19

As an Irish public limited company, certain capital structure decisions regarding Parent will require the approval of the shareholders of Parent, which may limit Parent’s flexibility to manage its capital structure.

Irish law generally provides that a board of directors may allot and issue shares (or rights to subscribe for or convert into shares) if authorized to do so by a company’s constitution or by an ordinary resolution. Such authorization may be granted for up to the maximum of a company’s authorized but unissued share capital and for a maximum period of five years, at which point it must be renewed by another ordinary resolution. Parent’s M&A authorizesauthorized the board of directors of Parent to allot shares up to the maximumfull amount of Parent’s authorized but unissued share capital until December 31, 2023. At Parent’s annual general meeting in September 2023, the shareholders granted the board of directors of Parent the authority to allot shares up to 20% of Parent’s authorized but unissued share capital until December 31, 2024. At an extraordinary general meeting of Parent in March 2024, the shareholders extended this authority and granted the board of directors of Parent the authority to allot shares up to the full amount of Parent’s authorized but unissued share capital until March 19, 2029. This authorization will need to be renewed by ordinary resolution upon its expiration and at periodic intervals thereafter.by March 19, 2029 unless otherwise renewed prior thereto. Under Irish law, an allotment authority may be given for up to five years at each renewal, but governance considerations may result in renewals for shorter periods or for less than the maximum permitted number of shares being sought or approved.

While Irish law also generally provides shareholders with pre-emptive rights when new shares are issued for cash, it is possible for Parent’s M&A, or for shareholders of Parent in a general meeting, to exclude such pre-emptive rights. Following Parent’s M&A excludesextraordinary general meeting in March 2024, pre-emptive rights are currently excluded until December 31, 2023.March 19, 2029. This exclusion will need to be renewed by special resolution upon its expiration and at periodic intervals thereafter. Under Irish law, a disapplication of pre-emption rights may be authorized for up to five years at each renewal, but governance considerations may result in renewals for shorter periods or for less than the maximum permitted number of unissued shares being sought or approved.by March 19, 2029 unless otherwise renewed prior thereto.

Attempted takeovers of Parent will be subject to the Irish Takeover Rules and will be under the supervisory jurisdiction of the Irish Takeover Panel. Accordingly, Parent’s board of directors may be limited by the Irish Takeover Rules in its ability to defend an unsolicited takeover attempt.

Due to the listing of the Class A Ordinary Shares on Nasdaq, Parent is subject to the Irish Takeover Panel Act, 1997, Irish Takeover Rules 2013 (“Irish Takeover Rules”), under which Parent is not be permitted to take certain actions that might “frustrate” an offer for Class A Ordinary Shares once the board of directors has received an offer, or has reason to believe an offer is or may be imminent, without the approval of more than 50% of shareholders entitled to vote at a general meeting of our shareholders or the consent of the Irish Takeover Panel. This could limit the ability of Parent’s board of directors to take defensive actions even if it believes that such defensive actions would be in our best interests or the best interests of our shareholders.

The Irish Takeover Rules are administered by the Irish Takeover Panel, which has supervisory jurisdiction over such transactions. Among other matters, the Irish Takeover Rules operate to ensure that no offer is frustrated or unfairly prejudiced and, in situations involving multiple bidders, that there is a level playing field. For example, pursuant to the Irish Takeover Rules, the board of directors of Parent will not be permitted, without shareholder approval, to take certain actions which might frustrate an offer for Parent Shares once the board of directors of Parent has received an approach that might lead to an offer or has reason to believe that an offer is, or may be, imminent.

20

Under the Irish Takeover Rules, if an acquisition of Class A Ordinary Shares and Class B Ordinary Shares were to increase the aggregate holdings of the acquirer (together with its concert parties) to 30% or more of the voting rights of Parent, such acquirer and, in certain circumstances, its concert parties would be required (except with the consent of the Irish Takeover Panel) to make an offer for the outstanding Class A Ordinary Shares and Class B Ordinary Shares at a price not less than the highest price paid by such acquirer or its concert parties for Parent Shares during the previous 12 months. This requirement would also be triggered by the acquisition of Class A Ordinary Shares and Class B Ordinary Shares by any person holding (together with its concert parties) between 30% and 50% of the voting rights of Parent if the effect of such acquisition were to increase that person’s voting rights by 0.05% within a 12-month period.

Anti-takeover provisions in Parent’s M&A could make an acquisition of Parent more difficult. Parent’s M&A contains provisions that may delay or prevent a change of control, discourage bids at a premium over the market price of Class A Ordinary Shares, adversely affect the market price of Class A Ordinary Shares, and adversely affect the voting and other rights of shareholders of Parent. These provisions include: (i) permitting the board of directors of Parent to issue preference shares without the approval of Parent’s shareholders, with such rights, preferences and privileges as they may designate; and (ii) allowing the board of directors of Parent to adopt a shareholder rights plan upon such terms and conditions as it deems expedient in the interests of Parent.

| 24 |

The operation of the Irish Takeover Rules may affect the ability of certain parties to acquire Class A Ordinary Shares.

Under the Irish Takeover Rules if an acquisition of ordinary shares were to increase the aggregate holding of the acquirer and its concert parties to ordinary shares that represent 30% or more of the voting rights of Parent, the acquirer and, in certain circumstances, its concert parties would be required (except with the consent of the Irish Takeover Panel) to make an offer for the outstanding ordinary shares at a price not less than the highest price paid for the ordinary shares by the acquirer or its concert parties during the previous 12 months. This requirement would also be triggered by an acquisition of ordinary shares by a person holding (together with its concert parties) ordinary shares that represent between 30% and 50% of the voting rights in Parent if the effect of such acquisition were to increase that person’s percentage of the voting rights by 0.05% within a 12 month12-month period. Under the Irish Takeover Rules, certain separate concert parties will be presumed to be acting in concert. The board of directors of Parent and their relevant family members, related trusts and “controlled companies” are presumed to be acting in concert with any corporate shareholder who holdholds 20% or more of Parent.

The application of these presumptions may result in restrictions upon the ability of any of the concert parties and/or members of Parent’s board of directors to acquire more of our securities, including under the terms of any executive incentive arrangements. Accordingly, the application of the Irish Takeover Rules may frustrate the ability of certain of our shareholders and directors to acquire our ordinary shares.

Investors may face difficulties in protecting their interests, and their ability to protect their rights through the U.S. federal courts may be limited, because Parent is formed under Irish law.

Parent is a company formed under the laws of Ireland, all of its properties are located outside of the United States, a majority of our directors and officers reside outside of the United States and all our assets are and are likely in the future to be located outside of the United States. As a result, it may be difficult, or in some cases not possible, for investors in the United States to enforce their legal rights against us, to effect service of process upon our directors or officers or to enforce judgements of United States courts predicated upon civil liabilities and criminal penalties on our directors under United States laws.

Our corporate affairs will be governed by our M&A, the Irish Companies Act and the common law of Ireland. The rights of shareholders to take action against the directors, actions by minority shareholders and the fiduciary responsibilities of our directors to us under Irish law are governed by the Irish Companies Act and the common law of Ireland. The rights of the Parent shareholders and the fiduciary responsibilities of our directors under Irish law may not be as clearly established as they would be under statutes or judicial precedent in some jurisdictions in the United States. In particular, Ireland has a less developed body of securities laws as compared to the United States, and some states, such as Delaware, have more fully developed and judicially interpreted bodies of corporate law.

21

The jurisdiction and choice of law clauses set forth in the Amended and Restated Warrant Agreement, and Parent’s status as an Irish company, may have the effect of limiting a warrantWarrant holder’s ability to effectively pursue its legal rights against Parent in any United States court.

The Amended and Restated Warrant Agreement provides that disputes arising under the Amended and Restated Warrant Agreement are governed by New York law and that Parent consents to jurisdiction in courts of the State of New York or the United States District Court for the Southern District of New York. This provision may limit the ability of warrantWarrant holders to bring a claim against Parent other than in courts of the State of New York or the United States District Court for the Southern District of New York and may limit a warrantWarrant holder’s ability to bring a claim in a judicial forum that it finds more favorable for disputes under the Amended and Restated Warrant Agreement. The Amended and Restated Warrant Agreement, however, also expressly makes clear that this choice of law and forum provision shall not restrict a warrantWarrant holder from bringing a claim under the Securities Act or the Exchange Act in any federal or state court having jurisdiction over such claim. To the extent that any such claims may be based upon federal law claims, Section 27 of the Exchange Act creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder. Furthermore, Section 22 of the Securities Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. Irrespective of the ability of a warrantWarrant holder to bring an action in any such forum, due to the fact that Parent is an Irish company with all of its properties located outside of the United States, if a warrantWarrant holder brings a claim against Parent under the Amended and Restated Warrant Agreement, the Securities Act or Exchange Act, or otherwise, such warrantWarrant holder may have difficulty pursuing its legal rights against Parent in any United States courts having jurisdiction over any such claims.

| 25 |

Parent may be classified as a passive foreign investment company for U.S. federal income tax purposes, which could result in adverse U.S. federal income tax consequences to U.S. investors in Parent’s securities.

Based on the current value of Parent’s assets and the composition of Parent’s potential income streams, assets and operations, we do not believe Parent classifies as a “passive foreign investment company,” or PFIC, for the taxable year ended on December 31, 2020,2023, and that it will not classify as a PFIC for 20212024 either. However, the application of the PFIC rules is subject to uncertainty in several respects and furthermore we cannot assure you that the U.S. Internal Revenue Service the (the “IRS”) will not take a contrary position. Furthermore, a separate determination must be made after the close of each taxable year as to whether Parent is a PFIC for that year. Accordingly, notwithstanding the current expectation that we will not be classified as a PFIC, we cannot assure you that we have not been a PFIC or that we will not be a PFIC for our current taxable year or any future taxable year. A non-US company will be considered a PFIC for any taxable year if (i) at least 75% of its gross income is passive income (including interest income), or (ii) at least 50% of the value of its assets (based on an average of the quarterly values of the assets during a taxable year) is attributable to assets that produce or are held for the production of passive income. If we were to be ultimately classified as a PFIC for any taxable year during which a U.S. holder holds the Class A Ordinary Shares, certain adverse U.S. federal income tax consequences could apply to such U.S. holder, including (i) the treatment of all or a portion of any gain on disposition of the Class A Ordinary Shares as ordinary income, (ii) the application of a deferred interest charge on such gain and the receipt of certain dividends and (iii) the obligation to comply with certain reporting requirements.

Resales of our Class A Ordinary Shares or Warrants, or the perception that such resales might occur, may cause the market price of the Class A Ordinary Shares or Warrants to drop significantly, even if Fusion Fuel’s business is doing well.

As of May 10, 2021,April 25, 2024 we have an aggregate of 10,993,72217,371,968 Class A Ordinary Shares and 8,869,633 Warrants outstanding. While a portion of such shares and warrantsWarrants are subject to transfer restrictions described elsewhere in this Annual Report, upon expiration of the applicable lock-up periods, large amounts of Class A Ordinary Shares and/or Warrants may be sold in the open market or in privately negotiated transactions. Such sales, or the perception in the public markets that such sales will occur, could have the effect of increasing the volatility in the trading price of the Class A Ordinary Shares and/or the Warrants or putting significant downward pressure on the price of the Class A Ordinary Shares and/or the Warrants.

Downward pressure on the market price of the Class A Ordinary Shares and/or the Warrants that likely will result from sales of Class A Ordinary Shares could encourage short sales of Class A Ordinary Shares and/or the Warrants by market participants. Generally, short selling means selling a security, contract or commodity not owned by the seller. The seller is committed to eventually purchase the financial instrument previously sold. Short sales are used to capitalize on an expected decline in the security’s price. Short sales of the Class A Ordinary Shares and/or Warrants could have a tendency to depress the price of the Class A Ordinary Shares and/or the Warrants, respectively, which could further increase the potential for short sales.

22

We also may issue additional Class A Ordinary Shares, Warrants, or other securities to finance our operations. We cannot predict the size of future issuances of Class A Ordinary Shares, Warrants, or other securities or the effect, if any, that future issuances and sales of shares of such securities will have on the market price of the Class A Ordinary Shares or the Warrants. Sales of substantial amounts of Class A Ordinary Shares or Warrants, or the perception that such sales could occur, may adversely affect prevailing market prices of Class A Ordinary Shares and/or Warrants.

A substantial number of our Class A Ordinary Shares may be issued upon the exercise of Warrants or the conversion of the Class B Ordinary Shares,and options which could adversely affect the price of our Class A Ordinary SharesShares..

We have an aggregate of 8,869,633 Warrants outstanding and may issue up to an aggregate of 1,137,000 additional Warrants if the earnout conditions set forth in the Business Combination Agreement are satisfied.outstanding. Each Warrant is exercisable for one Class A Ordinary Share at a price of $11.50 per share. In addition, we have options to purchase an aggregate of 1,482,628 Class A Ordinary Shares outstanding. If all of the Warrants and options are exercised for cash, we would be required to issue up to 8,869,63310,352,261 Class A Ordinary Shares, or approximately 80.7%60% of our Class A Ordinary Shares outstanding as of May 10, 2021.April 25, 2024. The warrantWarrant and option holders will likely exercise the Warrantssuch securities only at a time when it is economically beneficial to do so. Accordingly, the exercise of these Warrantssecurities will dilute our other equity holders and may adversely affect the market price of the Class A Ordinary Shares.

Similarly, we have an aggregate of 2,125,000 Class B Ordinary Shares outstanding. Each Class B Ordinary Share is convertible at any time into one Class A Ordinary Share at the option of the holder and all outstanding Class B Ordinary Shares will automatically convert into an equal number of Class A Ordinary Shares on December 31, 2023. If all Class B Ordinary Shares are converted into Class A Ordinary Shares, we would be required to issue 2,125,000 Class A Ordinary Shares, or approximately 19.3% of our Class A Ordinary Shares outstanding as of May 10, 2021. Accordingly, the conversion of these Class B Ordinary Shares will dilute the holders of our Class A Ordinary Shares and may adversely affect the market price of the Class A Ordinary Shares.

Our dual-class voting structure will limit your ability to influence corporate matters and could discourage others from pursuing any change of control transactions that holders of Class A Ordinary Shares may view as beneficial.

We adopted a dual-class voting structure such that our ordinary shares consist of Class A Ordinary Shares and Class B Ordinary Shares. Although the Class A Ordinary Shares and Class B Ordinary Shares each have one vote per share, for so long as at least 1,700,000 Class B Ordinary Shares continue to be beneficially owned collectively by the former Fusion Fuel Shareholders and certain permitted transferees, the holders of Class B Ordinary Shares will have certain protective rights, including the right to approve any liquidation, sale of substantially all assets or equity, merger, consolidation, or similar transaction, amendments to our M&A, the creation or issuance of any new class or series of capital stock or equity securities convertible into our capital stock, changes to the size of our or Fusion Fuel Portugal’s board of directors, and the removal of any member of Fusion Fuel Portugal’s board of directors (collectively, the “Class B Protective Provisions”). Each Class B Ordinary Share is convertible at any time into one Class A Ordinary Share at the option of the holder and all outstanding Class B Ordinary Shares will automatically convert into an equal number of Class A Ordinary Shares on December 31, 2023. The Class A Ordinary Shares will not be convertible into Class B Ordinary Shares under any circumstance.

The former Fusion Fuel Shareholders hold approximately 30% of the voting power of our outstanding Class A Ordinary Shares and Class B Ordinary Shares, taken together as a single class, as of the date of this Annual Report (without taking into effect any Class A Ordinary Shares or Warrants which may be issued as contingent consideration). The former Fusion Fuel Shareholders hold all of the Class B Ordinary Shares outstanding, which provide certain preemptive rights over matters such as electing directors and approving material mergers, acquisitions or other business combination transactions. This will limit your ability to influence corporate matters and could also discourage others from pursuing any potential merger, takeover or other change of control transactions, which could have the effect of depriving the holders of Class A Ordinary Shares and Warrants of the opportunity to sell their shares at a premium over the prevailing market price.

Additionally, our board of directors has three classes of directors with staggered terms, with each director serving for up to three years until his or her successor is designated and qualified. During such term, our shareholders will have no power to remove directors without cause. Our staggered board and the Class B Protective Provisions may discourage proxy contests for the election of directors and purchases of substantial blocks of shares by making it more difficult for a potential acquirer to gain control of our board of directors.

Notwithstanding the potential for concentration of ownership in the former Fusion Fuel Shareholders, no individual, group or other company will hold in excess of 50% of the voting power for the election of directors of Parent. Accordingly, we are not a “controlled company” under the rules of Nasdaq.

23

| 26 |

The dual class structure of our ordinary shares may adversely affect the trading market for the Class A Ordinary Shares and/or Warrants.

S&P Dow Jones and FTSE Russell have implemented changes to their eligibility criteria for inclusion of shares of public companies on certain indices, including the S&P 500, namely, to exclude companies with multiple classes of shares of common stock from being added to such indices. In addition, several shareholder advisory firms have announced their opposition to the use of multiple class structures. As a result, the dual class structure of our ordinary shares may prevent the inclusion of the Class A Ordinary Shares and/or Warrants in such indices and may cause shareholder advisory firms to publish negative commentary about our corporate governance practices or otherwise seek to cause us to change our capital structure. Any such exclusion from indices could result in a less active trading market for our Class A Ordinary Shares and/or Warrants. Any actions or publications by shareholder advisory firms critical of our corporate governance practices or capital structure could also adversely affect the value of the Class A Ordinary Shares and/or Warrants.

We may issue additional Class A Ordinary Shares or other equity securities without seeking shareholder approval, which would dilute your ownership interests and may depress the market price of the Class A Ordinary Shares.

An aggregate of 8,869,633 Warrants is outstanding. Additionally, assuming the earnout targets are satisfied,In addition, we will be required to issue an additional 1,137,000had 1,653,842 Class A Ordinary Shares available for issuance, and 1,137,000 Warrantsnot subject to certain of the former Fusion Fuel Shareholders. Our Class B Ordinary Shares will be convertible at the option of the holders into an aggregate of 2,125,000 Class A Ordinary Shares at any time and from time to time, and all Class B Ordinary Shares not voluntarily converted will be automatically converted into Class A Ordinary Shares on December 31, 2023.outstanding awards, under our Plan. Further, we may issue additional ordinary sharesClass A Ordinary Shares or other equity securities of equal or senior rank in the future for any reason or in connection with, among other things, future acquisitions, the redemption of outstanding Warrants, or repayment of outstanding indebtedness, without shareholder approval, in a number of circumstances.

Our issuance of additional Class A Ordinary Shares or other equity securities of equal or senior rank would have the following effects:

| ● | our existing shareholders’ proportionate ownership interest in us will decrease; | |

| ● | the amount of cash available per share, including for payment of dividends in the future, may decrease; | |

| ● | the relative voting strength of each previously outstanding Class A Ordinary Share may be diminished; and | |

| ● | the market price of the Class A Ordinary Shares may decline. |

If the Class A Ordinary Shares or Warrants are de-listed from Nasdaq, we could face significant material adverse consequences.

We may be unable to maintain the listing of our Class A Ordinary Shares and Warrants on in the future. If Nasdaq delists our Class A Ordinary Shares or Warrants, we could face significant material adverse consequences, including:

| ● | a limited availability of market quotations for the Class A Ordinary Shares and Warrants; | |

| ● | a reduced level of trading activity in the secondary trading market for the Class A Ordinary Shares and Warrants; | |

| ● | a limited amount of news and analyst coverage; | |

| ● | a decreased ability to issue additional securities or obtain additional financing in the future; | |

| ● | stamp duty may be chargeable on transfers of Class A Ordinary Shares and Warrants at a rate of 1% of the greater of the price paid or market value of the Class A Ordinary Shares and Warrants transferred; and | |

| ● | our securities would not be “covered securities” under the National Securities Markets Improvement Act of 1996, which is a federal statute that prevents or pre-empts the states from regulating the sale of certain securities, including securities listed on Nasdaq, in which case our securities would be subject to regulation in each state where we offer and sell securities. | |

24

The trading price of the Class A Ordinary Shares or Warrants may be volatile, and holders of the Class A Ordinary Shares or Warrants could incur substantial losses.

The stock market in general has experienced extreme volatility in the wake of the COVID-19 pandemicrecent times that has often been unrelated to the operating performance of particular companies.companies, including as a result of public health emergencies such as the COVID-19 pandemic. Military or other conflicts in Ukraine, the Middle East, Southwest Asia or elsewhere and other disruptions to the equity or debt capital markets, including as a result of inflation in the United States and elsewhere, have also led to increased volume and price volatility for publicly traded securities. As a result of this volatility, our shareholders may not be able to sell their Class A Ordinary Shares or Warrants at or above the price paid for such securities. The market price for the Class A Ordinary Shares and Warrants may be influenced by many factors, including the factors discussed elsewhere in this “Risk Factors” section and:

| ● | the overall performance of the equity markets; | |

| ● | actual or anticipated fluctuations in our revenue and other operating results; | |

| ● | changes in the financial projections we may provide to the public or the failure to meet these projections; | |

| ● | failure of securities analysts to initiate or maintain coverage of us, changes in financial estimates by any securities analysts who follow us or our failure to meet these estimates or the expectations of investors; | |

| ● | the issuance of reports from short sellers that may negatively impact the trading price of the Class A Ordinary Shares and/or Warrants; | |

| ● | recruitment or departure of key personnel; | |

| ● | the economy as a whole and market conditions in our industry; | |

| ● | stock market price and volume fluctuations of other publicly traded companies and, in particular, those that operate in the green energy or hydrogen industries | |

| ● | new laws, regulations, subsidies, or credits or new interpretations of them applicable to our business; | |

| ● | negative publicity related to problems in our manufacturing or the real or perceived quality of our products; | |

| ● | rumors and market speculation involving us or other companies in our industry; | |

| ● | announcements by us or our competitors of significant technical innovations, acquisitions, strategic partnerships, or capital commitments; | |

| ● | lawsuits threatened or filed against us; | |

| ● | other events or factors including those resulting from war, incidents of terrorism or responses to these events; | |

| ● | the expiration of contractual lock-up or market standoff agreements; | |

| ● | sales or anticipated sales of shares of the Class A Ordinary Shares and/or Warrants by us or our shareholders; and | |

| ● | the |

If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, the market price of the Class A Ordinary Shares and/or Warrants and trading volume could decline.

The market price for the Class A Ordinary Shares and Warrants depends in part on the research and reports that securities or industry analysts publish about us or our business. If industry analysts cease coverage of us, the trading price for the Class A Ordinary Shares and/or Warrants would be negatively affected. In addition, if one or more of the analysts who cover us downgrade the Class A Ordinary Shares and/or Warrants or publish inaccurate or unfavorable research about our business, the Class A Ordinary Share and/or Warrant price would likely decline. If one or more of these analysts cease coverage of us or fail to publish reports on us regularly, demand for the Class A Ordinary Shares and/or Warrants could decrease, which might cause the Class A Ordinary Share and/or Warrant price and trading volume to decline.

25

| 28 |

An active trading market of the Class A Ordinary Shares and Warrants may not be sustained, and investors may not be able to resell their Class A Ordinary Shares and Warrants at or above the price for which they purchased such securities.

An active trading market for the Class A Ordinary Shares and Warrants may not be sustained. In the absence of an active trading market for the Class A Ordinary Shares and/or Warrants, investors may not be able to sell their Class A Ordinary Shares or Warrants, respectively, at or above the price they paid at the time that they would like to sell. In addition, an inactive market may impair our ability to raise capital by selling shares or equity securities and may impair our ability to acquire business partners by using the Class A Ordinary Shares as consideration, which, in turn, could harm our business.

Because we currently do not have plans to pay cash dividends on the Class A Ordinary Shares, you may not receive any return on investment unless you sell your Class A Ordinary Shares for a price greater than that which you paid.

We currently do not expect to pay any cash dividends on Class A Ordinary Shares. Any future determination to pay cash dividends or other distributions on Class A Ordinary Shares will be at the discretion of the board of directors and will be dependent on our earnings, financial condition, operating results, capital requirements, and contractual, regulatory and other restrictions, including restrictions contained in the agreements governing any existing and future outstanding indebtedness we or our subsidiaries incur, on the payment of dividends by our subsidiaries to us, and other factors that our board of directors deems relevant. As a result, you may not receive any return on an investment in the Class A Ordinary Shares unless you sell the Class A Ordinary Shares for a price greater than that which you paid for them.

Risks Relating to COVID-19

The ongoing COVID-19 pandemic may adversely affect Parent’s business, results of operations, and financial condition.

The COVID-19 pandemic has resulted in governmental authorities worldwide implementing numerous measures to contain the virus, including travel restrictions, quarantines, shelter-in-place orders, and business limitations and shutdowns. More generally, the pandemic raises the possibility of an extended global economic downturn and has caused volatility in financial markets. The pandemic may also amplify many of the other risks described in this Annual Report.

Although the COVID-19 pandemic has not had a material effect on Fusion Fuel’s business to date, we cannot assure you that it will not materially affect Fusion Fuel’s business in the future. Fusion Fuel has been and will continue monitoring and adjusting as appropriate its operations in response to the COVID-19 pandemic, noting that there have been no positive COVID-19 cases from any of the teams supporting Fusion Fuel projects or activities. Although Fusion Fuel has been able to maintain some of its operations during the pandemic and has maintained its engagements with suppliers, other operations have been delayed or suspended under applicable government orders and guidance, including delays or disruptions in Fusion Fuel’s research and development, sales, marketing, installation and operations and maintenance activities. Although Fusion Fuel’s affected manufacturing facilities continue to operate while these orders are in effect and Fusion Fuel’s business activities have not been materially impacted to date, Fusion Fuel cannot provide assurances that the COVID-19 pandemic or additional governmental actions in response thereto will not further impact operations. For example, if Fusion Fuel’s management, employees, contractors, customers or affiliates, such as the third party general contractors with which Fusion Fuel partners for installations, are affected by illness or by preventative measures such as social distancing, Fusion Fuel’s operations, demand for Fusion Fuel’s product, and installation, maintenance and oversight activities may be disrupted or Fusion Fuel may be required to incur additional costs in order to maintain operations. In addition, to the extent that any of Fusion Fuel’s employees separate from Fusion Fuel in response to the pandemic or governmental responses to the pandemic, it may be difficult or impossible to replace them. Additionally, operations that are not currently impacted could be delayed or suspended at any time in the event of changes to applicable government orders or the interpretation of existing orders.

Fusion Fuel may also experience delays from certain vendors and suppliers that have been affected more directly by COVID-19, which, in turn, could cause delays in the manufacturing and installation of Fusion Fuel’s Hydrogen Generators. It may not be possible to find replacement products or supplies, and ongoing delays could affect Fusion Fuel’s business and growth. Government orders in various jurisdictions have had the effect of disrupting the supply chain on which Fusion Fuel relies for certain parts critical to Fusion Fuel’s manufacturing and maintenance capabilities, which impacts both Fusion Fuel’s sale and installation of new products and Fusion Fuel’s operations and maintenance of previously-sold Hydrogen Generators.

26

Even if Fusion Fuel is able to identify alternate suppliers that are able to meet its needs, the international air and sea logistics systems have been heavily impacted by the COVID-19 pandemic. Air carriers have significantly reduced their passenger and air freight capacity, and many ports are either temporarily closed or have reduced their hours of operation. Actions by government agencies may further restrict the operations of freight carriers, which would negatively impact Fusion Fuel’s ability to receive the parts and supplies it needs to manufacture its Hydrogen Generators or to deliver them to customers. This may also interfere with Fusion Fuel’s ability to develop business outside of Portugal, as Fusion Fuel’s team will experience difficulty meeting new prospective clients and visiting and monitoring installations in jurisdictions that are accessible only by air travel.

Fusion Fuel’s installation operations have also been adversely impacted by the COVID-19 pandemic, and these adverse impacts may increase in severity or continue indefinitely, including following the lifting of “shelter in place” orders. For example, Fusion Fuel’s projects have experienced delays and may continue to experience delays relating to, among other things, shortages in available labor for design, installation and other work; the effects on the COVID-19 pandemic on suppliers in general but especially Fusion Fuel’s general contractors, their sub-contractors, medium-voltage electrical gear suppliers, and a wide range of engineering and construction related specialist suppliers on whom Fusion Fuel relies for successful and timely installations; the completion of work required by gas and electric utilities on which Fusion Fuel is critically dependent; necessary civil and utility inspections; and the review of Fusion Fuel’s permit submissions and issuance of permits with multiple authorities that have jurisdiction over Fusion Fuel’s activities. Additionally, Fusion Fuel has experienced delays and interruptions to its installation activities where customers have shut down or otherwise limited access to their facilities. This may continue to affect Fusion Fuel’s ability to install its systems or increase in severity as the pandemic continues to affect key markets.

Fusion Fuel is not the only business impacted by these shortages and delays, which means that Fusion Fuel may in the future face increased competition for scarce resources, which may result in continuing delays or increases in the cost of obtaining such services, including increased labor costs and/or fees to expedite permitting. Additionally, while construction activities have to date been deemed “essential business” and allowed to proceed in many jurisdictions, Fusion Fuel has experienced interruptions and delays caused by confusion related to exemptions for “essential business” amongst suppliers and their sub-contractors. Future changes in applicable government orders or regulations, or changes in the interpretation of existing orders or regulations, could result in reductions in the scope of permitted construction activities or prohibitions on such activities. An inability to install Fusion Fuel’s Hydrogen Generators would negatively impact Fusion Fuel’s acceptances, cash and revenue.

Fusion Fuel cannot predict at this time the full extent to which COVID-19 will impact its business, results and financial condition, which will depend on many factors. These include, among others, the extent of harm to public health, the willingness of Fusion Fuel’s employees to travel and work in Fusion Fuel’s manufacturing facilities and at installation sites even if permitted to do so, the disruption to the global economy and to Fusion Fuel’s potential customer base, impacts on liquidity and the availability of capital, and governmental actions taken in response to the pandemic. Fusion Fuel is staying in close communication with its manufacturing facilities, employees, customers, suppliers and partners, and acting to mitigate the impact of this dynamic and evolving situation, but there is no guarantee that Fusion Fuel will be able to do so.

General Risks

As a foreign private issuer, we are exempt from a number of rules under the Exchange Act, we are permitted to file less information with the SEC than domestic companies, and we will be permitted to follow home country practice in lieu of the listing requirements of Nasdaq, subject to certain exceptions. Accordingly, there may be less publicly available information concerning us than there is for issuers that are not foreign private issuers.

As a foreign private issuer, we are exempt from certain rules under the Exchange Act, including certain disclosure and procedural requirements applicable to proxy solicitations under Section 14 of the Exchange Act, our board of directors, officers and principal shareholders are exempt from the reporting and “short-swing” profit recovery provisions of Section 16 of the Exchange Act, and we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as companies whose securities are registered under the Exchange Act but are not foreign private issuers. Foreign private issuers are also not required to comply with Regulation FD, which restricts the selective disclosure of material non-public information. Accordingly, there may be less publicly available information concerning us than there is for companies whose securities are registered under the Exchange Act but are not foreign private issuers, and such information may not be provided as promptly as it is provided by such companies.

27

In addition, certain information may be provided by us in accordance with Irish law, which may differ in substance or timing from such disclosure requirements under the Exchange Act. As a foreign private issuer, under Nasdaq rules we are subject to less stringent corporate governance requirements. Subject to certain exceptions, the rules of Nasdaq permit a foreign private issuer to follow its home country practice in lieu of certain of the listing requirements of Nasdaq, including, for example, certain internal controls as well as board, committee and director independence requirements.Nasdaq. We currently do not, and currently do not intendhave elected to follow any Irish corporate governance practices under Irish law in lieu of the requirements of Nasdaq corporate governance rules, but we cannot assure you that this will not change after consummationRule 5635(c) and 5635(d)(2), which require companies to obtain shareholder approval prior to the issuance of securities to officers, directors, employees or consultants under certain circumstances and when it seeks to engage in a transaction, other than a public offering, involving the sale, issuance or potential issuance of ordinary shares, which alone or together with sales by officers, directors or substantial shareholders of the Transactions. If we determine to followcompany, equals 20% or more of the ordinary shares or 20% or more of the voting power outstanding before the issuance at a price below a certain price indicated in such Nasdaq Rule. Irish corporate governancelaw and generally accepted business practices in lieu of Nasdaq corporate governance standards, we will disclose each Nasdaq rule that weIreland do not intend to follow and describe the Irish practicerequire that we will follow in lieu thereof.

Parent is an “emerging growth company” and it cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make the Class A Ordinary Shares less attractive to investors.

Parent is an “emerging growth company” as defined in the JOBS Act. As an emerging growth company, Parent is only required to provide two years of audited financial statements and only two years of related selected financial data and management discussion and analysis of financial condition and results of operations disclosure. In addition, Parentshareholders approve such transactions. Accordingly, shareholder approval is not required to obtain auditor attestationfor these types of its reporting on internal control over financial reporting, has reduced disclosure obligations regarding executive compensation and is not required to hold non-binding advisory votes on executive compensation. This allows an emerging growth company to delay the adoption of these accounting standards until they would otherwise apply to private companies. Parent has elected to take advantage of such extended transition period. Parent cannot predict whether investors will find the Class A Ordinary Shares to be less attractive as a result of its reliance on these exemptions. If some investors find the Class A Ordinary Shares to be less attractive as a result, there may be a less active trading market for the Class A Ordinary Shares and the price of the Class A Ordinary Shares may be more volatile.transactions by Parent.

Parent will remain an emerging growth company until the earliest of: (i) the end of the fiscal year in which Parent has total annual gross revenue of $1.07 billion; (ii) the last day of Parent’s fiscal year following the fifth anniversary of the date on which HL consummated its initial public offering; (iii) the date on which Parent issues more than $1.0 billion in non-convertible debt during the preceding three-year period; or (iv) the end of the fiscal year in which the market value of the Parent Ordinary Shares held by non-affiliates exceeds $700 million as of the last business day of its most recently completed second fiscal quarter.

| 29 |

Further, there is no guarantee that the exemptions available to Parent under the JOBS Act will result in significant savings. To the extent that Parent chooses not to use exemptions from various reporting requirements under the JOBS Act, it will incur additional compliance costs, which may impact Parent’s financial condition.

We will incur significant costs and devote substantial management time as a result of being subject to reporting requirements in the United States, which may adversely affect the operating results of Parent in the future.

As a company subject to reporting requirements in the United States, we will incur significant legal, accounting and other expenses that Parent would not have incurred as a private Irish company. For example, Parent will beis subject to the reporting requirements of the Exchange Act and is required to comply with the applicable requirements of the Sarbanes-Oxley Act and the Dodd-Frank Wall Street Reform and Consumer Protection Act, as well as rules and regulations subsequently implemented by the SEC, including the establishment and maintenance of effective disclosure and financial controls and changes in corporate governance practices. Compliance with these requirements will increaseincreases Parent’s legal and financial compliance costs and will makemakes some activities more time consuming and costly, while also diverting management attention. In particular, Parent expects to incur significant expenses and devote substantial management effort toward ensuring compliance with the requirements of Section 404 of the Sarbanes-Oxley Act, which will increase when it is no longer an emerging growth company as defined by the JOBS Act.

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud.

Effective internal controls over financial reporting are necessary for us to provide reliable and accurate financial reports and effectively prevent fraud. Our compliance with the annual internal control report requirement will dependdepends on the effectiveness of our financial reporting and data systems and controls. Inferior internal controls increase the possibility of errors and could cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our stock and our access to capital.

In addition, our internal control systems rely on people trained in the execution of the controls. LossThe loss of these people or our inability to replace them with similarly skilled and trained individuals or new processes in a timely manner could adversely impact our internal control mechanisms.

28

Future changes in U.S. and foreign tax laws could adversely affect us.

The U.S. Congress, the Organisation for Economic Co-operation and Development, and government agencies in jurisdictions where we and our affiliates do business have focused on issues related to the taxation of multinational corporations. In particular, specific attention has been paid to “base erosion and profit shifting”, where payments are made between affiliates from a jurisdiction with high tax rates to a jurisdiction with lower tax rates. As a result, the tax laws in Ireland, Portugal and other countries in which we and our affiliates do business could change on a prospective or retroactive basis, and any such change could adversely affect us.

Our business may be materially adversely affected by current global geopolitical conditions resulting from the ongoing Russia-Ukraine conflict and the recent escalation of the Israel-Hamas conflict.

United States and global markets are experiencing volatility and disruption following the geopolitical instability resulting from the ongoing Russia-Ukraine conflict and the recent escalation of the Israel-Hamas conflict. In response to the ongoing Russia-Ukraine conflict, the North Atlantic Treaty Organization (“NATO”) deployed additional military forces to eastern Europe, and the United States, the United Kingdom, the European Union and other countries have announced various sanctions and restrictive actions against Russia, Belarus and related individuals and entities, including the removal of certain financial institutions from the Society for Worldwide Interbank Financial Telecommunication (SWIFT) payment system. Certain countries, including the United States, have also provided and may continue to provide military aid or other assistance to Ukraine and to Israel, increasing geopolitical tensions among a number of nations. The invasion of Ukraine by Russia and the escalation of the Israel-Hamas conflict and the resulting measures that have been taken, and could be taken in the future, by NATO, the United States, the United Kingdom, the European Union, Israel and its neighboring states and other countries have created global security concerns that could have a lasting impact on regional and global economies. Although the length and impact of the ongoing conflicts are highly unpredictable, they could lead to market disruptions, including significant volatility in commodity prices, credit and capital markets, as well as supply chain interruptions and increased cyber-attacks. Additionally, any resulting sanctions could adversely affect the global economy and financial markets and lead to instability and lack of liquidity in capital markets.

| 30 |

Any of the abovementioned factors, or any other negative impact on the global economy, capital markets or other geopolitical conditions resulting from the Russian invasion of Ukraine, the escalation of the Israel-Hamas conflict and subsequent sanctions or related actions, could adversely affect our business.

The extent and duration of the ongoing conflicts, resulting sanctions and any related market disruptions are impossible to predict, but could be substantial, particularly if current or new sanctions continue for an extended period of time or if geopolitical tensions result in expanded military operations on a global scale. Any such disruptions may also have the effect of heightening many of the other risks described in this section. If these disruptions or other matters of global concern continue for an extensive period of time, our operations may be materially adversely affected.

ITEM 4. INFORMATION ON THE COMPANY

A. History and Development of the Company

Parent was incorporated in Ireland on April 3, 2020 as a private limited company under the name Dolya Holdco 3 Limited. On July 14, 2020, Parent effected a name change to Fusion Fuel Green Limited. On October 2, 2020, Parent converted into a public limited company incorporated in Ireland under the name “Fusion Fuel Green PLC.”

On December 10, 2020, Parent consummatedcompleted a business combination pursuant to that certain Amended and Restated Business Combination Agreement (“Business Combination Agreement”), which Parent entered into on August 25, 2020, with HL Acquisitions Corp. (“HL”), Fusion Welcome – Fuel, S.A., a public limited company domiciled in Portugal, sociedade anónima (now known as Fusion Fuel Portugal, S.A., “Fusion Fuel Portugal”), Fusion Fuel Atlantic Limited, a British Virgin Islands company and wholly-owned subsidiary of Parent (“Merger Sub”), and the shareholders of Fusion Fuel Portugal (“Fusion Fuel Shareholders”). Pursuant to the Business Combination Agreement, (i) Merger Sub merged with and into HL (the “Merger”), with HL being the surviving entity of the Merger and becoming a wholly-owned subsidiary of Parent, and (ii) Parent acquired all of the issued and outstanding shares of Fusion Fuel Portugal (the “Share Exchange,” and together with the Merger, the “Transactions”), resulting in Fusion Fuel Portugal and Merger Sub pursuant toHL becoming wholly-owned subsidiaries of Parent and the Business Combination Agreement.securityholders of Fusion Fuel Portugal and HL becoming securityholders of Parent. Immediately following the closing of the Transactions, Parent consummated the closing of a series of subscription agreements with accredited investors (“PIPE Investors”) for the sale in a private placement of 2,450,000 Class A Ordinary Shares in an aggregate investmentat a price of $10.25 per share for gross proceeds to Parent of approximately $25.1 million.million (the “PIPE”). Following the Transactions, HL was dissolved. On April 21, 2021, we formed our U.S. subsidiary, Fusion Fuel USA, Inc.

Prior to the Transactions, Fusion Fuel Portugal was a subsidiary of Negordy Investments, S.A. (formerly Fusion Welcome,Welcome) (“Negordy”), a European leader in concentrated photovoltaic technology (“CPV”) technology. Since 2008, Fusion Welcome has installed over 20 solar CPV plants throughout Europe and the MENA (Middle East and North Africa) region, and over time became the leading CPV solar solution provider in Europe. The management team also developed relationships with key stakeholders throughout the energy, regulatory, and commercial spheres. Recognizing the potential of Green Hydrogen,green hydrogen, the management team of Fusion WelcomeNegordy launched a subsidiary, Fusion Fuel Portugal, in July 2018, to begin R&D of an alternative to Brown and Grey Hydrogen, with the goal of minimizing the associated carbon footprint, and to provide a market solution for meeting emissions reduction targets.

Starting with the principle of recovering waste heat from the solar energy conversion process, Fusion Fuel created a miniaturized PEM electrolyzer, the HEVO, which could be attached to the back of the CPV solar modules, creating a single solar to green hydrogen system, which was subsequently externally validated by an independent laboratory in Portugal, the ISQ. This combination of CPV solar modules and HEVOs was the Company´s first product and was called the HEVO-Solar. In 2023, the Company began commercializing the HEVO-Chain solution. This product is built around the concept of the HEVOs working in sequence, making it easily scalable, and allowing it to explore possibilities to use thisoperate with any type of electrical energy to generate Green Hydrogen.input. However, Fusion Fuel Portugal’s technologyhas since shifted its offering to focus solely on the HEVO-Chain solution for any new proposals to clients given it is significantly easier to install and license, its lower space requirements and the fact that it can be used with any power input.

| 31 |

Until mid-2023, Fusion Fuel´s commercial focus was independently validated byon regions with very high solar irradiation levels. With the technology department from Lisbon’s Instituto Superior de Técnico (the “University”). The University produced a study commissioned by GALP, a major Portuguese oil and gas multi-national company. The purposelaunch of the study wasHEVO-Chain suite, the target addressable market has substantially grown and no longer needs to perform a technological assessment of the viability of Fusion Fuel Portugal’s Hydrogen Generator.be limited to regions with high solar irradiation levels. The study foundCompany has principally focused on European projects given that the Hydrogen Generator’s system presented a “differentiating advantage”product is designed for compliance with its technology as it haslocal certifications and during 2024 will evolve the typical characteristics of a conventional PEM (polymer electrolyte membrane) electrolyzer, but with a reduced size that is compactoffering to also be suitable for use in North America and integrated in a concentrator photovoltaic system. The reduced size of the electrolyzer allows for thermal and electrical integration through solar concentration directly in the cell. In other similar technologies, the concentrator photovoltaic system is not conducted within the cell. The University study acknowledges that the Hydrogen Generator was built with all of the appropriate materials available on the market and that the integration of the solar photovoltaic concentration system with the DC-PEHG electrolyzer seems well achieved. Fusion Fuel Portugal did not commission or fund any portion of this study, nor did Fusion Fuel Portugal have any role in selecting the professor that conducted the study, and has obtained permission to use the results of the study.Australia.

Fusion Fuel has a multi-faceted market approach; 1) Fusion Fuel is readyan electrolyzer technology supplier to bring its proprietarythird party led and owned projects, 2) Fusion Fuel provides engineering and procurement services for developers building hydrogen plants, and 3) in Iberia, Fusion Fuel also creates future hydrogen plants, structured in fully owned SPVs, with the aim to sell these projects and SPVs to infrastructure asset managers before construction begins.

Evora

Fusion Fuel’s first solar-to-green hydrogen plant, H2Evora, consists of 15 HEVO-Solar generators with the latest generation of Fusion Fuel’s HEVO micro-electrolyzer. H2Evora also includes state-of-the-art hydrogen purification, compression, and storage systems, as well as a Ballard Power Systems fuel cell to convert the green hydrogen into electricity to be fed into the national grid.

The H2Evora plant is also Fusion Fuel´s full size demonstration and R&D plant. When new versions of technology developments need to be tested at scale, this is the site where those activities are carried out. The plant has produced hydrogen on and off since the fourth quarter of 2021 and has seen various moments of upgrade and new technology installation. The plant is currently awaiting connection to the marketgrid for the sale of electricity from its fuel cell. However, while waiting for this to occur, when desired for product testing or validation, it is able to operate with the onsite solar panels and temporary generator for balance of plant requirements. Most recently the plant has seen the installation of three HEVO-Chain cube elements in addition to its 15 HEVO-Solar units for system integration testing.

Benavente

In the second quarter of 2021, we purchased a 14,000m3 factory in Benavente, Portugal for €5.0 million, inclusive of taxes. The renovations of the facility in Benavente, which began in late 2021, were completed in the first quarter of 2022. The second quarter of 2022 marked the start of the first production lines at our Benavente facility. This was a major milestone for Fusion Fuel and for Iberia, as the first industrial electrolyzer production to go live across Portugal and Spain. Our vision for Benavente is for it to be an industry-leading, state-of-the-art electrolyzer manufacturing facility, using automation and robotics wherever possible to improve the efficiency of production. In line with our efforts to be a leading clean energy company, we partnered with Helexia to install 1 MW of solar power on the roof of Benavente, which will not only reduce our carbon footprint, but will also lower our production costs given the exceedingly high cost of energy today.

In the fourth quarter of 2022, we announced the completion of our planned sale and leaseback of the Benavente electrolyzer manufacturing factory to CORUM Eurion, an ESG certified real estate investment fund managed by CORUM Asset Management. The €9.3 million transaction generated net proceeds of nearly €7.5 million after extensive production researchcertain holdbacks and testing, including external Green Hydrogen purity testing by LAQV Requimte Laboratorydeposits for the lease-back contract. The proceeds have been and will continue to confirm it can be used for all major industrial purposes and targeted key markets.by us to further the buildout of the Benavente factory, fund the development of Fusion Fuel owned projects and HEVO-Chain technology, and for general corporate purposes.

During 2023, the Benavente facility also began the first production of Fusion Fuel’s 4th generation HEVOs and the HEVO-Chain cube solution. This will be the solution produced for 2024 whereby the HEVO will be encased in dedicated cube structures or in containers depending on project requirements – the full solution will be developed, assembled and tested in Benavente before being shipped to clients and projects.

| 32 |

Iberian Activities

As of the end of 2023, Fusion Fuel has been contracted to provide its electrolyzer technology for five green hydrogen projects in Iberia, all of which include additional components of engineering and procurement services. The projects range from 300 kW to 1.25 MW of electrolyzer capacity and the engineering and procurement services range from providing engineering designs and specifications, providing the balance of plant equipment, all the way to full EPC services and turnkey project delivery.

In Portugal, all projects with government support or grants are required to undertake a tender process for the contracting of equipment or services, and this is currentlysomething that the Fusion Fuel commercial team actively engages on. As of end of March 2024, Fusion Fuel has five tender process proposals outstanding with prospective clients, some of which are awaiting client decision regarding partnership selection or in other cases on whether the project will proceed to the construction phase. It is expected that most of the potential sales in Portugal in the coming years will be through these processes. Often the tenders require a complete package proposal as opposed to the provision of specific equipment (e.g. standalone electrolyzer systems). This is where Fusion Fuel´s full offering capabilities create a significant advantage for the Company.

Fusion Fuel has developed a series of projects in Portugal for which we aim to secure key elements that make a project viable such as land, grant, permits, and potentially offtake agreements, before selling the project to a third party who will then make the capital investment to begin construction. Below is the overview of the projects that Fusion Fuel has in its portfolio in Portugal, all of which are 100% owned by Fusion Fuel at this time:

Fusion Fuel is in discussions and negotiations with various parties regarding the sale and/or an investment commitment for these projects, noting that it is likely that the Sines I, II and III projects will be undertaken with one single partner. For these projects, we aim to secure a provision contract with the final investor, whether with electrolyzer provisions, engineering or procurement services, or all three for certain cases.

In Spain, Fusion Fuel has multiple ongoing projects and also has a 50:50 joint venture with local developers called Fusion Fuel Spain. However, we do not expect to be developing its first Green Hydrogen plantnew wholly owned hydrogen projects in Evora,Spain and going forward intend to mainly focus on delivering equipment and services to third party plants in the country.

Fusion Fuel has the only electrolyzer manufacturing facility in Portugal and one of the largest and most varied portfolios of green hydrogen projects in the country. We fully expect to be one of the leading companies in the hydrogen sector in Portugal, and potentially Spain. Both countries have significant renewable energy advantages that make them particularly suitable to produce green hydrogen.

| 33 |

Other Markets

United States and North America

Passage of the Inflation Reduction Act (“IRA”) in the United States on August 16, 2022 positively impacted our outlook and business. The financial incentives of the IRA, in particular the $3/kg production tax credit, has made green hydrogen competitive with grey hydrogen. Considering these tailwinds, we have communicated our intention to accelerate our growth strategy into North America, with a total valuefocus on building partnerships to cover this strategic market.

To that end, Fusion Fuel entered into a partnership with Electus Energy in 2022 for a large-scale plant being developed in California. Most recently, the Company has engaged with Electus Energy on potential smaller projects currently under development in North America. In mid-2023, Fusion Fuel also entered into a partnership with Elemental Energy, a US development company led by two previous members of Fusion Fuel´s executive committee. This partnership allows Fusion Fuel to hold a minority stake in Elemental Energy of approximately 5%, but does not include management or board representation in the company.

In addition to the above, Fusion Fuel has also made proposals for both engineering services and electrolyzer systems for projects in North America for new prospective clients. We expect this to continue and will look to develop relationships and partnerships that allow us to grow our reach into the North American market with modest incremental costs. In preparation for projects in the North American market, we expect to receive the certification of the projectHEVO-Chain solution for use in both the United States and Canada during 2024.

Europe

In Europe, we continue to see an increased push to make the transition to green hydrogen a reality and a priority for most countries, with the continued launch of approximately €4.5 million. The financingfurther grant programs across most countries as well as the launch of the European Hydrogen Bank. In addition, in 2024 the European Commission also approved the next wave of “Important Projects of Common European Interest” (IPCEI), all focused around the energy transition movement and green hydrogen. Europe was the first region to truly push the transition to green hydrogen and is now in a position where many of the ingredients required for the execution of projects are in place. Therefore, we continue to expect a very significant portion of our business volume in the coming years to come from this region.

The past years have seen various European countries establishing the regulations and certificate of origin framework required to truly implement a widespread green hydrogen economy. With these moves, we have seen substantial increased momentum in the design, build-up and commitment going into new hydrogen projects. This is further supported by the continued desire to change the energy mix used in Europe and reduce the dependency on foreign energy sources.

We continue to strive to reach markets beyond Portugal and Spain and expect to deliver the first project to an Italian client in 2024. This first project is a 1 MW plant at Duferco’s industrial facility in Giammoro, Sicily, which will produce an estimated 46 tonnes of green hydrogen per annum and is expected to includebe developed in 2024. In addition, we continue to provide offers and proposals to further projects across Italy, France and Northern Europe.

Commercialization

In 2023, we delivered the first full plant to a grant fromclient, the Portuguese DepartmentExolum Torrejon plant in Madrid. We also started the delivery of Energy, whichservices, materials and equipment for CSIC and for a building materials company, both projects being located in Spain. The Exolum project uses the HEVO-Solar solution, the CSIC project will use a mix of HEVO-Solar and HEVO-Chain equipment, and the third project is a pure HEVO-Chain project. For all three projects, Fusion Fuel Portugal appliedundertook a substantial amount of the engineering work required for on August 6, 2020. In addition,project completion and is providing the balance of plant equipment as well.

We expect most projects in the coming years to use a combination of Fusion Fuel has begun business development in Southern Europeequipment as well as services for 10 MW projects and below. The ability to engage with a client beyond the Middle East and North Africa (“MENA”) region. In March 2021,electrolyzer provision is a key differentiator for Fusion Fuel changed its name fromas most other projects of this dimension are led by developers with limited gas handling experience and therefore need significant support to design a safe plant and to outline the full specifications a plant needs. For larger projects, there are several large engineering firms that provide this role but they mainly focus on projects significantly larger than 10 MW.

| 34 |

Given the different regulations and requirements across the various countries in Fusion Welcome – Fuel, S.A.Fuel´s target addressable market, we expect to engage with local integrators and EPC companies where Fusion Fuel Portugal, S.A.does not have the local engineering knowledge or experience. This can be seen in our collaboration with Duferco in Italy, but also in other projects with firms across North America, Israel and Northern Europe.

Going forward, Fusion Fuel will no longer be commercializing the HEVO-Solar solution, focusing instead on HEVO-Chain for any new projects and plants. The HEVO-Chain continues to use the same HEVO miniaturized PEM electrolyzer as the HEVO-Solar but is more versatile in its implementation, allowing for the use of any power source as well as a significantly easier licensing process given its smaller footprint.

Corporate Information

Parent serves as a holding company for Fusion Fuel Portugal and its subsidiaries. Parent’s principal executive office is located at 10The Victorians, 15-18 Earlsfort Terrace, Saint Kevin’s, Dublin 2, D02 T380,YX28, Ireland. Parent’s telephone number is +353 1 920 1000.

The SEC maintains an internet site (http://www.sec.gov) that contains report, proxy, and information statements and other information regarding issuers that file electronically with the SEC. Such information can also be found on Parent’s website (https://www.fusion-fuel.eu/). The information on or accessible through our website is not part of this Annual Report.

29

B. Business Overview

Fusion Fuel’s Vision

Fusion Fuel’s mission is to produce hydrogen with zero carbon emissions, thereby contributing to a future of sustainable and affordable clean energy and the reversal of climate change. Fusion Fuel produces Green Hydrogen with components built in-house and in partnership with MagP, an entity that is majority-owned by Fusion Welcome, one of our shareholders, and using the know-how and accumulated experience of its team’s strategic and continuous investment in research and development (“R&D”) around solar technologies. Hydrogen is a critical component in oil refining and ammonia production, century-old industries that account for most of the carbon emissions worldwide, and Fusion Fuel’s efficient solution allows Green Hydrogen to compete with other energy sources in an economically viable way.

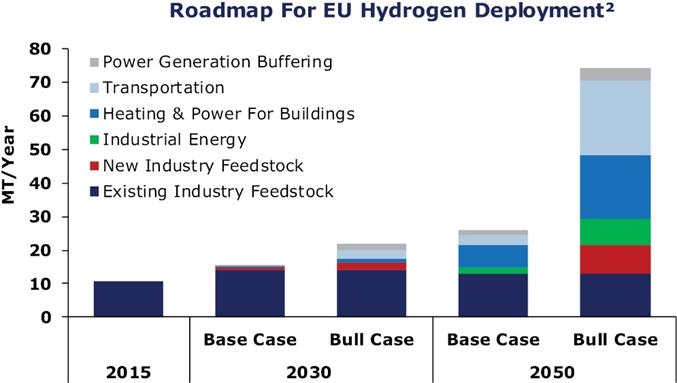

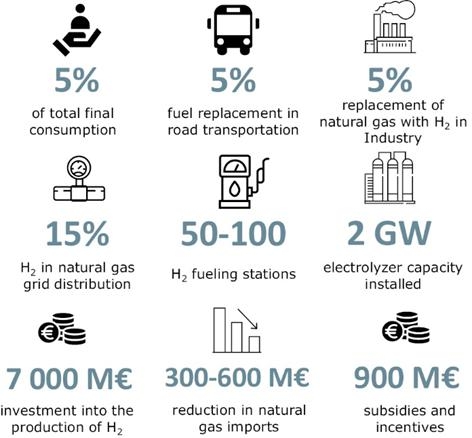

Fusion Fuel has developed and tested the DC-PEHG that produces Green Hydrogen at one of the highest efficiency ratios and at the most competitive cost (€/Kg) in the Green Hydrogen industry. The DC-PEHG uses solar energy to split water molecules into hydrogen and oxygen through a proprietary photon-electrochemical process. The process is coupled with a solar concentration system that harnesses solar energy for electricity and heat, which we refer to as concentrated photovoltaic technology or “CPV” technology. This coupled approach for generating hydrogen significantly increases the total system efficiency, results in a low cost per kilogram of hydrogen produced, and benefits from the high automation level of mass producing the DC-PEHG. Fusion Fuel uses this process to extract hydrogen from water molecules without the creation of any carbon emissions and with oxygen as the only biproduct. Therefore, the output is designated Green Hydrogen, which is hydrogen created in a fully carbon-free process, as opposed to the traditional methods of creating hydrogen which produce upwards of 9 tons of carbon emissions for every ton of hydrogen produced (designated as “Brown Hydrogen”). The development of this highly efficient combination of the DC-PEHG and CPV technology to create the “Hydrogen Generator” places Fusion Fuel in a key position in the strategic and long-term plans of the Portuguese and European Governments to reduce carbon emissions and achieve a carbon neutral state by 2050.

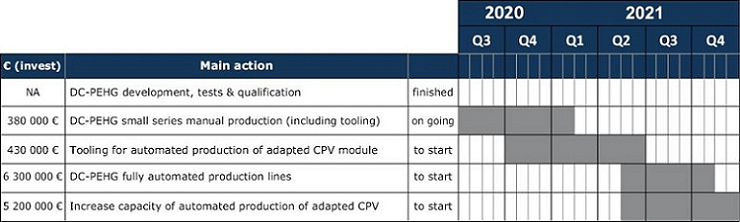

The DC-PEHG has been internally tested and validated in small-scale outdoor operation and in laboratory conditions. It has been tested in continuous and intermittent operation conditions with negligible degradation. Fusion Fuel has completed the necessary adaptations to implement the CPV technology in the Hydrogen Generator, which adaptations have been internally tested. At this time, Fusion Fuel produces the DC-PEHG using a manual production process. In order to be able to mass produce the Hydrogen Generator, Fusion Fuel must invest in the equipment and machinery necessary to convert production of the DC-PEHG from a manual production process to an automated assembly process, which Fusion Fuel plans to develop in the second half of 2021. Until then, the Hydrogen Generators will be produced using a small-scale manual production line for the DC-PEHG component and will use the existing semi-automated production line for the CPV modules and trackers.

30

Fusion Fuel’s business plan includes the sale of technology to parties interested in generating Green Hydrogen at an attractive cost (including to natural gas networks, ammonia producers, oil refineries, and other similar customers), the development of hydrogen plants to be operated by Fusion Fuel and active management of the portfolio of such hydrogen plants as assets, and the sale of Green Hydrogen as an output with pre-defined Hydrogen Purchase Agreements (“HPAs”). Fusion Fuel will initially focus on development in Portugal, Southern Europe and Morocco, but hopes to expand beyond this region as it believes the market potential is substantial in countries with high solar irradiation levels. Fusion Fuel believes that the significant growth and momentum of the hydrogen market will continue to increase as awareness of Green Hydrogen increases and as carbon emission taxes are charged on traditional hydrogen creation methods.

Recent Developments

Business CombinationOn February 16, 2024, the Company announced that it had received notification from the European Commission that the Company’s HEVO-Portugal project was among 33 entities selected for approval under the Important Projects of Common European Interest (“IPCEI”) Hy2Infra program. The Company’s €650 million, 630 MW project is to be developed in Sines, Portugal, and would produce 62,000 tonnes of green hydrogen per annum. A portion of the green hydrogen is expected to be used in the production of green ammonia and exported from the Port of Sines to the Port of Rotterdam in the Netherlands. The balance would be consumed by industrial customers in the domestic Portuguese market. The IPCEI approval positions Fusion Fuel and its partners to commence funding negotiations with the relevant government stakeholders, as well as with the European Investment Bank, which has committed to providing financing and advisory support to those projects selected for public funding.

On December 10, 2020, Parent completed a business combination pursuant to the

B. Business Combination Agreement, which Parent entered into on August 25, 2020, with HL, Fusion Fuel Portugal, Merger Sub, and the former Fusion Fuel Shareholders. Pursuant to the Business Combination Agreement, on December 10, 2020 (i) the Merger occurred, whereby Merger Sub merged with and into HL, with HL being the surviving entity of the Merger and becoming a wholly-owned subsidiary of Parent, and (ii) the Share Exchange occurred, whereby Parent acquired all of the issued and outstanding shares of Fusion Fuel Portugal, resulting in Fusion Fuel Portugal and HL becoming wholly-owned subsidiaries of Parent and the securityholders of Fusion Fuel Portugal and HL becoming securityholders of Parent. Immediately following the closing of the Transactions, Parent consummated the closing of a series of subscription agreements with the PIPE Investors for the sale in a private placement of 2,450,000 Class A Ordinary Shares at a price of $10.25 per share for gross proceeds to Parent of approximately $25.1 million.

COVID-19

The COVID-19 pandemic has resulted in governmental authorities worldwide implementing numerous measures to contain the virus, including travel restrictions, quarantines, shelter-in-place orders, and business limitations and shutdowns. More generally, the pandemic raises the possibility of an extended global economic downturn and has caused volatility in financial markets.

The COVID-19 pandemic has not had a material effect on Fusion Fuel’s business, but we cannot assure you that it will not materially affect Fusion Fuel’s business in the future. Although Fusion Fuel has been able to maintain some of its operations during the pandemic and has maintained its engagements with suppliers, other operations have been delayed or suspended under applicable government orders and guidance, including delays or disruptions in Fusion Fuel’s research and development, sales, marketing, installation and operations and maintenance activities. Further although Fusion Fuel’s affected manufacturing facilities continue to operate while these orders are in effect and Fusion Fuel’s business activities have not been materially impacted to date, Fusion Fuel cannot provide assurances that the COVID-19 pandemic or additional governmental actions in response thereto will not further impact operations. Fusion Fuel has been and will continue monitoring and adjusting as appropriate its operations in response to the COVID-19 pandemic.Overview

Recognition by Local Authorities and Main Energy StakeholdersAbout Fusion Fuel