UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

FORM 20-F

☐ Registration Statement Pursuant to Section 12(b) or 12(g) of The Securities Exchange Act of 1934

OR

OR

☒ Annual Report Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934 for the fiscal year ended December 31 2019, 2022

OR

OR

☐ Transition Report Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

OR

OR

☐ Shell Company Report Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Commission file number 0-30752001-38064

AETERNA ZENTARIS INC.

(Exact Name of Registrant as Specified in its Charter)

Not Applicable

(Translation of Registrant’s Name into English)

Canada

(Jurisdiction of Incorporation)

315 Sigma Drivec/o Norton Rose Fulbright Canada, LLP, 222 Bay Street, Suite 3000, PO Box 53, TorontoONM5K 1E7

Summerville, South Carolina, USA

29486

(Address of Principal Executive Offices)

Klaus Paulini

Telephone: +49-69-426020+49-69-426020

E-mail: KPaulini@aezsinc.com

Weismüllerstr. 50

Frankfurt am Main, Germany

D-60314

(Name, Telephone, E-mail and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

| Common Shares | AEZS | NASDAQ Capital Market | ||

| Toronto Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act: NONE

Securities for which there is a reporting obligation pursuant to Section 15(d) of the ACT: NONE

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as at the close of the period covered by the annual report: [19,994,510] Common Shares as at December 31, 2019.2022.

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No : ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definitions of “accelerated filer,” “large accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☒ Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

US GAAP ☐ International Financial Reporting Standards as issued by the Other ☐

International Accounting Standards Board ☒

If “other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

Basis of Presentation

General

Except where the context otherwise requires, all references in this Annual Report on Form 20-F to the “Company”, “Aeterna Zentaris”, “Aeterna”, “we”, “us”, “our” or similar words or phrases are to Aeterna Zentaris Inc. and its subsidiaries, taken together. In this Annual Report on Form 20-F, references to “$” and “U.S.$” are to United States (“U.S.”) dollars, references to “CAN$” are to Canadian dollars and references to “EUR” and “€” are to euros.euros, and references to “£” are to British Pounds. Unless otherwise indicated, the statistical and financial dataall information contained in this Annual Report on Form 20-F are presented as atof December 31, 2019.2022.

All share, option and share purchase warrant as well as per share, option and share purchase warrant information presented in this Annual Report on Form 20-F have been adjusted, including proportionate adjustments being made to each option and share purchase warrant exercise price, to reflect and to give effect to a share consolidation (or reverse stock split), on November 17, 2015, of our issued and outstanding common shares on a 100-to-1 basis (the “Share Consolidation”). The Share Consolidation affected all shareholders, optionholders and warrantholders uniformly and thus did not materially affect any securityholder’s percentage of ownership interest.

This Annual Report on Form 20-F also contains certain information regarding products or product candidates that may potentially compete with our products and product candidates, and such information has been primarily derived from information made publicly available by the companies developing such potentially competing products and product candidates and has not been independently verified by Aeterna Zentaris.

Special Note on Forward-Looking Statements

This Annual Report on Form 20-F and the documents incorporated herein by reference contain “forward-looking statements” made pursuant to the safe-harbor provision of the U.S. Private Securities Litigation Reform Act of 1995, which reflect our current expectations regarding future events. All statements other than statements of historical facts included in or incorporated by reference into this Annual Report on Form 20-F, under the caption “Key Information—Risk Factors” filed with the relevant Canadian securities regulatory authorities in lieu of an annual information form and with the U.S. Securities and Exchange Commission (“SEC”SEC”) that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements. Our forward-looking statements generallymay relate to the Company’s future outlook and anticipated events or results, and may include statements about ourregarding the financial position, business strategy, growth strategy, budgets, operations, financial results, taxes, dividends, plans and objectives strategies andof the Company. Particularly, statements regarding future results, performance, achievements, prospects regarding, among other things, our businesses, resultsor opportunities of operations, liquidity and financial condition.the Company are forward-looking statements. In some cases, we have identified these forward-looking statements withcan be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate” or “believes”, or variations of such words like “believe,” “may,” “could,” “might,” “possible,” “potential,” “project,”and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, “will” or “will” “should,” “expect,” “intend,” “plan,” “predict,” “anticipate,” “estimate,” “approximate,” “contemplate” be taken”, “occur” or “continue,”“be achieved” or the negative of these words or other words and terms of similar meaning. Known

Certain forward-looking statements contained herein about prospective results of operations, financial position or cash flows may constitute a financial outlook. Such statements are based on assumptions about future events, are given as at the date hereof and are based on economic conditions, proposed courses of action and management’s assessment of the relevant information currently available. Management of the Company has approved the financial outlook as of the date hereof. Readers are cautioned that such financial outlook information contained herein should not be used for purposes other than for which it is disclosed herein.

Forward-looking statements are based on the opinions and estimates of the Company as of the date of this Annual Report, and they are subject to known and unknown risks, uncertainties, assumptions and uncertainties couldother factors that may cause ourthe actual results, level of activity, performance or achievements to differbe materially different from those inexpressed or implied by such forward-looking statements. Such risks and uncertainties include,statements, including but are not limited to the following:factors described in “Risk Factors” and those relating to: Aeterna’s expectations with respect to the DETECT-trial (including regarding the enrollment of subjects in the DETECT-trial, the application of the macimorelin growth hormone stimulation tests and the completion of the DETECT-trial); Aeterna’s expectations regarding conducting pre-clinical research to identify and characterize an AIM Biologicals-based development candidate for the treatment of NMOSD as well as Parkinson’s disease, and developing a manufacturing process for selected candidates; Aeterna’s expectations regarding conducting assessments in relevant Parkinson’s disease models; The University of Queensland undertaking a subsequent investigator initiated clinical trial evaluating macimorelin as a potential therapeutic for the treatment of ALS and Aeterna formulating a pre-clinical development plan for same; the commencement of Aeterna’s formal pre-clinical development of AEZS-150 in preparation for a potential IND filing for conducting the first in-human clinical study of AEZS-150; and the impacts associated with the termination of the license agreement with Novo Nordisk Healthcare AG.

| 2 |

Forward-looking statements involve known and unknown risks and uncertainties, and other factors which may cause the actual results, performance or achievements stated herein to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks and uncertainties include, among others, our reliance on the success of the pediatric clinical trial in the European Union and U.S. for Macrilen™ (macimorelin); the commencement of the DETECT-trial may be delayed or we may not obtain regulatory approval to initiate that study; we may be unable to enroll the expected number of subjects in the DETECT-trial and the result of the DETECT-trial may not support receipt of regulatory approval in CGHD; results from ongoing or planned pre-clinical studies of macimorelin by the University of Queensland or for our other products under development may not be successful or may not support advancing the product to human clinical trials; our ability to raise capital and obtain financing to continue our currently planned operations; our now heavy dependence on the success of Macrilen™ (macimorelin) and related out-licensing arrangements and the continued availability of funds and resources to successfully commercialize the product; our ability to enter into a new license agreement or similar arrangement following the termination of the license agreement with Novo Nordisk AG; the global instability due to the global pandemic of COVID-19, and its unknown potential effect on our planned operations; our ability to enter into out-licensing, development, manufacturing, marketing and distribution agreements with other pharmaceutical companies and keep such agreements in effect; and our ability to continue to list our common shares on the NASDAQ Capital Market (“NASDAQ”) or the Toronto Stock Exchange (“TSX”).

These risk factors are not intended to represent a complete list of the risk factors that could affect the Company. These factors and assumptions, however, should be considered carefully. More detailed information about these and other factors is included under “Risk Factors” in this Annual Report on Form 20-F and in other documents incorporated herein by reference. Many of these factors are beyond our control. Future events may vary substantially from what

However, we currently foresee. You should not place undue reliance on such forward-looking statements. We disavow and are under no obligation to update or alter such forward-looking statements whether as a result of new information, future results, events, developments or otherwise, unless required to do so by a governmental authority or applicable law. We advise you however, to review any further disclosures we make on related subjects in our reports on Form 6-K filed or furnished to the SEC.SEC and in our other public disclosure filed under our profile on SEDAR at www.sedar.com.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Many of these factors are beyond our control. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements, particularly in light of the ongoing and developing COVID-19 pandemic and its impact on the global economy and its uncertain impact on the Company’s business. Accordingly, readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements contained herein, except as required by applicable securities laws. New factors emerge from time to time, and it is not possible for the Company to predict all of these factors, or to assess in advance the impact of each such factor on the Company’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

| 3 |

TABLE OF CONTENTS

GENERAL INFORMATION

| 4 |

| 5 |

PART I

| Item 1. | Identity of Directors, Senior Management and Advisers |

| A. | Directors and senior management |

Not applicable.

| B. | Advisers |

Not applicable.

| C. | Auditors |

Not applicable.

| Item 2. | Offer Statistics and Expected Timetable |

| A. | Offer statistics |

Not applicable.

| B. | Method and expected timetable |

Not applicable.

| Item 3. | Key Information |

| A. |

The consolidated statement of comprehensive (loss) income information set forth in this Item 3.A. with respect to the years ended December 31, 2019, 2018 and 2017 and the consolidated statement of financial position information as at December 31, 2019and 2018 have been derived from the audited consolidated financial statements set forth in Item 18, which have been prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”). The consolidated statement of comprehensive income (loss) information with respect to the years ended December 31, 2016 and 2015 and the consolidated statement of financial position information as at December 31, 2017, 2016 and 2015 set forth in this Item 3.A. have been derived from our previous consolidated financial statements not included herein, and have also been prepared in accordance with IFRS, as issued by the IASB. The selected financial data should be read in conjunction with our audited consolidated financial statements and the related notes included elsewhere in this Annual Report on Form 20-F, as well as “Item 5. – Operating and Financial Review and Prospects” of this Annual Report on Form 20-F.

The Company has not declared or paid any dividends per share during the periods covered by the selected financial data.

Consolidated Statements of Comprehensive (Loss) Income Information

(in thousands of U.S. dollars, except share and per share data)

Derived from consolidated audited financial statements prepared in accordance with IFRS, as issued by the IASB

| December 31, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||

| Revenues | ||||||||||||||||||||

| License fees | 74 | 24,325 | 458 | 497 | 248 | |||||||||||||||

| Product sales | 129 | 2,167 | — | — | — | |||||||||||||||

| Royalty income | 45 | 184 | — | — | — | |||||||||||||||

| Sales commission | — | 110 | — | — | — | |||||||||||||||

| Supply chain | 284 | 95 | 465 | 414 | 297 | |||||||||||||||

| 532 | 26,881 | 923 | 911 | 545 | ||||||||||||||||

| Cost of sales | 410 | 2,104 | — | — | — | |||||||||||||||

| Research and development costs | 1,837 | 2,932 | 10,704 | 16,495 | 17,234 | |||||||||||||||

| General and administrative expenses | 6,615 | 8,894 | 8,198 | 7,147 | 11,308 | |||||||||||||||

| Selling expenses | 1,214 | 3,109 | 5,095 | 6,745 | 6,887 | |||||||||||||||

| Restructuring costs | 507 | — | — | — | — | |||||||||||||||

| Impairment of right of use asset | 22 | — | — | — | — | |||||||||||||||

| Write-off of other current assets | 169 | — | — | — | — | |||||||||||||||

| 10,774 | 17,039 | 23,997 | 30,387 | 35,429 | ||||||||||||||||

| (Loss) income from operations | (10,242 | ) | 9,842 | (23,074 | ) | (29,476 | ) | (34,884 | ) | |||||||||||

| Settlements | — | (1,400 | ) | — | — | — | ||||||||||||||

| Gain (loss) due to changes in foreign currency exchange rates | 87 | 656 | 502 | (70 | ) | (1,767 | ) | |||||||||||||

| Change in fair value of warrant liability | 4,518 | 263 | 2,222 | 4,437 | (10,956 | |||||||||||||||

| Warrant exercise inducement fee | — | — | — | — | (2,926 | ) | ||||||||||||||

| Other finance (costs) income | (593 | ) | 278 | 75 | 150 | 305 | ||||||||||||||

| Net finance income (costs) | 4,012 | 1,197 | 2,799 | 4,517 | (15,344 | ) | ||||||||||||||

| (Loss) income before income taxes | (6,230 | ) | 9,639 | (20,275 | ) | (24,959 | ) | (50,228 | ) | |||||||||||

| Income tax recovery (expense) | 188 | (5,452 | ) | 3,479 | — | — | ||||||||||||||

| Net (loss) income from operations | (6,042 | ) | 4,187 | (16,796 | ) | (24,959 | ) | (50,228 | ) | |||||||||||

| Net income from discontinued operations | — | — | — | — | 85 | |||||||||||||||

| Net (loss) income | (6,042 | ) | 4,187 | (16,796 | ) | (24,959 | ) | (50,143 | ) | |||||||||||

| Other comprehensive (loss) income: | ||||||||||||||||||||

| Items that may be reclassified subsequently to profit or loss: | ||||||||||||||||||||

| Foreign currency translation adjustments | 83 | (260 | ) | (1,430 | ) | 569 | 1,509 | |||||||||||||

| Items that will not be reclassified to profit or loss: | ||||||||||||||||||||

| Actuarial gain (loss) on defined benefit plans | (1,068 | ) | 193 | 694 | (1,479 | ) | 844 | |||||||||||||

| Comprehensive (loss) income | (7,027 | ) | 4,120 | (17,532 | ) | (25,869 | ) | (47,790 | ) | |||||||||||

| Basic net (loss) income per share from continuing operations(1) | (0.35 | ) | 0.25 | (1.12 | ) | (2.41 | ) | (18.17 | ) | |||||||||||

| Diluted net (loss) income per share from continuing operations(1) | (0.35 | ) | 0.24 | (1.12 | ) | (2.41 | ) | (18.17 | ) | |||||||||||

| Net income per share (basic and diluted) from discontinued operations1 | — | — | — | — | 0.03 | |||||||||||||||

| Net (loss) income per share (basic)1 | (0.35 | ) | 0.25 | (1.12 | ) | (2.41 | ) | (18.14 | ) | |||||||||||

| Net (loss) income per share (diluted)1 | (0.35 | ) | 0.24 | (1.12 | ) | (2.41 | ) | (18.14 | ) | |||||||||||

| Weighted average number of shares outstanding: | ||||||||||||||||||||

| Basic | 17,494,472 | 16,440,760 | 14,958,704 | 10,348,879 | 2,763,603 | |||||||||||||||

| Diluted | 17,494,472 | 17,034,812 | 14,958,704 | 10,348,879 | 2,763,603 | |||||||||||||||

Consolidated Statement of Financial Position Information

(in thousands of U.S. dollars)

Derived from consolidated financial statements prepared in accordance with IFRS, as issued by the IASB

| As at December 31, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||

| Cash and cash equivalents | 7,838 | 14,512 | 7,780 | 21,999 | 41,450 | |||||||||||||||

| Restricted cash equivalents | 364 | 418 | 381 | 496 | 255 | |||||||||||||||

| Total assets | 19,981 | 25,011 | 22,195 | 31,659 | 51,498 | |||||||||||||||

| Warrant liability (current and non-current portion) | 2,255 | 3,634 | 3,897 | 6,854 | 10,891 | |||||||||||||||

| Share capital | 224,528 | 222,335 | 222,335 | 213,980 | 204,596 | |||||||||||||||

| Shareholders’ (deficiency) equity | (2,463 | ) | 1,907 | (2,783 | ) | 6,212 | 21,615 | |||||||||||||

| B. | Capitalization and indebtedness |

Not applicable.

| C. | Reasons for the offer and use of proceeds |

Not applicable.

| D. | Risk factors |

An investment in our securities involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this Annual Report, before making an investment decision. If any of the following risks actually occurs,occur, our business, prospects, financial condition or results of operations could be materially, adversely affected by any of these risks. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. The trading price of our securities could decline due to any of these risks, and you may lose all or part of your investment. This Annual Report also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks mentioned below. Forward-looking statements included in this Annual Report are based on information available to us on the date hereof, and all forward-looking statements in the documents incorporated by reference are based on information available to us as of the date of each such document. We disavow and are under no obligation to update or alter such forward-looking statements whether as a result of new information, future events or otherwise, other than as required by applicable securities legislation.

| 6 |

Risks Relating to Us and Our Business

Summary of Risk Factors

The following is a summary of the risk factors our business faces. The list below is not exhaustive and investors should read this “Risk Factors” section in full. Some of the risks we face include:

| ● | the delisting of our Common Shares from the NASDAQ or the TSX could impact their market price and liquidity; |

| ● | we may be a passive foreign investment company, which could result in adverse tax consequences; |

| ● | our net operating losses may be limited under U.S. tax laws; |

| ● | our Rights Plan may prevent changes of control of the Company; |

| ● | the economic effects of COVID-19 may impact the market price of our Common Shares; |

| ● | investments in biopharmaceutical companies are generally considered to be speculative; |

| ● | risks relating to the failure to commercialize or out-license Macrilen™ (macimorelin); |

| ● | our revenues and expenses may fluctuate significantly and we may fail to meet financial expectations; |

| ● | the failure to complete the clinical trial program for the pediatric indication of Macrilen™ (macimorelin) could impact our operations; |

| ● | our dependence on strategic third party relationships regarding Macrilen™ (macimorelin); |

| ● | we may be unsuccessful in completing further out-licensing arrangement for Macrilen™ (macimorelin); |

| ● | we have initiated significant early-stage pre-clinical programs; |

| ● | we may require significant additional financing, and we may not have access to sufficient capital; |

| ● | we are and will be subject to ongoing government regulation for our products; |

| ● | marketing approval for Macrilen™ (macimorelin) could be subject to restrictions or withdrawals; |

| ● | healthcare reforms could hinder the commercial success of a product and affect our business; |

| ● | we may be subject to civil or criminal penalties if we interact with healthcare practitioners in a way that violates healthcare fraud or abuse laws; |

| ● | we may be unable to generate significant revenues if Macrilen™ (macimorelin) does not gain market acceptance; |

| ● | we may expend our limited resources to pursue a particular product or indication and fail to capitalize on other products or indications for which there may be a greater likelihood of success; |

| ● | we may not achieve our projected development goals in the time-frames we announce and expect; |

| ● | if we fail to obtain acceptable prices or adequate reimbursement for Macrilen™ (macimorelin), our ability to generate revenues will be diminished; |

| ● | competition in our targeted markets is intense, and development by other companies could render Macrilen™ (macimorelin), or any of our future products, non-competitive; |

| ● | we may not obtain adequate protection for Macrilen™ (macimorelin) through our intellectual property; |

| ● | we may infringe the intellectual property rights of others; |

| ● | patent litigation is costly and time consuming and may subject us to liabilities; |

| ● | we may not obtain trademark registrations for our current or future products; |

| 7 |

| ● | we rely on third parties to conduct, supervise and monitor our clinical trials, and those third parties may not perform satisfactorily; |

| ● | any difficulties or delays in our clinical trials could result in increased costs to us, delay or limit our ability to generate revenue and adversely affect our commercial prospects; |

| ● | the FDA and other foreign equivalents may not accept data from clinical trials outside the United States, in which case our development plans will be delayed, which could materially harm our business; |

| ● | in carrying out our operations, we are dependent on a stable and consistent supply of ingredients and raw materials; |

| ● | the failure to perform satisfactorily by third parties upon which we expect to rely to manufacture and supply products may lead to supply shortfalls; |

| ● | we are subject to intense competition for our skilled personnel, and the loss of key personnel or the inability to attract additional personnel could impair our ability to conduct our operations; |

| ● | we may be subject to litigation in the future; |

| ● | we are subject to the risk of product liability claims for which we may not have adequate insurance coverage; |

| ● | claims of creditors of our subsidiaries will generally have priority as to the assets of such subsidiaries over our claims and those of our creditors and shareholders; |

| ● | it may be difficult for U.S. investors to obtain and enforce judgments against us because of our Canadian incorporation and German presence; |

| ● | we can provide no assurance that we will, at all times in the future, be able to report that our internal controls over financial reporting are effective; |

| ● | we may have material weaknesses in our internal controls over financial reporting which could have a material adverse effect on the price of our Common Shares |

| ● | we are subject to environmental laws and may be subject to environmental remediation obligations. The impact of these obligations may have a material adverse effect on our business; |

| ● | we may incur losses associated with foreign currency fluctuations; |

| ● | legislative actions, new accounting pronouncements and higher insurance costs may adversely impact our future financial position or results of operations; |

| ● | data security breaches may disrupt our operations and adversely affect our operating results; |

| ● | our share price is volatile, which may result from factors outside of our control; |

| ● | we do not intend to pay dividends in the near future; |

| ● | future issuances of securities and hedging activities may depress the trading price of our Common Shares; |

| ● | in the event we were to lose our foreign private issuer status as of June 30 of a given financial year, we would be required to comply with the Securities Exchange Act of 1934 domestic reporting regime, which could cause us to incur additional legal, accounting and other expenses; |

| ● | our articles of incorporation contain “blank check” preferred share provisions, which could delay or impede an acquisition of our company; and |

| ● | our business could be negatively affected as a result of the actions of activist shareholders. |

| 8 |

Our Common Shares may be delisted from the NASDAQ or the TSX, which could affect their market price and liquidity. If our Common Shares were to be delisted, investors may have difficulty in disposing their Common Shares.

Our Common Shares are currently listed on both the NASDAQ and the TSX under the symbol “AEZS”. We maymust meet continuing listing requirements to maintain the listing of our Common Shares on the NASDAQ and the TSX. For continued listing, the NASDAQ requires, among other things, that listed securities maintain a minimum closing bid price of not be ableless than $1.00 per share.

On July 28, 2021, we received a letter from the Listing Qualifications Staff of the NASDAQ (the “Staff”), notifying us that for the last 30 consecutive business days prior to continuethe date of the letter, the closing bid price of our common shares was below $1.00 per share and, therefore, we did not meet the requirement for continued listing on Nasdaq as required by Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”). In accordance with Nasdaq Listing Rule 5810(c)(3)(A), we were granted a grace period of 180 calendar days, through January 24, 2022, and on January 26, 2022, we were granted a subsequent 180 calendar day extension, through July 26, 2022, to evidence compliance with the Bid Price Rule. In order to regain compliance with the Bid Price Rule, the Company implemented a reverse stock split (also known as a going concern if we do not obtain cashshare consolidation) effective July 21, 2022 on the basis of one post-consolidation Common Share for every twenty-five pre-consolidation Common Shares. In addition to the minimum bid price requirement, the continued listing rules of the NASDAQ require us to meet at least one of the following listing standards: (i) stockholders’ equity of at least $2.5 million, (ii) market value of listed securities (calculated by multiplying the daily closing bid price of our securities by our total outstanding securities) of at least $35 million or (iii) net income from AEZS Germany to fund our North Americancontinuing operations and we do not obtain additional financing.

We have incurred, and expect to continue to incur, substantial expenses(in the latest fiscal year or in our efforts to develop Macrilen™ (macimorelin). Consequently, we have incurred operating losses and negative cash flow from operations historically and in eachtwo of the last several years exceptthree fiscal years) of at least $500,000.

It is possible that we may be a passive foreign investment company, which could result in adverse tax consequences to U.S. investors.

Adverse U.S. federal income tax rules apply to “U.S. Holders” who directly or indirectly hold stock of a passive foreign investment company (“PFIC”). We would be classified as a PFIC for U.S. federal income tax purposes for a taxable year if (i) at least 75% of our gross income is “passive income” or (ii) at least 50% of the average value of our assets, including goodwill (based on annual quarterly average), is attributable to assets which produce passive income or are held for the production of passive income.

The determination of whether we are, or will be, a PFIC for a taxable year ended December 31, 2018, whendepends, in part, on the application of complex U.S. federal income tax rules, which are subject to various interpretations. Although the matter is not free from doubt, we earned revenue from the sale ofbelieve that we were not a licensePFIC during our 2022 taxable year and will not likely be a PFIC during our 2023 taxable year. Because PFIC status is based on our income, assets and activities for the adult indicationentire taxable year, and our market capitalization, it is not possible to determine whether we will be characterized as a PFIC for the 2023 taxable year until after the close of Macrilen™ (macimorelin) in the U.S.taxable year. The tests for determining PFIC status are subject to a number of uncertainties. These tests are applied annually, and Canada.

The abilityit is difficult to realize ouraccurately predict future income, assets and meet our obligations as they come due is dependent on earning sufficient revenues underactivities relevant to this determination. In addition, because the license and assignment agreement with a subsidiary of Novo (the “License Agreement”), monetizing commercial opportunities for Macrilen™ (macimorelin) in the rest of the world (“ROW”), realizing other monetizing transactions and raising additional sources of funding, the outcome of which cannot be predicted at this time. The revenue provided under the License Agreement was $45,000 for the year ended December 31, 2019. Furthermore, the Company had cash of $7,838,000 for the year ended December 31, 2019. In September 2019, the Company closed an equity financing which provided approximately $4,193,000 in net cash proceeds (“September 2019 Financing”). Subsequent to 2019, in February 2020, the Company closed an equity financing which provided approximately $3,900,000 in net cash proceeds (“February 2020 Financing”).

Aeterna Zentaris is a holding company and a substantial portionmarket price of our non-cash assetsCommon Shares is likely to fluctuate, the share capitalmarket price may affect the determination of our subsidiaries. Our principal operating subsidiary, AEZS Germany, holds most of our intellectual property rights and is also the counter-party for revenue earned under the License Agreement. In the event that Aeterna Zentaris is unable to obtain additional funding from third party sources, it will require cash from AEZS Germany to fund its North American operations. If and when current and medium term liabilities of AEZS Germany exceed the values ascribed to AEZS Germany’s assets, it may no longer be possible under applicable German solvency laws for AEZS Germany’s operations to continue. The Company has some discretion to manage research and development costs, administrative expenses and capital expenditures in order to maintain its cash liquidity; however, the Company will need to conclude agreement(s) for licensing or selling the European or worldwide rights to Macrilen™ (macimorelin) and, if necessary, obtain further financing in order to continue its currently planned operations. Management has assessed the Company’s ability to continue as a going concern and concluded that additional capitalwhether we will be required.considered a PFIC. There can be no assurance that we will not be considered a PFIC for any taxable year (including our 2023 taxable year).

If we are a PFIC for any taxable year during which a U.S. Holder holds Common Shares, we generally would continue to be treated as a PFIC with respect to that U.S. Holder for all succeeding years during which the CompanyU.S. Holder holds such Common Shares, even if we ceased to meet the threshold requirements for PFIC status. Accordingly, no assurance can be given that we will not constitute a PFIC in the current (or any future) tax year or that the Internal Revenue Service (the “IRS”) will not challenge any determination made by us concerning our PFIC status. PFIC characterization could result in adverse U.S. federal income tax consequences to U.S. Holders. In particular, absent certain elections, a U.S. Holder would generally be subject to U.S. federal income tax at ordinary income tax rates, plus a possible interest charge, in respect of a gain derived from a disposition of our Common Shares, as well as certain distributions by us. If we are treated as a PFIC for any taxable year, a U.S. Holder may be able to execute licensemake an election to “mark-to-market” Common Shares each taxable year and recognize ordinary income pursuant to such election based upon increases in the value of the Common Shares.

In addition, U.S. Holders may mitigate the adverse tax consequences of the PFIC rules by making a “qualified electing fund” (“QEF”) election; however, there can be no assurance that we will satisfy the record keeping requirements applicable to a QEF or purchase agreementsthat we will provide the information regarding our income that would be necessary for a U.S. Holder to make a QEF election.

| 9 |

If the Company is a PFIC, U.S. Holders will generally be required to file an annual information return with the IRS (on IRS Form 8621 Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund, which PFIC shareholders will be required to obtain equityfile with their U.S. federal income tax or debt financing,information returns) relating to their ownership of Common Shares. This filing requirement is in addition to any pre-existing reporting requirements that apply to a U.S. Holder’s interest in a PFIC (which this requirement does not affect).

Our net operating losses may be limited for U.S. federal income tax purposes under Section 382 of the Internal Revenue Code.

If a corporation with net operating losses (“NOLs”) undergoes an “ownership change” within the meaning of Section 382 of the United States Internal Revenue Code of 1986, as amended (the “Code”), then such corporation’s use of such “pre-change” NOLs to offset income incurred following such ownership change may be limited. Such limitation also may apply to certain losses or deductions that are “built-in” (i.e., attributable to periods prior to the ownership change, but not yet taken into account for tax purposes) as of the date of the ownership change that are subsequently recognized. An ownership change generally occurs when there is either (i) a shift in ownership involving one or more “5% shareholders,” or (ii) an “equity structure shift” and, as a result, the percentage of stock of the corporation owned by one or more 5% shareholders (based on terms acceptablevalue) has increased by more than 50 percentage points over the lowest percentage of stock of the corporation owned by such shareholders during the “testing period” (generally the 3 years preceding the testing date). In general, if such change occurs, the corporation’s ability to it. Factors withinutilize its NOL carry-forwards and certain other tax attributes would be subject to an annual limitation, as described below. The unused portion of any such NOL carry-forwards or tax attributes each year is carried forward, subject to the same limitation in future years. The impact of an ownership change on state NOL carry forwards may vary from state to state. Due to previous ownership changes, or if we undergo an ownership change in connection with or after this offering, our ability to use our NOLs could be limited by Section 382 of the Code. Future changes to our stock ownership, some of which are outside of our control, could result in an ownership change under Section 382 of the Code. Recent legislation added several limitations to the ability to claim deductions for NOLs in future years, particularly for tax years beginning after December 31, 2021, including a deduction limit equal to 80% of taxable income and a restriction on NOL carryback deductions. For these reasons, we may not be able to use a material portion of the NOLs, even if we attain profitability.

Prevention of Transactions Involving a Change of Control of the Company

Effective May 8, 2019, the shareholders re-approved our Rights Plan that provides the Board and the Company’s control couldshareholders with additional time to assess any unsolicited take-over bid for the Company and, where appropriate, to pursue other alternatives for maximizing shareholder value. Under the Rights Plan, one right has been issued for each currently issued Common Share, and one right will be issued with each additional Common Share that may be issued from time to time. The Rights Plan may have a significant bearing on its abilityanti-takeover effect. The Rights Plan has the potential to obtain additional financing. Assignificantly dilute the ownership interests of an acquiror of our shares, and therefore may have the effect of delaying, deterring or preventing a result, management has determined that there are material uncertainties that may cast significant doubt upon the Company’s ability to continue as a going concern. For additional discussion of risks related to licensing and selling of Macrilen™ (macimorelin), see risk factor titled “If we are unable to successfully commercialize or out-license Macrilen™ (macimorelin), or if we experience significant delayschange in doing so, our business would be materially harmed, and the future and viabilitycontrol of the Company could be imperiled” below.Company.

In the event we use up the proceeds from recent third party financings and are not able to transfer cash from AEZS Germany to fund our North American operations and/or secure additional funding, we may be forced to curtail operations, cease operations altogether or file for bankruptcy.

The economic effects of a pandemic, epidemic or outbreak of an infectious disease could adversely affect our operations or the market price of our Common Shares.

Public health crises such as pandemics, epidemics or similar outbreaks, including the novel strain of coronavirus known as “COVID-19”, could adversely impact our operations or the market price of our Common Shares. In December 2019, a novel strain of coronavirus (“COVID-19”) was reported to have surfaced in Wuhan, China and has reached multiple other countries, resulting in government-imposed quarantines, travel restrictions, school closures and other significant restrictions on business operations imposed by governmental authorities in North America, Europe and worldwide. On January 30, 2020, the World Health Organization declared the outbreak of the COVID-19 a “Public Health Emergency of International Concern.” On January 31, 2020, U.S. Health and Human Services Secretary Alex M. Azar II declared a public health emergency for the U.S. to aid the U.S. healthcare community in responding to COVID-19, and on March 11, 2020, the World Health Organization characterized the outbreak as a “pandemic”. The extent to which the COVID-19 impacts our operations or the market price of our Common Shares will depend on future developments, which are highly uncertain and cannot be predicted with confidence, either internationally or within the U.S., Canada or Germany, including the duration of the outbreak, new information that may emerge concerning the severity of the COVID-19, and the actions to contain the virus or treat its impact, among others. COVID-19, however, has already resulted in significant volatility in the world and the national trading markets.

| 10 |

The spread of COVID-19 may impact our operations, including the potential interruption of our clinical trial activities and our supply chain. For example, the rise in the Omicron variant in the COVID-19 outbreak may delaypandemic has caused delays in site initiation and patient enrollment in our pediatricPhase 3 DETECT clinical trial for diagnostic use in childhood-onset growth hormone deficiency. As well, sales activities for Macrilen™ in the US by Novo Nordisk may be impacted due to prioritizationdelays of hospital resources towarddiagnostic activities on adult growth hormone deficiency (“AGHD”) in the outbreak, andU.S. In addition, the COVID-19 pandemic may also cause some patients mayto be unwilling to enroll in our trials or be unable to comply with clinical trial protocols if quarantines impede patient movement or interrupt healthcare services, which would delay our ability to conduct clinical trials or release clinical trial results on a timely basis and could delay our ability to obtain regulatory approval and commercialize our product candidates. The spread of an infectious disease, including COVID-19, may also result in the inability of our suppliers to deliver components or raw materials on a timely basis or at all. In addition, hospitals may reduce staffing and reduce or postpone certain treatments in response to the spread of an infectious disease. Such events may result in a period of business disruption and, in reduced operations, doctors or medical providers may be unwilling to participate in our clinical trials, any of which could materially affect our business, financial condition or results of operations. The significant spread of COVID-19 within the U.S., Canada or Germany resulted in a widespread health crisis and has had adverse effect on the national economies generally, the markets that we serve, our operations and the market price of our Common Shares.

Investments in biopharmaceutical companies are generally considered to be speculative in nature.

The prospects for companies operating in the biopharmaceutical industry are uncertain, given the very nature of the industry, in which companies often experience lengthy development time, extensive capital requirements, rapid technological developments and accordingly,a high degree of competition based primarily on scientific and technological factors. These factors include the availability to obtain patent and other protection for technology and products, the ability to commercialize technological developments and the ability to obtain government approval for testing, manufacturing and marketing. Accordingly, investments in biopharmaceutical companies should be considered to be speculative assets.

If we are unable to successfully commercialize or out-license Macrilen™ (macimorelin), or if we experience significant delays in doing so, our business would be materially harmed, and the future and viability of the Company could be imperiled.

Our principal focus is on the licensing and development oflead product, Macrilen™ (macimorelin), is the first and only U.S. Food and Drug Administration and European Commission approved oral test indicated for the diagnosis of patients with AGHD and we currently do not have any other product. products. We are focused on opportunistically utilizing our network with universities in Europe and the U.S., which we believe will provide vital access to innovative development candidates in different indications, with a focus on rare or orphan indications and potential for pediatric use. To date, we have signed agreements to establish this growing pipeline across a number of indications, including neuromyelitis optica spectrum disorder (“NMOSD”) and Parkinson’s disease (“PD”), primary hypoparathyroidism and amyotrophic lateral sclerosis (“ALS”, or Lou Gehrig’s disease).

We are a party to the License Agreementlicense agreements to carry out development, manufacturing, registration and commercialization of Macrilen™ (macimorelin) in the U.S., Canada, the European Economic Area, the United Kingdom, and Canada.the Republic of Korea. We are party to a distribution agreement for the commercialization of Macrilen™ (macimorelin) in Israel and the Palestinian Authority, Turkey and some non-European Union Balkan countries. We continue to explore licensing and distribution opportunities worldwide.

As noted above, on August 26, 2022, the Company announced that it will regain full rights to Macrilen™ in the U.S. and Canada, following Novo’s termination of the development and commercialization license agreement, which triggered a 270-day notice period. Although the Company is actively engaged in exploring all options for Macrilen™ in the U.S. and Canada, there can be no assurance that the Company will be able to enter into a similar agreement or any agreement with respect to the rights to Macrilen™ in the U.S. and Canada.

The commercial success of Macrilen™ (macimorelin) depends on several factors, including, but not limited to, the following:

| ● | receipt of approvals from foreign regulatory authorities; | |

| ● | successfully negotiating pricing and reimbursement in key markets in the | |

| ● | successfully contracting with qualified third-party suppliers to manufacture | |

| ● | developing appropriate distribution and marketing infrastructure and arrangements for our product; |

| 11 |

| ● | launching and growing commercial sales of the product; | |

| ● | out-licensing | |

| ● | acceptance of the product in the medical community, among patients and with third-party payers. |

If we are unable to successfully achieve any of these factors, our business, financial condition and results of operations may be materially, adversely affected.

Our revenues and expenses may fluctuate significantly, and any failure to meet financial expectations may disappoint securities analysts or investors and result in a decline in the price or the value of our Common Shares or other securities.

We have a history of operating losses. Our revenues and expenses have fluctuated in the past and may continue to do so in the future. These fluctuations could cause our share price of Common Shares or the value of our other securities to decline. Some of the factors that could cause our revenues and expenses to fluctuate include, but are not limited to, the following:

| ● | the timing and willingness of any current or future collaborators to invest the resources necessary to commercialize Macrilen™ (macimorelin); | |

| ● | not obtaining necessary regulatory approvals from the | |

| ● | the timing of regulatory submissions and approvals; | |

| ● | the nature and timing of licensing fee revenues; | |

| ● | the outcome of future litigation; | |

| ● | foreign currency fluctuations; | |

| ● | the effects of the recent outbreak of COVID-19, including the effects of intensified efforts to contain the spread of the virus, which has, to date, included, among other things, quarantines and travel | |

| ● | the timing of the achievement and the receipt of milestone payments from current or future licensing partners; and | |

| ● | failure to enter into new or the expiration or termination of current agreements with suppliers who manufacture Macrilen™ (macimorelin). |

Due to fluctuations in our revenues and expenses, we believe that period-to-period comparisons of our results of operations are not necessarily indicative of our future performance. It is possible that in some future periods, our revenues and expenses will be above or below the expectations of securities analysts or investors. In this case, the share price of our Common Shares and the value of our other securities could fluctuate significantly or decline.

If we are unable to successfully complete the pediatric clinical trial program for Macrilen™ (macimorelin), or if such clinical trial takes longer to complete than we project, our ability to execute any related business strategy will be adversely affected.

If we experience delays in identifying and contracting with sites and/or in-patient enrollment in our pediatric clinical trial program for Macrilen™ (macimorelin), we may incur additional costs and delays in our development programs, and may not be able to complete our clinical trials on a cost-effective or timely basis. In addition, conducting multi-national studies adds another level of complexity and risk as we are subject to events affecting countries other than the U.S. and Canada. Moreover, negative or inconclusive results from the clinical trials we conduct or adverse medical events could cause us to have to repeat or terminate the clinical trials. Furthermore, children have different metabolic issues than adults. Accordingly, we may not be able to complete the pediatric clinical trial within an acceptable time-frame, if at all. If we or our contract research organization (a “CRO”Contract Research Organizations (“CRO”) have difficulty enrolling a sufficient number of patients to conduct our clinical trials as planned, we may need to delay or terminate ongoing clinical trials.

| 12 |

Clinical trials are subject to continuing oversight by governmental regulatory authorities and institutional review boards and must, among other requirements:

| ● | meet the requirements of these authorities from multiple countries and jurisdictions and their related statutes, regulations and guidance; | |

| ● | meet the requirements for informed consent; | |

| ● | meet the requirements for institutional review boards; and | |

| ● | meet the requirements for good clinical practices. |

We are currently dependent on certain strategic relationships with third parties for the development, manufacturing and licensing of Macrilen™ (macimorelin) and we may enter into future collaborations for the development, manufacturing and licensing of Macrilen™ (macimorelin).

Our arrangements with third parties may not provide us with the benefits we expect and may expose us to a number of risks.

Currently, we are dependent on Novovarious partners to commercialize Macrilen™ (macimorelin)macimorelin in the U.S.U.K. and Canada.EU and the Republic of Korea. As set out above, the Company will regain full rights to Macrilen™ following the termination of the license agreement with Novo Nordisk. Most of our potential revenue consists of contingent payments, including milestones and royalties on the sale of Macrilen™ (macimorelin). The milestone and royalty revenue that we may receive under this collaboration will depend upon Novo’sthese parties’ ability to successfully introduce, market and sell Macrilen™ (macimorelin) in the U.S.. If Novo doesthey do not devote sufficient time and resources to itstheir respective collaboration arrangementarrangements with us, we may not realize the potential commercial benefits of the arrangement, and our results of operations may be materially, adversely affected.

Our reliance on these relationships with Novo and other potential third parties poses a number of risks. We may not realize the contemplated benefits of such agreements nor can we be certain that any of these parties will fulfill their obligations in a manner which maximizes our revenue. These arrangements may also require us to transfer certain material rights to third parties. These agreements create certain additional risks. The occurrence of any of the following or other events may delay or impair commercialization of Macrilen™ (macimorelin):

| ● | in certain circumstances, third parties may assign their rights and obligations under these agreements to other third parties without our consent or approval; | |

| ● | the third parties may cease to conduct business for financial or other reasons; | |

| ● | we may not be able to renew such agreements; | |

| ● | the third parties may not properly maintain or defend certain intellectual property rights that may be important to the commercialization of Macrilen™ (macimorelin); | |

| ● | the third parties may encounter conflicts of interest, changes in business strategy or other issues which could adversely affect their willingness or ability to fulfill their obligations to us (for example, pharmaceutical companies historically have re-evaluated their priorities following mergers and consolidations, which have been common in this industry); | |

| ● | delays in, or failures to achieve, scale-up to commercial quantities, or changes to current raw material suppliers or product manufacturers (whether the change is attributable to us or the supplier or manufacturer) could delay clinical studies, regulatory submissions and commercialization of Macrilen™ (macimorelin); and | |

| ● | disputes may arise between us and the third parties that could result in the delay or termination of the manufacturing or commercialization of Macrilen™ (macimorelin), resulting in litigation or arbitration that could be time-consuming and expensive, or causing the third parties to act in their own self-interest and not in our interest or those of our shareholders. |

| 13 |

In addition, the third parties can terminate our agreements with them for a number of reasons based on the terms of the individual agreements that we have entered into with them. If one or more of these agreements were to be terminated, we would be required to devote additional resources to manufacturing and commercializing Macrilen™ (macimorelin), which would likely cause a drop in share price of our Common Shares..

We may be unsuccessful in consummating further out-licensing arrangements for MacrilenTM (macimorelin) on favorable terms and conditions, or we may be significantly delayed in doing so.

As part of our product development and commercialization strategy, we are evaluating out-licensing opportunities for macimorelinMacrilen™ (macimorelin) in addition to theexisting License Agreement.Agreements and commercialization agreements signed with Novo Nordisk, Consilient Health, MegaPharm Ltd. and ER Kim Pharmaceuticals Bulgaria Eood and NK MEDITECH Ltd. If we elect to collaborate with third parties in respect of macimorelin, we may not be able to negotiate a collaborative arrangement for macimorelin on favorable terms and conditions, if at all. Should any partner fail to successfully commercialize macimorelin, our business, financial condition and results of operations may be adversely affected.

We have initiated significant early-stage pre-clinical programs

Over the course of 2021, we in-licensed four new pre-clinical development programs related to potential therapeutics, all of which were added to our development pipeline based on their potential to represent significant individual market opportunities. These pre-clinical development programs are at an early stage of development and none of these potential products has obtained regulatory approval for commercial use and sale in any country and, as such, no revenues have resulted from product sales. Significant additional investment will be necessary to complete the development of any of our product candidates. Pre-clinical and clinical trial work must be completed before our potential products could be ready for use within the markets that we have identified. We may fail to develop any products, obtain regulatory approvals, enter clinical trials or commercialize any products. We do not know whether any of our potential product development efforts will prove to be effective, meet applicable regulatory standards, obtain the requisite regulatory approvals, be capable of being manufactured at a reasonable cost or be accepted in the marketplace. We also do not know whether sales, license fees or related royalties will allow us to recoup any investment we make in the commercialization of our products. The product candidates we are currently developing are not expected to be commercially viable for at least the next several years and we may encounter unforeseen difficulties or delays in commercializing our product candidates. In addition, our potential products may not be effective or may cause undesirable side effects.

Our product candidates require significant funding to reach regulatory approval assuming positive clinical results. Such funding for our product candidates may be difficult, or impossible to raise in the public or private markets or through partnerships. If funding or partnerships are not readily attainable, the development of our product candidates may be significantly delayed or stopped altogether. The announcement of a delay or discontinuation of development would likely have a negative impact on our share price.

We may require significant additional financing, and we may not have access to sufficient capital.

We may require significant additional capital to fund our commercialization efforts and may require additional capital to pursue planned clinical trials and regulatory approvals. Although we havebelieve that our existing cash on hand will be sufficient to fund our anticipated operating and capital fromexpenditure requirements for the License Agreement,next 12 months, we do not anticipate generating significant revenues from operations in the near future other than from the License Agreement.future. Moreover, we currently have no committed sources of capital. Please see the Risk Factor entitled “We may not be able to continue as a going concern if we do not obtain cash from AEZS Germany to fund our North American operations and we do not obtain additional financing.”

We may attempt to raise additional funds through public or private financings, collaborations with other pharmaceutical companies or from other sources, including, without limitation, through at-the-market offerings and issuances of securities. Additional funding may not be available on terms that are acceptable to us. If adequate funding is not available to us on reasonable terms, we may need to delay, reduce or eliminate our product development programs or obtain funds on terms less favorable than we would otherwise accept. To the extent that additional capital is raised through the sale of equity securities or securities convertible into or exchangeable or exercisable for equity securities, the issuance of those securities would result in dilution to our shareholders. Moreover, the incurrence of debt financing or the issuance of dividend-paying preferred shares, could result in a substantial portion of our future operating cash flow, if any, being dedicated to the payment of principal and interest on such indebtedness or the payment of dividends on such preferred shares and could impose restrictions on our operations and on our ability to make certain expenditures and/or to incur additional indebtedness, which could render us more vulnerable to competitive pressures and economic downturns.

| 14 |

Our future capital requirements are substantial and may increase beyond our current expectations depending on many factors, including, but not limited to, the following:

| ● | the duration of changes to and results of our clinical trials for any future products going forward; | |

| ● | unexpected delays or developments in seeking regulatory approvals; | |

| ● | the time and cost involved in preparing, filing, prosecuting, maintaining and enforcing patent claims; | |

| ● | unexpected developments encountered in implementing our business development and commercialization strategies; | |

| ● | the potential addition of commercialized products to our portfolio; | |

| ● | the outcome of future litigation; and | |

| ● | further arrangements, if any, with collaborators. |

In addition, global economic and market conditions, as well as future developments in the credit and capital markets, may make it even more difficult for us to raise additional financing in the future.

We are and will be subject to stringent ongoing government regulation for our products and our product candidates, even if we obtain regulatory approvals for the latter.

The manufacturing, marketing and sale of Macrilen™ (macimorelin) and our product candidates are and will be subject to strict and ongoing regulation, even with marketing approval by the FDA and the EC for Macrilen™ (macimorelin). Compliance with such regulation will be expensive and consume substantial financial and management resources. For example, the EC approval for macimorelin was conditioned on our agreement to conduct post-marketing follow-up studies to monitor the safety or efficacy of the product. In addition, as clinical experience with a drug expands after approval because the drug is used by a greater number and more diverse group of patients than during clinical trials, side effects or other problems may be observed after approval that were not observed or anticipated during pre-approval clinical trials. In such a case, a regulatory authority could restrict the indications for which the product may be sold or revoke the product’s regulatory approval.

We and our contract manufacturers will be required to comply with applicable Currentcurrent Good Manufacturing Practice (cGMP)(“GMP”) regulations for the manufacture of our current or future products and other regulations. These regulations include requirements relating to quality assurance, as well as the corresponding maintenance of rigorous records and documentation. Manufacturing facilities must be approved before we can use them in the commercial manufacturing of a product and are subject to subsequent periodic inspection by regulatory authorities. In addition, material changes in the methods of manufacturing or changes in the suppliers of raw materials are subject to further regulatory review and approval.

If we, or if any future marketing collaborators or contract manufacturers, fail to comply with applicable regulatory requirements, we may be subject to sanctions including fines, product recalls or seizures and related publicity requirements, injunctions, total or partial suspension of production, civil penalties, suspension or withdrawals of previously granted regulatory approvals, warning or untitled letters, refusal to approve pending applications for marketing approval of new products or of supplements to approved applications, complete withdrawal of a marketing application, exclusion from government healthcare programs, import or export bans or restrictions, and/or criminal prosecution and penalties. Any of these penalties could delay or prevent the promotion, marketing or sale of a product.

| 15 |

Even with marketing approval for MacrilenTM (macimorelin), such product approval could be subject to restrictions or withdrawals. Regulatory requirements are subject to change.

On December 20, 2017, the FDA granted marketing approval in the U.S. for Macrilen™ (macimorelin) to be used in the diagnosis of patients with adult growth hormone deficiency (“AGHD”),AGHD, and on January 16, 2019, the EC granted marketing approval in Europe for macimorelin for the diagnosis of AGHD. Regulatory authorities generally approve products for specified indications. If an approval is for a limited indication, this limitation reduces the size of the potential market for that product. Product approvals, once granted, are subject to continual review and periodic inspections by regulatory authorities. Our operations and practices are subject to regulation and scrutiny by the U.S. government, as well as governments of any other countries in which we do business or conduct activities. Later discovery of previously unknown problems or safety issues and/or failure to comply with domestic or foreign laws, knowingly or unknowingly, can result in various adverse consequences, including, among other things, a possible delay in the approval or refusal to approve a product, warning or untitled letters, fines, injunctions, civil penalties, recalls or seizures of products and related publicity requirements, total or partial suspension of production, import or export bans or restrictions, refusal of the government to renew marketing applications, complete withdrawal of a marketing application, criminal prosecution and penalties, suspension or withdrawals of previously granted regulatory approvals, withdrawal of an approved product from the market and/or exclusion from government healthcare programs. Such regulatory enforcement could have a direct and negative impact on the product for which approval is granted, but also could have a negative impact on the approval of any pending applications for marketing approval of new drugs or supplements to approved applications.

Because we operate in a highly regulated industry, regulatory authorities could take enforcement action against us in connection with our licensees’ or collaborators’ businesses or marketing activities for various reasons.

From time to time, new legislation is passed into law that could significantly change the statutory provisions governing the approval, manufacturing and marketing of products regulated by the FDA, the EC and other health authorities. In addition, regulations and guidance are often revised or reinterpreted by health agencies in ways that may significantly affect our business. It is impossible to predict whether further legislative changes will be enacted, or whether regulations, guidance, or interpretations will change, and what the impact of such changes, if any, may be.

Healthcare reform measures could hinder or prevent the commercial success of a product and adversely affect our business.

The business prospects and financial condition of pharmaceutical and biotechnology companies are affected by the efforts of governmental and third-party payers to contain or reduce the costs of healthcare. The U.S. government and other governments have shown significant interest in pursuing healthcare reform and reducing healthcare costs. Any government-adopted reform measures could cause significant pressure on the pricing of healthcare products and services, including Macrilen™ (macimorelin), both in the U.S. and internationally, as well as the amount of reimbursement available from governmental agencies and other third-party payers. If reimbursement for Macrilen™ (macimorelin) is substantially less than we expect, our revenue prospects could be materially and adversely impacted.

In the U.S. and in other jurisdictions there have been, and we expect that there will continue to be, a number of legislative and regulatory proposals aimed at changing the healthcare system, such as proposals relating to the pricing of healthcare products and services in the U.S. or internationally, the reimportation of drugs into the U.S. from other countries (where they are then sold at a lower price), and the amount of reimbursement available from governmental agencies or other third-party payers. Furthermore, the pricing of pharmaceutical products, in general, and specialty drugs, in particular, has been a topic of concern in the U.S. Congress, where hearings on the topic have been held, and has been a topic of speeches given by political figures, including the President Donald Trump.of the U.S. Additionally, in the U.S., individual states have also passed legislation and proposed bills that are aimed at drug pricing transparency, which will likely impact drug pricing. There can be no assurance as to how this scrutiny on pricing of pharmaceutical products will impact future pricing of Macrilen™ (macimorelin).

| 16 |

The Patient Protection and Affordable Care Act and the Healthcare and Education Affordability Reconciliation Act of 2010 (collectively, the “ACA”“ACA”) has had far-reaching consequences for most healthcare companies, including specialty biopharmaceutical companies like us. The future of the ACA is, however, uncertain. Since January 2017, the U.S. Congress has proposed various billsuncertain as there have been executive, judicial and congressional challenges to revisecertain aspects of the ACA. In addition, President Donald Trump has suggested similar actionJune 2021, the United States Supreme Court dismissed a challenge to the ACA on the grounds the plaintiffs did not have standing to attack as unconstitutional the ACA’s minimum essential coverage provision because they had not shown they had suffered damages from the defendants’ conduct in enforcing the ACA. It is unclear how other such litigation and enacted Executive Orders to curtailthe healthcare reform efforts of the Biden administration will impact the ACA and its impact on healthcare in the U.S. In addition, on December 18, 2019, the 5th Circuit of the U.S. ruled that the individual mandate in the ACA is unconstitutional, and sent the case back to the applicable District Court to determine whether the entire law is invalid or if some parts of the ACA can survive. We cannot predict the ultimate content, timing or effect of any healthcare reform legislation, or potential legislation, regulation, judicial review and orders, or their impact on us.our business.

In addition, the Food and Drug Administration Amendments Act of 2007 gives the FDA enhanced post-market authority, including the authority to require post-marketing studies and clinical trials, labeling changes based on new safety information, and compliance with risk evaluations and mitigation strategies approved by the FDA. The FDA’s exercise of this authority may result in delays or increased costs during the period of product development, clinical trials and regulatory review and approval, which may also increase costs related to complying with new post-approval regulatory requirements, and increase potential FDA restrictions on the sale or distribution of approved products.

If we or our licensees market products or interact with health care practitioners in a manner that violates healthcare fraud or abuse laws, we or our licensees may be subject to civil or criminal penalties, including exclusion from participation in government healthcare programs.

As a pharmaceutical company, even though we do not provide healthcare services or receive payments directly from or bill directly to Medicare, Medicaid or other national or third-party payers for our current product, U.S. federal and state healthcare laws and regulations, as well as certain E.U.EU regulatory and government agencies, pertaining to fraud or abuse are and will be applicable to our business. We, and our licensees, are subject to healthcare fraud and abuse regulation by E.U.EU regulatory and government agencies in the countries where we may seek marketing access, and the U.S. federal government and the states in which we conduct our business.

The laws that may affect ourus or that ofaffect our licensee’s ability to operate include the federal healthcare program anti-kickback statute, which prohibits, among other things, knowingly and willfully offering, paying, soliciting, or receiving remuneration to induce, or in return for, the purchase, lease or order, or arrangement for the purchase, lease or order of any healthcare item or service reimbursable under Medicare, Medicaid or other federally financed healthcare programs. This statute applies to arrangements between pharmaceutical manufacturers and prescribers, purchasers and formulary managers. Although there are a number of statutory exceptions and regulatory safe harbors protecting certain common activities, the exceptions and safe harbors are drawn narrowly, and practices that involve remuneration intended to induce prescribing, purchases or recommendations may be subject to scrutiny if they do not qualify for an exception or a safe harbor.

Federal false claims laws prohibit any person from knowingly presenting, or causing to be presented, a false claim for payment to the federal government, or knowingly making, or causing to be made, a false statement to get a false claim paid. Pharmaceutical companies have been prosecuted under these laws for a variety of alleged promotional and marketing activities, such as providing free product to customers with the expectation that the customers would bill federal programs for the product, reporting to pricing services inflated average wholesale prices that were then used by federal programs to set reimbursement rates, engaging in off-label promotion that caused claims to be submitted to Medicaid for non-covered off-label uses, and submitting inflated best price information to the Medicaid Drug Rebate Program.

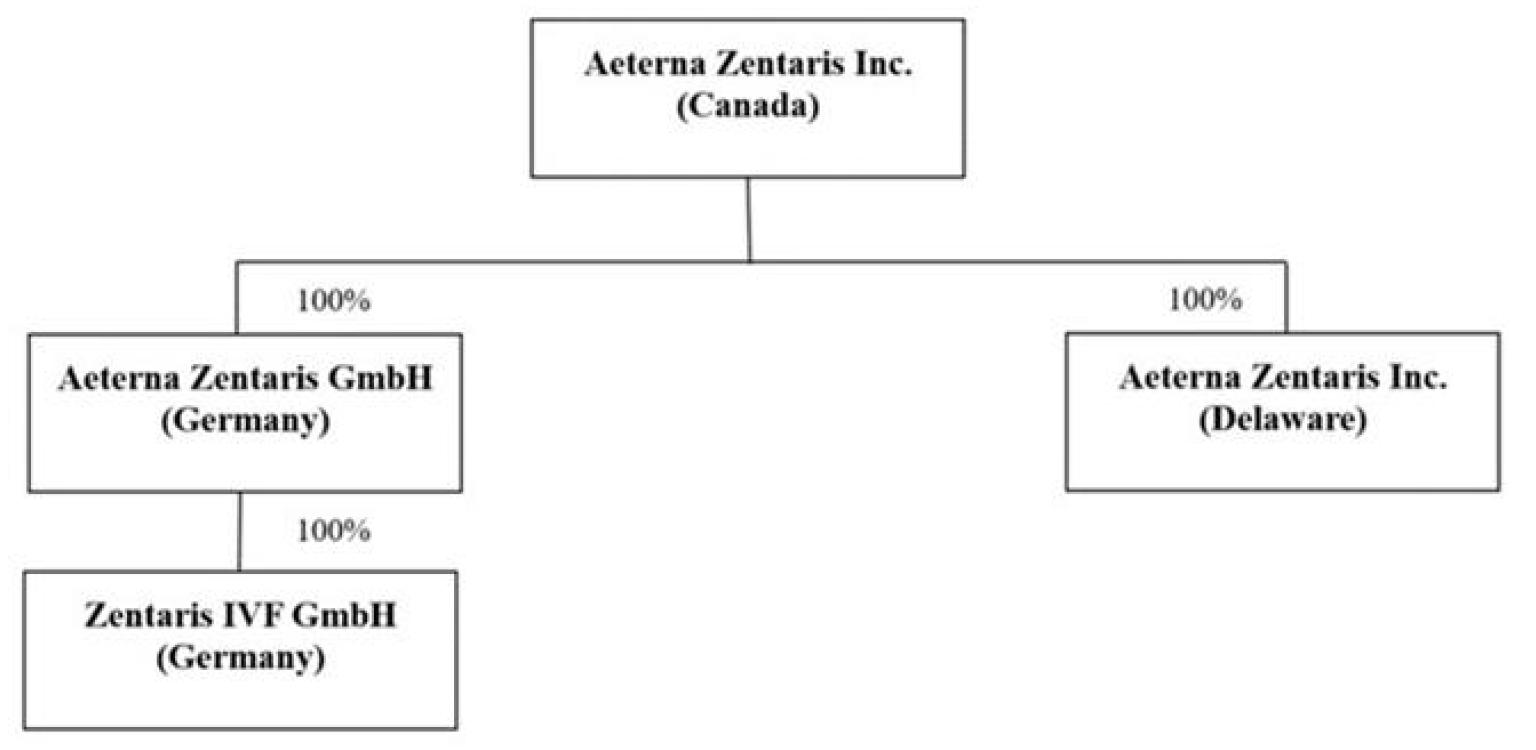

The Health Insurance Portability and Accountability Act of 1996 also created prohibitions against healthcare fraud and false statements relating to healthcare matters. The healthcare fraud statute prohibits knowingly and willfully executing a scheme to defraud any healthcare benefit program, including private payers. The false statements statute immediately noted above prohibits knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false, fictitious or fraudulent statement in connection with the delivery of or payment for healthcare benefits, items or services.