Insurance items that may be reclassified subsequently to profit or loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Gains / (losses) on financial assets measured at FVOCI | | | | | | | - | | | | - | | | | (14,571 | ) | | | - | | | | - | | | | - | | | | - | | | | (14,571 | ) | | | - | | | | (14,571 | ) | | | | | | | | | | | | | | Gains / (losses) transferred to income statement on disposal of financial assets measured at FVOCI | | | | | | | - | | | | - | | | | 488 | | | | - | | | | - | | | | - | | | | - | | | | 488 | | | | - | | | | 488 | | | | | | | | | | | | | | | Insurance finance expenses / (income) | | | | | | | - | | | | - | | | | 18,680 | | | | - | | | | - | | | | - | | | | - | | | | 18,680 | | | | - | | | | 18,680 | | | | | | | | | | | | | | | Reinsurance finance income / (expenses) | | | | | | | - | | | | - | | | | (4,672 | ) | | | - | | | | - | | | | - | | | | - | | | | (4,672 | ) | | | - | | | | (4,672 | ) | | | | | | | | | | | | | | Changes in cash flow hedging reserve | | | | | | | - | | | | - | | | | (241 | ) | | | - | | | | - | | | | - | | | | - | | | | (241 | ) | | | - | | | | (241 | ) | | | | | | | | | | | | | | Income tax relating to items that may be reclassified | | | | | | | - | | | | - | | | | 108 | | | | - | | | | - | | | | - | | | | - | | | | 108 | | | | - | | | | 108 | | | | | | | | | | | | | | Items that may be reclassified subsequently to profit or loss: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Gains / (losses) on financial assets measured at FVOCI | | | | | | | - | | | | - | | | | (1,703 | ) | | | - | | | | - | | | | - | | | | - | | | | (1,703 | ) | | | - | | | | (1,703 | ) | | | | | | | | | | | | | | Gains / (losses) on disposal of financial assets measured at FVOCI | | | | | | | - | | | | - | | | | 58 | | | | - | | | | - | | | | - | | | | - | | | | 58 | | | | - | | | | 58 | | | | | | | | | | | | | | | Changes in cash flow hedging reserve | | | | | | | - | | | | - | | | | 49 | | | | - | | | | - | | | | - | | | | - | | | | 49 | | | | - | | | | 49 | | | | | | | | | | | | | | | Movements in foreign currency translation and net foreign investment hedging reserves | | | | | | | - | | | | - | | | | (174 | ) | | | (20 | ) | | | 320 | | | | - | | | | - | | | | 125 | | | | 12 | | | | 137 | | | | | | | | | | | | | | | Equity movements of joint ventures | | | | | | | - | | | | - | | | | - | | | | - | | | | (35 | ) | | | - | | | | - | | | | (35 | ) | | | - | | | | (35 | ) | | | | | | | | | | | | | | Equity movements of associates | | | | | | | - | | | | - | | | | - | | | | - | | | | 2 | | | | - | | | | - | | | | 2 | | | | - | | | | 2 | | | | | | | | | | | | | | | Disposal of group assets | | | | | | | - | | | | - | | | | 14 | | | | - | | | | 135 | | | | - | | | | - | | | | 149 | | | | - | | | | 149 | | | | | | | | | | | | | | | Income tax relating to items that may be reclassified | | | | | | | - | | | | - | | | | 345 | | | | - | | | | (12 | ) | | | - | | | | - | | | | 333 | | | | - | | | | 333 | | | | | | | | | | | | | | Discontinued operations that may be reclassified3) | | | | | | | - | | | | - | | | | (315 | ) | | | - | | | | (14 | ) | | | - | | | | (16 | ) | | | (344 | ) | | | - | | | | (344 | ) | | | | | | | | | | | | | | Other | | | | | | | - | | | | 40 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 40 | | | | (0 | ) | | | 40 | | | | | | | | | | | | | | Total other comprehensive income / (loss) | | | | | | | | | | Our strategy and value creation

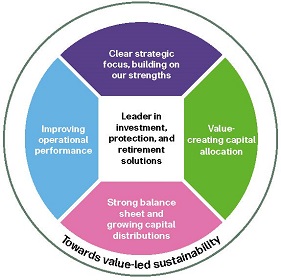

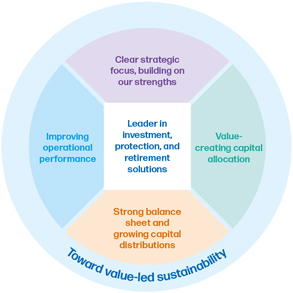

| | | | | | | | | | | building on our strengths

We have identified several areas of our business in our different markets, together with corresponding actions, that will best contribute to profitable growth and create value for our customers, shareholders, and other stakeholders in the years ahead.

In the United States, the largest of our core markets, we aim to harness the current market dynamics that play into the historical strengths and presence of Transamerica. Our Workplace Solutions division is well positioned for growth in terms of volume and earnings, and we will further invest in growth with a focus on small andmid-sized

employers. The Individual Solutions division will invest in selected individual life, accumulation, and investment products and leverage our strong distribution capabilities in this large market.In the Netherlands, following the transaction with a.s.r., the combined group will have a leading position in the Dutch pension market, become the market leader in disability insurance, and the number three player in property and casualty insurance. Furthermore, it will have enhanced scale in the origination and servicing of Dutch mortgages.

In the United Kingdom, where we are a market leader in workplace solutions and financial advice platforms, we aim to sharpen our competitive edge by improving the digital experience for customers, advisors, and employers.

We regard our global asset manager as an important contributor to realizing our strategy, and we aim to advance its growth. We are moving toward a globalnew-technology

platform to drive expenses down and make Aegon AM more scalable and client-focused.In Aegon’s growth markets, we will continue to expand our businesses by making the most of the scale and untapped potential of these regions. Our strong local partnerships are key to this ambition. In Spain & Portugal, for instance, we continue to grow the business via our long-standing bancassurance partnership with Banco Santander. We will invest further in China and Brazil, where we aim to generate growing volumes and earnings, including by expanding distribution.

One of Aegon’s most important resources is the deep knowledge and expertise of its global workforce. We have a clearly defined workforce strategy and culture, through which we aim to preserve and develop our human and intellectual capital. Strong leadership is at the heart of this approach. In line with our strategy, regular talent reviews now take place with every Aegon leader to ensure their competencies and skillsets directly support their assignment in their respective business unit. More widely, we are stepping up our efforts to develop our people, hire new talent where appropriate, and invest in execution capabilities and skills. Intensifying the organizational rhythm in this way allows Aegon to shift to a high-performance culture.

Our expertise and capabilities travel across our markets, as what works for one region or customer group can also work well in another. A key focus of our strategy is therefore to leverage business synergies across our company and our different markets. For example, the link between our Strategic Assets and our global asset manager is strong. Likewise, Aegon AM’s teams strive to deliver strong investment returns, to support the sound and effective management of the large back books of our Financial Assets. Clear strategies and decisive actions will make these connections even stronger and more powerful in the years ahead.

We implemented the concept of “accountability within a clear framework,” which enables faster decision-making and provides clear accountabilities. Within this model, Aegon Group outlines strategy, allocates capital, defines risk appetite, sets targets, and drives strategy implementation. In addition, Aegon takes a centralized approach to determine functional mandates, set policies and frameworks, and provide shareholder services. Our business units develop local strategies and operating plans within the company’s strategic framework and ensure their implementation.

| | | | | | | | | | | Aegon Annual Report on Form 20-F | | | |

|

| | | | |

| | Governance and risk management Financial information Non-financial information

| | | | | | | | | | |

Strong balance sheet and growing capital distributions

We maintain a strong balance sheet to be able to focus our time and energy on increasing our return on capital and the return of capital to shareholders. We have a clear capital management policy in place that informs our capital deployment decisions. The capital deployment of the company is driven by the Cash Capital at Holding and is supported by reliable remittances from the units. To strengthen our balance sheet, reduce our risk profile, and make Aegon more resilient, we have reduced our gross financial leverage to its target range.

In 2022, Aegon finalized the transaction to divest its Hungarian and Turkish operations, providing financial flexibility to reduce its financial leverage through a successful debt tender offer. In addition, we returned surplus cash capital to our shareholders via a EUR 300 million share buyback executed in three tranches over 2022.

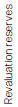

Meanwhile, Aegon continued to pursue a range of actions to strengthen its capital position and reduce the volatility of the company’s solvency ratios. These included updating the valuation of certain life insurance reserves in the United States in the second quarter of 2022. This action, which was enabled by a multi-year model enhancement program, significantly strengthened Transamerica’s capital position. In addition, Aegon has freed up capital by reinsuring the universal life portfolio of Transamerica Life (Bermuda), our Asianbusiness, to Transamerica. To further reduce its risk exposure, in 2022 Aegon successfully completed alump-sum

buy out program for certain variable annuity policies in Transamerica. Furthermore, Aegon achieved its extended target of USD 450 million rate increases for long-term care policies and will continue to work to get pending and future actuarially justified rate increases approved.We continue to take actions to maximize the value of our Financial Assets. Based on extensive analysis, we have concluded that the best option with respect to the US variable annuity portfolio is to continue to own and actively manage it, at least in the near term. Engagements with third parties, and the extensive work undertaken, provide confidence in Aegon’s actuarial assumptions, hedging strategy, and approach to managing the portfolio. The dynamic hedging program, which we expanded in 2021 to include all variable annuity guarantees, continued to perform well in difficult markets during 2022 with a hedge effectiveness ratio of 97%. To further reduce the volatility of the capital position for regulatory reporting, we have decided to establish a voluntary reserve to

better

align the recognition of fees on the variable annuities base contract with when they are earned.

Aegon’s dividends are typically expected to grow in line with sustainable free cash flows. Additional capital deployment

| Improving operational performance

In 2020, we began taking concrete steps to transform the company to improve our long-term performance and ensure we continue to create value for our customers, shareholders, and other stakeholders. We have executed a rigorous and granular company-wide operational improvement plan that comprised 1,199 specific initiatives. The aim of the plan was to improve Aegon’s operating performance by reducing costs, expanding margins, and growing profitably. Of the 1,199 initiatives executed between the launch of the operational improvement plan in 2020 and the end of 2022, 921 were related to expense savings.

As ofyear-end

2022, the operational improvement plan has resulted in an operating result uplift of EUR 627 million outperforming our expectations one year earlier than expected. Compared with the base year 2019, Aegon recorded a benefit from expense initiatives of EUR 366 million, or 92% of the savings targeted for 2023. Growth initiatives contributed EUR 262 million to the operating result. This is well above our target, and required less additional expenses than originally envisaged. As a result, Aegon achieved a greater net reduction in expense savings than the company had targeted.Given the overall success of the program, and in light of upcoming changes to the group’s structure and reporting due to the transaction with a.s.r., Aegon has decided to close out the reporting on the operational improvement program. At the same time, improving efficiency, and driving commercial momentum remain key focus areas for Aegon going forward.

|

decisions will consider our deleveraging target, as well as planned management actions to improve andde-risk

the company.We remain disciplined in our management of capital, and any surplus cash flows that are not used for value-added growth opportunities will be returned to shareholders over time, as demonstrated by the share buyback program executed in 2022. Following the completion of the transaction with a.s.r.,Aegon anticipates that it will return EUR 1.5 billion of the cash proceeds to shareholders, barring unforeseen circumstances, to offset the dilutive effect of the transaction on free cash flow per share. Furthermore, the company intends to reduce its gross financial leverage by up to EUR 700 million.Maintaining a strong balance sheet is a prerequisite for Aegon to achieve its vision and its sustainability ambitions. It allows us to build leading, advantaged businesses in our core and growth markets that can actively contribute to a healthier, more equitable society, and create value for our customers and wider stakeholder base in line with our purpose.

| | | | | | | | | | | Aegon Annual Report on Form 20-F | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Total comprehensive income / (loss) for 2022 | | | | | | | | | | | | | Our strategy and value creation

| | | | | | | | | | |

Aegon has a unique opportunity, and responsibility, to help create a healthy, equitable world. Our approach to sustainability is key to helping people live their best lives and protecting the future for all of us. We believe we have a responsibility to be part of global efforts to mitigate the threats presented by climate change and to capture the opportunities offered by moving to a more sustainable and equitable world. In 2022, we continued our efforts to integrate sustainability criteria into our products and activities, in line with stakeholders’ expectations. This included the adoption of our Sustainability Roadmap 2025 which will drive lasting value creation for our company and its stakeholders.

Addressing stakeholders’ expectations

At Aegon, we engage with our stakeholders to identify relevant sustainability issues. We consider the potential impact of sustainability issues on our business, as well as the societal and environmental impact we have as an organization in relation to these issues. In 2022, Aegon initiated its first double materiality assessment (DMA1

) as one of the steps toward meeting the requirements of the Corporate Sustainability Reporting Directive (CSRD; see also page 413). The assessment process covered a range of sustainability topics and reconfirmed climate change and inclusion and diversity as the main areas of focus for our sustainability agenda. These two key themes, chosen as our priority themes in 2021, create lasting value for our stakeholders and are areas where we can have an impact through our investments, products, and operations while also minimizing risk for Aegon and our stakeholders. Other material topics, also identified during the double materiality assessment, are included in our wider sustainability approach.Sustainability priority themes

In 2022, we took significant steps toward our ambitions for both our priority themes: climate change and inclusion and diversity. Furthermore, we are integrating these themes into our policies, and taking steps with our responsible investment approach to deliver further progress. This includes engaging with investors and collaborating with industry partners through initiatives such as the Principles of Responsible Investment (PRI; see page 16).

| | | | | | | Aegon’s 2025 climate change commitments:

◆

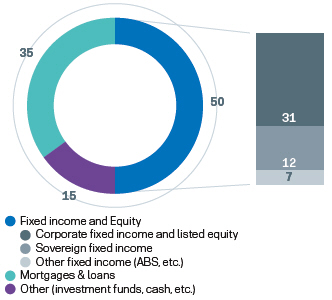

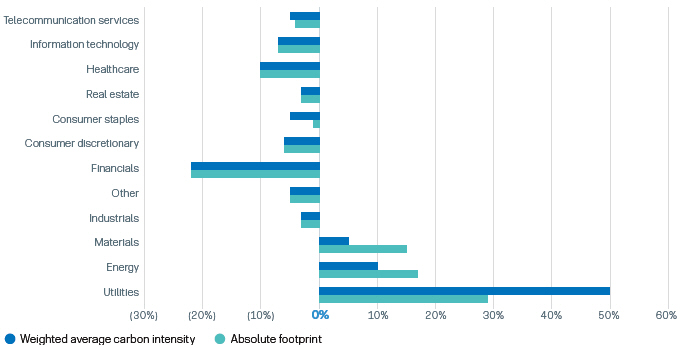

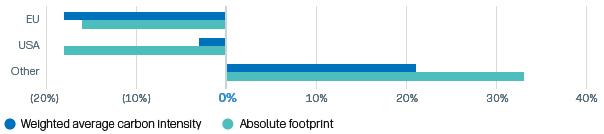

Reduce the weighted average carbon intensity (WACI) of our corporate fixed income and listed equity general account assets by 25% by 2025.◆

Invest USD 2.5 billion in activities to help mitigate climate change or adapt to the associated impacts by 2025.◆

Engage with at least the top 20 corporate carbon emitters in the portfolio by 2025. |

| | | | | 2022 climate performance indicators

◆

Weighted average carbon intensity of our corporate fixed income and listed equity general account assets: 390 metric tons CO2

e/EURm revenue2

◆

20% reduction in WACI against 2019◆

Operational carbon footprint3

16,999 metric tons CO2

e◆

Reduction of operational carbon footprint against 2019: 59%◆

Green electricity purchased: 94% |

Climate change is a topic that has increasing significance for Aegon and its stakeholders. As a diversified financial services business, Aegon is well positioned to support society’s transition to a climate-resilient economy and anet-zero

world through various means. We have opportunities to finance the energy transition and climate resilience through our proprietary investments and responsible investment framework. We also have a responsibility to manage our investments to take account of climate risk. In addition, we offer our customers products that accelerate the path to net zero and have climate resilience built into them. We also take steps to improve our own climate impact by addressing our operational footprint.Net-Zero

Asset Owner Alliance commitmentIn November 2021, Aegon announced its company-wide commitment to transitioning its general account investment portfolio tonet-zero

greenhouse gas (GHG) emissions by 2050. In this context, we joined theNet-Zero

Asset Owner Alliance (NZAOA), aUN-convened

group of institutional investors committed to decarbonization. To drive progress1 | At Aegon, we assess trends and developments on a regular basis to understand how they may impact our business and our stakeholders. We conduct a Business Environment Scan (BES) to identify emerging structural trends, risks, and opportunities with the potential to impact our financial strength and competitive position. Topics and developments identified through the BES are also factored into the Double Materiality Assessment (DMA), initiated by Aegon in 2022. The DMA complements the BES by enabling us to evaluate a range of sustainability-related topics, that have a high impact on Aegon and/or on which Aegon can impact society and the environment.

|

2 | For details on the methodology used, please see our TCFD disclosure (Methodology) on page 427.

|

3 | For details on the methodology used, please see footnote 12 Society: Operational footprint on page 446.

|

| | | | | | | | | | | Aegon Annual Report on Form 20-F | | | |

| | | | |  | | Governance and risk management Financial information Non-financial information

| | | | | | | | | | |

toward our 2050 commitment, we have set various targets, including the reduction of the weighted average carbon intensity (WACI) of our corporate fixed income and listed equity general account assets by 25% by 2025. In 2022, the weighted average carbon intensity of our own investment portfolio’s corporate fixed income and listed equity assets reduced by 20% compared with our 2019 baseline. This is the result of carbon considerations being further integrated into our investment processes, so we are on track to meet our 25% reduction target by 2025.

In line with the NZAOA Target Setting Protocol, at the end of 2022 Aegon added new targets to its overall commitment. These included publicly announcing our ambition to engage with (at least) the 20 biggest GHG emitters in our investment portfolio to encourage them to reduce their footprint. We have also committed to investing to help mitigate climate change or adapt to the associated impacts by 2025. For our climate change commitments, see the Box out Aegon’s 2025 climate change commitments on page 13.

In addition to our NZAOA commitments, Aegon has a number of other sustainability commitments, including to the UN Global Compact (UNGC), the UN Principles for Sustainable Insurance (PSI), and the Principles for Responsible Investment. A list of our commitments is available on page 419 of this report and on our website here:Undertaking regular climate risk analysis is a further key element of our climate-mitigation approach.

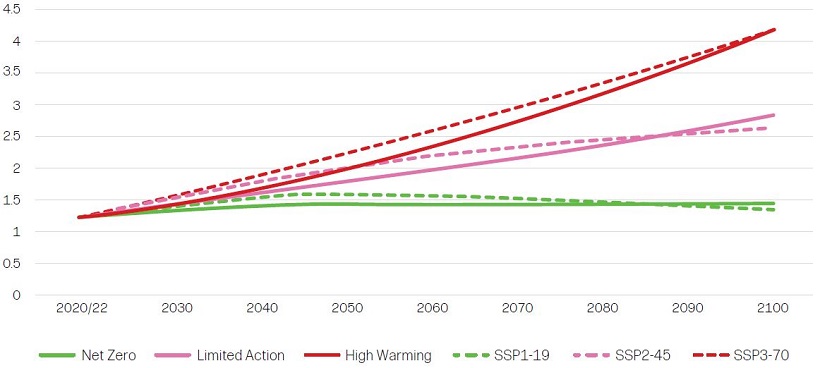

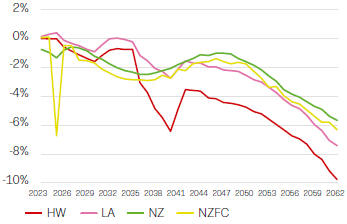

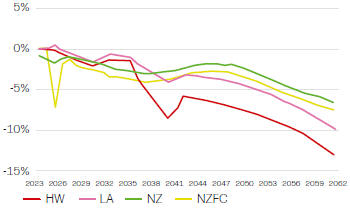

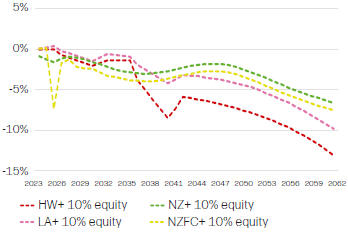

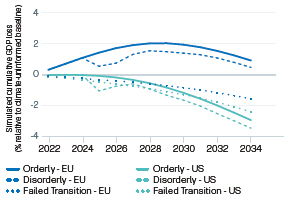

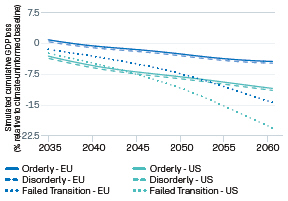

Aegon worked with Ortec Finance for a second consecutive year to conduct an extensive and systematic climate risk assessment for its general and separate account assets across all business units. The analysis investigated three plausible climate pathways (orderly, disorderly, and failed transitions) to explore potential future climate policies, interventions, and consequences of society’s failure to mitigate climate change.

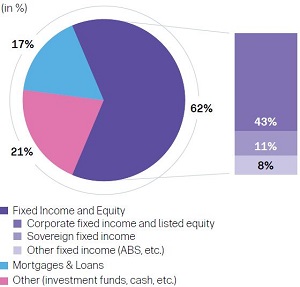

Modeling results continue to indicate that Aegon’s general account portfolio remains resilient against key systemic climate risk drivers across all modeled climate scenarios over a40-year

horizon. This is largely attributed to the high allocation of fixed income assets, which serves to limit the cumulative climate-related impact on returns.Continuing to monitor developments in climate science, policy, technology, regulation, and consumer sentiment will remain critical for understanding and adapting to the future.

Sustainable financial services

We are increasingly integrating sustainability into our product development process, offering sustainable and Environmental, Social, and Governance (ESG)-focused alternatives and considering impact investing for the benefit

of the climate and inclusion and diversity across different product ranges. We also promote active ownership by engaging on topics of climate risk. For example, we encourage the companies in which we invest on behalf of customers to use the Task Force on Climate-related Financial Disclosures (TCFD) guidelines for reporting. Additional information on our responsible investment activities, including recent product launches, is provided in the section on responsible investment on page 16.

In 2022, we expanded our range of sustainability-focused products. In the United Kingdom, we continued the process of transitioning a proportion of default funds to more sustainable strategies by incorporating newESG-focused

funds. We have now transitioned more than GBP 15 billion into such strategies and over 2022 the proportion of core default assets invested in ESG funds increased from 39% to 53%. In addition, we have created ESG “hubs” for customers, advisers, and employers. More widely, we continued to perform our regular customer assessments on sustainability preferences and differentiate how we educate our clients on key sustainability topics.We continue to offer our customers financial services solutions that help address climate issues. As part of its strategy, our mortgage business in the Netherlands, Aegon Hypotheken, is taking steps toward an energy-neutral mortgage portfolio, through which it will only financehomes by 2050. Its customers are able to finance up to 106% of the value of a home, 6% of which can be used toward sustainable improvements. They also receive personalized information through the MyAegon app to help make their homes more sustainable.As a central component of the financial services value chain, at Aegon we see it as our responsibility to work with our distribution and supply chain partners to promote sustainable practices wherever possible. As part of this approach, we strive to work with partners who share our values and can demonstrate accountability in terms of their environmental stewardship and climate mitigation. 50% of Aegon’s top 25 suppliers participate voluntarily in EcoVadis, a business sustainability ratings provider. In addition, we engage with our leading suppliers and distribution partners on sustainability topics ranging from climate change and Aegon’snet-zero

commitments to inclusion and diversity, and governance. Further information on Aegon’s responsible supply chain approach can be found in “Sharing value with our stakeholders” on page 25.In 2022, “Milieudefensie” (Friends of the Earth) published a report rating the climate action plans of 29 major Dutch companies. The report took a critical stance on certain aspects of Aegon’s sustainability ambitions, citing the company’s underperformance versus its peers

| | | | | | | | | | | Aegon Annual Report on Form 20-F | | |

| | | | | | | Our strategy and value creation

| | | | | | | | | | |

on its emission targets and exclusion policy, as well as the transparency of our engagements with investee companies. In response, Aegon engaged in a constructive dialog with “Milieudefensie” to discuss our strategy and approach to sustainability. We also had discussions with a number of other NGOs and interest groups on our sustainability strategy and roadmap.

Reducing our operational carbon footprint

While we do not operate energy- or resource-intensive processes as part of our direct business operations, GHG emissions are generated via the natural gas and electricity used by our facilities. We have therefore set firm targets to reduce the carbon footprint of our operational activities. At the end of 2022, Aegon had achieved a 59% reduction in our operational carbon footprint1 versus the 2019 baseline, putting us well ahead of our goal of a 25% reduction by 2025. Our emissions also fell by 22% on abasis in 2022. The impact of changing work patterns is a significant factor in reducing our facilities’ footprint. Therefore, we will continue to monitor the impact of hybrid working on our carbon footprint.Aegon’s vision for inclusion and diversity is to build a fair and inclusive company, where we overcome obstacles to participation and increase our diversity. Where everyone has a sense of belonging, everyone plays a role in fostering inclusion, and we can all live our best life, in our workplace, our marketplace, and our communities.

As part of our transformation journey, we adopted a company-wide strategy on inclusion and diversity in 2022 and our business units have signed up to our vision. We aim to ensure our policies and actions permeate all parts of the organization, and that our leaders, colleagues, and other stakeholders worldwide can each make an active contribution to building a more inclusive and diverse organization.

Our inclusion and diversity strategy builds on the work undertaken in recent years to develop a consistent and coherent way of working for the whole company.

Two fundamental elements of Aegon’s inclusion and diversity strategy are:

1. | Authentic action

– the recognition that, as an organization, we are on a journey to improve. We need to turn good intentions into actions to create a positive difference for our people and communities.

|

2. | Starting at the top

– the members of Aegon’s senior leadership are expected to act as role models for inclusion and diversity, including by sharing their own inclusion stories and championing a specific area of diversity excellence among employees.

|

| Scope 1 and scope 2 emissions.

|

| | | | | | | | Transamerica’s Employee395

Resource Groups have their say

Around the world, Aegon’s Employee Resource Groups (ERG) play an important role in making sure all employees have a say in the company’s future direction and that their specific needs are met during our transformation program. Our US business, Transamerica, has 12 ERGs, the first of which, the Women’s Impact Network, was launched in 2012.

In 2022, we provided new development opportunities for the leaders of our ERGs. At the start of the year, the leaders of the 12 groups gathered with their executive sponsors for Transamerica’s first annual ERG leader summit to present their annual plans and discuss opportunities forcross-ERG

collaborations. Then, on August 10, the ERG leaders met with Transamerica CEO, Will Fuller, and Aegon CEO, Lard Friese, to discuss their groups’ respective accomplishments, challenges, and opportunities. This was followed by a development workshop featuring Johns Hopkins Carey Business School on “Managing in a Diverse and Global World” and leaders from the 12 Transamerica ERGs. | | | |

In 2022, we appointed a Global Head of Inclusion and Diversity, who joins our Global HR Leadership Team and Global Sustainability Board (GSB). Among other priorities, the appointee is responsible for overseeing progress on Aegon’s I&D ambitions. A specific area of attention is maintaining a healthy gender balance at a senior management level across Aegon’s business units. In the Netherlands, specifically, Aegon is actively taking steps to increase female leadership participation, in line with the “Diversity at the Top” Act, which took effect in January 2022.

Wider progress on inclusion and diversity topics is monitored through Aegon’s Global Employee Survey. The third quarter edition of the survey showed positive increases for two key metrics: 78% of employees responded favorably to a set of questions on openness and inclusion, compared with 74% in the third quarter of 2021, while 76% answered favorably on the topic of diversity and equity, up from 72%.

The specific actions and initiatives Aegon took in 2022 to address inclusion and diversity are detailed in “Sharing value with our stakeholders”, on page 20.

| | | | | | | | | | | Aegon Annual Report on Form 20-F | | | |

| | | | |  | | Governance and risk management Financial information Non-financial information

| | | | | | | | | | |

Responsible investment at Aegon

One of the most significant ways Aegon can have an impact on sustainability topics is via responsible investment. We recognize our responsibility to limit the negative impacts of our investments on society or the environment. We apply this ethos to our own general account investments and use our influence to encourage similar standards in the investment decisions made by our customers. By taking an active approach to responsible investment, we seek to reduce the risks to our business and explore ways to serve the interests of our customers and society at large.

In 2022, Aegon became an asset-owner signatory to the United Nations-convened Principles for Responsible Investment (see below). This commitment prompted us to review the underlying processes of our company-wide Responsible Investment Policy. We are taking steps to refresh the policy, by introducing engagement with asset managers, establishing clearer reporting expectations, and delineating our approach to sustainability topics. For topics such as ESG integration, we take a “do no significant harm” approach whereas this policy will drive proactive steps through targets, engagement, and exclusions. The policy applies to all general account investments where Aegon has full management control.

Key responsible investment activities in 2022

In 2022, the responsible investment landscape continued to evolve rapidly, with climate action as the primary concern and with extensive regulatory change taking place to drive increased transparency, monitor progress, and address greenwashing. We continued to innovate investment solutions through Aegon Asset Management’s active global investment business.

Much of the focus was on managing climate-related risks and accelerating thelow-carbon

transition, areas that are increasingly becoming integral to our investment and stewardship processes. We evolved our Short Dated Investment Grade Bond Fund to focus on the transition to anet-zero

global economy. The fund was renamed as the Aegon Global Short Dated Climate Transition Fund and is classified under Article 8 of the European Union’s Sustainable Finance Disclosure Regulation. It provides clients with a clear targeted approach, including historical and forward-looking analysis, to ensuring their portfolios are aligned with the climate transition andnet-zero

objectives.Our prioritization of responsible investment was further reflected in the steady progress of important capacity building projects during the year. For example, Aegon AM enhanced its ESG materiality framework together with Aegon’s Credit Research team. We also strengthened our policies, procedures, and practices to better align with new disclosure requirements in the European Union.

| | | | | Aegon Asset Management has a Responsible Investment Framework that reflects the key elements of our Responsible Investment Policy, as well as similar policies put forward by Aegon AM’s clients. The framework is structured as follows:

◆

ESG integration

– Material ESG factors are fundamental to our investment decision-making across all Aegon AM portfolios. By integrating ESG considerations into traditional financial analysis, the Aegon AM research team arrives at an independent view of an issuer’s fundamentals.◆

Active ownership

– Aegon actively engages with investee companies to improve their ESG profile and address sustainability issues. We also exercise our shareholder voting rights to support our engagement efforts and enhance long-term value creation for all stakeholders.◆

Solutions

– Aegon AM provides a range of responsible investment solutions to pursue ESG objectives alongside financial returns, based on four categories:1) exclusion-based strategies

3) sustainability-themed strategies

Further information about Aegon Asset Management’s activities can be found in the dedicated Responsible Investment Report published by Aegon AM.

|

| | | | | as a signatory to the Principles

for Responsible Investment

The Principles for Responsible Investment (PRI) is a United Nations-supported international network of financial institutions working together to implement its six aspirational principles. The “Principles” provide ade-facto

industry standard that encourages companies to incorporate ESG issues into their investment practices. In 2022, Aegon became a company-wide signatory to the PRI, joining Aegon AM. Committing to the Principles will help us to align our responsible investment approach with market best practice, enabling us to continue to meet the expectations of our stakeholders. |

| | | | | | | | | | | Aegon Annual Report on Form 20-F | | |

| | | | | | | Our strategy and value creation

| | | | | | | | | | |

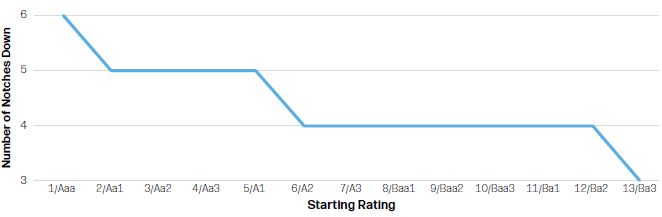

The roadmap and governance to realize our sustainability ambitions

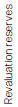

Our sustainability roadmap 2025 sets out the steps we are taking to deliver against our two priority themes of climate change and inclusion and diversity, as well as the other material topics identified through our materiality assessment. Specific colleagues and teams are entrusted with ensuring the milestones of the roadmap are met. The development of the Sustainability Roadmap was overseen by the Global Sustainability Board, which is also responsible for updating the roadmap annually through to 2025 and measuring progress against our targets. 2022 was the first full operational year for Aegon’s company-wide GSB, which was established in November 2021 to enhance governance and oversight of Aegon’s sustainability approach. The Board’s core function is to steer and strengthen the sustainability agenda across Aegon’s country units, elevating sustainable practices across our business operations. The GSB is currently chaired by the Chief Executive Officer (CEO) of Transamerica, Will Fuller.

Governance structure for sustainability at Aegon

In 2022, Aegon established a series of Local Sustainability Boards to guide its sustainability approach in the company’s core country units. The chairs of the respective Boards are also members of the GSB. This governance structure drives delivery of the roadmap and alignment on sustainability across the business, by ensuring that sustainability-related actions and decisions taken at a company level are consistent with those taken across Aegon’s business units, and vice versa.

Enhancing our sustainability reporting program

A key part of assessing the success of our roadmap will be regular reporting against our priority themes and other material topics. In addition, increased sustainability-related legislation and regulation will impact Aegon’s corporate reporting and disclosure requirements. This is particularly the case in the European Union, which has witnessed the accelerated development of new legislation, including the CSRD.

In 2022, we further enhanced our Sustainability Reporting Program, building on the process initiated the previous year. The program aims to meet evolving regulatory requirements, provide data for rating agencies, and support our Sustainability Roadmap and other ESG commitments. Responsibility for sustainability reporting was extended beyond Aegon’s Global Corporate Sustainability Team to include the company’s finance function, which has been tasked with collectingnon-financial

data, establishing processes and controls, and implementing robust reporting tooling.2022 was a transitional year as Aegon took steps to prepare for the forthcoming CSRD requirements. We are proactively makingnon-mandatory

disclosures, and we carried out an inaugural double materiality assessment. Aegon will undertake afollow-up

DMA exercise in 2023 and plans to conduct new assessments biennially, thereby regularly reviewing our list of material topics, capturing valuable stakeholder input, and preparing the company to be fully compliant with the CSRD requirements for the first reporting year 2024.

| | | | | | | | | | | Aegon Annual Report on Form 20-F | | | |

| | | | |  | | Governance and risk management Financial information Non-financial information

| | | | | | | | | | |

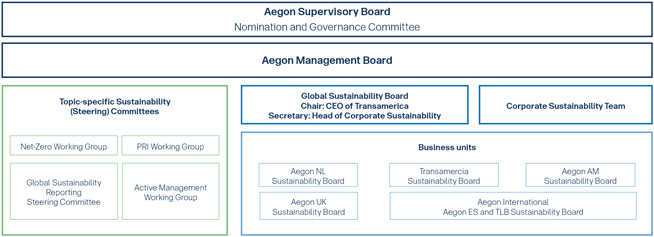

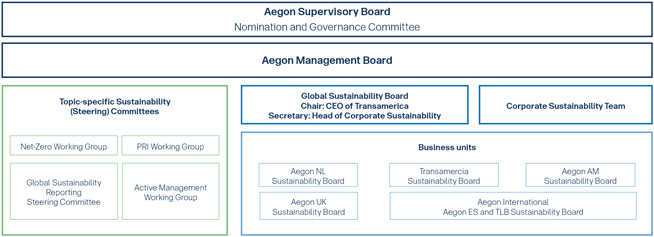

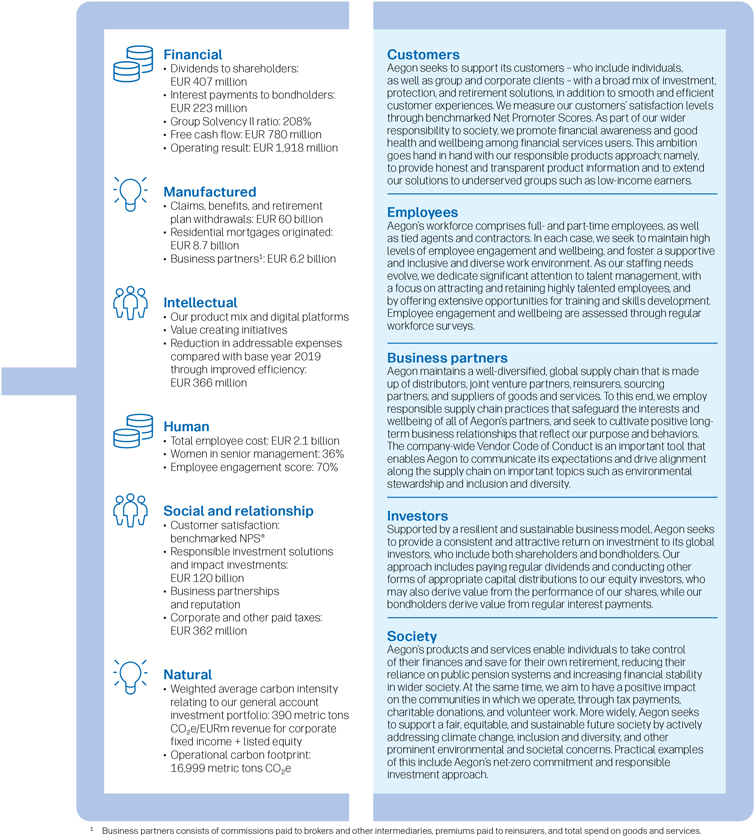

ncial leverage: EUR 5.6 billion • Solvency II Own Funds: EUR 16.3 billion • Solvency II Capital required: EUR 7.8 billion Manufactured • Our product mix and digital platforms • Gross premium income: EUR 14.8 billion • Gross deposits: EUR 194 billion • Fees and commissions received: EUR 2.9 billion • Investment income: EUR 7.3 billion • Revenue-generating investments: EUR 747 billion Intellectual • Internal processes, systems, and controls • Knowledge and expertise Human • Number of employees: 19,087 • Amount spent on training and development: EUR 10.9 million • Talent management • Number of tied agents: 2,475 Social and relationship • Number of customers: 29.5 million • Customer experience programs • Responsible sourcing and investing philosophy • Brand equity, purpose, and values • Relationship with intermediaries, business partners, suppliers, and other key stakeholders (e.g. regulators and NGOs) Natural • Our commitment to achieve net zero in 2050 • Total energy used by company: 55,256 MWh Aegon’s business model [Graphic Appears Here] Solutions development and pricing Development of our financial solutions begins with our customers. We assess their needs and develop products and services to suit. We then estimate and price the risk involved for us as a provider. Distribution Our products and services are then branded and marketed, before being distributed via intermediaries that include brokers, banks, and financial advisors. We also sell to our customers directly. Investments In exchange for products and services, customers pay fees or premiums. On certain pension, savings, and investment products, customers make deposits. We earn returns for Claims our customers and benefits by investing this money. We pay out claims, benefits, and retirement plan withdrawals. We use the remaining funds to cover our expenses, support new investments, and deliver profits to our shareholders. 1 Value creation is the balance of value created, preserved, and eroded.

| | | | | | | | | | | Aegon Annual Report on Form 20-F | | |

| | | | | | | Our strategy and value creation

| | | | | | | | | | |

| | | | | Outcome for our stakeholders

|

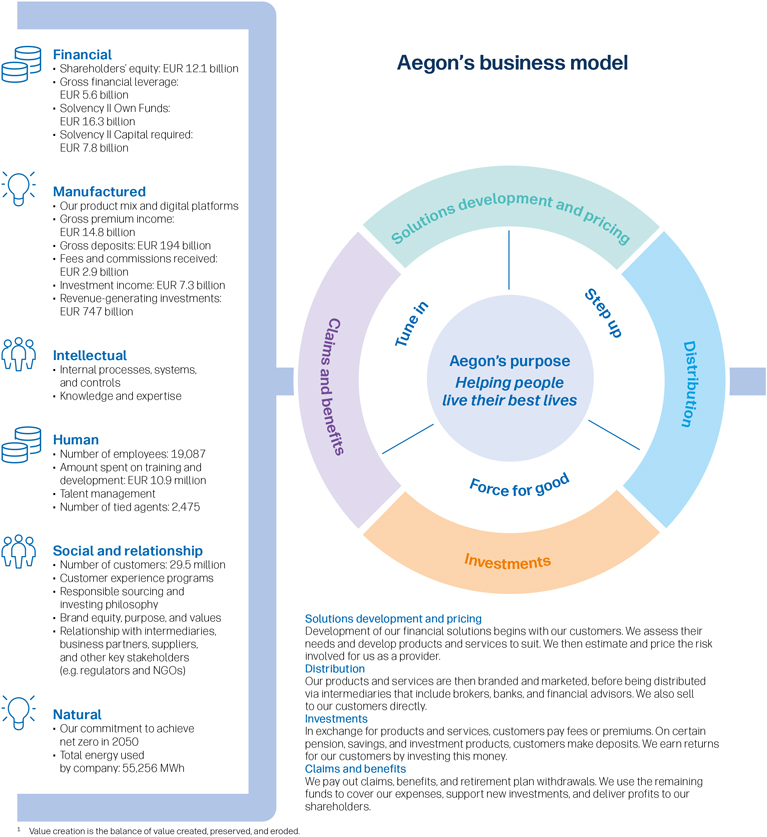

ndividuals to take control of their finances and save for their own retirement, reducing their Natural reliance on public pension systems and increasing financial stability • Weighted average carbon intensity in wider society. At the same time, we aim to have a positive impact relating to our general account on the communities in which we operate, through tax payments, investment portfolio: 390 metric tons charitable donations, and volunteer work. More widely, Aegon seeks CO e/EURm revenue for corporate to support a fair, equitable, and sustainable future society by actively fixed2 income + listed equity addressing climate change, inclusion and diversity, and other • Operational carbon footprint: prominent environmental and societal concerns. Practical examples 16,999 metric tons CO e of this include Aegon’s net-zero commitment and responsible 2 investment approach. 1 Business partners consists of commissions paid to brokers and other intermediaries, premiums paid to reinsurers, and total spend on goods and services.

| | | | | | | | | | | Aegon Annual Report on Form 20-F | | | |

| | | | |  | | Governance and risk management Financial information Non-financial information

| | | | | | | | | | |

At Aegon, our focus is on creating long-term value for a broad range of stakeholders, including our customers, employees, business partners, investors, and society at large. As underpinned by our purpose, strategy, and sustainability approach, we see our business as inherently beneficial to society and people’s lives. We believe the value we create as an organization is widely shared. However, we also recognize that certain decisions and actions can also erode value by having a negative effect on our stakeholders or on the environment. The active identification and management of potentially negative consequences is, therefore, an integral part of our decision-making.

Addressing climate change and inclusion and diversity have been identified by our stakeholders as strategic sustainability priorities for our business in the coming years. Given the complex ecosystem in which we operate, there are a number of additional sustainability-related topics that are material to our business and may influence our ability to create value for our stakeholders.

In the following pages of the report, we describe the impact of many of the material topics on our main stakeholder groups, as well as the actions and decisions we took in 2022 to create and preserve value for each group.

Aegon employs a coordinated approach to address each material topic. For topics that primarily affect specific stakeholder groups, we describe our approach in the relevant section of this part of the report (for example, see “Customers” on page 20 for details of our approach to Responsible products).

As Aegon customers embark on longer and more complex life journeys, we are developing new customer propositions, tools, and solutions to meet their changing needs and expectations. This includes enhancing interactions with all customers, whether intermediaries or end users, through a broad selection of engagement channels and platforms. As well as engaging with our existing customers, we are expanding our reach to underserved individuals and communities, while working to improve financial literacy, education, and awareness in all parts of society.

Enhancing the customer experience

In 2022, we took further steps to meet the changing needs of our growing customer base, with a view to improving customer satisfaction and maximizing attraction and retention. In addition to our focus on product development, we also looked at ways to further enhance the customer experience with an increased selection of (digital) engagement platforms and channels.

In the United States, our Transamerica business operates a Premier Services Group team to provide individual case management support for the most loyal andtop-producing

agents of the World Financial Group (WFG) distribution channel. This team enables agents to handle customer requests more directly and quickly with the help of a dedicated service employee, thereby enhancing the agent’s and the customer’s experience with Transamerica. Furthermore, Transamerica significantly reduced the average wait times and call transfers in its call centers by working closely with an external partner. Transamerica also added new products to the iGOe-App

®

, a digital application making it quicker and easier for agents to apply for life insurance.In the United Kingdom, we also continued to digitalize our customer-facing processes with the launch of a new dashboard to help advisers onboard new clients. The online solution allows advisers to receive and store servicing documents, submit and track applications, and provide a policy start date.

| | | | | | | | | | | Aegon Annual Report on Form 20-F | | |

| | | | | | | Our strategy and value creation

| | | | | | | | | | |

Elsewhere, ourBrazil-based

joint venture MAG Seguros introduced a new platform for managing complaints via Reclame Aqui, the country’s most visited complaints and reputation site. Meanwhile, our Spain & Portugal business unit took further steps to improve the customer journey by redesigning the purchasing process for insurance products to be more personalized and user-friendly. Aegon’s health insurance customers in the region have also received new features, including a telemedicine service that allows policyholders to speak to a doctor from the comfort of their own home.We measure customer satisfaction in our core markets in terms of benchmarked Net Promoter Scores (SM) (NPS®

), which are obtained by surveying customers about their experiences. We aim for scores that are in line with, or above, the average of our industry peers. Aegon’s quality control process for NPS®

, including the approach and methodology, is centrally ensured, while individual business units are responsible for commissioning field studies, monitoring and communicating results, as well as guiding and monitoringfollow-up

actions or improvement programs.In 2022, Aegon’s businesses in its core markets saw mixed NPS outcomes. Our US business, Transamerica, performed in line with the market average, while Aegon UK and Aegon the Netherlands were below the market average.

Despite increasing market-wide customer concerns in the United States, as shown by the decrease in market NPS®

, Transamerica still performed in line with the market average for both life and retirement. In the United Kingdom, the NPS®

outcome was in line with expectations, given service challenges during the year and customer concerns relating to financial market unrest throughout 2022.The NPS®

improvement realized by Aegon the Netherlands in recent years is slowing. Despite an improved customer service experience during the past few years, there is still a lack of emotional connection with the customer, which is even more relevant in these times of economic uncertainty.For further details of Aegon’s NPS®

outcomes, please see page 406 of this Annual Report. | What does financial wellbeing look like to you?

With people living longer, it is time to rethink the traditional industry concept of financial security. In the United Kingdom, Aegon is building on its previous work with the Initiative for Financial Wellbeing and Edinburgh University, by advancing research on the topic of financial wellbeing.

Our conclusion is that being financially well is about more than just money; to live their best life, people also need to take steps to improve their financial mindset. For example, the research shows that the more clearly someone can visualize their future financial status, the more likely they are to achieve the kind of retirement they want. We have therefore identified 10 different building blocks that contribute to an individual’s financial wellbeing:

◆

Money building blocks: income, long-term savings, a strong safety net, debt, assets◆

Mindset building blocks: happiness, future self, written plans, social comparisons, long-term perspectiveA series of customer-focused applications are being designed around these concepts. In 2022, we began developing the second iteration of the Future Self Tool, which helps future retirees envisage what life will look like after retirement. Aegon UK also updated its website with articles, podcasts, and other informative content on the subject of financial wellbeing.

|

| | | | | | | | | | | Aegon Annual Report on Form 20-F | | | |

| | | | |  | | Governance and risk management Financial information Non-financial information

| | | | | | | | | | |

Reaching more customers through responsible products

At Aegon, our purpose ofHelping people live their best lives

extends to the many, not the few. We aim to help all customers enjoy a long, healthy, fulfilling life, including individuals such aslow-income

earners, who have traditionally been underserved by the financial services industry. Around the world, we have dedicated policies in place to protect vulnerable customers. These go hand in hand with our strict processes for product development and lifecycle management, to ensure that the products we design meet the specific needs of our customers. We also focus on distribution. Through our partnership with World Financial Group, we serve customers in the US market who include first- or second-generation immigrants who may require financial advice in their native language.At the same time, we recognize we can do more to be more inclusive in our product offering, and provide a broader range of responsible investment and protection solutions. As part of our Sustainability Roadmap 2025, we will conduct further research to determine how we can better serve our customers with responsible solutions and translate our findings into new or existing propositions.

The events of 2022 further underlined the importance of our responsible products approach, as high inflation and the rising cost of living began to have an impact on consumers in our core and growth markets. At the start of the year, WinSocial, our Brazilian insurtech platform, presented its expanded portfolio of life micro-insurance products aimed at customers typically penalized or excluded by the insurance market due topre-existing

health conditions. As well as diabetes patients, the new portfolio also covers people with HIV, hypertension, and obesity, as well as those with a history of breast, prostate, andnon-melanoma

skin cancer.In the Netherlands, we continued to offer a “bespoke service” for customers experiencing difficulties paying their mortgage, which aims to help people identify the root cause of their financial issues. Aegon the Netherlands also continued to offer flexibility to mortgage customers experiencing challenging life circumstances, such as divorce, gaps in their state pension, or the death of a loved one. Meanwhile, we increased the accessibility of our Dutch digital banking platform, Knab, by extending our investing service to include self-employed individuals and by introducing a “workation” insurance product for entrepreneurs looking to take time out from their careers.

The success of Aegon’s responsible products approach is measured by the company’s ability to provide transparent product information in line with industry regulation. The sustainability performance indicator we use in relation to this material topic is the number of significant fines we receive in relation to themis-selling

of products. In 2022, no significant fines were imposed on Aegon.Promoting financial awareness, and health and wellbeing

Communication is an important driver of quality customer relationships at Aegon. Furthermore, providing clear and transparent information directly supports our approach to responsible products, by making it easier for people everywhere to engage with products and services that can support their financial health, together with their wider wellbeing.

At the end of 2022, the US Congress passed two important pieces of legislation intended to enhance financial awareness and encourage retirement savings. The first, the SECURE 2.0 Act, is a broadly supported package of retirement-related reforms primarily aimed at encouraging small business owners to offer qualified retirement plans to their employees either through pooled plan arrangements or individual plans. Transamerica is a leading record keeper of pooled plan solutions and is optimistic that this legislation will result in more people saving for their financial futures.

The second, the Registered Index Linked Annuity Act (RILA), requires the Securities and Exchange Commission to finalize a RILA-specific registration statement that should allow issuers like Transamerica to register new products and changes to existing products more quickly and provide consumers with more tailored product disclosures.

In the Netherlands, the new style defined contribution pension provider, Aegon Cappital, organized webinars to help pension plan participants get to know the business and better understand the workings of Aegon’s pension schemes. Furthermore, our Transamerica Employee Benefits business launched an email-based wellness campaign to help intermediary customers, including brokers and employers, engage with company employees on relevant issues. Topics included strategies for people to improve their financial wellbeing and overall health, as well as advice regarding health screenings and wellness benefit riders, and filing health insurance claims.

A further focus during the year was on helping existing and prospective Aegon customers to develop their general financial literacy and their understanding of issues with the potential to impact their long-term financial security.

In 2021, Aegon acquired Pension Geeks, aUK-based

educational platform aimed at fostering engagement with financial topics. 2022 saw the launch of Pension Geeks TV and a new financial education platform. Pension Geeks also facilitates Pension Awareness Week, an industry-wide event aimed at promoting the importance of pensions and investing. | | | | | | | | | | | Aegon Annual Report on Form 20-F | | |

| | | | | | | Our strategy and value creation

| | | | | | | | | | |

Aegon’s success depends on maintaining a skilled, motivated, andpurpose-led

workforce. Our employees are the starting point for how we add value to our stakeholders and realize our purpose. In an evolving operating landscape, our focus is on helping our people develop themselves and adapt to the changing world around us. At the same time, we are working to build an inclusive and diverse workplace culture in which people can be their true selves, and that reflects the diversity of the communities we serve.Engaging our global (hybrid) workforce

Maintaining an engaged and aligned workforce remained a top priority in 2022, as our organization continues to change shape due to our transformation program, as well as the ongoing transition to hybrid working. Over 2022, our employee engagement increased by two points to 70%. This is driven by significant improvements in areas previously identified as drivers for engagement, one of which is leadership. Employees increasingly experience that leaders have a vision for the company and see leaders role-modeling the vision. As a result the outcome for “Leadership” increased by four points against the previous year to 61%.

The introduction of our new purpose greatly contributed to providing employees with vision and perspective. At the start of the year, we introduced the new purpose to all employees via a company-wide virtual launch event. Our next step was to help our teams and country units around the world embed the purpose, along with our accompanying Best Life behaviors (see the box out Our Best Life behaviors on page 23), in their respective work practices and programs. As part of our Perform and Develop cycle, employees set self-development goals that require them to address a specific behavior and reflect on their progress at the end of the year. The identified behaviors also provide the foundation for our renewed recognition program, with colleagues encouraged to recognize peers who embody the behaviors in theiractivities.In our regular employee surveys, we also track how our culture is developing. In the third-quarter 2022 edition of the survey - only nine months after the launch - 71% of Aegon employees agreed that they know what the new purpose and behaviors are.

| ◆

We serve a diverse, ever-changing world and work tirelessly to stay relevant◆

We are curious and never stop learning from our customers, each other, and the wider world◆

We ensure all people around us feel seen, heard, and valued◆

We are a company of ambitious, positive problem-solvers who get things done◆

We excel by committing, following through, and finishing what we start◆

We are a team, not a group of individuals.Collaboration is our life force◆

It is our duty to leave things better than we find them◆

We speak up, ask for help, and think before we act◆

We prove our integrity daily, through our words and actions |

In 2022, the easing of theCOVID-19

pandemic throughout much of the world enabled Aegon to reopen many of its locations. We have embraced hybrid working as we believe it helps our people to have a full professional life. A healthy balance between working in and out of the office helps us to stay tuned in and perform at our best. To help people adjust back to a life that also includes the office, we strengthened our hybrid working model, which now offers people specific guidance and advice according to their role.Recent survey results show that 90% of Aegon employees feel they are working productively as part of the new hybrid way of working. Also important is that within the new way of working, the sense of wellbeing is improving. With an increase of five points over the year, employees are increasingly feeling that their stress levels are manageable. Given that there remains a discrepancy between the percentage of people who have positive experiences working remotely (93%) versus working in the office (67%), we continue to explore ways to make the office an engaging and impactful place to be.

To that end, employees are encouraged to use their time in the office in ways that directly support business objectives. Aegon’s leaders are also asked to be a visible and accessible presence in the office wherever possible. In all locations and offices, a wide variety of events and opportunities are created to maintain and strengthen connections and collaboration.

| | | | | | | | | | | Aegon Annual Report on Form 20-F | | | |

| | | | |  | | Governance and risk management Financial information Non-financial information

| | | | | | | | | | |

Toward the end of 2022, the announcement that Aegon will combine its Dutch businesses with a.s.r. was particularly felt by employees in the Netherlands, Asset Management, and Corporate Center. Given time to absorb these changes, the power of the combination is widely recognized by employees. For individuals, the changes inevitably lead to uncertainty which is why there is a strong focus on communications and a commitment to bring clarity where and when we can. At the same time, disentangling the Dutch businesses and managing the transition to a.s.r. creates unique professional opportunities for people at all levels.

A focus on talent management

Across Aegon, a further priority remained equipping people with the necessary capabilities and leadership skills to support Aegon’s transformation journey and meet the changing needs of the business. A focus on people development is also key to employee engagement. Employees increasingly see career development opportunities for themselves at Aegon, reflected in a 5 points increase in 2022. In spite of the increase, we still score below benchmark and we will continue our focus in 2023. During 2022, senior leaders took part in the Best Life Leadership program, which aims to provide leaders with the inspiration, challenge, and support they need to steer the organization and its people in living Aegon’s purpose and behaviors. In the United Kingdom, we introduced a new program to help colleagues with the ambition of becoming a people manager. So far, of 97 participants of the Aspiring Managers Program, 34% have stepped into a managerial role since participating in the program.

We also completed our employee-focused capability-building program, Ability2Execute, which aims to help people develop essential implementation capabilities and skills. Worldwide,one-third

of all Aegon employees have taken part in the program, which provides people with virtual learning sessions on a wide range of professional development topics, including effective prioritization, structured communications, and change management.In an increasingly challenging labor market, the need to attract, retain, and develop high-quality talents has become all the more important in 2022. In the United States, Transamerica expanded its university relations and internship programs. The number of interns taking part in these programs grew from 115 in 2021 to 160, while the proportion of participants taking up positions with Aegon on completing their internship doubled from 15% in 2021 to 30% in 2022. We also sponsored the introduction of new technical programs at local universities, to help drive the awareness of our brand on campus.

| | | | | | | | | | | | At Aegon, we believe that mentoring plays a key role in building an inclusive culture. Experience shows us that when employees experience mentorship from peers, they are more likely to feel included at work regardless of formal inclusion systems in place.

In early 2022, Aegon Asset Management launched Aegon’s first digital mentoring platform as a pilot for colleagues globally. The platform is open to all Aegon AM employees, who can join as a mentor or mentee, or both, with some 300 employees taking part within the first six months of launch. It has helped colleagues identify strengths and areas for development, lead change, and cope with difficult situations, and helped to prepare aspiring leaders of the business.

| | |

Building an inclusive and diverse organization

At Aegon, we are working to build an inclusive and diverse culture that encompasses all aspects of the employee experience, starting with talent attraction. In recent years, specific attention has been directed toward addressing the gender imbalances that persist in financial services. In 2022, Aegon’s country units continued to refine their hiring practices with a focus on inclusive recruitment, through gender-balanced candidate slates and interview panels. Furthermore, Aegon Asset Management continued to develop its partnerships with early careers programs, such as Girls are Investors and Investment 20/20, with a focus on creating a more inclusive investment industry. Aegon AM also took part in the launch of the Future Female Fund Managers Programme, aUK-led

initiative to address female under-representation in fund management.During the year, Aegon UK also set a long-term gender-diversity target to achieve a 50:50 gender split at all levels of the business, and helped to launch the Accelerating Change Together (ACT) research program organized by Women in Banking and Finance (WIBF). For year one of ACT, the focal point was the “Missing Middle,” a research program exploring the lack of a strong female talent pipeline into senior financial services roles. Subsequent findings have led to the development of the GOOD FINANCE Framework to help companies create a more supportive work environment for their employees. Aegon UK is currently implementing several of the Framework’s recommendations, including encouraging flexible and autonomous working styles and helping managers to develop an empathetic and inclusive leadership style.

| | | | | | | | | | | Aegon Annual Report on Form 20-F | | |

| | | | | | | Our strategy and value creation

| | | | | | | | | | |

Indeed, people development plays a central role in shaping a more inclusive culture at Aegon. In 2022, Aegon AM extended its Inclusive Leadership training program, with 150 senior leaders from across the business taking part in specialized development, while education on inclusion and diversity was made mandatory for all existing employees as well as new joiners. The company also launched a program to educate people on the differences between national cultures, to enhance collaboration between international colleagues. Transamerica invested in developing employee resource groups (ERGs; see Sustainability, page 15), in keeping with the approach taken in Aegon’s other core markets.

More generally, as our workforce and communities become more diverse, at Aegon we are taking steps to create a more inclusive and supportive environment for our employees. In 2022, Aegon the Netherlands expanded its employee leave policies. All employees in the Netherlands are now entitled to the various types of care leave set forth in the Dutch “Work and Care Act” (WAZO). Furthermore, they are allowed to exchange up to two Dutch national holidays per year for holidays befitting their specific religious or cultural background, such as Eidal-Fitr,

Chinese New Year, or Passover. During the year, Aegon AM also introduced gender-neutral parental leave for itsUK-based

employees.In the United States, we underlined our commitment to fostering racial equality in our local communities by donating to relevant causes via the Transamerica Foundation, as well as by making a public statement in support of racial equity. Transamerica also scored a perfect 100 on the Corporate Equality Index (CEI) rating, earning a “Best Place to Work for LGBTQ Equality” designation for the sixth year in a row.

New legislation came into force in the Netherlands in 2022 aiming to improve the gender diversity on corporate boards of listed and large companies. The Act on Gender Diversity at the Top requires Aegon the Netherlands to set ambitious targets for gender diversity, create a plan to achieve those targets and report on progress. Please refer to page 417 for further details on what the Act entails and how we are complying with it.

At Aegon, we seek to maintain a diverse global network of like-minded partners and suppliers who align with our purpose and values. These partnerships support our ambition to operate a successful and responsible business and create long-term value for all our stakeholders. In 2022, we continued to follow best- practice ESG criteria and requirements as part of our supplier selection and development activities, as well as our ordering processes. With this approach, we aim to improve the impact of our supply chains on society and the environment, while also delivering commercial and reputational benefits for the companies we work with.

Building a responsible supply chain

Building a responsible and transparent supply chain is central to our sustainability ambitions and is a key element of our Sustainability Roadmap 2025 (see “Sustainability”, page 14). As a diversified global business, Aegon seeks to drive company-wide alignment in this area, with tools such as the Vendor Code of Conduct. Our progress on this important topic is measured through sustainability performance indicators that have been jointly defined by Aegon’s Procurement and Finance teams.

In 2022, the Procurement team expanded its EcoVadis program. With the support of this leading sustainability ratings platform, the program seeks to contribute to the Sustainability Roadmap 2025 by increasing transparency surrounding the sustainability performance of Aegon’s strategic supplier base. By the end of 2022, the EcoVadis program covered 72% of our procurement expenditure involving the 250 largest vendors to our organization, up from 59% in 2021, while the total vendor expenditure coverage increased from 51% to 64%. Further indicators regarding the program can be found on page 440 of this Annual Report.

During the year, Aegon also undertook the tendering process for the mandatory rotation of its auditor, a thorough process involving all business units. The outcome is that Ernst & Young Accountants LLP (EY) will be appointed as Aegon’s new auditor, effective January 1, 2024, pending approval at the 2023 Annual General Meeting of Shareholders. The tender’s selection criteria emphasized the composition of the proposed supplier teams, supporting our ambition to help increase the diversity of our supply chains. During the process, the bidding audit firms changed the composition of their teams to meet our inclusion and diversity requirements.

| | | | | | | | | | | Aegon Annual Report on Form 20-F | | | |

| | | | |  | | Governance and risk management Financial information Non-financial information

| | | | | | | | | | |

Third-party risk management at

Aegon remains accountable for ensuring business continuity and reliable service for its customers, even when outsourcing critical activities. At the end of 2021, Aegon the Netherlands initiated a program to further improve its third-party risk management capabilities, with a view to increasing role clarity when selecting third parties, and monitoring and exiting supplier relationships. The program ensures that multiple disciplines, including Business Owners, Procurement & Vendor Management, Information Security, Privacy Office, and Risk and Compliance, all contribute to assessing and anticipating the inherent risks to our supply chain.

To ensure business continuity for its customers, Aegon must be prepared to manage a range of potential scenarios, from cyberthreats, to third parties experiencing a default situation. New regulation, such as the European Union’s impending Digital Operational Resilience Act (DORA), highlights the importance of further maturing our approach to third-party risk management and due diligence, and embedding this more firmly in our procurement processes.

Working with responsible vendors

In the United Kingdom, Aegon has committed to various initiatives to support responsible procurement and supply chain stewardship. We work closely with our partners to promote high standards of business conduct, as reflected in our Vendor Code of Conduct. Aegon’s Tier 1 suppliers must provide evidence that they meet these standards on an annual basis and are encouraged to register for assessment by EcoVadis, the leading sustainability ratings platform, or with an assessment body of their choice. Aegon UK is also a member of Social Enterprise UK, a membership body that helps businesses include social enterprises in their supply chains. In 2022, expenditure on social enterprises as part of our UK procurement activities met our target of GBP 100,000.

In 2021, Aegon UK was formally recognized as a Living Wage Employer. The business has since been working with itson-site

suppliers in the United Kingdom to make positive changes to their remuneration structures as part of their internal pay review cycles. The proposed increase is intended to reflect the rise in the real living wage, as announced by the UK government in September 2022.In 2022, Aegon UK identified 46 existing suppliers that it aims to collaborate with on matters related to sustainability. 50% of the potential suppliers are already undertaking sustainability assessments via EcoVadis or an equivalent provider, and 57% have made public commitments to reach net zero. Aegon UK will spend time working with each company to understand their potential contribution to the company’s scope 3 emissions and to agree on plans to reduce those contributions in future years.

Promoting supplier diversity at Transamerica

Through its Supplier Diversity Program, Transamerica actively seeks out certified diverse suppliers that can provide competitive, high-quality goods and services. In 2022, we undertook a concentrated effort to further expand our portfolio of registered diverse suppliers in the United States and maintaingrowth in terms of the proportion of our addressable spend invested with diverse suppliers.During the year, Transamerica also explored other strategies to reduce the environmental impact of its procurement activities. These included reducing the print, paper, and carbon emissions associated with mailing correspondence to clients and prospects, as well as working with third-party suppliers to digitize information for policyholders and agents through online self-service portals. In 2022, Transamerica eliminated the need for over three million envelopes by combining mailings into a single envelope, saving USD 1.4 million in expenses.

| | | | | | | | | | | Aegon Annual Report on Form 20-F | | |

| | | | | | | Our strategy and value creation

| | | | | | | | | | |

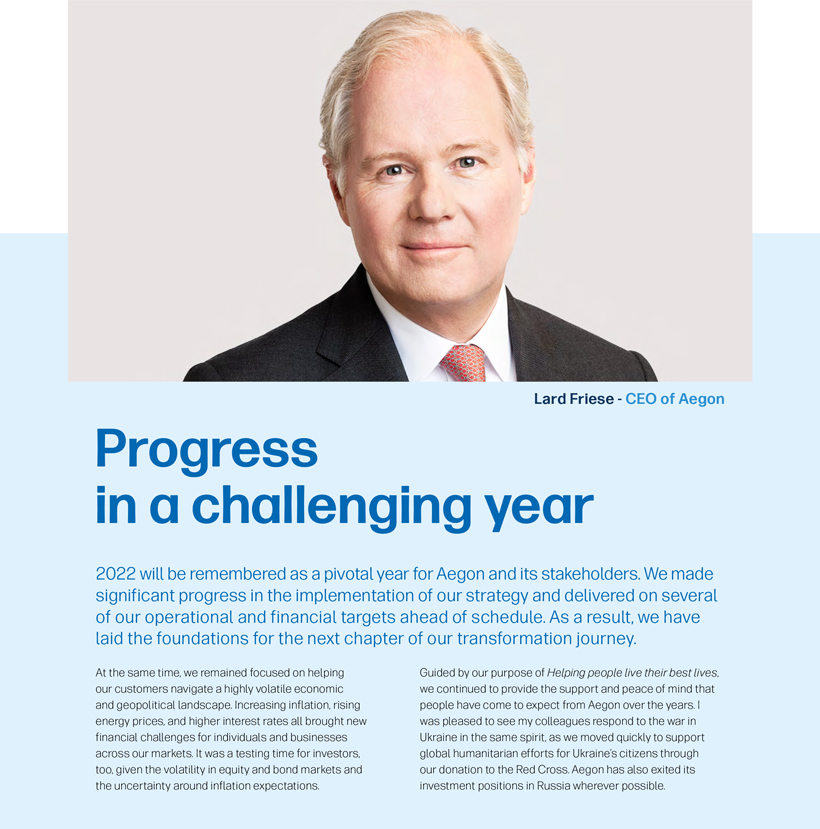

In 2022, Aegon made further progress in delivering on its strategic and financial commitments, despite an uncertain economic landscape and volatile financial markets. Against this challenging backdrop, we performed well, a testament to the strength of our strategy.

Solid financial performance

Building on the progress made on its transformation program, Aegon increased its expectations for cumulative free cash flow over the 2021–2023 period from between EUR 1.4 and 1.6 billion to at least EUR 2.2 billion. Our units also delivered operating capital generation of EUR 1.5 billion, significantly above the EUR 1.2 billion guidance for 2022 provided at the start of the year. This allows us to target a dividend of around 30 eurocents per common share over 2023, barring unforeseen circumstances. We increased the dividend target from 25 eurocents per common share previously. This also reflects the anticipated benefits from the transaction with a.s.r., including the expectation that the transaction will be accretive to free cash flows per share once the announced deleveraging and capital return to shareholders is completed.

In 2022, Aegon increased its interim dividend by 3 eurocents to 11 eurocents per common share and will propose to increase the final dividend by 3 eurocents to 12 eurocents per common share at the 2023 Annual General Meeting of Shareholders. In addition, we executed a share buyback program of EUR 300 million in three tranches between the second and fourth quarter of 2022. In total, Aegon delivered EUR 713 million in the form of dividends and share buybacks to shareholders in 2022.

At the end of 2022, Aegon had a gross financial leverage position of EUR 5.6 billion. This delivered EUR 223 million value in the form of interest payments to bondholders.

Value derived from share performance

Aegon’s share price rose by 7% in 2022. This resulted in the company outperforming the wider European insurance industry, with the STOXX Europe 600 Insurance Index ending the year down by 2%. We believe the relative overperformance was supported by the appreciation of the US dollar, progress made on our operational improvement plan, and management actions to improve our risk profile. Our total shareholder return for the year amounted to a gain of 12%. This measure considers the payment of dividends as well as share-price performance.

Safeguarding long-term value

We are taking steps to further strengthen our balance sheet. This allows for attractive and sustainable capital deployment decisions, which generate value for our investors over the longer term. With the debt tender offer executed in 2022, Aegon reduced its financial leverage by EUR 429 million during the year. This enabled us to achieve our gross financial leverage target of between EUR 5.0 billion and EUR 5.5 billion, accounting for the fact that this target was set at an EUR/USD exchange rate of 1.20.

Capital deployment decisions are driven by Cash Capital at Holding, taking into account our gross financial leverage target range and planned management actions to further improve the company’s risk profile. Cash Capital at Holding is supported by free cash flow, which is defined as the amount of cash available from remittances from country units after subtracting the holding funding and operating expenses, the latter resulting from paying interest to bondholders, for example. At Aegon, we seek to distribute free cash flow to shareholders over time, unless we invest it in value-creating opportunities. We expect to pay dividends to shareholders in line with growth in sustainable free cash flow, barring unforeseen circumstances.

| | | | | | | | | | | Aegon Annual Report on Form 20-F | | | |

| | | | |  | | Governance and risk management Financial information Non-financial information

| | | | | | | | | | |

As an investment provider and responsible business, Aegon can play a central role in addressing a range of social and environmental issues. Increasingly, we see opportunities to use our influence to help create a healthier, more equitable, and more inclusive world. We seek to add value through our community investments and volunteering efforts, as well as by helping individuals and communities take steps toward a cleaner, healthier planet.

Working with society to tackle climate change

At Aegon, we aim to use our influence at the center of the financial services value chain to effect positive change and address key societal issues that are affecting our stakeholders. Increasingly, our focus is on tackling the growing impact of climate change on the environment and society.

In tandem with company-wide efforts to tackle climate change, including through its investment activities (see “Sustainability,” page 16), Aegon also works closely with customers, partners, and communities at a local level to support the transition to a more sustainable and climate-resilient society. In March, Aegon Asset Managementco-launched

a new USD 600 million decarbonization venture in the United States. The partnership will see Aegon and its joint venture partners, private equity firm Taurus Investment Holdings, acquirevalue-add

multifamily properties. The homes will then be converted intolow-carbon,

energy-efficient buildings by deploying modern clean-energy technologies such as community solar installations.In October, Aegon and Taurus closed their second and third multifamily investments under the new venture, in the Tampa and Orlando submarkets. Elsewhere in the United States, Transamerica and Aegon Asset Management became the primary investors and anchor tenants in a new community solar garden in Iowa (see box out Helping to bring clean energy to the community in Cedar Rapids).