As filed with the Securities and Exchange Commission on September 22, 2017

April 11, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM20-F

☐REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR

OR

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2016

OR

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number:001-14862

BRASKEM S.A.

(Exact Name of Registrant as Specified in its Charter)

| N/A | The Federative Republic of BrazilD5 | |

| (Translation of Registrant’s Name into English) | (Jurisdiction of Incorporation or Organization) |

Rua Lemos Monteiro, 120 – 24° andar

Butantã— – São Paulo—Paulo, SP – CEP05501-050 – Brazil

(Address of Principal Executive Offices)

Pedro van Langendonck Teixeira de Freitas

Braskem S.A.

Rua Lemos Monteiro, 120 – 24° andar

Butantã— – São Paulo—Paulo, SP – CEP05501-050 – Brazil

Telephone: + (55 11)5511 3576-9000

Fax: + (55 11)55 11 3576-9532

(Name, Telephone,E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of Each Class | Trading Symbol | Name of Each Exchange on which Registered |

| Preferred Shares, Class A, without par value per share, each represented by American Depositary | BAK | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

TITLE OF EACH CLASS:

6.450% Notes due 2024, issued by Braskem Finance Limited None

The total number of issued shares of each class of stock of Braskem S.A. as of December 31, 20162023 was:

Common Shares, without par value

345,010,622 Preferred Shares, Class A, without par value

578,330 Preferred Shares, Class B, without par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ ☒ No ☒☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes☒No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of RegulationS-T (§ (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☐ ☒No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or anon-accelerated filer.an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and large accelerated filer”“emerging growth company” inRule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer☒ | Accelerated filer ☐ | Non-accelerated filer ☐ | Emerging growth company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards†standards provided pursuant to Section 13(a) of the Exchange Act. † The term “new or revised☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial accounting standard” refers to any update issuedreporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the Financial Accounting Standards Boardregistered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to its Accounting Standards Codification after April 5, 2012.Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive- based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ | International Financial Reporting Standards as issued by the International | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐Item 17 ☐Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined inRule 12b-2 of the Exchange Act). Yes ☐No ☒

☐

Page

| Table of Contents | ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

i

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

All references herein to the “real,” “reais” or “R$” are to the Brazilianreal, the official currency of the Federative Republic of Brazil, or Brazil. All references to “U.S. dollars,” “dollars” or “US$” are to U.S. dollars, the official currency of the United States. All references to “CHF” are to Swiss francs, the official currency of Switzerland.

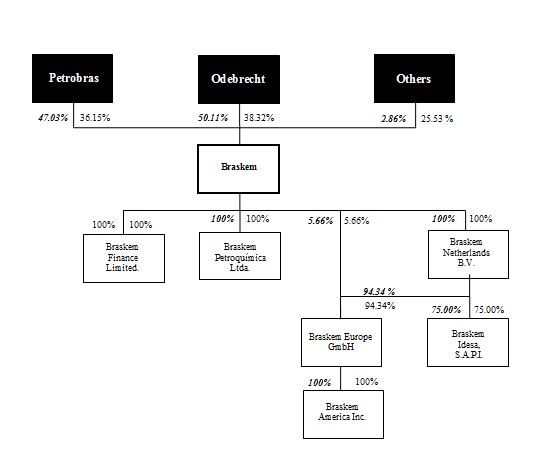

All references herein (1) to “we,” “us” or “our company” are references to Braskem S.A., its consolidated subsidiaries and jointly controlled entities, and (2) to “Braskem” are references solely to Braskem S.A. All references herein to “Braskem Europe” mean Braskem Europe GmbH and its consolidated subsidiaries, including Braskem America, Inc., or Braskem America.

On September 21, 2017, the exchange rate forreaisinto U.S. dollars was R$3.1347 to US$1.00, based on the selling rate as reported by the Central Bank of Brazil (Banco Central do Brasil), or the Central Bank. The selling rate was R$3.25914.8413 to US$1.00 onas of December 31, 2016,2023, R$3.90485.2177 to US$1.00 onas of December 31, 20152022, and R$2.65625.5805 to US$1.00 onas of December 31, 2014, in each case,2021, as reported by the Central Bank. Thereal/U.S. dollar exchange rate fluctuates widely, and thethese selling rate on September 21, 2017rates may not be indicative of future exchangeselling rates. See “Item 3. Key Information—Exchange Rates” for information regarding exchange rates for thereal since January 1, 2012.

Solely for the convenience of the reader we have translated, some to the extent applicable, real amounts included in “Item 3. Key Information—Selected Financial and Other Information” and elsewhere in this annual report fromreaisinto U.S. dollars usingat the selling rate as reported by the Central Bank as of December 31, 20162023, of R$3.25914.8413 to US$1.00. These translations should not be considered representations that any such amounts have been, could have been or could be converted into U.S. dollars at that or at any other exchange rate. Such translations should not be construed as representations that therealamounts represent

All references herein to (1) “we,” “us,” “the Company” or have been“our Company” are references to Braskem S.A., its consolidated subsidiaries and jointly controlled entities, and (2) “Braskem” are references solely to Braskem S.A. All references herein to “Braskem Europe” are to Braskem Europe GmbH and its consolidated subsidiaries, including Braskem America, Inc., or could be converted into U.S. dollars as of that or any other date.Braskem America.

Financial Statements

Braskem Financial Statements

We maintain our books and records in reais.reais. Our consolidated financial statements as of December 31, 20162023, and 20152022 and for the three years ended December 31, 20162023, have been audited, as stated in the report appearing herein,therein, and are included in this annual report. These financial statements and related notes included elsewhere in this annual report are collectively referred to as our audited consolidated financial statements herein and throughout this annual report.

We have prepared our consolidated financial statements included in this annual report in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IFRS.IASB.

The date of issue of the consolidated financial statements included in this annual report is different from the date of issue of our consolidated financial statements in Brazil and there are differences due to non-adjusting events after the reporting period, under IAS 10—Events after the Reporting Period.

Market Share and Other Information

We make statements in this annual report about our market share in the petrochemical industry in Brazil and our production capacity relative to that of other petrochemical producers in Brazil, other countries in Latin America, the United States and the world. We have made these statements on the basis of information obtained from third-party sources that we believe are reliable. We have calculated our Brazilian market share with respect to specific products by dividing our domestic net sales volumes of these products by the total Brazilian domestic consumption of these products. We derive information regarding the production capacity of other companies in the Brazilian petrochemical industry and the estimated total Brazilian domestic consumption of petrochemical products principally from reports published by the Brazilian Chemical Industry Association (Associação Brasileira da Indústria Química), or ABIQUIM. We derive information regarding the production capacity of other companies in the global petrochemical industry, international market prices for petrochemicals products and per capita consumption in certain geographic regions principally from reports published by IHS, Inc., or IHS.Chemical Market Analytics by OPIS, a Dow Jones Company (“CMA”). We derive information relating to Brazilian imports and exports from the System for Analyzing International Trade (Sistema de Análise das Informações de Comércio Exterior), orALICE-Web,ComexStat, produced by the Brazilian Secretary of International Trade (Secretaria de Comércio Exterior) and the Brazilian SecretaryMinistry of Development, Industry, Trade and TradeServices (Ministério do Desenvolvimento, Indústria, e Comércio Exteriore Serviços, the “MDIC”). We also derive information from reports published by Brazilian Association of the Alkali, Chlorine and Derivatives Industry (Associação Brasileira da Indústria de Álcalis, Cloro e Derivados, the “Abiclor”). We also include information and statistics regarding economic growth in emerging economies obtained from the International Monetary Fund (“IMF”), and statistics regarding gross domestic product, or GDP, growth in Brazil, the United States, Europe and Mexico obtained from independent public sources, such as the Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística), or; the IBGE;U.S. Bureau of Economic Analysis of the U.S. Department of Commerce, Eurostat,Commerce; the statistical office of the European Union;Union (Eurostat); and the Mexican Institute of Statistics and Geography (Instituto Nacional de Estadística y Geografía).

| i |

We provide information regarding domestic apparent consumption of some of our products based on information available from ComexStat, produced by the MDIC and reports published by Abiclor. Domestic apparent consumption is equal to domestic production plus imports minus exports. Domestic apparent consumption for any period may differ from actual consumption because this measure does not give effect to variations of inventory levels in the petrochemical supply chain.

ii

We have no reason to believe that any of this information is inaccurate in any material respect. However, we have not independently verified the production capacity, market share, market size or similar data provided by third parties or derived from industry or general publications.

We provide information regarding domestic apparent consumptionCertain Industry Terms

Glossary of some of our products, based on information available from the Brazilian government, Institute of Applied Economic Research (Instituto de Pesquisa Econômica Aplicada), IPEA and ABIQUIM. Domestic apparent consumption is equal to domestic production plus imports minus exports. Domestic apparent consumption for any period may differ from actual consumption because this measure does not give effect to variations of inventory levelsSelected Terms in the petrochemical supply chain.Petrochemical Industry and in the Context of Our Business

Term | Meaning | Main uses | In the context of our business |

| Aliphatics | Aliphatics are open-chain hydrocarbons that contain no stable rings connecting their atoms, in contrast to aromatics. | Used as fuels, solvents and as basic chemicals in the petrochemical industry. | We produce aliphatics, such as ethylene and propylene, in our Brazil Segment. |

| Aromatics | Aromatics are cyclic hydrocarbons with stable bonds connecting their carbon atoms. | Used as fuel additives, solvents, and basic chemicals in the petrochemical industry. | We produce aromatics, such as benzene, toluene and xylenes, as co-products in our Brazil Segment. |

| Benzene | An aromatic hydrocarbon. It is a natural constituent of crude oil. | Used primarily for the manufacture of chemicals with more complex structure, such as ethylbenzene and cumene. | We produce benzene as a by-product in our Brazil Segment. |

| BTX products | A mixture of benzene, toluene and the three xylene isomers (ortho, meta and para), all of which are aromatic hydrocarbons. | Used as fuel additives, solvents, and basic chemicals in the petrochemical industry. | We produce benzene, toluene and xylenes as BTX by-products in our Brazil Segment. |

| ii |

| Butadiene | An organic compound and a colorless gas. | Used industrially as a monomer in the production of synthetic rubber. | We produce butadiene as a by-product in our our Brazil Segment. |

| Butene | A colorless gas present in crude oil. | Used as a monomer in the production of polymers, as well as a petrochemical intermediate. | We use butene for the production of HDPE and LLDPE in our Brazil Segment. Butene is supplied by our chemicals operations that are part of our Brazil Segment. |

| Caustic soda | Caustic soda, or sodium hydroxide, is an inorganic compound. A colorless crystalline solid, caustic soda is toxic, corrosive and highly soluble in water. | Used in the manufacture of pulp and paper, textiles, drinking water, soaps and detergents, and as a drain cleaner. | We produce caustic soda in our Brazil Segment. Caustic soda is a by-product of chlorine production required to produce PVC. |

| Chlor-alkali | Electrolysis process used in the manufacture of chlorine, hydrogen and sodium hydroxide (caustic soda). | Main industrial process for the production of caustic soda. | We operate chlor-alkali plants in Brazil. |

| Chlorine | Chlorine is a chemical element (Cl), a toxic, greenish yellow gas at room temperature. It has a pungent suffocating odor. | Used in the production of paper products, antiseptics, plastics, dyes, textiles, medicines, insecticides, solvents and to treat swimming pools. | We use salt to produce chlorine in our Brazil Segment. |

| Condensate | Condensate, or natural gas condensate, is a low-density mixture of hydrocarbon liquids that are present as gaseous components in the raw natural gas. | Condensate is used as an input for petrochemical plants, burned for heat and cooking, and blended into vehicle fuel. | We use condensate as a raw material in our Brazil Segment. |

| iii |

| Cumene | An organic compound based on an aromatic hydrocarbon with an aliphatic substitution, cumene is a colorless liquid constituent of crude oil and refined fuels. | Used for the production of phenol and acetone. | We produce cumene as a by-product in our Brazil Segment. |

| Dicyclopentadiene | Dicyclopentadiene, or DCPD, is a yellow liquid with an acrid odor. | Used in polyester resins, inks, adhesives and paint. | We produce DCPD in our our Brazil Segment. |

| Ethane | A type of natural gas liquid (NGL), ethane is a colorless, odorless gas in standard temperature and pressure, extracted from natural gas in liquid form. | Used as a feedstock for ethylene production. | Ethane is one of the main raw materials that we use to produce ethylene in our Brazil Segment. |

| Ethanol | A simple alcohol, produced by the fermentation of sugars by yeasts or via petrochemical processes. | Used as a fuel for vehicles, as a disinfectant and as a chemical intermediate. | We use ethanol as a raw material to produce green polyethylene in our Brazil Segment, which are located in Triunfo, Brazil. |

| Ethyl tertiary-butyl ether | Ethyl tertiary-butyl ether, or ETBE, is a colorless liquid manufactured by the acid etherification of isobutylene with ethanol. | Used commonly as an additive in the production of gasoline. | We produce ETBE in our Brazil Segment. |

| Ethylene | A hydrocarbon, colorless gas and the most widely used organic compound in the chemical industry. Produced mainly via steam cracking of raw materials such as naphtha and NGLs. | Used mainly for the production of polyolefins, primarily polyethylene, the most used thermoplastic resin in the world. | We produce ethylene in our Brazil Segment, as a main product of the steam cracking of raw materials. |

| iv |

| EVA | Ethylene-vinyl acetate, or EVA, is a co-polymer of ethylene and vinyl acetate. | Used to produce rubber-like materials, with applications in adhesives, packaging, molding, and membranes for electronic devices. | We produce EVA in our Brazil Segment. |

| Gasoline | A flammable liquid obtained by refining crude oil. | Used primarily as a fuel in combustion engines. | We produce gasoline as a by-product in our Brazil Segment. |

| GHG emissions | Emissions of the six gases listed in the Kyoto Protocol: carbon dioxide (CO2); Methane (CH4); Nitrous Oxide (N2O); Hydrofluorocarbons (HFCs); Perfluorocarbons (PFCs); and Sulfur hexafluoride (SF6). | Used as a metric for our management and in accordance with applicable laws to measure GHG emissions. | We use the metric to assess our performance and define a strategy for reducing GHG emissions. |

| Green ethylene | A hydrocarbon derived from renewable feedstock | Used mainly for the production of polyolefins, primarily polyethylene. | We produce green ethylene from ethanol made by sugarcane in our Brazil Segment in order to produce green polyethylene. |

| HDPE | High-density polyethylene, or HDPE, is a thermoplastic resin produced by the polymerization of ethylene. | Used in a variety of industries, to produce plastic bottles, toys, chemical containers, pipe systems, and other plastic products. | We produce HDPE in our polyolefins operations that are part of our Brazil Segment. |

| Hexene | An aliphatic, hexane is a clear, colorless liquid with a petroleum-like odor. | Used as a solvent, paint thinner, and chemical reaction medium. Also used as a co-monomer for the production of HDPE. | We use hexene in our Mexico Segment as a raw material to produce HDPE. |

| Hydrocarbon resins | Also called petroleum resins, they are produced from the polymerization of aromatic hydrocarbons. | Generally used together with other kinds of resins, in the paint, ink, adhesive and rubber industry. | We produce hydrocarbon resins in our Brazil Segment. |

| v |

| Hydrogen | A chemical element, hydrogen is a colorless, odorless gas. | Used to make ammonia in the production of fertilizers and as an intermediate chemical in the production of plastics and pharmaceuticals. | We produce hydrogen in our Brazil Segment. |

| Hydrogenated solvents | Odorless, colorless solvents treated with hydrogen. | Used in the manufacture of paints. | We produce hydrogenated solvents in our Brazil Segment. |

| Isoprene | A common organic compound that is a component of natural rubber. Also a by-product of oil refining. | Used to produce synthetic rubber. | We produce isoprene in our Brazil Segment. |

| LDPE | Low-density polyethylene, or LDPE, is a thermoplastic resin made from the polymerization of ethylene. | Used for manufacturing containers, dispensing bottles, wash bottles, tubing, plastic bags and molded laboratory equipment. | We produce LDPE in our Brazil Segment. |

| Liquefied petroleum gas (LPG) | Liquefied petroleum gas, or LPG, is a mixture of propane and butane, which are two natural gas liquids. | Used in fuel heating appliances, cooking equipment, vehicle fuel, aerosol propellant, and as a refrigerant. | We produce LPG in our Brazil Segment. |

| LLDPE | Linear low-density polyethylene, or LLDPE, is a linear polymer made by the copolymerization of ethylene with longer-chain olefins. | Used in plastic bags and sheets, plastic wrap, stretch wrap, pouches, toys, covers, lids, pipes, buckets and containers, covering of cables and flexible tubing, among others. | We produce LLDPE in our Brazil Segment. |

| Methanol | Methanol is the simplest alcohol, a liquid produced industrially by hydrogenation of carbon monoxide. | Used as a precursor to other commodity chemicals, including formaldehyde, acetic acid and MTBE. | We use methanol as a raw material to produce MTBE in our Brazil Segment. |

| vi |

| Methyl tertiary-butyl ether (MTBE) | An intermediate hydrocarbon liquid stream derived mainly from the refining of crude oil | Used almost exclusively as a fuel additive in gasoline to raise the oxygen content. | We produce MTBE in our Brazil Segment. |

| Naphtha | An intermediate hydrocarbon liquid stream derived mainly from the refining of crude oil. | Used as a solvent, fuel additive and as a raw material in the petrochemical industry. | We use naphtha as a raw material for the production of petrochemical products in our Brazil Segment. |

| Natural gas | A naturally occurring hydrocarbon gas mixture, consisting primarily of methane. | Used as a source of energy for heating, cooking and electricity generation, as a fuel for vehicles and as a chemical feedstock. | We use natural gas for electricity generation in our production processes. |

| Natural gas liquids (NGL) | A mixture of hydrocarbon components of natural gas, primarily ethane, propane and butane, which are separated from the raw natural gas in the form of liquids. | Used as raw materials in the petrochemical industry, as fuel and in applications for heating and cooking. | We use NGLs such as ethane and propane as raw materials at our plants in Rio de Janeiro and Mexico. |

| N-hexane | A hydrocarbon, obtained by refining crude oil. | Used mixed with other solvents, to extract vegetable oils from crops, and as a cleaning agent in the printing, textile, furniture, and shoemaking industries. | We use n-hexane in our Brazil Segment as a raw material in the production of HDPE and LLDPE. |

| Nonene | A hydrocarbon, nonene is a colorless liquid with an odor reminiscent of gasoline. | Used as a plasticizer to make rigid plastics flexible, and to produce chemical intermediates. | We produce nonene in our Brazil Segment. |

| vii |

| Olefins | Unsaturated hydrocarbons that contain at least one carbon–carbon double bond, such as ethylene, propylene and butene. Obtained from steam cracking of raw materials. | Used as chemical intermediates for the production of other chemicals and resins. | We produce olefins in our Brazil Segment. |

| Para-xylene | An aromatic hydrocarbon, para-xylene is produced mainly in refineries and during the steam cracking of naphtha. | Used as a chemical feedstock in the production of polymers, especially PET. | We produce para-xylene as a by-product in our Brazil Segment. |

| PDH | Propane dehydrogenation, or PDH, is an on-purpose technology used for conversion of propane into propylene. | Industrial process for the production of propylene. | We use propylene from PDH units as a raw material in our plants in the United States. |

| Piperylene | A volatile, flammable hydrocarbon in liquid form, obtained as a by-product of ethylene production. | Used as a monomer in the manufacture of plastics, adhesives and resins. | We produce piperylene in our Brazil Segment. |

| Polyethylene (PE) | PE is the most common type of thermoplastic resin. It is lightweight and durable, and is obtained from the polymerization of ethylene. | PE has a large number of applications, such as: packaging, consumer goods, fibers, textiles, pipes, automotive, wiring, cables, construction, among others. | We produce PE in our Brazil Segment. |

| Polyisobutylene (PIB) | PIB is a gas-permeable synthetic rubber produced by the polymerization of isobutylene with isoprene. | Used as a fuel and lubricant additive, in explosives, as the base for chewing gum, and to improve the environmental stress-cracking resistance of polyethylene. | We produce PIB in our Brazil Segment. |

| viii |

| Polyolefins | Macromolecules formed by the polymerization of olefin monomer units. The most common are polypropylene (PP) and polyethylene (PE). | Used in a broad range of consumer and industrial applications. | We produce polyolefins our Brazil Segment. |

| Polypropylene (PP) | PP is a thermoplastic resin and the second most widely produced commodity plastic, after PE. Obtained by the polymerization of propylene, PP is generally harder and more heat resistant than PE. | Widely used in the automotive and furniture industry, in consumer goods, for packaging and labeling, and in other industrial applications. | We produce PP in our Brazil Segment. |

| Polyvinyl chloride (PVC) | PVC is the world’s third-most widely produced synthetic plastic polymer, after PE and PP, obtained by the polymerization of vinyl chloride monomer (VCM), a monomer generally made of ethylene and chlorine. | Used mainly in infrastructure and construction for pipes and profile applications, such as doors and windows, and also in plumbing, electrical cables, flooring, and as a replacement for rubber. | We produce PVC in our Brazil Segment. |

| Propane | A type of natural gas liquid (NGL), propane is a gas in standard temperature and pressure, and is extracted from natural gas in liquid form. | Commonly used together with butane in heating and cooking applications, and also as a raw material in the petrochemical industry. | We use propane together with ethane as a raw materials to produce petrochemical products in our Brazil Segment. |

| ix |

| Propylene | A hydrocarbon, propylene is a colorless gas, and the second most widely used olefin in the chemical industry, after ethylene. It can be obtained as a co-product of steam cracking or refining, and from on-purpose production. | Used mainly to produce polypropylene resins and a wide variety of other chemicals, such as propylene oxide and acrylonitrile. | We produce propylene in our Brazil Segment as a by-product of steam cracking. Propylene is also the main raw material that we use to produce polypropylene in our Brazil Segment, and USA and Europe Segment. |

| Refinery off gas | Gas that is produced as a by-product of the refining of crude oil. It is a mixture of methane, ethane, hydrogen and other gases. | Used as a feedstock in the petrochemical industry. | We use refinery off gas as a raw material in our Brazil Segment to produce ethylene. |

| Salt | Salt is a mineral composed primarily of sodium chloride. | Used in a wide variety of industries, mainly in the chlor-alkali process to produce caustic soda and chlorine, and as a food additive. | We use salt to produce chlorine and caustic soda in our Brazil Segment. |

| Sodium hypochlorite | Sodium hypochlorite is a chlorine compound. | Used as a disinfectant or a bleaching agent and to produce other chemicals. | We produce sodium hypochlorite in our Brazil Segment. |

| Tetramer | Tetramer, or propylene tetramer, is an olefin. | Used as a plasticizer, surfactant, lubricating oil additive and polymerization agent. | We produce propylene tetramer in our Brazil Segment. |

| Thermoplastic resins | Raw, unshaped polymers, such as PE, PP and PVC. | Used in the plastic industry and other industries. | We produce thermoplastic resins in our Brazil Segment. |

| Toluene | An aromatic hydrocarbon. | Used predominantly as an industrial feedstock and a solvent. | We produce toluene in our Brazil Segment. |

| x |

| UHMWPE | Ultra-high molecular weight polyethylene, or UHMWPE, is a special type of thermoplastic polyethylene. | Used in industrial applications that require durability, low friction, and chemical resistance, including wear strips, chain guides, and marine dock fender pads, among others. | We produce UHMWPE in our USA and Europe Segment. |

| Vinyls | Vinyls, or vinyl polymers, are a group of polymers derived from vinyl monomers. The most common type of vinyl is PVC. | Used in the plastic industry and other industries. | We produce vinyls in our Brazil Segment. |

Certain IndustryOther Selected Terms Used in This Annual Report

As used in this annual report:

| · | “first generation products” means basic petrochemical products such as ethylene and propylene produced from naphtha, natural gas, and ethane. The basic petrochemical products are used as feedstocks for the production of second generation products. We also sell certain first generation products to our customers; |

| · | “second generation products” means thermoplastics resins, such as PE, PP and PVC; |

| · | “third generation” means plastics converters; |

| · | “third generation products” means finished plastic products produced by molding thermoplastic resins into end-use applications; |

| · | “annual production capacity” means the annual nominal capacity for a particular facility, calculated based on operations during the 24 hours of the day for an entire year; |

| · | “production capacity” means the annual projected capacity for a particular facility, calculated based upon operations for 24 hours each day of a year and deducting scheduled downtime for regular maintenance; |

| · | “kton” means a kiloton, which is equal to 1,000 tons, or 2,204,622.62 pounds; |

| · | “ton” means a metric ton, which is equal to 1,000 kilograms or 2,204.62 pounds. |

Rounding

We have made rounding adjustments to some of the amounts included in this annual report. As a result, numerical figures shown as totals in some tables may not be arithmetic aggregations of the amounts that precede them.

iii

| xi |

CAUTIONARY STATEMENT WITH RESPECT TO FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements. Some of the matters discussed concerning our business operations and financial performance include forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended or the Securities Act,(the “Securities Act”), or the U.S. Securities Exchange Act of 1934, as amended or the Exchange Act.(the “Exchange Act”).

Statements that are predictive in nature, that depend upon or refer to future events or conditions or that include words such as “expects,” “anticipates,” “intends,” “plans,” “believes,”“expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and similar expressions are forward-looking statements. Although we believe that these forward-looking statements are based upon reasonable assumptions, these statements are subject to several risks and uncertainties and are made in light of information currently available to us.

Our forward-looking statements may be influenced by numerous factors, including, without limitation, the following:

| · |

| · | global macroeconomic conditions (including a United States recession) and their adverse effects on the margins of our products; |

| · | the adverse effect of war and other armed conflicts, such as the conflict involving Russia and Ukraine and/or Israel and Hammas, on our sales and operations in Brazil and internationally, and on the Brazilian and international petrochemical industry; |

| · | a deterioration in the world economy and its potential adverse effect on demand for petrochemicals and thermoplastic products; |

| · | any adverse effect of China’s economy deceleration on global demand and on our Brazilian and international business; |

| · | the adverse effect of global health crises on our Brazilian and international sales and operations, and on the Brazilian and international petrochemical industry; |

| · | the adverse effect of inflation globally on our Brazilian and international business; |

| · | the adverse effect of a more contractionary monetary policy globally on our Brazilian and international business; |

| · | demand for our petrochemical products, our manufacturing facilities, price of raw materials and other inputs of our production, global logistics for our products, raw materials and other inputs of our production, and supply chains; |

| · | general economic, political and business conditions in the markets or jurisdictions in which we operate or sell to, including governmental and electoral changes, and demand and supply for, and prices of, petrochemical and thermoplastic products; |

| · | interest rate fluctuations, inflation and exchange rate movements of thereal in relation to the U.S. dollar and other currencies; |

| · | our ability to successfully carry out our sustainable development strategy, and to successfully develop initiatives to adapt to and mitigate climate change; |

| xii |

| Table of Contents | ||

| · | competition in the global petrochemical and biopolymer industry; |

| · | our ability to successfully develop our innovation projects, in particular in renewable and recycling initiatives; |

| · | prices of naphtha, ethane, ethanol, propane, propylene and other raw materials and the terms and conditions of the supply agreements related thereto; |

| · | international prices of petrochemical and biopolymer products; |

| · | actions taken by our controlling shareholder; |

| · | inherent risks related to any change of our corporate control; |

| · | our ability to implement our financing strategy and to obtain financing on satisfactory terms; |

| · | our progress in integrating the operations of companies or assets that we may acquire in the future, so as to achieve the anticipated benefits of these acquisitions; |

| · | changes in laws and regulations, including, among others, laws and regulations affecting tax and environmental matters and import tariffs in other markets or jurisdictions in which we operate or to which we export our products; |

| · | political conditions in the countries where we operate, particularly in Brazil and Mexico; |

| · | future changes in governmental policies, including the adoption of new environmental policies and related actions undertaken by the governments of the locations in which we operate; |

| · | unfavorable decisions rendered in major pending or future tax, labor, environmental and other legal proceedings; and |

| · | other factors identified or discussed under “Item 3. Key Information—Risk Factors.” |

Our forward-looking statements are not guaranteesa guarantee of future performance, and our actual results of operations or other developments may differ materially from the expectations expressed in theour forward-looking statements. As for forward-looking statements that relate to future financial results and other projections, actual results will be different due to the inherent uncertainty of estimates, forecasts and projections. Because of these uncertainties, potential investorsreaders should not rely on these forward-looking statements.

iv

All forward-looking statements attributed to us or a person acting on our behalf are qualified in their entirety by this cautionary statement, and you should not place undue reliance on any forward-looking statement included in this annual report. Forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update them in lightas a result of new information or future developments ordevelopments.

For additional information on factors that could cause our actual results of operations to release publicly any revisions to thesediffer from expectations reflected in forward-looking statements, in order to reflect later events or circumstances or to reflect the occurrence of unanticipated events.please see “Item 3. Key Information—Risk Factors.”

| xiii |

v

I’TEMITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

Selected Financial and Other Information

The following selected information should be read in conjunction with “Presentation of Financial and Other Information,” “Item 5. Operating and Financial Review and Prospects” and our audited consolidated financial statements and the related notes thereto, which are included in this annual report.

The selected financial data as of December 31, 2016 and 2015 and for the three years ended December 31, 2016 have been derived from our audited consolidated financial statements, prepared in accordance with IFRS, and included in this annual report. Our audited consolidated financial statements as of December 31, 2014 and 2013 and for the years ended December 31, 2014 and 2013 have been adjusted for the effects of the restatement more fully described in this annual report and in note 2.4 to our audited consolidated financial statements.

As a result of the independent internal investigation that was conducted by law firms with extensive experience in similar cases in the United States and Brazil, each an Expert Firm and, collectively, the Expert Firms, into the allegations described in note 23.3 to our audited consolidated financial statements as of December 31, 2016 in the context of theso-called Operation Car Wash (Operação Lava Jato), or the Investigation, we identified several errors in our previously issued financial statements as of December 31, 2015 and 2014 and for the three years ended December 31, 2015, which have been restated.

The selected financial data as of December 31, 2013 and 2012 and for the years ended December 31, 2012 have been derived from Braskem’s accounting records and reflect the restatement of improperly classified expenses from selling and distribution expense to other expense and to correct errors in the calculation of tax payables.

We have included information with respect to the dividends and/or interest attributable to shareholders’ equity paid to holders of our common shares and preferred shares since January 1, 2012 inreaisand in U.S. dollars translated fromreaisat the commercial market selling rate in effect as of the payment date under the caption “Item 8. Financial Information—Dividends and Dividend Policy—Payment of Dividends.”

We prepare individual financial statements in accordance with the accounting practices adopted in Brazil, pursuant of Law 6,404/76 and subsequent adjustments, and of the standards issued by theComitê de Pronunciamentos Contábeis (CPC), including for the calculation of dividends.

Statement of Operations Data: Net sales revenue Cost of products sold Gross profit Income (expenses): Selling and Distribution General and administrative Research and development Results from equity investments Other operating income (expenses), net Operating profit Financial results: Financial expenses Financial income Exchange rate variations, net Financial expenses, net Profit (loss) before income tax and social contribution Current and deferred income tax and social contribution Profit (loss) from continuing operations Results from discontinued operations Profit (loss) Profit (loss) attributable to shareholders of the company Loss attributable tonon-controlling interest Profit (loss) per share: Basic: Common shares Preferred class “A” shares Preferred class “B” shares Diluted: Common shares Preferred class “A” shares Preferred class “B” shares ADS(2) For the Year Ended December 31, 2016(1) 2016 2015

Restated 2014

Restated 2013

Restated 2012

Restated (in millions of

US$, except

per share data) (in millions ofreais, except per share data) US$ 14,624,9 R$ 47,664.0 R$ 46,880.0 R$ 45,135.9 R$ 40,229.0 R$ 36,160.3 (10,720.9 ) (34,940.6 ) (36,728.0 ) (39,351.7 ) (35,225.4 ) (32,709.1 ) 3,904.0 12,723.4 10,152.0 5,784.2 5,003,6 3,451.2 (432.9 ) (1,410.8 ) (1,083.2 ) (1,037.4 ) (924.6 ) (932.8 ) (453.3 ) (1,477.2 ) (1,280.5 ) (1,195.5 ) (1,002.7 ) (1,071.0 ) (49.7 ) (162.0 ) (169.6 ) (128.1 ) (115.7 ) (106.2 ) 9.2 30.1 2.2 3.9 (3.2 ) (25.8 ) (1,151.3 ) (3,752.2 ) (731.2 ) 42.8 (320.9 ) 239.9 1,826.0 5,951.2 6,889.7 3,469.8 2,637.5 1,555.3 (1,095.7 ) (3,571.0 ) (3,163.4 ) (2,716.4 ) (2,534.2 ) (2,037.5 ) 211.8 690.1 584.9 399.9 772.0 312.2 (985.1 ) (3,210.4 ) 102.9 (84.1 ) 7.1 (1,678.9 ) (1,869.0 ) (6,091.3 ) (2,475.6 ) (2,400.6 ) (1,755.1 ) (3,404.2 ) (43.0 ) (140.0 ) 4,414.2 1,069.2 882.4 (1,848.9 ) (189.0 ) (616.0 ) (1,660.4 ) (491.0 ) (456.7 ) 783.1 (232.0 ) (756.1 ) 2,753.8 578.2 425.7 (1,065.8 ) 8.3 26.9 6.4 0.1 15.7 281.5 US$ (223.7 ) R$ (729.2 ) R$ 2,760.2 R$ 578.2 R$ 441.4 R$ (784.3 ) US$ (126.3 ) R$ (411.5 ) R$ 3,001.2 R$ 716.0 R$ 444.1 R$ (777.1 ) (97.5 ) (317.7 ) (241.5 ) (137.8 ) (2.7 ) (7.2 ) US$ (0.1691 ) R$ (0.5511 ) R$ 3.7651 R$ 0.8995 R$ 0.5210 R$ (1.3296 ) (0.1691 ) (0.5511 ) 3.7651 0.8995 0.6062 (1.3296 ) — — 0.6065 0.6062 0.6062 — US$ (0.1587 ) R$ (0.5173 ) R$ 3.7732 R$ 0.8996 R$ 0.5210 R$ (1.3296 ) (0.1587 ) (0.5173 ) 3.7731 0.8996 0.6062 (1.3296 ) — — 0.6065 0.6062 0.6062 — (0.3174 ) (1.0346 ) 7.5464 1.7992 1.0427 (2.6592 )

Balance Sheet Data: Cash and cash equivalents(2) Short-term trade accounts receivable Inventories(3) Property, plant and equipment Total assets Short-term borrowings (including current portion of long-term borrowings) Long-term borrowings Capital Shareholders’ equity (includingnon-controlling interest) Other Financial and Operating Information: Cash Flow Information: Net cash provided by (used in): Operating activities Investing activities Financing activities Other Information: Capital expenditures: Property, plant and equipment Investments in other companies Total Sales Volume Data* (in thousands of tons): Ethylene(4) Propylene(4) Polyethylene Polypropylene Polyvinyl chloride (PVC) At and For the Year Ended December 31, 2016(1) 2016 2015

Restated 2014

Restated 2013

Restated 2012

Restated (in millions of

US$, except as

indicated) (in millions ofreais, except as indicated) US$ 2,421.6 R$ 7,892.3 R$ 7,458.2 R$ 4,085.7 R$ 4,335.9 R$ 3,287.6 501.4 1,634.1 2,755.7 2,409.1 2,792.3 2,326.5 1,626.1 5,299.5 6,243.7 5,688.3 5,172.4 4,102.1 9,001.5 29,336.7 34,100.3 29,071.0 25,410.1 21,176.8 15,900.7 51,821.9 60,626.9 49,501.9 46,844.6 41,170.0 796.1 2,594.5 1,970.0 1,419.5 1,249.6 1,836.0 6,362.7 20,736.6 25,380.5 18,926.7 17,362.9 15,675.6 2,467.9 8,043.2 8,043.2 8,043.2 8,043.2 8,043.2 527.9 1,720.7 945.5 5,597.1 7,543.9 8,588.7 US$ 1,456.3 R$ 4,746.2 R$ 7,877.8 R$ 3,813.1 R$ 2,457.8 R$ 2,571.8 (871.7 ) (2,840.9 ) (4,120.3 ) (5,054.1 ) (4,954.2 ) (2,834.3 ) (846.0 ) (2,757.3 ) (97.5 ) 894.4 3,614.2 633.9 871.2 2,839.2 4,103.9 5,378.8 5,656.4 2,792.9 — — — 0.1 — — 576.1 548.6 511.4 535.4 531.9 — 370.6 416.5 445.7 389.0 406.6 — 2,729.7 2,626.9 2,386.5 2,543.7 2,530.0 — 1,671.9 1,513.1 1,591.9 1,580.8 1,648.8 — 645.2 594.9 659.6 636.5 560.9

Exchange Rates

The current laws and regulations governing the Brazilian foreign exchange system allowsallow the purchase and sale of foreign currency and the international transfer ofreais by any person or legal entity, regardless of the amount, subject to certain regulatory procedures. Since 1999, the Central Bank has allowed the U.S. dollar-real exchange rate to float freely, and, since then, the U.S. dollar-real exchange rate has fluctuated considerably.

In the past, the Central Bank has intervened occasionally to control unstable movements in foreign exchange rates. We cannot predict whether the Central Bank or the Brazilian government will continue to permit thereal to float freely or will intervene in the exchange rate market through the return of a currency band system or otherwise. Thereal may depreciate or appreciate against the U.S. dollar substantially. Furthermore, Brazilian law provides that, whenever there is a serious imbalance in Brazil’s balance of payments or there are serious reasons to foresee a serious imbalance, temporary restrictions may be imposed on remittances of foreign capital abroad. We cannot assure you that such measures will not be taken by the Brazilian government in the future. See “—Risk Factors—Risks Relating to Brazil—Brazilian government exchange control policies could increase the cost of servicing our foreign currency-denominated debt, adversely affect our ability to make payments under our foreign currency-denominated debt obligations and impair our liquidity” and “—Risk Factors—Risks Relating to Our Class A Preferred SharesEquity and the ADSs— Debt Securities—If holders of the ADSs exchange them for class A preferred shares, they may risk temporarily losing, or being limited in, the ability to remit foreign currency abroad and certain Brazilian tax advantages.”

The following table shows the selling rate for U.S. dollars for the periods and dates indicated. The informationITEM 3.A (Reserved)

ITEM 3.B CAPITALIZATION AND INDEBTEDNESS

Not applicable.

ITEM 3.C REASONS FOR THE OFFER AND USE OF PROCEEDS

Not applicable.

ITEM 3.D RISK FACTORS

Summary of Risk Factors

Below is a summary of certain factors that make an investment in the “Average” column represents the averageour securities speculative or risky. Importantly, this summary does not address all of the exchange rates onrisks and uncertainties that we face. This summary is qualified in its entirety by a more complete discussion of such risks and uncertainties. In evaluating an investment in our securities, investors should carefully read the last dayrisks described below, as well as other risks and uncertainties that we face, which can be found under “—Risk Factors” in this section of each month duringthis annual report. If any of the periods presented.following events occur, our business, financial condition, and operating results may be materially adversely affected. In that event, the trading price of our securities could decline, and you could lose all or part of your investment. Such risks include, but are not limited to:

| Reais per U.S. Dollars | ||||||||||||||||

Year | High | Low | Average | Period End | ||||||||||||

2012 | R$ | 2.112 | R$ | 1.702 | R$ | 1.955 | R$ | 2.043 | ||||||||

2013 | 2.446 | 1.953 | 2.161 | 2.343 | ||||||||||||

2014 | 2.740 | 2.197 | 2.355 | 2.656 | ||||||||||||

2015 | 4.195 | 2.575 | 3.339 | 3.905 | ||||||||||||

2016 | 4.156 | 3.119 | 3.483 | 3.259 | ||||||||||||

| Reais per U.S. Dollars | ||||||||||||||||

Month | High | Low | ||||||||||||||

March 2017 |

| R$ | 3.1735 | R$ | 3.0765 | |||||||||||

April 2017 |

| 3.1984 | 3.0923 | |||||||||||||

May 2017 |

| 3.3807 | 3.0924 | |||||||||||||

June 2017 |

| 3.3362 | 3.2307 | |||||||||||||

July 2017 |

| 3.3193 | 3.1256 | |||||||||||||

August 2017 |

| 3.1976 | 3.1161 | |||||||||||||

September 2017 (through September 21) |

| 3.1389 | 3.0852 | |||||||||||||

Source:Central Bank.

Risk Factors

| 1 |

Risks Relating to Our CompanyBusiness and the Petrochemical Industry

| · | The cyclical and volatile nature of the petrochemical industry may reduce our net revenue and gross margin. |

| · | Adverse conditions in the petrochemical industry may adversely affect demand for our products. |

| · | Global macroeconomic factors have had, and may continue to have, adverse effects on the margins that we realize on our products. |

| · | Higher costs for the acquisition of raw materials may increase the cost of the products we sell, and may reduce our gross margin and negatively affect our overall financial performance. |

| · | We may be affected by instability in the global economy and by financial turmoil, including as a result of military conflicts such as the Russia and Ukraine and/or Israel and Hammas conflicts. |

| · | We face competition from suppliers of polyethylene, polypropylene, PVC, and other products. |

| · | We may face competition from producers of substitutes for our products as a result of evolving technology, consumer and industry trends and preferences, and regulatory changes. |

| · | We depend on Petrobras to supply us with a substantial portion of our naphtha, ethane, propane, light refinery hydrocarbon, and propylene needs, and also on logistics services. |

| · | We depend on ethane supplied by Pemex TRI in Mexico. |

| · | Global or regional health pandemics or epidemics, may adversely affect our business, financial condition and results of operations. |

| · | We rely on limited or sole-source suppliers for our raw materials, inputs, and energy, including transportation thereof. |

| · | We may be materially adversely affected if there is an imbalance in global logistics, which may cause disruptions to our transport, storage, and distribution operations, negatively impacting the costs related thereto. |

| · | We rely on access to third-party licensed technology and related intellectual property, and if such rights cease to be available to us on commercially reasonable terms, or at all, or if any such third party ceases to provide us with technical support under license or technical services agreements, certain of our production facilities, our operating results and financial condition could be adversely affected. |

| · | Some of our shareholders may have the ability to determine the outcome of corporate actions or decisions, which could affect the holders of our class A preferred shares and the ADSs. |

| · | We may be subject to attempts to acquire our control, which may lead to significant changes in management, the strategies that we are currently pursuing, or in our current corporate governance practices. |

| · | We may face conflicts of interest in transactions with related parties. |

| · | Under our growth strategy, we may pursue strategic acquisitions, investments, and investments in new businesses. The failure of an acquisition, investment, or investments in new businesses to produce the anticipated results, or the inability to integrate an acquired company, could adversely affect our business's financial condition and results of operations. |

| · | Adjustments in tariffs on imports that compete with our products could cause us to lower our prices. |

| · | Changes in U.S. and global trade policies and other factors beyond our control may adversely impact our business, financial condition, and results of operations. |

| · | A failure to comply with export control or economic sanctions laws and regulations could have a material adverse impact on our results of operations, financial condition, and reputation. |

| · | Our business and operations are inherently subject to environmental, health, and safety risks. As a result, our business is also subject to several stringent regulations, including environmental regulations. |

| · | Unfavorable outcomes in pending or future litigation may reduce our liquidity and negatively affect our financial performance and financial condition, including potential new claims related to the geological event in Alagoas. |

| 2 |

| · | We could be materially affected by violations of the FCPA, the Brazilian Anti-Corruption Law, and similar anti-corruption laws. |

| · | Climate change may negatively affect our business, financial condition, results of operations, and cash flow. |

| · | If we are unable to comply with the restrictions and covenants in the agreements governing our indebtedness, there could be a default under the terms of these agreements, which could result in an acceleration of payment of funds that we have borrowed and could affect our ability to make principal and interest payments on our debt obligations. |

| · | Unauthorized disclosure or loss of intellectual property, trade secrets, other sensitive business or personal information, or disruption in information technology by cyberattacks or other security breaches, as well as our failure to comply with data protection laws and information security requirements, can subject us to significant penalties or liability and can adversely impact our operations, reputation, and financial results. |

| · | There can be no assurance that Novonor will remain our controlling shareholder. Novonor and Petrobras may enter into transactions or other arrangements that may result in us not having a controlling shareholder. If no single shareholder or group of shareholders holds more than 50% of our voting stock or exercises a controlling interest, there may be increased opportunities for alliances between shareholders and conflicts between them. |

| · | Novonor and Petrobras have requested us to conduct studies for a potential migration of Braskem to the Novo Mercado listing segment of the B3, which, if completed, would lead to the conversion of all of our class A and class B preferred shares into common shares and the revision of our corporate governance practices to conform to the Novo Mercado rules. |

| · | The intended corporate reorganization communicated by Novonor and Petrobras to us may not be approved or implemented, and the migration to the Novo Mercado listing segment of the B3 may not occur. |

| · | We expect to lose the right of preference set forth in the current shareholders’ agreement with respect to new business opportunities in the petrochemical sector, and as result, Petrobras, which is our largest supplier of raw materials in Brazil, will be able to invest in the petrochemical sector independently from us and without first giving us a preference to do so. |

| · | Changes in tax laws may result in increases in certain direct and indirect taxes, which could reduce our gross margin and negatively affect our overall financial performance. |

Risks Relating to Brazil

| · | Brazilian political, economic, and business conditions, as well as the Brazilian government’s economic and other policies, may negatively affect demand for our products as well as our net revenue and overall financial performance. |

| · | Fluctuations in the real/U.S. dollar exchange rate could increase inflation in Brazil, raise the cost of servicing our foreign currency-denominated debt, and negatively affect our overall financial performance. |

| · | Fluctuations or changes in, or the replacement of, interest rates could impact the cost of servicing our debt or reduce our financial revenue, affecting our financial performance. |

Risks Relating to Mexico

| · | A renegotiation of commercial treaties or changes in foreign policy among Mexico, Canada, and the United States may negatively affect our business, financial condition, results of operations, and prospects. |

| · | Political events in Mexico could affect the Mexican economic policy and our business, financial condition and results of operations. |

| · | We source part of our ethane feedstock from Pemex TRI in Mexico, which we expect to be our primary main source of ethane until the Ethane Import Terminal is operational. |

| 3 |

Risks Relating to Our Equity and Debt Securities

| · | All of the shares issued by Braskem and owned by NSP Inv. are secured for the benefit of certain secured creditors of the Novonor Group. |

| · | Holders of our class A preferred shares or the ADSs may not receive any dividends or interest on shareholders’ equity. |

| · | If holders of the ADSs exchange them for class A preferred shares, they may risk temporarily losing, or being limited in, the ability to remit foreign currency abroad and certain Brazilian tax advantages. |

| · | The relative volatility and liquidity of the Brazilian securities markets may adversely affect holders of our class A preferred shares and ADSs. |

| · | Brazilian insolvency laws may be less favorable to holders of our shares, ADSs, and outstanding debt securities than bankruptcy and insolvency laws in other jurisdictions. |

Risk Factors

Risks Relating To Our Business And The Petrochemical Industry

The cyclical and volatile nature of the petrochemical industry may reduce our net sales revenue and gross margin.

The petrochemical industry, including the global markets in which we compete, is cyclical and sensitive to changes in global supply and demand. This cyclicality may reduce our net sales revenue, increase our costs, and decrease our gross margin, including as follows:

| · | downturns in general business and global economic activity may cause demand for our products to decline; |

| · | when global demand falls, we may face competitive pressures to lower our prices; |

| · | increases in prices of the main raw materials we use, including naphtha, ethane, and propylene; and |

| · | if we decide to expand our plants or construct new plants, we may do so based on an estimate of future demand that may never materialize or may materialize at levels lower than we predicted. |

Historically, the international petrochemical markets have experienced alternating periods of limited supply, which have caused prices and profit margins to increase, followed by expansion of production capacity worldwide, which has resulted in oversupply and reduced prices and profit margins. Prices in the petrochemical industry follow the global petrochemical industry, and we establish the prices for the products we sell in Brazil, other countries in Latin America, the United States, Europe, and the world with reference to international market prices. Therefore, our net sales revenue, feedstock costs, and gross margin are increasingly linked to global industry conditions that we cannot control, and which may adversely affect our results of operations and financial position. Additionally, to the global supply and demand, changes in energy prices in the region in which we operate could impact the result of our operations.

Moreover, relevant events or changes in the cycle and in the petrochemical industry, including technological innovations, and regulatory changes including related to climate change, may materially affect the future profitability of our business and consequently reduce the recoverable value of our assets, which is reviewed by the annual impairment test, which may adversely affect the profit attributable to our shareholders.

| 4 |

Adverse conditions in the petrochemical industry may adversely affect demand for our products.

Sales of our petrochemical and chemical products are tied to global production levels and demand, which can be affected by macro-economic factors such as interest rates, international oil prices, energy prices, shifts to alternative products, consumer confidence, employment trends, regulatory and legislative oversight requirements, trade agreements, regulatory developments including related to climate change, as well as regional disruptions, armed conflicts, natural disasters, epidemics, pandemics, or other global events. Therefore, our net revenue, feedstock costs, and gross margin are linked to global conditions that we cannot control, and which may adversely affect our results of operations and financial position. For example, the persistence of the geopolitical conflicts, such as the war involving Russia and Ukraine and Hammas and Israel in the Gaza Strip (including economic sanctions and other regulations imposed by the United States and other international countries as a result thereof) could negatively impact supply chains worldwide and demand for our products and the raw materials we use. Should the conflict in Ukraine or other international locations further escalate, it is difficult to anticipate the extent to which the consequences of such conflict, including without limitation effects on the price of oil and current or future sanctions, could increase our costs, disrupt our supplies, reduce our sales, or otherwise affect our operations.

We face competition from suppliers of polyethylene, polypropylene, PVC, and other products.

We face strong competition across all of our products. Some of our foreign competitors are substantially larger and have greater financial, manufacturing, technological, and/or marketing resources than us. Our U.S. operations face competition in the United States from other North American suppliers that serve the North American market. Our European operations face competition in Europe and the other export markets that it serves from European and other foreign suppliers of polypropylene. Our Mexico operations face competition from Mexican and U.S. producers of polyethylene. Competitors from South America may export to Brazil with reduced or no import duties, including through the Manaus Free Trade Zone (“Zona Franca de Manaus”). In addition, suppliers of almost all continents have regular or specific sales to trading companies and direct customers in Brazil for our products, including resins.

We generally follow the international markets with respect to the prices for our products sold in Brazil. The domestic price is determined by the import parity, which is based on converters’ imports into Brazil and typically represents spot market price including exchange rate fluctuations, plus import tariffs that the Brazilian government uses to implement economic policies. Adjustments of tariffs could lead to increased competition from imports, causing us to lower our domestic prices and impact the demand for our products, which would likely result in lower net revenue and could negatively affect our overall financial performance. This effect combined would have a negative impact on our gross margins and overall financial performance. We have no control over the import tax rate policy in Brazil or Mercosur (the Southern Common Market, or Mercosur in Spanish), a common market that serves as a regional integration process and was initially established by Argentina, Brazil, Paraguay, and Uruguay, and subsequently joined by Venezuela and Bolivia. Petrochemical import taxes that are currently in place have changed in the past and may change in the future, including as a result of decisions of the Brazil government or Mercosur. We generally set the prices for our products exported from Brazil based on international market prices. We set the prices for products sold in the United States and Europe based on market pricing in such regions. The price for polyethylene in Mexico is based on prices in the U.S. Gulf Coast region.

As a result of the commissioned fractioned gas-based ethylene and new polyethylene capacities and of the expected new capacities for the production of resins and petrochemicals, coupled with the competitive pricing of feedstock for petrochemicals production such as ethane, we anticipate that we may experience increased competition from producers of thermoplastic resins, especially from North American, Middle Eastern, and Chinese producers, in the markets in which we sell our products. In addition, the Chinese government has exercised, and continues to exercise, significant influence over the Chinese economy, including governmental actions to incentivize and achieve self-sufficiency production in some specific chains, such as PE and PP. Those new capacities could lead to a rebalancing of global export flows and an increase in global competition from our competitors, which are larger and have greater competitive advantages than us.

| 5 |

In addition, exchange rate variations may affect the competitiveness dynamics in different regions in which we operate. For instance, the appreciation of the real against the U.S. dollar may increase the competitiveness of imported products, which may increase the competition from resins producers in Brazil. Also, (i) the appreciation of the Euro against the U.S. dollar may increase the competitiveness of imported products and, as a consequence, increase competition from imports, and (ii) the appreciation of the Mexican peso against the U.S. dollar may increase the competition from other resins producers in Mexico.

We may face competition from producers of substitutes for our products as a result of evolving technology, consumer and industry trends and preferences, and regulatory changes.

We compete in a market that relies on technological innovation and the ability to adapt to evolving consumer and global industry trends and preferences. Petrochemical products and other products produced with our petrochemical products, such as consumer plastic items, are subject to changing consumer and industry trends, demands, and preferences, as well as stringent and constantly evolving regulatory and environmental requirements. Therefore, products once favored may, over time, become disfavored by consumers or industries or no longer be perceived as the best option, which may, therefore, affect our results of operations and financial position.

Plastic waste and climate change are global environmental concerns that receive growing attention from society in general, national and local governments, private companies, trendsetters, and consumers worldwide. There has been a growing trend to attempt to move away from the use of plastic products, which has been backed by governmental and lawmaking initiatives.

In 2019, the European Union parliament approved regulations banning as of 2021 single-use plastic items such as plates, cutlery, straws, and cotton buds sticks and adopting a strategy for the disposal of plastic products in a circular economy that aims to increase recycling significantly and targets the plastic products most often found on beaches and in seas. The European Union is now currently revising such rules to increase recycling and recycled content targets, as well as to establish new regulations on the design and labeling of plastic products. In addition, state and local governments in other countries, for example in China and in Brazil, have also proposed or implemented bans on single-use plastic products. Regarding regulatory issues related to plastic for single use in Brazil, proposed regulations are being discussed at the federal, state, and municipal levels.

Additionally, legislative proposals on carbon border adjustment mechanisms aiming at preventing carbon leakage have been under discussion in several countries. So far, none of the proposals have yet affected chemicals and plastic resins, but this might change in the future. Recently, UNEP has started conversations to negotiate an international legally binding instrument aiming at eliminating plastics pollution. These rounds of negotiations are expected to take at least two years, but some of the proposals include reducing and even prohibiting the production of certain plastic products considered “problematic.” The expansion of regulation or the prohibition of the use and sale of plastic products could increase the costs incurred by our customers or otherwise limit the application of these products and could lead to a decrease in demand for resins and other products we make. Such a decrease in demand could adversely affect our business, results of operations, and financial condition.

| 6 |

We have as a core part of our strategy to grow our biobased and recycling business. We are supporting several initiatives to foster a low-carbon circular economy (reusing and repurposing resources within the economy), including, but not limited to (i) partnerships to develop new products and applications to improve efficiency and promote recycling and reuse (circular design); (ii) development of a portfolio of innovative products with recycled and biobased contents; (iii) development of recycling technology, supporting the advancement of studies and tests, for both chemical and mechanical recycling; (iv) environmental education and consumer engagement initiatives focused on educational actions, aimed at conscious consumption and proper disposal, with a positive impact on the recovery of plastic waste; and (v) circular design, which consists of the co-creation of new packaging solutions and businesses focused on circular solutions. We cannot predict the outcome of such initiatives since there still are many goals to be accomplished to reduce plastic waste and marine litter, which may lead to decreased interest in our products by our customers and consumers, impacting our results of operations and financial condition. Moreover, we may not be able to successfully implement our strategy to grow our renewables and recycling business, which could adversely affect our financial condition and results of operations.

Also, new competitors could develop new technologies to offer less carbon-intensive products, which could result in a loss of our competitiveness and a reduction of our revenues.

Factors that may affect consumer perception of our products or of consumer goods produced with our products may include health trends and attention to substitute products perceived as more environmentally friendly. For example, in recent years, we have witnessed a shift in consumer preference moving away from plastic straws and in favor of straws made from other materials, such as paper or other compounds. A failure to react to similar trends in the future could enable our competitors to grow or secure their market share before we have a chance to respond.

In addition, regulations may be amended or enacted in the future that would make it more difficult to appeal to our customers, end consumers, or marketing the products that we produce. For example, failure to comply with applicable policies, which could lead to lower demand for our products, banning of plastic products without allowing the search for alternatives employing efficient solutions, including resins produced by us, could have a material adverse effect on our business, results of operations and financial condition. Also, even if we are able to continue to promote our products, there can be no assurance that our competitors (including producers of substitutes) will not be successful in persuading consumers of our products to switch to their products. Some of our competitors may have greater access to financial or other resources than we do, which may better position them to react and adapt to evolving trends, preferences, and regulatory changes. Any loss of interest in our products or consumer products produced with our products may have a material adverse effect on our business, results of operations, and financial condition.

Our revenue from certain of our customers ismay be significant, and the credit risks associated with certain of these customers could adversely affect ourthe results of operations.our operations and increase expected credit losses.

We engage in a number ofseveral transactions where counterparty credit risk is a relevant factor, including transactions with certain of our customers and those businesses we work with to provide services, among others. These risks are dependent upon market conditions and also the real and perceived viability of the counterparty. The failure or perceived weakness of any of our counterparties has the potential to expose us to risk of loss in certain situations. Our revenue from certain of our customers ismay be significant, and the credit risks associated with certain of these customers could adversely affect our results of operations. Certain contracts and arrangements that we enter into with counterparties may provide us with indemnification clauses to protect us from financial loss. To the extent the credit quality of theseIn addition, delays in payment cycles by significant customers deteriorates or these customers seek bankruptcy protection,may adversely affect our ability to collect our receivables,liquidity and ultimately our results of operations, may be adversely affected.working capital.

Our results may be adversely affected by increases in reserves for uncollectible accounts receivable.

We have a large balance of accounts receivable and have established a reserve for the portion of such accounts receivable that we estimate will not be collected because of our customers’non-payment.

Additionally, If the viability of the business viability of certain of our customers deteriorates, these customers seek bankruptcy protection, or our credit policies are ineffective in reducing our exposure to credit risk relating to such customers, our ability to collect our receivables may be adversely affected, and additional increases in reserves for uncollectibleexpected credit losses accounts may be necessary, which could have a material adverse effect on our cash flows and results of operations. We record an allowance for doubtful accountsexpected credit losses in an amount we consider sufficient to cover estimated losses on the realization of our trade accounts receivable, taking into accountconsidering our loss experience and the average aging of our accounts receivable, but we cannot assure you that these amounts will be sufficient to cover eventual losses.

As of December 31, 2016, our total trade accounts receivable was R$2,084.9 million and the provision for doubtful accounts was R$380.6 million. Significant changesIn addition, delays in our historical loss experience on accounts receivable which are not apparent through our aging analysis could requirepayment cycles by significant changes to our provisions for doubtful accounts, and, therefore, have an adverse effect on our results of operations and financial condition.

Global macroeconomic factors have had, andcustomers may continue to have, adverse effects on the margins that we realize on our products.

Our results of operations may be materially affected by adverse conditions in the financial markets and depressed economic conditions generally. Economic downturns in geographic areas in which we sell our products may substantially reduce demand for our products and result in decreased sales volumes. Recessionary environments adversely affect our business because demand for our products is reduced.

Reduced or negative growth in emerging economies resulted in decreased growth in the global economy, which increase is estimated at 3.1% in 2016, according to the International Monetary Fund. In 2016, Brazil’s GDP contracted 3.6%, as compared to a contraction of 3.8% in 2015liquidity and growth of 0.5% in 2014, according to the IBGE. In 2016, demand for thermoplastic resins in Brazil declined by 1%.

In the United States, GDP grew by 1.6% in 2016 compared to growth of 2.6% in 2015 and growth of 2.4% in 2014, according to the U.S. Department of Commerce. In Europe, GDP grew by 1.7% in 2016 compared to growth of 2.0% in 2015 and growth of 1.4% in 2014, according to Eurostat, outpacing the United States for the first time since the 2008 financial crisis. Mexico’s GDP grew by 2.4% in 2016 compared to growth of 2.6% in 2015 and growth of 2.3% in 2014, according to Mexican Institute of Statistics and Geography.

Our ability to export to other countries is a function of the level of economic growth in those countries and other economic conditions, including prevailing inflation and interest rates. In addition, disruptions in the global balance between supply and demand may impair our ability to export our products in response to a decline in domestic demandobtain financing for these products. Prolonged volatility in economic activity in our key export markets,working capital, such as South America, Europe and Asia, could continue to reduce demand for somesales of our products and lead to increased margin pressure by importers into Brazil, which would adversely affect our results of operations.receivables.

We face competition from producers of polyethylene, polypropylene, PVC and other petrochemical products.

| 7 |

We face strong competition across all of our petrochemical products. Our U.S. operations face competition in the United States from other U.S. producers of polypropylene and the other foreign producers of polypropylene that serve the United States. Our German operations face competition in Europe and the other export markets that it serves from European and other foreign producers of polypropylene. Our Mexico operations face competition from Mexican and U.S. producers of polyethylene producers. In Brazil, although only our vinyls business faces competition in Brazil, players from South America are able to export to Brazil with reduced or no import duties. In addition, producers of almost all continents have regular or spot sales to trading companies and direct customers in Brazil for petrochemicals and resins.

We generally set the prices for our second generation products sold in Brazil with reference to the prices charged for these products by foreign producers in international markets. We generally set the prices for our second generation products exported from Brazil based on international spot market prices. We set the prices for polypropylene sold in the United States and Europe based on regional market pricing. The price for polyethylene in Mexico is based on prices for the polymer in the U.S Gulf Coast region.