UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| ☐ | Registration statement pursuant to section 12(b) or 12(g) of the Securities Exchange Act of 1934 |

or

| ☐ | Transition report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period fromto

or

| ☒ | Annual report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended March 31, 20172023

or

| ☐ | Shell company report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 |

Date of event requiring this shell company report

Commission file number 001-37909

Azure Power Global Limited

(Exact name of Registrant as specified in its charter)

Mauritius

(Jurisdiction of Incorporation or Organization)

8 Local Shopping Complexth Floor, Tower A, DLF Infinity, Cyber City, Phase II, Gurugram-122002, Haryana, India

Pushp Vihar, Madangir, New Delhi 110062, India

Telephone: (91-11) 49409800+91-124 4155755

(Address and Telephone Number of Principal Executive Offices)

Inderpreet Singh Wadhwa

Sunil Gupta, Chief Executive Officer

8 Local Shopping Complexth Floor, Tower A, DLF Infinity, Cyber City, Phase II, Gurugram-122002, Haryana, India

Pushp Vihar, Madangir, New Delhi 110062, India

Telephone: (91-11) 49409800+91-124 4155755, e-mail: sunil.gupta@azurepower.com

Sugata Sircar, Chief Financial Officer

8th Floor, Tower A, DLF Infinity, Cyber City, Phase II, Gurugram-122002, Haryana, India

Telephone: +91-124 4155755, e-mail: sugata.sircar@azurepower.com

(Name, Telephone, E-mailemail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

Equity Shares, par value US$0.000625

per share | | AZRE(1) | | New York Stock Exchange |

(Title of Class) | | (Name of Exchange On Which Registered)(1) |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

As of March 31, 2017, 25,915,9562023, 64,166,360 equity shares, par value US$0.000625 per share, were issued and outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this annual report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒(1)

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that are required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒☐ No ☐☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒☐ No ☐☒

Indicate by check mark whether the registrant is a large, accelerated filer, an accelerated filer or an emerging growth company. See the definitions of “large, accelerated filer”, “accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | |

| Large, accelerated filer ☐ | | Accelerated filer ☐☒ | | Non-accelerated filer ☒ | ☐ | | Emerging Growth Company | ☒ ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

U.S. GAAP ☒ | | International Financial Reporting Standards as issued

by the International Accounting Standards Board ☐ | | Other ☐ |

If “Other” has been checked in the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes ☐ No ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court: Yes ☐ No ☐

| (1) | During the fiscal year ended March 31, 2023 to which this annual report relates, Azure Power Global Limited had its equity shares registered under Section 12(b) of the Securities Exchange Act of 1934. As of the date of filing, due to the delisting of its equity shares from the New York Stock Exchange, Azure Power Global Limited no longer has securities registered under Section 12(b) of the Securities Exchange Act of 1934 and instead is required to file reports pursuant to Section 15(d) of the Securities Exchange Act of 1934. |

Table of Contents

FORM 20-F CROSS-REFERENCE GUIDE

| Item # | Form 20-F caption | Location in this Report | Page |

| Conventions used in the Annual report | Conventions used in this Annual Report | v, vi |

| Special note regarding FORWARD-LOOKING INFORMATION | Forward-Looking Statements | vii |

| 1 | Identity of directors, senior management and advisers | Not applicable | - |

| 2 | Offer statistics and expected timetable | Not applicable | - |

| 3 | Key information | | |

49 | 3A. [Reserved] | | - |

| 3B. Capitalization and Indebtedness | Not applicable | - |

| 3C. Reasons for the Offer and Use of Proceeds | Not applicable | - |

| 3D. Risk Factors | Risk Factors | 65 |

| 4 | Information on the Company | | |

| 4A. History and Development of the Company | Business Overview, Company Overview | 1, 6 |

ITEM 6. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

| 4B. Business Overview | Business Overview, Company Overview, Industry Overview | 1, 6, 9 |

| 4C. Organizational Structure | Company Overview | 6 |

| 4D. Property, Plants and Equipment | Overview | 21 |

| 4A | Unresolved staff comments | Unresolved SEC Staff comments | 101 |

| 5 | Operating and financial review and prospects | | |

80 | 5A. Operating Results | Results of Operations | 38 |

| 5B. Liquidity and Capital Resources | Liquidity and Capital Resources | 43 |

| 5C. Research and Development, Patents and Licenses, etc. | Not applicable | - |

| 5D. Trend Information | Trend Information | 42 |

| 5E. Critical Accounting Estimates | Critical Accounting Policies and Estimates | 50 |

| 6 | Directors, senior management and employees | | |

| 6A. Directors and Senior Management | Management | 52 |

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

| 6B. Compensation | Management Compensation | 58 |

| 6C. Board Practices | Board Practices, Board Committees | 57, 60 |

| 6D. Employees | Employees | 63 |

| 6E. Share Ownership | Major Shareholders | 51 |

| 7 | Major shareholders and related party transactions | | |

92 | 7A. Major Shareholders | Major Shareholders | 51 |

| 7B. Related Party Transactions | Related Party Transactions | 51 |

| 7C. Interest of Experts and Counsel | Not applicable | - |

| 8 | Financial information | | |

| 8A. Consolidated Statements and Other Financial Information | Financial statements, Legal Proceedings, Distribution | F-1, 52, 91 |

ITEM 8. FINANCIAL INFORMATION

| 8B. Significant Changes | Significant Changes | 52 |

| 9 | The offer and listing | | |

94 | 9A. Offer and Listing Details | Trading Markets | 52 |

| 9B. Plan of Distribution | Not applicable | - |

| 9C. Markets | Trading Markets | 52 |

| 9D. Selling Shareholders | Not applicable | - |

| 9E. Dilution | Not applicable | - |

| 9F. Expenses of the Issue | Not applicable | - |

| 10 | Additional information | | |

| 10A. Share Capital | Bylaws | 94 |

ITEM 9. THE OFFER AND LISTING

| 10B. Memorandum and Articles of Association | Bylaws | 94 |

| 10C. Material Contracts | Material Contracts | 94 |

| 10D. Exchange Controls | Exchange Controls and Other Limitations Affecting Security Holders | 95 |

| 10E. Taxation | Taxation | 95 |

| 10F. Dividends and Paying Agents | Not applicable | - |

| 10G. Statements by Experts | Not applicable | - |

| 10H. Documents on Display | Information Filed with Securities Regulators | 101 |

| 10I. Subsidiary Information | Not applicable | - |

| 11 | Quantitative and qualitative disclosures about market risk | | | 95 | |

| |

ITEM 10. ADDITIONAL INFORMATION

| | 11a. Quantitative information about market risk | 96Quantitative and Qualitative information about market risk | |

| |

ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

| | | 104 | |

| |

ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES

| | | 105 | |

| |

ITEM 13. DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES

| | | 106 | |

| |

ITEM 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS

| | | 106 | |

| |

ITEM 15. CONTROLS AND PROCEDURES

| | | 106 | |

| |

ITEM 16A. AUDIT COMMITTEE FINANCIAL EXPERT

| | | 107 | |

| |

ITEM 16B. CODE OF ETHICS

| | | 107 | |

| |

ITEM 16C. PRINCIPAL ACCOUNTANT FEES AND SERVICES

| | | 107 | |

| |

ITEM 16D. EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES

| | | 107 | |

| |

ITEM 16E. PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS

| | | 107 | |

| |

ITEM 16F. CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT

| | | 107 | |

| |

ITEM 16G. CORPORATE GOVERNANCE

| | | 108 | |

| |

ITEM 16H. MINE SAFETY DISCLOSURE

| | | 108 | |

| |

ITEM 17. FINANCIAL STATEMENTS

| | | 109 | |

| |

ITEM 18. FINANCIAL STATEMENTS

| | | 109 | |

| |

ITEM 19. EXHIBITS

| | | 109 | 98 |

| Item # | Form 20-F caption | Location in this Report | Page |

| | 11b. Qualitative information about market risk | Quantitative and Qualitative information about market risk | 98 |

| | 11c. Interim Period | Not applicable | - |

| 12 | Description of securities other than equity securities | | |

| | 12A. Debt Securities | Not applicable | - |

| | 12B. Warrants and Rights | Not applicable | - |

| | 12C. Other Securities | Not applicable | - |

| | 12D. American Depositary Shares | Not applicable | - |

| 13 | Defaults, dividend arrearages and delinquencies | Liquidity and Capital Resources | 43 |

| 14 | Material modifications to the right of security holders and use of proceeds | Material Modifications to the Rights of Security Holders and Use of Proceeds | 52 |

| 15 | Control and procedures | | |

| | 15a. Disclosure Controls and Procedures | Controls and Procedures | 99 |

| | 15b. Management’s Report on Internal Control over Financial Reporting | Controls and Procedures | 99 |

| | 15c. Attestation Report of the Registered Public Accounting Firm | Controls and Procedures | 99 |

| | 15d. Changes in Internal Control over Financial Reporting | Controls and Procedures | 99 |

| 16 | [Reserved] | | |

| 16A | Audit committee financial expert | Board Committees | 60 |

| 16B | Code of ethics | Whistle-Blower Policy | 100 |

| 16C | Principal accountant fees and services | Principal accountant fees and services | 101 |

| 16D | Exemptions from the listing standards for audit committees | Board Committees; Corporate Governance | 60, 100 |

| 16E | Purchase of equity securities by the issuer and affiliated purchasers | Not applicable | - |

| 16F | Change in registrant’s certifying accountant | Principal Accountant Fees and Services | 101 |

| 16G | Corporate Governance | Corporate Governance | 100 |

| 16H | Mine safety disclosure | Not applicable | - |

| 16I | Disclosures Regarding Foreign Jurisdictions that Prevent Inspections | Not applicable | - |

| 17 | Financial statements | Not applicable | - |

| 18 | Financial statements | Financial statements | F-1 |

| 19 | Exhibits | Exhibits | 102 |

CONVENTIONS USED IN THIS ANNUAL REPORT

Except where the context requires otherwise and for purposes of this annual report only:

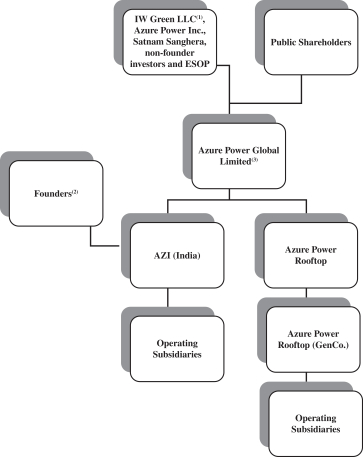

“We,” “us,” the “Company,” the “group,” “Azure” or “our” refers to Azure Power Global Limited, together with its subsidiaries (including Azure Power India Private Limited, or AZI, its predecessor and current subsidiary).

“Our holding company” refers to Azure Power Global Limited on a standalone basis.

| “Our Company”, “the Company”, “APGL”, or “Azure Power” refers to Azure Power Global Limited on a standalone basis |

| “We”, “us”, “the Group”, “Azure” or “our” refers to Azure Power Global Limited, a company organized under the laws of Mauritius, together with its subsidiaries (including Azure Power Rooftop Private Limited (“AZR”), and Azure Power India Private Limited, or APIPL, its predecessor and current subsidiaries) |

| “APERC” refers to Andhra Pradesh Electricity Regulatory Commission |

| “APTEL” refers to Appellate Tribunal for Electricity |

| “Awarded” refers to the capacity won and for which LoA has been received |

| “APIPL” a company organized under the laws of India, refers to Azure Power India Private Limited |

| “CAGR” refers to compounded annual growth rate |

| “CDPQ” refers to Caisse de dépôt et placement du Québec |

| “CDPQ Infrastructures” refers to CDPQ Infrastructures Asia Pte Ltd. |

| “CEA” refers to Central Electricity Authority |

| “CEO” refers to Chief Executive Officer |

| “CERC” refers to the Central Electricity Regulatory Commission of India, the state level counterparts of which are referred to as “State Electricity Regulatory Commission”, or “SERC” |

| “CFO” refers to Chief Financial Officer |

| “Contracted” refers to capacity won and for which a PPA has been signed with off taker |

| “COO” refers to Chief Operating Officer |

| “COVID-19” refers to novel coronavirus disease of 2019 |

| “CPSU” refers to Central Public Sector Undertaking |

| “CSR” refers to Corporate Social Responsibility |

| “CTU” refers to Central Transmission Utility |

| “Discom” refers to Distribution Company |

| “EPC” refers to Engineering, Procurement and Construction |

| “ERM” refers to Enterprise Risk Management |

| “ESG” refers to Environmental, Social and Governance |

| “FDI” refers to Foreign Direct Investment |

| “GBC” refers to Global Business Company |

| “GDP” refers to Gross Domestic Product |

| “GH/GA” refers to Green Hydrogen/ Green Ammonia |

| “GIB” refers to Great Indian Bustard |

| “GoI” refers to Government of India |

| “GST” refers to Goods and Service Tax |

| “GW” refers to Gigawatt |

| “INR”, “rupees”, or “Indian rupees” refers to the legal currency of India |

| “ISTS” refers to Inter State Transmission System |

| “KERC” refers to Karnataka Electricity Regulatory Commission |

| “LoA” refers to Letter of Award |

| “MNRE” refers to Ministry of New and Renewable Energy, Government of India. |

| “MoP” refers to Ministry of Power, Government of India |

| “MSEDCL” refers to Maharashtra State Electricity Distribution Co. Limited |

| “MMT” refers to million metric tonnes |

| “MW” refers to Megawatt |

| “NAPCC” refers to National Action Plan on Climate Change |

| “NSM” refers to the Jawaharlal Nehru National Solar Mission. |

| “NYSE” refers to New York Stock Exchange |

| “O&M” refers to Operation and Maintenance |

| “OMERS” refers to OMERS Infrastructure Asia Holdings Pte. Ltd. |

| “PFIC” refers to Passive Foreign Investment Company |

| “PIL” refers to Public Interest Litigation |

| “PLI” refers to Production Linked Incentive |

| “PPA” refers to Power Purchase Agreement |

| “PV” refers to Photovoltaic |

| “Radiance” refers to Radiance Renewables Private Limited |

| “RBI” refers to Reserve Bank of India |

| “RPO” refers to Renewable Purchase Obligation |

| “SEC” refers to the U.S. Securities and Exchange Commission |

| “SECI” refers to Solar Energy Corporation of India |

| “U.S. GAAP” refers to the Generally Accepted Accounting Principles in the United States |

| “US$”, “$” or “U.S. dollars” refers to the legal currency of the United States |

| “VGF” refers to Viability Gap Funding |

“U.S. GAAP” refers to the Generally Accepted Accounting Principles in the United States.

“US$” or “U.S. dollars” refers to the legal currency of the United States.

“INR,” “rupees,” or “Indian rupees” refers to the legal currency of India.

In this annual report, references to “U.S.” or the “United States” are to the United States of America, its territories and its possessions.possessions, any State of the United States and the District of Columbia. References to “India” are to the Republic of India.India, its territories and its possessions. References to “Mauritius” are to the Republic of Mauritius.

Unless otherwise indicated, the consolidated financial statements and related notes included in this annual report have been presented in Indian rupees and prepared in accordance with U.S. GAAP. References to a particular “Fiscal”, “fiscal” year, “fiscal year” or “FY” are to our fiscal year ended March 31 of that year, which is typical in our industry and in the jurisdictions in which we operate.

This annual report contains translations of certain Indian rupee amounts into U.S. dollars at specified rates solely for the convenience of the reader. Unless otherwise stated, the translation of Indian rupees into U.S. dollars has been made at INR 64.8582.19 to US$1.00, which is the noon buying rate in New York City for cable transfer in non-U.S. currencies as certified for customs purposes by the Federal Reserve Bank of New York on March 31, 2017, which is the date of our last reported financial statements.2023. We make no representation that the Indian rupee or U.S. dollar amounts referred to in this annual report could have been converted into U.S. dollars or Indian rupees, as the case may be, at any particular rate or at all.

As used in this annual report, all references to watts (e.g., megawatts, gigawatts, kilowatt hour, terawatt hour, MW, GW, kWh, etc.) refer to measurements of power generated.

The information in this annual report gives effect to a 16-for-1 stock split of our equity shares that was effective on October 6, 2016.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Forward-Looking Statements

This annual report contains forward looking statements about our current expectations and views of future events. All statements, other than statements of historical facts, contained in this annual report, including statements about our strategy, future operations, future financial position, future revenues, projected costs, prospects, plans and future megawatt goals of management, are forward looking statements. These statements relate to events that involve known and unknown risks, uncertainties and other factors, including those listed under “Item 3. Key Information — D. Risk“Risk Factors,” which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward lookingforward-looking statements. In some cases, these forward lookingforward-looking statements can be identified by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,” “is/are likely to” or other similar expressions.

These forward lookingforward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward lookingforward-looking statements reflect our current views about future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward lookingforward-looking statements because of a number of factors, including, without limitation, the risk factors set forth in “Item 3. Key Information — D. Risk“Risk Factors” and the following:

the pace of government sponsored auctions;

changes in auction rules;

| ● | the pace of government sponsored auctions and changes in auction rules; |

the government’s willingness to enforce Renewable Purchase Obligations, or RPOs;

| ● | availability of land for projects and transmission capacity installed for evacuation of power generated; |

permitting, development and construction of our project pipeline according to schedule;

| ● | permitting, development and construction of our project pipeline according to schedule; |

solar radiation

| ● | solar irradiation and wind availability in the regions in which we operate; |

| ● | adverse change in laws and regulations related to environmental, health and safety; |

| ● | developments in, or changes to, laws, regulations, governmental policies, incentives, and taxation affecting our operations; |

| ● | our ability to successfully implement any of our business strategies, including acquiring other companies and sale of our assets; |

| ● | our ability to enter into Power Purchase Agreements (“PPAs”), on acceptable terms, the occurrence of any event that may expose us to certain risks under our PPAs and the willingness and ability of counterparties to our PPAs to fulfil their obligations; |

| ● | solar power curtailments by state electricity authorities; |

| ● | material changes in the costs and availability of solar panels, raw materials, capital equipment’s and other equipment and manpower required for our operations; |

| ● | the impact of the recent delisting of our Company’s shares from the NYSE; |

| ● | the impact of fraud or other misconduct (including bribery) by our directors, officers and employees and former directors, officers and employees; and |

| ● | other risks and uncertainties, including those listed under the caption “Risk Factors.” |

We caution you that forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Actual results may differ materially from those in forward-looking statements as a result of various factors. These risks and uncertainties include factors relating to (i) economic, political and social issues in the country in which we operate;

developments in, or changes to, laws, regulations, governmental policies, incentives and taxation affecting our operations;

adverse changes or developments inoperate, (ii) the industry in which we operate;

our ability to maintain and enhance our market position;

our ability to successfully implement any of our business strategies, including acquiring other companies;

our ability to enter into power purchasing agreements, or PPAs, on acceptable terms, the occurrence of any event that may expose us to certain risks under our PPAs and the willingness and ability of counterparties to our PPAs to fulfill their obligations;

our ability to borrow additional funds and access capital markets,domestic as well as

our substantial indebtednessglobal economy, (iii) financial and

capital markets, (iv) Indian government policies and regulation on renewable energy, (v) tax related laws in the

possibility that we may incur additional indebtedness going forward;US, Mauritius and India, and (vi) degree of competition in the renewable energy market in India.

For additional information on risk factors that could cause our abilityactual results to establish and operate new solar projects;

our ability to compete against traditional and renewable energy companies;

the loss of one or more members of our senior management or key employees;

political and economic conditionsdiffer from expectations reflected in India;

material changes in the costs of solar panels and other equipment required for our operations;

fluctuations in inflation, interest rates and exchange rates;

other risks and uncertainties, including those listed under the caption “Item 3. Key Information — D. Risk Factors.”

The forwardforward- looking statements, made in this annual report relatesee “Risk Factors”. Forward-looking statements speak only to events or information as of the date on which the statementsthey are made, in this annual report. Except as required by law,and we do not undertake noany obligation to update or revise publicly any forward looking statements, whether as a resultthem in light of new information or future eventsdevelopments. All forward-looking statements attributed to us or otherwise, after the datea person acting on which the statementsour behalf are made or to reflect the occurrence of unanticipated events.expressly qualified in their entirety by this cautionary statement, and you should not place undue reliance on any forward-looking statement. You should read this annual report, the exhibits hereto and theother documents that we reference in this annual report and have filed as exhibits with the SEC of which this annual report is a part, completely and with the understanding that our actual future results or performance may be materially different from what we expect.

I. BUSINESS, COMPANY & INDUSTRY OVERVIEW

A. Business Overview

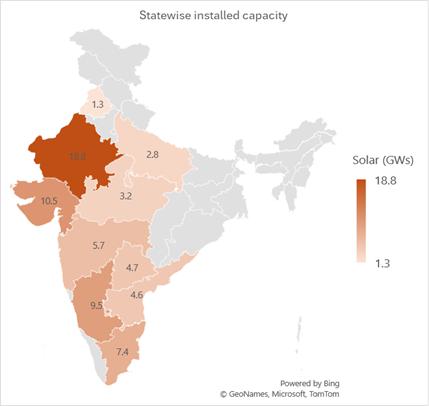

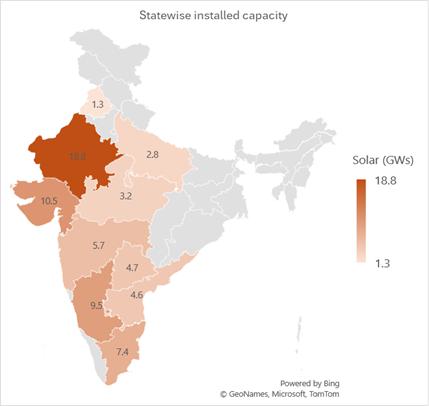

Azure is one of India’s leading utility scale renewable energy project developers and operators. We build, own, and operate large grid-scale renewable energy projects across India that supply clean energy to India’s power grid. We developed India’s first utility-scale solar power project in 2009 and have since then grown to achieve substantial scale in the Indian renewable industry. Our Operational, Contracted and Awarded capacity now stands at 4,278 MW (excluding 3,033 MW for which we will not continue with construction, see “– Project Pipeline”) including 86.5 MW of rooftop capacity and Contracted and Awarded capacity of 1,237 MW. We have a total operating capacity of 3,041 MW including rooftop capacity. Our operational power plants are spread over 12 Indian states. Out of total operational capacity, 90% of our plants are in high irradiation zones like Rajasthan, Gujarat, Maharashtra and Andhra Pradesh. Below are outlines of our utility scale operational portfolio.

We sell renewable power under long term PPAs, typically 25 years in duration, at a fixed tariff. The strength of our off take customers is fundamental to our business and more than 62% of our PPAs (operational capacity) are signed with top rated central government owned intermediaries such as SECI and NTPC, providing predictable and consistent revenues and cash flows. Further, according to a report published by MoP in April 2023, among the state government owned Discoms that we have large capacities contracted with, Gujarat is rated A+, Punjab & Assam are A rated, while the three Discoms of Karnataka (CESCOM, GESCOM and HESCOM) are B rated, and Maharashtra Discom is rated B-. Our counterparty exposure for the commissioned capacity is set out below:

During FY 2023, we generated 5,854 million units of clean and green electricity for the Indian power grid. Our goal is to remain a leader in the renewable energy market in India. All our operating assets are currently solar. We intend to explore adding wind, hybrid and storage assets over time, to complement our solar generation capacity.

Our Competitive Advantage

We believe that Azure has developed durable competitive advantages from a range of factors, including:

| (i) | Pioneer: Being a leader in renewable energy industry is fundamental to Azure. We have been early adopters of proven technologies, such as bi-facial modules, trackers, and robotic dry cleaning. Our track record in project financing and refinancing includes the issue of Green Bonds at the lowest rates in India’s renewable industry. |

| (ii) | Strong customer portfolio: More than 62% of our signed PPAs (operational capacity) are with central government owned intermediaries like SECI and NTPC. This means that our off take profile is strong with an industry leading portfolio receivable cycle and the least possible disruptions to revenue collections. |

| (iii) | Focus on efficiency and productivity: All our plants are connected to a Centralized Monitoring System which record and monitor our plant performance on real time basis and maintenance data on a daily, weekly and monthly basis. Being an early mover in the Indian solar industry we have inhouse expertise to manage substations from small to large voltage of up to 400kV, which is the second highest voltage level available in India. |

| (iv) | Access to capital: Capital is one of the most important resources in our business, and we believe that strong backing from our large shareholders is a critical advantage. This strong sponsorship and our solid track record supports us in the credit markets, demonstrated by the access to project and corporate debt in general and specifically in the refinancing of our first Green Bond in FY 2022. Refer to “Risk Factors ̶ Any downgrade of our credit rating may result in increase in interest cost or may trigger covenant defaults under our loan agreements” and “Certain Factors affecting our Results” for further discussion of rating updates. |

| (v) | Focus on ESG standards: At Azure, our efforts are focused on integrating sustainability with our business strategy and day to day operation of the company. A framework has been developed to link the executive compensation to its ESG performance by developing an organizational level scorecard. ESG risks have been integrated into our enterprise risk management (“ERM”) framework and we are a signatory to the United Nations Global Compact’s Ten Principles. As a pivotal partner in India’s transition to clean journey, we are taking measures to monitor and improve our environmental performance rolling out initiatives like deployment of robotic cleaning to reduce our dependence on ground water, planting trees across sites to enhance our natural capital and tracking and reducing our greenhouse gas emissions. We have institutionalized an EV Policy to replace our fossil-based vehicles to EVs in an effort to reduce its dependence on fossil fuel. We have committed to enhance natural capital by planting 50 trees per MW for projects that we install in future. We are ISO 140001 (Env.) and 45001 (Safety) certified. We are strictly governed by key policies including our anti-bribery and corruption policy, whistle blower policy, code of business conduct and ethics and corporate social responsibility. In October 2022, we won the prestigious Golden Peacock Award for Sustainability for 2022. |

| (vi) | Innovation: We have adopted world class technology and systems to deliver sustainable value in our business. To study new technologies and the interplay between various elements of renewable power generation, we setup a test laboratory in the state of Rajasthan in 2021. This facility is aimed at improving construction processes and testing new technologies before they are mainstreamed in our projects. We have developed design and execution technologies for module mounting structure and electrical connections to suit projects located even in challenging environments. Technologies recently deployed at scale include automated robotic cleaning at different sites, use of drone for predictive and rapid maintenance identification and improving revenue by reducing electrical mismatch and import energy. |

Our Business Strategy

India is our focus market which has emerged as the third largest producer and consumer of electricity in the world. It is a global pacesetter in terms of renewable energy capacity additions and is on track to become one of the world’s largest markets for clean energy technologies. In 2023 alone, various central and state government agencies and distribution companies in India auctioned 22.9 GW of renewable energy capacity. India has set ambitious climate change and energy transition targets, including Net-Zero carbon emissions by 2070, growth of non-fossil fuel energy capacity to 500 GW by 2030 and to achieve energy independence by 2047. The Government of India’s (“GoI”) support for the sector, macro factors such as increased electrification and rapid urbanization are expected to result in India representing a significant share in the global renewable energy market across technologies like solar and wind. For more information, see “– Industry Overview”.

We believe we are well positioned to benefit from the expanding renewable energy market in India. We expect to continue to invest in the capabilities that we believe give us an edge in an increasingly competitive market. These include:

| ● | in-house expertise in competitive bidding, design, construction, and operation of renewable energy assets to world class standards of quality and cost; |

| ● | deep engagement in the evolving Indian renewable energy ecosystem with policy makers, regulators and customers at central and state levels; |

| ● | leadership in raising and deploying both equity and debt capital, including project and climate financing; |

| ● | insight into and early deployment of evolving technologies, including construction techniques, and digital and automated optimization and grid interface; and |

| ● | strong and effective governance including corporate responsibility and community engagement. |

Our strategic priorities are:

| ● | to execute our pipeline while managing risk and delivering targeted investment returns; |

| ● | to bid for and win renewable energy auctions in India focused on solar, wind, storage, and their hybrid solutions with a bidding strategy that conforms to our risk-return profile; |

| ● | to maintain world class standards of safety, reliability and efficiency at our plants using leading digital and automated tools; |

| ● | to build capabilities to address a more demanding utility grid environment led by higher renewable energy penetration. in addition to existing solar capabilities, we plan to increase our non-solar generation, especially wind and storage; and |

| ● | to develop business beyond the core utility business by partnering with large energy users for their requirements by providing reliable renewable energy. |

To execute our pipeline of projects

Delivering on our pipeline in a timely and efficient manner – within acceptable risk and return parameters – is one of our key strategic priorities. We have signed PPAs for approximately 270 MW of our pipeline not including 3,033 MW for which we will not continue with construction, see “– Project Pipeline” and have signed Letters of Awards (“LoAs”) for another 967 MW. Whilst most of the pipeline is in solar, we have started early-stage development on wind projects and wind solar hybrid projects. We continue to identify project sites with good renewable energy resource potential, connectivity to the grid, and favourable on-ground working ecosystem.

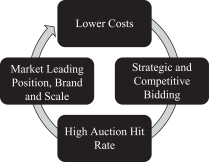

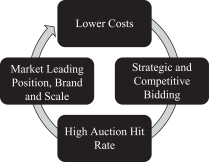

Bid for and win renewable energy auctions in India in line with our risk and return profile

The ambitious targets set by the GoI, combined with climate change commitments being announced by Indian corporates, are expected to substantially increase the demand for clean energy. India offers tremendous potential in solar and wind power, which should be the fastest growing sources of energy in the next decade and beyond. We will continue to bid in a disciplined manner to win projects at an acceptable rate of return and include PPAs with high grade off take. The PPAs signed by us are typically for 25 years duration and considering the long tenor of these contracts, it’s important to ensure that the counterparties to such agreements are organizations with robust business model and strong operational cashflows to service their PPA obligations. Based on the above, Azure only selects bidding opportunities that it believes minimize the risks, ensure bankability of our projects, and have a high probability of generating the expected cash-flows.

Maintain world class standards of safety, reliability and efficiency at our plants including using digital and automated tools

We are a fully integrated renewable energy company undertaking development, construction, ownership, operation and maintenance of renewable energy plants. New technologies, including digital and automation, will help optimize output and reduce cost, while better serving the grid requirement for firmer and more predictable power. We have rolled out multiple initiatives aimed at enhancing safety, efficiency and process improvements which include advanced automated robotic cleaning technologies for photovoltaic modules, drones for monitoring, centralized digital platform for asset performance monitoring, predictive analytics etc. We will continue to deploy technologies and innovations that help us deliver world class operating performance and simultaneously optimize the asset life.

Build capabilities in non-solar generation especially in wind, and in storage, to address a more demanding utility grid environment

As the share of renewable energy increases in the energy mix, the challenges to integrate Renewable Energy in the grid will increase due to their variable nature of generation. We expect that there will be an increasing focus to improve power system flexibility and reduce the intermittency associated with renewable power. The Indian wind energy profile complements India’s solar generation profile. Thus, we expect that wind energy, solar-wind hybrids and energy storage solutions will be increasingly deployed for a predictable and flatter renewable energy generation profile and grid stability. On similar lines, we expect that utility customers will increase their share of renewable energy consumption but will increasingly demand more predictable and continuous power. This annual reportwill require integration of solar, wind and storage technologies. In line with the evolving requirements of the market, we will continue to strengthen our capability to deliver firm and dispatchable renewable power to our customers by leveraging solar, wind and storage technologies.

Develop business beyond the core utility business by partnering with large energy users for their requirements for reliable green energy

With an increasing focus on decarbonization and sustainability, there is a significant and growing demand for renewable energy from commercial and industrial customers. We aim to partner with large energy consumers across segments to meet their requirements for reliable and affordable green energy. We will look for opportunities to replace their brown energy consumption with green power through various techno-commercial offerings tailored to specific customer needs. Such displacement would target not only the power requirements of our partners but also contains statistical datathe grey fuel usage for various heating, cooling and estimates,other process driven energy requirements.

We will continue to evaluate new technologies such as Green Hydrogen which present an opportunity to implement large scale renewable energy projects in a sustainable manner. We intend to identify such opportunities which integrate with our business strategy, add value to our existing portfolio and would leverage our core strength of building efficient renewable energy projects.

Project Pipeline

A major part of our project pipeline consisted of 4,000 MW allocated by SECI under their manufacturing linked tender, that we won in December 2019 and upsized in July 2020 to reflect the green-shoe. We had executed PPAs with SECI for aggregate capacity of 3,033 MW under the manufacturing linked tender, and PPAs for the balance capacity of 967 MW can be signed only after SECI has the power supply agreements for these remaining MW in place.

We are conducting an ongoing review of our projects under contract to consider their commercial and economic viability. In addition, a Special Committee of the Board (the “Special Committee”) was convened in August 2022 to review certain material projects and contracts over a three-year period for anti-corruption and related compliance issues. See “Risk Factors - We have conducted investigations into whistle-blower claims and other allegations against persons who served as our directors, officers and employees. We reported the allegations and our findings to the SEC and the U.S. Department of Justice and continue to cooperate with these authorities.”

Pursuant to the manufacturing linked tender award of 4,000 MW, the Group executed PPAs for a capacity of 2,333 MW with SECI, for which SECI executed a Power Sale Agreement (“PSA”) with the state of Andhra Pradesh during Fiscal 2022. In respect of these 2,333 MW projects, two PILs were filed in the High Court of Andhra Pradesh in Fiscal 2022, challenging various aspects of the manufacturing linked tender and seeking to quash the Andhra Pradesh Regulator’s approval for procurement of capacity tied up by Andhra Pradesh Discoms with SECI pursuant to the tender. The tariff adoption for the capacities by the CERC is subject to the outcome of the PILs. We are not a party to the PILs, and the PILs currently are pending adjudication. Currently, we cannot predict the outcome of these two PILs.

Based on the economics and uncertainties associated with the PILs and ongoing Special Committee review, the Group concluded that it should seek to terminate the PPAs in respect of these 2,333 MW projects and filed a petition at the Andhra Pradesh High Court seeking a declaration that the Group should be discharged from performance of the obligations under the Andhra Pradesh PPAs for a capacity of 2,333 MW as a result of the absence of the unconditional tariff adoption order from the regulatory commission. Since there was a threat by SECI to revoke the Bank Guarantee of US$14.2 million, the High Court in its order dated October 16, 2023, directed SECI not to take coercive steps against the Group until the next date of hearing. This matter is pending.

On March 18, 2024, we received two letters from SECI. In its first letter, SECI stated that it had terminated the PPAs with the Group in respect of the 2,333 MW projects and reserved its rights to take action against the Group including thoseforfeiture of the performance bank guarantees and success charges and fees in respect of the PPAs and other documentation associated with the 2,333 MW projects. In its second letter, SECI informed the Group that it was awarding the 2,333 MW projects and associated PPAs to a third-party. Further, SECI informed the Group that it had reduced Azure’s capacity allocation under the manufacturing Letter of Award by 2,333MW and its corresponding manufacturing capacity of solar cells and solar modules by 583 MW. Accordingly, the Group has taken a write-off of INR 254 million (US$ 3.1 million) towards irrecoverable costs and a provision of INR 1,223 million (US$14.9 million) towards Bank Guarantees in its consolidated financial statements for Fiscal 2023.

In light of the ongoing Special Committee review as well as economic and execution challenges, the Group also has decided to withdraw from the 700 MW projects which is part of the 4,000 MW manufacturing linked tender awarded by SECI in Fiscal 2020. The Group intends to commence discussions with SECI to ensure an orderly withdrawal from the 700 MW projects and from the obligations of the Group and its subsidiaries under the PPA, Performance Bank Guarantees and other guarantees relating to the solar industry and our competition from market research, analyst reports and other publicly available sources. These publications include forward looking statements being made byprojects. Accordingly, the authorsGroup has recognized a provision of such reports. These forward looking statements are subject to a number of risks, uncertainties and assumptions. Actual results could differ materially and adversely from those anticipated or impliedINR 1,053 million (US$ 12.8 million) in the forward looking statements.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable

ITEM 3. KEY INFORMATION

A. Selected Financial Data

The following selected consolidated statement of operations data for the fiscal years ended March 31, 2015, 2016 and 2017 and the selected consolidated balance sheet data as of March 31, 2016 and 2017, have been derived from our auditedits consolidated financial statements included elsewherefor Fiscal 2023 towards irrecoverable costs and Bank Guarantee in relation to the 700 MW projects.

In FY 2023, we also executed PPAs with SECI for our first 150 MW solar-wind hybrid project, and for our first wind project of 120 MW. The presently estimated scheduled commissioning timelines for these projects are May 2025 (for the 120 MW wind project), and November 2025 (for the 150 MW solar-wind hybrid project). These timelines are estimated based on anticipated dates of regulatory approvals (in case of the 120 MW wind project), and anticipated completion dates of the requisite elements of the grid’s transmission/evacuation system (in case of the 150 MW hybrid project).

In case of the 120 MW Wind Project, the tariff has only recently been adopted by CERC (in March 2024), after a delay of more than 16 months. The approval for power procurement by one of the buying state’s (procuring 45 MW out of the 120 MW contracted capacity) regulatory commission – is still awaited. Because of the inordinate delay in getting these regulatory approvals (which is a Condition Precedent to be fulfilled by SECI and/ or the buying utility under the PPA), this annual report. Selected consolidated balance sheet datatariff is no longer market competitive. Owing to this delay, and a few deviations in the PPA (from the standard bidding guidelines), we have written to SECI to withdraw their tariff adoption petition filed at CERC, and made a submission to the same effect at CERC as of March 31, 2015well. Now that the said tariff has been derived fromadopted at CERC, we are in the process of evaluating the same, and deciding further course of action.

Project Implementation

We have inhouse design, engineering, project execution, operations and maintenance capabilities. We remain one of the pioneers in executing and delivering renewable projects in India, demonstrated by our audited consolidated financial statements not includedearly adoption of proven technologies like bi-facial modules, trackers, and robotic dry cleaning. We aim to operate our plants to world-class standards of safety, reliability and efficiency using leading digital and automated tools with predictive and rapid response abilities.

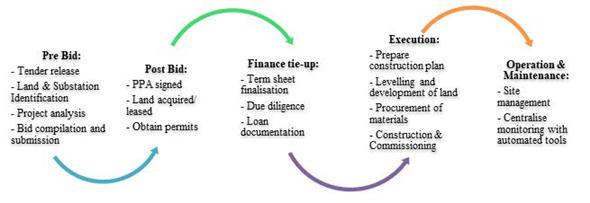

Many of our projects are in this annual report. Our consolidated financial statements are prepared and presented in accordancezones with US GAAP. Our historical results do not necessarily indicatehigh irradiation and/or strong winds. We position our results expectedpower plants to optimize generating efficiency, proximity to customers. The typical timeline available under a PPA for any future period.

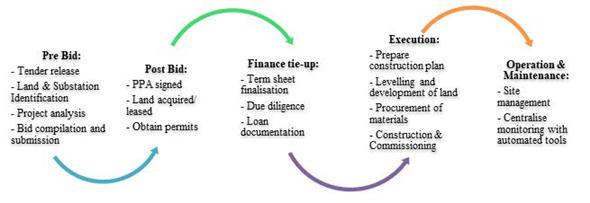

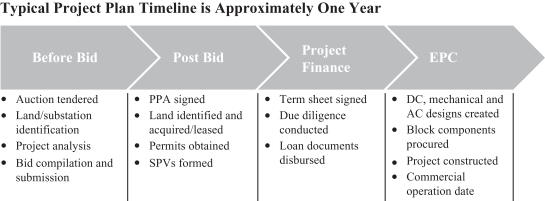

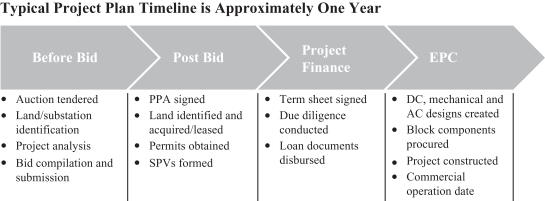

commissioning a power project is approximately 18-24 months. The following information shoulddiagram illustrates the key activities under life cycle of a typical project.

We procure major components such as solar modules and inverters directly from multiple manufacturers with industry standard warranty and guarantee terms. Our supply chain team are developing strategic relationships with a range of key suppliers of critical equipment and components both in India and globally. We select our suppliers based on quality, technology provided, expected cost, reliability, warranty coverage, ease of installation and other ancillary costs.

The price of components for our solar power plants have declined over the longer time horizon as manufacturers lower their cost of production via technological improvement and economies of scale. However, in the second half of FY 2022, we experienced challenges in receipt and pricing of material from suppliers, primarily due to price increases of raw materials and disruptions to trade flows due to COVID-19 shutdowns in source markets and the imposition of customs duties. We then responded to these supply headwinds by deepening our strategic partnerships with key suppliers like for modules we entered into an agreement with Premier Energies Group (“Premier Group”) and First Solar, Inc. in the second half of 2022. We agreed to invest INR 1,000 million (US$12.2 million) in Premier Group, one of India’s leading manufacturers of solar PV cells, of which an investment of INR 455 million (~US$ 5.5 million) has been made for the subscription of equity shares & compulsorily convertible debentures issued by Premier Energies Investment Private Limited (“PEIPL”), towards subscription of 26% shareholding in PEIPL and modules and also signed a Module Supply Agreement (“MSA”) for supply of modules up to 600 MW capacity per annum over next four years. Under the MSA, we have a right to procure modules of up to 600 MW per annum, with a minimum commitment given to off take 300 MW per annum, subject to agreed exemptions. The start date for the MSA with Premier Group has been deferred to April 1, 2026. With First Solar, we entered into an agreement for 600 MW (DC) of high-performance, advanced thin film photovoltaic (“PV”) solar modules. We continue to track market price movements and have multiple options for procurement as and when required. On February 13, 2024, FS India Solar Ventures Private Limited (“First Solar”) sent us a notice that First Solar was terminating the Master Supply Agreement, dated August 22, 2022 (“First Solar MSA”), between First Solar and APIPL. The notice claims that a termination payment of US$29.242 million is due to be readpaid by APIPL to First Solar under the First Solar MSA. APIPL disputes that such a termination payment is due and intends to engage in conjunctioncommercial discussions with First Solar to resolve the matter.

We also signed a Master Supply Agreement with Siemens Gamesa Renewable Power Private Limited (“Siemens Gamesa”) to supply 96 units of onshore wind turbines that will cater to an overall capacity of approximately 346 MW of wind projects. On March 05, 2024, Siemens Gamesa sent us a notice which claims a default and damages of INR 1,934 million (US$23.5 million) in connection with a supply agreement between Siemens Gamesa and APIPL in respect of our 345.6 MW wind power project in the state of Karnataka. APIPL disputes such claim of default and damages and intends to engage in mutual discussions with Simens Gamesa to resolve the matter.

Once a project is qualified in its entirety by referenceconstructed and grid-connected, it produces recurring revenue. Our project operating expenses are relatively lower than conventional power plants, with most cash flow servicing the capital costs of the project or contributing to “Item 5. our growth capital requirements including corporate overhead. Because plant operating margins are relatively stable, our growth and financial success depend on effective management of our expenses and the development of new projects. Also refer to “Operating and Financial Review and Prospects” and the audited consolidated financial statements and the notes thereto included elsewhere in this annual report.Prospects” for further details.

| | | | | | | | | | | | | | | | |

| | | Fiscal Year Ended March 31, | |

| | | 2015(1) | | | 2016(1) | | | 2017 | | | 2017(2) | |

Consolidated Statement of Operations data: | | (INR) | | | (INR) | | | (INR) | | | (US$) | |

| | | (In thousands) | |

Operating revenues: | | | | | | | | | | | | | | | | |

Sale of power | | | 1,124,138 | | | | 2,626,148 | | | | 4,182,985 | | | | 64,502 | |

| | | | |

Operating costs and expenses: | | | | | | | | | | | | | | | | |

Cost of operations (exclusive of depreciation and amortization shown separately below) | | | 79,816 | | | | 190,648 | | | | 375,787 | | | | 5,795 | |

General and administrative | | | 425,952 | | | | 672,841 | | | | 797,161 | | | | 12,292 | |

Depreciation and amortization | | | 322,430 | | | | 687,781 | | | | 1,046,565 | | | | 16,138 | |

| | | | | | | | | | | | | | | | |

Total operating costs and expenses: | | | 828,198 | | | | 1,551,270 | | | | 2,219,513 | | | | 34,225 | |

| | | | | | | | | | | | | | | | |

Operating income | | | 295,940 | | | | 1,074,878 | | | | 1,963,472 | | | | 30,277 | |

| | | | |

Other expense: | | | | | | | | | | | | | | | | |

Interest expense, net | | | 831,790 | | | | 2,058,836 | | | | 2,371,836 | | | | 36,574 | |

Loss (gain) on foreign currency exchange, net | | | 299,628 | | �� | | 343,137 | | | | (109,128 | ) | | | (1,683 | ) |

| | | | | | | | | | | | | | | | |

Total other expenses | | | 1,131,418 | | | | 2,401,973 | | | | 2,262,708 | | | | 34,891 | |

| | | | | | | | | | | | | | | | |

Loss before income tax | | | (835,478 | ) | | | (1,327,095 | ) | | | (299,236 | ) | | | (4,614 | ) |

Income tax expense | | | (253,112 | ) | | | (327,745 | ) | | | (892,333 | ) | | | (13,760 | ) |

| | | | | | | | | | | | | | | | |

Net loss | | | (1,088,590 | ) | | | (1,654,840 | ) | | | (1,191,569 | ) | | | (18,374 | ) |

| | | | | | | | | | | | | | | | |

Less: Net loss attributable to non-controlling interest | | | (5,595 | ) | | | (4,651 | ) | | | (18,924 | ) | | | (292 | ) |

Net loss attributable to APGL | | | (1,082,995 | ) | | | (1,650,189 | ) | | | (1,172,645 | ) | | | (18,082 | ) |

Accretion to Mezzanine CCPS | | | (755,207 | ) | | | (1,347,923 | ) | | | (235,853 | ) | | | (3,637 | ) |

Accretion to redeemable non-controlling interest | | | — | | | | (29,825 | ) | | | (44,073 | ) | | | (680 | ) |

| | | | | | | | | | | | | | | | |

Net loss attributable to APGL equity shareholders | | | (1,838,202 | ) | | | (3,027,937 | ) | | | (1,452,571 | ) | | | (22,399 | ) |

| | | | | | | | | | | | | | | | |

Net loss per share attributable to APGL equity stockholders | | | | | | | | | | | | | | | | |

Basic and diluted | | | (1,046 | ) | | | (1,722 | ) | | | (111 | ) | | | (1.72 | ) |

Shares used in computing basic and diluted per share amounts: | | | | | | | | | | | | | | | | |

Weighted average shares | | | 1,758,080 | | | | 1,758,080 | | | | 13,040,618 | | | | — | |

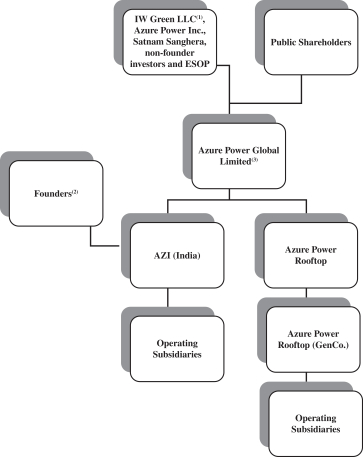

The following table sets forth a summary of our consolidated statement of financial position as of March 31, 2015, 2016, and 2017:B. Company Overview

| | | | | | | | | | | | | | | | |

| | | As of March 31, | |

Balance Sheet data: | | 2015(1) | | | 2016(1) | | | 2017 | | | 2017(2) | |

| | | (INR) | | | (INR) | | | (INR) | | | (US$) | |

| | | (in thousands) | |

Cash, cash equivalents, and current investments available for sale | | | 2,044,290 | | | | 3,090,386 | | | | 8,757,467 | | | | 135,042 | |

Property, plant and equipment, net | | | 15,145,674 | | | | 24,381,429 | | | | 40,942,608 | | | | 631,343 | |

Total assets | | | 19,923,708 | | | | 30,890,840 | | | | 57,493,965 | | | | 886,568 | |

Compulsorily convertible debentures and Series E & Series G compulsorily convertible preferred shares(3) | | | 2,461,200 | | | | 3,600,700 | | | | — | | | | — | |

Project level and other debt(4) | | | 15,271,653 | | | | 20,487,951 | | | | 35,157,808 | | | | 542,140 | |

Mezzanine CCPS shares(5) | | | 4,689,942 | | | | 9,733,272 | | | | — | | | | — | |

Total APGL shareholders’ (deficit)/equity | | | (4,447,154 | ) | | | (7,437,447 | ) | | | 13,222,130 | | | | 203,889 | |

Total shareholders’ (deficit)/equity and liabilities | | | 19,923,708 | | | | 30,890,840 | | | | 57,493,965 | | | | 886,568 | |

Notes:

(1) | Includes consolidated financial data of AZI prior to July 2015, since, the Company was incorporated in 2015, and AZI is considered as the predecessor of the Company. |

(2) | Translation of balances in the consolidated balance sheets and the consolidated statements of operations, comprehensive loss, shareholders’ (deficit)/equity and cash flows from INR into US$, as of and for the fiscal year ended March 31, 2017 are solely for the convenience of the readers and were calculated at the rate of US$1.00 = INR 64.85, the noon buying rate in New York City for cable transfers in non U.S. currencies, as certified for customs purposes by the Federal Reserve Bank of New York on March 31, 2017. No representation is made that the INR amounts could have been, or could be, converted, realized or settled into US$ at that rate on March 31, 2017, or at any other rate. |

(3) | The Series E and Series G compulsorily convertible preferred shares were classified as a current liability in the consolidated balance sheet because the preference shareholders had a right to convert their shares into variable number of equity shares to give them their required returns. |

(4) | This balance represents the short term and long-term portion of project level secured term loans and other secured bank loans. It is net of ancillary cost of borrowing of INR 909,131 (US$ 14,019) as on March 31, 2017 and INR 438,172 million as on March 31, 2016. |

(5) | Compulsorily convertible preferred shares include the Mezzanine CCPS and are classified as temporary equity in the consolidated balance sheet. |

Note: There may be differences due to rounding

EXCHANGE RATE INFORMATION

The consolidated financial statements and other financial data included in this annual report are presented in Indian rupees. Azure Power Global Limited’s functional currencyLimited is the U.S. dollara limited liability company incorporated in Mauritius We are a renewable energy developer and reporting currency is the Indian rupee. Further, AZI’s functional currency is Indian rupees. The functional currencies of AZI’s subsidiaries are their respective local country currencies. The translation from the applicable foreign currencies of AZI’s subsidiaries into Indian rupees is performed for balance sheet accounts using the exchange rate in effect as of the balance sheet date except for shareholders’ equity, preferred shares and certain debt, which are translated at the historical rates in effect at the dates of the underlying transactions. Revenue, expense and cash flow items are translated using average exchange rates for the respective period.

U.S. dollar balances have been translated from Indian rupee amounts solely for the convenience of the readers. The following table sets forth, for each of the periods indicated, the low, average, high and period-end noon buying rates in The City of New York for cable transfers, in Indian rupees per U.S. dollar, as certified for customs purposes by the Federal Reserve Bank of New York. These rates are provided solely for your

convenience and are not necessarily the exchange rates that we used in preparation of our consolidated financial statements or elsewhere in this annual report or will use in the preparation of our periodic reports or any other information to be provided to you. We make no representation that any Indian rupee or U.S. dollar amounts referred to in this annual report could have been or could be converted into U.S. dollars or Indian rupees, as the case may be, at any particular rate or at all.

The following table sets forth information concerning exchange rates between INR and the US$ for the periods indicated:

| | | | | | | | | | | | | | | | |

| | | INR per US$

Noon Buying Rate | |

Period | | Period End | | | Average(1) | | | Low | | | High | |

2011 | | | 53.01 | | | | 46.86 | | | | 44.00 | | | | 53.71 | |

2012 | | | 54.86 | | | | 53.41 | | | | 48.65 | | | | 57.13 | |

2013 | | | 61.92 | | | | 58.91 | | | | 52.99 | | | | 68.80 | |

2014 | | | 63.04 | | | | 61.21 | | | | 58.30 | | | | 63.67 | |

2015 | | | 66.15 | | | | 64.15 | | | | 61.41 | | | | 67.10 | |

2016 | | | 67.92 | | | | 67.16 | | | | 66.05 | | | | 68.86 | |

December | | | 67.92 | | | | 67.81 | | | | 67.38 | | | | 68.29 | |

2017: | | | | | | | | | | | | | | | | |

January | | | 67.48 | | | | 68.05 | | | | 67.48 | | | | 68.39 | |

February | | | 66.67 | | | | 66.97 | | | | 66.67 | | | | 67.40 | |

March | | | 64.85 | | | | 65.80 | | | | 64.85 | | | | 66.83 | |

April | | | 64.27 | | | | 64.54 | | | | 64.08 | | | | 65.10 | |

May | | | 64.50 | | | | 64.42 | | | | 64.03 | | | | 64.87 | |

June (through June 9) | | | 64.24 | | | | 64.35 | | | | 64.24 | | | | 64.42 | |

(1) | Averages for a period other than one month are calculated by using the average of the noon buying rate at the end of each month during the period. Monthly averages are calculated by using the average of the daily noon buying rates during the relevant month. |

Source: Federal Reserve Statistical Release

B. Capitalization and Indebtedness

Not applicable

C. Reasons for the Offer and Use of Proceeds

Not applicable

D. Risk Factors

If any of the following risks actually occur, our business, financial condition, results of operations and cash flows could be materially and adversely affected. In that event, the trading price of our equity shares could decline, and you may lose part or all of your investment. This annual report also contains forward-looking information that involves risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of many factors, including the risks described below and elsewhere in this annual report.

Risks Related to Us and Our Industry

We have never been profitable, and believe we may continue to incur net losses for the foreseeable future.

We have incurred losses since our inception, including a net loss of US$18.4 million for fiscal year 2017. We believe that we may continue to incur net losses as we expect to make continued significant investment in

our solar projects. As of March 31, 2017, we operated 32 utility scale projects and several commercial rooftop projects with a combined rated capacity of 651 MW. As of March 31, 2017, we were also constructing eight projects with a combined rated capacity of 354 MW and had an additional 64 MW of projects committed, bringing our total portfolio capacity to 1,069 MW. A significant number ofindependent renewable power projects are presently committed and under construction, and we can only monetize them, if at all, after each project is completed, which is subject to several factors, including receiving regulatory approvals, obtaining project funding, entering into transmission arrangements with the central or state transmission utilities, and acquiring land for projects. In addition, even after a project is operational, the monetization process may be quite long term with contracts running up to 25 years. Moreover, we may not succeed in addressing certain risks, including our ability to successfully develop or supervise the commissioning, operations and maintenance of our projects or maintain adequate control of our costs and expenses. Also, we may find that our growth plans are costlier than we anticipate and that they do not ultimately result in commensurate increases in revenue, which would further increase our losses. Additionally, we have not, and likely will not in the foreseeable future, generate sufficient cash flow required for our growth plans. We expect we may continue to experience losses, some of which could be significant. Results of operations will depend upon numerous factors, some of which are beyond our control, including the availability of preferential feed-in tariffs for solar power and other subsidies, global liquidity and competition.

The reduction, modification or elimination of central and state government subsidies and economic incentives in India may reduce the economic benefits of our existing solar projectsproducer, and our opportunities to develop or acquire suitable new solar projects.

The developmententire operations are currently in India. Our Green Bonds are listed on the Singapore Exchange (SGX) and profitability of renewable energy projects in the locations in which we operate are dependent on policy and regulatory frameworks that support such developments. The cost of generating electricity from solar energy in India currently exceeds, and very likely will continue to exceed for the foreseeable future, the cost of generating electricity from conventional energy sources such as domestic coal. These subsidies and incentives have been primarily in the form of preferential tariffs, project cost subsidies, tax incentives, tax holidays, and other incentives to end users, distributors, system integrators and manufacturers of solar energy products. For instance, the National Tariff Policy 2006 requires State Electricity Regulatory Commissions, or SERCs, to set Renewable Purchase Obligations, or RPOs, on their distribution companies of solar energy, and provides that procurement of electricity by such distribution companies must be done at preferential tariffs, which is determined by the relevant SERC from time to time. Further, the Indian Ministry of New and Renewable Energy, or the MNRE, has introduced the generation based incentive scheme to support small grid solar projects, pursuant to which the MNRE will pay incentives to the state utilities when they directly purchase solar power from project developers. Also, MNRE has introduced providing customs and excise duty exemptions to all rooftops Solar PV Power Projects for a minimum capacity of 100 kw. Further, India’s Income Tax Act, 1961 as amended, provides for certain tax benefits, including 100% tax deductions of the profits derived from generation of power for any 10 consecutive years, out ofinclude the first 15 years, beginningsolar Green Bond from the year in which project is completed. However, the exemption was only available to the projects completed on or before March 31, 2017. In addition, certain state policies also provide subsidies and economic incentives. For instance, the state policy in Punjab provides certain tax exemptions, including in relation to supply of capital goods used for setting up projects.

The availability and size of such subsidies and incentives depend, to a large extent, on political and policy developments relating to environmental concerns in India and are typically available only for a specified time. Generally, the amount of government subsidy for solar projects has been decreasing as the cost of producing energy has approached grid parity. Changes in central and state policies could lead to a significant reduction in or a discontinuation of the support for renewable energies. Reductions in government subsidies and economic incentives that apply to future solar projects could diminish the availability of our opportunities to continue to develop or acquire suitable newly developed solar projects. Such reductions may also apply retroactively to existing solar projects, which could significantly reduce the economic benefits we receive from our existing solar projects. Moreover, some of the solar program subsidies and incentives expire or decline over time, are limited in

total funding, require renewal from regulatory authorities or require us to meet certain investment or performance criteria. In addition, although various SERCs have specified RPOs for their distribution companies, the implementation of RPO schemes has not been uniform across Indian states. Although states are beginning to enforce RPOs under the guidance from the central government, RPOs have historically been breached without consequences.

Additionally, we may not continue to qualify for such subsidies and incentives. We may choose to implement other solar power projects, such as rooftop projects, that are outside the scope of such subsidies and incentives.

Further, increased emphasis on reducing greenhouse gas emissions and the possibility of trading carbon dioxide emission quotas has led to extra duties being levied on sources of energy, primarily fossil fuels, which cause carbon dioxide pollution. The imposition of these duties has indirectly supported the expansion of power generated from renewable energy and, in turn, solar projects in general. If such direct and indirect government support for renewable energy were terminated or reduced, it would make producing electricity from solar projects less competitive and reduce demand for new solar projects.

A significant reduction in the scope or discontinuation of government incentive programs in our markets could have a material adverse effect on our business, financial condition, results of operations, cash flows and prospects.

Our long term growth depends in part on the Indian government’s ability to meet its announced targeted capacity.

The Indian government increased its 2022 target for solar capacity from 20 GW to 100 GW. However, new capacity additions have historically been lower than the government’s announced targeted capacity. For example, actual capacity additions represented only 70% of the targeted capacity of 78.7GW in the Eleventh Five-Year Plan. This shortfall in capacity additions was due to issues in timely commissioning of conventional power plants, which included delays in land acquisition, obtaining regulatory permits and difficulties in securing reliable and cost efficient fuel supplies. Under the prior Five Year Plans before the Eleventh Five-Year Plan, solar capacity targets were not included.India. As such there is a short track record of meeting solar capacity targets. As for reaching target capacity for other renewable energy sources, in certain Five Year Plans those targets were met while others have fallen short. Any failure to meet the government’s targeted solar capacity may result in a slowdown in our growth opportunities and adversely affect our ability to achieve our long term business objectives, targets and goals.

Our operations are subject to extensive governmental, health, safety and environmental regulations, which require us to obtain and comply with the terms of various approvals, licenses and permits. Any failure to obtain, renew or comply with the terms of such approvals, licenses and permits in a timely manner or at all may have a material adverse effect on our results of operations, cash flows and financial condition.

The power generation business in India is subject to a broad range of environmental, health, safety and other laws and regulations. These laws and regulations require us to obtain and maintain a number of approvals, licenses, registrations and permits for developing and operating power projects. Additionally, we may need to apply for more approvals in the future, including renewal of approvals that may expire from time to time. For example, we require various approvals during construction of our solar projects and prior to the commissioning certificate is issued, including capacity allocation and capacity transfer approvals, approvals from the local pollution control boards, evacuation and grid connectivity approvals and approval from the chief electrical inspector for installation and energization of electrical installations at the solar project sites. In addition, we are required to comply with state-specific requirements. Certain approvals may not be obtained in a timely manner. Certain approvals may also be granted on a provisional basis or for a limited duration and require renewal. If the conditions specified therein are not satisfied at a later date, we may not be able to evacuate power from these projects.

In addition, we could be affected by the adoption or implementation of new safety, health and environmental laws and regulations, new interpretations of existing laws, increased governmental enforcement of

environmental laws or other similar developments in the future. For instance, we currently fall under an exemption granted to solar photovoltaic projects that exempts us from complying with the Environment Impact Assessment Notification, 2006, issued under the Environment (Protection) Act, 1986. While we are required to obtain consents to establish and operate in certain Indian states under the Water (Prevention and Control of Pollution) Act, 1974, Air (Prevention and Control of Pollution) Act, 1981, and the Hazardous Waste (Management, Handling and Transboundary Movement) Rules, 2008, certain state policies in relation to solar projects exempt us from obtaining such consents or have reduced or simplified procedural requirements for obtaining such consents. However, there can be no assurance that we will not be subject to any such consent requirements in the future, and that we will be able to obtain and maintain such consents or clearances in a timely manner, or at all, or that we will not become subject to any regulatory action on account of not having obtained or renewed such clearances in any past periods. Furthermore, our government approvals and licenses are subject to numerous conditions, some of which are onerous and require us to make substantial expenditure. We may incur substantial costs, including clean up or remediation costs, fines and civil or criminal sanctions, and third-party property damage or personal injury claims, as a result of any violations of or liabilities under environmental or health and safety laws or noncompliance with permits and approvals, which, as a result, may have an adverse effect on our business and financial condition.

We cannot assure you that we will be able to apply for or renew any approvals, licenses, registrations or permits in a timely manner, or at all, and that the relevant authorities will issue any of such approvals, licenses, registrations or permits in the time frames anticipated by us. Further, we cannot assure you that the approvals, licenses, registrations and permits issued to us would not be subject to suspension or revocation for non-compliance or alleged non-compliance with any terms or conditions thereof, or pursuant to any regulatory action. Any failure to apply for, renew and obtain the required approvals, licenses, registrations or permits, or any suspension or revocation of any of the approvals, licenses, registrations and permits that have been or may be issued to us, or any onerous conditions made applicable to us in terms of such approvals, licenses, registrations or permits may impede the successful commissioning and operations of our power projects, which may adversely affect our business, results of operations and cash flows.

Our limited operating history, especially with large-scale solar projects, may not serve as an adequate basis to judge our future prospects, results of operations and cash flows.

We began our business in 2008 and have a limited operating history. We established our first utility scale solar plant in India in 2009. As of March 31, 2017, we operated 32 utility scale projects and several commercial rooftop projects with a combined rated capacity of 651 MW. As of March 31, 2017, we were also constructing eight projects with a combined rated capacity of 354 MW and had an additional 64 MW of projects committed, bringing our total portfolio capacity to 1,069 MW. Accordingly, our relatively limited operating history may not be an adequate basis for evaluating our business prospects and financial performance, and makes it difficult to predict the future results of our operations. Period-to-period comparisons of our operating results and our results of operations for any period should not be relied upon as an indication of our performance for any future period. In particular, our results of operations, financial condition, cash flows and future success depend, to a significant extent, on our ability to continue to identify suitable sites, acquire land for solar projects, obtain required regulatory approvals, arrange financing from various sources, construct solar projects in a cost-effective and timely manner, expand our project pipeline and manage and operate solar projects that we develop. If we cannot do so, we may not be able to expand our business at a profit or at all, maintain our competitive position, satisfy our contractual obligations, or sustain growth and profitability.