0000313807ifrs-full:PresentValueOfDefinedBenefitObligationMembercountry:US2019-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

|

| | | | |

¨☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|

| | | | |

x☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended 31 December 20192020

OR

|

| | | | |

¨☐

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|

| | | | |

¨☐

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 1-62621-06262

BP p.l.c.

(Exact name of Registrant as specified in its charter)

England and Wales

(Jurisdiction of incorporation or organization)

1 St James’s Square, London SW1Y 4PD

United Kingdom

(Address of principal executive offices)

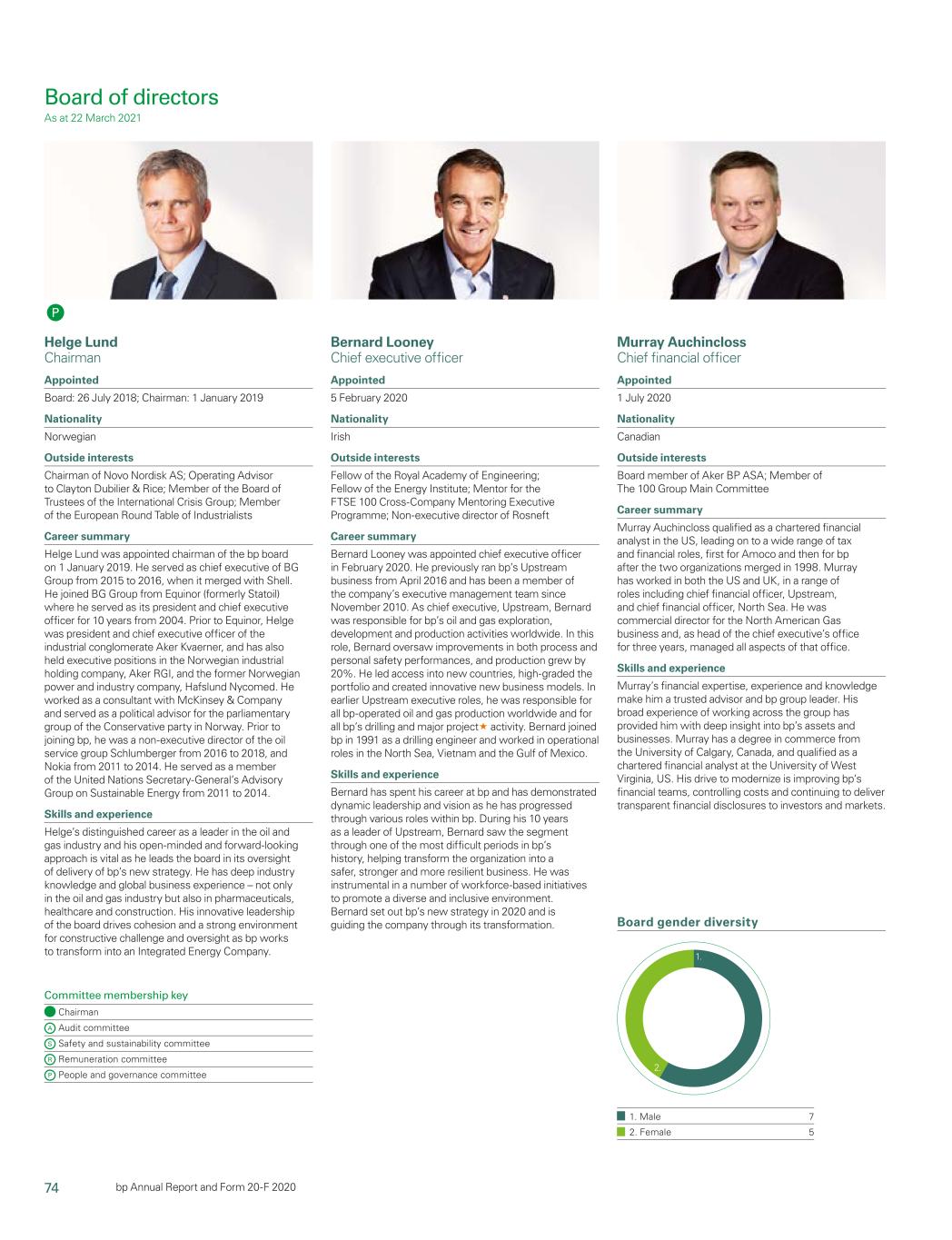

Dr Brian GilvaryMurray Auchincloss

BP p.l.c.

1 St James’s Square, London SW1Y 4PD

United Kingdom

Tel +44 (0) 20 7496 53114000

Fax +44 (0) 20 7496 45734630

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act

|

| | | | | | | | | | |

| | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | |

| American Depositary Shares | BP | New York Stock Exchange | |

| Ordinary Shares of 25c each | | New York Stock Exchange* |

Floating Rate Guaranteed Notes due 2020 | BP/20D | New York Stock Exchange | * |

| Floating Rate Guaranteed Notes due 2021 | BP/21D | New York Stock Exchange | |

| Floating Rate Guaranteed Notes due 2022 | BP/22D and

BP/22H

| New York Stock Exchange | |

4.500% Guaranteed Notes due 2020 | BP/20 and

BP/20C

| New York Stock Exchange |

| 4.742% Guaranteed Notes due 2021 | BP/21A and

BP/21F

| New York Stock Exchange | |

| 3.561% Guaranteed Notes due 2021 | BP/21B | New York Stock Exchange | |

| 2.112% Guaranteed Notes due 2021 | BP/21C and

BP/21E

| New York Stock Exchange | |

| 2.500% Guaranteed Notes due 2022 | BP/22B | New York Stock Exchange | |

| 2.520% Guaranteed Notes due 2022 | BP/22E and BP/22F | New York Stock Exchange | |

| 3.245% Guaranteed Notes due 2022 | BP/22A and BP/22G | New York Stock Exchange | |

| 3.062% Guaranteed Notes due 2022 | BP/22C | New York Stock Exchange | |

| 2.750% Guaranteed Notes due 2023 | BP/23 and

BP/23D

| New York Stock Exchange | |

| 2.937% Guaranteed Notes due 2023 | BP/23E | New York Stock Exchange | |

| 3.216% Guaranteed Notes due 2023 | BP/23B and

BP/23C

| New York Stock Exchange | |

| 3.994% Guaranteed Notes due 2023 | BP/23A | New York Stock Exchange | |

| 3.535% Guaranteed Notes due 2024 | BP/24A | New York Stock Exchange | |

| 3.814% Guaranteed Notes due 2024 | BP/24 | New York Stock Exchange | |

| 3.224% Guaranteed Notes due 2024 | BP/24B and

BP/24D

| New York Stock Exchange | |

| 3.790% Guaranteed Notes due 2024 | BP/24C | New York Stock Exchange | |

| 3.194% Guaranteed Notes due 2025 | BP/25B | New York Stock Exchange | |

| 3.506% Guaranteed Notes due 2025 | BP/25 | New York Stock Exchange | |

| 3.796% Guaranteed Notes due 2025 | BP/25A | New York Stock Exchange | |

| 3.119% Guaranteed Notes due 2026 | BP/26 and

BP/26A

| New York Stock Exchange | |

| 3.410% Guaranteed Notes due 2026 | BP/26C | New York Stock Exchange | |

| 3.017% Guaranteed Notes due 2027 | BP/27 and

BP/27D

| New York Stock Exchange | |

| 3.279% Guaranteed Notes due 2027 | BP/27B | New York Stock Exchange | |

| 3.543% Guaranteed Notes due 2027 | BP/27E | New York Stock Exchange | |

| 3.588% Guaranteed Notes due 2027 | BP/27A and

BP/27C

| New York Stock Exchange | |

| 3.723% Guaranteed Notes due 2028 | BP/28 | New York Stock Exchange | |

| 3.937% Guaranteed Notes due 2028 | BP/28A | New York Stock Exchange | |

| 4.234% Guaranteed Notes due 2028 | BP/28B | New York Stock Exchange | |

| 1.749% Guaranteed Notes due 2030 | BP/30A | New York Stock Exchange | |

| 3.633% Guaranteed Notes due 2030 | BP/30 | New York Stock Exchange | |

| 3.067% Guaranteed Notes due 2050 | BP/50 | New York Stock Exchange | |

| 3.000% Guaranteed Notes due 2050 | BP/50A | New York Stock Exchange | |

| 2.772% Guaranteed Notes due 2050 | BP/50B | New York Stock Exchange | |

| 2.939% Guaranteed Notes due 2051 | BP/51 | New York Stock Exchange | |

| 4.375% Perpetual Subordinated Non-Call 5.25 Fixed Rate Reset Notes | BP/P1 | New York Stock Exchange | |

| 4.875% Perpetual Subordinated Non-Call 10 Fixed Rate Reset Notes | BP/P2 | New York Stock Exchange | |

|

| | | | |

| * | Not for trading, but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. |

| | | | |

| |

| Ordinary Shares of 25c each | 21,535,839,81421,415,782,350 |

|

| Cumulative First Preference Shares of £1 each | 7,232,838 |

|

| Cumulative Second Preference Shares of £1 each | 5,473,414 |

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x☒ No ¨☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨☐ No x☒

Note—Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x☒ No ¨☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x☒ No ¨☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x☒ Accelerated filer ¨☐ Non-accelerated filer ¨☐ Emerging growth company ¨☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ¨☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

| | | | | | | | | | | | | |

U.S. GAAP ¨☐ | | International Financial Reporting Standards as issued by the International Accounting Standards Board x☒ | | Other ¨☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ¨☐ Item 18 ¨☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨☐ No x

☒

BPb p A n n u al R e p o rt an d F o rm 2 0 -F 2 0 2 0 bp Annual Report and Form 20-F 2019

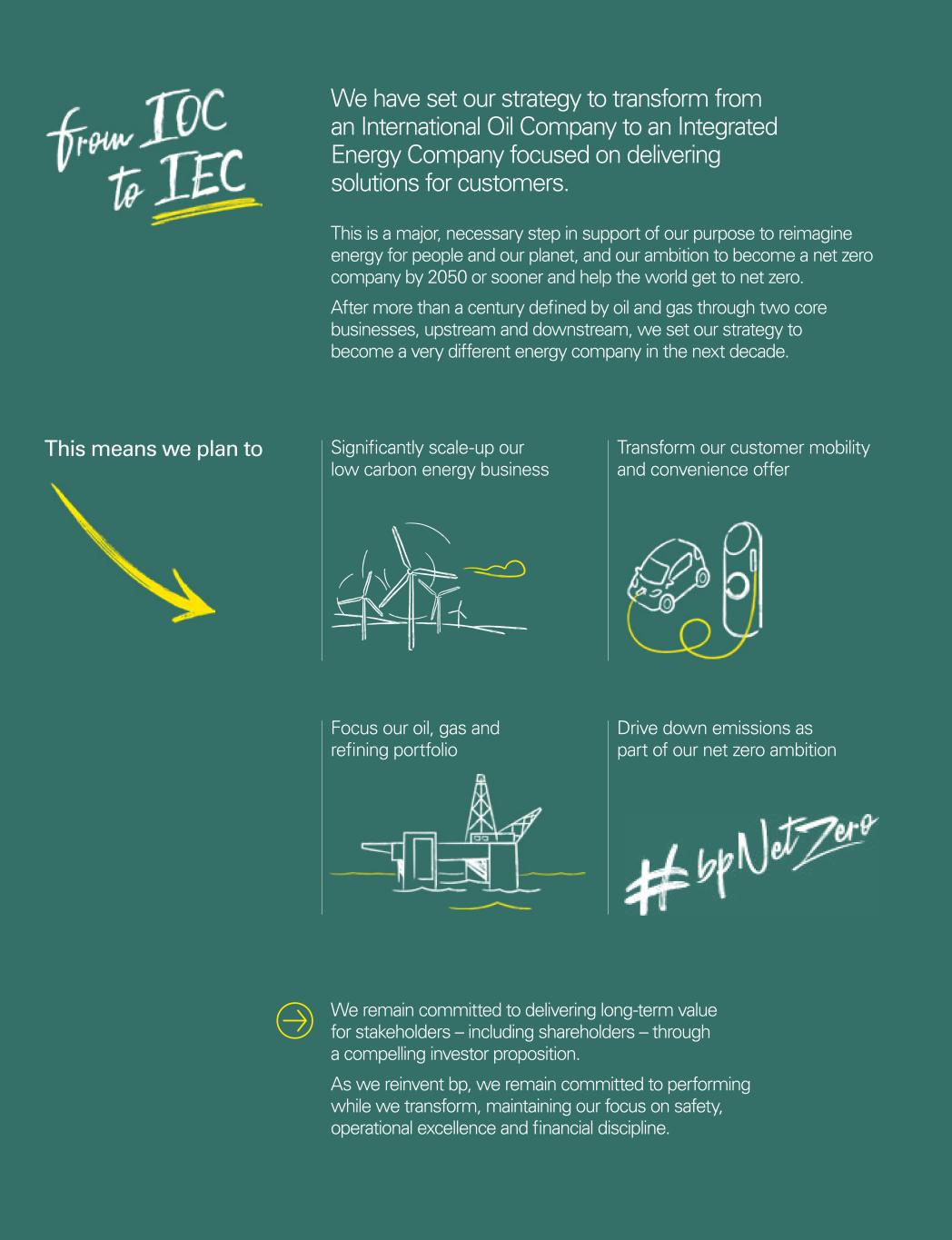

2020 from IOC to IEC

Our

This means we plan to We have set our strategy to transform from an International Oil Company to an Integrated Energy Company focused on delivering solutions for customers. This is a major, necessary step in support of our purpose is reimaginingto reimagine energy for people and our planet, and our ambition to become a net zero company by 2050 or sooner and help the world get to net zero. After more than a century defined by oil and gas through two core businesses, upstream and downstream, we set our strategy to become a very different energy company in the next decade. We remain committed to delivering long-term value for stakeholders – including shareholders – through a compelling investor proposition. As we reinvent bp, we remain committed to performing while we transform, maintaining our focus on safety, operational excellence and financial discipline. Significantly scale-up our low carbon energy business Focus our oil, gas and refining portfolio Transform our customer mobility and convenience offer Drive down emissions as part of our net zero ambition

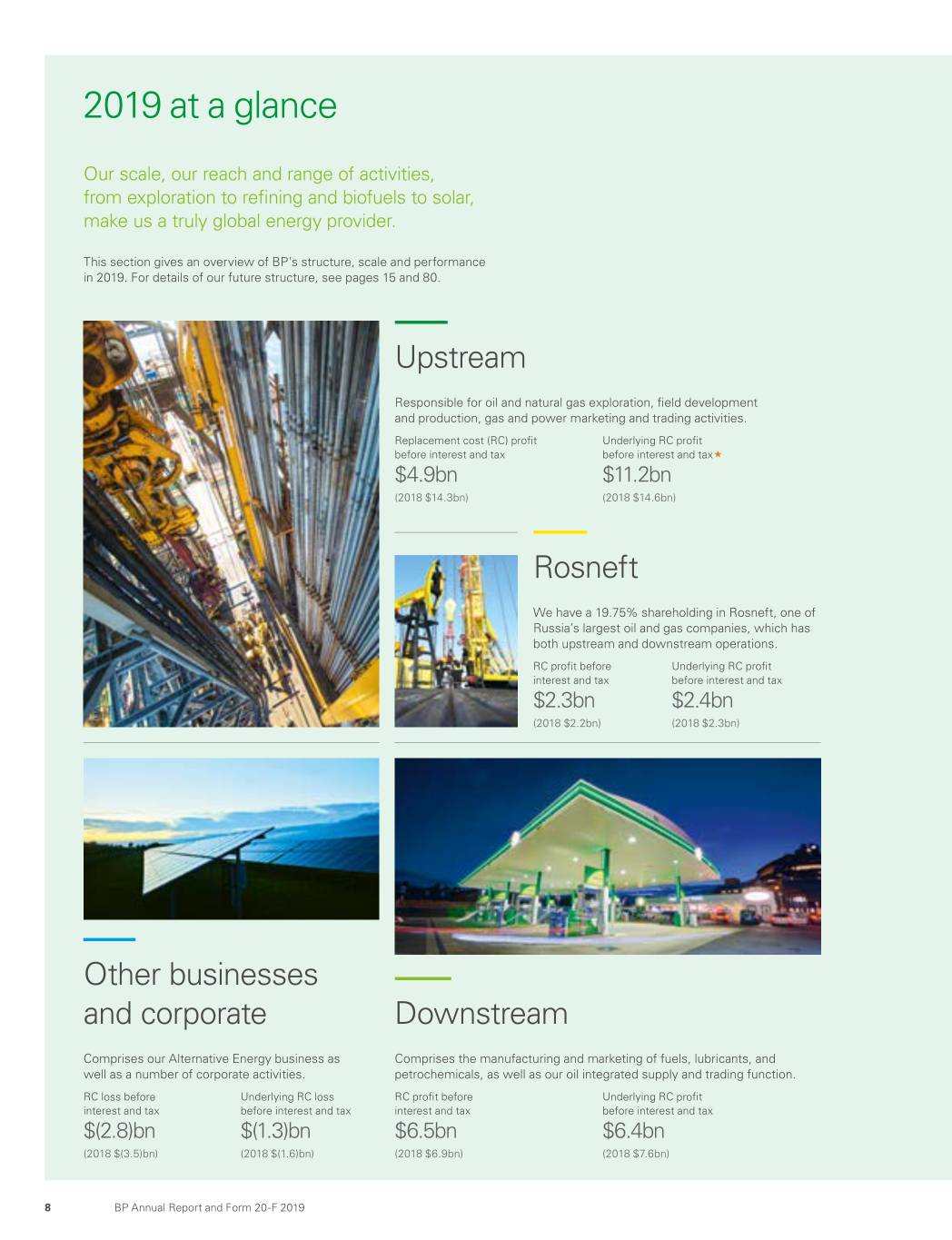

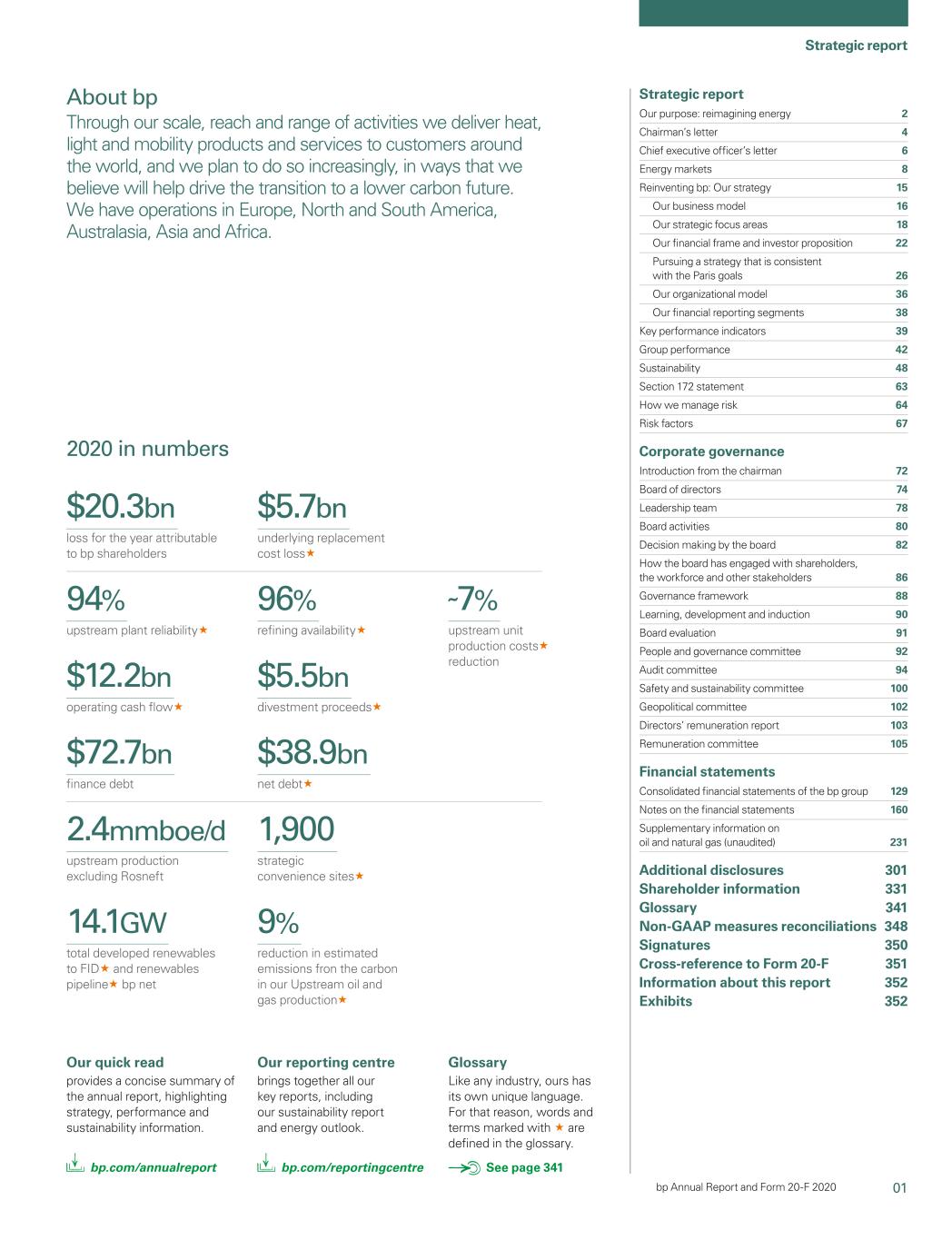

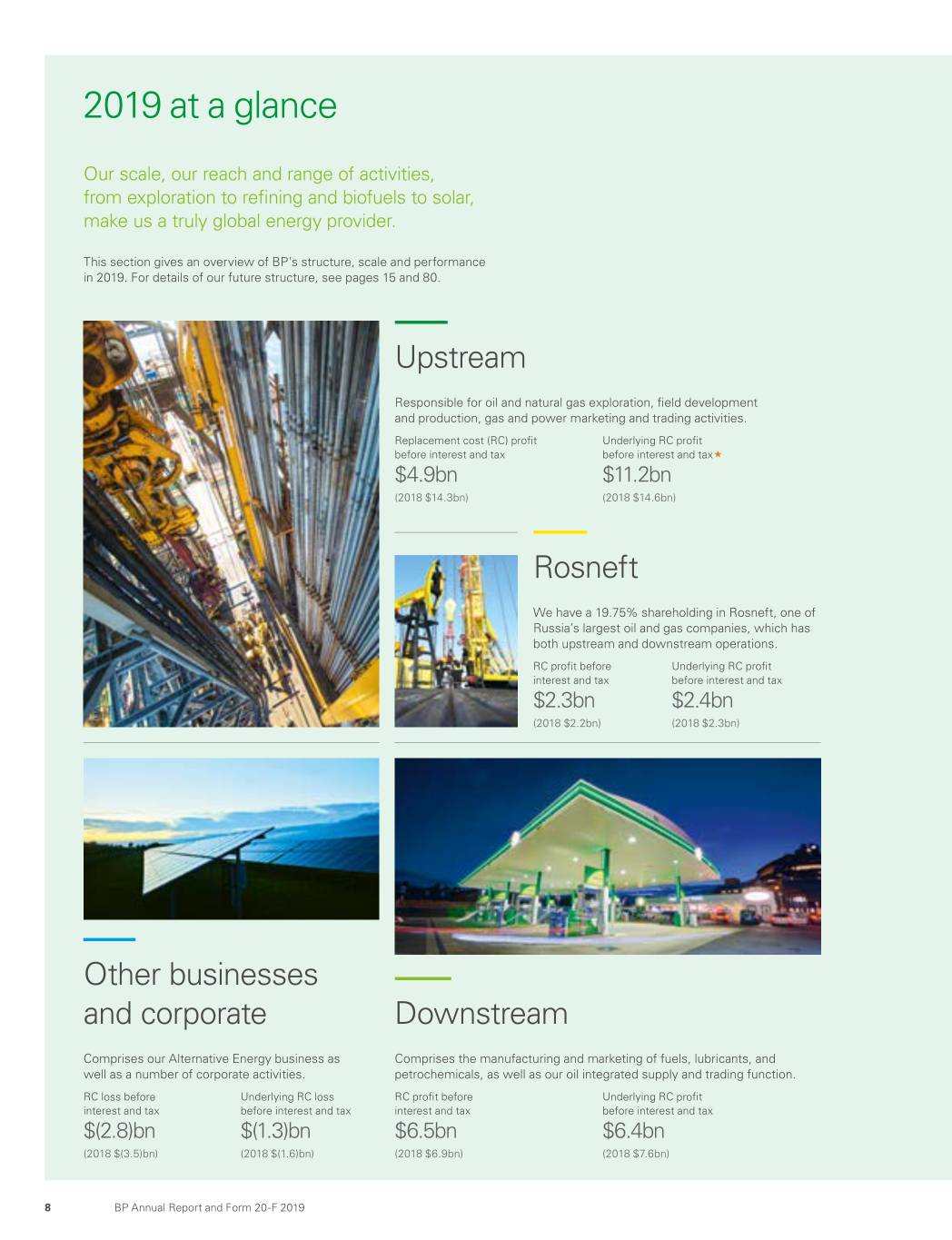

01 Strategic report bp Annual Report and Form 20-F 2020 Strategic report Our purpose: reimagining energy 2 Chairman’s letter 4 Chief executive officer’s letter 6 Energy markets 8 Reinventing bp: Our strategy 15 Our business model 16 Our strategic focus areas 18 Our financial frame and investor proposition 22 Pursuing a strategy that is consistent with the Paris goals 26 Our organizational model 36 Our financial reporting segments 38 Key performance indicators 39 Group performance 42 Sustainability 48 Section 172 statement 63 How we manage risk 64 Risk factors 67 Corporate governance Introduction from the chairman 72 Board of directors 74 Leadership team 78 Board activities 80 Decision making by the board 82 How the board has engaged with shareholders, the workforce and other stakeholders 86 Governance framework 88 Learning, development and induction 90 Board evaluation 91 People and governance committee 92 Audit committee 94 Safety and sustainability committee 100 Geopolitical committee 102 Directors’ remuneration report 103 Remuneration committee 105 Financial statements Consolidated financial statements of the bp group 129 Notes on the financial statements 160 Supplementary information on oil and natural gas (unaudited) 231 Additional disclosures 301 Shareholder information 331 Glossary 341 Non-GAAP measures reconciliations 348 Signatures 350 Cross-reference to Form 20-F 351 Information about this report 352 Exhibits 352 About bp Through our scale, reach and range of activities we deliver heat, light and mobility products and services to customers around the world, and we plan to do so increasingly, in ways that we believe will help drive the transition to a lower carbon future. We have operations in Europe, North and South America, Australasia, Asia and Africa. Our quick read provides a concise summary of the annual report, highlighting strategy, performance and sustainability information. bp.com/annualreport Our reporting centre brings together all our key reports, including our sustainability report and energy outlook. bp.com/reportingcentre Glossary Like any industry, ours has its own unique language. For that reason, words and terms marked with « are defined in the glossary. See page 341 2020 in numbers $20.3bn loss for the year attributable to bp shareholders 94% upstream plant reliability« $12.2bn operating cash flow« $72.7bn finance debt 2.4mmboe/d upstream production excluding Rosneft 14.1GW total developed renewables to FID« and renewables pipeline« bp net 9% reduction in estimated emissions fron the carbon in our Upstream oil and gas production« $5.7bn underlying replacement cost loss« 96% refining availability« ˜7% upstream unit production costs« reduction $5.5bn divestment proceeds« $38.9bn net debt« 1,900 strategic convenience sites«

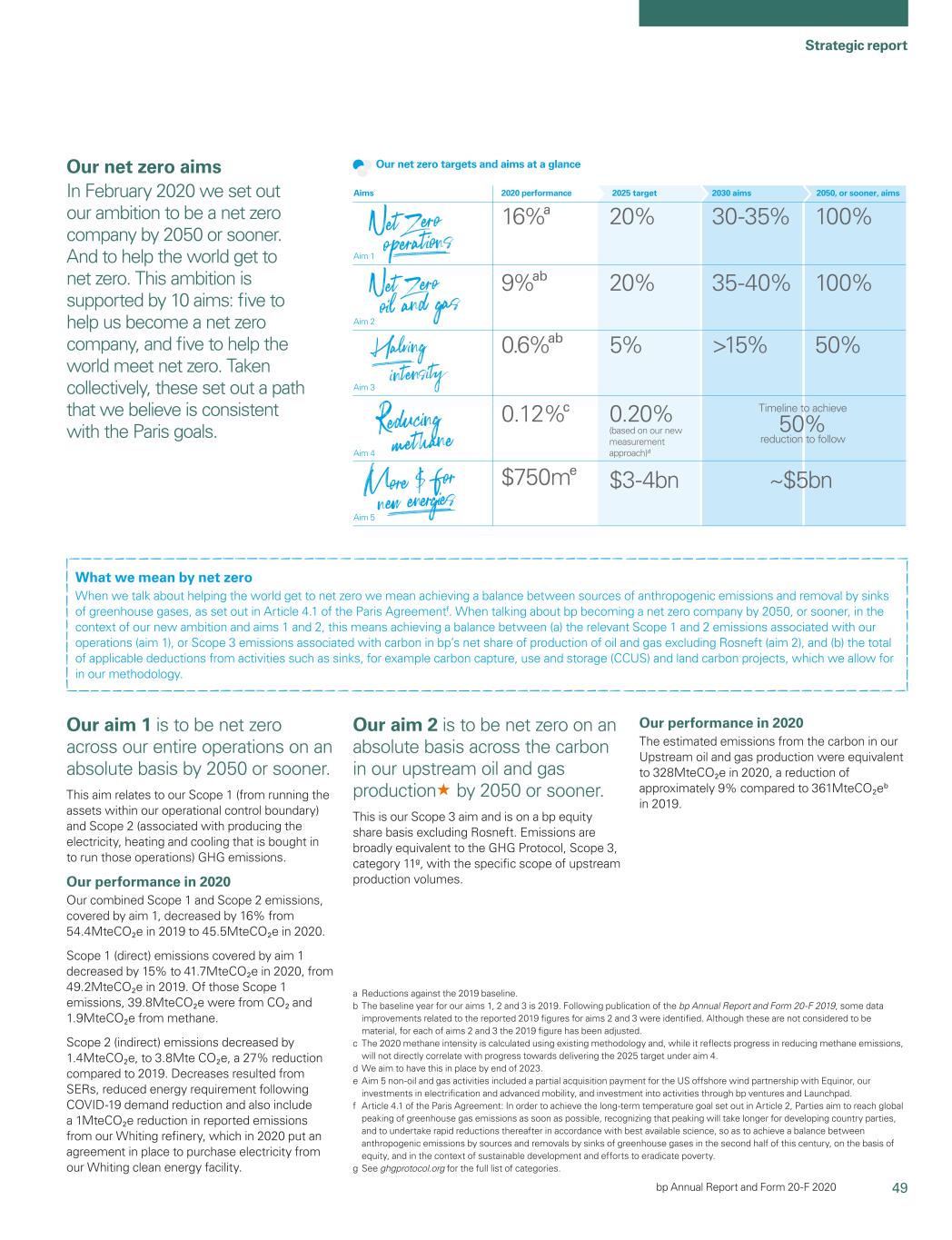

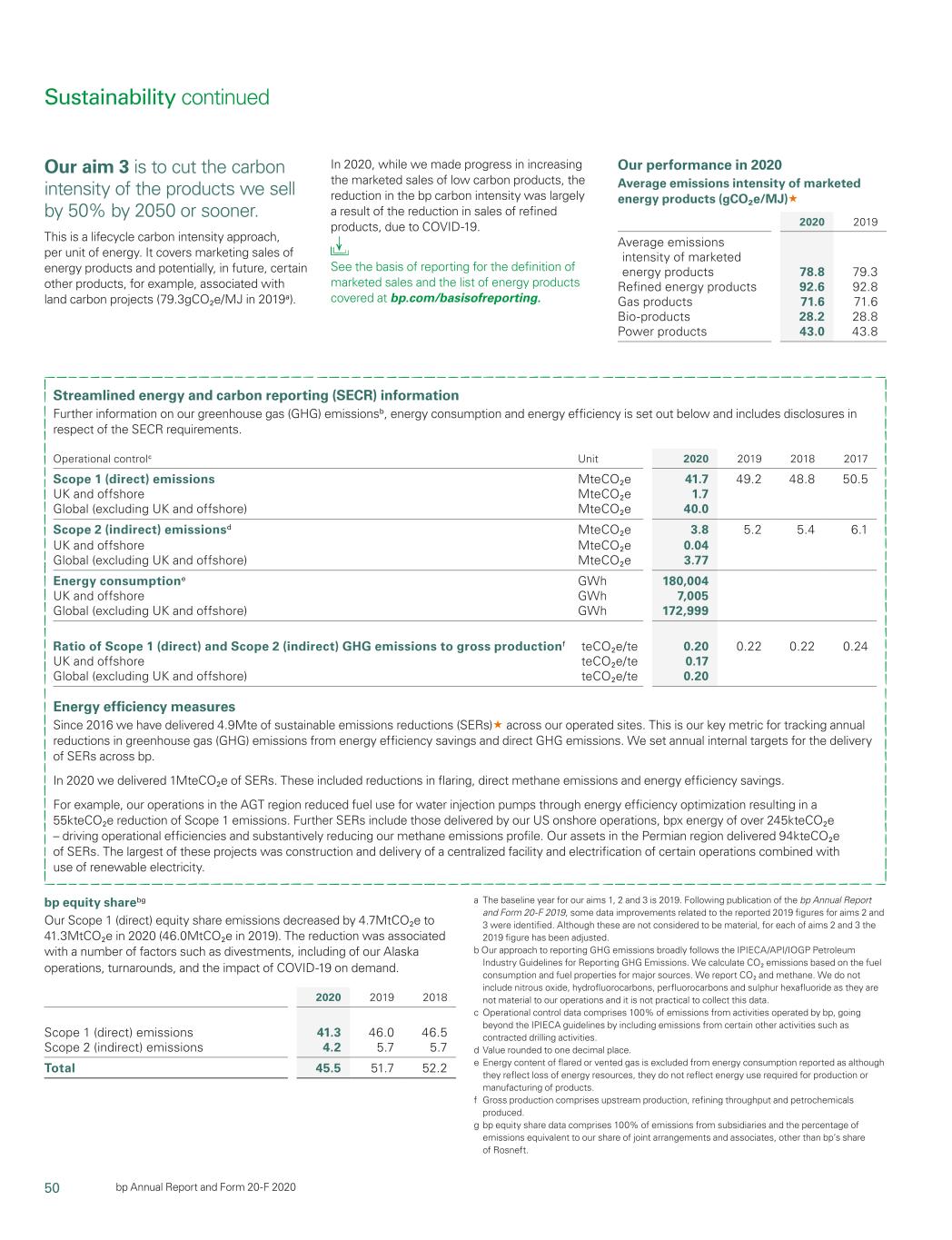

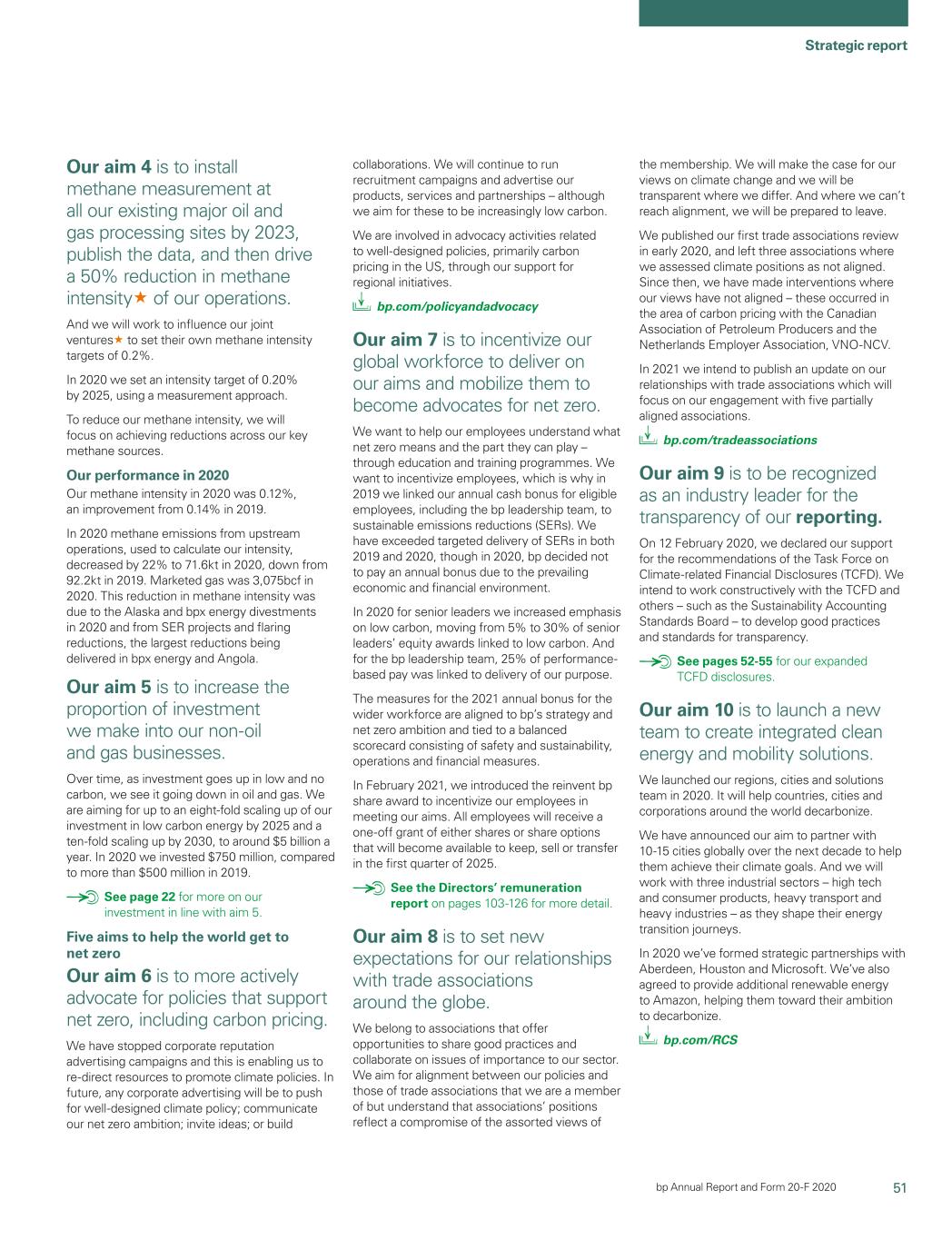

02 bp Annual Report and Form 20-F 2020 Our purpose for people and our planet. Five aims to get bp to net zero Five aims to help the world get to net zero Our ambition is to be a net zero company by 2050 or sooner and to help the world get to net zero. We’ve set out 10 net zero aims, five to help bp get to net zero and five to help the world get there too. We want to help the world reach net zero and improve people’speople’s lives. We will aim to dramatically reduce carbon in our operations and in our production, and grow new low carbon businesses, products and services. We will advocate for fundamental and rapid progress towards the Paris climate goals and striveaim to be aan industry leader in transparency.the transparency of our reporting. We know we don’tdon’t have all the answers and will listen to and work with others. We want to be an energy company with purpose; one that is trusted by society, valued by shareholders and motivating for everyone who works at BP.bp. We believe we have the experience and expertise, the relationships and the reach, the skill and the will to do this.

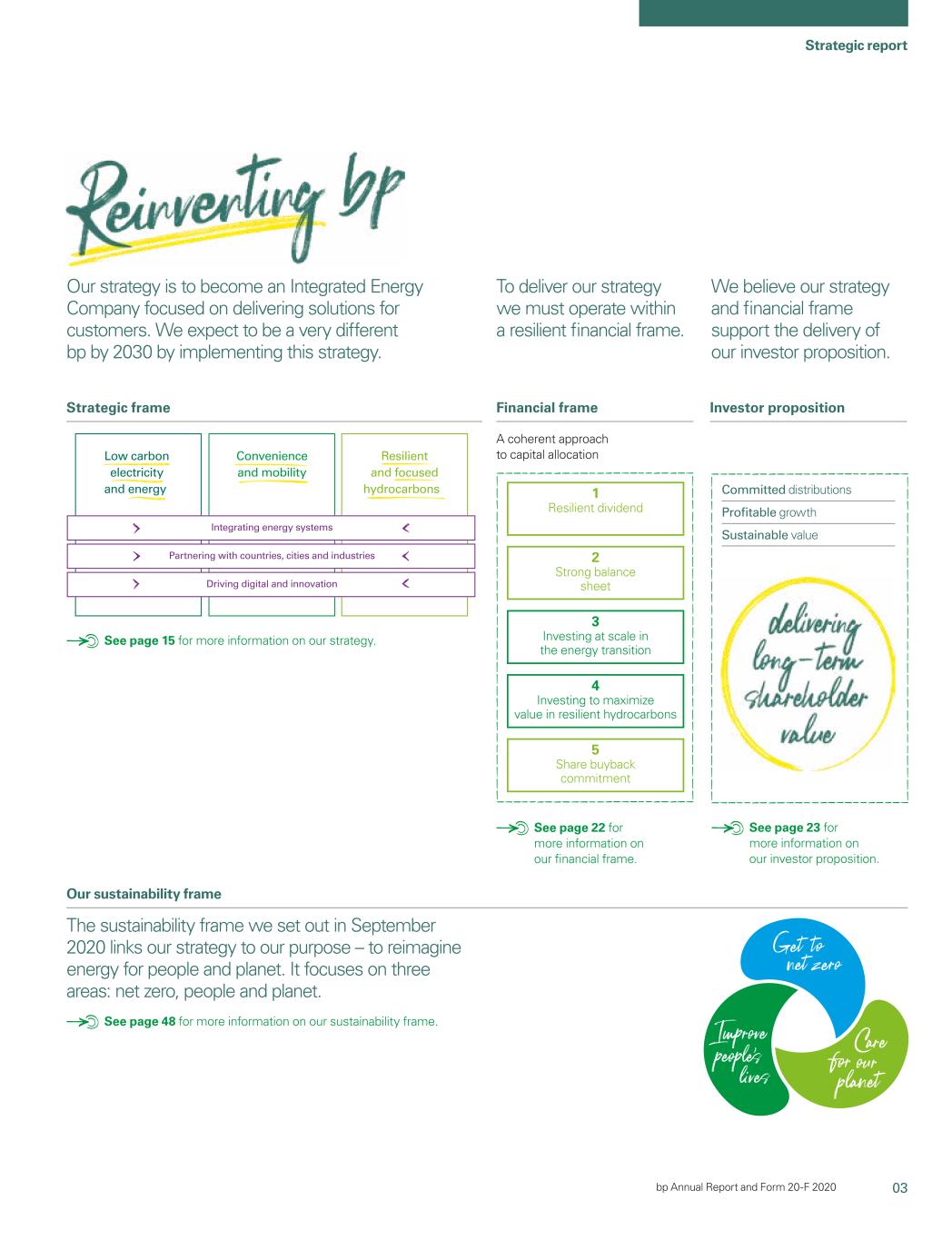

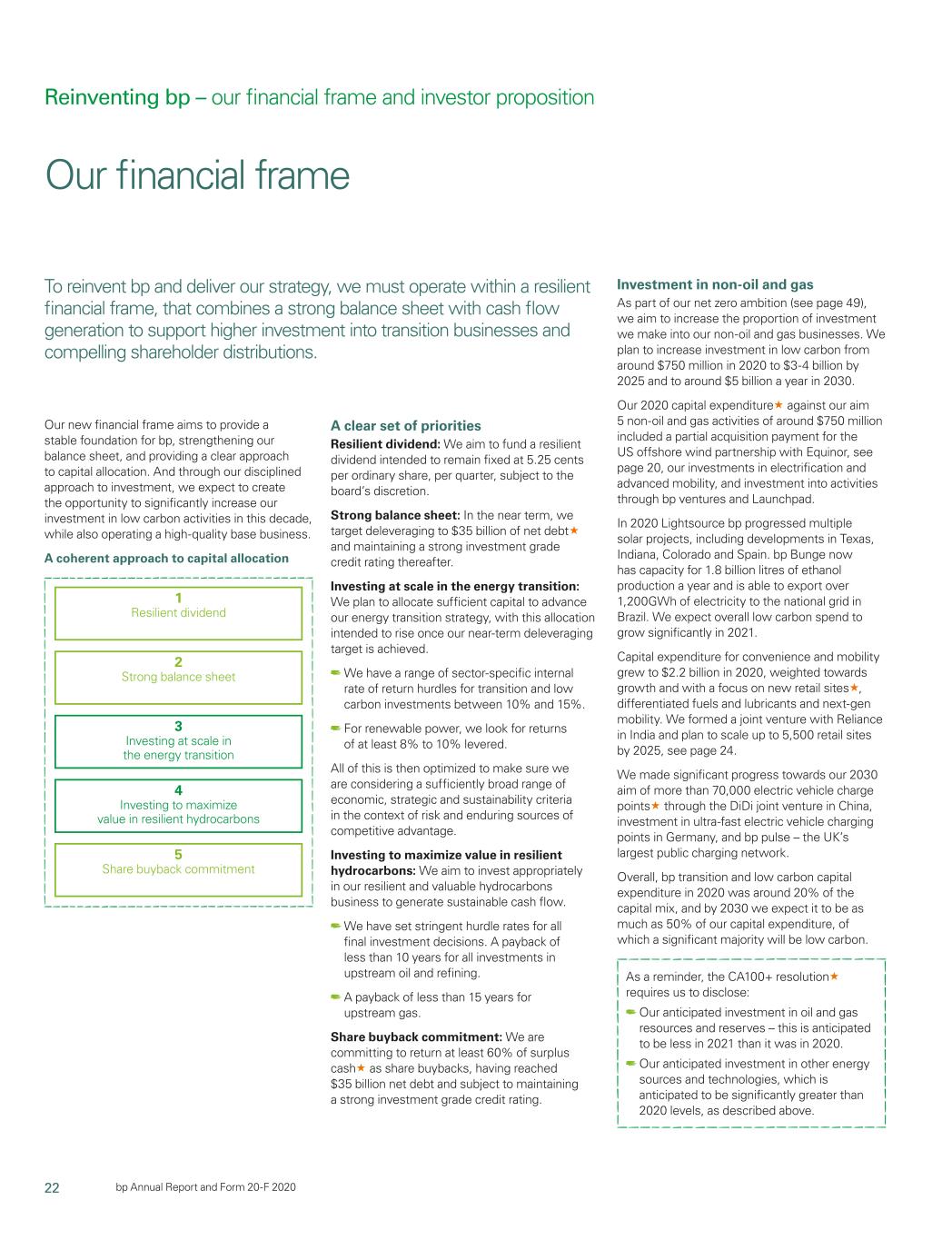

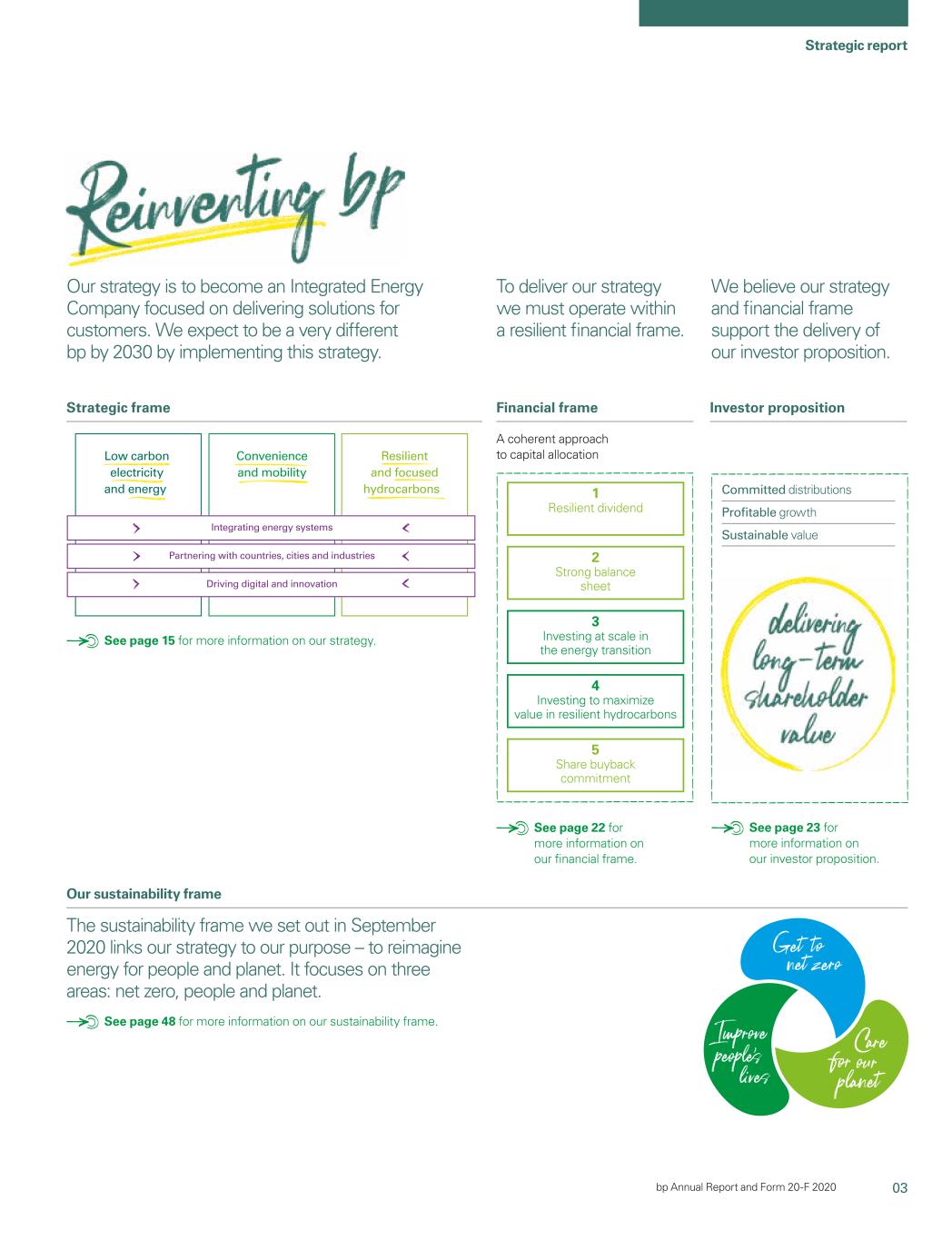

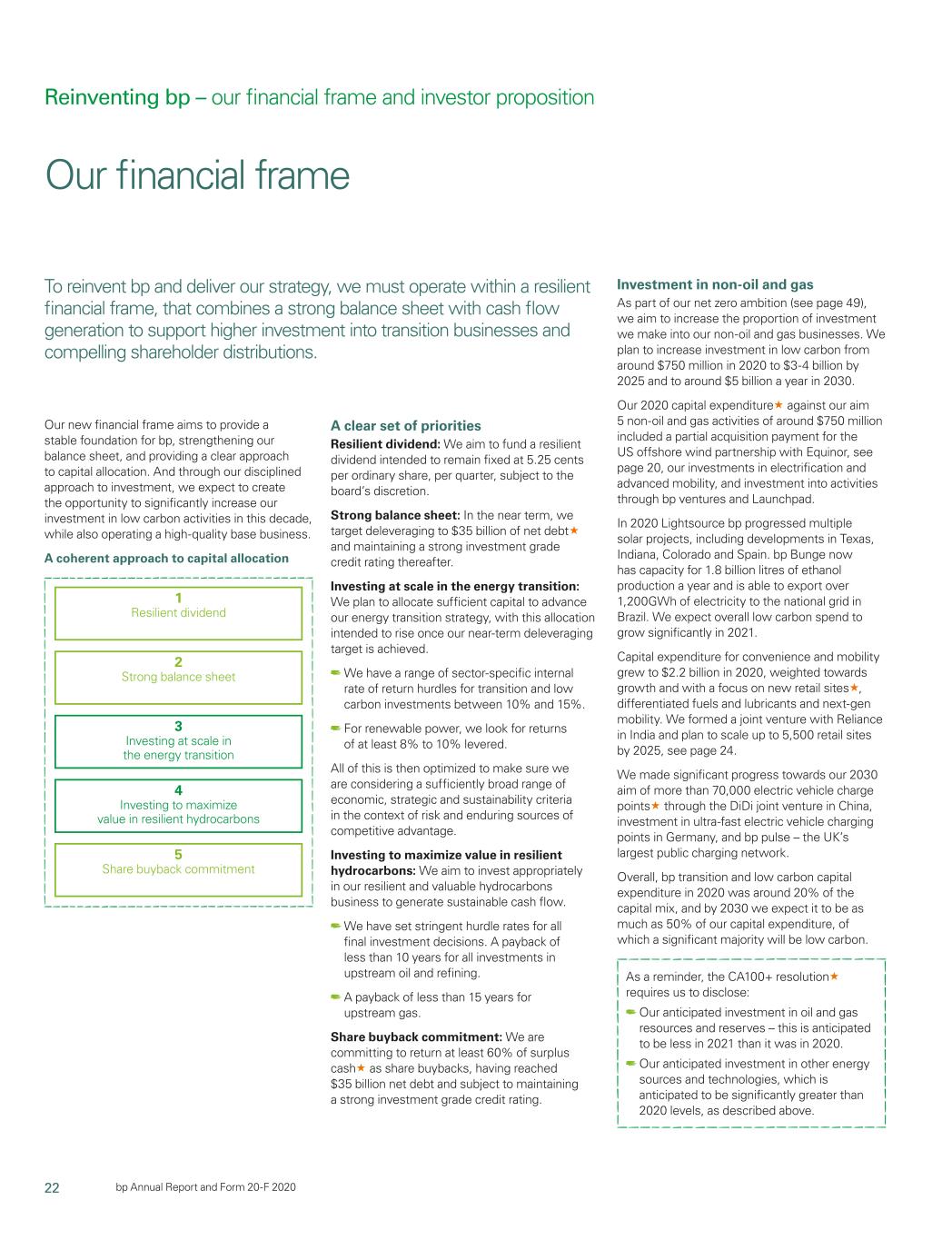

03 Strategic report Financial statements Chairman’s letter 2 Consolidated financial statements 131 Chief executive officer’s letter 4 of the BP groupA sustainability frame linking our purpose and Integrating energy systems Partnering with countries, cities and industries Driving digital and innovation Low carbon electricity and energy Convenience and mobility Resilient and focused hydrocarbons Embedding into our DN A Eng aging stakeholders Our ambition for the energy transition 6 Notes on the financial statements 157 At a glance 8 Supplementary information on 232 oilvalues and natural gas (unaudited) Global context 10 Our business model 14 Our strategy 16 Our investment process 19 Our strategy in action 24 Additional disclosures 297 Measuring our progress 32 Group performance 36 Shareholder information 327 Sustainability 39 Glossary 337 Upstream 50 Non-GAAP measures 344 reconciliations Downstream 56 Rosneft 61 Signatures 347 Other businesses and corporate 63 Cross-reference to Form 20-F 348 Alternative Energy 63 Information about this report 349 Section 172 statement 66 Exhibits 349 How we manage risk 68 Risk factors 70 Corporate governance Board of directors 74 Executive team 78 The leadership team 80 Introduction from the chair 82 Board activities in 2019 84 How the board has engaged with shareholders, 88 the workforce and other stakeholders Nomination and governance committee 90 Audit committee 91 Safety, environment and security 96 assurance committee Geopolitical committee 98 Chairman’s committee 99 Directors’ remuneration report 100 Remuneration committee 101 Navigating our reports Our fast read Our reporting centre Glossary provides a concise summary of the annual brings together all our key reports, including our Like any industry, ours has its own unique language. report, highlighting strategy, performance and sustainability report, as well as other reports on how For that reason, words and terms marked with sustainability information. we see the energy market evolving in the future. are defined in the glossary on page 337. bp.com/annualreport. bp.com/reportingcentre. BPfoundations bp Annual Report and Form 20-F 20192020 Our strategy is to become an Integrated Energy Company focused on delivering solutions for customers. We expect to be a very different bp by 2030 by implementing this strategy. We believe our strategy and financial frame support the delivery of our investor proposition. To deliver our strategy we must operate within a resilient financial frame. Strategic frame Our sustainability frame Financial frame A coherent approach to capital allocation Investor proposition The sustainability frame we set out in September 2020 links our strategy to our purpose – to reimagine energy for people and planet. It focuses on three areas: net zero, people and planet. See page 48 for more information on our sustainability frame. See page 22 for more information on our financial frame. See page 23 for more information on our investor proposition. See page 15 for more information on our strategy. 1

Resilient dividend 2 Strong balance sheet 3 Investing at scale in the energy transition 4 Investing to maximize value in resilient hydrocarbons 5 Share buyback commitment Committed distributions Profitable growth Sustainable value

Chairman’s

04 bp Annual Report and Form 20-F 2020 Chairman’s letter “We enterWhile this is a journey that will require patience, our goal is that bp over time will become a more valuable company for its shareholders and bring wider benefits for society. 7.9% annual dividend yield« ordinary share (2019 6.9%) $6.4bn total dividends distributed to bp shareholders (2019 $8.3bn)

05 Strategic report bp Annual Report and Form 20-F 2020 Dear fellow shareholders, 2020: the year of the pandemic In every sense, 2020 was an extraordinary year. The worst pandemic in a century has cost well over 2 million lives and caused worldwide economic and social disruption. While vaccination programmes are now building momentum, the path to recovery remains uncertain. Because demand for energy is closely linked to human activity, our sector was deeply affected. The combination of a steep fall in share values for almost all oil and gas companies and a new decadebp distribution policy significantly affected your shareholder returns. As chairman of your board, I am conscious of my responsibilities to bp’s shareholders. When the board decided to reset our distribution policy, it did so with a view to your long-term interests. Our priorities were, and remain, weathering the immediate challenge of the pandemic; paying a resilient dividend; strengthening our balance sheet; investing into the energy transition; investing in our resilient hydrocarbons business and, after that, returning surplus cash« to shareholders through buybacks. The board was unanimous in its support for this course of action, which will help establish bp as an Integrated Energy Company. I hope that bp’s new investor proposition and financial frame give reasons for optimism about bp’s long-term prospects. As we turn to 2021, the board’s focus is on supporting bp’s leadership team to deliver our new strategy, and on building renewed shareholder confidence through strategic progress and operational and financial performance. 2020 was also tough for our people. My board colleagues and I are proud of them. Their commitment – on rigs, in refineries, across retail stations and everywhere else in bp – helped keep the world’s lights on and allowed us to provide many emergency services with free or heavily discounted fuel. Despite new COVID-19-related practical challenges, our people maintained the safety of bp’s operations. That is a testament to their careful work. bp’s new purpose 2020 was a remarkable year for bp for other reasons too. With the backing of the board, our new CEO, Bernard Looney, introduced a new company purpose: reimagining energy for people and our planet. That purpose – together with our strong culture and values – underpins the net zero ambition that we set out last year, together with our new strategy, financial frame and investor proposition. It also informed bp’s reinvention – the selection of a new leadership team, and the replacement of bp’s upstream/downstream model with a new, integrated group structure. Change of this scale necessitated a reorganization of how we work. That reorganization will ultimately see close to 10,000 colleagues leaving bp. Saying goodbye has been difficult, but the result is a leaner, flatter, nimbler company purpose:– better able to realize the opportunities of the energy transition. Macro-economic developments have only strengthened the board’s belief that the direction in which we are taking bp is the right one – including China’s new net zero target, the EU’s Green Deal, the UK’s plan for a green industrial revolution, and the US’s recommitment to the Paris Agreement. Today, global energy markets are even further down the path of fundamental change – and bp is well-positioned to help to speed the world’s journey to net zero. A year of engagement While this is a journey that will require patience, our goal is that bp over time will become a more valuable company for its shareholders and bring wider benefits for society. Of course, the journey to net zero is, in part, one of discovery. For that reason, the board and bp’s leadership team know that we must be fully open to advice, learning and challenge. 2020 was therefore a year of engagement with our stakeholders, and I am grateful for the inputs we received – which helped us shape our new strategy, financial frame and investor proposition, sustainability frame and position on biodiversity. We will keep listening, and we count on you to share your feedback with us as we travel the road to net zero together. Evolution of the board As the company evolves, the board’s composition will evolve too – reflecting the need for new experiences and skills aligned with bp’s new direction. During the year, the board said goodbye to our former CEO, Bob Dudley, and to Brian Gilvary, our former CFO. Sir Ian Davis, Nils Andersen and Dame Alison Carnwath have also stepped down from the board, and we shall shortly say farewell to Brendan Nelson. Collectively and individually they served with distinction – bp is very fortunate to have had their wise advice and strong leadership. We are just as fortunate to welcome Tushar Morzaria, Karen Richardson and Johannes Teyssen to bp’s board for the first time. Closing thanks I would like to thank Bernard Looney, his leadership team and everyone in bp for their work during 2020. Throughout this challenging year, they showed characteristic determination. Finally, I thank you, our shareholders. I am grateful both for the continued support we received during 2020, and also for the support of our new shareholders. During 2020, we received investment and other endorsement from those who told us they would not have considered supporting bp were it not for the transformation we have begun. We look forward to repaying the faith you have placed in bp. Helge Lund, Chairman 22 March 2021

06 bp Annual Report and Form 20-F 2020 Chief executive officer’s letter $20.3bn loss attributable to bp shareholders Dear shareholders, The year 2020 will be remembered above all for the pain, sadness and loss of life caused by COVID-19. At bp, our thoughts are with the families and loved ones of the colleagues we have lost. Thousands more on our teams have had the virus, and life under lockdown has meant additional challenges, and anxiety for everyone. I want to pay particular tribute to those on the frontline of our business who have kept our plants and platforms running, our shops and forecourts open, and energy flowing to the world. They have sacrificed so much and earned our deepest respect and appreciation. Responding to brutal conditions We began our transformation from an International Oil Company to an Integrated Energy Company against this backdrop, along with lower oil and gas prices, lower refining margins and unprecedented falls in demand for our retail and aviation fuels. Our response included lowering costs, strengthening the balance sheet with an innovative hybrid bond issue, and advancing our strategy to become I want to pay particular tribute to those on the frontline of our business who have kept our plants and platforms running, our shops and forecourts open, and energy flowing to the world.

07 Strategic report bp Annual Report and Form 20-F 2020 a more diversified, resilient and lower carbon company. As part of our strategy planning process, we reviewed our portfolio and development plans. This work – informed by bp’s views of the long-term price environment – led to significant impairment charges and non-cash exploration write-offs in the second quarter. For shareholders, all this was reflected in a reset dividend and a diminished share price. I recognize the financial impact this must have had on you. However, I wholeheartedly believe we will not just restore, but will enhance the long-term sustainable value of your company through the actions we are taking to reinvent bp. And despite the most brutal operating conditions I can remember in almost 30 years in this industry, we have made considerable operational and strategic progress. Performing while transforming The loss of $20.3 billion we reported for the year is clearly disappointing. However, it in no way reflects the heroic efforts of the bp team in extremely difficult circumstances, or their deep commitment to performing while transforming: Most importantly – our safety performance continued to improve. Reliability of 94% for bp’s operated plants« and refining availability« of 96% represents remarkably strong performance, especially given the challenges faced by our frontline staff. Capital was reset and we delivered at the lower end of the range. We made good progress towards our net debt« target, including the contribution from high grading our portfolio and $6.6 billion of divestment and other proceeds received during the year. New oil and gas production came on from four major projects« – in India, Oman, the UK and the US. Natural gas from the Shah Deniz field in the Caspian Sea arrived in Italy following final completion of the historic Southern Gas Corridor project. And we doubled our retail network in growth markets to around 2,700 retail sites«, plus the addition of around 300 strategic convenience sites«. Reinventing bp This performance is even more remarkable given that we have been carrying out the most extensive reorganization in bp’s 112-year history. We have retired the upstream/downstream business model that has served bp very well. In its place we have introduced a leaner, flatter structure, stripping away tiers of management and lowering the workforce towards a target of around 10,000 fewer jobs. My role is now five layers at most away from more than half of our employees. That means people’s ideas and voices can be more easily heard – and decisions taken much faster. We are now more centralized, more agile, and better integrated. This enables us to maximize value creation in a rapidly evolving market through economies of scale, and by exploiting synergies and driving continuous improvement in operational performance. We are now organized around four business groups. Production & operations is the operating heart of the company – and is focusing our resilient hydrocarbons portfolio on value. Customers & products is growing our convenience and mobility offers for an increasing number of customers. Gas & low carbon energy is growing to help meet rapidly increasing clean energy demand. Innovation & engineering acts as a catalyst, opening up new and disruptive business models and driving our digital transformation. And our trading & shipping business and regions, cities & solutions team knit together the offers of our four core groups to drive greater value creation. Reimagining energy Completing our transformation to a net zero Integrated Energy Company will take time. But we are led by our purpose – to reimagine energy for people and our planet.”planet – and motivated by the opportunity we see in the energy transition. Trillions of dollars of investment will be needed over the next 30 years in replumbing and rewiring the global energy system. We now have offshore wind partnerships in the US with Equinor and in the UK with EnBW – two of the best regions globally for the world’s fastest-growing source of energy. Our solar development joint venture«, Lightsource bp, is growing prolifically. We are working with Ørsted to develop green hydrogen for our Lingen refinery. We have joined forces with the mobility platform DiDi to build a network of electric vehicle chargers in China, by far the world’s biggest market for EVs. And we have a growing list of low carbon partnerships with cities such as Aberdeen and Houston and some of the world’s leading companies, including Amazon, Microsoft, Qantas and Uber. A compelling investor proposition Growing sustainable free cash flowWe are fully focused at all times on the bottom line of the business – on executing our strategy while operating safely, reliably and distributionswith discipline. We continue to shareholdersbuild resilience and strength in the balance sheet as conditions remain challenging and uncertain while vaccines roll out, the pandemic recedes, and economies look to recover. At the same time, we are transforming to create value from the energy transition over the long term. $8.3bn total dividends distributedWe see tremendous business opportunity in providing people with the reliable, affordable, clean energy they want and need. Our net zero ambition is clearly the right thing for society, but we know it does not give us a free pass in a fast-changing world. We have to BP shareholders (2018 $8.1bn) 6.9% annualshow you the evidence that we can compete fiercely and add value – in service of the compelling investor proposition we believe we offer: Committed distributions – including the dividend yield ordinary share (2018 6.3%) 2 BPas the number one priority; Profitable growth; and Sustainable value. This is all in service of growing long-term shareholder value, that is our job. And I promise to keep you well informed as we execute our plans. As ever, thank you for your continued support – I will never take that for granted. And I look forward to any feedback you might have. Thank you. Bernard Looney, Chief executive officer 22 March 2021

08 bp Annual Report and Form 20-F 2019

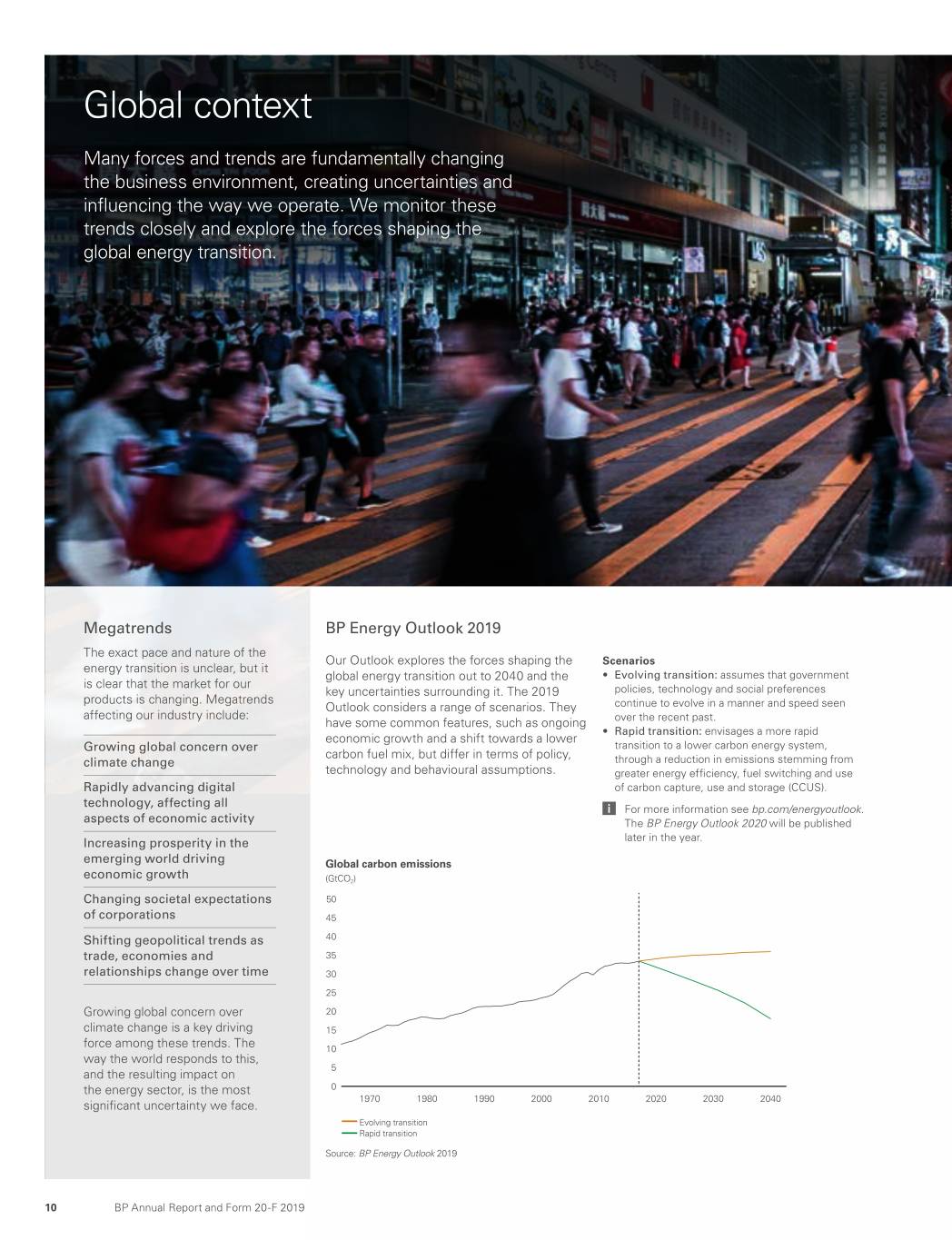

2020 Energy markets Global context Mobilizing safely in the North Sea In 2020 bp managed more than 15,000 journeys by people mobilizing to and from our North Sea assets. As the COVID-19 pandemic took hold in the UK, the bp North Sea team quickly implemented wide-ranging and robust COVID-19-specific measures to protect the safety and wellbeing of offshore colleagues. The ‘Safe Passage’ programme was introduced during the first UK lockdown to help individuals travel to Aberdeen for mobilization as safely as possible. The programme provided door-to-door transport, accommodation during the journey to Aberdeen and hotels in the city dedicated to bp staff and contractors. We introduced pre-mobilization COVID-19 testing in Aberdeen, one of the first operators in the North Sea to do this. Social distancing and enhanced hygiene and cleaning regimes continue to play a vital role in protecting the health and wellbeing of our offshore teams. Specialist ‘C-MED’ medevac helicopters, equipped with an on-board medic and configured to enable social distancing, were introduced to safely transport individuals suspected of contracting the virus back to shore for further treatment and support. COVID-19 The COVID-19 pandemic has affected individuals, countries and businesses. The spread of the pandemic quickly plunged the world economy into recession and reshaped social norms and attitudes. Globally, businesses have had to change established assumptions and introduce new models and ways of working. For bp, it has had an adverse impact on our business, including on the demand for our products and on their prices. But the more we understand about the consequences for the global economy – and the inevitable uncertainty it brings – the more convinced we are that our ambition and strategy are taking us in the right direction for bp, for our employees, our shareholders and society. Impact on the economy The global economy is estimated to have contracted 4.3% in 2020, the steepest decline in economic activity since 1946, caused by COVID-19. In advanced economies the recovery from the initial contraction was dampened by resurgences of COVID-19 cases, leading to an annual contraction of 5.4%. Most emerging markets, excluding China, also experienced deep recessions, with growth of -5% in 2020, while in China the economy grew by 2%a. a World Bank Global Economic Prospects, January 2021. Our response As COVID-19 continues to affect communities around the world, we have focused our effort on three priorities. 1 Protecting our people. 2 Supporting communities where we live and work. 3 Strengthening our finances. Our leadership teams were in daily discussions to respond to the conditions in the countries where we operate as the pandemic unfolded. We had a three-tier response model with executive-level, business, country and incident management steering committees. Some examples are given on the next page. The business environment is fundamentally changing. The world is on an unsustainable path and its carbon budget is running out. Energy markets have begun a process of significant, lasting change in response to this – shifting increasingly towards low carbon and renewables. And in 2020 we saw further changes, as COVID-19 spread across the globe.

09 Strategic report Dear fellow shareholders, focused on evolving BP’s strategy and Our focus throughout 2020 As I write, the world is facing an portfolio to address the challenges of One of the focal points for the board in unprecedented set of challenges. The tomorrow. This focus has included 2020 will be BP’s capital markets day coronavirus pandemic (COVID-19) is ensuring the smooth transition in in September, when Bernard and his spreading rapidly, with tragic consequences leadership from Bob to Bernard, followed leadership team will lay out more detail for many people across many geographies. by regular engagement by the board with about the strategy, near-term targets and Global efforts to stop the virus are also Bernard and his new leadership team to ways to measure progress. It will be the having significant economic consequences. develop BP’s purpose and net zero moment the vision and ambition set out in And in an oil market where demand has ambition. This is a process which has February becomes much more concrete. fallen, supply has sharply increased. been supported by our dialogue with We will do this while ensuring that we investors, governments, employees maintain a strong focus on high quality and Though unprecedented, a global energy and other key stakeholders. efficient operations and on delivering the company like BP should be prepared for promises we have made to our investors such challenges. Our enduring commitments BP is now set for a future that is different My thanks to you all BP is indeed prepared. Our global to its past, but some things won’t change. In addition to thanking Bob, two other operating structure and long time- BP’s values-based culture will be maintained departing senior leaders deserve a special horizons are intended to mitigate the and further developed. BP’s purpose and mention – chief financial officer Brian effect of near-term shocks. That is how ambition reflect its culture, and together Gilvary, who has decided to step down from BP has approached shocks and volatility they position BP well to develop as an the board in June after eight years in the job, in its 110-year history, and that is how increasingly sustainable company. and Downstream chief executive Tufan we will approach this storm too. In Erginbilgic, who leaves BP at the end of particular, the past decade has given Our commitment to safe and reliable March. On behalf of the board, I extend my BP unique experience in successfully operations will remain paramount. BP’s thanks and my deep appreciation for the handling crises – and we enter this one safety performance has seen near profound contributions they each made even better prepared. continuous improvement since 2010, and during an important period for the company. we must continue to learn and improve. But in this world of change, BP itself is also We believe that the new organizational Of course, each of our employees has a changing. We enter a new decade with a structure BP set out last month will help very important role to play in BP’s progress, new company purpose: to reimagine to reinforce this commitment. and they should be recognized. On behalf energy for people and our planet. We have of the board I extend my sincere thanks to also set a new ambition: to become a net As well as our enduring commitment all our people for a job well done in 2019. zero company by 2050 or sooner, and to to safety, BP’s commitment to its help the world get to net zero. And to lead relationships and partnerships will not Today, BP’s engagement with its and deliver on both we have a new chief change, including with governments customers, suppliers, shareholders, executive officer, Bernard Looney, who around the world. BP intends to use its employees and others is wider and deeper took on the role on 5 February 2020. energy market experience, skills and than ever, but it has to further develop as technology to help countries, cities and we progress on our journey. I therefore want Evolving for an uncertain world corporations decarbonize, while at the to use this opportunity to thank you, BP This is a new direction for BP, and it is only same time building a thriving, lower shareholders, for your continued support possible because of the foundation laid by carbon energy business. and engagement during 2019, including Bob Dudley. Bob served as BP’s group through your votes at our AGM in May. Your chief executive with distinction for almost BP’s new ambition also gives us extra challenge and input have been important in a decade, and he and his team deserve reason to maintain the capital discipline our effort to set a new strategic direction. our considerable thanks for guiding BP to and focus that has served the company so I look forward to continuing our dialogue. a position of operational and financial well. We can only reimagine energy if we strength and deepened resilience. generate the cash needed to manage the balance sheet, invest in new low carbon At these times, BP’s 110-year history of businesses, and continue to pay the navigating uncertainty is also reassuring. dividend on which you, our owners, depend. Your company has anticipated and That is how we will meet our ambition. It is responded to change many times over. something that I, together with the BP Helge Lund Indeed, throughout 2019 your board has board, look forward to working on with Chairman Bernard and his executive team. 18 March 2020 BPbp Annual Report and Form 20-F 2019 3

Chief executive officer’s letter Dear fellow shareholders, Reimagining2020 In 2020 we set a new target of $25 billion of proceeds between the second half of 2020 and reinventing energy Our investor proposition will remain2025, of which we’ve completed or agreed transactions for over half of this target. This includes the agreed sale of a 20% interest in Oman’s Block 61 and proceeds from the divestments of our petrochemicals business and Alaska interests. We have a deep hopper of potential future divestment options. As we publishexecute this report, the world is In February,programme, we announced a new unchanged as we lay out new near-term working through extraordinarily difficult purpose for BP, and a major reorganization plans later this year. This includes our times. Countries around the globe are to deliver our new ambition to be a net commitment to growing sustainable free battling the coronavirus pandemic zero company by 2050 or sooner and help cash flow and returns to shareholders (COVID-19). People’s lives are being the world get to net zero. over the long term. hugely disrupted, with tragic The current market shocks only reaffirm We will continue to maintain a strong consequences for many. The financial the need for this reimagining of energy and financial frame, including a focus on markets are reflecting the disruption and reinvention of BP. Our current upstream- deleveraging our balance sheet and our sector is particularly hard hit, not just downstream structure has served us well staying within a disciplined frame for our by a virus-related shock to demand but by for over a century, but I believe we now capital expenditure. a supply-side shock as well. need a different model for the rapidly And now, more than ever, we will focus At BP, we are taking calm and deliberate changing demands of the future. We need on managing costs, pursuing efficiencies actions for the well-being of our people an agile, highly integrated structure that is and driving waste out of the system. and the health of your company. We do more focused than ever on our core so with a robust balance sheet, strong capabilities in operations, customers, low A force for good and competitive returns liquidity and the flexibility in our portfolio carbon and innovation. The leadership team This new decade is a pivotal time for BP. and financial framework that provide us is working with the board to develop this We will continue to be an energy business,focused on value. Capital expenditure Capital expenditure« for 2020 was $14 billion, around 28% lower than 2019. Organic capital expenditure« for 2020 was $12 billion, in line with options. structure, alongthe guidance given in April. Liquidity Finance debt was $72.7 billion and net debt« was $38.9 billion at the end of 2020. We are actively managing the profile of our debt portfolio. We issued perpetual hybrid bonds with a new strategyUS dollar equivalent value of $11.9 billion in June 2020, and butwe bought back an aggregate US dollar equivalent value of $8 billion of debt in the third quarter of 2020, January 2021 and March 2021. bp had around $44 billion of liquidity, consisting of cash and cash equivalents (net of restricted cash) plus undrawn revolving credit facilities committed credit and bank facilities, at the end of 2020. In April 2020 Moody’s reaffirmed BP p.l.c.’s A1 credit rating and revised its outlook from stable to negative. The short-term P-1 rating was also reaffirmed. In January 2021 S&P revised its outlook on BP p.l.c. from stable to negative and affirmed BP p.l.c.’s long- and short-term corporate credit rating of A-/A-2. From January 2021, Fitch Ratings has provided a very different kindsolicited long-term corporate credit rating to BP p.l.c. of energy business near-term targets, which we intend to in years to come. We may not get A resilient company share with you in September 2020. everything right along the waystable outlook. In February 2021, Fitch Ratings assigned BP p.l.c. a short-term corporate credit rating of F1. bp’s financial performance, including cash flows and net debt, has been and will This resiliencecontinue to be impacted by the extent and duration of the current market conditions and the effectiveness of the actions that it and others take, including its financial interventions. It is a tributedifficult to Bob Dudley’s need to listenpredict when current supply and learn from others, not leadership overdemand imbalances will be resolved and what the past decade. I see huge opportunityultimate impact of COVID-19 will be. See page 22 for BP given our least you, our owners. Following the Deepwater Horizon distinctive combination of reach, accident, Bob’s steady hand has guided resources and relationships. The world will But with your continued support we BP through recovery and back to growth need to invest trillions of dollars in new expect to become leaner, faster-moving, as a safer, stronger and more disciplined energies over the next several decades. lower carbon – and more valuable. company – one that has deliveredinformation on capital allocation. We have addressed our response to COVID-19 in further detail throughout this report: See page 63 Our stakeholders. See page 64 How we manage risk. See page 67 Risk factors. See page 87 Workforce engagement. 1 Protecting our people Our first priority is the skillsafety and health of our people. Our people involved in, or supporting, critical operations continued at their normal workplace during the willpandemic and we put additional processes in place to help the Our destination is a thriving, sustainable consistentlyprotect them. These included operating robust protocols for 12 consecutive quarters world deliver a rapid energy transition. energy business in a net zero world. One on the planhealth and pre-mobilization checks, PPE, travel and workplace access, social distancing and isolation. Employees who were able to work from home were asked not to come into their workplace and we put forwardbusiness travel restrictions in 2017. Performing while transforming that isplace. Many office-based workers continue to work from home at the time of publication and are likely to do so for the foreseeable future as ways of working change. We liaised closely with industry peers and other organizations to regularly test our approach on specific safety issues. And we created a motivatingglobal COVID-19 OneMap, providing our businesses with current local COVID-19 risk profiles including rates of infection, vaccines rates and inspiring placeprocurement. 2 Supporting communities Providing essential support for the communities where our people live and our businesses operate was a priority throughout our response to •COVID-19. We made an underlying profitoffered support to governments and partners, using our expertise and resources to support the relief effort. The bp Foundation donated $2 million to the World Health Organization’s COVID-19 Solidarity Response Fund, which supports medical professionals and patients worldwide by providing critical aid and supplies. The fund also helps track and understand the spread of This may beCOVID-19 and supports efforts to develop tests, treatments and vaccines. 3 Strengthening our most wide-ranging workfinances The economic consequences of COVID-19 for the world remain uncertain at the time of publication. In response to this uncertainty, we took deliberate steps to strengthen our employees. That is wanted $10finances – reinforcing liquidity, rapidly reducing spending and costs, driving our cash balance point lower. Divestment programme We delivered our plans for $15 billion of announced divestments, which commenced at the start of 2019, in 2019. reorganization forJune 2020 – a year earlier than expected. In 2020 we supplied more than 10 million litres of free fuel to emergency service vehicles across the UK. We ran programmes during 2020 and 2021 offering free fuel to UK emergency vehicles – including police, fire, blood transportation, emergency NHS ambulances and NHS Trust non-emergency vehicles. Under the programmes, emergency services vehicles issued with either a century, but as well as needed by society. And one • Operating cash flow was strongbp Plus or Allstar fuel card could fill up without charge at I want to assure youbp’s network of our commitment that is valued by you, our shareholders, as $26 billion1,200 retail sites across the UK, including charging of electric vehicles through bp pulse. Supplying free fuel for the year. to perform as we transform. Among many a force for good as well as a provider of • That gave us the confidence to increase significant changes, however, there will be competitive returns. our dividend, which currently stands at no change to the fundamental principles 10.5c per ordinary share. that have served us well over the last decade and which apply equally in low During 2019, two colleagues sadly lost price environments as well as high. their lives while working at BP. My heart goes out to their families and friends. We Above all, our commitment to safe and must learn from these tragedies and reliable operations remains unchanged. Bernard Looney continue to make BP safer. I believe that Safety will always be a BP core value and Chief executive officer we can build on progress that last year we believe that the new structure we are 18 March 2020 saw our lowest-ever figure for BP people introducing will further strengthen our getting hurt at work (our recordable injury safety performance. frequency measure). Profit attributable to BP shareholders $4.0bn Nearest GAAP equivalent to underlying profit. 4 BPemergency services vehicles

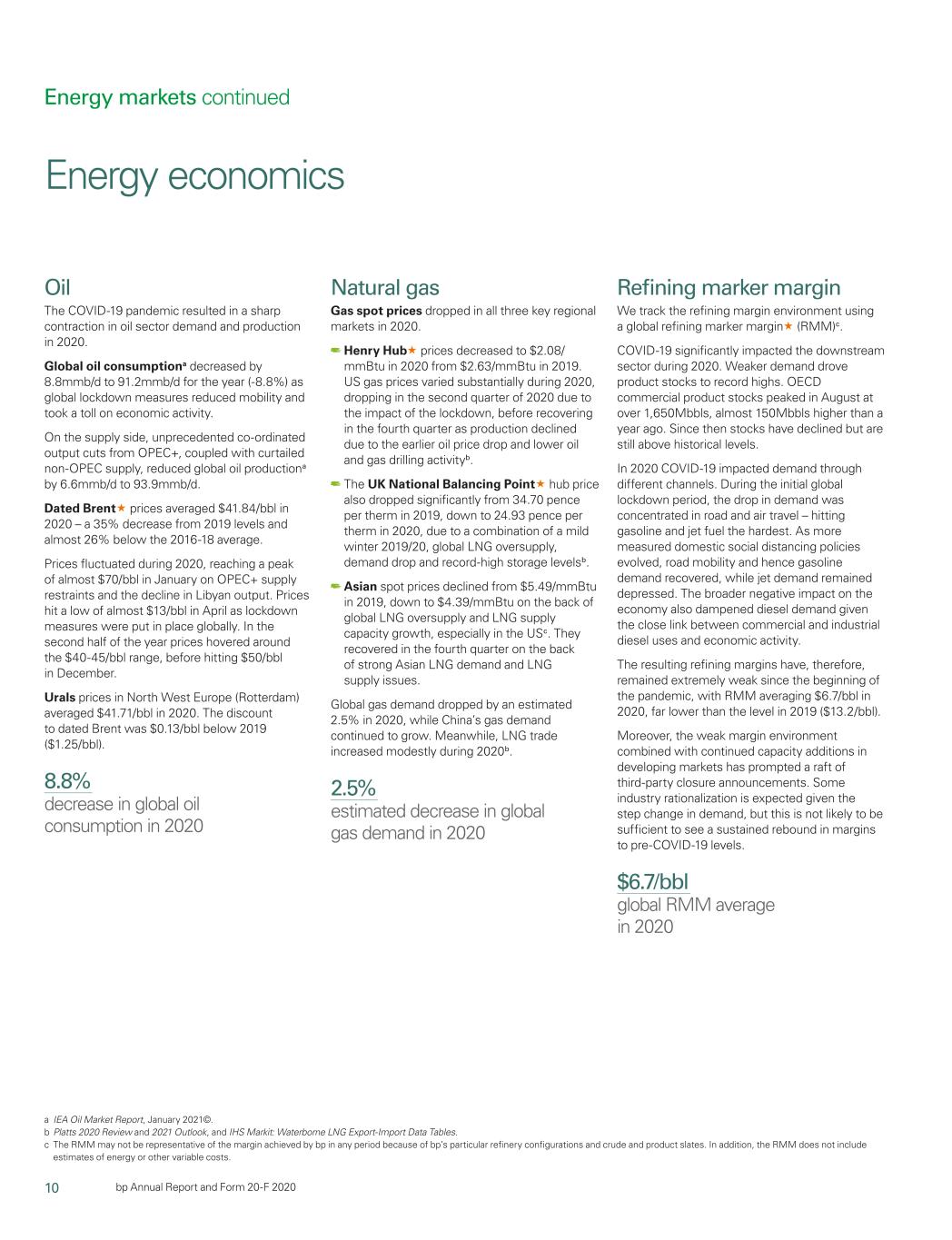

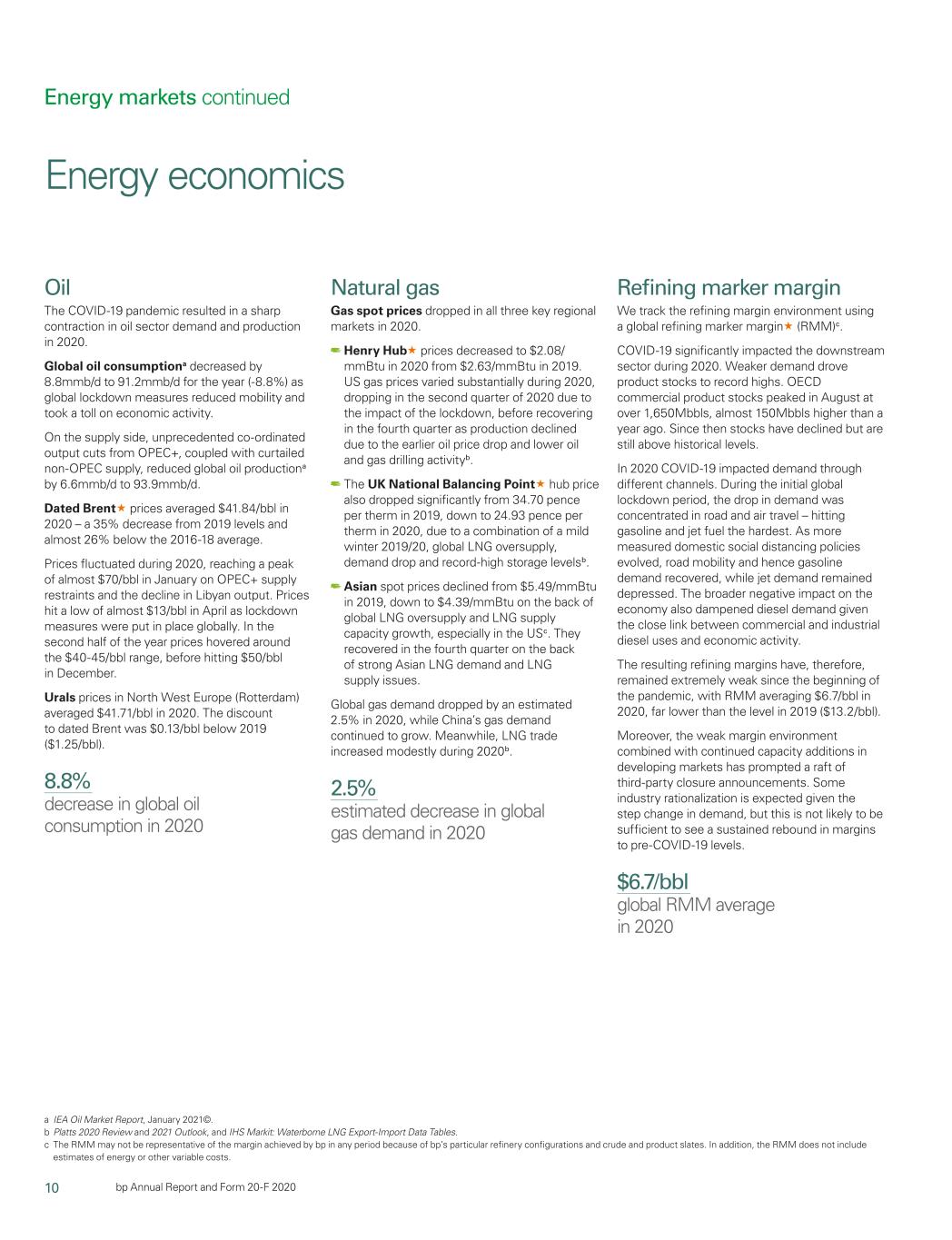

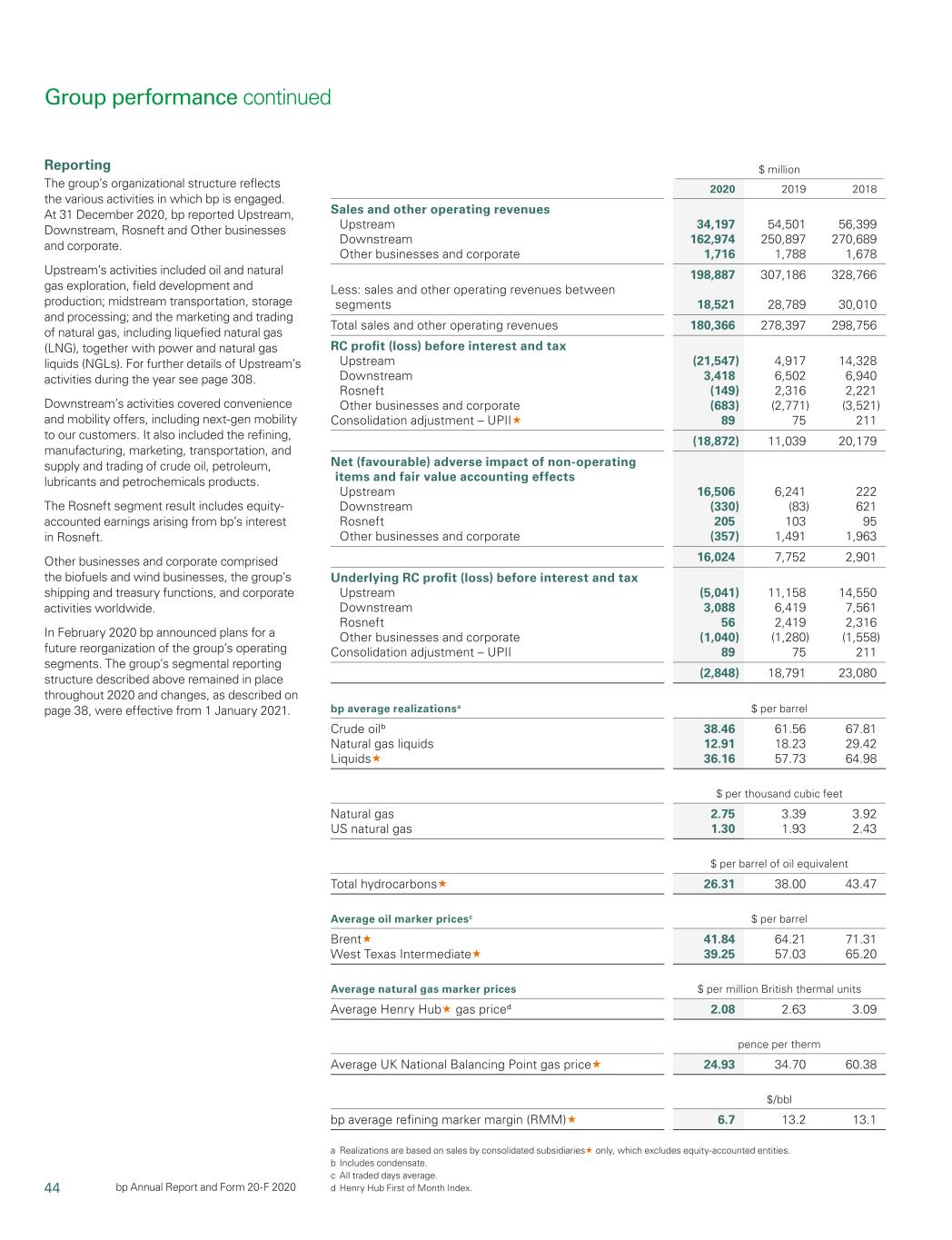

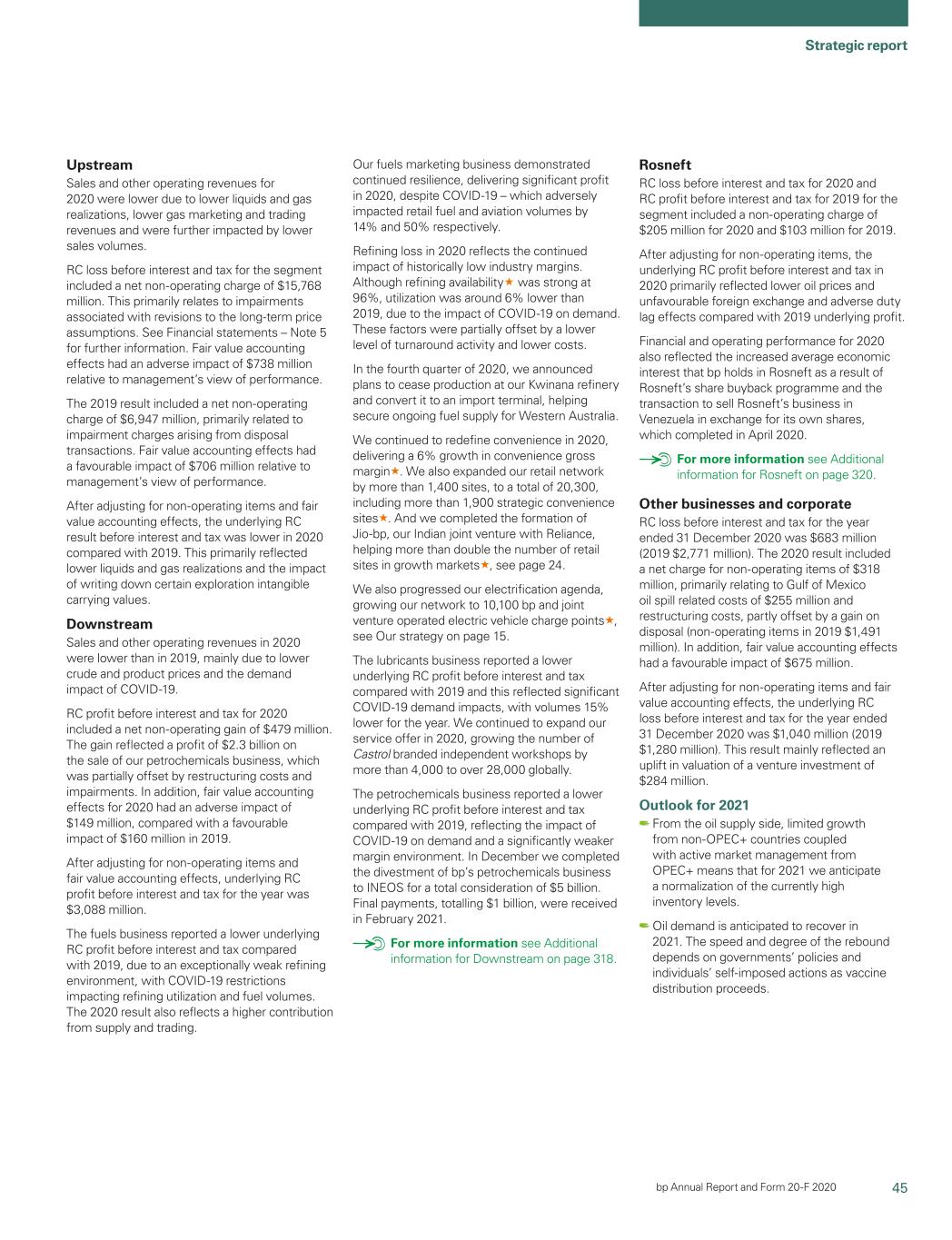

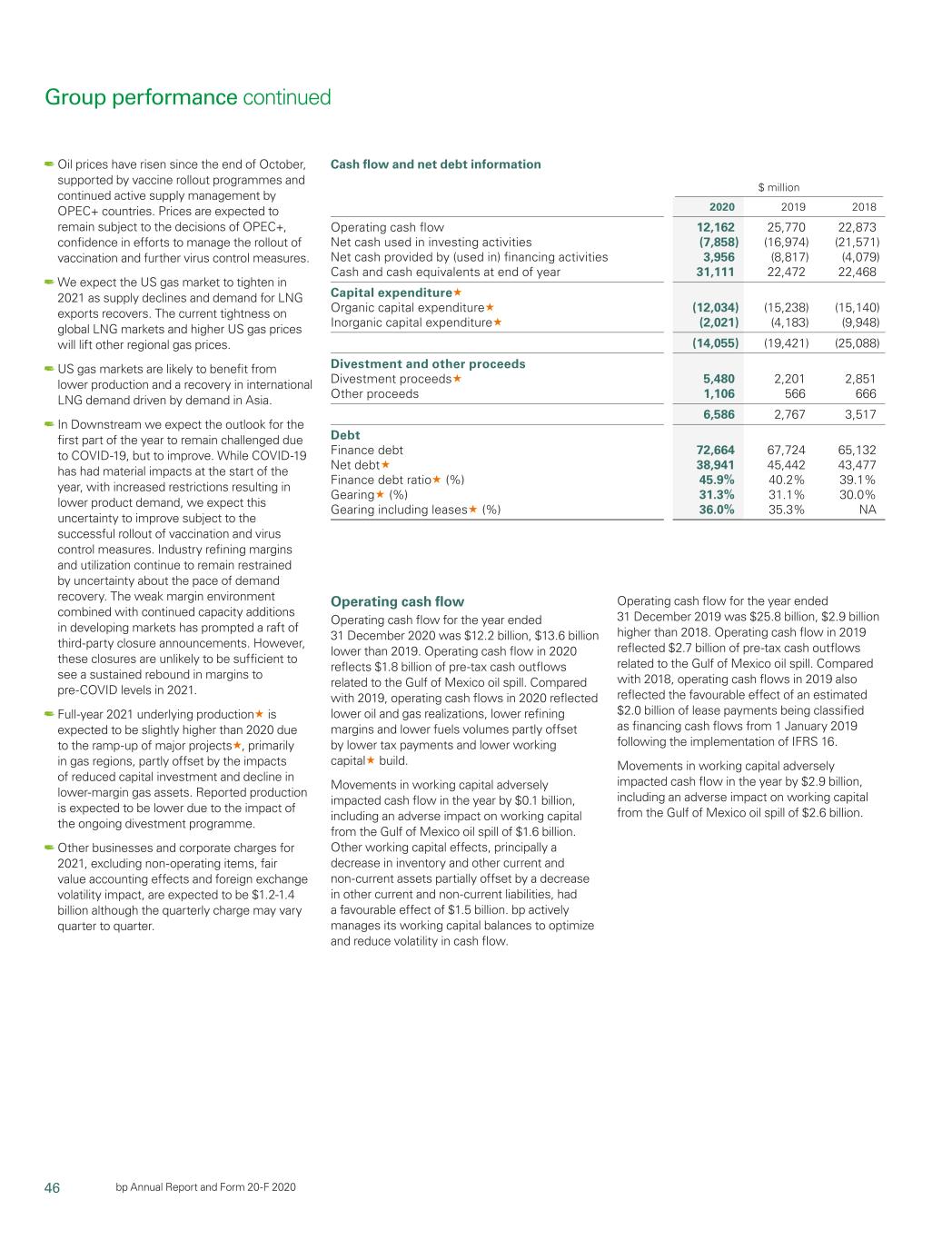

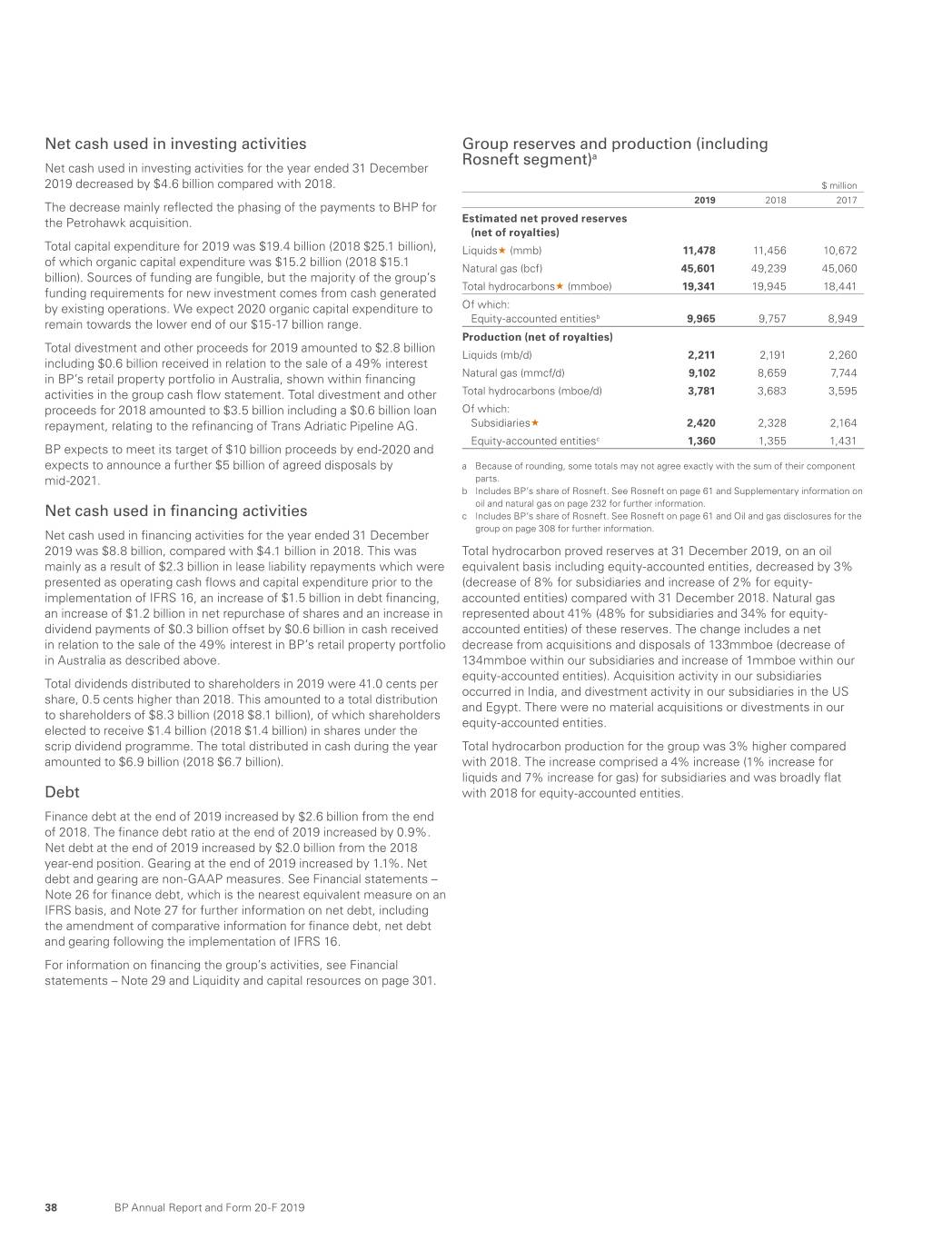

10 bp Annual Report and Form 20-F 2020 Oil The COVID-19 pandemic resulted in a sharp contraction in oil sector demand and production in 2020. Global oil consumptiona decreased by 8.8mmb/d to 91.2mmb/d for the year (-8.8%) as global lockdown measures reduced mobility and took a toll on economic activity. On the supply side, unprecedented co-ordinated output cuts from OPEC+, coupled with curtailed non-OPEC supply, reduced global oil productiona by 6.6mmb/d to 93.9mmb/d. Dated Brent« prices averaged $41.84/bbl in 2020 – a 35% decrease from 2019

levels and almost 26% below the 2016-18 average. Prices fluctuated during 2020, reaching a peak of almost $70/bbl in January on OPEC+ supply restraints and the decline in Libyan output. Prices hit a low of almost $13/bbl in April as lockdown measures were put in place globally. In the second half of the year prices hovered around the $40-45/bbl range, before hitting $50/bbl in December. Urals prices in North West Europe (Rotterdam) averaged $41.71/bbl in 2020. The discount to dated Brent was $0.13/bbl below 2019 ($1.25/bbl). 8.8% decrease in global oil consumption in 2020 Natural gas Gas spot prices dropped in all three key regional markets in 2020. Henry Hub« prices decreased to $2.08/ mmBtu in 2020 from $2.63/mmBtu in 2019. US gas prices varied substantially during 2020, dropping in the second quarter of 2020 due to the impact of the lockdown, before recovering in the fourth quarter as production declined due to the earlier oil price drop and lower oil and gas drilling activityb. The UK National Balancing Point« hub price also dropped significantly from 34.70 pence per therm in 2019, down to 24.93 pence per therm in 2020, due to a combination of a mild winter 2019/20, global LNG oversupply, demand drop and record-high storage levelsb. Asian spot prices declined from $5.49/mmBtu in 2019, down to $4.39/mmBtu on the back of global LNG oversupply and LNG supply capacity growth, especially in the USc. They recovered in the fourth quarter on the back of strong Asian LNG demand and LNG supply issues. Global gas demand dropped by an estimated 2.5% in 2020, while China’s gas demand continued to grow. Meanwhile, LNG trade increased modestly during 2020b. 2.5% estimated decrease in global gas demand in 2020 Refining marker margin We track the refining margin environment using a global refining marker margin« (RMM)c. COVID-19 significantly impacted the downstream sector during 2020. Weaker demand drove product stocks to record highs. OECD commercial product stocks peaked in August at over 1,650Mbbls, almost 150Mbbls higher than a year ago. Since then stocks have declined but are still above historical levels. In 2020 COVID-19 impacted demand through different channels. During the initial global lockdown period, the drop in demand was concentrated in road and air travel – hitting gasoline and jet fuel the hardest. As more measured domestic social distancing policies evolved, road mobility and hence gasoline demand recovered, while jet demand remained depressed. The broader negative impact on the economy also dampened diesel demand given the close link between commercial and industrial diesel uses and economic activity. The resulting refining margins have, therefore, remained extremely weak since the beginning of the pandemic, with RMM averaging $6.7/bbl in 2020, far lower than the level in 2019 ($13.2/bbl). Moreover, the weak margin environment combined with continued capacity additions in developing markets has prompted a raft of third-party closure announcements. Some industry rationalization is expected given the step change in demand, but this is not likely to be sufficient to see a sustained rebound in margins to pre-COVID-19 levels. $6.7/bbl global RMM average in 2020 a IEA Oil Market Report, January 2021©. b Platts 2020 Review and 2021 Outlook, and IHS Markit: Waterborne LNG Export-Import Data Tables. c The RMM may not be representative of the margin achieved by bp in any period because of bp’s particular refinery configurations and crude and product slates. In addition, the RMM does not include estimates of energy or other variable costs. Energy economics Energy markets continued

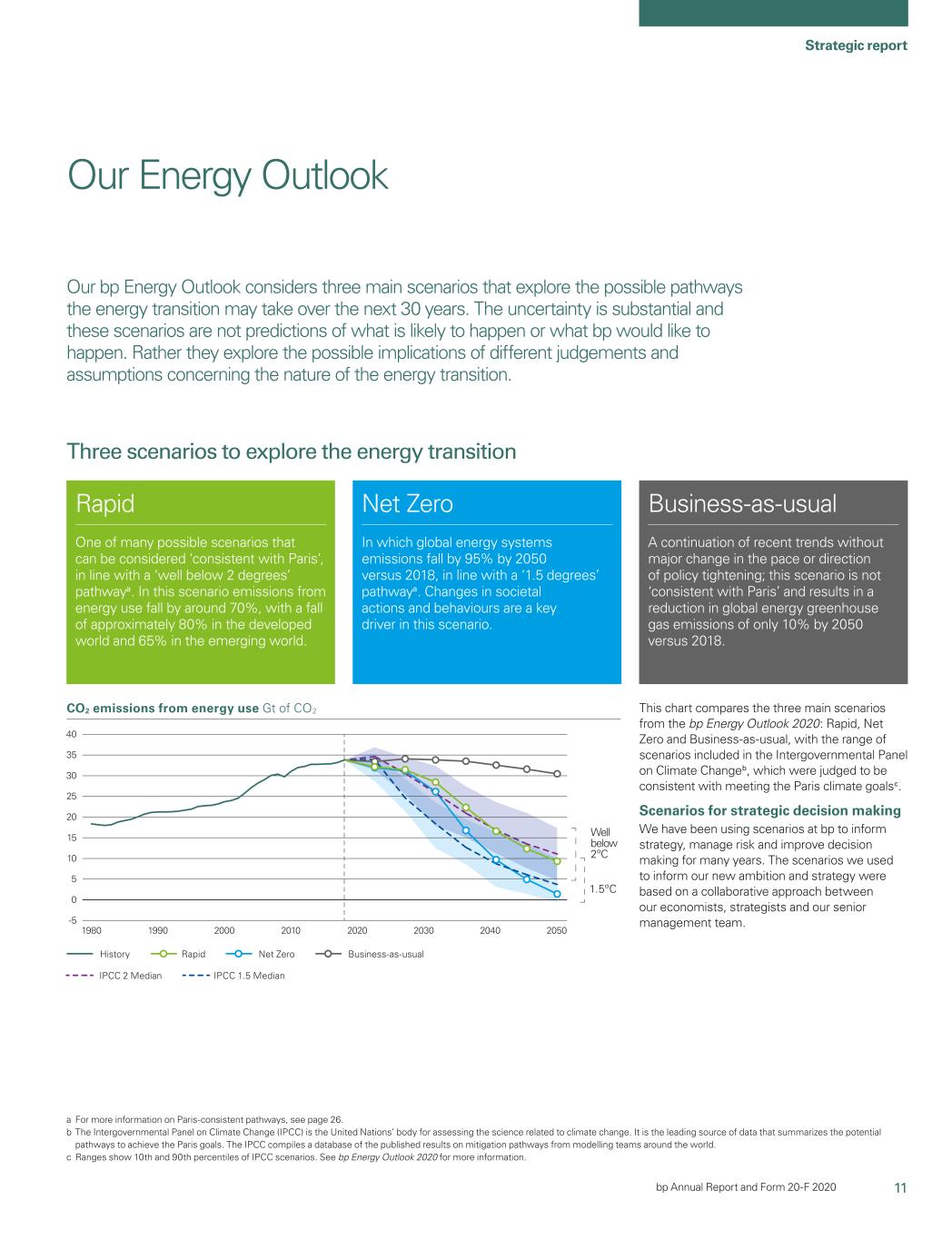

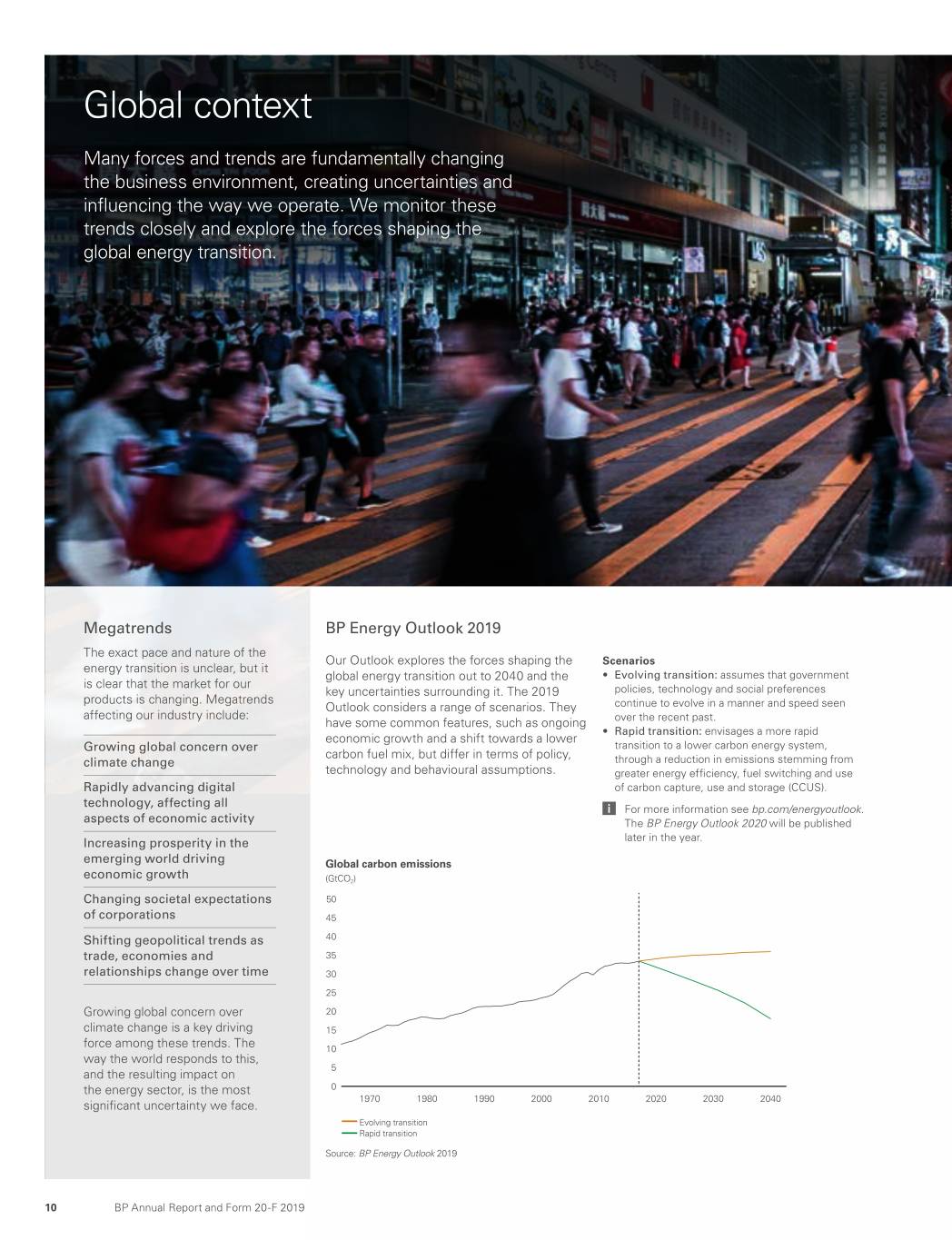

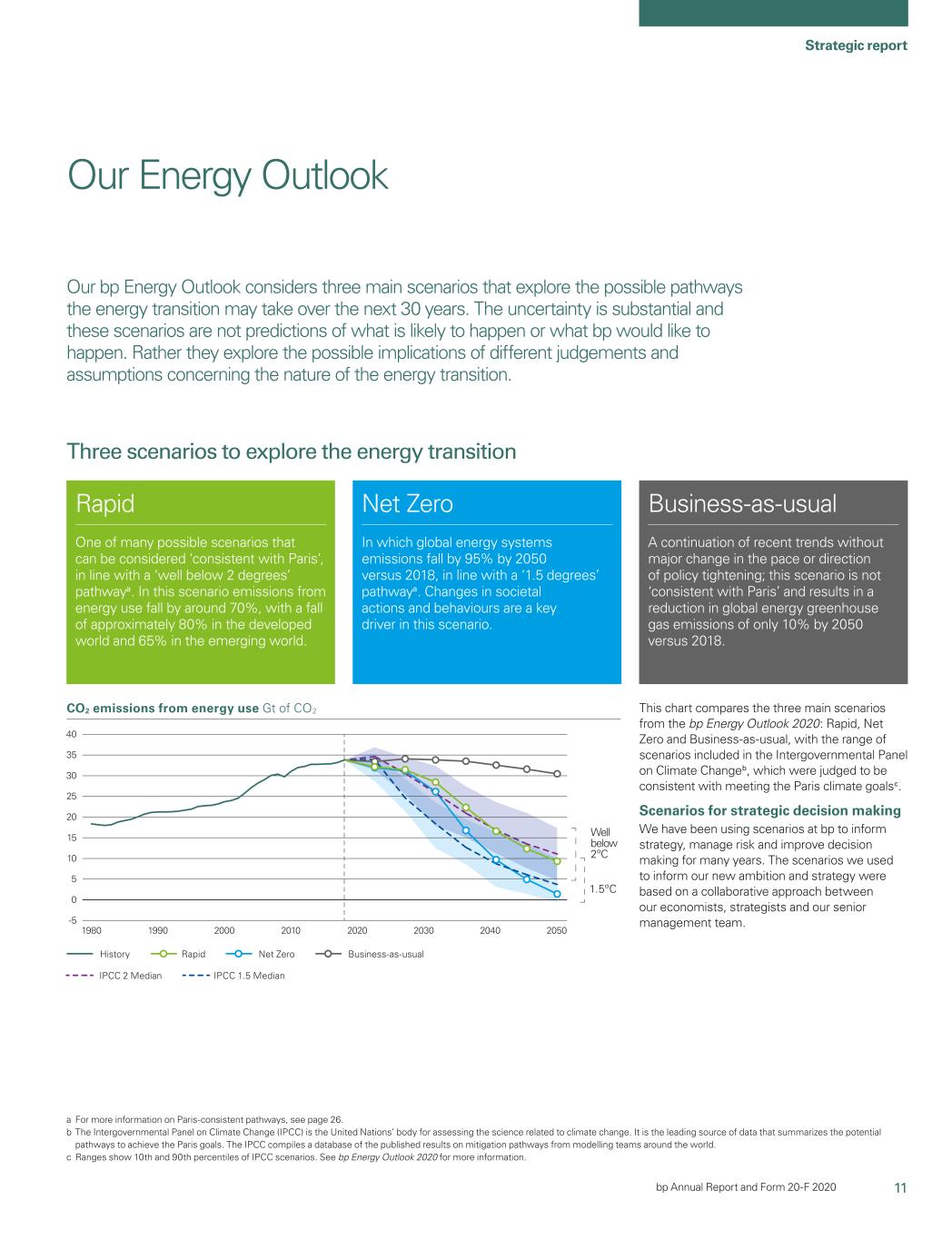

11 Strategic report “Our destination is a thriving, sustainableCO2 emissions from energy business in a net zero world. One that is a motivating and inspiring place to work for our employees.” Our purpose is reimagining energy for people and our planet. This will frame our thinking, our activities and our interactions. Introducing a new structure, new leadership team and new waysuse Gt of working. Our commitment to safe and reliable operations remains unchanged. And our investor proposition remains unchanged. BPCO2 20502020 2030 20402010200019901980 -5 40 IPCC 2 Median History Rapid Net Zero Business-as-usual IPCC 1.5 Median 0 5 10 15 20 25 30 35 Well below 2ºC 1.5ºC bp Annual Report and Form 20-F 2020 Our bp Energy Outlook considers three main scenarios that explore the possible pathways the energy transition may take over the next 30 years. The uncertainty is substantial and these scenarios are not predictions of what is likely to happen or what bp would like to happen. Rather they explore the possible implications of different judgements and assumptions concerning the nature of the energy transition. a For more information on Paris-consistent pathways, see page 26. b The Intergovernmental Panel on Climate Change (IPCC) is the United Nations’ body for assessing the science related to climate change. It is the leading source of data that summarizes the potential pathways to achieve the Paris goals. The IPCC compiles a database of the published results on mitigation pathways from modelling teams around the world. c Ranges show 10th and 90th percentiles of IPCC scenarios. See bp Energy Outlook 2020 for more information. This chart compares the three main scenarios from the bp Energy Outlook 2020: Rapid, Net Zero and Business-as-usual, with the range of scenarios included in the Intergovernmental Panel on Climate Changeb, which were judged to be consistent with meeting the Paris climate goalsc. Scenarios for strategic decision making We have been using scenarios at bp to inform strategy, manage risk and improve decision making for many years. The scenarios we used to inform our new ambition and strategy were based on a collaborative approach between our economists, strategists and our senior management team. Three scenarios to explore the energy transition Rapid One of many possible scenarios that can be considered ‘consistent with Paris’, in line with a ‘well below 2 degrees’ pathwaya. In this scenario emissions from energy use fall by around 70%, with a fall of approximately 80% in the developed world and 65% in the emerging world. Net Zero In which global energy systems emissions fall by 95% by 2050 versus 2018, in line with a ‘1.5 degrees’ pathwaya. Changes in societal actions and behaviours are a key driver in this scenario. Business-as-usual A continuation of recent trends without major change in the pace or direction of policy tightening; this scenario is not ‘consistent with Paris’ and results in a reduction in global energy greenhouse gas emissions of only 10% by 2050 versus 2018. Our Energy Outlook

12 bp Annual Report and Form 20-F 2020 Some scenarios start from today and project forward over a timeframe in which the current structure of the energy system helps to inform the pace and nature of the transition path. Other scenarios start in the distant future, breaking free from the inherent inertia in the energy system (and potentially our thinking), and look back to the present from that new perspective. In thinking about appropriate scenarios to inform our new strategy, we used both approaches. The scenarios chosen to explore the range of uncertainty surrounding the future of the global energy system span a broad range of energy transition paths. Importantly, the scenarios are not predictions of what is likely to happen or what bp would like to happen. Rather they consider the possible implications of different judgements and assumptions and so help to design a strategy which is resilient to the wide range of uncertainty we face. By considering various time horizons, we can identify key milestones or signposts which might emerge over the next five, 10 or 30 years and inform our view of the key sources of uncertainty affecting the global energy system. We actively monitor for changes in the external environment, and refresh or review our scenarios as needed in response to these signals. How we create scenarios We quantify these scenarios in the bp Energy Outlook 2020 using our global energy modelling system. This comprises of a suite of models developed over the past 10 years to help us understand supply and demand dynamics of the global energy system. The modelling framework uses historical data based on the bp Statistical Review of World Energy, IEA energy balances and a range of other energy and non-energy data sets. The model combines supply, end-use demand, and production in intermediate sectors, including power and hydrogen, to create global energy outlooks. Each scenario is determined by a set of key assumptions including population and economic growth, pace of technological change, resource constraints and government policies. Prices are used to balance supply and demand. The modelling techniques used vary by sector and include a combination of econometric modelling, least-cost optimization, adoption curves and consumer choice modelling. The regional coverage varies by sector but at its most aggregated the model produces views for 14 regions, across six sectors, more than 20 energy and technology sources and associated CO2 emissions from each. It produces annual data out to 2050. Scenarios are generated based on our own judgements alongside views from external organizations. For example, population growth from the United Nations, economic growth supported by views from Oxford Economics, resource availability based on Rystad Energy’s global upstream database, power modelling informed by Aurora Energy Research and global system dynamics based on a proprietary TIMES integrated assessment model. All scenarios typically take into account historical evidence, current policies, user judgement and specialist projections. In developing the scenarios, we benchmark our views against scenarios from external organizations including from the Intergovernmental Panel on Climate Change’s (IPPC) 2019 5

Special Report on Global Warming of 1.5°C, IEA’s World Energy Outlook 2020 and IHS Markit’s Energy and Climate Scenarios. How scenarios inform our strategy The scenarios described in the bp Energy Outlook 2020 helped inform bp’s strategy process, alongside a wide range of other analyses and information. As we developed the strategy, the scenarios were reviewed and refined to ensure they remained relevant, for example, they were completely refreshed to account for the possible implications of COVID-19, and they remained challenging for example, by including a scenario in which global emissions from energy reach near zero by 2050. The aim of the scenarios is to aid our understanding of how the pace and nature of the energy transition may affect the global energy system and so help our strategy be robust and resilient to the range of uncertainty we face. Given that, we believe that it is neither useful nor sensible to try to identify one scenario as being more or less likely than another. Energy markets continued In the bp Energy Outlook 2020, COVID-19 is assumed to have a persistent impact on economic activity and energy demand.

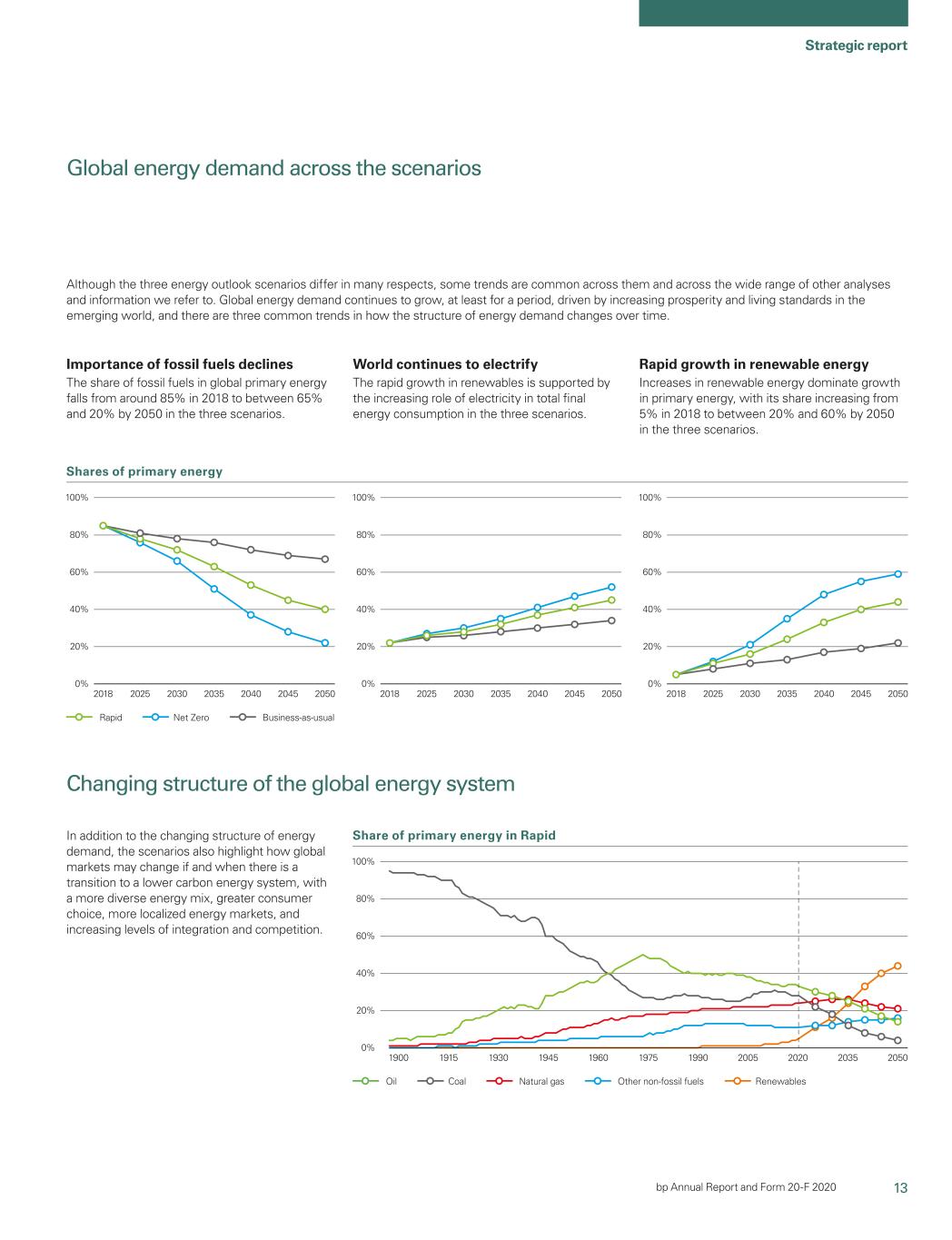

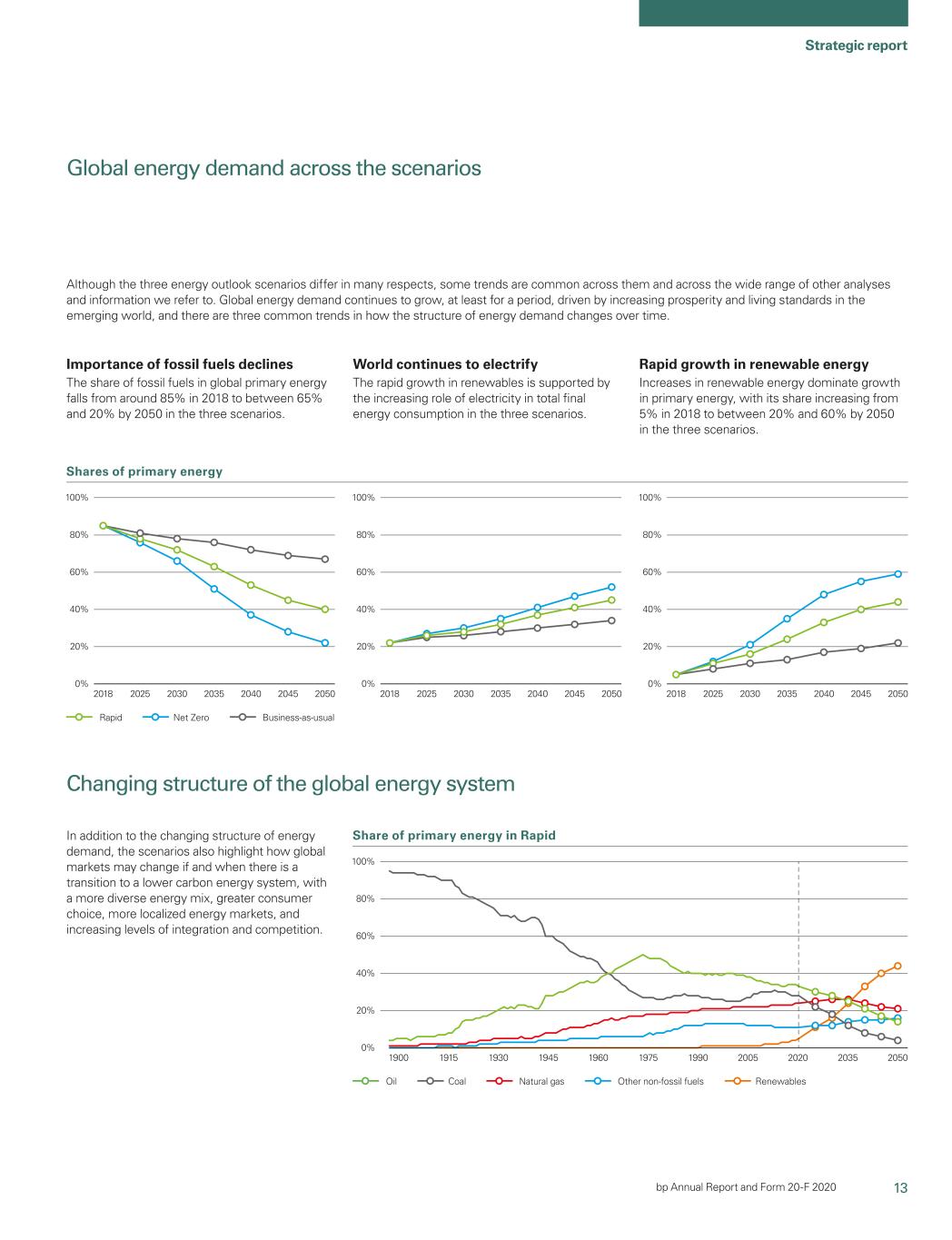

13 Strategic report Shares of primary energy 2040 2045 20502035203020252018 0% 20% 40% 60% 80% 100% Rapid Net Zero Business-as-usual Shares of primary energy 2040 2045 20502035203020252018 0% 20% 40% 60% 80% 100% Rapid Net Zero Business-as-usual Shares of total final comsumption 2040 2045 20502035203020252018 0% 20% 40% 60% 80% 100% Rapid Net Zero Business-as-usual Share of primary energy in Rapid 2035 2050202020051960 1975 19901945193019151900 0% 20% 40% 60% 80% 100% Other non-fossil fuelsOil Coal Natural gas Renewables bp Annual Report and Form 20-F 2020 World continues to electrify The rapid growth in renewables is supported by the increasing role of electricity in total final energy consumption in the three scenarios. Importance of fossil fuels declines The share of fossil fuels in global primary energy falls from around 85% in 2018 to between 65% and 20% by 2050 in the three scenarios. Rapid growth in renewable energy Increases in renewable energy dominate growth in primary energy, with its share increasing from 5% in 2018 to between 20% and 60% by 2050 in the three scenarios. Global energy demand across the scenarios Although the three energy outlook scenarios differ in many respects, some trends are common across them and across the wide range of other analyses and information we refer to. Global energy demand continues to grow, at least for a period, driven by increasing prosperity and living standards in the emerging world, and there are three common trends in how the structure of energy demand changes over time. In addition to the changing structure of energy demand, the scenarios also highlight how global markets may change if and when there is a transition to a lower carbon energy system, with a more diverse energy mix, greater consumer choice, more localized energy markets, and increasing levels of integration and competition. Changing structure of the global energy system

14 bp Annual Report and Form 20-F 2020 Our beliefs on the energy transition Energy markets continued Three features are common across our Energy Outlook scenarios and they form a set of three core beliefs as to how energy demand is likely to change over the next three decades. And those core beliefs lead to three more about how the energy system will have to change in response to evolving demand, out to 2050. These core beliefs underpin our new strategy. bp.com/energyoutlook The world will electrify, with renewables a clear winner Customers will redefine convenience and mobility, driven by electrification, digital and fleets Oil and gas challenged but will remain part of the energy mix for decades Digital will continue to transform our lives – creating opportunities to drive innovation, unlock value and engage new customers and markets Customers – countries, cities, industries and corporates – will demand bespoke energy solutions Energy systems will become increasingly multi-technology, integrated and local

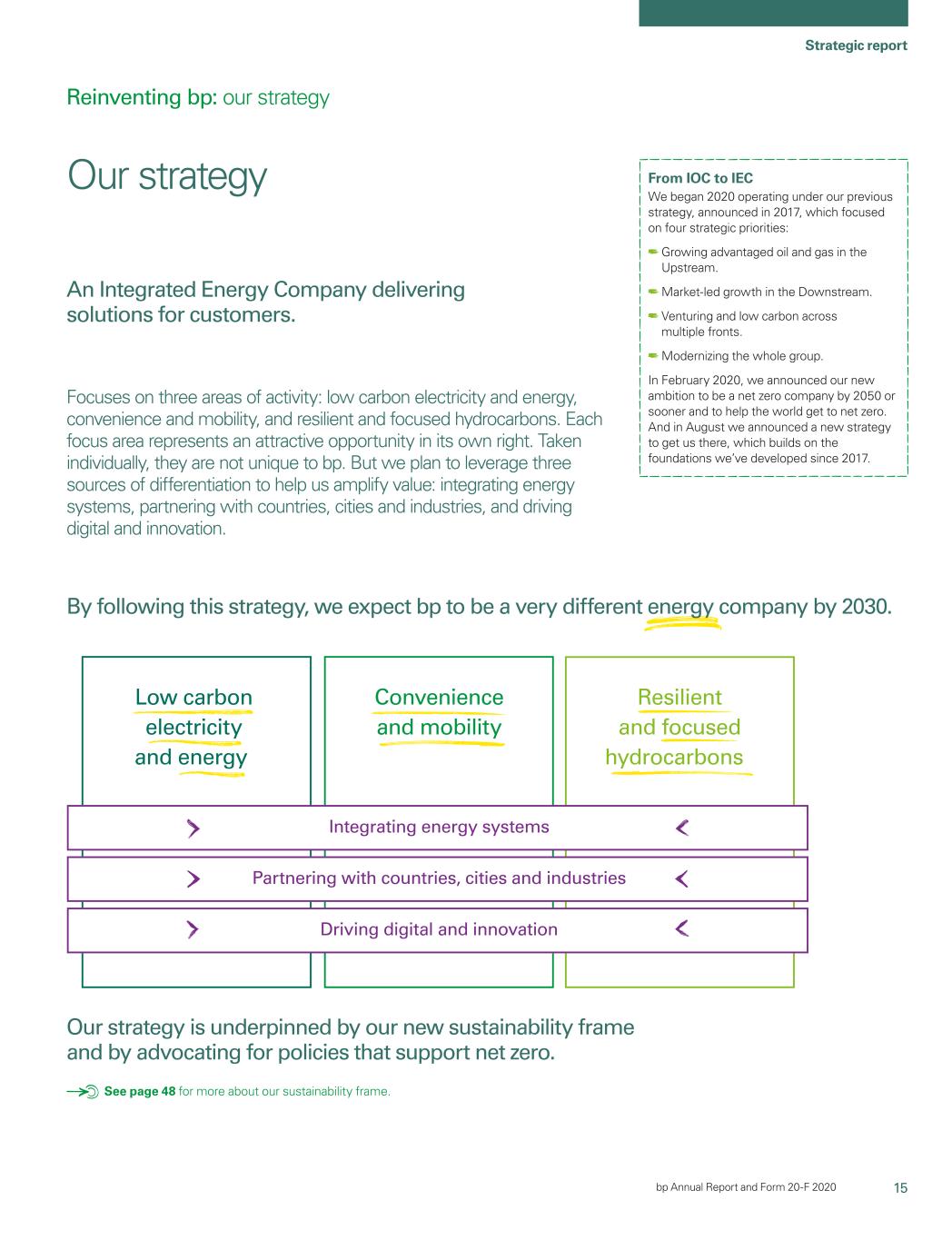

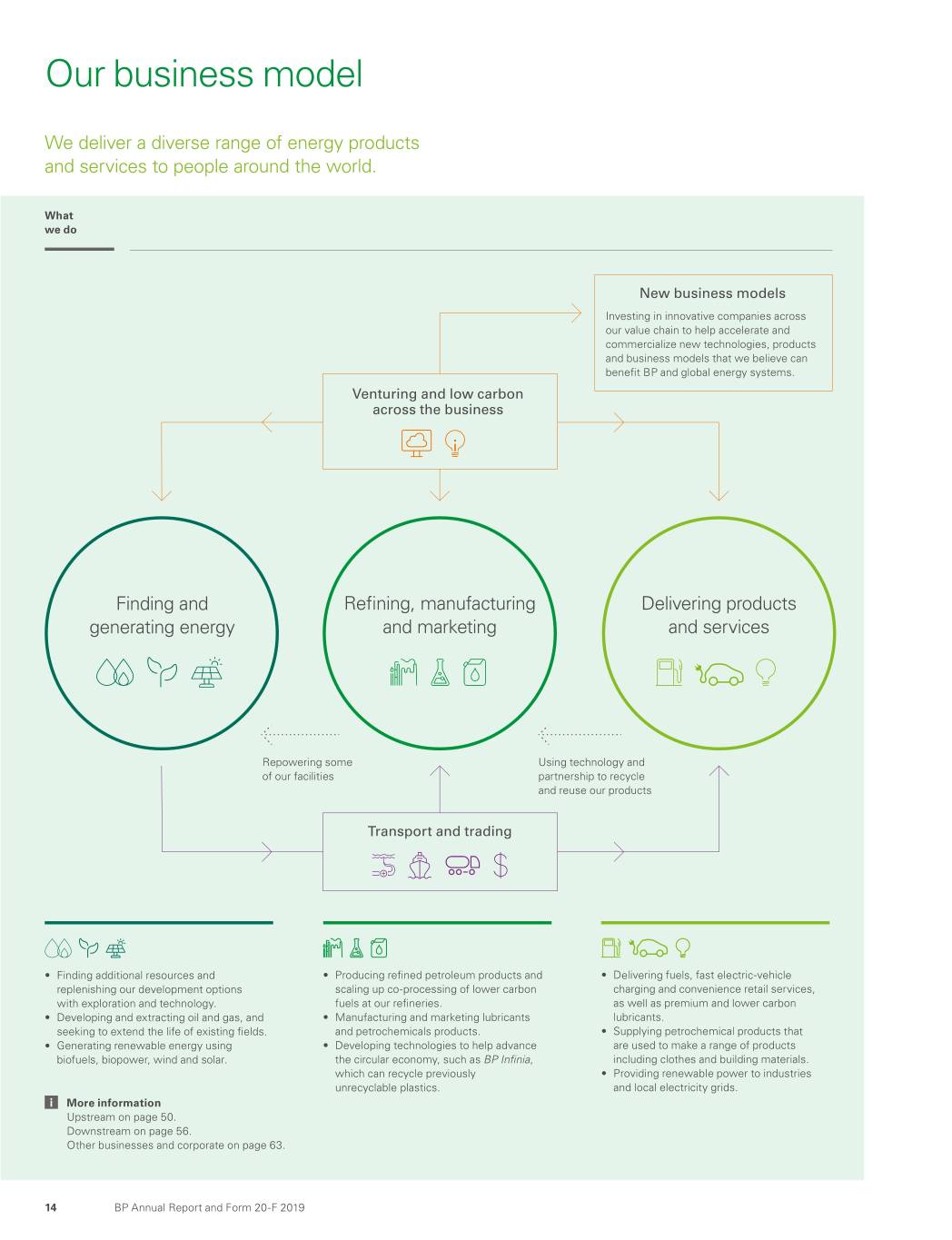

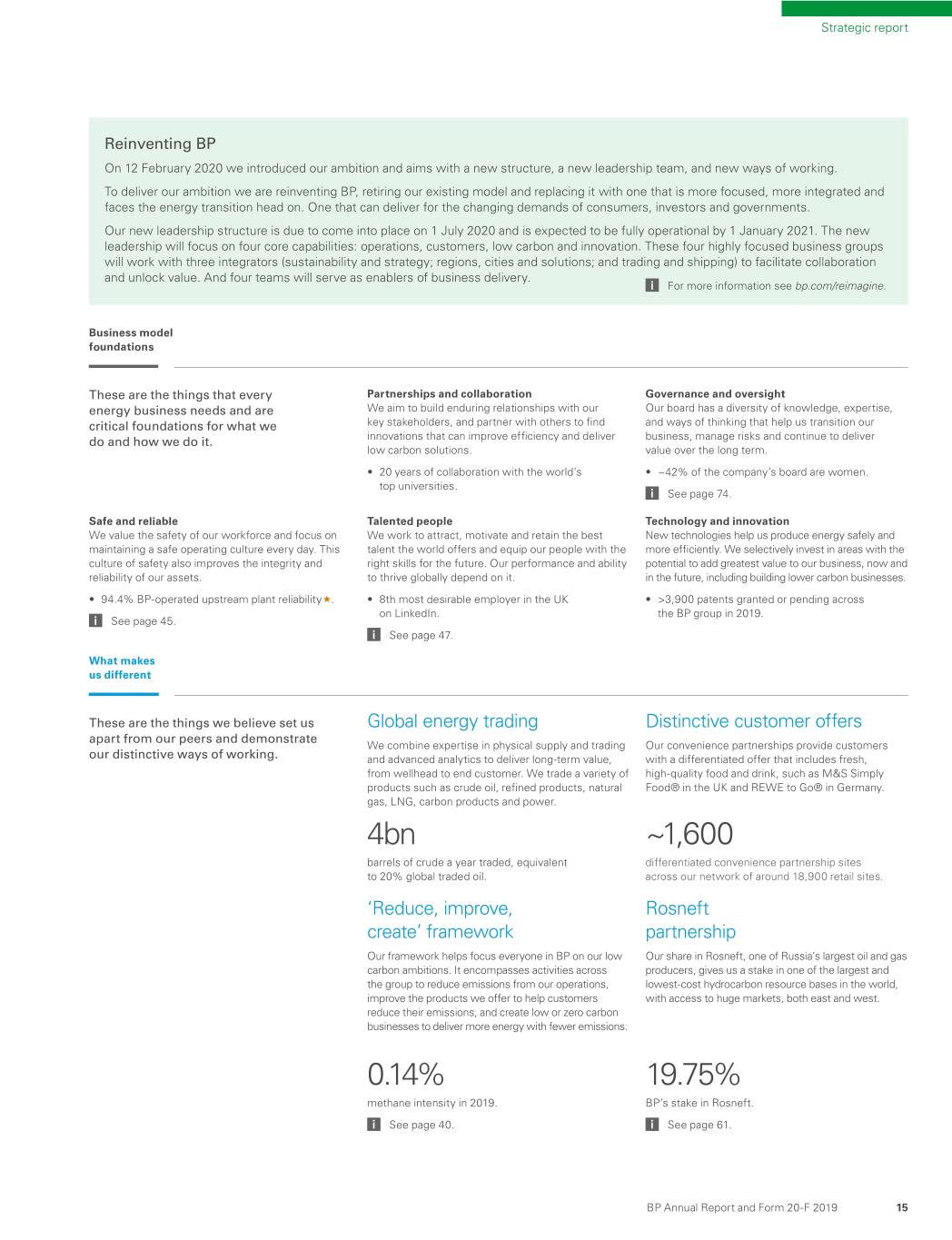

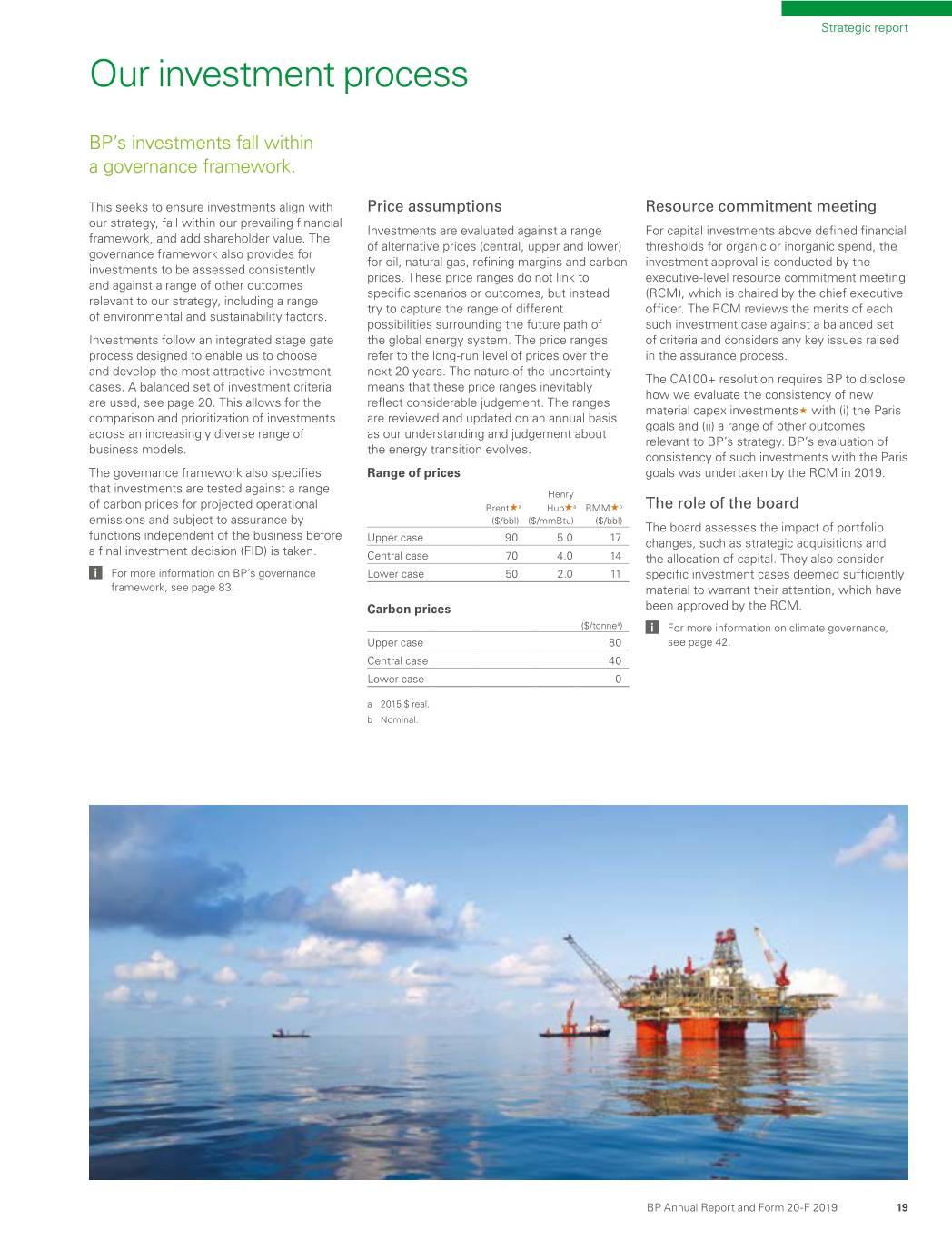

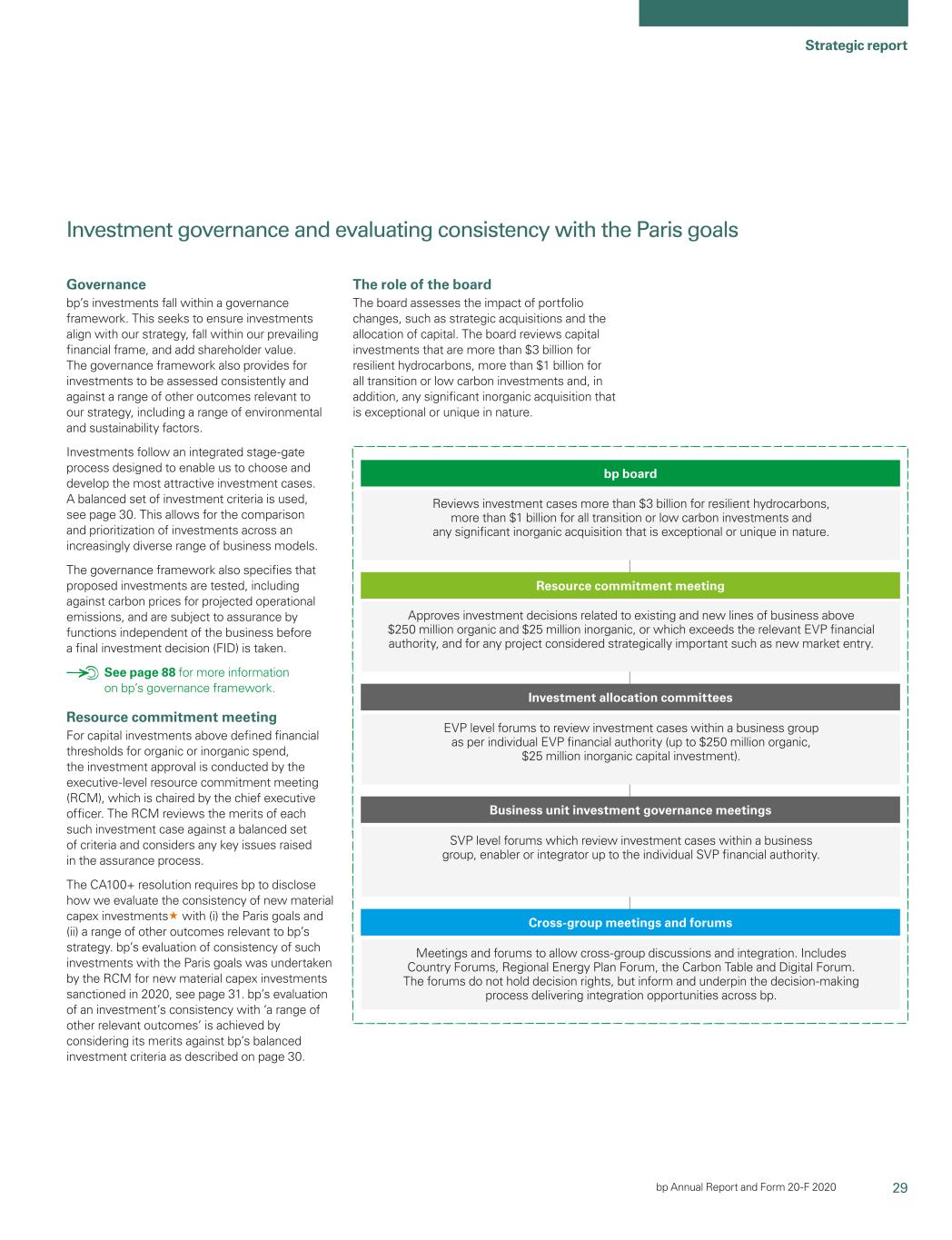

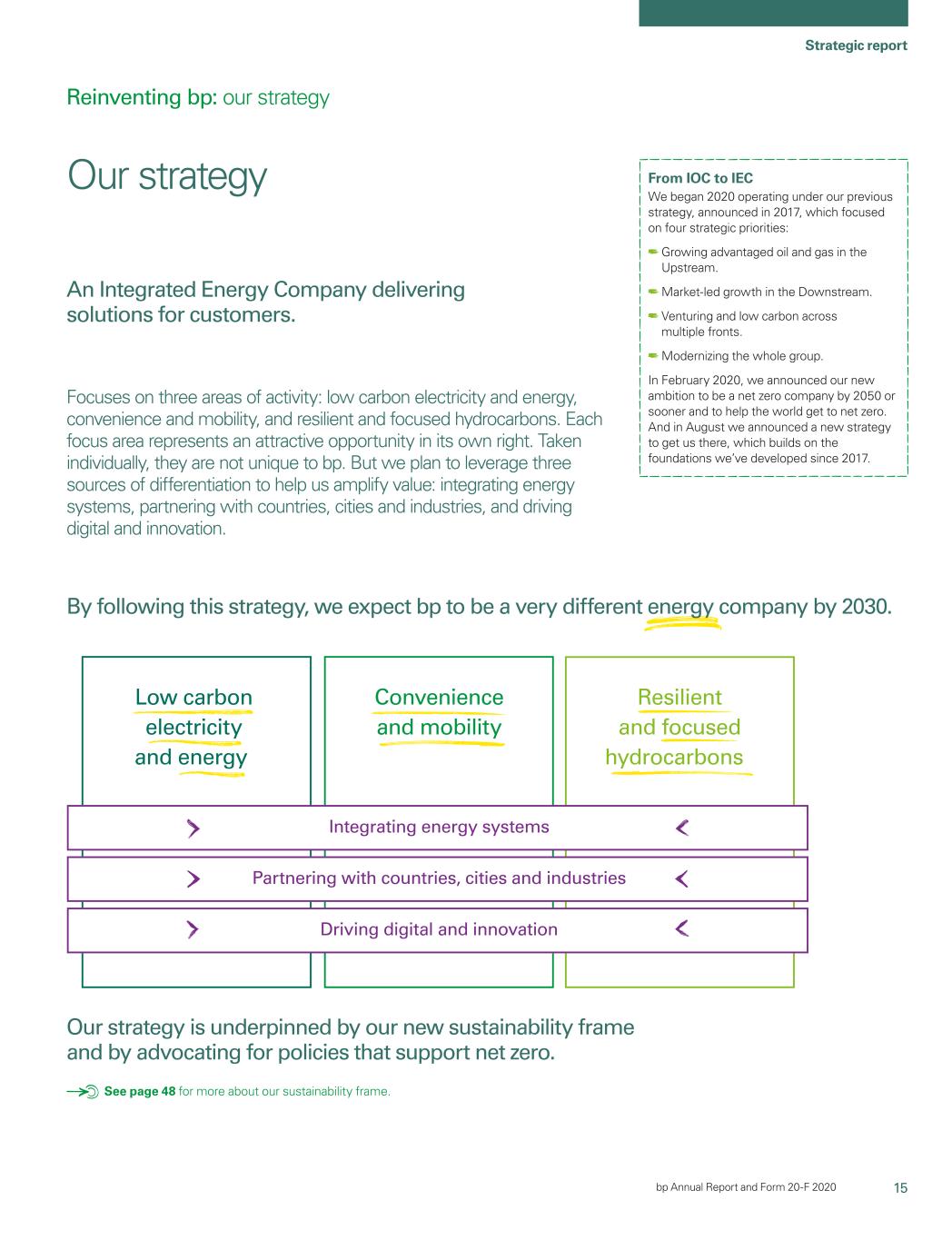

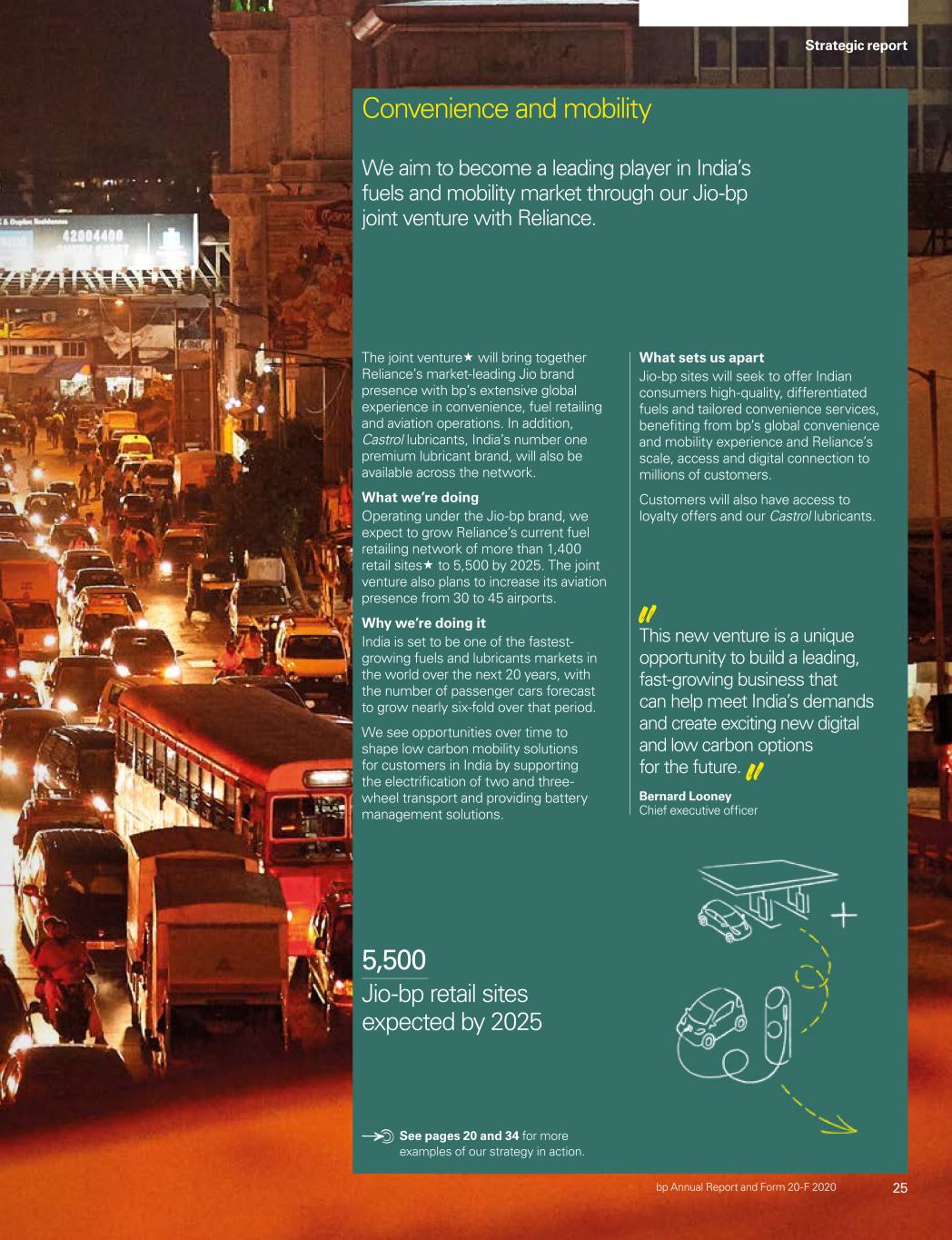

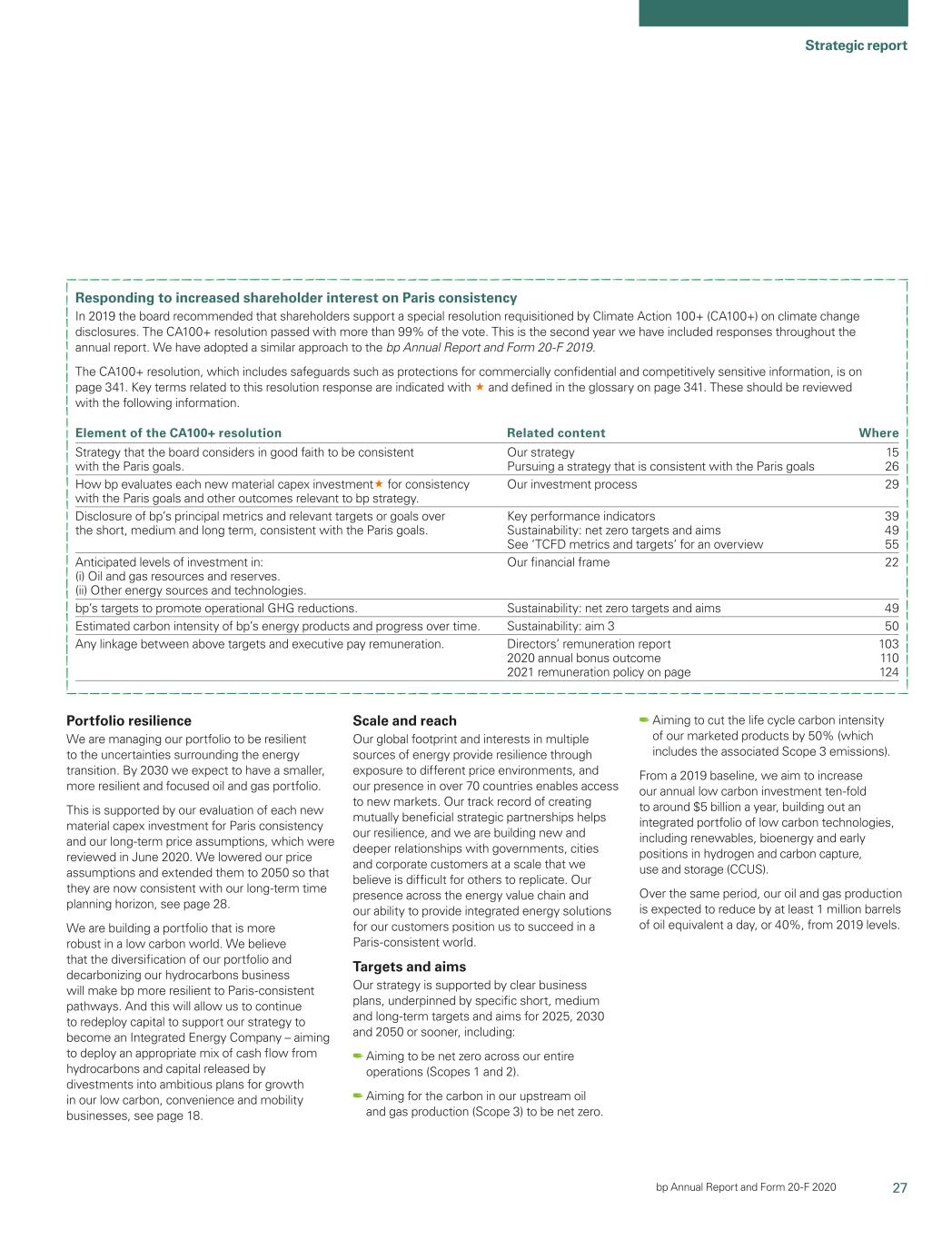

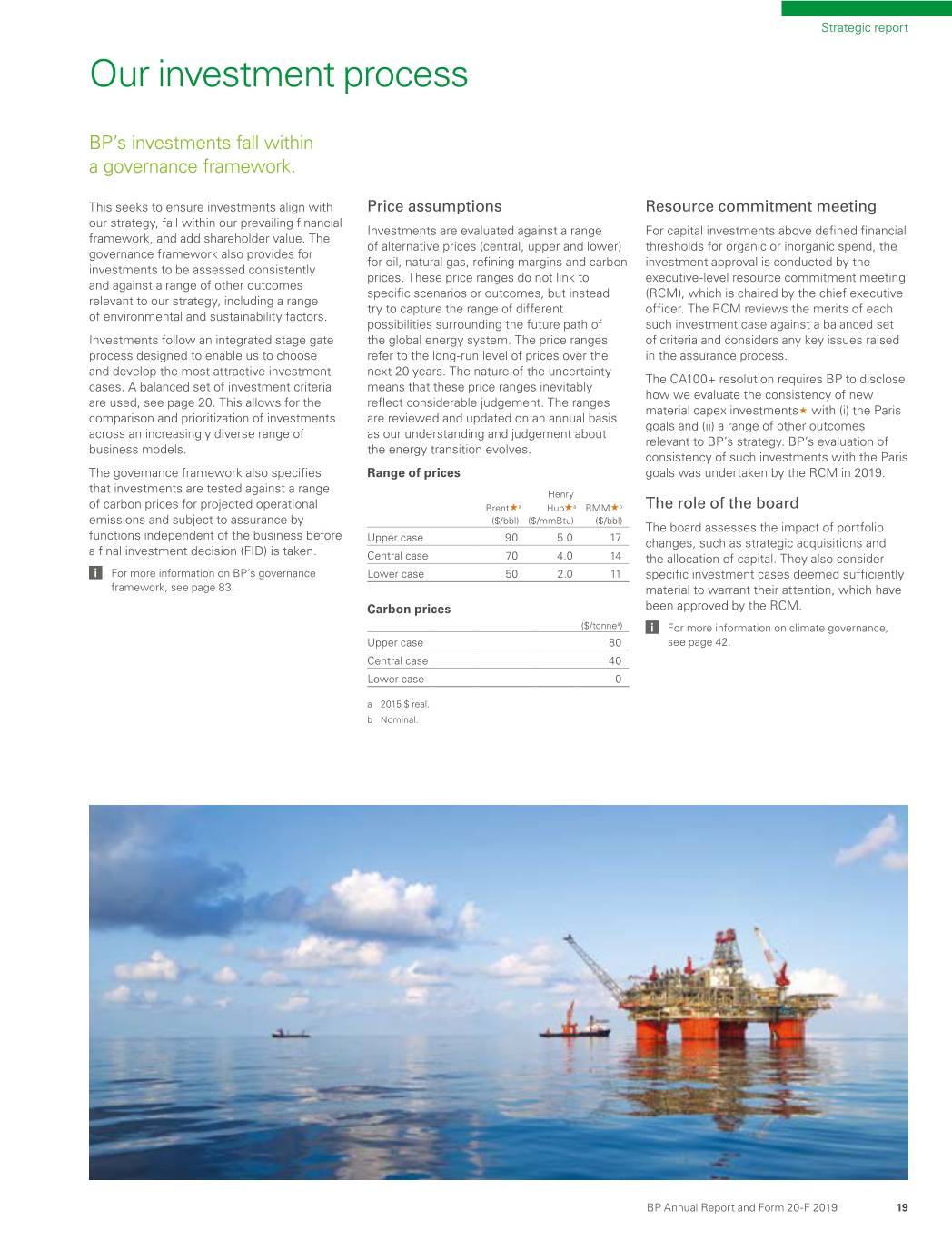

15 Strategic report A sustainability frame linking our purpose and Integrating energy systems Partnering with countries, cities and industries Driving digital and innovation Low carbon electricity and energy Convenience and mobility Resilient and focused hydrocarbons bp Annual Report and Form 20-F 2020 From IOC to IEC We began 2020 operating under our previous strategy, announced in 2017, which focused on four strategic priorities: Growing advantaged oil and gas in the Upstream. Market-led growth in the Downstream. Venturing and low carbon across multiple fronts. Modernizing the whole group. In February 2020, we announced our new ambition is to be a net zero company by 2050 or sooner and to help the world get to net zero. And in August we announced a new strategy to get us there, which builds on the foundations we’ve developed since 2017. See page 48 for more about our sustainability frame. Our ambitionstrategy is underpinned by our ew s stain bility frame and by advocating for policies that support net zero. Our strategy Focuses on three areas of activity: low carbon electricity and energy, convenience and mobility, and resilient and focused hydrocarbons. Each focus area represents an attractive opportunity in its own right. Taken individually, they are not unique to bp. But we plan to leverage three sources of differentiation to help us amplify value: integrating energy systems, partnering with countries, cities and industries, and driving digital and innovation. An Integrated Energy Company delivering solutions for customers. By following this strategy, we expect bp to be a very different energy company by 2030. Reinventing bp: our strategy

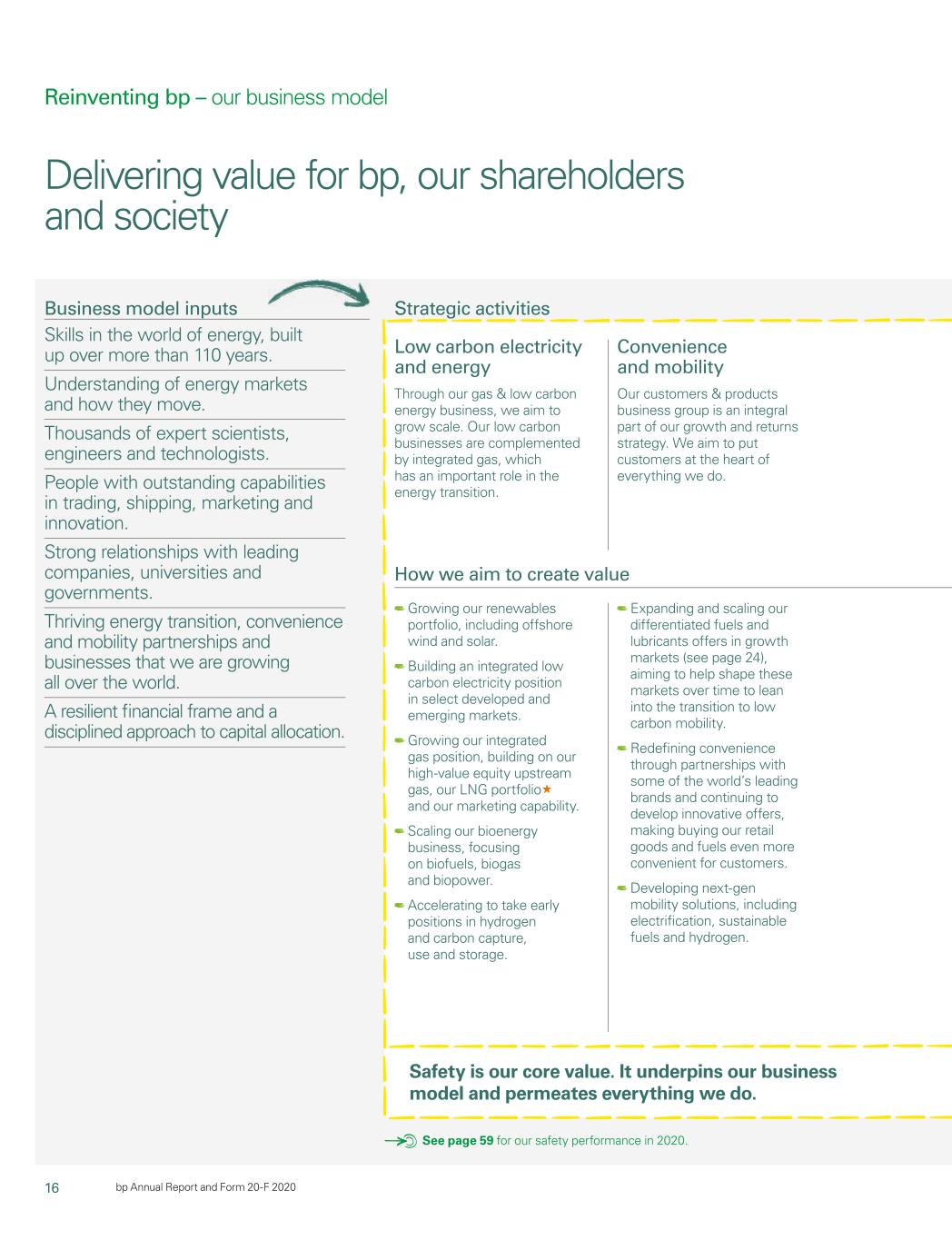

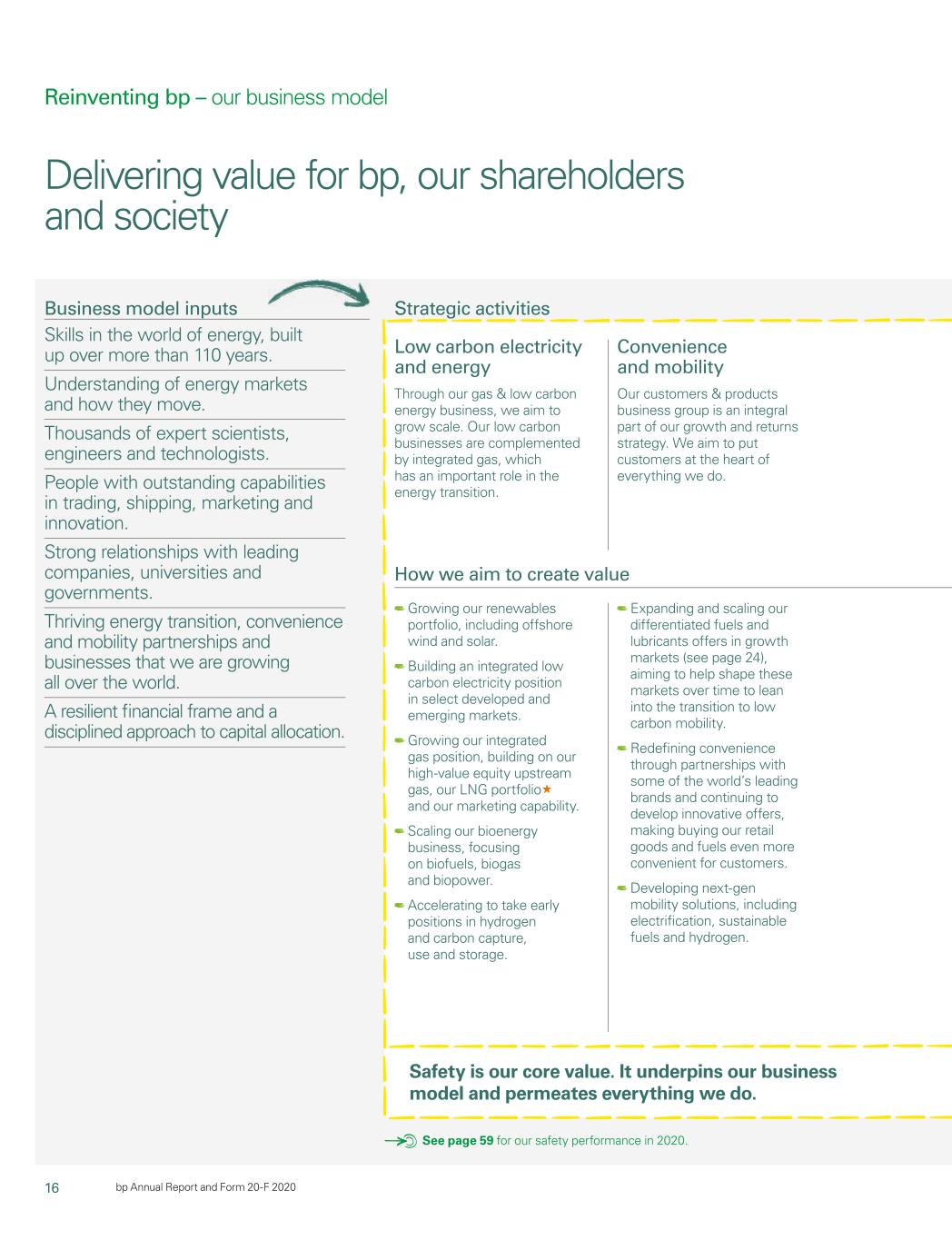

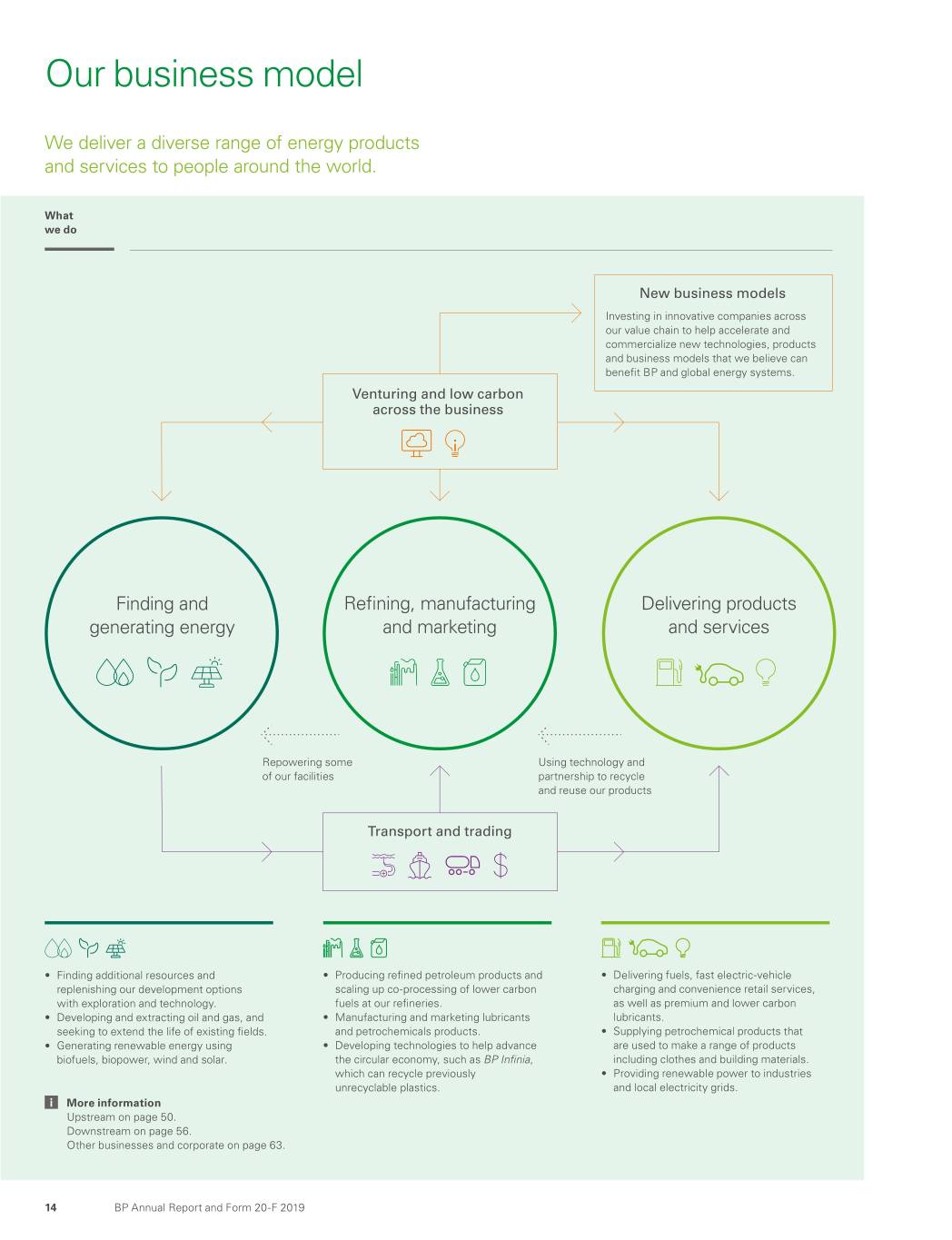

16 bp Annual Report and Form 20-F 2020 Reinventing bp – our business model Business model inputs Skills in the world of energy, built up over more than 110 years. Understanding of energy markets and how they move. Thousands of expert scientists, engineers and technologists. People with outstanding capabilities in trading, shipping, marketing and innovation. Strong relationships with leading companies, universities and governments. Thriving energy transition, convenience and mobility partnerships and businesses that we are growing all over the world. A resilient financial frame and a disciplined approach to capital allocation. Strategic activities How we aim to create value Safety is our core value. It underpins our business model and permeates everything we do. Convenience and mobility Our customers & products business group is an integral part of our growth and returns strategy. We aim to put customers at the heart of everything we do. Low carbon electricity and energy Through our gas & low carbon energy business, we aim to grow scale. Our low carbon businesses are complemented by integrated gas, which has an important role in the energy transition. Expanding and scaling our differentiated fuels and lubricants offers in growth markets (see page 24), aiming to help shape these markets over time to lean into the transition to low carbon mobility. Redefining convenience through partnerships with some of the world’s leading brands and continuing to develop innovative offers, making buying our retail goods and fuels even more convenient for customers. Developing next-gen mobility solutions, including electrification, sustainable fuels and hydrogen. Growing our renewables portfolio, including offshore wind and solar. Building an integrated low carbon electricity position in select developed and emerging markets. Growing our integrated gas position, building on our high-value equity upstream gas, our LNG portfolio« and our marketing capability. Scaling our bioenergy business, focusing on biofuels, biogas and biopower. Accelerating to take early positions in hydrogen and carbon capture, use and storage. Delivering value for bp, our shareholders and society See page 59 for our safety performance in 2020.

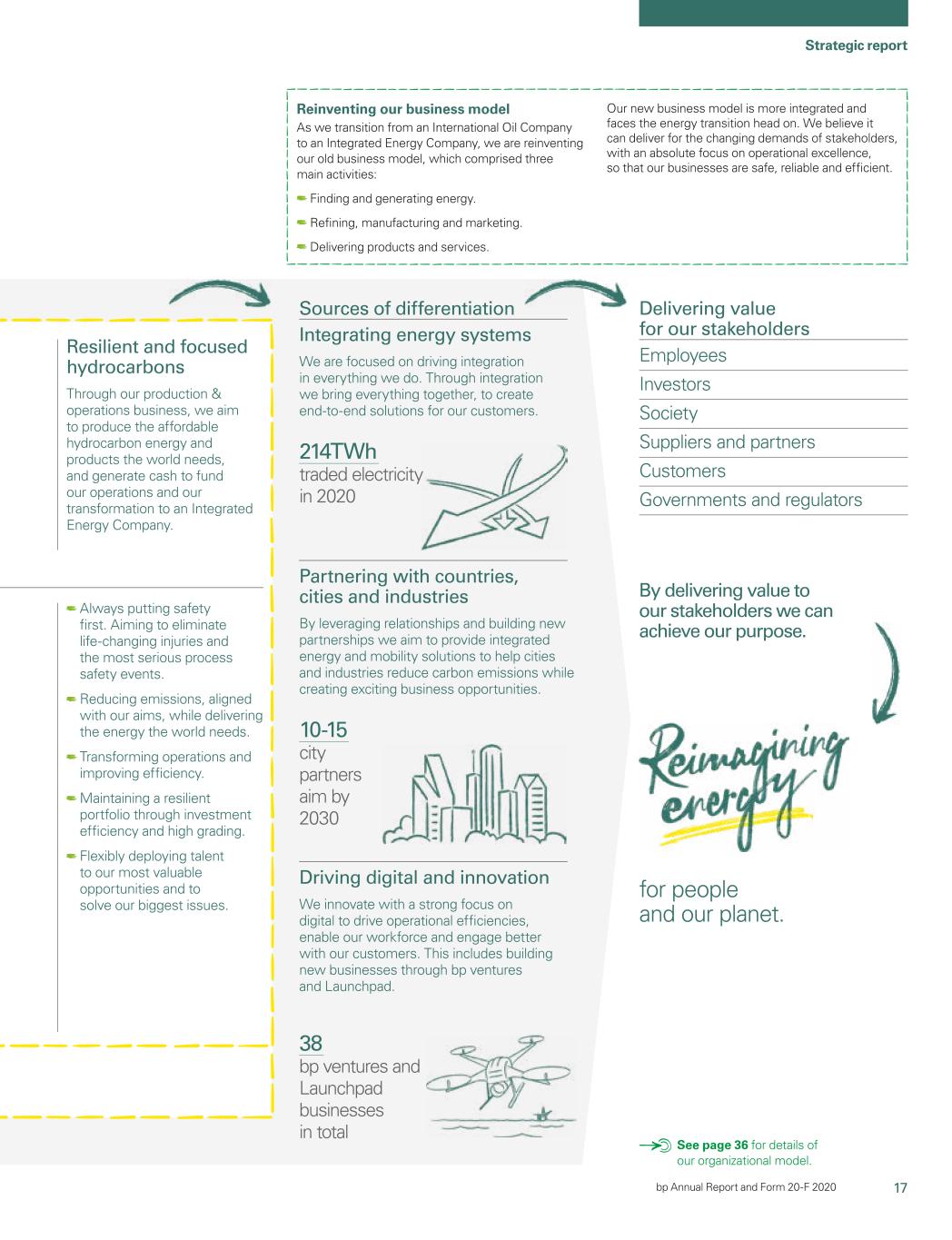

17 Strategic report bp Annual Report and Form 20-F 2020 Sources of differentiation Resilient and focused hydrocarbons Through our production & operations business, we aim to produce the affordable hydrocarbon energy and products the world needs, and generate cash to fund our operations and our transformation to an Integrated Energy Company. Integrating energy systems We are focused on driving integration in everything we do. Through integration we bring everything together, to create end-to-end solutions for our customers. Partnering with countries, cities and industries By leveraging relationships and building new partnerships we aim to provide integrated energy and mobility solutions to help cities and industries reduce carbon emissions while creating exciting business opportunities. Driving digital and innovation We innovate with a strong focus on digital to drive operational efficiencies, enable our workforce and engage better with our customers. This includes building new businesses through bp ventures and Launchpad. Always putting safety first. Aiming to eliminate life-changing injuries and the most serious process safety events. Reducing emissions, aligned with our aims, while delivering the energy the world needs. Transforming operations and improving efficiency. Maintaining a resilient portfolio through investment efficiency and high grading. Flexibly deploying talent to our most valuable opportunities and to solve our biggest issues. 214TWh traded electricity in 2020 10-15 city partners aim by 2030 38 bp ventures and Launchpad businesses in total Reinventing our business model As we transition from an International Oil Company to an Integrated Energy Company, we are reinventing our old business model, which comprised three main activities: Finding and generating energy. Refining, manufacturing and marketing. Delivering products and services. Our new business model is more integrated and faces the energy transition head on. We believe it can deliver for the changing demands of stakeholders, with an absolute focus on operational excellence, so that our businesses are safe, reliable and efficient. Delivering value for our stakeholders Employees Investors Society Suppliers and partners Customers Governments and regulators for people and our planet. By delivering value to our stakeholders we can achieve our purpose. See page 36 for details of our organizational model.

18 bp Annual Report and Form 20-F 2020 Reinventing bp – our strategic focus areas In order to advance our purpose and ambition, we have identified three strategic focus areas, and we’ve set targets and aims against these out to 2025 and 2030. These provide the basis for a common set of enduring objectives for bp as we transform the organization consistent with the long-term energy transition. Some examples of how we performed in 2020 are also set out here. As we deliver our strategy, we will focus on maximizing value through operational and commercial excellence, see pages 36-38 for more information. Strategic focus areas We aim to grow our renewables and bioenergy businesses, seek early positions in hydrogen and carbon capture utilization and storage and strengthen our gas position. These activities form an integrated low carbon portfolio that will help transform bp as we transition from an International Oil Company to an Integrated Energy Company. See page 20 for an example of our strategy in action. Metrics Developed renewables to final investment decision« Bioenergy production«	 LNG portfolio« Traded electricity« We will continue to focus on customers and respond to their changing needs. We aim to redefine convenience and scale up our differentiated offers in growth markets and next-gen mobility solutions, including electrification, sustainable fuels and hydrogen. See page 24 for an example of our strategy in action. Customer touchpoints« Strategic convenience sitesb« Retail sites in growth marketsb« Castrol sales and other operating revenues« Electric vehicle charge pointsa« Margin share from convenience and electrificationb« Our hydrocarbons business is essential to our transformation to an Integrated Energy Company. The cash flow from our oil, gas and refining activities enable our strategy, allowing us to invest in the energy transition and support our two growth areas – low carbon electricity and energy, and convenience and mobility. See page 34 for an example of our strategy in action. Unit production costs« Upstream productionc Upstream plant reliability« Refining throughput Refining availability«

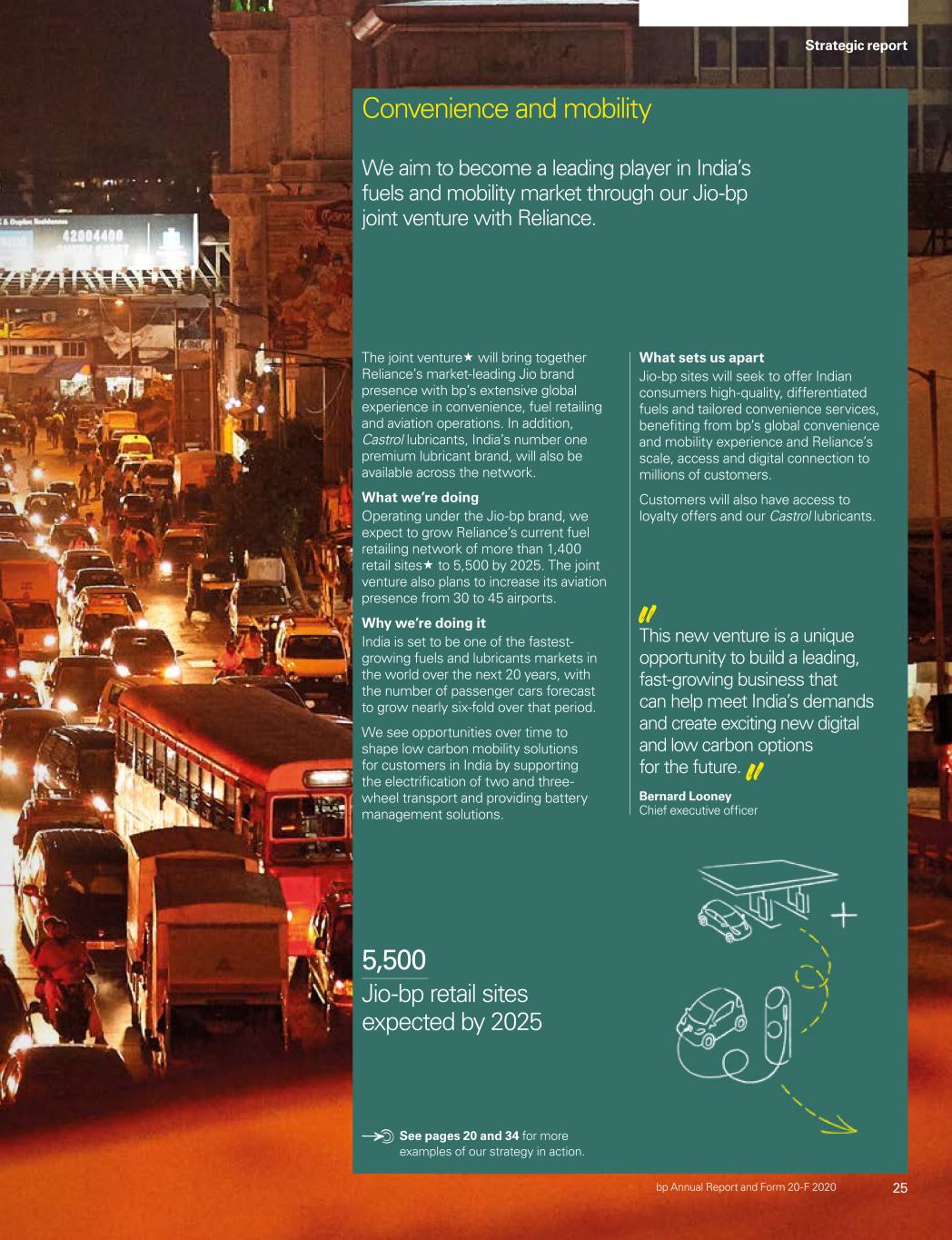

96% <1.5mmb/d 19 Strategic report bp Annual Report and Form 20-F 2020 2030 Performing while transforming2025 50Kb/d 25Mtpa 350TWh >100Kb/d 30Mtpa 500TWh 2020 3.3GW 2019 2.6GW 30Kb/d 2019 23Kb/d 20Mtpa 2019 15Mtpa 214TWh 2019 250TWh 20GW 50GW bp and Equinor strategic US offshore wind partnership, see page 20. Partnered with Microsoft to progress our respective sustainability aims, including plans to supply Microsoft with renewable energy and extend its cloud-based services within bp. Lightsource bp, in which we have a 50% share, has more than doubled its global presence from five to 14 countries and grown its development pipeline from 1.6GW to 17GW, since joining with bp in 2016. Formed the Northern Endurance Partnership, with five energy companies, to develop the offshore infrastructure to transport and store millions of tonnes of carbon dioxide emissions safely in the UK North Sea. Partnered with Ørsted and plan to develop an industrial-scale project to produce hydrogen from water, powered by wind. Joined with Aberdeen City Council to help achieve its net zero vision to reduce carbon emissions and become a climate-positive city. Agreed to extend our relationship with Amazon, to supply additional renewable energy to power its operations, and Amazon Web Services, enabling the acceleration of bp’s programme to digitize its infrastructure and operations. >15 million >20 million >2,300 >3,000 7,000 >8,000 ~$7.5bn >$8bn >25,000 >70,000 ~35% ~50% More than doubled retail sites in growth markets to 2,700. Added ~300 strategic convenience sites across our retail network, bringing the total to 1,900. Announced the start of our new mobility joint venture« in India with Reliance, Jio-bp, see page 24. Increased the number of electric vehicle charge points to 10,100 and began the rollout of ultrafast charging points across the UK and Germany. Rolled out 1,400 electric vehicle charge points as part of our joint venture with DiDi in China. Increased margin share from convenience and electrification to 27.6%. 11.5 million 2019 >10 million 1,900 2019 1,600 2,700 2019 1,300 $5.4bn 2019 >$6.5bn 10,100 2019 >7,500 27.6% 2019 ~25% ~$6/boe ~2mmboe/d ~1.5mmboe/d >96% ~1.2mmb/d 96% >96% We’re on track to deliver on our growth target since 2016 of 900mboe/d from new major projects« by the end of 2021, with 700mboe/d of production capacity on line by the end of 2020. And we started up four major projects: Atlantis in the Gulf of Mexico, see page 34, Ghazeer in Oman, Vorlich in the North Sea, and KG D6 R Cluster in India. Completed the Southern Gas Corridor pipeline system, with the Trans Adriatic pipeline beginning gas deliveries. Tested the green completions concept on our Ghazeer wells, sending hydrocarbons to a production facility instead of flaring them. Sold our petrochemicals business to INEOS. Ceased fuel production at our Kwinana refinery to convert it into an import terminal. Agreed to sell a 20% interest in Oman’s Block 61. $6.39/boe 2019 $6.84/boe 2.4mmboe/d 2019 2.6mmboe/d 94% 2019 94.4% 1.6mmb/d 2019 1.7mmb/d 96% 2019 94.9% c Relative to 2019, we expect our hydrocarbon production to be around 40% lower by 2030 reflecting active management and high-grading of the portfolio, including divestment of non-core assets. We will not undertake exploration activity in new countries. a Reported to the nearest 100. b The nearest GAAP measures of the numerator and denominator are RC profit before interest and tax for Downstream. A reconciliation to GAAP information is provided on page 318.

20 bp Annual Report and Form 20-F 2020 Reinventing bp – our strategy in action

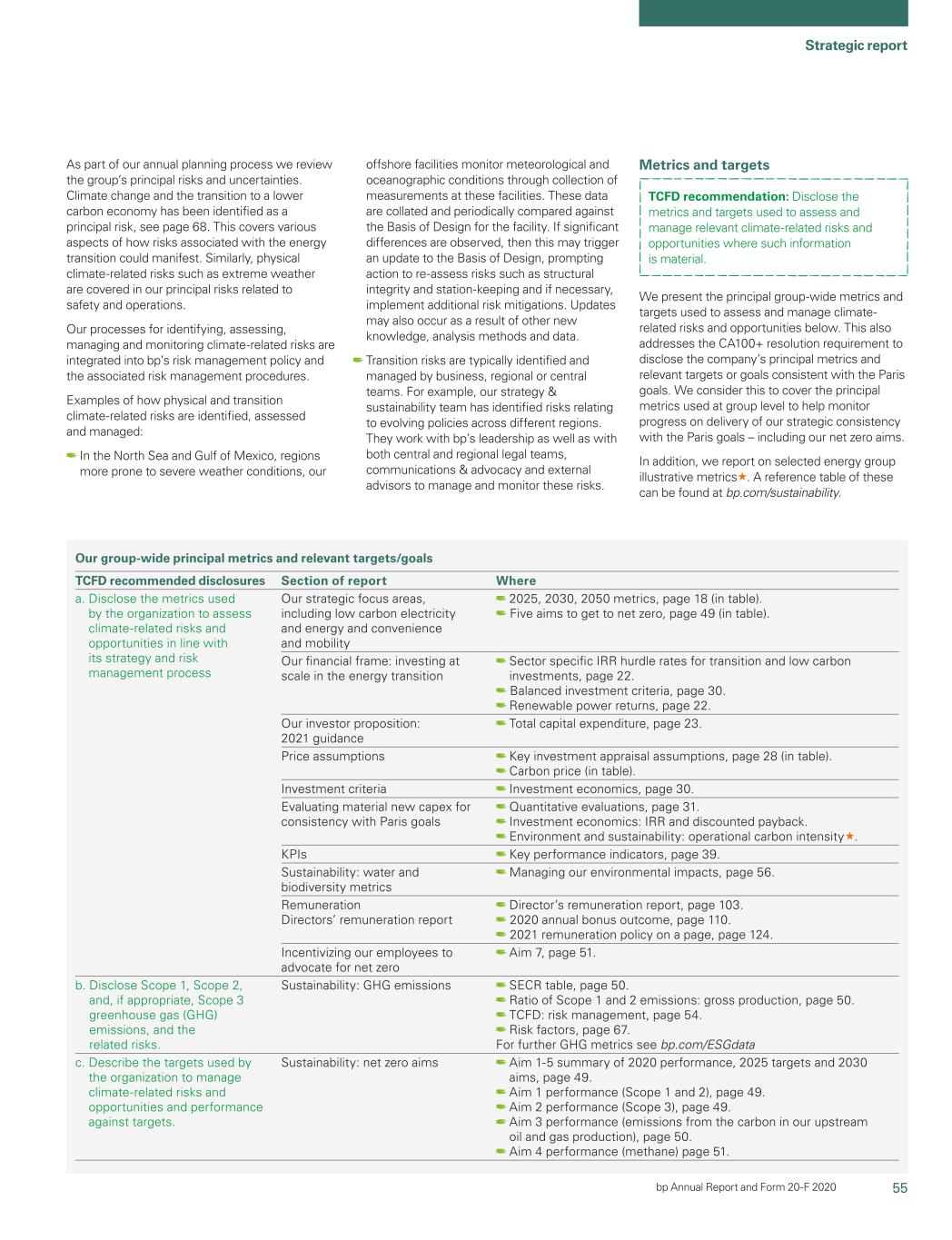

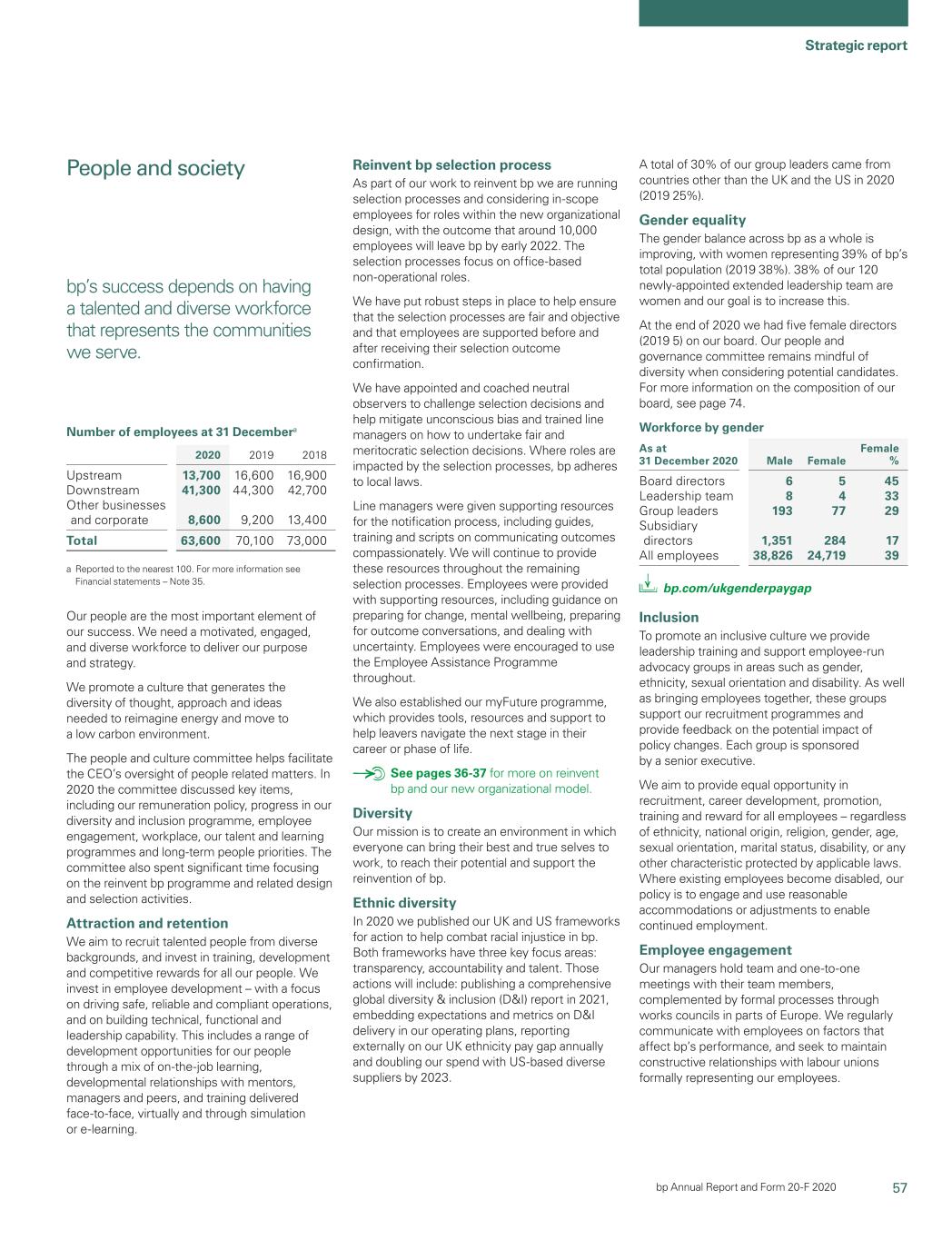

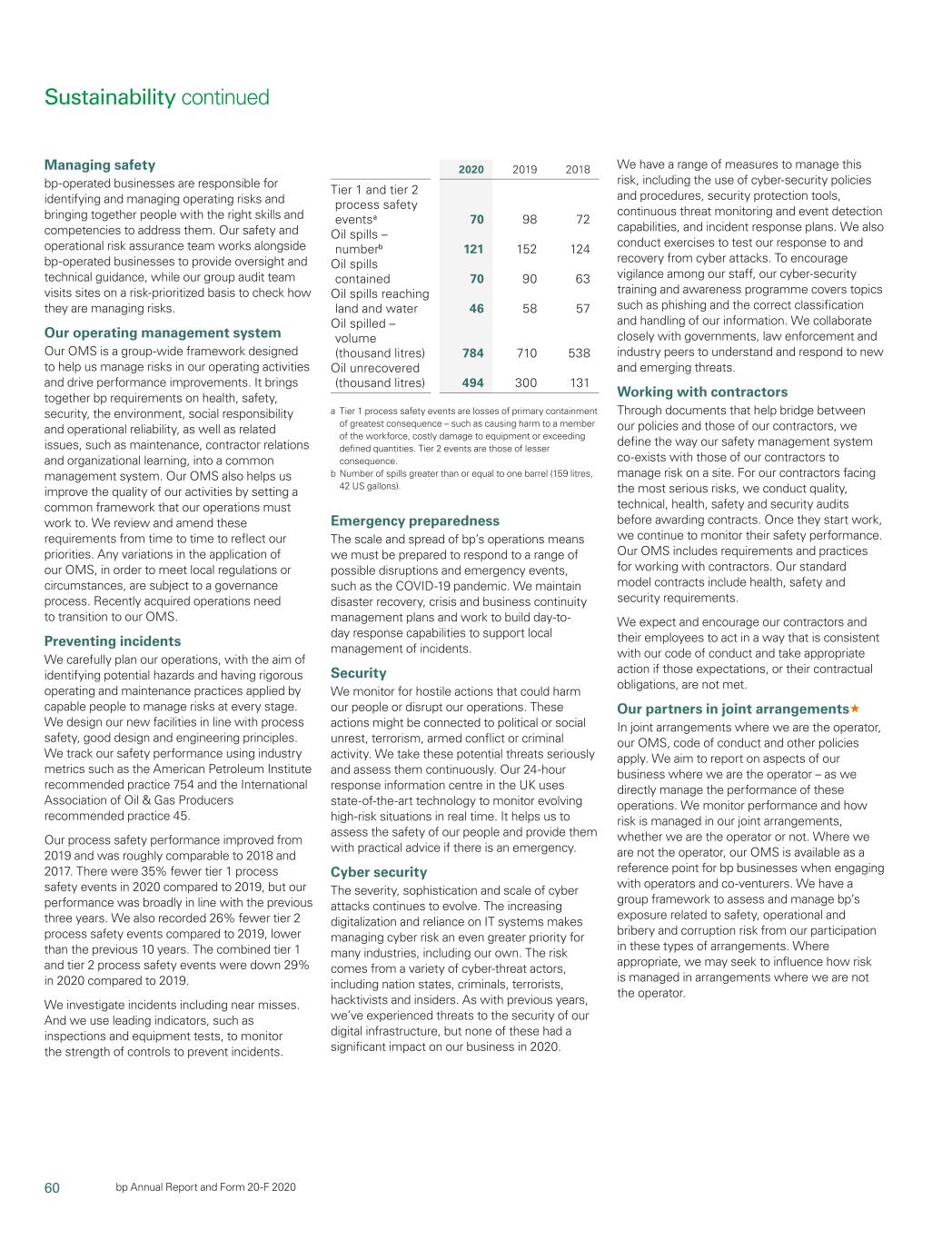

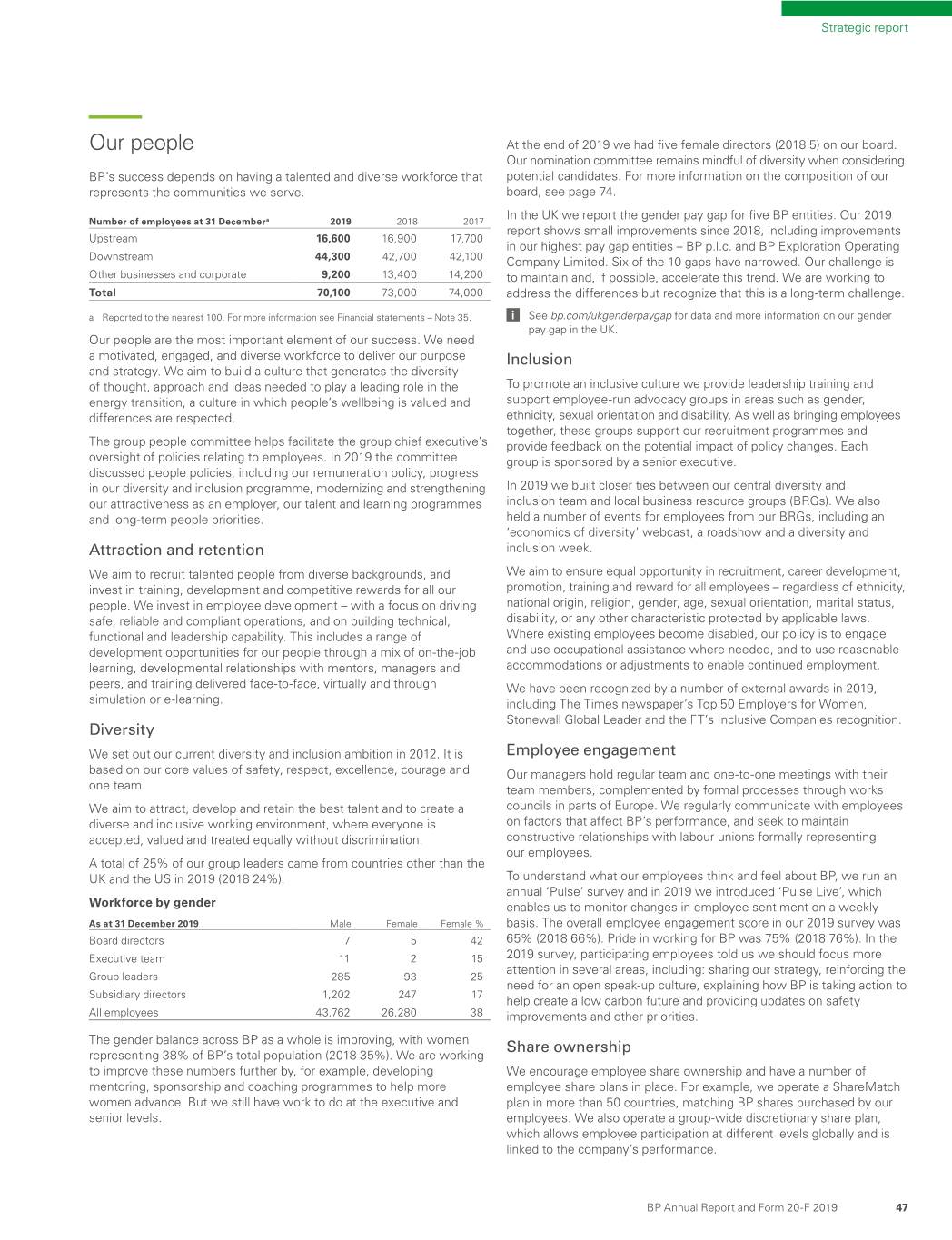

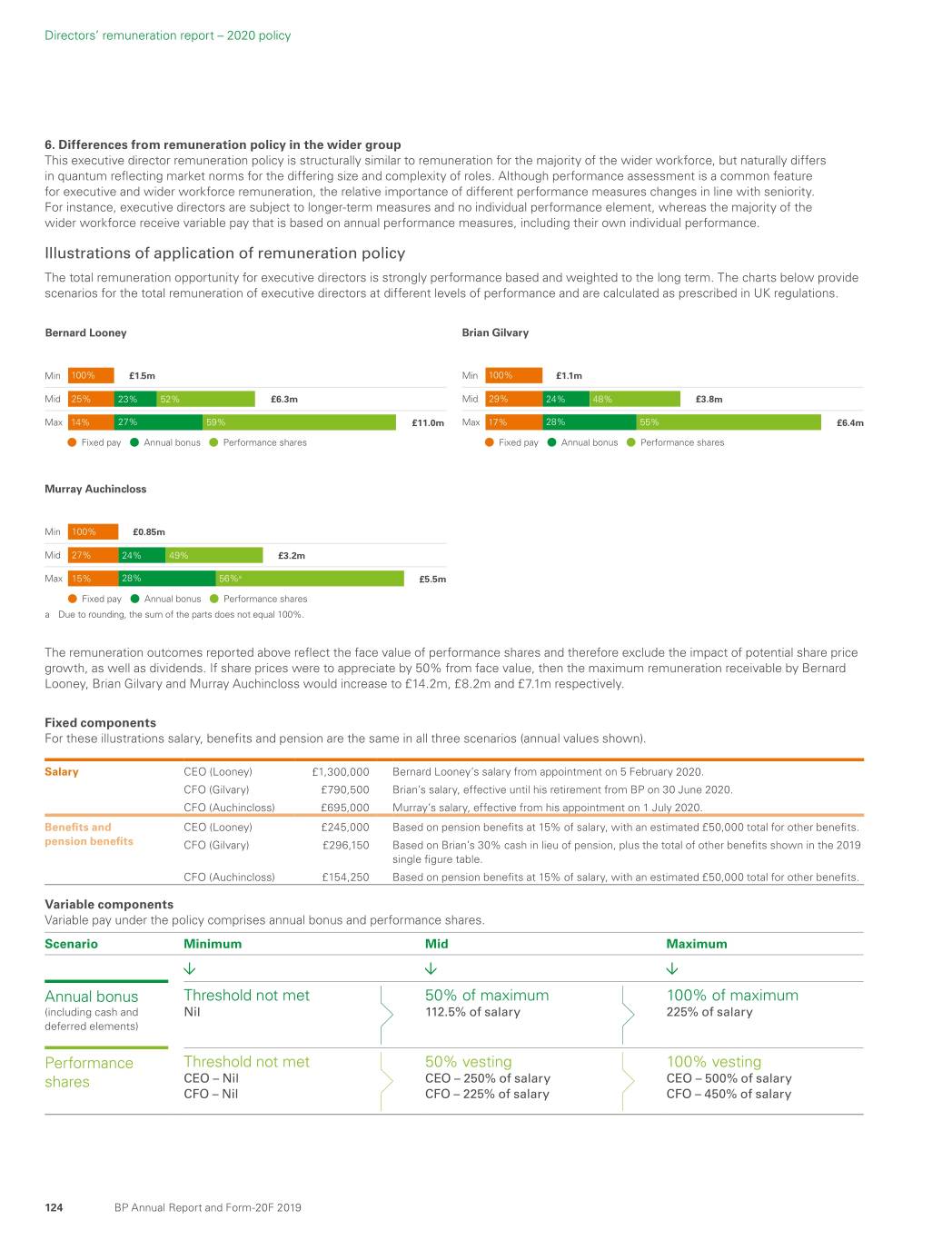

21 Strategic report bp Annual Report and Form 20-F 2020 Low carbon electricity and energy We’re teaming up with Equinor to form a new strategic partnership to develop offshore wind projects in the US. We believe we can achieve more together, working to become leaders in the fastest-growing renewables sector and helping the world get to net zero. What we’re doing The partnership includes development of four assets in two existing offshore wind leases on the US East Coast. And we expect to pursue further opportunities for offshore wind in the US. We’re investing $1.1 billion for a 50% share in two leases: Empire Wind and Beacon Wind. Empire Wind, NY, is expected to have 2GW generating capacity, once operational. Beacon Wind, MA, is expected to have 2.4GW generating capacity, once operational. In January 2021, the Empire Wind 2 and Beacon Wind 1 projects were selected to provide New York State with 2.5GW of power – the biggest US offshore wind award to date – adding to the existing commitment to supply 0.8GW. Why it matters Our strategy aims to increase our annual low carbon investment tenfold by 2030 and rapidly grow our developed renewable generating capacity. The partnership will leverage bp’s trading expertise and onshore wind experience with Equinor’s sector-leading track record in offshore wind, and is expected to deliver value for our shareholders and help the world transition to low carbon energy. Why offshore wind? Offshore wind is growing at around 20% a year globally and is recognized as a core part of reducing global emissions. This was bp’s first ever offshore wind venture and marks an important step in the delivery of our strategy to rapidly grow our renewable electricity and energy portfolio. Building on this progress in 2021, bp and Energie Baden-Wuerttemberg AG (EnBW) were selected as the preferred bidder for two major leases in the UK Offshore Wind Round 4, marking our entry into the largest offshore wind power sector in the world. 2 million Together, these assets have the potential to generate power for more than 2 million US homes. Our partnership with Equinor will play a vital role in allowing us to deliver our aim of rapidly scaling up our renewable energy capacity, and in doing so help deliver the energy the world wants and needs. Dev Sanyal EVP, gas & low carbon energy See pages 24 and 34 for more examples of our strategy in action.