Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

US$ 205,881,000 |

| 7.875% | Notes due February 1, 2027 | |

US$ 70,780,000 |

| 7.325% | Notes due February 1, 2037 | |

US$ 40,416,000 |

| 8.125% | Notes due February 1, 2097 | |

US$ 400,000,000 |

| 4.250% | Notes due April 15, 2024 | |

(Title of Class) | ||||

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☒x Yes ☐o No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐o Yes ☒x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days:

☒x Yes ☐o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☐x Yes ☐o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer o | Non-accelerated filer o | Emerging growth company o |

Large accelerated filer ☒ Accelerated filer ☐ Non-accelerated filer ☐ Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards † provided pursuant to Section 13(a) of the Exchange Act. ☐o

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP | International Financial Reporting Standards as issued

|

| Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow

☐o Item 17 ☐o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐o Yes ☒x No

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Shares of Common Stock: | 8,201,754,580 |

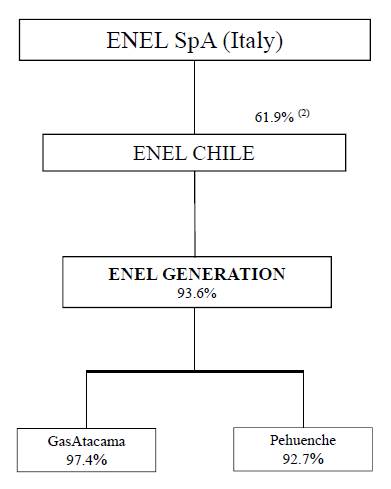

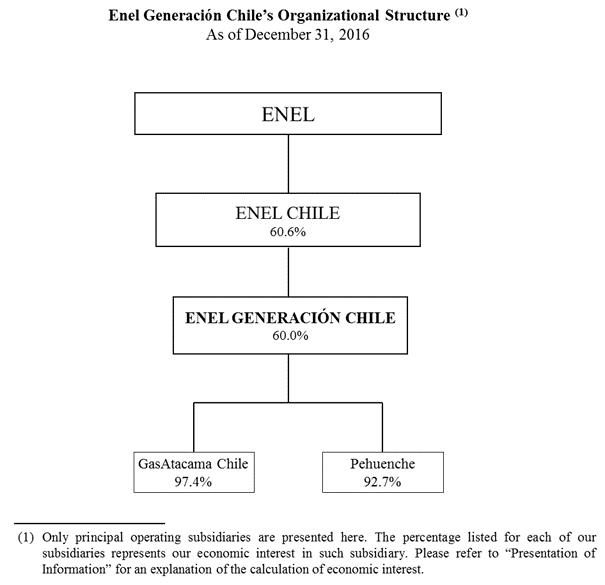

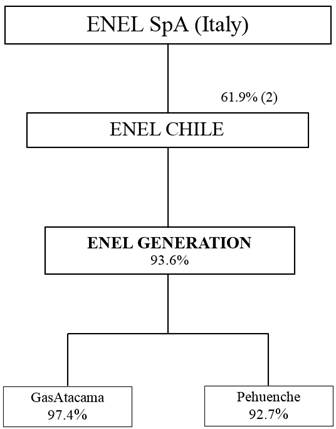

Enel Generation Chile’s Organizational Chart (1)

2

(1) Only principal operating subsidiaries are presented here. The percentage listed in the box for each of Enel Generation’s consolidated subsidiaries represents its economic interest in such consolidated subsidiary.

(2) Excluding treasury stock.

|

| Page | |||

4 | |||||

7 | |||||

8 | |||||

10 | |||||

|

| ||||

| |||||

11 | |||||

11 | |||||

21 | |||||

47 | |||||

47 | |||||

64 | |||||

71 | |||||

73 | |||||

75 | |||||

78 | |||||

93 | |||||

96 | |||||

|

| ||||

| |||||

| |||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

| Material Modifications to the Rights of Security Holders and Use of Proceeds |

| |||

|

| ||||

98 | |||||

| |||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

| Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

| |||

99 | |||||

99 | |||||

100 | |||||

|

| ||||

101 | |||||

101 | |||||

101 | |||||

AFP |

|

| ||

|

| |||

|

| |||

|

| |||

|

| |||

|

|

3

| Administradora de Fondos de Pensiones |

| A legal entity that manages a Chilean pension fund. | |

|

|

|

|

|

CDEC |

| Centro de Despacho Económico de Carga |

|

|

|

|

|

|

|

Celta |

| Compañía Eléctrica |

| Celta was a former Chilean generation subsidiary of Enel |

|

|

|

|

|

|

| Coordinador Eléctrico Nacional | An autonomous entity in charge of coordinating the efficient operation of the SEN, dispatching generation units to satisfy demand and known as the National Electricity Coordinator. It replaced the CDEC for both the SIC and SING in November 2017. | |

Chilean Stock Exchanges | Chilean Stock Exchanges |

| The | |

|

|

|

|

|

|

| Comisión para el Mercado Financiero | Chilean Financial Market Commission, the governmental authority that supervises the financial markets. Formerly known as the Chilean Superintendence of Securities and Insurance or SVS in its Spanish acronym. | |

CNE | Comisión Nacional de Energía |

| Chilean National Energy Commission, governmental entity with responsibilities under the Chilean regulatory framework. | |

|

|

|

|

|

DCV |

| Depósito Central de Valores S.A. |

| Chilean Central Securities Depositary. |

|

|

|

|

|

|

|

|

| |

| Enel S.p.A. |

| An Italian energy company with multinational operations in the power and gas markets. A | |

|

|

|

|

|

Enel Américas |

| Enel Américas S.A. |

|

|

|

|

|

|

|

Enel Chile |

| Enel Chile S.A. |

| Our parent company, a Chilean publicly held limited liability stock corporation, |

Enel Distribution |

| Enel Distribución Chile S.A. |

| |

|

| An affiliated Chilean | ||

|

|

|

|

|

Enel |

| Enel Generación Chile S.A. |

| Our company, a Chilean publicly held limited liability stock corporation, |

|

|

|

|

|

|

| Enel |

| A |

|

|

|

|

|

|

|

|

|

|

|

|

| ||

4

OSM |

| |||

|

|

| ||

| Ordinary Shareholders’ Meeting |

| Ordinary Shareholders’ Meeting. | |

|

|

|

|

|

Pehuenche |

| Empresa Eléctrica Pehuenche S.A. |

| A Chilean publicly held limited liability |

|

|

|

|

|

SEF |

| Superintendencia de Electricidad y Combustible |

| Chilean Superintendence of Electricity and Fuels, the governmental authority that supervises the Chilean electricity industry. |

|

|

|

|

|

|

| Sistema |

| The National Electricity System is the Chilean |

|

|

|

|

|

|

| Sistema Interconectado |

| Chilean central interconnected |

|

|

|

|

|

|

|

|

| Chilean |

|

|

|

|

|

UF |

| Unidad de Fomento |

| Chilean inflation-indexed, Chilean peso-denominated monetary unit equivalent to Ch$ |

|

|

|

|

|

UTA |

| Unidad Tributaria Anual |

| Chilean annual tax unit. One UTA equals 12 580,236. |

As used in this Report on Form 20-F (the “Report”), first person personal pronouns such as “we,” “us” or “our”, as well as “Enel Generación Chile”, “Enel Generation” or the “Company”, refer to Enel Generación Chile S.A. and our consolidated subsidiaries unless the context indicates otherwise. Unless otherwise noted, our interest in our principal subsidiaries, and jointly-controlled entities and associates is expressed in terms of our economic interest as of December 31, 2016.2018.

We are a Chilean company engaged in the electricity generation business in Chile directly and through our subsidiaries and jointly-controlled entities and are the surviving company spun off from Empresa Nacional de Electricidad S.A. (“Endesa Chile”).

We are a publicly held limited liability stock corporation originally organized on December 1, 1943 under the laws of the Republic of Chile. During 2016, we completed a corporate reorganization to separate our Chilean businesses from our non-Chilean businesses. On October 18, 2016, and as part of this process, (i) Endesa Chile changed its name to Enel Generación Chile S.A.; (ii) Chilectra Chile S.A. changed its name to Enel Distribución Chile S.A.; and (iii) Enersis Chile S.A. changed its name to Enel Chile S.A. For additional information relating the company and the corporate reorganization completed in 2016, please see “Item 4. Information on the Company — A. History and Development of the Company” and “— The 2016 Reorganization”.

As of the date of this Report and after giving effect to the 2018 Reorganization, (i) our direct controlling entity, Enel Chile S.A. (“Enel Chile”), owns 60.0%93.6% of our shares.

shares and (ii) Enel S.p.A. (“Enel”), an Italian energy company with multinational operations in the power and gas markets, beneficially owns 60.6%61.9% of Enel Chile as of December 31, 2018, and is our ultimate controlling shareholder. Enel hasshareholder with an economic interest of 36.4%57.9% in our Company.

During 2016, Enersis S.A. (now known as Enel Américas S.A.) and certain of its subsidiaries including Endesa Chile carried out a reorganization process, which, among other things, involved the separation of their Chilean and non-Chilean electricity businesses in South America. The separation of the businesses was effective on March 1, 2016, resulting, in among other things, the Company spinning off its non-Chilean businesses, resulting in the Company holding the Chilean generation business. For additional information relating to the reorganization,2018 Reorganization, see “Item 4. Information on the Company — A. History and Development of the Company — The 2016 Reorganization.”2018 Reorganization”.

6

Financial Information

In this Report, unless otherwise specified, references to “U.S. dollars” or “US$”, are to dollars of the United States of America (“United States”); references to “pesos” or “Ch$” are to Chilean pesos, the legal currency of Chile; and references to “UF” are to Unidades de Fomento. The UF is a Chilean inflation-indexed, peso-denominated monetary unit that is adjusted daily to reflect changes in the official Consumer Price Index (“CPI”) of the Chilean National Institute of Statistics (Instituto Nacional de Estadísticas or “INE”). The UF is adjusted in monthly cycles. Each day in the period beginning on the tenth day of the current month through the ninth day of the succeeding month, the nominal peso value of the UF is indexed in order to reflect a proportionate amount of the change in the Chilean CPI during the prior calendar month. As of December 31, 2016,2018, one UF was equivalent to Ch$ 26,347.98.27,565.79. The U.S. dollar equivalent of one UF was US$ 39.3639.68 as of December 31, 2016,2018, using the Observed Exchange Rate reported by the Central Bank of Chile (Banco Central de Chile) as of December 31, 20162018 of Ch$ 669.47694.77 per US$ 1.00. The U.S. dollar observed exchange rate (dólar observado) (the “Observed Exchange Rate”), which is reported by the Central Bank of Chile and published daily on its webpage, is the weighted average exchange rate of the previous business day’s transactions in the Formal Exchange Market. Unless the context specifies otherwise, all amounts translated from Chilean pesos to U.S. dollars or vice versa, or from UF to Chilean pesos, have been carried out at the rates applicable foras of December 31, 2016.2018.

The Central Bank of Chile may intervene by buying or selling foreign currency on the Formal Exchange Market to maintain the Observed Exchange Rate within a desired range.

As of April 25, 2017, one UF was equivalent to Ch$ 26,543.75. The U.S. dollar equivalent of one UF was US$ 40.22 as of the same date, using the Observed Exchange Rate reported by the Central Bank of Chile as of such date of Ch$ 660.04 per US$ 1.00.

Our consolidated financial statements and, unless otherwise indicated, other financial information concerning us included in this Report are presented in Chilean pesos. We have prepared our consolidated financial statements in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”).

All of our subsidiaries are integrated and all their assets, liabilities, income, expenses and cash flows are included in the consolidated financial statements after making the adjustments and eliminations related to intra-group transactions. InvestmentsOur participation in associated companies over which we exercise significant influence are included in our consolidated financial statements using the equity method. For detailed information regarding consolidated entities, jointly-controlled entities and associated companies, see Appendices 1, 2 and 3 to the consolidated financial statements.

Since the conditions established under IFRS were met by December 31, 2016, in the financial statements included in this Report, all operations regarding the former Chilean businesses have been presented as discontinued operations. Therefore, the financial statements

Solely for the year ended as of December 31, 2016 include discontinued operations for two months while the financial statements for the years ended December 31, 2015 and 2014 include discontinued operations for twelve months.

For the convenience of the reader, this Report contains translations of certain Chilean peso amounts into U.S. dollars at specified rates. Unless otherwise indicated, the U.S. dollar equivalent for information in Chilean pesos is based on the Observed Exchange Rate for December 31, 2016,2018, as defined in “Item 3. Key Information — A. Selected Financial Data — Exchange Rates.”Rates”. The Federal Reserve Bank of New York does not report a noon buying rate for Chilean pesos. No representation is made that the Chilean peso or U.S. dollar amounts shown in this Report could have been or could be converted into U.S. dollars or Chilean pesos, as the case may be, at such rate or at any other rate. See “Item 3. Key Information — A. Selected Financial Data — Exchange Rates.”Rates”.

During 2016, we completed a corporate reorganization, which involved the separation of our Chilean and non-Chilean electricity businesses in South America, resulting in our retaining only the Chilean electricity businesses, effective as of March 1, 2016. All operations regarding the former non-Chilean businesses in South America have been presented as discontinued operations. In order to comply with conditions established under IFRS, the financial statements for the year ended as of December 31, 2016 include discontinued operations for two months. The financial statements subsequent to December 31, 2016 do not include discontinued operations. For additional information relating to the corporate reorganization, please see “Item 4. Information on the Company — A. History and Development of the Company — The 2016 Reorganization”.

Technical Terms

References to “TW” are to terawatts (1012 watts or a trillion watts); references to “GW” and “GWh” are to gigawatts (109 watts or a billion watts) and gigawatt hours, respectively; references to “MW” and “MWh” are to megawatts (106 watts or a million watts) and megawatt hours, respectively; references to “kW” and “kWh” are to kilowatts (103watts or a thousand watts) and kilowatt hours, respectively; references to “kV” are to kilovolts, and references to “MVA” are to megavolt amperes. References to “BTU” and “MBTU” are to British thermal unit and million British thermal units, respectively. A “BTU” is an energy unit equal to approximately 1,055 joules. References to “Hz” are to hertz; and references to “mtpa” are to metric tons per annum. Unless otherwise indicated, statistics provided in this Report with respect to the installed capacity of electricity generation facilities are expressed in MW. One

TW equals 1,000 GW, one GW equals 1,000 MW and one MW equals 1,000 kW.The installed capacity we are presenting in this Report corresponds to the gross installed capacity, without considering the MW that each power plant consumes for its own operation.

Statistics relating to aggregate annual electricity production are expressed in GWh and based on a year of 8,760 hours, except for leap years, which are based on 8,784 hours. Statistics relating to installed capacity and production of the electricity industry do not include electricity of self-generators.

7

Energy losses experienced by generation companies during transmission are calculated by subtracting the number of GWh of energy sold from the number of GWh of energy generated (excluding their own energy consumption and losses on the part of the power plant), within a given period. Losses are expressed as a percentage of total energy generated.

Calculation of Economic Interest

References are made in this Report to the “economic interest” of Enel Generación ChileGeneration in its related companies. We could have direct and indirect interest is such companies. In circumstances where we do not directly own an interest in a related company, our economic interest in such ultimate related company is calculated by multiplying the percentage of economic interest in a directly held related company by the percentage of economic interest of any entity in the ownership chain of such related company. For example, if we directly own a 6% equity stake in an associatedassociate company and 40% is directly held by our 60%-owned subsidiary, our economic interest in such associate would be 60% times 40% plus 6%, orequal to 30%.

Rounding

Certain figures included in this Report have been rounded for ease of presentation. Because of this rounding, it is possible that amounts in tables may not add up to exactly the same amounts as the sum of the entries.

8

This Report contains statements that are or may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements appear throughout this Report and include statements regarding our intent, belief or current expectations, including, but not limited to, any statements concerning:

·our capital investment program;

·trends affecting our financial condition or results from operations;

·our dividend policy;

·the future impact of competition and regulation;

·political and economic conditions in the countries in which we or our related companies operate or may operate in the future;

·any statements preceded by, followed by or that include the words “believes,” “expects,” “predicts,” “anticipates,” “intends,” “estimates,” “should,” “may” or similar expressions; and

·other statements contained or incorporated by reference in this Report regarding matters that are not historical facts.

Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to:

·demographic developments, political events, economic fluctuations and interventionist measures by authorities in Chile;

hydrology,

· water supply, droughts, flooding and other weather conditions;

·changes in the Chilean environmental regulations and the regulatory framework of the electricity industry;

·our ability to implement proposed capital expenditures, including our ability to arrange financing where required;

·the nature and extent of future competition in our principal markets; and

·the factors discussed below under “Risk Factors.”

You should not place undue reliance on such statements, which speak only as of the date that they were made. Our independent registered public accounting firm has not examined or compiled the forward-looking statements and, accordingly, does not provide any assurance with respect to such statements. You should consider these cautionary statements together with any written or oral forward-looking statements that we may issue in the future. We do not undertake any obligation to release publicly any revisions to forward-looking statements contained in this Report to reflect later events or circumstances or to reflect the occurrence of unanticipated events.events, except as required by law.

For all these forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

9

Item 1.Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2.Offer Statistics and Expected Timetable

Not applicable.

A.InformationSelected Financial Data.

|

|

The following selected consolidated financial data should be read in conjunction with our consolidated financial statements included in this Report. The selected consolidated financial data as of December 31, 20162018, and 20152017 and for each of the years in the three-year period ended December 31, 20162018, are derived from our audited consolidated financial statements included in this Report. The selected consolidated financial data as of December 31, 20142016, 2015 and 2013,2014, and for the yearyears ended December 31, 20132015, and 2014 are derived from our consolidated financial statements not included in this Report. Our consolidated financial statements were prepared in accordance with IFRS, as issued by the IASB. Pursuant to transitional relief granted by

Amounts in the SEC, selected consolidated financial data as of and for the year ended December 31, 2012 have been omitted as such information cannot be provided on a restated basis to reflect the spin-off of Endesa Américas without unreasonable effort or expense.

Amountstables are expressed in millions, except for ratios, operating data and data for shares and American Depositary Shares (“ADS”). For the convenience of the reader, all data presented in U.S. dollars in the following summary, as of and for the year ended December 31, 2016,2018, has been converted at the U.S. dollar Observed Exchange Rate (dólar observado) for that date of Ch$ 669.47694.77 per US$ 1.00. The Observed Exchange Rate, which is reported and published daily on the Central Bank of Chile’s web page, corresponds to the weighted average exchange rate of the previous business day’s transactions in the Formal Exchange Market. For more information concerning historical exchange rates, see “Item 3. Key Information — A. Selected Financial Data — Exchange Rates” below.

10

The following tables set forth our selected consolidated financial data and operating data for the years indicated:

|

| As of and for the year ended December 31, |

|

| As of and for the year ended December 31, |

| |||||||||||||||||||||||||||

|

| 2016(1) |

|

| 2016 |

|

| 2015 |

|

| 2014 |

|

| 2013 |

|

| 2018(1) |

| 2018 |

| 2017 |

| 2016 |

| 2015 |

| 2014 |

| |||||

|

| (US$ millions) |

|

| (Ch$ millions) |

|

| (US$ millions) |

|

|

| (Ch$ millions) |

| ||||||||||||||||||||

Consolidated Statement of Comprehensive Income Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues and other operating income |

|

| 2,479 |

|

|

| 1,659,727 |

|

|

| 1,543,810 |

|

|

| 1,230,975 |

|

|

| 970,037 |

|

| 2,189 |

| 1,521,054 |

| 1,634,937 |

| 1,659,727 |

| 1,543,810 |

| 1,230,975 |

|

Operating costs(2) |

|

| (1,835 | ) |

|

| (1,228,341 | ) |

|

| (1,141,991 | ) |

|

| (978,713 | ) |

|

| (700,715 | ) |

| (1,521 | ) | (1,056,671 | ) | (1,171,077 | ) | (1,228,341 | ) | (1,141,991 | ) | (978,713 | ) |

Operating income from continuing operations |

|

| 644 |

|

|

| 431,386 |

|

|

| 401,819 |

|

|

| 252,262 |

|

|

| 269,322 |

| |||||||||||||

Operating income |

| 668 |

| 464,383 |

| 463,860 |

| 431,386 |

| 401,819 |

| 252,262 |

| ||||||||||||||||||||

Financial results(3) |

|

| (53.3 | ) |

|

| (35,679 | ) |

|

| (114,252 | ) |

|

| (77,345 | ) |

|

| (73,995 | ) |

| (69 | ) | (47,947 | ) | (36,610 | ) | (35,679 | ) | (114,252 | ) | (77,345 | ) |

Other gains |

|

| 181 |

|

|

| 121,491 |

|

|

| 4,015 |

|

|

| 42,652 |

|

|

| 2,514 |

|

| 5 |

| 3,435 |

| 113,089 |

| 121,491 |

| 4,015 |

| 42,652 |

|

Share of profit (loss) of associates and joint ventures accounted for using the equity method |

|

| 12 |

|

|

| 7,878 |

|

|

| 8,905 |

|

|

| (54,353 | ) |

|

| 24,309 |

|

| 5 |

| 3,281 |

| (2,697 | ) | 7,878 |

| 8,905 |

| (54,353 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations before income taxes |

|

| 784 |

|

|

| 525,077 |

|

|

| 300,487 |

|

|

| 163,216 |

|

|

| 222,150 |

| |||||||||||||

Income tax expense, from continuing operations |

|

| (124 | ) |

|

| (83,217 | ) |

|

| (76,656 | ) |

|

| (94,058 | ) |

|

| (36,995 | ) | |||||||||||||

Net income from continuing operations |

|

| 660 |

|

|

| 441,860 |

|

|

| 223,831 |

|

|

| 69,158 |

|

|

| 185,155 |

| |||||||||||||

Income before income taxes |

| 609 |

| 423,152 |

| 537,642 |

| 525,077 |

| 300,487 |

| 163,216 |

| ||||||||||||||||||||

Income tax expense |

| (151 | ) | (104,947 | ) | (112,100 | ) | (83,217 | ) | (76,656 | ) | (94,058 | ) | ||||||||||||||||||||

Net income |

| 458 |

| 318,205 |

| 425,542 |

| 441,860 |

| 223,831 |

| 69,158 |

| ||||||||||||||||||||

Profit after tax from discontinued operations |

|

| 119 |

|

|

| 79,572 |

|

|

| 411,190 |

|

|

| 489,919 |

|

|

| 378,351 |

|

| — |

| — |

| — |

| 79,572 |

| 411,190 |

| 489,919 |

|

Net income for the year |

|

| 779 |

|

|

| 521,432 |

|

|

| 635,021 |

|

|

| 559,077 |

|

|

| 563,506 |

|

| 458 |

| 318,205 |

| 425,542 |

| 521,432 |

| 635,021 |

| 559,077 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to the parent Company |

|

| 706 |

|

|

| 472,558 |

|

|

| 392,868 |

|

|

| 276,027 |

|

|

| 353,927 |

|

| 445 |

| 309,029 |

| 418,454 |

| 472,558 |

| 392,868 |

| 276,027 |

|

Net income attributable to non-controlling interests |

|

| 73 |

|

|

| 48,874 |

|

|

| 242,153 |

|

|

| 283,050 |

|

|

| 209,579 |

|

| 13 |

| 9,176 |

| 7,088 |

| 48,874 |

| 242,153 |

| 283,050 |

|

Basic and diluted earnings per share from continuing operations (Ch$/US$ per share) |

|

| 0.08 |

|

|

| 52.77 |

|

|

| 25.89 |

|

|

| 6.81 |

|

|

| 21.11 |

| |||||||||||||

Basic and diluted earnings per share from continuing operations (Ch$/US$ per share) |

|

| 2.36 |

|

|

| 1,583.10 |

|

|

| 776.70 |

|

|

| 204.30 |

|

|

| 633.30 |

| |||||||||||||

Basic and diluted earnings per share (Ch$/US$ per share) |

| 0.05 |

| 37.7 |

| 51.0 |

| 52.8 |

| 25.9 |

| 6.8 |

| ||||||||||||||||||||

Basic and diluted earnings per share (Ch$/US$ per ADS) |

| 1.63 |

| 1,130 |

| 1,531 |

| 1,583 |

| 777 |

| 204 |

| ||||||||||||||||||||

Total Basic and diluted earnings per share (Ch$/US$ per share) |

|

| 0.09 |

|

|

| 57.62 |

|

|

| 47.90 |

|

|

| 33.49 |

|

|

| 43.15 |

|

| 0.05 |

| 37.7 |

| 51.0 |

| 57.6 |

| 47.9 |

| 33.5 |

|

Total Basic and diluted earnings per ADS (Ch$/US$ per ADS) |

|

| 2.58 |

|

|

| 1,728.50 |

|

|

| 1,437.00 |

|

|

| 1,004.70 |

|

|

| 1,294.50 |

|

| 1.63 |

| 1,130 |

| 1,531 |

| 1,729 |

| 1,437 |

| 1,005 |

|

Cash dividends per share (Ch$/US$ per share) |

|

| 0.02 |

|

|

| 14.58 |

|

|

| 20.39 |

|

|

| 21.58 |

|

|

| 14.29 |

|

| 0.03 |

| 22.6 |

| 28.1 |

| 14.6 |

| 20.4 |

| 21.6 |

|

Cash dividends per ADS (Ch$/US$ per ADS) |

|

| 0.65 |

|

|

| 437.4 |

|

|

| 611.7 |

|

|

| 647.4 |

|

|

| 428.7 |

|

| 0.98 |

| 678 |

| 864 |

| 437 |

| 612 |

| 647 |

|

Number of shares of common stock (millions) |

|

|

|

|

|

| 8,202 |

|

|

| 8,202 |

|

|

| 8,202 |

|

|

| 8,202 |

|

| 8,202 |

| 8,202 |

| 8,202 |

| 8,202 |

| 8,202 |

| 8,202 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statement of Financial Position Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets and disposal groups held for sale or distribution to owners |

|

| 19.4 |

|

|

| 12,993 |

|

|

| 3,889,706 |

|

|

| 7,979 |

|

|

| — |

|

| — |

| — |

| 4,205 |

| 12,993 |

| 3,889,706 |

| 7,979 |

|

Total assets |

|

| 5,078 |

|

|

| 3,399,682 |

|

|

| 7,278,770 |

|

|

| 7,237,672 |

|

|

| 6,762,125 |

|

| 5,281 |

| 3,669,228 |

| 3,554,462 |

| 3,399,682 |

| 7,278,770 |

| 7,237,672 |

|

Non-current liabilities |

|

| 1,664.2 |

|

|

| 1,114,145 |

|

|

| 1,207,005 |

|

|

| 2,321,048 |

|

|

| 1,935,919 |

|

| 1,551 |

| 1,077,856 |

| 1,022,092 |

| 1,114,145 |

| 1,207,005 |

| 2,321,048 |

|

Liabilities associated with disposal groups held for sale or distribution to owners |

|

| — |

|

|

| — |

|

|

| 1,851,784 |

|

|

| 5,490 |

|

|

| — |

|

| — |

| — |

| — |

| — |

| 1,851,784 |

| 5,490 |

|

Equity attributable to the parent company |

|

| 2,541 |

|

|

| 1,700,962 |

|

|

| 2,648,190 |

|

|

| 2,700,280 |

|

|

| 2,651,968 |

|

| 2,836 |

| 1,970,521 |

| 1,961,518 |

| 1,700,962 |

| 2,648,190 |

| 2,700,280 |

|

Equity attributable to non-controlling interests |

|

| 43 |

|

|

| 28,798 |

|

|

| 895,700 |

|

|

| 823,606 |

|

|

| 935,846 |

|

| 39 |

| 26,970 |

| 27,496 |

| 28,798 |

| 895,700 |

| 823,606 |

|

Total equity |

|

| 2,584 |

|

|

| 1,729,760 |

|

|

| 3,543,890 |

|

|

| 3,523,886 |

|

|

| 3,587,814 |

|

| 2,875 |

| 1,997,491 |

| 1,989,014 |

| 1,729,760 |

| 3,543,890 |

| 3,523,886 |

|

Capital stock |

|

| 953 |

|

|

| 638,289 |

|

|

| 1,537,723 |

|

|

| 1,537,723 |

|

|

| 1,537,723 |

|

| 919 |

| 638,289 |

| 638,289 |

| 638,289 |

| 1,537,723 |

| 1,537,723 |

|

Other Consolidated Financial Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures (CAPEX) |

|

| 291 |

|

|

| 194,880 |

|

|

| 537,805 |

|

|

| 421,314 |

|

|

| 292,017 |

|

| 320 |

| 222,327 |

| 206,776 |

| 194,880 |

| 537,805 |

| 421,314 |

|

Depreciation, amortization and impairment losses |

|

| 244 |

|

|

| 163,386 |

|

|

| 115,042 |

|

|

| 113,766 |

|

|

| 92,577 |

|

| 170 |

| 117,866 |

| 117,282 |

| 163,386 |

| 115,042 |

| 113,766 |

|

(1) Solely for the convenience of the reader, Chilean peso amounts have been converted into U.S. dollars at the exchange rate of Ch$ 694.77 per U.S. dollar, as of December 31, 2018. (2) Operating costs represent raw materials and supplies used, other work performed by the entity, employee benefits expenses, depreciation and amortization expenses, impairment losses recognized in the period’s profit or loss and other expenses. (3) Financial results represent (+) financial income, (-) financial costs, (+/-) foreign currency exchange differences and net gains/losses from indexed assets and liabilities. (4) Please refer to Note 31 of the Notes to our consolidated financial statements. (5) One ADS = 30 shares of common stock. Please refer to Item 9. (6) Capital stock represents issued capital plus share premium. (7) CAPEX figures represent cash flows used for purchases of property, plant and equipment and intangible assets for each year. (8) For further detail please refer to Notes 27 and 29 of the Notes to our consolidated financial statements. |

|

|

|

|

|

|

|

|

|

|

|

|

| As of and for the year ended December 31, |

| |||||||||||||||||

|

| 2016 |

|

| 2015 |

|

| 2014 |

|

| 2013 |

|

| 2012 |

| |||||

OPERATING DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Installed capacity (MW)(1) |

|

| 6,351 |

|

|

| 6,351 |

|

|

| 6,351 |

|

|

| 5,571 |

|

|

| 5,571 |

|

Generation (GWh)(1) |

|

| 17,564 |

|

|

| 18,294 |

|

|

| 18,063 |

|

|

| 19,438 |

|

|

| 19,194 |

|

|

|

11

As of and for the year ended December 31, 2018 2017 2016 2015 2014 OPERATING DATA Installed capacity (MW)(1) 6,274 6,351 6,351 6,351 6,351 Generation (GWh)(1) 17,373 17,073 17,564 18,294 18,063

Exchange Rates

Fluctuations in the exchange rate between the Chilean peso and the U.S. dollar will affect the U.S. dollar equivalent of the peso price of our shares of common stock on the Santiago Stock Exchange (Bolsa de Comercio de Santiago),Santiago) and the Chilean Electronic Stock Exchange (Bolsa Electrónica de Chile) and the Valparaíso Stock Exchange (Bolsa de Corredores de Valparaíso)Chile). These exchange rate fluctuations affect the price of our American Depositary Shares (“ADSs”) and the conversion of cash dividends relating to the common shares represented by ADSs from Chilean pesos to U.S. dollars. In addition, to the extent that significant financial liabilities of the Company are denominated in foreign currencies, exchange rate fluctuations may have a significant impact on earnings.

In Chile, there are two currency markets, the Formal Exchange Market (Mercado Cambiario Formal)Formal) and the Informal Exchange Market (Mercado Cambiario Informal)Informal). The Formal Exchange Market is comprised of banks and other entities authorized by the Central Bank of Chile. The Informal Exchange Market is comprised of entities that are not expressly authorized to operate in the Formal Exchange Market, such as certain foreign currency exchange houses and travel agencies, among others. The Central Bank of Chile has the authority to require that certain purchases and sales of foreign currencies be carried out on the Formal Exchange Market. Both the Formal and Informal Exchange Markets are driven by free market forces. Current regulations require that the Central Bank of Chile be informed of certain transactions that must be carried out through the Formal Exchange Market.

The U.S. dollar Observed Exchange Rate, which is reported by the Central Bank of Chile and published daily on its web page, is the weighted average exchange rate of the previous business day’s transactions in the Formal Exchange Market. Nevertheless, the Central Bank of Chile may intervene by buying or selling foreign currency on the Formal Exchange Market to attempt to maintain the Observed Exchange Rate within a desired range.

The Informal Exchange Market reflects transactions carried out at an informal exchange rate (the “Informal Exchange Rate”). There are no limits imposed on the extent to which the rate of exchange in the Informal Exchange Market can fluctuate above or below the Observed Exchange Rate. Foreign currency for payments and distributions with respect to the ADSs may be purchased either in the Formal or the Informal Exchange Market, but such payments and distributions must be remitted through the Formal Exchange Market.

The Federal Reserve Bank of New York does not report a noon buying rate for Chilean pesos. As of December 31, 2016,2018, the U.S. dollar Observed Exchange Rate was Ch$ 669.47694.77 per US$ 1.00.

The following table sets forth the low, high, average and period-end Observed Exchange Rate for U.S. dollars for the periods set forth below, as reported by the Central Bank of Chile:

|

| Daily Observed Exchange Rate (Ch$ per US$)(1) |

| |||||||||||||

|

| Low(2) |

|

| High(2) |

|

| Average(3) |

|

| Period-end |

| ||||

Year ended December 31, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016 |

|

| 645.22 |

|

|

| 730.31 |

|

|

| 676.67 |

|

|

| 669.47 |

|

2015 |

|

| 597.10 |

|

|

| 715.66 |

|

|

| 654.66 |

|

|

| 710.16 |

|

2014 |

|

| 527.53 |

|

|

| 621.41 |

|

|

| 570.34 |

|

|

| 606.75 |

|

2013 |

|

| 466.50 |

|

|

| 533.95 |

|

|

| 498.83 |

|

|

| 524.61 |

|

2012 |

|

| 469.65 |

|

|

| 519.69 |

|

|

| 486.31 |

|

|

| 479.96 |

|

Month ended |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 2017 |

|

| 650.98 |

|

|

| 669.52 |

|

| n.a. |

|

|

| 663.97 |

| |

February 2017 |

|

| 638.35 |

|

|

| 648.88 |

|

| n.a. |

|

|

| 648.88 |

| |

January 2017 |

|

| 646.19 |

|

|

| 673.36 |

|

| n.a. |

|

|

| 646.19 |

| |

December 2016 |

|

| 649.40 |

|

|

| 677.11 |

|

| n.a. |

|

|

| 669.47 |

| |

November 2016 |

|

| 650.72 |

|

|

| 679.24 |

|

| n.a. |

|

|

| 673.54 |

| |

October 2016 |

|

| 651.18 |

|

|

| 670.88 |

|

| n.a. |

|

|

| 651.18 |

| |

Source: Central Bank of Chile.

|

|

|

|

|

|

As of April 25, 2017,22, 2019, the U.S. dollar Observed Exchange Rate was Ch$ 660.04663,91 per US$ 1.00.

Calculation of the appreciation or devaluation of the Chilean peso against the U.S. dollar in any given period is made by determining the percent change between the reciprocals of the Chilean peso equivalent of US$ 1.00 at the end of the preceding period

12

and the end of the period for which the calculation is being made. For example, to calculate the appreciationdevaluation of the year-end Chilean peso in 2016,2018, one determines the percentpercentage of change between the reciprocal of Ch$ 710.16,694.77, the value of one U.S. dollar as of December 31, 2015,2018, or 0.001408,0.001439, and the reciprocal of Ch$ 669.47,614.75, the value of one U.S. dollar as of December 31, 2016,2017, or 0.001494.0.001627. In this example, the percentage change between the two periods is 6.1%-11.5%, which represents the 20162018 year-end appreciationdevaluation of the Chilean peso against the 20152017 year-end U.S. dollar. A positive percentage change means that the Chilean peso appreciated against the U.S. dollar, while a negative percentage change means that the Chilean peso devaluated against the U.S. dollar.

The following table sets forth the period-end rates for U.S. dollars for the years ended December 31, 20122014 through December 31, 2016,2018, based on information published by the Central Bank of Chile.

|

| Ch$ per US$(1) |

|

| Ch$ per US$(1) |

| |||||||

|

| Period End |

|

| Appreciation (Devaluation) |

|

| Period End |

| Appreciation (Devaluation) |

| ||

|

| (in Ch$) |

|

| (in %) |

|

| (in Ch$) |

| (in %) |

| ||

Year ended December 31, |

|

|

|

|

|

|

|

|

|

|

|

|

|

2018 |

| 694.77 |

| (11.5 | ) | ||||||||

2017 |

| 614.75 |

| 8.9 |

| ||||||||

2016 |

|

| 669.5 |

|

|

| 6.1 |

|

| 669.47 |

| 6.1 |

|

2015 |

|

| 710.2 |

|

|

| (14.6 | ) |

| 710.16 |

| (14.6 | ) |

2014 |

|

| 606.8 |

|

|

| (13.5 | ) |

| 606.75 |

| (13.5 | ) |

2013 |

|

| 524.6 |

|

|

| (8.5 | ) | |||||

2012 |

|

| 480.0 |

|

|

| 8.2 |

| |||||

Source: Central Bank of Chile.

(1) Calculated based on the variation of period-end exchange rates. B.Capitalization and Indebtedness. |

|

|

|

Not applicable.

C.Reasons for the Offer and Use of Proceeds. |

|

Not applicable.

|

|

D.Risk Factors.

Chilean economic fluctuations, as well as certain economic interventionist measures by governmental authorities as well as political events or financial or other crises in any region worldwide may affect our results of operations, and financial condition and liquidity as well as the value of our securities.

All of our operations are located in Chile. Accordingly, our consolidated revenues may beare affected by the performance of the Chilean economy. If local, regional or worldwide economic trends adversely affect the Chilean economy, our financial condition and results from operations could be adversely affected. Insufficient cash flows could result in the inability to meet our debt obligations and the need to seek waivers to comply with restrictive debt covenants and increasing costs for subsequent financings.

The Chilean government has exercised in the past, and continues to exercise, a substantial influence over many aspects of the private sector, which may result in changes to economic or other policies. For example, in 2014 and 2016, the Chilean government approved Law 20,780, a tax reform law, and Law 20,940, a labor reform law, both of which may have a negative effect upon non-Chilean holders of shares or ADSs. For further details regarding Chilean tax considerations, please refer to “Item 10. Additional Information — E. Taxation.” Other governmental actions could involve wage, price and tariff rate controls, increase strikes and give workers greater collective bargaining power and other interventionist measures, such as expropriation or nationalization.

Future adverse developments in Chile or changes in policies regarding tariffs, water rights, exchange controls, regulations and taxation may impair our ability to execute our strategic plans,business plan, which could adversely affect our results of operations and financial condition. Inflation, devaluation, social instability and other political, economic or diplomatic developments including the response by governments in the region to these circumstances, could also reduce our profitability. In addition, Chilean financial and securities markets are influenced by economic and market conditions in other countries, and may be affected by events in other countries, which could adversely affect the value of our securities.

13

Because our businesses dependOur business depends heavily on hydrology, droughts, flooding and other weather conditions may adversely affect our operations and profitabilityhydrological conditions..

Approximately 55% of our consolidated installed generation capacity in 20162018 was hydroelectric. Accordingly, extremely dry hydrological conditions could adversely affect our business, results of operations and financial condition. Our results have been adversely affected when hydrological conditions in Chile have been significantly below their historical average.

In addition, the below-average hydrological conditions not only reduce our ability to operate our hydroelectric plants at full capacity, but also may result in increased water transportation costs for the operation of the San Isidro thermal power plant for cooling purposes. While Enel Generación Chile has

We have entered into certain agreements with the Chilean government and local irrigators regarding the use of water for hydroelectric generation purposes, especially during periods of low water levels, if drought conditionsdroughts persist, or become worse, we may face increased pressure by the Chilean government or other third parties to further restrict our water use.use further.

Thermal plant operating costs can be considerably higher than those of hydroelectric plants.

Our operating expenses increase during these drought periods when thermal plants, which have higher operating costs relative to hydroelectric plants, are useddispatched more frequently. In addition, depending on our commercial obligations, weWe may need to buy electricity at higher spot prices in order to comply with our contractual supply obligations and the cost of these electricity purchases may exceed our contracted electricity sale prices, thus potentially producing losses from those contracts. For further information with respect to the effect of hydrology on our business and financial results, please refer to “Item 5. Operating and Financial Review and Prospects—Prospects — A. Operating Results—1.Results —1. Discussion of Main Factors Affecting Operating Results and Financial Condition of the Company —a. Hydrological Conditions.Generation Business.”

Droughts also indirectly affect the operation of our thermal plants, including our facilities that use natural gas, fuel oil or coal, as fuel, in the following manner:

·Our thermal plants require water for cooling and droughts not onlyin extreme situations may reduce the availability of water but alsoand increase the concentrationcost of chemicals, such as sulfates in the water. The high concentration of chemicals in the water that we use for cooling increases the risk of damaging the equipment at our thermal plants as well as the risk of violating environmental regulations.transportation. As a result, we have had to purchase water for our San Isidro power plant from agricultural areas that are also experiencing water shortages. These water purchases may increase our operating costs and alsomay require us to further negotiate with the local communities.

|

|

The

· Thermal power plants that burn natural gas generate emissions such as nitrogen oxide (NO), carbon dioxide (CO2) and carbon monoxide (CO) gases. When operating with diesel they release NO, sulfur dioxide (SO2) and particulate matter into the atmosphere. Coal fired plants generate SO2 and NO emissions. Therefore, greater thermal plant use during droughts generally increases the risk of producing higher levels of greenhouse gas emissions, which also decreases our operating income due to the payment of so-called “green taxes.”

A full recovery from the drought that has been affecting the regions where most of our hydroelectric plants are located may last for an extended period andbut new drought periods may recur in the future. A prolonged drought may exacerbate the risks described above and have a further adverse effect upon our business, results of operations and financial condition.

Governmental regulations may adversely affect our business.businesses, cause delays, impede the development of new projects, or increase the costs of operations and capital expenditures.

Our businessbusinesses and the tariffs that we charge to our customers are subject to extensive regulation and these regulations may adversely affect our profitability. For example, governmental authorities might impose material rationing policies during droughts or prolonged failures of power facilities, which may adversely affect our business, results of operations and financial condition.

Our operating subsidiaries are also subject to environmental regulations that, among other things, require us to perform environmental impact studies for future projects and obtain construction and operating permits from both local and national regulators. The governmental authorities may withhold the approval of these environmental impact studies and therefore their processing time may be longer than expected. Similarly, electricity regulations issued by governmental authorities in Chile may affect the ability of our generation companies to collect revenues sufficient to offsetcover their operating costs.

In addition, changes

Environmental regulations for existing and future generation capacity have become stricter and require increased capital investments. Any delay in meeting the standards constitutes a violation of the regulations. Failure to certify the original implementation and ongoing emission standard requirements of such monitoring system may result in significant penalties and sanctions or legal claims for damages. We expect that even more restrictive emission limits will be established in the future. We are also subject to an annual green tax, based on our emission of pollutants in the previous year, and such taxes may increase in the future, and discourage thermal electricity generation.

Changes in the regulatory framework are often submitted to the legislators and administrative authorities and, some of these changes could have a material adverse impact on our business, results of operations and financial condition. For instance, in 2005 there was a change in the water rights law in Chile that requires us to pay for unused water rights, increasing the annual cost to maintain unused water rights for hydroelectric projects that are neither economically nor technically feasible. In August 2016, Enel Generación Chile waived its unused water rights and recorded a write-off of Ch$ 35.4 billion.

Regulatory authorities may impose fines on our subsidiaries due to operational failures or any breachbreaches of regulations.

Our electricity businesses may beare subject to regulatory fines for any breach of current regulations, including energy supply failures.

14

In Chile, such Such fines may be imposed for a maximum of 10,000 Annual Tax Units (“UTA” in its Spanish acronym), or Ch$ 5.55.8 billion using the UTA as of December 31, 2016.2018. Our electricity generation subsidiaries are supervised by local regulatory entitiesauthorities and may beare subject to these fines in cases where, in the opinion of the regulatory entity,authority, operational failures affecting the regular energy supply to the system, including coordination issues, are the fault of the company such as when agents are not coordinated with the system operator. In addition, the new transmission law establishesgenerator. Regulations establish a compensation fee to end customers when the energy supply is interrupted more than the standard allowed time. The compensationtime due to events or failures affecting transmission facilities. Compensation is a proportion of the energy not supplied with a minimum value between 20,000 UTA (Ch$ 11.111.6 billion) and the previous year'syear’s energy sales revenues in the case of generators. Fines may also be associated with breach of regulations.

In 2015, the CDEC-SING audited GasAtacama Chile’sGasAtacama’s thermal power plant and reported its findings to the Superintendence of Electricity and Fuels (“SEF”). In, which in August 2016 the SEF fined GasAtacama Chile Ch$ 5.5 billion10,000 UTA (Ch$ 5.8 billion) for allegedly providing inaccurate information to the CDEC-SING relatedCDEC-SING. In 2017, Gener and Engie, both competitors, demanded that Enel Generation pay US$ 65.8 million and US$ 160 million, respectively, as compensation for the alleged additional costs attributed to certain technical operating parameters that implied higher operating costs toGasAtacama in the system. These costs were associated with the technical minimum capacity reported by GasAtacama at 310 MW, with a 30-hour minimum operating time that the CEN later estimated to be only 118 MW and a 2-hour minimum operating time. Further compensation claims from other market players may arise in the future and further fines to any of our plants could adversely affect our business, results of operations and financial condition.

We depend in part on payments from our subsidiaries and jointly-controlled entitiesassociates to meet our payment obligations.

In order to pay our obligations, we may rely on cash from dividends, loans, interest payments, capital reductions and other distributions from our subsidiaries. The ability of our subsidiaries to pay dividends, interestSuch payments loans and other distributions to us isare subject to legal constraints such as dividend restrictions and fiduciary duties and contractual limitations that may be imposed by the authorities.obligations.

Dividend Limits and Other Legal Restrictions

Contractual Constraints. The ability of any of our subsidiaries that are not wholly-owned to distribute cash to us may be limited by the directors’ fiduciary duties of such subsidiaries to their minority shareholders. Furthermore, someDistribution restrictions included in certain credit agreements of our subsidiaries may be forced by law,prevent dividends and other distributions to shareholders if they are not in accordancecompliance with applicable regulation, to diminish or eliminate dividend payments. As a consequencecertain financial ratios. Our credit agreements typically prohibit any type of such restrictions, our subsidiaries could, under certain circumstances, be impeded from distributing cash to us.distribution if there is an ongoing default.

Operating Results of Our Subsidiaries. The ability of our subsidiaries to pay dividends or make loan payments or other distributions to us is limited by their operating results. To the extent that the cash requirements of any of our subsidiaries exceed their available cash, the subsidiary will not be able to make cash available to us.

Any of the situations described above could adversely affect our business, results of operations and financial condition.

We are involved in litigation proceedings.

We are currently involved in various litigation proceedings, which could result in unfavorable decisions or financial penalties against us. We will continue to be subject to future litigation proceedings, which could cause material adverse consequences to our business.

Our financial condition or results of operations could be adversely affected if we are unsuccessful in defending lawsuits and proceedings against us. For further information on litigation proceedings, please see “Item 8. Financial Information — A. Consolidated Statements and Other Financial Information — Legal Proceedings” and Note 3835.3 of the Notes to our consolidated financial statements.

Environmental regulations

Construction and other factorsoperation of power plants may cause encounter significant delays impede the developmentor halt and cost over-runs, as well as stakeholder opposition, which may damage our reputation and result in impairment of newour goodwill with stakeholders.

Our power plant projects or increase the costs of operations and capital expenditures.

We and our operating subsidiaries are subject to environmental regulations which, among other things, require us to perform environmental impact studies for future projects and obtain permits from both local and national regulators. The approval of these environmental impact studies may be withheld by governmental authoritiesdelayed in obtaining regulatory approvals, or may face shortages and therefore their processing time may be longer than expected.

The projects that require consultation with local stakeholdersincreases in their evaluation process may be rejectedthe price of equipment, materials or their development may be impeded or slowed down. Our stakeholders may also seek injunctive or other relief, which could negatively impact us iflabor, and they are successful. Moreover, projects that do not require consultation with local stakeholders may be subject to intervention or suffer continuous resistance, delaying their approval process or development.construction delays, strikes, adverse weather conditions, natural disasters, civil unrest, accidents, and human error. Any such event could adversely impact our business, results of operations and financial condition.

Environmental regulations for existing

Market conditions at the time when the projects are initially approved may differ significantly from those that prevail when the projects are completed, which in some cases make such projects commercially unfeasible. This has been the case with many of our former projects, which were initially planned under very different market conditions with higher energy prices prevailing in the market and future generation capacity may become stricter, requiring increased capital investments. For example, Decree13/2011less competition. Deviations in these assumptions, including the estimates of the Chilean Ministry of the Environment, published in June 2011, established stricter emission standards for existing thermoelectric plants that were requiredtiming and expenditures related to be met between 2014these projects, may lead to cost over-runs and 2016, and stricter standards for new facilities or additional capacity. This regulation also required the establishment of a system of continuous emission monitoring, pursuant to which thermoelectric plants must implement a monitoring system in accordance with the guidelines and protocols issued by the Chilean Superintendence of the Environment. In compliance with these Chilean environmental regulations, all thermal plants

15

made incremental investments to comply with the new regulations by installing abatement systems to control pollutant emissions. For example, we are improvingcompletion time widely exceeding our Tarapacá thermal plant through the installation of a desulphurizer to reduce sulfur oxides (SO2) and implementation of measures to improve combustion to reduce emissions of nitrogen oxide (NOx). As of December 31, 2016, the amount accrued in connection with such investments was Ch$ 65,718 million.

Any delay in meeting the standards constitutes a violation of the regulations which established emission limits effective June 23, 2015 or June 23, 2016 depending on the plant’s location and failure to certify the implementation of such monitoring system may result in penalties and sanctions.

In addition, any deviation from the environmental license to operate could result in severe sanctions from authorities. For example, during 2016 Enel Generación Chile paid fines of Ch$ 1.1 billion for non-compliance with the requirements under the environmental licenses and failing to send the monitoring reports for our Bocamina, Huasco and Diego de Almagro thermal plants in past years.

Currently, the Chilean Ministry of Environment is working on new prevention and decontamination plans in polluted areas and the Chilean Ministry of Energy is also preparing new mitigation plans to reduce carbon dioxide emissions and comply with the Paris Agreement under the United Nations Framework Convention on Climate Change. Such plans may modify Decree 13/2011 and even further restrict the emission standards for thermoelectric plants, which in turn may require additional investments in the future.

In September 2014, the Chilean government enacted Law 20,780, a tax reform law, which will come into effect in 2018, and thereby established an annual tax on stationary power generators, such as thermal generators, based on their emission of pollutants for the previous year. In December 2016, the Chilean Ministry of Environment published the list of thermal generators that are affected by this tax, and the list included all of our thermal plants. These plants will have to report their emissions during 2017 and will have an additional tax liability in 2018. It is possible that the tax expense might increase in the future, discouraging thermal generation given the increasing cost of operation.

In December 2016, Enel Generación Chile recorded a write-off of Ch$ 1.1 billion for the Tames 2 and Totoralillo thermal projects, due to their technology (steam turbine/coal), which is becoming more expensive because of stricter regulation and its uncertain profitability, among other reasons.

We may have to incur additional costs to remediate and implement our asbestos control and sanitation policy, or be subject to legal actions against us,initial estimates, which in turn may have a material adverse effect on our business, results of operation and financial condition.

In addition to environmental considerations, there are other factors that

The operation of our coal-fired thermal power plants may adversely affect our abilitygoodwill with stakeholders, due to build new facilities or to complete projects currently under development on time, including delays in obtaining regulatory approvals, shortages or increases in the price of equipment, materials or labor, constructions delays, strikes, adverse weather conditions, natural disasters, civil unrest, accidents, or other unforeseen events. For example, many of our power plants have been delayed by years in relation to their original planning and design. Any such event could adversely impact our results of operations and financial condition.

Delays or modifications to any proposed project and laws or regulations may change or be interpreted in a manner thatgreenhouse gas emissions, which could adversely affect our operationsthe environment and local residents. In addition, communities might have their own interests and different perceptions of the company, or our plans for companies in which we hold investments,be influenced by other stakeholders or motivations unrelated to the project. Therefore, if the company fails to engage with its relevant stakeholders, it might face opposition, which could adversely affect our business, results ofreputation, stall operations and financial condition.

Our business may be adversely affected by judicial decisions on environmental qualification resolutions for electricity projects in Chile.

The amount of time necessary to obtain an environmental qualification resolution for electricity generation or transmission projects in Chile has materially increased, primarily due to judicial decisions against such projects, environmental opposition, social criticism and government delays. This can cast doubt on the ability of a project to obtain such approval and increase the uncertainty for investing in electricity generation and transmission projects in Chile. The uncertainty is forcing companies to reassess their business strategies.

Our power plant projects may encounter significant opposition from different groups that may delay their development, increase costs, damage our reputation and potentially result in impairment of our goodwill with stakeholders.

a lawsuit. Our reputation is the foundation of our relationship with key stakeholders. If we are unable to effectively manage real or perceived issues that could impactaffect us negatively, our business, results of operations and financial condition could be adversely affected.

16

In 2015, the Chilean Ministry of Environment enacted Law 20,500, setting the procedures for stakeholder participation in the preliminary phase of the evaluation process to avoid risk of conflict and minimize the project impacts. Plants built before this adoption of these rules that were not submitted to local consultation may face opposition from several stakeholders, such as ethnic groups, environmental groups, land owners, farmers, local communities and political parties, among others, any of whom may impact the sponsoring company’s reputation and goodwill. For example, since December 2013, the Bocamina II power plant has encountered substantial opposition from local fishermen’s unions that claim that our facility negatively affects marine life and causes pollution, which resulted in the interruption of the operation of the power plant for more than a year. On July 1, 2015, the Bocamina II power plant resumed operations, after the approval of a new RCA in April 2015. Also, between November 23, 2015 and January 7, 2016, a second group of fishermen illegally occupied the first high-tension pylon which supports the 154 kV and 220 kV circuits owned by Transelec S.A. and serve the Bocamina I and II power plants. As a consequence, both Bocamina I and II power plants were temporarily shut down. This second group claimed that they should receive the same benefits that Enel Generación Chile granted to the first group of fishermen in the zone. The financial effects of this illegal occupation and electricity transmission interruption amounted to Ch$ 2.8 billion of losses between November 23, 2015 and January 7, 2016. At the level of the electrical system, this situation increased the spot prices and the anticipated use of hydroelectric reserves. Such groups and other similar groups may have the ability to block our power plants and directly affect our results.

The operation of our current thermal power plants may also affect our goodwill with stakeholders, due to emissions such as particulate matter, sulfur dioxide (SO2) and nitrogen oxide (NO), which could adversely affect the environment.

Damage to our reputation may exert considerable pressure on regulators, creditors, and other stakeholders and ultimately lead to projects and operations that may be abandoned, causing our share prices to drop and hindering our ability to attract and retain valuable employees, any of which could result in an impairment of our goodwill with stakeholders.

Political events or financial or other crises in any region worldwide can have a significant impact in Chile, and consequently, may adversely affect our operations as well as our liquidity.

Chile is vulnerable to external shocks, including financial and political events, which could cause significant economic difficulties and affect growth. If the Chilean economyChile experiences lower than expected economic growth or a recession, it is likely that our customers will demand less electricity and that some of our customers may experience difficulties paying their electric bills, possibly increasing our uncollectible accounts. Any of these situations could adversely affect our results of operations and financial condition.

Financial and political events in other parts of the world could also adversely affect our business. For example, the 2016 presidential electionsince 2018, U.S. and China have been involved in the United States considerablya trade war involving protectionist measures, which increased the volatility of financial markets worldwide based ondue to the uncertainty of political decisions. New United States policies could affect world markets and global trade and result in renewed volatility, especially in commodity prices. Moreover, instabilityInstability in the Middle East or in any other major oil producingoil-producing region could also result in higher fuel prices worldwide, which in turn could increaseincreasing the operating cost of fuel for our thermal generation plants and adversely affectaffecting our results of operations and financial condition.

In addition, an

The U.S. federal government has experienced shutdowns in recent times, including the 2018-2019 U.S. government shutdown, which affected the SEC among many other federal agencies, and extended for 35 days, the longest federal government shutdown in

U.S. history. Even temporary or threatened U.S. government shut-downs could have a material adverse effect on the timing, execution and increased expense associated with our international financings and our M&A activities.

An international financial crisis and its disruptive effects on the financial industry could adversely impact our ability to obtain new bank financings on the same historical terms and conditions that we have benefited from to date.

Political events or financial or other crises could also diminish our ability to access the Chilean and international capital markets or increase the interest rates available to us. Reduced liquidity, could, in turn, could adversely affect our capital expenditures, our long-term investments and acquisitions, our growth prospects and our dividend payout policy.

We may be unable to enter into suitable acquisitions.acquisitions or successfully integrate businesses that we acquire.

On an ongoing basis, we review acquisition prospects that may increase our market coverage or supplement our existing businesses, though there can be no assurance that we will be able to identify and consummate suitable acquisition transactions in the future. The acquisition and integration of independent companies that we do not control is generally a complex, costly and time-consuming process and requires significant efforts and expenditures. If we consummate an acquisition, it could result in the incurrence of substantial debt and assumption of unknown liabilities, the potential loss of key employees, amortization of expenses related to tangible assets and the diversion of management’s attention from other business concerns. In addition, anyintegrating acquired businesses may be difficult, expensive, time-consuming and a strain on our resources and our relationships with our employees and customers and ultimately may not be successful or achieve the benefits expected. Any delays or difficulties encountered in connection with acquisitions and the integration of multiple operationstheir businesses could have a material adverse effect on our business, financial condition or results of operations.

17

Our business and profitability could be adversely affected if water rights are denied or if water concessions are granted with limited duration.

We own water rights granted by the Chilean Water Authority (Dirección General de Aguas)Aguas) for the supply of water from rivers and lakes near our production facilities. Under current law, these water rights are (i) for unlimited duration, (ii) absolute and unconditional property rights and (iii) not subject to further challenge. Chilean generation companies must pay an annual license fee for unused water rights. New hydroelectric facilities are required to obtain water rights, the conditions of which may impactaffect design, timing or profitability of a project.

In addition, the Chilean Congress is currently discussinghas discussed amendments to the Water Code since 2014 in order to prioritize the use of water by defining its access as a basic human rightneed that must be guaranteed by the State. The amendment will establish that water use for human consumption, domestic subsistence and sanitation will always take precedence, in both the granting and limiting the exercise of rights of exploitation. Under the proposal: (i) new water use concessions would be limitedRestrictions enacted to 30 years, which would be extendable with respect to water rights actually used during the 30-year period, unless the Chilean Water Authority demonstrates the water rights have not been used effectively; (ii) new non-consumptive water rights would expire if the holder does not exercise the rights within eight years; (iii) existing non-consumptive water rights which have not been used would expire within eight years from the date of enactment of the new Water Code; and (iv) the preservation of waterpreserve environmental flows to protect the ecosystem for future water rights was added for both consumptive and non-consumptive water use and empowers the Chilean Water Authority to mandate an enviromental flow requirement for existing water rights. This last point would reduce water availability for generation purposes.

Any limitations on our current water rights, our need for additional water rights, or our current unlimited duration of water concessions could have a material adverse effect on our hydroelectric development projects and our profitability. Any limitations on our current water rights, our need for additional water rights, or our current unlimited durationAs of water concessions couldthe date of this Report, no resolutions have a material adverse effect on our hydroelectric development projectsbeen adopted and our profitability.the uncertainty remains.

Foreign exchange risks may adversely affect our results and the U.S. dollar value of dividends payable to ADS holders.