| | | (1) | (1) | | Amount Previously Paid: | | (2) | | | | | | (2) | | Form, Schedule or Registration Statement No.: | | (3) | Filing Party: | | | | (4) | (3) | | Filing Party: | | | | | | | | (4) | | Date Filed: | | | | | |

3333 S. Pinnacle Hills Parkway

Suite 220

Rogers, Arkansas 72758

(479) 259-2977

www.ecoarkusa.com 2017 PROXY STATEMENT AND

NOTICE OF ANNUAL MEETING | | | www.virtualshareholdermeeting.com/EARK |

ECOARK HOLDINGS, INC.

3333 S. Pinnacle Hills Parkway

Suite 220

Rogers, Arkansas 72758

(479) 259-2977 NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

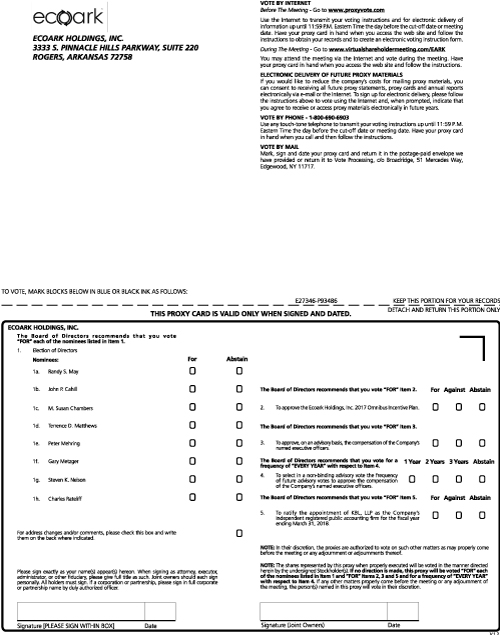

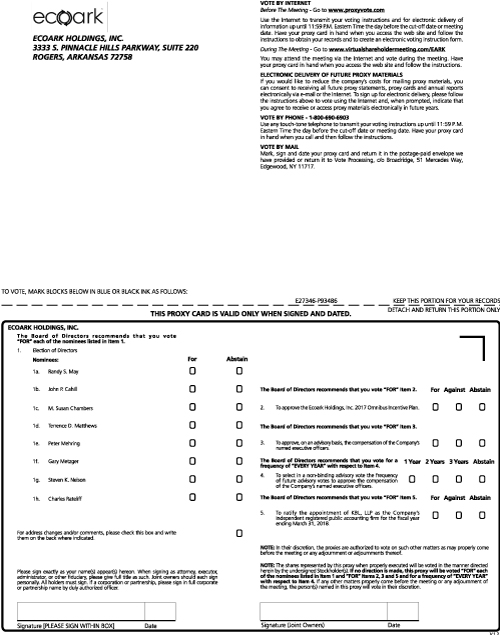

To Be Held on June 13, 2017 NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of Ecoark Holdings, Inc. (the “Company”) will be a virtual meeting held on June 13, 2017 at 10:00 a.m. (Central time) for the following purposes, all of which are discussed in greater detail in the accompanying proxy statement: 1. To elect the eight director nominees named in the accompanying proxy statement to serve until the 2018 annual meeting of stockholders and until successors are duly elected or until the earliest of their removal or resignation; 2. To approve the Ecoark Holdings, Inc. 2017 Omnibus Incentive Plan; 3. To approve, on an advisory basis, the compensation of the Company’s named executive officers; 4. To select in a non-binding advisory vote the frequency of future advisory votes to approve the compensation of the Company’s named executive officers; 5. To ratify the appointment of KBL, LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2018; and 6. To transact such other business as may properly come before the meeting or any adjournment thereof. Only those stockholders of record as of the close of business on April 18, 2017, the record date for the Annual Meeting, will be entitled to vote at the Annual Meeting and any adjournments or postponements thereof. We are pleased to take advantage of the rules of the U.S. Securities and Exchange Commission that allow companies to furnish their proxy materials over the Internet. As a result, beginning on May 1, 2017, we began mailing a Notice of Internet Availability of Proxy Materials to our stockholders rather than a full paper set of the proxy materials. The Notice of Internet Availability of Proxy Materials contains instructions on how to access our proxy materials over the Internet, as well as instructions on how stockholders may obtain a paper copy of our proxy materials. To make it easier for you to vote, both Internet and telephone voting are available. The instructions on the Notice of Internet Availability of Proxy Materials or, if you received a paper copy of the proxy materials, the proxy card describe how to use these convenient services. Your vote is important to us and to our business. Whether or not you plan to participate in the Annual Meeting, we encourage you to read the accompanying proxy statement and submit your proxy or voting instructions as soon as possible. | | BY ORDER OF THE BOARD OF DIRECTORS, | | | | | | Jay Puchir | Rogers, Arkansas

May 1, 2017 | | Chief Executive Officer |

Important notice regarding the availability of proxy materials for the 2017 Annual Meeting of Stockholders to be held on June 13, 2017: The Company’s proxy statement and Annual Report on Form 10-K for the fiscal year ended December 31, 2016 are available electronically at www.ecoarkusa.comand www.proxyvote.com. |

PROXY SUMMARY This summary highlights certain information contained elsewhere in the accompanying proxy statement, but does not contain all of the information you should consider before voting your shares. For more complete information regarding the proposals to be voted upon at the Annual Meeting of Stockholders and our fiscal year 2016 performance, please review the entire proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2016. Unless the context indicates otherwise, we use the terms “Ecoark” and “our” in this summary to refer to Ecoark Holdings, Inc. Annual Meeting | | | | Date: | | June 13, 2017 | Time: | | 10:00 a.m. (Central time) | Location: | | Via the Internet: www.virtualshareholdermeeting.com/EARK | Record Date: | | Holders of our common stock at the close of business on April 18, 2017 | | | | Voting Matters | | |

| | | | | | Board of Directors Recommendation | | | 1. | | Election of directors | | Plurality of Votes Present | | FOR each nominee | | 6 | 2. | | Approval of the Ecoark Holdings, Inc. 2017 Omnibus Incentive Plan | | Majority of Votes Cast | | FOR | | 19 | 3. | | Advisory vote to approve executive compensation | | Majority of Votes Cast | | FOR | | 26 | 4. | | Advisory vote on the frequency of future advisory votes to approve executive compensation | | Majority of Votes Cast | | EVERY YEAR | | 27 | 5. | | Ratification of auditors | | Majority of Votes Cast | | FOR | | 28 |

Director Nominees (see page 7) The following table contains information about the eight candidates who have been nominated for election to the Board of Directors of Ecoark. Each nominee is currently a director of Ecoark. | | | | Director | | Principal | | Financial | | Committee Memberships | | | | | | | | | | | | | | | | Randy S. May | | 53 | | 2016* | | Chairman of the Board of Ecoark | | — | | — | | — | | — | John P. Cahill | | 62 | | 2016 | | Counsel at Chadbourne & Parke LLP; Principal at

Pataki-Cahill Group LLC | | — | | — | | — | |

| M. Susan Chambers | | 59 | | 2017 | | Principal of Chambers Consulting LLC | | — | | — | |

| | — | Terrence D. Matthews | | 58 | | 2016 | | Executive Vice-President of JB Hunt Transport Services Inc. | | — | |

| |

| |

| Peter Mehring | | 55 | | 2017 | | CEO and President of Zest Labs, Inc. | | — | | — | | — | | — | Gary Metzger | | 65 | | 2016* | | Product Developer/Manager of Ravago Americas; Lead Director of Ecoark | | — | |

| |

| |

| Steven K. Nelson | | 59 | | 2017 | | Lecturer at University of Central Arkansas | |

| |

| | — | | — | Charles Rateliff | | 64 | | 2016 | | Chief Financial Officer and Treasurer of Ecoark | | — | | — | | — | | — |

3333 S. Pinnacle Hills Parkway

Suite 220

Rogers, Arkansas 72758

(479) 259-2977

www.ecoarkusa.com PRELIMINARY PROXY STATEMENT SUBJECT TO COMPLETION, DATED FEBRUARY 16, 2015

MAGNOLIA SOLAR CORPORATION

54 Cummings Park, Suite 316

Woburn, MA, 01801

Dear Magnolia Solar Stockholders:

This proxy statement (this “Proxy Statement”) is being furnished to holders of common stock, $0.001 par value per share, of Ecoark Holdings, Inc. (“Ecoark,” “the Company,” “we,” “our,” and “us”) beginning on May 1, 2017 in connection with the solicitation of proxies by the Board of Directors of the Company (the “Board of Directors” or the “Board”) to be used at the 2017 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on June 13, 2017 at 10:00 a.m. (Central time) and at any postponement or adjournment thereof. The Annual Meeting will be a completely “virtual meeting” of stockholders. You are cordially invitedwill be able to attend a Specialthe Annual Meeting as well as vote and submit your questions during the live webcast of the meeting by visiting www.virtualshareholdermeeting.com/EARK and entering the control number included in your Notice of Internet Availability of Proxy Materials, on your proxy card or in the instructions that accompanied your proxy materials.Because the Annual Meeting is entirely virtual and being webcast live over the Internet, stockholders will not be able to attend the Annual Meeting in person. Please read this Proxy Statement carefully then vote your shares promptly by telephone, by Internet or by signing, dating and returning your proxy card. ABOUT THE ANNUAL MEETING OF STOCKHOLDERS What is the purpose of the Annual Meeting? The following matters will be presented for stockholder consideration and voting at the Annual Meeting: • the election of directors; • approval of the Ecoark Holdings, Inc. 2017 Omnibus Incentive Plan; • an advisory vote on the compensation of our named executive officers; • an advisory vote on the frequency of future advisory votes to approve the compensation of our named executive officers; • the ratification of KBL, LLP as our independent registered public accounting firm for the year ending March 31, 2018; and • such other business as may properly come before the meeting or any adjournment thereof. Who is entitled to vote? Only our stockholders of Magnolia Solar Corporation,record at the close of business on the record date for the meeting, April 18, 2017, are entitled to vote at the Annual Meeting. On the record date, we had 42,381,321 shares of common stock issued and outstanding. 1 Can I access the proxy materials and annual report electronically? Yes. This Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2016 are available online atwww.ecoarkusa.com. How can I attend the Annual Meeting? Stockholders may attend the Annual Meeting by visitingwww.virtualshareholdermeeting.com/EARK. While all stockholders will be permitted to attend the Annual Meeting, only stockholders of record and beneficial owners as of the close of business on the record date, April 18, 2017, may vote and ask questions during the Annual Meeting. In order to vote or submit a question during the meeting, you will need to follow the instructions posted atwww.virtualshareholdermeeting.com/EARK and will also need the control number included in your Notice of Internet Availability of Proxy Materials, on your proxy card or in the instructions that accompanied your proxy materials. What is the difference between a stockholder of record and a beneficial owner of shares held in street name? Stockholder of record. If your shares are registered directly in your name with our transfer agent, Island Stock Transfer, you are considered the stockholder of record with respect to those shares, and we sent a Notice of Internet Availability of Proxy Materials or a printed set of the proxy materials, together with a proxy card, directly to you. Beneficial owner of shares held in street name. If your shares are held in an account at a broker, bank or other nominee, then you are the beneficial owner of those shares held in “street name,” and a Notice of Internet Availability of Proxy Materials or a printed set of the proxy materials, together with a voting instruction form, was forwarded to you by your broker, bank or other nominee who is considered the stockholder of record with respect to those shares. As a beneficial owner, you have the right to instruct your broker, bank or other nominee on how to vote the shares held in your account by following the instructions in the Notice of Internet Availability of Proxy Materials or on the voting instruction form you received. How can I vote my shares? The process for voting your shares depends on how your shares are held. Generally, as discussed above, you may hold shares as a “record holder” (that is, in your own name) or in “street name” (that is, through a nominee, such as a broker or bank). As explained above, if you hold shares in “street name,” you are considered to be the “beneficial owner” of those shares. Voting by record holders. If you are a record holder, you may vote by proxy prior to the Annual Meeting or you may vote during the Annual Meeting by joining the live webcast and following the instructions atwww.virtualshareholdermeeting.com/EARK. If you are a record holder and would like to vote your shares by proxy prior to the Annual Meeting, you have three ways to vote: • Go to the websitewww.proxyvote.com and follow the instructions at that website; • Call 1-800-690-6903 and follow the instructions provided on the call; or • If you received a proxy card in the mail, complete, sign, date, and mail the proxy card in the return envelope provided to you. Please note that telephone and Internet proxy voting will close at 10:59 p.m. (Central time) on June 12, 2017. If you received a proxy card in the mail and wish to vote by completing and returning the proxy card via mail, please note that your completed proxy card must be received before the polls close for voting at the Annual Meeting. Voting by beneficial owners of shares held in “street name.” If your shares are held in the name of a broker, bank, or other nominee (that is, your shares are held in “street name”), you should receive separate instructions from the record holder of your shares describing how to vote. 2 How are proxies voted? All shares represented by valid proxies received prior to the Annual Meeting will be voted, and where a stockholder specifies by means of the proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the stockholder’s instructions. What happens if I do not give specific voting instructions? Stockholders of record. If you are a stockholder of record and you sign and return a proxy card without giving specific voting instructions or you indicate when voting on the Internet or by telephone that you wish to vote as recommended by the Board, then the proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this Proxy Statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting. Beneficial owners of shares held in street name. If you are a beneficial owner of shares held in street name and do not join and vote at the Annual Meeting or provide the broker, bank or other nominee that holds your shares with specific voting instructions, then the broker, bank or other nominee that holds your shares may generally vote on routine matters but cannot vote on non-routine matters. If the broker, bank or other nominee that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the broker, bank or other nominee that holds your shares will inform the inspector of election that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.” Which ballot measures are considered ‘‘routine’’ or ‘‘non-routine’’? The ratification of the appointment of KBL, LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2018 (Proposal No. 5) is considered a “routine” matter. Your broker, therefore, may vote your shares in its discretion if you do not provide instructions on how to vote on this routine matter, and no broker non-votes are expected in connection with this proposal. The election of directors (Proposal No. 1), the approval of the Ecoark Holdings, Inc. 2017 Omnibus Incentive Plan (Proposal No. 2), the approval of the compensation of our named executive officers (Proposal No. 3), and the frequency of future advisory votes on named executive officer compensation (Proposal No. 4) are considered “non-routine” matters. Accordingly, a broker may not vote on these proposals without instructions from its customer and broker non-votes may occur with respect to these proposals. Can I change my vote or revoke my proxy after I return my proxy card or vote online? Yes. You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. After you submit your proxy or vote online, you may change your vote via the Internet or by telephone (in which case only your latest Internet or telephone proxy submitted prior to the Annual Meeting will be counted), by signing and returning a new proxy card or voting instruction form with a later date, or by attending the Annual Meeting and voting. However, your virtual attendance at the Annual Meeting will not automatically revoke your proxy unless you properly vote during the Annual Meeting or specifically request that your prior proxy be revoked by delivering written notice to the Secretary of the Company prior to the Annual Meeting at 3333 S. Pinnacle Hills Parkway, Suite 220, Rogers, AR 72758. What constitutes a quorum? The presence at the Annual Meeting, virtually or by proxy, of the holders of a majority of the outstanding shares of stock entitled to vote at the Annual Meeting will constitute a quorum at the Annual Meeting for the transaction of any business. If a quorum is established, each stockholder entitled to vote at the Annual Meeting will be entitled to one vote, virtually or by proxy, for each share of stock entitled to vote held by such stockholder on the record date, April 18, 2017. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of votes considered to be present at the Annual Meeting and will be counted for quorum purposes. If a quorum is not present, the Annual Meeting may be adjourned until a quorum is obtained. 3 What are the Board of Directors’ recommendations? The recommendations of the Board of Directors are set forth under the description of each proposal in this Proxy Statement. In summary, the Board of Directors recommends that you vote: •“FOR” each of the director nominees named herein (Proposal No. 1); •“FOR” approval of the Ecoark Holdings, Inc. 2017 Omnibus Incentive Plan (Proposal No. 2); •“FOR” approval of the resolution regarding compensation of our named executive officers (Proposal No. 3); • “EVERY YEAR” with respect to the frequency of future advisory votes on named executive officer compensation (Proposal No. 4); and •“FOR” the ratification of the appointment of KBL, LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2018 (Proposal No. 5). What vote is required to approve each Proposal? With respect to the election of directors (Proposal No. 1), our bylaws require that each director be elected by a plurality of the votes present at the meeting, either virtually or by proxy. In other words, the eight nominees receiving the greatest number of votes will be elected. You may vote for or abstain from voting for any or all of the director nominees nominated for election at the Annual Meeting and named in this Proxy Statement. Approval of the 2017 Omnibus Incentive Plan (Proposal No. 2), approval of the compensation of our named executive officers (Proposal No. 3), the frequency of future advisory votes on named executive officer compensation (Proposal No. 4), and ratification of the appointment of KBL, LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2018 (Proposal No. 5) require the affirmative vote of a majority of votes cast. You may vote for, against or abstain from voting for these proposals. Proposals No. 3 and No. 4, however, are merely advisory and are not binding on the Company, the Board or the Compensation Committee of the Board (the “Compensation Committee”). Despite the fact that Proposals No. 3 and No. 4 are not binding, the Board and the Compensation Committee will take the voting results of the proposals under advisement when making future decisions regarding the Company’s executive compensation program and the frequency of future advisory votes on named executive officer compensation. Will abstentions and broker non-votes have an impact on the proposals contained in this Proxy Statement? Abstentions and broker non-votes will be counted to determine whether there is a quorum present at the Annual Meeting, but will not be considered votes cast for voting purposes and thus will have no effect on any of the proposals to be presented at the Annual Meeting. Where can I find the voting results of the Annual Meeting? We intend to announce preliminary voting results at the Annual Meeting and disclose final results in a Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (the “SEC”) within four business days after the Annual Meeting. Who pays the cost for soliciting proxies by the Board of Directors? We will bear the cost of soliciting proxies, including the cost of preparing, printing and mailing the materials in connection with the solicitation of proxies. We will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending the proxy materials to the beneficial owners of our common stock. In addition to solicitations by mail, our officers and regular employees may, without being additionally compensated, solicit proxies personally and by mail, telephone, facsimile or electronic communication. 4 Who is Ecoark? Ecoark is a Nevada corporation whichincorporated on November 19, 2007 that has developed over the past three years through key acquisitions described below and organic growth. Ecoark is referredan innovative, emerging growth company focused on the development and deployment of business solutions and products to hereinthe retail, agriculture, and food service end markets. Ecoark has assembled a management team and a portfolio of proprietary, patented technologies to address the waste in operations, logistics and supply chain. Ecoark accomplishes this through two wholly-owned operating subsidiaries, Ecoark, Inc. and Magnolia Solar, Inc., as “Magnolia Solar,” “MSC,” the “Company,” “we,” “us” or “our,” to be held at 9 a.m., local time, on February [*], 2016, at the corporate offices of MSC, located at 54 Cummings Park, Suite 316, Woburn, MA, 01801. well as Ecoark, Inc.’s two operating subsidiaries, Zest Labs, Inc. and Pioneer Products, LLC. On January 29, 2016, weEcoark (previously known as Magnolia Solar Corporation) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Ecoark, Inc., a Delaware corporation that we referpursuant to as Ecoark. Pursuant to the Merger Agreement,which Ecoark, will mergeInc. merged with and into a subsidiary of the Company created for sole purpose of effectuating this MergerEcoark (the “Merger Sub”“Merger”). Ecoark, will be the surviving entity (sometimes referred toInc. and Magnolia Solar, Inc. continue as the “Surviving Corporation”). Assubsidiaries and businesses of Ecoark. From a resultlegal perspective, Magnolia Solar Corporation acquired Ecoark, Inc.; however, in compliance with financial accounting standards, the transaction was accounted for as a “reverse acquisition” in which it was treated as an acquisition of the Merger, the separate corporate existence of the Merger Sub shall cease. We referMagnolia Solar Corporation by Ecoark, Inc. Prior to this transaction as the Merger. Upon the closing of the Merger Agreement, without limiting the generality of the foregoing, all of the property, rights, privileges, immunities, powers, and franchises of the Merger Sub and Ecoark shall vest in the Surviving Corporation, and all debts, liabilities, and duties of the Merger Sub and Ecoark shall become the debts, liabilities, and duties of the Surviving Corporation. The completion of the Merger is subjecton March 24, 2016, in a special stockholder meeting on March 18, 2016, the Articles of Incorporation of Ecoark were amended to effect (1) a number of conditions, including proposals to amend our articles of incorporation containedchange in this proxy statement. We are sending you this proxy statement to invite you to attend a Special Meeting of MSC stockholders being held to vote on these proposals and to ask you to vote at the Special Meeting in favorname of the proposals.

The proposals that must be approved in order for the Mergercompany from Magnolia Solar Corporation to be consummated are the following:

| 1. | To approve an amendment to our Articles of Incorporation to effect a change in the name of our company from Magnolia Solar Corporation to Ecoark Holdings Inc.; |

| 2. | To approve an amendment to our Articles of Incorporation to effectEcoark Holdings, Inc., (2) a reverse stock split of our common stock by a ratio of one-for-two hundred fifty shares (1 for 250); |

| 3. | To approve an amendment to our Articles of Incorporation to effect an increase in the number of our authorized shares of common stock, par value $0.001 per share, to 100,000,000; |

| 4. | To approve an amendment to our Articles of Incorporation to effect the creation of 5,000,000 shares of “blank check” preferred stock; and |

| 5. | To approve the adjournment of the MSC Special Meeting, if necessary or appropriate, in the view of the MSC board of directors, to solicit additional proxies in favor of the Charter Proposals if there are not sufficient votes at the time of such adjournment to approve the Charter Proposals, which is referred to herein as the adjournment proposal. |

We cannot complete the Merger unless the MSC stockholders approve the above proposals (collectively, the “Proposals”) which, with the exception of Proposal 5, we refer to as the Charter Proposals. We are seeking approval of the Proposals at the Special Meeting of stockholders of MSC to be held on February [*], 2016.Your vote is very important, regardless of the number of shares you own. Whether or not you expect to attend the MSC Special Meeting in person, please submit your voting instructions as promptly as possible by signing and returning all proxy cards that you receive in the postage-paid envelope provided, so that your shares may be represented and voted at the MSC Special Meeting. A failure to vote your shares is the equivalent of a vote against the Charter Proposals and consequently the Merger.

Under Nevada law, if the Proposals are approved, holders of shares of MSC common stock will not have the right to seek appraisal of the fair value of their shares.

Revocation of Proxies or Voting Instructions

You have the power to revoke your proxy at any time before your proxy is voted at the Special Meeting. You can revoke your proxy or voting instructions in one of four ways:

| ● | you can grant a new, valid proxy bearing a later date; |

| ● | you can send a signed notice of revocation; |

| ● | if you are a holder of record of our common stock on the record date for the Special Meeting, you can attend the Special Meeting and vote in person, which will automatically cancel any proxy previously given, or you can revoke your proxy in person, but your attendance alone will not revoke any proxy that you have previously given; or |

| ● | if your shares of our common stock are held in an account with a broker, bank or other nominee, you must follow the instructions on the voting instruction card you received in order to change or revoke your instructions. |

The MSC board of directors determined that the Proposals and related matters are advisable and in the best interests of MSC and its stockholders, and the MSC board of directors recommends that the MSC stockholders vote “FOR” each of the Proposals to be submitted to the MSC stockholders at the MSC Special Meeting.

More information about MSC, the Proposals and the Merger is contained in this proxy statement. We encourage you to read this entire proxy statement carefully.

We thank you for your continued support of MSC and look forward to the successful Merger.

Dr. Ashok K. Sood

Chief Executive Officer and President

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved the Proposals or the Merger, passed upon the merits or fairness of the Proposals or the Merger, or determined if this proxy statement is accurate or complete. Any representation to the contrary is a criminal offense.

This proxy statement is dated February [*], 2016, and is first being mailed to MSC stockholders on or about February [*], 2016.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON FEBRUARY [*], 2016.

Our Proxy Statement, Annual Report on Form 10-K for the fiscal year ended December 31, 2014, and our Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2015 are enclosed with this mailing and are also available at http://www.magnoliasolar.com

PRELIMINARY PROXY STATEMENT, SUBJECT TO COMPLETION, DATED FEBRUARY 16, 2015

MAGNOLIA SOLAR CORPORATION

54 Cummings Park, Suite 316

Woburn, MA, 01801

NOTICE OF SPECIAL MEETING OF STOCKHOLDER

TO BE HELD ONFebruary[*], 2016

NOTICE IS HEREBY GIVEN that the Special Meeting of shareholders of Magnolia Solar Corporation, a Nevada corporation, which is often referred to herein as MSC, will be held at 9 a.m., local time, on February [*], 2016 at the corporate offices of MSC, located at 54 Cummings Park, Suite 316, Woburn, MA, 01801, to consider and vote upon the following proposals:

| 1. | To approve an amendment to our Articles of Incorporation to effect a change in the name of our company from Magnolia Solar Corporation to Ecoark Holdings Inc.; |

| 2. | To approve an amendment to our Articles of Incorporation to effect a reverse stock split of our common stock by a ratio of one-for-two hundred fifty shares (1 for 250); |

| 3. | To approve an amendment to our Articles of Incorporation to effect an increase in our the number of authorized shares of common stock, par value $0.001 per share, to 100,000,000; |

| 4. | To approve an amendment to our Articles of Incorporation to effect the creation of 5,000,000 shares of “blank check” preferred stock; and |

| 5. | To approve the adjournment of the MSC Special Meeting, if necessary or appropriate, in the view of the MSC board of directors, to solicit additional proxies in favor of the Charter Proposals if there are not sufficient votes at the time of such adjournment to approve the Charter Proposals, which is referred to herein as the adjournment proposal. |

Proposals 1 through 4 are at times referred to herein as the Charter Proposals, and all proposals are at times referred to as the Proposals.

These matters are described more fully in the accompanying proxy statement, which MSC shareholders are urged to read thoroughly. The MSC board of directors determined that the Charter Proposals and related matters are advisable and in the best interests of MSC and its stockholders, and the MSC board of directors recommends that the MSC stockholders vote “FOR” each of the Charter Proposals to be submitted to the MSC stockholders at the MSC Special Meeting.

All MSC shareholders are cordially invited to attend this Special Meeting with proper identification and, if applicable, acceptable proof of ownership, although only holders of record of MSC common stock at the close of business on February [5], 2016 (the “Record Date”), will be entitled to receive notice of, and to vote at, the MSC Special Meeting, or any adjournment or postponement thereof. On the Record Date, we anticipate that there were issued and outstanding and entitled to vote 49,004,912 shares of common stock, each of which is entitled to vote one vote on each Proposal at the MSC Special Meeting.

A quorum is necessary to hold a valid Special Meeting. A quorum will be present at the Special Meeting if the holders of a majority of the outstanding shares of our common stock entitled to vote at the Special Meeting are present, in person or by proxy. If a quorum is not present at the Special Meeting, the Company expects the presiding officer to adjourn the Special Meeting in order to solicit additional proxies. Abstentions will be counted as present for purposes of determining whether a quorum is present.

A list of shareholders entitled to receive notice of and vote at the MSC Special Meeting will be available in MSC’s offices located at 54 Cummings Park, Suite 316, Woburn, MA, 01801, during ordinary business hours for the ten-day period preceding the date of the MSC Special Meeting. A shareholder list will also be available at the MSC Special Meeting.

Approval of the Charter Proposals requires the affirmative vote of holders of a majority of the outstanding shares of MSC common stock, hereinafter referred to as the MSC Shareholder Approval.

In connection with MSC’s solicitation of proxies for the Special Meeting, MSC began mailing the accompanying proxy statement and proxy card on or about February [*], 2016. Whether or not you expect to attend the MSC Special Meeting in person, please submit your voting instructions as promptly as possible by signing and returning all proxy cards that you receive in the postage-paid envelope provided, so that your shares may be represented and voted at the MSC Special Meeting. This will not prevent you from voting in person, but it will help to secure a quorum and avoid added solicitation costs. Any holder of MSC common stock who is present at the Special Meeting may vote in person instead of by proxy, thereby canceling any previous proxy. In any event, a proxy may be revoked in writing at any time before its exercise at the MSC Special Meeting in the manner described in the accompanying proxy statement.

BY ORDER OF THE BOARD OF DIRECTORS,

Dr. Ashok K. Sood

Chief Executive Officer and President

Magnolia Solar Corporation

February [*], 2016

YOUR VOTE IS VERY IMPORTANT. PLEASE SUBMIT YOUR VOTING INSTRUCTIONS USING ONE OF THE METHODS ABOVE TO ENSURE THAT YOUR VOTE WILL BE COUNTED, REGARDLESS OF WHETHER YOU PLAN TO ATTEND THE MEETING. YOUR PROXY MAY BE REVOKED AT ANY TIME BEFORE THE VOTE AT THE MSC SPECIAL MEETING BY FOLLOWING THE PROCEDURES OUTLINED IN THE ACCOMPANYING PROXY STATEMENT. YOU CAN FIND INSTRUCTIONS FOR VOTING ON THE ENCLOSED PROXY CARD.

INFORMATION ABOUT ATTENDING THE MSC SPECIAL MEETING

Only shareholders of record on the record date of February [5], 2016 are entitled to notice of and to attend or vote at the MSC Special Meeting. If you plan to attend the MSC Special Meeting in person, please bring the following:

| 1. | Proper identification. | | | | | 2. | Acceptable Proof of Ownership if your shares are held in street name. |

Street name means your shares are held of record by brokers, banks or other institutions.

Acceptable Proof of Ownership is either (a) a letter from your broker stating that you beneficially owned MSC stock on the record date or (b) an account statement showing that you beneficially owned MSC stock on the record date.

PRELIMINARY PROXY STATEMENT, SUBJECT TO COMPLETION, DATED FEBRUARY 16, 2015

MAGNOLIA SOLAR CORPORATION

54 Cummings Park, Suite 316

Woburn, MA, 01801

PROXY STATEMENT

FOR A SPECIAL MEETING OF STOCKHOLDERS

This proxy statement is furnished to shareholders in connection with the solicitation of proxies by the Board of Directors of Magnolia Solar Corporation (“MSC”, the “Company”, “we”, “our”, or “us”) in connection with a special meeting of shareholders of the Company to be held on February [*], 2016 at 9 a.m. (local time) at the Company’s corporate offices, 54 Cummings Park, Suite 316, Woburn, Massachusetts, 01801 (the “Special Meeting”).

Additional copies of this proxy statement, an Annual Report on Form 10-K, a Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2015, a notice of meeting, form of proxy, and directions to be able to attend the meeting and vote in person, may be obtained from the Company's Secretary, 54 Cummings Park, Suite 316, Woburn, Massachusetts, 01801.

SOLICITATION AND REVOCABILITY OF PROXIES

The enclosed proxy for the Special Meeting is being solicited by the directors of the Company. If you choose to vote, please mark, date and sign the proxy card, and then return it in the enclosed envelope (no postage is necessary if mailed within the United States). Any person giving a proxy may revoke it at any time prior to the exercise thereof by filing with the Secretary of the Company a written revocation or duly executed proxy bearing a later date. The proxy may also be revoked by a shareholder attending the Special Meeting, withdrawing the proxy and voting in person.

The expense of preparing, printing and mailing the form of proxy and the material used in the solicitation thereof will be borne by the Company. In addition to solicitation by mail, proxies may be solicited by the directors, officers and regular employees of the Company (who will receive no additional compensation therefor) by means of personal interview, telephone or facsimile. It is anticipated that banks, brokerage houses and other institutions, custodians, nominees, fiduciaries or other record holders will be requested to forward the soliciting material to persons for whom they hold shares and to seek authority for the execution of proxies; in such cases, the Company will reimburse such holders for their charges and expenses.

VOTING SECURITIES

The close of business on February [5], 2016 has been fixed as the record date for determination of the shareholders entitled to notice of, and to vote at, the Special Meeting. On that date we anticipate there were issued and outstanding and entitled to vote 49,004,912 shares of common stock, each of which is entitled to one vote on each Proposal at the Special Meeting.

Pursuant to our Articles and bylaws, in addition to Nevada law, the vote of a majority of the shares of common stock issued and outstanding as of the record date will be required to approve an amendment to the Company’s Articles of Incorporation.

The presence, in person or by properly executed proxy, of the holders of shares of common stock entitled to cast a majority of all the votes entitled to be cast at the Special Meeting is necessary to constitute a quorum. Holders of shares of common stock represented by a properly signed, dated and returned proxy will be treated as present at the Special Meeting for purposes of determining a quorum. Proxies relating to “street name” shares that are voted by brokers will be counted as shares present for purposes of determining the presence of a quorum, but will not be treated as votes cast at the Special Meeting as to any proposal as to which the brokers do not have voting instructions and discretion. These missing votes are known as “broker non-votes.”

TABLE OF CONTENTS

| Page | SUMMARY TERM SHEET | 1 | QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING | 3 | | | CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | 7 | | | SPECIAL FACTORS | 8 | Description and Effects of the Merger | 8 | Background of the Merger | 8 | MSC’s Reasons for the Charter Proposals and the Merger, and the Recommendation of the Board of Directors | 8 | Accounting Treatment | 8 | Regulatory Approvals Required for the Merger | 8 | | | THE MERGER AGREEMENT | 9 | The Merger | 10 | Closing and Effective Time of the Merger | 10 | MSC Stockholder Approval | 10 | MSC Approval | 10 | Ecoark Stockholder Approval | 10 | Representations and Warranties | 10 | Pre-Closing Covenants | 12 | Conditions to the Completion of the Merger | 13 | Termination | 13 | Termination Fees | 13 | Expenses | 13 | | | THE SPECIAL MEETING | 14 | Date, Time and Place | 14 | Purpose of the Special Meeting | 14 | Recommendations of the Board of Directors of Magnolia Solar Corporation | 14 | Record Date; Stock Entitled to Vote | 14 | Quorum | 14 | Required Vote | 14 | Abstentions, Failures to Vote and Broker Non-Votes | 14 | Voting at the Special Meeting | 15 | Revocation of Proxies or Voting Instructions | 15 | Solicitation of Proxies | 15 | Adjournments and Postponements | 15 | | | PROPOSALS TO BE CONSIDERED AT THE SPECIAL MEETING | 16 | The Change in the Company’s Name (Item 1 on the Proxy Card) | 17 | Approval of a Reverse Stock Split (Item 2 on the Proxy Card) | 18 | The Increase in the Company’s Authorized Common Stock (Item 3 on the Proxy Card) | 19 | The Creation of Blank Check Preferred Stock (Item 4 on the Proxy Card) | 20 | The Adjournment (Item 5 on the Proxy Card) | 21 |

IMPORTANT INFORMATION REGARDING MAGNOLIA SOLAR | 22 | Business | 22 | Executive Officers and Directors of the Company | 22 | Legal Proceedings | 23 | Market for Common Equity and Related Stockholder Matters | 23 | Certain Relationships and Related Transactions | 23 | Description of Securities | 24 | Security Ownership of Certain Beneficial Owners and Management | 25 | Financial Statements | 25 | Management’s Discussion and Analysis | 26 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 30 | | | IMPORTANT INFORMATION REGARDING ECOARK, INC. | 30 | Business | 30 | Financial Statements | 31 | Management’s Discussion and Analysis | 32 | | | MANAGEMENT OF MAGNOLIA SOLAR FOLLOWING THE MERGER | 35 | | | MANAGEMENT OWNERSHIP FOLLOWING THE MERGER | 36 | | | MULTIPLE STOCKHOLDERS SHARING ONE ADDRESS | 37 | OTHER MATTERS | 37 | WHERE YOU CAN FIND MORE INFORMATION | 37 |

ANNEXES | | Annex A – Merger Agreement | Annex B – Magnolia Solar Annual Report on Form 10-K for the year ended December 31, 2014 | Annex C – Magnolia Solar Quarterly Report on Form 10-Q for the quarter ended September 30, 2015 | Annex D – Ecoark Consolidated Financial Statements for the nine months ended September 30, 2015 and 2014 (Unaudited) | Annex E – Ecoark Consolidated Financial Statements for the years ended December 31, 2014 and 2013 (Audited) | Annex F – Unaudited Pro Forma Condensed Combined Financial Information |

ABOUT THIS DOCUMENT

This document, which was filed with the Securities and Exchange Commission (referred to herein as the “SEC”), constitutes a proxy statement of Magnolia Solar Corporation, sometimes referred to herein as “Magnolia Solar,” “MSC,” “we,” “us” or the “Company,” under Section 14(a) of the Securities Exchange Act of 1934, which is referred to herein as the Exchange Act, and the rules thereunder, and a notice of meeting with respect to the Special Meeting of MSC’s stockholders (the “Special Meeting”) to consider and vote upon the proposals referenced herein.

You should rely only on the information contained or incorporated by reference in this proxy statement. No one has been authorized to provide you with information that is different from that contained in, or incorporated by reference in, this proxy statement. This proxy statement is dated February [*], 2016. You should not assume that the information contained in this proxy statement is accurate as of any date other than such date, or that the information incorporated by reference in this proxy statement is accurate as of any date other than the date of such incorporated documents. The mailing of this proxy statement to MSC stockholders will not create any implication to the contrary.

This proxy statement does not constitute the solicitation of a proxy in any jurisdiction to or from any person to whom or from whom it is unlawful to make any such solicitation in such jurisdiction.

SUMMARY TERM SHEET

This summary term sheet highlights information contained elsewhere in this proxy statement and may not contain all the information that is important to you. MSC urges you to read carefully the remainder of this proxy statement, including the attached annex, and the other documents to which MSC has referred you because this section does not provide all the information that might be important to you. See also the section entitled “Where You Can Find More Information” beginning on page - 31 -.

Description and Effects of the Merger

On January 29, 2016, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Ecoark, Inc., a Delaware corporation that we refer to as Ecoark. Pursuant to the Merger Agreement, Ecoark will merge with and into a subsidiary of the Company created for sole purpose of effectuating this Merger (the “Merger Sub”). Ecoark will be the surviving entity (the “Surviving Corporation”). As a result of the Merger, the separate corporate existence of the Merger Sub shall cease. We refer to this transaction as the Merger. Thus, upon the closing of the Merger Agreement, without limiting the generality of the foregoing, all of the property, rights, privileges, immunities, powers, and franchises of the Merger Sub and Ecoark shall vest in the Surviving Corporation, and all debts, liabilities, and duties of the Merger Sub and Ecoark shall become the debts, liabilities, and duties of the Surviving Corporation.

The Merger will have no effect on the market for the tradability of the shares of common stock of MSC, though the current ticker symbol for its shares is expected to be changed if and when its stockholders approve the change in its name (see Proposal 1). The Merger Agreement is attached asAnnex A to this proxy statement.

MSC and Ecoark expect to complete the Merger in the first quarter of 2016. Upon completion of the Merger, MSC will continue the businesses of both MSC and Ecoark. However, the Merger is subject to certain approvals, including but not limited to all the Charter Proposals, and certain other conditions. As a result, it is possible that factors outside the control of MSC and Ecoark could result in the Merger being completed at a later time, or not at all.

The Parties to the Merger

MSC

Magnolia Solar Corporation

54 Cummings Park, Suite 316

Woburn, MA 01801

Attention: Dr. Ashok K. Sood, Chief Executive Officer and President

Telephone: 1 (781) 497-2900

MSC was incorporated as a Nevada corporation on November 19, 2007. On December 31, 2009, MSC entered into an Agreement of Merger and Plan of Reorganization with Magnolia Solar, Inc., a privately held Delaware corporation (“MSI”), whereby MSC acquired MSI. Following the acquisition of MSI, MSC discontinued its former business and adopted the business of MSI as MSC’s sole line of business.

MSC, through its subsidiaries, is principally engaged in the development and commercialization of its nanotechnology-based, high-efficiency, thin-film technology that can be deposited on a variety of substrates, including glass and flexible structures. MSC believes that this technology has the potential to capture a larger part of the solar spectrum to produce high-efficiency solar cells, and incorporates a unique nanostructure-based antireflection coating technology to possibly further increase the solar cell's performance. If these goals are met, there is the potential of significantly reducing the cost per watt. MSC is a development stage company and to date has not generated material revenues or earnings as a result of its activities.

MAGNOLIA SOLAR ACQUISITION CORPORATION

54 Cummings Park, Suite 316

Woburn, MA 01801

Attention: Dr. Ashok K. Sood, Chief Executive Officer and President

Telephone: 1 (781) 497-2900

Magnolia Solar Acquisition Corporation., a Delaware corporation (the “Merger Sub”), was formed on January 28, 2016 for the sole purposes of consummating the Merger.

ECOARK, INC.

3333 Pinnacle Hills Pkwy

Suite 220

Rogers, AR 72758

Telephone: (479) 259-2977

Founded in 2011, Ecoark, Inc. is an innovative and growth-oriented company developing and deploying intelligent technologies and consumer products in order to meet the demand for sustainable, integrated solutions to contemporary business needs.

Ecoark consists of four subsidiaries. which bring together best-in-class technologies, product solutions, and industry professionals to address the market opportunity of reducing waste in retail and business by offering real-time supply chain analytic solutions. The Company’s operations and acquisitions are guided by a policy emphasizing the “triple bottom line” of social, economic, and environmental responsibility. Ecoark hopes to provide recurring revenue, increased profits, and sustainable growth by bringing a comprehensive suite of proprietary, patented products and services to a ready marketplace estimated to include thousands of businesses and over 300 million consumers.

Ecoark is comprised of four operating entities – Intelleflex, Eco360, Eco3D, and Pioneer Products. Collectively, these entities will enable Ecoark to emerge as a leader in sensor based technologies, big data analytics, tethered data solutions, Zero Waste processes, and global waste reduction.

The Merger Agreement

The Merger Agreement is included asAnnex A hereto. The Board encourages you to read carefully the Merger Agreement in its entirety. It is the principal document governing the Merger and the related transactions.

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

The following are answers to some questions that you, as a shareholder of MSC, may have regarding the Charter Proposals and the other matters being considered at the Special Meeting of shareholders of MSC, which is referred to herein as the Special Meeting or the MSC Special Meeting. MSC urges you to read carefully the remainder of this proxy statement because the information in this section does not provide all the information that might be important to you with respect to the Charter Proposals and the other matters being considered at the Special Meeting. Additional important information is also contained in the annexes to and the documents incorporated by reference into this proxy statement.

| Q: | Why am I receiving this proxy statement? | | | | | A: | The board of directors of MSC is soliciting your proxy to vote at the MSC Special Meeting of shareholders because you owned shares of MSC common stock at the close of business on February [5], 2016, the record date for the MSC Special Meeting, and are therefore entitled to vote at the MSC Special Meeting. This proxy statement, along with a proxy card or a voting instruction card, is being mailed to shareholders on or about February [*], 2016. This proxy statement summarizes the information that you need to know in order to cast your vote at the Special Meeting. You do not need to attend the Special Meeting in person to vote your shares of MSC common stock.

|

In order to complete the Merger, MSC shareholders must vote to approve the Charter Proposals, and all other conditions to the Merger must be satisfied or waived.

| Q: | When and where will the Special Meeting be held? |

| A: | The MSC Special Meeting will be held at 9 a.m., local time, on February [*], 2016 at the corporate offices of MSC, located at 54 Cummings Park, Suite 316, Woburn, MA 01801. |

| Q: | On what matters will I be voting? |

| A: | You are being asked to approve amendments to our Articles of Incorporation to effect: (i) a change in the name of our company from Magnolia Solar Corporation to Ecoark Holdings Inc.; (ii) a reverse stock split of our common stock by a ratio of one-for-two hundred fifty shares; (iii) an increase in our the number of authorized shares of common stock to 100,000,000; and (iv) the creation of 5,000,000 shares of “blank check” preferred stock. We refer to these proposals as the Charter Proposals. We cannot consummate the closing of the Merger Agreement unless all the Charter Proposals are approved. |

A copy of the Merger Agreement is attached to this proxy statement asAnnex A.

In addition you are also being asked to vote on a proposal to adjourn the MSC Special Meeting, if necessary or appropriate, in the view of the MSC board of directors, to solicit additional proxies in favor of any one or more of the Charter Proposals if there are not sufficient votes at the time of such adjournment to approve any of the Charter Proposals, which is referred to herein as the adjournment proposal.

| Q: | What consideration will MSC shareholders receive if the Merger is completed? |

| A: | There will be no consideration issued or issuable to the MSC shareholders in the Merger. MSC will upon closing of the Merger issue that number of shares to Ecoark shareholders as shall be equal to approximately ninety-five percent (95%) of all the shares of MSC common stock, calculated on a fully diluted basis, in consideration by the transfer by Ecoark to MSC of all issued and outstanding shares of Ecoark. |

| Q: | How does the MSC board of directors recommend that I vote? |

| A: | The MSC board of directors urges MSC shareholders to vote “FOR” the Charter Proposals and, if necessary, vote “FOR” the adjournment proposal. You should read “Special Factors—MSC’s Reasons for the Charter Proposals and the Merger and Recommendation of the Board of Directors” beginning on page 9 for a discussion of the factors that our board of directors considered in deciding to recommend the approval of the Charter Proposals. |

| A: | After you have carefully read this proxy statement and have decided that you wish to vote your shares of MSC common stock, please vote your shares promptly. |

Shareholders of Record

If your shares of MSC common stock are registered directly in your name with MSC’s transfer agent, Island Stock Transfer, you are the shareholder of record of those shares and these proxy materials have been mailed to you by MSC. Your vote authorizes Yash Puri, as your proxy, with the power to appoint his substitute, to represent and vote your shares as you directed. Please complete, date and sign your proxy card and return it in the postage-paid envelope provided.

| | Only the latest dated proxy received from you will be voted at the MSC Special Meeting. You may also vote in person at the MSC Special Meeting. |

Beneficial Owners

If your shares of MSC common stock are held in a stock brokerage account, by a bank, broker or other nominee, you are considered the beneficial owner of shares held in street name and these proxy materials are being forwarded to you by your bank, broker or nominee that is considered the holder of record of those shares. As the beneficial owner, you have the right to direct your bank, broker, trustee or nominee to sign and return a proxy card. Your bank, broker, trustee or nominee will send you instructions for voting your shares. Please note that you may not vote shares held in street name by returning a proxy card directly to MSC or by voting in person at the Special Meeting unless you provide a “legal proxy,” which you must obtain from your broker, bank or nominee. Further, brokers, banks and nominees who hold shares of MSC common stock on your behalf may not give a proxy to MSC to vote those shares without specific instructions from you.

For a discussion of the rules regarding the voting of shares held by beneficial owners, please see the question below entitled “If I am a beneficial owner of shares of MSC common stock, what happens if I don’t provide voting instructions? What is discretionary voting? What is a broker non-vote?”

| Q: | What vote is required to approve each proposal? |

| A: | Approval of the Charter Proposals requires the affirmative vote of holders of a majority of the outstanding shares of MSC common stock. |

Approval of the adjournment proposal requires the affirmative vote of the holders of a majority of the shares of MSC common stock present in person or represented by proxy at the Special Meeting.

| Q: | How many votes do I and others have? |

| A: | You are entitled to one vote for each share of MSC common stock that you held as of the record date. As of the close of business on February [5], 2016, the record date, there were 49,004,912 outstanding shares of MSC common stock. |

| Q: | How will our directors and executive officers vote on the proposal to approve the Merger Agreement? |

| A: | As of February [5], 2016, the record date, the directors and executive officers of MSC as a group owned and were entitled to vote 16,400,000 shares of the common stock of MSC, representing approximately 33.47% of the outstanding shares of MSC common stock on that date. MSC currently expects that its directors and executive officers will vote their shares in favor of the Charter Proposals, but none of MSC’s directors or executive officers has entered into any agreement obligating any of them to do so. |

| Q: | What will happen if I fail to vote or I abstain from voting? |

| A: | Your failure to vote or abstention from voting will have the same effect as a vote against the Proposals, but will have no effect on the adjournment proposal. |

| Q: | How many shares must be present to hold the MSC Special Meeting? |

| A: | Under Nevada law and the amended and restated bylaws of MSC, the presence in person or by proxy of a majority of the outstanding shares of MSC common stock entitled to vote at the Special Meeting is necessary to constitute a quorum at the MSC Special Meeting. The inspector of election will determine whether a quorum is present. If you are a beneficial owner (as defined above) of shares of MSC common stock and you do not instruct your bank, broker or other nominee how to vote your shares on any of the proposals, your shares will not be counted as present at the Special Meeting for purposes of determining whether a quorum exists. Votes of shareholders of record who are present at the Special Meeting in person or by proxy will be counted as present at the Special Meeting for purposes of determining whether a quorum exists, whether or not such holder abstains from voting on all of the proposals. |

| Q: | If I am a beneficial owner of shares of MSC common stock, what happens if I don’t provide voting instructions? What is discretionary voting? What is a broker non-vote? |

| A: | Under the rules that govern brokers who have record ownership of shares that are held in “street name” for their clients, who are the beneficial owners of the shares, brokers have discretion to vote these shares on routine matters but not on non-routine matters. A “broker non-vote” occurs when a broker expressly instructs on a proxy card that it is not voting on a matter, whether routine or non-routine. Broker non-votes are counted for the purpose of determining the presence or absence of a quorum but are not counted for determining the number of votes cast for or against a proposal. |

We expect that your broker will have discretionary authority to vote your shares on the adjournment proposal, based on this proposal being a routine matter, but not on any of the Charter Proposals, all of which are non-routine matters. Brokers holding shares beneficially owned by their clients no longer have the ability to cast votes with respect to non-routine matters unless they have received instructions from the beneficial owner of the shares. As a result, if you do not provide specific voting instructions to your record holder, that record holder will not be able to vote on any proposal but the adjournment proposal. It is therefore important that you provide voting instructions to your broker if your shares are held by a broker so that your vote with respect to all proposals but the adjournment proposal.

| Q: | What will happen if I return my proxy card without indicating how to vote? |

| A: | If you sign and return your proxy card without indicating how to vote on any particular proposal, the MSC common stock represented by your proxy will be voted in favor of each such proposal. Proxy cards that are returned without a signature will not be counted as present at the MSC Special Meeting and cannot be voted. |

| Q: | Can I change my vote after I have returned a proxy or voting instruction card? |

| A: | Yes. You can change your vote at any time before your proxy is voted at the Special Meeting. You can do this in one of four ways: |

| ● | you can grant a new, valid proxy bearing a later date; | | | | | ● | you can send a signed notice of revocation; or | | | | | ● | if you are a holder of record, you can attend the Special Meeting and vote in person, which will automatically cancel any proxy previously given, or you may revoke your proxy in person, but your attendance alone will not revoke any proxy that you have previously given. | | | | | ● | if your shares of MSC common stock are held in an account with a broker, bank or other nominee, you must follow the instructions on the voting instruction card you received in order to change or revoke your instructions. |

If you choose either of the first two methods, you must submit your notice of revocation or your new proxy to the Secretary of MSC, as specified in this proxy statement, no later than the beginning of the Special Meeting. If your shares are held in street name by your broker, bank or nominee, you should contact them to change your vote.

| Q: | Do I need identification to attend the MSC Special Meeting in person? |

| A: | Yes. Please bring proper identification, together with proof that you are a record owner of shares of MSC common stock. If your shares are held in street name, please bring acceptable proof of ownership, such as a letter from your broker or an account statement stating or showing that you beneficially owned shares of MSC common stock on the record date. |

| Q: | Are MSC shareholders entitled to appraisal rights? |

| A: | No. The Nevada Revised Statutes, or the NRS, do not provide for appraisal rights in connection with any of the Proposals and MSC does not intend to offer you appraisal rights. |

| Q: | What do I do if I receive more than one set of voting materials? |

| A: | You may receive more than one set of voting materials for the MSC Special Meeting, including multiple copies of this proxy statement, proxy cards and/or voting instruction forms. This can occur if you hold your shares of MSC common stock in more than one brokerage account, if you hold shares directly as a record holder and also in street name, or otherwise through a nominee, and in certain other circumstances. If you receive more than one set of voting materials, each should be voted and/or returned separately in order to ensure that all of your shares of MSC common stock are voted. |

| Q: | If I am an MSC shareholder, should I send in my MSC stock certificates with my proxy card? |

| A: | No. Please DO NOT send your MSC stock certificates with your proxy card. |

| Q: | When do you expect the Merger to be completed? |

| A: | MSC is working to complete the Merger as quickly as possible, and expects to complete the Merger in the first quarter of 2016. However, MSC cannot assure you when or if the Merger will occur. The Merger is subject to shareholder approvals and other conditions, and it is possible that factors outside the control of both MSC and Ecoark could result in the Merger being completed at a later time, or not at all. There may be a substantial amount of time between the MSC Special Meeting and the completion of the Merger. MSC hopes to complete the Merger as soon as reasonably practicable following the receipt of all required approvals. |

| Q: | Whom should I call with questions about the Special Meeting, the Charter Proposals or the Merger? |

| A: | You should call Yash Puri, the Company’s chief financial officer, at (781) 497-2900 with any questions. |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement and the documents incorporated by reference in this proxy statement contain “forward-looking statements.” These statements may be made directly in this proxy statement or may be incorporated in this proxy statement by reference to other documents and may include statements for periods following the Merger. Forward-looking statements are all statements other than statements of historical facts, such as those statements regarding general economic and business conditions; industry capacity; industry trends; competition; changes in business strategy or development plans; project performance; availability, terms, and deployment of capital; and availability of qualified personnel. The words “anticipates,” “may,” “can,” “plans,” “believes,” “estimates,” “expects,” “projects,” “intends,” “likely,” “will,” “should,” “to be,” and any similar expressions and/or statements that are not historical facts are intended to identify those assertions as forward-looking statements. Although the Company believes the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The underlying expected actions or the Company’s results of operations involve risks and uncertainties, many of which are outside the Company’s control, and any one of which, or a combination of which, could materially affect the Company’s results of operations and whether the forward-looking statements ultimately prove to be correct. These forward-looking statements speak only as of the date on which the statements were made and the Company undertakes no obligation to update or revise any forward-looking statements made in this proxy statement or elsewhere as a result of new information, future events or otherwise, except as required by law.

In addition to other factors and matters contained or incorporated in this document, we believe the following factors could cause actual results to differ materially from those discussed in the forward-looking statements:

| · | the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement; |

| · | the inability to complete the Merger due to the failure to satisfy any conditions to the completion of the Merger; |

| · | business uncertainty and contractual restrictions during the pendency of the Merger; |

| · | adverse outcomes of pending or threatened litigation; |

| · | the failure of the Merger to close for any other reason; |

| · | the amount of the costs, fees, expenses and charges related to the Merger; |

| · | diversion of management’s attention from ongoing business concerns; |

| · | the effect of the announcement of the Merger on our business and customer relationships, operating results and business generally, including our ability to retain key employees; |

| · | risks that the proposed Merger disrupts current plans and operations; and |

| · | the possible adverse effect on our business and the price of our common stock if the Merger is not completed in a timely fashion or at all. |

MSC cautions readers that forward-looking statements are not guarantees of future performance or exploration and development success, and its future financial results may differ materially from those anticipated, projected or assumed in the forward-looking statements. In addition to those items set forth above, important factors that may cause MSC’s actual results to differ materially from those anticipated by the forward-looking statements include, but are not limited to, those factors described in Part I, Item 1A. “Risk Factors” included in MSC’s annual report on Form 10-K for the year ended December 31, 2014, as updated by MSC’s subsequent filings with the SEC. The risks and uncertainties identified in this proxy statement should be read in conjunction with the other information in this proxy statement and MSC’s other filings with the SEC. The forward-looking statements included in this proxy statement are made only as of the date of this proxy statement and MSC undertakes no obligation to update any forward-looking statements except as required by law.

SPECIAL FACTORS

Description and Effects of the Merger

Pursuant to the Merger Agreement, Ecoark will merge into a subsidiary of the Company created for sole purpose of effectuating this Merger (the “Merger Sub”). Ecoark will be the surviving entity (the “Surviving Corporation”). As a result of the Merger, the separate corporate existence of the Merger Sub shall cease. We refer to this transaction as the Merger. Thus, upon the closing of the Merger Agreement, without limiting the generality of the foregoing, all of the property, rights, privileges, immunities, powers, and franchises of the Merger Sub and Ecoark shall vest in the Surviving Corporation, and all debts, liabilities, and duties of the Merger Sub and Ecoark shall become the debts, liabilities, and duties of the Surviving Corporation.

The Merger will have no effect on the market for the tradability of the shares of common stock of MSC, though the current ticker symbol for its shares is expected to be changed if and when its stockholders approve the change in its name (see Proposal 1). Additionally, the Financial Industry Regulatory Authority (“FINRA”) will also need to approve the transaction. The Merger Agreement is attached asAnnex A to this proxy statement.

MSC and Ecoark expect to complete the Merger in the first quarter of 2016. However, the Merger is subject to certain approvals, including but not limited to all the Proposals, and certain other conditions. As a result, it is possible that factors outside the control of MSC and Ecoark could result in the Merger being completed at a later time, or not at all.

Background of the Merger

The following is a discussion of the Merger, including the process undertaken by the Company and the board of directors in identifying and determining whether to engage in the proposed transaction. This discussion of the Merger is qualified by reference to the Merger Agreement, which is attached to this proxy statement asAnnex A. You should read the entire Merger Agreement carefully as it is the legal document that governs the Merger.

On January 29, 2016, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Ecoark, Inc., a Delaware corporation that we refer to as Ecoark. Pursuant to the Merger Agreement, Ecoark will merge with and into Magnolia Solar Acquisition Corporation, a wholly-owned Delaware subsidiary corporation of the Company created for sole purpose of effectuating this Merger (“Magnolia Solar Acquisition” or the “Merger Sub”). Ecoark will be the surviving entity (the “Surviving Corporation”). As a result of the Merger, the separate corporate existence of the Merger Sub shall cease. We refer to this transaction as the Merger. Thus, upon the closing of the Merger Agreement, without limiting the generality of the foregoing, all of the property, rights, privileges, immunities, powers, and franchises of the Merger Sub and Ecoark shall vest in the Surviving Corporation, and all debts, liabilities, and duties of the Merger Sub and Ecoark shall become the debts, liabilities, and duties of the Surviving Corporation.

The Merger will have no effect on the market for the tradability of the shares of common stock of MSC, though the current ticker symbol for its shares is expected to be changed if and when its stockholders approve the change in its name (see Proposal 1). The Merger Agreement is attached asAnnex A to this proxy statement.

MSC and Ecoark expect to complete the Merger in the first quarter of 2016. However, the Merger is subject to certain approvals, including but not limited to all the Charter Proposals, and certain other conditions. As a result, it is possible that factors outside the control of MSC and Ecoark could result in the Merger being completed at a later time, or not at all.

MSC’s Reasons for the Charter Proposals and the Merger, and the Recommendation of the Board of Directors

MSC believes that the Merger with Ecoark will provide access to new markets that have a potential of significant growth in the future. The Board of Directors has unanimously voted in favor of the Merger.

Accounting Treatment

MSC prepares its financial statements in accordance with GAAP. The Merger will be accounted for using the acquisition method of accounting with Ecoark treated as the acquirer of Magnolia Solar Acquisition for accounting purposes. Under the acquisition method of accounting assets acquired and liabilities assumed will be recorded as of the acquisition date, at their respective fair values and added to those of Ecoark.

Regulatory Approvals Required for the Merger

The Merger does not require the filing of a notification and report form under the Hart–Scott–Rodino Antitrust Improvements Act.

THE MERGER AGREEMENT

The following is a summary of the material terms and conditions of the Merger Agreement. The description in this section and elsewhere in this proxy statement is qualified in its entirety by reference to the complete text of the Merger Agreement, a copy of which is attached asAnnex A, and is incorporated by reference into this proxy statement. This summary does not purport to be complete and may not contain all of the information about the Merger Agreement that is important to you. We encourage you to read the Merger Agreement carefully and in its entirety because it is the legal document that governs the Merger.

The Merger Agreement and this summary of its terms have been included to provide you with information regarding the terms of the Merger Agreement. Factual disclosures about the Company contained in this proxy statement or in the Company’s public reports filed with the SEC may supplement, update or modify the factual disclosures about the Company contained in the Merger Agreement and described in this summary. The representations, warranties and covenants were qualified and subject to important limitations agreed to by the parties to the Merger Agreement in connection with negotiating the terms of the Merger Agreement. In particular, in your review of the representations and warranties contained in the Merger Agreement and described in this summary, it is important to bear in mind that the representations and warranties were negotiated with the principal purposes of establishing the circumstances in which a party to the Merger Agreement may have the right not to close the Merger if the representations and warranties of the other party prove to be untrue due to a change in circumstance or otherwise and allocating risk between the parties to the Merger Agreement, rather than establishing matters as facts. The representations and warranties may also be subject to a contractual standard of materiality different from those generally applicable to stockholders and reports and documents filed with the SEC and in some cases were qualified by disclosures that were made by Company to Ecoark, which disclosures are not reflected in the Merger Agreement. Moreover, information concerning the subject matter of the representations and warranties, which do not purport to be accurate as of the date of this proxy statement, may have changed since the date of the Merger Agreement and subsequent developments or new information affecting a representation or warranty may not have been included in this proxy statement.

In reviewing the Merger Agreement, please remember that it is included to provide you with information regarding its terms and conditions. The Merger Agreement contains representations and warranties by each of the parties to the Merger Agreement, made as of specific dates. These representations and warranties were made solely for the benefit of the other parties to the Merger Agreement and:

| ● | were not intended to be treated as statements of fact, but rather as a way of allocating risk to one of the parties if those statements prove to be inaccurate; and | | | | | ● | have been qualified in the Merger Agreement by reference to certain disclosures contained in separate disclosure letters delivered by the parties to each other and in certain SEC filings made by MSC. |

Accordingly, the representations and warranties and other provisions of the Merger Agreement should not be read alone as characterizations of the actual state of facts about the Company or Ecoark, but instead should be read together with the information provided elsewhere in this proxy statement and in the other documents incorporated by reference herein. For information regarding the Company, see the sections entitled “Important Information Regarding the Company” and “Where You Can Find More Information.”

The Merger

Pursuant to the Merger Agreement, Ecoark will merge into a subsidiary of the Company created for sole purpose of effectuating this Merger (the “Merger Sub”). Ecoark will be the surviving entity (the “Surviving Corporation”). As a result of the Merger, the separate corporate existence of the Merger Sub shall cease. We refer to this transaction as the Merger. Thus, upon the closing of the Merger Agreement, without limiting the generality of the foregoing, all of the property, rights, privileges, immunities, powers, and franchises of the Merger Sub and Ecoark shall vest in the Surviving Corporation, and all debts, liabilities, and duties of the Merger Sub and Ecoark shall become the debts, liabilities, and duties of the Surviving Corporation.

Prior the effective time, the articles of incorporation of MSC shall be amended in accordance with the Charter Proposals described herein, provided that such Charter Proposals are approved at the MSC Special Meeting, until amended in accordance with their terms or by applicable law.

Closing and Effective Time of the Merger

The Closing of the Merger will take place as soon as reasonably practicable after the date on which the conditions to closing of the Merger (described in “Conditions to the Completion of the Merger” below) have been satisfied or waived (other than the conditions that by their nature are to be satisfied at the closing of the Merger, but subject to the satisfaction or waiver of those conditions), unless another date is agreed to in writing by the parties to the Merger Agreement.

At the Effective Time, which shall occur as soon as practicable after the Closing, MSC shall cause to be filed Articles of Merger with the State of Delaware.

MSC Stockholder Approval

The Company’s stockholders are not being asked to vote on the Merger Agreement as such approval is not necessary. However, approval of the Charter Proposals is a condition of closing of the Merger Agreement. For additional information regarding the Proposals to be considered at the MSC Special Meeting and the applicable vote requirements, see the sections entitled “The Special Meeting” beginning on page- 15 -and “Proposals to be Considered at the Special Meeting” beginning on page- 17 -.

Ecoark Stockholder Approval

Shareholders holding a majority of Ecoark’s shares entitled to vote have approved the merger.

Representations and Warranties

The Merger Agreement contains representations and warranties made by MSC, on the one hand, and Ecoark, on the other hand, to each other as of specific dates. The statements embodied in representations and warranties made were for purposes of the Merger Agreement and are subject to qualifications and limitations agreed to by the parties in connection with negotiating the terms of the Merger Agreement. In addition, some of those representations and warranties made as of a specific date may be subject to a contractual standard of materiality different from that generally applicable to stockholders or may have been used for the purpose of allocating risk between the parties to the Merger Agreement rather than establishing matters as facts. For the foregoing reasons, you should not rely on the representations and warranties as statements of factual information.

The representations and warranties made by the Company to Ecoark include representations and warranties relating to, among other things: