UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20142015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number 001-36153File Number 001-36697

DBV TECHNOLOGIES S.A.

(Exact name of Registrant as specified in its charter and translation of Registrant’s name into English)

France

(Jurisdiction of incorporation or organization)

Green Square-Bâtiment D177-181 avenue Pierre Brossolette

80/84 rue des Meuniers

92220 Bagneux92120 Montrouge France

(Address of principal executive offices)

Dr. Pierre-Henri Benhamou

Chairman and Chief Executive Officer

DBV Technologies S.A.

Green Square-Bâtiment D177-181 avenue Pierre Brossolette

80/84 rue des Meuniers

92220 Bagneux92120 Montrouge France

Tel: +33 1 55 42 78 78 Fax: +33 1 43 26 10 83

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class | Name of each exchange on which registered | |

| American Depositary Shares, each representing one-half of one ordinary share, nominal value €0.10 per share | The Nasdaq Stock Market LLC | |

| Ordinary shares, nominal value €0.10 per share* | The Nasdaq Stock Market LLC* |

| * | Not for trading, but only in connection with the registration of the American Depositary Shares. |

Securities registered or to be registered pursuant to Section 12(g) of the Act. None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report.annual report.

Ordinary shares, nominal value €0.10 per share: 19,160,66124,205,129 as of December 31, 20142015

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes x No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨x Accelerated filer ¨ Non-accelerated filer x¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ¨ | International Financial Reporting Standards as issued by the International Accounting Standards Board x | Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ¨ Item 17 ¨ Item 18

If this is an Annual Report,annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

| PAGE | ||||||

| INTRODUCTION | ||||||

| PART I | ||||||

| Item 1. | 4 | |||||

| Item 2. | 4 | |||||

| Item 3. | 4 | |||||

| 4 | ||||||

| 6 | ||||||

| 6 | ||||||

| 6 | ||||||

| Item 4. | ||||||

| Item 4A. | ||||||

| Item 5. | ||||||

| Item 6. | ||||||

| Item 7. | ||||||

| Item 8. | ||||||

i

| Item 9. | ||||||

| Item 10. | ||||||

| Item 11. | ||||||

| Item 12. | ||||||

| PART II | ||||||

| Item 13. | ||||||

| Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | |||||

| Item 15. | ||||||

| Item 16A. | ||||||

| Item 16B. | ||||||

| Item 16C. | ||||||

| Item 16D. | ||||||

| Item 16E. | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | |||||

| Item 16F. | ||||||

| Item 16G. | ||||||

| Item 16H. | ||||||

| PART III | ||||||

| Item 17. | ||||||

| Item 18. | ||||||

| Item 19. | ||||||

ii

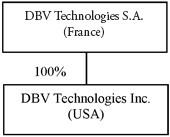

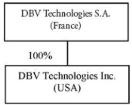

Unless otherwise indicated, “DBV,” “the company,” “our company,” “we,” “us” and “our” refer to DBV Technologies S.A. and its consolidated subsidiary.

We own various trademark registrations and applications, and unregistered trademarks and servicemarks, including “Diallertest®“Diallertest®,” “Viaskin®“Viaskin®,” “EPIT™,” “DBV Technologies®Technologies®” and our corporate logo. All other trademarks or trade names referred to in this Annual Report on Form 20-F are the property of their respective owners. Trade names, trademarks and service marks of other companies appearing in this Annual Report on Form 20-F are the property of their respective holders. Solely for convenience, the trademarks and trade names in this Annual Report on Form 20-F may be referred to without the® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend to use or display other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Our audited consolidated financial statements have been prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. Our consolidated financial statements are presented in euros. All references in this Annual Report on Form 20-F to “$,” “US$,” “U.S.$,” “U.S. dollars,” “dollars” and “USD” mean U.S. dollars and all references to “€” and “euros” mean euros, unless otherwise noted. Throughout this Annual Report on Form 20-F, references to ADSs mean ADSs or ordinary shares represented by ADSs, as the case may be.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 20-F contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than present and historical facts and conditions contained in this Annual Report on Form 20-F, including statements regarding our future results of operations and financial positions, business strategy, plans and our objectives for future operations, are forward-looking statements. When used in this Annual Report on Form 20-F, the words “anticipate,” “believe,” “can,” “could,” “estimate,” “expect,” “intend,” “is designed to,” “may,” “might,” “plan,” “potential,” “predict,” “objective,” “should,” or the negative of these and similar expressions identify forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

You should refer to the section of this Annual Report on Form 20-F titled “Item 3.D—Risk Factors” for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Annual Report on Form 20-F will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame or at all. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

You should read this Annual Report on Form 20-F and the documents that we reference in this Annual Report on Form 20-F and have filed as exhibits to this Annual Report on Form 20-F completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

This Annual Report on Form 20-F contains market data and industry forecasts that were obtained from industry publications. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. We have not independently verified any third-party information. While we believe the market position, market opportunity and market size information included in this Annual Report on Form 20-F is generally reliable, such information is inherently imprecise.

| Item 1. |

Not applicable.

| Item 2. | Offer Statistics and Expected Timetable. |

Not applicable.

| Item 3. | Key Information. |

| A. | Selected Financial Data |

Our consolidated audited financial statements have been prepared in accordance with IFRS, as issued by the IASB. We derived the selected statements of consolidated income data for the years ended December 31, 2012, 2013, 2014 and 20142015 and selected statements of consolidated financial position data as of December 31, 2012, 2013, 2014 and 20142015 from our consolidated audited financial statements included elsewhere in this Annual Report on Form 20-F. The selected consolidated statement of income data for the year ended December 31, 2012 and the selected consolidated financial position data as of December 31, 2012 have been derived from our audited consolidated financial statements and notes thereto which are not included in this Annual Report on Form 20-F. This data should be read together with, and is qualified in its entirety by reference to, “Item 5. Operating and Financial Review and Prospects” as well as our financial statements and notes thereto appearing elsewhere in this Annual Report on Form 20-F. Our historical results are not necessarily indicative of the results to be expected in the future.

Statement of Income (Loss) Data:Data (in thousands, except share and per share data):

| 2012 (3) | 2013 (3) | 2014 | Year Ended December 31, | |||||||||||||||||||||||||||||||||

| Euro | Euro | Euro | US$(1) | 2012(1) | 2013(1) | 2014 | 2015 | |||||||||||||||||||||||||||||

| Euros | Euros | Euros | Euros | US$(2) | ||||||||||||||||||||||||||||||||

Operating income | € | 2,776,588 | € | 3,826,313 | € | 4,761,522 | $ | 5,761,918 | 2,777 | 3,826 | 4,762 | 6,166 | 6,696 | |||||||||||||||||||||||

Operating expenses: | ||||||||||||||||||||||||||||||||||||

Cost of goods sold | 82,958 | 102,366 | 136,296 | 164,932 | 83 | 102 | 136 | 128 | 139 | |||||||||||||||||||||||||||

Research and development | 11,499,368 | 17,366,538 | 21,143,442 | 25,585,679 | 11,499 | 17,366 | 21,143 | 34,234 | 37,175 | |||||||||||||||||||||||||||

General and administration | 4,598,699 | 6,309,750 | 8,117,664 | 9,823,185 | ||||||||||||||||||||||||||||||||

Selling, general and administration | 4,599 | 6,310 | 8,118 | 17,350 | 18,840 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

Total operating expenses | 16,181,025 | 23,778,654 | 29,397,402 | 35,573,796 | 16,181 | 23,779 | 29,397 | 51,712 | 56,154 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

Operating profit (loss) | (13,404,437 | ) | (19,952,340 | ) | (24,635,880 | ) | (29,811,878 | ) | (13,404 | ) | (19,952 | ) | (24,636 | ) | (45,546 | ) | (49,458 | ) | ||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

Financial profit (loss) | 492,337 | 645,925 | 624,000 | 755,102 | 492 | 646 | 624 | 871 | 946 | |||||||||||||||||||||||||||

Net profit (loss) | € | (12,912,100 | ) | € | (19,306,416 | ) | € | (24,011,880 | ) | $ | (29,056,776 | ) | (12,912 | ) | (19,306 | ) | (24,012 | ) | (44,674 | ) | (48,513 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

Earnings (losses) per share | ||||||||||||||||||||||||||||||||||||

Basic | € | (1.05 | ) | € | (1.42 | ) | € | (1.49 | ) | $ | (1.81 | ) | € | (1.05 | ) | € | (1.42 | ) | € | (1.49 | ) | € | (2.08 | ) | $ | (2.26 | ) | |||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

Diluted | € | (1.05 | ) | € | (1.42 | ) | € | (1.49 | ) | $ | (1.81 | ) | € | (1.05 | ) | € | (1.42 | ) | € | (1.49 | ) | € | (2.08 | ) | $ | (2.26 | ) | |||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

Number of shares used for computing | ||||||||||||||||||||||||||||||||||||

Basic | 12,326,779 | 13,604,687 | 16,086,247 | 16,086,247 | 12,326,779 | 13,604,687 | 16,086,247 | 21,522,342 | 21,522,342 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

Diluted | 12,326,779 | 13,604,687 | 16,086,247 | 16,086,247 | 12,326,779 | 13,604,687 | 16,086,247 | 21,522,342 | 21,522,342 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

| (1) | The statement of consolidated income (loss) as of December 31, 2013 and 2012 corresponds solely to DBV Technologies S.A., as the company had no consolidated subsidiary as of this date. |

| (2) | Translated solely for convenience into dollars at the noon buying rate of |

| See Note 22 to our financial statements for further details on the calculation of basic and diluted loss per ordinary share. |

Statement of Financial Position Data (in thousands, except share and per share data):

| As of December 31, | ||||||||||||||||||||

| 2012 (1) | 2013 (1) | 2014 | 2015 | |||||||||||||||||

| Euros | Euros | Euros | Euros | US$(2) | ||||||||||||||||

Cash and cash equivalents | 38,348 | 39,403 | 114,583 | 323,381 | 351,159 | |||||||||||||||

Total assets | 42,975 | 46,236 | 125,416 | 343,280 | 372,768 | |||||||||||||||

Total shareholders’ equity | 39,173 | 40,395 | 115,445 | 322,076 | 349,742 | |||||||||||||||

Trade non-current liabilities | 632 | 1,607 | 4,419 | 5,183 | 5,628 | |||||||||||||||

Total current liabilities | 3,170 | 4,234 | 5,552 | 16,021 | 17,397 | |||||||||||||||

Total liabilities | 3,802 | 5,841 | 9,971 | 21,204 | 23,025 | |||||||||||||||

Total liabilities and shareholders’ equity | 42,975 | 46,236 | 125,416 | 343,280 | 372,768 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| The statement of consolidated |

Statement of Financial Position Data:

| As of December 31, | ||||||||||||||||

| 2012 (2) | 2013 (2) | 2014 | ||||||||||||||

| Euro | Euro | Euro | US$(1) | |||||||||||||

Cash and cash equivalents | € | 38,348,130 | € | 39,402,761 | € | 114,583,141 | $ | 138,657,059 | ||||||||

Total assets | 42,974,817 | 46,236,009 | 125,415,511 | 151,765,310 | ||||||||||||

Total shareholders’ equity | 39,173,135 | 40,394,685 | 115,444,959 | 139,699,945 | ||||||||||||

Trade non-current liabilities | 631,592 | 1,607,228 | 4,418,902 | 5,347,313 | ||||||||||||

Total current liabilities | 3,170,090 | 4,234,096 | 5,551,650 | 6,718,052 | ||||||||||||

Total liabilities | 3,801,682 | 5,841,324 | 9,970,552 | 12,065,365 | ||||||||||||

Total liabilities and shareholders’ equity | 42,974,817 | 46,236,009 | 125,415,511 | 151,765,310 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

| Translated solely for convenience into dollars at the noon buying rate of |

Exchange Rate Information

In this Annual Report on Form 20-F, for convenience only, we have translated certain euro amounts reflected in our financial statements as of and for the year ended December 31, 20142015 into U.S. dollars at the rate of €1.00$1.00 = US$1.2101,€1.0859, the noon buying rate of the Federal Reserve Bank of New York for euros onat December 31, 2014.2015. You should not assume that, on that or on any other date, one could have converted these amounts of euros into U.S. dollars at that or any other exchange rate.

The following table sets forth, for each period indicated, the low and high exchange rates for euros expressed in U.S. dollars, the exchange rate at the end of such period and the average of such exchange rates on the last day of each month during such period, based on the noon buying rate inof the CityFederal Reserve Bank of New York for the euro.euros into dollars. As used in this document,Annual Report, the term “noon buying rate” refers to the rate of exchange for the euro, expressed in U.S. dollars per euro, as certified by the Federal Reserve Bank of New York for customs purposes.

| Year Ended December 31, | ||||||||||||||||||||

| 2010 | 2011 | 2012 | 2013 | 2014 | ||||||||||||||||

High | 1.4536 | 1.4875 | 1.3463 | 1.3816 | 1.3927 | |||||||||||||||

Low | 1.1959 | 1.2926 | 1.2062 | 1.2774 | 1.2101 | |||||||||||||||

Rate at end of period | 1.3269 | 1.2973 | 1.3187 | 1.3779 | 1.2101 | |||||||||||||||

Average rate per period | 1.3216 | 1.4002 | 1.2909 | 1.3303 | 1.3297 | |||||||||||||||

High Low Rate at end of period Average rate per period Year Ended December 31, 2011 2012 2013 2014 2015 1.4875 1.3463 1.3816 1.3927 1.2015 1.2926 1.2062 1.2774 1.2101 1.0524 1.2973 1.3186 1.3779 1.2101 1.0859 1.3931 1.2854 1.3275 1.3306 1.1098

The following table sets forth, for each of the last six months, the low and high exchange rates for euros expressed in U.S. dollars and the exchange rate at the end of the monthsuch period, based on the noon buying rate as described above.

| October 2014 | November 2014 | December 2014 | January 2015 | February 2015 | March 2015 | |||||||||||||||||||

High | 1.2812 | 1.2554 | 1.2504 | 1.2015 | 1.1462 | 1.1212 | ||||||||||||||||||

Low | 1.2517 | 1.2394 | 1.2101 | 1.1279 | 1.1197 | 1.0524 | ||||||||||||||||||

Rate at end of period | 1.2530 | 1.2438 | 1.2101 | 1.1290 | 1.1197 | 1.0741 | ||||||||||||||||||

On December 31, 2014, the noon buying rate of the Federal Reserve Bank of New York for the euro was €1.00 = US$1.2101. Unless otherwise indicated, currency translations in this Annual Report on Form 20-F reflect theeuro.

| October 2015 | November 2015 | December 2015 | January 2016 | February 2016 | March 2016 | |||||||||||||||||||

High | 1.1437 | 1.1026 | 1.1025 | 1.0964 | 1.1362 | 1.1390 | ||||||||||||||||||

Low | 1.0963 | 1.0562 | 1.0573 | 1.0743 | 1.0868 | 1.0845 | ||||||||||||||||||

Rate at end of period | 1.1042 | 1.0562 | 1.0859 | 1.0832 | 1.0868 | 1.1390 | ||||||||||||||||||

On December 31, 2014 exchange rate.

On April 24, 2015, the noon buying rate of the Federal Reserve Bank of New York for the euro was €1.00$1.00 = $1.0876.€1.0859. Unless otherwise indicated, currency translations in this Annual Report on Form 20-F reflect the December 31, 2015 exchange rate.

On April 15, 2016, the noon buying rate of the Federal Reserve Bank of New York for the euro was $1.00 = €1.1295.

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

Our business faces significant risks. You should carefully consider all of the information set forth in this annual reportAnnual Report and in our other filings with the United States Securities and Exchange Commission, or the SEC, including the following risk factors which we face and which are faced by our industry. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. This report also contains forward-looking statements that involve risks and uncertainties. Our results could materially differ from those anticipated in these forward-looking statements, as a result of certain factors including the risks described below and elsewhere in this reportAnnual Report and our other SEC filings. See “Special Note Regarding Forward-Looking Statements” above.

Risks Related to Our BusinessFinancial Condition and IndustryCapital Requirements

We Have Incurred Significant Losses Since Our Inception And Anticipate That We Will Continue To Incur Significant Losses For The Foreseeable Future.

We are a clinical-stage biopharmaceutical company, and we have not yet generated significant income, with the exception of the French research tax credit (crédit d’impôt recherche), or CIR, which is classified as other income in our statement of income (loss). We have incurred net losses in each year since our inception in 2002, including

net losses of €12.9 million, €19.3 million, €24.0 million and €24.0€44.7 million for the years ended December 31, 2012, 2013, 2014 and 2014,2015, respectively. Although we have historically generated non-meaningful revenues through the sale of our Diallertest Milk product in France, we discontinued our commercial partnership with respect to the product and ceased selling Diallertest Milk during the second half of 2015. We do not expect these sales to be a pointderive any revenues in 2016 from the sale of strategic focus for our company in the future and we may even discontinue these sales in the future.Diallertest Milk. As of December 31, 2014,2015, we had an accumulated deficit of €54.8€99.4 million.

We have devoted most of our financial resources to research and development, including our clinical and pre-clinical development activities. To date, we have financed our operations primarily through the sale of equity securities, obtaining public assistance in support of innovation, such as conditional advances from OSEO Innovation, or OSEO, and reimbursements of research tax credit claims. The amount of our future net losses will depend, in part, on the pace and amount of our future expenditures and our ability to obtain funding through equity or debt financings, strategic collaborations or additional grants or tax credits. WeWhile we have initiated a pivotal Phase III trial to evaluate the safety and efficacy of Viaskin Peanut, we have not yet completed pivotal clinical trials for any of our lead product candidates and it will be several years, if ever, before we have a product candidate ready for

commercialization, if at all. Even if we obtain regulatory approval to market a product candidate, our future revenues will depend upon the size of any markets in which our product candidates have received approval, and our ability to achieve sufficient market acceptance, reimbursement from third-party payors and adequate market share for our product candidates in those markets.

We expect to continue to incur significant expenses and increasing operating losses for the foreseeable future. We anticipate that our expenses will increase substantially if and as we:

The net losses we incur may fluctuate significantly from year to year, such that a period-to-period comparison of our results of operations may not be a good indication of our future performance. In any particular period or periods, our operating results could be below the expectations of securities analysts or investors, which could cause the price of theour ADSs or ordinary shares to decline.

We May Need To Raise Additional Funding, Which May Not Be Available On Acceptable Terms, Or At All. Failure To Obtain This Necessary Capital When Needed May Force Us To Delay, Limit Or Terminate Our Product Development Efforts Or Other Operations.

We are currently advancing our product candidates through pre-clinical and clinical development. Developing product candidates is expensive, lengthy and risky, and we expect our research and development expenses to increase substantially in connection with our ongoing activities, particularly as we advance Viaskin Peanut and Viaskin Milk through clinical development. We initiated the Peanut EPIT Efficacy and Safety Study, or PEPITES, a pivotal Phase III trial, of Viaskin Peanut in December 2015.

As of December 31, 2014,2015, our cash and cash equivalents were €114.6€323.4 million. We expect that our existing cash will be sufficient to fund our current operations until the end of 2016.2017. However, our operating plan may change as a result of many factors currently unknown to us, and we may need to seek additional funds sooner than planned, through public or private equity or debt financings, government or other third-party funding, marketing and distribution arrangements and other collaborations, strategic alliances and licensing arrangements or a combination of these approaches. In any event, we will require additional capital to pursue pre-clinical and clinical activities, pursue regulatory approval for, and to commercialize, our product candidates. Raising funds in the current economic environment may present additional challenges. Even if we believe we have sufficient funds for our current or future operating plans, we may seek additional capital if market conditions are favorable or if we have specific strategic considerations.

Any additional fundraising efforts may divert our management from their day-to-day activities, which may adversely affect our ability to develop and commercialize our product candidates. In addition, we cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us, if at all. Moreover, the terms of any financing may adversely affect the holdings or the rights of our shareholders and the issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of theour ADSs or ordinary shares to decline. The sale of additional equity or convertible securities would dilute all of our shareholders. The incurrence of indebtedness would result in increased fixed payment obligations and we may be required to agree to certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. We could also be required to seek funds through arrangements with collaborative partners or otherwise at an earlier stage than otherwise would be desirable and we may be required to relinquish rights to some of our technologies or product candidate or otherwise agree to terms unfavorable to us, any of which may have a material adverse effect on our business, operating results and prospects.

If we are unable to obtain funding on a timely basis, we may be required to significantly curtail, delay or discontinue one or more of our research or development programs or the commercialization of any product candidate or be unable to expand our operations or otherwise capitalize on our business opportunities, as desired, which could materially affect our business, financial condition and results of operations.

We Are Limited In Our Ability To Raise Additional Share Capital, Which May Make It Difficult For Us To Raise Capital To Fund Our Operations.

Under French law, our share capital may be increased only with shareholders’ approval at an extraordinary general shareholders’ meeting following the recommendation of our board of directors. The shareholders may delegate to our board of directors either the authority (délégation de compétence) or the power (délégation de pouvoir) to carry out any increase in share capital. SeeAs discussed further under “Item 10. B—Memorandum and Articles of Association”,Association,” our board may be precluded from issuing additional ordinary shares without first obtaining shareholders’ approval.

In addition, the French Commercial Code imposes certain limitations on our ability to price any offering of our share capital without preferential subscription right (sans droit préférentiel de souscription), which limitation may prevent us from successfully completing any such offering. Specifically, under the French Commercial Code, unless the offering is less than 10% of issued share capital, securities cannot be sold in an offering if it is not possible to fix the per share price of the shares at a level at least equal to the volume weighted average trading price on Euronext Paris over the last three trading days preceding the commencement of the marketing of the transaction, referred to as the “book building” process, less a maximum discount of 5%.

We Have Identified A Material Weakness In Our Internal Control Over Financial Reporting For The Year Ended December 31, 2015 And May Identify Additional Material Weaknesses In The Future Or Otherwise Fail To Maintain An Effective System Of Internal Controls, Which May Result In Material Misstatements Of Our Financial Statements Or Could Have A Material Adverse Effect On Our Business And Trading Price Of Our Securities.

As of the end of our second quarter of fiscal 2015, the market value of our common stock held by non-affiliates exceeded $700 million and we ceased to be an “emerging growth company” at the conclusion of fiscal 2015. Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, or Section 404, we are required to furnish a report by our management on our internal control over financial reporting, and we are required to include an attestation report on internal control over financial reporting issued by our independent registered public accounting firm.

In connection with the audit of our consolidated financial statements as of and for the year ended December 31, 2015 and our management’s assessment of our internal control over financial reporting, we identified a material weakness in our internal control over financial reporting. A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. The material weakness that we identified is related to a lack of adequate segregation of duties given the size of our finance and accounting team to allow for appropriate monitoring of financial reporting matters and internal control over financial reporting.

This material weakness did not result in any adjustments or restatements of our audited consolidated financial statements or disclosures for any prior period previously reported by the company. However, there is a reasonable possibility that a material misstatement of the consolidated financial statements would not have been prevented or detected on a timely basis due to the failure in designing and implementing appropriate controls over the segregation of duties, and therefore, it has been evaluated as a material weakness. However, if the material weakness is not remediated, then it could result in material financial misstatements in the future.

We have limited accounting and financial reporting personnel and other resources with which to address our internal controls and procedures. We are currently designing and implementing new procedures and controls intended to remediate the material weakness described above. We have hired additional accounting and finance staff, who have significant external reporting experience and experience with establishing appropriate financial reporting policies and procedures, and engaged a professional advisor with sufficient technical accounting expertise to assist us in the implementation of internal controls over financial reporting and segregating duties amongst accounting personnel.

We expect to incur additional costs to remediate this weakness, primarily personnel costs and external consulting fees. We cannot assure you that the measures we have taken to date, together with any measures we may take in the future, will be sufficient to remediate the control deficiencies that led to the material weakness in our internal control over financial reporting or to avoid potential future material weaknesses.

If we are unable to successfully remediate our existing or any future material weakness in our internal control over financial reporting, or if we identify any additional material weaknesses, the accuracy and timing of our financial reporting may be adversely affected. If we are unable to maintain effective internal controls, we may not have adequate, accurate or timely financial information, and we may be unable to meet our reporting obligations as a U.S. public company or comply with the requirements of the SEC or Section 404. This could result in a restatement of our financial statements, the imposition of civil or criminal sanctions, the inability of registered broker dealers to make a market in our ADSs or ordinary shares, or an investigation by regulatory authorities. Any such action or other negative results caused by our inability to meet our reporting requirements or comply with legal and regulatory requirements or by disclosure of an accounting, reporting or control issue could adversely affect the trading price of our securities and our business. Our reporting and compliance obligations may place a significant strain on our management, operational and financial resources and systems for the foreseeable future. Failure to remedy any material weakness in our internal control over financial reporting, or to implement or maintain other effective control systems required of U.S. public companies, could also restrict our future access to the capital markets.

If We Do Not Obtain The Capital Necessary To Fund Our Operations, We Will Be Unable To Successfully Develop, Pursue Regulatory Approval For, And Commercialize, Our Biopharmaceutical Products.

The development of biopharmaceutical products is capital-intensive. We anticipate we may require additional financing to continue to fund our operations. Our future capital requirements will depend on, and could increase significantly as a result of, many factors including:

Until we can generate significant continuing revenues, we expect to satisfy our future cash needs through collaboration arrangements, sales of our securities, debt financings, obtaining public assistance in support of innovation, such as conditional advances from OSEO, and reimbursements of research tax credit claims, or by licensing one or more of our future product candidates. Dislocations in the financial markets have generally made equity and debt financing more difficult to obtain, and may have a material adverse effect on our ability to meet our future fundraising needs. We cannot be certain that additional funding will be available to us on acceptable terms, if at all. If funds are not available, we may be required to delay, reduce the scope of, or eliminate one or more of our research or development programs or our commercialization efforts. Additional funding, if obtained, may significantly dilute existing shareholders if that financing is obtained through issuing equity or instruments convertible into equity.

Our Product Development Programs For Candidates May Require Substantial Financial Resources And May Ultimately Be Unsuccessful.

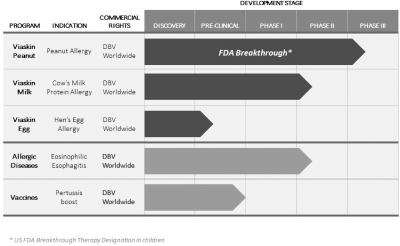

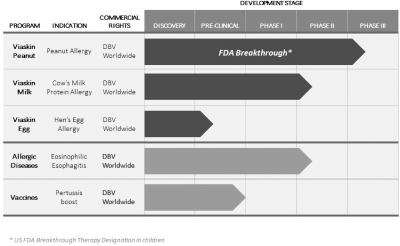

In addition to the development of our lead product candidates, we may pursue development of our other early-stage development programs. In November 2015, we announced the enrollment of the first patient in theStudy of efficacy and safety of Viaskin Milk in Milk-Induced Eosinophilic Esophagitis, or SMILEE, a Phase IIa clinical trial assessing the safety and efficacy of Viaskin Milk for the treatment of milk-induced eosinophilic esophagitis. Our other earlier stage product development programs include a booster vaccine for pertussis, as well as potential treatments for Crohn’s disease and respiratory syncytial virus. Our current early-stage development programs are still in the pre-clinical proof-of-concept phase and may not result in product candidates we can advance to the clinical development phase. None of our other potential product candidates has commenced clinical trials, and there are a number of U.S. Food and Drug Administration, or FDA, and European Medicines Agency, or EMA, regulatory requirements that we must satisfy before we can commence these clinical trials, if at all. Satisfaction of these requirements will entail substantial time, effort and financial resources. We may never satisfy these requirements. Any time, effort and financial resources we expend on our other early-stage development programs may adversely affect our ability to continue development and commercialization of Viaskin patch product candidates based on our Viaskin technology platform, and we may never commence clinical trials of such development programs despite expending significant resources in pursuit of their development. Even if we do commence clinical trials of our other potential product candidates, such product candidates may never be approved by the FDA or the EMA.

The Requirements Of Being A U.S. Public Company May Strain Our Resources, Divert Management’s Attention And Affect Our Ability To Attract And Retain Executive Management And Qualified Board Members.

As a U.S. public company, we arehave incurred and will continue to incur significant legal, accounting, and other expenses that we did not previously incur. We are subject to the reporting requirements of the Securities Exchange Act of 1934, or the Exchange Act, the Sarbanes-Oxley Act, the Dodd-Frank Wall Street Reform and Consumer Protection Act, the Nasdaq listing requirements and other applicable securities rules and regulations. Compliance with these rules and regulations will continue to increase our legal and financial compliance costs, make some activities more difficult, time-consuming or costly and increase demand on our systems and resources, particularly after we are no longer an “emerging growth company” and/orqualify as a foreign private issuer. The Exchange Act requires that, as a public company, we file annual, semi-annual and current reports with respect to our business, financial condition and result of operations. However, as a foreign private issuer, we are not required to file quarterly reports with respect to our business, financial condition and results of operations. We currently make annual and semi-annual filings with respect to our listing on Euronext Paris. Unless otherwise required by the Exchange Act or the listing rules of the Nasdaq Global Select Market, we do not expect to file quarterly financial reports and will continue to file financial reports on an annual and semi-annual basis. Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, or Section 404, we are required to furnish a report by our management on our internal control over financial reporting, including an attestation report on internal control over financial reporting issued by our independent registered public accounting firm. However, while we remain an emerging growth company, we are not required to include an attestation report on internal control over financial reporting issued by our independent registered public accounting firm. To achieve compliance with Section 404 within the prescribed period, we have been and continue to be engaged in a process to document and evaluate our internal control over financial reporting, which is both costly and challenging. In this regard, we need to continue to dedicate internal resources, potentially engage outside consultants and adopt a detailed work plan to assess and document the adequacy of internal control over financial reporting, continue steps to improve control processes as appropriate, validate through testing that controls are functioning as documented and implement a continuous reporting and improvement process for internal control over financial reporting. As a result of being a U.S. public company, management’s attention may be diverted from other business concerns, which could adversely affect our business and results of operations. We may need to hire more employees in the future or engage outside consultants to comply with these requirements, which will increase our cost and expense. Despite our efforts, there is a risk that neither we nor our independent registered public accounting firm will be able to conclude within the prescribed timeframe that our internal control over financial reporting is effective as required by Section 404. This could result in an adverse reaction in the financial markets due to a loss of confidence in the reliability of our financial statements.

In addition, changing laws, regulations and standards relating to corporate governance and public disclosure are creating uncertainty for public companies, increasing legal and financial compliance costs and making some activities more time-consuming. These laws, regulations and standards are subject to varying interpretations, in many cases due to their lack of specificity, and, as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. We intend to invest resources to comply with evolving laws, regulations and standards, and this investment may result in increased general and administrative expense and a diversion of management’s time and attention from revenue-generating activities to compliance activities. If our efforts to comply with new laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to their application and practice, regulatory authorities may initiate legal proceedings against us and our business may be adversely affected.

As a U.S. public company that is subject to these rules and regulations, we may find it is more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced coverage or incur substantially higher costs to obtain coverage. These factors could also make it more difficult for us to attract and retain qualified members of our board of directors, particularly to serve on our audit committee and compensation committee, and qualified executive officers.

As a result of disclosure of information in filings required of a U.S. public company, our business and financial condition will become more visible, which we believe may result in threatened or actual litigation, including by

competitors and other third parties. If such claims are successful, our business and results of operations could be adversely affected, and even if the claims do not result in litigation or are resolved in our favor, these claims, and the time and resources necessary to resolve them, could divert the resources of our management and adversely affect our business and results of operations.

Further, being a U.S. public company and a French public company has an impact on disclosure of information and compliance with two sets of applicable rules. This could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices.

Risks Related to Product Development, Regulatory Approval and Commercialization

We Depend Almost Entirely On The Successful Development Of Our Novel Viaskin Technology. We Cannot Be Certain That We Will Be Able To Obtain Regulatory Approval For, Or Successfully Commercialize, Viaskin Products.

We currently have two lead Viaskin technology-based product candidates, Viaskin Peanut and Viaskin Milk, in clinical development, and our business depends almost entirely on their successful clinical development, regulatory approval and commercialization. We currently have no drug or biological product approved for sale and may never be able to develop a marketable drug or biological product. Viaskin Peanut and Viaskin Milk will require substantial additional clinical development, testing, and regulatory approval before we are permitted to commence their commercialization. Our other product candidates, such as Viaskin HDM,Egg, are still in pre-clinical development. The clinical trials of our product candidates are, and the manufacturing and marketing of our product candidates will be, subject to extensive and rigorous review and regulation by numerous government authorities in the United States and in other countries where we intend to test and, if approved, market any product candidate. Before obtaining regulatory approvals for the commercial sale of any product candidate, we must demonstrate through pre-clinical testing and clinical trials that, among other things, the product candidate is safe and effective for use in each target indication. This process can take many years and may include post-marketingpost- marketing studies and surveillance, which will require the expenditure of substantial resources. Of the large number of drugs in development in the United States, only a small percentage successfully completes the FDA regulatory approval process and is commercialized. Accordingly, even if we are able to obtain the requisite financing to continue to fund our development and clinical programs, we cannot assure you that Viaskin Peanut, Viaskin Milk or any other of our product candidates will be successfully developed or commercialized.

We are not permitted to market Viaskin Peanut or Viaskin Milk in the United States until we receive approval of a Biologic License Application, or a BLA, from the FDA, or in any other countries until we receive the requisite approval from such countries. Obtaining approval of a BLA, or requisite approval in other countries, is a complex, lengthy, expensive and uncertain process, and the FDA may delay, limit or deny approval of Viaskin Peanut and Viaskin Milk for many reasons, including, among others:

Any of these factors, many of which are beyond our control, could jeopardize our ability to obtain regulatory approval for and successfully market any of our product candidates based on our Viaskin patch product candidates.technology platform. Moreover, because our business is almost entirely dependent upon Viaskin technology, any such setback in our pursuit of regulatory approval would have a material adverse effect on our business and prospects.

Our Product Candidates Are Expected To Undergo Clinical Trials That Are Time-consumingTime-Consuming And Expensive, The Outcomes Of Which Are Unpredictable, And For Which There Is A High Risk Of Failure. If Clinical Trials Of Our Product Candidates Fail To Satisfactorily Demonstrate Safety And Efficacy To The FDA And Other Regulators, We, Or Our Collaborators, May Incur Additional Costs Or Experience Delays In Completing, Or Ultimately Be Unable To Complete, The Development And Commercialization Of These Product Candidates.

Pre-clinical testing and clinical trials are long, expensive and unpredictable processes that can be subject to extensive delays. We cannot guarantee that any clinical trials will be conducted as planned or completed on schedule, if at all. It may take several years to complete the pre-clinical testing and clinical development necessary to commercialize a drug or biologic, and delays or failure can occur at any stage. Interim results of clinical trials do not necessarily predict final results, and success in pre-clinical testing and early clinical trials does not ensure that later clinical trials will be successful. A number of companies in the pharmaceutical, biopharmaceutical and biotechnology industries have suffered significant setbacks in advanced clinical trials even after promising results in earlier trials, and we cannot be certain that we will not face similar setbacks. The design of a clinical trial can determine whether its results will support approval of a product, and flaws in the design of a clinical trial may not become apparent until the clinical trial is well advanced. An unfavorable outcome in one or more trials would be a major setback for our product candidates and for us. Due to our limited financial resources, an unfavorable outcome in one or more trials may require us to delay, reduce the scope of, or eliminate one or more product development programs, which could have a material adverse effect on our business and financial condition and on the value of the ADSs.our ADSs and ordinary shares.

In connection with clinical testing and trials, we face a number of risks, including:

The results of pre-clinical studies do not necessarily predict clinical success, and larger and later-stage clinical trials may not produce the same results as earlier-stage clinical trials. The prior clinical trials of Viaskin patchour product candidates based on our Viaskin technology platform showed favorable safety and efficacy data; however, we may have different enrollment criteria in our future clinical trials. As a result, we may not observe a similarly favorable safety and efficacy profile as our prior clinical trials. In addition, we cannot assure you that in the course of potential widespread use in future, some drawbacks would not appear in maintaining production quality, protein stability or allergenic strength. Frequently, product candidates developed by pharmaceutical, biopharmaceutical and biotechnology companies have shown promising results in early pre-clinical studies or clinical trials, but have subsequently suffered significant setbacks or failed in later clinical trials. In addition, clinical trials of potential products often reveal that it is not possible or practical to continue development efforts for these product candidates.

If we do not successfully complete pre-clinical and clinical development, we will be unable to market and sell our product candidates and generate revenues. Even if we do successfully complete clinical trials, those results are not necessarily predictive of results of additional trials that may be needed before a BLA may be submitted to the FDA. Although there are a large number of drugs and biologics in development in the United States and other countries, only a small percentage result in the submission of a BLA to the FDA, even fewer are approved for commercialization, and only a small number achieve widespread physician and consumer acceptance following regulatory approval. If our clinical trials are substantially delayed or fail to prove the safety and effectiveness of our product candidates in development, we may not receive regulatory approval of any of these product candidates and our business and financial condition will be materially harmed.

In Our Clinical Trials, We Utilize An Oral Food Challenge Procedure Intentionally Designed To Trigger An Allergic Reaction, Which Could Be Severe Or Life-Threatening.

In accordance with our food allergy clinical trial protocols, we utilize a double-blind, placebo-controlled food challenge procedure. This consists of giving the offending food protein to patients in order to assess the sensitivity of their food allergy, and thus the safety and efficacy of our product candidates versus placebo. The food challenge protocol is meant to induce objective symptoms of an allergic reaction. These oral food challenge procedures can potentially trigger anaphylaxis or potentially life-threatening systemic allergic reactions. Even though these procedures are well-controlled, standardized and performed in highly specialized centers with intensive care units, there are inherent risks in conducting a trial of this nature. An uncontrolled allergic reaction could potentially lead to serious or even fatal reactions. Any such serious clinical event could potentially adversely affect our clinical development timelines, including a complete clinical hold on our food allergy clinical trials. We may also become liable to subjects who participate in our clinical trials and experience any such serious or fatal reactions. Any of the foregoing could have a material adverse effect on our business, prospects, stock price or financial condition.

Delays, Suspensions And Terminations In Our Clinical Trials Could Result In Increased Costs To Us And Delay Or Prevent Our Ability To Generate Revenues.

Human clinical trials are very expensive, time-consuming, and difficult to design, implement and complete. The completion of trials for Viaskin Peanut, Viaskin Milk or our other product candidates may be delayed for a variety of reasons, including delays in:

The commencement and completion of clinical trials for our product candidates may be delayed, suspended or terminated due to a number of factors, including:

Many of these factors may also ultimately lead to denial of our BLA for our product candidate. If we experience delay, suspensions or terminations in a clinical trial, the commercial prospects for the related product candidate will be harmed, and our ability to generate product revenues will be delayed or such revenues could be reduced or fail to materialize.

In addition, we may encounter delays or product candidate rejections based on new governmental regulations, future legislative or administrative actions, or changes in FDA or other similar foreign regulatory agency policy or interpretation during the period of product development. If we obtain required regulatory approvals, such approvals may later be withdrawn. Delays or failures in obtaining regulatory approvals may result in:

Furthermore, if we fail to comply with applicable FDA and other regulatory requirements at any stage during this regulatory process, we may encounter or be subject to:

If Our Product Candidates Are Not Approved By The FDA, We Will Be Unable To Commercialize Them In The United States.

The FDA must approve any new drug or biologic before it can be commercialized, marketed, promoted or sold in the United States. We must provide the FDA with data from pre-clinical studies and clinical trials that demonstrate that, among other things, our product candidates are safe and effective for a defined indication before they can be approved for commercial distribution. Clinical testing is expensive, difficult to design and implement, can take many years to complete and is inherently uncertain as to outcome. We must provide data to ensure the identity, strength, quality and purity of the drug substance and drug product. Also, we must assure the FDA that the characteristics and performance of the clinical batches will be replicated consistently in the commercial batches. We will not obtain approval for a product candidate unless and until the FDA approves a BLA, if at all. The processes by which regulatory approvals are obtained from the FDA to market and sell a new or repositioned product are complex, require a number of years and involve the expenditure of substantial resources. We cannot assure you that any of our product candidates will receive FDA approval in the future, and the time for receipt of any such approval is currently incapable of estimation.

A Fast Track Designation By The FDA May Not Actually Lead To A Faster Development Or Regulatory Review Or Approval Process.Process, And It Does Not Increase The Likelihood That Our Product Candidates Will Receive Marketing Approval.

We have obtained fast track designation from the FDA for Viaskin Peanut, and we may pursue that designation for other product candidates as well. If a product is intended for the treatment of a serious or life-threatening condition and nonclinical or clinical data demonstrate the potential to address unmet medical needs for this condition, the sponsor may apply for FDA fast track designation. The FDA has broad discretion whether or not to grant this designation, and even if we believe our product candidates are eligible for this designation, we cannot be sure that the FDA would decide to grant it. Even if we do have fast track designation, we may not experience a faster development process, review or approval compared to conventional FDA procedures. The FDA may withdraw fast track designation if it believes that the designation is no longer supported by data from our clinical development program.

A Breakthrough Therapy Designation By The FDA For Our Product Candidates May Not Lead To A Faster Development Or Regulatory Review Or Approval Process, And It Does Not Increase The Likelihood That Our Product Candidates Will Receive Marketing Approval.

We have obtained breakthrough therapy designation for Viaskin Peanut in children, 6 to 11 years of age, and we may pursue that designation for other product candidates as well. A breakthrough therapy is defined as a product that is intended, alone or in combination with one or more other drugs, to treat a serious or life-threateninglife- threatening condition, and preliminary clinical evidence indicates that the product may demonstrate substantial improvement over existing therapies on one or more clinically significant endpoints. For product candidates that have been designated as breakthrough therapies, interaction and communication between the FDA and the sponsor of the trial can help identify the most efficient path for clinical development while minimizing the number of patients placed in ineffective control regimens. Such designation also offers an intensive and efficient review involving FDA senior managers and experienced review and regulatory health project management staff across disciplines. A breakthrough therapy designation affords the possibility of rolling review, enabling the agency to review portions of the marketing application before submission of a complete application, and priority review if supported by clinical data at the time of our BLA submission.

Designation as a breakthrough therapy is within the discretion of the FDA. Accordingly, even if we believe that our product candidates, in addition to Viaskin Peanut, meet the criteria for designation as a breakthrough therapy, the FDA may disagree and instead determine not to make such designation. In any event, the receipt of a breakthrough therapy designation for a product candidate may not result in a faster development process, review or approval compared to products considered for approval under conventional FDA procedures and does not assure ultimate approval by the FDA. In addition, even if one or more of our product candidates qualify as breakthrough therapies, the FDA may later decide that the products no longer meet the conditions for qualification.

The Approval Process Outside The United States Varies Among Countries And May Limit Our Ability To Develop, Manufacture And Sell Our Products Internationally. Failure To Obtain Marketing Approval In International Jurisdictions Would Prevent Our Product Candidates From Being Marketed Abroad.

In order to market and sell our product candidates in the European Union and many other jurisdictions, we, and our collaborators, must obtain separate marketing approvals and comply with numerous and varying regulatory requirements. The approval procedure varies among countries and may involve additional testing. We may conduct clinical trials for, and seek regulatory approval to market, our product candidates in countries other than the United States. Depending on the results of clinical trials and the process for obtaining regulatory approvals in other countries, we may decide to first seek regulatory approvals of a product candidate in countries other than the United States,

or we may simultaneously seek regulatory approvals in the United States and other countries. If we or our collaborators seek marketing approvals for a product candidate outside the United States, we will be subject to the regulatory requirements of health authorities in each country in which we seek approvals. With respect to marketing authorizations in Europe, we will be required to submit a European marketing authorization application, or MAA, to the EMA which conducts a validation and scientific approval process in evaluating a product for safety and efficacy. The approval procedure varies among regions and countries and may involve additional testing, and the time required to obtain approvals may differ from that required to obtain FDA approval.

Pursuing regulatory approvals from health authorities in countries outside the United States is likely to subject us to all of the risks associated with pursuing FDA approval described above. In addition, marketing approval by the FDA does not ensure approval by the health authorities of any other country, and approval by foreign health authorities does not ensure marketing approval by the FDA.

Even If We, Or Our Collaborators, Obtain Marketing Approvals For Our Product Candidates, The Terms Of Approvals And Ongoing Regulation Of Our Products May Limit How We Or They Market Our Products, Which Could Materially Impair Our Ability To Generate Revenue.

Even if we receive regulatory approval for a product candidate, this approval may carry conditions that limit the market for the product or put the product at a competitive disadvantage relative to alternative therapies. For instance, a regulatory approval may limit the indicated uses for which we can market a product or the patient population that may utilize the product, or may be required to carry a warning in its labeling and on its packaging. Products with boxed warnings are subject to more restrictive advertising regulations than products without such warnings. These restrictions could make it more difficult to market any product candidate effectively. Accordingly, assuming we, or our collaborators, receive marketing approval for one or more of our product candidates, we, and our collaborators will continue to expend time, money and effort in all areas of regulatory compliance.

Any Of Our Product Candidates For Which We, Or Our Collaborators, Obtain Marketing Approval In The Future Could Be Subject To Post-marketing Restrictions Or Withdrawal From The Market And We, And Our Collaborators, May Be Subject To Substantial Penalties If We, Or They, Fail To Comply With Regulatory Requirements Or If We, Or They, Experience Unanticipated Problems With Our Products Following Approval.

Any of our product candidates for which we, or our collaborators, obtain marketing approval in the future, as well as the manufacturing processes, post-approval studies and measures, labeling, advertising and promotional activities for such products, among other things, will be subject to continual requirements of and review by the FDA and other regulatory authorities. These requirements include submissions of safety and other post-marketing information and reports, registration and listing requirements, requirements relating to manufacturing, quality control, quality assurance and corresponding maintenance of records and documents, requirements regarding the distribution of samples to physicians and recordkeeping. Even if marketing approval of a product candidate is granted, the approval may be subject to limitations on the indicated uses for which the product may be marketed or to the conditions of approval, including the FDA requirement to implement a REMS to ensure that the benefits of a drug or biological product outweigh its risks.

The FDA may also impose requirements for costly post-marketing studies or clinical trials and surveillance to monitor the safety or efficacy of a product, such as long term observational studies on natural exposure. The FDA and other agencies, including the Department of Justice, closely regulate and monitor the post-approval marketing and promotion of products to ensure that they are manufactured, marketed and distributed only for the approved indications and in accordance with the provisions of the approved labeling. The FDA imposes stringent restrictions on manufacturers’ communications regarding off-label use and if we, or our collaborators, market any of our product candidates for which we, or they, receive marketing approval for treatment other than their approved

indications, we, or they, may be subject to warnings or enforcement action for off-label marketing. Violation of the FDCA and other statutes, including the False Claims Act, relating to the promotion and advertising of prescription drugs may lead to investigations or allegations of violations of federal and state health care fraud and abuse laws and state consumer protection laws.

If We Do Not Achieve Our Projected Development And Commercialization Goals In The Timeframes We Announce And Expect, The Commercialization Of Our Product Candidates May Be Delayed, And Our Business Will Be Harmed.

We sometimes estimate for planning purposes the timing of the accomplishment of various scientific, clinical, regulatory and other product development objectives.objectives for planning purposes. These milestones may include our expectations regarding the commencement or completion of scientific studies, clinical trials, the submission of regulatory filings, or commercialization objectives. From time to time, we may publicly announce the expected timing of some of these milestones, such as the completion of an ongoing clinical trial, the initiation of other clinical programs, receipt of marketing approval, or a commercial launch of a product. The achievement of many of these milestones may be outside of our control. All of these milestones are based on a variety of assumptions which may cause the timing of achievement of the milestones to vary considerably from our estimates, including:

If we fail to achieve announced milestones in the timeframes we expect, the commercialization of our product candidates may be delayed, our business and results of operations may be harmed, the trading price of the ADSs or ordinary shares may decline.

Access To Raw Materials And Products Necessary For The Conduct Of Clinical Trials And Manufacturing Of Our Product Candidates Is Not Guaranteed.

We are dependent on third parties for the supply of various materials, chemical or biological products that are necessary to produce patches for our clinical trials or diagnosis patches. The supply of these materials could be reduced or interrupted at any time. In such case, we may not be able to find other suppliers of acceptable materials in appropriate quantities at an acceptable cost. If key suppliers or manufacturers are lost or the supply of materials is diminished or discontinued, we may not be able to continue to develop, manufacture and market our product candidates or products in a timely and competitive manner. In addition, these materials are subject to stringent manufacturing processes and rigorous testing. Delays in the completion and validation of facilities and manufacturing processes of these materials could adversely affect our ability to complete trials and commercialize our products in a cost-effective and timely manner. To prevent such situations, we intend to diversify our supply

sources by identifying at a minimum a second source of supply for critical raw materials and materials, such as natural protein and polymer film with a titanium coating. If we encounter difficulties in the supply of these materials, chemicals or biological products, if we were not able to maintain our supply agreements or establish new agreements to develop and manufacture our products in the future, our business, prospects, financial condition, results and development could be significantly affected.

Relying On Third-partyThird-Party Manufacturers May Result In Delays In Our Clinical Trials And Product Introductions. We Or The Third Parties Upon Whom We Depend May Be Adversely Affected By Earthquakes Or Other Natural Disasters And Our Business Continuity And Disaster Recovery Plans May Not Adequately Protect Us From A Serious Disaster.

Developing and commercializing new medicines entails significant risks and expenses. Our clinical trials may be delayed if third-party manufacturers are unable to assure a sufficient quantity of the drug product to meet our study needs. Currently, we have only one manufacturer, for peanut protein extract, anSanofi S.A., or Sanofi, of the active pharmaceutical ingredientingredients used in our Viaskin Peanut clinical trials.product candidates, such peanut protein extract. If such manufacturerSanofi cannot manufacture the peanut protein extractactive pharmaceutical ingredients as required by us in a timely manner, we may not be able to find a substitute manufacturer on a timely basis and our clinic trials may be delayed. If our clinical trials are delayed, our commercialization efforts may be impeded, or our costs may increase. Further, we are aware that Sanofi has entered into licensing agreements of discovery platforms in selected food allergies, notably with Immune Design Corp. and Selecta Biosciences Inc. This potential competitive dynamic may make Sanofi less inclined to continue or renew their manufacturing arrangement with us on commercially reasonable terms or at all and, notwithstanding contractual protections, Sanofi may be able to utilize knowledge gained through their relationship with us in furtherance of their development of competitive therapies.

Once regulatory approval is obtained, a marketed product and its manufacturer are subject to continual review. The discovery of previously unknown problems with a product or manufacturer may result in restrictions on the product, manufacturer or manufacturing facility, including withdrawal of the product from the market. Any manufacturers with which we contract are required to operate in accordance with FDA-mandated current good manufacturing practices, or cGMPs. A failure of any of our contract manufacturers to establish and follow cGMPs and to document their adherence to such practices may lead to significant delays in the launch of products based on our product candidates into the market. Moreover, the constituent parts of a combination product retain their regulatory status (as a biologic or device, for example) and, as such, we or our contract manufacturers may be subject to additional requirements in the Quality System Regulation, or QSR, applicable to medical devices, such as design controls, purchasing controls, and corrective and preventive action. Failure by third-party manufacturers to comply with applicable regulations could result in sanctions being imposed on us, including fines, injunctions, civil penalties, revocation or suspension of marketing approval for any products granted pre-market approvals, seizures or recalls of products, operating restrictions, and criminal prosecutions.

Earthquakes or other natural disasters could severely disrupt our operations, and have a material adverse effect on our business, results of operations, financial condition and prospects. If a natural disaster, power outage or other event occurred that prevented us from using all or a significant portion of our headquarters, that damaged critical infrastructure, such as the manufacturing facilities of our third-party contract manufacturers, or that otherwise disrupted operations, it may be difficult or, in certain cases, impossible for us to continue our business for a substantial period of time. The disaster recovery and business continuity plans we have in place may prove inadequate in the event of a serious disaster or similar event. We may incur substantial expenses as a result of the limited nature of our disaster recovery and business continuity plans, which, particularly when taken together with our lack of earthquake insurance, could have a material adverse effect on our business.

We Rely, And Will Rely In The Future, On Third Parties To Conduct Our Clinical Trials And Perform Data Collection And Analysis, Which May Result In Costs And Delays That Prevent Us From Successfully Commercializing Product Candidates.

We rely, and will rely in the future, on medical institutions, clinical investigators, CROs, contract laboratories, and collaborators to perform data collection and analysis and others to carry out our clinical trials. Our development activities or clinical trials conducted in reliance on third parties may be delayed, suspended, or terminated if:

Third party performance failures may increase our development costs, delay our ability to obtain regulatory approval, and delay or prevent the commercialization of our product candidates. While we believe that there are numerous alternative sources to provide these services, in the event that we seek such alternative sources, we may not be able to enter into replacement arrangements without incurring delays or additional costs.

Even If Collaborators With Which We Contract In The Future Successfully Complete Clinical Trials Of Our Product Candidates, Those Candidates May Not Be Commercialized Successfully For Other Reasons.

Even if we contract with collaborators that successfully complete clinical trials for one or more of our product candidates, those candidates may not be commercialized for other reasons, including:

Our Viaskin Product Candidates May Not Be Able To Be Manufactured Profitably On A Large Enough Scale To Support Commercialization.

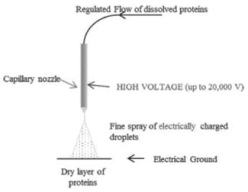

To date, our Viaskin product candidates have only been manufactured at a scale which is adequate to supply our research activities and clinical trials. There can be no assurance that the procedures currently used to manufacture our product candidates will work at a scale which is adequate for commercial needs and we may encounter difficulties in the production of Viaskin patches due to our or our partners’ manufacturing capabilities. We have not built commercial-scale manufacturing facilities, and we have limited manufacturing experience with Viaskin patches. We are working to develop a commercial-scale version of our electrospray manufacturing tool, but cannot predict or control issues that may arise with its development. These difficulties could delay the commercialization of our product candidates, reduce sales of our products, if approved, or increase our costs, any of which could harm our business.

We rely on a single supplier to produce, or contract for the production of, active ingredients for our clinical trials and for our commercial supplies of any future approved products. Even if we were to obtain access to quantities of

active ingredients sufficient to allow us otherwise to expand our Viaskin manufacturing capabilities, we may not be able to produce sufficient quantities of the product at an acceptable cost, or at all. In the event our Viaskin product candidates cannot be manufactured in sufficient quantities for commercialization, our future prospects could be significantly impacted and our financial prospects would be materially harmed.

We May Enter Into Agreements With Third Parties To Sell And Market Any Products We Develop And For Which We Obtain Regulatory Approvals, Which May Affect The Sales Of Our Products And Our Ability To Generate Revenues.

Given our development stage, we have limited experience in sales, marketing and distribution of biopharmaceutical products. However, if our product candidates obtain marketing approval, we intend to develop sales and marketing capacity, either alone or with strategic partners by contracting with, or licensing, them to market any of our products. Outsourcing sales and marketing in this manner may subject us to a variety of risks, including:

If we are unable to partner with a third party that has adequate sales, marketing, and distribution capabilities, we may have difficulty commercializing our product candidates, which would adversely affect our business, financial condition, and ability to generate product revenues.

Our Product Candidates Are Regulated As Biological Products, Or Biologics, Which May Subject Them To Competition Sooner Than Anticipated.

The Biologics Price Competition and Innovation Act of 2009, or BPCIA, was enacted as part of the 2010 enactments of the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act of 2010, or collectively, the ACA, to establish an abbreviated licensure pathway for biological products shown to be biosimilar to, or interchangeable with, an FDA-licensed biological reference product. “Biosimilarity” means that the biological product is highly similar to the reference product notwithstanding minor differences in clinically inactive components and there are no clinically meaningful differences between the biological product and the reference product in terms of safety, purity, and potency of the product. To meet the higher standard of “interchangeability,” an applicant must provide sufficient information to show biosimilarity and demonstrate that the biological product can be expected to produce the same clinical result as the reference product in any given patient and, if the biological product is administrated more than once to an individual, the risk in terms of safety or diminished efficacy of alternating or switching between the use of the biological product and the reference product is not greater than the risk of using the reference product without such alternation or switch.

Under the BPCIA, an application for a biosimilar or interchangeable product cannot be approved by the FDA until 12 years after the reference product was first licensed, and the FDA will not even accept an application for review until four years after the date of first