Globally, there have been large advances in processes of digitization and technological innovation, some of them as a result of the COVID-19 pandemic. These new technologies could generate new risks in their implementation that could impact us directly or indirectly. As an example, at the beginning of 2022, the implementation of 5G in the United States had a temporary impact on operations at certain airports and generated a review by the FAA on the specific requirements for its implementation. All processes of digitization and technological innovation may be exposed to this risk.

Similarly, the rapidly increasing technological transformation may advance faster than the review and control capacity of the authorities and the knowledge about the effects of their possible impacts, which could affect us directly or indirectly in ways we cannot foresee.

Increases in our labor costs, which constitute a substantial portion of our total operating expenses, could directly impact our earnings.

Labor costs constitute a significant percentage of our total operating expenses (18.5%cost of sales (12% in 2019)2022) and at times in our operating history we have experienced pressure to increase wages and benefits for our employees. A significant increase in our labor costs could result in a material reduction in our earnings.

Collective action by employees could cause operating disruptions and adversely impact our business.

Certain employee groups such as pilots, flight attendants, mechanics and our airport personnel have highly specialized skills. As a consequence, actions by these groups, such as strikes, walk-outs or stoppages, could severely disrupt our operations and adversely impact our operating and financial performance, as well as our image.

A strike, work interruption or stoppage or any prolonged dispute with our employees who are represented by any of these unions could have an adverse impact on our operations. These risks are typically exacerbated during periods of renegotiation with the unions, which typically occurs every two to four years depending on the jurisdiction and the union. Any renegotiated collective bargaining agreement could feature significant wage increases and a consequent increase in our operating expenses. Any failure to reach an agreement during negotiations with unions may require us to enter into arbitration proceedings, use financial and management resources, and potentially agree to terms that are less favorable to us than our existing agreements. Employees who are not currently members of unions may also form new unions that may seek further wage increases or benefits.

In November 2022, a union representing the majority of our pilots in Chile voted to begin a strike, initiating a mediation process mandated by Chilean law. On November 9, 2022, we announced that we had reached an agreement averting a strike. There is no guarantee, however, that we will be able to reach a mutually beneficial agreement in the event of future disagreements with our employees.

Our business may experience adverse consequences if we are unable to reach satisfactory collective bargaining agreements with our unionized employees.

As of December 31, 2019,2022, approximately 46%49% of ourthe group’s employees, including administrative personnel, cabin crew, flight attendants, pilots and maintenance technicians are members of unions and have contracts and collective bargaining agreements which expire on a regular basis. OurThe business, financial condition and results of operations could be materially adversely affected by a failure to reach agreement with any labor union representing such employees or by an agreement with a labor union that contains terms that are not in line with our expectations or that prevent usthe group from competing effectively with other airlines. For further information regarding the unions representing our employees in each country in which we operatethe group operates and with which we havethere are established collective bargaining agreements, see “Item 6. Directors, Senior Management and Employees—D. Employees—LaborEmployees-D. Employees-Labor Relations.”

WeLATAM may experience difficulty finding, training and retaining employees.

OurThe business is labor intensive. We employThe group employs a large number of pilots, flight attendants, maintenance technicians and other operating and administrative personnel. The airline industry has, from time to time, experienced a shortage of qualified personnel, especially pilots and maintenance technicians.technicians, which has somewhat intensified during the recovery phase of air traffic following the peak of the pandemic. Such shortage of qualified personnel is further exacerbated by our recent emergence from bankruptcy and the resulting uncertainties facing the business. In addition, as is common with most of our competitors, wethe group may, from time to time, face considerable turnover of our employees. Should the turnover of employees, particularly pilots and maintenance technicians, sharply increase, our training costs will be significantly higher. WeLATAM cannot assure you that weit will be able to recruit, train and retain the managers, pilots, technicians and other qualified employees that we needare needed to continue ourthe current operations or replace departing employees. An increase in turnover or failure to recruit, train and retain qualified employees at a reasonable cost could materially adversely affect ourthe business, financial condition, and results of operations. The group may also experience increased levels of employee attrition associated with the recent emergence from Chapter 11 proceedings. A loss of key personnel or material erosion of employee morale could impair the ability to execute strategy and implement operational initiatives, thereby adversely affecting the group.

Risks RelatedRelating to the Airline Industry and the Countries in Which We Operatethe Group Operates

Our performance is heavily dependent on economic conditions in the countries in which we dothe group does business. Negative economic conditions in those countries could adversely impact ourthe group’s business and results of operations and cause the market price of our common shares and ADSs to decrease.

Passenger and cargo demand is heavily cyclical and highly dependent on global and local economic growth, economic expectations and foreign exchange rate variations, among other things. In the past, our business has been adversely affected by global economic recessionary conditions, weak economic growth in Chile, recessionrecessions in Brazil and Argentina, and poor economic performance in certain emerging market countries in which we operate.the group operates. The occurrence of similar events in the future could adversely affect our business. We planThe group plans to continue to expand our operations based in Latin America, and ourwhich means that performance will therefore, continue to depend heavily on economic conditions in the region.

Any of the following factors could adversely affect ourthe business, financial condition and results of operations in the countries in which we operate:the group operates:

| ● | changes in economic or other governmental policies; |

| ● | changes in regulatory, legal or administrative practices; |

| ● | weak economic performance, including, but not limited to, a slowdown in the Brazilian economy, political instability, low economic growth, low consumption and/or investment rates, and increased inflation rates; or |

| ● | other political or economic developments over which we have no control. |

No assurance can be given that capacity reductions or other steps wethe group may take in response to weakened demand will be adequate to offset any future reduction in our cargo and/or air travel demand in markets in which we operate.the group operates. Sustained weak demand may adversely impact our revenues, results of operations or financial condition.

An adverse economic environment, whether global, regional or in a particular country, could result in a reduction in passenger traffic, as well as a reduction in ourthe cargo business, and could also impact ourthe ability to raiseset fares, which in turn would materially and negatively affect our financial condition and results of operations.

We are exposed to increases in landing fees and other airport service charges that could adversely affect our margin and competitive position. Also, it cannot be assured that in the future we will have access to adequate facilities and landing rights necessary to achieve our expansion plans.

WeThe group must pay fees to airport operators for the use of their facilities. Any substantial increase in airport charges, including at Guarulhos International Airport in São Paulo, Jorge Chavez International Airport in Lima or Comodoro Arturo Merino Benitez International Airport in Santiago, could have a material adverse impact on our results of operations. Passenger taxes and airport charges have increased substantially in recent years. We cannot assure you that the airports in which we operatethe group operates will not increase or maintain high passenger taxes and service charges in the future. Any such increases could have an adverse effect on our financial condition and results of operations.

Certain airports that we serve (or that we plan to serve in the future) are subject to capacity constraints and impose various restrictions, including takeoff and landing slot restrictions during certain periods of the day and limits on aircraft noise levels. We cannot be certain that wethe group will be able to obtain a sufficient number of slots, gates and other facilities at airports to expand our services in line with our growth strategy. It is also possible that airports not currently subject to capacity constraints may become so in the future. In addition, an airline must use its slots on a regular and timely basis or risk having those slots re-allocated to others. Where slots or other airport resources are not available or their availability is restricted in some way, wethe group may have to amend our schedules, change routes or reduce aircraft utilization. It is also possible that aviation authorities in the countries in which we operate,the group operates, change the rules for the assignment of takeoff and landing slots, as it was the case with the São Paulo airport (Congonhas) in 2019 where the slots previously operated by Avianca Brazil were reassigned.reassigned mostly to Azul, and where Agência Nacional de Aviação Civil in Brazil (“ANAC”) has approved new rules to the distribution of new slots. Any of these alternatives could have an adverse financial impact on our operations. We cannot ensure that airports at which there are no such restrictions may not implement restrictions in the future or that, where such restrictions exist, they may not become more onerous. Such restrictions may limit our ability to continue to provide or to increase services at such airports.

OurThe business is highly regulated and changes in the regulatory environment in the different countries in which we operate may adversely affect our business and results of operations.

Our business is highly regulated and depends substantially upon the regulatory environment in the countries in which we operatethe group operates or intendintends to operate. For example, price controls on fares may limit our ability to effectively apply customer segmentation profit maximization techniques (“passenger revenue management”) and adjust prices to reflect cost pressures. High levels of government regulation may limit the scope of our operations and our growth plans. The possible failure of aviation authorities to maintain the required governmental authorizations, or our failure to comply with applicable regulations, may adversely affect our business and results of operations.

Our business, financial condition, results of operations and the price of preferredcommon shares and ADSs may be adversely affected by changes in policy or regulations at the federal, state or municipal level in the countries in which we operate,the group operates, involving or affecting factors such as:

| ● | interest rates; |

| ● | currency fluctuations; |

| ● | monetary policies; |

| ● | inflation; |

| ● | liquidity of capital and lending markets; |

| ● | tax and social security policies; |

| ● | labor regulations; |

| ● | energy and water shortages and rationing; and |

| ● | other political, social and economic developments in or affecting Brazil, Chile, Peru, and the United States, among others. |

For example, the Brazilian federal government has frequently intervened in the domestic economy and made drastic changes in policy and regulations to control inflation and affect other policies and regulations. This has required the federal government to increase interest rates, change taxes and social security policies, implement price controls, currency exchange and remittance controls, devaluations, capital controls and limits on imports.

Uncertainty over whether the Brazilian federal government will implement changes in policy or regulation affecting these or other factors may contribute to economic uncertainty in Brazil and to heightened volatility in the Brazilian securities markets and securities issued abroad by Brazilian companies. These and other developments in the Brazilian economy and governmental policies may adversely affect us and our business and results of operations and may adversely affect the trading price of our preferredcommon shares and ADSs.

We are also subject to international bilateral air transport agreements that provide for the exchange of air traffic rights between the countries where we operate,the group operates, and we must obtain permission from the applicable foreign governments to provide service to foreign destinations. There can be no assurance that such existing bilateral agreements will continue, or that we will be able to obtain more route rights under those agreements to accommodate our future expansion plans. Certain bilateral agreements also include provisions that require substantial ownership or effective control. Any modification, suspension or revocation of one or more bilateral agreements could have a material adverse effect on our business, financial condition and results of operations. The suspension of our permits to operate to certain airports or destinations, the inability for us to obtain favorable take-off and landing authorizations at certain high-density airports or the imposition of other sanctions could also have a negative impact on our business. We cannot be certain that a change in ownership or effective control or in a foreign government’s administration of current laws and regulations or the adoption of new laws and regulations will not have a material adverse effect on our business, financial condition and results of operations.

Losses and liabilities in the event of an accident involving one or more of our aircraft could materially affect our business.

We are exposed to potential catastrophic losses in the event of an aircraft accident, terrorist incident or any other similar event. There can be no assurance that, as a result of an aircraft accident or significant incident:

| ● | we will not need to increase our insurance coverage; |

| ● | our insurance premiums will not increase significantly; |

| ● | our insurance coverage will fully cover all of our |

| ● | we will not be forced to bear substantial losses. |

Substantial claims resulting from an accident or significant incident in excess of our related insurance coverage could have a material adverse effect on our business, financial condition and results of operations. Moreover, any aircraft accident, even if fully insured, could cause the negative public perception that our operations or aircraft are less safe or reliable than those operated by other airlines, or by other flight operators, which could have a material adverse effect on our business, financial condition and results of operations.

Insurance premiums may also increase due to an accident or incident affecting onethat affected our Peruvian affiliate. On November 18, 2022, LATAM Airlines Peru reported that during the take-off of our alliance partners or other airlines, or due toflight LA 2213 at Lima’s Jorge Chávez International Airport a perceptionfire engine entered the runway and collided with its aircraft. Authorities subsequently confirmed fatalities of increased risktwo firefighters who were in the industry relatedfire engine that struck the aircraft. There were no fatalities among the 102 passengers and 6 crew members. The investigation of the cause of the accident is still in progress. LATAM Airlines Peru is cooperating with the relevant investigations. The aircraft damage is covered by insurance. We are not yet able to concerns about war or terrorist attacks,make a final conclusion as to the general industry, or general industry safety.financial impact of this incident.

High levels of competition in the airline industry, such as the presenceincrease of low-cost carriers and the consolidation or mergers of competitors in the markets in which we operate,the group operates, may adversely affect ourthe level of operations.

Our business, financial condition and results of operations could be adversely affected by high levels of competition within the industry, particularly the entrance of new competitors into the markets in which we operate.the group operates. Airlines compete primarily over fare levels, frequency and dependability of service, brand recognition, passenger amenities (such as frequent flyer programs) and the availability and convenience of other passenger or cargo services. New and existing airlines (and companies providing ground cargo or passenger transportation) could enter our markets and compete with us on any of these bases, including by offering lower prices, more attractive services or increasing their route offerings in an effort to gain greater market share. For more information regarding our main competitors, see “Item 4. Information of the Company—B.Company-B. Business Overview—Passenger Operations—InternationalOverview-Passenger Operations-International Passenger Operations” and “Item 4. Information of the Company—B.Company-B. Business Overview—Passenger Operations—BusinessOverview-Passenger Operations-Business Model for Domestic Operations.”

Low-cost carriers have an important impact inon the industry’s revenues given their low unit costs. Lower costs allow low-cost carriers to offer inexpensive fares which, in turn, allow price sensitive customers to fly or to shift from large to low cost carriers. In past years we have seen more interest in the development of the low-cost model throughout Latin America. For example, in the Chilean market, Sky Airline, our main competitor, has been migrating to a low-cost model since 2015, while in July 2017, JetSmart, a new low-cost airline, started operations. In the Peruvian domestic market, VivaAir Peru, a new low-cost airline, started operations in May 2017, and in April 2019, another low-cost airline, Sky Airline Peru, started operations.operations, followed by the entrance of JetSmart in June 2022. In Colombia, low-cost competitor VivaColombia has been operating in the domestic market since May 2012. Low-cost competitors FlybondiDue to the impacts associated to the COVID-19 pandemic, some of these airlines have adopted strategies to consolidate in alliances or mergers with legacy airlines, such as Avianca and Norwegian began operationsGol (Abra Group), Avianca and Viva in the Argentinian domestic market during 2018, and in April 2019,Colombia, or JetSmart another low-cost airline, started operations and announced the acquisition of Norwegian´s Argetinian subsidiary operations in December 2019. A number of low-cost carriers have announced growth strategies including commitmentswhere American Airlines had been approved by authorities without any conditions to acquire significant numbersminor participation. In the Cargo business, and also due to some effects of aircraft for deliveryCOVID-19 pandemic and the scarcity of containers, companies such as Maersk, CMA CGM and MSC have begun to compete in air transportation; CMA CGM and Air France-KLM airlines agreed to share cargo space in their airplanes; and American Airlines Cargo and Web Cargo have partnered to increase their destinations. These consolidations, mergers or new alliances might continue to appear, increasing the next few years. The entryconcentration and levels of competition. Specifically, in February 2023, LATAM expressed its interest in initiating negotiations to acquire VivaColombia. Any transaction is subject to a financial analysis, an agreement between the low-cost carriers local into markets in which we compete, including those described above, could have a material adverse effect on our operationsparties, and financial performance.the corresponding regulatory approvals.

Our internationalInternational strategic growth plans rely, in part, upon receipt of regulatory approvals of the countries in which we plan to expand our operations with a Joint Business Agreementjoint business agreements (JBA). WeThe group may not be able to obtain those approvals, while other competitors might be approved. Accordingly, we might not be able to compete for the same routes as our competitors, which could diminish our market share and adversely impact our financial results. No assurances can be given as to any benefits, if any, that we may derive from such agreements.

Some of our competitors may receive external support, which could adversely impact our competitive position.

Some of our competitors may receive support from external sources, such as their national governments, which may be unavailable to us. Support may include, among others, subsidies, financial aid or tax waivers. This support could place usthe group at a competitive disadvantage and adversely affect our operations and financial performance. For example, Aerolineas Argentinas has historically been government subsidized. Additionally, during the COVID-19 pandemic, some of our competitors on long-haul routes received government support.

Moreover, as a result of the competitive environment, there may be further consolidation in the Latin American and global airline industry, whether by means of acquisitions, joint ventures, partnerships or strategic alliances. We cannot predict the effects of further consolidation on the industry. Furthermore, consolidation in the airline industry and changes in international alliances will continue to affect the competitive landscape in the industry and may result in the development of airlines and alliances with increased financial resources, more extensive global networks and reduced cost structures.

Some of the countries where we operatethe group operates may not comply with international agreements previously established, which could increase the risk perception of doing business in that specific market and as a consequence impact ourthe business and financial results.

Rulings by a bankruptcy court in Brazil and a Chapter 15 ruling by higher judicial authoritiesthe Bankruptcy Court related to the bankruptcy proceedings of Avianca Brazil may appear to be inconsistent with the timeline set out for a debtor to cure a default or to return an aircraft in the Cape Town Convention (CTC) treaty that Brazil has signed, thus raising concerns about the rights oftimings for remedies by creditors in respect of financings secured by aircraft. Accordingly, if creditors may perceive that an increaseincreased business risk is created by these rulings for leasing or other financing transactions involving aircraft in Brazil and there is a possibility that rating agencies may issue lower credit ratings in respect of financings that are secured by aircraft in Brazil. As a result, our business and financial results may be adversely affected if our financing activities in Brazil are impacted by such events.

OurLATAM’s operations are subject to local, national and international environmental regulations; costs of compliance with applicable regulations, or the consequences of noncompliance, could adversely affect our results, our business or our reputation.

OurLATAM’s operations are affected by environmental regulations at local, national and international levels. These regulations cover, among other things, emissions to the atmosphere, disposal of solid waste and aqueous effluents, aircraft noise and other activities incident to ourthe business. Future operations and financial results may vary as a result of such regulations. Compliance with these regulations and new or existing regulations that may be applicable to us in the future could increase our cost base and adversely affect our operations and financial results. In addition, failure to comply with these regulations could adversely affect us in a variety of ways, including adverse effects on ourthe group’s reputation.

In 2016, the International Civil Aviation Organization (“ICAO”) adopted a resolution creating the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), providing a framework for a global market-based measure to stabilize carbon dioxide (“CO2”) emissions in international civil aviation (i.e., civil aviation flights that depart in one country and arrive in a different country). CORSIA will be implemented in phases, starting with the participation of ICAO member states on a voluntary basis during a pilot phase (from 2021 through 2023), followed by a first phase (from 2024 through 2026) and a second phase (from 2027). Currently, CORSIA focuses on defining standards for monitoring, reporting and verification of emissions from air operators, as well as on defining steps to offset CO2 emissions after 2020. ToIn order to comply with this strategy, we have developed sustainability strategies focused on climate change and we have taken different measures, such as the alliance with the Cataruben foundation in Colombia, with the objectives of offsetting CO2 through reducing deforestation and switching to sustainable agriculture practices, amongst others, thus contributing to improve the communities’ life quality and the protection of biodiversity. In addition, we have other initiatives in place such as the promotion of SAF (green fuel produced with vegetable bases and mixed with conventional fossil fuels) with local governments and the lean fuel program. Nevertheless, to the extent most of the countries in which we operatethe group operates continue to be ICAO member states, in the future we may be affected by regulations adopted pursuant to the CORSIA framework. In addition, frameworks such as the Emissions Trading System, both in the EU and UK (“EU-ETS” and “UK-ETS”), are regulations related to the European market, where airlines have a pre-established amount of CO2 emissions for each year, which are then reduced over time, similar to a “cap and trade” system. Airlines must report and verify emissions related to this scheme and surrender the allocated allowances in time in order to comply. Should operations exceed the maximum allocated emissions, airlines must either acquire more from the market or pay the corresponding fee to the authority.

The proliferation of national regulations and taxes on CO2 emissions in the countries that we have domestic operations, including environmental regulations that the airline industry is facing in Colombia, where limits on offsetting programs were included in the new Tax Reform of 2022, may also affect our coststhe cost of operations and ourthe margins.

Our business may be adversely affected by a downturn in the airline industry caused by exogenous events that affect travel behavior or increase costs, such as outbreak of disease, weather conditions and natural disasters, war or terrorist attacks.

Demand for air transportation may be adversely impacted by exogenous events, such as adverse weather conditions and natural disasters, epidemics (such as Ebola and Zika) and outbreaks suchpandemics (such as the recent coronavirus,COVID-19 pandemic), terrorist attacks, war or political and social instability. Increasing geopolitical tensions and hostilities in connection with the conflict in Ukraine, and the trade and monetary sanctions that have been imposed in connection with those developments, have affected, and could significantly affect, worldwide oil prices and demand, cause turmoil in the global financial system and negatively impact air travel. Situations such as these in one or more of the markets in which we operate could have a material impact on ourthe business, financial condition and results of operations. Furthermore, the current spread of the coronavirusCOVID-19 pandemic and its variants and other adverse public health developments could have a prolonged effect on air transportation demand and any prolonged or widespread effects could significantly impact our operations.

After the terrorist attacks in the United States on September 11, 2001, the Company made the decision to reduce its flights to the United States. In connection with the reduction in service, the Company reduced its workforce resulting in additional expenses due to severance payments to terminated employees during 2001. Any future terrorist attacks or threat of attacks, whether or not involving commercial aircraft, any increase in hostilities relating to reprisals against terrorist organizations or otherwise and any related economic impact could result in decreased passenger traffic and materially and negatively affect ourthe business, financial condition and results of operations.

After the 2001 terrorist attacks, airlines have experienced increased costs resulting from additional security measures that may be made even more rigorous in the future. In addition to measures imposed by the U.S. Department of Homeland Security and the TSA, IATA and certain foreign governments have also begun to institute additional security measures at foreign airports we serve.

Revenues for airlines depend on the number of passengers carried, the fare paid by each passenger and service factors, such as the timeliness of flight departures and arrivals. During periods of fog, ice, low temperatures, storms or other adverse weather conditions or natural disasters outside of our control, some or all of our flights may be cancelledcanceled or significantly delayed, affecting and disrupting our operations and reducing profitability. For example, in 2011, a volcanic eruption in Chile had a prolonged adverse effect on air travel, halting flights in Argentina, Chile, Uruguay and the southern part of Brazil for several days. As a result, our profitability.operations to and from these regions were temporarily disrupted, including certain aircraft being grounded in the affected regions. In 2012, an incident with an aircraft from a cargo airline caused the closing of a runway at Viracopos airport for 45 hours, which negatively impacted our operations and forced us to re-accommodate our passengers to new flights. In 2022, a LATAM aircraft was severely damaged after flying through stormy weather on approach to Asuncion Airport in Paraguay, having to make an emergency landing. Increases in the frequency, severity or duration of thunderstorms, hurricanes, typhoons, floods or other severe weather events, including from changes in the global climate and rising global temperatures, could result in increases in delays and cancellations, turbulence-related injuries and fuel consumption to avoid such weather, any of which could result in loss of revenue and higher costs. In addition, fuel prices and supplies, which constitute a significant cost for us, may increase as a result of any future terrorist attacks, a general increase in hostilities or a reduction in output of fuel, voluntary or otherwise, by oil-producing countries. Such increases may result in both higher airline ticket prices and decreased demand for air travel generally, which could have an adverse effect on our revenues and results of operations.

A pandemicOur business may be adversely affected by the consequences of climate change.

There are regulatory risks associated with the management of climate change in the short and medium term, due to the fact that, in an effort of different countries to contribute to the fight against climate change, there is a tendency to impose economic instruments such as carbon taxes or emissions trading systems that seek to regulate emissions from different industries, including the widespread outbreakaviation industry. These mechanisms seek to discourage the consumption of contagious illnesses canfossil fuels, through imposing an additional cost. However, in the case of the airline industry, especially in the South American region, there is no viable substitute fuel that would allow the industry to migrate to other types of fuels. The related risks present an opportunity to work hand in hand with the relevant governments to implement public policies allowing for progress in the production of sustainable aviation fuels in the region, thus promoting the migration away from fossil fuels and creating policies and instruments relevant to industries such as aviation, which currently has no substitute fuel available in South America. In the long term, there are physical risks associated with climate change, including the risk for greater intensity of meteorological phenomena, such as storms, tornados, hurricanes, floods and others, which in turn may pose a risk to infrastructure (destinations, airports) and communities. As a consequence, it may be necessary to modify routes and destinations.

An accumulation of ticket refunds could have a materialan adverse effect on our businessfinancial results.

The COVID-19 pandemic and resultsthe corresponding widespread government-imposed travel restrictions that were outside of operations.

The widespreadLATAM’s control resulted in an unprecedented number of requests for ticket refunds from customers due to changed or canceled flights. Although at this time the issue has been managed, we cannot assure that the COVID-19 pandemic or other outbreak of a contagious illness suchwill not result in additional changed or canceled flights, and we cannot predict the total amount of refunds that customers might request as a result thereof. If the novel COVID-19 (Coronavirus), first identifiedgroup is required to pay out a substantial amount of ticket refunds in Wuhan, Hubei Province, China and which has been declared a pandemic by the World Health Organization (WHO), or fear of suchcash, this could have an event, is materially reducing demand for, and availability of, worldwide air travel and therefore is having a material adverse effect on our business andfinancial results of operations.

In 2003, an outbreak of a coronavirus known as severe acute respiratory syndrome (SARS) originating in China became an epidemic and resulted in a slowdown of passenger air traffic due contagion fears. Ator liquidity position. Furthermore, the time, RPK growth was reduced due to oversupply inCompany has agreements with financial institutions that process customer credit card transactions for the market as airlines tried to cut capacity.

The recent outbreaksale of Coronavirus has negatively affected global economic conditions, disrupted supply chains and otherwise negatively impacted aircraft manufacturing operations and may reduce the availability of aircraft and aircraft spare parts. The ultimate severity of the Coronavirus outbreak is uncertain at this time and therefore we cannot predict the impact it may have on the availability of aircraft or aircraft spare parts. However, the effect on our results may be material and adverse if supply chain disruptions persist and preclude our ability to adequately maintain our fleet.

The recent outbreak of Coronavirus has also led to government-imposed travel restrictions, flight cancellations, and a marked decline in passenger demand for air travel. Accordingly, LATAM Airlines Group and its affiliates implemented a reduction in international flights of approximately 30% and recently updatedthe decrease in capacity to approximately 70% of the total operations, corresponding 90% to international operations and 40% to domestic operations. These measures will apply principally to flights from South America to Europe and the US between April 1 and May 30, 2020. The potential for a period of significantly reduced demand for travel has and will likely continue to result in significant lost revenue. As a result of these or other conditions beyond our control, our results of operations could be volatile and subject to rapid and unexpected change. In addition, if the spread of the Coronavirus were to continue unabated, our operations could also be negatively affected if employees are quarantined as the result of exposure to the contagious illness.We cannot currently fully predict the impact that the Coronavirus outbreak will have on global air travel and the extent to which it may impact the demand for air travel in the regions we operate. Continued travel restrictions or operational issues resulting from the rapid spreadother services. Under certain of the CoronavirusCompany’s credit card processing agreements, the financial institutions in certain circumstances have the right to require that the Company maintain a reserve equal to a portion of advance ticket sales that have been processed by that financial institution, but for which the Company has not yet provided the air transportation. Such financial institutions may require cash or other contagious illnesses that adversely reduce demandcollateral reserves to be established or withholding of payments related to receivables to be collected, including if the Company does not maintain certain minimum levels of unrestricted cash, cash equivalents and short-term investments. Refunds lower our liquidity and put us at risk of triggering liquidity covenants in these processing agreements and, in doing so, could force us to post cash collateral with the credit card companies for air travel in a part of the world in which we have significant operations could a material adverse effect on our business and results of operations.advance ticket sales.

We areLATAM is subject to risks relatedrelating to litigation and administrative proceedings that could adversely affect ourthe business and financial performance in the event of an unfavorable ruling.

The nature of ourthe business exposes us to litigation relating to labor, insurance and safety matters, regulatory, tax and administrative proceedings, governmental investigations, tort claims and contract disputes. Litigation is inherently costly and unpredictable, making it difficult to accurately estimate the outcome among other matters. Currently, as in the past, we are subject to proceedings or investigations of actual or potential litigation. Although we establish accounting provisions as we deem necessary, the amounts that we reserve could vary significantly from any amounts we actually have to pay due to the inherent uncertainties in the estimation process. We cannot assure you that these or other legal proceedings will not materially affect ourthe business. For further information, see “Item 8. Financial Information—LegalInformation-Legal and Arbitration Proceedings.”Proceedings” and Note 3130 to our audited consolidated financial statements included in this report.

15

We areThe group is subject to anti-corruption, anti-bribery, anti-money laundering and antitrust laws and regulations in Chile, Brazil, Peru, the United States and in the various other countries we operate.in which it operates. Violations of any such laws or regulations could have a material adverse impact on our reputation and results of operations and financial condition.

We are subject to anti-corruption, anti-bribery, anti-money laundering, antitrust and other international laws and regulations and are required to comply with the applicable laws and regulations of all jurisdictions where we operate.the group operates. In addition, we are subject to economic sanctions regulations that restrict our dealings with certain sanctioned countries, individuals and entities. There can be no assurance that our internal policies and procedures will be sufficient to prevent or detect all inappropriate practices, fraud or violations of law by our affiliates, employees, directors, officers, partners, agents and service providers or that any such persons will not take actions in violation of our policies and procedures. Any violations by us of laws or regulations could have a material adverse effect on ourthe business, reputation, results of operations and financial condition.

Latin American governments have exercised and continue to exercise significant influence over their economies.

Governments in Latin America frequently intervene in the economies of their respective countries and occasionally make significant changes in policy and regulations. Governmental actions have often involved, among other measures, nationalizations and expropriations, price controls, currency devaluations, mandatory increases on wages and employee benefits, capital controls and limits on imports. Our business, financial condition and results of operations may be adversely affected by changes in government policies or regulations, including such factors as exchange rates and exchange control policies;policies, inflation control policies;policies, price control policies;policies, consumer protection policies;policies, import duties and restrictions;restrictions, liquidity of domestic capital and lending markets;markets, electricity rationing;rationing, tax policies, including tax increases and retroactive tax claims;claims, and other political, diplomatic, social and economic developments in or affecting the countries where we operate.the group operates.

For example, the Brazilian government’s actions to control inflation and implement other policies have involved wage and price controls, depreciation of the real, controls over remittance of funds abroad, intervention by the Central Bank to affect base interest rates and other measures. In the future, the level of intervention by Latin American governments may continue or increase. We cannot assure you that these or other measures will not have a material adverse effect on the economy of each respective country and, consequently, will not adversely affect our business, financial condition and results of operations.

Political instability and social unrest in Latin America may adversely affect ourthe business.

We operateLATAM operates primarily within Latin America and areis thus subject to a full range of risks associated with our operations in this region. These risks may include unstable political or social conditions, lack of well-established or reliable legal systems, exchange controls and other limits on our ability to repatriate earnings and changeable legal and regulatory requirements.

Although political and social conditions in one country may differ significantly from another country, events in any of our key markets could adversely affect ourthe business, financial conditions or results of operations.

For example, in Brazil, in the last couple of years, as a result of the ongoing Lava Jato investigation (“Operation Car Wash (Lava Jato investigation)Wash”), a number of senior politicians have resigned or been arrested and other senior elected officials and public officials are being investigated for allegations of corruption. One of the most significant events that elapsed from this operation was the impeachment of the former President Rousseff by the Brazilian Senate on August, 2016, for violations of fiscal responsibility laws and the governing of its Vice-President, Michel Temer, during the last two years of the presidential mandate, which, due to the development of the investigations conducted by the Federal Police Department and the General Federal Prosecutor’s Office, indicted President Temer on corruption charges. Along with the political and economic uncertainty period the country was facing, in July 2017, former and recently re-elected President Luiz Inácio Lula da Silva was convicted of corruption and money laundering by a lower federal court in the State of Paraná in connection with theOperation Car Wash. Operation Car Wash (Lava Jato). is still in progress by Brazilian authorities and additional relevant information may come to light affecting the Brazilian economy.

Furthermore, former President Jair Bolsonaro is being investigated by the Brazilian Supreme Court for alleged misconduct. Several impeachment procedures have been filed in relation to the management of the response to the COVID-19 pandemic by the president.

In addition, Argentineafter having his criminal convictions related to Operation Car Wash overturned and his political rights restored by the Brazilian Supreme Court, former President Luiz Inácio Lula da Silva ran for office in the presidential elections held inelection of October 2019, saw2022 and narrowly defeated President Bolsonaro. Former President Bolsonaro questioned the returnresults of the formerelections, resulting in demonstrations across the country. Luiz Inácio Lula da Silva was sworn in as president in January 2023. We cannot predict which policies the incoming president Luiz Inácio Lula da Silva may adopt or change during his term in office, or the effect that any such policies might have on our business and on the Brazilian economy.

In Peru, on December 7, 2022, President Pedro Castillo announced the dissolution of Argentina, Cristina Fernandez de Kirchner whothe congress and called for new elections as soon as possible, provoking an attempted coup d’état. Subsequently, he was elected Vice-Presidentremoved from office and who was previously prosecuted for alleged corruption. In 2019, Peru experienced a constitutional crisis began whenarrested. On the same day, Vice President Martín Vizcarra dissolvedDina Boluarte assumed the Congresspresidency of Peru, to serve the remaining presidential term until 2026. However, on SeptemberDecember 11, 2022, President Boluarte announced she would introduce a bill to move the general elections up to April 2024, which proposal is under discussion and may be subject to change. Since then, there has been considerable political unrest in Peru, and demonstrations related to the political situation have led to multiple clashes between protestors and security forces, resulting in casualties and deaths. The political unrest has also given rise to many roadblocks across the country. In addition, some smaller airports such as Andahuaylas, Cusco, Juliaca and Arequipa across Peru have seen their operations interrupted.

On December 14, 2022, the Peruvian government declared a national state of emergency for 30 2019.days. No assurance can be given as to how long the unrest and blockades will continue. The Peruvian Congress responded by declaring Vizcarra's presidency suspendedeffect of any such disruption or interference cannot accurately be predicted and appointed Vice President Mercedes Aráoz as interim president, moves that were largely seen as null and void. The Peruvian Constitutional Court ruled that President Martín Vizcarra had not exceeded his powers when he took the step amidcould have a stand-off between the government and opposition-controlled Congress. Opposition lawmakers had denounced it as a coup but the headssignificant adverse effect on our business, financial conditions or results of armed forces and the police backed the president. operations.

In October 2019.2019, Chile saw significant protests associated with economic conditions resulting in the declaration of a state of emergency in several major cities. The protests in Chile began over criticisms about asocial inequality, lack of quality education, weak pensions, increasing prices and low minimum wage. CurrentIf social unrest in Chile were to continue or intensify, it could lead to operational delays or adversely impact our ability to operate in Chile.

Furthermore, current initiatives to address the concerns of the protesters are under discussion in the Chilean Congress. These initiatives include labor reforms, tax reforms and pension reforms, among others. It is not possible to predict the effect of these changes as they are still under discussion, but could potentially result in higher payments of wages and salaries and an increase in taxes. On October 25, 2020 (postponed from April 26, 2020 due to the impact of the COVID-19 pandemic), Chile will holdwidely approved a referendum to redraft the constitution via constitutional convention. The election for selecting the 155-member constitutional convention took place on whetherMay 15 and how16, 2021. On July 4, 2021, the constitutional convention was installed, having 9 months, with the possibility of a one-time, three-month extension, to changepresent a new constitution. The proposed constitution was finalized on July 4, 2022. On September 4, 2022, a referendum was held, in which the proposed constitution was rejected by a margin of 62% to 38% of voters. On December 12, 2022, Chilean lawmakers announced that they had agreed to a document entitled “Acuerdo por Chile” (Agreement for Chile). This document constitutes a new consensus and a starting point to begin drafting a new constitution. On December 26, 2022, the Constitutional Commission of the Senate started working on this document. In addition, Chile held presidential elections in December 2021, with leftist Gabriel Boric winning by a wide margin. Mr. Boric was sworn in as president in March 2022. There can be no assurance that the recent changes in the Chilean administration, its constitution or any future civil unrest will not adversely affect our business, operating results and financial condition in Chile.

Presidential elections were held in Colombia in 2022, and Gustavo Petro was narrowly elected president in Colombia, becoming the country’s first elected leftist president. Such elections recorded the lowest abstention percentages ever in Colombia. On August 7, 2022, Gustavo Petro was sworn in as the new president of Colombia.

In Ecuador, during June of 2022, people took to the streets of Guayaquil. There was a mixture of claims ranging from high prices, lack of medicines, insecurity and even voices calling for the resignation of the current constitution, which could lead to additional protests. If social unrest in Chile were to continue or intensify, it could lead to operational delays or adversely impact our ability to operate in Chile. LATAM took a series of measures to alleviate the impact for its passengers, including refunds and changes of tickets. The Company estimated a total impact of approximately US$40 million for 2019.president, Guillermo Lasso.

Although conditions throughout Latin America vary from country to country, our customers’ reactions to developments in Latin America generally may result in a reduction in passenger traffic, which could materially and negatively affect our financial condition and results of operations.

Latin American countries have experienced periods of adverse macroeconomic conditionsconditions..

OurThe business is dependent upon economic conditions prevalent in Latin America. Latin American countries have historically experienced economic instability, including uneven periods of economic growth as well as significant downturns. High interest, inflation (in some cases substantial and prolonged), and unemployment rates generally characterize each economy. Because commodities such as agricultural products, minerals, and metals represent a significant percentage of exports of many Latin American countries, the economies of those countries are particularly sensitive to fluctuations in commodity prices. Investments in the region may also be subject to currency risks, such as restrictions on the flow of money in and out of the country, extreme volatility relative to the U.S. dollar, and devaluation.

For example, in the past, Peru has experienced periods of severe economic recession, currency devaluation, high inflation, and political instability, which have led to adverse economic consequences. WeLATAM cannot assure youensure that Peru will not experience similar adverse developments in the future even though for some years now, several democratic procedures have been completed without any violence. WeLATAM cannot assure youensure that the current or any future administration will maintain business-friendly and open-marketopen market economic policies or policies that stimulate economic growth and social stability. In Brazil, the Brazil Real GDPgross domestic product increased 1.2% in 2019, decreased 3.5%3.9% in 2015, decreased 3.3% in 2016, increased 1.1% in 20172020, and increased 1.1%4.6% in 2018,2021, according to the Brazilian Institute for Geography and Statistics (Instituto(Instituto Brasileiro de Geografia e Estadística, or “IGBE”). In addition, the credit rating of the Brazilian federal governmentPerú was downgraded in 20152021 and 2016 by all major credit rating agenciesin 2022 is rated as BBB with a negative outlook. Ecuador and is no longer investment grade. We can offer no assurances asChile were also downgraded in 2020, and Colombia in 2021, but keep a stable outlook. Brazil has a stable outlook but in monitoring due to recent events and protests related to the policies that may be implemented by the recently elected Argentine administration, or that political developments in Argentina will not adversely affect the Argentine economy.transition of government.

Accordingly, any changes in the economies of the Latin American countries in which LATAM and its affiliates operate or the governments’ economic policies may have a negative effect on ourthe business, financial condition and results of operations.

Risks RelatedRelating to our Common Shares and ADSs

Holders of ADRs may be adversely affected by the substantial dilution of the shares represented by ADRs.

On June 18, 2022, the United States Bankruptcy Court for the Southern District of New York entered an order confirming the joint plan of reorganization (as amended, restated, modified, revised or supplemented from time to time, the “Plan”) filed by the Reorganized Debtors and dated as of May 25, 2022 [ECF No. 5753]. Pursuant to the Plan, on September 13, 2022, the Reorganized Debtors commenced the preemptive rights offerings for the New Convertible Notes Class A, New Convertible Notes Class B, New Convertible Notes Class C (collectively, “New Convertible Notes”) and ERO New Common Stock (each as defined in the Plan), which offerings concluded on October 12, 2022. On November 3, 2022, the Plan became effective pursuant to its terms and we emerged from bankruptcy. In connection with our emergence and the conversion of the New Convertible Notes into shares of the Company, the equity interests of existing shareholders were substantially diluted. The shares represented by ADRs currently amount to a small portion of our capital. The market prices of the shares represented by ADRs may be adversely affected by such dilution and may experience significant fluctuation and volatility.

Our major shareholders may have interests that differ from those of our other shareholders.

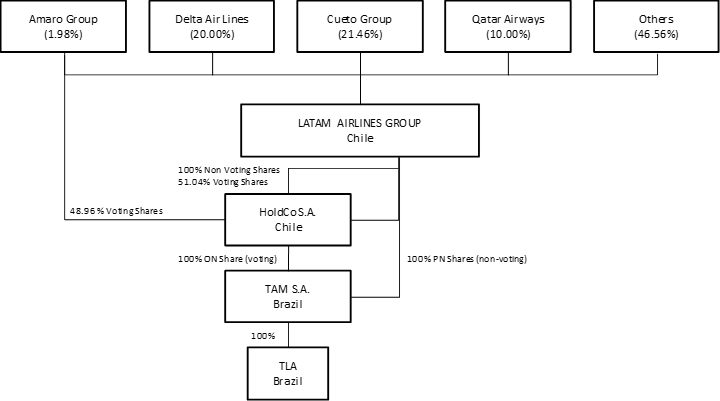

The major shareholder group,As of February 28, 2023, Sixth Street Partners beneficially owned 27.9% of our common shares; Strategic Value Partners beneficially owned 16.0% of our common shares, Delta Air Lines owned 10.0% of our common shares; Qatar Airways Investments (UK) Ltd. owned 10.0% of our common shares (9.999999992% over LATAM’s statutory capital), Sculptor Capital beneficially owned 6.5% of our common shares; and the Cueto Group (the “Cueto Group”), beneficially owned 21.46%5.0% of our common shares as of February 29, 2020. In addition, the Cueto Group entered into a shareholders’ agreement with the Amaro Group (the “Amaro Group”), which as of February 29, 2020, held 1.98% of LATAM shares through TEP Chile, in addition to the indirect stake it has through the 21.88% interest it holds in Costa Verde Aeronáutica S.A., the main legal vehicle through which the Cueto Group holds LATAM shares, pursuant to which these two major shareholder groups have agreed to vote together to elect individuals to our board of directors in accordance with their direct and indirect shareholder interest in LATAM. Pursuant to the shareholders’ agreement, the Cueto Group and the Amaro Group have also agreed to use their good faith efforts to reach an agreement and act jointly on all actions to be taken by our board of directors or shareholders’ meeting, and if unable to reach to such agreement, to follow the proposals made by our board of directors. Decisions by the Company that require supermajority votes under Chilean law are subject to voting arrangements by the Cueto Group and the Amaro Group. In addition, othershares. These shareholders including, Delta Air Lines, Inc, which, as of February 29, 2020, held 20.00% of our common shares, and Qatar Airways Investments (UK) Ltd., which as of February 29, 2020, held 10.00% of our common shares, could have interests that may differ from those of our other shareholders. See “Item 7. Major Shareholders and Related Party Transactions—A.Transactions-A. Major Shareholders.”

Under the terms of the deposit agreement governing the ADSs, if holders of ADSs do not provide JP Morgan Chase Bank, N.A., in its capacity as depositary for the ADSs, with timely instructions on the voting of the common shares underlying their ADRs, the depositary will be deemed to have been instructed to give a person designated by the board of directors the discretionary right to vote those common shares. The person designated by the board of directors to exercise this discretionary voting right may have interests that are aligned with our controllingmajor shareholders, which may differ from those of our other shareholders. Historically, our board of directors has designated its chairman to exercise this right; for example,right, which is however no guarantee that it will do so in the future. The members of the board of directors elected by the shareholders in 20192022 designated Mr. Ignacio Cueto, to serve in this role.

17

Trading of our ADSs and common shares in the securities markets is limited and could experience further illiquidity and price volatility.

As a result of our Chapter 11 proceedings, on June 10, 2020, the NYSE notified the SEC of its intention to remove the ADSs from listing and registration on the NYSE, effective at the opening of business on June 22, 2020. As of the date of this annual report, the ADSs are traded in the over-the-counter market, which is a less liquid market, and our ADR program, with JP Morgan Chase Bank, N.A. as depositary, is not open for issuances. There is no defined timeline for re-opening the ADR program or for returning to the U.S. public markets. In addition, there can be no assurance that the ADSs will continue to trade in the over-the-counter market or that any public market for the ADSs will exist in the future, whether broker-dealers will continue to provide public quotes of the ADSs, whether the trading volume of the ADSs will be sufficient to provide for an efficient trading market, whether quotes for the ADSs may be blocked in the future or that we will be able to relist the ADSs on a securities exchange.

Our common shares are listed on the various Chilean stock exchanges.Santiago Stock Exchange. Chilean securities markets are substantially smaller, less liquid and more volatile than major securities markets in the United States. In addition, Chilean securities markets may be materially affected by developments in other emerging markets, particularly other countries in Latin America. Accordingly, although you are entitled to withdraw the common shares underlying the ADSs from the depositary at any time, your ability to sell the common shares underlying ADSs in the amount and at the price and time of your choice may be substantially limited. This limited trading market may also increase the price volatility of the ADSs or the common shares underlying the ADSs.ADSs, which could also result in price disparity between the trading prices of the two.

Holders of ADRs may be adversely affected by currency devaluations and foreign exchange fluctuations.

If the Chilean peso exchange rate falls relative to the U.S. dollar, the value of the ADSs and any distributions made thereon from the depositary could be adversely affected. Cash distributions made in respect of the ADSs are received by the depositary (represented by the custodian bank in Chile) in pesos, converted by the custodian bank into U.S. dollars at the then-prevailing exchange rate and distributed by the depositary to the holders of the ADRs evidencing those ADSs. In addition, the depositary will incur foreign currency conversion costs (to be borne by the holders of the ADRs) in connection with the foreign currency conversion and subsequent distribution of dividends or other payments with respect to the ADSs.

Future changes in Chilean foreign investment controls and withholding taxes could negatively affect non-Chilean residents that invest in our shares.

Equity investments in Chile by non-Chilean residents have been subject in the past to various exchange control regulations that govern investment repatriation and earnings thereon. Although not currently in effect, regulations of the Central Bank of Chile have in the past required, and could again require,imposed such exchange controls. Nevertheless, foreign investors acquiring securities instill have to provide the secondary market in ChileCentral Bank with information related to maintain a cash reserve or to pay a fee upon conversion of foreign currency to purchaseequity investments and must conduct such securities.operations within the formal exchange market. Furthermore, any changes in withholding taxes could negatively affect non-Chilean residents that invest in our shares.

We cannot assure you that additional Chilean restrictions applicable to the holders of ADRs, the disposition of the common shares underlying ADSs or the repatriation of the proceeds from an acquisition, a disposition or a dividend payment, will not be imposed or required in the future, nor could we make an assessment as to the duration or impact, were any such restrictions to be imposed or required. For further information, see “Item 10. Additional Information—D.Information-D. Exchange Controls—ForeignControls-Foreign Investment and Exchange Controls in Chile.”

Our ADS holders may not be able to exercise preemptive rights in certain circumstances.

The Chilean Corporation Law providesAs described further in “Item 10. Additional Information-Preemptive Rights and Increases in Share Capital,” to the extent that a holder of our ADSs is unable to exercise its preemptive rights shall be grantedbecause a registration statement has not been filed, the depositary may attempt to all shareholders whenever a company issues new shares for cash, giving such holderssell the right to purchase a sufficient numberholder’s preemptive rights and distribute the net proceeds of shares to maintain their existing ownership percentage. We will not be able to offer shares to holdersthe sale, net of ADSsthe depositary’s fees and shareholders located in the United States pursuantexpenses, to the holder, provided that a secondary market for those rights exists and a premium can be recognized over the cost of the sale. A secondary market for the sale of preemptive rights grantedcan be expected to shareholdersdevelop if the subscription price of the shares of our common stock upon exercise of the rights is below the prevailing market price of the shares of our common stock. However, we cannot assure you that a secondary market in preemptive rights will develop in connection with any future issuance of shares unlessof our common stock or that if a registration statement undermarket develops, a premium can be recognized on their sale. Amounts received in exchange for the U.S. Securities Actsale or assignment of 1933, as amended, (the “Securities Act”), is effective with respectpreemptive rights relating to such rightsshares of our common stock will be taxable in Chile and shares, or an exemption from the registration requirements of the Securities Act is available. At the time of any rights offering, we will evaluate the potential costs and liabilities associated with any such registration statement in light of any indirect benefit to us of enabling U.S. holders of ADRs evidencing ADSs and shareholders located in the United StatesStates. See “Item 10. Additional Information-E. Taxation-Chilean Tax-Capital Gains.” As described further in “Item 10. Additional Information-B. Memorandum and Articles of Association-Preemptive Rights and Increases in Share Capital,” the inability of holders of ADSs to exercise preemptive rights in respect of common shares underlying their ADSs could result in a change in their percentage ownership of common shares following a preemptive rights offering. If a secondary market for the sale of preemptive rights does not develop and such rights cannot be sold, they will expire and a holder of our ADSs will not realize any value from the grant of the preemptive rights. In either case, the equity interest of a holder of our ADSs in us will be diluted proportionately. Pursuant to the Registration Rights Agreement, we have entered into with the Backstop Creditors and the Backstop Shareholders, we have reached an agreement to amend the terms of the deposit agreement governing our ADSs, to provide for (a) full flexibility (subject to applicable fees and procedures contained in the deposit agreement) to deposit and withdraw, at the election of the respective holders of ADS, any ordinary shares from time to time held by the backstop parties or their transferees into or out of the ADS program; (b) participation in dividends and distributions subject to the procedures of the depositary as wellset forth in the deposit agreement and subject to compliance with applicable law (including, without limitation, Chilean law); (c) participation in voting at the instruction of the respective holders of ADS, subject to the procedures of the depositary as any other factors that may be considered appropriate at that time,set forth in the deposit agreement and we will then make a decision assubject to whether we will file a registration statement. We cannot assure you that we will decidecompliance with applicable law (including, without limitation, Chilean law); and (d) participation in preemptive rights offerings in the form of additional ADS subject to file a registration statement orcompliance with applicable law (including, without limitation, Chilean law) and the procedures of the Depositary set forth in the deposit agreement; provided that such rights will be availableofferings are for ordinary shares constituting at least two percent (2%) of the outstanding ordinary shares (excluding any Ordinary Shares subject to ADS holders and shareholders located in the United States.lock-up).

We are not required to disclose as much information to investors as a U.S. issuer is required to disclose and, as a result, you may receive less information about us than you would receive from a comparable U.S. company.

The corporate disclosure requirements that apply to us may not be equivalent to the disclosure requirements that apply to a U.S. company and, as a result, you may receive less information about us than you would receive from a comparable U.S. company. We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended or the Exchange Act.(the “Exchange Act”). The disclosure requirements applicable to foreign issuers under the Exchange Act are more limited than the disclosure requirements applicable to U.S. issuers. Publicly available information about issuers of securities listed on Chilean stock exchanges also provides less detail in certain respects than the information regularly published by listed companies in the United States or in certain other countries. Furthermore, there is a lower level of regulation of the Chilean securities market and of the activities of investors in such markets as compared with the level of regulation of the securities markets in the United States and in certain other developed countries. For further information, see “Item 16. Reserved—G. Corporate Governance.”

ITEM 4 INFORMATION ON THE COMPANY

A. HISTORY AND DEVELOPMENT OF THE COMPANYGeneral

General

LATAM Airlines Group S.A. is a Chilean-based airline and holding company formed through the business combination ofthat changed its name from LAN Airlines S.A. of Chile andafter its combination with TAM of Brazil in 2012. Following the combination, LAN Airlines S.A. became “LATAM Airlines Group S.A.” and TAM S.A. continues to exist as a subsidiary of LATAM. The Company is primarily involved in the transportation of passengers and cargo and operates as one unified business enterprise. During 2016, we began the transition of unifying LAN and TAM into a single brand: LATAM.

LATAM’s airline holdings include LATAM and its affiliates in Chile, Peru, Argentina, Colombia and Ecuador, and LATAM Cargo and its affiliate LANCO (in Colombia), as well as TAM S.A. and its affiliates TAM Linhas Aereas S.A (LATAMLATAM Airlines Brazil), TAM Transportes Aereos del MercosurBrazil, LATAM Airlines Paraguay, ABSA and Multiplus S.A., (LATAM (“Multiplus”). LATAM Airlines Paraguay) and LATAM Cargo. LATAMGroup is a publicly traded corporation listed on the Santiago Stock Exchange (“SSE”), the Chilean Electronic Exchange, and its ADSs currently trade in the New York Stock Exchange (“NYSE”) withover-the-counter market. LATAM Airlines Group has a market capitalization of US$4.12 billion 4,565 million as of February 29, 2020.28, 2023.

LATAM’s history goes back to 1929, when the Chilean government founded LAN. In 1989, the Chilean government sold 51.0% of LAN’s capital stock to Chilean investors and to SAS,the Scandinavian Airlines System. In 1994, the Cueto Group, one of LATAM’s current controlling shareholders, together with other major shareholders, acquired 98.7% of LAN’s stock, including the remaining shares then held by the Chilean government. In 1997, LAN became the first Latin American airline to list its shares (which trade in the form of ADSs) on the New York Stock Exchange.

Over the past decade, the LATAM group has significantly expanded its passenger operations in Latin America, initiating services in Peru in 1999, Ecuador in 2003, Argentina in 2005, Ecuador in 2009, and Colombia in 2010. The business combination of LAN and TAM inMoreover, since June 2012 further expanded the Company’s operations in Brazil, whereBrazilian affiliate, TAM Linhas Aéreas S.A. (“TLA” or “LATAM Airlines Brazil”), the TAM operating entity, ishas been a leading domestic and international airline offering flights throughout Brazil with a strong domestic market share, international passenger services and significant cargo operations. TAM was founded in

As a result of the COVID-19 pandemic and its profound impact on worldwide travel and our operations, on May 1997 (under the nameCompanhia de Investimentos em Transportes), for the purpose of participating in, managing and consolidating shareholdings in airlines. In September 2002, TAM’s name was changed to TAM26, 2020, LATAM Airlines Group S.A. and 28 affiliates filed their petitions for relief under Chapter 11 of the Bankruptcy Code, with the Bankruptcy Court. On July 7, 2020 and July 9, 2020 nine additional affiliates of LATAM Airlines Group S.A. filed their petitions for relief under Chapter 11 of the Bankruptcy Code with the Bankruptcy Court. Additional parallel and ancillary proceedings were filed in the Cayman Islands, Colombia, Perú and Chile. In June 2020, LATAM Airlines Argentina announced its shares were listedindefinite cessation of passenger and cargo operations.

Throughout the Chapter 11 proceedings, the Reorganized Debtors worked on different fronts, among other things, right-sizing our fleet and executing our fleet strategy, reducing our total headcount, reviewing claims filed against the Reorganized Debtors and refining the total claims pool, and streamlining the Reorganized Debtors’ prepetition agreements by rejecting executory contracts and leases and negotiating favorable post-petition and post-emergence agreements with key vendors across our business. The Reorganized Debtors also worked steadily to develop a long-term business plan, obtaining new sources of financing to support their exit financing as part of their emergence from Chapter 11 and building a new capital structure according to the terms of their plan of reorganization.

Following a series of relevant milestones with respect to LATAM’s Chapter 11 proceedings, the Company emerged from its reorganization process on November 3, 2022 (the “Effective Date”). For more information on the Brazilian Stock Exchange (“Bovespa”) in June 2005. From 2006 until the combination with LAN in 2012, TAM ADSs were also listedChapter 11 proceedings see “Item 3. Key Information-D. Risk Factors-Risks Relating to Our Emergence from Chapter 11 Bankruptcy Proceedings” and “Item 4. Information on the NYSE.Company - B. Business Overview - Chapter 11 Proceedings through 2022.” As of the Effective Date, the Plan was substantially consummated and became binding on all parties in interest. Pursuant to the Plan, the Company received an infusion of approximately US$ 8.19 billion through a mix of new equity, convertible notes, and debt, which enabled the Company to exit Chapter 11 with appropriate capitalization to effectuate its business plan. Upon emergence, the Company had total debt of approximately US$ 6.8 billion, cash and cash equivalents of approximately US$1.1 billion and revolving facilities fully undrawn in the amount of US$1.1 billion.

Our principal executive offices are located at Presidente Riesco 5711, 20th floor, Las Condes, Santiago, Chile and our general telephone number at this location is (56-2) 2565-2525.2565-3844. We have designated LATAM Airlines Group as our agent in the United States, located at 970 South Dixie Highway,6500 NW 22nd Street, Miami, Florida 33156.33122. Our Investor Relations website address is www.latamairlinesgroup.net. Information obtained on, or accessible through, this website is not incorporated by reference herein and shall not be considered part of this annual report. For more information, contact Andrés del Valle, Senior Vice President of Corporate Finance and Investor Relations, at InvestorRelations@latam.com.

The SEC maintains an internet site at http://www.sec.gov that contains reports, information statements, and other information regarding issuers that file electronically with the SEC.

Capital Expenditures

For a description of our capital expenditures, see “Item 5. Operating and Financial Review and Prospects—B.Prospects-B. Liquidity and Capital Resources—CapitalResources-Capital Expenditures.”

B. BUSINESS OVERVIEW

| B. | Business Overview |

General

LATAM is the largest passenger airline group in South America.America as measured by ASKs for the year ended December 31, 2022. We are also one of the largest airline groups in the world in terms of network connections, as of December 31, 2022, providing passenger transport services to approximately 145144 destinations in 2622 countries and cargo services to approximately 151154 destinations in 2925 countries, with an operating fleet of 331310 aircraft and a set of bilateral alliances. In total, LATAM Airlines Group has approximately 42,00032,500 employees.

For the year 2019,2022, LATAM transported approximately 7462 million passengers. LATAM Airlines Group and its affiliates currently provide domestic services in Brazil, Chile, Peru, Argentina, Colombia and Ecuador; and also provide intra-regional and long-haul operations. The cargo affiliate carriers of LATAM in Chile, Brazil, and Colombia carry out cargo operations through the use of belly space on the passenger flights and dedicated cargo operations using freightfreighter aircraft. WeThe group also offeroffers other services, such as ground handling, courier, logistics and maintenance.

As of December 31, 2019, we2022, the group provided scheduled passenger service to 17 destinations in Chile, 2019 destinations in Peru, six8 destinations in Ecuador, 13 destinations in Argentina, 1417 destinations in Colombia, 4554 destinations in Brazil, 1014 destinations in other Latin American countries and the Caribbean, seven5 destinations in North America, seven8 destinations in Europe, fourand 2 destinations in Australasia, one destinationOceania, an increase from last year as the COVID-19 restrictions both within the region and in Asia and one destination in Africa.the international markets where we operate continued to ease during the year, accompanied by strong levels of demand for air travel.

In addition, as of December 31, 2019,2022, through our various code-sharing agreements, we offerthe group offers service to 66105 destinations in North America, 6732 destinations in South America, 86 destinations in Europe, 1517 destinations in Australasia, 2238 destinations in Asia and 711 destinations in Africa.

Competitive Strengths

Our strategy is to maintain LATAM Airlines Group’s position as the leading airline group in South America by leveraging our unique position in the airline industry. LATAM Airlines Group is the only airline group in the region with a domestic presence in sixfive markets, as well as intra-regional and long-haul operations to fivethree continents. As a result, the CompanyLATAM group has geographical diversity and operational flexibility, as well as a proven track record of acting quickly to adapt its business to economic challenges. Moreover, LATAM’s unique leadership positionnetwork and market share in a region with growth potential and the focus on our existing competitive strengths, will allow us to continue building our business model and fuel our future growth, ensuring LATAM’s long term sustainability.growth. We believe our most important competitive strengths are:

Leader in the South America Airlines Space, with a Unique Leadership Position among Global Airlines

| ● | Leader in the South America Airlines Space, with a Unique Network and Market Share among Global Airlines |