![[keegan201020fannualreport001.jpg]](https://capedge.com/proxy/20-F/0001217160-10-000141/keegan201020fannualreport001.jpg)

[ ]

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[X]

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| [ ] | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| OR |

[X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

[ ]

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

2011

| OR |

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

[ ]

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| OR |

| [ ] | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Tony M. Ricci,

683-8193greg.mccunn@keeganresources.com

2011.

oInternational Financial Reporting Standards as issued

[ ]

oOther [X]

x

PART I | 1 | ||

| ITEM | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS | 1 | |

| ITEM | OFFER STATISTICS AND EXPECTED TIMETABLE | 1 | |

| ITEM | KEY INFORMATION | 1 | |

| ITEM | INFORMATION ON THE COMPANY | 8 | |

| ITEM | UNRESOLVED STAFF COMMENTS |

| |

| ITEM | OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

| |

| ITEM | DIRECTORS, SENIOR MANAGEMENT, AND EMPLOYEES |

| |

| ITEM 7. | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS |

| |

| ITEM 8. | FINANCIAL INFORMATION |

| |

| Esaase Lawsuit | 52 | ||

| |||

ITEM 9. | THE OFFER AND LISTING |

| |

| ITEM 10. | ADDITIONAL INFORMATION |

| |

| ITEM | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

| |

| ITEM 12. | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES |

| |

PART II |

| ||

| ITEM 13. | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES |

| |

| ITEM 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

| |

| ITEM 15. | CONTROLS AND PROCEDURES |

| |

| ITEM 16A. | AUDIT COMMITTEE FINANCIAL EXPERT |

| |

| ITEM | CODE OF ETHICS |

| |

| ITEM 16C. | PRINCIPAL ACCOUNTING FEES AND SERVICES |

| |

| ITEM 16D. | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES |

| |

| ITEM 16E. | PURCHASES OF EQUITY SECURITIES BY KEEGAN/AFFILIATED PURCHASERS |

| |

| ITEM 16F. | CHANGE IN REGISTRANTS CERTIFYING ACCOUNTANT | 72 | |

| ITEM 16G. | CORPORATE GOVERNANCE | 72 | |

PART III |

| ||

|

|

| |

| ITEM | FINANCIAL STATEMENTS |

| |

| ITEM 18. | FINANCIAL STATEMENTS | 73 | |

| ITEM 19. | EXHIBITS |

| |

Mineral Reserve | The terms “mineral reserve,” “proven mineral reserve” and “probable mineral reserve” used in Keegan Resources Inc.’s (“Keegan” or the “Company”) disclosure are Canadian mining terms that are defined in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Best Practice Guidelines for the Estimation of Mineral Resource and Mineral Reserves (the “CIM Standards”), adopted by the CIM Council on November 23, 2003. These definitions differ from the definitions in the United States Securities and Exchange Commission (the “SEC”) Industry Guide 7 under the Securities Act of 1933, as amended (the “Securities Act”). Under Industry Guide 7 standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Under Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. |

Mineral Resource | The terms “mineral resource,” “measured mineral resource,” “indicated mineral resource” and “inferred mineral resource” used in the Registrant’s disclosure are Canadian mining terms that are defined in accordance with NI 43-101 under the guidelines set out in the CIM Standards; however, these terms are not defined terms under Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically mineable. |

ITEM 1

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

| ITEM 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS |

Directors and Senior Management

Advisers

Auditors

ITEM 2

OFFER STATISTICS AND EXPECTED TIMETABLE

| ITEM 2 | OFFER STATISTICS AND EXPECTED TIMETABLE |

ITEM 3

KEY INFORMATION

| ITEM 3 | KEY INFORMATION |

Selected Financial Data

Year Ended March 31, 2010 | Year Ended March 31, 2009 | Year Ended March 31, 2008 | Year Ended March 31, 2007 | Year Ended March 31, 2006 | ||

CANADIAN GAAP | ||||||

Revenue | Nil | Nil | Nil | Nil | Nil | |

Expenses | ($6,943) | ($3,619) | ($4,170) | ($3,641) | ($1,798) | |

Other Income (Expenses) | ($30) | ($557) | ($146) | ($740) | ($1,191) | |

Loss for the Period | ($6,973) | ($4,176) | ($4,316) | ($4,381) | ($2,989) | |

Loss Per Share | ($0.18) | ($0.15) | ($0.17) | ($0.28) | ($0.31) | |

Wtg. Avg. Shares (000) | 38,019 | 28,233 | 24,605 | 15,595 | 9,602 | |

Period-End Shares | 45,047 | 28,505 | 27,468 | 22,808 | 12,164 | |

Working Capital | $47,945 | $2,504 | $15,064 | $13,907 | $625 | |

Resource Properties | $41,123 | $30,358 | $19,105 | $7,198 | $1,449 | |

Long-Term Debt | Nil | Nil | Nil | Nil | Nil | |

Capital Stock | $104,887 | $43,096 | $40,489 | $25,459 | $4,982 | |

Shareholders’ Equity | $89,386 | $33,065 | $34,293 | $21,142 | $2,112 | |

Total Assets | $90,534 | $33,718 | $34,670 | $21,494 | $2,372 | |

US GAAP | ||||||

Net Loss | ($17,738) | ($15,234) | ($14,549) | ($9,661) | ($4,095) | |

Loss Per Share | ($0.47) | ($0.54) | ($0.59) | ($0.62) | ($0.43) | |

Resource Properties | $2,975 | $2,975 | $2,779 | $1,105 | $343 | |

Shareholders’ Equity | $51,238 | $5,682 | $17,968 | $15,049 | $1,006 | |

Total Assets | $52,386 | $6,335 | $18,344 | $15,401 | $1,266 | |

Year Ended March 31, 2011 | Year Ended March 31, 2010 | Year Ended March 31, 2009 | Year Ended March 31, 2008 | Year Ended March 31, 2007 | |

| CANADIAN GAAP | |||||

| Revenue | Nil | Nil | Nil | Nil | Nil |

| Expenses | ($12,785) | ($6,943) | ($3,619) | ($4,170) | ($3,641) |

| Other Income (Expenses) | ($126) | ($30) | ($557) | ($146) | ($740) |

| Loss for the Period | ($12,910) | ($6,973) | ($4,176) | ($4,316) | ($4,381) |

| Loss Per Share | ($0.26) | ($0.18) | ($0.15) | ($0.17) | ($0.28) |

| Wtg. Avg. Shares (000) | 49,178 | 38,019 | 28,233 | 24,605 | 15,595 |

| Period-End Shares (000) | 74,885 | 45,047 | 28,505 | 27,468 | 22,808 |

| Working Capital | $224,459 | $47,995 | $2,504 | $15,064 | $13,907 |

| Resource Properties | $74,843 | $41,123 | $30,358 | $19,105 | $7,198 |

| Long-Term Debt | Nil | Nil | Nil | Nil | Nil |

| Capital Stock | 314,408 | $104,887 | $43,096 | $40,489 | $25,459 |

| Shareholders’ Equity | $295,077 | $89,386 | $33,065 | $34,293 | $21,142 |

| Total Assets | $304,916 | $90,534 | $33,718 | $34,670 | $21,494 |

| US GAAP | |||||

| Net Loss | ($44,988) | ($17,738) | ($15,234) | ($14,549) | ($9,661) |

| Loss Per Share | ($0.91) | ($0.47) | ($0.54) | ($0.59) | ($0.62) |

| Resource Properties | $4,165 | $2,975 | $2,975 | $2,779 | $1,105 |

| Shareholders’ Equity | $224,379 | $51,238 | $5,682 | $17,968 | $15,049 |

| Total Assets | $234,218 | $52,386 | $6,335 | $18,344 | $15,401 |

Period | Average | High | Low | Close | |

Fiscal Year Ended March 31, 2010 | $1.09 | 1.26 | $1.01 | $1.02 | |

Fiscal Year Ended March 31, 2009 | $1.13 | $1.30 | $0.98 | $1.26 | |

Fiscal Year Ended March 31, 2008 | $1.03 | $1.16 | $0.92 | $1.03 | |

Fiscal Year Ended March 31, 2007 | $1.14 | $1.19 | $1.10 | $1.15 | |

Fiscal Year Ended March 31, 2006 | $1.19 | $1.27 | $1.13 | $1.17 | |

Period | Average | High | Low | Close |

| Fiscal Year Ended March 31, 2011 | $0.93 | $1.03 | $1.00 | $1.02 |

| Fiscal Year Ended March 31, 2010 | $1.09 | $1.26 | $1.01 | $1.02 |

| Fiscal Year Ended March 31, 2009 | $1.13 | $1.30 | $0.98 | $1.26 |

| Fiscal Year Ended March 31, 2008 | $1.03 | $1.16 | $0.92 | $1.03 |

| Fiscal Year Ended March 31, 2007 | $1.14 | $1.19 | $1.10 | $1.15 |

Dec. 2009 | Jan. 2010 | Feb. 2010 | Mar. 2010 | Apr. 2010 | May 2010 | ||

Average | $1.05 | $1.04 | $1.06 | $1.02 | $1.01 | $1.04 | |

High | $1.07 | $1.07 | $1.08 | $1.06 | $1.02 | $1.08 | |

Low | $1.04 | $1.02 | $1.04 | $1.01 | $0.99 | $1.01 | |

Close | $1.05 | $1.07 | $1.05 | $1.02 | $1.02 | $1.04 | |

Dec. 2010 | Jan. 2011 | Feb. 2011 | Mar. 2011 | Apr. 2011 | May 2011 | |

| Average | $1.01 | $0.99 | $0.99 | $0.98 | $0.96 | $0.97 |

| High | $1.02 | $1.00 | $1.00 | $0.99 | $0.97 | $0.98 |

| Low | $1.00 | $0.99 | $0.97 | $0.97 | $0.96 | $0.95 |

| Close | $1.00 | $1.00 | $0.97 | $0.97 | $0.95 | $0.97 |

Capitalization and Indebtedness

Reasons for the Offer and Use of Proceeds

Risk Factors

4

•

unanticipated adverse geotechnical conditions;

•

incorrect data on which engineering assumptions are made;

•

costs of constructing and operating a mine in a specific environment;

•

cost of processing and refining;

•

availability of economic sources of power;

•

availability of qualified staff;

•

adequacy of water supply;

•

adequate access to the site including competing land uses (such as agriculture and illegal mining);

•

unanticipated transportation costs and shipping incidents and losses;

•

significant increases in the cost of diesel fuel, cyanide or other major components of operating costs;

•

government regulations (including regulations relating to prices, royalties, duties, taxes, permitting, restrictions on production, quotas on exportation of minerals, as well as the costs of protection of the environment and agricultural lands);

| · | unanticipated adverse geotechnical conditions; |

| · | incorrect data on which engineering assumptions are made; |

| · | costs of constructing and operating a mine in a specific environment; |

| · | cost of processing and refining; |

| · | availability of economic sources of power; |

| · | availability of qualified staff; |

| · | adequacy of water supply; |

| · | adequate access to the site including competing land uses (such as agriculture and illegal mining); |

| · | unanticipated transportation costs and shipping incidents and losses; |

| · | significant increases in the cost of diesel fuel, cyanide or other major components of operating costs; |

•

fluctuations in gold prices;

•

accidents, labour actions and force majeure events;

•

the identification of potential gold mineralization based on superficial analysis;

•

availability of prospective land;

•

availability of government-granted exploration and exploitation permits;

•

the quality of our management and our geological and technical expertise; and

•

the funding available for exploration and development.

| · | government regulations (including regulations relating to prices, royalties, duties, taxes, permitting, restrictions on production, quotas on exportation of minerals, as well as the costs of protection of the environment and agricultural lands); |

| · | fluctuations in gold prices; |

| · | accidents, labour actions and force majeure events; |

| · | the identification of potential gold mineralization based on superficial analysis; |

| · | availability of prospective land; |

| · | availability of government-granted exploration and exploitation permits; |

| · | the quality of our management and our geological and technical expertise; and |

| · | the funding available for exploration and development. |

7

The submissionRetrieval (commonly known as “SEDAR”), an electronic database maintained on behalf of proxy and annual meeting of shareholder information (preparedthe Canadian provincial securities regulators, but are only required to Canadian standards)be furnished to the SEC on Form 6-K results6-K.

ITEM 4

INFORMATION ON THE COMPANY

| ITEM 4 | INFORMATION ON THE COMPANY |

History and Development of the Company

Financings

The Company has financed its operations through funds raised in public/private placements of common shares and shares issued upon exercise of stock options and share purchase warrants. Over the past three fiscal years, the Company raised funds through the issuance of the following common shares:

Fiscal Year | Nature of Share Issuance | Number of Shares | Amount | |

Fiscal 2008 | Private Placement, net of share issue costs | 3,300,000 | $12,358,089 | |

Exercise of share purchase warrants | 1,115,470 | $2,033,528 | ||

Exercise of share purchase options | 200,000 | $184,000 | ||

Fiscal 2009 | Exercise of share purchase warrants | 773,000 | $1,982,700 | |

Exercise of share purchase options | 263,905 | $242,793 | ||

Fiscal 2010 | Bought deal share offering, net of share issue costs | 8,000,000 | $18,059,533 | |

Brokered private placement, net of share issue costs | 7,015,000 | $39,003,739 | ||

Exercise of share purchase warrants | 162,667 | $504,268 | ||

Exercise of share purchase options | 1,289,903 | $2,301,880 | ||

8

Capital Expenditures

The Company’s principal capital expenditures (there have been no material divestitures) over the three fiscal years ended March 31, 2009 are as follows:

Year | Resource property acquisition costs | Deferred exploration costs | Furniture, equipment and leasehold improvements | Total |

2008 | $1,515,725 | $9,861,207 | $110,459 | $11,487,391 |

2009 | $237,161 | $10,901,528 | $119,631 | $11,258,320 |

2010 | $nil | $9,368,626 | $214,751 | $10,979,934 |

Item 4.B

Business Overview

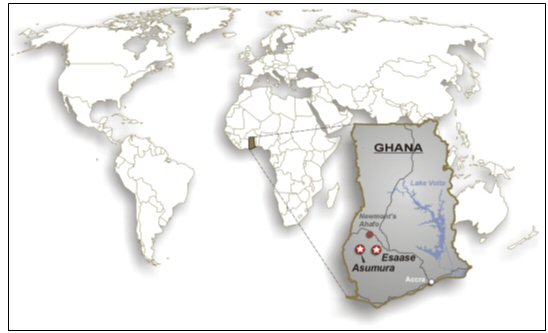

Keegan is a natural resource company currently engaged in the acquisition and exploration of mineral resources in West Ghana.

On June 11, 2003, Keegan announced that it had entered into a letter of intent to purchase an interest in a property located in Australia. On July 22, 2003, Keegan announced that it had decided not to proceed with this transaction because, upon further examination of the property, management determined that it did not warrant further exploration.

On September 5, 2003, Keegan announced that it entered into another letter of intent to purchase a 100% interest in some mining claims located in British Columbia. This agreement was also terminated during the year ended March 31, 2004 because, upon further examination of the property, management determined that it did not warrant further exploration.

9

On March 4, 2005, Keegan announced that it had entered into an option agreement to acquire a 100% interest in the Regent Gold Silver Project located in Mineral County, Nevada. Keegan terminated its interest in this property in 2007 due to its focus on its properties in Ghana.

On June 2, 2005, Keegan announced that it had entered into an option agreement to acquire a 100% interest in the Fri Property located in Nye County, Nevada. During the fiscal year ended March 31, 2006, the Company decided not to pursue its option pertaining to the Fri Property because, after completing preliminary exploration work, management determined that the results did not warrant further exploration work.

On December 7, 2005, Keegan announced that it had entered into an option agreement to acquire a 100% interest in the Black Velvet Gold Project located in Pershing County, Nevada. Keegan terminated its interest in this property in 2007 due to its focus on its properties in Ghana.

Fiscal Year | Nature of Share Issuance | Number of Shares | Amount |

| Fiscal 2008 | Private Placement, net of share issue costs | 3,300,000 | $12,358,089 |

| Exercise of share purchase warrants | 1,115,470 | $2,033,528 | |

| Exercise of share purchase options | 200,000 | $184,000 | |

| Fiscal 2009 | Exercise of share purchase warrants | 773,000 | $1,982,700 |

| Exercise of share purchase options | 263,905 | $242,793 | |

| Fiscal 2010 | Bought deal share offering, net of share issue costs | 8,000,000 | $18,059,533 |

| Brokered private placement, net of share issue costs | 7,015,000 | $39,003,739 | |

| Exercise of share purchase warrants | 162,667 | $504,268 | |

| Exercise of share purchase options | 1,289,903 | $2,301,880 | |

| Fiscal 2011 | Bought deal share offering, net of share issue costs | 28,405,000 | $202,184,925 |

| Exercise of share purchase warrants | 237,333 | 735,732 | |

| Exercise of share purchase options | 1,195,132 | 3,704,178 |

| Year | Resource property acquisition costs | Deferred exploration costs | Furniture, equipment and leasehold improvements | Total |

| 2009 | $237,161 | $10,901,528 | $119,631 | $11,258,320 |

2010 2011 | $nil $639,220 | $9,319,015 $21,238,903 | $214,751 $320,843 | $9,533,766 $22,198,966 |

(a)

undertake additional exploration at the Esaase Property to add to the existing resource estimates and convert additional resources from inferred to measured and indicated resources categories. Exploration will consist of reverse circulation drilling of current exploration and resource extension targets and core drilling targeting higher grade targets of the deposit down dip and along strike to the north;

(b)

complete metallurgical and hydrogeological drill programs in conjunction with engineering studies to support the Esaase Property’s pre-feasibility and feasibility studies;

(c)

continue working with local communities, the Ghanaian government and the Ghanaian Enviromental Protection Agency (the “EPA”) to both advance community relations and the permitting of the Esaase Property; and,

(d)

continue exploration of the Asumura Property.

| (a) | complete the pre-feasibility and feasibility studies for the Esaase Gold project; |

| (b) | continue exploration at Esaase to add to the existing resource estimates and convert additional resources to an indicated resources category. Exploration will consist of reverse circulation and core drilling of current exploration and resource extension targets including down dip on the deposit, with-in the Dawohodo concession and along the B and D zones to the north east of the deposit; |

| (c) | commence detailed engineering studies for the ultimate design and operation of facilities at Esaase and review potential purchases for long-lead capital purchases; |

| (d) | continue working with local communities, the Ghanaian government and the EPA to both advance community relations and the permitting of the Esaase project. |

2012

During2012

Esaase gold project.

11

future as the Company further advances the development of its Esaase Gold project.

Organization Structure

| Subsidiary name | Jurisdiction | Ownership |

| Keegan Resources Ghana Limited | Ghana | 90% |

| Keegan International (Barbados) Inc. | Barbados | 100% |

| Keegan Ghana (Barbados) Inc. | Barbados | 100% |

Quicksilver Ventures (Nevada) Inc. | Nevada, USA | 100% |

international tax planning.

Property, Plant and Equipment

UMS is a private company which Keegan acquired the sole common share on April 14, 2010. UMS has certain directors in common with the Company and was incorporated to provide geological, corporate development, administrative and management services to, and incur third party costs on behalf of, the Company, its subsidiaries and other publically listed mining companies on a full cost recovery basis pursuant to a service agreement.

lease are approximately $30,000.

The Asumura Property

12

-

US$10,000 upon signing the agreement (paid);

-

US$30,000 on or before October 8, 2006 (paid through the issuance of 16,775 shares)

-

US$60,000 on or before October 8, 2007. (paid through the issuance of 20,087 shares)

| - | US$10,000 upon signing the agreement (paid); |

| - | US$30,000 on or before October 8, 2006 (paid through the issuance of 16,775 shares) |

| - | US$60,000 on or before October 8, 2007. (paid through the issuance of 20,087 shares) |

-

common shares with a value of US$10,000 upon regulatory approval (issued 13,899 shares);

-

common shares with a value of US$30,000 based on the 10 day average closing price prior to issuance on or before October 8, 2006 (issued 16,775 shares); and,

-

common shares with a value of US$60,000 based on the 10 day average closing price prior to issuance on or before October 8, 2007 (issued 20,088 shares).

| - | common shares with a value of US$10,000 upon regulatory approval (issued 13,899 shares); |

| - | common shares with a value of US$30,000 based on the 10 day average closing price prior to issuance on or before October 8, 2006 (issued 16,775 shares); and, |

| - | common shares with a value of US$60,000 based on the 10 day average closing price prior to issuance on or before October 8, 2007 (issued 20,088 shares). |

-

US$80,000 on or before July 31, 2005, (incurred);

-

an additional US$400,000 on or before July 31, 2006 (incurred); and

-

an additional US$520,000 on or before July 31, 2007 (incurred).

| - | US$80,000 on or before July 31, 2005, (incurred); |

| - | an additional US$400,000 on or before July 31, 2006 (incurred); and |

| - | an additional US$520,000 on or before July 31, 2007 (incurred). |

13

![[keegan201020fannualreport001.jpg]](https://capedge.com/proxy/20-F/0001217160-10-000141/keegan201020fannualreport001.jpg)

14

15

| Asumura Gold Property Deferred Costs | Three Months June 30, 2010 | Three Months Sept 30, 2010 | Three Months Dec 31, 2010 | Three Months March 31, 2011 | Year March 31, 2011 |

| Camp Operations | $78,450 | $42,991 | $27,498 | $32,836 | $181,775 |

| Equipment and Infrastructure Costs | 6,936 | 6,351 | 9,901 | 6,241 | 29,429 |

| Exploration Support Costs | 67,278 | 83,046 | 89,773 | 56,090 | 296,187 |

| Exploration Drilling | 140,965 | 320,910 | 351,214 | 209,890 | 1,022,979 |

| Total for the period: | $293,629 | $453,298 | $478,386 | $305,057 | $1,530,370 |

| Beginning balance: | 6,391,911 | 6,685,540 | 7,138,838 | 7,617,224 | 6,391,911 |

| Ending balance: | $6,685,540 | $7,138,838 | $7,617,224 | $7,922,281 | $7,922,281 |

|

|

|

|

|

|

|

|

|

|

72,000. Rock Formations and Mineralization of Potential Economic Significance

16

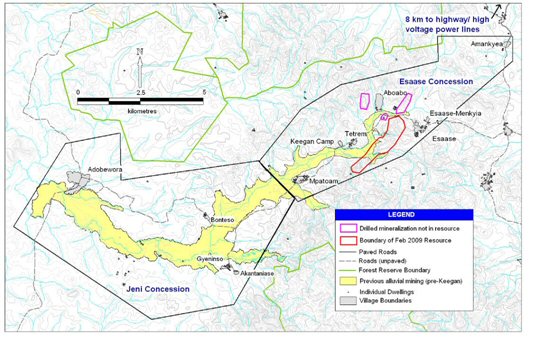

Esaase Gold Property

| Esaase Gold Property Deferred Costs | Three Months | Three Months | Three Months | Three Months | Year |

| 30-Jun-10 | 30-Sep-10 | 31-Dec-10 | 31-Mar-11 | 31-Mar-11 | |

| Acquisition Costs | $- | $- | $149,861 | $1,020,578 | $1,170,439 |

| Asset retirement obligation | 5,126,210 | 5,126,210 | |||

| Camp operations | 132,755 | 166,457 | 169,878 | 157,068 | 626,158 |

| Development support costs | 379,072 | 266,496 | 537,049 | 714,175 | 1,896,792 |

| Equipment and infrastructure costs | 457,788 | 283,859 | 306,135 | 194,255 | 1,242,037 |

| Exploration support costs | 1,030,532 | 954,109 | 1,137,147 | 1,633,108 | 4,754,896 |

| Exploration drilling | 1,180,405 | 2,333,914 | 1,272,341 | 207,158 | 4,993,818 |

| Engineering studies | 219,296 | 314,962 | 630,065 | 870,150 | 2,034,473 |

| Health, safety and environmental studies | 174,589 | 295,013 | 192,050 | 537,900 | 1,199,552 |

| Technical and In-fill Drilling | 671,062 | 293,077 | 1,005,373 | 3,651,870 | 5,621,382 |

| Stock-based compensation | 650,555 | 450,711 | 814,139 | 1,608,350 | 3,523,755 |

| Total for the period: | $4,896,054 | $5,358,598 | $6,214,038 | $15,720,822 | $32,189,512 |

| Beginning balance: | 34,731,217 | 39,627,271 | 44,985,869 | 51,199,907 | 34,731,217 |

| Ending balance: | $39,627,271 | $44,985,869 | $51,199,907 | $66,920,729 | $66,920,729 |

17

![[keegan201020fannualreport003.jpg]](https://capedge.com/proxy/20-F/0001217160-10-000141/keegan201020fannualreport003.jpg)

18

![[keegan201020fannualreport004.jpg]](https://capedge.com/proxy/20-F/0001217160-10-000141/keegan201020fannualreport004.jpg)

19

20

21

22

23

Report.

Table 1: Esaase PropertyDrilling and Sampling Statistics

Method | Number | Average Length | Total Metres |

RC | 597 | 160 | 95,572 |

RC Precollars with diamond tails | 166 | 302 | 50,205 |

Diamond | 82 | 210 | 17,220 |

Total | 845 | 672 | 162,997 |

24

25

0.1ppm

Table 2:viability.

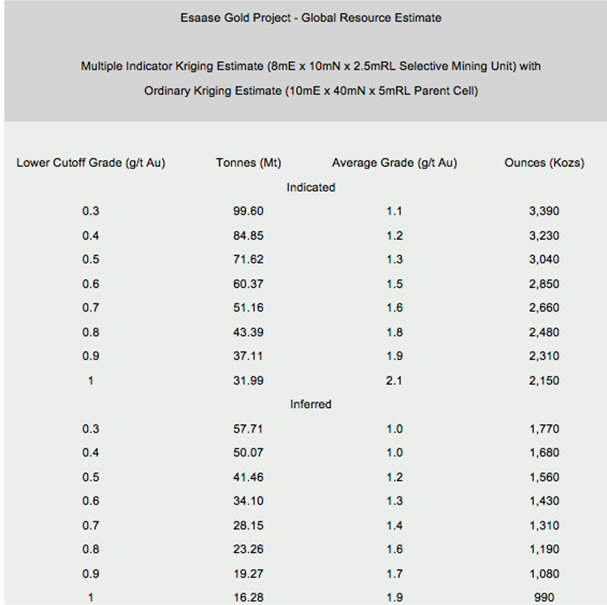

Cautionary Note to U.S. Investors Concerning Estimates of Indicated Mineral Resources. The following paragraph and accompanying table refers to “indicated mineral resources”. We advise U.S. investors that while this term is recognized and, in certain circumstances, required by Canadian securities regulations (under National Instrument 43-101 - Standards of Disclosure for Mineral Projects, as adopted by the Canadian Securities Administrators), it is not recognized by the U.S. Securities and Exchange Commission. The estimation of “indicated mineral resources” involves greater uncertainty as to their economic feasibility than the estimation of proven and probable reserves. U.S. investors are cautioned not to assume that any part or all of the mineral deposits in this category will ever be converted into reserves. Cautionary Note to U.S. Investors Concerning Estimates of Inferred Mineral Resources. The following paragraph and accompanying table below also refers to “inferred mineral resources”. We advise U.S. investors that while this term is recognized and, in certain circumstances, required by Canadian securities regulations (under National Instrument 43-101 - Standards of Disclosure for Mineral Projects, as adopted by the Canadian Securities Administrators), it is not recognized by the U.S. Securities and Exchange Commission. The estimation of “inferred mineral resources” involves far greater uncertainty as to their existence, economic viability and legal feasibility than the estimation of other categories of resources. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian securities legislation, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, or economic studies, except in rare cases. U.S. investors are cautioned not to assume that part or all of an inferred mineral resource exists, or is economically or legally mineable. |

Lower | Tonnes | Average Grade | Gold Metal |

Indicated | |||

0.4 | 57.987 | 1.2 | 2.278 |

0.5 | 49.248 | 1.4 | 2.153 |

0.6 | 41.942 | 1.5 | 2.025 |

0.7 | 35.748 | 1.7 | 1.898 |

0.8 | 30.656 | 1.8 | 1.777 |

0.9 | 26.322 | 2.0 | 1.660 |

1.0 | 22.782 | 2.1 | 1.552 |

Inferred | |||

0.4 | 41.664 | 1.2 | 1.653 |

0.5 | 34.054 | 1.4 | 1.546 |

0.6 | 28.573 | 1.6 | 1.451 |

0.7 | 24.430 | 1.7 | 1.365 |

0.8 | 20.649 | 1.9 | 1.275 |

0.9 | 17.914 | 2.1 | 1.201 |

1.0 | 15.852 | 2.2 | 1.139 |

gold (an increase of 42%) in an Indicated Mineral Resource category with an average grade of 1.2 g/t Au at a 0.4 g/t Au cutoff and 1.68 million ounces of gold (an increase of 2%) in an Inferred Mineral Resource category at an average grade of 1.0 g/t Au applying a 0.4 g/t Au cut-off for a total inferred and indicated resource of 4.91 Moz of gold. A total of 770 holes drilled at collar spacing ranging from 25m by 40m to 40m by 80m and over 190,000m of drilling were used to establish the resource. This resource estimation represents over 3.5 km of strike length along the A-1 structure and includes drilling done in the B-1 and D-1 mineralized zones.

26

27

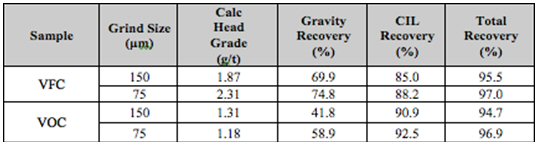

![[keegan201020fannualreport006.jpg]](https://capedge.com/proxy/20-F/0001217160-10-000141/keegan201020fannualreport006.jpg)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cautionary Note to U.S. Investors Concerning Estimates of Indicated Mineral Resources. The disclosure below uses the term “indicated mineral resources”. We advise U.S. investors that while this term is recognized and, in certain circumstances, required by Canadian securities regulations (under National Instrument 43-101 - Standards of Disclosure for Mineral Projects, as adopted by the Canadian Securities Administrators), it is not recognized by the U.S. Securities and Exchange Commission. The estimation of “indicated mineral resources” involves greater uncertainty as to their economic feasibility than the estimation of proven and probable reserves. U.S. investors are cautioned not to assume that any part or all of the mineral deposits in this category will ever be converted into reserves. Cautionary Note to U.S. Investors Concerning Estimates of Inferred Mineral Resources. The disclosure below also uses the term “inferred mineral resources”. We advise U.S. investors that while this term is recognized and, in certain circumstances, required by Canadian securities regulations (under National Instrument 43-101 - Standards of Disclosure for Mineral Projects, as adopted by the Canadian Securities Administrators), it is not recognized by the U.S. Securities and Exchange Commission. The estimation of “inferred mineral resources” involves far greater uncertainty as to their existence, economic viability and legal feasibility than the estimation of other categories of resources. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian securities legislation, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, or economic studies, except in rare cases. U.S. investors are cautioned not to assume that part or all of an inferred mineral resource exists, or is economically or legally mineable. |

28

Development and Exploration programs in progress

Keegan has completed additional post-Study metallurgical, geotechnical, and hydrological (in progress) drilling of the deposit on the Esaase Property. Keegan is also in the midst of an extensive exploration drill program, as well as undertake additional exploration to add to the existing resource estimates and convert additional resources to an indicated resources category. Drilling has and will be taking place both along strike of the existing resource, on subsidiary targets, internal to the existing resource as well as down dip. Keegan is also contemplating further acquisitions in the area.

The budget for fiscal 2011 exploration and development on the Esaase Property has a total budget of US$18,800,000 which consists of:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ITEM 4A

UNRESOLVED STAFF COMMENTS

| ITEM 4A | UNRESOLVED STAFF COMMENTS |

ITEM 5

OPERATING AND FINANCIAL REVIEW AND PROSPECTS

| ITEM 5 | OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

29

30

$735,732 from the exercise of broker’s warrants.

Cash and cash equivalents increased by $24,711,254 from $2,001,118The Company may also consider other forms of project financing that may include but won’t be limited to, debt.

The other sources of funds potentially available to the Company are through the exercise of 237,333 broker warrants with an exercise price of $7.50 and of the outstanding 214,000 share purchase warrants at $3.10 per share which expire November 26, 2010 and stock options with terms as follows:

Exercise price | Number outstanding at June 25, 2010 | Expiry date | Number exercisable at June 25, 2010 | |

$1.16 | 120,000 | November 22, 2010 | 120,000 | |

$2,48 | 40,000 | February 2, 2011 | 40,000 | |

$2.44 | 387,909 | November 10, 2011 | 387,909 | |

$3.60 | 50,000 | October 17, 2012 | 50,000 | |

$4.20 | 550,000 | February 5, 2013 | 550,000 | |

$1.12 | 12,500 | January 15, 2014 | - | |

$3.31 | 170,000 | June 2, 2014 | 127,500 | |

$3.10 | 225,000 | July 2, 2014 | 140,625 | |

$3.10 | 75,000 | July 17, 2014 | 46,875 | |

$4.01 | 485,000 | October 6, 2014 | 242,500 | |

$6.50 | 220,000 | Dec 14, 2014 | 110,000 | |

$6.19 | 1,625,000 | May 26, 2014 | 406,250 | |

3,960,409 | 2,232,597 |

31

| Number outstanding at | Number exercisable at | ||

| Exercise price | March 31, 2011 | Expiry date | March 31, 2011 |

| $2.44 | 305,000 | November 10, 2011 | 305,000 |

| $3.60 | 25,000 | October 17, 2012 | 25,000 |

| $4.20 | 440,000 | February 5, 2013 | 440,000 |

| $1.12 | 12,500 | January 15, 2014 | 12,500 |

| $3.31 | 120,000 | June 2, 2014 | 120,000 |

| $3.10 | 225,000 | July 2, 2014 | 225,000 |

| $3.10 | 75,000 | July 17, 2014 | 75,000 |

| $4.01 | 416,250 | October 6, 2014 | 355,625 |

| $6.50 | 220,000 | December 14, 2014 | 192,500 |

| $6.19 | 1,505,000 | May 26, 2015 | 912,500 |

| $7.83 | 115,000 | October 20, 2015 | 43,125 |

| $9.00 | 225,000 | November 30, 2015 | 84,375 |

| $8.00 | 2,530,000 | March 17, 2016 | 632,500 |

| 6,213,750 | 3,423,125 | ||

Financing

Research and Development, Patents and Licenses, etc.

Trend Information

Off-Balance Sheet Arrangements

Tabular Disclosure of Contractual Obligations

On May 20, 2010, the Company negotiated the cancellation their existing lease commitment set to expire on November 30, 2013. In its place, the Company signed a letter of guarantee over the premises and transferred the lease plus an extension of the lease to May 31, 2015 to Universal Mineral Services Ltd. (“UMS”). The amount guaranteed are the monthly rent payments of $ 23,767 plus operating costs over the term of the lease.

UMS is a private company which Keegan acquired the sole common share on April 14, 2010. UMS has certain directors in common with the Company and was incorporated to provide geological, corporate development, administrative and management services to, and incur third party costs on behalf of, the Company, its subsidiaries and other publically listed mining companies on a full cost recovery basis pursuant to a service agreement.

To date, no service agreement has been signed and no related party balances with UMS are outstanding.

32

2011 | 68,140 | |

2012 | 68,140 | |

2013 | 68,140 | |

$ 204,420 |

| Payments due by period | |||||

| Contractual Obligations | Total | Less than 1 year | 1-3 years | 3-5 years | More than 5 years |

| $ | $ | $ | $ | $ | |

| Operating Lease Obligations | 2,451,182 | 586,088 | 1,770,354 | 94,740 | - |

| Total | 2,451,182 | 586,088 | 1,770,345 | 94,740 | - |

ITEM 6

DIRECTORS, SENIOR MANAGEMENT, AND EMPLOYEES

| ITEM 6 | DIRECTORS, SENIOR MANAGEMENT, AND EMPLOYEES |

Directors and Senior Management

Name | Position | Age |

|

Maurice Tagami | President, CEO & Director |

| April 16, 2010 |

Shawn Wallace | Director / Executive Chair |

| March 3, 2010 |

Marcel de Groot(1) | Director / Chair of Audit/Compensation/Nominating Committee |

| Oct 1, 2009 |

Keith Minty | Director / Chair of Technical Committee |

| Oct 1, 2009 |

Tony Ricci | Chief Financial Officer |

| November 21, 2005 |

Michael Bebek(2) Greg McCunn | Corporate Secretary Incoming Chief Financial Officer |

35 42 | December 1, 2005 April 4, 2011 |

Robert J. McLeod(1) | Director |

| February 3, 2005 |

Gordon J. Fretwell (1) | Director |

| February 24, 2004 |

Dan McCoy | Director / Chief Geologist |

| November 25, 2004 |

(1)

Member of Audit Committee

| (1) | Member of Audit Committee |

| (2) | Michael Bebek resigned as Corporate Secretary in August 2010. |

Position | From | Until |

Keegan Resources Inc., Executive Chair | March 2010 | Present |

623845BC Ltd., President | March 2001 | Present |

Hunter Dickenson Inc. | September 1989 | March 2001 |

Glenbriar Technologies Inc., Director | April 2003 | March 2004 |

Advanced Projects, Director | March 2000 | May 2001 |

Skye Resources Inc., Director | May 2001 | Jan 2002 |

|

| Present |

Cayden Resources Inc., Director | July 2009 | Present |

Full Metal Minerals Corp., Director Georgetown Capital Corp., Director | November 2009 February 2011 | Present Present |

33

Position | From | Until |

Keegan Resources Inc., President & CEO | July 2009 | Present |

Brett Resources Inc. Director | May 2008 | Present |

Kobex Resources Ltd., COO | February 2007 | June 2009 |

Self Employed Consultant | Jan 2006 | January 2007 |

Canico Resources Corp., Sr. Project Manager | May 2003 | December 2005 |

Self-Employed | September 2001 | April 2003 |

Eurozinc Mining Corp., Manager of Metallurgy | November 1999 | August 2001 |

Sutton Resources, Manager of Metallurgy | July 1996 | October 1999 |

Position | From | Until |

Independent Consultant | March 2004 | Present |

Underworld Resources Inc., Director | December 2006 | Present |

Luna Gold Corp., Director | June 2000 | Present |

Sandstorm Resources Ltd., Director | April 2008 | March 2009 |

Ashton Mining of Canada, Director | October 2006 | January 2007 |

Diamond Fields International, CFO | April 2003 | February 2004 |

Chalk Media Corp., Director | November 2003 | November 2004 |

Independent Consultant Keegan Resources Inc., Independent Director | October 1999 July 2009 | April 2003 Present |

34

Position | From | Until |

Placer Dome, Senior Geologist | January 1997 | November 2004 |

Keegan Resources Cayden Resouces Inc., Director Georgetown Capital Corp., Independent Director | November 2004 September 2010 February 2011 | Present Present Present |

Position | From | Until |

Self-employed consultant | 1994 | Present |

CFO and Director, Norsement Mining Inc. | August 2005 | October 2007 |

CFO, Director, Keegan Resources Inc. | November 2005 November 2005 |

April 2011 September 2007 |

CFO, Remstar Resources Ltd. | April 2006 | June 2010 |

CFO and Secretary Altair Ventures | January 2006 | Present |

CFO, Petaquilla Minerals Ltd. | November 2006 | January 2008 |

CFO, Mosam Capital Corp. | March 2006 | April 2008 |

Director, Milk Capital Corporation | December 2006 | Present |

CFO, Petaquilla Copper Ltd. | January 2007 | January 2008 |

CFO and Director, Lornex Capital Inc. | May 2008 | June 2010 |

President and Director Jantar Resources Ltd. | May 2008 | Present |

CFO, EmerGeo Solutions Inc. CEO and Director, Georgetown Capital Corp. | May 2008 February 2011 | Present Present |

Position | From | Until |

|

|

|

|

|

|

Keegan Resources Inc., |

|

|

| May 2011 | Present |

| Farallon Mining Ltd., CFO | June 2008 | January 2011 |

| Zincore Metals Inc., VP Project Development | June 2007 | June 2008 |

Hunter Dickinson Inc., Senior project Analyst and Engineer Placer Dome Ltd., Senior Analyst, Corporate Development Teck Resources |

March 2006 February 2004 January 2001 |

June 2007 March 2006 February 2004 |

35

Position | From | Until |

Miramar Mining Inc., Project Manager | January 2000 | January 2003 |

Atna Resources Inc., Vice President | January 2003 | January 2004 |

Keegan Resources Inc., Director | January 2004 | Present |

Full Metals Minerals Corp., VP Exploration and Director | June 2003 | Present |

Position | From | Until |

Keegan Resources Inc., Director | October 2009 | Present |

Thani Dubai Mining Ltd., COO | April 2008 | Present |

Star Gold Mines Inc., Director | May 2007 | April 2009 |

K. Minty & Associates, President | February 2003 | December 2007 |

China Diamond Corp., Director | March 2006 | September 2006 |

Crow Fight Resources, President & CEO | April 2003 | August 2003 |

Beartooth Platinum, President & CEO | August 2004 | April 2005 |

North American Palladium, President & CEO | December 1997 | February 2003 |

36

Compensation

Annual Compensation | ||||||

Payouts | ||||||

Name and | Year | Salary | Bonus | LTIP | All Other | Total Cash Compensation ($) |

Shawn Wallace | 2010 | 145,000 | Nil | Nil | Nil | 145,000 |

Maurice Tagami President & CEO | 2010 | 107,500 | Nil | Nil | Nil | 107,500 |

Daniel T. McCoy Director/ Chief Geologist | 2010 | 198,051 | 50,000 | Nil | 21,480 | 269,531 |

Tony M. Ricci CFO | 2010 | Nil | Nil | Nil | 98,410 | 98,410 |

Michael Bebek Corporate Secretary | 2010 | 81,585 | 15,000 | Nil | Nil | 96,585 |

Robert J. McLeod Director | 2010 | 11,650 | Nil | Nil | Nil | 11,650 |

Gordon J. Fretwell Director | 2010 | 11,650 | Nil | Nil | Nil | 11,650 |

Marcel de Groot Director | 2010 | 11,725 | Nil | Nil | Nil | 11,650 |

Keith Minty Director | 2010 | 9,300 | Nil l | Nil | Nil | 9,300 |

| Annual Compensation | ||||||

| Payouts | ||||||

Name and Principal Position | Year | Salary ($) | Bonus ($) | LTIP Pay-outs ($) | All Other Compensation ($) | Total Cash Compensation ($) |

Shawn Wallace Executive Chair | 2011 | 256,042 | 40,000 | Nil | Nil | 296,042 |

Maurice Tagami President & CEO | 2011 | 270,000 | 50,000 | Nil | Nil | 320,000 |

Daniel T. McCoy Director/ Chief Geologist | 2011 | Nil | Nil | Nil | 256,507 | 256,507 |

Tony M. Ricci CFO | 2011 | 93,750 | Nil | Nil | 15,850 | 109,600 |

Michael Bebek Corporate Secretary | 2011 | 60,000 | 5,000 | Nil | Nil | 65,000 |

Richard Haslinger VP | 2011 | 48,570 | 10,000 | Nil | Nil | 58,570 |

Andrea Zaradic VP | 2011 | 30,625 | Nil | Nil | Nil | 30,625 |

Robert J. McLeod Director | 2011 | 25,000 | Nil | Nil | Nil | 25,000 |

Gordon J. Fretwell Director | 2011 | 25,0000 | Nil | Nil | Nil | 25,000 |

Marcel de Groot Director | 2011 | 32,500 | Nil | Nil | Nil | 32,500 |

Keith Minty Director | 2011 | 30,000 | Nil l | Nil | Nil | 30,000 |

37

2011:

Name | Number of Options Held | % Of Total Options Granted | Exercise Price per Share | Grant Date | Expiration Date | Mkt. Value of Securities Underlying Options on Date of Grant |

Tony Ricci | 75,000 | 34% | $1.16 | 11/21/05 | 11/21/10 | $1.16 |

25,000 | 2% | $2.44 | 11/10/06 | 11/10/11 | $2.44 | |

30,000 | 3% | $4.20 | 02/05/08 | 02/05/13 | $4.20 | |

100,000 | 21% | $4.01 | 06/10/09 | 06/10/14 | $4.01 | |

Shawn Wallace | 150,000 | 17% | $4.20 | 02/05/08 | 02/05/13 | $4.20 |

50,000 | 29% | $3.31 | 02/06/09 | 02/06/14 | $3.31 | |

50,000 | 10% | $4.01 | 06/10/09 | 06/10/14 | $4.01 | |

Maurice Tagami | 150,000 | 50% | $3.10 | 02/07/10 | 02/07/14 | $3.10 |

50,000 | 10% | $4.01 | 06/10/09 | 06/10/14 | $4.01 | |

Dan McCoy | 32,909 | 18% | $2.44 | 11/10/06 | 11/10/11 | $2.44 |

75,000 | 8% | $4.20 | 02/05/08 | 02/05/13 | $4.20 | |

50,000 | 10% | $4.01 | 06/10/09 | 06/10/14 | $4.01 | |

Marcel de Groot | 75,000 | 25% | $3.10 | 02/07/10 | 02/07/14 | $3.10 |

25,000 | 5% | $4.01 | 06/10/09 | 06/10/14 | $4.01 | |

Keith Minty | 75,000 | 25% | $3.10 | 02/07/10 | 02/07/14 | $3.10 |

25,000 | 5% | $4.01 | 06/10/09 | 06/10/14 | $4.01 | |

Gordon Fretwell | 25,000 | 5% | $4.01 | 06/10/09 | 06/10/14 | $4.01 |

25,000 | 2% | $2.44 | 11/10/06 | 11/10/11 | $2.44 | |

20,000 | 2% | $4.20 | 02/05/08 | 02/05/13 | $4.20 | |

Rob Mcleod | 25,000 | 5% | $4.01 | 06/10/09 | 06/10/14 | $4.01 |

50,000 | 4% | $2.44 | 11/10/06 | 11/10/11 | $2.44 | |

20,000 | 2% | $4.20 | 02/05/08 | 02/05/13 | $4.20 | |

Michael Bebek | 50,000 | 4% | $2.44 | 11/10/06 | 11/10/11 | $2.44 |

50,000 | 5% | $4.20 | 02/05/08 | 02/05/13 | $4.20 | |

25,000 | 5% | $4.01 | 06/10/09 | 06/10/14 | $4.01 | |

38

Name | Number of Options Held | % Of Total Options Granted | Exercise Price per Share | Grant Date | Expiration Date | Mkt. Value of Securities Underlying Options on Date of Grant |

| Tony Ricci | 75,000 | 34% | $1.16 | 11/21/05 | 11/21/10 | $1.16 |

| 25,000 | 2% | $2.44 | 11/10/06 | 11/10/11 | $2.44 | |

| 30,000 | 3% | $4.20 | 02/05/08 | 02/05/13 | $4.20 | |

100,000 45,000 | 21% | 4.01 $6.19 | 06/10/09 05/26/10 | 06/10/14 05/16/2015 | $4.01 $6.19 | |

| Shawn Wallace | 150,000 | 17% | $4.20 | 02/05/08 | 02/05/13 | $4.20 |

| 50,000 | 29% | $3.31 | 02/06/09 | 02/06/14 | $3.31 | |

50,000 125,000 220,000 250,000 | 10% | $4.01 $6.19 $8.00 | 06/10/09 01/27/10 05/26/10 03/17/11 | 06/10/14 01/27/15 05/26/15 03/17/16 | $4.01 $6.19 $8.00 | |

| Maurice Tagami | 150,000 | 50% | $3.10 | 02/07/10 | 02/07/14 | $3.10 |

50,000 125,000 220,000 250,000 | 10% | $4.01 $6.19 $8.00 | 06/10/09 01/27/10 05/26/10 03/17/11 | 06/10/14 01/27/15 05/26/15 03/17/16 | $4.01 $6.19 $8.00 | |

| Dan McCoy | 32,909 | 18% | $2.44 | 11/10/06 | 11/10/11 | $2.44 |

| 75,000 | 8% | $4.20 | 02/05/08 | 02/05/13 | $4.20 | |

50,000 125,000 220,000 150,000 | 10% | $4.01 $6.19 $8.00 | 06/10/09 01/27/10 05/26/10 03/17/11 | 06/10/14 01/27/15 05/26/15 03/17/16 | $4.01 $6.19 $8.00 | |

| Marcel de Groot | 75,000 | 25% | $3.10 | 02/07/10 | 02/07/14 | $3.10 |

25,000 45,000 45,000 50,000 | 5% | $4.01 $6.19 $8.00 | 06/10/09 01/27/10 05/26/10 03/17/11 | 06/10/14 01/27/15 05/26/15 03/17/16 | $4.01 $6.19 $8.00 | |

| Keith Minty | 75,000 | 25% | $3.10 | 02/07/10 | 02/07/14 | $3.10 |

25,000 45,000 45,000 50,000 | 5% | $4.01 $6.19 $8.00 | 06/10/09 01/27/10 05/26/10 03/17/11 | 06/10/14 01/27/15 05/26/15 03/17/16 | $4.01 $6.19 $8.00 | |

| Gordon Fretwell | 25,000 | 5% | $4.01 | 06/10/09 | 06/10/14 | $4.01 |

| 25,000 | 2% | $2.44 | 11/10/06 | 11/10/11 | $2.44 | |

20,000 45,000 45,000 50,000 | 2% | $4.20 $6.19 $8.00 | 02/05/08 01/27/10 05/26/10 03/17/11 | 02/05/13 01/27/15 05/26/15 03/17/16 | $4.20 $6.19 $8.00 | |

| Rob Mcleod | 25,000 | 5% | $4.01 | 06/10/09 | 06/10/14 | $4.01 |

| 50,000 | 4% | $2.44 | 11/10/06 | 11/10/11 | $2.44 | |

20,000 45,000 45,000 50,000 | 2% | $4.20 $6.19 $8.00 | 02/05/08 01/27/10 05/26/10 03/17/11 | 02/05/13 01/27/15 05/26/15 03/17/16 | $4.20 $6.19 $8.00 | |

| Michael Bebek | 50,000 | 4% | $2.44 | 11/10/06 | 11/10/11 | $2.44 |

| 50,000 | 5% | $4.20 | 02/05/08 | 02/05/13 | $4.20 | |

25,000 50,000 45,000 | 5% | $4.01 $6.19 | 06/10/09 01/27/10 05/26/10 | 06/10/14 01/27/15 05/26/15 | $4.01 $6.19 |

During the fiscal 2010, Shawn Wallace exercised 225,00050,000 options at a price of $2.44 per share, 22,500 options at a price of $6.19 per share, 21,875 options at a price of $4.01 per share, and 50,000 options at a price of $4.20 per share.

During fiscal 2010,2011, Dan McCoy exercised 194,410 options at a price of $0.92 per share and 150,49341,598 options at a price of $2.44 per share, and 32,909 options at a price of $2.44 per share.

Board Practices

39

2011.

40

to the extent feasible, the responsibility to satisfy itself as to the integrity of the chief executive officer and other executive officers and that the chief executive officers and the other executive officers create a culture of integrity throughout the Company;

responsibility for the adoption of a strategic planning process and approval of a strategic plan;

responsibility for the identification of the principal risks of the Company’s business and ensuring the implementation of appropriate systems to manage these risks;

oversight over succession planning;

responsibility over appointing, monitoring, evaluating and, where necessary, terminating senior management;

responsibility for the implementation of a communication policy for the Company regarding disclosure of corporate information;

responsibility for the Company’s internal control and management information systems including accounting systems, and

responsibility over developing the Company’s approach to corporate governance, including developing a set of corporate governance principles and guidelines that are specifically applicable to the Company.

41

Employees

Share Ownership

Title of Class | Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class |

Common | Shawn Wallace | 267,200 | 1% |

Common | Maurice Tagami | 200,000 | 1% |

Common | Daniel T. McCoy | 356,600 | 1% |

Common | Tony M. Ricci | 275,000 | * |

Common | Marcel Degroot | 100,000 | * |

Common | Robert J. McLeod | 164,500 | * |

Common | Gordon J. Fretwell | 121,300 | * |

Common | Keith Minty | 145,000 | * |

Common | Michael Bebek | 170,000 | * |

Total | 1,799,600 | 3.9 % |

Title of Class | Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class |

| Common | Shawn Wallace | 720,000 | * |

| Common | Maurice Tagami | 670,000 | * |

| Common | Daniel T. McCoy | 495,600 | * |

| Common | Tony M. Ricci | 250,000 | * |

| Common | Marcel Degroot | 195,000 | * |

| Common | Robert J. McLeod | 190,000 | * |

| Common | Gordon J. Fretwell | 165,000 | * |

| Common | Keith Minty | 145,000 | * |

| Total | 2,830,600 | 3.8 % |

.

42

Report on Form 20-F for the year ended March 31, 2009, as filed with the SEC on July 1, 2009.

the number of Common Shares issuable to insiders as a group under the New2008 Option Plan, when combined with Common Shares issuable to insiders under all the Company’s other security based compensation plans, may not exceed 10% of the issued Common Shares within any 12 month period;

the number of Common Shares issuable to insiders as a group under the New2008 Option Plan, when combined with Common Shares issuable to insiders under all the Company’s other security based compensation plans, may not exceed 10% of the Company’s issued Common Shares at any time;

options to purchase Common Shares granted to any one Consultant within any 12 month period may not exceed 2% of the issued and outstanding Common Shares of the Company;

the number of Common Shares, in aggregate, issuable to all Employees conducting Investor Relations Activities, in any 12 month period, must not exceed 2% of the issued and outstanding Common Shares of the Company;

all options granted to Consultants performing Investor Relations Activities must vest in stages over 12 months with no more than 25% of the options vesting in any three month period;

no exercise price of an option granted to an insider may be reduced nor an extension to the term of an option granted to an insider extended without further approval of the disinterested shareholders of the Company; and

the maximum aggregate number of Common Shares issuable upon exercise of Options to non-employee directors must not exceed 1% of the total common shares of the Company outstanding at any time and no more than $100,000 in total award value per non-employee director on an annual calendar basis.

43

all options granted under the New2008 Option Plan are non-assignable and non-transferable and are issuable for a period of up to five years;

for stock options granted to employees or service providers (inclusive of management company employees), the Company must ensure that the proposed optionee is a bona fide employee or service provider (inclusive of management company employees), as the case may be, of the Company or any subsidiary;

if an optionee ceases to be employed by the Company (other than as a result of termination with cause), or ceased to provide services to the Company, or ceases to act as a director or officer of the Company or a subsidiary of the Company, any option held by such optionee may be exercised at the earlier of the date of expiration of the term of 90 days after the date such optionee ceases to be employed as an officer or director or, as the case may be;

if an optionee dies, any vested option held by him at the date of death will become exercisable by the optionee’s lawful personal representatives, heirs or executors until the earlier of one year after the date of death of such optionee and the date of expiration of the term otherwise applicable to such option;

in the case of an optionee being dismissed from employment or service for cause, such optionee’s options, whether or not vested at the date of dismissal, will immediately terminate without right to exercise same;

the minimum exercise price of an option granted under the New2008 Option Plan must not be less than the Market Price calculated the day before the grant (as defined in the New2008 Option Plan);

vesting of options shall be in accordance with the option commitment in the New2008 Option Plan or otherwise, at the discretion of the Board, and will generally be subject to: (i) the service provider remaining employed by or continuing to provide services to the Company or any of its affiliates as well as, at the discretion of the Board, achieving certain milestones which may be defined by the Board from time to time or receiving a satisfactory performance review by the Company or any of its affiliates during the vesting period; or (ii) the service provider remaining as a Director of the Company or any of its affiliates during the vesting period;

the maximum aggregate number of shares issuable upon exercise of options to non-employee directors must not exceed 1% of the total common shares of the Company outstanding at any time and no more than $100,000 in total award value per non-employee director on an annual calendar basis; and

the Board reserves the right in its absolute discretion to terminate the New2008 Option Plan with respect to all New2008 Option Plan shares in respect of Options which have not yet been granted under the New2008 Option Plan.

44

it may make amendments which are of a typographical, grammatical or clerical nature only;

it may change the vesting provisions of an option or the New2008 Option Plan;

it may change the termination provision of an option or the New2008 Option Plan which does not entail an extension beyond 5 years from the original expiry date of an option;

it may amend the expiry date of an option of non-Insider optionees which does not entail an extension beyond 5 years from the original date of grant;

it may add a cashless exercise feature payable in cash or shares to the New2008 Option Plan;

it may make amendments necessary as a result of changes in securities laws applicable to the Company;

if the Company becomes listed or quoted on a stock exchange or stock market senior to the TSX, it may make such amendments as may be required by the policies of such senior stock exchange or stock market; and

ITEM 7.

MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

| ITEM 7. | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS |

Major Shareholders

Related Party Transactions

During the year ended March 31, 2010 and to June 25, 2010, the

Included in professional fees is $Nil (2008 - $Nil; 2008 - $24,119) paid or accrued for legal fees tohas a consulting agreement with a company controlled by Gordon Fretwell, a director of the Company and $98,410 (2009 - $76,660; 2008 - $51,380) for accounting fees to Tony M. Ricci Inc., a private company controlled by Tony M. Ricci, CFO of the Company.

Included in consulting fees, wages and benefits is $Nil (2009 - $91,270; 2008 - $65,722) paid or accrued for consulting fees paid to Michael Bebek, the Company’s corporate secretary.

45

The Company entered into a consulting agreement with Dan McCoy, President and a director of the Company in the amount of US$12,000 17,500 per month plus benefits for the period up to May 1, 2009February 28, 2011 and US$ 17,5008,750 plus benefits there after. During the year ended March 31, 2010,2011, the Company paid consulting fees, benefits and benefitsa bonus of $269,531 (2009$306,507 (2010 - $211,632; 2008$269,531; 2009 - $183,258)$211,632) under this agreement.

These chargescosts have been included in resource properties.

Management believes that all of these transactions were on terms at least as favorable to Keegan as could have been obtained from unaffiliated third parties.

Accounting Fees

Keegan paid accounting fees of $98,410 (2009 - $76,660; 2008 - $51,380) to Tony M. Ricci, Inc., a company controlled by Tony M. Ricci, CFO of the Company.

Amounts Owing to Senior Management/Directors

As at March 31, 2010, there is $70,028 (March 31, 2009 - $61,939) owing senior management or members of the Board of Directors.

Interests of Experts and Counsel

ITEM 8.

FINANCIAL INFORMATION

| ITEM 8. | FINANCIAL INFORMATION |

Consolidated Statements and Other Financial Information

46

Legal Proceedings

Esaase Lawsuit

| Esaase Lawsuit |

Dividends

47

Significant Changes

ITEM 9.

THE OFFER AND LISTING

| ITEM 9. | THE OFFER AND LISTING |

Common Share Trading Information

Period | High | Low | |

Year Ended: | |||

March 31, 2010 | 7.98 | 2.25 | |

March 31, 2009 | 5.85 | 0.49 | |

March 31, 2008 | 5.49 | 2.22 | |

March 31, 2007 | 4.95 | 1.30 | |

March 31, 2006 | 2.75 | 1.51 | |

Quarter Ended: | |||

March 31, 2010 | 7.34 | 5.35 | |

December 31, 2009 | 7.98 | 3.65 | |

September 30, 2009 | 4.40 | 2.25 | |

June 30, 2009 | 4.39 | 2.25 | |

March 31, 2009 | 3.07 | 1.01 | |

December 31, 2008 | 1.99 | 0.49 | |

September 30, 2008 | 3.50 | 1.46 | |

June 30, 2008 | 5.85 | 3.12 | |

Month Ended: | |||

May 31, 2010 | 7.00 | 5.51 | |

April 30, 2010 | 6.82 | 6.07 | |

March 31, 2010 | 6.41 | 5.73 | |

February 28, 2010 | 6.56 | 5.35 | |

January 31, 2010 | 7.34 | 5.77 | |

December 31, 2009 | 7.75 | 6.20 | |

48

Period | High | Low |

Year Ended: March 31, 2011 | 9.29 | 4.92 |

| March 31, 2010 | 7.98 | 2.25 |

| March 31, 2009 | 5.85 | 0.49 |

| March 31, 2008 | 5.49 | 2.22 |

| March 31, 2007 | 4.95 | 1.30 |

| March 31, 2006 | 2.75 | 1.51 |

| Quarter Ended: | ||

March 31, 2011 December 31, 2010 September 30, 2010 June 30, 2010 March 31, 2010 | 9.03 9.29 8.70 7.00 7.34 | 7.25 7.16 4.92 5.30 5.35 |

| December 31, 2009 | 7.98 | 3.65 |

| September 30, 2009 | 4.40 | 2.25 |

| June 30, 2009 | 4.39 | 2.25 |

| Month Ended: | ||

| May 31, 2011 | 8.80 | 7.38 |

| April 30, 2011 | 9.24 | 8.25 |

| March 31, 2011 | 9.03 | 7.25 |

| February 28, 2011 | 7.77 | 7.30 |

| January 31, 2011 | 8.86 | 7.27 |

| December 31, 2010 | 9.29 | 8.63 |

12

Period | High | Low | |

Year Ended: | |||

March 31, 2010 | 7.57 | 1.76 | |

March 31, 2009 | 5.76 | 0.36 | |

March 31, 2008 | N/A | N/A | |

March 31, 2007 | N/A | N/A | |

March 31, 2006 | N/A | N/A | |

Quarter Ended: | |||

March 31, 2010 | 7.10 | 5.03 | |

December 31, 2009 | 7.57 | 3.36 | |

September 30, 2009 | 4.13 | 1.91 | |

June 30, 2009 | 4.00 | 1.76 | |

March 31, 2009 | 2.68 | 0.79 | |

December 31, 2008 | 1.89 | 0.36 | |

September 30, 2008 | 3.56 | 1.37 | |

June 30, 2008 | 5.76 | 3.18 | |

Month Ended: | |||

May 31, 2010 | 6.93 | 5.14 | |

April 30, 2010 | 6.78 | 5.98 | |

March 31, 2010 | 6.29 | 5.55 | |

February 28, 2010 | 6.17 | 5.03 | |

January 31, 2010 | 7.10 | 5.40 | |

December 31, 2009 | 7.42 | 5.89 | |

Period | High | Low |

| Year Ended: | ||

March 31, 2011 March 31, 2010 | 9.20 7.57 | 4.70 1.76 |

| March 31, 2009 | 5.76 | 0.36 |

| March 31, 2008 | N/A | N/A |

| March 31, 2007 | N/A | N/A |

| March 31, 2006 | N/A | N/A |

Quarter Ended: | ||

March 31, 2011 December 31, 2010 September 30, 2010 June 30, 2010 March 31, 2010 | 9.20 9.19 8.48 6.93 7.10 | 7.30 6.96 4.70 5.11 5.03 |

| December 31, 2009 | 7.57 | 3.36 |

| September 30, 2009 | 4.13 | 1.91 |

| June 30, 2009 | 4.00 | 1.76 |

| Month Ended: | ||

| May 31, 2011 | 9.24 | 7.60 |

| April 30, 2011 | 9.65 | 8.54 |

| March 31, 2011 | 9.20 | 7.32 |

| February 28, 2011 | 7.87 | 7.37 |

| January 31, 2011 | 9.00 | 7.30 |

| December 31, 2010 | 9.19 | 8.58 |

2011.

49

Effective Date of Issuance | Number of Share Purchase Warrants Currently Outstanding | Year #1 | Year #2 | Expiration Date of Share Purchase Warrants |

05/27/09 | 214,000 | $3.10 | $3.10 | 11/27/10 |

214,000 |

Effective Date of Issuance | Number of Share Purchase Warrants Currently Outstanding | Year #1 | Year #2 | Expiration Date of Share Purchase Warrants |

| February 17, 2013 | 284,050 | $7.50 | $7.50 | February 17, 2015 |

| 284,050 |

Effective Date

. The effective date of the Shareholder Rights Plan is September 1, 2006 (the “Effective Date”).Term

. The Shareholder Rights Plan will terminate on the sixth anniversary of the Effective Date, subject to ratification by the shareholders at the Meeting and to reconfirmation by shareholders at the third annual general meeting thereafter.Shareholder Approval.

For the Shareholder Rights Plan to continue in effect following the Meeting, the Shareholder Rights Plan Resolution must be approved by a majority of the votes cast at the Meeting by shareholders voting in person and by proxy.Issue of Rights.

On the Effective Date, one right (a “Right”) is issued and attached to each Common share outstanding and will attach to each Common share subsequently issued.Rights Exercise Privilege.

The Rights will separate from the Common shares and will be exercisable eight business days (or such later business day as may be determined by the board of directors) (the “Separation Time”) after a person has acquired, or commences or publicly announces or discloses its intention to commence a take-over bid to acquire, 20% or more of the Common shares, other than by an acquisition pursuant to a take-over bid permitted by the Shareholder Rights Plan (a “Permitted Bid”). The acquisition by any person (an “Acquiring Person”) of 20% or more of the Common shares, other than by way of a Permitted Bid, is referred to as a “Flip-in Event”. Any Rights held by an Acquiring Person will become void upon the occurrence of a Flip-in Event. From and after the Separation Time, each Right (other than those held by the Acquiring Person), will permit the purchase of CDN$100 worth of Common shares (at the market50

Certificates and Transferability

. Prior to the Separation Time, the Rights will be evidenced by a legend imprinted on certificates for Common shares issued from and after the Effective Date and will not be transferable separately from the Common shares. From and after the Separation Time, the Rights will be evidenced by Rights certificates which will be transferable and traded separately from the Common shares.(g)

the take-over bid must be made by way of a take-over bid circular;

the take-over bid must be made to all holders of Common shares;

the take-over bid must be outstanding for a minimum period of 60 days and Common shares tendered pursuant to the take-over bid may not be taken up and paid for prior to the expiry of such 60-day period and only if at such time more than 50% of the Common shares held by shareholders other than the bidder, its affiliates and persons acting jointly or in concert with the bidder (collectively, the “Independent Shareholders”) have been tendered to the take-over bid and not withdrawn;

the Common shares deposited pursuant to the take-over bid may be withdrawn until taken up and paid for; and

if more than 50% of the Common shares held by Independent Shareholders are tendered to the take-over bid within such 60-day period, then the bidder must make a public announcement of that fact and the take-over bid must remain open for deposits of Common shares for an additional 10 business days from the date of such public announcement.

Waiver and Redemption.

The board of directors may, prior to the Flip-in Event, waive the dilutive effects of the Shareholder Rights Plan in respect of a particular Flip-in Event resulting from a take-over bid made by way of a take-over bid circular to all holders of Common shares, or to waive one or more of the requirements of a Permitted Bid, or a Competing Permitted Bid, in which event such waiver would be deemed also to be a waiver in respect of any other Flip-in Event, and any such requirement, occurring under a take-over bid made by way of a take-over bid circular to all holders of Common shares. The board of directors may also waive the Shareholder Rights Plan in respect of a particular Flip-in Event that has occurred through inadvertence, provided that the Acquiring Person that inadvertently triggered such Flip-in Event reduces its beneficial holdings to less than 20% of the outstanding voting shares of the Company within 14 days or such later date as may be specified by the board of directors. With the majority consent of shareholders or Rights holders at any time prior to the later of a Flip-in Event and the Separation time, the board of directors may at its option redeem all, but not less than all, of the outstanding Rights at a price of CDN$0.00001 each.Exemptions for Investment Advisors

. Investment advisors (for client accounts), trust companies (acting in their capacities as trustees and administrators), statutory bodies managing investment funds (for employee benefit plans, pension plans, insurance plans or various public bodies) and administrators or trustees of registered pension funds or plans acquiring greater than 20% of the Common shares are exempted from triggering a Flip-in Event, provided that they are not making, or are not part of a group making, or proposing to make or participate in, or has not announced a current intention to make, a take-over bid.51

Exemptions for Lock-up Agreements.

A person is deemed not to be the beneficial owner of Common shares if the holder of such Common shares has agreed to deposit or tender its Common shares pursuant to a “Permitted Lock-up Agreement” to a take-over bid (the “Lock-up Bid”) made by such person. In order for an agreement to constitute a Permitted Lock-up Agreement, certain conditions must be met including, among other things, (i) any “break-up” fees payable by the tendering shareholder, cannot exceed in the aggregate the greater of the cash equivalent of 2.5% of the price or value of the consideration payable under the Lock-up Bid and 50% of the amount by which the price or value of the consideration payable under another take-over bid or transaction exceeds the price or value of the consideration that would have been received under the Lock-up Bid and (ii) the terms of such agreement are publicly disclosed and a copy of which is madeSupplements and Amendments.

The Company is authorized to make amendments to the Shareholder Rights Plan to correct any clerical or typographical error or to maintain the validity of the Shareholder Rights Plan as a result of changes in law, regulation or rules. Prior to the Meeting, the Company is authorized to amend or supplement the Shareholder Rights Plan as the board of directors may in good faith deem necessary or desirable. No such amendments have been made to date. The Company will issue a press release relating to any significant amendment made to the Shareholder Rights Plan prior to the Meeting and will advise the shareholders of any such amendment at the Meeting. Other amendments or supplements to the Shareholder Rights Plan may be made with the prior approval of shareholders or Rights holders.Statement on Form 20-F.

Markets

ITEM 10.

ADDITIONAL INFORMATION

| ITEM 10. | ADDITIONAL INFORMATION |

Share Capital

Memorandum and Articles of Association

Material Contracts

Exchange Controls

52

The Company does not believe the Investment Act will have any affect on it or on its non-Canadian shareholders due to a number of factors including the nature of its operations.

A The size and nature of a proposed transaction may give rise to an obligation to notify the Director to seek an advance ruling.

| (a) | first, if it was an investment to acquire control (within the meaning of the Investment Act) and the value of the Company’s assets, as determined under Investment Act regulations, was CDN$5 million or more; |

| (b) | second, if an order for review was made by the federal cabinet of the Canadian government on the grounds that the investment related to Canada’s cultural heritage or national identity (as prescribed under the Investment Act), regardless of asset value; |

| (c) | third, if an order for review was made by the federal cabinet of the Canadian government on the grounds that an investment by a non-Canadian could be injurious to national security, regardless of asset value. |

For a direct acquisition that would result in anacquirer. An acquisition of control for the purposes of the Company, subject to the exception for “WTO-investors” that are controlled by persons who are resident in World Trade Organization (“WTO”) member nations,Investment Act also could occur as a proposed investment would be reviewable where the valueresult of the acquired assets is $5 million or more, or if an order for review was madeacquisition by the federal cabinet on the grounds that the investment related to Canada’s cultural heritage or national identity, regardless of the value of the assets of the Company.

For a proposed indirect acquisition that would result in an acquisition of control of the Company through the acquisition of a non-Canadian parent entity, the investment would be reviewable where (a) the value of the Canadian assets acquired in the transaction is $50 millionall or more, or (b) the value of the Canadian assets is greater than 50% of the value ofsubstantially all of the assets acquiredCompany’s assets.

In the case of a direct acquisition by or from a “WTO investor”, the threshold is significantly higher, and is adjusted for inflation each year. The 2008 threshold is $295 million. Other than the exception noted below, an indirect acquisition involving a WTO investor is not reviewable under the Investment Act.

The higher WTO threshold for direct investments and the exemption for indirect investments do not apply where the relevant Canadian business is carrying on the following businesses that have been deemed to be sensitive: (i) the production of uranium and the ownership ofor own an interest in a producing uranium property in Canada; (ii)Canada, or provide any financial service or transportation service, as the provision of any “financial service”; (iii) the provision of any “transportation service”; or (iv) a “cultural business”.

rules governing these businesses are different.

(a)

acquisition of common shares of the Company by a person in the ordinary course of that person’s business as a trader or dealer in securities,

(b)

acquisition of control of the Company in connection with the realization of security granted for a loan or other financial assistance and not for a purpose related to the provisions on the Investment Act, and

53

(c)

acquisition of control of the Company by reason of an amalgamation, merger, consolidation or corporate reorganization following which the ultimate direct or indirect control in fact of the Company, through the ownership of common shares, remained unchanged.

including:

| (a) | an acquisition of common shares of the Company by a person in the ordinary course of that person’s business as a trader or dealer in securities, |

| (b) | an acquisition of control of the Company in connection with the realization of security granted for a loan or other financial assistance and not for a purpose related to the provisions on the Investment Act, and |

| (c) | an acquisition of control of the Company by reason of an amalgamation, merger, consolidation or corporate reorganization following which the ultimate direct or indirect control in fact of the Company, through the ownership of common shares, remained unchanged. |

Taxation

54

As long as

Furthermore, on March 4, 2010, the Department of Finance (Canada) announced in the 2010 Federal Budget that it is proposing to amend the definition of “taxable Canadian property”certain other circumstances specified in the Tax Act to exclude (unless otherwise deemed to be taxable Canadian property)Act.

Non-Resident Holders for whom the common shares may be considered or be deemed to be consideredas taxable Canadian property should consult their own tax advisors, including with respect to any relief that may be available under the provisions of the Tax Treaty, if applicable.

any applicable income tax treaty or convention.

CONSIDERATIONS

The following discussionconsequences to U.S. Holders of the acquisition, ownership, and disposition of common shares. Each U.S. Holder should consult its own tax advisor regarding the U.S. federal, U.S. federal alternative minimum, U.S. federal estate and gift, U.S. state and local, and foreign tax consequences relating to the acquisition, ownership and disposition of common shares.

| · | an individual who is a citizen or resident of the U.S.; |

| · | a corporation (or other entity taxable as a corporation for U.S. federal income tax purposes) organized under the laws of the U.S., any state thereof or the District of Columbia; |

| · | an estate whose income is subject to U.S. federal income taxation regardless of its source; or |

| · | a trust that (1) is subject to the primary supervision of a court within the U.S. and the control of one or more U.S. persons for all substantial decisions or (2) has a valid election in effect under applicable Treasury Regulations to be treated as a U.S. person. |

not a U.S. Holders

As used herein, a (“U.S. Holder”) includes a holder of common shares of the Company who is a citizen or resident of the United States, a corporation created or organized in or under the laws of the United States or of any political subdivision thereof, an estate whose income is taxable in the United States irrespective of source or a trust subject to the primary supervision of a court within the United States and control of a United States fiduciary as described in Section 7701(a)(30) of the Code.Holder. This summary does not address the U.S. federal income tax consequences to non-U.S. Holders arising from and relating to the acquisition, ownership, and disposition of common shares. Accordingly, a non-U.S. Holder should consult its own tax advisor regarding the U.S. Holderfederal, U.S. federal alternative minimum, U.S. federal estate and gift, U.S. state and local, and foreign tax consequences (including the potential application of and operation of any income tax treaties) relating to the acquisition, ownership, and disposition of common shares.

55

Distribution on Common Sharesmore of the Company

U.S. Holders receiving dividend distributions (including constructive dividends) with respect to common sharesgross income of the Company is passive income (the “income test”) or (b) 50% or more of the value of the Company’s assets either produce passive income or are required to include in grossheld for the production of passive income, for United States Federal income tax purposesbased on the gross amountquarterly average of such distributions equal to the U.S. dollarfair market value of such distributions onassets (the “asset test”). “Gross income” generally includes all sales revenues less the datecost of receipt (based ongoods sold, and “passive income” generally includes, for example, dividends, interest, certain rents and royalties, certain gains from the exchange rate onsale of stock and securities, and certain gains from commodities transactions.

In Deductions for capital losses are subject to significant limitations under the caseCode.

Dividendsloss, and generally will be U.S. source income or loss for foreign tax credit purposes. Each U.S. Holder should consult its own U.S. tax advisor regarding the U.S. federal income tax consequences of receiving, owning, and disposing of foreign currency.

foreign tax credit rules.

Foreign Tax Credit