UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20202023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________OR

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report ____________________________________

For the transition period from ___________ to ___________

Commission file number: 000-56154001-40848

GUARDFORCE AI CO., LIMITED

(Exact Name of Registrant as Specified in Its Charter)

Not Applicable

(Translation of Registrant’s Name Into English)

Cayman Islands

(Jurisdiction of Incorporation or Organization)

Lei WANG (olivia.wang@guardforceai.com)

96 Vibhavadi Rangsit10 Anson Road, Talad Bangkhen, Laksi, Bangkok 10210, Thailand#28-01 International Plaza, Singapore 079903

Tel: +65 6702 1179

(Address of Principal Executive Offices)

96 Vibhavadi RangsitLei Wang, CEO

+65 6702 1179

olivia.wang@guardforceai.com

10 Anson Road, Talad Bangkhen, Laksi, Bangkok 10210, Thailand#28-01 International Plaza, Singapore 079903

Tel: +66 (0) 2973 6011

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange Which Registered | ||

| Warrants, No par value | GFAIW | The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

ordinary shares, $0.001 par value per shareNone

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 52,068,959report (December 31, 2023): There were 9,830,373 shares of the registrant’s ordinary shares outstanding.outstanding, par value $0.12 per share.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☐☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definitionthe definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ |

| Non-Accelerated Filer | Emerging growth company | ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards†standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting ☒ | Other ☐ | ||

| Standards as issued by the International Accounting Standards Board |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ☐ Yes ☐ No

Annual Report on Form 20-F

Year Ended December 31, 2023

TABLE OF CONTENTS

i

i

ii

| ITEM 16C. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 103 | ||

| ITEM 16D. | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | 104 | ||

| ITEM 16E. | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 104 | ||

| ITEM 16F. | CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT | 104 | ||

| ITEM 16G. | CORPORATE GOVERNANCE | 105 | ||

| ITEM 16H. | MINE SAFETY DISCLOSURE. | 105 | ||

| ITEM 16I. | DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS. | 105 | ||

| PART III | ||||

| ITEM 17. | FINANCIAL STATEMENTS | 106 | ||

| ITEM 18. | FINANCIAL STATEMENTS | 106 | ||

| ITEM 19. | EXHIBITS | 106 |

iii

INTRODUCTORY NOTES

Use of Certain Defined Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to:

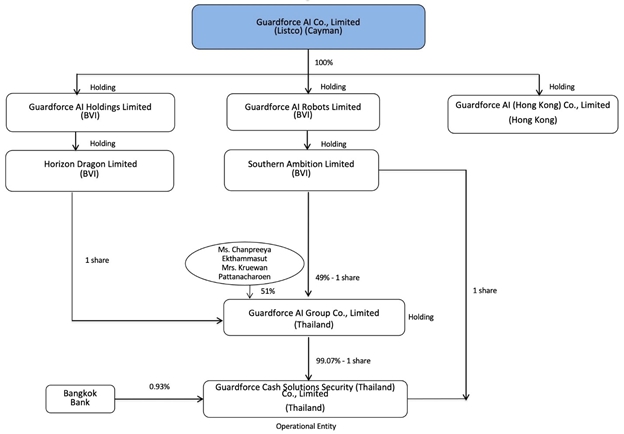

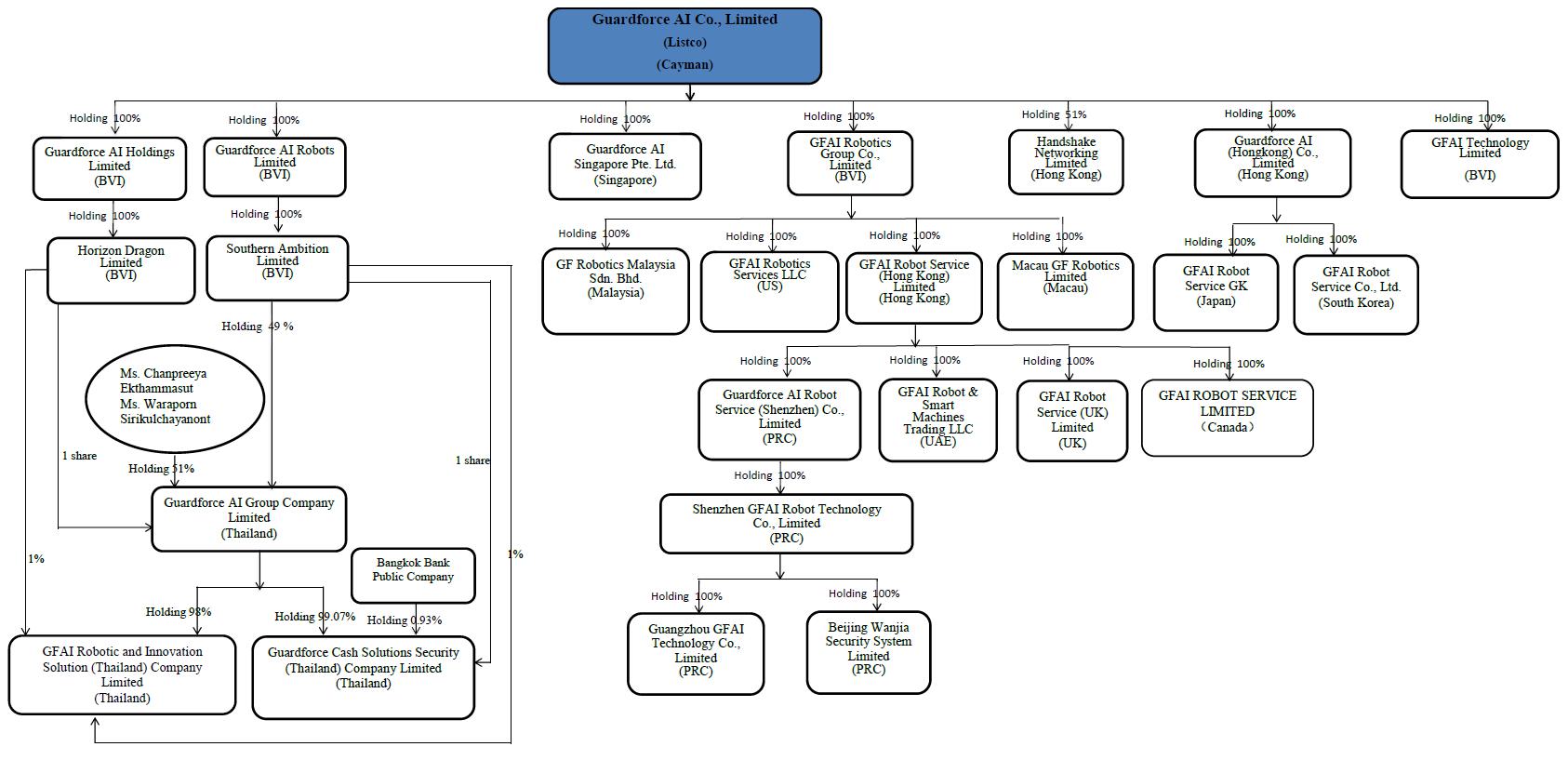

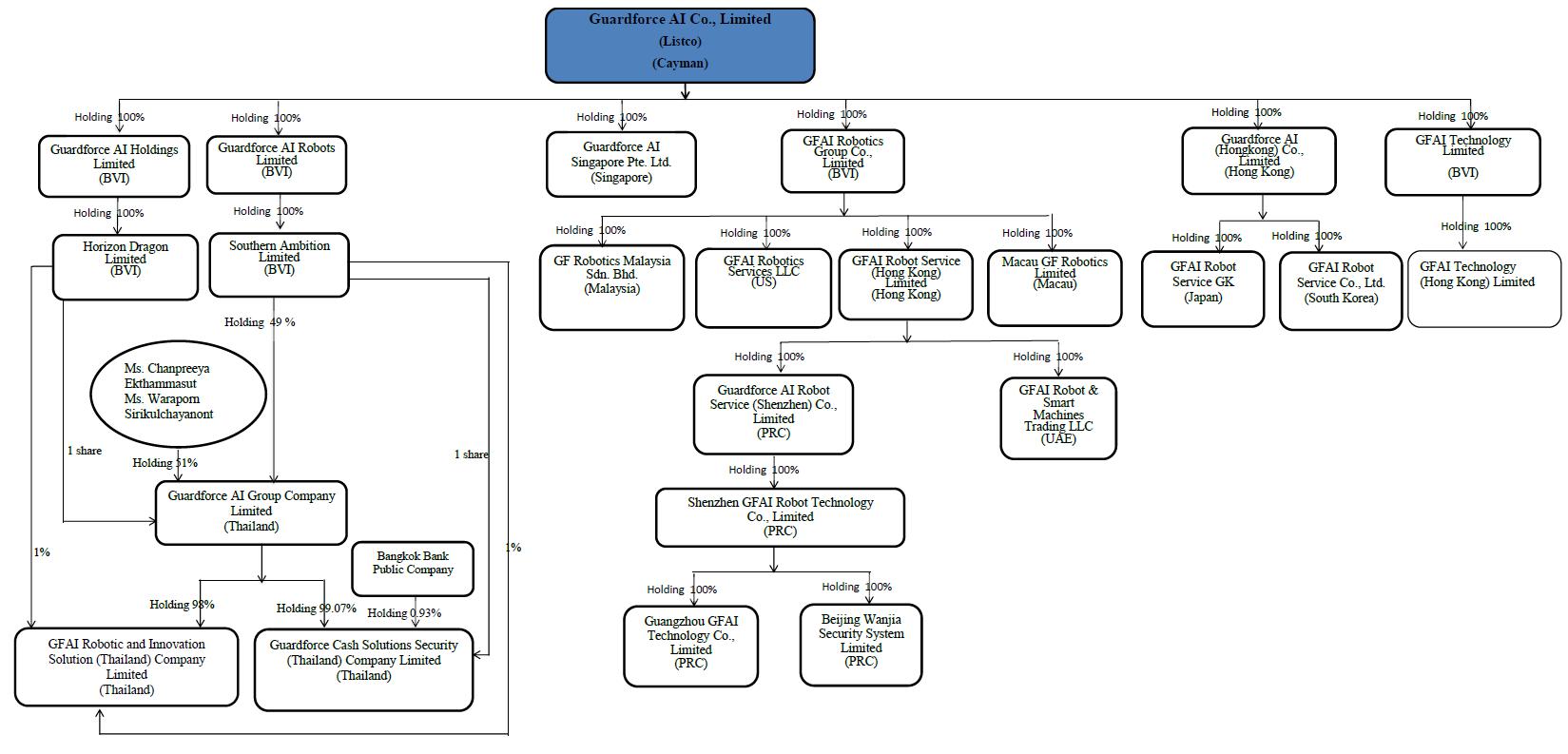

| ● | “AI Holdings” are to Guardforce AI Holdings Limited, a BVI company and our wholly owned subsidiary; | |

| ● | “AI Hong Kong” are to Guardforce AI (Hongkong) Co., Limited, a Hong Kong company and our wholly owned subsidiary; | |

| ● | “AI Robots” are to Guardforce AI Robots Limited, a BVI company and our wholly owned subsidiary; | |

| ● | “AI Singapore” are to Guardforce AI Singapore Pte Ltd., a Singapore company and our wholly owned subsidiary; | |

| ● | “AI Technology” are to Guardforce AI Technology Limited, a BVI company and one of our shareholders; | |

| ● | “AI Thailand” are to Guardforce AI Group Co., Limited, a Thailand company and our wholly controlled subsidiary; | |

| ● | “Baht” and “THB” are to the legal currency of Thailand; | |

| ● | “Bank of Thailand” or “BOT” are to Thailand’s central bank; | |

| ● | “BVI” are to the British Virgin Islands; | |

| ● | “Beijing Wanjia” are to Beijing Wanjia Security System Limited, a PRC company and Shenzhen GFAI’s wholly owned subsidiary; | |

| ● | “CIT” are to cash-in-transit or cash/valuables-in-transit; | |

| ● | “Companies Act” are to the Companies Act (As Revised), as consolidated and revised, of the Cayman Islands; | |

| ● | “Exchange Act” are to the Securities Exchange Act of 1934, as amended; | |

| ● | “FINRA” are to the Financial Industry Regulatory Authority; | |

| ● | “GF Cash (CIT)” are to Guardforce Cash Solutions Security (Thailand) Co., Ltd., a Thailand company and AI Thailand’s 99.07% owned subsidiary; |

| ● | “Guardforce,” “we,” “us,” “our” and the “Company” are to the combined business of Guardforce AI Co., Limited, a Cayman Islands company, its subsidiaries and other consolidated entities; | |

| ● | “GFAI Japan” are to GFAI Robot Service GK, a Japan company and AI Hong Kong’s wholly owned subsidiary; | |

| ● | “GFAI Korea” are to GFAI Robot Service Co., Ltd., a South Korea company and AI Hong Kong’s wholly owned subsidiary; | |

| ● | “GFAI R&I” are to GFAI Robotic and Innovation Solution (Thailand) Company Limited, a Thailand company and 98% owned by AI Thailand, 1% owned by Horizon Dragon and 1% owned by Southern Ambition; | |

| ● | “GFAI UK” are to GFAI Robot Service (UK) Limited, a UK company and Robot Service Hong Kong’s wholly owned subsidiary; |

iv

| ● | “GFAI Canada” are to GFAI Robot Service Limited, a company incorporated in the Province of Ontario, Canada, and Robot Service Hong Kong’s wholly owned subsidiary, on January 5, 2024, the Company deregistered GFAI Canada; | |

| ● | “GFAI Vietnam” are to GFAI Robot Service (Vietnam) Co., Ltd, a Vietnam company and AI Hong Kong’s wholly owned subsidiary, on March 22, 2023, the Company deregistered AI Vietnam; | |

| ● | “Guangzhou GFAI” are to Guangzhou GFAI Technology Co., Limited, formerly known as Guangzhou Kewei Robot Technology, a PRC company and Shenzhen GFAI’s wholly owned subsidiary; | |

| ● | “GFAI Technology” are to GFAI Technology Limited, a BVI company and our wholly owned subsidiary; | |

| ● | “ |

| ● |

| “Handshake” are to Handshake Networking Limited, a Hong Kong |

| ● | “Hong Kong” are to the Hong Kong Special Administrative Region of the People’s Republic of China; |

| ● | “Horizon Dragon” are to Horizon Dragon Limited, a BVI company and AI Holdings’ wholly owned subsidiary; | |

| ● | “Macau” are to the Macau Special Administrative Region of the People’s Republic of China; | |

| ● | “PRC” and “China” are to the People’s Republic of China; | |

| ● | “Robotics BVI” are to GFAI Robotics Group Co., Limited, a BVI company and our wholly owned subsidiary; | |

| ● | “Robotics Malaysia” are to GF Robotics Malaysia Sdn. Bhd., a Malaysia company and Robotics BVI’s wholly owned subsidiary; | |

| ● | “Robot Service Hong Kong” are to GFAI Robot Service (Hong Kong) Limited, a Hong Kong company and Robotics BVI’s wholly owned subsidiary; | |

| ● | “Robot Service Australia” are to GFAI Robot Service (Australia) Pty Ltd., an Australia company and Robot Service Hong Kong’s wholly owned subsidiary, on September 25, 2023, the Company deregistered Robot Service Australia; | |

| ● | “Robotics US” are to GFAI Robotics Services LLC, a Delaware limited liability company and Robotics BVI’s wholly owned subsidiary; | |

| ● | “Robotics Macau” are to Macau GF Robotics Limited, a Macau company and Robotics BVI’s wholly owned subsidiary; | |

| ● | “Robot Service Shenzhen” are to Guardforce AI Robot Service (Shenzhen) Co., Limited, a PRC company and Robot Service Hong Kong’s wholly owned subsidiary; | |

| ● | “Robot Trading Dubai” are to GFAI Robot & Smart Machines Trading LLC, an UAE limited liability company and Robot Service Hong Kong’s wholly owned subsidiary; | |

| ● | “Shenzhen GFAI” are to Shenzhen GFAI Robot Technology Co., Limited, formerly name as Shenzhen Keweien Robot Service Co. Limited, a PRC company and Robot Service Shenzhen’s wholly owned subsidiary; | |

| ● | “Robot Jian” are to Guardforce AI Robot (Jian) Co., Limited, a PRC company and Robot Service Hong Kong’s wholly owned subsidiary, on November 22,2023, the Company deregistered Robot Jian; | |

| ● | “Securities Act” is to the Securities Act of 1933, as amended; | |

| ● | “Shenzhen Kewei” are to Shenzhen Kewei Robot Technology Co., Limited, a PRC company; | |

| ● | “Shenzhen Yeantec” are to Shenzhen Yeantec Co., Limited, a PRC company. |

v

| ● | “ | |

| ● | “South Korea” are to the |

| ● | “SEC” are to the Securities and Exchange Commission; |

| ● | “ |

| ● | “ |

| ● | “ |

| ● |

| “U.S. dollars,” “dollars,” “USD” and “$” are to the legal currency of the United States; |

| ● | “Vietnam” are to Socialist Republic of Vietnam; | |

| ● | “VCAB” are to VCAB Eight |

| ● | “ |

iii

Forward-Looking Information

This Annual Report on Form 20-FIn addition to historical information, this annual report contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will” or similar expressions which are intended to identify forward-looking statements. Such statements include, among others, those concerning market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins, or other financial items; any statements of the plans, strategies and objectives of management for future operations; and any statements regarding future economic conditions or performance, as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, as well as assumptions, which, if they were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements. Potential risks and uncertainties include, among other things, the possibility that third parties hold proprietary rights that preclude us from marketing our products, the emergence of additional competing technologies, changes in domestic and foreign laws, regulations and taxes, changes in economic conditions, uncertainties related to legal system and economic, political and social events in Thailand, a general economic downturn, a downturn in the securities markets, and other risks and uncertainties which are generally set forth under Item 3 “Key information—D. Risk Factors” and elsewhere in this annual report.

Readers are urged to carefully review and consider the various disclosures made by us in this report and our other filings with the SEC. These reports attempt to advise interested parties of the risks and factors that may affect our business, financial condition and results of operations and prospects. The forward-looking statements made in this report speak only as of the date hereof and we disclaim any obligation, except as required by law, to provide updates, revisions, or amendments to any forward-looking statements to reflect changes in our expectations or future events.

iv

vi

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors and Senior Management

For the sake of clarity, thisNot applicable for annual report follows the English naming convention of given name followed by surname name, regardless of whether an individual’s name is Chinese or English. For example, the name of our Director and CEO will be presented as “Lei Wang,” even though, in Chinese, her name is presented as “Wang Lei.”

Our legal adviser with respect to US securities laws and the filing of this annual reportreports on Form 20-F is Bevilacqua PLLC, with a business address at 1050 Connecticut Avenue, NW, Suite 500, Washington, DC 20036.20-F.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE Not applicable for annual reports on Form 20-F. A. Our independent registered public accounting firm with respect to the audits of the Company’s consolidated financial statements as of December 31, 2020 and 2019 and for the years then ended included in this Annual Report on Form 20-F is Wei, Wei & Co., LLP, with a business address at 133-10 39th Avenue, Flushing, New York 11354.Not applicable.B. Method and Expected TimetableNot applicable.Guardforce was incorporated on April 20, 2018 in the Cayman Islands as a holding company to acquire the business of GF Cash (CIT) which operates as our indirect subsidiary. GF Cash (CIT) was incorporated in 1982 in Thailand and has been operating in the cash-in-transit, or CIT, industry since that time.Selected Financial Data[RESERVED]

Not applicable.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

An investment in our securities involves a high degree of risk. Yourisk and our ordinary shares and warrants should be purchased only by persons who can afford to lose the entire amount invested. Before purchasing any of our securities, you should carefully consider the risks described below, together with allfollowing factors relating to our business and prospects. You should pay particular attention to the fact that we currently conduct a significant portion of our operations in Thailand and are governed by a legal and regulatory environment that in some respects differs significantly from the environment that may prevail in the U.S. and other information included in this annual report, before making an investment decision.countries. If any of the following risks actually occurs, our business, financial condition or operating results of operations could suffer. In that case,will suffer, the trading pricevalue of our ordinary shares could decline, and you may lose all or part of your investment.

Summary of Risk Factors

Investing in our company involves significant risks. These risks include the following:

Risks Relating to Our Business and Industry

Risks and uncertainties related to our business and industry include, but are not limited to, the following:

| ● | Our negative operating profits may raise substantial doubt regarding our ability to continue as a going concern; |

| ● | We operate in highly competitive industries; |

| ● | We currently report our financial results under IFRS; |

| ● | We have substantial customer concentration, with a limited number of customers accounting for a substantial portion of our recent revenues; |

| ● | Changes to legislation in Thailand may negatively affect our business; |

| ● | Unexpected increases in minimum wages in Thailand would reduce our net profits; |

| ● | Increases in fuel cost would negatively impact our cost of operations; |

| ● | Our strategy may not be successful; |

| ● | We might not have sufficient cash or to obtain necessary funding to fully execute our growth strategy; |

| ● | Our business success depends on retaining our leadership team and attracting and retaining qualified personnel; |

| ● | In the future we may not be able to use the Guardforce trademark, which could have a negative impact on our business; |

| ● | We may be subject to service quality or liability claims, which may cause us to incur litigation expenses and to devote significant management time to defending such claims, and if such claims are determined adversely to us, we may be required to pay significant damage awards; |

| ● | Decreasing use of cash could have a negative impact on our business; | |

| ● | We may encounter provisions and impairments on our assets due to our business model and the development of our AI and robotics business, particularly amidst the fast-changing technologies. | |

| ● | The AI industry is confronting a multitude of challenges across different dimensions, including laws & regulations, regulatory compliance, ethical and societal considerations. Failure to comply with the updated rules and regulations may lead to financial loss, or reputational damage. |

| ● | Implementation of our AI & robotics solution has required, and may continue to require, significant capital and other expenditures, which we may not recoup; | |

| ● | Divestiture of previously acquired Handshake may affect certain investors’ interest in our business growth. |

● | We may fail to successfully integrate our other acquisitions of Shenzhen GFAI, Guangzhou GFAI, and Beijing Wanjia, and may fail to realize the anticipated benefits and resulted in losing the goodwill of these subsidiaries; |

| ● | We may not be able to obtain the necessary funding for our future capital or refinancing needs; |

| ● | Any compromise of information security of our platform could materially and adversely affect our business, operations, and reputation; and |

| ● | Our transfer pricing decisions may result in uncertain tax exposures for our group. |

| ● | We are currently operating in a period of economic uncertainty and capital markets disruption, which has been significantly impacted by geopolitical instability due to the ongoing military conflicts between Russia and Ukraine, and the war in the Middle East. Our business, financial condition and results of operations may be materially adversely affected by any impact on the global economy and capital markets resulting from the conflicts above or any other geopolitical tensions. |

Risks Relating to our BusinessCorporate Structure

Risks and uncertainties related to our corporate structure include, but are not limited to, the following:

| ● | We rely upon structural arrangements to establish control over certain entities and government authorities may determine that these arrangements do not comply with existing laws and regulations. |

The effect of the coronavirus, or the perception of its effects, on our operationsRisks Relating to Dissolving Foreign Subsidiaries

| ● | We may face legal and regulatory risks associated with the closure of our foreign subsidiaries, especially when nominee directors are appointed, as the process of dissolution is subject to specific laws and regulations in each jurisdiction that may be complex and vary; | |

| ● | We may face risks related to employment and labor relations, including potential claims for wrongful termination, disputes over severance packages, and other employment-related liabilities; |

| ● | The existing contractual obligations of the subsidiaries may not be terminated without incurring costs, such as tax liabilities arising from the settlement of intercompany transactions; moreover, we may face lawsuits for breach of contract; and |

| ● | The process of dissolving foreign subsidiaries may incur significant costs, including settlement of lease, contract termination fees, employee severance, and other closure-related expenses, impacting our financial position. |

Risks Relating to Doing Business in Thailand

Risks and the operations of our customers and suppliers could have a material adverse effect on ouruncertainties related to doing business financial condition, results of operations and cash flows.

We have been closely monitoring the outbreak of the Coronavirus (“COVID-19”) that is now spreading all over the world, including to Thailand. The duration and extent of the coronavirus pandemic and related government actions may impact many aspects of our business, including creating workforce limitations, travel restrictions and impacting our customers and suppliers. If a significant percentage of our workforce is unable to work, either because of illness or travel or government restrictions in connection with the coronavirus outbreak, our operations may be negatively impacted. The Company’s response strategy in areas of high impact may result in a temporary reduced workforce as a result of self-isolation or other government or Company imposed measures to quarantine impacted employees and prevent infections at the workplace.

In addition, the coronavirus may result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, including Thailand, resulting in an economic downturn that could affect demand for our products and services. Imposed government regulations could adversely impact the Company’s results of operations, business, financial condition, or prospects derived from its operations in Thailand or other affected areas. Further,include, but are not limited to, the outbreakfollowing:

| ● | A severe or prolonged downturn in the global economy or the markets that we primarily operate in could materially and adversely affect our revenues and results of operations; |

| ● | We are vulnerable to foreign currency exchange risk exposure; and |

| ● | The ability of our subsidiaries to distribute dividends to us may be subject to restrictions under the laws of their respective jurisdictions. |

Risks Relating to Doing Business in China

Risks and uncertainties related to doing business in China include, but are not limited to, the coronavirus may negativelyfollowing:

| ● | Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and operations; |

| ● | Uncertainties with respect to the PRC legal system could adversely affect us; |

| ● | The PRC government exerts substantial influence over the manner in which our PRC subsidiaries must conduct their business activities. If the Chinese government significantly changes the regulations related to the business operations of our PRC subsidiaries in the future and our PRC subsidiaries are not able to substantially comply with such regulations, the business operations of our PRC subsidiaries may be materially and adversely affected, and the value of our ordinary shares may significantly decrease; |

| ● | Our business is subject to complex and evolving laws and regulations regarding privacy and data protection. Compliance with China’s new Data Security Law, Cybersecurity Review Measures, Personal Information Protection Law, as well as additional laws, regulations, and guidelines that the Chinese government promulgates in the future may entail significant expenses and could materially affect our business; |

| ● | PRC regulation of loans to, and direct investments in, PRC entities by offshore holding companies may delay or prevent us from using proceeds from our future financing activities to make loans or additional capital contributions to our PRC subsidiaries; |

| ● | We may rely on dividends paid by our subsidiaries for our cash needs, and any limitation on the ability of our subsidiaries to make payments to us could have a material adverse effect on our ability to conduct business; |

| ● | Under the Enterprise Income Tax Law, we may be classified as a “Resident Enterprise” of China. Any classification as such will likely result in unfavorable tax consequences to us and our non-PRC shareholders; |

| ● | You may be subject to PRC income tax on any gain realized on the transfer of our ordinary shares; |

| ● | PRC laws and regulations establish complex procedures in connection with certain acquisitions of China-based companies by foreign investors, especially when such investor has a related party relationship with the China-based companies, which could make it more difficult for us to pursue growth through acquisitions or mergers in China; and |

| ● | Fluctuations in exchange rates could have a material adverse impact on our results of operations and the value of your investment. |

Risks Relating to Our Ordinary Shares and Warrants

Risks and uncertainties related to our customersordinary shares and related service providers, which would likely impact our revenueswarrants include, but are not limited to, the following:

| ● | You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing actions against us or our management named in the report based on foreign laws; |

| ● | We are a foreign private issuer within the meaning of the rules under the Exchange Act, and as such we are exempt from certain provisions applicable to U.S. domestic public companies; |

| ● | As a foreign private issuer, we are permitted to rely on exemptions from certain Nasdaq corporate governance standards applicable to domestic U.S. issuers. This may afford less protection to holders of our shares; and |

| ● | Future issuances of debt securities, which would rank senior to our ordinary shares upon our bankruptcy or liquidation, and future issuances of preferred shares, which could rank senior to our ordinary shares for the purposes of dividends and liquidating distributions, may adversely affect the level of return you may be able to achieve from an investment in our Securities. |

Risks Relating to Our Business and operating results. Any of these events could have a material adverse effect on the Company’s business, financial condition, results of operations and cash flows. At this point, the extent to which the coronavirus may impact our results is uncertain.Industry

Our negative operating profits may raise substantial doubt regarding our ability to continue as a going concern.

As of December 31, 2020, we had a deficit of approximately $4.7 million and negative equity of $2.2 million. Our recurring2023, our operating losses raiseraised substantial doubt about our ability to continue as a going concern. Our financial statements include a note describing the conditions which raise this substantial doubt. Our ability to continue as a going concern will requirerequires us to obtain additional financing to fund our operations. The perception of our ability to continue as a going concern may make it more difficult for us to obtain financing or obtain financing on favorable terms for the continuation of our operations and could result in the loss of confidence by investors, suppliers, and employees. If we are not successful in raising capital through equity offerings, debt financings, collaborations, licensing arrangements or any other means or are not successful in reducing our expenses, we may exhaust our cash resources and be unable to continue our operations. If we cannot continue as a viable entity, our shareholders would likely lose most or all of their investment in us.

We operate in highly competitive industries.

We compete in industries that are subject to significant competition and pricing pressures in most markets.

Risk relating to research and development activities on AI technology.

AI has been developing faster than the market expected, especially with the rapid evolvement of foundational models that leading AI companies such as OpenAI and Google launched. In our AI technology R&D endeavors, we may encounter challenges spanning technological complexity, intellectual property concerns, data privacy and security risks, and regulatory compliance hurdles. The intricate nature of AI technology may exceed expectations, potentially infringing upon existing intellectual property rights, necessitating robust protection of data privacy and security, and confronting increasingly stringent regulatory compliance demands.

Secured logistics:

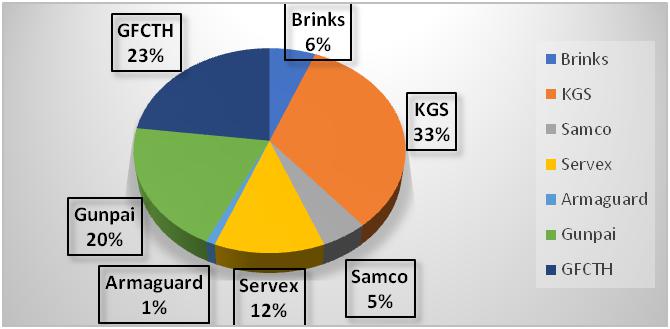

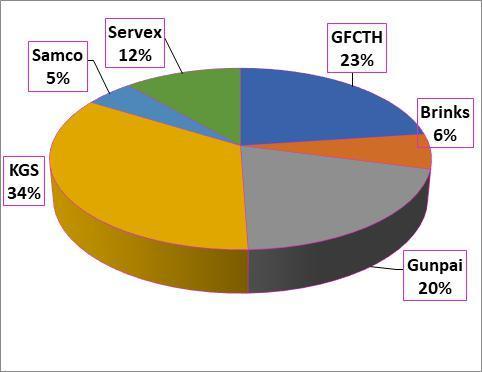

Our competition mainly comes from international companies likedlike Brinks and Armaguard. There are also a number ofseveral local CIT companies having very good relationships with their clients.customers. Additionally, we are facing potential competition from the commercial banks which market their own cash management solutions to their customers and hire CIT companies as their subcontracted CIT suppliers. Furthermore, many banks have their own captive CIT subsidiaries to serve them exclusively.

Our business model requires significant fixed costs associated with offering many of our services including, but not limited to, costs to operate a fleet of armored vehicles. Because we believe we have competitive advantages such as brand name recognition and a reputation for a high level of service and security, we resist competing on price alone. However, continued pricing pressure from competitors or failure to achieve pricing based on the competitive advantages identified above could result in lost volume of business and could have an adverse effect on our business, financial condition, results of operations and cash flows. In addition, given the highly competitive nature of our industry, it is important to develop new solutions and product and service offerings to help retain and expand our customer base. Failure to develop, sell and execute new solutions and offerings in a timely and efficient manner could also negatively affect our ability to retain our existing customer base or pricing structure and have an adverse effect on our business, financial condition, results of operations and cash flows.

2

General Security Solutions:

The competition is intense in China as there are many local and international companies providing the same security alarm installation service. Additionally, the economy and business are affected by the government policies that could be changed rapidly.

Most of our business is sub-contracted to local service providers that we are unable to monitor or control the sub-contractors’ quality of service provided to our end customers. We may lose the major customers if they are dissatisfied with the services.

AI & Robotics Solutions:

The robotics industries in Thailand, China, other Asia Pacific countries, and the United States and globally are still in their infancy. Within the robotics manufacturing field, the competition is high as most competitors are engaged in selling robots as a stand-alone product. Our business model started from a robotics-as-a-service model (RaaS) based upon the robots manufactured by related-party robotics manufacturers. There can be no assurance that these robotics manufacturers will not change their business model to offer RaaS solution globally and compete against us. Should this occur, it will negatively affect our ability to compete effectively and, as a result, this may have an adverse effect on our business strategy and plans for rolling out our robotics solution.

We started to explore AI integrations to expand our robotic solutions in 2022 and formed three types of AI solutions with our robots through our research and development and through partnerships. The AI industry is driving increasing attention and developing at a faster speed than the market expected. With the rapid revolutions of the foundational models the leading companies launched such as ChatGPT, Claude, Google Gemini and etc, the solutions we’re developing could face fierce competition and require rapid upgrades to catch up with the trends. As for our AI solutions through partnerships, there is no assurance that we will continue working with all current partners and they may become our competitors when the partnership ends.

We have substantial customer concentration, with a limited number of customers accounting for a substantial portion of our recent revenues.

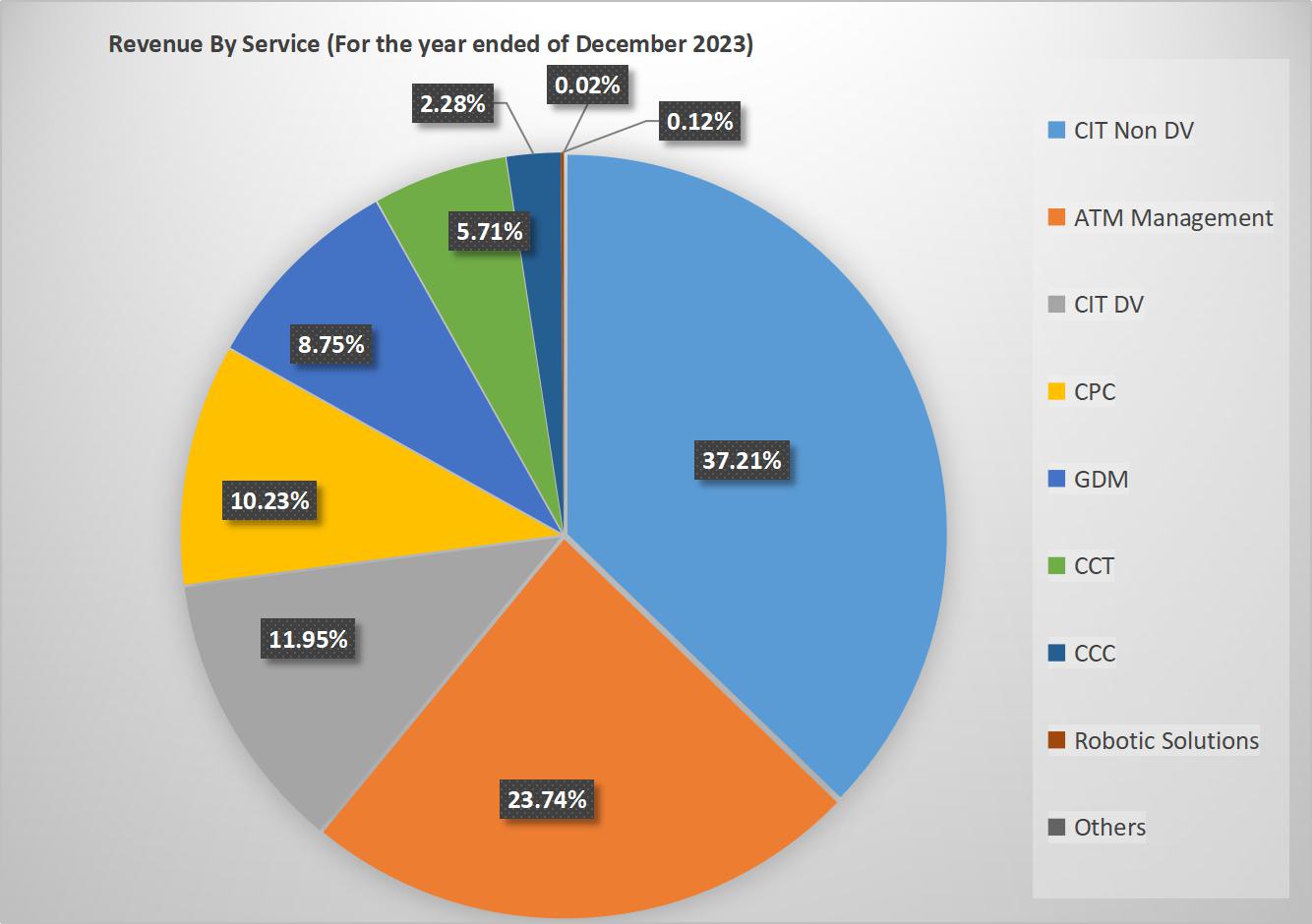

Historically, weWe have derived a significant portion of our revenues from our top five customers, four customers. For the year ended December 31, 2023, the largest customer is a state-owned bank, two of which are commercial banks, and one of which is a state-owned bank.retail customer. For the yearyears ended December 31, 2020,2023, 2022 and 2021, revenue derived from the state-owned bank (the Government Savings Bank) was approximately $7.5 million, $8.1 million and $9.6 million, respectively, which accounted for approximately $10.2 million in revenue or 27.2%20.8%, 23.5% and 27.3% of our revenue.total revenues, respectively.

For the yearyears ended December 31, 2020,2023, 2022 and 2021, revenues from the next fourthree largest customers combined were approximately $17.0$13.3 million, $13.4 million, and $14.3 million, respectively, or 45.2%36.7%, 38.8% and 40.8% of our revenue. Ourtotal revenues, respectively. Therefore, for the years ended December 31, 2023, 2022 and 2021, our top fivefour customers combined accounted for approximately 72.4%57.5%, 62.3% and 68.1% of our revenue.total revenues, respectively. We have three, three and four customers that accounted for 10% or more of our revenue for the years ended December 31, 2023, 2022 and 2021, respectively (See Note 26 “Concentrations” in our audited consolidated financial statements for details).

There are inherent risks whenever a large percentage of total revenues are concentrated with a limited number of customers. It is not possible for us to predict the future level of demand for our services that will be generated by these customers. In addition, revenues from these larger customers, especially our two largest customers may fluctuate from time to time based on the commencement and completion of projects, the timing of which may be affected by market conditions or other facts, some of which may be outside of our control. Further, some of our contracts with these larger customers permit them to terminate our services at any time (subject to notice and certain other provisions). If any of these customers experience declining or delayed sales due to market, economic or competitive conditions, we could be pressured to reduce the prices we charge for our services which could have an adverse effect on our margins and financial position and could negatively affect our revenues and results of operations and/or trading price of our ordinary shares.shares and warrants. If eitherany of our twothese largest customers terminates our services, such termination would negatively affect our revenues and results of operations and/or trading price of our ordinary shares.shares and warrants.

We currently report our financial results under IFRS, which differs in certain significant respect from U.S. generally accepted accounting principles.

We report our financial statements under IFRS. There have been and there may in the future be certain significant differences between IFRS and United States generally accepted accounting principles, or U.S. GAAP, including differences related to revenue recognition, intangible assets, share-based compensation expense, income tax and earnings per share. As a result, our financial information and reported earnings for historical or future periods could be significantly different if they were prepared in accordance with U.S. GAAP. In addition, we do not intend to provide a reconciliation between IFRS and U.S. GAAP unless it is required under applicable law. As a result, you may not be able to meaningfully compare our financial statements under IFRS with those companies that prepare financial statements under U.S. GAAP.

Changes to legislation in Thailand may negatively affect our business.

The legislation in Thailand relating to the security industry is not fully developed and may changeevolve depending on the government and a new prime minister. Also,in place. For example, new security acts which were launched in 2017 have applied very strictresulted in an increase in stricter control onover staff issues such as recruitment standards, training criteria and firearms. This increased the cost of recruitment, training and retention. The government of Thailand may introduce additional regulations in the future which could have a negative impact on our costs and thus profitability of our operations and cash flow. These developments could have an adverse effect on our business, financial condition, and results of operations.

Unexpected increases in minimum wages in Thailand would reduce our net profits.

The government of Thailand does not have a regular system to review minimum wages and may enact, on very short notice, when, for example, the local political environment changes or there is a new prime minister, new laws and regulations to increase minimum wages. Any material increase in minimum wages will directly impact the cost of services of the Company and reduce net profits.

Increases in fuel cost would negatively impact our cost of operations.

As theThe CIT industry relies on a large consumption of fuel for the operation of its vehicles,vehicles. Although we conduct price comparisons and enter into three-year supply contracts at fixed and discounted rates, an increase in oil prices will, most likely, negatively impact the operating costs of the Company.

Our strategy may not be successful.

We might not have sufficient cash or to obtain necessary funding to fully execute our growth strategy.

We expect that we will have sufficient cash on hand and cash in the bank, generated from our financing activities and our annual cash flows, to fund our planned growth strategy capital expenditures. We believe our existing cash, cash equivalents and cash flow from future operations and cash borrowings will be sufficient to fund our operations for the next 12 months. If we are unable to achieve our strategic objectives and anticipated operating profit improvements, our results of operations and cash flows may be adversely affected.

We might not have sufficient cash to fully execute our growth strategy.

We expect that we will need approximately U.S. $3.0 million per year (approximately 8% of our annual revenue) to execute the growth strategy outlined elsewhere in this annual report. We expect that we will have sufficient cash on hand and cash in the bank, generated from our annual cash flows, to fund our planned growth strategy capital expenditures. To the extent that there may be shortfalls in internal cash available for our growth plans, we expect to be able to access commercial banking credit facilities as the need arises. If necessary, we may also be required to raise additional capital for our future growth needs or to refinance current indebtedness and future indebtedness through public or private financing, strategic relationships, or other arrangements. There can be no assurance, however, that we will have or be able to acquire the necessary capital to accomplish our listed strategic objectives. If we are not able to fully execute our growth strategy, our business could suffer.

We might not have sufficient cash to repay a related party loan obligation.

As discussed elsewhere in this annual report, we have a loan outstanding in the principal amount of $13.51 million due and payable in full on December 31, 2022, to Profit Raider Investment Limited, or Profit Raider. We will require an extension of the maturity date of this loan and we cannot be sure whether or not Profit Raider will extend the maturity date of the loan. If Profit Raider does not extend the loan, we will need to seek an alternative source of funding to replace the loan. There can be no assurance, however, that we would be able to find such alternative funding on terms acceptable to us, if at all. If we cannot obtain an extension of the maturity date of the loan and are not otherwise able to refinance the loan, we may default on the loan and such default would have a material adverse effect on our financial condition, cash flows and results of operations and could result in an action by Profit Rader against us to collect the amount due under the loan along with interest, fees and any other applicable chargers.

Our business success depends on retaining our leadership team and attracting and retaining qualified personnel.

Our future success depends, in part, on the continuing services and contributions of our leadership team to execute on our strategic plan and to identify and pursue new opportunities. Our future success also depends, in part, on our continued ability to attract and retain highly skilled and qualified personnel. Any turnover in senior management or inability to attract and retain qualified personnel could have a negative effect on our results of operations. We do not maintain key life insurance on any members of management or key employees. Turnover in key leadership positions within the Company may adversely affect our ability to manage the company efficiently and effectively, could be disruptive and distracting to management and may lead to additional departures of current personnel, any of which could have a material adverse effect on our business and results of operations. In the AI and robotics business, skilled AI researchers and developers are in high demand, and the fast-paced nature of the industry means that attracting and retaining top talent is challenging. We may struggle to maintain a talented workforce capable of keeping up with technological advancements.

In the future we may not be able to use the Guardforce trademark, which could have a negative impact on our business.

We license the “Guardforce” name and trademarktrademarks from Guardforce Security Thailand(Thailand) Company Limited, (THAI SP)or THAI SP, under the terms of a binding memorandum of understanding effective March 2, 20202023, between GF Cash (CIT) and Guardforce Security Thailand Company Limited (THAI SP).THAI SP. Under the terms of this license we can use in Thailand, at no cost and on a non-exclusive, non-transferable basis, the “Guardforce” name and related trademark(s)trademarks in promoting (i) GF Cash (CIT)’s business and selling any goods and services solely related to the business of cash-in-transit and (ii) other ancillary services provided by GF Cash (CIT) in Thailand,and its related parties (as selected and agreed thereto), solely in the manner approved by THAI SP from time to time. This license has a term of three years and will renew automatically for additional three-year periods unless either party gives written notice to terminate the agreement no less than 30 days prior to the next upcoming renewal period start date.expiry of the license, either party may propose and discuss about the arrangement for renewing it. Additionally, the license may be cancelled by either party at any time with sixthree months’ prior written notice to the other party.

If for any reason our license with THAI SP is terminated or expires, our business may suffer and the value that we believe we have built in our brand name throughout Thailand will be lost. In such event, we would have to market our business under a new brand, and it may take significant time before our existing customers and future customers recognize our new brand. The loss of our ability to continue to utilize the Guardforce name and related trademarks could have a material adverse effect on our business.

We may be subject to service quality or liability claims, which may cause us to incur litigation expenses and to devote significant management time to defending such claims, and if such claims are determined adversely to us we may be required to pay significant damage awards.

We may be subject to legal proceedings and claims from time to time relating to the quality of our services. The defense of these proceedings and claims could be both costly and time-consuming and significantly divert the efforts and resources of our management. An adverse determination in any such proceeding could subject us to significant liability. In addition, any such proceeding, even if ultimately determined in our favor, could damage our reputation, and prevent us from maintaining or increasing revenues and market share. Protracted litigation could also result in our customers or potential customers limiting their use of our service.

As of the date of this report, we are a defendant in various labor related lawsuits in Thailand and China totaling approximately $0.14 and $0.07 million, respectively. In addition, we are a defendant for various lawsuits filed by Mr. Tu, a related party, including various purchase contract related lawsuits totaling approximately $3.32 million in China and totaling approximately $0.09 million in Hong Kong. Apart from the money claims, two lawsuits have been filed in Hong Kong by Mr. Tu as a former director of two of the subsidiaries, namely GFAI Robot Service (Hong Kong) Limited and Guardforce AI (Hongkong) Co., Limited, to sue us for executing improper director’s removal process and therefore to seek his reinstatement to the Board. Our management believes we have substantial defenses in the labor related cases. They are without merit and the Company is confident that such lawsuits will be dismissed. Regarding the cases with Mr. Tu, a related party, the Company had sought legal advice to resolve these legal disputes through mediation and had reach a settlement with Mr. Tu on March 22, 2024, including Mr. Tu agreed to withdraw all the claims against us. On March 27, 2024, Mr. Tu had withdrawn all the claims against the Company. We believe the remaining cases will not have a material adverse effect on our business, financial condition or operating results.

Decreasing use of cash could have a negative impact on our business.

The proliferation of payment options other than cash, including credit cards, debit cards, stored-value cards, mobile payments and on-line purchase activity and digital currencies, could result in a reduced need for cash in the marketplace and a decline in the need for physical bank branches and retail stores. To mitigate this risk, we are developing new lines of business, including, among other things, cash management solutions for retail chains and banks, multi-function machines (for cash and digital cash) and coins solutions for minting facilities. In addition, we are developing non-cash security technology related solutions such as robotics, cybersecurityinformation security and data analytics (including artificial intelligence) but there is a risk that these initiatives may not offset the risks associated with our traditional cash-based business and that our business, financial condition, results of operations and cash flows could be negatively impacted.

We may encounter provisions and impairments on our assets due to our business model and the development of our AI and robotics business, particularly amidst the fast-changing technologies.

One of our successful marketing strategies, initiated in late 2020, involves offering free trial periods of our robots to customers. This approach has enabled us to quickly gather customer feedback and gain traction in the market. However, given the swift advancement in AI and robotics technologies, coupled with the continuous upgrades of the foundational models like ChatGPT, the solutions we are developing and integrating may become outdated sooner than anticipated. Additionally, the current robots in our inventory may not be compatible to deliver the solutions. These factors mentioned above could result in significant provisions and impairments on our robot assets.

Our robots are managed under our data-based cloud platforms, Guardforce AI Intelligent Cloud Platform (ICP) and Cloud Technology Platform (CTP). As part of our upgrade plan, we have integrated functionalities from both platforms together to upgrade them under the ICP platform by removing duplicated functions and developing new functions. This integration aims to reduce maintenance and further development costs by eliminating duplicated functionalities and introducing new ones. However, the consolidation could result in certain accounting impairments on both platforms.

The AI industry is confronting a multitude of challenges across different dimensions, including laws & regulations, regulatory compliance, ethical and societal considerations. Failure to comply with the updated rules and regulations may lead to financial loss, or reputational damage.

The rapid development of AI technology often surpasses the pace of regulatory adaptation. As government and organizations worldwide implement stricter regulations around AI usage and AI implementations, AI initiatives could encounter increasing challenges. Moreover, the rapid adoption of AI implementations could raise social or ethical concerns such as job displacement, privacy breaches, biases and more. Effectively addressing these complex issues is challenging and mishandling them could result in financial loss or reputational damages.

Implementation of our AI & robotics solutionsolutions has required, and may continue to require, significant capital and other expenditures, which we may not recoup.

AI technology requires significant investment in research, development, and infrastructure. We have made, and intend to continue to make, capital investments to develop and launchbuild our AI & robotics solution. In 2020, we utilized our existing resources to build and develop our robotics solution. We plan to make further capital investments related to our robotics solution in the future.solutions. Our roboticsAI & robotics- related investment plans are subject to change, and will depend, in part, on market demand for robotic services, the competitive landscape for provision of such services and the development of competing technologies. There is no assurance of the success of our entry into the AI & robotics business as there may not be sufficient demand for our AI & robotics solution,solutions, as a result of competition or otherwise, to permit us to recoup or profit from our AI & robotics related capital investments.

WeDivestiture of the previously acquired Handshake may fail to successfully integrateaffect certain investors’ interest in our acquisition of Handshake Networking Ltd. and may fail to realize the anticipated benefits.business growth.

In March 2021, we completed the acquisition of 51% of Handshake Networking Ltd. While we are hopingwith the goal to benefit from a range of synergies from this acquisition, including by offering our customers bundled physical and cybersecurity services,information security services. After reviewing overall performance, future growth potential and the global environment for information security, we completed the separation with Handshake on February 6, 2024. As a result of this transaction, Handshake ceased to be a subsidiary of the Company. The divesture of Handshake has resulted in the loss of goodwill. Additionally, parting ways with Handshake might lead to legal concerns. Changes in our business structure may conflict with existing contracts with other companies, potentially leading to legal action or financial obligations.

We may fail to successfully integrate our other acquisitions of Shenzhen GFAI, Guangzhou GFAI, and Beijing Wanjia, and may fail to realize the anticipated benefits and resulted in losing the goodwill of these subsidiaries.

In March 2022, we completed acquisitions for 100% equity interests in Shenzhen GFAI and 100% of Guangzhou GFAI. In June 2022, we completed the acquisition for 100% equity interests in Beijing Wanjia. In December 2022, we executed an asset acquisition agreement with Shenzhen Kewei to acquire its robotic equipment, customer and business resource ownership, human resources involved in the business such as leasing, advertising replacement and sales of robots and other equipment under the name of Shenzhen Kewei. While we are hoping to benefit from a range of synergies from these acquisitions, including using them as our gateway into the Chinese robotics market, we may not be able to integrate thisthese new businessbusinesses and may fail to realize the expected benefits in the near term, or at all. Handshake operatesThese companies operate in athe highly competitive cybersecurityrobotics industry. ItsTheir business success will depend, in part, on market demand for its cybersecuritytheir robotics solutions services, the competitive landscape for the provision of such serviceservices and the development of competing technologies. Our business and financial condition may be adversely affected if theeither business of Handshake fails, or we fail to manage our investment in Handshakethem successfully.

We may not be able to obtain the necessary funding for our future capital or refinancing needs.

We may be required to raise additional funds for our future capital needs or to refinance our current indebtedness and future indebtedness through public or private financing, strategic relationships or other arrangements. There can be no assurance that the funding, if needed, will be available to us or provided on acceptable terms.

Any compromise of the cyberinformation security of our platform could materially and adversely affect our business, operations, and reputation.

Our products and services involve the storage and transmission of users’ and other customers’ information, and security breaches expose us to a risk of loss of this information, litigation, and potential liability. Our security measures may also be breached due to employee error, malfeasance or otherwise. Additionally, outside parties may attempt to fraudulently induce employees, users or other customers to disclose sensitive information in order to gain access to our data or our users’ or other customers’ data or accounts or may otherwise obtain access to such data or accounts. Because the techniques used to obtain unauthorized access, disable, or degrade service or sabotage systems change frequently and often are not recognized until launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. If an actual or perceived breach of our security occurs, the market perception of the effectiveness of our security measures could be harmed, we could lose users and other customers, and may be exposed to significant legal and financial risks, including legal claims and regulatory fines and penalties. Any of these actions could have a material and adverse effect on our business, reputation, and results of operations.

Our transfer pricing decisions may result in uncertain tax exposures for our group.

We have entered into transfer pricing arrangements that establish transfer prices for our inter-company operations in relations to the purchase of robotics equipment for our robotics solutions businesses in the region. However, our transfer pricing procedures are not binding on the applicable taxing authorities. No official authority in any countries has made a binding determination as to whether or not we are operating in compliance with its transfer pricing laws. Accordingly, taxing authorities in any of the countries in which we operate could challenge our transfer prices and require us to adjust them to reallocate our income and potentially to pay additional taxes for prior tax periods. We expect that the issue of the validity of our transfer pricing procedures will become of greater importance as we continue our expansion in markets in which we currently have a limited presence and attempt to penetrate new markets. Any change to the allocation of our income as a result of reviews by taxing authorities could have a negative effect on our financial condition and results of operations. In addition, there maybemay be challenges involved in complying with local pertinent tax rules and regulations.

We are currently operating in a period of economic uncertainty and capital markets disruption, which has been significantly impacted by geopolitical instability due to the ongoing military conflicts between Russia and Ukraine, and the war in the Middle east. Our business, financial condition and results of operations may be materially adversely affected by any negative impact on the global economy and capital markets resulting from the conflicts above or any other geopolitical tensions.

U.S. and global markets are experiencing volatility and disruption following the escalation of geopolitical tensions and the start of the military conflict between Russia and Ukraine and the war in the Middle East. On February 24, 2022, a full-scale military invasion of Ukraine by Russian troops was reported. On October 7, 2023, it was reported that an armed conflict between Israel and the Hamas-led Palestinian military group took place mainly in and around the Gaza Strip. Governments in the United States and many other countries, or the Sanctioning Bodies, have imposed economic sanctions on certain Russian individuals, including politicians, and Russian corporate and banking entities since the conflicts started. In the Middle East, besides the economy in Israel and Palestine, the war has affected the Red Sea area and could cause significant increase in shipping costs, eventually could increase costs for commodities such as oil, auto parts, food and cause fears of global inflation. Although the length and impact of the ongoing military conflicts above is highly unpredictable, and although we currently have no operations or sales in either Russia, Ukraine, Israel nor Palestine, the war in Ukraine could lead to market disruptions, including significant volatility in commodity prices, credit and capital markets. We are continuing to monitor the situation and assessing its potential impact on our business.

The outbreak of the COVID-19 pandemic has and may continue to adversely affect the Company’s business and results of operations.

The rapid spread of COVID-19, and the measures taken to slow its spread, have adversely affected the Company’s business and financial results. On May 5, 2023, the WHO ended the emergency status for COVID-19. However, COVID-19 is still a significant public health problem and may continue to challenge health systems worldwide in the long term. The COVID-19 pandemic had been spreading all over the world, including to Thailand. The duration and extent of the coronavirus pandemic and related government actions impacted many aspects of our business, including creating workforce limitations, travel restrictions and impacting our customers and suppliers. We experienced a significant percentage of our workforce was unable to work, either because of illness or travel or government restrictions in connection with the coronavirus outbreak, our operations were negatively impacted in fiscal years 2021 and 2022. The Company’s response strategy in areas of high impact resulted in a temporary reduced workforce as a result of self-isolation or other government or Company imposed measures to quarantine impacted employees and prevent infections at the workplace.

In 2023, many of our operating regions such as Thailand, China, Singapore, and Malaysia completely lifted the pandemic restrictions. Currently, COVID-19 no longer poses a threat to our business, and we have adapted our technology to meet the needs that arose during the pandemic. Even so, the economic growth of these regions is not back to the pre-pandemic level, affecting the overall customer demands in various industries including security, robotics, and more. Even after the COVID-19 pandemic has subsided, we may experience impacts on the Company’s business as a result of any economic recession, downturn or volatility that has occurred or may occur in the future. The COVID-19 pandemic may also have the effect of heightening many of the other risks described below, including those related to ability to service indebtedness and share price fluctuation.

Risks Relating to our Corporate Structure

We rely upon structural arrangements to establish control over certain entities and government authorities may determine that these arrangements do not comply with existing laws and regulations.

The laws and regulations in Thailand place restrictions on foreign investment in and ownership of entities engaged in a number ofseveral business activities. The Thai Foreign Business Act B.E. 2542 (1999), or FBA, requires foreigners to obtain approval under the FBA in order to engage in most service businesses. A company registered in Thailand will be considered a foreigner under the FBA if foreigners hold 50% or more of the shares in the company. The Security Guard Business Act B.E. 2558 (2015), or SGBA, also requires that companies applying for approval to engage in the business of providing security guard services by providing licensed security guards to protect people or personal property must have more than half of its shares owned by shareholders of Thai nationality and must have more than half of its directors being of Thai nationality.

We conduct our business activities in Thailand using a tiered shareholding structure in which direct foreign ownership in each Thai entity is less than 50%. See “Item 4. Information on the Company—C. Organizational Structure—Thailand Shareholding Structure.” The FBA considers the immediate level of shareholding of a company to determine the number of shares held by foreigners in that company for the purposes of determining whether the company is a foreigner within the meaning of the FBA, and will have regard to the shareholdings of a corporate shareholder which holds shares in that company to determine whether that corporate shareholder is a foreigner, however no cumulative calculation is applied to determine the foreign ownership status of a company when it has several levels of foreign shareholding. Such shareholding structure has allowed us to consolidate our Thai operating entities as our subsidiaries.

We have engaged legal counsel Watson Farley & Williams (Thailand) Limited in Thailand, and they are of the opinion that the shareholding structure of GF Cash (CIT) does not result in GF Cash (CIT) being a foreigner within the meaning of the FBA or failing to comply with the nationality requirements imposed by the SGBA. However, the local or national authorities or regulatory agencies in Thailand may reach a different conclusion, which could lead to an action being brought against us by administrative orders or in local courts. The FBA prohibits Thai nationals and non-foreigner companies from assisting, aiding, and abetting or participating in the operation of a foreigner’s business if the foreigner would require approval under the FBA to engage in that business, or to act as a nominee in holding shares in a company to enable a foreigner to operate a business in contravention of the FBA. The FBA does not provide detailed guidance on what degree of assistance contravenes the FBA, however Thai shareholders are likely to be regarded as nominees under the FBA if they do not have sufficient funds to acquire their shares or did not pay for their shares, or if they have agreed to not to be paid the dividends to which they would be entitled under the company’s articles of association.

Documentation filed with the Ministry of Commerce includes supporting evidence that the Thai nationals holding shares in AI Thailand had sufficient financial resources to acquire their shares and confirms that AI Thailand has received the amount payable for those shares. If the authorities in Thailand find that our arrangements do not comply with their prohibition or restrictions on foreign investment in our lines of business, or if the relevant government entity otherwise finds that we or any of our subsidiaries is in violation of the relevant laws or regulations or lack the necessary registrations, permits or licenses to operate our businesses in Thailand, they would have broad discretion in dealing with such violations or failures, including:

| ● | revoking the business licenses and/or operating licenses of such entities; |

| ● | imposing penalties of up to |

| ● | ordering the cessation of any aiding or abetting contrary to the FBA; |

| ● | discontinuing or placing restrictions or onerous conditions on the operations of our Thai subsidiaries, or on our operations through any transactions between our Company or our Cayman Islands or BVI subsidiaries on the one hand and our Thai subsidiaries on the other hand; |

| ● | confiscating income from us, our BVI subsidiaries, or Thai subsidiaries, or imposing other requirements with which such entities may not be able to comply; |

| ● | imposing criminal penalties, including fines and imprisonment on our Thai subsidiaries, their shareholders or directors; |

| ● | requiring us to restructure our ownership structure or operations, including the sale of shares in GF Cash (CIT), which in turn would affect our ability to consolidate, derive economic interests from, or exert effective control over our Thai subsidiaries; or |

| ● | restricting or prohibiting our use of the proceeds of any public offering we may conduct to finance our business and operations in Thailand. |

Any of these actions could cause significant disruption to our business operations and severely damage our reputation, which would in turn materially and adversely affect our business, financial condition, and results of operations. If any of these occurrences results in our inability to direct the activities of our Thai subsidiaries that most significantly impact their economic performance or prevent us from receiving the economic benefits or absorbing losses from these entities, we may not be able to consolidate these entities in our consolidated financial statements in accordance with IFRS.

Risks Relating to Doing Business in Thailand

A severe or prolonged downturn in the global economy or the markets that we primarily operate in could materially and adversely affect our revenues and results of operations.

We primarily operate in Thailand. Weak economic conditions as a result of a global economic downturn and decreased demand and prices due to the increased popularity of digital cash across the world may have a negative impact on our business. Decreased demand and prices would reduce our income and weaken our business. There are still great uncertainties regarding economic conditions and the demand for cash processing services. Any turbulence in global economies and prolonged declines in demand and prices in Thailand may adversely affect our business, revenues, and results of operations. Apart from the above, the following factors may also affect our business: (1) the threat of terrorism is high within Thailand; (2) the political situation is not stable especially under the military rule and governance; (3) currency exchange rates; (4) bribery and corruption; (5) high tax rates; and (6) unstable energy prices.

We are vulnerable to foreign currency exchange risk exposure.

The value of the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in political and economic conditions.

Our consolidated financial statements are expressed in U.S. dollars, which is our reporting currency. Most of the revenues and expenses of GF Cash (CIT) are denominated in the THB. Meanwhile, our functional currency of our various other subsidiaries, is the U.S. dollar. To the extent that we need to convert THB into U.S. dollars for our operations, appreciation of the U.S. dollar against the THB would adversely affect the U.S. dollar amounts we recognize from the conversion. Fluctuations in the exchange rate will also affect the relative value of the U.S. dollar-denominated loan that we have borrowed from a related party.

The ability of our subsidiaries to distribute dividends to us may be subject to restrictions under the laws of their respective jurisdictions.

We are a holding company, and our main operating subsidiary is located in Thailand. Part of our primary internal sources of funds to meet our cash needs is our share of the dividends, if any, paid by our subsidiaries. The distribution of dividends to us from the subsidiaries in these markets as well as other markets where we operate is subject to restrictions imposed by the applicable laws and regulations in these markets. See “Item 4. Information on the Company—B. Business Overview—Regulation—Thailand—Regulations on Dividend Distributions.” Companies remitting payments to recipients outside of Thailand must obtain approval from the Bank of Thailand at the time of the remittance if the remittance exceeds the equivalent of US$50,000.$50,000. In practice, this approval is managed by the Bank of Thailand and is typically granted if copies of the supporting documentation showing the need for the transaction can be provided. In addition, although there are currently no foreign exchange control regulations which restrict the ability of our subsidiaries in Thailand to distribute dividends to us, the relevant regulations may be changed and the ability of these subsidiaries to distribute dividends to us may be restricted in the future.

Risks RelatingRelated to Doing Business in China

Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and operations.

We have engaged legal counsel Junzejun Law Offices in China. We have acquired and may acquire in the future, subsidiaries which are in China. Accordingly, our business, financial condition, results of operations and prospects may be influenced by political, economic and social conditions in China generally. The PRC economy differs from the economies of most developed countries in many respects, including the level of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. Although the PRC government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets, and the establishment of improved corporate governance in business enterprises, a substantial portion of productive assets in China is still owned by the government. In addition, the PRC government continues to play a significant role in regulating industry development by imposing industrial policies.

The PRC government also exercises significant control over China’s economic growth through allocating resources, controlling payment of foreign currency-denominated obligations, setting monetary policy, and providing preferential treatment to particular industries or companies.

While the PRC economy has experienced significant growth over the past decades, growth has been uneven, both geographically and among various sectors of the economy, and the rate of growth has been slowing since 2012. Any adverse changes in economic conditions in China, in the policies of the PRC government or in the laws and regulations in China could have a material adverse effect on the overall economic growth of China. Such developments could adversely affect our business and operating results, lead to reduction in demand for our services and adversely affect our competitive position. The PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures may benefit the overall PRC economy but may have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations. In addition, in the past the PRC government has implemented certain measures, including interest rate adjustment, to control the pace of economic growth. These measures may cause decreased economic activity in China, which may adversely affect our business and operating results.

Uncertainties with respect to the MarketPRC legal system could adversely affect us.

The PRC legal system is a civil law system based on written statutes. Unlike the common law system, prior court decisions under the civil law system may be cited for reference but have limited precedential value. Since these laws and regulations are relatively new and the PRC legal system continues to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform and the enforcement of these laws, regulations and rules involves uncertainties.

In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters in general. The overall effect of legislation over the past three decades has significantly enhanced the protections afforded to various forms of foreign investments in China. However, China has not developed a fully integrated legal system, and recently enacted laws and regulations may not sufficiently cover all aspects of economic activities in China. In particular, the interpretation and enforcement of these laws and regulations involve uncertainties. Since PRC administrative and court authorities have significant discretion in interpreting and implementing statutory provisions and contractual terms, it may be difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection we enjoy. These uncertainties may affect our Common Sharesjudgment on the relevance of legal requirements and our ability to enforce our contractual rights or tort claims. In addition, the regulatory uncertainties may be exploited through unmerited or frivolous legal actions or threats in attempts to extract payments or benefits from us.

ThereFurthermore, the PRC legal system is no active public trading market for our common sharesbased in part on government policies and youinternal rules, some of which are not published on a timely basis or at all and may have retroactive effect. As a result, we may not be aware of our violation of any of these policies and rules until sometime after the violation. In addition, any administrative and court proceedings in China may be protracted, resulting in substantial costs and diversion of resources and management attention.

In addition, we are subject to risks and uncertainties of the interpretations and applications of PRC laws and regulations, including but not limited to, limitations on foreign ownership in our industry. We are also subject to the risks and uncertainties about any future actions of the PRC government. If any future action of the PRC government results in a material change in our subsidiaries’ operations, the value of our ordinary shares may depreciate significantly or become worthless.

The PRC government exerts substantial influence over the manner in which our PRC subsidiaries must conduct their business activities. If the Chinese government significantly changes the regulations related to the business operations of our PRC subsidiaries in the future and our PRC subsidiaries are not able to resellsubstantially comply with such regulations, the business operations of our common shares.PRC subsidiaries may be materially and adversely affected and the value of our ordinary shares may significantly decrease.