practices may not comply with current or future statutes, regulations or case law involving applicable fraud and abuse or other healthcare laws and regulations.laws. If our operations are found to be in violation of any of these laws or any other governmental regulations that may apply to us, we may be subject to significant administrative, civil, and/or criminal and administrative penalties, including, without limitation, damages, fines, disgorgement, individual imprisonment, exclusion from participation in government funded healthcare programs, such as Medicare and Medicaid, and the curtailment or restructuring of our operations or other sanctions.operations. If any of the physicians or other healthcare providers or entities with whom we expect to do business isare found to be not in compliance with applicable laws, and regulations, itthey also may be subject to criminal,administrative, civil, and/or administrativecriminal sanctions, including exclusions from participation in government funded healthcare programs.

FailureLegal Proceedings

From time to buildtime we may become involved in legal proceedings or be subject to claims arising in the ordinary course of our finance infrastructure and improve our accounting systems and controls could impair our ability to comply with the financial reporting and internal controls requirements for publicly traded companies.

As a U.S. public company, we operate in an increasingly demanding regulatory environment that requires us to comply with, among things, the Sarbanes-Oxley Act of 2002, or “SOX” as from December 31, 2016, and related rules and regulationsbusiness. Regardless of the SEC’s substantial disclosure requirements, accelerated reporting requirementsoutcome, litigation can have an adverse impact on us because of defense and complex accounting rules. Company responsibilities required by the Sarbanes-Oxley Act include establishing corporate oversightsettlement costs, diversion of management resources and adequate internal control over financial reporting and disclosure controls and procedures. Effective internal controls are necessary for us to produce reliable financial reports and are important to help prevent financial fraud.other factors.

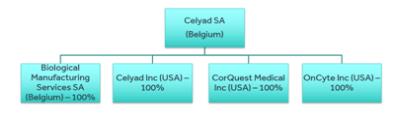

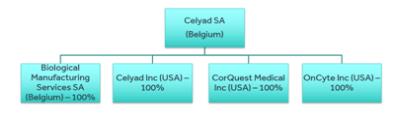

C. Organizational Structure.

We have limited accounting personnel and other resources to address our internal controls and procedures. Our independent registered public accounting firm has not conducted an audit of our internal control over financial reporting. However, in connection with the audit of our consolidated financial statements as of and for the year ended December 31, 2016, we identified a material weakness in our internal control over financial reporting. A material weakness is a deficiency,subsidiaries, or combination of deficiencies, such that there is reasonable possibility that a material misstatement of our annual or interim consolidated financial statements will not be prevented or detected on a timely basis by our employees. The material weakness identified is related to a lack of segregation of duties given the size of our finance and accounting team.

As of December 31, 2014, we reported three material weaknesses. Since then, we have taken several remedial actions to address these material weaknesses. In particular, we have hired in 2015 additional staff for the finance and legal departments, including a corporate controller and legal advisor. Also, the Group, has worked in 2016 with an independent firm to better define, formalize and upgrade our internal controls and processes with the goal of being compliant with the SOX regulation by end of 2016. Under the supervisionis made of the Company’s management, an independent firm tested our internal controls and processes respectively in September 2016 and January 2017 in light of the SOX regulation. No additional material weaknesses were identified other than those related to the segregation of duties. Management will be addressing the recommendations of the independent firm in view of a continuous improvement of our processes.

As a result of these actions, two out of three material weaknesses identifiedfollowing entities as of December 31, 2014 are no longer valid.2018. The lack of accounting resources to fulfill the reporting requirements of IFRSfollowing diagram illustrates our corporate structure.

| | | | | | | | | | | | | | | | | | |

Name | | Country of

Incorporation

and Place of

Business | | | Nature of

Business | | Proportion of

ordinary shares

directly held by

parent (%) | | | Proportion of

ordinary

shares held

by the group

(%) | | | Proportion of

ordinary

shares held by

non-controlling

interests (%) | |

Celyad SA | | | BE | | | Biopharma | | | Parent company | | | | | | | | | |

Celyad Inc. | | | US | | | Biopharma | | | 100 | % | | | 100 | % | | | 0 | % |

Biological Manufacturing Services SA | | | BE | | | Manufacturing | | | 100 | % | | | 100 | % | | | 0 | % |

CorQuest Medical, Inc. | | | US | | | Medical Device | | | 100 | % | | | 100 | % | | | 0 | % |

See “Item 4.A.—History and the lack of comprehensive knowledge of IFRS accounting policies are no longer identified as material weaknesses as of December 31, 2016.

Furthermore, we believe it is possible that if our independent registered public accounting firm had performed an audit of our internal control over financial reporting, other material weaknesses may have been identified. Section 404Development of the Sarbanes-Oxley Act, or Section 404, requires that we includeCompany.”

D. Property, Plants and Equipment.

We rent a report of management on our internal control over financial reporting2,284 square meter office space from the Axis Parc developer located at the Axis Parc in our annual report on Form20-F beginning with our annual report for the fiscal year ending December 31, 2016. However, until we ceaseMont-Saint-Guibert pursuant to be an “emerging growth company,”a lease agreement dated October 15, 2015 as that term is defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, our independent registered public accounting firm will not be required to attest to and report on the effectiveness of our internal control over financial reporting.

Our management may conclude that our internal control over financial reporting is not effective. Moreover, even if our management concludes that our internal control over financial reporting is effective, our independent registered public accounting firm, after conducting its own independent testing, may issue a report that is qualified if it is not satisfied with our internal controls or the level at which our controls are documented, designed, operated or reviewed, or if it interprets the relevant requirements differently from us. In addition, after we become a public company, our reporting obligations may place a significant strain on our management, operational and financial resources and systems for the foreseeable future. We may be unable to timely complete our evaluation, testing and any required remediation.

In addition, if we fail to maintain the adequacy of our internal control over financial reporting, as these standards are modified, supplemented or amended from time to time, we may not be able to concludewhich expires on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404. If we fail to achieveSeptember 30, 2025. We also rent a 1,120 square meter office and maintain an effective internal control environment, we could experience material misstatements in our consolidated financial statements and fail to meet our reporting obligations, which would likely cause investors to lose confidence in our reported financial information. This could in turn limit our access to capital markets, harm our results of operations, and leadlaboratory space from the Axis Parc developer pursuant to a decline in the trading price of our ordinary shares. Additionally, ineffective internal control over financial reporting could expose us to increased risk of fraud or misuse of corporate assets and subject us to potential delisting from The NASDAQ Global Market, or NASDAQ, regulatory investigations and civil or criminal sanctions. We may also be required to restate our financial statements for prior periods.

Our business and operations would suffer in the event of system failures.

Despite the implementation of security measures, our internal computer systems and those of our current and future CROs and other contractors and consultants are vulnerable to damage from computer viruses, unauthorized access, natural disasters, terrorism, war and telecommunication and electrical failures. While we have not experienced any such material system failure, accident or security breach to date, if such an event were to occur and cause interruptions in our operations, it could result in a material disruption of our development programs and our business operations. For example, the loss of clinical trial data from completed or future clinical trials could result in delays in our regulatory approval efforts and significantly increase our costs to recover or reproduce the data. To the extent that any disruption or security breach were to result in a loss of, or damage to, our data or applications, or inappropriate disclosure of confidential or proprietary information, we could incur liability and the further development and commercialization of our product candidates could be delayed.

Business disruptions could seriously harm our future revenue and financial condition and increase our costs and expenses.

Our operations, and those of our third-party research institution collaborators, CROs, CMOs, suppliers, and other contractors and consultants, could be subject to earthquakes, power shortages, telecommunications failures, water shortages, floods, hurricanes, typhoons, fires, extreme weather conditions, medical epidemics, and other natural orman-made disasters or business interruptions. The occurrence of any of these business disruptions could seriously harm our operations and financial condition and increase our costs and expenses. Damage or extended periods of interruption to our corporate, development or research facilities due to fire, natural disaster, power loss, communications failure, unauthorized entry or other events could cause us to cease or delay development of some or all of our drug product candidates. Although we maintain property damage and business interruption insurance coverage on these facilities, our insurance might not cover all losses under such circumstances and our business may be seriously harmed by such delays and interruption.

If product liability lawsuits are brought against us, we may incur substantial liabilities and may be required to limit commercialization of our drug product candidates.

We face an inherent risk of product liabilitylease agreement dated November 11, 2017, as a result of the clinical testing of our drug product candidates and will face an even greater risk if we commercialize any products. For example, we may be sued if our drug product candidates cause or are perceived to cause injury or are found to be otherwise unsuitable during clinical testing, manufacturing, marketing or sale. Any such product liability claims may include allegations of defects in manufacturing, defects in design, a failure to warn of dangers inherent in the product, negligence, strict liability or a breach of warranties. Claims could also be asserted under state consumer protection acts. If we cannot successfully defend ourselves against product liability claims, we may incur substantial liabilities or be required to limit commercialization of our drug product candidates.

Even successful defense would require significant financial and management resources. Regardless of the merits or eventual outcome, liability claims may result in:

decreased demand for our products;

injury to our reputation;

withdrawal of clinical trial participants and inability to continue clinical trials;

initiation of investigations by regulators;

costs to defend the related litigation;

a diversion of management’s time and our resources;

substantial monetary awards to trial participants or patients;

product recalls, withdrawals or labeling, marketing or promotional restrictions;

loss of revenue;

exhaustion of any available insurance and our capital resources;

the inability to commercialize any drug product candidate; and

a decline in our share price.

Our inability to obtain sufficient product liability insurance at an acceptable cost to protect against potential product liability claims could prevent or inhibit the commercialization of products we develop, alone or with collaborators. Although our clinical trials are currently covered by a clinical trial insurance, the amount of such insurance coverage may not be adequate, we may be unable to maintain such insurance, or we may not be able to obtain additional or replacement insurance at a reasonable cost, if at all. Our insurance policies may also have various exclusions, and we may be subject to a product liability claim for which we have no coverage. We may have to pay any amounts awarded by a court or negotiated in a settlement that exceed our coverage limitations or that are not covered by our insurance, and we may not have, or be able to obtain, sufficient capital to pay such amounts. Even if our agreements with any future corporate collaborators entitle us to indemnification against losses, such indemnification may not be available or adequate should any claim arise.

Our international operations subject us to various risks, and our failure to manage these risks could adversely affect our results of operations.

We face significant operational risks as a result of doing business internationally, such as:

fluctuations in foreign currency exchange rates;

potentially adverse and/or unexpected tax consequences, including penalties due to the failure of tax planning or due to the challenge by tax authorities on the basis of transfer pricing and liabilities imposed from inconsistent enforcement;

potential changes to the accounting standards, which may influence our financial situation and results;

becoming subject to the different, complex and changing laws, regulations and court systems of multiple jurisdictions and compliance with a wide variety of foreign laws, treaties and regulations;

reduced protection of, or significant difficulties in enforcing, intellectual property rights in certain countries;

difficulties in attracting and retaining qualified personnel;

restrictions imposed by local labor practices and laws on our business and operations, including unilateral cancellation or modification of contracts; and

rapid changes in global government, economic and political policies and conditions, political or civil unrest or instability, terrorism or epidemics and other similar outbreaks or events, and potential failure in confidence of our suppliers or customers due to such changes or events; and tariffs, trade protection measures, import or export licensing requirements, trade embargoes and other trade barriers.

We are subject to certain covenants as a result of certainnon-dilutive financial support we have received to date.

We have receivednon-dilutive financial support totaling €23.1 million as of December 31, 2016, to support various research programs from the Walloon Region, or the Region. The support has been granted in the form of recoverable cash advances, or RCAs, and subsidies.

In the event we decide to exploit any discoveries or products from the research funded by under an RCA, the relevant RCA becomes refundable, otherwise the RCA is not refundable. We own the intellectual property rights which result from the research programs partially funded by the Region, unless we decide not to exploit, or cease to exploit, the results of the research in which case the results and intellectual property rights are transferred to the Region. Subject to certain exceptions, however, we cannot grant to third parties, by way of license or otherwise, any right to use the results without the prior consent of the Region. We also need the consent of the Region to transfer an intellectual property right resulting from the research programs or a transfer or license of a prototype or installation. Obtaining such consent from the Region could give rise to a review of the applicable financial terms. The RCAs also contain provisions prohibiting us from conducting research for any other person which would fall within the scope of a research program of one of the RCAs. Most RCAs provide that this prohibition is applicable during the research phase and the decision phase but a number of RCAs extend it beyond these phases.

Subsidies received from the Region are dedicated to funding research programs and patent applications and are not refundable. We own the intellectual property rights which result from the research programs or with regard to a patent covered by a subsidy. Subject to certain exceptions, however, we cannot grant to third parties, by way of license, transfer or otherwise, any right to use the patents or research results without the prior consent of the Region. In addition, certain subsidies require that we exploit the patent in the countries where the protection was granted and to make an industrial use of the underlying invention. In case of bankruptcy, liquidation or dissolution, the rights to the patents covered by the patent subsidies will be assumed by the Region by operation of law unless the subsidy is reimbursed. Furthermore, we would lose our qualification as a small ormedium-sized enterprise, the patent subsidies will terminate and no additional expenses will be covered by such patent subsidies.

We may be exposed to significant foreign exchange risk.

We incur portions of our expenses, and may in the future derive revenues, in currencies other than the euro, in particular, the U.S. dollar. As a result, we are exposed to foreign currency exchange risk as our results of operations and cash flows are subject to fluctuations in foreign currency exchange rates. We currently do not engage in hedging transactions to protect against uncertainty in future exchange rates between particular foreign currencies and the euro. Therefore, for example, an increase in the value of the euro against the U.S. dollar could be expected to have a negative impact on our revenue and earnings growth as U.S. dollar revenue and earnings, if any, would be translated into euros at a reduced value. We cannot predict the impact of foreign currency fluctuations, and foreign currency fluctuations in the future may adversely affect our financial condition, results of operations and cash flows.

The requirements of being a U.S. public company may strain our resources and divert management’s attention.

We are required to comply with various corporate governance and financial reporting requirements under the Sarbanes-Oxley Act of 2002, the Securities and Exchange Act of 1934, as amended or the Exchange Act, and the rules and regulations adopted by the SEC and the Public Corporation Accounting Oversight Board. Further, compliance with various regulatory reporting requires significant commitments of time from our management and our directors, which reduces the time available for the performance of their other responsibilities. Our failure to track and comply with the various rules may materially adversely affect our reputation, ability to obtain the necessary certifications to financial statements, lead to additional regulatory enforcement actions, and could adversely affect the value of the ADSs or the ordinary shares.

The investment of our cash and cash equivalents may be subject to risks that may cause losses and affect the liquidity of these investments.

As of December 31, 2016, we had cash and cash equivalents of €48.4 million and short term investments of €34.2 million. We historically have invested substantially all of our available cash and cash equivalents in corporate bank accounts. Pending their use in our business, we may invest the net proceeds of the global offering in investments that may include corporate bonds, commercial paper, certificates of deposit and money market funds. These investments may be subject to general credit, liquidity, and market and interest rate risks. We may realize losses in the fair value of these investments or a complete loss of these investments, which would have a negative effect on our financial statements.

Risks Related to Ownership of our Ordinary Shares and ADSs

The market price for the ADSs may be volatile or may decline regardless of our operating performance.

The trading price of the ADSs has fluctuated, and is likely to continue to fluctuate, substantially. The trading price of the ADSs depends on a number of factors, many of which are beyond our control and may not be related to our operating performance, including, among others:

actual or anticipated fluctuations in our financial condition and operating results;

actual or anticipated changes in our growth rate relative to our competitors;

competition from existing products or new products that may emerge;

announcements by us, our partners or our competitors of significant acquisitions, strategic partnerships, joint ventures, collaborations, or capital commitments;

failure to meet or exceed financial estimates and projections of the investment community or that we provide to the public;

issuance of new or updated research or reports by securities analysts;

fluctuations in the valuation of companies perceived by investors to be comparable to us;

additions or departures of key management or scientific personnel;

disputes or other developments related to proprietary rights, including patents, litigation matters, and our ability to obtain patent protection for our technologies;

changes to coverage policies or reimbursement levels by commercial third-party payors and government payors and any announcements relating to coverage policies or reimbursement levels;

announcement or expectation of additional debt or equity financing efforts;

sales of the ADSs or ordinary shares by us, our insiders or our other shareholders; and

general economic and market conditions.

These and other market and industry factors may cause the market price and demand for the ADSs to fluctuate substantially, regardless of our actual operating performance, which may limit or prevent investors from readily selling their ADSs and may otherwise negatively affect the liquidity of our ADSs shares. In addition, the stock market in general, and biotechnology and biopharmaceutical companies in particular, have experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of these companies.

Fluctuations in the exchange rate between the U.S. dollar and the euro may increase the risk of holding the ADSs.

Our shares currently trade on Euronext Brussels and Euronext Paris in euros, while the ADSs trade on NASDAQ in U.S. dollars. Fluctuations in the exchange rate between the U.S. dollar and the euro may result in differences between the value of the ADSs and the value of our ordinary shares, which may result in heavy trading by investors seeking to exploit such differences. In addition, as a result of fluctuations in the exchange rate between the U.S. dollar and the euro, the U.S. dollar equivalent of the proceeds that a holder of the ADSs would receive upon the sale in Belgium of any ordinary shares withdrawn from the depositary upon calculation of the corresponding ADSs and the U.S. dollar equivalent of any cash dividends paid in euros on our ordinary shares represented by the ADSs could also decline.

Holders of the ADSs are not treated as shareholders of our company.

Holders of the ADSs are not treated as shareholders of our company, unless they cancel the ADSs and withdraw our ordinary shares underlying the ADSs. The depositary (or its nominee) is the shareholder of the ordinary shares underlying the ADSs. Holders of ADSs therefore do not have any rights as shareholders of our company, other than the rights that they have pursuant to the deposit agreement.

If securities or industry analysts do not publish research or publish inaccurate research or unfavorable research about our business, the price of the ordinary shares and the ADSs and trading volume could decline.

The trading market for the ordinary shares and the ADSs depends in part on the research and reports that securities or industry analysts publish about us or our business. If no or few securities or industry analysts cover our company, the trading price for the ordinary shares and the ADSs would be negatively impacted. If one or more of the analysts who covers us downgrades the ordinary shares or the ADSs or publishes incorrect or unfavorable research about our business, the price of the ordinary shares and the ADSs would likely decline. If one or more of these analysts ceases coverage of our company or fails to publish reports on us regularly, or downgrades the ordinary shares or the ADSs, demand for the ADSs and ordinary shares could decrease, which could cause the price of the ADSs and ordinary shares or trading volume to decline.

We have no present intention to pay dividends on our ordinary shares in the foreseeable future and, consequently, your only opportunity to achieve a return on your investment during that time is if the price of the ADSs or the ordinary shares increases.

We have no present intention to pay dividends in the foreseeable future. Any recommendation by our board of directors to pay dividends will depend on many factors, including our financial condition (including losses carried-forward), results of operations, legal requirements and other factors. Furthermore, pursuant to Belgian law, the calculation of amounts available for distribution to shareholders, as dividends or otherwise, must be determined on the basis of ournon-consolidated statutory accounts prepared in accordance with Belgian accounting rules. In addition, in accordance with Belgian law and our articles of association, we must allocate each year an amount of at least 5% of our annual net profit under ournon-consolidated statutory accounts to a legal reserve until the reserve equals 10% of our share capital. Therefore, we are unlikely to pay dividends or other distributions in the foreseeable future. If the price of the ADSs or the ordinary shares declines before we pay dividends, you will incur a loss on your investment, without the likelihood that this loss will be offset in part or at all by potential future cash dividends.

Our shareholders residing in countries other than Belgium may be subject to double withholding taxation with respect to dividends or other distributions made by us.

Any dividends or other distributions we make to shareholders will, in principle, be subject to withholding tax in Belgium at a rate of 25%, except for shareholders which qualify for an exemption of withholding tax such as, among others, qualifying pension funds or a company qualifying as a parent company within the meaning of the Council Directive (90/435/EEC) July 23, 1990, known as the Parent-Subsidiary Directive, or that qualify for a lower withholding tax rate or an exemption by virtue of a tax treaty. Various conditions may apply and shareholders residing in countries other than Belgium are advised to consult their advisers regarding the tax consequences of dividends or other distributions made by us. Our shareholders residing in countries other than Belgium may not be able to credit the amount of such withholding tax to any tax due on such dividends or other distributions in any other country than Belgium. As a result, such shareholders may be subject to double taxation in respect of such dividends or other distributions. Belgium and the United States have concluded a double tax treaty concerning the avoidance of double taxation, or the U.S.-Belgium Tax Treaty. The U.S.-Belgium Tax Treaty reduces the applicability of Belgian withholding tax to 15%, 5% or 0% for U.S. taxpayers, provided that the U.S. taxpayer meets the limitation of benefits conditions imposed by the U.S.-Belgium Tax Treaty. The Belgian withholding tax is generally reduced to 15% under the U.S.-Belgium Tax Treaty. The 5% withholding tax applies in case where the U.S. shareholder is a company which holds at least 10% of the shares in the company. A 0% Belgian withholding tax applies when the shareholder is a company which has held at least 10% of the shares in the company for at least 12 months, or is, subject to certain conditions, a U.S. pension fund. The U.S. shareholders are encouraged to consult their own tax advisers to determine whether they can invoke the benefits and meet the limitation of benefits conditions as imposed by the U.S.-Belgium Tax Treaty.

We believe that we were a passive foreign investment company (a “PFIC”) for the 2015 taxable year and in prior taxable years, but that we likely were not a PFIC for our 2016 taxable year. It is uncertain whether we will be a PFIC in future taxable years. Our status as a PFIC is a fact intensive determination and we cannot provide any assurances regarding our PFIC status for past, current or future taxable years. U.S. holders of the ADSs may suffer adverse tax consequences if we are characterized as a PFIC for any taxable year.

Generally, if, for any taxable year, at least 75% of our gross income is passive income, or at least 50% of the value of our assets is attributable to assets that produce passive income or are held for the production of passive income, including cash, we would be characterized as a passive foreign investment company, or PFIC, for U.S. federal income tax purposes. For purposes of these tests, passive income includes dividends, interest, and gains from the sale or exchange of investment property and rents and royalties other than rents and royalties which are received from unrelated parties in connection with the active conduct of a trade or business. If we are characterized as a PFIC, U.S. holders of the ADSs may suffer adverse tax consequences, including having gains realized on the sale of the ADSs treated as ordinary income, rather than capital gain, the loss of the preferential rate applicable to dividends received on the ADSs by individuals who are U.S. holders, and having interest charges apply to distributions by us and the proceeds of sales of the ADSs.

Our status as a PFIC will depend on the composition of our income, including the receipt of milestones, and the composition and value of our assets (which may be determined in large part by reference to the market value of the ADSs and ordinary shares, which may be volatile) from time to time.

We believe we were a PFIC in our 2015 taxable year and in prior taxable years, but that we likely were not a PFIC for our 2016 taxable year. With respect to our 2017 taxable year and possibly future taxable years, it is uncertain whether we will be a PFIC based upon the expected value of our assets, including any goodwill, and the expected composition of our income and assets. Our status as a PFIC is a fact intensive determination made on an annual basis and we cannot provide any assurances regarding our PFIC status for past, current or future taxable years.

Future Sales Of Ordinary Shares Or ADSs By Existing Shareholders Could Depress The Market Price Of The ADSs.

If our existing shareholders sell, or indicate an intent to sell, substantial amounts of ordinary shares or ADSs in the public market, the trading price of the ADSs could decline significantly. In the future we may file one or more registration statements with the SEC covering ordinary shares available for future issuance under our equity incentive plans. Upon effectiveness of such registration statements, any shares subsequently issued under such plans will be eligible for sale in the public market, except to the extent that they are restricted by thelock-up agreements referred to above and subject to compliance with Rule 144 in the case of our affiliates. Sales of a large number of the shares issued under these plans in the public market could have an adverse effect on the market price of the ADSs and the ordinary shares.

We are a Belgian public limited liability company, and shareholders of our company may have different and in some cases more limited shareholder rights than shareholders of a U.S. listed corporation.

We are a public limited liability company incorporated under the laws of Belgium. Our corporate affairs are governed by Belgian corporate and securities law. The rights provided to our shareholders under Belgian corporate law and our articles of association differ in certain respects from the rights that you would typically enjoy as a shareholder of a U.S. corporation under applicable U.S. federal and state laws. Under Belgian corporate law, other than certain information that we must make public and except in certain limited circumstances, our shareholders may not ask for an inspection of our corporate records, while under Delaware corporate law any shareholder, irrespective of the size of its shareholdings, may do so. Shareholders of a Belgian corporation have more limited rights to initiate a derivative action, a remedy typically available to shareholders of U.S. companies, in order to enforce a right of our Company, in case we fail to enforce such right ourselves.

A liability action can be instituted for our account by one or more of our shareholders who, individually or together, hold securities representing at least 1.0% of the votes or a part of the capital worth at least €1.25 million and have not approved of the discharge from liability that was granted to the directors. If the court orders the directors to pay damages, they are due to us, though the amounts advanced by the minority shareholders (for example attorney’s fees) are to be reimbursed by us. If the action is disallowed, the minority shareholders may be ordered to pay the costs, and, should there be grounds therefor, to pay damages to the directors, for example for having conducted provocative and reckless legal proceedings.

In addition, a majority of our shareholders present or represented at our meeting of shareholders may release a director from any claim of liability we may have, provided that the financial position of the company is accurately reflected in the annual accounts. This includes a release from liability for any acts of the directors beyond their statutory powers or in breach of the Belgian Company Code, provided that the relevant acts were specifically mentioned in the convening notice to the meeting of shareholders deliberating on the discharge. In contrast, most U.S. federal and state laws prohibit a company or its shareholders from releasing a director from liability altogether if he or she has acted in bad faith or has breached his or her duty of loyalty to the company. Finally, Belgian corporate law does not provide any form of appraisal rights in the case of a business combination. As a result of these differences between Belgian corporate law and our articles of association, on the one hand, and the U.S. federal and state laws, on the other hand, in certain instances, you could receive less protection as an ADS holder of our company than you would as a shareholder of a listed U.S. company.

Takeover provisions in the national law of Belgium may make a takeover difficult.

Public takeover bids on our shares and other voting securities, such as warrants or convertible bonds, if any, are subject to the Belgian Act of April 1, 2007 on public takeover bids, as amended and implemented by the Belgian Royal Decree of April 27, 2007, or Royal Decree, and to the supervision by the Belgian Financial Services and Markets Authority, or FSMA. Public takeover bids must be made for all of our voting securities, as well as for all other securities that entitle the holders thereof to the subscription to, the acquisition of or the conversion into voting securities. Prior to making a bid, a bidder must issue and disseminate a prospectus, which must be approved by the FSMA. The bidder must also obtain approval of the relevant competition authorities, where such approval is legally required for the acquisition of our company. The Belgian Act of April 1, 2007 provides that a mandatory bid will be required to be launched for all of our outstanding shares and securities giving access to ordinary shares if a person, as a result of its own acquisition or the acquisition by persons acting in concert with it or by persons acting on their account, directly or indirectly holds more than 30% of the voting securities in a company that has its registered office in Belgium and of which at least part of the voting securities are traded on a regulated market or on a multilateral trading facility designated by the Royal Decree. The mere fact of exceeding the relevant threshold through the acquisition of one or more shares will give rise to a mandatory bid, irrespective of whether or not the price paid in the relevant transaction exceeds the current market price.

There are several provisions of Belgian company law and certain other provisions of Belgian law, such as the obligation to disclose important shareholdings and merger control, that may apply to us and which may make an unfriendly tender offer, merger, change in management or other change in control, more difficult. These provisions could discourage potential takeover attempts that third parties may consider and thus deprive the shareholders of the opportunity to sell their shares at a premium (which is typically offered in the framework of a takeover bid).

Holders of ADSs do not have the same voting rights as holders of our ordinary shares.

Holders of ADSs may exercise voting rights with respect to the ordinary shares represented by the ADSs only in accordance with the provisions of the deposit agreement. The deposit agreement provides that, upon receipt of notice of any meeting of holders of our ordinary shares, the depositary will fix a record date for the determination of ADS holders who shall be entitled to give instructions for the exercise of voting rights. Upon timely receipt of notice from us, if we so request, the depositary shall distribute to the holders as of the record date (1) the notice of the meeting or solicitation of consent or proxy sent by us and (2) a statement as to the manner in which instructions may be given by the holders. You may instruct the depositary of your ADSs to vote the ordinary shares underlying your ADSs. Otherwise, you will not be able to exercise your right to vote, unless you withdraw the ordinary shares underlying the ADSs you hold. However, you may not know about the meeting far enough in advance to withdraw those ordinary shares. We cannot guarantee you that you will receive the voting materials in time to ensure that you can instruct the depositary to vote your ordinary shares or to withdraw your ordinary shares so that you can vote them yourself. In addition, the depositary and its agents are not responsible for failing to carry out voting instructions or for the manner of carrying out voting instructions. This means that you may not be able to exercise your right to vote, and there may be nothing you can do if the ordinary shares underlying your ADSs are not voted as you requested.

Holders of ADSs may be subject to limitations on the transfer of their ADSs and the withdrawal of the underlying ordinary shares.

ADSs are transferable on the books of the depositary. However, the depositary may close its books at any time or from time to time, when it deems expedientwhich expires on September 30, 2020. In January 2016, we entered into asix-year lease agreement for our U.S. corporate offices located in connection with the performance of its duties. The depositary may refuse to deliver, transfer or register transfers of your ADSs generally when our books or the books of the depositary are closed, or at any time if we or the depositary think it is advisable to do so because of any requirement of law, government or governmental body, or under any provision of the deposit agreement, or for any other reason, subject to your right to cancel your ADSs and withdraw the underlying ordinary shares. Temporary delays in the cancellation of your ADSs and withdrawal of the underlying ordinary shares may arise because the depositary has closed its transfer books or we have closed our transfer books, the transfer of ordinary shares is blocked to permit voting at a shareholders’ meeting or we are paying a dividend on our ordinary shares.

In addition, you may not be able to cancel your ADSs and withdraw the underlying ordinary shares when you owe money for fees, taxes and similar charges and when it is necessary to prohibit withdrawals in order to comply with any laws or governmental regulations that apply to ADSs or to the withdrawal of ordinary shares or other deposited securities.

We are an “emerging growth company” and are availing ourselves of reduced disclosure requirements applicable to emerging growth companies, which could make the ADSs or the ordinary shares less attractive to investors.Boston, Massachusetts.

We are an “emerging growth company,” as defined in the JOBS Act, and we intend to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find the ADSs or the ordinary shares less attractive because we may rely on these exemptions. If some investors find the ADSs or the ordinary shares less attractive as a result, there may be a less active trading market for the ADSs or the ordinary shares and the price of the ADSs or the ordinary shares may be more volatile. We may take advantage of these reporting exemptions until we are no longer an emerging growth company. We would cease to be an emerging growth company upon the earliest to occur of (1) the last day of the fiscal year in which we have more than $1.0 billion in annual revenue; (2) the date we qualify as a “large accelerated filer,” with at least $700 million of equity securities held bynon-affiliates; (3) the issuance, in any three-year period, by our company of more than $1.0 billion innon-convertible debt securities held bynon-affiliates; and (4) December 31, 2020. We may choose to take advantage of some but not all of these exemptions.

Even after we no longer qualify as an emerging growth company, we may still qualify as a “smaller reporting company” which would allow us to take advantage of many of the same exemptions from disclosure requirements, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act and reduced disclosure obligations regarding executive compensation. We cannot predict if investors will find our ordinary shares less attractive because we may rely on these exemptions. If some investors find our ordinary shares less attractive as a result, there may be a less active trading market for our ordinary shares and our share price may be more volatile.

As a foreign private issuer, we are exempt from a number of rules under the U.S. securities laws and are permitted to file less information with the SEC than a U.S. company. This may limit the information available to holders of ADSs or ordinary shares.

We are a “foreign private issuer,” as defined in the SEC’s rules and regulations and, consequently, we are not subject to all of the disclosure requirements applicable to public companies organized within the United States. For example, we are exempt from certain rules under the Exchange Act, that regulate disclosure obligations and procedural requirements related to the solicitation of proxies, consents or authorizations applicable to a security registered under the Exchange Act, including the U.S. proxy rules under Section 14 of the Exchange Act. In addition, our officers and directors are exempt from the reporting and “short-swing” profit recovery provisions of Section 16 of the Exchange Act and related rules with respect to their purchases and sales of our securities. Moreover, while we currently make annual and semi-annual filings with respect to our listing on Euronext Brussels and Euronext Paris, we will not be required to file periodic reports and financial statements with the SEC as frequently or as promptly as U.S. domestic issuers and will not be required to file quarterly reports on Form10-Q or current reports on Form8-K under the Exchange Act. Accordingly, there will be less publicly available information concerning our company than there would be if we were not a foreign private issuer.

As a foreign private issuer, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from NASDAQ corporate governance listing standards. These practices may afford less protection to shareholders than they would enjoy if we complied fully with corporate governance listing standards.

As a foreign private issuer listed on NASDAQ, we are subject to corporate governance listing standards. However, rules permit a foreign private issuer like us to follow the corporate governance practices of its home country. Certain corporate governance practices in Belgium, which is our home country, may differ significantly from corporate governance listing standards. For example, neither the corporate laws of Belgium nor our articles of association require a majority of our directors to be independent and we could includenon-independent directors as members of our Nomination and Remuneration Committee, and our independent directors would not necessarily hold regularly scheduled meetings at which only independent directors are present. Currently, we intend to follow home country practice to the maximum extent possible. Therefore, our shareholders may be afforded less protection than they otherwise would have under corporate governance listing standards applicable to U.S. domestic issuers.

We may lose our foreign private issuer status in the future, which could result in significant additional cost and expense.

While we currently qualify as a foreign private issuer, the determination of foreign private issuer status is made annually on the last business day of an issuer’s most recently completed second fiscal quarter and, accordingly, the next determination will be made with respect to us on June 30, 2017. In the future, we would lose our foreign private issuer status if we to fail to meet the requirements necessarycommitted to maintain our foreign private issuer status asheadquarters and registered office in the Walloon region of the relevant determination date. For example, if more than 50%Belgium and all of our securities are held by U.S. residents and more than 50% ofexisting activities will continue to be performed in the members of our executive management team or members of our board of directors are residents or citizens of the United States, we could lose our foreign private issuer status.

The regulatory and compliance costs to us under U.S. securities laws as a U.S. domestic issuer may be significantly more than costs we incur as a foreign private issuer. If we are not a foreign private issuer, we will be required to file periodic reports and registration statements on U.S. domestic issuer forms with the SEC, which are more detailed and extensive in certain respects than the forms available to a foreign private issuer. We would be required under current SEC rules to prepare our financial statements in accordance with U.S. generally accepted accounting principles, or U.S. GAAP, rather than IFRS, and modify certain of our policies to comply with corporate governance practices associated with U.S. domestic issuers. Such conversion of our financial statements to U.S. GAAP will involve significant time and cost. In addition, we may lose our ability to rely upon exemptions from certain corporate governance requirements on U.S. stock exchanges that are available to foreign private issuers such as the ones described above and exemptions from procedural requirements related to the solicitation of proxies.

It may be difficult for investors outside Belgium to serve process on, or enforce foreign judgments against, us or our directors and senior management.

We are a Belgian public limited liability company. Less than a majority of the members of our board of directors and members of our executive management team are residents of the United States. All or a substantial portion of the assets of suchnon-resident persons and most of our assets are located outside the United States. As a result, it may not be possible for investors to effect service of process upon such persons or on us or to enforce against them or us a judgment obtained in U.S. courts. Original actions or actions for the enforcement of judgments of U.S. courts relating to the civil liability provisions of the federal or state securities laws of the United States are not directly enforceable in Belgium.

The United States and Belgium do not currently have a multilateral or bilateral treaty providing for reciprocal recognition and enforcement of judgments, other than arbitral awards, in civil and commercial matters. In order for a final judgment for the payment of money rendered by U.S. courts based on civil liability to produce any effect on Belgian soil, it is accordingly required that this judgment be recognized or be declared enforceable by a Belgian court in accordance with Articles 22 to 25 of the 2004 Belgian Code of Private International Law. Recognition or enforcement does not imply a review of the merits of the case and is irrespective of any reciprocity requirement. A U.S. judgment will, however, not be recognized or declared enforceable in Belgium if it infringes upon one or more of the grounds for refusal that are exhaustively listed in Article 25 of the Belgian Code of Private International Law. Actions for the enforcement of judgments of U.S. courts might be successful only if the Belgian court confirms the substantive correctness of the judgment of the U.S. court and is satisfied that:Walloon region.

the effect of the enforcement judgment is not manifestly incompatible with Belgian public policy;

the judgment did not violate the rights of the defendant;

the judgment was not rendered in a matter where the parties transferred rights subject to transfer restrictions with the sole purpose of avoiding the application of the law applicable according to Belgian international private law;

the judgment is not subject to further recourse under U.S. law;

the judgment is not compatible with a judgment rendered in Belgium or with a subsequent judgment rendered abroad that might be recognized in Belgium;

a claim was not filed outside Belgium after the same claim was filed in Belgium, while the claim filed in Belgium is still pending;

the Belgian courts did not have exclusive jurisdiction to rule on the matter;

the U.S. court did not accept its jurisdiction solely on the basis of either the nationality of the plaintiff or the location of the disputed goods; and

the judgment submitted to the Belgian court is authentic.

In addition to recognition or enforcement, a judgment by a federal or state court in the United States against us may also serve as evidence in a similar action in a Belgian court if it meets the conditions required for the authenticity of judgments according to the law of the state where it was rendered. The findings of a federal or state court in the United States will not, however, be taken into account to the extent they appear incompatible with Belgian public policy.

We may be subject at an increased risk of securities class action litigation.

Historically, securities class action litigation has often been brought against a company following a decline in the market price of its securities. This risk is especially relevant for us because biotechnology and biopharmaceutical companies have experienced significant share price volatility in recent years. If we were to be sued, it could result in substantial costs and a diversion of management’s attention and resources, which could harm our business.

ITEM 4 –INFORMATION ON THE COMPANY

A. History And Development Of The Company

Our legal and commercial name is Celyad SA. Prior to May 5, 2015, our corporate name was Cardio3 Biosciences SA. We are a limited liability company incorporated in the form of anaamloze vennootschap/société anonyme under Belgian law. We are registered with the Register of Legal Entities (RPM Nivelles) under the enterprise number 891.118.115. We were incorporated in Belgium on July 24, 2007 for an unlimited duration. Our fiscal year ends December 31.

Our principal executive and registered offices are located at rue Edouard Belin 2, 1435 Mont-Saint-Guibert, Belgium and our telephone number is +32 10 394 100. Our agent for service of process in the United States is CT Corporation System. We also maintain a website at www.celyad.com. The reference to our website is an inactive textual reference only and the information contained in, or that can be accessed through, our website is not a part of this Annual Report.

Our actual capital expenditures for the years ended December 31, 2014,2015 and 2016 amounted to €0.6 million, €0.8 million and €1.8 million, respectively. These capital expenditures primarily consisted of the acquisition of laboratory equipment and industrial tools, the refurbishment of our research and development laboratories and leasehold improvements of our corporate offices located in Belgium and the United States. We expect our capital expenditures to increase in absolute terms in the near term as we continue to advance our research and development programs and grow our operations. We anticipate our capital expenditure in 2017 to be financed mostly from finance leases and partly with proceeds of our global offering.

B. Business Overview

Overview

We are a leader in engineered cell therapy treatments with clinical programs currently targeting indications in immune-oncology.

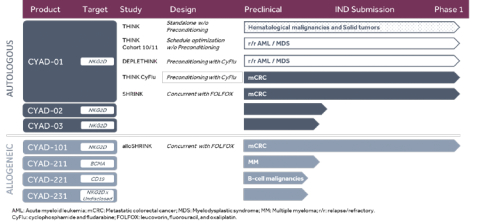

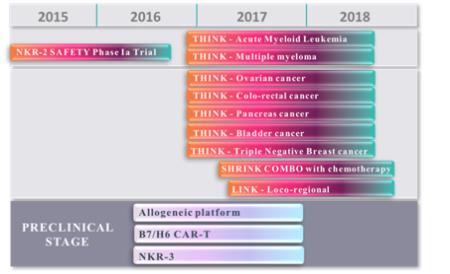

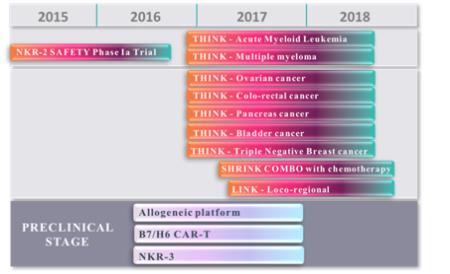

Our lead product candidate in oncology isCAR-TNKR-2, an autologous chimeric antigen receptor, or CAR, using NKG2D, an activating receptor of Natural Killer, or NK, cells transduced onT-lymphocytes. We successfully completed in 2016 our first clinical trial for this product candidate, called theCM-CS1 trial. TheCM-CS1 trial was a Phase 1 dose escalation study that was conducted at the Dana Farber Cancer Institute in Boston, Massachusetts. It enrolled patients with refractory or relapsed acute myeloid leukemia, or AML, or multiple myeloma, or MM. The outcome of theCM-CS1 trial was presented at the 2016 American Society of Hematology, or ASH, Annual Meeting in December 2016. No treatment-related safety concerns were reported at the four doses tested. First signals of activity were also identified and reported.

In December 2016, a second Phase 1 clinical trial was initiated. The THINK trial (THerapeutic Immunotherapy withCAR-TNKR-2) is a multinational (EU/US) open-label Phase 1b trial to assess the safety and clinical activity of multiple administrations of autologousCAR-TNKR-2 cells in seven refractory cancers, including five solid tumors (colorectal, ovarian, bladder, triple-negative breast and pancreatic cancers) and two hematological tumors (AML and MM). The THINK trial will test three dose levels adjusted to body weight: up to 3x108, 1x109 and 3x109CAR-TNKR-2 cells. At each dose, the patients will receive three successive administrations, two weeks apart, ofCAR-TNKR-2 cells. The dose escalation part of the study will enroll up to 24 patients while the extension phase would enroll 86 additional patients. The dose escalation part is expected to be completed in the last quarter of 2017.

In July 2016, we announced the signing of an exclusive licensing agreement with the Japanese immuno-oncology company ONO Pharmaceutical Co. Ltd., or ONO, for the development and commercialization of our allogeneicCAR-TNKR-2 immunotherapy. The license agreement with ONO grants them the exclusive right to develop and commercialize our allogeneicCAR-TNKR-2T-Cell immunotherapy in Japan, Korea and Taiwan. In exchange for receiving a license in these countries, ONO will pay us up to $311.5 million in development and commercial milestones, including an upfront payment of $12.5 million plus double digit royalties on net sales in ONO territories.

Our lead drug product candidate in cardiovascular disease is calledC-Cure, an autologous cell therapy for the treatment of patients with ischemic heart failure, or HF.C-Cure was evaluated inCHART-1, a Phase 3 trial conducted in Europe and Israel with 290 patients suffering from advanced ischemic HF. Topline results from theCHART-1 trial were reported in June 2016. Results indicated that the trial was overall neutral but with a positive trend, consistent across all parameters tested. Although the primary endpoint of the randomized trial was not met among the entireCHART-1 patient population, a significant

subpopulation representing more than 60% of the overall trial patients, defined by their Left Ventricular End Diastolic Volume, did meet the trial primary endpoint with a P value of 0.015. Based on the results of theCHART-1 trial, a U.S. trial, orCHART-2, has been designed to exclusively enroll the subset of patients that met the primary endpoint of theCHART-1 trial. We are currently seeking partners to further develop and commercializeC-Cure.

Strategy

Our goal is to become a leader inCAR-T cell therapies dedicated to the treatment of cancer. The key elements of this strategy are as follows:

| • | | Rapidly advanceCAR-TNKR-2 clinical development for the treatment of hematological and solid indications targeted in our THINK trial. We are currently enrolling patients with refractory or relapsed AML, MM, colorectal, bladder, ovarian, pancreatic and triple negative breast cancers in a Phase 1b clinical trial ofCAR-TNKR-2 in Belgium and in the United States. We intend to progressCAR-TNKR-2 in further stages of development in the indications that demonstrate clinical activity. |

| • | | Explore the potentially synergisticeffect of the combination ofCAR-TNKR-2 with standard chemotherapy in first or second line metastatic colorectal cancer patients. We believe there is an opportunity to study the properties of increased ligand expression in tumor cells exposed to aggressive chemotherapy regime, with the administration ofCAR-TNKR-2 in between the chemotherapy cycles. |

| • | | Explore the potential ofCAR-TNKR-2 administered loco regionally.We believe there is an opportunity to study the safety and effectiveness of administration ofCAR-TNKR-2 in the liver in colorectal cancer patients with liver metastasis. |

| • | | Develop our allogeneicCAR-TNKR-2 clinical program. We are developing a proprietary approach to inhibitT-cell receptor, or TCR, expression inCAR-T cells that allows us to use donor cells as opposed to the patient’s own T lymphocytes, which may make the administration ofCAR-T therapies feasible in patients lacking sufficient T lymphocytes, and, potentially, provide an approach to the administration ofCAR-T cells in certain conditions where the resident immune system can be temporarily inhibited. |

| • | | Make manufacturing and logistics of autologousCAR-T therapies feasible to address large indications. While current autologous approaches may be suited for relatively small indications, and allogeneic approaches have yet to demonstrate their equivalent effectiveness innon-hematological malignancies, we believe it is important to find manufacturing and supply chain solutions that allow the administration ofCAR-T cells in large indications feasible, cost effective and safe. Building on our experience in autologous cell therapy from ourC-Cure program, we, with external partners, are developing a fully automated point of care manufacturing solution that will may provide a paradigm shift in the field of autologous cell therapy. |

| • | | Leverage our expertise and knowledge of engineered-cell therapies to expand ourNKR-T cell therapy drug product candidate pipeline. In addition, we are continuing preclinical studies of our other preclinical product candidates, including NKp30, which is another activating receptor of NK cells, and B7H6, which is a NKp30 ligand expressed on cancer cells. We expect that B7H6 will enter clinical development in 2018 for the treatment of a pediatric rare and serious malignancy neuroblastoma. |

| • | | Find a partner to continue the development of our cardiovascular assets, in particularC-Cure. Based on the results from our previous trials, we believe thatC-Cure is a promising candidate for the treatment of ischemic HF. We are actively seeking a partner that could leverage that data and conductCHART-2 for registration ofC-Cure in the United States and in Europe. |

Drug product candidates

We currently hold worldwide rights to develop and commercialize all of our drug product candidates.

Our most advanced product candidates are autologous cell therapy treatments. In autologous procedures, a patient’s cells are harvested, selected, reprogrammed and expanded, and then infused back into the same patient. A benefit of autologous therapies is that autologous cells are not recognized as foreign by patients’ immune systems. We believe that we are well positionned to effectively advance autologous cell therapy treatments for cancer and other indications as a result of the expertise andknow-how that we have acquired through our development ofC-Cure.

Oncology

Cancer is the second leading cause of death in the United States after cardiovascular diseases, according to the U.S. Centers for Disease Control and Prevention. According to the American Cancer Society, in 2014, there were an estimated 1.6 million new cancer cases diagnosed and over 550,000 cancer deaths in the United States alone. In the past decades, the cornerstones of cancer therapies have been surgery, chemotherapy and radiation therapy. Since 2001, molecules that specifically target cancer cells have emerged as standard treatments for a number of cancers. For example, Gleevec is marketed by Novartis AG for the treatment of leukemia, and Herceptin is marketed by Genentech, Inc. for the treatment of breast and gastric cancer. Although targeted therapies have significantly improved the outcomes for certain patients with these cancers, there is still a high unmet need for the treatment of these and many other cancers.

Below are the statistics regarding certain forms of solid and hematological cancers and their estimated death rates in the United States for 2017:

| | | | | | | | |

| | | 2017 estimates for the US | |

| | | New cases | | | Deaths | |

Acute myeloid leukemia | | | 21,380 | | | | 11,960 | |

Multiple myeloma | | | 30,280 | | | | 12,790 | |

Colorectal cancer | | | 135,430 | | | | 50,260 | |

Pancreatic cancer | | | 53,670 | | | | 43,090 | |

Urinary bladder cancer | | | 79,030 | | | | 16,870 | |

Ovary cancer | | | 22,440 | | | | 14,080 | |

Triple negative breast cancer | | | 30,620 | | | | >>4,900 | |

Source: SEER, American Cancer Society

CART-Cell Therapy

The immune system has a natural response to cancer, as cancer cells express antigens that can be recognized by cells of the immune system. Upon recognition of a cancer antigen, activatedT-cells release substances that kill cancer cells and attract other immune cells to assist in the killing process. However, cancer cells can develop the ability to release inhibitory factors that allow them to evade immune response, resulting in the formation of cancers.

CART-cell therapy is a new technology that broadly involves engineering patients’ ownT-cells to express CARs so that thesere-engineered cells recognize and kill cancer cells, overcoming cancer cells’ ability to evade the immune response. CARs are comprised of the following elements:

binding domains that encode proteins, such as variable fragments of antibodies that are expressed on the surface of aT-cell and allow theT-cell to recognize specific antigens on cancer cells;

intracellular signaling domains derived fromT-cell receptors that activate the signaling pathways responsible for the immune response following binding to cancer cells. This allows the T cell to trigger the killing activity of the target cancer cell once it is recognized; and

costimulatory and adaptor domains, which enhance the effectiveness of theT-cells in their immune response.

Once activated, CART-cells proliferate and kill cancer cells directly through the secretion of cytotoxins that destroy cancer cells, and these cytokines attract other immune cells to the tumor site to assist in the killing process.

The CART-cell manufacturing process starts with collecting cells from a patient’s blood.T-cells are then selected, following which the CAR is introduced into theT-cells using vectors. The CART-cells are then expanded prior to injection back into the patient.

Current Investigational Treatments of Cancer using CART-Cells

CAR-T cell therapy is an emerging approach for the treatment of some cancers, such asB-cell malignancies.

CAR CD19 is the most studied CAR. CAR CD19 has an antigen binding domain that recognizes the CD19 antigen that is present on all B lymphocytes. This means that if a cancer originates from B lymphocytes, such as Acute Lymphoblastic Leukemia (ALL), then a CAR bearing the CD19 antibody could potentially recognize it and destroy it. Indeed, results of a clinical trial reported in the New England Journal of Medicine in October 2014 demonstrated that CAR CD19 CAR therapy was effective in treating patients with relapsed and refractory ALL. Treatment was associated with a complete remission rate of 90% and sustained remissions of up to two year after treatment. Despite its promise, CAR CD19 therapy is inherently limited to the treatment ofB-cell malignancies. CAR CD19 also targets normal B lymphocytes leading to the need to treat those patients with gamma globulins.

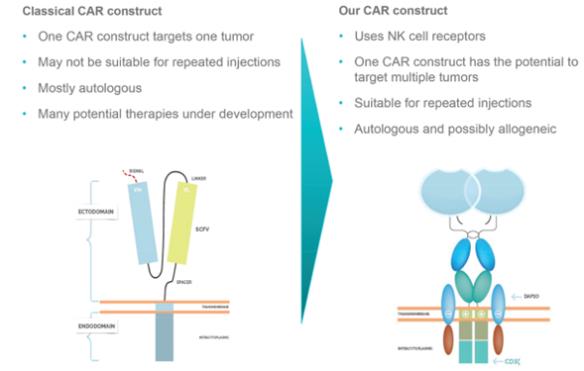

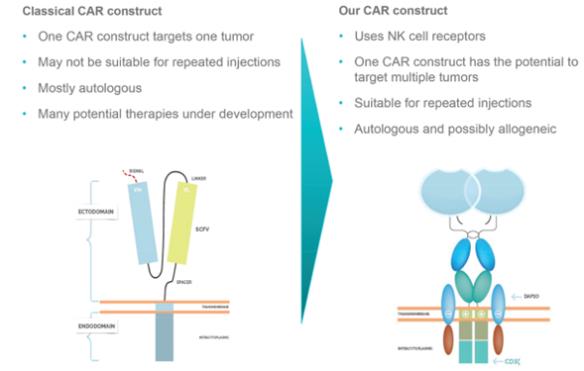

Our Approach to CART-Cell Therapy

Our approach toCAR-T cell therapy has the potential to treat a broader range of cancers than CD19 CARs as we employ natural receptors that target multiple ligands, and not just CD 19. Our most advanced CAR technologies use activating receptors of NK cells, which are lymphocytes of the innate immune system that kill diseased cells directly and indirectly, by secreting cytokines that attract other immune cells to assist in the killing process. The receptors of NK cells used in our therapies target the ligands that are activated in cancer cells, but are absent or expressed at very low levels in normal cells.

CAR-TNKR-2

Our leadCAR-TNKR-T cell drug product candidate isCAR-TNKR-2.CAR-TNKR-2 uses the native sequence of NKG2D in the CAR construct. InCAR-TNKR-2, the human natural sequence of NKG2D is expressed outside the T lymphocyte and bound to an intra cellular domain called CD3 Zeta. This intracellular domain is the same as the one used in other CARs and is responsible for the activation of theT-cell once NKG2D recognizes and binds to its target. In addition, the complex NKG2D CD3 Zeta binds to DAP 10 which is aco-stimulatory molecule present onT-cells, which means that the activation triggered by the primary stimulatory chain CD3 Zeta is further strengthened by DAP 10, a secondary orco-stimulatory domain.

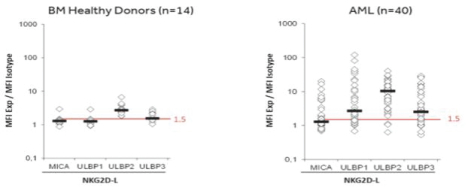

Ligands for the NKG2D receptor are expressed at the surface of cancer cells, allowing for the targeting of multiple tumor types. NKG2D receptor ligands, such asULBP1-6, MICA and MICB, are expressed in numerous solid tumors and blood cancers, including ovarian, bladder, breast, lung and liver cancers, as well as leukemia, lymphoma and myeloma. Within a given cell population, we have observedin vitro effectiveness ofCAR-TNKR-2 even when as few as 7% of the cancer cells expressed a NKG2D receptor ligand.

Preclinical Development

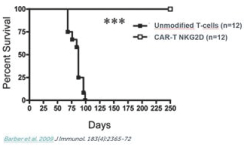

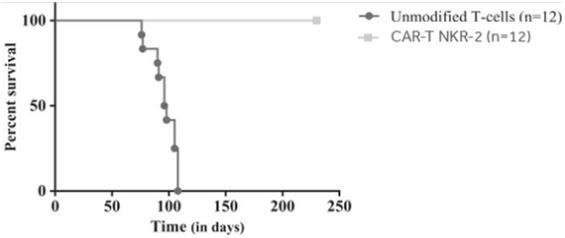

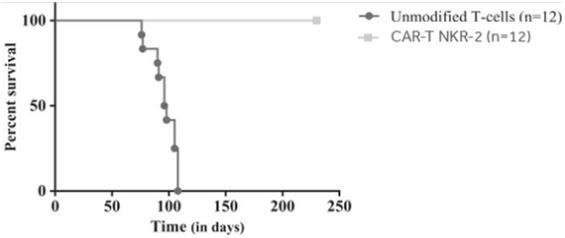

CAR-TNKR-2 has been tested in preclinical models of solid and blood cancers, including lymphoma, ovarian cancer, melanoma and myeloma. In preclinical studies, treatment withCAR-TNKR-2 significantly increased survival. In studies, 100% of treated mice survived through thefollow-up period of the applicable study, which in one study was 325 days. All untreated mice died during thefollow-up period of the applicable study.

In one representative study, as shown in the figure below, the treatment withCAR-TNKR-2 completely prevented tumor development in mice injected with ovarian cancer cells and followed over a period of 225 days. In contrast, all mice injected with ovarian cancer cells that were treated with unmodifiedT-cells developed cancerous tumors and died during that period.

Our leadCAR-TNKR-T cell drug product candidate isCAR-TNKR-2.CAR-TNKR-2 uses the native sequence of NKG2D in the CAR construct. InCAR-TNKR-2, the human natural sequence of NKG2D is expressed outside the T lymphocyte and bound to an intra cellular domain called CD3 Zeta. This intracellular domain is the same as the one used in other CAR and is responsible for the activation of the T cell once NKG2D recognizes and binds to its target. In addition, the complex NKG2D CD3 Zeta binds to DAP 10 which is a co stimulatory molecule present on T cell, which means that the activation triggered by the primary stimulatory chain CD3 Zeta is further strengthened by DAP 10 a secondary or co stimulatory domain.

Ligands for the NKG2D receptor are expressed at the surface of cancer cells, allowing for the targeting of multiple tumor types. NKG2D receptor ligands, such asULBP1-6, MICA and MICB, are expressed in numerous solid tumors and blood cancers, including ovarian, bladder, breast, lung and liver cancers, as well as leukemia, lymphoma and myeloma. Within a given cell population, we have shownin vitro effectiveness ofNKR-2 even when as few as 7% of the cancer cells expressed a NKG2D receptor ligand.

Preclinical Development

CAR-TNKR-2 has been tested in preclinical models of solid and blood cancers, including lymphoma, ovarian cancer, melanoma and myeloma. In preclinical studies, treatment withNKR-2 significantly increased survival. In studies, 100% of treated mice survived through thefollow-up period of the applicable study, which in one study was 325 days. All untreated mice died during thefollow-up period of the applicable study.

In one representative study, as shown in the figure below, the treatment withNKR-2 completely prevented tumor development in mice injected with ovarian cancer cells and followed over a period of 225 days. In contrast, all mice injected with ovarian cancer cells that were treated with unmodifiedT-cells developed cancerous tumors and died during that period.

Our preclinical models have shown that administration ofCAR-TNKR-2 is followed by changes in a tumor’s micro-environment resulting from the local release of chemokines, a family of small cytokines.

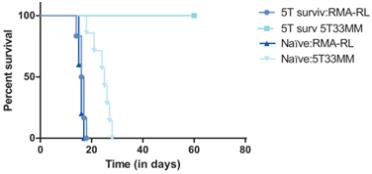

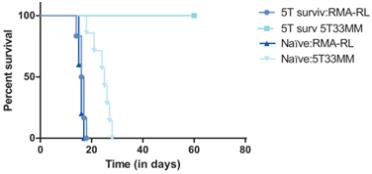

In a preclinical study, mice that had been injected with 5T33MM cancer cells (a myeloma cancer) and treated withCAR-TNKR-2 were rechallenged, either with the 5T33MM cancer cells or a different tumor type (RMA lymphoma cells). The mice that were rechallenged with the same tumor type survived, while the mice that were challenged with a different tumor type died, as shown in the figure below. Of note, at the time of there-challenge of the surviving animals, noCAR-TNKR-2 were detected in the animals, hence the protection against the original tumor is linked to an adaptive immunity mechanism.

We do not believe that this effect has been observed with other CARs.

Moreover, preclinical studies have suggested thatCART-TNKR-2 could potentially have a direct effect on tumor vasculature. Tumor vessels express ligands for the NKG2D receptor that are not generally expressed by normal vessels. We believe that this expression may be linked to genotoxic stress, hypoxia andre-oxygenation in tumors and therefore thatCART-TNKR-2 could potentially inhibit tumor growth by decreasing tumor vasculature, which enhances the activity through a virtuous circle of anoxia of tumor cells and increased ligand expression of tumor cells.

Preclinical studies also suggest thatCART-TNKR-2 is active without lymphodepletion conditioning, which is the destruction of lymphocytes andT-cells, normally by radiation. We believe this absence of apre-conditioning regimen may significantly expand the range of patients eligible for CART-cell treatment, reduce costs, reduce toxicity and thereby improve patient experience and acceptance.

No significant toxicology findings were reported from preclinical multiple-dose studies at dose levels below 107CART-TNKR-2 per animal. Some temporary weight loss was noted in animals treated withCART-TNKR-2 at doses of 2x107 per animal, a dose practically unattainable in human equivalents.

Clinical Development

CM-CS1 Phase 1a trial

On June 9, 2014, we filed an IND with the FDA in order to conduct a clinical trial for ourCAR-TNKR-2 product candidate. This trial was calledCM-CS1. The purpose of the trial was to evaluate the safety and feasibility of administering a single intravenous dose ofCAR-TNKR-2 to patients with AML and MM. The trial was designed to start at low doses in order to evaluate the potential “on target/off tumor” toxicity, meaning the undue targeting of healthy tissues.

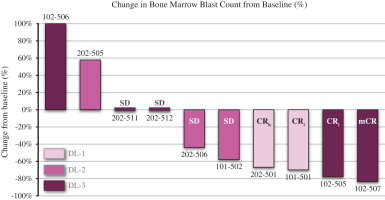

All patients enrolled in theCM-CS1 trial were patients with (i) AML who are not in remission and for which standard therapy options are not available or (ii) relapsed or refractory progressive MM. All patients received a single-dose intravenous administration ofCAR-TNKR-2T-cells without prior lymphodepletion conditioning.CM-CS1 was a dose escalation trial to test four different dose levels. Patients received doses from 1×106 up to 3×107CAR-TNKR-2 in a single intravenous injection. For each dose level, three patients, one with AML, one with MM, and one with either AML or MM, were recruited.

This trial was conducted at the Dana Farber Cancer Institute in the United States. The outcome of the trial was:

• | | Among AML/MDS and MM patients, a single dose ofCAR-TNKR-2 cells without lymphodepletion was feasible and well tolerated without dose limiting toxicities, or DLTs, over a range of 1×106 to 3×107 T cells. |

Cases of unexpected survival and/or improvement in hematologic parameters were noted in both AML and MM patients, some with and some without subsequent therapy.

NKG2DCAR-T-specific activity against autologous tumor-containing cells was observed in vitro in the patients tested.

TheCMCS-1 trial results that were presented at ASH in December 2016 and paved the way for studies of multiple infusions and higher doses ofCAR-TNKR-2 cells, closer to a potential therapeutic range, in numerous malignancies.

THINK Phase 1b Trial

In December 2016, we initiated THINK, a second clinical trial with ourCAR-TNKR-2 product candidate.

THINK (THerapeutic Immunotherapywith NKr-2) is a multinational (EU/US) open-label Phase Ib study to assess the safety and clinical activity of multiple administrations of autologousCAR-TNKR-2 cells in seven cancers, including five solid tumors (colorectal, ovarian, bladder, triple-negative breast and pancreatic cancers) and two hematological tumors (acute myeloid leukemia and multiple myeloma) in patients who did not respond to or relapsed after first line therapies.

The trial will test three dose levels adjusted to body weight: up to 3x108, 1x109 and 3x109CAR-TNKR-2 cells. At each dose, the patients will receive three successive administrations of the specified dose, two weeks apart. The dose escalation part of the study will enroll up to 24 patients while the extension phase is planned to enroll a maximum of 86 additional patients.

Other CART-Cell Development

Additional Autologous Programs

We also have two additional autologousNKR-T cells programs that are in preclinical development. One program involves the use of aNKR-T expressing NKp30, another activated receptor of NK cells.NKR-T cells expressing NKp30 target ligands, which are expressed on many types of cancer cells, including lymphoma, leukemia and gastrointestional stromal tumors. The primary ligand of NKp30 is B7H6. Previous preclinical studies performed at Dartmouth College and reported in the Journal of Immunology in 2012 demonstrated thatNKR-T cells expressing NKp30 were able to kill cancer cells expressing NKp30 ligands both in vitro and in vivo. Another program involves the specific targeting of B7H6 to kill cancer cells that express B7H6. This program is a more canonical CAR using B7H6 as a single chain variable fragement antibody associated with primary CD3 Zeta andco-stimulatory CD 28 domains, and with the lymphodepletion to allow in vivo proliferation. Previous preclinical studies performed at Dartmouth College and reported in the Journal of Immunology in 2015 demonstrated that therapy targeting B7H6 decreased tumor burden of melanoma- and ovarian cancer-bearing mice. We intend to initiate clinical development ofCAR-T B7H6 in Neuroblastoma, a devastating pediatric malignancy, in early 2018.

Allogeneic Platform