As filed with the Securities and Exchange Commission on March 12, 201310, 2015

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Or

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20122014

Or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Or

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 1-3334 | Commission file number: 1-13688 |

| REED ELSEVIER PLC | REED ELSEVIER NV | |

| (Exact name of Registrant as specified in its charter) | (Exact name of Registrant as specified in its charter) | |

| England | The Netherlands | |

| (Jurisdiction of incorporation or organisation) | (Jurisdiction of incorporation or organisation) | |

| 1-3 Strand, London, WC2N 5JR, England | Radarweg 29, 1043 NX, Amsterdam, The Netherlands | |

| (Address of principal executive offices) | (Address of principal executive offices) | |

| Henry Udow | Jans van der Woude | |

| Company Secretary | Company Secretary | |

| Reed Elsevier PLC | Reed Elsevier NV | |

| 1-3 Strand, London, WC2N 5JR, England | Radarweg 29, 1043 NX, Amsterdam, The Netherlands | |

| 011 44 20 7166 5500 | 011 31 20 485 2222 | |

| j.vanderwoude@reedelsevier.com | ||

| (Name, telephone, e-mail and/or facsimile number and address of Company Contact Person) | (Name, telephone, e-mail and/or facsimile number and address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class | Name of exchange on which | |

Reed Elsevier PLC: | ||

American Depositary Shares | New York Stock Exchange | |

Ordinary shares of 14 51/116p each | New York Stock Exchange* | |

Reed Elsevier NV: | ||

American Depositary Shares | New York Stock Exchange | |

Ordinary shares of €0.07 each | New York Stock Exchange* |

| * | Listed, not for trading, but only in connection with the listing of the applicable Registrant’s American Depositary Shares issued in respect thereof. |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuers’ classes of capital or common stock as of December 31, 2012:2014:

Reed Elsevier PLC: | Number of outstanding shares | |||||

Ordinary shares of 14 51/116p each | ||||||

Reed Elsevier NV: | ||||||

Ordinary shares of €0.07 each | ||||||

R shares of €0.70 each (held by a subsidiary of Reed Elsevier PLC) | 4,303,179 | |||||

Indicate by check mark if the registrants are well-known seasoned issuers, as defined in Rule 405 of the Securities Act.

Yes þ No ¨

If this report is an annual or transition report, indicate by check mark if the registrants are not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ¨ No þ

Indicate by check mark whether the registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) have been subject to such filing requirements for the past 90 days:days.

Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No ¨

Indicate by check mark whether the registrants are large accelerated filers, accelerated filers, or non-accelerated filers. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ Accelerated filer ¨ Non-accelerated filer ¨

Indicate by check mark which basis of accounting the registrants have used to prepare the financial statements included in this filing.

¨ US GAAP þ International Financial Reporting Standards as issued by the International Accounting Standards Board ¨ Other

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrants have elected to follow:

Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrants are shell companies (as defined in Rule 12b-2 of the Exchange Act):.

Yes ¨ No þ

| Page | ||||||

| 1 | ||||||

SPECIAL NOTE REGARDING | 2 | |||||

ITEM 1: | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | N/A | ||||

ITEM 2: | OFFER STATISTICS AND EXPECTED TIMETABLE | N/A | ||||

ITEM 3: | KEY INFORMATION | 3 | ||||

| 3 | ||||||

| 7 | ||||||

ITEM 4: | INFORMATION ON | 11 | ||||

| 11 | ||||||

ITEM 4A: | UNRESOLVED STAFF COMMENTS | N/A | ||||

ITEM 5: | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | |||||

ITEM 6: | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | |||||

| 61 | ||||||

ITEM 7: | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | |||||

ITEM 8: | FINANCIAL INFORMATION | |||||

ITEM 9: | THE OFFER AND LISTING | |||||

ITEM 10: | ADDITIONAL INFORMATION | |||||

| ||||||

ITEM 11: | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |||||

ITEM 12: | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | |||||

| Page | ||||||

ITEM 13: | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | N/A | ||||

ITEM 14: | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | N/A | ||||

ITEM 15: | CONTROLS AND PROCEDURES | |||||

ITEM 16A: | AUDIT COMMITTEE FINANCIAL EXPERT | |||||

ITEM 16B: | CODES OF ETHICS | |||||

ITEM 16C: | PRINCIPAL ACCOUNTANT FEES AND SERVICES | |||||

ITEM 16D: | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | |||||

ITEM 16E: | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | |||||

ITEM 16F: | CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT | |||||

ITEM 16G: | CORPORATE GOVERNANCE | |||||

ITEM 16H: | MINE SAFETY DISCLOSURE | N/A | ||||

ITEM 17: | FINANCIAL STATEMENTS* | |||||

ITEM 18: | FINANCIAL STATEMENTS | F-1 | ||||

ITEM 19: | EXHIBITS | S-3 | ||||

| * | The registrants have responded to Item 18 in lieu of responding to this Item. |

THIS PAGE INTENTIONALLY BLANK

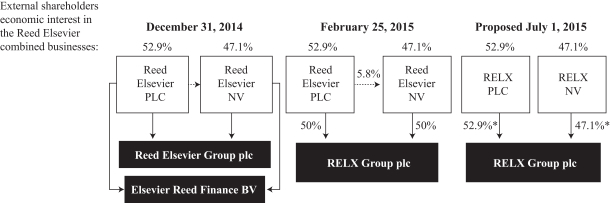

Reed Elsevier PLC and Reed Elsevier NV conductconducted their business through two jointly owned companies during 2014, Reed Elsevier Group plc and Elsevier Reed Finance BV. Reed Elsevier PLC and Reed Elsevier NV have retained their separate legal identities. Effective February 25, 2015, Reed Elsevier PLC and national identities. “Reed Elsevier”Reed Elsevier NV transferred their direct ownership interests in Elsevier Reed Finance BV to their jointly-owned company Reed Elsevier Group plc and named this newly-combined single group entity RELX Group plc. As a result, RELX Group plc now holds all Reed Elsevier businesses, subsidiaries and financing activities. Further information is not a legal entity but a collective referenceprovided on pages 23 to 24. As used in this Annual Report on Form 20-F, the separate legal entities ofterms the “Group,” “RELX,” the “combined businesses,” “we,” “our” or “us” refer collectively, to Reed Elsevier PLC, Reed Elsevier NV, Reed ElsevierRELX Group plc and Elsevier Reed Finance BV and their respective subsidiaries, associates and joint ventures. The businesses of all of the entities comprising Reed Elsevier are collectively referred to in this annual report as “Reed Elsevier”, and the financial statements of the combined businesses are referred to herein as the “combined financial statements”. In this annual report, references to “we”, “our”, or “us”Additional terms are to alldefined in the Glossary of the entities comprising Reed Elsevier.Terms on pages S-1 and S-2.

In this annual report, references to US dollars, $ and ¢ are to US currency; references to sterling, £, pence or p are to UK currency; references to euro and € are to the currency of the European Economic and Monetary Union.

Statements regarding our competitive position included herein were obtained from internal surveys, market research, publicly available information and industry publications. While we believe that the market research, publicly available information and industry publications we use are reliable, we have not independently verified market and industry data from third-party sources. Moreover, while we believe our internal surveys are reliable, they have not been verified by any independent source.

SPECIAL NOTE REGARDING FORWARD LOOKINGFORWARD-LOOKING STATEMENTS

This document contains or incorporates by reference a number of forward lookingforward-looking statements within the meaning of Section 27A of the United States Securities Act of 1933, as amended, and Section 21E of the United States Securities Exchange Act of 1934, as amended, with respect to:

| — | financial condition; |

| — | results of operations; |

| — | competitive positions; |

| — | the features and functions of and markets for the products and services we offer; and |

| — | our business plans and strategies. |

We consider any statements that are not historical facts to be “forward looking“forward-looking statements”. These statements are based on the current expectations of the management of our businesses and are subject to risks and uncertainties that could cause actual results or outcomes to differ from those expressed in any forward lookingforward-looking statement. These differences could be material; therefore, you should evaluate forward lookingforward-looking statements in light of various important factors, including those set forth or incorporated by reference in this document.

Important factors that could cause actual results to differ materially from estimates or forecasts contained in the forward looking statements include, among others:

| — | competitive factors in the industries in which we operate; |

| — | demand for our products and services; |

| — | exchange rate fluctuations; |

| — | general economic, political and business conditions; |

| — | legislative, fiscal, tax and regulatory developments and political risks; |

| — | the availability of third party content and data; |

| — | breaches of our data security systems or other unauthorised access to our databases; |

| — | our ability to maintain high quality management; |

| — | changes in law and legal interpretation affecting our intellectual property rights and internet communications; |

| — | uncertainties as to whether our strategies, business plans and acquisitions will produce the expected returns; |

| — | significant failures or interruptions of our electronic platforms; |

| — | failure of third parties to whom we have outsourced business activities; |

| — | changes in the market values of defined benefit pension scheme assets and in the market related assumptions used to value scheme liabilities; |

| — | downgrades to the credit ratings of our debt; |

| — | breaches of generally accepted ethical business standards or applicable statutes; |

| — | our ability to manage our environmental impact; and |

| — | other risks referenced from time to time in the filings of Reed Elsevier PLC and Reed Elsevier NV with the Securities and Exchange Commission (the “SEC”). |

The terms “estimate”, “project”, “plan”, “intend”, “expect”, “should be”, “will be”, “believe”, “trends” and similar expressions identify forward lookingforward-looking statements. These forward lookingforward-looking statements are found at various places throughout this annual report and the other documents incorporated by reference in this annual report (see “Item 19: Exhibits” on pages S-3 and S-4 of this annual report).report.

You should not place undue reliance on these forward lookingforward-looking statements, which speak only as of the date of this annual report. WeExcept as may be required by law, we undertake no obligation to publicly update or release any revisions to these forward lookingforward-looking statements to reflect events or circumstances after the date of this annual report or to reflect the occurrence of unanticipated events.

REED ELSEVIERTHE GROUP

The selected combined financial data for Reed Elsevierthe Group should be read in conjunction with, and is qualified by, the combined financial statements included in this annual report. In addition, as separate legal entities, Reed Elsevier PLC and Reed Elsevier NV prepare separate consolidated financial statements which reflect their respective shareholders’ economic interests in Reed Elsevierthe Group accounted for on an equity basis.

All ofThe combined financial statements are prepared in accordance with accounting policies that are in conformity with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and as adopted by the European Union (“EU”). The selected financial data for Reed Elsevierthe Group (in £) as at and for the years ended December 31, 2014, 2013 and 2012 set out below has been extracted or derived from the audited combined financial statements.statements, included herein. The selected financial data for the Group as at and for the years ended December 31, 2011 and 2010 set out below has been extracted or derived from our audited financial statements, which are not included herein, and restated for the adoption of International Accounting Standard (“IAS”) 19 Employee Benefits (revised), which was adopted in the year ended December 31, 2013.

Combined Income Statement Data(1)

| For the year ended December 31, | For the year ended December 31, | |||||||||||||||||||||||||||||||||||

| 2012(2) | 2012 | 2011 | 2010 | 2009 | 2008 | 2014(2) | 2014 | 2013 | 2012 | 2011 Restated | 2010 | |||||||||||||||||||||||||

| (in millions) | (in millions) | |||||||||||||||||||||||||||||||||||

Amounts in accordance with IFRS: | ||||||||||||||||||||||||||||||||||||

Revenue | $ | 9,908 | £ | 6,116 | £ | 6,002 | £ | 6,055 | £ | 6,071 | £ | 5,334 | $9,006 | £5,773 | £6,035 | £6,116 | £6,002 | £6,055 | ||||||||||||||||||

Operating profit(3) | 2,200 | 1,358 | 1,205 | 1,090 | 787 | 901 | 2,187 | 1,402 | 1,376 | 1,333 | 1,171 | 1,064 | ||||||||||||||||||||||||

Net finance costs | (350 | ) | (216 | ) | (235 | ) | (276 | ) | (291 | ) | (192 | ) | (253) | (162) | (196) | (227) | (244) | (289) | ||||||||||||||||||

Disposals and other non operating items(4) | 73 | 45 | (22 | ) | (46 | ) | (61 | ) | (92 | ) | (17) | (11) | 16 | 45 | (22) | (46) | ||||||||||||||||||||

Profit before tax | 1,923 | 1,187 | 948 | 768 | 435 | 617 | 1,917 | 1,229 | 1,196 | 1,151 | 905 | 729 | ||||||||||||||||||||||||

Taxation(5) | (183 | ) | (113 | ) | (181 | ) | (120 | ) | (40 | ) | (155 | ) | ||||||||||||||||||||||||

Net profit | 1,740 | 1,074 | 767 | 648 | 395 | 462 | ||||||||||||||||||||||||||||||

Net profit from discontinued operations(6) | — | — | — | — | — | 18 | ||||||||||||||||||||||||||||||

Non-controlling interests | (8 | ) | (5 | ) | (7 | ) | (6 | ) | (4 | ) | (4 | ) | ||||||||||||||||||||||||

Profit attributable to parent companies’ shareholders | 1,732 | 1,069 | 760 | 642 | 391 | 476 | ||||||||||||||||||||||||||||||

Tax expense(5) | (419) | (269) | (81) | (102) | (167) | (132) | ||||||||||||||||||||||||||||||

Net profit for the year | 1,498 | 960 | 1,115 | 1,049 | 738 | 597 | ||||||||||||||||||||||||||||||

Net profit for the year attributable to non-controlling interests | (8) | (5) | (5) | (5) | (7) | (6) | ||||||||||||||||||||||||||||||

Net profit attributable to parent companies’ shareholders | 1,490 | 955 | 1,110 | 1,044 | 731 | 591 | ||||||||||||||||||||||||||||||

Combined Statement of Financial Position Data(1)

| As at December 31, | As at December 31, | |||||||||||||||||||||||||||||||||||

| 2012(2) | 2012 | 2011 | 2010 | 2009 | 2008 | 2014(2) | 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||||||||||||

| (in millions) | (in millions) | |||||||||||||||||||||||||||||||||||

Amounts in accordance with IFRS: | ||||||||||||||||||||||||||||||||||||

Total assets | $ | 17,843 | £ | 11,014 | £ | 11,503 | £ | 11,158 | £ | 11,334 | £ | 12,866 | $17,296 | £11,087 | £10,495 | £11,014 | £11,503 | £11,158 | ||||||||||||||||||

Long term borrowings | (5,122 | ) | (3,162 | ) | (3,300 | ) | (3,786 | ) | (4,028 | ) | (5,694 | ) | (4,912) | (3,149) | (2,633) | (3,162) | (3,300) | (3,786) | ||||||||||||||||||

Net assets | 3,749 | 2,314 | 2,197 | 1,970 | 1,759 | 981 | 3,334 | 2,137 | 2,423 | 2,314 | 2,197 | 1,970 | ||||||||||||||||||||||||

Non-controlling interests | (55 | ) | (34 | ) | (25 | ) | (27 | ) | (27 | ) | (28 | ) | (49) | (31) | (33) | (34) | (25) | (27) | ||||||||||||||||||

Combined shareholders’ equity | 3,694 | 2,280 | 2,172 | 1,943 | 1,732 | 953 | 3,285 | 2,106 | 2,390 | 2,280 | 2,172 | 1,943 | ||||||||||||||||||||||||

| (1) | The combined financial statements are prepared in accordance with accounting policies that are in conformity with |

| (2) | Noon buying rates as at December 31, |

| (3) | Operating profit is stated after charging |

| 2010: £57 |

| (4) | Disposals and other non operating items comprise |

| (5) |

REED ELSEVIER PLC

The selected financial data for Reed Elsevier PLC should be read in conjunction with, and is qualified in its entirety by, the consolidated financial statements of Reed Elsevier PLC included in this annual report. The results and financial position of Reed Elsevier PLC reflect the 52.9% economic interest of Reed Elsevier PLC’s shareholders in Reed Elsevier,the Group, after taking account of results arising in Reed Elsevier PLC and its subsidiaries. These interests have been accounted for on an equity basis.

All ofThe consolidated financial statements are prepared in accordance with accounting policies that are in conformity with IFRS as issued by the IASB and as adopted by the EU. The selected consolidated financial data for Reed Elsevier PLC (in £) as at and for the years ended December 31, 2014, 2013 and 2012 set out below has been extracted or derived from the audited consolidated financial statements, ofincluded herein. The selected financial data for Reed Elsevier PLC.PLC as at and for the years ended December 31, 2011 and 2010 set out below has been extracted or derived from our audited financial statements, which are not included herein, and restated for the adoption of IAS19 Employee Benefits (revised), which was adopted in the year ended December 31, 2013.

| For the year ended December 31, | For the year ended December 31, | |||||||||||||||||||||||||||||||||||||||||||||||

| 2012(3) | 2012 | 2011 | 2010 | 2009 | 2008 | 2014(3) | 2014 | 2013 | 2012 | 2011 Restated | 2010 Restated | |||||||||||||||||||||||||||||||||||||

| (in millions, except per share amounts) | (in millions, except per share amounts) | |||||||||||||||||||||||||||||||||||||||||||||||

Amounts in accordance with IFRS:(1) | ||||||||||||||||||||||||||||||||||||||||||||||||

Profit before tax(2) | $ | 884 | £ | 546 | £ | 390 | £ | 328 | £ | 201 | £ | 247 | $769 | £493 | £576 | £532 | £375 | £301 | ||||||||||||||||||||||||||||||

Taxation | 10 | 6 | (1 | ) | (1 | ) | (6 | ) | (6 | ) | ||||||||||||||||||||||||||||||||||||||

Tax (expense)/credit | (5 | ) | (3 | ) | (4 | ) | 6 | (1 | ) | (1 | ) | |||||||||||||||||||||||||||||||||||||

Profit attributable to ordinary shareholders | 894 | 552 | 389 | 327 | 195 | 241 | 764 | 490 | 572 | 538 | 374 | 300 | ||||||||||||||||||||||||||||||||||||

Earnings per Reed Elsevier PLC ordinary share from total operations of the combined businesses | 74.5 | ¢ | 46.0 | p | 32.4 | p | 27.3 | p | 17.2 | p | 22.1 | p | 67 | ¢ | 43.0p | 48.8p | 44.8p | 31.1p | 25.0p | |||||||||||||||||||||||||||||

Earnings per Reed Elsevier PLC ordinary share from continuing operations of the combined businesses | 74.5 | ¢ | 46.0 | p | 32.4 | p | 27.3 | p | 17.2 | p | 21.2 | p | ||||||||||||||||||||||||||||||||||||

Diluted earnings per Reed Elsevier PLC ordinary share from total operations of the combined businesses | 73.5 | ¢ | 45.4 | p | 32.1 | p | 27.1 | p | 17.1 | p | 21.9 | p | 66 | ¢ | 42.5p | 48.2p | 44.3p | 30.9p | 24.9p | |||||||||||||||||||||||||||||

Dividends per Reed Elsevier PLC ordinary share(4) | 35.5 | ¢ | 21.9 | p | 20.65 | p | 20.4 | p | 20.4 | p | 100.9 | p | 39 | ¢ | 24.95p | 23.65p | 21.9p | 20.65p | 20.4p | |||||||||||||||||||||||||||||

Total assets | $ | 1,955 | £ | 1,207 | £ | 1,158 | £ | 1,037 | £ | 927 | £ | 515 | $1,743 | £1,117 | £1,266 | £1,207 | £1,158 | £1,037 | ||||||||||||||||||||||||||||||

Total equity/Net assets | 1,954 | 1,206 | 1,149 | 1,028 | 916 | 504 | 1,741 | 1,116 | 1,264 | 1,206 | 1,149 | 1,028 | ||||||||||||||||||||||||||||||||||||

Weighted average number of shares(5) | 1,200.6 | 1,200.6 | 1,202.0 | 1,199.1 | 1,131.4 | 1,089.5 | 1,140.2 | 1,140.2 | 1,172.2 | 1,200.6 | 1,202.0 | 1,199.1 | ||||||||||||||||||||||||||||||||||||

| (1) | The consolidated financial statements of Reed Elsevier PLC are prepared in accordance with accounting policies that are in conformity with IFRS as issued by the IASB and as adopted by the EU. The figures for |

| (2) | Profit before tax includes Reed Elsevier PLC’s share of the post-tax earnings of joint ventures, being |

| (3) | Noon buying rates as at December 31, |

| (4) | The amount of dividends per Reed Elsevier PLC ordinary share shown excludes the UK tax credit available to certain Reed Elsevier PLC shareholders; see “Item 10: Additional Information — |

| Dividends |

| Dividends per Reed Elsevier PLC ordinary share in respect of the financial year ended December 31, |

| (5) | Weighted average number of shares excludes shares held in treasury and shares held by the |

| During |

REED ELSEVIER NV

The selected financial data for Reed Elsevier NV should be read in conjunction with, and is qualified in its entirety by, the consolidated financial statements of Reed Elsevier NV included in this annual report. The results and financial position of Reed Elsevier NV reflect the 50% economic interest of Reed Elsevier NV’s shareholders in Reed Elsevier.the Group. These interests are accounted for on an equity basis.

All ofThe consolidated financial statements are prepared in accordance with accounting policies that are in conformity with IFRS as issued by the IASB and as adopted by the EU. The selected financial data for Reed Elsevier NV (in €) as at and for the years ended December 31, 2014, 2013 and 2012 set out below has been extracted or derived from the audited consolidated financial statements, ofincluded herein. The selected financial data for Reed Elsevier NV.NV as at and for the years ended December 31, 2011 and 2010 set out below has been extracted or derived from our audited financial statements, which are not included herein, and restated for the adoption of IAS19 Employee Benefits (revised), which was adopted in the year ended December 31, 2013.

| For the year ended December 31, | For the year ended December 31, | |||||||||||||||||||||||||||||||||||||||||||||||

| 2012(3) | 2012 | 2011 | 2010 | 2009 | 2008 | 2014(3) | 2014 | 2013 | 2012 | 2011 Restated | 2010 Restated | |||||||||||||||||||||||||||||||||||||

| (in millions, except per share amounts) | (in millions, except per share amounts) | |||||||||||||||||||||||||||||||||||||||||||||||

Amounts in accordance with IFRS:(1) | ||||||||||||||||||||||||||||||||||||||||||||||||

Profit before tax(2) | $ | 871 | € | 660 | € | 438 | € | 379 | € | 217 | € | 313 | $722 | €597 | €659 | €644 | €421 | €349 | ||||||||||||||||||||||||||||||

Taxation | (3 | ) | (2 | ) | (1 | ) | (3 | ) | 2 | (19 | ) | |||||||||||||||||||||||||||||||||||||

Tax (expense) | (6 | ) | (5 | ) | (4 | ) | (2 | ) | (1 | ) | (3 | ) | ||||||||||||||||||||||||||||||||||||

Profit attributable to ordinary shareholders | 868 | 658 | 437 | 376 | 219 | 294 | 716 | 592 | 655 | 642 | 420 | 346 | ||||||||||||||||||||||||||||||||||||

Earnings per Reed Elsevier NV share from total operations of the combined businesses | $ | 1.19 | € | 0.90 | € | 0.59 | € | 0.51 | € | 0.32 | € | 0.44 | $1.03 | €0.85 | €0.91 | €0.87 | €0.57 | €0.47 | ||||||||||||||||||||||||||||||

Earnings per Reed Elsevier NV share from continuing operations of the combined businesses | $ | 1.19 | € | 0.90 | € | 0.59 | € | 0.51 | € | 0.32 | € | 0.43 | ||||||||||||||||||||||||||||||||||||

Diluted earnings per Reed Elsevier NV share from total operations of the combined businesses | $ | 1.17 | € | 0.89 | € | 0.59 | € | 0.51 | € | 0.31 | € | 0.44 | $1.02 | €0.84 | €0.90 | €0.87 | €0.57 | €0.47 | ||||||||||||||||||||||||||||||

Dividends per Reed Elsevier NV ordinary share(4) | $ | 0.60 | € | 0.456 | € | 0.413 | € | 0.402 | € | 0.397 | € | 2.192 | $0.64 | €0.525 | €0.469 | €0.456 | €0.413 | €0.402 | ||||||||||||||||||||||||||||||

Total assets | $ | 1,927 | € | 1,460 | € | 1,364 | € | 1,203 | € | 1,036 | € | 567 | $1,719 | €1,421 | €1,494 | €1,460 | €1,364 | €1,203 | ||||||||||||||||||||||||||||||

Total equity/Net assets | 1,851 | 1,402 | 1,303 | 1,137 | 970 | 491 | 1,644 | 1,359 | 1,434 | 1,402 | 1,303 | 1,137 | ||||||||||||||||||||||||||||||||||||

Weighted average number of shares(5) | 734.0 | 734.0 | 735.3 | 734.5 | 693.9 | 669.0 | 700.1 | 700.1 | 717.6 | 734.0 | 735.3 | 734.5 | ||||||||||||||||||||||||||||||||||||

| (1) | The consolidated financial statements of Reed Elsevier NV are prepared in accordance with accounting policies that are in conformity with IFRS as issued by the IASB and as adopted by the EU. The figures for |

| (2) | Profit before tax includes Reed Elsevier NV’s share of post-tax earnings of joint ventures, being |

| (3) | Noon buying rates as at December 31, |

| (4) | Dividends |

| Dividends per Reed Elsevier NV ordinary share in respect of the financial year ended December 31, |

| (5) | Weighted average number of shares excludes shares held in treasury and shares held by the |

| During |

EXCHANGE RATES

For a discussion of the impact of currency fluctuations on Reed Elsevier’sthe Group’s combined results of operations and combined financial position, see “Item 5: Operating and Financial Review and Prospects”.

The following tables illustrate, for the periods and dates indicated, certain information concerning the Noon Buying Rate for pounds sterling expressed in US dollars per £1.00 and for the euro expressed in US dollars per €1.00. The exchange rate on February 27, 20122015 was £1.00 = $1.51$1.54 and €1.00 = $1.31.$1.12.

US dollars per £1.00 — Noon Buying Rates

| Period | ||||||||||||||||

Year ended December 31, | End | Average(1) | High | Low | ||||||||||||

2012 | 1.62 | 1.59 | 1.63 | 1.53 | ||||||||||||

2011 | 1.55 | 1.60 | 1.67 | 1.54 | ||||||||||||

2010 | 1.56 | 1.55 | 1.64 | 1.43 | ||||||||||||

2009 | 1.62 | 1.57 | 1.70 | 1.37 | ||||||||||||

2008 | 1.45 | 1.85 | 2.03 | 1.44 | ||||||||||||

Month | High | Low | ||||||||||||||

February 2013 (through February 27, 2013) |

| 1.58 | 1.51 | |||||||||||||

January 2013 |

| 1.63 | 1.57 | |||||||||||||

December 2012 |

| 1.63 | 1.60 | |||||||||||||

November 2012 |

| 1.61 | 1.58 | |||||||||||||

October 2012 |

| 1.62 | 1.59 | |||||||||||||

September 2012 |

| 1.63 | 1.59 | |||||||||||||

August 2012 |

| 1.59 | 1.55 | |||||||||||||

| Period | ||||||||||||||||

Year ended December 31, | End | Average(1) | High | Low | ||||||||||||

2014 | 1.56 | 1.65 | 1.72 | 1.55 | ||||||||||||

2013 | 1.66 | 1.56 | 1.66 | 1.48 | ||||||||||||

2012 | 1.62 | 1.59 | �� | 1.63 | 1.53 | |||||||||||

2011 | 1.55 | 1.60 | 1.67 | 1.54 | ||||||||||||

2010 | 1.56 | 1.55 | 1.64 | 1.43 | ||||||||||||

Month | High | Low | ||||||||||||||

February 2015 |

| 1.55 | 1.50 | |||||||||||||

January 2015 |

| 1.56 | 1.50 | |||||||||||||

December 2014 |

| 1.57 | 1.55 | |||||||||||||

November 2014 |

| 1.60 | 1.56 | |||||||||||||

October 2014 |

| 1.62 | 1.59 | |||||||||||||

September 2014 |

| 1.66 | 1.61 | |||||||||||||

US dollars per €1.00 — Noon Buying Rates

| Period | ||||||||||||||||

Year ended December 31, | End | Average(1) | High | Low | ||||||||||||

2012 | 1.32 | 1.29 | 1.35 | 1.21 | ||||||||||||

2011 | 1.29 | 1.39 | 1.49 | 1.29 | ||||||||||||

2010 | 1.33 | 1.32 | 1.45 | 1.20 | ||||||||||||

2009 | 1.44 | 1.40 | 1.51 | 1.25 | ||||||||||||

2008 | 1.41 | 1.47 | 1.60 | 1.24 | ||||||||||||

Month | High | Low | ||||||||||||||

February 2013 (through February 27, 2013) |

| 1.37 | 1.31 | |||||||||||||

January 2013 |

| 1.36 | 1.30 | |||||||||||||

December 2012 |

| 1.33 | 1.29 | |||||||||||||

November 2012 |

| 1.30 | 1.27 | |||||||||||||

October 2012 |

| 1.31 | 1.29 | |||||||||||||

September 2012 |

| 1.31 | 1.26 | |||||||||||||

August 2012 |

| 1.26 | 1.21 | |||||||||||||

| Period | ||||||||||||||||

Year ended December 31, | End | Average(1) | High | Low | ||||||||||||

2014 | 1.21 | 1.33 | 1.39 | 1.21 | ||||||||||||

2013 | 1.38 | 1.32 | 1.38 | 1.28 | ||||||||||||

2012 | 1.32 | 1.29 | 1.35 | 1.21 | ||||||||||||

2011 | 1.29 | 1.39 | 1.49 | 1.29 | ||||||||||||

2010 | 1.33 | 1.32 | 1.45 | 1.20 | ||||||||||||

Month | High | Low | ||||||||||||||

February 2015 |

| 1.15 | 1.12 | |||||||||||||

January 2015 |

| 1.21 | 1.13 | |||||||||||||

December 2014 |

| 1.25 | 1.21 | |||||||||||||

November 2014 |

| 1.26 | 1.24 | |||||||||||||

October 2014 |

| 1.28 | 1.25 | |||||||||||||

September 2014 |

| 1.32 | 1.26 | |||||||||||||

| (1) | The average of the Noon Buying Rates on the last day of each month during the relevant period. |

Noon Buying Rates have not been used in the preparation of the Reed Elsevier combined financial statements, the Reed Elsevier PLC consolidated financial statements or the Reed Elsevier NV consolidated financial statements but have been used for certain convenience translations where indicated.

The key materialprincipal risks tofacing our business are included below. Additional risks not presently known to us or that we currently deem immaterial may also impair our business.

We operate in a highly competitive environment that is subject to rapid change.

Our businesses operate in highly competitive markets. These markets continue to change in response to technological innovations, changing legislation,legislative and regulatory changes, the entrance of new competitors, and other factors. We cannot predict with certainty the changes that may occur and the effect of those changes on the competitiveness of our businesses. In particular, the means of delivering our products and services, and the products and services themselves, may be subject to rapid technological and other changes. We cannot predict whether technological innovations, changing legislation or other factors will, in the future, make some of our products wholly or partially obsolete or less profitable. Failure to anticipate market trends could impact the competitiveness of our products and services and consequently adversely affect our revenue and profit.

We cannot assure you that there will be continued demand for our products and services.

Our businesses are dependent on the continued acceptance by our customers of our products and services and the value placed on them. We cannot predict whether there will be changes in the future, either in the market demand or from the actions of competitors, which will affect the acceptability of products, services and prices to our customers. Failure to meet evolving customer needs could impact demand for our products and services and consequently adversely affect our revenue.

Fluctuations in exchange rates may affect our reported results.

Our financial statements are expressed in pounds sterling and euros and are, therefore, subject to movements in exchange rates on the translation of the financial information of businesses whose operational currencies are other than our reporting currencies. The United States is our most important market and, accordingly, significant fluctuations in US dollar exchange rates can significantly affect our reported results and financial position from year to year. In addition, in some of our businesses we incur costs in currencies other than those in which revenues are earned. The relative movements between the exchange rates in the currencies in which costs are incurred and the currencies in which revenues are earned can significantly affect the results of those businesses.

Current and future economic, political and market forces, and dislocations beyond our control may adversely affect demand for our products and services.

The demand for our products and services may be impacted by factors that are beyond our control, including macro economic, political and market conditions, the availability of short term and long term funding and capital and the level of volatility of interest rates, currency exchange rates and inflation. The United States, Europe and other major economies have recentlyin recent years undergone a period of severe economic turbulence, and the global economic environment has recently been less favourable than in prior years and this may continue into the future. Any one or more of these factors may contribute to reduced activity by our customers, may result in a reduction of demand for our products and services, and may adversely affect suppliers and third parties to whom we have outsourced business activities. Further disruption to global credit markets, which has significantly contributed to the recent economic turbulence described above, could have further disruptive consequences for global economic growth and customer demand.

Changes in tax laws or uncertainty over their application and interpretation may adversely affect our reported results.

Our businesses operate worldwideglobally and our earnings are subject to taxation in many differing jurisdictions and at differing rates. We seek to organise our affairs in a tax efficient manner, taking account of the jurisdictions in which we operate. However, tax laws that apply to our businesses may be amended or interpreted differently by the relevant authorities, which could adversely affect our reported results.

Changes in regulation of information collection and use could adversely affect our revenues and our costs.business.

Legal regulation relating to internet communications, data protection, e-commerce, direct marketing, credit scoring and digital advertising, privacy, information governance and use of public records is becoming more prevalent.prevalent worldwide. Existing and proposed legislation and regulations, including changes in the manner in which such legislation and regulations are interpreted by courts in the United States, the European Union and other jurisdictionsregulators may impose limits on our collection and use of certain kinds of information about individuals and our ability to communicate such information effectively with our customers. For example, many of the products offered by Risk Solutions& Business Information are governed bysubject to regulation under the US Fair Credit Reporting Act (“FCRA”), GrahamGramm Leach Bliley Act (“GLBA”), Drivers Privacy Protection Act (“DPPA”) and related state laws. Certain of these laws further provide for statutory penalties and attorneys fees for non-compliance. We are unable to predict in what form laws and regulations will be adopted or modified or how they will be construed by the courts and regulators, or the extent to which any such laws or interpretation changes might adversely affect our business.

Changes in provision of third party information to us could adversely affect our businesses.

A number of our businesses rely extensively upon content and data from external sources to maintain our databases.sources. Data is obtained from public records, governmental authorities, customers and other information companies, including competitors. In the case of public records, including social security number data which are obtained from public authorities, our access is governed by law. We also obtain the credit header data in our databases from consumer credit reporting agencies. The disruption or loss of data sources, in the future,either because of changes in the law or because data suppliers decide not to supply them, could adversely affect our businesses if we were unable to arrange for substitute sources in a timely manner or at all.products and services.

Our business, operations and reputation could be adversely affected by a failure to comply with FTC Settlement Orders.

Through our Risk Solutions& Business Information business in the United States, we are party to two consent orders and two subsequent related supplemental orders (the “FTC Settlement Orders”) embodying settlements with the US Federal Trade Commission (“FTC”) that resolved FTC investigations into our compliance with federal laws governing consumer information security and related issues, including certain fraudulent data access incidents. We also entered into an Assurance of Voluntary Compliance and Discontinuance (“AVC”(the “AVC”) with the Attorneys General of 43 states and the District of Columbia in connection with one such FTC investigation. The FTC Settlement Orders and the AVC require us to institute and maintain information security, verification, credentialing, audit and compliance, and reporting and record retention programmes and to obtain an assessment from a qualified, independent third party every two years for twenty years (with the FTC having the right to extend such twenty-year period by up to two additional biennial assessment periods) to ensure that our performance under these information security programmes complies with the FTC Settlement Orders. Failure to comply with the FTC Settlement Orders and the AVC could result in civil penalties and adversely affect our business, operations and reputation.

Breaches of our data security systems or other unauthorised access to our databases could adversely affect our business and operations.

Our businesses provide customers with access to database information such as case law, treatises, journals, and publications as well as other data. Our Risk Solutions businessSome of our businesses also providesprovide authorised customers with access to public records and other information on US individuals made available in accordance with applicable privacy laws and regulations. There are persons who try to breach our data security systems or gain other unauthorised access to our databases in order to misappropriate such information for potentially fraudulent purposes and we have previously disclosed incidents of such unauthorised access. Because the techniques used by such persons change frequently, we may be unable to anticipate or protect against the threat of breaches of data security or other unauthorised access. Breaches of our data security systems or other unauthorised access to our databases could damage our reputation and expose us to a risk of loss or litigation and possible liability, as well as increase the likelihood of more extensive governmental regulation of these activities in a way that could adversely affect this aspect of our business.

Changes in levels of government funding of, or spending by, academic institutions may adversely affect demand for the products and services of our sciencescientific, technical and medical (“STM”) businesses.

The principal customers for the information products and services offered by our science and medicalSTM publishing businesses are academic institutions, which fund purchases of these products and services from limited budgets that may be sensitive to changes in private and governmental sources of funding. Accordingly, any decreases in budgets of academic institutions or changes in the spending patterns of academic institutions could negatively impact our businesses.business and revenues.

Our intellectual property rights may not be adequately protected under current laws in some jurisdictions, which may adversely affect our results and our ability to grow.

Our products and services are largely comprised of intellectual property content delivered through a variety of media, including online, journals books, compact discs, and online, including the internet.books. We rely on trademark, copyright, patent, trade secret and other intellectual property laws to establish and protect our proprietary rights in these products and services. However, we cannot assure you that our proprietary rights will not be challenged, limited, invalidated or circumvented. Despite trademark and copyright protection and similar intellectual property protection laws, third parties may be able to copy, infringe or otherwise profit from our proprietary rights without our authorisation. These unauthorised activities may be facilitated by the internet.

In addition, whilst there is now certain internet-specific copyright legislation in the United States and in the European Union, there remains significant uncertainty as to the date from which such legislation will be enforced and the form copyright law regulating digital content may ultimately take. In several jurisdictions, including the United States, Australia and the European Union, copyright laws are increasingly coming under legal review. These factors create additional challenges for us in protecting our proprietary rights in content delivered through the internet and electronic platforms. Moreover, whilst non-copyrightable databases are protected in many circumstances by law in the European Union, there is no equivalent legal protection in the United States.

We may be unable to implement and execute our strategic and business plans if we cannot maintain high qualityhigh-quality management.

The implementation and execution of our strategic and business plans depend on our ability to recruit, motivate and retain high qualityhigh-quality people. We compete globally and across business sectors for talented management and skilled individuals, particularly those with technology and data analytics capabilities,capabilities. An inability to recruit, motivate or retain such people could adversely affect our business performance.

We may not realizerealise all of the future anticipated benefits of acquisitions.

From time to time, we acquire businessesWe regularly make small business acquisitions to strengthen our portfolio. Whilst our acquisitions are made within the framework of our overall strategy, which emphasizesemphasises organic development, we cannot assure you we will be able to generate the anticipated benefits such as revenue growth synergies and/or cost savings associated with these acquisitions. Failure to realizerealise the anticipated benefits of acquisitions could adversely affect our return on invested capital and financial condition.

We cannot assure you whether our substantial investment in electronic product and platform initiatives will produce satisfactory, long term returns.

We are investing significant amounts to develop and promote electronic products and platforms. The provision of electronic products and services is very competitive and we may experience difficulties developing this aspect of our business due to a variety of factors, many of which are beyond our control. These factors may include competition from comparable and new technologies and changes in regulation.

Our businesses may be adversely affected if their electronic delivery platforms, networks or distribution systems experience a significant failure or interruption.

Our businesses are dependent on electronic platforms and distribution systems, primarily the internet, for delivery of their products and services. From time to time we have experienced verifiable attacks on our platforms and systems by unauthorised parties. To date such attacks have not resulted in any material damage to us, however, our businesses could be adversely affected if their electronic delivery platforms and networks experience a significant failure, interruption or security breach.

Our businesses may be adversely affected by the failure of third parties to whom we have outsourced business activities.

Our organisational and operational structures have increased dependencyare dependent on outsourced and offshored functions. Poor performance or the failure of third parties to whom we have outsourced business functions could adversely affect our business performance, reputation and financial condition.

Our scientific, technical and medical primary publications could be adversely affected by changes in the market.

Our scientific, technical and medical (“STM”)STM primary publications, like those of most of our competitors, are published on a paid subscription basis. There is continued debate in government, academic and library communities, which are the principal customers for our STM publications, regarding, whetherto what extent such publications should be free and funded instead through fees charged to authors and from governmental and other subsidies or authors’ funders and/or made freely available in some form after a period following publication. If these methods of STM publishing are widely adopted or mandated, it could adversely affect our revenue from our paid subscription publications.

Spending by companies on advertising and other marketing activities, which comprises a significant portion of our revenue, has historically been cyclical.

In 2012 6%2014 2% of our revenue was derived from advertising and 14% from exhibitions. In Business Information, 30% of revenue was derived from advertising in 2012 compared with 37% in 2011.advertising. Total advertising revenues for our businesses in 20122014 were £350£135 million compared with £437£240 million in 2011.

2013. Traditionally, spending by companies on advertising and other marketing activities has been cyclical, with companies spending significantly less on advertising in times of economic slowdown or turbulence. In addition, there has been a structural shift of advertising and lead generation to Google and other search engines.

The exhibitions businessExhibitions is similarly affected by cyclical pressures on spending by companies. Additionally, participation and attendance at exhibitions is affected by the availability of exhibition venues and the propensity of exhibitors and attendees to travel. Our results could be adversely affected if the availability of venues or the demand from exhibitors and attendees were reduced, for example due to international security or public health concerns or acts of terrorism or war.

Changes in the market values of defined benefit pension scheme assets and in the assumptions used to value defined benefit pension scheme obligations may adversely affect our businesses.

We operate a number of pension schemes around the world. Historically, the largest schemes have been local versions of the defined benefit type in the United Kingdom, the United States and the Netherlands. The assets and obligations associated

with defined benefit pension schemes are particularly sensitive to changes in the market values of assets and the market related assumptions used to value scheme liabilities. In particular, declines in asset values, or increases in pension scheme liabilities, due to adverse changes to asset values,in discount rates, inflation or inflationmortality assumptions could increase future pension costs and funding requirements.

Our impairment analysis of goodwill and indefinite lived intangible assets incorporates various assumptions which are highly judgemental. If these assumptions are not realised, we may be required to recognise a charge in the future for impairment.

As at December 31, 2012,2014, goodwill on the combined statement of financial position amounted to £4,545£4,981 million and intangible assets with an indefinite life amounted to £354£369 million. We conduct an impairment test at least annually, which involves a comparison of the carrying value of goodwill and indefinite lived intangible assets by cash generating unit with estimated values in use based on latest management cash flow projections. The assumptions used in the estimation of value in use are, by their very nature, highly judgemental, and include profit growth of the business over a five year forecast period, the long term growth rate of the business thereafter, and related discount rates. There is no guarantee that our businesses will be able to achieve the forecasted results which have been included in the impairment tests and impairment charges may be required in future periods if we are unable to meet these assumptions.

Our borrowing costs and access to capital may be adversely affected if the credit ratings assigned to our debt are downgraded.

Our outstanding debt instruments are, and any of our future debt instruments may be, publicly rated by independent rating agencies such as Moody’s Investors Service Inc., Standard & Poor’s Rating Services and Fitch Ratings. A rating is based upon information furnished by us or obtained by the relevant rating agency from its own sources and from publicly available information and is subject to revision, suspension or withdrawal by the rating agency at any time. Rating agencies may review the assigned ratings due to developments that are beyond our control. Factors cited as a basis for a ratings downgrade or an assignment of a negative outlook could include the macro economic environment and the level of our indebtedness as a consequence of an acquisition. If the ratings of our debt are downgraded in the future, our borrowing costs and access to capital may be adversely affected.

Breaches of generally accepted ethical business standards or applicable statutes concerning bribery could adversely affect our reputation and financial condition.

As a leading global provider of professional information solutions to the science, medical, risk, legalSTM, Risk & Business Information, Legal and business sectors,Exhibitions markets, we are expected to adhere to high standards of independence and ethical conduct. Whilst our employees are expected to abide by the Reed Elsevierour Code of Ethics and Business Conduct, employees may still fail to abide by its guidelines relating to anti-bribery and principled business conduct. Similarly, whilst our major suppliers are expected to abide by our Supplier Code of Conduct, suppliers may still fail to abide by its guidelineguidelines relating to anti-bribery and principled business conduct. A breach of generally accepted principledethical business standards or applicable statuesstatutes concerning bribery by our employees or our suppliers could adversely affect our business performance, reputation and financial condition.

Failure to manage our environmental impact could adversely affect our businesses.

Our businesses have an impact on the environment, principally through the use of energy and water, waste generation and, in our supply chain, through our paper use and print and production technologies. Whilst we are committed to reducing these impacts by limiting resource use and by efficiently employing sustainable materials and technologies, we cannot assure you that these efforts and expenditures incurred by us in order to comply with either new environmental legislation and regulations, new interpretations or existing laws and regulations or more rigorous enforcement of such laws and regulations will not adversely impact on our businesses or reputation.

ITEM 4: INFORMATION ON REED ELSEVIERTHE GROUP

Corporate structureIntroduction

Reed Elsevier came into existenceNV was originally incorporated in January1880 and Reed Elsevier PLC in 1903. In 1993 whenthey contributed their respective businesses to two jointly owned companies, Reed Elsevier Group plc and Elsevier Reed Finance BV. The parent companies, Reed Elsevier PLC and Reed Elsevier NV, contributed their respective businesses to two jointly-owned companies,are separate, publicly-held entities. Reed Elsevier PLC’s ordinary shares are listed in London and New York, and Reed Elsevier NV’s ordinary shares are listed in Amsterdam and New York. Trading on the New York Stock Exchange is in the form of American Depositary Shares (ADSs), evidenced by American Depositary Receipts (ADRs) issued by Citibank N.A., as depositary. During 2014, Reed Elsevier Group plc, a UK registered company which ownsincorporated in England, owned the publishing and information businesses and Elsevier Reed Finance BV, a Dutch registered company which ownsincorporated in the Netherlands, oversaw financing and treasury activities. Reed Elsevier PLC and Reed Elsevier NV have retained their separate legal and national identities and are publiclyeach held companies. Reed Elsevier PLC’s securities are listed in London and New York, and Reed Elsevier NV’s securities are listed in Amsterdam and New York.

Equalisation arrangements

Reed Elsevier PLC and Reed Elsevier NV each hold a 50% interest in Reed Elsevier Group plc. Until February 2015, Reed Elsevier PLC holdsheld a 39% interest in Elsevier Reed Finance BV withand Reed Elsevier NV holdingheld a 61% interest. Reed Elsevier PLC additionally holds a 5.8%an indirect equity interest in Reed Elsevier NV, reflecting the arrangements entered into between the two companiesReed Elsevier PLC and Reed Elsevier NV at the time of the merger, which determined the equalisation ratio whereby one Reed Elsevier NV ordinary share is, in broad terms, intended to confer equivalent economic interests to 1.538 Reed Elsevier PLC ordinary shares. The equalisation ratio is subject to change to reflect share splits and similar events that affect the number of outstanding ordinary shares of either Reed Elsevier PLC or Reed Elsevier NV.

Under the equalisation arrangements, Reed Elsevier PLC shareholders have a 52.9% economic interest in Reed Elsevier, and Reed Elsevier NV shareholders (other than Reed Elsevier PLC) have a 47.1% economic interest in Reed Elsevier. Holders of ordinary shares inEffective February 25, 2015, Reed Elsevier PLC and Reed Elsevier NV enjoy substantially equivalent dividend and capital rights with respect totransferred their ordinary shares.

The Boards of both Reed Elsevier PLC and Reed Elsevier NV have agreed, other than in special circumstances, to recommend equivalent gross dividends (including, with respect to the dividend on Reed Elsevier PLC ordinary shares, the associated UK tax credit), based on the equalisation ratio. A Reed Elsevier PLC ordinary share pays dividends in sterling and is subject to UK tax law with respect to dividend and capital rights. A Reed Elsevier NV ordinary share pays dividends in euros and is subject to Dutch tax law with respect to dividend and capital rights.

The principal assets of Reed Elsevier PLC comprise its 50% interest in Reed Elsevier Group plc, its 39% interestdirect ownership interests in Elsevier Reed Finance BV its indirect equity interest in Reed Elsevier NV and certain amounts receivable from subsidiaries of Reed Elsevier Group plc. The principal assets of Reed Elsevier NV comprise its 50% interest into their jointly-owned company Reed Elsevier Group plc its 61% interest in Elsevier Reed Finance BV and certain amounts receivable from subsidiaries ofnamed this newly-combined single group entity RELX Group plc. As a result, RELX Group plc now holds all Reed Elsevier Group plc. Reed Elsevier NV also owns shares, carrying special dividend rights, in Reed Elsevier Overseas BV, a Dutch registered subsidiary of Reed Elsevier Group plc.businesses, subsidiaries and financing activities. Further information is provided on pages 23 to 24.

Material acquisitions and disposals

Total acquisition expenditure in the three years ended December 31, 2012, including the buy out of non-controlling interests,2014, was £924£933 million, net of cash acquired.acquired of £35 million. During 2012,2014, a number of acquisitions were made for total consideration of £341£396 million, net of cash acquired of £9 million. During 2013, a number of acquisitions were made for total consideration of £221 million, net of cash acquired of £14 million. During 2012, a number of acquisitions were made for a total consideration of £316 million, net of cash acquired of £12 million. During 2011, a number

The net cash received on the disposal of acquisitions, including the buy out of non-controlling interests, were made for a total consideration of £540 million, net of cash acquired. During 2010, a number of small acquisitions were made for a total consideration of £43 million.

Gross cash proceeds from disposals amounted to £242 million (2011: £101 million; 2010: £66 million), including £7 million from the sale of non-controlling interests. Net cash proceeds, before tax, amounted to £160 million (2011: £80 million; 2010: £6 million),non-strategic assets, after relatedtiming differences and separation and transaction costs, additional pension scheme contributions, and working capital and other adjustments in respect of prior year transactions.was £53 million (2013: £195 million; 2012: £160 million).

Capital expenditure

Capital expenditure on property, plant, equipment and internally developed intangible assets principally relates to investment in systems infrastructure to support electronic publishing activities, computer equipment and office facilities. Total such capital expenditure, which was financed from operatingusing cash flows generated from operations, amounted to £333£270 million in 2012 (2011: £3502014 (2013: £308 million; 2010: £3112012: £333 million). In 2012,2014, there was continued investment in new product and related infrastructure, particularly in Legal.the Legal segment. Further information on capital expenditure is given in notes 1615 and 1817 to the combined financial statements.

Principal Executive Offices

The principal executive offices of Reed Elsevier PLC are located at 1-3 Strand, London WC2N 5JR, England. Tel: +44 20 7166 5500. The principal executive offices of Reed Elsevier NV are located at Radarweg 29, 1043 NX Amsterdam, the Netherlands. Tel: +31 20 485 2222. The principal executive office located in the United States is at 125230 Park Avenue, 23rd Floor, New York, New York, 10017.10169. Tel: +1 212 309 5498.8100. Our internet address is www.reedelsevier.com.www.relxgroup.com. The information on our website is not incorporated by reference into this report.

Our agent in the United States is Kenneth Thompson II, General Counsel Intellectual Property, Privacy and Governance, RELX Group, kenneth.thompson@relxgroup.com, 9443 Springboro Pike, B4/F5/514, Miamisburg, Ohio, 45342.

Reed Elsevier isWe are a world leading provider of professional information solutions operatingfor professional customers across severalindustries. We operate in four market segments: Scientific, Technical & Medical, providing information and tools to help its customers improve scientific and healthcare outcomes; Risk Solutions,& Business Information, providing data services and tools that combine proprietary, public and third-party information, with advanced technology and analytics; Business Information, providing data services, information and marketing solutionsanalytics to business professionals;and government customers; Legal, providing legal, tax, regulatory news and business information to legal, corporate, government and academic markets; and Exhibitions, organising exhibitions and conferences.

The Group’s reported segments are based on the internal reporting structure and financial information provided to the Boards. During 2014, Risk Solutions and Business Information have been combined into one business area, having previously operated separately. Accordingly, they are now presented as a single operating segment. Comparative figures have been presented as if the businesses had operated on a combined basis in the prior year.

Our principal operations are in North America and Europe. For the year ended December 31, 20122014 we had total revenue of approximately £6.1£5.8 billion and an average of approximately 30,500of28,200 employees. As at December 31, 20122014 we had approximately 30,400had28,500 employees. In 2012,2014, North America represented our largest single geographic market, contributing 52%contributing50% of our total revenue.

Revenue is derived principally from subscriptions, circulation and transactional sales, exhibition fees and advertising sales. In 2012, 49%2014, 51% of Reed Elsevier’sour revenue was derived from subscriptions; 26%subscriptions,47% from circulation and transactional sales; 14% from exhibition fees; 6%sales and2% from advertising sales; and 5% from other sources.sales. An increasing proportion of revenue is derived from electronic information products, principally internet based. In 2012, 64%2014, 66% of our revenue was derived from such sources, including 96%including85% of Risk Solutions revenue, 76%& Business Information revenue,77% of Legal revenue, 68%revenue,74% of Scientific, Technical & Medical revenue, 54% of Business Information revenue, and 2%revenueand3% of Exhibitions revenue.

Subscription sales are defined as revenue derived from the periodic distribution or update of a product or from the provision of access to online services, which is often prepaid. Circulation and transactionalTransactional sales include all other revenue from the distribution of a product and transactional salestransactions of online services, usually on cash or credit terms. The level of publishing related advertising sales and exhibition fees has historically been tied closely to the economic and business investment cycle with changes in the profit performance of advertisers, business confidence and other economic factors having a high correlation with changes in the size of the market. Subscription sales and circulation and transactional sales have tended to be more stable than advertising sales through economic cycles.

Revenue is recognised for the various categories as follows: subscriptions — on periodic despatch of subscribed product or rateably over the period of the subscription where performance is not measurable by despatch; circulation and transactional — on despatch or occurrence of the transaction; exhibitions — on occurrence of the exhibitiontransaction or exhibition; and advertising — on publication or period of online display. Where sales consist of two or more independent components whose value can be reliably measured, revenue is recognised on each component as it is completed by performance, based on the attribution of relative value.

Our businesses compete for subscription, circulationtransactional, and transaction, and marketingadvertising expenditures in scientific and medical, risk, legal and business sectors. The bases of competition include, for readers and users of the information, the quality and variety of the editorial content and data, the quality of the software to derive added value from the information, the timeliness and the price of the products and, for exhibitors and advertisers, the quality and the size of the audiences targeted.

For additional information regarding revenue from our business activities and geographic markets, see “Item 5: Operating and Financial Review and Prospects” on page 26.

| Revenue Year ended December 31, | ||||||||||||||||||||||||

| 2012 | 2011 | 2010 | ||||||||||||||||||||||

| (in millions, except percentages) | ||||||||||||||||||||||||

Scientific, Technical & Medical | £ | 2,063 | 34 | % | £ | 2,058 | 34 | % | £ | 2,026 | 34 | % | ||||||||||||

Risk Solutions | 926 | 15 | 908 | 15 | 927 | 15 | ||||||||||||||||||

Business Information | 663 | 11 | 695 | 12 | 718 | 12 | ||||||||||||||||||

Legal | 1,610 | 26 | 1,634 | 27 | 1,691 | 28 | ||||||||||||||||||

Exhibitions | 854 | 14 | 707 | 12 | 693 | 11 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | £ | 6,116 | 100 | % | £ | 6,002 | 100 | % | £ | 6,055 | 100 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| Revenue Year ended December 31, | ||||||||||||||||||||||||

| 2014 | 2013 | 2012 | ||||||||||||||||||||||

| (in millions, except percentages) | ||||||||||||||||||||||||

Scientific, Technical & Medical | £ | 2,048 | 36 | % | £ | 2,126 | 35 | % | £ | 2,063 | 34 | % | ||||||||||||

Risk & Business Information | 1,439 | 25 | 1,480 | 25 | 1,589 | 26 | ||||||||||||||||||

Legal | 1,396 | 24 | 1,567 | 26 | 1,610 | 26 | ||||||||||||||||||

Exhibitions | 890 | 15 | 862 | 14 | 854 | 14 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | £ | 5,773 | 100 | % | £ | 6,035 | 100 | % | £ | 6,116 | 100 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

SCIENTIFIC, TECHNICAL & MEDICAL

| Year ended December 31, | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| (in millions) | ||||||||||||

Revenue | £ | 2,063 | £ | 2,058 | £ | 2,026 | ||||||

|

|

|

|

|

| |||||||

| Year ended December 31, | ||||||||||||

| 2014 | 2013 | 2012 | ||||||||||

| (in millions) | ||||||||||||

Revenue | £ | 2,048 | £ | 2,126 | £ | 2,063 | ||||||

|

|

|

|

|

| |||||||

In Scientific, Technical & Medical markets, we provide information and tools to help customers improve scientific and healthcare outcomes.

Elsevier is a leading provider of scientific, technical and& medical information and servesserving scientists, health professionals and students worldwide. Its objective is to help its customers advance science and improve healthcare by providing world class informationcontent and innovative information solutions that enable them to make critical decisions, enhance productivity and improve outcomes.

Elsevier is a global business with principal operations in Amsterdam, Beijing, Boston, Chennai, Delhi, London, Madrid, Munich, New York, Oxford, Paris, Philadelphia, Rio de Janeiro, St. Louis, San Diego, Singapore and Tokyo. It has 7,000 employees.

In 2014, approximately 68% of revenue came from subscription sales, 30% from transactional sales, and 2% from advertising. Approximately37% of revenue by destination in 2014 was derived from North America,30% from Europe and the remaining33% from the rest of the world.74% of revenue was delivered electronically.

Elsevier serves the needs of the science, technology and health& medical markets by publishing primary research, reference, and education content, as well as by providing a range of database and workflow solutions. Elsevier’s customers are scientists, academic institutions, educators, research leaders and administrators, medical researchers, doctors, nurses, allied health professionals and students, as well as hospitals, research institutions, health insurers, managed healthcare organisations, research-intensive corporations, and governments. All of these customers rely on Elsevier to provide high qualityhigh-quality content and critical information for making scientific and medical decisions; to review, publish, disseminate and preserve research findings; to create innovative tools to help focus research strategies, increase research effectiveness, improve medical outcomes, and enhance the efficiency of healthcare and healthcare education.

In 2012, approximately 65% of revenue came from subscription sales, 27% from circulation and transactional sales, 3% from advertising, and the remaining 5% from other sources. Approximately 40% of revenue by destination in 2012 was derived from North America, 31% from Europe and the remaining 29% from the rest of the world. 68% of revenues were delivered electronically.

In the primary research market during 2012, over 12014, over1.1 million research papers were submitted to Elsevier, a double digit increase on the prior year.Elsevier. Over 10,00016,000 editors managed the peer review and selection of these papers, resulting in the publication of more than 330,000360,000 articles in almost 2000over 2,000 journals, many of which are the foremost publications in their field and a primary point of reference for new research. This content was accessed by around 1112 million people, with nearly 700more than 750 million full text article downloads last year. Content is provided free or at very low cost in most of the world’s poorest countries. Elsevier’s journals are primarily published and delivered through theScienceDirectplatform, the world’s largest database of scientific and medical research, hosting over 1112 million articles,pieces of content, and over 11,00030,000 full-text e-books. Flagship journals includeCellandThe Lancetfamilies of titles.

In 2014, Elsevier continuously innovates to improveexpanded the utility and effectiveness of its journals. For example, its “Article of the Future” enhances the traditional scientific paper withLancet collection, adding new and broader types of content,titles such as links to experimental data, related content,The Lancet Psychiatry, The Lancet HIV and enhanced media to supplement the article’s text.The Lancet Haematology.

Elsevier is also a global leader in the scientific, technical and& medical reference market, providing authoritative and current professional reference content. While reference has traditionally been aprovided in print, industry, Elsevier has been a leader in driving the shift from print to electronic. Elsevier publishes over 20,000 reference titles, with 1,400 new titles published annually along with supporting bibliographic data, indices and abstracts. Approximately 85% of these titles are available electronically. Flagship titles include works such asGray’s Anatomy,,Nelson’s PediatricsandNetter’s Atlas of Human Anatomy.Anatomy.

Elsevier’s flagship clinical reference platform, ClinicalKey, provides physicians with access to leading Elsevier launchedClinicalKeyin 2012, a product that allows physicians to access the leadingand third-party reference and evidence-based medicinemedical content in a single, fully-integratedfully integrated site.ClinicalKeyincludes a full taxonomy is continuing to grow, and improved smart content search to help clinicians look up detailed information on highly specific topics as they seek to answer clinical questions. The platform covers Elsevier’s as well as relevant third-party health content.ClinicalKeyhas already been deployed at leading teaching hospitals, such as Oxford University’s John Radcliffe, the Cleveland Clinic, and the US Department of Veterans Affairs.is currently accessed by over 2,000 institutions.

In medical education, Elsevier serves students of medicine, nursing and allied health professions through print and electronic books, as well as electronic solutions. For example, itsEvolveportal provides a rich resourceHESI, an online testing and remediation solution designed to support faculty andhelp students and now has over 3.5 million registered users;Evolve Reachprovides online review and testing tools forof nursing and the allied health professions;Evolve Teach provides online resources and solutions to support faculty.professionals, conducted over 700,000 tests in 2014.

Elsevier’s database and workflow products provide a range of tools and solutions for professionals in the science, technical, and medical fields. Customers include academic and corporate researchers, research administrators and healthcare professionals.

For academic and corporate researchers, significant products includeScopus,,Geofacets, Reaxys, andReaxys. Knovel. Scopusis the largest abstract and citation database of research literature in the world, with abstractsover 56 million abstract and bibliographic information on almost 50 million scientific research articlesrecords from 19,500 peer reviewedmore than 21,000 peer-reviewed journals and 5,000 international publishers.Geofacetsis an oil and gas exploration tool which packages research-relevant Elsevier and third-party geological content and tags that content to enable rich search functionality.Reaxysis a leading solution for synthetic chemists, integrating chemical reaction and compound data searching with synthesis planning.

In December 2012, Elsevier acquiredKnovel, provides a range of web-based provider of productivity tools for the engineering community, integrating technical information with analytics and search to deliver trusted answers and drive innovation.

Elsevier serves academic and government research administrators through itsSciValitsElsevier Research Intelligence suite of products that help them evaluate their institutions’ research performance, determine research strategies and increase institutional efficiencies.products. Leveraging bibliometric data such as citations fromScopus, and other data types, SciVal, Spotlighthelps institutions to establish, execute and governments to identify their distinctiveevaluate research strengths, evaluatestrategies. Pure is a comprehensive research information management system which enables evidence-based research management decisions, promotes collaboration, simplifies administration and optimises impact. Our Analytical Services team provides accurate, unbiased analysis on research performance by combining high quality data sources with technical and increase the focus of their research and development investments.metrics expertise. SciVal Fundingassists researchers and institutions in identifying grants that are most relevant in their research areas.

In August 2012, Elsevier bolstered its research management portfolio by acquiringAtira, a provider of software and tools that complement theSciValplatform and help academic institutions and researchers improve their research outcomes.

For healthcare professionals, Elsevier develops products to deliver patient-specific solutions at the point of care to improve patient outcomes. Its clinical solutions includeGold Standard, ExitCare which provides criticalpatient education and discharge information on drug interactions to assist effective treatment, andCPM Resource Center,, which provides a data-driven framework to support nurses in undertaking procedures.

Elsevier further bolstered its clinical solutions portfolio with the acquisition in September 2012 ofExitCare, a provider of patient education and discharge instructions.ExitCare’sproducts, incorporated into Elsevier’s clinical decision support content and tools, will help healthcare providers improve the delivery of healthcare information and services across all care environments.

Market Opportunitiesopportunities

Scientific, Technicaltechnical & Medicalmedical information markets have good long-term demand growth characteristics. The importance of research and development to economic performance and competitive positioning is well understood by governments, academic institutions and corporations. This is reflected in the long-term growth in research and development spend and in the number of researchers worldwide.

Growth in health markets is driven by ageing populations in developed markets, rising prosperity in developing markets and the increasing focus on improving medical outcomes and efficiency. Given that a significant proportion of scientific research and healthcare is funded directly or indirectly by governments, spending is influenced by governmental budgetary considerations. The commitment to research and health provision does, however, remain high, even in more difficult budgetary environments.

Strategic Prioritiespriorities

Elsevier’s strategic goal is to providelead the way in providing information solutions that advance science, technology and improve health. To achieve this, Elsevier creates solutions that reflect deep insight into the way its users work and the outcomes they are seeking to achieve; drivesstrives for excellence in content, service and technology;execution; constantly adapts and revitalises its products, solutionsbusiness models and business models;technology; and leverages its sharedinstitutional skills, assets and resources and knowledge to promote innovation efficiency and excellence in execution.efficiency.

For academic and corporate researchers,Elsevier’s strategic priorities are to continue to strengthen journal brandsincrease content volume and the quality of published articles,quality; to expand content coverage, building out integrated solutions combining Elsevier, third-party and customer data; to increase content utility, using “Smart Content” to enable new e-solutions; to combine content with analytics and technology, focused on measurably improving productivity and outcomes for customers; and to further improve scientific communicationcontinue to drive operational efficiency and user experience witheffectiveness.