UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20202023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report__________

Commission file number 001-39822

Pharming Group N.V.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| | |

| The Netherlands | 2834 | Not applicable |

| (Jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (Translation of Registrant’s name into English) |

Darwinweg 24

2333 CR Leiden

The Netherlands

Tel: +31 (0)71 5247 400

(Address including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Dr. Sijmen de Vries, CEO

+31 71 5247 400

E: investor@pharming.com

Pharming Healthcare Inc.Group N.V.

Darwinweg 24

2333 CR Leiden

The Netherlands

10 Independence Blvd, 4

th Floor

Warren, New Jersey 7059

+1 908 524 0888

(Name, telephone, e-mail and/or facsimile number, and address including zip code, and telephone number, including area code, of agent for service)company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

American Depositary Shares, each representing ten ordinary shares, nominal value EUR 0.01 per share

Ordinary shares, nominal value EUR 0.01 per share* | | PHAR | | The Nasdaq Stock Market LLC

The Nasdaq Stock Market LLC* |

Securities registered or to be registered pursuant to Section 12(g) of the Act. None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Reportannual report.

638,821,619671,073,243 ordinary shares, nominal value €0.01 per share, as of December 31, 2020.2023.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐☒ Yes ☒☐ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 daysdays. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐☒ Accelerated filer ☐ Non-accelerated filer ☒☐ Emerging growth company ☒☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☒☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the

registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

†

The term “new or revised financial accounting standard” refers

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.§240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | | | | | |

| U.S. GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an Annual Report,annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

listed not for trading or quotation purposes, but only in connection with the registration of American Depository Shares representing such ordinary shares pursuant to the requirements of the Securities and Exchange Commission. The American Depository Shares are registered under the Securities Act of 1933, as amended, pursuant to a separate registration statement on Form F-6 (File No. 333-251421).

| | | | | | | | |

| TABLE OF CONTENTS |

| | PAGE |

| | |

| Part I | | |

| Item 1. | | |

| Item 2. | | |

| Item 3. | | |

| | |

| | |

| | |

| | |

| Item 4. | | |

| | |

| | |

| | |

| | |

| Item 4 A. | | |

| Item 5. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 6. | | |

| | |

| | |

| | |

| | |

| | |

| Item 7. | | |

| | |

| | |

| | |

| Item 8. | | |

| | |

| | |

| Item 9. | | |

| | |

| | |

| | |

| | |

| | |

| | | | | | | | |

| | | | | | | | | |

| | |

| | |

| | |

| Item 10. | | |

| | |

| B. MEMORANDUM AND ARTICLES OF ASSOCIATION | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 11. | | |

| Item 12. | | |

| | |

| | |

| | |

| | |

| Part II | | |

| Item 13. | | |

| Item 14. | | |

| Item 15. | | |

| Item 16. | | |

| Item 16A. | AUDIT COMMITTEE FINANCIAL EXPERT | | |

| Item 16B. | CODE OF ETHICS | |

| Item 16C. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | |

| Item 16D. | | |

| Item 16E. | | |

| Item 16F. | | |

| Item 16G. | CORPORATE GOVERNANCE | | |

| Item 16H. | MINE SAFETY DISCLOSURE | 124 |

| Item 16I. | DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTION | |

| INSIDER TRADING | 125 |

| Item 16K. | CYBERSECURITY | 125 |

| Part III | | |

| Item 17. | | |

| Item 18. | | |

| Item 19. | | |

GENERAL INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

In this Annual Report on Form 20-F, (“or Annual Report”)Report, the terms “Pharming,”“Pharming”, “Pharming Group,”Group”, “Pharming Group N.V.”,” “Pharming Healthcare Inc.,” “the company,” “we,”Group”, “the Company”, “we”, “us” and “our” refer to Pharming Group N.V. together with its subsidiaries.subsidiaries, except where the context otherwise requires.

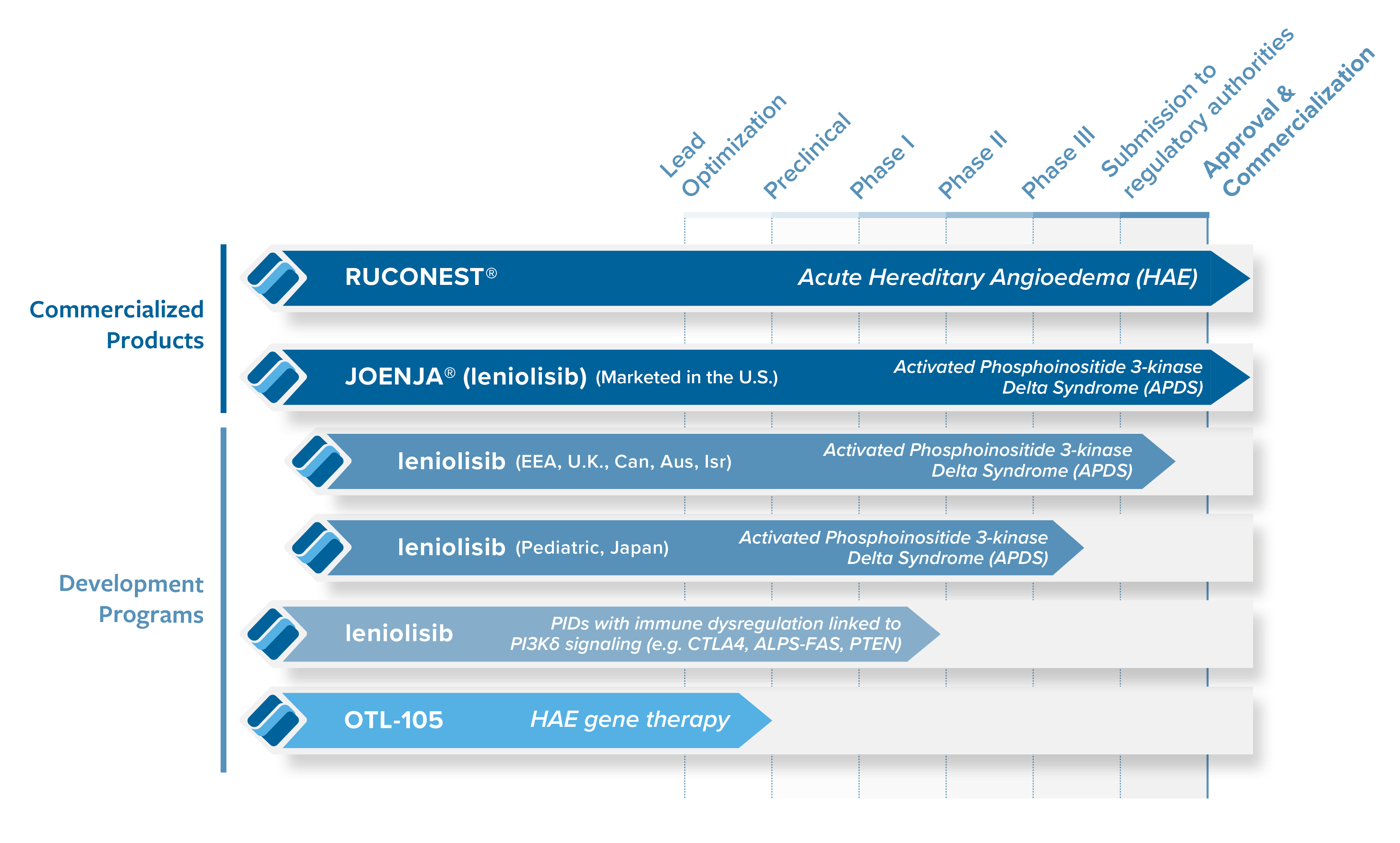

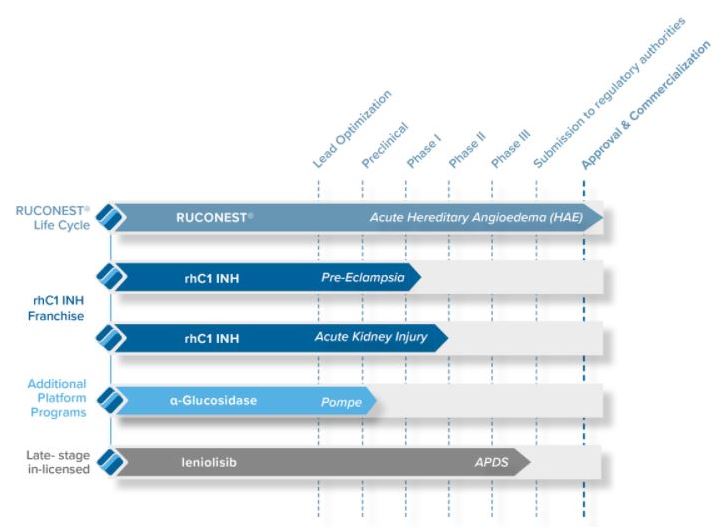

“Joenja®” is the global registered trademark for leniolisib. When discussing the U.S. market or the commercialized product in the U.S., we generally use the trademarked name Joenja® instead of leniolisib.

“leniolisib” is the term we generally use when discussing clinical trials or studies prior to U.S. approval or the product as related to markets outside of the U.S.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

We own or have rights to trademarks, service marks and trade names that we use in connection with the operation of our business, including our corporate name, logos and website names. We own the trademarks RUCONEST® and Joenja® among others, as well as the graphic trademark found on our website. There are trademarks, service marks and trade names appearing in this Annual Report that are the property of their respective owners. Solely for convenience, some of the trademarks, service marks and trade names referred to in this Annual Report are listed without the ® symbol, but we will assert, to the fullest extent under applicable law, our rights to our trademarks, service marks and trade names.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 20-F contains forward-looking statements that involve substantial risks and uncertainties. In some cases, you can identify forward- lookingforward-looking statements by the words “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “objective,” “anticipate,” “believe,” “estimate,” “predict,” “potential,”“may”, “might”, “will”, “could”, “would”, “should”, “expect”, “intend”, “plan”, “objective”, “anticipate”, “believe”, “estimate”, “predict”, “potential”, “continue” and “ongoing,”“ongoing”, or the negative of these terms, or other comparable terminology intended to identify statements about the future. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. The forward-looking statements and opinions contained in this Annual Report on Form 20-F are based upon information available to us as of the date of this Annual Report on Form 20-F and, while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. Forward-looking statements include, but are not limited to, statements about:

•the development of our product candidates, including statements regarding the timing of initiation, completion and the outcome of clinical trials and related preparatory work, the period during which the results of the trials will become available and our research and development programs;

•our ability to obtain and maintain regulatory approval of our product candidates in the indications for which we plan to develop them, and any related restrictions, limitations or warnings in the label of an approved drug or therapy;

•our plans to collaborate, or statements regarding the ongoing collaborations, with third parties;

•our plans to research, develop, manufacture and commercialize our product candidates;

•the timing of our regulatory filings for our product candidates;

•the size and growth potential of the markets for our product candidates;

•our ability to raise additional capital;

•our commercialization, marketing and manufacturing capabilities and strategy;

•our expectations regarding our ability to obtain and maintain intellectual property protection;

•our ability to attract and retain qualified employees and key personnel;

•our ability to contract with third-party suppliers and manufacturers and their ability to perform adequately;

•our estimates regarding future revenues, expenses and needs for additional financing;

•our belief that our existing cash, cash equivalents and term deposits will be sufficient to fund our operating expenses and capital expenditure requirements through as we currently expect; and

•

our ability to overcome the challenges posed by the COVID-19 pandemic to the conduct of our business; and

•regulatory developments in the United States, theThe Netherlands, other European Union, or EU Member States and other jurisdictions including tax matters.

You should refer to the section of this Annual Report on Form 20-F titled "Item 3.D—“Item 3 — D. Risk Factors"Factors” for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Annual Report on Form 20-F will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. Forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update them in light of new information or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances or to reflect the occurrence of unanticipated events.

You should read this Annual Report on Form 20-F and the documents that we reference in this Annual Report on Form 20-F and have filed as exhibits to this Annual Report on Form 20-F completely and with the

understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

This Annual Report on Form 20-F contains estimates, projections and other information concerning our industry, our business and the markets for our product candidates. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. Unless otherwise expressly stated, we obtained this industry, business, market and other data from our own internal estimates and research as well as from reports, research surveys, studies and similar data prepared by market research firms and other third parties such as investment banking analysts, industry, medical and general publications, government data and similar sources. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, assumptions and estimates of our and our industry'sindustry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled "Item 3.D—“Item 3 — D. Risk Factors. "These” These and other factors could cause our future performance to differ materially from our assumptions and estimates.

APPLICATION OF INTERNATIONAL FINANCIAL REPORTING STANDARDS

We adopted International Financial Reporting Standards, (“IFRS”),or IFRS, as issued by the International Accounting Standards Board. Unless otherwise stated, all information presented herein has been prepared in accordance with IFRS and all prior period amounts have been prepared in accordance with IFRS.

CURRENCY

Unless otherwise stated, “€“$”, when used in this Annual Report, on Form 20-F, refers to EurosU.S. dollars and “$“€” refers to United States dollars.Euros.

Item 11. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 22. Offer Statistics and Expected Timetable

Not applicable.

Item 33. Key Information

A. Selected financial data.

This item is no longer required as we have elected to early adopt the changes to Item 301 of Regulation S-K contained in SEC Release No. 33-10890 in Management’s Discussion and Analysis and Selected Financial Data.[Reserved]

B. Capitalization and Indebtedness.Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds.Proceeds

Not applicable.

D. Risk Factors.Factors

Our businesses facebusiness faces significant risks and uncertainties. You should carefully consider all of the information set forth in this Annual Report and in other documents we file with or furnish to the Securities and Exchange Commission, or SEC, including the following risk factors, before deciding to invest in or to maintain an investment in our securities. Our business, as well as our reputation, financial condition, results of operations, and share price, could be materially adversely affected by any of these risks, as well as other risks and uncertainties not currently known to us or not currently considered material.

Summary of Selected Risks Associated with Our Business

Risks Related

•The development and commercialization of pharmaceuticals and biologics is highly competitive. In particular, RUCONEST® faces competition from other products (acute and prophylactic) used to Our Businesstreat Hereditary Angioedema, or HAE, including products to prevent and treat HAE attacks. There are several products from other competitors that have been approved in the U.S. and Europe for the treatment of HAE attacks. Consequently, we may not obtain sufficient market penetration with RUCONEST® or a sufficient level of sales of the product to remain profitable.

•We are heavily dependent on sales of RUCONEST® in the United States and Europe. If we are unable to continue to commercialize RUCONEST®, our business could be materially harmed. In addition, our development pipeline remains dependent on the C1INH franchise in the near term.

•We face significant competition,Joenja® is a newly approved drug in the U.S. and could develop unexpected safety or efficacy concerns, which may result in others discovering, developing or commercializing products before or more successfully than we do.would likely have a material adverse effect on us.

•We have only recently establishedThe commercial success of our direct salesapproved products depends, and marketing organizationthe commercial success of any product candidate will depend, upon the degree of market acceptance by physicians, patients, payors and others in Europe. the medical community.

•If we are unable to maintain and grow our sales and marketing capabilities, particularly outside of the United States, or enter into agreements with third parties to market and sell our products outside of the United States and Europe, our business will be adversely affected.

•We rely on named patient sales of RUCONEST® in certain territories where it has not yet been approved; however, there are no assurances that named patient sales ofRevenue from our approved products will continue at current levels, or at all.

•The commercial success of any current or future product candidate will depend upondepends, and the degree of market acceptance by physicians, patients, payors and others in the medical community

•The successful commercialization of our product candidates will depend, in part, on the extent to which governmental authorities and health insurers maintain or establish, as applicable, adequate coverage, reimbursement levels and pricing policies. Failure to obtainmaintain or maintainobtain coverage and adequate reimbursement for our approved products and our product candidates, if approved, could limit our ability to market those products and decrease revenue generating ability.

•ManySince many of our product candidates are at an early stage. Westage of development, we may spend several years developing currentforego or futuredelay pursuit of opportunities with certain programs or product candidates and failure can occur at any stage.or for indications that later prove to have greater commercial potential than our current product candidates due to limited resources available.

•The outbreakcosts and timing of COVID-19 may result in disruptions to our commercialization,potential clinical trials, manufacturingfilings and other business operations, which could have a material adverse effect on our business, financial condition, operating profit, cash flowsapprovals, and prospects.

•Any future acquisitions we make may expose us to risks that could adversely affect our business,the potential therapeutic scope of the development and we may not achieve the anticipated benefits of acquisitions of businesses or technologies.

•Negative public opinion and increased regulatory scrutiny of transgenic manufacturing techniques, or activism regarding the ethical treatment of our livestock, may damage public perception of RUCONEST® and our product candidates, which may adversely affect salescommercialization of our products involve a high degree of uncertainty and our abilityrisk which make it difficult to obtain marketing approvals for ourpredict the time and costs of product candidates.development of novel approaches.

•We rely on third parties for the conduct of significant aspects of our preclinical studies and clinical trials and intend to rely on third parties in the future. If these third parties do not successfully carry out their contractual duties, our business may be adversely impacted.

•We are currently conductingconduct clinical trials for certain of our product candidates at sites outside the United States. The U.S. Food and Drug Administration, or the FDA, may not accept data from trials conducted in such locations.

•We may not be able to obtain or maintain orphan drug exclusivity for our products or product candidates. If our competitors are able to obtain orphan drug exclusivity for their products, we may not be able to have competing products approved by the applicable regulatory authority for a significant period of time.

•The results from our clinical trials may not be sufficiently robust to support the submission of marketing approval for our product candidates. Before we submit our product candidates for marketing

approval, the FDA and/or the European Medicines Agency, or the EMA, may require us to conduct additional clinical trials or evaluate patients for an additional follow-up period.

•Our assumptions and estimates regarding prevalence and the addressable markets for our products and product candidates may be inaccurate, which could have a material adverse effect on our revenues and cash position.

•We are dependent on a limited number of suppliers for some of our components and materials used in our product candidates and product.

•Any contamination in the manufacturing process for our recombinant products, shortages of raw materials or failure of any of our key suppliers to deliver necessary components could result in delays in our clinical development or marketing schedules.

•We depend on third-party manufacturers for the production of rhC1INH for commercial supply and clinical trials of RUCONEST®, as well as our other product candidates for clinical trials. Interruption in supply could materially and adversely affect sales.

•We do not have experience as a company managing a manufacturing facility.

•Our future success depends on our ability to hire and retain key executives and to attract, retain and motivate qualified personnel.

•Our business, products or product pricing could be subject to negative publicity, which could have a material adverse effect on our reputation, business, financial position, results of operations, liquidity and cash flows.

•We depend on our information technology systems and any failurehave been and may in the future be the victim of these systems could harm our business. Any real or perceived security breaches, loss of data, and other disruptions or incidents couldcyberattacks which compromise the privacy, security, integrity or confidentiality of sensitive information related to our business or prevent us from accessing critical information and expose us to liability and reputational harm, which could adversely affect our business, results of operations and financial condition.condition.

•Any contamination in the manufacturing process for our recombinant products, shortages of raw materials or failure of any of our key suppliers to deliver necessary components could result in delays in our clinical development or marketing schedules and significantly impact commercially available goods.

•We are dependent on a limited number of suppliers for some of the components and materials used in our product candidates and product. Any disruption in the supply of these materials could adversely affect our ability to deliver product or complete clinical trials. Other studies of product candidates, regulatory applications or commercializing product candidates in a timely and commercially valuable manner, may be adversely affected, should supply be disrupted.

•We depend on third-party manufacturers for the production of Joenja® and for the production of rhC1INH for commercial supply and for use in clinical trials of RUCONEST®, as well as our product candidates for clinical trials. Interruption in supply could materially and adversely affect sales.

•We experience significant customer concentration, with a limited number of customers accounting for a significant portion of our revenues.

•Our success is dependent on our ability to obtain and protect rights to proprietary technology and to develop our technology and products without infringing the proprietary rights of third parties.

•Our patents may be challenged, deemed unenforceable, invalidated or circumvented, and if we do not obtain or maintain patent protection for the products, our business may be materially harmed.

•There are material weaknesses in our internal control over financial reporting and if we are unable to remediate them, or if we identify additional material weaknesses in the future or otherwise fail to maintain an effective system of internal control, we may not be able to accurately or timely report our financial condition or results of operations, which may adversely affect our business and stock price.

•Our business and operations may be negatively impacted by the failure, or perceived failure, of achieving environmental, social and governance, or ESG, objectives.

Risks Related to Our Business

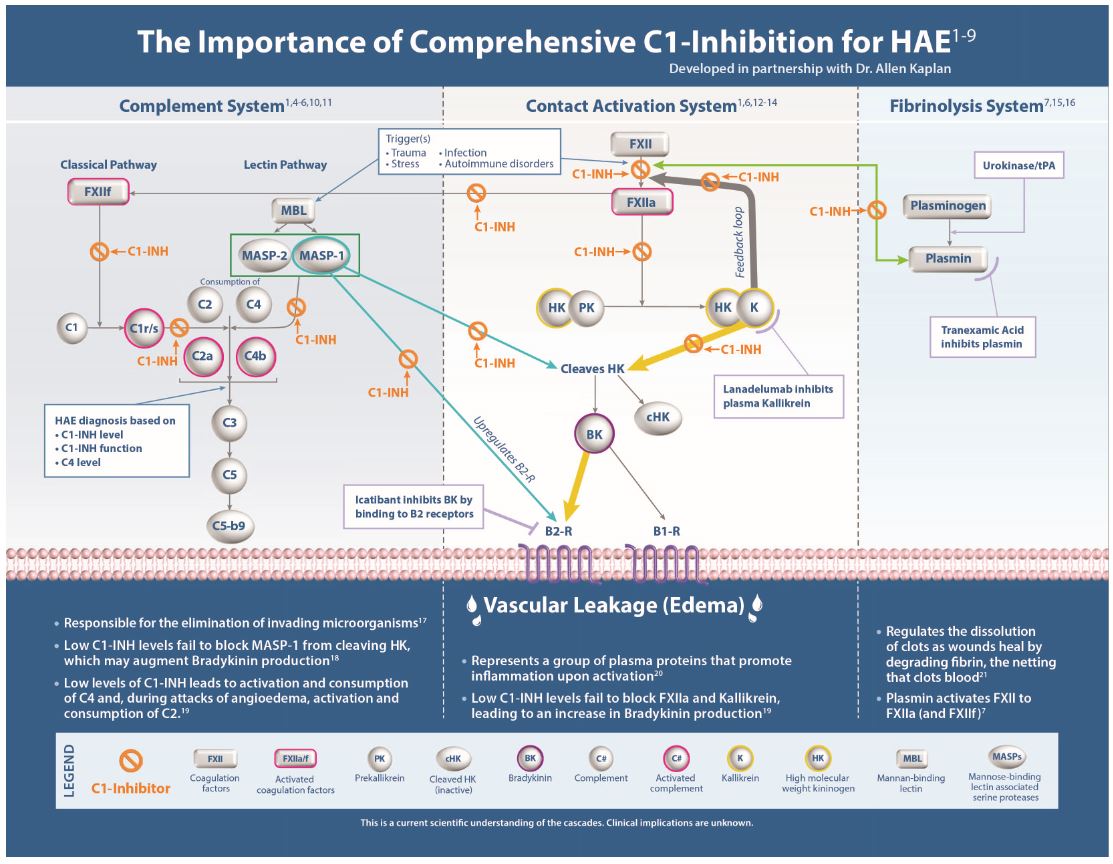

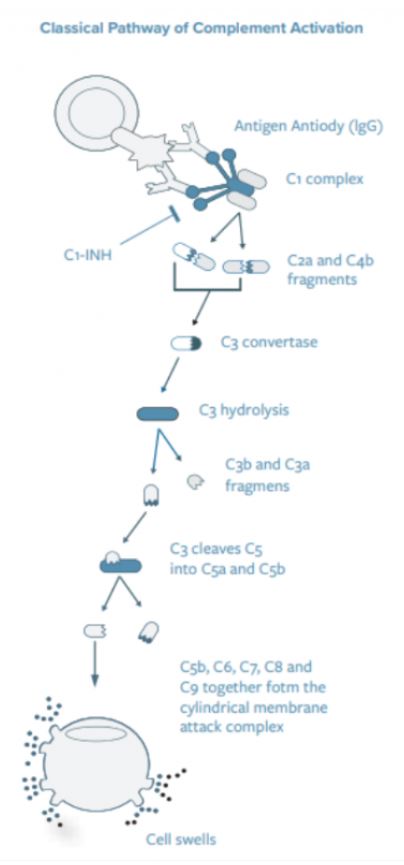

The development and commercialization of pharmaceuticals and biologics is highly competitive. In particular, RUCONEST® faces intense competition from other products used to treat Hereditary Angioedema, or HAE. Several products have been approved in the U.S. and Europe for the treatment of HAE attacks. Consequently, we may not obtain sufficient market penetration with RUCONEST® or a sufficient level of sales of the product to remain profitable.

The development and commercialization of pharmaceuticals and biologics is highly competitive. In particular, RUCONEST® faces intense competition from other products used to treat HAE. We face the risk that RUCONEST® may no longer be competitive and accepted by physicians, patients, payors and others in the medical community within acute HAE market. Prophylactic therapies are increasingly used, which may result in HAE patients requiring less acute rescue medicine. RUCONEST® is not approved for prophylactic use.

Several products have been approved in the U.S. and Europe for the treatment of HAE attacks, including human blood plasma derived C1INH products. Oral products for the prevention of HAE attacks are also being developed. Orladeyo® (berotralstat) is an oral prophylactic product which was approved in the fourth quarter of 2020. In the acute market, we face pricing competition as a result of the 2019 market entry of generic equivalents to the acute treatment: Firayzr® (icatibant injection). Consequently, we may not obtain sufficient market penetration with RUCONEST® or a sufficient level of sales of the product to allow it to remain profitable. New technologies from competitors may make RUCONEST® obsolete.

Our competitors include major international pharmaceutical companies as well as smaller or regional specialty pharmaceutical and biotechnology companies. Many of our competitors are larger and have greater financial resources and expertise in research and development, manufacturing, preclinical testing, conducting clinical trials, obtaining regulatory approvals, prosecuting intellectual property rights and marketing approved products

than we do. Such competitors may be better equipped to withstand changes in economic and industry conditions. Smaller or early stage companies may also be significant competitors, particularly through collaborative arrangements with large, established companies. Key competitive factors affecting the commercial success of our products and any other products that we develop or acquire are likely to be safety, efficacy, tolerability profile, reliability, convenience of dosing, price and reimbursement. We may also face future competition from companies selling generic alternatives to RUCONEST® in countries where we do not have patent coverage, orphan drug status or another form of data or marketing exclusivity or where patent coverage or data or marketing exclusivity has expired, is not enforced, or may, in the future, be challenged.

We are heavily dependent on sales of RUCONEST® in the United States and Europe. If we are unable to continue to commercialize RUCONEST®, our business could be materially harmed.

We have, to date, been substantially focused on the development and commercialization of RUCONEST®, and we expect to continue to be dependent primarily on revenues from RUCONEST® sales in the near term. Although we have begun sales of Joenja® in the United States, RUCONEST® sales accounted for approximately 92.6% of our total revenues in 2023, and we expect it to continue to make up the majority of our revenues for the foreseeable future. Accordingly, any adverse events or findings regarding the properties, efficacy or safety of RUCONEST®, or material constraints on the manufacturing of RUCONEST®, may have a material impact on our financial results and operations.

Our ability to meet expectations with respect to sales of RUCONEST®, generate revenues from such sales, and attain and maintain positive cash flow from operations, in the time periods anticipated, or at all, will depend on a number of factors, including, among others:

•the ability to continue to maintain and grow market acceptance for RUCONEST® among healthcare professionals and patients in the United States, EU, and other key markets for the treatment of approved indications;

•our ability to maintain regulatory approvals without onerous restrictions or limitations in key markets;

•our ability to secure regulatory approvals in additional markets on a timely basis and with commercially feasible labels;

•our ability to obtain pricing and reimbursement approvals at adequate levels, where required, on a timely basis;

•presence of side effects or other safety issues associated with the use of RUCONEST® that could require us or our distributors to modify or halt commercialization;

•whether we will be required by regulatory agencies to conduct additional studies regarding the safety and efficacy of RUCONEST®, which we have not planned or anticipated;

•increased competition from competitors;

•obtaining and maintaining commercial distribution agreements with third-party distributors outside the United States and Europe;

•obtaining and maintaining patent protection and regulatory exclusivity; and adequately investing in the manufacturing, sales, marketing, market access, medical affairs and other functions that are supportive of our commercialization efforts.

Joenja® is a newly approved drug in the U.S. and could develop unexpected safety or efficacy concerns, which would likely have a material adverse effect on us.

Joenja® was granted approval by the FDA in late March 2023. In the United States, Joenja® will now be used by larger numbers of patients, potentially for longer periods of time, and we and others (including regulatory agencies and private payors) will collect extensive information on the efficacy and safety of Joenja® by monitoring its use in the marketplace. New safety or efficacy data from market surveillance may result in negative consequences including the following:

•Modification to product labeling or promotional statements, such as additional boxed or other warnings or contraindications, or the issuance of additional “Dear Doctor Letters” or similar communications to healthcare professionals;

•Required changes in the administration of Joenja®;

•Imposition of additional post-marketing surveillance, post-marketing clinical trial requirements, distribution restrictions or other risk management measures, such as a risk evaluation and mitigation strategy;

•Suspension or withdrawal of regulatory approval or delays or declination of regulatory approval outside of the United States;

•Suspension of, or imposition of restrictions on, our operations, including costly new manufacturing requirements with respect to Joenja®; and

•Voluntary or mandatory product recalls or withdrawals from the market and costly product liability claims.

Any of these circumstances could reduce Joenja’s® market acceptance and would be likely to materially adversely affect our business.

The commercial success of our approved products depends, and the commercial success of any product candidate will depend, upon the degree of market acceptance by physicians, patients, payors and others in the medical community.

The commercial success of our approved products depends, and of our product candidates will depend, in part, on the medical community, patients, and payors accepting them as effective, safe and cost-effective. If our product candidates do not achieve an adequate level of acceptance, we may struggle to continue to generate significant product revenues and may not in the future generate any profits from operations. The degree of market acceptance of our approved products, in particular Joenja®, or our product candidates, if approved for commercial sale, will depend on a number of factors, including:

•the potential efficacy and potential advantages over alternative treatments;

•the frequency and severity of any side effects, including any limitations or warnings contained in a product’s approved labeling;

•the frequency and severity of any side effects resulting from the conditioning regimen or follow-up requirements for the administration of our product candidates;

•the relative convenience and ease of administration;

•the willingness of the target patient population to try new therapies and of physicians to prescribe these therapies;

•the strength of marketing and distribution support and timing of market introduction of competitive products;

•publicity concerning our products or competing products and treatments;

•continued demand from two U.S. specialty wholesale companies that in 2023 represented 83% of our revenues; and

•sufficient third-party insurance coverage or reimbursement.

Even if a product candidate displays a favorable efficacy and safety profile in preclinical studies and clinical trials, market acceptance of the product, if approved for commercial sale, will not be known until after it is launched. Our efforts to educate the medical community and payors on the benefits of our products, particularly Joenja® given its recent approval, and product candidates may require significant resources and may never be successful. Such efforts to educate the marketplace may require more resources than are required by the conventional technologies marketed by our competitors.

If we are unable to maintain and grow our sales and marketing capabilities, particularly outside of the United States, or enter into agreements with third parties to market and sell our products outside of the United States and Europe, our business will be adversely affected.

We have been promoting RUCONEST® in Europe and the Middle East since we re-acquired the license in 2020 and are currently preparing for the launch of leniolisib in Europe, the U.K., the Middle East, Africa, and Asia-Pacific. Establishing and maintaining internal medical and commercial capabilities, as we are doing for Joenja®, carries an element of risk. For example, recruiting and training an integrated medical and commercial organization can be expensive and time consuming and could delay any product launch. Furthermore, if the commercialization of a product is delayed, , establishing a commercial organization prematurely would result in the need to reconfigure the organization.

Factorsthatmayinhibitoureffortstocommercializeourproductsonourown include:

•theinabilitytorecruit,trainandretainadequatenumbersofeffectivemedical, access, salesandmarketingpersonnel;

•inability to obtain appropriate regulatory approval and subsequent reimbursement coverage

•theinabilityofsalespersonneltoobtainaccesstophysiciansorpersuadeadequatenumbersof physicians to prescribe any future product that we may develop;

•thelackofcomplementarytreatmentstobeofferedbysalespersonnel,whichmayputusata competitive disadvantage relative to companies with more extensive product lines; and

•unforeseencostsandexpensesassociatedwithcreatinganindependentsalesandmarketing organization.

We enter into arrangements with a variety of third-parties to perform a range of activities including medical affairs, regulatory and reimbursement support and, sales, marketing and distribution services outside of the United States and Europe. We have made leniolisib available for APDS patients in select key markets in Europe, the U.K., Japan, Asia-Pacific, the Middle East, and Canada. Where viable, following regulatory approval, we intend to market leniolisib directly in a number of these markets. Prior to regulatory approval in certain markets, we will make leniolisib available via a variety of access schemes. In addition, we have granted the China State Institute of Pharmaceutical Industry, or the CSIPI, an exclusive license to commercialize RUCONEST® in China, and the CSIPI is collaborating with the Chengdu Institute of Biological Products Co, Ltd, or the CDIBP,and we are solely dependent on their efforts to commercialize RUCONEST® in that territory. On December 15, 2023, the CDIBP announced that it received clinical trial approval from the Center for Drug Evaluation of the National Medical Product Administration for the clinical development of rhC1INH in China. We may receive certain regulatory and manufacturing-associated milestones, and we are eligible to receive low to mid-single digit royalties from sales in China by the CSIPI, affiliates of the CSIPI and sublicencees of the CSIPI. Dependence on distribution arrangements to commercialize our products in certain jurisdictions subjects us to a number of risks. We do not have control over such third parties and any of them may fail to devote the necessary resources and attention to distribute our products effectively. In addition, any potential non-compliance with applicable laws and regulations by such third parties would potentially expose us to sanctions.Ifsuchthird-partyarrangements are terminated or allowed to expire, the marketing and sales of a product in that jurisdiction may be interrupted, which could adversely affect our revenues. In addition, we may not be successful in entering into arrangements withthird partiestosellandmarketourproductcandidatesormaybeunabletodosoontermsthatarefavorable to us. See “Item 3 – D. Risk Factors – We are subject to U.S. and certain foreign export and import controls, sanctions, embargoes, anti-corruption laws, and anti-money laundering laws and regulations. Compliance with these legal standards could impair our ability to compete in domestic markets. We can face criminal liability and other seriousconsequences for violations, which can harm our business” of this Annual Report.

Revenue from our approved products depends, and the successful commercialization of our product candidates will depend, in part, on the extent to which governmental authorities and health insurers maintain or establish, as applicable, adequate coverage, reimbursement levels and pricing policies. Failure to maintain or obtain coverage and adequate reimbursement for our approved products and our product candidates, if approved, could limit our ability to market those products and decrease revenue generating ability.

The availability and adequacy of coverage and reimbursement by governmental healthcare programs such as Medicare and Medicaid, private health insurers and other third-party payors is essential for many patients to be able to afford prescription medications such as RUCONEST® and Joenja® and potential product candidates, assuming regulatory approval is obtained. Our ability to achieve acceptable levels of coverage and reimbursement for products by governmental authorities, private health insurers and other organizations fundamentally impacts the potential success of RUCONEST® and Joenja® and potential product candidates. Assuming we obtain coverage for our product candidatesbythird-partypayors,theresultingreimbursementpaymentratesmaynotbeadequateormayrequire co-payments that patients find unacceptably high. We cannot be sure that coverage and reimbursement in the United States, the EU Member States, or elsewhere will be maintained for our approved products or available for our product candidates or any product that we may develop, and any reimbursement that may be or become available may be decreased or eliminated in the future. There is an increasing tendency of health insurers to reduce healthcare costs by limiting both the coverage and breadth of reimbursement for new therapeutic products and in some cases by refusing to provide coverage altogether.

Because coverage and reimbursement determinations are made on a payor-by-payor basis, obtaining coverage and adequate reimbursement from a third-party payor does not guarantee that we will obtain similar coverage or reimbursement from another third-party payor. Reimbursement may impact the demand for, or the price of, any productcandidateforwhichweobtainmarketingapproval.Ifreimbursementisnotavailableorisavailableonly tolimitedlevels,wemaynotbeabletosuccessfullycommercializeanyproductsforwhichweobtainmarketing approval. Failureto secureor retain adequatecoverageor reimbursementfor our productsby third-party payors, or delays in processing approvals by those payors, could result in the loss of sales, loss of customers, or reputational damage, which could have a material adverse effect on our business, financial condition and operating profit.

Further, it is possible that a third-party payor may consider our product candidates as similar to alternative treatment options and only offer to reimburse patients for a less expensive product. In some cases this can involve a requirement that patients try the less expensive product first, only approving other therapies after the patient does poorly on the less expensive product. Even if we show improved efficacy or convenience of administration with our product candidates compared to products marketed by our competitors and the prevailing standard of care, the pricing of existing therapies may still limit the amount we could charge. Third-party payors may deny or revoke the reimbursement status of any given product or establish new prices for existing marketed products that inhibit us from realizing an appropriate return on our investment in the product candidates. If reimbursement is not available or is available only at limited levels, we may not be able to successfully commercialize our product candidates, and may not be able to obtain a satisfactory financial return on them.

Outside the United States, international operations are generally subject to extensive governmental price controls and other market regulations, and we believe the increasing emphasis on cost-containment initiatives in Europe, Canada, and other countries has and will continue to put pressure on the pricing and usage of our products. In many countries, the prices of medical products are subject to varying price control mechanisms as part of national health systems. Other countries allow companies to set their own prices for medical products but monitor and control company profits. Additional foreign price controls or other changes in pricing regulation could restrict the amount that we are able to charge for our product candidates. Accordingly, in markets outside the United States, the reimbursement for our products may be reduced compared with the United States and may be insufficient to generate commercially reasonable revenues and profits.

Since many of our product candidates are at an early stage of development, we may forego or delay pursuit of opportunities with certain programs or product candidates or for indications that later prove to have greater commercial potential than our product candidates due to limited resources available.

Other than Joenja®, which was approved by the FDA on March 24, 2023, our product pipeline candidates are all in the early stages of clinical and preclinical development. For example, our gene therapy product candidate is in preclinical development. Our spending on current and future research and development programs may not yield any commercially viable product candidates. If we do not accurately evaluate the commercial potential for a particular product candidate, we may relinquish valuable rights to that product candidate through strategic collaborations, licensing or other arrangements in cases in which it would have been more advantageous for us to retain sole development and commercialization rights to such product candidate. If any of these events occur, we may be forced to abandon our development efforts with respect to a particular product candidate or fail to develop a potentially successful product candidate.

The costs and timing of potential clinical trials, filings and approvals, and the potential therapeutic scope of the development and commercialization of our products involve a high degree of uncertainty and risk which make it difficult to predict the time and costs of product development of novel approaches.

New product development and indication expansions of existing products is very expensive and involves a high degree of uncertainty and risk. Only a small number of research and development programs result in the commercialization of a new product. Furthermore, the development of novel approaches for the treatment of diseases, including development efforts in new and innovative modalities present additional challenges and risks. Clinical trial data and results are subject to differing interpretations by regulatory authorities. We may view data as sufficient to support the safety, effectiveness, or approval of an investigational therapy, while regulatory authorities may disagree and may require additional data, may limit the scope of an approval

or may deny approval altogether. There can be difficulty in predicting the time and cost of product development of novel approaches for the treatment of diseases across regulatory approval authorities.

Success in preclinical work or early-stage clinical trials does not ensure that later stage or larger scale clinical trials will be successful. The results of clinical trials may indicate that our product candidates lack efficacy, have harmful side effects, result in unexpected adverse events or raise other concerns that may significantly reduce the likelihood of regulatory approval. This may result in terminated programs, significant restrictions on use and safety warnings in an approved label, adverse placement within the treatment paradigm or significant reduction in the commercial potential of the product candidate.

Even if we could successfully develop new products or indications, we may make a strategic decision to discontinue development of a product candidate or indication if, for example, we believe commercialization will be difficult relative to the standard of care or other opportunities in our pipeline.

We rely on third parties for the conduct of significant aspects of our preclinical studies and clinical trials and intend to rely on third parties in the future. If these third parties do not successfully carry out their contractual duties, our business may be adversely impacted.

We rely on third parties for the conduct of significant aspects of our preclinical studies and clinical trials. These third parties include contract research organizations, or CROs, medical institutions, clinical investigators and contract laboratories. Although we design the clinical trials for our product candidates, we depend on these third parties for aspects of performing the trials. Our reliance on these third parties for research and development activities will reduce our control over these activities but will not relieve us of our regulatory or contractual responsibilities. For example, we will remain responsible for ensuring that each of our clinical trials is conducted in accordance with the general investigational plan and protocols for the trial.

The third parties we rely upon may fail to successfully carry out their contractual duties or meet expected deadlines, which may cause delays in the conduct of our preclinical and clinical studies.

If the CROs do not perform preclinical studies and clinical trials in a satisfactory manner, breach their obligations to us or fail to comply with regulatory requirements and other compliance obligations, the development, regulatory approval and commercialization of our product candidates may be delayed, we may not be able to obtain regulatory approval and commercialize our product candidates, or our development programs may be materially and irreversibly harmed. If we are unable to rely on preclinical and clinical data collected by our CROs, we could be required to repeat, extend the duration of, or increase the size of any clinical trials we conduct and this could significantly delay commercialization and require significantly greater expenditures. See “Item 3 – D. Risk Factors – We are subject to U.S. and certain foreign export and import controls, sanctions, embargoes, anti-corruption laws, and anti-money laundering laws and regulations. Compliance with these legal standards could impair our ability to compete in domestic markets. We can face criminal liability and other serious consequences for violations, which can harm our business” of this Annual Report.

We conduct clinical trials for certain of our product candidates at sites outside the United States. The FDA may not accept data from trials conducted in such locations.

We and the investigators conducting clinical trials for certain of our product candidates study our product candidates outside the United States. Although the FDA may accept data from clinical trials conducted outside the United States, acceptance of these data is subject to conditions imposed by the FDA. For example, the clinical trial must be well designed and conducted and performed by qualified investigators in accordance with ethical principles. The trial population must also adequately represent the U.S. population, and the data must be applicable to the U.S. population and U.S. medical practice in ways that the FDA deems clinically meaningful.

In addition, while these clinical trials are subject to the applicable local laws, FDA acceptance of the data will depend on its determination that the trials also complied with all applicable U.S. laws and regulations. If the FDA does not accept the data from any trial that we conduct outside the United States, it would likely result in the need for additional trials, which would be costly and time-consuming and would delay or permanently halt our development of the applicable product candidates or indications. In addition, in order to commence a clinical trial in the United States, we are required to seek FDA acceptance of an Investigational New Drug application, or IND, for each of our product candidates. We cannot be certain that any IND we submit to the

FDA, or any similar Clinical Trial Application, or CTA, we submit in other countries, will be accepted. We may also be required to conduct additional preclinical testing prior to submitting an IND for any of our product candidates, and the results of any such testing may not be positive. Consequently, we may be unable to successfully and efficiently execute and complete necessary clinical trials in a way that leads to a New Drug Application, or NDA, or Biologics License Application, or BLA, submission and approval of our product candidates. We may require more time and incur greater costs than our competitors and may not succeed in obtaining regulatory approvals of product candidates that we develop. Failure to commence or complete, or delays in, our planned clinical trials, could prevent us from or delay us in commercializing our product candidates.

We may not be able to obtain or maintain orphan drug exclusivity for our products or product candidates. If our competitors are able to obtain orphan drug exclusivity for their products, we may not be able to have competing products approved by the applicable regulatory authority for a significant period of time.

Regulatory authorities in some jurisdictions, including the United States, the EU and the United Kingdom, may designate drugs for relatively small patient populations as orphan drugs. We obtained orphan drug designation for RUCONEST® from the FDA for the treatment of acute HAE attacks. Joenja® has also received this designation from the FDA and the EMA. However, no assurances can be made for our product candidates.

Generally, if a product with an orphan drug designation subsequently receives the first marketing approval for the indication for which it has such designation, the product is entitled to a period of market exclusivity, which, subject to certain exceptions, precludes the acceptance or approval by a regulatory authority in the EU of another marketing application for a similar medicinal product or the approval by the FDA of another marketing application for the same drug for the same indication for that time period. The FDA defines “same drug” as a drug or biologic that contains the same active moiety and is intended for the same use. The applicable market exclusivity period for orphan drugs is ten years in the EU and the United Kingdom and seven years in the United States. The EU and United Kingdom exclusivity period can be reduced to six years if a drug no longer meets the criteria for orphan drug designation.

In the EU and the United Kingdom, a “similar medicinal product” is a medicinal product containing a similar active substance or substances as contained in a currently authorized orphan medicinal product, and which is intended for the same therapeutic indication. A “similar active substance” is “an identical active substance, or an active substance with the same principal molecular structural features (but not necessarily all of the same molecular structural features) and which acts via the same mechanism. However, in the case of advanced therapy medicinal products, for which the principal molecular structural features cannot be fully defined, the similarity between two active substances shall be assessed on the basis of the biological and functional characteristics.” Obtaining orphan drug exclusivity for our product candidates is important to the product candidate’s success. If a competitor obtains orphan drug exclusivity for, and approval of, a product with the same indications as our product candidates before we do and if the competitor’s product is the same drug or a similar medicinal product as ours, we could be excluded from the market for a certain period of time. If another product has obtained a marketing authorization for the same indication, we would have to prepare a similarity report (addressing the possible similarity between the authorized product and our product), which will take additional time.

Although we have obtained orphan drug exclusivity for Joenja® from the FDA, the EMA, and the Ministry of Health, Labour and Welfare of Japan, or MHLW, we may not be able to maintain it. For example, if a competitive product that is the same drug or a similar medicinal product as our product or product candidate is shown to be clinically superior to our product or product candidate, as applicable, any orphan drug exclusivity we have obtained will not block the approval of such competitive product. In addition, orphan drug exclusivity will not prevent the approval of a product that is the same drug as our product or product candidate if the FDA, EMA or United Kingdom’s Medicines and Healthcare products Regulatory Agency, or MHRA, finds that we cannot assure the availability of sufficient quantities of the drug to meet the needs of the persons with the disease or condition for which the drug was designated in the relevant jurisdiction.

The FDA Reauthorization Act of 2017 authorizes the FDA to impose additional clinical trial requirements on manufacturers seeking orphan drug designation and/or pediatric indications. Additionally, it should be noted that the European Commission is currently reviewing the EU general pharmaceutical legislation. While any revisions to the legislation will not be applicable for a number of years, the European Commission intends to

make changes to the rules on orphan medicinal products including potentially reducing the duration of data and market exclusivity available.

The results from our clinical trials may not be sufficiently robust to support the submission of marketing approval for our product candidates. Before we submit our product candidates for marketing approval, the FDA, the EMA, or any other regulatory body may require us to conduct additional clinical trials or evaluate patients for an additional follow-up period.

The results from our clinical trials may not be sufficiently robust to support the submission for marketing approval for our product candidates. The FDA normally requires two registrational trials to approve a drug or biologic product, and thus the FDA may require that we conduct additional clinical trials of our product candidates prior to a BLA or NDA submission. The FDA typically does not consider a single clinical trial to be adequate to serve as a registrational trial unless among other things, it is well-controlled and demonstrates a clinically meaningful effect on mortality, irreversible morbidity, or prevention of a disease with potentially serious outcome, and a confirmatory study would be practically or ethically impossible. Additionally, while the FDA recognizes the potential for natural history models to augment the need for placebo arms in trials for drugs that target very rare disease, where trial recruitment can be especially challenging, the FDA has found the use of natural history data as a historical comparator to be unsuitable for adequate and well-controlled trials in many circumstances. The FDA generally finds trials using historical controls to be credible only when the observed effect is large in comparison to variability in disease course. Like the FDA, the EMA and MHRA also expect applicants to submit sufficient clinical data, which is usually generated from clinical studies, to demonstrate the safety and efficacy of the medicinal product.

Due to the nature of the indications our product candidates are designed to treat, and the limited number of patients with these conditions, a placebo-controlled and blinded study may not be practicable for ethical and other reasons. It is possible the FDA, EMA and/or MHRA will not consider our comparisons to natural history data and, where available, historical transplant data, to provide clinically meaningful results. Additionally, even though a product candidate may have achieved the primary endpoints in a registrational clinical trial, it is possible that the FDA, EMA and/or MHRA may require us to conduct additional registrational trials, possibly involving a larger sample size or a different clinical trial design, especially if the FDA, EMA and/or MHRA do not find the results from these trials to be sufficiently persuasive to support a BLA/NDA or Marketing Authorization Application, or MAA, submission, as applicable. The FDA, EMA and/or MHRA may also require that we conduct a longer follow-up period of post-market surveillance of patients treated with our product candidates prior to accepting our BLA/NDA or MAA submission, as applicable.

In addition, data obtained from preclinical and clinical activities are subject to varying interpretations, which may delay, limit or prevent regulatory approval. There can be no assurance that the FDA, EMA or other regulatory bodies will find the efficacy endpoints in our registrational trials or any efficacy endpoint we propose in future registrational trials to be sufficiently validated and clinically meaningful, or that our product candidates will achieve the pre-specified endpoints in current or future registrational trials to a degree of statistical significance, and with acceptable safety profiles. We also may experience regulatory delays or rejections as a result of many factors, including serious adverse events involving our product candidates, changes in regulatory policy or changes in requirements during the period of our product candidate development. Any such delays could materially and adversely affect our business, financial condition, results of operations and prospects.

We expect that the FDA, EMA and/or MHRA will assess the totality of the safety and efficacy data from our product candidates in reviewing any future BLA, NDA, or MAA, submissions. Based on this assessment, the FDA, EMA and/or MHRA may require that we conduct additional preclinical studies or clinical trials prior to submitting or approving a BLA, NDA, or MAA, for our target indications.

If the FDA, EMA and/or MHRA requires additional trials, we would incur increased costs and delays in the marketing approval process, which may require us to expend more resources than we have available. In addition, it is possible that the FDA, EMA and/or MHRA may have divergent opinions on the elements necessary for a successful BLA/NDA and MAA, respectively, which may cause us to alter our development, regulatory and/or commercialization strategies.

Any future acquisitions we make may expose us to risks that could adversely affect our business, and we may not achieve the anticipated benefits of acquisitions of businesses or technologies.

As a part of our growth strategy, we may make additional acquisitions of complementary businesses, products or research. Any future acquisition will involve numerous risks and operational, financial and managerial challenges, including the following, any of which could adversely affect our business, financial condition or results of operations:

•limited support and user knowledge for legacy systems of acquired companies;

•problems maintaining uniform procedures, controls and policies with respect to our financial accounting systems;

•difficulties in managing geographically dispersed operations, including risks associated with entering foreign markets in which we have no or limited prior experience;

•underperformance of any acquired technology, product or business relative to our expectations and the price we paid;

•negative near-term impacts on financial results after an acquisition, including acquisition-related earnings charges;

•the potential loss of key employees, customers and strategic partners of acquired companies;

•claims by terminated employees and shareholders of acquired companies or other third parties related to the transaction;

•the assumption or incurrence of additional debt obligations or expenses, or use of substantial portions of our cash;

•the issuance of equity securities to finance or as consideration for any acquisitions that dilute the ownership of our shareholders;

•any collaboration, strategic alliance and licensing arrangement may require us to relinquish valuable rights to our technologies or product candidates, or grant licenses on terms that are not favorable to us;

•risks and uncertainties associated with the other party to such a transaction, including the prospects of that party and their existing products or product candidates and regulatory approvals;

•diversion of management’s attention and company resources from existing operations of the business;

•inconsistencies in standards, controls, procedures and policies;

•the impairment of intangible assets as a result of technological advancements, or worse-than-expected performance of acquired companies;

•assumption of, or exposure to, historical liabilities of the acquired business, including unknown contingent or similar liabilities that are difficult to identify or accurately quantify;

•our inability to generate revenues from acquired technology or products sufficient to meet our objectives in undertaking the acquisition or even to offset the associated acquisition and maintenance costs; and

•risks associated with acquiring intellectual property, including potential disputes regarding acquired companies’ intellectual property.

There can be no assurance that any of the acquisitions we may make will be successful or will be, or will remain, profitable. Our failure to successfully address the foregoing risks may prevent us from achieving the anticipated benefits from any acquisition in a reasonable time frame, or at all.

Negative public opinion and increased regulatory scrutiny of transgenic manufacturing techniques, or activism regarding the ethical treatment of livestock, may damage public perception of RUCONEST® and our product candidates, which may adversely affect sales of our products and our ability to obtain marketing approvals for our product candidates.

Public perception may be influenced by negative public statements regarding our transgenic manufacturing technology. Our transgenic manufacturing technology platform involves the genetic engineering of animals for the production of recombinant proteins. Genetic modification of food and livestock are a common subject of debate and negative publicity. In addition, animal rights activists commonly engage in campaigns to reduce or eliminate the use of animals in the commercialization of pharmaceutical products.

Negative publicity regarding genetic modification in general, and our transgenic manufacturing techniques in particular, or activism regarding the treatment of our livestock could result in reduced market acceptance for our products, increased governmental regulation, unfavorable public perception, potential regulatory delays in the testing or approval of our potential product candidates, stricter labeling requirements for those product

candidates that are approved and a decrease in demand for any such product candidates. If any such adverse events occur, commercialization of RUCONEST® or further advancement of our clinical trials could be halted or delayed, which would have a material adverse effect on our business and operations.

Our assumptions and estimates regarding prevalence and the addressable markets for our products and product candidates may be inaccurate, which could have a material adverse effect on our revenues and cash position.

If there are fewer actual patients than estimated, or if any product approval is based on narrower definitions of patient populations, our revenues and cash position could be materially and adversely affected. The patient population for the diseases that our products treat is very small, and networking, data gathering and support channels are not as established as those for more prevalent and researched disease indications. There are limited patient registries and other methods of establishing with precision the actual number of patients of our existing and potential future indications in any geography. Estimating the prevalence of a rare disease is difficult and we therefore must rely on assumptions, beliefs and an amalgam of information from multiple sources, resulting in potential under or over-reporting. There is no guarantee that our assumptions and beliefs are correct, or that the methodologies used and data collected have generated or will continue to generate accurate estimates. There is therefore uncertainty around the estimated total potential addressable patient population for treatment with RUCONEST® and Joenja® worldwide. In addition, the potential market opportunity for our product candidates that we may develop is difficult to estimate precisely, particularly given that the orphan drug markets which are targeted are, by their nature, relatively unknown. Our estimates of the potential market opportunity for each of these product candidates are predicated on several key assumptions, such as industry knowledge and publications, third-party research reports and other surveys. If any of our assumptions prove to be inaccurate, then the actual market for RUCONEST®, Joenja®, or our product candidates, could be smaller than our estimates of the potential market opportunity. If that turns out to be the case, our product revenue may be limited, and we may be unable to achieve or maintain profitability, which could have a material adverse effect on our business, financial condition, results of operations and prospects.

We depend on our information technology systems have been and may in the future be the victim of cyberattacks, which compromise the privacy, security, integrity or confidentiality of sensitive information related to our business or prevent us from accessing critical information and expose us to liability and reputational harm, which could adversely affect our business, results of operations and financial condition.

We collect and maintain data and information that is necessary to conduct our business, and we are increasingly dependent on information technology systems and infrastructure to operate our business, including systems infrastructure operated and maintained by our third-party suppliers or providers. In the ordinary course of our business, we collect, store and transmit large amounts of confidential information, including intellectual property, proprietary business information and personal information. It is critical that we do so in a secure manner to maintain the privacy, security, confidentiality and integrity of such confidential information. We have established physical, electronic and organizational measures to safeguard and secure our systems and facilities to prevent an information compromise, and rely on commercially available systems, software, tools and monitoring to provide security for our information technology systems and the processing, transmission and storage of digital information. We have also outsourced elements of our information technology infrastructure, and as a result, a number of third-party vendors may or could have access to our confidential information. Our internal information technology systems and infrastructure, and those of our current and any future collaborators, contractors and consultants and other third parties on which we rely, are vulnerable to damage or unauthorized access or use resulting from computer viruses, malware, natural disasters, terrorism, war, telecommunication and electrical failures, denial-of-service attacks, cyber-attacks or cyber-intrusions over the Internet, hacking, phishing and other social engineering attacks, attachments to emails, persons inside our organization (including employees or contractors), lost or stolen devices, or persons with access to systems inside our organization. We have been, and may in the future be, subject to cyberattacks.

A breach may require notification to governmental agencies, supervisory bodies, credit reporting agencies, the media or individuals pursuant to various federal, state and foreign data protection, privacy and security laws, regulations and guidelines, if applicable. These may include state breach notification laws, and the General Data Protection Regulation, or GDPR. Accordingly, a data security breach or privacy violation that leads to unauthorized access to, disclosure or modification of personal information (including protected health information), that prevents access to personal information or materially compromises the privacy, security, or

confidentiality of the personal information, could result in fines, increased costs or loss of revenue and we could incur liability, our competitive position could be harmed and the further development and commercialization of our product candidates could be delayed. Furthermore, federal, state and international laws and regulations, such as the GDPR, can expose us to enforcement actions and investigations by regulatory authorities, and potentially result in regulatory penalties and significant legal liability, if our information technology security efforts fail.

We rely on third parties for all quality control procedures.

The release of finished product to the market is dependent on the satisfaction of a set of quality control procedures. Some of these procedures, although validated, are very sensitive and complex (specifically for the protein platform). While ensuring and maintaining Good Manufacturing Practice, or GMP, activities at our partnered contract manufacturing organization, or CMO, sites we do not have our own GMP certified analytical laboratory capable of performing the quality control procedures needed for the release of product, and we rely on third parties for this task. We have started a program to challenge and reassess all currently used quality control procedures with the aim to improve or replace those by more robust, and easier to perform analyses and where possible create a more robust external partnership management process.

Any contamination in the manufacturing process for our recombinant products, shortages of raw materials or failure of any of our key suppliers to deliver necessary components could result in delays in our clinical development or marketing schedules and significantly impact commercially available goods.

We use living mammals as the source for our recombinant proteins. Our transgenic manufacturing platform bears the risk of failure due to contamination of the produced milk, diseases of the producing livestock, or a breakdown of the facilities. Any contamination could adversely affect our ability to produce, release, or administer our recombinant products on schedule and could, therefore, harm our results of operations and cause reputational damage. Additionally, although our recombinant products are tested for contamination prior to release, if a contaminated product was administered to a patient, it could result in harm to the patient. A raw material shortage, contamination, recall or restriction on the goods we use in the manufacture of our products could adversely impact or disrupt the commercial manufacturing or the production of clinical material, which could adversely affect our clinical development timelines and availability of finished goods for commercial use, impacting patient access, our business, financial condition, results of operations, and prospects.

We are dependent on a limited number of suppliers for some of our components and materials used in our product candidates and products. Any disruption in the supply of these materials could adversely affect our ability to deliver product or complete clinical trials. Other studies of product candidates, regulatory applications or commercializing product candidates in a timely and commercially valuable manner, may be adversely affected, should supply be disrupted.

We rely on a limited number of suppliers for certain essential materials incorporated into, or used in the manufacture of, products and product candidates. Since RUCONEST® is authorized for use in rare and ultra-rare diseases, it might be difficult to find suppliers that can or are willing to handle small-scale quantities, which may also limit our negotiation power with these suppliers.

Many component suppliers are based in Europe, while a significant percentage of RUCONEST® sales are conducted in the U.S. If international shipping is disrupted, we may not be able to supply sufficient quantities of RUCONEST® for sale in the U.S. Any disruption in the supply of these materials could adversely affect our ability to deliver product or complete clinical trials. In addition, studies of product candidates, regulatory applications and our ability to commercialize product candidates in a timely and commercially valuable manner, may be adversely affected, should supply be disrupted.

We cannot be sure that these suppliers will remain in business, or that they will not be purchased by one of our competitors or another company that is not interested in continuing to produce these materials for our intended purpose. Our use of a limited number of suppliers of raw materials, components and finished goods exposes us to several risks, including disruptions in supply, price increases, late deliveries and an inability to meet customer demand. There are, in general, relatively few alternative sources of supply for these components. These vendors may be unable or unwilling to meet our future demands for our clinical trials or commercial sale. Establishing additional or replacement suppliers for these components could take a substantial amount of time and it may be