UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

☐

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20172019

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________________ to __________________.

OR

☐

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report __________________.

Commission file number 001-38376

Central Puerto S.A.

(Exact name of Registrant as specified in its charter)

Port Central S.A.

(Translation of Registrant’s name into English)

REPUBLIC OF ARGENTINA

(Jurisdiction of incorporation or organization)

Avenida Thomas Edison 2701

C1104BAB Buenos Aires

Republic of Argentina

(Address of principal executive offices)

Fernando Roberto Bonnet

Avenida Thomas Edison 2701

C1104BAB Buenos Aires

Republic of Argentina.

Facsimile: +54 (11) 4317-5900

Email: inversores@centralpuerto.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| American Depositary Shares, each representing 10 common shares of Central Puerto S.A.* | CEPU | New York Stock Exchange* |

| | |

*

Not for trading, but only in connection with the registration of American Depositary Shares pursuant to the requirements of the New York Stock Exchange.

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

| | |

| Title of each class | | Outstanding at December 31, 20172019 |

| Common shares, nominal value Ps.1.00 per share | | 1,514,022,256 |

| | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐☒ No ☒☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.*

*The registrant became subject to such requirements on February 1, 2018.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). *

*The registrant became subject to such requirements on February 1, 2018.

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐☒ Accelerated filer ☐ Non-accelerated filer ☒☐ Emerging growth company ☒☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (§ 15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ International Financial Reporting Standards as issued Other ☐

by the International Accounting Standards Board ☒

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes ☐ No ☐

TABLE OF CONTENTS

| Item 1. | Identity of Directors, Senior Management and Advisors | 1 |

| Item 2. | Offer Statistics and Expected Timetable | 1 |

| Item 3. | Key Information | 1 |

| Item 3.A. | Selected Financial Data | 1 |

| Item 3.B | Capitalization and indebtedness | 5 |

| Item 3.C | Reasons for the offer and use of proceeds | 5 |

| Item 3.D | Risk Factors | 5 |

| Item 4. | Information of the Company | 3040 |

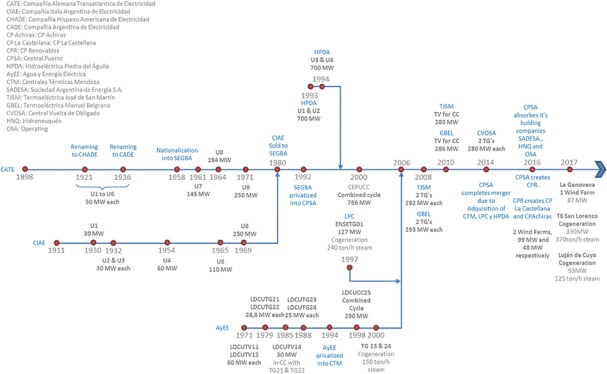

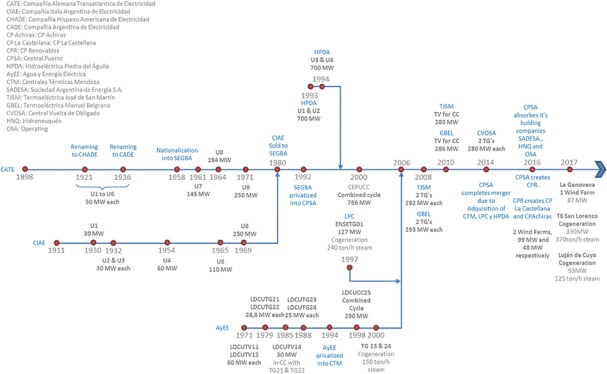

| Item 4.A | History and development of the Company | 3245 |

| Item 4.B | Business overview | 3650 |

| Item 4.C | Organizational structure | 117145 |

| Item 4.D | Property, plants and equipment | 118145 |

| Item 5. | Operating and Financial Review and Prospects | 119147 |

| Item 5.A | Operating Results | 119147 |

| Item 5.B | Liquidity and Capital Resources | 145173 |

| Item 5.C | Research and Development, patents and licenses, etc. | 151181 |

| Item 5.D | Trend Information | 151181 |

| Item 5.E | Off-balance sheet arrangements | 153184 |

| Item 5.F | Contractual Obligations | 153184 |

| Item 5.G | Safe Harbor | 155186 |

| Item 6. | Directors, Senior Management and Employees | 155186 |

| Item 7. | Shareholders and Related Party Transactions | 167198 |

| Item 7.A. | Major Shareholders | 167198 |

| Item 7.B | Related Party Transactions | 168199 |

| Item 7.C | Interests of experts and counsel | 170201 |

| Item 8. | Financial Information | 170201 |

| Item 8.A. | Consolidated Statements and Other Financial Information. | 170201 |

| Item 8.B | Significant Changes | 171203 |

| Item 9. | The Offer and Listing | 173204 |

| Item 9.A. | Offer and listing details | 173204

|

| Item 9.B. | Plan of Distribution | 174204 |

| Item 9.C. | Markets | 174204 |

| Item 9.D. | Selling Shareholders | 174204 |

| Item 9.E. | Dilution | 174204 |

| Item 9.F. | Expenses of the issue | 174204 |

| Item 10. | Additional Information | 175204 |

| Item 10.A. | Share capital | 175204 |

| Item 10.B. | Memorandum and articles of association | 175204 |

| Item 10.C | Material contracts | 180209 |

| Item 10.D | Exchange Controls | 180210 |

| Item 10.E | Taxation | 181215 |

| Item 10.F | Dividends and paying agents | 188223 |

| Item 10.G | Statement by experts | 188223 |

| Item 10.H | Documents on display | 188223 |

| Item 10.I. | Subsidiary Information | 188223 |

| Item 11. | Quantitative and Qualitative Disclosures about Market Risk | 188223 |

| Item 12. | Description of Securities Other Than Equity Securities | 191228 |

| Item 12.A | Debt Securities | 191228 |

| Item 12.B | Warrants and Rights | 191228 |

| Item 12.C | Other Securities | 191228 |

| Item 12.D | American Depositary Shares | 191228 |

| Item 13. | Defaults, Dividend Arrearages and Delinquencies | 192229 |

| Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | 192229 |

| Item 15. | Controls and Procedures | 193229 |

| Item 16.A | Audit committee financial expert | 193230 |

| Item 16.B | Code of Ethics | 193230 |

| Item 16.C | Principal Accountant Fees and Services | 193231 |

| Item 16.D | Exemptions from the Listing Standards for Audit Committees | 194231 |

| Item 16.E | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 194231 |

| Item 16.F | Change in Registrant’s Certifying Accountant | 194231 |

| Item 16.G | Corporate Governance | 194232 |

| Item 16.H. | Mine Safety Disclosure | 197234 |

| Item 17. | Financial Statements | 197234 |

| Item 18. | Financial Statements | 197235 |

| Item 19. | Exhibits | 198235 |

CERTAIN DEFINITIONS

In this annual report, except where otherwise indicated or where the context otherwise requires:

●

“Argentine Corporate Law” refers to Law No. 19,550, as amended;

●

“Authorized Generators” refers to electricity generators that do not have contracts in the term market in any of its methods;

●

“BYMA” refers to Bolsas y Mercados Argentinos S.A.;

●

“CAMMESA”CAMMESA” refers to Compañía Administradora del Mercado Mayorista Eléctrico Sociedad Anónima. See “Item 4.B, Business Overview—Overview— The Argentine Electric Power Sector—Sector—General Overview of Legal Framework—Framework—CAMMESA;”

●

“CNV” refers to the Comisión Nacional de Valores, the Argentine Securities Commission;

●

“COD” refers to Commercial Operation Date, the day in which a generation unit is authorized by CAMMESA (in Spanish, “Habilitación Comercial”) to sell electric energy through the grid under the applicable commercial conditions;

●

“CTM”CTM” refers to Centrales Térmicas Mendoza S.A.;

●

“CVO” refers to the thermal plant Central Vuelta de Obligado;

●

“CVO Agreement” refers to the Agreement for Project Management and Operation, Increase of Thermal Generation Availability and Adaptation of Remuneration for Generation 2008-2011” executed on November 25, 2010 among the Secretariat of Energy and Central Puerto along with other electric power generators;

●

“CVOSA”CVOSA” refers to Central Vuelta de Obligado S.A.;

●

“Ecogas”Ecogas” refers collectively to Distribuidora de Gas Cuyana (“DGCU”(“DGCU”) and Distribuidora de Gas del Centro (“DGCE”(“DGCE”);

●

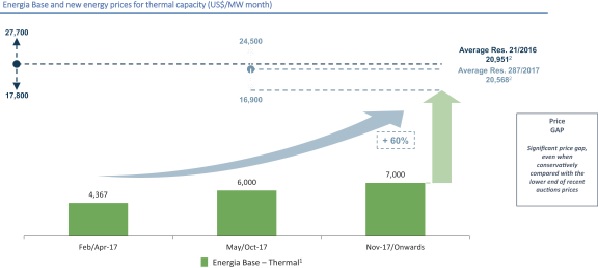

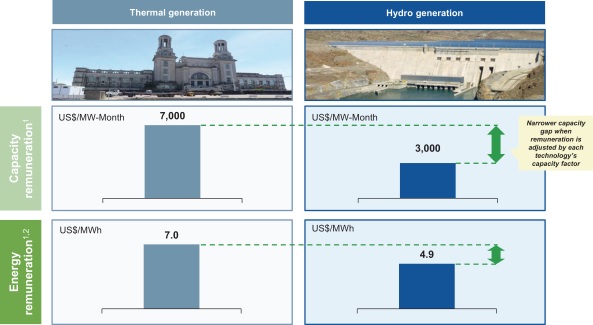

“Energía Base”Base” refers to the regulatory framework established under Resolution SE No. 95/13, as amended, and, sincefrom February 2017 to February 2019, regulated by Resolution SEE No. 19/17.17, from March 2019 to January 2020, regulated by Resolution No. 1/19 of the Secretary of Renewable Resources and Electric Market of the National Ministry of Economy and since February 2020 regulated by Resolution No. 31/20 of the Secretary of Energy. See “Item“Item 4.B, Business Overview—Overview—The Argentine Electric Power Sector;”

●

“Energía Plus”Plus” refers to the regulatory framework established under Resolution SE No. 1281/06, as amended. See “Item“Item 4.B, Business Overview—Overview—The Argentine Electric Power Sector—Sector—Structure of the Industry—Energ’Industry—Energía Plus;”

●

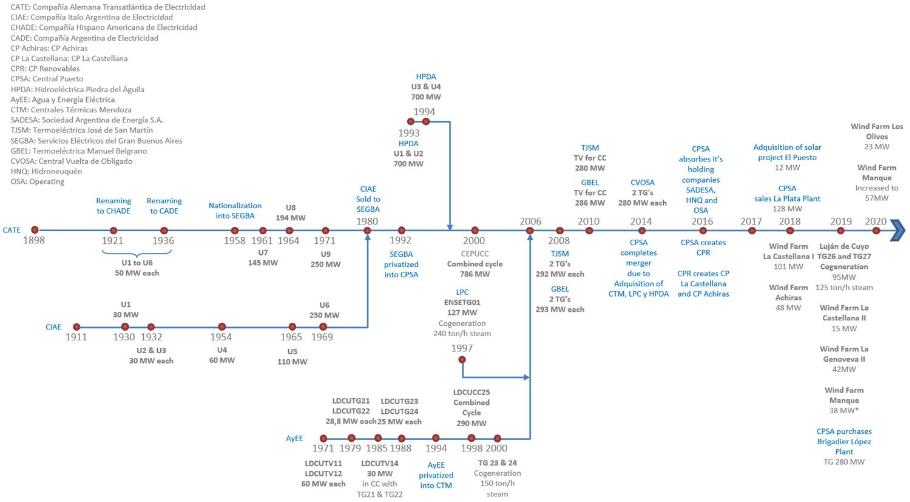

“FONINVEMEM”FONINVEMEM” or “FONI” refers to the Fondo para Inversiones Necesarias que Permitan Incrementar la Oferta de Energía Eléctrica en el Mercado Eléctrico Mayorista (the Fund for Investments Required to Increase the Electric Power Supply). and similar programs, including the CVO Agreement. See “Item“Item 4.B, Business Overview—Overview—The Argentine Electric Power Sector—Sector—Structure of the Industry—Industry—The FONINVEMEM and Similar ProgramsPrograms;”

●

“FONINVEMEM Plants” refers to the plants José de San Martín, Manuel Belgrano and Vuelta de Obligado;

●

“HPDA”HPDA” refers Hidroeléctrica Piedra del Águila S.A., the corporation that previously owned the Piedra del AguilaÁguila plant;

●

“IEASA” refers to Integración Energética Argentina S.A.;

●

“IGCE” refers to Inversora de Gas del Centro S.A.;

●

“IGCU” refers to Inversora de Gas Cuyana S.A.;

●

“La Plata Plant Sale”Sale” refers to the sale of the La Plata plant to YPF EE, effective as of January 5, 2018. For further information on the La Plata Plant Sale, see “Item 4. Information“Item 4.A. History and development of the Company—Recent Developments—La Plata Plant Sale;”

●

“La Plata Plant Sale Effective Date”Date” is January 5, 2018. For more information on the La Plata Plant Sale Effective Date, see “Item 4. Information“Item 4.A. History and development of the Company—Recent Developments—La Plata Plant Sale;”

●

“LPC”LPC” refers to La Plata Cogeneración S.A., the corporation that owned the La Plata plant prior to us;

●

“LVFVD”LVFVD” refers to liquidaciones de venta con fecha de vencimientos a definir, or receivables from CAMMESA without a fixed due date. See “Item“Item 4.B, Business Overview—Overview—FONINVEMEM and Similar Programs;”

●

“MATER” refers to Term Market for Renewable Energy (“MATER”) Resolution No. 281-E/17;

●

“MULC”MULC” refers to the foreign exchange market;

●

“PPA” refers to Power Purchase Agreements, power capacity and energy supply agreements for a defined period of time or energy quantity;

●

“Resolution SRRyME No. 1/19” refers to the resolution No. 1/19 issued on March 1, 2019 by the Secretary of Renewable Resources and Electric Markey of the National Ministry of Economy by which the Secretary modified the remuneration scheme (for capacity and energy) applicable to Authorized Generators (electricity generators which do not have contracts in the term market in any of its modalities) acting in the WEM;

●

“Resolution 31/20” or “Res. 31/20” refers to the resolution No. 31/20 issued on February 27, 2020 by the Secretary of Energy of the National Ministry of Production Development by which the Secretary modified the remuneration scheme (for capacity and energy) applicable from February 1, 2020, to Authorized Generators (electricity generators which do not have contracts in the term market in any of its modalities) acting in the WEM;

●

“SADI” refers to the Argentine Interconnection System;

●

“sales under contracts”contracts” refers collectively to (i) term market sales of energy under contracts with private and public sector counterparties, and (ii) sales of energy sold under the Energía Plus;Plus and (iii) sales of energy under the RenovAr Program;

●

the “spot market”“spot market” refers to energy sold by generators to the WEM and remunerated by CAMMESA pursuant to the framework in place prior to the Energía Base. See “Item“Item 4.B, Business Overview—Overview—The Argentine Electric Power Sector—Sector—Structure of the Industry—Industry—Electricity Dispatch and Spot Market Pricing prior to Resolution SE No. 95/13;”

●

“PPA” refers to capacity and energy supply agreements with customers;

●

“YPF”YPF” refers to YPF S.A., Argentina’sArgentina’s state-owned oil and gas company;

●

“YPF EE”EE” refers to YPF Energía EléEléctrica S.A., a subsidiary of YPF; and

●

“WEM”WEM” refers to the Argentine Mercado Eléctrico Mayorista, the wholesale electric power market. See “Item“Item 4.B, Business Overview—Overview—The Argentine Electric Power Sector—Sector—General Overview of Legal Framework—Framework—CAMMESA.”

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Financial Statements

We maintain our financial books and records and publish our consolidated financial statements (as defined below) in Argentine pesos, which is our functional currency. This annual report contains our audited consolidated financial statements as of December 31, 20172019 and 20162018 and for each of the years ended December 31, 2019, 2018, and 2017 2016 and 2015 (our “audited“audited consolidated financial statements”statements”), which were approved by our board of directors (our “Board of Directors”) on April 24, 2018.22, 2020. Our Board of Directors delegated to our Management the issuance of such financial statements, once the auditor's reports have been issued. The auditor's reports have been issued on April 24,2020.

We prepare our audited consolidated financial statements in Argentine pesos and in conformity with the IFRS as issued by the IASB.

Because we qualify as an emerging growth company (an “EGC”) as defined in Section 2(a)(19)In accordance with IAS 29, the restatement of the U.S. Securities Actfinancial statements is necessary when the functional currency of 1933,an entity is the currency of a hyperinflationary economy. To define a hyperinflationary state, IAS 29 provides a series of non-exclusive guidelines that consist of (i) analyzing the behavior of the population, prices, interest rates and wages before the evolution of price indexes and the loss of the currency’s purchasing power, and (ii) as amended (the a quantitative characteristic, verifying if the three-year cumulative inflation rate approaches or exceeds 100%. Due to macroeconomic factors, the triennial inflation was above that figure in 2018 and Argentina has been considered hyperinflationary since July 1, 2018. See “Risks Relating to Argentina—As of July 1“stSecurities Act, 2018, the Argentine Peso qualifies as a currency of a hyperinflationary economy and we are required to restate our historical financial statements to apply inflationary adjustments, which could adversely affect our results of operations and financial condition and those of our Argentine subsidiaries” and “—If the current levels of inflation do not decrease, the Argentine economy could be adversely affected.”)

Therefore, our audited consolidated financial statements included herein, including the figures for the previous periods (this fact not affecting the decisions taken on the financial information for such periods), we have elected to provideand, unless otherwise stated, the financial information included elsewhere in this annual report, were restated to consider the changes in the general purchasing power of the functional currency of the Company (Argentine peso) pursuant to IAS 29 and General Resolution no. 777/2018 of the CNV. Consequently, the financial statements are stated in the current measurement unit as of December 31, 2019. The information included in our audited consolidated financial statements is not comparable to the financial statements previously published by us. For more limited disclosures than an issuer that would not qualify as an EGC would be requiredinformation, see “Item 5.A. Operating Results—Factors Affecting our Results of Operations—Inflation” and Note 2.1.2 to provide. our audited consolidated financial statements.

We remind investors that we are required to file financial statements and other periodic reports with the CNV because we are a public company in Argentina. Investors can access our historical financial statements published in Spanish on the CNV’sCNV’s website at www.cnv.gob.ar.www.cnv.gob.ar. The information found on the CNV’sCNV’s website is not a part of this annual report. Investors are cautioned not to place undue reliance on our financial statements not included in this annual report.

We have determined that, as of December 31, 2017, the Argentine peso does not qualify as a currency of a hyperinflationary economy according to the guidelines IAS 29, Financial Reporting in Hyperinflationary Economies, whereby financial information recorded in a hyperinflationary currency is adjusted by applying a general price index and expressed in the measuring unit (the hyperinflationary currency) current at the end of the reporting period. Therefore, the consolidated financial statements included herein were not restated in constant currency. For more information, see “Item 5.A. Operating Results—Factors Affecting our Results of Operations—Inflation.” Notwithstanding the above, in recent years, certain macroeconomic variables affecting our business, such as the cost of labor, the exchange rate of the Argentine peso to the U.S. dollar and costs of sales associated with inputs necessary to run our business that are denominated in pesos, have experienced significant annual changes, which, although they may not surpass the levels established in IAS 29 are significant and should be considered in the assessment and interpretation of our financial performance reported in this annual report. See “Item 3.D. Risk Factors—Risks Relating to Argentina—If the current levels of inflation do not decrease, the Argentine economy could be adversely affected.” Argentine inflation could therefore affect the comparability of the different periods presented herein.

Currency and Rounding

All references herein to “pesos,“pesos,” “Argentine pesos”“Argentine pesos” or “Ps.“Ps.” are to Argentine pesos, the legal currency of Argentina. All references to “U.S.“U.S. dollars,” “dollars”“dollars” or “US$“US$” are to U.S. dollars. All references to “SEK$“SEK$” are to Swedish krona. A “billion”“billion” is a thousand million.

Solely for the convenience of the reader, we have translated certain amounts included in this annual report from pesos into U.S. dollars, unless otherwise indicated, using the seller rate for U.S. dollars quoted by the Banco de la Nación Argentina for wire transfers (divisas) as of December 29, 2017,31, 2019, of Ps.18.649Ps.59.89 per US$1.00. The Federal Reserve Bank of New York does not report a noon buying rate for pesos. The U.S. dollar equivalent information presented in this annual report is provided solely for the convenience of the reader and should not be construed to represent that the peso amounts have been, or could have been or could be, converted into U.S. dollars at such rates or at any other rate. See “Item 3.A. Selected Financial Data—Exchange Rates.”

Certain figures included in this annual report and in the audited consolidated financial statements contained herein have been rounded for ease of presentation. Percentage figures included in this annual report have in some cases been calculated on the basis of such figures prior to rounding. For this reason, certain percentage amounts in this annual report may vary from those obtained by performing the same calculations using the figures in this annual report and in the consolidated financial statements contained herein. Certain other amounts that appear in this annual report may not sum due to rounding.

Market Share and Other Information

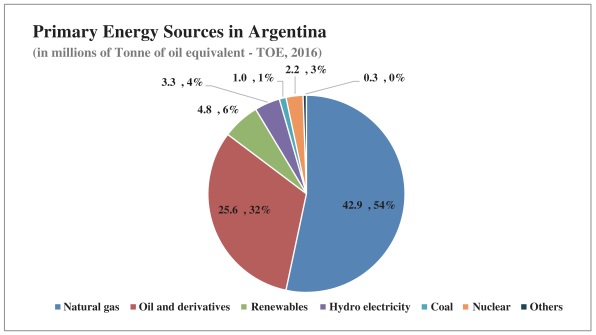

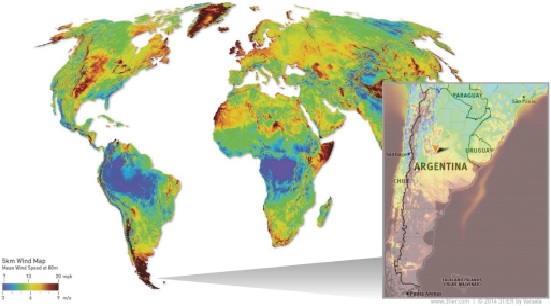

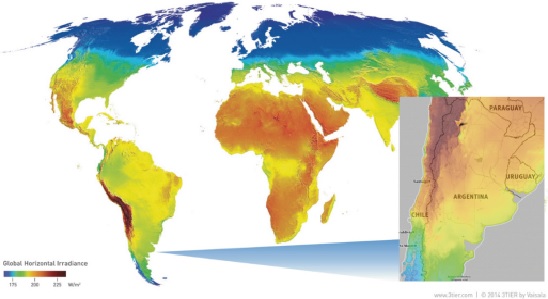

The information set forth in this annual report with respect to the market environment, market developments, growth rates and trends in the markets in which we operate areis based on information published by the Argentine federal and local governments through the Instituto Nacional de Estad’siticasEstadísiticas y Censos (the National Statistics and Census Institute, or “INDEC”“INDEC”), the Ministry of Interior, the Ministry of Energy, the Banco Central de la República Argentina (the Argentine Central Bank, or “Central Bank”) CAMMESA, the Dirección General de Estadística y Censos de la Ciudad de Buenos Aires (General Directorate of Statistics and Census of the City of Buenos Aires) and the Dirección Provincial de Estadística y Censos de la Provincia de San Luis (Provincial Directorate of Statistics and Census of the Province of San Luis), as well as on independent third-party data, statistical information and reports produced by unaffiliated entities, such as well as on our own internal estimates. In addition, this annual report contains information from (i) an industry report commissioned by us and prepared by Daniel G. Gerold of G&G Energy Consultants, an independent research firm, to provide information regarding our industry and the Argentine market and (ii) Vaisala, Inc. (“(“Vaisala - 3 Tier”Tier”), a company that develops, manufactures and markets products and services for environmental and industrial measurement.

This annual report also contains estimates that we have made based on third-party market data. Market studies are frequently based on information and assumptions that may not be exact or appropriate.

Although we have no reason to believe any of this information or these sources are inaccurate in any material respect, we have not verified the figures, market data or other information on which third parties have based their studies, nor have we confirmed that such third parties have verified the external sources on which such estimates are based. Therefore, we do not guarantee, nor do we assume responsibility for, the accuracy of the information from third-party studies presented in this annual report.

This annual report also contains estimates of market data and information derived therefrom which cannot be gathered from publications by market research institutions or any other independent sources. Such information is based on our internal estimates. In many cases there is no publicly available information on such market data, for example from industry associations, public authorities or other organizations and institutions. We believe that these internal estimates of market data and information derived therefrom are helpful in order to give investors a better understanding of the industry in which we operate as well as our position within this industry. Although we believe that our internal market observations are reliable, our estimates are not reviewed or verified by any external sources. These may deviate from estimates made by our competitors or future statistics provided by market research institutes or other independent sources. We cannot assure you that our estimates or the assumptions are accurate or correctly reflect the state and development of, or our position in, the industry.

FORWARD-LOOKING STATEMENTS

This annual report contains estimates and forward-looking statements, principally in “Item“Item 3.D. Risk Factors,” “Item 4.B. Business Overview”Overview” and “Item 5. Operating and Financial Review and Prospects.”

Our estimates and forward-looking statements are mainly based on our current beliefs, expectations and estimates of future courses of action, events and trends that affect or may affect our business and results of operations. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to several risks and uncertainties and are made in light of information currently available to us.

Many important factors, in addition to those discussed elsewhere in this annual report, could cause our actual results to differ substantially from those anticipated in our forward-looking statements, including, among other things:

●

changes in general economic, financial, business, political, legal, social or other conditions in Argentina;

●

changes in conditions elsewhere in Latin America or in either developed or emerging markets;

●

changes in capital markets in general that may affect policies or attitudes toward lending to or investing in Argentina or Argentine companies, including volatility in domestic and international financial markets;

●

increased inflation;the impact of political developments and uncertainties relating to political and economic conditions in Argentina, including the policies of the new government in Argentina, on the demand for securities of Argentine companies;

●

fluctuations in exchange rates, including a significant devaluation of the Argentine peso;

●

changes in the law, norms and regulations applicable to the Argentine electric power and energy sector, including changes to the current regulatory frameworks, changes to programs established to incentivize investments in new generation capacity and reductions in government subsidies to consumers;

●

our ability to develop our expansion projects and to win awards for new potential projects;

●

increases in financing costs or the inability to obtain additional debt or equity financing on attractive terms, which may limit our ability to fund new activities;

●

government intervention, including measures that result in changes to the Argentine labor market, exchange market or tax system;

●

adverse legal or regulatory disputes or proceedings;

●

changes in the price of energy, power and other related services;

●

changes in the prices and supply of natural gas or liquid fuels;

●

changes in the amount of rainfall and accumulated water;

●

changes in environmental regulations, including exposure to risks associated with our business activities;

●

risks inherent to the demand for and sale of energy;

●

the operational risks related to the generation, as well as the transmission and distribution, of electric power;

●

ability to implement our business strategy, including the ability to complete our construction and expansion plans in a timely manner and according to our budget;

●

competition in the energy sector, including as a result of the construction of new generation capacity;

●

exposure to credit risk due to credit arrangements with CAMMESA;

●

our ability to retain key members of our senior management and key technical employees;

●

the effects of a pandemic or epidemic and any subsequent mandatory regulatory restrictions or containment measures;

●

our relationship with our employees; and

●

other factors discussed under “Item“Item 3.D.—Risk Factors”Factors” in this annual report.

The words “believe,“believe,” “may,“may,” “will,“will,” “aim,“aim,” “estimate,“estimate,” “continue,“continue,” “anticipate,“anticipate,” “intend,“intend,” “expect,“expect,” “forecast”“forecast” and similar words are intended to identify forward-looking statements. Forward-looking statements include information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities, the effects of future regulation and the effects of competition. Forward-looking statements speak only as of the date they were made, and we do not undertake any obligation to update publicly or to revise any forward-looking statements after we distribute this annual report because of new information, future events or other factors, except as required by applicable law. In light of the risks and uncertainties described above, the forward-looking events and circumstances discussed in this annual report might not occur and do not constitute guarantees of future performance. Because of these uncertainties, you should not make any investment decisions based on these estimates and forward-looking statements.

PART I

Item 1.

Identity of Directors, Senior Management and Advisors

Not applicable.

Offer Statistics and Expected Timetable

Not applicable.

Item 3.A.

Selected Financial Data

The following tables present selected consolidated financial data for us as of the dates and for the periods indicated. You should read this information in conjunction with our audited consolidated financial statements and related notes beginning on page F-1, and the information under “Item 5.A Operating Results” included elsewhere in this annual report.

The selected consolidated financial data as of December 31, 20172019 and 20162018 and for the years ended December 31, 2017, 20162019, 2018 and 20152017 has been derived from our audited consolidated financial statements included in this annual report. The selected consolidated financial data as of December 31, 2015 has been derived from our audited consolidated financial statements not included in this annual report. Prior period amounts have been restated to reflect the La Plata plant operations as discontinued operations in all periods presented. Please see Note 21 to our audited consolidated financial statements for further information on how we have accounted for the La Plata Plant Sale in our audited consolidated financial statements. Our historical results are not necessarily indicative of our future results. Our audited consolidated financial statements have been audited by Pistrelli, Henry Martin y Asociados S.R.L. (a member firm of Ernst & Young Global), an independent registered public accounting firm, whose audit report is included elsewhere in this annual report.

We maintain our financial books and records and publish our audited consolidated financial statements in Argentine pesos, which is our functional currency. We prepare our audited consolidated financial statements in Argentine pesos and in conformity with IFRS as issued by the IASB.

In accordance with IAS 29, the restatement of the financial statements is necessary when the functional currency of an entity is the currency of a hyperinflationary economy. To define a hyperinflationary state, IAS 29 provides a series of non-exclusive guidelines that consist of (i) analyzing the behavior of the population, prices, interest rates and wages before the evolution of price indexes and the loss of the currency’s purchasing power, and (ii) as a quantitative characteristic, verifying if the three-year cumulative inflation rate approaches or exceeds 100%. Due to macroeconomic factors, the triennial inflation was above that figure in 2018 and Argentina has been considered hyperinflationary since July 1, 2018. See “Risks Relating to Argentina—As of July 1st, 2018, the Argentine Peso qualifies as a currency of a hyperinflationary economy and we are required to restate our historical financial statements to apply inflationary adjustments, which could adversely affect our results of operations and financial condition and those of our Argentine subsidiaries” and “—If the current levels of inflation do not decrease, the Argentine economy could be adversely affected.”

Therefore, our audited consolidated financial statements included herein, including the figures for the previous periods (this fact not affecting the decisions taken on the financial information for such periods), and, unless otherwise stated, the financial information included elsewhere in this annual report, were restated to consider the changes in the general purchasing power of the functional currency of the Company (Argentine peso) pursuant to IAS 29 and General Resolution no. 777/2018 of the CNV. Consequently, the financial statements are stated in the current measurement unit as of December 31, 2019. The information included in our audited consolidated financial statements, is not comparable to the financial statements previously published by us. For more information, see “Item 5.A. Operating Results—Factors Affecting our Results of Operations—Inflation” and Note 2.1.2 to our audited consolidated financial statements.

The selected consolidated statement of comprehensive income data for the years ended December 31, 2017 and 2016 and the selected consolidated statement of financial position data as of December 31, 2017 have been restated pursuant to IAS 29 to reflect the effect of hyperinflation in Argentina. As a result of such restatement, the selected financial information included in this annual report differ from previously reported financial information.

The selected consolidated statement of financial position data as of December 31, 2016 and the selected consolidated statement of financial position and statement of comprehensive income as of and for the year ended December 31, 2015 have not been presented as they cannot be provided on a restated basis without unreasonable effort or expense.

Solely for convenience of the reader, Peso amounts as of and for the year ended December 31, 20172019 have been translated into U.S. dollars. The rate used to translate such amounts as of December 31, 20172019 was Ps. 18.64959.89 to US$1.00, which was the reference exchange rate reported by the Banco de la Nación Argentina for wire transfers (divisas) as of December 29, 2017. 30, 2019.

The U.S. dollar equivalent information presented in this annual report is provided solely for the convenience of the reader and should not be construed to represent that the Peso amounts have been, or could have been or could be, converted into, U.S. dollars at such rates or any other rate.

See “Item 3.A. Selected Financial Data—Exchange Rates.”

Selected Consolidated Statement of Comprehensive Income Data

| | |

| | | |

| | | | | |

Continuing operations Revenues | 319,406 | 5,956,596 | 3,562,721 | 2,654,180 |

| Cost of sales | (147,040) | (2,742,147) | (2,069,752) | (1,397,365) |

| Gross income | 172,366 | 3,214,449 | 1,492,969 | 1,256,815 |

| Administrative and selling expenses | (34,917) | (651,168) | (445,412) | (371,485) |

| Other operating income | 34,344 | 640,480 | 1,137,736 | 735,517 |

| Other operating expenses | (4,960) | (92,497) | (84,845) | (52,702) |

| Operating income | 166,833 | 3,111,264 | 2,100,448 | 1,568,145 |

| Finance income | 49,988 | 932,227 | 420,988 | 362,363 |

| Finance expenses | (37,409) | (697,638) | (620,448) | (138,308) |

Share of the profit of associates | 38,340 | 715,001 | 147,513 | 43,390 |

| Income before income tax from continuing operations | 217,752 | 4,060,854 | 2,048,501 | 1,835,590 |

| (56,405) | (1,051,896) | (717,639) | (625,451) |

| Net income for the year from continuing operations | 161,347 | 3,008,958 | 1,330,862 | 1,210,139 |

| Discontinued operations | | | | |

| | | | | |

| Income after tax for the year from discontinued operations | 26,009 | 485,041 | 437,974 | 131,859 |

| | | | | |

| Net income for the year | 187,356 | 3,493,999 | 1,768,836 | 1,341,998 |

| Other comprehensive income, net | (16,407) | (305,976) | 199,075 | 132,953 |

| Total comprehensive income for the year | 170,949 | 3,188,023 | 1,967,911 | 1,474,951 |

| Number of Outstanding Shares (basic and diluted) | 1,505,695,134 | 1,505,695,134 | 1,505,695,134 | 1,505,695,134 |

| Net income per share (basic and diluted) (Ps.) | 0.12 | 2.33 | 1.17 | 0.89 |

Net income per share from continuing operations (Ps.)

| 0.11

| 2.01

| 0.88

| 0.80

|

| Cash dividend per share (Ps.) | 0.05 | 0.85 | 0.925 | 0.226 |

(1) | Solely for the convenience of the reader, peso amounts as of December 31, 2017 have been translated into U.S. dollars at the exchange rate as of December 29, 2017 of Ps.18.649 to US$1.00. See “Exchange Rates” and “Presentation of Financial and Other Information” for further information on recent fluctuations in exchange rates. |

| | |

| | | |

| | | | | | |

| Continuing operations | | | | | |

| Revenues | 600,447 | 35,960,784 | 21,944,761 | 14,827,241 | 10,836,014 |

| Cost of sales | (316,525) | (18,956,674) | (9,978,643) | (7,997,976) | (7,661,201) |

| Gross income | 283,922 | 17,004,110 | 11,966,118 | 6,829,265 | 3,174,813 |

| Administrative and selling expenses | (43,971) | (2,633,405) | (2,137,249) | (1,624,866) | (1,373,148) |

| Other operating income | 306,449 | 18,353,204 | 20,341,015 | 1,430,737 | 3,575,439 |

| Other operating expenses | (4,521) | (270,755) | (204,414) | (215,578) | (264,518) |

| Impairment of property, plant and equipment and intangible assets | (73,542) | (4,404,441) | – | – | – |

| CVO receivables update | – | – | 16,947,737 | – | – |

| Operating income | 468,337 | 28,048,713 | 46,913,207 | 6,419,558 | 5,112,586 |

| Loss on net monetary position | (40,604) | (2,431,753) | (6,208,977) | (233,678) | (2,825,326) |

| Finance income | 60,122 | 3,600,707 | 3,507,676 | 2,397,964 | 1,344,364 |

| Finance expenses | (265,902) | (15,924,867) | (9,692,797) | (1,846,995) | (1,864,368) |

| Share of the profit of associates | 18,589 | 1,113,297 | 1,652,445 | 1,804,460 | 650,173 |

| Income before income tax from continuing operations | 240,543 | 14,406,097 | 36,171,554 | 8,541,309 | 2,427,429 |

| Income tax for the year | (95,930) | (5,745,242) | (10,159,632) | (1,663,201) | (1,548,195) |

| Net income for the year from continuing operations | 144,613 | 8,660,855 | 26,011,922 | 6,878,108 | 879,234 |

| Discontinued operations | | | | | |

| Income after tax for the year from discontinued operations | - | - | 424,850 | 1,217,236 | 1,241,411 |

| Net income for the year | 144,613 | 8,660,855 | 26,436,772 | 8,095,344 | 2,120,645 |

| Other comprehensive income, net | (535) | (32,070) | (297,840) | (801,290) | 550,583 |

| Total comprehensive income for the year | 144,077 | 8,628,785 | 26,138,932 | 7,294,054 | 2,671,228 |

| Number of Outstanding Shares (basic and diluted) | 1,505,170,408 | 1,505,170,408 | 1,505,170,408 | 1,505,170,408 | 1,505,170,408 |

| Net income per share (basic and diluted) | 0.10 | 5.85 | 17.91 | 5.41 | 1.42 |

| Net income per share from continuing operations (Ps.) | 0.10 | 5.85 | 17.62 | 4.60 | 0.58 |

| Cash dividend per share (Ps.) in nominal terms | 0.01 | 0.71 | 0.70 | 0.85 | 0.925 |

| Dividend declaration date | | | | | |

Foreign exchange rate as of the dividend declaration date (2) Ps. per US$) | | 59.77 | 20.54 | 17.07 | 15.21 |

Convenience translation of cash dividend per share (US$) in nominal terms (2) | | 0.011879 | 0.034080 | 0.049795 | 0.060815 |

(1)

Solely for the convenience of the reader, peso amounts as of December 31, 2019 have been translated into U.S. dollars at the exchange rate as of December 30, 2019 of Ps. 59.89 to US$1.00. See “Exchange Rates” and “Presentation of Financial and Other Information” for further information on recent fluctuations in exchange rates.

(2)

Peso amounts have been translated into U.S. dollars at the exchange rate quoted by Banco de la Nación Argentina for wire transfers as of the date of each dividend declaration date.

Selected Consolidated Statement of Financial Position

| | |

| | | |

| | | | | |

| Non-current assets | | | | |

| Property, plant and equipment | | | | |

| Intangible assets | 10,072 | 187,833 | 236,530 | 276,691 |

| Investment in associates | 52,852 | 985,646 | 307,012 | 210,529 |

Trade and other receivables(2) | 139,536 | 2,602,213 | 3,553,129 | 2,780,635 |

| Other non-financial assets | 682 | 12,721 | 1,466,547 | 487,429 |

| Inventories | 2,585 | 48,203 | 30,830 | 29,619 |

| Total non-current assets | 604,233 | 11,268,344 | 8,405,587 | 5,753,051 |

| Current assets | | | | |

| Inventories | 5,914 | 110,290 | 137,965 | 82,672 |

| Other non-financial assets | 25,250 | 470,895 | 137,110 | 135,012 |

Trade and other receivables(2) | 208,433 | 3,887,065 | 2,215,535 | 1,267,032 |

| Other financial assets | 59,560 | 1,110,728 | 1,796,756 | 1,912,016 |

| Cash and cash equivalents | 4,753 | 88,633 | 30,008 | 292,489 |

| Total current assets | 303,910 | 5,667,611 | 4,317,374 | 3,689,221 |

| Assets held for sale | 7,669 | 143,014 | - | - |

| Total assets | 915,812 | 17,078,969 | 12,722,961 | 9,442,272 |

| Equity and liabilities | | | | |

| Equity | | | | |

| Capital stock | 81,185 | 1,514,022 | 1,514,022 | 199,742 |

| Adjustment to capital stock | 35,658 | 664,988 | 664,988 | 664,988 |

| Merger premium | 20,193 | 376,571 | 376,571 | 366,082 |

| Legal and other reserves | 27,840 | 519,189 | 431,007 | 363,289 |

| Voluntary reserve | 24,176 | 450,865 | 68,913 | 1,507,513 |

| Retained earnings | 187,841 | 3,503,046 | 1,757,051 | 1,347,763 |

| Accumulated other comprehensive income | 2,321 | 43,284 | 334,747 | 122,286 |

| Non-controlling interests | 15,499 | 289,035 | 6,717 | - |

| Total equity | 394,713 | 7,361,000 | 5,154,016 | 4,571,663 |

| Non-current liabilities | | | | |

| Other non-financial liabilities | 25,132 | 468,695 | 635,162 | 596,632 |

| Other loans and borrowings | 79,293 | 1,478,729 | - | 318,410 |

| Borrowings from CAMMESA | 56,601 | 1,055,558 | 1,284,783 | 542,858 |

| Compensation and employee benefits liabilities | 6,065 | 113,097 | 87,705 | 56,112 |

| Deferred income tax liabilities | 37,736 | 703,744 | 1,136,481 | 770,737 |

| Provisions | - | - | 125,201 | 133,284 |

| Total non-current liabilities | 204,827 | 3,819,823 | 3,269,332 | 2,418,033 |

| Current liabilities | | | | |

| Trade and other payables | 54,550 | 1,017,306 | 655,598 | 381,128 |

| Other non-financial liabilities | 35,373 | 659,668 | 476,785 | 177,664 |

| Other loans and borrowings | 27,112

| 505,604

| 1,293,178 | 511,555 |

| Borrowings from CAMMESA | 94,002

| 1,753,038

| 1,047,722 | 661,086 |

| Compensation and employee benefits liabilities | 17,324 | 323,078 | 205,923 | 147,770 |

| Income tax payable | 58,814 | 1,096,817 | 278,922 | 330,496 |

| Provisions | 22,171 | 413,474 | 341,485 | 242,877 |

| Total current liabilities | 309,346 | 5,768,985 | 4,299,613 | 2,452,576 |

| Liabilities directly associated with the assets held for sale | 6,926 | 129,161 | - | - |

| Total liabilities | 521,099 | 9,717,969 | 7,568,945 | 4,870,609 |

| Total equity and liabilities | 915,812 | 17,078,969 | 12,722,961 | 9,442,272 |

| | |

| | | | |

| | | | | | |

| Capital stock | 25,280 | 1,514,022 | 1,514,022 | 1,514,022 | 1,514,022 |

| Equity | 987,657 | 59,150,797 | 50,655,159 | 26,199,932 | 21,038,164 |

| Total Assets | 1,983,569 | 118,795,975 | 88,084,228 | 52,839,883 | 46,763,175 |

(1) | Solely for the convenience of the reader, peso amounts as of December 31, 2017 have been translated into U.S. dollars at the exchange rate as of December 29, 2017 of Ps.18.649 to US$1.00. See “—Exchange Rates” and “Presentation of Financial and Other Information” for further information on recent fluctuations in exchange rates. |

(2) | Trade and other receivables include receivables from CAMMESA. See “Item 5. Operating and Financial Review and Prospects—Receivables from CAMMESA,” and “—Liquidity and Capital Resources.” |

(1)

Solely for the convenience of the reader, peso amounts as of December 31, 2019 have been translated into U.S. dollars at the exchange rate as of December 30, 2019 of Ps.59.89 to US$1.00. See “—Exchange Rates” and “Presentation of Financial and Other Information” for further information on recent fluctuations in exchange rates.

EXCHANGE RATES

| | |

| | | | |

| | | | | |

| Non-current assets | | | | |

| Property, plant and equipment | 928,700 | 55,619,873 | 34,715,815 | 26,846,322 |

| Intangible assets | 136,010 | 8,145,647 | 3,438,508 | 3,059,116 |

| Investment in associates | 57,615 | 3,450,569 | 3,074,088 | 2,815,345 |

Trade and other receivables (2) | 404,895 | 24,249,144 | 25,646,335 | 5,910,324 |

| Other non-financial assets | 11,508 | 689,185 | 343,163 | 28,893 |

| Deferred tax asset | - | - | - | 4,609 |

| Inventories | 2,407 | 144,169 | 114,893 | 109,507 |

| Total non-current assets | 1,541,135 | 92,298,587 | 67,332,802 | 38,774,116 |

| Current assets | | | | |

| Inventories | 10,980 | 657,594 | 339,810 | 299,418 |

| Other non-financial assets | 16,802 | 1,006,247 | 761,670 | 1,069,617 |

Trade and other receivables(2) | 261,161 | 15,640,947 | 16,273,973 | 8,820,661 |

| Other financial assets | 128,548 | 7,698,732 | 3,022,238 | 2,522,761 |

| Cash and cash equivalents | 24,944 | 1,493,868 | 353,735 | 201,310 |

| Total current assets | 442,434 | 26,497,388 | 20,751,426 | 12,913,767 |

| Assets held for sale | - | - | - | 1,151,999 |

| Total assets | 1,983,569 | 118,795,975 | 88,084,228 | 52,839,882 |

| Equity and liabilities | | | | |

| Equity | | | | |

| Capital stock | 25,280 | 1,514,022 | 1,514,022 | 1,514,022 |

| Adjustment to capital stock | 307,510 | 18,416,762 | 18,416,762 | 18,416,759 |

| Legal reserve | 39,718 | 2,378,736 | 589,783 | 249,947 |

| Voluntary reserve | 442,662 | 26,511,002 | 6,778,288 | 1,568,895 |

| Retained earnings | 159,285 | 9,539,556 | 22,636,866 | 3,394,024 |

| Accumulated other comprehensive income | 974,454 | 58,360,078 | 49,935,721 | 319,970 |

| Non-controlling interests | 13,203 | 790,719 | 719,438 | 736,402 |

| Total equity | 987,657 | 59,150,797 | 50,655,159 | 26,200,019 |

| Non-current liabilities | | | | |

| Other non-financial liabilities | 72,711 | 4,354,668 | 3,013,397 | 1,064,534 |

| Other loans and borrowings | 512,394 | 30,687,277 | 8,005,484 | 3,358,589 |

| Borrowings from CAMMESA | - | - | 1,544,945 | 2,397,455 |

| Compensation and employee benefits liabilities | 3,828 | 229,279 | 228,395 | 256,874 |

| Previsions | 156 | 9,348 | - | - |

| Deferred income tax liabilities | 105,363 | 6,310,170 | 7,373,778 | 5,917,983 |

| Total non-current liabilities | 694,452 | 41,590,742 | 20,165,999 | 12,995,435 |

| Current liabilities | | | | |

| Trade and other payables | 98,505 | 5,899,436 | 2,661,249 | 2,310,386 |

| Other non-financial liabilities | 28,959 | 1,734,349 | 2,555,070 | 1,498,283 |

| Other loans and borrowings | 134,011 | 8,025,892 | 1,034,781 | 3,981,618 |

| Borrowings from CAMMESA | - | - | 2,788,843 | 1,148,363 |

| Compensation and employee benefits liabilities | 11,667 | 698,709 | 601,743 | 733,990 |

| Income tax payable | 27,861 | 1,668,594 | 6,794,536 | 2,491,165 |

| Provisions | 458 | 27,456 | 826,848 | 939,110 |

| Total current liabilities | 301,460 | 18,054,436 | 17,263,070 | 13,102,915 |

| Liabilities directly associated to the assets held for sale | - | - | - | 541,513 |

| Total liabilities | 995,912 | 59,645,178 | 37,429,069 | 26,639,863 |

| Total equity and liabilities | 1,983,569 | 118,795,975 | 88,084,228 | 52,839,882 |

(1)

Solely for the convenience of the reader, peso amounts as of December 31, 2019 have been translated into U.S. dollars at the exchange rate as of December 30, 2019 of Ps.59.89 to US$1.00. See “—Exchange Rates” and “Presentation of Financial and Other Information” for further information on recent fluctuations in exchange rates.

(2)

Trade and other receivables include receivables from CAMMESA. See “Item 5. Operating and Financial Review and Prospects—Liquidity and Capital Resources,” and “—Receivables from CAMMESA.”

Exchange Rates

From April 1, 1991 until the end of 2001, Law No. 23,928 (the “Convertibility Law”“Convertibility Law”) established a regime under which the Central Bank was obliged to sell U.S. dollars at a fixed rate of one peso per U.S. dollar. On January 6, 2002, the Argentine Congress enacted the Public Emergency Law, formally ending the regime of the Convertibility Law, abandoning over ten years of U.S. dollar-peso parity and eliminating the requirement that the Central Bank’sBank’s reserves in gold, foreign currency and foreign currency denominated debt be at all times equivalent to 100% of the monetary base.

The Public Emergency Law, which was in effect until December 31, 2017, granted the Argentine governmentGovernment the power to set the exchange rate between the peso and foreign currencies and to issue regulations related to the MULC. Following a brief period during which the Argentine governmentGovernment established a temporary dual exchange rate system, pursuant to the Public Emergency Law, the peso has been allowed to float freely against other currencies since February 2002. However, the Argentine Central Bank has had the power to intervene in the exchange rate market by buying and selling foreign currency for its own account, a practice in which it engaged on a regular basis. In recent years and particularlyParticularly since 2011, the Argentine governmentGovernment has increased controls on exchange rates and the transfer of funds into and out of Argentina.

With the tightening of exchange controls beginning in late 2011, in particular with the introduction of measures that allowed limited access to foreign currency by private sector companies and individuals (such as requiring an authorization of tax authorities to access the foreign currency exchange market), the implied exchange rate, as reflected in the quotations for Argentine securities that trade in foreign markets, compared to the corresponding quotations in the local market, increased significantly over the official exchange rate. Most of the foreign exchange restrictions were gradually lifted in since December 2015, and finally on May 19, 2017, the Central Bank issued Communication “A”“A” 6244, which substantially modified the applicable foreign exchange regulations and eliminated the set of restrictions for accessing the MULC. As a result of the elimination of the limit amount for the purchase of foreign currency without specific allocation or need of prior approval the substantial spread between the official exchange rate and the implicit exchange rate derived from securities transactions has substantially decreased. In addition, by virtue of the 2018 IMF Agreement (see “Item 4. Information of the Company—Recent Political and Economic Developments in Argentina— IMF Agreement”), from October 1, 2018, the Central Bank introduced an exchange rate band. The peso’s exchange rate with the U.S. Dollar was allowed to fluctuate between Ps.34.00 and Ps.44.00 per US$1.00 (range that was adjusted daily at an annual rate of 3% until December 2018, and for the first quarter of 2019, was adjusted daily at an annual rate of 2%) without the Central Bank’s intervention. On April 29, 2019, the Monetary Policy Counsel (Comité de Política Monetaria) of the Central Bank (the “COPOM”) decided to introduce changes to the monetary policy, with an aim to reducing volatility in the foreign exchange market.

After the results in the primary elections in August 2019, the peso devalued almost 30% and the share price of listed companies collapsed 38%. The ‘Country Risks’ peaked to one of the highest levels in Argentine history, placing itself above 2000 points on August 28, 2019. As a consequence of the aforementioned effects, in order to control the currency outflow and restrict exchange rate fluctuations, the Central Bank re-implemented exchange controls, in hopes of strengthening the normal functioning of the economy, fostering a prudent administration of the exchange market, reducing the volatility of financial variables and containing the impact of the variations of financial flows on the real economy. For a description of the measures adopted by the Argentine Government and the Central Bank beginning September 1, 2019, see “Item 10.D.—Exchange Controls.”

After several years of moderate variations in the nominal exchange rate, in 2012 the peso lostdepreciated approximately 14% of its value with respect to the U.S. dollar. This was followed in 2013 and 2014 by a devaluationdepreciation of the peso with respect to the U.S. dollar that exceeded 30%, including a loss of approximately 23% in January 2014. In 2015, the peso lostdepreciated approximately 52% of its value with respect to the U.S. dollar, including, approximately, a 10% devaluation from January 1, 2015 to September 30, 2015 and a 38% devaluation during the last quarter of the year, mainly concentrated after December 16, 2015 when certain exchange controls were lifted. From January 1,In 2017, to December 31, 2017,2018 and 2019, the peso lostdepreciated approximately 17% of its value17.36%, 102.16% and from January 1, 2016 to December 31, 2016, the peso lost approximately 22% of its value58.86%, respectively, in each case, with respect to the U.S. dollardollar. The peso depreciated approximately 10.92% from December 31, 2019 through April 24, 2020 ( see “Item 3.D. Risk Factors—Risk Relating to Argentina—Significant fluctuations in the value of the peso could adversely affect the Argentine economy and, in turn, adversely affect our results of operations”).

The following table sets forth the annual high, low, average and period-end exchange rates for the periods indicated, expressed in pesos per U.S. dollar and not adjusted for inflation. There can be no assurance that the peso will not depreciate or appreciate again in the future. The Federal Reserve Bank of New York does not report a buying rate for pesos.

| | | |

| | | | | | | | | |

| 2013 | 6.5210 | 4.9250 | 5.5458 | 6.5210 | |

| 2014 | 8.5570 | 6.5210 | 8.2267 | 8.5510 | |

| 2015 | 13.4000 | 8.5550 | 9.4468 | 13.0400 | 13.4000 | 8.5550 | 9.2653 | 13.0400 |

| 2016 | 16.0300 | 13.2000 | 14.9916 | 15.8900 | 16.0300 | 13.2000 | 14.8403 | 15.8900 |

| 2017 | 19.2000 | 15.1900 | 16.4473 | 18.6490 | 19.2000 | 15.1900 | 16.5704 | 18.6490 |

| 2018 | | 41.2500 | 18.4100 | 28.1762 | 37.7000 |

| 2019 | | 60.4000 | 36.9000 | 48.2802 | 59.8900 |

| October | 17.7000 | 17.3350 | 17.4619 | 17.6550 | 60.0000 | 57.6400 | 58.5403 | 59.6700 |

| November | 17.6500 | 17.3050 | 17.4762 | 17.3050 | 59.9500 | 59.4700 | 59.7315 | 59.9400 |

| December | 19.2000 | 17.2300 | 17.7342 | 18.6490 | 59.9900 | 59.8150 | 59.8748 | 59.8900 |

| 2018 | | |

| 2020 | | |

| January | 19.6500 | 18.4100 | 19.0380 | 19.6500 | 60.3500 | 59.8150 | 60.0114 | 60.3500 |

| February | 20.2000 | 19.3800 | 19.8331 | 20.1100 | 62.2100 | 60.4700 | 61.3561 | 62.2100 |

| March | 20.4100 | 20.1490 | 20.2422 | 20.1490 | 64.4690 | 62.2590 | 63.1241 | 64.4690 |

April (3) | 20.2600 | 20.135 | 20.1933 | 20.2600 | 66.4300 | 64.5290 | 65.5290 | 66.4300 |

(1)

(1) | Pesos to U.S. dollars exchange rate as quoted by the Banco de la NacióPesos to U.S. dollars exchange rate as quoted by the Banco de la Nación Argentina for wire transfers (divisas).

(2) Average of the exchange rates based on working day’s averages for each month. (3) Through April 24, 2020. |

(2) | For 2013-2017, average of the exchange rates on the last day of each month during the period. For 2018, based on working day’s averages for each month.

|

(3) | Through April 24, 2018. |

Capitalization and indebtedness

Not applicable.

Reasons for the offer and use of proceeds

Not applicable.

You should carefully consider the risks described below, as well as the other information in this annual report. Our business, results of operations, financial condition or prospects could be materially and adversely affected if any of these risks occurs, and as a result, the market price of our common shares and ADSs could decline. The risks described below are those known to us and that we currently believe may materially affect us.

Risks Relating to Argentina

Substantially all of our revenues are generated in Argentina and thus are highly dependent on economic and political conditions in Argentina

Central Puerto is an Argentine corporation (sociedad anónima). All of our assets and operations are located in Argentina. Accordingly, our financial condition and results of operations depend to a significant extent on macroeconomic, regulatory, social and political conditions prevailing in Argentina, including the level of growth, inflation rates, foreign exchange rates, interest rates and international developments and conditions that may affect Argentina. Between 2007 and 2015,In the Fernández de Kirchner administrationspast, some governments increased direct intervention in the Argentine economy, including the implementation of expropriation measures, price controls, exchange controls and changes in laws and regulations affecting foreign trade and investment. These measures had a material adverse effect on private sector entities, including us. It is possible that similar measures could be adopted by the current or future Argentine governmentGovernment or that economic, social and political developments in Argentina, over which we have no control, could have a material adverse effect on the Argentine economy and, in turn, adversely affect our financial condition and results of operations. See “Management’s“Management’s Discussion and Analysis of Financial Condition and Results of Operations—Operations—Factors Affecting our Results of Operations—Operations—Argentine Economic Conditions.Conditions and the impact of COVID-19.”

The Argentine economy remains vulnerable and any significant decline could adversely affect our results of operations

The Argentine economy has experienced significant volatility in recent decades, characterized by periods of low or negative growth, high levels of inflation and currency devaluation. Sustainable economic growth in Argentina is dependent on a variety of factors, including the international demand for Argentine exports, the stability and competitiveness of the peso against foreign currencies, confidence among consumers and foreign and domestic investors, a stable rate of inflation, national employment levels and the circumstances of Argentina’sArgentina’s regional trade partners.

The ArgentineArgentina’s economy contracted during 2019 and the country’s economy remains vulnerable and unstable, as reflected by the following economic conditions:

●

inflation remains high and may continue at similar levels in the future; according to a report published by INDEC, cumulative consumer price inflation from December 2018 to December, 2019 was 53.83%, and inflation during January 2020 and February2020, was 2.3% and 2.0%, respectively;

●

according to the revised calculation of the 2004 GDPGross Domestic Product (“GDP”) published by the INDEC in March 2017, which forms the basis for the real GDP calculation for every year after 2004, GDP decreased by 2.3% in 2016 (as compared to 2015) and increased by 2.6% in 2015, as compared to a decline of 2.5% in 2014 and growth of 2.4% in 2013. According to the INDEC GDP for 2017 increased by 2.9% while it decreased by 2.5% in 2018. According to preliminary data published by the INDEC on March 22, 201825, 2020, GDP for 2017 increased by 2.9%2019 decreased 2.2%. Argentina’Argentina’ s GDP performance has depended to a significant extent on high commodity prices which despite having favorable long-term trends, are volatile in the short-term and beyond the control of the Argentine governmentGovernment and private sector;

●

Argentina’ sArgentina’s public debt as a percentage of GDP remains high;

●

the discretionary increase in public expenditures has resulted, and could continue to result, in a fiscal deficit;

●

investment as a percentage of GDP remains too low to sustain the growth rate of the past decade;low;

●

a significant number of protests or strikes could take place, as has occurred in the past, which could adversely affect various sectors of the Argentine economy;

●

energy or natural gas supply may not be sufficient to supply industrial activity (thereby limiting industrial development) and consumption;

●

unemployment and informal employment remain high;high, according to INDEC, unemployment rate during the fourth quarter of 2019 was 8.9%; and

●

in the climate created by the above mentioned conditions, demand for foreign currency could grow, generating a capital flight effect as in recent years.

Argentina’s fiscal imbalances, its dependence on foreign revenues to cover its fiscal deficit, and material rigidities that have historically limited the ability of the economy to absorb and adapt to external factors, have added to the severity of the current crisis.

As a result of the Argentine Peso’s increased volatility, the Argentine government and the Central Bank implemented several measures to restore market confidence and stabilize the value of the Peso. Such measures included, among others, a US$55.7 billion stand-by credit agreement (“SBA”) with the International Monetary Fund (“IMF”), from which, as of the date of this annual report, Argentina has drawn the equivalent of US$44 billion, measures intended to control money supply during 2018 and the first half of 2019 that have been since relaxed, an increase of short term interest rates and the sale by the Central Bank of foreign currency reserves.

In addition, in September 2019, in light of the economic instability and the significant devaluation that followed the primary elections as described below, the Argentine government and the Central Bank adopted a series of measures reinstating foreign exchange controls, which apply with respect to access to the foreign exchange market by residents for savings and investment purposes abroad, the payment of external financial debts, the payment of dividends in foreign currency abroad, payments of goods and services in foreign currencies, payments of imports of goods and services, and the obligation to repatriate and settle for pesos the proceeds from exports of goods and services, among others. Other financial transactions such as derivatives and securities related operations, were also covered by the new foreign exchange regime. Following the change in government, the new administration extended the validity of such measures, which were originally in effect until December 31, 2019, and established further restrictions by means of the recently enacted Solidarity Law (as defined below), including a new tax on certain transactions involving the purchase of foreign currency by both Argentine individuals and entities. Although the official exchange rate has stabilized since the adoption of the foreign exchange controls, we cannot assure you that the official exchange rate will not fluctuate significantly in the future. There can be no assurances regarding future modifications to exchange controls. Exchange controls could adversely affect our financial condition or results of operations and our ability to meet our foreign currency obligations and execute our financing plans.

As in the recent past, Argentina’sArgentina’s economy may be adversely affected if political and social pressures inhibit the implementation by the Argentine governmentGovernment of policies designed to control inflation, generate growth and enhance consumer and investor confidence, or if policies implemented by the Argentine governmentGovernment that are designed to achieve these goals are not successful. These events could materially adversely affect our financial condition and results of operations.

Any decline in economic growth, increased economic instability or expansion of economic policies and measures taken by the Argentine governmentGovernment to control inflation or address other macroeconomic developments that affect private sector entities such as us, all developments over which we have no control, could have an adverse effect on our financial condition or results of operations.

The Macri administration has implemented significantCertain risks are inherent in any investment in a company operating in a developing country such as Argentina

Argentina is developing country and investing in developing countries generally carries risks. These risks include political, social and economic instability that may affect Argentina’s economic results which can stem from many factors, including the following:

●

abrupt changes in policycurrency values;

●

high levels of inflation;

●

wage and announced additional measures, but its abilityprice controls;

●

changes in performing contracts;

●

regulations to successfully implement such additional measures,import equipment and the eventual outcome of such other necessities relevant for operations;

●

changes is unknownin governmental economic, administrative or tax policies; and

●

political and social tensions.

Presidential and congressional elections in Argentina took place on October 25, 2015, and a runoff election (ballotage) between the two leading presidential candidates was held on November 22, 2015, which resulted in Mr. Mauricio Macri being elected PresidentAny of Argentina. The Macri administration assumed office on December 10, 2015.

On October 22, 2017, mid-term legislative elections were held at the federal and provincial government levels. Macri’s Cambiemos alliance obtained the most votes in the City of Buenos Aires,these factors, as well as volatility in the provincescapital markets, may adversely affect our business, results of Buenos Aires, Chaco, Córdoba, Corrientes, Entre Ríos, Jujuy, La Rioja, Mendoza, Neuquén, Salta, Santa Cruzoperations, financial condition, the value of our ADSs, and Santa Fe. As a result, asour ability to meet our financial obligations.

Economic and political developments in Argentina and future policies of December 10, 2017, Cambiemos increased its representation in the Argentine Congress by nine senators (holding inGovernment, may affect the aggregate 24 of a total of 72 seats ineconomy, as well as the Senate) and by 21 membersoperations of the Chamberenergy industry, including the operations of Deputies (holding in the aggregate 107 of a total of 257 seats in such Chamber).Central Puerto

Since assuming office on December 10, 2019, the MacriFernandez administration has announced and implemented several significant economic and policy reforms including:

●

INDEC reforms. On January 8, 2016, based on its determination that the INDEC had failed to produce reliable statistical information, particularly with respect to the CPI, GDP, poverty and foreign trade data, the Macri administration declared the national statistical system and the INDEC in a state of administrative emergency through December 31, 2016, which was not renewed. The INDEC implemented certain methodological reforms and adjusted certain macroeconomic statistics on the basis of these reforms. See “—The credibility of several Argentine economic indices has been called into question, which has led to a lack of confidence in the Argentine economy and could affect your evaluation(see “Item 4. Information of the market value ofCompany—Recent Political and Economic Developments in Argentina.”), including those related to public health concerns derived from the ADSs.”COVID-19 pandemic crisis and its scale and duration discussed elsewhere herein which remain uncertain but could impact our earnings, cash flow and financial condition. As of the date of this annual report, the INDEC has begun publishing certain revised data, including GDP, poverty, foreign tradelong-term impact of these measures and balance of payment statistics.

●

Agreement with holdout creditors. The Macri administration has reached agreements with a large majority of holdout creditors (in terms of claims) and regained access to the international financial markets for the country. For more information on these agreements, see “—A lack of financing for Argentine companies due to the unresolved litigation with holdout bondholders may negatively impact our financial condition or cash flows.”

●

Foreign exchange reforms. The Macri administration eliminated a significant portion of foreign exchange restrictions, including currency controls that were imposedany future measures taken by the previous administration. With the aim of providing more flexibility to the foreign exchange system and promoting competition, the Decree N° 27/2018 publishedcurrent administration on January 11, 2018 created the free-floating exchange market (the “Exchange Market”). Furthermore, on August 8, 2016, the Central Bank introduced material changes to the foreign exchange regime and established a new foreign exchange regime by means of Communication “A” 6037 and Communication “A” 6244 which significantly ease access to the Exchange Market. Furthermore, on December 26, 2017, by virtue of Communication “A” 6401, the Central Bank replaced the reporting regimes set forth by Communications “A” 3602 and “A” 4237 with a new, unified regime applicable for information as of December 31, 2017. The unified reporting regime involves an annual mandatory statement filing for every person whose total flow of funds or balance of assets and liabilities is or exceeds US$1 million during the previous calendar year. See “Item 10.D Exchange Controls.”

●

Foreign trade reforms. The Kirchner and Fernández de Kirchner administrations imposed export duties and other restrictions on several sectors, particularly the agricultural sector. The Macri administration eliminated export duties on wheat, corn, beef, mining and regional products, and reduced the duty on soybean exports by 5%, from 35% to 30% beginning in January 2018 and until December 2019. Further, a 5% export duty on most industrial exports was eliminated. With respect to payments for imports of goods and services, the Macri administration eliminated the restrictions on access to the MULC.

●

Fiscal policy. The Macri administration took steps to anchor the fiscal accounts, reducing the primary fiscal deficit by approximately 1.3% of GDP in December 2015 through a series of taxation and other measures and announced its intention to reduce the primary fiscal deficit in 2016 and 2017 from approximately 5.8% of GDP in 2015, in part by eliminating public services subsidies that were in place, such as those applying to electric power and gas services. For 2018, the Argentine government seteconomy as a fiscal deficit target of 3.2% of GDP. For 2017, the aggregate primary fiscal deficit was reported to be 3.8% of GDP. The Macri administration’s aim is to achieve a primary fiscal deficit of 2.2% GDP in 2019,whole and 1.2% in 2020.

●

Correction of monetary imbalances. The Macri administration announced the adoption of an inflation targeting regime in parallel with the floating exchange rate regime and set inflation targets for the next three years. The Central Bank has increased its efforts to reduce excess monetary imbalances and also raised peso interest rates to counterbalance inflationary pressure. On December 28, 2017, the Central Bank announced its inflation targets for 2018, 2019 and 2020. The inflation target for 2018 is 15%, an increase from the Central Bank’s previous target range of 8%-12% for the same year. Inflation targets for 2019 and 2020 are 10% and 5%, respectively.

●

National electric power state of emergency and reforms. Following years of very limited investment in the energy sector as well as the continued freeze on electric power and natural gas tariffs since the 2001-2002 economic crisis, Argentina began to experience energy shortages in 2011. In response to the growing energy crisis. In December 2015, the Macri administration declared a state of emergency with respect to the national electric power system, which remained in effect until December 31, 2017. The state of emergency allowed the Argentine government to take actions designed to ensure the supply of electric power to the country, such as instructing the Ministry of Energy and Mining to design and implement, with the cooperation of all federal public entities, a coordinated program to guarantee the quality and security of the electric power system. In addition, the Macri administration announced the elimination of certain energy subsidies and a substantial increase in electric power rates. By correcting tariffs and subsidies and modifying the regulatory framework, the Macri administration aims to correct distortions in the energy sector and stimulate investment. Following tariff increases, preliminary injunctions suspending such increases were requested by customers, politicians and non-governmental organizations that defend customers’ rights, which preliminary injunctions were granted by Argentine courts. Among the different rulings in this respect, two separate rulings led to the suspension of end-users tariff increases of electric power in the Province of Buenos Aires and in the whole territory of Argentina. However, on September 6, 2016, the Supreme Court denied these injunctions that suspended end-users electric power tariff increases, arguing formal objections and procedural defects and therefore, as of the date of this annual report, increases of the electric power end-users tariffs are not suspended.

Pursuant to Resolution No. 522/16, the ENRE ordered a public hearing to be held to evaluate the proposals for the full tariff review filed by EDENOR and EDESUR for the period beginning January 1, 2017 to December 31, 2021. The hearing was held on October 28, 2016, and following such hearing, on January 31, 2017, the ENRE issued Resolution No. 63/17, by virtue of which such administrative authority approved the tariffs to be applied by EDENOR. Similarly, Resolution No. 64/17 approved EDESUR’s tariffs. With regards to transmission tariffs, seven public hearings were held pursuant to Resolutions Nos. 601/16, 602/16, 603/16, 604/16, 605/16, 606/16, 607/16 of the ENRE. In such public hearings the tariff proposals filed by transmission companies Transener S.A, Distrocuyo S.A., Transcomahue S.A., Ente Provincial de Energía de Neuquén, Transba S.A., Transnea S.A., Transnoa S.A., and Transpa S.A. for the period beginning January 1, 2017 to December 31, 2021 were evaluated. Pursuant to Resolutions Nos. 66/17, 68/17, 69/17, 71/17, 73/17, 75/17, 77/17 and 79/17, the ENRE approved the new applicable tariffs of such companies.