In addition, the

The stock markets in general hashave experienced substantial price and volume fluctuationsvolatility that havehas often been unrelated or disproportionate to the operating performance of particular companies affected.companies. These types of broad market and industry factorsfluctuations may materially harmadversely affect the markettrading price of the ADSs andour Series A shares regardless of our operating performance.and ADSs. In the past, stockholders have sometimes instituted securities class action litigation against companies following periods of volatility in the market price of certain companies’their securities. See Item 8: “Financial Information—Legal Proceedings—IPO Securities Litigation” for a description of a securities securities class-action litigationclass action lawsuit (that has been instituteddismissed) against these companies. Suchus, our CEO, CFO, three current directors and our former chairman, brought on behalf of purchasers of ADSs in our initial public offering. Any similar litigation if instituted against us could have a material adverse effect on us.result in substantial costs, divert management’s attention and resources, and harm our business or results of operations.

The relatively low liquidity and high volatility of the Mexican securities market may cause trading prices and volumes of our Series A shares and the ADSs to fluctuate significantly.

The Mexican Stock Exchange is one of Latin America’s largest exchanges in terms of aggregate market capitalization of the companies listed therein, but it remains relatively illiquid and volatile compared to other major foreign stock markets. Although the public participates in the trading of securities on the Mexican Stock Exchange, a substantial portion of trading activity on the Mexican Stock Exchange is conducted by or on behalf of large institutional investors. The trading volume for securities issued by emerging market companies, as Mexican companies, tends to be lower than the trading volume of securities issued by companies in more developed countries. These market characteristics may limit the ability of a holder of our Series A shares to sell its Series A shares and may also adversely affect the market price of the Series A shares and, as a result, the market price of the ADSs.

If securities or industry analysts do not publish research or reports about our business, or publish negative reports about our business, our share price and trading volume could decline.

The trading market for our common stock depends in part on the research and reports that securities or industry analysts publish about us or our business. If one or more of the analysts who cover us downgrade our stock or publish inaccurate or unfavorable research about our business, our stock price would likely decline. If one or more of these analysts cease coverage of our company or fail to publish reports on us regularly, demand for our stock could decrease, which might cause our stock price and trading volume to decline.

If we issue additional equity securities in the future, shareholders may suffer dilution, and trading prices for our securities may decline.

In connection with our business strategy of expanding through acquisitions, we may finance corporate needs and expenditures, or future transactions, by issuing additional capital stock. Any such issuances of capital stock would result in the dilution of shareholders’ ownership stake. In addition, future issuances of our equity securities or sales by our shareholders or management, or the announcement that we or they intend to make such an issuance or sale, could result in a decrease in the market price of the ADSs and Series A shares.

Provisions of Mexican law and ourby-laws make a takeover more difficult, which may impede the ability of holders of Series A shares or ADSs to benefit from a change in control or to change our management and board of directors.

Provisions of Mexican law and ourby-laws may make it difficult and costly for a third party to pursue a tender offer or other takeover attempt resulting in a change of control. Holders of ADSs may desire to participate in one of these transactions, but may not have an opportunity to do so. For example, ourby-laws contain provisions which, among other things, require board approval prior to any person or group of persons acquiring, directly or indirectly, (i) 5% or more of our shares (whether directly or by acquiring ADSs or CPOs), or (ii) 20% or more of our shares (whether directly or by acquiring ADSs or CPOs) and in the case of this item (ii) if such approval is obtained, require the acquiring person to make a tender offer to purchase 100% of our shares and CPOs (or other securities that represent them) at a substantial premium over the market price of our shares to be determined by the board of directors, based upon the advice of a financial advisor.

These provisions could substantially impede the ability of a third party to control us, and be detrimental to shareholders desiring to benefit from any change of control premium paid on the sale of the company in connection with a tender offer. See Item 10: “Additional Information—Memorandum and Articles of Association—Overview—Change of Control Provisions” and “Additional Information—Memorandum and Articles of Association—Overview —Voting Rights.”

Substantial future sales of the ADSs or Series A shares could cause the price of the ADSs or Series A shares to decrease.

We may finance future corporate needs and expenditures by using shares of Series A common stock, to be evidenced by Series A shares or ADSs. Any such issuances of such shares could result in a dilution of our shareholders’your ownership stake or a decrease in the market price of the ADSs or the Series A shares. In addition, our principal shareholders are entitled to rights with respect to registration of their shares under the Securities Act, of 1933, as amended, or the Securities Act, pursuant to athe registration rights agreement.agreement we have on file with the SEC. Please see Item 7: “Major Shareholders and related Party Transactions—Major Shareholders.” If theyFor example, on November 16, 2015, certain of our principal shareholders, including affiliates of Discovery Americas, and Blue Sky Investments, exercised registration rights in the form of ADS’s, pursuant to our shelf registration statement on FormF-3 filed with the Securities and Exchange Commission (the “SEC”), and sold 99,000,000 CPOs in the form of ADSs at a price to the public of U.S. $16.00 per ADS in the United States and the other countries outside of Mexico. In connection with that offering, the underwriters also exercised their option in full to purchase 9,900,000 additional CPOs in the form of ADSs to cover over-allotments, for a total offering of 108,900,000 CPOs in the form of ADSs. This exercise of their registration rights, and any future exercise, with respect to such shares, thenmeans that there will be additionalare Series A shares eligible for trading in the public market, which may have an adverse effect on the market price of our Series A shares and ADSs.

Non-Mexican investors may not hold our Series A shares directly and must have them held in a CPO trust at all times.

Each ADS represents ten CPOs and each CPO represents a financial interest in one Series A share.Non-Mexican investors in the ADSs may not directly hold the underlying Series A shares, but may hold them only indirectly through CPOs issued by a Mexican bank as trustee under the CPO trust or ADSs evidencing CPOs. Upon expiration of the50-year term of our CPO trust agreement, the underlying Series A shares must be placed in a new trust similar to the current CPO trust fornon-Mexican investors to hold an economic interest in such Series A shares, or be sold to third parties or be delivered tonon-Mexican holders to the extent then permitted by applicable law (not currently permitted). We cannot assure you that a new trust similar to the CPO trust will be created if the current CPO trust terminates, or that, if necessary, the Series A shares represented by the CPOs will be sold at an adequate price, or that Mexican law will be amended to permit the transfer of Series A shares tonon-Mexican holders in the event that the trust is terminated. In that event, unless Mexican law has changed to permitnon-Mexican investors to hold our shares directly,non-Mexican holders may be required to cause all of the Series A shares represented by the CPOs to be sold to a Mexican individual or corporation.

We have obtained authorization from the Mexican Ministry of Economy (Secretaría de Economía) for the issuance up to 90% of our outstanding capital stock in CPOs. Sincenon-Mexican investors are required to invest in CPOs in order to hold any interest in our capital stock, if this 90% threshold were to be met, we would be unable to obtain additional capital contributions fromnon-Mexican investors.

Holders of the ADSs and CPOs do not have no voting rights.

Holders of the ADSs and CPOs are not entitled to vote the underlying Series A shares. As a result, holders of the ADSs and CPOs do not have any influence over the decisions made relating to our company’s business or operations, nor are they being protected from the results of any such corporate action taken by our holders of Series A shares and Series B shares. Mexican investors will determine the outcome of substantially all shareholder matters, subject to the rights of the holders of Series B shares that are required to vote affirmatively to approve certain limited matters. For a more complete description of the circumstances under which holders of our securities may vote, see Item 10: “Additional Information—Memorandum and Articles of Association—Overview.”

Preemptive rights may be unavailable tonon-Mexican holders of the ADSs and CPOs and, as a result, such holders may suffer dilution.

Except in certain circumstances, under Mexican law, if we issue new shares of common stock for cash as part of a capital increase, we generallymust grant our shareholders the right to subscribe and pay for a sufficient number of shares to maintain their existing ownership percentage in our company. Rights to subscribe and pay for shares in these circumstances are known as preemptive rights. We may not legally be permitted to allow holders of ADSs and CPOs in the United States to exercise any preemptive rights in any future capital increase unless we file a registration statement with the SEC with respect to that future issuance of shares or the offering

qualifies for an exemption from the registration requirements of the Securities Act. Similar restrictions may apply to holders of ADSs and CPOs in other jurisdictions. We cannot assure you that we will file a registration statement with the SEC, or any other regulatory authority, to allow holders of ADSs and CPOs in the United States, or any other jurisdiction, to participate in a preemptive rights offering. At the time of any future capital increase, we will evaluate the costs and potential liabilities associated with filing a registration statement with the SEC and any other factors that we consider important to determine whether we will file such a registration statement. Under Mexican law, sales by the depositary of preemptive rights and distribution of the proceeds from such sales to you, the ADS holders, is not possible.

In addition, additional CPOs may be issued only if the CPO deed permits the issuance of a number of CPOs sufficient to represent the shares to be issued to and held by the CPO trustee upon the exercise of preemptive rights. Becausenon-Mexican holders of ADSs and CPOs are not entitled to acquire direct ownership of the underlying Series A shares in respect of such ADSs and CPOs, they may not be able to exercise their preemptive rights if the CPO deed will not permit additional CPOs to be delivered in an amount sufficient to represent the shares of common stock to be issued as a result of the exercise of preemptive rights on behalf of non-Mexicannon-

Mexican ADS or CPO holders, unless the CPO deed is modified, or a new CPO deed is entered into, which permits delivery of the number of CPOs necessary to represent the shares to be subscribed and paid as a result of the exercise of such preemptive rights. Although we expect to take all measures necessary to maintain sufficient CPOs available to permitnon-Mexican holders of ADSs and CPOs to exercise preemptive rights, if and when applicable, no assurances can be made that we will be able to do so, particularly because regulatory approvals in Mexico are necessary for the issuance and delivery of CPOs. As a result of the limitations described above, if we issue additional shares in the future in connection with circumstances giving rise to preemptive rights, the equity interests of holders of ADSs and CPOs may be diluted. See Item 10: “Additional Information—Memorandum and Articles of Association—Preemptive Rights.”

We do not intend to pay cash dividends for the foreseeable future, and our revolving line of credit with Banco Santander México and Bancomext may limit our ability to declare and pay dividends.

We have never declared or paid cash dividends on our common stock. We currently intend to retain our future earnings, if any, to finance the further development and expansion of our business and do not intend to pay cash dividends in the foreseeable future. Any future determination to pay dividends will be at the discretion of our board of directors, will require the approval of our general shareholders meeting, may only be paid if losses for prior fiscal years have been unpaid and if shareholders have approved the net income from which the dividends are paid, and will depend on our financial condition, results of operations, capital requirements, restrictions contained in current or future financing instruments and such other factors as our board of directors deems relevant. In addition, our revolving line of credit with Banco Santander México and Bancomext may limit our ability to declare and pay dividends in the event that we fail to comply with the payment terms thereunder. See Item 5: “Operating and Financial Review and Prospects—Liquidity and Capital Resources—Loan Agreements” and Item 8: “Financial Information—Consolidated Statements and Other Financial Information—Dividend Policy.”

Minority shareholders may be less able to enforce their rights against us, our directors, or our controlling shareholders in Mexico.

Under Mexican law, the protections afforded to minority shareholders are different from those afforded to minority shareholders in the United States. For example, because Mexican laws concerning fiduciary duties of directors (i.e., the duty of care and the duty of loyalty) have been in existence for a relatively short period and are not as developed as securities laws in other jurisdictions, it is complex for minority shareholders to bring an action against directors for breach of this duty,these duties, as would be permitted in some other foreign jurisdictions. Also, such actions may not be initiated as a direct action, but as a shareholder derivative suit (that is for the benefit of our company)company and not the initiating shareholder). The grounds for shareholder derivative actions under Mexican law are limited. Even though applicable law has been modified to so permit, and procedures for class action lawsuits have been adopted in Mexico, there is very limited experience with regards to class action lawsuits and how procedures for such suits are followed in Mexico. Therefore, it will be much more difficult for minority shareholders to enforce their rights against us, our directors, or our controlling shareholders than it would be for minority shareholders of a U.S. company.

Mexico has different corporate disclosure and accounting standards than those in the United States and other countries.

A principal objective of the securities laws of the United States, Mexico and other countries is to promote full and fair disclosure of all material corporate information, including accounting information. However, there may be different or less publicly available information about issuers of securities in Mexico than is regularly made available by public companies in countries with highly developed capital markets, including the United States.

We will be required to assess our internal control over financial reporting on an annual basis and any future adverse findings from such assessment could result in a loss of investor confidence in our financial reports, and significant expenses to remediate any internal control deficiencies and could ultimately have an adverse effect on the market price of the ADSs and Series A shares.

Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, and beginning with our Annual Report on Form 20-F for the year ending December 31, 2014, our management will be required to report on the effectiveness of our internal control over financial reporting. In addition, although our independent registered public accounting firm are not required to attest to the effectiveness of our internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 because we currently meet the emerging growth company definition under the JOBS Act, we have determined that we will not avail ourselves of the exemption to Section 404 for emerging growth companies under Section 404(b) and that, consequently, we intend to cause our independent registered public accounting firm to provide such attestation starting in 2014. The rules governing the standards that must be met for management to assess our internal control over financial reporting are complex and require significant documentation, testing and possible remediation. We are currently in the process of reviewing, documenting and testing our internal control over financial reporting. We may encounter problems or delays in completing the implementation of any changes necessary to make a favorable assessment of our internal control over financial reporting. In connection with the attestation process by our independent registered public accounting firm, we may encounter problems or delays in completing the implementation of any requested improvements and receiving a favorable attestation. In addition, if we fail to maintain the adequacy of our internal control over financial reporting we will not be able to conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002.

The requirements of being a public company may strain our resources, divert management’s attention and affect our ability to attract and retain qualified board members.

As a public company, we will incur significant legal, accounting and other expenses that we have not incurred as a private company, including costs associated with public company reporting requirements. We also have incurred and will incur costs associated with the Sarbanes-Oxley Act of 2002 and related rules implemented by the SEC. The expenses incurred by public companies generally for reporting and corporate governance purposes have been increasing. We expect these rules and regulations to increase our legal and financial compliance costs and to make some activities more time-consuming and costly, although we are currently unable to estimate these costs with any degree of certainty. These laws and regulations could also make it more difficult or costly for us to obtain certain types of insurance, including director and officer liability insurance, and we may be forced to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. These laws and regulations could also make it more difficult for us to attract and retain qualified persons to serve on our board of directors, our board committees or as our executive officers and may divert management’s attention. Furthermore, if we are unable to satisfy our obligations as a public company, we could be subject to delisting of our Series A shares and ADSs, fines, sanctions and other regulatory action and potentially civil litigation.

| ITEM | INFORMATION ON THE COMPANY |

| A. | History and Development of the Company |

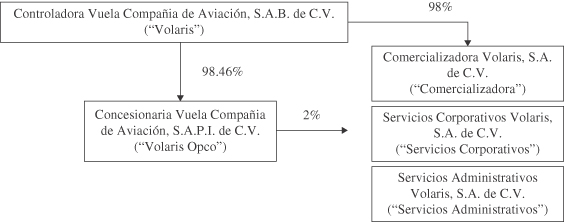

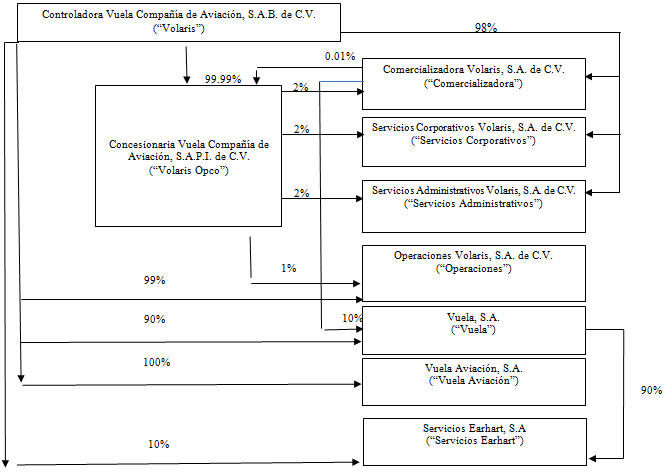

We were founded on October 27, 2005 under the name Controladora Vuela Compañía de Aviación, S.A. de C.V. by Blue Sky Investments, S.à r.l., Discovery Air Investments, L.P., Corporativo Vasco de Quiroga, S.A. de C.V. and Sinca Inbursa, S.A. de C.V., Sociedad de Inversión de Capitales.

In July 2010, we underwent a change in our ownership with the incorporation of Mexican investors, certain investment funds managed by Discovery Americas (including Discovery Air), Blue Sky Investments and Indigo as new equity shareholders with expertise in the aviation industry.

On July 16, 2010, we became asociedad anónima promotora de inversión de capital variable, or variable capital investment promotion stock corporation. In June 2013, we became asociedad anónima bursátil de capital variable, or variable capital public stock corporation, under the name Controladora Vuela Compañía de Aviación, S.A.B. de C.V. See Item 9: “The Offer and Listing—Markets—The Mexican Stock Market—Mexican Securities Market Law” for a description of the differences between these two forms of legal entities.

On September 23, 2013, we and certain of our shareholders completed a dual-listing initial public offering on NYSE and the Mexican Stock Exchange. The Company raised Ps.2,684,280Ps.2.68 billion (approximately US$207.7U.S. $207.7 million) of gross proceeds from the global offering of 173,076,910 Series A shares, consisting of (i) an offering of Series A shares in Mexico and (ii) a concurrent international offering of CPOs in the form of ADSs in the United States and other countries outside of Mexico, at a public offering price of Ps.15.51 per share (US$1.20(U.S. $1.20 dollars) or US$12.00U.S. $12.00 per ADS. Each ADS represents ten CPOs and each CPO represents a financial interest in one of our Series A shares. The Series A shares were listed on the Mexican Stock Exchange under the trading symbol “VOLAR” and the ADSs were listed on NYSE under the trading symbol “VLRS.” The Series A shares and ADSs began trading on September 18, 2013.

On November 16, 2015, certain of our principal shareholders, including affiliates of Discovery Americas, and Blue Sky Investments, exercised registration rights in the form of ADS’s and sold 99,000,000 CPOs in the form of ADSs, at a price to the public of U.S. $16.00 per ADS in the United States and the other countries outside of Mexico, pursuant to our shelf registration statement on FormF-3 filed with the SEC. In connection with that offering, the underwriters also exercised their option in full to purchase 9,900,000 additional CPOs in the form of ADSs to cover over-allotments, for a total offering of 108,900,000 CPOs in the form of ADSs.

Overview

We are anultra-low-cost carrier, or ULCC, incorporated under the laws of the United Mexican States.Mexico. Our primary corporate offices and headquarters are located in Mexico City at Av. Antonio Dovalí Jaime No.70,No. 70, 13th Floor, Tower B, Colonia Zedec Santa Fe, México D.F.City, México, zip code 01210. Our telephone number is +52-55-5261-6400.+52-55-5261-6400.

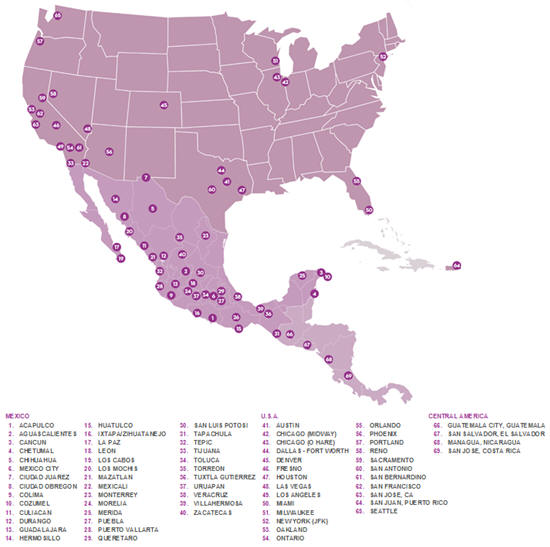

Since we began operations in 2006, we have increased our routes from five to more than 100164 and grown our cost-efficient Airbus A320 family aircraft from four to 44.69 as of December 31, 2016. We currently operate up to 215302 daily flight segments on routes that connect 3340 cities in Mexico and 13as well as 28 cities in the United States.States and Central America. We have substantial market presence in the top five airports in Mexico, based on number of passengers, comprising Cancún, Guadalajara, Mexico City, Monterrey and Tijuana. The tenmain cities we currently serve are home to some of the most populous Mexican communities in the United States based on data from the Pew Hispanic Research Center. Additionally, our operating subsidiary in Costa Rica, Vuela Aviación, S.A., began operations on December 1, 2016. We seek to replicate ourultra-low cost model in Central America by offering low base fares andpoint-to-point service in the region.

We are the lowest cost carrier based on CASM among the other Latin American publicly traded airlines. In 2013,2016, our CASM was Ps.1.164Ps.124.4 cents (U.S.$0.089) $6.0 cents), compared to an average CASM of U.S.$0.143 $10.5 cents for the other Latin American publicly traded airlines. We also have lower costs than our U.S.-based publicly traded target market competitors, including Alaska Air, American, Delta, JetBlue, Southwest Airlines and United, which had an average CASM of U.S.$0.144 $12.4 cents in 2013.2016. With our ULCC business model, we have grown significantly while maintaining a low CASM over the last five years. We have achieved this through our efficient and uniform fleet, high asset utilization, our emphasis on direct sales and distribution and our variable, performance-based compensation structure. We have a relentless focus on low costs as part of our organizational culture, and we believe that we can further lower our CASM by deploying additional sharklet technology equipped Airbus A320 aircraft and leveraging our existing infrastructure to drive economies of scale. We believe that further reductions to our CASM will allow us to continue to lower base fares, stimulate market demand and increasenon-ticket revenue opportunities.

Our ULCC business model and low CASM allow us to compete principally through offering low base fares to stimulate demand. We use our yield management system to set our fares in an effort to achieve appropriate yields and load factors on each route we operate. We use promotional fares to stimulate demand and our base fares are priced to compete with long-distance bus fares in Mexico. During 2013,2016, our average base fare was Ps.1,243Ps.1,189 (U.S.$95.1) $58) and we regularly offer promotional base fares of Ps.700down to Ps.699 (U.S.$54) or less. $34). Since May 2012, we have unbundled certain components of our air travel service as part of a strategy to enable our passengers to select and pay for the products and services they want to use. This unbundling strategy has allowed us to significantly grow ournon-ticket and total revenue. We plan to continue to use low base fares to stimulate additional passenger demand, shift bus passengers to air travel and increase our load factor. In 2013,2016, our average load factor was 82.6%85.8%, compared to an average load factor of 77.0%81.7% for the other Latin American publicly traded airlines and 83.9%83.3% for our U.S.-based publicly traded target market competitors. Higher load factors help us generate additionalnon-ticket and total revenue, which in turn, allow us to further lower base fares and stimulate new demand.

In addition to low fares, we also aim to deliver a high quality flying experience to our passengers. We strive to deliveron-time performance to our customers, with an 88.2% 75.4%on-time performance rate in 2013.2016. We believe that we have developed strong brand recognition due to our focus on delivering good value and a positive traveling experience to our customers. We believe that our corporate culture of positive “customer relationship management” has also been a key element of our success.

Principal Capital Expenditures

For the years ended December 31, 2011, 20122014, 2015 and 2013,2016, we incurred capital expenditures of Ps.321.3 million, Ps.687.3 millionPs.1.6 billion, Ps.1.5 billion and Ps.1,029.0 million,Ps.2.3 billion, which include acquisitions of two spare engines, rotable spare parts, furniture and equipment and acquisitions of intangible assets. For a discussion of our capital expenditures and future projections, see Item 5: “Operating and Financial Review and Prospects—Liquidity and Capital Resources.”

Mexican Regulation

Operational Regulation

Air transportation services for passengers provided on a regular basis, as opposed to charter flights and permits, are considered a public service in Mexico. To render regular air transportations services, a concession granted by the Mexican federal government is required. The legal framework of the air transportation industry in Mexico is primarily established by the Mexican Aviation Law (Ley de Aviación Civil) and its regulations, the Mexican Airport Law (Ley de Aeropuertos) and its regulations, the General Communications Ways Law (Ley de Vias Generales de Comunicación), and applicable Mexican Official Rules (Normas Oficiales Mexicanas). The main regulatory authority overseeing air transportation is the SCT, acting mainly through the DGAC.

Pursuant to the Mexican Aviation Law, the SCT, through the DGAC, is responsible and has the authority, among others, to (i) impose and conduct the policies and programs for the regulation and development of air transportation services; (ii) grant concessions and permits, oversee compliance with, and, if applicable, resolve amendments to or termination of such concessions or permits; (iii) issue the Mexican Official Rules and other administrative provisions; (iv) provide and control the air navigation services; (v) issue and enforce the safety and health rules that must be observed in air transportation services; (vi) issue certificates of registration, certificates of airworthiness, and certificates to air services providers and declare the suspension, cancellation, revalidation or revocation of such certificates; (vii) maintain and operate the Mexican Aeronautical Registry (Registro Aéronautico Mexicano), where aircraft and leases over aircrafts are regulated; (viii) participate in the international agencies and in the negotiation of treaties; (ix) promote the development and training of the aeronautical technical staff; (x) issue and, if applicable, revalidate or cancel the licenses of the aeronautical technical staff; (xi) interpret the Mexican Aviation Law and its regulations for administrative purposes; (xii) authorize the verification visits; (xiii) appoint or, if applicable, remove the regional commanding officer and the commanding officers for airports, heliports and civil airdromes in general, and (xiv) approve flight plans.

The DGAC primarily oversees and verifies compliance by the concessionaires, licensees, operators and airline services providers with the Mexican Aviation Law, its regulations, the Mexican Official Rules and any other applicable provisions.

A concession granted by the SCT is required to render domestic and regular air transportation services in Mexico. Any such concession may only be granted to Mexican entities which meet certain technical, financial, legal and administrative requirements that are deemed necessary to adequately provide services with quality, safety, and timeliness. Other requirements to be met to obtain a concession are (i) the availability of aircraft and aircraft equipment, which is required to comply with technical requirements of safety, airworthiness conditions and environmental conditions; (ii) the availability of hangars, repair shops and infrastructure needed for operations, as well as the availability of technical and administrative staff trained for the operation of the concession; and (iii) experience in the industry. To provide any other air transportation service in Mexico, different from domestic and regular air transportation, a permit from the SCT is required pursuant to the Mexican Aviation Law.

Concession and Permits

Through our subsidiary Volaris Opco, we hold (i) the Concession, which authorizes us to provide domestic regular passenger, cargo and mail air transportation services within Mexico, (ii) a permit for domestic charter air transportation passenger services, and (iii) a permit for international regular passenger and charter passenger air transportation services.

Our Concession was granted by the Mexican federal government through SCT, on May 9, 2005 originally for a period of five years, and was extended by SCT on February 17, 2010 for an additional period of ten years. The Concession authorizes us the use of certain aircraft and certain routes. Pursuant to the terms of the Mexican Aviation Law, our Concession, together with specific authorizations granted to us by the DGAC, allow us to provide domestic and international regular air transportation services. Pursuant to our Concession, we have to pay to the Mexican federal government certain fees arising from the services we render. The exhibits to the Concession must be updated every time a new aircraft is operated by Volaris Opco, any time new routes are added, or existing routes are modified. For more information regarding our aircraft and routes, see Item 4: Information“Information on the Company—Business Overview.”

The permit for domestic charter air transportation of passengers was granted by the SCT on April 16, 2007, without a termination date; it authorizes certain aircraft to operate under such permit and specifies, among other terms and conditions, that Volaris Opco is required to request authorization from the DGAC before carrying out any charter flight.

The permit for international charter air transportation of passengers was granted by the DGAC on June 3, 2009 for an unspecified period of time; it authorizes certain aircraft to operate under such permit and indicates, among other terms and conditions, that Volaris Opco is required to request authorization from the DGAC, before carrying out any charter flight.

To operate our aircraft, each aircraft is required to have on board its certificate of registration, its certificate of airworthiness, and its insurance policy. All aircraft must have on board all documents and equipment required by the treaties, the Mexican Aviation Law and all applicable provisions. We believe we hold all necessary operating and airworthiness authorizations, certificates and licenses, and carry all necessary insurance policies and are operating in compliance with applicable law.

The Mexican Aviation Law provides that concessions and permits may be revoked for any of the following principal reasons: (i) failure to exercise rights conferred by the concessions or permits for a period exceeding 180 calendar days from the date that such concessions or permits were granted; (ii) failure to maintain in effect the insurance required pursuant to the Mexican Aviation Law; (iii) change of nationality of the holder of the

concession or permit; (iv) assignment, mortgage, transfer or conveyance of concessions, permits or rights thereunder to any foreign government or foreign state; (v) assignment, mortgage, transfer or conveyance of concessions, permits or rights thereunder to any person without the approval of the SCT; (vi) applying fares different from the registered or approved fares, as applicable; (vii) interruption of the services without authorization from the SCT, except in the events of acts of God or force majeure; (viii) rendering services different to those set forth in the respective permit or concession; (ix) failure to comply with safety conditions; (x) failure to indemnify from damages arising from the services rendered and (xi) in general, failure to comply with any obligation or condition set forth in the Mexican Aviation Law, its regulations or the respective concession or permit. In the event our Concession was revoked, for any of the reasons specified above, we will not be entitled to any compensation and we will be unable to continue to conduct our business.

Aircraft

Pursuant to the Mexican Aviation Law and our Concession, all the aircraft used to provide our services must be registered in Mexico before the Mexican Aeronautical Registry and flagged as Mexican aircraft and, if registered in other countries, such aircraft need to be authorized to operate in Mexico. The registration with the Mexican Aeronautical Registry is granted subject to compliance with certain legal and technical requirements. All the aircraft which comprise our fleet as of this date have been authorized by and registered with the DGAC.

We have to maintain our aircraft in airworthiness condition. The maintenance must be provided as specified in the manufacturers’ maintenance manuals and pursuant to a maintenance program approved by the DGAC. The DGAC has authority to inspect our aircraft, their maintenance records and our safety procedures. Based on such inspections, the DGAC may declare our aircraft unfit to fly and in certain cases revoke our Concession.

Routes

Pursuant to the Mexican Aviation Law and our Concession, we may only provide our services on routes approved under our Concession. Any new route or change in the existing routes must be approved by the DGAC. Domestic Routes are subject to our Concession and the Mexican Aviation Law. As we only fly in internationalInternational routes to the United States such routes are subject to our Concession, the international routes authorization permits issued by the DGAC, the Mexican Aviation Law and the USA Mexico Bilateral Air Transport Agreement dated August 16, 1960, as amended on December 12, 2005.18, 2015, pursuant to which we were granted a general exemption from the DOT to allow us to operate any route into the United States. The USA Mexico Bilateral Air Transport Agreement provides a legal framework for the international routes of Mexican and U.S. carriers between the United States and Mexico and vice versa. Under the USA Mexico Bilateral Air Transport Agreement each of the governments has the rightany American or Mexican carrier may request authorization to appoint two (or three) airlines of eachfly from any city pair, as the airlines authorizedin Mexico to render air transportation services in each route from the United States to Mexico and vice versa.

Fares

According to the Mexican Aviation Law, concessionaries or licensees of air transportation may freely set fares for the services provided by them on terms that permit the rendering of services in satisfactory conditions of quality, competitiveness, safety and consistency. The international fares must be approved by the SCT pursuant to applicable treaties.treaties except that fares for routes to and from the United States do not require approval or registration from either the SCT or any other authority. The fares (both domestic and international) must be registered with the SCT and be permanently available to users of the services. The SCT may deny the registration of fares set by the concessionaires or licensees if such fares imply predatory or monopolistic practices, dominance in the market from a competition perspective or disloyal competition which prevents the participation in the market of other concessionaires or licensees. The SCT may also set minimum and maximum levels of fares (restricting, in that case, the ability of concessionaires and holders of licenses to freely determine rates), as applicable, for the corresponding services, to promote competition. The fares will describe clearly and explicitly the restrictions such fares are subject to and will remain valid for the time and under the conditions offered.

The Mexican Aviation Law provides that in the event that the SCT considers that there is no competition among concession and permit holders, the SCT may request the opinion of the Mexican Antitrust Commission

and then approve regulations governing fares that may be charged for air transportation services, thus limiting the ability of participants to freely determine rates. Such regulations will be maintained only during the existence of the conditions that resulted in the negative competition effects.

Slots

Under Mexican Law, a “slot” is the schedule for the landing and taking off of aircraft. The regulation of the slots is provided by the Mexican Airport Law and its regulations. A slot is assigned to an operator by the airport administrator considering the recommendation of a committee of operations, for the organization and planning of the flights at the relevant airport. According to the regulations to the Mexican Airport Law, the operating rules of each airport in Mexico, must contain the guidelines for the assignment of slots. Therefore, the different airports’ administrations will establish in such guidelines how slots are to be assigned considering (i) the operation schedule of the airport, (ii) safety and efficiency criteria, (iii) capacity of the services providers, (iv) schedule availability, and (v) compliance with the requirements for the assignment of the slots.

Taking or Seizure

Pursuant to Mexican law and our Concession, the Mexican federal government may take or seize our assets temporarily or permanently, in the event of natural disasters, war, serious changes to public order or in the event of imminent danger to the national security, internal peace or the national economy. The Mexican federal government, in all cases, except in the event of international war, must indemnify us by paying the respective losses and damages at market value. See Item 3: “Key Information—Risk Factors—Under Mexican law, our assets could be taken or seized by the Mexican government under certain circumstances.”

Foreign Ownership

The Mexican Foreign Investment Law (Ley de Inversión Extranjera) limits foreign investment in companies rendering domestic air transportation services up to 25% of such companies’ voting stock. This limit applies to Volaris Opco, but not to us as a holding company. We, as a holding company, must remain a Mexican-investor controlled entity, as a means to control Volaris Opco. The acquisition of our Series A shares through the CPOs, thatstrip-out voting rights but grant any and all economic rights, by foreign investors, is deemed neutral, from a foreign investment perspective, and is not, as a result, counted as foreign investment excluded from this restriction. For a discussion of the procedures we instituted to ensure compliance with these foreign ownership rules, see Item 10: “Additional Information—Memorandum and Articles of Association—Other Provisions—Foreign Investment Regulations.”

Environmental Regulation

We are subject to regulations relating to the protection of the environment such as the General Law of Ecological Balance and Environmental Protection (Ley General del Equilibrio Ecológico y la Protección al Ambiente), the regulations of the General Law of Ecological Balance and Environmental Protection regarding Environmental Impact, Prevention and Control of Air Pollution and of Hazardous Waste (Reglamentos en Materia de Evaluación del Impacto Ambiental, Prevención y Control de Contaminación del Aire y Desperdicios Peligrosos), the General Law for Prevention and Handling of Wastes (Ley General de Prevención y Gestión Integral de Riesgos) and the National Waters Law(Ley Nacional de AguasAguas)) and its regulations, official Mexican standards, international treaties, bilateral agreements and specifically by an Official Rule NOM 036 SCT3 2000 which regulates the maximum limits of the aircraft noise emissions as well as the requirements to comply with such limits. Volaris Opco is ISO 14,000 certified.

Labor Regulation

We are subject to the provisions of the Mexican Labor Law (Ley Federal del Trabajo) and the provisions contained in the collective bargaining agreements withSindicato de Trabajadores de la Industria Aeronáutica,

Similares y Conexos de la República Mexicana-STIAS. For more information on our relationship with such labor union and our labor collective bargaining agreements, see Item 6: “Directors, Senior Management and Employees—Employees.”

U.S. and International Regulation

Operational Regulation

The airline industry is heavily regulated by the U.S. government. Two of the primary regulatory authorities overseeing air transportation in the United States are the DOT and the FAA. The DOT has jurisdiction over economic issues affecting air transportation, such as unfair or deceptive competition, advertising, baggage liability and disabled passenger transportation. The DOT has authority to issue permits required for airlines to provide air transportation. We hold a general exemption issued by the DOT permits authorizingthat authorizes us to engage in scheduled air transportation of passengers, property and mail to and from certain destinationsany destination in the United States. Each permit is valid for one year and renewable for one-year terms.

The FAA is responsible for regulating and overseeing matters relating to air carrier flight operations, including airline operating certificates, aircraft certification and maintenance and other matters affecting air safety. The FAA requires each commercial airline to obtain and hold an FAA air carrier certificate and to comply with Federal Aviation Regulations 129 and 145. This certificate, in combination with operations specifications issued to the airline by the FAA, authorizes the airline to operate at specific airports using aircraft approved by the FAA. As of the date of this annual report, we had FAA airworthiness certificates for 2327 of our aircraft (the remainder being registered with the DGAC), we had obtained the necessary FAA authority to fly to all of the cities we currently serve and all of aircraft had been certified for over-water operations. Pilots operating and mechanics providing maintenance services on “N” or U.S.-registered aircraft require a special license issued by the FAA. We hold all necessary operating and airworthiness authorizations, certificates and licenses and are operating in compliance with applicable DOT and FAA regulations, interpretations and policies.

International Regulation

Our service to the U.S. is also subject to U.S. Customs and Border Protection, or CBP (a law enforcement agency that is part of the U.S. Department of Homeland Security), immigration and agriculture requirements and the requirements of equivalent foreign governmental agencies. Like other airlines flying international routes, from time to time we may be subject to civil fines and penalties imposed by CBP ifun-manifested or illegal cargo, such as illegal narcotics, is found on our aircraft. These fines and penalties, which in the case of narcotics are based upon the retail value of the seizure, may be substantial. We have implemented a comprehensive security program at our airports to reduce the risk of illegal cargo being placed on our aircraft, and we seek to cooperate actively with CBP and other U.S. and foreign law enforcement agencies in investigating incidents or attempts to introduce illegal cargo.

Security Regulation

The TSA was created in 2001 with the responsibility and authority to oversee the implementation, and ensure the adequacy, of security measures at airports and other transportation facilities in the United States. Since the creation of the TSA, airport security has seen significant changes including enhancement of flight deck security, the deployment of federal air marshals onboard flights, increased airport perimeter access security, increased airline crew security training, enhanced security screening of passengers, baggage, cargo and employees, training of security screening personnel, increased passenger data to CBP, background checks and background checks.restrictions oncarry-on baggage. Funding for passenger security is provided in part by a per enplanement ticket tax (passenger security fee) of U.S.$2.50 $2.50 per passenger flight segment, subject to a U.S.$5 $5 perone-way trip cap. The TSA was granted authority to impose additional fees on air carriers if necessary to cover additional federal aviation security costs. Pursuant to its authority, the TSA may revise the way it assesses this fee, which could result in increased costs for

passengers and/or us. We cannot forecast what additional security and safety requirements may be imposed in the future or the costs or revenue impact that would be associated with complying with such requirements. The TSA also assess an Aviation Security Infrastructure Fee, or ASIF, on each airline.

Environmental Regulation

We are subject to various federal, state and local U.S. laws and regulations relating to the protection of the environment and affecting matters such as aircraft engine emissions, aircraft noise emissions, and the discharge or disposal of materials and chemicals, which laws and regulations are administered by numerous state and federal agencies. The Environmental Protection Agency, or EPA, regulates our operations in the United States, including air carrier operations, which affect the quality of air in the United States. We believe the aircraft in our fleet meet all emission standards issued by the EPA. Concern about climate change and greenhouse gases may result in additional regulation or taxation of aircraft emissions in the United States and abroad.

U.S. law recognizes the right of airport operators with special noise problems to implement local noise abatement procedures so long as those procedures do not interfere unreasonably with interstate and foreign commerce and the national air transportation system. These restrictions can include limiting nighttime operations, directing specific aircraft operational procedures during takeoff and initial climb, and limiting the overall number of flights at an airport. None of the airports we serve currently restricts the number of flights or hours of operation, although it is possible one or more of such airports may do so in the future with or without advance notice.

Other Regulations

In the U.S., Wewe are subject to certain provisions of the Communications Act of 1934, as amended, and are required to obtain an aeronautical radio license from the Federal Communications Commission, or FCC. To the extent we are subject to FCC requirements, we will take all necessary steps to comply with those requirements. We are also subject to state and local laws and regulations at locations where we operate and the regulations of various local authorities that operate the airports we serve.

Future Regulations

The Mexican, U.S. and other foreign governments may consider and adopt new laws, regulations, interpretations and policies regarding a wide variety of matters that could directly or indirectly affect our results of operations. We cannot predict what laws, regulations, interpretations and policies might be considered in the future, nor can we judge what impact, if any, the implementation of any of these proposals or changes might have on our business.

| B. | Business Overview |

Industry

There are two main categories of passenger airlines that operate in the domestic and international Mexican market: (i) the traditional legacy network carriers, which include Grupo Aeroméxico, and (ii) thelow-cost carriers, which include Interjet, VivaAerobus and Volaris. The ULCC business model is a subset of thelow-cost carrier market.

Legacy carriers offer scheduled flights to major domestic and international routes (directly or through membership in an alliance, such as Star Alliance, Oneworld and/or Skyteam) and serve numerous smaller cities. These carriers operate mainly through a “hub-and-spoke”“hub-and-spoke” network route system. This system concentrates most of an airline’s operations in a limited number of hub cities, serving other destinations in the system by providingone-stop or connecting service through hub airports to end destinations on the spokes. Such an arrangement

permits travelers to fly from a given point of origin to more destinations without switching to another airline. Traditional legacy carriers typically have higher cost structures thanlow-cost carriers due to higher labor costs, flight crew and aircraft scheduling inefficiencies, concentration of operations in higher cost airports, and multiple classes of services. Other examples of legacy carriers in the Latin American market include Avianca-TACA,Avianca, Copa, and LATAM.

Low-cost carriers typically fly direct,point-to-point flights, which tends to improve aircraft and crew scheduling efficiency. In addition,low-cost carriers often serve major markets through secondary, lower cost airports in the same regions as major population centers. Manylow-cost carriers only provide a single class of service, thereby increasing the number of seats on each flight and avoiding the significant and incremental cost of offering premium-class services. Finally,low-cost carriers tend to operate fleets with only one or two aircraft families at most, in order to maximize the utilization of flight crews across the fleet, improve aircraft scheduling flexibility and minimize inventory and aircraft maintenance costs. The Mexican market, which has a large population of VFR and leisure travelers, has seen demand for theselow-cost carriers expand in recent years.Low-cost carriers have made a significant emergence in the Latin American market in recent years, particularly in Brazil, where Gol, Webjet (merged with Gol in 2012), Azul, and Trip (merged with Azul in 2012) have started operations in the last ten years.

In recent years, many traditional legacy network carriers globally have undergone significant financial restructuring, including ceasing operations or merging and consolidating with one another. These restructurings have allowed legacy carriers to reduce high labor costs, restructure debt, modify or terminate pension plans and generally reduce their cost structure. This has resulted in improved workforce flexibility and reduced costs while simultaneously improving product offerings similar to those of otherlow-cost carriers. Furthermore, many of the legacy carriers have made these improvements while still maintaining their expansive route networks, alliances and frequent flier programs.

One result of the restructuring of the network carriers is that the difference in the cost structures, and the competitive advantage previously enjoyed bylow-cost airlines, has somewhat diminished. We believe that this trend has provided an opportunity for the introduction of the ULCC business model in Mexico as a subset of the more mature group oflow-cost carriers. The ULCC business model involves, among other things, intense

focus on low cost, efficient asset utilization, unbundled revenue sources aside from the basic fare with multiple products and services offered for additional fees. Globally, ULCCs with highly successful business models include Allegiant and Spirit in the United States, Ryanair and Wizz in Europe, and AirAsia in Asia.

ULCCs are able to achievelow-cost operations due to highly efficient and uniform fleets with high density seating and single aisle configurations. Additionally, ULCCs provide extremely low fares to customers in order to stimulate market demand and generate high aircraft utilization rates. With high aircraft utilization rates, ULCCs are able to generate substantial ancillary revenues through the offering of additional products and services, such as baggage fees, advanced seat selection, extra legroom, ticket change fees, and/or itinerary attachments such as hotels, airport transportation, and rental cars. ULCCs focus on VFR and leisure customers as opposed to business travelers. The ULCC product appeals to the cost-conscious customer because they are offered a low base-fare and are able to choose to pay for only the additional products and services they want to receive.

Economic and Demographic Trends

We believe the Mexican airline industry has strong potential for growth, given the country’s young demographics, improving macroeconomic base and growing middle class, which will likely facilitate organic expansion of the airline sector. In addition, the national airline industry is relatively underpenetrated when compared to other countries of similar size and demographic characteristics. These elements combine at a time when the industry is under considerable attrition due in part from some of the legacy operators ceasing operations.

In terms of the macroeconomic environment, GDP growth in Mexico is expected to be 3.1%1.5% in 20142017 and 3.9%2.1% in 20152018 according to the Mexican Central Bank (Banco de México).Bank. These estimates are higherlower than the

estimates for the United States by 2.8%81 and 41 basis points in 20142017 and 3.0% in 20152018 according to the International Monetary Fund.Fund, respectively. This projected GDP growth is expected to result in the continuing growth trend of middle-income homes, having already grown from 12.0 million in 2000 to 15.2 million in 2010, according to information derived from the Mexican Association of Market Research and Public Opinion Agencies (Asociación Mexicana de Agencias de Investigación de Mercado y Opinión Pública, A.C.) and the National Statistics and Geography Institute (Instituto Nacional de Estadística y Geografía). As of 2010,2015, according to the INEGI intercensal survey, approximately 39%36% of the Mexican

population was under 20 years of age, which we believe benefits Volaris by providing a strong base of young, potential passengers in the future. This contrasts favorably with more mature aviation markets like the United States, where approximately 27% of the population is currently under 20 years of age. Additionally, the Mexican aviation market is currently underpenetrated, as evidenced by the number of trips per capita. On a global basis the World Bank estimates that there are, on average 0.380.47 annual trips per capita, whereas in Mexico the number is roughly one-thirda portion of that.

The Mexicanlow-cost airline industry competes with ground transportation alternatives, primarilylong-distance bus companies. Given the limited passenger rail services in Mexico, travel by bus has traditionally been the onlylow-cost option for long-distance travel for a significant portion of the Mexican population. In 2013,2016, bus companies transported over 2.83.0 billion passengers in Mexico, of which approximately 7580 million were executive and luxury passenger segments, as measured in segments which include both long- (five hours or greater) and short-distance travel, according to the Mexican General Direction of Ground Transportation Authority. We believe that just a small shift of bus passengers to air travel would significantly increase the number of airline passengers. We believe that an increased shift in demand from bus to air travel in Mexico presents a significant opportunity as the macroeconomic environment improves and rising demographics take shape across the country. Furthermore, we believe that long-distance bus passengers will continue to shift to airplane travel when certain promotional fares are priced lower than bus fares for similar routes.

In recent years the Mexican government has made a substantial investment in developing Mexico’s airport infrastructure. In 1998, the Mexican government created a program to open Mexico’s airports to private investments. Three private airport operators (Grupo Aeroportuario del Pacífico, S.A.B. de C.V., Grupo Aeroportuario del Centro Norte, S.A.B. de C.V. and Aeropuertos del Sureste de Mexico, S.A.B. de C.V.) were incorporated and granted50-year concessions to operate airports in Mexico. In the first stage of the privatization process, the Mexican government sold a minority stake to strategic partners. The privatization process culminated inmid-2006, when the Mexican government sold the balance of its holdings to the public via initial public offerings. The Mexican government still manages and operates the Mexico City International Airport (AICM), which it considers strategic, as well as other minor airports in the country. The National Development Plan, published in the Official Gazette of the Federation on May 20, 2013, describes the plans for the airline sector for the years 2013 to 2018. The plan provides for (i) investments in air transportation and airports; (ii) supervision of airlines to ensure safety, efficiency, and quality standards; (iii) the execution of new bilateral air transportation agreements in order to increase the penetration of the Mexican domestic airline industry in international markets; and (iv) the development of airport services for the metropolitan area of Mexico City, as well as regional airports. In addition, on July 15, 2013 the 2013-2018 Investment in Transportation and Communications Infrastructure Program was announced, which is a program with a multi-modal focus, that is intended to improve highways, railroads, ports, airports, and telecommunications through an investment of Ps. 4.0Ps.4.0 billion. We believe this strong foundational infrastructure, and continued investment and development will result in significant growth potential for the Mexican airline market. In September 2014, the Mexican government announced the construction of a new international airport for Mexico City to replace the current international airport, which is now operating at full capacity at most times of the day. This new international airport is expected to start operations in 2020.

Boeing estimates that the Latin American airline industry will have a higher growth rate than that of the global industry over the next 20 years, with an average passenger to economic growth ratio (RPK/GDP) of 1.62.0 times. As a result, a GDP growth of 4.1%2.9% in the next 20 years could imply an industry growth rate of around 38%33% by 20182021 and over 90%75% by 2023.2026.

The Mexican aviation industry has undergone a significant transformation due to the emergence oflow-cost carriers, including us, Interjet and VivaAerobús, the exit of eight carriers (Aerocalifornia, Aladia, Alma, Aviacsa,

Avolar, Azteca, Nova Air and Grupo Mexicana). Changes in the Mexican airline competitive environment have resulted in an important increase in the domestic market load factor for the remaining carriers. While load factor in Mexico has historically lagged more than in developed markets, this positive trend will likely drive greater profitability among the remaining airlines in Mexico. This dramatic capacity reduction and itslow-fare strategy allowed Volaris to increase load factor to 82.6%85.8% in 2013.2016.

Market Environment

The airline industry is highly competitive. The principal competitive factors in the airline industry include fare pricing, total ticket price, flight schedules, aircraft type, passenger amenities, number of routes/destinations served from a city, customer service, safety record and reputation, code-sharing relationships, frequent flier programs and redemption opportunities. The airline industry is particularly susceptible to price discounting because once a flight is scheduled, airlines incur only nominal incremental costs to provide service to passengers occupying otherwise unsold seats. The expenses of a scheduled aircraft flight do not vary significantly with the number of passengers carried, and, as a result, a relatively small change in the number of passengers or in pricing can have a disproportionate effect on an airline’s operating and financial results. Price competition occurs on amarket-by-market basis through price discounts, changes in pricing structures, fare matching, targeted promotions and frequent flier initiatives. Airlines typically use discount fares and other promotions to stimulate traffic during normally slower travel periods to generate cash flow and to maximize revenue per ASM. The prevalence of discount fares can be particularly acute when an airline has excess capacity and is under financial pressure to sell tickets.

In Mexico and the United States the scheduled passenger service market consists of three principal groups of travelers: business travelers, leisure travelers, and travelers visiting friends and relatives, or VFR. Leisure travelers and VFR travelers typically place most of their emphasis on lower fares, whereas business travelers typically place a high emphasis on flight frequency, scheduling flexibility, breadth of network and service enhancements, including loyalty programs and airport lounges, as well as price.

VFR and leisure passengers travel for a number of reasons, including social visits and vacation travel. We believe that VFR and leisure traffic are the most important components of the traffic in the markets we target and serve and are important contributors to ournon-ticket revenue production. We believe that VFR and leisure passengers represent a significant percentage of our total passenger volume. As part of our route development strategy, we target markets that will likely appeal to VFR and leisure travels at price points that were previously not available. This strategy allows us to stimulate demand in new markets by encouraging travel by VFR and leisure travelers.

Domestic passenger volumes have grown in Mexico by a CAGR of 4.7%6.5% and international volumes have grown by a CAGR of 2.4%4.0% from 2006 to 20132016 according to the DGAC. The following table sets forth the historical passenger volumes on international and domestic routes in Mexico from 2006 to 2013:2016:

Passenger Volumes (millions of segment passengers) | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | ||||||||||||||||||||||||

International | 27.4 | 27.2 | 27.9 | 24.2 | 25.8 | 26.8 | 28.5 | 30.9 | ||||||||||||||||||||||||

% growth | 6.1 | % | (0.5 | %) | 2.5 | % | (13.2 | %) | 6.3 | % | 4.1 | % | 6.5 | % | 8.1 | % | ||||||||||||||||

Domestic | 22.2 | 27.4 | 27.6 | 24.4 | 24.5 | 25.5 | 28.1 | 30.5 | ||||||||||||||||||||||||

% growth | 11.8 | % | 23.6 | % | 0.9 | % | (11.6 | %) | 0.3 | % | 3.9 | % | 10.3 | % | 8.6 | % | ||||||||||||||||

Total | 49.5 | 54.6 | 55.6 | 48.7 | 50.3 | 52.3 | 56.6 | 61.4 | ||||||||||||||||||||||||

% growth | 8.6 | % | 10.3 | % | 1.7 | % | (12.4 | %) | 3.3 | % | 4.0 | % | 8.4 | % | 8.5 | % | ||||||||||||||||

Passenger Volumes (millions of segment passengers) | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |||||||||||||||||||||||||||||||||

International | 27.4 | 27.2 | 27.9 | 24.2 | 25.8 | 26.8 | 28.5 | 30.9 | 33.6 | 37.5 | 40.5 | |||||||||||||||||||||||||||||||||

% growth (decreased) | 6.1 | % | (0.5 | %) | 2.5 | % | (13.2 | %) | 6.3 | % | 4.1 | % | 6.5 | % | 8.1 | % | 9.2 | % | 11.7 | % | 8.0 | % | ||||||||||||||||||||||

Domestic | 22.2 | 27.4 | 27.6 | 24.4 | 24.5 | 25.5 | 28.1 | 30.5 | 32.9 | 37.1 | 41.8 | |||||||||||||||||||||||||||||||||

% growth (decreased) | 11.8 | % | 23.6 | % | 0.9 | % | (11.6 | %) | 0.3 | % | 3.9 | % | 10.3 | % | 8.6 | % | 8.0 | % | 12.9 | % | 12.5 | % | ||||||||||||||||||||||

Total | 49.5 | 54.6 | 55.6 | 48.7 | 50.3 | 52.3 | 56.6 | 61.4 | 66.5 | 74.6 | 82.3 | |||||||||||||||||||||||||||||||||

% growth (decreased) | 8.6 | % | 10.3 | % | 1.7 | % | (12.4 | %) | 3.3 | % | 4.0 | % | 8.4 | % | 8.5 | % | 8.3 | % | 12.3 | % | 10.2 | % | ||||||||||||||||||||||

Source: DGAC

Our international growth strategy has focused on targeting markets in the United States with large Mexican and Mexican-American communities in order to stimulate VFR demand and leisure traffic in those markets. Approximately 68% of international passengers in Mexico fly to the United States, making the United States the largest international destination for air passengers in Mexico. All of the major U.S. legacy carriers fly to and from Mexico, but at a higher cost thanlow-cost carriers. We have learned that many Mexicans in the United States purchase airline tickets for family members living in Mexico to fly to the United States to visit. For this reason, we focus our international routes on U.S. cities with significant Mexican and Mexican-American communities. These cities include Chicago, Los Angeles, San DiegoAntonio and San Francisco-Oakland, with Mexicans andMexican-Americans in each of them amounting to 1.5 million, 4.6 million, 0.9 million and 0.7 million, respectively, according to PEW Research Hispanic Center based on U.S. Census Bureau data.

In 2013,2016, the Mexicanlow-cost and ULCCs (Interjet, VivaAerobus and Volaris) together maintained 59.9%63.5% of the domestic market, based on passenger flight segments, according to the DGAC. The following table sets forth the historical market shares on domestic routes, based on passenger flight segments, of each major market participant for each of the periods indicated:

Market Share(1) Domestic | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Volaris(2) | 4.04 | % | 7.94 | % | 12.16 | % | 12.82 | % | 14.79 | % | 18.05 | % | 20.48 | % | 23.15 | % | 4.04 | % | 7.94 | % | 12.16 | % | 12.82 | % | 14.79 | % | 18.05 | % | 20.48 | % | 23.15 | % | 23.31 | % | 24.76 | % | 27.50 | % | ||||||||||||||||||||||||||||||||||||||

Grupo Aeroméxico | 32.91 | % | 28.58 | % | 28.01 | % | 32.28 | % | 36.20 | % | 40.10 | % | 37.73 | % | 35.74 | % | 32.91 | % | 28.58 | % | 28.01 | % | 32.28 | % | 36.20 | % | 40.10 | % | 37.73 | % | 35.74 | % | 36.08 | % | 33.81 | % | 31.19 | % | ||||||||||||||||||||||||||||||||||||||

Grupo Mexicana(3) | 26.99 | % | 24.07 | % | 24.05 | % | 27.16 | % | 18.55 | % | — | — | — | 26.99 | % | 24.07 | % | 24.05 | % | 27.16 | % | 18.55 | % | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

Interjet(4) | 5.65 | % | 7.04 | % | 10.83 | % | 12.71 | % | 16.35 | % | 24.90 | % | 23.92 | % | 24.46 | % | 5.65 | % | 7.04 | % | 10.83 | % | 12.71 | % | 16.35 | % | 24.90 | % | 23.92 | % | 24.46 | % | 23.75 | % | 24.61 | % | 21.69 | % | ||||||||||||||||||||||||||||||||||||||

VivaAerobus(5) | 0.30 | % | 4.44 | % | 4.83 | % | 5.83 | % | 8.85 | % | 11.54 | % | 12.53 | % | 12.25 | % | 0.30 | % | 4.44 | % | 4.83 | % | 5.83 | % | 8.85 | % | 11.54 | % | 12.53 | % | 12.25 | % | 11.85 | % | 11.74 | % | 14.30 | % | ||||||||||||||||||||||||||||||||||||||

Source: DGAC

| (1) | Market share is obtained by dividing each airline’s number of passengers by the total number of passengers for all airlines for the period indicated. |

| (2) | Began operations in March 2006. |

| (3) | Ceased |

| (4) | Began operations in December 2005. |

| (5) | Began operations in November 2006. |

The airline industry in Mexico has recently seen sharp attrition, with the exit of eight airlines since 2007, including the bankruptcy of Grupo Mexicana in April 2014. This allowed us to further expand our international product offering in a very short timeframe. We have recently requested the DGAC to permanently grant us the six routes from the Mexico City international airport to the United States that we have been operating since late 2010 and 2011, which had been primarily operated by Grupo Mexicana prior to ceasing its operations; however, we cannot be certain that the DGAC will permanently grant us such routes.

The following table sets forth the historical market shares on international routes between Mexico, the United States and other countries, based on passenger flight segments, of key Mexican industry participants for each of the periods indicated:

Market Share(1) International | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Volaris(2) | — | — | — | 2.92 | % | 9.38 | % | 21.95 | % | 21.91 | % | 20.84 | % | — | — | — | 2.92 | % | 9.38 | % | 21.95 | % | 21.91 | % | 20.84 | % | 21.73 | % | 23.08 | % | 24.79 | % | ||||||||||||||||||||||||||||||||||||||||||||

Grupo Aeroméxico | 31.68 | % | 34.05 | % | 31.73 | % | 31.06 | % | 39.83 | % | 74.87 | % | 66.96 | % | 64.46 | % | 31.68 | % | 34.05 | % | 31.73 | % | 31.06 | % | 39.83 | % | 74.87 | % | 66.96 | % | 64.46 | % | 65.71 | % | 61.59 | % | 56.82 | % | ||||||||||||||||||||||||||||||||||||||

Grupo Mexicana(3) | 64.56 | % | 63.85 | % | 66.08 | % | 65.36 | % | 49.94 | % | — | — | — | 64.56 | % | 63.85 | % | 66.08 | % | 65.36 | % | 49.94 | % | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

Interjet(4) | — | 0.10 | % | 0.28 | % | — | — | 1.56 | % | 8.95 | % | 13.68 | % | — | 0.10 | % | 0.28 | % | — | — | 1.56 | % | 8.95 | % | 13.68 | % | 11.31 | % | 13.67 | % | 17.86 | % | ||||||||||||||||||||||||||||||||||||||||||||

VivaAerobus(5) | — | — | 0.85 | % | 0.43 | % | 0.84 | % | 1.60 | % | 2.18 | % | 0.68 | % | — | — | 0.85 | % | 0.43 | % | 0.84 | % | 1.60 | % | 2.18 | % | 0.68 | % | 0.93 | % | 1.55 | % | 0.40 | % | ||||||||||||||||||||||||||||||||||||||||||

Source: DGAC

| (1) | Market share is obtained by dividing each Mexican airline’s number of passengers by the total number of passengers for all Mexican airlines for the period indicated. |

| (2) | Began operations in March 2006. |

| (3) | Ceased operation in August 2010. |

| (4) | Began operations in December 2005. |

| (5) | Began operations in November 2006. |

We have been able to grow our international market share substantially over the past five years even with significant competition from leading U.S. carriers including United, American, Alaska Airways,Air, and Delta. As of December 31, 2013,2016, we were the sixthfifth largest international carrier in terms of passenger flight segments out of all airlines flying internationally to and from Mexico. We have been able to grow our international market share substantially due to the Grupo Méxicana reorganization and our strategy to target and stimulate markets in the United States with large Mexican and Mexican-American communities.

In terms of both domestic and international ticketed passengers, our total passenger volume increased at a CAGR of 38.7%32.6% from 2006 to 2013,2016, with approximately 0.9 million booked passengers in 2006 and 8.915.0 million booked passengers in 2013.2016. We attribute the rapid growth of our business to the favorable economic environment in Mexico, our dedicated ULCC strategy targeted at VFR and leisure travelers, our strong focus on delivering high quality customer service, and our tremendous brand recognition among domestic and international travelers in Mexico and the United States.

Our Business Model

Our business model is based on that of other ULCCs operating elsewhere in the world, such as Allegiant and Spirit in the United States, Ryanair and Wizz in Europe and AirAsia in Asia. We utilize our ULCC business model and efficient operations to offer low base fares and to stimulate demand while aiming to provide high quality customer service. Our unbundled pricing strategy allows us to provide low base fares and enables our passengers to select and pay for a range of optional products and services for additional fees. We target VFR, cost-conscious business people and leisure travelers in Mexico and to select destinations in the United States.

Since May 2012, we have unbundled certain components of our air travel service as part of a strategy to enable our passengers to select and pay for the products and services they want to use. This unbundling strategy has allowed us to significantly grow ournon-ticket and total revenue. We plan to continue to use low base fares to stimulate additional passenger demand, shift bus passengers to air travel and increase our load factor. We believe a small percentage shift of bus passengers to air travel would dramatically increase the number of airline passengers. Higher load factors help us generate additionalnon-ticket and total revenue, which in turn, allow us to further lower base fares and stimulate new demand.

We have a relentless focus on low costs as part of our organizational culture. We are the lowest cost airline carrier in Latin America, based on CASM, compared to the other Latin American publicly traded companies. We are also the lowest cost carrier in our target markets in Mexico and the United States, compared to our target market competitors, according to public information available from such competitors. We are able to keep our costs low due to our efficient and uniform fleet, high asset utilization, our emphasis on direct sales and distribution and our variable, performance-based compensation structure.

We were established and are operated to achieve the following goals: (i) to create a profitable and sustainable business model; (ii) to successfully compete by creating structural advantages over other carriers serving Mexico through our ULCC business model; (iii) to provide affordable air travel with a high quality experience for our customers; and (iv) to create a dynamic, cost conscious and entrepreneurial working culture for our employees. We believe that our strengths are:

Lowest Cost Structure.We believe that in 20132016 we had the lowest cost structure of any of the other Latin American publicly traded airlines, with CASM of Ps.1.164Ps.124.4 cents (U.S.$0.089) $6.0 cents), compared to Avianca-TACAAvianca at U.S.$0.175, $13.2 cents, Copa at U.S.$0.110, $8.8 cents, Gol at U.S.$0.130, $9.8 cents, Grupo Aeroméxico at U.S.$0.145 $9.0 cents and LATAM at

U.S.$0.155. $10.7 cents. We also have lower costs than our U.S.-based publicly traded target market competitors, including Alaska Air at U.S.$0.128, $10.4 cents, American at U.S.$0.151, $12.8 cents, Delta at U.S.$0.148 $13.0 cents, Jet Blue at U.S. $10.8 cents, Southwest Airlines at U.S. $11.2 cents and United at U.S.$0.151 $12.7 cents in 2013,2016, according to publicly available financial information. We achieve our low operating costs in large part due to:

| • | Efficient and Uniform |

| • | High Asset |

| • | Direct Sales |

| • | Variable, Performance-Based Compensation |

Ancillary Revenue Generation.We have been able to grow ournon-ticket revenue by allowing our passengers to choose what additional products and services they purchase and use. Thanks to our “Tú Decides” (“You Decide”) strategy, we have increased averagenon-ticket revenue per passenger flight segment from approximately U.S.$7.6 $6.92 in 2009 to U.S.$16.1 $18.45 in 20132016 by, among other things: