1. ORGANIZATION AND PRINCIPAL ACTIVITIES

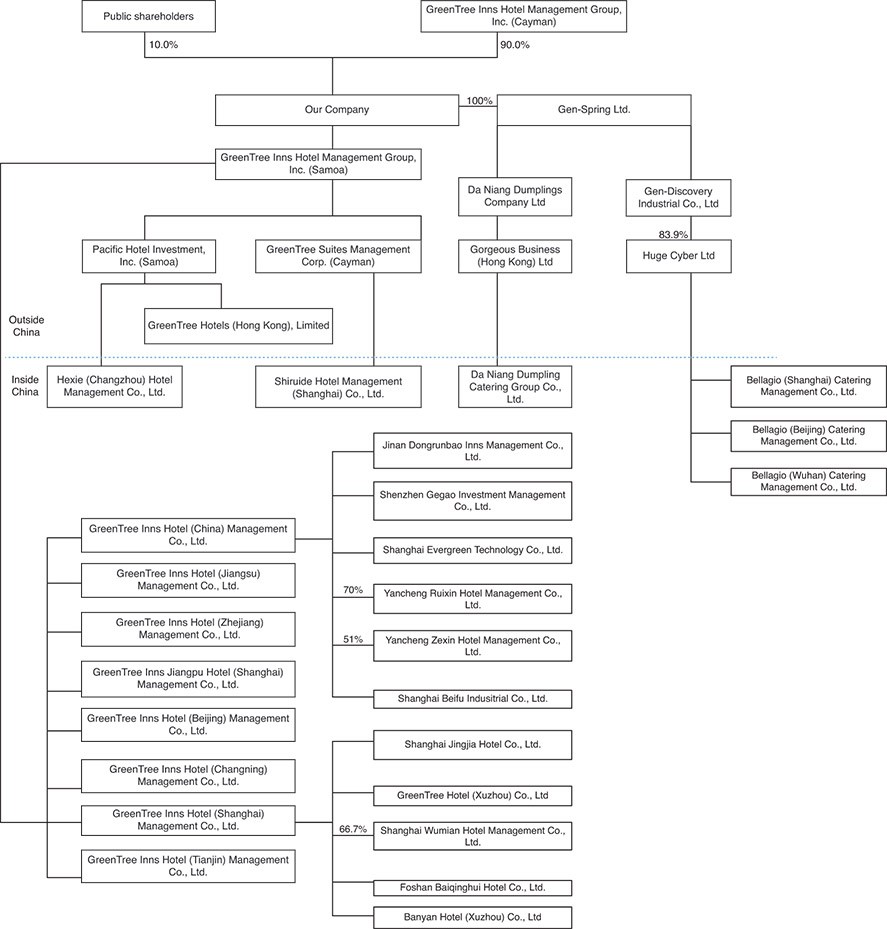

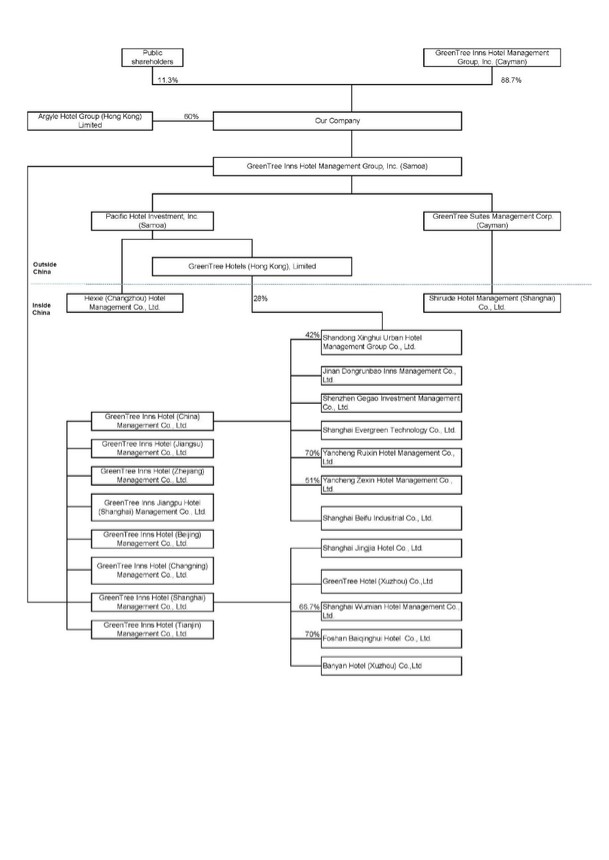

GreenTree Hospitality Group Ltd. (the “Company”) was incorporated in the Cayman Islands on October 18, 2017. Alex S. Xu is the founder, Chief Executive Officer (“CEO”) and controlling shareholder of the Company. The Company (through his shareholding of Class A ordinary shares and Class B ordinary shares of Green Tree Inns Hotel Management Group. Inc. “GTI”) which account for 78.19% of the voting interest of the Company (the “Founder”).

In preparation of its initial public offering in the United States, the Company had undergone a reorganization in 2017 whereby the Company became the parent entity of its consolidated subsidiaries. As part of the reorganization, the business operations of the consolidated subsidiaries were transferred to the Company. In return, the Company issued 48,635,252 Class A ordinary shares and 42,716,957 Class B ordinary shares to GTI, a company controlled by the Founder (the “Reorganization”). Subsequent to the Reorganization, GTI became the sole shareholder of the Company.

As the Company, its subsidiaries are all underhereinafter referred to as the control of the Founder, the reorganization was accounted for as a transaction under common control in a manner similar to a pooling of interests. Therefore, the accompanying consolidated financial statements have been prepared as if the corporate structure of the Company had been in existence since the beginning of the periods presented.

In February and March 2018, the Company declared and paid a cash dividend of USD25,578,618 pursuant to a board resolution.

On March 11, 2018, 7,594,048 Class B ordinary shares were redesignated as Class A ordinary shares.“Group.”

On March 27, 2018, the Company completed an initial public offering (“IPO”) on the New York Stock Exchange. The CompanyExchange and offered 10,200,000 ADSs representing 10,200,000 Class A ordinary shares at USD14.00 per ADS. Net proceeds from the IPO deducting underwriting discount were USD133,518,000. IPO costs of RMB30,827,578 were recorded as reduction of the proceeds from the IPO in shareholders’ equity.

In January 2019, the Company declared and paid a cash dividend of USD30,559,675 pursuant to a board resolution.

On January 25, 2019 and June 27, 2019, the Company issued an aggregate of 626,746 Class A ordinary shares as a portion of the purchase consideration for the acquisition of 60% equity interest mainly in Argyle Hotel Management (Beijing) Co., Ltd (“Argyle Beijing”, ”Argyle Hotel Group”).

In December 2019, the Company declared and paid a cash dividend of USD25,544,739 pursuant to a board resolution.

On January 15, 2020, the Company issued 870,908 Class A ordinary shares as a portion of the purchase consideration for the acquisition of 70% equity interest in Shandong Xinghui Urban Hotel Management Group Co., Ltd (“Shandong Xinghui”Urban”).

On December 20, 2021, the Company announced that its board of directors approved the payment of a cash dividend of USD0.55 per ordinary share and the total amount of cash distributed for the dividend was USD56,667,425, among which USD50,243,715 (equivalent to RMB320,253,160) was paid in 2021 and the rest USD6,423,710 (equivalent to RMB40,999,458) was paid in January 2022.

In October and December 2023, the Company repurchased 554,158 and 81,276 Class A ordinary shares respectively and the total amount of cash paid to repurchase these shares are RMB19,706,775 (USD2,775,641).

In June 2022, the Group deconsolidated Argyle Beijing and its subsidiaries due to loss of effective control. In November 2022, the Group deconsolidated Urban and its subsidiaries (Note 4).

In March 2023, the Group completed the acquisition of Da Niang Dumpling Catering Group Co., Ltd. (“Da Niang”) and Huge Cyber Ltd (“Bellagio”) and their subsidiaries, two restaurant chain businesses in China (collectively, the “Restaurant Business”) from GTI. As the Group and the Restaurant Business are under the common control of GTI before and after the acquisition, the acquisition was accounted for as a common control transaction in a manner similar to the pooling-of-interests method (Note 3). Therefore, the Group is required to recast its prior period financial statements to include the Restaurant Business for all periods presented as if the combination had been in effect since the inception of common control, which was prior to the beginning of the earliest presented period.

)

)

)

) )

)

)

) )

) )

) )

)

)

) )

) ) has served as an independent director of our company since December 2021. Ms. Zhu has served as the chief financial officer of Baozun Inc. (Nasdaq: BZUN and HKEX: 9991) (“Baozun”) since April 2024. Prior to joining Baozun, she served as the finance director for Cue & Co., Group Ltd. and then IBR between April 2018 and October 2020. From September 2016 to February 2018, Ms. Zhu worked as a finance controller with Xperience Communications (Shanghai) Co., Ltd. Between March 2013 and September 2016, she worked as a finance manager first with Lend Lease Project Management & Construction (Shanghai) Co., Ltd., and then with Porsche Centre Shanghai Waigaoqiao Limited. Prior to that, Ms. Zhu worked as an audit manager with KPMG in its Shanghai office from August 2005 to February 2013. Ms. Zhu received a bachelor’s degree in business administration from Shanghai International Studies University in July 2005. Ms. Zhu is a member of the Chinese Institute of Certified Public Accountants and the Institute of Internal Auditors.

) has served as an independent director of our company since December 2021. Ms. Zhu has served as the chief financial officer of Baozun Inc. (Nasdaq: BZUN and HKEX: 9991) (“Baozun”) since April 2024. Prior to joining Baozun, she served as the finance director for Cue & Co., Group Ltd. and then IBR between April 2018 and October 2020. From September 2016 to February 2018, Ms. Zhu worked as a finance controller with Xperience Communications (Shanghai) Co., Ltd. Between March 2013 and September 2016, she worked as a finance manager first with Lend Lease Project Management & Construction (Shanghai) Co., Ltd., and then with Porsche Centre Shanghai Waigaoqiao Limited. Prior to that, Ms. Zhu worked as an audit manager with KPMG in its Shanghai office from August 2005 to February 2013. Ms. Zhu received a bachelor’s degree in business administration from Shanghai International Studies University in July 2005. Ms. Zhu is a member of the Chinese Institute of Certified Public Accountants and the Institute of Internal Auditors. )

)  )

)  )

)