As filed with the Securities and Exchange Commission on March 17, 2022.27, 2024.

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 20-F

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGEEXCHANGE ACT OF 1934

For the fiscal year ended: December 31 2021, 2023

Commission file number: 001-38256

NEXA RESOURCES S.A.

(Exact name of Registrant as specified in its charter)

Grand Duchy of Luxembourg

(Jurisdiction of incorporation or organization)

Rodrigo MenckJosé Carlos del Valle

Senior Vice President of Finance and Group Chief Financial Officer

Phone: +3522826 37 27

37A, Avenue J.F. Kennedy

L-1855, Luxembourg

Grand Duchy of Luxembourg

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | ||

| Common shares, each with par value of US$1.00 | NEXA | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

The number of outstanding shares of each class of stock of Nexa Resources S.A. as of December 31, 20212023 was:

common shares, each with par value of US$1.00

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐o No þ

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐oNo þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ☐

o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes þ No ☐

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See definition of “accelerated filer,” “large accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | Accelerated filer þ | Non-accelerated filer | Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐☐

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. þx

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ International Financial Reporting Standards as issued by the International Accounting Standards Board þ Other ☐

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐o Item 18 ☐

o

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ Noo No þ

| ii |

Table of contents

TABLE OF CONTENTS

Page

| Form 20-F cross reference guide | |||

| Forward-looking statements | 1 | ||

| About the Company | 3 | ||

| Presentation of financial and other information | 4 | ||

| Risk factors | 6 |

| I. | Information on the Company |

| II. | |||

| Operating and financial review and prospects |

| Overview | |||

| Results of operations | |||

| Liquidity and capital resources | |||

| Critical accounting estimates | |||

| Risk management |

| III. | Share ownership and trading |

| Major shareholders | |||

| Related party transactions | |||

| Distributions | |||

| Trading markets | |||

| Purchases of equity securities by the issuer and affiliated purchasers |

| IV. | Corporate governance, management and employees |

| Corporate governance | |||

| Board of directors | |||

| Executive officers and | |||

| Executive and director compensation | |||

| Employees | 187 |

| V. | Additional information |

| iii |

Form 20-F Cross Reference Guide |

Form 20-F cross reference guide

| Item | Form 20-F caption | Location in this report | Page | Form 20-F caption | Location in this report | Page |

| 1 | Identity of directors, senior management and advisers | Not applicable | – | Identity of directors, senior management and advisers | Not applicable | – |

| 2 | Offer statistics and expected timetable | Not applicable | – | Offer statistics and expected timetable | Not applicable | – |

| 3 | Key information | Key information | ||||

| 3A Reserved | Not applicable | – | 3A Reserved | Not applicable | – | |

| 3B Capitalization and indebtedness | Not applicable | – | 3B Capitalization and indebtedness | Not applicable | – | |

| 3C Reasons for the offer and use of proceeds | Not applicable | – | 3C Reasons for the offer and use of proceeds | Not applicable | – | |

| 3D Risk factors | Risk factors | 6 | 3D Risk factors | Risk factors | 6 | |

| 4 | Information on the Company | Information on the Company | ||||

| 4A History and development of the Company | About the Company, Business overview, Capital expenditures | 3, 22, 82 | 4A History and development of the Company | About the Company, Business overview, Capital expenditures | 3, 29, 102 | |

| 4B Business overview | Business overview, Mining operations, Smelting operations, Other operations, Mineral Reserves and Resources, Regulatory matters | 22, 27, 62, 65, 70, 89 | 4B Business overview | Business overview, Mining operations, Smelting operations, Other operations, Mineral Reserves and Resources, Regulatory matters | 29, 35, 78, 82, 87, 112 | |

| 4C Organizational structure | Business overview, List of Subsidiaries | 22, Exhibit 8 | 4C Organizational structure | Business overview, List of Subsidiaries | 29, Exhibit 8 | |

| 4D Property, plants and equipment | Mining operations, Smelting operations, Other operations, Capital expenditures, Regulatory matters | 27, 62, 65, 82, 89 | 4D Property, plants and equipment | Mining operations, Smelting operations, Other operations, Capital expenditures, Regulatory matters | 35, 78, 82, 102, 112 | |

| 4A | Unresolved staff comments | None | – | Unresolved staff comments | None | – |

| 5 | Operating and financial review and prospects | Operating and financial review and prospects | ||||

| 5A Operating results | Results of operations | 107 | 5A Operating results | Results of operations | 130 | |

| 5B Liquidity and capital resources | Liquidity and capital resources | 120 | 5B Liquidity and capital resources | Liquidity and capital resources | 142 | |

| 5C Research and development, patents and licenses, etc. | Business overview | 22 | 5C Research and development, patents and licenses, etc. | Business overview | 29 | |

| 5D Trend information | Results of operations | 107 | 5D Trend information | Results of operations | 130 | |

| 5E Critical Accounting Estimates | Critical Accounting Estimates | 126 | 5E Critical Accounting Estimates | Critical Accounting Estimates | 148 | |

| 6 | Directors, senior management and employees | Directors, senior management and employees | ||||

| 6A Directors and senior management | Board of directors, Executive officers and management committee | 144, 154 | 6A Directors and senior management | Board of directors, Executive officers and Management committee | 168, 178 | |

| 6B Compensation | Executive and director compensation | 158 | 6B Compensation | Executive and director compensation | 182 | |

| 6C Board practices | Corporate governance, Board of directors | 139, 144 | 6C Board practices | Corporate governance, Board of directors | 163, 168 | |

| 6D Employees | Employees | 162 | 6D Employees | Employees | 187 | |

| 6E Share ownership | Board of directors—Share ownership | 153 | 6E Share ownership | Board of directors—Share ownership | 177 | |

| 6F Disclosure of a registrant’s action to recover erroneously awarded compensation | Not applicable | – | ||||

| 7 | Major shareholders and related party transactions | Major shareholders and related party transactions | ||||

| 7A Major shareholders | Major shareholders | 132 | 7A Major shareholders | Major shareholders | 156 | |

| 7B Related party transactions | Related party transactions | 133 | 7B Related party transactions | Related party transactions | 157 | |

| 7C Interests of experts and counsel | Not applicable | – | 7C Interests of experts and counsel | Not applicable | – | |

| 8 | Financial information | Financial information | ||||

| 8A Consolidated statements and other financial information | Nexa Resources S.A. Financial statements, Distributions, Legal proceedings | 186, 135, 163 | 8A Consolidated statements and other financial information | Nexa Resources S.A. Financial Statements, Distributions, Legal proceedings | 213, 159, 188 | |

| 8B Significant changes | Not applicable | – | 8B Significant changes | Not applicable | – | |

| 9 | The offer and listing | The offer and listing | ||||

| 9A. Offer and listing details | Trading markets | 137 | 9A. Offer and listing details | Trading markets | 161 | |

| 9B Plan of distribution | Not applicable | – | 9B Plan of distribution | Not applicable | – | |

| 9C Markets | Trading markets | 137 | ||||

| 9D Selling shareholders | Not applicable | – | ||||

| 9E Dilution | Not applicable | – | ||||

| iv |

Form 20-F Cross Reference Guide |

| 9C Markets | Trading markets | 161 | ||||

| 9D Selling shareholders | Not applicable | – | ||||

| 9E Dilution | Not applicable | – | ||||

| 9F Expenses of the issue | Not applicable | – | 9F Expenses of the issue | Not applicable | – | |

| 10 | Additional information | Additional information | ||||

| 10A Share capital | Not applicable | – | ||||

| 10A Share capital | Not applicable | – | 10B Memorandum and articles of association | Articles of association | 190 | |

| 10B Memorandum and articles of association | Articles of association | 164 | 10C Material contracts | Business overview, Results of operations, Related party transactions | 29, 130, 157 | |

| 10C Material contracts | Business overview, Results of operations, Related party transactions | 22, 107, 133 | 10D Exchange controls | Exchange controls and other limitations affecting security holders | 203 | |

| 10D Exchange controls | Exchange controls and other limitations affecting security holders | 176 | 10E Taxation | Taxation | 194 | |

| 10E Taxation | Taxation | 168 | 10F Dividends and paying agents | Not applicable | – | |

| 10F Dividends and paying agents | Not applicable | – | 10G Statement by experts | Not applicable | – | |

| 10G Statement by experts | Not applicable | – | 10H Documents on display | Information filed with securities regulators | 207 | |

| 10H Documents on display | Information filed with securities regulators | 180 | 10I Subsidiary information | Not applicable | – | |

| 10I Subsidiary information | Not applicable | – | 10J Annual Report to Security Holders | Not applicable | – | |

| 11 | Quantitative and qualitative disclosures about market risk | Risk management | 129 | Quantitative and qualitative disclosures about market risk | Risk management | 151 |

| 12 | Description of securities other than equity securities | Not applicable | Description of securities other than equity securities | Not applicable | – | |

| 13 | Defaults, dividend arrearages and delinquencies | Not applicable | – | Defaults, dividend arrearages and delinquencies | Not applicable | – |

| 14 | Material modifications to the rights of security holders and use of proceeds | Not applicable | – | Material modifications to the rights of security holders and use of proceeds | Not applicable | – |

| 15 | Controls and procedures | Evaluation of disclosure controls and procedures, Internal control over financial reporting | 177, 178 | Controls and procedures | Evaluation of disclosure controls and procedures, Internal control over financial reporting | 204, 205 |

| 16A | Audit committee financial expert | Board of directors—Committees of our board of directors—Audit committee | 149 | Audit committee financial expert | Board of directors—Committees of our Board of directors—Audit committee | 173 |

| 16B | Code of ethics | Corporate governance—Code of conduct | 139 | Code of ethics | Corporate governance—Code of conduct | 163 |

| 16C | Principal accountant fees and services | Principal accountant fees and services | 179 | Principal accountant fees and services | Principal accountant fees and services | 206 |

| 16D | Exemptions from the listing standards for audit committees | Not applicable | – | Exemptions from the listing standards for audit committees | Not applicable | – |

| 16E | Purchases of equity securities by the issuer and affiliated purchasers | Purchases of equity securities by the issuer and affiliated purchasers | 138 | Purchases of equity securities by the issuer and affiliated purchasers | Purchases of equity securities by the issuer and affiliated purchasers | 162 |

| 16F | Change in registrant’s certifying accountant | Not applicable | – | Change in registrant’s certifying accountant | Not applicable | – |

| 16G | Corporate governance | Corporate governance | 139 | Corporate governance | Corporate governance | 163 |

| 16H | Mine safety disclosure | Not applicable | – | Mine safety disclosure | Not applicable | – |

| 16K | Cybersecurity | Risk management | 151 | |||

| 16J | Insider trading policies | Executive and Director Compensation | 182 | |||

| 17 | Financial statements | Not applicable | – | Financial statements | Not applicable | – |

| 18 | Financial statements | Nexa Resources S.A. Financial statements | 186 | Financial statements | Nexa Resources S.A. Financial Statements | 213 |

| 19 | Exhibits | Exhibits | 184 | Exhibits | Exhibits | 211 |

| v |

Forward-Looking Statements |

Forward-looking statements

This annual report includes statements that constitute estimates and forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act, as amended, or Exchange Act. The words “believe,” “will,” “may,” “may have,” “would,” “estimate,” “continues,” “anticipates,” “intends,” “plans,” “expects,” “budget,” “scheduled,” “forecasts” and similar words are intended to identify estimates and forward-looking statements. Estimates and forward-looking statements refer only to the date when they were made, and we do not undertake any obligation to update or revise any estimate or forward-looking statement due to new information, future events or otherwise, except as required by law. Estimates and forward-looking statements involve risks and uncertainties and do not guarantee future performance, as actual results or developments may be substantially different from the expectations described in the forward-looking statements.

These statements appear in a number of places in this report and include statements regarding our intent, belief or current expectations, and those of our officers and employees, with respect to, among other things: (i) our future financial or operating performance; (ii) our growth strategy; (iii) future trends that may affect our business and results of operations; (iv) the impact of competition and applicable laws and regulations on our results; (v) planned capital investments; (vi) future of zinc or other metal prices; (vii) estimation of mineral reserves; (viii) mine life; and (ix) our financial liquidity.

Forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Actual results and developments may be substantially different from the expectations described in the forward-looking statements for several reasons, many of which are not under our control, among them the activities of our competition, the future global economic situation, weather conditions, market prices and conditions, exchange rates, and operational and financial risks. The unexpected occurrence of one or more of the abovementioned events may significantly change the results of our operations on which we have based our estimates and forward-looking statements. Our estimates and forward-looking statements may be influenced by the following factors, including, among others:

| · | the cyclical and volatile prices of commodities; |

| · | the changes in the expected level of supply and demand for commodities; |

| · | foreign exchange rates and inflation; |

| · | the risks and uncertainties relating to economic and political conditions in the countries in which we operate; |

| · | changes in global market conditions; |

| · | the impact of expanded regional or global conflict, including the conflicts between Russian and Ukraine and the Israel-Hamas conflict, and the resulting potential impacts on supply and demand for commodities, global security concerns, and market volatility; |

| · | outbreaks of contagious diseases or health crises impacting overall economic activity regionally or globally, |

| · | increasing demand and evolving expectations from stakeholders with respect to our environmental, social and governance (“ESG”) practices, performance and |

| disclosures, including the ability to meet energy requirements while complying with greenhouse gas emissions regulations and other energy transition policy changes and laws in the countries in which we operate; |

| · | the impact of climate change on our operations, workforce and value chain; |

| · | environmental, safety and engineering challenges and risks inherent to mining; |

| 1 |

Forward-Looking Statements |

| · | severe natural disasters, such as storms and earthquakes, disrupting our operations; |

| · | operational risks, such as operator errors, mechanical failures and other accidents; |

| · | the availability of materials, supplies, insurance coverage, equipment, required permits or approvals and financing; |

| · | supply-chain and logistic related interruptions, including impacts to international freight and transportation networks; |

| · | the implementation of our growth strategy, the availability of capital and the risks associated with related capital expenditures; |

| · | failure to obtain financial assurance to meet closure and remediation obligations; |

| · | the possible material differences between our estimates of Mineral Reserves and Mineral Resources and the mineral quantities we actually recover; |

| · | the possibility that our concessions may be terminated or not renewed by governmental authorities in the countries in which we operate; |

| · | the impact of political and government changes in the countries in which we operate, and the effects of potential new legislation, |

| · | legal and regulatory risks, including ongoing or future investigations by local authorities with respect to our business and operations, as well as the conduct of our customers, along with the impact to our financial statements regarding the resolution of any such matters; |

| · | labor disputes or disagreements with local communities or unions in the countries in which we operate; |

| · | loss of reputation due to unanticipated operational failures or significant occupational incidents; |

| · | failure or outage of our digital infrastructure or information and operating technology systems; |

| · | cyber events or attacks (including ransomware, state-sponsored and other cyberattacks) due to negligence or IT security failures; |

| · | the future impact of competition and changes in domestic and international governmental and regulatory policies that apply to our operations; and |

| · | other factors discussed under “Risk Factors.” |

Considering the risks and uncertainties described above, the events referred to in the estimates and forward-looking statements included in this report may or may not occur, and our business performance and results of operation may differ materially from those expressed in our estimates and forward-looking statements, due to factors that include but are not limited to those mentioned above.

These forward-looking statements are made as of the date of this annual report, and we assume no obligation to update them or revise them to reflect new events or circumstances. There can be no assurance that the forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements.

| 2 |

About the Company |

About the Company

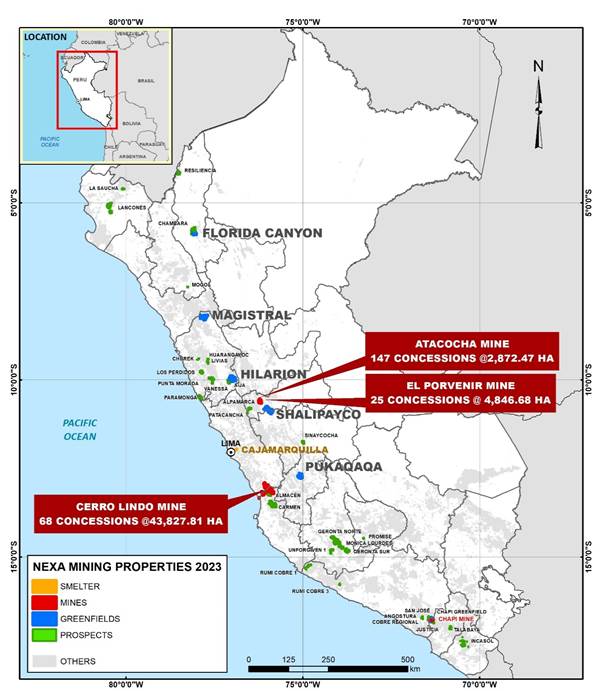

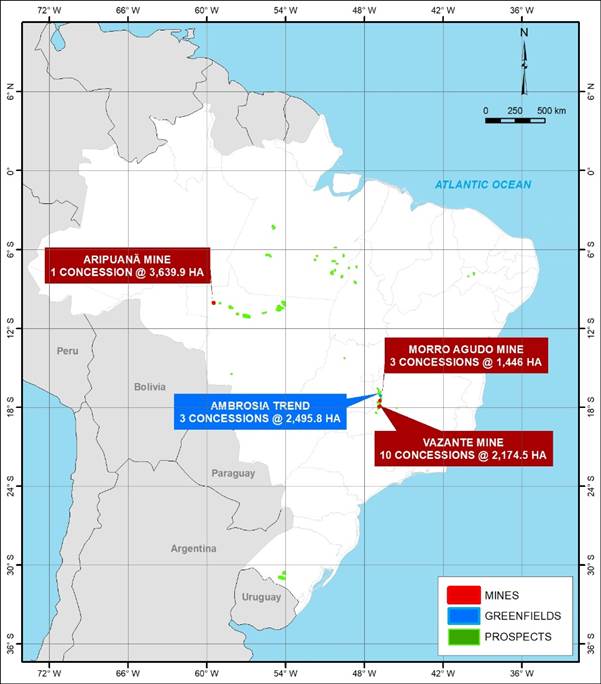

We are a large-scale, low-cost, integrated zinc producer with over 6065 years of experience developing and operating mining and smelting assets in Latin America. We currently own and operate fivesix long-life underground polymetallic mines—mines – three located in the Central Andes of Peru, and two located in the state of Minas Gerais in Brazil—Brazil, and we expect to complete construction atone in the state of Mato Grosso in Brazil, the Aripuanã Project, our sixth underground mine, currently in Mato Grosso, Brazil, and ramp up is scheduled for the third quarterramp-up phase as of 2022.the date of this annual report.

Nexa Resources S.A. is a public limited liability company (société anonyme) incorporated under the laws of Luxembourg on February 26, 2014. Our registered office is located at 37A, Avenue J.F. Kennedy, L-1855, Luxembourg, Grand Duchy of Luxembourg, and we are registered with the Luxembourg Trade and Companies Register under number B185489. Our telephone number at this address is +352 28 26 37 27.3727. Our main office outside of Luxembourg is located at Avenida Engenheiro Luís Carlos Berrini, n° 105, 6th floor, São Paulo, State of São Paulo, Brazil. Our website is www.nexaresources.com. None of the information available on our website is incorporated in this annual report and it should not be relied upon in deciding to invest in our common shares.

| 3 |

Presentation of Financial and Other Information |

Presentation of financial and other information

Certain definitions

Unless otherwise indicated or the context otherwise requires, the terms below are defined in the following manner.

| · | “Nexa,” “we,” “us” and “our” or similar terms refer to Nexa Resources and, unless the context otherwise requires, its consolidated subsidiaries; |

| · | “Nexa Resources” refers to Nexa Resources S.A., a Luxembourg public limited liability company (société anonyme); |

| · | “Nexa CJM” refers to our subsidiary Nexa Resources Cajamarquilla S.A. (previously known as Votorantim Metais—Cajamarquilla S.A.), a corporation organized as a sociedad anónima under the laws of Peru; |

| · | “Nexa Brazil” refers to our subsidiary Nexa Recursos Minerais S.A. (previously known as Votorantim Metais Zinco S.A.), a corporation organized as a sociedade anônima under the laws of Brazil; |

| · | “Nexa Peru” refers to our subsidiary Nexa Resources Peru S.A.A. (previously known as Compañía Minera Milpo S.A.A.), a corporation organized as a sociedad anónima abierta under the laws of Peru and publicly traded on the Lima Stock Exchange; |

| · | “ |

| · | “VSA” refers to our controlling shareholder Votorantim S.A., a corporation organized as a sociedade anônima under the laws of Brazil; |

| · | the “Votorantim Group” refers to our controlling shareholder VSA and, unless the context otherwise requires, its consolidated subsidiaries; |

| · | the “real,” “reais” or “R$” refers to the Brazilian real, the official currency of Brazil; |

| · | “sol,” “soles” or “S/.” refers to the Peruvian sol, the official currency of Peru; and |

In addition, the meaning of other defined terms used in this report are set out in “Glossary.”

Financial information

Our consolidated financial statements as of December 31, 20212023 and 20202022 and for each of the three years ended December 31, 20212023 are included in this annual report. Our consolidated financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”)IFRS accounting standards and interpretations, as issued by the International Accounting Standards Board (“IASB”) and the IFRS Interpretations Committee (“IFRS Accounting Standards”). References in this report to “our consolidated financial statements” are to our consolidated financial statements as of December 31, 20212023 and 20202022 and for each of the three years ended December 31, 2021,2023, and the related notes thereto included elsewhere in this report.

The financial information presented in this report should be read in conjunction with our consolidated financial statements, including the related notes, and the section of this report titled “Operating and financial review and prospects.”

The main consolidated companies included in our consolidated financial statements are:

| · | Nexa CJM – a Peruvian company that is 99.997% directly and indirectly owned by Nexa Resources and is mainly engaged in smelting zinc contained in concentrate. Nexa CJM’s functional currency is the U.S. dollar. |

| 4 |

| Forward-Looking Statements |

| · | Nexa Peru – a Peruvian company that is |

|

| · | Nexa Brazil – a Brazilian company that is 100% owned by Nexa Resources and is mainly engaged in exploring, extracting and producing zinc, copper and lead concentrates, and smelting zinc contained in concentrate with operations in the |

Non-IFRS Accounting Standards measures

OurFor a discussion of how our management uses non-IFRS Accounting Standards measures such as Adjusted EBITDA and cash cost, among other measures, for internal planning and performance measurement purposes. We believe these measures provide useful information about the financialan additional measure of operational performance of our operations that facilitates period-to-period comparisons on a consistent basis. Management uses Adjusted EBITDA internally to evaluate our underlying operating performance for the reporting periods presented and to assist with the planning and forecasting of future operating results. Management believes that Adjusted EBITDA is a useful measure of our performance because it reflects our cash generation potential from our operational activities excluding impairment of non-current assets and other miscellaneous adjustments, if any, for the period. These measures should not be considered individually or as a substitute for net income or operating income, as indicators of operating performance, or as alternatives to cash flow as measures of liquidity. Additionally, our calculation of Adjusted EBITDA and other non-IFRS measures may be different from the calculation used by other companies,Company’s business, including our competitors in the mining industry, so our measures may not be comparable to those of other companies. See “Results of Operations” for a discussion of our use of non-IFRS measures in this report, including the reasons why we believe this information is useful to management and to investors, and aAdjusted EBITDA, reconciliation to thewith most comparable IFRS measures.Accounting Standards figures and changes made in 2023, see “Operating and financial review and prospects—Results of Operations—Non-IFRS Accounting Standards measures and reconciliation.”

All forward-looking non-IFRS Accounting Standards financial measures in this document, including cash cost guidance, are provided only on a non-IFRS Accounting Standards basis. This is due to the inherent difficulty of forecasting the timing or number of items that would be included in the most directly comparable forward-looking IFRS Accounting Standards financial measures. As a result, reconciliation of the forward-looking non-IFRS Accounting Standards financial measures to IFRS Accounting Standards financial measures is not available without unreasonable effort and we are unable to assess the probable significance of the unavailable information.

Country, market and industry information

This report contains and refers to information and statistics regarding the countries in which we operate and the markets for the metals we produce. This data is obtained from independent public sources, including publications and materials from participants in the industry, such as Wood Mackenzie and from governmental entities such as the Brazilian Central Bank, Bloomberg Finance L.P., London Metal Exchange (“LME”), London Bullion Market Association (“LBMA”), Brazilian Ministry of TreasuryEconomy (Ministério da FazendaEconomia), Brazilian Ministry of Mines and Energy (Ministério de Minas e Energia, or “MME”), National Mining Agency (Agência Nacional de Mineração, or “ANM”), Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística, or “IBGE”), the Getulio Vargas Foundation (Fundação Getúlio Vargas, or “FGV”), the Peruvian Stock Market Superintendency (Superintendencia del Mercado de Valores), the Peruvian Central Bank, the Peruvian Ministry of Economy and Finance (Ministerio de Economía y Finanzas) and the Peruvian National Institute of Statistics and Informatics (Instituto Nacional de Estadística e Informática). Some data is also based on our estimates, which are derived from our review of internal reports, as well as independent sources.

Volume information

All tonnage information in this report is expressed in metric tonnes, unless stated otherwise, and all references to ounces are to troy ounces, in each case, unless otherwise specified.

| 5 |

Risk Factors |

Risk factors

Nexa and its operations are exposed to several inherent risks and uncertainties, including those described below. The risks described below are not the only ones that we face. Additional risks that we do not presently consider material, or of which we are not currently aware, may also affect us. Our business, results of operations, financial condition and cash flows could be materially and adversely affected if any of these risks materialize. You should carefully consider these risks with respect to an investment in Nexa. This section is divided in two sub-sections: the “Risk Factors Summary”, which provides a brief summary of our Risk Factors and “Detailed Risk Factors,” providing detailed information in relation to each Risk Factor identified.

Risk Factors Summary

The following summarizes the main risks to which we are subject. You should carefully consider all of the information discussed below in “Item 3—Key Information—Risk Factors—Detailed Risk Factors” in this annual report for a comprehensive description of these and other risks.

Business risks

| · | Our business is highly dependent on the international market prices of the metals we produce, which are both cyclical and volatile. |

| · | Changes in the demand for the metals we produce, including as a result of the cyclicality of global economic activity, could adversely affect our sales volume and revenues. |

| · | Adverse economic developments in China could have a negative impact on our revenues, cash flow and profitability. |

| · | The mining industry is highly competitive. |

Operational risks

| · | The mining business is subject to inherent risks, some of which are not insurable. |

| · | We may be materially adversely affected by challenges relating to slope and stability of underground openings. |

| · | Our projects are subject to operational risks that may result in increased costs or delays that prevent their successful implementation. |

| · | We may be adversely affected by the failure or unavailability of adequate infrastructure and skilled labor. |

| · | The failure of a tailings dam could negatively impact our business, reputation and results of operations, and the implementation of associated regulations and decommissioning processes may be expensive. |

| · | A disruption in zinc concentrate supply could have a material adverse effect on our production levels and financial results. |

| · | Inadequate supply of zinc secondary feed materials and zinc calcine could affect the results of our smelters. |

| · | Interruptions of energy supply or increases in energy costs may materially adversely affect our operations. |

| · | Shortages of water supply due to permitting, licensing, and other governmental regulations, explosives, critical spare parts, maintenance service and new equipment and machinery may materially adversely affect our operations and development projects. |

| · | There are unique risks inherent to the development of underground mines, which may have a material adverse impact on our cash flows. |

| · | We may be adversely affected by labor disputes, may be liable for certain payments to individuals employed by third-party contractors and may be subject to misconduct by our employees or third-party contractors. |

| · | The nature of our business includes risks related to litigation and administrative proceedings that could materially adversely affect our business and financial performance in the event of unfavorable rulings. |

Financial risks

| · | Our financial position and results of operations may be materially adversely affected by currency exchange rate fluctuations. |

| · | Fluctuations in interest rates could increase the cost of servicing our debt, affect returns on our financial investments and negatively affect our overall financial performance. |

| 6 |

| Risk Factors |

| · | We may engage in hedging activity that may not be successful and may result in losses to us. |

| · | Our business requires substantial capital expenditures and is subject to financing risks. |

| · | We are exposed to credit risk in relation to our contractual and trading counterparties as well as to hedging and derivative counterparty risk, and our results of operations may be negatively impacted by increases in expected credit losses. |

| · | Any acquisitions or divestitures we make may not be successful or achieve the expected benefits. |

| · | Changes in the assumptions underlying the carrying amount of certain assets could result in impairment charges. |

| · | We might not be able to pay the principal and interest amounts on our debt obligations in case they are accelerated as a result of the noncompliance with the restrictive covenants and clauses of our debt contracts. |

Risks related to our Mineral Reserves and Resources

| · | Our estimates of Mineral Reserves and Resources may be materially different from the total mineral quantities we actually recover, and changes in metal prices, operating and capital costs, and other assumptions used to calculate these estimates may render certain Mineral Reserves and Resources uneconomical to mine. |

| · | We depend on our ability to replenish our Mineral Reserves for our long-term viability. |

| · | Our mineral exploration efforts are highly speculative in nature and may be unsuccessful. |

Health, safety and environmental risks

| · | Health, safety and environmental laws and regulations, including regulations pertaining to climate change, may increase our costs of doing business, restrict our operations or result in the imposition of fines or revocation of permits. |

| · | ESG issues, including those related to climate change and sustainability, may have an adverse effect on our business, financial condition, and results of operations, could damage our reputation, and may increase costs. |

| · | Failure to meet environmental, social, and governance expectations or standards or achieve the Company’s environmental and social related goals could adversely affect its business, reputation, brand, results of operations, and/or financial condition. |

| · | Natural disasters and climate change could affect our business. |

| · | Global or regional health considerations, including the outbreak of a pandemic or contagious disease, such as the COVID-19 pandemic, have impacted and could continue to impact our business, financial condition and results of operations. |

Political, economic, social and regulatory risks

| · | Political, economic and social conditions in the countries in which we have operations or projects, or in which we do business, could adversely impact our business, financial condition results of operations and the trading price of our securities. |

| · | Recent and potential changes in commercial and mining laws, including trends like resource nationalism, may significantly impact our mining operations. |

| · | Our mineral rights may be terminated or not renewed by governmental authorities. |

| · | Our operations depend on our relations and agreements with local communities, and new projects require carrying out a prior consultation procedure. |

| · | Changes in tax laws, and any related tax agreements we have entered into or may enter into with local governments, may increase our tax burden and, as a result, could adversely affect our business, financial position and results of operations. |

| · | Our business, financial position and results of operations may be adversely affected by inflation. |

| · | We are subject to anti-corruption, anti-bribery and anti-money laundering laws and regulations in various jurisdictions. Any violations of any such laws or regulations could have a material adverse impact on our reputation and results of operations and financial position. |

| · | Political and social opposition to mining activities generally in the regions we operate could adversely impact our business and reputation. |

| 7 |

| Risk Factors |

| · | Differing interpretations of agency regulations or court rulings and the application of such laws and regulations could result in unintended non-compliance and may have a material effect on our business, results of operations, and financial position. |

| · | Regulation of other activities |

Risks relating to our corporate structure

| · | VSA has substantial control over us, which could limit our shareholders’ ability to influence the outcome of important corporate decisions. |

| · | Dividends or other distributions paid by us on our common shares will generally be subject to Luxembourg withholding tax. |

| · | The rights of our shareholders, and the responsibilities of VSA as our controlling shareholder, are governed by Luxembourg law and differ in some respects from the rights and responsibilities of shareholders under the laws of other jurisdictions, including the United States and Canada, and shareholders may have more difficulty protecting their interests than they would as shareholders of a U.S. corporation. |

| · | Our ability to pay dividends or other distributions and repurchase shares is subject to several factors and conditions. |

| · | It could be difficult for investors to enforce any judgment obtained outside Luxembourg against us or any of our associates. |

Detailed Risk Factors

Nexa and its operations are exposed to several inherent risks and uncertainties, including those described below.

Business risks

Our business is highly dependent on the international market prices of the metals we produce, which are both cyclical and volatile.

Our business and financial performance is significantly affected by the market prices of the metals we produce, particularly the market prices of zinc, copper, silver, lead and, to a lesser extent, gold. Historically, prices of such metals have been subject to wide fluctuations and are affected by numerous factors beyond our control, including international economic and political conditions, the cyclicality of consumption, actual or perceived changes in levels of supply and demand, the availability and costs of substitutes, inventory levels maintained by users, actions of participants in the commodities markets and currency exchange rates. We cannot predict whether, and to what extent, metal prices will rise or fall in the future.

The COVID-19 pandemic has had a material impactIn 2023, international prices decreased for zinc, copper and lead, and increased for silver and gold as compared to their respective 2022 averages. Overall, there continued to be downward pressure on the global economy. In 2021, demand and international market prices infor the base metals we produce, rebounded frommainly driven by the low levels reached in the first halfpersistence of 2020, as progress has been made in containing the COVID-19 pandemic. The emergence of new variants of COVID-19negative external factors including inflation and further outbreakshigh interest rates, residual economic impacts on key sectors of the pandemic, however, continue to affectChinese economy, especially civil construction and real estate market, and ongoing variable global macroeconomic conditions contributingrelating to increasedconflicts between Russia and Ukraine and the Israel-Hamas conflict.

Mine supply also contributed to the volatility of zinc prices in metal2023. The sharp drop in prices and demand for our products.from the first to the second quarter, combined with higher levels of production costs around the world, caused a series of zinc mine closures during 2023, as some assets were operating on negative margins. None of Nexa’s mines closed or reduced production in 2023 because of the drop in prices. However, these other mine closures caused zinc prices to slightly rise, especially at the end of 2023, as well as caused the Chinese spot treatment charges to significantly drop throughout the year compared to the 2022 average. There are still assets that may have negative margins at current zinc prices, so further closures of other mines around the globe remains a possibility in 2024.

The recent invasion ofongoing conflict between Russia and Ukraine, by Russia, the resulting conflict, and retaliatory measures by the global community have created global security concerns, including the possibility of expanded regional or global conflict, which have had, and are likely tomay continue to have, adverse impacts around the globe. PotentialThe fluctuating value of the US dollar, resulting in part from global conflicts, also directly impacts commodities prices.

| 8 |

| Risk Factors |

Also, on October 7, 2023, Hamas, a terrorist group in control of Gaza, carried out a surprise attack on Israeli cities and towns near the Gaza strip. Following this terrorist attack, Israel declared war on Hamas and other terrorist organizations in Gaza. The military conflict is ongoing, and its length and outcome are highly unpredictable. Further escalation of this conflict could lead to significant disruptions, which could have a material adverse effect on our business, financial position, results of operations and cash flows.

Continued ramifications of these global conflicts include disruption of the supply chain, which has led, and may impactcontinue to lead, to impacts on production, investment, and demand and prices for our products,products; higher and more volatile prices for commodities, including oil and gas, volatility in commodity prices, andgas; disruption of global financial markets, and further exacerbatingexacerbation of overall macroeconomic trends, including high inflation and rising interest rates. However, asFor more information see “Operating and Financial Review and Prospects—Overview”. As of the date of this report, we cannot predict the conflicts between Russia and Ukraine and in the Middle East have had no material impact that this conflict will have on our business and operations. However, the conflicts are still ongoing, and we cannot predict the future impact they may have. We continue to monitor developments related to this conflictthese conflicts as of the day of this report.

Future declines in metal prices, whether related to the ongoing impact of the COVID-19 pandemic or otherwise, and especially with respect to zinc, copper, silver and lead prices, could have an adverse impact on our results of operations and financial position, and we might consider curtailing or modifying certain operations, selling certain operations or not proceeding with our sustaining and/or growth strategy. In addition, we may not be able to adjust production volume in a timely or cost-efficient manner in response to changes in metal prices. Lower utilization of capacity during periods of weak prices may expose us to higher unit production costs since a significant portion of our cost structure is fixed in the short-term due to the high capital intensity of mining operations. Conversely, during periods of high prices, our ability to rapidly increase production capacity may be limited, which could prevent us from selling more products. Moreover, we may be unable to complete expansions and greenfield projects in time to take advantage of rising prices for zinc, copper, lead or other products.

Changes in the demand for the metals we produce, including as a result of the cyclicality of global economic activity, could adversely affect our sales volume and revenues.

Our revenues depend on the volume of metals we sell (and, to a lesser extent, the volume of metals produced by others that are smelted in our facilities), which in turn depend on the level of industrial and consumer demand for these metals. An increase in the production of zinc, copper, silver and lead worldwide, along with a reduction in demand for these metals, due to changes in technology, industrial processes or consumer habits, including increased demand for substitute materials, economic slow-downs or other factors, may have the potential to impact these metal prices. In 2023, international prices decreased for zinc, copper and lead, and increased for silver and gold as compared to their respective 2022 averages. The impact of price decreases may also compromise the profitability of smelters, as we might consider reducing the volume of metals we sell and therefore materially adversely impact our operational results and financial position. Even if our volumes are not affected by reduced prices, this decrease can impact our revenues.

|

The mining industry has historically been highly volatile largely due to the cyclical nature of industrial production, which affects the demand for minerals and metals. Demand for minerals and metals thus generally correlates to macroeconomic fluctuations in the global economy. Changes in the demand for the metals we produce could adversely affect our sales volume and revenues.

Adverse economic developments in China could have a negative impact on our revenues, cash flow and profitability.

China has been the mainprimary source of global demand for commodities over the last few years. According to Wood Mackenzie, in 2021,2023, Chinese demand represented 50%51% of global demand for refined zinc and 52%56% of global demand for refined copper. Any slowdown in China’s economic growth that is not offset by increased demand or reduced supply from other regions could have an adverse effect on demand for our products or commodity prices and result in lower revenues, cash flow and profitability.

| 9 |

| Risk Factors |

The mining industry is highly competitive.

We face competition from other mining, processing, trading and industrial companies in Brazil, Peru and around the world. Competition principally involves the following factors: sales, supply and labor prices; contractual terms and conditions; attracting and retaining qualified personnel; and securing the services, supplies and technologies we need for our operations. Slower development in technology and innovation could impact costs, productivity and competitiveness. In addition, mines have limited lives and, as a result, we must seek to replace and expand our mineral reserves by acquiring new properties. Significant competition exists to acquire mining concessions, land and related assets. We cannot assure shareholders that competition will not adversely affect us in the future.

The international trade environment faces increasing uncertainty. Potential changes to international trade regulations and agreements, as well as other political and economic arrangements (including direct or indirect subsidies), may benefit competitors operating in countries other than where our mining operations are currently located. These changes could also adversely affect the prices we pay for the supplies we need and our export costs when we engage in international transactions. We cannot assure shareholders that we will be able to compete based on price or other factors with companies that in the future may benefit from favorable regulations, lower cost of capital, trading or other arrangements or that we will be able to maintain the cost of the supplies that we require as well as our export costs.

Operational risks

The mining business is subject to inherent risks, some of which are not insurable.

The business of mining zinc, copper, silver, lead and other minerals is generally subject to numerous risks and hazards. Hazards associated with underground mining operations include underground fires and explosions, including those caused by flammable gas, gas and coal outbursts, cave-ins or falls of ground, rock falls, openings collapse, lack of oxygen, air pollution, tailings dam failures or other discharges of tailings, hazardous substances and materials, gases and toxic chemicals, water ingress and flooding, sinkhole formation, ground subsidence, and other accidents and conditions resulting from underground mining activities, such as drilling, blasting, removing and processing material. In addition, we may encounter geotechnical challenges as we continue with and expand our mining activities, including the possibility of failure of underground openings. For example, see “Mining Operations—Vazante—Operations and infrastructure.” We could incur additional expenses in connection with preventive and remediating measures related to underground openings, which could materially adversely affect results of our operations and financial position.

Such occurrences could result in damage to, or destruction of, our properties or production facilities, third-party property, human exposure to pollution, personal injury or death, environmental and natural resource damage or contamination, delays in mining, monetary losses and legal liability. In addition, any such occurrences could adversely affect our reputation. Damages to our reputation could result in additional environmental and health and safety legal oversight, and authorities could impose more stringent conditions in connection with the licensing process of our projects and operations. In addition, our customers may be less willing to buy metals from us if we have been subject to significant adverse publicity. We maintain insurance typical in the mining industry, and in amounts that we believe to be adequate, but which may not provide complete coverage in certain circumstances. Insurance against certain risks (including certain liabilities for environmental contamination, tailings dam failures and other hazards as a result of exploration, and production)production or extreme weather) may not be generally available or is uneconomical to afford. If we incur significant liability for which we are not fully insured, we may not be able to finance the uninsured liability amount on acceptable terms to us or at all, and we could be required to divert a significant portion of our cash flow from normal business operations. This could have a material impact on our financial position.

We could also incur additional expenses due to failures in our industrial drainage system or other environmental control equipment. Any such failures could also have adverse impacts on the environment, which could lead to adverse climate changes and further impact our reputation if we are found to contribute, or there is a perception that we have contributed, to adverse environmental impacts in the areas in which we operate.

| 10 |

Risk Factors |

We may be materially adversely affected by challenges relating to slope and stability of underground openings.

Our underground mines get deeper, and our waste and tailings deposits increase in size as we continue with and expand our mining activities. This presents certain geotechnical challenges, including the possibility of failure of underground openings. If we are required to further reinforce such openings or take additional actions to prevent such a failure, we could incur additional costs and expenses, and our operations and stated mineral reserves could be negatively affected. We have taken actions we consider appropriate to maintain the stability of underground openings, but additional actions may be required in the future. Unexpected failures or additional requirements to prevent such failures may materially adversely affect our costs and expose us to health, safety and other liabilities in the event of an accident, as well as adversely impact our reputation. These developments may in turn materially adversely affect the results of our operations and financial position, as well as potentially diminish our stated mineral reserves.

Our projects are subject to operational risks that may result in increased costs or delays that prevent their successful implementation.

We invest in sustaining and increasing our mine and metal production capacity and developing new operations. Our projects are subject to several risks that may materially adversely affect our growth prospects and profitability, including the following:

| · | we may encounter delays or higher than expected costs in completing technical and engineering studies and obtaining the necessary equipment, machinery, materials, supplies, labor or services, in project execution by third-party contractors and in implementing new technologies to develop and operate a project; |

| · | we may experience delays in commencing and/or ramping up the operations of a new project or the expansion of an existing |

| · | our efforts to develop projects according to schedule may be hampered by a lack of infrastructure, including a reliable power supply; |

| · | we may fail to obtain or renew, or experience delays or higher than expected costs in obtaining or renewing, the required agreements, authorizations, licenses, approvals and permits to develop a project, including the prior consultation procedure and agreements with local communities; |

| · | changes in market conditions or regulations may make a project less profitable than expected at the time we initiated work on it; |

| · | accidents, natural disasters, labor disputes, equipment failures, water shortages, logistical issues, interruption of energy supply and increase in energy costs; |

| · | adverse mining conditions may delay and hamper our ability to produce the expected quantities and qualities of minerals upon which the project was budgeted; |

| · | mineral reserves and resources are estimates based on the interpretation of limited sampling data and test work that may not be representative of the deposits as a whole, or the technical and economic assumptions used in the estimates may prove to be materially different when the deposits are mined, that could result in materially different economic outcomes; and |

|

| · | conflicts with local communities, unions and/or strikes or other labor disputes may delay the implementation or the development of projects. |

We may be adversely affected by the failure or unavailability of adequate infrastructure and skilled labor.

Our mining, smelting, processing, development and exploration activities depend to a large degree on adequate infrastructure. The regions where certain of our current operations, projects and prospects are located are sparsely populated and difficult to access. We require reliable roads, bridges, power sources and water supplies to access and properly conduct our operations. As a result, the availability and cost of this infrastructure affects capital and operating costs and our ability to maintain expected levels of production and sales. We could also experience an increase in transit-related accidents due to the need to transport employees to remote areas. Unusual weather, such as excessive rains and flooding, or other natural phenomena, sabotage, government or external interference (including protest activities from local communities that may lead to temporary suspensions of our projects) in the maintenance or provision of such infrastructure could impact the development of a project, reduce mining volumes, increase mining or exploration costs or delay the transportation of raw materials to the mines and projects or concentrates to the customers. See “Risk factors—Health, safety and environmental risks—Natural disasters and climate change could affect our business.”

| 11 |

| Risk Factors |

In addition, the mining industry is labor intensive, and our success depends to a significant extent on our ability and our contractors’ ability to attract, hire, train and retain qualified employees, including our ability and our contractors’ ability to attract employees with the necessary skills in the regions in which we operate. We could experience increases in our recruiting and training costs and decreases in our operating efficiency, productivity and profit margins if we are unable to attract, hire and retain a sufficient number of skilled employees to support our operations.

The failure of a tailings dam could negatively impact our business, reputation and results of operations, and the implementation of associated regulations and decommissioning processes may be expensive.

Mining companies face inherent risks in their operations of tailings dams—structures built for the containment of the mining or industrial waste, known as tailings—that exposes us to certain risks. Our tailings dams include, in some cases, materials that could increase the hazard potential in the event of unexpected failure. If any such risks were to occur, this could lead to negative environmental effects and materially adversely affect our reputation and our ability to conduct our operations and could make us subject to liability and, as a result, have a material adverse effect on our business, financial position and results of operations.

In addition, the changes in regulation that occurred as a result of recent dam failures, like those that have occurred in Brazil, could increase the time and costs to build, operate, inspect, maintain and decommission tailings dams, obtain new licenses or renew existing licenses to build or expand tailings dams, or require the use of new technologies. NewBrazilian laws in Brazil include a requirement for obtaining an environmental license for new dams or for the raising of existing dams. As part of the process, companies must present a proposal for an environmental bond with the purpose of guaranteeing the socio-environmental recovery in the event of an accident or the deactivation of the dam. New

In December 2023, the State of Minas Gerais published State Decree No. 48,747/2023, regulating the environmental recovery policies that companies are required to have in place in the event of an accident or deactivation of a dam, pursuant to a prior state law passed in 2019. Under State Decree No. 48,747/2023, any dams that meet the requirements established under the 2019 Dam Safety Policy law must have an environmental guarantee policy in place. Nexa estimates that it will require US$27.3 million to cover the applicable dams under this policy. The guarantee can be made by one of the following methods: (i) cash deposit; (ii) bank deposit certificate – (“CDB”); (iii) bank guarantee; or (iv) guarantee insurance. The Company has until March 29, 2024 to submit an environmental recovery proposal and must contract for 50% of the policy by December 31, 2024, 25% by December 31, 2025 and 25% by December 31, 2026. For more information on State Decree No. 48,747/2023 and its impact on Nexa, see “Information on the Company—Mining operations—Tailings disposal” and Notes 27 and 32(b) of our consolidated financial statements.

The Company has been conducting engineering studies to confirm the construction method of old inactive industrial waste containment structures that have been closed for more than 20 years. None of them contain mining tailings, water or liquid waste. Based on results of the conceptual engineering studies, Nexa recognized a provision for dams obligations in the amount of US$7.0 million in its financial statements for the year ended December 31, 2023 and the Company may reserve additional amounts related to estimated costs of anticipated additional obligations in relation to these closed dams, which could have a material impact on the Company’s financial position.

| 12 |

| Risk Factors |

Certain regulations, such as those enacted in Brazil duringby ANM between 2020 and 2023, may also impose more restrictive requirements that may exceed our current standards, including mandated compliance with emergency plans and increased insurance requirements and premiums, or require us to pay additional fees or royalties to operate tailings dams. We may also be required to facilitate the relocation of communities and facilities impacted by tailings dam failures. Moreover, insurance coverage for damages resulting from tailings dams’ failure may not be available. For more information see “Information on the Company—Mining operations—Tailings disposal.”

A disruption in zinc concentrate supply could have a material adverse effect on our production levels and financial results.

A portion of the zinc concentrate used byprocessed in our smelters is obtained from third parties, and we may be adversely affected if we are not able to source adequate supplies of zinc for such operations. In 2021, 47.1%2023, 49.6% of the zinc concentrate used byprocessed in our smelters was obtained from third parties, with the remainder supplied by our own mining operations. The availability and price of zinc concentrate used by our smelters may be negatively affected by several factors largely beyond our control, including interruptions in production in our mines or by our suppliers, decisions by suppliers to allocate supplies of concentrate to other purchasers, price fluctuations and increasing transport cost.

|

In addition, the efficiency of a smelter’s production over time is affected by the mix of the zinc concentrate qualities and grades it processes. In circumstances where we cannot source adequate supplies of the zinc concentrate qualities and grades that comprise the most efficient mix for our smelters, alternative types of concentrate may be available, but the use thereof may increase our costs of production or reduce the productivity of our smelters and adversely affect our business, results of operations and financial position.

Inadequate supply of zinc secondary feed materials and zinc calcine could affect the results of our smelters.

Zinc sourced from suppliers of secondary feed materials represented approximately 19.3%16.5% of the zinc content used by our Juiz de Fora smelter in 2021.2023. The use of zinc secondary feed material is a competitive advantage in relation to the use of zinc concentrate, mainly due to lower acquisition costs and, to a lesser extent, operational gains. In addition, since 2021 we have recently incorporated zinc calcine processed by third parties into our operations to increase the production in our smelters. Our smelters then use this zinc calcine processed by third parties to produce additional refined zinc products that they would not produce were they to rely solely on other inputs. To the extent we are unable to obtain adequate supplies of zinc secondary feeds or zinc calcine, or if we must pay higher than anticipated prices of these inputs, our business, results of operations and financial position may be adversely affected. In 2021, one of our calcine supplierssupplier in Peru shutdownshut down its facility, whichfacilities, impacting our smelter production. In 2021, 2022 and 2023, we expectwere able to have a negative impact on production in 2022 due to long-termpartially offset the reduction in calcine availability.availability through the development and consumption of new sources of raw material, such as third party waelz oxide, however, we cannot assure shareholders that we will be able to have secure access to the raw materials required for our operations in the future. For more information, see “Information on the Company—Smelting Operations—Smelter sales”sales.”

Interruptions of energy supply or increases in energy costs may materially adversely affect our operations.

Energy is an important component of our production costs. In Peru, we obtain almost all electric power for our operations from third parties through electricityenergy supply contracts. Although we are party to a long-term power purchase agreement with Electroperú S.A., we cannot assure youensure that we will have secure access to energy sources in Peru at the same prices and conditions in the event of any interruption or failure of our sources of electricity,energy, failures or congestion in any part of the Sistema Eléctrico Interconectado Nacional (“SEIN”) or, any failure to renew or extend our other existing electricityenergy supply contracts.contracts, or due to any regulatory changes that may impact energy rates. Between May and September 2023, there was an increase in spot prices, mainly explained by the lack of rain in central Peru, given the most energy consumption in the country comes from hydroelectric plants. In addition, the shutdown of certain Peruvian natural gas processing plants due to maintenance occurred in July 2023, led to increase in energy costs reaching US$180/MWh, which was the highest rate in fifteen years. This increase in energy prices in part resulted from inefficient energy generation in the SEIN, which currently lacks renewable energy projects (i.e., hydroelectric, wind and solar). These types of renewable projects are expected to lower the prices that energy generators are able to offer to large industrial users.

| 13 |

| Risk Factors |

In Brazil, we obtain electric power for our operations from hydroelectric plants grouped into several legal entities—which are directly or indirectly jointly owned by us, our controlling shareholder and its affiliates—pursuant to long-term power purchase agreements. Self-productionIn 2023, self-production plants represent 92.7%represented 86.8% of energy supply, in terms of energy acquired via energy purchase and sale contracts. Furthermore, our energy costs under these agreements could increase in the event of differences in the hydrology forecast due to these hydroelectric plants share of the hydrological risk, in addition to payment of higher energy taxes. For more information, see “Information on the Company—Other operations—Power and energy supply.”

The prices forPrices and availability of energy resources for our operations may be subject to changechanges or curtailment due to, among other things, new laws or regulations, the imposition of new taxes or tariffs, supply interruptions, equipment damage, volatility and increase in worldwide price levels for energy and related components, market conditions and any inability to renew our existing supply contracts. Disruptions in energy supply or increases in costs of energy resources could increase our production costs and have a material adverse effect on our financial position and results of operations.

Shortages of water supply due to permitting, licensing, and other governmental regulations, explosives, critical spare parts, maintenance service and new equipment and machinery may materially adversely affect our operations and development projects.

Our mining and smelting operations require the use of significant quantities of water for extraction activities, processing and related auxiliary facilities. Water usage, including extraction, containment, and recycling requires appropriate permits, which are granted by regulatory authorities in Brazil and Peru. The available water supply may be adversely affected by shortages or changes in governmental regulations. We cannot assure shareholders that water will be available in sufficient quantities to meet our future production needs or will prove sufficient to meet our water supply needs. In addition, we cannot assure shareholders that we will maintain our existing licenses related to water rights, particularly if political changes lead to additional regulatory requirements or review of existing licenses. A reduction in our water supply could materially adversely affect our business, results of operations and financial position. In addition, if we have not yet obtainedare unable to obtain the necessary licenses with respect to water rights to supportuse, we may be prevented from pursuing some of our planned expansion projects, and our inability to obtain those rights could prevent us from pursuing those expansions.

|

projects.

In addition to water, our mining operations require intensive use of equipment and machinery as well as explosives. To be able to acquire and use explosives, we must first obtain the corresponding authorizations, which are granted by the relevant regulatory authorities in Brazil and Peru. A shortage in the supply of key spare parts, adequate maintenance service, new equipment and machinery to replace old ones and cover expansion requirements, or explosives, including due to the inability to deliver such water, energy, supplies, critical spare parts, explosives, or equipment and machinery to our operations, or regulatory change impacting our ability to obtain authorization for the acquisition of such materials, could materially adversely affect our operations and development projects.

There are unique risks inherent to the development of underground mines, which may have a material adverse impact on our cash flows.

The development of underground mines is subject to other unique risks including, but not limited to, underground floods, issues relating to ventilating harmful gases, fall-of-ground accidents, and seismic activity resulting from unexpected or difficult geological conditions. While we anticipate taking all measures to safely operate, there is no assurance that the effect of these risks will not cause schedule delays, revised mine plans, injuries to persons and property, and/or increased capital costs, any of which may have a material adverse impact on our cash flows.

We may be adversely affected by labor disputes.

Mining is a labor-intensive industry. We depend on more than 13,00014,000 workers, including employees and contractors, to carry out our operations. A portion of our employees are unionized. We cannot assure that we will not experience work slowdowns, work stoppages, strikes or other labor disputes in the future, particularly in the context of the annual renegotiation of our collective bargaining agreements.

| 14 |

| Risk Factors |

We may also be affected by labor-related disputes that broadly develop in the countries in which we operate. Strikes and other labor disruptions at any of our operations could have a material adverse effect on our business, financial position and results of operations.

We may be liable for certain payments to individuals employed by third-party contractors.

Under Peruvian law, we may become responsible under certain circumstances to pay mandatory labor benefits or other obligations to personnel employed by our third-party contracts or sub-contractors. Although we believe that we are in substantial compliance with Peruvian labor laws, we cannot assure shareholders that any proceedings initiated by outsourced employees will be resolved in our favor and that we will not be liable for any mandatory labor benefits or for-profit sharing benefits. In addition, the Peruvian government is reviewingbeginning of 2022, a new law that proposeswas published in Peru prohibiting companies from outsourcing core operational activities. More than 70% of our Peruvian workforce is employed by third party contractors. In July 2023, the law was deemed to eliminate outsourcing of main operational activities, with the aim of contracting workers directlybe unconstitutional because it was determined to be an unenforceable bureaucratic barrier by the company. If passed, this law would affectNational Institute for the mining sector and other economic sectors in the country that have a significant percentageDefense of outsourced workforce. The above-mentioned bill of law is under review by the CongressCompetition and the Executive Branch. SeeProtection of Intellectual Property (“INDECOPI”), and therefore is not expected to have any material impact on Nexa. In addition, a lawsuit was initiated by Nexa which is seeking to declare the unconstitutionality of the aforementioned law. However, any future laws or regulations that would make Nexa responsible under Peruvian law for paying mandatory labor benefits or for-profit sharing benefits for individuals employed by third-party contractors could have an adverse impact on our business, financial position and results of operations. For more information, see “Information on the Company—Regulatory matters—Peruvian regulatory framework—Regulation of other activities.”

Under Brazilian law, outsourcing is also permitted if certain requirements are met. In addition, Brazilian law provides that the contractor will be held liable on a secondary basis if the outsourced or subcontracted companies do not fulfill their labor obligations. In cases where the outsourced or subcontracted companies do not pay the workers the labor sums they are entitled to, the contractor is responsible for those payments. These payments may have an adverse effect on our results of operation and financial position.”

We may be subject to misconduct by our employees or third-party contractors.

We may be subject to misconduct by our employees or third-party contractors, such as theft, bribery, sabotage, fraud, insider trading, violation of laws, slander or other illegal actions. Any such misconduct may lead to fines or other penalties, slow-downs in production, increased costs, lost revenues, increased liabilities to third parties, impairment of assets or harmed reputation, any of which may have a material adverse effect on our business, results of operations or financial position.

The nature of our business includes risks related to litigation and administrative proceedings that could materially adversely affect our business and financial performance in the event of unfavorable rulings.

The nature of our business exposes us to various litigation matters, including civil liability claims, environmental matters, health and safety matters, regulatory and administrative proceedings, governmental investigations, tort claims, contract disputes, labor matters and tax matters, among others. We cannot assure shareholders that these or other legal proceedings will not have a material adverse effect on our ability to conduct our business or on our financial position and results of operations, through distraction of our management team, diversion of resources or otherwise. In addition, although we establish provisions as we deem necessary in accordance with IFRS as issued by the IASB,Accounting Standards, the level of provisions that we record could vary significantly from any amounts we actually pay, due to the inherent uncertainties in the estimation process.

Any tax-related investigations carried out by state or local governments may result in a material impact on our business, results of operations and financial condition.