0001499505agro:OthersMemberagro:SugarEthanolandEnergyMember2020-01-012020-12-31SownLandCropsSunflowerMemberifrs-full:TopOfRangeMember2023-01-012023-12-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FormFORM 20-F

| | | | | | | | |

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | OR | |

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED ON DECEMBER 31, 20202023 |

| | OR | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | FOR THE TRANSITION PERIOD FROM TO ________________ | |

| | OR | |

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | Date of event requiring this shell company report | |

COMMISSION FILE NUMBER: 001-35052

Adecoagro S.A.

(Exact name of Registrantregistrant as specified in its charter)

N/A

(Translation of Registrant’sregistrant’s name into English)

Grand Duchy of Luxembourg

(Jurisdiction of incorporation or organization)

Vertigo Naos Building, 6, Rue Eugène Ruppert,

L - 2453 Luxembourg

Tel: +352.2644.9372

(Address of principal executive offices)

Aurelien CorrionManuela Lamellari

Vertigo Naos Building, 6, Rue Eugène Ruppert,

L - 2453 Luxembourg

Email:aurelien.corrion@intertrustgroup.com manuela.lamellari@intertrustgroup.com

Tel: +352.26449.167+352.26449.494

(Name, Telephone, E-Mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common Shares | AGRO | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

The number of outstanding shares of each of the issuer’s classes of capital stock

as of December 31, 2020:2023:

117,296,951106,005,500 Common Shares, par value $1.50 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act

Yes ¨ No þ

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ¨ No þ

Indicate by check mark whether the Registrantregistrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrantregistrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer," accelerated” “accelerated filer,” and "emerging“emerging growth company"company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | |

Large accelerated filer ¨ ☐ | Accelerated filer þ | Non-accelerated filer ¨ |

| | | Emerging growth company ¨ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

☑ Yes ☐ No

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the

registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ¨ International Financial Reporting Standards as issued by the International Accounting Standards Board þ Other ¨

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the Registrantregistrant has elected to follow:

Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

TABLE OF CONTENTS

| | | | | | | | | | | |

| |

| | |

| |

| | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | | | |

| | | | |

| | | | |

| E. | E. | | |

| CRITICAL ACCOUNTING ESTIMATES | | F. | |

| | | |

| | | | |

| | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | ERRONEOUSLY AWARDED COMPENSATION | |

| | | | |

| | |

| | | | |

| | | | |

| | | | |

| | | | | | | | | | | |

| | | | |

| | | | |

| | | |

| Item 16 J. | Insider Trading Policies. | |

| Item 16 K. | Cybersecurity. | |

| | | | |

| | | |

| | | | |

| | |

| | | |

| | |

| | | |

| | |

FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements that are based on our current expectations, assumptions, estimates and projections about us and our industry. These forward-looking statements can be identified by words or phrases such as “anticipate,” “believe,” “continue,” “estimate,” “expect,” “intend,” “is/are likely to,” “may,” “plan,” “should,” “would,” or other similar expressions. The forward-looking statements included in this annual report relate to, among others:

•our business prospects and future results of operations;

•weather and other natural phenomena;

•the length and severity of the coronavirus (COVID-19) pandemic;

•developments in, or changes to, the laws, regulations and governmental policies governing our business, including limitations on ownership of farmland by foreign entities in certain jurisdictionjurisdictions in which we operate, environmental laws and regulations;

•the implementation of our business strategy;

•the correlation between petroleum, ethanol and sugar prices;

•our plans relating to acquisitions, joint ventures, strategic alliances or divestitures;divestitures, and to consolidate our position in different businesses;

•the efficiencies, cost savings and competitive advantages resulting from acquisitions;

•the implementation of our financing strategy and capital expenditure plan;

•the maintenance of our relationships with customers;

•the competitive nature of the industries in which we operate;

•the cost and availability of financing;

•future demand for the commodities we produce;

•international prices for commodities;

•the condition of our land holdings;

•the development of the logistics and infrastructure for transportation of our products in the countries where we operate;

•the length and severity of the coronavirus (COVID-19) pandemic or any other pandemic outbreak;

•the performance of the South American and world economies;

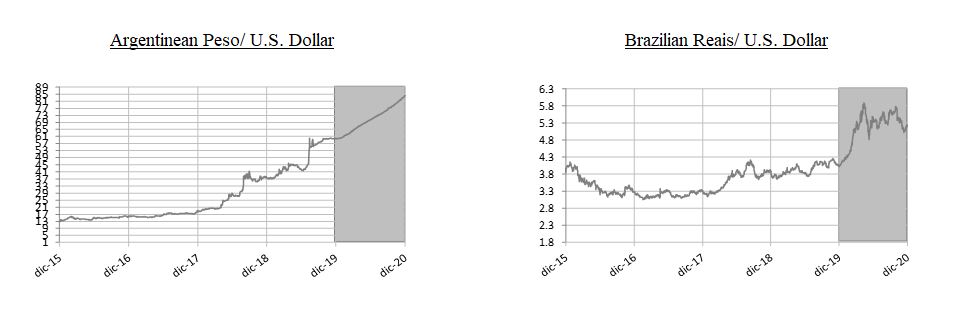

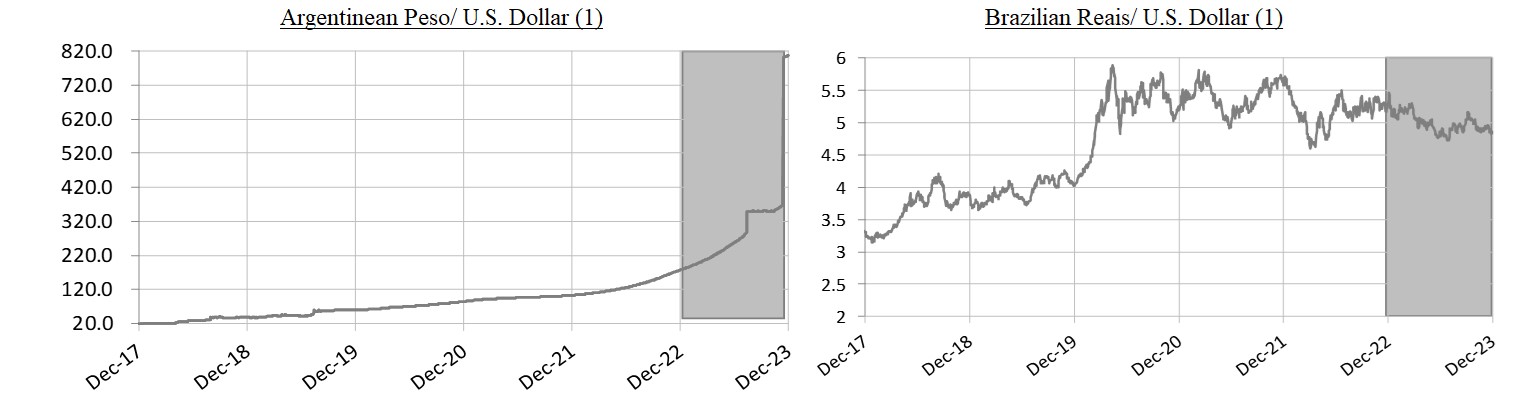

•the relative value of the Brazilian Real, the Argentine Peso and the Uruguayan Peso compared to other currencies; and

•the factors discussed under the section entitled “Risk Factors” in this annual report.

These forward-looking statements involve various risks and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations may turn out to be incorrect. Our actual results could be materially different from our expectations. In light of the risks and uncertainties described above, the estimates and forward-looking statements discussed in this annual report might not occur, and our future results and our performance may differ materially from those expressed in these forward-looking statements due to, including, but not limited to, the factors mentioned above. Because of these uncertainties, you should not make any investment decision based on these estimates and forward-looking statements.

The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events.

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Certain Defined Terms

In this annual report, unless otherwise specified or if the context so requires:

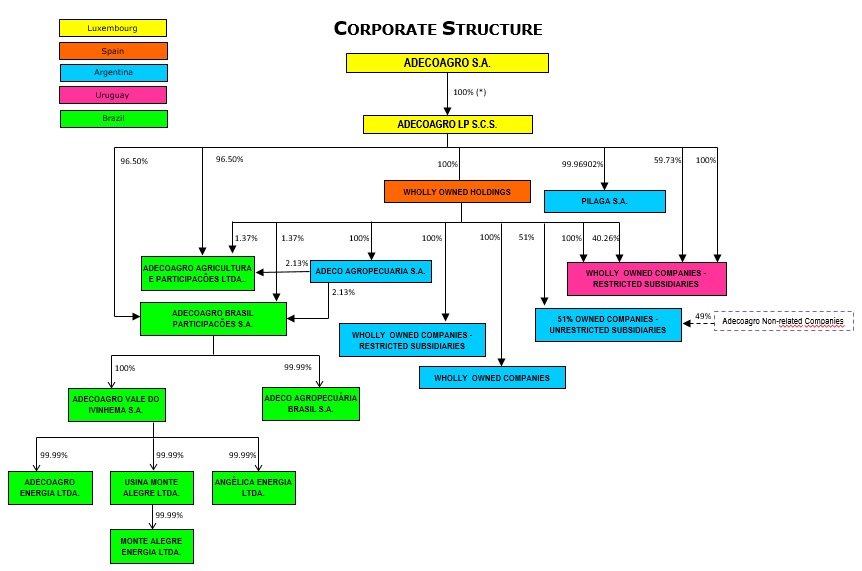

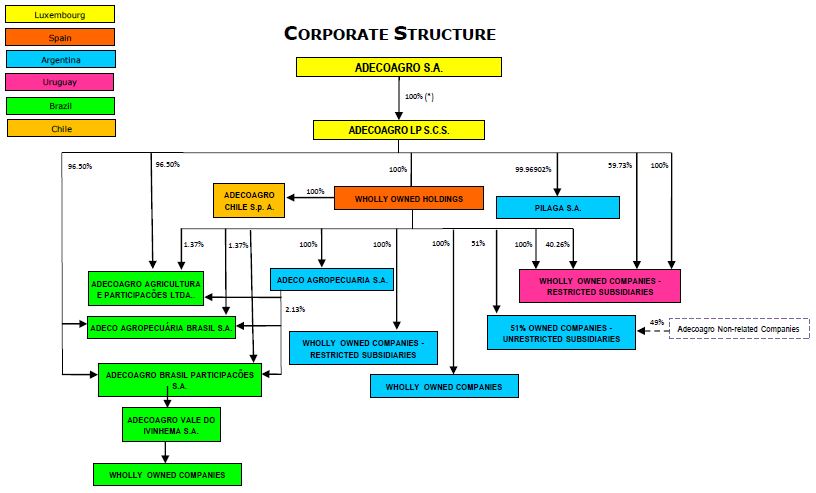

•References to the terms “Adecoagro S.A.S.A,”, “Adecoagro”, “we”, “us”, “our”, “Adecoagro,” “we,” “us,” “our,” “Company”; and “our company” refer to, Adecoagro S.A., a corporation organized under the form of a société anonyme under the laws of the Grand Duchy of Luxembourg, and its subsidiaries.

•References to “IFH” and “IFH LP” mean the former International Farmland Holdings, LP, a limited partnership, (previously IFH LP and International Farmland Holdings, LLC, or IFH LLC) which was merged into Adecoagro LP.

•References to “Adecoagro LP” mean Adecoagro, LP SCS, a limited partnership organized under the form of a société comandite simple under the laws of the Grand Duchy of Luxembourg (previously Adecoagro LP and Adecoagro, LLC).

•References to “$,” “US$,” “U.S. dollars” and “dollars” are to U.S. dollars.

•References to “Argentine Pesos,” “Pesos” or “Ps.” are to Argentine Pesos, the official currency of Argentina.

•References to “Brazilian Real,” “Real,” “Reais” or “R$” are to the Brazilian Real, the official currency of Brazil.

•References to “Uruguayan Pesos,” are to Uruguayan Pesos, the official currency of Uruguay.

•Unless stated otherwise, references to “sales” are to the consolidated sales of manufactured productsgoods and services rendered plus sales of agricultural produce and biological assets.service rendered.

•References to “IFRS” are International Financial Reportingto IFRS Accounting Standards as issued by the International Accounting Standards Board (“IASB”) and the interpretations of the International Financial Reporting Interpretations Committee (“IFRIC”), together “IFRS.”Committee.

Background

As part of a corporate reorganization (the “Reorganization”), Adecoagro, a Luxembourg corporation under the form of a société anonyme, was formed as a holding company for IFH for the purpose, among others, of facilitating the initial public offering (the “IPO”) of our common shares, completed on January 28, 2011. Before the IPO, Adecoagro had not engaged in any business or other activities except in connection with its formation and the Reorganization. For an additional discussion of the Reorganization, see “Item 4. Information on the Company—A. History and Development of the Company—History.”

During 2011, we contributed the net proceeds of the IPO to increase our interest in IFH from 98%98.0% to 98.64%. During 2012, we issued, in a series of transactions, 1,654,752 shares to certain limited partners of IFH in exchange for their residual interest in IFH, totaling 1.3595%1.36%, thereby increasing our interest in IFH to approximately 100%. During 2015 IFH was merged into Adecoagro LP, our wholly-owned subsidiary. For further information please see "Item 4 - “Item 4. Information on the Company—A. History and developmentDevelopment of the Company - General Information"Company—History”.

The Consolidated Financial Statements as of December 31, 20202023 and 20192022 and for the years ended December 31, 2020, 20192023, 2022 and 20182021 (hereinafter, the “Consolidated Financial Statements”) included in this annual report have been prepared in accordance with IFRS. All IFRS effective at the time of preparing the Consolidated Financial Statements have been applied.

Description of accounting policies that changed during 2020 and 2019

ReclassificationFinancial reporting in a hyperinflationary economy

DuringIn order to conclude whether an economy is categorized as hyperinflationary under the period ended September 30, 2020, the Company changed its accounting policy related to the applicationterms of IAS 29, Inflation Accounting,the Standard details a series of factors to be considered, including the existence of a cumulative inflation rate for a three year period that was implemented in 2018. Theapproximates or exceeds 100 %.

Since 2018, when the cumulative initial effect of inflation accounting until December 31, 2017 divided by the exchange rate at that date was recognized directly in equity, in the line “Adjustment of opening balance for the application of IAS 29”, as part of retained earnings. The ongoing effect of hyperinflation adjustment and retranslation of comparative amountsrelevant three year period exceeded the 100% threshold, our operations in Argentina have been deemed to closing exchange rates after initial recognition was recognizedbe conducted in Other Comprehensive Income, as part ofa hyperinflationary economy for accounting purposes under the cumulative translation adjustment (“CTA”).

The Company has changed its accounting policy for the presentation of the effect of the initial application of IAS 29, and reclassified it to Other Comprehensive Income, as part of the cumulative translation adjustment (“CTA”); instead of presenting it within retained earnings. This change in the presentation policy was adopted in order to provide uniformity of disclosure for the same concept and only required a reclassification of the constituent elements of the equity and did not affect total shareholders equity.

In addition, and related to hyperinflation accounting,terms of IAS 29. Accordingly, IAS 29 has been applied in the Company has also changed its accounting policyfinancial reporting of our subsidiaries that use the Argentine peso as their functional currency since 2018.

The inflation adjustment for the presentationyears ended December 31, 2023, 2022 and 2021 was calculated by means of finance income /expense. Until June 2020,conversion factor derived from the Company did not segregateArgentine price index published by the impactNational Institute of inflation on financial results. The company has decided toStatistics and the year-over-year change its presentation policy and segregate the impact of inflation over financial results, considering the segregation of such effects provides reliable and more relevant information. Financial results will be presented reflecting interest and exchange difference, net of its inflation effects. This change represents only a reclassification within Financial results and does not have any impact on total financial results, net or net income.

Both changes have been reflected in the comparative periods, thus, comparative figures have been restated. See Note 34 to our Consolidated Financial Statements.

Description of accounting policies that changed during 2019

Leases

IFRS 16 - Leases -index was adopted following the simplified approach, without restating comparative figures. The reclassifications3.114; 1.9479 and the adjustments arising from the new lease accounting rules were directly recognized in the opening balance sheet on January 1, 2019.

On adoption of IFRS 16, the Company recognized lease liabilities in relation to leases, which had previously been classified as ‘operating leases’ under the principles of IAS 17 Leases. For the initial recognition, these liabilities were measured at the present value of the remaining lease payments, and discounted using the lessee’s incremental borrowing rate as of January 1, 2019.

The adoption of IFRS 16 Leases from January 1, 2019, resulted in changes in accounting policies and adjustments to the amounts recognized in the Consolidated Financial Statements. For further details see Note 34 to our Consolidated Financial Statements.

Financial Statements1.509, respectively.

Non-IFRS Financial Measures

To supplement our Consolidated Financial Statements, which are prepared and presented in accordance with IFRS, we use the following non-IFRS financial measures in this annual report, which are based on the information that arose from segment information (Note 3 of ourthe Consolidated Financial Statements).Statements:

•Adjusted Consolidated EBITDAEBITDA;

•Adjusted Segment EBITDAEBITDA;

•Adjusted Consolidated EBITEBIT;

•Adjusted Segment EBITEBIT;

•Adjusted Net Income;

•Adjusted Free Cash FlowFlow;

•Adjusted Free Cash Flow from OperationsOperations;

•Net DebtDebt; and

•Net Debt to Adjusted Consolidated EBITDA Ratio

In particular, Adjusted Consolidated EBITDA, Adjusted Segment EBITDA, Adjusted Consolidated EBIT and Adjusted Segment EBIT arose from our segment information in the Consolidated Financial Statements. Please refer to Note 3 to our Consolidated Financial Statements - Segment Information.

In this section, we provide an explanation and a reconciliation of each of our non-IFRS financial measures to the most directly comparable IFRS measures. The presentation of these financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with IFRS.

We use non-IFRS measures to internally evaluate and analyze financial results. We believe these non-IFRS financial measures provide investors with useful supplemental information about the liquidity and financial performance of our business, enable comparison of financial results between periods where certain items may vary independent of business performance, and enable comparison of our financial results with other public companies, many of which present similar non-IFRS financial measures.

There are limitations associated with the use of non-IFRS financial measures as an analytical tool. In particular, many of the adjustments to our IFRS financial measures reflect the exclusion of items, such as depreciation of property, plant and equipment and amortization of intangible assets, changes in fair value and the related income tax effects of the aforementioned exclusions, that are recurring and will be reflected in our financial results for the foreseeable future. In addition, these measures

may be different from non-IFRS financial measures used by other companies, limiting their usefulness for comparison purposes.

Adjusted Consolidated EBITDA, Adjusted Segment EBITDA, Adjusted Consolidated EBIT and Adjusted Segment EBIT

We present Adjusted Consolidated EBITDA, Adjusted Segment EBITDA, Adjusted Consolidated EBIT and Adjusted Segment EBIT in this annual report as supplemental measures of performance of our company and of each operating segment, respectively, thatwhich are not required by, or presented in accordance with IFRS.

Adjusted Consolidated EBITDA equals the sum of our Adjusted Segment EBITDA for each of our operating segments. We define “Adjusted Consolidated EBITDA” as (i) consolidated net profit (loss) for the year, as applicable, before interest expense, income taxes, depreciation of property, plant and equipment, and amortization of intangible assets, net gain or loss from fair value adjustments of investment property land foreign exchange gains or losses, other net financial results;results and bargain purchase gain on acquisition (ii) adjusted by profit or loss from discontinued operations; (iii) adjusted by those items, that do not impact profit and loss, but are recorded directly in shareholders'shareholders’ equity, including (a) the gains or losses from disposals of non-controllingnoncontrolling interests in subsidiaries whose main underlying asset is farmland, reflected under the line item: "Reserve“Reserve from the sale of non-controllingnoncontrolling interests in subsidiaries” and (b) the net increase in value of sold farmland, which has beenis recognized in either revaluation surplus or retained earnings and reflected in shareholders’ equity under the line item “Reverse of retained earnings;revaluation surplus derived from disposals of assets”; and (iv)(iii) net of the combined effect of the application of IAS 29 and IAS 21 from the Argentine operations included in profit from operations. (See "Item 5. Operating and Financial Review and Prospects — A. Operating Results - Critical Accounting Policies and Estimates.")

We define “Adjusted Segment EBITDA” for each of our operating segments as (i) the segment’s share of consolidated profit (loss) from operations before financing and taxation per segment information for the year, as applicable, before depreciation of property, plant and equipment and amortization of intangible assets;assets and bargain purchase gain on acquisition, (ii) adjusted by profit or loss from discontinued operations; (iii) adjusted by those items, that do not impact profit and loss, but are recorded directly in shareholders'shareholders’ equity, including (a) the gains or losses from disposals of non-controllingnoncontrolling interests in subsidiaries whose main underlying asset is farmland, reflected under the line item: "Reserveitem “Reserve from the sale of non-controllingnoncontrolling interests in subsidiaries” and (b) the net increase in value of sold farmland, which has beenis recognized in either revaluation surplus or retained earnings, and reflected in shareholder’ equity under the line item “Reverse of retained earnings.revaluation surplus derived from disposals of assets;” and (iii) net of the combined effect of the application of IAS 29 and IAS 21 to our Argentine operations included in profit from operations.

We believe that Adjusted Consolidated EBITDA and Adjusted Segment EBITDA are important measures of operating performance for our company and each operating segment, respectively, because they allow investors to evaluate and compare our consolidated operating results and to evaluate and compare the operating performance of our segments, respectively, including our return on capital and operating efficiencies, from period to period by removing the impact of our capital structure (interest expense from our outstanding debt), asset base (depreciation and amortization), tax consequences (income taxes), bargain purchase gain, foreign exchange gains or losses and other financial results. In addition, by including the gains or losses from disposals of non-controllingnoncontrolling interests in subsidiaries whose main underlying asset is farmland, investors can also evaluate and compare the full value and returns generated by our land transformation activities. Other companies may calculate Adjusted Consolidated EBITDA and Adjusted Segment EBITDA differently, and therefore our Adjusted Consolidated EBITDA and Adjusted Segment EBITDA may not be comparable to similarly titledsimilar measures used by other companies. Adjusted Consolidated EBITDA and Adjusted Segment EBITDA are not measures of financial performance under IFRS, and should not be considered in isolation or as an alternative to consolidated net profit (loss), cash flows from operating activities, segment’ssegment profit from operations before financing and taxation and other measures determined in accordance with IFRS. Items excluded from Adjusted Consolidated EBITDA and Adjusted Segment EBITDA are significant and necessary components to the operations of our business, and, therefore, Adjusted Consolidated EBITDA and Adjusted Segment EBITDA should only be used as a supplemental measure of our company’s operating performance, and of each of our operating segments, respectively. We also believe Adjusted Consolidated EBITDA and Adjusted Segment EBITDA are useful for securities analysts, investors and others to evaluate and compare the financial performance of our company and other companies in the agricultural industry. These non-IFRS measures should be considered in addition to, but not as a substitute for or superior to, the information contained in either our statements of income or segment information.

Our Adjusted Consolidated EBIT equals the sum of our Adjusted Segment EBITs for each of our operating segments. We define “Adjusted Consolidated EBIT” as (i) consolidated net profit (loss) for the year, as applicable, before interest expense, income taxes, foreign exchange gains or losses and other net financial results; and (ii) adjusted by profit or loss from discontinued operations ; (iii) adjusted by gains or losses from disposals of non controllingnoncontrolling interests in subsidiaries whose main underlying asset farmland; (iii) the net increase in value of sold farmland, ;which has been recognized in either revaluation surplus or retained earnings; (iv) net gain/loss from fair value adjustments of investment property land; (v) bargain purchase gain on acquisition and (iv)(vi) net of the combined effect of the application of IAS 29 and IAS 21 fromto the Argentine operations included in profit from operations. We define “Adjusted Segment EBIT” for each of our operating segments as the segment’s share of (i) consolidated profit (loss) from operations before financing and taxation as per segment information for the year, as applicable; and (ii) adjusted by profit or net gain/loss from discontinued operations;fair value adjustments of investment property land; (iii) bargain purchase gain on acquisition; and (iii)(iv) adjusted by those items, that do not impact profit and loss, but are recorded directly in shareholders'shareholders’ equity, including (a) the gains or losses from disposals of

non-controlling noncontrolling interests in subsidiaries whose main underlying asset is farmland, reflected under the line item: "Reserve from the sale of non-controllingnoncontrolling interests in subsidiaries”; (b) the net increase in value of sold farmland, which has been recognized in either revaluation surplus of retained earnings.

We believe that Adjusted Consolidated EBIT and Adjusted Segment EBIT are important measures of operating performance, for our company and each operating segment, respectively, because they allow investors to evaluate and compare our consolidated operating results and to evaluate and compare the operating performance of our segments, from period to period by including the impact of depreciable fixed assets and removing the impact of our capital structure (interest expense from our outstanding debt), tax consequences (income taxes), foreign exchange gains or losses and other financial results. In addition, by including the gains or losses from disposals of non-controllingnoncontrolling interests in subsidiaries whose main underlying asset is farmland and also the sale of farmlands, investors can evaluate the full value and returns generated by our land transformation activities. Other companies may calculate Adjusted Consolidated EBIT and Adjusted Segment EBIT differently, and therefore our Adjusted Consolidated EBIT and Adjusted Segment EBIT may not be comparable to similarly titledsimilar measures used by other companies. Adjusted Consolidated EBIT and Adjusted Segment EBIT are not measures of financial performance under IFRS, and should not be considered in isolation or as an alternative to consolidated net profit (loss), cash flows from operating activities, segment’ssegment profit from operations before financing and taxation and other measures determined in accordance with IFRS. Items excluded from Adjusted Consolidated EBIT and Adjusted Segment EBIT are significant and necessary components to the operations of our business, and, therefore, Adjusted Consolidated EBIT and Adjusted Segment EBIT should only be used as a supplemental measure of the operating performance of our company, and of each of our operating segments, respectively.

Adjusted Net Income

We define Adjusted Net Income as (i) profit / (loss) of the period/year before net gain / (losses) from fair value adjustments of investment property land and bargain purchase gain on acquisition; plus (ii) any non-cash finance costs resulting from foreign exchange gain/losses for such period, which are composed by both exchange differences and cash flow hedge transfer from equity, included in Financial Results, net, in our statement of income; net of the related income tax effects, plus (iii) gains or losses from disposals of non-controlling interests in subsidiaries whose main underlying asset is farmland, which are reflected in our shareholders’ equity under the line item “Reserve from the sale of non-controlling interests in subsidiaries” if any, plus (iv) the reversal of the aforementioned income tax effect, plus (v) inflation accounting effect; plus (vi) the net increase in value of sold farmland, which has been recognized in either revaluation surplus or retained earnings, if any.

We believe that Adjusted Net Income is an important measure of performance for our company allowing investors to properly assess the impact of the results of our operations in our equity. In fact, results arising from the revaluation effect of our net monetary position held in foreign currency in the countries where our functional currency is the local currency do not affect the equity of the Company, when measured in foreign / reporting currency. Conversely, the tax effect resulting from the aforementioned revaluation effect does impact the equity of the Company, since it reduces/increases the income tax to be paid in each country. Accordingly we have added back the income tax effect to Adjusted Net Income.

In addition, by including the gains or losses from disposals of non-controlling interests in subsidiaries whose main underlying asset is farmland, investors can also include the full value and returns generated by our land transformation activities.

Other companies may calculate Adjusted Net Income differently, and therefore our Adjusted Net Income may not be comparable to similar measures used by other companies. Adjusted Net Income is not a measure of financial performance under IFRS, and should not be considered in isolation or as an alternative to consolidated net profit (loss). This non-IFRS measure should be considered in addition to, but not as a substitute for or superior to, the information contained in our consolidated financial statements.

Adjusted Free Cash Flow and Adjusted Free Cash Flow from Operations

We believe that the measures ofdefine Adjusted Free Cash Flow as the aggregate of (i) net cash generated from operating activities net of the combined effect of the application of IAS 29 and IAS 21 to the Argentine operations, (ii) net cash used in investing activities net of the combined effect of the application of IAS 29 and IAS 21 to the Argentine operations -excluding the combined effect in other financial income-, less (iii) interest paid net of the combined effect of the application of IAS 29 and IAS 21 to the Argentine operations, plus (iv) proceeds from the sale of non-controlling interest in farming subsidiaries; less (v) lease payments, less (vi) dividends paid to noncontrolling interest, plus (vii) the net of acquisition/disposal of restricted short-term investments, namely US-Treasury Bills used as collateral of short term borrowings, and less (viii) other financial income derived from gains on bond arbitrage transactions. We define Adjusted Free Cash Flow from Operations are important measures of liquidity that enable investors to draw important comparisons year to year of the amount of cash generated by the Company’s principal business and financing activities, which includes the cash generated from our land transformation activities, after paying for recurrent items, including interest, taxes and maintenance capital expenditures.

We define Adjusted Free Cash Flow as (i) net cash generated from operating activities net of the combined effect of the application of IAS 29 and IAS 21 to the Argentine operations, less (ii) net cash used in investing activities net of the combined effect of the application of IAS 29 and IAS 21 to the Argentine Operations -excluding the net of the combined effect in other financial income-, less (iii) interest paid net of the combined effect of the application of IAS 29 and IAS 21 to the Argentine operations, plus (iv) proceeds from the sale of non-controllingnoncontrolling interest in farming subsidiaries; less (v) lease payments. payments, less (vi) dividends paid to noncontrolling interest plus (vii) the

net of acquisition/disposal of restricted short-term investments, namely US-Treasury Bills used as collateral of short term borrowings, less (viii) other financial income derived from gains on bond arbitrage transactions, less (ix) expansion capital expenditures.

We definebelieve that the measures of Adjusted Free Cash Flow and Adjusted Free Cash Flow from Operations as (i) netare important measures of liquidity that enable investors to draw important comparisons year to year of the amount of cash generated from operatingby the Company’s principal business and financing activities, net of the combined effect of the application of IAS 29after paying for recurrent items, including interest, taxes and IAS 21 less (ii) net cash used in investing activities net of the combined effect of the application of IAS 29 and IAS 21, less (iii) interest paid net of the combined effect of the application of IAS 29 and IAS 21 to the Argentine operations, plus (iv) proceeds from the sale of non-controlling interest in subsidiaries; less (v) lease payments; plus (vi) expansionmaintenance capital expenditures. (See "Item 3. Key Information— A Selected Financial Data." and "Item 5. Operating and Financial Review and Prospects — A. Operating Results -- Critical Accounting Policies and Estimates"

Expansion capital expenditures is defined as the required investment to expand current production capacity including organic growth, joint ventures and acquisitions. We define maintenance capital expenditures as the necessary investments in order to maintain the current level of productivity both at an agricultural and industrial level. Proceeds from the sale of non-controllingnoncontrolling interest in farming subsidiaries is a measure of the cash generated from our land transformation business thatby the sale of farms, which is included under cash from financing activities pursuant to IFRS.

We believe Adjusted Free Cash Flow is an important liquidity measure for the Company because it allows investors and others to evaluate and compare the amount of cash generated by the Company business and financing activities to undertake growth investments, to fund acquisitions, to reduce outstanding financial debt, and to provide a return to shareholders in the form of dividends and/or share repurchases, among other things.others.

We believe Adjusted Free Cash Flow from Operations is an additional important liquidity metric for the Company because it allows investors and others to evaluate and compare the total amount of cash generated by the Company’s business and financing activities after paying for recurrent items including interests, taxes and maintenance capital expenses.expenditures. We believe this metric is relevant in evaluating the overall performance of our business.

Other companies may calculate Adjusted Free Cash Flow and Adjusted Free Cash Flow from Operations differently, and therefore, our formulation may not be comparable to similarly titled measures used by other companies. Adjusted Free Cash Flow and Adjusted Free Cash Flow from Operations are not measures of liquidity under IFRS, and should not be considered in

isolation or as an alternative to consolidated, cash flows from operating activities, net increase, (decrease) in cash and cash equivalents and other measures determined in accordance with IFRS.

Net Debt and Net Debt to Adjusted Consolidated EBITDA Ratio

Net debt is defined as the sum of non-currentcurrent and currentnon-current borrowings, less cash and cash equivalents.equivalents and restricted short-term investments (namely US-Treasury Bills used as collateral of short-term borrowings). This measure is widely used by management.

Management is consistently tracking our leverage position and our ability to repay and service our debt obligations over time. We have therefore set a leverage ratio target that is measured by net debt divided by Adjusted Consolidated EBITDA.

We believe that the ratio of net debt to Adjusted Consolidated EBITDA provides useful information to investors because management uses it to manage our debt-equity ratio in order to promote access to capital markets and our ability to meet scheduled debt service obligations.

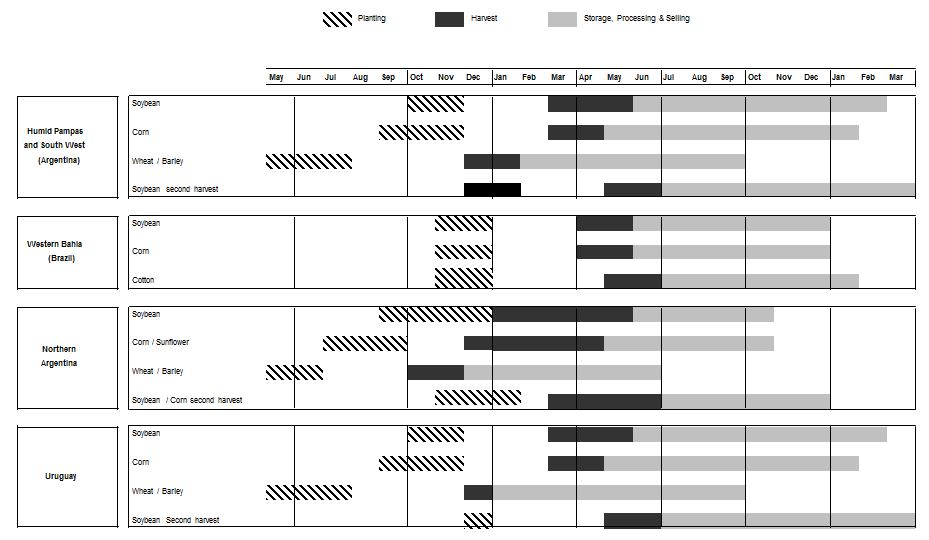

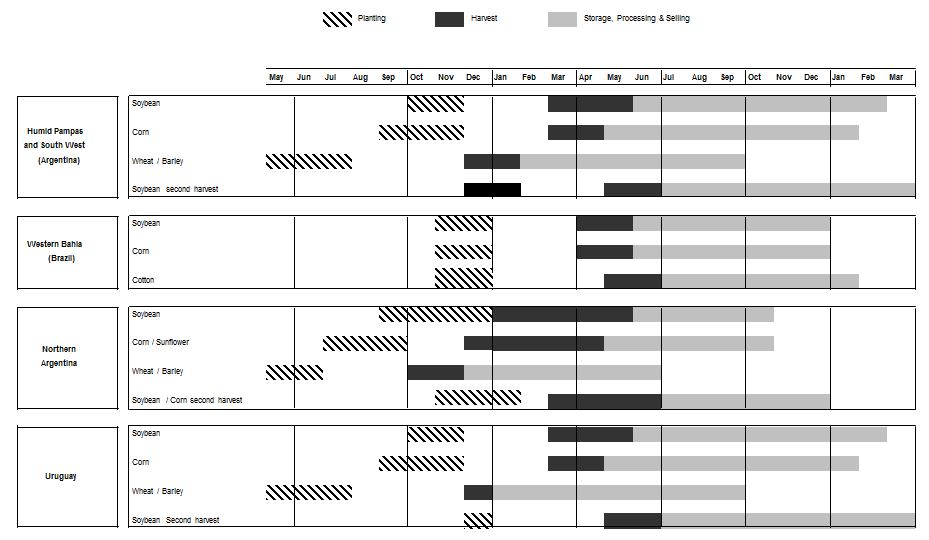

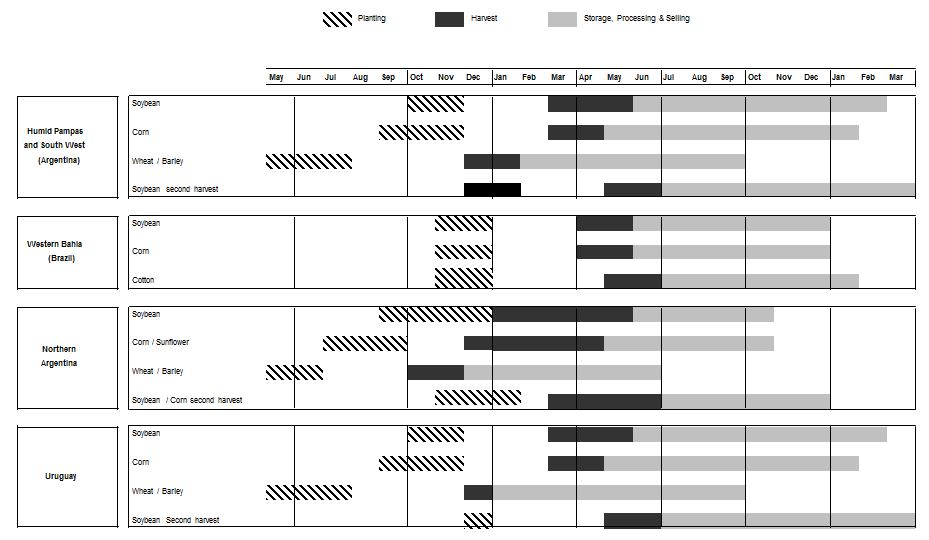

Fiscal Year and Harvest Year

Our fiscal year begins on January 1 and ends on December 31 of each year. However, our production is based on the harvest yearharvest-year for each of our crops and rice. A harvest yearharvest-year varies according to the crop or rice and to the climate in which it is grown. Due to the geographic diversity of our farms, the planting period for a given crop or rice may start earlier on one farm than on another, causing differences in their respective harvesting periods. The presentation of production volume (tons) and product area (hectares) in this annual report, in respect of the harvest yearsharvest-years for each of our crops and rice, starts with the first day of the planting period at the first farm to start planting on that harvest yearharvest-year and continues to the last day of the harvesting period of the respective crop or rice on the last farm to finish harvesting that harvest year,harvest-year, as shown in the table below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Planting | | | Harvest | | | Storage, Processing & Selling | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | Feb | Mar |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Humid Pampas and South West (Argentina) | | Soybean | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Corn | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Wheat / Barley | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Soybean second harvest | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Corn second harvest | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Peanut | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Sunflower | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Northern Argentina | | Soybean | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Corn / Sunflower | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Wheat / Barley | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Soybean / Corn second harvest | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Cotton | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Rice | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Uruguay | | Soybean | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Corn | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Wheat / Barley | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Soybean / Corn second harvest | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Rice | | | | | | | | | | | | | | | | | | | | | | | |

Product area for cattle is presented on a harvest yearharvest-year basis given that land utilized for cattle operations is linked to our farming operations and use of farmland during a harvest year. Production volumes for dairy and cattle operations are presented on a fiscal year basis. On the other hand, production volumes and product area in our sugar, ethanolSugar, Ethanol and energyEnergy business are presented on a fiscal yearfiscal-year basis.

The financial results for all of our products are presented on a fiscal yearfiscal-year basis.

Certain Weight Units and Measures in the Agricultural Business

Weight units and measures used in agriculture vary according to the crop and producing country. In order to permit comparability of our operating data with operating data from the international markets, the following table sets forth key weight units and measures used in the agricultureagricultural industry:

| | | | | | | | |

| Agricultural weight units and measures | | |

| 1 metric ton | 1,000 kg | 1.102 U.S. (short) tons |

| 1 cubic meter | 1,000 liters | |

| 1 kilogram (kg) | 2.20462 pounds | |

| 1 pound | 0.45359 kg | |

| 1 acre | 0.40469 hectares | |

| 1 hectare (ha) | 2.47105 acres | |

| Soybean and Wheat | | |

| 1 bushel of soybean | 60 pounds | 27.2155 kg |

| 1 bag of soybean | 60 kg | 2.20462 bushels |

| 1 bushel/acre | 67.25 kg/ha | |

| 1.00 U.S. dollar/bushel | 2.2046 U.S. dollar/bag | |

| Corn | | |

| 1 bushel of corn | 56 pounds | 25.4012 kg |

| 1 bag of corn | 60 kg | 2.36210 bushels |

| 1 bushel/acre | 62.77 kg/ha | |

| 1.00 U.S. dollar/bushel | 2.3621 U.S. dollar/bag | |

| Dairy | | |

| 1 liter | 0.264 gallons | 2.273 pounds |

| 1 gallon | 3.785 liters | 8.604 pounds |

| 1 lbs | 0.440 liters | 0.116 gallons |

| 1.00 U.S. dollar/liter | 43.995 U.S. dollar/cwt | 3.785 U.S. dollar/gallon |

| 1.00 U.S. dollar/cwt | 0.023 U.S. dollar/liter | 0.086 U.S. dollar/gallon |

| 1.00 U.S. dollar/gallon | 0.264 U.S. dollar/liter | 11.622 U.S. dollar/cwt |

Sugar &and Ethanol | | |

| 1 kg of TRS equivalent | 0.95 kg of VHP Sugar | 0.59 liters of Hydrated Ethanol |

| 1.00 US$ cents/pound | 22.04 U.S. dollar/ton | |

Presentation of Information — Market Data and Forecasts

This annual report includes information provided by us and by third-party sources that we believe are reliable, including data related to the economic conditions in the markets in which we operate. Unless otherwise indicated, information in this annual report concerning economic conditions is based on publicly available information from third-party sources which we believe to be reasonable. The economic conditions in the markets in which we operate may deteriorate, and those economies may not grow at the rates projected by market data, or at all. The deterioration of the economic conditions in the markets in which we operate may have a material adverse effect on our business, results of operations and financial condition and the market price of our common shares.

Rounding

We have made rounding adjustments to reach some of the figures included in this annual report. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

A. SELECTED FINANCIAL DATA

The following selected statement of financial position data as of December 31, 2020 and 2019 and selected statement of income data and cash flow data for each of the three years in the period ended December 31, 2020, 2019 and 2018 have been derived from our Consolidated Financial Statements appearing elsewhere in this annual report on Form 20-F. The selected statement of financial position data as of December 31, 2018, 2017 and 2016 and for the years ended December 31, 2017 and 2016 has been derived from our annual consolidated financial statements which are not included in this annual report.

The Consolidated Financial Statements are prepared in accordance with IFRS. All IFRS effective at the time of preparing the Consolidated Financial Statements have been applied.

You should read the information contained in the following tables in conjunction with “Item 5. Operating and Financial Review and Prospects”, “Item 8. Financial Information”, “Item 18. Financial Statements” and the Consolidated Financial Statements and the accompanying notes included elsewhere in this annual report.

Financial reporting in a hyperinflation economy

IAS 29 “Financial Reporting in Hyperinflationary Economies” requires that the financial statements of entities whose functional currency is that of a hyperinflationary economy to be adjusted for the effects of changes in a suitable general price index and to be expressed in terms of the current unit of measurement at the closing date of the reporting period. Accordingly, the inflation produced from the date of acquisition or from the revaluation date, as applicable, must be computed in the non-monetary items.

In order to conclude on whether an economy is categorized as hyperinflationary under the terms of IAS 29, the Standard details a series of factors to be considered, including the existence of a cumulative inflation rate in three years that approximates or exceeds 100 %.

Since 2018, when cumulative inflation rate in three years exceeded the 100% threshold, Argentina´s operations are considered to be under hyperinflationary economy for accounting purposes under the terms of IAS 29 and since then, it has been applied IAS 29 in the financial reporting of its subsidiaries and associates with Argentine peso as functional currency.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the years ended December 31, |

| | 2020 | | 2019 (*) | | 2018 (*) | | 2017 | | 2016 |

| | (In thousands of $) |

| Statements of Income Data: | | | | | | | | | |

| Sale of goods and services rendered | 817,764 | | | 887,138 | | | 793,239 | | | 933,178 | | | 869,235 | |

| Cost of goods sold and services rendered | (611,946) | | | (671,173) | | | (609,965) | | | (766,727) | | | (678,581) | |

| Initial recognition and changes in fair value of biological assets and agricultural produce | 122,729 | | | 68,589 | | | 16,195 | | | 63,220 | | | 125,456 | |

| Changes in net realizable value of agricultural produce after harvest | 7,005 | | | 1,825 | | | (909) | | | 8,852 | | | (5,841) | |

| Margin on manufacturing and agricultural activities before operating expenses | 335,552 | | | 286,379 | | | 198,560 | | | 238,523 | | | 310,269 | |

| General and administrative expenses | (53,428) | | | (57,202) | | | (56,080) | | | (57,299) | | | (50,750) | |

| Selling expenses | (95,058) | | | (106,972) | | | (90,215) | | | (95,399) | | | (80,673) | |

| Other operating income, net | 1,987 | | | (822) | | | 104,232 | | | 43,763 | | | 5,752 | |

| | | | | | | | | |

| Profit from operations before financing and taxation | 189,053 | | | 121,383 | | | 156,497 | | | 129,588 | | | 184,598 | |

| Finance income | 26,054 | | | 8,979 | | | 8,394 | | | 11,744 | | | 7,957 | |

| Finance costs | (213,776) | | | (126,111) | | | (163,937) | | | (131,349) | | | (165,380) | |

| Other financial results - Net gain of inflation effects on the monetary items | 12,064 | | | 16,911 | | | (25,211) | | | — | | | — | |

| Financial results, net | (175,658) | | | (100,221) | | | (180,754) | | | (119,605) | | | (157,423) | |

| Profit / (Loss) before income tax | 13,395 | | | 21,162 | | | (24,257) | | | 9,983 | | | 27,175 | |

| Income tax (expense) / benefit | (12,325) | | | (20,820) | | | 1,024 | | | 4,992 | | | (12,899) | |

| Profit / (loss) for the year | 1,070 | | | 342 | | | (23,233) | | | 14,975 | | | 14,276 | |

| | | | | | | | | |

| Attributable to: | | | | | | | | | |

| Equity holders of the parent | 412 | | | (772) | | | (24,622) | | | 13,198 | | | 11,568 | |

| Non-controlling interest | 658 | | | 1,114 | | | 1,389 | | | 1,777 | | | 2,708 | |

| | | | | | | | | |

| Earnings / (loss) per share from operations attributable to the equity holders of the parent during the year: | | | | | | | | | |

| Basic earnings / (loss) per share | 0.003 | | | (0.007) | | | (0.211) | | | 0.109 | | | 0.095 | |

| Diluted earnings / (loss) per share | 0.003 | | | (0.007) | | | (0.211) | | | 0.108 | | | 0.094 | |

(*) Prior periods have been recast to reflect the Company's change in accounting policy for the reclassification within financial results as explained in "Description of accounting policies that changed during 2020 and 2019" Note 34.1 to our Consolidated Financial Statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Year Ended December 31, |

| | 2020 | | 2019 (*) | | 2018 (*) | | 2017 | | 2016 |

| Cash Flow Data: | | | | | | | | | |

| Net cash generated from operating activities (a) | 257,125 | | | 322,110 | | | 218,513 | | | 237,105 | | | 255,401 | |

| Net cash used in investing activities (b) | (121,916) | | | (249,639) | | | (175,109) | | | (188,335) | | | (122,014) | |

| Net cash generated from financing activities (c) | (53,919) | | | (37,863) | | | (20,854) | | | 70,194 | | | (181,682) | |

| (a) Includes 23,550 and 7,598 of the combined effect of IAS 29 and IAS 21 of the Argentine subsidiaries for 2019 and 2018, respectively. |

| (b) Includes 3,851 and 4,122 of the combined effect of IAS 29 and IAS 21 of the Argentine subsidiaries for 2019 and 2018, respectively. |

| (c) Includes (14,340) and (8,231) of the combined effect of IAS 29 and IAS 21 of the Argentine subsidiaries for 2019 and 2018, respectively. |

| Other Financial Data: | | | | | | | | | |

Adjusted Segment EBITDA (unaudited) (1) | | | | | | | | | |

| Crops | 35,694 | | | 25,654 | | | 34,012 | | | 25,678 | | | 27,462 | |

| Rice | 34,108 | | | 20,328 | | | 18,827 | | | 12,179 | | | 11,698 | |

| Dairy | 18,153 | | | 14,965 | | | 7,189 | | | 12,243 | | | 5,717 | |

| All Other segments | 1,620 | | | 266 | | | (460) | | | 556 | | | 9,085 | |

| Farming subtotal | 89,575 | | | 61,213 | | | 59,568 | | | 50,656 | | | 53,962 | |

| Ethanol, sugar and energy | 253,052 | | | 253,069 | | | 238,284 | | | 247,301 | | | 265,044 | |

| Land transformation | 18,132 | | | 10,526 | | | 36,850 | | | — | | | — | |

| Corporate | (18,806) | | | (19,639) | | | (19,971) | | | (21,664) | | | (20,957) | |

Adjusted Consolidated EBITDA (unaudited) (1) | 341,953 | | | 305,169 | | | 314,731 | | | 276,293 | | | 298,049 | |

(1)See “Presentation of Financial and Other Information” for the definitions of Adjusted Segment EBITDA and Adjusted Consolidated EBITDA and the reconciliation in the table below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of December 31, |

| | 2020 | | 2019 (*) | | 2018 | | 2017 | | 2016 |

| | (In thousands of $) |

| Statement of Financial Position Data: | | | | | | | | | |

| Biological assets | 165,693 | | | 130,436 | | | 105,387 | | | 167,994 | | | 145,404 | |

| Inventories | 133,461 | | | 112,790 | | | 128,102 | | | 108,919 | | | 111,754 | |

| Property, plant and equipment, net | 1,358,292 | | | 1,493,220 | | | 1,480,439 | | | 831,377 | | | 814,867 | |

| Right of use assets | 209,694 | | | 238,053 | | | — | | | — | | | — | |

| Total assets | 2,482,236 | | | 2,521,307 | | | 2,277,372 | | | 1,645,089 | | | 1,496,397 | |

| Non-current lease liabilities | 159,435 | | | 174,570 | | | — | | | — | | | — | |

| Total lease liabilities | 195,772 | | | 216,384 | | | — | | | — | | | — | |

| Non-current borrowings | 813,464 | | | 780,202 | | | 718,484 | | | 663,060 | | | 430,304 | |

| Total borrowings | 971,090 | | | 968,280 | | | 862,116 | | | 817,958 | | | 635,396 | |

| Share Capital | 183,573 | | | 183,573 | | | 183,573 | | | 183,573 | | | 183,573 | |

| Equity attributable to equity holders of the parent | 925,041 | | | 988,269 | | | 1,063,636 | | | 673,880 | | | 700,334 | |

| Non-controlling interest | 38,683 | | | 40,614 | | | 44,509 | | | 9,139 | | | 11,970 | |

| Number of shares (including treasury shares) | 122,382 | | | 122,382 | | | 122,382 | | | 122,382 | | | 122,382 | |

(*) Prior period has been recast to reflect the Company's change in accounting policy for the reclassification within financial results as explained in "Description of accounting policies that changed during 2020 and 2019" Note 34.1 to our Consolidated Financial Statements.

The following tables show a reconciliation of Adjusted Segment EBITDA to our segments’ profit / (loss) from operations before financing and taxation, the most directly comparable IFRS financial measure, and a reconciliation of Adjusted Consolidated EBITDA to our net profit (loss) for the year, the most directly comparable IFRS financial measure.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the year ended December 31, 2020 |

| | Crops | | Rice | | Dairy | | All other

segments | | Farming

Subtotal | | Sugar,

Ethanol

and

Energy | | Land

Trans-

formation | | Corporate | | Total |

| | (In thousands of $) |

Adjusted Segment EBITDA

(unaudited) | | | | | | | | | | | | | | | | | |

Profit/(Loss) from

Operations Before Financing and Taxation as per Segment Information | 30,297 | | | 27,456 | | | 11,444 | | | 2,562 | | | 71,759 | | | 130,536 | | | 7,934 | | | (19,682) | | | 190,547 | |

| Net (gain) from Fair value adjustment of investment property as per Segment Information | — | | | — | | | — | | | (1,080) | | | (1,080) | | | — | | | — | | | — | | | (1,080) | |

| Reverse of revaluation surplus derived from the disposals of assets before taxes | — | | | — | | | — | | | — | | | — | | | — | | | 10,198 | | | — | | | 10,198 | |

Adjusted Segment EBIT (unaudited)(1) | 30,297 | | | 27,456 | | | 11,444 | | | 1,482 | | | 70,679 | | | 130,536 | | | 18,132 | | | (19,682) | | | 199,665 | |

| Depreciation of Property, plant and equipment and amortization of Intangible Assets as per Segment Information | 5,397 | | | 6,652 | | | 6,709 | | | 138 | | | 18,896 | | | 122,516 | | | — | | | 876 | | | 142,288 | |

Adjusted Segment EBITDA (unaudited)(1) | 35,694 | | | 34,108 | | | 18,153 | | | 1,620 | | | 89,575 | | | 253,052 | | | 18,132 | | | (18,806) | | | 341,953 | |

| Reconciliation to Profit | | | | | | | | | | | | | | | | | |

| Profit for the year | | | | | | | | | | | | | | | | | 1,070 | |

| Income tax expense | | | | | | | | | | | | | | | | | 12,325 | |

| Interest expense, net | | | | | | | | | | | | | | | | | 54,198 | |

| Foreign exchange, net | | | | | | | | | | | | | | | | | 109,266 | |

| Other financial results - Net gain of inflation effects on the monetary items | | | | | | | | | | | | | | | | | (12,064) | |

| Other financial results, net | | | | | | | | | | | | | | | | | 24,258 | |

| Combined effects of IAS 29 and IAS 21 of the Argentine subsidiaries of Profit from operations | | | | | | | | | | | | | | | | | 1,494 | |

| Net (gain) from Fair value adjustment of investment property as per Segment Information | | | | | | | | | | | | | | | | | (1,080) | |

Adjusted Consolidated EBIT (unaudited) (1) | | | | | | | | | | | | | | | | | 189,467 | |

| Depreciation of Property, Plant and Equipment and amortization of Intangible Assets as per Segment Information | | | | | | | | | | | | | | | | | 142,288 | |

| Reverse of revaluation surplus derived from the disposals of assets before taxes | | | | | | | | | | | | | | | | | 10,198 | |

Adjusted Consolidated EBITDA (unaudited)(1) | | | | | | | | | | | | | | | | | 341,953 | |

(1)See “Presentation of Financial and Other Information” for the definitions of Adjusted Segment EBIT, Adjusted Consolidated EBIT, Adjusted Segment EBITDA and Adjusted Consolidated EBITDA.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the year ended December 31, 2019 |

| | Crops | | Rice | | Dairy | | All other

segments | | Farming

Subtotal | | Sugar,

Ethanol

and

Energy | | Land

Trans-

formation | | Corporate | | Total |

| | (In thousands of $) |

Adjusted Segment EBITDA

(unaudited) | | | | | | | | | | | | | | | | | |

Profit/(Loss) from

Operations Before Financing and Taxation | 20,992 | | | 13,334 | | | 9,901 | | | (842) | | | 43,385 | | | 95,412 | | | 2,504 | | | (19,659) | | | 121,642 | |

| Net loss from Fair value adjustment of investment property | — | | | — | | | — | | | 927 | | | 927 | | | — | | | — | | | — | | | 927 | |

| Reverse of revaluation surplus derived from the disposals of assets before taxes | — | | | — | | | — | | | — | | | — | | | — | | | 8,022 | | | — | | | 8,022 | |

Adjusted Segment EBIT (unaudited)(1) | 20,992 | | | 13,334 | | | 9,901 | | | 85 | | | 44,312 | | | 95,412 | | | 10,526 | | | (19,659) | | | 130,591 | |

| Depreciation and amortization | 4,662 | | | 6,994 | | | 5,064 | | | 181 | | | 16,901 | | | 157,657 | | | — | | | 20 | | | 174,578 | |

Adjusted Segment EBITDA (unaudited)(1) | 25,654 | | | 20,328 | | | 14,965 | | | 266 | | | 61,213 | | | 253,069 | | | 10,526 | | | (19,639) | | | 305,169 | |

| Reconciliation to Profit | | | | | | | | | | | | | | | | | |

| Profit for the year | | | | | | | | | | | | | | | | | 342 | |

| Income tax expense | | | | | | | | | | | | | | | | | 20,820 | |

Interest expense, net (2) | | | | | | | | | | | | | | | | | 50,078 | |

Foreign exchange, net (2) | | | | | | | | | | | | | | | | | 25,779 | |

Other financial results - Net gain of inflation effects on the monetary items (2) | | | | | | | | | | | | | | | | | (16,911) | |

Other financial results, net (2) | | | | | | | | | | | | | | | | | 41,275 | |

| Combined effects of IAS 29 and IAS 21 of the Argentine subsidiaries of Profit from operations | | | | | | | | | | | | | | | | | 259 | |

| Net gain from Fair value adjustment of investment property | | | | | | | | | | | | | | | | | 927 | |

Adjusted Consolidated EBIT (unaudited)(1) | | | | | | | | | | | | | | | | | 122,569 | |

| Depreciation and amortization | | | | | | | | | | | | | | | | | 174,578 | |

| Reverse of revaluation surplus derived from the disposals of assets before taxes | | | | | | | | | | | | | | | | | 8,022 | |

Adjusted Consolidated EBITDA (unaudited)(1) | | | | | | | | | | | | | | | | | 305,169 | |

(1)See “Presentation of Financial and Other Information” for the definitions of Adjusted Segment EBIT, Adjusted Consolidated EBIT, Adjusted Segment EBITDA and Adjusted Consolidated EBITDA.

(2)Prior periods have been recast to reflect the Company's change in accounting policy for the reclassification within financial results as explained in "Description of accounting policies that changed during 2020 and 2019" Note 34.1 to our Consolidated Financial Statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the year ended December 31, 2018 |

| | Crops | | Rice | | Dairy | | All other

segments | | Farming

Subtotal | | Sugar,

Ethanol

and

Energy | | Land

Trans-

formation | | Corporate | | Total |

| | (In thousands of $) |

Adjusted Segment EBITDA

(unaudited) | | | | | | | | | | | | | | | | | |

Profit/(Loss) from

Operations Before Financing and Taxation | 32,315 | | | 12,981 | | | 4,936 | | | 10,049 | | | 60,281 | | | 95,082 | | | 36,850 | | | (19,971) | | | 172,242 | |

| Net gain from fair value adjustment of investment property | — | | | — | | | — | | | (10,680) | | | (10,680) | | | — | | | — | | | — | | | (10,680) | |

Adjusted Segment EBIT (unaudited)(1) | 32,315 | | | 12,981 | | | 4,936 | | | (631) | | | 49,601 | | | 95,082 | | | 36,850 | | | (19,971) | | | 161,562 | |

| Depreciation and amortization | 1,697 | | | 5,846 | | | 2,253 | | | 171 | | | 9,967 | | | 143,202 | | | — | | | — | | | 153,169 | |

Adjusted Segment EBITDA (unaudited)(1) | 34,012 | | | 18,827 | | | 7,189 | | | (460) | | | 59,568 | | | 238,284 | | | 36,850 | | | (19,971) | | | 314,731 | |

| Reconciliation to Profit | | | | | | | | | | | | | | | | | |

| Loss for the year | | | | | | | | | | | | | | | | | (23,233) | |

| Income tax benefit | | | | | | | | | | | | | | | | | (1,024) | |

Interest expense, net (2) | | | | | | | | | | | | | | | | | 39,538 | |

Foreign exchange, net (2) | | | | | | | | | | | | | | | | | 68,787 | |

Other financial results - Net gain of inflation effects on the monetary items (2) | | | | | | | | | | | | | | | | | 25,211 | |

Other financial results, net (2) | | | | | | | | | | | | | | | | | 47,218 | |

| Combined effects of IAS 29 and IAS 21 of the Argentine subsidiaries of Profit from operations | | | | | | | | | | | | | | | | | 15,745 | |

| Net gain from fair value adjustment of investment property | | | | | | | | | | | | | | | | | (10,680) | |

Adjusted Consolidated EBIT (unaudited)(1) | | | | | | | | | | | | | | | | | 161,562 | |

| Depreciation and amortization | | | | | | | | | | | | | | | | | 153,169 | |

Adjusted Consolidated EBITDA (unaudited)(1) | | | | | | | | | | | | | | | | | 314,731 | |

(1)See “Presentation of Financial and Other Information” for the definitions of Adjusted Segment EBIT, Adjusted Consolidated EBIT, Adjusted Segment EBITDA and Adjusted Consolidated EBITDA.

(2)Prior periods have been recast to reflect the Company's change in accounting policy for the reclassification within financial results as explained in "Description of accounting policies that changed during 2020 and 2019" Note 34.1 to our Consolidated Financial Statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the year ended December 31, 2017 |

| | Crops | | Rice | | Dairy | | All other

segment | | Farming

Subtotal | | Sugar,

Ethanol

and

Energy | | Land

Trans-

formation | | Corporate | | Total |

| | (In thousands of $) |

Adjusted Segment EBITDA

(unaudited) | | | | | | | | | | | | | | | | | |

Profit/(Loss) from

Operations Before Financing and Taxation | 24,167 | | | 8,328 | | | 11,206 | | | 4,699 | | | 48,400 | | | 102,852 | | | — | | | (21,664) | | | 129,588 | |

| Net gain from fair value adjustment of investment property | — | | | — | | | — | | | (4,302) | | | (4,302) | | | — | | | — | | | — | | | (4,302) | |

Adjusted Segment EBIT (unaudited)(1) | 24,167 | | | 8,328 | | | 11,206 | | | 397 | | | 44,098 | | | 102,852 | | | — | | | (21,664) | | | 125,286 | |

| Depreciation and amortization | 1,511 | | | 3,851 | | | 1,037 | | | 159 | | | 6,558 | | | 144,449 | | | — | | | — | | | 151,007 | |

Adjusted Segment EBITDA (unaudited)(1) | 25,678 | | | 12,179 | | | 12,243 | | | 556 | | | 50,656 | | | 247,301 | | | — | | | (21,664) | | | 276,293 | |

| Reconciliation to Profit | | | | | | | | | | | | | | | | | |

| Profit for the year | | | | | | | | | | | | | | | | | 14,975 | |

| Income tax expense | | | | | | | | | | | | | | | | | (4,992) | |

| Interest expense, net | | | | | | | | | | | | | | | | | 41,078 | |

| Foreign exchange, net | | | | | | | | | | | | | | | | | 38,708 | |

| Other financial results, net | | | | | | | | | | | | | | | | | 39,819 | |

| Net gain from fair value adjustment of investment property | | | | | | | | | | | | | | | | | (4,302) | |

Adjusted Consolidated EBIT (unaudited)(1) | | | | | | | | | | | | | | | | | 125,286 | |

| Depreciation and amortization | | | | | | | | | | | | | | | | | 151,007 | |

Adjusted Consolidated EBITDA (unaudited)(1) | | | | | | | | | | | | | | | | | 276,293 | |

(1)See “Presentation of Financial and Other Information” for the definitions of Adjusted Segment EBIT, Adjusted Consolidated EBIT, Adjusted Segment EBITDA and Adjusted Consolidated EBITDA.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the year ended December 31, 2016 |

| | Crops | | Rice | | Dairy | | All other

segments | | Farming

Subtotal | | Sugar,

Ethanol

and

Energy | | Land

Trans-

formation | | Corporate | | Total |

| | (In thousands of $) |

Adjusted Segment EBITDA

(unaudited) | | | | | | | | | | | | | | | | | |

Profit/(Loss) from

Operations Before Financing and Taxation | 26,093 | | | 8,932 | | | 4,753 | | | 22,942 | | | 62,720 | | | 142,835 | | | — | | | (20,957) | | | 184,598 | |

| Net gain from fair value adjustment of investment property | — | | | — | | | — | | | (14,049) | | | (14,049) | | | — | | | — | | | — | | | (14,049) | |

Adjusted Segment EBIT (unaudited)(1) | 26,093 | | | 8,932 | | | 4,753 | | | 8,893 | | | 48,671 | | | 142,835 | | | — | | | (20,957) | | | 170,549 | |

| Depreciation and amortization | 1,369 | | | 2,766 | | | 964 | | | 192 | | | 5,291 | | | 122,209 | | | — | | | — | | | 127,500 | |

Adjusted Segment EBITDA (unaudited)(1) | 27,462 | | | 11,698 | | | 5,717 | | | 9,085 | | | 53,962 | | | 265,044 | | | — | | | (20,957) | | | 298,049 | |

| Reconciliation to Profit | | | | | | | | | | | | | | | | | |

| Profit for the year | | | | | | | | | | | | | | | | | 14,276 | |

| Income tax expense | | | | | | | | | | | | | | | | | 12,899 | |

| Interest expense, net | | | | | | | | | | | | | | | | | 40,527 | |

| Foreign exchange losses, net | | | | | | | | | | | | | | | | | 19,062 | |

| Other financial results, net | | | | | | | | | | | | | | | | | 97,834 | |

| Net gain from fair value adjustment of investment property | | | | | | | | | | | | | | | | | (14,049) | |

Adjusted Consolidated EBIT (unaudited)(1) | | | | | | | | | | | | | | | | | 170,549 | |

| Depreciation and amortization | | | | | | | | | | | | | | | | | 127,500 | |

Adjusted Consolidated EBITDA (unaudited)(1) | | | | | | | | | | | | | | | | | 298,049 | |

(1)See “Presentation of Financial and Other Information” for the definitions of Adjusted Segment EBIT, Adjusted Consolidated EBIT, Adjusted Segment EBITDA and Adjusted Consolidated EBITDA.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Free Cash Flow | 2020 | | 2019 | | 2018 | | 2017 | | 2016 |

| Net cash generated from operating activities | 257,125 | | | 322,110 | | | 218,513 | | | 237,105 | | | 255,401 | |

| Net cash used in investing activities | (121,916) | | | (249,639) | | | (175,109) | | | (188,335) | | | (122,014) | |

| Interest paid | (60,026) | | | (53,996) | | | (50,021) | | | (41,612) | | | (48,400) | |

| Lease payments | (40,336) | | | (49,081) | | | — | | | — | | | — | |

| Reversal of Expansion Capital expenditures (unaudited) | 56,719 | | | 129,074 | | | 98,011 | | | 70,804 | | | 48,295 | |

| IAS 29 & IAS 21 effect for operating Activities | 14,956 | | | (23,550) | | | (7,598) | | | — | | | — | |

| IAS 29 & IAS 21 effect for investing Activities | 429 | | | (2,922) | | | (3,935) | | | — | | | — | |

| IAS 29 & IAS 21 effect for Interest Paid | 1,639 | | | (4,408) | | | — | | | — | | | — | |

| Adjusted Free Cash Flow from Operations (unaudited) | 108,590 | | | 67,588 | | | 79,861 | | | 77,962 | | | 133,282 | |

| Expansion Capital expenditures (unaudited) | (56,719) | | | (129,074) | | | (98,011) | | | (70,804) | | | (48,295) | |

| Adjusted Free Cash Flow (unaudited) | 51,871 | | | (61,486) | | | (18,150) | | | 7,158 | | | 84,987 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Indebtedness | 2020 | | 2019 | | 2018 | | 2017 | | 2016 |

| Net Debt (unaudited) | 634,808 | | | 678,004 | | | 588,481 | | | 548,763 | | | 476,828 | |

| Net Debt / Adjusted Consolidated EBITDA (unaudited) | 1.86 x | | 2.22 x | | 1.87 | x | | 1.98 | x | | 1.60 | x |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation - Net Debt | 2020 | | 2019 | | 2018 | | 2017 | | 2016 |

| Total Borrowings | 971,090 | | | 968,280 | | | 862,116 | | | 817,958 | | | 635,396 | |

| Cash and cash equivalents | (336,282) | | | (290,276) | | | (273,635) | | | (269,195) | | | (158,568) | |

| Net Debt (unaudited) | 634,808 | | | 678,004 | | | 588,481 | | | 548,763 | | | 476,828 | |

Reconciliation of Adjusted Free Cash Flow to Net increase/(decrease) in Cash and Cash Equivalents

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2020 | | 2019 | | 2018 | | 2017 | | 2016 |

| Net increase/(decrease) in cash and cash equivalents | 81,290 | | | 34,608 | | | 22,550 | | | 118,964 | | | (48,295) | |

| Interest Paid | (60,026) | | | (53,996) | | | (50,021) | | | (41,612) | | | (48,400) | |

| Lease Payments | (40,336) | | | (49,081) | | | — | | | — | | | — | |

| Net cash generated from financing activities | 53,919 | | | 37,863 | | | 20,854 | | | (70,194) | | | 181,682 | |

| IAS 29 & IAS 21 effect for operating activities | 14,956 | | | (23,550) | | | (7,598) | | | — | | | — | |

| IAS 29 & IAS 21 effect for investing activities | 429 | | | (2,922) | | | (3,935) | | | — | | | — | |

| IAS 29 & IAS 21 effect for interest paid | 1,639 | | | (4,408) | | | — | | | — | | | — | |

| Adjusted Free Cash Flow (unaudited) | 51,871 | | | (61,486) | | | (18,150) | | | 7,158 | | | 84,987 | |

Reconciliation of Adjusted Free Cash Flow from operations to Net increase/(decrease) in Cash and Cash Equivalents

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2020 | | 2019 | | 2018 | | 2017 | | 2016 |

| Net increase/(decrease) in cash and cash equivalents | 81,290 | | | 34,608 | | | 22,550 | | | 118,964 | | | (48,295) | |

| Expansion Capital Expenditures (unaudited) | 56,719 | | | 129,074 | | | 98,011 | | | 71,891 | | | 48,295 | |

| Interest Paid | (60,026) | | | (53,996) | | | (50,021) | | | (41,612) | | | (48,400) | |

| Lease payments | (40,336) | | | (49,081) | | | — | | | — | | | — | |

| Net cash used / (generated) from financing activities | 53,919 | | | 37,863 | | | 20,854 | | | (70,194) | | | 181,682 | |

| IAS 29 & IAS 21 effect for operating activities | 14,956 | | | (23,550) | | | (7,598) | | | — | | | — | |

| IAS 29 & IAS 21 effect for investing activities | 429 | | | (2,922) | | | (3,935) | | | — | | | — | |

| IAS 29 & IAS 21 effect for interest paid | 1,639 | | | (4,408) | | | — | | | — | | | — | |

| Adjusted Free Cash Flow from operations (unaudited) | 108,590 | | | 67,588 | | | 79,861 | | | 79,049 | | | 133,282 | |

B. CAPITALIZATION AND INDEBTEDNESS

Not Applicable.

C. REASONS FOR THE OFFER AND USE OF PROCEEDS

Not Applicable.

D. RISK FACTORS

Investing in our common shares involves a high degree of risk. Before making an investment decision, you should carefully consider the information contained in this annual report, particularly the risks described below, as well as in our Consolidated Financial Statements and accompanying notes. Our business activities, cash flow, financial condition and results of operations could be materially and adversely affected by any of the risks and uncertainties mentioned below. The market price of our common shares may decrease due to any of these risks or other factors, and you may lose all or part of your investment. The risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business operations.

For purposes of this section, the indication that a risk, uncertainty or problem may or will have a “material adverse effect on us” or that we may experience a “material adverse effect” means that the risk, uncertainty or problem could have a material adverse effect on our business, financial condition or results of operations and/or the market price of our common shares, except as otherwise indicated or as the context may otherwise require. Investors should view similar expressions in this section as having a similar meaning.

Summary of Risk Factors

The risks facing us and our business are many and varied. Set forth below is a summary of the risk factors more fully described herein.

The risks related to our business and industries include risks related to:the following:

• health epidemics, and the COVID-19 in particular, that could adversely impact our ability to operate our business and results of operations;

• unpredictableUnpredictable weather conditions, including as a result of climate change, pest infestations and diseases that may have an adverse impact on agricultural production;production.

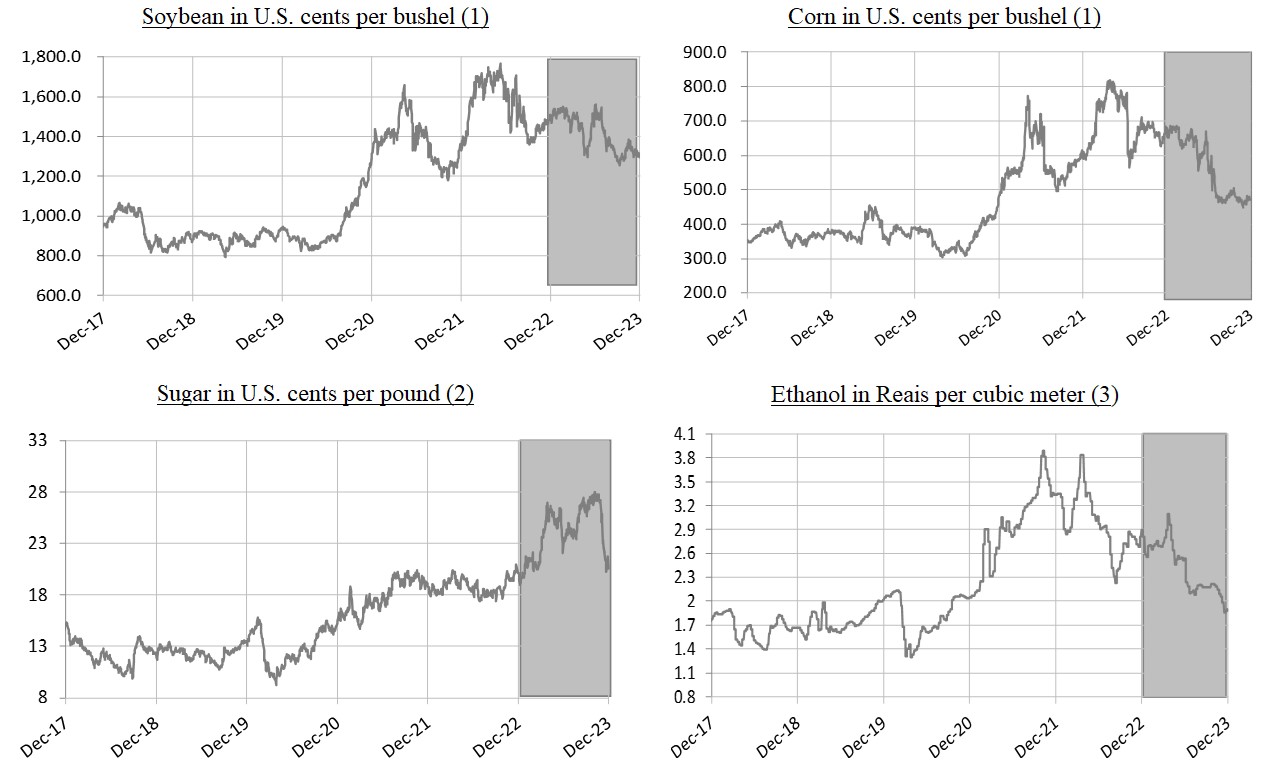

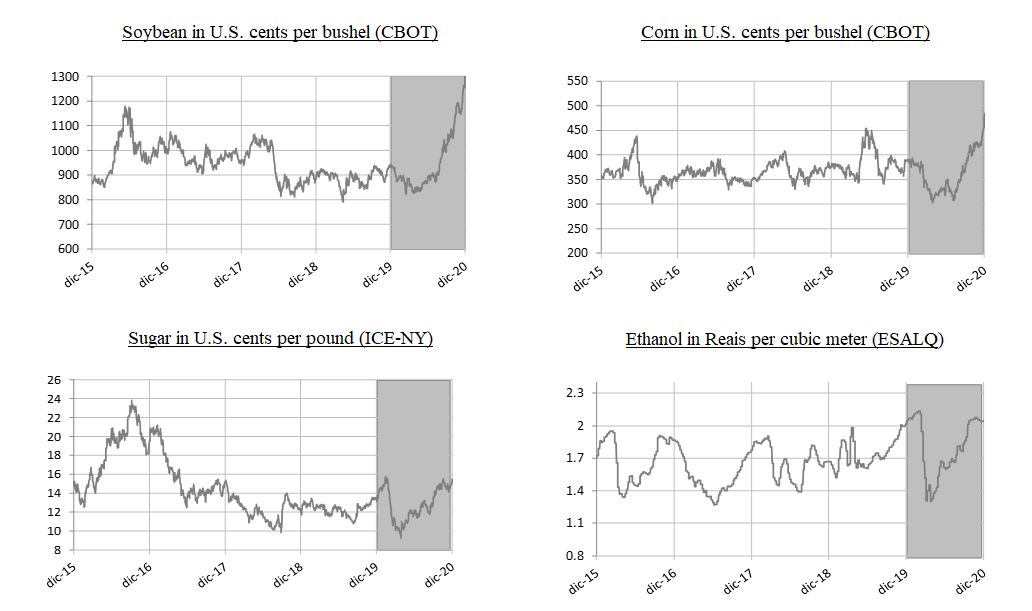

• fluctuationsFluctuations in market prices for our products that could adversely affect our financial condition and results of operations;operations.

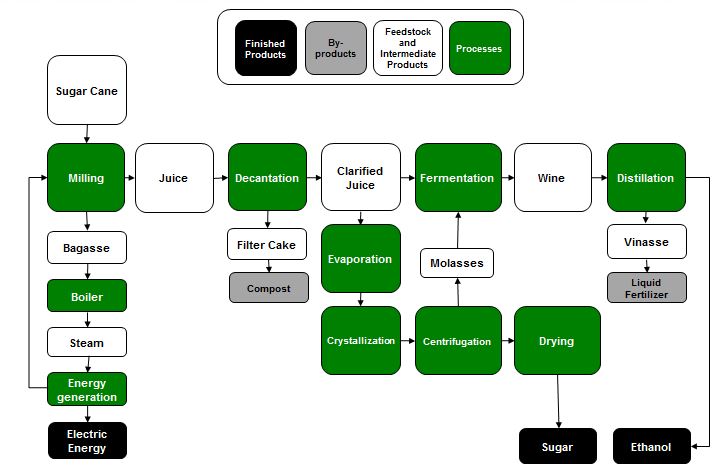

• the relationship between the price of ethanol and sugarEthanol prices are correlated to the price of oil,sugar and are also closely correlated to the price of petroleum, so that a decline in the price of sugar or a decline in the price of oilpetroleum will adversely affect our sugar and ethanol businesses;businesses.

• theThe expansion of our business through acquisitions which poses risks that may reduce the benefits we anticipate from these transactions;transactions.

• increasesA significant increase in the price of raw materials we use in our operations, or the shortage of such raw materials, that could adversely affect our results of operations;operations.

• increasesWe cannot guarantee that our suppliers will not engage in improper practices, including inappropriate labor or manufacturing practices.

•Increased fuel and energy prices and frequent interruptions of energy supply that could adversely affect our business;business.

• our dependenceOur business may be materially and adversely affected by the emergence of epidemics or pandemics, such as COVID 19.

•We depend on stable international trade and economic and other conditions in key export markets for our products;products.

• aA worldwide economic downturn that could weaken demand for our products or lower prices;prices.

• the seasonality of ourOur business is seasonal and our results which may fluctuate significantly depending on the growing cycle of our crops;crops.

• potential diseases to our dairy cattle;

•We face significant competition from Brazilian and foreign producers,across our business segments, which could adversely affect our financial performance;performance.

• ourOur current insurance coverage which may not be sufficient to cover our potential losses;losses.

• a reduction in market demand for ethanol or a change in governmentalCybersecurity incidents, including attacks on the infrastructure necessary to maintain our IT systems, may adversely affect us.

•Governmental policies reducing the amount of ethanol required to be added to gasoline, whichor eliminating tax incentives for flex-fuel vehicles, may adversely affect our business;business.

• competition from alternative fuels, productsGrowth in the sale and production methods;distribution of ethanol depends in part on infrastructure improvements, which may not occur on a timely basis, if at all.

• the lack of liquidity of aA substantial portion of our assets constituted by farmland;is farmland that is highly illiquid.

• theWe have entered into agriculture partnership agreements in respect of a significant portion of our sugarcane plantationsplantations.

•Our performance depends on favorable working relationships with our employees and associated risks;

•compliance with labor disputes from time to time that maylaws. Any strain on these relationships or increased labor costs could adversely affect us;our business.

• a failure toWe may not possess all of the permits and licenses required to operate our business, or failurewe may fail to renew or maintain the licenses and permits we currently hold;

• extensive environmental regulation, and concerns regarding climate change that mayhold which could subject us to even stricter environmental regulations;fines and other penalties.