in August 2013. We expect to announce a longer-term dividend policy after the current regulatory review is complete and its implications are clear.

Safety

This year has seen three fatalities occur. Any fatality associated with our business, whether an employee, contractor or member of the public, is deeply regrettable. Following thorough investigations, we are undertaking a wide range of measures to ensure we learn from these tragic events.

Safety is a top priority and will remain at the forefront of our core objectives. The Board’s governance arrangements for the oversight of safety are being strengthened and the Chief Executive is leading a new drive to further improve our safety performance. We will always be exposed to high risk working environments on a daily basis and embedding safety procedures and principles in our people is a key part of improving our performance. We continue to foster the belief across our businesses that all accidents can be avoided.

Operating responsibly

We are mindful of our responsibility to the environments in which we operate and ensuring we continue operating in a socially responsible manner is fundamental to our continued delivery of sustainable profits and creating long-term value for our investors.

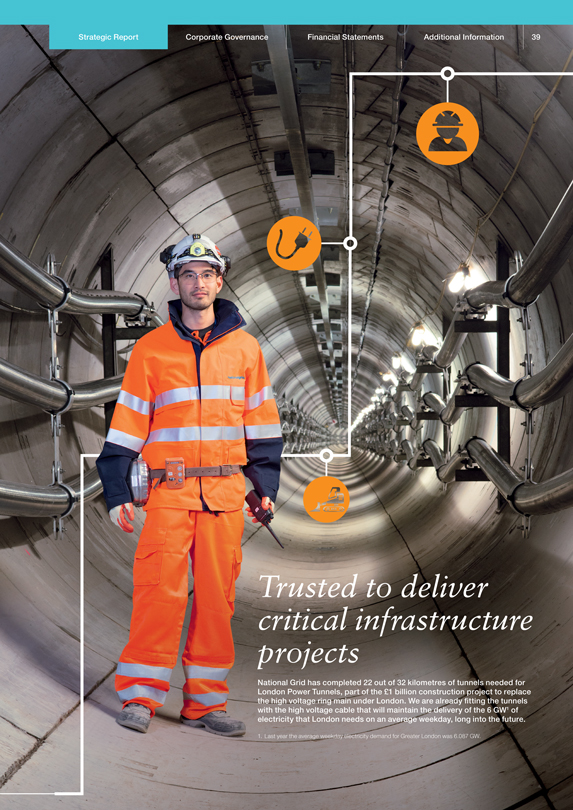

This year, we have made significant contributions across a number of areas including new education initiatives, such as the opening of the London tunnels energy education centre, our ongoing partnership with Special Olympics Great Britain and our work in the US on the engineering our future initiative. Our UK and US employees also continue to give up their time to volunteer and support community projects such as City Year. Details of a range of activities we and our employees support are available on our website.

Innovation is a key driver in our business, especially when it comes to connecting new sources of energy. The UK public debate around overhead lines versus underground cables provokes strong opinion and we are mindful of Government guidance when developing new connections and consider carefully the impact of our work on local communities. What is clear is that, at higher voltages, undergrounding is much more expensive. The right balance between landscape and affordability needs to be struck with society deciding whether it is

04National Grid plcAnnual Report and Accounts 2011/12

www.nationalgrid.com

willing to accept the higher cost. We continue to work with those concerned to inform the debate, while also exploring innovative solutions to issues such as the visual impact of pylons (see page 50).

We have established a new energy partnership with the Buffalo Niagara medical campus which engages community stakeholders in innovative energy initiatives and helps support economic development and growth in the region. This partnership aims to set the benchmark for future energy efficient living and offers valuable insight into how people can embrace smart technologies in their everyday lives.

People

I am privileged to have taken over the role as Chairman of National Grid and would like to thank Sir John Parker for his personal contribution to the Company’s success during his time as chairman, and for all the guidance and support he offered during my induction. I am delighted to be his successor.

A balance of skills, experience, knowledge and diversity is key to an effective Board and will remain a priority as we continue to refresh the composition of our Board over the next two years, as outlined on page 81. During the year, we welcomed Ruth Kelly and Paul Golby as Non-executive Directors. Both bring with them independence, knowledge and experience which will be invaluable as we address future opportunities and challenges.

Furthermore, Nora Brownell will join our Board as a Non-executive Director from 1 June 2012. Nora brings with her a vast amount of experience of the US energy industry and regulatory environment that will help further strengthen our Board.

Stephen Pettit and Linda Adamany will step down from the Board with effect from 30 July and 31 October 2012 respectively. Both have made an invaluable contribution to the Board, with Stephen chairing our Risk & Responsibility Committee for a number of years. I would like to thank them both for their committed service.

We must continue to develop robust succession planning for our Directors and senior management by actively looking to recruit new and diverse talent into the business, and by ensuring our existing employees are developed and challenged to reach their full potential. Attracting new talent into the business through innovative recruitment drives, the development of new recruits, our apprentice schemes and the maintenance of our graduate programme as one of the industry leading programmes, will continue to form part of our focus.

The Board is aware of the ongoing discussions and opinions being voiced with regard to executive remuneration and the heightened profile of this topic. We acknowledge this is an important area for shareholders. Our new chair of the Remuneration Committee is focused on this matter and we have taken steps to enhance our disclosures as part of the Remuneration Report starting on page 90.

The Chairman’s Awards, a global employee recognition scheme, are an excellent initiative introduced by my predecessor and I am delighted to offer these my full support. This year attracted more than 160 submissions and the winners will be announced in June. They provide a perfect illustration of the talent and tireless effort of our employees to make National Grid an improved place to work and to make positive contributions to local communities. We were particularly interested in ideas to improve safety and wellbeing in the workplace and are pleased that a number of the initiatives submitted really strove to go the extra mile and demonstrate innovation.

Governance

We are again committed to setting the tone at the top and look to adopt best practice in corporate governance. Personally, I am dedicated to this approach and will continue to ensure that, as a Board, we remain engaged in exploring ways that can further improve our performance. Further details on Board evaluation and effectiveness are provided on page 82.

Outlook

The Board and I remain committed to delivering increased shareholder value and returns. We are more focused than ever on improving our safety performance, recognising the need for all our employees and contractors to be able to operate safely on a day-to-day basis to enable our business to continue to operate at an optimum level.

I extend my thanks to our US employees, who demonstrated outstanding commitment in responding to the severe storms experienced earlier this year, as well as to all our employees for their hard work and dedication to the success of the Company. This reinforces my belief that we are well positioned to meet the future opportunities and challenges we face.

Sir Peter Gershon

Annual Report and Accounts 2011/12National Grid plc05

Business Review

Steve Holliday, Chief Executive

Over the course of 2011/12, we have made good progress on our key priorities: disciplined investment; delivering improved performance and returns in the US; preparing for the new regulatory arrangements in the UK; and focusing on operational excellence across all our principal operations, in particular, through our restructuring of the US business and UK Gas Distribution. We remain at the centre of the challenge to connect future energy solutions in both the UK and northeastern US and continue to progress these through ongoing engagement with our stakeholders.

Financials

Throughout 2011/12, we have delivered good financial performance. Adjusted operating profit is up 8%, excluding the timing differences that benefited 2010/11 and the impact of two major storms in the US. We delivered another significant year of capital expenditure with £3.4 billion reflecting the sustained investment in our regulated activities. The launch of our first UK RPI linked retail bond proved a great success, raising further capital as well as securing a new investor base. We continued to manage our portfolio of businesses in a disciplined manner, releasing value through sales of two of our non-regulated businesses, OnStream in the UK and Seneca-Upshur in the US.

In November, Ofgem published final proposals for the one year (2012/13) transmission price control rollover for our UK Transmission business (TPCR4). These included real increases in revenues for electricity and gas transmission, reflecting the capital investment we have made over the current price control period.

Safety

Safety remains a top priority, as our financial and business performance must always be underpinned by a strong safety record. I must reiterate the message from our Chairman; the three fatalities associated with our business are deeply regrettable.

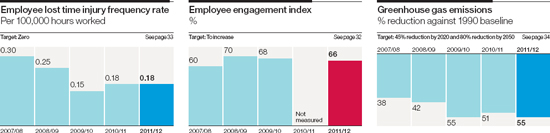

During 2011/12, our injury frequency rate was unchanged at 0.18. This remains an area where we must increase our efforts and strive to achieve zero injuries. Last year we focused on trends associated with high potential incidents and mitigating actions, our incident review process, and ever increasing engagement across the entire leadership team. These actions will continue to be in place going forward as we accept that more must be done to ensure all employees and contractors operate safely.

Delivering our strategy

We own and manage the networks to which many different energy sources are connected. That puts us at the heart of one of the greatest challenges facing our society: creating new sustainable energy solutions for the future and developing an energy system that can support economic prosperity in the 21st century.

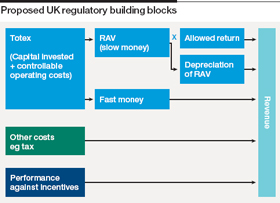

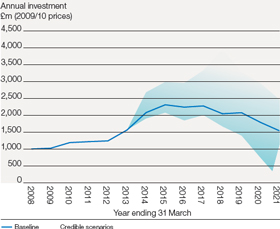

This year, our programme of capital expenditure continued to be largely driven by our UK electricity and gas businesses and improvement of our networks. Highlighted in our business plans, submitted in support of the new regulatory framework RIIO (revenue = incentives + innovation + outputs), the level of investment in this area is planned to reach £31 billion through to 2021. We continue to work with Ofgem to reach an acceptable RIIO outcome for our UK regulated businesses. Details on the new framework can be found on page 25.

Following last year’s announcement of the changes in our US business, we have an increased local focus that has helped improve, in particular, our performance and responsiveness when interacting with our customers and regulators. Through the reorganisation, we were also able to achieve the targeted annualised cost saving of $200 million. The increased local engagement has already seen positive results. In December 2011, NYPSC approved our request to recover certain deferred costs and a portion of recent storm costs in our Niagara Mohawk electricity business. In April 2012, we also submitted important new rate filings for our Niagara Mohawk and Narragansett businesses.

In December, the UK Government published its technical update for the Electricity Market Reform bill, which is expected to be passed into legislation during the current parliamentary session. The changes proposed will be key in shaping investment decisions in new generation capacity and it is envisaged that we will assume responsibility for administration of the new framework for renewable and low carbon generation payments.

Operational

Maintaining a safe and reliable supply is a critical part of our job. Operationally we have performed well, with reliability of the UK electricity and gas transmission network at more than 99%. However, during the severe winter of 2010/11 we failed standards for uncontrolled gas escapes in all four of our networks and for controlled gas escapes in two of them, resulting in a fine of £4.3 million from Ofgem. The lessons we learnt were used to improve plans for the winter of 2011/12 when we met all our targets.

06National Grid plcAnnual Report and Accounts 2011/12

www.nationalgrid.com

In the US, our reliability was 93%. However, these figures always exclude major storms and 2011/12 was an exceptional year for weather events. Over the summer we faced tropical storm Irene, flooding and tornadoes, while in Massachusetts, an unseasonal snow storm in October affected 92% of the communities we serve. The level of devastation experienced as a result of these storms was huge and the process of rebuilding communities and replacing infrastructure was a challenge. The response, passion and commitment of our teams and the support we received from neighbouring states, were exceptional. The process of restoring power to communities can always be improved, but in such exceptional circumstances I am proud of the efforts of all those involved.

In December 2011, LIPA announced that we had not been selected to continue to manage and operate Long Island’s electricity system beyond the term of the current agreement, expiring on 31 December 2013. We are naturally disappointed by this decision, but our substantive assets on Long Island are not affected. We will continue to provide high quality services for the remainder of our contract and support the complex transition.

Customer

We remain determined to improve customer service and further understand customers’ needs so we can serve them in the most effective and efficient manner. This year has seen the opening of our new UK Gas Distribution customer centres, specifically designed to provide a more responsive and integrated service. The result of this and other initiatives implemented are already showing, with our customer satisfaction increasing by an average of 5.5% this year. Further improvement is important to us and will have even greater significance under the new regulatory framework, with incentives being introduced. Embedding customer focus now should enable us to be ready for this.

In the US, our results have been mixed. However, the success of the new structure and the deeper engagement with our stakeholders is already starting to improve relationships, with positive feedback being received. The ‘elevate 2015’ programme aims to design and implement more customer focused processes better aligned to meeting their needs, and by doing so, will enable greater improvement in our customer service performance.

We continue to progress efficiency initiatives across all our businesses. The UK Gas Distribution front office programme has successfully implemented replacement systems and streamlined core business processes that should help us move to upper quartile

customer performance. In addition, our US foundations project, which will integrate multiple information systems and improve control processes, is on target for late 2012 implementation. It aims to deliver a single financial system, a single cost allocation methodology and enhanced jurisdictional and functional reporting.

People

Our people form the foundation of our business. Personally, I remain committed to developing all of them to the best of their abilities. We need to deliver the planned increase in capital expenditure and without the correct people and capabilities we will be unable to meet this challenge.

In the UK, over the next nine years we are looking to recruit in the region of 2,500 engineers – a mixture of experienced engineers and development programme trainees – to support our investment programme. In the US, we also expect to fill around 800 management roles requiring an engineering background over the next 10 years. Developing talent is vital to our success and we recognise our role in enthusing the next generation of young people to pursue science, technology and mathematics at school and beyond. We are working with schools and partnerships to bring alive the opportunities that exist via the different routes into industry. Over the last year, our UK employees interacted with more than 3,900 students through work experience, Imagineering clubs and open days, and our US employees continue to be active in supporting local schools and communities. Our focus on inspiring the younger generation into engineering and science will continue on both sides of the Atlantic.

This year saw an 84% response rate to the employee survey. I am pleased with this, as the results provide a true reflection of how we are doing. Overall, our results have improved from the last survey, with customer and safety both scoring higher. There is still more work to be done on engagement and, as a leadership team across the Company, we are already starting to address this area.

Looking forward

The scale of the challenges we face over the next decade is significant, as we must deliver the networks to support future needs. Our job remains to connect people safely and reliably to the energy they use; this is a privileged position.

Our priorities for 2012/13 are focused towards:

|

|

|

|

|

|

Steve Holliday

Annual Report and Accounts 2011/12National Grid plc07

Business Review

1. Sir Peter Gershon CBE,

Chairman

Appointment to the Board: 1 August 2011 as Deputy Chairman, Chairman with effect from 1 January 2012

Committee membership: N (ch)

Career experience: Previous appointments include Chairman of Premier Farnell plc, Chief Executive of the Office of Government Commerce and Managing Director of Marconi Electronic Systems.

External appointments: Chairman of Tate & Lyle plc, member of the UK Defence Academy Advisory Board and HM Government Efficiency Board.

2. Steve Holliday,

Chief Executive

Appointment to the Board: October 2002, appointed to National Grid Group plc 2001, Chief Executive with effect from January 2007

Committee membership: E (ch), F

Career experience: Formerly Executive Director of British Borneo Oil and Gas; he also spent 19 years within the Exxon Group, where he held senior positions in the international gas business and managed major operational areas such as refining and shipping.

External appointments: Non-executive Director of Marks and Spencer Group plc and Chairman of the UK Business Council for Sustainable Energy, Crisis UK, the Technician Council and a member of the Board of Trustee Directors for Business in the Community and Infrastructure UK Advisory Council.

3. Andrew Bonfield,

Finance Director

Appointment to the Board: November 2010

Committee membership: E, F

Career experience: Chief Financial Officer at Cadbury plc until March 2010; he also spent five years as Executive Vice President & Chief Financial Officer of Bristol-Myers Squibb Company and has previous experience in the energy sector as Finance Director of BG Group plc.

External appointments: Non-executive Director of Kingfisher plc.

4. Tom King,

Executive Director, US

Appointment to the Board: August 2007

Committee membership: E

Career experience: President of PG&E Corporation and Chairman and CEO of Pacific Gas and Electric Company from 2003 to 2007, having held a number of senior positions within the PG&E group since joining in 1998. Senior management positions with Kinder Morgan Energy Partners and Enron Corporation.

5. Nick Winser,

Executive Director, UK

Appointment to the Board: April 2003

Committee membership: E

Career experience: Previously Chief Operating Officer of the US transmission business for National Grid Transco plc having joined The National Grid Company plc in 1993, becoming Director of Engineering in 2001. Prior to this, Nick had been with Powergen since 1991 as principal negotiator on commercial matters.

External appointments: Non-executive Director of Kier Group plc and co-Chair of the Energy Research Partnership.

6. Ken Harvey CBE,

Non-executive Director and

Senior Independent Director

Appointment to the Board: October 2002, appointed to Lattice Group plc board in 2000, Senior Independent Director with effect from October 2004

Committee membership: N, R (ch), R&R

Career experience: Formerly Engineering Director and then Deputy Chairman of London Electricity and Chairman and Chief Executive of NORWEB plc.

External appointments: Chairman of Pennon Group Plc.

7. Linda Adamany,

Non-executive Director

Appointment to the Board: November 2006

Committee membership: A, N, R&R

Career experience: Various executive roles for BP in both the UK and US, including Chief Executive of BP Shipping and Group Vice President and Commercial Director, BP Refining & Marketing and until April 2008, Group Vice President, BP plc.

8. Philip Aiken,

Non-executive Director

Appointment to the Board: May 2008

Committee membership: A, N, R&R

Career experience: Formerly Group President of BHP Billiton’s Energy business, Executive Director of BTR plc, held senior roles in BOC Group plc and was senior advisor to Macquarie Capital (Europe) Limited.

External appointments: Chairman of Robert Walters plc, Deputy Chairman of AVEVA Group plc, Non-executive and Senior Independent Director of Kazakhmys PLC and Non-executive Director of Miclyn Express Offshore Limited and Essar Energy plc.

9. Paul Golby CBE,

Non-executive Director

Appointment to the Board: 1 February 2012

Committee membership: N, R, R&R

Career experience: Formerly Executive Director of Clayhithe plc before joining East Midlands Electricity plc in 1998 as Managing Director. Appointed as Chief Executive of E.ON UK plc in 2002, and later additionally as Chairman, stepping down from the E.ON Board in December 2011.

External appointments: Non-executive Chairman of AEA Technology Group plc, Chairman of Engineering UK, Chair of the Engineering and Physical Sciences Research Council and a member of the Council for Science and Technology.

10. Ruth Kelly,

Non-executive Director

Appointment to the Board: 1 October 2011

Committee membership: A, F, N

Career experience: Various senior roles in Government from 2001 to 2008, including Secretary of State for Transport, Secretary of State for Communities and Local Government, Secretary of State for Education and Skills and Financial Secretary to the Treasury.

External appointments: Managing Director at HSBC and Governor for the National Institute of Economic and Social Research.

11. Stephen Pettit,

Non-executive Director

Appointment to the Board: October 2002, appointed to Lattice Group plc board in 2001

Committee membership: F, N, R, R&R (ch)

Career experience: Formerly Chairman of ROK plc, Executive Director of Cable & Wireless plc and Chief Executive, Petrochemicals at British Petroleum.

External appointments: Non-executive Director of Halma p.l.c and a member of BT Group plc’s Equality of Access Board.

12. Maria Richter,

Non-executive Director

Appointment to the Board: October 2003

Committee membership: A, F (ch), N

Career experience: With Morgan Stanley from 1993 to 2002, latterly as Managing Director of its Corporate Finance Retail Group; Vice President of Independent Power Group for Salomon Brothers and Vice President of Prudential Capital Corporation and Power Funding Associates.

External appointments: Non-executive Chairman of Pro Mujer UK and Non-executive Director of The Pantry, Inc., The Vitec Group plc and The Bessemer Group Inc.

08National Grid plcAnnual Report and Accounts 2011/12

www.nationalgrid.com

standards” |  | |

|

Annual Report and Accounts 2011/12National Grid plc09v

Item | Form 20-F caption | Location in the document | Page(s) | |||||

“Additional Information—Directors’ Report disclosures—Share capital” | 174-175 | |||||||

10C Material contracts | “Additional Information—Other disclosures—Material contracts” | 179 | ||||||

10D Exchange controls | “Additional Information—Other disclosures—Exchange controls” | 178 | ||||||

10E Taxation | “Additional Information——Other disclosures—Taxation” | 179-181 | ||||||

10F Dividends and paying agents | Not applicable | – | ||||||

10G Statement by experts | Not applicable | – | ||||||

10H Documents on display | “Additional Information—Other disclosures—Documents on display” | 178 | ||||||

10I Subsidiary information | Not applicable | – | ||||||

11 |

Quantitative and qualitative disclosures about market risk | |||||||

11A Quantitative information about market risk | “Financial Statements—Notes to the consolidated financial statements—15. Derivative financial instruments” | 114-116 | ||||||

“Financial Statements—Notes to the consolidated financial statements—30. Financial risk management—(a) Credit risk”; “—(b) Liquidity risk”; “—(c) Interest rate risk”; “—(d) Currency risk”; “—(e) Commodity risk”; “—(f) Capital risk management”; and “—(g) Fair value analysis” | 137-144 | |||||||

“Strategic Report—Financial review” | 6-9 | |||||||

11B Qualitative information about market risk | “Financial Statements—Notes to the consolidated financial statements—15. Derivative financial instruments” | 114-116 | ||||||

“Financial Statements—Notes to the consolidated financial statements—30. Financial risk management—(a) Credit risk”; “—(b) Liquidity risk”; “—(c) Interest rate risk”; “—(d) Currency risk”; “—(e) Commodity risk”; “—(f) Capital risk management”; and “—(g) Fair value analysis” | 137-144 | |||||||

“Strategic Report—Financial review” | 6-9 | |||||||

“Additional Information—Risk factors” | 167-169 | |||||||

12 | Description of securities other than equity securities | |||||||

12A Debt securities | Not applicable | – | ||||||

12B Warrants and rights | Not applicable | – | ||||||

12C Other securities | Not applicable | – | ||||||

12D American depositary shares | “Additional Information—Other disclosures—Description of securities other than equity securities: depositary fees and charges” | 178 | ||||||

“Additional Information—Other disclosures—Depositary payments to the Company” | 177 | |||||||

“Additional Information—Definitions and glossary of terms” | 188-191 | |||||||

13 |

Defaults, dividend arrearages and delinquencies | Not applicable | – | |||||

14 |

Material modifications to the rights of security holders and use of proceeds | Not applicable | – | |||||

15 |

Controls and procedures | “Additional Information—Internal control— Disclosure controls” and “—Internal control over financial reporting” | 170 |

vi

Item | Form 20-F caption | Location in the document | Page(s) | |||||

16 | 16A Audit committee financial expert | “Corporate Governance—Audit Committee—Experience” | 49 | |||||

16B Code of ethics | “Additional Information—Other disclosures—Code of Ethics” | 177 | ||||||

16C Principal accountant fees and services | “Corporate Governance—Audit Committee—External audit” | 51 | ||||||

“Financial Statements—Notes to the consolidated financial statements—3. Operating costs—(e) Auditors’ remuneration” | 98 | |||||||

16D Exemptions from the listing standards for audit committees | Not applicable | – | ||||||

16E Purchases of equity securities by the issuer and affiliated purchasers | Not applicable | – | ||||||

16F Change in registrant’s certifying accountant | Not applicable | – | ||||||

16G Corporate governance | “Additional Information—Other disclosures—Corporate governance practices: differences from New York Stock Exchange (NYSE) listing standards” | 177 | ||||||

16H Mine safety disclosure | Not applicable | – | ||||||

17 | Financial statements | Not applicable | – | |||||

18 | Financial statements | “Financial Statements—Company accounting policies” | 155 | |||||

“Financial Statements—Basis of preparation” | 82-83 | |||||||

“Financial Statements—Recent accounting developments” | 83 | |||||||

“Financial Statements—Consolidated income statement”; “—Consolidated statement of comprehensive income”; “—Consolidated statement of changes in equity”; “—Consolidated statement of financial position”; and “—Consolidated cash flow statement” | 84-91 | |||||||

“Financial Statements—Notes to the consolidated financial statements—analysis of items in the primary statements” | 92-131 | |||||||

“Financial Statements—Notes to the consolidated financial statements—supplementary information” | 132-154 | |||||||

“Financial Statements—Report of Independent Registered Public Accounting Firm—Audit opinion for Form 20-F” | 81 | |||||||

19 | Exhibits | Filed with the SEC | – |

vii

Business Review

Board diversity and succession

We believe creating an inclusive and diverse culture supports the attraction and retention of talented people, improves effectiveness, delivers superior performance and enhances the success of the Company. While criteria such as gender or ethnicity are important, we also value diversity of skills, experience, knowledge and expertise, as can be seen below. Our Board brings together people with different experience and backgrounds, and sometimes divergent opinions, but with shared goals.

|  |  |  | |||||||||

|

|

|

| |||||||||

Strategic Report | Corporate Governance | Financial Statements | Additional Information | 01 | ||||||||

Strategic Report pages 02 to 41 | ||||

02 | ||||

| 04 | Chief Executive’s review | |||

| 06 | Financial review | |||

| 10 | Non-financial KPIs | |||

| 12 | Operating environment | |||

| 14 | Our vision and strategy | |||

| 16 | What we do | |||

| 20 | How we make money from our regulated assets | |||

| 21 | How our strategy creates value | |||

| 22 | Internal control and risk management | |||

| 26 | How executive remuneration aligns to Company strategy | |||

| 29 | Principal operations | |||

| 40 | ||||

Corporate Governance pages 42 to 73 | ||||

The Corporate Governance Report, introduced by the Chairman, contains details about the activities of the Board and its committees during the year, including reports from the Audit, Nominations, Remuneration, Finance, and Safety, Environment and Health Committees, as well as details of our shareholder engagement activities. | ||||

| 42 | Corporate Governance contents | |||

| 57 | Directors’ Report statutory and other disclosures | |||

58 | ||||

Financial Statements pages 74 to 159 | ||||

Including the independent auditors’ reports, consolidated financial statements prepared in accordance with IFRS and notes to the consolidated financial statements, as well as the Company financial statements prepared in accordance with UK GAAP. | ||||

| 74 | Contents of financial statements | |||

| 75 | Introduction to the financial statements | |||

| 76 | Statement of Directors’ responsibilities | |||

| 77 | Independent auditors’ report | |||

81 | Report of Independent Registered Public Accounting Firm | |||

Additional Information pages 160 to the inside back cover | ||||

Additional disclosures and information, definitions and glossary of terms, summary consolidated financial information and other useful information for shareholders, including contact details for more information or help. | ||||

| 160 | Contents of Additional Information | |||

188 | Definitions and glossary of terms | |||

Glossary | ||||

We use a number of technical terms and abbreviations within this document. For brevity, we do not define terms or provide explanations every time they are used; please refer to the glossary on pages 188 to 191 for this information. | ||||

02 National Grid Annual Report and Accounts 2013/14 | ||||||||||||||||||||

|  |  | |||||||||

statement | Our vision statement ‘Connecting you to your energy today, trusted to help you meet your energy needs tomorrow’ emphasises the importance of trust, which we earn not just by meeting our commitments, but by making sure that we do so in the right way. | ||||||||||

| ||||||||||||

It has been an important and challenging year for National Grid – and the energy sector in general – on both sides of the Atlantic. Although we did not experience any major storm-related outages in our service areas during 2013/14, severe winter weather conditions – the polar vortex in the US and serious flooding in the UK – continued to test the resilience of our networks. I am pleased to report these have performed well as a result of prudent investments in past years, as well as the commitment of our people. Energy policies in both the UK and US strive to find an acceptable balance between affordability to the ultimate consumers, security of supply and sustainability considerations. Particularly since last September, the focus of UK media and political attention has been moving between each of these three factors, with no enduring consensus of what constitutes the optimum position. In the UK, the eight year RIIO settlement we accepted in February 2013 incentivises us to be as efficient as possible while ensuring that savings we achieve can be shared with consumers. Through these incentives we can maximise our efforts to help hard-pressed consumers and deliver good returns to our shareholders.

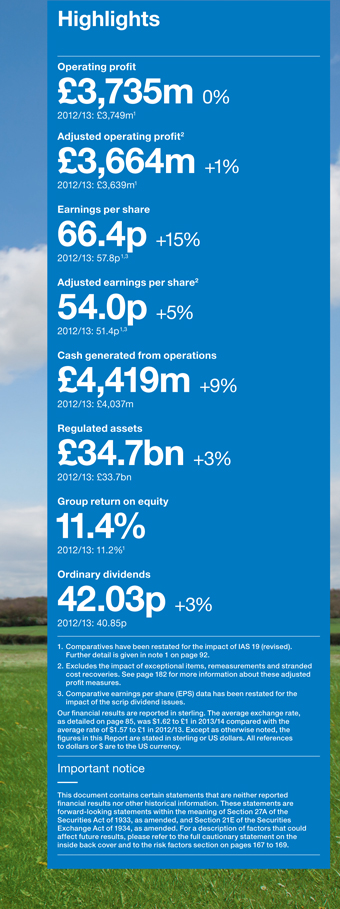

In our continuing efforts to be fair, balanced and understandable in our reporting we are including additional information this year and explaining some technical matters in greater detail, so that we are as transparent as we can be. In particular, I draw your attention to one aspect of our results. There have always been differences between IFRS reported results and underlying economic performance; however, one of the benefits of the RIIO price control regime is that it provides greater transparency of regulatory adjustments to | revenue in our principal UK businesses. The commentary on ‘timing differences and regulated revenue adjustments’ contained in the Financial review on page 08 aims to help understanding of this matter. The Board has recommended an increase in the final dividend to 27.54p per ordinary share ($2.3107 per American Depositary Share). If approved, this will bring the full-year dividend to 42.03p per ordinary share ($3.4801 per American Depositary Share), an increase of 2.9% over the 40.85p per ordinary share in respect of the financial year ending 31 March 2013.

We have developed a new remuneration policy to align more closely with RIIO, the continued evolution of our US business and shareholder value creation. The policy will be subject to shareholder approval at the AGM in July – a requirement of recent legislation. You can read our full Remuneration Report, introduced by Jonathan Dawson, our new Remuneration Committee Chairman, on page 58. As we describe on page 07, the high level of take-up of the scrip dividend in the last couple of years led to concerns about the potential dilutive effect of this option. This meant that we decided not to offer the scrip element for the 2013/14 interim dividend paid in January this year, as our forecast capital investment programme was already fully funded. I do appreciate, from the letters sent to me, that this caused some dissatisfaction. We have now identified a way of offering the scrip option for both the full-year and interim dividend, which balances shareholders’ appetite for the scrip dividend option with our cash requirements. At the AGM we are seeking approval for the allotment and buy-back authorities we need to do this. The scrip dividend option has been offered for the 2013/14 final dividend subject to shareholder approval of the relevant resolutions at the AGM. | |||||||||||

The Board is proposing

|

|

|

| ||||||||||||||

Strategic Report | Corporate Governance | Financial Statements | Additional Information | 03 |

Nick Winser, Executive Director UK, will step down from the Board in July 2014 at the AGM. He will continue with his roles as President of the European Network of Transmission System Operators for Electricity (ENTSO-E) and as Chairman of National Grid Electricity Transmission (NGET) and National Grid Gas (NGG) through to July 2015 before leaving the Company. After July 2015, the role of President of ENTSO-E will no longer be undertaken within the Company, and arrangements for a smooth handover of Nick’s other responsibilities will be announced in due course. This year we have welcomed Therese Esperdy and John Pettigrew to our Board and we will be saying goodbye to Maria Richter following the AGM. During Maria’s 10 years with the Company she has made a significant contribution to the Board and Finance Committee in particular and I would like to thank her for her commitment and wish her all the best in her future endeavours. Therese, who will be taking over as chairman of the Finance Committee from Maria, brings a wealth of corporate finance and debt market experience to our Board. We have also appointed a new Executive Director, John Pettigrew. John joined National Grid as a graduate entrant in 1991 and has been a member of the Executive Committee for nearly two years. The appointments of Therese and John have been part of a significant transition of the Board over the last three years through which we have secured a broad range of skills, experience, perspectives and challenge. Together with strong teamwork, I believe these qualities are contributing towards an effective Board, which will continue to set the right tone from the top, helping to meet the challenges ahead. | contributed £1.4 billion in taxes in the UK alone. Additionally, we estimate we support more than 28,500 jobs in the first tier of our supply chain – companies that are our suppliers across the globe. We aim to develop and operate our business with an inclusive and diverse culture. You can read more about our approach to diversity on page 41, as well as our Board diversity policy on page 56. Looking ahead Over the next 12 months the UK and US will see a dynamic political environment. In the UK, the Scottish independence referendum later this year and the general election in 2015 are likely to increase the focus on issues such as the affordability and security of energy supply, as will the proposed review of the energy industry by the Competition and Markets Authority. In the US, the mid-term US Congressional elections are on the horizon, together with the gubernatorial elections (election of the state governor) in New York, Rhode Island and Massachusetts. We expect debate to continue on essential infrastructure, resilience and sustainability, including our Connect21 dialogue with stakeholders. You can read more about Connect21 on page 35. Our people have a crucial role to play in meeting the opportunities ahead. I would like to thank our employees for their hard work and dedication over the past year. Rising to the challenges brought by severe weather and changes within the industry, they have continued to make National Grid a company we can be proud of. |

Governance pages 42 – 57 | ||||||

Being a responsible business Our vision statement ‘Connecting you to your energy today, trusted to help you meet your energy needs tomorrow’ emphasises the importance of trust, which we earn not just by meeting our commitments, but by making sure that we do so in the right way. That is why how we work is as important as what we do, and why doing the right thing is at the core of everything we do. During 2013/14 we spent time reinforcing the standards we expect of our employees in terms of ethical behaviour. As part of this, we have sent our employees a refreshed copy of ‘Doing the Right Thing’, which is our guide to ethical business conduct. We contribute to the communities in which we operate directly and indirectly in many ways. We maintain and operate the critical infrastructure needed to keep the lights on and the heating working across the UK and northeastern US; we employ more than 23,000 people; and in 2013/14 |  | |||||||

10National Grid plcAnnual Report and Accounts 2011/12

www.nationalgrid.com

Davies Review

In relation to gender diversity, as a result of the transition of our Board, see page 81, we expect the number of female Board members to fluctuate in coming months. We aspire to meet the targets set by Lord Davies by 2015 and the Board will be considering a formal diversity policy during the year ahead.

Our executive and leadership population is regularly and rigorously assessed against achievement of individual objectives and key leadership qualities to help build a sustainable development and succession plan. The Board reviews the talent pipeline to the

Executive Committee and the quality and diversity of talent further down the organisation. Individuals who are identified as potential successors to the Executive Committee within a three year timeframe also undergo an external benchmarking and assessment process carried out by an independent third party. At the same time, we have initiated a programme of executive sponsorship and mentoring of high potential female and minority ethnic managers in order to ensure increased diversity throughout the leadership of the Company.

|

|

|

| |||||||||||

04 National Grid Annual Report and Accounts 2013/14 | ||||||||||||||

|

| ||||||||

| |||||||||

It has been a year of solid performance for National Grid against a backdrop of intense public focus on energy prices, as well as new regulatory frameworks in both the UK and US. Safety is, as always, at the heart of the way we operate. In the UK we achieved an employee lost time injury frequency rate (IFR) of below 0.1. This is a world-class performance and I am incredibly proud of our teams who have worked so hard to get us to this significant milestone. You can read more about this achievement on page 10. The challenge now is to replicate this performance in the US, where we have more work to do. We will never let up on our relentless focus on safety. Despite the freezing and protracted winter in the US and the wettest winter on record in the UK, we achieved one of our best years in terms of reliability, keeping the lights on and the gas flowing. The investment we made in bolstering our flood defences in the UK protected potentially vulnerable assets such as substations, even though in some cases the surrounding areas suffered considerable flooding. In the US, our reliability performance was excellent as a result of continued targeted resiliency investment and management of our networks. The introduction of RIIO in the UK has been an appropriate development for our industry. If we can outperform against the incentives it offers and find ways to reduce our costs, the benefits are shared with our customers. Getting ready for RIIO has been a significant challenge for the UK business, but I am delighted to say that we have made a good start. There have also been significant Government and regulatory policy changes affecting our business in the UK, including the introduction of Electricity Market Reform (EMR) and the evolution of the system operator role in the long-term planning of the network. | We have adapted our ways of working so we can meet the needs of our customers and stakeholders and deliver value under RIIO. For example, we used innovative techniques to protect a section of the pipeline that carries gas from the liquefied natural gas (LNG) importation terminal in west Wales, prior to the construction of a new road. This meant we were able to meet the timescales of the local authority building the road without disrupting gas supply to consumers. In the US, it has been the first year of working under the new upstate New York and Rhode Island regulatory contracts and I am pleased that we have performed well in both cases. You can read more about developments in our US rate filings and regulatory environment on page 164. We have introduced Connect21, our thinking on advancing the USA’s natural gas and electricity infrastructure beyond its 20th century limitations (see page 35). Another priority in the US was the transition of the operation and maintenance of the Long Island Power Authority’s (LIPA) electric transmission and distribution system on Long Island to Public Service Electric and Gas Company – Long Island (PSEG-LI). We successfully handed over the contract on 31 December 2013 and have entered into a transition services agreement with LIPA/PSEG-LI. US enterprise resource planning system stabilisation continued, remedying the errors of poor implementation from the prior year. Over the course of the year, the US business made significant progress in the activities required to upgrade the system, with implementation expected in mid-2014. The focus is now on reducing the ongoing costs associated with the complex manual processes that are required to compensate for identified weaknesses in internal controls over financial reporting in the US. While these control weaknesses have not reduced the quality of financial statements |

|

|

| ||||||||||||

| ||||||||||||||

|

Annual Report and Accounts 2011/12National Grid plc11

Business Review

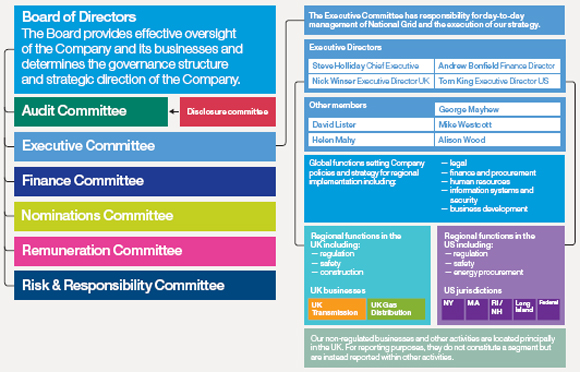

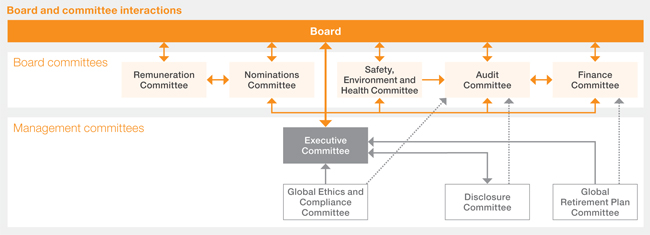

The Board’s purpose is to create and deliver the long-term success of the Company and returns for shareholders.

There are a number of areas where the Board takes the lead, for example around corporate governance, strategic direction, financial policy – including the budget and business plan – and the reputation of the Company and its businesses.

The composition of the Board and the diverse skills and experience our Directors bring to the table are vital for ensuring shareholders’ interests are best represented and that there is sufficient constructive challenge and debate.

Our Non-executive Directors commit sufficient time to perform their duties and to understand the Company, for example through their work on the Committees, site visits, induction programmes for new Directors and meetings with management and employees.

While the Board delegates authority to its Committees to carry out certain tasks on its behalf – as set out in each Committee’s terms of reference, available on our website – it ensures that what has been discussed and any decisions taken are communicated to the other Directors. The chairman of each Committee provides a summary back to the Board at the following meeting.

For more information on the operation of the Board and its Committees refer to pages 80 to 89.

12National Grid plcAnnual Report and Accounts 2011/12

www.nationalgrid.com

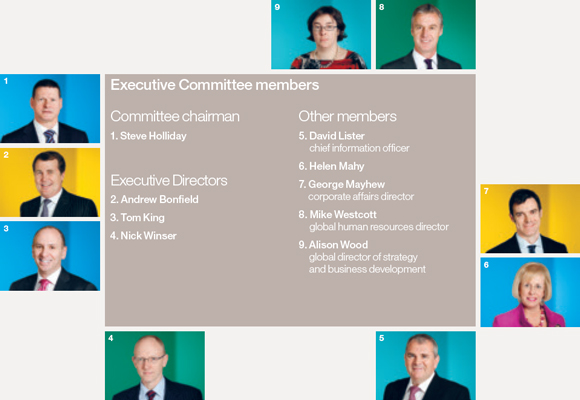

The Executive Committee has responsibility for making day-to-day management and operational decisions to safeguard the interests of the Company.

The nine members of the Committee have a broad range of skills and expertise which is constantly being updated through training and development, as well as through holding external non-executive directorships. This broadens experience and gives exposure to other companies’ governance frameworks and board practices. The Committee officially met 11 times this year but interaction among the members occurs much more regularly.

The Committee oversees the safety, operational and financial performance of the Company, taking management action it considers necessary to safeguard the interests of the Company and is responsible for furthering the strategy, business objectives and targets established by the Board. It approves capital and operational expenditure within its authority levels and regularly discusses, formulates and approves proposals to be considered by the Board.

Although the other members of the Committee do not sit on the Board, they all regularly attend Board meetings and other Committees (with Helen Mahy, the Company Secretary & General Counsel, attending all Board and Nominations Committee meetings as secretary) to ensure that every member is fully up to date and knowledge is shared.

|

Annual Report and Accounts 2011/12National Grid plc13

Business Review

14National Grid plcAnnual Report and Accounts 2011/12

www.nationalgrid.com

|

Annual Report and Accounts 2011/12National Grid plc15

Business Review

In common with all international companies, we operate in a complex environment with a number of external factors affecting our operations.

UK energy policy

The Climate Change Act 2008 requires the UK to cut greenhouse gas (GHG) emissions by 34% from the 1990 levels by 2020 and 80% by 2050. Continuing the drive toward these goals, in December 2011, DECC published its technical update for the Electricity Market Reform bill, which was confirmed in the Queen’s speech on 9 May 2012 and is expected to be passed into legislation during the current parliamentary session. The changes proposed by this legislation will be instrumental in shaping investment in new generation capacity over the coming decade which, in turn, underpins our expected capital investment plans.

DECC remains committed to reducing the costs of renewable generation and published a joint report with Ofgem in March 2012 highlighting that offshore and onshore development must be considered together when looking at network development needs. Our role as system operator includes offshore networks and we will play a key role in ensuring onshore and offshore network development is coordinated.

EU energy policy

With the implementation of the 3rd Energy Package in 2011, the development of the European Infrastructure Package in 2012 and emerging EU thinking on a roadmap to 2050 (ie moving beyond the 2020 CO2 targets), the EU is another factor in the development of energy policy in the UK. The 3rd Energy Package is largely associated with the development of EU level codes, to establish EU wide rules on technical and commercial issues relating to cross border trade. These codes are the responsibility of the European networks for transmission system operators for electricity and the European networks for transmission system operators for gas, and we have been working closely with both of them. In the years to come, we expect policy to develop around greater interconnection in the electricity market and networks in the North Sea.

US energy policy

US energy policy continues to be shaped by debates over the economy, the costs and benefits of regulation, and concerns over energy security. During the year, Congress enacted an extension of the Pipeline Safety Act and debated a variety of other energy related legislation including a clean energy standard, energy efficiency, renewable energy incentives and cyber security. The most significant changes however, came in the form of new US Environmental Protection Agency regulations. These included rules for mandatory reporting of GHG emissions from electricity and gas utility facilities and the promotion of the Mercury and Air Toxics Standards rule and the Cross-State Air Pollution Rule which will help to ensure air and water quality.