Washington, D.C. 20549

FORM 20-F

☐ Registration Statement Pursuant to Section 12(b) or 12(g) of The Securities Exchange Act of 1934

OR

☒ Annual Report Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934 for the fiscal year ended December 31, 2019 OR ☐ Transition Report Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934 OR ☐ Shell Company Report Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

|

AETERNA ZENTARIS INC.

(Exact Name of Registrant as Specified in its Charter)

Not Applicable

(Translation of Registrant'sRegistrant’s Name into English)

Canada

(Jurisdiction of Incorporation)

315 Sigma Drive

Summerville, South Carolina, USA

29486

(Address of Principal Executive Offices)

Klaus Paulini

Telephone: 843-900-3201

E-mail: mward@aezsinc.com

Weismüllerstr. 50

Frankfurt am Main, Germany

D-60314

(Name, Telephone, E-mail and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Shares | NASDAQ Capital Market | |

| Toronto Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act: NONENONE

Securities for which there is a reporting obligation pursuant to Section 15(d) of the ACT: NONENONE

Indicate the number of outstanding shares of each of the issuer'sissuer’s classes of capital or common stock as at the close of the period covered by the annual report: 16,440,760[19,994,510] Common Shares as at December 31, 2017.

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definitions of "accelerated“accelerated filer," "large” “large accelerated filer,"” and "emerging“emerging growth company"company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

† The term "new“new or revised financial accounting standard"standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

US GAAP

International Accounting Standards Board

If "other"“other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

Basis of Presentation

General

Except where the context otherwise requires, all references in this Annual Report on Form 20-F to the "Company"“Company”, "Aeterna Zentaris"“Aeterna Zentaris”, "we"“we”, "us"“us”, "our"“our” or similar words or phrases are to Aeterna Zentaris Inc. and its subsidiaries, taken together. In this Annual Report on Form 20-F, references to "$"“$” and "U.S.“U.S.$"” are to United States ("(“U.S."”) dollars, references to "CAN$"“CAN$” are to Canadian dollars and references to "EUR"“EUR” are to euros. Unless otherwise indicated, the statistical and financial data contained in this Annual Report on Form 20-F are presented as at December 31, 2017.

All share, option and share purchase warrant as well as per share, option and share purchase warrant information presented in this Annual Report on Form 20-F have been adjusted, including proportionate adjustments being made to each option and share purchase warrant exercise price, to reflect and to give effect to a share consolidation (or reverse stock split), on November 17, 2015, of our issued and outstanding common shares on a 100-to-1 basis (the "Share Consolidation"“Share Consolidation”). The Share Consolidation affected all shareholders, optionholders and warrantholders uniformly and thus did not materially affect any securityholder'ssecurityholder’s percentage of ownership interest.

This Annual Report on Form 20-F also contains certain information regarding products or product candidates that may potentially compete with our products and product candidates, and such information has been primarily derived from information made publicly available by the companies developing such potentially competing products and product candidates and has not been independently verified by Aeterna Zentaris Inc.

Special Note on Forward-Looking Statements

This Annual Report on Form 20-F contains forward-looking statementsand the documents incorporated herein by reference contain “forward-looking statements” made pursuant to the safe-harbor provision of the U.S. Private Securities Litigation Reform Act of 1995, which reflect our current expectations regarding future events. Forward-lookingAll statements may include, but are not limited toother than statements precededof historical facts included in or incorporated by followed by, or that include the words "will," "expects," "believes," "intends," "would," "could," "may," "anticipates," and similar terms that relate to future events, performance, or our results. Forward-looking statements involve known risks and uncertainties, including those discussed inreference into this Annual Report on Form 20-F, under the caption "Key Information - “Key Information—Risk Factors"Factors” filed with the relevant Canadian securities regulatory authorities in lieu of an annual information form and with the U.S. Securities and Exchange Commission ("SEC"(“SEC”). that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements. Our forward-looking statements generally include statements about our plans, objectives, strategies and prospects regarding, among other things, our businesses, results of operations, liquidity and financial condition. In some cases, we have identified these forward-looking statements with words like “believe,” “may,” “could,” “might,” “possible,” “potential,” “project,” “will,” “should,” “expect,” “intend,” “plan,” “predict,” “anticipate,” “estimate,” “approximate,” “contemplate” or “continue,” or the negative of these words or other words and terms of similar meaning. Known and unknown risks and uncertainties could cause our actual results to differ materially from those in forward-looking statements. Such risks and uncertainties include, among others, our now heavy dependence on the success of Macrilen™ (macimorelin) and related out-licensing arrangements and the continued availability of funds and resources to successfully launch the product, the ability of Aeterna Zentaris to enter into out-licensing, development, manufacturing and marketing and distribution agreements with other pharmaceutical companies and keep such agreements in effect, reliance on third parties for the manufacturing and commercialization of our product candidates, potential disputes with third parties, leading to delays in or termination of the manufacturing, development, out-licensing or commercialization of our product candidates, or resulting in significant litigation or arbitration, and, more generally, uncertainties relatedbut are not limited to, the regulatory process, thefollowing:

| ● | our ability to raise capital and obtain financing to continue our currently planned operations; | |

| ● | our ability to continue to list our Common Shares on the NASDAQ; | |

| ● | our ability to continue as a going concern is dependent, in part, on our ability to transfer cash from Aeterna Zentaris GmbH (“AEZS Germany”) to Aeterna Zentaris and the U.S. subsidiary and secure additional financing; | |

| ● | our now heavy dependence on the success of Macrilen™ (macimorelin) and related out-licensing arrangements and the continued availability of funds and resources to successfully commercialize the product, including our heavy reliance on the success of the license and assignment agreement with Novo Nordisk A/S (“Novo”); | |

| ● | our ability to enter into out-licensing, development, manufacturing, marketing and distribution agreements with other pharmaceutical companies and keep such agreements in effect; |

| ● | our reliance on third parties for the manufacturing and commercialization of Macrilen™ (macimorelin); | |

| ● | potential disputes with third parties, leading to delays in or termination of the manufacturing, development, out-licensing or commercialization of our product candidates, or resulting in significant litigation or arbitration; | |

| ● | uncertainties related to the regulatory process; | |

| ● | unforeseen global instability, including the instability due to the global pandemic of the novel coronavirus; | |

| ● | our ability to efficiently commercialize or out-license Macrilen™ (macimorelin); | |

| ● | our reliance on the success of the pediatric clinical trial in the European Union (“E.U.”) and U.S. for Macrilen™ (macimorelin); | |

| ● | the degree of market acceptance of Macrilen™ (macimorelin); | |

| ● | our ability to obtain necessary approvals from the relevant regulatory authorities to enable us to use the desired brand names for our product; | |

| ● | our ability to successfully negotiate pricing and reimbursement in key markets in the E.U. for Macrilen™ (macimorelin); | |

| ● | any evaluation of potential strategic alternatives to maximize potential future growth and shareholder value may not result in any such alternative being pursued, and even if pursued, may not result in the anticipated benefits; | |

| ● | our ability to take advantage of business opportunities in the pharmaceutical industry; | |

| ● | our ability to protect our intellectual property; and | |

| ● | the potential of liability arising from shareholder lawsuits and general changes in economic conditions. |

More detailed information about these and other factors is included under “Risk Factors” in this Annual Report on Form 20-F and in other documents incorporated herein by reference. Many of the Company to efficiently commercialize or out-license Macrilen™ (macimorelin), the degree of market acceptance of Macrilen™ (macimorelin),these factors are beyond our ability to obtain necessary approvalscontrol. Future events may vary substantially from the relevant regulatory authorities to enable us to use the desired brand names for our products, the impact of securities class action litigation, the litigation involving two of our former officers, or other litigation, on our cash flow, results of operations and financial position; any evaluation of potential strategic alternatives to maximize potential future growth and stakeholder value maywhat we currently foresee. You should not result in any such alternative being pursued, and even if pursued, may not result in the anticipated benefits, our ability to take advantage of business opportunities in the pharmaceutical industry, our ability to protect our intellectual property, the potential of liability arising from shareholder lawsuits and general changes in economic conditions. Investors should consult the Company's quarterly and annual filings with the Canadian and U.S. securities commissions for additional information on risks and uncertainties. Given these uncertainties and risk factors, readers are cautioned not to place undue reliance on thesesuch forward-looking statements. We disclaim anydisavow and are under no obligation to update anyor alter such factors or to publicly announce any revisions to any of the forward-looking statements contained herein to reflectwhether as a result of new information, future results, events, developments or developments,otherwise, unless required to do so by a governmental authority or applicable law. We advise you, however, to review any further disclosures we make on related subjects in our reports on Form 6-K filed or furnished to the SEC.

TABLE OF CONTENTS

GENERAL INFORMATION

Page | ||

| Item 1. | ||

| 6 | ||

| 6 | ||

| 6 | ||

| Item 2. | ||

| 6 | ||

| 6 | ||

| Item 3. | ||

| 6 | ||

| 8 | ||

| 8 | ||

| 8 | ||

| Item 4. | ||

| 29 | ||

| 30 | ||

| 41 | ||

| 42 | ||

| Item 4A. | 42 | |

| Item 5. | ||

| 46 | ||

| 52 | ||

| 57 | ||

| 57 | ||

| 58 | ||

| 58 | ||

| Item 6. | ||

| 58 | ||

| 60 | ||

| 74 | ||

| 75 | ||

| 76 | ||

| Item 7. | ||

| 76 | ||

| 77 | ||

| 77 | ||

| Item 8. | ||

| 77 | ||

| 77 | ||

| Item 9. | ||

| 78 | ||

| 78 | ||

| 78 | ||

| 78 | ||

| 78 | ||

| 78 | ||

| Item 10. | |||

| 78 | |||

| 78 | |||

| 89 | |||

| 92 | |||

| 92 | |||

| 100 | |||

| 100 | |||

| 100 | |||

| 100 | |||

| Item 11. | 100 | ||

| Item 12. | |||

| 102 | |||

| 102 | |||

| 102 | |||

| 102 | |||

| Item 13. | 102 | ||

| Item 14. | 102 | ||

| Item 15. | 103 | ||

| Item 16A. | 103 | ||

| Item 16B. | 104 | ||

| Item 16C. | 104 | ||

| Item 16D. | 105 | ||

| Item 16E. | 105 | ||

| Item 16F. | 105 | ||

| Item 16G. | 105 | ||

| Item 16H. | 105 | ||

| Item 17. | 106 | ||

| Item 18. | 106 | ||

| Item 19. | 107 | ||

PART I

| Item 1. | Identity of Directors, Senior Management and Advisers |

| A. | |

| Directors and senior management |

Not applicable.

| B. | |

| Advisers |

Not applicable.

| C. | |

| Auditors |

Not applicable.

| Item 2. | Offer Statistics and Expected Timetable |

| A. | |

| Offer statistics |

Not applicable.

| B. | |

| Method and expected timetable |

Not applicable.

| Item 3. | Key Information |

| A. | |

| Selected financial data |

The consolidated statement of comprehensive (loss) income information set forth in this Item 3.A. with respect to the years ended December 31, 20172019, 20162018 and 20152017 and the consolidated statement of financial position information as at December 31, 20172019and 20162018 have been derived from the audited consolidated financial statements set forth in Item 18, which have been prepared in accordance with International Financial Reporting Standards ("IFRS"(“IFRS”), as issued by the International Accounting Standards Board ("IASB"(“IASB”). The consolidated statement of comprehensive income (loss) income information with respect to the years ended December 31, 20142016 and 20132015 and the consolidated statement of financial position information as at December 31, 2015, 20142017, 2016 and 20132015 set forth in this Item 3.A. have been derived from our previous consolidated financial statements not included herein, and have also been prepared in accordance with IFRS, as issued by the IASB. The selected financial data should be read in conjunction with our audited consolidated financial statements and the related notes included elsewhere in this Annual Report on Form 20-F, as well as "Item“Item 5. – Operating and Financial Review and Prospects"Prospects” of this Annual Report on Form 20-F.

The Company has not declared or paid any dividends per share during the periods covered by the selected financial data.

Consolidated Statements of Comprehensive (Loss) Income Information

(in thousands of U.S. dollars, except share and per share data)

Derived from consolidated audited financial statements prepared in accordance with IFRS, as issued by the IASB

| December 31, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||

| Revenues | ||||||||||||||||||||

| License fees | 74 | 24,325 | 458 | 497 | 248 | |||||||||||||||

| Product sales | 129 | 2,167 | — | — | — | |||||||||||||||

| Royalty income | 45 | 184 | — | — | — | |||||||||||||||

| Sales commission | — | 110 | — | — | — | |||||||||||||||

| Supply chain | 284 | 95 | 465 | 414 | 297 | |||||||||||||||

| 532 | 26,881 | 923 | 911 | 545 | ||||||||||||||||

| Cost of sales | 410 | 2,104 | — | — | — | |||||||||||||||

| Research and development costs | 1,837 | 2,932 | 10,704 | 16,495 | 17,234 | |||||||||||||||

| General and administrative expenses | 6,615 | 8,894 | 8,198 | 7,147 | 11,308 | |||||||||||||||

| Selling expenses | 1,214 | 3,109 | 5,095 | 6,745 | 6,887 | |||||||||||||||

| Restructuring costs | 507 | — | — | — | — | |||||||||||||||

| Impairment of right of use asset | 22 | — | — | — | — | |||||||||||||||

| Write-off of other current assets | 169 | — | — | — | — | |||||||||||||||

| 10,774 | 17,039 | 23,997 | 30,387 | 35,429 | ||||||||||||||||

| (Loss) income from operations | (10,242 | ) | 9,842 | (23,074 | ) | (29,476 | ) | (34,884 | ) | |||||||||||

| Settlements | — | (1,400 | ) | — | — | — | ||||||||||||||

| Gain (loss) due to changes in foreign currency exchange rates | 87 | 656 | 502 | (70 | ) | (1,767 | ) | |||||||||||||

| Change in fair value of warrant liability | 4,518 | 263 | 2,222 | 4,437 | (10,956 | |||||||||||||||

| Warrant exercise inducement fee | — | — | — | — | (2,926 | ) | ||||||||||||||

| Other finance (costs) income | (593 | ) | 278 | 75 | 150 | 305 | ||||||||||||||

| Net finance income (costs) | 4,012 | 1,197 | 2,799 | 4,517 | (15,344 | ) | ||||||||||||||

| (Loss) income before income taxes | (6,230 | ) | 9,639 | (20,275 | ) | (24,959 | ) | (50,228 | ) | |||||||||||

| Income tax recovery (expense) | 188 | (5,452 | ) | 3,479 | — | — | ||||||||||||||

| Net (loss) income from operations | (6,042 | ) | 4,187 | (16,796 | ) | (24,959 | ) | (50,228 | ) | |||||||||||

| Net income from discontinued operations | — | — | — | — | 85 | |||||||||||||||

| Net (loss) income | (6,042 | ) | 4,187 | (16,796 | ) | (24,959 | ) | (50,143 | ) | |||||||||||

| Other comprehensive (loss) income: | ||||||||||||||||||||

| Items that may be reclassified subsequently to profit or loss: | ||||||||||||||||||||

| Foreign currency translation adjustments | 83 | (260 | ) | (1,430 | ) | 569 | 1,509 | |||||||||||||

| Items that will not be reclassified to profit or loss: | ||||||||||||||||||||

| Actuarial gain (loss) on defined benefit plans | (1,068 | ) | 193 | 694 | (1,479 | ) | 844 | |||||||||||||

| Comprehensive (loss) income | (7,027 | ) | 4,120 | (17,532 | ) | (25,869 | ) | (47,790 | ) | |||||||||||

| Basic net (loss) income per share from continuing operations(1) | (0.35 | ) | 0.25 | (1.12 | ) | (2.41 | ) | (18.17 | ) | |||||||||||

| Diluted net (loss) income per share from continuing operations(1) | (0.35 | ) | 0.24 | (1.12 | ) | (2.41 | ) | (18.17 | ) | |||||||||||

| Net income per share (basic and diluted) from discontinued operations1 | — | — | — | — | 0.03 | |||||||||||||||

| Net (loss) income per share (basic)1 | (0.35 | ) | 0.25 | (1.12 | ) | (2.41 | ) | (18.14 | ) | |||||||||||

| Net (loss) income per share (diluted)1 | (0.35 | ) | 0.24 | (1.12 | ) | (2.41 | ) | (18.14 | ) | |||||||||||

| Weighted average number of shares outstanding: | ||||||||||||||||||||

| Basic | 17,494,472 | 16,440,760 | 14,958,704 | 10,348,879 | 2,763,603 | |||||||||||||||

| Diluted | 17,494,472 | 17,034,812 | 14,958,704 | 10,348,879 | 2,763,603 | |||||||||||||||

| 1 | Adjusted to reflect the November 17, 2015 100-to-1 Share Consolidation |

| 7 |

Consolidated Statement of Financial Position Information

(in thousands of U.S. dollars)

Derived from consolidated financial statements prepared in accordance with IFRS, as issued by the IASB

| December 31, | ||||||||||||||

| 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||

| $ | $ | $ | $ | $ | ||||||||||

| Revenues | ||||||||||||||

| Sales commission and other | 465 | 414 | 297 | — | 96 | |||||||||

| License fees | 458 | 497 | 248 | 11 | 6,079 | |||||||||

| 923 | 911 | 545 | 11 | 6,175 | ||||||||||

| Operating expenses | ||||||||||||||

| Cost of Sales | — | — | — | — | 51 | |||||||||

| Research and development costs | 10,704 | 16,495 | 17,234 | 23,716 | 21,284 | |||||||||

| General and administrative expenses | 8,198 | 7,147 | 11,308 | 9,840 | 11,091 | |||||||||

| Selling expenses | 5,095 | 6,745 | 6,887 | 3,850 | 1,225 | |||||||||

| 23,997 | 30,387 | 35,429 | 37,406 | 33,651 | ||||||||||

| Loss from operations | (23,074 | ) | (29,476 | ) | (34,884 | ) | (37,395 | ) | (27,476 | ) | ||||

| Gain (loss) due to changes in foreign currency exchange rates | 502 | (70 | ) | (1,767 | ) | 1,879 | (1,512 | ) | ||||||

| Change in fair value of warrant liability | 2,222 | 4,437 | (10,956 | ) | 18,272 | 1,563 | ||||||||

| Warrant exercise inducement fee | — | — | (2,926 | ) | — | — | ||||||||

| Other finance income | 75 | 150 | 305 | 168 | 185 | |||||||||

| Net finance income (costs) | 2,799 | 4,517 | (15,344 | ) | 20,319 | 236 | ||||||||

| Loss before income taxes | (20,275 | ) | (24,959 | ) | (50,228 | ) | (17,076 | ) | (27,240 | ) | ||||

| Income tax recovery | 3,479 | — | — | (111 | ) | — | ||||||||

| Net loss from continuing operations | (16,796 | ) | (24,959 | ) | (50,228 | ) | (17,187 | ) | (27,240 | ) | ||||

| Net income from discontinued operations | — | — | 85 | 623 | 34,055 | |||||||||

| Net (loss) income | (16,796 | ) | (24,959 | ) | (50,143 | ) | (16,564 | ) | 6,815 | |||||

| Other comprehensive (loss) income: | ||||||||||||||

| Items that may be reclassified subsequently to profit or loss: | ||||||||||||||

| Foreign currency translation adjustments | (1,430 | ) | 569 | 1,509 | (1,158 | ) | 1,073 | |||||||

| Items that will not be reclassified to profit or loss: | ||||||||||||||

| Actuarial gain (loss) on defined benefit plans | 694 | (1,479 | ) | 844 | (1,833 | ) | 2,346 | |||||||

| Comprehensive (loss) income | (17,532 | ) | (25,869 | ) | (47,790 | ) | (19,555 | ) | 10,234 | |||||

Net loss per share (basic diluted) from continuing operations1 | (1.12 | ) | (2.41 | ) | (18.17 | ) | (29.12 | ) | (92.41 | ) | ||||

Net income per share (basic and diluted) from discontinued operations1 | — | — | 0.03 | 1.06 | 115.52 | |||||||||

Net (loss) income per share (basic and diluted)1 | (1.12 | ) | (2.41 | ) | (18.14 | ) | (28.06 | ) | 23.11 | |||||

Weighted average number of shares outstanding:1 | ||||||||||||||

| Basic and diluted | 14,958,704 | 10,348,879 | 2,763,603 | 590,247 | 294,765 | |||||||||

| As at December 31, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||

| Cash and cash equivalents | 7,838 | 14,512 | 7,780 | 21,999 | 41,450 | |||||||||||||||

| Restricted cash equivalents | 364 | 418 | 381 | 496 | 255 | |||||||||||||||

| Total assets | 19,981 | 25,011 | 22,195 | 31,659 | 51,498 | |||||||||||||||

| Warrant liability (current and non-current portion) | 2,255 | 3,634 | 3,897 | 6,854 | 10,891 | |||||||||||||||

| Share capital | 224,528 | 222,335 | 222,335 | 213,980 | 204,596 | |||||||||||||||

| Shareholders’ (deficiency) equity | (2,463 | ) | 1,907 | (2,783 | ) | 6,212 | 21,615 | |||||||||||||

| B. | |

| As at December 31, | |||||||||||||||

| 2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||

| $ | $ | $ | $ | $ | |||||||||||

| Cash and cash equivalents | 7,780 | 21,999 | 41,450 | 34,931 | 43,202 | ||||||||||

| Restricted cash equivalents | 381 | 496 | 255 | 760 | 865 | ||||||||||

| Total assets | 22,195 | 31,659 | 51,498 | 47,435 | 59,196 | ||||||||||

| Warrant liability (current and non-current portion) | 3,897 | 6,854 | 10,891 | 8,225 | 18,010 | ||||||||||

| Share capital | 222,335 | 213,980 | 204,596 | 150,544 | 134,101 | ||||||||||

| Shareholders' (deficiency) equity | (2,783 | ) | 6,212 | 21,615 | 14,484 | 17,064 | |||||||||

| Capitalization and indebtedness |

Not applicable.

| C. | |

| Reasons for the offer and use of proceeds |

Not applicable.

| D. | |

| Risk factors |

An investment in our securities involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this Annual Report, before making an investment decision. If any of the following risks actually occurs, our business, prospects, financial condition or results of operations could suffer. Inbe materially, adversely affected by any of these risks. Additional risks not presently known to us or that case, thewe currently deem immaterial may also impair our business operations. The trading price if any, of our securities could decline due to any of these risks, and you may lose all or part of your investment.

Risks Relating to Us and Our Business

We may not be able to continue as a going concern if we do not obtain cash from AEZS Germany to fund our North American operations, and we do not obtain additional financing.

We have incurred, and expect to continue to incur, substantial expenses in our efforts to develop Macrilen™ (macimorelin). Consequently, we have incurred operating losses and negative cash flow from operations historically and in each of the last several years except for the year ended December 31, 2018, when we earned revenue from the sale of a license for the adult indication of Macrilen™ (macimorelin) in the U.S. and Canada.

The ability to realize our assets and meet our obligations as they come due is dependent on earning sufficient revenues under the license and assignment agreement with a subsidiary of Novo (the “License Agreement”), monetizing commercial opportunities for Macrilen™ (macimorelin) in the rest of the world (“ROW”), realizing other monetizing transactions and raising additional sources of funding, the outcome of which cannot be predicted at this time. The revenue provided under the License Agreement was $45,000 for the year ended December 31, 2019. Furthermore, the Company had cash of $7,838,000 for the year ended December 31, 2019. In September 2019, the Company closed an equity financing which provided approximately $4,193,000 in net cash proceeds (“September 2019 Financing”). Subsequent to 2019, in February 2020, the Company closed an equity financing which provided approximately $3,900,000 in net cash proceeds (“February 2020 Financing”).

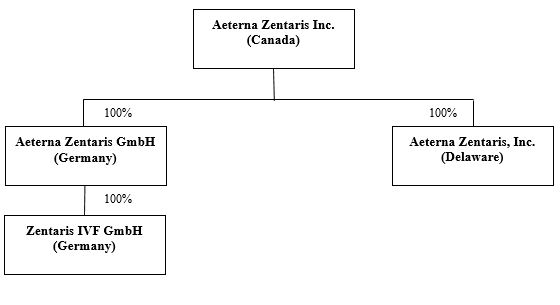

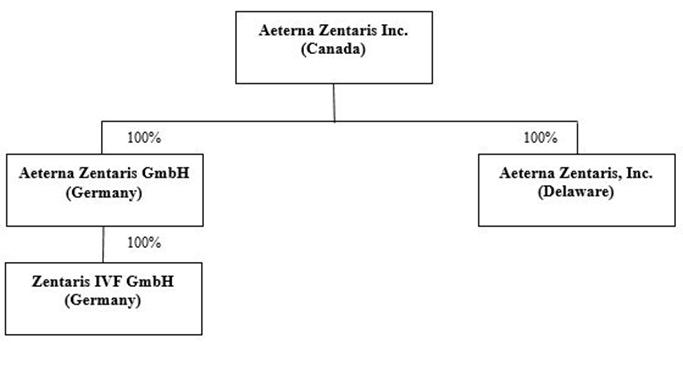

Aeterna Zentaris is a holding company and a substantial portion of our non-cash assets is the share capital of our subsidiaries. Our principal operating subsidiary, AEZS Germany, holds most of our intellectual property rights and is also the counter-party for revenue earned under the License Agreement. In the event that Aeterna Zentaris is unable to obtain additional funding from third party sources, it will require cash from AEZS Germany to fund its North American operations. If and when current and medium term liabilities of AEZS Germany exceed the values ascribed to AEZS Germany’s assets, it may no longer be possible under applicable German solvency laws for AEZS Germany’s operations to continue. The Company has some discretion to manage research and development costs, administrative expenses and capital expenditures in order to maintain its cash liquidity; however, the Company will need to conclude agreement(s) for licensing or selling the European or worldwide rights to Macrilen™ (macimorelin) and, if necessary, obtain further financing in order to continue its currently planned operations. Management has assessed the Company’s ability to continue as a going concern and concluded that additional capital will be required. There can be no assurance that the Company will be able to execute license or purchase agreements or to obtain equity or debt financing, or on terms acceptable to it. Factors within and outside the Company’s control could have a significant bearing on its ability to obtain additional financing. As a result, management has determined that there are material uncertainties that may cast significant doubt upon the Company’s ability to continue as a going concern. For additional discussion of risks related to licensing and selling of Macrilen™ (macimorelin), see risk factor titled “If we are unable to successfully commercialize or out-license Macrilen™ (macimorelin), or if we experience significant delays in doing so, our business would be materially harmed, and the future and viability of the Company could be imperiled” below.

In the event we use up the proceeds from recent third party financings and are not able to transfer cash from AEZS Germany to fund our North American operations and/or secure additional funding, we may be forced to curtail operations, cease operations altogether or file for bankruptcy.

The economic effects of a pandemic, epidemic or outbreak of an infectious disease could adversely affect our operations or the market price of our Common Shares.

Public health crises such as pandemics, epidemics or similar outbreaks could adversely impact our operations or the market price of our Common Shares. In December 2019, a novel strain of coronavirus (“COVID-19”) was reported to have surfaced in Wuhan, China and has reached multiple other countries, resulting in government-imposed quarantines, travel restrictions, school closures and other significant restrictions on business operations imposed by governmental authorities in North America, Europe and worldwide. On January 30, 2020, the World Health Organization declared the outbreak of the COVID-19 a “Public Health Emergency of International Concern.” On January 31, 2020, U.S. Health and Human Services Secretary Alex M. Azar II declared a public health emergency for the U.S. to aid the U.S. healthcare community in responding to COVID-19, and on March 11, 2020, the World Health Organization characterized the outbreak as a “pandemic”. The extent to which the COVID-19 impacts our operations or market price of our Common Shares will depend on future developments, which are highly uncertain and cannot be predicted with confidence, either internationally or within the U.S., Canada or Germany, including the duration of the outbreak, new information that may emerge concerning the severity of the COVID-19 and the actions to contain the virus or treat its impact, among others. COVID-19, however, has already resulted in significant volatility in the world and the national trading markets.

The spread of COVID-19 may impact our operations, including the potential interruption of our clinical trial activities and our supply chain. For example, the COVID-19 outbreak may delay enrollment in our pediatric clinical trial due to prioritization of hospital resources toward the outbreak, and some patients may be unwilling to enroll in our trials or be unable to comply with clinical trial protocols if quarantines impede patient movement or interrupt healthcare services, which would delay our ability to conduct clinical trials or release clinical trial results and could delay our ability to obtain regulatory approval and commercialize our product candidates. The spread of an infectious disease, including COVID-19, may also result in the inability of our suppliers to deliver components or raw materials on a timely basis or at all. In addition, hospitals may reduce staffing and reduce or postpone certain treatments in response to the spread of an infectious disease. Such events may result in a period of business disruption and, in reduced operations, doctors or medical providers may be unwilling to participate in our clinical trials, any of which could materially affect our business, financial condition or results of operations. The significant spread of COVID-19 within the U.S., Canada or Germany resulted in a widespread health crisis and has had adverse effect on the national economies generally, the markets that we serve, our operations and the market price of our Common Shares.

Investments in biopharmaceutical companies are generally considered to be speculative.

The prospects for companies operating in the biopharmaceutical industry are uncertain, given the very nature of the industry, and, accordingly, investments in biopharmaceutical companies should be considered to be speculative assets.

If we are unable to successfully commercialize or out-license Macrilen™ (macimorelin), or if we experience significant delays in doing so, our business would be materially harmed, and the future and viability of operating lossesthe Company could be imperiled.

Our principal focus is on the licensing and development of Macrilen™ (macimorelin) and we may never achieve or maintain operating profitability. In addition, if we are unsuccessful in generating new revenue, increasing our revenue and/or raising additional funding, we may not be able to continue as a going concern.

The commercial products, we could incur additional operating losses for at least the next several years. If we do not ultimately generate sufficient revenue from a commercialized product and achieve or maintain operating profitability, an investment in our Common Shares or other securities could result in a significant or total loss.

| ● | receipt of approvals from foreign regulatory authorities; |

| ● | successfully negotiating pricing and reimbursement in key markets in the E.U. for macimorelin; |

| ● | successfully contracting with qualified third-party suppliers to manufacture macimorelin; |

| ● | developing appropriate distribution and marketing infrastructure and arrangements for our product; |

| ● | launching and growing commercial sales of the product; |

| ● | out-licensing macimorelin to third parties; and |

| ● | acceptance of the product in the medical community, among patients and with third-party payers. |

If we are unable to successfully achieve any of financing, such as strategic alliances with third parties, the salethese factors, our business, financial condition and results of assets or licensing of our technology or intellectual property, a combination of operating and related initiatives or a substantial reorganization of our business.

Our revenues and expenses may fluctuate significantly, and any failure to meet financial expectations may disappoint securities analysts or investors and result in a decline in the price or the value of our Common Shares or other securities.

We have a history of operating losses. Our revenues and expenses have fluctuated in the past and may continue to do so in the future. These fluctuations could cause our share price of Common Shares or the value of our other securities to decline. Some of the factors that could cause our revenues and expenses to fluctuate include, but are not limited to:

| ● | the timing and willingness of any current or future collaborators to invest the resources necessary to commercialize Macrilen™ (macimorelin); |

| ● | not obtaining necessary regulatory approvals from the U.S. Food and Drug Administration (“FDA”), the European Medicines Agency (“EMA”), the European Commission (“EC”) or other agencies that may delay or prevent us from obtaining approval of a pediatric indication for Macrilen™ (macimorelin), which may affect the share price of our Common Shares; |

| ● | the timing of regulatory submissions and approvals; |

| ● | the nature and timing of licensing fee revenues; |

| ● | the outcome of future litigation; |

| ● | foreign currency fluctuations; |

| ● | the effects of the recent outbreak of COVID-19, including the effects of intensified efforts to contain the spread of the virus, which has, to date, included, among other things, quarantines and travel restrictions. |

| ● | the timing of the achievement and the receipt of milestone payments from current or future licensing partners; and |

| ● | failure to enter into new or the expiration or termination of current agreements with suppliers who manufacture Macrilen™ (macimorelin). |

Due to fluctuations in our revenues and expenses, we believe that period-to-period comparisons of our results of operations are not necessarily indicative of our future performance. It is possible that in some future periods, our revenues and expenses will be above or below the expectations of securities analysts or investors. In this case, the share price of our Common Shares and/orand the value of our other securities could fluctuate significantly or decline.

If we decide to pursue new clinical trial programs for new products in the future and are unable to successfully complete thosethe pediatric clinical trial programs,program for Macrilen™ (macimorelin), or if such clinical trials taketrial takes longer to complete than we project, our ability to execute any related business strategy will be adversely affected.

If we experience delays in identifying and contracting with sites and/or in-patient enrollment in our futurepediatric clinical trial programs,program for Macrilen™ (macimorelin), we may incur additional costs and delays in our development programs, and may not be able to complete our clinical trials on a cost-effective or timely basis. In

Clinical trials are subject to continuing oversight by governmental regulatory authorities and institutional review boards and must, among other requirements:

| ● | meet the requirements of these authorities from multiple countries and jurisdictions and their related statutes, regulations and guidance; |

| ● | meet the requirements for informed consent; |

| ● | meet the requirements for institutional review boards; and |

| ● | meet the requirements for good clinical practices. |

We are currently dependent on certain strategic relationships with third parties for the development, manufacturing and licensing of Macrilen™ (macimorelin) and we may enter into future collaborations for the development, manufacturing and licensing of Macrilen™ (macimorelin) or future products.

Our arrangements with these third parties may not provide us with the benefits we expect and may expose us to a number of risks.

Currently, we are dependent on Novo to commercialize Macrilen™ (macimorelin) in the U.S. and rely upon, third parties to perform various functions related toCanada. Most of our business,potential revenue consists of contingent payments, including but not limited to, development, manufacturingmilestones and licensingroyalties on the sale of Macrilen™ (macimorelin). The milestone and royalty revenue that we may receive under this collaboration will depend upon Novo’s ability to successfully introduce, market and sell Macrilen™ (macimorelin) in the U.S. If Novo does not devote sufficient time and resources to its collaboration arrangement with us, we may not realize the potential commercial benefits of the arrangement, and our results of operations may be materially, adversely affected.

Our reliance on these relationships with Novo and other potential third parties poses a number of risks. We may not realize the contemplated benefits of such agreements nor can we be certain that any of these parties will fulfill their obligations in a manner which maximizes our revenue. These arrangements may also require us to transfer certain material rights to third parties. These agreements create certain additional risks. The occurrence of any of the following or other events may delay or impair commercialization of our products:

| ● | in certain circumstances, third parties may assign their rights and obligations under these agreements to other third parties without our consent or approval; |

| ● | the third parties may cease to conduct business for financial or other reasons; |

| ● | we may not be able to renew such agreements; |

| ● | the third parties may not properly maintain or defend certain intellectual property rights that may be important to the commercialization of Macrilen™ (macimorelin); |

| ● | the third parties may encounter conflicts of interest, changes in business strategy or other issues which could adversely affect their willingness or ability to fulfill their obligations to us (for example, pharmaceutical companies historically have re-evaluated their priorities following mergers and consolidations, which have been common in this industry); |

| ● | delays in, or failures to achieve, scale-up to commercial quantities, or changes to current raw material suppliers or product manufacturers (whether the change is attributable to us or the supplier or manufacturer) could delay clinical studies, regulatory submissions and commercialization of Macrilen™ (macimorelin); and |

| ● | disputes may arise between us and the third parties that could result in the delay or termination of the manufacturing or commercialization of Macrilen™ (macimorelin), resulting in litigation or arbitration that could be time-consuming and expensive, or causing the third parties to act in their own self-interest and not in our interest or those of our shareholders. |

In addition, the third parties can terminate our agreements with them for a number of reasons based on the terms of the individual agreements that we have entered into with them. If one or more of these agreements were to be terminated, we would be required to devote additional resources to developing, manufacturing and commercializing our products, seek a new third party with which to contract or abandon the product candidate,Macrilen™ (macimorelin), which would likely cause a drop in theshare price of our Common Shares and/Shares.

We may be unsuccessful in consummating further out-licensing arrangements for MacrilenTM (macimorelin) on favorable terms and conditions, or a declinewe may be significantly delayed in the valuedoing so.

As part of our other securities.

We may require significant additional financing, and we may not have access to sufficient capital.

We may require significant additional capital to fund our commercial operationscommercialization efforts and may require additional capital to pursue planned clinical trials and regulatory approvals, as well as further R&D and marketing efforts for our product candidates and potential products.approvals. Although we have capital from the Strongbridge License Agreement, we do not anticipate generating significant revenues from operations in the near future other than from the Strongbridge License Agreement, andAgreement. Moreover, we currently have no committed sources of capital.

We may attempt to raise additional funds through public or private financings, collaborations with other pharmaceutical companies or from other sources, including, without limitation, through at-the-market offerings and issuances of Common Shares.securities. Additional funding may not be available on terms that are acceptable to us. If adequate funding is not available to us on reasonable terms, we may need to delay, reduce or eliminate one or more of our product development programs or obtain funds on terms less favorable than we would otherwise accept. To the extent that additional capital is raised through the sale of equity securities or securities convertible into or exchangeable or exercisable for equity securities, the issuance of those securities would result in dilution to our shareholders. Moreover, the incurrence of debt financing or the issuance of dividend-paying preferred shares, could result in a substantial portion of our future operating cash flow, if any, being dedicated to the payment of principal and interest on such indebtedness or the payment of dividends on such preferred shares and could impose restrictions on our operations and on our ability to make certain expenditures and/or to incur additional indebtedness, which could render us more vulnerable to competitive pressures and economic downturns.

Our future capital requirements are substantial and may increase beyond our current expectations depending on many factors, including:

| ● | the duration of changes to and results of our clinical trials for any future products going forward; |

| ● | unexpected delays or developments in seeking regulatory approvals; |

| ● | the time and cost involved in preparing, filing, prosecuting, maintaining and enforcing patent claims; |

| ● | unexpected developments encountered in implementing our business development and commercialization strategies; |

| ● | the potential addition of commercialized products to our portfolio; |

| ● | the outcome of future litigation; and |

| ● | further arrangements, if any, with collaborators. |

In addition, global economic and market conditions, as well as future developments in the credit and capital markets, may make it even more difficult for us to raise additional financing in the future.

We are and will be subject to stringent ongoing government regulation for our products and our product candidates, even if we obtain regulatory approvals for the latter.

The manufacture,manufacturing, marketing and sale of Macrilen™ (macimorelin) and future products are and will be subject to strict and ongoing regulation, even with marketing approval by the FDA and the EC for Macrilen™ (macimorelin), and even if the EMA and other regulatory authorities approve our future products.. Compliance with such regulation will be expensive and consume substantial financial and management resources. For example, anthe EC approval for a product may bemacimorelin was conditioned on our agreement to conduct costly post-marketing follow-up studies to monitor the safety or efficacy of the products.product. In addition, as clinical experience with a drug expands after approval because the drug is used by a greater number and more diverse group of patients than during clinical trials, side effects or other problems may be observed after approval that were not observed or anticipated during pre-approval clinical trials. In such a case, a regulatory authority could restrict the indications for which the product may be sold or revoke the product'sproduct’s regulatory approval. Even though the New Drug Application ("NDA") regarding Macrilen™ (macimorelin) is approved by the FDA, the FDA may still require post-market clinical studies and there is a risk that the results of the studies may not meet FDA's requirements.

We and our contract manufacturers will be required to comply with applicable Current Good Manufacturing Practice (cGMP) regulations for the manufacture of our current or future products and other regulations. These regulations include requirements relating to quality assurance, as well as the corresponding maintenance of rigorous records and documentation. Manufacturing facilities must be approved before we can use them in the commercial manufacturing of a product and are subject to subsequent periodic inspection by regulatory authorities. In addition, material changes in the methods of manufacturing or changes in the suppliers of raw materials are subject to further regulatory review and approval.

If we, or if any future marketing collaborators or contract manufacturers, fail to comply with applicable regulatory requirements, we may be subject to sanctions including fines, product recalls or seizures and related publicity requirements, injunctions, total or partial suspension of production, civil penalties, suspension or withdrawals of previously granted regulatory approvals, warning or untitled letters, refusal to approve pending applications for marketing approval of new products or of supplements to approved applications, complete withdrawal of a marketing application, exclusion from government healthcare programs, import or export bans or restrictions, and/or criminal prosecution and penalties. Any of these penalties could delay or prevent the promotion, marketing or sale of a product.

Even with marketing approval for Macrilen™MacrilenTM (macimorelin),such product approval could be subject to restrictions or withdrawals. Regulatory requirements are subject to change.

On December 20, 2017, the FDA granted marketing approval in the U.S. for Macrilen™ (macimorelin) to be used in the diagnosis of patients with adult growth hormone deficiency ("AGHD"(“AGHD”)., and on January 16, 2019, the EC granted marketing approval in Europe for macimorelin for the diagnosis of AGHD. Regulatory authorities generally approve products for specified indications. If an approval is for a limited indication, this limitation reduces the size of the potential market for that product. Product approvals, once granted, are subject to continual review and periodic inspections by regulatory authorities. Our operations and practices are subject to regulation and scrutiny by the U.S. government, as well as governments of any other countries in which we do business or conduct activities. Later discovery of previously unknown problems or safety issues and/or failure to comply with domestic or foreign laws, knowingly or unknowingly, can result in various adverse consequences, including, among other things, a possible delay in the approval or refusal to approve a product, warning or untitled letters, fines, injunctions, civil penalties, recalls or seizures of products and related publicity requirements, total or partial suspension of production, import or export bans or restrictions, refusal of the government to renew marketing applications, complete withdrawal of a marketing application, criminal prosecution and penalties, suspension or withdrawals of previously granted regulatory approvals, withdrawal of an approved product from the market and/or exclusion from government healthcare programs. Such regulatory enforcement could have a direct and negative impact on the product for which approval is granted, but also could have a negative impact on the approval of any pending applications for marketing approval of new drugs or supplements to approved applications.

Because we operate in a highly regulated industry, regulatory authorities could take enforcement action against us in connection with our licensees’ or our licensees'collaborators’ businesses or collaborators', business and marketing activities for various reasons.

From time to time, new legislation is passed into law that could significantly change the statutory provisions governing the approval, manufacturing and marketing of products regulated by the FDA, EMAthe EC and other health authorities. Additionally,In addition, regulations and guidance are often revised or reinterpreted by health agencies in ways that may significantly affect our business Macrilen™ (macimorelin) and our future products.business. It is impossible to predict whether further legislative changes will be enacted, or whether regulations, guidance, or interpretations will change, and what the impact of such changes, if any, may be.

Healthcare reform measures could hinder or prevent the commercial success of a product and adversely affect our business.

The business prospects and financial condition of pharmaceutical and biotechnology companies are affected by the efforts of governmental and third-party payers to contain or reduce the costs of healthcare. The U.S. government and other governments have shown significant interest in pursuing healthcare reform and reducing healthcare costs. Any government-adopted reform measures could cause significant pressure on the pricing of healthcare products and services, including Macrilen™ (macimorelin) and future products,, both in the United StatesU.S. and internationally, as well as the amount of reimbursement available from governmental agencies and other third-party payers. If reimbursement for Macrilen™ (macimorelin) or future products is substantially less than we expect, our revenue prospects could be materially and adversely impacted.

In the United StatesU.S. and in other jurisdictions there have been, and we expect that there will continue to be, a number of legislative and regulatory proposals aimed at changing the healthcare system, such as proposals relating to the pricing of healthcare products and services in the United StatesU.S. or internationally, the reimportation of drugs into the U.S. from other countries (where they are then sold at a lower price), and the amount of reimbursement available from governmental agencies or other third partythird-party payers. Furthermore, the pricing of pharmaceutical products, in general, and specialty drugs, in particular, has been a topic of concern in the U.S. Congress, where hearings on the topic have been held, and has been a topic of speeches given by political figures, including President Donald Trump. Additionally, in the United States,U.S., individual states have also passed legislation and proposed bills that are aimed at drug pricing transparency, which will likely impact drug pricing. There can be no assurance as to how this scrutiny on pricing of pharmaceutical products will impact future pricing of Macrilen™ (macimorelin), our future products, or orphan drugs or pharmaceutical products generally.

The Patient Protection and Affordable Care Act and the Healthcare and Education Affordability Reconciliation Act of 2010 (collectively, the "ACA"“ACA”) has had far-reaching consequences for most healthcare companies, including specialty biopharmaceutical companies like us. The future of the ACA is, however, uncertain. Since January 2017, the U.S. Congress has proposed various bills to revise the ACA. Additionally,In addition, President Donald Trump has suggested similar action and enacted Executive Orders to curtail the ACA and its impactsimpact on healthcare in the United States.U.S. In addition, on December 18, 2019, the 5th Circuit of the U.S. ruled that the individual mandate in the ACA is unconstitutional, and sent the case back to the applicable District Court to determine whether the entire law is invalid or if some parts of the ACA can survive. We cannot predict the ultimate content, timing or effect of any healthcare reform legislation, or the impact of potential legislation, regulation, judicial review and orders, or their impact on us.

In addition, the Food and Drug Administration Amendments Act of 2007 gives the FDA enhanced post-market authority, including the authority to require post-marketing studies and clinical trials, labeling changes based on new safety information, and compliance with risk evaluations and mitigation strategies approved by the FDA. The FDA'sFDA’s exercise of this authority may result in delays or increased costs during the period of product development, clinical trials and regulatory review and approval, which may also increase costs related to complying with new post-approval regulatory requirements, and increase potential FDA restrictions on the sale or distribution of approved products.

If we or our licensees market products or interact with health care practitioners in a manner that violates healthcare fraud andor abuse laws, we or our licensees may be subject to civil or criminal penalties, including exclusion from participation in government healthcare programs.

As a pharmaceutical company, even though we do not provide healthcare services or receive payments directly from or bill directly to Medicare, Medicaid or other national or third-party payers for our current or future products, certainproduct, U.S. federal and state healthcare laws and regulations, as well as certain E.U. regulatory and government agencies, pertaining to fraud andor abuse are and will be applicable to our business. We and our licensees are subject to healthcare fraud and abuse regulation by bothE.U. regulatory and government agencies in the countries where we may seek marketing access, and the U.S. federal government and the states in which we conduct our business.

The laws that may affect our or that of our licensee’s ability to operate include the federal healthcare program anti-kickback statute, which prohibits, among other things, knowingly and willfully offering, paying, soliciting, or receiving remuneration to induce, or in return for, the purchase, lease or order, or arrangement for the purchase, lease or order of any healthcare item or service reimbursable under Medicare, Medicaid or other federally financed healthcare programs. This statute applies to arrangements between pharmaceutical manufacturers and prescribers, purchasers and formulary managers. Although there are a number of statutory exceptions and regulatory safe harbors protecting certain common activities, the exceptions and safe harbors are drawn narrowly, and practices that involve remuneration intended to induce prescribing, purchases or recommendations may be subject to scrutiny if they do not qualify for an exception or a safe harbor.

Federal false claims laws prohibit any person from knowingly presenting, or causing to be presented, a false claim for payment to the federal government, or knowingly making, or causing to be made, a false statement to get a false claim paid. Pharmaceutical companies have been prosecuted under these laws for a variety of alleged promotional and marketing activities, such as providing free product to customers with the expectation that the customers would bill federal programs for the product;product, reporting to pricing services inflated average wholesale prices that were then used by federal programs to set reimbursement rates;rates, engaging in off-label promotion that caused claims to be submitted to Medicaid for non-covered off-label uses;uses and submitting inflated best price information to the Medicaid Drug Rebate Program.

The Health Insurance Portability and Accountability Act of 1996 also created prohibitions against healthcare fraud and false statements relating to healthcare matters. The healthcare fraud statute prohibits knowingly and willfully executing a scheme to defraud any healthcare benefit program, including private payers. The false statements statute immediately noted above prohibits knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false, fictitious or fraudulent statement in connection with the delivery of or payment for healthcare benefits, items or services.

In addition, there has been a recent trend of increased federal and state regulation of payments made to physicians. The ACA, through the Physician Payment Sunshine Act of 2010, imposed new requirements on manufacturers of drugs, devices, biologics and medical supplies for which payment is available under Medicare, Medicaid or the Children'sChildren’s Health Insurance Program (with certain exceptions) to report annually to the Centers for Medicare and Medicaid Services ("CMS"(“CMS”) information related to payments or other "transfers“transfers of value"value” made to physicians (defined to include doctors, dentists, optometrists, podiatrists and chiropractors) and teaching hospitals, and applicable manufacturers and group purchasing organizations to report annually to CMS ownership and investment interests held by physicians (as defined above) and their immediate family members and payments or other "transfers“transfers of value"value” to such physician owners and their immediate family members. Manufacturers are required to report such data to the government by the 90th calendar day of each year.

The majority of states also have statutes or regulations similar to these federal laws, which apply to items and services reimbursed under Medicaid and other state programs, or, in several states, apply regardless of the payer. In addition, some states have laws that require pharmaceutical companies to adopt comprehensive compliance programs. For example, under California law, pharmaceutical companies must comply with both the April 2003 Office of Inspector General Compliance Program Guidance for Pharmaceutical Manufacturers and the PhRMA Code on Interactions with Healthcare Professionals, as amended. Certain states also mandate the tracking and reporting of gifts, compensation, and other remuneration paid by us to physicians and other healthcare providers.

Although compliance programs can mitigate the risk of investigation and prosecution for violations of these laws, the risks cannot be entirely eliminated. Any action against us or our licensees for violation of these laws, even if we successfully defend against it, could cause us to incur significant legal expenses, cause reputational harm and divert our management'smanagement’s attention from the operation of our business. Moreover, achieving and sustaining compliance with E.U. government and regulatory agencies and applicable U.S. federal and state laws may prove costly.

Because of the breadth of these laws and the narrowness of the safe harbors, it is possible that some of our business activities could be subject to challenge under one or more of such laws. The ACA also made several important changes to the federal anti-kickback statute, false claims laws and healthcare fraud statute by weakening the intent requirement under the anti-kickback and healthcare fraud statutes that may make it easier for the government or whistleblowers to charge such fraud and abuse violations. A person or entity no longer needs to have actual knowledge of this statute or specific intent to violate it. In addition, the ACA provides that the government may assert that a claim including items or services resulting from a violation of the federal anti-kickback statute constitutes a false or fraudulent claim for purposes of the false claims statutes. In addition, the ACA increases penalties for fraud and abuse violations. If our past, present or future operations are found to be in violation of any of the laws described above or other similar governmental regulations to which we are subject, we may be subject to significant civil, criminal and administrative penalties, damages, fines, imprisonment, exclusion from government funded healthcare programs, such as Medicare and Medicaid, and the curtailment or restructuring of our operations, any of which could adversely affect our ability to operate our business and negatively impact our financial results.

If our products doMacrilen™ (macimorelin) does not gain market acceptance, we may be unable to generate significant revenues.

Market acceptance of Macrilen™ (macimorelin) or any of our products will dependdepends on a number of factors, including, but not limited to:

| ● | demonstration of clinical efficacy and safety; |

| ● | the prevalence and severity of any adverse side effects; |

| ● | limitations or warnings contained in the product’s approved labeling; |

| ● | availability of alternative treatments or tests for the indications we target; |

| ● | the advantages and disadvantages of Macrilen™ (macimorelin) relative to current or alternative treatments and tests; |

| ● | the availability of acceptable pricing and adequate third-party reimbursement; and |

| ● | the effectiveness of marketing and distribution methods for Macrilen™ (macimorelin). |

If Macrilen™ (macimorelin) or our future products dodoes not gain market acceptance among physicians, patients, healthcare payers and others in the medical community, who may not accept or utilize our products,Macrilen™ (macimorelin), our ability to generate significant revenues from these productsMacrilen™ (macimorelin) would be limited, and our financial condition could be materially, adversely affected. In addition, if we fail to further penetrate our core markets and existing geographic markets or to successfully expand our business into new markets, the growth in sales of our current or future products,Macrilen™ (macimorelin), along with our operating results, could be negatively impacted.

Our ability to further penetrate our core markets and existing geographic markets in which we compete or to successfully expand our business into additional countries in Europe, Asia or elsewhere is subject to numerous factors, many of which are beyond our control. Macrilen™ (macimorelin) or our future products,, if successfully developed,commercialized, may compete with a number of drugs, therapies, products and tests currently manufactured and marketed by major pharmaceutical and other biotechnology companies. Macrilen™ (macimorelin) or our future products may also compete with new products currently under development by others or with products which may be less expensive than our current or future products.Macrilen™ (macimorelin). There can be no assurance that our efforts to increase market penetration in our core markets and existing geographic markets will be successful. Our failure to do so could have an adverse effect on our operating results and would likely cause a drop in the share price of our Common Shares and/or a decline in the value of our other securities.

We may expend our limited resources to pursue a particular product or indication and fail to capitalize on other products or indications for which there may be a greater likelihood of success.

Because we have limited financial and managerial resources, we are currently focusing our efforts on Macrilen™ (macimorelin), and we are doing so for specific indications. As a result, we may forego or delay pursuit of opportunities with products or for other potential indications for Macrilen™ (macimorelin), which there may be a greater likelihood of success or may prove to have greater commercial potential. Research programs to identify new product candidates or pursue alternative indications for Macrilen™ (macimorelin) require substantial technical, financial and human resources. These activities – if pursued – may initially show promise in identifying potential product candidates or indications, yet fail to yield product candidates or indications for further clinical development.

We may not achieve our projected development goals in the time-frames we announce and expect.

We may set goals and make public statements regarding the timing of the accomplishment of objectives material to our success, such as the commencement, enrollment and anticipated completion of clinical trials, anticipated regulatory submission and approval dates and time of product launch. The actual timing of these events can vary dramatically due to factors such as delays or failures in any clinical trials, the uncertainties inherent in the regulatory approval process and delays in achieving manufacturing or marketing arrangements sufficient to commercialize Macrilen™ (macimorelin) or future products.. There can be no assurance that we will make regulatory submissions or receive regulatory approvals as planned or that Strongbridgewe will be able to adhere to its currentour schedule for the launchlaunching of Macrilen™ (macimorelin) or for any future products we might acquire or license.outside of the U.S. If we fail to achieve one or more of these milestones as planned, the share price of our Common Shares and/or the value of our other securities would likely decline.

If we fail to obtain acceptable prices or adequate reimbursement for Macrilen™ (macimorelin) or future products,, our ability to generate revenues will be diminished.

Our ability or that of our licensee(s) to successfully commercialize Macrilen™ (macimorelin) or future products will depend significantly on our or their ability to obtain acceptable prices and the availability of reimbursement to the patient from third-party payers, such as governmental and private insurance plans. These third-party payers frequently require companies to provide predetermined discounts from list prices, and they are increasingly challenging the prices charged for pharmaceuticals and other medical products. Macrilen™ (macimorelin) or our future products may not be considered cost-effective, and reimbursement to the patient may not be available or sufficient to allow us or our licensee(s) to sell our products on a competitive basis. It may not be possible to negotiate favorable reimbursement rates for Macrilen™ (macimorelin) or future products.. Adverse pricing and reimbursement conditions would also likely diminish our ability to induce third parties to in-license Macrilen™ (macimorelin) or our future products.

In addition, the continuing efforts of third-party payers to contain or reduce the costs of healthcare through various means may limit our commercial opportunity and reduce any associated revenue and profits. We expect that proposals to implement similar government controls will continue. The pricing of pharmaceutical products, in general, and specialty drugs, in particular, has been

If we or our licensee(s) fail to obtain acceptable prices or an adequate level of reimbursement for Macrilen™ (macimorelin) or future products,, the sales of these productsMacrilen™ (macimorelin) would be adversely affected or there may be no commercially viable market for these products.

Competition in our targeted markets is intense, and development by other companies could render Macrilen™ (macimorelin) or future products or technologies non-competitive.

The biopharmaceutical field is highly competitive. New products developed by other companies in the industry could render Macrilen™ (macimorelin) uncompetitive or future products uncompetitive.significantly less competitive. Competitors are developing and testing products and technologies that would compete with Macrilen™ (macimorelin) or products that we could develop, acquire or license.. Some of these products may be more effective or have an entirely different approach or means of accomplishing the desired effect than Macrilen™ (macimorelin) or future products.. We expect competition from pharmaceutical and biopharmaceutical companies and academic research institutions to continue to increase over time. Many of our competitors and potential competitors have substantially greater product development capabilities and financial, scientific, marketing and human resources than we do. Our competitors may succeed in developing products earlier and in obtaining regulatory approvals and patent protection for such products more rapidly than we can or at a lower price.

We may not obtain adequate protection for our productsMacrilen™ (macimorelin) through our intellectual property.

We rely heavily on our proprietary information in developing and manufacturing our product candidates.Macrilen™ (macimorelin). Our success depends, in large part, on our ability to protect our competitive position through patents, trade secrets, trademarks and other intellectual property rights. The patent positions of pharmaceutical and biopharmaceutical firms, including us, are uncertain and involve complex questions of law and fact for which important legal issues remain unresolved. We have filed and are pursuing applications for patents and trademarks in many countries. Pending patent applications may not result in the issuance of patents, and we may not be able to obtain additional issued patents relating to our technology or products.

The laws of some countries do not protect intellectual property rights to the same extent as the laws of the United StatesU.S. and Canada. Many companies have encountered significant problems in protecting and defending such rights in foreign jurisdictions. Many countries, including certain countries in Europe, have compulsory licensing laws under which a patent owner may be compelled to grant licenses to third parties. In addition, many countries limit the enforceability of patents against government agencies or government contractors. In these countries, the patent owner may have limited remedies, which could materially diminish the value of the patent. Compulsory licensing of life-saving drugs is also becoming increasingly popular in developing countries either through direct legislation or international initiatives. Such compulsory licenses could be extended to include some of our product candidates, which could limit our potential revenue opportunities. Moreover, the legal systems of certain countries, particularly certain developing countries, do not favor the aggressive enforcement of patent and other intellectual property protection, which makes it difficult to stop and prevent infringement.

Our patents and/or the patents that we license from others may be challenged, narrowed, invalidated, held to be unenforceable or circumvented, which could limit our ability to stop competitors from marketing similar products or limit the length of term of patent protection we may have for our products.Macrilen™ (macimorelin). Changes in either patent laws or in interpretations of patent laws in the U.S. and other countries may diminish the value of our intellectual property or narrow the scope of our patent protection.protection for Macrilen™ (macimorelin). The patents issued or to be issued to us for Macrilen™ (macimorelin) may not provide us with any competitive advantage or protect us against competitors with similar technology. In addition, it is possible that third parties with products that are very similar to ours will circumvent our patents by means of alternate designs or processes. We may have to rely on method-of-use, methods of manufacture and/or new-formulation protection for our compounds in development, and any resulting products, which may not confer the same protection as claims to compounds per se.

In addition, our patents may be challenged by third parties in patent litigation, which is becoming widespread in the biopharmaceutical industry. There may be prior art of which we are not aware that may affect the validity or enforceability of a patent claim. There may also be prior art of which we are aware, but which we do not believe affects the validity or enforceability of a claim, which may, nonetheless, ultimately be found to affect the validity or enforceability of a claim. No assurance can be given that our patents would, if challenged, be held by a court to be valid or enforceable or that a competitor'scompetitor’s technology or product would be found by a court to infringe our patents. Our granted patents could also be challenged and revoked in U.S. post-grant proceedings as well as in opposition or nullity proceedings in certain countries outside the U.S. In addition, we may be required to disclaim part of the term of certain patents.

We also rely on trade secrets and proprietary know-how to protect our intellectual property. If we are unable to protect the confidentiality of our proprietary information and know-how, the value of our technology and products could be adversely affected. We seek to protect our unpatented proprietary information in part by requiring our employees, consultants, outside scientific collaborators and sponsored researchers and other advisors to enter into confidentiality agreements. These agreements provide that all confidential information developed or made known to the individual during the course of the individual'sindividual’s relationship with us is to be kept confidential and not disclosed to third parties except in specific circumstances. In the case of our employees, the agreements provide that all of the technology that is conceived by the individual during the course of employment is our exclusive property. These agreements may not provide meaningful protection or adequate remedies in the event of unauthorized use or disclosure of our proprietary information. In addition, it is possible that third parties could independently develop proprietary information and techniques substantially similar to ours or otherwise gain access to our trade secrets. If we are unable to protect the confidentiality of our proprietary information and know-how, competitors may be able to use this information to develop products that compete with our products and technologies, which could adversely impact our business.

We currently have the right to use certain patents and technologies under license agreements with third parties. Our failure to comply with the requirements of one or more of our license agreements could result in the termination of such agreements, which could cause us to terminate the related development program and cause a complete loss of our investment in that program.program or given market. Inventions claimed in certain in-licensed patents may have been made with funding from the U.S. government and may be subject to the rights of the U.S. government and we may be subject to additional requirements in the event we seek to commercialize or manufacture product candidates incorporating such in-licensed technology.

As a result of the foregoing factors, we may not be able to rely on our intellectual property to protect our productsMacrilen™ (macimorelin) in the marketplace.

We may infringe the intellectual property rights of others.