As filed with the Securities and Exchange Commission on February 25, 201423, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 20-F

(Mark one)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20132015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-05146-01

KONINKLIJKE PHILIPS N.V.

(Exact name of Registrant as specified in charter)

ROYAL PHILIPS

(Translation of Registrant’s name into English)

The Netherlands

(Jurisdiction of incorporation or organization)

BreitnerPhilips Center, Amstelplein 2, 1096 BC Amsterdam, The Netherlands

(Address of principal executive office)

Eric Coutinho,Marnix van Ginneken, Chief Legal Officer & Secretary to the Board of Management

+31 20 59 77232, eric.coutinho@philips.com, Breitnermarnix.van.ginneken@philips.com, Philips Center, Amstelplein 2, 1096 BC Amsterdam, The Netherlands

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | | | |

| Title of each class | | | | Name of each exchange on which registered |

| Common Shares – par value | | | | New York Stock Exchange |

| | |

| Euro (EUR) 0.20 per share | | | | |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

| | |

| Class | | Outstanding at December 31, 20132015 |

| Koninklijke Philips N.V. | | 937,845,789931,130,387 shares, including |

| Common Shares par value EUR 0.20 per share | | 24,508,02214,026,801 treasury shares

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. x Yes No¨ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934. ¨ Yes x No

Note-Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

U.S. GAAP ¨ | | International Financial Reporting Standards as issued by by the International Accounting Standards Board x | | Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ¨ Item 17 ¨ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

IFRS basis of presentation

The financial information included in this document is based on IFRS, as explained in note 1, Significant accounting policies, of this report, unless otherwise indicated.

Dutch Financial Markets Supervision Act

This document comprises regulated information within the meaning of the Dutch Financial Markets Supervision Act (Wet op het Financieel Toezicht).

Statutory financial statements and management report

The chapters Group financial statements and Company financial statements contain the statutory financial statements of the Company. The introduction to the chapter Group financial statements sets out which parts of this Annual Report form the Management report within the meaning of Section 2:391 of the Dutch Civil Code (and related Decrees).

Significant developments

In September 2014, Philips announced its plan to sharpen its strategic focus by establishing two stand-alone companies focused on the HealthTech and Lighting opportunities respectively. We have established a stand-alone structure for Philips Lighting within the Philips Group effective February 1, 2016. We expect to be able to announce the separation of the Lighting business in the first half of 2016, subject to market conditions and other relevant circumstances. As previously stated, we are reviewing all strategic options for Philips Lighting, including an initial public offering and a private sale.

It should however be noted that the completion of the separation could take more time than originally planned or anticipated and that there is no certainty as to the method or timing of the separation of the Lighting business, which may expose Philips to risks of additional cost and other adverse consequences. For further information on specific risks involved in the separation please refer to chapter 7, Risk management, of this report.

The separation impacts all businesses and markets as well as all supporting functions and all assets and liabilities of the Group. With effect from Q1 2016 onwards Philips plans to report and discuss its financial performance on the basis of different reportable segments than the sectors currently presented and discussed in this Annual Report. For more details on the new segment reporting in 2016 and onwards, please refer to the introduction of chapter 6, Sector performance, of this report.

As announced on January 22, 2016, the agreement pursuant to which the consortium led by GO Scale Capital would acquire an 80.1% interest in the combined businesses of Lumileds and Automotive, has been terminated. Philips is now actively engaging with other parties that have expressed an interest in the businesses and will continue to report the Lumileds and Automotive businesses as discontinued operations (see note 3, Discontinued operations and other assets classified as held for sale).

Further updates will be provided in the course of 2016.

| | |

| | Philips ArenaVision LED is the world’s first LED pitch lighting to meet the stringent requirements of international television broadcasters and sports federations, ensuring a fantastic match experience, both for the fans in the stadium and those watching at home. Increasingly, Philips is teaming up with hospital and health systems to understand their needs, provide integrated solutions, and engage in multi-year cooperation to drive improvements in terms of patient outcomes, quality of care delivery and cost productivity. |

Contents

2 Annual Report 20132015

Annual Report 20132015 3

| | | | | | |

| 18.9 | | Exhibit 15 (a) | | | 292 | |

| 18.10 | | Exhibit 15 (b) | | | 293 | |

| | | | | | |

| | |

| 19 | | Exhibits | | | 272 | |

19.1 | | Index of exhibits | | | 272 | |

19.2 | | Signatures | | | 273 | |

19.3 | | Exhibits | | | 274 | |

19.4 | | Exhibit 1 English translation of the Articles of Association of the Company | | | 275 | |

19.5 | | Exhibit 4 (a) Services contract between the Company and Mr F.A. van Houten | | | 289 | |

19.6 | | Exhibit 4 (b) Services contract between the Company and Mr A. Bhattacharya | | | 294 | |

19.7 | | Exhibit 4 (c) Services contract between the Company and Mr P.A.J. Nota | | | 299 | |

19.8 | | Exhibit 7 | | | 304 | |

19.9 | | Exhibit 8 List of subsidiaries | | | 305 | |

19.10 | | Exhibit 12 (a) Certification | | | 314 | |

19.11 | | Exhibit 12 (b) Certification | | | 315 | |

19.12 | | Exhibit 13 (a) | | | 316 | |

19.13 | | Exhibit 13 (b) | | | 317 | |

19.14 | | Exhibit 15 (a) | | | 318 | |

19.15 | | Exhibit 15 (b) Letter of KPMG relating to disclosure under Item 16F | | | 319 | |

19.16 | | Exhibit 15 (c) | | | 320 | |

4 Annual Report 20132015

Introduction

Introduction

This document contains information required for the annual reportAnnual Report on Form 20-F for the year ended December 31, 20132015 of Koninklijke Philips N.V. (the 20132015 Form 20-F). Reference is made to the Form 20-F cross reference table herein. Only (i) the information in this document that is referenced in the Form 20-F cross reference table, (ii) this introduction, the cautionary statement “forward-looking statements” and explanation on “use of non-GAAP information” on the next three pages and (iii) the Exhibits shall be deemed to be filed with the Securities and Exchange Commission for any purpose. Any additional information in this document which is not referenced in the Form 20-F cross reference table, or the Exhibits themselves, shall not be deemed to be so incorporated by reference, shall not be part of the 20132015 Form 20-F and is furnished to the Securities and Exchange Commission for information only.

The terms “Philips”, the “Company”, “Group”, “we”, “our” and “us” refer to Koninklijke (Royal) Philips N.V. and as applicable to its subsidiaries and and/or its interest in joint ventures and associates.

IFRS based information

The audited consolidated financial statements as of December 31, 20132015 and 2012,2014, and for each of the years in the three-year period ended December 31, 2013,2015, included in the 20132015 Form 20-F have been prepared in accordance with International Financial Reporting Standards (IFRS) as endorsed by the European Union (EU). All standards and interpretations issued by the International Accounting Standards Board (IASB) and the IFRS Interpretations Committee effective year-end 20132015 have been endorsed by the EU, except that the EU did not adopt certain paragraphs of IAS 39 applicable to certain hedge transactions. Philips has no hedge transactions to which these paragraphs are applicable. Consequently, the accounting policies applied by Philips also comply fully with IFRS as issued by the IASB.

Non-GAAP information

In presenting and discussing the Philips Group’s financial position, operating results and cash flows, management uses certain non-GAAP financial measures such as: comparable growth; adjusted income from operations; net operating capital; net debt; cash flow before financing activities; net capital expenditures and free cash flow. These non-GAAP financial measures should not be viewed in isolation as alternatives to the equivalent IFRS measure and should be used in conjunction with the most directly comparable IFRS measure(s). Reference is made to the section titled “Use of non-GAAP information” for further information.

Third-party market share data

Statements regarding market share, contained in this document, including those regarding Philips’ competitive position, are based on outside sources such as specialized research institutes, industry and dealer panels in combination with management estimates. Where full year information regarding 20132015 is not yet available to Philips, market share statements may also be based on estimates and projections prepared by outside sources or management. Rankings are based on sales unless otherwise stated.

Fair value information

In presenting the Philips Group’s financial position, fair values are used for the measurement of various items in accordance with the applicable accounting standards. These fair values are based on market prices, where available, and are obtained from sources that are deemed to be reliable. Readers are cautioned that these values are subject to changes over time and are only valid at the balance sheet date. When quoted prices or observable market values do not exist, fair values are estimated using valuation models, which we believe are appropriate for their purpose. They require management to make significant assumptions with respect to future developments which are inherently uncertain and may therefore deviate from actual developments. Critical assumptions used are disclosed in the financial statements. In certain cases, independent valuations are obtained to support management’s determination of fair values.

Documents on display

It is possible to read and copy documents referred to in the 20132015 Form 20-F that have been filed with the SEC at the SEC’s public reference room located at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference rooms and their copy charges. Philips SEC filings are also publicly available through the SEC’s website atwww.sec.gov.

Annual Report 2013 5

Introduction

For definitions and abbreviations reference is made to chapter 17,18, Definitions and abbreviations, of this report.

Annual Report 2015 5

Introduction

Forward-looking statements

Pursuant to provisions of the United States Private Securities Litigation Reform Act of 1995, Philips is providing the following cautionary statement.

This document, including the information referred to in the Form 20-F cross reference table, contains certain forward lookingforward-looking statements with respect to the financial condition, results of operations and business of Philips and certain of the plans and objectives of Philips with respect to these items, in particular, among other statements, certain statements in Item 4 “Information on the Company” with regard to management objectives, market trends, market standing, product volumes, business risks, the implementation of our Accelerate! program, the statements in Item 8 “Financial Information” relating to legal proceedings, the statements in Itemitem 5 “Operating and financial review and prospects” with regardregards to trends in results of operations, margins overall market trends, risk management, exchange rates, the statements in Item 8 “Financial Information” relating to legal proceedings and goodwill and statements in Item 11 “Quantitative and qualitative disclosures about market risks” relating to risk caused by derivative positions, interest rate fluctuations and other financial exposure are forward-looking in nature. Forward-looking statements can be identified generally as those containing words such as “anticipates”, “assumes”, “believes”, “estimates”, “expects”, “should”, “will”, “will likely result”, “forecast”, “outlook”, “projects”, “may” or similar expressions. By their nature, forward-looking statements involve risk and uncertainty, because they relate to events that depend on circumstances that will occur in the future. There are a number of factors that could cause actual results and developments to differ materially from those expressed or implied by these forward-looking statements.

These factors include, but are not limited to, domestic and global economic and business conditions, developments within the euro zone, the successful implementation of our strategy and our ability to realize the benefits of this strategy, our ability to develop and market new products, changes in legislation, legal claims, changes in exchange and interest rates, changes in tax rates, pension costs and actuarial assumptions, raw materials and employee costs, our ability to identify and complete successful acquisitions and to integrate those acquisitions into our business,

6 Annual Report 2013

Introduction

our ability to successfully exit certain businesses or restructure our operations, the rate of technological changes, political, economic and other developments in countries where Philips operates, industry consolidation and competition.competition and the state of international capital markets as they may affect the timing and nature of the disposition by Philips of its interests in the Lighting business and the Lumileds and Automotive business.

As a result, Philips’ actual future results may differ materially from the plans, goals and expectations set forth in such forward-looking statements. For a discussion of factors that could cause future results to differ from such forward-looking statements, reference is made to the information in Item 3D “Risk Factors”.

6 Annual Report 2015

Introduction

Use of non-GAAP information

Koninklijke Philips N.V. (the ‘Company’) believes that an understanding of sales performance is enhanced when the effects of currency movements and acquisitions and divestments (changes in consolidation) are excluded. Accordingly, in addition to presenting ‘nominal growth’, ‘comparable growth’nominal sales growth, comparable sales growth is provided.

Comparable sales exclude the effects of currency movements and changes in consolidation. As indicated in the note 1, Significant accounting policies, sales and income are translated from foreign currencies into the Company’s reporting currency, the euro, at the exchange rate on transaction dates during the respective years. As a result of significant currency movements during the years presented, the effects of translating foreign currency sales amounts into euros could have a material impact on our sales figures.impact. Therefore, these impacts have been excluded in arriving at the comparable sales in euros. Currency effects have been calculated by translating previous years’ foreign currency sales amounts into euros at the following year’s exchange rates in comparison with the sales in euros as historically reported. The years under review were characterized by a number of acquisitions and divestments, as a result of which activities were consolidated or deconsolidated. The effect of consolidation changes has also been excluded in arriving at the comparable sales. For the purpose of calculating comparable sales, growth, when a previously consolidated entity is sold or contributed to a venture that is not consolidated by the Company, relevant sales are excluded from impacted prior-year periods. Similarly, when an entity is acquired, relevant sales are excluded from impacted periods.

Philips discusses “adjusted income from operations” in the 20132015 Form 20-F. Adjusted income from operations represents income from operations before amortization and impairment of intangible assets generated in acquisitions (excluding software and capitalized development expenses).

Annual Report 2013 7

Introduction

The Company uses the term “adjusted income from operations” to evaluate the performance of the Philips Group and its sectors. Referencing “adjusted income from operations” is considered appropriate in light of the following:

Philips has announced that one of its strategic drivers is to increase profitability through re-allocation of its resources towards opportunities offering more consistent and higher returns. Moreover, Philips intends to redeploy capital through value-creating acquisitions. Since 2006, management has used the “adjusted income from operations” measurement internally to monitor performance of the businesses on a comparable basis. As of 2007, Philips has also set external performance targets based on this measurement as it will not be distorted by the unpredictable effects of future, unidentified acquisitions.

Non US investors are advised that such presentation is different from the terms used in Philips’ results announcements and 2013 Annual Report. Philips believes that an understanding of the Group’s financial condition is enhanced by the disclosure of net operating capital (NOC), as this figure is used by Philips’ management to evaluate the capital efficiency of the Philips Group and its operating sectors. NOC is defined as: total assets excluding assets from discontinued operationsclassified as held for saleless: (a) cash and cash equivalents, (b) deferred tax assets, (c) other (non)-currentnon-current financial assets and current financial assets, (d) investments in associates, and after deduction of: (e) provisions, (f) accounts and notes payable, (g) accrued liabilities, (h) current/noncurrentother non-current liabilities and other current liabilities.

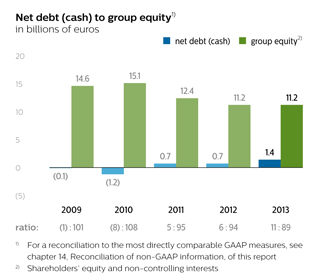

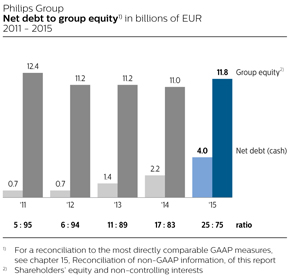

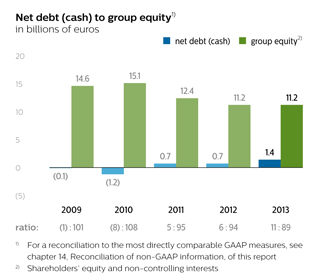

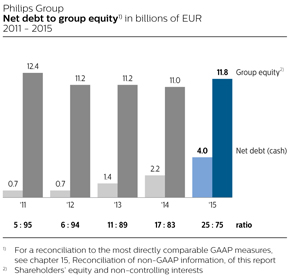

Net debt is defined as the sum of long- and short-term debt minus cash and cash equivalents. The net debt position as a percentage of the sum of group equity (shareholders’ equity and non-controlling interests) and net debt is presented to express the financial strength of the Company. This measure is widely used by management and investment analysts and is therefore included in the disclosure.

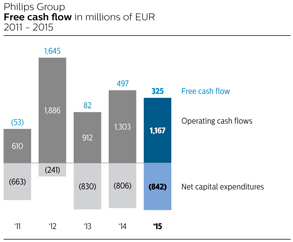

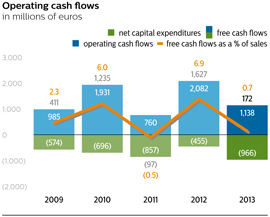

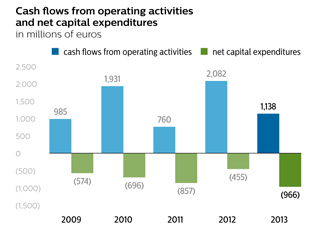

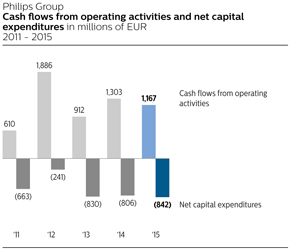

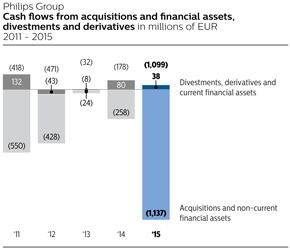

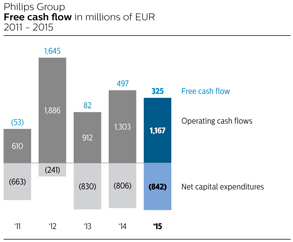

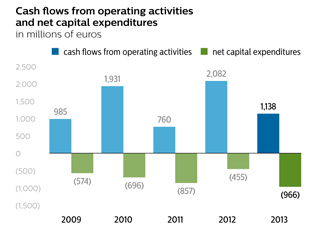

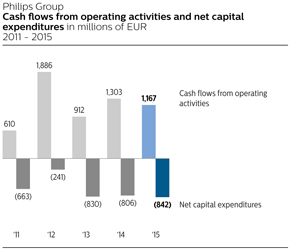

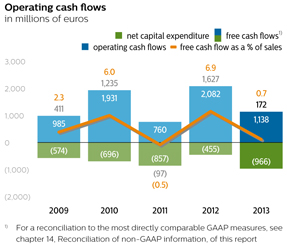

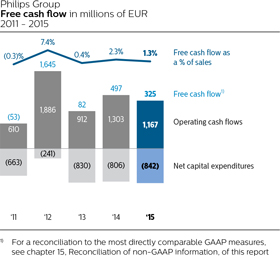

Cash flows before financing activities, being the sum total of net cash from operating activities and net cash from investing activities, and free cash flow, being net cash from operating activities minus net capital expenditures, are presented separately to facilitate the reader’s understanding of the Company’s funding requirements.

Net capital expenditures comprise of purchase of intangible assets, proceeds from sale of intangible assets, expenditures on development assets, capital expenditures on property, plant and equipment and proceeds from disposals of property, plant and equipment. This measure is widely used by management to calculate free cash flow.

8 Annual Report 20132015 7

Form 20-F cross reference table

Form 20-F cross reference table

Only (i) the information in this document that is referenced in the Form 20-F cross reference table, (ii) the Introduction, the cautionary statements concerning Forward-looking statements and explanation on use of non-GAAP information, of this report on pages 5-8,5-7, and (iii) the Exhibits shall be deemed to be filed with the Securities and Exchange Commission for any purpose. The content of Philips’ websites and other websites referenced herein should not be considered to be a part of or incorporated into the 20132015 Form 20-F. Any additional information which is not referenced in the Form 20-F cross reference table or the Exhibits themselves shall not be deemed to be so incorporated by reference, shall not be part of the 20132015 Form 20-F and is furnished to the Securities and Exchange Commission for information only.

The table below sets out the location in this document of the information required by SEC Form 20-F. The exact location is included in the column ‘Location in this document’. The column ‘Page’ includes the starting page of the section/paragraph for reference only.

8 Annual Report 2013 92015

Form 20-F cross reference table

| | | | | | | | |

| Item | | Form 20-F caption | | Location in this document | | Page | |

| Part 1 | | | | | | | | |

1 | | Identity of directors, senior management and advisors | | Not applicable | | | | |

2 | | Offer statistics and expected timetable | | Not applicable | | | | |

3 | | Key information | | | | | | |

| | | |

| | A Selected financial data | | 15.16.1. Five-year overview (condensed) | | | 256255 | |

| | | | 16.1.17.1. Key financials and dividend policy - Proposed distribution | | | 257 | |

| | | | 16.1.17.1. Key financials and dividend policy - Information for US investors in New York Registry shares program | | | 257 | |

| | | |

| | B Capitalization and indebtedness | | Not applicable | | | | |

| | | |

| | C Reason for the offer and use of proceeds | | Not applicable | | | | |

| | | |

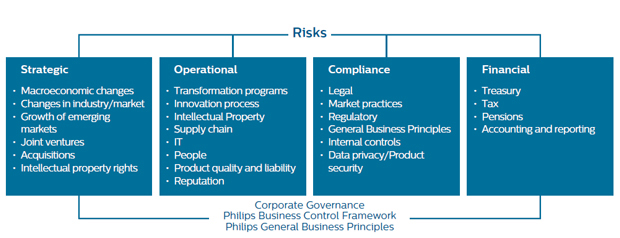

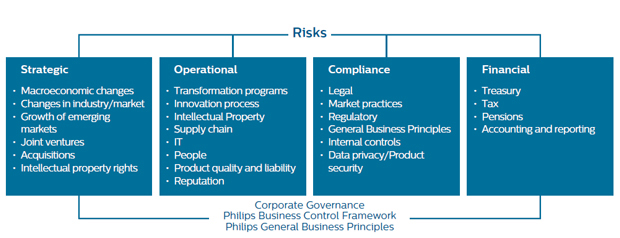

| | D Risk factors | | 6.2.7.2. Risk categories and factors -Second paragraph | | | 11991 | |

| | | | 6.3.7.3. Strategic risks | | | 12092 | |

| | | | 6.4.7.4. Operational risks | | | 12193 | |

| | | | 6.5.7.5. Compliance risks | | | 12395 | |

| | | | 7.6. Financial risks | | | 96 | |

| | | | | 6.6. Financial risks7.7. Separation risk | | | 12597 | |

4 | | Information on the Company | | | | | | |

| | | |

| | A History and development of the company | | 2.1. Our rich heritageContents - Significant developments | | | 332 | |

| | | | 4.1.11. Discontinued operations5.1.6. Restructuring and impairment charges | | | 6040 | |

| | | | 4.1.13. Acquisitions and divestments5.1.11. Discontinued operations | | | 6143 | |

| | | | 4.1.15.5.1.13. Acquisitions and divestments | | | 43 | |

| | | | 5.1.15. Cash flows provided by continuing operations | | | 6245 | |

| | | | 5.6. Sector performance - Our structure in 2015 & 2016 and beyond | | | 9166 | |

| | | | 10.11. Corporate governance - Corporate governance of the Philips groupGroup - Introduction | | | 142114 | |

| | | | 11.5. Investor Relations - Corporate seat and head office | | | 126 | |

| | | | Note 73 Discontinued operations and other assets classified as held for sale | | | 180154 | |

| | | | Note 94 Acquisitions and divestments | | | 182155 | |

| | | | Note 3632 Subsequent events | | | 213199 | |

| | | | 16.5. Philips’ acquisitions | | | 265 | |

| | | | 16.7.17.6. Investor contact - How to reach us | | | 266264 | |

| | | |

| | B Business Overview | | Introduction - Third-party market share data | | | 5 | |

| | | | 4.1.5.1. Financial performance- from 4.1.15.1.1 to 4.1.25.1.2 and from 4.1.45.1.4 to 4.1.145.1.14 | | | 5033 | |

| | | | 4.1.24. Supply management5.1.24. Procurement | | | 51 | |

| | | | 5.2.10. Addressing issues deeper in the supply chain | | | 57 | |

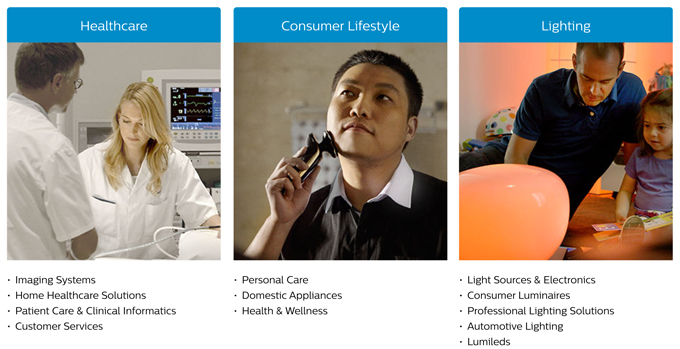

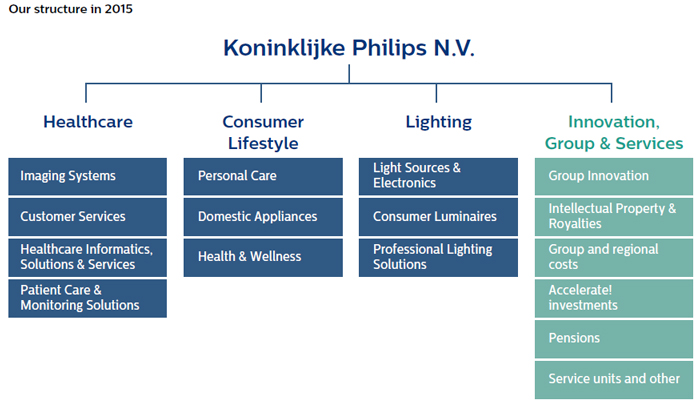

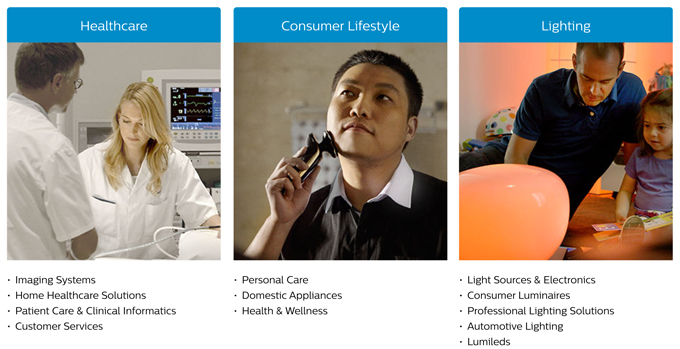

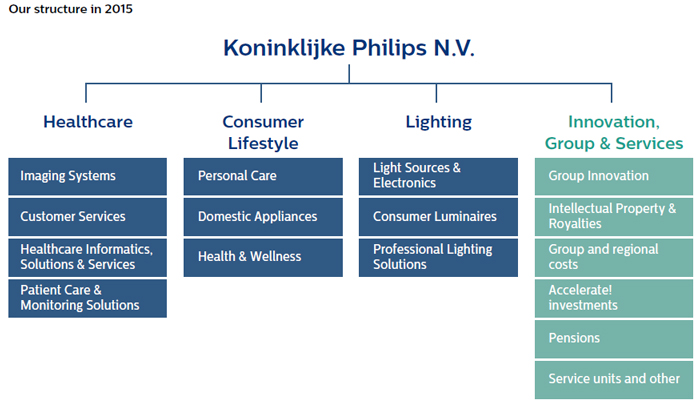

| | | | 6. Sector performance - Our structure in 2015 | | | 66 | |

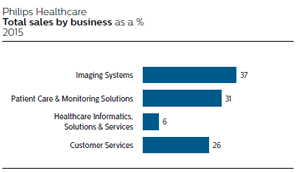

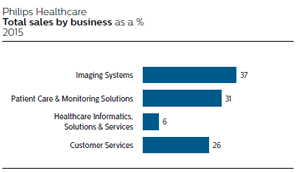

| | | | 6.1.2. About Healthcare in 2015 | | | 68 | |

| | | | 6.1.4. 2015 financial performance | | | 70 | |

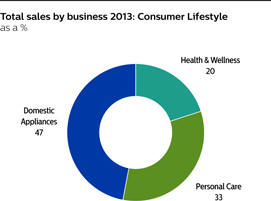

| | | | 4.2.11. Conflict minerals: issues further down the chain6.2.2. About Consumer Lifestyle in 2015 | | | 8074 | |

| | | | 5. Sector6.2.4. 2015 financial performance - Our structure | | | 9175 | |

| | | | 5.1.2.6.3.2. About Philips HealthcareLighting in 2015 | | | 9478 | |

| | | | 5.1.4. 20136.3.4. 2015 financial performance | | | 9679 | |

| | | | 5.2.2.6.4.1. About Philips Consumer LifestyleInnovation, Group & Services in 2015 | | | 10083 | |

| | | | 5.2.4. 20136.4.2. 2015 financial performance | | | 10186 | |

| | | | 5.3.2. About Philips Lighting | | | 106 | |

| | | | 5.3.4. 2013 financial performance | | | 107 | |

| | | | 5.4.1. About Innovation, Group & Services | | | 111 | |

| | | | 5.4.2. 2013 financial performance | | | 114 | |

| | | | 6.1.7.1. Our approach to risk management and business control | | | 11688 | |

| | | | 6.4. Operational risks -7.3. Strategic risks-ThirdLast paragraph | | | 12192 | |

| | | | Note 36 Subsequent events7.4. Operational risks -Third & fourth paragraph | | | 21393 | |

| | | | 13.2.2. Supplier indicators -Issues further down the chain7.5. Compliance risks | | | 22895 | |

| | | | 17. Definitions and abbreviations11. Corporate governance- Corporate governance of the Philips Group - Introduction | | | 274 | |

| | | |

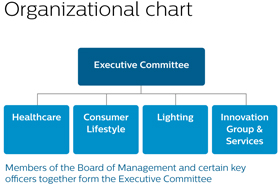

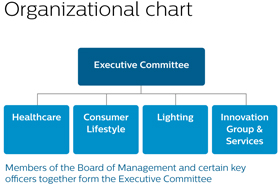

| | C Organizational structure | | 5. Sector performance - Our structure | | | 91114 | |

| | | | Note 2 Information by sector and main country | | | 171152 | |

| | | | Note 6 Interests14.2.8. Supplier indicators - Responsible Sourcing of Minerals: Addressing issues deeper in entitiesthe supply chain | | | 179225 | |

| | | | 18.4. Exhibit 8 List of subsidiaries18. Definitions and abbreviations | | | 281270 | |

10 Annual Report 2013

Form 20-F cross reference table

| | | | | | | | |

Item | | Form 20-F captionC Organizational structure | | Location6. Sector performance - Our structure in this document2015 | | Page | 66 | |

| | D Property, plant and equipment | | Note 2 Information by sector and main country | | | 171 | |

| | | | Note 10 Property, plant and equipment | | | 184 | |

| | | | Note 21 Provisions | | | 192 | |

| | | | Note 25 Contractual obligations | | | 194 | |

| | | | Note 26 Contingent assets and liabilities -Environmental remediation

| | | 195 | |

4A | | Unresolved staff comments | | Not applicable | | | | |

5 | | Operating and financial review and prospects | | | | | | |

| | A Operating results | | Use of non-GAAP information | | | 7 | |

| | | | 4.1. Financial performance - Management summary | | | 50 | |

| | | | 4.1. Financial performance - from 4.1.1 to 4.1.2 and from 4.1.4 to 4.1.14 | | | 50 | |

| | | | 5.1.2. About Philips Healthcare - Regulatory requirements | | | 94 | |

| | | | 5.1.4. 2013 financial performance | | | 96 | |

| | | | 5.2.2. About Philips Consumer Lifestyle - Regulatory requirements | | | 100 | |

| | | | 5.2.4. 2013 financial performance | | | 101 | |

| | | | 5.3.2. About Philips Lighting - Regulatory requirements | | | 106 | |

| | | | 5.3.4. 2013 financial performance | | | 107 | |

| | | | 5.4.2. 2013 financial performance | | | 114 | |

| | | | 4.6. Critical accounting policies | | | 87 | |

| | | | Note 4 Financial income and expenses | | | 175 | |

| | | | Note 7 Discontinued operations and other assets classified as held for sale | | | 180 | |

| | | | Note 9 Acquisitions and divestments | | | 182 | |

| | | | Note 11 Goodwill | | | 185 | |

| | | | Note 12 Intangible assets excluding goodwill | | | 186 | |

| | | | Note 35 Details of treasury / other financial risks | | | 210 | |

| | | | 6.3. Strategic risks | | | 120 | |

| | | | 6.5. Compliance risks | | | 123 | |

| | | | 6.6. Financial risks | | | 125 | |

| | | | 14. Reconciliation of non-GAAP information | | | 251 | |

| | | |

| | B Liquidity and capital resources | | 4.1. Financial performance - from 4.1.15 to 4.1.23 | | | 50 | |

| | | | Note 20 Long-term debt and short-term debt | | | 191 | |

| | | | Note 25 Contractual obligations | | | 194 | |

| | | | Note 19 Equity | | | 189 | |

| | | | Note 35 Details of treasury / other financial risks | | | 210 | |

| | | |

| | C Research and development, patents and licenses, etc. | | 4.1.4. Research and development | | | 55 | |

| | | | 5.4.1. About Innovation, Group & Services | | | 111 | |

| | | |

| | D Trend information | | 4.5. Outlook | | | 87 | |

| | | |

| | E Off-balance sheet arrangements | | 4.1.23. Cash obligations | | | 69 | |

| | | | Note 25 Contractual obligations | | | 194 | |

| | | | Note 26 Contingent assets and liabilities | | | 195 | |

| | | | Note 35 Details of treasury / other financial risks | | | 210 | |

| | | |

| | F Tabular disclosure of contractual obligations | | 4.1.23. Cash obligations | | | 69 | |

| | | | Note 25 Contractual obligations | | | 194 | |

| | | |

| | G Safe Harbor | | Forward-looking statements | | | 6 | |

6 | | Directors, senior management and employees | | | | | | |

| | | |

| | A Directors and senior management | | 7. Management | | | 127 | |

| | | | 8. Supervisory Board | | | 129152 | |

Annual Report 2013 112015 9

Form 20-F cross reference table

| | | | | | |

| Item | | Form 20-F caption | | Location in this document | | Page |

| | | | 10.1.Note 5 Interests in entities | | 156 |

| | | | 19.9. Exhibit 8 List of subsidiaries | | 305 |

| | | |

| | D Property, plant and equipment | | Note 2 Information by sector and main country | | 152 |

| | | | Note 10 Property, plant and equipment | | 164 |

| | | | Note 19 Provisions - Environmental provisions | | 173 |

| | | | Note 25 Contractual obligations | | 182 |

| | | | Note 26 Contingent assets and liabilities - Contingent liabilities - Environmental remediation | | 183 |

4A | | Unresolved staff comments | | Not applicable | | |

5 | | Operating and financial review and prospects | | | | |

| | A Operating results | | Use of non-GAAP information | | 7 |

| | | | 5.1. Financial performance- Management summary | | 33 |

| | | | 5.1. Financial performance - from 5.1.1 to 5.1.2 and from 5.1.4 to 5.1.14 | | 33 |

| | | | 6.1.2. About Healthcare in 2015 - Regulatory requirements | | 68 |

| | | | 6.1.4. 2015 financial performance | | 70 |

| | | | 6.2.2. About Consumer Lifestyle in 2015 - Regulatory requirements | | 74 |

| | | | 6.2.4. 2015 financial performance | | 75 |

| | | | 6.3.2. About Lighting in 2015 - Regulatory requirements | | 78 |

| | | | 6.3.4. 2015 financial performance | | 79 |

| | | | 6.4.2. 2015 financial performance | | 86 |

| | | | 5.6. Critical accounting policies | | 64 |

| | | | Note 3 Discontinued operations and other assets classified as held for sale | | 154 |

| | | | Note 4 Acquisitions and divestments | | 155 |

| | | | Note 6 Income from operations | | 157 |

| | | | Note 7 Financial income and expenses | | 159 |

| | | | Note 11 Goodwill | | 165 |

| | | | Note 12 Intangible assets excluding goodwill | | 167 |

| | | | Note 31 Details of treasury / other financial risks | | 195 |

| | | | 7.3. Strategic risks | | 92 |

| | | | 7.4. Operational risks | | 93 |

| | | | 7.5. Compliance risks | | 95 |

| | | | 7.6. Financial risks | | 96 |

| | | | 7.7. Separation risk | | 97 |

| | | | 15. Reconciliation of non-GAAP information | | 249 |

| | | |

| | B Liquidity and capital resources | | 5.1. Financial performance - from 5.1.15 to 5.1.23 | | 33 |

| | | | Note 17 Equity | | 169 |

| | | | Note 18 Debt | | 172 |

| | | | Note 25 Contractual obligations | | 182 |

| | | | Note 31 Details of treasury / other financial risks | | 195 |

| | | |

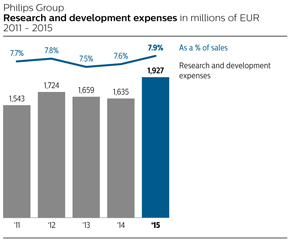

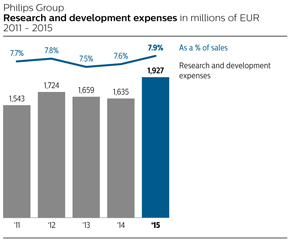

| | C Research and development, patents and licenses, etc. | | 5.1.4. Research and development | | 39 |

| | | | 6.4.1. About Innovation, Group & Services in 2015 | | 83 |

| | | |

| | D Trend information | | 5.5. Outlook | | 63 |

| | | |

| | E Off-balance sheet arrangements | | 5.1.23. Cash obligations | | 50 |

| | | | Note 25 Contractual obligations | | 182 |

| | | | Note 26 Contingent assets and liabilities | | 183 |

| | | | Note 31 Details of treasury / other financial risks | | 195 |

| | | |

| | F Tabular disclosure of contractual obligations | | 5.1.23. Cash obligations | | 50 |

| | | | Note 25 Contractual obligations | | 182 |

| | | |

| | G Safe Harbor | | Forward-looking statements | | 6 |

10 Annual Report 2015

Form 20-F cross reference table

| | | | | | | | |

| Item | | Form 20-F caption | | Location in this document | | Page | |

6 | | Directors, senior management and employees | | | | | | |

| | | |

| | A Directors and senior management | | 8. Management | | | 99 | |

| | | | 9. Supervisory Board | | | 101 | |

| | | | 11.1. Board of Management - Introduction | | 142 | 114 | |

| | | | 10.1.11.1. Board of Management - (Term of) Appointment and conflicts of interest | | 142 | 114 | |

| | | | 10.2.11.2. Supervisory Board - (Term of) Appointment, individual data and conflicts of interests | | 144 | 118 | |

| | | |

| | B Compensation | | Note 3020 Post-employment benefits | | 197 | 176 | |

| | | | Note 3128 Share-based compensation | | 200 | 186 | |

| | | | Note 3329 Information on remuneration | | 204 | 189 | |

| | | | 9.2.10.2. Report of the Remuneration Committee | | 135 | 107 | |

| | | |

| | C Board practices | | 7.8. Management | | 127 |

| 99 | | | | 8. Supervisory Board | | 129 |

| | | | 9. Supervisory Board report | | 131 | 101 | |

| | | | 10.1.10. Supervisory Board of Managementreport | | 142 | 103 | |

| | | | 10.2. Supervisory11.1. Board of Management | | 144 | 114 | |

| | | | 10.4. Logistics of the General11.2. Supervisory Board | | | 118 | |

| | | | 11.4. Meeting of Shareholderslogistics and provision ofother information - Internal controls and disclosure policies | | 147 | 123 | |

| | | | 10.4. Logistics of the General11.4. Meeting of Shareholderslogistics and provision ofother information - Auditor information | | 147 | 123 | |

| | | |

| | D Employees | | 4.2.4.5.2.4. Employment | | 73 | 54 | |

| | | | Note 36 Income from operations - Employees | | 174 | 157 | |

| | | |

| | E Share ownership | | 10.1.11.1. Board of Management- Amount and composition of the remuneration of the Board of Management | | 142 | 114 | |

| | | | Note 20 Long-term debt and short-term debt - Short-term debt17 Equity | | 191 | 169 | |

| | | | Note 19 Equity | | 189 |

| | | | Note 3128 Share-based compensation | | 200 | 186 | |

| | | | | Note 3329 Information on remuneration | | 204 | 189 | |

7 | | Major shareholders and related party transactions | | | | | | |

| | | |

| | A Major shareholders | | 10.5.11.5. Investor Relations - Major shareholders and other information for shareholders | | 149 | 126 | |

| | | | 10.6.11.6. Additional information- Major shareholders as filed with SECinformation - Articles of association | | 149 | 127 | |

| | | | 17.2. Share information | | | 259 | |

| | | |

| | B Related party transactions | | 10.1.11.1. Board of Management | | 142 | 114 | |

| | | | Note 65 Interests in entities | | 179 | 156 | |

| | | | Note 3227 Related-party transactions | | 204 |

| 186 | | | | Note 36 Subsequent events | | 213 |

| | | |

| | | C Interests of experts and counsel | | Not applicable | | | | |

8 | | Financial information | | | | | | |

| | | |

| | A Consolidated statements and other financial information | | 11.12. Group financial statements - from 12.4 to 12.9 | | 154 | 131 | |

| | | | 16.1.17.1. Key financials and dividend policy - Dividend policy | | | 257 | |

| | | |

| | | B Significant changes | | Note 3632 Subsequent events | | 213 | 199 | |

9 | | The offer and listing | | | | | | |

| | | |

| | A Offer and listing details | | 10.4. Logistics of the General Meeting of Shareholders and provision of information - Preference shares and the Stichting Preferente Aandelen Philips | | 147 |

| | | | 10.5. Investor Relations - Major shareholders and other information for shareholders | | 149 |

| | | | 10.6. Additional information | | 149 |

| | | | Note 19 Equity | | 189 |

| | | | 16.4.17.4. Performance in relation to market indices | | 262 | 261 | |

12 Annual Report 2013

Form 20-F cross reference table

| | | | | | |

Item | | Form 20-F caption | | Location in this document | | Page |

| | B Plan of distribution | | Not applicable | | | | |

| | | |

| | C Markets | | 16.4.17.4. Performance in relation to market indices | | 262 | 261 | |

| | | |

| | D Selling shareholders | | Not applicable | | | | |

Annual Report 2015 11

Form 20-F cross reference table

| | | | | | |

| Item | | Form 20-F caption | | Location in this document | | Page |

| | E Dilution | | Not applicable | | |

| | | |

| | | F Expense of the issue | | Not applicable | | |

10 | | Additional information | | | | |

| | | |

| | A Share capital | | Not applicable | | |

| | | |

| | B Memorandum and articles of association | | 10.1.11.1. Board of Management - (Term of) Appointment and conflicts of interest | | 142114 |

| | | | 10.2.11.2. Supervisory Board - (Term of) Appointment, individual data and conflicts of interest | | 144118 |

| | | | 10.3.11.3. General Meeting of Shareholders - Main powers of the General Meeting of Shareholders | | 146122 |

| | | | 10.6. Additional11.4. Meeting logistics and other information | | 149123 |

| | | | 18.1. Index11.6. Additional information - Articles of exhibits Exhibit 1association | | 277127 |

| | | | 10.4. Logistics19.1. Index of the General Meeting of Shareholders and provision of informationexhibits - Exhibit 1 | | 147272 |

| | | |

| | C Material contracts | | 9.2.2.10.2.2. Contracts for the provision of services | | 135107 |

| | | | 18.3. Exhibits19.1. Index of exhibits - Exhibit 4 (a), (b) and (c) | | 280272 |

| | | |

| | D Exchange controls | | 10.6.11.6. Additional information- Exchange controls | | 149127 |

| | | |

| | E Taxation | | 16.8.17.7. Taxation | | 268266 |

| | | |

| | F Dividends and paying agents | | Not applicable | | |

| | | |

| | G Statements by experts | | Not applicable | | |

| | | |

| | H Documents on display | | Introduction - Documents on display | | 5 |

| | | |

| | | I Subsidiary information | | Not applicable | | |

11 | | Quantitative and qualitative disclosure about market risk | | | | |

| | | |

| | A Quantitative information about market risk | | Note 3531 Details of treasury / other financial risks | | 210195 |

| | | |

| | B Qualitative information about market risk | | Note 3531 Details of treasury / other financial risks | | 210195 |

| | | |

| | C Interim periods | | Not applicable | | |

| | | |

| | D Safe harbor | | Note 3531 Details of treasury / other financial risks Forward-looking statements

| | 210

195 |

| | | | Forward-looking statements | | 6 |

| | | |

| | | E Small business issuers | | Not applicable | | |

12 | | Description of securities other than equity securities | | | | |

| | | |

| | A Debt securities | | Not applicable | | |

| | | |

| | B Warranty and rights | | Not applicable | | |

| | | |

| | C Other securities | | Not applicable | | |

| | | |

| | D American depository shares | | 17.8. New York Registry Shares | | 269 |

| | | |

Part 2 | | | | | | |

13 | | Defaults, dividend arrearages and delinquencies | | Not applicable | | |

12 Annual Report 2013 132015

Form 20-F cross reference table

| | Item | | Form 20-F caption | | Location in this document | | Page | | Form 20-F caption | | Location in this document | | Page |

| | | B Warranty and rights | | Not applicable | | | |

| | | C Other securities | | Not applicable | | | |

| | | | D American depository shares | | 16.9. New York Registry Shares | | 272 | |

| | Part 2 | | | | | | | |

| 13 | | Defaults, dividend arrearages and delinquencies | | Not applicable | | | |

| 14 | | Material modifications to the rights of security holders and use of proceeds | | Not applicable | | | | Material modifications to the rights of security holders and use of proceeds | | Not applicable | | |

| 15 | | Controls and procedures | | | | | | Controls and procedures | | | | |

| | | A Disclosure controls and procedures | | 11.1.1. Disclosure controls and procedures | | 154 | | A Disclosure controls and procedures | | 12.1.1. Disclosure controls and procedures | | 132 |

| | | B Management annual report on internal control over financial reporting | | 11.1. Management’s report on internal control | | 154 | | B Management Annual Report on internal control over financial reporting | | 12.1. Management’s report on internal control | | 132 |

| | | C Attestation report of the registered public accounting firm | | 11.3. Auditor’s report on internal control over financial reporting | | 155 | | C Attestation report of the registered public accounting firm | | 12.3.2. Independent auditors’ report on internal control over financial reporting | | 134 |

| | | | D Changes in internal control over financial reporting | | 11.1.2. Changes in internal control over financial reporting | | 154 | | D Changes in internal control over financial reporting | | 12.1.2. Changes in internal control over financial reporting | | 132 |

| 16A | | Audit Committee Financial Expert | | 10.2. Supervisory Board - The Audit Committee | | 144 | | Audit Committee Financial Expert | | 11.2. Supervisory Board - The Audit Committee | | 118 |

| 16B | | Code of Ethics | | 6.1. Our approach to risk management and business control - Financial Code of Ethics | | 116 | | Code of Ethics | | 7.1. Our approach to risk management and business control - Financial Code of Ethics | | 88 |

| 16C | | Principal Accountant Fees and Services | | 9.3. Report of the Audit Committee | | 140 | | Principal Accountant Fees and Services | | 10.3. Report of the Audit Committee | | 112 |

| | | | 10.4. Logistics of the General Meeting of Shareholders and provision of information - Auditor policy | | 147 | | | | 11.4. Meeting logistics and other information - Auditor policy | | 123 |

| | | | | | Note 3 Income from operations - Audit fees | | 174 | | | | Note 6 Income from operations - Audit fees | | 157 |

| 16D | | Exemptions from the Listing Standards for Audit Committees | | Not applicable | | | | Exemptions from the Listing Standards for Audit Committees | | Not applicable | | |

| 16E | | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | | Note 19 Equity - Treasury shares | | 189 | | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | | 11.3. General Meeting of Shareholders - Repurchase and issue of (rights to) own shares | | 122 |

| | | | 10.3. General Meeting of Shareholders - Repurchase and issue of (rights to) own shares | | 146 | | | | 17.2. Share information - Share repurchase programs for capital reduction purposes | | 259 |

| | | | | 16.2. Share information - Share repurchase programs for capital reduction purposes | | 259 | |

| 16F | | Change in Registrant’s Certifying Accountant | | Not applicable | | | | Change in Registrant’s Certifying Accountant | | 11.6. Additional information - Change in Registrant’s Certifying Accountant | | 127 |

| 16G | | Corporate Governance | | 9. Supervisory Board report | | 131 | | Corporate Governance | | 11. Corporate governance - Corporate governance of the Philips Group - Introduction | | 114 |

| | | | | 10. Corporate governance | | 142 | | | | 11.6. Additional information - General | | 128 |

| | | | | 11.6. Additional information - Board structure | | 128 |

| | | | | 11.6. Additional information - Independence of members of our Supervisory Board | | 128 |

| | | | | 11.6. Additional information - Committees of our Supervisory Board | | 128 |

| | | | | 11.6. Additional information - Equity compensation plans | | 129 |

| | | | | | 11.6. Additional information - Code of business conduct | | 129 |

16H | | | Mine Safety Disclosure | | Not applicable | | |

| Part 3 | | | | | | | | | | | | |

| 17 | | Financial statements | | Not applicable | | | | Financial statements | | Not applicable | | |

| 18 | | Financial statements | | 11. Group financial statements | | 154 | | Financial statements | | 12. Group financial statements - from 12.4 to 12.9 | | 131 |

| 19 | | Exhibits | | 18.1. Index of exhibits | | 277 | | Exhibits | | 19.1. Index of exhibits | | 272 |

14 Annual Report 20132015 13

Performance highlights 1

1 Performance highlights

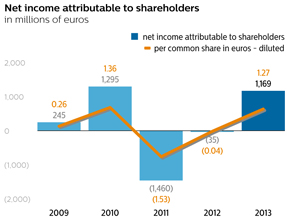

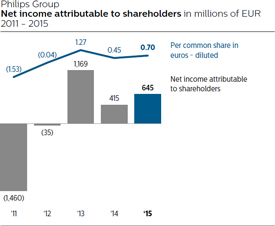

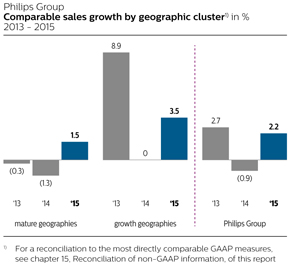

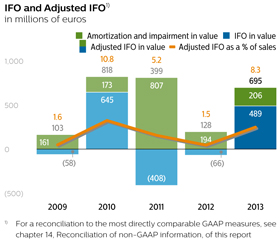

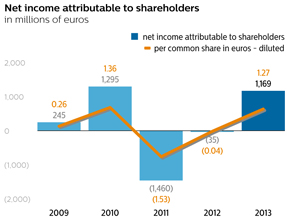

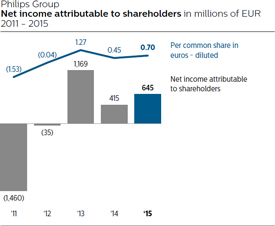

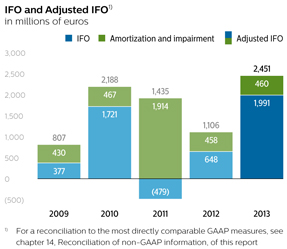

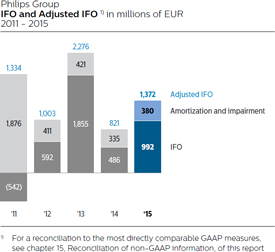

Prior-period financial statements and related information have been restated for the treatment of Audio, Video, Multimedia and Accessories as discontinued operations (see note 7, Discontinued operations and other assets classified as held for sale) and the adoption of IAS 19R, which mainly relates to accounting for pensions (see note 30, Post-employment benefits). For a reconciliation to the most directly comparable GAAP measures, seeReconciliation of non-GAAP information.Philips Group

Financial table

all amounts Key datain millions of eurosEUR unless otherwise stated

2014 - 2015

| | | | | | |

| | | | | | | | 2014 | | 2015 | |

| | | 2011 | | 2012 | | 2013 | | | | | |

Sales | | | 20,992 | | | | 23,457 | | | | 23,329 | | | | 21,391 | | | | 24,244 | |

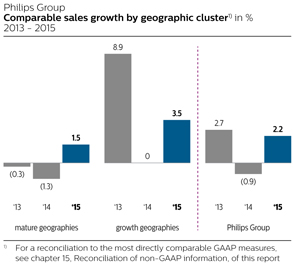

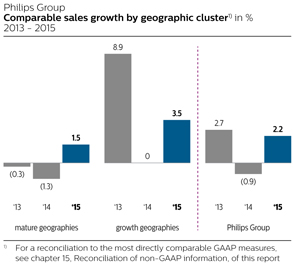

| Comparable sales growth | | | | (1 | )% | | | 2 | % |

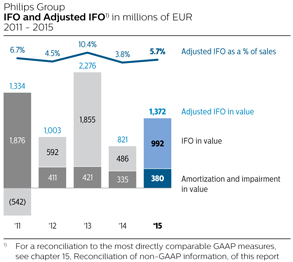

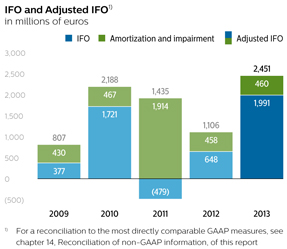

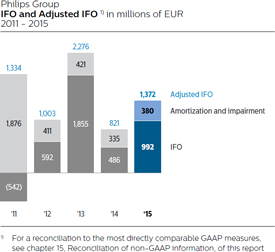

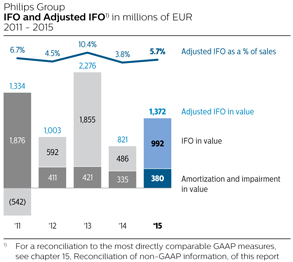

| Adjusted IFO | | | 1,435 | | | | 1,106 | | | | 2,451 | | | | 821 | | | | 1,372 | |

as a % of sales | | | 6.8 | | | | 4.7 | | | | 10.5 | | | | 3.8 | % | | | 5.7 | % |

| IFO | | | (479 | ) | | | 648 | | | | 1,991 | | | | 486 | | | | 992 | |

as a % of sales | | | (2.3 | ) | | | 2.8 | | | | 8.5 | | | | 2.3 | % | | | 4.1 | % |

| Net income (loss) | | | (1,456 | ) | | | (30 | ) | | | 1,172 | | |

Net income | | | | 411 | | | | 659 | |

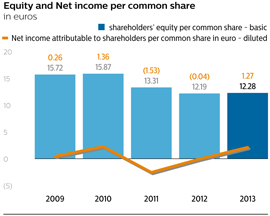

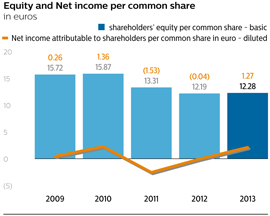

| Net income attributable to shareholders per common share in euro: | | | | | | | |

- basic | | | (1.53 | ) | | | (0.04 | ) | | | 1.28 | | |

- diluted | | | (1.53 | ) | | | (0.04 | ) | | | 1.27 | | |

Net income attributable to shareholders per common share in EUR: | | | | | |

basic | | | | 0.45 | | | | 0.70 | |

diluted | | | | 0.45 | | | | 0.70 | |

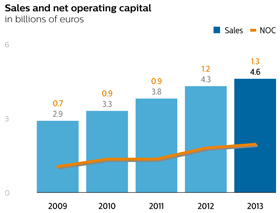

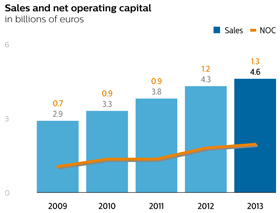

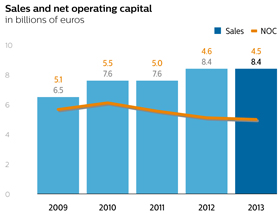

| Net operating capital | | | 10,382 | | | | 9,316 | | | | 10,238 | | | | 8,838 | | | | 11,096 | |

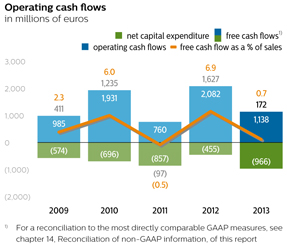

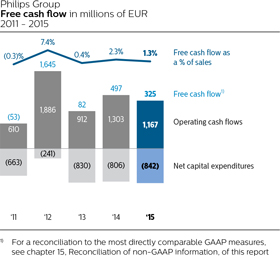

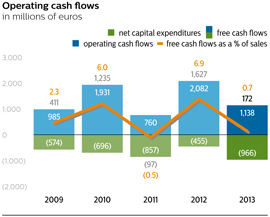

| Free cash flows | | | (97 | ) | | | 1,627 | | | | 172 | | |

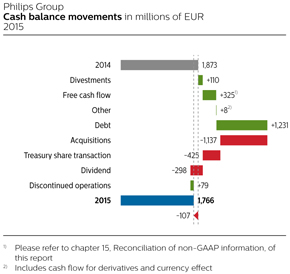

Free cash flow | | | | 497 | | | | 325 | |

| Shareholders’ equity | | | 12,328 | | | | 11,151 | | | | 11,214 | | | | 10,867 | | | | 11,662 | |

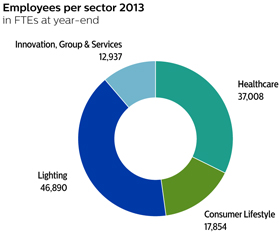

| Employees at December 31 | | | 125,240 | | | | 118,087 | | | | 116,681 | | | | 113,678 | | | | 112,959 | |

of which discontinued operations | | | 5,645 | | | | 2,005 | | | | 1,992 | | |

continuing operations | | | | 105,365 | | | | 104,204 | |

discontinued operations | | | | 8,313 | | | | 8,755 | |

| | | | | |

Performancein millions of EUR unless otherwise stated

2014 - 2015

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | Group | | | Healthcare | | | Consumer Lifestyle | | | Lighting | |

| | | 2014 | | | 2015 | | | | | | 2014 | | | 2015 | | | | | | 2014 | | | 2015 | | | | | | 2014 | | | 2015 | | | | |

| | | | |

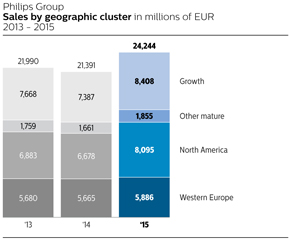

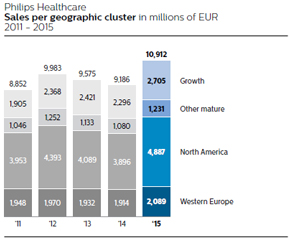

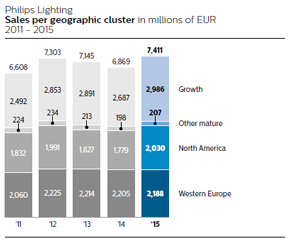

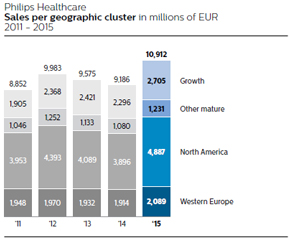

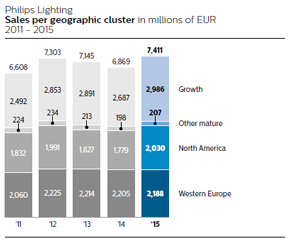

Sales | | | 21,391 | | | | 24,244 | | | | 13% | | | | 9,186 | | | | 10,912 | | | | 19% | | | | 4,731 | | | | 5,347 | | | | 13% | | | | 6,869 | | | | 7,411 | | | | 8% | |

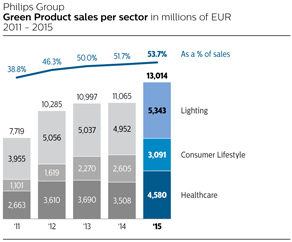

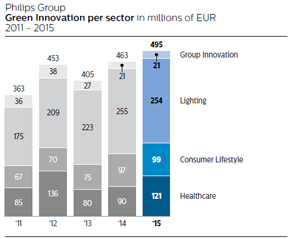

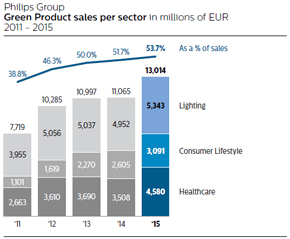

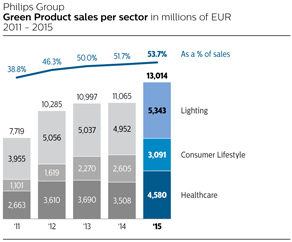

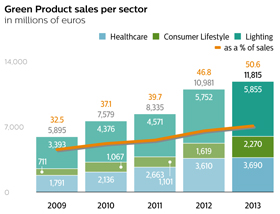

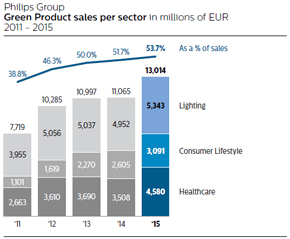

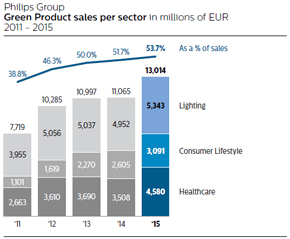

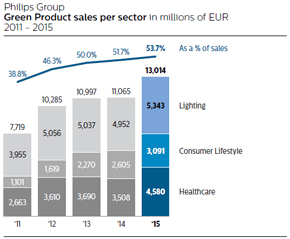

Green Product sales | | | 11,065 | | | | 13,014 | | | | 18% | | | | 3,508 | | | | 4,580 | | | | 31% | | | | 2,605 | | | | 3,091 | | | | 19% | | | | 4,952 | | | | 5,343 | | | | 8% | |

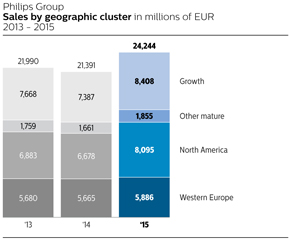

Sales in mature geographies1) | | | 14,004 | | | | 15,836 | | | | 13% | | | | 6,890 | | | | 8,207 | | | | 19% | | | | 2,508 | | | | 2,784 | | | | 11% | | | | 4,182 | | | | 4,425 | | | | 6% | |

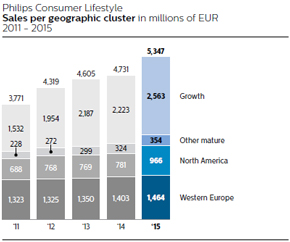

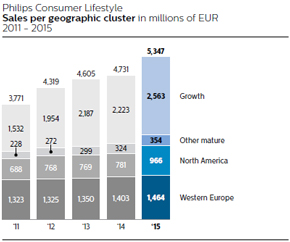

Sales in growth geographies1) | | | 7,387 | | | | 8,408 | | | | 14% | | | | 2,296 | | | | 2,705 | | | | 18% | | | | 2,223 | | | | 2,563 | | | | 15% | | | | 2,687 | | | | 2,986 | | | | 11% | |

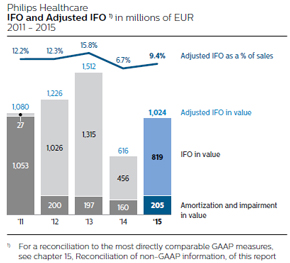

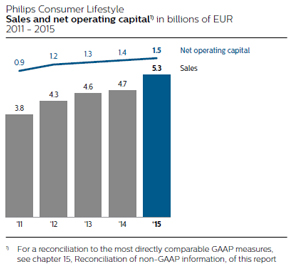

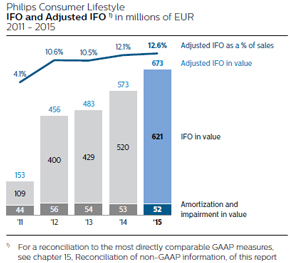

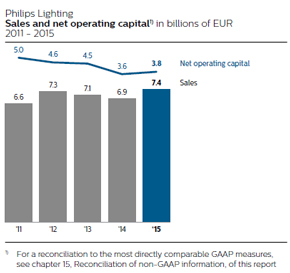

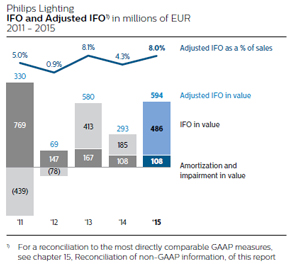

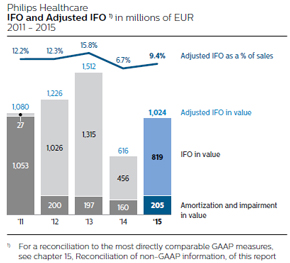

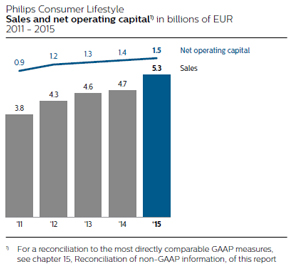

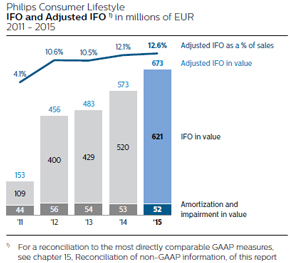

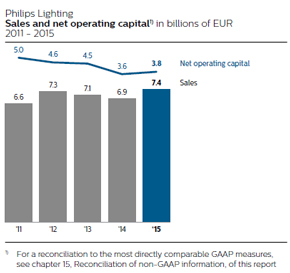

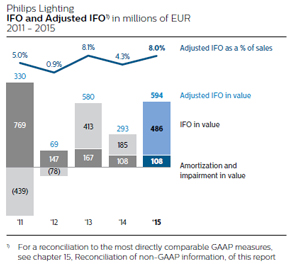

Adjusted IFO | | | 821 | | | | 1,372 | | | | 67% | | | | 616 | | | | 1,024 | | | | 66% | | | | 573 | | | | 673 | | | | 17% | | | | 293 | | | | 594 | | | | 103% | |

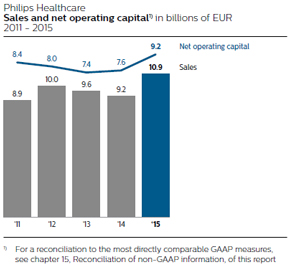

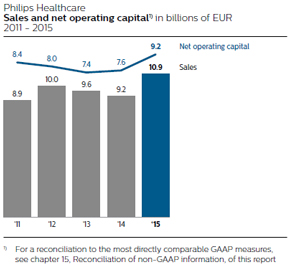

Net operating capital | | | 8,838 | | | | 11,096 | | | | 26% | | | | 7,565 | | | | 9,212 | | | | 22% | | | | 1,353 | | | | 1,453 | | | | 7% | | | | 3,638 | | | | 3,813 | | | | 5% | |

| | | | |

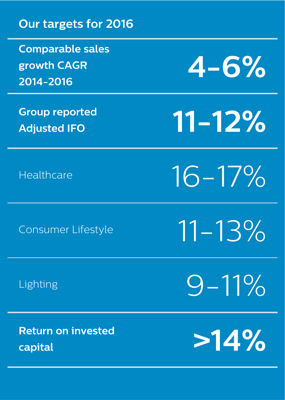

| 1) | Mid-term financial targets |

2) | Including restructuring and acquisitions |

3) | Excluding Mergers & Acquisitions impact |

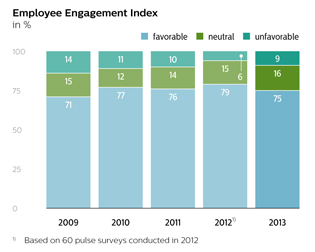

4) | Based on the results of 60 “pulse surveys” as there was no full-scope Employee Engagement Survey in 2012 |

5) | For a definition of of mature and growth geographies see chapter 17,18, Definitions and abbreviations, of this report |

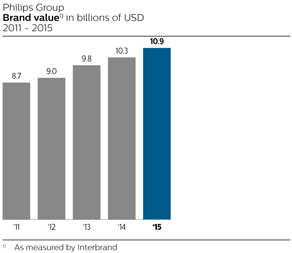

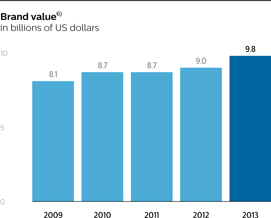

6) | As measured by Interbrand |

Financial performance 2013

| | | | | | | | |

| | Target1) | | | Actual | |

CAGR 2012 - 2013 %

| | | 4-6 | % | | | 4.5 | % |

Adjusted IFO as % of sales2)

| | | 10-12 | % | | | 10.5 | % |

ROIC %3)

| | | 12-14 | % | | | 15.3 | % |

Performance highlights 1

Annual Report 20132015 15

Performance highlightsMessage from the CEO 2

Performance

in millions of euros

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Group | | | Healthcare | | | Consumer Lifestyle | | | Lighting | |

| | | 2012 | | | 2013 | | | | | | 2012 | | | 2013 | | | | | | 2012 | | | 2013 | | | | | | 2012 | | | 2013 | | | | |

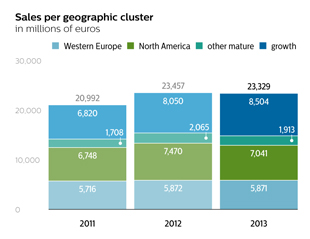

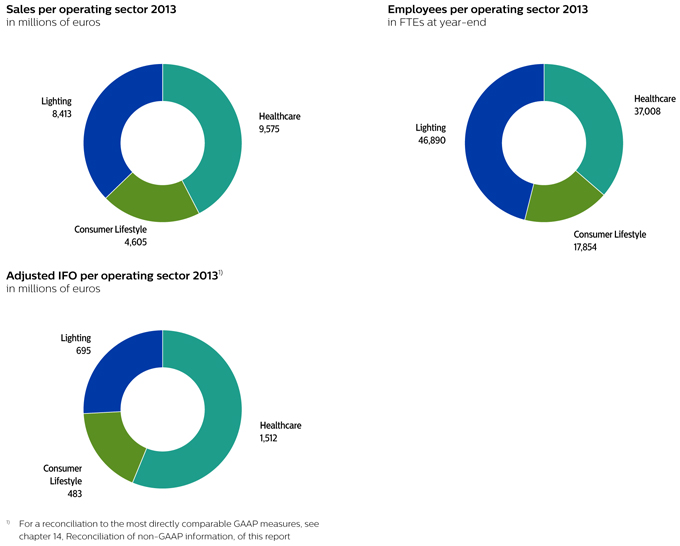

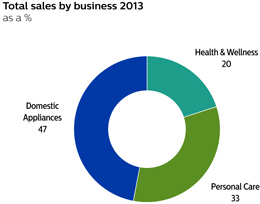

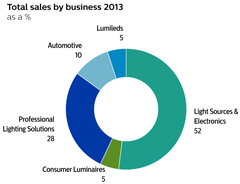

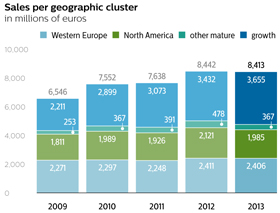

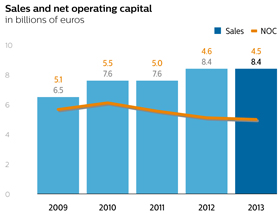

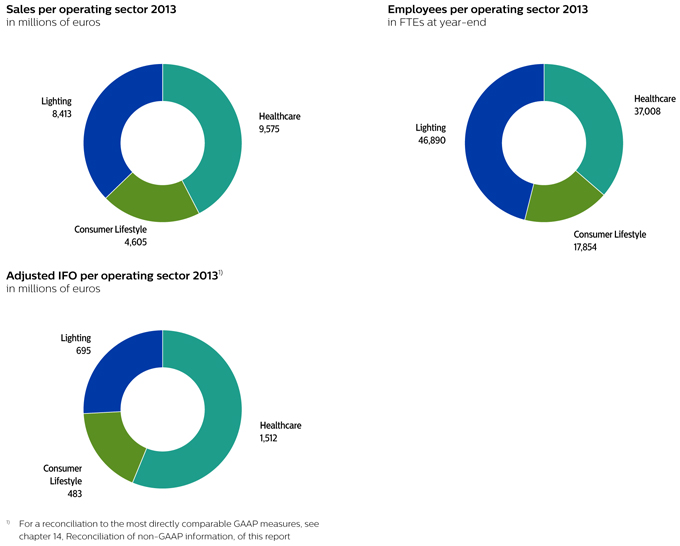

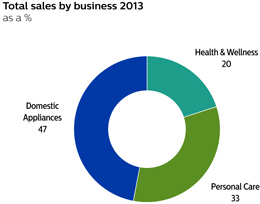

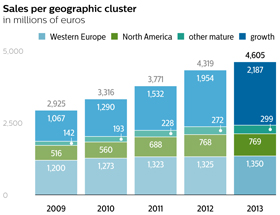

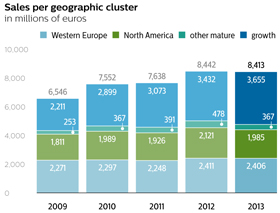

Sales | | | 23,457 | | | | 23,329 | | | | 1% | | | | 9,983 | | | | 9,575 | | | | 4% | | | | 4,139 | | | | 4,605 | | | | 7% | | | | 8,442 | | | | 8,413 | | | | 0% | |

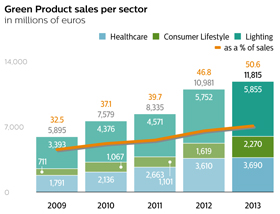

Green product sales | | | 10,981 | | | | 11,815 | | | | 8% | | | | 3,610 | | | | 3,690 | | | | 2% | | | | 1,619 | | | | 2,270 | | | | 40% | | | | 5,572 | | | | 5,855 | | | | 2% | |

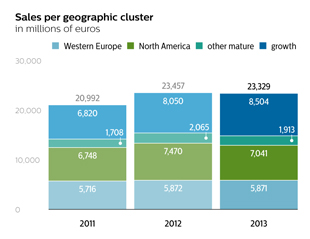

Sales in mature geographies5) | | | 15,407 | | | | 14,825 | | | | 4% | | | | 7,615 | | | | 7,154 | | | | 6% | | | | 2,365 | | | | 2,418 | | | | 2% | | | | 5,010 | | | | 4,758 | | | | 5% | |

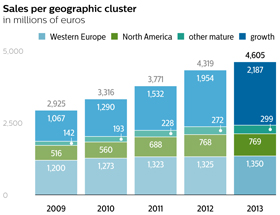

Sales in growth geographies5) | | | 8,050 | | | | 8,504 | | | | 6% | | | | 2,368 | | | | 2,421 | | | | 2% | | | | 1,954 | | | | 2,187 | | | | 12%  | | | | 3,432 | | | | 3,655 | | | | 6% | |

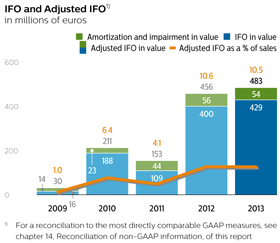

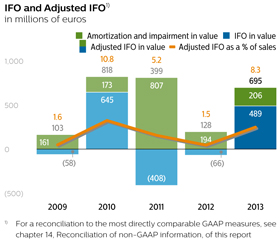

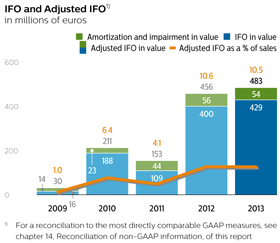

Adjusted IFO | | | 1,106 | | | | 2,451 | | | | 122%  | | | | 1,226 | | | | 1,512 | | | | 23%  | | | | 456 | | | | 483 | | | | 6% | | | | 128 | | | | 695 | | | | 443%  | |

Net operating capital | | | 9,316 | | | | 10,238 | | | | 10% | | | | 7,976 | | | | 7,437 | | | | 7% | | | | 1,205 | | | | 1,261 | | | | 5% | | | | 4,635 | | | | 4,462 | | | | 4% | |

“ After separating, Philips will focus on driving higher growth and higher value from its core activities in the field of health technology, and Lighting will have a great future as a stand-alone company.” Frans van Houten, CEO Royal Philips

2015 was a crucial year for Philips as we restored growth and improved productivity. We also took the decisive next step in our Accelerate! transformation – separating out our Lighting business and moving away from a diversified holding structure to create two stand-alone companies, each with their own clearly defined strategic direction and focus. We believe this is the best way to create lasting value for our customers and shareholders and a bright future for our employees.

Two companies with a bright future

Philips will focus on the exciting opportunities in the area of health technology, delivering meaningful innovation to improve people’s lives across the health continuum – through new, more integrated forms of care delivery.

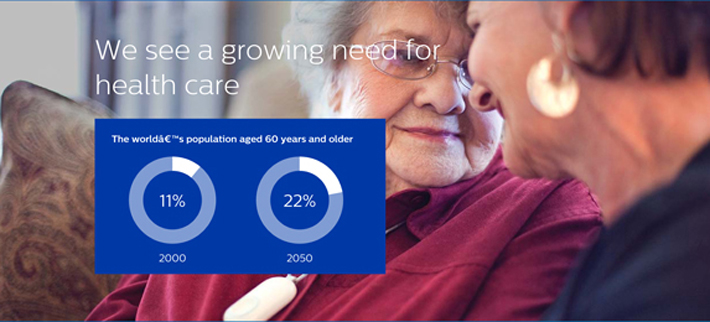

With an expanding and aging population, the rise of chronic diseases, and global resource constraints, health systems all over the world are under tremendous pressure. At the same time, more and more people are keen to take an active role in managing their own health. And digital technology, whilst bringing vast new opportunities, is shifting value from devices to software and services. All of this is driving the convergence of professional healthcare and consumer end-markets.

By leveraging our advanced technology, deep clinical and consumer insights, long-standing customer relationships, our new HealthSuite digital cloud platform, and integrated solutions portfolio, we can improve people’s health and enable better outcomes at lower cost across the health continuum.

16 Annual Report 20132015

Message from the CEO 2

Message fromIn the CEOfield of lighting, the industry is undergoing a radical transformation. Population growth and urbanization are increasing demand for light, specifically energy-efficient light. At the same time, the rapid rise of LED and the mass adoption of digital technology are driving a shift towards connected lighting. With connected lighting, the lighting fixtures not only provide high-quality illumination, but are also fitted with sensors and connected to the building’s IT network infrastructure, forming an ‘information pathway’. This is opening up new applications where we can deliver extraordinary value beyond illumination, also via new service-based business models.

As a more agile, stand-alone company with direct access to capital markets, we believe that our Lighting business will be better able to strengthen its position as the world leader in lighting solutions, boost scale and capture growth.

2015 a year of solid progress

Amidst all this transformation, it was vital that we improved our performance in 2015, giving our customers the product and service innovation they expect.

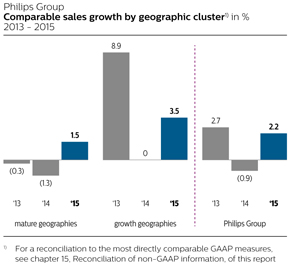

Overall, 2015 was a solid year for Philips, in which we recorded consistent performance improvements in the face of challenging economic conditions. Sales were up 2% on a comparable basis, driven by 4.5% growth in our HealthTech portfolio. Profitability also increased thanks to the improved operational performance, overhead cost savings, a reduction in cost of goods sold and process optimization, partly offset by the significant impact of currency headwinds, higher investments in R&D, settlement costs for pension de-risking, and ongoing investments to improve our quality management systems.

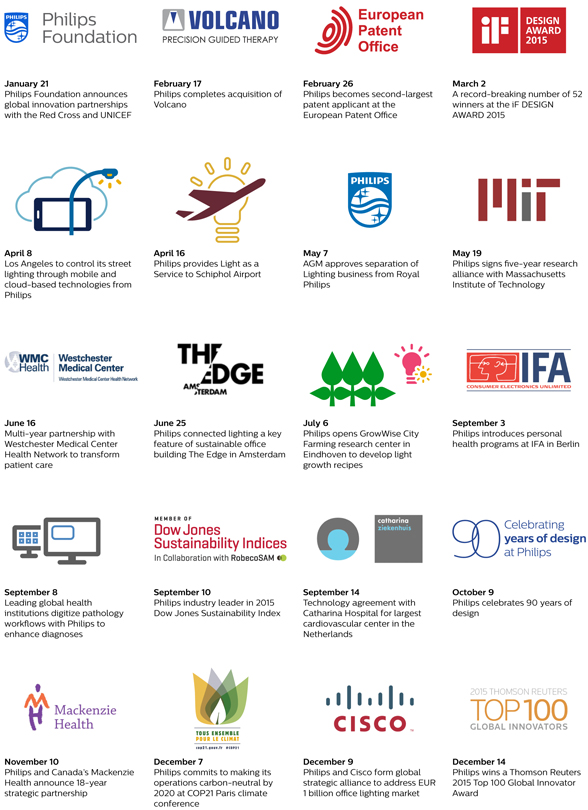

We reinvigorated our Healthcare business in North America and gained momentum in winning large-scale multi-year healthcare enterprise deals, e.g. with Westchester Medical Center (USA) and Mackenzie Health (Canada). And at our Imaging Systems facility in Cleveland we saw a gradual ramp-up of production in the course of the year. In February 2015 we completed the acquisition of Volcano, improving our position in the growing image-guided therapy market and strengthening our ability to deliver the benefits of minimally invasive therapies, such as faster recovery and shorter hospital stays. Post-merger integration is making good progress.

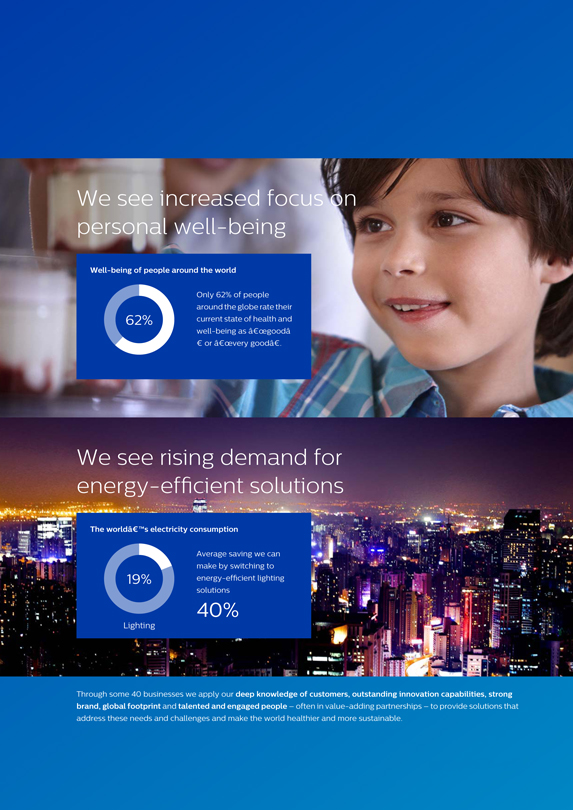

We also continued to deliver impressive growth and strong earnings across the majority of our Consumer Lifestyle portfolio. Our Health & Wellness and Personal Care businesses performed very well, delivering another year of high growth and margin expansion. Expanding our offering to help consumers make healthier choices, we launched the first in a series of personal health apps at the IFA trade fair in Berlin. Built on our Philips HealthSuite digital platform, these personal health programs represent a new era in connected care, as healthcare continues to move outside the hospital and into our homes and everyday lives.

“Our The power of our connected lighting propositions, based on IoT (Internet of Things) technology, was underscored by the opening of the world’s most sustainable office building, The Edge in Amsterdam, which features Philips’ smart connected lighting solution, with Power over Ethernet. In the US, Los Angeles remotely manages more than 100,000 street lights with our CityTouch lighting management system to create a more livable and safe city. And in the home, our Hue connected lighting platform continues to be a resounding success. Towards the end of the year, we teamed up with Cisco and SAP to address the opportunities in the office and street lighting markets respectively.

The termination of the planned sale of Lumileds to a consortium led by GO Scale Capital was of course a disappointing outcome, but we are actively engaging with other parties that have expressed an interest in the Lumileds business.

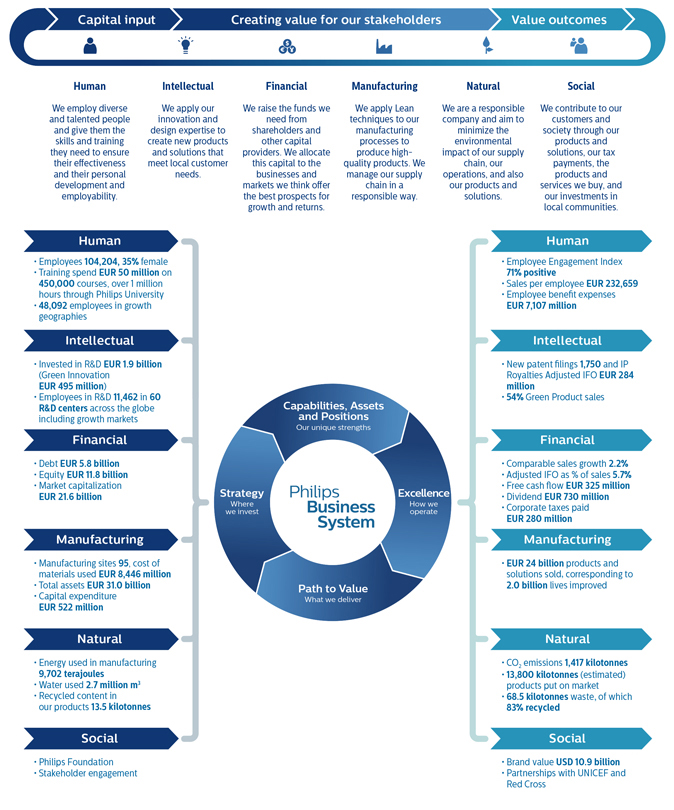

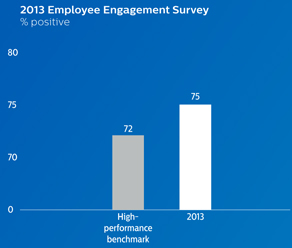

Accelerate! initiativesdriving performance improvement

In 2015, our multi-year Accelerate! program again helped us to achieve our mid-term 2013 targets. We are implementingstep up growth and increase margins, despite deteriorating macro-economic conditions in a number of markets. Through Accelerate! and the implementation of the Philips Business System (PBS) we continue to drive improvements across the companyorganization. The PBS is helping us to improve customerfurther tighten our focus on quality and operational excellence and enhance productivity through continuous improvement methodologies, while embedding new capabilities and making us more agile, entrepreneurial and customer-centric, with a culture of higher performance. This is evidenced by the many large-scale multi-year hospital deals we won in 2015 and our improving growth and margins despite the difficult economic times.

The PBS is also helping to reduce time-to-market for our innovations through Lean transformations of our customer value chains. And it is supporting our drive to become a digital company, both in how we work and in what we offer to the market, e.g. our businesses systematically to global leadership performance. With our mission to deliver meaningful innovation to make the world healthierPhilips HealthSuite digital platform and more sustainable, we are well positionedconnected LED lighting. Last but not least, it is driving overhead cost and productivity savings, offsetting headwinds and enabling us to improve our growth rate.” Frans van Houten, CEO

Dear stakeholder,

In 2013 we passed a major milestone onoperating results over the year, notwithstanding an increase in our Accelerate! transformation journeyResearch & Development expenses to unlock Philips’ full potential. Despite economic headwinds, especially in Europe and the United States, our Accelerate! initiatives helped us to achieve our mid-term 2013 targets. I am delighted with this result, as it underlines yet again that Philips is, above all, a case7.9% of self-help.

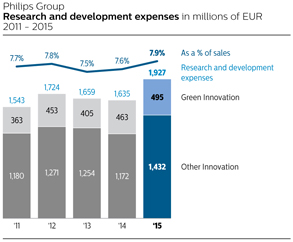

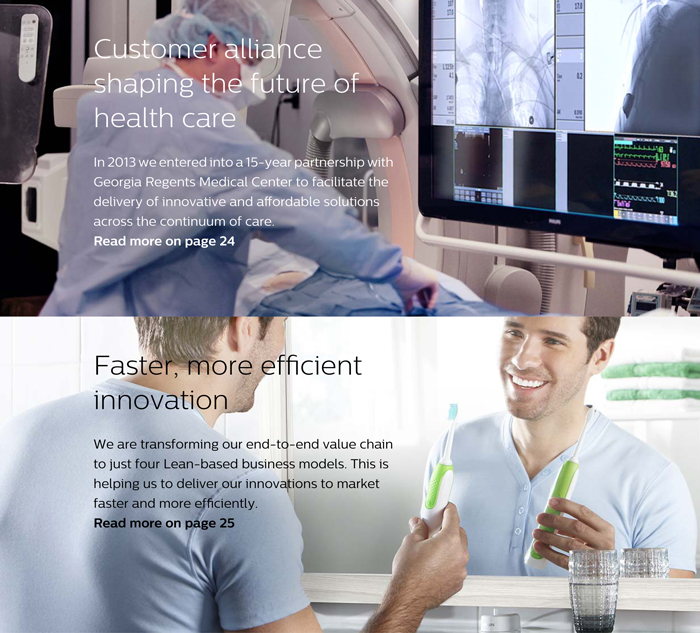

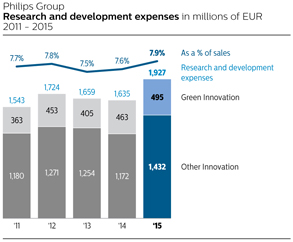

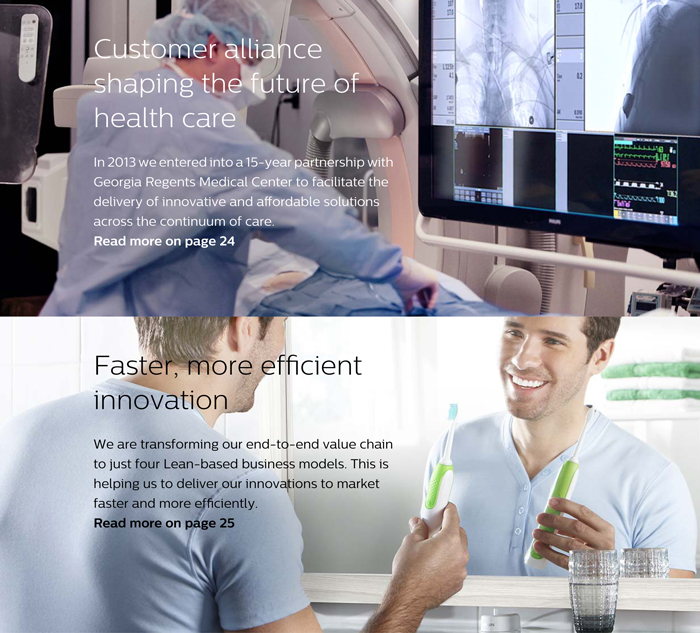

Accelerate! is helping us get closer to our customers, as illustrated by our landmark alliance with Georgia Regents Medical Center. And the transformation of our value chains is speeding up the introduction of locally relevant innovations in key markets around the world. Innovations like our EPIQ ultrasound imaging system, our Smart Air Purifier and Airfryer home appliances, and our energy-efficient CityTouch lighting management system.sales.

Annual Report 20132015 17

Message from the CEO 2

We are also seeing the steady development ofInnovating for a growth and performance culture characterized by strong employee engagement, teamwork, the drive for operational excellence and accountability for results. This is making ushealthier, more agile, entrepreneurial and innovative.

Financial performance

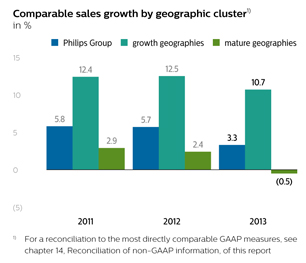

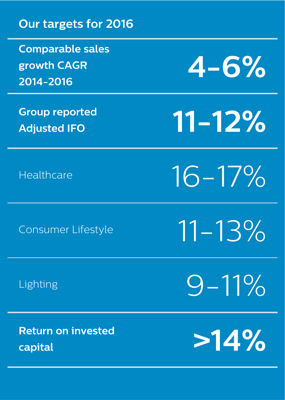

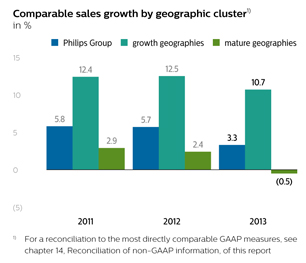

The economic environment in 2013 was challenging. Full-year sales declined by 1% in nominal terms, but increased by 3% on a comparable basis. Closing the year with strong 7% top-line growth in the fourth quarter, we delivered a compound annual growth rate for comparable sales over the period 2012-2013 of 4.5%, compared to our target of 4-6%. In regional terms, our growth geographies delivered 11% comparable sales growth in 2013 and now make up 36% of total sales.

Profitability improved significantly on the back of increased gross margins and productivity gains from our Accelerate! program. This resulted in a reported Adjusted IFO of 10.5%, within the target bandwidth of 10-12%. And our return on invested capital was 15.3%, above the targeted range of 12-14%.

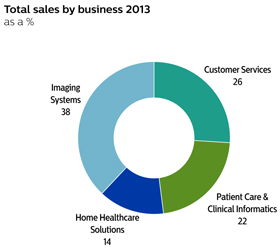

Our Healthcare business increased operational earnings despite a virtually flat top line. With the issues surrounding health care reform in the US and budget constraints in key markets, we are increasingly focusing on becoming the technology solutions partner of choice to major hospitals as a way to unlock new growth. Reflecting the success of its innovative propositions for personal health and well-being, Consumer Lifestyle posted strong growth and good earnings, while Lighting recorded higher sales, driven by a 38% increase in LED-based sales, and improved operational earnings.

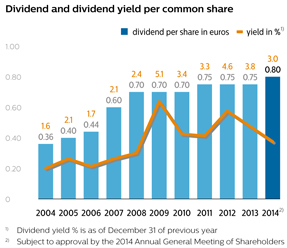

In 2013 we also completed the execution of our EUR 2 billion share buy-back program, thereby improving the efficiency of our balance sheet, and announced a new EUR 1.5 billion program to be concluded over the next 2-3 years. By the end of 2013 we had completed 7% of this new program.

Other 2013 highlightssustainable world

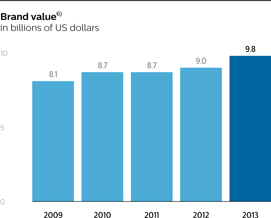

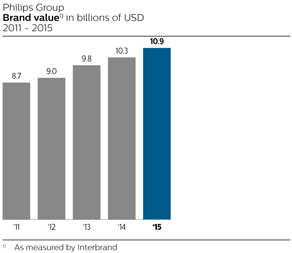

In 2013 we rose to # 40 on Interbrand’s annual ranking of the top-100 global brands, with2015, our brand value increasing by 8% to close to USD 10 billion. And in November we unveiled our new brand positioninginnovative solutions and brand line – “innovation and you” – and our redesigned shield, which enjoyed an enthusiastic reception from customers, employees and other stakeholders.

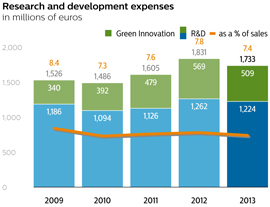

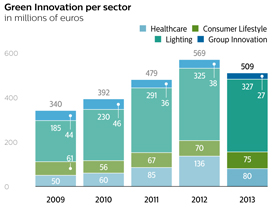

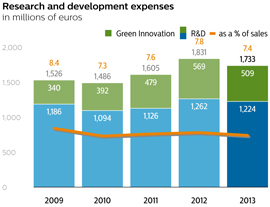

In 2014 we celebrate 100 years of Philips Research, and over the past year we underlined our commitment to innovation by investing EUR 1.7 billion in research and development. We filed over 1,500 patent applications in 2013. Other innovation highlights included the increasing adoption of our Digital Pathology solution and the development of the 200 lm/W TLED prototype to replace fluorescent tube lighting.

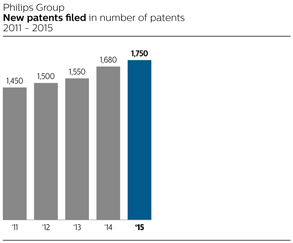

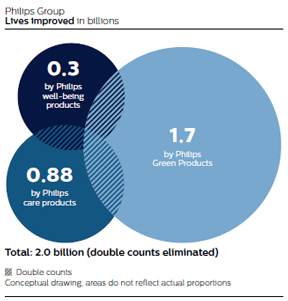

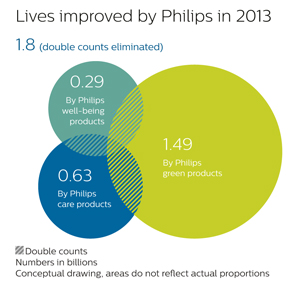

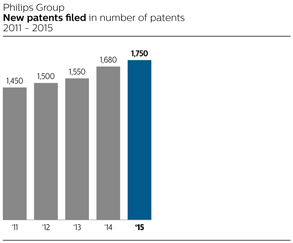

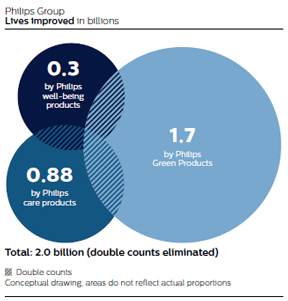

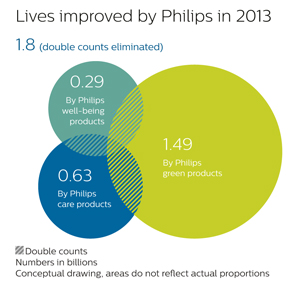

We also continued to deliver on our EcoVision sustainability commitments in 2013, improvingservices improved the lives of 1.82 billion people around the globeworld. Underlining our strength in the creation and hittingprotection of intellectual property we filed 1,750 new patents during the year and were named the world’s second-largest patent applicant for patents filed at the European Patent Office.

We also entered into a five-year research alliance with Massachusetts Institute of Technology (MIT) to develop breakthrough innovations in health technology and connected lighting. And our North American research organization moved to the Cambridge, Mass. area to facilitate collaboration with MIT, academic hospitals, and business partners.

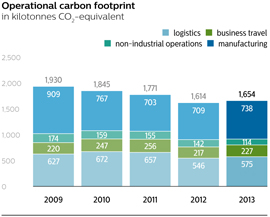

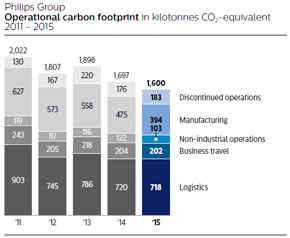

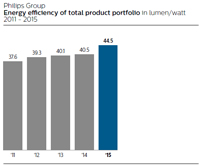

In 2015, we again delivered on our sustainability commitments, with Green Product sales target of 50%Products accounting for 54% of total sales two years ahead of schedule. In Buenos Aires we were awarded the order to renovate most of the city’s 125,000 street lights with our CityTouch system, and in Dubai we were selected to transform over 260 Municipality buildings with intelligent LED solutions – both projects reducing energy consumption by some 50%. Our efforts to createsales. Philips was recognized as a healthier and more sustainable world received recognitionleader for corporate action on climate change, achieving a perfect score (100A) in the form ofCarbon Disclosure Project (CDP) Climate Change survey for the 3rd year in a riserow, and being named Leader in the Industrial Conglomerates category in the Dow Jones Sustainability Index. Keeping up the momentum, we committed to 23rd place in Interbrand’s ranking ofmaking Philips’ operations carbon-neutral by 2020 at the top 50 Best Global Green Brands,2015 Paris climate conference.

Underlining the importance we attach to ‘doing good while doing well’, the Philips Foundation entered into global innovation partnerships with the Red Cross and UNICEF, as well as supporting a top rating fromhost of innovation projects designed to make a difference in the Carbon Disclosure Project.

Of course, no year is entirely freecommunities and lives of disappointment, andthose most in 2013 we had to contend with the termination of the deal with Funai for our Audio, Video, Multimedia and Accessories business. We also faced compliance issues relating to our General Business Principles, which we are refining and strengthening.

Looking ahead – our Path to Value by 2016

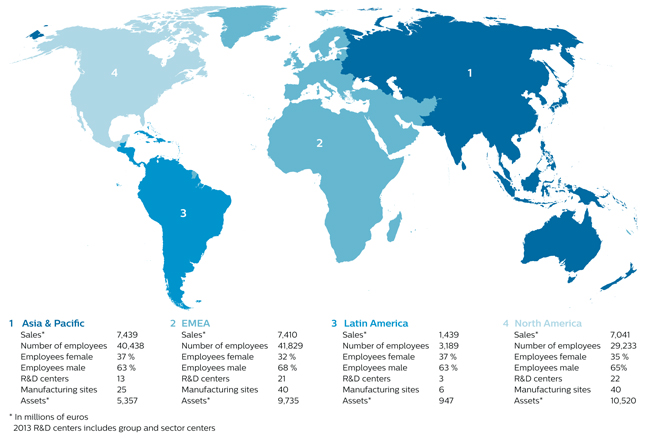

Philips is a diversified technology company with a portfolio of some 40 businesses across various strategic domains. Over half of these businesses hold global leadership positions. Our portfolio is underpinned by strong assets: deep market insights; world-class innovation capabilities – technology, know-how and strong IP positions; our global footprint; our talented, engaged people; and the Philips brand.

The significant changes we have made to our portfolio in recent years have created a better growth platform with higher profit potential. And with the transformation of our business model architecture, we are increasingly becoming a technology solutions partner, with recurring revenue streams accounting for over 25% of sales.need.

Meeting the needs of a changing worldStrategic priorities for 2016

In light of the mega-trendsglobal trends and challengesopportunities outlined above and the world is facing,innovative competencies we can bring to bear, both our health technology and lighting businesses are confident inwell placed to thrive as markets drive greater demand for our chosen strategic direction. With its focus on healthsolutions and sustainability, ourservices.

18 Annual Report 2013

Message from the CEO

vision to improve the lives of 3 billion people a year by 2025 helps to differentiate us from the competition, have a closer relationship with our customers, create IP and ultimately create more value.

We see the shift from a linear to a circular economy as a further opportunity to create value. In a linear economy, productsBoth companies are used briefly and then discarded as waste. In a circular economy, products are designed so they become part of a value network where re-use and refurbishment ensure continuous re-exploitation of resources.

We are redesigning our products in order to capture their residual value. And we are shifting from transactions to relationships via service and solution business models. A good example is the 10-year performance contract we were awarded to install, monitor and maintain 13,000 connected lighting fixtures and energy management controls for parking garages in Washington, DC. Because we are ensuring light levels and delivering the solutions as a service that is paid for by the energy savings, Washington gets brighter, safer LED lighting for its garages with none of the up-front cost, thereby removing one of the main barriers to the adoption of energy-efficient technology.

Driving productivity improvement

Over the coming years we will continue to drive operational excellence and invest in innovation and sales development. We will also continue to focus on improving profitability, e.g. by further reducing overhead costs and driving value engineering through our Design for Excellence (DfX) program. Altogether we see significant potential to improve productivity over the next few years. We also have scope for value-creating bolt-on acquisitions, but will remain prudent with our capital allocation. Most of our growth opportunities are organic.

In 2014 we will roll out a new IT landscape to make Philips a truly real-time company, and we will further embed the Philips Business System (PBS). The PBS is the way we run our company to ensure business success is repeatable. This year will also see our new brand positioning being activated across the globe.

New growth initiatives

I am pleased to say that Philips has multiple new growth opportunities in the making. Within our Healthcare sector we have established the Healthcare Informatics Solutions & Services business group, which is focusing on a digital connected healthcare delivery platform, advanced informatics and big data analytics, and world-class integration and consulting services. At Consumer Lifestyle we have a new business initiative on Personal Health. And in our Innovation, Group & Services sector we have several highly promising start-ups, although it will be a few years before they are margin-accretive because of the necessary investments. Examples of these exciting new business areas include point-of-care diagnostics as well as horticultural and city farming technology.

Confident in the future

While remaining cautious about the short-term macro- economic outlook, we aredeeply committed to delivering on their strategic opportunities. For Philips, serving the health technology markets, this means building strong consultative customer relationships, selling value-added solutions and winning more large-scale, multi-year projects with healthcare providers. It also means delivering growth from innovation investments, establishing the Philips HealthSuite digital platform as a leading cloud-based enabling solution, and boosting scale in its existing businesses.

For Lighting, as a stand-alone company, it means: optimizing returns from conventional products to fund innovation in LED, to outpace the market; leading the shift to LED systems, building the largest IoT connected installed base; capturing adjacent value through new Services business models; and being its customers’ best business partner locally, leveraging its global scale.

Both companies will remain strongly committed to improve performance and capture higher growth, focusing ever more closely on customers’ needs, driving new ways to innovate and leveraging partnerships, embracing digital technology in their ways of working, and relentlessly driving a mindset of continuous improvement and operational excellence.

It is my deepest conviction that both Philips and Lighting stand to benefit from the separation, as it will enable greater focus on their respective attractive markets and allow them to capture higher growth and deliver higher profitability.

In conclusion

For 2016, we continue to expect modest comparable sales growth and we will build on our 2016 financial2015 operational performance targets. As a signimprovement. Taking into account ongoing macro-economic headwinds and the phasing of our confidencecosts and sales, we expect improvements in Philips’ future, wethe year to be back-end loaded.

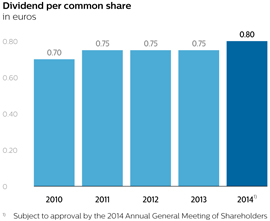

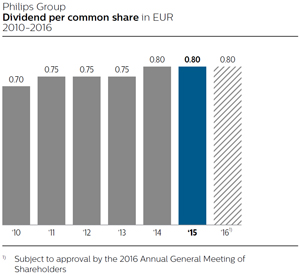

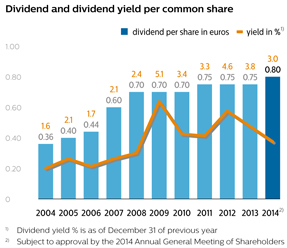

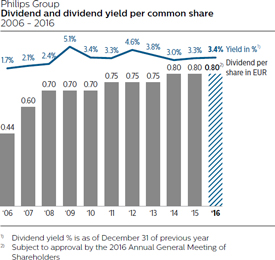

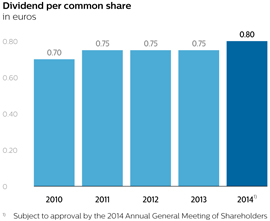

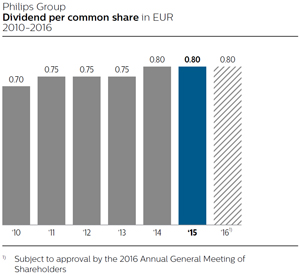

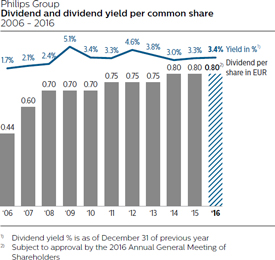

We are proposing to the upcoming Annual General Meeting of Shareholders to increasemaintain this year’s dividend todistribution at EUR 0.80 per common share, in cash or stock.shares.

On behalf of my colleagues on the Executive Committee, I wish to thank all our employees for embracing Accelerate!, helping to build a great company fit for the demands of the 21st century, and delivering innovations that matter to people the world over. And

I would like to thank our customers, shareholders and other stakeholders for their continued trustsupport. I also want to thank all our employees for their dedication and support.effort this past year.

In 2016, Philips celebrates 125 years in business. That’s a tremendous feat for an innovation company, especially in such a fast-changing world. And I’m convinced that there is much more to come, as we continue to improve people’s lives through meaningful innovation.

Frans van Houten

Chief Executive Officer

18 Annual Report 2013 192015

1. Our transformation3 Philips in 2015 at a glance

Driving change and improvement

Now in its third year, Accelerate! is making Philips a more agile and entrepreneurial innovator. The program, which is set to run through 2017, is made up of five streams designed to:

Annual Report 2013 212015 19

2. Business Impact

Accelerated! in action

224 Our strategic focus

4.1 Addressing global challenges

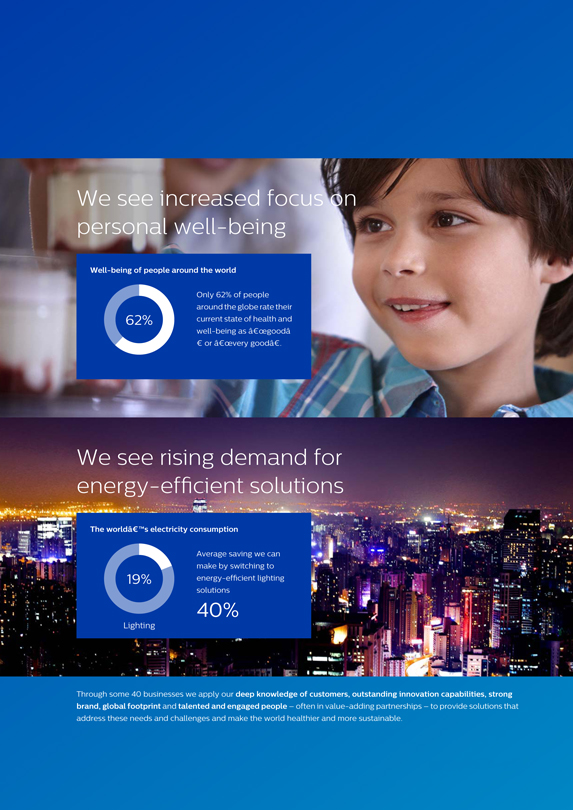

Guided by our passion to improve people’s lives, Philips has been a leader in building and shaping markets with meaningful innovations for 125 years. With the world facing the challenge of tackling climate change and energy constraints, as well as providing effective and affordable healthcare to a growing global population, we see compelling opportunities in the health technology and lighting markets.

Determined to win in both, we are separating out our Lighting activities as a stand-alone company. This will create more focus, giving Lighting the opportunity to grow and capture the vast opportunities in energy-efficient, digital lighting products, systems and services, and Philips the enhanced focus to expand its core business to address the opportunities in the health technology market.

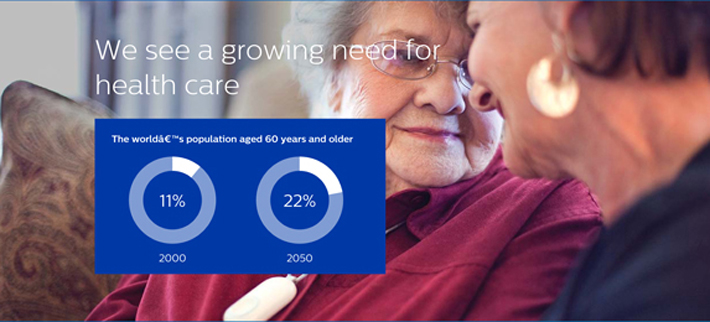

We see a growing need for better health and better care at lower cost

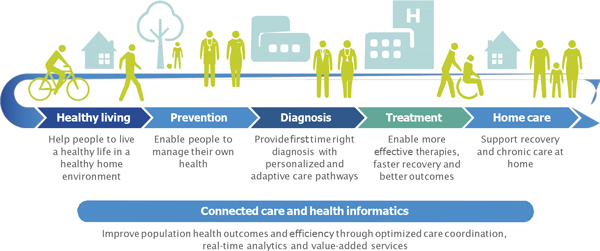

Global resource constraints on health systems are driving a shift to value-based healthcare to reduce cost, increase access and improve outcomes. At the same time, aging populations across the globe and the rise of chronic conditions are driving a shift of care to lower-cost settings and the home.

In parallel, more and more people are looking for new ways to proactively monitor and manage their health. And the digitalization of healthcare is shifting value from devices to software and services.

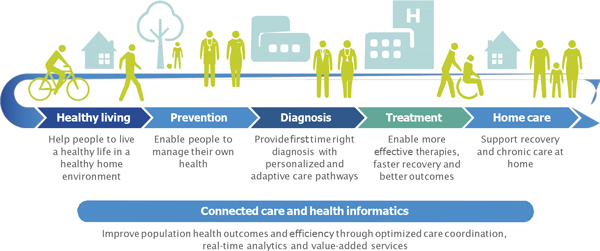

These challenges can only be met through new, more integrated forms of care delivery across the health continuum, with a shift away from today’s focus on acute care and late-stage interventions.

In an increasingly connected world, the convergence of Philips’ consumer technologies that facilitate healthy living, medical technologies that help clinicians to deliver better diagnosis and treatment, and cloud-based technologies that enable data sharing and analysis, will be a key enabler of more effective, lower-cost integrated health solutions. This fits very well with our core strengths in professional healthcare and in consumer health and well-being.

20 Annual Report 20132015

In a total addressable market estimated at over EUR 140 billion, we are well positioned to leverage advanced technology and our deep clinical and consumer insights to deliver integrated solutions that improve people’s health and enable better outcomes across the health continuum.

We have defined five priority areas: personal health, definitive diagnosis, minimally invasive guided therapy, population health management, and connected care delivery. And our focus on cardiology, oncology, respiratory care, and fertility, pregnancy and parenting already gives us a broad-based opportunity to expand our integrated solutions capabilities.

More and more, we are teaming up with hospital and health systems to understand their needs, provide integrated solutions, and engage in multi-year cooperation to drive improvements in terms of patient outcomes, quality of care delivery and cost productivity.

Going forward, we will further drive the benefits of scale in our current businesses while delivering additional growth from continuing investments in innovation. And establishing the Philips HealthSuite digital platform as a leading cloud solution to connect consumers, patients and providers will allow us to introduce value propositions with recurring revenue streams.

We see increasing demand for energy-efficient and connected digital lighting