As filed with the Securities and Exchange Commission on December 31, 201227, 2013

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the year ended August 31, 20122013

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number: 000-30354

City Telecom (H.K.)Hong Kong Television Network Limited

(Exact Name of Registrant as Specified in its Charter)

Hong Kong Special Administrative Region,

The People’s Republic of China

(Jurisdiction of Incorporation or Organization)

13th Floor, Trans Asia Centre

No. 18 Kin Hong Street

Kwai Chung, New Territories

Hong Kong

(Address of Principal Executive Offices)

Ms. Wong Nga Lai, Alice

13th Floor, Trans Asia Centre

No.18 Kin Hong Street

Kwai Chung, New Territories

Hong Kong

Telephone : (852) 3145 6888

Facsimile : (852) 2199 8354

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title Of Each Class | Name Of Each Exchange On Which Registered | |

American Depositary Shares, each representing 20 Ordinary Shares, par value HK$0.10 per share | The Nasdaq Stock Market LLC | |

| Ordinary Shares, par value HK$0.10 per share* | The Nasdaq Stock Market LLC* | |

Securities registered or to be registered pursuant to Section 12(g) of the Act:SECURITIESREGISTEREDORTOBEREGISTEREDPURSUANTTO SECTION 12(G)OFTHE ACT:

NoneNONE

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:SECURITIESFORWHICHTHEREISAREPORTINGOBLIGATIONPURSUANTTO SECTION 15(D)OFTHE ACT:

NoneNONE

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 809,016,643 Ordinary Shares, par value HK$0.10 per share .share.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer¨ Accelerated filerx Non-accelerated filer ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ¨ International Financial Reporting Standards as issued x Other ¨

by the International Accounting Standards Board

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has selected to follow. Item 17 ¨ Item 18 ¨

If this report is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

| * | Not for trading, but only in connection with the registration of the American Depositary Shares |

i

| 54 | |||||||||

G. | ||||||||||

H. | 55 | |||||||||

I. | 55 | |||||||||

ITEM 11 QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 55 | |||||||||

ITEM 12 DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 55 | |||||||||

A. | 55 | |||||||||

B. | 55 | |||||||||

C. | 55 | |||||||||

D. | 56 | |||||||||

| 57 | ||||||||||

ITEM 14 MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | ||||||||||

A. | ||||||||||

B. | Management’s report on internal control over financial reporting | |||||||||

C. | ||||||||||

D. | ||||||||||

ITEM | ||||||||||

ITEM | ||||||||||

| PART III | 60 | |||||||||

| 61 | ||||||||||

ii

USE OF DEFINED AND TECHNICAL TERMS

Except as otherwise indicated by the context, references in this annual report to:

“Articles” are to the Company’s existing Memorandum and Articles;

“Articles” | are to the Company’s Memorandum and Articles of Association; | |

“Centre” | are to the Television and Multimedia Production Centre under construction in Tseung Kwan O Industrial Estate in Hong Kong; | |

“Exchange Act” | are to the Securities Exchange Act of 1934; | |

“fiscal year” or “fiscal” | are to the Company’s fiscal year ended August 31 for the year referenced; | |

“FTNS Business” | are to our former business segment in which we provided fixed telecommunications network services, including dial-up and broadband Internet access services, local VoIP services, IP-TV services and corporate data services; | |

“Guangzhou Agreement” | are to the sale and purchase agreement dated April 19, 2012 entered into by the Company and Metropolitan Light (HK) Company Limited, a company incorporated in Hong Kong and a wholly-owned subsidiary of Metropolitan Light Company Limited; | |

“Hong Kong Companies Ordinance” | are to Chapter 32 of the laws of Hong Kong; | |

“HKBA” or the “Hong Kong Broadcasting Authority” | are to an independent statutory body established by the Hong Kong government for the regulation of the broadcasting industry in Hong Kong; | |

“HKCA” or the “Office of the Communications Authority” | are to a unified regulatory body for the broadcasting and the telecommunications sectors, which has taken over the functions and responsibilities of the HKBA and the Hong Kong Telecommunications Authority since April 1, 2012; | |

“HKBN” | are to Hong Kong Broadband Network Limited, a former wholly-owned subsidiary of the Company; | |

“HKMA” or “Hong Kong Monetary Authority” | are to the government authority in Hong Kong responsible for maintaining monetary and banking stability in Hong Kong; | |

“HKSE” | are to The Stock Exchange of Hong Kong Limited; | |

“HKSE Listing Rules” | are to Rules Governing the Listing of Securities on the HKSE; | |

“HKTV” or the “Company” | are to Hong Kong Television Network Limited; | |

“IDD Business” | are to our former business segment in which we provided international direct dialing telecommunications services, including international long distance call services; | |

“IFRSs” | are to International Financial Reporting Standards, as issued by the International Accounting Standards Board; | |

“OTT” | are to Over-The-Top, which is the delivery of multimedia contents over the Internet; | |

“Mobile TV Acquisition” | are to our acquisition on December 20, 2013 of the entire issued share capital of the Target Company pursuant to an option exercised by the Company under an agreement dated August 16, 2013 entered into between the Company and the Vendor; | |

“Mobile TV Spectrum” | are to the frequency at 678 – 686 MHz and microwave link in the frequency range of 7910 – 7920 MHz for the provision of broadcast-type mobile television services; | |

“

| are to our business in which we provide multimedia production and distribution and other multimedia related services, including the offer of television programming, multimedia and drama productions, content distribution and other related services; | |

“Sarbanes-Oxley Act” | are to the Sarbanes-Oxley Act of 2002; | |

“SEC” | are to the Securities and Exchange Commission; | |

“Securities Act” | are to the Securities Act of 1933; | |

“Talents” | are to all individuals employed by us including the directors of the Company; | |

“Target Company” | are to China Mobile Hong Kong Corporation Limited, a company incorporated in Hong Kong with limited liability and, prior to the Mobile TV Acquisition, a wholly-owned subsidiary of the Vendor; | |

“Telecom Group Agreement” | are to the sale and purchase agreement dated March 31, 2012 entered into between the Company and Metropolitan Light Company Limited in relation to the disposal of 100% of the issued share capital of City Telecom International Limited, Credibility Holdings Limited and Automedia Holdings Limited; | |

“Telecom Business” | are to the disposed businesses, which include the FTNS Business and IDD Business; | |

“Unified Carrier Licence” | are to a unified carrier licence issued by the Communications Authority to the Target Company; | |

“Vendor” | are to China Mobile Hong Kong Company Limited, a company incorporated in Hong Kong with limited liability and an wholly-owned subsidiary of China Mobile Limited, a company listed on the New York Stock Exchange and the main board of the HKSE; and | |

“we” | are to Hong Kong Television Network Limited and/or its subsidiaries, as the context requires. | |

CURRENCY TRANSLATION

We publish our consolidated financial statements in Hong Kong dollars. In this annual report, references to “Hong Kong dollars” or “HK$” are to the currency of Hong Kong, and references to “U.S. dollars” or “US$” are to the currency of the United States. This annual report contains translations of Hong Kong dollar amounts into U.S. dollar amounts, solely for your convenience. Unless otherwise indicated, the translations have been made at US$1.00 = HK$7.7560,7.7544, which was the exchange rate set forth in the H.10 statistical release of the Federal Reserve Board on August 31, 2012.30, 2013. On December 14, 201213, 2013 the exchange rate was

US$1.00 = HK$7.7496.7.7534. You should not construe these translations as representations that the Hong Kong dollar amounts actually represent such U.S. dollar amounts or could have been or could be converted into U.S. dollars at the rates indicated or at any other rates.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements that are, by their nature, subject to significant risks and uncertainties. These include statements with respect to City Telecom and our plans, strategies and beliefs and other statements that are not historical facts. These statements can be identified by the use of forward-looking terminology such as “may”, “will”, “expect”, “anticipate”, “intend”, “estimate”, “continue”, “plan”, “predict”, “project” or other similar words. The statements are based on management’s assumptions and beliefs in light of the information currently available to us.

These assumptions involve risks and uncertainties which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievementsthose expressed or implied by such forward looking statements. Potential risks and uncertainties include, without limitation:include:

grantour ability to identify and implement other business plans for the development of our Multimedia Business after the rejection on our application for the domestic free television programme service licence by the government;

increasing competition in the multimedia market, including the domestic free television programming and content production market in Hong Kong and the international content licensing and distribution market;

viewer preferences on self-produced and purchased contents;

our ability to successfully introduce new servicesthe stability and the popularity of our new services to the market;

changes in the our ability to successfully introduce new services and the popularity of our new services to the market;

the continued development and stability of certain capacity of the telecommunications network of theour prior Telecom Business, to which the Company is undergranted a 20 years20-year indefeasible right of use, granted to the Company and which will be used asform one of the main channelchannels of distribution in Hong Kong for the domestic freeCompany’s television programming services to be offered by the Company subject to the licence grant;

contrary to the Telecom Business with 20 years operational track record before its disposal, our business development intolimited experience in multimedia production and free television subject to licence grant, is a new line of business for us, for which we have limited direct experience,content distribution, thereby making forecasting much more difficult;

changes in technology; and

changes in the localHong Kong and global economic environment.

When considering such forward-looking statements, you should keep in mind the factors described in Item 3 “Key information - risk factors” and other cautionary statements appearing in Item 5 “Operating and financial review and prospects” of this annual report. Such risk factors and statements describe circumstances that could cause actual results to differ materially from those contained in any forward-looking statement.

ITEM 1 IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2 OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

| ITEM 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

City Telecom’s historicalNot applicable.

| ITEM 2 | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3 | KEY INFORMATION |

Historical financial information

The following table presents our selected historical financial data of our Company as of and for each of the five years in the five-year period ended August 31, 2012.2013. Except for amounts presented in U.S. dollars, the selected historical consolidated income statement data and other financial data for the years ended August 31, 2010, 2011, 2012 and 20122013 and the selected historical consolidated balance sheet data as of August 31, 20112012 and 20122013 set forth below are derived from, should be read in conjunction with, and are qualified in their entirety by reference to, our audited consolidated financial statements, including the related notes, included elsewhere in this annual report on Form 20-F.report. The selected historical consolidated balance sheet data as of August 31, 2008, 2009, 2010 and 20102011 set forth below are derived from our audited consolidated financial statements that are not included in this annual report on Form 20-F.report. The selected historical consolidated income statement data for the years ended August 31, 20082009 and 20092010 are presented on the same basis as our consolidated financial statements included in the annual report on Form 20-F to show the results of the disposed Telecom Business as discontinued operations. Our consolidated financial statements have been prepared in accordance with International Financial Reporting Standards, or IFRSs, as issued by the International Accounting Standards Board.IFRSs.

Selected consolidated income statement data:

| For the year ended August 31, | For the year ended August 31, | |||||||||||||||||||||||||||||||||||||||||||||||

| 2008 | 2009 | 2010 | 2011 | 2012 | 2012 | 2009 | 2010 | 2011 | 2012 | 2013 | 2013 | |||||||||||||||||||||||||||||||||||||

| HK$ | HK$ | HK$ | HK$ | HK$ | US$ | HK$ | HK$ | HK$ | HK$ | HK$ | US$ | |||||||||||||||||||||||||||||||||||||

| (in thousands, except per share data) | (in thousands, except per share data) | |||||||||||||||||||||||||||||||||||||||||||||||

Continuing operations: | ||||||||||||||||||||||||||||||||||||||||||||||||

Revenue | — | — | — | — | 3,762 | 485 | ||||||||||||||||||||||||||||||||||||||||||

Turnover | — | — | — | 3,762 | 7,802 | 1,006 | ||||||||||||||||||||||||||||||||||||||||||

Cost of sales | — | — | — | — | (6,006 | ) | (774 | ) | — | — | — | (6,006 | ) | (15,706 | ) | (2,025 | ) | |||||||||||||||||||||||||||||||

Valuation gains on investment properties | — | — | — | — | 18,200 | 2,347 | — | — | — | 18,200 | 43,400 | 5,597 | ||||||||||||||||||||||||||||||||||||

Other operating expenses | (18,402 | ) | (20,071 | ) | (21,932 | ) | (23,481 | ) | (104,960 | ) | (13,533 | ) | (20,071 | ) | (21,932 | ) | (23,481 | ) | (104,960 | ) | (201,514 | ) | (25,987 | ) | ||||||||||||||||||||||||

Other income/(loss), net | 19,500 | 37,049 | (7,696 | ) | 3,456 | 19,920 | 2,568 | 37,049 | (7,696 | ) | 3,456 | 19,920 | 128,909 | 16,624 | ||||||||||||||||||||||||||||||||||

Finance costs, net | (71,701 | ) | (54,241 | ) | (21,289 | ) | (7,303 | ) | (2,455 | ) | (317 | ) | (54,241 | ) | (21,289 | ) | (7,303 | ) | (2,455 | ) | (4,860 | ) | (627 | ) | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Loss before taxation | (70,603 | ) | (37,263 | ) | (50,917 | ) | (27,328 | ) | (71,539 | ) | (9,224 | ) | (37,263 | ) | (50,917 | ) | (27,328 | ) | (71,539 | ) | (41,969 | ) | (5,412 | ) | ||||||||||||||||||||||||

Income tax benefit/(expenses) | 1,906 | 321 | (5,611 | ) | (4,782 | ) | (2,281 | ) | (294 | ) | ||||||||||||||||||||||||||||||||||||||

Income tax credit/ (expenses) | 321 | (5,611 | ) | (4,782 | ) | (2,281 | ) | 1,659 | 214 | |||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Loss from continuing operations | (68,697 | ) | (36,942 | ) | (56,528 | ) | (32,110 | ) | (73,820 | ) | (9,518 | ) | (36,942 | ) | (56,528 | ) | (32,110 | ) | (73,820 | ) | (40,310 | ) | (5,198 | ) | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Discontinued operations: | ||||||||||||||||||||||||||||||||||||||||||||||||

Profit from discontinued operations (net of tax) | 249,771 | 273,394 | 346,025 | 3,771,694 | — | — | ||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||

Discontinued operations: | ||||||||||||||||||||||||||||||||||||||||||||||||

Profit from discontinued operation (net of tax) | 193,887 | 249,771 | 273,394 | 346,025 | 3,771,694 | 486,294 | ||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||

Profit for the year | 125,190 | 212,829 | 216,866 | 313,915 | 3,697,874 | 476,776 | ||||||||||||||||||||||||||||||||||||||||||

(Loss)/profit for the year | 212,829 | 216,866 | 313,915 | 3,697,874 | (40,310 | ) | (5,198 | ) | ||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Attributable to: | ||||||||||||||||||||||||||||||||||||||||||||||||

Equity shareholders of the Company | ||||||||||||||||||||||||||||||||||||||||||||||||

-Continuing operations | (68,697 | ) | (36,942 | ) | (56,528 | ) | (32,110 | ) | (71,406 | ) | (9,207 | ) | (36,942 | ) | (56,528 | ) | (32,110 | ) | (71,406 | ) | (40,310 | ) | (5,198 | ) | ||||||||||||||||||||||||

-Discontinued operations | 193,887 | 249,771 | 273,394 | 346,025 | 3,771,694 | 486,294 | 249,771 | 273,394 | 346,025 | 3,771,694 | — | — | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

| 125,190 | 212,829 | 216,866 | 313,915 | 3,700,288 | 477,087 | 212,829 | 216,866 | 313,915 | 3,700,288 | (40,310 | ) | (5,198 | ) | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Non-controlling interest | ||||||||||||||||||||||||||||||||||||||||||||||||

-Continuing operations | — | — | — | — | (2,414 | ) | (311 | ) | — | — | — | (2,414 | ) | — | — | |||||||||||||||||||||||||||||||||

-Discontinued operations | — | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

| — | — | — | — | (2,414 | ) | (311 | ) | — | — | — | (2,414 | ) | — | — | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Profit for the year | 125,190 | 212,829 | 216,866 | 313,915 | 3,697,874 | 476,776 | ||||||||||||||||||||||||||||||||||||||||||

(Loss)/profit for the year | 212,829 | 216,866 | 313,915 | 3,697,874 | (40,310 | ) | (5,198 | ) | ||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

| For the year ended August 31, | ||||||||||||||||||||||||

| 2009 | 2010 | 2011 | 2012 | 2013 | 2013 | |||||||||||||||||||

| HK$ | HK$ | HK$ | HK$ | HK$ | US$ | |||||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||||||

Basic (loss)/earnings per share (cents) | ||||||||||||||||||||||||

-Continuing and discontinued operations | 32.4 | 30.7 | 40.8 | 471.9 | (5.0 | ) | (0.6 | ) | ||||||||||||||||

-Continuing operations | (5.6 | ) | (8.0 | ) | (4.1 | ) | (9.0 | ) | (5.0 | ) | (0.6 | ) | ||||||||||||

-Discontinued operations | 38.0 | 38.7 | 44.9 | 480.9 | — | — | ||||||||||||||||||

Diluted (loss)/earnings per share (cents)(1) | ||||||||||||||||||||||||

-Continuing and discontinued operations | 31.8 | 29.4 | 39.6 | 465.1 | (5.0 | ) | (0.6 | ) | ||||||||||||||||

-Continuing operations | (5.6 | ) | (8.0 | ) | (4.1 | ) | (9.0 | ) | (5.0 | ) | (0.6 | ) | ||||||||||||

-Discontinued operations | 37.3 | 37.1 | 43.7 | 474.1 | — | — | ||||||||||||||||||

Basic (loss)/earnings per share (cents) -Continuing and discontinued operations -Continuing operations -Discontinued operations Diluted (loss)/earnings per share (cents)(1) -Continuing and discontinued operations -Continuing operations -Discontinued operations For the year ended August 31, 2008 2009 2010 2011 2012 2012 HK$ HK$ HK$ HK$ HK$ US$ (in thousands, except per share data) 19.7 32.4 30.7 40.8 471.9 60.8 (10.8 ) (5.6 ) (8.0 ) (4.1 ) (9.0 ) (1.2 ) 30.5 38.0 38.7 44.9 480.9 62.0 19.0 31.8 29.4 39.6 465.1 60.0 (10.8 ) (5.6 ) (8.0 ) (4.1 ) (9.0 ) (1.2 ) 29.5 37.3 37.1 43.7 474.1 61.1

Selected consolidated balance sheet data:

| As of August 31, | As of August 31, | |||||||||||||||||||||||||||||||||||||||||||||||

| 2008 | 2009 | 2010 | 2011 | 2012 | 2012 | 2009 | 2010 | 2011 | 2012 | 2013 | 2013 | |||||||||||||||||||||||||||||||||||||

| HK$ | HK$ | HK$ | HK$ | HK$ | US$ | HK$ | HK$ | HK$ | HK$ | HK$ | US$ | |||||||||||||||||||||||||||||||||||||

| (in thousands) | (in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||

Total assets | 2,093,410 | 1,790,408 | 2,251,549 | 2,264,462 | 3,537,356 | 456,080 | 1,790,408 | 2,251,549 | 2,264,462 | 3,537,356 | 3,833,047 | 494,306 | ||||||||||||||||||||||||||||||||||||

10-year senior notes due 2015 | (683,242 | ) | (162,586 | ) | — | — | — | — | (162,586 | ) | — | — | — | — | — | |||||||||||||||||||||||||||||||||

Long-term bank loan – unsecured | — | — | (123,567 | ) | — | — | — | — | (123,567 | ) | — | — | — | — | ||||||||||||||||||||||||||||||||||

Finance lease obligations – non-current portion | (255 | ) | (530 | ) | (393 | ) | (288 | ) | (160 | ) | (21 | ) | (530 | ) | (393 | ) | (288 | ) | (160 | ) | (70 | ) | (9 | ) | ||||||||||||||||||||||||

Derivative financial instrument | — | — | (11,293 | ) | (11,564 | ) | (9,663 | ) | (1,246 | ) | — | (11,293 | ) | (11,564 | ) | (9,663 | ) | (5,181 | ) | (668 | ) | |||||||||||||||||||||||||||

Finance lease obligations – current portion | (121 | ) | (202 | ) | (212 | ) | (105 | ) | (85 | ) | (11 | ) | (202 | ) | (212 | ) | (105 | ) | (85 | ) | (90 | ) | (12 | ) | ||||||||||||||||||||||||

Other liabilities | (377,185 | ) | (398,563 | ) | (427,545 | ) | (455,124 | ) | (44,055 | ) | (5,680 | ) | (398,563 | ) | (427,545 | ) | (455,124 | ) | (44,055 | ) | (577,084 | ) | (74,420 | ) | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Total liabilities | (1,060,803 | ) | (561,881 | ) | (563,010 | ) | (467,081 | ) | (53,963 | ) | (6,958 | ) | (561,881 | ) | (563,010 | ) | (467,081 | ) | (53,963 | ) | (582,425 | ) | (75,109 | ) | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Net assets | 1,032,607 | 1,228,527 | 1,688,539 | 1,797,381 | 3,483,393 | 449,122 | 1,228,527 | 1,688,539 | 1,797,381 | 3,483,393 | 3,250,622 | 419,197 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Share capital | 65,062 | 66,418 | 76,500 | 77,191 | 80,902 | 10,431 | 66,418 | 76,500 | 77,191 | 80,902 | 80,902 | 10,433 | ||||||||||||||||||||||||||||||||||||

Share premium | 670,717 | 681,208 | 1,074,997 | 1,083,495 | 1,188,005 | 153,172 | 681,208 | 1,074,997 | 1,083,495 | 1,188,005 | 1,188,005 | 153,203 | ||||||||||||||||||||||||||||||||||||

Reserves | 296,828 | 480,901 | 537,042 | 636,695 | 2,214,486 | 285,519 | 480,901 | 537,042 | 636,695 | 2,214,486 | 1,981,715 | 255,561 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Total shareholders’ equity | 1,032,607 | 1,228,527 | 1,688,539 | 1,797,381 | 3,483,393 | 449,122 | 1,228,527 | 1,688,539 | 1,797,381 | 3,483,393 | 3,250,622 | 419,197 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Other financial data:

| For the year ended August 31, | For the year ended August 31, | |||||||||||||||||||||||||||||||||||||||||||||||

| 2008 | 2009 | 2010 | 2011 | 2012 | 2012 | 2009 | 2010 | 2011 | 2012 | 2013 | 2013 | |||||||||||||||||||||||||||||||||||||

| HK$ | HK$ | HK$ | HK$ | HK$ | US$ | HK$ | HK$ | HK$ | HK$ | HK$ | US$ | |||||||||||||||||||||||||||||||||||||

| (in thousands) | (in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||

Net cash inflow from operating activities | 381,991 | 536,771 | 485,340 | 585,899 | 181,924 | 23,456 | ||||||||||||||||||||||||||||||||||||||||||

Net cash (outflow)/inflow from operating activities | 536,771 | 485,340 | 585,899 | 181,924 | (356,804 | ) | (46,013 | ) | ||||||||||||||||||||||||||||||||||||||||

Net cash (outflow)/inflow from investing activities | (147,750 | ) | (176,488 | ) | (306,254 | ) | (414,189 | ) | 3,681,791 | 474,702 | (176,488 | ) | (306,254 | ) | (414,189 | ) | 3,681,791 | (1,781,342 | ) | (229,720 | ) | |||||||||||||||||||||||||||

Net cash (outflow)/inflow from financing activities | (345,978 | ) | (561,292 | ) | 178,307 | (343,112 | ) | (2,191,749 | ) | (282,588 | ) | |||||||||||||||||||||||||||||||||||||

Capital expenditures(2) | ||||||||||||||||||||||||||||||||||||||||||||||||

Net cash inflow/(outflow) from financing activities | (561,292 | ) | 178,307 | (343,112 | ) | (2,191,749 | ) | 403,762 | 52,069 | |||||||||||||||||||||||||||||||||||||||

Capital expenditures(2) | ||||||||||||||||||||||||||||||||||||||||||||||||

-Continuing operations | — | — | — | 51,255 | 178,750 | 23,047 | — | — | 51,255 | 178,750 | 37,708 | 4,863 | ||||||||||||||||||||||||||||||||||||

-Discontinued operations | 211,684 | 286,734 | 344,844 | 397,941 | 283,643 | 36,571 | 286,734 | 344,844 | 397,941 | 283,643 | — | — | ||||||||||||||||||||||||||||||||||||

Notes:

| (1) | Diluted (loss)/earnings per share is computed by dividing (loss)/profit for the |

| (2) | Capital expenditures represent additions to fixed assets and include non-cash transactions. |

Exchange rate information

The Hong Kong dollar is freely convertible into other currencies (including the U.S. dollar). Since 1983, the Hong Kong dollar has been officially linked to the U.S. dollar and the current rate is US$1.00 to HK$7.80. Despite the efforts of the HKMA to keep the official exchange rate stable, the market exchange rate of the Hong Kong dollar against the U.S. dollar continues to beis influenced by the forces of supply and demand in the foreign exchange markets. Furthermore, the official exchange rate is itself subject to fluctuations and can be reset in circumstances where the secondary foreign exchange markets move beyond the HKMA’s ability to back the official rate with foreign reserves.

Exchange rates between the Hong Kong dollar and other currencies are influenced by the rate between the U.S. dollar and the Hong Kong dollar.

The following table sets forth the average, high, low and period-end exchange rate between the Hong Kong dollar and the U.S. dollar (in Hong Kong dollars per U.S. dollar) for the fiscal periods indicated:

| Average(1) | High | Low | Period-end | |||||||||||||

| HK$ | HK$ | HK$ | HK$ | |||||||||||||

Fiscal 2008 | 7.7915 | 7.8159 | 7.7497 | 7.8036 | ||||||||||||

Fiscal 2009 | 7.7550 | 7.8094 | 7.7495 | 7.7505 | ||||||||||||

Fiscal 2010 | 7.7646 | 7.8040 | 7.7495 | 7.7781 | ||||||||||||

Fiscal 2011 | 7.7776 | 7.8087 | 7.7506 | 7.7876 | ||||||||||||

Fiscal 2012 | 7.7670 | 7.8040 | 7.7532 | 7.7560 | ||||||||||||

June 2012 | 7.7590 | 7.7610 | 7.7572 | 7.7572 | ||||||||||||

July 2012 | 7.7561 | 7.7586 | 7.7538 | 7.7538 | ||||||||||||

August 2012 | 7.7562 | 7.7574 | 7.7543 | 7.7560 | ||||||||||||

September 2012 | 7.7540 | 7.7569 | 7.7510 | 7.7540 | ||||||||||||

October 2012 | 7.7515 | 7.7549 | 7.7494 | 7.7494 | ||||||||||||

November 2012 | 7.7505 | 7.7518 | 7.7493 | 7.7501 | ||||||||||||

December 2012 (through December 14, 2012) | 7.7497 | 7.7500 | 7.7493 | 7.7496 | ||||||||||||

| Average(1) | High | Low | Period-end | |||||||||||||

| HK$ | HK$ | HK$ | HK$ | |||||||||||||

Fiscal 2009 | 7.7550 | 7.8094 | 7.7495 | 7.7505 | ||||||||||||

Fiscal 2010 | 7.7646 | 7.8040 | 7.7495 | 7.7781 | ||||||||||||

Fiscal 2011 | 7.7776 | 7.8087 | 7.7506 | 7.7876 | ||||||||||||

Fiscal 2012 | 7.7670 | 7.8040 | 7.7532 | 7.7560 | ||||||||||||

Fiscal 2013 | 7.7559 | 7.7654 | 7.7493 | 7.7544 | ||||||||||||

June 2013 | 7.7602 | 7.7654 | 7.7534 | 7.7560 | ||||||||||||

July 2013 | 7.7567 | 7.7587 | 7.7535 | 7.7558 | ||||||||||||

August 2013 | 7.7553 | 7.7564 | 7.7537 | 7.7544 | ||||||||||||

September 2013 | 7.7543 | 7.7557 | 7.7533 | 7.7551 | ||||||||||||

October 2013 | 7.7536 | 7.7545 | 7.7524 | 7.7530 | ||||||||||||

November 2013 | 7.7523 | 7.7535 | 7.7512 | 7.7526 | ||||||||||||

December 2013 (through December 13, 2013) | 7.7532 | 7.7543 | 7.7517 | 7.7534 | ||||||||||||

Note:

| (1) | The average rates on the last business day of each month during the relevant fiscal year |

Source: For all periods prior to January 1, 2009, the exchange rate refers to the noon buying rate as reported by the Federal Reserve Bank of New York. For periods beginning on or after January 1, 2009, the exchange rate refers to the exchange rate as set forth in the H.10 statistical release of the Federal Reserve Board.

B. Capitalization and indebtedness

Not applicable.

C. Reasons for the offer and use of proceeds

Not applicable

You should carefully consider the risks described below and other information contained in this annual report before making an investment decision. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us, or that we currently deem immaterial, may also adversely affect us.

Risks Relating to Our Business and Operations

Risks relatingOur application for a domestic free television programme service licence in Hong Kong was rejected.

In 2009, we submitted an application for a domestic free television programme service licence in Hong Kong to the HKBA. On October 15, 2013, the Chief Executive in Council announced that it had rejected our application. As a result, we are not able to operate domestic free television programme services in Hong Kong. As domestic free television was expected to be one of the major distribution channels for our self-produced television contents and the primary source of our advertising revenue, we will need to explore other distribution channels. Developing alternative distribution channels involves significant uncertainties, and we may not be able to generate revenue in the short term or become profitable in the long run.

We have taken legal advice and are considering and preparing to apply for leave for commencing judicial review against the Chief Executive in Council’s decision. The judicial review process may be protracted and costly and might not be successful. Even if a judicial review of the Chief Executive in Council’s decision is successful, we will not necessarily be granted a domestic free television programme service licence; a successful judicial review may merely mean that the Chief Executive in Council shall reconsider our application in light of the outcome of the judicial review.

If we do not make real progress in obtaining a domestic free television programme service licence in Hong Kong within the next several months, we may cease pursuing the domestic free television business in Hong Kong, which may have a material adverse effect on our business, prospects, financial condition and operationsresults of operations.

We have a limited operating history in our Multimedia Production Business, which makes it difficult to evaluate our business.

We have a limited operating history in the Multimedia Production Business for you to evaluate our business, financial performance and prospects. Our historical results, which arewere largely based largely on the Telecom Business that we disposed of in May 2012, are not indicative of our future performance. To date, we have not achieved significant revenue or profitability in our Multimedia Production Business and, going forward, we may not be able to generate revenue or achieve profitability on annual basis.profitability.

We may not be able to implement our business plans and expansion strategies successfully.

We intendmight not be able to increaseimplement our business plans and expansion strategies successfully. Our business plans include expanding our presence in the production volume of ourmultimedia and television content significantly in 2013 and 2014.industry. We also plan to distribute our television contentmultimedia contents to Internet portals and overseas markets. In particular, we have decided to launch our OTT and mobile television services and expect to begin distributing our multimedia contents through these platforms on or about July 1, 2014. Our business plans and strategies have been formulated based on a number of assumptions, including successful cooperation with our business partners. We might not be able to implement our business planspartners, and expansion strategies successfully.

Our expansion strategies are expected to place substantial demands on our managerial, operational, financial and other resources.

The success of our business plans and expansion strategies dependdepends on a number of factors including our ability to:

build our infrastructure on schedule and within budget;

manage to produce good qualityhigh-quality contents within budget which is appealing to our customers;

able to generate revenue from the good quality contents through advertising, and content licensing and distribution,

develop effective marketing channels in Hong Kong and international markets;

and

controlmaintain effective operational costs and maintain effective quality controls; and

obtain the domestic free television programme service licence for broadcasting in Hong Kong.

The failure to achieve any of the above could increase our costs of operation and investments. The execution of our growth strategies will also incur substantial costs and require substantial resources. We may not be able to manage our operations efficiently to compete successfully in our existing markets or any new markets that we may enter, which may materially and adversely affect our business, prospects, financial condition and results of operations.

If we are not successful in integrating and managing our strategic acquisitions, our business and results of operations may suffer and we may incur exceptional expenses or write-offs.

We have completed acquisitions in the past and may not be granted a domestic freecontinue to pursue strategic acquisitions in line with our business strategy. For example, on December 20, 2013, we, through one of our wholly-owned subsidiaries, acquired the Target Company, which is principally engaged in the provision of mobile television programme service licence.

On December 31, 2009, we submitted an applicationand related services and holds, among other things, the Mobile TV Spectrum, the Unified Carrier Licence and access to infrastructure, facilities and equipment for the domestic freeprovision of broadcast-type mobile television programme service licence in Hong Kong to the HKBA. If granted, this licence will allow us to provide free television programme services in Hong Kong. The grant of the licence is still pending. If the Chief Executive in Council rejects our application or if there is a prolonged delay in granting the licence, we willTarget Company does not be able to operate domestic free television programmeprovide any mobile telephony services in Hong KongKong. For the Target Company and other companies we may acquire in the short termfuture, we could have difficulty in assimilating the acquired company’s personnel, operations, products, services and technology into our operations. In addition, we may be unsuccessful in obtaining qualifications or at all. As domestic free television programme services is expected to be oneconsents necessary for the operation of the major distribution channelsacquired businesses. These difficulties could disrupt our business, distract our management and employees and increase our expenses, including causing us to incur significant one-time expenses, impairment charges and write-offs. Furthermore, any acquisition or investment that we attempt, whether or not completed, or any media reports or rumors with respect to any such transactions, may adversely affect the value of our self-produced television content and the primary source of advertising revenue, this will mean that the Group will need to explore other distribution channels which involves large uncertainties, this may in turn adversely affect our financial condition and results of operations, and weADSs.

Our Multimedia Business may not be able to generate revenueprofitable.

We are actively pursuing and evaluating the feasibility of different distribution channels and platforms and other approaches, including film production, content licensing and co-production of programme contents with mainland Chinese and overseas producers. We may incur substantial expenditures in the short term or become profitable in the long term.

Moreover, if there is a prolonged delay in obtaining the domestic free television programme service licence, we may not be able to effectively manage our financial resources, given that the operation of domestic free television programme service is expected to incur a substantial amount of capital and operating expenditure, and while awaiting the grant of the licence, we would not be able to optimally utilize our financial resources in longer term investments.

Our new business in the provision of domestic free television programme services may not become profitable in the long term.

If the domestic free television programme service licence is granted, we will incur additional expenditure for programme productionconnection with these endeavors before we can generate revenue. In addition, given that the Multimedia Production Business is a new business venture, and the industry incumbent, Television Broadcasts Limited has dominated the viewership on domestic free television programme services by a large margin, we may not be able to become profitable in the long term.profitable.

The construction and development of a Television and Multimedia Productionthe Centre is subject to a number of risks beyond our control.

Since February 2012, we have startedbeen building a Television and Multimedia Productionthe Centre on land granted by Hong Kong Science and Technology Parks Corporation atin the Tseung Kwan O Industrial Estate. ConstructionWe have authorized HK$800.0 million for the construction of the TelevisionCentre.

In light of the rejection of our application for a domestic free television programme service licence in Hong Kong, we temporarily slowed down construction of the Centre. Although we subsequently announced that we will enter into the next phase of the construction of the Centre as we develop our OTT and Multimedia Production Centre is expected to cost at least HK$800.0 million.

Themobile television services, the construction and development of thisthe Centre are subject to a number of risks which are beyond our control, including:

the possibility of construction delay or costs over runoverrun due to inclement weather, labor or material shortages, work stoppages, market inflation and delayed regulatory approvals;

the possibility of discovering previously undetected defects or problems; and

natural disasters, social disorder and other extraordinary events.

The occurrence of any of these events could further delay the construction and development of the Television and Multimedia Production Centre or increase ourconstruction costs, which may in turn have a material adverse effect on our business, prospects, financial condition and results of operations.

The development of our Multimedia Production Business and Distribution Business requires significant capital expenditures, which may not be available on terms satisfactory to usterms or may impose a burden on our other business activities.

We expect to incur significant capital expenditures of approximately HK$700.0 million in 2013, majorityto develop our Multimedia Business, a major portion of which will be for the building of the TelevisionCentre. Our capital expenditure plans will also include the development of our OTT and Multimedia Production Centre.mobile television services. While we intend to fund such expenditures by using our currently available cash, as well as unutilized banking facilities, we may not have adequate capital to fund our projected capital expenditures if there is any event which could cause prolongedfurther delay in the launch of our domestic free television programme service, prolonged delay in the construction and development of the Television and Multimedia Production Centrecapital expenditure plans or if there is an increase in the construction costs. If we cannot finance our operations and capital expenditureexpenditures using existing available cash and cash generated from operations, if any,unutilized banking facilities, we may be required to among other things, incur additional debt, reduce capital expenditures, sell assets, or raise equity. Market conditions may impair our ability to obtain financing to support our capital expansion plans. Additional debt or equity financing may not be available, and debt financing, if available, may involve restrictions on our investing, financing and operating activities.

If we fail to capture viewer preferences, our business prospects and reputation could be materially and adversely affected.

The success of our self-produced multimedia contents, including television contentcontents, depends primarily depends on our ability to capture viewer preferences, which vary infor different demographic groups and regions and could change rapidly. In general, the popularity of television contentmultimedia contents among viewers is mainly determined by the producer’s ability to originate and source viewer-engaging content,contents, create high-quality scripts and characters that appeal to a broad range of viewers, and cast popular talents and directors. If the viewers’ reaction to our television contentmultimedia contents is largely different from ourthose we have predicted, viewer preferences, the success and popularity of the television content willour multimedia contents may be at risk. If our television content failsmultimedia contents fail to perform as expected, we may not be able to establish a strong reputation in television contentthe multimedia contents production business and our business prospects may be materially and adversely affected.

Changes in consumer viewing habits could adversely affect our business.

The manner in which consumers view multimedia contents is changing rapidly. Digital cable, wireless and Internet content providers are continuing to improve technologies, content offerings, user interface, and business models that allow consumers to access multimedia contents with interactive capabilities. The devices through which multimedia contents can be consumed are also changing rapidly. Currently, multimedia contents may be viewed on laptops and contents from Internet content providers may be viewed on TVs. Although we expect to begin distributing our multimedia contents through the OTT platform and mobile television devices in 2014, if other providers of multimedia contents address the changes in consumer viewing habits in a manner that is better able to meet consumer needs and expectations, our business could be materially and adversely affected.

Our distribution of television and multimedia contents may be materially and adversely affected by instability of the network of our prior Telecom Business or disruption in the network’s continued development. Upon the completion of the disposal of the Telecom Business, we were granted an indefeasible right of use, amongst other rights, to use certain of HKBN’s telecommunications capacity for a term of 20 years to enable the delivery of our television and multimedia contents through the telecommunications network operated by HKBN. We expect the indefeasible right of use will form one of the main channels of distribution in Hong Kong for the Company’s television and multimedia contents. Instability of the telecommunications network or disruption in the network’s continued development could materially and adversely affect our operations. Our business could be materially and adversely affected by claims of infringement of intellectual property rights.

Monitoring and preventing the unauthorized use of the Group’sour intellectual property rights may be difficult, costly and time-consuming. If we are unable to adequately protect our copyrights and other intellectual property rights, these rights may be infringed, and our business, financial condition, results of operations and prospects may be materially and adversely affected.

Moreover, third parties may claim that our self-produced multimedia contents, including television content misappropriatescontents, misappropriate or infringesinfringe their intellectual property rights, including those with respect to their previous productions, scripts and characters. Any litigation regardingLitigation over intellectual property rights could be costly and time-consuming and could divert the attention of our management and key personnel from our business operations. If we are unsuccessful in defending any such assertions or claims, our business, financial condition, results of operations and reputation may be materially and adversely affected.

Our success depends on our ability to attract and retain high-quality production crew and talent artistes in a highly competitive market.

The Multimedia Production Business requires the collaboration of many different work streamsworkstreams and people with different expertise, and henceexpertise. As such, our ability to attract and retain high-quality production crew and popular talent artistes is a key factor forin our success. Loss of producers, other members of our production team or talent artistes could adversely affect our production volume and quality and, as a result, we could be materially and adversely affected. In addition, in October 2013, we announced a redundancy of about 320 Talents. Subject to the progress of the development of our OTT and mobile television services and business needs, we currently plan to offer to re-hire the approximately 320 Talents in phases. We may not be able to re-hire these Talents or replacement hires to meet our future business needs, however.

In addition, we face competition for high-quality production crew and popular talent artistes from other television contentmultimedia contents production companies and other organizations. Competition for these individuals could require us to offer higher compensation and other benefits in order to attract and retain them, which would increase our operating expenses.

We may lose investor confidence in the reliability of our financial statements if we fail to achieve and maintain effective internal control over financial reporting, which in turn could harm our business and adversely affect the trading prices of our ADRs.

Under the Sarbanes-Oxley Act of 2002, every public company must include a management report on its internal controls over financial reporting in its annual report, which contains management’s assessment of the effectiveness of the company’s internal controls over financial reporting. Under the Sarbanes-Oxley Act, we are also required to have an independent registered public accounting firm to attest to and report on the effectiveness of our internal controls over financial reporting.

We have evaluated our internal controls surrounding the financial reporting process for the current fiscal period so that management can attest to the effectiveness of these controls. However, we may identify conditions that could result in significant deficiencies or material weaknesses. As a result, we could experience a negative reaction in the financial markets and incur additional costs in improving the condition of our internal controls. For a detailed discussion of controls and procedures, see Item 15 “Controls and procedures.”

Notwithstanding our efforts, our management could conclude that our internal control over financial reporting is not effective. Further, even if our management concludes that our internal controls over financial reporting are effective, our independent registered public accounting firm may conclude that our internal control over financial reporting is not effective. If we do not successfully design and implement changes to our internal controls and management systems, or if we fail to maintain the adequacy of these controls as such standards are modified or amended from time to time, we may not be able to comply with the Sarbanes-Oxley Act. This could subject us to regulatory scrutiny and penalties that may result in a loss of public confidence in our management, which could, among other things, adversely affect our customer and vendor confidence, stock price and our ability to raise additional capital and operate our business as projected.

We depend on certain key personnel, and our business and growth prospects may be disrupted by the loss of their services.

Our success depends upon the continued service of our key executives and Talents. If any of our key personnel were unable or unwilling to continue in their present positions we may not be able to replace them easily, our business may be significantly disrupted. Furthermore, as our industry is characterized by high demand and increased competition for Talents, we may need to offer higher compensation and other benefits in order to attract and retain key personnel. We might not be able to attract and retain the key personnel that we need to achieve our business objectives.

We may lose investor confidence in the reliability of our financial statements if we fail to maintain effective internal controls over financial reporting, which in turn could harm our business and adversely affect the trading prices of our ADRs. Under the Sarbanes-Oxley Act, every public company must include a management report on its internal controls over financial reporting in its annual report, which contains management’s assessment of the effectiveness of the company’s internal controls over financial reporting. Under the Sarbanes-Oxley Act, we are also required to have an independent registered public accounting firm to attest to and report on the effectiveness of our internal controls over financial reporting. For a detailed discussion of our controls and procedures, see Item 15 “Controls and procedures.” Notwithstanding our efforts, our management could conclude that our internal controls over financial reporting are not effective. Further, even if our management concludes that our internal controls over financial reporting are effective, our independent registered public accounting firm may conclude that our internal controls over financial reporting are not effective. If this were to occur, we could experience a negative reaction in the financial markets and incur additional costs to improve our internal controls. If we do not successfully design and implement changes to our internal controls and management systems, or if we fail to maintain the adequacy of these controls as such standards are modified or amended from time to time, we may not be able to comply with the Sarbanes-Oxley Act. This could subject us to regulatory scrutiny and penalties that may result in a loss of public confidence in our management, which could, among other things, adversely affect our shareholders’ confidence, stock price and our ability to raise additional capital and operate our business as projected. We may not be able to sustain the level of other income we generated in fiscal 2013. We recorded “other income, net” of HK$128.9 million in fiscal 2013, which was significantly more than in previous years. The increase was mainly due to an increase in returns from investment of surplus cash retained from the proceeds from the sale of the Telecom Business. In fiscal 2013, our “other income, net” mainly comprised interest income from available-for-sale securities, bank interest income, net exchange gain and rental income from investment properties. As we develop our Multimedia Business, less surplus cash will be available for these investments and, accordingly, we may not be able to generate a similar level of other income as we did in fiscal 2013. In addition, our investment income is affected by many factors beyond our control. For example, our interest income is affected by changes in interest rates, which are highly sensitive to many factors, including governmental monetary policies and domestic and international economic and political conditions. Deterioration in the credit of the securities in which we have invested and general market conditions may also materially and adversely affect our investment income. We may not be able to realize our investment in other financial assets at our desired time, price and transaction size, or to receive the debt principal back upon maturity. We recorded other financial assets of HK$1,961.6 million as of August 31, 2013 which represented investment in In addition, we may not be able to recover the par value of our investment in available-for-sale debt securities, upon maturity or at all, if the credit quality and financial position of the debt issuers deteriorate.

available-for-sale securities mainly composed of debt securities, a significant portion of which has a maturity date of over 1 year, and equity securities. Although we mostly invested in liquid instruments with sound credit quality, such as investment grade products, securities of constituents in major stock indices or securities of state-owned or -controlled companies, we may still face liquidity risk, which is highly sensitive to many factors, including issuer’s credit and financial condition, governmental monetary policies and general market conditions. We may not be able to realize our investment in other financial assets at our desired time, price and transaction size.

Risks relatingRelating to the regulatory, politicalRegulatory, Political and economic environmentEconomic Environment

Currency fluctuations of the Hong Kong dollar, our functional currency, may increase our operating costs and long term liability.adversely affect our profitability.

We are exposed to a certain amount of foreign exchange risk because our expected revenue will be predominantly denominated in Hong Kong dollars, while a certain portion of our operating costs and some of our capital expenditure plans are expected to be denominated in U.S. dollars, Renminbi or other foreign currencies. In addition, a significant portion of our investments in available-for-sale securities and deposits is denominated in U.S. dollars and Renminbi.

Although the Hong Kong dollar has been linked to the U.S. dollar since 1983 at the rate of HK$7.80 per US$1.00, it may not continue to be linked. Any depreciation of the Hong Kong dollar against the U.S. dollar, Renminbi or other currencies would increase our operating costs, make some of our capital expenditure plans more expensive and adversely affect our profitability. In addition, any depreciation in U.S. dollar or Renminbi against the Hong Kong dollar would reduce the value of our investments in

available-for-sale securities and deposits.

Our Chairman and Vice Chairman have significant ownership interestinterests in the company.Company. They could engage in transactions that lead to conflicts of interest resulting from their ownership interests.

Our Chairman and Vice Chairman each have an indirect ownership interest in our Company through Top Group International Limited, which, as of December 18, 2012,2013, held approximately 42.00% of the Company’s shares, of which 42.12% and 27.06% was owned by our Chairman and Vice Chairman, respectively. Top Group International Limited is a special purpose vehicle incorporated in the British Virgin Islands. Its board of directors consists of Mr. Wong and Mr. Cheung. Mr. Wong and Mr. Cheung have entered into a voting agreement pursuant to which they agreed to vote the 339,814,284 shares held by Top Group International Limited, the 15,236,893 shares held by Mr. Wong individually, and the 50,377,763 shares held by Mr. Cheung individually, collectively as a group. Our Chairman and Vice Chairman could take actions that may not be in the best interests of our other shareholders.

We may be classified asbelieve we were a passive foreign investment company for our taxable year ended August 31, 2013, which could result in adverse U.S. federal income tax consequences to U.S. Holders of our American depository shares or ordinary shares.

Based on the market price of our American depository shares, the value of our assets, and the composition of our income and assets, though not without doubt, we do not believe we were a passive foreign investment company, or PFIC, for U.S. federal income tax purposes for our taxable year ended August 31, 2012. However, the application2013. In addition, it is likely one or more of the PFIC rules is subject to uncertainty in several respects, and we cannot assure you the U.S. Internal Revenue Service will not take a contrary position.our subsidiaries were also PFICs for such year. A non-U.S. corporation will be a PFIC for any taxable year if either (1) at least 75% of its gross income for such year is passive income or (2) at least 50% of the value of its assets (based on an average of the quarterly values of the assets) during such year is attributable to assets that produce passive income or are held for the production of passive income.income (the “asset test”). In general, the total value of our assets for purposes of the asset test will be determined based on the market price of our American depositary shares and ordinary shares. A separate determination must be made after the close of each taxable year as to whether we were a PFIC for that year. Because the value of our assets for purposes of the PFIC test will generally be determined by reference to the market price of our American depositorydepositary shares and ordinary shares, fluctuationsour PFIC status will depend in large part on the market price of ourthe American depositorydepositary shares and ordinary shares, which may cause us to become a PFIC. In addition, changes in the composition of our income or assets may cause us to become a PFIC.fluctuate significantly. Furthermore, unless our share value increases and/or we invest a substantial amount of our cash and other passive assets in assets that produce active income, there is a significant risk we maywill be a PFIC for our current taxable year ending August 31, 2013. If2014. Because we arebelieve we were a PFIC for anyour taxable year during whichended August 31, 2013, certain adverse U.S. federal income tax consequences could apply to a U.S. Holder (as defined in “Item 10. Additional Information—E. Taxation—United States Federal Income Taxation”) who holds an American depository share or an ordinary share certain adverse U.S. federal income tax consequences could applywith respect to such U.S. Holder.any “excess distribution” received from us and any gain from a sale or other disposition of the American depositary shares or ordinary shares. See “Item 10. Additional Information—E. Taxation—United States Federal Income Taxation—Passive Foreign Investment Company.”

Risks relatingRelating to our ADSs.Our ADSs

As a foreign private issuer, we are not subject to U.S. proxy rules and are subject to Exchange Act reporting obligations that to some extent, are more lenient than those of a U.S. issuer.

As a foreign private issuer, we are exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic issuers, including (i) the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act, (ii) the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time and (iii) the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K upon the occurrence of specified significant events. In addition, the executive compensation disclosure requirements to which we are subject under Form 20-F are be less rigorous than those required of U.S. issuers under Form 10-K. Furthermore, foreign private issuers are not required to file their annual report on Form 20-F until 120 days after the end of each fiscal year, while U.S. domestic issuers that are not large accelerated filers or accelerated filers are required to file their annual report on Form 10-K within 90 days after the end of each fiscal year. Foreign private issuers are also exempt from the Regulation FD, aimed at preventing issuers from making selective disclosures of material information.

Holders of ADSs must act through the depositary to exercise their rights as shareholders of our company.Company.

Holders of our ADSs do not have the same rights of our shareholders and may only exercise the voting rights with respect to the underlying ordinary shares in accordance with the provisions of the deposit agreement for the ADSs. When a general meeting is convened, you may not receive sufficient notice to permit you to withdraw your ordinary shares to allow you to cast your vote with respect to any specific matter. In addition, the depositary and its agents may not be able to send voting instructions to you or carry out your voting instructions in a timely manner. We will make all reasonable efforts to cause the depositary to extend voting rights to you in a timely manner, but you might not receive the voting materials in time to ensure that you can instruct the depositary to vote your ADSs. Furthermore, the depositary and its agents will not be responsible for any failure to carry out any instructions to vote, for the manner in which any vote is cast or for the effect of any such vote. As a result, you may not be able to exercise your right to vote and you may lack recourse if your ADSs are not voted as you requested. In addition, in your capacity as an ADS holder, you will not be able to call a shareholders’ meeting.

The depositary for our ADSs will give us a discretionary proxy to vote our ordinary shares underlying your ADSs if you do not vote at shareholders’ meetings, except in limited circumstances, which could adversely affect your interests. Holders of our ordinary shares are not subject to this discretionary proxy.

You may be subject to limitations on transfers of your ADSs.

YourOur ADSs are transferable on the books of the depositary. However, the depositary may close its transfer books at any time or from time to time when it deems expedient in connection with the performance of its duties. In addition, the depositary may refuse to deliver, transfer or register transfers of ADSs generally when our books or the books of the depositary are closed, or at any time if we or the depositary deems it advisable to do so because of any requirement of law or of any government or governmental body, or under any provision of the deposit agreement, or for any other reason.

Your right to participate in any future rights offerings may be limited, which may cause dilution to your holdings and you may not receive cash dividends or other distributions if it is impractical to make them available to you.

We may from time to time distribute rights to our shareholders, including rights to acquire our securities. However, we cannot make rights available to you in the United States unless we register the rights and the securities to which the rights relate under the Securities Act or an exemption from the registration requirements is available. Also, under the deposit agreement, the depositary will not make rights available to you unless either both the rights and any related securities are registered under the Securities Act, or the distribution of them to ADS holders is exempted from registration under the Securities Act. We are under no obligationnot obligated to file a registration statement with respect to any such rights or securities or to endeavor to cause such a registration statement to be declared effective. Moreover, we may not be able to establish an exemption from registration under the Securities Act. Accordingly, you may be unable to participate in our rights offerings and may experience dilution in your holdings.

ITEM 4 INFORMATION ON THE COMPANYThe holding, acquisition or exercise of voting control by non-Hong Kong resident ADS holders and shareholders may be restricted if we obtain a domestic free television programme service licence in Hong Kong.

The holding, acquisition or exercise of voting control of a domestic free television programme service licensee by persons who do not meet certain Hong Kong residency requirements as set out in the Broadcasting Ordinance (“Unqualified Voting Controllers”) is restricted in various ways by the Broadcasting Ordinance. Such restrictions include, but are not limited to the requirement for prior approval from the HKCA for the holding, acquisition or exercise of voting control by an Unqualified Voting Controller of more than 2% of a licensee and restrictions on the exercise of “voting control” by such Unqualified Voting Controller. Under the Broadcasting Ordinance, “voting control” means “the control of or the ability to control, whether directly or indirectly, the exercise of the right to vote attaching to one or more voting shares of a licensee.” If we obtain a domestic free television programme service licence, our Company and any Unqualified Voting Controller will be subject to the these restrictions. See “Item 4. Information on the

Company—B. Business Overview—Regulatory Framework—Domestic Free Television Programme Services—Foreign Ownership Restrictions.”

| ITEM 4 | INFORMATION ON THE COMPANY |

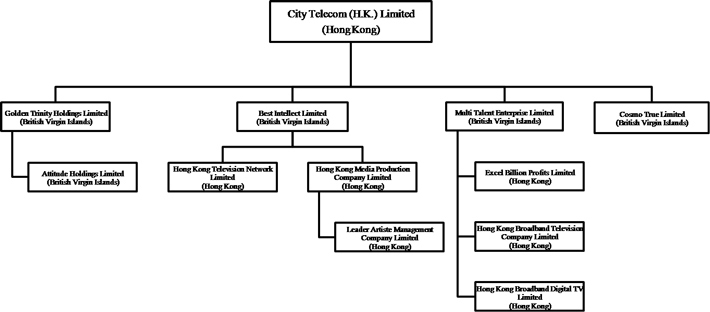

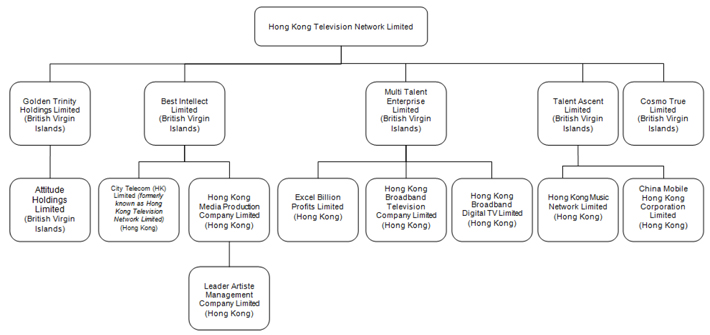

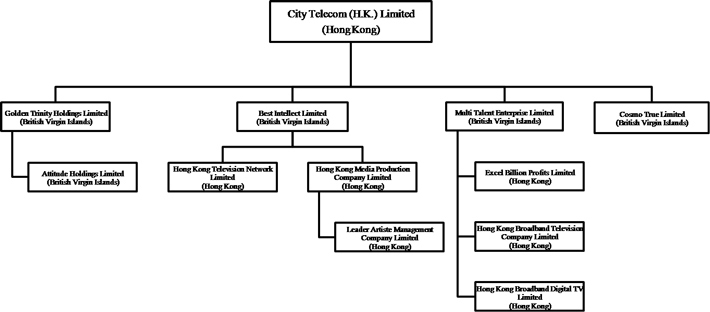

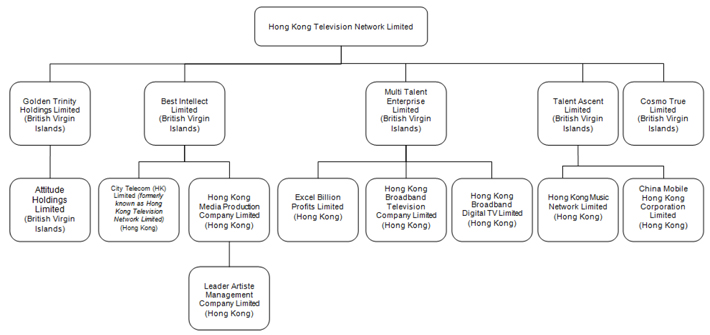

A. History and development of the Company

The legal and commercial name of our Company is Hong Kong Television Network Limited effective from January 10, 2013 (our Company was formerly known as City Telecom (H.K.) Limited.Limited). We were incorporated on May 19, 1992 under the Hong Kong Companies Ordinance and is a limited liability company. Our registered office is located at 13th Floor, Trans Asia Centre, No.18 Kin Hong Street, Kwai Chung, New Territories, Hong Kong, telephone (852) 3145-6888. Our agent for U.S. federal securities laws purposes is CT Corporation System, 111 Eighth Avenue, New York, NY 10011.

We began offering international telecommunications services in September 1992 and in January 1999, we became the first company in Hong Kong to obtain a PNETS Licence. This licence, giveswhich gave us the right to offer international telecommunications services using the ISR method and has had a significant positive impact on our international telecommunications revenues. We incorporated HKBN in Hong Kong in August 1999 and launched our broadband Internet access services in March 2000. In addition, we began providing local VoIP services in April 2002, IP-TV services in August 2003, and corporate data services in July 2004 using our Next Generation Network. In September 2007, we launched

“Fibre-To-The-Home” residential broadband, including the “FibreHome100”, “FibreHome200” and “FibreHome1000” services. In December 2009, we achieved theone-million mark for fixed telecommunications network services subscriptions.

In December 2009, we submitted an application to the HKBA to obtain a domestic free television programme service licence in Hong Kong, which is still subject to be granted.

Kong. In August 2011, Hong Kong Science and Technology Parks Corporation granted us a parcel of land in Tseung Kwan O Industrial Estate, New Territories to build a Televisioncentre for television and Multimedia Production Centre. Expected to be completed in 2014,multimedia production. The construction of the Centre will possess a gross floor areawas temporarily slowed down during the year ended August 31, 2013 because of approximately 500,000 square feet and consist of 12 studios, including an 18,000 square feet studio, which is expected to be the largestlong delay in the decision by the Hong Kong Government in relation to the domestic free television programme service licence. In light of our development of OTT and smaller studiosmobile television services, we subsequently announced that we will enter into the next phase of 3,000 square feet each. Thethe construction of the Centre. Upon completion, the Centre will become our headquarter.headquarters.

In March and April 2012, we entered into the Telecom Group Agreement and the Guangzhou Agreement, respectively, and in May 2012, we completed the very substantial disposal transaction of both the FTNS businessBusiness and the IDD business.Business. Since then, the Multimedia Production Business has become thebeen our principal focus, of the Group, which includes the production, sales and distribution of Cantonese television drama series, news programmes and other television programmes. It willprogrammes locally and internationally. Our business also include the offering of free television programmingincludes artiste management services in Hong Kong, subject to the grant of the domestic free television programme service licence by the Chief Executive in Council.and independent content production.

Since mid-2011, we embarked a large scale recruitment process in the multimedia industry. From creative directors to post-production professionals, we now havehad a professional team of more than 500 talents together with about 220 artistes.200 artistes as of August 31, 2013. In April 2012, we started our production, and so far,as of August 31, 2013, we have completed shooting or under production of about 190 episodes’ drama programmes and 70 episodes’ variety and infotainment programmes. On drama programme production, we encourage our talents to go beyond traditional or mass market drama programme type. We conducted different workshops and invited different experts to push for four televisionnew creative and production ideas, such as conducted numerous focus groups by inviting mass market audiences to provide feedback on the first episode of certain drama series, with four others in progress (rangingput the first episode of “Borderline” on YouTube to receive feedback on a larger scale basis, held workshops to benchmark our creative and production skills and standard to United States drama series, external professional courses to facilitate script writing on particular role, character or drama type, such as sexual therapy, criminal behaviors, etc., and workshop from 10–30 hours per series). professional consultants for field production and post-production talents to enhance their techniques on shooting, lighting and color grading skills when using Hollywood grade cameras.

Our infotainment and variety programmes cover a spectrum of programmes with no boundary on subjects and locations, ranging from world class productions, such as “Challenge” to execute impossible missions including chasing a hurricane in the United States, climbing into a live volcano in Vanuatu, etc., to programmes introducing domestic local culture, such as “Secret of Food.” A remarkable journey was made in March 2013, we invited our artistes, Mr. Ai Wai, Ms. Lau Yuk Chui and Mr. Chou Tsun Wai to join us and became the first production crew in the world to walk through the entire Hang Son Doong, the world’s biggest cave in central Vietnam, which measures more than seven kilometres in length, 90 meters in width and 200 meters in height. This challenging trip was concluded by climbing up the 90 meters muddy calcite named as the “Great Wall” of Vietnam.

Upon the disposal of the Telecom Business, the news production operation unit remained with the Company and will continue to provideprovided news content to the Telecom Business for their bbTV broadcasting use under a licensing arrangement. Once our broadcasting start, our news production operation unit will fully support the news programme production.

The licensing arrangement expired on August 31, 2013. Apart from the above self-produced programmes, we also purchased popular and high quality contents from Japan, Korea and Mainland China including television drama series and cartoons. To adapt to local audiences, we maintain a professional dubbing team for the post production process, including dubbing to local language and subtitling. As of August 31, 2012,2013, we had more than 8501,000 episodes of purchased content in our library.

On October 15, 2013, the Chief Executive in Council announced its decision against HKTV’s application for a domestic free television programme service licence in Hong Kong which was first made in December 2009. In the light of this decision, in order to ensure its long term well-being, the Company made redundant about 320 Talents, who have started leaving us in phases since October 2013.

On December 20, 2013, we announced our decision to launch our OTT and mobile television services. We expect to begin distributing our multimedia contents through these platforms on or about July 1, 2014. Subject to the progress of the development of our OTT and mobile television services and business needs, we currently plan to offer to re-hire in phases the approximately 320 Talents who were made redundant as announced on October 16, 2013. On the same day, we acquired the Target Company, which is principally engaged in the provision of mobile television and related services and holds, among other things, the Mobile TV Spectrum, the Unified Carrier Licence and access to infrastructure, facilities and equipment for the provision of broadcast-type mobile television services in Hong Kong. The Target Company does not provide any mobile telephony services in Hong Kong. See “—B. Business Overview—Recent Developments.”

Some of the key events in our history and development include the following:

In October 2006, our Liu Xiang “Be Ahead of Yourself” marketing campaign won the “Certificate of Excellence” of HKMA/TVB Awards for Marketing Excellence 2006.

In February 2007, we launched our “bb50 and bb200” symmetric residential broadband service supported by our special duty unit (“SDU”), personalized customer care service.

In June 2007, we were awarded “Best Retention Strategies” at the Hong Kong HRM Awards 2007.

In July 2007, we were awarded “Integrated Support Team” of the year at the Asia Pacific Customer Service Consortium Customer Relationship Excellence Awards.

In September 2007, we launched “Fibre-To-The-Home” residential broadband service, “FibreHome100”, “FibreHome200” and “FibreHome1000.” At the same time, we upgraded our entry level service broadband Internet access from 10 Mbps to 25 Mbps.