Table4.12*

| | English Translation of ContentsLease Agreement dated September 1, 2023, by and between CN Energy Development and Lishui Yonglian Startup Services Co., Ltd. 4.11

| | Form of Subscription Agreement (incorporated herein by reference to Exhibit 10.1 to the Form 6-K (File No. 001-39978) filed with the Securities and Exchange Commission on June 11, 2021)

| 4.12

| | Form of Registration Rights Agreement (incorporated herein by reference to Exhibit 10.2 to the Form 6-K (File No. 001-39978) filed with the Securities and Exchange Commission on June 11, 2021)

| 4.13

| | Placement Agreement, by and between the Company and Network 1 Financial Securities, Inc. dated April 20, 2021 (incorporated herein by reference to Exhibit 1.1 to the Form 6-K (File No. 001-39978) filed with the Securities and Exchange Commission on June 11, 2021)

| 4.14

| | Escrow Agreement, by and among the Company, Network 1 Financial Securities, Inc., and the Escrow Agent (incorporated herein by reference to Exhibit 10.3 to the Form 6-K (File No. 001-39978) filed with the Securities and Exchange Commission on June 11, 2021)

| 4.15*

| | English Translation of Loan Agreement dated June 18, 2021, by and between Khingan Forasen and Industrial and Commercial Bank of China Tahe Branch

| 4.16*

| | English Translation of Loan Guarantee Agreement dated June 18, 2021, by and between CN Energy Development and Industrial and Commercial Bank of China Tahe Branch

| 4.17*

| | English Translation of Account Supervision Agreement dated June 18, 2021, by and between Khingan Forasen and Industrial and Commercial Bank of China Tahe Branch

| 4.18*

| | English Translation of Form of Loan Agreement, by and between Tahe Biopower Plant and Industrial and Commercial Bank of China Tahe Branch, and a schedule of all executed Loan Agreements adopting the same form

| 4.19*

|

| English Translation of Line of Credit Agreement dated December 14, 2021, by and between Hangzhou Forasen and Bank of Beijing Hangzhou Branch

| 4.20*

|

| English Translation of Loan Agreement dated December 14, 2021, by and between Hangzhou Forasen and Bank of Beijing Hangzhou Branch

| 8.1*

| | List of subsidiaries of the Registrant

| 11.1

| | Code of Business Conduct and Ethics of the Registrant (incorporated herein by reference to Exhibit 99.1 to the registration statement on Form F-1 (File No. 333-239659), as amended, initially filed with the Securities and Exchange Commission on July 2, 2020)

| 12.1*

| | Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

| 12.2*

| | Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

| 13.1 **

| | Certification of Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

| 13.2 **

| | Certification of Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

| 15.1*

| | Consent of Yingke Wuxi Law Firm

| 101*

| | The following financial statements from the Company’s Annual Report on Form 20-F for the fiscal year ended September 30, 2021, formatted in Inline XBRL: (i) Consolidated Balance Sheets, (ii) Consolidated Statements of Operations and Comprehensive Income, (iii) Consolidated Statements of Changes in Equity, (iv) Consolidated Statements of Cash Flows, and (v) Notes to Consolidated Financial Statements, tagged as blocks of text and including detailed tags

| 4.13 | | Securities Purchase Agreement dated December 30, 2022, by and between the Registrant and Streeterville Capital, LLC (incorporated herein by reference to Exhibit 10.1 to the Form 6-K (File No. 001-39978) filed with the Securities and Exchange Commission on January 3, 2023) | 4.14 | | Services Agreement with AA CORNERSTONE INC (incorporated herein by reference to Exhibit 10.1 to the Form 6-K (File No. 001-39978) filed with the Securities and Exchange Commission on March 10, 2023) | 4.15 | | Forbearance Agreement with Streeterville Capital, LLC dated November 29, 2023 (incorporated herein by reference to Exhibit 10.1 to the Form 6-K (File No. 001-39978) filed with the Securities and Exchange Commission on December 4, 2023) | 8.1* | | List of subsidiaries of the Registrant | 11.1 | | Code of Business Conduct and Ethics of the Registrant (incorporated herein by reference to Exhibit 99.1 to the registration statement on Form F‑1 (File No. 333‑239659), as amended, initially filed with the Securities and Exchange Commission on July 2, 2020) | 11.2* | | Insider Trading Policy of the Registrant | 12.1* | | Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | 12.2* | | Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | 13.1** | | Certification of Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | 13.2** | | Certification of Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | 15.1* | | Consent of Universal Law Offices of Hangzhou | 15.2* | | Consent of Enrome LLP | 15.3* | | Consent of Friedman LLP | 97.1* | | Compensation Recovery Policy of the Registrant | 101.INS* | | Inline XBRL Instance Document | 101.SCH* | | Inline XBRL Taxonomy Extension Schema Document | 101.CAL* | | Inline XBRL Taxonomy Extension Calculation Linkbase Document | 101.DEF* | | Inline XBRL Taxonomy Extension Definition Linkbase Document | 101.LAB* | | Inline XBRL Taxonomy Extension Label Linkbase Document | 101.PRE* | | Inline XBRL Taxonomy Extension Presentation Linkbase Document | 104* | | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

_____________________________ *

*

| Filed with this annual report on Form 20-F

| Filed with this annual report on Form 20‑F |

**

| Furnished with this annual report on Form 20-F

| ** | Furnished with this annual report on Form 20‑F |

| | 103 |

| Table of ContentsSIGNATURES

The registrant hereby certifies that it meets all of the requirements for filing on Form 20-F

|

SIGNATURES The registrant hereby certifies that it meets all of the requirements for filing on Form 20‑F and that it has duly caused and authorized the undersigned to sign this annual report on its behalf. | | | | CN ENERGY GROUP. INC. | | | | | | By:

| /s/ Kangbin Zheng

| | | Kangbin Zheng

| | | Chief Executive Officer, Director, and

| | | Chairman of the Board of Directors

| | | | Date: February 15, 2022

| | |

| By:

| /s/ Xinyang Wang

|

|

| 94

| Xinyang Wang | | | | Chief Executive Officer, Director, and | | | | Chairwoman of the Board of Directors | | | | | | Date: February 15, 2024 | | | |

CN ENERGY GROUP. INC. INDEX TO CONSOLIDATED FINANCIAL STATEMENTS TABLE OF CONTENTS CONTENTS | | PAGE(S) | | | | CONSOLIDATED FINANCIAL STATEMENTS | TABLE OF CONTENTS

|

| | | CONTENTS

| | | PAGE(S)

| |

| | CONSOLIDATED FINANCIAL STATEMENTS

|

| | |

| | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (PCAOB ID: 711)

|

| F-2

| |

| | CONSOLIDATED BALANCE SHEETS AS OF SEPTEMBER 30, 2021 AND 2020

|

| F-3

| |

| | CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME FOR THE FISCAL YEARS ENDED SEPTEMBER 30, 2021, 2020, AND 2019

|

| F-4

| |

| | CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY FOR THE FISCAL YEARS ENDED SEPTEMBER 30, 2021, 2020, AND 2019

|

| F-5

| |

| | CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE FISCAL YEARS ENDED SEPTEMBER 30, 2021, 2020, AND 2019

|

| F-6

| |

| | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

|

| F-7

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (PCAOB ID: 6907) | | F-2 | | | | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (PCAOB ID: 711) | | F-3 | | | | CONSOLIDATED BALANCE SHEETS AS OF SEPTEMBER 30, 2023 AND 2022 | | F-4 | | | | CONSOLIDATED STATEMENTS OF INCOME (LOSS) AND COMPREHENSIVE INCOME (LOSS) FOR THE FISCAL YEARS ENDED SEPTEMBER 30, 2023, 2022, AND 2021 | | F-5 | | | | CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY FOR THE FISCAL YEARS ENDED SEPTEMBER 30, 2023, 2022, AND 2021 | | F-6 | | | | CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE FISCAL YEARS ENDED SEPTEMBER 30, 2023, 2022, AND 2021 | | F-7 | | | | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | | F-8 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Shareholders and Board of Directors CN Energy Group. Inc. Opinion on the Financial Statements We have audited the accompanying consolidated balance sheets of CN Energy Group. Inc. and its subsidiaries (the “Company”) as of September 30, 2023 and 2022, the related consolidated statements of income (loss) and comprehensive income (loss), changes in shareholders’ equity, and cash flows for each of the years ended September 30, 2023 and 2022 and the related notes (collectively referred to as the “consolidated financial statements”). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company as of September 30, 2023 and 2022, and the results of its operations and its cash flows for each of the years ended September 30, 2023 and 2022, in conformity with accounting principles generally accepted in the United States of America (“US GAAP”). Basis for Opinion These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our audits in accordance with the standards of the PCAOB and in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audits provide a reasonable basis for our opinion. Emphasis of Matters Restatement adjustments for changes in share re-designation and share consolidation or reverse share split The consolidated financial statements of the Company as of September 30, 2021 were audited by other auditor. As described in note 21, the Company adjusted all shares and per share data periods presented for the shares re-designation and share consolidation or reverse share split. We audited the adjustments that were applied to restate the disclosure for share re-designation and share consolidation or reverse share split reflected in the September 30, 2022 and 2021 consolidated financial statements to retrospectively apply the effects of the share re-designation and share consolidation or reverse share split that occurred subsequent to the year ended September 30, 2021. However, we were not engaged to audit, review, or apply any procedures to the September 30, 2021 consolidated financial statements of the Company other than with respect to such adjustments and, accordingly, we do not express an opinion or any other form of assurance on the September 30, 2021 consolidated financial statements taken as a whole. We have served as the Company’s auditor since 2022. Singapore February 15, 2024 REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of CN Energy Group. Inc. Opinion on the Financial Statements We have audited, before the effects of the adjustments to retrospectively apply the change in accounting related to the share re-designation and share consolidation or reverse share split as described in Note 21, the accompanying consolidated balance sheets of CN Energy Group. Inc. and its subsidiaries (collectively, the “Company”) as of September 30, 2021 and 2020, and the related consolidated statements of income and comprehensive income, changes in shareholders’ equity, and cash flows of CN Energy Group. Inc. and its subsidiaries (collectively, the “Company”) for each of the three years in the periodyear ended September 30, 2021, and the related notes (collectively referred to as the “consolidated financial statements”). In our opinion, before the effects of share re-designation and share consolidation or reverse share split to restate all shares and per share data for all periods presented as described in Note 21, the consolidated financial statements present fairly, in all material respects, the financial position of the Company as of September 30, 2021 and 2020, and the results of its operations and its cash flows for each of the three years in the periodyear ended September 30, 2021, in conformity with accounting principles generally accepted in the United States of America. We were not engaged to audit, review or apply any procedures to adjustments to retrospectively apply the change in accounting related to the share re-designation and share consolidation or reverse share split as described in Note 21, accordingly, we do not express an opinion or any other form of assurance about whether such adjustments are appropriate and have been properly applied. Those adjustments were audited by other auditors. Basis for Opinion These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s consolidated financial statements based on our audits.audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our auditsaudit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the auditsaudit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our auditsaudit we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. Our auditsaudit included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our auditsaudit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audits provideaudit provides a reasonable basis for our opinion. /s/ Friedman LLP We have served as the Company’s auditor since 2018.from 2018 to 2022. New York, New York February 15, 2022

CN ENERGY GROUP. INC. CONSOLIDATED BALANCE SHEETS

| | | | | | | ASSETS | | | | | | | | | September 30, | | September 30, | | | 2021 | | 2020 | Current Assets: | | | | | | | Cash | | $ | 190,758 | | $ | 1,570,035 | Term deposit | | | 3,096,000 | | | — | Accounts receivable, net | | | 12,375,425 | | | 8,727,364 | Inventory | | | 1,116,613 | | | 2,809,584 | Advances to suppliers, net | | | 10,800,478 | | | 1,561,274 | Other receivables | | | 21,153,506 | | | — | Prepaid expenses and other current assets | | | 155,021 | | | 32,628 | Total current assets | | | 48,887,801 | | | 14,700,885 | | | | | | | | Property, plant and equipment, net | | | 14,285,557 | | | 14,294,703 | Prepayment for property and equipment | | | 3,781,844 | | | — | Intangible assets, net | | | 68,427 | | | 171,287 | Land use right, net | | | 574,587 | | | 557,179 | Right of use lease assets, net | | | 97,160 | | | 141,991 | Long-term deposits | | | 1,238,555 | | | 1,176,051 | Deferred offering costs | | | — | | | 385,193 | Deferred tax assets | | | 29,209 | | | 15,674 | Total Assets | | $ | 68,963,140 | | $ | 31,442,963 | | | | | | | | | | | | | | | LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | | | | | | Current Liabilities: | | | | | | | Short-term bank loans | | $ | 1,238,400 | | $ | 1,613,928 | Long-term bank loan, current | | | 264,393 | | | — | Accounts payable | | | 1,776,626 | | | 4,830,110 | Deferred revenue, current | | | 111,301 | | | 120,383 | Due to related parties | | | 1,426,631 | | | 187,062 | Taxes payable | | | 243,413 | | | 244,169 | Operating lease liabilities, current | | | 36,720 | | | 68,833 | Accrued expenses and other current liabilities | | | 545,632 | | | 639,125 | Total current liabilities | | | 5,643,116 | | | 7,703,610 | | | | | | | | Long-term bank loan, non-current | | | 22,033 | | | — | Deferred revenue, non-current | | | 489,439 | | | 555,725 | Operating lease liabilities, non-current | | | 32,351 | | | 65,586 | Deferred tax liabilities | | | 97,249 | | | — | Total liabilities | | | 6,284,188 | | | 8,324,921 | | | | | | | | Commitments and contingencies | | | | | | | | | | | | | | Shareholders’ Equity: | | | | | | | Ordinary shares, 0 par value, unlimited number of ordinary shares authorized, 20,319,276 and 10,000,000 ordinary shares issued and outstanding at September 30, 2021 and 2020, respectively | | | 52,980,825 | | | 14,005,621 | Convertible preferred shares, 0 par value, an unlimited number of convertible preferred shares authorized, NaN and 500,000 convertible preferred shares issued and outstanding at September 30, 2021 and 2020, respectively | | | — | | | 1,800,000 | Additional paid-in capital | | | 8,865,199 | | | 7,890,199 | Statutory reserves | | | 315,808 | | | 129,497 | Retained earnings | | | 394,556 | | | 259,507 | Accumulated other comprehensive income (loss) | | | 122,564 | | | (966,782) | Total Shareholders’ equity | | | 62,678,952 | | | 23,118,042 | | | | | | | | Total Liabilities and Shareholders’ Equity | | $ | 68,963,140 | | $ | 31,442,963 |

ASSETS | | | September 30, | | | September 30, | | | | 2023 | | | 2022 | | Current Assets: | | | | | | | Cash | | $ | 195,502 | | | $ | 18,046,872 | | Accounts receivable | | | 29,012,866 | | | | 18,764,549 | | Inventories | | | 2,655,233 | | | | 784,251 | | Advances to suppliers, net | | | 39,044,834 | | | | 18,262,520 | | Prepayment for an acquisition of a subsidiary | | | - | | | | 17,746,979 | | Due from a related party | | | - | | | | 116,250 | | Prepaid expenses and other current assets | | | 1,541,698 | | | | 495,344 | | Total current assets | | | 72,449,365 | | | | 74,216,765 | | | | | | | | | | | Property, plant, and equipment, net | | | 13,834,393 | | | | 14,538,686 | | Prepayment for property, plant and equipment | | | 3,606,708 | | | | 4,224,229 | | Intangible assets, net | | | 3,060 | | | | 11,913 | | Land use right, net | | | 6,653,666 | | | | 511,177 | | Right-of-use assets | | | 195,813 | | | | 314,339 | | Long-term deposits | | | 1,096,628 | | | | 1,124,763 | | Biological assets | | | 28,355,589 | | | | - | | Total Assets | | $ | 126,195,222 | | | $ | 94,941,872 | | | | | | | | | | | LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | | | Current Liabilities: | | | | | | | | | Short-term loans | | $ | 4,646,382 | | | $ | 3,711,253 | | Long-term loans, current portion | | | 548,245 | | | | 20,009 | | Convertible notes | | | 2,027,500 | | | | - | | Accounts payable | | | 12,565,401 | | | | 7,487,319 | | Deferred revenue, current | | | 80,866 | | | | 96,542 | | Proceeds from private placement | | | - | | | | 18,000,000 | | Due to related parties | | | 152,556 | | | | - | | Taxes payable | | | 83,190 | | | | 589,315 | | Lease liabilities | | | 31,602 | | | | 32,899 | | Prepayment from customers | | | 1,146,988 | | | | - | | Accrued expenses and other current liabilities | | | 1,160,540 | | | | 524,197 | | Total current liabilities | | | 22,524,707 | | | | 30,461,534 | | | | | | | | | | | Long-term loans, non-current portion | | | 34,266 | | | | 421,733 | | Deferred revenue, non-current | | | 121,299 | | | | 207,352 | | Lease liabilities | | | - | | | | 15,484 | | Deferred tax liabilities | | | 34,153 | | | | 53,443 | | Total liabilities | | | 22,632,988 | | | | 31,159,546 | | | | | | | | | | | Commitments and contingencies | | | | | | | | | | | | | | | | | | Shareholders' Equity: | | | | | | | | | Class A ordinary share, no par value, unlimited number of shares authorized; 2,285,826 and 668,755 shares issued and outstanding as of September 30, 2023 and 2022, respectively* | | | 101,922,676 | | | | 54,278,472 | | Class B ordinary share, no par value, unlimited number of shares authorized; 100,698 shares issued and outstanding as of September 30, 2023 and 2022.* | | | 4,231,055 | | | | 4,231,055 | | Additional paid-in capital | | | 8,865,199 | | | | 8,865,199 | | Statutory reserves | | | 526,217 | | | | 524,723 | | (Accumulated deficits) retained earnings | | | (3,211,885 | ) | | | 2,415,349 | | Accumulated other comprehensive loss | | | (8,771,028 | ) | | | (6,532,472 | ) | Total shareholders' equity | | | 103,562,234 | | | | 63,782,326 | | | | | | | | | | | Total Liabilities and Shareholders' Equity | | $ | 126,195,222 | | | $ | 94,941,872 | |

* Retrospectively restated for effect of share re-designation on July 22, 2022 and 1-for-30 reverse share split on January 18, 2024 (see Note 21). The accompanying notes are an integral part of these consolidated financial statements.

CN ENERGY GROUP. INC. CONSOLIDATED STATEMENTS OF INCOME (LOSS) AND COMPREHENSIVE INCOME (LOSS)

| | | | | | | | | | | | For the Years Ended September 30, | | | 2021 | | 2020 | | 2019 | | | | | | | | | | | Revenues | | $ | 19,846,921 | | $ | 12,476,314 | | $ | 10,893,164 | | | | | | | | | | | Cost of revenues | | | (17,230,306) | | | (9,117,125) | | | (7,920,879) | | | | | | | | | | | Gross profit | | | 2,616,615 | | | 3,359,189 | | | 2,972,285 | | | | | | | | | | | Operating expenses: | | | | | | | | | | Selling expenses | | | 198,443 | | | 148,137 | | | 332,621 | General and administrative expenses | | | 1,449,267 | | | 920,062 | | | 857,765 | Research and development expenses | | | 385,525 | | | 287,299 | | | 593,992 | Total operating expenses | | | 2,033,235 | | | 1,355,498 | | | 1,784,378 | | | | | | | | | | | Income from operations | | | 583,380 | | | 2,003,691 | | | 1,187,907 | | | | | | | | | | | Other income (expenses): | | | | | | | | | | Interest income (expense) | | | 191,227 | | | (27,691) | | | (6,553) | Government subsidy income | | | 1,079,348 | | | 470,865 | | | 587,958 | Other income (expenses) | | | (120,246) | | | 68,024 | | | 7,311 | Total other income, net | | | 1,150,329 | | | 511,198 | | | 588,716 | | | | | | | | | | | Income before income taxes | | | 1,733,709 | | | 2,514,889 | | | 1,776,623 | | | | | | | | | | | Provision for income taxes | | | 437,349 | | | 170,119 | | | 108,811 | | | | | | | | | | | Net income | | | 1,296,360 | | | 2,344,770 | | | 1,667,812 | | | | | | | | | | | Deemed dividend on conversion of Convertible Preferred Shares to Common Shares | | | (975,000) | | | — | | | — | | | | | | | | | | | Net income attributable to Shareholders | | $ | 321,360 | | $ | 2,344,770 | | $ | 1,667,812 | | | | | | | | | | | | | | | | | | | | | Net income | | $ | 1,296,360 | | $ | 2,344,770 | | $ | 1,667,812 | | | | | | | | | | | Other comprehensive income (loss): | | | | | | | | | | Foreign currency translation gain (loss) | | | 1,089,346 | | | 977,659 | | | (712,400) | | | | | | | | | | | Comprehensive income | | $ | 2,385,706 | | $ | 3,322,429 | | $ | 955,412 | | | | | | | | | | | Earnings per share – basic and diluted | | $ | 0.02 | | $ | 0.23 | | $ | 0.17 | | | | | | | | | | | Weighted average shares outstanding – basic and diluted | | | 15,197,508 | | | 10,000,000 | | | 10,000,000 |

| | For the Fiscal Years Ended September 30, | | | | 2023 | | | 2022 | | | 2021 | | | | | | | | | | | | Revenue | | $ | 57,899,096 | | | $ | 40,205,586 | | | $ | 19,846,921 | | Cost of revenue | | | (57,110,446 | ) | | | (36,563,945 | ) | | | (17,230,306 | ) | Gross profit | | | 788,650 | | | | 3,641,641 | | | | 2,616,615 | | Operating expenses: | | | | | | | | | | | | | Allowance for inventory | | | (195,355 | ) | | | - | | | | - | | Selling expenses | | | (53,008 | ) | | | (89,312 | ) | | | (198,443 | ) | General and administrative expenses | | | (5,730,147 | ) | | | (2,060,122 | ) | | | (1,449,267 | ) | Research and development expenses | | | (988,559 | ) | | | (1,032,378 | ) | | | (385,525 | ) | Total operating expenses | | | 6,967,069 | | | | (3,181,812 | ) | | | (2,033,235 | ) | | | | | | | | | | | | | | (Loss) income from operations | | | (6,178,419 | ) | | | 459,829 | | | | 583,380 | | | | | | | | | | | | | | | Other income (expenses): | | | | | | | | | | | | | Interest expense | | | (712,490 | ) | | | (157,221 | ) | | | - | | Government subsidy income | | | 925,983 | | | | 1,636,491 | | | | 1,079,348 | | Interest income | | | 489 | | | | 702,872 | | | | 191,227 | | Other income (expenses) | | | 116,575 | | | | (97,990 | ) | | | (120,246 | ) | Total other income, net | | | 330,557 | | | | 2,084,152 | | | | 1,150,329 | | | | | | | | | | | | | | | (Loss) income before income taxes | | | (5,847,862 | ) | | | 2,543,981 | | | | 1,733,709 | | Income tax benefits/(expenses) | | | 222,122 | | | | (314,273 | ) | | | (437,349 | ) | Net (loss) income | | | (5,625,740 | ) | | | 2,229,708 | | | | 1,296,360 | | Deemed dividend on conversion of Convertible Preferred Shares to Ordinary Shares | | $ | - | | | | - | | | | (975,000 | ) | Net income (loss) attributable to Shareholders | | $ | (5,625,740 | ) | | $ | 2,229,708 | | | $ | 321,360 | | | | | | | | | | | | | | | Net (loss) income | | | (5,625,740 | ) | | | 2,229,708 | | | | 1,296,360 | | Other comprehensive (loss) income: | | | | | | | | | | | | | Foreign currency translation (loss) gain | | $ | (2,238,556 | ) | | | (6,655,036 | ) | | | 1,089,346 | | Comprehensive (loss) income | | $ | (7,864,296 | ) | | $ | (4,425,328 | ) | | $ | 2,385,706 | | | | | | | | | | | | | | | (Loss) earnings per share* | | $ | | | | | | | | | | | Basic | | $ | (3.12 | ) | | $ | 3.09 | | | $ | 2.56 | | Diluted | | $ | (3.12 | ) | | $ | 3.09 | | | $ | 2.56 | | Weighted average shares outstanding* | | | | | | | | | | | | | Basic | | | 1,802,948 | | | | 721,993 | | | | 506,584 | | Diluted | | $ | 2,267,082 | | | | 721,993 | | | | 506,584 | |

* Retrospectively restated for effect of share re-designation on July 22, 2022 and 1-for-30 reverse share split on January 18, 2024 (see Note 21). The accompanying notes are an integral part of these consolidated financial statements.

CN ENERGY GROUP. INC. CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY FOR THE FISCAL YEARS ENDED SEPTEMBER 30, 2021, 20202023, 2022, AND 20192021

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Accumulated | | | | | | | | | | | | | | | | | | | | | | Retained | | Other | | | | | | | | | | | Preferred | | Additional | | | | | Earnings | | Comprehensive | | Total | | | Ordinary Shares | | Shares | | Paid-in | | Statutory | | (Accumulated | | Income | | Shareholders’ | | | Shares | | Amount | | Shares | | Amount | | Capital | | Reserves | | Deficit) | | (Loss) | | Equity | | | | | | | | | | | | | | | | | | | | | | | | | | | Balance at September 30, 2018 | | 10,000,000 | | $ | 14,005,621 | | — | | $ | — | | $ | 7,890,199 | | $ | — | | $ | (3,623,578) | | $ | (1,232,041) | | $ | 17,040,201 | | | | | | | | | | | | | | | | | | | | | | | | | | | Net income for the year | | — | | | — | | — | | | — | | | — | | | — | | | 1,667,812 | | | — | | | 1,667,812 | Foreign currency translation loss | | — | | | — | | — | | | — | | | — | | | — | | | — | | | (712,400) | | | (712,400) | | | | | | | | | | | | | | | | | | | | | | | | | | | Balance at September 30, 2019 | | 10,000,000 | | $ | 14,005,621 | | — | | $ | — | | $ | 7,890,199 | | $ | — | | $ | (1,955,766) | | $ | (1,944,441) | | $ | 17,995,613 | | | | | | | | | | | | | | | | | | | | | | | | | | | Issuance of convertible preferred shares | | — | | | — | | 500,000 | | | 1,800,000 | | | — | | | — | | | — | | | — | | | 1,800,000 | Net income for the year | | — | | | — | | — | | | — | | | — | | | — | | | 2,344,770 | | | — | | | 2,344,770 | Appropriation to statutory reserve | | | | | | | | | | | | | | | | 129,497 | | | (129,497) | | | | | | — | Foreign currency translation gain | | — | | | — | | — | | | — | | | — | | | — | | | — | | | 977,659 | | | 977,659 | | | | | | | | | | | | | | | | | | | | | | | | | | | Balance at September 30, 2020 | | 10,000,000 | | $ | 14,005,621 | | 500,000 | | $ | 1,800,000 | | $ | 7,890,199 | | $ | 129,497 | | $ | 259,507 | | $ | (966,782) | | $ | 23,118,042 | | | | | | | | | | | | | | | | | | | | | | | | | | | Issuance of Ordinary Shares, net of offering expenses | | 5,750,000 | | | 20,135,204 | | — | | | — | | | — | | | — | | | — | | | — | | | 20,135,204 | Preferred Shares converted into Ordinary Shares | | 500,000 | | | 1,800,000 | | (500,000) | | | (1,800,000) | | | — | | | — | | | — | | | — | | | — | Issuance of Ordinary Shares for private placement, net | | 4,000,000 | | | 17,040,000 | | — | | | — | | | — | | | — | | | — | | | — | | | 17,040,000 | Exercise of warrants | | 69,276 | | | — | | — | | | — | | | — | | | — | | | — | | | — | | | — | Deemed dividend on conversion of Convertible Preferred Shares to Ordinary Shares | | — | | | — | | — | | | — | | | 975,000 | | | — | | | (975,000) | | | — | | | — | Net income for the year | | — | | | — | | — | | | — | | | — | | | — | | | 1,296,360 | | | — | | | 1,296,360 | Appropriation to statutory reserve | | | | | | | | | | | | | | | | 186,311 | | | (186,311) | | | — | | | — | Foreign currency translation gain | | — | | | — | | — | | | — | | | — | | | — | | | — | | | 1,089,346 | | | 1,089,346 | | | | | | | | | | | | | | | | | | | | | | | | | | | Balance at September 30, 2021 | | 20,319,276 | | $ | 52,980,825 | | — | | $ | — | | $ | 8,865,199 | | $ | 315,808 | | $ | 394,556 | | $ | 122,564 | | $ | 62,678,952 |

| | Ordinary Shares* | | | | | | | | | | | | | | | Retained | | | Accumulated Other | | | | | | | Class A Ordinary Shares | | | Class B Ordinary Shares | | | Preferred Shares | | | Additional Paid-in | | | Statutory | | | Earnings (Accumulated | | | Comprehensive Income | | | Total Shareholders' | | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Reserves | | | Deficit) | | | (Loss) | | | Equity | | Balance as of September 30, 2020 | | | 213,967 | | | $ | 8,990,479 | | | | 119,365 | | | $ | 5,015,142 | | | $ | 500,000 | | | $ | 1,800,000 | | | $ | 7,890,199 | | | $ | 129,497 | | | $ | 259,507 | | | $ | (966,782 | ) | | $ | 23,118,042 | | Issuance of Ordinary Shares, net of offering expenses | | | 191,667 | | | | 20,135,204 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 20,135,204 | | Preferred Shares converted into Ordinary Shares | | | 16,667 | | | | 1,800,000 | | | | - | | | | - | | | | (500,000 | ) | | | (1,800,000 | ) | | | - | | | | - | | | | - | | | | - | | | | - | | Issuance of Ordinary Shares for private placement, net | | | 133,333 | | | | 17,040,000 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 17,040,000 | | Exercise of warrants | | | 2,309 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | Deemed dividend on conversion of Convertible Preferred Shares to Ordinary Shares | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 975,000 | | | | - | | | | (975,000 | ) | | | - | | | | - | | Net income for the year | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,296,360 | | | | - | | | | 1,296,360 | | Appropriation to statutory reserve | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 186,311 | | | | (186,311 | ) | | | - | | | | - | | Foreign currency translation gain | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,089,346 | | | | 1,089,346 | | Balance as of September 30, 2021 | | | 557,943 | | | $ | 47,965,683 | | | | 119,365 | | | $ | 5,015,142 | | | | - | | | | - | | | $ | 8,865,199 | | | $ | 315,808 | | | $ | 394,556 | | | $ | 122,564 | | | $ | 62,678,952 | | Class B Ordinary Shares converted into Class A Ordinary Shares | | | 18,667 | | | | 784,087 | | | | (18,667 | ) | | | (784,087 | ) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | Issuance of Ordinary Shares for private placement, net | | | 92,145 | | | | 5,528,702 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 5,528,702 | | Net income for the year | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 2,229,708 | | | | - | | | | 2,229,708 | | Appropriation to statutory reserve | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 208,915 | | | | (208,915 | ) | | | - | | | | - | | Foreign currency translation loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (6,655,036 | ) | | | (6,655,036 | ) | Balance as of September 30, 2022 | | | 668,755 | | | $ | 54,278,472 | | | | 100,698 | | | $ | 4,231,055 | | | | - | | | $ | - | | | $ | 8,865,199 | | | $ | 524,723 | | | $ | 2,415,349 | | | $ | (6,532,472 | ) | | $ | 63,782,326 | | Issuance of ordinary shares for private placement, net | | | 350,467 | | | | 17,975,000 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 17,975,000 | | Issuance of ordinary shares for acquisition | | | 293,984 | | | | 18,373,771 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 18,373,771 | | Issuance of ordinary shares and warrants, net | | | 606,057 | | | | 8,945,433 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 8,945,433 | | Issuance of ordinary shares for services | | | 66,667 | | | | 1,100,000 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,100,000 | | Issuance of ordinary shares for convertible bond redemption | | | 299,896 | | | | 1,250,000 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,250,000 | | Net loss for the year | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (5,625,740 | ) | | | - | | | | (5,625,740 | ) | Appropriation to statutory reserve | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,494 | | | | (1,494 | ) | | | - | | | | - | | Foreign currency translation gain | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (2,238,556 | ) | | | (2,238,556 | ) | Balance as of September 30, 2023 | | | 2,285,826 | | | $ | 101,922,676 | | | | 100,698 | | | $ | 4,231,055 | | | | - | | | | - | | | $ | 8,865,199 | | | $ | 526,217 | | | $ | (3,211,885 | ) | | $ | (8,771,028 | ) | | $ | 103,562,234 | |

* Retrospectively restated for effect of share re-designation on July 22, 2022 and 1-for-30 reverse share split on January 18, 2024 (see Note 21). The accompanying notes are an integral part of these consolidated financial statements.

CN ENERGY GROUP. INC. CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | | | | | | | | | For the Years Ended September 30, | | | 2021 | | 2020 | | 2019 | Cash flows from operating activities: | | | | | | | | | | Net income | | $ | 1,296,360 | | $ | 2,344,770 | | $ | 1,667,812 | Adjustments to reconcile net income to net cash | | | | | | | | | | provided by (used in) operating activities: | | | | | | | | | | Depreciation expense | | | 1,050,924 | | | 916,386 | | | 942,615 | Loss on sale of property and equipment | | | 68,155 | | | — | | | — | Amortization of operating lease right-of-use assets | | | 51,972 | | | 8,814 | | | — | Amortization of intangible assets and land use right | | | 123,205 | | | 114,091 | | | 115,251 | Changes in bad debt allowances | | | 39,953 | | | 56,100 | | | 4,130 | Deferred income taxes | | | 83,893 | | | (8,415) | | | (1,916) | Amortization of deferred revenue | | | (110,438) | | | 40,105 | | | (104,591) | Changes in operating assets and liabilities: | | | | | | | | | | Accounts receivable | | | (3,159,543) | | | (4,216,674) | | | (1,290,889) | Inventory | | | 1,828,011 | | | (231,162) | | | 104,029 | Advances to suppliers | | | (9,125,201) | | | 250,028 | | | (256,221) | Prepaid expenses and other current assets | | | (278,122) | | | (425) | | | 2,923,310 | Accounts payable | | | (3,284,531) | | | (1,060,649) | | | (4,111,721) | Operating lease liabilities | | | (71,929) | | | (16,167) | | | — | Taxes payable | | | (13,627) | | | 87,713 | | | (21,239) | Accrued expenses and other current liabilities | | | (92,151) | | | (103,427) | | | 154,317 | Net cash provided by (used in) operating activities | | | (11,593,069) | | | (1,818,912) | | | 124,887 | | | | | | | | | | | Cash flows from investing activities: | | | | | | | | | | Other receivables | | | (20,739,840) | | | — | | | — | Prepayment for purchase of property, plant and equipment | | | (3,752,528) | | | — | | | — | Purchase of property, plant and equipment | | | (434,834) | | | (14,693) | | | (886,721) | Proceeds from sale of property, plant and equipment | | | 77,527 | | | — | | | — | Purchase of term deposit | | | (3,072,000) | | | — | | | — | Purchase of intangible assets | | | — | | | (4,663) | | | — | Purchase of land use right | | | — | | | — | | | (573,398) | Long-term deposits | | | — | | | (856,475) | | | 23,653 | Proceeds from notes receivable | | | — | | | — | | | 97,318 | Proceeds from loans to related parties | | | — | | | — | | | 148,621 | Net cash used in investing activities | | | (27,921,675) | | | (875,831) | | | (1,190,527) | | | | | | | | | | | Cash flows from financing activities: | | | | | | | | | | Deferred offering costs | | | — | | | (26,929) | | | — | Issuance of convertible preferred shares | | | — | | | 1,800,000 | | | — | Proceeds from the Initial Public Offering | | | 23,000,000 | | | — | | | — | Direct costs disbursed from Initial Public Offering proceeds | | | (2,377,450) | | | — | | | — | Proceeds from private placement | | | 18,000,000 | | | — | | | — | Direct costs disbursed from private placement proceeds | | | (960,000) | | | — | | | — | Repayment of related parties loans | | | — | | | (433,769) | | | 502,244 | Proceeds from related parties loans | | | 534,226 | | | — | | | — | Repayment of short-term bank loans | | | (1,689,600) | | | (710,756) | | | — | Proceeds from short-term bank loans | | | 1,231,872 | | | 1,995,254 | | | 288,027 | Proceeds from long-term bank loan | | | 284,206 | | | — | | | — | Net cash provided by financing activities | | | 38,023,254 | | | 2,623,800 | | | 790,271 | | | | | | | | | | | Effect of exchange rate changes on cash | | | 112,213 | | | 80,643 | | | (61,098) | | | | | | | | | | | Net increase (decrease) in cash | | | (1,379,277) | | | 9,700 | | | (336,467) | | | | | | | | | | | Cash, beginning of year | | | 1,570,035 | | | 1,560,335 | | | 1,896,802 | | | | | | | | | | | Cash, end of year | | $ | 190,758 | | $ | 1,570,035 | | $ | 1,560,335 | | | | | | | | | | | Supplemental disclosure information: | | | | | | | | | | Cash paid for income tax | | $ | 387,595 | | $ | 93,086 | | $ | 15,180 | Cash paid for interest | | $ | 58,703 | | $ | 27,873 | | $ | 6,730 | | | | | | | | | | | Supplemental non-cash activities: | | | | | | | | | | Accrued deferred offering costs | | $ | — | | $ | 34,650 | | $ | 189,308 | Payment of professional fees funded by related party loans | | $ | — | | $ | 351,121 | | $ | — | Deferred offering costs funded by a related party through related party loans | | $ | 487,346 | | $ | 8,142 | | $ | 125,000 | Accounts payable related to construction in progress | | $ | — | | $ | 1,729,261 | | $ | 2,118,884 | Right of use assets obtained in exchange for operating lease obligations | | $ | — | | $ | 146,684 | | $ | — | Deemed dividend on conversion of Convertible Preferred Shares to Ordinary Shares | | $ | 975,000 | | $ | — | | $ | — |

| | For the Fiscal Years Ended September 30, | | | | 2023 | | | 2022 | | | 2021 | | Cash flows from operating activities: | | | | | | | | | | Net (loss) income | | $ | (5,625,740 | ) | | $ | 2,229,708 | | | $ | 1,296,360 | | Adjustments to reconcile net (loss) income to net cash | | | | | | | | | | | | | (used in) provided by operating activities: | | | | | | | | | | | | | Allowance for accounts receivable | | | 179,562 | | | | 358,218 | | | | 39,953 | | Allowance for advances to suppliers | | | (207,668 | ) | | | 136,966 | | | | - | | Allowance for prepaid expenses and other current assets | | | (3,616 | ) | | | 2,213 | | | | - | | Allowance for inventories | | | 195,335 | | | | - | | | | - | | Depreciation expenses | | | 1,564,673 | | | | 1,365,830 | | | | 1,050,924 | | Loss on disposal of property, plant and equipment | | | 536 | | | | 42 | | | | 68,155 | | Amortization of operating lease right-of-use assets | | | 114,472 | | | | 106,011 | | | | 51,972 | | Amortization of intangible assets and land use right | | | 207,348 | | | | 65,852 | | | | 123,205 | | Amortization of biological assets | | | 873,358 | | | | - | | | | - | | Deferred income taxes | | | (961,506 | ) | | | (9,033 | ) | | | 83,893 | | Amortization of deferred revenue | | | (97,366 | ) | | | (261,533 | ) | | | (110,438 | ) | Amortization of debts issuance costs | | | 277,500 | | | | - | | | | - | | Issuance of ordinary shares for services | | | 1,100,000 | | | | - | | | | - | | Changes in operating assets and liabilities: | | | | | | | | | | | | | Accounts receivable | | | (11,266,039 | ) | | | (8,503,455 | ) | | | (3,159,543 | ) | Inventories | | | (2,151,007 | ) | | | 248,675 | | | | 1,828,011 | | Advances to suppliers | | | (21,761,492 | ) | | | (9,286,781 | ) | | | (9,125,201 | ) | Prepaid expenses and other current assets | | | (295,191 | ) | | | (384,367 | ) | | | (278,122 | ) | Accounts payable | | | 5,446,546 | | | | 6,357,128 | | | | (3,284,531 | ) | Lease liabilities | | | (16,107 | ) | | | (366,239 | ) | | | (71,929 | ) | Taxes payable | | | (508,292 | ) | | | 398,560 | | | | (13,627 | ) | Accrued expenses and other current liabilities | | | 2,769,703 | | | | 27,586 | | | | (92,151 | ) | Net cash used in operating activities | | | (30,164,971 | ) | | | (7,514,619 | ) | | | (11,593,069 | ) | | | | | | | | | | | | | | Cash flows from investing activities: | | | | | | | | | | | | | Other receivables | | | (769,875 | ) | | | 20,790,311 | | | | (20,739,840 | ) | Prepayment to acquire a subsidiary | | | - | | | | (17,746,979 | ) | | | - | | Prepayment for purchase of property, plant, and equipment | | | - | | | | (1,421,646 | ) | | | (3,752,528 | ) | Purchase of property, plant, and equipment | | | (683,392 | ) | | | (2,493,448 | ) | | | (434,834 | ) | Proceeds from sale of property, plant, and equipment | | | - | | | | - | | | | 77,527 | | Term deposits | | | - | | | | 3,042,843 | | | | (3,072,000 | ) | Acquisition of a subsidiary, net of cash | | | 613 | | | | - | | | | - | | Net cash (used in) provided by investing activities | | | (1,452,654 | ) | | | 2,171,081 | | | | (27,921,675 | ) | | | | | | | | | | | | | | Cash flows from financing activities: | | | | | | | | | | | | | Proceeds from the Initial Public Offering | | | - | | | | - | | | | 23,000,000 | | Direct costs disbursed from Initial Public Offering proceeds | | | - | | | | - | | | | (2,377,450 | ) | Proceeds from private placements | | | - | | | | 18,000,000 | | | | - | | Proceeds from issuance of shares and warrants | | | 8,945,433 | | | | 5,528,702 | | | | 18,000,000 | | Proceeds from convertible notes | | | 3,000,000 | | | | - | | | | (960,000 | ) | Repayment of related-party loans | | | - | | | | (2,000,295 | ) | | | - | | Proceeds from related-party loans | | | 266,739 | | | | 414,814 | | | | 534,226 | | Repayment of bank loans | | | (4,578,329 | ) | | | (2,922,341 | ) | | | (1,689,600 | ) | Proceeds from bank loans | | | 5,798,704 | | | | 5,918,330 | | | | 1,231,872 | | Proceeds from long-term bank loan | | | - | | | | - | | | | 284,206 | | Net cash provided by financing activities | | | 13,432,547 | | | | 24,939,210 | | | | 38,023,254 | | | | | | | | | | | | | | | Effect of exchange rate changes on cash | | | 333,708 | | | | (1,739,558 | ) | | | 112,213 | | | | | | | | | | | | | | | Net (decrease) increase in cash | | | (17,851,370 | ) | | | 17,856,114 | | | | (1,379,277 | ) | Cash, beginning of year | | | 18,046,872 | | | | 190,758 | | | | 1,570,035 | | Cash, end of year | | $ | 195,502 | | | $ | 18,046,872 | | | $ | 190,758 | | | | | | | | | | | | | | | Supplemental disclosure information: | | | | | | | | | | | | | Cash paid for income tax | | $ | 28,764 | | | $ | 71,849 | | | $ | 387,595 | | Cash paid for interest | | $ | 241,484 | | | $ | 45,218 | | | $ | 58,703 | | | | | | | | | | | | | | | Supplemental non-cash activities: | | | | | | | | | | | | | Issuance of shares for acquisition | | | 18,373,771 | | | | — | | | | — | | Lease liabilities arising from obtaining right-of-use assets | | $ | 1,156 | | | $ | 2,866 | | | | — | | Deferred offering costs funded by a related party through related party loans | | | | | | | | | | $ | 487,346 | | Deemed dividend on conversion of Convertible Preferred Shares to Ordinary Shares | | | — | | | | — | | | $ | 975,000 | |

The accompanying notes are an integral part of these consolidated financial statements.

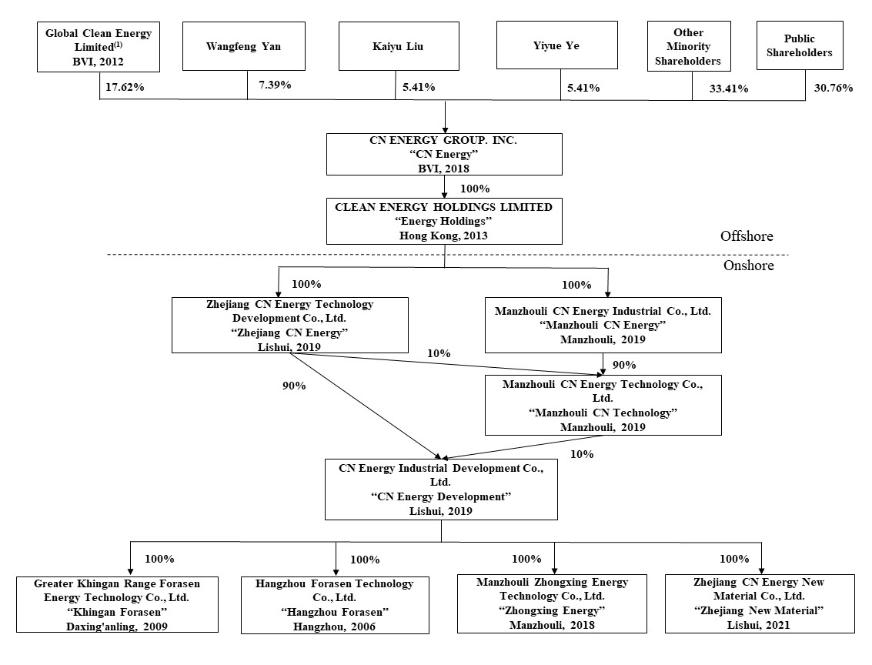

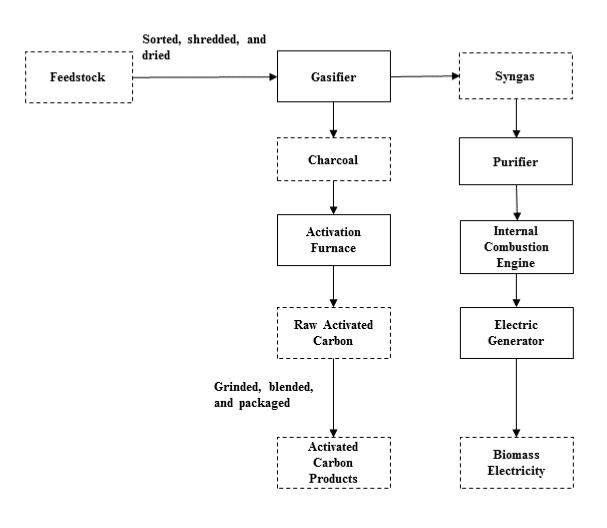

Note 1 – Organization and nature of business CN ENERGY GROUP. INC. (“CN Energy”) is a holding company incorporated under the laws of the British Virgin Islands on November 23, 2018. CN Energy, through its subsidiaries (collectively, the “Company”), is a manufacturermanufactures and supplier ofsupplies wood-based activated carbon that is primarily used in pharmaceutical manufacturing, industrial manufacturing, water purification, environmental protection, and food and beverage production (“Activated Carbon Production”), and a producer ofproduces biomass electricity generated in the process of producing activated carbon (“Biomass Electricity Production”). Reorganization In connection with its initial public offering, the Company undertook a reorganization of its legal structure (the “Reorganization”). The Reorganization involved: (1) the incorporation of CN Energy, a British Virgin Islands holding company; (2) the incorporation of Clean Energy Holdings Limited (“Energy Holdings”), a Hong Kong holding company; (3) the incorporation of Zhejiang CN Energy Technology Development Co., Ltd. (“Zhejiang CN Energy”) and Manzhouli CN Energy Industrial Co., Ltd. (“Manzhouli CN Energy”), two new wholly foreign-owned enterprises (“WFOE”) formed by Energy Holdings under the laws of the People’s Republic of China (“China” or the “PRC”); (4) the incorporation of Manzhouli CN Energy Technology Co., Ltd. (“Manzhouli CN Technology”), a PRC company, of which 90% of the equity interests are owned by Manzhouli CN Energy, and the remaining 10% by Zhejiang CN Energy; (5) the incorporation of CN Energy Industrial Development Co., Ltd. (“CN Energy Development”), a PRC company, of which 70% of the equity interests are owned by Manzhouli CN Technology and the remaining 30% by Zhejiang CN Energy; (6) the acquisition of 100% of the equity interests of Greater Khingan Range Forasen Energy Technology Co., Ltd. (“Khingan Forasen”) by CN Energy Development; and (7) the issuance of 10,000,000 ordinary shares of CN Energy (reflecting an approximate or rounded 71.62-for-171.62‑for‑1 forward split of the Company’s ordinary shares on April 20, 2020) to the original shareholders of Khingan Forasen. In relation to the Reorganization, a series of agreements were signed among CN Energy, the original shareholders of Khingan Forasen, CN Energy Development, and offshore holding companies controlled by the original shareholders of Khingan Forasen on August 12, 2019 and August 28, 2019. All share amounts and per share amounts have been presented giving effect to the forward split. The Company has retroactively restated all shares and per share data for all the periods presented. In accordance with Accounting Standards Codification (“ASC”) 805-50-25,805‑50‑25, the Reorganization has been accounted for as a recapitalization among entities under common control since the same shareholders controlled all these entities prior to the Reorganization. The consolidation of CN Energy and its subsidiaries has been accounted for at historical cost and prepared on the basis as if the aforementioned transactions had become effective as of the beginning of the first period presented in the accompanying consolidated financial statements. Results of operations for the period presented comprise those of the previously separate entities combined from the beginning of the period to the end of the period. By eliminating the effects of intra-entity transactions in determining the results of operations for the period before the Reorganization, those results will be on substantially the same basis as the results of operations for the period after the date of Reorganization. The effects of intra-entity transactions on current assets, current liabilities, revenue, and cost of sales for periods presented and on retained earnings (accumulated deficit) at the beginning of the periods presented are eliminated to the extent possible. Furthermore, ASC 805-50-45-5805‑50‑45‑5 indicates that the financial statements and financial information presented for prior years also shall be retrospectively adjusted to furnish comparative information. In May and June 2021, the Company conducted another reorganization in order to simplify its corporate structure and make use of supportive government policies. The reorganization consisted of (i) the transfer of 60% of the equity interests in CN Energy Development from Manzhouli CN Technology to Zhejiang CN Energy, (ii) the transfer of 100% of the equity interests in Manzhouli Zhongxing Energy Technology Co., Ltd. (“Zhongxing Energy”) from Khingan Forasen to CN Energy Development, (iii) the transfer of 100% of the equity interests in Hangzhou Forasen Technology Co., Ltd. (“Hangzhou Forasen”) from Khingan Forasen to CN Energy Development, and (iv) the formation of Zhejiang CN Energy New Material Co., Ltd. (“Zhejiang New Material”), a PRC company wholly owned by CN Energy Development.

Note 1 – Organization and nature of business (Continued)

Reorganization (Continued) CN Energy, the ultimate holding company, currently owns 100% of the equity interests of CN Energy Development, which in turn owns 100% of the equity interests of Khingan Forasen, Hangzhou Forasen, Zhongxing Energy, and Zhejiang New Material. Upon

On March 31, 2022, CN Energy USA Inc. (“CN Energy USA”) was incorporated under the completionlaws of the Reorganizations mentioned above,State of Delaware, the United States of America. CN Energy owns 100% of the equity interests in CN Energy USA. On April 8, 2022, Zhoushan Xinyue Trading Co., Ltd (“Zhoushan Trading”) was incorporated under the laws of the PRC. Hangzhou Forasen owns 100% of the equity interests in Zhoushan Trading. On April 13, 2022, Ningbo Nadoutong Trading Co., Ltd (“Ningbo Trading”) was incorporated under the laws of the PRC. CN Energy Development owns 100% of the equity interests in Ningbo Trading. On October 11, 2022, Zhejiang Yongfeng New Material Technology Co., Ltd. (“Zhejiang Yongfeng New Material”) was incorporated under the laws of the PRC. Hangzhou Forasen owns 100% of the equity interests in Zhejiang Yongfeng New Material. On November 11, 2022, CN Energy completed an acquisition of MZ Mining International Co., Ltd (“MZ HK”), a Hong Kong company that wholly owns MZ Pintai Mining (Zhejiang) Co., Ltd (“MZ Pintai”), which is a Chinese company that wholly owns Yunnan Yuemu Agriculture and Forestry Technology Co., Ltd (“Yunnan Yuemu”), pursuant to an equity transfer agreement (the “Equity Transfer Agreement”) dated September 30, 2022 with Shenzhen Xiangfeng Trading Co., Ltd. (the “Seller”). The Seller is independent from all directors and officers of CN Energy, and the Company itself. Pursuant to the Equity Transfer Agreement, the Seller first transferred 100% of its equity interests in Yunnan Honghao Forestry Development Co., Ltd. (“Yunnan Honghao”), a wholly owned subsidiary of the Seller, to Yunnan Yuemu, and the Seller then sold and transferred, and CN Energy purchased and acquired, 100% of its equity interests in MZ HK for a consideration of $17,706,575.88 and the issuance of 8,819,520 Class A ordinary shares of CN Energy, having a value of $18,373,771, delivered to the Seller and its designees. Currently, CN Energy has subsidiaries in countries and jurisdictions including the PRC, Hong Kong, and the British Virgin Islands.Islands, and the State of Delaware. Details of the subsidiaries of the CompanyCN Energy are set out below:

| | | | | | | | | | |

|

| Date of

|

| Place of

|

| % of

|

|

| Name of Entity |

| Incorporation |

| Incorporation |

| Ownership |

|

| Principal Activities | | CN Energy |

| November 23, 2018 | | British Virgin Islands | | Parent | | | Holding Companycompany | | Energy Holdings |

| August 29, 2013 | | Hong Kong, China | | 100

| %100%

| | | Holding Companycompany | | Zhejiang CN Energy |

| January 14, 2019 | | Zhejiang, China | | 100

| %100%

| | | Holding Companycompany | | Manzhouli CN Energy |

| January 24, 2019 | | Inner Mongolia, China | | 100

| %100%

| | | Holding Companycompany | | Manzhouli CN Technology |

| June 10,201910, 2019 | | Inner Mongolia, China | | 100

| %100%

| | | Holding Companycompany | | CN Energy Development |

| April 18, 2019 | | Zhejiang, China | | 100

| %100%

| | | Holding Companycompany | | Khingan Forasen |

| March 5,20095, 2009 | | Heilongjiang, China | | 100

| %100%

| | | Produces and distributes activated carbon and biomass electricity | | Hangzhou Forasen |

| March 16,200616, 2006 | | Zhejiang, China | | 100

| %100%

| | | Distributes activated carbon products | | Zhongxing Energy |

| May 21,201821, 2018 | | Inner Mongolia, China | | 100

| %100%

| | | Expected to produceProduce activated carbon and steam for heating in the future

| | Zhejiang New Material |

| May 24, 2021 | | Zhejiang, China | | 100

| %100%

| | | Expected to produceProduce and salesell wading activated carbon in the future

| | CN Energy USA | | March 31, 2022 | | Delaware, U.S. | | | 100% | | | Investment, consultation and trading, inactive | | Zhoushan Trading | | April 8, 2022 | | Zhejiang, China | | | 100% | | | Trading | | Ningbo Trading | | April 13, 2022 | | Zhejiang, China | | | 100% | | | Trading | | Zhejiang Yongfeng New Material | | October 11, 2022 | | Zhejiang, China | | | 100% | | | Trading | | MZ HK | | December 6, 2018 | | Hong Kong, China | | | 100% | | | Holding company | | MZ Pintai | | January 22, 2019 | | Zhejiang, China | | | 100% | | | Holding company | | Yunnan Yuemu | | September 2, 2022 | | Yunnan, China | | | 100% | | | Holding company | | Yunnan Honghao | | May 6, 2013 | | Yunnan, China | | | 100% | | | Forestry project investment and development | | Zhejiang Yongfeng | | October 11, 2022 | | Zhejiang, China | | | 100% | | | Holding company | |

Initial Public Offering

On February 9, 2021, the Company closed its initial public offering (“IPO”) of 5,000,000 ordinary shares at public offering price of $4.00 per share. On February 10, 2021, the underwriters exercised their over-allotment option to purchase an additional 750,000 ordinary shares at a price of $4.00 per share. The net proceeds of the Company’s IPO, including the proceeds from the sale of the over-allotment shares, totaled approximately $20 million, after deducting underwriting discounts and other related expenses. The Company’s ordinary shares commenced trading under the ticker symbol “CNEY” on February 5, 2021.

Private Placement

From June 8 to June 10, 2021, the Company entered into certain subscription agreements (the “Subscription Agreements”) with six investors (the “Purchasers”). Pursuant to the Subscription Agreements, the Company agreed to sell and the Purchasers agreed to purchase an aggregate of 4,000,000 ordinary shares of the Company at a price of $4.50 per share (the “Private Placement”). On June 11, 2021, the Company closed the Private Placement and received gross proceeds of $18 million, before deducting the placement agent’s fees of $900,000 and other related offering expenses of $60,000.

Note 2 – Summary of significant accounting policies Basis of presentation and principles of consolidation

The accompanying consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”U.S.GAAP”). All transactions and balances among the Company and its subsidiaries have been consistently applied.eliminated upon consolidation. The consolidated financial statements include the financial statements of the Company reflect the principal activities of CN Energy and its subsidiaries. All significant intercompanySubsidiaries are all entities (including structured entities) over which the Company has control. The Company controls an entity when the Company is exposed to, or has rights to, variable returns from its involvement with the entity and has the ability to affect those returns through its power over the entity. Subsidiaries are fully consolidated from the date on which control is transferred to the Company. They are de-consolidated from the date on which control ceases. In preparing the consolidated financial statements, transactions, balances and unrealized gains on transactions between group entities are eliminated. Unrealized losses are also eliminated upon consolidation.unless the transactions provide evidence of an impairment indicator of the transferred asset. Accounting policies of subsidiaries have been changed where necessary to ensure consistency with the policies adopted by the Company. Use of estimates In preparing the consolidated financial statements in conformity with U.S. GAAP, management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the dates of the consolidated financial statements, as well as the reported amounts of revenue and expenses during the reporting periods. Significant items subject to such estimates and assumptions include, but are not limited to, the valuation of inventory, accounts receivable, advances to suppliers, other receivables, useful lives of property, plant, and equipment and intangible assets, the recoverability of long-lived assets, provision necessary for contingent liabilities, revenue recognition, and realization of deferred tax assets. Actual results could differ from those estimates. Cash and cash equivalents

For purposes

Note 2 – Summary of the statements of cash flows, the Company considers all highly liquid instruments purchased with an original maturity of three months or less and money market accounts to be cash equivalents. The Company maintains all of its bank accounts in the PRC. As of September 30, 2021 and 2020, the Company had no cash equivalents.significant accounting policies (Continued) Term deposit

Term deposit represents fixed-term deposit of money into an account at a financial institution with maturity over three months. As of September 30, 2021 and 2020, the Company had term deposit of $3,096,000 and $NaN, respectively. The Company earns interest at a fixed annual rate of 2% with a one-year maturity on this term deposit.

Accounts receivable Accounts receivable are presented net of an allowance for doubtful accounts. The Company maintains an allowance for doubtful accounts for estimated losses. The Company reviews its accounts receivable on a periodic basis and makes general and specific allowances when there is doubt as to the collectability of individual balances. In evaluatingThe Company makes estimates of expected credit losses for the collectabilityallowance for credit losses based on assessment of individual receivable balances, the Company considers manyvarious factors, including historical experience, the age of the balance, customer payment history, customer’s current credit-worthiness, andaccounts receivable balances, credit quality of certain accounts receivables, current economic trends. Accountsconditions, reasonable and supportable forecasts of future economic conditions and other factors that may affect its ability to collect from the counterparties. Uncollectible accounts receivables are written off againstwhen a settlement is reached for an amount that is less than the allowance after efforts at collection prove unsuccessful.outstanding historical balance or when the Company has determined that is not probable for the balance to be collected. InventoryInventories

The Company values its inventory at the lower of cost, determined on a weighted average basis, or net realizable value. Costs include the cost of raw materials, freight, direct labor, and related production overhead. Net realizable value is estimated using selling price in the normal course of business less any costs to complete and sell products. The Company reviews its inventory periodically to determine if any reserves are necessary for potential obsolescence or if the carrying value exceeds net realizable value. NaN inventoryInventory reserves were recorded$0.2 million and nil as of September 30, 20212023 and 2020.2022, respectively. The costs of forestry inventories are transferred from biological assets at their costs at the point of harvest. The cost of inventories also includes capitalized production costs, including labor, materials, post-harvest costs, and depreciation. Inventoried costs are transferred to cost of goods sold in the same period as when the products are sold. Forestry inventories, capitalized production costs, and biological asset adjustments are measured at the lower of cost or net realizable value. The amount of any write-down of inventories to net realizable value and all losses of inventories are recognized as an expense in the period when the write-down or loss occurs. Advances to suppliers Advances to suppliers consist of balances paid to suppliers for services and materials that have not been provided or received. The Company reviews its advances to suppliers on a periodic basis and makes general and specific allowances when there is doubt as to the ability of a supplier to provide supplies to the Company or refund an advance. Note 2 – Summary of significant accounting policies (Continued)

Property, plant and equipment Property, plant and equipment are stated at cost less accumulated depreciation. The cost of an asset comprises its purchase price and any directly attributable costs of bringing the asset to its present working condition and location for its intended use. Depreciation is computed on a straight-line basis over the estimated useful lives of the related assets. The estimated useful lives for significant property, plant, and equipment are as follows:

| | |

|

| Useful life | Property and buildings |

| 20 years | Machinery and equipment | | 10 years | Vehicles | | 4 years | Office equipment | | 103 - 5 years

| Vehicles

| |

| 4 years

| Office equipment

| | 3 - 5 years

|

Expenditures for maintenance and repair, which do not materially extend the useful lives of the assets, are charged to expense as incurred. Expenditures for major renewals and betterments which substantially extend the useful life of assets are capitalized. The cost and related accumulated depreciation of assets retired or sold are removed from the respective accounts, and any gain or loss is recognized in the consolidated statements of income (loss) and comprehensive income (loss) in income from operations. Construction-in-progress represents property and buildings under construction and consists of construction expenditures, equipment procurement, and other direct costs attributable to the construction. Construction-in-progress is not depreciated. Upon completion and ready for intended use, construction-in-progress is reclassified to the appropriate category within property, plant, and equipment. Prepayment for property, plant and equipment represents payment made for production line equipment to be installed in the new production plant in Manzhouli City. Prepayment for property, plant, and equipment is not depreciated. Upon readiness for intended use, prepayment for property, plant and equipment is reclassified to the appropriate category within property, plant, and equipment. Land use right Land use right is recorded at cost less accumulated amortization. Amortization is provided on a straight-line basis over the estimated useful life which is 50 years and represents the shorter of the estimated usage period or the terms of the agreement. Note 2 – Summary of significant accounting policies (Continued) Intangible assets Intangible assets consist primarily of patents and software. Intangible assets are stated at cost less accumulated amortization, which are amortized using the straight-line method with the following estimated useful lives:

| | |

|

| Useful life | Patents |

| 10 years

| Software

| | 10 years | Software | | 10 years |

Biological assets

The Company’s biological assets consist of forests which are not yet harvested. Biological assets are initially measured at cost and subsequently depreciated on a straight-line basis over its estimated useful lives. The Company capitalizes all related direct and indirect costs of production to the biological assets at costs at each reporting date. At the point of harvest, the biological assets are transferred to inventory at their costs. Goodwill In accordance with ASC 350, Intangibles - Goodwill and Other, the Company assesses goodwill for impairment annually as of September 30, and more frequently if events and circumstances indicate that goodwill might be impaired. Goodwill impairment testing is performed at the reporting unit level. Goodwill is assigned to reporting units at the date the goodwill is initially recorded. Once goodwill has been assigned to reporting units, it no longer retains its association with a particular acquisition, and all of the activities within a reporting unit, whether acquired or internally generated, are available to support the value of the goodwill. Traditionally, goodwill impairment testing is a two-step process. Step one involves comparing the fair value of the reporting units to its carrying amount. If the carrying amount of a reporting unit is greater than zero and its fair value is greater than its carrying amount, there is no impairment. If the reporting unit’s carrying amount is greater than the fair value, the second step must be completed to measure the amount of impairment, if any. Step two involves calculating an implied fair value of goodwill. The Company determines the fair value of its reporting units using an income approach. Under the income approach, the Company determined fair value based on estimated discounted future cash flows of each reporting unit. Determining the fair value of a reporting unit is judgmental in nature and requires the use of significant estimates and assumptions, including revenue growth rates and EBITDA margins, discount rates and future market conditions, among others. If the initial accounting for a business combination is incomplete by the end of the reporting period in which the combination occurs, the Company reports provisional amounts for the items for which the accounting is incomplete. Those provisional amounts are adjusted during the measurement period (see below), or additional assets or liabilities are recognized, to reflect new information obtained about facts and circumstances that existed as of the acquisition date that, if known, would have affected the amounts recognized as of that date. The measurement period is the period from the date of acquisition to the date the Company obtains complete information about facts and circumstances that existed as of the acquisition date and is subject to a maximum of one year from acquisition date. Impairment of long-lived assets The Company reviews long-lived assets, including definitive-lived intangible assets, for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. If the estimated cash flows from the use of the asset and its eventual disposition are below the asset’s carrying value, then the asset is deemed to be impaired and written down to its fair value. There were no impairments of these assets as of September 30, 20212023 and 2020.2022.

Note 2 – Summary of significant accounting policies (Continued)

Leases The Company accountshas operating leases for leases following ASC 842, Leases (“Topic 842”). its corporate offices and equipment. The Company determines if an arrangement is a lease at inception. Operating leases are included in operating lease right-of-use (“ROU”)Lease assets current portion of obligations under operating leases, and obligations under operating leases, non-current on the Company’s consolidated balance sheets. Operating lease ROU assets and operating lease liabilities are recognized based onat the present value of the future minimum lease payments overat the lease term at commencement date. As mostThe interest rate used to determine the present value of the Company’s leases do not provide an implicit rate,future lease payments is the Company uses itsCompany’s incremental borrowing rate based on the information available at the lease commencement datedate. The Company generally uses the base, non-cancellable lease term and renewal options, when it believes it will exercise the renewal option, in determiningcalculating the presentright-of-use assets and liabilities.

The Company adopted the practical expedient that allows lessees to treat the lease and non-lease components of a lease as a single lease component. Non-lease components include payments for building management services, utilities and property taxes. It separates the non-lease components from the lease components to which they relate. The Company evaluates the impairment of its right-of-use assets consistent with the approach applied for its other long-lived assets. The Company reviews the recoverability of its long-lived assets when events or changes in circumstances occur that indicate that the carrying value of the asset may not be recoverable. The assessment of possible impairment is based on its ability to recover the carrying value of the asset from the expected undiscounted future payments.pre-tax cash flows of the related operations. The Company has elected to include the carrying amount of finance and operating lease ROUliabilities in any tested asset also includes anygroup and include the associated lease payments madein the undiscounted future pre-tax cash flows. As of September 30, 2022 and excludes lease incentives and includes initial direct costs incurred. The Company’s lease terms may include options to extend or terminate the lease when it is reasonably certain that2023, the Company will exercise that option. Lease expensesdid not have any impairment loss for minimumits operating lease payments are recognized on a straight-line basis over the lease term. See Note 18 for further discussion.right-of-use assets. Fair value of financial instruments On October 1, 2020,

The Company adopted Accounted Standards Update (“ASU”) 2018-13, applies ASC 820, Fair Value Measurement (Topic 820): Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Measurement,Measurements and the adoption of this ASU did not have a material impact on the Company’s consolidated financial statements. TopicDisclosures (“ASC 820”). ASC 820 clarifies the definition ofdefines fair value, prescribes methodsestablishes a framework for measuring fair value, and expands disclosures about fair value measurements. ASC 820 requires disclosures to be provided on fair value measurement. ASC 820 establishes a three-tier fair value hierarchy, to classifywhich prioritizes the inputs used in measuring fair value as follows: | •· | Level 1 - Inputs are unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date. |

| •· | Level 2 - Inputs are unadjusted quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other than quoted prices that are observable, and inputs derived from or corroborated by observable market data. |

| •· | Level 3 - Inputs are unobservable inputs which reflect the reporting entity’s own assumptions about what assumptions market participants would use in pricing the asset or liability based on the best available information. |

Any transfers of assets or liabilities between Level 1, Level 2, and Level 3 of the fair value hierarchy will be recognized at the end of the reporting period in which the transfer occurs. There were no transfers between fair value levels in any of the periods presented herein. Unless otherwise disclosed, the fair value of the Company’s financial instruments including cash, term deposit, accounts receivable, advances to suppliers, other receivables, prepaid expenses and other current assets, short-term bank loans, accounts payable, due to related parties, taxes payable, and accrued expenses and other current liabilities approximate their recorded values due to their short-term maturities. The fair value of long-term bank loan and operating lease liabilities approximate their recorded values as their stated interest rates approximate the rates currently available.

F-11The Company accounts for leases following ASC 842, (“Topic 842”).

Note 2 – Summary of significant accounting policies (Continued)