As filed with the Securities and Exchange Commission on 2927 March 20182020

|

|

| |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 205420549 |

| |

FORM 20-F

|

| |

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934 OR |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 OR |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 OR |

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FINANCIAL YEAR ENDED 31 December 20172019

Commission file number: 1-14846

AngloGold Ashanti Limited

(Exact Name of Registrant as Specified in its Charter)

Republic of South Africa

(Jurisdiction of Incorporation or Organisation)

76 Rahima Moosa Street, Newtown, Johannesburg, 2001

(P.O. Box 62117, Marshalltown, 2107)

South Africa

(Address of Principal Executive Offices)

|

|

| |

Kandimathie Christine Ramon, Chief Financial Officer, Telephone: +27 11 6376019 E-mail: cramon@anglogoldashanti.com, 76 Rahima Moosa Street, Newtown, Johannesburg, 2001, South Africa (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) |

| |

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of each class | Trading Symbols | Name of each exchange on which registered |

| American Depositary Shares | AU | New York Stock Exchange |

| Ordinary Shares | AU | New York Stock Exchange* |

| 5.375% Notes due 2020 | AU/20 | New York Stock Exchange |

| 5.125% Notes due 2022 | AU/22 | New York Stock Exchange |

| 6.50% Notes due 2040 | AU/40 | New York Stock Exchange |

* Not for trading, but only in connection with the registration of American Depositary Shares pursuant to the requirements of the Securities and Exchange Commission

Securities registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

|

| | |

| Ordinary Shares of 25 ZAR cents each | 410,054,615415,301,215 |

|

| A Redeemable Preference Shares of 50 ZAR cents each | 2,000,000 |

|

| B Redeemable Preference Shares of 1 ZAR cent each | 778,896 |

|

|

| | |

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | | Yes ☒x No☐ |

| | | |

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

| | Yes ☐ No ☒x |

| | | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| | Yes ☒x No ☐ |

| | | |

Indicate by check mark whether the registrant (1) has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

| | Yes ☒x No ☐ |

| | | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.filer, or an emerging growth company. See definition of “large accelerated filer”, “accelerated filer,” and large accelerated filer”“emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

| | | | | | | | |

| | (Check one): Large Accelerated Filer ☒x | | Accelerated Filer ☐ | | Non-Accelerated Filer ☐ | | Emerging growth company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

|

| | |

| Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing: |

| | U.S. GAAP ☐ |

International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ xOther☐

|

| | |

| If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | | Yes ☐ No ☒x |

|

| | | |

| TABLE OF CONTENTS | |

| | Page |

| | |

| |

| |

| |

| | | |

| | | |

| | | |

| | | |

|

| Item 1: | | |

| Item 2: | | |

| Item 3: | | |

| | 3A. | | |

| | 3B. | | |

| | 3C. | | |

| | 3D. | | |

| Item 4: | | |

| | 4A. | | |

| | 4B. | | |

| | 4C. | | |

| | 4D. | | |

| Item 4A: | | |

| Item 5: | | |

| | 5A. | | |

| | 5B. | | |

| | 5C. | | |

| | 5D. | | |

| | 5E. | | |

| | 5F. | | |

| Item 6: | | |

| | 6A. | | |

| | 6B. | | |

| | 6C. | | |

| | 6D. | | |

| | 6E. | | |

| Item 7: | | |

| | 7A. | | |

| | 7B. | | |

| | 7C. | | |

| Item 8: | | |

| | 8A. | | |

| | | | |

| | | | |

| | 8B. | | |

|

| | | | | |

| Item 9: | | |

| | 9A. | | |

| | 9B. | | |

| | 9C. | | |

| | 9D. | | |

| | 9E. | | |

| | 9F. | | |

| Item 10: | | |

| | 10A. | | |

| | 10B. | | |

| | 10C. | | |

| | 10D. | | |

| | 10E. | | |

| | 10F. | | |

| | 10G. | | |

| | 10H. | | |

| | 10I. | | |

| Item 11: | | |

| Item 12: | | |

| | 12A. | | |

| | 12B. | | |

| | 12C. | | |

| | 12D. | | |

| | | 12D.3 | | |

| | | 12D.4 | | |

| |

| Item 13: | | |

| Item 14: | | |

| Item 15: | | |

| Item 16A: | | |

| Item 16B: | | |

| Item 16C: | | |

| Item 16D: | | |

| Item 16E: | | |

| Item 16F: | | |

| Item 16G: | | |

| Item 16H: | | |

| |

| Item 17: | | |

| Item 18: | | |

| Item 19 | | |

PRESENTATION OF INFORMATION

AngloGold Ashanti Limited

In this annual report on Form 20-F, unless the context otherwise requires, references to AngloGold, AngloGold Ashanti, AGA, the company, the Company and the group are references to AngloGold Ashanti Limited including, as appropriate, subsidiaries and associate companies of AngloGold Ashanti Limited.

IFRS financial statements

As a company incorporated in the Republic of South Africa, AngloGold Ashanti prepares annual audited consolidated financial statements and unaudited consolidated half-year financial statements in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB) in the English language.. These financial statements are distributed to shareholders and are submitted to the JSE Limited (JSE), as well as the New York, Australian and Ghana stock exchanges.

Currency

AngloGold Ashanti presents its consolidated financial statements in United States dollars.

In this annual report, references to rands, ZAR and R are to the lawful currency of the Republic of South Africa, references to US dollars, dollar, US$ or $ are to the lawful currency of the United States, references to € and Euro are to the lawful currency of the European Union, references to ARS and Argentinean peso are to the lawful currency of Argentina, references to AUD, Australian dollars and A$ are to the lawful currency of Australia, references to BRL are to the lawful currency of Brazil, references to TshTZS are to the lawful currency of the United Republic of Tanzania, and references to GHC,GHS, cedi or Gh¢ are to the lawful currency of Ghana.

See “Item 3A: Selected financial data – Exchange rate information” for historical information regardingGhana and references to British pounds are to the US dollar/South African rand exchange rate. On 19 March 2018,lawful currency of the US dollar/South African rand exchange rate as reported by Reuters was R12.01/$1.00.United Kingdom.

Non-GAAP financial measures

In this annual report on Form 20-F, AngloGold Ashanti presents the financial items “total cash costs”costs net of by-product revenue”, “total cash costs per ounce”, “all-in sustaining costs”, “all-in sustaining costs per ounce”, “all-in costs” and “all-in costs per ounce”, which are not IFRS measures. An investor should not consider these items in isolation or as alternatives to cost of sales, profit/(loss) applicable to equity shareholders, profit/(loss) before taxation, cash flows from operating activities or any other measure of financial performance presented in accordance with IFRS.

While the Gold Institute provided definitions for the calculation of total cash costs net of by-product revenue and during June 2013 the World Gold Council published a Guidance Note on “all-in sustaining costs” and “all-in costs” metrics, the calculation of total cash costs net of by-product revenue, total cash costs per ounce, all-in sustaining costs, all-in sustaining costs per ounce, all-in costs and all-in costs per ounce may vary significantly among gold mining companies, and by themselves do not necessarily provide a basis for comparison with other gold mining companies. See “—Glossary“-Glossary of selected terms–Financial terms–Totalterms-Financial terms-Total cash costs”costs net of by-product revenue”, “ —Glossary-Glossary of selected terms–Financial terms–All-interms-Financial terms-All-in sustaining costs” and “—Glossary“-Glossary of selected terms–Financial terms–All-interms-Financial terms-All-in costs”. Nevertheless, AngloGold Ashanti believes that total cash costs net of by-product revenue, all-in sustaining costs and all-in costs in total and per ounce are useful indicators to investors and management as they provide:

an indication of profitability, efficiency and cash flows;

the trend in costs as the mining operations mature over time on a consistent basis; and

an internal benchmark of performance to allow for comparison against other mines, both within the AngloGold Ashanti group and at other gold mining companies.

Management prepares its internal management reporting documentation, for use and decision making by the Chief Operating Decision Maker, on an attributable basis. The key metrics are based on the attributable ounces, gold income, total cash costs net of by-product revenue, all-in costs and all-in sustaining costs from each operation and as a consequence includes our share of the total cash costs net of by-product revenue, all-in costs and all-in sustaining costs of our joint ventures that are accounted for on the equity method. In a capital intensive industry, this basis allows management to make operating and resource allocation decisions on a comparable basis between mining operations irrespective of whether they are consolidated or accounted for under the equity method. This basis of calculating the metrics, where costs should be reported on the same basis as sales (i.e. if sales are reported on an attributable basis, then costs should be reported on an attributable basis), is also consistent with the World Gold Council’s Guidance Note on Non-GAAP Metrics - All-in-All-in Sustaining and All-In Costs.Costs.

Although we have shareholder rights and board representation commensurate with our ownership interests in our equity accounted joint ventures and review the underlying operating results including total cash costs net of by-product revenue, all-in costs and all-in sustaining costs with them at each reporting period, we do not have direct control over their operations or resulting revenue and expenses, nor do we have a proportionate legal interest in each financial statement line item. Our use of total cash costs net of by-product revenue, all-in costs and all-in sustaining costs on an attributable basis, is not intended to imply that we have any such control or proportionate legal interest, but rather to reflect the non-GAAP measures on a basis consistent with our internal and external segmental reporting.

A reconciliation of both cost of sales and total cash costs as included in the company’s audited financial statements to total“all-in sustaining costs”, “all-in sustaining costs per ounce”, “all-in costs”, “all-in costs per ounce”, “total cash costs all-in sustainingnet of by-product revenue” and “total cash costs and all-in costsper ounce” for each of the three years in the period ended 31 December 2015, 2016 and 20172019 is presented herein. See “Item 5:5A: Operating and Financial Review and Prospects—Total all-in sustaining costs, all-in costs and total cash costs”Results-Non-GAAP analysis”.

DiscontinuedOperations

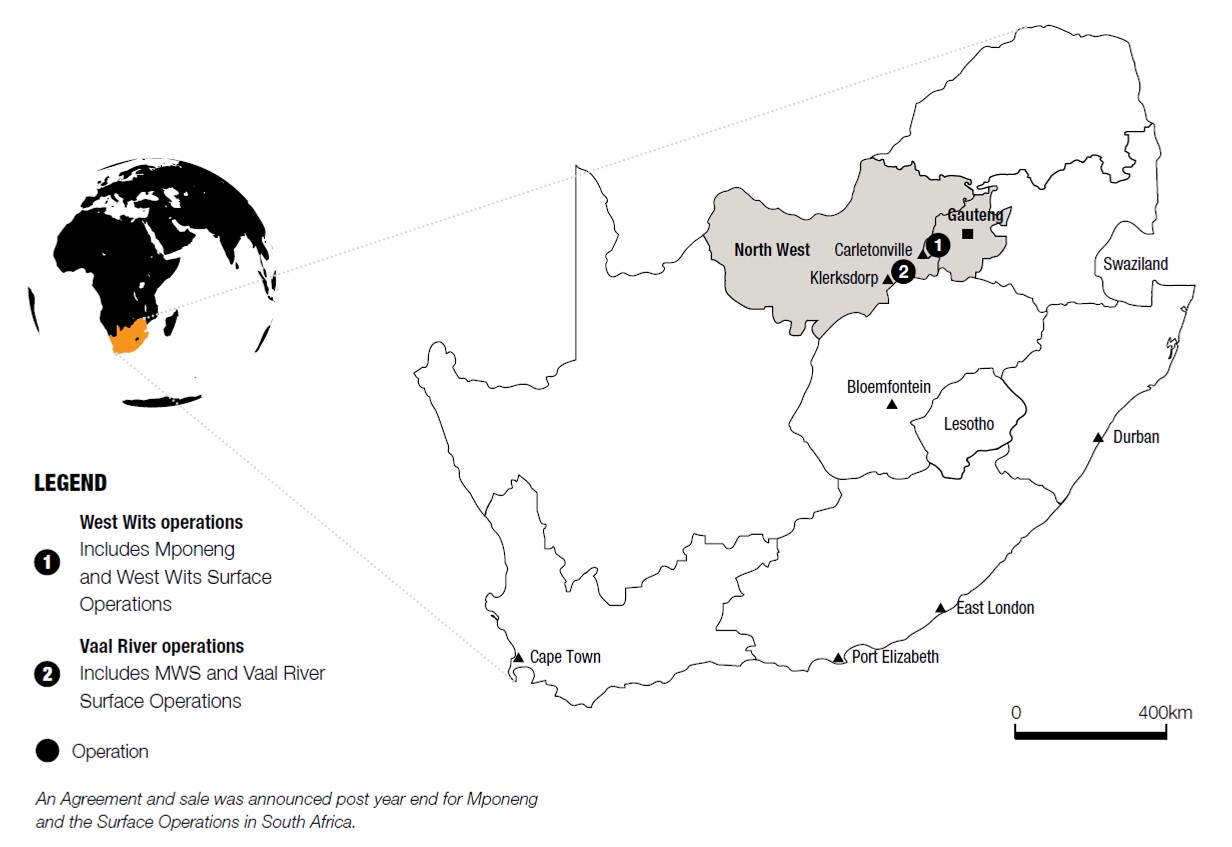

On 12 February 2020, AngloGold Ashanti announced that it reached an agreement to sell its remaining South African producing assets and related liabilities to Harmony Gold Mining Company Limited. The South African asset sale was assessed as a major geographical area of operations and part of a single co-ordinated plan to dispose of a major geographical area of operations and accordingly, it was classified as a discontinued operation.

The financial information contained herein for the years ended 31 December 2019, 2018 and 2017 has been restated to separate continuing operations from discontinued operations in accordance with IFRS 5 Non-current Assets Held for Sale and Discontinued Operations, as a consequence of the classification of the sale of the South African producing assets and related liabilities as a discontinued operation.

Shares and shareholders

In this annual report on Form 20-F, references to ordinary shares, ordinary shareholders, equity shareholders and shareholders/members, should be read as common stock, common stockholders and stockholders, respectively, and vice versa.

CERTAIN FORWARD-LOOKING STATEMENTS

Certain statements contained in this document, other than statements of historical fact, including, without limitation, those concerning the economic outlook for the gold mining industry, expectations regarding gold prices, production, total cash costs, all-in sustaining costs, all-in costs, cost savings and other operating results, productivity improvements, growth prospects and outlook of AngloGold Ashanti’s operations, individually or in the aggregate, including the achievement of project milestones, commencement and completion of commercial operations of certain of AngloGold Ashanti’s exploration and production projects and the completion of acquisitions, dispositions or joint venture transactions, AngloGold Ashanti’s liquidity and capital resources and capital expenditures and the outcome and consequence of any potential or pending litigation or regulatory proceedings or environmental, health and safety issues, are forward-looking statements regarding AngloGold Ashanti’s operations, economic performance and financial condition.

These forward-looking statements or forecasts involve known and unknown risks, uncertainties and other factors that may cause AngloGold Ashanti’s actual results, performance or achievements to differ materially from the anticipated results, performance or achievements expressed or implied in these forward-looking statements. Although AngloGold Ashanti believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. Accordingly, results could differ materially from those set out in the forward-looking statements as a result of among other factors, changes in economic, social and political and market conditions (including as a result of the COVID-19 pandemic), the success of business and operating initiatives, changes in the regulatory environment and other government actions, including environmental approvals, fluctuations in gold prices and exchange rates (including as a result of the COVID-19 pandemic), the outcome of pending or future litigation proceedings and business and operational risk management and other factors as described in “Item 3D: Risk factors”Factors” and elsewhere in this annual report.report (including as a result of the COVID-19 pandemic). These factors are not necessarily all of the important factors that could cause AngloGold Ashanti’s actual results to differ materially from those expressed in any forward-looking statements. Other unknown or unpredictable factors could also have material adverse effects on future results. Consequently, readers are cautioned not to place undue reliance on forward-looking statements.

AngloGold Ashanti undertakes no obligation to update publicly or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this annual report or to reflect the occurrence of unanticipated events, except to the extent required by applicable law. All subsequent written or oral forward-looking statements attributable to AngloGold Ashanti or any person acting on its behalf are qualified by the cautionary statements herein.

GLOSSARY OF SELECTED TERMS

Mining terms

|

|

All injury frequency rate: The total number of injuries and fatalities that occurs per million hours worked. |

BIF: Banded Ironstone Formation. A chemically formed iron-rich sedimentary rock. |

By-products: Any products that emanate from the core process of producing gold, including silver, uranium and sulphuric acid. |

Carbon-in-leach (CIL): Gold is leached from a slurry of gold ore with cyanide in agitated tanks and adsorbed on to activated carbon granules at the same time (i.e. when cyanide is introduced in the leach tank, there is already activated carbon in the tank and there is no distinction between leach and adsorption stages). The carbon granules are separated from the slurry and treated in an elution circuit to remove the gold. |

Carbon-in-pulp (CIP): Gold is leached conventionally from a slurry of gold ore with cyanide in agitated tanks. The leached slurry then passes into the CIP circuit where activated carbon granules are mixed with the slurry and gold is adsorbed on to the activated carbon. The gold-loaded carbon is separated from the slurry and treated in an elution circuit to remove the gold. |

CLR: Carbon leader reef. |

Comminution: Comminution is the crushing and grinding of ore to make gold available for treatment. (See also “Milling”). |

Contained gold: The total gold content (tons multiplied by grade) of the material being described. |

Depletion: The decrease in the quantity of ore in a deposit or property resulting from extraction or production. |

Development: The process of accessing an orebody through shafts and/or tunneling in underground mining operations. |

Diorite: An igneous rock formed by the solidification of molten material (magma). |

Doré: Impure alloy of gold and silver produced at a mine to be refined to a higher purity. |

Electro-winning: A process of recovering gold from solution by means of electrolytic chemical reaction into a form that can be smelted easily into gold bars. |

Elution: Recovery of the gold from the activated carbon into solution before zinc precipitation or electro-winning. |

Feasibility study: A comprehensive technical and economic study of the selected development option for a mineral project that includes appropriately detailed assessments of applicable Modifying Factors together with any other relevant operational factors and detailed financial analysis that are necessary to demonstrate at the time of reporting that extraction is reasonably justified (economically mineable). The results of the study may reasonably serve as the basis for a final decision by a proponent or financial institution to proceed with, or finance, the development of the project. The confidence level of the study will be higher than that of a Pre-Feasibility Study (JORC 2012). |

Flotation: Concentration of gold and gold-hosting minerals into a small mass by various techniques (e.g. collectors, frothers, agitation, air-flow) that collectively enhance the buoyancy of the target minerals, relative to unwanted gangue, for recovery into an over-flowing froth phase. |

Gold Produced: Refined gold in a saleable form derived from the mining process. |

Grade: The quantity of gold contained within a unit weight of gold-bearing material generally expressed in ounces per short ton of ore (oz/t), or grams per metric tonne (g/t). |

Greenschist: A schistose metamorphic rock whose green colour is due to the presence of chlorite, epidote or actinolite. |

Leaching: Dissolution of gold from crushed or milled material, including reclaimed slime, prior to adsorption on to activated carbon or direct zinc precipitation. |

Life of mine (LOM): Number of years for which an operation is planning to mine and treat ore, and is taken from the current mine plan. |

|

|

Metallurgical plant: A processing plant constructed to treat ore and extract gold. |

|

|

Milling: A process of reducing broken ore to a size at which concentrating can be undertaken. (See also “Comminution”). |

Mine call factor: The ratio, expressed as a percentage, of the total quantity of recovered and unrecovered mineral product after processing with the amount estimated in the ore based on sampling. The ratio of contained gold delivered to the metallurgical plant divided by the estimated contained gold of ore mined based on sampling. |

Mineral deposit: A mineral deposit is a concentration (or occurrence) of material of possible economic interest in or on the earth’s crust. |

Mineral Resource: A concentration or occurrence of solid material of economic interest in or on the earth’s crust is such form, grade (or quality), and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade (or quality), continuity and other geological characteristics of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. Mineral Resources are sub-divided in order of increasing geological confidence, into Inferred, Indicated or Measured categories (JORC 2012). |

Modifying Factors: Modifying Factors’ are considerations used to convert Mineral Resource to Ore Reserve. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors. |

Ore Reserve: That part of a mineral deposit which could be economically and legally extracted or produced at the time of the Ore Reserve determination. |

Ounce (oz) (troy): Used in imperial statistics. A kilogram is equal to 32.1507 ounces. A troy ounce is equal to 31.1035 grams. |

Pay limit: The grade of a unit of ore at which the revenue from the recovered mineral content of the ore is equal to the sum of total cash costs, closure costs, Ore Reserve development and stay-in-business capital. This grade is expressed as an in-situ value in grams per tonne or ounces per short ton (before dilution and mineral losses). |

Precipitate: The solid product formed when a change in solution chemical conditions results in conversion of some pre-dissolved ions into solid state. |

Probable Ore Reserve: Ore Reserve for which quantity and grade are computed from information similar to that used for Proven Ore Reserve, but the sites for inspection, sampling, and measurement are further apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for Proven Ore Reserve, is high enough to assume continuity between points of observation. |

Productivity: An expression of labour productivity based on the ratio of ounces of gold produced per month to the total number of employees in mining operations. |

Project capital: Capital expenditure to either bring a new operation into production; to materially increase production capacity; or to materially extend the productive life of an asset. |

Proven Ore Reserve: A ‘Proven Ore Reserve’ is the economically mineable part of a Measured Mineral Resource. A Proven Ore Reserve implies a high degree of confidence in the Modifying Factors. |

Recovered grade: The recovered mineral content per unit of ore treated. |

Reef: A gold-bearing sedimentary horizon, normally a conglomerate band that may contain economic levels of gold. |

Refining: The final purification process of a metal or mineral. |

Rehabilitation: The process of reclaiming land disturbed by mining to allow an appropriate post-mining use. Rehabilitation standards are defined by country-specific laws, including but not limited to the South African Department of Mineral Resources, the US Bureau of Land Management, the US Forest Service, and the relevant Australian mining authorities, and address among other issues, ground and surface water, topsoil, final slope gradient, waste handling and re-vegetation issuesissues. |

Seismic event: A sudden inelastic deformation within a given volume of rock that radiates detectable seismic energy. |

Shaft: A vertical or subvertical excavation used for accessing an underground mine; for transporting personnel, equipment and supplies; for hoisting ore and waste; for ventilation and utilities; and/or as an auxiliary exit. |

Short ton: Used in imperial statistics. Equal to 2,000 pounds. |

|

|

Smelting: A pyro-metallurgical operation in which gold precipitate from electro-winning or zinc precipitation is further separated from impurities. |

|

|

Stoping: The process of excavating ore underground. |

Stripping ratio: The ratio of waste tonnes to ore tonnes mined calculated as total tonnes mined less ore tonnes mined divided by ore tonnes mined. |

Tailings: Finely ground rock of low residual value from which valuable minerals have been extracted. |

Tonnage: Quantity of material measured in tonnes or tons. |

Tonne: Used in metric statistics. Equal to 1,000 kilograms. |

VCR: Ventersdorp Contact Reef. |

Waste: Material that contains insufficient mineralisation for consideration for future treatment and, as such, is discarded. |

Yield: The amount of valuable mineral or metal recovered from each unit mass of ore expressed as ounces per short ton or grams per metric tonne. |

Zinc precipitation: Zinc precipitation is the chemical reaction using zinc dust that converts gold in solution to a solid form for smelting into unrefined gold bars. |

Financial terms

|

|

All-in costs: All-in costs are all-in sustaining costs including additional non-sustaining costs which reflect the varying costs of producing gold over the life-cycle of a mine. Non-sustaining costs are those costs incurred at new operations and costs related to ‘major projects’ at existing operations where these projects will materially increase production. All-in costs per ounce is arrived at by dividing the dollar value of the sum of these cost metrics, by the ounces of gold sold. |

All-in sustaining costs:costs (AISC): During June 2013 the World Gold Council (WGC), an industry body, published a Guidance Note on the “all-in sustaining costs” metric, which gold mining companies can use to supplement their overall non-GAAP disclosure. “All-in sustaining costs” is an extension of the existing “total cash cost” metric and incorporates all costs related to sustaining production and in particular recognises the sustaining capital expenditure associated with developing and maintaining gold mines. In addition, this metric includes the cost associated with developing and maintaining gold mines, the cost associated with corporate office structures that support these operations, the community and rehabilitation costs attendant with responsible mining and any exploration and evaluation costs associated with sustaining current operations. All-in sustaining costs per ounce is arrived at by dividing the dollar value of the sum of these cost metrics, by the ounces of gold sold. |

Average gold price received per ounce: Average gold price received per ounce is the sum of proceeds from gold sales in the spot market and sales from Mine Waste Solution to Franco-Nevada Corporation at contracted prices, divided by gold sales in ounces. |

Average number of employees: The monthly average number of production and non-production employees and contractors employed during the year, where contractors are defined as individuals who have entered into a fixed-term contract of employment with a group company or subsidiary. Employee numbers of joint ventures represent the group’s attributable share. |

Capital expenditure: Total capital expenditure on tangible assets. |

Effective tax rate: Current and deferred taxation charge for the year as a percentage of profit before taxation. |

Market spot gold price: The price of gold traded at any given moment on the Over-The-Counter(OTC) wholesale market of which the transaction will be settled in two business days’ time. |

Non-sustaining capital expenditure: Capital expenditure incurred at new operations and capital expenditure related to ‘major projects’ at existing operations where these projects will materially increase production. .

|

Rated bonds: The $700 million 5.375 percent bonds due 2020, $300 million 6.5 percent bonds due 2040 and the $750 million 5.125 percent bonds due 2022. |

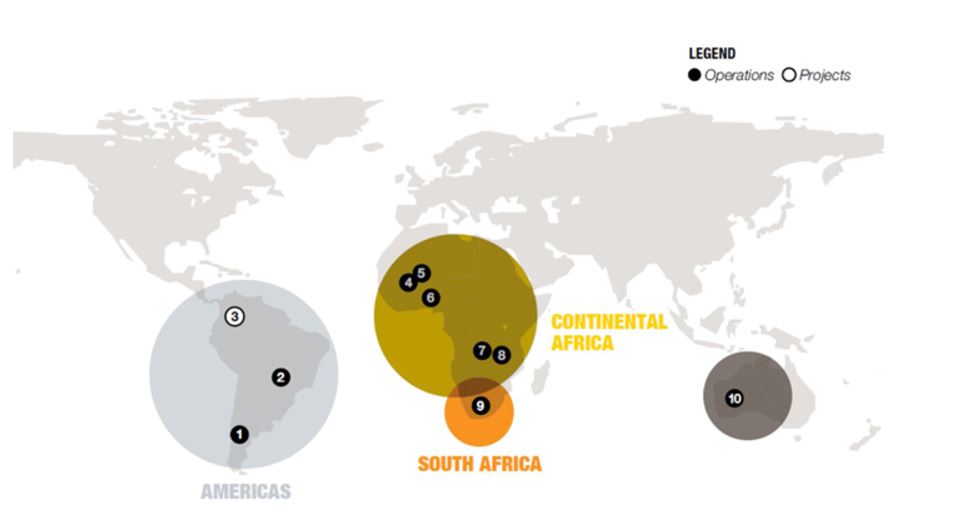

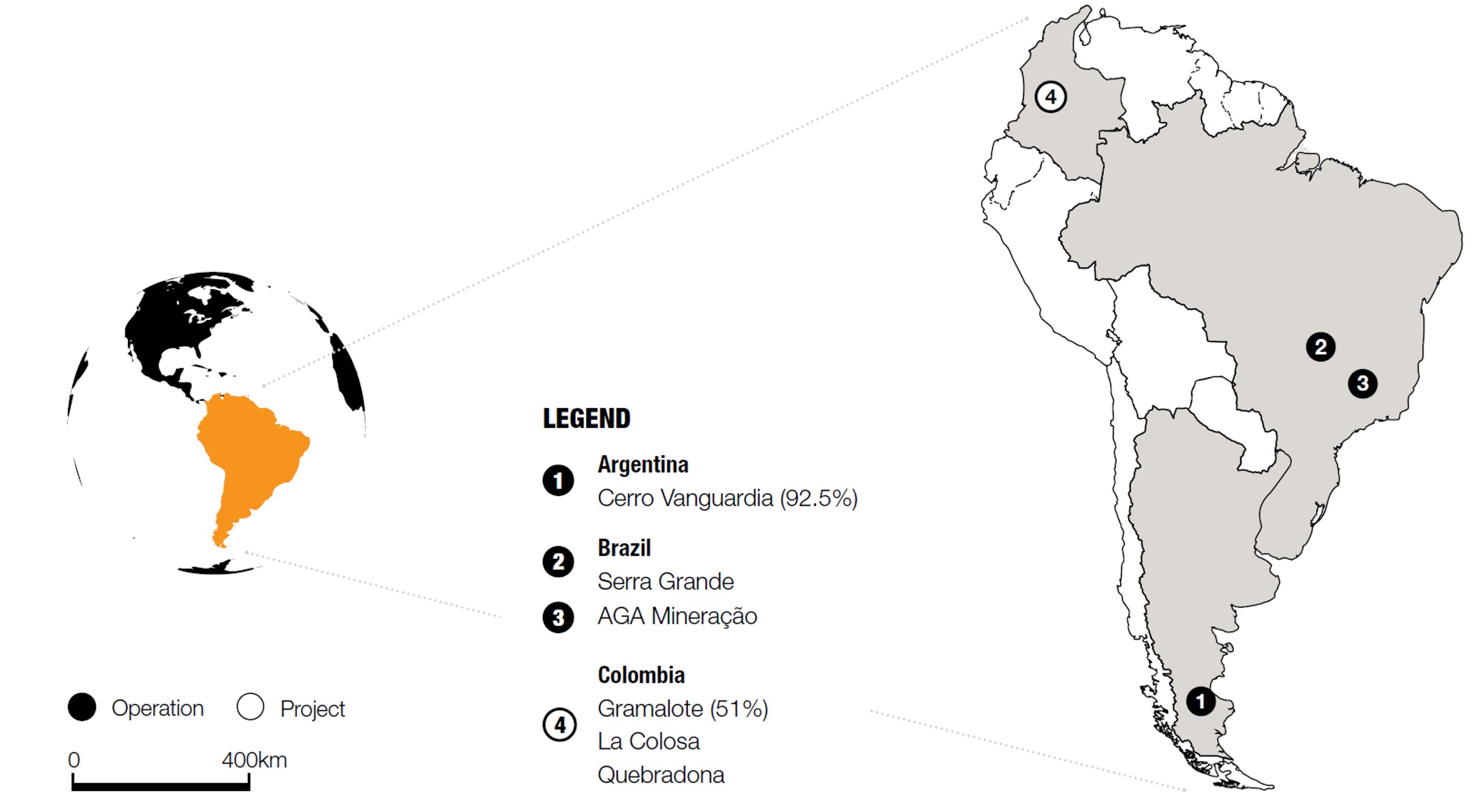

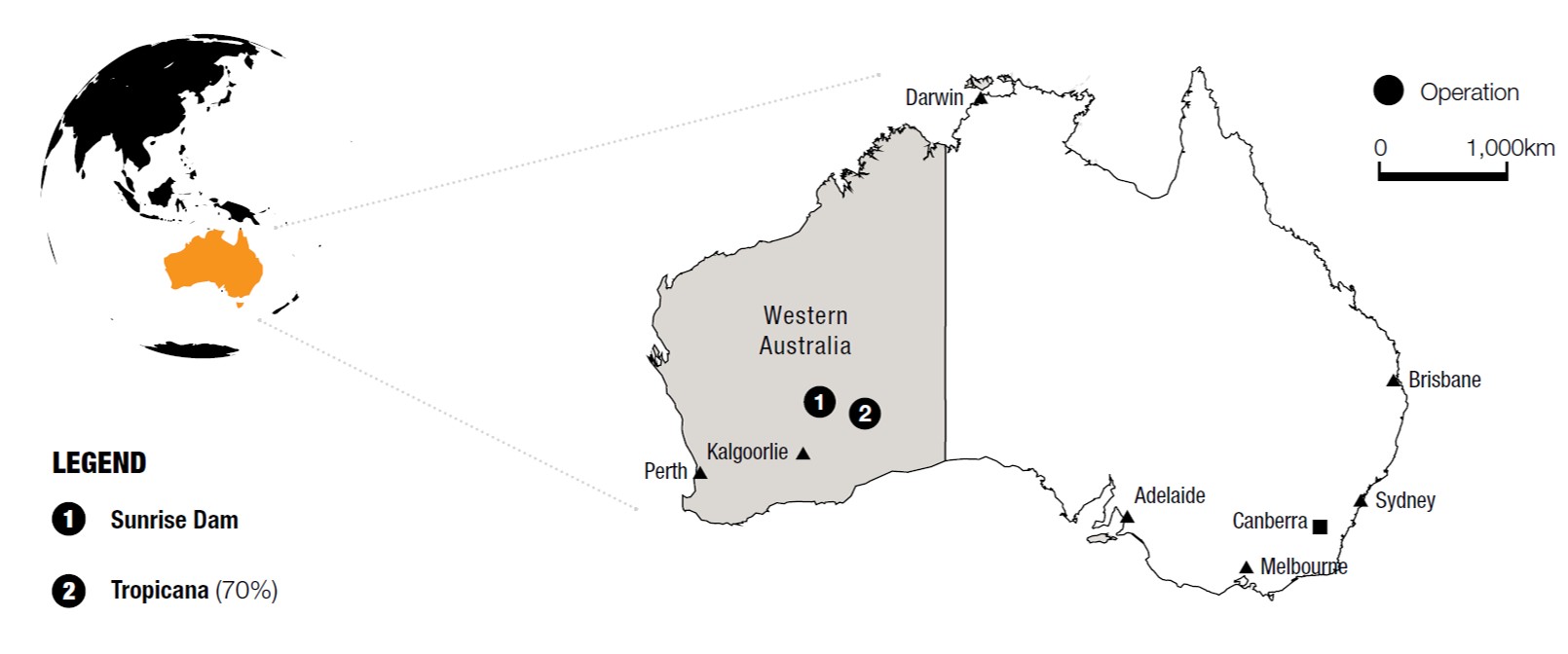

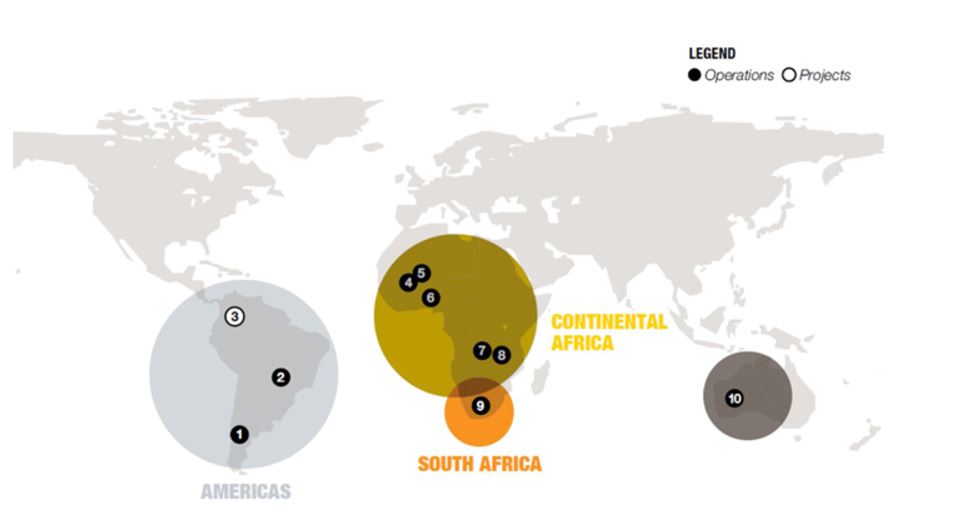

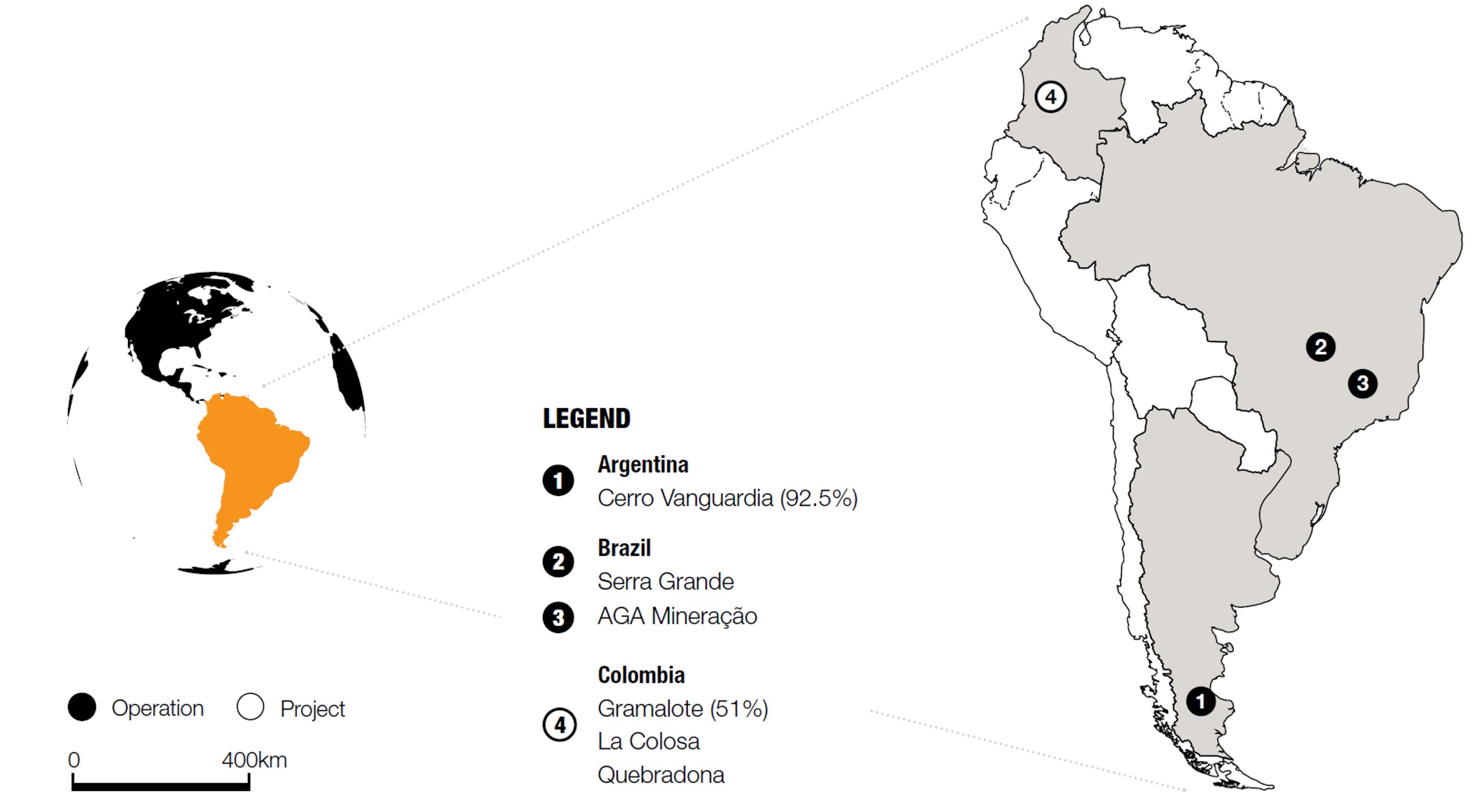

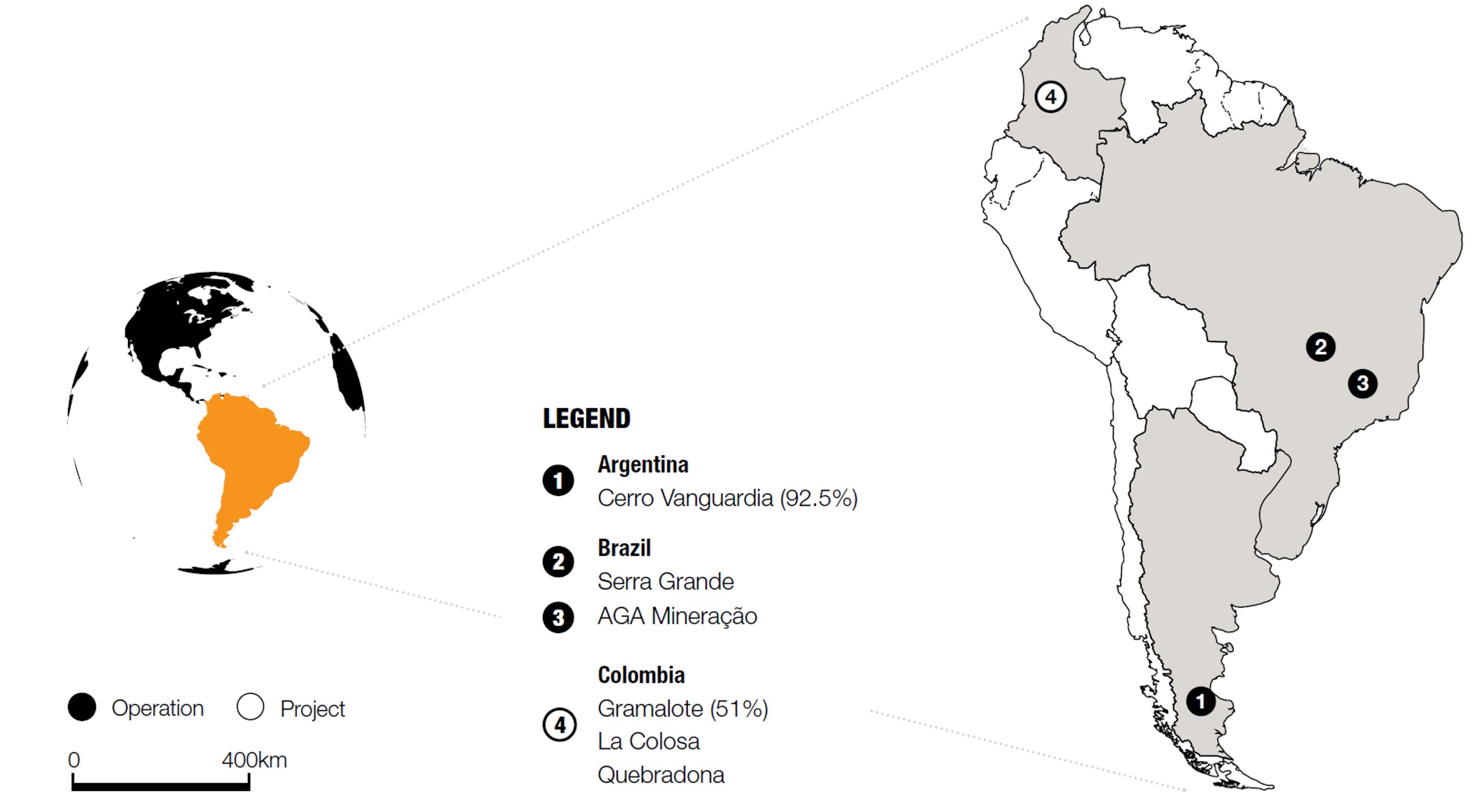

Region: Defines the operational management divisions within AngloGold Ashanti Limited, namely South Africa, Continental Africa (DRC, Ghana, Guinea, Mali and Tanzania), AustralasiaAustralia and the Americas (Argentina and Brazil). |

Related party: Parties are considered related if one party has the ability to control the other party or exercise significant influence over the other party in making financial and operating decisions or if such parties are under common control. |

Significant influence: The ability, directly or indirectly, to participate in, but not exercise control over, the financial and operating policy decision of an entity so as to obtain economic benefit from its activities. |

Stay-in-business capital: Capital expenditure to extend useful lives of existing production assets. This includes replacement of vehicles, plant and machinery, Ore Reserve development, deferred stripping and capital expenditure related to financial benefit initiatives, safety, health and the environment.

|

Strate: The licensed Central Securities Depository (CSD) for the electronic settlement of financial instruments in South Africa. |

Sustaining capital: Capital expenditure incurred to sustain and maintain existing assets at their current productive capacity in order to achieve constant planned levels of productive output. |

Total cash costs:costs (net of by-product revenue): Total cash costs net of by-product revenue include site costs for all mining, processing and administration reduced by contributions from by-products and are inclusive of royalties and production taxes. Depreciation, depletion and amortisation, rehabilitation, corporate administration, employee severance costs, capital and exploration costs are excluded. Total cash costs net of by-product revenue per ounce are the attributable total cash costs divided by the attributable ounces of gold produced. |

Total production costs: Total cash costs plus depreciation, depletion and amortisation, employee severance costs, rehabilitation and other non-cash costs. Corporate administration, exploration costs, other operating expenditure and costs reflected as special items are excluded. Total production costs per ounce are the attributable total production costs divided by the attributable ounces of gold produced.

|

Weighted average number of ordinary shares: The number of ordinary shares in issue at the beginning of the year, increased by shares issued during the year, weighted on a time basis for the period during which they have participated in the income of the group, and increased by share options that are virtually certain to be exercised. |

Currencies

|

| |

| $, US$, USD, US dollars or dollar | United States dollars |

| ARS | Argentinean peso |

| A$, Australian dollars or AUD | Australian dollars |

| BRL | Brazilian real |

| € or Euro | European Euro |

GHC,GHS, cedi or Gh¢ | Ghanaian cedi |

TshTZS | Tanzanian Shillings |

| ZAR, R or rand | South African rands |

Abbreviations

|

| |

| ADR | American Depositary Receipt |

| ADS | American Depositary Share |

| AIFR | All injury frequency rate |

| ASX | Australian Securities Exchange |

| Au | Contained gold |

| BBBEE | Broad-Based Black Economic Empowerment |

| BBSY | Bank Bill Swap Bid Rate |

| BEE | Black Economic Empowerment |

| bn | Billion |

| CDI | Chess Depositary Interests |

| CHESS | Clearing House Electronic Settlement System |

CLRCompanies Act | Carbon Leader Reef |

CR | Crystalkop Reef |

DMTNP | Domestic medium-term notes programmeSouth African Companies Act, No. 71 of 2008, as amended |

| DRC | Democratic Republic of the Congo |

| ERP | Enterprise resource planning |

| Exchange Act | United States Securities Exchange Act of 1934, as amended |

| FVTOCI | Fair value through other comprehensive income |

| FVTPL | Fair value through profit or loss |

| G or g | Grams |

| GhDS | Ghanaian Depositary Share |

| GhSE | Ghana Stock Exchange |

| IASB | International Accounting Standards Board |

| IFRS | International Financial Reporting Standards as issued by the IASB |

| JIBAR | Johannesburg Interbank Agreed Rate |

| JORC | Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves |

| JSE | JSE Limited (Johannesburg Stock Exchange) |

| King III and IV | The King Report on Corporate Governance for South Africa |

| Kg or kg | Kilograms |

| Km or km | Kilometres |

Km2Km2 | SquaredSquare kilometres |

| Koz | Thousand ounces |

| LIBOR | London Interbank Offer Rate |

| M or m | Metre or million, depending on the context |

| Mlbs | Million pounds |

| Moz | Million ounces |

| Mt | Million tonnes or tons |

| Mtpa | Million tonnes/tons per annum |

| NYSE | New York Stock Exchange |

| Oz or oz | Ounces (troy) |

| oz/t | Ounces per ton |

| oz/TEC | Ounces per total employee costed |

| SAMREC | South African Code for the Reporting of Exploration Results, Mineral Resources and Mineral Reserves 2016 edition |

| SEC | United States Securities and Exchange Commission |

The CompaniesSecurities Act | South African CompaniesUnited States Securities Act No. 71 of 2008,1933, as amended |

| T or t | Tons (short) or tonnes (metric) |

| Tpa or tpa | Tonnes/tons per annum |

| TSF | Tailings storage facility |

| US/U.S./USA/United States | United States of America |

VR | Vaal Reef |

VCR | Ventersdorp Contact Reef |

| XBRL | eXtensible Business Reporting Language |

Note: Rounding of figures in this report may result in computational discrepancies.

PART I

ITEM 1: IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

Not applicable.

ITEM 2: OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3: KEY INFORMATION

| |

| 3A. | SELECTED FINANCIAL DATA |

The selected financial information set forth below for the years ended and as at 31 December 2017, 20162019, 2018 and 20152017 has been derived from, and should be read in conjunction with, the IFRS financial statements included under Item 18 of this annual report. The selected financial information for the years ended and as at 31 December 20142016 and 20132015 has been derived from the IFRS financial statements not included in this annual report.

|

| | | | | | | | | | | | | | |

| | Year ended 31 December |

| | 2019 |

| | 2018 |

| | 2017 |

| | 2016 (1) |

| | 2015 (1) |

|

| | $ |

| | $ |

| | $ |

| | $ |

| | $ |

|

| | (in millions, except share and per share amounts) |

| Consolidated income statement | | | | | | | | | |

| Revenue from product sales | 3,525 |

| | 3,336 |

| | 3,394 |

| | 4,223 |

| | 4,015 |

|

| Cost of sales | (2,626 | ) | | (2,584 | ) | | (2,607 | ) | | (3,401 | ) | | (3,294 | ) |

| Gain (loss) on non-hedge derivatives and other commodity contracts | 5 |

| | (2 | ) | | — |

| | 19 |

| | (7 | ) |

| Gross profit | 904 |

| | 750 |

| | 787 |

| | 841 |

| | 714 |

|

| Corporate administration, marketing and other expenses | (82 | ) | | (76 | ) | | (64 | ) | | (61 | ) | | (78 | ) |

| Exploration and evaluation costs | (112 | ) | | (98 | ) | | (105 | ) | | (133 | ) | | (132 | ) |

| Impairment, derecognition of assets and p/l on disposal | (6 | ) | | (7 | ) | | (2 | ) | | — |

| | — |

|

| Other expenses (income) | (83 | ) | | (79 | ) | | (150 | ) | | — |

| | — |

|

| Other operating expenses | — |

| | — |

| | — |

| | (110 | ) | | (96 | ) |

| Special items | — |

| | — |

| | — |

| | (42 | ) | | (71 | ) |

| Operating profit (loss) | 621 |

| | 490 |

| | 466 |

| | 495 |

| | 337 |

|

| Dividends received | — |

| | 2 |

| | — |

| | — |

| | — |

|

| Interest income | 14 |

| | 8 |

| | 8 |

| | 22 |

| | 28 |

|

| Foreign exchange losses | (12 | ) | | (9 | ) | | (11 | ) | | (88 | ) | | (17 | ) |

| Finance costs and unwinding of obligations | (172 | ) | | (168 | ) | | (157 | ) | | (180 | ) | | (245 | ) |

| Fair value adjustments | — |

| | — |

| | — |

| | 9 |

| | 66 |

|

| Share of associates and joint ventures’ profit (loss) | 168 |

| | 122 |

| | 22 |

| | 11 |

| | 88 |

|

| Profit (loss) before taxation | 619 |

| | 445 |

| | 328 |

| | 269 |

| | 257 |

|

| Taxation | (250 | ) | | (212 | ) | | (163 | ) | | (189 | ) | | (211 | ) |

| Profit (loss) after taxation from continuing operations | 369 |

| | 233 |

| | 165 |

| | 80 |

| | 46 |

|

| Discontinued operations | | | | | | | | | |

| Profit (loss) from discontinued operations | (376 | ) | | (83 | ) | | (336 | ) | | | | (116 | ) |

| Profit (loss) for the year | (7 | ) | | 150 |

| | (171 | ) | | 80 |

| | (70 | ) |

| | | | | | | | | | |

| Allocated as follows | | | | | | | | | |

| Equity shareholders | | | | | | | | | |

| - Continuing operations | 364 |

| | 216 |

| | 145 |

| | 63 |

| | 31 |

|

| - Discontinued operations | (376 | ) | | (83 | ) | | (336 | ) | | — |

| | (116 | ) |

| Non-controlling interests | | | | | | | | | |

| - Continuing operations | 5 |

| | 17 |

| | 20 |

| | 17 |

| | 15 |

|

| | (7 | ) | | 150 |

| | (171 | ) | | 80 |

| | (70 | ) |

| | | | | | | | | | |

| Basic earnings (loss) per ordinary share (U.S. cents) | (3 | ) | | 32 |

| | (46 | ) | | 15 |

| | (20 | ) |

| Earnings (loss) per ordinary share from continuing operations | 87 |

| | 52 |

| | 35 |

| | 15 |

| | 8 |

|

| Earnings (loss) per ordinary share from discontinued operations | (90 | ) | | (20 | ) | | (81 | ) | | — |

| | (28 | ) |

| | | | | | | | | | |

| Diluted earnings (loss) per ordinary share (U.S. cents) | (3 | ) | | 32 |

| | (46 | ) | | 15 |

| | (20 | ) |

| Earnings (loss) per ordinary share from continuing operations | 87 |

| | 52 |

| | 35 |

| | 15 |

| | 8 |

|

| Earnings (loss) per ordinary share from discontinued operations | (90 | ) | | (20 | ) | | (81 | ) | | — |

| | (28 | ) |

| Dividend per ordinary share (U.S. cents) | 7 |

| | 6 |

| | 10 |

| | — |

| | — |

|

| |

(1) | The selected financial information presented for the years ended 31 December 2016 and 2015 has not been reclassified for the changes in disclosure of "Special items" or restated to reflect the disposal of the South African assets and liabilities as a discontinued operation, as such financial information cannot be provided on a reclassified or restated basis without unreasonable effort and expense. The discontinued operation reported in 2015 related to the sale of Cripple Creek &Victor gold mine to Newmont Corp. |

|

| | | | | | | | | | | | | | |

| | Year ended 31 December |

| | 2017 |

| | 2016 |

| | 2015 |

| | 2014 |

| | 2013 |

|

| | $ |

| | $ |

| | $ |

| | $ |

| | $ |

|

| | (in millions, except share and per share amounts) |

| Consolidated income statement | | | | | | | | | |

| Revenue | 4,543 |

| | 4,254 |

| | 4,174 |

| | 5,110 |

| | 5,383 |

|

| Gold income | 4,356 |

| | 4,085 |

| | 4,015 |

| | 4,952 |

| | 5,172 |

|

| Cost of sales | (3,582 | ) | | (3,263 | ) | | (3,294 | ) | | (3,972 | ) | | (3,947 | ) |

| Gain (loss) on non-hedge derivatives and other commodity contracts | 10 |

| | 19 |

| | (7 | ) | | 13 |

| | 94 |

|

| Gross profit | 784 |

| | 841 |

| | 714 |

| | 993 |

| | 1,319 |

|

| Corporate administration, marketing, other expenses and other income | (64 | ) | | (61 | ) | | (78 | ) | | (92 | ) | | (201 | ) |

| Exploration and evaluation costs | (114 | ) | | (133 | ) | | (132 | ) | | (142 | ) | | (250 | ) |

| Other operating expenses | (88 | ) | | (110 | ) | | (96 | ) | | (28 | ) | | (19 | ) |

| Special items | (438 | ) | | (42 | ) | | (71 | ) | | (260 | ) | | (2,951 | ) |

| Operating profit (loss) | 80 |

| | 495 |

| | 337 |

| | 471 |

| | (2,102 | ) |

| Dividends received | — |

| | — |

| | — |

| | — |

| | 5 |

|

| Interest received | 15 |

| | 22 |

| | 28 |

| | 24 |

| | 39 |

|

| Exchange gain (loss) | (11 | ) | | (88 | ) | | (17 | ) | | (7 | ) | | 14 |

|

| Finance costs and unwinding of obligations | (169 | ) | | (180 | ) | | (245 | ) | | (276 | ) | | (293 | ) |

| Fair value adjustment on issued bonds | — |

| | 9 |

| | 66 |

| | (17 | ) | | 307 |

|

| Share of associates and joint ventures’ profit (loss) | 22 |

| | 11 |

| | 88 |

| | (25 | ) | | (162 | ) |

| Profit (loss) before taxation | (63 | ) | | 269 |

| | 257 |

| | 170 |

| | (2,192 | ) |

| Taxation | (108 | ) | | (189 | ) | | (211 | ) | | (225 | ) | | 237 |

|

| Profit (loss) after taxation from continuing operations | (171 | ) | | 80 |

| | 46 |

| | (55 | ) | | (1,955 | ) |

| Discontinued operations | | | | | | | | | |

| Profit (loss) from discontinued operations | — |

| | — |

| | (116 | ) | | 16 |

| | (245 | ) |

| Profit (loss) for the year | (171 | ) | | 80 |

| | (70 | ) | | (39 | ) | | (2,200 | ) |

| | | | | | | | | | |

| Allocated as follows | | | | | | | | | |

| Equity shareholders | | | | | | | | | |

| - Continuing operations | (191 | ) | | 63 |

| | 31 |

| | (74 | ) | | (1,985 | ) |

| - Discontinued operations | — |

| | — |

| | (116 | ) | | 16 |

| | (245 | ) |

| Non-controlling interests | | | | | | | | | |

| - Continuing operations | 20 |

| | 17 |

| | 15 |

| | 19 |

| | 30 |

|

| | (171 | ) | | 80 |

| | (70 | ) | | (39 | ) | | (2,200 | ) |

| | | | | | | | | | |

| Basic earnings (loss) per ordinary share (cents) | (46 | ) | | 15 |

| | (20 | ) | | (14 | ) | | (568 | ) |

| Earnings (loss) per ordinary share from continuing operations | (46 | ) | | 15 |

| | 8 |

| | (18 | ) | | (506 | ) |

| Earnings (loss) per ordinary share from discontinued operations | — |

| | — |

| | (28 | ) | | 4 |

| | (62 | ) |

| | | | | | | | | | |

| Diluted earnings (loss) per ordinary share (cents) | (46 | ) | | 15 |

| | (20 | ) | | (14 | ) | | (631 | ) |

| Earnings (loss) per ordinary share from continuing operations | (46 | ) | | 15 |

| | 8 |

| | (18 | ) | | (571 | ) |

| Earnings (loss) per ordinary share from discontinued operations | — |

| | — |

| | (28 | ) | | 4 |

| | (62 | ) |

| Dividend per ordinary share (cents) | 10 |

| | — |

| | — |

| | — |

| | 10 |

|

| | | | As at 31 December | As at 31 December |

| | 2017 |

| | 2016 |

| | 2015 |

| | 2014 |

| | 2013 |

| 2019 |

| | 2018 |

| | 2017 |

| | 2016 |

| | 2015 |

|

| | $ |

| | $ |

| | $ |

| | $ |

| | $ |

| $ |

| | $ |

| | $ |

| | $ |

| | $ |

|

| | (in millions, except share and per share amounts) | (in millions, except share and per share amounts) |

| Consolidated balance sheet data | | | | | | | | | | | | | | | | | | |

| ASSETS | | | | | | | | | | | | | | | | | | |

| Non-current assets | | | | | | | | | | | | | | | | | | |

| Tangible assets | 3,742 |

| | 4,111 |

| | 4,058 |

| | 4,863 |

| | 4,815 |

| 2,592 |

| | 3,381 |

| | 3,742 |

| | 4,111 |

| | 4,058 |

|

| Right of use assets | | 158 |

| | — |

| | — |

| | — |

| | — |

|

| Intangible assets | 138 |

| | 145 |

| | 161 |

| | 225 |

| | 267 |

| 123 |

| | 123 |

| | 138 |

| | 145 |

| | 161 |

|

| Investments in associates and joint ventures | 1,507 |

| | 1,448 |

| | 1,465 |

| | 1,427 |

| | 1,327 |

| 1,581 |

| | 1,528 |

| | 1,507 |

| | 1,448 |

| | 1,465 |

|

| Other investments | 131 |

| | 125 |

| | 91 |

| | 126 |

| | 131 |

| 76 |

| | 141 |

| | 131 |

| | 125 |

| | 91 |

|

| Inventories | 100 |

| | 84 |

| | 90 |

| | 636 |

| | 586 |

| 93 |

| | 106 |

| | 100 |

| | 84 |

| | 90 |

|

| Trade, other receivables and other assets | 67 |

| | 34 |

| | 13 |

| | 20 |

| | 29 |

| 122 |

| | 102 |

| | 67 |

| | 34 |

| | 13 |

|

| Deferred taxation | 4 |

| | 4 |

| | 1 |

| | 127 |

| | 177 |

| 105 |

| | — |

| | 4 |

| | 4 |

| | 1 |

|

| Cash restricted for use | 37 |

| | 36 |

| | 37 |

| | 36 |

| | 31 |

| 31 |

| | 35 |

| | 37 |

| | 36 |

| | 37 |

|

| Other non-current assets | — |

| | — |

| | 18 |

| | 25 |

| | 41 |

| — |

| | — |

| | — |

| | — |

| | 18 |

|

| | 5,726 |

| | 5,987 |

| | 5,934 |

| | 7,485 |

| | 7,404 |

| 4,881 |

| | 5,416 |

| | 5,726 |

| | 5,987 |

| | 5,934 |

|

| Current assets | | | | | | | | | | | | | | | | | | |

| Other investments | 7 |

| | 5 |

| | 1 |

| | — |

| | 1 |

| 10 |

| | 6 |

| | 7 |

| | 5 |

| | 1 |

|

| Inventories | 683 |

| | 672 |

| | 646 |

| | 888 |

| | 1,053 |

| 632 |

| | 652 |

| | 683 |

| | 672 |

| | 646 |

|

| Trade, other receivables and other assets | 222 |

| | 255 |

| | 196 |

| | 278 |

| | 369 |

| 250 |

| | 209 |

| | 222 |

| | 255 |

| | 196 |

|

| Cash restricted for use | 28 |

| | 19 |

| | 23 |

| | 15 |

| | 46 |

| 33 |

| | 31 |

| | 28 |

| | 19 |

| | 23 |

|

| Cash and cash equivalents | 205 |

| | 215 |

| | 484 |

| | 468 |

| | 648 |

| 456 |

| | 329 |

| | 205 |

| | 215 |

| | 484 |

|

| | 1,145 |

| | 1,166 |

| | 1,350 |

| | 1,649 |

| | 2,117 |

| 1,381 |

| | 1,227 |

| | 1,145 |

| | 1,166 |

| | 1,350 |

|

| Non-current assets held for sale | 348 |

| | — |

| | — |

| | — |

| | 153 |

| |

| Assets held for sale | | 601 |

| | — |

| | 348 |

| | — |

| | — |

|

| | 1,493 |

| | 1,166 |

| | 1,350 |

| | 1,649 |

| | 2,270 |

| 1,982 |

| | 1,227 |

| | 1,493 |

| | 1,166 |

| | 1,350 |

|

| Total assets | 7,219 |

| | 7,153 |

| | 7,284 |

| | 9,134 |

| | 9,674 |

| 6,863 |

| | 6,643 |

| | 7,219 |

| | 7,153 |

| | 7,284 |

|

| EQUITY AND LIABILITIES | | | | | | | | | | | | | | | | | | |

| Share capital and premium | 7,134 |

| | 7,108 |

| | 7,066 |

| | 7,041 |

| | 7,006 |

| 7,199 |

| | 7,171 |

| | 7,134 |

| | 7,108 |

| | 7,066 |

|

| Accumulated losses and other reserves | (4,471 | ) | | (4,393 | ) | | (4,636 | ) | | (4,196 | ) | | (3,927 | ) | (4,559 | ) | | (4,519 | ) | | (4,471 | ) | | (4,393 | ) | | (4,636 | ) |

| Shareholders’ equity | 2,663 |

| | 2,715 |

| | 2,430 |

| | 2,845 |

| | 3,079 |

| 2,640 |

| | 2,652 |

| | 2,663 |

| | 2,715 |

| | 2,430 |

|

| Non-controlling interests | 41 |

| | 39 |

| | 37 |

| | 26 |

| | 28 |

| 36 |

| | 42 |

| | 41 |

| | 39 |

| | 37 |

|

| Total equity | 2,704 |

| | 2,754 |

| | 2,467 |

| | 2,871 |

| | 3,107 |

| 2,676 |

| | 2,694 |

| | 2,704 |

| | 2,754 |

| | 2,467 |

|

| Non-current liabilities | | | | | | | | | | | | | | | | | | |

| Borrowings | 2,230 |

| | 2,144 |

| | 2,637 |

| | 3,498 |

| | 3,633 |

| 1,299 |

| | 1,911 |

| | 2,230 |

| | 2,144 |

| | 2,637 |

|

| Lease liabilities | | 126 |

| | — |

| | — |

| | — |

| | — |

|

| Environmental rehabilitation and other provisions | 942 |

| | 877 |

| | 847 |

| | 1,052 |

| | 963 |

| 697 |

| | 827 |

| | 942 |

| | 877 |

| | 847 |

|

| Provision for pension and post-retirement benefits | 122 |

| | 118 |

| | 107 |

| | 147 |

| | 152 |

| 100 |

| | 100 |

| | 122 |

| | 118 |

| | 107 |

|

| Trade, other payables and deferred income | 3 |

| | 4 |

| | 5 |

| | 15 |

| | 4 |

| |

| Trade, other payables and provisions | | 15 |

| | 3 |

| | 3 |

| | 4 |

| | 5 |

|

| Deferred taxation | 363 |

| | 496 |

| | 514 |

| | 567 |

| | 579 |

| 241 |

| | 315 |

| | 363 |

| | 496 |

| | 514 |

|

| | 3,660 |

| | 3,639 |

| | 4,110 |

| | 5,279 |

| | 5,331 |

| 2,478 |

| | 3,156 |

| | 3,660 |

| | 3,639 |

| | 4,110 |

|

| Current liabilities | | | | | | | | | | | | | | | | | | |

| Borrowings | 38 |

| | 34 |

| | 100 |

| | 223 |

| | 258 |

| 734 |

| | 139 |

| | 38 |

| | 34 |

| | 100 |

|

| Trade, other payables and deferred income | 638 |

| | 615 |

| | 516 |

| | 695 |

| | 820 |

| |

| Bank overdraft | — |

| | — |

| | — |

| | — |

| | 20 |

| |

| Lease liabilities | | 45 |

| | — |

| | — |

| | — |

| | — |

|

| Trade, other payables and provisions | | 586 |

| | 594 |

| | 638 |

| | 615 |

| | 516 |

|

| Taxation | 53 |

| | 111 |

| | 91 |

| | 66 |

| | 81 |

| 72 |

| | 60 |

| | 53 |

| | 111 |

| | 91 |

|

| | 729 |

| | 760 |

| | 707 |

| | 984 |

| | 1,179 |

| 1,437 |

| | 793 |

| | 729 |

| | 760 |

| | 707 |

|

| Non-current liabilities held for sale | 126 |

| | — |

| | — |

| | — |

| | 57 |

| |

| Liabilities held for sale | | 272 |

| | — |

| | 126 |

| | — |

| | — |

|

| | 855 |

| | 760 |

| | 707 |

| | 984 |

| | 1,236 |

| 1,709 |

| | 793 |

| | 855 |

| | 760 |

| | 707 |

|

| Total liabilities | 4,515 |

| | 4,399 |

| | 4,817 |

| | 6,263 |

| | 6,567 |

| 4,187 |

| | 3,949 |

| | 4,515 |

| | 4,399 |

| | 4,817 |

|

| Total equity and liabilities | 7,219 |

| | 7,153 |

| | 7,284 |

| | 9,134 |

| | 9,674 |

| 6,863 |

| | 6,643 |

| | 7,219 |

| | 7,153 |

| | 7,284 |

|

| Number of ordinary shares as adjusted to reflect changes in share capital | 410,054,615 |

| | 408,223,760 |

| | 405,265,315 |

| | 404,010,360 |

| | 402,628,406 |

| 415,301,215 |

| | 412,769,980 |

| | 410,054,615 |

| | 408,223,760 |

| | 405,265,315 |

|

| Share capital (exclusive of long-term debt and redeemable preference shares) | 16 |

| | 16 |

| | 16 |

| | 16 |

| | 16 |

| 17 |

| | 16 |

| | 16 |

| | 16 |

| | 16 |

|

| Net assets | 2,704 |

| | 2,754 |

| | 2,467 |

| | 2,871 |

| | 3,107 |

| 2,676 |

| | 2,694 |

| | 2,704 |

| | 2,754 |

| | 2,467 |

|

Annual dividends

The table below sets forth the amounts of interim, final and total dividends declared in respect of the past five years in cents per ordinary share.

| | Year ended 31 December (1) | 2017 (3) |

| | 2016 |

| | 2015 |

| | 2014 |

| | 2013 |

| 2019 |

| | 2018 |

| | 2017 |

| | 2016 |

| | 2015 |

|

| South African cents per ordinary share | 130 |

| | — |

| | — |

| | — |

| | 100 |

| 95 |

| | 70 |

| | 130 |

| | — |

| | — |

|

| | | | | | | | | | | | | | | | | | | |

US cents per ordinary share(2) | 10 |

| | — |

| | — |

| | — |

| | 10 |

| 7 |

| | 6 |

| | 10 |

| | — |

| | — |

|

| |

(1) | During 2013,Since 2017, the Company changeddividend policy allows the frequencycompany's Board of Directors, at its discretion, to declare an annual dividend payments to be dependent uponbased on 10 percent of the board’s ongoing assessment of AngloGold Ashanti’s earnings.free cash flow generated by the business, before growth capital expenditure, for that financial year. |

| |

(2) | Dividends for these periods were declared in South African cents. US dollar cents per share figures have been calculated based on exchange rates prevailing on each of the respective payment dates. |

| |

(3)

| The dividend policy allows the Board, at its discretion, to declare an annual dividend to be based on 10 percent of the free cash flow generated by the business, before growth capital expenditure, for that financial year. |

For further information on the company’s policy on dividend distributions, see “Item 8A: Consolidated Financial Statements and Other Financial Information—Dividends”.

Exchange rate information

The following table sets forth, for the periods and dates indicated, certain information concerning US dollar/South African rand exchange rates expressed in rands per $1.00. On 19 March 2018, the exchange rate between South African rands and US dollars as reported by Reuters was R12.01/$1.00.

|

| | | | | | | | | | | | |

Year ended 31 December (2) | High |

| | Low |

| | Year end |

| | Average (1) |

|

| 2013 | 10.51 |

| | 8.47 |

| | 10.49 |

| | 9.63 |

|

| 2014 | 11.69 |

| | 10.28 |

| | 11.60 |

| | 10.84 |

|

| 2015 | 15.87 |

| | 11.36 |

| | 15.53 |

| | 12.77 |

|

| 2016 | 16.87 |

| | 13.18 |

| | 13.73 |

| | 14.68 |

|

| 2017 | 14.46 |

| | 12.25 |

| | 12.36 |

| | 13.30 |

|

2018(3) | 12.45 |

| | 11.54 |

| | | | 11.98 |

|

| |

(1)

| The average rate of exchange on the last business day of each month during the year. |

| |

(2)

| Based on the exchange rate as reported by Reuters. |

| |

(3)

| Through to 19 March 2018. |

|

| | | | | |

Exchange rate information for the months of (1) | High |

| | Low |

|

| September 2017 | 13.58 |

| | 12.76 |

|

| October 2017 | 14.23 |

| | 13.26 |

|

| November 2017 | 14.46 |

| | 13.65 |

|

| December 2017 | 13.73 |

| | 12.25 |

|

| January 2018 | 12.45 |

| | 11.85 |

|

| February 2018 | 12.16 |

| | 11.54 |

|

March 2018 (2) | 12.01 |

| | 11.76 |

|

| |

(1)

| Based on the exchange rate as reported by Reuters. |

| |

(2)

| Through to 19 March 2018. |

| |

| 3B. | CAPITALISATION AND INDEBTEDNESS |

Not applicable.

| |

| 3C. | REASONS FOR THE OFFER AND USE OF PROCEEDS |

Not applicable.

3D. RISK FACTORS

This section describes many of the risks that could affect AngloGold Ashanti. There may, however, be additional risks unknown to AngloGold Ashanti and other risks, currently believed to be immaterial, that could turn out to be material. Additional risks may arise or become material subsequent to the date of this document. These risks, either individually or simultaneously, could significantly affect the group’s business, financial results and the price of its securities.

Risks related to AngloGold Ashanti’s results of operations and financial condition as a result of factors that impact the gold mining industry generally.

Commodity market price fluctuations could adversely affect the profitability of operations.

AngloGold Ashanti’s revenues are primarily derived from the sale of gold and, to a lesser extent, uranium, silver and sulphuric acid. The company’s current policy is to sell its products at prevailing market prices and not to enter into price hedging arrangements. The market prices for these commodities fluctuate widely. These fluctuations are caused by numerous factors beyond the company’s control. For example, the market price of gold may change for a variety of reasons, including:

speculative positions taken by investors or traders in gold;

monetary policies announced or implemented by central banks, including the U.S. Federal Reserve;

changes in the demand for gold as an investment ;investment;

changes in the demand for gold used in jewellery and for other industrial uses, including as a result of prevailing economic conditions;

changes in the supply of gold from production, divestment, scrap and hedging;

financial market expectations regarding the rate of inflation;

the strength of the U.S. dollar (the currency in which gold trades internationally) relative to other currencies;

changes in interest rates;

actual or anticipated sales or purchases of gold by central banks and the International Monetary Fund (IMF);

gold hedging and de-hedging by gold producers;

global or regional political or economic events; and

the cost of gold production in major gold producing countries.

The market price of gold has been and continues to be significantly volatile. During 2017,2019, the market spot gold price traded from a low of $1,158.82$1,270.20 per ounce to a high of $1,348.80$1,552.35 per ounce, remaining well below a peak of $1,900 per ounce in September 2011. Between 1 January 20182020 and 19 March 2018,2020, the market spot gold price traded between a low of $1,312.58$1,469.80 per ounce and a high of $1,358.09$1,679.60 per ounce. On 19 March 20182020 the afternoon price for gold on the London Bullion Market was $1,316.56$1,474.25 per ounce. In addition to protracted declines such as the one experienced from 2011 through 2015, the price of gold is also often subject to sharp, short-term changes. For example, the market spot gold price decreased from a high of $1,687.00 per ounce on 6 March 2020 to a low of $1,469.80 per ounce on 19 March 2020 in the midst of a wider market dislocation related to the COVID-19 pandemic and despite the alleged investor perception of gold as a relatively safe haven in periods of market volatility.

For example, during the three-day period from Friday, 12 April 2013, to Monday, 15 April 2013, the price of gold fell by $228 per ounce. Additionally, the spot price of gold fell by more than four percent to $1,086 per ounce in overnight trading on 20 July 2015 after traders sold 57 tonnes of gold in Shanghai and New York. By taking the price of gold below $1,100 per ounce, the July 2015 sell-off triggered a high volume of stop-loss orders that had been put in place by traders to automatically sell when the gold price reached a predetermined level. This caused the gold price to drop further. Any sharp or prolonged fluctuations in the price of gold can have a material adverse impact on the company’s profitability and financial condition.

Central banks’ policies can affect the price of gold. If gold is treated as a safe alternative investment during economic downturns, the price of gold may fall when central banks end quantitative easing or increase interest rates. For example, the price of gold fell to annual lows when the Chairman of the U.S. Federal Reserve announced a reduction in quantitative easing in June 2013, the end of the quantitative easing programme in October 2014 and an increase in interest rates in December 2015. Similarly, gold

prices continued on a downward trend after the Chairman’s announcement of an increase in interest rates in December 2016. However, the gold price has generally increased since the beginning of 2017 despite the Chairman’s announcement of another interest rate increase in March of 2017 and may continue to be unpredictable. Any futureIn addition, any announcements or proposals by central banks, such as the U.S. Federal Reserve, or any of its board members or regional presidents or other similar officials in other major economies, may materially and adversely affect the price of gold and, as a result, AngloGold Ashanti’s financial condition and results of operations.

Whilst overallEvents that affect the supply and demand typically do not affect the gold price in the same manner or to the same degree as other commodities due to the considerable size of historical mined stocks of gold, events that affect supply and demandsuch as government intervention, may nonetheless have an impact. According toimpact on the World Gold Council, demand for gold is generally driven by four main sectors, namely jewellery, investment, central banks and technology. The market for gold bullion bar, AngloGold Ashanti’s primary product, is generally limited to bullion banks, the numberprice of which has declined in recent years. Central banks’ purchases can be adversely affected by declines in foreign exchange reserves. For example, this was one of the factors that drove a 33 percent decline in net gold purchases by central banks in 2016 compared to 2015.gold. Demand for gold is also largely impacted by trends in China and India, which account for the highest gold consumption worldwide. Demand for gold may be particularly affected by government policies in these countries. For example, according to the World Gold Council, gold demand in China fell 38 percent in 2014 compared to 2013 and demand for gold bars and coins fell by 50 percent

due in part to the Chinese government’s anti-corruption programme, which put limited pressure on demand for gold ornaments and so-called “gift bars”. In India, government intervention to try to reduce the trade deficit, a material portion of which is linked to gold imports, led to various import taxes being introduced, which unsettled the domestic market for gold in 2016. The Indian government also introduced measures in 2016 to reduce undeclared income, including a demonetisation policy put in place in November 2016. Although gold imports temporarily increased when the Indian government announced its decision to retire the 500-rupee and 1,000-rupee bank notes, as soon-to-be obsolete notes were used to buy gold, gold imports registered a 55 percent decline by value the following month due to the lack of liquidity resulting from the demonetisation. These and similar policies in India, China or other large gold-importing countries could adversely affect demand for, and consequently prices of, gold.gold and, as a result, may adversely affect AngloGold Ashanti’s financial condition and results of operations.

Furthermore, the shift in demand from physical gold to gold-related investments and speculative instruments may exacerbate the volatility of the gold price. For example, the Finance Ministry in India announced an offering of sovereign gold bonds as an alternative to the purchase of physical gold in March 2015 and conducted several follow-on offerings in 2016. This and other policies of the Indian government contributed to a 22 percent decline in gold jewellery demand in India between 2015 and 2016. Slower consumption of physical gold in India, resulting from a move toward gold-tracking investments or otherwise, may have an adverse impact on global demand for, and prices of, bullion.gold.

A sustained period of significant gold price volatility may adversely affect the company’s ability to evaluate the feasibility of undertaking new capital projects or the continuity of existing operations, to meet its operational targets or to make other long-term strategic decisions. Lower and more volatile gold prices, together with other factors, have led AngloGold Ashanti to alter its expansion and development strategy and consider ways to align its asset portfolio to take account of such expectations and trends. As a result, the company may decide to curtail or temporarily or permanently shut down certain of its exploration and production operations, which may be difficult and costly to effect. A further sustained decrease in the price of gold could also have a material adverse effect on AngloGold Ashanti’s financial condition and results of operations, as it may be unable to quickly adjust its cost structure to reflect the reduced gold price environment. Mines with marginal headroom may be subject to decreases in value that are not temporary, which may result in impairment losses. See “-Certain factors may affect AngloGold Ashanti’s ability to support the carrying amount of its property, plant and equipment, intangible assets and goodwill on the balance sheet. If the carrying amount of its assets is not recoverable, AngloGold Ashanti may be required to recognise an impairment charge, which could be significant.”significant”. The market value of gold inventory may be reduced, and marginal stockpile and heap leach inventories may be written down to net realisable value or may not be processed further as it may not be economically viable at lower gold prices. In addition, AngloGold Ashanti is obliged to meet certain financial covenants under the terms of its borrowing facilities and its ability to continue to meet these covenants could be adversely affected by a further sustained decrease in the price of gold. The use of lower gold prices in Ore Reserve estimates and life of mine plans could also result in material impairments of the company’s investment in mining properties or a reduction in its Ore Reserve estimates and corresponding restatements of its Ore Reserve and increased amortisation, reclamation and closure charges.

The spot price of uranium has been volatile in past years. During 2017, the price varied between a low of approximately $19 per pound and a high of $27 per pound. On 19 March 2018, the spot price of uranium was $ 22 per pound.

In 2016, high inventory levels, an increase in the use of uranium enrichment at the expense of mined uranium and a slowdown in China’s uranium purchases caused uranium prices to continue a ten-year decline. Uranium prices can also be affected by several other factors, including demand for nuclear reactors, uranium production shortfalls and restocking by utilities. Additionally, events like those surrounding the earthquake and tsunami that occurred in Japan in 2011 can have a material adverse impact on the price of and demand for uranium.

The price of silver has also experienced significant fluctuations in past years. During 2017,2019, the price varied between a low of $15.58$14.35 per ounce and a high of $18.52$19.57 per ounce. On 19 March 2018,2020, the price of silver was $16.30$12.11 per ounce.

Factors affecting the price of silver include investor demand, physical demand for silver bars, industrial and retail off-take, and silver coin minting.

If revenue from sales of gold, uranium, silver or sulphuric acid falls below their respective cost of production for an extended period, AngloGold Ashanti may experience losses and curtail or suspend some or all of its exploration projects and existing operations or sell underperforming assets. Declining commodities prices may also force a reassessment of the feasibility of a particular project or projects, which could cause substantial delays or interrupt operations until the reassessment can be completed.

Foreign exchange fluctuations could have a material adverse effect on AngloGold Ashanti’s results of operations and financial condition.

Gold is principally a U.S. dollar-priced commodity and most of the company’s revenues are realised in, or linked to, U.S. dollars, whilst cost of sales are largely incurred in the local currency where the relevant operation is located. Given the company’s global operations and local foreign exchange regulations, some of its funds are held in local currencies, such as the South African rand, Ghanaian cedi, Brazilian real, Argentinian peso and the Australian dollar. The weakness of the U.S. dollar against local currencies results in higher cost of sales in U.S. dollar terms. Conversely, the strengthening of the U.S. dollar lowers local cost of sales in U.S. dollar terms.

From time to time, AngloGold Ashanti may implement currency hedges intended to reduce volatility in our foreign currency exposure. Such hedging strategies may not be successful, and any of AngloGold Ashanti unhedged exchange payments will continue to be subject to market fluctuations.

Exchange rate movements may have a material impact on AngloGold Ashanti’s operating results. results. For example, based on average exchange rates received in 2017,2019, the company estimates that a one percent strengthening of all of the South African rand, Brazilian real, the Argentinian peso or the Australian dollar against the U.S. dollar will, other factors remaining equal, result in an increase in cost of sales and total cash costs per ounce of approximately $6.0$17 million and $4 per ounce.ounce, respectively.

From time to time, AngloGold Ashanti may implement currency hedges. Such hedging strategies may not be successful, and any of AngloGold Ashanti unhedged exchange payments will continue to be subject to market fluctuations.

The profitability of mining companies’ operations and the cash flows generated by these operations are significantly affected by fluctuations in input production prices, many of which are linked to the prices of oil and steel.

Fuel, energy and consumables, including diesel, heavy fuel oil, chemical reagents, explosives, tyres, steel and mining equipment used or consumed in mining operations form a relatively large part of the operating costs and capital expenditure of any mining company.

AngloGold Ashanti has no influence over the cost of these consumables, many of which are linked to some degree to the price of oil and steel. Whilst, from time to time, AngloGold Ashanti may implement diesel hedges intended to reduce exposure to changes in the oil price, such hedging strategies may not always be successful, and any of the company’s unhedged diesel consumption will continue to be subject to market fluctuations.

The price of oil has fluctuated between $54 and $64$61 per barrel of Brent Crude in 2017.2019. As of 19 March 2018,2020, the price of oil was at $64$24.43 per barrel of Brent Crude.

AngloGold Ashanti estimates that for each U.S. dollar per barrel rise or fall in the oil price, other factors remaining equal, cost of sales and total cash costs per ounce of all its operations change by approximately $1.00$2 million and $0.6 per ounce.ounce, respectively. The cost of sales and total cash costs per ounce of certain of the company’s mines, particularly Sadiola, Siguiri, Geita, Tropicana Iduapriem and KibaliIduapriem are most sensitive to changes in the price of oil. Even when fuel prices are in decline, expected savings may be partly offset by increases in governments’ fixed fuel levies or the introduction by governments of new levies. For example, in Tanzania, fuel duty claims are required to be submitted after consumption of the related fuel and are subject to authorisation by the Customs and Excise authorities. The Minister of Finance and Economic Affairs revoked the Government Notice No. 480 of 2000, as from 1 July 2009. The notice applies to the excise duty exemption on fuel products granted to mining companies. While Anglogold Ashanti believes that this will not affect its status to claim exemption on fuel duty as the duty relief is protected by the Mine Development Agreement (MDA) there can be no assurance of protection under the MDA with respect to future changes to this or other duty exemptions. This has resulted in a cumulative cost impact at AngloGold Ashanti's Geita mine of approximately $25million.

Furthermore, the price of steel has also been volatile. Steel is used in the manufacture of most forms of fixed and mobile mining equipment, which is a relatively large contributor to the operating costs and capital expenditure of a mine. For example, in 2016 the price of flat hot rolled coil (North American Domestic FOB) steel traded between $379 per tonne as of 1 January 2016 and $630 per tonne as of 29 June 2016. On 19 March 2018,2020, the price of flat hot rolled coil (North American Domestic FOB) was $822$492.62 per tonne.

Fluctuations in oil and steel prices have a significant impact on operating costs and capital expenditure estimates and, in the absence of other economic fluctuations, could result in significant changes in the total expenditure estimates for new mining projects or render certain projects non-viable, which could have a material adverse impact on the company’s results of operations and financial condition.

Energy cost increases and power fluctuations and stoppages could adversely impact the company’s results of operations and financial condition.

Increasing global demand for energy, concerns about nuclear power and the limited growth of new supply are impacting the price and supply of energy. The transition of emerging markets to higher energy consumption, actual and proposed taxation of carbon

emissions as well as unrest and potential conflict in the Middle East, amongst other factors, could result in increased demand or constrained supply and sharply escalating oil and energy prices.

AngloGold Ashanti’s mining operations are substantially dependent upon electrical power generated by local utilities or by power plants situated at some of its operations. The unreliability of these local sources of power can have a material adverse effect on the company’s operations, as large amounts of power are required for ventilation, exploration, development, extraction, processing and other mining activities on the company’s properties.