As filed with the Securities and Exchange Commission on 02 April 201531 March 2017

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM20-F

REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934 OR |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 OR |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 OR |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FINANCIAL YEAR ENDED 31 December 20142016

Commission file number:1-14846

AngloGold Ashanti Limited

(Exact Name of Registrant as Specified in its Charter)

Republic of South Africa

(Jurisdiction of Incorporation or Organisation)

76 JeppeRahima Moosa Street, Newtown, Johannesburg, 2001

(P.O. Box 62117, Marshalltown, 2107)

South Africa

(Address of Principal Executive Offices)

Kandimathie Christine Ramon, Chief Financial Officer, Telephone: +27 11 6376019

E-mail: cramon@anglogoldashanti.com, 76 JeppeRahima Moosa Street, Newtown, Johannesburg, 2001, South Africa

(Name, Telephone,E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

American Depositary Shares | New York Stock Exchange | |

Ordinary Shares | New York Stock Exchange* | |

5.375% | ||

| New York Stock Exchange | |

5.125% Notes due 2022 | New York Stock Exchange | |

6.50% Notes due 2040 | New York Stock Exchange |

| * | Not for trading, but only in connection with the registration of American Depositary Shares pursuant to the requirements of the Securities and Exchange Commission |

Securities registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Ordinary Shares of 25 ZAR cents each | ||||

| ||||

A Redeemable Preference Shares of 50 ZAR cents each | 2,000,000 | |||

B Redeemable Preference Shares of 1 ZAR cent each | 778,896 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| Yes |

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

| Yes |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| Yes |

Indicate by check mark whether the registrant (1) has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of RegulationS-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files)*.

| Yes |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or anon-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule12b-2 of the Exchange Act.

(Check one): Large Accelerated Filer | Accelerated Filer | Non-Accelerated Filer |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP |

International Financial Reporting Standards as issued by the International Accounting Standards Boardx☒ Other¨☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule12b-2 of the Exchange Act). | Yes |

| * | This requirement does not apply to the registrant. |

| Page | ||||||||

| 3 | ||||||||

| 4 | ||||||||

| 5 | ||||||||

| 5 | ||||||||

| 8 | ||||||||

| 9 | ||||||||

| 10 | ||||||||

Item 1: | 11 | |||||||

Item 2: | 11 | |||||||

Item 3: | ||||||||

| 3A. | 11 | |||||||

| 3B. | 15 | |||||||

| 3C. | 15 | |||||||

| 3D. | 15 | |||||||

Item 4: | Information on the company | 48 | ||||||

| 4A. | 48 | |||||||

| 4B. | 49 | |||||||

| 4C. | 104 | |||||||

| 4D. | 105 | |||||||

Item 4A: | 130 | |||||||

Item 5: | 131 | |||||||

| 5A. | 132 | |||||||

| 5B. | 175 | |||||||

| 5C. | 180 | |||||||

| 5D. | 181 | |||||||

| 5E. | 181 | |||||||

| 5F. | 181 | |||||||

Item 6: | 182 | |||||||

| 6A. | 182 | |||||||

| 6B. | 189 | |||||||

| 6C. | 192 | |||||||

| 6D. | 196 | |||||||

| 6E. | 197 | |||||||

Item 7: | 203 | |||||||

| 7A. | 204 | |||||||

| 7B. | 205 | |||||||

| 7C. | 205 | |||||||

Item 8: | 206 | |||||||

| 8A. | Consolidated financial statements and other financial information | 206 | ||||||

| 206 | ||||||||

| 211 | ||||||||

| 8B. | 211 | |||||||

1

Item 9: | 212 | |||||

| 9A. | ||||||

| 9B. | ||||||

| 9C. | ||||||

| 9D. | ||||||

| 9E. | ||||||

| 9F. | ||||||

Item 10: | 214 | |||||

| 10A. | ||||||

| 10B. | ||||||

| 10C. | ||||||

| 10D. | ||||||

| 10E. | ||||||

| 10F. | ||||||

| 10G. | ||||||

| 10H. | ||||||

| 10I. | ||||||

Item 11: | ||||||

Item 12: | 243 | |||||

| 12A. | ||||||

| 12B. | ||||||

| 12C. | ||||||

| 12D. | 243 | |||||

244 | ||||||

Item 13: | ||||||

Item 14: | Material modifications to the rights of security holders and use of proceeds | |||||

Item 15: | ||||||

Item 16A: | ||||||

Item 16B: | ||||||

Item 16C: | ||||||

Item 16D: | ||||||

Item 16E: | Purchases of equity securities by the issuer and affiliated purchasers | |||||

Item 16F: | ||||||

Item 16G: | ||||||

Item 16H: | ||||||

253 | ||||||

Item 17: | ||||||

Item 18: | ||||||

Item 19 | E pages | |||||

2

AngloGold Ashanti Limited

In this annual report on Form20-F, unless the context otherwise requires, references to AngloGold, AngloGold Ashanti, AGA, the company, the Company and the group are references to AngloGold Ashanti Limited including, as appropriate, subsidiaries and associate companies of AngloGold Ashanti.Ashanti Limited.

IFRS financial statements

As a company incorporated in the Republic of South Africa, AngloGold Ashanti has prepared and filedprepares annual audited consolidated financial statements and unaudited consolidated quarterlyhalf-year financial statements in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB) in the English language since 1998.language. These financial statements are distributed to shareholders and are submitted to the JSE Limited (JSE), as well as the New York, Australian and Ghana stock exchanges.

Currency

AngloGold Ashanti presents its consolidated financial statements in United States dollars.

In this annual report, references to rands, ZAR and R are to the lawful currency of the Republic of South Africa, references to US dollars, dollar or $ are to the lawful currency of the United States, references to€ and Euro are to the lawful currency of the European Union, references to C$ or CAD are to the lawful currency of Canada, references to ARS and Argentinean peso are to the lawful currency of Argentina, references to AUD and A$ are to the lawful currency of Australia, references to BRL are to the lawful currency of Brazil, references to NAD are to the lawful currency of Namibia, references to Tsh are to the lawful currency of the United Republic of Tanzania and references to GHC, cedi or Gh¢ are to the lawful currency of Ghana.

See “Item 3A.:3A: Selected financial data – Exchange rate information” for historical information regarding the US dollar/South African rand exchange rate. On 2322 March 2015,2017, the interbank US dollar/South African rand exchange rate as reported by OANDA CorporationReuters was R11.99/R12.57/$1.00.

Non-GAAP financial measures

In this annual report on Form20-F, AngloGold Ashanti presents the financial items “total cash costs”, “total cash costs per ounce”, “total production costs”, “total production costs per ounce”, “all-in“all-in sustaining costs”,“all-in sustaining costs per ounce”, “all-in“all-in costs” and “all-in“all-in costs per ounce”, which have been determined using industry guidelines and practices and are not IFRS measures. An investor should not consider these items in isolation or as alternatives to production costs,cost of sales, profit/(loss) applicable to equity shareholders, profit/(loss) before taxation, cash flows from operating activities or any other measure of financial performance presented in accordance with IFRS. The

While the Gold Institute provided definitions for the calculation of total cash costs and total production costs and during June 2013 the World Gold Council published a Guidance Note on “all-in“all-in sustaining costs” and “all-in“all-in costs” metrics. Themetrics, the calculation of total cash costs, total cash costs per ounce, total production costs, total production costs per ounce, all-in sustaining costs,all-in sustaining costs per ounce,all-in costs andall-in costs per ounce may vary significantly among gold mining companies, and by themselves do not necessarily provide a basis for comparison with other gold mining companies. See “Glossary“—Glossary of selected terms – terms–Financial terms – terms–Total cash costs”, “Total production costs”, “All-in“ —Glossary of selected terms–Financialterms–All-in sustaining costs” and “All-in“—Glossary of selected terms–Financialterms–All-in costs”. Nevertheless, AngloGold Ashanti believes that total cash costs,all-in sustaining costs andall-in costs in total and per ounce are useful indicators to investors and management as they provide:

an indication of profitability, efficiency and cash flows;

the trend in costs as the mining operations mature over time on a consistent basis; and

an internal benchmark of performance to allow for comparison against other mines, both within the AngloGold Ashanti group and at other gold mining companies.

A reconciliation of both cost of sales and total cash costs as included in the company’s audited financial statements to total cash costs,all-in sustaining costs andall-in costs for each of the three years ended 31 December 2014, 2015 and 2016 is presented herein. See “Item 5: Operating and Financial Review and Prospects—Totalall-in sustaining costs,all-in costs and total cash costs”.

Shares and shareholders

In this annual report on Form20-F, references to ordinary shares, ordinary shareholders, equity shareholders and shareholders/members, should be read as common stock, common stockholders and stockholders, respectively, and vice versa.

3

CERTAIN FORWARD-LOOKING STATEMENTS

Certain statements contained in this document, other than statements of historical fact, including, without limitation, those concerning the economic outlook for the gold mining industry, expectations regarding gold prices, production, total cash costs,all-in sustaining costs,all-in costs, cost savings and other operating results, return on equity, productivity improvements, growth prospects and outlook of AngloGold Ashanti’s operations, individually or in the aggregate, including the achievement of project milestones, commencement and completion of commercial operations of certain of AngloGold Ashanti’s exploration and production projects and the completion of acquisitions, dispositions or joint venture transactions, AngloGold Ashanti’s liquidity and capital resources and capital expenditures and the outcome and consequence of any potential or pending litigation or regulatory proceedings or environmental, health and safety issues, are forward-looking statements regarding AngloGold Ashanti’s operations, economic performance and financial condition.

These forward-looking statements or forecasts involve known and unknown risks, uncertainties and other factors that may cause AngloGold Ashanti’s actual results, performance or achievements to differ materially from the anticipated results, performance or achievements expressed or implied in these forward-looking statements. Although AngloGold Ashanti believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. Accordingly, results could differ materially from those set out in the forward-looking statements as a result of among other factors, changes in economic, social and political and market conditions, the success of business and operating initiatives, changes in the regulatory environment and other government actions, including environmental approvals, fluctuations in gold prices and exchange rates, the outcome of pending or future litigation proceedings and business and operational risk management and other factors as described in “Item 3D.:3D: Risk factors” and elsewhere in this annual report. These factors are not necessarily all of the important factors that could cause AngloGold Ashanti’s actual results to differ materially from those expressed in any forward-looking statements. Other unknown or unpredictable factors could also have material adverse effects on future results. Consequently, readers are cautioned not to place undue reliance on forward-looking statements.

AngloGold Ashanti undertakes no obligation to update publicly or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this annual report or to reflect the occurrence of unanticipated events, except to the extent required by applicable law. All subsequent written or oral forward-looking statements attributable to AngloGold Ashanti or any person acting on its behalf are qualified by the cautionary statements herein.

4

The following explanations are not intended as technical definitions but should assist the reader in understanding terminology used in this annual report. Unless expressly stated otherwise, all explanations are applicable to both underground and surface mining operations.

All injury frequency rate:The total number of injuries and fatalities that occurs per million hours worked.

BIF:Banded Ironstone Formation. A chemically formed iron-rich sedimentary rock.

By-products:Any products that emanate from the core process of producing gold, including silver, uranium and sulphuric acid.

Carbon-in-leach (CIL):Gold is leached from a slurry of gold ore with cyanide in agitated tanks and adsorbed on to activated carbon granules at the same time (i.e. when cyanide is introduced in the leach tank, there is already activated carbon in the tank and there is no distinction between leach and adsorption stages). The carbon granules are separated from the slurry and treated in an elution circuit to remove the gold.

Carbon-in-pulp (CIP): Gold is leached conventionally from a slurry of gold ore with cyanide in agitated tanks. The leached slurry then passes into the CIP circuit where activated carbon granules are mixed with the slurry and gold is adsorbed on to the activated carbon. The gold-loaded carbon is separated from the slurry and treated in an elution circuit to remove the gold.

CLR:Carbon leader reef.

Comminution:Comminution is the crushing and grinding of ore to make gold available for treatment. (See also “Milling”).

Contained gold:The total gold content (tons multiplied by grade) of the material being described.

Depletion:The decrease in the quantity of ore in a deposit or property resulting from extraction or production.

Development:The process of accessing an orebody through shafts and/or tunneling in underground mining operations.

Diorite:An igneous rock formed by the solidification of molten material (magma).

Doré:Impure alloy of gold and silver produced at a mine to be refined to a higher purity.

Electro-winning:A process of recovering gold from solution by means of electrolytic chemical reaction into a form that can be smelted easily into gold bars.

Elution:Recovery of the gold from the activated carbon into solution before zinc precipitation or electro-winning.

Feasibility study:A comprehensive technical and economic study of the selected development option for a mineral project that includes appropriately detailed assessments of applicable Modifying Factors together with any other relevant operational factors and detailed financial analysis that are necessary to demonstrate at the time of reporting that extraction is reasonably justified (economically mineable). The results of the study may reasonably serve as the basis for a final decision by a proponent or financial institution to proceed with, or finance, the development of the project. The confidence level of the study will be higher than that of aPre-Feasibility Study (JORC 2012).

Flotation:Concentration of gold and gold-hosting minerals into a small mass by various techniques (e.g. collectors, frothers, agitation,air-flow) that collectively enhance the buoyancy of the target minerals, relative to unwanted gangue, for recovery into an over-flowing froth phase.

5

Gold Produced:Refined gold in a saleable form derived from the mining process.

Grade:The quantity of gold contained within a unit weight of gold-bearing material generally expressed in ounces per short ton of ore (oz/t), or grams per metric tonne (g/t).

Greenschist:A schistose metamorphic rock whose green colour is due to the presence of chlorite, epidote or actinolite.

Leaching:Dissolution of gold from crushed or milled material, including reclaimed slime, prior to adsorption on to activated carbon or direct zinc precipitation.

Life of mine (LOM):Number of years for which an operation is planning to mine and treat ore, and is taken from the current mine plan.

Metallurgical plant:A processing plant constructed to treat ore and extract gold.

Milling:A process of reducing broken ore to a size at which concentrating can be undertaken. (See also “Comminution”).

Mine call factor:The ratio, expressed as a percentage, of the total quantity of recovered and unrecovered mineral product after processing with the amount estimated in the ore based on sampling. The ratio of contained gold delivered to the metallurgical plant divided by the estimated contained gold of ore mined based on sampling.

Mineral deposit:A mineral deposit is a concentration (or occurrence) of material of possible economic interest in or on the earth’s crust.

Mineral Resource:A concentration or occurrence of solid material of economic interest in or on the earth’s crust is such form, grade (or quality), and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade (or quality), continuity and other geological characteristics of a mineral resourceMineral Resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. Mineral resourcesResources aresub-divided in order of increasing geological confidence, into inferred, indicatedInferred, Indicated or measuredMeasured categories (JORC 2012).

Modifying factors:Factors:Modifying Factors’ are considerations used to convert Mineral Resources to Ore Reserves. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors.

Ore Reserve:That part of a mineral deposit which could be economically and legally extracted or produced at the time of the Ore Reserve determination.

Ounce (oz) (troy):Used in imperial statistics. A kilogram is equal to 32.1507 ounces. A troy ounce is equal to 31.1035 grams.

Pay limit:The grade of a unit of ore at which the revenue from the recovered mineral content of the ore is equal to the sum of total cash costs, closure costs, Ore Reserve development andstay-in-business capital. This grade is expressed as anin-situ value in grams per tonne or ounces per short ton (before dilution and mineral losses).

Precipitate:The solid product formed when a change in solution chemical conditions results in conversion of somepre-dissolved ions into solid state.

Probable Ore Reserve:Ore Reserve for which quantity and grade are computed from information similar to that used for Proven Reserves, but the sites for inspection, sampling, and measurement are further apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for Proven Reserves, is high enough to assume continuity between points of observation.

Productivity:An expression of labour productivity based on the ratio of ounces of gold produced per month to the total number of employees in mining operations.

Project capital:Capital expenditure to either bring a new operation into production; to materially increase production capacity; or to materially extend the productive life of an asset.

6

Proven Ore Reserve:A ‘Proven Ore Reserve’ is the economically mineable part of a Measured Mineral Resource. A Proven Ore Reserve implies a high degree of confidence in the Modifying Factors.

Project capital: Capital expenditure to either bring a new operation into production; to materially increase production capacity; or to materially extend the productive life of an asset.

Recovered grade:The recovered mineral content per unit of ore treated.

Reef:A gold-bearing sedimentary horizon, normally a conglomerate band that may contain economic levels of gold.

Refining:The final purification process of a metal or mineral.

Rehabilitation:The process of reclaiming land disturbed by mining to allow an appropriate post-mining use. Rehabilitation standards are defined by country-specific laws, including but not limited to the South African Department of Mineral Resources, the US Bureau of Land Management, the US Forest Service, and the relevant Australian mining authorities, and address among other issues, ground and surface water, topsoil, final slope gradient, waste handling andre-vegetation issues.

Seismic event:A sudden inelastic deformation within a given volume of rock that radiates detectable seismic energy.

Shaft:A vertical or subvertical excavation used for accessing an underground mine; for transporting personnel, equipment and supplies; for hoisting ore and waste; for ventilation and utilities; and/or as an auxiliary exit.

Short ton:Used in imperial statistics. Equal to 2,000 pounds.

Skarn:Smelting A rock of complex mineralogical composition, formed by contact metamorphism and metasomatism of carbonate rocks.

Smelting::A pyro-metallurgical operation in which gold precipitate from electro-winning or zinc precipitation is further separated from impurities.

Stoping:The process of excavating ore underground.

Stripping ratio: The ratio of waste tonnes to ore tonnes mined calculated as total tonnes mined less ore tonnes mined divided by ore tonnes mined.

Tailings:Finely ground rock of low residual value from which valuable minerals have been extracted.

Tonnage:Quantity of material measured in tonnes or tons.

Tonne:Used in metric statistics. Equal to 1,000 kilograms.

Tonnage: Quantity of material measured in tonnes or tons.

Waste:Material that contains insufficient mineralisation for consideration for future treatment and, as such, is discarded.

Yield:The amount of valuable mineral or metal recovered from each unit mass of ore expressed as ounces per short ton or grams per metric tonne.

Zinc precipitation:Zinc precipitation is the chemical reaction using zinc dust that converts gold in solution to a solid form for smelting into unrefined gold bars.

7

All-in costs:All-in Costs costs are All-in Sustainingall-in sustaining costs including additionalnon-sustaining costs which reflect the varying costs of producing gold over the life-cycle of a mine.Non-sustaining costs are those costs incurred at new operations and costs related to ‘major projects’ at existing operations where these projects will materially increase production.All-in costs per ounce is arrived at by dividing the dollar value of the sum of these cost metrics, by the ounces of gold sold.

All-in Sustaining sustaining costs:During June 2013 the World Gold Council (WGC), an industry body, published a Guidance Note on “all-in“all-in sustaining costs” metric, which gold mining companies can use to supplement their overallnon-GAAP disclosure. “All-in“All-in sustaining costs” is an extension of the existing “cash“total cash cost” metric and incorporates all costs related to sustaining production and in particular recognises the sustaining capital expenditure associated with developing and maintaining gold mines. In addition, this metric includes the cost associated with developing and maintaining gold mines. In addition, this metric includes the cost associated with corporate office structures that support these operations, the community and rehabilitation costs attendant with responsible mining and any exploration and evaluation costs associated with sustaining current operations.All-in sustaining costs per ounce is arrived at by dividing the dollar value of the sum of these cost metrics, by the ounces of gold sold.

Average number of employees:The monthly average number of production andnon-production employees and contractors employed during the year, where contractors are defined as individuals who have entered into a fixed-term contract of employment with a group company or subsidiary. Employee numbers of joint ventures represents the group’s attributable share.

Capital expenditure:Total capital expenditure on tangible assets.

Effective tax rate:Current and deferred taxation charge for the year as a percentage of profit before taxation.

OANDA Corporation: An internet-based provider of forex trading and currency information services.

Rated bonds:The $700 million 5.375 percent bonds due 2020, $300 million 6.5 percent bonds due 2040 and the $750 million 5.125 percent bonds due 2022.

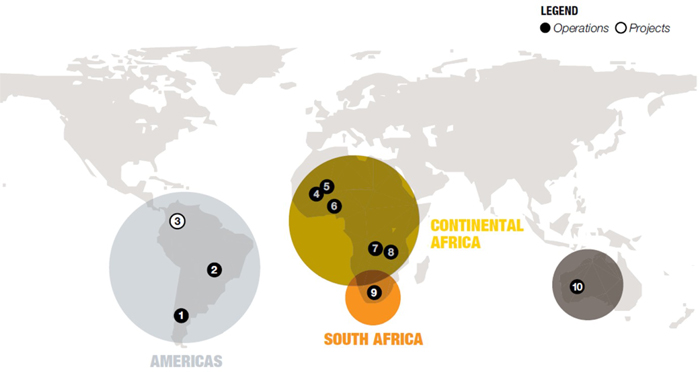

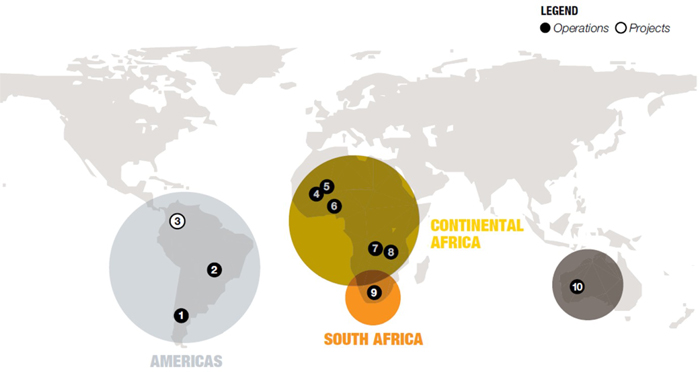

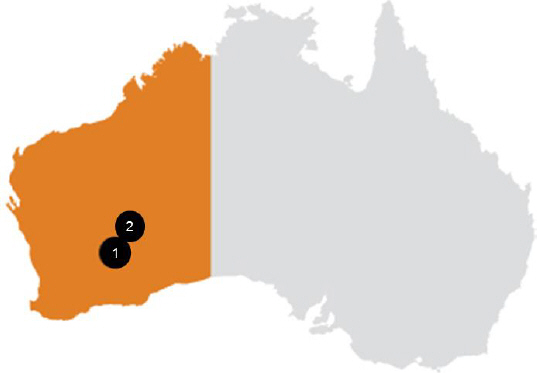

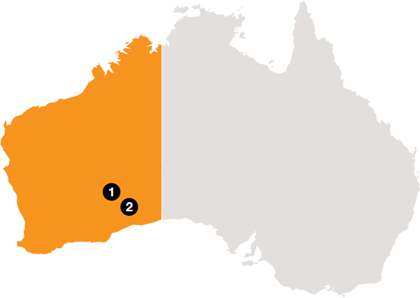

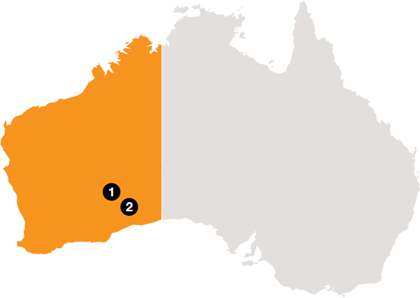

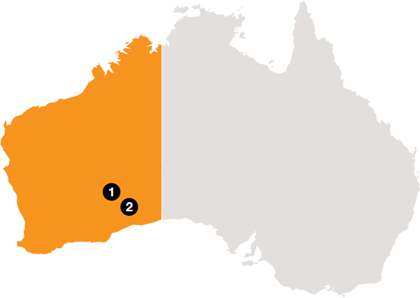

Region:Defines the operational management divisions within AngloGold Ashanti Limited, namely South Africa, Continental Africa (DRC, Ghana, Guinea, Mali and Tanzania), Australasia, and the Americas (Argentina Brazil and United States of America)Brazil).

Related party:Parties are considered related if one party has the ability to control the other party or exercise significant influence over the other party in making financial and operating decisions.

Significant influence:The ability, directly or indirectly, to participate in, but not exercise control over, the financial and operating policy decision of an entity so as to obtain economic benefit from its activities.

STRATE:Stay in business capital:Capital expenditure to extend useful lives of existing production assets. This includes replacement of vehicles, plant and machinery, Ore Reserve development, deferred stripping and capital expenditure related to financial benefit initiatives, safety, health and the environment.

Strate:The licensed Central Securities Depository (CSD) for the electronic settlement of financial instruments in South Africa.

Total cash costs:Total cash costs include site costs for all mining, processing and administration, reduced by contributions fromby-products and are inclusive of royalties and production taxes. Depreciation, depletion and amortization,amortisation, rehabilitation, corporate administration, employee severance costs, capital and exploration costs are excluded. Total cash costs per ounce are the attributable total cash costs divided by the attributable ounces of gold produced.

Total production costs:Total cash costs plus depreciation, depletion and amortization,amortisation, employee severance costs, rehabilitation and othernon-cash costs. Corporate administration and exploration costs are excluded. Total production costs per ounce are the attributable total production costs divided by the attributable ounces of gold produced.

Weighted average number of ordinary shares:The number of ordinary shares in issue at the beginning of the year, increased by shares issued during the year, weighted on a time basis for the period during which they have participated in the income of the group, and increased by share options that are virtually certain to be exercised.

8

$, US$ or dollar | United States dollars | |||||

ARS | Argentinean peso | |||||

A$ or AUD | Australian dollars | |||||

BRL | Brazilian real | |||||

|

| |||||

€ or Euro | European Euro | |||||

GHC, cedi or | Ghanaian cedi | |||||

|

| |||||

Tsh | Tanzanian Shillings | |||||

ZAR, R or rand | South African rands |

9

ADR | American Depositary Receipt | |

ADS | American Depositary Share | |

|

| |

AIFR | All injury frequency rate | |

ASX | Australian Securities Exchange | |

Au | Contained gold | |

BBSY | Bank Bill Swap Bid Rate | |

BEE | Black Economic Empowerment | |

bn | Billion | |

CDI | Chess Depositary Interests | |

CHESS | Clearing House Electronic Settlement System | |

CLR | Carbon Leader Reef | |

CR | Crystalkop Reef | |

DMTNP | Domestic medium-term notes programme | |

DRC | Democratic Republic of the Congo | |

ERP | Enterprise resource planning | |

|

| |

G or g | Grams | |

GhDS | Ghanaian Depositary Share | |

GhSE | Ghana Stock Exchange | |

IASB | International Accounting Standards Board | |

IFRS | International Financial Reporting Standards as issued by the IASB | |

JIBAR | Johannesburg Interbank Agreed Rate | |

JORC | Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves | |

|

| |

JSE | JSE Limited (Johannesburg Stock Exchange) | |

King III | The King Code on Corporate Governance for South Africa | |

Kg or kg | Kilograms | |

Km or km | Kilometres | |

| Squared kilometres | |

Koz | Thousand ounces | |

LIBOR | London Interbank Offer Rate | |

M or m | Metre or million, depending on the context | |

Moz | Million ounces | |

Mt | Million tonnes or tons | |

Mtpa | Million tonnes/tons per annum | |

NYSE | New York Stock Exchange | |

Oz or oz | Ounces (troy) | |

oz/t | Ounces per ton | |

oz/TEC | Ounces per total employee costed | |

SAMREC | South African Code for the Reporting of Exploration Results, Mineral Resources and Mineral Reserves | |

SEC | United States Securities and Exchange Commission | |

The Companies Act | South African Companies Act, No. 71 of 2008, as amended | |

T or t | Tons (short) or tonnes (metric) | |

Tpa or tpa | Tonnes/tons per annum | |

US/USA/United States | United States of America | |

|

| |

VCR | Ventersdorp Contact Reef |

Note:Rounding of figures in this report may result in computational discrepancies.

10

ITEM 1: IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

Not applicable.

ITEM 2: OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

| 3A. | SELECTED FINANCIAL DATA |

The selected financial information set forth below for the years ended and as at 31 December 2014, 20132016, 2015 and 20122014 has been derived from, and should be read in conjunction with, the IFRS financial statements included under Item 18 of this annual report. The selected financial information for the years ended and as at 31 December 20102013 and 20112012 has been derived from the IFRS financial statements not included in this annual report.

The financial statements have been prepared under IFRS.

Consolidated income statement Revenue Gold income Cost of sales Gain (loss) onnon-hedge derivatives and other commodity contracts Gross profit Corporate administration, marketing, other expenses and other income Exploration and evaluation costs Other operating expenses Special items Operating profit (loss) Dividends received Interest received Exchange (loss) gain Finance costs and unwinding of obligations Fair value adjustment on issued bonds Share of associates and joint ventures’ profit (loss) Profit (loss) before taxation Taxation Profit (loss) after taxation from continuing operations Discontinued operations (Loss) profit from discontinued operations Profit (loss) for the year Allocated as follows Equity shareholders - Continuing operations - Discontinued operations Non-controlling interests - Continuing operations Basic earnings (loss) per ordinary share (cents) Earnings (loss) per ordinary share from continuing operations (Loss) earnings per ordinary share from discontinued operations Diluted earnings (loss) per ordinary share (cents) Earnings (loss) per ordinary share from continuing operations (Loss) earnings per ordinary share from discontinued operations Dividend per ordinary share (cents) Year ended 31 December 2016 2015 2014 2013 2012 $ $ $ $ $ (in millions, except share and per share amounts) 4,254 4,174 5,110 5,383 6,222 4,085 4,015 4,952 5,172 5,943 (3,263 ) (3,294 ) (3,972 ) (3,947 ) (3,765 ) 19 (7 ) 13 94 (36 ) 841 714 993 1,319 2,142 (61 ) (78 ) (92 ) (201 ) (288 ) (133 ) (132 ) (142 ) (250 ) (390 ) (110 ) (96 ) (28 ) (19 ) (47 ) (42 ) (71 ) (260 ) (2,951 ) (402 ) 495 337 471 (2,102 ) 1,015 - - - 5 7 22 28 24 39 43 (88 ) (17 ) (7 ) 14 8 (180 ) (245 ) (276 ) (293 ) (228 ) 9 66 (17 ) 307 245 11 88 (25 ) (162 ) (30 ) 269 257 170 (2,192 ) 1,060 (189 ) (211 ) (225 ) 237 (285 ) 80 46 (55 ) (1,955 ) 775 - (116 ) 16 (245 ) 140 80 (70 ) (39 ) (2,200 ) 915 63 31 (74 ) (1,985 ) 757 - (116 ) 16 (245 ) 140 17 15 19 30 18 80 (70 ) (39 ) (2,200 ) 915 15 (20 ) (14 ) (568 ) 232 15 8 (18 ) (506 ) 196 - (28 ) 4 (62 ) 36 15 (20 ) (14 ) (631 ) 177 15 8 (18 ) (571 ) 144 - (28 ) 4 (62 ) 33 - - - 10 56

Consolidated balance sheet data ASSETS Non-current assets Tangible assets Intangible assets Investments in associates and joint ventures Other investments Inventories Trade, other receivables and other assets Deferred taxation Cash restricted for use Othernon-current assets Current assets Other investments Inventories Trade, other receivables and other assets Cash restricted for use Cash and cash equivalents Non-current assets held for sale Total assets EQUITY AND LIABILITIES Share capital and premium Accumulated losses and other reserves Shareholders’ equity Non-controlling interests Total equity Non-current liabilities Borrowings Environmental rehabilitation and other provisions Provision for pension and post-retirement benefits Trade, other payables and deferred income Derivatives Deferred taxation Current liabilities Borrowings Trade, other payables and deferred income Bank overdraft Taxation Non-current liabilities held for sale Total liabilities Total equity and liabilities Number of ordinary shares as adjusted to reflect changes in share capital Share capital (exclusive of long-term debt and redeemable preference shares) Net assets11 As at 31 December 2016 2015 2014 2013 2012 $ $ $ $ $ (in millions, except share and per share amounts) 4,111 4,058 4,863 4,815 7,776 145 161 225 267 315 1,448 1,465 1,427 1,327 1,047 125 91 126 131 167 84 90 636 586 610 34 13 20 29 79 4 1 127 177 97 36 37 36 31 29 - 18 25 41 7 5,987 5,934 7,485 7,404 10,127 5 1 - 1 - 672 646 888 1,053 1,213 255 196 278 369 472 19 23 15 46 35 215 484 468 648 892 1,166 1,350 1,649 2,117 2,612 - - - 153 - 1,166 1,350 1,649 2,270 2,612 7,153 7,284 9,134 9,674 12,739 7,108 7,066 7,041 7,006 6,742 (4,393 ) (4,636 ) (4,196 ) (3,927 ) (1,269 ) 2,715 2,430 2,845 3,079 5,473 39 37 26 28 21 2,754 2,467 2,871 3,107 5,494 2,144 2,637 3,498 3,633 2,724 877 847 1,052 963 1,238 118 107 147 152 221 4 5 15 4 10 - - - - 10 496 514 567 579 1,084 3,639 4,110 5,279 5,331 5,287 34 100 223 258 859 615 516 695 820 979 - - - 20 - 111 91 66 81 120 760 707 984 1,179 1,958 - - - 57 - 760 707 984 1,236 1,958 4,399 4,817 6,263 6,567 7,245 7,153 7,284 9,134 9,674 12,739 408,223,760 405,265,315 404,010,360 402,628,406 383,320,962 16 16 16 16 16 2,754 2,467 2,871 3,107 5,494

| Year ended 31 December | ||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010(1) | ||||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||

| (in millions, except share and per share amounts) | ||||||||||||||||||||

Consolidated income statement | ||||||||||||||||||||

Revenue | 5,378 | 5,708 | 6,632 | 6,925 | 5,514 | |||||||||||||||

Gold income | 5,218 | 5,497 | 6,353 | 6,570 | 5,334 | |||||||||||||||

Cost of sales | (4,190 | ) | (4,146 | ) | (3,964 | ) | (3,892 | ) | (3,550 | ) | ||||||||||

Gain (loss) on non-hedge derivatives and other commodity contracts | 15 | 94 | (35 | ) | (1 | ) | (702 | ) | ||||||||||||

Gross profit | 1,043 | 1,445 | 2,354 | 2,677 | 1,082 | |||||||||||||||

Corporate administration, marketing and other expenses | (92 | ) | (201 | ) | (291 | ) | (278 | ) | (220 | ) | ||||||||||

Exploration and evaluation costs | (144 | ) | (255 | ) | (395 | ) | (279 | ) | (198 | ) | ||||||||||

Other operating expenses | (28 | ) | (19 | ) | (47 | ) | (31 | ) | (20 | ) | ||||||||||

Special items | (260 | ) | (3,410 | ) | (402 | ) | 163 | (126 | ) | |||||||||||

Operating profit (loss) | 519 | (2,440 | ) | 1,219 | 2,252 | 518 | ||||||||||||||

Dividends received | - | 5 | 7 | - | - | |||||||||||||||

Interest received | 24 | 39 | 43 | 52 | 43 | |||||||||||||||

Exchange gain | (7 | ) | 14 | 8 | 2 | 3 | ||||||||||||||

Finance costs and unwinding of obligations | (278 | ) | (296 | ) | (231 | ) | (196 | ) | (166 | ) | ||||||||||

Fair value adjustment on $1.25bn bonds | (17 | ) | (58 | ) | - | - | - | |||||||||||||

Fair value adjustment on option component of convertible bonds | - | 9 | 83 | 84 | (1 | ) | ||||||||||||||

Fair value adjustment on mandatory convertible bonds | - | 356 | 162 | 104 | (55 | ) | ||||||||||||||

Share of associates and joint ventures’ (loss) profit | (25 | ) | (162 | ) | (30 | ) | 72 | 63 | ||||||||||||

Profit (loss) before taxation | 216 | (2,533 | ) | 1,261 | 2,370 | 405 | ||||||||||||||

Taxation | (255 | ) | 333 | (346 | ) | (737 | ) | (276 | ) | |||||||||||

(Loss) profit for the year | (39 | ) | (2,200 | ) | 915 | 1,633 | 129 | |||||||||||||

Allocated as follows | ||||||||||||||||||||

Equity shareholders | (58 | ) | (2,230 | ) | 897 | 1,587 | 76 | |||||||||||||

Non-controlling interests | 19 | 30 | 18 | 46 | 53 | |||||||||||||||

| (39 | ) | (2,200 | ) | 915 | 1,633 | 129 | ||||||||||||||

Basic (loss) earnings per ordinary share (cents) | (14 | ) | (568 | ) | 232 | 411 | 20 | |||||||||||||

Diluted (loss) earnings per ordinary share (cents) | (14 | ) | (631 | ) | 177 | 355 | 20 | |||||||||||||

Dividend per ordinary share (cents) | - | 10 | 56 | 34 | 18 | |||||||||||||||

|

12

| As at 31 December | ||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010(1) | ||||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||

| (in millions, except share and per share amounts) | ||||||||||||||||||||

Consolidated balance sheet data | ||||||||||||||||||||

ASSETS | ||||||||||||||||||||

Non-current assets | ||||||||||||||||||||

Tangible assets | 4,863 | 4,815 | 7,776 | 6,545 | 6,180 | |||||||||||||||

Intangible assets | 225 | 267 | 315 | 210 | 194 | |||||||||||||||

Investments in associates and joint ventures | 1,427 | 1,327 | 1,047 | 691 | 622 | |||||||||||||||

Other investments | 126 | 131 | 167 | 186 | 237 | |||||||||||||||

Inventories | 636 | 586 | 610 | 410 | 345 | |||||||||||||||

Trade and other receivables | 20 | 29 | 79 | 76 | 152 | |||||||||||||||

Derivatives | - | - | - | - | 1 | |||||||||||||||

Deferred taxation | 127 | 177 | 97 | 79 | 20 | |||||||||||||||

Cash restricted for use | 36 | 31 | 29 | 23 | 33 | |||||||||||||||

Other non-current assets | 25 | 41 | 7 | 9 | 9 | |||||||||||||||

| 7,485 | 7,404 | 10,127 | 8,229 | 7,793 | ||||||||||||||||

Current assets | ||||||||||||||||||||

Other investments | - | 1 | - | - | - | |||||||||||||||

Inventories | 888 | 1,053 | 1,213 | 998 | 890 | |||||||||||||||

Trade and other receivables | 278 | 369 | 472 | 354 | 247 | |||||||||||||||

Current portion of other non-current assets | - | - | - | - | 1 | |||||||||||||||

Cash restricted for use | 15 | 46 | 35 | 35 | 10 | |||||||||||||||

Cash and cash equivalents | 468 | 648 | 892 | 1,112 | 575 | |||||||||||||||

| 1,649 | 2,117 | 2,612 | 2,499 | 1,723 | ||||||||||||||||

Non-current assets held for sale | - | 153 | - | 21 | 16 | |||||||||||||||

| 1,649 | 2,270 | 2,612 | 2,520 | 1,739 | ||||||||||||||||

Total assets | 9,134 | 9,674 | 12,739 | 10,749 | 9,532 | |||||||||||||||

EQUITY AND LIABILITIES | ||||||||||||||||||||

Share capital and premium | 7,041 | 7,006 | 6,742 | 6,689 | 6,627 | |||||||||||||||

Accumulated losses and other reserves | (4,196 | ) | (3,927 | ) | (1,269 | ) | (1,706 | ) | (2,638 | ) | ||||||||||

Shareholders’ equity | 2,845 | 3,079 | 5,473 | 4,983 | 3,989 | |||||||||||||||

Non-controlling interests | 26 | 28 | 21 | 137 | 124 | |||||||||||||||

Total equity | 2,871 | 3,107 | 5,494 | 5,120 | 4,113 | |||||||||||||||

Non-current liabilities | ||||||||||||||||||||

Borrowings | 3,498 | 3,633 | 2,724 | 2,456 | 2,569 | |||||||||||||||

Environmental rehabilitation and other provisions | 1,052 | 963 | 1,238 | 782 | 589 | |||||||||||||||

Provision for pension and post-retirement benefits | 147 | 152 | 221 | 195 | 191 | |||||||||||||||

Trade, other payables and deferred income | 15 | 4 | 10 | 14 | 17 | |||||||||||||||

Derivatives | - | - | 10 | 93 | 176 | |||||||||||||||

Deferred taxation | 567 | 579 | 1,084 | 1,148 | 900 | |||||||||||||||

| 5,279 | 5,331 | 5,287 | 4,688 | 4,442 | ||||||||||||||||

Current liabilities | ||||||||||||||||||||

Borrowings | 223 | 258 | 859 | 32 | 135 | |||||||||||||||

Trade, other payables and deferred income | 695 | 820 | 979 | 751 | 705 | |||||||||||||||

Bank overdraft | - | 20 | - | - | - | |||||||||||||||

Taxation | 66 | 81 | 120 | 158 | 134 | |||||||||||||||

| 984 | 1,179 | 1,958 | 941 | 974 | ||||||||||||||||

Non-current liabilities held for sale | - | 57 | - | - | 3 | |||||||||||||||

| 984 | 1,236 | 1,958 | 941 | 977 | ||||||||||||||||

Total liabilities | 6,263 | 6,567 | 7,245 | 5,629 | 5,419 | |||||||||||||||

Total equity and liabilities | 9,134 | 9,674 | 12,739 | 10,749 | 9,532 | |||||||||||||||

Number of ordinary shares as adjusted to reflect changes in share capital | 404,010,360 | 402,628,406 | 383,320,962 | 382,242,343 | 381,204,080 | |||||||||||||||

Share capital (exclusive of long-term debt and redeemable preference shares) | 16 | 16 | 16 | 16 | 16 | |||||||||||||||

Net assets | 2,871 | 3,107 | 5,494 | 5,120 | 4,113 | |||||||||||||||

|

13

Annual dividends

The table below sets forth the amounts of interim, final and total dividends declared in respect of the past five years in cents per ordinary share.

| Year ended 31 December(1) | 2014 | 2013 | 2012 | 2011 | 2010 | 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||||||||||||||||

South African cents per ordinary share | ||||||||||||||||||||||||||||||||||||||||

First quarter | - | 50 | 200 | 80 | 70 | - | - | - | 50 | 200 | ||||||||||||||||||||||||||||||

Second quarter | - | 50 | 100 | - | - | - | - | - | 50 | 100 | ||||||||||||||||||||||||||||||

Third quarter | - | - | 100 | 90 | 65 | - | - | - | - | 100 | ||||||||||||||||||||||||||||||

Fourth quarter | - | - | 50 | 90 | - | - | - | - | - | 50 | ||||||||||||||||||||||||||||||

Total | - | 100 | 450 | 260 | 135 | - | - | - | 100 | 450 | ||||||||||||||||||||||||||||||

US cents per ordinary share(2) | ||||||||||||||||||||||||||||||||||||||||

First quarter | - | 5 | 26 | 11 | 9 | - | - | - | 5 | 26 | ||||||||||||||||||||||||||||||

Second quarter | - | 5 | 12 | - | - | - | - | - | 5 | 12 | ||||||||||||||||||||||||||||||

Third quarter | - | - | 12 | 12 | 9 | - | - | - | - | 12 | ||||||||||||||||||||||||||||||

Fourth quarter | - | - | 6 | 11 | - | - | - | - | - | 6 | ||||||||||||||||||||||||||||||

Total | - | 10 | 56 | 34 | 18 | - | - | - | 10 | 56 | ||||||||||||||||||||||||||||||

| (1) |

|

| (2) | Dividends for these periods were declared in South African cents. US dollar cents per share figures have been calculated based on exchange rates prevailing on each of the respective payment dates. |

For further information on the company’s policy on dividend distributions, see “Item 8A: Consolidated financial statementsFinancial Statements and other information – Other Information—Dividends”.

Exchange rate information

The following table sets forth, for the periods and dates indicated, certain information concerning US dollar/South African rand exchange rates expressed in rands per $1.00. On 2322 March 2015,2017, the interbank rate between South African rands and US dollars as reported by OANDA CorporationReuters was R11.99/$12.57 /$1.00.

| Year ended 31 December(2) | High | Low | Year end | Average (1) | High | Low | Year end | Average (1) | ||||||||||||||||||||||||

2010 | 8.08 | 6.57 | 6.64 | 7.34 | ||||||||||||||||||||||||||||

2011 | 8.60 | 6.49 | 8.14 | 7.27 | ||||||||||||||||||||||||||||

2012 | 8.95 | 7.46 | 8.47 | 8.20 | 8.95 | 7.46 | 8.47 | 8.20 | ||||||||||||||||||||||||

2013 | 10.51 | 8.47 | 10.49 | 9.63 | 10.51 | 8.47 | 10.49 | 9.63 | ||||||||||||||||||||||||

2014 | 11.69 | 10.28 | 11.60 | 10.84 | 11.69 | 10.28 | 11.60 | 10.84 | ||||||||||||||||||||||||

2015(3) | 12.47 | 11.36 | 11.71 | |||||||||||||||||||||||||||||

2015 | 15.87 | 11.36 | 15.53 | 12.77 | ||||||||||||||||||||||||||||

2016 | 16.87 | 13.18 | 13.73 | 14.68 | ||||||||||||||||||||||||||||

2017(3) | 13.82 | 12.56 | 13.26 | |||||||||||||||||||||||||||||

| (1) | The average rate of exchange on the last business day of each month during the year. |

| (2) | Based on the interbank rate as reported by |

| (3) | Through to |

| Exchange rate information for the months of(1) | High | Low | ||||||

September 2014 | 11.26 | 10.63 | ||||||

October 2014 | 11.33 | 10.86 | ||||||

November 2014 | 11.27 | 10.92 | ||||||

December 2014 | 11.69 | 11.04 | ||||||

January 2015 | 11.71 | 11.39 | ||||||

February 2015 | 11.79 | 11.36 | ||||||

March 2015(2) | 12.47 | 11.65 | ||||||

| Exchange rate information for the months of (1) | High | Low | ||||||

September 2016 | 14.59 | 13.44 | ||||||

October 2016 | 14.36 | 13.46 | ||||||

November 2016 | 14.47 | 13.18 | ||||||

December 2016 | 14.12 | 13.46 | ||||||

January 2017 | 13.82 | 13.23 | ||||||

February 2017 | 13.46 | 12.90 | ||||||

March 2017(2) | 13.33 | 12.56 | ||||||

| (1) | Based on the interbank rate as reported by |

| (2) | Through to |

14

| 3B. | CAPITALISATION AND INDEBTEDNESS |

Not applicable.

| 3C. | REASONS FOR THE OFFER AND USE OF PROCEEDS |

Not applicable.

| 3D. | RISK FACTORS |

This section describes many of the risks that could affect AngloGold Ashanti. There may, however, be additional risks unknown to AngloGold Ashanti and other risks, currently believed to be immaterial, that could turn out to be material. Additional risks may arise or become material subsequent to the date of this document. These risks, either individually or simultaneously, could significantly affect the group’s business, financial results and the price of its securities.

Risks related to AngloGold Ashanti’s results of operations and financial condition as a result of factors that impact the gold mining industry generally.

Commodity market price fluctuations could adversely affect the profitability of operations.

AngloGold Ashanti’s revenues are primarily derived from the sale of gold and, to a lesser extent, uranium, silver and sulphuric acid. The compay’scompany’s current policy is to sell its products at prevailing market prices and not to enter into price hedging arrangements. The market prices for these commodities fluctuate widely. These fluctuations are caused by numerous factors beyond the company’s control. For example, the market price of gold may change for a variety of reasons, including:

speculative positions taken by investors or traders in gold;

monetary policies announced or implemented by central banks, including the U.S. Federal Reserve;

changes in the demand for gold as an investment or as a result of leasing arrangements;

changes in the demand for gold used in jewellery and for other industrial uses, including as a result of prevailing economic conditions;

changes in the supply of gold from production, divestment, scrap and hedging;

financial market expectations regarding the rate of inflation;

the strength of the U.S. dollar (the currency in which the gold price trades internationally) relative to other currencies;

changes in interest rates;

actual or anticipated sales or purchases of gold by central banks and the International Monetary Fund;Fund (IMF);

gold hedging andde-hedging by gold producers;

global or regional political or economic events; and

the cost of gold production in major gold producing countries.

The market price of gold has been and continues to be significantly volatile. During 2014,2016, the gold price traded from a low of $1,141$1,060.24 per ounce to a high of $1,382$1,374.91 per ounce, remaining well below a peak of $1,900 per ounce in September 2011. Between 1 January 2017 and 22 March 2017, the gold price traded between a low of $1,163.40 per ounce and a high of $1,256.56 per ounce. On 2322 March 2015,2017 the afternoon price for gold on the London Bullion Market was $1,186$1,249.05 per ounce. TheIn addition to protracted declines such as the one experienced from 2011 through 2015, the price of gold is also often subject to sharp, short-term changes; forchanges. For example, during thethree-day period from Friday, 12 April 2013, through to Monday, 15 April 2013, the price of gold droppedfell by $228 per ounce.

During 2012 Additionally, the spot price of gold fell by more than four percent to $1,086 per ounce in overnight trading on 20 July 2015 after traders sold 57 tonnes of gold in Shanghai and 2013, a correlation existed between the central banks’ policies andNew York. By taking the price of gold withbelow $1,100 per ounce, the July 2015sell-off triggered a high volume of stop-loss orders that had been put in place by traders to automatically sell when the gold price reached a predetermined level. This caused the gold price to drop further. Any sharp or prolonged fluctuations in the price falling atof gold can have a material adverse impact on the prospectcompany’s profitability and financial condition.

Central banks’ policies can affect the price of gold. If gold is treated as a safe alternative investment during economic downturns, the price of gold may fall when central banks end of quantitative easing in some of the main economies.or increase interest rates. For example, on 19 June 2013, Chairman Ben Bernanke of the Federal Reserve announced that the Federal Reserve may begin reducing its quantitative easing programme in 2013. During the course of the following week, the price of gold fell to $1,180 per ounce, its lowest levelannual lows when the Chairman of the U.S. Federal Reserve announced a reduction in 34 months. Furthermore,quantitative easing in the week following Janet Yellen’s announcement ofJune 2013, the end of the quantitative easing programme of the Federal Reserve on 29in October 2014 and an increase in interest rates in December 2015. Similarly, gold prices continued on a downward trend after the Chairman’s announcement of an increase in interest rates in December 2016. However, the gold price has generally increased since the beginning of gold reached its annual low2017 despite the Chairman’s announcement of $1,141 per ounce.another interest rate increase in March of 2017 and may continue to be unpredictable. Any future announcements or proposals by the U.S. Federal Reserve, or any of its board members or regional presidents or other similar officials relating to any such reduction,in other major economies may materially and adversely affect the price of gold and, as a result, AngloGold Ashanti’s financial condition and results of operations.

15

LikeWhilst overall supply and demand typically do not affect the gold prices, gold demand can fluctuate materially from one yearprice in the same manner or to the next, includingsame degree as other commodities due to the considerable size of historical mined stocks of gold, events that affect supply and demand may nonetheless have an impact. According to the World Gold Council, demand for gold is generally driven by four main sectors, namely jewellery, investment, central banks and technology. The market for gold bullion bar, AngloGold Ashanti’s primary product, is generally limited to bullion banks, the number of which has declined in recent years. Central banks’ purchases can be adversely affected by declines in foreign exchange reserves. For example, this was one of the countriesfactors that drove a 33 percent decline in net gold purchases by central banks in 2016 compared to 2015. Demand for gold is also largely impacted by trends in China and India, which account for the highest gold consumption worldwide. Demand for gold may be particularly affected by government policies in these countries. For example, according to the World Gold Council, gold demand in China fell 38%38 percent in 2014 compared to 2013 according to the World Gold Council. Over the same period,and demand for gold bars and coins fell by 50% both in China and in India. In China, the decline was50 percent due in part to the government’s anti-corruption programme, which put limited pressure on demand for gold ornaments andso-called “gift bars”. WhilstIn India, government intervention to try to reduce the considerable sizetrade deficit, a material portion of historical mined (i.e., above ground) stocks ofwhich is linked to gold imports, led to various import taxes being introduced, which unsettled the metal means that overall supply and demand of gold typically do not affect the gold price in the same manner or degree compared to other commodities, events that impact supply and demand may nonetheless affect gold’sdomestic market price. Demand for gold may be affected, in particular, by2016. The Indian government policies,also introduced measures in 2016 to reduce undeclared income, including taxes and duties. For example, over the course of 2013,a demonetisation policy put in place in November 2016. Although gold imports temporarily increased when the Indian Finance Ministry increasedgovernment announced its decision to retire the500-rupee and1,000-rupee bank notes, assoon-to-be obsolete notes were used to buy gold, import dutiesgold imports registered a 55 percent decline by value the following month due to the lack of liquidity resulting from 2% to 10%, with the most recent increase to 10% occurring in August 2013. In addition, at least a fifth of gold imported into India must be exported. Such increases,demonetisation. These and any similar import duty increasespolicies in India, China or other large gold importinggold-importing countries could adversely affect demand for, and consequently prices of, gold.

Furthermore, the shift in demand from physical gold to gold-related investments and speculative instruments may exacerbate the volatility of the gold price. For example, in March 2015, the Finance Ministry in India which overtook China as the world’s largest consumer of gold in 2014, announced the creationan offering of sovereign gold bonds as an alternative to the purchase of physical gold.gold in March 2015 and conducted severalfollow-on offerings in 2016. This and other policies of the Indian government contributed to a 22 percent decline in gold jewellery demand in India between 2015 and 2016. Slower consumption of physical gold in India, resulting from a move toward gold-tracking investments or otherwise, may have an adverse impact on global demand for, and prices of, bullion.

A sustained period of significant gold price volatility may adversely affect the company’s ability to evaluate the feasibility of undertaking new capital projects or the continuity of existing operations, to meet its operational targets or to make other long-term strategic decisions. Lower and more volatile gold prices, together with other factors, have led AngloGold Ashanti to alter its expansion and development strategy and consider ways to align its asset portfolio to take account of such expectations and trends. As a result, the company may decide to curtail or temporarily or permanently shut down certain of its exploration and production operations, which may be difficult and costly to effect. A further sustained decrease in the price of gold could also have a material adverse effect on AngloGold Ashanti’s financial condition and results of operations, as it may be unable to quickly adjust its cost structure to reflect the reduced gold price environment. Mines with marginal headroom may be subject to decreases in value that are other than temporary, which may result in impairment losses. During 2013, the company reviewedSee “—Certain factors may affect AngloGold Ashanti’s ability to support the carrying valueamount of its miningproperty, plant and equipment, intangible assets (including ore stockpiles),and goodwill and intangibles and, based on revised forecast gold prices, booked a charge of $3,245 million (2014: $12 million) in relation to impairments, derecognition and revaluation of net realisable valuethe balance sheet. If the carrying amount of its mining assets (including ore stockpiles), goodwill and intangibles.is not recoverable, AngloGold Ashanti may be required to recognise an impairment charge, which could be significant.” The market value of gold inventory may be reduced and marginal stockpile and heap leach inventories may be written down to net realisable value or may not be processed further as it may not be economically viable at lower gold prices. In addition, AngloGold Ashanti is obliged to meet certain financial covenants under the terms of its borrowing facilities and its ability to continue to meet these covenants could be adversely affected by a further sustained decrease in the price of gold. The use of lower gold prices in reserve calculationsOre Reserve estimates and life of mine plans could also result in material impairments of the company’s investment in mining properties or a reduction in its Ore Reserves estimates and corresponding restatements of its Ore Reserves and increased amortisation, reclamation and closure charges.

The spot price of uranium has been volatile in past years. During 2014,2016, the price varied between a low of approximately $28$18 per pound and a high of $44$35 per pound. On 2322 March 2015,2017, the spot price of uranium was $40$24.50 per pound. In 2016, high inventory levels, an increase in the use of uranium enrichment at the expense of mined uranium and a slowdown in China’s uranium purchases caused uranium prices to continue aten-year decline. Uranium prices can also be affected by several other factors, including demand for nuclear reactors, uranium production shortfalls and restocking by utilities. EventsAdditionally, events like those surrounding the earthquake and tsunami that occurred in Japan in 2011 can also have a material adverse impact on the price of and demand for uranium.

The price of silver has also experienced significant fluctuations. For example,fluctuations in past years. During 2016, the price varied from a highlow of $32$13.71 per ounce in January 2013,2016 to a high of $21.10 per ounce in July 2016. On 22 March 2017, the price of silver declined to a low of $18was $17.50 per ounce by June 2013. Additionally, after climbing back to $22 per ounce in February 2014, the price declined further to a low of $15 per ounce in November 2014.ounce. Factors affecting the price of silver include investor demand, physical demand for silver bars, industrial and retailoff-take, and silver coin minting. On 23 March 2015, the price of silver was $17 per ounce.

If revenue from sales of gold, uranium, silver or sulphuric acid falls below their respective cost of production for an extended period, AngloGold Ashanti may experience losses and curtail or suspend some or all of its exploration projects and existing operations or sell underperforming assets. Declining commodities prices may also force a reassessment of the feasibility of a particular project or projects, which could cause substantial delays or interrupt operations until the reassessment can be completed.

16

Foreign exchange fluctuations could have a material adverse effect on AngloGold Ashanti’s results of operations and financial condition.

Gold is principally a U.S. dollar-priced commodity and most of the company’s revenues are realised in, or linked to, U.S. dollars, whilst production costscost of sales are largely incurred in the local currency where the relevant operation is located. Given the company’s global operations and local foreign exchange regulations, some of its funds are held in local currencies, such as the South African rand, Ghanaian cedi, Brazilian real, ArgentineanArgentinian peso and the Australian dollar. The weakness of the U.S. dollar against local currencies results in higher production costscost of sales in U.S. dollar terms. Conversely, the strengthening of the dollar lowers local production costscost of sales in U.S. dollar terms.

From time to time, AngloGold Ashanti may implement currency hedges intended to reduce exposure to changes in the foreign currency exchange. Such hedging strategies may not however be successful, and any of AngloGold Ashanti unhedged exchange payments will continue to be subject to market fluctuations.

Exchange rate movements may have a material impact on AngloGold Ashanti’s operating results. For example, based on average exchange rates received in 2016, the company estimates that a 1%one percent strengthening of all of the South African rand, Brazilian real, the ArgentineanArgentinian peso or the Australian dollar against the U.S. dollar will, other factors remaining equal, result in an increase in total cash costs of approximately $6 per ounce, or approximately 1%, of the company’s total cash costs.ounce.

The profitability of mining companies’ operations and the cash flows generated by these operations are significantly affected by fluctuations in input production prices, many of which are linked to the prices of oil and steel.

Fuel, energy and consumables, including diesel, heavy fuel oil, chemical reagents, explosives, tyres, steel and mining equipment consumed in mining operations form a relatively large part of the operating costs and capital expenditure of any mining company.

AngloGold Ashanti has no influence over the cost of these consumables, many of which are linked to some degree to the price of oil and steel. Whilst, from time to time, AngloGold Ashanti may implement diesel hedges intended to reduce exposure to changes in the oil price, such hedging strategies may not always be successful, and any of the company’s unhedged diesel consumption will continue to be subject to market fluctuations.

The price of oil has been volatile, fluctuating between $55$25 and $115$55 per barrel of Brent Crude in 2014.2016. As of 2322 March 2015,2017, the price of oil was at $54$49.46 per barrel of Brent Crude. AngloGold Ashanti estimates that for each U.S. dollar per barrel rise or fall in the oil price, other factors remaining equal, the total cash costs of all its operations change by approximately $0.78$0.76 per ounce. The total cash costs of certain of the company’s mines, particularly Sadiola, Siguiri, Geita, Cripple Creek & Victor, and Tropicana are most sensitive to changes in the price of oil. Even when fuel prices are in decline, expected savings may be partly offset by increases in governments’ fixed fuel levies or the introduction by governments of new levies. For example, in Tanzania, the government introduced a levy charged at 1.5 percent of the price including Cost, Insurance and Freight of fuel, earmarked for railway infrastructure development, effective 1 July 2015. This resulted in an additional annual cost impact at AngloGold Ashanti’s Geita mine of approximately $2.7 million in 2016 and is expected to have a similar annual cost impact going forward.

Furthermore, the price of steel has also been volatile. Steel is used in the manufacture of most forms of fixed and mobile mining equipment, which is a relatively large contributor to the operating costs and capital expenditure of a mine. For example, in 2016 the price of flat hot rolled coil (North American Domestic FOB) steel traded between $608$379 per tonne as of 1 January 2016 and $696$630 per tonne in 2014.as of 29 June 2016. On 2322 March 2015,2017, the price of flat hot rolled coil (North American Domestic FOB) was $481$648 per tonne.

Fluctuations in oil and steel prices have a significant impact on operating costs and capital expenditure estimates and, in the absence of other economic fluctuations, could result in significant changes in the total expenditure estimates for new mining projects or render certain projects non-viable.non-viable, which could have a material adverse impact on the company’s results of operations and financial condition.

Energy cost increases and power fluctuations and stoppages could adversely impact the company’s results of operations and financial condition.

Increasing global demand for energy, concerns about nuclear power and the limited growth of new supply are impacting the price and supply of energy. The transition of emerging markets to higher energy consumption, actual and proposed taxation of carbon taxationemissions as well as unrest and potential conflict in the Middle East, amongst other factors, could result in increased demand or constrained supply and sharply escalating oil and energy prices.

AngloGold Ashanti’s mining operations are substantially dependent upon electrical power generated by local utilities or by power plants situated at some of its operations. The unreliability of these local sources of power can have a material effect on the company’s operations, as large amounts of power are required for ventilation, exploration, development, extraction, processing and other mining activities on the company’s properties.

17

In South Africa, the company’s operations are dependent on electricity supplied by onea parastatal agency of Eskom, a state-owned power generation company, Eskom.company. Although other competitors in the renewable energy market have now entered the power supply market, the power supply is still channelled through the Eskom infrastructure. Electricity is used for most of our business and safety-critical operations, that includeincluding cooling, hoisting and dewatering. Loss of power can therefore impact production and employee safety, and prolonged outages could lead to flooding of workings and ore sterilisation. In 2008, Eskom and the South African government declared a national emergency and warned that they could no longer guarantee the availability of electricity due to a national supply shortage which at the time was blamed on coal supply shortages, heavy rain fall and unplannedgeneration-set outages as a result of maintenance backlog and asset age. The entire country went into a programme of rolling blackouts and AngloGold Ashanti and other mining companies operating in South Africa were forced in late January untilmid-March of 2008 to temporarily suspend mining operations.

A warning of the “very high” risk of blackouts was reissued at the start of 2011 and each year since.until 2015. On 20 February 2014, Eskom declared a power emergency pursuant to its regulatory protocols to protect the national electricity grid. The power emergency was caused by the loss of additional generating units, reduced importsa 1,500MW reduction in imported electricity resulting from the failure of power lines from Coharaat the Cahora Bassa hydro scheme in Mozambique and the extensive use of emergency reserves. Eskom alerted key industrial customers, including AngloGold Ashanti, asking them to reduce their load by a minimum of 10%10 percent during critical periods. Since February 2014, AngloGold Ashanti has reduced its electricity consumption in South Africa by more than 10%10 percent measured in Gigawatt hour usage. Then, inIn November 2014, Eskom reintroduced a schedule of rolling blackouts, or “load shedding”. Whilst a national energy conservation programme isAlthough the last blackout was imposed in place,2015, Eskom cannot guarantee that there will be no power interruptions and is again facing very tight supply reserve margins in 2015, which can be expected to continue for many years to come.the future. Management expects that these interruptions may resume in the future.

Furthermore, the power supply to the company’s South African operations has been and may be load curtailed or interrupted again in the future for reasons other than government action.reasons. For example, lightning or other damage to power stations can also result in power interruptions at the company’s operations. In this regard, AngloGold Ashanti’s two main operational sites in the West Wits region in South Africa had all mainexperienced power interruptedreductions between 13 March 2013 and 15 March 2013 after a fire caused by lightning damaged a transformer at asevere damage to the 500MVA transformers situated close to the main regional substation.road passing through the West Rand area.

Eskom and the National Energy Regulator of South Africa (“NERSA”)(NERSA) recognise the need to increase electricity supply capacity, and a series of tariff increases and proposals have been enacted since 2010 to assist in the funding of this expansion. NERSA originally approved an increase of 24.8% for 2010, 25.8% for 2011, 25.9% for 2012, and 16.0% for 2013. The actual increase implemented for 2012 was lowered to 16.09% after government intervention. In 2013, NERSA announced that Eskom would be allowed to increase electricity tariffs for the five-year period that began in April 2013 at an average yearly increase of 8%,8 percent, which was half of that sought by the utility in its application. InHowever, in October 2014, NERSA granted a 12.69%12.69 percent increase in electricity prices with effect from April 2015. In early 2016, NERSA heard a second application from Eskom to increase tariffs and an increase of 9.4 percent was granted, effective 1 April 2016. Although a lower increase of 2.2 percent was approved in February 2017, effective 1 April 2017, greater tariff increases may be imposed

in future years. Instability in the industry is further exacerbated by uncertainty around the approval, cost and continuation of a nuclear energy programme and additional delays expected in connection with the completion of the Medupi and Ingula coal power stations.

There can be no assurance as to the existence or nature of any government intervention with respect to tariff increases in the future. Other difficulties at Eskom, relating to a large financial deficit, may result in additional tariff increases. As energy represents a large proportion of the company’s operating costs in South Africa, these increases have had, and any future increases will have, a materially adverse impact on the total cash costs of its South African operations.

The company has also identified a risk of energy shortages in Argentina, Brazil, Ghana and the DRC. All theBrazil. The company’s mining operations in Ghana depend on hydroelectric power supplied by the state-controlled Volta River Authority (“VRA”)(VRA), which is supplemented by thermal power from the Takoradi plant and a smaller unit at Tema. AngloGold Ashanti negotiates rates directly with the VRA to power the Obuasi mining operations and the VRA may not agree to a satisfactory rate during future rounds of negotiations. AngloGold Ashanti procures electricity for Iduapriem from the Electricity Company of Ghana (ECG) which is supplied by the VRA.

Ghana has a major power generation deficit that has resulted in significant load shedding across the country. For example, the company experienced extended power interruptions in Ghana in the first quarter of 2014, which limited access to higher grade areas. It also experienced frequent load shedding at Iduapriem in 2015, at times experiencing multiple outages in a single day. During periods of below average inflows from the Volta reservoir, electricity supplies from the Akosombo Dam, the VRA’s primary generation source, may be curtailed as occurred in 1998, 2003, 2006, 2007 and 2007.2016. During periods of limited electricity availability, the grid is subject to disturbances and voltage fluctuations which can damage equipment. Recent disruptionsDisruptions in the natural gas supply from Nigeria in March 2015, via the West Africa Gas Pipeline, hashave led to some reduction in thermal generation capacity and the use of more expensive light crude oil, which is putting upward pressure on power tariffs. In the past, the VRA has obtained power from neighbouring Côte d’Ivoire, which has intermittently experienced political instability and civil unrest. AngloGold Ashanti negotiates rates directly with the VRA and the VRA may not agree to a satisfactory rate during future rounds of negotiations.

In Brazil, severe water shortages from low rainfall have been experiencedatwo-year drought in 2014 and 2015 and are expected to adversely affectaffected hydro-electrical power generation. Similar water shortages in the future could have an adverse impact on AngloGold Ashanti’s operations in Brazil.

The company’s mining operations in Guinea, Tanzania and Mali are dependent on power supplied by outside contractors and supplies of fuel are delivered by road. Power supplies have been disrupted in the past, resulting in production losses due to equipment failure.

Increased energy prices could negatively impact operating costs and cash flow of AngloGold Ashanti’s operations.

18

Global economic conditions could adversely affect the profitability of operations.

AngloGold Ashanti’s operations and performance depend significantly on worldwide economic conditions. Despite signs of economic recovery in certain geographic markets, global financial markets have experienced considerable volatility from uncertainty surrounding the level and sustainability of the sovereign debt of various countries. Concerns remain regarding the sustainability of the European Monetary Union and its common currency, the Euro, in their current form, as well asparticularly following the vote in favour of the United Kingdom’s exit from the European Union in June 2016 and in light of elections to be held in several European countries in 2017. Concerns also exist regarding the negative impacts of the downgrade of the sovereign credit rating of the Republic of South Africa in 2012, 2013, 2014 and 2014. 2015. During 2016, rating agencies warned that weak South African economic growth, government bailouts of state-owned companies and an unfavourable political environment could lead to a downgrade of the sovereign credit rating of the Republic of South Africa below investment grade in 2017.

These conditions and other disruptions to international credit markets and financial systems caused a loss of investor confidence and resulted in widening credit spreads, a lack of price transparency, increased credit losses and tighter credit conditions. Although aggressive measures taken by governments, the private sector and central banks have recently corresponded with signs ofresulted in a modest economic recovery since 2012, any such recovery may remain limited in geographic scope. A significant risk also remains that this recovery could be slow or that the global economy could quickly fall back into an even deeper and longer lasting recession or even a depression. Recently,In 2014 and 2015, the credit ratings of some of the largest South African banks were downgraded by a major credit rating agency.agencies. Any significant weakening of the South African banking system could have a negative effect on the overall South African economy.

Global economic turmoil, or the expectation that economic turmoil could worsen, could havefollow-on effects on AngloGold Ashanti’s business that include inflationary cost pressures, interest rate fluctuations and commodity market fluctuations. Other effects that could negatively affect AngloGold Ashanti’s financial results and results of operations include, for example:

the insolvency of key suppliers or contractors, which could result in contractual breaches and a supply chain breakdown;

the insolvency of one or more joint venture partners, which could result in contractual breaches and disruptions at the operations of the company’s joint ventures;

changes in other income and expense, which could vary materially from expectations, depending on gains or losses realised on the sale or exchange of financial instruments and impairment charges that may be incurred with respect to investments;

the inability of AngloGold Ashanti’s defined benefit pension fund may notto achieve expected returns on its investments, which could require the company to make substantial cash payments to fund any resulting deficits;

a reduction in the availability of credit, which may make it more difficult for the company to obtain financing for its operations and capital expenditures or make that financing more costly;

exposure to the liquidity and insolvency risks of the company’s lenders and customers; and