| Notes: Numbers may not total due to rounding. tbpd = thousand barrels per day. API gravity refers to the specific gravity or density of liquid petroleum products, measured in degrees on the American Petroleum Institute (API) scale. On the API scale, oil with the lowest specific gravity has the highest API gravity. In addition, holding all other factors constant, the higher the API gravity, the greater the value of the crude oil. | (1) | During 2018 and 2019 we used Olmeca crude oil for processing in our refineries and did not export Olmeca crude oil. |

Source: PMI operating statistics as of January 9, 2018.7, 2020. | | | | Year ended December 31, | | | Year ended December 31, | | | | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | 2019 | | | | | (U.S. dollars per barrel) | | | (U.S. dollars per barrel) | | Crude Oil Prices | | | | | | | | | | | | | | | | | | | | | Olmeca | | U.S.$ | 107.92 | | | U.S.$ | 93.54 | | | U.S.$ | 51.46 | | | U.S.$ | 39.71 | | | U.S.$ | 51.79 | | | U.S. $ | 51.46 | | | U.S. $ | 39.71 | | | U.S. $ | 51.79 | | | U.S. $ | — | | | U.S. $ | — | | Isthmus | | | 104.69 | | | | 93.39 | | | | 49.28 | | | | 37.72 | | | | 50.75 | | | | 49.28 | | | | 37.72 | | | | 50.75 | | | | 64.54 | | | | 60.43 | | Maya | | | 96.89 | | | | 83.75 | | | | 41.12 | | | | 35.30 | | | | 46.41 | | | | 41.12 | | | | 35.30 | | | | 46.48 | | | | 61.47 | | | | 55.83 | | Altamira | | | 94.35 | | | | 81.30 | | | | 36.19 | | | | 30.35 | | | | 39.45 | | | | 36.19 | | | | 30.35 | | | | 39.45 | | | | 57.81 | | | | 53.69 | | Talam | | | — | | | | 36.74 | | | | 36.40 | | | | 28.44 | | | | — | | | | 36.40 | | | | 28.44 | | | | — | | | | 59.47 | | | | 53.72 | | | | | | | | | | | | | | | | | | | Weighted average realized price | | U.S. $ | 98.44 | | | U.S. $ | 85.48 | | | U.S. $ | 43.12 | | | U.S. $ | 35.65 | | | U.S. $ | 46.73 | | | U.S. $ | 43.12 | | | U.S. $ | 35.65 | | | U.S. $ | 46.79 | | | U.S. $ | 61.41 | | | U.S. $ | 55.63 | | | | | | | | | | | | | | | | | | |

Source: PMI operating statistics as of January 9, 2018.7, 2020. Geographic Distribution of Export Sales As of December 31, 2017,2019, PMI had more than 3023 customers in 12eight countries. Since 2013, the proportion of our crude oil export sales to the United States has declined, while the proportion of our crude oil export sales to Europe and Asia has increased. In 2017, 53%2019, 55.2% of our crude oil export sales were to customers in the United States and Canada, which represents a 21%9.0% decrease as compared to 2013.2018. Since 2013,2014, primarily as a result of increased availability of light crude oil in the United States and other developing trends in international demand for imported crude oil, we have expanded the scope of our geographic distribution and adapted our strategy to diversify and strengthen the position of Mexican crude oil in the international market. As part of that strategy, in January 2014, PMI started exporting Olmeca crude oil to several European countries and in recent years PMI has expanded its export sales in Asia and continued to do so in 2017. The following table sets forth the geographic distribution of PMI’s sales of crude oil exports for the five years ended December 31, 2017.2019. The table also presents the distribution of exports among PMI’s crude oil types for those years:years. Composition and Geographic Distribution of Crude Oil Export Sales | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Year ended December 31, | | | | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | | | (tbpd) | | | (%) | | | (tbpd) | | | (%) | | | (tbpd) | | | (%) | | | (tbpd) | | | (%) | | | (tbpd) | | | (%) | | | | | | | | | | | | | PMI Crude Oil Export Sales to: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | United States and Canada | | | 879 | | | | 74 | | | | 813 | | | | 71 | | | | 690 | | | | 59 | | | | 572 | | | | 48 | | | | 617 | | | | 53 | | Europe | | | 179 | | | | 15 | | | | 215 | | | | 18 | | | | 248 | | | | 21 | | | | 273 | | | | 23 | | | | 219 | | | | 19 | | Asia | | | 116 | | | | 10 | | | | 100 | | | | 9 | | | | 219 | | | | 19 | | | | 319 | | | | 27 | | | | 317 | | | | 27 | | Central and South America | | | 15 | | | | 1 | | | | 15 | | | | 1 | | | | 15 | | | | 1 | | | | 34 | | | | 3 | | | | 20 | | | | 2 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total | | | 1,189 | | | | 100 | | | | 1,142 | | | | 100 | | | | 1,172 | | | | 100 | | | | 1,198 | | | | 100 | | | | 1,174 | | | | 100 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Olmeca (API gravity of 38°-39°) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | United States and Canada | | | 90 | | | | 8 | | | | 35 | | | | 3 | | | | 40 | | | | 4 | | | | 4 | | | | 0.3 | | | | — | | | | — | | Others | | | 8 | | | | 1 | | | | 56 | | | | 5 | | | | 84 | | | | 7 | | | | 104 | | | | 9 | | | | 19 | | | | 2 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total | | | 99 | | | | 8 | | | | 91 | | | | 8 | | | | 124 | | | | 11 | | | | 108 | | | | 9 | | | | 19 | | | | 2 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Isthmus (API gravity of 32°-33°) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | United States and Canada | | | 62 | | | | 5 | | | | 89 | | | | 8 | | | | 78 | | | | 7 | | | | 3 | | | | 0.3 | | | | 5 | | | | 0.4 | | Others | | | 41 | | | | 3 | | | | 45 | | | | 4 | | | | 116 | | | | 10 | | | | 150 | | | | 13 | | | | 81 | | | | 7 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total | | | 103 | | | | 9 | | | | 134 | | | | 12 | | | | 194 | | | | 17 | | | | 153 | | | | 13 | | | | 86 | | | | 7 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Maya (API gravity of 21°-22°) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | United States and Canada | | | 707 | | | | 60 | | | | 662 | | | | 58 | | | | 513 | | | | 44 | | | | 541 | | | | 45 | | | | 597 | | | | 51 | | Others | | | 260 | | | | 22 | | | | 225 | | | | 20 | | | | 230 | | | | 20 | | | | 326 | | | | 27 | | | | 457 | | | | 39 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total | | | 968 | | | | 81 | | | | 887 | | | | 78 | | | | 743 | | | | 63 | | | | 867 | | | | 72 | | | | 1,054 | | | | 90 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Altamira (API gravity of 15.0°-16.5°) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | United States and Canada | | | 20 | | | | 2 | | | | 27 | | | | 2 | | | | 28 | | | | 2 | | | | 22 | | | | 2 | | | | 15 | | | | 1 | | Others | | | — | | | | — | | | | 0.4 | | | | 0.04 | | | | — | | | | — | | | | 2 | | | | 0.2 | | | | — | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total | | | 20 | | | | 2 | | | | 27 | | | | 2 | | | | 28 | | | | 2 | | | | 24 | | | | 2 | | | | 15 | | | | 1 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Talam (API gravity of 15.8º) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | United States and Canada | | | — | | | | — | | | | — | | | | — | | | | 31 | | | | 3 | | | | 1 | | | | 0.1 | | | | — | | | | — | | Others | | | — | | | | — | | | | 3 | | | | 0.3 | | | | 52 | | | | 4 | | | | 44 | | | | 4 | | | | — | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total | | | — | | | | — | | | | 3 | | | | 0.3 | | | | 83 | | | | 7 | | | | 45 | | | | 4 | | | | — | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Year ended December 31, | | | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | 2019 | | | | | (tbpd) | | | (%) | | | (tbpd) | | | (%) | | | (tbpd) | | | (%) | | | (tbpd) | | | (%) | | | (tbpd) | | | (%) | | PMI Crude Oil Export Sales to: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | United States and Canada | | | 689.6 | | | | 58.8 | | | | 571.8 | | | | 47.7 | | | | 617.2 | | | | 52.6 | | | | 669.8 | | | | 56.6 | | | | 609.2 | | | | 55.2 | | Europe | | | 257.4 | | | | 22.0 | | | | 294.1 | | | | 24.6 | | | | 219.1 | | | | 18.7 | | | | 199.1 | | | | 16.8 | | | | 181.8 | | | | 16.5 | | Asia | | | 219.2 | | | | 18.7 | | | | 319.1 | | | | 26.6 | | | | 317.2 | | | | 27.0 | | | | 311.4 | | | | 26.3 | | | | 312.6 | | | | 28.3 | | Central and South America | | | 6.2 | | | | 0.5 | | | | 12.5 | | | | 1.0 | | | | 20.4 | | | | 1.7 | | | | 3.8 | | | | 0.3 | | | | — | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total | | | 1,172.4 | | | | 100 | | | | 1,197.6 | | | | 100 | | | | 1,173.9 | | | | 100 | | | | 1,184.0 | | | | 100 | | | | 1,103.7 | | | | 100 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Olmeca (API gravity of38°-39°)(1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | United States and Canada | | | 39.8 | | | | 3.4 | | | | 4.1 | | | | 0.3 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | Others | | | 84.4 | | | | 7.2 | | | | 104.2 | | | | 8.7 | | | | 18.9 | | | | 1.6 | | | | — | | | | — | | | | — | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total | | | 124.2 | | | | 10.6 | | | | 108.3 | | | | 9.0 | | | | 18.9 | | | | 1.6 | | | | — | | | | — | | | | — | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Isthmus (API gravity of32°-33°) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | United States and Canada | | | 78.1 | | | | 6.7 | | | | 3.2 | | | | 0.3 | | | | 4.7 | | | | 0.4 | | | | — | | | | — | | | | 2.7 | | | | 0.3 | | Others | | | 115.9 | | | | 9.9 | | | | 149.9 | | | | 12.5 | | | | 81.1 | | | | 6.9 | | | | 30.7 | | | | 2.6 | | | | 1.4 | | | | 0.1 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total | | | 194.0 | | | | 16.5 | | | | 153.1 | | | | 12.8 | | | | 85.8 | | | | 7.3 | | | | 30.7 | | | | 2.6 | | | | 4.1 | | | | 0.4 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Maya (API gravity of21°-22°) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | United States and Canada | | | 513.2 | | | | 43.8 | | | | 541.3 | | | | 45.2 | | | | 597.2 | | | | 50.9 | | | | 623.9 | | | | 52.7 | | | | 506.1 | | | | 45.9 | | Others | | | 230.2 | | | | 19.6 | | | | 325.9 | | | | 27.2 | | | | 456.7 | | | | 38.9 | | | | 466.1 | | | | 39.4 | | | | 478.9 | | | | 43.4 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total | | | 743.4 | | | | 63.4 | | | | 867.2 | | | | 72.4 | | | | 1,053.9 | | | | 89.8 | | | | 1,090.0 | | | | 92.1 | | | | 985.0 | | | | 89.3 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Altamira (API gravity of15.0°-16.5°) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | United States and Canada | | | 27.7 | | | | 2.4 | | | | 21.9 | | | | 1.8 | | | | 15.3 | | | | 1.3 | | | | 19.9 | | | | 1.7 | | | | 20.7 | | | | 1.9 | | Others | | | — | | | | — | | | | 1.8 | | | | 0.1 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total | | | 27.7 | | | | 2.4 | | | | 23.7 | | | | 2.0 | | | | 15.3 | | | | 1.3 | | | | 19.9 | | | | 1.7 | | | | 20.7 | | | | 1.9 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Talam (API gravity of 15.8°) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | United States and Canada | | | 30.7 | | | | 2.6 | | | | 1.3 | | | | 0.1 | | | | — | | | | — | | | | 25.8 | | | | 2.2 | | | | 79.7 | | | | 7.2 | | Others | | | 52.4 | | | | 4.5 | | | | 44.0 | | | | 3.7 | | | | — | | | | — | | | | 17.6 | | | | 1.5 | | | | 14.2 | | | | 1.3 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total | | | 83.1 | | | | 7.1 | | | | 45.3 | | | | 3.8 | | | | — | | | | — | | | | 43.5 | | | | 3.7 | | | | 93.9 | | | | 8.5 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Notes: | Numbers may not total due to rounding. |

Notes: Numbers may not total due to rounding. tbpd = thousand barrels per day. API gravity refers to the specific gravity or density of liquid petroleum products, measured in degrees on the API scale. On the API scale, oil with the lowest specific gravity has the highest API gravity. In addition, holding all other factors constant, the higher the API gravity, the greater the value of the crude oil. | (1) | During 2019 we used Olmeca crude oil for processing in our refineries and did not export Olmeca crude oil. |

Source: PMI operating statistics as of April 2018.January 7, 2020. In total, we exported 1,174.01,103.7 thousand barrels of crude oil per day in 2017,2019, and in 20182020 we expect to export approximately 1,100.01,086.0 thousand barrels of crude oil per day. We sell the crude oil produced by Pemex Exploration and Production under a variety of contractual arrangements. Of the 1,100.01,086.0 thousand barrels of crude oil per day we expect to export in 2018,2020, we are contractually committed to deliver approximately 980.01,056.0 thousand barrels per day pursuant to existing supply commitments. We believe that our proved developed and proved undeveloped reserves will be sufficient to allow us to fulfill our supply commitments. The following table sets forth the average volume of our exports and imports of crude oil, natural gas and petroleum products for the five years ended December 31, 2017.2019. Volume of Exports and Imports | | | | Year ended December 31, | | | 2017

vs. 2016 | | | Year ended December 31, | | | 2019 | | | | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | 2019 | | | vs. 2018 | | | | | (in thousands of barrels per day, except as noted) | | | (%) | | | (in thousands of barrels per day, except as noted) | | | (%) | | Exports | | | | | | | | | | | | | | | | | | | Crude Oil: | | | | | | | | | | | | | | | | | | | | | | | | | Olmeca | | | 98.6 | | | | 91.2 | | | | 124.2 | | | | 108.0 | | | | 18.9 | | | | (82.5 | ) | | | 124.2 | | | | 108.3 | | | | 18.9 | | | | — | | | | — | | | | — | | Isthmus | | | 102.7 | | | | 133.7 | | | | 194.0 | | | | 152.7 | | | | 85.8 | | | | (43.8 | ) | | | 194.0 | | | | 153.1 | | | | 85.8 | | | | 30.7 | | | | 4.1 | | | | (86.6 | ) | Maya | | | 967.6 | | | | 887.1 | | | | 743.4 | | | | 864.9 | | | | 1,054.0 | | | | 21.9 | | | | 743.4 | | | | 867.2 | | | | 1,053.9 | | | | 1,090.0 | | | | 985.0 | | | | (9.6 | ) | Altamira | | | 19.9 | | | | 27.2 | | | | 27.8 | | | | 23.6 | | | | 15.3 | | | | (35.2 | ) | | | 27.7 | | | | 23.7 | | | | 15.3 | | | | 19.9 | | | | 20.7 | | | | 4.0 | | Talam | | | — | | | | 3.0 | | | | 83.1 | | | | 45.2 | | | | — | | | | (100 | ) | | | 83.1 | | | | 45.3 | | | | — | | | | 43.5 | | | | 93.9 | | | | 115.9 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total crude oil | | | 1,188.8 | | | | 1,142.2 | | | | 1,172.4 | | | | 1,194.3 | | | | 1,174.0 | | | | (1.7 | ) | | | 1,172.4 | | | | 1,197.6 | | | | 1,173.9 | | | | 1,184.0 | | | | 1,103.7 | | | | (6.8 | ) | Natural gas(1) | | | 3.1 | | | | 4.1 | | | | 2.7 | | | | 2.2 | | | | 1.7 | | | | (22.7 | ) | | | 2.7 | | | | 2.2 | | | | 1.7 | | | | 1.4 | | | | 1.3 | | | | (5.8 | ) | Gasoline | | | 66.8 | | | | 66.0 | | | | 62.9 | | | | 52.7 | | | | 45.0 | | | | (14.6 | ) | | | 62.9 | | | | 52.7 | | | | 45.0 | | | | 37.7 | | | | 33.6 | | | | (10.9 | ) | Other petroleum products | | | 109.6 | | | | 133.3 | | | | 130.8 | | | | 132.9 | | | | 113.1 | | | | (14.9 | ) | | | 130.8 | | | | 132.9 | | | | 113.1 | | | | 95.1 | | | | 82.3 | | | | (13.4 | ) | Petrochemical products(2)(3) | | | 614.3 | | | | 406.1 | | | | 333.8 | | | | 124.7 | | | | 60.4 | | | | (51.6 | ) | | Petrochemical products(2) | | | | 333.8 | | | | 124.7 | | | | 60.5 | | | | 57.8 | | | | 71.9 | | | | 24.5 | | Imports | | | | | | | | | | | | | | | | | | | | | | | | | Natural gas(1) | | | 1,289.7 | | | | 1,357.8 | | | | 1,415.8 | | | | 1,933.9 | | | | 1,766.0 | | | | (8.7 | ) | | | 1,415.8 | | | | 1,933.9 | | | | 1,766.0 | | | | 1,316.5 | | | | 965.9 | | | | (26.6 | ) | Gasoline | | | 375.2 | | | | 389.7 | | | | 440.1 | | | | 510.8 | | | | 582.5 | | | | 14.0 | | | | 440.1 | | | | 510.9 | | | | 583.7 | | | | 607.3 | | | | 544.3 | | | | (10.4 | ) | Other petroleum products and LPG(4)(1) | | | 226.3 | | | | 248.7 | | | | 299.7 | | | | 289.6 | | | | 353.6 | | | | 22.1 | | | | 299.7 | | | | 289.6 | | | | 354.1 | | | | 378.7 | | | | 302.7 | | | | (20.1 | ) | Petrochemical products(2)(5) | | | 74.1 | | | | 85.3 | | | | 107.3 | | | | 278.2 | | | | 332.8 | | | | 19.6 | | | Petrochemical products(2) | | | | 107.3 | | | | 278.2 | | | | 332.8 | | | | 831.8 | | | | 877.3 | | | | 5.5 | |

Note: Numbers subject to adjustment because crude oil exports may be adjusted to reflect the percentage of water in each shipment. | (1) | Numbers expressed in millions of cubic feet per day. |

| (2) | Thousands of metric tons. |

(4) | In 2013, we began importing liquefied natural gas through Manzanillo. |

(5) | Includes isobutane, butane andN-butane. |

Source: PMI operating statistics as of January 9, 2018,7, 2020, and Pemex Industrial Transformation. Crude oil exports decreased by 1.7%6.8% in 2017,2019, from 1,194.31,184.0 thousand barrels per day in 20162018 to 1,174.01,103.7 thousand barrels per day in 2017,2019, mainly due to an increase of86.6% decrease in light crude oil Istmo exports of 21.9% ofand a 9.6% decrease in heavy crude oil Maya crude oil,exports, which was partially offset by a 43.8% decrease115.9% increase in exports of IsthmusTalam crude oil exports and a decrease of 82.5%4.0% increase in Altamira crude oil exports in 2019. We did not export Olmeca crude oil export during 2017. NaturalWe import dry gas, importsa variety of natural gas, to satisfy shortfalls in our production and to meet demand in areas of northern Mexico that, due to their distance from the fields, can be supplied more efficiently by importing natural gas from the United States. Domestic sales of dry gas decreased by 8.7% in 2017,22.3%, as compared to 2018, from 1,933.92,064.3 million cubic feet per day in 20162018 to 1,766.01,604.4 million cubic feet per day in 2017, which includes2019, mainly due to competition from third-party supply in the national market. Natural gas imports of liquefieddecreased by 26.6% in 2019, from 1,316.5 million cubic feet per day in 2018 to 965.9 million cubic feet per day in 2019. This decrease in natural gas through Manzanillo. This decrease isimports was primarily due to a decreasedecreased demand in the volume of sales required by the electricity sector.

In 2017, exports of petroleum products decreased by 14.8%, from 185.5 thousand barrels per day in 2016 to 158.0 thousand barrels per day in 2017, mainlydomestic market due to a 74.2% decrease in the volume of exports of diluent, an 8.6% decrease in the volume of sales of oil fuel and a 14.6% decrease in the volume of sales of natural gasoline. Imports of petroleum products increased by 17.0% in 2017,competition from 800.4 thousand barrels per day in 2016 to 936.2 thousand barrels per day in 2017, primarily due to a decrease in domestic production of petroleum products.third party suppliers.

P.M.I. Trading Ltd.DAC sells refined and petrochemical products on anFOB,Delivered ExEx-ship-ship andCost and Freight basis and buys refined and petrochemical products on anFOB,Cost and Freight andDelivered Ex-ship, orDelivery at FrontierandDelivered at Place basis. The following table sets forth the value of exports and imports of crude oil, natural gas and petroleum products for the five years ended December 31, 2017.2019. Value of Exports and Imports(1) | | | | Year ended December 31, | | 2017

vs. 2016 | | | Year ended December 31, 2019 | | 2019 | | | | | 2013 | | 2014 | | 2015 | | 2016 | | 2017 | | | 2015 | | | 2016 | | 2017 | | 2018 | | 2019 | | vs. 2018 | | | | | (in millions of U.S. dollars) | | (%) | | | (in millions of U.S. dollars) | | (%) | | Exports | | | | | | | | | | | | | | | | | | | | | Olmeca | | U.S.$ | 3,883.9 | | | U.S.$ | 3,114.7 | | | U.S.$ | 2,333.1 | | | U.S.$ | 1,569.4 | | | U.S.$ | 358.1 | | | (77.2 | ) | | U.S. $ | 2,333.1 | | | U.S. $ | 1,569.3 | | | U.S. $ | 358.1 | | | U.S. $ | — | | | U.S. $ | — | | | | — | | Isthmus | | 3,925.7 | | | 4,557.1 | | | 3,489.0 | | | 2,107.6 | | | 1,589.1 | | | (24.6 | ) | | | 3,489.0 | | | | 2,107.6 | | | | 1,588.7 | | | | 722.2 | | | | 90.1 | | | | (87.5 | ) | Altamira | | 683.7 | | | 806.8 | | | 366.6 | | | 262.4 | | | 219.8 | | | (16.2 | ) | | | 366.6 | | | | 262.4 | | | | 219.8 | | | | 419.5 | | | | 405.5 | | | | (3.3 | ) | Maya | | 34,217.9 | | | 27,119.4 | | | 11,158.8 | | | 11,172.7 | | | 17,856.4 | | | 60.0 | | | | 11,158.9 | | | | 11,172.6 | | | | 17,880.6 | | | | 24,455.6 | | | | 20,072.90 | | | | (17.9 | ) | Talam | | | — | | | 40.4 | | | 1,103.6 | | | 470.1 | | | | — | | | (100 | ) | | | 1,103.6 | | | | 470.1 | | | | — | | | | 943.4 | | | | 1,840.80 | | | | 95.1 | | Total crude oil(2) | | U.S.$ | 42,711.2 | | | U.S.$ | 35,638.4 | | | U.S.$ | 18,451.1 | | | U.S.$ | 15,582.2 | | | U.S$ | 20,023.4 | | | 28.5 | | | | | | | | | | | | | | | | | | | | | | | Total crude oil(2) | | | U.S. $ | 18,451.2 | | | U.S. $ | 15,582.0 | | | U.S $ | 20,047.2 | | | U.S. $ | 26,540.7 | | | U.S. $ | 22,409.3 | | | | (15.6 | ) | | | | | | | | | | | | | | | | | | | | | Natural gas | | 2.8 | | | 4.8 | | | 1.6 | | | 1.1 | | | 1.3 | | | 18.2 | | | | 1.6 | | | | 1.1 | | | | 1.3 | | | | 1.0 | | | | 0.8 | | | | (20.0 | ) | Gasoline | | 2,162.5 | | | 1,985.9 | | | 1,007.4 | | | 733.2 | | | 746.9 | | | 1.9 | | | | 1,007.4 | | | | 733.2 | | | | 746.9 | | | | 813.9 | | | | 626.6 | | | | (23.0 | ) | Other petroleum products | | 3,364.6 | | | 3,425.7 | | | 1,580.2 | | | 1,161.9 | | | 1,655.6 | | | 42.5 | | | | 1,580.2 | | | | 1,161.9 | | | | 1,655.6 | | | | 1,938.1 | | | | 1,429.70 | | | | (26.2 | ) | Petrochemical products | | 171.0 | | | 132.4 | | | 63.5 | | | 20.5 | | | 37.7 | | | 84.0 | | | | 63.5 | | | | 20.5 | | | | 37.8 | | | | 39.2 | | | | 39.6 | | | | 1.0 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total natural gas, petroleum and petrochemical products | | U.S.$ | 5,700.8 | | | U.S.$ | 5,548.8 | | | U.S.$ | 2,652.7 | | | U.S.$ | 1,916.7 | | | U.S.$ | 2,441.4 | | | 27.4 | | | U.S. $ | 2,652.7 | | | U.S. $ | 1,916.7 | | | U.S. $ | 2,441.5 | | | U.S. $ | 2,792.3 | | | U.S. $ | 2,096.7 | | | | (24.9 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total exports | | U.S.$ | 48,412.0 | | | U.S.$ | 41,187.2 | | | U.S.$ | 21,103.8 | | | U.S.$ | 17,498.9 | | | U.S.$ | 22,464.8 | | | 28.4 | | | U.S. $ | 21,103.9 | | | U.S. $ | 17,498.7 | | | U.S. $ | 22,488.8 | | | U.S. $ | 29,333.0 | | | U.S. $ | 24,506.0 | | | | (16.5 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Imports | | | | | | | | | | | | | | | | | | | | | | | | | Natural gas | | U.S.$ | 2,495.3 | | | U.S.$ | 2,819.3 | | | U.S.$ | 1,673.7 | | | U.S.$ | 2,097.9 | | | U.S.$ | 2,484.1 | | | 18.4 | | | U.S. $ | 1,673.7 | | | U.S. $ | 2,097.9 | | | U.S. $ | 2,484.1 | | | U.S. $ | 2,043.2 | | | U.S. $ | 1,072.5 | | | | (47.5 | ) | Gasoline | | 17,485.9 | | | 16,691.2 | | | 12,805.2 | | | 11,994.8 | | | 15,380.1 | | | 28.2 | | | | 12,805.2 | | | | 11,994.8 | | | | 15,380.1 | | | | 18,867.5 | | | | 15,353.90 | | | | (18.6 | ) | Other petroleum products and LPG | | 8,153.9 | | | 8,738.7 | | | 6,178.6 | | | 5,699.9 | | | 8,446.3 | | | 48.2 | | | | 6,178.6 | | | | 5,699.9 | | | | 8,466.3 | | | | 11,103.3 | | | | 7,983.90 | | | | (28.1 | ) | Petrochemical products | | 128.9 | | | 168.1 | | | 196.3 | | | 85.5 | | | 122.5 | | | 43.3 | | | | 196.3 | | | | 85.5 | | | | 122.5 | | | | 588.8 | | | | 657.2 | | | | 11.6 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total imports | | U.S.$ | 28,264.0 | | | U.S.$ | 28,417.3 | | | U.S.$ | 20,853.7 | | | U.S.$ | 19,878.1 | | | U.S.$ | 26,433.0 | | | 33.0 | | | U.S. $ | 20,853.7 | | | U.S. $ | 19,878.1 | | | U.S. $ | 26,433.3 | | | U.S. $ | 32,602.8 | | | U.S. $ | 25,067.6 | | | | (23.1 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Net exports (imports) | | U.S.$ | 20,148.0 | | | U.S.$ | 12,769.9 | | | U.S.$ | 250.1 | | | U.S.$ | (2,379.2 | ) | | U.S.$ | (3,968.2 | ) | | 66.8 | | | U.S. $ | 250.1 | | | U.S. $ | (2,379.4 | ) | | U.S. $ | (3,944.2 | ) | | U.S. $ | (3,269.8 | ) | | U.S. $ | (561.6 | ) | | | (82.8 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Note: Numbers may not total due to rounding. | (1) | Does not include crude oil, refined products and petrochemicals purchased by P.M.I. Trading Ltd.DAC, orPMI-NASA from third parties outside of Mexico and resold in the international markets. The figures expressed in this table differ from the amounts contained under the line item “Net Sales” in our financial statements because of differences in methodology associated with the calculation of the exchange rates and other minor adjustments. |

| (2) | Crude oil exports are subject to adjustment to reflect the percentage of water in each shipment. |

Source: PMI operating statistics as of January 9, 2018,7, 2020, which are based on information in bills of lading, and Pemex Industrial Transformation. ImportsIn 2019, imports of natural gas increaseddecreased in value by 18.4% during 2017,47.5% as compared to 2018, primarily as a result of an increasea decrease in the average sales pricevolume of natural gas.gas imports. Imports of gasoline increaseddecreased in value by 28.2%18.6% over the same period due to an increasea decrease in the volume of gasoline imported resulting from higher domestic gasoline sales and in the average sales priceproduction of gasoline.

The following table describes the composition of our exports and imports of selected refined products in 2015, 2016 and 2017.for the three years ended December 31, 2019. Exports and Imports of Selected Petroleum Products | | | | Year ended December 31, | | | Year ended December 31, | | | | | 2015 | | | 2016 | | | 2017 | | | 2017 | | | 2018 | | | 2019 | | | | | (tbpd) | | | (%) | | | (tbpd) | | | (%) | | | (tbpd) | | | (%) | | | (tbpd) | | | (%) | | | (tbpd) | | | (%) | | | (tbpd) | | | (%) | | Exports | | | | | | | | | | | | | | | | | | | | | | | | | Liquefied petroleum gas(1) | | | — | | | | — | | | | 4.5 | | | | 2.4 | | | | 5.7 | | | | 3.6 | | | | 5.7 | | | | 3.6 | | | | 1.2 | | | | 0.9 | | | | 0.7 | | | | 0.6 | | Fuel oil | | | 123.9 | | | | 64.0 | | | | 113.3 | | | | 61.0 | | | | 103.5 | | | | 65.5 | | | | 103.5 | | | | 65.5 | | | | 89.8 | | | | 67.6 | | | | 69.3 | | | | 59.7 | | Gasoline | | | 62.9 | | | | 32.5 | | | | 52.7 | | | | 28.4 | | | | 45.0 | | | | 28.4 | | | | 45.0 | | | | 28.5 | | | | 37.7 | | | | 28.4 | | | | 33.6 | | | | 29.0 | | Others | | | 6.8 | | | | 3.5 | | | | 15.1 | | | | 8.2 | | | | 3.9 | | | | 2.5 | | | | 3.9 | | | | 2.5 | | | | 4.0 | | | | 3.0 | | | | 12.4 | | | | 10.7 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total | | | 193.7 | | | | 100.0 | % | | | 185.5 | | | | 100.0 | % | | | 158.0 | | | | 100.0 | % | | | 158.0 | | | | 100.0 | | | | 132.8 | | | | 100 | | | | 116.0 | | | | 100.0 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Imports | | | | | | | | | | | | | | | | | | | | | | | | | Gasoline(3)(2) | | | 440.1 | | | | 59.5 | | | | 510.8 | | | | 63.8 | | | | 582.5 | | | | 62.2 | | | | 582.5 | | | | 62.2 | | | | 607.3 | | | | 61.6 | | | | 544.3 | | | | 64.3 | | Fuel oil | | | 17.0 | | | | 2.3 | | | | 10.7 | | | | 1.3 | | | | 24.4 | | | | 2.6 | | | | 24.4 | | | | 2.6 | | | | 16.5 | | | | 1.7 | | | | 11.8 | | | | 1.4 | | Liquefied petroleum gas(2) | | | 105.2 | | | | 14.2 | | | | 50.6 | | | | 6.3 | | | | 42.6 | | | | 4.5 | | | | 42.6 | | | | 4.5 | | | | 61.8 | | | | 6.3 | | | | 53.9 | | | | 6.4 | | Diesel | | | 145.3 | | | | 19.6 | | | | 187.8 | | | | 23.5 | | | | 237.5 | | | | 25.4 | | | | 237.5 | | | | 25.4 | | | | 240.6 | | | | 24.4 | | | | 178.4 | | | | 21.1 | | Others | | | 32.2 | | | | 4.3 | | | | 40.4 | | | | 5.1 | | | | 49.1 | | | | 5.2 | | | | 49.1 | | | | 5.2 | | | | 59.8 | | | | 6.1 | | | | 58.7 | | | | 6.9 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total | | | 739.8 | | | | 100.0 | % | | | 800.4 | | | | 100.0 | % | | | 936.2 | | | | 100.0 | % | | | 936.2 | | | | 100.0 | | | | 985.9 | | | | 100 | | | | 846.9 | | | | 100.0 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Notes: | Numbers may not total due to rounding. |

tbpd | = thousand barrels per day. |

Notes: Numbers may not total due to rounding. tbpd = thousand barrels per day. | (1) | Includes butanes and propane. |

| (2) | Includes methyl tert-butyl ether (MTBE). |

(3) | Includes premium gasoline, regular gasoline, premium components and naphtasnaphthas |

Source: Pemex BDI. In 2019, exports of petroleum products decreased by 12.7%, from 132.8 thousand barrels per day in 2018 to 116.0 thousand barrels per day in 2019, mainly due to decreases in the export volumes of fuel oil and natural gas of 22.8% and 10.9%, respectively. Imports of petroleum products decreased by 14.1% in 2019, from 985.9 thousand barrels per day in 2018 to 846.9 thousand barrels per day in 2019, primarily due to an increase in domestic production of petroleum products. Exports of petroleum products increaseddecreased in value by 26.8%25.3% in 2017,2019, primarily due to a 59.9% increase16.8% decrease in salesthe average price of fuel oil and increasesdecreases in the average prices of other petroleum products. In 2017,2019, imports of petroleum products increaseddecreased in value, by 34.7%22.1%, primarily due to a 17.0% increase12.8 % decrease in volume of imports due to increasedcaused by lower domestic demand for regular gasoline sales and an increasea decrease in the average price of gasoline as compared to priorthe previous year. Our net imports of petroleum products for 20172019 totaled U.S. $21,423.9$561.6 million, which represents a 35.6% increasean 82.8% decrease from our net imports of petroleum products of U.S. $15,799.0$3,269.8 million in 2016.2018. The Secretary of Energy has entered into certain agreements to reduce or increase crude oil exports.exports and production. See “Item 4—Information on the Company—Trade Regulation, Export Agreement and ExportProduction Agreements” below in this Item 4. Hedging Operations P.M.I. Trading Ltd.DAC engages in hedging operations to cover its price exposure in the trading of petroleum products. The internal policies and procedures of P.M.I. Trading Ltd.DAC establish: (1) that DFIs are used exclusively to mitigate the volatility of oil and gas prices; (2) limits on the maximum amount of capital at risk and on the daily and accumulated annual losses for each business unit; and (3) the segregation ofrisk-taking and risk measurement. Capital at risk is calculated on a daily basis in order to compare the actual figures with the aforementioned limit. P.M.I. Trading, Ltd. has a risk management subcommittee that reviews risk and hedging operations and meets on a quarterly basis. See “Item 11—Quantitative and Qualitative Disclosures about Market Risk—Changes in Exposure to Main Risks—Hydrocarbon Price Risk.”

Gas Stations in the United States Between late 2015 and early 2016, we opened fiveIn 2019, additional Pemex brand gas stations in Houston, Texas that are owned and operated by franchisees. This is part of our strategy to expand our operations to the United States opened, for a combined total of 13 locations in order to fulfill the energy reform mandate to generate economic valueareas with different demographic characteristics (nine in international markets. Further, it will allow us to measure the impactTexas and four in California) as of our brand against others and identify business opportunities abroad.December 31, 2019. The gas stations’ fuel supply at these gas stations is derived from the United States wholesale market and the selling prices are subject to the local market conditions. AsWe believe that all these Pemex brand gas stations will allow Pemex to evaluate in detail the market response to the Pemex brand and to establish a brand experience in accordance to the demand of December 31, 2017,the subset market segments. Additionally, we have seen an increase in fuel consumption of up to 150% as compared to 2016, primarily in areas with large Hispanic populations. We are looking to build on this strategy and expandexpect that the information gathered from all our presencegas stations in the United States overwill help to develop a market penetration strategy to maximize the next several years.value of the Pemex brand through major U.S. fuel marketers.

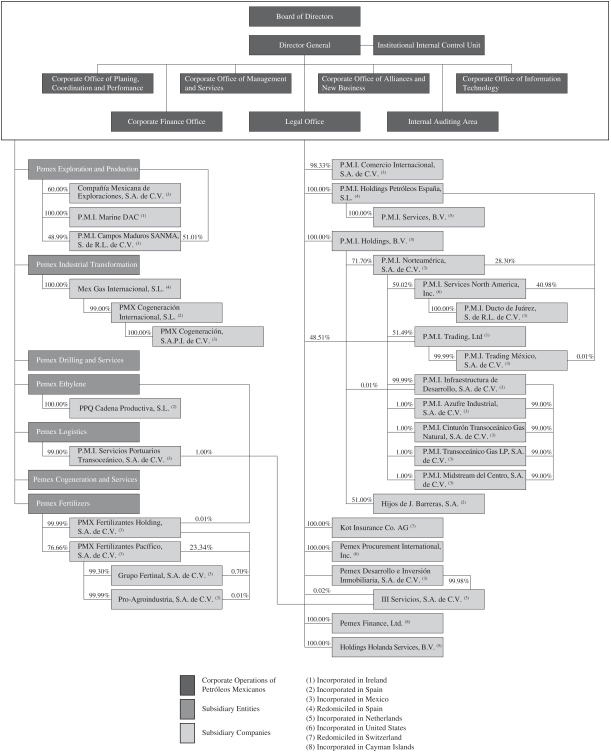

PEMEX Corporate Matters In addition to the operating activities that we undertake through the activities of our subsidiary entities and subsidiary companies, we have certain centralized corporate operations that coordinate general labor, safety, insurance and legal matters. Industrial Safety and Environmental Protection Our Corporate Office of Planning, Coordination and Performance is responsible for planning, conducting and coordinating programs to: foster a company culture of safety, environmental protection and environmental protection;efficient and rational use of energy; improve the safety of our workers and facilities; reduce risks to residents of the areas surrounding our facilities; and reduce greenhouse gas emissions and identify the risks associated with climate change in Mexico in order to develop strategies to minimize the impact of climate change on our operations. We intend to further develop industrial safety and environmental programs for each subsidiary entity. The environmental and safety division of each subsidiary entity coordinates closely with the Corporate Office of Planning, Coordination and Performance.Performance to promote sustainable performance focused on continuous improvement. Insurance We maintain a comprehensive property and general liability insurance program for onshore and offshore properties and liabilities. All onshore properties, such as refineries, processing plants, pipelines and storage facilities are covered, as are all of our offshore assets, such as drilling platforms, rigs, gas gathering systems, maritime terminals and production facilities. Our insurance covers risks of sudden and accidental physical damage to or destruction of our properties, as well as risk of sudden and accidental physical loss, including as a consequence of purposeful terrorist acts. This insurance also provides coverage for the contents of pipelines and storage facilities, and any of our liabilities arising from such acts. Our insurance also covers extraordinary costs related to the operation of offshore wells, such as control andre-drilling costs, evacuation expenses and liability costs associated with spills. We also maintain protection and indemnity insurance for our full marine fleet, in addition to life insurance, aircraft, automobile and heavy equipment insurance, cargo and marine hull insurance, as well as insurance for deep water drilling activities and onshore and offshore minor construction projects on operating facilities. In accordance with Mexican law, we have entered into all of our insurance contracts with Mexican insurance carriers. These policies have limits of U.S. $1.8 billion for onshore property, U.S. $1.9 billion for offshore property, U.S. $0.3 billion for extraordinary costs related to the operation of offshore wells, U.S. $1.0 billion for marine-related liabilities, U.S. $1.1 billion for onshore and offshore liabilities, U.S. $0.5 billion for offshore terrorist acts and U.S. $0.5 billion for onshore terrorist acts.Limitsacts. Limits of insurance policies purchased for each category of risk are determined using professional risk management assessment surveys conducted by international companies on an annual basis and the market capacity available per risk and must be in compliance with local regulations enacted following the energy reform. In addition, in compliance with the regulations enacted in June of 2016 by the NationalAgencia Nacional de Seguridad Industrial y de Protección al Medio Ambiente del Sector Hidrocarburos (National Agency for Industrial Safety and Environmental Protection of the Hydrocarbons Sector (ASEA)or ASEA), we maintain insurance coverage with respect to third party liability, liability for environmental damage and control of well, works or drilling activities and extraction of hydrocarbons, the treatment and refining of crude oil and the processing of natural gas. We have also made the necessary endorsements to ensureensured that we maintain insurance coverage in connection with our new strategic alliances and other joint arrangements. Since June 2003, we have not maintained business interruption insurance, which in the past compensated us for loss of revenues resulting from damages to our facilities. Instead, we purchasead-hoc ad hoc business interruption mitigation insurance coverage, which compensates us for the additional expenses necessary to recover our production capabilities in the shortest time possible. During 20172019 we continued to engage in deep water exploratory and drilling activities that were covered by our existing insurance program.Inprogram until December 31, 2019. In August 2012, we purchased a policy to increase the coverage available for potential property damage, third-partythird party liability and control of well risks related to these activities. Under this policy, we maintainmaintained coverage for each deep water well drilled, and the limits are determined based on the risk profile of the corresponding well. This policy hashad a limit of U.S. $3.3 billion, including U.S. $1.3 billion for control of well risks, U.S. $1.1 billion for casualtyliability and U.S. $0.9 billion for property damage. This policy also included contemplates additional coverage for environmental liabilities and remediation activities relating to deep water exploration and drilling. All of our insurance policies are in turn reinsured through Kot Insurance Company, AG (which we refer to as Kot AG). Kot AG is a wholly owned subsidiary company that was originally formed in 1993 under the laws of Bermuda as Kot Insurance Company, Ltd. and was subsequently organized under the laws of Switzerland in 2004. Kot AG is used as a risk management tool to structure and distribute risks across the international reinsurance markets. The purpose of Kot AG is to reinsure policies held through our local insurance carriers and to maintain control over the cost and quality of the insurance covering our risks. Kot AG reinsures over 90%80% of its reinsurance policies with unaffiliated third-party reinsurers. Kot AG carefully monitors the financial performance of its reinsurers and actively manages counterparty credit risk across its reinsurance portfolio to ensure its own financial stability and maintain its creditworthiness. Kot AG maintains solid capitalization and solvency margins consistent with guidelines provided by Swiss insurance authorities and regulations. As of December 31, 2017,2019, Kot AG’s net risk retention is capped atabout U.S. $327$425 million spread across different reinsurance coverages to mitigate potential aggregation factors. InvestmentCompliance at Pemex

Our new corporate compliance programPemex Cumplewas authorized by the Board of Directors of Petróleos Mexicanos in RepsolNovember 2019. This program amends and supplements our existing compliance program, which was approved by the Board of Directors of Petróleos Mexicanos in July 2017. On October 26, 2017, PMI HBV sold all of its shares in Repsol, S.A. (formerly known as Repsol YPF, S.A., and which we refer to as Repsol)—21,333,870 shares in total – to Credit Agricole CIB. This sale resulted in a loss of Ps. 3.5 billion. As of the datepart of this annual report,new program, we do not hold any shares in Repsol. See Note 10implemented a compliance hub with different lines of attention: ethics and integrity, anticorruption and due diligence, legal compliance, and data protection and transparency. The program is aimed to strengthen our consolidated financial statements included herein.compliance culture with respect to national anticorruption strategy and international laws, international treaties, specific regulations for the oil and gas sector, economic competition and internal policies.

Ethics Committee Our Ethics Committee consists of members from our management team, with the head of the Institutional Internal Control Unit at Petróleos Mexicanos serving as its chairman. Our Ethics Committee is primarily responsible for: promoting awareness and use of our code of ethics and code of conduct, including through online training available for our employees, in order to improve our culture of ethics; establishing procedures that implement the principles found in our code of ethics in order to increase compliance and to detect behavior that adversely affects our activities; analyzing and giving instructions to the appropriate areas on possible violations to our code of ethics and code of conduct that are reported through the Ethics Line;ethics tip line; and working with the Liabilities Unit at Petróleos Mexicanos and our Internal Auditing Area to exchange information regarding violations of our code of ethics and our code of conduct. See “Item 16B—Code of Ethics” for more information regarding our code of ethics. Collaboration and Other Agreements On September 30, 2014, Petróleos Mexicanos and theSecretaria de Desarrollo Social (SEDESOL), signed a collaboration agreement with the objective of supporting community development in the zones of influence of oil industries by providing food and nutrition support as part of theCruzada Nacional Contra el Hambre (National Cruzade Against Hunger). This collaboration agreement expired in November 2017. On October 27, 2014, Petróleos Mexicanos and theSecretariaSecretaría de Agricultura, Ganadería, Desarrollo Rural, Pesca y Alimentación(SAGARPA) signed, now SADER, entered into a collaboration agreement to provide community and environmentalcarry out concurrent actions to support to communities within the zones of influencewell-being of the oil industries. This collaboration agreement is setcommunities in which we operate under thePrograma de Apoyo a la Comunidad y Medio Ambiente (Program to expire in November 2018.Support Communities and the Environment, which we refer to as PACMA).

On February 5, 2015, Petróleos Mexicanos and theInstituto Politécnico Nacional (National Polytechnic Institute) of Mexico entered into a collaboration agreement for the development of human resources, technology and research, with the aim of promoting and supporting joint research programs and the development of knowledge related to the hydrocarbons industry. On February 18, 2015, Petróleos Mexicanos and the Organisation for EconomicCo-operation and Development (OECD) signed a memorandum of understanding with the aim of benefiting from the OECD’s knowledge of and experiences with international best practices relating to the procurement of goods and services. On February 19, 2015, Petróleos Mexicanos signed a memorandum of understanding with the Infraestructura Energética Nova, S.A.B. de C.V. and Sempra LNG units of the U.S. energy company Sempra Energy for the potential joint development of a natural gas liquefaction project at the site of the Energía Costa Azul facility located in Ensenada, Mexico. On April 7, 2015, Petróleos Mexicanos and First Reserve signed a memorandum of understanding and cooperation to explore new opportunities for joint energy projects, which would provide access to financing, as well as the exchange of technical and operational experience. This agreement contemplates up to U.S. $1.0 billion of investments in potential projects relating to infrastructure, maritime transport and power cogeneration, among others. On May 12, 2015, Petróleos Mexicanos and Global Water Development Partners, a company founded by private equity funds operated by Blackstone, signed a memorandum of understanding with the aim of creating a partnership to invest in water and wastewater infrastructure for Petróleos Mexicanos’ upstream and downstream facilities. This partnership is intended to finance and carry out environmentally sustainable projects for water treatment in Petróleos Mexicanos’ operations. On May 12, 2015, PMX Cogeneración, S.A.P.I. de C.V., an affiliate of Petróleos Mexicanos, signed a memorandum of understanding with the consortium formed by Enel S.p.A., an Italian renewable energy company, and Abengoa, S.A., a Spanish renewable energy company, to develop a cogeneration power plant to generate and supply clean energy to the Antonio Dovali Jaime refinery in Salina Cruz, as well as the Mexican national grid. On June 1,29, 2015, Petróleos Mexicanos and the U.S. based global asset manager BlackRock Financial Management Inc. signed a memorandum of understanding with the aim of accelerating the development and financing ofenergy-related infrastructure projects that are of strategic importance to Petróleos Mexicanos.

On July 20, 2015, Petróleos Mexicanos, through its Corporate Office of Procurement and Supply, signed an agreement with the OECD with the aim of adopting and promoting best practices in procurement and fostering efficient management strategies and transparency in Petróleos Mexicanos’ processes. The agreement also contemplates the training of our personnel by the OECD on issues of transparency and ethics, the design of procurement procedures and mitigating risks of collusion. On July 22, 2015, Petróleos Mexicanos and theSecretaría de Desarrollo Agrario, Territorial y Urbano (Ministry of Agriculture, Land and Urban Development) signed a collaboration agreement with the aim of establishing consulting and training mechanisms for the development of hydrocarbon exploration, extraction and distribution projects in strict observance of the applicable legal framework and with full respect for agricultural landowners. On July 23, 2015, Petróleos Mexicanos and the Instituto Tecnológico y de Estudios Superiores de Monterrey, A.C. signed a collaboration agreement with the purpose of (1) fostering competitive development within the Mexican oil and gas industry; (2) carrying out specialized research and consulting services, including lectures, seminars, conferences and other events of common interest to the institutions; and (3) providing postgraduate studies for our employees and internships for college students at Petróleos Mexicanos. On July 28, 2015, Petróleos Mexicanos and Banco Santander, S.A. (Santander) signed a collaboration agreement with the purpose of providing our franchisees with access to Santander banking services such as bank card sales, deposits ande-banking services, payroll management and the transportation of money. On September 9, 2015, Petróleos Mexicanos and General Electric signed a memorandum of understanding with the aim of creating a partnership to invest in new technology and financing initiatives for gas compression, power generation and the production of hydrocarbons, both onshore and offshore, including in deepwater fields.

On October 7, 2015, Petróleos Mexicanos, through its subsidiary Pemex Cogeneration and Services, and Dominion Technologies signed a memorandum of understanding to form a company aimed at the joint implementation of cogeneration projects. On October 10, 2015, Petróleos Mexicanos and the United Nations Development Programme in Mexico reaffirmed their commitment to use best practices in terms of inclusion, equality andnon-discrimination in the workplace.

On November 30, 2015, Petróleos Mexicanos and Global Water Development Partners agreed to create a joint venture intended to invest approximately U.S. $800 million in water and wastewater treatment infrastructure for upstream and downstream facilities in Mexico. This partnership aims to (1) provide access to advanced technology to meet the supply and treatment requirements of wastewater at our facilities, in both onshore and offshore production areas, as well as in refineries and petrochemical plants; and (2) in the future, to potentially implement and finance environmentally sustainable solutions for water management.

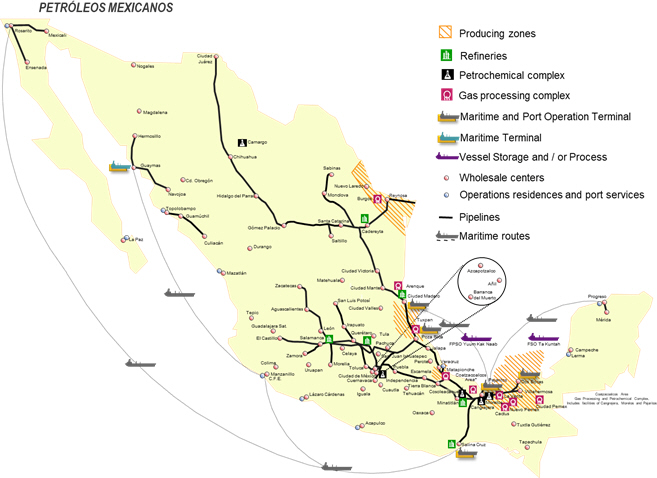

On January 19, 2016, Petróleos Mexicanos and Mubadala Petroleum signed a memorandum of understating agreeing to joint projects to explore the Mexican energy sector, including its upstream activities, primary midstream activities and infrastructure projects for a total investment of approximately U.S. $4.0 billion. Among these projects is a commercial logistic infrastructure system in the Salina Cruz, Oaxaca area, for an approximate investment in excess of U.S. $3.0 billion. On January 19, 2016, Petróleos Mexicanos and the Abu Dhabi National Oil Company signed a memorandum of understanding with the aim to share each company’s best practices with respect to different upstream activities, including exploration, development and production in oil fields; improved recovery, handling and processing of liquefied natural gas; as well as human resources training, sustainability, internal controls, transparency, process development andcyber-security. On January 19, 2016, Petróleos Mexicanos and Saudi Aramco signed a memorandum of understanding renewing and strengthening the relationship between both companies and establishing an exchange of ideas surrounding operational excellence, sustainability and energy efficiency, and innovation and technological development. On April 1, 2018, Petróleos Mexicanos, the SENER, the CNH and Natural Resources Canada subscribed to a memorandum of understanding and collaboration in order for Mexico and Canada to share demonstrations of technology and practices for the conservation of hydrocarbons and the measurement and reduction of emissions. On March 6, 2019, Petróleos Mexicanos and the JBIC signed a memorandum of understanding with the purpose of exchanging experiences and promoting development in the energy sector. On November 15, 2019, Petróleos Mexicanos and China Export & Credit Insurance Corporation (Sinosure) signed a memorandum of understanding with the purpose of strengthening the cooperative relationship between these two entities. Through these agreements, we seek to increase our technical and scientific knowledge in areas that include exploration and drilling. These broad agreements of technological and scientific collaboration are strictlynon-commercial,i.e., there is no transfer of resources among the parties. Property, Plants and Equipment General Substantially all of our property, consisting of refineries, storage, production, manufacturing and transportation facilities and certain retail outlets, is located in Mexico, including Mexican waters in the Gulf of Mexico. The location, character, utilization and productive capacity of our exploration, drilling, refining, petrochemical production, transportation and storage facilities are described above. See “—Exploration and Production,” “—Drilling and Services,” “Industrial Transformation,” “—Ethylene,” “—Fertilizers,”Fertilizers” and “—Logistics” and “—Cogeneration and Services.”. The insurance program covering all of our properties is also described above. See “—Insurance.” Reserves Under Mexican law, all crude oil and other oil and gas reserves located in the subsoil of Mexico are owned by the Mexican nation and not by us. The Mexican Government has granted us the right to exploit the petroleum and other oil and gas reserves assigned to us in connection with the process that occurred in August 2014 and is commonly referred to as Round Zero, as well as the right to explore for and exploit petroleum and other oil and gas reserves in areas that have been granted to us in Round 1.4.various subsequent rounds. Productivestate-owned companies and other companies participating in the Mexican oil and gas industry may report assignments or contracts and the corresponding expected benefits for accounting and financial purposes. See “Information on the Company—History and Development—Energy Reform”Legal Regime” above in this Item 4. Our estimates of hydrocarbons reserves are described under “—Exploration and Production—Reserves” above. GENERAL REGULATORY FRAMEWORK Petróleos Mexicanos is regulated by the Mexican Constitution, the Petróleos Mexicanos Law and the Hydrocarbons Law, among other regulations. The purpose of the Petróleos Mexicanos Law is to regulate the organization, management, operation, monitoring, evaluation and accountability of Petróleos Mexicanos as aproductive-state owned company of the Mexican Government. On October 31, 2014, the Regulations to the Petróleos Mexicanos Law were published in the Official Gazette of the Federation. These regulations were modified on February 9, 2015. The purpose of these regulations is to regulate, among other things, the appointment and removal of the members of the Board of Directors of Petróleos Mexicanos, potential conflicts of interest for Board members, and the evaluation of Petróleos Mexicanos. The Mexican Government and its ministries regulate our operations in the oil and gas sector. The Ministry of EnergySENER monitors our operations, and the Secretary of Energy acts as the chairperson of the Board of Directors of Petróleos Mexicanos. In addition, theLey de los Órganos Reguladores Coordinados en Materia Energética (Coordinated Energy Regulatory Bodies Law related to the Energy Matters Law,Law), which was enacted as part of the Secondary Legislation and took effect on August 12, 2014)2014, establishes mechanisms for the coordination of these entities with the Ministry of EnergySENER and other ministries of the Mexican Government. The CNH has the authority to award and execute contracts for exploration and production in connection with competitive bidding rounds. The CRE has the authority to grant permits for the storage, transportation and distribution of oil, gas, petroleum products and petrochemicals in Mexico, and to regulate thefirst-hand sale of these products. The regulatory powers of the CNH and the CRE extend to all oil and gas companies operating in Mexico, including Petróleos Mexicanos and our subsidiary entities. On December 2, 2014, the Ministry of EnergySENER published in the Official Gazette of the Federation a statement declaring that the new Board of Directors of Petróleos Mexicanos was performing its duties and the mechanisms for our oversight, transparency and accountability had been implemented in accordance with the Petróleos Mexicanos Law. As a result, the special regime that governs Petróleos Mexicanos’ activities relating to productivestate-owned subsidiaries, affiliates, compensation, assets, administrative liabilities, budget, debt levels and the state dividend took effect. On June 10, 2015 the General Provisions for Contracting with Petróleos Mexicanos and its ProductiveState-Owned Subsidiaries were published in the Official Gazette of the Federation, and on June 11, 2015, the special regime for acquisitions, leases, services and public became effective. On May 18, 2018, new General Provisions for Contracting with Petróleos Mexicanos and its Productive State-Owned Subsidiaries were published in the Official Gazette of the Federation, repealing the previous general provisions published in June 2015 and their subsequent amendments. These General Provisions regulate the legal process for acquisitions, leases, works and services needed for our projects and require that our suppliers, contractors and other participants with whom we have or intend to have a commercial relationship recognize and adopt our Compliance Program (as defined below) and establish prevention and compliance systems in accordance with applicable law. New amendments to these General Provisions were published in the Official Gazette of the Federation on August 1, 2018. In accordance with the Petróleos Mexicanos Law, each year the Ministry of Finance and Public Credit provides us with estimated macroeconomic indicators for the following fiscal year, which we are to use to prepare the consolidated annual budget for Petróleos Mexicanos and the subsidiary entities, including our financing program. Upon approval by the Board of Directors of Petróleos Mexicanos, our consolidated budget and financing program is then submitted to the Ministry of Finance and Public Credit, which has the authority to adjust our financial balance goal and the ceiling on our wage and salary expenditures for the fiscal year. The consolidated annual budget and financing program of Petróleos Mexicanos and the subsidiary entities, including any adjustments made by the Ministry of Finance and Public Credit, is then incorporated into the federal budget for approval by the Chamber of Deputies. The Mexican Government is not, however, liable for the financial obligations that we incur. In approving the federal budget, the Chamber of Deputies authorizes our financial balance goal and the ceiling on our wage and salary expenditures for the fiscal year, which it may subsequently adjust at any time by modifying the applicable law. We are also subject to various domestic and international laws and regulations related toanti-corruption,anti-bribery andanti-money laundering. The laundering, such as theCódigo Penal Federal (Federal Criminal Code), which criminalizes certain corrupt practices, including bribery, embezzlement and abuse of authority. Theauthority; theLey FederalGeneral del Sistema Nacional Anticorrupción en Contrataciones Públicas (General Law of the National Anti-Corruption System); theLey de Fiscalización y Rendición de Cuentas de la Federación (Federal Audit and Accountability Law) and theLey General de Responsabilidades Administrativas (General Law of Anti-Corruption in Public Contracting) sanctions companiesAdministrative Liabilities), among others. These laws establish a national anti-corruption system designed to coordinate efforts among the Mexican Government, federal entities, states and individuals that violate this law while participating in federal government contracting in Mexico,municipalities to prevent, investigate and punish corrupt activities and oversee public resources, as well as Mexican companies and individuals engaged in international commercial transactions. This law is analogous in many respects to the FCPA. In addition, the Federal Lawdetermine administrative liabilities of Administrative Responsibilities of Public Officials prohibits the bribery of federal public officials in Mexico, including members of the Mexican Congress and the federal judiciary.applicable penalties. We also employ internal control procedures and guidelines designed to monitor the activities of our employees, including senior management, and to ensure compliance with applicableanti-corruption,anti-bribery andanti-money laundering laws and regulations. TheLineamientos que regulan el sistema de control interno en Petróleos Mexicanos, sus empresas productivas subsidiarias y empresas filiales (Guidelines governing the internal control system of Petróleos Mexicanos, its productive subsidiary entities and affiliates) set forth the principles underlying our internal controls system and the procedures necessary for its implementation and monitoring. In addition, theLineamientos para la participación de testigos sociales durante actividades de procura y abastecimiento y procedimiento de contratación deregular a los Testigos Sociales en Petróleos Mexicanos y sus empresas productivas subsidiarias (Guidelines for the participation ofto regulate public witnesses in the procurement and supply activities and contracting procedures of Petróleos Mexicanos and its productive subsidiary entities and affiliates)entities), delineates the ways in which public witnesses may act asthird-party observers in connection with our procurement procedures. These internal controls and guidelines are applicable to Petróleos Mexicanos and the subsidiary entities. For a description of the risks relating toanti-corruption,anti-bribery andanti-money laundering laws and regulations, see “Item 3—Key Information—Risk Factors—Risk Factors Related to our Operations—We are subject to Mexican and internationalanti-corruption,anti-bribery andanti-money laundering laws. Our failure to comply with these laws could result in penalties, which could harm our reputation, prevent us from obtaining governmental authorizations needed to carry out our operations and have an adverse effect on our business, results of operations and financial condition.” Petróleos Mexicanos and the subsidiary entities, as public entities of the Mexican Government, are subject to theLey General del Sistema Nacional Anticorrupción (General Law of the National Anti-corruption System), theLey de Fiscalización y Rendición de Cuentas de la Federación (Federal Audit and Accountability Law), and theLey General de Responsabilidades Administrativas (General Law of Administrative Liabilities), among others. These laws establish a national anti-corruption system to coordinate efforts among the Mexican Government, federal entities, states and municipalities to prevent, investigate and punish corrupt activities and oversee public resources, as well as determine administrative liabilities of public officials and the applicable penalties.

On July 14, 2017, the Board of Directors of Petróleos Mexicanos approved our “Compliance Program”,compliance program, which is a series of procedures aimedintended to complyaid our compliance with legal, accounting and financial provisions in order to prevent corruption and to promote ethical values. These procedures include a focus on internal controls, risk management, ethical principles and corporate integrity, as well as policies promoting transparency and accountability. This compliance program was superseded by our new corporate compliance program,Pemex Cumple,which was authorized by the Board of Directors of Petróleos Mexicanos in November 2019. As part of this new program, we have implemented a compliance hub with different lines of attention: ethics and integrity, anticorruption and due diligence, legal compliance, and data protection and transparency. The program is aimed to strengthen our compliance culture, with respect to national anticorruption strategy and international laws, international treaties, specific regulations for the oil and gas sector, economic competition and internal policies. On August 28, 2017, a newNovember 11, 2019,Código de Conducta de Petróleos Mexicanos, sus empresas productivas subsidiarias y, en su caso, empresasfiliales (Code of Conduct of Petróleos Mexicanos, its productive subsidiary entities and, where applicable, affiliated companies, or the Code of Conduct), was published in the Official Gazette of the Federation, replacing the code of conduct issued in February 2015.on August 28, 2017. This Code of Conduct delineates behaviors expected of and banned for our employees, in accordance with the values established in our Code of Ethics, and includes data protection and transparency related matters. Our newCódigo de Ética para Petróleos Mexicanos, sus empresas productivas subsidiarias y empresas filiales (Code of Ethics for Petróleos Mexicanos, its productive subsidiary entities and affiliates, or the Code of Ethics, whichEthics) was also published on that same day in the Official Gazette of the Federation on December 24, 2019. This new Code of Ethics was approved by the Board of the Directors of Petróleos Mexicanos inon November 2016, such as:26, 2019. Our new Code of Ethics includes respect,non-discrimination, honesty, loyalty, responsibility, legality, impartiality and integrity, human rights protection and inclusion practices, among others. On September 11, 2017, thePolíticas y Lineamientos Anticorrupción para Petróleos Mexicanos, sus empresas productivas subsidiarias y, en su caso, Empresas Filiales (Anti-corruption(Anti-corruption Policies and Guidelines for Petróleos Mexicanos, its productive subsidiary entities and, where applicable, affiliated companies) and thePolíticas y Lineamientos para el desarrollo de la Debida Diligencia en Petróleos Mexicanos, sus empresas productivas subsidiarias y, en su caso, Empresas Filiales, en Materia de Ética e Integridad Corporativa (Policies and Guidelines to carry out Due Diligence in Petróleos Mexicanos, its productive subsidiary entities and, where applicable, affiliated companies, in Ethics and Corporate Integrity matters)Matters) became effective. The purpose of these regulations is to set up actions againstto prevent acts of corruption as well as provide means to confront and fight them and mitigate our own risks as well asthird-party risks that may affect the activities of PEMEX for acts of corruption, lack of ethics or corporate integrity or our involvement in illicit acts of any kind. As an issuer of debt securities that are registered under the Securities Act and in connection with certain representations and covenants included in our financing agreements, we must comply with the U.S. Foreign Corrupt Practices Act, or the FCPA. The FCPA generally prohibits companies and anyone acting on their behalf from offering or making improper payments or providing benefits to government officials for the purpose of obtaining or keeping business. In addition, we are subject to other international laws and regulations related toanti-corruption,anti-bribery andanti-money laundering, including the U.K. Bribery Act 2010, which prohibits the solicitation of, the agreement to receive and the acceptance of bribes. ENVIRONMENTAL REGULATION Legal Framework We are subject to the environmental laws and regulations issued by the local and state governments where our facilities are located, including those associated with atmospheric emissions, water usage and wastewater discharge, as well as thewaste management of hazardous andnon-hazardous waste. care for affected sites. In particular, we are subject to the provisions of theLey General del Equilibrio Ecológico y la Protección al Ambiente (General Law on Ecological Equilibrium and Environmental Protection, which we refer to as the Environmental Law) and related regulations, the Ley General de Cambio Climático (General Law on Climate Change) and other technical environmental standards issued by the Secretaría del Medio Ambiente y Recursos Naturales (Secretariat of the Environment and Natural Resources or SEMARNAT) and theAgencia de Seguridad, Energía y Ambiente (National Agency for Industrial Safety and Environmental Protection of the Hydrocarbons Sector or ASEA). We are also subject to theLey General para la Prevención y Gestión Integral de los Residuos (General Law on Waste Prevention and Integral Management) and, theLey General de Transición EnergéticaCambio Climático (Law(General Law on Climate Change) and other technical environmental standards issued by theSecretaría del Medio Ambiente y Recursos Naturales(Ministry of the Energy Transition)Environment and Natural Resources, or SEMARNAT) and the ASEA. In April 1997, the SEMARNAT issued regulations governing the procedures for obtaining an environmental license, under which new industrial facilities can comply with all applicable environmental requirements through a single administrative procedure. Each environmental license integrates all of the different permits, licenses and authorizations related to environmental matters for a particular facility. Since these regulations went into effect, we have been required to obtain an environmental license for any new facility. Our facilities that existed prior to the effectiveness of these regulations are not subject to this requirement. Before we carry out any activity that may have an adverse impact on the environment, we are required to obtain certain authorizations from ASEA, the SEMARNAT, the Ministry of Energy,SENER, the NationalComisión Nacional del Agua (National Water Commission, or CONAGUA) and the Mexican Navy,SEMAR, as applicable. In particular, specific environmental regulations apply to petrochemical, crude oil refining and extraction activities, as well as to the construction of crude oil and natural gas pipelines. Before authorizing a new project, ASEA requires the submission of an environmental impact and risk analysis. ASEA is an administrative body of the SEMARNAT that operates with technical and administrative autonomy and has the authority to regulate and supervise companies participating in the hydrocarbon sector through its issuance of rules establishing safety standards limits on greenhouse gas emissions and guidelines for the dismantling and abandonment of facilities, among other things. TheLey de la Agencia Nacional de Seguridad Industrial y de Protección al Medio Ambiente del Sector Hidrocarburos (Law(Law of the Hydrocarbons Industrial Safety and Environmental Protection Agency of the Hydrocarbon Sector) provides that until the general administrative provisions and Official Mexican Standards proposed by the Hydrocarbons Industrial Safety and Environmental Protection AgencyASEA are in effect, obligations will continue under the guidelines, technical and administrative arrangements, agreements and Official Mexican Standards promulgated by the SEMARNAT, CNH and CRE. The environmental regulations specify, among other matters, the maximum levels of emissions and waste water discharge that are permissible. These regulations also establish procedures for measuring pollution levels, the management of hazardous andnon-hazardous waste and the treatment of sites affected by hydrocarbon production.

We are also subject to theNOM-001-SEMARNAT-1996 issued by CONAGUA in conjunction with theProcuraduría Federal de Protección al Ambiente (PROFEPA), which sets forth the maximum permissible levels of pollutants in wastewater that can be discharged into national bodies of water. In addition, we are subject to theNOM-052-SEMARNAT-2006 and theNOM-001-ASEA-2019,which regulatesregulate hazardous waste theNOM-161-SEMARNAT-2011, which regulatesand its special waste management procedures,handling, respectively, as well as theNOM-138-SEMARNAT/SSA1-2012, which establishes the maximum permissible levels of hydrocarbons in the soil and sets forth guidelines with respect to soil testing and the treatment of sites affected by hydrocarbon production. We are also subject to theNOM-006-ASEA-2017, which provides technical guidelines and criteria for industrial safety, operational safety and environmental protection for each of the phases of the design, construction,pre-start, operation, maintenance, closing and, finally, the dismantling of land installations for the storage of petroleum and petroleum products, except liquefied petroleum gas. Federal and state authorities are authorized to inspect any facility to determine its compliance with the Environmental Law, localstate environmental laws, regulations and technical environmental regulations. Violations ornon-compliance with environmental standards and regulations may result in substantial fines, temporary or permanent shutdown of a facility, required capital expenditures to minimize the effect of our operations on the environment, cleanup of contaminated soil and water, cancellation of a concession or revocation of an authorization to carry out certain activities and, in certain cases, criminal proceedings. See “Item 3—Key Information—Risk Factors—Risk Factors Related to Our Operations—Our compliance with environmental regulations in Mexico could result in material adverse effects on our results of operations.” The Mexican Government regularly participates in multilateral negotiations on climate change to promote a sustainable andlow-carbon economy. In September 2016, the Mexican Government ratified the Paris Agreement and endorsed its Nationally Determined Contribution (NDC) by unconditionally committing Mexico to the reduction of 22% of its greenhouse gas emissions and 51% of its black carbon emissions by 2030. This commitment adopts 2013 metrics as a baseline. This commitment may also be increased by an additional reduction of up to 36% of Mexico’s greenhouse gas emissions and 70% of its black carbon emissions, on a conditional basis and subject to the adoption of a global market agreement, which would promote international carbon pricing, as well as financial and technical cooperation. In order to satisfy this comment, the Mexican Government has indicated that it intends to strengthen the adaptation capacities of at least 50% of the most vulnerable municipalities in the national territory, to establish early warning systems and risk management at all levels of its government, and to promote ecosystem-based adaptation intended to achieve a deforestation rate of zero by 2030. Mexico’s NDC commitment envisions participation of all social and economic segments of the country, especially the energy and industrial sectors. As a result, in July 2018, the second transitory article of the General Law on Climate Change was amended to include the commitments made by the government. Pursuant to the General Law on Climate Change, greenhouse gas emissions from the oil and gas sector are required to decrease by 14% by the year 2030, as compared to the sector’s baseline. Additionally, Article 94 of the General Law on Climate Change was supplemented to indicate that the SEMARNAT must gradually and progressively establish a national emissions trading system, designed to promote emission reduction actions at the lowest possible cost. Pursuant to this law, emissions reductions must be measurable, reportable and verifiable. In order to ease the transition for the system participants, thePrograma de Prueba del Sistema de Comercio de Emisiones (Pilot Program for the Emissions Trading System) is to operate from 2020 to 2022. Between 2020 and 2022, we are required to participate actively and increase the evaluation of initiatives and projects that could reduce our emissions, taking into consideration the additional cost that such initiatives will have once emissions caps are defined for each participant. Mexico generally reviews and updates its environmental regulatory framework every five years, , and we work with the Mexican Government to develop new environmental regulations of activities related to the oil and gashydrocarbon industry. During 2016, the CNH updated the technical provisions for the use of natural gas in exploration and extraction activities and issued regulations for drilling, exploration and development.

Also in 2016, ASEA required that CONAGUA monitor water tables before we began drilling shale gas exploratory wells in the northern part of Veracruz and the southern part of Tamaulipas.

During 2016, ASEA issued further regulations that establish guidelines on, among others, implementing and authorizing industrial safety management systems, operational safety and environmental protection, as well as the reporting of incidents to the authorities. Moreover, in 2017 ASEA issued regulations for the external auditing of the performance of such safety systems.

Climate Change On June 6, 2012,Our 2019-2023 Business Plan includes goals such as the General Law on Climate Change was publishedreduction of the environmental impact of our industrial activities and the improvement of our energy management systems. The implementation of these goals requires a set of projects and initiatives to be developed in the Official Gazette ofcoming years. We are likewise working to develop projects and initiatives related to our emissions intensity goals for our main productive activities. Furthermore, the Federation, with the objectives of regulatingmethodologies used for calculating Mexico’s greenhouse gas emissions were updated in 2019 in order to increase the certainty levels of the values being reported and reducing the vulnerability of Mexico’s infrastructure, population and ecosystemsto adjust to the adverse effects of climate change. The General Law on Climate Change establishes a series of financial, regulatory and technical rules and regulations, as well as tools for strategy formation, evaluation and monitoring that formrecent legal requirements in the framework for a comprehensive public policy on climate change.

Our Special Climate Change Program 2014-2018 aims to reduce greenhouse gas emissions, improve energy and operational efficiency, reduce gas flaring and promote the efficient use of gas, among other things. Pursuant to this program, in 2016, we began upgrading the Ing. Antonio Dovalí Jaime Refinery in Salina Cruz, Oaxaca to operate on cleaner natural gas. We also began the test period for a cogeneration project to increase energy efficiency at the Antonio M. Amor Refinery in Salamanca, Guanajuato, and to evaluate the reduction of greenhouse gas emissions.country. In addition, we continue to work on our PEMEX Environmental Strategy 2016-2020, which incorporates our former Plan de Acción Climática (Climate Action Plan), to identify action items, projects and best practices to mitigate the impact of2019, our operations on climate change. These actions include the construction of infrastructure for transportation and gas management.

We also work with several national and international entities to develop and promote initiatives that mitigate the effects of climate change. For instance, we participate in the Climate and Clean Air Coalition (CCAC), with which we aim to identify emission sources in our key facilities and substantially reduce emissions of climate pollutants. In compliance with CCAC criteria, we carried out inspections in nine facilities, including Dos Bocas, Cactus and Atasta and have mitigated the emissions identified in those inspections.

In accordance with the actions carried out by the Mexican Government to mitigate global climate change, we are analyzing the implementation of carbon capture, use and storage (CCUS) techniques. In 2014, the “Technology Route Map of CCUS in Mexico” was developed in conjunction with SENER, SEMARNAT and

CFE. This led to the execution of integrated carbon dioxide capture projects at PEMEX and CFE facilities and enhanced oil recovery (EOR) initiatives. In 2016, several tools were developed to evaluate the firstCCUS-EOR project in Mexico. This project included a plan to inject carbon dioxide produced at our Cosoleacaque Petrochemical Complex into the Brillante producing field at the Cinco Presidentes business unit. By the end of 2017, we had put in place the necessary environmental and social safeguards for the pilot projects, which in turn allows us to receive support from the World Bank.