UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM20-F

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20182020

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from to

Commission file number001-35991

GRAÑA Y MONTEROAENZA S.A.A.

(Formerly “Graña y Montero S.A.A.”)

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

Republic of Peru

(Jurisdiction of incorporation or organization)

Av. Paseo de la República 4667

Surquillo

Lima 34, Peru

(Address of principal executive offices)

Daniel Urbina Pérez, Chief Legal Officer

Tel.011-51-1-213-6565

relacion.inversionistas@gym.com.perelacion.inversionistas@aenza.com.pe

Av. Paseo de la República 4667

Surquillo

Lima 34, Peru

(Name, telephone,e-mail and/or facsimile number and address of company contact person)

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Common Shares, par value s/.1.001.00 per share American Depositary Shares, each representing five Common Shares | | AENZ | | New York Stock Exchange* New York Stock Exchange |

| * | Not for trading purposes, but only in connection with the registration on the New York Stock Exchange of the American Depositary Shares representing those common shares. |

Securities registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation

pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

| | |

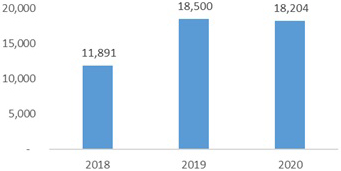

At December 31, 20182020 | | 729,434,192871,917,855 shares of common stock |

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Note –- Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of RegulationS-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, anon-accelerated filer, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | |

Large accelerated filer ☒ | | ☐ | | Accelerated filer ☐ | | ☒ | | Non-accelerated filer | | ☐ |

| | | | | |

| | | | | | | | Emerging growth company | | ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☒ No ☐

Indicate by check mark which basis of accounting the Registrant has used to prepare the financial statements included in this filing:

| | | | | | | | |

U.S. GAAP ☐ | | | | International Financial Reporting Standards as issued | | | | | | Other ☐ |

| | by the International Accounting Standards Board | | ☒ | | Other ☐ | | |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the Registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule12b-2 of the Exchange Act). Yes ☐ No ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

PART I.

PART I.INTRODUCTION

INTRODUCTION

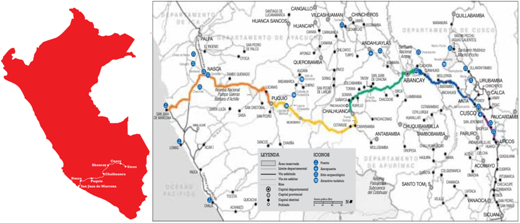

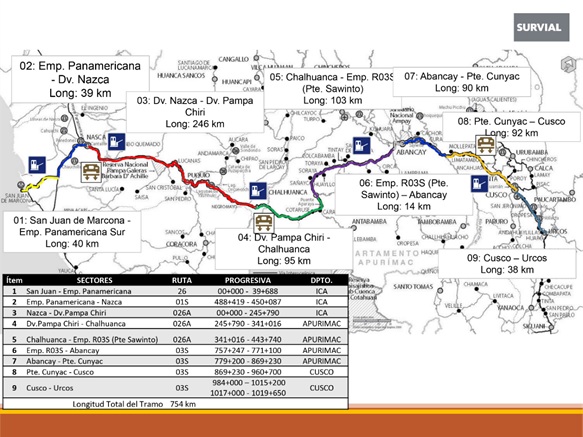

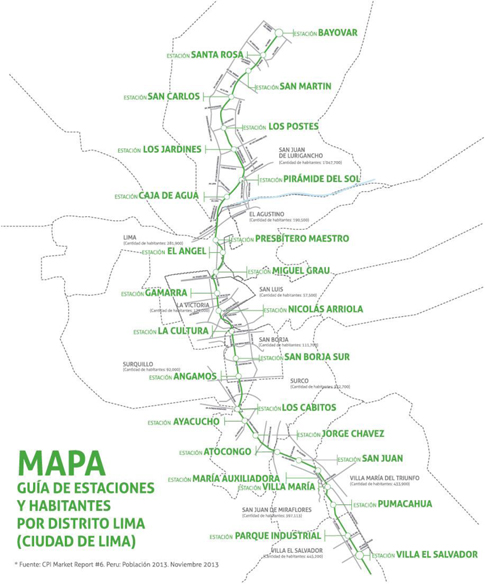

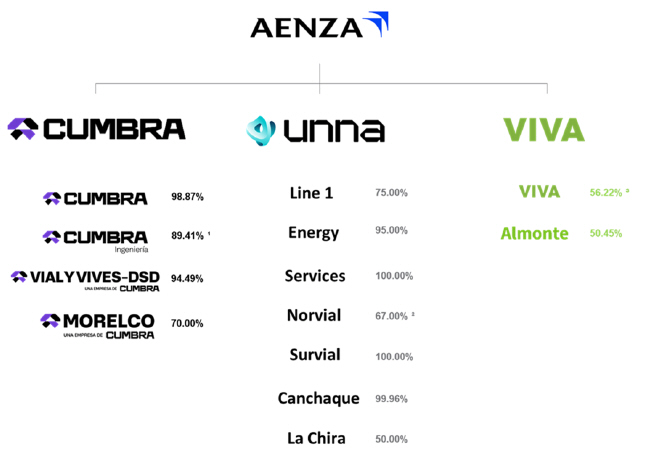

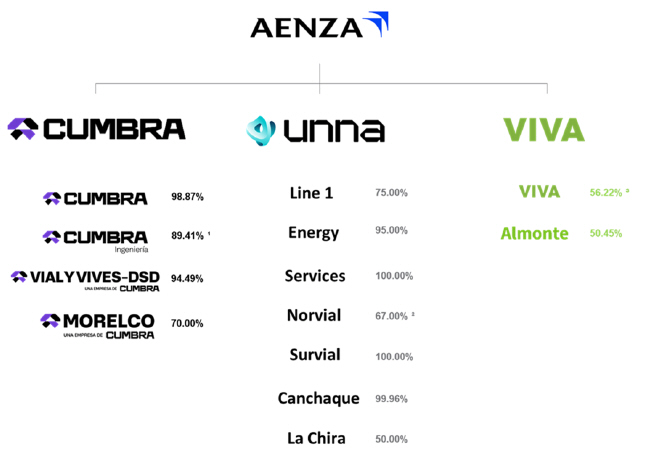

Certain Definitions

All references to “we”, “us”, “our”,“we,” “us,” “our, company”,” “our company,” “the group” and “Graña y Montero”“AENZA” in this annual report are to GrañAENZA S.A.A. (formerly, “Graña y Montero S.A.A.,”) a publicly-held corporation (sociedad anónima abierta) organized under the laws of Peru.the Republic of Peru (“Peru”). In this annual report, we refer to our principal subsidiaries, joint operations, joint ventures and associated companies as follows: (i) in our Engineering and Construction (E&C)(“E&C”) segment: Cumbra Perú S.A. (formerly GyM S.A.) as “GyM”“Cumbra”; Vial y Vives—DSD S.A. as “Vial y Vives—DSD”; Cumbra Ingeniería S.A. (formerly GMI S.A.) as “GMI”“Cumbra Ingeniería”; Morelco S.A.S. as “Morelco”; (ii) in our Infrastructure segment: Norvial S.A. as “Norvial”; Survial S.A. as “Survial”; Concesión Canchaque S.A. as “Canchaque”; Tren Urbano de Lima S.A. (formerly, GyM Ferrovías S.A.) as “GyM Ferrovías”“Línea 1”; Concesionaria La Chira S.A. as “La Chira”; UNNA Energía S.A. (formerly GMP S.A.) as “UNNA Energía”; and Concar S.A. as “GMP”“Concar”; and (iii) in our Real Estate segment: Viva Negocio Inmobiliario S.A. (formerly Viva GyM S.A.) as “Viva GyM”;“Viva” and Inmobiliaria Almonte S.A.C. as “Almonte” and Concar S.A. as “Concar.”. For more information on our subsidiaries, joint operations, joint ventures or associated companies, see notes 6a, 6c and 1615 to our audited annual consolidated financial statements included in this annual report.

The gas pipeline concession of Gasoducto Sur Peruano S.A. (“GSP”) was terminated on January 24, 2017, and, as a result, we recognized impairments with respect to our investment in GSP and our participation in the related construction consortium (Consorcio Constructor Ductos del Sur, or “CCDS”). Both GSP and CCDS are in the process of being liquidated. Additionally, we have recently sold certain assets and businesses, including: on April 24, 2017, the sale of our interest in Compañía Operadora de Gas del Amazonas (“COGA”); on June 6, 2017, the sale of our interest in GMD S.A. (“GMD”); on April 11, 2018, the sale of our interest in Stracon GyM S.A. (“Stracon GyM”); and, on December 4, 2018, the sale of our interest in CAM Chile S.A. (“CAM”) and CAM Servicios del Perú S.A. (“CAM Servicios”). In addition, we are in the process of marketing for sale our subsidiary Adexus S.A. (“Adexus”). For more information, see “Item 5.A. Operating and Financial Review and Prospects—Operating Results—Recent Developments.”

The term “U.S. dollar” and the symbol “US$” refer to the legal currency of the United States; the term “sol” and the symbol “S/.” refer to the legal currency of Peru; the term “Chilean peso” and the symbol “CLP” refer to the legal currency of Chile; and the term “Colombian peso” and the symbol “COP” refer to the legal currency of Colombia.

Presentation of Financial Information

Our consolidated financial statements included in this annual report have been prepared in soles and in accordance with International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”). Our annual consolidated financial statements as of December 31, 20172019 and 20182020 and for the years ended December 31, 2016, 20172018, 2019 and 20182020 have been audited by Moore StephensAssurance S.A.S. (a member firm of Moore Global Network Limited) in accordance with the standards of the Public Company Accounting Oversight Board (United States).

Our consolidated financial statements for the year ended December 31, 2017 included in this annual report have been restated. In our consolidated financial statements included in our annual report on Form20-F for the year ended December 31, 2017, we inadvertently presented the gain on the sale of GMD under “Gain from the sale of investments” in error and, accordingly, we have restated our 2017 income statement and the related notes to reflect GMD as a discontinued operation. The previously issued consolidated financial statements of the company for the 2017 fiscal year (and the related audit opinion) included in the company’s annual report on Form20-F for the year ended December 31, 2017 should not be relied upon. For more information, see note 2.31 to our audited annual consolidated financial statements included in this annual report.

We manage our business in three segments: Engineering and Construction (E&C); Infrastructure; and Real Estate. Prior to December 31, 2017, in addition to the foregoing segments, we had a Technical Services segment. However, we transferred Concar from this segment to our Infrastructure segment beginning on April 1, 2017; on June 6, 2017, we sold our interest in our former technical services subsidiary, GMD; and we are in the process of marketing for sale Adexus, our other technical services subsidiary. The historical segment financial information included in this annual report has been adjusted accordingly. For information on our results of operations by business segment, see note 7 to our audited annual consolidated financial statements included in this annual report.

We previously accounted for Adexus S.A. (“Adexus”), our technical services subsidiary, which we are marketing for sale, as an investment held for sale. However, as of September 30, 2020, following restructuring proceedings in Chile, we reclassified Adexus as a continuing operation. As a result, our financial information included in this annual report has been adjusted accordingly. Our segment data presents Adexus as a parent company operation not part of the saleany of GMDour three business segments. See note 36 to our audited annual consolidated financial statements included in this annual report.

On December 4, 2018, we sold our interests in each of CAM Chile S.A. (“CAM”) and CAM Servicios del Perú S.A. (“CAM Servicios”) and on June 6, 2017,April 11, 2018, we sold our interest in Stracon GyM S.A. (“Stracon”). As a result, we present GMDCAM, CAM Servicios and Stracon as a discontinued operationoperations in our audited annual consolidated financial statements for the years ended December 31, 20172018, 2019 and 2018. We have reclassified our consolidated financial statements for the year ended December 31, 2016, and selected financial information for the years ended December 31, 2014 and 2015, included in this annual report, to show GMD as a discontinued operation. In addition, (i) on December 4, 2018, we sold our interests in each of CAM and CAM Servicios, (ii) on April 11, 2018, we sold our interest in Stracon GyM, and (iii) we are in the process of marketing for sale our subsidiary Adexus. As a result, we present CAM, CAM Servicios and Stracon GyM as discontinued operations, and Adexus as an investment held for sale, in our audited annual consolidated financial statements for the year ended December 31, 2018. We have reclassified our consolidated financial statements for the years ended December 31, 2016 and 2017, and the selected financial information for the years ended December 31, 2014 and 2015, included in this annual report to show CAM, CAM Servicios and Stracon GyM as discontinued operations and Adexus as an investment held for sale. We have also revised prior backlog data included in this annual report to exclude the presentation of entities that are presented as discontinued operations.

We requested that the staff of the U.S. Securities and Exchange Commission (the “SEC”) grant relief from the financial statement filing requirements of Rule3-09 of RegulationS-X (“Rule3-09”) pursuant to Section 2430 of the Division of Corporation Finance Financial Reporting Manual, with respect to our investment in GSP. The SEC has not granted our company’s waiver request and, as a result, our company is required to file with the SEC separate financial statements for GSP for 2015, 2016 and 2017, with 2016 being audited. However, it is currently impracticable for our company to comply with this requirement, because the audit opinion that was issued with respect to GSP’s 2016 financial statements included a disclaimer, our company’s loss of significant influence over GSP, and GSP’s limited management as the entity is in insolvency proceedings. We believe that GSP’s financial statements would not provide additional material information to investors. However, we cannot assure you that that the SEC will not take actions against our company relating to ournon-compliance, among other matters, in the event of a capital raise, our company may be temporarily unable to have a registration statement for a public offering of securities in the United States declared effective by the SEC. For more information, see “Item 3.D. Key Information—Risk Factors—Risks Related to our Company—we are not fully compliant with our reporting requirements under the Exchange Act because of our inability to provide audited financial statements for GSP in accordance with Rule3-09 . For more information on GSP, see notes 5(e), 5(f) and 16 to our audited annual consolidated financial statements included in this annual report.2020.

Non-IFRS Data

In this annual report, we present EBITDA, anon-GAAP financial measure. Anon-GAAP financial measure is generally defined as one that purports to measure financial performance, financial position or cash flows but excludes or includes amounts that would not be so adjusted in the most comparable IFRS measure. We present EBITDA because we believe it provides readers with a supplemental measure of the financial performance of our core operations that facilitatesperiod-to-period comparisons on a consistent basis. Furthermore, we regularly present EBITDA in our filings with the Lima Stock Exchange in Peru. Our management uses EBITDA,

among other measures, for internal planning and performance measurement purposes. We believe that EBITDA is useful in evaluating our operating performance compared to other companies operating in our sectors because the calculation of EBITDA generally eliminates the effects of financing and income taxes and the accounting effects of capital spending, which items may vary for different companies for reasons unrelated to overall operating performance. EBITDA should not be construed as an alternative to net profit or operating profit, as an indicator of operating performance, as an alternative to cash flow provided by operating activities or as a measure of liquidity (in each case, as determined in accordance with IFRS). EBITDA, as calculated by us, may not be comparable to similarly titled measures reported by other companies. For our definition of EBITDA and a reconciliation of EBITDA to the most directly comparable IFRS financial measure, see “Item 3.A. Key Information—Selected FinancialData—Non-GAAP Financial Measure and Reconciliation.”

Currency Translations

Our consolidated financial statements are prepared in soles. For a description of our translation of amounts in currencies other than soles in our consolidated financial statements, see note 2.4 to our audited annual consolidated financial statements included in this annual report.

We have translated some of the soles amounts contained in this annual report into U.S. dollars and some U.S. dollars amounts contained in this annual report into soles, for convenience purposes only. Unless otherwise indicated or the context otherwise requires, the rate used to translate soles amounts to U.S. dollars and U.S. dollars amounts into soles was S/.3.3793.624 to US$1.00, which was the exchange rate reported for December 31, 20182020 by the Peruvian Superintendency of Banks, Insurance and Private Pension Fund Administrators (Superintendencia de Banca, Seguros y AFPs, or “SBS”). We present our backlog in U.S. dollars. For contracts denominated in soles or other local currencies, amounts have been converted into U.S. dollars based on the exchange rate published by the SBS on December 31 of the corresponding year. When we present our ratios of backlog and revenues in this annual report, we similarly convert our revenues, which are reported in soles, into U.S. dollars based on the exchange rate reported for December 31 of the corresponding year. For conversions of macroeconomic indicators (particularly in “Item 5.D. Operating and Financial Review and Prospects—Trend Information” in this annual report), average annual exchange rates for the currencies of each of the countries addressed are used. The Federal Reserve Bank of New York does not report a noon buying rate for soles. The U.S. dollar equivalent information presented in this annual report is provided solely for convenience of the reader and should not be construed as implying that the soles or other currency amounts represent, or could have been or could be converted into, U.S. dollars at such rates or at any other rate.

Rounding

Certain figures included in this annual report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be arithmetic aggregations of the figures that precede them.

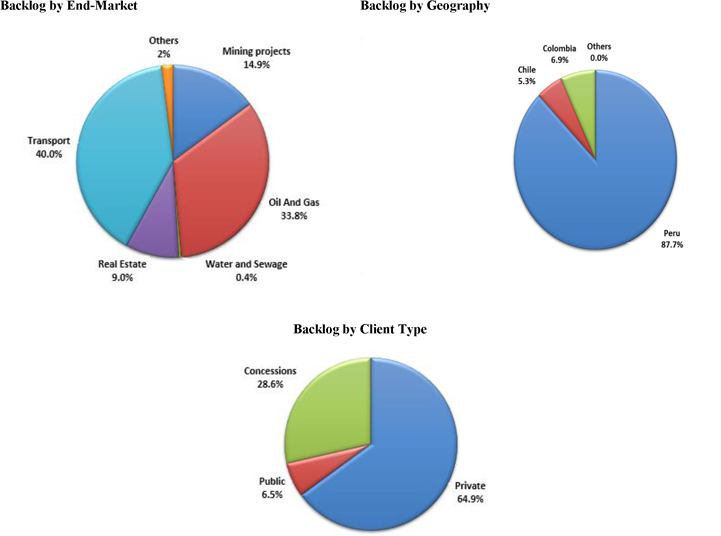

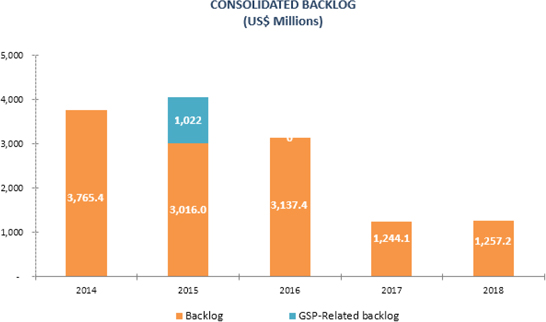

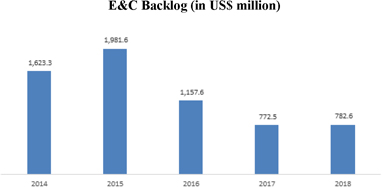

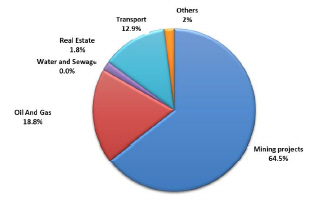

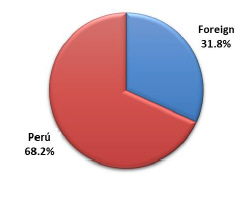

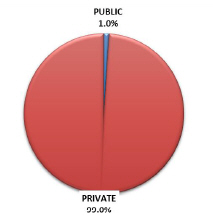

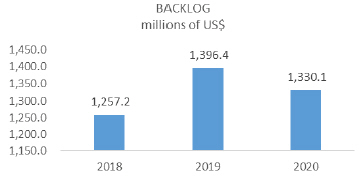

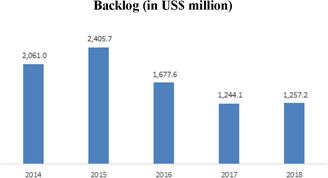

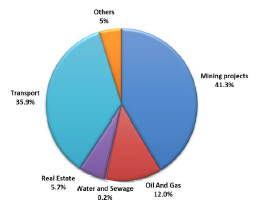

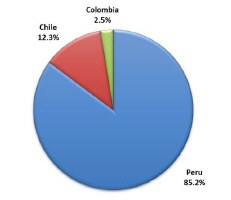

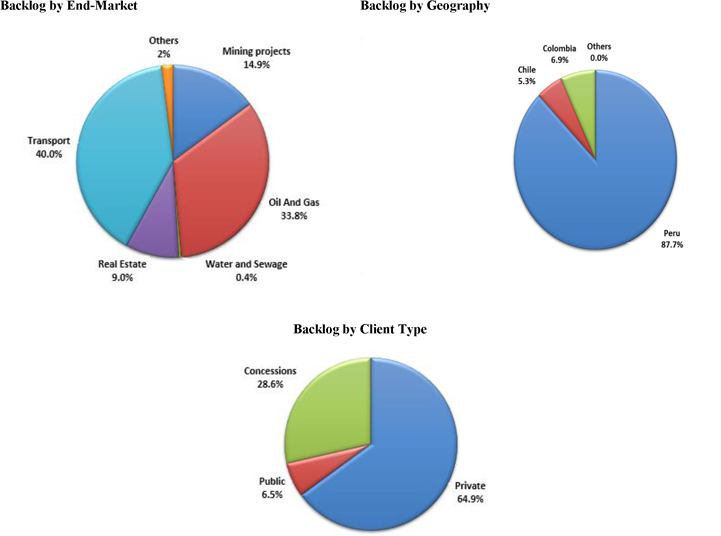

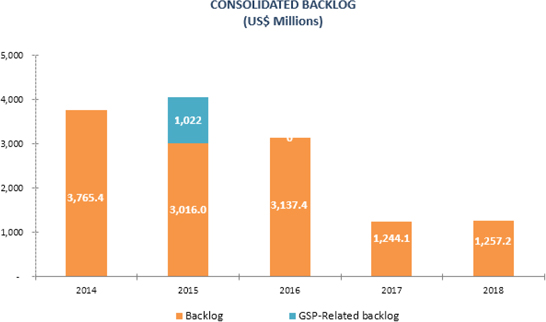

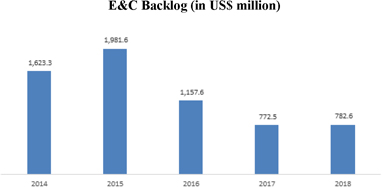

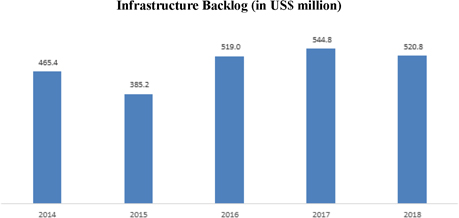

Backlog

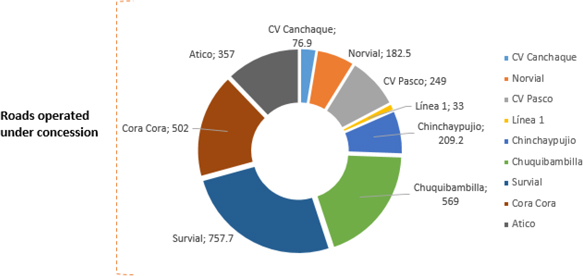

This annual report includes our backlog for our Engineering and Construction (E&C), Infrastructure and Real Estate segments. We do not include backlog in this annual report in our Infrastructure segment for: (i) our Norvial toll road concession because its revenues from the concession are derived from toll fees charged to vehicles using the highway, and, as a result, such revenues are dependent on vehicular traffic levels; and (ii) our Energy line of business because: (a) our revenues from hydrocarbon extraction services are dependent on the amounts of oil and gas we produce and market prices, which fluctuate significantly; (b) our revenues from our gas processing plant are dependent on the amount of gas we process and market prices for natural gas liquids, which fluctuate significantly; and (c) our revenues from our fuel storage terminal operation partially depend on the volume of fuel stored and dispatched. When we present backlog on a segment basis, we do not include eliminations that are included in our consolidated backlog. Backlog is not a measure defined by IFRS, and our methodology for determining backlog may not be comparable to the methodology used by other companies in determining their backlog. Backlog is not audited. We have revised priorhistorical backlog data included in this annual report to exclude the presentation of entities that are presented as discontinued operations. For our definition of backlog, see “Item 4.B. Information on the Company—Business Overview—Backlog.” See also “Item 3.D. Key Information—Risk Factors—Risks Related to our Company—Our backlog and our ratio of historical backlog to revenues may not be reliable indicators of future revenues or profit.”

The GSP gas pipeline concession was terminated on January 24, 2017, which had a significant impact on our backlog for our E&C and our consolidated backlog. For more information, see “Item 5.A. Operating and Financial Review and Prospects—Operating Results—Recent Developments.”

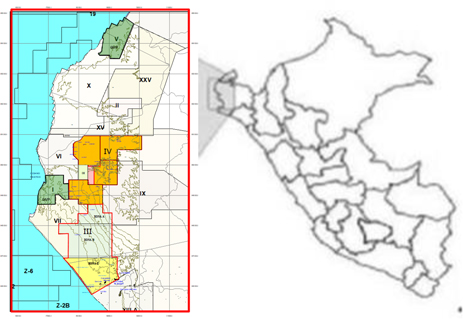

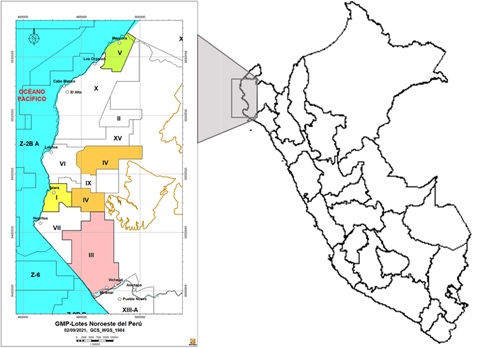

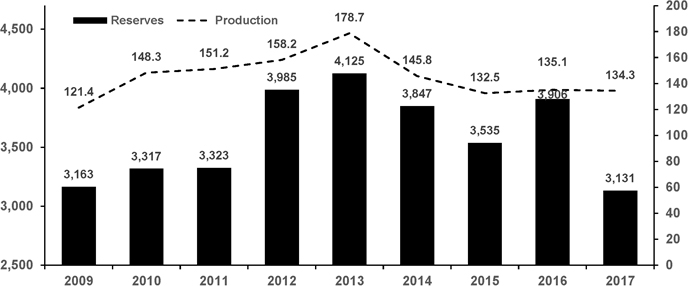

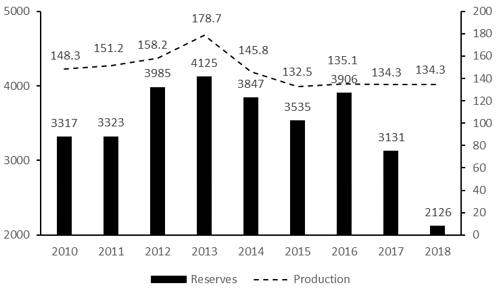

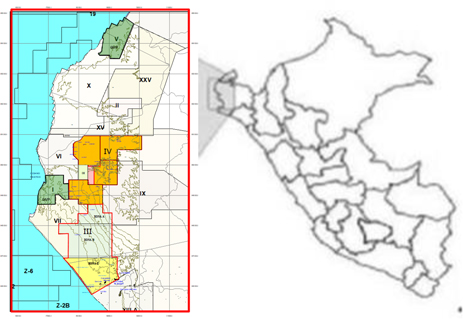

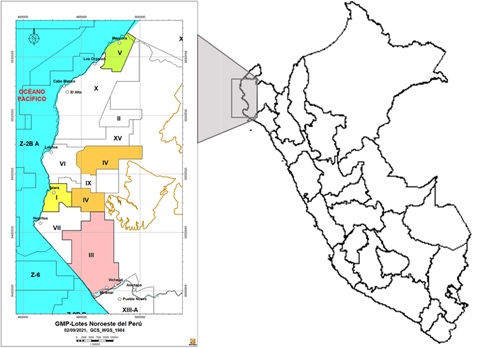

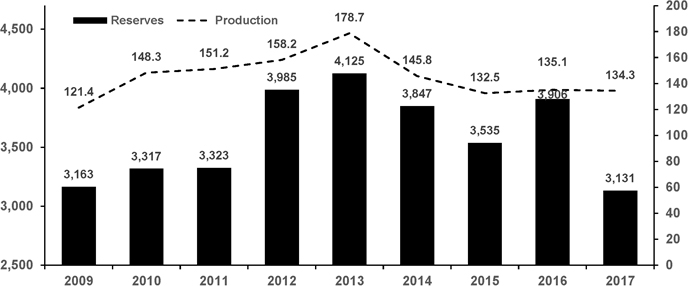

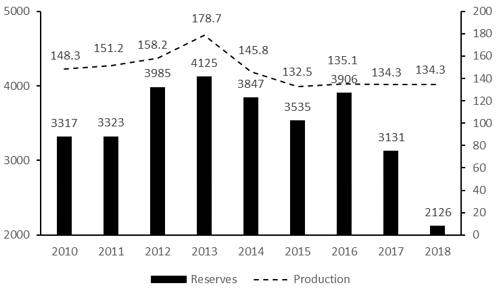

Reserves Estimates

This annual report includes our estimates for proved reserves in Blocks I and V, where GMPUNNA Energía provides hydrocarbon extraction services to, and Blocks III and IV, where GMPUNNA Energía extracts hydrocarbon under license agreements with, Perupetro S.A. (“Perupetro”). These reserves estimates were prepared internally by our team of engineers and have not been audited or reviewed by any independent external engineers. For further information on these reserves estimates, see “Item 3.D. Key Information—Risks RelatingRelated to Our Company – Company—Additional Risks Related to our Infrastructure Business” and “Item 4.B. Information on the Company—Business Overview—Infrastructure—Principal Infrastructure Lines of Business—Energy—Oil and Gas Production.”

Market Information

We make estimates in this annual report regarding our competitive position and market share, as well as the market size and expected growth of the engineering and construction, infrastructure and real estate services industries in Peru and elsewhere in Latin America. We have made these estimates on the basis of our management’s knowledge and statistics and other information, which we believe to be the most recently available as of the date of this annual report, from government agencies, industry professional organizations, industry publications and other sources. While we believe these estimates to be accurate as of the date of this annual report, we have not independently verified the data from third-party sources and our internal data has not been verified by any independent source. We paid Great Place to Work® Institute, a human resources consulting, research and training firm, for our employees to participate in their market survey referenced in this annual report (Copyright© 2018 Great Place to Work® Institute, Inc. All rights reserved.). In this annual report we present gross domestic product (“GDP”) both on a nominal and real basis. Real GDP is nominal GDP adjusted to exclude the effect of inflation. Unless otherwise indicated, references to GDP are to real GDP.

Measurements and Other Data

In this annual report, we use the following measurements:

“m” means one meter, which equals approximately 3.28084 feet;

“m2” means one square meter, which equals approximately 10.7630 square feet;

“km” means one kilometer, which equals approximately 0.621371 miles;

“hectare” means one hectare, which equals approximately 2.47105 acres;

“tonne” means one metric ton, which equals approximately 2,204.6 pounds;

“bbl” or barrel of oil means one stock tank barrel, which is equivalent to approximately 0.15898 cubic meters;

“boe” means one barrel of oil equivalent, which equals approximately 160.2167 cubic meters, determined using the ratio of 5,658 cubic feet of natural gas to one barrel of oil;

“cf” means one cubic foot;

“M,” when used before bbl, boe or cf, means one thousand bbl, boe and cf, respectively;

“MM,” when used before bbl, boe or cf, means one million bbl, boe and cf, respectively;

“MW” means one megawatt, which equals one million watts; and

“Gwh” means one gigawatt hour, which equals one billion watt hours.

In this annual report, we use the term accident incident rate“accident incidence rate” with respect to our E&C segment, which is calculated as the number of injuries divided by the total number of hours worked by all full-time employees of our E&C segment during the relevant year divided by 200,000 (which reflects 40 hours worked per week in a50-week year by 100 equivalent full-time workers).

Forward-Looking Statements

This annual report contains forward-looking statements. Forward-looking statements convey our current expectations or forecasts of future events. These statements involve known and unknown risks, uncertainties and other factors, including those listed under “Item 3.D. Key Information—Risk Factors,” which may cause our actual results, performance or achievements to differ materially from the forward-looking statements that we make.

Forward-looking statements typically are identified by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “project,” “plan,” “believe,” “potential,” “continue,” “is/are likely to,” or other similar expressions. Any or all of our forward-looking statements in this annual report may turn out to be inaccurate. Our actual results could differ materially from those contained in forward-looking statements due to a number of factors, including, among others:

the impact that the ongoing Novel Coronavirus 2019 (“COVID-19”) pandemic, and governments’ extraordinary measures to limit the spread of the virus, will continue to have on economic activity and the industries in which we operate;

the impact on our business reputation from our past association with Odebrecht S.A. (“Odebrecht”) affiliates in Peru;

the potential effects of investigations of our company and certain of our former directors and executive officers,senior management, or any future investigations, regarding corruption or other illegal acts;acts, including the outcome from our ongoing settlement and cooperation agreement discussions with Peruvian authorities, which may include, among other restrictions, significant penalties, admissions of guilt and temporary debarment from entering into new contracts with the government of Peru;

the potential impact of the class action civil lawsuit against our company and certain of our former directors and former and current executive officers, including our ability to comply with the payment terms of the settlement agreement;

uncertainty with regards to the timing and amount of the governmentany payment we are entitled to receive as an equity investor and creditor of Gasoducto Sur Peruano S.A. (“GSP”) in connection with the government payment required as a result of the termination of the GSP pipeline concession;concession in January of 2017;

our ability to fund our working capital and other obligations, including resulting from investigations of our company or the class action civil lawsuit against our company, through cash flow from operating activities, financing sources or the sale of assets;

our ability to comply with the covenants in our debt instruments or obtain waivers in the event ofnon-compliance;

our ability to obtain financing on favorable terms, including our ability to obtain performance bonds and similar financings required in the ordinary course of our business;

our ability to consummate asset sales or other strategic transactions on favorable terms on a timely basis, or at all;

the potential impact of the class action civil suit against our company and certain of our former directors and our former and current executive officers;

global macroeconomic conditions, including commodity prices;

economic, political and social conditions in the markets in which we operate, particularlyincluding as a result of the upcoming presidential elections and political disputes between the executive branch and congress in Peru, including the resignation of former President Pedro Pablo Kuczynskiand widespread protests in March 2018 following corruption allegations;

political conflictsChile and, deadlocks in Peru between the Peruvian Congress and the executive branch;more recently, Colombia;

major changes in Peruvian government policies at the national, regional or municipal levels, including in connection with infrastructure concessions, investments in infrastructure and affordable housing subsidies;

social conflicts in Peru that disrupt infrastructure projects, particularly in the mining sector;

interest rate fluctuation, inflation and devaluation or appreciation of the sol or Chilean peso or Colombian peso in relation to the U.S. dollar (or other currencies in which we receive revenue);

our backlog may not be a reliable indicator of future revenues or profit;

the cyclical nature of some of our business segments;

the level of capital investments and financings available for infrastructure projects of the types that we perform, both in the private and public sectors;

competition in our markets, both from local and international companies;

performance under contracts, where a failure to meet schedules, cost estimates or performance targets on a timely basis could result in reduced profit margins or losses and impact our reputation;

developments, some of which may be beyond our control, that affect our reputation in our markets, including a deterioration in our safety record;

industry-specific operational risks, such as operator errors, mechanical failures and other accidents;

availability and costs of energy, raw materials, equipment and labor;

our ability to obtain financing on favorable terms, including our ability to obtain performance bonds and similar financings; required in the ordinary course of our business;

our ability to attract and retain qualified personnel;

our ability to enter into joint operations, and rules involved in operating under joint operation or similar arrangements;

our exposure to potential liability claims and contract disputes, including as a result of environmental damage alleged to have been caused by our operations;

our and our clients’ compliance with environmental, health and safety laws and regulations, and changes in government policies and regulations in the countries in which we operate;

negotiations of claims with our clients of cost and schedule variances and change orders on major projects;

delays in client payments, and increased financing costs for working capital resulting from those delays;

volatility in global prices of oil and gas;

the cyclical naturegas, including as a result of some of our business segments;

limitations on our ability to operate our concessions profitably, including changes in traffic patterns, and limitations on our ability to obtain new concessions;

our ability to accurately estimate the costs of our projects;disputes among OPEC members;

changes in real estate market prices, customer demand, preference and purchasing power, and financing availability and terms;

our ability to obtain zoning and other license requirements for our real estate development;

changes in tax, laws;environmental, health and safety, or other laws and regulations;

natural disasters, severe weather or other events that may adversely impact our business; and

other factors identified or discussed under “Item 3.D. Key Information—Risk Factors.”

The forward-looking statements in this annual report represent our expectations and forecasts as of the date of this annual report. These statements are intended to qualify for the safe harbors from liability provided by Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this annual report. In particular, the COVID-19 pandemic, and governments’ extraordinary measures to limit the spread of the virus, are disrupting economic activity and the industries in which we operate, and consequently adversely affecting our business, results of operation and financial condition and, as conditions are recent, uncertain and changing rapidly, it is difficult to predict the full extent of the impact that the pandemic will have on our company.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 1.ITEM 3. KEY INFORMATION | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

|

Not applicable.

ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE

|

Not applicable.

| A. | Selected Financial Data |

The following selected consolidated financial data should be read together with “Part I. Introduction. Presentation of Financial Information,” “Item 5. Operations and Financial Review and Prospects” and our audited annual consolidated financial statements included in this annual report.

The following selected financial data aspreviously required by Item 3.A of December 31, 2017 and 2018 and for the years ended December 31, 2016, 2017 and 2018 have been derived from our audited annual consolidated financial statements included in this annual report. The following selected financial data as of December 31, 2014, 2015 and 2016 and for the years ended December 31, 2014 and 2015 have been derived from our audited annual consolidated financial statements not included in this annual report. Our annual consolidated financial statements for the years ended December 31, 2016, 2017 and 2018 have been audited by Moore Stephens in accordance with the standards of the Public Company Accounting Oversight Board (United States). Our consolidated financial statements for the year ended December 31, 2017 included in this annual report have been restated. In our consolidated financial statements included in our annual report on Form20-F for the year ended December 31, 2017, we inadvertently presented the gainhas been omitted in reliance on the sale of GMD under “Gain from the sale of investments” in errorSEC Release No. 33-10890,Management’s Discussion and accordingly, we have restated our 2017 income statementAnalysis, Selected Financial Data and the related notes to reflect GMD as a discontinued operation. For more information, see note 2.31 to our audited annual consolidated financial statements included in this annual report.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2014 | | | 2015 | | | 2016(1) | | | 2017

Restated | | | 2018 | | | 2018 | |

| | | | | | (in millions of S/.) | | | | | | | | | (in millions of

US$)(2) | |

Income Statement Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Revenues | | | 4,861.0 | | | | 5,542.3 | | | | 4,137.3 | | | | 4,014.0 | | | | 3,899.5 | | | | 1,154.0 | |

Cost of sales | | | (4,212.5 | ) | | | (5,210.6 | ) | | | (3,821.2 | ) | | | (3,511.6 | ) | | | (3,225.0 | ) | | | (954.4 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 648.5 | | | | 331.7 | | | | 316.1 | | | | 502.5 | | | | 674.5 | | | | 199.6 | |

Administrative expenses | | | (298.4 | ) | | | (291.3 | ) | | | (278.3 | ) | | | (322.5 | ) | | | (278.4 | ) | | | (82.4 | ) |

Other income and expenses, net(3) | | | 5.2 | | | | 18.3 | | | | (21.9 | ) | | | (33.3 | ) | | | (61.2 | ) | | | (18.1 | ) |

Profit (losses) from sale of investments | | | 2.1 | | | | — | | | | 46.3 | | | | 34.5 | | | | — | | | | — | |

Other (expenses) income, net | | | (0.1 | ) | | | 0.3 | | | | (0.5 | ) | | | 0.5 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating profit | | | 357.3 | | | | 58.4 | | | | 61.8 | | | | 181.7 | | | | 334.7 | | | | 99.1 | |

Financial (expense) income, net(3) | | | (58.3 | ) | | | (97.7 | ) | | | (179.8 | ) | | | (137.0 | ) | | | (197.1 | ) | | | (58.3 | ) |

Share of the profit and loss obtained from associates and joint ventures under the equity method of accounting | | | 52.9 | | | | 24.4 | | | | (590.1 | ) | | | 0.5 | | | | (3.7 | ) | | | (1.1 | ) |

Profit before income tax | | | 351.9 | | | | (14.9 | ) | | | (708.1 | ) | | | 45.1 | | | | 133.9 | | | | 39.6 | |

Income tax | | | (104.3 | ) | | | (78.7 | ) | | | 152.2 | | | | (46.3 | ) | | | (113.3 | ) | | | (33.5 | ) |

Profit from continuing operations | | | 247.6 | | | | (93.5 | ) | | | (556.0 | ) | | | (1.2 | ) | | | 20.6 | | | | 6.1 | |

Profit from discontinued operations | | | 113.7 | | | | 149.1 | | | | 104.4 | | | | 210.4 | | | | 36.8 | | | | 10.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net profit | | | 361.2 | | | | 55.6 | | | | (451.6 | ) | | | 209.2 | | | | 57.4 | | | | 17.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net profit (loss) attributable to controlling interest(4) | | | 299.7 | | | | 7.1 | | | | (509.7 | ) | | | 148.7 | | | | (83.2 | ) | | | (24.6 | ) |

Net profit (loss) attributable tonon-controlling interest(4) | | | 61.5 | | | | 48.5 | | | | 58.1 | | | | 60.5 | | | | 140.6 | | | | 41.6 | |

(1) | For the effects on our results of operations for 2016 resulting from the termination of the GSP gas pipeline concession, see “Item 5.A. Operating and Financial Review and Prospects—Operating Results—Recent Developments” and notes 5(e), 5(f), and 16 to our audited annual consolidated financial statements included in this annual report. In particular, we recognized an impairment to our investment in GSP of S/.593.1 million in 2016, which is recorded in Share of the profit and loss obtained from associates and joint ventures under the equity method of accounting.

|

(2) | Calculated based on an exchange rate of S/.3.379 to US$1.00 as of December 31, 2018.

|

(3) | Reflects exchange losses due to the depreciation of the sol against the U.S. dollar and our U.S. dollar denominated liabilities. For more information, see note 28 to our audited annual consolidated financial statements included in this annual report.

|

(4) | We consolidate the results of our subsidiaries in our financial statements and we reflect the profit corresponding to the minority interests in our subsidiaries under “net profit attributable tonon-controlling interests” in our income statement. With respect to our joint operations, we recognize in our consolidated financial statements the revenue and expenses, including our share of any asset, liability, revenue or expense we hold jointly with partners. We reflect the results of our associated companies under the equity method of accounting in our consolidated financial statements under the line item “share of the profit and loss in associates” in our income statement. See “Item 5.A. Operating and Financial Review and Prospects—Operating Results—Factors Affecting Our Results of Operations—Acquisitions,” “—General—Accounting for Subsidiaries, Joint Operations, Joint Ventures and Associated Companies” and note 2.2 to our audited annual consolidated financial statements included in this annual report.

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | As of December 31, | |

| | | 2014 | | | 2015 | | | 2016(1) | | | 2017 | | | 2018 | | | 2018 | |

| Balance Sheet Data: | | | | | (in millions of S/.) | | | | | | | | | (in millions of

US$)(2) | |

Total current assets | | | 4,635.7 | | | | 5,200.4 | | | | 4,328.7 | | | | 3,891.9 | | | | 2,985.5 | | | | 883.5 | |

Cash and cash equivalents | | | 818.4 | | | | 554.0 | | | | 607.0 | | | | 626.2 | | | | 801.1 | | | | 237.1 | |

Accounts receivables | | | 1,768.6 | | | | 2,143.3 | | | | 1,862.5 | | | | 2,381.9 | | | | 1,631.2 | | | | 482.7 | |

Outstanding work in progress | | | 1,152.8 | | | | 1,278.2 | | | | 680.9 | | | | 61.8 | | | | 28.5 | | | | 8.4 | |

Inventories(3) | | | 833.6 | | | | 1,159.2 | | | | 1,104.3 | | | | 770.7 | | | | 514.0 | | | | 152.1 | |

Totalnon-current assets | | | 3,094.2 | | | | 3,699.6 | | | | 4,718.0 | | | | 4,775.7 | | | | 4,197.1 | | | | 1,242.1 | |

Long-term accounts receivables(4) | | | 624.5 | | | | 687.8 | | | | 1,754.4 | | | | 2,180.8 | | | | 2,133.5 | | | | 631.4 | |

Investments in associates and joint ventures | | | 229.6 | | | | 637.0 | | | | 389.8 | | | | 268.7 | | | | 257.8 | | | | 76.3 | |

Property, plant and equipment | | | 1,148.7 | | | | 1,111.8 | | | | 1,113.6 | | | | 865.7 | | | | 470.6 | | | | 139.3 | |

Intangible assets(5) | | | 780.8 | | | | 878.3 | | | | 960.3 | | | | 940.1 | | | | 847.1 | | | | 250.7 | |

Total current liabilities | | | 3,796.1 | | | | 4,092.3 | | | | 4,537.0 | | | | 3,549.2 | | | | 2,665.8 | | | | 788.9 | |

Short-term borrowings | | | 1,425.5 | | | | 1,265.1 | | | | 2,007.1 | | | | 1,093.4 | | | | 865.6 | | | | 256.2 | |

Accounts payable(6) (7) | | | 2,151.4 | | | | 2,779.6 | | | | 2,453.1 | | | | 2,356.7 | | | | 1,768.1 | | | | 523.3 | |

Totalnon-current liabilities | | | 753.8 | | | | 1,725.8 | | | | 2,019.9 | | | | 2,529.4 | | | | 2,048.9 | | | | 606.3 | |

Long-term borrowings | | | 624.8 | | | | 1,310.3 | | | | 1,341.0 | | | | 1,544.2 | | | | 1,274.1 | | | | 377.1 | |

Capital stock | | | 660.1 | | | | 660.1 | | | | 660.1 | | | | 660.1 | | | | 729.4 | | | | 215.9 | |

Shareholders’ equity | | | 2,691.7 | | | | 2,558.8 | | | | 1,980.4 | | | | 2,123.3 | | | | 2,088.4 | | | | 618.0 | |

Non-controlling interest | | | 488.7 | | | | 523.1 | | | | 509.3 | | | | 465.7 | | | | 401.6 | | | | 118.8 | |

(1) | For the effects on our financial condition as of December 31, 2016 resulting from the termination of the GSP gas pipeline concession, see “Item 5.A. Operating and Financial Review and Prospects—Operating Results—Recent Developments” and notes 5(e), 5(f) and 26 to our audited annual consolidated financial statements included in this annual report.

|

(2) | Calculated based on an exchange rate of S/.3.379 to US$1.00 as of December 31, 2018.

|

(3) | Includes investments for the purchase of land by our Real Estate segment. These investments in land are recorded at acquisition cost and are notmarked-to-market for changes in fair value. See note 15 to our audited annual consolidated financial statements included in this annual report.

|

(4) | Includes payments required to be made by the Peruvian government for the amounts we invest to purchase trains and other infrastructure for the Lima Metro. See “Item 5.A. Operating and Financial Review and Prospects—Operating Results—Results of Operations—General—Infrastructure” and note 11 to our audited annual consolidated financial statements included in this annual report.

|

(5) | We recognize our investments in the construction of the highway of our Norvial concession as intangible assets. See note 18(c) to our audited annual consolidated financial statements included in this annual report.

|

(6) | Includes S/.684.3 million, S/.607.1 million, S/.810.8 million, S/.726.3 million and S/.496.5 million in advance payments made by our clients as of December 31, 2014, 2015, 2016, 2017 and 2018, respectively, in connection with our E&C segment and the operation and maintenance of infrastructure assets contracts. See “Item 5.A. Operating and Financial Review and Prospects—Operating Results—Results of Operations—General—Engineering and Construction” and note 22 to our audited annual consolidated financial statements included in this annual report.

|

(7) | Includes our payable to Chubb Insurance Company (US$52.5 million as of December 31, 2016 and US$15.6 million as of December 31, 2017) relating to the termination of the GSP gas pipeline concession, which was fully repaid as of December 31, 2018. For more information, see “Item 5.A. Operating and Financial Review and Prospects—Operating Results—Recent Developments” and “—Liquidity and Capital Resources—Indebtedness.”

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | As of and for the year ended December 31, | |

| | | 2014 | | | 2015 | | | 2016(1) | | | 2017

Restated | | | 2018 | | | 2018 | |

| | | (in millions of S/.) | | | | | | (in millions of US$)(2) | |

Other Data: | | | | | | | | | | | | | | | | | | | | | | | | |

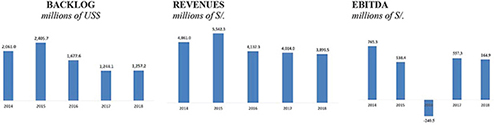

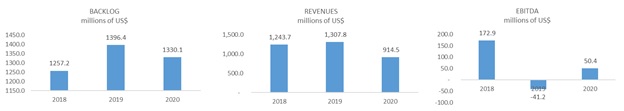

EBITDA(3) (in millions of S/. or US$) | | | 783.9 | | | | 538.4 | | | | (240.5 | ) | | | 572.3 | | | | 557.3 | | | | 164.9 | |

Gross margin | | | 13.3 | % | | | 6.0 | % | | | 7.6 | % | | | 12.5 | % | | | 17.3 | % | | | 17.3 | % |

EBITDA margin(4) | | | 16.13 | % | | | 9.7 | % | | | (5.8 | )% | | | 14.3 | % | | | 14.3 | % | | | 14.3 | % |

Outstanding shares (thousands) | | | 660,054 | | | | 660,054 | | | | 660,054 | | | | 660,054 | | | | 729,434 | | | | 215,873 | |

Profit per share (in S/.or US$) | | | 0.55 | | | | 0.08 | | | | (0.68 | ) | | | 0.31 | | | | 0.08 | | | | 0.02 | |

Profit attributable to controlling interest per share (in S/.or US$) | | | 0.45 | | | | 0.01 | | | | (0.77 | ) | | | 0.23 | | | | (0.13 | ) | | | (0.04 | ) |

Dividend per share (in S/.or US$)(5) | | | 0.16 | | | | 0.05 | | | | — | | | | — | | | | — | | | | — | |

Net debt(6)/ EBITDA ratio | | | 1.1 | x | | | 3.5 | x | | | (11.4 | )x | | | 3.5 | x | | | 2.4 | x | | | 2.4 | x |

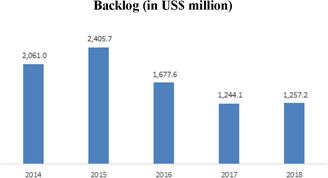

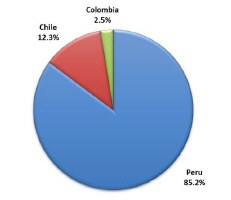

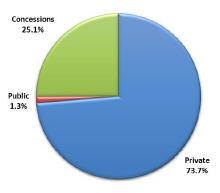

Backlog (in millions of US$) (Unaudited)(7) | | | 3,765.4 | | | | 3,918.4 | | | | 3,011.6 | | | | 2,388.4 | | | | 1,257.2 | | | | 1,257.2 | |

Backlog/revenues ratio (Unaudited)(7) | | | 1.6 | x | | | 1.9 | x | | | 1.8 | x | | | 1.3 | x | | | 1.1 | x | | | 1.1 | x |

(1) | For the effects on our results of operations and backlog for 2016 resulting from the termination of the GSP gas pipeline concession, see “Item 5.A. Operating and Financial Review and Prospects—Operating Results—Recent Developments” and notes 5(e), 5(f) and 16 to our audited annual consolidated financial statements included in this annual report.

|

(2) | Calculated based on an exchange rate of S/.3.379 to US$1.00 as of December 31, 2018.

|

(3) | For further information on the definition of EBITDA, see“—Non-GAAP Financial Measure and Reconciliation.”

|

(4) | Reflects EBITDA as a percentage of revenues.

|

(5) | Payment of dividends for the year’s profit.

|

(6) | Net debt is calculated as total borrowings (including current andnon-current borrowings) less cash and cash equivalents.

|

(7) | For further information on our backlog, see “Item 4.B. Business Overview—Backlog.” Does not include, in our Infrastructure segment, our Norvial toll road concession and our Energy line of business. Backlog is calculated as of the last day of the applicable year. Revenues are calculated for that year and converted into U.S. dollars based on the exchange rate published by the SBS on December 31 of the corresponding year, which was S/.2.989 to US$1.00 as of December 31, 2014, S/.3.413 to US$1.00 as of December 31, 2015, S/.3.36 to US$1.00 as of December 31, 2016, S/.3.245 to US$1.00 as of December 31, 2017 and S/.3.379 to US$1.00 as of December 31, 2018. Includes revenues only for businesses included in our backlog.

|

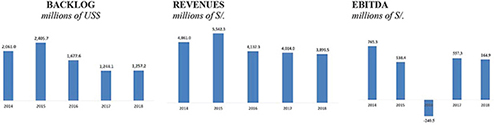

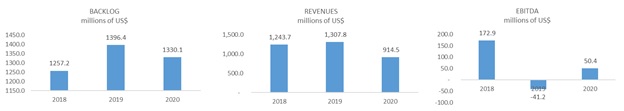

The following tables set forth summary financial data for each of our business segments. For more information on the results of operations of our segments, see “Item 5.A. Operating andSupplementary Financial Review and Prospects—Operating Results—Results of Operations” and note 7 to our audited annual consolidated financial statements included in this annual report. The effects of the termination of the GSP gas pipeline concession on our results of operations and financial condition for 2016 are reflected in Corporate (the Parent Company Operations) and, with respect to CCDS, in our E&C segment.Information.

Beginning on April 1, 2017, we transferred Concar from our former Technical Services segment to our Infrastructure segment. For ease of comparison, the historical segment financial information included in this annual report presents Concar in the Infrastructure segment. This change does not impact our consolidated financial results.

1. Engineering & Construction

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | 2018 | |

| | | (in millions of S/.) | | | (in millions of US$)(1) | |

Income Statement Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Revenues | | | 3,718.0 | | | | 4,352.7 | | | | 2,936.8 | | | | 2,331.9 | | | | 1,960.9 | | | | 580.3 | |

Cost of sales | | | (3,354.1 | ) | | | (4,244.4 | ) | | | (2,876.6 | ) | | | (2,155.4 | ) | | | (1,898.8 | ) | | | (561.9 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 363.8 | | | | 108.3 | | | | 60.2 | | | | 176.5 | | | | 62.1 | | | | 18.4 | |

Administrative expenses | | | (219.7 | ) | | | (243.6 | ) | | | (212.0 | ) | | | (188.2 | ) | | | (136.1 | ) | | | (40.3 | ) |

Other income and (expenses), net | | | (12.5 | ) | | | 6.4 | | | | (14.2 | ) | | | (46.5 | ) | | | (13.5 | ) | | | (4.0 | ) |

Other (losses) gains, net | | | — | | | | (0.2 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating profit | | | 131.7 | | | | (129.2 | ) | | | (166.1 | ) | | | (58.1 | ) | | | (87.5 | ) | | | (25.9 | ) |

Financial (expense) income, net | | | (44.8 | ) | | | (96.8 | ) | | | (50.8 | ) | | | (38.2 | ) | | | (67.7 | ) | | | (20.0 | ) |

Share of the profit or loss in associates under the equity method of accounting | | | 48.2 | | | | 15.0 | | | | 16.5 | | | | 31.0 | | | | 11.4 | | | | 3.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Profit (loss) before income tax | | | 131.1 | | | | (210.9 | ) | | | (200.4 | ) | | | (65.3 | ) | | | (143.9 | ) | | | (42.6 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | 2018 | |

| | | (in millions of S/.) | | | (in millions of US$)(1) | |

Income tax | | | (24.4 | ) | | | (15.2 | ) | | | 19.7 | | | | 0.9 | | | | 14.4 | | | | 4.3 | |

Profit from discontinued operations | | | 82.9 | | | | 104.2 | | | | 87.2 | | | | 76.8 | | | | 44.1 | | | | 13.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net profit (loss) | | | 193.6 | | | | (121.8 | ) | | | (93.4 | ) | | | 12.4 | | | | (85.4 | ) | | | (25.3 | ) |

Net profit attributable to controlling

interest | | | 164.1 | | | | (131.2 | ) | | | (87.2 | ) | | | 12.1 | | | | (86.9 | ) | | | (25.7 | ) |

Net profit (loss) attributable tonon-controlling interest | | | 29.5 | | | | 9.3 | | | | (5.7 | ) | | | 0.3 | | | | 1.5 | | | | 0.43 | |

| |

| | | As of December 31, | |

| | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | 2018 | |

| | | (in millions of S/.) | | | (in millions of US$)(1) | |

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Total current assets | | | 2,676.6 | | | | 3,157.1 | | | | 1,910.9 | | | | 1,949.0 | | | | 1,408.0 | | | | 416.7 | |

Cash and cash equivalents | | | 285.4 | | | | 172.1 | | | | 93.5 | | | | 184.4 | | | | 177.5 | | | | 52.5 | |

Accounts receivables | | | 1,092.9 | | | | 1,526.4 | | | | 1,060.5 | | | | 1,640.0 | | | | 1,173.9 | | | | 347.4 | |

Outstanding work in progress | | | 1,145.4 | | | | 1,260.5 | | | | 648.9 | | | | 55.8 | | | | 25.0 | | | | 7.4 | |

Other current assets | | | 152.9 | | | | 198.1 | | | | 108.0 | | | | 68.9 | | | | 31.7 | | | | 9.4 | |

Totalnon-current assets | | | 1,250.0 | | | | 1,118.4 | | | | 1,328.0 | | | | 1,382.3 | | | | 993.2 | | | | 293.9 | |

Long-term accounts receivables | | | 6.2 | | | | 0.5 | | | | 214.4 | | | | 392.5 | | | | 346.1 | | | | 102.4 | |

Property, plant and equipment | | | 651.2 | | | | 606.2 | | | | 592.2 | | | | 509.7 | | | | 205.7 | | | | 60.9 | |

Othernon-current assets | | | 592.6 | | | | 511.7 | | | | 521.4 | | | | 480.1 | | | | 441.4 | | | | 130.6 | |

Total current liabilities | | | 2,500.2 | | | | 2,846.3 | | | | 2,101.5 | | | | 2,189.6 | | | | 1,585.2 | | | | 469.1 | |

Short-term borrowings | | | 629.6 | | | | 653.0 | | | | 582.3 | | | | 592.0 | | | | 232.4 | | | | 68.8 | |

Accounts payable(2) | | | 1,701.9 | | | | 2,174.0 | | | | 1,482.1 | | | | 1,561.6 | | | | 1,346.4 | | | | 398.5 | |

Totalnon-current liabilities | | | 445.2 | | | | 629.2 | | | | 471.8 | | | | 546.3 | | | | 413.0 | | | | 122.2 | |

Long-term borrowings | | | 144.1 | | | | 376.0 | | | | 246.3 | | | | 127.8 | | | | 9.3 | | | | 2.8 | |

Other long-term liabilities | | | 301.1 | | | | 253.3 | | | | 225.5 | | | | 418.6 | | | | 403.7 | | | | 119.5 | |

Shareholders’ equity | | | 817.8 | | | | 639.2 | | | | 551.7 | | | | 487.9 | | | | 331.2 | | | | 98.0 | |

Non-controlling interest | | | 163.4 | | | | 160.8 | | | | 113.9 | | | | 107.5 | | | | 71.8 | | | | 21.2 | |

| | | | | | |

| 2. Infrastructure | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | For the year ended December 31, | |

| | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | 2018 | |

| | | (in millions of S/.) | | | | | | (in millions of US$)(1) | |

Income Statement Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Revenues | | | 1,613.5 | | | | 1,353.1 | | | | 1,174.8 | | | | 1,447.9 | | | | 1,883.3 | | | | 557.3 | |

Cost of sales | | | (1,351.6 | ) | | | (1,107.2 | ) | | | (963.4 | ) | | | (1,187.8 | ) | | | (1,532.6 | ) | | | 453.6 | |

Gross profit | | | 261.9 | | | | 245.9 | | | | 211.4 | | | | 260.2 | | | | 350.6 | | | | 103.8 | |

Administrative expenses | | | (102.8 | ) | | | (67.0 | ) | | | (66.1 | ) | | | (63.9 | ) | | | (68.8 | ) | | | (20.4 | ) |

Other income and (expenses), net | | | (1.9 | ) | | | 2.0 | | | | 1.3 | | | | 5.8 | | | | 1.4 | | | | 0.4 | |

Other (losses) gains, net | | | (0.1 | ) | | | (0.1 | ) | | | (0.5 | ) | | | 0.4 | | | | — | | | | — | |

Operating profit | | | 157.1 | | | | 180.8 | | | | 146.1 | | | | 202.5 | | | | 283.0 | | | | 83.8 | |

Financial (expense) income, net | | | (35.2 | ) | | | (22.9 | ) | | | (9.6 | ) | | | (19.5 | ) | | | (20.1 | ) | | | (5.9 | ) |

Share of the profit or loss in associates under the equity method of accounting | | | — | | | | 0.9 | | | | 1.6 | | | | 1.6 | | | | 1.6 | | | | 0.5 | |

Profit before income tax | | | 121.9 | | | | 158.9 | | | | 138.1 | | | | 184.5 | | | | 264.6 | | | | 78.3 | |

Income tax | | | (55.8 | ) | | | (46.5 | ) | | | (39.9 | ) | | | (55.2 | ) | | | (80.5 | ) | | | (23.9 | ) |

Net profit | | | 66.1 | | | | 112.4 | | | | 98.3 | | | | 129.3 | | | | 184.0 | | | | 54.5 | |

Net profit attributable to controlling interest | | | 59.5 | | | | 93.0 | | | | 74.4 | | | | 103.8 | | | | 152.3 | | | | 45.1 | |

Net profit (loss) attributable tonon-controlling interest | | | 6.5 | | | | 19.4 | | | | 23.8 | | | | 25.5 | | | | 31.8 | | | | 9.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | As of December 31, | |

| | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | 2018 | |

| | | (in millions of S/.) | | | (in millions of

US$)(1) | |

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Total current assets | | | 614.1 | | | | 639.3 | | | | 806.5 | | | | 923.3 | | | | 969.1 | | | | 286.8 | |

Cash and cash equivalents | | | 173.4 | | | | 240.3 | | | | 303.9 | | | | 331.1 | | | | 401.2 | | | | 118.7 | |

Accounts receivables | | | 378.8 | | | | 331.9 | | | | 409.2 | | | | 535.0 | | | | 509.2 | | | | 150.7 | |

Outstanding work in progress | | | 16.4 | | | | 17.7 | | | | 32.1 | | | | — | | | | — | | | | — | |

Other current assets | | | 45.6 | | | | 49.5 | | | | 61.3 | | | | 57.2 | | | | 58.7 | | | | 17.4 | |

Totalnon-current assets | | | 1,297.9 | | | | 1,514.4 | | | | 1,801.6 | | | | 2,098.4 | | | | 2,111.3 | | | | 624.8 | |

Long-term accounts receivables(3) | | | 602.3 | | | | 670.7 | | | | 930.2 | | | | 1,164.0 | | | | 1,214.2 | | | | 359.3 | |

Property, plant and equipment | | | 236.3 | | | | 225.4 | | | | 200.2 | | | | 190.4 | | | | 187.7 | | | | 55.6 | |

Othernon-current assets | | | 412.8 | | | | 536.1 | | | | 623.5 | | | | 743.9 | | | | 709.5 | | | | 210.0 | |

Total current liabilities | | | 1,180.4 | | | | 458.4 | | | | 407.2 | | | | 580.2 | | | | 737.2 | | | | 218.2 | |

Short-term borrowings | | | 588.8 | | | | 197.2 | | | | 85.1 | | | | 86.2 | | | | 290.6 | | | | 86.0 | |

Accounts payable | | | 568.3 | | | | 241.3 | | | | 261.5 | | | | 486.2 | | | | 426.9 | | | | 126.3 | |

Totalnon-current liabilities | | | 154.5 | | | | 1,010.3 | | | | 1,444.7 | | | | 1,585.9 | | | | 1,368.3 | | | | 405.0 | |

Long-term borrowings | | | 103.3 | | | | 842.5 | | | | 1,004.6 | | | | 1,014.4 | | | | 985.6 | | | | 291.7 | |

Other long-term liabilities | | | 51.1 | | | | 167.8 | | | | 440.1 | | | | 571.4 | | | | 382.7 | | | | 113.3 | |

Shareholders’ equity | | | 497.1 | | | | 586.2 | | | | 643.3 | | | | 729.5 | | | | 828.3 | | | | 245.1 | |

Non-controlling interest | | | 80.0 | | | | 98.8 | | | | 112.9 | | | | 126.1 | | | | 146.6 | | | | 43.4 | |

| | | | | | |

| 3. Real Estate | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | For the year ended December 31, | |

| | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | 2018 | |

| | | (in millions of S/.) | | | (in millions of

US$)(1) | |

Income Statement Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Revenues | | | 224.6 | | | | 215.8 | | | | 411.5 | | | | 647.5 | | | | 630.1 | | | | 186.5 | |

Cost of sales | | | (162.1 | ) | | | (164.0 | ) | | | (275.0 | ) | | | (500.2 | ) | | | (342.2 | ) | | | (101.3 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 62.4 | | | | 51.8 | | | | 136.5 | | | | 147.4 | | | | 288.0 | | | | 85.2 | |

Administrative expenses | | | (21.1 | ) | | | (20.5 | ) | | | (28.4 | ) | | | (21.2 | ) | | | (50.7 | ) | | | (15.0 | ) |

Other income and (expenses), net | | | (0.8 | ) | | | 1.8 | | | | 0.8 | | | | (3.7 | ) | | | (2.0 | ) | | | (0.6 | ) |

Other (losses) gains, net | | | — | | | | — | | | | — | | | | 49.0 | | | | — | | | | — | |

Profit from the sale of investments | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating profit | | | 40.5 | | | | 33.0 | | | | 108.9 | | | | 171.5 | | | | 235.3 | | | | 69.6 | |

Financial (expense) income, net | | | (14.7 | ) | | | (10.9 | ) | | | (11.6 | ) | | | (18.3 | ) | | | (8.3 | ) | | | (2.5 | ) |

Share of the profit or loss in associates under the equity method of accounting | | | 12.2 | | | | 14.9 | | | | 6.8 | | | | 0.5 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Profit before income tax | | | 38.0 | | | | 37.0 | | | | 104.2 | | | | 153.6 | | | | 226.9 | | | | 67.2 | |

Income tax | | | (11.5 | ) | | | (7.6 | ) | | | (27.1 | ) | | | (35.9 | ) | | | (69.2 | ) | | | (20.5 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net profit | | | 26.5 | | | | 29.3 | | | | 77.2 | | | | 117.7 | | | | 157.8 | | | | 46.7 | |

Net profit attributable to controlling interest(4) | | | 9.5 | | | | 12.4 | | | | 22.1 | | | | 48.6 | | | | 28.9 | | | | 8.6 | |

Net profit (loss) attributable tonon-controlling interest(4) | | | 17.0 | | | | 17.0 | | | | 55.1 | | | | 69.1 | | | | 128.9 | | | | 38.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | As of December 31, | |

| | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | 2018 | |

| | | (in millions of S/.) | | | (in millions of

US$)(1) | |

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Total current assets | | | 760.8 | | | | 1,109.3 | | | | 1,117.1 | | | | 884.6 | | | | 721.0 | | | | 213.4 | |

Cash and cash equivalents | | | 54.3 | | | | 74.5 | | | | 58.9 | | | | 85.2 | | | | 93.3 | | | | 27.6 | |

Accounts receivables | | | 75.6 | | | | 114.4 | | | | 111.2 | | | | 155.3 | | | | 179.3 | | | | 53.1 | |

Outstanding work in progress | | | 631.0 | | | | 920.4 | | | | — | | | | — | | | | — | | | | — | |

Other current assets(5) | | | 117.4 | | | | 91.7 | | | | 947.0 | | | | 644.1 | | | | 448.4 | | | | 132.7 | |

Totalnon-current assets | | | 9.7 | | | | 14.7 | | | | 113.6 | | | | 78.5 | | | | 98.5 | | | | 29.2 | |

Long-term accounts receivables(3) | | | 7.3 | | | | 11.3 | | | | 17.9 | | | | 9.8 | | | | 36.3 | | | | 10.7 | |

Property, plant and equipment | | | 36.2 | | | | 34.7 | | | | 13.0 | | | | 11.6 | | | | 9.2 | | | | 2.7 | |

Othernon-current assets | | | 64.1 | | | | 30.9 | | | | 82.7 | | | | 57.0 | | | | 53.0 | | | | 15.7 | |

Total current liabilities | | | 266.6 | | | | 555.1 | | | | 515.8 | | | | 352.1 | | | | 310.1 | | | | 91.8 | |

Short-term borrowings | | | 144.3 | | | | 224.4 | | | | 206.5 | | | | 162.0 | | | | 133.1 | | | | 39.4 | |

Accounts payable | | | 120.1 | | | | 330.7 | | | | 291.2 | | | | 144.8 | | | | 172.5 | | | | 51.1 | |

Totalnon-current liabilities | | | 138.9 | | | | 159.6 | | | | 104.2 | | | | 44.1 | | | | 37.2 | | | | 11.0 | |

Long-term borrowings | | | 16.4 | | | | 27.6 | | | | 16.5 | | | | 12.0 | | | | 10.7 | | | | 3.2 | |

Other long-term liabilities | | | 122.5 | | | | 132.0 | | | | 87.6 | | | | 32.1 | | | | 26.5 | | | | 7.8 | |

Shareholders’ equity | | | 157.3 | | | | 158.6 | | | | 234.4 | | | | 217.3 | | | | 193.5 | | | | 57.3 | |

Non-controlling interest | | | 315.4 | | | | 327.6 | | | | 376.3 | | | | 349.6 | | | | 278.7 | | | | 82.5 | |

(1) | Calculated based on an exchange rate of S/.3.379 to US$1.00 as of December 31, 2018.

|

(2) | Includes advance payments, which reflects advance payments made by our clients in connection with our E&C and Operation and Maintenance of Infrastructure Assets contracts. See “Item 5.A. Operating and Financial Review and Prospects—Operating Results—Results of Operations—General—Engineering and Construction” and note 22 to our audited annual consolidated financial statements included in this annual report.

|

(3) | Includes payments required to be made by the Peruvian government for the amounts we invest to purchase trains and other infrastructure for the Lima Metro. See “Item 5.A. Operating and Financial Review and Prospects—Operating and Financial Review and Prospects—Operating Results—Results of Operations—General—Infrastructure” and note 11 to our audited annual consolidated financial statements included in this annual report.

|

(4) | The net profit attributable to controlling interests of our Real Estate segment is significantly affected by the financing and commercial arrangements we use to purchase land and to develop real estate projects. Depending on the level ofnon-controlling interests used to finance our real estate projects, our Real Estate segment tends to have significant net profit attributable tonon-controlling interests. See “Item 5.A. Operating and Financial Review and Prospects—Operating Results—Results of Operations—General—Real Estate.”

|

(5) | Includes inventories, which includes investments for the purchase of land by our Real Estate segment. These investments in land are recorded at book value and are not marked to market for changes in fair value. See note 15 to our audited annual consolidated financial statements included in this annual report.

|

Non-GAAP Financial Measure and Reconciliation

In this annual report, we present EBITDA, anon-GAAP financial measure. Anon-GAAP financial measure is generally defined as one that purports to measure financial performance, financial position or cash flows but excludes or includes amounts that would not be so adjusted in the most comparable IFRS measure. We define EBITDA as net profit plus: financial (expense) income, net; income tax; and depreciation and amortization.

We present EBITDA because we believe it provides readers with a supplemental measure of the financial performance of our core operations that facilitatesperiod-to-period comparisons on a consistent basis. Furthermore, we regularly present EBITDA in our filings with the Lima Stock Exchange in Peru. Our management uses EBITDA, among other measures, for internal planning and performance measurement purposes. We believe that EBITDA is useful in evaluating our operating performance compared to that of other companies operating in our sectors because the calculation of EBITDA and EBITDA generally eliminates the effects of financing and income taxes and the accounting effects of capital spending, which items may vary for different companies for reasons unrelated to overall operating performance. EBITDA should not be construed as an alternative to net profit or operating profit, as an indicator of operating performance, as an alternative to cash flow provided by operating activities or as a measure of liquidity (in each case, as determined in accordance with IFRS). EBITDA, as calculated by us, may not be comparable to similarly titled measures reported by other companies. The following table sets forth the reconciliation of our net profit to EBITDA on a consolidated basis.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2014 | | | 2015 | | | 2016 | | | 2017

Restated | | | 2018 | | | 2018 | |

| | | (in millions of S/.) | | | (in millions of

US$)(1) | |

Net profit (loss) | | | 361.2 | | | | 55.6 | | | | (451.6 | ) | | | 209.2 | | | | 57.4 | | | | 17.0 | |

Financial expense | | | 381.8 | | | | 518.6 | | | | 942.5 | | | | 473.9 | | | | 630.1 | | | | 186.5 | |

Financial income | | | (323.6 | ) | | | (420.9 | ) | | | (762.7 | ) | | | (336.8 | ) | | | (433.0 | ) | | | (128.2 | ) |

Income tax | | | 104.6 | | | | 78.7 | | | | (152.2 | ) | | | 46.3 | | | | 113.3 | | | | 33.5 | |

Depreciation and amortization | | | 260.0 | | | | 306.4 | | | | 183.4 | | | | 179.7 | | | | 189.5 | | | | 56.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA | | | 783.9 | | | | 538.4 | | | | (240.5 | ) | | | 572.3 | | | | 557.3 | | | | 164.9 | |

(1) | Calculated based on an exchange rate of S/.3.379 to US$1.00 as of December 31, 2018.

|

The following table shows a reconciliation of the EBITDA for our three segments, Parent company operations and intercompany eliminations:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2014 | | | 2015 | | | 2016 | | | 2017

Restated | | | 2018 | | | 2018 | |

| | | (in millions of S/.) | | | (in millions of

US$)(1) | |

Engineering and construction | | | 407.0 | | | | 158.3 | | | | 19.3 | | | | 120.0 | | | | 19.2 | | | | 5.69 | |

Infrastructure | | | 257.2 | | | | 272.2 | | | | 237.8 | | | | 300.9 | | | | 411.5 | | | | 121.8 | |

Real estate | | | 56.5 | | | | 52.8 | | | | 121.4 | | | | 177.3 | | | | 241.0 | | | | 71.3 | |

Parent company operations | | | 258.2 | | | | (34.1 | ) | | | (1,025.2 | ) | | | 125.9 | | | | (27.8 | ) | | | 8.2 | |

Intercompany eliminations | | | (245.4 | ) | | | 16.2 | | | | 406.2 | | | | (151.8 | ) | | | (86.6 | ) | | | (25.6 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA | | | 783.9 | | | | 538.4 | | | | (240.5 | ) | | | 572.3 | | | | 557.3 | | | | 164.9 | |

|

(1) Calculated based on an exchange rate of S/.3.379 to US$1.00 as of December 31, 2018. | |

|

The following tables set forth the reconciliation of our net profit to EBITDA for each of our business segments and certain of our lines of business or subsidiaries within these segments. The effects of the termination of the GSP gas pipeline concession on our results of operations and financial condition for 2016 are reflected in Corporate (the Parent Company Operations) and, with respect to the related construction consortium (CCDS), in our E&C segment. Beginning on April 1, 2017, we transferred Concar from our Technical Services segment to our former Infrastructure segment. This change does not impact our consolidated financial results. For more information, see note 7 to our audited annual consolidated financial statements included in this annual report. | |

|

| 1. Engineering & Construction | |

| |

| | | For the year ended December 31, | |

| | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | 2018 | |

| | | (in millions of S/.) | | | (in millions of

US$)(2) | |

Net profit (loss) | | | 193.6 | | | | (121.8 | ) | | | (93.5 | ) | | | 12.4 | | | | (85.4 | ) | | | (25.3 | ) |

Financial expense | | | 201.2 | | | | 375.8 | | | | 555.8 | | | | 212.3 | | | | 284.7 | | | | 84.3 | |

Financial income | | | (156.4 | ) | | | (279.0 | ) | | | (505.0 | ) | | | (174.1 | ) | | | (217.0 | ) | | | (64.2 | ) |

Income tax | | | 24.4 | | | | 15.2 | | | | (19.7 | ) | | | (0.9 | ) | | | (14.4 | ) | | | (4.3 | ) |

Depreciation and amortization | | | 144.2 | | | | 168.1 | | | | 81.6 | | | | 70.3 | | | | 51.3 | | | | 15.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA | | | 407.0 | | | | 158.3 | | | | 19.3 | | | | 120.0 | | | | 19.2 | | | | 5.7 | |

| | | | | | |

2. Infrastructure | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

2.1 Full Segment | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | For the year ended December 31, | |

| | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | 2018 | |

| | | (in millions of S/.) | | | (in millions of

US$)(2) | |

Net profit | | | 92.6 | | | | 112.4 | | | | 98.3 | | | | 129.3 | | | | 184.0 | | | | 54.5 | |

Financial expense | | | 101.6 | | | | 78.2 | | | | 101.7 | | | | 62.6 | | | | 143.1 | | | | 42.4 | |

Financial income | | | (71.2 | ) | | | (55.3 | ) | | | (92.0 | ) | | | (43.1 | ) | | | (123.1 | ) | | | (36.4 | ) |

Income tax | | | 56.6 | | | | 46.5 | | | | 39.9 | | | | 55.2 | | | | 80.5 | | | | 23.8 | |

Depreciation and amortization | | | 77.6 | | | | 90.5 | | | | 90.0 | | | | 96.9 | | | | 126.8 | | | | 37.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA | | | 257.2 | | | | 272.3 | | | | 237.8 | | | | 300.9 | | | | 411.5 | | | | 121.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

2.2(a) All Toll Roads | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | For the year ended December 31, | |

| | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | 2018 | |

| | | (in millions of S/.) | | | (in millions of

US$)(2) | |

Net profit | | | 43.0 | | | | 53.5 | | | | 44.9 | | | | 55.0 | | | | 29.2 | | | | 8.6 | |

Financial expense | | | 19.0 | | | | 10.8 | | | | 14.9 | | | | 7.7 | | | | 28.6 | | | | 8.5 | |

Financial income | | | (9.5 | ) | | | (14.8 | ) | | | (9.6 | ) | | | (3.5 | ) | | | (7.2 | ) | | | (2.1 | ) |

Income tax | | | 16.2 | | | | 18.8 | | | | 15.5 | | | | 20.9 | | | | 8.8 | | | | 2.6 | |

Depreciation and amortization | | | 11.4 | | | | 10.9 | | | | 11.1 | | | | 11.0 | | | | 42.9 | | | | 12.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA | | | 80.1 | | | | 79.2 | | | | 76.8 | | | | 91.1 | | | | 102.3 | | | | 30.3 | |

| | | | | | |

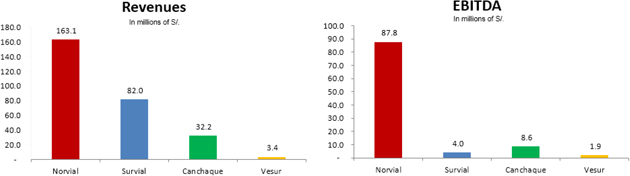

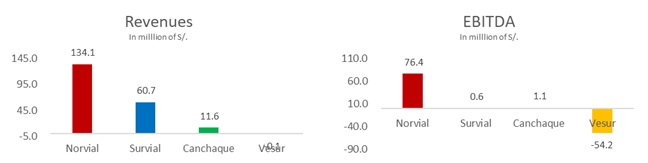

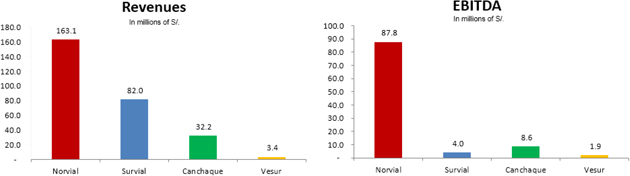

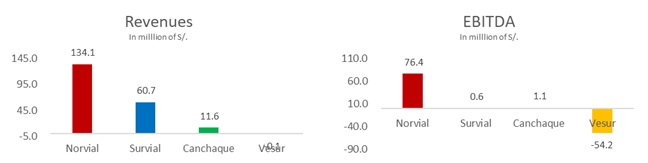

2.2(b) Norvial | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | For the year ended December 31, | |

| | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | 2018 | |

| | | (in millions of S/.) | | | (in millions of

US$)(2) | |

Net profit | | | 31.1 | | | | 40.9 | | | | 47.3 | | | | 49.4 | | | | 17.2 | | | | 5.1 | |

Financial expense | | | 9.7 | | | | 4.1 | | | | 4.9 | | | | 3.4 | | | | 25.0 | | | | 7.4 | |

Financial income | | | (0.4 | ) | | | (0.4 | ) | | | (1.6 | ) | | | (0.9 | ) | | | (1.0 | ) | | | (0.3 | ) |

Income tax | | | 10.9 | | | | 13.6 | | | | 16.3 | | | | 18.7 | | | | 3.9 | | | | 1.1 | |

Depreciation and amortization | | | 11.0 | | | | 10.8 | | | | 10.9 | | | | 10.8 | | | | 42.7 | | | | 12.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA | | | 62.3 | | | | 68.9 | | | | 77.7 | | | | 81.4 | | | | 87.8 | | | | 26.0 | |

| | | | | | |

2.3 Mass Transit | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | For the year ended December 31, | |

| | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | 2018 | |

| | | (in millions of S/.) | | | (in millions of

US$)(2) | |

Net profit (loss) | | | 12.1 | | | | 18.8 | | | | 23.9 | | | | 19.5 | | | | 87.1 | | | | 25.8 | |

Financial expense | | | 39.8 | | | | 7.9 | | | | 20.5 | | | | 18.4 | | | | 72.5 | | | | 21.4 | |

Financial income | | | (35.3 | ) | | | (4.9 | ) | | | (25.8 | ) | | | (14.0 | ) | | | (87.0 | ) | | | (25.8 | ) |

Income tax | | | 10.8 | | | | 8.1 | | | | 10.9 | | | | 9.5 | | | | 38.0 | | | | 11.3 | |

Depreciation and amortization | | | 0.9 | | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.2 | | | | 0.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA | | | 28.3 | | | | 30.0 | | | | 29.6 | | | | 33.5 | | | | 110.8 | | | | 32.8 | |

| | | | | | |

2.4 Energy | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | For the year ended December 31, | |

| | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | 2018 | |

| | | (in millions of S/.) | | | (in millions of

US$)(2) | |

Net profit | | | 62.7 | | | | 20.2 | | | | 12.0 | | | | 38.1 | | | | 65.0 | | | | 19.2 | |

Financial expense | | | 30.6 | | | | 50.3 | | | | 61.7 | | | | 34.8 | | | | 37.9 | | | | 11.2 | |

Financial income | | | (19.2 | ) | | | (30.5 | ) | | | (52.0 | ) | | | (23.3 | ) | | | (26.9 | ) | | | (7.9 | ) |

Income tax | | | 29.8 | | | | 7.7 | | | | 5.3 | | | | 13.2 | | | | 26.3 | | | | 7.8 | |

Depreciation and amortization | | | 58.1 | | | | 74.2 | | | | 72.5 | | | | 79.4 | | | | 76.6 | | | | 22.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA | | | 162.0 | | | | 121.8 | | | | 99.5 | | | | 142.1 | | | | 178.9 | | | | 52.9 | |

2.5 Concar

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | 2018 | |

| | | (in millions of S/.) | | | (in millions of

US$)(2) | |

Net profit (loss) | | | (26.5 | ) | | | 18.5 | | | | 14.0 | | | | 16.9 | | | | 2.4 | | | | 0.7 | |

Financial expense | | | 12.0 | | | | 9.1 | | | | 4.5 | | | | 1.7 | | | | 4.2 | | | | 1.2 | |

Financial income | | | (7.2 | ) | | | (5.0 | ) | | | (4.6 | ) | | | (2.3 | ) | | | (1.4 | ) | | | (0.4 | ) |

Income tax | | | (0.8 | ) | | | 11.4 | | | | 6.7 | | | | 11.4 | | | | 6.9 | | | | 2.0 | |

Depreciation and amortization | | | 7.1 | | | | 5.3 | | | | 6.4 | | | | 6.4 | | | | 7.1 | | | | 2.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA | | | (15.3 | ) | | | 39.3 | | | | 27.0 | | | | 34.1 | | | | 19.2 | | | | 5.7 | |

| | | | | | |

3. Real Estate | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | For the year ended December 31, | |

| | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | 2018 | |

| | | (in millions of S/.) | | | (in millions of

US$)(2) | |

Net profit | | | 26.5 | | | | 29.3 | | | | 77.2 | | | | 117.7 | | | | 157.8 | | | | 46.7 | |

Financial expense | | | 30.4 | | | | 47.7 | | | | 65.1 | | | | 36.0 | | | | 25.2 | | | | 7.5 | |

Financial income | | | (15.6 | ) | | | (36.8 | ) | | | (53.5 | ) | | | (17.7 | ) | | | (16.9 | ) | | | (5.0 | ) |

Income tax | | | 11.5 | | | | 7.6 | | | | 27.1 | | | | 35.9 | | | | 69.2 | | | | 20.5 | |

Depreciation and amortization | | | 3.8 | | | | 4.9 | | | | 5.6 | | | | 5.3 | | | | 5.7 | | | | 1.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA | | | 56.5 | | | | 52.8 | | | | 121.4 | | | | 177.3 | | | | 241.0 | | | | 71.3 | |

(1) | For the effects on our results of operations for 2016 resulting from the termination of the GSP gas pipeline concession, see “Item. S.A. Operating and Financial Review and Prospects—Operating Results—Recent Developments” and notes 5(e) and 16 to our audited annual consolidated financial statements included in this annual report.

|

(2) | Calculated based on an exchange rate of S/.3.379 to US$1.00 as of December 31, 2018.

|

(3) | Our E&C segment EBITDA includes S/.48.2 million, S/.15.0 million,S/.16.5 million, S/.31.0 million and S/.11.4 in 2014, 2015, 2016, 2017 and 2018, respectively, which represents GyM’s 39.0% equity interest in Viva GyM’s net profit.

|

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

Risks Related to RecentKey Developments

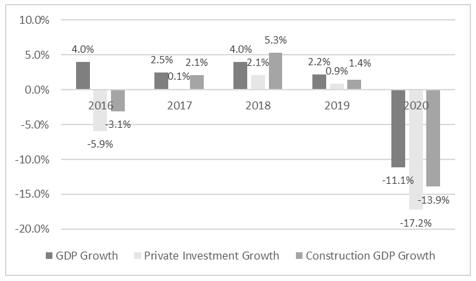

The ongoing COVID-19 pandemic and government measures to contain the spread of the virus are disrupting economic activity in the countries where we operate and adversely affecting our business, results of operations and financial condition.

The outbreak of the Novel Coronavirus 2019 (COVID-19) pandemic, which has been declared by the World Health Organization to be a “public health emergency of international concern,” has spread across the world since the end of 2019. The virus has spread significantly in Latin America, and the countries where we operate have fewer resources to address the continued health care effects of the pandemic. In response, countries around the world—including Peru as well as Chile and Colombia—have adopted extraordinary measures to contain the spread of COVID-19, including imposing travel restrictions, requiring closures of non-essential businesses, establishing restrictions on public gatherings, instructing residents to practice social distancing, issuing stay-at-home orders, implementing quarantines and similar actions. Depending on how the spread of the virus continues to evolve, governments may continue to extend these measures.