The following table sets forth our estimates of proven and probable reserves and other mineral deposits at our mines reflecting the results of reserve studies. They have been calculated in accordance with the technical definitions contained in the SEC’s Industry Guide 7, and estimates of mine life described herein are derived from such reserve estimates. In the case of the Engenho and Fernandinho mines, where we own 60% of interests, the mineralized materialmaterials disclosed are for the entire mine, and not just for our proportional interest in the mine.

According to the report “Audit of Ore Reserves for CSN Casa de Pedra Iron Mine”, prepared by Golder Associates in May 2007, our reserve estimation process is subject to some smoothing, but does not reflect losses for mine dilution and mining recovery. We intend to perform studies regarding those losses during the preparation process for the new reserve audit. Likewise, Namisa’s estimation process for the Engenho and Fernandinho mines does not reflect losses for mine dilution and mining recovery.

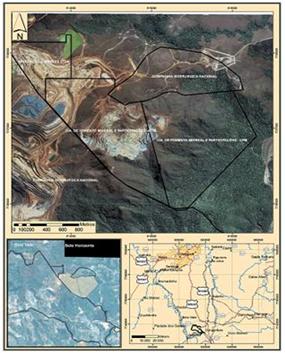

In 2006, we concluded an extensive, multi-year study of our iron ore reserves at Casa de Pedra. The study consisted of three phases. Phase one, which was completed in 1999, covered the ore bodies that are currently being mined or are close to the current operating open pits. Phase two, which was completed in early 2003, covered theotherthe other iron ore deposits at Casa de Pedra site. Phase three started in 2005 and involved a complete revaluation of our mineral reserves at Casa de Pedra.

Eurodollar and Euronotes issued in accordance with Rule 144A and Regulation S under the Securities Act reflect senior unsecured debt instruments issued by us and our offshore subsidiaries, including (i) the US$U.S.$300 million bonds, 10% per annum coupon, and the US$U.S.$300 million notes, 8.25% per annum coupon, issued in 1997 with final maturity in 2047; (ii) the issuance in December 2003 and January 2004 of US$U.S.$550 million notes, 9.75% per annum coupon with final maturity in 2013; (iii) the US$U.S.$400 million notes, 10% per annum coupon,issued in September 2004 and January 2005 with final maturity in 2015, and (iv) the US$U.S.$750 million notes, 6.875% per annum coupon, issued in September 2009 with maturity in 2019.

The table below shows the average interest rate and the average life of our debt.

SIGNATURE

The registrant hereby certifies that it meets all the requirements for filing on Form 20-F and that it has duly caused and authorized the undersigned to sign this annual report on its behalf.

| | |

April 27, 201230, 2014 | Companhia Siderúrgica Nacional |

| | |

| /s/ By:

| Benjamin Steinbruch

|

| | Name:/s/ Benjamin Steinbruch

| Benjamin Steinbruch |

| | Title: | Chief Executive Officer |

|

| /s/

By: | /s/ Rogério Leme Borges dos Santos |

| | Name:

| Rogério Leme Borges dos Santos |

| | Title: | Controller / Principal Financial Officer |

| | | |

147

table of contents

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Report of Independent Registered Public Accounting Firm

TheTo the Board of Directors and Shareholders of

Companhia SiderúrgicaSiderurgica Nacional

São Paulo – SP, Brazil

We have audited the accompanying consolidated balance sheetsinternal control over financial reporting of Companhia SiderúrgicaSiderurgica Nacional and subsidiaries (“the Company”(the "Company") as of December 31, 2011 and 2010, and the related consolidated statements of income, changes in shareholders’ equity, comprehensive income and cash flows for each of the years in the three-year period ended December 31, 2011. We also have audited the Company’s internal control over financial reporting as of December 31, 2011,2013, based on the criteria established in Internal Control –— Integrated Framework (1992) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO)”.- COSO. The Company’sCompany's management is responsible for these consolidated financial statements, for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management’s Report on Internal Control over Financial Reporting. Our responsibility is to express an opinion on these consolidated financial statements and an opinion on the Company’sCompany's internal control over financial reporting based on our audits.audit.

We conducted our auditsaudit in accordance with the standards of the Public Company Accounting Oversight Board (United States). - PCAOB. Those standards require that we plan and perform the auditsaudit to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting was maintained in all material respects. Our audits of the consolidated financial statements included examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our audit of internal control over financial reporting included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audits also includedrisk, and performing such other procedures as we considered necessary in the circumstances. We believe that our audits provideaudit provides a reasonable basis for our opinions.opinion.

A company’scompany's internal control over financial reporting is a process designed by, or under the supervision of, the company's principal executive and principal financial officers, or persons performing similar functions, and effected by the company's board of directors, management, and other personnel to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.International Financial Reporting Standards as issued by the International Accounting Standards Board - IASB. A company’scompany's internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles,International Financial Reporting Standards as issued by the International Accounting Standards Board - IASB, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’scompany's assets that could have a material effect on the financial statements.

Because of itsthe inherent limitations of internal control over financial reporting, including the possibility of collusion or improper management override of controls, material misstatements due to error or fraud may not preventbe prevented or detect misstatements.detected on a timely basis. Also, projections of any evaluation of the effectiveness of the internal control over financial reporting to future periods are subject to the risk that the controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Companhia Siderúrgica Nacional and subsidiaries as of December 31, 2011 and 2010, and the results of their operations and their cash flows for each of the years in the three-year period ended December 31, 2011, in conformity with International Financial Report Standards, as issued by the International Accounting Standards Board. Also in our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2011,2013, based on the criteria established in Internal Control –— Integrated Framework (1992) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO)”- COSO.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) - PCAOB, the consolidated financial statements as of and for the years ended December 31, 2013 and 2012 of the Company and our report dated April 30, 2014 expressed an unqualified opinion on those financial statements and included an explanatory paragraph regarding the Company’s adoption of new accounting standards as described in notes 2.y) and 3.

/s/ Deloitte Touche Tohmatsu Auditores Independentes

DELOITTE TOUCHE TOHMATSU AUDITORES INDEPENDENTES

São Paulo – SP, Brazil

April 30, 2014

FS-R1

table of contents

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

Companhia Siderurgica Nacional

São Paulo – SP, Brazil

We have audited the accompanying consolidated balance sheets of Companhia Siderurgica Nacional and subsidiaries (the "Company") as of December 31, 2013 and 2012, and the related consolidated statements of income, comprehensive income, shareholders' equity, and cash flows for the years then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States) - PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such consolidated financial statements present fairly, in all material respects, the financial position of Companhia Siderurgica Nacional and subsidiaries as of December 31, 2013 and 2012, and the results of their operations and their cash flows for the years then ended, in conformity with International Financial Reporting Standards as issued by theInternational Accounting Standards Board - IASB.

As discussed in notes 2.y) and 3 to the consolidated financial statements, the accompanying financial statements as of and for the year ended December 31, 2012 have been retrospectively adjusted for the adoption of International Financial Reporting Standards (“IFRS”) 10,Consolidated Financial Statements, IFRS 11,Joint Arrangements, IFRS 12,Disclosures of Interests in Other Entities, and IAS 1,Presentation of Financial Statements, and various amendments as part of the IFRS Annual Improvements 2009 – 2011.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) - PCAOB, the Company's internal control over financial reporting as of December 31, 2013, based on the criteria established in Internal Control — Integrated Framework (1992) issued by the Committee of Sponsoring Organizations of the Treadway Commission - COSO and our report dated April 30, 2014 expressed an unqualified opinion on the Company's internal control over financial reporting.

/s/ Deloitte Touche Tohmatsu Auditores Independentes

DELOITTE TOUCHE TOHMATSU AUDITORES INDEPENDENTES

São Paulo – SP, Brazil

April 30, 2014

FS-R2

table of contents

Report of Independent Registered Public Accounting Firm

The Board of Directors and Shareholders

Companhia Siderúrgica Nacional

We have audited the accompanying consolidated statements of income, changes in shareholders’ equity, comprehensive income and cash flows of Companhia Siderúrgica Nacionaland its subsidiaries (the “Company”) for the year ended December 31, 2011. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the results of their operations and their cash flows of the Company for the year ended December 31, 2011 , in conformity with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB).

Emphasis

As described in explanatory note 3 to the December 31, 2013 consolidated financial statements, the Company adopted the provisions of IFRS 10 – Consolidated Financial Statements and IFRS 11 - Joint Arrangements in 2013, which included the disclosure of the January 1, 2012 balance sheet.

/s/ KPMG Auditores Independentes

São Paulo, SP - Brazil

April 27,27, 2012, except for explanatory note 3 to the December 31, 2013 consolidated financial statements as to which the date is April 30, 2014.

FS-R1

FS-R3

| | | | | | | |

| Companhia Siderúrgica Nacional and Subsidiaries | | | | |

| Consolidated Balance Sheet | | | | | | |

| Thousands of Brazilian reais |

| |

| Assets | | | | |

| | | Note | | 2011 | | 2010 |

| CURRENT ASSETS | | | | | | |

Cash and cash equivalents | | 5 | | 15,417,393 | | 10,239,278 |

Trade receivables | | 6 | | 1,616,206 | | 1,367,759 |

Inventories | | 7 | | 3,734,984 | | 3,355,786 |

Recoverable taxes | | | | 584,273 | | 473,787 |

Other current assets | | 8 | | 591,450 | | 357,078 |

Total current assets | | | | 21,944,306 | | 15,793,688 |

| |

| NON-CURRENT ASSETS | | | | | | |

Long-term receivables | | | | | | |

Short-term investments measured at fair value | | | | 139,679 | | 112,484 |

Trade receivables | | | | 10,043 | | 58,485 |

Deferred income taxes | | 9 | | 1,840,773 | | 1,592,941 |

Receivables from related parties | | | | 0 | | 479,120 |

Other non-current assets | | 10 | | 2,866,226 | | 3,676,080 |

| | | | | 4,856,721 | | 5,919,110 |

| |

Investments | | 11 | | 2,088,225 | | 2,103,624 |

Property, plant and equipment | | 12 | | 17,377,076 | | 13,776,567 |

Intangible assets | | 13 | | 603,374 | | 462,456 |

Total non-current assets | | | | 24,925,396 | | 22,261,757 |

| |

| TOTAL ASSETS | | | | 46,869,702 | | 38,055,445 |

Companhia Siderúrgica Nacional and Subsidiaries |

Consolidated Balance Sheet |

Thousands of Brazilian reais |

| | | | | | | | |

Assets | | | | | | | |

| | | | | | | | |

| | Note | | 2013 | | 2012 | | 01/01/2012 |

CURRENT ASSETS | | | | | | | |

Cash and cash equivalents | 4 | | 9,995,672 | | 11,891,821 | | 13,440,690 |

Trade receivables | 5 | | 2,522,465 | | 2,661,417 | | 2,146,662 |

Inventories | 6 | | 3,160,985 | | 3,393,193 | | 3,518,907 |

Other current assets | 7 | | 722,920 | | 1,152,155 | | 1,057,717 |

Total current assets | | | 16,402,042 | | 19,098,586 | | 20,163,976 |

| | | | | | | | |

NON-CURRENT ASSETS | | | | | | | |

Long-term receivables | | | | | | | |

Investments measured at fair value | | | 30,756 | | 116,753 | | 139,679 |

Deferred income taxes | 8 | | 2,770,527 | | 2,177,079 | | 1,473,739 |

Other non-current assets | 7 | | 1,835,325 | | 1,627,139 | | 2,930,843 |

| | | | 4,636,608 | | 3,920,971 | | 4,544,261 |

| | | | | | | |

Investments | 9 | | 13,487,023 | | 10,839,787 | | 10,017,456 |

Property, plant and equipment | 10 | | 14,911,426 | | 18,519,064 | | 15,764,495 |

Intangible assets | 11 | | 965,440 | | 904,861 | | 230,979 |

Total non-current assets | | | 34,000,497 | | 34,184,683 | | 30,557,191 |

| | | | | | | | |

TOTAL ASSETS | | | 50,402,539 | | 53,283,269 | | 50,721,167 |

| | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements. |

FS-1

| | | | | | | |

| Companhia Siderúrgica Nacional and Subsidiaries | | | | | | |

| Consolidated Balance Sheet | | | | | | |

| Thousands of Brazilian reais |

| |

| Liabilities and shareholders´ equity | | | | |

| | | Note | | 2011 | | 2010 |

| SHAREHOLDERS' EQUITY AND LIABILITIES | | | | | | |

| CURRENT LIABILITIES | | | | | | |

| Payroll and related taxes | | | | 202,469 | | 164,799 |

| Trade payables | | | | 1,232,075 | | 623,233 |

| Taxes payable | | | | 325,132 | | 275,991 |

| Borrowings and financing | | 14 | | 2,702,083 | | 1,308,632 |

| Other payables | | 16 | | 1,728,445 | | 1,854,952 |

| Provisions for tax, social security, labor and civil risks | | 19 | | 292,178 | | 222,461 |

| Other provisions | | | | 14,565 | | 5,887 |

| Total current liabilities | | | | 6,496,947 | | 4,455,955 |

| |

| NON-CURRENT LIABILITIES | | | | | | |

| Borrowings and financing | | 14 | | 25,186,505 | | 18,780,815 |

| Other payables | | 16 | | 5,593,520 | | 4,321,666 |

| Deferred income taxes | | 9 | | 37,851 | | |

| Provisions for tax, social security, labor and civil risks | | 19 | | 346,285 | | 2,016,842 |

| Employee Benefits | | 29 | | 469,050 | | 367,839 |

| Other provisions | | | | 322,374 | | 289,640 |

| Total non-current liabilities | | | | 31,955,585 | | 25,776,802 |

| |

| Equity | | 21 | | | | |

| Issued capital | | | | 1,680,947 | | 1,680,947 |

| Capital reserves | | | | 30 | | 30 |

| Earnings reserves | | | | 7,671,620 | | 6,119,798 |

| Other comprehensive income/(loss) | | | | -1,366,776 | | -168,015 |

| Total equity attributable to owners of the Company | | | | 7,985,821 | | 7,632,760 |

| |

| Non-controlling interests | | | | 431,349 | | 189,928 |

| |

| Total equity | | | | 8,417,170 | | 7,822,688 |

| |

| TOTAL EQUITY AND LIABILITIES | | | | 46,869,702 | | 38,055,445 |

| |

| |

| The accompanying notes are an integral part of these consolidated financial statements. | | | | |

Companhia Siderúrgica Nacional and Subsidiaries |

Consolidated Balance Sheet |

Thousands of Brazilian reais |

| | | | | | | | |

Liabilities and shareholders´ equity | | | | | | | |

| | | | | | | | |

| | Note | | 2013 | | 2012 | | 01/01/2012 |

LIABILITIES AND SHAREHOLDERS´ EQUITY | | | | | | | |

CURRENT LIABILITIES | | | | | | | |

Payroll and related taxes | | | 208,921 | | 184,963 | | 164,942 |

Trade payables | 13 | | 1,102,037 | | 2,025,461 | | 1,102,600 |

Taxes payable | | | 304,095 | | 272,766 | | 318,315 |

Borrowings and financing | 12 | | 2,642,807 | | 2,169,122 | | 2,598,045 |

Other payables | 14 | | 972,851 | | 1,582,040 | | 1,939,199 |

Provisions for tax, social security, labor and civil risks | 17 | | 333,519 | | 316,547 | | 258,914 |

Other provisions | | | | | | | 8,133 |

Total current liabilities | | | 5,564,230 | | 6,550,899 | | 6,390,148 |

| | | | | | | | |

NON-CURRENT LIABILITIES | | | | | | | |

Borrowings and financing | 12 | | 25,103,623 | | 27,135,582 | | 24,551,642 |

Other payables | 14 | | 10,061,571 | | 9,009,049 | | 10,210,273 |

Deferred income taxes | 15 | | 268,833 | | 238,241 | | 19,763 |

Provisions for tax, social security, labor and civil risks | 17 | | 479,664 | | 371,697 | | 346,285 |

Pension and healthcare plan | 28 | | 485,105 | | 565,591 | | 469,050 |

Provision for environmental liabilities and decommissioning of assets | 18 | | 370,454 | | 404,697 | | |

Other provisions | | | | | | | 316,836 |

Total non-current liabilities | | | 36,769,250 | | 37,724,857 | | 35,913,849 |

| | | | | | | | |

Equity | 20 | | | | | | |

Issued capital | | | 4,540,000 | | 4,540,000 | | 1,680,947 |

Capital reserves | | | 30 | | 30 | | 30 |

Earnings reserves | | | 2,839,568 | | 3,690,543 | | 7,671,620 |

Other comprehensive income/(loss) | | | 716,972 | | 386,324 | | -1,366,776 |

Total equity attributable to owners of the Company | | | 8,096,570 | | 8,616,897 | | 7,985,821 |

| | | | | | | | |

Non-controlling interests | | | -27,511 | | 390,616 | | 431,349 |

| | | | | | | | |

Total equity | | | 8,069,059 | | 9,007,513 | | 8,417,170 |

| | | | | | | | |

TOTAL LIABILITIES AND SHAREHOLDERS´ EQUITY | | | 50,402,539 | | 53,283,269 | | 50,721,167 |

| | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements. |

FS-2

| | | | | | | | | |

| Companhia Siderúrgica Nacional and Subsidiaries | | | | | | | | |

| Consolidated Statements of Income | | | | | | | | |

| Thousands of Brazilian reais |

| |

| | | | | | | | | |

| | | Note | | 2011 | | 2010 | | 2009 |

| Net Revenue from sales and/or services | | 23 | | 16.519.584 | | 14.450.510 | | 10.978.364 |

| Cost of sales and/or services | | 24 | | -9.800.844 | | -7.882.726 | | -7.210.774 |

| |

| Gross profit | | | | 6.718.740 | | 6.567.784 | | 3.767.590 |

| |

| Operating expenses | | | | -961.818 | | -1.569.438 | | -206.358 |

| Selling expenses | | 24 | | -604.108 | | -481.978 | | -447.129 |

| General and administrative expenses | | 24 | | -575.585 | | -536.857 | | -480.072 |

| Other operating income | | 25 | | 719.177 | | 48.821 | | 1.368.594 |

| Other operating expenses | | 25 | | -501.302 | | -599.424 | | -647.764 |

| Share of profits of subsidiaries | | | | | | | | 13 |

| |

| Profit before finance income (costs) and taxes | | | | 5.756.922 | | 4.998.346 | | 3.561.232 |

| Finance income | | 26 | | 717.450 | | 643.140 | | 586.025 |

| Finance costs | | 26 | | -2.723.253 | | -2.554.598 | | -832.460 |

| |

| Profit before income taxes | | | | 3.751.119 | | 3.086.888 | | 3.314.797 |

| |

| Income tax and social contribution | | 9 | | -83.885 | | -570.697 | | -699.616 |

| |

| Profit from continuing operations | | | | 3.667.234 | | 2.516.191 | | 2.615.181 |

| |

| Profit for the year attributed to: | | | | | | | | |

| Companhia Siderúrgica Nacional | | | | 3.706.033 | | 2.516.376 | | 2.618.934 |

| Non-controlling interests | | | | -38.799 | | -185 | | -3.753 |

| |

| Earnings per common share - (reais/share) | | | | | | | | |

| Basic | | 28 | | 2.54191 | | 1.72594 | | 1.75478 |

| Diluted | | 28 | | 2.54191 | | 1.72594 | | 1.75478 |

| |

| |

| The accompanying notes are an integral part of these consolidated financial statements. | | | | |

Companhia Siderúrgica Nacional and Subsidiaries | | | | | | |

Consolidated Statements of Income | | | | | | | |

Thousands of Brazilian reais | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | Note | | 2013 | | 2012 | | 2011 (*) |

Net Revenue from sales and/or services | 22 | | 17,312,432 | | 15,228,589 | | 16,519,584 |

Cost of sales and/or services | 23 | | -12,422,706 | | -11,258,667 | | -9,800,844 |

| | | | | | | |

Gross profit | | | 4,889,726 | | 3,969,922 | | 6,718,740 |

| | | | | | | |

Operating expenses | | | -1,769,972 | | -3,251,353 | | -961,818 |

Selling expenses | 23 | | -874,875 | | -773,488 | | -604,108 |

General and administrative expenses | 23 | | -485,090 | | -467,920 | | -575,585 |

Other operating income | 24 | | 566,063 | | 110,901 | | 719,177 |

Other operating expenses | 24 | | -1,134,208 | | -2,762,282 | | -501,302 |

Share of profits of subsidiaries | 9 | | 158,138 | | 641,436 | | |

| | | | | | | | |

Profit before finance income (costs) and taxes | | | 3,119,754 | | 718,569 | | 5,756,922 |

Finance income | 25 | | 171,984 | | 391,844 | | 717,450 |

Finance costs | 25 | | -2,683,583 | | -2,543,195 | | -2,723,253 |

| | | | | | | | |

Profit (loss) before income taxes | | | 608,155 | | -1,432,782 | | 3,751,119 |

| | | | | | | | |

Income tax and social contribution | 15 | | -74,161 | | 952,208 | | -83,885 |

| | | | | | | | |

Profit (loss) from continuing operations | | | 533,994 | | -480,574 | | 3,667,234 |

| | | | | | | | |

Profit (loss) for the year attributed to: | | | | | | | |

Companhia Siderúrgica Nacional | | | 509,025 | | -420,113 | | 3,706,033 |

Non-controlling interests | | | 24,969 | | -60,461 | | -38,799 |

| | | | | | | | |

Earnings (losses) per common share - (reais/share) | | | | | | | |

Basic | 27 | | 0.34913 | | -0.28815 | | 2.54191 |

Diluted | 27 | | 0.34913 | | -0.28815 | | 2.54191 |

| | | | | | | | |

(*) As disclosed in notes 2(y) and 3, the financial information related to 12/31/11 was not restated by the adoption of the IFRS 10 and 11, as allowed by the IFRS 10 and 11’s relief |

| | | |

The accompanying notes are an integral part of these consolidated financial statements. |

FS-3

| | | | | | | | | |

| Companhia Siderúrgica Nacional and Subsidiaries | | | | | | | | |

| Consolidated Statement of Cash Flow | | | | | | | | |

| Thousands of Brazilian reais |

| |

| |

| | | Note | | 2011 | | 2010 | | 2009 |

| |

| Profit for the year | | | | 3,667,234 | | 2,516,191 | | 2,615,181 |

| Accrued charges on borrowings and financing | | | | 2,650,622 | | 1,489,191 | | 1,130,089 |

| Depreciation/ depletion / amortization | | 12.b) | | 948,251 | | 814,034 | | 797,341 |

| Proceeds from write-off and disposal of assets | | | | 54,727 | | 5,827 | | 70,494 |

| Realization of available-for-sale investments | | | | -698,164 | | | | |

| Deferred income tax and social contribution | | 9 | | -52,542 | | 207,268 | | 122,152 |

| Provision of swaps/forwards transactions | | | | 110,009 | | 126,492 | | -88,986 |

| Gain/(loss) on change in percentage equity interest | | | | | | | | -835,115 |

| Provision for actuarial liabilities | | | | -11,412 | | 2,393 | | -47,622 |

| Provision for tax, social security, labor and civil risks | | | | 62,746 | | 199,558 | | 99,157 |

| Inflation adjustment and exchange differences | | | | -250,083 | | 57,119 | | -2,024,573 |

| Allowance for doubtful debts | | | | 189 | | -46,675 | | 1,527 |

| Other provisions | | | | -19,651 | | -80,570 | | 399,076 |

| Cash generated from operations | | | | 6,461,926 | | 5,290,828 | | 2,238,721 |

| |

| Trade receivables | | | | -339,427 | | 143,250 | | -51,082 |

| Inventories | | | | -410,264 | | -794,331 | | 926,260 |

| Receivables from related parties | | | | 471,666 | | | | |

| Recoverable taxes | | | | 16,700 | | 297,424 | | -317,968 |

| Trade payables | | | | 544,300 | | 11,964 | | -1,137,203 |

| Payroll and related taxes | | | | -47,072 | | -36,757 | | 15,257 |

| Taxes payable | | | | 135,765 | | -101,723 | | 263,734 |

| Taxes in installments - REFIS | | | | -296,304 | | -414,473 | | -103,775 |

| Judicial deposits | | | | -20,253 | | -33,822 | | -737,041 |

| Contingent liabilities | | | | 120,951 | | 16,868 | | -422,375 |

| Interest paid | | | | -2,145,400 | | -1,190,423 | | -992,280 |

| Interest paid on swap transactions | | | | -360,976 | | -676,163 | | -742,700 |

| Other | | | | 70,168 | | 4,662 | | 376,306 |

| Increase (decrease) in assets and liabilities | | | | -2,260,146 | | -2,773,524 | | -2,922,867 |

| |

| Net cash generated by (used in) operating activities | | | | 4,201,780 | | 2,517,304 | | -684,146 |

| |

| Receipt/payment in derivative transactions | | | | -57,157 | | 395,346 | | 248,966 |

| Disposal of investments | | | | 1,310,171 | | | | |

| Net effects of equity swap | | | | | | | | 1,420,322 |

| Investments | | | | -2,126,493 | | -1,370,016 | | -284,232 |

| Property, plant and equipment | | 12 | | -4,400,825 | | -3,635,911 | | -1,996,759 |

| Intangible assets | | 13 | | -707 | | -25,216 | | -5,628 |

| Net cash used in investing activities | | | | -5,275,011 | | -4,635,797 | | -617,331 |

| |

| Borrowings and financing | | 14 | | 7,824,012 | | 8,754,779 | | 7,582,823 |

| Repayments to financial institutions - principal | | 14 | | -1,469,206 | | -2,706,982 | | -2,783,313 |

| Dividends and interest on capital | | | | -1,856,381 | | -1,560,795 | | -2,027,600 |

| Treasury shares | | | | | | | | -1,350,307 |

| Capital contribution by non-controlling shareholders | | | | 242,290 | | 128,811 | | |

| Net cash generated by financing activities | | | | 4,740,715 | | 4,615,813 | | 1,421,603 |

| |

| Exchange rate changes on cash and cash equivalents | | | | 1,510,631 | | -228,833 | | -1,300,744 |

| |

| Increase (decrease) in cash and cash equivalents | | | | 5,178,115 | | 2,268,487 | | -1,180,618 |

| Cash and cash equivalents at the beginning of the year | | | | 10,239,278 | | 7,970,791 | | 9,151,409 |

| Cash and cash equivalents at the end of the year | | | | 15,417,393 | | 10,239,278 | | 7,970,791 |

table of contents

Companhia Siderúrgica Nacional and Subsidiaries |

Consolidated Statements of Comprehensive Income |

Thousands of Brazilian reais |

| | | | | | |

| | | | | | |

| | 2013 | | 2012 | | 2011 (*) |

Profit (loss) for the year | 533,994 | | -480,574 | | 3,667,234 |

| | | | | | |

Other comprehensive income | 330,648 | | 1,753,100 | | -1,198,761 |

Exchange differences arising on translation of foreign operations | 218,927 | | 147,735 | | 195,046 |

Actuarial gains/(losses) on defined benefit plan, net of taxes | 64,336 | | 106,209 | | -74,331 |

Net change in fair value of available-for-sale financial assets, net of taxes | 44,084 | | -8,329 | | -621,312 |

Net change in fair value of available-for-sale financial assets transferred to profit or loss | | | | | -698,164 |

Impairment of available-for-sale assets, net of taxes | 3,301 | | 1,507,485 | | |

| | | | | |

Comprehensive income for the year | 864,642 | | 1,272,526 | | 2,468,473 |

| | | | | |

Attributable to: | | | | | |

Companhia Siderúrgica Nacional | 839,673 | | 1,332,987 | | 2,507,272 |

Non-controlling interests | 24,969 | | -60,461 | | -38,799 |

| |

(*) As disclosed in notes 2(y) and 3, the financial information related to 12/31/11 was not restated by the adoption of the IFRS 10 and 11, as allowed by the IFRS 10 and 11’s relief |

| | | | |

The accompanying notes are an integral part of these consolidated financial statements. |

The accompanying notes are an integral part of these consolidated financial statements.

FS-4

| | | | | | | | | | | | | | | | | |

| Companhia Siderúrgica Nacional and Subsidiaries | | | | | | |

| Consolidated Statement of Changes in Shareholders' Equity | | | | | | |

| Thousands of Brazilian reais |

| | | |

| | | Paid-in Capital | | CapitalReserve | | EarningsReserve | | Retained earnings | | Other comprehensive income | | Equity | | Non-Controling interests | | Consolidated Equity |

| At December 31, 2008 as reported | | 1,680,947 | | 30 | | 3,768,756 | | 1,012,732 | | 200,124 | | 6,662,589 | | | | 6,662,589 |

| Impact of restated of prior years | | | | | | | | (176,185) | | | | (176,185) | | | | (176,185) |

| At December 31, 2008 | | 1,680,947 | | 30 | | 3,768,756 | | 836,547 | | 200,124 | | 6,486,404 | | | | 6,486,404 |

| Unrealized Gain/Loss - Investiments | | | | | | | | | | (602) | | (602) | | | | (602) |

| IFRS adjustments | | | | | | 485,816 | | 175,257 | | (200,124) | | 460,949 | | | | 460,949 |

| Opening balance at January 1, 2009 | | 1,680,947 | | 30 | | 4,254,572 | | 1,011,804 | | (602) | | 6,946,751 | | | | 6,946,751 |

| Approval of prior year’s proposed dividends | | | | | | (485,816) | | | | | | (485,816) | | | | (485,816) |

| Profit for the year | | | | | | | | 2,618,934 | | | | 2,618,934 | | (3,753) | | 2,615,181 |

| Alocation of profit for the year | | | | | | | | | | | | | | | | |

| Declared dividends (R$1,028.82 per thousand shares) | | | | | | | | (1,500,000) | | | | (1,500,000) | | | | (1,500,000) |

| Interest on capital (R$219.46 per thousand shares) | | | | | | | | (319,965) | | | | (319,965) | | | | (319,965) |

| Reserves | | | | | | 1,847,522 | | (1,847,522) | | | | | | | | |

| Proposal to the General Meeting | | | | | | 1,178,635 | | | | | | 1,178,635 | | | | 1,178,635 |

| Comprehensive income | | | | | | | | | | (585,113) | | (585,113) | | | | (585,113) |

| Repurchase of treasury shares as per EGM 8/13/2009 | | | | | | (1,350,308) | | | | | | (1,350,308) | | | | (1,350,308) |

| Cancelation of treasury shares as per EGM 8/21 and 9/14/2009 | | | | | | | | | | | | | | | | |

| Non-controlling interests | | | | | | | | | | | | | | 86,813 | | 86,813 |

| Other | | | | | | | | 3,332 | | | | 3,332 | | | | 3,332 |

| Balances at December 31, 2009 | | 1,680,947 | | 30 | | 5,444,605 | | (33,417) | | (585,715) | | 6,506,450 | | 83,060 | | 6,589,510 |

| Approval of prior year’s proposed dividends | | | | | | (1,178,635) | | | | | | (1,178,635) | | | | (1,178,635) |

| Profit for the year | | | | | | | | 2,516,376 | | | | 2,516,376 | | (185) | | 2,516,191 |

| Allocation of profit for the year | | | | | | | | (272,297) | | | | (272,297) | | | | (272,297) |

| Declared dividends (R$186.76 per thousand shares) | | | | | | | | (356,800) | | | | (356,800) | | | | (356,800) |

| Interest on capital (R$244.72 per thousand shares) | | | | | | | | (1,227,703) | | | | (1,227,703) | | | | (1,227,703) |

| Additional dividends proposed (R$842.06 per thousand shares) | | | | | | 1,227,703 | | | | | | 1,227,703 | | | | 1,227,703 |

| Investment reserve | | | | | | 626,159 | | (626,159) | | | | | | | | |

| Cancelation of treasury shares | | | | | | (34) | | | | | | (34) | | | | (34) |

| Comprehensive income | | | | | | | | | | 417,700 | | 417,700 | | | | 417,700 |

| Non-controlling interests | | | | | | | | | | | | | | 107,053 | | 107,053 |

| Balances at December 31, 2010 | | 1,680,947 | | 30 | | 6,119,798 | | | | (168,015) | | 7,632,760 | | 189,928 | | 7,822,688 |

| Approval of prior year’s proposed dividends | | | | | | (1,227,703) | | | | | | (1,227,703) | | | | (1,227,703) |

| Profit for the year | | | | | | | | 3,706,033 | | | | 3,706,033 | | (38,799) | | 3,667,234 |

| Allocation of profit for the year | | | | | | | | | | | | | | | | |

| Declared dividends (R$635.48 per thousand shared) | | | | | | | | (926,508) | | | | (926,508) | | | | (926,508) |

| Additional dividends proposed (R$599.12 per thousand shares) | | | | | | 273,492 | | (273,492) | | | | | | | | |

| Other comprehensive income | | | | | | | | | | (1,198,761) | | (1,198,761) | | | | (1,198,761) |

| Recognition of reserves | | | | | | 2,506,033 | | (2,506,033) | | | | | | | | |

| Non-controlling interests | | | | | | | | | | | | | | 280,220 | | 280,220 |

| Balances at December 31, 2011 | | 1,680,947 | | 30 | | 7,671,620 | | | | (1,366,776) | | 7,985,821 | | 431,349 | | 8,417,170 |

table of contents

Companhia Siderúrgica Nacional and Subsidiaries |

Consolidated Statement of Cash Flow |

Thousands of Brazilian reais |

| | | | | | | | |

| | Note | | 2013 | | 2012 | | 2011(*) |

| | | | | | | | |

Profit (loss) for the year | | | 533,994 | | -480,574 | | 3,667,234 |

Accrued charges on borrowings and financing | | | 2,233,500 | | 2,203,057 | | 2,650,622 |

Depreciation/ depletion / amortization | | | 1,155,593 | | 1,100,472 | | 948,251 |

Share of profits of investees | | | -158,138 | | -641,436 | | |

Deferred income tax and social contribution | | | -1,216,594 | | -1,274,207 | | -52,542 |

Provision for tax, social security, labor and civil risks | | | 97,371 | | 232,308 | | 183,697 |

Monetary variation and exchange differences | | | 1,638,653 | | 1,010,237 | | -250,083 |

Provision of swaps/forwards transactions | | | 25,597 | | 13,739 | | 110,009 |

Impairment of available-for-sale assets | | | 5,002 | | 2,022,793 | | |

Gain from write off and disposal of assets | | | 31,660 | | 9,759 | | 54,727 |

Provision for actuarial liabilities | | | 13,488 | | -30,655 | | -11,412 |

Realization of available-for-sale investments | | | | | | | -698,164 |

Impairment loss adjustment | | | 48,469 | | | | |

Gain on loss of control over Transnordestina | | | -473,899 | | | | |

Impairment of the Transnordestina old railway network | | | 216,446 | | | | |

Other provisions | | | -3,886 | | 43,372 | | -19,462 |

Cash generated from operations | | | 4,147,256 | | 4,208,865 | | 6,582,877 |

| | | | | | | | |

Trade receivables - third parties | | | -225,028 | | 55,349 | | -482,544 |

Trade receivables - related parties | | | -62,795 | | -318,080 | | 143,117 |

Inventories | | | 259,301 | | 164,755 | | -410,264 |

Receivables from related parties | | | -54,931 | | -4,393 | | 471,666 |

Recoverable taxes | | | 486,787 | | 172,402 | | 16,700 |

Judicial deposits | | | 5,821 | | 32,595 | | -20,253 |

Dividends received from related parties | | | 324,180 | | 247,403 | | |

Trade payables | | | -841,157 | | 727,337 | | 544,300 |

Payroll and related taxes | | | 148,556 | | -110,999 | | -47,072 |

Taxes in installments - REFIS | | | 446,443 | | -125,896 | | -160,539 |

Payables to related parties | | | -3,063 | | | | |

Interest paid | | | -2,376,537 | | -2,447,407 | | -2,145,400 |

Interest on swaps paid | | | -4,617 | | -39,040 | | -360,976 |

Other | | | -52,137 | | -33,918 | | 70,168 |

Increase (decrease) in assets and liabilities | | | -1,949,177 | | -1,679,892 | | -2,381,097 |

| | | | | | | | |

Net cash generated by operating activities | | | 2,198,079 | | 2,528,973 | | 4,201,780 |

| | | | | | | | |

Investments | | | -5,131 | | -166,915 | | -57,157 |

Purchase of property, plant and equipment | | | -2,489,569 | | -2,736,452 | | 1,310,171 |

Cash from merger of subsidiaries | | | | | 14,880 | | |

Receipt/payment in derivative transactions | | | 426,328 | | 65,931 | | -2,126,493 |

Acquisition of subsidiaries | | | | | -301,192 | | -4,400,825 |

Purchase of intangible assets | | | -635 | | -1,388 | | -707 |

Cash and cash equivalents on the loss of control over Transnordestina | | | -146,475 | | | | |

Short-term investment, net of redeemed amount | | | -30,324 | | 22,926 | | |

Net cash used in investing activities | | | -2,245,806 | | -3,102,210 | | -5,275,011 |

| | | | | | | | |

Borrowings and financing raised | | | 1,697,363 | | 3,520,263 | | 7,824,012 |

Repayments to financial institutions - principal | | | -1,923,703 | | -2,429,046 | | -1,469,206 |

Repayments of principal - acquisition of subsidiaries | | | | | -803,456 | | |

Dividends and interest on capital | | | -1,660,503 | | -1,199,734 | | -1,856,381 |

Capital contribution by non-controlling shareholders | | | 5,424 | | 56,194 | | 242,290 |

Net cash (used in) generated by financing activities | | | -1,881,419 | | -855,779 | | 4,740,715 |

| | | | | | | |

Exchange rate changes on cash and cash equivalents | | | 32,997 | | -119,853 | | 1,510,631 |

| | | | | | | |

Increase (decrease) in cash and cash equivalents | | | -1,896,149 | | -1,548,869 | | 5,178,115 |

Cash and cash equivalents at the beginning of the year | | | 11,891,821 | | 13,440,690 | | 10,239,278 |

Cash and cash equivalents at the end of the year | | | 9,995,672 | | 11,891,821 | | 15,417,393 |

(*) As disclosed in notes 2(y) and 3, the financial information related to 12/31/11 was not restated by the adoption of the IFRS 10 and 11, as allowed by the IFRS 10 and 11’s relief

The accompanying notes are an integral part of these consolidated financial statements.

FS-5

| | | | | | | |

| Companhia Siderúrgica Nacional and Subsidiaries | | | | | | |

| Consolidated Statements of Comprehensive Income | | | | | | |

| Thousands of Brazilian reais |

| |

| | | |

| | | 2011 | | 2010 | | 2009 |

| Profit for the year | | 3,667,234 | | 2,516,191 | | 2,615,181 |

| |

| Other comprehensive income | | -1,198,761 | | 417,700 | | -585,113 |

| Exchange differences arising on translation of foreign operations, net of taxes | | 195,046 | | -69,270 | | -618,723 |

| Actuarial gains/(losses) on defined benefit plan, net of taxes | | -74,331 | | -28,603 | | -3,275 |

| Net change in fair value of available-for-sale financial assets, net of taxes | | -621,312 | | 515,573 | | 36,885 |

| Net change in fair value of available-for-sale financial assets transferred to profit or loss | | -698,164 | | 0 | | 0 |

| |

| Comprehensive income for the year | | 2,468,473 | | 2,933,891 | | 2,030,068 |

| |

| Attributable to: | | | | | | |

| Companhia Siderúrgica Nacional | | 2,507,272 | | 2,934,076 | | 2,033,821 |

| Non-controlling interests | | -38,799 | | -185 | | -3,753 |

table of contents

Companhia Siderúrgica Nacional and Subsidiaries |

Consolidated Statement of Changes in Shareholders' Equity |

Thousands of Brazilian reais |

| | | | | | | | | |

| | Paid-in Capital | Capital Reserve | Earnings Reserve | Retained earnings | Other Comprehensive income | Shareholders´ Equity | Non-Controling interests | Consolidated Equity |

Opening balance at January 1, 2011 | 1,680,947 | 30 | 6,119,798 | | -168,015 | 7,632,760 | 189,928 | 7,822,688 |

Approval of prior year’s proposed dividends | | | -1,227,703 | | | -1,227,703 | | -1,227,703 |

Profit for the year | | | | 3,706,033 | | 3,706,033 | -38,799 | 3,667,234 |

Allocation of profit for the year | | | | | | | | |

Declared dividends (R$635.48 per thousand shares) | | | | -926,508 | | -926,508 | | -926,508 |

Additional dividends proposed (R$187.58 per thousand shares) | | | 273,492 | -273,492 | | | | |

Other comprehensive income | | | | | -1,198,761 | -1,198,761 | | -1,198,761 |

Recognition of reserves | | | 2,506,033 | -2,506,033 | | | | |

Non-controlling interests | | | | | | | 280,220 | 280,220 |

Balances at December 31, 2011 (*) | 1,680,947 | 30 | 7,671,620 | | -1,366,776 | 7,985,821 | 431,349 | 8,417,170 |

Capital transactions with shareholders | 2,859,053 | | -3,432,545 | | | -573,492 | | -573,492 |

Capital increases | 2,859,053 | | -2,859,053 | | | | | |

Declared dividends (R$205.77 per thousand shared) | | | -300,000 | | | -300,000 | | -300,000 |

Interest on capital (R$384.10 per thousand shares) | | | -560,000 | | | -560,000 | | -560,000 |

Interest on capital proposed | | | 560,000 | | | 560,000 | | 560,000 |

Approval of prior year’s proposed dividends | | | -273,492 | | | -273,492 | | -273,492 |

Total comprehensive income | | | | -548,532 | 1,753,100 | 1,204,568 | -60,461 | 1,144,107 |

Profit for the year | | | | -420,113 | | -420,113 | -60,461 | -480,574 |

Other comprehensive income | | | | -128,419 | 1,753,100 | 1,624,681 | | 1,624,681 |

Cumulative translation adjustments for the period | | | | | 147,735 | 147,735 | | 147,735 |

Actuarial (losses)/gains on defined benefit pension plan | | | | | -22,21 | -22,210 | | -22,210 |

Available-for-sale assets, net of taxes | | | | | 1,499,156 | 1,499,156 | | 1,499,156 |

Acturial losses reclassification | | | | -128,419 | 128,419 | | | |

Internal changes in shareholders' equity | | | -548,532 | 548,532 | | | | |

Losses absorption for the period | | | -420,113 | 420,113 | | | | |

Acturial losses absorption | | | -128,419 | 128,419 | | | | |

Non-controlling interests in subsidiaries | | | | | | | 19,728 | 19,728 |

Balances at December 31, 2012 | 4,540,000 | 30 | 3,690,543 | | 386,324 | 8,616,897 | 390,616 | 9,007,513 |

Capital transactions with shareholders | | | -560,000 | -800,000 | | -1,360,000 | | -1,360,000 |

Capital increases | | | | | | | | |

Declared dividends (R$418.39 per thousand shared) | | | | -610,000 | | -610,000 | | -610,000 |

Interest on capital (R$130.32 per thousand shares) | | | | -190,000 | | -190,000 | | -190,000 |

Approval of prior year’s proposed dividends | | | -560,000 | | | -560,000 | | -560,000 |

FS-6

Companhia Siderúrgica Nacional and Subsidiaries |

Consolidated Statement of Changes in Shareholders' Equity |

Thousands of Brazilian reais |

| | | | | | | | | |

| | | | | | | | | |

| | Paid-in Capital | Capital Reserve | Earnings Reserve | Retained earnings | Other comprehensive income | Shareholders´Equity | Non-Controling interests | Consolidated Equity |

Total comprehensive income | | | | 509,025 | 330,648 | 839,673 | 24,969 | 864,642 |

Profit for the year | | | | 509,025 | | 509,025 | 24,969 | 533,994 |

Other comprehensive income | | | | | 330,648 | 330,648 | | 330,648 |

Cumulative translation adjustments for the period | | | | | 218,927 | 218,927 | | 218,927 |

Actuarial (losses)/gains on defined benefit pension plan | | | | | 64,336 | 64,336 | | 64,336 |

Available-for-sale assets, net of taxes | | | | | 44,084 | 44,084 | | 44,084 |

Impairment of available-for-sale assets | | | | | 3,301 | 3,301 | | 3,301 |

Internal changes in shareholders' equity | | | -290,975 | 290,975 | | | -443,096 | -443,096 |

Recognition of reserves | | | 25,451 | -25,451 | | | | |

Reversal of statutory working capital reserve | | | -316,426 | 316,426 | | | | |

Non-controlling interests in subsidiaries | | | | | | | -443,096 | -443,096 |

Balances at December 31, 2013 | 4,540,000 | 30 | 2,839,568 | | 716,972 | 8,096,570 | -27,511 | 8,069,059 |

(*) As disclosed in notes 2(y) and 3, the financial information related to 12/31/11 was not restated by the adoption of the IFRS 10 and 11, as allowed by the IFRS 10 and 11’s relief

The accompanying notes are an integral part of these consolidated financial statements.

FS-6FS-7

(expressed Intable of contents

(Expressed in thousands of reais – R$, unless otherwise stated)

1. DESCRIPTION OF BUSINESS

Companhia Siderúrgica Nacional “CSN”, also referred to as the Company, is a publicly-held company incorporated on April 9, 1941, under the laws of the Federative Republic of Brazil (Companhia Siderúrgica Nacional, its subsidiaries, associates and jointly controlled entities collectively referred to herein as "CSN" or the “Company”"Group”).The. The Company’s registered office social is located at Avenida Brigadeiro Faria Lima, 3400 –in São Paulo, SP.SP, Brazil.

CSN is a Company withhas shares listed on the São Paulo Stock Exchange (BOVESPA)(BM&F BOVESPA) and the New York Stock Exchange (NYSE). Accordingly, it reports its information to the Brazilian Securities Commission (CVM) and the U.S. Securities and Exchange Commission (SEC).

The Group's main operating activities of CSN are divided into 5 (five)five (5) operating segments as follows:

The Company’s main industrial facility is the Presidente Vargas Steel Mill (“UPV”), located in the city of Volta Redonda, State of Rio de Janeiro. This segment consolidates the operations related to the production, distribution and sale of flat steel, long steel, metallic packagingcontainers and galvanized steel. In addition to the facilities in Brazil, CSN has operations in the United States, Portugal and PortugalGermany aimed at gaining markets and performing excellent services for final consumers. Its steels are used in the home appliances, civil construction and automobile industries.

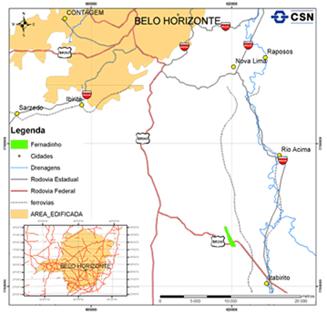

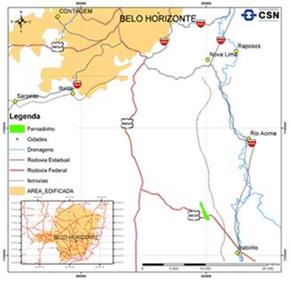

The production of iron ore is developed in the city of Congonhas, in the State of Minas Gerais. It further mines tin in the State of Rondônia to supply the needs of UPV, with the excess of these raw materials being sold to subsidiaries and third parties.CSNparties. CSN holds athe concession to operate TECAR, a solid bulk maritime terminal, one of the 4 (four) terminals that formcomprise the Itaguaí Port, located in Rio de Janeiro. Importations of coal and coke are carried out through this terminal.

The CompanyCSN entered the cement market boosted by the synergy between this new activity and its already existing businesses. Next to the Presidente Vargas Steel Mill in Volta Redonda (RJ), it installed a new business unit: CSN Cimentos, which produces CP-III type cement by using slag produced by the UPV blast furnaces in Volta Redonda. ExploresIt also explores limestone and dolomitodolomite at the Arches drive in the State of Minas Gerais, to feedsupply the needs of UPV and CSN Cement, andof the surplus of such raw materials is sold to subsidiaries and third parties.cement plant.

During 2011, the Clinker used in the manufacture of cement was purchased from third parties, however, by the end of 2011, with the completion of the first stage of the Clinker plant in Arcos (MG), this has already filled the needs of grinding of CSN Cimentos located in Volta Redonda.

Railroads:

CSN has equity interests in twothree railroad companies: MRS Logística S. A., which manages the former Southeast NetworkRailway System of Rede Ferroviária Federal S.A. (RFFSA), and Transnordestina Logística S. A. (“TLSA”) and FTL - Ferrovia Transnordestina Logística S.A. (“FTL”), which operatesoperate the former Northeast NetworkNortheastern Railway System of the RFFSA, in the statesStates of Maranhão, Piauí, Ceará, Rio Grande do Norte, Paraíba, Pernambuco and Alagoas.Alagoas, with TLSA being responsible for the sections of Missão Velha - Salgueiro, Salgueiro - Trindade, Trindade - Eliseu Martins, Salgueiro - Porto de Suape and Missão Velha - Porto de Pecém (Railway System II) and FTL being responsible for the sections of São Luiz - Mucuripe, Arrojado - Recife, Itabaiana - Cabedelo, Paula Cavalcante - Macau and Propriá - Jorge Lins (Railway System I).

PortsPorts::

FS-7FS-8

table of contents

In the State of Rio de Janeiro, by means of its subsidiary Sepetiba Tecon S. A., the Company operates the Container Terminal known as Sepetiba Tecon(Tecon) at the Itaguaí Port. Located in the Bay of Sepetiba, this port has privileged highway, railroad and maritime access.

Tecon handles the shipments of CSN steel products, movement of containers, as well as storage, consolidation and deconsolidation of cargo.

As energy is fundamental in its production process, the Company has invested in assets for generation of electric power to guarantee its self-sufficiency.

For further details on strategic investments in the Company’sGroup's segments, see Note 27 –26 - Business Segment Information.Reporting.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The consolidated financial statements have been prepared and are being presented in accordance with International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB).

The preparation of financial statements in conformity with IFRS requires the use of certain critical accounting estimates. It also requires management to exercise its judgment in the process of applying the Company’s accounting policies. The areas involving a higher degree of judgment or complexity, or areas where assumptions and estimates are significant to the consolidated financial statements, are disclosed in the notes to this report and refer to the allowance for doubtful debts, provisionallowance for inventory losses, provision for labor, civil, tax, environmental and social security risks, depreciation, amortization, depletion, provision for impairment, deferred taxes, financial instruments and employee benefits. Actual results may differ from these estimates.

The financial statements are presented in thousands of Brazilian reais (R$). Depending on the applicable IFRS standard, the measurement criterion used in preparing the financial statements considers the historical cost, net realizable value, fair value or recoverable amount.

Some balances for the financial years 2009 and 2010 were reclassified to permit a better comparability with 2011.

The consolidated financial statements were approved by the Board of Directors and authorized for issue on AprilApril30 26, 2012. , 2014.

(b) Consolidated financial statements

The accounting policies have been consistently applied to all consolidated companies.

The consolidated financial statements for the years ended December 31, 20112013 and 20102012 include the following direct and indirect subsidiaries and jointly-controlled subsidiaries,jointly controlled entities, as well as the exclusive funds Diplic, Mugen and Mugen:Vértice:

FS-9

table of contents

· Companies

| | | Equity interests (%) | | |

Companies | | 12/31/2013 | | 12/31/2012 | | Core business |

| | | | | | | |

Direct interest in subsidiaries: full consolidation | | | | | | |

CSN Islands VII Corp. | | 100.00 | | 100.00 | | Financial transactions |

CSN Islands VIII Corp. | | 100.00 | | 100.00 | | Financial transactions |

CSN Islands IX Corp. | | 100.00 | | 100.00 | | Financial transactions |

CSN Islands X Corp. | | 100.00 | | 100.00 | | Financial transactions |

CSN Islands XI Corp. | | 100.00 | | 100.00 | | Financial transactions |

CSN Islands XII Corp. | | 100.00 | | 100.00 | | Financial transactions |

International Investment Fund (1) | | | | 100.00 | | Equity interests and financial transactions |

CSN Minerals S.L.U. | | 100.00 | | 100.00 | | Equity interests |

CSN Export Europe, S.L.U. | | 100.00 | | 100.00 | | Financial transactions and equity interests |

CSN Metals S.L.U. | | 100.00 | | 100.00 | | Equity interests and financial transactions |

CSN Americas S.L.U. | | 100.00 | | 100.00 | | Equity interests and financial transactions |

CSN Steel S.L.U. | | 100.00 | | 100.00 | | Equity interests and financial transactions |

TdBB S.A | | 100.00 | | 100.00 | | Dormant company |

Sepetiba Tecon S.A. | | 99.99 | | 99.99 | | Port services |

Mineração Nacional S.A. | | 99.99 | | 99.99 | | Mining and equity interests |

Florestal Nacional S.A. (2) | | | | 99.99 | | Reforestation |

Companhia Florestal do Brasil | | 99.99 | | | | Reforestation |

Estanho de Rondônia S.A. | | 99.99 | | 99.99 | | Tin mining |

Cia Metalic Nordeste | | 99.99 | | 99.99 | | Manufacture of packaging and distribution of steel products |

Companhia Metalúrgica Prada | | 99.99 | | 99.99 | | Manufacture of packaging and distribution of steel products |

CSN Cimentos S.A. | | 99.99 | | 99.99 | | Cement manufacturing |

CSN Gestão de Recursos Financeiros Ltda. | | 99.99 | | 99.99 | | Dormant company |

Congonhas Minérios S.A. | | 99.99 | | 99.99 | | Mining and equity interests |

CSN Energia S.A. | | 99.99 | | 99.99 | | Sale of electric powe |

FTL - Ferrovia Transnordestina Logística S.A. (3) | | 88.41 | | 99.99 | | Railroad logistics |

Transnordestina Logística S.A. (4) | | | | 76.13 | | Railroad logistics |

| | | | | | | |

Indirect interest in subsidiaries: full consolidation | | | | | | |

CSN Aceros S.A. | | 100.00 | | 100.00 | | Equity interests |

Companhia Siderúrgica Nacional LLC | | 100.00 | | 100.00 | | Steel |

CSN Europe Lda. | | 100.00 | | 100.00 | | Financial transactions, product sales and equity interests |

CSN Ibéria Lda. | | 100.00 | | 100.00 | | Financial transactions, product sales and equity interests |

CSN Portugal, Unipessoal Lda. | | 100.00 | | 100.00 | | Financial transactions and product sales |

Lusosider Projectos Siderúrgicos S.A. | | 99.99 | | 100.00 | | Equity interests |

Lusosider Aços Planos, S. A. | | 99.98 | | 99.94 | | Steel and equity interests |

CSN Acquisitions, Ltd. | | 100.00 | | 100.00 | | Financial transactions and equity interests |

CSN Resources S.A. | | 100.00 | | 100.00 | | Financial transactions and equity interests |

CSN Holdings (UK) Ltd | | 100.00 | | 100.00 | | Financial transactions and equity interests |

CSN Handel GmbH | | 100.00 | | 100.00 | | Financial transactions, product sales and equity interests |

Companhia Brasileira de Latas | | 59.17 | | 59.17 | | Sale of cans and containers in general and equity interests |

Rimet Empreendimentos Industriais e Comerciais S. A. | | 58.96 | | 58.96 | | Production and sale of steel containers and forestry |

Companhia de Embalagens Metálicas MMSA | | 58.98 | | 58.98 | | Production and sale of cans and related activities |

Empresa de Embalagens Metálicas - LBM Ltda. | | 58.98 | | 58.98 | | Sales of containers and holding interests in other entities |

Empresa de Embalagens Metálicas - MUD Ltda. | | 58.98 | | 58.98 | | Production and sale of household appliances and related products |

Companhia de Embalagens Metálicas - MTM do Nordeste | | 58.98 | | 58.98 | | Production and sale of cans and related activities |

Companhia de Embalagens Metálicas - MTM | | 58.98 | | 58.98 | | Production and sale of cans and related activities |

CSN Steel Comercializadora, S.L.U. | | 100.00 | | 100.00 | | Financial transactions, product sales and equity interests |

CSN Steel Holdings 1, S.L.U. | | 100.00 | | 100.00 | | Financial transactions, product sales and equity interests |

CSN Steel Holdings 2, S.L.U. | | 100.00 | | 100.00 | | Financial transactions, product sales and equity interests |

Stalhwerk Thüringen GmbH | | 100.00 | | 100.00 | | Production and sale of long steel and related activities |

CSN Steel Sections UK Limited | | 100.00 | | 100.00 | | Financial transactions, product sales and equity interests |

CSN Steel Sections Czech Republic s.r.o. | | 100.00 | | 100.00 | | Financial transactions, product sales and equity interests |

CSN Steel Sections Polska Sp.Z.o.o | | 100.00 | | 100.00 | | Financial transactions, product sales and equity interests |

| | | | | | | |

Direct interest in jointly controlled entities: proportionate consolidation | | | | |

Itá Energética S.A. | | 48.75 | | 48.75 | | Electric power generation |

CGPAR - Construção Pesada S.A. | | 50.00 | | 50.00 | | Mining support services and equity interests |

Consórcio da Usina Hidrelétrica de Igarapava | | 17.92 | | 17.92 | | Electric power consortium |

| | | | | | | |

Direct interest in jointly controlled entities: equity method | | | | | | |

Nacional Minérios S.A. | | 60.00 | | 60.00 | | Mining and equity interests |

MRS Logística S.A. | | 27.27 | | 27.27 | | Railroad transportation |

Aceros Del Orinoco S.A. | | 22.73 | | 22.73 | | Dormant company |

CBSI - Companhia Brasileira de Serviços de Infraestrutura | | 50.00 | | 50.00 | | Provision of services |

Transnordestina Logística S.A. (4) | | 77.30 | | | | Railroad logistics |

| | | | | | | |

Indirect interest in jointly controlled entities: equity method | | | | | | |

Namisa International Minérios SLU | | 60.00 | | 60.00 | | Financial transactions, product sales and equity interests |

Namisa Europe, Unipessoal Lda. | | 60.00 | | 60.00 | | Equity interests and sales of products and minerals |

Namisa Handel GmbH | | 60.00 | | 60.00 | | Financial transactions, product sales and equity interests |

MRS Logística S.A. | | 6.00 | | 6.00 | | Railroad transportation |

Aceros Del Orinoco S.A. | | 9.08 | | 9.08 | | Dormant company |

| | | | | | | |

Direct interest in associates: equity method | | | | | | |

Arvedi Metalfer do Brasil S.A. | | 20.00 | | 20.00 | | Steel and equity interests |

(1)Company liquidated on May 9, 2013.

(2)Company merged on September 30, 2013.

(3)New corporate name of TFNE - Transnordestina Ferrovias do Nordeste S.A., changed on February 15, 2013.

FS-8FS-10

| | | | | | | |

| | | Equity interest (%) | | |

| Companies | | 12/31/2011 | | 12/31/2010 | | Main activities |

| Direct interest: full consolidation | | | | | | |

| CSN Islands VII Corp. | | 100.00 | | 100.00 | | Financial transactions |

| CSN Islands VIII Corp. | | 100.00 | | 100.00 | | Financial transactions |

| CSN Islands IX Corp. | | 100.00 | | 100.00 | | Financial transactions |

| CSN Islands X Corp. | | 100.00 | | 100.00 | | Financial transactions |

| CSN Islands XI Corp. | | 100.00 | | 100.00 | | Financial transactions |

| CSN Islands XII Corp. | | 100.00 | | 100.00 | | Financial transactions |

| Tangua Inc. | | 100.00 | | 100.00 | | Financial transactions |

| International Investment Fund | | 100.00 | | 100.00 | | Equity interests and financial transactions |

| CSN Minerals S. L.(1) | | 100.00 | | 100.00 | | Equity interests |

| CSN Export Europe, S.L. (2) | | 100.00 | | 100.00 | | Financial transactions, product sales and equity interests |

| CSN Metals S.L. (3) | | 100.00 | | 100.00 | | Equity interests and financial transactions |

| CSN Americas S.L. (4) | | 100.00 | | 100.00 | | Equity interests and financial transactions |

| CSN Steel S.L. (5) | | 100.00 | | 100.00 | | Equity interests and financial transactions |

| TdBB S.A | | 100.00 | | 100.00 | | Dormant company |

| Sepetiba Tecon S.A. | | 99.99 | | 99.99 | | Port services |

| Mineração Nacional S.A. | | 99.99 | | 99.99 | | Mining and equity interests |

| CSN Aços Longos S.A.- merged by Parent Company on 1/28/2011 | | | | 99.99 | | Manufacture and sale of steel and/or metallurgical products |

| Florestal Nacional S.A.(6) | | 99.99 | | 99.99 | | Reforestation |

| Estanho de Rondônia S.A. | | 99.99 | | 99.99 | | Tin mining |

| Cia Metalic Nordeste | | 99.99 | | 99.99 | | Manufacture of packaging and distribution of steel products |

| Companhia Metalúrgica Prada | | 99.99 | | 99.99 | | Manufacture of packaging and distribution of steel products |

| CSN Cimentos S.A. | | 99.99 | | 99.99 | | Cement manufacturing |

| Inal Nordeste S.A.- merged by Parent Company on 5/30/2011 | | | | 99.99 | | Service center for steel products |

| CSN Gestão de Recursos Financeiros Ltda. | | 99.99 | | 99.99 | | Dormant company |

| Congonhas Minérios S.A. | | 99.99 | | 99.99 | | Mining and equity interests |

| CSN Energia S.A. | | 99.99 | | 99.99 | | Sale of electric power |

| Transnordestina Logística S.A. | | 70.91 | | 76.45 | | Railroad logistics |

| Indirect interest: full consolidation | | | | | | |

| CSN Aceros S.A. | | 100.00 | | 100.00 | | Equity interests |

| Companhia Siderurgica Nacional LLC | | 100.00 | | 100.00 | | Steel |

| CSN Europe Lda.(7) | | 100.00 | | 100.00 | | Financial transactions, product sales and equity interests |

| CSN Ibéria Lda. | | 100.00 | | 100.00 | | Financial transactions and equity interests |

| CSN Portugal, Unipessoal Lda. (8) | | 100.00 | | 100.00 | | Financial transactions and product sales |

| Lusosider Projectos Siderúrgicos S.A. | | 100.00 | | 100.00 | | Equity interests |

| Lusosider Aços Planos, S. A. | | 99.94 | | 99.94 | | Steel and equity interests |

| CSN Acquisitions, Ltd. | | 100.00 | | 100.00 | | Financial transactions and equity interests |

| CSN Resources S.A.(9) | | 100.00 | | 100.00 | | Financial transactions and equity interests |

| CSN Finance UK Ltd | | 100.00 | | 100.00 | | Financial transactions and equity interests |

| CSN Holdings UK Ltd | | 100.00 | | 100.00 | | Financial transactions and equity interests |

| CSN Handel GmbH(10) | | 100.00 | | | | Financial transactions, product sales and equity interests |

| Itamambuca Participações S. A. - merged by CSN Cimentos em 5/30/2011 | | | | 99.99 | | Mining and equity interests |

| Companhia Brasileira de Latas (11) | | 59.17 | | | | Sale of cans and containers in general and equity interests |

| Rimet Empreendimentos Industriais e Comerciais S. A.(11) | | 58.08 | | | | Production and sale of steel containers and forestry |

| Companhia de Embalagens Metálicas MMSA (11) | | 58.98 | | | | Production and sale of cans and related activities |

| Empresa de Embalagens Metálicas - LBM Ltda. (11) | | 58.98 | | | | Sales of containers and holding interests in other entities |

| Empresa de Embalagens Metálicas - MUD Ltda. (11) | | 58.98 | | | | Production and sale of household appliances and related products |

| Empresa de Embalagens Metálicas - MTM do Nordeste (11) | | 58.98 | | | | Production and sale of cans and related activities |

| Companhia de Embalagens Metálicas - MTM (11) | | 58.98 | | | | Production and sale of cans and related activities |

| Direct interest: proportionate consolidation | | | | | | |

| Nacional Minérios S.A. | | 60.00 | | 60.00 | | Mining and equity interests |

| Itá Energética S.A. | | 48.75 | | 48.75 | | Generation of electric power |

| MRS Logística S.A. | | 27.27 | | 22.93 | | Railroad transportation |

| Consórcio da Usina Hidrelétrica de Igarapava | | 17.92 | | 17.92 | | Electric power consortium |

| Aceros Del Orinoco S.A. | | 22.73 | | 22.73 | | Dormant company |

| CBSI - Companhia Brasileira de Serviços de Infraestrutura (12) | | 50.00 | | | | Provision of services |

| Indirect interest: proportionate consolidation | | | | | | |

| Namisa International Minerios SLU | | 60.00 | | 60.00 | | Equity interests and sales of products and minerals |

| Namisa Europe, Unipessoal Lda. | | 60.00 | | 60.00 | | Equity interests and sales of products and minerals |

| MRS Logística S.A. | | 6.00 | | 10.34 | | Railroad transportation |

| Aceros Del Orinoco S.A. | | 9.08 | | 9.08 | | Dormant company |

| Aloadus Handel GmbH (10) | | 60.00 | | | | Financial transactions, product sales and equity interests |

| | |

(1) | | New corporate name of CSN Energy S.à.r.l., changed on December 15, 2010. |

(2) | | New corporate name of CSN Export S.à.r.l., changed on August 9, 2011. |

(3) | | New corporate name of CSN Overseas S.à.r.l., changed on December 15, 2010. |

(4) | | New corporate name of CSN Panamá S.à.r.l., changed on December 15, 2010. |

(5) | | New corporate name of CSN Steel S.à.r.l., changed on December 17, 2010. |

(6) | | New corporate name of Itaguaí Logística S.A., changed on December 27, 2010. |

(7) | | New corporate name of CSN Madeira Lda., changed on January 8, 2010. |

(8) | | New corporate name of Hickory-Comércio Internacional e Serviços Lda., changed on January 8, 2010. |

(9) | | New corporate name of CSN Cement S.à.r.l., changed on June 18, 2010. |

(10) | | Companies that became subsidiaries on November 3, 2011. |

table of contents

FS-9

(11)(4)Companies thatOn December 27, 2013, TLSA became subsidiaries on July 12, 2011.

(12)Equity interest acquired on December 5, 2011.a jointly controlled entity and the investment accounted for under the equity method, as mentioned in note 9.b.

· Exclusive funds

| | | | | | | | |

| | | Interest held | | | | Equity interests (%) | | |

| Exclusive funds | | 12/31/2011 | | 12/31/2010 | | Main activities | | 12/31/2013 | | 12/31/2012 | | Core business |

| | | | | | | | |

| Direct interest: full consolidation | | | | | | | | | | | | |

| DIPLIC - Fundo de investimento multimercado | | 100.00 | | 100.00 | | Investment fund | |

| Mugen - Fundo de investimento multimercado | | 100.00 | | 100.00 | | Investment fund | |

DIPLIC - Private credit balanced mutual fund | | | 100.00 | | 100.00 | | Investment fund |

Mugen - Private credit balanced mutual fund | | | 100.00 | | 100.00 | | Investment fund |

Caixa Vértice - Private credit balanced mutual fund | | Caixa Vértice - Private credit balanced mutual fund | 100.00 | | 100.00 | | Investment fund |

In preparing the consolidated financial statements the following consolidation procedures have been applied:

Unrealized gains on transactions with subsidiaries and jointly controlled entities are eliminated to the extent of CSN’s equity interests in the related entity in the consolidation process. Unrealized losses are eliminated in the same manner as unrealized gains, although only to the extent that there are indications of impairment. The base date of the financial statements of the subsidiaries and jointly controlled entities and affiliated companiesis the same as that of the Company, and their accounting policies are in line with the policies adopted by the Company.

· Subsidiaries

Subsidiaries are all entities (including special purpose entities) over which the Company has the power to determine the, whose financial and operating policies generally accompanying a shareholding of more than one half ofcan be conducted by the voting rights.Company and when it is exposed to, or has rights to, variable returns from its involvement with the entity and has the ability to use its power to affect its returns. The existence and effect of potential voting rights that are actually exercisable or convertible are taken into consideration when assessing whether the Company controls another entity. Subsidiaries are fully consolidated from the date when control is transferred to the Company and are deconsolidated from the date when such control ceases.

· JointJointly controlled entities

Jointly controlled entities are all entities over which the Group has joint control with one or more other parties. The investments in joint arrangements are classified as joint operations or joint ventures depending on the contractual rights and characteristics of each investor.

The investments in jointly controlled entities classified as joint venturesare accounted for under the equity method and are not consolidated. Some joint arrangements were considered as joint operation in 2013, due to the application of IFRS 11, see further details in note 3.

Jointly arrangements are all entities over which the Company has joint control with one or more other parties. The investments in joint arrangements are classified as joint operations or joint ventures depending on the contractual rights and characteristics of each investor.

Joint arrangements are accounted for in the financial statements in order to represent the Company's contractual rights and obligations. Thus, the assets, liabilities, revenues and expenses related to its interests in joint arrangements are accounted for individually in the financial statements.

The Company eliminates the effect on profit or loss of transactions carried out with joint controlled entities and, as a result, reclassifies part of the share of profits (losses) of jointly controlled entities are included in the consolidated financial statements from the date when shared control starts through the date when shared control ceases to exist. Jointly controlled entities are proportionately consolidated.finance costs, cost of sales and income tax and social contribution.

·Associates

Associates are all entities over which the Company has significant influence but not control, generally through a shareholding of 20% to 50% of the voting rights. Investments in associates are accounted for under the equity method of accounting and are initially recognized at cost.

FS-11

· Transactions and non-controlling interests

The Company treats transactions with non-controlling interests as transactions with owners of Company equity. For purchases from non-controlling interests, the difference between any consideration paid and the relevant share acquired of the carrying value of net assets of the subsidiary is recorded in shareholders' equity. Gains and losses on disposals to non-controlling interests are also recognized directly in shareholders' equity, in line item “Valuation adjustments to equity”.

When the Company no longer holds control, any retained interest in the entity is remeasured to its fair value, with the change in the carrying amount recognized in profit or loss. The fair value is the initial carrying amount for the purposes of subsequently accounting for the retained interest asin an associate, joint venture or financial asset. In addition, any amounts previously recognized in other comprehensive income in respect of that entity are accounted for as if the Company had directly disposed of the related assets or liabilities. This may mean that amounts previously recognized in other comprehensive income are reclassified to profit or loss.

(c) Foreign currencies

i. Functional and presentation currency

FS-10

Items included in the financial statements of each one of the Company’sCompany's subsidiaries are measured using the currency of the primary economic environment in which the subsidiary operates (“functional currency”). The consolidated financial statements are presented in Brazilian reais (R$), which is the Company’s functional currency and the Group’s presentation currency.

ii. Balances and transactions

Transactions in foreign currencies are translated into the functional currency using the exchange rates in effect at the dates of the transactions or valuation on which items are remeasured. Foreign exchange gains and losses resulting from the settlement of these transactions and from the translation at exchange rates in effect as as of December 31, 20112013 of monetary assets and liabilities denominated in foreign currencies are recognized in the income statement, except when they are recognized in shareholders' equity as qualifying cash flow hedges and qualifying net investment hedges.

The asset and liability balances are translated at the exchange rate in effect at the end of the reporting period. As of December 31, 2011,2013, US$1 is equivalent to R$1.87582.3426 (R$1.66622.0435 as of December 31, 2010)2012), EUR€$ 1 is equivalent to R$2.43423.2265 (R$2.22802.6954 as of December 31, 2010), A$2012) and ¥$ 1 is equivalent to R$1.91160.02233 (R$1.69590.02372 as of December 31, 2010) and JPY 1 is equivalent to R$0.02431 (R$0.0205 as of December 31, 2010)2012).

All other foreign exchange gains and losses, including foreign exchange gains and losses related to loans and cash and cash equivalents, are presented in the income statement as finance income or costs.

Changes in the fair value of monetary securities denominated in foreign currency, classified as available-for-sale, are segregated into translation differences resulting from changes in the amortized cost of the security and other changes in the carrying amount of the security. Exchange differences related to changes in amortized cost are recognized in profit or loss, and other changes in the carrying amount are recognized in shareholders' equity.

Exchange differences on non-monetary financial assets and liabilities classified as measured at fair value through profit or loss are recognized in profit or loss as part of the gain or loss on the fair value. Exchange differences on non-monetary financial assets, such as investments in shares classified as available-for-sale, are included in comprehensive income in shareholders' equity.

iii. Group companies

The results and financial position of all the Group’s entities (none of which has the currency of a hyper-inflationary economy) that have a functional currency different from the reporting currency are translated into the reporting currency as follows:

FS-12

· Assets and liabilities in each balance sheet presented have been translated at the exchange rate at the end of the reporting period.period;

· Income and expenses of each income statement are translated at average exchange rates (unless this average is not a reasonable approximation of the cumulative effect of the rates in effect at the transaction dates, in which case income and expenses are translated at the rate in effect at the transaction dates); and

· All resulting exchange differences are recognized as a separate component in other comprehensive income.

On consolidation, exchange differences resulting from the translation of monetary items with characteristics of net investment in foreign operations are recognized in shareholders' equity. When a foreign operation is partly disposed of or sold, exchange differences previously recorded in other comprehensive income are recognized in the income statement as part of the gain or loss on sale.

(d) Cash and cash equivalents

FS-11

Cash and cash equivalents include cash on hand and in banks and other short-term highly liquid investments redeemable within 90 days from the end of the reporting period, readily convertible into a known amount of cash and subject to an insignificant risk of change in value. Certificates of deposit that can be redeemed at any time without penalties are considered as cash equivalents.

(e) Trade receivables