SG | Specific gravity |

| is a geologic period and system that extends from the end of the Ordovician Period, about 443.7 ± 1.5 million years ago (mya), to the beginning of the Devonian Period, about 416.0 ± 2.8 million years ago. |

slaven chert | A thin-bedded brown to gray-green chert with interbeds of black argillite, siltstone, and bedded barite. |

| a widely used term for the geologic period from 65 million to 2.6 million years ago. |

| Imperial measurement of weight equivalent to 2,000 pounds. |

| Metric measurement of weight equivalent to 1,000 kilograms (or 2,204.6 pounds). |

trench | A long, narrow excavation dug through overburden, or blasted out of rock, to expose a vein or ore structure. |

| The mineral deposits that are found filling openings in rocks created by faults or replacing rocks on either side of faults. |

wenban limestone | Devonian limestones best exposed on the western flank of Wenban Peak south of the town of Cortez, Nevada. |

| Table of Contents |

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

| A. Selected Financial Data For the years ended January 31, 2018, 2017, 2016, 2015 and 2014, we have prepared our consolidated financial statements in accordance with IFRS, as issued by the IASB.

|

The selected historical consolidated financial information set forth below has been derived from our annual audited consolidated financial statements for each of the years in the five-year period ended January 31, 2016.

For the years ended January 31, 2016, 2015, 2014, 2013, and 2012 we have prepared our consolidated financial statements in accordance with IFRS, as issued by the IASB.2018.

The selected historical consolidated financial information presented below is condensed and may not contain all of the information that you should consider. This selected financial data should be read in conjunction with our annual audited consolidated financial statements, the notes thereto and the section entitled ''Item 5 — Operating‘‘Item 5-Operating and Financial Review and Prospects.''’’

Years Ended January 31, 2018 2017 2016 2015 2014 Operations Revenue Expense Operating and Administrative Net Income (Loss) Earnings (Loss) Per Share – Basic Earnings (Loss) Per Share – Diluted Weighted Average Number of Shares Outstanding – Basic Weighted Average Number of Shares Outstanding – Diluted In accordance with IFRS$ - $ - $ - $ - $ - 1,375,982 580,066 642,193 538,469 860,517 2,015,340 (981,139 ) 50,521 527 (50,871 ) 0.04 (0.02 ) 0.00 0.00 (0.00 ) 0.04 (0.02 ) 0.00 0.00 (0.00 ) 47,570,158 48,396,734 44,200,953 42,016,049 36,024,532 50,519,282 48,396,734 44,200,953 42,741,915 36,024,532

As at January 31, 2018 2017 2016 2015 2014 Balance Sheet Working Capital (deficit) Total Assets Liabilities Equity The tables below set forth selected consolidated financial data under IFRS for the years ended January 31, 2016, 2015, 2014, 2013 and 2012. The information has been derived from our annual audited consolidated financial statements.$ 15,296,877 $ (117,528 ) $ 470,078 $ 11,324 $ (486,109 ) 21,937,782 19,641,035 20,088,148 20,275,844 19,856,395 2,881,168 1,793,502 1,413,790 2,011,063 2,750,713 19,056,614 17,837,213 18,674,358 18,264,781 17,105,682

Years Ended January 31, 2016 2015 2014 2013 2012 Operations Revenue Expense Operating and Administrative Net Income (loss) Net Earnings (loss) Per Share Weighted Average Number of Shares Outstanding $ - $ - $ - $ - $ - 642,193 538,469 860,517 1,365,288 772,587 50,521 527 (50,871 ) (1,542,564 ) (773,813 ) 0.00 0.00 (0.00 ) (0.05 ) (0.02 ) 44,200,953 42,016,049 36,024,532 33,563,649 33,483,650

| Table of Contents |

|

| As at January 31, |

| |||||||||||||||||

| 2016 |

|

| 2015 |

|

| 2014 |

|

| 2013 |

|

| 2012 |

| ||||||

Balance Sheet | ||||||||||||||||||||

Working Capital (deficit) |

| $ | 470,078 |

|

| $ | 11,324 |

|

| $ | (486,109 | ) |

| $ | (539,814 | ) |

| $ | 1,166,663 |

|

Total Assets |

|

| 20,088,148 |

|

|

| 20,275,844 |

|

|

| 19,856,395 |

|

|

| 20,330,548 |

|

|

| 20,756,599 |

|

Liabilities |

|

| 1,413,790 |

|

|

| 2,011,063 |

|

|

| 2,750,713 |

|

|

| 3,435,002 |

|

|

| 2,719,920 |

|

Equity |

|

| 18,674,358 |

|

|

| 18,264,781 |

|

|

| 17,105,682 |

|

|

| 16,895,546 |

|

|

| 18,036,679 |

|

Exchange Rates

The following table sets forth information as to the period end, average, the high and the low exchange rate for Canadian Dollars and U.S. Dollars for the periods indicated based on the noon buying rate in New York City for cable transfers in Canadian Dollars as certified for customs purposes by the Federal Reserve Bank of New York (Canadian dollar = US$1).

Year Ended January 31, |

| Average |

| Period End |

| High |

| Low |

|

| Average |

| Period End |

| High |

| Low |

| ||||||||||||||

2012 |

| 0.9970 |

| 1.0052 |

| 1.0604 |

| 0.9449 |

| |||||||||||||||||||||||

2013 |

| 0.9978 |

| 0.9973 |

| 1.0299 |

| 0.9599 |

| |||||||||||||||||||||||

2014 |

| 1.0389 |

| 1.1138 |

| 1.1178 |

| 0.9955 |

|

| 1.0389 |

| 1.1138 |

| 1.1178 |

| 0.9955 |

| ||||||||||||||

2015 |

| 1.1151 |

| 1.2711 |

| 1.2711 |

| 1.0639 |

|

| 1.1151 |

| 1.2711 |

| 1.2711 |

| 1.0639 |

| ||||||||||||||

2016 |

| 1.2964 |

| 1.4080 |

| 1.4223 |

| 1.2185 |

|

| 1.2964 |

| 1.4080 |

| 1.4223 |

| 1.2185 |

| ||||||||||||||

2017 |

| 1.3165 |

| 1.3030 |

| 1.4039 |

| 1.2544 |

| |||||||||||||||||||||||

2018 |

| 1.2922 |

| 1.2293 |

| 1.3745 |

| 1.2131 |

| |||||||||||||||||||||||

The following table sets forth the high and low exchange rate for the past six months based on the noon buying rate. As of June 9, 2016,May 31, 2018, the exchange rate was CDN$1.27311.2970 for each US$1.

Month |

| High |

|

| Low |

| ||

December 2015 |

|

| 1.3990 |

|

|

| 1.3360 |

|

January 2016 |

|

| 1.4589 |

|

|

| 1.3969 |

|

February 2016 |

|

| 1.4040 |

|

|

| 1.3523 |

|

March 2016 |

|

| 1.3468 |

|

|

| 1.2962 |

|

April 2016 |

|

| 1.3170 |

|

|

| 1.2544 |

|

May 2016 |

|

| 1.3136 |

|

|

| 1.2548 |

|

Month High Low December 2017 January 2018 February 2018 March 2018 April 2018 May 2018 1.2900 1.2517 1.2534 1.2293 1.2806 1.2280 1.3096 1.2822 1.2918 1.2548 1.3027 1.2761

| B. Capitalization and Indebtedness

|

Not Applicable.

| C. Reasons for the Offer and Use of Proceeds

|

Not Applicable.

| D. Risk Factors

|

In addition to the other information presented in this Annual Report, the following should be considered carefully in evaluating the Company and its business. This Annual Report contains forward lookingforward-looking statements that involve risks and uncertainties. The Company'sCompany’s actual results may differ materially from the results discussed in the forward lookingforward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed below and elsewhere in this Annual Report.

Although the Company recognized net income for the year ended January 31, 2018, the Company does not anticipate any revenues in the near future and will incur losses.During the year ended January 31, 2018, the Company recognized net income from the sale of the Robertson mining claims. The Company’s remaining properties are in the exploration stage. Therefore until such properties can develop or the Company can acquire properties that can be development and revenues can be derived therefrom, the Company will incur losses.

As of January 31, 2018, our internal controls over financial reporting were ineffective, and if we continue to fail to improve such controls and procedures, investors could lose confidence in our financial and other reports, the price of our shares of common stock may decline, and we may be subject to increased risks and liabilities.As a public company, we are subject to the reporting requirements of the United States Securities Exchange Act of 1934, as amended, and the Sarbanes-Oxley Act of 2002. The Exchange Act requires, among other things, that we file annual reports with respect to our business and financial condition. Section 404 of the Sarbanes-Oxley Act requires, among other things, that we include certifications of our management regarding the effectiveness of our disclosure controls and procedures. For the year ended January 31, 2018, our management has concluded that our disclosure controls and procedures were not effective to provide reasonable assurance that material information relating to the Company and its consolidated subsidiaries is made known to management and disclosed in accordance with applicable securities regulations. Further, management concluded the Company’s internal control over financial reporting was not effective as at January 31, 2018, due to the following material weaknesses: (i) due to the limited number of staff resources, the Company believes there are instances where a lack of segregation of duties exist to provide effective controls; and (ii) due to the limited number of staff resources, the Company may not have the necessary in-house knowledge to address complex accounting and tax issues that may arise. If we cannot effectively and efficiently improve our controls and procedures, we could suffer material misstatements in our financial statements and other information we report and fail to meet our reporting obligations, which would likely cause investors to lose confidence in our reported financial and other information. This could lead to a decline in the trading price for our common shares.

| Table of Contents |

We will be required to raise additional capital to mine our properties. The Company is currently in the exploration stage of its properties. If the Company determines, based on its most recent information, that it is feasible to begin development and operations on its properties, the Company will be required to raise additional capital in order to develop and bring the properties into production. The Company'sCompany’s ability to raise funds will depend on several factors, including, but not limited to, current economic conditions, its properties, its prospects, metal prices, businesses competing for financing and its financial condition. The Company may not be able to raise funds, or to raise funds on commercially reasonable terms. If the Company is unable to raise additional funds, it may not be able to develop its properties or any of its business plans as described in this Annual Report.

The commercial quantities of ore cannot be accurately predicted. Whether an ore body will be commercially viable depends on a number of factors including the particular attributes of the deposit, such as size, grade and proximity to infrastructure, as well as mineral prices and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in a mineral deposit being unprofitable.

The mining industry is highly speculative and involves substantial risks. The mining industry, from exploration, development and production is a speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but from finding mineral deposits which, though present, are insufficient in quantity and quality to return a profit from production. The marketability of minerals acquired or discovered by the Company may be affected by numerous factors which are beyond the control of the Company and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment, and government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection. The combination of such factors may result in the Company not receiving any or an adequate return on investment capital.

The Company'sCompany’s properties are all at the exploration stage and have no proven reserves. All of the Company'sCompany’s properties are in the exploration stage only and are without a known body of ore. If the Company does not discover a body of ore in its properties, the Company will search for other properties where it can continue similar work.

The Company'sCompany’s mineral exploration efforts may be unsuccessful. Despite exploration work on its mineral claims, no known bodies of commercial ore or economic deposits have been established on any of the Company'sCompany’s properties. In addition, the Company is at the exploration stage on all of its properties and substantial additional work will be required in order to determine if any economic deposits occur on the Company'sCompany’s properties. Even in the event commercial quantities of minerals are discovered, the exploration properties might not be brought into a state of commercial production. Finding mineral deposits is dependent on a number of factors, including the technical skill of exploration personnel involved. The commercial viability of a mineral deposit once discovered is also dependent on a number of factors, some of which are particular attributes of the deposit, such as size, grade and proximity to infrastructure, as well as metal prices.

Competition for mineral land. There is a limited supply of desirable mineral lands available for acquisition, claim staking or leasing in the areas where the Company contemplates expanding its operations and conducting exploration activities. Many participants are engaged in the mining business, including large, established mining companies. Accordingly, there can be no assurance that the Company will be able to compete successfully for new mining properties.

Uncertainty of exploration and development programs. The Company'sCompany’s results of operations are significantly affected by the costs and results of its exploration and development programs. Exploration for minerals is highly speculative in nature, involves many risks and is frequently unsuccessful. Among the many uncertainties inherent in any gold and silver exploration and development program are the location of economic ore bodies, the development of appropriate metallurgical processes, the receipt of necessary governmental permits and the construction of mining and processing facilities. Assuming the discovery of an economic deposit, depending on the type of mining operation involved, several years may elapse from the initial phases of drilling until commercial operations are commenced and, during such time, the economic feasibility of production may change. Accordingly, the Company'sCompany’s exploration and development programs may not result in any new economically viable mining operations or yield new mineral reserves to expand current mineral reserves.

| Table of Contents |

Licenses and permits. The operations of the Company require licenses and permits from various governmental authorities. The Company believes that it holds all necessary licenses and permits required under applicable laws and regulations and believes that it is presently complying in all material respects with the terms of such licenses and permits. However, such licenses and permits are subject to change in various circumstances. There can be no guarantee that the Company will be able to obtain or maintain all necessary licenses and permits as are required to explore and develop its properties, commence construction or operation of mining facilities and properties under exploration or development or to maintain continued operations that economically justify the cost.

Litigation. Although the Company is not currently subject to litigation, it may become involved in disputes with other parties in the future which may result in litigation. Any litigation could be costly and time consuming and could divert the Company's management from the Company's business operations. In addition, if the Company is unable to resolve any litigation favorably, it may have a material adverse impact on the Company's financial performance, cash flow and results of operations.

Acquisitions. The Company undertakes evaluations of opportunities to acquire additional mining properties. Any resultant acquisitions may be significant in size, may change the scale of the Company's business, and may expose the Company to new geographic, political, operating, financial and geological risks. The Company's success in its acquisition activities depends on its ability to identify suitable acquisition candidates, acquire them on acceptable terms, and integrate their operations successfully. Any acquisitions would be accompanied by risks, such as a significant decline in the price of gold or silver, the ore body proving to be below expectations, the difficulty of assimilating the operations and personnel of any acquired companies, the potential disruption of the Company's ongoing business, the inability of management to maximize the financial and strategic position of the Company through the successful integration of acquired assets and businesses, the maintenance of uniform standards, controls, procedures and policies, the impairment of relationships with customers and contractors as a result of any integration of new management personnel and the potential unknown liabilities associated with acquired mining properties. In addition, the Company may need additional capital to finance an acquisition. Historically, the Company has raised funds through equity financing and the exercise of options and warrants. However, the market prices for natural resources are highly speculative and volatile. Accordingly, instability in prices may affect interest in resource properties and the development of and production from such properties that may adversely affect the Company's ability to raise capital to acquire and explore resource properties. There can be no assurance that the Company would be successful in overcoming these risks or any other problems encountered in connection with such acquisitions.

Conflict of interest. Certain directors and officers of the Company are officers and/or directors of, or are associated with, other natural resource companies that acquire interests in mineral properties. Such associations may give rise to conflicts of interest from time to time. The directors are required by law, however, to act honestly and in good faith with a view to the best interests of the Company and its shareholders and to disclose any personal interest which they may have in any material transaction which is proposed to be entered into with the Company and to abstain from voting as a director for the approval of any such transaction.

Uncertainty of continuing as a going concern. The continuation of the Company and the recoverability of mineral property costs depends upon its ability to discover economically recoverable mineral reserves, attain profitable operations and generate cash flow from operations and/or to raise equity capital through the sale of its securities. The Company's consolidated financial statements do not include the adjustments that would be necessary if the Company were unable to continue as a going concern.

Limited and volatile trading volume.volume. Although the Company'sCompany’s common shares are listed on the TSX Venture Exchange (the "TSX-V"“TSX-V”), the Frankfurt Stock Exchange (the "FSE"“FSE”), and the Berlin-Bremen Stock Exchange and quoted in the United States on the OTCPink,OTCQX, the volume of trading has been limited and volatile in the past and is likely to continue to be so in the future, reducing the liquidity of an investment in the Company'sCompany’s common shares and making it difficult for investors to readily sell their shares in the open market. Without a liquid market for the Company'sCompany’s common shares, investors may be unable to sell their shares at favorable times and prices and may be required to hold their shares in declining markets or to sell them at unfavorable prices.

Volatility of share price.price. In recent years, securities markets in Canada have experienced a high level of price volatility. The market price of many resource companies, particularly those, like the Company, that are considered speculative exploration companies, have experienced wide fluctuations in price, resulting in substantial losses to investors who have sold their shares at a low price point. These fluctuations are based only in part on the level of progress of exploration, and can reflect general economic and market trends, world events or investor sentiment, and may sometimes bear no apparent relation to any objective factors or criteria. During the 20162018 fiscal year, the Company'sCompany’s common share price fluctuated on the TSX-V between a low of $0.06$0.29 and a high of $0.18.$0.42. Significant fluctuations in the Company'sCompany’s common share price isare likely to continue, and could potentially increase in the future.

Difficulty for United States investors to effect service of process against the Company.Company. The Company is incorporated under the laws of the Province of British Columbia, Canada. Consequently, it will be difficult for United States investors to effect service of process in the United States upon the directors or officers of the Company, or to realize in the United States uponCanada judgments of United States courts predicated upon civil liabilities under the Exchange Act. The majority of the Company'sCompany’s directors and officers are residents of Canada. A judgment of a United States court predicated solely upon such civil liabilities would likely be enforceable in Canada by a Canadian court if the United States court in which the judgment was obtained had jurisdiction, as determined by the Canadian court, in the matter. There is substantial doubt whether an original action could be brought successfully in Canada against any of such persons or the Company predicated solely upon such civil liabilities.

The Company is subject to foreign currency fluctuations. The Company operates in more than one country and the Company's functional currency is the Canadian Dollar. The Company's offices are located in Canada, all of its mining exploration properties are located in United States, and the Company's financial results are reported in Canadian Dollars. The Company's currency fluctuation exposure is primarily to the U.S. Dollar and the Canadian Dollar. The Company reported a foreign exchange loss of $9,714 during the year ended January 31, 2016. The Company does not use derivative financial instruments for speculative trading purposes, nor does the Company hedge its foreign currency exposure to manage the Company's foreign currency fluctuation risk. Fluctuations in and among the various currencies in which the Company operates could have a material effect on the Company's operations and its financial results.

The Company has incurred net losses since its inception and expects losses to continue. The Company has not been profitable since its inception. For the fiscal year ended January 31, 2016, the Company had net income of $50,521 due to deferred income tax recovery and an accumulated deficit on January 31, 2016 of $27,829,911. As the Company is currently at the exploration stage and has no reserves of precious metals, there is no assurance that the Company will be profitable in the future.

There are no assurances that we will discover minerals on a commercially viable basis. The Company'sCompany’s ability to generate revenues and profits is expected to occur through exploration, development and production of its existing properties as well as through acquisitions of interests in new properties. Substantial expenditures will be incurred in an attempt to establish the economic feasibility of mining operations by identifying mineral deposits and establishing ore reserves through drilling and other techniques, developing metallurgical processes to extract metals from ore, designing facilities and planning mining operations. The economic feasibility of a project depends on numerous factors, including the cost of mining and production facilities required to extract the desired minerals, the total mineral deposits that can be mined using a given facility, the proximity of the mineral deposits to a user of the minerals, and the market price of the minerals at the time of sale. There is no assurance that existing or future exploration programs or acquisitions will result in the identification of deposits that can be mined profitably.

| 10 |

| Table of Contents |

The Company'sCompany’s exploration activities are subject to various federal, state and local laws and regulations. Laws and regulations govern various aspects of the Company'sCompany’s business including the following: taxes; labor standards; occupational health; waste disposal; protection of the environment; mine safety; toxic substances; and the exploration, development, mining, production, importing and exporting of minerals. In many cases, licenses and permits are required to conduct mining operations. Amendments to current laws and regulations governing operations and activities of mining companies or more stringent implementation thereof could have a substantial adverse impact on the Company. Applicable laws and regulations will require the Company to make certain capital and operating expenditures to initiate new operations. Under certain circumstances, the Company may be required to stop its exploration activities once it is started until a particular problem is remedied or to undertake other remedial actions.

Market price is highly speculative.speculative. The market prices of metals are highly speculative and volatile. Instability in metal prices may affect the interest in mining properties and the exploration, development and production of such properties. If gold prices substantially decline, this may adversely affect the Company'sCompany’s ability to raise capital to explore for existing and new mineral properties.

The Company operates in a highly competitive industry. The Company competes with other developmental resource companies which have similar operations, and many competitors have operations and financial resources and industry experience greater than those of the Company. The Company may encounter increasing competition from other mining companies in its efforts to acquire mineral properties and hire experienced resource industry professionals. Increased competition in the Company'sCompany’s business could adversely affect its ability to attract necessary capital funding or acquire suitable producing properties or prospects for mineral exploration in the future.

Penny stock rules may make it more difficult to trade the Company'sCompany’s common shares. The SEC has adopted regulations which generally define a "penny stock"“penny stock” to be any equity security that has a market price of less than US$5.00 per share or an exercise price of less than US$5.00 per share, subject to certain exceptions. The Company'sCompany’s securities may be covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors such as institutions with assets in excess of US$5,000,000 or an individual with net worth in excess of US$1,000,000 or annual income exceeding US$200,000 or US$300,000 jointly with his or her spouse. For transactions covered by this rule, the broker-dealers must make a special suitability determination for the purchase and receive the purchaser'spurchaser’s written agreement of the transaction prior to the sale. Consequently, the rule may affect the ability of broker-dealers to sell the Company'sCompany’s securities and also affect the ability of its investors to sell their shares in the secondary market.

FINRA rules will make it more difficult to trade the Company'sCompany’s common shares.shares. The Financial Industry Regulatory Authority, or FINRA, has adopted sales practice requirements which may limit a stockholder'sstockholder’s ability to buy and sell our stock. In addition to the "penny stock"“penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer'scustomer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

| 11 |

| Table of Contents |

Item 4. Information on the Company

| A. History and Development of the Company

|

The Company was incorporated under the Company Act of the Province of British Columbia, Canada on January 22, 1981 under the name of Carol Energy Corporation, which name was changed to Coral Energy Corporation on March 3, 1982, and to Coral Gold Corp. on September 9, 1987. On September 14, 2004, the Company changed its name to Coral Gold Resources Ltd. in conjunction with a 10 to 1 share consolidation. On July 17, 2007, the shareholders of the Company amended the share structure by subdividing the Company'sCompany’s issued share capital of 8,267,360 common shares into 24,802,080 common shares, every one common share being subdivided into three common shares. On July 15, 2004, the Company transitioned to the British Columbia Business Corporations Act. The principal executive office of the Company is located at 570 Granville Street, Suite 900, Vancouver, British Columbia V6C 3P1, and its telephone number is 604-682-3701.

The Company is a natural resource company primarily engaged in the exploration and development of natural resource properties. Its principal business activities have been the exploration of certain mineral properties located in the states of Nevada and California in the United States. The carrying value of the Company's mineral property acquisition and exploration expenditures at January 31, 2016 is $19,192,353.

Please refer to Note 46 of the financial statements (Item 18) for information regarding the Company's principal expenditures on its mineral properties.Company’s exploration and evaluation assets.

B. Business Overview |

Operations and Principal Activities

Presently, the Company'sCompany’s principal business activity is the exploration and development of three mineral properties. The Company is in the process of exploring its mineral properties and has not yet determined whether its mineral properties contain ore reserves that are economically recoverable. There is no assurance that a commercially viable mineral deposit exists on any of the Company'sCompany’s properties, and future exploration will be required before final evaluation as to the economic and legal feasibility is determined.

The Company's mining claims are located in the states of Nevada and California in the United States. The Company's present principal exploration activities have been focused on the Robertson Mining Claims located in Crescent Valley, Nevada.

Competition

The mining industry in which the Company is engaged and is highly competitive. Competitors include well-capitalized mining companies, independent mining companies and other companies having financial and other resources far greater than those of the Company. The companies competeCompany competes with other mining companies in connection with the acquisition of gold and other precious metal properties. In general, properties with a higher grade of recoverable mineral and/or which are more readily minable afford the owners a competitive advantage in that the cost of production of the final mineral product is lower. Thus, a degree of competition exists between those engaged in the mining industries to acquire the most valuable properties. As a result, the Company may eventually be unable to acquire attractive gold mining properties.

Seasonality

Due to the climate in the States of Nevada and California, the Company is generally not affected by seasonality.

Dependence on Customers and Suppliers

The Company is not dependent upon a single or few customers or suppliers for revenues or its operations.

Government Regulation

We are subject to various federal and state laws and regulations including environmental laws and regulations. Environmental regulations impose, among other things, restrictions, liabilities and obligations in connection with the generation, handling, use, storage, transportation, treatment and disposal of hazardous substances and waste and in connection with spills, releases and emissions of various substances to the environment. Environmental regulation also requires that facility sites and other properties associated with our operations be operated, maintained, abandoned and reclaimed to the satisfaction of applicable regulatory authorities. In addition, certain types of operations, including exploration and development projects and changes to certain existing projects, may require the submission and approval of environmental impact assessments or permit applications. Compliance with environmental regulation can require significant expenditures, including expenditures for clean up costs and damages arising out of contaminated properties and failure to comply with environmental regulations may result in the imposition of fines and penalties. We believe that we are in substantial compliance with such laws and regulations; however, such laws and regulations may change in the future in a manner which will increase the burden and cost of compliance.

Certain laws and governmental regulations may impose liability on us for personal injuries, clean-up costs, environmental damages and property damages, as well as administrative, civil and criminal penalties. We maintain limited insurance coverage for sudden and accidental environmental damages, but do not maintain insurance coverage for the full potential liability that could be caused by sudden and accidental environmental damage. Accordingly, we may be subject to liability or may be required to cease production from properties in the event of such damages.

Environmental Regulations

The Company'sCompany’s exploration programs in Nevada and California are subject to state and federal regulations regarding environmental considerations. All operations involving the exploration for the production of minerals are subject to existing laws and regulations relating to exploration procedures, safety precautions, employee health and safety, air quality standards, pollution of streams and fresh water sources, odor, noise, dust and other environmental protection controls adopted by federal, state and local governmental authorities as well as the rights of adjoining property owners. The Company may be required to prepare and present to federal, state or local authorities data pertaining to the effect or impact that any proposed exploration for or production of minerals may have upon the environment. All requirements imposed by any such authorities may be costly, time consuming and may delay commencement or continuation of exploration or production operations. Future legislation may significantly emphasize the protection of the environment, and, as a consequence, the activities of the Company may be more closely regulated to further the cause of environmental protection. Such legislation, as well as further interpretation of existing laws in the United States, may require substantial increases in equipment and operating costs to the Company and delays, interruptions, or a termination of operations, the extent of which cannot be predicted. Environmental problems known to exist at this time in the United States may not be in compliance with regulations that may come into existence in the future. This may have a substantial impact upon the capital expenditures required of the Company in order to deal with such problem and could substantially reduce earnings. At the present time, the Company'sCompany’s exploration activities in Nevada and California are in compliance with all known environmental requirements.

The primary regulatory bodies that directly regulate the Company'sCompany’s activities are the Bureau of Land Management (Federal) and, the Nevada Department of Environmental Protection (State).and various state agencies in the State of California including the Office of Mine Reclamation.

| C. Organizational Structure

|

The Company has two wholly-owned subsidiaries: Coral Energy Corporation of California, a California corporation which holds title to the Company'sCompany’s California property, and Coral Resources, Inc., a Nevada corporation, which holds title to the Company'sCompany’s mining claims located in Nevada. In the 2006 fiscal year, the Company completed the purchase of 1,391,860 shares, representing 98.49% of the issued shares, ofMarcus Corporation, a Nevada Corporation that owns the Marcus mining claims, consisting of 39 unpatented lode claims and two placer claims, and which comprise a portion of the Company's Robertson Property.

| D. Property, Plant and Equipment

|

Presently, the Company is an "exploration“exploration stage company"company”, as all of the Company'sCompany’s properties are currently in the exploratory stage of development. In order to determine if a commercially viable mineral deposit exists in any of the Company'sCompany’s properties, further geological work will need to be done and a final evaluation based upon the results obtained to conclude economic and legal feasibility.

The Company's primary focus has been on the Robertson Mining Claims, in Nevada, United States.

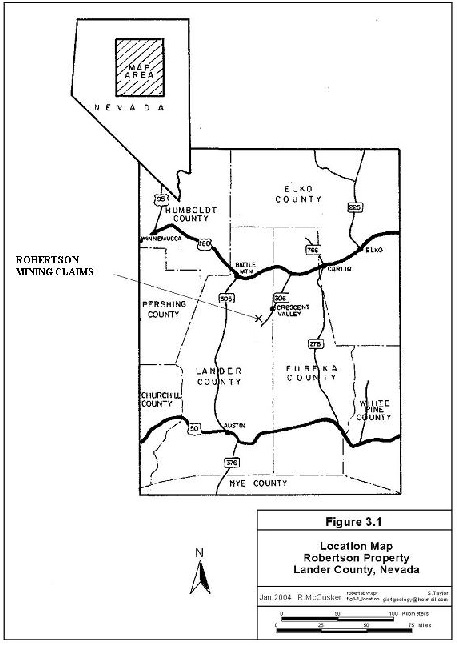

Prior Property - Robertson Mining Claims, Nevada, U.S.A.

TheCompleted Sale of Robertson Mining Claims are located in Crescent Valley, Nevada onProperties

On June 8, 2017, Coral completed the western flankspurchase and sale agreement (the “Agreement”) with Barrick Cortez Inc. (“Barrick”), a subsidiary of Barrick Gold Corp., for the sale of the Shoshone Range, 28 miles to the southeast of Battle Mountain, Nevada, which lies approximately 230 miles northeast of Reno, Nevada. The Robertson Mining Claims comprise approximately 9,200 acresProperty in the Bullion Mining District, Lander County, Nevada, and currently include 435 unpatented Federal claims and 9 patented lode claims.to Barrick in consideration of:

| 1. | The payment to Coral of US$15.75 million (Cdn $21.84 million based on the closing exchange rate) in cash (the “Cash Consideration”); | |

| 2. | The return of 4,150,000 common shares of Coral held by Barrick (which represent approximately 8.5% of the Company’s basic common shares outstanding as of June 8, 2017) for cancellation by the Company (the “Share Reduction”); and | |

| 3. | A sliding scale 1% to 2.25% net smelter returns royalty (the “NSR”) on the Robertson Property, payable quarterly, subject to potential advance royalty payments as outlined below, as well as a right of first refusal enabling Barrick to acquire the NSR in the event that the Company wishes to sell the NSR to any third party (the “Transaction”). |

| 13 |

| Table of Contents |

These mining claims have been acquired over aThe sliding scale NSR rate will be determined based on the observed gold price during each quarterly period of several years from different sources. The entire Robertson Mining Claims are subject to a 3% net smelter royalty to Geomex Development Eighth Partnership ("Geomex 8"), which royalty shall cease at such timebased on the average LBMA Gold Price PM during the quarterly period, as the sum of US$1,250,000 has been paid to Geomex 8, and various mining leases requiring minimum annual advanced royalties ranging from 4% to 10% of net smelter returns.follows:

There is no underground or surface plant or equipment located on the Robertson Mining Claims and the following figures provide location details with respect to the Robertson Mining Claims.

Average Gold Price/Oz During the Quarter (USD) | Applicable NSR Royalty Rate |

Up to and including $1,200.00 $1,200.01 to $1,400.00 $1,400.01 to $1,600.00 $1,600.01 to $1,800.00 $1,800.01 to $2,000.00 Over $2,000.00 | |

1.00% 1.25% 1.50% 1.75% 2.00% 2.25% |

|

ThePursuant to the Agreement, as amended, and due to the delay in closing, in the event that the Robertson Property is the subject of four technical reports dated January 15, 2004, April 25, 2006, January 27, 2008 and January 18, 2012. The first two technical reports were prepared by Robert McCusker, P.Geol. in accordance with NI 43-101 ("McCusker Reports"). The third and fourth reports were prepared by Beacon Hill Consultants (1988) Ltd. ("Beacon Hill") of Vancouver, British Columbia (the "Beacon Hill Report"). The first Beacon Hill report was a NI 43-101 resource estimate that included the zones located within the Robertson's Core claims only. The Company's other claim blocks, including Norma Sass, Lander Ranch, Ruf, Blue Nugget and the Excluded (Carve Out) claims (joint ventured with Cortez Gold Mines ("Cortez"), a joint venture ownednot placed into production by Barrick by December 31, 2024, then beginning on January 1, 2025, and continuing on an annual basis thereafter until the earlier of (i) the date commercial production commences and (ii) January 2, 2034, Barrick will make advance royalty payments to Coral Gold Corporation), were not part of US$0.5M, which will be non-refundable and fully credited against any future obligations under the estimate. The 2012 report was an NI 43-101 compliant preliminary economic assessment ofNSR. These dates have all been extended by one year from the advanced stage Altenburg Hill, Porphyry and Gold Pan zones analyzing a combination of open pit mining methods and cyanide heap leach.dates in Coral’s earlier announcement.

Barrick will also assume all liabilities relating to the Robertson Property, Description and Locationwill provide replacement security for the reclamation bond.

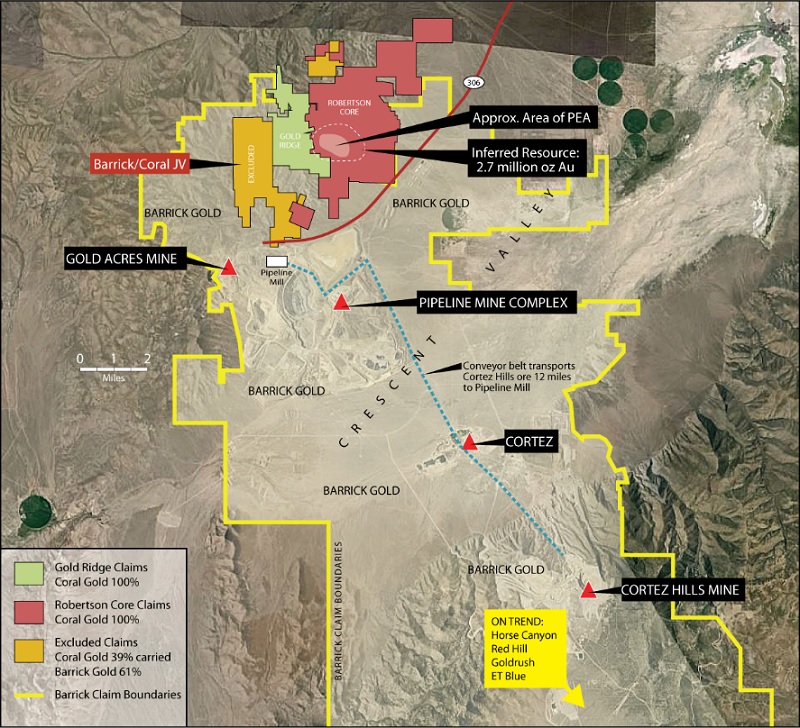

The Robertson Property includes the properties also known as the Core, Gold Ridge, Excluded and the Ruf mining claims, but does not include the properties known as the Norma Sass, Eagle, and JDN mining claims. The Robertson Property is an advanced-stage gold exploration project located in eastern Lander County, Nevada, 60sixty miles southwest of Elko. Coral Resources, Inc., a wholly owned subsidiary of the Company, acquired control of the Robertson Property in 1986. The core property consists of 300 unpatented federal lode claims, mill sites, and nine patented lode claims covering over 6,200 acres of public lands administered by the U.S. Bureau of Land Management (the "BLM"). The Company controls an additional 31 claims through a series of mineral leases and option agreements.

In 2001, a boundary agreement between the Company and Cortez resolved claim boundary overlaps and seniority issues along the east and southwest sides of the Robertson claim block. This agreement required both parties to amend and/or abandon certain claims in order to achieve the agreed upon boundary. This was completed during the 2002-2003 assessment year.

Approximately 31 of the 300 of the claims that comprise the Robertson Property are controlled by the Company through 4 mining leases and option agreements. The Core Claims held by the Company under lease or option agreements require minimum advance royalty payments and production royalties in the event of production. Total annual payments for the various leases and minimum advance royalties are approximately US$51,600.

A summary compilation of the terms of these agreements are presented in the table below:

Mining Lease and Option Agreements

Company/Date |

| Number of Claims |

| Option Payment |

| Production Royalty | Advance Royalty Payment | |||||||

Core: Tenabo Gold Mining Co. Nov. 30, 1975 |

| 13 |

| US$ | 2,000,000 |

| 8% NSR | US$ | 12,000/yr | |||||

Northern Nevada Au, Inc. Sept. 30, 1986 |

| 12 |

| US$ | - |

| 4% GSR | US$ | 9,600/yr | |||||

Albany Gold Corp. (Geomex) |

| All |

| US$ | 1,250,000 |

| 3% NSR |

| Nil | |||||

Filippini/Breckon (June Claims) |

| 6 |

| US$ | 1,000,000 |

| 3% NSR | US$ | 30,000/yr | |||||

Annual federal rental fees of US$82,305 payable to the BLM, and Notice of Intent to Hold Mining Claims have been filed for the 2015-2016 assessment year.

History and Exploration

The Robertson Property is located in the Tenabo area, a sub-district of the Bullion mining district in Lander County, Nevada. Historic lode mining in this district dates from 1905 and placer gold was discovered in many of the dry washes in the Tenabo area in 1916. Between 1937 and 1939, a small dragline dredge and washing plant operated in the district, and a dredge was reported by Humphrey to be operating in lower Mill Gulch in 1945.

During 1966 through 1970, a number of companies explored the district in search of porphyry copper-style mineralization. In 1968, while drilling a series of shallow rotary holes near the Gold Pan mine, Superior Oil discovered a small, but relatively high-grade zone of gold at shallow depths in what is now known as the Gold Pan zone; however, with additional drilling, Superior Oil lost interest in the district. They were followed by a number of mining companies, including Placer Development (1974-75), Teck Corporation (1977), Aaron Mining Ltd. (1975-86), and E & B Exploration Ltd. (1980-81), all of which sporadically explored the Tenabo area with limited success.

Modern open pit mining and heap leaching began in 1974, when Aaron Mining Ltd. ("Aaron"), initiated a pilot leach operation on the Robertson Property. From 1978 through 1980, Aaron expanded its leaching operations and continued exploration and acquiring claims in the district.

In 1986, the Company acquired Aaron's interest in the Robertson Property and immediately began a series of major drilling programs beginning in 1986 and continuing until 1989. Mining operations on the Robertson Property commenced in 1988, but were suspended less than one year later. During the operating life of the Robertson Property mine approximately 350,000 tons of low-grade material was placed on leach pads from which about 6,200 ounces of gold were recovered.

During 1986 through 1989, the Company completed approximately 380 reverse circulation drill holes and seven diamond drill holes, totaling about 109,377 feet. Much of this drilling was focused in four resources areas: Gold Pan, Gold Quartz, Gold Quartz extension (also called Gold Quartz West) and the Triplet Gulch areas. The purpose of this drilling was to determine the limits and continuity of mineralization within these zones. Nearly all of the reverse circulation holes were drilled vertically to an average depth of about 300 feet.

In 1990, the Company and Amax Gold Exploration Inc. ("Amax") entered into an amended and restated option and earn-in agreement in which Amax could earn a 60% interest in the Robertson Property by producing a bankable feasibility study. Amax completed an exploration program that included drilling 338 reverse circulation holes and 62 diamond drill holes, totaling over 176,000 feet. As the feasibility study did not meet the requirements of the agreement, Amax returned the property to the Company in 1996.

During the fiscal year ended January 31, 1999, the Company entered into an option agreement dated October 8, 1998 (the "Option Agreement"), with Placer Dome U.S. Inc. ("Placer"), which was later assigned by Placer to Cortez. Under the agreement, Cortez could earn a 70% interest in the Robertson Property by producing a bankable feasibility study. The focus of Cortez's exploration was to expand the 39A zone and test a number of outlying targets. During 1999, Cortez completed 46 reverse circulation drill holes and a single flood rotary hole, totaling 57,000 feet. Of the 13 holes directed at expanding the 39A zone, only two holes, 99401 and 99413, encountered significant mineralization. This drilling program did little to expand the resource. Of the remaining holes drilled by Cortez, only two holes (99406 and 99419) encountered significant mineralization. Both holes were designed to offset and/or follow up existing drill intersections and surface gold anomalies.

After completing this drilling program, Cortez declared its interest in renegotiating the terms of the Option Agreement with the Company. When the Company declined, Cortez terminated the Option Agreement on December 30, 1999, and did not earn an interest in the Robertson Property.

During 2004 and 2005, the Company conducted three drilling programs consisting of 32 reverse circulation holes totaling 24,020 feet on the Robertson Property. The focus of this exploration was to expand and further define the 39A Zone, test the "deep" Gold Pan Zone for extensions of the 39A Zone and offset previous ore-grade intersections in the "distal target area".

A report entitled "Update of the Geological Report on the Robertson Property" April 25, 2006 on gold resources at the Robertson Property was submitted by Robert McCusker, Consulting Geologist, a "qualified person" in accordance with the requirements of NI 43-101.

During fiscal 2006, the Company completed a major drilling program on the Robertson Property. Drilling was completed in two phases. The drilling program totaled 35,615 feet of reverse circulation drilling in 46 holes. Depths ranged from 450 feet to 1,500 feet. Due to the relatively flat-lying nature of mineralization at the Robertson Property, all holes were drilled vertically. Phase Iconsisted of 14 reverse circulation (RC) drill holes, CR06-2 through CR06-15, totaling 11,355 feet which were completed in the immediate vicinity of the existing 39A Zone indicated mineral resource. Phase IIconsisted of 32 RC holes, CR06-16 through CR06-48A, totaling 24,260 feet which were completed in (1) the Distal Zone; (2) on the northeast flank of Altenburg Hill; (3) in the gravel-covered area between the Altenburg Hill and the Porphyry Zone mineral resource; and (4) along a northeast-striking structural zone in the Porphyry Zone. Drilling operations during Phase I and Phase II drilling were directly supervised by Robert McCusker.

In February 2008, the Company received an NI 43-101 compliant resource estimate titled Mineral Resource Estimate for the Robertson Property, Lander County, Nevada report dated January 27, 2008, prepared by Beacon Hill, Robert McCusker and Jasman Yee (updated in October 2009). This resource estimate is no longer considered current.

Later in 2008, the Company commissioned Beacon Hill to not only update the Robertson Property resource estimate but to also outline a program for continued development of the Core Claims in 2008 and beyond. Beacon Hill recommended a three-pronged development approach:

| ||

| ||

|

Beacon Hill recommended the following drilling on the Core Claims:

Phase I: 52 RC holes ranging in depth from 500 feet to 1,200 feet and totaling 37,600 feet, to focus on:

|

| |

|

| |

|

| |

|

|

Phase II: would consist of 21 diamond core holes (HQ diameter) ranging from 300 feet to 1,000 feet-deep and totaling 11,900 feet. The purpose of core drilling is to provide geological data on the controls of mineralization, acquire geotechnical data (RQD and specific gravity), confirm grade and continuity and provide material for metallurgical testing. Drilling has been recommended as follows:

|

| |

|

| |

|

| |

|

|

In March 2008, the Company announced that it had entered into a contract for 37,600 feet of reverse circulation drilling on Robertson Property. The agreement, signed with Lang Exploratory Drilling of Salt Lake City, Utah, began in April following permit approval from the BLM. Robert McCusker supervised the drill program as the "qualified person" under NI 43-101.

In September 2008, the Company completed its reverse circulation drilling program at Robertson. The program totaled 22,835 feet of drilling in 33 vertical holes which ranged in depth from 500 to 1200 feet. The holes were located on the Altenburg Hill, South Porphyry, 39A and Distal zones in order to increase the gold resource in these zones.

Both Phase I and Phase II were aimed at expanding and upgrading the Robertson Property inferred resource.

The planned 21 diamond drill holes of Phase II ranged from 300 to 1,000 feet in depth. It was anticipated that Phase II drilling would:

| ||

| ||

| ||

|

To help derive exploration priorities to expand the current resource with the 2008 drilling campaign, a series of in-house, draft open pit shapes were modeled around the 2008 NI 43-101 compliant inferred resource.

During the fiscal year ending January 31, 2008, the Company purchased 100% interest in the 72 claims comprising the Fanny Komp/Elwood Wright lease which forms part of the core area of the Robertson Property for US$250,000.

In October 2009, the Company received a revised resource for the Robertson Property from Beacon Hill utilizing lower cut-off grades to reflect the positive movement in the price of gold over the previous three years. The revised values were based on the NI 43-101 report titled Mineral Resource Estimate for the Robertson Property, Lander County, Nevada prepared by Beacon Hill in January 2008; this report is no longer considered current.

Despite the permitting setback, 12 RC holes at Triplet Gulch that were previously permitted under the 2007 PO were drilled in 2010.

A limited diamond drilling program at the Gold Pan and Altenburg Hill zones was also permitted under the 2007 PO. A program totaling 6,700 feet was conducted that represents the first phase of the diamond core drill program announced in the company's 2010 work plan and budget. The program was designed to verify the 2008 RC drilling assay results and provide material for metallurgical test work. The Gold Pan, Altenburg Hill and Porphyry zones represent near surface resources that could potentially be developed as an open pit/heap leach operation. Past metallurgical testing of Porphyry Zone mineralization returned favorable gold recoveries from the oxide material.

Also in 2010, Coral commissioned Beacon Hill to commence a Preliminary Economic Assessment ("PEA") that would meet the NI 43-101 standard on the Gold Pan, Altenburg Hill and Porphyry zones. The report was finalized and made public in late January 2012 and outlined steps to move the project towards pre-feasibility. (see section below titled Preliminary Economic Assessment for details)

In June 2011, the BLM accepted the fifth submission of the APO and a kick off meeting was held on July 20th, 2011. The meeting outlined the need for a new EA. In particular, the various categories to be studied in the EA including cultural, wild life, native religions, hazmat, paleontology, range management, noxious weeds, air quality, hydrology, riparian zones, migratory birds, environmental justice and socio economic issues.

Studies had been in progress since November 2010 but the EA did not officially start until July 2011. The cultural studies were done by Kautz and Co. of Reno, Nevada. Most of the other studies are by SRK out of Elko, Nevada who have overseen the entire environmental assessment.

As Coral anticipated, the work did not locate native religious sites or burial grounds etc. but the ghost mining town of Tenabo required detailed study.

Coral's cultural and wildlife surveys were sufficiently completed by the end of 2011 to allow the Company to demonstrate to the BLM that 13 proposed diamond core holes on the Porphyry zone would not impact on cultural or wildlife areas. The program consisted of 13 diamond drill core holes that twinned existing Amax Gold Inc. ("Amax") holes (circa 1990 -- 1996) and provided core for leach tests at McClelland Laboratories Inc. ("McClelland Labs") in Reno, Nevada. The holes were part of the Phase 1 drill program as proposed in the January 2012 PEA Assessmentand were designed to verify Amax's historic drilling data, and to upgrade the level of confidence in resources contained in the oxidized zones. The Phase 1 drill program represented Coral's first step towards pre-feasibility as defined by the PEA.

By July 13th, 2012 the baseline vegetation and wildlife field work had been completed and the baseline studies report was submitted to the BLM.

The BLM's response to Corals Baseline Studies was received July 27th and delivered to SRK Consultants who then supplied a response to the modifications to the Baseline Studies required by the BLM.

On September 24, 2012, Coral announced thatSRK had completed and submitted the EA to the BLM.

Compliance with the EA process was mandatory. The various categories studied were the subject of numerous Nevada State and US Federal laws. Fortunately not all are applicable to the Robertson property.

In September 2013, Coral received a notice from the BLM, which included the Decision on the Robertson Project Amendment to the Exploration Plan of Operations and Reclamation Permit Application and also the Finding of No Significant Impact ("FONSI").

On January 13, 2014, Coral announced that its US subsidiary, Coral Resources Inc. had received notice from the Bureau of Mining Regulation and Reclamation (BMRR) of the State of Nevada that it had approved the Plan of Amendment for Coral Resources Inc.'s Robertson Project.

The Amended Plan of Operations ("APO") was originally approved by the federal Bureau of Land Management (see news release dated Sept 16, 2013). Now that the APO has been approved by the State of Nevada (NDEP and subsidiary BMRR) Coral can proceed with drilling and other programs at Robertson.

Reclamation Activities

Following the dissolution of the option agreement with Cortez in 1999, Coral was required to post its own security for the reclamation bond for the Robertson Property and obtain a full release of Placer's guarantee of the original reclamation bond. In order to satisfy its obligations under the Option Agreement, the Company spent a large portion of fiscal year 2003 conducting reclamation on the Robertson Property to reduce its US$2,000,000 reclamation bond that Placer had guaranteed for the Company. Coral was able to obtain a release of Placer's guarantee by conducting sufficient reclamation work to reduce the bonding requirement, and by raising sufficient funds to provide satisfactory alternative security of the reclamation bond. The reclamation bond was reduced to US$786,100 during the fiscal year ended 2003, for which the Company posted cash.

In fiscal year ended 2006, with more reclamation work having been completed and accounted for, the reclamation bond was further reduced to US$228,205. In fiscal year ended 2007, with further drilling activities being proposed and performed, the required reclamation bond was increased to US$282,268. In fiscal year ended 2008, additional planned exploration activities in Nevada were approved and the required reclamation bond was increased to US$319,400 and then again in fiscal year ended 2009 up to US$389,387.

In August 2008, SRK Consulting prepared an "Aerial Survey Ground Truthing and Revised Cost Estimate" report for the Company, which following amendments and revisions were submitted to the BLM and NDEP in October 2008. The report outlined and updated results of reclamation done by the Company at the Robertson Property up to 2008.

The BLM and NDEP replied with required changes and updates in April 2009 and a revised "Aerial Survey Ground Truthing and Revised Cost Estimate" was prepared by SRK Consulting on June 10, 2009 and submitted to the BLM and NDEP.

In the Try/View area of the Robertson Property, the Company renewed the Notice of Intent to allow further deep drilling.

In the core area of the Robertson Property, the Company also submitted a new "Storm Water Pollution Prevention Plan" and technical report which was approved by the BLM and NDEP in June 2009.

In addition the Company authorized SRK Consulting to prepare:

| ||

|

The Company spent approximately $12,750 on reclamation and maintenance in fiscal 2011, reclaiming past mining and exploration related disturbances to public lands as required by the BLM and the NDEP.

In fiscal 2012 the Company increased the reclamation bonds by US$34,600. During fiscal 2013 the Company was required to increase its reclamation bonds by a further US$58,937 as the result of receiving approval to drill 13 holes. During fiscal 2015, the Company received approval for its amended plan of operations, which required that the reclamation bonds are further increased by US$40,149.

Environmental Liabilities

In 1988-89, the Company operated a small open pit gold mining operation and heap leach facility on the Robertson Property. The resulting disturbances include three small open pit mines, waste dumps, haul roads, drill roads, open drill holes, and a 350,000 ton heap leach facility and related recovery plant. In 1994, a reclamation plan was prepared by Amax and submitted to the Battle Mountain office of the BLM. The cost to perform the reclamation of the mine site was estimated at that time to be US$2,000,000. In 2001, the Company began reclamation activities which were accelerated in 2002, with the re-contouring of waste dumps, reclamation of the leach pad, haul roads and the filling of all open drill holes. As a result of this activity, in June 2003, the BLM reducedsale, the bonding requirements for the project to US$406,000.Company recorded a gain of $5,871,719, net of transaction costs.

In March 2003, on behalf of the Company, SRK Consulting submitted a final plan for permanent closure of the mine with the BLM and NDEP. The closure plan was approved by both agencies. As a result of this work, during 2004 the BLM lowered the bonding requirements to US$226,205.Existing Properties

(i) PermittingNorma Sass Claims, Nevada

In 2002, the Company submitted and was granted a five year renewal of Water Pollution Control Permit (NEV60035) by the NDEP for the Robertson Property. This permit is now renewed annually and reports are submitted quarterly. In addition, the Company has a storm water pollution control permit which is also renewed annually.

The Company continues to conduct reclamation and exploration activities under a Plan of Operation (NV067688) approved in 1989 by the BLM, which was subsequently updated to the 2007 PO. In April 2010, SRK Consulting, submitted the APO to the BLM and NDEP to allow the Company to carry out its 2010 work plan. A setback occurred when the BLM declined the drilling permit application because the Company's existing EA was out of date. The BLM suggested that the APO be withdrawn and to revert back to a previous 2007 PO that allowed drilling on certain areas of the property without any amendments. In June 2010, the APO was withdrawn. SRK Consulting was immediately commissioned to commence work on the new EA. SRK finalized the EA and re-filed it in June 2013 which then went out for public comment which resulted in no significant challenges.

From 2000 to 2003, no exploration activity was conducted on the Robertson Property; however, during that period a significant amount of surface reclamation was completed on the property. As a result, any new exploration activities in reclaimed areas will require submission and approval of an Amendment to the Plan of Operation. Additionally, the National Historic Preservation Act requires that all operators on public lands conduct an archeological survey of the proposed sites of new disturbance. Much of the Robertson Property has been previously cleared under various surveys conducted by Amax. Recent and planned future exploration activities by the Company have moved outside the area covered by previous archeological surveys. It is possible that future exploration will experience delays in receiving approval because additional surveys will be required by state and federal agencies.

Geological Setting

Geologically, the Robertson Property consists of a series of relatively flat-lying, vertically stacked thrust sheets that form part of the Roberts Mountain allochthon, which is composed of siliciclastic rocks from Ordovician to the Devonian age. The district is dominated by a very thick sequence of middle to late Devonian Slaven Chert composed mainly of argillite, chert, lesser siltstone and shale, and minor intermediate volcanic rocks. Structurally overlying the Slaven Chert along the north and east sides of the district are a sequence of rusty brown weathering siltstone, sandstone and very minor limestone of the Silurian Elder Sandstone.

Intruding the thick Paleozoic sequence is an elliptical-shaped, composite granodiorite stock (or lacolith) of Eocene age. The orientation of the principal axis of the stock is approximately east-west. Associated with it are numerous dikes, sills and plugs that vary in composition from diorite, the earliest known intrusion, to rhyolite, the latest. Most of the identified gold resources, including the Porphyry, Gold Pan and 39A zones, lie along or near the northern contact of the composite stock. A series of narrow and laterally continuous (up to 1,600 feet) intrusive "pebble" dikes extend northward from the northern contact of the granodiorite stock. Near contacts with the Tertiary intrusions, many of the sedimentary and volcanic rocks, and early phases of the stock, have undergone significant thermal metamorphism, intense recrystallization, bleaching and pervasive metasomatism. Many of these rocks have been converted to layered sequences of biotite, "quartz" and calc-silicate hornfels, marble, exoskarn and endoskarn.

Mineralization at the Robertson Property is strongly controlled by a system of low and high-angle faults and related fracture zones. Brecciation associated with axial plane shear zones developed in isoclinal folds are also important hosts for mineralization. Although individual structures host ore-grade gold, higher grades commonly occur where one or more structures intersect.

Deposit Types and Mineralization

The Company has been focusing its exploration activities on four zones localized along the northern and eastern contacts of the Tenabo stock forming the general east-west trend, the Porphyry, Gold Pan, Altenburg Hill and 39A zones. The Porphyry, Gold Pan and Altenburg Hill zones occur in highly fractured hornfels and skarn units at the contact of the granodiorite stock, whereas the 39A zone is localized at the intersection of two high-angle faults in retrograde-altered hornfels.

Preliminary Economic Assessment

In 2010, Coral commissioned Beacon Hill to commence a Preliminary Economic Assessment ("PEA") that would meet the NI 43-101 standard on three of its gold deposits located on the Robertson Property. The report was finalized and made public in late January 2012 (See news release dated January 18, 2012).

The results of the evaluation are as follows:

Resources and Mining

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

|

Note: Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues. The quantity and grade of reported Inferred resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred resources as an Indicated or Measured mineral resource and it is uncertain if further exploration will result in upgrading them to the Indicated or Measured mineral resource category.

Economics

Two alternatives were reviewed, owner operated and contractor operated. The results shown are after tax. Taxes are considered indicative only.

Description |

| Owner Operated ($US millions) |

|

| Contractor Operated ($US millions) |

| ||

Development Cost |

|

| 16.5 |

|

|

| 16.5 |

|

Initial Capital Cost |

|

| 122.1 |

|

|

| 97.0 |

|

Ongoing Capital Cost |

|

| 54.2 |

|

|

| 26.1 |

|

Average Operating Cost US$/ton mined |

|

| 5.28 |

|

|

| 6.45 |

|

Results of Economic Analysis at Various Gold Prices (Owner Operated)

Gold Price US$/oz |

|

| IRR % |

|

| NPV undiscounted US$ million |

|

| NPV discounted 5% US$ million |

|

| Payback Period Years |

| ||||

| 1350 |

|

|

| 15.44 |

|

|

| 180.6 |

|

|

| 96.2 |

|

|

| 5.91 |

|

| 1500 |

|

|

| 20.13 |

|

|

| 247.2 |

|

|

| 147.1 |

|

|

| 4.72 |

|

| 1750 |

|

|

| 27.40 |

|

|

| 358.3 |

|

|

| 230.7 |

|

|

| 3.91 |

|

Results of Economic Analysis at Various Gold Prices (Contactor Operated)

Gold Price US$/oz |

|

| IRR % |

|

| NPV undiscounted US$ million |

|

| NPV discounted 5% US$ million |

|

| Payback Period Years |

| ||||

| 1350 |

|

|

| 15.43 |

|

|

| 159.4 |

|

|

| 85.4 |

|

|

| 5.94 |

|

| 1500 |

|

|

| 20.96 |

|

|

| 226.4 |

|

|

| 135.9 |

|

|

| 4.86 |

|

| 1750 |

|

|

| 29.18 |

|

|

| 337.8 |

|

|

| 219.7 |

|

|

| 3.82 |

|

Note: It should be noted that the economic analysis of this deposit is based upon the expenditures from the time a construction decision is taken and that all development costs to that point have been considered as sunk costs whether they have been expended or not at this time.

The PEA is considered preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. Mineral resources that are not mineral reserves have not yet demonstrated economic viability. Due to the uncertainty that may be attached to inferred mineral resources, it cannot be assumed that all or any part of an inferred mineral resource will be upgraded to an indicated or measured mineral resource as a result of continued exploration or mineral reserves once economic considerations are applied. Therefore there is no certainty that the production profile concluded in the PEA will be realized.

The PEA indicates that the Robertson Property is one of merit that warrants further development. The first phase of this development is recommended to be exploration drilling, metallurgical test work, environmental studies and permitting and completion of a prefeasibility study. The cost of this work is estimated to be US$7.9 million as shown below.

Summary of Expenditures to Completion of Prefeasibility:

|

| |||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

Exploration and definition drilling consists of the following:

The Phase I should consist of drilling 40 HQ diameter diamond core holes and 42 RC holes having an average depth of 400-500 ft and totaling about 40,000 ft in the;

| ||

| ||

| ||

|

The proposed metallurgical test work consists of variability testing and will be performed on samples obtained both spatially and at depth for the oxide and transition to sulfide ore zones. This work will encompass;

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Note also that the PEA concerns only the relatively shallow portions of these three deposits: Gold Pan, Porphyry and Altenburg Hill. Other deposits such as Distal, 39A, Triplet Gulch and a zone to the east of Gold Pan were not part of this study. However, all deposits form part of the 2011 calculation of the resources by Beacon Hill using a base case of US$1,350 per ounce. (Inferred mineral resource of 191 million tonnes @ 0.0143 oz Au/ton containing a total of 2.741 million ounces). It should be noted the resources are reported with consideration for their reasonable expectation of economic extraction as defined using an optimized pit shell.

The PEA also shows the logistical advantages of the Robertson Property, namely:

|

| |

|

| |

|

| |

|

| |

|

|

Mineral Resource Estimates

In 2007, Beacon Hill was commissioned by the Company to update the resource estimate on the Robertson Property. The purpose of the study was to incorporate additional drilling completed in 2006 in an updated resource estimate and to establish a program for continued development and provide a basis for a subsequent technical report. The final NI 43-101 compliant report, Mineral Resource Estimate for the Robertson Property, Lander County, Nevada report was received by the Company in February 2008.

Coral's current NI 43-101 compliant inferred resource estimate at the Robertson property was calculated in the 2012 PEA Report by Coral's independent engineering firm, Beacon Hill Consultants (1988) Ltd. ("Beacon Hill"). Gold ounces were calculated on the basis of US$1,350/oz Au and 70% Au recovery. The 0.0067 ozAu/t cut-off grade utilized to report the resource was derived from a mining cost of US$1.02/ton, process cost of US$5.00/ton and waste cost of US$1.14/ton. The mineral resources in the table below were estimated using the CIM Standards on Mineral Resources and Reserves:

Zone |

|

| Tons |

|

| Ounces per Ton |

|

| Ounces of Au (Inferred) |

| |||

| 39 A |

|

| 26,779,714 |

|

|

| 0.023 |

|

|

| 615,933 |

| |

GP Oxide |

|

|

| 21,939,550 |

|

|

| 0.0127 |

|

|

| 278,632 |

|

GP Sulphide |

|

|

| 48,759,224 |

|

|

| 0.0119 |

|

|

| 580,235 |

|

Porphyry Oxide |

|

|

| 59,707,994 |

|

|

| 0.0137 |

|

|

| 818,000 |

|

Porphyry Sulphide |

|

|

| 9,817,623 |

|

|

| 0.0132 |

|

|

| 129,593 |

|

Altenburg Hill Oxide |

|

|

| 23,170,083 |

|

|

| 0.0131 |

|

|

| 303,528 |

|

Altenburg Hill Sulphide |

|

|

| 178,279 |

|

|

| 0.0087 |

|

|

| 1,551 |

|

Triplett Gulch Sulphide |

|

|

| 678,279 |

|

|

| 0.0152 |

|

|

| 10,310 |

|

East Zone Sulphide |

|

|

| 694,672 |

|

|

| 0.0171 |

|

|

| 11,879 |

|

Total |

|

|

| 191,725,418 |

|

|

| 0.0143 |

|

|

| 2,741,673 |

|

Note: Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues. The quantity and grade of reported Inferred resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred resources as an Indicated or Measured mineral resource and it is uncertain if further exploration will result in upgrading them to the Indicated or Measured mineral resource category.

Proposed Exploration

The Company believes that there is a potential for discovery of additional mineral resources on the Robertson Property. The Company plans to continue to explore the Robertson Property or seek third party partners for further exploration.

|

Property Description and Location

The Gold Ridge Property consists of 135 claims covering approximately 2.5 square miles, and is adjacent to the western side of the Robertson claim block located in North Central Nevada on the Cortez Gold Trend. The property was initially comprised of 107 claims but was partly re-staked following the 2014 agreement with Barrick that is outlined below.

There is no underground or surface plant or equipment located on the Gold Ridge Property, nor any known body of commercial ore.

History and Exploration

Follow up mapping, rock sampling, and infill gravity surveys in 2008 lead to the Company's identification of a new lower plate target zone that extends from the Company's deep hole, 2 km to the south.