As-As filed with the Securities and Exchange Commission on April 30, 2014March 29, 2017

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM20-F

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20132016

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number:1-14728

LATAM Airlines Group S.A.

(Exact name of registrant as specified in its charter)

| LATAM Airlines Group S.A. | Republic of Chile | |

| (Translation of registrant’s name into English) | (Jurisdiction of incorporation or organization) |

Presidente Riesco 5711, 20th Floor

Las Condes

Santiago, Chile

(Address of principal executive offices)

Gisela Escobar Koch

Tel.:56-2-2565-3944 •E-mail: InvestorRelations@latam.com• E-mail: gisela.escobar@lan.com

Presidente Riesco 5711, 20th Floor

Las Condes

Santiago, Chile

(Name, telephone,e-mail and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class: | Name of each exchange on which registered: | |

| American Depositary Shares (as evidenced by American Depositary Receipts), each representing one share of Common Stock, without par value | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 551,847,819.606,407,693.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x☒ No ¨☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨☐ No x☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x☒ No ¨☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of RegulationS-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨☐ No ¨☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or anon-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule12b-2 of the Exchange Act. (Check one):

Large Accelerated filer ☒ Accelerated filer ☐ Non-Accelerated filer ☐

|

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP | International Financial Reporting Standards as issued by the International Accounting Standards Board | Other | ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 ¨☐ Item 18 ¨☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule12b-2 of the Exchange Act). Yes ¨☐ No x☒

| 2 | ||||||

| 3 | ||||||

ITEM 1. | 5 | |||||

ITEM 2. | 5 | |||||

ITEM 3. | 5 | |||||

ITEM 4. | ||||||

ITEM 4A | ||||||

ITEM 5. | ||||||

ITEM 6. | ||||||

ITEM 7. | 77 | |||||

ITEM 8. | 83 | |||||

ITEM 9. | 86 | |||||

ITEM 10. | 88 | |||||

ITEM 11. | 114 | |||||

ITEM |

| 118 | ||||

| PART II | ||||||

ITEM 13. | 119 | |||||

ITEM | MATERIAL MODIFICATIONS TO THE | 119 | ||||

ITEM 15. | 119 | |||||

ITEM 16. | 120 | |||||

| PART III | ||||||

ITEM 17. | 123 | |||||

ITEM | ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

ITEM 19. | ||||||

InThroughout this annual report on Form20-F unless we make numerous references to “LATAM”. Unless the context otherwise requires, references to “LATAM Airlines Group” are to LATAM Airlines Group S.A., the unconsolidated operating entity, and references to “LATAM,” “we,” “us” or the “Company” are to LATAM Airlines Group S.A. and its consolidated subsidiaries:affiliates: Transporte Aéreo S.A. (which does business under the name “LAN Express”“LATAM Airlines Chile”), LAN Perú S.A. (“LANLATAM Airlines Peru”), Aerolane, Líneas Aéreas Nacionales del Ecuador S.A. (“LANLATAM Airlines Ecuador”), LAN Argentina S.A. (“LANLATAM Airlines Argentina,” previously Aero 2000 S.A.), Aerovías de Integración Regional, Aires S.A. (which does business under the name “LAN“LATAM Airlines Colombia”), TAM S.A. (“TAM”), LAN Cargo S.A. (“LANLATAM Cargo”) and Multiplus S.A. (“Multiplus”), and its three regional affiliates: Aero Transportes Mas de Carga S.A. de C.V. (“MasAir”) in Mexico, Linea Aerea Carguera de Colombia S.A. (“LANCO”) in Colombia and Aerolinhas Brasileiras S.A. (“ABSA”) in Brazil. AllOther references to “Chile”“LATAM”, however, are to the LATAM brand which was launched in 2016 and brings together, under one internationally recognized name, all of the affiliate brands such as LATAM Airlines Chile, LATAM Airlines Peru, LATAM Airlines Argentina, LATAM Airlines Colombia, LATAM Airlines Ecuador and LATAM Airlines Brazil.

References to “LATAM” and all references to the Republic of Chile.

On June 22, 2012,“LAN” are to LAN Airlines S.A., currently known as LATAM was formed followingAirlines Group S.A. and its consolidated affiliates, in connection with circumstances and facts occurring prior to the completion date of the business combination between LAN Airlines S.A. and its consolidated subsidiaries (“LAN”) with TAM S.A. and its consolidated subsidiaries (“TAM”). Following the combination, LAN Airlines S.A. became “LATAM Airlines Group S.A.” and TAM continues to exist as a subsidiary of Holdco I S.A. (“Holdco I”) and a subsidiary of LATAM Airlines Group. LATAM’s consolidated financial statements for the year ended December 31, 2012 include TAM’s financial results from June 23, 2012. As LATAM Airlines Group S.A. is the owner of substantially all the economic rights in TAM, TAM and its consolidated subsidiaries are for the purposes of this annual report and LATAM’s consolidated financial statements treated as being subsidiaries of LATAM Airlines Group S.A. See “Item 4. Information on the Company—A. History and Development of the Company—Combination of LAN and TAM.”

Throughout this annual report on Form 20-F we make numerous references to “LAN”. Some references to “LAN” are to LAN Airlines S.A., currently known as LATAM Airlines Group S.A. and its consolidated subsidiaries, in connection with circumstances and facts occurring prior to June 22, 2012. Other references to “LAN”, however, are to the LAN brand which was launched in 2004 and brings together, under one internationally recognized name, all of the affiliate brands such as LAN Chile, LAN Peru, LAN Argentina, LAN Colombia and LAN Ecuador.

In this annual report on Form20-F, unless the context otherwise requires, references to “TAM” are to TAM S.A., and its consolidated subsidiaries,affiliates, including TAM Linhas Aereas S.A. (“TLA”), which does business under the operating entity,name “LATAM Airlines Brazil”, Multiplus S.A. (“Multiplus”), Pantanal Linhas Aéreas S.A. (“Pantanal”), Fidelidade Viagens e Turismo Limited (“TAM Viagens”), and Transportes Aéreos Del Mercosur S.A. (“TAM Mercosur”).

LATAM Airlines Group and the majority of our affiliates maintain their accounting records and prepare their financial statements in U.S. dollars. Some of our other affiliates, however, maintain their accounting records and prepare their financial statements in Chilean pesos, Argentinean pesos, Colombian pesos or Brazilian reais. In particular, TAM maintains its accounting records and prepares its financial statements in Brazilian reais. Our audited consolidated financial statements include the results of these affiliates translated into U.S. dollars. International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”), require assets and liabilities to be translated atperiod-end exchange rates, while revenue and expense accounts are translated at each transaction date, although a monthly rate may also be used if exchange rates do not vary widely.

In this annual report on Form20-F, all references to “Chile” are references to the Republic of Chile. This annual report contains conversions of certain Chilean peso and Brazilian real amounts into U.S. dollars at specified rates solely for the convenience of the reader. These conversions should not be construed as representations that the Chilean peso and the Brazilian real amounts actually represent such U.S. dollar amounts or could be converted into U.S. dollars at the rate indicated. Unless we specify otherwise, all references to “$”, “US$” “US$,” “U.S. dollars” or “dollars” are to United States dollars, references to “pesos,” “Chilean pesos” or “Ch$” are to Chilean pesos. References to “reais,” “Brazilian reais,”reais” or “R$” are to Brazilian reais, and references to “UF” are toUnidades de Fomento, a daily indexed Chilean peso-denominated monetary unit that takes into account the effect of the Chilean inflation rate. Unless we indicate otherwise, the U.S. dollar equivalent for information in Chilean pesos used in this annual report and in our audited consolidated financial statements is based on the “dólar observado” or “observed” exchange rate published byBanco Central de Chile (which we refer to as the Central Bank of Chile) on December 30, 2013,31, 2016, which was Ch$523.76669.47 = US$1.00. The observed exchange rate on April 25, 2014February 28, 2017, was Ch$559.67 =645.19= US$1.00. Unless we indicate otherwise, the U.S. dollar equivalent for information in Brazilian reais used in this annual report and in our audited consolidated financial statements is based on the average “dólar observadobid and offer rate” or “observed” exchange rate published byBanco Central doBrasildo Brasil (which we refer to as the Central Bank of Brazil) on December 31, 2013,2016, which was R$2.3423.259 = US$1.00. The observed exchange rate on April 25, 2014February 28, 2017 was R$2.231$R$3.099 = US$1.00. The Federal Reserve Bank of New York does not report a noon buying rate for Chilean pesos nor Brazilian reais. See “Item 3. Key Information—A. Selected Financial Data—Chilean Peso Exchange Rates” and “Item 3. Key Information—A. Selected Financial Data—Brazilian Exchange Rates.”

LATAM Airlines Group and the majority of our subsidiaries maintain their accounting records and prepare their financial statements in U.S. dollars. Some of our other subsidiaries, however, maintain their accounting records and prepare their financial statements in Chilean pesos, Argentinean pesos, Colombian pesos or Brazilian reais. In particular, TAM maintains its accounting records and prepares its financial statements in Brazilian reais. Our audited consolidated financial statements include the results of these subsidiaries translated into U.S. dollars. International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”), require assets and liabilities to be translated at period-end exchange rates, while revenue and expense accounts are translated at each transaction date, although a monthly rate may also be used if exchange rates do not vary widely.

LATAM’s audited consolidated financial statements for the periods ended December 31, 2009, 2010, 2011, 2012 and 2013 were prepared in accordance with IFRS.

We have rounded percentages and certain U.S. dollar, Chilean peso and Brazilian reais amounts contained in this annual report for ease of presentation. Any discrepancies in any table between totals and the sums of the amounts listed are due to rounding.

LATAM’s audited consolidated financial statements for the periods ended December 31, 2012, 2013, 2014, 2015 and 2016 were prepared in accordance with IFRS.

This annual report contains certain terms that may be unfamiliar to some readers. You can find a glossary of these terms on page 4 of this annual report.

This annual report contains forward-looking statements, including those relating to our recently completed combination with TAM. See “Item 3. Key Information—D. Risk Factors—Risks Relating to the Combination of LAN and TAM.”statements. Such statements may include words such as “anticipate,” “could” “estimate,” “expect,” “project,” “intend,” “plan,” “believe” or other similar expressions. Forward-looking statements, including statements about our beliefs and expectations, are not statements of historical facts. These statements are based on current plans, estimates and projections, and, therefore, you should not place undue reliance on them. There is no assurance that the expected events, trends or results will actually occur. Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. These factors include, but are not limited to:

Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly any of them, whether in light of new information, future events or otherwise. You should also read carefully the risk factors described in “Item 3. Key Information—D. Risk Factors.”

The following terms, as used in this annual report, have the meanings set forth below.

Capacity Measurements: | ||

| “available seat kilometers” or “ASKs” | The sum, across our network, of the number of seats made available for sale on each flight multiplied by the kilometers | |

| “available ton kilometers” or “ATKs” | The sum, across our network, of the number of tons available for the transportation of revenue load (cargo) on each flight multiplied by the kilometers | |

| “available seat kilometers equivalent” or “ASK equivalent” | The sum, across our network, of the number of seats made available for sale on each flight plus the quotient of cargo ATKs divided by 0.095, all multiplied by the kilometers | |

| Traffic Measurements: | ||

| “revenue passenger kilometers” or “RPKs” | The sum, across our network, of the number of passengers on each flight multiplied by the number of kilometers | |

| “revenue ton kilometers” or “RTKs” | The sum, across our network, of the load (cargo) in tons on each flight multiplied by the kilometers | |

| “traffic revenue” | Revenue from passenger and cargo operations. | |

| Yield Measurements: | ||

| “cargo yield” | Revenue from cargo operations divided by RTKs. | |

| “ | ||

| Revenue from passenger operations divided by RPKs. | ||

| Load Factors: | ||

| “cargo load factor” | RTKs | |

| “passenger load factor” | RPKs expressed as a percentage of ASKs. | |

| Other: | ||

| “ | ||

| The Airbus A318, Airbus A319, Airbus A320 and Airbus A321 models of aircraft. | ||

| “ | ||

| “ton” | A metric ton, equivalent to 2,204.6 pounds. | |

| “utilization rates” | The actual number of flight hours per aircraft per operating day. | |

| “operating expenses” | Operating expenses, which are calculated in accordance with IFRS, comprise the sum of the line items “cost of sales” plus “distribution costs” plus “administrative expenses” plus “other operating | |

“MiSchDynamicDT” | Market Intelligence Schedule Dynamic Table. | |

| “Diio Mi” | Data In Intelligence Out Market Intelligence. | |

| “CO2” | Carbon Dioxide Gas | |

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

A. Selected Financial Data

LATAM’s Historical Financial Information

The summary consolidated annual financial information of LATAM as of December 31, 2016, 2015, 2014, 2013 and 2012 has been prepared in accordance with IFRS(*). On June 22, 2012, LATAM Airlines Group was formed through the business combination of LAN and TAM. Following the combination, LAN Airlines S.A. became “LATAM Airlines Group S.A.” and TAM continues to exist as a subsidiary of Holdco I and a subsidiary of LATAM Airlines Group. Financial statements for LATAM fully consolidate TAM’s results since June 23, 2012.

LATAM’s Historical Financial Information

The summary consolidated annual financial information of LATAM as of December 31, 2013, 2012, 2011, 2010 and 2009 and for each of the five years ended December 31, 2013, 2012, 2011, 2010 and 2009 has been prepared in accordance with IFRS. LATAM’s consolidated annual financial information as of and for the year ended December 31, 2012, includes TAM’s results of operations from June 23, 2012, and was included in a previous annual report filed by LATAM with the SEC. The LATAM Historical Financial Information as of and for the years ended December 31, 2011, 2010 and 2009 represents LAN’s historical audited consolidated financial information and were included in previous annual reports filed by LAN with the SEC.

The following table sets forth certain income statement and balance sheet data for LATAM Airlines Group, as of and for the year ended December 31, 2012 (including TAM’s results from June 23, 2012), as retrospectively revised. For more information see “Item 5.—Operating and Financial Review and Prospects—A. Operating Results—Accounting Impact of the Business Combination”.

LATAM’s Annual Financial Information

| Year ended December 31, | Year ended December 31, | |||||||||||||||||||||||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||||||||||||||||||

| (in US$ millions, except per share and capital stock data) | (in US$ millions, except per share and capital stock data) | |||||||||||||||||||||||||||||||||||||||

The Company(1)(2) | ||||||||||||||||||||||||||||||||||||||||

Statement of Income Data: | ||||||||||||||||||||||||||||||||||||||||

Operating revenues | ||||||||||||||||||||||||||||||||||||||||

Passenger | 11,061.6 | 7,966.8 | 4,008.9 | 3,109.8 | 2,623.6 | 7,877.7 | 8,410.6 | 10,380.1 | 11,061.5 | 7,966.8 | ||||||||||||||||||||||||||||||

Cargo | 1,863.0 | 1,743.5 | 1,576.5 | 1,280.7 | 895.6 | 1,110.6 | 1,329.4 | 1,713.4 | 1,863.0 | 1,743.6 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Total operating revenues | 12,924.5 | 9,710.4 | 5,585.4 | 4,390.5 | 3,519.2 | 8,988.3 | 9,740.0 | 12,093.5 | 12,924.5 | 9,710.4 | ||||||||||||||||||||||||||||||

Cost of sales | (10,054.2 | ) | (7,634.5 | ) | (4,078.6 | ) | (3,012.7 | ) | (2,522.8 | ) | (6,967.0 | ) | (7,636.7 | ) | (9,624.5 | ) | (10,054.2 | ) | (7,634.5 | ) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Gross margin | 2,870.4 | 2,075.9 | 1,506.8 | 1,377.8 | 996.4 | 2,021.3 | 2,103.3 | 2,469.0 | 2,870.3 | 2,075.9 | ||||||||||||||||||||||||||||||

Other operating income(3) | 341.6 | 220.2 | 132.8 | 132.8 | 136.4 | 538.7 | 385.8 | 377.6 | 341.6 | 220.2 | ||||||||||||||||||||||||||||||

Distribution costs | (1,025.9 | ) | (803.6 | ) | (479.8 | ) | (383.5 | ) | (327.0 | ) | (747.4 | ) | (783.3 | ) | (957.1 | ) | (1,025.9 | ) | (803.6 | ) | ||||||||||||||||||||

Administrative expenses | (1,136.1 | ) | (888.7 | ) | (405.7 | ) | (331.8 | ) | (270.0 | ) | (873.0 | ) | (878.0 | ) | (980.7 | ) | (1,136.1 | ) | (888.7 | ) | ||||||||||||||||||||

Other expenses | (408.7 | ) | (311.8 | ) | (214.4 | ) | (172.4 | ) | (100.5 | ) | (373.7 | ) | (324.0 | ) | (401.0 | ) | (408.7 | ) | (311.8 | ) | ||||||||||||||||||||

Other gains/(losses) | (55.4 | ) | (45.8 | ) | (33.0 | ) | 5.4 | (11.7 | ) | (72.6 | ) | (55.3 | ) | 33.5 | (55.4 | ) | (45.8 | ) | ||||||||||||||||||||||

Financial income | 72.8 | 77.5 | 14.5 | 14.9 | 18.2 | 74.9 | 75.1 | 90.5 | 72.8 | 77.5 | ||||||||||||||||||||||||||||||

Financial costs | (462.5 | ) | (294.6 | ) | (139.1 | ) | (155.3 | ) | (153.1 | ) | (416.3 | ) | (413.4 | ) | (430.0 | ) | (462.5 | ) | (294.6 | ) | ||||||||||||||||||||

Equity accounted earnings | 2.0 | 1.0 | 0.5 | 0.1 | 0.3 | 0.0 | 0.0 | (6.5 | ) | 2.0 | 1.0 | |||||||||||||||||||||||||||||

Exchange rate differences | (482.2 | ) | 66.7 | (0.3 | ) | 13.8 | (11.2 | ) | 121.7 | (467.9 | ) | (130.2 | ) | (482.2 | ) | 66.6 | ||||||||||||||||||||||||

Result of indexation units | 0.2 | 0 | 0.1 | 0.1 | (0.6 | ) | 0.3 | 0.6 | 0.1 | 0.3 | 0.0 | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Income before income taxes | (283.9 | ) | 96.7 | 382.4 | 502.0 | 277.5 | ||||||||||||||||||||||||||||||||||

Income tax | 20.1 | (102.4 | ) | (61.8 | ) | (81.1 | ) | (44.5 | ) | |||||||||||||||||||||||||||||||

Income (loss) before income taxes | 273.9 | (357.1 | ) | 65.2 | (283.8 | ) | 96.7 | |||||||||||||||||||||||||||||||||

Income (loss) tax expense/benefit | (163.2 | ) | 178.4 | (292.4 | ) | 20.0 | (102.3 | ) | ||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Net income for the period | (263.8 | ) | (5.6 | ) | 320.6 | 420.9 | 233.0 | |||||||||||||||||||||||||||||||||

Income attributable to the parent company’s equity holders | (281.1 | ) | 19.1 | 320.2 | 419.7 | 231.1 | ||||||||||||||||||||||||||||||||||

Income attributable to non-controlling interests | 17.3 | 13.4 | 0.4 | 1.2 | 1.9 | |||||||||||||||||||||||||||||||||||

Net (loss) income for the period | 110.7 | (178.7 | ) | (227.2 | ) | (263.8 | ) | (5.6 | ) | |||||||||||||||||||||||||||||||

Income (loss) attributable to the parent company’s equity holders | 69.2 | (219.3 | ) | (260.0 | ) | (281.1 | ) | (19.1 | ) | |||||||||||||||||||||||||||||||

Income (loss) attributable tonon-controlling interests | 41.5 | 40.5 | 32.8 | 17.3 | 13.5 | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Net income (loss) for the year | 110.7 | (178.7 | ) | (227.2 | ) | (263.8 | ) | (5.6 | ) | |||||||||||||||||||||||||||||||

Earnings per share | ||||||||||||||||||||||||||||||||||||||||

Average number of Shares | 549,559,559 | 545,547,819 | 545,547,819 | 487,930,977 | 412,267,624 | |||||||||||||||||||||||||||||||||||

Net income for the period Earnings per share Average number of Shares Basic earnings per share (US$)(4) Diluted earnings per share(US$) Year ended December 31, 2013 2012 2011 2010 2009 (in US$ millions, except per share and capital stock data) (263.8 ) (5.6 ) 320.6 420.9 233.0 487,930,977 412,267,624 339,424,598 338,790,909 338,790,909 (0.57613 ) (0.0463 ) 0.94335 1.23882 0.68221 (0.57613 ) (0.0463 ) 0.9426 1.23534 0.68221

| Year ended December 31, | ||||||||||||||||||||||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||||||||||||||||||||||

| (in US$ millions, except per share and capital stock data) | ||||||||||||||||||||||||||||||||||||||||

Basic earnings (loss) per share (US$) | 0.12665 | (0.40193 | ) | (0.47656 | ) | (0.57613 | ) | (0.0463 | ) | |||||||||||||||||||||||||||||||

Diluted earnings (loss) per share (US$) | 0.12665 | (0.40193 | ) | (0.47656 | ) | (0.57613 | ) | (0.0463 | ) | |||||||||||||||||||||||||||||||

| At December 31, | At December 31, | |||||||||||||||||||||||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||||||||||||||||||

| (in US$ millions, except per share and capital stock data) | (in US$ millions, except per share and capital stock data) | |||||||||||||||||||||||||||||||||||||||

Balance Sheet Data: | ||||||||||||||||||||||||||||||||||||||||

Cash, and cash equivalents | 1,984.9 | 650.3 | 374.4 | 631.1 | 731.5 | 949.3 | 753.5 | 989.4 | 1,984.9 | 650.3 | ||||||||||||||||||||||||||||||

Other current assets in operation | 2,992.2 | 2,626.2 | 964.3 | 896.5 | 666.6 | 2,340.3 | 2,067.4 | 2,644.1 | 2,992.2 | 2,626.2 | ||||||||||||||||||||||||||||||

Non-current assets and disposal groups held for sale | 2.4 | 47.7 | 4.7 | 5.5 | 10.9 | 337.2 | 2.0 | 1.1 | 2.4 | 47.7 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Total current assets | 4,979.5 | 3,324.2 | 1,343.4 | 1,533.1 | 1,409.0 | 3,626.8 | 2,822.9 | 3,634.6 | 4,979.5 | 3,324.2 | ||||||||||||||||||||||||||||||

Property and equipment | 10,982.8 | 11,807.1 | 5,928.0 | 4,948.4 | 4,196.6 | 10,498.1 | 10,938.7 | 10,773.1 | 10,982.8 | 11,807.1 | ||||||||||||||||||||||||||||||

Other non-current assets | 6,668.8 | 7,195.0 | 377.3 | 304.4 | 166.4 | 5,073.3 | 4,339.8 | 6,076.7 | 6,668.8 | 7,195.0 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Total non-current assets | 17,651.6 | 19,002.1 | 6,305.3 | 5,252.8 | 4,363.0 | 15,571.4 | 15,278.5 | 16,849.8 | 17,651.6 | 19,002.1 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Total assets | 22,631.1 | 22,326.3 | 7,648.7 | 6,785.9 | 5,772.0 | 19,198.2 | 18,101.4 | 20,484.4 | 22,631.1 | 22,326.3 | ||||||||||||||||||||||||||||||

Total current liabilities | 6,509.1 | 6,297.5 | 2,322.1 | 2,144.0 | 1,523.3 | 6,222.2 | 5,641.0 | 5,829.7 | 6,509.1 | 6,297.5 | ||||||||||||||||||||||||||||||

Total non-current liabilities | 10,795.6 | 10,808.1 | 3,869.2 | 3,341.8 | 3,142.7 | 8,790.7 | 9,522.9 | 10,151.0 | 10,795.6 | 10,808.1 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Total liabilities | 17,304.7 | 17,105.6 | 6,191.3 | 5,485.8 | 4,666.0 | 15,012.9 | 15,163.9 | 15,980.7 | 17,304.7 | 17,105.6 | ||||||||||||||||||||||||||||||

Issued Capital | 2,389.4 | 1,501.0 | 473.9 | 453.4 | 453.4 | |||||||||||||||||||||||||||||||||||

Issued capital | 3,149.6 | 2,545.7 | 2,545.7 | 2,389.4 | 1,501.0 | |||||||||||||||||||||||||||||||||||

Net equity attributable to the parent company’s equity holders | 5,238.8 | 5,112.1 | 1,445.3 | 1,296.8 | 1,098.8 | 4,096.7 | 2,856.5 | 4,401.9 | 5,238.8 | 5,112.1 | ||||||||||||||||||||||||||||||

Minority interest | 87.6 | 108.6 | 12.0 | 3.2 | 7.1 | |||||||||||||||||||||||||||||||||||

Non-controlling interest | 88.6 | 81.0 | 101.8 | 87.7 | 108.6 | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Total net equity | 5,326.5 | 5,220.7 | 1,457.4 | 1,300.1 | 1,105.9 | 4,185.3 | 2,937.5 | 4,503.7 | 5,326.5 | 5,220.7 | ||||||||||||||||||||||||||||||

Shares Outstanding | 606,407,693 | 545,547,819 | 545,547,819 | 535,243,229 | 479,107,860 | |||||||||||||||||||||||||||||||||||

| (1) | For more information on the |

| (2) | The addition of the items may differ from the total amount due to rounding. |

| (3) | Other operating income included in this Statement of Income Data is equivalent to the sum of income derived from |

(*)Law No. 20,780 issued on September 29, 2014, introduced modifications to the income tax system in Chile and other tax matters. On October 17, 2014 the Chilean Superintendence of Securities and Insurance (the “SVS”) issued Circular No. 856, which established that the effects of the change in the income tax rates on deferred tax assets and liabilities must be recognized directly on the Balance Sheet within “Retained earnings” instead of on the Income Statement as required by IAS 12. In order to comply with IAS 12, the financial statements in this document for the period ended December 31, 2014 are different from those presented to the SVS as the modifications introduced by Law No. 20,780 have been recognized within the income statement. For more information on the reconciliation of such differencessee Note 2.1 and Note 18 to our audited consolidated financial statements.

The table below presents LATAM’s unaudited operating data of LATAM as at and for the year ended December 31, 2009, 2010, 2011 (which represents LAN’s historical unaudited operating data), as atof and for the year ended December 31, 2012 (which includes TAM’s unaudited operating data since June 23, 2012), and as atof and for the yearyears ended December 31, 2013.2013, December 31, 2014, December 31, 2015 and December 31, 2016. LATAM believes this operating data is useful to reportin reporting the operating performance of its business and may be used by certain investors in evaluating companies operating in the global air transportation sector. However, these measures may differ from similarly titled measures reported by other companies, and should not be considered in isolation or as a substitute for measures of performance in accordance with IFRS. This unaudited operating data is not included in or derived from LATAM’s financial statements.

| For the year ended and as at December 31, | ||||||||||||||||||||

| Operating Data: | 2013 | 2012(1) | 2011 | 2010 | 2009 | |||||||||||||||

ASKs (million) | 131,690.7 | 93,319.2 | 48,153.6 | 42,355.2 | 38,776.2 | |||||||||||||||

RPKs (million) | 106,466.4 | 74,694.9 | 38,422.9 | 33,147.5 | 29,836.2 | |||||||||||||||

ATKs (million) | 7,651.9 | 6,449.6 | 5,192.7 | 4,628.7 | 3,848.9 | |||||||||||||||

RTKs (million) | 4,466.7 | 4,044.5 | 3,612.4 | 3,245.3 | 2,627.4 | |||||||||||||||

ASK Equivalent (million) | 212,236.8 | 161,209.3 | 102,813.6 | 91,078.4 | 79,290.9 | |||||||||||||||

Although most of our revenues and expenses are denominated in U.S. dollars, some are denominated in different currencies, such as the Chilean peso or the Brazilian real. Fluctuations in foreign exchange rates could lead to changes in the value of these items in U.S. dollars. Nevertheless, the impact on our results stemming from any such fluctuations is partially mitigated by the fact that 42% of our revenues and 60% of our operating expenses for the year ended December 31, 2013 are denominated in U.S. dollars.

LATAM Unaudited Pro Forma Financial Information

The unaudited pro forma statement of income data for the year ended December 31, 2012 combines the historical consolidated statements of income of LAN and TAM, giving effect to the combination as if it had been consummated on January 1, 2012. The table below compares the actual financial information of LATAM as of December 31, 2013 with the unaudited pro forma financial information of LATAM as at December 31, 2012.

The unaudited pro forma information has been prepared using the purchase method of accounting, with LAN treated as the acquirer of TAM. A reconciliation of the unaudited LATAM Pro Forma Financial Information to LATAM’s audited consolidated income statements for the year ended December 31, 2012, which have been prepared in accordance with IFRS, is included under “Item 5. Operating and Financial Review and Prospects—A. Operating Results—LATAM Airlines Group Financial Results Discussion: Year ended December 31, 2013 (Actual) compared to year ended December 31, 2012 (Pro forma)—Pro Forma Adjustments.”

The LATAM unaudited Pro Forma Financial Information is provided for illustrative purposes only and does not purport to represent what the actual consolidated results of operations or the consolidated financial position of LATAM would have been had the proposed combination occurred on the date assumed, nor are they necessarily indicative of future consolidated results of operations or consolidated financial position of LATAM.

LATAM has incurred and expects to incur significant costs in the future associated with integrating the operations of LAN and TAM. The LATAM unaudited Pro Forma Financial Information does not reflect the costs of any integration activities that had not already been incurred as of dates for which financial information is presented or benefits that may result from realization of future cost savings from operating efficiencies or revenue synergies expected to result from the proposed combination. You should read the unaudited pro forma financial information below in conjunction with our audited consolidated financial statements and the notes thereto, as well as “Item 5. Operating and Financial Review and Prospects—A. Operating Results—LATAM Airlines Group Financial Results Discussion: Year ended December 31, 2013 (Actual) compared to year ended December 31, 2012 (Pro forma)—Pro Forma Adjustments,” “Presentation of Information” and “Item 5. Operating and Financial Review and Prospects.”

The Company(2)(3) Statement of Income Data: Operating revenues Passenger Cargo Total operating revenues Cost of sales Gross margin Other operating income(4) Distribution costs Administrative expenses Other expenses Other gains/(losses) Financial income Financial costs Equity accounted earnings Exchange rate differences Result of indexation units Income before income taxes Income tax Net income for the period Income attributable to the parent company’s equity holders Income attributable to non-controlling interests Net income for the period Earnings per share(5) Average number of Shares Basic earnings per share (US$) Diluted earnings per share(US$) Year ended December 31, 2013 2012(1) (actual) (pro forma) 11,061.6 11,017.0 1,863.0 1,939.8 12,924.5 12,956.7 (10,054.2 ) (10,536.7 ) 2,870.4 2,420.1 341.6 265.4 (1,025.9 ) (1,059.7 ) (1,136.1 ) (1,174.8 ) (408.7 ) (364.5 ) (55.4 ) (34.8 ) 72.8 117.2 (462.5 ) (444.2 ) 2.0 1.0 (482.2 ) (290.1 ) 0.2 (0.0 ) (283.9 ) (564.5 ) 20.1 69.7 (263.8 ) (494.9 ) (281.1 ) (523.1 ) 17.3 28.3 (263.8 ) (496.7 ) 487,930,977 476,293,870 (0.57613 ) (1.26891 ) (0.57613 ) (1.26891 )

The table below compares the unaudited operating data of LATAM as at December 31, 2013 with the unaudited pro forma operating data of LATAM as at December 31, 2012, which has been prepared by adding the operating data for TAM for the period between January 1, 2012 and June 22, 2012 to LAN’s historical operating data for that period. LATAM believes this operating data is useful to report the operating performance of its business and may be used by certain investors in evaluating companies operating in the global air transportation sector. However these measures may differ from similarly titled measures reported by other companies, and should not be considered in isolation or as a substitute for measures of performance in accordance with IFRS. The unaudited operating data and the unaudited pro forma operating data is not included in or derived from LATAM’s financial statements.

ASKs (million) RPKs (million) ATKs (million) RTKs (million) ASK Equivalent (million) For the year ended and as

at December 31, Pro Forma Operating Data: 2013

(actual) 2012(1)

(pro forma) 131,690.7 132,185.9 106,466.4 103,886.1 7,651.9 7,645.9 4,466.7 4,488.3 212,236.8 212,669.5

| For the year ended and as of December 31, | ||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

Operating Data: | ||||||||||||||||||||

ASKs (million) | 134,967.7 | 134,167.1 | 130,200.9 | 131,690.9 | 132,186.0 | |||||||||||||||

RPKs (million) | 113,626.9 | 111,509.9 | 108,534.0 | 106,466.5 | 103,886.1 | |||||||||||||||

ATKs (million) | 6,704.1 | 7,082.8 | 7,219.7 | 7,651.9 | 7,645.9 | |||||||||||||||

RTKs (million) | 3,465.9 | 3,797.0 | 4,317.2 | 4,466.7 | 4,488.3 | |||||||||||||||

ASK Equivalent (million) | 205,537.5 | 208,722.5 | 206,197.9 | 212,237.0 | 212,669.6 | |||||||||||||||

Dividend Policy

In accordance with theLey sobre Sociedades Anónimas No. 18,046 (Chilean(“Chilean Corporation Act)Act”) andReglamento de Sociedades Anónimas(“Regulation to the Chilean Corporation Act)Act”) (collectively, the “Chilean Corporation Law”), we must pay annual cash dividends equal to at least 30.0% of our annual consolidated distributable net income eachfor the prior year, (calculated in accordance with IFRS), subject to limited exceptions. LATAM Airlines Group’s board of directors has the authority to declare interim dividends.Year-end dividends, if any, are declared by our shareholders at our annual meeting. For a description of our dividend policy, see “Item 8. Financial Information—A. Consolidated Financial Statements and Other Financial Information—Dividend Policy” and “Item 10. Additional Information—B. Memorandum and Articles of Association—Dividend and Liquidation Rights.”Rights”. LATAM did not pay an interim dividenddividends in 2013.2014, 2015 or 2016. Dividend reserves of US$20,766,199 have been set aside in 2016, to be paid in 2017.

We declare cash dividends in U.S. dollars, but make dividend payments in Chilean pesos, converted from U.S. dollars at the observed exchange rate two business days prior to the day we first make payment to shareholders. Payments of cash dividends to holders of ADRs,ADSs, if any, are made in Chilean pesos to the custodian, which converts those Chilean pesos into U.S. dollars and delivers U.S. dollars to the depositary for distribution to holders. In the event that the custodian is unable to convert immediately the Chilean currency received as dividends into U.S. dollars, theThe amount of U.S. dollars payabledistributed to holders of ADRsADSs may be adversely affected by a devaluation of the Chilean currency that may occur before such dividends are converted and remitted.

LATAM’s Dividend Payments

The table below sets forth the cash dividends per common share and per ADS paid by LATAM, as well as the number of common shares entitled to such dividends, for the years indicated. Dividends per common share amounts have not been adjusted for inflation and reflect common share amounts outstanding immediately prior to the distribution of such dividend.

Dividend for year: | Payment date(s) | Total dividend payment | Number of common shares entitled to dividend | Cash dividend per common share | Cash dividend per ADS | |||||||||||||||

| (U.S. dollars) | (in millions) | (U.S. dollars) | (U.S. dollars) | |||||||||||||||||

2009 | August 20, 2009 | 34,621,043 | 338.79 | 0.10219 | 0.10219 | |||||||||||||||

| January 21, 2010 | 70,000,978 | 338.79 | 0.20662 | 0.20662 | ||||||||||||||||

| May 20, 2010 | 10,939,558 | 338.79 | 0.03229 | 0.03229 | ||||||||||||||||

2010 | August 19, 2010 | 74,466,242 | 338.79 | 0.21980 | 0.2198 | |||||||||||||||

| January 13, 2011 | 125,000,294 | 338.79 | 0.36896 | 0.36896 | ||||||||||||||||

| April 29, 2011 | 10,386,295 | 339.31 | 0.03061 | 0.03061 | ||||||||||||||||

2011 | September 15, 2011 | 56,594,769 | 339.36 | 0.16677 | 0.16677 | |||||||||||||||

| January 12, 2012 | 85,000,207 | 340.16 | 0.24988 | 0.24988 | ||||||||||||||||

| May 17 , 2012 | 18,461,735 | 341.00 | 0.05414 | 0.05414 | ||||||||||||||||

2012 | May 17, 2013 | 3,288,125 | 483,55 | 0.00680 | 0.00680 | |||||||||||||||

Chilean Peso Exchange Rates

The following table sets forth, for the periods indicated, the high, low, average andperiod-end observed exchange rate for the purchase of U.S. dollars, expressed in Chilean pesos per U.S. dollar. The rates have not been restated in constant currency units. On April 25, 2014February 28, 2017 the observed exchange rate was Ch$559.67=645.19 = US$1.00.

| Daily Observed Exchange Rate | ||||||||||||||||

Year Ended December 31, | High | Low | Average(1) | Period-End | ||||||||||||

| Ch$ per US$ | ||||||||||||||||

2012 | 519.69 | 469.65 | 486.75 | 478.60 | ||||||||||||

2013 | 533.95 | 466.50 | 495.00 | 523.76 | ||||||||||||

2014 | 621.41 | 524.61 | 570.01 | 607.38 | ||||||||||||

2015 | 715.66 | 597.10 | 654.25 | 707.34 | ||||||||||||

2016 | 730.31 | 645.22 | 676.83 | 669.47 | ||||||||||||

2016 | ||||||||||||||||

October | 670.88 | 651.65 | 663.92 | 651.65 | ||||||||||||

November | 679.24 | 650.72 | 666.12 | 675.48 | ||||||||||||

December | 677.11 | 649.40 | 667.17 | 669.47 | ||||||||||||

2017 | ||||||||||||||||

Year Ended December 31, 2008 2009 2010 2011 2012 2013 September October November December 2014 January February March April(2) Year Ended December 31, January February Daily Observed Exchange Rate High Low Average (1) Period-End Ch$ per US$ 676.75 431.22 528.88 629.11 643.87 491.09 553.77 506.43 549.17 468.37 511.20 468.37 533.74 455.91 483.67 521.46 519.69 469.65 486.75 478.60 495.34 534.12 467.05 525.45 510.38 496.49 504.57 502.97 508.58 493.36 500.81 508.58 528.19 507.64 519.25 528.19 533.95 523.76 529.45 524.01 550.53 524.61 537.03 547.22 563.32 546.94 554.41 563.32 573.24 550.53 563.84 550.53 563.76 544.96 553.72 559.67 Daily Observed Exchange Rate High Low Average(1) Period-End Ch$ per US$ 673.36 648.31 661.19 648.87 646.97 638.35 643.21 645.19

Source: Central Bank of Chile

| (1) | For each year, the average |

Brazilian Exchange Rates

TAM maintains its accounting records and prepares its financial statements in Brazilian reais. The following tables set forth, for the periods indicated, the high, low, average and period-end observed exchange rate for the purchase of U.S. dollars, expressed in Brazilian reais per U.S. dollar. The rates have not been restated in constant currency units. On April 25, 2014 the observed exchange rate was R$2.231 = US$1.00.

| Daily Observed Exchange Rate | ||||||||||||||||

Year Ended December 31, | High | Low | Average (1) | Period-End | ||||||||||||

| R$ per US$ | ||||||||||||||||

2009 | 2.422 | 1.702 | 1.998 | 1.741 | ||||||||||||

2010 | 1.881 | 1.655 | 1.759 | 1.666 | ||||||||||||

2011 | 1.902 | 1.535 | 1.675 | 1.876 | ||||||||||||

2012 | 2.112 | 1.702 | 1.955 | 2.043 | ||||||||||||

2013 | 2.454 | 1.944 | 2.161 | 2.362 | ||||||||||||

September | 2.390 | 2.203 | 2.270 | 2.230 | ||||||||||||

October | 2.210 | 2.160 | 2.190 | 2.203 | ||||||||||||

November | 2.340 | 2.240 | 2.300 | 2.325 | ||||||||||||

December | 2.380 | 2.310 | 2.350 | 2.342 | ||||||||||||

2014 | ||||||||||||||||

January | 2.440 | 2,330 | 2,380 | 2,430 | ||||||||||||

February | 2.420 | 2.330 | 2.380 | 2.330 | ||||||||||||

March | 2.360 | 2.260 | 2.330 | 2.260 | ||||||||||||

April(2) | 2.280 | 2.168 | 2.232 | 2.231 | ||||||||||||

Source: Central Bank of Brazil

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

We wish to caution readers that theThe following important factors, and those important factors described in other reports submittedwe submit to or filedfile with the Securities and Exchange Commission (“SEC”) among other factors,, could affect our actual results and could cause our actual results to differ materially from those expressed in any forward-looking statements made by us or on our behalf. In particular, as we are anon-U.S. company, there are risks associated with investing in our ADSs that are not typical for investments in the shares of U.S. companies. Prior to making an investment decision, you should carefully consider all of the information contained in this document, including the following risk factors.

RisksRisk Factors Relating to the Combination of LAN and TAM

LATAM Airlines Group may be unable to fully realize the anticipated benefits of the combination of LAN and TAM

In June 2012, LAN and TAM completed its business combination, which has required significant efforts in order to integrate both business practices and operations. The success of the combination will depend, in part, on the ability of LATAM Airlines Group to realize anticipated revenue synergies, cost savings and growth opportunities by combining the businesses of LAN and TAM. There is a risk, however, that LATAM Airlines Group may not be able to combine the businesses of LAN and TAM in a manner that permits LATAM Airlines Group to realize these revenue synergies, cost savings and growth opportunities in the time, manner or amounts it expects. Potential difficulties include the increased complexity associated with managing both companies, the need to integrate procedures and systems, potential loss of key employees, coordination, and potential unknown liabilitites and one-time costs related to the business combination. In addition, the fact that LAN and TAM will continue to operate with different airline certificates may introduce other complexities in terms of the diversion of management’s attention; and each company’s standards, controls and procedures,

If LATAM fails to achieve the planned restructuring effectively within the time frame that is currently contemplated or to the extent that is currently planned, or if for any other reason the expected revenue synergies, cost savings and growth opportunities fail to materialize, the combination may not produce the benefits LATAM anticipates. As of December 2013 the merged company has established numerous initiatives in order to integrate both companies and generate the estimated synergies, but we cannot assure you that these initiatives will be successful.

LATAM has incurred and will continue to incur significant costs and expenses in connection with the combination and integration of the business operations of LAN and TAM

LATAM has incurred and will continue to incur expenses in connection with the combination and the integration of LAN and TAM. In 2012 and 2013, LATAM incurred US$59.2 and US$56.0 million, respectively, of non-recurring expenses in connection with the business combination and integration of LAN and TAM, principally relating to consulting fees and travel expenses. These costs and expenses included financial advisory, legal, accounting, consulting and other advisory fees and expenses, reorganization and restructuring costs, severance/employee benefit-related expenses, filing fees, printing expenses and other related charges. There are also a large number of processes, policies, procedures, operations, technologies and systems that must be integrated in connection with the combination. Any delay in the integration of the business operations of LAN and TAM or factors beyond LATAM’s control could affect the total amount or the timing of the integration and implementation expenses.

If additional unanticipated significant costs are incurred in connection with the combination or integration of these businesses, such costs and expenses could, particularly in the near term, exceed the savings that LATAM expects to achieve from the elimination of duplicative expenses and the realization of economies of scale, other efficiencies and cost savings. Although LATAM expects to achieve savings and economies of scale sufficient to offset these integration and implementation costs over time, this net benefit may not be achieved in the near term or at all.our Company

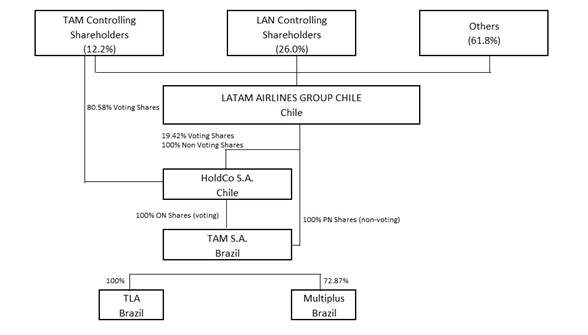

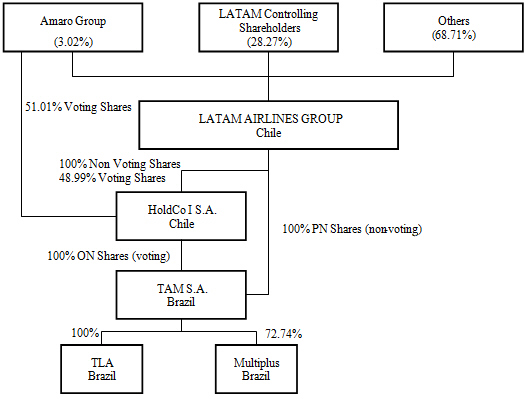

LATAM does not control the voting shares or board of directors of TAM

FollowingDue to Brazilian law restrictions on foreign ownership of Brazilian airlines, LATAM does not control the combinationvoting shares or board of LAN and TAM:directors of TAM. As of February 28, 2017, the ownership structure of TAM is as follows:

As a result of this ownership structure:

LATAM Airlines Group and TEP Chile and other parties have entered into shareholders’ agreements that establish agreements and restrictions relating to corporate governance in an attempt to balance LATAM’s interests, as the owner of substantially all of the economic rights in TAM, and the TAM controlling shareholders, as the continuing controlling shareholders of TAM under Brazilian law. See “Item 7. Controlling Shareholders and Related Party Transactions A. Major Shareholders—Shareholders’ Agreements.” These shareholders’ agreements prohibit the taking of certain specified material corporate actions and decisions without prior supermajority approval of the shareholders (5/6 of the total of the shareholders) and/or the board of directors of Holdco I or TAM. However, no assurances can be given that LATAM and the TAM controlling shareholders will be able to reach an agreement with respect to suchTAM. Certain specified actions require supermajority voting or board mattersapproval, which in the future and ifturn means they do not, the businesses, financial condition, results of operations and prospects of the combined companies could be adversely affected. In addition, pursuant to these shareholder agreements, neither Holdco I, TAM nor TAM’s subsidiaries may take certain actions without the prior approval of a supermajority of the board of directors and/or the shareholders of Holdco I or TAM. As a result of these supermajority requirements, these actions will effectively require the prior approval of both LATAM and TEP Chile (which is wholly owned by the TAM controlling shareholders). ActionsChile. Examples of actions requiring supermajority approval by the board of directors of Holdco I or TAM include, among others, entering into acquisitions or business collaborations, amending or approving budgets, business plans, financial statements and accounting policies, incurring indebtedness, encumbering assets, entering into certain agreements, making certain investments, modifying rights or claims, entering into settlements, appointing executives, creating security interests, issuing, redeeming or repurchasing securities and voting on matters as a shareholder of subsidiaries affiliates

of TAM. Actions requiring supermajority shareholder approval of Holdco I or TAM include, among others, certain changes to theby-laws of Holdco I, TAM or TAM’s subsidiariesaffiliates or any dissolution/liquidation, corporate reorganization, payment of dividends, issuance of securities, disposal or encumbrance of certain assets, creation of securities interestsecurity interests or entering into guarantees and agreements with related parties. For more information on the shareholders’ agreements, see “Item 7. Controlling Shareholders and Related Party Transactions—Shareholders’ Agreements.”

Our assets include a significant amount of goodwill.

TheOur assets of the LATAM Airlines Group included US$3,7282,710.4 million of goodwill as of December 31, 2013,2016, US$3,5642,582.5 million of which results from the merger withcombination of LAN and TAM. Under IFRS, goodwill is subject to an annual impairment test and may be required to be tested more frequently if events or circumstances indicate a potential impairment. In 2016, mainly as a result of the appreciation of the Brazilian real against the U.S. dollar, the value of our goodwill increased by 18.8% as compared with 2015. Any impairment could result in the recognition of a significant charge to earnings in LATAM’sour statement of income, which could materially and adversely impact our consolidated results for the period in which the impairment occurs.

A failure to successfully implement our strategy or a failure adjusting the strategy to the current economic situation would harm our business and the market value of our ADSs and common shares.

We have developed a strategic plan with the goal of becoming one of the best airlines in the world and renewing our commitment to sustained profitability and superior returns to shareholders. Our strategy requires us to identify value propositions that are attractive to our clients, to find efficiencies in our daily operations, and to transform ourselves into a stronger and more risk-resilient company. A tenet of our strategic plan is the adoption of a new travel model for domestic services in the six countries where we have domestic operations to address the changing dynamics of customers and the industry, and to increase our competitiveness. The financialnew travel model is based on a continued reduction in air fares that makes air travel accessible to a wider audience, and in particular to those wish to fly more frequently. This model requires continued cost reduction efforts, and in order to achieve this the Company is implementing a series of initiatives to reduce cost per ASK in all its domestic operations.

Difficulties in implementing our strategy may adversely affect our business, results of LATAM are more exposedoperation and the market value of our ADSs and common shares.

A failure to foreign currency fluctuations followingsuccessfully transfer the value proposition of the LAN and TAM brands to a new single brand, may adversely affect our business and the market value of our ADSs and common shares.

Following the combination in 2012, LAN and TAM continued to operate with TAM.

The financial results of LATAM are more exposed to currency exchange rate fluctuations as a result oftheir original brands. During 2016, we began the combination with TAM and the resulting increase in the proportion of its assets, liabilities and earnings that are denominated in currencies other than U.S. dollars.

LATAM prepares and presents its consolidated financial statements in U.S. dollars, which was the functional and presentation currency of LAN. The combinationtransition of LAN and TAM has significantly increasesinto a single brand. LAN and TAM had different value propositions, and there can be no assurances that we will be able to fully transfer the proportionvalue of LATAM’s consolidated net assets, revenuesthe original LAN and incomeTAM brands to our new single brand “LATAM”. Difficulties in non-U.S. dollar currencies, primarily Chileanpesosimplementing our single brand may prevent us from consolidating as a customer preferred carrier and Brazilianreais. In particular, the majority of TAM’s revenues are denominated in Brazilian reais, while a significant portion of its operating expenses are denominated in, or linked to, the U.S. dollar or other foreign currencies. The consolidated financial conditionmay adversely affect our business and results of operations of LATAM will therefore be more sensitive to movements in exchange rates between the U.S. dollar and other currencies. A depreciation of non-U.S. dollar currencies relative to the U.S. dollar could have an adverse impact on the financial condition, results of operations and prospects of LATAM.

Following the combination, Fitch Ratings Inc. (“Fitch”) lowered LATAM’s credit rating. This downgrade, or further downgrades from securities rating agencies, could have a negative effect on LAN’s business

Prior to the combination, TAM had a lower credit rating and was more leveraged than LAN. Following the combination, Fitch Ratings Inc. downgraded LATAM Airlines Group S.A.’s long-term foreign currency issuer default rating from BBB to BB+, which is below investment grade. Later, on May 3, 2013, Fitch downgraded LATAM’s rating again, to BB, citing the Company’s operational performance and the deteriorationmarket value of its capital structure. The Fitch downgradeour ADSs and any further securities rating agencies downgrades could increase LATAM’s financing costs and affect LATAM’s ability to finance future fleet acquisitions and could adversely affect the financial condition, results of operations and prospects of the combined companies.common shares.

It may take time to combine the frequent flyer programs of LAN and TAMTAM.

We have integrated the separate frequent flyer programs of LAN and TAM each previously ran their own frequent flyer programs. While LATAM has integrated these programs so that passengers can use frequent flyer miles earned with either LAN or TAM interchangeably,interchangeably. During 2016, LAN and TAM announced their revamped frequent flyer programs, which have new names: LATAM Pass and LATAM Fidelidade, respectively. The change is part of the process of consolidating the airline group’s new brand identity (LATAM) and the evolution of the programs, which enhances existing benefits and introduces new benefits for program members. However, there is no guarantee that full integration of the two plans will be completed in the near term or at all. Even if the integration occurs, the successful integration of these programs will involve some time and expense. Moreover, during 2016, LATAM Pass and LATAM Fidelidade approved changes in their mileage earning policy which may impact the attractiveness of the programs to passengers. Until LATAMwe effectively combinescombine these programs, passengers may prefer frequent flyer programs offered by other airlines, which may adversely affect our business.

TAM has leftOur financial results are exposed to foreign currency fluctuations.

We prepare and present our consolidated financial statements in U.S. dollars. LATAM and its affiliates operate in numerous countries and face the Star Alliancerisk of variation in foreign currency exchange rates against the U.S. dollar or between the currencies of these various countries. Changes in the exchange rate between the U.S. dollar and become a member of the oneworld® airline alliance. This changecurrencies in the countries in which we operate could adversely affect LATAM’sour business, financial condition and results of operations.. If the value of the Brazilian real, Chilean peso or other currencies in which revenues are denominated declines against the U.S. dollar, our results of operations and financial condition will be affected. The exchange rate of the Chilean peso, Brazilian real and other currencies against the U.S. dollar may fluctuate significantly in the future.

Changes in Chilean, Brazilian and other governmental economic policies affecting foreign exchange rates could also adversely affect our business, financial condition, results of operations and the return to our shareholders on their common shares or ADSs.

We depend on strategic alliances or commercial relationships in many of the countries in which we operate, and our business may suffer if clients prefer other alliances.any of our strategic alliances or commercial relationships terminates.

We maintain a number of alliances and other commercial relationships in many of the jurisdictions in which LATAM announcedand its affiliates operate. These alliances or commercial relationships allow us to enhance our network and, in some cases, to offer our customers services that we could not otherwise offer. If any of our strategic alliances or commercial relationships, deteriorates, or any of these agreements are terminated, our business, financial condition and results of operations could be adversely affected.

Our business and results of operations may suffer if we fail to obtain and maintain routes, suitable airport access, slots and other operating permits.

Our business depends upon our access to key routes and airports. Bilateral aviation agreements between countries, open skies laws and local aviation approvals frequently involve political and other considerations outside of our control. Our operations could be constrained by any delay or inability to gain access to key routes or airports, including:

We operate numerous international routes, subject to bilateral agreements, and also internal flights within Chile, Peru, Brazil, Argentina, Ecuador, Colombia and other countries, subject to local route and airport access approvals. See “Item 4. Information on the Company—B. Business Overview—Regulation.”

There can be no assurance that TAM will leave Star Alliance and become a member ofoneworld® airline alliance. On October 1, 2013 LATAM ratifiedoneworld® as the global alliance for its airline members. With this decision, TAM left Star Alliance on March 30, 2014 and joinedoneworld® on March 31, 2014, complyingexisting bilateral agreements with the requirement imposedcountries in which our companies are based and permits from foreign governments will continue. A modification, suspension or revocation of one or more bilateral agreements could have a material adverse effect on our business, financial condition and results of operations. The suspension of our permission to operate in certain airports, destinations or slots, or the imposition of other sanctions could also have a material adverse effect. A change in the administration of current laws and regulations or the adoption of new laws and regulations in any of the countries in which we operate that restrict our route, airport or other access may have a material adverse effect on our business, financial condition and results of operations.

A significant portion of our cargo revenue comes from relatively few product types and may be impacted by events affecting their production, trade or demand.

Our cargo demand, especially from Latin American exporters, is concentrated in a small number of product categories, such as exports of fish, sea products and fruits from Chile, and asparagus from Peru, and exports of fresh flowers from Ecuador and Colombia. Events that adversely affect the production, trade or demand for these goods may adversely affect the volume of goods that we transport and may have a significant impact on our results of operations. Some of our cargo products are sensitive to foreign exchange rates and, therefore, traffic volumes could be impacted by the appreciation or depreciation of local currencies.

Our operations are subject to fluctuations in the supply and cost of jet fuel, which could adversely impact our business.

Higher jet fuel prices could have a materially adverse effect on our business, financial condition and results of operations. Jet fuel costs have historically accounted for a significant amount of our operating expenses, and accounted for 23.0% of our operating expenses in 2016. Both the cost and availability of fuel are subject to many economic and political factors and events that we can neither control nor predict. We have entered into fuel hedging arrangements, but there can be no assurance that such arrangements will be adequate to protect us from an increase in fuel prices in the near future or in the long term. Also, while these hedging arrangements are designed to limit the effect of an increase in fuel prices, our hedging methods may also limit our ability to take advantage of any decrease in fuel prices, as was the case in 2015 and, to a lesser extent, in 2016. Although we have implemented measures to pass a portion of incremental fuel costs to our customers, our ability to lessen the impact of any increase in fuel costs using these types of mechanisms may be limited.

We rely on maintaining a high aircraft utilization rate to increase our revenues and absorb our fixed costs, which makes us especially vulnerable to delays.

A key element of our strategy is to maintain a high daily aircraft utilization rate, which measures the number of flight hours we use our aircraft per day. High daily aircraft utilization allows us to maximize the amount of revenue we generate from our aircraft and

absorb the fixed costs associated with our fleet and is achieved, in part, by reducing turnaround times at airports and developing schedules that enable us to increase the average hours flown per day. Our rate of aircraft utilization could be adversely affected by a number of different factors that are beyond our control, including air traffic and airport congestion, adverse weather conditions, unanticipated maintenance and delays by third-party service providers relating to matters such as fueling and ground handling. If an aircraft falls behind schedule, the resulting delays could cause a disruption in our operating performance.

We fly and depend upon Airbus and Boeing aircraft, and our business could suffer if we do not receive timely deliveries of aircraft, if aircraft from these companies becomes unavailable or if the public negatively perceives our aircraft.

As our fleet has grown, our reliance on Airbus and Boeing has also grown. As of December 31, 2016, LATAM Airlines Group has a fleet of 250 Airbus and 82 Boeing aircraft. Risks relating to Airbus and Boeing include:

The occurrence of any one or more of these factors could restrict our ability to use aircraft to generate profits, respond to increased demands, or could otherwise limit our operations and adversely affect our business.

If we are unable to incorporate leased aircraft into our fleet at acceptable rates and terms in connection withthe future, our business could be adversely affected.

A large portion of our aircraft fleet is subject to long-term operating leases. Our operating leases typically run from three to 12 years from the date of delivery. We may face more competition for, or a limited supply of, leased aircraft, making it difficult for us to negotiate on competitive terms upon expiration of our current operating leases or to lease additional capacity required for our targeted level of operations. If we are forced to pay higher lease rates in the future to maintain our capacity and the number of aircraft in our fleet, our profitability could be adversely affected.

Our business may be adversely affected if we are unable to service our debt or meet our future financing requirements.

We have a high degree of debt and payment obligations under our aircraft operating leases and financial debt arrangements. We require significant amounts of financing to meet our aircraft capital requirements and may require additional financing to fund our other business needs. We cannot guarantee that we will have access to or be able to arrange for financing in the future on favorable terms. Following the combination with TAM. The withdrawal from the Star Alliance may impede LATAM from providing customers with exactly the same benefits previously provided byof LAN and TAM, suchFitch Ratings Inc. and Standard and Poor’s downgraded LATAM Airlines Group S.A.’s credit rating to levels that are below investment grade. Any further securities rating agencies downgrades could increase our financing costs. Higher financing costs could affect our ability to expand or renew our fleet, which in turn could adversely affect our business.

In addition, the majority of our property and equipment is subject to liens securing our indebtedness. In the event that we fail to make payments on secured indebtedness, creditors’ enforcement of liens could limit or end our ability to use the affected property and equipment to fulfill our operational needs and thus generate revenue.

Moreover, external conditions in the financial and credit markets may limit the availability of funding at particular times or increase its costs, which could adversely affect our profitability, our competitive position and result in lower net interest margins, earnings and cash flows, as well as lower returns on shareholders’ equity and invested capital. Factors that may affect the same travel destinations, combinedavailability of funding or cause an increase in our funding costs include global macro-economic crises, reduction of our credit rating, and other potential market disruptions.

We have significant exposure to LIBOR and other floating interest rates; increases in interest rates will increase our financing costs and may have adverse effects on our financial condition and results of operations.

We are exposed to the risk of interest rate variations, principally in relation to the U.S. dollar London Interbank Offer Rate (“LIBOR”). Many of our operating and financial leases are denominated in U.S. dollars and bear interest at a floating rate. 36.9% of our outstanding consolidated debt as of December 31, 2016 bears interest at a floating rate after giving effect to interest rate hedging agreements. Volatility in LIBOR or other reference rates could increase our periodic interest and lease payments and have an adverse effect on our total financing costs. We may be unable to adequately adjust our prices to offset any increased financing costs, which would have an adverse effect on our revenues and our results of operations.

Increases in insurance costs and/or significant reductions in coverage could harm our financial condition and results of operations.

Major events affecting the aviation insurance industry (such as terrorist attacks, hijackings or airline crashes) may result in significant increases of airlines’ insurance premiums or in significant decreases of insurance coverage, as occurred after the September 11, 2001 terrorist attacks. Increases in insurance costs and/or significant reductions in coverage could harm our financial condition and results of operations and increases the risk that we experience uncovered losses.

Problems with air traffic control systems or other technical failures could interrupt our operations and have a material adverse effect on our business.

Our operations, including our ability to deliver customer service, are dependent on the effective operation of our equipment, including our aircraft, maintenance systems and reservation system, itinerary flexibility, among others.systems. Our operations are also dependent on the effective operation of domestic and international air traffic control systems and the air traffic control infrastructure by the corresponding authorities in the markets in which we operate. Equipment failures, personnel shortages, air traffic control problems and other factors that could interrupt operations could adversely affect our operations and financial results as well as our reputation.

We depend on a limited number of suppliers for certain aircraft and engine parts.

We depend on a limited number of suppliers for aircraft, aircraft engines and many aircraft and engine parts. As a result, we are vulnerable to any problems associated with the supply of those aircraft, parts and engines, including design defects, mechanical problems, contractual performance by the suppliers, or adverse perception by the public that would result in customer avoidance or in actions by the aviation authorities resulting in an inability to operate our aircraft.

Our business relies extensively on third-party service providers. Failure of these parties to perform as expected, or interruptions in our relationships with these providers or their provision of services to us, could have an adverse effect on our financial position and results of operations.

We have engaged a significant number of third-party service providers to perform a large number of functions that are integral to our business, including regional operations, operation of customer service call centers, distribution and sale of airline seat inventory, provision of information technology infrastructure and services, provision of aircraft maintenance and repairs, catering, ground services, and provision of various utilities and performance of aircraft fueling operations, among other vital functions and services. We do not directly control these third-party service providers, although we do enter into agreements with many of them that define expected service performance. Any of these third-party service providers, however, may materially fail to meet their service performance commitments, may suffer disruptions to their systems that could impact their services, or the agreements with such providers may be terminated. For example, flight reservations booked by customers and/or travel agencies via third-party GDSs (Global Distribution Systems) may be adversely affected by disruptions in our business relationships with GDS operators. Such disruptions, including a failure to agree upon acceptable contract terms when contracts expire or otherwise become subject to renegotiation, may cause the carriers’ flight information to be limited or unavailable for display, significantly increase fees for both us and GDS users, and impair our relationships with customers and travel agencies. The failure of any of our third-party service providers to adequately perform their service obligations, or other interruptions of services, may reduce our revenues and increase our expenses or prevent us from operating our flights and providing other services to our customers. In addition, our business, financial performance and reputation could be materially harmed if our customers believe that our services are unreliable or unsatisfactory.

Disruptions or security breaches of our information technology infrastructure or systems could interfere with our operations, compromise passenger or employee information, and expose us to liability, possibly causing our business and reputation to suffer.

A serious internal technology error or failure impacting systems hosted internally at our data centers or externally at third-party locations, or large-scale interruption in technology infrastructure we depend on, such as power, telecommunications or the internet, may disrupt our technology network with potential impacton our operations. Our technology systems and related data may also be vulnerable to a variety of sources of interruption, including natural disasters, terrorist attacks, telecommunications failures, computer viruses, hackers and other security issues. While we have in place, and continue to invest in, technology security initiatives and disaster recovery plans, these measures may not be adequate or implemented properly so as to prevent a business disruption and its adverse financial and reputational consequences to our business.

In addition, as a part of our ordinary business operations, we collect and store sensitive data, including personal information of our passengers and employees and information of our business partners. The secure operation of the networks and systems on which this type of information is stored, processed and maintained is critical to our business operations and strategy. Unauthorized parties may prefer alliances offered by LATAM’s competitors,attempt to gain access to our systems or information through fraud or deception. Hardware or software we develop or acquire

may contain defects that could unexpectedly compromise information security. The compromise of our technology systems resulting in the loss, disclosure, misappropriation of, or access to, customers’, employees’ or business partners’ information could result in legal claims or proceedings, liability or regulatory penalties under laws protecting the privacy of personal information, disruption to our operations and consequently decidedamage to fly with them,our reputation, any or all of which maycould adversely affect LATAM’sour business.

Increases in our labor costs, which constitute a substantial portion of our total operating expenses, could directly impact our earnings.

Labor costs constitute a significant percentage of our total operating expenses (21.8% in 2016) and at times in our operating history we have experienced pressure to increase wages and benefits for our employees. A significant increase in our labor costs could result in a material reduction in our earnings.

Our business may experience adverse consequences if we are unable to reach satisfactory collective bargaining agreements with our unionized employees.

As of December 31, 2016, approximately 72.9% of our employees, including administrative personnel, cabin crew, flight attendants, pilots and maintenance technicians are members of unions and have contracts and collective bargaining agreements which expire on a regular basis. Our business, financial condition and results of operations could be materially adversely affected by a failure to reach agreement with any labor union representing such employees or by an agreement with a labor union that contains terms that are not in line with our expectations or that prevent us from competing effectively with other airlines.

Collective action by employees could cause operating disruptions and adversely impact our business.

Certain employee groups such as pilots, flight attendants, mechanics and our airport personnel have highly specialized skills. As a consequence, actions by these groups, such as strikes, walk-outs or stoppages, could severely disrupt our operations and adversely impact our operating and financial performance, as well as our image.

We may experience difficulty finding, training and retaining employees.

Our business is labor intensive. We employ a large number of pilots, flight attendants, maintenance technicians and other operating and administrative personnel. The airline industry has, from time to time, experienced a shortage of qualified personnel, especially pilots and maintenance technicians. In addition, as is common with most of our competitors, we may, from time to time, face considerable turnover of our employees. Should the turnover of employees, particularly pilots and maintenance technicians, sharply increase, our training costs will be significantly higher. A failure to recruit, train and retain qualified employees at a reasonable cost could materially adversely affect our business, financial condition and results of operations.

Risks Related to our Operationsthe Airline Industry and the Airline IndustryCountries in Which We Operate

Our performance is heavily dependent on economic conditions in the countries in which we do business and negativebusiness. Negative economic conditions in those countries could have an adverseadversely impact on our business.business and results of operations and cause the market price of our common shares and ADSs to decrease.