As filed with the Securities and Exchange Commission on March 10, 2015February 22, 2018

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMFORM 20-F

(Mark One)

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Or

| ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20142017

Or

| TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Or

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

| Commission file number: | ||

| RELX PLC | RELX NV | |

| (Exact name of Registrant as specified in its charter) | (Exact name of Registrant as specified in its charter) | |

| England | The Netherlands | |

| (Jurisdiction of incorporation or organisation) | (Jurisdiction of incorporation or organisation) | |

| 1-3 Strand, London, WC2N 5JR, England | Radarweg 29, 1043 NX, Amsterdam, The Netherlands | |

| (Address of principal executive offices) | (Address of principal executive offices) | |

| Henry Udow | Jans van der Woude | |

| Company Secretary | Company Secretary | |

| 1-3 Strand, London, WC2N 5JR, England | Radarweg 29, 1043 NX, Amsterdam, The Netherlands | |

| 011 44 20 7166 5500 | 011 31 20 485 2222 | |

(Name, telephone,e-mail and/or facsimile number and address of Company Contact Person) | (Name, telephone,e-mail and/or facsimile number and address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class | Name of exchange on which registered | |

| ||

American Depositary Shares | New York Stock Exchange | |

Ordinary shares of 14 51/116p each | New York Stock Exchange* | |

| ||

American Depositary Shares | New York Stock Exchange | |

Ordinary shares of €0.07 each | New York Stock Exchange* |

| * | Listed, not for trading, but only in connection with the listing of the applicable Registrant’s American Depositary Shares issued in respect thereof. |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuers’ classes of capital or common stock as of December 31, 2014:2017:

| Number of outstanding shares | |||||

Ordinary shares of 14 51/116p each | ||||||

| ||||||

Ordinary shares of €0.07 each | ||||||

| ||||||

Indicate by check mark if the registrants are well-known seasoned issuers, as defined in Rule 405 of the Securities Act.

Yes þ☑ No ¨☐

If this report is an annual or transition report, indicate by check mark if the registrants are not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ¨☐ No þ☑

Indicate by check mark whether the registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) have been subject to such filing requirements for the past 90 days.

Yes þ☑ No ¨☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of RegulationS-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨☑ No ¨☐

Indicate by check mark whether the registrants are large accelerated filers, accelerated filers,non-accelerated filers or non-accelerated filers.emerging growth companies. See definition of “accelerated filer and largefiler”, “large accelerated filer” and “emerging growth company” in Rule12b-2 of the Exchange Act.

| Large accelerated filer ☑ | Accelerated filer ☐ | Non-accelerated filer ☐ | ||

| Emerging growth company ☐ |

Large accelerated filer þ Accelerated filer ¨ Non-accelerated filer ¨If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrants have used to prepare the financial statements included in this filing.

¨☐ US GAAP þ☑ International Financial Reporting Standards as issued by the International Accounting Standards Board ¨☐ Other

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrants have elected to follow:

Item 17 ¨☐ Item 18 ¨☐

If this is an annual report, indicate by check mark whether the registrants are shell companies (as defined in Rule12b-2 of the Exchange Act).

Yes ¨☐ No þ☑

| Page | ||||||

| 1 | ||||||

| 2 | ||||||

ITEM 1: | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | N/A | ||||

ITEM 2: | OFFER STATISTICS AND EXPECTED TIMETABLE | N/A | ||||

ITEM 3: | KEY INFORMATION | 3 | ||||

| 3 | ||||||

| 5 | ||||||

ITEM 4: | INFORMATION ON THE GROUP | |||||

| 9 | ||||||

| 10 | ||||||

| 11 | ||||||

ITEM 4A: | UNRESOLVED STAFF COMMENTS | N/A | ||||

ITEM 5: | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | |||||

| 14 | ||||||

| 24 | ||||||

| 26 | ||||||

| ||||||

ITEM 6: | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | |||||

| 28 | ||||||

ITEM 7: | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | |||||

ITEM 8: | FINANCIAL INFORMATION | |||||

ITEM 9: | THE OFFER AND LISTING | |||||

ITEM 10: | ADDITIONAL INFORMATION | |||||

ITEM 11: | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |||||

ITEM 12: | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | |||||

| Page | ||||||

ITEM 13: | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | N/A | ||||

ITEM 14: | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | N/A | ||||

ITEM 15: | CONTROLS AND PROCEDURES | |||||

ITEM 16A: | AUDIT COMMITTEE FINANCIAL EXPERT | |||||

ITEM 16B: | CODES OF ETHICS | |||||

ITEM 16C: | PRINCIPAL ACCOUNTANT FEES AND SERVICES | |||||

ITEM 16D: | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | |||||

ITEM 16E: | PURCHASES OF EQUITY SECURITIES BY THE | |||||

ITEM 16F: | CHANGE IN | |||||

ITEM 16G: | CORPORATE GOVERNANCE | |||||

ITEM 16H: | MINE SAFETY DISCLOSURE | N/A | ||||

ITEM 17: | FINANCIAL STATEMENTS* | |||||

ITEM 18: | FINANCIAL STATEMENTS | F-1 | ||||

| F-2 | ||||||

| S-1 | ||||||

ITEM 19: | EXHIBITS | S-3 | ||||

| * | The registrants have responded to Item 18 in lieu of responding to this Item. |

THIS PAGE INTENTIONALLY BLANK

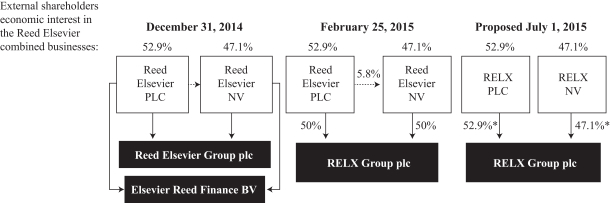

Reed ElsevierRELX PLC and Reed Elsevier NV conducted their business through two jointly owned companies during 2014, Reed Elsevier Group plc and Elsevier Reed Finance BV. Reed Elsevier PLC and Reed Elsevier NV have retained their separate legal identities. Effective February 25, 2015, Reed Elsevier PLC and Reed Elsevier NV transferred their direct ownership interests in Elsevier Reed Finance BV to their jointly-owned company Reed Elsevier Group plc and named this newly-combined single group entityis a holding company. It owns 52.9% of the shares of RELX Group plc. As

RELX NV is a result,holding company. It owns 47.1% of the shares of RELX Group plc now holds all Reed Elsevier businesses, subsidiaries and financing activities. Further information is provided on pages 23 to 24. plc.

As used in this Annual Report on Form20-F, the terms the “Group,”“the Group”, “RELX” the “combined businesses,” Group”, “RELX”, “we,” “our” or “us” refer collectively, to Reed ElsevierRELX PLC, Reed ElsevierRELX NV, RELX Group plc and theirits subsidiaries, associates and joint ventures. The financial statements of the combined businesses are referred to herein as the “combined financial statements”. Additional terms are defined in the Glossary of Terms on pagesS-1 andS-2.

In this annual report, references to US dollars, $ and ¢ are to US currency; references to sterling, £, pence or p are to UK currency; references to euro and € are to the currency of the European Economic and Monetary Union.

Statements regarding our competitive position included herein were obtained from internal surveys, market research, publicly available information and industry publications. While we believe that the market research, publicly available information and industry publications we use are reliable, we have not independently verified market and industry data from third-party sources. Moreover, while we believe our internal surveys are reliable, they have not been verified by any independent source.

This document contains references to the RELX Group website, either within the document or incorporated by reference. Information not specifically stated as being incorporated by reference from the RELX Group website or any other website referenced is not incorporated into this document and should not be considered part of this document.

Pursuant to Rule12b-23(a) of the Securities Exchange Act of 1934, as amended, certain information in this Annual Report on Form20-F is being incorporated by reference to the Group’s Annual Reports and Financial Statements 2017 appended hereto as Exhibit 15.2. With the exception of the items and pages so specified, the Group’s Annual Reports and Financial Statements 2017 are not deemed to be filed as part of this Form20-F.

1

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This documentannual report contains a number of forward-looking statements within the meaning of Section 27A of the United States Securities Act of 1933, as amended, and Section 21E of the United States Securities Exchange Act of 1934, as amended, with respect to:to, among others:

our financial condition; |

our results of operations; |

our competitive positions; |

the features and functions of and markets for the products and services we offer; and |

our business plans and strategies. |

We consider any statements that are not historical facts to be “forward-looking statements”.statements.” These statements are based on the current expectations of the management of our businesses and are subject to risks and uncertainties that could cause actual results or outcomes to differ from those expressed in any forward-looking statement. These differences could be material; therefore, you should evaluate forward-looking statements in light of various important factors, including those set forth or incorporated by reference in this document.annual report.

Important factors that could cause our actual results to differ materially from estimates or forecasts contained in the forward lookingforward-looking statements include, among others:

|

|

|

|

|

|

|

|

changes in law and legal interpretation affecting our intellectual property rights and internet communications; |

|

|

| demand for our products and services; |

| ● | competitive factors in the industries in which we operate; |

| ● | ability to realise the future anticipated benefits of acquisitions; |

| ● | significant failure or interruption of our systems; |

| ● | compromises of our data security systems or other unauthorised access to our databases; |

| ● | failure to comply with FTC Settlement Orders; |

| ● | failure of third parties to whom we have outsourced business activities; |

| our ability to retain high-quality management; |

| ● | changes in the market values of defined benefit pension scheme assets and in the market related assumptions used to value scheme liabilities; |

| changes in tax laws and uncertainty in their application; |

| ● | exchange rate fluctuations; |

| ● | adverse market conditions or downgrades to the credit ratings of our debt; |

breaches of generally accepted ethical business standards or applicable |

our ability to manage our environmental impact; |

| failure to realise our assumptions regarding goodwill and indefinite lived intangible assets; and |

| ● | other risks referenced from time to time in the filings of |

The terms “estimate”, “project”, “plan”, “intend”, “expect”,“estimate,” “project,” “plan,” “intend,” “expect,” “should, be”,” “could,” “will, be”, “believe”, “trends”” “believe,” “trends,” and similar expressions identifymay indicate a forward-looking statements. These forward-lookingstatement. Forward-looking statements are found at various places throughout this annual report and the other documentsinformation incorporated by reference in this annual report.

You should not place undue reliance on these forward-looking statements, which speak only as of the date of this annual report. Except as may be required by law, we undertake no obligation to publicly update or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this annual report or to reflect the occurrence of unanticipated events.

2

THE GROUP

The selected combinedconsolidated financial data for the Group should be read in conjunction with, and is qualified by, the combined financial statements included in this annual report. In addition, as separate legal entities, Reed Elsevier PLC and Reed Elsevier NV prepare separate consolidated financial statements for RELX Group which reflectare set forth on pages 117 to 164 of the Group’s Annual Reports and Financial Statements 2017, and incorporated herein by reference to Exhibit 15.2.

RELX PLC and RELX NV are separate, publicly-held entities. RELX PLC and RELX NV jointly own RELX Group plc which holds all of the Group’s operating businesses and financing activities. The Directors have concluded that the Group forms a single reporting entity for the presentation of consolidated financial statements and, accordingly, the Group’s consolidated financial information represents the interests of both sets of shareholders and is presented by both RELX PLC and RELX NV as their respective shareholders’ economic interests in the Group accounted for on an equity basis.consolidated financial statements.

The combinedconsolidated financial statements are prepared in accordance with accounting policies that are in conformity with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and as adopted by the European Union (“EU”). The selected financial data for the Group (in £) as at December 31, 2017, and 2016 and for the years ended December 31, 2014, 20132017, 2016 and 20122015 set out below has been extracted or derived from the audited combinedconsolidated financial statements, included herein.set forth on pages 117 to 164 of the Group’s Annual Reports and Financial Statements 2017 and incorporated herein by reference to Exhibit 15.2. The selected financial data for the Group as at December 31, 2015, 2014 and 2013 and for the years ended December 31, 20112014 and 20102013 set out below has been extracted or derived from our audited financial statements, which are not included herein, and restated for the adoption of International Accounting Standard (“IAS”) 19 Employee Benefits (revised), which was adopted in the year ended December 31, 2013.herein.

CombinedConsolidated Income Statement Data(1)

For the year ended December 31, | For the year ended December 31, | |||||||||||||||||||||||||||||||

2014(2) | 2014 | 2013 | 2012 | 2011 Restated | 2010 | 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||||||||

| (in millions) | (in millions) | |||||||||||||||||||||||||||||||

Amounts in accordance with IFRS: | ||||||||||||||||||||||||||||||||

Revenue | $9,006 | £5,773 | £6,035 | £6,116 | £6,002 | £6,055 | £ | 7,355 | £ | 6,895 | £ | 5,971 | £ | 5,773 | £ | 6,035 | ||||||||||||||||

Operating profit | 2,187 | 1,402 | 1,376 | 1,333 | 1,171 | 1,064 | 1,905 | 1,708 | 1,497 | 1,402 | 1,376 | |||||||||||||||||||||

Net finance costs | (253) | (162) | (196) | (227) | (244) | (289) | (182 | ) | (195 | ) | (174 | ) | (162 | ) | (196 | ) | ||||||||||||||||

Disposals and other non operating items(4) | (17) | (11) | 16 | 45 | (22) | (46) | ||||||||||||||||||||||||||

Disposals and othernon-operating items(3) | 11 | (40 | ) | (11 | ) | (11 | ) | 16 | ||||||||||||||||||||||||

Profit before tax | 1,917 | 1,229 | 1,196 | 1,151 | 905 | 729 | 1,734 | 1,473 | 1,312 | 1,229 | 1,196 | |||||||||||||||||||||

Tax expense | (419) | (269) | (81) | (102) | (167) | (132) | (67 | ) | (304 | ) | (298 | ) | (269 | ) | (81 | ) | ||||||||||||||||

Net profit for the year | 1,498 | 960 | 1,115 | 1,049 | 738 | 597 | 1,667 | 1,169 | 1,014 | 960 | 1,115 | |||||||||||||||||||||

Net profit for the year attributable to non-controlling interests | (8) | (5) | (5) | (5) | (7) | (6) | (8 | ) | (8 | ) | (6 | ) | (5 | ) | (5 | ) | ||||||||||||||||

Net profit attributable to parent companies’ shareholders | 1,490 | 955 | 1,110 | 1,044 | 731 | 591 | ||||||||||||||||||||||||||

Net profit attributable to RELX PLC and RELX NV shareholders | £ | 1,659 | £ | 1,161 | £ | 1,008 | £ | 955 | £ | 1,110 | ||||||||||||||||||||||

CombinedConsolidated Statement of Financial Position Data(1)

As at December 31, | As at December 31, | |||||||||||||||||||||||||||||||

2014(2) | 2014 | 2013 | 2012 | 2011 | 2010 | 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||||||||

| (in millions) | (in millions) | |||||||||||||||||||||||||||||||

Amounts in accordance with IFRS: | ||||||||||||||||||||||||||||||||

Total assets | $17,296 | £11,087 | £10,495 | £11,014 | £11,503 | £11,158 | £ | 12,283 | £ | 13,323 | £ | 11,185 | £ | 11,087 | £ | 10,495 | ||||||||||||||||

Long term borrowings | (4,912) | (3,149) | (2,633) | (3,162) | (3,300) | (3,786) | ||||||||||||||||||||||||||

Non-current borrowings | (4,208 | ) | (3,684 | ) | (3,278 | ) | (3,149 | ) | (2,633 | ) | ||||||||||||||||||||||

Net assets | 3,334 | 2,137 | 2,423 | 2,314 | 2,197 | 1,970 | 2,374 | 2,358 | 2,178 | 2,137 | 2,423 | |||||||||||||||||||||

Non-controlling interests | (49) | (31) | (33) | (34) | (25) | (27) | (21 | ) | (38 | ) | (34 | ) | (31 | ) | (33 | ) | ||||||||||||||||

Combined shareholders’ equity | 3,285 | 2,106 | 2,390 | 2,280 | 2,172 | 1,943 | ||||||||||||||||||||||||||

Shareholders’ equity | £ | 2,353 | £ | 2,320 | £ | 2,144 | £ | 2,106 | £ | 2,390 | ||||||||||||||||||||||

| (1) | The |

3

Operating profit is stated after charging |

| Disposals and other |

| Tax expense in |

REED ELSEVIER PLC

The selected financial data for Reed Elsevier PLC should be read in conjunction with,Earnings per share and is qualified in its entirety by, the consolidated financial statements of Reed Elsevier PLC included in this annual report. The results of Reed Elsevier PLC reflect the 52.9% economic interest of Reed Elsevier PLC’s shareholders in the Group, after taking account of results arising in Reed Elsevier PLC and its subsidiaries. These interests have been accounted for on an equity basis.

The consolidated financial statements are prepared in accordance with accounting policies that are in conformity with IFRS as issued by the IASB and as adopted by the EU. The selected financial data for Reed Elsevier PLC (in £) as at and for the years ended December 31, 2014, 2013 and 2012 set out below has been extracted or derived from the audited consolidated financial statements, included herein. The selected financial data for Reed Elsevier PLC as at and for the years ended December 31, 2011 and 2010 set out below has been extracted or derived from our audited financial statements, which are not included herein, and restated for the adoption of IAS19 Employee Benefits (revised), which was adopted in the year ended December 31, 2013.dividends

| For the year ended December 31, | ||||||||||||||||||||||||

| 2014(3) | 2014 | 2013 | 2012 | 2011 Restated | 2010 Restated | |||||||||||||||||||

| (in millions, except per share amounts) | ||||||||||||||||||||||||

Amounts in accordance with IFRS:(1) | ||||||||||||||||||||||||

Profit before tax(2) | $769 | £493 | £576 | £532 | £375 | £301 | ||||||||||||||||||

Tax (expense)/credit | (5 | ) | (3 | ) | (4 | ) | 6 | (1 | ) | (1 | ) | |||||||||||||

Profit attributable to ordinary shareholders | 764 | 490 | 572 | 538 | 374 | 300 | ||||||||||||||||||

Earnings per Reed Elsevier PLC ordinary share from total operations of the combined businesses | 67 | ¢ | 43.0p | 48.8p | 44.8p | 31.1p | 25.0p | |||||||||||||||||

Diluted earnings per Reed Elsevier PLC ordinary share from total operations of the combined businesses | 66 | ¢ | 42.5p | 48.2p | 44.3p | 30.9p | 24.9p | |||||||||||||||||

Dividends per Reed Elsevier PLC ordinary share(4) | 39 | ¢ | 24.95p | 23.65p | 21.9p | 20.65p | 20.4p | |||||||||||||||||

Total assets | $1,743 | £1,117 | £1,266 | £1,207 | £1,158 | £1,037 | ||||||||||||||||||

Total equity/Net assets | 1,741 | 1,116 | 1,264 | 1,206 | 1,149 | 1,028 | ||||||||||||||||||

Weighted average number of shares(5) | 1,140.2 | 1,140.2 | 1,172.2 | 1,200.6 | 1,202.0 | 1,199.1 | ||||||||||||||||||

| For the year ended December 31, | ||||||||||||||||||||

| 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||

| (in millions, except per share amounts) | ||||||||||||||||||||

Amounts in accordance with IFRS(1): | ||||||||||||||||||||

RELX PLC | ||||||||||||||||||||

Earnings per RELX PLC ordinary share | 82.2p | 56.3p | 46.4p | 43.0p | 49.0p | |||||||||||||||

Diluted earnings per RELX PLC ordinary share | 81.5p | 55.8p | 46.0p | 42.5p | 48.3p | |||||||||||||||

Dividends per RELX PLC ordinary share(2) | 37.4p | 32.55p | 26.40p | 24.95p | 23.65p | |||||||||||||||

Weighted average number of shares(3) | 1,068.3 | 1,091.0 | 1,116.2 | 1,140.2 | 1,172.2 | |||||||||||||||

RELX NV(4) | ||||||||||||||||||||

Earnings per RELX NV share | 82.2p | 56.3p | 49.4p | 45.8p | 51.6p | |||||||||||||||

Diluted earnings per RELX NV share | 81.5p | 55.8p | 48.9p | 45.3p | 51.0p | |||||||||||||||

Dividends per RELX NV ordinary share(2) | €0.433 | €0.410 | €0.400 | €0.383 | €0.329 | |||||||||||||||

Weighted average number of shares(3) | 951.1 | 971.3 | 992.4 | 1,014.2 | 1,038.5 | |||||||||||||||

| (1) | With effect from April 6, 2016, the UK government has abolished tax credits on dividends paid after this date, including the 2015 final dividend, which was paid in May 2016. As a result of the abolition of this tax credit, dividends and therefore earnings per share are equal for both RELX PLC and RELX NV in 2016 and 2017. In calculating earnings per share of the Group up until the end of 2015 (prior to the abolition of the tax credit), the earnings for each class of share were calculated on the basis that earnings are fully distributed. The |

| (2) |

RELX NV dividends paid in the year, in amounts per ordinary share, comprise a 2016 final dividend of €0.301 and 2017 interim dividend of €0.132 giving a total of €0.433. The directors of RELX NV have proposed a 2017 final dividend of €0.316 (2016: €0.301; 2015: €0.288; 2014: €0.285; 2013: €0.243), giving a total ordinary dividend in respect of the financial year of €0.448 (2016: €0.423; 2015: €0.403; 2014: €0.383; 2013: €0.329). Translated at the December 31, 2017 noon buying rate of $1.20 per €1.00, dividends paid in the year amount to $0.52 per RELX NV share and total ordinary dividends in respect of the financial year amount to $0.54 per RELX NV share. See “— Exchange Rates” on page 5.

| Weighted average number of shares excludes shares held in treasury and shares held by the Employee Benefit Trust. |

REED ELSEVIER NV

The selected financial data for Reed Elsevier NV should be read in conjunction with, and is qualified in its entirety by, the consolidated financial statements of Reed Elsevier NV included in this annual report. The results and financial position of Reed Elsevier NV reflect the 50% economic interest of Reed Elsevier NV’s shareholders in the Group. These interests are accounted for on an equity basis.

The consolidated financial statements are prepared in accordance with accounting policies that are in conformity with IFRS as issued by the IASB and as adopted by the EU. The selected financial data for Reed Elsevier NV (in €) as at and for the years ended December 31, 2014, 2013 and 2012 set out below has been extracted or derived from the audited consolidated financial statements, included herein. The selected financial data for Reed Elsevier NV as at and for the years ended December 31, 2011 and 2010 set out below has been extracted or derived from our audited financial statements, which are not included herein, and restated for the adoption of IAS19 Employee Benefits (revised), which was adopted in the year ended December 31, 2013.

| For the year ended December 31, | ||||||||||||||||||||||||

| 2014(3) | 2014 | 2013 | 2012 | 2011 Restated | 2010 Restated | |||||||||||||||||||

| (in millions, except per share amounts) | ||||||||||||||||||||||||

Amounts in accordance with IFRS:(1) | ||||||||||||||||||||||||

Profit before tax(2) | $722 | €597 | €659 | €644 | €421 | €349 | ||||||||||||||||||

Tax (expense) | (6 | ) | (5 | ) | (4 | ) | (2 | ) | (1 | ) | (3 | ) | ||||||||||||

Profit attributable to ordinary shareholders | 716 | 592 | 655 | 642 | 420 | 346 | ||||||||||||||||||

Earnings per Reed Elsevier NV share from total operations of the combined businesses | $1.03 | €0.85 | €0.91 | €0.87 | €0.57 | €0.47 | ||||||||||||||||||

Diluted earnings per Reed Elsevier NV share from total operations of the combined businesses | $1.02 | €0.84 | €0.90 | €0.87 | €0.57 | €0.47 | ||||||||||||||||||

Dividends per Reed Elsevier NV ordinary share(4) | $0.64 | €0.525 | €0.469 | €0.456 | €0.413 | €0.402 | ||||||||||||||||||

Total assets | $1,719 | €1,421 | €1,494 | €1,460 | €1,364 | €1,203 | ||||||||||||||||||

Total equity/Net assets | 1,644 | 1,359 | 1,434 | 1,402 | 1,303 | 1,137 | ||||||||||||||||||

Weighted average number of shares(5) | 700.1 | 700.1 | 717.6 | 734.0 | 735.3 | 734.5 | ||||||||||||||||||

| (4) |

4

For a discussion of the impact of currency fluctuations on the Group’s combinedconsolidated results of operations and combinedconsolidated financial position, see “Item 5: Operating and Financial Review and Prospects”.

The following tables illustrate, for the periods and dates indicated, certain information concerning the Noon Buying Rate for pounds sterling expressed in US dollars per £1.00 and for the euro expressed in US dollars per €1.00. The exchange rate on February 27, 2015 14, 2018 was £1.00£1.00 = $1.54$1.40 and €1.00€1.00 = $1.12.$1.24.

US dollars per £1.00 — Noon Buying Rates

| Period | ||||||||||||||||

Year ended December 31, | End | Average(1) | High | Low | ||||||||||||

2014 | 1.56 | 1.65 | 1.72 | 1.55 | ||||||||||||

2013 | 1.66 | 1.56 | 1.66 | 1.48 | ||||||||||||

2012 | 1.62 | 1.59 | �� | 1.63 | 1.53 | |||||||||||

2011 | 1.55 | 1.60 | 1.67 | 1.54 | ||||||||||||

2010 | 1.56 | 1.55 | 1.64 | 1.43 | ||||||||||||

Month | High | Low | ||||||||||||||

February 2015 |

| 1.55 | 1.50 | |||||||||||||

January 2015 |

| 1.56 | 1.50 | |||||||||||||

December 2014 |

| 1.57 | 1.55 | |||||||||||||

November 2014 |

| 1.60 | 1.56 | |||||||||||||

October 2014 |

| 1.62 | 1.59 | |||||||||||||

September 2014 |

| 1.66 | 1.61 | |||||||||||||

| Period | ||||||||||||||||

Year ended December 31, | End | Average(1) | High | Low | ||||||||||||

2017 | 1.35 | 1.29 | 1.36 | 1.21 | ||||||||||||

2016 | 1.23 | 1.36 | 1.48 | 1.22 | ||||||||||||

2015 | 1.47 | 1.53 | 1.59 | 1.46 | ||||||||||||

2014 | 1.56 | 1.65 | 1.72 | 1.55 | ||||||||||||

2013 | 1.66 | 1.56 | 1.66 | 1.48 | ||||||||||||

Month | High | Low | ||||||||||||||

February 2018 (through February 16, 2018) |

| 1.42 | 1.38 | |||||||||||||

January 2018 |

| 1.43 | 1.35 | |||||||||||||

December 2017 |

| 1.35 | 1.33 | |||||||||||||

November 2017 |

| 1.35 | 1.31 | |||||||||||||

October 2017 |

| 1.33 | 1.31 | |||||||||||||

September 2017 |

| 1.36 | 1.30 | |||||||||||||

US dollars per €1.00 — Noon Buying Rates

| Period | ||||||||||||||||

Year ended December 31, | End | Average(1) | High | Low | ||||||||||||

2014 | 1.21 | 1.33 | 1.39 | 1.21 | ||||||||||||

2013 | 1.38 | 1.32 | 1.38 | 1.28 | ||||||||||||

2012 | 1.32 | 1.29 | 1.35 | 1.21 | ||||||||||||

2011 | 1.29 | 1.39 | 1.49 | 1.29 | ||||||||||||

2010 | 1.33 | 1.32 | 1.45 | 1.20 | ||||||||||||

Month | High | Low | ||||||||||||||

February 2015 |

| 1.15 | 1.12 | |||||||||||||

January 2015 |

| 1.21 | 1.13 | |||||||||||||

December 2014 |

| 1.25 | 1.21 | |||||||||||||

November 2014 |

| 1.26 | 1.24 | |||||||||||||

October 2014 |

| 1.28 | 1.25 | |||||||||||||

September 2014 |

| 1.32 | 1.26 | |||||||||||||

| Period | ||||||||||||||||

Year ended December 31, | End | Average(1) | High | Low | ||||||||||||

2017 | 1.20 | 1.13 | 1.20 | 1.04 | ||||||||||||

2016 | 1.05 | 1.11 | 1.15 | 1.04 | ||||||||||||

2015 | 1.09 | 1.11 | 1.21 | 1.05 | ||||||||||||

2014 | 1.21 | 1.33 | 1.39 | 1.21 | ||||||||||||

2013 | 1.38 | 1.32 | 1.38 | 1.28 | ||||||||||||

Month | High | Low | ||||||||||||||

February 2018 (through February 16, 2018) |

| 1.25 | 1.22 | |||||||||||||

January 2018 |

| 1.25 | 1.19 | |||||||||||||

December 2017 |

| 1.20 | 1.17 | |||||||||||||

November 2017 |

| 1.19 | 1.16 | |||||||||||||

October 2017 |

| 1.19 | 1.16 | |||||||||||||

September 2017 |

| 1.20 | 1.17 | |||||||||||||

| (1) | The average of the Noon Buying Rates on |

Noon Buying Rates have not been used in the preparation of the combined financial statements, the Reed Elsevier PLC consolidated financial statements or the Reed Elsevier NV consolidated financial statements but have been used for certain convenience translations where indicated.

5

The principal risks facing our business are included below. Additional risks not presently known to us or that we currently deem immaterial may also impair our business.

We operate in a highly competitive environment that is subject to rapid change.

Our businesses operate in highly competitive markets. These markets continue to change in response to technological innovations, legislative and regulatory changes, the entrance of new competitors, and other factors. We cannot predict the changes that may occur and the effect of those changes on the competitiveness of our businesses. In particular, the means of delivering our products and services, and the products and services themselves, may be subject to rapid technological and other changes. We cannot predict whether technological innovations, changing legislation or other factors will, in the future, make some of our products wholly or partially obsolete or less profitable. Failure to anticipate market trends could impact the competitiveness of our products and services and consequently adversely affect our revenue and profit.

We cannot assure you that there will be continued demand for our products and services.

Our businesses are dependent on the continued acceptance by our customers of our products and services and the value placed on them. We cannot predict whether there will be changes in the future, either in the market demand or from the actions of competitors, which will affect the acceptability of products, services and prices to our customers. Failure to meet evolving customer needs could impact demand for our products and services and consequently adversely affect our revenue.

Fluctuations in exchange rates may affect our reported results.

Our financial statements are expressed in pounds sterling and euros and are, therefore, subject to movements in exchange rates on the translation of the financial information of businesses whose operational currencies are other than our reporting currencies. The United States is our most important market and, accordingly, significant fluctuations in US dollar exchange rates can significantly affect our reported results and financial position from year to year. In addition, in some of our businesses we incur costs in currencies other than those in which revenues are earned. The relative movements between the exchange rates in the currencies in which costs are incurred and the currencies in which revenues are earned can significantly affect the results of those businesses.

Current and future economic, political and market forces, and dislocations beyond our control may adversely affect demand for our products and services.

The demandDemand for our products and services may be adversely impacted by factors that are beyond our control, including macrosuch as the economic political and market conditions,environment in the availability of short term and long term funding and capital and the level of volatility of interest rates, currency exchange rates and inflation. The United States, Europe and other major economies, havepolitical uncertainties (including the potential consequences of the United Kingdom’s withdrawal from the European Union under Article 50 of the Treaty of Lisbon), acts of war, terrorism and civil unrest as well as levels of government and private funding provided to academic and research institutions.

Our intellectual property rights may not be adequately protected under current laws in recent years undergone a period of economic turbulence, and this may continue into the future. Any one or more of these factors may contribute to reduced activity by our customers, may result in a reduction of demand for our products and services, and may adversely affect suppliers and third parties to whom we have outsourced business activities.

Changes in tax laws or uncertainty over their application and interpretationsome jurisdictions, which may adversely affect our reported results.results and our ability to grow.

Our businesses operate globallyproducts and services include and utilise intellectual property. We rely on trademark, copyright, patent and other intellectual property laws to establish and protect our earningsproprietary rights in this intellectual property. There is a risk that our proprietary rights could be challenged, limited, invalidated or circumvented, which may impact demand for and pricing of our products and services. Copyright laws are subject to taxationnational legislative initiatives, as well as cross border initiatives such as those from the European Commission, and increased judicial scrutiny in many differing jurisdictions and at differing rates. We seek to organise our affairs in a tax efficient manner, taking account of theseveral jurisdictions in which we operate. However, tax laws that apply toThis creates additional challenges for us in protecting our businesses may be amendedproprietary rights in content delivered through the internet and electronic platforms.

Regulatory and other changes regarding the collection or interpreted differently by the relevant authorities, which could adversely affect our reported results.

Changes in regulation of information collection and use could adversely affect our business.

Legal regulation relating to internet communications, data protection, e-commerce, direct marketing, credit scoring and digital advertising, privacy, information governance and use of public records is becoming more prevalent worldwide. Existing and proposed legislation and regulations, including changes in the manner in which such legislation and regulations are interpreted by courts and regulators may impose limits on our collection and use of certain kinds of information about individuals and our ability to communicate such information effectively with our customers. For example, many of the products offered by Risk & Business Information are subject to regulation under the US Fair Credit Reporting Act (“FCRA”), Gramm Leach Bliley Act (“GLBA”), Drivers Privacy Protection Act (“DPPA”) and related state laws. Certain of these laws further provide for statutory penalties and attorneys fees for non-compliance. We are unable to predict in what form laws and regulations will be adopted or modified or how they will be construed by the courts and regulators, or the extent to which any such laws or interpretation changes might adversely affect our business.

Changes in provision of third partythird-party information to us could adversely affect our businesses.

A number of our businesses rely extensively upon content and data from external sources. Data is obtained from public records, governmental authorities, customers and other information companies, including competitors. InLegal regulations, such as the caseEuropean Union’s General Data Protection Regulation (“GDPR”), relating to internet communications, privacy and data protection,e-commerce, information governance and use of public records, including social security number data which are obtained from public authorities, our access is governed by law. We also obtain the credit header data in our databases from consumer credit reporting agencies.becoming more prevalent worldwide. The disruption or loss of data sources, either because of changes in the law or because data suppliers decide not to supply them, may impose limits on our collection and use of certain kinds of information about individuals and our ability to communicate such information effectively with our customers.

Changes in the payment model for our Scientific, Technical & Medical primary research content could adversely affect our operations.

Our Scientific, Technical & Medical (STM) primary research content, like that of most of our competitors, is sold largely on a paid subscription basis. There is continued debate in government, academic and library communities, which are the principal customers for our STM content, regarding to what extent such content should be funded instead through fees charged to authors or authors’ funders and/or made freely available in some form after a period following publication. Some of these methods, if widely adopted, could adversely affect our STM revenue from paid subscriptions.

We cannot assure you that there will be continued demand for our products and services.

Our businesses are dependent on the continued acceptance by our customers of our products and services and the value placed on them. Failure to meet evolving customer needs could impact demand for our products and services and consequently adversely affect our revenue or the long-term returns from our investment in electronic product and platform initiatives.

We operate in a highly competitive environment that is subject to rapid change.

Our businesses operate in highly competitive markets, and the means of delivering our products and services, and the products and services themselves, continue to change in response to rapid technological innovations, legislative and regulatory changes, the entrance of new competitors and other factors. Failure to anticipate and quickly adapt to these changes could impact the competitiveness of our products and services and consequently adversely affect our revenue.

We may not realise all of the future anticipated benefits of acquisitions.

We supplement our organic development with selected acquisitions. If we are unable to generate the anticipated benefits such as revenue growth and/or cost savings associated with these acquisitions this could adversely affect return on invested capital and financial condition, or lead to an impairment of goodwill.

6

A significant failure or interruption of our electronic delivery platforms, networks or distribution systems could adversely affect our businesses and operations.

Our businesses are dependent on electronic platforms and networks, primarily the internet, for delivery of our products and services. These could be adversely affected if our electronic delivery platforms or networks experience a significant failure, interruption or security breach.

Compromises of our cyber security systems and other unauthorised access to our databases, could adversely affect our businesses and operations.

Our businesses maintain online databases and information, including public records and other personal information. As part of maintaining this information and delivering our products and services, we rely on and provide data to third parties, including customers and service providers. These databases and information are a target for compromise and face a risk of unauthorised access and use by unauthorised parties.

Our cyber security measures, and the measures used by our third-party service providers, may not detect or prevent all attempts to compromise our systems, which may jeopardise the security of the data we maintain or may disrupt our systems. Failures of our cyber security measures could result in unauthorised access to our systems, misappropriation of our or our users’ data, deletion or modification of stored information or other interruption to our business operations. As techniques used to obtain unauthorised access to or to sabotage systems change frequently, and may not be known until launched against us or our third-party service providers, we may be unable to anticipate or implement adequate measures to protect against these attacks and our service providers and customers may likewise be unable to do so. Compromises of our or our third-party service providers’ systems, or failure to comply with applicable legislation or regulatory or contractual requirements could adversely affect our financial performance, damage our reputation and expose us to risk of loss, fines and penalties, litigation and increased regulation.

Our business, operations and reputation could be adversely affected by a failure to comply with FTC Settlement Orders.

ThroughWe are subject to numerous and evolving laws and regulations designed to protect certain information and, through our Risk & Business InformationAnalytics business in the United States, we are party to two consent orders and two subsequent related supplemental orders (the “FTC Settlement Orders”) embodying settlements, with the US Federal Trade Commission (“FTC”) that resolved FTC investigations intoregarding our compliance with US federal laws governing consumer information security and relatedsecurity-related issues, including certain fraudulent data access incidents. We also entered into an Assurance of Voluntary Compliance and Discontinuance (the “AVC”) with the Attorneys General of 43 states and the District of Columbia in connection with one such FTC investigation. The FTC Settlement Orders and the AVC require us to institute and maintain information security, verification, credentialing, audit and compliance, and reporting and record retention programmes and to obtain an assessment from a qualified, independent third party every two years for twenty years (with the FTC having the right to extend such twenty-year period by up to two additional biennial assessment periods) to ensure that our performance under these information security programmes complies with the FTC Settlement Orders. Failure to comply with the FTC Settlement Orders and the AVCthese orders could result in civil penalties and adversely affect our business, operations and reputation.

BreachesOur businesses may be adversely affected by the failure of our data security systemsthird parties to whom we have outsourced business activities.

Our organisational and operational structures depend on outsourced and offshored functions, including use of cloud service providers. Poor performance, failure or other unauthorised accessbreach of third parties to our databaseswhom we have outsourced activities could adversely affect our business and operations.

Our businesses provide customers with access to database information such as case law, treatises, journals, and publications as well as other data. Some of our businesses also provide authorised customers with access to public records and other information on US individuals made available in accordance with applicable privacy laws and regulations. There are persons who try to breach our data security systems or gain other unauthorised access to our databases in order to misappropriate such information for potentially fraudulent purposes and we have previously disclosed incidents of such unauthorised access. Because the techniques used by such persons change frequently, we may be unable to anticipate or protect against the threat of breaches of data security or other unauthorised access. Breaches of our data security systems or other unauthorised access to our databases could damage ourperformance, reputation and expose us to a risk of loss or litigation and possible liability, as well as increase the likelihood of more extensive governmental regulation of these activities in a way that could adversely affect this aspect of our business.financial condition.

Changes in levels of government funding of, or spending by, academic institutions may adversely affect demand for the products and services of our scientific, technical and medical (“STM”) businesses.

The principal customers for the information products and services offered by our STM publishing businesses are academic institutions, which fund purchases of these products and services from limited budgets that may be sensitive to changes in private and governmental sources of funding. Accordingly, any decreases in budgets of academic institutions or changes in the spending patterns of academic institutions could negatively impact our business and revenues.

Our intellectual property rights may not be adequately protected under current laws in some jurisdictions, which may adversely affect our results and our ability to grow.

Our products and services are largely comprised of intellectual property content delivered through a variety of media, including online, journals and books. We rely on trademark, copyright, patent, trade secret and other intellectual property laws to establish and protect our proprietary rights in these products and services. However, we cannot assure you that our proprietary rights will not be challenged, limited, invalidated or circumvented. Despite trademark and copyright protection and similar intellectual property protection laws, third parties may be able to copy, infringe or otherwise profit from our proprietary rights without our authorisation. These unauthorised activities may be facilitated by the internet.

In addition, whilst there is now certain internet-specific copyright legislation in the United States and in the European Union, there remains significant uncertainty as to the date from which such legislation will be enforced and the form copyright law regulating digital content may ultimately take. In several jurisdictions, including the United States, Australia and the European Union, copyright laws are increasingly coming under legal review. These factors create additional challenges for us in protecting our proprietary rights in content delivered through the internet and electronic platforms. Moreover, whilst non-copyrightable databases are protected in many circumstances by law in the European Union, there is no equivalent legal protection in the United States.

We may be unable to implement and execute our strategic and business plans if we cannot maintain high-quality management.

The implementation and execution of our strategicstrategies and business plans depend on our ability to recruit, motivate and retain high-quality people.skilled employees and management. We compete globally and across business sectors for talented management and skilled individuals, particularly those with technology and data analytics capabilities. An inability to recruit, motivate or retain such peopletalent could adversely affect our business performance.

We may not realise all of the future anticipated benefits of acquisitions.

We regularly make small business acquisitions to strengthen our portfolio. Whilst our acquisitions are made within the framework of our overall strategy, which emphasises organic development, we cannot assure you we will be able to generate the anticipated benefits such as revenue growth and/or cost savings associated with these acquisitions. Failure to realise the anticipated benefits of acquisitionsrecruit and develop a diverse and inclusive workforce could adversely affect our return on invested capital and financial condition.

We cannot assure you whether our substantial investment in electronic product and platform initiatives will produce satisfactory, long term returns.

We are investing significant amounts to develop and promote electronic products and platforms. The provision of electronic products and services is very competitive and we may experience difficulties developing this aspect of our business due to a variety of factors, many of which are beyond our control. These factors may include competition from comparable and new technologies and changes in regulation.

Our businesses may be adversely affected if their electronic delivery platforms, networks or distribution systems experience a significant failure or interruption.

Our businesses are dependent on electronic platforms and distribution systems, primarily the internet, for delivery of their products and services. From time to time we have experienced verifiable attacks on our platforms and systems by unauthorised parties. To date such attacks have not resulted in any material damage to us, however, our businesses could be adversely affected if their electronic delivery platforms and networks experience a significant failure, interruption or security breach.

Our businesses may be adversely affected by the failure of third parties to whom we have outsourced business activities.

Our organisational and operational structures are dependent on outsourced and offshored functions. Poor performance or the failure of third parties to whom we have outsourced business functions could adversely affect our business performance, reputation and financial condition.business performance.

Our scientific, technical and medical primary publications could be adversely affected by changes in the market.

Our STM primary publications, like those of most of our competitors, are published on a paid subscription basis. There is continued debate in government, academic and library communities, which are the principal customers for our STM publications, regarding, to what extent such publications should be funded instead through fees charged to authors or authors’ funders and/or made freely available in some form after a period following publication. If these methods of STM publishing are widely adopted or mandated, it could adversely affect our revenue from our paid subscription publications.

Spending by companies on advertising and other marketing activities, which comprises a significant portion of our revenue, has historically been cyclical.

In 2014 2% of our revenue was derived from advertising. Total advertising revenues for our businesses in 2014 were £135 million compared with £240 million in 2013. Traditionally, spending by companies on advertising and other marketing activities has been cyclical, with companies spending significantly less on advertising in times of economic slowdown or turbulence. In addition, there has been a structural shift of advertising and lead generation to Google and other search engines.

Exhibitions is similarly affected by cyclical pressures on spending by companies. Additionally, participation and attendance at exhibitions is affected by the availability of exhibition venues and the propensity of exhibitors and attendees to travel. Our results could be adversely affected if the availability of venues or the demand from exhibitors and attendees were reduced, for example due to international security or public health concerns or acts of terrorism or war.

Changes in the market values of defined benefit pension scheme assets and in the assumptions used to value defined benefit pension scheme obligations may adversely affect our businesses.

We operate a number of pension schemes around the world. Historically, the largest schemes have beenworld, including local versions of the defined benefit type in the United Kingdom,UK and the United States and the Netherlands.States. The assets and obligations associated

with defined benefitthose pension schemes are sensitive to changes in the market values of assetsthe scheme’s investments and the market relatedmarket-related assumptions used to value scheme liabilities. In particular, declines inAdverse changes to asset values, or increases in pension scheme liabilities, due to adverse changes in discount rates, inflationlongevity assumptions or mortality assumptionsinflation could increase future pension costs and funding requirements.

Changes in tax laws or uncertainty over their application and interpretation may adversely affect our reported results.

Our businesses operate globally and our profits are subject to taxation in many different jurisdictions and at differing tax rates. The Organisation for EconomicCo-operation and Development (OECD)’s reports on Base Erosion and Profit Shifting

7

suggest a range of new approaches that national governments might adopt when taxing the activities of multinational enterprises. The OECD continues to explore options around the taxation of the digital economy. As a result of the OECD’s work and other international initiatives, tax laws that currently apply to our businesses may be amended by the relevant authorities or interpreted differently by them, and these changes could adversely affect our reported results.

Fluctuations in exchange rates may affect our results.

The RELX Group consolidated financial statements are expressed in pounds sterling and are subject to movements in exchange rates on the translation of the financial information of businesses whose operational currencies are other than sterling. The United States is our most important market and, accordingly, significant fluctuations in the US dollar exchange rate could significantly affect our reported results. We also earn revenues and incur costs in a range of other currencies, including the euro and the yen, and significant fluctuations in these exchange rates could also significantly impact our reported results.

Market conditions and credit ratings may affect the availability and cost of funding.

Macroeconomic, political and market conditions may adversely affect the availability and terms of short and long-term funding, volatility of interest rates, the credit quality of our counterparties, currency exchange rates and inflation. The majority of our outstanding debt instruments are, and any of our future debt instruments may be, publicly rated by independent rating agencies. Our borrowing costs and access to capital may be adversely affected if the credit ratings assigned to our debt are downgraded.

Breaches of generally accepted ethical business standards or applicable statutes concerning bribery could adversely affect our reputation and financial condition.

As a world-leading provider of professional information solutions to the STM, risk and business analytics, legal and exhibitions markets we, our employees and major suppliers are expected to adhere to high standards of independence and ethical conduct, including those related to anti-bribery and anti-corruption, promoting human rights and principled business conduct. A breach of generally accepted ethical business standards or applicable anti-bribery and anti-corruption or competition statutes could adversely affect our business performance, reputation and financial condition.

Failure to manage our environmental impact could adversely affect our businesses and reputation.

Our businesses have an impact on the environment, principally through the use of energy and water, waste generation and, in our supply chain, through paper use and print and production technologies. Failure to manage our environmental impact could adversely affect our reputation.

Our impairment analysis of goodwill and indefinite lived intangible assets incorporates various assumptions which are highly judgemental.judgmental. If these assumptions are not realised, we may be required to recognise a charge in the future for impairment.

As at December 31, 2014,2017, goodwill on the combinedconsolidated statement of financial position amounted to £4,981£5,965 million and intangible assets with an indefinite life amounted to £369£112 million. We conduct an impairment test at least annually, which involves a comparison of the carrying value of goodwill and indefinite lived intangible assets by cash generating unit with estimated values in use based on latest management cash flow projections. The assumptions used in the estimation of value in use are, by their very nature, highly judgemental,judgmental, and include profit growth of the business over a five year forecast period, the long term growth rate of the business thereafter, and related discount rates. There is no guarantee that our businesses will be able to achieve the forecasted results which have been included in the impairment tests and impairment charges may be required in future periods if we are unable to meet these assumptions.

Our borrowing costs and access to capital may be adversely affected if the credit ratings assigned to our debt are downgraded.

Our outstanding debt instruments are, and any of our future debt instruments may be, publicly rated by independent rating agencies such as Moody’s Investors Service Inc., Standard & Poor’s Rating Services and Fitch Ratings. A rating is based upon information furnished by us or obtained by the relevant rating agency from its own sources and from publicly available information and is subject to revision, suspension or withdrawal by the rating agency at any time. Rating agencies may review the assigned ratings due to developments that are beyond our control. Factors cited as a basis for a ratings downgrade or an assignment of a negative outlook could include the macro economic environment and the level of our indebtedness as a consequence of an acquisition. If the ratings of our debt are downgraded in the future, our borrowing costs and access to capital may be adversely affected.8

Breaches of generally accepted ethical business standards or applicable statutes concerning bribery could adversely affect our reputation and financial condition.

As a leading provider of professional information solutions to the STM, Risk & Business Information, Legal and Exhibitions markets, we are expected to adhere to high standards of independence and ethical conduct. Whilst our employees are expected to abide by our Code of Ethics and Business Conduct, employees may still fail to abide by its guidelines relating to anti-bribery and principled business conduct. Similarly, whilst our major suppliers are expected to abide by our Supplier Code of Conduct, suppliers may still fail to abide by its guidelines relating to anti-bribery and principled business conduct. A breach of generally accepted ethical business standards or applicable statutes concerning bribery by our employees or our suppliers could adversely affect our business performance, reputation and financial condition.

Failure to manage our environmental impact could adversely affect our businesses.

Our businesses have an impact on the environment, principally through the use of energy and water, waste generation and, in our supply chain, through our paper use and print and production technologies. Whilst we are committed to reducing these impacts by limiting resource use and by efficiently employing sustainable materials and technologies, we cannot assure you that these efforts and expenditures incurred by us in order to comply with either new environmental legislation and regulations, new interpretations or existing laws and regulations or more rigorous enforcement of such laws and regulations will not adversely impact our businesses or reputation.

ITEM 4: INFORMATION ON THE GROUP

HISTORY AND DEVELOPMENTBUSINESS OVERVIEW

IntroductionRELX PLC is a holding company. It owns 52.9% of the shares of RELX Group plc.

Reed ElsevierRELX NV was originallyis a holding company. It owns 47.1% of the shares of RELX Group plc.

RELX Group is a global provider of information and analytics for professional and business customers across industries. The Group serves customers in more than 180 countries and has offices in about 40 countries. It employs approximately 31,000 people of whom almost half are in North America.

We operate in four major market segments: Scientific, Technical & Medical; Risk & Business Analytics; Legal; and Exhibitions.

| ● | Scientific, Technical & Medical is a global information and analytics business that helps institutions and professionals advance healthcare, open science, and improve performance for the benefit of humanity. |

| ● | Risk & Business Analytics provides customers with solutions and decision tools that combine public and industry specific content with advanced technology and analytics to assist them in evaluating and predicting risk and enhancing operational efficiency. |

| ● | Legal is a leading global provider of legal, regulatory and business information and analytics that helps customers increase productivity, improve decision-making and outcomes and advance the rule of law around the world. |

| ● | Exhibitions is the world’s leading events business, enhancing the power offace-to-face through data and digital tools at over 500 events a year, in more than 30 countries, attracting more than 7 million participants. |

| Revenue Year ended December 31, | ||||||||||||||||||||||||

| 2017 | 2016 | 2015 | ||||||||||||||||||||||

| (in millions, except percentages) | ||||||||||||||||||||||||

Scientific, Technical & Medical | £ | 2,478 | 34 | % | £ | 2,320 | 34 | % | £ | 2,070 | 35 | % | ||||||||||||

Risk & Business Analytics | 2,076 | 28 | 1,906 | 28 | 1,601 | 27 | ||||||||||||||||||

Legal | 1,692 | 23 | 1,622 | 23 | 1,443 | 24 | ||||||||||||||||||

Exhibitions | 1,109 | 15 | 1,047 | 15 | 857 | 14 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | £ | 7,355 | 100 | % | £ | 6,895 | 100 | % | £ | 5,971 | 100 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

SCIENTIFIC, TECHNICAL & MEDICAL

The information set forth under the headings ‘Business Overview’, ‘Market opportunities’, ‘Strategic priorities’ and ‘Business model, distribution channels and competition’ on pages 14 to 17 of the Group’s Annual Reports and Financial Statements 2017 is incorporated in 1880herein by reference to Exhibit 15.2.

RISK & BUSINESS ANALYTICS

The information set forth under the headings ‘Business Overview’, ‘Market opportunities’, ‘Strategic priorities’ and Reed Elsevier‘Business model, distribution channels and competition’ on pages 20 to 23 of the Group’s Annual Reports and Financial Statements 2017 is incorporated herein by reference to Exhibit 15.2.

LEGAL

The information set forth under the headings ‘Business Overview’, ‘Market opportunities’, ‘Strategic priorities’ and ‘Business model, distribution channels and competition’ on pages 28 to 31 of the Group’s Annual Reports and Financial Statements 2017 is incorporated herein by reference to Exhibit 15.2.

EXHIBITIONS

The information set forth under the headings ‘Business Overview’, ‘Market opportunities’, ‘Strategic priorities’ and ‘Business model, distribution channels and competition’ on pages 34 to 37 of the Group’s Annual Reports and Financial Statements 2017 is incorporated herein by reference to Exhibit 15.2.

9

RELX PLC in 1903. In 1993 they contributed their respective businesses to two jointly owned companies, Reed Elsevier Group plc and Elsevier Reed Finance BV. The parent companies, Reed Elsevier PLC and Reed Elsevier NV, are separate, publicly-held entities. Reed Elsevier PLC’s ordinaryis a publicly-traded holding company with its shares are listed inon the London and New York and Reed Elsevier NV’s ordinarystock exchanges. Its principal asset is the shares areit owns in RELX Group plc, which represent a 52.9% ownership interest in RELX Group plc.

RELX NV is a publicly-traded holding company with its shares listed inon the Euronext Amsterdam and New York. York stock exchanges. Its principal asset is the shares it owns in RELX Group plc, which represent a 47.1% ownership interest in RELX Group plc.

RELX Group plc holds all the operating businesses, subsidiaries, interests in associates and joint ventures and financing activities of RELX Group, a global provider of information and analytics for professional and business customers across industries.

Trading on the New York Stock Exchange is in the form of American Depositary Shares (ADSs), evidenced by American Depositary Receipts (ADRs) issued by Citibank N.A., as depositary. During 2014, Reed Elsevier

A further description of our corporate structure as of December 31, 2017 is contained in note 1 to our consolidated financial statements as set forth on page 122 and under the heading ‘Corporate structure’ on page 71 of the Group’s Annual Reports and Financial Statements 2017 and incorporated herein by reference to Exhibit 15.2, including RELX PLC and RELX NV’s equal voting interests in RELX Group plc,plc.

We are proposing a companyset of measures that will further simplify our corporate structure into a single parent company. We believe this is a natural next step for RELX Group, removing complexity and increasing transparency. The changes will be cost and profit neutral on an ongoing basis and will not impact the economic interests of any shareholder. RELX NV shareholders will receive one new RELX PLC share in exchange for each RELX NV share held and, following the additional listing of RELX PLC shares on Euronext Amsterdam noted below, will have the option of trading new RELX PLC shares on Euronext Amsterdam, quoted and traded in euros, and receive dividend payments in euros. RELX PLC will continue to have a premium listing on the London Stock Exchange and we will be applying for an additional listing of RELX PLC on Euronext Amsterdam. RELX NV ADRs will be convertedone-for-one to RELX PLC ADRs which will continue to be listed on the New York Stock Exchange. There will be no changes to the locations, activities or staffing levels of RELX Group or its four business areas. The simplification is subject to the approval of both RELX PLC and RELX NV shareholders. We expect a circular to be sent to shareholders in Q2 2018, with implementation in Q3 2018.

Further information is set out in consolidated financial statements set forth under the section ‘Corporate Governance’ on pages 70 and 71 of the Group’s Annual Reports and Financial Statements 2017 and is incorporated herein by reference to Exhibit 15.2.

Significant Subsidiaries, Associates, Joint Ventures and Business Units

A list of significant subsidiaries, associates, joint ventures and business units is included as Exhibit 8.0 to this Form20-F.

Introduction

RELX NV was originally incorporated in England,1880 and RELX PLC in 1903. In 1993, they combined their respective businesses by contributing them to two jointly owned companies. In 2015 the publishing and information businesses and Elsevier Reed Finance BV, a company incorporated in the Netherlands, oversaw financing and treasury activities. Reed Elsevier PLC and Reed Elsevier NV each held a 50% interest in Reed Elsevier Group plc. Until February 2015, Reed Elsevier PLC held a 39% interest in Elsevier Reed Finance BV and Reed Elsevier NV held a 61% interest. Reed Elsevier PLC additionally holds an indirect equity interest in Reed Elsevier NV, reflecting the arrangements entered into between Reed Elsevier PLC and Reed Elsevier NV at the timestructure was simplified so that all of the merger, which determined the equalisation ratio wherebybusinesses are now owned by one Reed Elsevier NV ordinary share is, in broad terms, intended to confer equivalent economic interests to 1.538 Reed Elsevier PLC ordinary shares.

Effective February 25, 2015, Reed Elsevier PLC and Reed Elsevier NV transferred their direct ownership interests in Elsevier Reed Finance BV to their jointly-ownedjointly owned company, Reed Elsevier Group plc and named this newly-combined single group entity RELX Group plc. As a result,RELX PLC, RELX NV and RELX Group plc now holds all Reed Elsevier businesses,(and its subsidiaries, associates and financing activities. Further information is provided on pages 23joint ventures) are together known as RELX Group. As part of the 2015 simplification, a bonus issue of RELX NV shares was made such that, since the 2015 bonus issue, one RELX PLC ordinary share confers an equivalent economic interest to 24.one RELX NV ordinary share.

Material acquisitions and disposals

Total acquisition expenditurecash spent on acquisitions in the three years ended December 31, 2014,2017, was £933£715 million. Cash spent on acquisitions in 2017 was £141 million net of cash acquired of £35 million. During 2014, a number of acquisitions were made for total(2016: £367 million; 2015: £207 million) including deferred consideration of £396£13 million net(2016: £24 million; 2015: £25 million) on past acquisitions and spend on venture capital investments of £10 million (2016: £6 million; 2015: £16 million). Acquisition payments in respect ofnon-controlling interests in 2017 were nil (2016: nil; 2015: nil).

Net cash acquired of £9 million. During 2013, a number of acquisitions wereinflow in relation to disposals made for total consideration of £221 million, net of cash acquired of £14 million. During 2012, a number of acquisitions were made for a total consideration of £316 million, net of cash acquired of £12 million.

The net cash received on the disposal of non-strategic assets,in 2017, after timing differences and separation and transaction costs, was £53£34 million (2013: £195 million; 2012: £160 million)(2016: £13 million paid; 2015: £34 million received).

Capital expenditure

Capital expenditure on property, plant, equipment and internally developed intangible assets principally relates to the development of electronic products and investment in systems infrastructure, to support electronic publishing activities, computer equipment and office facilities. Total

10

such capital expenditure, which was financed using cash flows generated from operations, amounted to £270£354 million in 2014 (2013: £3082017 (2016: £333 million; 2012: £3332015: £307 million). In 2014,2017, there was continued investment in new productproducts and related infrastructure, particularly in the Legal segment.and in Scientific, Technical & Medical. Further information on capital expenditure is givenincluded in notes 152, 16 and 1718 to the combinedconsolidated financial statements.statements and is set forth on pages 124, 143 and 146 respectively of the Group’s Annual Reports and Financial Statements 2017 and incorporated herein by reference to Exhibit 15.2.

Principal Executive Officesexecutive offices

The principal executive offices of Reed ElsevierRELX PLC are located at1-3 Strand, London WC2N 5JR, England. Tel: +44 20 7166 5500. The principal executive offices of Reed ElsevierRELX NV are located at Radarweg 29, 1043 NX Amsterdam, the Netherlands. Tel: +31 20 485 2222. The principal executive offices of RELX Group plc are located at1-3 Strand, London, WC2N 5JR, England. Tel: +44 20 7166 5500. The principal executive office located in the United States is at 230 Park Avenue, New York, New York, 10169. Tel: +1 212 309 8100. Our internet address is www.relxgroup.com.www.relx.com. The information on our website is not incorporated by reference into this report.

Our agent in the United States is Kenneth Thompson II, General Counsel Intellectual Property, Privacy and Governance, RELX Group, kenneth.thompson@relxgroup.com,Group; kenneth.thompson@relx.com, 9443 Springboro Pike, B4/F5/514,S14, Miamisburg, Ohio, 45342.

BUSINESS OVERVIEWPROPERTY, PLANT AND EQUIPMENT

We are a leading provider of information solutions for professional customers across industries. We operate in four market segments: Scientific, Technical & Medical, providing information and tools to help its customers improve scientific and healthcare outcomes; Risk & Business Information, providing data services and tools that combine proprietary, public and third-party information, with technology and analytics to business and government customers; Legal, providing legal, tax, regulatory news and business information to legal, corporate, government and academic markets; and Exhibitions, organising exhibitions and conferences.

The Group’s reported segments are based on the internal reporting structure and financial information provided to the Boards. During 2014, Risk Solutions and Business Information have been combined into one business area, having previously operated separately. Accordingly, they are now presented as a single operating segment. Comparative figures have been presented as if the businesses had operated on a combined basis in the prior year.

Our principal operations are in North America and Europe. For the year ended December 31, 2014 we had total revenue ofown or lease approximately £5.8 billion and an average of28,200 employees. As at December 31, 2014 we had28,500 employees. In 2014, North America represented our largest single geographic market, contributing50% of our total revenue.

Revenue is derived principally from subscriptions, transactional and advertising sales. In 2014, 51% of our revenue was derived from subscriptions,47% from transactional sales and2% from advertising sales. An increasing proportion of revenue is derived from electronic information products, principally internet based. In 2014, 66% of our revenue was derived from such sources, including85% of Risk & Business Information revenue,77% of Legal revenue,74% of Scientific, Technical & Medical revenueand3% of Exhibitions revenue.

Subscription sales are defined as revenue derived from the periodic distribution or update of a product or from the provision of access to online services, which is often prepaid. Transactional sales include all other revenue from the distribution of a product and transactions of online services, usually on cash or credit terms. The level of publishing related advertising sales has historically been tied closely to the economic and business investment cycle with changes in the profit performance of advertisers, business confidence and other economic factors having a high correlation with changes in the size of the market. Subscription sales and transactional sales have tended to be more stable than advertising sales through economic cycles.

Revenue is recognised for the various categories as follows: subscriptions — on periodic despatch of subscribed product or rateably over the period of the subscription where performance is not measurable by despatch; transactional — on despatch or occurrence of the transaction or exhibition; and advertising — on publication or period of online display. Where sales consist of two or more independent components whose value can be reliably measured, revenue is recognised on each component as it is completed by performance, based on the attribution of relative value.

Our businesses compete for subscription, transactional, and advertising expenditures in scientific and medical, risk, legal and business sectors. The bases of competition include, for readers and users of the information, the quality and variety of the editorial content and data, the quality of the software to derive added value from the information, the timeliness and the price of the products and, for exhibitors and advertisers, the quality and the size of the audiences targeted.

For additional information regarding revenue from our business activities and geographic markets, see “Item 5: Operating and Financial Review and Prospects” on page 26.

| Revenue Year ended December 31, | ||||||||||||||||||||||||

| 2014 | 2013 | 2012 | ||||||||||||||||||||||

| (in millions, except percentages) | ||||||||||||||||||||||||

Scientific, Technical & Medical | £ | 2,048 | 36 | % | £ | 2,126 | 35 | % | £ | 2,063 | 34 | % | ||||||||||||

Risk & Business Information | 1,439 | 25 | 1,480 | 25 | 1,589 | 26 | ||||||||||||||||||

Legal | 1,396 | 24 | 1,567 | 26 | 1,610 | 26 | ||||||||||||||||||

Exhibitions | 890 | 15 | 862 | 14 | 854 | 14 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | £ | 5,773 | 100 | % | £ | 6,035 | 100 | % | £ | 6,116 | 100 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

SCIENTIFIC, TECHNICAL & MEDICAL

| Year ended December 31, | ||||||||||||

| 2014 | 2013 | 2012 | ||||||||||

| (in millions) | ||||||||||||

Revenue | £ | 2,048 | £ | 2,126 | £ | 2,063 | ||||||

|

|

|

|

|

| |||||||