Certain Risks Relating to Our Business and Industry

We may not be able to identify and acquire new medical higher education institutions or meet our strategic and financial goals in connection with any business acquisition we seek, and difficulties in effectively integrating and managing a growing number of acquisitions may adversely affect our strategic objectives.

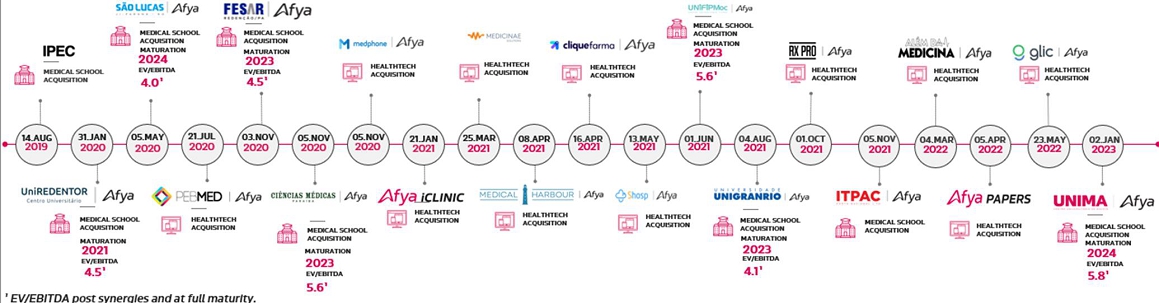

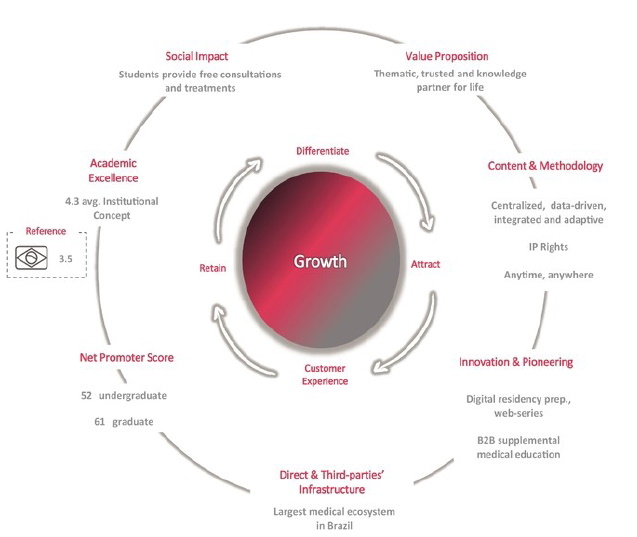

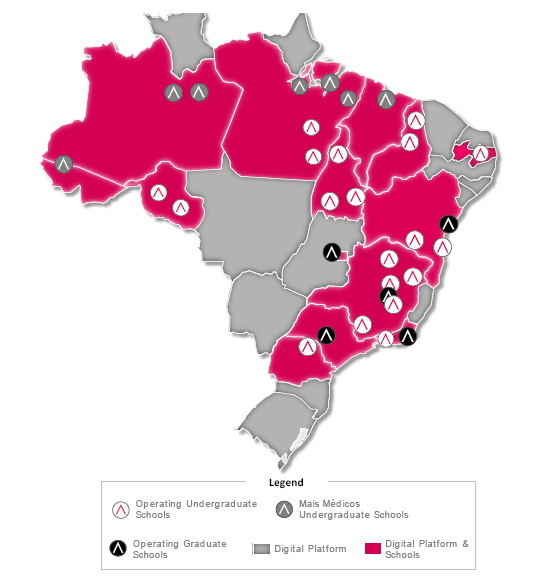

We expect to continue to acquire medical higher education institutions, as part of our strategy to expand our operations, including through acquisitions that may be material in size and/or of strategic relevance, and healthtech companies, as part of our strategy to become the partner of choice for every physician in Brazil not only through educational products, but also providing digital services relevant to their daily routine. We cannot assure you that we will continue to be able to identify post-secondary education institutions focused on medicine that provide suitable acquisition opportunities, or to acquire such institutions on favorable terms when necessary.

In addition, our previous and any future acquisitions involve a number of risks and challenges that may have a material adverse effect on our business and results, including the following:

| · | Infrastructure and workforce deficiency in Brazil may impact economic growth and have a material adverse effect on us. Growth is limited by inadequate infrastructure, including potential energy shortages and deficient transportation, logistics and telecommunication sectors, general strikes, the |

| · |

| global markets or economy deteriorate, the |

We may require additional funds to continue our expansion strategy. If we are unable to obtain adequate financing on favorable terms to complete any potential acquisition and implement our expansion plans, our growth strategy may be materially and adversely affected.

In addition, we may face significant challenges in the process of integrating the operations of any acquired companies with our existing business, such as the inability to manage a greater number of geographically dispersed employees and create and implement efficient uniform controls, procedures and policies, in addition to the incurrence of high or unexpected integration costs. In particular, the social distancing policies currently in place in Brazil resulting from the COVID-19 outbreak may place additional challenges for an expedited and timely integration of such acquired companies with our existing business. As of the date of this annual report, we have fully integrated the operations of 11 of our acquisitions and are in the process of integrating the operations of another 9 of our acquisitions with our existing business (UniSL, PEBMED, FESAR, MedPhone, FCMPB, iClinic, Medicinae, Medical Harbour and Cliquefarma). The anticipated benefits of the acquisitions we may pursue will not be achieved unless we successfully and efficiently integrate the acquired companies into our operations and effectively manage, market and apply our business strategy to them. We may also be unable to integrate faculty and personnel with different professional experience and from different corporate cultures, and our relationship with current and new employees, including professors, may be impaired. In addition, we may face challenges in entering into successful collective bargaining arrangements with unions due to differences in the negotiation procedures followed in the different geographic regions of the acquired companies. If we are not able to manage our expanded operations and these integrations effectively, our business could be materially adversely affected.

As of the date of this annual report, the COVID-19 pandemic is still evolving, and Brazilian authorities may maintain a lockdown of our on-campus activities for an undefined extended period of time or impose a more severe lockdown, among other measures, all of which are outside of our control and have materially adversely affected our business and results of operations. For further information, see “—Public health outbreaks, epidemics or pandemics, such as the COVID-19 pandemic, have adversely affected and may continue to adversely affect our business,” and “Item 5. Operating and Financial Review and Prospects.”

Our revenues are highly concentrated in the tuition fees we charge for our medical courses and other health sciences programs, and any economic, market or regulatory factors adversely affecting such medical courses and health sciences programs could lead to decreased demand in the medical and health courses we offer, which could materially adversely affect us.

A significant portion of our historical undergraduate programs combined tuition fees are currently concentrated in the tuition fees we charge for our medical courses and other health sciences programs across our network. For the years ended December 31, 2020, 2019 and 2018, 86.0%, 81.7% and 86.3% respectively, of total historical undergraduate programs combined tuition fees were derived from tuition fees we or our subsidiaries charged for medical courses and other health sciences programs. Therefore, economic, market or regulatory factors, such as in the context of an economic crisis due to the COVID-19 pandemic, affecting either the amount of tuition fees we are able to charge for the medical courses and health sciences programs we offer or the ability of our students to pay such tuition fees could result in significantly decreased demand for our services, which could materially adversely affect us.

Changes to the rules or delays or suspension of tuition payments made through FIES may adversely affect our cash flows and our business.

Some of our students finance their tuition fees through the Higher Education Student Financing Fund (Fundo de Financiamento ao Estudante do Ensino Superior, or FIES) created by the Brazilian federal government, and operated through the National Fund for Educational Development (Fundo Nacional de Desenvolvimento da Educação, or FNDE), which offers financing to low-income students enrolled in undergraduate programs in private higher education institutions. As of 2018, we have adhered to the “New FIES,” a new federal program aimed at providing student financing. Similar to the FIES, the New FIES provides financial support for low-income students throughout Brazil, in particular in the North, Northeast and Midwest regions. As a result, our exposure to the risks associated with delays in the transfer of monthly tuition payments from the FIES program operated by the Brazilian federal government, which we calculate by dividing the sum of the historical undergraduate programs combined tuition fees financed through FIES by total historical undergraduate programs combined tuition fees, was 11.8%, 9.4% and 13.0% of total historical undergraduate programs combined tuition fees as of December 31, 2020, 2019 and 2018, respectively.

Should (i) the Brazilian federal government terminate or reduce the transfer of monthly payments to our institutions that participate in FIES or New FIES, (ii) the students benefiting from FIES or New FIES fail to meet the requirements for enrollment in the programs or (iii) the Brazilian federal government extend the term to make reimbursements under FIES or New FIES or adversely change their rules, our results of operations and cash flow may be materially adversely affected. We may also experience a decline in revenues and a decline in the number of students at our campuses from the FIES and the New FIES programs.

Moreover, recent changes to the rules to renew FIES contracts, as well as the shutdown of the system to enter into new student financing agreements, may negatively affect the number of students enrolled in our courses, causing a reduction in our revenues. For more information regarding the changes to FIES contracts, see “Item 4. Information on the Company—Business Overview—Regulatory Overview.”

If we lose the benefits of federal tax exemptions provided under the PROUNI program, our business, financial condition and results of operations may be materially adversely affected.

Some of our students participate in the University for All Program (Programa Universidade para Todos, or PROUNI program). Through the PROUNI program, the Brazilian federal government grants a number of full and partial scholarships to low-income post-secondary education students. As a result of our participation in the PROUNI program, we benefit from certain federal tax exemptions relating to bachelor’s and associate’s degree programs, such as (i) income tax, (ii) Social Contribution Tax on Gross Revenue (Programa de Integração Social, or PIS), (iii) Social Security Financing Tax on Gross Revenue (Contribuição para o Financiamento da Seguridade Social, or COFINS), and (iv) Social Contribution Tax on Net Profit (Contribuição Social sobre o Lucro Líquido, or CSLL), regarding our revenues from undergraduate and associate programs.

We may be disqualified from the PROUNI program and lose our tax exemptions if we do not comply with certain requirements, such as providing total or partial scholarships for a percentage of students who paid their tuition in the previous year, granting partial scholarships, and submitting to MEC semi-annual records of attendance, achievement and dropout of students receiving scholarships, among others. See “Item 4. Information on the Company—Business Overview—Regulatory Overview.” If we lose our tax exemptions or are unable to comply with other, more stringent requirements that may be introduced in the future, our business, financial condition and results of operations could be materially adversely affected.

There is a risk that additional changes in tax laws may prohibit, interrupt or modify the use of existing tax exemptions, and we cannot assure you that we will fully maintain such tax and other benefits related to PROUNI in the event the tax laws are amended further. Any suspension, accelerated default, repayment or inability to renew our tax exemptions may have an adverse effect on our results of operations. As of the date of this annual report, there are two main proposed tax law amendments that are under review by the Brazilian congress: (i) Bill No. 3887/2020, which expressly revokes the PIS and COFINS tax exemptions for the PROUNI program; and (ii) Constitutional Amendment Proposal No. 45/2020, which proposes a new tax to substitute PIS and COFINS (and other state and municipal taxes) with no tax exemptions. If we lose our tax exemptions and incentives, if we are unable to comply with future requirements or if changes in the law limit our ability to maintain these tax benefits, our business, financial condition and results of operations may be significantly and adversely affected.

Our limited operating history as a consolidated company, our recent acquisitions and the comparability of our results may make it difficult for investors to evaluate our business, financial condition, results of operations and prospects.

Our limited operating history as a consolidated company and recent acquisitions may make it difficult for you to evaluate our business, financial condition, results of operations and prospects. Because the historical information included elsewhere in this annual report may not be representative of our results as a consolidated company, investors may have limited financial information on which to evaluate us, their investment decision and our prior performance. Our results of operations for the year ended December 31, 2020 are not directly comparable to our results of operations for the year ended December 31, 2019, and our results of operations for the year ended December 31, 2019 are not directly comparable to our results of operations for the year ended December 31, 2018, due to the effects of the acquisition of the Acquired Companies. Our ability to forecast our future operating results, including revenue, cash flows and profitability, as well as the operational inefficiencies that we may face as we continue to integrate the Acquired Companies, is limited and subject to a number of uncertainties. Moreover, past performance is no assurance of future returns.

The interests of our management team may be focused on the short-term market price of our Class A common shares, which may not coincide with your interests. In addition, our shareholders may suffer dilution of their interests in our share capital and in the value of their investments due to the issuance of new shares for settlement of our share-based incentive plans.

Our directors and officers, among others, own shares issued by us and are beneficiaries under our stock option plans. Our 2018 stock option plan, which has now been formally terminated, was fully vested and exercised upon the completion of our initial public offering and we approved a new stock option plan for our managers and employees in August 2019 (as amended in July 2020), and reserved up to 4% of our common shares at any time for issuance under this new equity incentive plan. See “Item 6. Directors, Senior Management and Employees—B. Compensation—New Long-Term Incentive Plan.”

Due to the issuance of stock options to members of our management team, a significant portion of their compensation is closely tied to our results of operations and, more specifically to the trading price of our Class A common shares, which may lead such individuals to direct our business and conduct our activities with an emphasis on short-term profit generation. In view of the market disruption cause by the COVID-19 pandemic, the trading price of our Class A common shares has significantly decreased, which if sustained for a longer period of time may also adversely affect our ability to retain members of our management. As a result of these factors, the interests of our management team may not coincide with the interests of our other shareholders that have longer-term investment objectives.

Once the options have been exercised by the participants, our board of directors will determine whether our capital stock should be increased through the issuance of new shares to be subscribed by participants, or if they will be settled through shares held in treasury. In the event settlement occurs through the issuance of new shares, our shareholders will suffer dilution, of their interests in our share capital and in the value of their investments, up to a maximum of 4% of our common shares at any time.

In case of new stock option grants, whether under existing plans or new plans that may be approved by our shareholders at the shareholders’ meeting, our shareholders will be subject to additional dilution. For additional information on our stock option plan, see “Item 6. Directors, Senior Management and Employees—B. Compensation of Directors and Officers” for additional information.

An increase in delays and/or defaults in the payment of tuition fees may adversely affect our income and cash flows.

We depend on the full and timely payment of the tuition we charge our students, including tuition payments we receive through FIES, which is largely outside of our control, such as in the context of an economic crisis due to the COVID-19 pandemic. An increase in payment delinquency or default by our students may have a material adverse effect on our cash flows and our business, including our ability to meet our obligations. Our allowance for doubtful accounts expenses as a percentage of our net revenues was 2.7%, 2.0% and 2.3% for the years ended December 31, 2020, 2019 and 2018, respectively.

Difficulties in identifying, opening and efficiently managing new campuses or in obtaining regulatory authorizations and accreditations on a timely basis as part of our organic growth strategy may adversely affect our business.

Our organic strategy includes expanding by opening new campuses and integrating them into our educational network. This growth plan creates significant challenges in terms of maintaining our teaching quality and culture, as a result of the complexity and difficulty of effectively managing a greater number of campuses and programs. If we are unable to maintain our current quality standards, we may lose market share and be adversely affected.

Establishing new campuses poses important challenges and requires us to make significant investments in infrastructure, marketing, personnel and other pre-operational expenses, mainly identifying new sites for lease or purchase. We prioritize identifying strategic sites, negotiating the purchase or lease of properties, building or refurbishing facilities (including libraries, laboratories and classrooms), obtaining local permits, hiring and training faculty and staff, and investing in administration and support.

We are also required to register our new campuses with MEC, before opening and operating them, as well as having our new programs accredited by MEC in order to issue official degrees and certificates to our students. If we do not succeed in identifying and establishing our campuses in a cost-effective manner or in obtaining such authorizations or accreditations on a timely basis, or if MEC imposes restrictions or conditions on our accreditation requests for new campuses, our business may be adversely affected.

We may not be able to successfully expand our presence and performance in the distance learning business.

We may face difficulties in successfully operating our distance learning program and in implementing and investing in the technologies necessary to operate a successful distance learning program, where the technological needs, the expectations of our customers and market standards change rapidly. We have to quickly modify our products and services to adapt to new distance learning technologies, practices and standards. We may be adversely affected if current or future competitors introduce products or service platforms that are superior to those we offer, or if our resources are not adequate to develop and adapt our technological capabilities rapidly enough to maintain our competitive position.

In addition, the success of our distance learning programs depends on the general population having easy and affordable access to the internet, as well as on other technological factors that are outside of our control. If the internet becomes inaccessible or access costs increase to levels higher than current prices, or if the number of students interested in distance learning educational methods does not increase, we may be unable to successfully implement our distance learning program strategy, which would have an adverse effect on our growth strategy.

We face significant competition in each program we offer and each geographic region in which we operate. If we fail to compete efficiently, we may lose market share and our profitability may be adversely affected.

We compete with various public and private post-secondary education institutions, including distance learning institutions. Our competitors may offer programs or courses similar to or better than those offered by us, have access to more funds, be more prestigious or well-regarded within the academic community, have more conveniently located campuses with better infrastructure, or charge lower tuition. In addition, on April 5, 2018, MEC issued Ordinance No. 328/18, pursuant to which, among other measures, MEC imposed a five-year suspension on the granting of authorizations for the creation of new medical education courses. Accordingly, institutions cannot create and implement new undergraduate medical education courses until April 2023. In the event MEC lifts these restrictions prior to April 2023, this may result in the creation of new medical education courses, which will in turn increase competition and may create greater pricing or operating pressure on us. Accordingly, and to compete effectively, we may be required to reduce our tuition or increase our operating expenses (including our costs per student) in order to retain or attract students or to pursue new market opportunities. Furthermore, we were awarded, seven new undergraduate campuses as part of the “Mais Médicos” program, all of which are located in remote regions of Brazil and which operations are subject to the verification by the MEC of the satisfactory implementation by Afya Brazil of all regulatory requirements. We cannot assure you that there will be sufficient student demand to fill all medical school seats available on such campuses.

As a result of the foregoing, our revenues and profitability may decrease. We cannot assure you that we will be able to compete successfully against our current or future competitors. If we are unable to maintain our competitive position or otherwise respond to competitive pressures effectively, we may lose our market share, our profits may decrease and we may be adversely affected.

We may not be able to update, improve or offer the content of our existing programs to our students on a cost-effective basis, which may materially adversely affect our ability to attract and retain students.

To differentiate ourselves and remain competitive, we must continually update our courses and develop new educational programs, including through the adoption of new technological tools. Updates to our current courses and the development of new educational programs may not be readily accepted by our students or by the market. Also, we may not be able to introduce new educational programs at the same pace as our competitors or at the pace required by the labor market. If we do not adequately modify our educational programs in response to market demand, whether due to financial restrictions, unusual technological changes or otherwise, our ability to attract and retain students may be impaired and we may be materially adversely affected.

If we continue to grow, we may not be able to appropriately manage the expansion of our business and staff, the increased complexity of our software and platforms, or grow in our addressable market.

We are currently experiencing a period of significant expansion and are facing a number of expansion-related issues, such as the acquisition and retention of experienced and talented personnel, cash flow management, corporate culture and efficacy of internal controls, among others. These issues and the significant amount of time spent on addressing them may result in the diversion of our management’s attention from other business issues and opportunities. In addition, we believe that our corporate culture and values are critical to our success, and we have invested a significant amount of time and resources building them. If we fail to preserve our corporate culture and values, our ability to recruit, retain and develop personnel and to effectively implement our strategic plans may be harmed.

We must constantly update our software, enhance and improve our billing, transaction and other business systems, and add and train new software designers and engineers, as well as other personnel. This process is time intensive and expensive, and may lead to higher costs in the future. Furthermore, we may need to enter into relationships with various strategic partners other online service providers and other third parties necessary to our business. The increased complexity of managing multiple commercial relationships could lead to execution problems that can affect current and future revenues, and operating margins.

We cannot assure you that our current and planned platform and systems, procedures and controls, personnel and third-party relationships will be adequate to support our future operations. In addition, our current expansion has placed significant strain on management and on our operational and financial resources, and this strain is expected to continue. Our failure to manage growth effectively could seriously harm our business, results of operations and financial condition.

The ability to attract, recruit, retain and develop key personnel and qualified employees is critical to our success and growth. If we lose key personnel, our business, financial condition and results of operations may be adversely affected.

In order for us to successfully compete and grow, we must attract, recruit, retain and develop the necessary personnel who can provide the needed expertise across the entire spectrum of our intellectual capital needs. While we have a number of our key personnel who have substantial experience with our operations, we must also develop our personnel to provide succession plans capable of maintaining continuity in the midst of the inevitable unpredictability of human capital. However, the market for qualified personnel is competitive, and we may not succeed in recruiting additional personnel or may fail to effectively replace key current personnel who depart with qualified or effective successors. We must continue to hire additional personnel to execute our strategic plans. Our effort to retain and develop personnel may also result in significant additional expenses, which could adversely affect our profitability. We cannot assure you that qualified employees will continue to be employed, that we will manage them successfully, or that, in the future, we will be able to attract qualified personnel with similar skills and expertise at equivalent cost and retain them.

We are also dependent upon the ability and experience of a number of our key personnel who have substantial experience with our operations. Many of our key personnel have worked for us for a significant amount of time or were recruited by us specifically due to their industry experience. It is possible that the failure to retain or attract the services of one or a combination of our senior executives, board members (including those with M&A experience related to our industry), or key managers, could have a material adverse effect on our business, financial condition and results of operations.

Any increase in the attrition rates of students in our education programs may adversely affect our results of operations.

We believe that our attrition rates are primarily related to the personal motivation and financial situation of our current and potential students, as well as to socioeconomic conditions in Brazil. Our student attrition rate, meaning the number of students that leave the program of study before it has finished, was 4.0% and 4.2% for the years ended December 31, 2020 and 2019. Significant changes in future attrition rates and/or failure to re-enroll may affect our enrollment numbers, such as in the context of an economic crisis due to the COVID-19 pandemic, and may have a material adverse effect on our revenues and our results of operations.

Public health outbreaks, epidemics or pandemics, such as the COVID-19 pandemic, have adversely affected and may continue to adversely affect our business.

Public health outbreaks, epidemics or pandemics, such as the COVID-19 pandemic, could materially adversely impact our business. In December 2019, a novel strain of coronavirus (COVID-19) was reported to have emerged in Wuhan, China. COVID-19 has since spread to most of the countries around the globe, including every state in Brazil. On March 11, 2020, the World Health Organization declared the COVID-19 outbreak a pandemic, and on March 20, 2020, the Brazilian federal government declared a national emergency with respect to COVID-19, which remained in place until December 31, 2020.

The global COVID-19 outbreak is an unprecedented and rapidly evolving situation. The effect on our operations is still highly uncertain and cannot be predicted with confidence. The spread of COVID-19, or actions taken to mitigate its spread, has and may continue to have material and adverse effects on our ability to operate effectively. We may be required to completely or partially close facilities, and we may suffer labor shortages, particularly of our teaching faculty, which is mostly composed of doctors who continue to work shifts at hospitals and are consequently more exposed to COVID-19 than non-medical administrative staff. Likewise, we may suffer financial and reputational harm were an outbreak to occur among our students, as our students participating in in-person hospital and healthcare residency programs are more exposed to COVID-19 than our students who are currently partaking in educational activities solely via our online platform. We may not be able to provide online classes to our students and keep them engaged with online classes during the COVID-19 pandemic or resume on-campus practical classes for the majority of our medical students during the COVID-19 pandemic. Factors that have affected and will continue influencing the effect on our operations, most of which are outside of our control, include the economic consequences and duration of the outbreak, new information that emerges concerning the severity of COVID-19 and actions taken to contain the outbreak or treat its impact, among others. The extent of the adverse effect on our operations, including, among others, the regular functioning of our facilities, will depend on the extent and severity of the continued spread of COVID-19 in Brazil. Since March 17, 2020, there have been interruptions of our on-campus activities due to Brazilian government authorities’ mandatory lockdowns, which remained in place until December 31, 2020 to varying degrees depending on the region of Brazil, with a significant portion of our nonpractical educational activities being temporarily offered through our online platform (rather than on-site), and the calendar of our practical educational activities being rescheduled to when authorities will allow on-campus activities to resume.

In response to the impact of the COVID-19 pandemic, we assessed whether we had satisfied all of our contracts containing customer performance obligations in accordance with IFRS 15, and concluded it was necessary to defer a portion of our net revenue for the second half of 2020. We were able to manage, replace and reschedule these activities so that all of our performance obligations were satisfied and we recognized these revenues from customers. Some of our second half practical educational activities (particularly for students in the first to fourth years) will need to be replaced during the first half of 2021. Therefore, a portion of our revenue recognition has been postponed.

By December 31, 2020, the States of Rio de Janeiro, Pará, Tocantins, Piauí, Rondonia, Maranhão, Bahia and Paraíba had issued state decrees granting discounts to all students in such states, and we consequently granted mandatory discounts to our students totaling R$6.5 million. As of the date of this annual report, except in the case of Paraíba state, these mandatory discounts have been suspended as their constitutionality has been challenged in the superior courts. The laws of the states of Bahia and Maranhão on the reduction of tuition fees in private educational institutions were ruled as unconstitutional by the Brazilian Federal Supreme Court in December 2020. Additionally, we are also facing individual and collective legal proceedings all across the country. For further information, see “Item 6. Directors, Senior Management and Employees—A. Directors and Senior Management—Legal Proceedings.”

The COVID-19 pandemic is still evolving, and Brazilian authorities may maintain a lockdown of our on-campus activities for an undefined extended period of time or impose a more severe lockdown, among other measures, all of which are outside of our control and may materially adversely affect our business, financial condition, results of operations and cash flows for an extended period of time. We may also suffer labor shortages, particularly of our teaching faculty, which is mostly composed of doctors that continue to have work shifts at hospitals and are consequently more exposed to COVID-19 than non-medical administrative staff. The COVID-19 pandemic is expected to cause a material and adverse effect on the general economic, financial, political, demographic and business conditions in Brazil, which may reduce the disposable income of our students and their families, and consequently (i) result in an adverse impact on the ability of our students (current and/or prospective) to pay our tuition fees and/or (ii) trigger an increase in our attrition rates.

As a result, it is still uncertain whether or not the pandemic will lead to a risk of an increase in impairment of our financial assets and a reduction of our cash generation and the recoverable amounts of our cash-generating units.

In addition, the impact of the COVID-19 pandemic amplifies the risk that disruptions in public and private infrastructure, including communications and financial services, could materially and adversely disrupt our normal business operations. We have transitioned a significant subset of our employees to a remote work environment in an effort to mitigate the spread of COVID-19, which may exacerbate certain risks to our business, including an increased demand for information technology resources, increased risk of phishing and other cybersecurity attacks, and increased risk of unauthorized dissemination of personal information, sensitive personal information or proprietary or confidential information about us or our customers or other third parties. Further, we process personal data, and we therefore will be subject to the Brazilian Data Protection Law (Lei Geral de Proteção de Dados, or LGPD). Considering that our processing of personal data has increased as a result of the measures we adopted due to the COVID-19 pandemic, if we fail to comply with any provisions provided for in the LGPD, we could be subject to lawsuits filed by the data subjects, public authorities and private associations, including those for compensation for damages arising from the violation of the data subjects’ rights, and we could be subject to the penalties provided for not only in the LGPD, but also in sectorial legislation, such as the Brazilian Consumer Defense and Protection Code (Código de Defesa do Consumidor) and the Brazilian Civil Framework of the Internet (Marco Civil da Internet). If we do not comply with the LGPD and are in turn subject to sanctions, we may suffer financial and reputational losses, which may adversely affect our financial results. See “Item 3. Key Information—D. Risk Factors—Certain Risks Relating to Our Business and Industry—Failure to prevent or detect a malicious cyber-attack on our systems and databases could result in a misappropriation of confidential information or access to highly sensitive information,” “Item 3. Key Information—D. Risk Factors—Certain Risks Relating to Our Business and Industry—Our success depends on our ability to monitor and adapt to technological changes in the education sector and maintain a technological infrastructure that works adequately and without interruption,” and “Item 3. Key Information—D. Risk Factors—Certain Risks Relating to Our Business and Industry—Failure to comply with data privacy regulations could result in reputational damage to our brands and adversely affect our business, financial condition and results of operations.”

The rapid development and fluidity of this situation precludes our ability to predict the ultimate adverse impact of COVID-19 on us. We are continuing to monitor the spread of the COVID-19 and related risks. There are no comparable recent events that may provide guidance as to the effect of the spread of COVID-19 pandemic, and, as a result, the ultimate impact of the COVID-19 pandemic is highly uncertain and subject to change.

We could be adversely affected if we are unable to renegotiate collective bargaining agreements with the labor unions representing our professors and administrative employees or by strikes and other union activity.

Our payroll costs and expenses account for the majority of the costs of services and general and administrative expenses, or 53.3%, 59.2% and 65.8% of such costs and expenses for the years ended December 31, 2020, 2019 and 2018, respectively. Our faculty and administrative employees are represented by labor unions in the higher education sector and are covered by collective bargaining agreements or similar arrangements determining the number of working hours, minimum compensation, vacations and fringe benefits, among other terms. These agreements are subject to annual renegotiation and may be so modified. We could also be adversely affected if we fail to achieve and maintain cooperative relationships with our professors’ or administrative employees’ unions or face strikes, stoppages or other labor disruptions by our professors or employees. In addition, we may not be able to pass on any increase in costs arising from the renegotiation of collective bargaining agreements to the monthly tuition fees paid by students, which may have a material adverse effect on our business.

We may be held liable for extraordinary events that may occur at our campuses, which may have an adverse effect on our image and, consequently, our results of operations.

We may be held liable for the actions of officers, directors, professors or other employees at our campuses, including allegations of non-compliance by officers, directors, professors or other employees with specific legislation and regulations implemented by MEC relating to our programs. In the event of accidents, injuries or other damages affecting students, professors, other employees or third parties at our campuses, we may face claims alleging that we were negligent, provided inadequate supervision or were otherwise liable for the injury. We may also be subject to claims alleging that officers, directors, professors or other employees committed moral or sexual harassment or other unlawful acts. Our insurance coverage may not cover certain indemnifications we may be required to pay, be insufficient to cover these types of claims, or may not cover certain acts or events. We may also not be able to renew our current insurance policies under the same terms. Such liability claims may affect our reputation and harm our financial results. See “Item 4. Information on the Company—Business Overview—Insurance.” In addition, we may also be subject to legal proceedings by current and/or former students alleging breaches of rights granted by the Brazilian Consumer Protection Code (Código de Defesa do Consumidor), and to legal proceedings by current and/or former employees alleging breaches of applicable labor laws. Even if unsuccessful, these claims may cause negative publicity, reduce enrollment numbers, increase student attrition rates, entail substantial expenses and divert the time and attention of our management, materially adversely affecting our results of operations and financial condition.

We may face restrictions and penalties under the Brazilian Consumer Protection Code in the future.

Brazil has a series of strict consumer protection laws, referred to collectively as the Consumer Protection Code (Código de Defesa do Consumidor). These laws apply to all companies in Brazil that supply products or services to Brazilian consumers. They include protection against misleading and deceptive advertising, protection against coercive or unfair business practices and protection in the formation and interpretation of contracts, usually in the form of civil liabilities and administrative penalties for violations.

These penalties are often levied by the Brazilian Consumer Protection Agencies (Fundação de Proteção e Defesa do Consumidor, or PROCONs), which oversee consumer issues on a district-by-district basis. Companies that operate across Brazil may face penalties from multiple PROCONs, as well as from the National Secretariat for Consumers (Secretaria Nacional do Consumidor, or SENACON). Companies may settle claims made by consumers via PROCONs by paying compensation for violations directly to consumers and through a mechanism that allows them to adjust their conduct, called a conduct adjustment agreement (Termo de Ajustamento de Conduta, or TAC).

Brazilian public prosecutors may also commence investigations of alleged violations of consumer rights and require companies to enter into TACs. Companies that violate TACs face potential enforcement proceedings and other potential penalties such as fines, as set forth in the relevant TAC. Brazilian public prosecutors may also file public civil actions against companies who violate consumer rights or competition rules, seeking strict adherence to the consumer protection laws and compensation for any damages to consumers. In certain cases, we may also face investigations and/or sanctions by the CADE, in the event our business practices are found to affect the competitiveness of the markets in which we operate or the consumers in such markets.

Any change or review of the tax treatment of our activities, or the loss or reduction in tax benefits on the sale of books (including digital content) may materially adversely affect us.

We benefit from Brazilian Federal Law No. 10,865/2004, as amended by Brazilian Federal Law No. 11,033/2004, which establishes a zero rate for PIS and COFINS on the sale of books. The sale of books is also exempt by the Brazilian constitution from Brazilian municipal taxes, Brazilian services tax (Imposto Sobre Serviços, or ISS) and from the Brazilian tax on the circulation of goods, interstate and intercity transportation and communication services (Imposto sobre Operações relativas à Circulação de Mercadorias e sobre Prestações de Serviços de Transporte Interestadual e Intermunicipal e de Comunicação, or ICMS). If the Brazilian government or any Brazilian municipality or tax authority or the Brazilian courts decide to change or review the tax treatment of our activities, or cancel or reduce the tax benefit applied on the sale of books (including digital books and e-readers) and/or challenge it, and we are unable to pass any cost increase onto our students, our results may be materially adversely affected.

If we are unable to maintain consistent educational quality throughout our network, including the education materials of our post-secondary education institutions, or keep or adequately train our faculty members, we may be adversely affected.

Our teaching faculty, including teachers and professors at our post-secondary education institutions, is essential for maintaining the quality of our programs and the strength of our brand and reputation. We promote training in order for our faculty to attain and maintain the qualifications we require and for us to provide updating programs on trends and changes in their areas. Due to shortages in the supply of qualified professors, competition for hiring and retaining qualified professionals has increased substantially. We cannot assure you that we will succeed in retaining our current professors or recruiting or training new professors who meet our quality standards, particularly as we continue to expand our operations.

The quality of our academic curricula and the infrastructure of our campuses are also key elements of the quality of the education we provide. We cannot assure you that we will succeed in identifying facilities with adequate infrastructure for our new campuses, develop adequate infrastructure in properties we acquire or have enough resources to continue expanding through acquisitions or development of new projects. In addition, we cannot assure you that we will be able to develop academic curricula for our new programs with the same levels of excellence as existing programs and meeting the standards set forth by MEC. Shortages of qualified professors, adequate infrastructure or quality academic curricula for new programs according to our business model and the parameters set forth by MEC, may have a material adverse effect on our business.

Our business depends on the continued success of the brands of each of our institutions, as well as the “Afya” brand, and if we fail to maintain and enhance recognition of our brands, we may face difficulty enrolling new students, and our reputation and operating results may be harmed.

We believe that market awareness of our brands has contributed significantly to the success of our business. Maintaining and enhancing our brands is critical to our efforts to grow student enrollments. Failure to maintain and enhance our brand recognition could have a material and adverse effect on our business, operating results and financial condition. We have devoted significant resources to our brand promotion efforts in recent years, but we cannot assure you that these efforts will be successful. If we are unable to further enhance our brand recognition, or if we incur excessive marketing and promotion expenses, or if our brand image is negatively impacted by any negative publicity, our business and results of operations may be materially and adversely affected.

If we are not able to maintain our current MEC evaluation ratings and the evaluation ratings of our students, we may be adversely affected.

We and our students are regularly evaluated and rated by MEC. If our campuses, programs or students receive lower scores from MEC than in previous years in any of its evaluations, including the IGC (Índice Geral de Cursos), and the Student Performance National Exam (Exame Nacional de Desempenho de Estudantes, or ENADE), we may experience a reduction in enrollments and be adversely affected by perceptions of decreased educational quality, which may negatively affect our reputation and, consequently, our results of operations and financial condition.

Finally, in the event that any of our programs receive unsatisfactory evaluations, the post-secondary education institution offering the programs may be required to enter into an agreement with MEC setting forth proposed measures and timetables to improve the program and remedy the unsatisfactory evaluation. Non-compliance with the terms of the agreement may result in additional penalties on the institution. These penalties could include, but are not limited to, suspending our ability to enroll students in our programs, denial of accreditation or re-accreditation of our institutions or prohibiting us from holding regular class sessions, all of which can adversely affect our results of operations and financial condition.

We are subject to supervision by MEC and, consequently, may suffer sanctions as a result of non-compliance with any regulatory requirements.

Brazilian Federal Law No. 10,861/2004, regulated by Decree No. 9,235/2017, implemented the activities of supervision of post-secondary education entities and courses in the Brazilian federal education system. The Secretariat for Regulation and Supervision of Post-secondary Education, or SERES, of MEC is responsible for the regular and special supervision of the corresponding courses and programs.

Regular supervision derives from complaints and allegations by students, parents and faculty members, as well as by public entities and the press. These complaints and allegations involve specific cases of entities with courses showing evidence of irregularities or deficiencies. We are subject to those complaints and representations. Special supervision, on the other hand, may be commenced by MEC itself, based on its post-secondary education regularity and quality standards, and involves more than one course or entity, grouped according to the criteria chosen for the special supervision. These criteria may include unsatisfactory results in the ENADE and the Difference Indicator between Expected and Actual Performance (Indicador de Diferença entre os Desempenhos Observado e Esperado), among other quality indicators, the history of course evaluations by INEP, as well as compliance with specific legal requirements as, for example, the minimum ratio between faculty members with master’s or doctorate degrees.

Administrative irregularities can include, among others: (i) unlicensed or irregular post-secondary courses; (ii) any outsourcing of post-secondary education activities; (iii) the failure to file a re-accreditation or recognition or renewal request with respect to post-secondary education courses within the time periods enacted by MEC pursuant to Decree No. 9,235/2017; and (iv) failure to comply with any penalties imposed by the MEC.

If MEC concludes, as part of its supervisory activities, that an irregularity constitutes an imminent risk or threat to students or the public interest, it may impose the following measures on the relevant educational institution for a period to be determined by SERES: (i) suspend the admission of new students; (ii) suspend the offering of undergraduate or postgraduate lato sensu courses; (iii) suspend the institution’s discretionary ability to, among other things, create new post-secondary courses and establish course curricula, if applicable; (iv) suspend the license to establish new distance learning programs; (v) override any ongoing regulatory requests filed by the institution and prohibit new regulatory requests; (vi) suspend participation in the New FIES; (vii) suspend participation in PROUNI; and (viii) suspend or restrict participation in other federal education programs. The educational institution can contest the MEC’s findings by filing motions with MEC or with Brazilian courts.

Upon completion of the supervisory process and to the extent MEC concludes that there are administrative irregularities, SERES may apply the penalties provided for by Law No. 9,394/1996, namely (i) discontinue courses; (ii) directly intervene in the educational institution; (iii) temporarily suspend the institution’s discretionary ability to, among other things, create new post-secondary courses and establish course curricula, if applicable; (iv) disqualify the institution as an educational institution; (v) reduce the number of student vacancies; (vi) temporarily suspend new student enrollments; or (vii) temporarily suspend courses.

The post-secondary education sector is highly regulated, and our failure to comply with existing or future laws and regulations could significantly impact our business

We are subject to various federal laws and extensive government regulations by MEC, Conselho Nacional de Educação (National Education Council, or CNE), INEP, FIES and the National Post-secondary Education Assessment Commission (Comissão Nacional de Avaliação da Educação Superior, or CONAES), among others, including, but not limited to Law No. 12,871, of October 22, 2013, which created the “Mais Médicos” program.

Brazilian education regulations define three types of post-secondary education institutions: (i) colleges, (ii) university centers and (iii) universities. The three categories depend on previous accreditation by MEC to operate. Colleges differ from the other categories with respect to the programs offered, as colleges depend on previous authorization from MEC to implement new programs, while university centers and universities are not subject to such requirements, except for courses in law, medicine, psychology, nursing and dentistry, which require the prior approval of MEC.

All accredited educational institutions require the prior approval of MEC to create campuses outside their headquarters. All post-secondary education programs must be recognized by MEC as a requirement, together with registration of the program, to validate the diplomas issued by them. However, pursuant to article 101 of Ordinance No. 23/2017 of MEC, issued diplomas may be valid even if the program is not formally recognized by MEC, so long as the educational institution has filed the request with MEC to certify the program, and the request is pending formal review and approval by MEC. As a result, any failure to comply with legal and regulatory requirements by post-secondary education entities may result in the imposition of sanctions by MEC, as well as damage to the program’s reputation.

MEC must authorize our campuses located outside our headquarters before they can start their operations and programs. For further information, see “Item 4. Information on the Company—Business Overview—Regulatory Overview.” Distance learning programs, as well as on-campus learning, are also subject to strict accreditation requirements for their implementation and operation. We must comply with all such requirements in order to obtain and renew all authorizations.

We cannot assure you we will be able to comply with these regulations and maintain the validity of our authorizations, enrollments and accreditations in the future. If we fail to comply with these regulatory requirements, MEC could place limitations on our operations, including cancellation of programs, reduction in the number of positions we offer to students, termination of our ability to issue degrees and certificates and revocation of our accreditation, any of which could adversely affect our financial condition and results of operations.

We cannot assure you that we will obtain accreditation or re-accreditation of our post-secondary education institutions, or that our courses will receive authorization or reauthorization as scheduled, or that they will have all of the accreditations, re-accreditations, authorizations and re-authorizations required by MEC. The absence of such accreditations and authorizations from the MEC or any delays in obtaining them could adversely affect our financial condition and results of operations.

In addition, we may also be adversely affected by any changes in the laws and regulations applicable to post-secondary education institutions, particularly by changes related to: (i) any revocation of accreditation of private educational institutions; (ii) the imposition of controls on monthly tuition payments or restrictions on profitability of private educational institutions; (iii) faculty credentials; (iv) academic requirements for courses and curricula; (v) infrastructure requirements of campuses, such as libraries, laboratories and administrative support; (vi) the “Mais Médicos” Program; (vii) the promulgation by the MEC of new rules and regulations affecting post-secondary education, in particular with respect to distance learning programs; and (viii) local restrictions imposed to curb the impact of the COVID-19 pandemic in the places we operate.

We may be materially adversely affected if we are unable to obtain these authorizations, accreditations and course recognitions in a timely manner, if we cannot introduce new courses as quickly as our competitors, if we are not able to or do not comply with any new rules or regulations promulgated by the MEC or if laws and regulations are passed adverse to the business and operations of post-secondary education institutions.

Our success depends on our ability to operate in strategically located property that is easily accessible by public transportation.

We believe that urban mobility, inadequate public transportation systems and high transportation costs in many Brazilian cities make the location and accessibility of campuses a decisive factor for students choosing an educational institution. Therefore, a key component of the success of our business consists in finding, renting and/or buying strategically located property that meets the needs of our students. We cannot guarantee that we will be able to keep our current property or acquire new property that is strategically located in the future. In addition, acquisition costs, costs associated with improvements, construction, and repairs of existing properties and rental values for the properties we use might increase in the future and could have a material adverse effect on our business. Finally, due to demographic and socioeconomic changes in the regions in which we operate, we cannot guarantee that the location of our campuses will continue to be attractive and convenient to students.

Failure to protect or enforce our intellectual property and other proprietary rights could adversely affect our business and financial condition and results of operations.

We rely and expect to continue to rely on a combination of trademark, copyright, patent and trade secret protection laws, as well as confidentiality and license agreements with our employees, consultants and third parties with whom we have relationships to protect our intellectual property and proprietary rights. As of the date of this annual report, we had no issued patents and one patent application pending in Brazil. As of December 31, 2020, we were party to 92 agreements, with third-party authors with respect to educational content. As of December 31, 2020, we owned 56 trademark registrations and 84 registered domain names in Brazil. We also had 16 pending trademark applications in Brazil as of the date of this annual report and unregistered trademarks that we use to promote our brand. From time to time, we expect to file additional patent, copyright and trademark applications in Brazil and abroad. Nevertheless, these applications may not be approved or otherwise provide the full protection we seek. Any dismissal of our “AFYA” trademark application may impact our business. Third parties may challenge any patents, copyrights, trademarks and other intellectual property and proprietary rights owned or held by us. Third parties may knowingly or unknowingly infringe, misappropriate or otherwise violate our patents, copyrights, trademarks and other proprietary rights, and we may not be able to prevent infringement, misappropriation or other violation without substantial expense to us.

Furthermore, we cannot guarantee that:

If we pursue litigation to assert or enforce our intellectual property or proprietary rights, an adverse decision in any of these legal actions could limit our ability to assert our intellectual property or proprietary rights, limit the value of our intellectual property or proprietary rights or otherwise negatively impact our business, financial condition and results of operations. If the protection of our intellectual property and proprietary rights is inadequate to prevent use or misappropriation by third parties, the value of our brand and other intangible assets may be diminished, competitors may be able to more effectively mimic our service and methods of operations, the perception of our business and service to customers and potential customers may become confused in the marketplace and our ability to attract customers may be adversely affected.

We may in the future be subject to intellectual property claims, which are costly to defend and, if we do not succeed in defending such claims, could harm our business, financial condition and operating results.

From time to time, third parties may allege in the future that we or our business infringes, misappropriates or otherwise violates their intellectual property or proprietary rights, including with respect to our publications. Many companies, including various “non-practicing entities” or “patent trolls,” are devoting significant resources to developing or acquiring patents that could potentially affect many aspects of our business. We have not exhaustively searched patents related to our technology. In addition, the publishing industry has been, and we expect in the future will continue to be, the target of counterfeiting and piracy. We may implement measures in an effort to protect against these potential liabilities that could require us to spend substantial resources. Any costs incurred as a result of liability or asserted liability relating to sales of unauthorized or counterfeit educational materials could harm our business, reputation and financial condition.

Third parties may initiate litigation against us without warning. Others may send us letters or other communications that make allegations without initiating litigation. We have in the past and may in the future receive such communications, which we assess on a case-by-case basis. We may elect not to respond to the communication if we believe it is without merit or we may attempt to resolve disputes out of court by electing to pay royalties or other fees for licenses. If we are forced to defend ourselves against intellectual property claims, whether they are with or without merit or are determined in our favor, we may face costly litigation, diversion of technical and management personnel, inability to use our current website or inability to market our service or merchandise our products. As a result of a dispute, we may have to develop non-infringing technology, including partially or fully revising any publication that infringes intellectual property rights, enter into licensing agreements, adjust our merchandising or marketing activities or take other action to resolve the claims. These actions, if required, may be unavailable on terms acceptable to us or may be costly or unavailable. If we are unable to obtain sufficient rights or develop non-infringing intellectual property or otherwise alter our business practices, as appropriate, on a timely basis, our reputation or brand, our business and our competitive position may be affected adversely and we may be subject to an injunction or be required to pay or incur substantial damages and/or fees and/or royalties.

Most of our services are provided using proprietary software and our software is mainly developed by our employees, who assign to us their copyrights over the software. In this regard, though applicable law establishes that employers shall have full title over rights relating to software developed by their employees, we could be subject to lawsuits by former employees claiming ownership of such software. As a result, we may be required to obtain licenses of such software, incurring costs relating to payments of royalties and/or damages and we may be forced to cease the use of such software. If we are unable to use certain of our proprietary software as a result of any of the foregoing or otherwise, this could have a material adverse effect on our business, financial condition and results of operations.

In addition, we use open source software in connection with certain of our products and services. Companies that incorporate open source software into their products have, from time to time, faced claims challenging the ownership of open source software and/or compliance with open source license terms. As a result, we could be subject to suits by parties claiming ownership of what we believe to be open source software or non-compliance with open source licensing terms. Some open source software licenses require users who distribute or use open source software as part of their software to publicly disclose all or part of the source code to such software and/or make available any derivative works of the open source code on unfavorable terms or at no cost. Any requirement to disclose our proprietary source code or pay damages for breach of contract could have a material adverse effect on our business, financial condition and results of operations.

Unfavorable decisions in our legal, arbitration or administrative proceedings may adversely affect us.

We are, and we, our controlling shareholders, directors or officers may be in the future, party to legal, arbitration and administrative investigations, inspections and proceedings arising from the ordinary course of our business or from nonrecurring corporate, tax, criminal or regulatory events, involving our suppliers, students, faculty members, as well as environmental, competition and tax authorities, especially with respect to civil, tax, criminal and labor claims. We cannot guarantee that the results of these proceedings will be favorable to us or that we have made sufficient provisions for liabilities that may arise as a result of these or other proceedings. Adverse decisions on material legal, arbitration or administrative proceedings may damage our reputation and may adversely affect our results of operations and the price of our Class A common shares.

In addition, Mr. Nicolau Carvalho Esteves, our chairman and one of our controlling shareholders, is currently party to a public civil proceeding filed by the federal prosecutor’s office against Mr. Carvalho Esteves and other individuals in connection with certain irregular administrative acts alleged to have taken place during each of their respective terms as Health Secretary of the State of Tocantins (Secretário de Saúde do Estado de Tocantins) between 2012 and 2014, a position held by Mr. Carvalho Esteves for a period of four months, from March 9, 2012 to July 20, 2012. If Mr. Carvalho Esteves is found liable, he may be subject to penalties, including a three-year prohibition on him or any legal entity under his control transacting with public entities or being granted tax incentives/benefits, including Afya. We cannot guarantee that the results of these proceedings will be favorable to Mr. Carvalho Esteves and any adverse decision may (i) damage our reputation, (ii) disqualify us from participating in the PROUNI program, and consequently cause us to lose our current tax incentives/benefits, including with respect to (a) corporate income tax (IRPJ) and CSLL rates, which were at an aggregate effective tax rate of 8.1% and 7.6% for the years ended December 31, 2020 and 2019, respectively, and which would gradually increase to an aggregate effective tax rate of up to 34.0%, and (b) PIS and COFINS rates, which are currently zero and which would gradually increase to an aggregate tax rate of up to 3.65%, (iii) result in our suspension from the New FIES program which would prohibit our institutions from enrolling new students that are funded by FIES (for the years ended December 31, 2020 and 2019, FIES represented 11.8% and 9.4% and of our historical undergraduate programs combined tuition fees), and (iv) prevent us from entering into new agreements with public entities located in Brazil, any of which may have an adverse effect on our business, reputation, results of operations and the price of our Class A common shares. For further information, see “Item 6. Directors, Senior Management and Employees—A. Directors and Senior Management—Legal Proceedings.”

We are currently in the process of obtaining or renewing local licenses and permits, including licenses from the fire department, for some of the real estate we use. Failure to obtain renewals of these licenses and permits in a timely manner may result in penalties, including closures of some of our campuses.

The use of all of our buildings, including our operational and administrative buildings, is subject to the successful issuance of an occupancy permit (Habite-se), or equivalent certificate, issued by the municipality where the property is located, certifying that the building was constructed in compliance with applicable zoning and municipal regulations. In addition, non-residential properties are required to have a use and operations license and/or permit, issued by the competent municipality, and a fire department inspection certificate, issued by the fire department, prior to being used regularly.

We are currently in the process of obtaining and/or renewing these licenses for some of the real estate we use. The absence of such licenses may result in penalties ranging from fines to forced demolition of the areas that were not built in compliance with applicable codes or, in the worst-case scenario, the temporary or permanent closure of the campus or branch lacking the licenses and permits to the extent the relevant penalties and fines have not been paid and the licenses and permits have not been obtained following notifications from the relevant authorities. Any penalties imposed, and in particular the forced closure of any of our campuses or branches, may result in a material adverse effect on our business. Moreover, in the event of any accident at our campuses or branches, the lack of such licenses may result in civil and criminal liability, as well as cause the cancellation of insurance policies, if any, for the respective campus or branch and may damage our reputation.

We may not be able to maintain or renew our existing leases.

We lease substantially all of the properties on our campuses. According to Brazilian lease laws, a lessee has the right to renew existing leases for subsequent terms equal to the original term of the lease. In order for a lessee to enforce this right, the following criteria must be met (i) the non-residential lease agreement must have a fixed term equal to or greater than five consecutive years, or, in the event there is more than one agreement or amendment thereto regarding the same real estate, the aggregate term in such agreement or amendment must be greater than five consecutive years (ii) the lessee must have been using the property for the same purpose for a minimum and continuous period of three years and (iii) the lessee must claim the right of automatic renewal at the most one year and at least six months prior to the end of the term of the lease agreement.

Lease agreements with terms lasting less than five years are not entitled to a right of compulsory renewal and, as a result, the lessor has the right to refuse renewal of the lease upon expiration of its term. The lease agreements relating to our campuses generally have terms lasting from five to 20 years and are renewable in accordance with applicable Brazilian lease laws. If we are forced to close any of our campuses due to the termination of a lease agreement and our inability to renew the lease, our business and results of operations may be adversely affected.

In addition, most of our lease agreements are not registered with the relevant real estate registries. We therefore do not have a right of first refusal over the applicable property in the event of a sale by its landlord and the subsequent purchaser may require that we vacate the property.

Acquisitions of educational institutions, in certain circumstances, must be approved by the Administrative Council for Economic Defense.

Brazilian legislation provides that acquisitions of educational institutions meeting certain requirements must be approved by Brazil’s Administrative Council for Economic Defense (Conselho Administrativo de Defesa Econômica, or CADE) prior to the completion of the acquisition if one of the companies or group of companies involved has gross annual revenues in Brazil of at least R$750.0 million in the year immediately prior to the acquisition and any other party or group of companies involved has gross income of at least R$75.0 million in that same period. As part of this process, CADE must determine whether the specific operation affects the competitiveness of the market in question or the consumers in such markets. CADE may not approve our future acquisitions or may condition approval of our acquisitions on our disposal of some of the operations of the target of the acquisition, or impose restrictions on the operations and commercialization of the target. Failure to obtain approval for future acquisitions or any conditional approvals of future acquisitions may result in expenses that may adversely affect our results of operations and financial condition. As a result of our growth strategy through acquisitions of new entities, we may need additional funds to implement our strategy. Therefore, if we cannot obtain adequate financing to conclude any potential acquisition and implement our expansion plans, our growth strategy will be affected.

Some of the properties that we occupy are owned by companies controlled by one of our controlling shareholders. Therefore, we are exposed to conflicts of interest, since the administration of such properties may conflict with our interests, those of such controlling shareholder and those of our other shareholders.

Some of the properties we occupy, including properties where some of our campuses are located, are owned and operated by companies controlled by one of our controlling shareholders. Therefore, the interests of our controlling shareholder in the administration of such property may conflict with our interests and those of our other shareholders. For further information, see “Item 7. Major Shareholders and Related Party Transactions—Related Party Transactions” and note 8 to our audited consolidated financial statements.

Our holding company structure makes us dependent on the operations of our subsidiaries. We depend on dividend distributions by our subsidiaries, and we may be adversely affected if the performance of our subsidiaries is not positive.

We are a Cayman Islands exempted company with limited liability. Our material assets are our direct and indirect equity interests in our subsidiaries. We control a number of subsidiary companies that carry out the business activities of our corporate group. Our ability to comply with our financial obligations and to pay dividends to our shareholders depends on our ability to receive distributions from the companies we control, which in turn depends on the cash flow and profits of those companies. There is no guarantee that the cash flow and profits of our controlled companies will be sufficient for us to comply with our financial obligations and pay dividends or interest on shareholders’ equity to our shareholders. Furthermore, exchange rate fluctuation will affect the U.S. dollar value of any distributions our subsidiaries make with respect to our equity interests in those subsidiaries.

In addition, the Brazilian federal government recently stated that the income tax exemption on the distribution of dividends may be repealed and income tax assessed on the distribution of dividends in the future, and that applicable taxes on the payment of interest on shareholders’ equity may be increased in the future. Any repeal of the income tax exemption on the distribution of dividends and any increase in applicable taxes on the payment of interest on shareholders’ equity may adversely affect us.

We and our subsidiaries may be held directly or indirectly responsible for labor claims pursuant to contracted services.

To meet the needs of our students and offer greater comfort and quality in all areas and aspects of our activities, we depend on service providers and suppliers for services such as cleaning, surveillance, telemarketing and security. We may be adversely affected if these third-party service providers and suppliers do not meet their obligations under Brazilian labor laws. In particular, according to Brazilian law we may be liable to the employees of these service providers and suppliers for labor obligations of these service providers and suppliers to the extent such service providers and suppliers fail to indemnify such employees pursuant to court orders, and we may also be fined by the relevant authorities. If we are held liable for such claims, we may be adversely affected.

We may not be able to pass on increases in our costs by adjusting our monthly tuition fees.

Our primary source of income is the monthly tuition payments we charge to our students. Our payroll costs and expenses account for the majority of the costs of services and general and administrative expenses, or 53.3%, 59.2% and 65.8% of such costs and expenses for the years ended December 31, 2020, 2019 and 2018, respectively. Our utilities expenses (comprised mainly of water, electricity and telephone expenses) represented 0.7%, 1.2% and 1.1%, respectively, of our costs of services and general and administrative expenses. Personnel costs and expenses, lease values and the cost of electricity are adjusted regularly using indices that reflect changes in inflation levels. If we are not able to transfer any increases in our costs and expenses to students by increasing the amounts of their monthly tuition fees, such as in the context of an economic crisis due to the COVID-19 pandemic, our operating results may be adversely affected.

If we are not able to attract and retain students, or are unable to do so without decreasing our tuition fees, our revenues may decline.

The success of our business depends primarily on the number of students enrolled in our programs and the tuition fees that they pay. Our ability to attract and retain students depends mainly on the tuition fees we charge, the convenient locations of our facilities, the infrastructure of our campuses and the quality of our programs as perceived by our existing and potential students. These factors are affected by, among other things, our ability to (i) respond to increasing competitive pressures, (ii) develop our educational systems to address changing market trends and demands from post-secondary education institutions and students, (iii) develop new programs and enhance existing programs to respond to changes in market trends and student demands, (iv) adequately prepare our students for careers in their chosen professional occupations, (v) successfully implement our expansion strategy, (vi) manage our growth while maintaining our teaching quality and (vii) effectively market and sell our programs to a broader base of prospective students. If we are unable to continue to attract new students to enroll in our programs and to retain our current students without significantly decreasing tuition, for example as a result of changes in our students preferences due to an economic crisis arising from the COVID-19 pandemic, our revenues and our business may decline and we may be adversely affected.

Our Business Unit 2 is subject to seasonal fluctuations, which may cause our operating results to fluctuate from quarter-to-quarter and adversely impact our working capital and liquidity throughout the year, adversely affecting our business, financial condition and results of operations.