UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM20-F

(Mark one)

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 20172018

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from to

Commission file number001-04547

UNILEVER N.V.

(Exact name of Registrant as specified in its charter)

The Netherlands

(Jurisdiction of incorporation or organization)

Weena 455, 3013 AL, Rotterdam, The Netherlands

(Address of principal executive offices)

R. Sotamaa, Chief Legal Officer and Group Secretary

Tel: +44(0)2078225252, Fax: +44(0)2078225464

100 Victoria Embankment, London EC4Y 0DY UK

(Name, telephone number, facsimile number and address of Company Contact)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

N.V. New York registry shares each representing one ordinary share of nominal amount of€0.16 each | New York Stock Exchange | |

4.8% Notes due 2019 2.2% Notes due 2019 2.1% Notes due 2020 1.8% Notes due 2020 4.25% Notes due 2021 2.75% Notes due 2021 1.375% Notes due 2021 3.0% Notes due 2022 2.2% Notes due 2022 3.125% Notes due 2023 3.25% Notes due 2024 2.6% Notes due 2024 3.375% Notes due 2025 3.1% Notes due 2025 2.0% Notes due 2026 2.9% Notes due 2027 3.5% Notes due 2028 5.9% Notes due 2032

| New York Stock Exchange New York Stock Exchange New York Stock Exchange New York Stock Exchange New York Stock Exchange New York Stock Exchange New York Stock Exchange New York Stock Exchange New York Stock Exchange New York Stock Exchange New York Stock Exchange New York Stock Exchange New York Stock Exchange New York Stock Exchange New York Stock Exchange New York Stock Exchange New York Stock Exchange New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

The total number of outstanding shares of the issuer’s capital stock at the close of the period covered by the annual report was:1,714,727,700 ordinary shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act:

Yes☒ No☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934:

Yes☐ No☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes☒ No☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of RegulationS-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes☐☒ No☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or anon-accelerated filer. See definition of “accelerated filer,” “large accelerated filer,” and “emerging growth company” inRule 12b-2 of the Exchange Act.

| Large Accelerated filer ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ | Emerging Growth Company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards* provided pursuant to Section 13(a) of the Exchange Act. ☐

*The term ‘‘new or revised financial accounting standard’’ refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board☒ | Other ☐ |

If ‘Other’ has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined inRule 12b-2 of the Exchange Act):

Yes ☐ No ☒

CAUTIONARY STATEMENT

This document may contain forward-looking statements, including ‘forward-looking statements’ within the meaning of the United States Private Securities Litigation Reform Act of 1995. Words such as ‘will’, ‘aim’, ‘expects’, ‘anticipates’, ‘intends’, ‘looks’, ‘believes’, ‘vision’, or the negative of these terms and other similar expressions of future performance or results, and their negatives, are intended to identify such forward-looking statements. These forward-looking statements are based upon current expectations and assumptions regarding anticipated developments and other factors affecting the Unilever Group (the ‘Group’). They are not historical facts, nor are they guarantees of future performance.

Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause actual results to differ materially from those expressed or implied by these forward-looking statements. Among other risks and uncertainties, the material or principal factors which could cause actual results to differ materially are: Unilever’s global brands not meeting consumer preferences; Unilever’s ability to innovate and remain competitive; Unilever’s investment choices in its portfolio management; inability to find sustainable solutions to support long-term growth;growth including to plastic packaging; the effect of climate change on Unilever’s business; significant changes or deterioration in customer relationships; the recruitment and retention of talented employees; disruptions in our supply chain;chain and distribution; increases or volatility in the cost of raw materials and commodities; the production of safe and high quality products; secure and reliable IT infrastructure; successful execution of acquisitions, divestitures and business transformation projects; economic, social and political risks and natural disasters; financial risks; failure to meet high and ethical standards; and managing regulatory, tax and legal matters.

These forward-looking statements speak only as of the date of this document. Except as required by any applicable law or regulation, the Group expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Group’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

Further details of potential risks and uncertainties affecting the Group are described in the Group’s filings with the London Stock Exchange, Euronext Amsterdam and the US Securities and Exchange Commission, including in the Unilever Annual Report and Accounts 2017.2018.

MAKING

SUSTAINABLE LIVING

COMMONPLACE

ANNUAL REPORT ON

FORM20-F 2017 2018

ANNUAL REPORT ON

FORM20-F 20172018

This document is made up of the Strategic Report, the Governance Report, the Financial Statements and Notes, and Additional Information for US Listing Purposes.

The Unilever Group consists of Unilever N.V. (NV) and Unilever PLC (PLC) together with the companies they control. The terms “Unilever”, the “Group”, “we”, “our” and “us” refer to the Unilever Group.

Our Strategic Report, pages 1 to 33,35, contains information about us, how we create value and how we run our business. It includes our strategy, business model, market outlook and key performance indicators, as well as our approach to sustainability and risk. The Strategic Report is only part of the Annual Report and Accounts 2017.2018. The Strategic Report has been approved by the Boards and signed on their behalf by Ritva Sotamaa – Group Secretary.

Our Governance Report, pages 3436 to 7665 contains detailed corporate governance information, our Committee reports and how we remunerate our Directors.

Our Financial Statements and Notes are on pages 7766 to 155.127.

Pages 1 to 157147 constitute the Unilever Annual Report and Accounts 20172018 for UK and Dutch purposes, which we may also refer to as ‘this Annual Report and Accounts’ throughout this document.

The Directors’ Report of PLC on pages 3436 to 46, 7749, 66 (Statement of Directors’ responsibilities), 10897 (Dividends on ordinary capital), 121110 to 126115 (Treasury Risk Management), 145 (branch disclosure)133 and 151 and 155137 (Post balance sheet event) and 145 (branch disclosure) has been approved by the PLC Board and signed on its behalf by Ritva Sotamaa – Group Secretary.

The Strategic Report, together with the Governance Report, constitutes the report of the Directors within the meaning of SectionArticle 2:391 of the Dutch Civil Code and has been approved by the NV Board and signed on its behalf by Ritva Sotamaa – Group Secretary.

Pages 158148 to 179167 are included as Additional Information for US Listing Purposes.

ONLINE

You can find more information about Unilever online at

| www.unilever.com |

For further information on the Unilever Sustainable Living Plan (USLP) visit

| www.unilever.com/sustainable-living |

The Annual Report on Form20-F 20172018 along with other relevant documents can be downloaded at

| www.unilever.com/ |

| CONTENTS | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 13 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 43 | ||||

Report of the | ||||

| ||||

| Directors’ Remuneration Report | 50 | |||

| 66 | ||||

| Independent auditors’ reports | 67 | |||

| Consolidated financial statements | 75 | |||

| Consolidated income statement | 75 | |||

| Consolidated statement of comprehensive income | 75 | |||

| Consolidated statement of changes in equity | 76 | |||

| Consolidated balance sheet | 77 | |||

| 78 | |||

| ||||

| ABOUT US |

AT A GLANCE

UNILEVER IS ONEOUR BRANDS ARE AVAILABLE IN OVER 190 COUNTRIES. THIS GIVES US A UNIQUE OPPORTUNITY TO POSITIVELY IMPACT THE LIVES OF PEOPLE ALL OVER THE WORLD’S LEADING CONSUMER GOODS COMPANIES, MAKING AND SELLING AROUND 400 BRANDS IN MORE THAN 190 COUNTRIES.WORLD.

Every day, 2.5 billion people use our products to feel good, look good and get more out of life. Our range of world-leading, household-namearound 400 household brands includes Lipton, Knorr, Dove, Axe,Rexona, Hellmann’s and Omo. ThirteenWe are one of the largest fast moving consumer goods (FMCG) companies globally. In 2018 we had 12 brands with turnover of over a billion euros or more. The strength of our global brands is reflected in Kantar’s Brand Footprint report published in May 2018. It found that 13 of the world’s top 50 FMCG brands – based on market penetration and consumer interactions – are owned by Unilever up from twelvewith these brands chosen 36 billion times each year. This is significantly more than any other FMCG company in the previous year, with our nearest competitor owning just five, according to Kantar’s brand footprint report in May 2017.study.

In 2017 we had 13 billion euro brands. In addition ourOur portfolio also includes trusted and iconic local brands designed to meet the specific needs of consumers in their home market such as Bango in Indonesia, PureitBrooke Bond in India and SuaveBrilhante in the United States.Brazil. We are increasingly seeing our local brands and innovations being rolled out to more markets such as Lakme and Breyers Delights. Our geographic reach gives us an unparalleled global presence, including a unique position in emerging markets which generate 58% of our turnover.

During 2017,From the beginning of 2018, Unilever operatedbegan operating across four categories.three new Divisions created as part of our efforts to accelerate shareholder value creation. The largest wasby turnover is Beauty & Personal Care followed by Foods & Refreshment then Home Care and Refreshment. Each one is discussed in more detailCare. Details of each can be found on pages 11 andto 12. In April 2017, we announced our intention to combine our Foods and Refreshment categories (which took effect on 1 January 2018) and the divestmentThe sale of our Spreadsspreads business which we expect to completewas also completed inmid-2018mid-2018. after a€6.825 billion offer from KKR in December 2017. These changes willcreate a strong platform to accelerate our strategy of long-term, sustainable shareholder value creation. In this Annual Report and Accounts, we report the performance of Foods and Refreshment separately because they were separate categories for the reporting period. They will be reported together from 2018 onwards.Our strategy is explained in detail on page 10.

Our business activities span a complex global value chain. Seechain which is described on page 9 for more details.9. At the heart of our business is a workforce of 161,000155,000 people (as at 31 December 2018) who are driven by our Purposepurpose and empowered to excel in our fast-changing markets. Unilever’sThe combination of global scale and local agility has become yet more effective through the continued implementation of our Connected 4 Growth (C4G) change programme to meet consumer trends which are detailed on page 8. Our employees are supported by leadership teams with representatives from over 70 countries. Of our business leaders, 80% are local to their markets reflecting the deep local expertise at the heart of our business. This rises to more than 90% when we include managers who support those teams.

In this volatile and uncertain world, protecting Unilever through the fostering of business integrity is anon-negotiable for all employees. Our Code of Business Principles (the Code), and the 24 policies that support it (Code Policies), set out the behaviour standards required from all our employees.people. The Code Policies cover a number of areas, including counteringanti-bribery and corruption, (eg anti-bribery), respecting people (eg respect, dignity and fair treatment)treatment of people and safeguarding information.personal data and privacy. Together, the Code and Code Policies help us put our values of Integrity, Respect, Responsibility and Pioneering into practice. See page 16 for more on our Code and Code Policies.

Our employeesDuring the year the Boards withdrew proposals to simplify Unilever’s dual-headed legal structure after extensive engagement with shareholders. We remain firmly committed to our 2020 financial programme and are supported by a management team with representatives from around 90 countries. In emerging markets, more than 70%confident of our country leadership teams are local. It is this combination of global strengthmeeting its key targets and deep local expertise which lies at the heart ofobjectives as our success in developing strong, consumer-relevant innovation.

To harness these global and local advantages we have changed the way we are organised. Central to this strategy is the accelerated implementation of Connected 4 Growth (C4G), the largest change programme Unilever has undergone in the last ten years to create a faster, simpler organisation. Our new C4G organisation is now fully operational. We expect the benefits of C4G to be realised progressively during 2018delivers more efficiency, lower costs and 2019. C4G’s strategic role is explained in moresignificant operational and financial benefits.

This Annual Report and Accounts provides further detail on page 10.

A further change to make Unileverour performance during the year and how our business model is delivering strong returns for shareholders and a simplermore sustainable way of doing business for the benefit of all our stakeholders. Find out more about our performance on pages 6 and more flexible business has been a review by the Boards of our dual-headed legal structure. The review by the Boards is continuing and the outcome will be announced in due course.7.

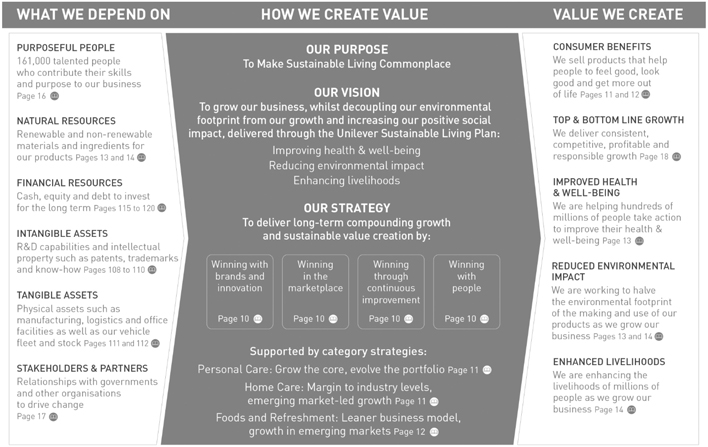

OUR PURPOSE

UNILEVER HAS A CLEARUNILEVER’S PURPOSE –IS TO MAKE SUSTAINABLE LIVING COMMONPLACE. WE BELIEVE THIS IS THE BEST WAY TO DELIVER LONG-TERM SUSTAINABLE GROWTH.

AsWe believe long-term sustainable growth is best delivered through brands that offer great performance and have a genuine purpose. Washing shirts whiter or making hair healthier and shinier is still vitally important, but product performance by itself is no longer enough. Consumers are looking for more.

At Unilever, we encourage our brand managers to take a stance and make a positive difference to society. Purpose defines a brand in people’s minds and is best delivered through action. It’s only through action that consumers will see purpose as more than marketing.

Our company purpose ‘To make sustainable living commonplace’ is unequivocal. We want to help create a world where everyone can live well within the pacenatural limits of change accelerates inthe planet. We put sustainable living at the heart of everything we do, including our markets, we are creating a stronger, simplerbrands and more agile business. These changes will help us to deliverproducts, our Purposestandards of behaviour and our Visionpartnerships which drive transformational change across our value chain.

Purpose takes many forms amongst our brands. Some, like Lifebuoy, take on life-threatening diseases associated with poor hygiene with programmes to growchange handwashing behaviour. Domestos’ purpose is to improve sanitation for millions of people who do not have access to a toilet. Our brands can also be a catalyst to promote positive cultural norms. Brooke Bond’s purpose ‘Common ground is only a cup away’ is highly relevant in an increasingly divided world and can be applied well locally. In India, it addresses religious tensions. In the Gulf, divorce. In Canada,same-sex relationships.

Some of our brands take an activist stance, mobilising citizens to change policy or create social movements. For example, Ben & Jerry’s builds movements around issues such as climate change and the refugee crisis. Seventh Generation – with its plant-based products – campaigns for renewable energy. Deodorant brand Rexona’s purpose is to help reverse physical inactivity, a big issue for societies facing increasingly sedentary lifestyles. Rexona believes ‘the more you move, the more you live’ supported by Motion Sense technology which works through movement. Radiant believes everyone deserves an opportunity to shine. It goes beyond bright clothes and helping consumers ‘dress to progress’, enhancing skills through its Career Academies. Each market focuses on the skills that matter locally. In Brazil that’s entrepreneurial and business whilst decouplingskills. In India, English language skills.

All of Unilever’s brands are on a journey to becoming purposeful. Sustainable Living brands are those that are furthest ahead. In 2017, 26 of our brands qualified as Sustainable Living brands including ourB-Corp certified brands such as Ben & Jerry’s, Seventh Generation and Pukka Herbs, which means that they meet high standards of social and environmental footprint from ourperformance, transparency and legal accountability. Our Sustainable Living brands grew 46% faster than the rest of the business and delivered more than 70% of Unilever’s growth, and increasing our positive social impact.driven by consumer demand for brands with purpose at their core.

However volatile and uncertain the world becomes,is, Unilever’s Purposepurpose – supported by the Unilever Sustainable Living Plan (USLP) and Visionbrands with purpose – will remain steadfast because we believe that managing for the long termbenefit of multiple stakeholders is the best way for us to grow.

We are well placednow looking beyond the current USLP as many of our targets end in 2020. We carried out an extensive listening exercise on the future of sustainable business. We spoke to deliver long-term value through our strategy, category strategies and the Unilever Sustainable Living Plan (USLP), launched in 2010. These are supported by a transformational change agenda which combines our own actions with a stakeholder approach to external advocacy and public policy. Our scale and reach mean we are well placed to capture the economic opportunities presented by the United Nations Sustainable Development Goals (SDGs). Find out more about how we are creating value from the SDGs on page 15.

The USLP is a value driver in its own right. Our commitment to the USLP’s three big goals of improving health and well-being forapproximately 300 stakeholders, including more than 1 billion people by 2020, halving our environmental footprint by 2030,130 external experts, and enhancing livelihoods for millions by 2020 has delivered growth forheard from over 40,000 employees through a ‘Have Your Say’ survey. They gave us their views on the business. In 2016, 18 of our top 40 brands qualified as Sustainable Living brands, growing 50% faster than the rest of the business, while delivering more than 60% of Unilever’s growth. Their success is driven by the growing consumer demand for brandspriorities that have purpose at their core. Our 2017 Sustainable Living brandsthey would like Unilever to focus on. The results will be announced in May 2018 once the analysis is complete. Find out more about our Sustainable Living brands on pages 11used to 13.

The USLP also delivers lower costs through reduced waste, energy and packaging. It lowers risks in our supply chain by securing a sustainable supply of critical raw materials such as palm oil and tea. And it also increases trust in our business - particularly among consumers, employees, investors and governments.

We work in partnership with governments and other organisations to drive transformational change across society with initiatives to help realise the SDGs. These are themselves opportunities to grow our business by addressing unmet challenges while alleviating major social and environmental issues, such as climate change and deforestation, creating more opportunities for women and enhancing livelihoods, promoting health and well-being and championing sustainable agriculture and food security.

Our track record over the past eight years proves our multi-stakeholder model of long-term, compounding, sustainable growth is working for shareholders. See page 18 for more details. At the same time, we have helped more than 601 million people improve their health and hygiene. We have enabled 1.6 million small-scale retailers and 716,000 smallholder farmers to access initiatives aiming to increase their incomes or improve their agricultural practices. And we have sourced 56% of our agricultural raw materials sustainably.

This Annual Report and Accounts provides further detail on our performance during the year and how our business model is delivering accelerated returns for shareholders and a more sustainable way of doing business for the benefit of all our stakeholders. Find out more about our performance on pages 6 and 7.co-create Unilever’s future agenda.

| Annual Report on Form 20-F | Strategic Report | 1 |

| CHAIRMAN’S STATEMENT |

As we look back on 2017, it2018 PERFORMANCE

I am pleased to report that 2018 was another year of consistent top and bottom line performance for Unilever. Solid revenue growth was combined with good profitability and cash flow delivery. This despite a challenging year for the global economy, with subdued growth and high levels of volatility undermining consumer confidence in many parts of the world.

Unilever is quite clearalso operating in a sector that the consumer goods sector is going through a vast amount ofexperiencing widespread change and disruption. Increasingly fragmented media channels and routesAlthough challenging, these changes offer significant opportunities to market are transforming the shopper experience and leaving the way open for many more new players to enter our markets. Consumers’ own behaviour is also changing, with a much higher importance being placed today on products that satisfy a growing desire for naturalness and authenticity.

It all makes this a very exciting time to be in consumer goods and while change on this scale brings its own challenges, there are many more opportunities in my view, especially for companies able to respondmove with the kind of speed and agility and who can tailor their offering to changing consumer preferences. To that today’s environment demands.

For Unilever,end, the organisational changes of recent years - with a much greater focus on front-line empowerment - combined withBoards are very confident that Unilever’s strategy and the steady strengtheningmeasures it has taken to strengthen its organisation, sharpen its portfolio and sharpening of our portfolio, mean that the Group isdigitise its operations make it well placed to take advantagecapture new and emerging growth opportunities.

The Boards also believe that the Unilever Sustainable Living Plan continues to set Unilever apart as a business highly attuned to the growing desire among consumers for companies and brands that serve a wider societal and environmental need.

In 2018 we also completed successfully the complex disposal of the spreads business. Our ShareBuy-back programme delivered on its intention to buy back shares with an aggregate market value of€6 billion, in line with Unilever’s objective to return theafter-tax proceeds of the spreads disposal to shareholders.

SIMPLIFICATION

Following a thorough review and widespread consultation, the Boards put forward proposals in 2018 to simplify Unilever’s dual-headed structure under a new single holding company.

In developing the proposal – including a recommendation to incorporate in the Netherlands while maintaining listings in the Netherlands, the UK and the US – the Boards were motivated by the opportunity to unlock value by simplifying Unilever and giving it added flexibility to compete effectively over the longer-term.

We recognised however that the proposal did not receive support from a significant group of shareholders and therefore considered it appropriate to withdraw. The Boards still believe that simplifying Unilever’s dual-headed structure would, over time, provide opportunities to further accelerate value creation and would serve Unilever’s best long-term interests.

Since withdrawing the proposal, I have met with a significant number of PLC and NV shareholders to discuss further ideas and possible next steps. It is clear from all these changing market dynamics. Theremeetings that there is widespread support for the principles and strategic rationale behind Simplification. In these meetings, I also no doubt,took the opportunity to reaffirm our commitment to further strengthen our corporate governance. Accordingly, in my view,February 2019, we followed through on our commitment to cancel the NV Preference Shares, in itself a major step towards simplifying the company’s share capital.

BOARD COMPOSITION AND SUCCESSION

The 2018 AGMs marked the retirement of Ann Fudge as aNon-Executive Director and Vice-Chairman of the Boards. On behalf of the Boards, I would like to thank Ann for her outstanding and valued contribution to Unilever.

I was also delighted that you elected Andrea Jung as aNon-Executive Director at the same AGMs. Andrea brings highly relevant experience and expertise to Unilever and is a very welcome addition to the Boards.

CEO SUCCESSION

A key focus for the Boards last year was to manage the CEO succession, with Paul Polman stepping down as CEO after 10 years with the Group.

After a rigorous and wide-ranging selection process, the Boards were unanimous in its decision to appoint Alan Jope to the role. Alan became CEO on 1 January 2019 and is being proposed as an Executive Director at the 2019 AGMs.

Alan has led Unilever’s unflinchinglargest Division, Beauty & Personal Care, for the last four years and he has been a member of the Group’s Leadership Executive since 2011. His previous roles include running Unilever’s business in North Asia. Alan has deep understanding and wide experience of Unilever’s business and markets. He is a strong, dynamic and values-driven leader with an impressive track record of delivering consistent high-quality performance across both developed and emerging markets. The Boards warmly welcome Alan to the role and look forward to working closely with him in the years ahead.

Unilever has been transformed under the leadership of Paul Polman. He has overseen ten years of consistent top and bottom line growth and very competitive returns to shareholders. He leaves with the company’s geographic footprint and brand portfolio stronger and well positioned for future growth.

Paul’s pioneering commitment to sustainable and equitable growth have marked him – and the company – out as reflectedleaders in the field. Thanks to his visionary leadership and tireless efforts, Unilever Sustainable Living Plan, has growing resonance among consumersis not only one of the most admired and respected companies in the world over.today, but also one of the most desired employers.

These factors certainly contributed to another strong year for Unilever, with solid revenue growth, strong profitabilityPaul retired as CEO and good cash flow performances. These results capped what has been an eventful year foras a Board member on 31 December 2018. He will support the transition process in the first half of 2019 and will leave the Group which included – in February – an unexpected takeover attempt.

The Board had no hesitation in rejectingearly July. We thank him for his remarkable contribution to the offer for all the shares of Unilever N.V.company and PLC, which we believed was without any financial or strategic merit. Even though the offer was quickly withdrawn, it did highlight further opportunities to capture the value we see in Unilever at a faster rate.

To that end, the Board and management undertook a thorough review on how to accelerate sustainable shareholder value creation, building on the Group’s successful long-term compounding growth model. A wide-ranging package of measures announced in April was well received and by the end of the year the Group was able to report strong progress towards those goals.

At the heart of the review was an acceleration of the Group’s existing strategy, including faster implementation of the successful Connected for Growth change programme, first introduced in 2016, as well as the further sharpening and strengthening of the portfolio. No fewer than twelve acquisitions were announced or completed in 2017. Significantly, the Group also announced in December the sale of the Spreads business to KKR.

As part of the review the Group also announced the setting of a long-term goal towards an underlying operating margin target of 20% by 2020 and the completion of a€5 billion sharebuy-back programme. Another important outcome was a commitment to simplify the Group’s capital structure, and hence provide Unilever with the flexibility for further – and bigger – portfolio change if deemed necessarywish him every success in the future. The review of the dual-headed structure is progressing well, and while no decisions have yet been taken, the Board considers that unification with a single share class would be in the best interests of Unilever and its shareholders as a whole.

Whatever the outcome of the dual-headed structure review, the Board is determined that Unilever will remain at the forefront of good corporate governance and to that end we have already announced that it would be our intention to maintain listings in the Netherlands, the United Kingdom and the United States, and continue to apply both the UK and Dutch corporate governance codes.

These are important matters, but the Board also remains firmly focussed on the Group’s number one priority of continued outperformance over both the medium and the long-term. The events of this year havere-affirmed our confidence that Unilever has both the quality of management and the clarity of strategy needed to deliver on this objective.REMUNERATION

During the review earlier in the year, I met2018 we also continued to consult with investors in Europe and North America as part of a consultation exercise involving 50 of the Group’s top shareholders and other investors. The meetings were valuable in confirming the widespread support among shareholders for Unilever’s long-term compounding growth model, whilst also helping to identify opportunities to accelerate value creation.

We also conducted a separate consultation on our proposed new Remuneration Policy, particularly for the Executive Directors. At the 2017 AGMs you provided your strong support to the implementation of a reward framework that encourages and enhances thea strong performance culture that Paul Polman has built at Unilever by enabling Unilever managers within Unilever to have an even stronger personal commitment to Unilever share ownership. The proposed

At the 2018 AGMs, we asked shareholders to approve a new Remuneration Policy will be put tothat would align the pay of our Executive Directors fully with the Reward Framework we introduced following the 2017 AGMs. Whilst shareholders to beapproved the new Remuneration Policy, we recognised that a significant minority of NV and PLC shareholders voted upon atagainst the proposal. On pages 50 and 51 of the 2018 AGMsDirectors’ Remuneration Report, we describe in Maydetail the principal concerns and how we responded to enable this. Further information on our proposals can be found inthem and other changes to the Compensation Committee’s report on pages 47 to 76.implementation of the Remuneration Policy.

EVALUATION

OurFollowing the external Board evaluation in 2017, was externally facilitated andwe used a simplified internal evaluation this year. While we concluded that the results were discussed atBoards continued to operate in an effective manner overall, the April 2017 Board meeting. The Board continues to perform effectively with good leadership and competent and engaged members, and has the appropriateBoards decided that it will maintain a particular focus on bothin-year performanceportfolio and strategy for the future. Reflecting on the lessons learnt by thechannel strategies and digitisation. Each Board in the previous year the Board agreed, in particular, in the evaluation discussions to:

Further detail on the evaluation process this year, together with the Board’s remit, operations and the topics the Board regularly discusses and debates can be found in the Governance section on pages 34 to 76.

BOARD COMPOSITION AND SUCCESSION

During the year, we saw the departure of Professor Louise Fresco who I would like to thank for her outstanding contribution to Unilever. The Board remains truly diverse in their nationality, experience and gender, with the proportion of femaleNon-Executive Directors in 2017 at 45%.effectiveness further. These are described within each Committee Report.

LOOKING AHEAD

Confidence in our outlook was reflected earlier in the year when we announced a 12% increase in the dividend for the 2017 financial year. Despite the factEven though trading conditions are likely to remain challenging in 2018,2019, the Board remainsBoards remain confident both in the outlook and in the strategy for the Group.Group, reflected by an 8% increase in the dividend for the 2018 financial year.

Finally, on behalfOver the year, Board members have visited Unilever operations in several parts of the Board, I would like to thank our many stakeholdersworld, including China and the United States. We have seenfirst-hand the depth of talent that exists within the company, as well as the 161,000 hardworkingcommitment of Unilever people to go on improving the lives of consumers and the societies in which the company operates. On behalf of the Boards, I want to thank all of the 155,000 employees of Unilever for their remarkable efforts.

Equally we have been pleased to engage with many of the company’s other stakeholders, without whom Unilever could not be successful. That includes our shareholders, who I also want to thank for their continued support and commitment.of the company.

MARIJN DEKKERS

CHAIRMAN

| 2 | Strategic Report | Annual Report on Form 20-F |

| BOARD OF DIRECTORS |

OVERVIEW OF EXECUTIVE &NON-EXECUTIVE DIRECTORS

MARIJN DEKKERSChairman

Previous experience: Bayer AG (CEO); Thermo Fisher Scientific Inc. (CEO).

Current external appointments: Novalis LifeSciences LLC (Founder and Chairman); General Electric Company (NED); Quanterix Corporation (Director); Georgetown University (member Board of Directors); Foundation for the National Institutes of Health (Director).

|

|

|

| |||

YOUNGME MOON |

|

GRAEME PITKETHLY

|

NILS SMEDEGAARD | |||

| Vice-Chairman/Senior | CEO | CFO | ANDERSEN | |||

| Independent Director | ||||||

|

|

|

| |||

Previous experience: Current external appointments: |

Previous experience:

| NationalityBritish Previous experience:Unilever UK and Ireland (EVP and General Manager); Finance Global Markets (EVP); Group Treasurer; Head of M&A; FLAG Telecom (VP Corporate Development); PwC. Current external appointments:Financial Stability Board Task Force on Climate Related Financial Disclosure (Vice Chair). | Previous experience:A.P. Moller – Maersk A/S (Group CEO); Carlsberg A/S and Carlsberg Breweries A/S (CEO); European Round Table of Industrialists (Vice-Chairman); Unifeeder S/A (Chairman). Current external appointments:AKZO Nobel N.V. (Chairman); BP Plc (NED); Dansk Supermarked A/S | |||

|

|

|

| |||

LAURA CHA

|

VITTORIO COLAO |

JUDITH HARTMANN |

| |||

|

|

|

| |||

Previous experience:Securities and Futures Commission, Hong Kong (Deputy Chairman); China Securities Regulatory Commission (Vice Chairman); China Telecom Corporation Limited (NED); 12th National People’s Congress of China (Hong Kong Delegate). Current external appointments:HSBC Holdings plc (NED);

| Previous experience:Vodafone Group plc (CEO); RCS MediaGroup SpA (CEO); McKinsey & Company (Partner); Finmeccanica Group Services SpA (renamed to Leonardo SpA) (NED); RAS Insurance SpA (merged with Allianz AG) Current external appointments: | Previous experience:General Electric (various roles); Bertelsmann SE & Co. KGaA (CFO); RTL Group SA (NED); Penguin Random House LLC (NED). Current external appointments:ENGIE Group | Previous experience:Avon Products Inc (CEO); General Electric (Board Member); Daimler AG (Board Member). Currentexternal appointments:Grameen America Inc (President and CEO); Apple Inc (NED); Wayfair Inc (NED). | |||

MARY MA | STRIVE MASIYIWA | JOHN RISHTON | FEIKE SIJBESMA | |||

Previous experience:TPG Capital, LP (Partner); TPG China Partners(Co-Chairman). Current external appointments:Lenovo Group Ltd. (NED); Boyu Capital Consultancy Co. Ltd (Managing Partner); MXZ Investment Limited (Director); Securities and Futures Commission, Hong Kong (NED). | ||||||

|

|

|

| |||

Previous experience:Africa Against Ebola Solidarity Trust(Co-Founder and Chairman); Grow Africa(Co-Chairman); Nutrition International (formerly known as Micronutrient Initiative) (Chairman). Current external appointments:Econet Group (Founder and Group Executive Chairman); Econet Wireless Zimbabwe Ltd (Director); The Alliance for a Green Revolution in Africa (AGRA)Not-for-Profit Corporation (Chairman); Rockefeller Foundation (Trustee). | Previous experience:

|

Current external appointments:Informa plc (NED); Serco Group plc (NED); Associated British Ports Holdings Ltd. (NED). | Previous experience:Supervisory Board of DSM Nederland B.V. (Chairman); Utrecht University Current external appointments:Koninklijke DSM NV (CEO and Chairman of the Managing Board); De Nederlandsche Bank NV (Member of the Supervisory Board); Carbon Pricing Leadership Coalition (High Level Assembly

| |||

|

|

|

| |||

NON-EXECUTIVE DIRECTORS

| MARIJN | NILS | LAURA | VITTORIO | ANN | JUDITH | MARY | STRIVE | YOUNGME | JOHN | FEIKE | MARIJN | NILS | LAURA | VITTORIO | JUDITH | ANDREA | MARY | STRIVE | YOUNGME | JOHN | FEIKE | |||||||||||||||||||||||

| DEKKERS | ANDERSEN | CHA | COLAO | FUDGE | HARTMANN | MA | MASIYIWA | MOON | RISHTON | SIJBESMA | DEKKERS | ANDERSEN | CHA | COLAO | HARTMANN | JUNG | MA | MASIYIWA | MOON | RISHTON | SIJBESMA | |||||||||||||||||||||||

Age | 60 | 59 | 68 | 56 | 66 | 48 | 65 | 57 | 53 | 60 | 58 | 61 | 60 | 69 | 57 | 49 | 59 | 66 | 58 | 54 | 61 | 59 | ||||||||||||||||||||||

Gender | Male | Male | Female | Male | Female | Female | Female | Male | Female | Male | Male | Male | Male | Female | Male | Female | Female | Female | Male | Female | Male | Male | ||||||||||||||||||||||

Nationality | Dutch / American | Danish | Chinese | Italian | American | Austrian | Chinese | Zimbab- wean | American | British | Dutch | Dutch / American | Danish | Chinese | Italian | Austrian | American / Canadian | Chinese | Zimbabwean | American | British | Dutch | ||||||||||||||||||||||

Appointment date | April 2016 | April 2015 | May 2013 | July 2015 | May 2009 | April 2015 | May 2013 | April 2016 | April 2016 | May 2013 | November 2014 | April 2016 | April 2015 | May 2013 | July 2015 | April 2015 | May 2018 | May 2013 | April 2016 | April 2016 | May 2013 | November 2014 | ||||||||||||||||||||||

Committee membership* | CC, NCGC | AC | NCGC | CC | CC (Chairman) | AC | CC | CRC (Chairman) | CRC | AC (Chairman) | CRC, NCGC (Chairman) | CC, NCGC (Chairman) | AC | NCGC | CC (Chairman) | AC | CC | CC | CRC (Chairman) | CRC | AC (Chairman) | CRC, NCGC | ||||||||||||||||||||||

Leadership of complex global entities | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||

Finance | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||||

Broad Board experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||

Consumer / FMCG insights | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||

Geo-political exposure | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||

Financial expertise | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||||

FMCG/consumer insights | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||

Emerging markets experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||

Digital insights | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||||||||

Sales & marketing | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||||||

Marketing and sales expertise | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||||||

Science & technology | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||||||||

Science, technology and innovation expertise | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||||||||

CSR experience | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||||||||

HR and remuneration in international firms | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||||

Attendance at planned Board Meetings | 6/6 | 6/6 | 6/6 | 6/6 | 6/6 | 6/6 | 6/6 | 6/6 | 6/6 | 6/6 | 6/6 | 6/6 | 6/6 | 6/6 | 6/6 | 6/6 | 3/3 | 6/6 | 6/6 | 6/6 | 6/6 | 6/6 | ||||||||||||||||||||||

Attendance at ad hoc Board Meetings | 8/8 | 8/8 | 6/8 | 7/8 | 5/8 | 6/8 | 8/8 | 7/8 | 7/8 | 5/8 | 7/8 | 4/4 | 2/4 | 2/4 | 4/4 | 3/4 | 3/3 | 4/4 | 3/4 | 4/4 | 3/4 | 4/4 | ||||||||||||||||||||||

Tenure as at 2017 AGMs | 1 | 2 | 4 | 2 | 8 | 2 | 4 | 1 | 1 | 4 | 3 | |||||||||||||||||||||||||||||||||

Tenure as at 2018 AGMs | 2 | 3 | 5 | 3 | 3 | 0 | 5 | 2 | 2 | 5 | 4 | |||||||||||||||||||||||||||||||||

| * | AC refers to the Audit Committee; CC refers to the Compensation Committee; CRC refers to the Corporate Responsibility Committee; and NCGC refers to the Nominating and Corporate Governance Committee. |

| Annual Report on Form 20-F | Strategic Report | 3 |

| CHIEF EXECUTIVE OFFICER’S REVIEW | ||

Widespread economic and geopolitical uncertainty meant that the global business environment remained challenging in 2018. Currency depreciation in a number of key markets fuelled inflationary pressures and dampened consumer demand, while input costs rose steadily on the back of escalating commodity prices.

A CHALLENGING BACKDROP TO THE YEARSOLID PERFORMANCE

2017Against this backdrop, Unilever delivered a solid performance. Underlying sales grew by 3.1%, excluding the recently-divested spreads business (2.9% including spreads). Growth was another challenging yearprofitable, bringing our underlying operating margin to 18.4%, up 90 basis points, which also drove a healthy free cash flow of€5 billion for the world economy,year.

Importantly, the overall shape and quality of the performance was encouraging. We achieved a good balance of price and volume growth. Growth was broad-based, across each of our three global Divisions – Beauty & Personal Care, Home Care and Foods & Refreshment. Our continuing margin progression was underpinned by well-embedded savings and efficiency programmes, and an improving mix from underlying sales growth in particular forBeauty & Personal Care.

Inspired by the consumer goods industry. Consumer confidence continued to be hit by a combination of stagnating wages, recessionary pressuresUnilever Sustainable Living Plan, we also saw our brands with the most distinct and widespread politicalwell-articulated social and economic uncertainty. While the economic system is working for some, the benefits are still not widely felt, and inequality is rising in most countries. That’s not good for the consumer goods industry. Climate change is also becoming an increasing risk factor for most sectors, makingenvironmental purpose grow significantly faster than our own mitigating actions even more important.other brands.

At the same time, our industry experienced unprecedented levels of disruptionThe performance last year driven by the accelerating pacedemonstrates I believe that our strategy is working. By empowering our three global Divisions, we are allowing for more strategic allocation of technology. When combined with significant changesresource and for greater differentiation in meeting changing consumer behaviour, these events are causing manufacturersneeds. Beauty & Personal Care, for example, made good progress in moving to more premium positions and retailers alike to rethink fundamentally how they reach, serve and – ultimately – delight consumers in markets that are more dynamic and open to entry than ever before.

THE IMPORTANCE OF CONSISTENT PERFORMANCE

Delivering consistent, market-beating performance in such volatile and fast-changing markets is increasingly challenging. Not many companies achieve it. In fact, a McKinsey & Co study found that over a thirty-year period only 40% of nonfinancial companies thenexpanding in the S&P 500 survived. “It’s grow or go” they concluded and “60% have gone” (‘Why it’s a world of grow or go’. McKinsey & Co). By contrast, those companies that can deliver consistent performance in a responsible way get rewarded.

Judged against these criteria, it is not difficult to see why Unilever finds itself one of the best performing companies in our sector,high growth segments. Home Care built on its already strong emerging market footprint with a total shareholder return overstrategy of market development andbenefit-led innovation for emerging needs. Whilst Foods & Refreshment was combined into a single division bringing more scale and focus to allow faster transformation of our portfolio.

The results in 2018re-affirm the last nine yearsenduring strength of closeUnilever’s brands and the growing resilience of our organisational model, as well as underlining Unilever’s ability to 300%. In that time the Group has also delivereddeliver consistent top and bottom line progress. This goesperformance even in very challenging conditions. Nevertheless, we are determined to step up the proportion of our business that is winning market share as part of moving our sales growth more consistently into the middle of our multi-year3-5% targeted range.

A YEAR OF PROGRESS

As well as delivering a solid set of results, we also made good progress in 2018 in strengthening the overall business to be ready for future opportunities:

A GOOD YEAR

2017 saw a continuation of this trend. Underlying sales excluding spreads, which we have agreed to sell, grew 3.5% (3.1% including spreads), representing a good performance in largely subdued markets. Growth was broad-based – across all our categories – and of good quality, supported by high levels of brand and marketing investment.

There was excellent progress on absolute profitability and on underlying operating margin – by 110 basis points – helped by strong delivery against the key savings and efficiency programmes behindworld, our Connected for Growth (C4G) change programme, which started inorganisational model is helping to increase speed and agility, as well as giving rise to a greater entrepreneurial spirit inside the company. As an illustration of this, time to market with new innovations to meet local trends is now40%-50% faster compared to 2016. We also launched 19 new brands, including Love Home and Planet, a range of plant-based, home-cleaning products and aTwo-thirdsfollow-up to our successful launch of the more than€2 billion of savings generated in 2017 werere-invested behind growing our brands innatural and sustainable hair and skincare product range, Love Beauty and Planet.

By any measure, this represents a good,all-round performance, as well as further evidencethe direction of the transformation of Unilever to a sustainable growth company. In this environment, we continue to believe that a long-term focus on multiple stakeholders, behind a purpose-driven sustainable business model, is the best guarantee of future success.

LOOKING AHEAD WITH CONFIDENCE

Although the global economy is showing signs of improvement, we can expect 2018 to be another challenging year, with further rapid and wide-ranging disruption to our markets. In addressing these challenges, we are benefiting, I believe, from having started early in anticipating – and responding to – manyfaster-growing segments of the trends and developments we currently seere-shaping our markets.

By anticipating, for example, themarket, especially those that speak to consumers’ growing desire of consumers for more natural products and authentic productspurpose-driven brands. The vast majority of businesses we have acquired over recent years are now growing by double digits on a yearly basis and we were delighted at the end of last year to announce the acquisition of GlaxoSmithKline’s Health Food Drinks portfolio, including its iconic Horlicks brand in India and the rest of Asia, further increasing our presence in the highly attractive health-food category. We also completed successfully the complex disposal of the spreads business, returning theafter-tax proceeds to shareholders.

new and faster-growing channels. Oure-commerce sales were up by 47%, ahead of globale-commerce market growth and putting us well on the road to building a scalee-commerce business. We also accelerated the growth of our business with Discounters, in the Health and Beauty channel and in theout-of-home eating market. |

that the growth of our sustainable living brands was outstripping other brandsalmost 50 countries. That is a remarkable achievement, and accounted for 60% oftestament to Unilever’s growth.

The leadership role Unilever has played more widely in pioneering responsible business models was also further acknowledged last year. Indeed, for the seventh consecutive year Unilever topped the GlobeScan/SustainAbility ranking of 1,000 sustainability experts around the world – the longest-running and most extensive survey of its kind. The study identified integrating sustainability into the heart of the business, demonstrating executive leadership, strong performance in supply chain management,values and commitment to be a force for good in the world.

Strengthened by these measures, we are good in shape for the future. We ended 2018 with 58% of our turnover in the emerging markets and enjoying number 1 or 2 positions in 85% of the key markets and categories in which we compete. Our Beauty & Personal Care business – where some of the biggest growth opportunities exist – now represents 40% of our turnover. All of this makes us well placed to capture the many opportunities that exist across our markets.

LOOKING AHEAD

Building on these strong foundations, I have already made clear that my first priority as CEO will be to accelerate quality growth. For us, that means aninvestment-led approach based on delivering our 4G growth model – consistent growth, competitive growth, profitable growth and responsible growth, with an equal focus on each.

In particular, I want to leave no doubt that I intend to build further on Unilever’scentury-old commitment to responsible business. ‘Making Sustainable Development Goals (SDGs),Living Commonplace’ will remain our purpose as among key reasons behinda company and we will use this to keep Unilever at the Group’s leadership, concludingforefront of ensuring business is a force for good. More and more of our brands will become explicit about the positive social and environmental impact they have. This is entirely aligned to the instincts of our people and to the expectations of our consumers. It is not about putting purpose ahead of profits, it is purpose that “Unilever continues to be seen asdrives profits.

Despite the global leader on sustainability”.

We areprogress we have made in recent years, I am also benefiting from the company-wide implementation of Connected for Growth. By streamlining the Group and by empowering our front-line operators, C4G is providing the combination of resilience and agilityclear that today’s trading environment demands. We are already seeing the benefits, with employees reporting– in a significant improvement inworld where the speed of decision-makingchange is relentless – we need to quicken the pace of everything we do still further. I want to make speed and skills for a greater ‘biasdigital age a hallmark of Unilever under my leadership.

If we can do all this then I am confident we can achieve our strategic aims and deliver many years of solid cash flow, further underlying operating margin improvement and good quality growth.

AND FINALLY…

I want to thank my colleagues throughout the whole company for action’.their hard work in delivering these results. Unilever is fortunate to have such talented and dedicated people and I am deeply aware of my responsibilities to them – and to our many other stakeholders – in being asked to lead this wonderful company.

A key measure of C4G’s longer term success will be our abilityI especially want toroll-out bigger and more impactful innovations even quicker, both globally and locally. Again, there is evidence of improved performance. The number of local launches was substantially up in 2017. Our key emphasis, however, remains on our core, global brands and on developing strategic, global launches based on larger projects with more consumer benefits. We already see some great examples of this, including in 2017 with thank my predecessor, Paul Polman. Unilever has been transformed under his inspiring leadership. He has worked tirelessly to make the launch of Magnum Pints, providing the ultimateice-cream and chocolate experience in a tub; theroll-out of Baby Dove to a further 19 countries; the relaunch of the Hellmann’s brand with strengthened naturalness claims in 28 markets, as well as theroll-out of Hellmann’s organic variants in both Europe and North America;company stronger and the continuedroll-outworld a better place. It has been a privilege to serve with him and an honour now to succeed him.

I also want to thank the Unilever Board of Directors for their confidence and invaluable guidance as I take on the incredibly successful Domestos toilet blocks, now in 33 countries, helpingrole. And, finally, to drive double-digit growthour shareholders, thank you for the brand. It is a further measure of the strength of our brands that more of them appearyour ongoing support and belief in the annual Kantar Global Ranking of Most Chosen Consumer Brands than those of our competitors.

In the spirit of the C4G changes, we also announced last year the bringing together of our Foods and Refreshment categories into a single division, based in Rotterdam. The work for this was completed in 2017. We believe the new Foods & Refreshment division can become an even stronger global powerhouse, benefiting from the scale and efficiencies that the integration will bring.

We have also moved decisively in recent years to reshape our portfolio in anticipation of changing consumer trends and to help maximise new and burgeoning growth opportunities. Over the last three years, we have made – or announced – 22 acquisitions. Twelve of these came last year alone as we accelerated our portfolio transformation further, making 2017 one of the most active acquisition periods in the company’s history.

These new businesses strengthen our portfolio in a variety of ways. Some give us access to fast-growing segments of markets incompany, which we are already active but currently under-represented, such as Carver Korea, which will enable us to leverage the growing demand for Korean skin care products. Others will enable us to expand in complementary, adjacent categories, such as colour cosmetics (Hourglass) and air purification (Blue Air). Some give us greater regional scale in existing categories, as is the case with the acquisition of the Quala home and personal care business in Latin America and EAC in Myanmar. And others bring skills and capabilities in new, rapidly emerging segments, including subscription anddirect-to-consumer models (e.g. Dollar Shave Club and our Prestige beauty businesses).

Having announced earlier in the year the intention to divest our spreads business, 2017 also ended with the announcement of the sale of the business to KKR for a little over€6.8 billion.

This combination of an increasingly relevant Unilever Sustainable Living Plan, a C4G change model that supports the kind of speed, agility and organisational resilience needed to compete in today’s markets; and a sharper portfolio better weighted to higher growth categories and geographies, gives us the confidence that we can go on delivering consistent, market-beating performance.

We are also particularly well placed, I believe, to capture the opportunities of the digital revolution - and the unprecedented explosion in data – which are transforming our markets and our ways of operating. Again, we started early. Our digital marketing capabilities, for example, have frequently been recognised as among the best in the industry and the online sales of our brands increased by a further 80% last year, making it a€1.7 billion business for us. However, this area is moving fast. The amount of data in the world is more than doubling every two years. Our ambition is to build a billionone-to-one consumer relationships, leveraging ourin-house People Data Centres and the opportunity they give us to connect with consumers in a meaningful way through real-time analytics. We need to continue driving this critical agenda, which is why we are investing heavily in digital, experimenting with a range of new,direct-to-consumer business models and embarking on an enterprise wide digital transformation programme.

THE POWER OF OUR PEOPLE

Ultimately, Unilever’s success will come down to its ability to attract and retain the most talented individuals and to motivate and inspire them with a mission and a purpose that speaks to the long-term aims and values of the company.

Here, again, we start from a strong base. A remarkable 90% of employees’ express pride in working for Unilever, well above the industry average. And last year the number of countries in which Unilever was named ‘most desired employer’ rose to 44 of the 52

markets in which we recruit - a more than 25% increase on the year before and a remarkable testament to the attractiveness of our employer proposition and our purpose-driven model.

At the heart of our people agenda is a focus on creating a balanced and inclusive workforce. This focus not only underpins Unilever’s longstanding values – especially tolerance and respect - but also guarantees the diversity of thought and ideas on which our business depends. We made further strides again in 2017, not least in the area of gender balance, with the proportion of female managers rising to 47% of our total management population.

DELIVERING FOR ALL OUR STAKEHOLDERS

In conclusion, let me thank all of the wonderful people of Unilever – and the many more we partner with around the world – who worked soalways work hard to make 2017 such a strong and positive year for the Group. It was a year in which our long-term compounding growth model was questioned by some, but was ultimately shown to be a model that unequivocally delivers in the interests of Unilever and its multiple stakeholders, including shareholders.retain.

PAUL POLMANALAN JOPE

CHIEF EXECUTIVE OFFICER

| 4 | Strategic Report | Annual Report on Form 20-F 2018 |

UNILEVER LEADERSHIP EXECUTIVE (ULE) OVERVIEW

FOR PAUL POLMANALAN JOPE AND GRAEME PITKETHLY SEE PAGE 3

|

|

|

| |||

DAVID BLANCHARD Chief R&D Officer

| MARC ENGEL Chief Supply Chain Officer | HANNEKE FABER President, Europe |

President, | |||

|

|

|

| |||

NationalityBritishAge Appointed to ULEJanuary 2013 (will retire in April 2019) Joined Unilever1986 Previous Unilever posts include: Unilever Research & Development (SVP); Unilever Canada Inc. (Chairman); Foods America (SVP Marketing Operations); Global Dressings (VP R&D); Margarine and Spreads (Director of Product Development). Current external appointments: Ingleby Farms and Forests (NED). | NationalityDutchAge Appointed to ULEJanuary 2016 Joined Unilever1990 Previous Unilever posts include: Unilever East Africa and Emerging Markets (EVP); Chief Procurement Officer; Supply Chain, Spreads, Dressings and Olive Oil Europe (VP); Ice Cream Brazil (Managing Director); Ice Cream Brazil (VP); Corporate Strategy Group; Birds Eye Wall’s, Unilever UK (Operations Manager). Current external appointments: PostNL (Supervisory Board member).

| NationalityDutchAge Joined Unilever2018 Previous posts include: Royal Ahold Delhaize (CEIO & EC) Royal Ahold (CCO) Current external appointments: Bayer AG (Supervisory Board member), Leading Executives Advancing Diversity (LEAD) (advisory board member). | Nationality

| |||

|

|

|

| |||

Appointed to ULENovember 2011 Joined Unilever1993 Previous Unilever posts include:President, North America and Global Head of Customer Development; Brazil (EVP); Unilever Foods South Africa (CEO); Unilever Bestfoods Asia (SVP and Board member). Current external

| ||||||

LEENA NAIR Chief Human Resources Officer | NITIN PARANJPE President, Foods and | RITVA SOTAMAA Chief Legal Officer and Group Secretary | AMANDA SOURRY President, North America & Global Head of Customer Development | |||

NationalityIndianAge Appointed to ULEMarch 2016 Joined Unilever1992 Previous Unilever posts include:HR Leadership and Organisational Development and Global Head of Diversity (SVP); Hindustan Unilever Limited (Executive Director HR); Hindustan Lever (various roles). | NationalityIndianAge Appointed to ULEOctober 2013 Joined Unilever1987 Previous Unilever posts | NationalityFinnishAge Appointed to ULEFebruary 2013 Joined Unilever2013 Previous posts include:Siemens AG – Siemens Healthcare (GC); General Electric Company – GE Healthcare (various positions including GE Healthcare Systems (GC)); Instrumentarium Corporation (GC). Current external appointments: Fiskars Corporation (NED). | ||||

|

| |||||

NationalityBritishAge Appointed to ULEOctober 2015 Joined Unilever1985 Previous Unilever posts include: President Foods; Global Hair (EVP); Unilever UK and Ireland (EVP and Chairman); Global Spreads and Dressings (EVP); Unilever US Foods (SVP). Current external appointments:PVH Corporation. (NED).

| ||||||

KEITH WEED Chief Marketing & Communications Officer | ||||||

NationalityBritishAge Appointed to ULEApril 2010 (will retire in May 2019). Joined Unilever1983 Previous Unilever posts include: Global Home Care and Hygiene (EVP); Lever Fabergé (Chairman); Hair and Oral Care (SVP). Current external appointments: Business in the Community

| ||||||

| ||||||

| Annual Report on Form 20-F | Strategic Report | 5 |

| GROWING THE BUSINESS | 2017 | 2016 | 2015 | |||||||||

| GROUP | ||||||||||||

TURNOVER GROWTH | ||||||||||||

Turnover growth averaged 1.0% over five years | 1.9% | (1.0%) | 10.0% | |||||||||

UNDERLYING SALES GROWTH* | ||||||||||||

Underlying sales growth averaged 3.6% over five years | 3.1%^ | 3.7% | 4.1% | |||||||||

UNDERLYING VOLUME GROWTH* | ||||||||||||

Underlying volume growth averaged 1.5% over five years | 0.8% | 0.9% | 2.1% | |||||||||

OPERATING MARGIN | ||||||||||||

Operating margin averaged 15.4% over five years | 16.5% | 14.8% | 14.1% | |||||||||

UNDERLYING OPERATING MARGIN* | ||||||||||||

Underlying operating margin has steadily increased over five years from 15.1% to 17.5% | 17.5% | 16.4% | 15.6% | |||||||||

FREE CASH FLOW* | ||||||||||||

Unilever has generated free cash flow of€22.0 billion over five years | €5.4 billion | €4.8 billion | €4.8 billion | |||||||||

| CATEGORIES | ||||||||||||

PERSONAL CARE | ||||||||||||

Turnover | €20.7 billion | €20.2 billion | €20.1 billion | |||||||||

Turnover growth | 2.6% | 0.5% | 13.2% | |||||||||

Underlying sales growth | 2.9%^ | 4.2% | 4.1% | |||||||||

Operating margin | 19.8% | 18.4% | 18.1% | |||||||||

Underlying operating margin | 21.1% | 20.0% | 19.7% | |||||||||

HOME CARE | ||||||||||||

Turnover | €10.6 billion | €10.0 billion | €10.2 billion | |||||||||

Turnover growth | 5.6% | (1.5%) | 10.9% | |||||||||

Underlying sales growth | 4.4 %^ | 4.9% | 5.9 % | |||||||||

Operating margin | 10.8% | 9.5% | 7.3% | |||||||||

Underlying operating margin | 12.2% | 10.9% | 8.4% | |||||||||

FOODS | ||||||||||||

Turnover | €12.5 billion | €12.5 billion | €12.9 billion | |||||||||

Turnover growth | (0.1%) | (3.1%) | 4.5% | |||||||||

Underlying sales growth | 1.0%^ | 2.1% | 1.5% | |||||||||

Operating margin | 18.2% | 17.4% | 17.8% | |||||||||

Underlying operating margin | 19.7% | 19.1% | 19.1% | |||||||||

REFRESHMENT | ||||||||||||

Turnover | €9.9 billion | €10.0 billion | € | 10.1 billion | ||||||||

Turnover growth | (0.8%) | (1.1%) | 10.3% | |||||||||

Underlying sales growth | 4.9%^ | 3.5% | 5.4 % | |||||||||

Operating margin | 13.5% | 9.7% | 8.3% | |||||||||

Underlying operating margin | 12.7% | 11.1% | 10.2% | |||||||||

Underlying sales growth, underlying volume growth, underlying operating margin and free cash flow arenon-GAAP measures. In order to provide a clear picture of our performance against the objectives set out in our strategic review we report underlying operating margin, which excludes restructuring costs, in place of the previously reported core operating margin. For further information about these measures, and the reasons why we believe they are important for an understanding of the performance of the business, please refer to our commentary onnon-GAAP measures on page 22.

UNILEVER SUSTAINABLE LIVING PLAN

| 2017 | 2016 | 2015 | ||||||||||

| IMPROVING HEALTH & WELL-BEING | ||||||||||||

| BIG GOAL: By 2020 we will help more than a billion people take action to improve their health and well-being. See page 13 | ||||||||||||

HEALTH & HYGIENE | ||||||||||||

| Target: By 2020 we will help more than a billion people to improve their health and hygiene. This will help reduce the incidence of life-threatening diseases like diarrhoea. | 601 million | 538 million | f | 482 millionr | ||||||||

NUTRITION | ||||||||||||

| Target: By 2020 we will double the proportion of our portfolio that meets the highest nutritional standards, based on globally recognised dietary guidelines. This will help hundreds of millions of people to achieve a healthier diet. | 39% | ◇ | 35% | 34%r | ||||||||

| REDUCING ENVIRONMENTAL IMPACT | ||||||||||||

| BIG GOAL: By 2030 our goal is to halve the environmental footprint of the making and use of our products as we grow our business. See pages 13 and 14 | ||||||||||||

GREENHOUSE GASES | ||||||||||||

Target: Halve the greenhouse gas impact of our products across the lifecycle by 2030 (greenhouse gas impact per consumer use). | 9% | ◇ | 8% | 7%q | ||||||||

| Target: By 2020 CO2emissions from energy from our factories will be at or below 2008 levels despite significantly higher volumes (reduction in CO2from energy per tonne of production since 2008).**+ | (47%) | ◇ | (43%)f | (39%)r | ||||||||

WATER | ||||||||||||

Target: Halve the water associated with the consumer use of our products by 2020 (water impact per consumer use). | (2%) | ◇ | (7%) | (1%)r | ||||||||

| Target: By 2020 water abstraction by our global factory network will be at or below 2008 levels despite significantly higher volumes (reduction in water abstraction per tonne of production since 2008).** | (39%) | ◇ | (37%)f | (37%)r | ||||||||

WASTE | ||||||||||||

Target: Halve the waste associated with the disposal of our products by 2020 (waste impact per consumer use). | (29%) | (28%)f | (26%)q | |||||||||

| Target: By 2020 total waste sent for disposal will be at or below 2008 levels despite significantly higher volumes (reduction in total waste per tonne of production since 2008).** | (98%) | ◇ | (96%)f | (97%)r | ||||||||

SUSTAINABLE SOURCING | ||||||||||||

Target: By 2020 we will source 100% of our agricultural raw materials sustainably (% of tonnes purchased). | 56% | 51% | 60%^ | |||||||||

| ENHANCING LIVELIHOODS | ||||||||||||

| BIG GOAL: By 2020 we will enhance the livelihoods of millions of people as we grow our business. See page 14 | ||||||||||||

FAIRNESS IN THE WORKPLACE | ||||||||||||

Target: By 2020 we will advance human rights across our operations and extended supply chain, by: | ||||||||||||

• Sourcing 100% of procurement spend from suppliers meeting the mandatory requirements of the Responsible Sourcing Policy (% of spend of suppliers meeting the Policy) | 55% | ‡ | - | - | ||||||||

• Reducing workplace injuries and accidents (Total Recordable Frequency Rate of workplace accidents per million hours worked)** | 0.89 | ◇ | 1.01f | 1.12r | ||||||||

OPPORTUNITIES FOR WOMEN | ||||||||||||

| Target: By 2020 we will empower 5 million women, by: | 1,259,000 | ◇ | 920,000 | 806,000 | ||||||||

• Promoting safety for women in communities where we operate | 7,000 | ◇ | 7,000 | 6,000 | ||||||||

• Enhancing access to training and skills (number of women) | 1,175,000 | ◇ | 836,000 | 730,000 | ||||||||

• Expanding opportunities in our value chain (number of women) | 77,000 | ◇ | 77,000 | 70,000 | ||||||||

• Building a gender-balance organisation with a focus on management (% of managers that are women)** | 47% | ◇ | 46% | 45% | ||||||||

INCLUSIVE BUSINESS | ||||||||||||

| Target: By 2020 we will have a positive impact on the lives of 5.5 million people by: | ||||||||||||

• Enabling small-scale retailers to access initiatives aiming to improve their income | 1.6 millio | n | 1.5 million | 1.8 million | ||||||||

• Enabling smallholder farmers to access initiatives aiming to improve their agricultural practices | 716,000 | ◇ | 650,000 | 600,000 | ||||||||

Baseline 2010 unless otherwise stated

|

UNILEVER OPERATES IN THE FAST-MOVING CONSUMER GOODS (FMCG) INDUSTRY, ONE OF THE LARGEST AND MOST COMPETITIVE INDUSTRIES IN THE WORLD.

The top 25 global FMCG players generate sales of over€500 billion in markets characterised by their highly dynamic nature. Rapid change is now a constant, caused by fragmentation throughout the value chain, requiring fast, innovative and profitable responses in areas such as supply chain, customer development, marketing and brand innovation.

In response we have taken a number of strategic actions including the sale of our Spreads business, the integration of our Foods and Refreshment categories, the announcement or completion of 12 acquisitions in faster growing segments and channels, and the acceleration of our Connected 4 Growth (C4G) change programme. Launched in 2016 to create a faster, simpler organisation, we are realising C4G’s benefits through digitally connectedend-to-end marketing, R&D and supply chain, and a more agile organisation leveraging our global scale and local expertise.

FASTER PACE OF CHANGE

There is no doubt that the business environment is changing at a faster pace than ever. These changes bring challenges but also significant opportunity. We see changes in a number of areas, notably in consumer preferences,route-to-market channels, media and brand communication and the competitive landscape.

Consumers are taking radically different paths when purchasing brands, often combining both offline and online channels where influencers are a growing force. Younger consumers are prioritising meaning over materialism, demanding brands with a point of view and more authenticity, transparency and sustainability. More people moving into the global workforce, especially in emerging markets, is resulting in long-term shifts in demand for products with greater convenience and time-saving attributes, notably in Foods and Home Care, but without sacrificing quality or sustainability benefits. The trend of growing middle classes continues, albeit challenged by incomes rising only slowly in some emerging markets and inequality increasing globally.

Channels to reach consumers are also fragmenting, with less reliance on ‘big box’ retailers ase-commerce continues to grow, driven in part bydirect-to-consumer models. The global FMCGe-commerce channel continues to grow by 30% a year according to the latest industry reports. Specialist channels, such as drug stores, continue to grow in significance as do discount and convenience stores.

The proliferation of diverse digital and social media channels has led to significant media fragmentation. Digital advertising is playing an increasingly important role in brand advertising – now around 40% of the total advertising market. However, tackling viewability standards and fraud in digital advertising through verification of views – and demonstrating the value of digital advertising spend – are ongoing challenges for the industry.

Responses to change are predicated on the need for efficiency and margin improvement as competition intensifies. Some global players are adopting models prioritising cost-cutting over long-term investment.

Local players present a growing challenge. They react swiftly with innovations meeting local trends, one reason why responses, such as Unilever’s C4G programme, are critical in marrying the benefits of global scale, in areas such as marketing and R&D, with entrepreneurial country teams empowered to lead launches that meet local trends.

A MIXED ECONOMIC OUTLOOK

This pace of change comes as market conditions across many of our markets remain challenging. There are, however, grounds for optimism as local currencies are stabilising and real wages are making a recovery. We are starting to see signs of improvement in some of the large emerging markets such as India and China but others, notably Brazil, are suffering economic problems with consumers spending less. This requires further rapid, local responses from brands.

In Europe, the industry is seeing high promotion levels keeping prices down. Volumes are slowly picking up in certain markets. Consumers, while remaining cost conscious, are also seeking occasions to buy more premium and prestige products in return for economising on some of their routine household shopping. In North America, although GDP performance is positive, this has not translated into significant growth in our markets.

LONGER-TERM MACRO FORCES