As filed with the Securities and Exchange Commission on February 25, 201421, 2017

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form20-F

(Mark one)

| | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20132016

OR

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number001-05146-01

KONINKLIJKE PHILIPS N.V.

(Exact name of Registrant as specified in charter)

ROYAL PHILIPS

(Translation of Registrant’s name into English)

The Netherlands

(Jurisdiction of incorporation or organization)

BreitnerPhilips Center, Amstelplein 2, 1096 BC Amsterdam, The Netherlands

(Address of principal executive office)

Eric Coutinho,Marnix van Ginneken, Chief Legal Officer & Secretary to the Board of Management

+31 20 59 77232, eric.coutinho@philips.com, Breitnermarnix.van.ginneken@philips.com, Philips Center, Amstelplein 2, 1096 BC Amsterdam, The Netherlands

(Name, Telephone,E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |||

| Common Shares – par value | New York Stock Exchange | |||

| Euro (EUR) 0.20 per share | ||||

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

| Class | Outstanding at December 31, | |

| Koninklijke Philips N.V. | ||

| Common Shares par value EUR 0.20 per share |

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. x☒ Yes ¨No ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934. ¨☐ Yes x☒ No

Note-Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x☒ Yes ¨☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of RegulationS-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨☐ Yes ¨☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or anon-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule12b-2 of the Exchange Act. (Check one):

Large accelerated filer x☒ Accelerated filer ☐ ¨Non-accelerated Non-accelerated filer ¨☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP | International Financial Reporting Standards as issued by by the International Accounting Standards Board | Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ¨☐ Item 17 ¨☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule12b-2 of the Exchange Act). ¨☐ Yes x☒ No

IFRS basis of presentation

The financial information included in this document is based on IFRS, as explained innote 1, Significant accounting policies, of this report, unless otherwise indicated.

Dutch Financial Markets Supervision Act

This document comprises regulated information within the meaning of the Dutch Financial Markets Supervision Act(Wet op het financieel toezicht).

Statutory financial statements and management report

The chapters Group financial statements and Company financial statements contain the statutory financial statements of the Company. The introduction to the chapter Group financial statements sets out which parts of this Annual Report form the Management report within the meaning of Section 2:391 of the Dutch Civil Code (and related Decrees).

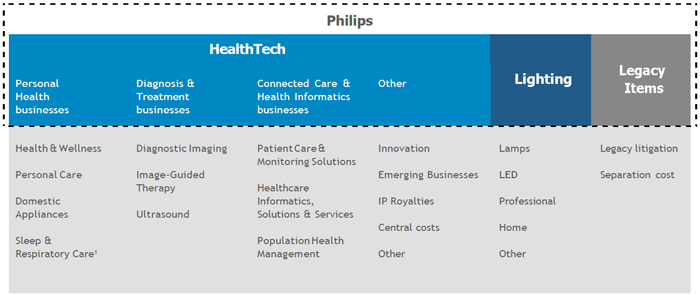

Significant developments

In September 2014, Philips announced its plan to sharpen its strategic focus by establishing two stand-alone companies focused on the HealthTech and Lighting opportunities respectively. To this end, a stand-alone structure was established for Philips Lighting within the Philips Group, effective February 1, 2016. Then, on May 27, 2016, Philips Lighting was listed and started trading on Euronext in Amsterdam under the symbol ‘LIGHT’. Following the listing of Philips Lighting, Philips retained a 71.225% stake and continued to consolidate Philips Lighting through 2016. On February 8, 2017, Philips announced that it had successfully completed an accelerated bookbuild offering to institutional investors and to Philips Lighting of 26.0 million shares in Philips Lighting, reducing Philips’ stake in Philips Lighting’s issued and outstanding share capital from 71.225% to approximately 55.180%. The transaction is in line with Philips’ stated objective to fully sell down its stake in Philips Lighting over the next several years.

Philips has signed an agreement to sell an 80.1% interest in the combined Lumileds and Automotive businesses to certain funds managed by affiliates of Apollo Global Management, LLC. Philips will retain the remaining 19.9% interest. The transaction is expected to be completed in the first half of 2017, subject to customary closing conditions, including the relevant regulatory approvals.

| The integration of Volcano, aUS-based global leader in catheter-based imaging and measurement solutions for cardiovascular applications, into our Image-Guided Therapy business group has been successful, helping to drive synergies and improved performance. |

2 Annual Report 20132016

| ||||||||

| ||||||||

|

| |||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

|

| |||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

|

| |||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

|

| |||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

|

| |||||||

|

| |||||||

|

| |||||||

|

| |||||||

|

| |||||||

|

| |||||||

Annual Report 20132016 3

| 18.9 | Exhibit 15 (a) | 292 | ||||

| 18.10 | Exhibit 15 (b) | 293 |

4 Annual Report 2013

Introduction

This document contains information required for the annual reportAnnual Report on Form20-F for the year ended December 31, 20132016 of Koninklijke Philips N.V. (the 20132016 Form20-F). Reference is made to the Form20-F cross reference table herein. Only (i) the information in this document that is referenced in the Form20-F cross reference table, (ii) this introduction and the cautionary statement “forward-looking statements” and explanation on “use of non-GAAP information” on the next threetwo pages and (iii) the Exhibits shall be deemed to be filed with the Securities and Exchange Commission for any purpose. Any additional information in this document which is not referenced in the Form20-F cross reference table, or the Exhibits themselves, shall not be deemed to be so incorporated by reference, shall not be part of the 20132016 Form20-F and is furnished to the Securities and Exchange Commission for information only.

The terms “Philips”, the “Company”, “Group”, “we”, “our” and “us” refer to Koninklijke (Royal) Philips N.V. and as applicable to its subsidiaries and and/or its interest in joint ventures and associates.

IFRS based information

The audited consolidated financial statements as of December 31, 20132016 and 2012,2015, and for each of the years in thethree-year period ended December 31, 2013,2016, included in the 20132016 Form20-F have been prepared in accordance with International Financial Reporting Standards (IFRS) as endorsed by the European Union (EU). All standards and interpretations issued by the International Accounting Standards Board (IASB) and the IFRS Interpretations Committee effectiveyear-end 2013 2016 have been endorsed by the EU, except that the EU did not adopt certain paragraphs of IAS 39 applicable to certain hedge transactions. Philips has no hedge transactions to which these paragraphs are applicable. Consequently, the accounting policies applied by Philips also comply fully with IFRS as issued by the IASB.

Non-GAAPUse ofnon-GAAP information

In presenting and discussing the Philips Group’sGroup financial position, operating results and cash flows, management uses certainnon-GAAP financial measures such as: comparable growth; adjusted income from operations; net operating capital; net debt; cash flow before financing activities; net capital expenditures and free cash flow.measures. Thesenon-GAAP financial measures should not be viewed in isolation as alternatives to the equivalent IFRS measure and should be used in conjunction with the most directly comparable IFRS measure(s).measures.Non-GAAP financial measures do not have standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. A reconciliation of thesenon-GAAP measures to the most directly comparable IFRS measures is contained in this document. Reference is made to the section titled “Useinchapter 4, Reconciliation ofnon-GAAP information” for further information. information, of this report.

Third-party market share data

Statements regarding market share, contained in this document, including those regarding Philips’ competitive position, are based on outside sources such as specialized research institutes, industry and dealer panels in combination with management estimates. Where full year information regarding 20132016 is not yet available to Philips, market share statements may also be based on estimates and projections prepared by outside sources or management. Rankings are based on sales unless otherwise stated.

Fair value informationUse of fair-value measurement

In presenting the Philips Group’sGroup financial position, fair values are used for the measurement of various items in accordance with the applicable accounting standards. These fair values are based on market prices, where available, and are obtained from sources that are deemed to be reliable. Readers are cautioned that these values are subject to changes over time and are only valid at the balance sheet date. When quoted prices or observable market values doare not exist,readily available, fair values are estimated using valuation models, which we believe are appropriate for their purpose. Theyand unobservable inputs. Such fair value estimates require management to make significant assumptions with respect to future developments which are inherently uncertain and may therefore deviate from actual developments. Critical assumptions used are disclosed in the financial statements. In certain cases, independent

Independent valuations aremay have been obtained to support management’s determination of fair values.

Documents on display

It is possible to read and copy documents referred to in the 20132016 Form20-F that have been filed with the SEC at the SEC’s public reference room located at 100 F Street, N.E., Room 1580, Washington, D.C. 20549.

Please call the SEC at1-800-SEC-0330 for further information on the public reference rooms and their copy charges. Philips SEC filings are also publicly available through the SEC’s website atwww.sec.gov.www.sec.gov.

Annual Report 2013 5

Introduction

For definitions and abbreviations reference is made tochapter 17,15, Definitions and abbreviations, of this report.

4 Annual Report 2016

Introduction

Pursuant to provisions of the United States Private Securities Litigation Reform Act of 1995, Philips is providing the following cautionary statement.

This document, including the information referred to in the Form20-F cross reference table, contains certain forward lookingforward-looking statements with respect to the financial condition, results of operations and business of Philips and certain of the plans and objectives of Philips with respect to these items, in particular, among other statements, certain statements in Item 4 “Information on the Company” with regard to management objectives, market trends, market standing, product volumes, business risks, the implementation of our Accelerate! program, the statements in Item 8 “Financial Information” relating to legal proceedings, the statements in Item 5 “Operating and financial review and prospects” with regardregards to trends in results of operations, margins overall market trends, risk management, exchange rates, the statements in Item 8 “Financial Information” relating to legal proceedings and goodwill and statements in Item 11 “Quantitative and qualitative disclosuresdisclosure about market risks” relating to risk caused by derivative positions, interest rate fluctuations and other financial exposure are forward-lookingforward- looking in nature. Forward-looking statements can be identified generally as those containing words such as “anticipates”, “assumes”, “believes”, “estimates”, “expects”, “should”, “will”, “will likely result”, “forecast”, “outlook”, “projects”, “may” or similar expressions. By their nature, forward-lookingthese statements involve risk and uncertainty because they relate to future events that depend onand circumstances that will occur in the future. Thereand there are a number ofmany factors that could cause actual results and developments to differ materially from those expressed or implied by these forward-looking statements.

These factors include, but are not limited to, domestic and global economic and business conditions, developments within the euro zone, the successful implementation of our strategy and our ability to realize the benefits of this strategy, our ability to develop and market new products, changes in legislation, legal claims, intellectual property, disputes, data protection challenges, changes in exchange and interest rates, changes in tax rates, pension costs and actuarial assumptions, raw materials and employee costs, our ability to identify and complete successful acquisitions and to integrate those acquisitions into our business,

6 Annual Report 2013

Introduction

our ability to successfully exit certain businesses or restructure our operations, the rate of technological changes, political, economic and other developments in countries where Philips operates, industry consolidation and competition.competition and the state of international capital markets as they may affect the timing and nature of the disposition by Philips of its interests in Philips Lighting and the Lumileds and Automotive business.

As a result, Philips’ actual future results may differ materially from the plans, goals and expectations set forth in such forward-looking statements. For a discussion of factors that could cause future results to differ from such forward-looking statements, reference is made to the information in Item 3D “Risk Factors”.

Koninklijke Philips N.V. (the ‘Company’) believes that an understanding of sales performance is enhanced when the effects of currency movements and acquisitions and divestments (changes in consolidation) are excluded. Accordingly, in addition to presenting ‘nominal growth’, ‘comparable growth’ is provided.

Comparable sales exclude the effects of currency movements and changes in consolidation. As indicated in the note 1, Significant accounting policies, sales and income are translated from foreign currencies into the Company’s reporting currency, the euro, at the exchange rate on transaction dates during the respective years. As a result of significant currency movements during the years presented, the effects of translating foreign currency sales amounts into euros could have a material impact on our sales figures. Therefore, these impacts have been excluded in arriving at the comparable sales in euros. Currency effects have been calculated by translating previous years’ foreign currency sales amounts into euros at the following year’s exchange rates in comparison with the sales in euros as historically reported. The years under review were characterized by a number of acquisitions and divestments, as a result of which activities were consolidated or deconsolidated. The effect of consolidation changes has also been excluded in arriving at the comparable sales. For the purpose of calculating comparable sales growth, when a previously consolidated entity is sold or contributed to a venture that is not consolidated by the Company, relevant sales are excluded from impacted prior-year periods. Similarly, when an entity is acquired, relevant sales are excluded from impacted periods.

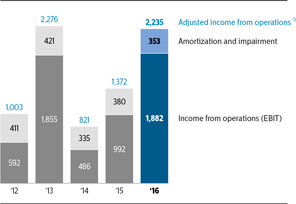

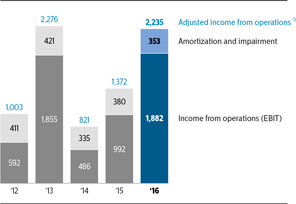

Philips discusses “adjusted income from operations” in the 2013 Form 20-F. Adjusted income from operations represents income from operations before amortization and impairment of intangible assets generated in acquisitions (excluding software and capitalized development expenses).

Annual Report 2013 72016 5

IntroductionForm20-F

The Company uses the term “adjusted income from operations” to evaluate the performance of the Philips Group and its sectors. Referencing “adjusted income from operations” is considered appropriate in light of the following:

Philips has announced that one of its strategic drivers is to increase profitability through re-allocation of its resources towards opportunities offering more consistent and higher returns. Moreover, Philips intends to redeploy capital through value-creating acquisitions. Since 2006, management has used the “adjusted income from operations” measurement internally to monitor performance of the businesses on a comparable basis. As of 2007, Philips has also set external performance targets based on this measurement as it will not be distorted by the unpredictable effects of future, unidentified acquisitions.

Non US investors are advised that such presentation is different from the terms used in Philips’ results announcements and 2013 Annual Report. Philips believes that an understanding of the Group’s financial condition is enhanced by the disclosure of net operating capital (NOC), as this figure is used by Philips’ management to evaluate the capital efficiency of the Philips Group and its operating sectors. NOC is defined as: total assets excluding assets from discontinued operationsless: (a) cash and cash equivalents, (b) deferred tax assets, (c) other (non)-current financial assets, (d) investments in associates, and after deduction of: (e) provisions, (f) accounts and notes payable, (g) accrued liabilities, (h) current/noncurrent liabilities.

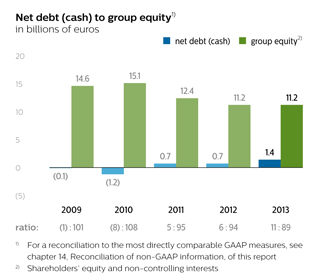

Net debt is defined as the sum of long- and short-term debt minus cash and cash equivalents. The net debt position as a percentage of the sum of group equity (shareholders’ equity and non-controlling interests) and net debt is presented to express the financial strength of the Company. This measure is widely used by management and investment analysts and is therefore included in the disclosure.

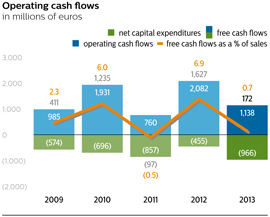

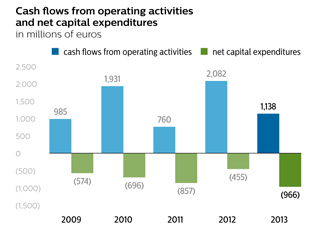

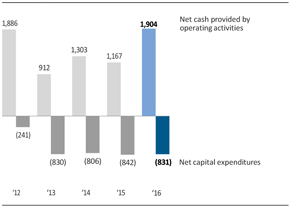

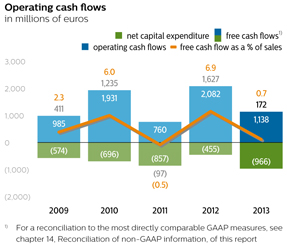

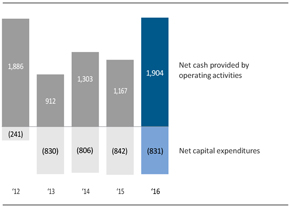

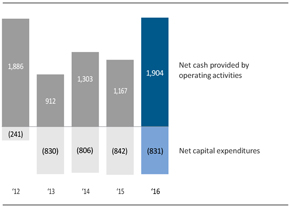

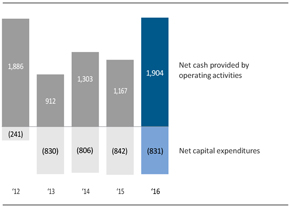

Cash flows before financing activities, being the sum total of net cash from operating activities and net cash from investing activities, and free cash flow, being net cash from operating activities minus net capital expenditures, are presented separately to facilitate the reader’s understanding of the Company’s funding requirements.

Net capital expenditures comprise of purchase of intangible assets, expenditures on development assets, capital expenditures on property, plant and equipment and proceeds from disposals of property, plant and equipment. This measure is widely used by management to calculate free cash flow.

8 Annual Report 2013

Form 20-F cross reference table

Form20-F cross reference table

Only (i) the information in this document that is referenced in the Form20-F cross reference table, (ii) the Introduction and the cautionary statements concerning Forward-lookingforward-looking statements and explanation on use of non-GAAP information, of this report on pages 5-8,4-5, and (iii) the Exhibits shall be deemed to be filed with the Securities and Exchange Commission for any purpose. The content of Philips’ websites and other websites referenced herein should not be considered to be a part of or incorporated into the 20132016 Form20-F. Any additional information which is not referenced in the Form20-F cross reference table or the Exhibits themselves shall not be deemed to be so incorporated by reference, shall not be part of the 20132016 Form20-F and is furnished to the Securities and Exchange Commission for information only.

The table below sets out the location in this document of the information required by SEC Form20-F. The exact location is included in the column ‘Location in this document’. The column ‘Page’ includes the starting page of the section/paragraph for reference only.

6 Annual Report 2013 92016

Form 20-F cross reference table

| Item | Form 20-F caption | Location in this document | Page | |||||

| Part 1 | ||||||||

1 | Identity of directors, senior management and advisors | Not applicable | ||||||

2 | Offer statistics and expected timetable | Not applicable | ||||||

3 | Key information | |||||||

| A Selected financial data | ||||||||

| B Capitalization and indebtedness | Not applicable | |||||||

| C Reason for the offer and use of proceeds | Not applicable | |||||||

| D Risk factors | ||||||||

4 | Information on the Company | |||||||

| A History and development of the company | ||||||||

| 2.1.6. Restructuring and impairment charges | 25 | |||||||

| 9.5. Investor Relations - Corporate seat and head office | 109 | |||||||

| Note | ||||||||

| Note | ||||||||

| Note | ||||||||

| B Business Overview | Introduction - Third-party market share data | |||||||

2.1.24. Procurement | ||||||||

3. Segment performance - Our structure in 2016 | ||||||||

3.1.1. About Personal Health businesses | ||||||||

3.1.3. 2016 financial performance | ||||||||

3.2.1. About Diagnosis & Treatment businesses | ||||||||

3.2.3. 2016 financial performance | ||||||||

10 Annual Report 2013

Form 20-F cross reference table

3.3.1. About Connected Care & Health Informatics businesses | ||||||||

3.3.3. 2016 financial performance | ||||||||

3.4.1. About HealthTech Other | ||||||||

3.4.3. 2016 financial performance | ||||||||

3.5.2. About Lighting | ||||||||

3.5.4. 2016 financial performance | ||||||||

3.6. Legacy Items | ||||||||

3.6.1. 2016 financial performance | ||||||||

5.1. Our approach to risk management | ||||||||

5.3. Strategic risks - | ||||||||

5.4. Operational risks -Fourth & fifth paragraph | ||||||||

5.5. Compliance risks | ||||||||

9. Corporate governance - Corporate governance of the Philips Group - | ||||||||

Introduction | ||||||||

Note | ||||||||

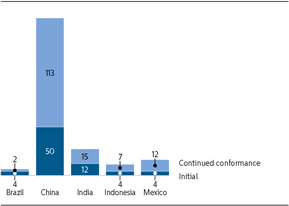

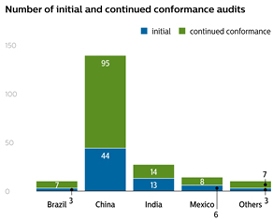

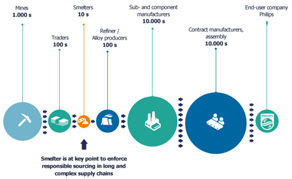

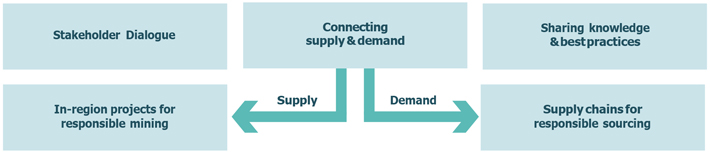

12.3.8. Supplier indicators - Responsible Sourcing of Minerals | ||||||||

Annual Report 2013 112016 7

Form 20-F cross reference table

| Item | Form 20-F caption | Location in this document | Page | |||

| C Organizational structure | 3. Segment performance - Our structure in 2016 | 49 | ||||

| 141 | ||||||

Note 5 Interests in entities | 145 | |||||

16.6. Exhibit 8 | 271 | |||||

| D Property, plant and equipment | Note 2 Information by segment and main country | 141 | ||||

Note 10 Property, plant and equipment | 154 | |||||

Note 19 Provisions - Environmental provisions | 164 | |||||

Note 24 Contractual obligations | 173 | |||||

Note 25 Contingent assets and liabilities - Contingent liabilities - Environmental remediation | 174 | |||||

4A | Unresolved staff comments | Not applicable | ||||

5 | Operating and financial review and prospects | |||||

| A Operating results | 4. Reconciliation ofnon-GAAP information | 69 | ||||

2.1. Financial performance - Management summary | 16 | |||||

2.1. Financial performance - from 2.1.1 to 2.1.14 | 16 | |||||

2.5. Critical accounting policies | 47 | |||||

3.1.1. About Personal Health businesses | 51 | |||||

3.1.3. 2016 financial performance | 52 | |||||

3.2.1. About Diagnosis & Treatment businesses | 54 | |||||

3.2.3. 2016 financial performance | 56 | |||||

3.3.1. About Connected Care & Health Informatics businesses | 58 | |||||

3.3.3. 2016 financial performance | 60 | |||||

3.4.1. About HealthTech Other | 62 | |||||

3.4.3. 2016 financial performance | 64 | |||||

3.5.2. About Lighting | 65 | |||||

3.5.4. 2016 financial performance | 66 | |||||

3.6. Legacy Items | 68 | |||||

3.6.1. 2016 financial performance | 68 | |||||

5.3. Strategic risks | 77 | |||||

5.4. Operational risks | 79 | |||||

5.5. Compliance risks | 81 | |||||

5.6. Financial risks | 82 | |||||

Note 3 Discontinued operations and other assets classified as held for sale | 143 | |||||

Note 4 Acquisitions and divestments | 144 | |||||

Note 6 Income from operations | 147 | |||||

Note 7 Financial income and expenses | 149 | |||||

Note 11 Goodwill | 155 | |||||

Note 12 Intangible assets excluding goodwill | 157 | |||||

Note 30 Details of treasury / other financial risks | 187 | |||||

| B Liquidity and capital resources | 2.1. Financial performance | 16 | ||||

Note 17 Equity | 159 | |||||

Note 18 Debt | 162 | |||||

Note 23 Cash flow statement supplementary information | 173 | |||||

Note 24 Contractual obligations | 173 | |||||

Note 30 Details of treasury / other financial risks | 187 | |||||

| C Research and development, patents and licenses, etc. | 2.1.4. Research and development | 23 | ||||

3.4.1. About HealthTech Other | 62 | |||||

| D Trend information | 2.1. Financial performance | 16 | ||||

2.1.24. Procurement | 34 | |||||

5.3. Strategic risks- First & second paragraph | 77 | |||||

8 Annual Report 2016

Form 20-F cross reference table

| Item | Form 20-F caption | Location in this document | Page | |||

| EOff-balance sheet arrangements | 2.1.23. Cash obligations | 33 | ||||

Note 24 Contractual obligations | 173 | |||||

Note 25 Contingent assets and liabilities | 174 | |||||

Note 30 Details of treasury / other financial risks | 187 | |||||

| F Tabular disclosure of contractual obligations | 2.1.23. Cash obligations | 33 | ||||

Note 24 Contractual obligations | 173 | |||||

| G Safe Harbor | Forward-looking statements | 5 | ||||

6 | Directors, senior management and employees | |||||

| A Directors and senior management | 6. Management | 84 | ||||

7. Supervisory Board | 85 | |||||

9.1. Board of Management and Executive Committee - Introduction | 98 | |||||

| 9.1. Board of Management and Executive Committee - (Term of) Appointment and conflicts of interest | ||||||

| B Compensation | Note | |||||

Note | ||||||

8.2. Report of the Remuneration Committee | ||||||

| C Board practices | ||||||

7. Supervisory Board | ||||||

8. Supervisory Board report | ||||||

9.1. Board of Management and Executive Committee | ||||||

9.2. Supervisory Board | ||||||

9.4. Meeting | ||||||

| D Employees | ||||||

Note | ||||||

| E Share ownership | ||||||

Note | ||||||

Note | ||||||

Note

| ||||||

7 | Major shareholders and related party transactions | |||||

| A Major shareholders | ||||||

9.6. Additional | ||||||

14.2. Share information | 240 | |||||

| B Related party transactions | ||||||

Note | ||||||

Note | ||||||

| C Interests of experts and counsel | Not applicable

| |||||

8 | Financial information | |||||

Annual Report 2016 9

Form 20-F cross reference table

| Item | Form 20-F caption | Location in this document | Page | |||

| A Consolidated statements and other financial information | ||||||

| 115 | ||||||

| 10.4. Independent auditors’ reports on the consolidated financial statements | 118 | |||||

| 14.1. Key financials and dividend | ||||||

B Significant changes | Note

| |||||

9 | The offer and listing | |||||

| A Offer and listing details | ||||||

12 Annual Report 2013

Form 20-F cross reference table

| B Plan of distribution | Not applicable | ||||||||

| C Markets | |||||||||

| D Selling shareholders | Not applicable | ||||||||

| E Dilution | Not applicable | ||||||||

F Expense of the issue | Not applicable

| ||||||||

10 | Additional information | ||||||||

| A Share capital | Not applicable | ||||||||

| B Memorandum and articles of association | |||||||||

| 105 | |||||||||

| 9.3. General Meeting of Shareholders - Main powers of the General Meeting of Shareholders | |||||||||

| C Material contracts | |||||||||

| D Exchange controls | |||||||||

| E Taxation | |||||||||

| F Dividends and paying agents | Not applicable | ||||||||

| G Statements by experts | Not applicable | ||||||||

| H Documents on display | Introduction - Documents on display | ||||||||

| I Subsidiary information | Not applicable

| ||||||||

11 | Quantitative and qualitative disclosure about market risk | ||||||||

| A Quantitative information about market risk | Note | ||||||||

| B Qualitative information about market risk | Note | ||||||||

| C Interim periods | Not applicable | ||||||||

10 Annual Report 2016

Form 20-F cross reference table

| Item | Form20-F caption | Location in this document | Page | |||

| D Safe harbor | Note

|

| ||||

| Forward-looking statements | 5 | |||||

| E Small business issuers | Not applicable

| |||||

12 | Description of securities other than equity securities | |||||

| A Debt securities | Not applicable | |||||

| B Warranty and rights | Not applicable | |||||

| C Other securities | Not applicable | |||||

| D American depository shares | 14.8. New York Registry Shares | 249 | ||||

Part 2 | ||||||

13 | Defaults, dividend arrearages and delinquencies | Not applicable | ||||

14 | Material modifications to the rights of security holders and use of proceeds | Not applicable | ||||

15 | Controls and procedures | |||||

| A Disclosure controls and procedures | 10.1.1. Disclosure controls and procedures | 115 | ||||

| B Management Annual Report on internal control over financial reporting | 10.1. Management’s report on internal control | 115 | ||||

| C Attestation report of the registered public accounting firm | 10.3. Independent auditors’ report on internal control over financial reporting | 117 | ||||

D Changes in internal control over financial reporting | 10.1.2. Changes in internal control over financial reporting | 115 | ||||

16A | Audit Committee Financial Expert | 9.2. Supervisory Board - The Audit Committee | 101 | |||

16B | Code of Ethics | 5.1. Our approach to risk management - Financial Code of Ethics | 73 | |||

16C | Principal Accountant Fees and Services | 8.3. Report of the Audit Committee | 95 | |||

| 9.4. Meeting logistics and other information - Auditor policy | 107 | |||||

| Note 6 Income from operations - Audit fees | 147 | |||||

16D | Exemptions from the Listing Standards for Audit Committees | Not applicable | ||||

16E | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 9.3. General Meeting of Shareholders - Repurchase and issue of (rights to) own shares | 105 | |||

14.2. Share information - Share repurchase programs for capital reduction purposes | 240 | |||||

16F | Change in Registrant’s Certifying Accountant | Not applicable | ||||

16G | Corporate Governance | 9. Corporate governance - Corporate governance of the Philips Group - Introduction | 97 | |||

| 9.6. Additional information - General | 110 | |||||

| 9.6. Additional information - Board structure | ||||||

| 9.6. Additional information - Independence of members of our Supervisory Board | ||||||

| 9.6. Additional information - Committees of our Supervisory Board | ||||||

| 9.6. Additional information - Equity compensation plans | ||||||

| 9.6. Additional information - Code of business conduct | ||||||

16H | Mine Safety Disclosure | Not applicable | ||||

Annual Report 2013 132016 11

Form 20-F cross reference table

| Item | Form 20-F caption | Location in this document | Page | |||

| B Warranty and rights | Not applicable | |||||

| C Other securities | Not applicable | |||||

| D American depository shares | 16.9. New York Registry Shares

| 272 | ||||

| Part 2 | ||||||

| 13 | Defaults, dividend arrearages and delinquencies | Not applicable | ||||

| 14 | Material modifications to the rights of security holders and use of proceeds | Not applicable | ||||

| 15 | Controls and procedures | |||||

| A Disclosure controls and procedures | 11.1.1. Disclosure controls and procedures | 154 | ||||

| B Management annual report on internal control over financial reporting | 11.1. Management’s report on internal control | 154 | ||||

| C Attestation report of the registered public accounting firm | 11.3. Auditor’s report on internal control over financial reporting | 155 | ||||

D Changes in internal control over financial reporting

| 11.1.2. Changes in internal control over financial reporting | 154 | ||||

| 16A | Audit Committee Financial Expert | 10.2. Supervisory Board - The Audit Committee | 144 | |||

| 16B | Code of Ethics | 6.1. Our approach to risk management and business control - Financial Code of Ethics | 116 | |||

| 16C | Principal Accountant Fees and Services | 9.3. Report of the Audit Committee | 140 | |||

| 10.4. Logistics of the General Meeting of Shareholders and provision of information - Auditor policy | 147 | |||||

| Note 3 Income from operations - Audit fees | 174 | |||||

| 16D | Exemptions from the Listing Standards for Audit Committees | Not applicable | ||||

| 16E | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | Note 19 Equity - Treasury shares | 189 | |||

| 10.3. General Meeting of Shareholders - Repurchase and issue of (rights to) own shares | 146 | |||||

16.2. Share information - Share repurchase programs for capital reduction purposes

| 259 | |||||

| 16F | Change in Registrant’s Certifying Accountant | Not applicable | ||||

| 16G | Corporate Governance | 9. Supervisory Board report | 131 | |||

10. Corporate governance

| 142 | |||||

| Part 3 | ||||||

| 17 | Financial statements | Not applicable | ||||

| 18 | Financial statements | 11. Group financial statements | 154 | |||

| 19 | Exhibits | 18.1. Index of exhibits | 277 | |||

| Item | Form20-F caption | Location in this document | Page | |||

Part 3 | ||||||

17 | Financial statements | Not applicable | ||||

18 | Financial statements | 10. Group financial statements - from 10.4 to 10.9 | 114 | |||

19 | Exhibits | 16.1. Index of exhibits | 253 |

1412 Annual Report 2013

Performance highlights

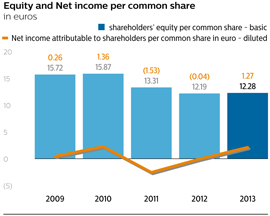

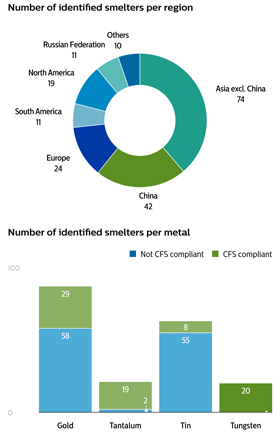

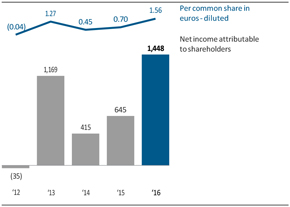

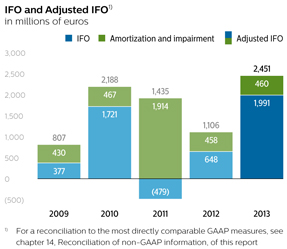

Prior-period financial statements and related information have been restated for the treatment of Audio, Video, Multimedia and Accessories as discontinued operations (see note 7, Discontinued operations and other assets classified as held for sale) and the adoption of IAS 19R, which mainly relates to accounting for pensions (see note 30, Post-employment benefits). For a reconciliation to the most directly comparable GAAP measures, seeReconciliation of non-GAAP information.

Financial table

all amounts in millions of euros unless otherwise stated

| 2011 | 2012 | 2013 | ||||||||||

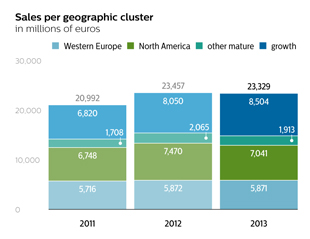

Sales | 20,992 | 23,457 | 23,329 | |||||||||

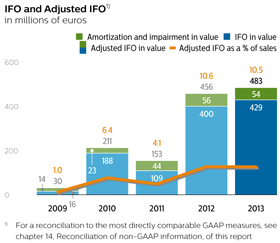

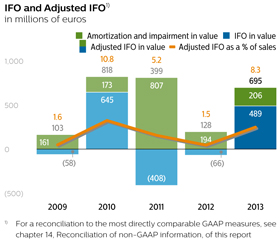

Adjusted IFO | 1,435 | 1,106 | 2,451 | |||||||||

as a % of sales | 6.8 | 4.7 | 10.5 | |||||||||

IFO | (479 | ) | 648 | 1,991 | ||||||||

as a % of sales | (2.3 | ) | 2.8 | 8.5 | ||||||||

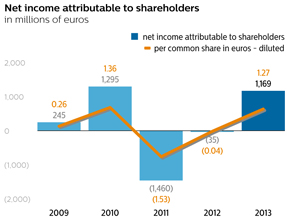

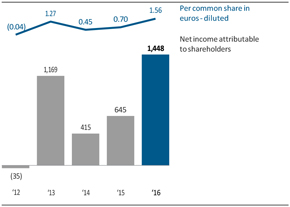

Net income (loss) | (1,456 | ) | (30 | ) | 1,172 | |||||||

Net income attributable to shareholders per common share in euro: | ||||||||||||

- basic | (1.53 | ) | (0.04 | ) | 1.28 | |||||||

- diluted | (1.53 | ) | (0.04 | ) | 1.27 | |||||||

Net operating capital | 10,382 | 9,316 | 10,238 | |||||||||

Free cash flows | (97 | ) | 1,627 | 172 | ||||||||

Shareholders’ equity | 12,328 | 11,151 | 11,214 | |||||||||

Employees at December 31 | 125,240 | 118,087 | 116,681 | |||||||||

of which discontinued operations | 5,645 | 2,005 | 1,992 | |||||||||

Financial performance 2013

| ||||||||

| ||||||||

| ||||||||

Annual Report 2013 15

Performance highlights

Performance

in millions of euros

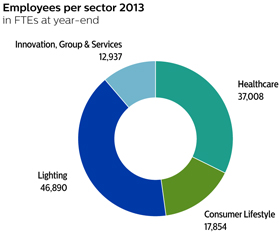

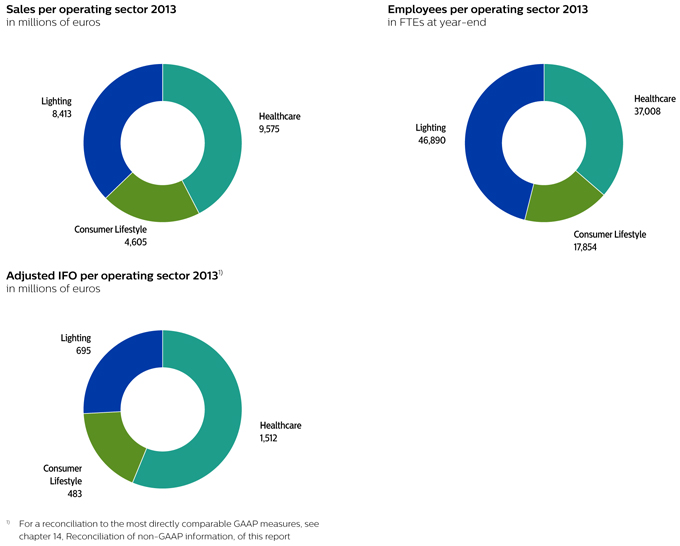

| Group | Healthcare | Consumer Lifestyle | Lighting | |||||||||||||||||||||||||||||||||||||||||||||

| 2012 | 2013 | 2012 | 2013 | 2012 | 2013 | 2012 | 2013 | |||||||||||||||||||||||||||||||||||||||||

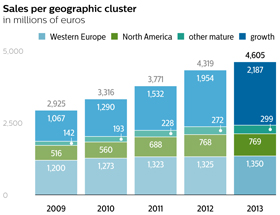

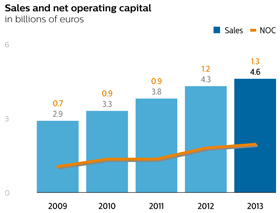

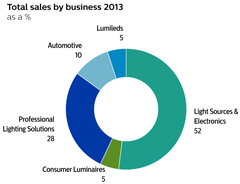

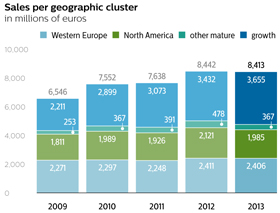

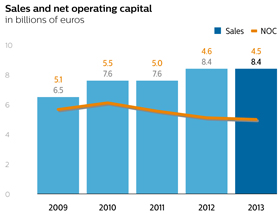

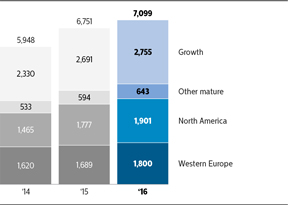

Sales | 23,457 | 23,329 | 1% | 9,983 | 9,575 | 4% | 4,139 | 4,605 | 7% | 8,442 | 8,413 | 0% | ||||||||||||||||||||||||||||||||||||

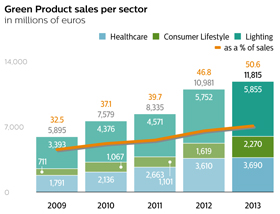

Green product sales | 10,981 | 11,815 | 8% | 3,610 | 3,690 | 2% | 1,619 | 2,270 | 40% | 5,572 | 5,855 | 2% | ||||||||||||||||||||||||||||||||||||

Sales in mature geographies5) | 15,407 | 14,825 | 4% | 7,615 | 7,154 | 6% | 2,365 | 2,418 | 2% | 5,010 | 4,758 | 5% | ||||||||||||||||||||||||||||||||||||

Sales in growth geographies5) | 8,050 | 8,504 | 6% | 2,368 | 2,421 | 2% | 1,954 | 2,187 | 12%  | 3,432 | 3,655 | 6% | ||||||||||||||||||||||||||||||||||||

Adjusted IFO | 1,106 | 2,451 | 122%  | 1,226 | 1,512 | 23%  | 456 | 483 | 6% | 128 | 695 | 443%  | ||||||||||||||||||||||||||||||||||||

Net operating capital | 9,316 | 10,238 | 10% | 7,976 | 7,437 | 7% | 1,205 | 1,261 | 5% | 4,635 | 4,462 | 4% | ||||||||||||||||||||||||||||||||||||

16 Annual Report 20132016

Message from the CEO 1

“Our Accelerate! initiatives helped us to achieve our mid-term 2013 targets. We are implementing thehave transformed Philips Business System across the company to improve customer focus and operational excellence, and drive our businesses systematically to global leadership performance. With our mission to deliver meaningfulinto a focused leader in health technology, delivering innovation to make the world healthierhelp people manage their health and more sustainable, we are well positioned to improve our growth rate.support care providers in delivering care effectively.”

Frans van Houten, CEO Royal Philips

Dear stakeholder,Stakeholder,

I am very excited about the future of Philips as a focused leader in health technology, innovating new approaches to global health challenges. 2016 was a defining year for our company as we celebrated our 125th year as an innovation company and continued to advance our transformation. Our strategic focus is already delivering results.

We have successfully integrated our Volcano acquisition, achieving multiple quarters of double-digit growth, significant growth synergies with our image-guided therapy business, and cost synergies well beyond our original plans.

We separated the Lighting business, executing a complex project on time and below budget. In May we successfully listed Philips Lighting on the Amsterdam Euronext stock exchange, giving it the opportunity to build on its leadership position in the exciting lighting industry. In its first year as a stand-alone company, Philips Lighting delivered strong LED sales growth and a significant increase in profitability, demonstrating the continued progress that the largest lighting company in the industry is making. In February 2017 we further reduced our stake in Philips Lighting’s issued and outstanding share capital to approximately 55%, in line with our stated aim to fully sell down our stake in Philips Lighting over the next several years. Separately, in December we signed an agreement to sell the combined Lumileds and automotive lighting businesses, effectively completing our portfolio transformation.

I am pleased with the momentum in the overall business performance of our HealthTech portfolio as our health technology businesses posted 5% comparable sales growth1 and a significant increase in profitability. At the same time, we again stepped up our investments in quality, growth initiatives and innovation.

Our solutions approach – where we combine suites of systems, smart devices, software and services to help our customers improve patient outcomes and productivity – continues to gain traction, as evidenced by 11% solutions revenue growth in the year and our winning 15 new long-term strategic partnerships around the world with an aggregate value of approximately EUR 900 million.

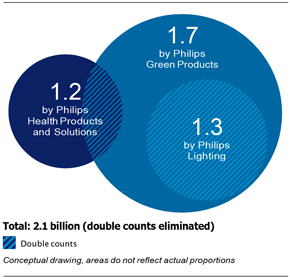

In 2013 we passed a major milestone on2016, our Accelerate! transformation journey to unlock Philips’ full potential. Despite economic headwinds, especially in Europeproducts and services improved the United States, our Accelerate! initiatives helped us to achieve our mid-term 2013 targets. I am delighted with this result, as it underlines yet again that Philips is, above all, a caselives of self-help.

Accelerate! is helping us get closer to our customers, as illustrated by our landmark alliance with Georgia Regents Medical Center. And the transformation of our value chains is speeding up the introduction of locally relevant innovations in key markets2.1 billion people around the world. Innovations likeWe also launched our EPIQ ultrasound imaging system,new five-year ‘Healthy people, sustainable planet’ program, supporting the aim of improving the lives of 3 billion people per year by 2025 and becoming carbon-neutral in our Smart Air Purifieroperations by 2020. And at the World Economic Forum in January 2017 the Chairman of our Supervisory Board and AirfryerI signed the Compact for Responsive and Responsible Leadership, an initiative to promote and align the long-term sustainability of corporations and the long-term goals of society, with an inclusive approach for all stakeholders.

Our overall 2016 performance gives me great confidence for the future as we build upon outstanding positions in the hospital and the home, appliances,expand our solutions capability and continue to deliver on the promise of digitization and smart, connected care.

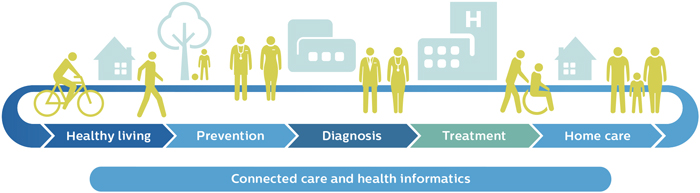

Transforming the delivery of care

As consumers take a more active role in managing their health, we see professional healthcare and consumer health converging. This provides a tremendous opportunity for technology to play a role in data-enabled healthcare delivery, also supporting the shift from hospital care and acute reactive care to more proactive ambulatory and home care.

Through our energy-efficient CityTouch lightingmarket-leading propositions in personal health, we have natural touchpoints with consumers to promote healthy lifestyles, which are critical to good health. For example, our Dream Family is a comprehensive solution comprising sleep therapy devices, a comfortable mask, therapy management system.software and services to provide a good night’s sleep for people with obstructive sleep apnea. And our connected Sonicare toothbrushes with smart sensor technology help to improve oral healthcare through real-time feedback and post-brush analytics.

| 1 | Non-GAAP financial measure. For the definition and reconciliation to the most directly comparable GAAP measure, refer to chapter 4, Reconciliation ofnon-GAAP information, of this Annual Report |

Annual Report 2013 172016 13

Message from the CEO 1

In the hospital we are leading in integrated diagnostic solutions across various disciplines including radiology, pathology and genomics, combining advanced imaging modalities and clinical decision support aided by artificial intelligence and practice management software.

We are also seeingleading in image-guided, minimally invasive therapies which, compared with open surgery, have the steady developmentbenefits reduced patient trauma, shorter recovery times and higher productivity. Our suites of ainterventional imaging technologies and navigation software, combined with interventional devices such as smart catheters, enable complex procedures in cardiology and oncology, for example. Our enterprise patient monitoring informatics solutions greatly reduce adverse events for patients and lighten the workload for nurses. And we are increasing our contribution to improve population health management with data analytics and targeted programs to improve health outcomes of patient cohorts with multipleco-morbidities and to reduce costs.

HealthSuite, our secure yet open healthcare Internet of Things cloud platform, connects patients and millions of devices with care providers, supported by powerful artificial intelligence. It ‘connects the dots’, enabling the flow of data needed to support first-time-right precision diagnoses and to deliver personalized treatments. At Philips, we believe this will improve outcomes, reduce costs and increase well-being.

Our initiative to build primary care capacity in developing markets through the Community Life Centers has passed its clinical and practical validation tests and will soon be ready for furtherroll-out, with the aim of cost-effectively improving access to care for millions of people.

Significant opportunities for value creation

Our EUR 17 billion health technology portfolio serves markets that offer attractive prospects in terms of growth and profitability.

We see a great opportunity tofurther improve our operational performance culture characterized by strong employee engagement, teamwork, and to deal forthrightly with the drive for operationalpossible impact of regulatory investigations. We believe we are making progress in improving our customer excellence programs and accountability for results.in strengthening margins through productivity. This is making us more agile, entrepreneuriala continuation of our Accelerate! program, where there is considerable scope for ‘self-help’ by applying the Philips Business System. We will drive higher productivity by lowering the cost of goods,non-manufacturing cost and innovative.the cost ofnon-quality, while at the same time embedding the digital transformation in everything we do. Digitization is a great enabler of cutting-edge value propositions, as well as driving higher levels of customer service, productivity and quality.

Financial performance

The economic environment in 2013 was challenging. Full-year sales declined by 1% in nominal terms, but increased by 3% on a comparable basis. Closing the year with strong 7% top-lineSecond, we see opportunities toboost growth in our existing core health technology businesses. We will do this by executing more effectively on customer partnerships, further transforming the fourth quarter,business model from ‘transactional’ to one of ‘long-term partnerships’, with shared business goals and recurring revenue streams. Another proven avenue of growth is via geographical adjacencies. This approach has worked well in our Personal Health businesses, where we delivered a compound annual growth rate for comparable sales over the period 2012-2013 of 4.5%, compared to our target of 4-6%. In regional terms, our growth geographies delivered 11% comparable sales growth in 2013 and now make up 36% of total sales.

Profitability improved significantly on the back of increased gross margins and productivity gains from our Accelerate! program. This resulted in a reported Adjusted IFO of 10.5%, within the target bandwidth of 10-12%. And our return on invested capital was 15.3%, above the targeted range of 12-14%.

Our Healthcare business increased operational earnings despite a virtually flat top line. With the issues surrounding health care reformhave taken products that have been successful in the USUnited States or Japan, for example, and budget constraintsbrought them into emerging economies, where there is a huge appetite for innovation and our brand. We anticipate market share gains in key markets,several of our businesses, including our Diagnostic Imaging business, which has largely overcome the incidents of the past.

Third, we are increasingly focusing on becoming the technology solutions partner of choice to major hospitals as a way to unlock new growth. Reflecting the success of its innovative propositions for personal health and well-being, Consumer Lifestyle posted strongdriving future growth and good earnings, while Lighting recorded higher sales, driven by a 38% increase in LED-based sales, and improved operational earnings.

In 2013 we also completed the execution of our EUR 2 billion share buy-back program, thereby improving the efficiency of our balance sheet, and announced a new EUR 1.5 billion program to be concluded over the next 2-3 years. By the end of 2013 we had completed 7% of this new program.

Other 2013 highlights

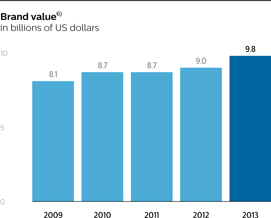

In 2013 we rose to # 40 on Interbrand’s annual ranking of the top-100 global brands,profit expansion with our brand value increasing by 8%shift to close to USD 10 billion. And in November we unveiled our new brand positioning and brand line – “innovation and you” – and our redesigned shield, which enjoyed an enthusiastic reception from customers, employees and other stakeholders.

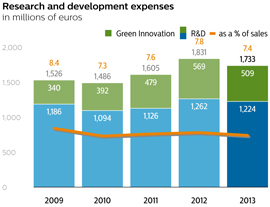

In 2014 we celebrate 100 years of Philips Research, and over the past year we underlined our commitment to innovation bysolutions. We are investing EUR 1.7 billionstrongly in research and development. We filed over 1,500 patent applications in 2013. Other innovation highlights includeddevelopment for value-added, integrated solutions along the increasing adoption of our Digital Pathology solution and the development of the 200 lm/W TLED prototype to replace fluorescent tube lighting.

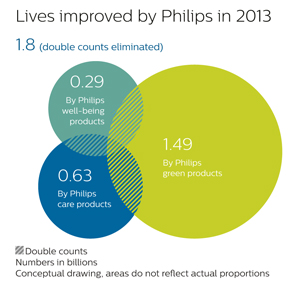

We also continued to deliver on our EcoVision sustainability commitments in 2013, improving the lives of 1.8 billion people around the globe and hitting our Green Product sales target of 50% of total sales two years ahead of schedule. In Buenos Aires we were awarded the order to renovatehealth continuum, most of the city’s 125,000 street lights with our CityTouch system, and in Dubai we were selected to transform over 260 Municipality buildings with intelligent LED solutions – both projects reducing energy consumption by some 50%. Our efforts to create a healthier and more sustainable world received recognitionnotably in the formareas of a rise to 23rd place in Interbrand’s ranking of the top 50 Best Global Green Brands, as well as a top rating from the Carbon Disclosure Project.

Of course, no year is entirely free of disappointment,precision diagnostics, cardiology, oncology, respiratory, and in 2013 we had to contend with the termination of the deal with Funai for our Audio, Video, Multimedia and Accessories business. We also faced compliance issues relating to our General Business Principles, which we are refining and strengthening.

Looking ahead – our Path to Value by 2016

Philips is a diversified technology company with a portfolio of some 40 businesses across various strategic domains. Over half of these businesses hold global leadership positions. Our portfolio is underpinned by strong assets: deep market insights; world-class innovation capabilities – technology, know-how and strong IP positions; our global footprint; our talented, engaged people; and the Philips brand.

The significant changes we have made to our portfolio in recent years have created a better growth platform with higher profit potential. And with the transformation of our business model architecture, we are increasingly becoming a technology solutions partner, with recurring revenue streams accounting for over 25% of sales.

Meeting the needs of a changing worldpopulation health.

In light of the mega-trends and challenges the world is facing, we are confident in our chosen strategic direction. With its focus on health and sustainability, our

1814 Annual Report 20132016

Message from the CEO 1

visionRoadmap to improvewin

We do need to navigate carefully the many potentialgeo-political risks that we see today. Given that we have a balanced footprint across the world, we believe this is manageable. We are also still exposed to certain risks from legacy issues, which we aim to manage with strong focus and care.

In conclusion

I would like to thank all our customers and stakeholders for their continued support. I would also like to pay tribute to our teams around the world for their outstanding work – and the progress they achieved – in the course of the year.

With a strong commitment to continuous improvement, we will deliver the meaningful innovation and quality our customers expect – and take the next steps on our journey to reach our goal of improving the lives of 3 billion people a year by 2025 helps to differentiate us from the competition, have a closer relationship with our customers, create IP and ultimately create more value.

We see the shift from a linear to a circular economy as a further opportunity to create value. In a linear economy, products are used briefly and then discarded as waste. In a circular economy, products are designed so they become part of a value network where re-use and refurbishment ensure continuous re-exploitation of resources.

We are redesigning our products in order to capture their residual value. And we are shifting from transactions to relationships via service and solution business models. A good example is the 10-year performance contract we were awarded to install, monitor and maintain 13,000 connected lighting fixtures and energy management controls for parking garages in Washington, DC. Because we are ensuring light levels and delivering the solutions as a service that is paid for by the energy savings, Washington gets brighter, safer LED lighting for its garages with none of the up-front cost, thereby removing one of the main barriers to the adoption of energy-efficient technology.2025!

Driving productivity improvement

Over the coming years we will continue to drive operational excellence and invest in innovation and sales development. We will also continue to focus on improving profitability, e.g. by further reducing overhead costs and driving value engineering through our Design for Excellence (DfX) program. Altogether we see significant potential to improve productivity over the next few years. We also have scope for value-creating bolt-on acquisitions, but will remain prudent with our capital allocation. Most of our growth opportunities are organic.

In 2014 we will roll out a new IT landscape to make Philips a truly real-time company, and we will further embed the Philips Business System (PBS). The PBS is the way we run our company to ensure business success is repeatable. This year will also see our new brand positioning being activated across the globe.

New growth initiatives

I am pleased to say that Philips has multiple new growth opportunities in the making. Within our Healthcare sector we have established the Healthcare Informatics Solutions & Services business group, which is focusing on a digital connected healthcare delivery platform, advanced informatics and big data analytics, and world-class integration and consulting services. At Consumer Lifestyle we have a new business initiative on Personal Health. And in our Innovation, Group & Services sector we have several highly promising start-ups, although it will be a few years before they are margin-accretive because of the necessary investments. Examples of these exciting new business areas include point-of-care diagnostics as well as horticultural and city farming technology.

Confident in the future

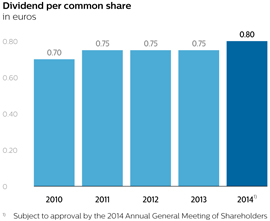

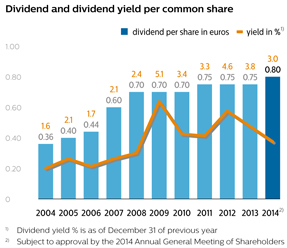

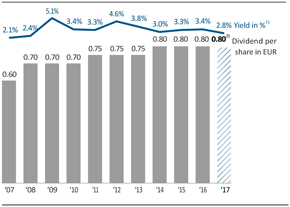

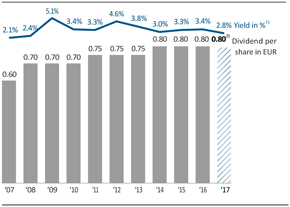

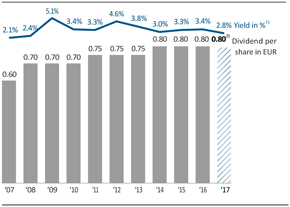

While remaining cautious about the short-term macro- economic outlook, we are committed to delivering on our 2016 financial performance targets. As a sign of our confidence in Philips’ future, we are proposing to the upcoming General Meeting of Shareholders to increase this year’s dividend to EUR 0.80 per common share, in cash or stock.

On behalf of my colleagues on the Executive Committee, I wish to thank all our employees for embracing Accelerate!, helping to build a great company fit for the demands of the 21st century, and delivering innovations that matter to people the world over. And I would like to thank our customers, shareholders and other stakeholders, for their continued trust and support.

Frans van Houten

Chief Executive Officer

Annual Report 2013 192016 15

Driving change and improvement

Now in its third year, Accelerate! is making Philips a more agile and entrepreneurial innovator. The program, which is set to run through 2017, is made up of five streams designed to:

Annual Report 2013 21

Accelerated! in action

22 Annual Report 2013

Annual Report 2013 23

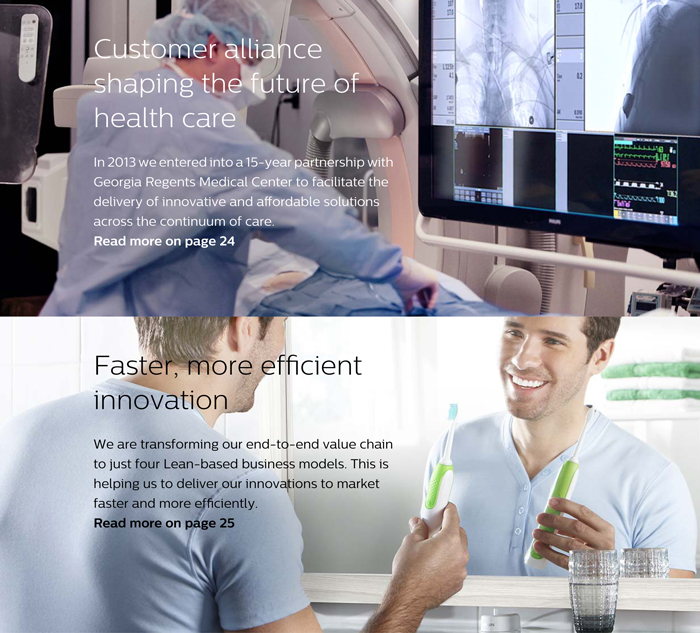

With the help of patient advisors like Alice Reece, Philips and Georgia Regents Medical Center are working to redefine patient and family care.

“When I think about the future of healthcare we have to re-think everything: every square foot, every person, every dollar, every resource. And that forces real dynamic change in a way that this industry hasn’t seen in years.”

David Hefner

Executive Vice President

Georgia Regents Medical Center

“Providing care requires us to be innovative, requires us to think differently. The partnership that we now have with Philips really stresses a better outcome for our patients.”

Dr Ricardo Azziz

CEO

Georgia Regents Health System

24 Annual Report 2013

Around the world, we are working together with our partners and customers to optimize every step in the value chain. This end-to-end approach is enabling us to innovate and execute faster and more efficiently.

Driving growth in oral healthcare

In Germany, we are building on our professional recommendation strategy and driving conversion of manual toothbrush users to electric tooth brushing through innovation leadership, portfolio expansion and distribution via new channels. This end-to-end approach resulted in a market share improvement of over 7%.

With only a third of German households owning a rechargeable toothbrush, there is a significant opportunity to expand our leadership in the sonic toothbrush segment. Taking an end-to-end perspective, we identified three key drivers for expansion: driving and communicating innovation leadership with superior propositions; creating a Philips Sonicare proposition at a price-point accessible for a broader audience; and making that proposition available to consumers in channels like drugstores and hypermarkets.

Philips Sonicare is already leading in the German market, with consumers responding to superior propositions like Flexcare Platinum and DiamondClean. In 2013, our leadership position was further supported through celebrity endorsement, which is driving awareness and conversion.

To present current manual toothbrush users with more alternatives from Philips Sonicare, driving growth in the mid-segment, we created a more accessibly priced proposition, the Philips Sonicare PowerUp. This product features similar brushing movements to manual and is gentle and effective. Research showed that over 90% of consumers surveyed preferred the Sonicare PowerUp over their manual toothbrush.

The majority of electric toothbrushes and replacement brush heads are sold in drugstores and hypermarkets. To leverage this opportunity, Sonicare PowerUp launched in DM and Budni drugstores, as well as Kaufland and Marktkauf hypermarkets, adding 2,000 stores to our distribution. We optimized our supply chain to work with these partners, designing bespoke packaging, significantly reducing time-to-market and improving transparency.

In less than a year our end-to-end strategy resulted in strong market share gains and double-digit growth in brush head sales. Consumer satisfaction increased, with patients advised by their dentist to switch to electric brushing conveniently able to purchase a Philips Sonicare and replacement brush heads at their local drugstore.

Annual Report 2013 25

LED façade lighting faster to market

Through our end-to-end transformation program, we have identified and driven improvements along the entire LED value chain in China. This has resulted in a broad range of competitively priced façade lighting solutions for the mid-tier market segment in China, with a 40% reduction in time-to-market for new product introductions and a significant increase in on-time delivery.

In 2012, market intelligence showed that we were missing out on the LED façade lighting segment in China – a segment predicted to reach € 520 million by 2015, 70% of which will be taken by mid-range solutions. The problem was that in China we only offered top-range LED façade solutions. Clearly, something had to be done.

An end-to-end transformation program was immediately initiated, and a cross-functional team representing both the business and our market organization was assembled to address all opportunities along the value chain. The team took ownership of the common goal to achieve ambitious cost targets. It invested in market research and started with market sizing and customer segmentation, before developing imaginative strategies for product positioning, go-to-market and time-to-market. From the outset, everyone knew that the new product line had to be conceived, developed and fine-tuned extremely quickly.

The result was a new range of competitive LED façade lighting solutions specially designed for the mid-range market in China. And all in just under 28 weeks – a massive reduction compared to the 12 months it previously took to bring a new product line to market. Another benefit of this end-to-end collaboration is that achievement of the delivery time target of 25 days has increased from 43% to 66%, with a further rise to 95% expected by 2015.

26 Annual Report 2013

In 2013 we continued to drive structural change through our multi-year transformation program Accelerate! We are seeing the steady emergence of a growth and performance culture that is making us more agile, entrepreneurial and innovative.

With our Accelerate! behaviors – Eager to win, Take ownership and Team up to excel – firmly embedded in the organization, we are rolling out a wide range of initiatives designed to harness the talents, viewpoints and experience of our employees and so build a winning culture. A culture anchored by our General Business Principles.

Transformation and change

To date, over 1,350 of our leading executives have taken part in our Accelerate! Leadership Program (ALP). This immersive program is designed to strengthen our leaders’ transformational capabilities so they can drive change in the organization. Complementing the ALP, the Accelerate! Team Performance (ATP) is a transformational session designed to reinforce behaviors that enhance team effectiveness. By year-end, more than 200 teams and 3,650 participants had been through the program, which also touched more than 2,000 employees via viral events.

The transformation drive is being embraced across the organization. In Healthcare, to name just one example, a group of over 160 employee advocates or “Culture Champions” is now in place, role-modeling and instilling the new culture from the middle of the organization outwards. They are providing invaluable insights and helping to drive changes in day-to-day activities and behaviors.

Capability building

ALP and ATP are also an integral part of our capability-building efforts. In 2013 we took the next steps in becoming a learning organization by completing the organizational design of Philips University. This involved a fundamental shift to align our learning activities with the organizational development priorities we have set to enable us to deliver on our business strategy. New flagship learning programs will be introduced early in 2014, and a move to one single learning management system is scheduled for the second half of the year.

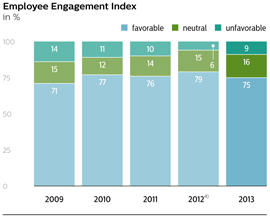

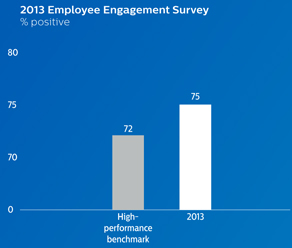

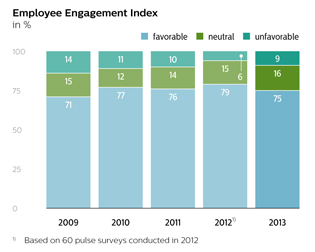

Employee engagement

In October 2013 we launched our renewed bi-annual Employee Engagement Survey (EES), emphasizing the dimensions of employee behavior that affect performance, including change agility, alignment, and engagement. The overall engagement index shows a positive score of 75% – 3 percentage points above the chosen global external high-performance benchmark.

Annual Report 2013 27

Bringing our brand to life

Reflecting this culture of engagement, our employees also play a crucial role as ambassadors of our brand. In May 2013 our Employee Brand Jam focused on engaging employees around our new brand promise. They were asked to share, via a dedicated dashboard, their stories about how Philips delivers innovation to them. This campaign won a European Excellence Award in the Internal Communications category.

In the lead-up to brand launch day, 13 November, we invited the world to uncover our redesigned shield through a mosaic launched via social media. Over 14,000 individuals took part in the 48 hours ahead of the reveal. On the day itself, over 60 sites around the world hosted simultaneous events linked to a live feed of the unveiling at our head office in Amsterdam. In this way, a highly engaged workforce was brought together to celebrate a landmark event in the history of the company.

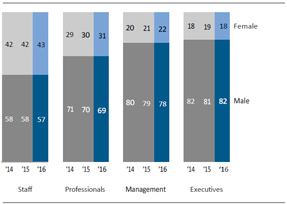

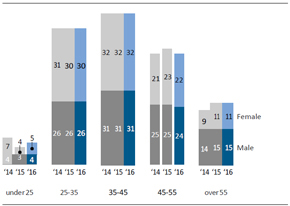

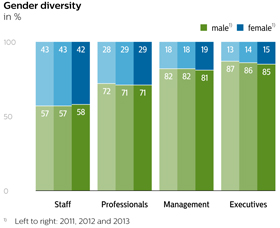

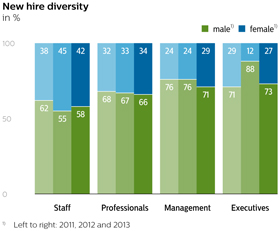

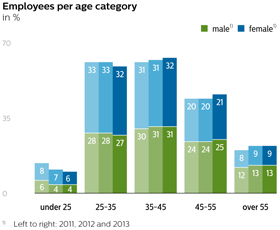

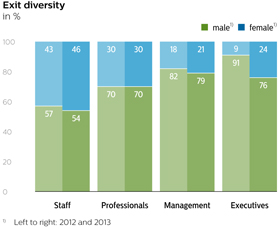

Diversity and inclusion

Having an inclusive culture where differences are honored, respected and encouraged and a diverse workforce that mirrors the markets we’re active in, enables us to deliver innovation that matters to our customers and consumers and thus to create value for Philips and its stakeholders. Our new Diversity & Inclusion Policy defines our global standards and the role all employees need to play to create a diverse and inclusive workplace.

28 Annual Report 2013

In 2011, Philips embarked on a comprehensive program to significantly increase the efficiency of its overhead structure: those activities which take place mainly above the level of operational businesses and market organizations. Since then, real progress has been made – with more work to be done over the coming years.

The Accelerate! productivity program looked first to benchmarks – to what was currently industry best-in-class – and subsequently leveraged this insight to re-engineer the company’s overhead activities such as IT, Finance, Human Resources and Real Estate. The objective was to deliver improved service levels to internal customers in a faster, simpler, easier-to-experience way – at lower cost.

The focus of the program was on the operating model – how the function was set up to deliver its services. These ‘smarter functions’ looked to pool services into Centers of Expertise which then provide high-quality, 24/7 support to a wide range of businesses and geographies from a single hub. Equally impactful was the increased use of ‘output-based delivery’, swapping contract workers brought into Philips to support initiatives for clear output-based contracts with the 3rd-party suppliers. Last, but by no means least, was the reduction in managerial layers and subsequent increase in span of control of individual managers; this has led to less bureaucracy and faster decision making across the company.

Finance is a good example. Traditionally, finance professionals were spread widely across Philips, each supporting business management in everything from basic bookkeeping to analysis of upcoming Asian competition. As of 2013, we have re-engineered the operating model of our Finance activity, pooling knowledge into efficient, dedicated Centers of Expertise – one focused on fundamental bookkeeping and internal control, another on financial planning and analysis of business performance, yet another on expert company-wide advice on specific topics ranging from foreign exchange to pensions. This has led to a simpler, leaner, more effective operating model which, critically, is able to deliver faster, better services to its internal customers. Similar transformations in the other functions – and indeed more broadly in business management – have, collectively, allowed us to substantially improve the efficiency and effectiveness of our overhead structure and – in the process – report a gross cost reduction of over EUR 1 billion through the end of 2013.

Annual Report 2013 29

Our 2013 results

30 Annual Report 2013

The journey continues

First milestone passed

Accelerate! is working and driving our transformation. We are pleased to have achieved the first major milestone on our Accelerate! journey – our mid-term 2013 financial targets. However, we still have a way to go before we have delivered Philips’ full potential.

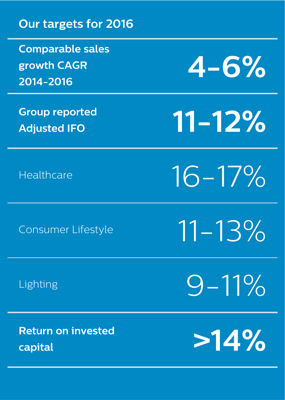

New targets on Path to Value

That’s why we have set ourselves challenging new targets, to be realized by the end of 2016. These indicate the value we create, as measured by sales growth, profitability and our use of capital:

Annual Report 2013 31

A born innovator

Philips was founded in Eindhoven, Netherlands, in 1891 by Frederik and Gerard Philips – later joined by Gerard’s brother Anton – to “manufacture incandescent lamps and other electrical products”. For the 120-plus years since then, we have been improving people’s lives with a steady flow of ground-breaking innovations.

Today, we are building upon this rich heritage as we touch billions of lives each year with our innovative healthcare and lighting solutions and our personal health and well-being products.

Whatweaspireto

At Philips, we strive to make the world healthier and more sustainable through innovation.

Our goal is to improve the lives of 3 billion people a year by 2025.

We will be the best place to work for people who share our passion.

Together we will deliver superior value for our customers and shareholders.

Annual Report 2013 33

Responding to global challenges

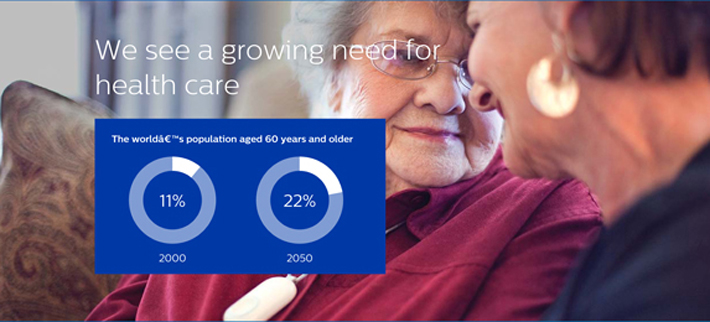

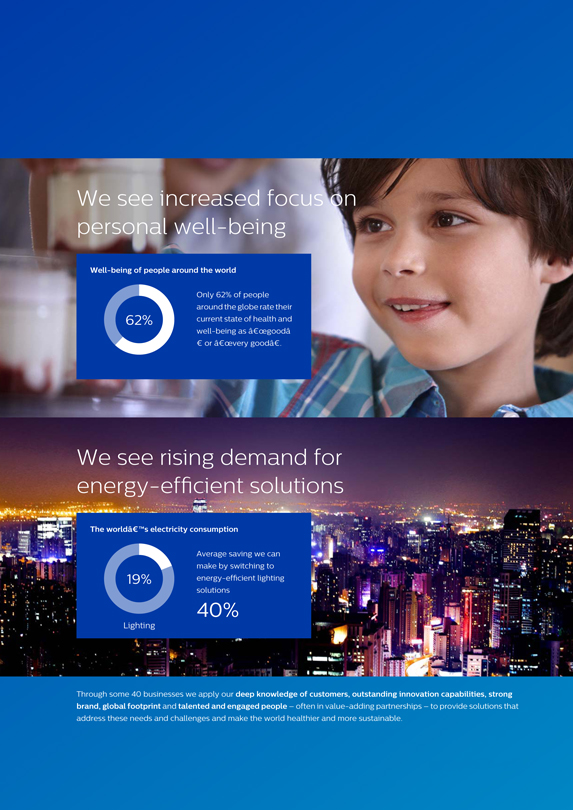

With our understanding of many of the longer-term challenges our world faces, we see major opportunities to apply our innovative competencies and create value for our stakeholders.

34 Annual Report 2013

Ensuring success is repeatable

The Philips Business System is the way we run our company to deliver on our mission and vision. It is designed to ensure that success is repeatable, i.e. that we create value for our stakeholders time after time.

Group Strategy: We manage our portfolio with clearly defined strategies and allocate resources to maximize value creation.

CAPs: We strengthen and leverage our core Capabilities, Assets and Positions as they create differential value: deep customer insight, technology innovation, our brand, global footprint, and our people.

Excellence: We are a learning organization that applies common operating principles to deliver Philips Excellence.

Path to Value: We define and execute business plans that deliver sustainable results along a credible Path to Value.

Engaged employees crucial for success

We need all our people collaborating effectively – in a diverse and inclusive environment, where they can grow and fulfill their ambitions. Engagement supports our culture of growth and performance improvement, reinforcing our goal of being the best place to work for people who share our passion.

36 Annual Report 2013

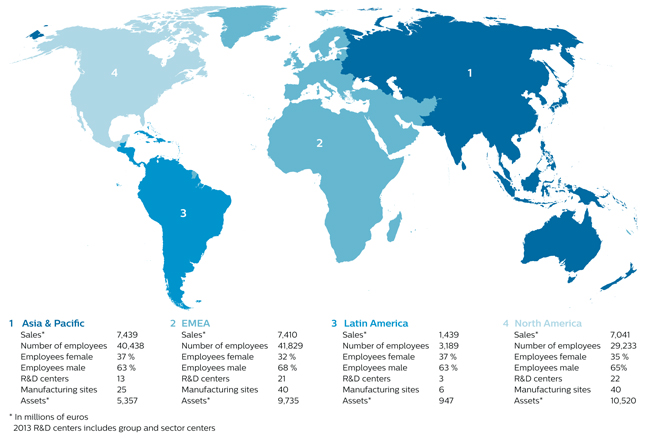

Find out more about the scale and location of our activities throughout the world.

Annual Report 2013 37

Who do we mean by ‘you’?

Philips delivers innovation that matters to you.

But just who is ‘you’? And what matters to you? To get ever closer to our customers, these are questions we ask every day.

With our global presence – we have customer-facing staff in over 100 countries – and our trusted brand, we are uniquely placed to capture local customer insights.

By understanding the challenges local people face – whether they be a hospital director, a city planner, a doctor or a consumer – we ensure that their actual needs and aspirations drive our innovation efforts. So we can deliver what really matters to them.

Annual Report 2013 39

2. Understanding people’s needs

What matters to you?

40 Annual Report 2013

Annual Report 2013 41

42 Annual Report 2013

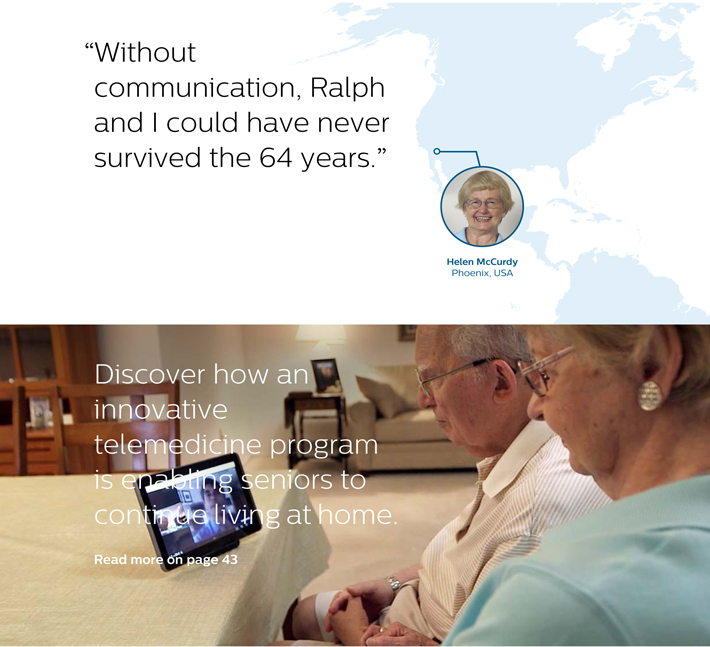

Ralph and Helen McCurdy, a loving husband and wife who can live together at home and receive high-quality health care, thanks to an innovative and efficient telemedicine program from Philips and Banner Health.

“Without communication, Ralph and I could have never survived the 64 years. To be able to talk to a doctor on a video and we don’t have to wait two or three days for a doctor appointment, it’s fabulous.”

Helen McCurdy

This is the future. It’s really an amazing model of care that doesn’t exist anywhere else… yet. When I have a team of people, augmented by a lot of Philips technology, I can catch things earlier, treat things earlier, and intervene in a way that allows me to accomplish what I set out to do as a geriatrician, and ultimately to do some good in these patient’s lives.”

Edward Perrin, MD

Geriatric Care Specialist & Medical Director

Banner Hospice

Annual Report 2013 43

The Philips Airfryer lets Dable Kwan prepare spring rolls and other delicious fried foods with much less oil. Who knew innovation could be so good for you, and taste so good too?

“My name is Dable and I live in Hong Kong. I’m a housewife and I love to cook. I really started to cook seriously about 10 years ago.

My husband loves fried food. Back then I would tell him, ‘No, there’s too much oil and grease, and it’s not good for your health.’ But since getting the Philips Airfryer, ah, what a happy man.”

“It really makes cooking much easier, much healthier, and much more fun. Now, I’m using less oil, less salt, less everything else. We just had our check-ups and our cholesterol, blood sugar and everything else are at very healthy levels.”

44 Annual Report 2013

The port of Da Nang has grown in prosperity since Philips LEDs began lighting up the Dragon Bridge. See how the lives of fisherman Le Van Khe and his daughter Le Thi Vinh are improving.

“The lights make the structure more vibrant and interesting for people who come to marvel at it… The bridge has been central to our overall growth. This year we’re hoping to receive around 3 million tourists.”

Tran Chi Cuong

Deputy Director

Danang Department of Culture, Sports and Tourism

“I have my own sugarcane juice cart near the Dragon Bridge. When the bridge opened I saw a lot of tourists arrive and figured that selling sugarcane to them would be better than working at the factory. My father is very happy that I no longer have to struggle working at the factory.

On a Saturday and Sunday it’s so much fun to see the show. The bridge is very important to my family and me. My life lit up because the bridge lit up. It has changed our lives for the better.”

Le Thi Vinh

Annual Report 2013 45

How we innovate for you

Armed with deep insights into local customer needs, we then bring together our R&D and design expertise and our local business-creation capabilities to address these needs.

The locally relevant solutions we develop – often in collaboration with our customers – do not always involve ‘new technology’. Instead, they may mean a new application or a unique customer proposition brought about by an innovative partnership.

Discover overleaf how we applied our innovation and design capability to help women breastfeed for longer.

46 Annual Report 2013

Almost 25% of mothers stop breastfeeding within the first three months because it becomes too painful. A further 40% stop because of a decreased milk supply. Discover how the Philips AVENT Natural range addresses these problems.

Using a breast pump to express milk can make it easier for mothers to continue breastfeeding. People researchers at Philips discovered that moms thought pumps were too cold and mechanical, and forced them to lean forward to make sure the milk flows down into the bottle.