the expectations of stakeholders, hinder access to capital or expose AngloGold Ashanti to additional risks, including disinvestment and litigation.

Companies across all industries are facing increasing scrutiny related to ESG issues, including their internal ESG policies and governance practices. Investor advocacy groups, certain institutional investors, investment funds, lenders and other market participants are increasingly focused on ESG-related matters and in recent years have placed increasing importance on the environmental and social costs and impact of their investments. The increased focus and activism related to ESG and similar matters may hinder access to capital, as investors and lenders may decide to reallocate capital or to not commit capital as a result of their assessment of a company’s ESG practices. In addition, host communities, as well as certain governmental and non-governmental actors, are increasingly focused on a company’s ability to operate in a sustainable manner and to mitigate related risks, as well as the public commitments and quantitative metrics used to demonstrate performance and track progress. For AngloGold Ashanti, this includes, in particular, the safe operation of its mines, mitigating its impact to local environments and affected communities and reducing GHG emissions in line with the Company’s voluntary commitments. If AngloGold Ashanti’s performance fails to meet internal or adopted external ESG standards, or AngloGold Ashanti otherwise fails to satisfy stakeholder expectations with respect to its commitments and performance, regardless of whether there is a legal requirement to do so, such failure could result in reputational damage to and litigation against the Company and its business, financial condition, and/or stock price could be materially and adversely affected.

In particular, AngloGold Ashanti faces increasing pressures from stakeholders, who are increasingly focused on climate change, to prioritise energy efficiency in its operations, reduce its carbon footprint and improve water and other resource consumption, as well as to be transparent about how climate-related risks and opportunities are managed throughout the supply chain to foster and promote business resiliency, accountability and stakeholder value. AngloGold Ashanti has implemented numerous initiatives since 2008 to reduce its GHG emissions by installing new technology, such as heat pumps and underground cooling and water treatment systems, reducing power consumption and improving energy efficiency. AngloGold Ashanti has also made certain voluntary commitments to take future actions, including to achieve net zero Scope 1 and 2 GHG emissions by 2050, to achieve a 30% absolute reduction in Scope 1 and 2 GHG emissions by 2030 (as compared to a 2021 baseline), and, in partnership with value chain partners, to set Scope 3 GHG reduction targets, if not by the end of 2023, as soon as possible thereafter. AngloGold Ashanti continues to enhance its governance around climate-related risks and opportunities, including implementing the action plans of its Climate Change Strategy, which was approved by its board in November 2021. Nevertheless, AngloGold Ashanti may be required to implement even more stringent ESG practices or standards to meet the expectations of existing and future stakeholders and, if the Company fails to achieve these objectives or to adhere to internal or adopted external standards, or is perceived to be insufficiently committed to addressing ESG concerns across all of its operations and activities, the Company’s reputation and brand image could be damaged, it could lose the trust of its stakeholders (including governments, NGOs, investors, customers and employees) or be subject to litigation brought by those stakeholders, and its business, financial condition and results of operations could be adversely impacted.

AngloGold Ashanti’s inability to maintain an effective system of internal control over financial reporting may have an adverse effect on investors’ confidence in the reliability of its financial statements.

Internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of the company’sAngloGold Ashanti’s financial statements for external purposes in accordance with International Financial Reporting Standards (IFRS)(“IFRS”) as issued by the International Accounting Standards Board (IASB)(“IASB”). Disclosure controls and procedures are designed to ensure that information required to be disclosed by a company in reports that it files or submits under the Exchange Act is recorded, processed, summarised and reported within the time periods specified in the rules and forms of the SEC. These disclosure controls and procedures include without limitation, controls and procedures designed to ensure that information required to be disclosed by the companyCompany in reports that it files or submits under the Exchange Act is accumulated and communicated to the company’sCompany’s management, including its chief executive officer and chief financial officer, as appropriate to allow timely decisions regarding disclosure. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance with respect to the reliability of financial reporting and financial statement preparation. If AngloGold Ashanti is unable to maintain an effective system of internal control over financial reporting or disclosure controls and procedures, investors may lose confidence in the reliability of its financial statements and this may have an adverse impact on investors’ abilitiesability to make decisions about their investment in AngloGold Ashanti. See “Item 15: Controls and Procedures”.

Breaches in cybersecurity and violations of data protection laws may adversely impact or disrupt AngloGold Ashanti’s business.

AngloGold Ashanti maintains global information, digital technology (IT)(“DT”) and communication networks and applications to support its business activities. AngloGold Ashanti outsources several information technologiesdigital technology functions and applications to third-party vendors and these engagements may have an impact on the overall cybersecurity position of the company.Company. The primary company systems managed by third-party vendors include, but are not limited to, cloud infrastructure, data centre management, server/personal computing support, enterprise resource planning business applications, email and digital documents and the Cyber Security Operations Centre.

47

AngloGold Ashanti must continuously monitor the solutions implemented to support its global informationdigital technology and communication networks and applications to maintain a suitable and well-managed environment. There can be no assurance that these efforts will always be successful.

The sophistication and magnitude of cybersecurity incidents are increasing and include malicious software, attempts to gain unauthorised access to data and other electronic security and protected information breaches that could lead to production downtimes, operational delays, safety incidents, the compromising of confidential or otherwise protected information, destruction or corruption of data, other manipulation or improper use of AngloGold Ashanti’s systems and networks or financial losses from remedial actions. For example, in late 2020, a threat to the company’sCompany’s computer systems was detected and neutralised within hours in connection with the SolarWinds supply chain compromise which affected over 18,000 companies. The systems affected were limited to network monitoring applications in Brazil which monitored certain technology systems across the local network. In addition, there was a notable increase in phishing campaigns linked to COVID-19 in the second half of 2020 which continued through the year.first half of 2021. A sharp increase in ransomware-related threats have also been recorded throughout the mining industry with several high-profile organisations experiencing disruptions.

The interpretation and application of consumer and data protection laws in South Africa, the United States and elsewhere are evolving. It is possible that these laws may be interpreted and applied in a manner that is inconsistent with AngloGold Ashanti’s data practices. Complying with these various laws is essential and could cause the companyCompany to incur substantial costs or require it to change its business practices in a manner adverse to its business.

For example, the penalties for failure to comply with the South African Protection of Personal Information Act, No. 4 of 2013 (POPIA)(“POPIA”) are severe and may include an administrative fine of up to R10 million or imprisonment of up to ten years. The European General Data Protection Regulation (GDPR)(“GDPR”) may lead to administrative fines of up to €20 million or four percent of a company’s total worldwide annual turnover of the preceding financial year, whichever is higher. Also, the GDPR has a scope that extends beyond the borders of the EU and does not only affect EU operations.

U.S. securities laws do not require AngloGold Ashanti to disclose as much information to investors as a U.S. issuer is required to disclose, and investors may receive less information about the companyCompany than they might otherwise receive from a comparable U.S. company.

AngloGold Ashanti is subject to the periodic reporting requirements of the SEC and the New York Stock Exchange that apply to “foreign private issuers”. The periodic disclosure required of foreign private issuers under applicable rules is more limited than the periodic disclosure required of U.S. issuers. Accordingly, there may be less publicly available information concerning the companyAngloGold Ashanti than there is for U.S. public companies. For example, in 2016, AngloGold Ashanti announced that it would no longer voluntarilyhas a half-yearly reporting cycle and does not publish reviewed financial statements and analyses of operating and financial results for the quarters ended 31 March and 30 September of each year. As a result of this transition to half-yearly reporting, investors will receive less information about AngloGold Ashanti than they had in years preceding that change. In addition, AngloGold Ashanti is not required to file periodic

reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the U.S. Securities Exchange Act of 1934, as amended (Exchange Act)(the “Exchange Act”). As a result, investors will also receive less timely financial reports than they otherwise might receive from a comparable U.S. company or from certain of the company’sCompany’s peers in the industry. This may have an adverse impact on investors’ abilitiesability to make decisions about their investment in AngloGold Ashanti.

48

ITEM 4: INFORMATION ON THE COMPANY

4A. HISTORY AND DEVELOPMENT OF THE COMPANY

GROUP INFORMATION

AngloGold Limited was formed in June 1998 with the consolidation of the gold mining interests of Anglo American plc. AngloGold Ashanti Limited, as the companyCompany exists today, was formed on 26 April 2004 following the business combination between AngloGold Limited and Ashanti Goldfields Company Limited.

CURRENT PROFILE

AngloGold Ashanti Limited, a Company incorporated under the laws of the Republic of South Africa, is headquartered in Johannesburg, South Africa. The companyCompany (Registration number 1944/017354/06) was incorporated in the Republic of South Africa in 1944 under the name of Vaal Reefs Exploration and Mining Company Limited and operates under the South African Companies Act, No. 71 of 2008, as amended (the “SA Companies Act)Act”).

The Company’s legal and commercial name is AngloGold Ashanti Limited. Its registered office is at 76 Rahima Moosa Street, Newtown,112 Oxford Road, Houghton Estate, Johannesburg, 2001,2198, South Africa. The general telephone number is +27 11 637 6000 and the internet address is

https://www.anglogoldashanti.com. No material on the AngloGold Ashanti website forms any part of, or is incorporated by reference into, this annual report on Form 20-F. References herein to the Company’s website shall not be deemed to cause such incorporation.

While AngloGold Ashanti’s primary listing is on the Johannesburg Stock Exchange (JSE), the companyCompany is also listed on the New York Stock Exchange (NYSE), the Ghana Stock Exchange (GhSE) and the Australian Securities Exchange (ASX). AngloGold Ashanti was approved for a secondary listing on A2X Markets (A2X) in South Africa and its shares were admitted to trading on A2X on 6 June 2022. AngloGold Ashanti’s issued share capital will be unaffected by the additional listing on A2X. Our agent for service of process in the United States is AngloGold Ashanti North America Inc., 4601 DTC Boulevard, Suite 550, Denver, CO 80237. The U.S. Securities and Exchange Commission (SEC) maintains a public internet site that contains AngloGold Ashanti’s filings with the SEC and reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC (http://www.sec.gov).

HISTORY AND SIGNIFICANT DEVELOPMENTS

Below are highlights of key corporate activities from 1998:

1998

•Formation of AngloGold Limited through the consolidation of East Rand Gold and Uranium Company Limited; Eastvaal Gold Holdings Limited; Southvaal Holdings Limited; Free State Consolidated Gold Mines Limited; Elandsrand Gold Mining Company Limited; H.J. Joel Gold Mining Company Limited and Western Deep Levels Limited into a single, focused, independent gold mining company. Vaal Reefs Exploration and Mining Company Limited (Vaal Reefs), the vehicle for the consolidation, changed its name to AngloGold Limited and increased its authorised share capital, effective 30 March 1998.

1998-2004

•Expansion of AngloGold Limited’s operations outside of South Africa.

2004

•Conclusion of the business combination with Ashanti Goldfields Company Limited, at which time the companyCompany changed its name to AngloGold Ashanti Limited.

2007

•Sale by Anglo American plc of 69,100,000 ordinary shares of AngloGold Ashanti, thereby reducing Anglo American’s shareholding in AngloGold Ashanti from 41.7 percent to 16.6 percent.

2009

•Sale by Anglo American plc of its remaining shareholding in AngloGold Ashanti to Paulson & Co. Inc.

2010

•Elimination of AngloGold Ashanti’s hedge book, thereby gaining full exposure to spot gold prices.

49

2012

•Acquisition of the remaining 50 percent interest in Serra Grande in Brazil for $215 million.

•Acquisition of 100 percent of First Uranium (Proprietary) Limited for $335 million.

2013

•Commission of two new gold projects -— Tropicana and Kibali -— in the second half of 2013.

2015

•Sale of the Cripple Creek & Victor gold mine in theColorado, USA for $819 million.

2017

•South Africa region restructured -— TauTona mine placed on orderly closure. Negotiations of the sales of Moab Khotsong and Kopanang mines.

2018

•Completion of the sales of the Moab Khotsong and Kopanang mines in South Africa for $300 million and $9 million, respectively.

2019

•Announcement of a review of divestment options for assets in South Africa, Mali and Argentina.

2020

•Sale of the remaining South African producing assets and related liabilities to Harmony for $200 million plus deferred consideration based on future production at the Mponeng mine.

•Completion of the sales of the Sadiola and Morila mines in Mali for cash proceeds of $25 million and $1 million, respectively.

2021

•Announcement of offer to purchase Corvus Gold Inc. (“Corvus Gold”), in Nevada USA.

2022

•Acquisition of the remaining 80.5 percent interest in Corvus Gold, for a cash consideration of $365 million.

•Acquisition of 100 percent of Coeur Sterling, Inc. (“Coeur Sterling”), in Nevada, USA for a cash consideration of $152 million.

2023 YTD

•On 16 March 2023, AngloGold Ashanti and Gold Fields Limited (“Gold Fields”) announced that they have agreed the key terms of a proposed joint venture in Ghana between Gold Fields' Tarkwa and AngloGold Ashanti's neighbouring Iduapriem Mines.

CAPITAL EXPENDITURE AND DIVESTITURES

For information concerning the company’sCompany’s principal capital expenditures currently in progress, including the distribution of these investments geographically and the method of financing, refer to “Item“Item 4B: Business Overview—AngloGold Ashanti Global Operations: 2020”2022”, “Item 5A: Operating Results—Capital expenditure”Comparison of capital expenditure in 2022, 2021 and 2020” and “Item 5B: Liquidity and Capital Resources”.

For information concerning the company’sCompany’s divestitures, including the sale of the remaining South African producing assets and related liabilities announced on 12 February 2020 and completed on 30 September 2020, refer to “Item 5A:“Item 5: Operating Results—Discontinued operations”, “Item 18:and Financial Statements—Note 9—Discontinued operationsReview and assets and liabilities held for sale”Prospects—Overview”.

50

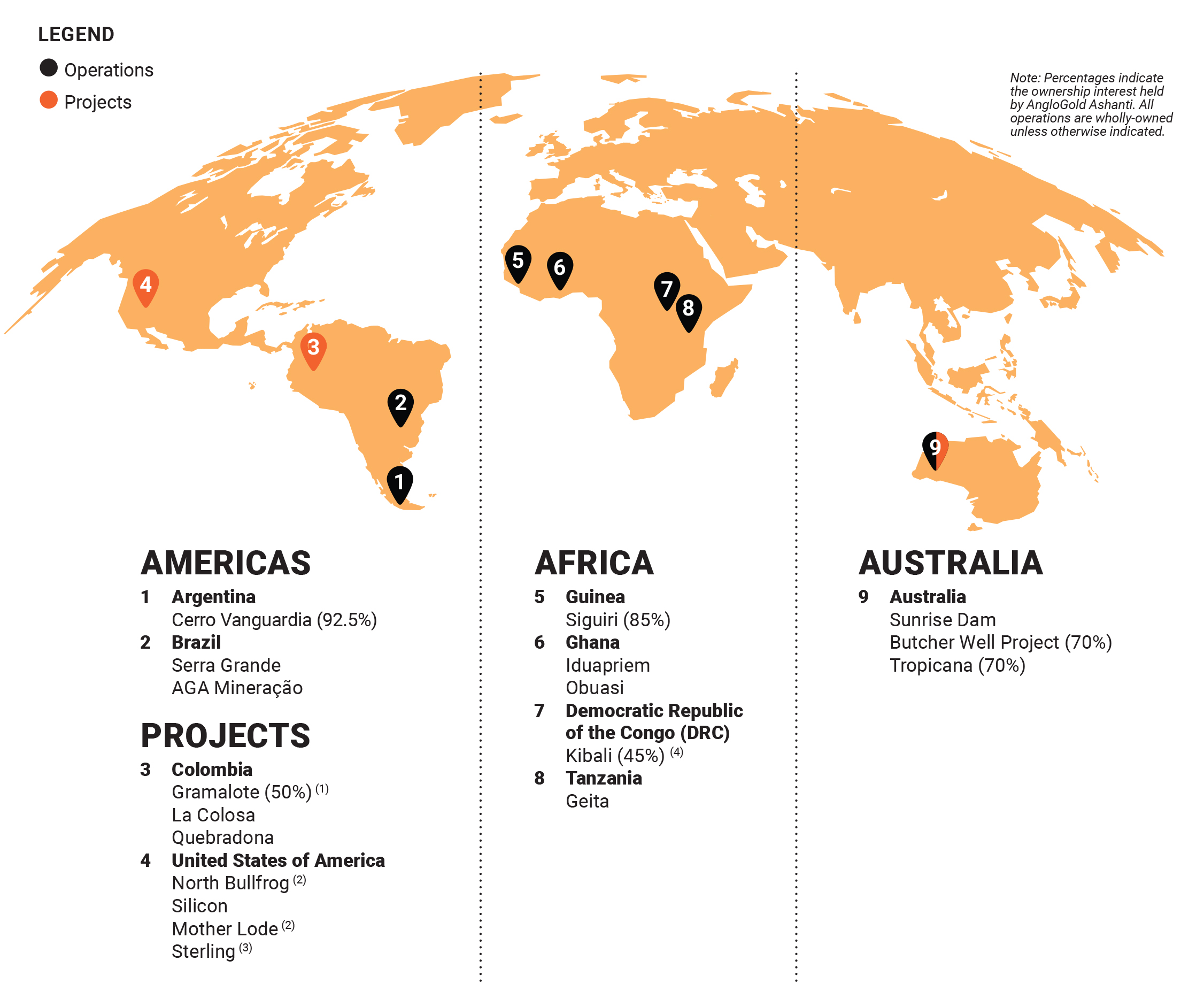

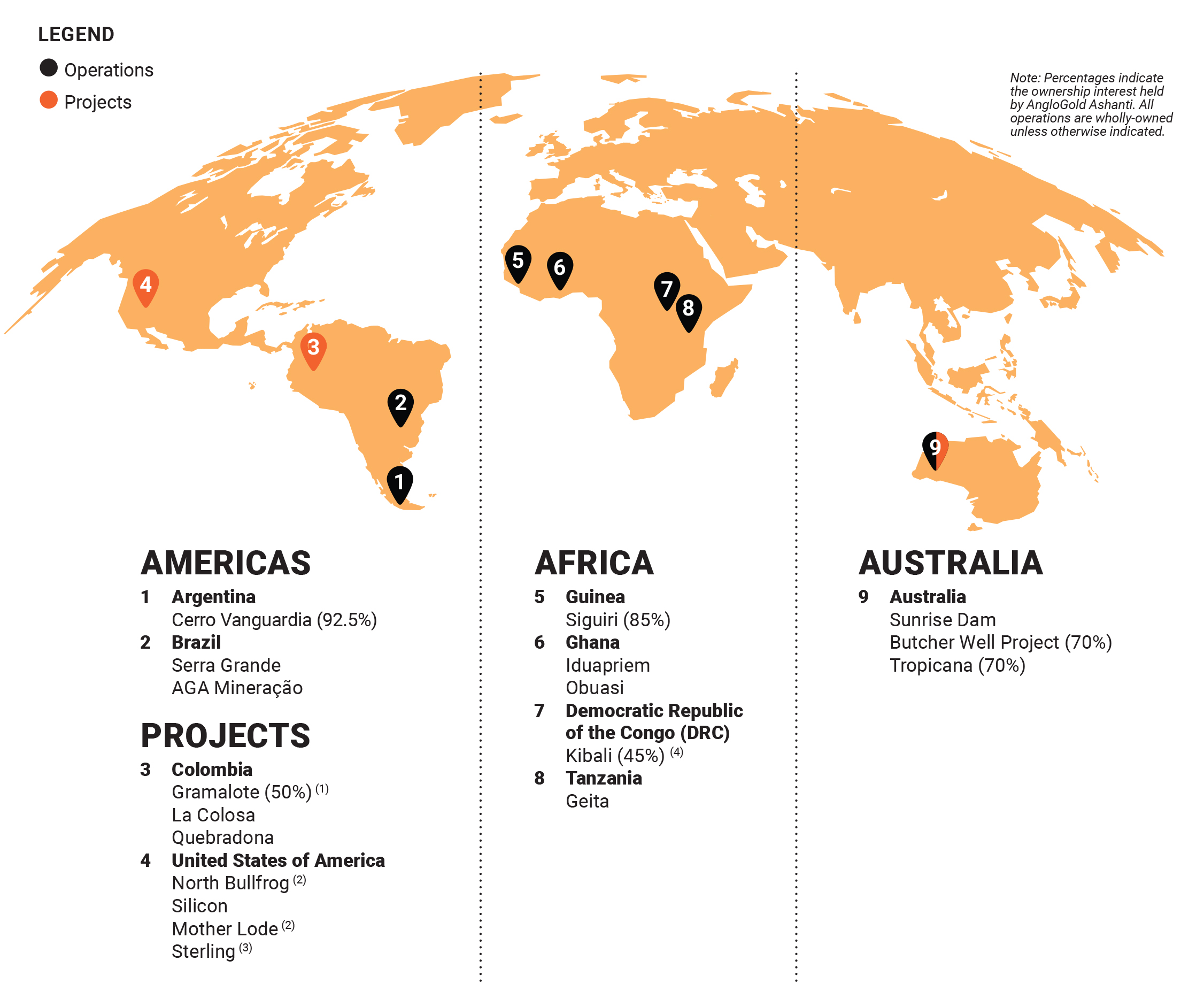

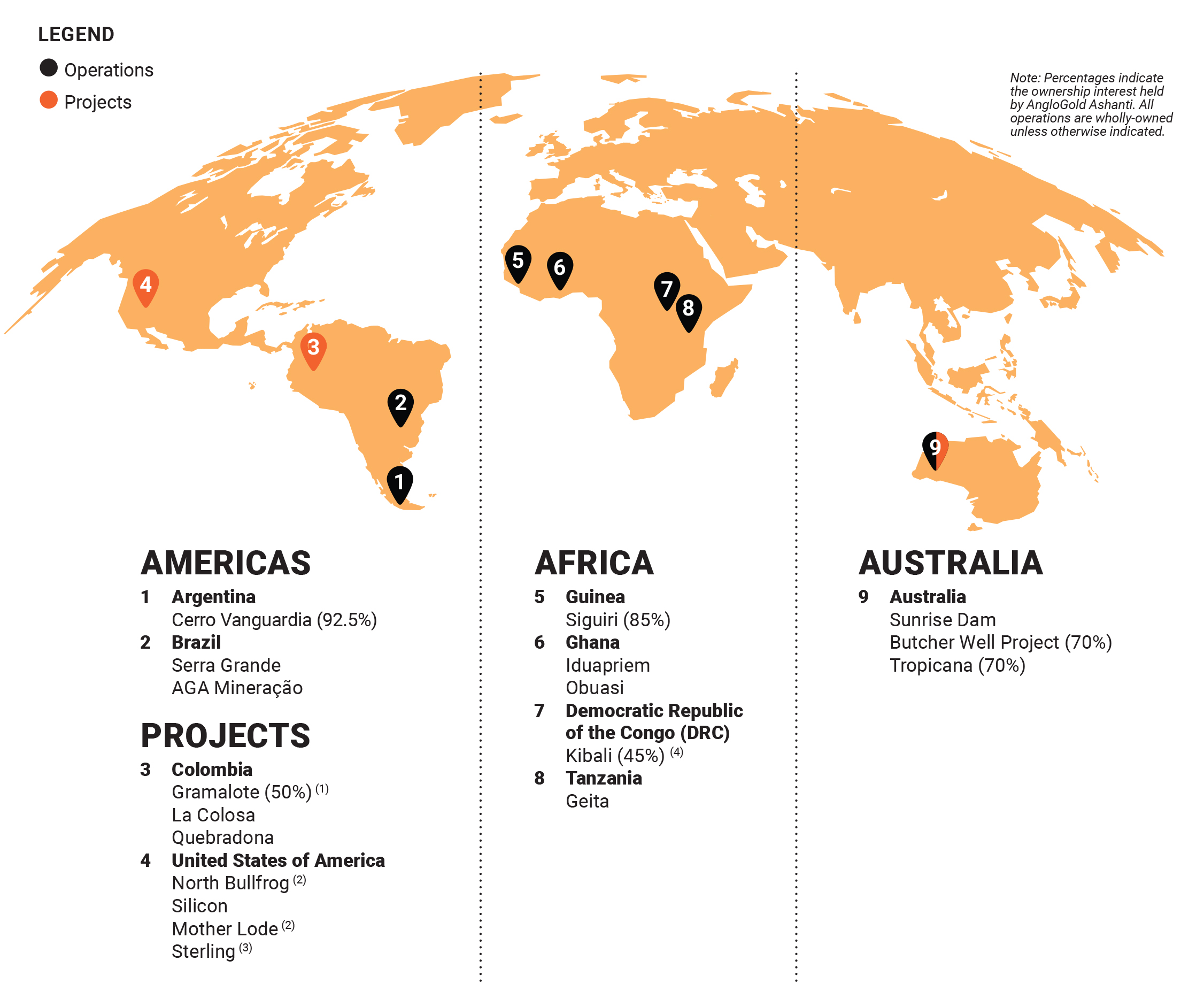

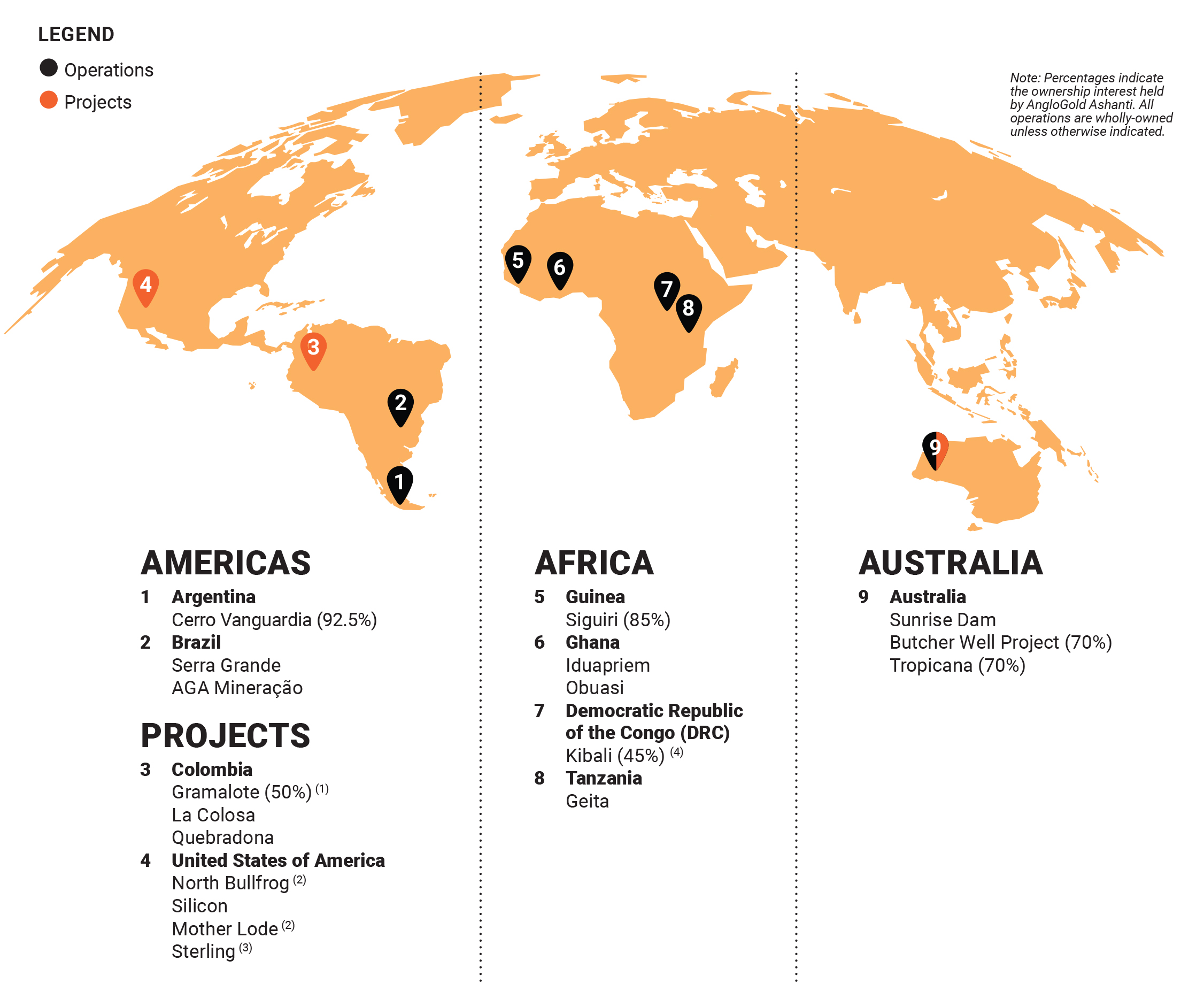

4B. BUSINESS OVERVIEW

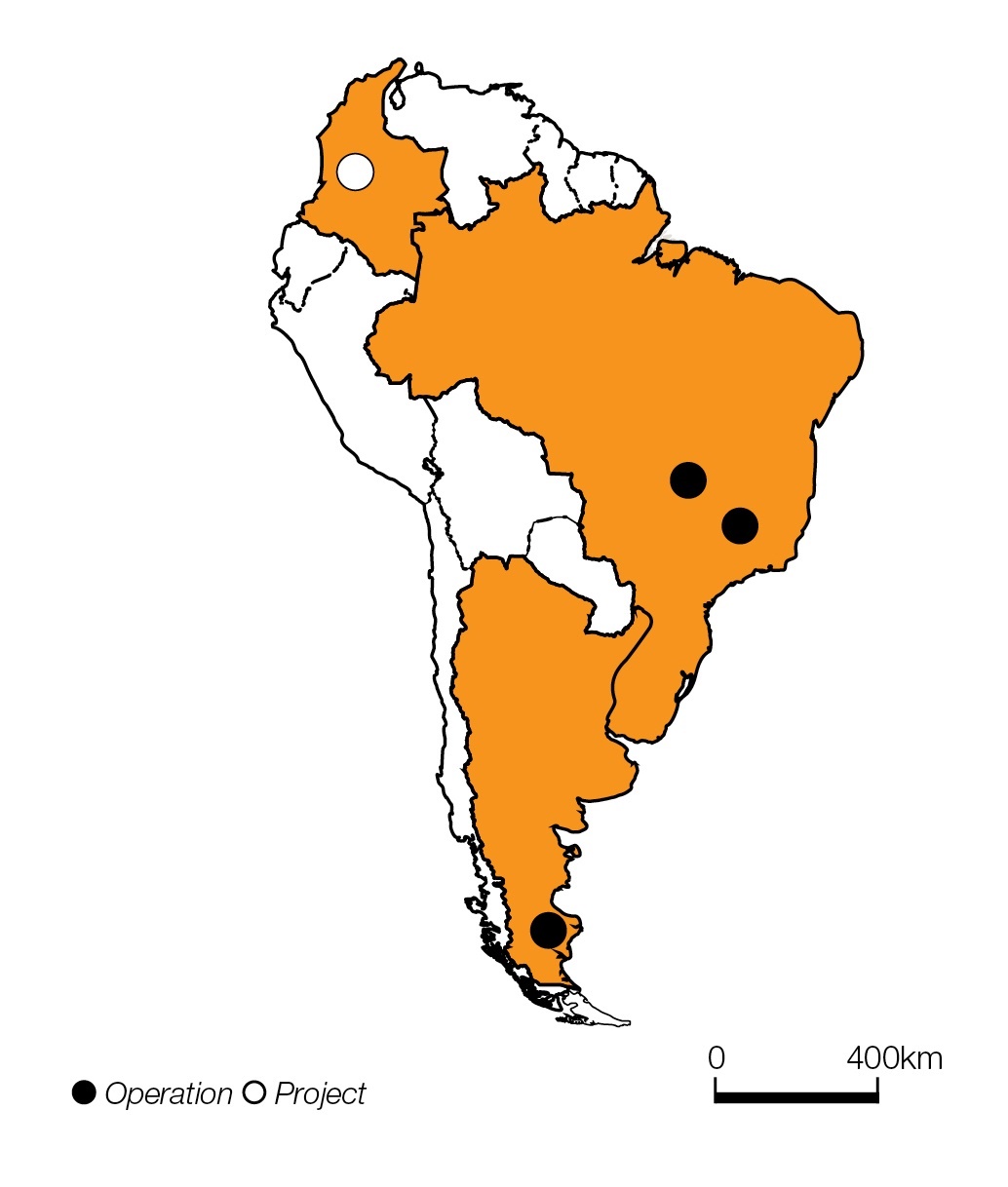

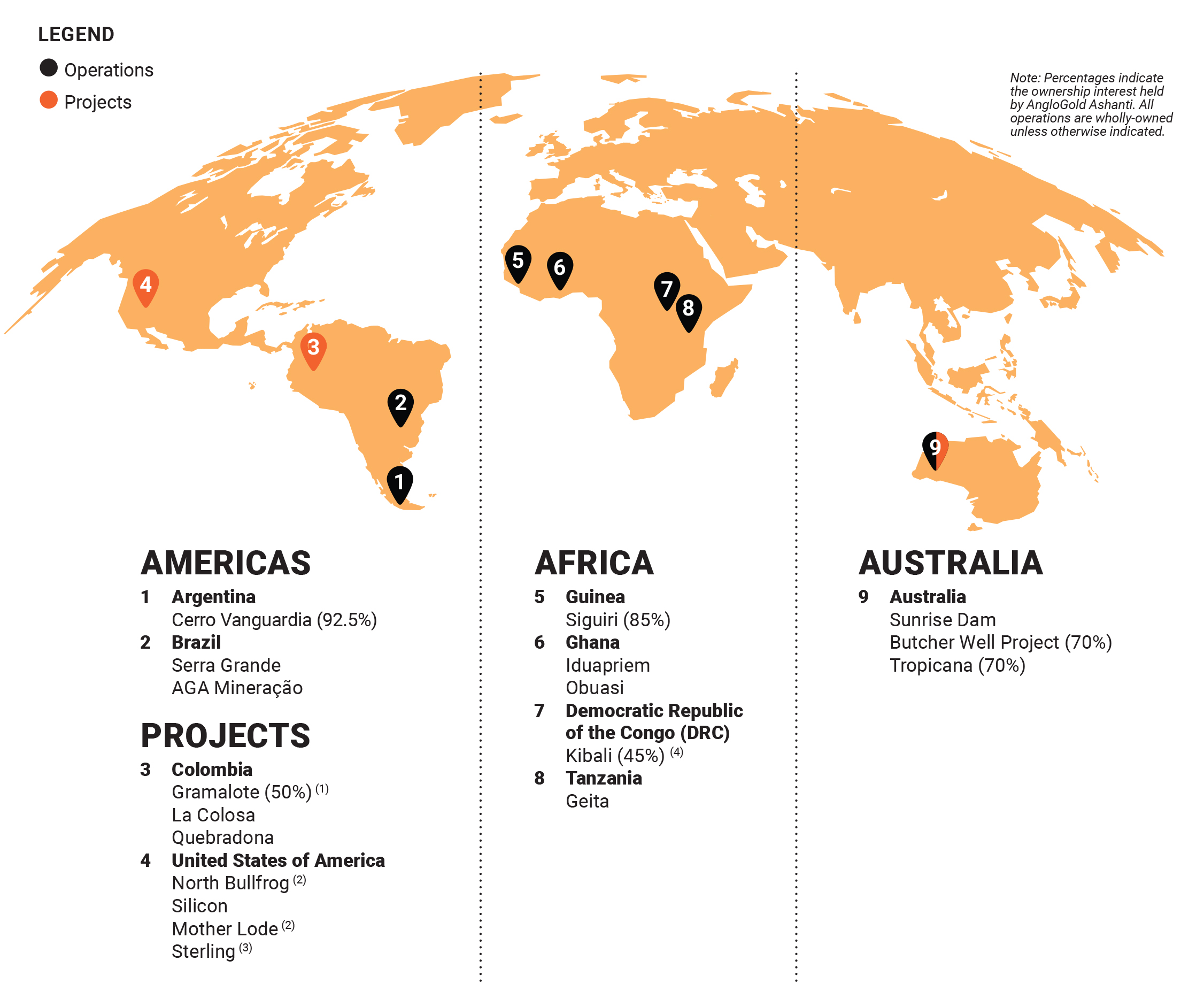

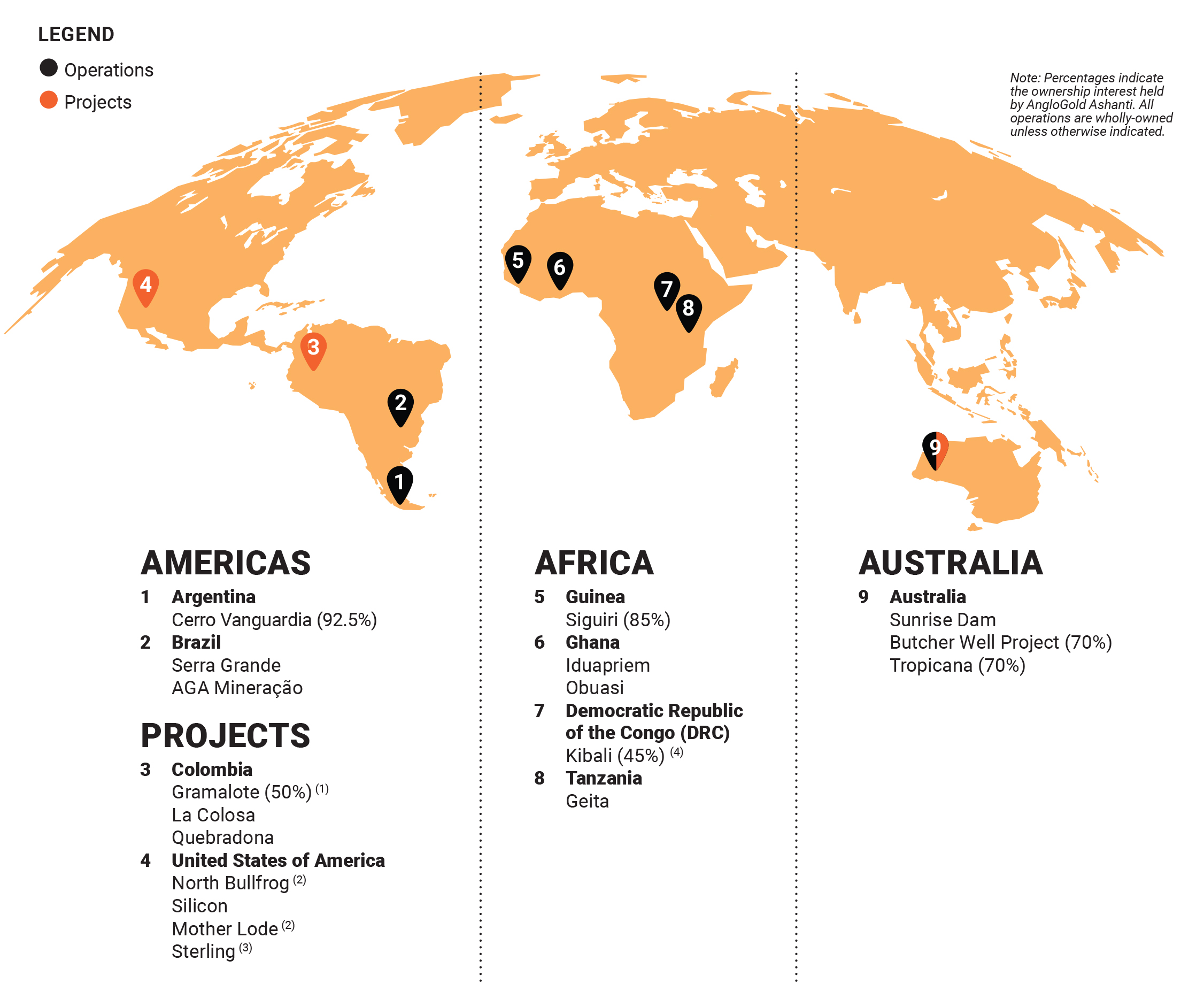

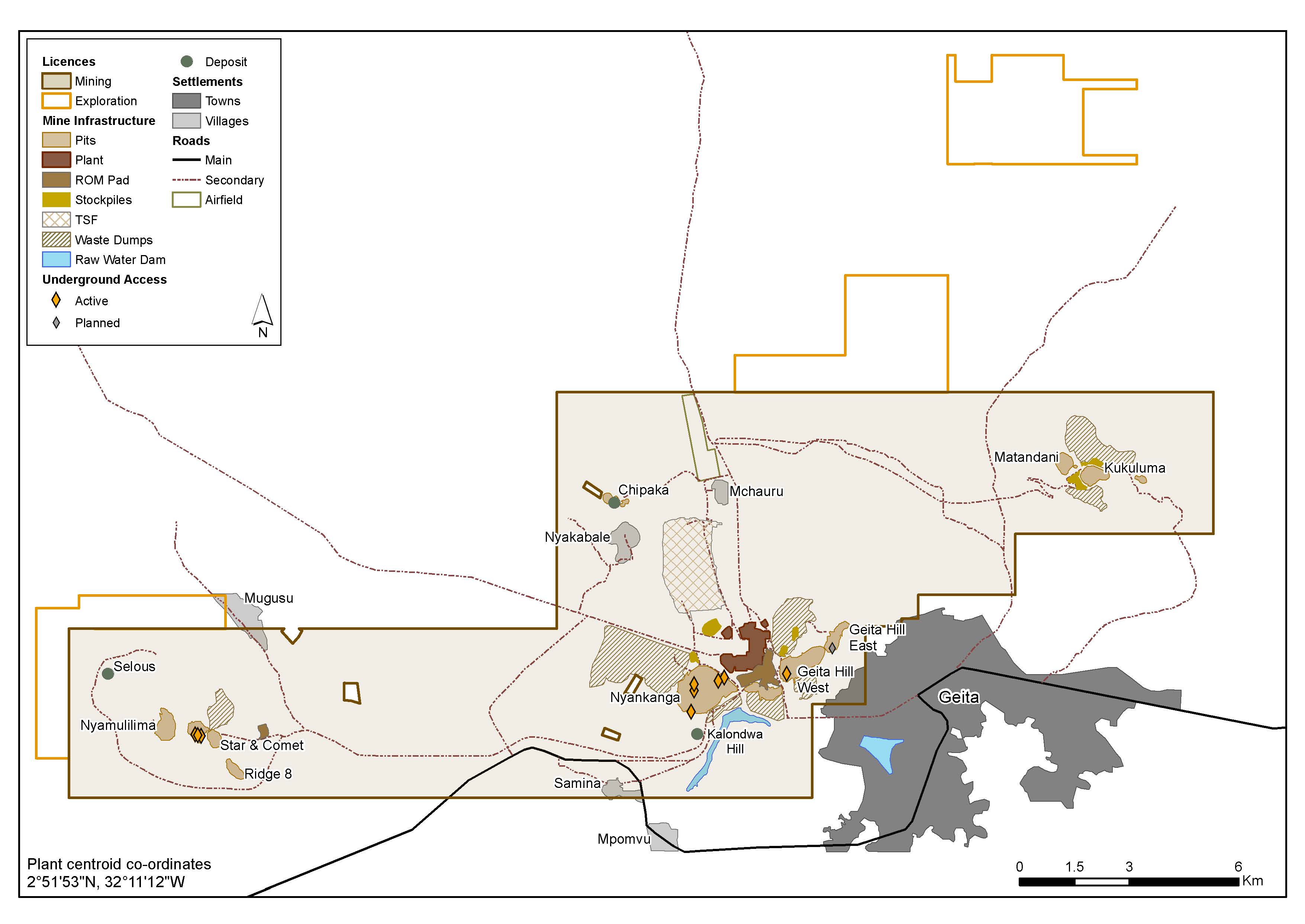

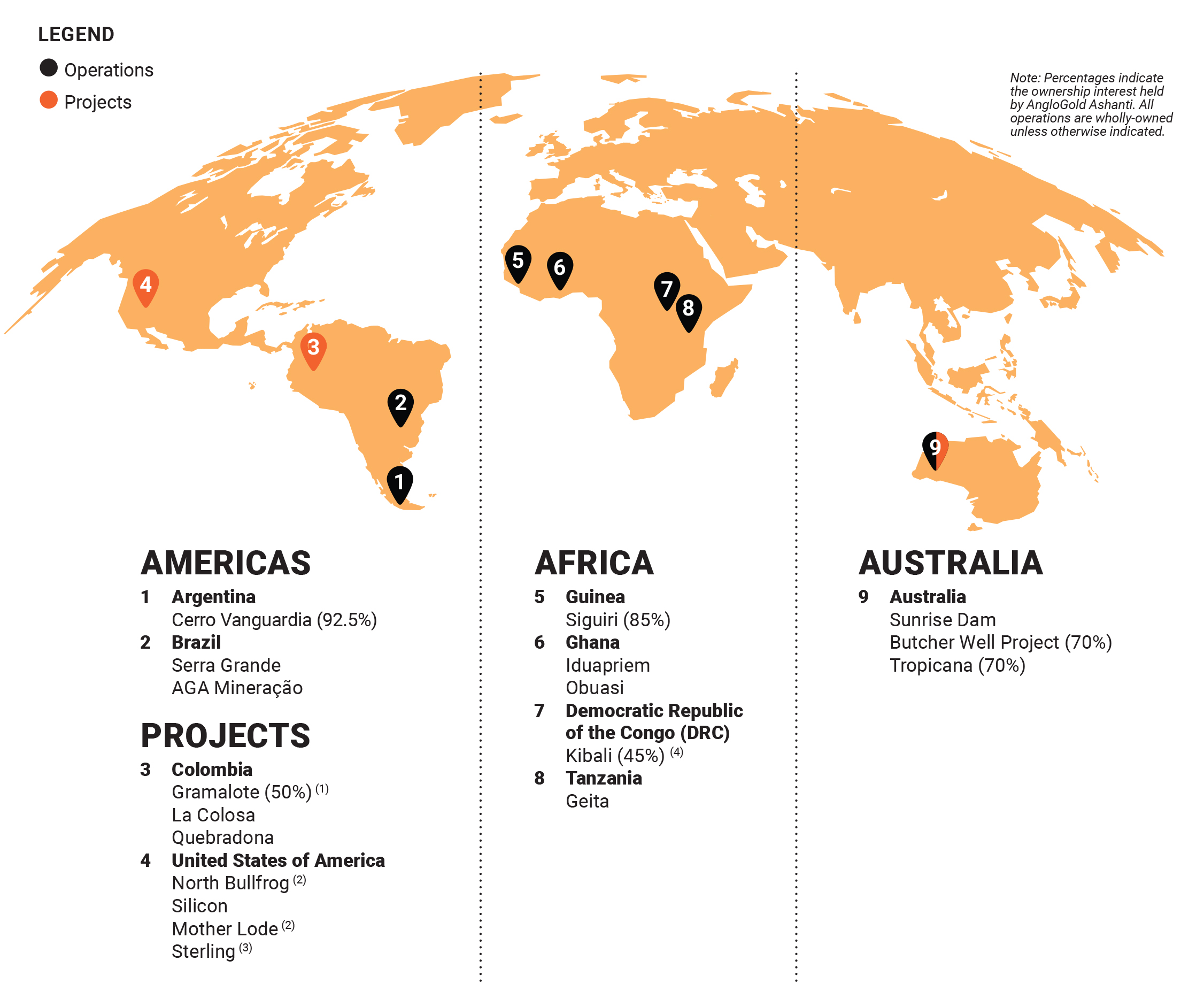

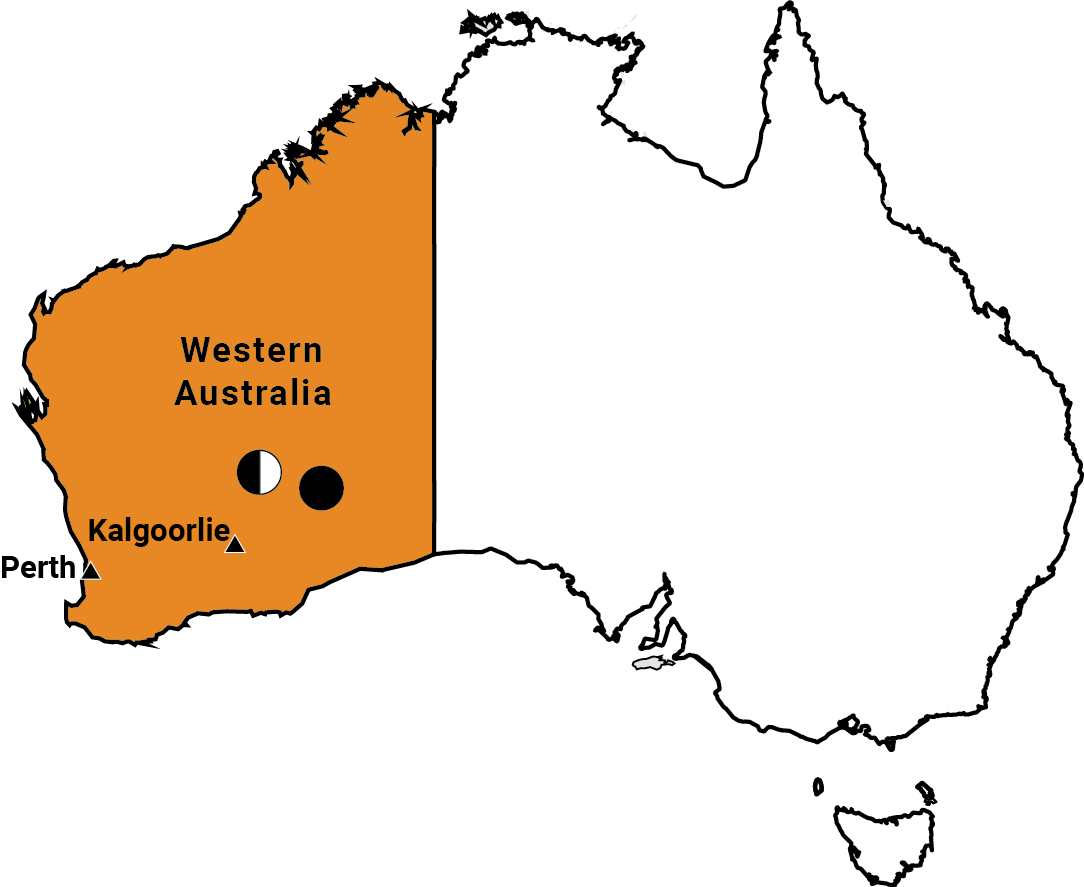

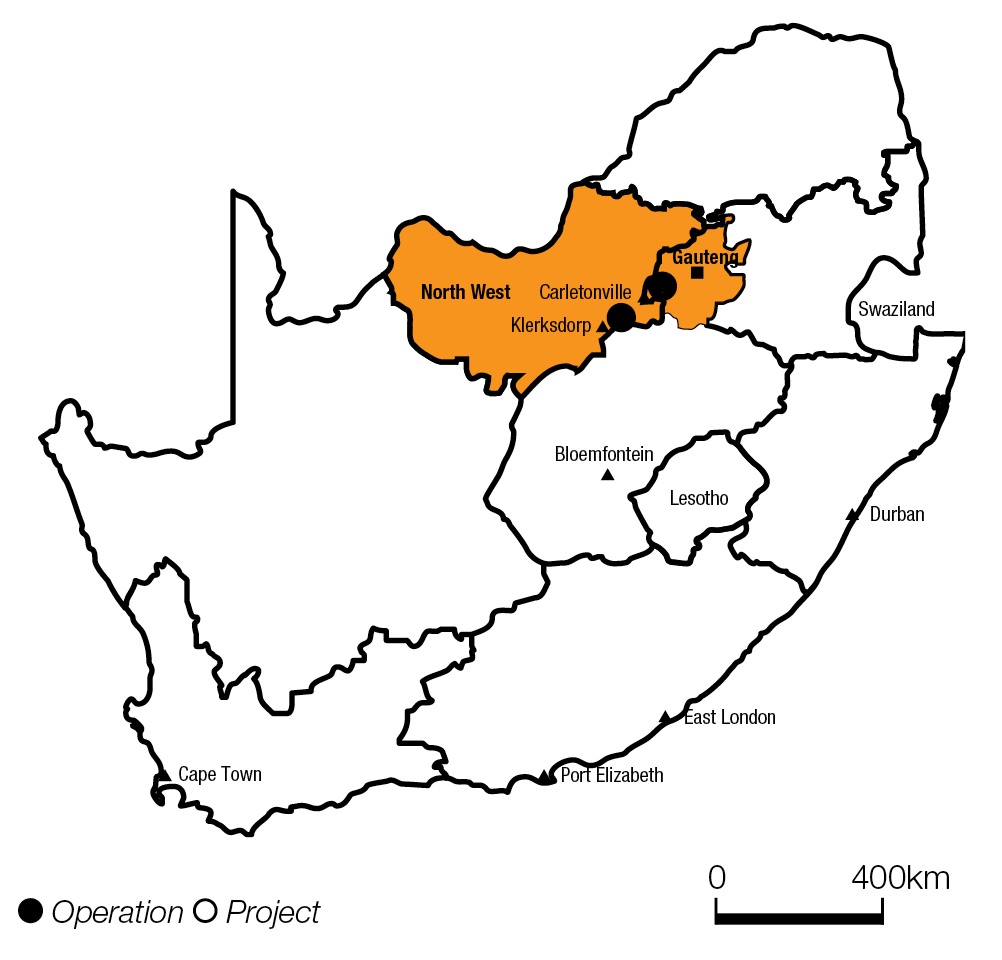

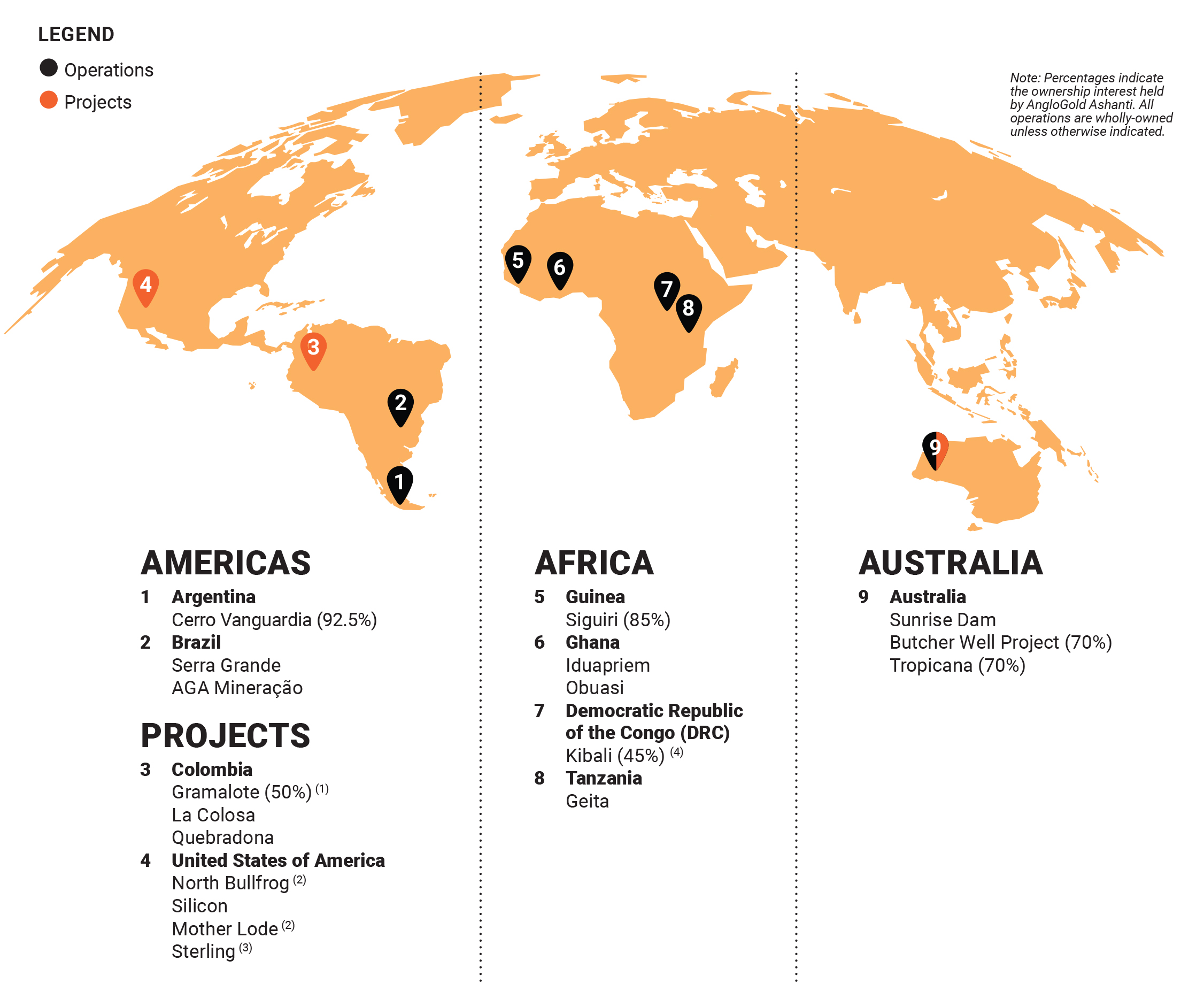

AngloGold Ashanti Limited (AngloGold Ashanti) is an independent, global gold mining company with a diverse portfolio of operations, projects and exploration activities across nine countries on four continents. While gold is our principal product, we also produce silver (Argentina) and sulphuric acid (Brazil) as by-products. We are currently developing two projects in Colombia, including the Quebradona mine that is expected to produce both gold and copper, and continuing exploration activities in the United States. The Company is headquartered in Johannesburg, South Africa. Measured by production, AngloGold Ashanti is the third largest gold mining company in the world.

PRODUCTS

AngloGold Ashanti’s main product is gold. Once mined, the gold ore is processed into doré (unrefined gold bars) on site and then dispatched to precious metals refineries for refining to a purity of at least 99.5%,99.5 percent, in accordance with the standards of ‘good delivery’ as determined by the London Bullion Market Association (LBMA). This refined gold is then sold directly to bullion banks.

By-products of our gold mining operations, often a function of local geological characteristics, include silver in Argentina and sulphuric acid in Brazil.

OPERATIONS

Our operations and projects are grouped regionally as follows:

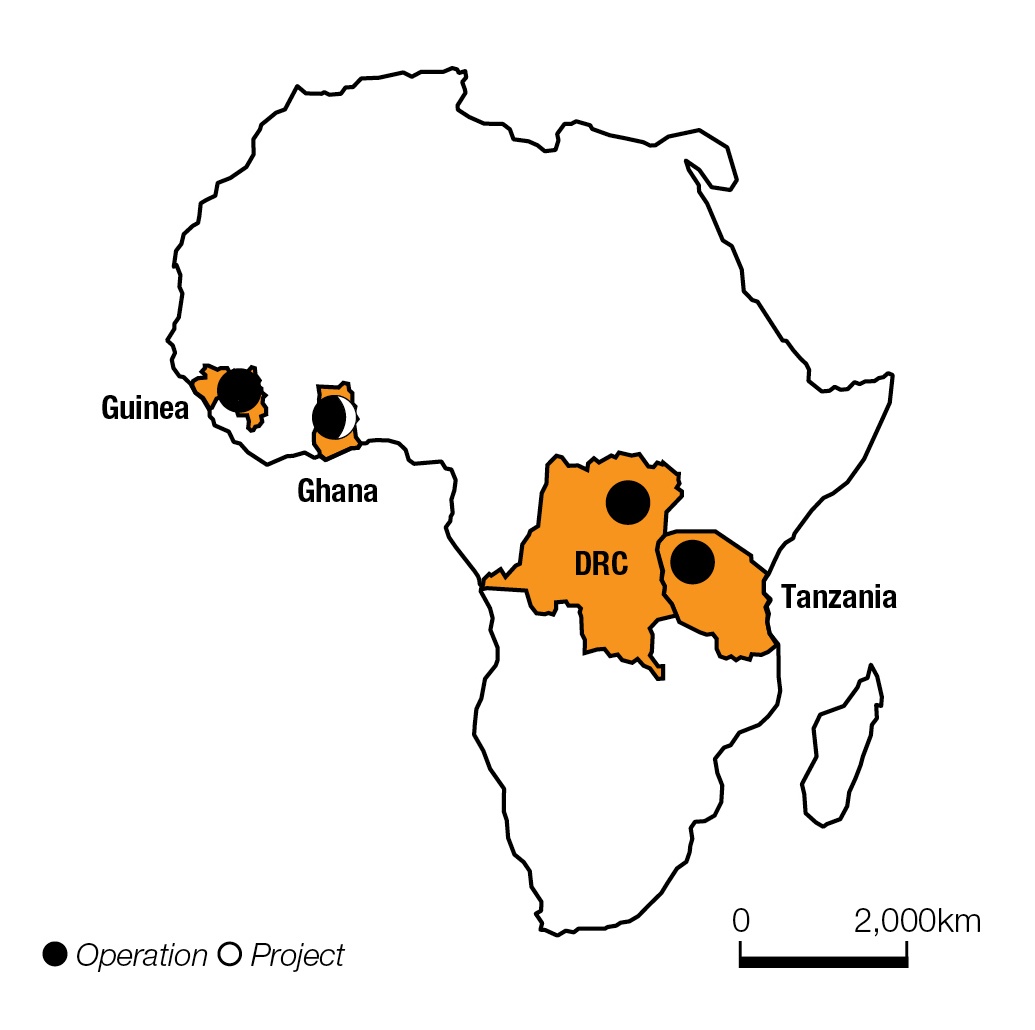

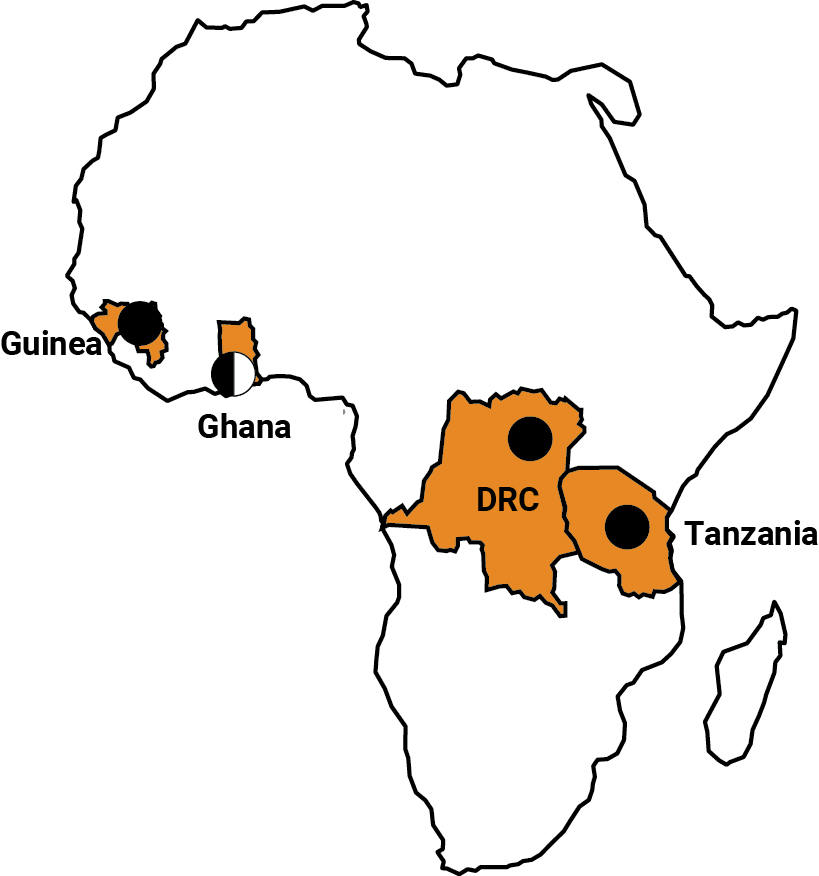

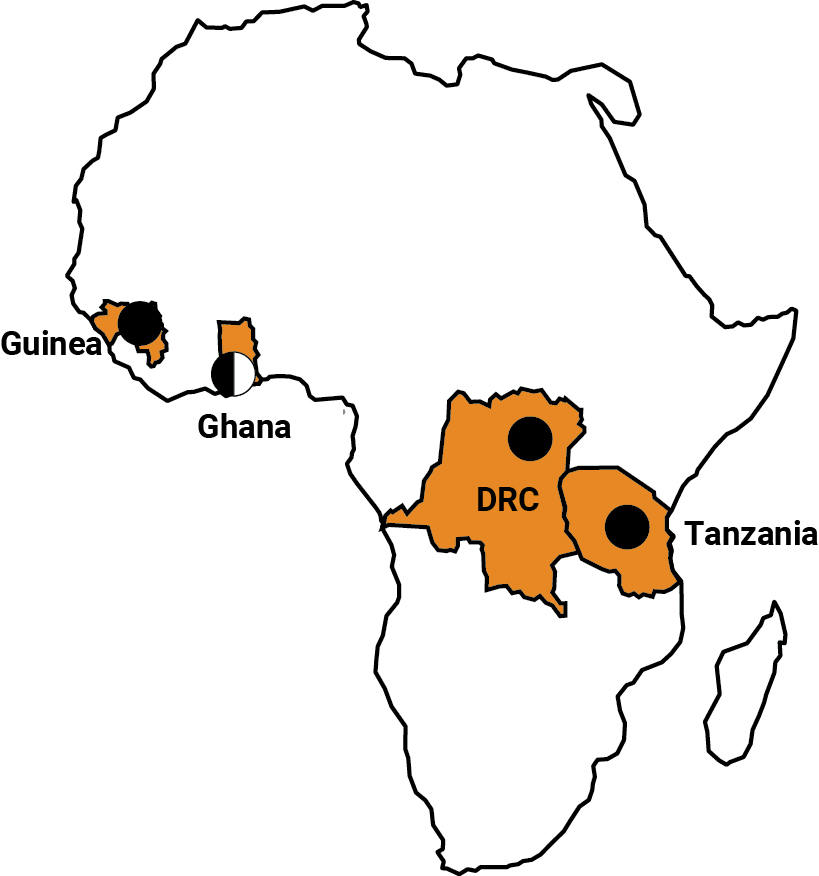

•Africa region (Democratic Republic of the Congo,(DRC, Ghana, Guinea and Tanzania and Mali - sold during 2020)ania);

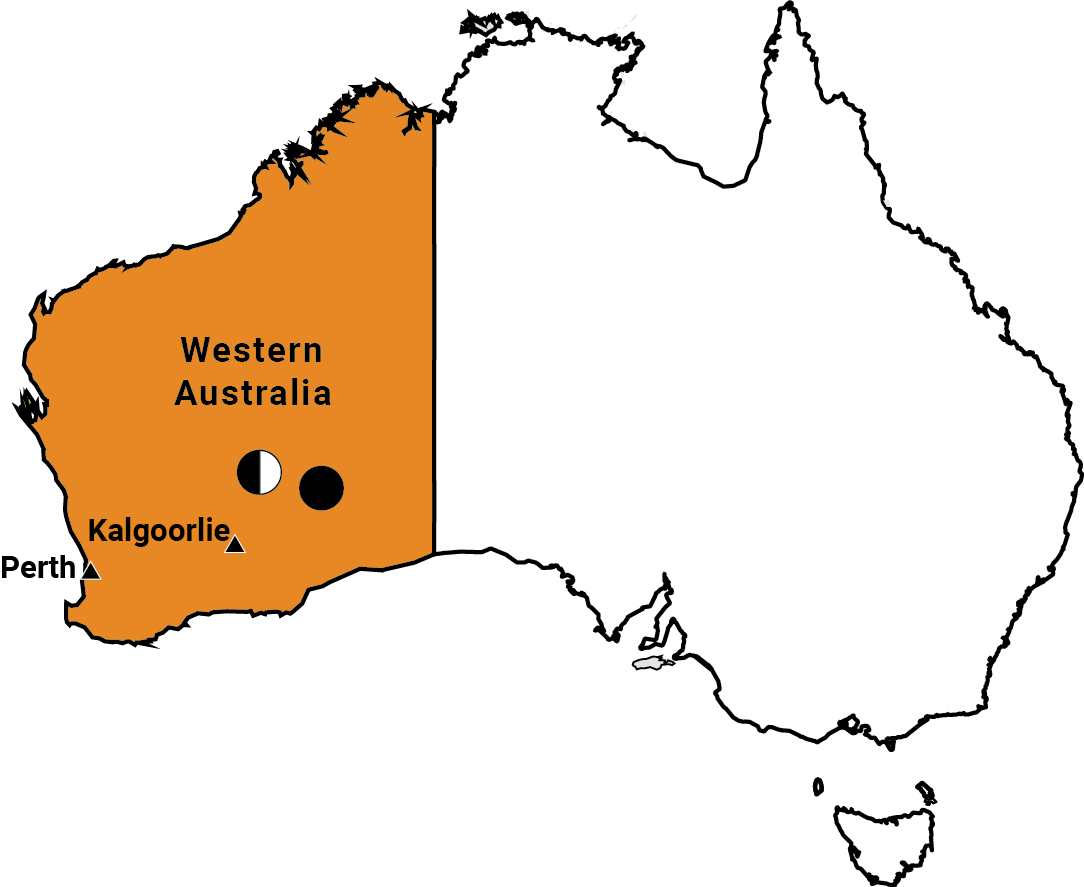

•Americas (Argentina and Brazil, and projects in the United States and Colombia); and

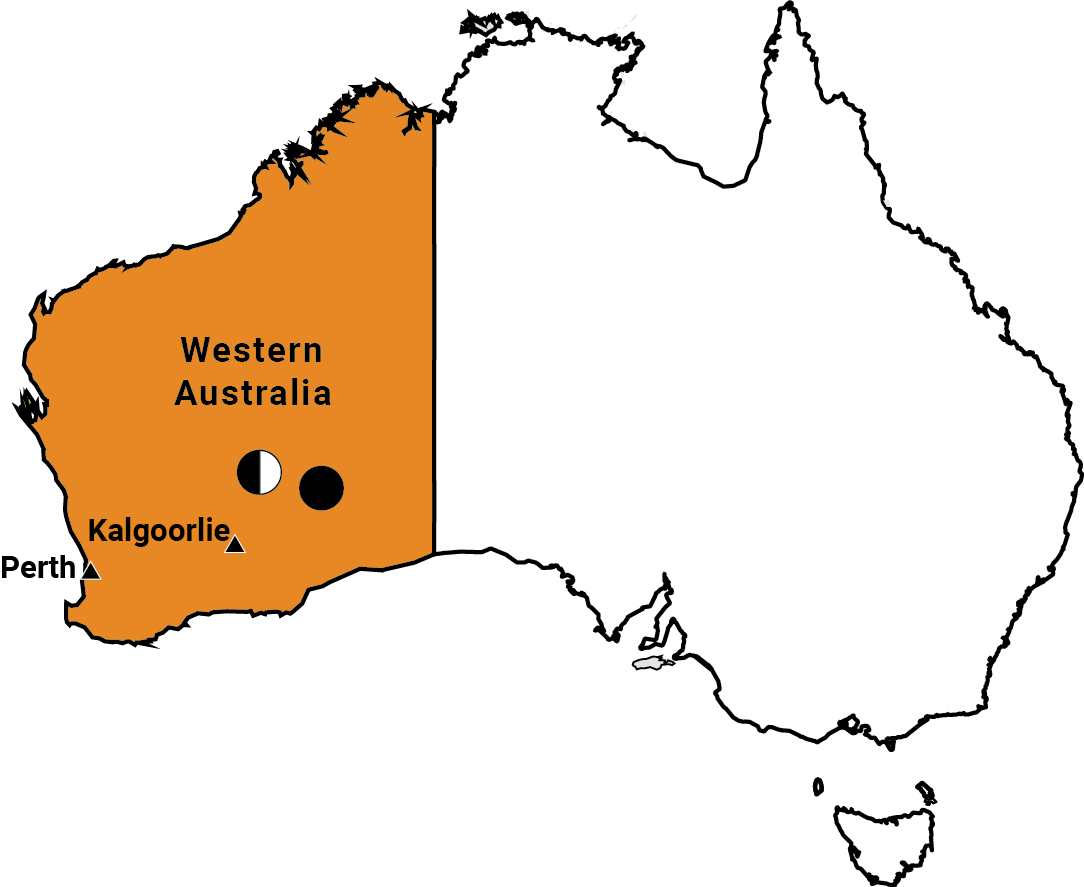

•Australia (Australia).

EXPLORATION

Our exploration programme is focused on creating significant value for the company'sCompany’s stakeholders by providing long-term optionality and improving the quality of our asset portfolio.

Greenfields and brownfields exploration takes place in both established and new gold-producing regions through managed and non-managed joint ventures,arrangements, strategic alliances and wholly-ownedwholly owned ground holdings. AngloGold Ashanti’s discoveries include La Colosa Gramalote and Quebradona (Nuevo Chaquiro) in Colombia.Colombia and Silicon, North Bullfrog, Mother Lode and Sterling in Nevada, USA.

GOLD MARKET AND JEWELLERY DEMAND

According to the World Gold Council, (WGC), global2022 was the strongest year for gold demand in over a decade and saw an annual average market spot gold price of $1,802 per ounce. Demand for gold rose 18 percent to 4,741 tonnes in 2022, with a ten percent increase in investment demand grew 40which reached 1,107 tonnes and a two percent increase in demand for gold bars and coins to 1,217 tonnes. Demand for gold in technology saw a record annual highfull year decline of 1,773.2 tonnes. Global gold-backed ETFs holdings grewseven percent as deteriorating global economic conditions hampered demand for consumer electronics and jewellery consumption softened by 877.1 tonnes during 2020, reaching record year-end holdings of 3,751.5 tonnes. Bar and coin investment of 896.1 tonnes was three percent higher year-on-year, with consistent growth coming throughat 2,086 tonnes as the gold price surged in the second halffourth quarter of the year.2022.

For more information, see “Item 5A: Operating Results—Introduction”.

51

COMPETITION

As gold mining is a mature and regulated industry, and very significant volumes of gold and gold derivatives trade in the world markets independent of gold mine supply, AngloGold Ashanti does not consider that competition for sales plays any role in its operations as a gold producer. For more information on a geographical analysis of gold income by destination, refer to “Item“Item 18: Financial Statements—Note 2—Segmental Information”.

However, gold producers do compete against each other for acquisition of mining assets, exploration opportunities and human resources. See “Item“Item 3D: Risk Factors—Mining companies faceAngloGold Ashanti faces strong competition and industry consolidation”.

SEASONALITY

Subject to other factors and unforeseen circumstances, in the first quarter production is generally lower than production during the rest of the year as a result of the ramp-up of operations after annual holiday production declines.

RAW MATERIALS

AngloGold Ashanti uses chemicals, including cyanide and lime, in the production of gold. These chemicals are available from a large number of suppliers and do not represent a material portion of the company’sCompany’s costs. We are not currently experiencing any supply shortages on critical consumables utilised in the production of gold across our global operations. In addition, our stocking strategies account for potential lead time variation and supply constraints, thus minimising the risk of changes in the marketplace. While commodity pricing is subject to volatility over time, we are currently realising stable pricing, and our contractual terms limit future changes. However the war in Ukraine has led to a sharp increase in oil and energy prices, which are important costs for the Company's business. In 2022, prices for several hard and soft commodities had reached their highest levels in a decade or more, or in some cases had set records. The higher cost for basic commodities used in our host countries and communities, and as key production inputs, could impact the costs of our raw materials.

STRATEGY

We have five key areas, namely: people, safety and sustainability; ensuring financial flexibility; actively managing all expenditures; improving the quality of our portfolio; and maintaining long-term optionality. These strategic focus areas which enable us to deliver on our overall strategy which is to create value. They guide decision-making and are aimed at generating increased cash flows; extending mine lives; creating an organic pipeline of economically viable orebodies; and enhancing our social licence to operate. The overall aim is creating and preserving value.

Strategic focus areas

AngloGold Ashanti’s five strategic focus areas are set out below:

•Focus onPrioritise people, safety, health, environment and sustainabilitycommunities. People areThis strategic focus area embodies our corporate ethos and encompasses our sustainability performance. It underpins our business strategy and the foundationdelivery of our business. To remain sustainable in the long term, we must livesustained, long-term value creation and is aligned with our values in the conduct ofand responsibilities as a corporate citizen. This strategic focus area covers our business. This encompasses being accountable for our actionsemployees, their safety, health and decisions, and respecting all, including employees,wellbeing, communities and the environment. ESG principles are integrated into every aspect of our business.

•PromoteMaintain financial flexibility. We must ensure our balance sheet always remainsis able to meet our core funding needs.

•Optimise overhead costs and capital expenditure. All spending decisions must be thoroughly scrutinised to ensure they are optimally structured and necessary to fulfil our core business objective.objectives.

•Improve portfolio quality. AngloGold Ashanti builds on its portfolio quality through projects such as our FP programme to ensure optimal mine performance. We have a portfolio of assets that must be actively managed to improveare flexible in delivering on our mine plans, allowing for the overall mix ofbest results, as we progress our projects and replace our production base as we strive forwith a competitive valuation as a business.growing Mineral Reserve and Mineral Resource base.

•Maintain long-term optionality. While we areAs part of focused on ensuring the most efficient day-to-day operationand responsible management of our Mineral Resource and Mineral Reserve, our exploration programme and related planning is vital in optimising the operating lives of our portfolio. Through continued exploration and the acquisition of properties that are a good fit with our business and offer reserve potential, we must keep an eye on creating a competitive pipelineadd to the long-term sustainability of long-term opportunities.AngloGold Ashanti.

INTELLECTUAL PROPERTY

AngloGold Ashanti, as a group, is not dependent on intellectual property (including patents or licences), industrial, commercial or financial contracts (including contracts with customers or suppliers) or new manufacturing processes for the conduct of its business as a whole.

52

THE REGULATORY ENVIRONMENT ENABLING ANGLOGOLD ASHANTI TO MINE

AngloGold Ashanti’s rights to own and exploit Oredevelop Mineral Reserve and deposits are governed by the laws and regulations of the jurisdictions in which these mineral properties lie.are located.

AngloGold Ashanti is subject to a wide range of laws and regulations governing all aspects of its operations, including such areas aswith respect to environmental protection, reclamation, exploration, development, production, taxes, immigration, labour standards and employment issues, occupational health, mine safety, dam safety, toxic substances and wastes, securities and foreign corrupt practices. AngloGold Ashanti has made, and expects to make in the future, significant expenditures to comply with these laws and regulations. Non-compliance can result in violations and legal claims, as well as substantial fines, penalties, reputational damage and delays in or suspension of day-to-day operations. Pending or proposed changes to existing laws and regulations, as well as any proposed or contemplated new laws or regulations, could also have significant impacts on AngloGold Ashanti’s business and results of operations, the extent of which cannot always be predicted.

There are in some cases certain restrictions on AngloGold Ashanti’s ability to independently move assets out of certain countries in which it has operations, or transfer assets within the group,Group, without the prior consent of the local government or minority shareholders involved. See “Item“Item 10D: Exchange controls” for details.

For more information on the risks and uncertainties associated with AngloGold Ashanti’s mining rights, see “Item“Item 3D: Risk factors”Factors”, in particular the risk factors entitled “AngloGold Ashanti’s mining rights in the countries in which it operates could be altered, suspended or cancelled for a variety of reasons, including breaches in its obligations in respect of such mining rights”, “Failure to comply with laws, regulations, standards and contractual obligations, breaches in governance processes or fraud, bribery and corruption may lead to regulatory penalties, loss of licences or permits, negative effects on AngloGold Ashanti’s reported financial results, and adversely affect its reputation”, “Title to AngloGold Ashanti’s properties may be uncertain and subject to challenge”, “AngloGold Ashanti’s mineral deposits, OreMineral Reserve, and mining operations are located in countries where political, tax and economic laws and policies may change rapidly and unpredictably and such changes and policies may adversely affect both the terms of its mining concessions, as well as its ability to conduct operations in certain countries” and “AngloGold Ashanti’s OreMineral Reserve, deposits and mining operations are located in countries that face instability and security risks that may adversely affect both the terms of its mining concessions, as well as its ability to conduct operations in certain countries”.

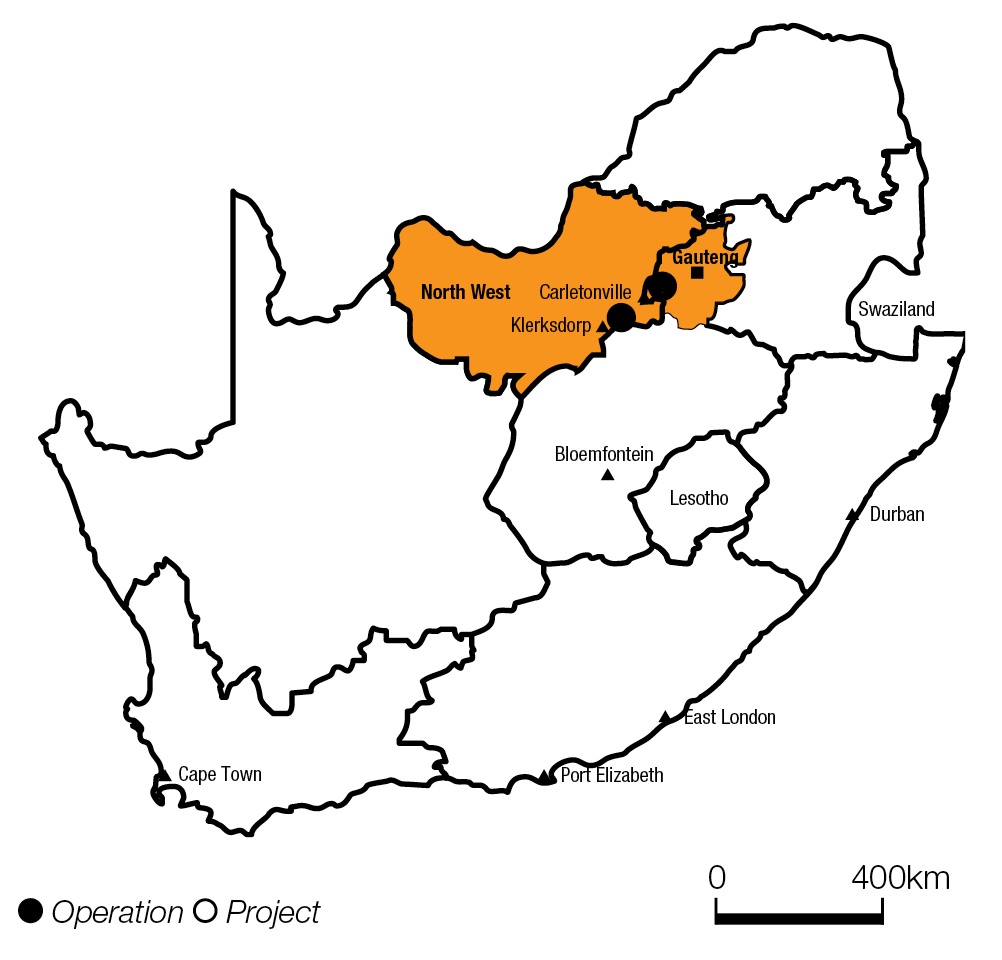

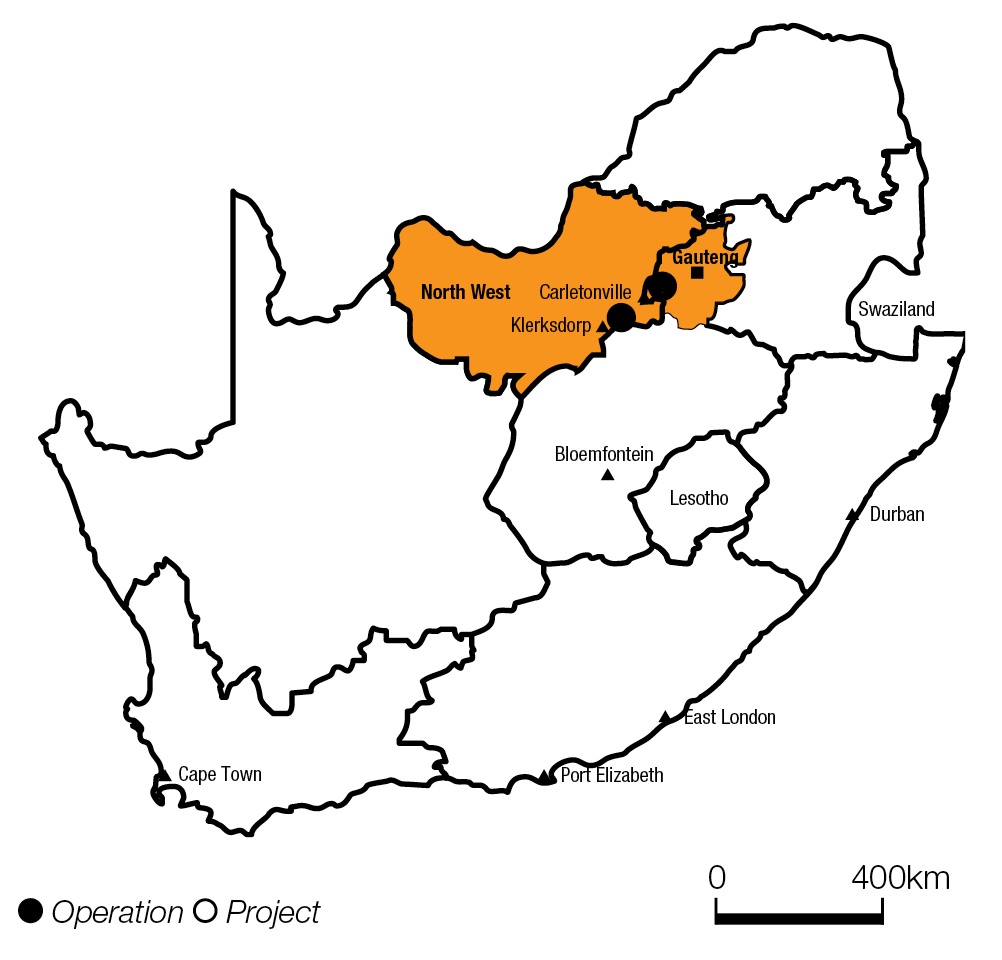

SOUTH AFRICA

As part of the South African asset sale, AngloGold Ashanti Limited sold its remaining three mining rights in South Africa to Golden Core Trade and Invest (Pty) Ltd (Golden Core)(“Golden Core”) and Harmony Gold Mining Company Limited pursuant to a sale agreement concluded on or about 12 February 2020, as amended and reinstated from time to time (SA(the “SA Sale Agreement)Agreement”). These mining rights relate to operations in the West Wits area. For further information on the South African asset sale, see “Item 18: Financial Statements—Note 9—Discontinued operations and assets and liabilities held for sale—South African asset sale”.

The Deed of Cession has been lodged for registration at the Mineral and Petroleum Titles Registration Office (MPTRO) to transfer such mining rights from AngloGold Ashanti to Golden Core. While the registration of the Deed of Cession is still pending, the risk in, benefit of, and ownership of these mining rights between the parties shall be deemed to have passed to the cessionary on 30 September 2020, the date of the notarial execution of the Deed of Cession, pursuant to clause 2 of the Deed of Cession.MPRDA

The Mining Chartermining charter

53

2021, the South African Department of Mineral Resources and Energy (“DMRE”) informed the parliamentary portfolio committee on mineral resources and energy that it does not intend to appeal the outcome of the judgement, but instead will consider steps to achieve the empowerment objectives through legislative amendments to the MPRDA.

The BBBEEB-BBEE Act

The Broad-Based Black Economic Empowerment Act, No. 53 of 2003 (BBBEE Act)(the “B-BBEE Act”) is a law of general application in respect of Broad-Based Black Economic Empowerment (BBBEE)(“B-BBEE”) and enables the Minister of Trade and Industryto drive BBBEEB-BBEE across all sectors of the economy. On 23 JanuaryIn 2014, the President of South Africa assented to the Broad-Based Black Economic Empowerment Amendment Act, No. 46 of 2013 (BBBEE(the “B-BBEE Amendment Act). The BBBEE Amendment ActAct”) came into effect on 24 October 2014 with the object of amending the BBBEEB-BBEE Act to provide a framework of principles, strategies and guidelines aimed at promoting the broad-based socio-economic empowerment of HDSAs across the South African economy and society in the form of ownership, management, employment equity, skills development, preferential procurement, enterprise development and socio-economic development.

Environmental laws relating to mining

The MPRDAA repealed the sections in the MPRDA providing for environmental regulation of mining and prospecting operations. This was the first step in migrating environmental regulation provisions from the MPRDA into National Environmental Management Act, No. 107 of 1998, (NEMA). NEMA was thenas amended by the National Environmental Management Amendment Act, No. 62 of 2008 and then again by the National Environmental Management Laws Amendment Act, No. 25 of 2014, and now(the “NEMA”) includes provisions to deal with environmental regulation of mining and prospecting, which provisions are administered by the MRE Minister. Pursuant to section 24N(8) of NEMA, directors of a company are jointly and severally liable for any negative impact on the environment, whether advertently or inadvertently caused by the company they represent, including damage, degradation and pollution. See also “Item 4B: Business Overview—Mine Site Rehabilitation and Closure” and “Item 4B: Business Overview—Environmental, Health and Safety Matters”.

From an environmental perspective, given the wide scope of the statutory duty of care in South African environmental law, erstwhile land owners may be held liable for historic contamination by the regulatory authorities. The duty of care primarily applies to persons responsible for or in control of the activity that caused the pollution, which includes erstwhile landowners and operators. The “polluter pays” principle in South Africa enables the competent authority to seek recourse against various responsible parties based on their historical or current relationship to the source and receptor of degradation or pollution. The duty of care also applies retrospectively to significant pollution or degradation that occurred before the entry into force of NEMA (i.e., 29 January 1999), as well as significant pollution or degradation that arises or is likely to arise at a different time from the actual activity that caused the contamination (e.g., latent or residual impact) or arises through an act or activity of a person that exacerbates pre-existing contamination. The authorities can also seek compensation in respect of clean-up measures that it is required to take on behalf of the responsible parties and apportion liability amongst the responsible parties, which could technically include a historic landowner or mining company that caused the pollution. Although the purchasers of AngloGold Ashanti’s assets in South Africa have contractually assumed all environmental liability associated with its former South African operations and agreed to indemnify AngloGold Ashanti for the same, there remains a risk, at least theoretically, of statutory liability to the state.

AngloGold Ashanti’s rights and permits

Pursuant to the SA Sale Agreement, AngloGold Ashanti and Golden Core executed a notarial deed of cession of the mining rights with DMRE references GP 30/5/1/2/2/01 MR and GP 30/5/1/2/2/248 MR to transfer and cede these mining rights to Golden Core (the “Deed of Cession”). On 14 June 2021, the Deed of Cession was registered at the Mineral and Petroleum Titles Registration Office (the “MPTRO”).

With respect to the mining right held under DMRE reference GP 30/5/1/2/2/11 MR, AngloGold Ashanti and Golden Core agreed to make an application in terms of section 102 of the MPRDA at the DMRE after the closing date of the SA Sale Agreement requesting, among other matters, the incorporation of this mining right into the mining right with DMRE reference GP 30/5/1/2/2/01 MR (the “Harmony Consolidation Application”). AngloGold Ashanti also executed a notarial conditional deed of abandonment pursuant to which it conditionally abandons this mining right in terms of section 56(f) of the MPRDA (the “Deed of Abandonment”) on condition that ministerial consent is granted in respect of the Harmony Consolidation Application. The Harmony Consolidation Application, which was submitted to the DMRE on 17 January 2022, is still pending. On the date of the grant of the Harmony Consolidation Application, AngloGold Ashanti will cease to be a holder of any mining rights in South Africa. Once the transaction has been fully implemented, the general laws relating to mining outlined above will no longer be applicable to the Company, other than the statutory duty of care in terms of NEMA as described above.

AFRICA REGION

Democratic Republic of the Congo (DRC)

General laws relating to mining

The mining industry in the DRC is primarily regulated by Law No. 007/2002 dated 11 July 2002 (2002(the “2002 DRC Code)Code”), as amended and supplemented by Law No. 18/001 dated 29 January9 March 2018 (Reformed(the “Reformed DRC Mining Code)Code”) and Decree No. 038/2003 dated 26 March 2003, as amended and supplemented by Decree No. 18/024 dated 8 June 2018 (Reformed(the “Reformed DRC Mining Regulations)Regulations”).

54

With respect to the application of the Reformed DRC Mining Code and Reformed DRC Mining Regulations, Kibali Goldmines S.A. (Kibali)(“Kibali Goldmines”) has reserved and continues reserving its rights, including, without limitation, its stability rights under, among other legal sources, the 2002 DRC Code. Discussions with the DRC government on these issues and the possible application of incentives that may be available under the Reformed DRC Mining Code and Reformed DRC Mining Regulations, in particular under article 220 of the Reformed DRC Mining Code which provides that the Prime Minister of the DRC may grant a number of incentives to provinces with infrastructure deficits to encourage economic development from mining resources, are ongoing.

Companies holding mining titles issued prior to the entry into force of the Reformed DRC Mining Code and Reformed DRC Mining Regulations have claims to a 10-yearten-year stability provision in accordance with prior mining legislation. Notwithstanding the adoption of the new regulatory regime, their rights with respect to such stability provision are reserved.

The Reformed DRC Mining Code grants the DRC Minister of Mines the authority to grant, refuse, suspend or terminate mineral rights, subject to conditions set out in the Reformed DRC Mining Code. Mineral rights may be granted in the form of exploration permits for an initial period of five years renewable once for a further five-year period or in the form of miningexploitation permits which are granted for an initial period of 25 years. Anyears, renewable several times for 15-year periods until the end of the mine’s life. Prior to commencing exploration work, the holder of an exploration permit may, at any time before expiry, be transformed partially intomust submit for approval a mining permit or a small-scale mining permit. Miningmitigation and rehabilitation plan pursuant to which it must undertake to carry out certain mitigation measures of the impact of its activities on the environment, as well as rehabilitation measures. Exploitation permits are granted upon successful completion of exploration and satisfaction of certain requirements, including approval of a feasibility study, an environmental and social impact study and an environmental and social management plan. To protect and enforce rights acquired under an exploration or mining permit, the Reformed DRC Mining Code provides, depending on the nature of a dispute or threat, administrative, judicial and national or international arbitral recourses.

The holder of a miningan exploitation permit is required to commence development and mine construction within three years of the awardgrant of such permit. Failure to do so may lead to forfeiture of the miningexploitation permit. ATo protect and enforce rights acquired under an exploration or exploitation permit, holder must comply with specific rules relating to, amongst other things, protectionthe Reformed DRC Mining Code provides, depending on the nature of the environment, cultural heritage, healthdispute or controversy, administrative, judicial and safety, construction and infrastructure planning. Mining and exploration activities are required to be undertaken in a way that minimizes the impact on the interests of lawful occupants of land and surface rights holders, including their customary rights. The exercise of mineral rights by title holders which effectively deprivesnational or interferes with the rights of occupants and surface rights holders requires payment of fair compensation by the mineral title holder.international arbitral recourses.

Mining companies are required to grant a free-carried and non-contributory participation to the DRC government. The DRC government’s free participation was originally set at 5five percent, which was increased to 10ten percent in respect of mining titlesexploitation permits issued after the entry into force of the Reformed DRC Mining Code. All mining companies are required to grant an additional 5five percent free-carried participation to the DRC government upon each renewal of their exploitation permit. Under the Reformed DRC Mining Code, a 10ten percent local contributory participation is also mandatory for mining titlesexploitation permits issued after its entry into force.

Tax laws relating to mining

The Reformed DRC Mining Code sets out an exclusive and comprehensive tax and customs regime that is applicable to mining activities. Mining title holders are subject, amongst other things, to a corporate income tax of 30 percent, a windfall tax of 50 percent (subject to certain prerequisites) and are required to pay mining royalties to the DRC government. The royalty rate applicable to gold has been set at 3.5 percent. Mining title holders are also required to contribute a minimum of 0.3 percent of total turnover to community development.

The standard rate of VAT is 16 percent and is applicable to all mining companies. In the DRC, Kibali Goldmines is due certain refunds of VAT which, to date, remain outstanding. During 2020,2022, AngloGold Ashanti recovered $2.23 million in the form ofdid not recover any VAT offsets and refunds from its operations in the DRC. We believe that our attributable share of the net recoverable VAT balance (including recoverable fuel duty and after discounting provisions) owed to us by the DRC government amounted to $69$86 million as of 31 December 2020.2022. While an agreement was reached with the DRC government on the reimbursement of the refundable VAT in the last quarter of 2018, uncertainty remains regarding the timing and level of cash receipts and offsets against other taxes for purposes of the recovery of our VAT receivables in the DRC.

The Reformed DRC Mining Code also provides for a level of fiscal stability. A stability clause stipulates that existing tax, customs and exchange control provisions applicable to mining activities are guaranteed to remain unchanged for a period of five years from the enactment of the Reformed DRC Mining Code.

Foreign exchange control regime

The Reformed DRC Mining Code imposed new exchange control rules requiring that mining title holders repatriate onshore 60 percent of sale revenues received during the investment amortizationamortisation period and 100 percent once the investment amortizationamortisation is completed. As a result of these new rules, we were not able to fully repatriate dividends from our DRC operations to date.

During 2020,2022, AngloGold Ashanti repatriated $140$694 million from its operations in the DRC, in the form of dividends received from Kibali (Jersey) Limited. Kibali (Jersey) Limited received such cash from Kibali Goldmines in the form of loan repayments (net of bank fees) (AngloGold Ashanti’s attributable share: $658 million) and dividends (net of withholding taxes) (AngloGold Ashanti’s attributable share: $36 million). Our attributable share of the outstanding cash balances awaiting repatriation from the DRC amounted to $424$40 million as of 31 December 2020. Our joint venture partner, Barrick Gold Corporation, which operates2022. The cash is fully available for the operational requirements of Kibali gold mine, continuesGoldmines. The cash and cash equivalents held at Kibali Goldmines are subject to engage withvarious steps before they can be distributed to Kibali (Jersey) Limited and are held across four banks in the DRC, government regarding the Reformed DRC Mining Code and the cash repatriation.including two domestic banks.

55

AngloGold Ashanti’s rights and permits

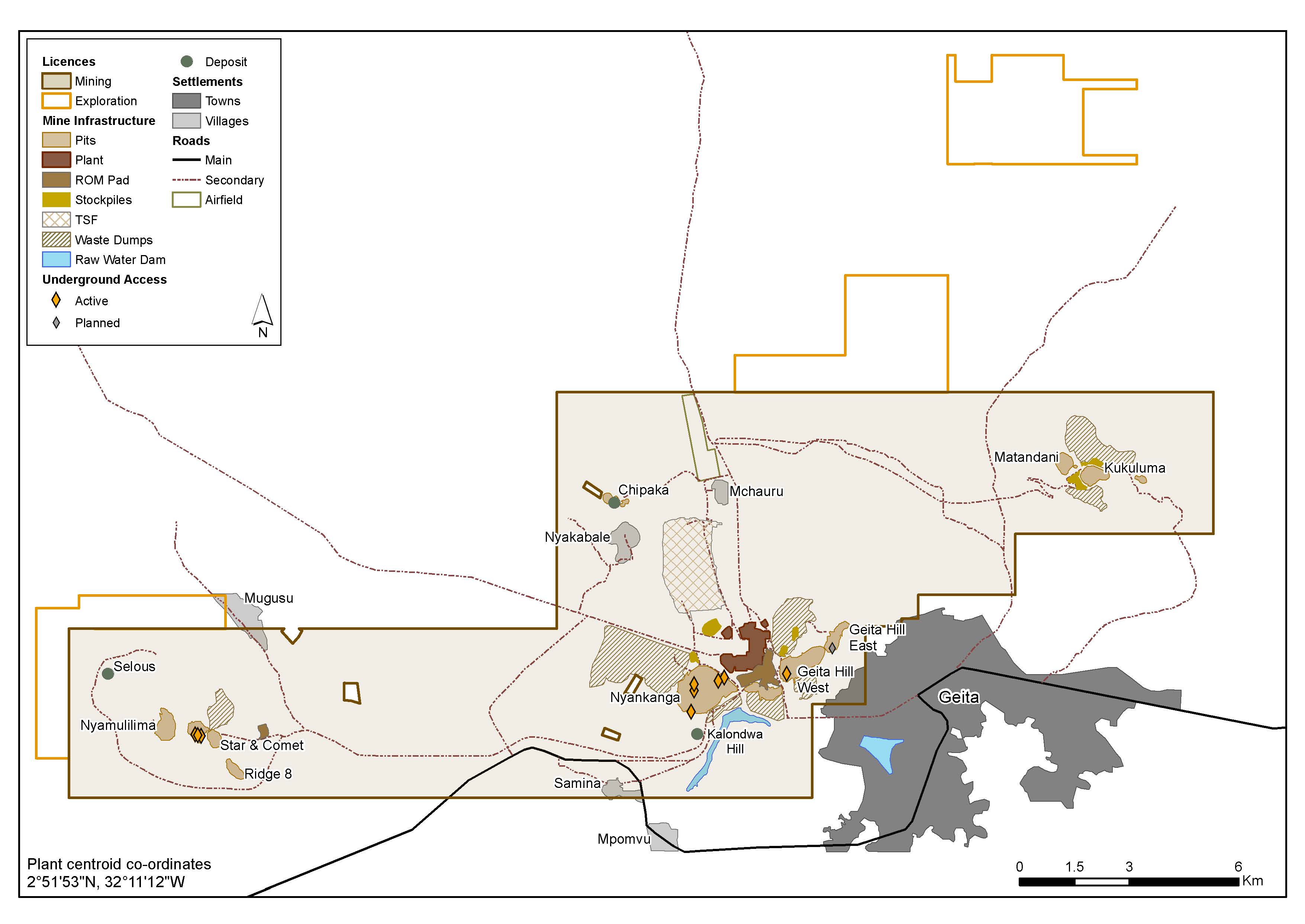

AngloGold Ashanti holds a significant stake in the Kibali gold mine which is located in the north-eastern part of the DRC. The Kibali gold mine is owned by Kibali Goldmines S.A. (Kibali) which is a joint venture between Barrick Gold Corporation (45 percent), AngloGold Ashanti (45 percent) and Société Minière de Kilo-Moto S.A. (SOKIMO)(“SOKIMO”) (10 percent) which represents the interest of the DRC government. AngloGold Ashanti and Barrick Gold Corporation each have a 50 percent interest in Kibali (Jersey) Limited which holds our effective 45%their respective 45 percent interest in Kibali. The Kibali gold mine is operated by Barrick Gold Corporation.Goldmines.

The Kibali gold project is operated by Barrick Gold Corporation and comprises ten exploitation permits, of which seveneight expire in 2029 and threetwo in 2030. Those exploitation permits (11447, 11467, 11468, 11469, 11470, 11471, 11472, 5052, 5073, and 5088) cover an area of approximately 1,836 km2in the Moto goldfields.

Ghana

General laws relating to mining

Control of minerals and mining companies

The Constitution of Ghana as well as the Minerals and Mining Act, 2006 (Act 703) (GMM Act)(the “GMM Act”) provide that all minerals in Ghana in their natural state are the property of the State and title to them is vested in the President on behalf of and in trust for the people of Ghana, with rights of reconnaissance, prospecting, recovery and associated land usage being granted under licence or lease.

The grant of a mining lease by the Ghana Minister of Lands and Natural Resources (LNR Minister)(the “LNR Minister”) upon the advice of the Minerals Commission is subject to parliamentary ratification unless the mining lease falls into a class of transactions exempted by the Ghanaian Parliament.

The LNR Minister has the power to object to a person becoming or remaining a controller of a company which has been granted a mining lease if the LNR Minister believes, on reasonable grounds, that the public interest would be prejudiced by the person concerned becoming, or remaining, such a controller.

Stability and development agreements

The GMM Act provides for stability and development agreements. Stability agreements asguarantee for a mechanism to guaranteeperiod of 15 years certain terms and conditions mainly fiscal,(mainly fiscal) to which a company’s operations are subject for a period of 15 years. Stabilitysubject. Development agreements are subject to ratification by Parliament. A development agreement, as provided for by the GMM Act, may be made availablegranted to a mineral right holder with a proposed investment exceeding USD 500 million.that proposes to invest over $500 million in its mineral operations in Ghana. The GMM Act also provides that the terms of apermits stability provisions to be incorporated into development agreement may contain stability terms as provided for in stability agreements. AStability and development agreement isagreements are subject to parliamentary ratification.

In January 2020, the Minerals Commissionit was proposed certain amendments tothat the GMM Act including, among other measures, the abolishment ofbe amended by abolishing development agreements and shortening the shorteningmaximum term of stability agreements from a period not exceeding 15 years to a period of five years (with a possible extension of anotherfor a further five years). The Minerals Commission is currently engaging with stakeholders on If the GMM Act were amended along these proposed amendments. Following this engagement, the Minerals Commission may present the proposedlines, such amendments to the LNR Minister who can then decide to submit a draft bill to Parliament. If such bill were to be adopted by Parliament, it would not apply retroactively. As a result, the proposed amendments willretroactively and would therefore not have an impact on existing development agreements, including the Obuasi Development Agreement (as described below). Those amendments to the GMM Act have not yet been adopted.

Ghana Stability Agreement

In 2004, AngloGold Limited and the Government of Ghana signed a stability agreement (Ghana Stability Agreement) governing certain aspects of the fiscal and regulatory framework under which the company would operate in Ghana for a period of 15 years following the implementation of the business combination between AngloGold Limited and Ashanti Goldfields Company Limited. Under the Ghana Stability Agreement,Limited, AngloGold Limited and the Government of Ghana agreed, among other matters, to extend the termsigned a stability agreement (the “Ghana Stability Agreement”) governing certain aspects of the mining lease relating tofiscal and regulatory framework within which the Obuasi mine until 2054 on terms existing prior to the business combination.

company would operate in Ghana for a period of 15 years. In June 2018, the Ghana Stability Agreement ceased to apply to the Obuasi mine as a resultbecause of the parliamentary ratification of a new development agreement and a new tax concession agreement in relation to thethat mine (as described below). However, the

The Ghana Stability Agreement continued to apply to the Iduapriem mine until it expired in April 2019. Since then, AngloGold Ashanti (Iduapriem) Limited (AGA Iduapriem)(“AGA Iduapriem”) no longer benefits from the Ghana Stability Agreement. Relevant engagements are currently ongoing between AGA Iduapriem benefits from certain concessions under two deeds of warranty, including exemptions from withholding taxes on dividends, interest and the Minerals Commission to obtain a new agreementpayments for the Iduapriem mine.foreign services, and allowable deductions.

Obuasi Development Agreement

AngloGold Ashanti (Ghana) Limited (AGA Ghana)(“AGA Ghana”) negotiated a new development agreement in relation to the Obuasi mine (Obuasi DA)(the “Obuasi DA”) with the Government of Ghana. On 21 June 2018, the Ghanaian Parliament ratified the Obuasi DA which contains stability terms as provided for in stability agreements.

The Obuasi DA confers the followinga number of rights and obligations on AGA Ghana with respect to the Obuasi mine:

56

Obuasi Tax Concession Agreement

The key termsObuasi TCA contains a number of tax concessions for AGA Ghana with respect to the Obuasi TCA are as follows:

Government’s Golden Share

Section 60(1) of the GMM Act provides that the Government of Ghana can require a mining company to issue for no consideration to the Republic of Ghana for no consideration a special share (Golden Share) by notice in writing to such mining company.(a “Golden Share”). A Golden Share may only be held by or transferred to a Minister of the Government or any person acting on behalf of such Government and authorised in writing by such Minister. The Government of Ghana holds a Golden Share in AGA Ghana was issued to the Government of Ghana and the Obuasi DA confirms that the Government’s rights with respect to its Golden Share apply only in respect of AGA Ghana’s assets and operations in Ghana.

The following matters require, and will not be effective without,Golden Share confers certain rights on the Government in respect of AGA Ghana. For example, written consent of the holder of the Golden Share:

Tax laws relating to mining

Currently, the main tax laws in Ghana include the following acts and regulations:regulations, which have been frequently amended over the years:

•Income Tax Act, 2015 (Act 896) (as amended) and Income Tax Regulations, 2016 (L.I. 2244);

•Customs Act, 2015 (Act 891) (as amended) and Customs Regulations, 2016 (L.I. 2248);

•Value Added Tax, 2013 (Act 870) (as amended) and Value Added Tax Regulations, 2016 (L.I. 2243); and

•Revenue Administration Act, 2016 (Act 915).

The provision of goods and services is liable to Value Added Tax (VAT) at a revised rate of 12.5 percent. In addition, there are separate levies, including a 2.5 percent National Health Insurance Levy and a 2.5 percent Ghana Education Trust Fund Levy.

Furthermore, mining companies must pay ground rent and royalties. Ground rent (mineral concession rent)

is payable annually and is calculated based on the number of cadastral units of land held. Royalties are calculated as a percentage of total revenue from minerals obtained by the mining company. The Fees and Charges (Amendment) Instrument, 2015 (L.I. 2208) was passed by Parliament on 23 December 2015 and fixed, among other things, the paymentGovernment of ground rent byGhana currently applies a five percent royalty rate to mining companies at GHS 15 cedis per acre per annum.

who have not agreed a different royalty rate under an agreement with the State. AGA Ghana is paying $670 (GHS 3,705 cedis) per km2 per annumpays royalties on a sliding scale ranging between three percent and five percent as provided for allby the AGA Ghana leases. The Obuasi DA protects AGA Ghana from any increase in ground rent for the duration of that development agreement.TCA. AGA Iduapriem is also paying $670 (GHS 3,705 cedis) per km2 per annum for all the AGA Iduapriem leases.

The companyprovision of goods and services is requiredliable to value added tax (“VAT”) at a revised rate of 15 percent. In addition, there are separate levies, including a 2.5 percent National Health Insurance Levy (“NHIL”), a 2.5 percent Ghana Education Trust Fund Levy (“GetFund Levy”) and a one percent COVID-19 Levy. By virtue of the Obuasi TCA, AGA Ghana is exempt from the payment of the NHIL and GetFund Levy. In addition, while AGA Ghana is technically exempt from the payment of the COVID-19 Levy (as it became operational subsequent to the effective date of the Obuasi DA), the Company decided to pay ground rent to the GovernmentCOVID-19 Levy voluntarily. AGA Iduapriem is not exempt from any of Ghana (as described above) as well as such other fees as are prescribed by legislation, including royalties on timber felled within the lease area.

The Minerals Income Investment FundExemptions Act, 20182022 (Act 978), which was amended1083) (“Exemptions Act”) defines the scope of tax exemptions that may be granted under Ghanaian law, and sets out the administrative process for obtaining a tax exemption. The Exemptions Act requires a person with the benefit of an existing tax exemption to apply to the Ghana Minister of Finance by 11 March 2023 in order to continue to benefit from that tax exemption. The requirement to apply to the Minerals Income Investment Fund (Amendment) Act, 2020 (Act 1024), establishes a fundMinister of Finance does not affect AGA Ghana (as, by virtue of the Obuasi DA, AGA Ghana is stabilized against the adverse effects of, or obligations imposed by, any new laws). By contrast, AGA Iduapriem is subject to receive mineral royalties and related income from mineral rights holders and also provides for the disbursement and managementprovisions of such royalties and related income. The Minerals Income Investment Fund also acts as a special purpose vehicle holding the Ghanaian Government’s carried interests in mining companies. No additional burdens are imposed on mining companies as the effect of this legislation is merely to substitute the legal person holding the Government’s carried interests.Exemptions Act.

Environmental laws relating to mining

adverse effects of the mining operations, for submission to the Ghana EPA. The Minerals and Mining (Health, Safety and Technical) Regulations, 2012 (L.I. 2182) also impose further obligations to obtain the necessary permits from the Inspectorate Division of the Minerals Commission for the operation of mines. The environmental permits of AGA Ghana (for the Obuasi redevelopment project and for the construction and operation of tailings and water infrastructure projects) are valid until June 2024. The environmental permits for AGA Iduapriem in connection with (i) gold mining and processing, (ii) the re-mining of Block 5 and for the tertiary crusher installation project and (iii) the construction and operation of a tailings storage facility (“TSF”) expired in August 2021, July 2022 and January 2023, respectively. The renewal process for the AGA Iduapriem environmental permits, which was commenced in advance of the expiry of the permits, is underway.

Environmental laws in Ghana also require mining operators to rehabilitate land negatively impacted by mining operations according to an environmental cost reclamation plan agreed with the Ghana EPA. The environmental cost reclamation plan includes two cost estimates, namely the cost of rehabilitating the mining area at the end of the life of the mine as well as the cost of rehabilitating the mine as at the date of the reclamation plan. These estimates are reviewed annually and updated every two years. Each mining company is typically required to secure a percentage (typically between 50 percent and 100 percent) of the estimated rehabilitation costs by posting reclamation bonds underwritten by banks and restricted cash. The terms of each reclamation bond are determined by a reclamation security agreement between that company and the Ghana EPA. Both AGA Ghana and AGA Iduapriem have bank guarantees in place for environmental reclamation liabilities as well as escrow accounts with joint signatories from the Ghana EPA. The guarantees for AGA Iduapriem expired in October 2022, whereas the guarantees for AGA Ghana expired in December 2022. Renewal of the bank guarantees (which commenced in advance of the expiry of the existing guarantees) has not yet been completed due to the continued depreciation of the Ghanaian cedi and its impact on the Bank of Ghana’s single obligor limit. AGA Ghana and AGA Iduapriem have notified the Ghana EPA of the resultant delays.

Foreign exchange, export and other rules

Retention of foreign earnings

Rules regarding the export of gold and diamonds

The Bank of Ghana introduced new measures to regulate and monitor the export of gold and diamonds from Ghana in 2015. From 15 September 2015, all exports of gold and diamonds must be carried out through the Precious Minerals Marketing Company Ltd (PMMC)(“PMMC”), except where the exporter is the holder of a licence that permits it to export directly. The Ghana Revenue Authority (Customs Division) only permits gold to be exported by a licensed gold exporter who has a completed Form FEX A4 bearing Bank of Ghana’s embossment. The export measures do not apply to AngloGold Ashanti because the companyCompany holds a licence granted by the LNR Minister to sell and export its production.

In November 2016, the Ministry of Lands and Natural Resources issued a ministerial directive appointing the PMMC as designated laboratory for assaying in Ghana. The directive requests all persons holding export licenseslicences for gold to submit all gold

to be exported to the PMMC for assay before export. Mining businesses, including AngloGold Ashanti, acting through the Ghana Chamber of Mines were opposed to this directive due to its potential negative impact on mining companies in the region. As a result, the Chamber initiated proceedings to reverse or modify the directive. Following discussions in respect of the mining industry’s concerns, the Chamber and Government agreed on the modalities for implementing the national assaying policy and it was introduced in February 2018 following a one-month pilot among certain mining companies. A final documentSubsequently, in June 2019, the LNR Minister released a statement reiterating the Government of Ghana’s plans to locally refine 30 percent of the gold produced in the country. Discussions between the Ghana Chamber of Mines and the Government of Ghana’s economic management team in 2019 led to the Chamber agreeing to consider the proposal and for the implementation ofparties to discuss detailed modalities to ensure that a move to locally refined gold does not become detrimental to the program will be executed once the Chamber and the PMMC address a few outstanding issues regarding assaying methodologies.mining industry.

Mining companies must submit a detailed programme for the recruitment and training of Ghanaians with a view to achieving “localisation”, which is the replacement of expatriate personnel in a company’s Ghanaian operations by Ghanaian personnel. In addition, mining companies must give preference to Ghanaian products and personnel, to the maximum extent possible, consistent with safety, efficiency and economies. The Minerals and Mining (General) Regulations, 2012 (L.I. 2173) give further details on the localisation policy. On 15 October 2020, theThe Minerals and Mining (Local Content and Local Participation) Regulations, 2020 (L.I. 2431) were adopted in order to expandcame into force on 22 December 2020 with the scopepurpose of local content requirementsdeveloping Ghanaian participation in the mining industry. The Minerals Commission is taskedindustry value chain by imposing an obligation on mining companies to publish a local procurement list ofprocure goods and services that must havewith Ghanaian content. Mining companies must also submit a five-year procurement plancontent to the Minerals Commission. Technical and engineering services generally must be provided by Ghanaian-owned companies subject to limited exceptions. Only the services of financial institutions incorporated in Ghana are to be procured and not less than 25 percent of transactions are required to be undertaken with financial institutions owned by Ghanaian citizens. Other services such as haulage, security, contract mining services for small-scale mining operations and supply of fuel are required to be provided by Ghanaians. Furthermore, if the planned capital expenditures of a holder of a mineral right exceeds certain limits set by the LNR Minister, it is required to list at least 20 percent of its equity on the Ghana Stock Exchange within five years after commencement of mining operations. In addition, there are also restrictions on the number of expatriates that can be employed by mineral rights holders and mine support service providers in a bid to enhance the participation of Ghanaians in the mining industry.maximum extent possible.

58

The Government’s election to purchase gold

In June 2021, the Bank of Ghana launched a “Domestic Gold Purchase Programme” through which the Bank of Ghana intends to purchase refined gold from AGA Ghana, AGA Iduapriem and other large-scale mining companies through voluntary arrangements pursuant to the Bank of Ghana Act, 2002 (Act 612). The LNR Minister indicated in November 2022 that the Government of Ghana intended to exercise its statutory right of pre-emption pursuant to the GMM Act to compel large-scale mining companies to sell 20 percent of their Ghana gold production and/or the resultant refined gold to the Bank of Ghana in exchange for Ghanaian cedis. Each of AGA Ghana and AGA Iduapriem executed voluntary gold purchase agreements with the Bank of Ghana on 29 December 2022. As at 10 March 2020,2023, the ImpositionGovernment of Restrictions Act, 2020 (Act 1012) was enacted to put in place measures to address the COVID-19 pandemic. It gives the President power to impose restrictions on personsGhana had not exercised its statutory right of pre-emption as prescribed in the event of an emergency, disaster or similar circumstance to ensure public safety, public health and protection. Numerous executive instruments have been issued in exercise of this power conferred on the President pursuant to this legislation to manage the pandemic.GMM Act.

AngloGold Ashanti’s rights and permits

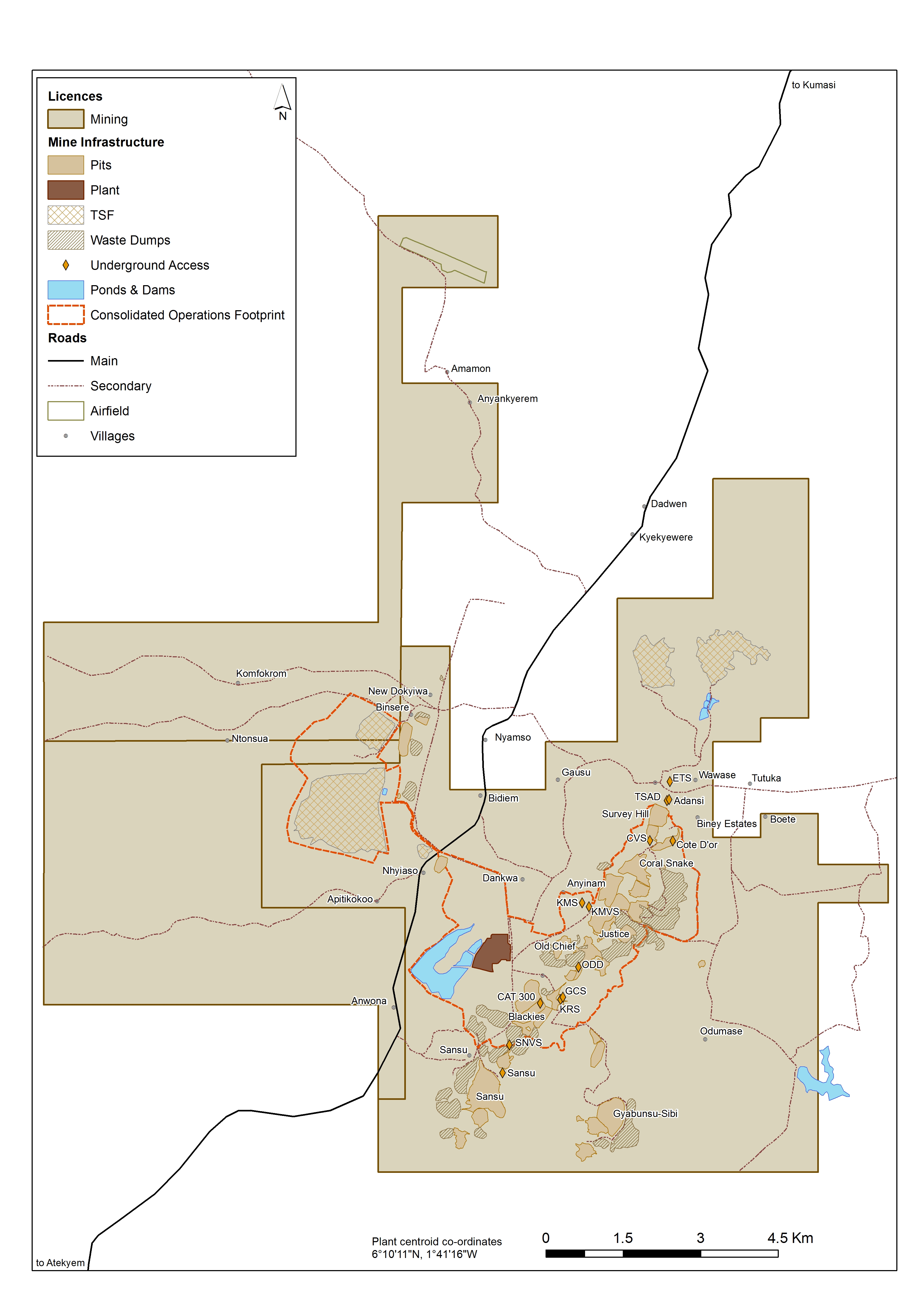

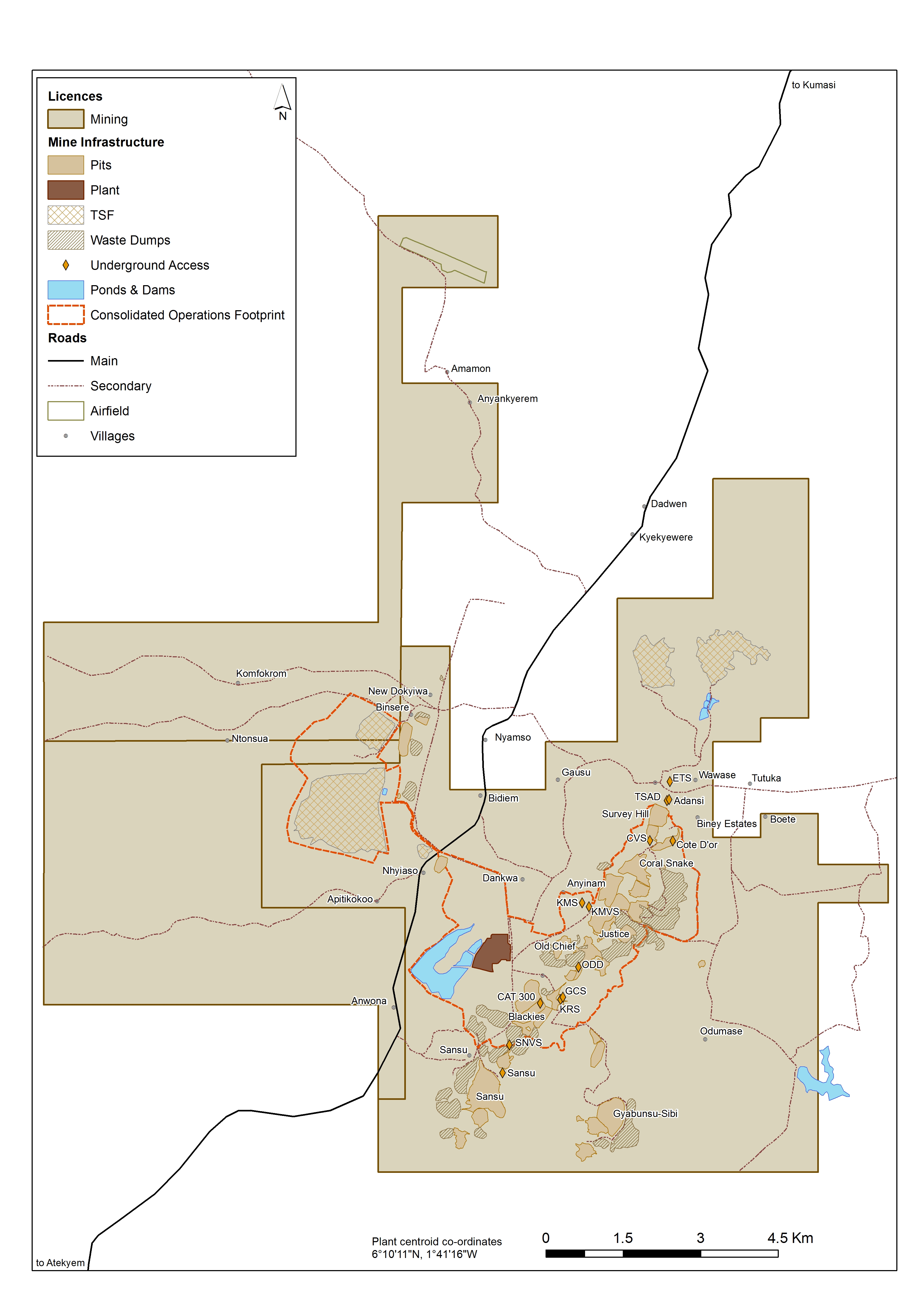

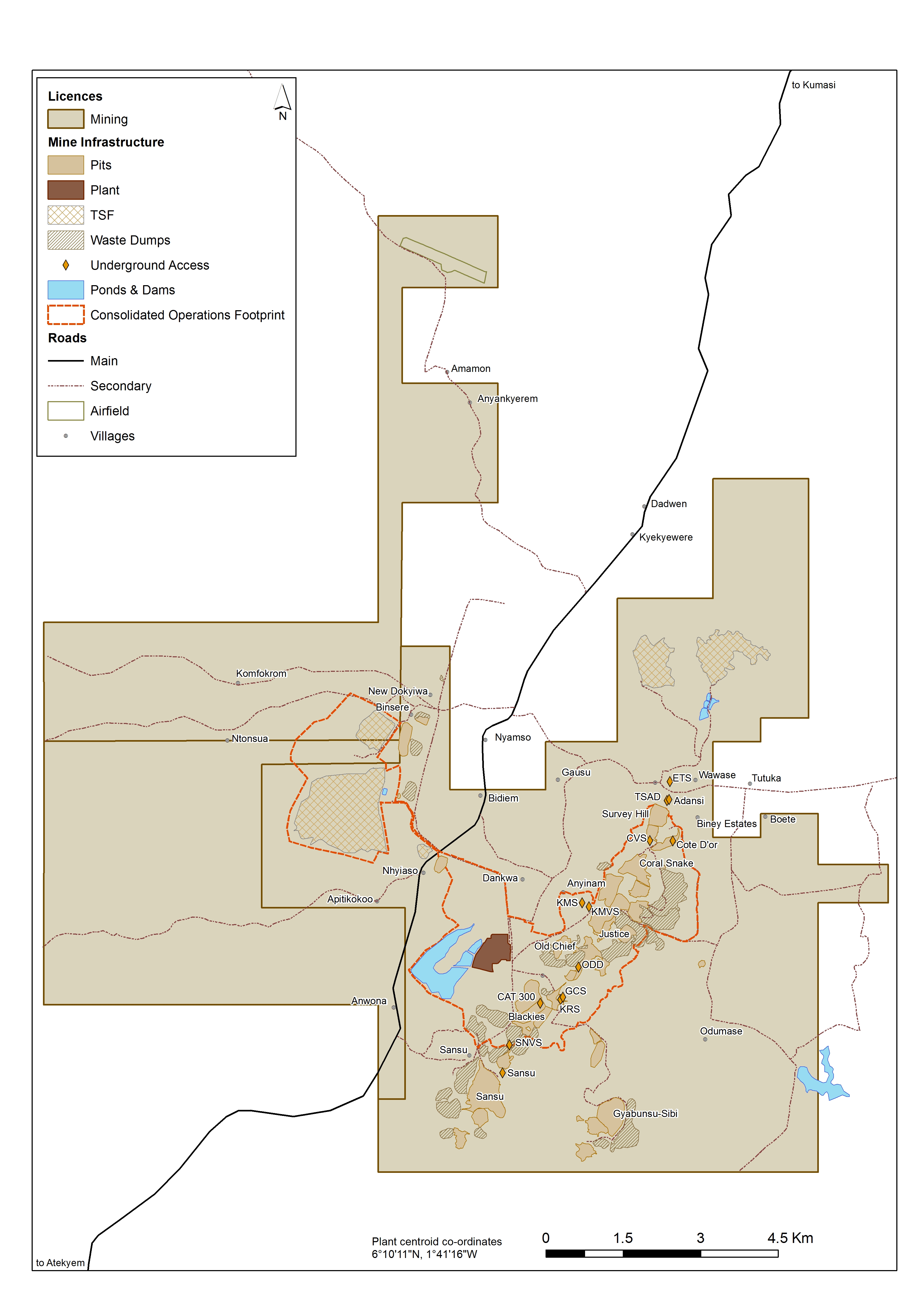

Obuasi

The currentObuasi mine originally held four contiguous mining lease forleases, namely, the Obuasi, areaBinsere 1, Binsere 2 and Binsere 3 Mining Leases. The Obuasi Mining Lease was granted by the Government of Ghana on 5 March 1994. It grants mining concessions to land with1994, covering an area of approximately 338 km2 in the Amansie East and Adansi West districts of the Ashanti region, for a term of 30 years from the date of the agreement. In addition, a mining lease overThe Binsere Mining Leases were granted on 9 April 1998, covering an adjacentarea of 140 km2 was also granted, resulting, for a term of 30 years from the date of the agreement. All leases in respect of the total area underObuasi mine had been duly ratified in accordance with Ghanaian law. In March 2007, the mining lease increasing to 474 km2. The Government of Ghana agreed to extend the term of the mining lease relating to the Obuasi mine until 2054.Mining Lease for a further term of 30 years. The mining leaseamended Obuasi Mining Lease was formallyalso ratified by Parliament on 23 October 2008. The Obuasi Mining Lease will expire in March 2054 and the Binsere Mining Leases in April 2028. The mining leases are renewable. On 3 March 2016, the Minerals Commission approved AGA Ghana’s application to surrender approximately 273.54 km2 of the area to the Government of Ghana, reducing the combined area under AGA Ghana’s lease areas to 201.46 km2. The remaining parcel of land that will be subject to the mining lease is situated within various villages and townships in the region but excludes the municipality of Obuasi. On 15 January 2021, the Minerals Commission approved AGA Ghana’s application to relinquishsurrender a further 60.24 km2 of lease area, thereby reducing the total lease areasarea to 141.22 km2 under three mining leases, namely, the Obuasi Mining Lease (87.48 km2), in order to avoid encroachmentthe Binsere 1 Mining Lease (29.03 km2) and illegalthe Binsere 2 Mining Lease (24.71 km2). These mining activities within the mine’s footprint while maintaining its social license to operate.

Iduapriem

The Iduapriem mine operates under four different mining leases:leases, namely, the Iduapriem Mining Lease (LVB1539/89) (36.47 km2), the Ajopa Mining Lease (LVB/WR326/09) (46.12 km2), the Teberebie Mining Lease (LVB3722H/92) (28.53 km2) and the Ajopa South Mining Lease (LR#1109/1999) (28.10 km2). Prior to all four mining leases expiring in 2018 and 2019, AGA Iduapriem submitted all relevant documents to apply for renewal of the leases. On 17 February 2020, the mining leases were extended for a further period of 15 years and such leases will now expire in February 2035. The Ajopa Mining Lease and the Ajopa South Mining Lease were ratified by the Ghanaian Parliament on 15 July 2020. The Iduapriem Mining Lease and the Teberebie Mining Lease were both ratified on 22 December 2020.

Guinea

General laws relating to mining

In Guinea, all mineral substances are the property of the State. Mining activities aremining industry is primarily regulated by Law L/2011/006/CNT dated 9 September 2011 as amended by Law L/2013/053/CNT dated 8 April 2013 and promulgated by Decree D/2013/075/PRG/SGG dated 17 April 2013 (together, the Guinea“Guinea Mining Code)Code”).

The Guinea Mining Code is implemented by various decrees and orders, including Decree D/2014/015/PRG/SGG adopting a model of mining convention, dated 17 January 2014, Order A/2016/1584/MMG/SGG related to the administration’s capacities for the management of integrated mining projects (PARCA-GPI) and its steering committee, dated 6 June 2016, and Decree D/2016/163/PRG/SGG on the national agency for the development of mining infrastructures (ANAIM), dated 13 June 2016, and Decree D/2016/215/PRG/SRG on the appointment of executives to the Ministry of Mines and Geology, dated 8 July 2016.

In 2017, Decree D/2017/285/PRG/SGG was adopted, which sets forth the conditions for the constitution and management of the Local Development Fund (Fodel)(“Fodel”), as well as Joint Order A/2017/6326/MMG/MATD/SGG, which sets forth the conditions for the use, management and control of the Fodel. Together, these set forth the use of the mining companies’ financial contribution to the development of the local communities and the rules applying to the Fodel, which was created under the Guinea Mining Code. In addition, Joint Order AC/2017/3228/MATD/MMG/SGG, issued by the Ministry of Territorial Administration and Decentralisation and the Ministry of Mines and Geology and dated 21 July 2017, updates the act on the establishment, attribution and functioning of the coordination committees in mining communities (CCLMS). The main purpose of the CCLMs, in which all concerned mining companies are represented, is to prevent and settle disputes that may arise in mining communities. On 13 July 2018, a Joint Order A/2018/5212/MEF/MMG/MB/MATD/SGG was issued, which regulates the use, management and monitoring of the resources allocated to local authorities pursuant to article 165 of the Guinea Mining Code. In 2019, an inter-ministerial committee was created to supervise and control the Fodel through the adoption of Joint Order AC/2019/089/MMG/MATD/SGG setting out the conditions for the constitution, powers and management of said inter-ministerial committee. On 6 September 2019, Decree D/2019/263/PRG/SGG was issued, which sets forth local content requirements in the framework of the implementation of public and private projects in Guinea. On 27 May 2021, Order A/2021/1229/MMG/SGG was issued to establish the Steering Committee for local content in the mining sector. On 21 October 2022, Law L/2022/010/CNT, dated 22 September 2022, setting up the legal framework for local content in public and private projects was enacted (the “Local Content Act”). In particular, the Local Content Act regulates local employment, procurement of goods and services, and subcontracting

59

requirements. As the Local Content Act does not expressly repeal the provisions of Decree D/2019/263/PRG/SGG, those provisions remain in force to the extent that they do not conflict with the Local Content Act.

On 16 June 2020, a new procedure for the export of gold by mining companies was enacted through the adoption of Decree D/2020/113/PRG/SGG, which sets out, amongst other things: (i) when the industrial production tax referred to in article 161-1 of the Guinea Mining Code shall be paid, and (ii) the process to be followed to export gold bullion.

On 27 April 2021, a Joint Order AC/2021/824/MMG/BCRG/SGG was issued establishing the fees and costs charged by the Guinean mining authorities and the Guinean Central Bank in connection with the administrative procedures for the export of gold by industrial and semi-industrial companies.

AngloGold Ashanti’s rights and permits

The right to undertake mining operations in Guinea can only be obtained by one of the following mining titles: surveying permit, small-scale mining licence, exploration licence, mining licence or mining concession.

Key elements of the Revised Mining Convention de Base include the following:

•a duration of 25 years, expiring 23 January 2042, subject to further renewal if mining operations continue;

•the term of the Mining Concession is aligned with the term of the Revised Mining Convention de Base such thatsince the Republic of Guinea committed to maintain the Mining Concession will be renewed as long asfor the entire duration of the Revised Convention de Base remains in force;Mining Convention;

•SAG’s operations remain governed by the 1995 Guinea Mining Code (the prior mining code) and are only subject to the provisions of the Guinea Mining Code to the extent they are expressly set out in the Revised Convention de Base;Mining Convention;

•the stability of the customs and tax regime is guaranteed for the entire initial term of the Revised Mining Convention, de Base, and subject to certain conditions being met, any renewal period(s);

•the Republic of Guinea holds a 15 percent free-carried/non-contributory interest;

•the Republic of Guinea is entitled to a royalty on gold of 5five percent based on a spot gold price as per LBMA fixing (PM) up until the date of steady state commercial production of the first phase of the Expansion, after which the royalty rate applicable to gold will vary depending on threshold prices as per LBMA fixing (PM), namely: 3three percent if the gold price is USD 1,300$1,300 or less, 5five percent, if above USD 1,300$1,300 and up to USD 2,000$2,000 and 7seven percent if above USD 2,000;$2,000;

•SAG benefits from 5-year income tax holiday from the beginning of steady state commercial production of the first phase of the Expansion, after which the income tax rate is set at 30 percent;

•a local development tax of 0.4 percent is payable on the sale price for gold and silver received by SAG up until 31 December 2027, after which it will be increased to 0.6 percent;

•salaries of expatriate employees are subject to a 10ten percent income tax;

•goods imported into Guinea for purposes related to the construction and commissioning of the first phase of the Expansion are exempt from all customs taxes and duties; and

•SAG is committed to adopting and progressively implementing a plan for the effective rehabilitation of the mining areas disturbed or affected by its operations.

The Mining Concession covers an area divided into four blocks totalingtotalling approximately 1,495 km2. SAG has the exclusive right to explore and mine in any part of the concession area for the duration of the Revised Convention de Base.Mining Convention. The Revised Mining Convention de Base also grants SAG the option to secure certain land rights over additional areas currently covered by exploration permits, but to which SAG may need access for purposes of establishing roads or storage of tailings. While the Mining Concession expired on 4 August 2022, a renewal request had been filed prior to its expiry in accordance with the provisions of the Revised Mining Convention on 1 February 2022. Pursuant to the Revised Mining Convention, the Mining Concession can be renewed for one or more period(s) that cannot exceed ten years each as long as the Revised Mining Convention is in force.

The Revised Mining Convention de Base is subject to early termination if the parties formally and expressly agree to it, if the last of the mining title held by SAG expires or is relinquished without any renewal application having been filed, if all project activities are voluntarily suspended for a continuous period of 12 months or are permanently abandoned by SAG, or if SAG goes into voluntary liquidation or is placed into liquidation by a court of competent jurisdiction.

60

Mali

General laws relating to mining

The mining industry in Mali is primarily regulated by Ordinance No. 2019-022/P-RM dated 27 September 2019 containing the new mining code of the Republic of Mali (2019 Mali(the “Mali Mining Code)Code”) and Decree No. 2020-0177/PT-RM dated 12 November 2020 implementing the 2019 Mali Mining Code. On 8 December 2020, Decree No. 2020-0288/PM-RM enacted the new model mining convention referred to in Decree No. 2020-0177/PT-RM.

The 2019 Mali Mining Code applies to the mining operations previously carried out by AngloGold Ashanti entities in Mali (as further described below) except with respect to the validity, scope and duration of their exploitation permits and the provisions on tax and customs regime contained in their mining conventions (conventions d’établissement) for their remaining duration. In this regard, the transitory rules of the 2019 Mali Mining Code specify that mining conventions in force remain valid for their remaining term and their holders continue to benefit from the stability of the tax and customs regime set out therein.

Exploration and prospecting activities are carried out under exploration authorisations (autorisation d’exploration)(autorisation d’exploration) or exploration permits (permis(permis de recherche). Exploration authorisations and exploration permitsrecherche), which give their holder the exclusive right to carry out exploration activities over a given area. Exploration authorisations are granted by the Mining Administration (Administration chargée des Mines) for a non-renewable period of three months, while exploration permits are granted by Ministerial Order for a period of three years renewable twice for additional 3-year periods. Applications for exploration authorisations and exploration permits must contain various documents attesting to the financial and technical capacity of the applicant as well as a detailed works and costs programme. Exploration authorisations are granted by the Mining Administration (Administration chargée des Mines) while exploration permits are granted by Ministerial Order.

A large scale permit exploitation permit (permis(permis d’exploitation de grande mine)mine) is required to mine a deposit located within the area of an exploration permit. The large scale exploitation permit and grants the holder an exclusive right to exploit the named substances and proceed with the processing and commercialisation of the substances extracted within its perimeter. Large scale exploitation permits are granted by decree of the Head of Government for a maximum period of 12 years renewable for 10ten year-periods until depletion of the deposits. The large scale exploitation permit is granted only to the holder of an exploration permit and covers only the area governed by the exploration permit. An application must be submitted to the Mining Administration (Administration(Administration chargée des Mines)Mines) and must contain various documents attesting to the financial and technical capacity of the applicant, a feasibility study, a detailed environmental study in respect of the impact of the project on the environment, an environmental permit, a closure and rehabilitation plan as well as a community development plan. The large scale exploitation permit is granted by decree of the Head of Government. As soon as the large scale exploitation permit is granted, the permit holder must incorporate a company under the laws of Mali. The permit holder willMali and assign the large scale exploitation permit for free to this company. The State will have a 10ten percent free-carried interest in the company. This interest will be converted into priority shares and the State’s participation will not be diluted in case of an increase in capital. In addition, the company is required to ensure that private Malian investors are offered the possibility to acquire 5five percent of their capital.

All mining titles mentioned above (save for the exploration authorisation) require an establishmenta mining convention (convention(convention d’établissement)tablissement) to be signed by the State and the titleholder defining their rights and obligations, the duration of which is 20 years.

AngloGold Ashanti’s rights and permits