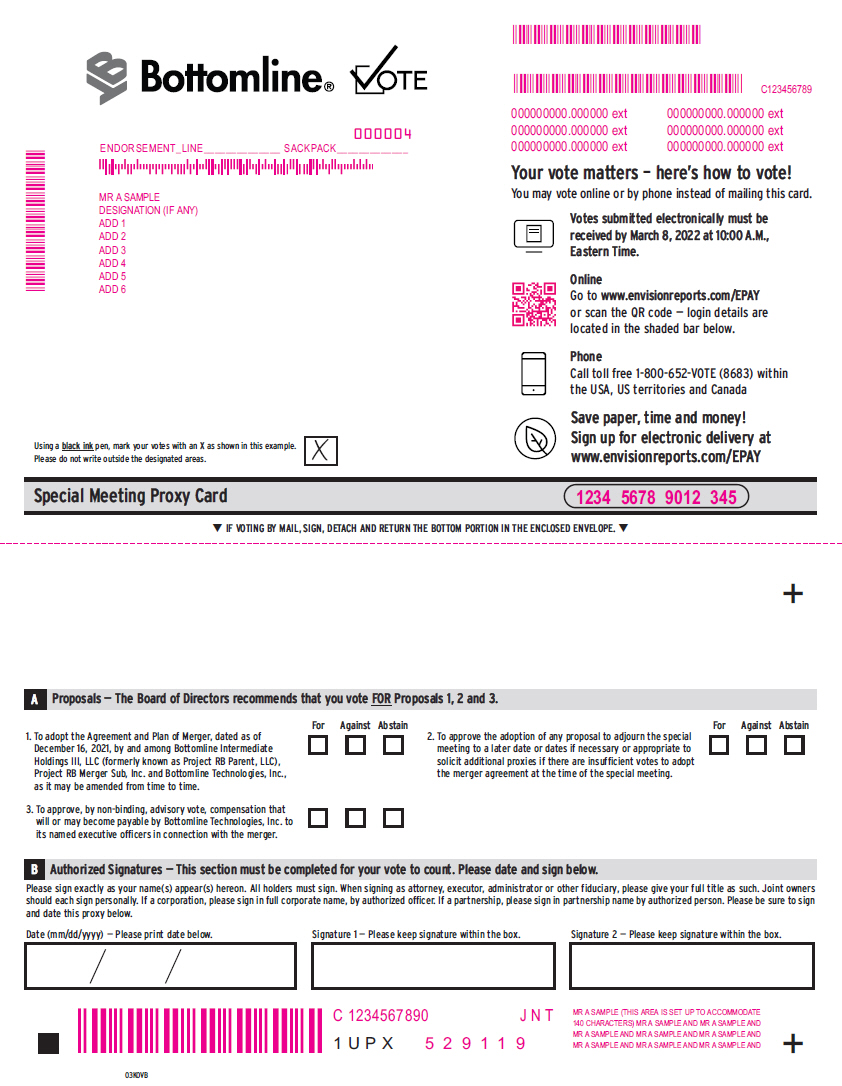

PRELIMINARY PROXY CARD—SUBJECT TO COMPLETIONBottomline Vote

ENDORSEMENT_LINE

SACKPACK

MR A SAMPLE

DESIGNATION (IF ANY) ADD 1 ADD 2 ADD 3 ADD 4 ADD 5 ADD 6

C123456789

000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext

Your vote matters – here’s how to vote!

You may vote online or by phone instead of mailing this card.

Votes submitted electronically must be received by March 8, 2022 at 10:00 A.M., Eastern Time.

Online

Go to www.envisionreports.com/EPAY or scan the QR code — login details are located in the shaded bar below.

Phone Call toll free 1-800-652-VOTE (8683) within the USA, US territories and Canada

Save paper, time and money! Sign up for electronic delivery at www.envisionreports.com/EPAY

Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas.

Special Meeting Proxy Card

IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.

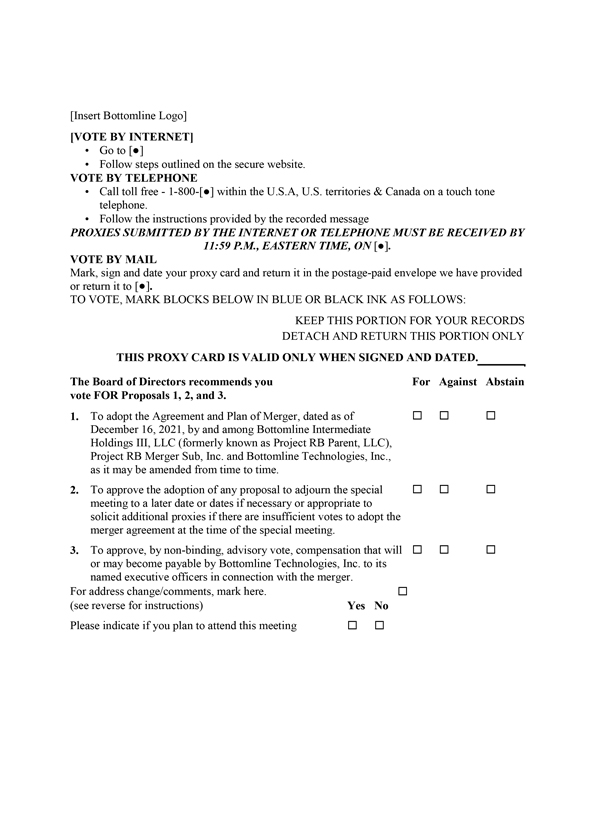

A Proposals — The Board of Directors recommends that you vote FOR Proposals 1, 2 and 3.

1. To adopt the Agreement and Plan of Merger, dated as of December 16, 2021, by and among Bottomline Intermediate Holdings III, LLC (formerly known as Project RB Parent, LLC), Project RB Merger Sub, Inc. and Bottomline Technologies, Inc. Special Meeting, as it may be amended from time to time.

3. To approve, by non-binding, advisory vote, compensation that will or may become payable by Bottomline Technologies, Inc. to its named executive officers in connection with the merger.

For Against Abstain

2. To approve the adoption of Stockholdersany proposal to adjourn the special meeting to a later date or dates if necessary or appropriate to solicit additional proxies if there are insufficient votes to adopt the merger agreement at the time of the special meeting.

For Against Abstain

B Authorized Signatures — This section must be completed for your vote to count. Please date and sign below.

Please sign exactly as your name(s) appear(s) hereon. All holders must sign. When signing as attorney, executor, administrator or other fiduciary, please give your full title as such. Joint owners should each sign personally. If a corporation, please sign in full corporate name, by authorized officer. If a partnership, please sign in partnership name by authorized person. Please be sure to sign and date this proxy below.

Date (mm/dd/yyyy) — Please print date below. Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box.

C 1234567890 J N T MR A SAMPLE (THIS AREA IS SET UP TO ACCOMMODATE

140 CHARACTERS) MR A SAMPLE AND MR A SAMPLE AND

MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND

1 U P X 5 2 9 1 1 9 MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND