UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM20-F

(Mark One)

| Registration statement pursuant to section 12(b) or (g) of the Securities Exchange Act of 1934 |

or

| Annual report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended March 31, 20162017

or

| Transition report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 |

or

| Shell company report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 |

Date of event requiring this shell company report

From the transition period from to

Commission file number001-33175

Vedanta Limited

(Exact Name of Registrant as specified in its charter)

| Republic of India |

Mumbai - 400 093, Maharashtra, India | |

| (Jurisdiction of Incorporation or Organization) | (Address of Principal Executive Offices) |

Bhumika Sood

Compliance Officer

DLF Atria,Phase-2, Jacaranda Marg, DLF City

Gurgaon – 122002, Haryana, India

(91) 124 4763518

comp.sect@vedanta.co.in

(Name, Telephone,E-mail and/or facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

American Depositary Shares each representing four equity shares par value | New York Stock Exchange | |

| (Title of Each Class) | (Name of Exchange On Which Registered) |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

As of March 31, 2016, 2,964,694,2392017, 2,965,004,871 equity shares, par value Re.Rs. 1 per equity share, were issued and outstanding, of which 228,184,620217,019,900 equity shares were held in the form of 57,046,15554,254,975

American Depositary Shares or ADSs.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x☒ No ¨☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ¨☐ No x☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x☒ No ¨☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of RegulationS-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨☐ No ¨☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, anon-accelerated filer, or a non-accelerated filer.an emerging growth company. See the definitionsdefinition of “large accelerated filer,” “accelerated filer” and “accelerated filer”“emerging growth company” in Rule12b-2 of the Exchange Act.

| Large accelerated filer ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ | ||

| Emerging growth company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. (Check one):☐

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

US GAAP | International Financial Reporting Standards as issued by the International Accounting Standards Board | Other |

If “Other” has been checked in the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ¨☐ Item 18 ¨☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule12b-2 of the Securities Exchange Act of 1934).

Yes ¨☐ No x☒

| PAGE | ||||||

| 4 | ||||||

ITEM 1. | 4 | |||||

ITEM 2. | 4 | |||||

ITEM 3. | 4 | |||||

ITEM 4. | ||||||

ITEM 4A. | ||||||

ITEM 5. | ||||||

ITEM 6. | ||||||

ITEM 7. | ||||||

ITEM 8. | ||||||

ITEM 9. | ||||||

ITEM 10. | ||||||

ITEM 11. | ||||||

ITEM 12. | ||||||

ITEM 13. | ||||||

ITEM 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | |||||

ITEM 15. | ||||||

ITEM 16A. | ||||||

ITEM 16B. | ||||||

ITEM 16C. | ||||||

ITEM 16D. | ||||||

ITEM 16E. | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | |||||

ITEM 16F. | ||||||

ITEM 16G. | ||||||

ITEM 16H. | ||||||

ITEM 17. | ||||||

ITEM 18. | ||||||

ITEM 19. | ||||||

| F-1 | ||||||

CONVENTIONS USED IN THIS ANNUAL REPORT

In this Annual Report, we refer to information regarding the zinc, oil and gas, iron ore, copper, aluminium and power industries and our competitors from market research reports, analyst reports and other publicly available sources. Although we believe that this information is reliable, we have not independently verified the accuracy and completeness of the information. We caution you not to place undue reliance on this data.

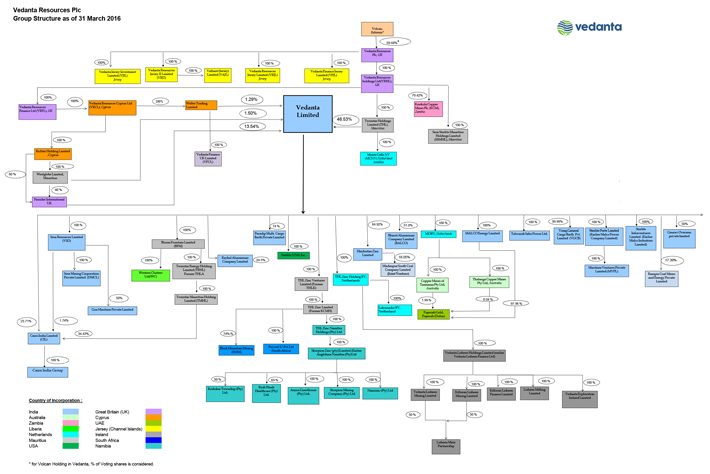

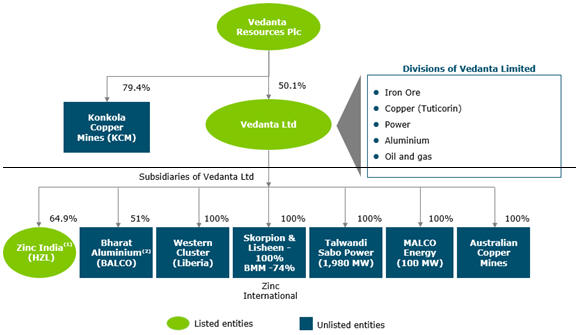

On February 25, 2012, Vedanta Resources Plc (“Vedanta”), the parent company of Sterlite Industries (India) Limited (“Sterlite” or “SIIL”), Sesa Goa Limited (“Sesa Goa”), Vedanta Aluminium Limited (“Vedanta Aluminium”), Sterlite Energy Limited (“Sterlite Energy”), Cairn India Limited (“Cairn India Limited”) and The Madras Aluminium Company Limited (“MALCO”) announced anall-share merger of majority owned subsidiaries, Sesa Goa and SIIL, to create Sesa Sterlite Limited (“Sesa Sterlite” or “SSL”) and a consolidation of various subsidiaries held by Vedanta to effect the consolidation and simplification of Vedanta’s corporate structure through two series of transactions (together the “Re-organization“Re-organization Transactions” consisting of the “Amalgamation andRe-organization Scheme” and the “Cairn India Limited Consolidation”). TheRe-organization transactions were completed during the fiscal year 2014 and the name of the merged entity was changed to Sesa Sterlite Limited with effect from September 18, 2013. Please see “Item 5. Operating and Financial Review and Prospects – Consolidation and re-organization of Sesa Goa, Sterlite, Vedanta Aluminium, Sterlite Energy and MALCO to form Sesa Sterlite and transfer of Vedanta’s shareholding in Cairn India Limited to Sesa Sterlite”. On April 21, 2015 theThe name of Sesa Sterlite Limited was changed to Vedanta Limited.Limited, with effect from April 21, 2015. Cairn India Limited has merged into Vedanta Limited by way of a scheme of arrangement and the Board of Directors of both the companies made the merger operative on April 11, 2017 (the “Cairn India Merger”). See “Item 4 A. History and Development of our Company.

Sterlite Energy was a wholly owned subsidiary of SIIL and SIIL, Vedanta Aluminium, Sesa Goa, MALCO and Cairn India Limited were subsidiaries of Vedanta, the ultimate holding company. Therefore, theRe-organization Transactions (as described elsewhere in this Annual Report)and Cairn India Merger fall within the purview of the common control business combination transactions. The accounting policies described in Notes 1 and 3.D - “Business3.D—“Business Combinations” of the consolidated financial statements included elsewhere in this Annual Report requires that financial statements of the combined entity, Vedanta Limited, be retroactively adjusted, as if the transaction had occurred at the earliest reporting period (or from the date the entity came under common control, where such a date is later). The financial information of Cairn India Limited is included from December 8, 2011, the date of acquisition of Cairn India Limited by Vedanta.

In this Annual Report, references to the “ADS offering” is to the initial public offering of our equity shares in the form of American Depositary Shares (“ADSs”), each currently representing four equity shares, in the United States (or the “US”) completed in June 2007.

Unless otherwise indicated, our accompanying financial information has been prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board, or IASB, for the fiscal years ended March 31 2012, 2013, 2014, 2015, 2016 and 2016.2017. References to a particular “fiscal year”“fiscal” year or “FY” are to our fiscal year ended March 31 of that year. Our fiscal quarters end on June 30, September 30 and December 31. References to a year other than a “fiscal” year are to the calendar year ended December 31.

Our consolidated financial statements are reported in Indian Rupees or “Rs.”. Unless otherwise specified, translation of amounts for the convenience of the reader has been made in this Annual Report (i) from Indian Rupees to US dollars at the rate of Rs. 66.2564.85 per $ 1.00 based on the exchange rate quoted by the Federal Reserve Bank of New York as of March 31, 2016;2017; (ii) from Australian dollars to US dollars at the rate of AUD 0.770.76 per $ 1.00 based on the exchange rate quoted by the Federal Reserve Bank of New York as of March 31, 2016;2017; (iii) from South African Rand to US dollars at the rate of ZAR 14.7113.42 per $ 1.00 based on the exchange rate quoted by the Federal Reserve Bank of New York as of March 31, 20162017 and (iv) from Namibian dollars to US dollars at the rate of NAD 15.0412.97 per $ 1.00 based on the exchange rate quoted by Oanda (data available at www.oanda.com) as of March 31, 2016.2017. As of July 15, 2016,28, 2017, the exchange rate between US dollars and Indian Rupees was $ 1.00 = Rs. 67.0764.11 as quoted by the Federal Reserve Bank of New York.

In this Annual Report, references to “US” or the “United States” are to the United States of America, its territories and its possessions. References to “UK” are to the United Kingdom. References to “India” are to the Republic of India. References to “Namibia” are to the Republic of Namibia. References to “South Africa” are to the Republic of South Africa. References to “Ireland” are to the “RepublicRepublic of Ireland”.Ireland. References to “Sri Lanka” are to the “DemocraticDemocratic Socialist Republic of Sri Lanka”.Lanka. References to “UAE” are to the United Arab Emirates. References to “$”, “dollars” or “US dollars” are to the legal currency of the United States. References to “Rs.”, “Re.”, “Rs”, “Rupees”, “INR” or “Indian Rupees” are to the legal currency of the Republic of India. References to “AUD”, “Australian dollars” are to the legal currency of the Commonwealth of Australia. References to “NAD” or “Namibian dollars” are to the legal currency of Namibia. References to “ZAR” or “RAND” are to the legal currency of the Republic of South Africa. References to “¢” are to US cents. References to “RMB”, “Renminbi”, “CNY” or “Chinese Yuan” are to the legal currency of the Republic of China.

References to “lb” are to the imperial pounds (mass) equivalent to 0.4536 kilograms, references to “mt” or “tons” are to metric tons, references to “mmt” are to million metric tons, references to “tpd” are to tons per day, references to “tpa” are to tons per annum, a unit of mass equivalent to 1,000 kilograms or 2,204.6 lb, references to “mtpa” are to million tons per annum, “mmtpa” are to million metric tons per annum, references to “wmt” are to wet metric tons, references to “dmt” are to dry metric tons, references to “oz” are to ounces, with one kilogram being equivalent to 32.1507 oz and one ton equivalent to 32,151 oz, references to “mm” are to millimeters, references to “ha” are to hectares, references to “kms” are to kilometers, a unit of area equal to 10,000 square meters or 107,639 square feet, references to “GW” are to giga watts, references to “kt” are to kilo tons, references to “bbls” are to barrels, references to “blpd” are to barrels of liquid per day, references to “mmboe” are to million barrels of oil equivalent, references to “bboe” are to billion barrels of oil equivalent, references to “mmbopd” are to million barrels of oil per day, references to “kbopd” are to kilo barrels of oil per day, references to “bopd” are to barrels of oil per day, references to “boepd” are to barrels of oil equivalent per day, references to “tcm” are to trillion cubic meters, references to “mmscmd” are to million metric standard cubic meter per day, references to “mscf” are to thousand standard cubic feet, references to “mmscf” are to million metric standard cubic feet, references to “mmscfd” are to million metric standard cubic feet per day, references to “bcf” are to billion cubic feet, references to “PPA” are to power purchase agreement and references to “TcRc” are to treatment and refining charges. References to net oil and gas production are to the entitlement interest production of Cairn India Limited and its subsidiaries, in which the Ravva royalty is not netted off.

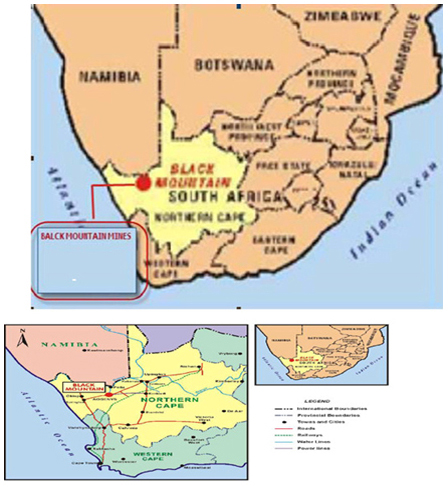

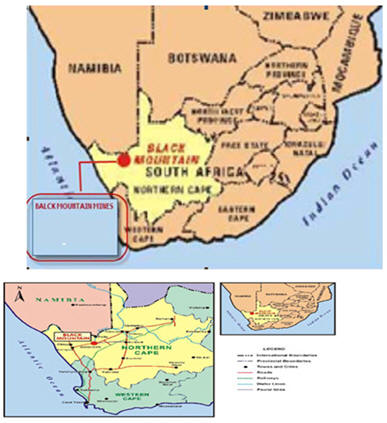

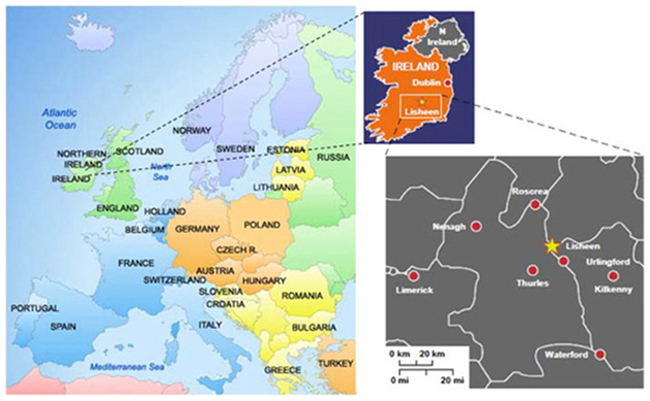

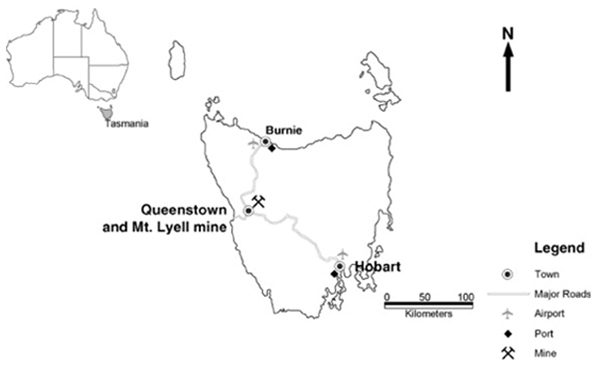

We conduct our businesses both directly and through a consolidated group of companies that we have ownership interests in. See “Item 4. Information on the Company” for more information on these companies and their relationships to us. Unless otherwise stated in this Annual Report or unless the context otherwise requires, references in this Annual Report to “we”, “us”, “our”, “Vedanta Limited”, “Sesa Sterlite Limited (SSL)”, “Sesa Sterlite”, “our Company”, “the Company” or “our consolidated group of companies” mean Vedanta Limited, its consolidated subsidiaries and its predecessors, collectively, including Cairn India Limited and its subsidiaries (“Cairn India”), Monte Cello BV (“Monte Cello”), Copper Mines of Tasmania Proprietary Limited (“CMT”), Thalanga Copper Mines Proprietary Limited, Bharat Aluminium Company Limited (“BALCO”), Hindustan Zinc Limited (“HZL”), Fujairah Gold FZC, Sterlite (USA), Inc., (“Sterlite USA”), Talwandi Sabo Power Limited (“TSPL”), THL Zinc Ventures Limited, THL Zinc Limited, THL Zinc Holding B.V., THL Zinc Namibia Holdings (Proprietary) Limited (“ Skorpion”), Skorpion Zinc (Proprietary) Limited, Skorpion Mining Company (Proprietary) Limited, Namzinc (Proprietary) Limited, Amica Guesthouse (Proprietary) Limited, Rosh Pinah Health Care (Proprietary) Limited, Black Mountain Mining (Proprietary) Limited (“BMM”), Vedanta Lisheen Holdings Limited(“Limited (“Lisheen”), Vedanta Lisheen Mining Limited, Killoran Lisheen Mining Limited, Killoran Lisheen Finance Limited, Lisheen Milling Limited, Vedanta Exploration Ireland Limited, Lisheen Mine Partnership, Sterlite Ports Limited, Sterlite Infraventures Limited, Vizag General Cargo Berth Private Limited, Paradip Multi Cargo Berth Private Limited, Pecvest 17 Proprietary Limited, Lakomasko B.V., MALCO Energy Limited (“MALCO Energy”) (formerly known as Vedanta Aluminium), Sesa Resources Limited, Sesa Mining Corporation Limited, Bloom Fountain Limited (“BFL”), Goa Sea Port Private Limited, Twin Star Energy Holdings Limited (“TEHL”), Twin Star Mauritius Holdings Limited (“TMHL”), Western Cluster Limited (“WCL”), Vedanta Exploration Ireland Limited, Maritime Ventures Private Limited, Sesa Sterlite Mauritius Holdings Limited and Twinstar Energy Holding Limited.

Our consolidated financial information does not include our controlling shareholder Vedanta, its shareholders and various companies owned directly or indirectly by it (other than us and our consolidated group of companies described above), including without limitations, Vedanta Resources Holdings Limited (“VRHL”), Konkola Copper Mines Plc, Konkola Resources Plc, Twin Star Holdings Limited (“Twin Star”), Welter Trading Limited (“Welter Trading”), the Anil Agarwal Discretionary Trust (“Trust”), Conclave PTC Limited (“Conclave”), Sterlite Technologies Limited, Monte Cello Corporation NV, Valliant (Jersey) Limited, Vedanta Resources Jersey II Limited, Vedanta Resources Finance Limited, Vedanta Resources Cyprus Limited, Richter Holding Limited (“Richter”), Westglobe Limited (“Westglobe”), Finsider International Company Limited (“Finsider”), Vedanta Resources Jersey Limited, Vedanta Finance (Jersey) Limited, Vedanta Jersey Investments Limited, Vedanta Finance UK Limited, Sesa Sterlite Mauritius Holdings Limited and Sterlite Grid Limited. References to the “Group” is to Vedanta Limited and its subsidiaries on a consolidated basis and references to the “Vedanta Group” is to Vedanta and its subsidiaries on a consolidated basis.

In this Annual Report, references to The London Metal Exchange Limited (“LME”) price of zinc, copper, aluminium are to the cash seller and settlement price on the LME for copper, zinc or aluminium for the period indicated. References to primary market share in this Annual Report are to the market that includes sales by producers of metal from copper concentrate or alumina, as applicable, and do not include sales by producers of recycled metal or imports.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains “forward-looking statements” as defined in the safe harbor provisions of the US Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on our current expectations, assumptions, estimates and projections about our company and our industry. These forward-looking statements are subject to various risks and uncertainties. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “will,” “project,” “seek,” “should” and similar expressions. These forward-looking statements include, among other things, the discussions of our business strategy and expectations concerning our market position, future operations, margins, profitability, liquidity and capital resources. We caution you that reliance on any forward-looking statement involves risks and uncertainties, and that, although we believe that the assumptions on which our forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate and, as a result, the forward-looking statements based on those assumptions could be materially incorrect. Factors which could cause these assumptions to be incorrect include, but are not limited to:

These and other factors are more fully discussed in “Item 3. Key Information—D. Risk Factors,” “Item 5. Operating and Financial Review and Prospects” and elsewhere in this Annual Report. In light of these and other uncertainties, you should not conclude that we will necessarily achieve any plans, objectives or projected financial results referred to in any of the forward-looking statements. Except as required by law, we do not undertake to release revisions to any of these forward-looking statements to reflect future events or circumstances.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable

| ITEM 3. | KEY INFORMATION |

A. Selected Consolidated Financial Data

The selected consolidated financial data presented below as of March 31, 20152016 and 20162017 and for the years ended March 31, 2014, 2015, 2016 and 20162017 has been derived from our consolidated financial statements included herein, which have been prepared in conformity with IFRS as issued by the IASB. TheseThe consolidated financial statements as of March 31, 2017 and for the year ended March 31, 2017 have been audited by S.R. Batliboi & Co. LLP, India, our independent registered public accounting firm, and included elsewhere in this Annual Report. The consolidated financial statements as of March 31, 2016 and 2015 and for the years ended March 31, 2015 and 2016 were audited by Deloitte Haskins & Sells LLP, Mumbai, India, or Deloitte, our former independent registered public accounting firm, and included elsewhere in this Annual Report.firm.

The selected consolidated financial data presented below as of March 31, 2012, 2013, 2014 and 2014,2015, and for the years ended March 31, 20122013 and 20132014 has been derived from our consolidated financial statements, which also have been prepared in conformity with IFRS as issued by the IASB, and which have not been included elsewhere in this Annual Report.

We have also disclosed below, for all periods presented herein, segment revenue and segment profit, based on the segment disclosures in our consolidated financial statements and cost of production by segment. Cost of production per unit is not a recognized measure under IFRS as issued by the IASB. We have included cost of production as it is a key performance indicator used by the management to assess the performance of the operations. We also believe it is a measure used by investors and analysts to evaluate companies in our industry. Our results of operations are, to a significant degree, dependent upon our ability to efficiently run our operations and maintain low costs of production. Efficiencies relating to recovery of metal from the ore, process improvements, by-product management and increasing productivity help drive our costs down. Our computation of cost of production should be considered in addition to, and not as a substitute for other measures of financial performance and liquidity reported in accordance with IFRS as issued by the IASB. Cost of production is a measure intended for monitoring the operating performance of our operations. This measure is presented by other metal companies, though our measure may not be comparable to similarly titled measures reported by other companies in our industry.

Our historical results do not necessarily indicate our expected results for any future period. The translations of Indian Rupee amounts to US dollars presented in the tables below, are solely for the convenience of the reader and are based on the noon buying rate of Rs. 66.2564.85 per $ 1.00 in the City of New York for cable transfers of Indian Rupees, respectively, as certified for customs purposes by the Federal Reserve Bank of New York on March 31, 2016.2017. No representation is made that the Indian Rupee amounts represent US dollar amounts or have been, could have been or could be converted into US dollars at such rates or at any other rates.

You should read the following information in conjunction with “Item 5. Operating and Financial Review and Prospects” and the consolidated financial statements included elsewhere in this Annual Report.

| For the Year Ended March 31, | For the Year Ended March 31, | |||||||||||||||||||||||||||||||||||||||||||||||

| 2012 | 2013 | 2014 | 2015 | 2016 | 2016 | 2013 | 2014 | 2015 | 2016 | 2017 | 2017 | |||||||||||||||||||||||||||||||||||||

| (Rs.) (in millions except shares and per share data) | (Rs.) (in millions except shares and per share data) | (Rs.) (in millions except shares and per share data) | (Rs.) (in millions except shares and per share data) | (Rs.) (in millions except shares and per share data) | (US Dollar) (in millions except shares and per share data) | (Rs.) (in millions except shares and per share data) | (Rs.) (in millions except shares and per share data) | (Rs.) (in millions except shares and per share data) | (Rs.) (in millions except shares and per share data) | (Rs.) (in millions except shares and per share data) | (US Dollar) (in millions except shares and per share data) | |||||||||||||||||||||||||||||||||||||

Revenue | 598,116 | 722,303 | 725,243 | 733,579 | 639,493 | 9,652.7 | 722,303 | 725,243 | 733,579 | 639,493 | 717,207 | 11,059.5 | ||||||||||||||||||||||||||||||||||||

Cost of sales | (435,993) | (556,663) | (557,900) | (995,968) | (875,756) | (13,219.0) | (556,663 | ) | (557,900 | ) | (995,968 | ) | (875,756 | ) | (533,989 | ) | (8,234.2 | ) | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Gross profit/(Loss) | 162,123 | 165,640 | 167,343 | (262,389) | (236,263) | (3,566.3) | 165,640 | 167,343 | (262,389 | ) | (236,263 | ) | 183,218 | 2,825.3 | ||||||||||||||||||||||||||||||||||

Other operating income | 2,252 | 3,791 | 4,541 | 4,802 | 4,785 | 72.2 | 3,791 | 4,541 | 4,802 | 4,785 | 5,186 | 79.9 | ||||||||||||||||||||||||||||||||||||

Distribution expenses | (32,151) | (16,430) | (12,127) | (10,078) | (12,070) | (182.2) | (16,430 | ) | (12,127 | ) | (10,078 | ) | (12,070 | ) | (16,361 | ) | (252.3 | ) | ||||||||||||||||||||||||||||||

Administration expenses | (24,699) | (23,490) | (32,229) | (31,550) | (25,274) | (381.4) | (23,490) | (32,229) | (31,550) | (25,274) | (19,299) | (297.6) | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Operating profit/(loss) | 107,525 | 129,511 | 127,528 | (299,215) | (268,822) | (4,057.7) | 129,511 | 127,528 | (299,215 | ) | (268,822 | ) | 152,744 | 2,355.3 | ||||||||||||||||||||||||||||||||||

Investment and other income | 23,583 | 34,931 | 42,165 | 51,154 | 43,998 | 664.1 | 34,931 | 42,165 | 51,154 | 43,998 | 45,428 | 700.5 | ||||||||||||||||||||||||||||||||||||

Finance and other costs | (46,323) | (54,716) | (72,821) | (63,398) | (59,584) | (899.4) | (54,716 | ) | (72,821 | ) | (63,398 | ) | (59,584 | ) | (61,600 | ) | (949.8 | ) | ||||||||||||||||||||||||||||||

| Share in consolidated profit of associate | 4,404 | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Profit/(Loss) before tax | 89,189 | 109,726 | 96,872 | (311,459) | (284,408) | (4,293.0) | 109,726 | 96,872 | (311,459 | ) | (284,408 | ) | 136,572 | 2,106.0 | ||||||||||||||||||||||||||||||||||

Income tax expense | (7,710) | 7,502 | (34,646) | 108,320 | 103,060 | 1,555.7 | 7,502 | (34,646 | ) | 108,320 | 103,060 | (38,027 | ) | (586.4 | ) | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Profit/(Loss) for the year | 81,479 | 117,228 | 62,226 | (203,139) | (181,348) | (2,737.3) | 117,228 | 62,226 | (203,139 | ) | (181,348 | ) | 98,545 | 1,519.6 | ||||||||||||||||||||||||||||||||||

| Profit/(Loss) attributable to: | ||||||||||||||||||||||||||||||||||||||||||||||||

Equity holders of the parent | 51,811 | 62,363 | 15,466 | (128,350) | (125,153) | (1,889.1) | 62,363 | 15,466 | (128,350 | ) | (125,153 | ) | 55,033 | 848.6 | ||||||||||||||||||||||||||||||||||

Non-controlling interest | 29,668 | 54,865 | 46,760 | (74,789) | (56,195) | (848.2) | 54,865 | 46,760 | (74,789 | ) | (56,195 | ) | 43,512 | 671.0 | ||||||||||||||||||||||||||||||||||

| Earnings/(Loss) per share (refer to Note 27 to consolidated financial statements) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Earnings/(Loss) per share | ||||||||||||||||||||||||||||||||||||||||||||||||

Basic | 17.47 | 21.03 | 5.22 | (43.29) | (42.21) | (0.6) | 21.03 | 5.22 | (43.29 | ) | (42.21 | ) | 18.57 | 0.3 | ||||||||||||||||||||||||||||||||||

Diluted | 17.47 | 21.03 | 5.22 | (43.29) | (42.21) | (0.6) | 21.03 | 5.22 | (43.29 | ) | (42.21 | ) | 18.56 | 0.3 | ||||||||||||||||||||||||||||||||||

Number of equity shares | ||||||||||||||||||||||||||||||||||||||||||||||||

Period End | 2,965,004,871 | 2,965,004,871 | 2,965,004,871 | 2,965,004,871 | 2,965,004,871 | 2,965,004,871 | ||||||||||||||||||||||||||||||||||||||||||

Weighted Average | 2,965,004,871 | 2,965,004,871 | 2,965,004,871 | 2,965,004,871 | 2,965,004,871 | 2,965,004,871 | ||||||||||||||||||||||||||||||||||||||||||

Diluted | 2,965,004,871 | 2,965,004,871 | 2,965,004,871 | 2,965,004,871 | 2,965,004,871 | 2,965,004,871 | ||||||||||||||||||||||||||||||||||||||||||

| Dividend declared per share(1),(2) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Weighted average number of equity shares used in computing earnings per share | ||||||||||||||||||||||||||||||||||||||||||||||||

Basic Diluted For the Year Ended March 31, 2013 2014 2015 2016 2017 2017 (Rs.) (in millions

except shares

and per share

data) (Rs.) (in millions

except shares

and per share

data) (Rs.) (in millions

except shares

and per share

data) (Rs.) (in millions

except shares

and per share

data) (Rs.) (in millions

except shares

and per share

data) (US Dollar) (in

millions except

shares and per

share data) 2,965,004,871 2,965,004,871 2,965,004,871 2,965,004,871 2,964,333,584 2,964,333,584 2,965,004,871 2,965,004,871 2,965,004,871 2,965,004,871 2,965,560,871 2,965,560,871 Dividend declared per share(1),(2)

Notes:

| (1) |

On October 28, 2016 the board of directors of Vedanta Limited declared an interim dividend of Rs. 1.75 ($0.03) per equity share for the year ended March 31, 2017. The dividend amounting to Rs. 5,189 million ($80.0 million) has been subsequently paid before the due date. On March 30, 2017 the board of directors of Vedanta Limited declared an interim dividend of Rs. 17.70 ($0.3) per equity share for the year ended March 31, 2017. The dividend amounting to Rs. 65,799.8 million ($1,014.6 million) has been subsequently paid.

| (2) | Vedanta Limited declared and paid dividend of Rs. |

| As of March 31, | As of March 31, | |||||||||||||||||||||||||||||||||||||||||||||||

| 2012 | 2013 | 2014 | 2015 | 2016 | 2016 | 2013 | 2014 | 2015 | 2016 | 2017 | 2017 | |||||||||||||||||||||||||||||||||||||

| (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (US dollars in millions) | (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (US dollars in millions) | |||||||||||||||||||||||||||||||||||||

| Consolidated Financial Position Data: | ||||||||||||||||||||||||||||||||||||||||||||||||

Cash and cash equivalents | 65,270 | 15,199 | 12,960 | 8,621 | 20,870 | 315.0 | 15,199 | 12,960 | 8,621 | 20,870 | 97,202 | 1,498.9 | ||||||||||||||||||||||||||||||||||||

Restricted cash and cash equivalents | 154 | 706 | 2,463 | 4,090 | 3,367 | 50.8 | 706 | 2,463 | 4,090 | 3,367 | 11,747 | 181.1 | ||||||||||||||||||||||||||||||||||||

Total assets | 2,209,684 | 2,414,382 | 2,581,939 | 2,161,704 | 1,869,255 | 28,215.1 | 2,414,382 | 2,581,939 | 2,161,704 | 1,869,255 | 1,918,861 | 29,589.2 | ||||||||||||||||||||||||||||||||||||

Net assets | 1,058,786 | 1,183,269 | 1,262,343 | 1,028,608 | 776,258 | 11,717.1 | 1,183,269 | 1,262,343 | 1,028,608 | 776,258 | 713,788 | 11,006.8 | ||||||||||||||||||||||||||||||||||||

Long-term borrowings | 546,704 | 523,038 | 547,375 | 517,852 | 493,784 | 7,453.3 | 523,038 | 547,375 | 517,852 | 493,784 | 332,654 | 5,129.6 | ||||||||||||||||||||||||||||||||||||

Short-term borrowings | 129,928 | 178,413 | 161,728 | 161,233 | 182,328 | 2,752.1 | 178,413 | 161,728 | 161,233 | 182,328 | 413,126 | 6,370.5 | ||||||||||||||||||||||||||||||||||||

| Equity attributable to equity holders of the parent | 620,809 | 680,609 | 699,570 | 561,119 | 411,160 | 6,206.2 | 680,609 | 699,570 | 561,119 | 411,160 | 576,538 | 8,890.4 | ||||||||||||||||||||||||||||||||||||

| For the Year Ended March 31, | ||||||||||||||||||||||||

| 2012 | 2013 | 2014 | 2015 | 2016 | 2016 | |||||||||||||||||||

| (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (US dollars in millions) | |||||||||||||||||||

Cash Flow Data: | ||||||||||||||||||||||||

Net cash provided by (used in): | ||||||||||||||||||||||||

Operating activities | 154,064 | 97,110 | 56,199 | 125,710 | 107,352 | 1,620.4 | ||||||||||||||||||

Investing activities | (484,939) | (153,176) | (52,631) | (43,939) | (42,613) | (643.2) | ||||||||||||||||||

Financing activities | 370,706 | 1,855 | (6,280) | (86,448) | (52,714) | (795.7) | ||||||||||||||||||

Segment Data: | ||||||||||||||||||||||||

Revenue from external customers: | ||||||||||||||||||||||||

Zinc India | 111,319 | 123,241 | 131,980 | 144,127 | 137,945 | 2,082.2 | ||||||||||||||||||

Zinc International | 41,272 | 43,475 | 40,156 | 35,886 | 25,631 | 386.9 | ||||||||||||||||||

Oil & Gas* | 44,944 | 175,518 | 187,103 | 146,945 | 86,559 | 1,306.6 | ||||||||||||||||||

Iron Ore | 88,248 | 26,054 | 16,516 | 19,039 | 22,233 | 335.6 | ||||||||||||||||||

Copper | 201,647 | 217,262 | 205,577 | 225,198 | 209,239 | 3,158.3 | ||||||||||||||||||

Aluminium | 82,195 | 99,073 | 107,790 | 126,900 | 110,781 | 1,672.2 | ||||||||||||||||||

Power | 26,088 | 34,169 | 35,076 | 33,906 | 45,523 | 687.1 | ||||||||||||||||||

Others | 2,403 | 3,511 | 1,045 | 1,578 | 1,582 | 23.8 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 598,116 | 722,303 | 725,243 | 733,579 | 639,493 | 9,652.7 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Operating profit/(loss): | ||||||||||||||||||||||||

Zinc India | 54,060 | 58,341 | 61,696 | 62,267 | 59,412 | 896.8 | ||||||||||||||||||

Zinc International | 6,008 | 5,078 | 2,484 | 4,268 | 831 | 12.5 | ||||||||||||||||||

Oil & Gas* | 16,887 | 50,370 | 53,942 | (395,146) | (342,813) | (5,174.5) | ||||||||||||||||||

Iron Ore | 23,115 | (77) | (5,476) | (3,422) | (15,793) | (238.4) | ||||||||||||||||||

Copper | 7,765 | 8,517 | 8,876 | 14,344 | 19,660 | 296.8 | ||||||||||||||||||

Aluminium | (2,585) | 960 | 4,979 | 13,752 | 1,416 | 21.4 | ||||||||||||||||||

Power | 2,335 | 6,393 | 1,494 | 4,484 | 8,221 | 124.1 | ||||||||||||||||||

Others | (60) | (71) | (467) | 238 | 244 | 3.7 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 107,525 | 129,511 | 127,528 | (299,215) | (268,822) | (4,057.7) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Segment profit/(loss) | ||||||||||||||||||||||||

Zinc India | 59,296 | 64,227 | 68,642 | 70,605 | 66,970 | 1,010.9 | ||||||||||||||||||

Zinc International | 17,367 | 15,712 | 12,829 | 11,059 | 4,561 | 68.8 | ||||||||||||||||||

Oil & Gas* | 33,825 | 128,502 | 139,453 | 88,671 | 34,273 | 517.3 | ||||||||||||||||||

Iron Ore | 34,229 | 4,530 | (2,700) | (891) | 4,367 | 65.9 | ||||||||||||||||||

Copper | 9,938 | 10,868 | 11,429 | 17,385 | 22,205 | 335.2 | ||||||||||||||||||

Aluminium | 7,742 | 11,285 | 16,131 | 22,529 | 8,467 | 127.8 | ||||||||||||||||||

Power | 6,299 | 11,551 | 7,429 | 8,424 | 12,659 | 191.1 | ||||||||||||||||||

Others | (60) | (61) | (257) | 532 | 568 | 8.6 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 168,636 | 246,614 | 252,956 | 218,314 | 154,070 | 2,325.6 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| For the Year Ended March 31, | ||||||||||||||||||||||||

| 2013 | 2014 | 2015 | 2016 | 2017 | 2017 | |||||||||||||||||||

| (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (US dollars in millions) | |||||||||||||||||||

Cash Flow Data: | ||||||||||||||||||||||||

Net cash provided by (used in): | ||||||||||||||||||||||||

Operating activities | 97,110 | 56,199 | 125,710 | 107,352 | 212,105 | 3,270.5 | ||||||||||||||||||

Investing activities | (153,176 | ) | (52,631 | ) | (43,939 | ) | (42,613 | ) | (79,910 | ) | (1,232.1 | ) | ||||||||||||

Financing activities | 1,855 | (6,280 | ) | (86,448 | ) | (52,714 | ) | (49,123 | ) | (757.4 | ) | |||||||||||||

Segment Data: | ||||||||||||||||||||||||

Revenue from external customers: | ||||||||||||||||||||||||

Zinc India | 123,241 | 131,980 | 144,127 | 137,945 | 169,194 | 2,609.0 | ||||||||||||||||||

Zinc International | 43,475 | 40,156 | 35,886 | 25,631 | 22,302 | 343.9 | ||||||||||||||||||

Oil and Gas | 175,518 | 187,103 | 146,945 | 86,559 | 82,041 | 1,265.1 | ||||||||||||||||||

Iron Ore | 26,054 | 16,516 | 19,039 | 22,233 | 40,880 | 630.4 | ||||||||||||||||||

Copper | 217,262 | 205,577 | 225,198 | 209,239 | 210,021 | 3,238.6 | ||||||||||||||||||

Aluminium | 99,073 | 107,790 | 126,900 | 110,781 | 136,667 | 2,107.4 | ||||||||||||||||||

Power | 34,169 | 35,076 | 33,906 | 45,523 | 55,189 | 851.0 | ||||||||||||||||||

Others | 3,511 | 1,045 | 1,578 | 1,582 | 913 | 14.1 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 722,303 | 725,243 | 733,579 | 639,493 | 717,207 | 11,059.5 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Operating profit/(loss): | ||||||||||||||||||||||||

Zinc India | 58,341 | 61,696 | 62,267 | 59,412 | 85,491 | 1,318.3 | ||||||||||||||||||

Zinc International | 5,078 | 2,484 | 4,268 | 831 | 7,336 | 113.1 | ||||||||||||||||||

Oil and Gas | 50,370 | 53,942 | (395,146 | ) | (342,813 | ) | 14,205 | 219.0 | ||||||||||||||||

Iron Ore | (77 | ) | (5,476 | ) | (3,422 | ) | (15,793 | ) | 8,403 | 129.6 | ||||||||||||||

Copper | 8,517 | 8,876 | 14,344 | 19,660 | 15,026 | 231.7 | ||||||||||||||||||

Aluminium | 960 | 4,979 | 13,752 | 1,416 | 11,725 | 180.8 | ||||||||||||||||||

Power | 6,393 | 1,494 | 4,484 | 8,221 | 10,757 | 165.9 | ||||||||||||||||||

Others | (71 | ) | (467 | ) | 238 | 244 | (199 | ) | (3.1 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 129,511 | 127,528 | (299,215 | ) | (268,822 | ) | 152,744 | 2,355.3 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Segment profit/(loss) | ||||||||||||||||||||||||

Zinc India | 64,227 | 68,642 | 70,605 | 66,970 | 95,499 | 1,472.6 | ||||||||||||||||||

Zinc International | 15,712 | 12,829 | 11,059 | 4,561 | 9,181 | 141.6 | ||||||||||||||||||

Oil and Gas | 128,502 | 139,453 | 88,671 | 34,273 | 40,892 | 630.6 | ||||||||||||||||||

Iron Ore | 4,530 | (2,700 | ) | (891 | ) | 4,367 | 13,091 | 201.9 | ||||||||||||||||

Copper | 10,868 | 11,429 | 17,385 | 22,205 | 16,964 | 261.6 | ||||||||||||||||||

Aluminium | 11,285 | 16,131 | 22,529 | 8,467 | 23,200 | 357.7 | ||||||||||||||||||

Power | 11,551 | 7,429 | 8,424 | 12,659 | 16,442 | 253.5 | ||||||||||||||||||

Others | (61 | ) | (257 | ) | 532 | 568 | 114 | 1.7 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 246,614 | 252,956 | 218,314 | 154,070 | 215,383 | 3,321.2 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Notes:

| (1) | Segment profit is presented as required by IFRS 8 and is calculated by adjusting operating profit to exclude depreciation, amortization and impairment. Our segment profit may not be comparable to similarly titled measures reported by other companies due to potential inconsistencies in the method of calculation. We have included our segment profit because we believe it is an indicative measure of our operating performance and is used by investors and analysts to evaluate companies in our industry. Our segment profit should be considered in addition to, and not as a substitute for, other measures of financial performance and liquidity reported in accordance with IFRS as issued by the IASB. We believe that the inclusion of supplementary adjustments applied in our presentation of segment profit are appropriate because we believe it is an indicative measure of our baseline performance as it excludes certain charges that our management considers to be outside of our core operating results. In addition, our segment profit is among the primary indicators that our management uses as a basis for planning and forecasting future periods. The following table reconciles operating profit to segment profit for the periods indicated: |

| For the Year Ended March 31, | For the Year Ended March 31, | |||||||||||||||||||||||||||||||||||||||||||||||

| 2012 | 2013 | 2014 | 2015 | 2016 | 2016 | 2013 | 2014 | 2015 | 2016 | 2017 | 2017 | |||||||||||||||||||||||||||||||||||||

| (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (US dollars in millions) | (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (US dollars in millions) | |||||||||||||||||||||||||||||||||||||

Zinc India: | ||||||||||||||||||||||||||||||||||||||||||||||||

Operating profit | 54,060 | 58,341 | 61,696 | 62,267 | 59,412 | 896.8 | 58,341 | 61,696 | 62,267 | 59,412 | 85,491 | 1,318.3 | ||||||||||||||||||||||||||||||||||||

| Plus: Depreciation and amortization | 5,236 | 5,886 | 6,946 | 8,338 | 7,558 | 114.1 | 5,886 | 6,946 | 8,338 | 7,558 | 10,008 | 154.3 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Segment profit | 59,296 | 64,227 | 68,642 | 70,605 | 66,970 | 1,010.9 | 64,227 | 68,642 | 70,605 | 66,970 | 95,499 | 1,472.6 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Zinc International | ||||||||||||||||||||||||||||||||||||||||||||||||

Operating profit | 6,008 | 5,078 | 2,484 | 4,268 | 831 | 12.5 | 5,078 | 2,484 | 4,268 | 831 | 7,336 | 113.1 | ||||||||||||||||||||||||||||||||||||

| Plus: Depreciation and amortization(1) | 11,359 | 10,634 | 10,345 | 6,791 | 3,730 | 56.3 | 10,634 | 10,345 | 6,791 | 3,730 | 1,845 | 28.5 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Segment profit | 17,367 | 15,712 | 12,829 | 11,059 | 4,561 | 68.8 | 15,712 | 12,829 | 11,059 | 4,561 | 9,181 | 141.6 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Oil & Gas | ||||||||||||||||||||||||||||||||||||||||||||||||

Oil and Gas | ||||||||||||||||||||||||||||||||||||||||||||||||

Operating profit/(loss) | 16,887 | 50,370 | 53,942 | (395,146) | (342,813) | (5,174.5) | 50,370 | 53,942 | (395,146 | ) | (342,813 | ) | 14,205 | 219.0 | ||||||||||||||||||||||||||||||||||

| Plus: Depreciation and amortization(2) | 16,938 | 78,132 | 85,511 | 483,817 | 377,086 | 5,691.8 | 78,132 | 85,511 | 483,817 | 377,086 | 26,687 | 411.6 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Segment profit | 33,825 | 128,502 | 139,453 | 88,671 | 34,273 | 517.3 | 128,502 | 139,453 | 88,671 | 34,273 | 40,892 | 630.6 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Iron Ore | ||||||||||||||||||||||||||||||||||||||||||||||||

Operating profit/(loss) | 23,115 | (77) | (5,476) | (3,422) | (15,793) | (238.4) | ||||||||||||||||||||||||||||||||||||||||||

| Plus: Depreciation and amortization(3) | 11,114 | 4,607 | 2,776 | 2,531 | 20,160 | 304.3 | ||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||

Segment profit/(loss) | 34,229 | 4,530 | (2,700) | (891) | 4,367 | 65.9 | ||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||

Copper: | ||||||||||||||||||||||||||||||||||||||||||||||||

Operating profit | 7,765 | 8,517 | 8,876 | 14,344 | 19,660 | 296.8 | ||||||||||||||||||||||||||||||||||||||||||

| Plus: Depreciation and amortization(4) | 2,173 | 2,351 | 2,553 | 3,041 | 2,545 | 38.4 | ||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||

Segment profit | 9,938 | 10,868 | 11,429 | 17,385 | 22,205 | 335.2 | ||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||

Aluminium: | ||||||||||||||||||||||||||||||||||||||||||||||||

Operating profit/(loss) | (2,585) | 960 | 4,979 | 13,752 | 1,416 | 21.4 | ||||||||||||||||||||||||||||||||||||||||||

| Plus: Depreciation and amortization(5) | 10,327 | 10,325 | 11,152 | 8,777 | 7,051 | 106.4 | ||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||

Segment profit | 7,742 | 11,285 | 16,131 | 22,529 | 8,467 | 127.8 | ||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||

| For the Year Ended March 31, | For the Year Ended March 31, | |||||||||||||||||||||||||||||||||||||||||||||||

| 2012 | 2013 | 2014 | 2015 | 2016 | 2016 | 2013 | 2014 | 2015 | 2016 | 2017 | 2017 | |||||||||||||||||||||||||||||||||||||

| (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (US dollars in millions) | |||||||||||||||||||||||||||||||||||||||||||

Iron Ore | ||||||||||||||||||||||||||||||||||||||||||||||||

Operating profit/(loss) | (77 | ) | (5,476 | ) | (3,422 | ) | (15,793 | ) | 8,403 | 129.6 | ||||||||||||||||||||||||||||||||||||||

| Plus: Depreciation and amortization(3) | 4,607 | 2,776 | 2,531 | 20,160 | 4,688 | 72.3 | ||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||

Segment profit/(loss) | 4,530 | (2,700 | ) | (891 | ) | 4,367 | 13,091 | 201.9 | ||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||

Copper: | ||||||||||||||||||||||||||||||||||||||||||||||||

Operating profit | 8,517 | 8,876 | 14,344 | 19,660 | 15,026 | 231.7 | ||||||||||||||||||||||||||||||||||||||||||

| Plus: Depreciation and amortization(4) | 2,351 | 2,553 | 3,041 | 2,545 | 1,938 | 29.9 | ||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||

Segment profit | 10,868 | 11,429 | 17,385 | 22,205 | 16,964 | 261.6 | ||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||

Aluminium: | ||||||||||||||||||||||||||||||||||||||||||||||||

Operating profit/(loss) | 960 | 4,979 | 13,752 | 1,416 | 11,725 | 180.8 | ||||||||||||||||||||||||||||||||||||||||||

| Plus: Depreciation and amortization(5) | 10,325 | 11,152 | 8,777 | 7,051 | 11,475 | 176.9 | ||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||

Segment profit | 11,285 | 16,131 | 22,529 | 8,467 | 23,200 | 357.7 | ||||||||||||||||||||||||||||||||||||||||||

| (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (Rs. in millions) | (US dollars in millions) |

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Power: | ||||||||||||||||||||||||||||||||||||||||||||||||

Operating profit | 2,335 | 6,393 | 1,494 | 4,484 | 8,221 | 124.1 | 6,393 | 1,494 | 4,484 | 8,221 | 10,757 | 165.9 | ||||||||||||||||||||||||||||||||||||

| Plus: Depreciation and amortization | 3,964 | 5,158 | 5,935 | 3,940 | 4,438 | 67.0 | 5,158 | 5,935 | 3,940 | 4,438 | 5,685 | 87.6 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Segment profit | 6,299 | 11,551 | 7,429 | 8,424 | 12,659 | 191.1 | 11,551 | 7,429 | 8,424 | 12,659 | 16,442 | 253.5 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Others: | ||||||||||||||||||||||||||||||||||||||||||||||||

Operating profit/(loss) | (60) | (71) | (467) | 238 | 244 | 3.7 | (71 | ) | (467 | ) | 238 | 244 | (199 | ) | (3.1 | ) | ||||||||||||||||||||||||||||||||

| Plus: Depreciation and amortization | — | 10 | 210 | 294 | 324 | 4.9 | 10 | 210 | 294 | 324 | 313 | 4.8 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Segment profit/(loss) | (60) | (61) | (257) | 532 | 568 | 8.6 | (61 | ) | (257 | ) | 532 | 568 | 114 | 1.7 | ||||||||||||||||||||||||||||||||||

| (1) | Includes impairment charge of Rs. 2,873 million in fiscal year |

| (2) | Includes impairment charge of Rs. 406,144 million in fiscal year 2015, |

| (3) | Includes impairment charge of Rs. 16,054 million |

| (4) | Includes impairment charge of Rs. 497 million |

| (5) | Includes impairment charge of Rs. 668 million in fiscal year 2014, |

Exchange Rates

Substantially all of our revenue is denominated or paid with reference to US dollars and most of our expenses are incurred and paid in Indian Rupees. We report our financial results in Indian Rupees. The exchange rates among the Indian Rupee and the US dollar have changed substantially in recent years and may fluctuate substantially in the future. The results of our operations are affected as the Indian Rupee appreciate or depreciate against the US dollar and, as a result, any such appreciation or depreciation will likely affect the market price of our ADSs in the United States.

The following table sets forth, for the periods indicated, information concerning the exchange rates between Indian Rupees and US dollars based on the rates quoted on Federal Reserve Bank of New York:

| For the Year Ended March 31, | ||||||||||||||

| Unit of Measurement | 2014 | 2015 | 2016 | |||||||||||

| (in US dollars per ton, except as indicated) | ||||||||||||||

TcRc (1) | ¢/lb | 16.6 | 21.4 | 24.1 | ||||||||||

Cost of production before by-product revenue(2) | ||||||||||||||

Zinc India | $ | 1,069 | 1,215 | 1,151 | ||||||||||

Zinc International | $ | 1,300 | 1,533 | 1,548 | ||||||||||

Oil and Gas | $/boe | 20.9 | 22.9 | 21.8 | ||||||||||

Iron ore | $ | 40.9 | 134.9 | 24.6 | ||||||||||

Copper smelting and refining | ¢/lb | 18.8 | 14.0 | 11.3 | ||||||||||

Aluminium | $ | 1,664 | 1,790 | 1,589 | ||||||||||

Power – Jharsuguda 2400 MW plant | Rs./unit | 2.1 | 2.1 | 2.1 | ||||||||||

Cost of production net of by-product revenue(2) | ||||||||||||||

Zinc India | $ | 985 | 1,111 | 1,046 | ||||||||||

Zinc International | $ | 1,167 | 1,393 | 1,432 | ||||||||||

Oil and Gas | $/boe | 20.9 | 22.9 | 21.8 | ||||||||||

Iron ore | $ | 40.9 | 134.9 | 24.6 | ||||||||||

Copper smelting and refining | ¢/lb | 9.7 | 4.2 | 3.2 | ||||||||||

Aluminium | $ | 1,658 | 1,785 | 1,573 | ||||||||||

Power - Jharsuguda 2400 MW plant | Rs./unit | 2.1 | 2.1 | 2.1 | ||||||||||

| Period End(1) | Average(1)(2) | High | Low | |||||||||||||

Fiscal Year: | ||||||||||||||||

2013 | 54.52 | 54.47 | 57.13 | 50.64 | ||||||||||||

2014 | 60.00 | 60.35 | 68.80 | 53.65 | ||||||||||||

2015 | 62.31 | 61.11 | 63.67 | 58.30 | ||||||||||||

2016 | 66.25 | 65.39 | 68.84 | 61.99 | ||||||||||||

2017 | 64.85 | 67.01 | 68.86 | 64.85 | ||||||||||||

Month: | ||||||||||||||||

January 2017 | 67.48 | 68.05 | 68.39 | 67.48 | ||||||||||||

February 2017 | 66.67 | 66.97 | 67.40 | 66.67 | ||||||||||||

March 2017 | 64.85 | 65.80 | 66.83 | 64.85 | ||||||||||||

April 2017 | 64.27 | 64.54 | 65.10 | 64.08 | ||||||||||||

May 2017 | 64.50 | 64.42 | 64.87 | 64.03 | ||||||||||||

June 2017 | 64.62 | 64.45 | 64.66 | 64.23 | ||||||||||||

July 2017 (through July 28, 2017) | 64.11 | 64.44 | 64.84 | 64.11 | ||||||||||||

Notes:

| (1) |

| (2) |

We present below costs of production for our metal products on the following basis:

We explain the cost of production for each metal as set forth below:

Our iron ore operations in Goa recommenced in August 2015, after receiving necessary approvals from the state government. Our iron ore operations had been suspended during fiscal year 2015 due to the continued mining ban in the state of Goa. Our cost of production of iron ore shows a significant decrease as the cost of production of fiscal year 2015 also factors in fixed administrative costs incurred in our Goa operations and Karnataka operations which will be now spread over to larger production compared to last year.

(Rs.in millions, except Production output and Cost of production) (Rs.in millions, except Production output and Cost (Rs.in millions, except Production output and Cost of production) (Rs.in millions, except Production output and Cost (Rs.in millions, except Production output and Cost Zinc—India: Segment revenue Less: Segment profit Less: Cost of tolling including raw material cost Cost of intermediary product sold Cost of lead metal sold Others(c) By-product revenue Total after adjusting for by-product revenues Production output (in tons) Zinc—International: Segment revenue Less: Segment profit Less: TcRc Cost of lead metal sold Others(c) By-product revenue Total after adjusting for by-product revenues Production output (in tons) For the Year Ended March 31, 2012 2013 2014 2015 2016

of production)

of production)

of production) Rs. 111,319 Rs. 123,241 Rs. 132,811 Rs. 144,127 Rs. 137,945 (59,296) (64,227) (68,642) (70,605) (66,970) 52,023 59,014 64,169 73,522 70,975 (3,121) (6,805) — — — (149) (1,806) (3,461) (3,230) (2,348) (5,260) (6,962) (8,115) (8,991) (10,264) (1,451) (2,506) (4,146) (6,773) (1,185) Total before adjusting for by-product revenues Rs. 42,042 Rs. 40,934 Rs. 48,447 Rs. 54,528 Rs. 57,178 (5,315) (4,766) (3,821) (4,692) (5,234) Rs. 36,727 Rs. 36,168 Rs. 44,626 Rs. 49,836 Rs. 51,944 758,716 676,923 749,167 733,805 758,938 Cost of production before by-product revenue (per ton) (a) $ 1,156 $ 1,111 $ 1,069 $ 1,215 $ 1,151 Cost of production net of by- Product revenue (per ton) (a) $ 1,010 $ 981 $ 985 $ 1,111 $ 1,046 Cost of production net of by- Product revenue (per ton) (a) Rs. 48,407 Rs. 53,430 Rs. 59,568 Rs. 67,914 Rs. 68,442 Rs. 42,771 Rs. 43,475 Rs. 40,156 Rs. 35,886 Rs. 25,631 (17,367) (15,712) (12,829) (11,059) (4,561) 25,404 27,763 27,327 24,827 21,070 3,344 3,344 4,191 4,943 3,757 (6,240) (5,336) (4,631) (4,486) (3,859) (2,228) (3,351) (2,900) (894) (2,419) Total before adjusting for by-product revenues Rs. 21,276 Rs. 22,421 Rs. 23,987 Rs. 24,390 Rs. 18,549 (1,621) (1,459) (2,464) (2,230) (1,390) Rs. 19,655 Rs. 20,962 Rs. 21,522 Rs. 22,160 Rs. 17,159 359,730 353,404 304,945 260,106 183,035 Cost of production before by-product revenue (per ton) (a) $ 1,233 $ 1,165 $ 1,300 $ 1,533 $ 1,548

(Rs.in millions, except Production output and Cost of production) (Rs.in millions, except Production output and Cost (Rs.in millions, except Production output and Cost of production) (Rs.in millions, except Production output and Cost (Rs.in millions, except Production output and Cost Oil & Gas Segment revenue Less: Segment profit Less: Unsuccessful Exploration Cost Other income Pre award cost Others(c) By-product revenue Total after adjusting for by-product revenues Net Production (in mmboe) Iron Ore Segment revenue Less: Segment profit Less: Cost of Intermediary product sold Export Duty Others(c) By-product revenue Total after adjusting for by-product revenues Production output (in million dmt) For the Year Ended March 31, 2012 2013 2014 2015 2016

of production)

of production)

of production) Cost of production net of by-product revenue (per ton) (a) $ 1,139 $ 1,089 $ 1,167 $ 1,393 $ 1,432 44,944 175,518 187,103 146,945 86,559 (33,825) (128,502) (139,453) (88,671) (34,273) 11,119 47,016 47,650 58,274 52,286 (709) (2,821) (653) (7,867) (294) 180 1,025 379 103 176 (67) (194) (242) (1) (71) (2,954) (5,217) (5,575) (5,619) (4,606) Total before adjusting for by-product revenues Rs. 7,569 Rs. 39,810 Rs. 41,560 Rs. 44,890 Rs. 47,491 — — — — — Rs. 7,569 Rs. 39,810 Rs. 41,560 Rs. 44,890 Rs. 47,491 8.57 33.00 32.89 32.01 33.33 Cost of production before by-product revenue (per boe)(a) $ 17.4 $ 22.2 $ 20.9 $ 22.9 $ 21.8 Cost of production net of by-product revenue (per boe)(a) $ 17.4 $ 22.2 $ 20.9 $ 22.9 $ 21.8 88,339 26,119 16,558 19,963 22,774 (34,229) (4,530) 2,700 891 (4,367) 54,110 21,589 19,258 20,854 18,407 (8,018) (9,309) (16,340) (15,953) (11,652) (16,233) (4,430) — — (250) (7,665) 500 810 214 1,810 Total before adjusting for by-product revenues 22,194 8,351 3,728 5,115 8,316 — — — — — 22,194 8,351 3,728 5,115 8,316 13.75 3.71 1.51 0.62 5.17 Cost of production before by-product revenue (per dmt) (a) $ 33.7 $ 41.3 $ 40.9 $ 134.9 $ 24.6 Cost of production net of by-product revenue (per dmt) (a) $ 33.7 $ 41.3 $ 40.9 $ 134.9 $ 24.6

(Rs.in millions, except Production output and Cost of production) (Rs.in millions, except Production output and Cost (Rs.in millions, except Production output and Cost of production) (Rs.in millions, except Production output and Cost (Rs.in millions, except Production output and Cost Copper: Segment revenue Less: Segment profit Less: Purchased concentrate/rock Cost for downstream products Others(c): By-product revenues Free Copper net sale Production output (in tons) Aluminium: Segment revenue Less: Segment profit Cost for downstream products Others(c): By-product revenue Total after adjusting for by-product revenues Production output (hot metal) (in tons) For the Year Ended March 31, 2012 2013 2014 2015 2016

of production)

of production)

of production) Rs. 201,647 Rs. 217,374 Rs. 205,879 Rs. 226,298 Rs. 209,262 (9,938) (10,868) (11,429) (17,385) (22,205) 191,709 206,506 194,450 208,913 187,057 (181,766) (193,200) (182,399) (196,428) (177,067) (1,481) (2,163) (3,354) (3,441) (1,533) (1,779) (2,630) (1,295) (2,220) (2,181) Total before adjusting for by-product and free copper revenues Rs. 6,683 Rs. 8,513 Rs. 7,402 Rs. 6,824 Rs. 6,276 (3,976) (2,165) (1,208) (2,215) (2,377) (2,708) (2,647) (2,385) (2,559) (2,138) Total after adjusting for by-product and free copper revenues Rs. (1 ) Rs. 3,701 Rs. 3,809 Rs. 2,050 Rs. 1,761 325,877 353,154 294,434 362,373 384,047 Cost of production before by-product and free copper revenue (a) ¢/lb 19.4 ¢/lb 20.1 ¢/lb 18.8 ¢/lb 14.0 ¢/lb 11.3 Cost of production net of by-product and free copper revenue (a) ¢/lb 0.0 ¢/lb 8.7 ¢/lb 9.7 ¢/lb 4.2 ¢/lb 3.2 82,302 99,633 107,989 127,130 110,910 (7,742) (11,285) (16,131) (22,529) (8,467) 74,560 88,348 91,858 104,601 102,443 (4,122) (5,140) (4,230) (4,611) (3,998) (1,887) (3,613) (7,540) (7,707) (7,707) Total before adjusting for by-product revenues Rs. 68,551 Rs. 79,594 Rs. 80,087 Rs. 92,283 Rs. 90,738 (290) (299) (281) (223) (903) Rs. 68,261 Rs. 79,296 Rs. 79,807 Rs. 92,060 Rs. 89,835 680,461 774,851 795,728 843,219 872,591 Cost of production before by-product revenue (per ton)(a) $ 2,101 $ 1,887 $ 1,664 $ 1,790 $ 1,589 Cost of production net of by-product (per ton) (a) $ 2,091 $ 1,879 $ 1,658 $ 1,785 $ 1,573 Cost of production net of by-product (per ton) (a) Rs. 100,268 Rs. 102,337 Rs. 100,294 Rs. 109,177 Rs. 102,953

(Rs.in millions, except Production output and Cost of production) (Rs.in millions, except Production output and Cost (Rs.in millions, except Production output and Cost of production) (Rs.in millions, except Production output and Cost (Rs.in millions, except Production output and Cost Power Segment revenue Less: Segment profit Less: Others(c): Total Production output (in MU)(b) For the Year Ended March 31, 2012 2013 2014 2015 2016

of production)

of production)

of production) 28,473 36,365 37,638 41,186 49,826 (6,299) (11,551) (7,429) (8,424) (12,659) 22,174 24,814 30,209 32,762 37,167 Cost of power at TSPL, BALCO, HZL and MALCO Energy (8,188) (8,286) (9,456) (13,725) (19,284) (1,828) (2,555) (4,710) (3,589) (2,287) Rs. 12,157 Rs. 13,973 Rs. 16,043 Rs. 15,448 Rs. 15,596 4,637 6,718 7,625 7,216 7,464 Cost of production before by-product revenue (per unit) Rs. 2.6 Rs. 2.1 Rs. 2.1 Rs. 2.1 Rs. 2.1 Cost of production net of by-product revenue (per unit) Rs. 2.6 Rs. 2.1 Rs. 2.1 Rs. 2.1 Rs. 2.1

Notes:

B. Capitalization and Indebtedness

Not applicable

C. Reasons for the Offer and Use of Proceeds

Not applicable

D. Risk Factors

This Annual Report contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those described in the following risk factors and elsewhere in this Annual Report. If any of the following risks actually occur, our business, financial condition and results of operations could suffer and the trading price of our equity shares and ADSs could decline.

Risks Relating to Our Business

Our operations are subject to governmental, health and safety and environmental regulations, which require us to obtain and comply with the terms of various approvals, licenses and permits. Any failure to obtain, renew or comply with the terms of such approvals, licenses and permits in a timely manner may have a material adverse effect on our business, financial condition and results of operations and financial condition.

Numerous governmental permits, approvals and leaseslicenses are required for our operations as the industries in which we operate and seek to operate are subject to numerous laws and extensive regulation by national, state and local authorities in jurisdictions including India, Sri Lanka,UAE, Australia, Namibia, South Africa, Ireland, Liberia and any other jurisdictions where we may operate in future. Our operations are also subject to laws, regulations and regulationsstandards relating to employment, the protection of health and safety of employees as well as the environment, including conservation and climate change. Evolving regulations, standards and stakeholder expectations could result in increased cost, litigation or threaten the viability of operations in extreme cases. For instance, we are required to obtain various environmental and labor-related approvals in connection with our operations in India, including clearances from the Ministry of Environment and Forests (“MoEF”), Government of India (“GoI”) and from the relevant pollution control boards in various states in India in which we operate in order to establish and operate our facilities. Certain of such approvals are valid for certain specified periods of time and require periodic renewals, such as consents to operate and under the Air (Prevention and Control of Pollution) Act, 1981, as amended, and the Water (Prevention and Control of Pollution) Act, 1981 from the relevant Pollution Control Boards, which are generally granted for a period of one year.

Further, our oil and gas, exploration and mining activities depend on the grant or renewal of various exploration and mining licenses and production sharing contracts and other regulatory approvals that are valid for a specific period of time. In addition, such licenses and contracts contain various obligations and restrictions, including restrictions on assignment or any other form of transfer of a mining lease or on the employment of a person who is not an Indian national. For instance, in connection with our mining operations in India, mining leases are typically granted for a period of 20 to 30 years and stipulate conditions including approved limits on extraction. Similarly, in connection with our oil and gas operations in India, Cairn India is required to enter into a production sharing contract and obtain an exploration license, which typically extends to 7 or 8 years following the award of a block before it can commence exploration activities and if exploration is successful, Cairn India is then required to procure a petroleum mining lease from the relevant government authority which typically extends for 20 years in order to conduct extraction operations for oil and gas.

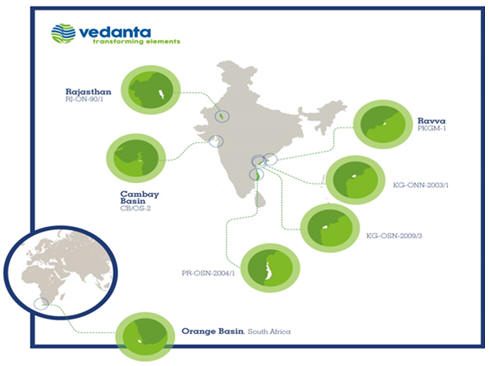

Our current oil and gas reserves and production are significantly dependent on the Rajasthan block in India. The current production sharing contract for the block is valid until May 2020. If the production sharing contract does not get extended or gets extended on unfavorable terms, for example, if the GoI seeks a higher profit share, or the Oil and Natural Gas Corporation Limited (“ONGC”) seeks higher shareholding in the Rajasthan block, this could result in a substantial loss of value and could have a material and adverse effect on our results of operations and financial condition. On April 7, 2017, the Ministry of Petroleum and Natural Gas issued a policy for the grant of extension to the production sharing contracts signed by the GoI awardingPre-New Exploration Licensing Policy(“Pre-NELP”) Exploration Blocks(“Pre-NELP Extension Policy”). ThePre-NELP Extension Policy defines the framework for granting of extension forPre-NELP blocks including the Rajasthan and Cambay fields. Under thePre-NELP Extension Policy, the Government’s share of profit petroleum during the extended period of contracts would be at higher rates for the applicable fields. Furthermore, under the terms of the production sharing contracts, we are obliged to sell our entitlement to crude oil in the domestic Indian market until such time as the total availability of the crude oil and condensate from all domestic petroleum production activities meets the total national demand and India achieves self-sufficiency. There is currently a mismatch between the demand and the supply for crude oil in India, with the demand outweighing the domestic production of crude oil, and this mismatch is expected to continue in the long term. Further, to the extent our Indian blocks yield crude oil that is not suitable for processing by refineries in India, it may be difficult for us to monetize such domestic crude oil reserves and this could have a material adverse effect on our oil and gas business, financial condition or results of operations.

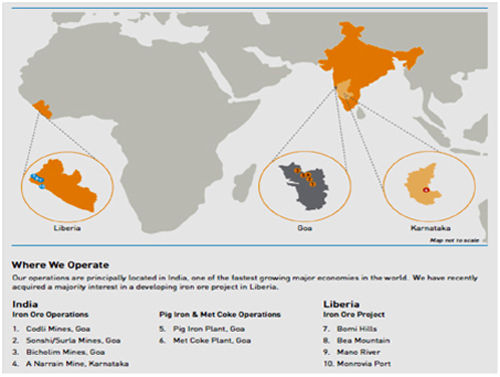

Government approval is also required, generally, for the continuation of mining as well as oil and gas exploration and production activities in India and other jurisdictions, and such approval can be revoked for a variety of circumstances by the GoI, Indian courts or other authorities. Any general suspension of mining activities by the government of a jurisdiction containing our mining operations could have the effect of closing or limiting production from our operations. For example, our total iron ore production declined from 13.8 mmt in fiscal year 2012 to 0.6 mmt in fiscal year 2015 due to the suspension imposed by the state government of Goa on the mining activities in the state of Goa. In January 2015, the government of Goa revoked the order suspending mining operations in the state of Goa and the MOEFMoEF revoked the suspension of environmental clearances in March 2015. Lease deeds for all working leases have been executed and registered. We have obtained Consent to Operate under the Air (Prevention of Pollution) Act and Water (Prevention of Pollution) Act from the Goa State pollution Control Board and have resumed operations at our major mines. All mining plans have been approved by the Indian Bureau of Mines and the state government of Goa allocations of mining cap is in line with the Supreme Court’s directive. We continue to actively pursue the lifting of mining caps and additional allocation of production from the state government of Goa. See “Item 8. Financial Information— A. Consolidated Statements and Other Financial Information— Legal Proceedings.” for further details.

Further, the state government of Goa appointed an independent firm in August 2014 to undertake an audit of production levels in excess of environment clearances of all mining companies operating in the state of Goa, including our Company for the period from fiscal year 2008 to fiscal year 2013. The independent firm submitted its final report to the state Directorate of Mines and Geology (DMG) on May 5, 2015. Observations raised by the audit with respect to our Company included production levels to be in excess of environmental clearances for the leases of the Company, and whether the royalty can be payable on a dry metric ton (DMT) basis instead of wet metric ton (WMT) basis, and the audit process was based on the formats and procedures specified by DMG and the report was submitted accordingly. The Company has refuted these observations and provided its responses to these observations to the firm based upon a legal opinion of our Indian counsel, and these responses have been filed in the audit report of the Independent firm to the state DMG. In doing so, the Company has reserved its rights without prejudice to its responses and requested an opportunity to furnish further documentation and information as may be appropriate before any further steps in this regard are taken by the state government. We received a show cause notice from DMG on August 5, 2016 to which we filed a reply on November 24, 2016. The Company has not received any further notice or communication in this regard. If the Company is subject to any subsequent action based upon the recommendations of the audit report, we could be subject to significantly higher royalty payments and / or other penalties. Such an outcome or any other adverse outcome could result in a material adverse effect on our financial condition and results of operations.

Furthermore,

Our global presence exposes us to a number of jurisdictions in which regulations or laws have been or are being considered to limit or reduce emissions. The likely effect of these changes will be to increase the cost for fossil fuels, impose levies for emissions in excess of certain permitted levels and increased administrative costs for monitoring and reporting. Increasing regulation of greenhouse gas (GHG) emissions, including the progressive introduction of carbon emissions trading mechanisms and tighter emission reduction targets, is likely to raise costs and reduce demand growth. These regulations in the jurisdictions of our major customers and in relation to international shipping could also have an adverse effect on the demand for our products. Our smelting and mineral processing operations are energy intensive and depend heavily on fossil fuels. Increasing regulation of climate change issues such as greenhouse gas emissions, including the progressive introduction of carbon emissions trading mechanisms and tighter emission reduction targets, may raise energy costs and costs of production over the coming years.

Any failure to comply with applicable laws, regulations or recognized international standards, or to obtain or renew the necessary permits, approvals and leaseslicenses may result in the loss of the right to operate our facilities or continue our operations, the imposition of significant administrative liabilities, or costly compliance procedures, or other enforcement measures that could have the effect of closing or limiting production from our operations. If we were to fail to meet environmental requirements or to have a major accident or disaster, we may also be subject to administrative, civil and criminal proceedings by governmental authorities, as well as civil proceedings by environmental groups and other individuals, which could result in substantial fines, penalties and damages against us, as well as subject to orders that could limit or halt or even cause closure of our operations, any of which could have a material adverse effect on our business, financial condition and results of operations and financial condition.operations.

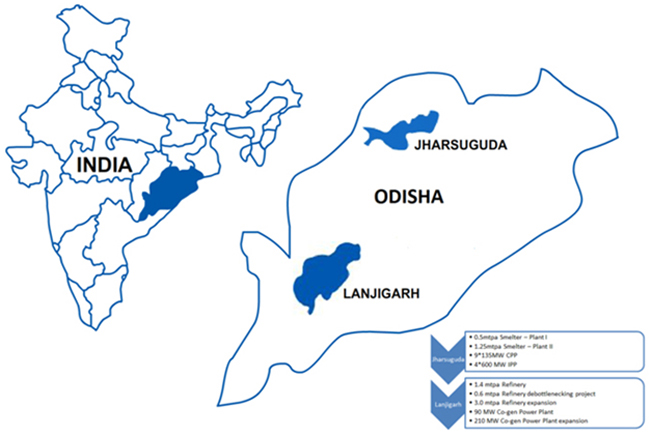

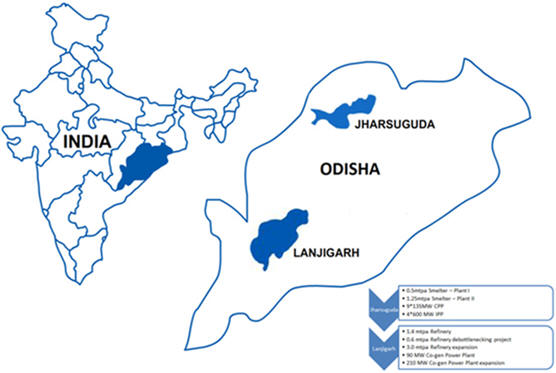

For example, in March 2013, the Tamil Nadu Pollution Control Board (“TNPCB”) ordered the closure of the copper smelter at Tuticorin due to complaints regarding a noxious gas leak by local residents. We filed a petition in theThe National Green Tribunal challenging the order of the TNPCB. The National Green Tribunalthereafter passed an interim order in May 2013 allowing the copper smelter to recommence operations subject to certain conditions. Weconditions, and we recommenced operations onin June 16, 2013. We have implemented all the recommendations during fiscal year 2013. However, the TNPCB filed a notice of appeal against the orders of the National Green Tribunal. The appeals areTribunal, which is currently pending before the Green bench of the Supreme Court of India. In addition, the expansion of the alumina refinery at Lanjigarh has been on hold since October 2010 because the environmental approval has been withheld by the MoEF. On November 20, 2015, the MOEFMoEF granted environmental clearance for the expansion of the Alumina Refinery up to 4 MTPAmtpa and ECenvironmental clearance up to 6 MTPAmtpa will be received as an amendment to existing EC after the completion of the land acquisition of the balance area of 666.03 HA. Further, Consentconsent to Establishestablish for 6 MTPA4 mtpa and Consentconsent to operate 2 MTPAmtpa has also been obtained. However the environmental clearance for the expansion of Alumina Refinery at Lanjigarh was challenged by an individual Prafulla Samantra before the National Green Tribunal, wherein MoEF, Orissa State Pollution Control Board and Vedanta Limited have been made parties. We filed our response to challenge and the matter is listed for hearing on September 12, 2017. In addition, another individual has filed an interlocutory application to be impleaded in the matter before National Green Tribunal, Kolkata. See “Item 8. Financial Information— A. Consolidated Statements and Other Financial Information— Legal Proceedings.” for further details.

Any prolonged closure of our operations could have a material adverse effect on our businesses, results of operations, financial condition or prospects or may result in the recognition of an impairment of our assets.

We are exposed to the political, economic, legal, regulatory and social risks of the countries in which we operate

We are exposed to the political, economic, legal, regulatory and social risks of the countries in which we operate or intend to operate. These risks potentially include expropriation and nationalization of property, instability in political, economic or financial systems, uncertainty arising from underdeveloped legal and regulatory systems, corruption, civil strife or labor unrest, acts of war, armed conflict, terrorism, outbreaks of infectious diseases, prohibitions, limitations or price controls on hydrocarbon exports and limitations or the imposition of tariffs or duties on imports of certain goods. Countries in which we have operations or intend to have operations have transportation, telecommunications and financial services infrastructures that may present logistical challenges not associated with doing business in more developed locales. Furthermore, we may have difficulty in ascertaining our legal obligations and enforcing any rights that we may have.

For example, under the terms of the shareholders’ agreement between the GoI and us, we were granted two call options to acquire all the shares in HZL held by the GoI at the time of exercise. We exercised the first call option on August 29, 2003. The GoI has disputed and refused to act upon the second call option. Also, GoI has disputed our exercise of the call option to purchase the remaining ownership interest of the GoI in BALCO. See “Item 4. Information on the Company—B. Business Overview—Our Business—Options to Increase Interests in HZL and BALCO.”

Further, during fiscal year 2015, the Audit CommitteeBoard of Directors was made aware that charges have been filed against several persons unconnected with the Group and one employee of Cairn India Limited who was previously arrested and subsequently released, for alleged possession and access to government information. Cairn India Limited has not been named in the charges. Cairn India Limited has in place a comprehensive compliance program and controls,controls. Further, on an annual basis all directors and employees including senior management of Cairn India Limited provide affirmation of compliance of the code of business ethics adopted by the Company. Cairn India Limited also regularly undertakes review of its controls.

Political, legal, economic and commercial instability or community disputes in the countries and territories in which we operate could affect our operations. Some of our current and potential operations are located in or near communities that may regard such operations as having a detrimental effect on their environmental, economic or social circumstances.