Page

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

We have made statements in this Annual Report on Form 20-F that constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements appear throughout this report and include statements regarding our intent, belief or current expectations regarding:

| · | asset growth and alternative sources of funding |

| · | growth of our fee-based business |

| · | financing plans |

| · | impact of competition |

| · | impact of regulation |

| · | exposure to market risks including: |

| · | interest rate risk |

| · | foreign exchange risk |

| · | equity price risk |

| · | projected capital expenditures |

| · | liquidity |

| · | trends affecting: |

| · | our financial condition |

| · | our results of operation |

The sections of this Annual Report which contain forward-looking statements include, without limitation, “Item 3. Key Information—Risk Factors,” “Item 4. Information on the Company—C.B. Business Overview—Competition,” “Item 5. Operating and Financial Review and Prospects,” “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information—Legal Proceedings,” and “Item 11. Quantitative and Qualitative Disclosures About Market Risk.” Our forward-looking statements also may be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “could,” “may,” “seeks,” “aim,” “combined,” “estimates,” “probability,” “risk,” “VaR,” “target,” “goal,” “objective,” “future” or similar expressions.

You should understand that the following important factors, in addition to those discussed elsewhere in this Annual Report and in the documents which are incorporated by reference, could affect our future results and could cause those results or other outcomes to differ materially from those expressed in our forward-looking statements:

| · | changes in capital markets in general that may affect policies or attitudes towards lending to Chile or Chilean companies; |

| · | changes in economic conditions; |

| · | the monetary and interest rate policies of Central Bank (as defined below); |

| · | inflation; |

| · | deflation; |

| · | unemployment; |

| · | increases in defaults by our customers and in impairment losses; |

| · | decreases in deposits; |

| · | customer loss or revenue loss; |

| · | unanticipated turbulence in interest rates; |

| · | movements in foreign exchange rates; |

| · | movements in equity prices or other rates or prices; |

| · | the effects of non-linear market behavior that cannot be captured by linear statistical models, such as the VaR model we use; |

| · | changes in Chilean and foreign laws and regulations; |

| · | changes in taxes; |

| · | competition, changes in competition and pricing environments; |

| · | our inability to hedge certain risks economically; |

| · | the adequacy of loss allowances; |

| · | technological changes; |

| · | changes in consumer spending and saving habits; |

| · | changes in demographics, consumer spending, investment or saving habits; |

| · | increased costs; |

| · | unanticipated increases in financing and other costs or the inability to obtain additional debt or equity financing on attractive terms; |

| · | changes in, or failure to comply with, banking regulations; |

| · | acquisitions or restructurings of businesses that may not perform in accordance with our expectations; |

| · | our ability to successfully market and sell additional services to our existing customers; |

| · | disruptions in client service; |

| · | damage to our reputation; |

| · | natural disasters; |

| · | implementation of new technologies; |

| · | the Group’s exposure to operational losses (e.g., failed internal or external processes, people and systems); and |

| · | an inaccurate or ineffective client segmentation model. |

You should not place undue reliance on such statements, which speak only as of the date at which they were made. The forward-looking statements contained in this report speak only as of the date of this Annual Report, and we do not undertake to update any forward-looking statement to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

As used in this annual report (the “Annual Report”), “Santander-Chile”, “the Bank”, “we,” “our” and “us” or similar terms refer to Banco Santander-Chile together with its consolidated subsidiaries.

When we refer to “Santander Spain,” we refer to our parent company, Banco Santander, S.A. References to “the Group,” “Santander Group” or “Grupo Santander” mean the worldwide operations of the Santander Spain conglomerate, as indirectly controlled by Santander Spain and its consolidated subsidiaries, including Santander-Chile.

As used in this Annual Report, the term “billion” means one thousand million (1,000,000,000).

In this Annual Report, references to “$”, “U.S.$”, “U.S. dollars” and “dollars” are to United States dollars; references to “Chilean pesos,” “pesos” or “Ch$” are to Chilean pesos; references to “CHF” or “CHF$” are to Swiss francs; references to “CNY” or “CNY$” are to Chinese yuan renminbi); and references to “UF” are toUnidades de Fomento. The UF is an inflation-indexed Chilean monetary unit with a value in Chilean pesos that changes daily to reflect changes in the official Consumer Price Index (“CPI”) of theInstituto Nacional de Estadísticas (the Chilean National Institute of Statistics) for the previous month. See “Item 3. Key Information—A. Selected Financial Data—Exchange Rates” for information regarding exchange rates.

As used in this Annual Report, the terms “write-offs” and “charge-offs” are synonyms.

In this Annual Report, references to the Audit Committee are to the Bank’sComité de Directores y Auditoría.

In this Annual Report, references to “BIS” are to the Bank for International Settlement, and references to “BIS ratio” are to the capital adequacy ratio as calculated in accordance with the Basel Capital Accord. References to the “Central Bank” are to theBanco Central de Chile. References to the SBIF are to the Superintendency of Banks and Financial Institutions.

Certain figures included in this Annual Report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

PRESENTATION OF FINANCIAL INFORMATION

Santander-Chile is a Chilean bank and maintains its financial books and records in Chilean pesos and prepares its consolidated financial statements in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). Any reference to IFRS in this document is to IFRS as issued by the IASB.

As required by local regulations, our locally filed consolidated financial statements have been prepared in accordance with Chilean accounting principles issued by the SBIF (“Chilean Bank GAAP”). Therefore, our locally filed consolidated financial statements have been adjusted to IFRS in order to comply with the requirements of the Securities and Exchange Commission (the “SEC”). Chilean Bank GAAP principles are substantially similar to IFRS but there are some exceptions. For further details and a discussion of the main differences between Chilean Bank GAAP and IFRS, see to “Item 5. Operating and Financial Review and Prospects—A. Accounting Standards Applied in 2013.2015.”

This Annual Report contains our consolidated financial statements as of December 31, 2013, 20122015 and 20112014 and for the years then ended December 31, 2015, 2014 and 2013 (the “Audited Consolidated Financial Statements”). Such Audited Consolidated Financial Statements have been prepared in accordance with IFRS as issued by the IASB, and have been audited by Deloitte Auditores y Consultores Limitada, independent registered public accountants.accounting firm. See page F-1F-2 of the Audited Consolidated Financial

Statements for the 2013, 2012 and 20112015 report prepared by Deloitte Auditores y Consultores Limitada. The Audited Consolidated Financial Statements have been prepared from accounting records maintained by the Bank and its subsidiaries.

The notes to the Audited Consolidated Financial Statements contain information in addition to that presented inform an integral part of the Audited Consolidated Financial Statements which provideand contain additional information and narrative descriptions or details of these financial statements.

We have formatted our financial information according to the classification format for banks used in Chile.Chile for purposes of IFRS. We have not reclassified the line items to comply with Article 9 of Regulation S-X. Article 9 is a regulation of the SEC that contains formatting requirements for bank holding company financial statements.

Functional and Presentation Currency

The Chilean peso is the currency of the primary economic environment in which the Bank operates and the currency that influences its structure of costs and revenues, and in accordance with International Accounting Standard 21 –The Effects of Changes in Foreign Exchange Rates has been defined as the functional and presentation currency. Accordingly, all balances and transactions denominated in currencies other than the Chilean peso are treated as “foreign currency.”

For presentational purposes, we have translated millions of Chilean pesos (Ch$ million) into thousands of USU.S. dollars (U.S.$ thousand) using the rate as indicated below under “Exchange Rates,” for the financial information included in this Annual Report. See “Note 1—Summary of Significant Accounting Principles—e) Functional and presentation currency.”

Loans

Unless otherwise specified, all references herein (except in the Audited Consolidated Financial Statements) to loans are to loans and financial leases before deduction for loan loss allowance, and, except as otherwise specified, all market share data presented herein is based on information published periodically by the SBIF. Non-performing loans include the entire principal amount and accrued but unpaid interest on loans for which either principal or interest is past-due for 90 days or more and which do not accrue interest. Restructured loans for which no payments are past-due are not ordinarily classified as non-performing loans. See “Item 5. Operating and Financial Review and Prospects—F.C. Selected Statistical Information—Classification of Loan Portfolio Based on the Borrower’s Payment Performance.”

Under IFRS, a loan is evaluated on each financial statement reporting date to determine whether objective evidence of impairment exists. A loan will be impaired if, and only if, objective evidence of impairment exists as a result of one or more events that occurred after the initial recognition of the loan, and such event or events have an impact on the estimated future cash flows of such loan that can be reliably estimated. It may not be possible to identify a single event that was the individual cause of the impairment.

An impairment loss relating to aan individually significant loan recorded at amortized cost which has experienced objective evidence of impairment is calculated as the difference between the carryingrecorded amount of the financial assetloan and the presentfair value of estimated future cash flows discounted at the effective interest rate.collateral less costs to sell (practical expedient as allowed under IAS 39, “Financial Instruments”, Application Guidance paragraph 84).

Individually significantThose loans individually assessed for impairment and found not to be individually impaired are included in the loans collectively assessed for impairment (so that the collective assessment includes both the remainder of the loans not individually tested for impairment. The remaining financial assets are evaluated collectively in groups withassessed and those not found to be individually impaired) where grouping of such loans on a collective basis is performed using similar credit risk characteristics.

The reversal of an impairment loss occurs only if it can be objectively related to an event occurring after the initial impairment loss was recorded. In the case of loans recorded at amortized cost, the reversal is recorded in income. See “Item 5. Operating and Financial Review and Prospects—F.C. Selected Statistical Information—Analysis of Loan Loss Allowances.”

Outstanding loans and the related percentages of our loan portfolio consisting of corporate and consumer loans in the section entitled “Item 4. Information on the Company—C.B. Business Overview” are categorized based on the nature of the borrower. Outstanding loans and related percentages of our loan portfolio consisting of corporate and consumer loans in the section entitled “Item 5. Operating and Financial Review and Prospects—F.C. Selected Statistical Information” are categorized in accordance with the reporting requirements of the SBIF, which are based on the type and term of loans. This disclosure is consistent with IFRS.

Effect of Rounding

Certain figures included in this Annual Report and in the Audited Consolidated Financial Statements have been rounded up for ease of presentation. Percentage figures included in this Annual Report have not in all cases been calculated on the basis of such rounded figures but on the basis of such amounts prior to rounding. For this reason, certain percentage amounts in this Annual Report may vary from those obtained by performing the same calculations using the figures in the Audited Consolidated Financial Statements. Certain other amounts that appear in this Annual Report may not sum due to rounding.

Economic and Market Data

In this Annual Report, unless otherwise indicated, all macroeconomic data related to the Chilean economy is based on information published by the Central Bank, and all market share and other data related to the Chilean financial system is based on information published by the SBIF and our analysis of such information. Information regarding the consolidated risk index of the Chilean financial system as a whole is not available.

Exchange Rates

This Annual Report contains translations of certain Chilean peso amounts into U.S. dollars at specified rates solely for the convenience of the reader. These translations should not be construed as representations that the Chilean peso amounts actually represent such U.S. dollar amounts, were converted from U.S. dollars at the rate indicated in preparing the Audited Consolidated Financial Statements, could be converted into U.S. dollars at the rate indicated, were converted or will be converted at all.

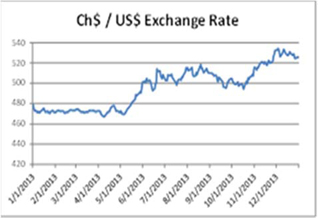

Unless otherwise indicated, all U.S. dollar amounts at any year end, for any period have been translated from Chilean pesos based on the interbank market rate published by Reuters at 1:30 pm on the last business day of the period. On December 31, 20122014 and 2013,2015 the exchange rate in the Informal Exchange Market as published by Reuters at 1:30 pm on these days was Ch$478.85608.33 and Ch$524.20707.80 respectively, or 0.05% less0.16% and 0.08%0.06% more, respectively, than the published observed exchange rate published by the Central Bank for such date of Ch$478.60607,38 and Ch$523.76,707.34 respectively, per U.S.$1.00. The Federal Reserve Bank of New York does not report a noon buying rate for the Chilean peso. For more information on the observed exchange rate, see “Item 3. Key Information—A. Selected Financial Data—Exchange Rates” of the Annual Report.

As of December 31, 20122014 and 2013,2015, one UF was equivalent to Ch$ 22,840.7524,627.10 and Ch$ 23,309.5625,629.09, respectively. The U.S. dollar equivalent of one UF was U.S.$44.5036.21 as of December 31, 2013,2015, using the observed exchange rate reported by the Central Bank as of December 31, 2013,30, 2015 of Ch$ 523.7636.23 per U.S.$1.00.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORSADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

A. Selected Financial Data

The following table presents selected historical financial information for Santander-Chile as of the dates and for each of the periods indicated. Financial information for Santander-Chile as of and for the years ended December 31, 2015, 2014, 2013, 2012, 2011, 2010, and 20092011 has been derived from our audited consolidated financial statementsAudited Consolidated Financial Statements prepared in accordance with IFRS. In the F-pages of this Annual Report on Form 20-F, our audited financial statements for the years 2015, 2014 and 2013 are presented. The audited financial statements for 2012 and 2011 are not included in this document, but they can be found in our previous Annual Reports on Form 20-F. These consolidated financial statements differ in some respects from our locally filed financial statements at and for the years ended December 31, 2015, 2014, 2013, 2012, 2011, 2010, and 20092011 prepared in accordance with Chilean Bank GAAP.

The following table should be read in conjunction with, and is qualified in its entirety by reference to, our Audited Consolidated Financial Statements appearing elsewhere in this Annual Report.

| As of and for the years ended December 31, | ||||||

2013 | 2013 | 2012 | 2011 | 2010 | 2009 | |

| In U.S.$ thousands (1) | In Ch$ millions (2) | |||||

| CONSOLIDATED STATEMENT OF INCOME DATA (IFRS) | ||||||

| Net interest income | 2,054,106 | 1,076,762 | 1,042,734 | 972,300 | 939,719 | 856,516 |

| Provision for loan losses | (708,626) | (371,462) | (403,692) | (316,137) | (253,915) | (333,145) |

| Net fee and commission income | 438,451 | 229,836 | 270,572 | 277,836 | 263,582 | 254,130 |

| Operating costs (3) | (1,064,199) | (557,853) | (539,742) | (500,447) | (451,936) | (407,894) |

| Other income, net (4) | 308,423 | 161,676 | 36,034 | 50,878 | 95,365 | 155,927 |

| Income before tax | 1,028,155 | 538,959 | 405,906 | 484,430 | 592,815 | 525,534 |

| Income tax expense | (180,332) | (94,530) | (44,473) | (77,308) | (85,343) | (88,924) |

| Net income for the year | 847,823 | 444,429 | 361,433 | 407,122 | 507,472 | 436,610 |

| Net income attributable to: | ||||||

| Bank shareholders | 843,750 | 442,294 | 356,808 | 402,191 | 505,393 | 431,557 |

| Non-controlling interests | 4,073 | 2,135 | 4,625 | 4,931 | 2,079 | 5,053 |

| Net income attributable to Bank shareholders per share | 4.48 | 2.35 | 1.89 | 2.13 | 2.68 | 2.29 |

| Net income attributable to Bank shareholders per ADS (5) | 1.79 | 938.83 | 757.37 | 2,217.48 | 2,786.48 | 2,379.39 |

| Weighted-average shares outstanding (in millions) | 188,446.1 | 188,446.1 | 188,446.1 | 188,446.1 | 188,446.1 | 188,446.1 |

| Weighted-average ADS outstanding (in millions) (5) | 471.1 | 471.1 | 471.1 | 181.4 | 181.4 | 181.4 |

| CONSOLIDATED STATEMENT OF FINANCIAL POSITION DATA (IFRS) | ||||||

| Cash and deposits in banks | 2,998,493 | 1,571,810 | 1,250,414 | 2,793,701 | 1,762,198 | 2,043,458 |

| Financial investments (6) | 3,826,839 | 2,006,029 | 2,171,438 | 2,084,002 | 2,024,635 | 2,642,649 |

| Loans before allowance from loan losses | 40,176,958 | 21,060,761 | 18,966,652 | 17,434,782 | 15,727,282 | 13,751,276 |

| Loan loss allowance | (1,173,089) | (614,933) | (550,048) | (488,468) | (425,447) | (349,527) |

| Financial derivative contracts (assets) | 2,850,092 | 1,494,018 | 1,293,212 | 1,601,896 | 1,624,378 | 1,393,878 |

| Other assets (7) | 3,060,934 | 1,604,542 | 1,627,434 | 1,241,979 | 1,377,668 | 1,291,141 |

| Total assets | 51,740,227 | 27,122,227 | 24,759,102 | 24,667,892 | 22,090,714 | 20,772,875 |

| Deposits (8) | 29,179,769 | 15,296,035 | 14,082,232 | 13,334,929 | 11,495,191 | 10,708,791 |

| Other interest bearing liabilities (9) | 13,887,424 | 7,279,788 | 6,506,020 | 7,264,311 | 6,235,959 | 6,232,982 |

| Financial derivative contracts (liabilities) | 2,464,297 | 1,291,785 | 1,146,161 | 1,292,402 | 1,643,979 | 1,348,906 |

| Total equity (10) | 4,525,860 | 2,372,456 | 2,196,501 | 2,093,280 | 1,937,977 | 1,689,903 |

| Equity attributable to Bank shareholders | 4,471,484 | 2,343,952 | 2,162,236 | 2,059,479 | 1,906,168 | 1,660,104 |

As of and for the years ended December 31, | |||||

2013 | 2012 | 2011 | 2010 | 2009 | |

| CONSOLIDATED RATIOS | |||||

| (IFRS) | |||||

| Profitability and performance: | |||||

| Net interest margin (11) | 4.6% | 4.8% | 4.8% | 5.4% | 5.3% |

| Return on average total assets (12) | 1.6% | 1.4% | 1.7% | 2.4% | 2.2% |

| Return on average equity (13) | 18.9% | 16.5% | 20.4% | 29.0% | 27.3% |

| Capital: | |||||

| Average equity as a percentage of average total assets (14) | 8.7% | 8.7% | 8.3% | 8.4% | 8.0% |

| Total liabilities as a multiple of equity (15) | 10.4 | 10.3 | 10.8 | 10.4 | 11.3 |

| Credit Quality: | |||||

| Non-performing loans as a percentage of total loans (16) | 2.9% | 3.2% | 2.9% | 2.7% | 3.0% |

| Allowance for loan losses as percentage of total loans | 2.9% | 2.9% | 2.8% | 2.7% | 2.5% |

| Operating Ratios: | |||||

| Operating expenses /operating revenue (17) | 40.2% | 42.5% | 41.4% | 37.0% | 34.2% |

| Operating expenses /average total assets | 2.3% | 2.4% | 2.3% | 2.2% | 2.2% |

| OTHER DATA | |||||

| CPI Inflation Rate (18) | 3.0% | 1.5% | 4.4% | 3.0% | -1.4% |

| Revaluation (devaluation) rate (Ch$/U.S.$) at year end (18) | 9.4% | -8.2% | 11.3% | -7.5% | -19.5% |

| Number of employees at period end | 11,516 | 11,713 | 11,566 | 11,001 | 11,118 |

| Number of branches and offices at period end | 493 | 504 | 499 | 504 | 498 |

| As of and for the years ended December 31, | ||||||||||||||||||||||||

| 2015 | 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||||||

| In U.S.$ thousands(1) | In Ch$ millions (2) | |||||||||||||||||||||||

| CONSOLIDATED STATEMENT OF INCOME DATA (IFRS) | ||||||||||||||||||||||||

| Net interest income | 1,773,391 | 1,255,206 | 1,317,104 | 1,076,762 | 1,042,734 | 972,300 | ||||||||||||||||||

| Net fee and commission income | 335,727 | 237,627 | 227,283 | 229,836 | 270,572 | 277,836 | ||||||||||||||||||

| Financial transactions, net | 205,565 | 145,499 | 112,565 | 124,437 | 82,299 | 94,197 | ||||||||||||||||||

| Other operating income | 9,097 | 6,439 | 6,545 | 88,155 | 13,105 | 18,749 | ||||||||||||||||||

| Net operating profit before provision for loan losses | 2,323,780 | 1,644,771 | 1,663,497 | 1,519,190 | 1,408,710 | 1,363,082 | ||||||||||||||||||

| Provision for loan losses | (564,110 | ) | (399,277 | ) | (354,903 | ) | (371,462 | ) | (403,692 | ) | (316,137 | ) | ||||||||||||

| Net operating profit | 1,759,670 | 1,245,494 | 1,308,594 | 1,147,728 | 1,005,018 | 1,046,945 | ||||||||||||||||||

| Total operating expenses | (1,017,177 | ) | (719,958 | ) | (683,819 | ) | (610,191 | ) | (599,379 | ) | (564,655 | ) | ||||||||||||

| Operating income | 742,493 | 525,536 | 624,775 | 537,537 | 405,639 | 482,290 | ||||||||||||||||||

| Income from investments in associates and other companies | 3,656 | 2,588 | 2,165 | 1,422 | 267 | 2,140 | ||||||||||||||||||

| Income before tax | 746,149 | 528,124 | 626,940 | 538,959 | 405,906 | 484,430 | ||||||||||||||||||

| Income tax expense | (107,933 | ) | (76,395 | ) | (51,050 | ) | (94,530 | ) | (44,473 | ) | (77,308 | ) | ||||||||||||

| Net income for the year | 638,216 | 451,729 | 575,890 | 444,429 | 361,433 | 407,122 | ||||||||||||||||||

| Net income for the period attributable to: | ||||||||||||||||||||||||

| Equity holders of the Bank | 633,606 | 448,466 | 569,910 | 442,294 | 356,808 | 402,191 | ||||||||||||||||||

| Non-controlling interests | 4,610 | 3,263 | 5,980 | 2,135 | 4,625 | 4,931 | ||||||||||||||||||

| Net income attributable to Equity holders of the Bank per share | 3.36 | 2.38 | 3.02 | 2.35 | 1.89 | 2.13 | ||||||||||||||||||

| Net income attributable to Equity holders of the Bank per ADS (3) | 1,344.90 | 951.92 | 1,208.00 | 938.83 | 757.37 | 2,217.48 | ||||||||||||||||||

| Weighted-average shares outstanding (in millions) | 188,446.1 | 188,446.1 | 188,446.1 | 188,446.1 | 188,446.1 | 188,446.1 | ||||||||||||||||||

| Weighted-average ADS outstanding (in millions) (3) | 471.1 | 471.1 | 471.1 | 471.1 | 471.1 | 181.4 | ||||||||||||||||||

| CONSOLIDATED STATEMENT OF FINANCIAL POSITION DATA (IFRS) | ||||||||||||||||||||||||

| Cash and deposits in banks | 2,917,217 | 2,064,806 | 1,608,888 | 1,571,810 | 1,250,414 | 2,793,701 | ||||||||||||||||||

| Cash items in process of collection | 1,023,624 | 724,521 | 531,373 | 604,077 | 520,267 | 276,454 | ||||||||||||||||||

| Trading investments | 458,139 | 324,271 | 774,815 | 287,567 | 338,287 | 409,763 | ||||||||||||||||||

| Investments under resale agreements | 3,480 | 2,463 | - | 17,469 | 6,993 | 12,928 | ||||||||||||||||||

| Financial derivative contracts | 4,529,424 | 3,205,926 | 2,727,563 | 1,494,018 | 1,293,212 | 1,601,896 | ||||||||||||||||||

| Interbank loans, net | 13,720 | 9,711 | 11,942 | 124,954 | 90,414 | 87,677 | ||||||||||||||||||

| Loans and accounts receivable from customers, net | 34,654,910 | 24,528,745 | 22,196,390 | 20,320,874 | 18,326,190 | 16,858,637 | ||||||||||||||||||

| Available for sale investments | 2,888,402 | 2,044,411 | 1,651,598 | 1,700,993 | 1,826,158 | 1,661,311 | ||||||||||||||||||

| Investments in associates and other companies | 28,693 | 20,309 | 17,914 | 9,681 | 7,614 | 8,728 | ||||||||||||||||||

| Intangible assets | 72,248 | 51,137 | 40,983 | 66,703 | 87,347 | 80,739 | ||||||||||||||||||

| Property, plant, and equipment | 340,010 | 240,659 | 211,561 | 180,215 | 162,214 | 153,059 | ||||||||||||||||||

| Current taxes | - | - | 2,241 | 1,643 | 10,227 | 37,253 | ||||||||||||||||||

| Deferred taxes | 452,850 | 320,527 | 272,118 | 227,285 | 181,875 | 136,521 | ||||||||||||||||||

| Other assets | 1,554,357 | 1,100,174 | 927,961 | 514,938 | 657,890 | 550,326 | ||||||||||||||||||

| TOTAL ASSETS | 48,937,074 | 34,637,660 | 30,975,347 | 27,122,227 | 24,759,102 | 24,668,993 | ||||||||||||||||||

| Deposits and other demand liabilities | 10,392,937 | 7,356,121 | 6,480,497 | 5,620,763 | 4,970,019 | 4,413,815 | ||||||||||||||||||

| Cash items in process of being cleared | 652,949 | 462,157 | 281,259 | 276,379 | 284,953 | 89,486 | ||||||||||||||||||

| Obligations under repurchase agreements | 203,008 | 143,689 | 392,126 | 208,972 | 304,117 | 544,381 | ||||||||||||||||||

| Time deposits and other time liabilities | 17,212,160 | 12,182,767 | 10,413,940 | 9,675,272 | 9,112,213 | 8,921,114 | ||||||||||||||||||

| Financial derivative contracts | 4,044,371 | 2,862,606 | 2,561,384 | 1,291,785 | 1,146,161 | 1,292,402 | ||||||||||||||||||

| Interbank borrowing s | 1,847,378 | 1,307,574 | 1,231,601 | 1,682,377 | 1,438,003 | 1,920,092 | ||||||||||||||||||

| Issued debt instruments | 8,416,353 | 5,957,095 | 5,785,112 | 5,198,658 | 4,571,289 | 4,623,239 | ||||||||||||||||||

| Other financial liabilities | 311,567 | 220,527 | 205,125 | 189,781 | 192,611 | 176,599 | ||||||||||||||||||

| Current taxes | 25,143 | 17,796 | 1,077 | 50,242 | 525 | 1,498 | ||||||||||||||||||

| Deferred taxes | 5,519 | 3,906 | 7,631 | 26,753 | 9,544 | 5,315 | ||||||||||||||||||

| Provisions | 388,525 | 274,998 | 285,970 | 217,310 | 191,892 | 187,557 | ||||||||||||||||||

| Other liabilities | 1,477,634 | 1,045,869 | 654,557 | 311,479 | 341,274 | 398,977 | ||||||||||||||||||

| TOTAL LIABILITIES | 44,977,544 | 31,835,105 | 28,300,279 | 24,749,771 | 22,562,601 | 22,574,475 | ||||||||||||||||||

| Capital | 1,259,258 | 891,303 | 891,303 | 891,303 | 891,303 | 891,303 | ||||||||||||||||||

| Reserves | 2,158,651 | 1,527,893 | 1,307,761 | 1,130,991 | 975,460 | 802,528 | ||||||||||||||||||

| Valuation adjustments | 1,820 | 1,288 | 25,600 | (5,964 | ) | (3,781 | ) | 2,832 | ||||||||||||||||

| Retained earnings | 497,160 | 351,890 | 417,321 | 327,622 | 299,254 | 364,054 | ||||||||||||||||||

| Attributable to Equity holders of the Bank | 3,916,889 | 2,772,374 | 2,641,985 | 2,343,952 | 2,162,236 | 2,060,717 | ||||||||||||||||||

| Non-controlling interest | 42,641 | 30,181 | 33,083 | 28,504 | 34,265 | 33,801 | ||||||||||||||||||

| TOTAL EQUITY | 3,959,530 | 2,802,555 | 2,675,068 | 2,372,456 | 2,196,501 | 2,094,518 | ||||||||||||||||||

| TOTAL LIABILITIES AND EQUITY | 48,937,074 | 34,637,660 | 30,975,347 | 27,122,227 | 24,759,102 | 24,668,933 | ||||||||||||||||||

| As of and for the years ended December 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| CONSOLIDATED RATIOS | ||||||||||||||||||||

| (IFRS) | ||||||||||||||||||||

| Profitability and performance: | ||||||||||||||||||||

| Net interest margin (5) | 4.4 | % | 4.9 | % | 4.6 | % | 4.8 | % | 4.8 | % | ||||||||||

| Return on average total assets (6) | 1.3 | % | 1.8 | % | 1.6 | % | 1.4 | % | 1.7 | % | ||||||||||

| Return on average equity (7) | 16.0 | % | 21.4 | % | 18.9 | % | 16.5 | % | 20.4 | % | ||||||||||

| Capital: | ||||||||||||||||||||

| Average equity as a percentage of average total assets (8) | 8.2 | % | 8.2 | % | 8.7 | % | 8.7 | % | 8.3 | % | ||||||||||

| Total liabilities as a multiple of equity (9) | 11.4 | 10.6 | 10.4 | 10.3 | 10.8 | |||||||||||||||

| Credit Quality: | ||||||||||||||||||||

| Non-performing loans as a percentage of total loans (10) | 2.5 | % | 2.8 | % | 2.9 | % | 3.2 | % | 2.9 | % | ||||||||||

| Allowance for loan losses as percentage of total loans | 3.0 | % | 2.9 | % | 2.9 | % | 2.9 | % | 2.8 | % | ||||||||||

| Operating Ratios: | ||||||||||||||||||||

| Operating expenses /operating revenue (11) | 43.8 | % | 41.1 | % | 40.2 | % | 42.5 | % | 41.4 | % | ||||||||||

| Operating expenses /average total assets | 2.1 | % | 2.1 | % | 2.3 | % | 2.4 | % | 2.3 | % | ||||||||||

| OTHER DATA | ||||||||||||||||||||

| CPI Inflation Rate (12) | 4.4 | % | 4.7 | % | 3.0 | % | 1.5 | % | 4.4 | % | ||||||||||

| Revaluation (devaluation) rate (Ch$/U.S.$) at year end (12) | (16.5 | %) | (16.0 | %) | (9.4 | %) | 8.2 | % | (11.3 | %) | ||||||||||

| Number of employees at period end | 11,723 | 11,478 | 11,516 | 11,713 | 11,566 | |||||||||||||||

| Number of branches and offices at period end | 471 | 474 | 493 | 504 | 499 | |||||||||||||||

| (1) | Amounts stated in U.S. dollars at and for the year ended December 31, | |

| (2) | Except per share data, percentages and ratios, share numbers, employee numbers and branch numbers. | |

| (3) | ||

| On October 22, 2012 the Bank performed an ADR split: for each old ADR, an ADR holder received 2.5975 new ADRs, and the ratio of ADS to shares became 1 ADS = 400 shares. For the years | ||

| interests. |

| Net interest income divided by average interest earning assets (as presented in “Item 5. Operating and Financial Review and Prospects— | ||

| Net income for the year divided by average total assets (as presented in “Item 5. Operating and Financial Review and Prospects— | ||

| Net income for the year divided by average equity (as presented in “Item 5. Operating and Financial Review and Prospects— | ||

| This ratio is calculated using total average equity (as presented in “Item 5. Operating and Financial Review and Prospects— C. Selected Statistical Information”) including non-controlling interest. | ||

| Total liabilities divided by equity. | ||

| Non-performing loans include the aggregate unpaid principal and accrued but unpaid interest on all loans with at least one installment over 90 days past-due. | ||

| The efficiency ratio is equal to operating expenses over operating income. Operating expenses includes personnel salaries and expenses, administrative expenses, depreciation and amortization, impairment and other operating expenses. Operating income includes net interest income, net fee and commission income, net income from financial operations (net trading income), foreign exchange profit (loss), net and other operating income. | ||

| Based on information published by the Central Bank. |

Exchange Rates

Chile has two currency markets, theMercado Cambiario Formal, or the Formal Exchange Market, and theMercado Cambiario Informal, or the Informal Exchange Market. According to Law 18,840, the organic law of the Central Bank and the Central Bank Act (Ley Orgánica Constitucional del Banco Central de Chile), the Central Bank determines which purchases and sales of foreign currencies must be carried out in the Formal Exchange Market. Pursuant to Central Bank regulations currently in effect, all payments, remittances or transfers of foreign currency abroad which are required to be effected through the Formal Exchange Market may be effected with foreign currency procured outside the Formal Exchange Market. The Formal Exchange Market is comprised of the banks and other entities so authorized by the Central Bank. The Informal Exchange Market is comprised of entities that are not expressly authorized to operate in the Formal Exchange Market, such as certain foreign exchange houses and travel agencies, among others. The Central Bank is empowered to require that certain purchases and sales of foreign currencies be carried out on the Formal Exchange Market. The conversion from pesos to U.S. dollars of all payments and distributions with respect to the ADSs described in this Annual Report must be transacted at the spot market rate in the Formal Exchange Market.

Both the Formal and Informal Exchange Markets are driven by free market forces. Current regulations require that the Central Bank be informed of certain transactions and that they be effected through the Formal Exchange Market. In order to keep the average exchange rate within certain limits, the Central Bank may intervene by buying or selling foreign currency on the Formal Exchange Market.

The U.S.$ Observed Exchange Rate (dólar observado), which is reported by the Central Bank and published daily in the Chilean newspapers, is the weighted average exchange rate of the previous business day’s transactions in the Formal Exchange Market. The Central Bank has the power to intervene by buying or selling foreign currency on the Formal Exchange Market to attempt to maintain the Observed Exchange Rate within a desired range. Even though the Central Bank is authorized to carry out its transactions at the Observed Exchange Rate, it generally uses spot rates for its transactions. Other banks generally carry out authorized transactions at spot rates as well.

Purchases and sales of foreign currencies may be legally carried out in the Informal Exchange Market. The Informal Exchange Market reflects transactions carried out at informal exchange rates by entities not expressly authorized to operate in the Formal Exchange Market. There are no limits imposed on the extent to which the rate of exchange in the Informal Exchange Market can fluctuate above or below the Observed Exchange Rate. In recent years, the variation between the Observed Exchange Rate and the Informal Exchange Rate has not been significant. On December 31, 20122014 and 2013,2015 the exchange rate in the Informal Exchange Market as published by Reuters at 1:30 pm on these days was Ch$478.85608.33 and Ch$524.20707.80 respectively, or 0.05% less0.16% and 0.08%0.06% more, respectively, than the Central Bank’s published observed exchange rate for such date of Ch$478.60607.38 and Ch$523.76,707.34, respectively, per U.S.$1.00.

The following table sets forth the annual low, high, average and period-end observed exchange rate for U.S. dollars for each of the following periods, as reported by the Central Bank. We make no representation that the Chilean peso or the U.S. dollar amounts referred to herein actually represent, could have been or could be converted into U.S. dollars or Chilean pesos, as the case may be, at the rates indicated, at any particular rate or at all. The Federal Reserve Bank of New York does not report a noon buying rate for pesos.

Daily Observed Exchange Rate Ch$ Per U.S.$(1) | ||||

Year | Low(2) | High(2) | Average(3) | Period End |

| 2009 | 491.09 | 643.87 | 559.67 | 506.43 |

| 2010 | 468.37 | 549.17 | 510.38 | 468.37 |

| 2011 | 455.91 | 533.74 | 483.36 | 521.46 |

| 2012 | 469.65 | 519.69 | 494.99 | 478.60 |

| 2013 | 466.50 | 533.95 | 495.09 | 523.76 |

| Daily Observed Exchange Rate Ch$ Per U.S.$(1) | ||||||||||||||||||

| Year | Low(2) | High(2) | Average(3) | Period End | ||||||||||||||

| 2011 | 455.91 | 533.74 | 483.36 | 521.46 | ||||||||||||||

| 2012 | 469.65 | 519.69 | 494.99 | 478.60 | ||||||||||||||

| 2013 | 466.50 | 533.95 | 495.09 | 523.76 | ||||||||||||||

| 2014 | 524.61 | 621.41 | 570.01 | 607.38 | ||||||||||||||

| 2015 | 597.10 | 715.66 | 654.25 | 707.34 | ||||||||||||||

9

Daily Observed Exchange Rate Ch$ Per U.S.$(1) | ||||

Month | Low(2) | High(2) | Average(3) | Period End |

| October 2013 | 493.36 | 508.58 | 500.81 | 508.58 |

| November 2013 | 507.64 | 528.19 | 519.25 | 528.19 |

| December 2013 | 523.76 | 533.95 | 529.45 | 523.76 |

| January 2014 | 524.61 | 550.53 | 537.03 | 547.22 |

| February 2014 | 546.94 | 563.32 | 554.41 | 563.32 |

| March 2014 | 550.53 | 573.24 | 563.84 | 550.53 |

| April 2014 (until April 28, 2014) | 544.96 | 563.76 | 554.07 | 560.36 |

| Daily Observed Exchange Rate Ch$ Per U.S.$(1) | ||||||||||||||||||

| Month | Low(2) | High(2) | Average(3) | Period End | ||||||||||||||

| October 2015 | 673.91 | 698.72 | 685.31 | 690.34 | ||||||||||||||

| November 2015 | 688.94 | 715.66 | 704.00 | 712.63 | ||||||||||||||

| December 2015 | 693.72 | 711.52 | 704.24 | 707.34 | ||||||||||||||

| January 2016 | 710.16 | 730.31 | 721.95 | 711.72 | ||||||||||||||

| February 2016 | 689.18 | 715.41 | 703.51 | 689.18 | ||||||||||||||

| March 2016 | 671.97 | 694.82 | 682.07 | 675.10 | ||||||||||||||

| April 2016 (until April 28, 2016) | 657.90 | 682.45 | 670.26 | 668.49 | ||||||||||||||

Source: Central Bank.

| (1) | Nominal figures. | |

| (2) | Exchange rates are the actual low and high, on a day-by-day basis for each period. | |

| (3) | The average of monthly average rates during the year. |

Dividends

Under the current General Banking Law, a Chilean bank may only pay a single dividend per year (i.e.(i.e., interim dividends are not permitted). Santander-Chile’s annual dividend is proposed by its Board of Directors and is approved by the shareholders at the annual ordinary shareholders’ meeting held the year following that in which the dividend is generated. For example, the 20132015 dividend must be proposed and approved during the first four months of 2014.2016. Following shareholder approval, the proposed dividend is declared and paid. Historically, the dividend for a particular year has been declared and paid no later than one month following the shareholders’ meeting. Dividends are paid to shareholders of record on the fifth day preceding the date set for payment of the dividend. The applicable record dates for the payment of dividends to holders of ADSs will, to the extent practicable, be the same.

Under the General Banking Law, a bank must distribute cash dividends in respect of any fiscal year in an amount equal to at least 30% of its net income for that year, as long as the dividend does not result in the infringement of minimum capital requirements. The balances of our distributable net income are generally retained for use in our business (including for the maintenance of any required legal reserves). Although our Board of Directors currently intends to pay regular annual dividends, the amount of dividend payments will depend upon, among other factors, our then current level of earnings, capital and legal reserve requirements, as well as market conditions, and there can be no assurance as to the amount or timing of future dividends.

Dividends payable to holders of ADSs are net of foreign currency conversion expenses of JPMorgan ChaseThe Bank N.A.,of New York Mellon, as depositary (the “Depositary”) and will be subject to the Chilean withholding tax currently at the rate of 35% (subject to credits in certain cases as described in “Item 10. Additional Information—E. Taxation—Material Tax Consequences of Owning Shares of Our Common Stock or ADSs”).

Under the Foreign Investment Contract (as defined herein), the Depositary, on behalf of ADS holders, is granted access to the Formal Exchange Market to convert cash dividends from Chilean pesos to U.S. dollars and to pay such U.S. dollars to ADS holders outside Chile, net of taxes, and no separate registration by ADS holders is required. In the past, Chilean law required that holders of shares of Chilean companies who were not residents of Chile to register as foreign investors under one of the foreign investment regimes contemplated by Chilean law in order to have dividends, sale proceeds or other amounts with respect to their shares remitted outside Chile through the Formal Exchange Market. On April 19, 2001, the Central Bank deregulated the Exchange Market and eliminated the need to obtain approval from the Central Bank in order to remit dividends, but at the same time this eliminated the possibility of accessing the Formal Exchange Market. These changes do not affect the current Foreign Investment Contract, which was signed prior to April 19, 2001, which grants access to the Formal Exchange Market with prior approval of the Central Bank. See “Item 10. Additional Information—D. Exchange Controls.”

The following table presents dividends declared and paid by us in nominal terms in the past four years:

Year | Dividend | Per share | Per ADR | % over | % over |

| 2010 | 258,752 | 1.37 | 1,426.63 | 60 | 60 |

| 2011 | 286,294 | 1.52 | 1,578.48 | 60 | 57 |

| 2012 | 261,051 | 1.39 | 1,439.08 | 60 | 65 |

| 2013 | 232,780 | 1.24 | 494.10 | 60 | 65 |

| 2014(6) | 265,156 | 1.41 | 562.83 | 60 | 60 |

| Year | Dividend Ch$ mn (1) | Dividend US$ mn (2) | Per share Ch$/share (3) | Per ADS US$/ADS (4) | % over earnings (5) | % over earnings (6) | ||||||||||||||||||||

| 2012 | 261,051 | 533.1 | 1.39 | 2.94 | 60 | 65 | ||||||||||||||||||||

| 2013 | 232,780 | 493.1 | 1.24 | 1.05 | 60 | 65 | ||||||||||||||||||||

| 2014 | 265,156 | 476.0 | 1.41 | 1.01 | 60 | 60 | ||||||||||||||||||||

| 2015 | 330,198 | 540.4 | 1.75 | 1.15 | 60 | 58 | ||||||||||||||||||||

| 2016 (6) | 336,659 | 503.7 | 1.79 | 1.07 | 75 | 75 | ||||||||||||||||||||

| (1) | ||

| (2) | Millions of US$ using the observed exchange rate of the day the dividend was approved in the annual shareholders meeting. |

| (3) | Calculated on the basis of 188,446 million shares. | |

| ADS. |

| (5) | Calculated by dividing dividend paid in the year by net income attributable to | |

| Chilean GAAP. |

| (6) |

B. Capitalization and Indebtedness

| B. | Capitalization and Indebtedness |

Not applicable.

C. Reasons for the Offer and Use of Proceeds

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

D. Risk Factors

| D. | Risk Factors |

You should carefully consider the following risk factors, which should be read in conjunction with all the other information presented in this Annual Report. The risks and uncertainties described below are not the only ones that we face. Additional risks and uncertainties that we do not know about or that we currently think are immaterial may also impair our business operations. Any of the following risks, if they actually occur, could materially and adversely affect our business, results of operations, prospects and financial condition.

We are subject to market risks that are presented both in this subsection and in “Item 5. Operating and Financial Review and Prospects” and “Item 11. Quantitative and Qualitative Disclosures about Market Risk.”

Risks Associated with Our Business

We are vulnerable to the current disruptions and volatility in the global financial markets.

In the recent past, six years, financial systems worldwide have experienced difficult credit and liquidity conditions and disruptions leading to less liquidity, greater volatility general widening of spreads(such as volatility in spreads) and, in some cases, lack of price transparency on interbank lending rates. Global economic conditions deteriorated significantly between 2007 and 2009, and many countries fell into recession. Recessionary conditions continue in some countries.Although most countries have begun to recover, this recovery may not be sustainable. Many major financial institutions, including some of the world’s largest global commercial banks, investment banks, mortgage lenders, mortgage guarantors and insurance companies experienced, and some continue to experience, significant difficulties. Around the world, there have also been runs on deposits at several financial institutions, numerous institutions have sought additional capital or have been assisted by governments, and many lenders and institutional investors have reduced or ceased providing funding to borrowers (including to other financial institutions).

Increased disruption and volatility in the global financial markets could have a material adverse effect on us, including our ability to access capital and liquidity on financial terms acceptable to us, if at all. If capital markets financing ceases to become available, or becomes excessively expensive, we may be forced to raise the rates we pay on deposits to attract more customers and become unable to maintain certain liability maturities. Any such increase in capital markets funding availability or costs or in deposit rates could have a material adverse effect on our interest margins and liquidity.

In particular, we may face, among others, the following risks related to the economic downturn:risks:

| · | Increased regulation of our industry. Compliance with such regulation will increase our costs and may affect the pricing for our products and services and limit our ability to pursue business opportunities. |

| · | Reduced demand for our products and services. |

| · | Inability of our borrowers to timely or fully comply with their existing obligations. |

| · | The process we use to estimate losses inherent in our credit exposure requires complex judgments, including forecasts of economic conditions and how these economic conditions might impair the ability of our borrowers to repay their loans. The degree of uncertainty concerning economic conditions may adversely affect the accuracy of our estimates, which may, in turn, impact the reliability of the process and the sufficiency of our loan loss allowances. |

| · | The value and liquidity of the portfolio of investment securities that we hold may be adversely affected. |

| · | Any worsening of global economic conditions may delay the recovery of the international financial industry and impact our financial condition and results of operations. |

| · | The recoverability of our retail loans in particular may be increasingly vulnerable to macroeconomic shocks that could negatively impact the household income of our retail customers and result in increased loan losses. |

SomeDespite recent improvements in certain segments of the global economy, uncertainty remains concerning the future economic environment. While certainThere can be no assurance that economic conditions in these segments ofwill continue to improve or that the global economy have experiencedeconomic condition as a moderate recovery, we expect suchwhole will improve significantly. Such economic uncertainty will continue, which could have a negative impact on our business and results of operations. Investors remain cautious. A slowing or failing of the economic recovery would likely aggravate the adverse effects of these difficult economic and market conditions on us and on others in the financial services industry.

Increased disruption and volatility in the global financial markets could have a material adverse effect on us, including our ability to access capital and liquidity on financial terms acceptable to us, if at all. If capital markets financing ceases to become available, or becomes excessively expensive, we may be forced to raise the rates we pay on deposits to attract more customers and become unable to maintain certain liability maturities. Any such increase in capital markets funding availability or costs or in deposit rates could have a material adverse effect on our interest margins and liquidity.

If all or some of the foregoing risks were to materialize, this could have a material adverse effect on us.

Credit, market and liquidity risk may have an adverse effect on our credit ratings and our cost of funds. Any downgrading in Chile’s, our controlling shareholder’sshareholders or our credit rating would likely increase our cost of funding, require us to post additional collateral or take other actions under some of our derivative contracts and adversely affect our interest margins and results of operations.

Credit ratings affect the cost and other terms upon which we are able to obtain funding. Rating agencies regularly evaluate us, and their ratings of our long-term debt are based on a number of factors, including our financial strength, conditions that affect the financial services industry generally and the economic environment in which the company operates. In addition, due to the methodology of the main rating agencies, our credit rating is affected by the rating of Chile’s sovereign debt. If Chile’s sovereign debt is downgraded, our credit rating would also likely be downgraded by an equivalent amount.

In addition, our ratings may be adversely affected by any downgrade in the ratings of our parent company, Santander Spain. The long-term debt of Santander Spain is currently rated investment grade by the major rating agencies—A3 by Moody’s Investors Service España, S.A., (“Moody’s”) A- by Standard & Poor’s Ratings Services (“S&P”) and A- by Fitch Ratings Ltd. (“Fitch”)—all of which have a stable outlook due to the gradual economic improvement in Spain.

Any downgrade in our debt credit ratings would likely increase our borrowing costs and require us to post additional collateral or take other actions under some of our derivative contracts, and could limit our access to capital markets and adversely affect our commercial business. For example, a ratings downgrade could adversely affect our ability to sell or market certain of our products, engage in certain longer-term and derivatives transactions and retain our customers, particularly customers who need a minimum rating threshold in order to invest. In addition, under the terms of certain of our derivative contracts, we may be required to maintain a minimum credit rating or terminate such contracts. Any of these results of a ratings downgrade, in turn, could reduce our liquidity and have an adverse effect on us, including our operating results and financial condition.

The long-term debt of Santander Spain is currently rated investment grade by the major rating agencies—Baa2 by Moody’s Investors Service España, S.A., (“Moody’s”) BBB by Standard & Poor’s Ratings Services (“S&P”) and BBB+ by Fitch Ratings Ltd. (“Fitch”)—all of which have a stable outlook due to the gradual economic improvement in Spain.

All three agencies had downgraded Santander Spain’s rating in February 2012 together with that of the other main Spanish banks, due to the weaker-than-previously-anticipated macroeconomic and financial environment in Spain with dimming growth prospects in the near term, depressed real estate market activity and heightened turbulence in the capital markets. In addition, S&P downgraded Santander Spain’s rating by two notches in April 2012 together with that of 15 other Spanish banks following that rating agency’s decision to downgrade Spain’s sovereign debt rating by two notches. Moody’s Investors Service España, S.A. further downgraded Santander Spain’s rating in May 2012, together with downgrades of 15 other Spanish banks and Santander UK plc, a United Kingdom-domiciled subsidiary of Santander Spain. In June 2012, Fitch cut the rating of Spanish sovereign debt three notches to BBB- with a negative outlook, and Moody’s followed shortly thereafter by downgrading Spanish sovereign debt three notches to Baa3, its lowest investment grade rating. Following its downgrade of Spanish sovereign debt, Fitch further downgraded Santander Spain’s rating on June 11, 2012 from A to BBB+, with a negative outlook. Moody’s downgraded Santander Spain’s rating on June 25, 2012 from A3 to Baa2, with a negative outlook. On October 15, 2012, S&P further downgraded Santander Spain’s rating from A- to BBB, with a negative outlook, following S&P’s additional downgrade of the Spanish sovereign debt rating.

Recently the ratings agencies have acknowledged the gradual improvement in Spain’s economic conditions which have in turn improved the outlook for Santander Spain’s long-term debt. Accordingly, the ratings agencies have each changed their outlook on Santander Spain’s long-term debt to stable, from negative. Moreover, Fitch and S&P affirmed their BBB+ and BBB ratings on November 8, 2013 and December 20, 2013, respectively. In addition, on March 12, 2014, Moody’s raised its rating to Baa1, from Baa2. However, we can provide no assurances that ratings agencies will not change their view based on changes in economic conditions or otherwise.

Following these downgrades, Moody’s placed our short- and long-term ratings on outlook negative. Fitch placed our long-term ratings on outlook negative. S&P downgraded our long-term foreign issuer credit rating by one notch to A in February 2012, and in June 2012, placed our long-term ratings on outlook negative. By March 2014, all three rating agencies that rate us have placed our ratings on outlook stable.

While certain potential impacts of these downgrades are contractual and quantifiable, the full consequences of a credit rating downgrade are inherently uncertain, as they depend upon numerous dynamic, complex and inter-related factors and assumptions, including market conditions at the time of any downgrade, whether any downgrade of a firm’s long-term credit rating precipitates downgrades to its short-term credit rating, and assumptions about the potential behaviors of various customers, investors and counterparties. Actual outflows could be higher or lower than this hypothetical example, depending upon certain factors including which credit rating agency downgrades our credit rating, any management or restructuring actions that could be taken to reduce cash outflows and the potential liquidity impact from loss of unsecured funding (such as from money market funds) or loss of secured funding capacity. Although, unsecured and secured funding stresses are included in our stress testing scenarios and a portion of our total liquid assets is held against these risks, it is still the case that a credit rating downgrade could have a material adverse effect on us.

In addition, if we were required to cancel our derivatives contracts with certain counterparties and were unable to replace such contracts, our market risk profile could be altered.

In light of the difficulties in the financial services industry and the financial markets, there can be no assurance that the rating agencies will maintain the current ratings or outlooks. Failure to maintain favorable ratings and outlooks would likely increase the cost of funding to us and adversely affect interest margins, which could have a material adverse effect on us.

Increased competition and industry consolidation may adversely affect our results of operations.

The Chilean market for financial services is highly competitive. We compete with other private sector Chilean and non-Chilean banks, with Banco del Estado de Chile, the principal government-owned sector bank, with department stores and with larger supermarket chains that make consumer loans and sell other financial products to a large portion of the Chilean population. The lower to middle-income segments of the Chilean population and the small- and mid- sized corporate segments have become the target markets of several banks and competition in these segments may increase. We also face competition from non-bank (such as department stores, insurance companies,cajas de compensaciónand cooperativas) and non-finance competitors (principally department stores and larger supermarket chains) with respect to some of our credit products, such as credit cards, consumer loans and insurance brokerage. In addition, we face competition from non-bank finance competitors, such as leasing, factoring and automobile finance companies, with respect to credit products, and from mutual funds, pension funds and insurance companies with respect to savings products.Increasing competition could require that we increase our rates offered on deposits or lower the rates we charge on

loans, which could also have a material adverse effect on us, including our profitability. It may also negatively affect our business results and prospects by, among other things, limiting our ability to increase our customer base and expand our operations and increasing competition for investment opportunities.

Non-traditional providers of banking services, such as Internet based e-commerce providers, mobile telephone companies and internet search engines may offer and/or increase their offerings of financial products and services directly to customers. These non-traditional providers of banking services currently have an advantage over traditional providers because they are not subject to banking regulation. Several of these competitors may have long operating histories, large customer bases, strong brand recognition and significant financial, marketing and other resources. They may adopt more aggressive pricing and rates and devote more resources to technology, infrastructure and marketing. New competitors may enter the market or existing competitors may adjust their services with unique product or service offerings or approaches to providing banking services. If we are unable to successfully compete with current and new competitors, or if we are unable to anticipate and adapt our offerings to changing banking industry trends, including technological changes, our business may be adversely affected. In addition, our failure to effectively anticipate or adapt to emerging technologies or changes in customer behavior,

including among younger customers, could delay or prevent our access to new digital-based markets which would in turn have an adverse effect on our competitive position and business.

The increase in competition within the Chilean banking industry in recent years has led to consolidation in the industry. We expect the trends of increased competition and consolidation to continue and to result in the formation of large new financial groupswith which we must now compete. There can be no assurance that this increased competition will not adversely affect our growth prospects, and therefore our operations.

In addition, if our customer service levels were perceived by the market to be materially below those of our competitor financial institutions, we could lose existing and potential business. If we are not successful in retaining and strengthening customer relationships, we may lose market share, incur losses on some or all of our activities or fail to attract new deposits or retain existing deposits, which could have a material adverse effect on our operating results, financial condition and prospects.

Our ability to maintain our competitive position depends, in part, on the success of new products and services we offer our clients and our ability to continue offering products and services from third parties, and we may not be able to manage various risks we face as we expand our range of products and services that could have a material adverse effect on us.

The success of our operations and our profitability depends, in part, on the success of new products and services we offer our clients and our ability to continue offering products and services from third parties. However, we cannot guarantee that our new products and services will be responsive to client demands or successful once they are offered to our clients, or that they will be successful in the future. In addition, our clients’ needs or desires may change over time, and such changes may render our products and services obsolete, outdated or unattractive and we may not be able to develop new products that meet our clients’ changing needs. Our success is also dependent on our ability to anticipate and leverage new and existing technologies that may have an impact on products and services in the banking industry. Technological changes may further intensify and complicate the competitive landscape and influence client behavior. If our products and services employ technology that is not as attractive to our clients as that employed by our competitors, if we fail to employ technologies desired by our clients before our competitors do so, or if we fail to execute effectively on targeted strategic technology initiatives, our business and results could be adversely affected. In addition, if we cannot respond in a timely fashion to the changing needs of our clients, we may lose clients, which could in turn materially and adversely affect us.

As we expand the range of our products and services, some of which may be at an early stage of development in the markets of certain regions where we operate, we will be exposed to new and potentially increasingly complex risks and development expenses in those markets, with respect to which our experience and the experience of our partners may not be helpful.sufficient. Our employees and our risk management systems may not be adequate to handle or manage such risks. In addition, the cost of developing products that are not launched is likely to affect our results of operations. Any or all of these factors, individually or collectively, could have a material adverse effect on us.

Our strong position in the credit card market is in part due to our credit card co-branding agreement with Chile’s largest airline. This agreement expires in August 20152020 and no assurance can be given that it will be renewed, which may materially and adversely affect our results of operations and financial condition in the credit card business.

Further, our customers may issue complaints and seek redress if they consider that they have suffered loss from our products and services, for example, as a result of any alleged mis-selling or incorrect application of the terms and conditions of a particular product. This could in turn subject us to risks of potential legal action by our customers and intervention by our regulators. For further detail on our legal and regulatory risk exposures, please see the risk factor entitled “We are exposed to risk of loss from legal and regulatory proceedings.”

The financial problems faced by our customers could adversely affect us.

Market turmoil and economic recession could materially and adversely affect the liquidity, credit ratings, businesses and/or financial conditions of our borrowers, which could in turn increase our own non-performing loan ratios, impair our loan and other financial assets and result in decreased demand for borrowings in general. In addition, our customers may further significantly decrease their risk tolerance to non-deposit investments such as stocks, bonds and mutual funds, which would adversely affect our fee and commission income. We may also be adversely affected by the negative effects of the heightened regulatory environment on our customers due to the high

costs associated with regulatory compliance and proceedings. Any of the conditions described above could have a material adverse effect on our business, financial condition and results of operations.

We may generate lower revenues from fee and commission based businesses.

The fees and commissions that we earn from the different banking and other financial services that we provide represent a significant source of our revenues. Market downturns have led, and are likely to continue to lead, to a decline in the volume of transactions that we execute for ourOur customers and, therefore, to a decline in our non-interest revenues. In addition, because the fees that we charge for managing our clients’ portfolios are in many cases based on

the value or performance of those portfolios, a market downturn that reduces the value of our clients’ portfolios or increases the amount of withdrawals would reduce the revenues we receive from our asset management, private banking and custody businesses and adversely affect our results of operations. Moreover, our customers may further significantly decrease their risk tolerance to non-deposit investments such as stocks, bonds and mutual funds for a number of reasons, including a market downturn, which would adversely affect us, including our fee and commission income.

EvenBanco Santander Chile sold its asset management business in 2013 and signed a management service agreement for a 10 year-period with the acquirer of this business in which we sell asset management funds on their behalf. Therefore, even in the absence of a market downturn, below-market performance by the mutual funds of the firm we broker for may result in increased withdrawals and reduced inflows, which would reduce thea reduction in revenue we receive from theselling asset management business we brokerfunds and adversely affect our results of operations.

Market conditions have resulted, and could result, in material changes to the estimated fair values of our financial assets. Negative fair value adjustments could have a material adverse effect on our operating results, financial condition and prospects.

In the recent past, six years, financial markets have been subject to significant stress resulting in steep falls in perceived or actual financial asset values, particularly due to volatility in global financial markets and the resulting widening of credit spreads. We have material exposures to securities and other investments that are recorded at fair value and are therefore exposed to potential negative fair value adjustments. Asset valuations in future periods, reflecting then-prevailing market conditions, may result in negative changes in the fair values of our financial assets and these may also translate into increased impairments. In addition, the value ultimately realized by us on disposal may be lower than the current fair value. Any of these factors could require us to record negative fair value adjustments, which may have a material adverse effect on our operating results, financial condition or prospects.

In addition, to the extent that fair values are determined using financial valuation models, such values may be inaccurate or subject to change, as the data used by such models may not be available or may become unavailable due to changes in market conditions, particularly for illiquid assets, and particularly in times of economic instability. In such circumstances, our valuation methodologies require us to make assumptions, judgments and estimates in order to establish fair value, and reliable assumptions are difficult to make and are inherently uncertain and valuation models are complex, making them inherently imperfect predictors of actual results. Any consequential impairments or write-downs could have a material adverse effect on our operating results, financial condition and prospects.

If we are unable to effectively control the level of non-performing or poor credit quality loans in the future, or if our loan loss reserves are insufficient to cover future loan losses, this could have a material adverse effect on us.

Risks arising from changes in credit quality and the recoverability of loans and amounts due from counterparties are inherent in a wide range of our businesses. Non-performing or low credit quality loans have in the past and can continue to negatively impact our results of operations. We cannot assure you that we will be able to effectively control the level of the impaired loans in our total loan portfolio. In particular, the amount of our reported non-performing loans may increase in the future as a result of growth in our total loan portfolio, including as a result of loan portfolios that we may acquire in the future, or factors beyond our control, such as adverse changes in the credit quality of our borrowers and counterparties or a general deterioration in economic conditions in Chile or global economic conditions, impact of political events, events affecting certain industries or events affecting financial markets and global economies.

As of December 31, 2013,2015, our non-performing loans were Ch$613,301643,468 million, and the ratio of our non-performing loans to total loans was 2.91%2.5%. As of December 31, 2013,2015, our allowance for loan losses was Ch$614,933762,301 million, and the ratio of our allowance for loan losses to total loans was 2.92%3.0%. For additional information on our asset quality, see “Item 5. Operating and Financial Review and Prospects— F.C. Selected Statistical Information–Classification of Loan Portfolio Based on the Borrower’s Payment Performance.”

Our current allowance for loan losses may not be adequate to cover an increase in the amount of non-performing loans or any future deterioration in the overall credit quality of our total loan portfolio. Our allowance for loan losses is based on our current assessment of and expectations concerning various factors affecting us, including the quality of our loan portfolio. These factors include, among other things, our borrowers’ financial condition, repayment abilities and repayment intentions, the realizable value of any collateral, the prospects for support from any guarantor, Chile’s economy, government macroeconomic policies, interest rates and the legal and regulatory environment. As the recent global financial crisis has demonstrated, many of these factors are beyond our control. In addition, as these factors

evolve, the models we use to determine the appropriate level of allowance for loan losses and other assets require recalibration, which can lead to increased provision expense. See “Item 5. Operating and Financial Review and Prospects—C.A. Operating Results–Results of Operations for the Years ended December 31, 2013, 20122015, 2014 and 2011—2013—Provision for loan losses, net of recoveries.”

As a result, there is no precise method for predicting loan and credit losses, and we cannot assure you that our allowance for loan losses will be sufficient in the future to cover actual loan and credit losses. If our assessment of and expectations concerning the above-mentioned factors differ from actual developments, if the quality of our total loan portfolio deteriorates, for any reason, including the increase in lending to individuals and SMEs,small and medium enterprises, the volume increase in the consumer loan portfolio and the introduction of new products, or if the future actual losses exceed our estimates of incurred losses, we may be required to increase our provisions and allowance for loan losses, which may adversely affect us. If we are unable to control or reduce the level of our non-performing or poor credit quality loans, this could have a material adverse effect on us.

The value of the collateral securing our loans may not be sufficient, and we may be unable to realize the full value of the collateral securing our loan portfolio.

The value of the collateral securing our loan portfolio may significantly fluctuate or decline due to factors beyond our control, including macroeconomic factors affecting Chile’s economy. The value of the collateral securing our loan portfolio may be adversely affected by force majeure events, such as natural disasters, particularly in locations where a significant portion of our loan portfolio is composed of real estate loans. Natural disasters such as earthquakes and floods may cause widespread damage, which could impair the asset quality of our loan portfolio and could have an adverse impact on Chile’s economy. The real estate market is particularly vulnerable in the current economic climate and this may affect us, as real estate represents a significant portion of the collateral securing our residential mortgage loan portfolio. We may also not have sufficiently recent information on the value of collateral, which may result in an inaccurate assessment for impairment losses of our loans secured by such collateral. If this were to occur, we may need to make additional provisions to cover actual impairment losses of our loans, which may materially and adversely affect our results of operations and financial condition.

Additionally, there are certain provisions under Chilean law that may affect our ability to foreclose or liquidate residential mortgages if the real estate in question has been declared as “family property” by a court. Family Property refers to a legal term in which a Family Court may declare a residential property as family property in a divorce or separation case. If this occurs, in the deed of the residence, a clause is included identifying the residence as family property and any process of change in ownership or foreclosure must have the consent of both the husband and the wife. This may limit our ability to foreclose on property with this legal status.

The growth of our loan portfolio may expose us to increased loan losses. Our exposure to individuals and small and mid-sized businesses could lead to higher levels of past due loans, allowances for loan losses and charge-offs.

The further expansion of our loan portfolio (particularly in the consumer, small- and mid-sized companies and real estate segments) can be expected to expose us to a higher level of loan losses and require us to establish higher levels of provisions for loan losses. See “Note 9—8—Interbank Loans” and “Note 10—9—Loans and Accounts Receivables from Customers” in our Audited Consolidated Financial Statements for a description and presentation of our loan portfolio as well as “Item 5-Selected Statistical Information—Loan Portfolio.”

A substantial number of ourRetail customers consist of individuals (approximately 49.5%represent 66.36% of the value of the total loan portfolio as of December 31, 2013, if interbank loans are included) and, to a lesser extent, small- and mid-sized companies (those with annual revenues of less than U.S.$2.3 million), which comprised approximately 15.3% of the value of the total loan portfolio as of December 31, 2013.2015. As part of our business strategy, we seek to increase lending and other services to small companies and individuals. Small companies and lower- to middle-income individualsretail clients, which are however, more likely to be adversely affected by downturns in the Chilean economy than large corporations and higher-income individuals.economy. In addition, as of December 31, 2013,2015, our residential mortgage loan portfolio totaled Ch$5,625,8127,812,850 million, representing 26.7%30.9% of our total loans. See “Note 10—9—Loans and Accounts Receivables from Customers” in our Audited Consolidated Financial Statements for a description and presentation of our residential mortgage loan portfolio. If the economy and real estate market in Chile experience a significant downturn, this could materially adversely affect the liquidity, businesses and financial conditions of our customers, which may in turn cause us to experience higher levels of past-due loans, thereby resulting in higher provisions for loan losses and subsequent charge-offs. This may materially and adversely affect our asset quality, results of operations and financial condition.

Our loan portfolio may not continue to grow at the same rate and economic turmoil may lead to a contraction in our loan portfolio.

There can be no assurance that our loan portfolio will continue to grow at similar rates to the historical growth rate described above. A reversal of the rate of growth of the Chilean economy, a slowdown in the growth of customer demand, an increase in market competition or changes in governmental regulations could adversely affect the rate of growth of our loan portfolio and our risk index and, accordingly, increase our required allowances for loan losses. An economic turmoil could materially adversely affect the liquidity, businesses and financial condition of our customers as well as lead to a general decline in consumer spending and a rise in unemployment. All this could in turn lead to decreased demand for borrowings in general.

Our financial results are constantly exposed to market risk. We are subject to fluctuations in interest rates and other market risks, which may materially and adversely affect us.

Market risk refers to the probability of variations in our net interest income or in the market value of our assets and liabilities due to volatility of interest rate, inflation, exchange rate or equity price. Changes in interest rates affect the following areas, among others, of our business:

| · | net interest income; |

| · | the volume of loans originated; |

| · | volatility of credit spreads; |

| · | the market value of our securities holdings; |

| · | gains from sales of loans and |

| · | gains and losses from derivatives. |