We may experience delays or setbacks in our ongoing clinical trials, and we do not know whether future clinical trials will begin on time, need to be redesigned, enroll an adequate number of patients on time or be completed on schedule, if at all. Clinical trials can be delayed or terminated for a variety of reasons, including delay or failure to:

generate sufficient preclinical, toxicology, or other in vivo or in vitro data to support the initiation or continuation of clinical trials

obtain regulatory approvalauthorization to commence a trial, if applicable;trial;

reach agreement on acceptable terms with prospective contract research organizations, or CROs, and clinical trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites;

obtain Ethics Committee, institutional review board, or IRB, or ethics committee approval at each site;

manufacture, test, release, validate or import sufficient quantities of drug product for use in a trial;

recruit, screen and enroll suitable patients to participate in a trial;

have patients complete a trial or return forpost-treatmentfollow-up;post-treatment follow-up;

ensure that clinical sites observe trial protocol or continue to participate in a trial;

address any patient safety concerns that arise during the course of a trial;

address any conflicts with new or existing laws or regulations; or

initiate or add a sufficient number of clinical trial sites; orsites.

manufacture sufficient quantities of product candidate for use in clinical trials.

There is alsoThe novel Coronavirus (COVID-19) pandemic has had, and may continue to have an evolving impact of the novel Coronavirus(COVID-19) pandemic on the conduct of clinical trials of investigational therapeutic candidates, and any challenges which may arise, for example, from quarantines, site closures, travel limitations, interruptions to the supply chain for our product candidates, or other considerations if site personnel or trial subjects become infected withCOVID-19, which may lead to difficulties in meeting protocol-specified procedures, including administering or using the therapeutic candidate or adhering to protocol-mandated visits and laboratory/diagnostic testing, unavoidable protocol deviations due toCOVID-19 illness and/orCOVID-19 control measures, which will likely vary depending on many factors, including the nature of disease under study, the trial design, and in what region(s) the study is being conducted.

Patient enrollment is a significant factor in the timing of clinical trials and is affected by many factors, including the size and nature of the patient population, the proximity of patients to clinical sites, the eligibility criteria for the trial, the design of the clinical trial, competing clinical trials and clinicians’ and patients’ perceptions as to the potential advantages of the drug being studied in relation to other available therapies, including any new drugs or treatments that may be approved for the indications we are investigating.

We could also encounter delays if a clinical trial is suspended or terminated by us our collaboration partner for a product candidate, by the Ethics Committee or IRBs of the institutions in which such trials are being conducted, by an independent data safety monitoring board, or DSMB, for such trial or by European Economic Area, or EEA, Competent Authorities, the FDA or similar regulatory authorities. Such authorities, or we, may suspend or terminate a clinical trial due to a number of factors, including failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols, inspection of the clinical trial operations or trial site by EEA Competent Authorities, the FDA or similar regulatory authorities resulting in the imposition of a clinical hold, unforeseen safety issues or adverse side effects, failure to demonstrate a benefit from using a drug, changes in governmental regulations or administrative actions or lack of adequate funding to continue the clinical trial.

Further, we are conducting, phase 3 studiesand plan to conduct, clinical trials in sites outside of TransCon hGH across clinical sites located in North America, Europe, the Middle East, and Oceania (Australia/New Zealand).United States. Conducting clinical trials in foreign countries presents additional risks that may delay completion of clinical trials. These risks include the failure of physicians or enrolled patients in foreign countries to adhere to clinical protocol as a result of differences in healthcare services or cultural customs, managing additional administrative burdens associated with foreign regulatory schemes, as well as political and economic risks relevant to such foreign countries. In addition, the EMA or the FDA may determine that the clinical trial results obtained in foreign subjects do not representestablish the safety and efficacy of a product candidate when administered in EEA or U.S. patients, and are thus not supportive of an application for a marketing authorization in

the EEA or of a New Drug Application, or NDA, or Biologics License Application, or BLA, approval in the United States. As a result, the EMA or the FDA may not accept data from clinical trials conducted outside the EEA or the United States, respectively, and may require that we conduct additional clinical trials or obtain additional data before we can submit an NDA or BLA in the United States or a marketing authorization application in the EEA. The EMA or the FDA may even require conducting additional clinical trials in the EEA or the United States, respectively.

If there are delays in the completion of, or termination of, any clinical trial of our product candidates or if we are required to conduct additional clinical trials in addition to those we have currently planned, the commercial prospects of our product candidates may be harmed, and our ability to generate revenue from commercial product sales from any of these product candidates will be delayed. In addition, any delays in completing the clinical trials will increase costs, slow down our product candidate development and approval process and jeopardize the ability to commence product sales and generate revenue from commercial product sales. Any of these occurrences may significantly harm our business, financial condition and prospects. Clinical trial delays may also allow our competitors to bring products to market before we do, which could impair our ability to obtain orphan exclusivity for our products that potentially qualify for orphan drug designation. In addition, many of the factors that cause, or lead to, a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of our product candidates.

We depend on certain collaboration partners to develop and conduct clinical studies with, obtain regulatory approvals for, market and sell our collaboration product candidates, and if such collaboration partners fail to perform as expected, or are unable to obtain the required regulatory approvals for such product candidates, the potential for us to generate future revenue fromof such product candidates would be significantly reduced and our business would be significantly harmed.

We rely on our collaboration partners to conduct certain clinical studies. For example, in November 2018, we announced the formation of VISEN Pharmaceuticals, or Visen,VISEN, a company established to develop, manufacture, and commercialize our endocrinology rare disease therapies in Greater China. In connection with the formation of Visen,VISEN, we granted VisenVISEN exclusive rights to develop and commercialize our rare disease endocrinology products based on our proprietary TransCon technologies, including TransCon hGH, TransCon PTH and TransCon CNP, in Greater China for use in all human indications, subject to certain exceptions. We may also enter into collaboration agreements with other parties in the future relating to our other product candidates. Under our existing collaboration agreements, our collaboration partners are responsible for completing preclinical and/or clinical development and obtaining and maintaining regulatory approval for the applicable product candidates from the EMA, the FDA, the National Medical Product Administrations of the People’s Republic of China, or NMPA, and similar regulatory authorities. Ultimately, if such product candidates are advanced through clinical trials and receive marketing approval from the EMA, the FDA, the NMPA or similar regulatory authorities, such partners will be responsible for commercialization of these collaboration products. The potential for us to obtain future development milestone payments and, ultimately, generate revenue from royalties on sales of such collaboration products depends entirely on successful development, regulatory approval, marketing and commercialization by our collaboration partners.

If our collaboration partners do not perform in the manner we expect or fulfill their responsibilities in a timely manner, or at all, if our agreements with them terminate or if the quality or accuracy of the clinical data they obtain is compromised, the clinical development, regulatory approval and commercialization efforts related to our collaboration product candidates could be delayed or terminated and it could become necessary for us to assume the responsibility at our own expense for the clinical development of such product candidates. In that event, we would likely be required to limit the size and scope of efforts for the development and commercialization of such product candidate, to seek additional financing to fund further development, or to identify alternative collaboration partners, and our potential to generate future revenue from royalties and milestone payments from such product candidate would be significantly reduced or delayed and our business would be harmed. Our existing collaborations and any future collaboration arrangements that we may enter into with third partiesthird-parties may not be scientifically or commercially successful. In addition to the risks inherent in the development of a drug product candidate, factors that may affect the success of our collaborations include the following:

our collaboration partners have the unilateral ability to choose not to develop a collaboration product for one or more indications for which such product has been or is currently being evaluated, and our collaboration partners may choose to pursue an indication that is not in our strategic best interest or to forego an indication that they believe does not provide significant market potential even if clinical data is supportive of further development for such indication;

our collaboration partners may choose not to develop and commercialize our collaboration products in certain relevant markets;

our collaboration partners may take considerably more time advancing our product candidates through the clinical and regulatory process than we currently anticipate, which could materially delay the achievement of milestones and, consequently the receipt of milestone payments from our collaboration partners;

our collaboration partners have substantial discretion under their respective agreements regarding how they structure their efforts and allocate resources to fulfill their obligations to diligently develop, obtain regulatory approval for and commercialize our collaboration products;

our collaboration partners control all aspects of commercialization efforts under their respective license agreements and may change the focus of their development and commercialization efforts or pursuehigher-priority programs and, accordingly, reduce the efforts and resources allocated to their collaborations with us;

our collaboration partners are solely responsible for obtaining and maintaining all regulatory approvals and we or our collaboration partners may fail to develop a commercially viable formulation or manufacturing process for our product candidates, and we or our collaboration partners may fail to manufacture or supply sufficient drug substance for commercial use, if approved, which could result in lost revenue under such collaborations;

our collaboration partners may not comply with all applicable regulatory requirements or may fail to report safety data in accordance with all applicable regulatory requirements;

if any of our agreements with our collaboration partners terminate, we will no longer have any rights to receive potential revenue under such agreement, in which case we would need to identify alternative means to continue the development, manufacture and commercialization of the affected product candidates, alone or with others;

our collaboration partners have the discretion to sublicense their rights with respect to our collaboration technology in connection with collaboration product candidates to one or more third partiesthird-parties without our consent; and

our collaboration partners may be pursuing alternative technologies or developing alternative products, either on their own or in collaboration with others, that may be competitive with products on which they are collaborating with us or which could affect our collaboration partners’ commitment to the collaboration; and

if our collaboration partners receive approval for any of the collaboration product candidates, reductions in marketing or sales efforts or a discontinuation of marketing or sales of our product candidates by our collaboration partners would reduce any royalties we could be entitled to receive, which are based on the sales of our product candidates by our collaboration partners.collaboration.

In addition, the collaboration agreements provide our collaboration partners with rights to terminate such agreements and licenses under various conditions, which if exercised would adversely affect our product development efforts, make it difficult for us to attract new partners and adversely affect our reputation in the business and financial communities. Our collaboration partners have the right to terminate their respective collaboration agreements with us, upon advance written notice, in the event of our uncured material breach of the agreement and for convenience. In addition, Visenparticular, VISEN may terminate in the event of our bankruptcy or insolvency.

The timing and amount of any milestone and royalty payments we may receive under our agreements with our collaboration partners and the value of any equity we own in our collaboration partners (such as the equity we own in Visen)VISEN) will depend on, among other things, the efforts, allocation of resources, and successful development and commercialization of our product candidates by our collaboration partners. We cannot be certain that any of the development and regulatory milestones will be achieved or that we will receive any future milestone payments under these agreements.agreements we may enter into with collaboration partners. In addition, in certain circumstances we may believe that we have achieved a particular milestone and the applicable collaboration partner may disagree with our belief. In that case, receipt of that milestone payment may be delayed or may never be received, which may require us to adjust our operating plans. We also cannot be certain that any equity we own in our collaboration partners (such as the equity we own in Visen)VISEN) will maintain its value or grow in value.

We may form additional strategic collaborations in the future with respect to our proprietary programs, but we may not realize the benefits of such collaborations.

We may form strategic collaborations, create joint ventures or enter into licensing arrangements with third partiesthird-parties with respect to our independent programs that we believe will complement or augment our existing business. We have historically engaged, and intend to continue to engage, in partnering discussions with a range of biopharmaceutical companies and could enter into new collaborations at any time. For example, in November 2018, we announced the formation of Visen,VISEN, a company established to develop, manufacture, and commercialize our endocrinology rare disease therapies in Greater China. In connection with the formation of Visen,VISEN, we granted VisenVISEN exclusive rights to develop and commercialize our rare disease endocrinology products based on our proprietary TransCon technologies, including TransCon hGH, TransCon PTH and TransCon CNP, in Greater China for use in all human indications, subject to certain exceptions. We face significant competition in seeking appropriate strategic partners, and the negotiation process to secure appropriate terms istime-consuming and complex. Any delays in identifying suitable development partners and entering into agreements to develop our product candidates could also delay the commercialization of our product candidates, which may reduce their competitiveness even if they reach the market. Moreover, we may not be successful in our efforts to establish such a strategic partnership for any future product candidates and programs on terms that are acceptable to us, or at all. This may be for a number of reasons. For example, under our collaboration with Visen, VisenVISEN, VISEN has a right of first negotiation to develop certain of our endocrinology product candidates in Greater China, so our ability to negotiate such a collaboration with suitable third partiesthird-parties may be hampered by such rights we granted to Visen.VISEN. Additionally, our product candidates and programs may be deemed to be at too early of a stage of development for collaborative effort, our research and development pipeline may be viewed as insufficient, and/or third partiesthird-parties may not view our product candidates and programs as having sufficient potential for commercialization, including the likelihood of an adequate safety and efficacy profile. Even if we are successful in entering into a strategic alliance or license arrangement, there is no guarantee that the collaboration will be successful, or that any future collaboration partner will commit sufficient resources to the development, regulatory approval, and commercialization of our product candidates, or that such alliances will result in us achieving revenues that justify such transactions.

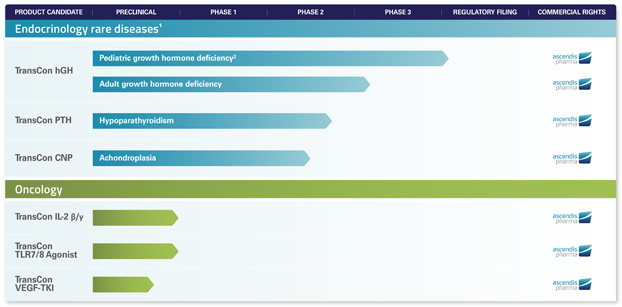

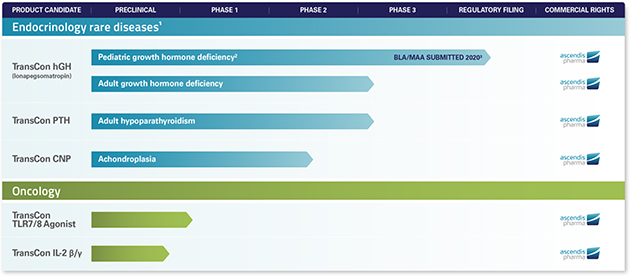

OurCertain of our product candidates other than TransCon hGH, TransCon PTH and TransCon CNP, are in various stages of preclinical development and we may not be successful in our efforts to successfully develop these products or expand our pipeline of product candidates.

A key element of our strategy is to expand our pipeline of product candidates utilizing our proprietary TransCon technologies, and to advance such product candidates through clinical development, either ondevelopment. Certain of our own or in conjunction with strategic collaboration partners. Our other product candidates are in preclinical development and may require significant time and additional research and development before we can file INDINDs or equivalent foreign regulatory filings with regulatory authorities to begin clinical studies. Of the large number of drugs in development, only a small percentage of such drugs successfully complete the EMA or FDA regulatory approval process and are commercialized. Accordingly, even if we are able to continue to fund such development programs, our product candidates may not be advanced to clinical studies or be successfully developed or commercialized. In addition, our preclinical product candidates may not demonstrate the advantages we expect from application of our TransCon technologies in preclinical studies. In such event, we may decide not to progress any such product candidates into clinical trials.

Research programs to identify product candidates require substantial technical, financial and human resources, whether or not any product candidates are ultimately identified. Although our research and development efforts to date have resulted in several development programs, we may not be able to develop product candidates that are safe and effective. Our research programs may initially show promise in identifying potential product candidates, yet fail

to yield product candidates for clinical development or commercialization for many reasons, including the following:

the research methodology used and our TransCon technologies may not be successful in creating potential product candidates;

competitors may develop alternatives that render our product candidates obsolete or less attractive;

product candidates we develop may nevertheless be covered by third parties’third-parties’ intellectual property rights or other types of exclusivity and we may not be able to obtain a license from such third partythird-party or the license terms may not be acceptable to us;

the market for a product candidate may change during our program or we may discover that such market was smaller than initially expected so that such a product may become financially unfeasible to continue to develop;

a product candidate may be demonstrated to have harmful side effects or not to be effective, or otherwise not to meet other requirements for regulatory approval;

a product candidate may not be capable of being produced in commercial quantities at an acceptable cost, or at all; and

a product candidate may not be accepted as safe and effective by patients, the medical community orthird-party payors, or reimbursable bythird-party payors, if applicable.

Even if we are successful in continuing to expand our pipeline, through our own research and development efforts or by pursuingin-licensing or acquisition of product candidates, the potential product candidates that we identify or acquire may not be suitable for clinical development, including as a result of being shown to have harmful side effects or other characteristics that indicate that they are unlikely to receive marketing approval and achieve market acceptance. If we do not successfully develop and commercialize a product pipeline, we may not be able to generate revenue from commercial product sales in future periods or achieve or sustain profitability.

Interim, and/or“topline” and preliminary data from our clinical trials that we have announced, or that we may announce or publish from time to time may change as more patient data become available and are subject to audit and verification procedures that could result in material changes in the final data.

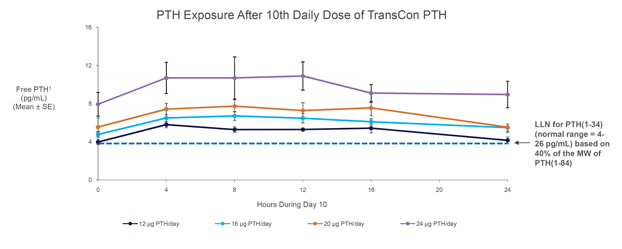

From time to time, we may publish interimpublicly disclose preliminary or preliminarytop-line data from our preclinical studies and clinical studies. For example, in January 2020, we announcedtrials, which is based on a preliminary analysis of then-available data, from our phase 2 study of TransCon PTH. Interim data forand the trials we may completeresults and related findings and conclusions are subject to change following a more comprehensive review of the riskdata related to the particular study or trial. We also make assumptions, estimations, calculations and conclusions as part of our analyses of data, and we may not have received or had the opportunity to fully and carefully evaluate all data. As a result, the top-line or preliminary results that onewe report may differ from future results of the same studies, or more of clinical outcomesdifferent conclusions or considerations may materially change as patient enrollment continues and/or more patientqualify such results, once additional data become available. Preliminaryhave been received and fully evaluated. Top-line data would also remain subject to audit and verification procedures that may result in the final data being materially different from the preliminary data we previously published. As a result, any interim and preliminarytop-line data should be viewed with caution until the final data are available. Material adverse changes in

From time to time, we may also disclose interim data from our preclinical studies and clinical trials. Interim data from clinical trials that we may complete are subject to the risk that one or more of the clinical outcomes may materially change as patient enrollment continues and more patient data become available or as patients from our clinical trials continue other treatments for their disease. Adverse differences between preliminary or interim data and final data could significantly harm our business prospects.

Further, others, including regulatory agencies, may not accept or agree with our assumptions, estimates, calculations, conclusions or analyses or may interpret or weigh the importance of data differently, which could impact the value of the particular program, the approvability or commercialization of the particular product candidate or product and our company in general. In addition, the information we choose to publicly disclose regarding a particular study or clinical trial is based on what is typically extensive information, and others may not agree with what we determine is material or otherwise appropriate information to include in our disclosure. If the interim, top-line, or preliminary data that we report differ from actual results, or if others, including regulatory authorities, disagree with the conclusions reached, our ability to obtain approval for, and commercialize, our product candidates may be harmed, which could harm our business, operating results, prospects or financial condition.

We may expendBy expending our limited resources to pursue a particular product candidate or indicationcandidates and areas of focus we may fail to capitalize on product candidates or indicationsareas of focus that may beare more profitable or for which there is a greater likelihood of success.

We have focused on research programs and product candidates that utilize our proprietary TransCon technologies.on the endocrinology and oncology therapeutic areas of focus. As a result, we may forego or delay pursuit of opportunities with other product candidates or forin other indicationsfocus areas that later prove to have greater commercial potential. Our resource allocation decisions may cause us to fail to capitalize on viable commercial products or profitable market opportunities. Our spending on current and future research and development programs and product candidates for specific indications may not yield any commercially viable products. If we do not accurately evaluate the commercial potential or target market for a particular product candidate, we may relinquish valuable rights to that product candidate through collaboration, licensing or other royalty arrangements in cases in which it would have been more advantageous for us to retain sole development and commercialization rights to such product candidate.

We rely on third partiesthird-parties to conduct our nonclinical studies and clinical trials. If these third partiesthird-parties do not successfully carry out their contractual duties or meet expected deadlines, we may be unable to obtain regulatory approval for, or commercialize, our product candidates.

We do not currently have the ability to independently conduct clinical trials or nonclinical studies. We rely on medical institutions, clinical investigators, contract laboratories, collaboration partners and other third parties,third-parties, such as CROs, to conduct clinical trials of our product candidates. The third partiesthird-parties with whom we contract for execution of our clinical trials play a significant role in the conduct of these trials and the subsequent collection and analysis of data. However, these third partiesthird-parties are not our employees, and except for contractual duties and obligations, we control only certain aspects of their activities and have limited ability to control the amount or timing of resources that they devote to our programs. Although we rely on these third partiesthird-parties to conduct our nonclinical studies and our clinical trials, we remain responsible for ensuring that each of our nonclinical studies and clinical trials is conducted in accordance with the applicable protocol, legal, regulatory and scientific standards and our reliance on third partiesthird-parties does not relieve us of our regulatory responsibilities. We and these third partiesthird-parties are required to comply with current good laboratory practices, or GLPs, for nonclinical studies, and good clinical practices, or GCPs, for clinical studies. GLPs and GCPs are regulations and guidelines enforced by the Competent Authorities of the Member States of the European Economic Area, or EEA, the FDA and comparable foreign regulatory authorities for all of our products in nonclinical and clinical development, respectively. Regulatory authorities enforce GCPs through periodic inspections of trial sponsors, principal investigators and trial sites. If we or any of our third partythird-party contractors fail to comply with applicable regulatory requirements, including GCPs, the clinical data generated in our clinical trials may be deemed unreliable and the EMA, the FDA, or similar regulatory authorities may require us to perform additional clinical trials before approving our marketing applications. We cannot be certain that upon inspection by a given regulatory authority, such regulatory authority will determine that any of our clinical trials comply with GCP regulations. In addition, our clinical trials must be conducted with products produced under cGMP regulations. The failure of our contract manufacturers to comply with these regulations may require us to repeat clinical trials, which would delay the regulatory approval process.

Even if our product candidates obtain regulatory approval, they may never achieve market acceptance or commercial success, which will depend, in part, upon the degree of acceptance among physicians, patients, patient advocacy groups,third-party payors and the medical community.

Even if our product candidates obtain EMA, FDA or other regulatory approvals, and are ultimately commercialized, our product candidates may not achieve market acceptance among physicians, patients,third-party payors, patient advocacy groups and the medical community. The degree of market acceptance, if any, for our most advanced product candidates for which marketing approval is obtained will depend on a number of factors, including:

the efficacy of the products as demonstrated in clinical trials;

the prevalence and severity of any side effects and overall safety profile of the product;

the perceived safety of the TransCon technologies;

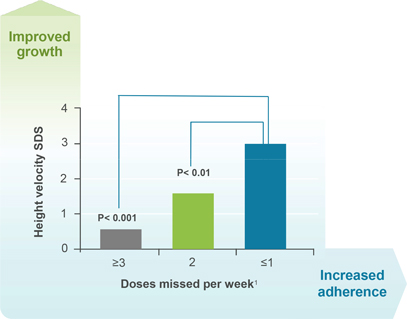

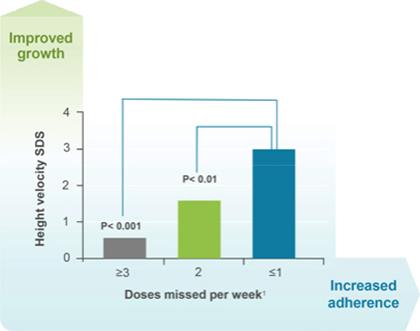

the convenience and features of theauto-injector or drug delivery device used to administer the drug;

the clinical indications for which the product is approved;

acceptance by physicians, major operators of clinics and patients of the product as a safe and effective treatment and their willingness to pay for them;

relative convenience and ease of administration of our products;

the potential and perceived advantages of our product candidates over current treatment options or alternative treatments, including future alternative treatments;

the availability of supply of our products and their ability to meet market demand;

marketing and distribution support for our product candidates;

the quality of our relationships with patient advocacy groups; and

coverage and reimbursement policies of government and otherthird-party payors.

If our product candidates that obtain regulatory approval do not achieve significant market acceptance or commercial success, this could harm our business, results of operations and prospects, and the value of our shares or ADSs.

Our product candidates may cause undesirable side effects or have other properties that could delay or prevent their regulatory approval, limit the commercial profile of an approved label, or result in significant negative consequences following regulatory approval, if any. If any of our product candidates receives marketing approval and subsequently causes undesirable side effects, the ability to market the product candidates could be compromised.

Undesirable side effects caused by TransCon hGH,lonapegsomatropin, TransCon PTH, TransCon CNP, or our other product candidates could cause us or regulatory authorities to interrupt, delay or halt clinical trials and could result in a more restrictive label or the delay or denial of regulatory approval by the EMA, the FDA or similar authorities. In the event that trials conducted by us or ourany collaboration partners, or trials we conduct with our unlicensed product candidates, reveal a high and unacceptable severity and prevalence of side effects, such trials could be suspended or terminated and the EMA, the FDA or similar regulatory authorities could order ourany collaboration partners or us to cease further development of or deny approval of our product candidates for any or all targeted indications. Thedrug-related side effects could affect patient recruitment or the ability of enrolled patients to complete the trial or result in potential product liability claims. Any of these occurrences may harm our business, financial condition and prospects significantly.

Additionally, if we successfully develop a product candidate and it receives marketing approval, the FDA could require us to adopt a Risk Evaluation and Mitigation Strategy, or REMS, to ensure that the benefits of treatment with such product candidate outweigh the risks for each potential patient, which may include, among other things, a communication plan to health care practitioners, patient education, extensive patient monitoring or distribution systems and processes that are highly controlled, restrictive and more costly than what is typical for the industry. For example, in June 2020, we submitted a BLA to the FDA for approval of lonapegsomatropin for the treatment of pediatric GHD. In our discussions with the FDA relating to this BLA submission to date, the FDA has indicated that it has not identified significant safety issues and a REMS is not currently being considered for lonapegsomatropin, if approved; however, the FDA’s review of this BLA submission is ongoing and the FDA may still require us to adopt a REMS for lonapegsomatropin for the treatment of GHD.

In addition, in the event that any of our product candidates receives regulatory approval and we or others later identify undesirable side effects caused by one of our products, a number of potentially significant negative consequences could occur, including:

regulatory authorities may withdraw their approval of the product or seize the product;

we, or ourany collaboration partners, may be required to recall the product;

additional restrictions may be imposed on the marketing of the particular product or the manufacturing processes for the product or any component thereof, including the imposition of a REMS or requirements for similar actions, such as patient education, certification of health care professionals or specific monitoring;

we, or ourany collaboration partners, may be subject to fines, injunctions or the imposition of civil or criminal penalties;

regulatory authorities may require the addition of labeling statements, such as a “black box” warning or a contraindication;

we could be sued and held liable for harm caused to patients;

the product may become less competitive; and

our reputation may suffer.

Any of the foregoing events could prevent us, or ourany collaboration partners, from achieving or maintaining market acceptance of a particular product candidate, if approved, and could result in the loss of significant revenue to us, which would harm our results of operations and business.

Competition in the biotechnology and pharmaceutical industries is intense and our competitors may discover, develop or commercialize products faster or more successfully than us. If we are unable to compete effectively our business, results of operations and prospects will suffer.

The markets in which we intend to compete are undergoing, and are expected to continue to undergo, rapid and significant technological changes. Some of our product candidates are for fields in which competitive products already exist and are established. We expect competition to intensify as technological advances are made or new drugs and biotechnology products are introduced. New developments by competitors may render our current or future product candidates and/or technologiesnon-competitive, obsolete or not economical. Our competitors’ products may be more efficacious or marketed and sold more effectively than any of our product candidates.

We are aware of several pharmaceutical and biopharmaceutical companies that have commenced clinical studies of products or have successfully commercialized products addressing areas that we are targeting. WhileTo our knowledge, as of the date of this report, there are currently no commercially available long-acting growth hormone treatment options available in the United States or Europe, aEurope. A permanently PEGylated long-acting growth hormone developed by GeneScience Pharmaceuticals Co., Ltd. is available in China and the Somatropin Biopartners product (LB03002), is available in Korea. On August 28, 2020, the FDA granted Novo Nordisk Inc. approval of somapacitan for replacement of endogenous growth hormone in adult patients with GHD but as of the date of this report to our knowledge Novo Nordisk has not commercially launched the product in the United States. In additionJanuary 2021, Novo Nordisk received a positive opinion from the Committee for Medicinal Products for Human Use, under the EMA for once-weekly somapacitan, recommending marketing authorisation for use in adult patients with GHD. Pfizer (in collaboration with OPKO Health Inc.) has submitted to the currently approved and marketed dailyFDA, a Biologics License Application, or BLA, for somatrogon, a long-acting growth hormone therapies, there are a varietyfor the treatment of pediatric patients with GHD. In January 2021, Pfizer (in collaboration with OPKO Health) announced the FDA has accepted the regulatory submission and set the PDUFA goal date in October 2021. Other experimental growth hormone therapies based on permanent modification are in different stages of clinical development by various companies, including GeneScience Pharmaceuticals Co., Ltd., Genexine Inc,Inc., I-MAB, and JCR Pharmaceuticals Co., Ltd., Novo Nordisk A/S, and OPKO Health, Inc. (in collaboration with Pfizer Inc.). In addition, Shire plc owns the rights to NATPARA,Natpara, a treatment for hypoparathyroidism. NATPARANatpara was voluntarily recalled in September 2019 in the U.S. and is now only available to a limited number of seriously-ill patients through a Special Use Program offered by its manufacturer, Takeda Pharmaceutical Company. In addition, we are aware of several academic groups and companies working on making longer actinglonger-acting agonists of the PTH receptor, or PTH1R. Other companies and groups are developing or commercializing therapies for hypoparathyroidism, including Shire, Chugai Pharmaceutical Co., Ltd., Entera Bio, Extend Biosciences, Massachusetts General Hospital, AlizéAmolyt Pharma, Bridgebio and Eli Lilly and Company. Other companies are developing therapies for achondroplasia, including BioMarin, Pfizer, QED Therapeutics and BioClin Therapeutics. BioMarin Pharmaceutical, Inc. is developing vosoritide for the treatment of achondroplasia, and other companies thatTherachon and BioClin Therapeutics, Inc. are developing therapiescompounds for achondroplasia include Pfizer, QEDachondroplasia. Other companies are developing toll like receptor agonists for cancer immunotherapy including: Nektar Therapeutics, CureVac N.V., Seven and BioClinEight Biopharmaceuticals Inc., Idera Pharmaceuticals, Inc., Checkmate Pharmaceuticals, Inc., Exicure, Inc., Bolt Therapeutics, Inc., and Silverback Therapeutics, Inc. In addition to product basedproduct-based competition, our TransCon technologies face technology basedtechnology-based competition as we believe other companies are developing or evaluating enhanced drug delivery and sustained release technologies. In particular, we believe Nektar Therapeutics, OPKO Health, Inc., ProLynx LLC and Serina Therapeutics, Inc. are developing technologies that use reversible linkers and that may be competitive with our TransCon technologies.

It is also possible that our competitors will commercialize competing drugs or treatments before we or our collaboration partners can launch any products developed from our product candidates. We also anticipate that we will face increased competition in the future as new companies enter into our target markets.

Furthermore, to the extent we are developing TransCon product candidates that incorporate already approved drugs, we face competition from the pharmaceutical companies which are currently marketing such approved products. These pharmaceutical companies can generally be expected to seek to delay the introduction of competing products through a variety of means including:

filing new formulation patent applications on drugs whose original patent protection is about to expire;

filing an increasing number of patent applications that are more complex and costly to challenge;

filing suits for alleged patent infringement that automatically delay FDA approval;

developing patentedcontrolled-release or other“next-generation” products, which may compete with TransCon product candidates;

establishing exclusive contracts with third partythird-party payors; or

changing product claims and product labeling.

Any one of these strategies may increase the costs and risks associated with our efforts to introduce any of our product candidates and may delay or altogether prevent such introduction.

Many of our competitors have:

significantly greater name recognition, financial, marketing, research, drug development and technical and human resources than we have at every stage of the discovery, development, manufacturing and commercialization process and additional mergers and acquisitions in the biotechnology industries may result in even more resources being concentrated in our competitors;

more extensive experience in commercializing drugs, conducting preclinical testing, conducting clinical studies, obtaining regulatory approvals, challenging patents and in manufacturing and marketing pharmaceutical products;

products that have been approved or are in late stages of development; and

collaboration arrangements in our target markets with leading companies and research institutions.

If we successfully develop and obtain approval for our product candidates, we will face competition based on many different factors, including:

the safety and effectiveness of our product candidates;

the timing of and specific circumstances relating to regulatory approvals for these product candidates;

the availability and cost of manufacturing, marketing and sales capabilities;

the effectiveness of our marketing and sales capabilities;

the price of our product candidates;

the availability and amount ofthird-party reimbursement for our product candidates; and

the strength of our patent position.

In addition, academic institutions, government agencies, and other public and private organizations conducting research may seek patent protection with respect to potentially competitive products or technologies. These organizations may also establish exclusive collaborative or licensing relationships with our competitors.

Our competitors may develop or commercialize products with significant advantages in regard to any of these factors. Our competitors may therefore be more successful in commercializing their products than we are, which could adversely affect our business, results of operations and prospects, and the value of our shares or ADSs.

For additional information regarding the competitive landscape for our product candidates, see “Item 4 B. Information on the Company – Business Overview – TransCon Product Candidates.”

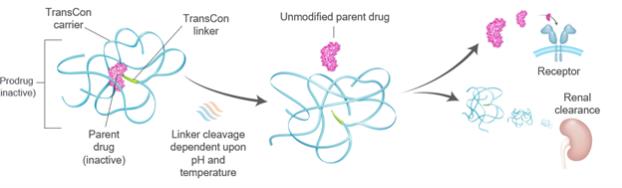

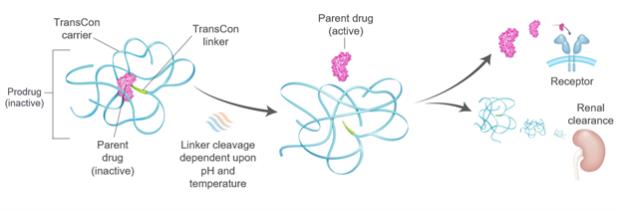

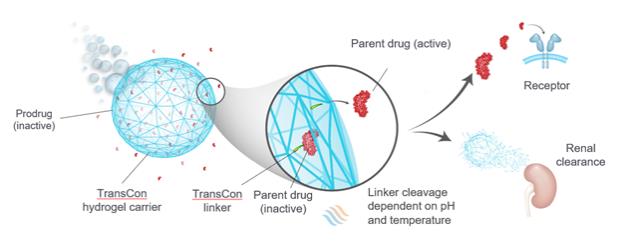

Our proprietary TransCon technologies include a new approach to extending the residence time and duration of action of a variety of drug products and may not result in any products of commercial value.

Our TransCon technologies have been developed to improve the delivery of a variety of drug products. However, we cannot be certain that our TransCon technologies will be deemed safe or efficacious, nor that any aspects of our TransCon technologies will yield additional product candidates that could be commercially valuable. Further, one of our two carrier systems, the TransCon hydrogel carrier system, has never been used in humans. As a result, our TransCon hydrogel carriers, when dosed in humans, may fail to perform as we expect. Failure of any of our product candidates to be successfully developed and approved may result in our TransCon technologies being viewed as an ineffective approach to developing drug products which would harm our business and prospects.

We apply our TransCon technologies to both approved and unapproved parent drugs to extend the life of such drugs in the body, and to enhance the overall benefit of a given therapy. Even when applied to approved parent drugs, we have generated limited clinical data on our product candidates using our systemic TransCon technologies with respect to safety and efficacy forlong-term treatment in humans. Thelong-term safety and efficacy of our TransCon

technologies and the extended life in the body of our product candidates utilizing TransCon technologies compared to currently approved products is unknown, and it is possible that our product candidates may have an increased risk of unforeseen reactions following extended treatment relative to other currently approved products. If extended treatment with product candidates utilizing TransCon in our ongoing or future clinical trials results in any concerns about the safety or efficacy of our TransCon technologies, we may be unable to successfully develop or commercialize our product candidates.

Product candidates created utilizing the TransCon technologies are new chemical entities that employ novel technologies that have not yet been approved by the FDA, EMA or other regulatory authorities. These regulatory authorities have limited experience in evaluating our technologies and product candidates.

Our TransCon technologies allow for the creation of new molecular entities through the transient conjugation of parent drug molecules to our soluble and microparticle TransCon carrier molecules via our TransCon linkers. We and our collaboration partners are developingdevelop product candidates based on these novel technologies, and we intend to work closely with our collaboration partners to understand and deliver the requisite demonstration of safety and efficacy that the FDA, the EMA and other regulatory authorities may seek for the approval of product candidates that incorporate the TransCon technologies. It is possible that the regulatory approval process may take significant time and resources and require deliverables from independent third partiesthird-parties not under our control. For some of our product candidates, the regulatory approval path and requirements may not be clear, which could add significant delay and expense. Delays or failure to obtain regulatory approval of any of the products that we or ourany collaboration partners develop using our novel technologies would adversely affect our business.

We have limited clinical data on product candidates utilizing theour TransCon technology platformtechnologies to indicate whether they are safe or effective forlong-term use in humans.

Our product candidates transiently link a parent drug molecule to select TransCon carriers via our TransCon linkers. Once injected, we believe that our prodrugs predictably release the unmodified parent drug molecule over time, thus preserving the parent drug’s original mode of action, and, we believe, the parent drug’s original safety and efficacy profile. We believe that our TransCon carriers remain bound to our TransCon linkers and that they are cleared from the body predominantly by renal filtration and biliary transport with fecal excretion. We have limited clinical data on product candidates utilizing the systemic TransCon technologies to indicate whether they are safe or effective forlong-term use in humans, including the safety of any degradation products that may result after the TransCon carrier and TransCon linker are cleaved from the parent drug molecule. As an example, our TransCon prodrugs utilize polyethylene glycol, or PEG, and hydrogels incorporatingPEG-based polymers as TransCon carriers. Although the safety and efficacy of PEG and permanently PEGylated proteins has been demonstrated within their respective

indications by the approval of drugs such as PegIntron®, PegaSys®, Neulasta®, Somavert®, Cimzia®, Krystexxa®, Adynovate® and Rebinyn® and we are not aware of any evidence forPEG-related safety issues with PEGylated proteins in the clinic, health authorities, including the EMA, have historically posed general questions relating to the distribution, elimination, and the potential for PEG accumulation to pharmaceutical companies involved in the development of PEGylated drug products. If treatment with any of our product candidates in our clinical trials results in concerns about their safety or efficacy, we and ourany collaboration partners may be unable to successfully develop or commercialize any or all of our TransCon technologies based product candidates or enter into collaborations with respect to our product candidates.

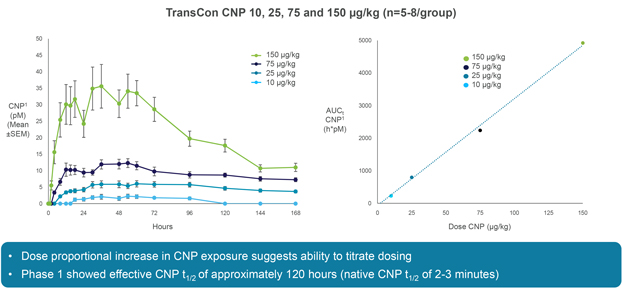

We have limited clinical data on TransCon PTH and TransCon CNP and no clinical data on our other preclinical product candidates, to indicate whether they are safe or effective forlong-term use in humans.

We have generated limited clinical data on TransCon PTH and TransCon CNP. It is unknown whetherlong-term repeated administration of TransCon PTH or TransCon CNP could result in issues that may adversely affect safety. In addition, we have generated no clinical data on our preclinical product candidates. If extended treatment with TransCon PTH, TransCon CNP, or any of our preclinical product candidates, in our clinical trials, results in any safety or efficacy concerns, we may be unable to successfully develop or commercialize our product candidates or enter into collaborations with respect to our product candidates.

We may seek orphan drug designation for some of our product candidates and we may be unsuccessful, or may be unable to maintain the benefits associated with orphan drug designation, including the potential for market exclusivity, for product candidates for which we obtain orphan drug designation.

Regulatory authorities in some jurisdictions, including the United States, may designate drugs or biologics intended to treat relatively small patient populations as orphan drug products. Under the Orphan Drug Act, the FDA may designate a drug or biologic as an orphan drug if it is intended to treat a rare disease or condition, which is generally defined as a patient population of fewer than 200,000 individuals in the United States, or a patient population greater than 200,000 in the United States where there is no reasonable expectation that the cost of developing the drug will be recovered from sales in the United States. In the European Union, the EMA’s, Committee for Orphan Medicinal Products grants orphan drug designation to promote the development of products that are intended for the diagnosis, prevention or treatment of a life-threatening or chronically debilitating condition affecting not more than five in 10,000 persons in the European Union. Orphan drug designation must be requested before submitting a BLA or NDA in the United States or an MAA in Europe.

If a drug or biologic with an orphan drug designation subsequently receives the first marketing approval for the indication for which it has such designation, the drug or biologic is entitled to a period of marketing exclusivity, which precludes the FDA from approving another marketing application for the same drug and indication for that time period, except in limited circumstances. If our competitors are able to obtain orphan drug exclusivity prior to us, for products that constitute the “same drug” and treat the same indications as our product candidates, we may not be able to have competing products approved by the applicable regulatory authority for a significant period of time. The applicable period is seven years in the United States. The applicable exclusivity period is ten years in the European Union (“EU”), but such exclusivity period can be reduced to six years if a product no longer meets the criteria for orphan designation or if the product is sufficiently profitable so that market exclusivity is no longer justified.

As part of our business strategy, we intend to pursue orphan drug designation for certain of our product candidates. For example, in June 2018 we were granted orphan drug designation by the FDA for TransCon PTH andfor the treatment of hypoparathyroidism, in February 2019, we were granted orphan drug designation by the FDA for TransCon CNP.CNP for the treatment of achondroplasia, and in April 2020, we were granted orphan drug designation by the FDA for lonapegsomatropin for the treatment of GHD. Additionally, in August 2020, we were granted orphan designation by the European Commission for TransCon CNP for the treatment of achondroplasia and in October 2020, we were granted orphan designation by the European Commission for TransCon PTH for Treatment of hypoparathyroidism. In October 2019, we were granted orphan designation by the European Commission for lonapegsomatropin for GHD. However, we may be unsuccessful in obtaining orphan drug designation or orphan designation for other product candidates, and may be unable to maintain the benefits associated with orphan drug designation.

Even if we obtain orphan drug exclusivity for any of our product candidates, that exclusivity may not effectively protect those product candidates from competition because different drugs can be approved for the same condition, and orphan drug exclusivity does not prevent the FDA from approving the same or a different drug in another indication. Even after an orphan drug is granted orphan exclusivity and approved, the FDA can subsequently approve a later application for the same drug for the same condition before the expiration of the seven-year exclusivity period if the FDA concludes that the later drug is clinically superior in that it is shown to be safer in a substantial portion of the target populations, more effective or makes a major contribution to patient care. In addition, a designated orphan drug may not receive orphan drug exclusivity if it is approved for a use that is broader than the indication for which it received orphan designation. Moreover,orphan-drug-exclusive marketing rights in the United States may be lost if the FDA later determines that the request for designation was materially defective or if we are unable to manufacture sufficient quantities of the product to meet the needs of patients with the rare disease or condition. Orphan drug designation neither shortens the development time or regulatory review time of a drug nor gives the drug any advantage in the regulatory review or approval process.

Any biological product for which we intend to seek approval may face competition sooner than anticipated.

The Affordable Care Act, or the ACA, includes a subtitle called the Biologics Price Competition and Innovation Act of 2009, or BPCIA, which created an abbreviated approval pathway for biological products that are biosimilar to or interchangeable with anFDA-licensed reference biological product. Under the BPCIA, an application for a biosimilar product may not be submitted to the FDA until four years following the date that the reference product was first licensed by the FDA. In addition, the approval of a biosimilar product may not be made effective by the FDA until twelve years from the date on which the reference product was first licensed. During thistwelve-year period of exclusivity, another company may still market a competing version of the reference product if the FDA approves a full BLA for the competing product containing the sponsor’s own preclinical data and data from adequate andwell-controlled clinical trials to demonstrate the safety, purity and potency of its product. The law is complex and is still being interpreted and implemented by the FDA. As a result, its ultimate impact, implementation and meaning are subject to uncertainty, and any processes adopted by the FDA to implement the BPCIA could have a material adverse effect on the future commercial prospects for our biological products.

We believe that any of our future biological product candidates approved under a BLA should qualify for thetwelve-year period of exclusivity. However, there is a risk that this exclusivity could be shortened due to Congressional action or otherwise, or that the FDA will not consider our product candidates to be reference products for competing products, potentially creating the opportunity for generic competition sooner than anticipated. Other

aspects of the BPCIA, some of which may impact the BPCIA exclusivity provisions, have also been the subject of recent litigation. Moreover, the extent to which a biosimilar, once approved, could be substituted for any one of our reference products in a way that is similar to traditional generic substitution fornon-biological products will depend on a number of marketplace and regulatory factors that are still developing.

We have limited direct sales and distribution capabilities and no sales experience with any of our own product candidates and we may not be able to successfully commercialize any of our product candidates.

We have limited direct sales and distribution capabilities and no sales experience with any of our own product candidates. Except for our license agreements with VisenVISEN for Greater China, we have no sales, marketing or distribution agreements for TransCon hGH, TransCon PTH, TransCon CNP, or our other product candidates. We may enter into arrangements with third partiesthird-parties to market and sell certain of our other product candidates in one or multiple geographies. We may not be able to enter into such marketing and sales arrangements with others on acceptable terms, if at all. To the extent that we enter into marketing and sales arrangements with other companies, our revenues, if any, will depend on the terms of any such arrangements and the efforts of others. These efforts may turn out not to be sufficient.

We currently have a limited sales organization and have no sales experience with any of our own product candidates. To commercialize any of our product candidates, we or ourany collaboration partners must build and/or maintain marketing, sales, distribution, managerial and othernon-technical capabilities or make arrangements with third partiesthird-parties to perform these services, and we or ourany collaboration partners may not be successful in doing so. If one or more of our product candidates receives regulatory approval, we may establish a specialty sales organization with technical expertise and supporting distribution capabilities toco-promote and/or commercialize our product candidates, which will be expensive and time consuming. As a company, we have no prior experience in the sale and distribution of pharmaceutical products and there are significant risks involved in building and managing a sales organization, including our ability to hire, retain, and incentivize qualified individuals, generate sufficient sales leads, provide adequate training to sales and marketing personnel, comply with regulatory requirements applicable to the marketing and sale of drug products and effectively manage a geographically dispersed sales and marketing team. Any failure or delay in the development of our internal sales, marketing and distribution capabilities with respect to anon-licensed product candidate would adversely impact the commercialization of such product candidate.

We may choose to work with third partiesthird-parties that have direct sales forces and established distribution systems, either to augment our own sales force and distribution systems or in lieu of our own sales force and distribution systems. If we are unable to enter into such arrangements on acceptable terms or at all, we may not be able to successfully commercialize our product candidates.

We rely on third partiesthird-parties to manufacture our preclinical and clinical drug supplies, and we intend to rely on third partiesthird-parties to produce commercial supplies of any approved product candidate and device.

We do not own facilities for manufacturing our products and product candidates for the potential pivotal clinical studies and/or commercial manufacturing of our products and product candidates. We depend on our collaboration partners and other third partiesthird-parties to manufacture and provide analytical services with respect to our most advanced product candidates and device.

In addition, if our product candidates are approved, to produce the quantities necessary to meet anticipated market demand, we and/or ourany collaboration partners will need to secure sufficient manufacturing capacity withthird-party manufacturers. If we and/or ourany collaboration partners are unable to produce our product candidates in sufficient quantities to meet the requirements for the launch of the product or to meet future demand, our revenues and gross margins could be adversely affected. For example, public health epidemics or pandemics, such as the novel coronavirus disease(COVID-19) currently impacting multiple jurisdictions worldwide may impact the ability of our existing or future manufacturers to perform their obligations under our manufacturing agreements with such parties. Such failure or substantial delay could materially harm our business. To be successful, our product candidates must be manufactured in commercial quantities in compliance with regulatory requirements and at acceptable costs. We and/or ourany collaboration partners will regularly need to secure access to facilities to manufacture some of our product candidates commercially. All of this will require additional funds and inspection and approval by the Competent Authorities of the Member States of the EEA, the FDA and other regulatory authorities. If we and/or our

any collaboration partners are unable to establish and maintain a manufacturing capacity within our planned time and cost parameters, the development and sales of our products and product candidates as well as our business, results of operations and prospects, and the value of our shares or ADSs could be adversely affected.

We and/or ourany collaboration partners may encounter problems with aspects of manufacturing our collaboration products and product candidates, including the following:

production yields;

quality control and assurance;

shortages of qualified personnel;

compliance with FDA and EEA regulations;

production costs; and

development of advanced manufacturing techniques and process controls.

We evaluate our options for clinical study supplies and commercial production of our product candidates on a regular basis, which may include use ofthird-party manufacturers, or entering into a manufacturing joint venture relationship with a third party. We are aware of only a limited number of companies on a worldwide basis who operate manufacturing facilities in which our product candidates can be manufactured under cGMP regulations, a requirement for all pharmaceutical products. We cannot be certain that we or our collaboration partners will be able to contract with any of these companies on acceptable terms, if at all, all of which could harm our business, results of operations and prospects, and the value of our shares or ADSs.

In addition, we, or our collaboration partners, as well as anythird-party manufacturer, will be required to register such manufacturing facilities with the FDA (and have a U.S. agent for the facility, if outside the United States), the Competent Authorities of the Member States of the EEA, and other regulatory authorities. The facilities will be subject to inspections confirming compliance with the FDA, the Competent Authorities of the Member States of the EEAs, or other regulatory authority cGMPs requirements. We do not control the manufacturing process of our product candidates, and other than with respect to our collaboration product candidates, we are dependent on our contract manufacturing partners for compliance with cGMPs regulations for manufacture of both active drug substances and finished drug products. If we or our collaboration partners or anythird-party manufacturer fails to maintain regulatory compliance, our business, financial condition and results of operations may be harmed, and the FDA, the Competent Authorities of the Member States of the EEA, or other regulatory authorities can impose regulatory sanctions that range from a warning letter to withdrawal of approval to seeking product seizures, injunctions and, where appropriate, criminal prosecution.

Under our collaborationagreements with Visen,VISEN, we are obligated to use commercially reasonable efforts to supply clinical trial material for VisenVISEN to conduct certain clinical trials, therefor, and will negotiate in good faith with VisenVISEN the terms and conditions governing our commercial supply of relevant products to Visen.VISEN. In turn, we currently rely on third partythird-party manufacturers in fulfilling our supply obligations to Visen. For additional information regarding the risks of our dependence on our collaboration partners, see the risk factors above “Item 3 D. Risk Factors—We are substantially dependent on the success of our product candidates, which may not be successful in nonclinical studies or clinical trials, receive regulatory approval or be successfully commercialized” and “Item 3 D. Risk Factors—We depend on collaboration partners to develop and conduct clinical studies with, obtain regulatory approvals for, and market and sell our collaboration product candidates, and if such collaboration partners fail to perform as expected, or are unable to obtain the required regulatory approvals for such product candidates, the potential for us to generate future revenue from such product candidates would be significantly reduced and our business would be significantly harmed.”VISEN.

If our contract manufacturers cannot successfully manufacture material that conforms to our specifications and the strict regulatory requirements of the FDA or similar regulatory authorities, they will not be able to secure and/or maintain regulatory approval for their manufacturing facilities. In addition, we have no control over the ability of our contract manufacturers to maintain adequate quality control, quality assurance and qualified personnel. If the FDA, the Competent Authorities of the Member States of the EEA, or a similar regulatory authority does not

approve these facilities for the manufacture of our product candidates or if it withdraws any such approval in the future, we may need to find alternative manufacturing facilities, which would significantly impact our ability to develop, obtain regulatory approval for or market our product candidates, if approved.

We rely on our manufacturers to purchase fromthird-party suppliers the materials necessary to produce our product candidates for our clinical studies. Any significant delay or discontinuation in the supply of such materials would delay completion of our clinical studies or clinical studies conducted by our collaboration partners who rely on us for supply, and harm our business.

There are a limited number of suppliers for raw materials that we use to manufacture our drugs, and there may be a need to identify alternate suppliers to prevent a possible disruption of the manufacture of the materials necessary to produce our product candidates for our clinical studies, and, if approved, ultimately for commercial sale. We do not have any control over the process or timing of the acquisition of these raw materials by our manufacturers. Although we generally do not begin a clinical study unless we believe we have on hand, or will be able to manufacture, a sufficient supply of a product candidate to complete such study, and we currently envision that Visen,VISEN, who relies on us for clinical supply of our product candidates, would do the same, any significant delay or discontinuity in the supply of a product candidate, or the raw material components thereof, for a clinical study due to the need to replace athird-party manufacturer could considerably delay completion of our or Visen’sVISEN’s clinical studies, product testing, and potential regulatory approval of our product candidates, which could harm our business and results of operations.

Any inability to obtain suppliers, including an inability to obtain, or delay in obtaining, approval of a supplier from the Competent Authorities of the Member States of the EMA, the FDA or other regulatory authorities, would delay or prevent the clinical development and commercialization of our product candidates, and could impact our ability to meet supply obligations to collaboration partners for the development of, or future marketing and sale, of our product candidates.

If product liability lawsuits are brought against us, we may incur substantial liabilities and may be required to limit commercialization of our product candidates.

Our business exposes us to potential product liability risks which are inherent in research and development, preclinical and clinical studies, manufacturing, marketing and use of our product candidates. For example, we may be sued if any product we develop allegedly causes injury or is found to be otherwise unsuitable during product testing, manufacturing, marketing or sale. Any such product liability claims may include allegations of defects in manufacturing, defects in design, a failure to warn of dangers inherent in the product, negligence, strict liability, and a breach of warranties. Claims could also be asserted under state consumer protection acts. Product liability claims may be expensive to defend and may result in judgmentsjudgements against us which are potentially punitive. If we cannot successfully defend ourselves against product liability claims, we may incur substantial liabilities or be required to limit commercialization of our product candidates. Even successful defense would require significant financial and management resources. Regardless of the merits or eventual outcome, liability claims may result in:

decreased demand for our product candidates;

injury to our reputation;

withdrawal of clinical trial participants;

costs to defend the related litigation;

a diversion of management’s time and our resources;

substantial monetary awards to trial participants or patients;

regulatory investigations, product recalls or withdrawals, or labeling, marketing or promotional restrictions;

loss of revenue; and

the inability to commercialize orco-promote our product candidates.

It is generally necessary for us to secure certain levels of insurance as a condition for the conduct of clinical studies. We believe that our product liability insurance for clinical studies is sufficient to cover claims. We currently maintain liability insurance with certain specified coverage limits. We cannot be certain that the insurance policies will be sufficient to cover all claims that may be made against us. Our inability to obtain and maintain sufficient product liability insurance at an acceptable cost and scope of coverage to protect against potential product liability claims could prevent or inhibit the commercialization of any products we develop. We currently carry product liability insurance covering use in our clinical trials in the amount of $20 million in the aggregate on our primary insurance policy and $40 million in the aggregate on our excess insurance policy. Any claim that may be brought against us could result in a court judgmentjudgement or settlement in an amount that is not covered, in whole or in part, by our insurance or that is in excess of the limits of our insurance coverage. Our insurance policies also have various, limits, exclusions and deductibles, and given these various limits, exclusions and deductibles, we may be subject to a product liability claim for which we have no coverage. We will have to pay any amounts awarded by a court or negotiated in a settlement that exceed our coverage limitations or that are not covered by our insurance, and we may not have, or be able to obtain, sufficient capital to pay such amounts. Moreover, in the future, we may not be able to maintain insurance coverage at a reasonable cost or in sufficient amounts to protect us against losses. Product liability insurance is expensive, difficult to obtain and may not be available in the future on acceptable terms.

We will need to significantly increase the size of our organization and we may have difficulties in managing our growth and expanding our operations successfully.

As of December 31, 2019,2020, we had 330482 full-time employees worldwide, with key facilities in Denmark, Germany, and the United States. As we and/or our collaboration partners advance our product candidates through the development and commercialization process, we will need to expand managerial, operational, financial and other resources to manage our operations, preclinical and clinical trials, research and development activities, regulatory filings, manufacturing and supply activities, and any marketing and commercialization activities or contract with other organizations to provide these capabilities for us. As operations expand, we expect that we will need to manage additional relationships with various collaboration partners, suppliers and other organizations. Our ability to manage our operations and growth requires us to continue to improve our operational, financial and management controls, reporting systems and procedures across a global organization. Such growth could place a strain on our administrative and operational infrastructure. We may not be able to make improvements to our management information and control systems in an efficient or timely manner and may discover deficiencies in existing systems and controls. Our management, personnel, systems and facilities currently in place may not be adequate to support this future growth. Our need to effectively execute our growth strategy requires that we either internally, together with our collaboration partners or through third partythird-party contractors, as applicable:

expand our general and administrative functions;

identify, recruit, retain, incentivize and integrate additional employees;

manage our internal development efforts effectively while carrying out our contractual obligations to third parties;third-parties;

establish and build a marketing and commercial organization; and

continue to improve our operational, legal, financial and management controls, reporting systems and procedures.

If we are not able to attract, retain and motivate necessary personnel to accomplish our business objectives, we may experience constraints that will significantly impede the achievement of our development objectives, our ability to raise additional capital and our ability to implement our business strategy.

We incur significant costs as a result of operating as a public company, and our management devotes substantial time to compliance initiatives. We may fail to comply with the rules that apply to public companies, including Section 404 of theSarbanes-Oxley Act of 2002, which could result in sanctions or other penalties that would harm our business.

We incur significant legal, accounting and other expenses as a public company, including costs resulting from public company reporting obligations under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and regulations regarding corporate governance practices. Our senior management and other personnel need to devote a substantial amount of time to ensure that we maintain compliance with all of these requirements. Moreover, the reporting requirements, rules and regulations increase our legal and financial compliance costs and make some activities more time consuming and costly. Any changes we make to comply with these obligations may not be sufficient to allow us to satisfy our obligations as a public company on a timely basis, or at all. These reporting requirements, rules and regulations, coupled with the increase in potential litigation exposure associated with being a public company, could also make it more difficult for us to attract and retain qualified persons to serve on our board of directors or board committees or to serve as members of our senior management, or to obtain certain types of insurance, including directors’ and officers’ insurance, on acceptable terms.

We are subject to Section 404 of TheSarbanes-Oxley Act of 2002, or Section 404, and the related rules of the Securities and Exchange Commission, or SEC, which generally require our senior management and independent registered public accounting firm to report on the effectiveness of our internal control over financial reporting. Beginning with the year ended December 31, 2015, Section 404 requiredrequires an annual management assessment of the effectiveness of our internal control over financial reporting, and beginning with the year ended December 31, 2018, we are required to include an opinion from our independent registered public accounting firm on the effectiveness of our internal controls over financial reporting.