| ||

| AND PROXY STATEMENT | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. 1))

Filed by the Registrant☒

Filed by a Party other than the Registrant☐

Check the appropriate box:

| ☐ | ||

Preliminary Proxy Statement | ||

Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

Definitive Proxy Statement |

Definitive Additional Materials |

Soliciting Material under §240.14a-12 |

E. I. du Pont de Nemours and Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | ||||

No fee required. | ||||

Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | ||||

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||

(1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

PRELIMINARY PROXY – SUBJECT TO COMPLETION

| ||

| AND PROXY STATEMENT | |

![]()

| ||||||

|

Annual Meeting — [DATE], 2015

[Date], 2015

Dear Fellow DuPont Stockholder:

I cordially invite you to attend DuPont's 2015 Annual Meeting on [DAY], [DATE], 2015, in [ · ].

Your Board of Directors is recommending a highly qualified and experienced slate of director nominees for election to the Board of Directors at the Annual Meeting. At the Annual Meeting, we will ask you to: (1) elect twelve directors; (2) ratify the appointment of PricewaterhouseCoopers LLP, an independent registered public accounting firm, as our independent auditors for the fiscal year ending December 31, 2015; (3) consider an advisory vote on the compensation of our named executive officers; (4) vote on various stockholder proposals, if properly presented at the Annual Meeting; and (5) take action upon any other business as may properly come before the Annual Meeting.

The accompanying materials include the Notice of Annual Meeting of Stockholders and Proxy Statement. The Proxy Statement describes the business that we will conduct at the Annual Meeting. It also provides information about us that you should consider when you vote your shares.

You should have also received aWHITE proxy card and postage-paid return envelope.WHITE proxy cards are being solicited on behalf of our Board of Directors.

Your vote will be especially important at the meeting. As you may have heard, Trian Partners, L.P. and certain of its affiliates (together, "Trian") have notified the company that Trian intends to nominate a slate of four nominees for election as directors at the meeting in opposition to the nominees recommended by our Board of Directors and to present a proposal to repeal any bylaws adopted without stockholder approval since August 12, 2013. You may receive a proxy statement, Gold proxy card and other solicitation materials from Trian. The Company is not responsible for the accuracy of any information provided by or relating to Trian or its nominees contained in solicitation materials filed or disseminated by or on behalf of Trian or any other statements that Trian may make.

The Board of Directors does NOT endorse any Trian nominees and unanimously recommends that you vote FOR the election of each of the nominees proposed by the Board of Directors and AGAINST Trian's Proposal described above. The Board of Directors strongly urges you NOT to sign or return any proxy card sent to you by Trian. If you have previously submitted a Gold proxy card sent to you by Trian, you can revoke that proxy and vote for our Board of Directors' nominees and on the other matters to be voted on at the meeting by using the enclosed WHITE proxy card.

If your brokerage firm, bank, broker-dealer or other similar organization is the holder of record of your shares (i.e., your shares are held in "street name"), you will receive voting instructions from the holder of record. You must follow these instructions in order for your shares to be voted. Your broker is required to vote those shares in accordance with your instructions.Because of the contested nature of the proposals, if you do not give instructions to your broker, your broker will not be able to vote your shares with respect to the election of directors (Proposal 1) or the stockholder proposals (Proposals 4, 5, 6 and 7). We urge

you to instruct your broker or other nominee, by following those instructions, to vote your shares for the WHITE proxy card.

Holders of shares as of the close of business on [DATE], the record date for voting at the Annual Meeting, are urged to submit a WHITE proxy card, even if your shares were sold after such date.

Your management team expects to provide you with further information during the course of the solicitation and at the Annual Meeting on the progress with regard to separation of Performance Chemicals business operations, our cost-cutting organizational redesign initiative and our continued transformation into a higher-growth, higher-value company with our focus centering on three areas: Agriculture & Nutrition, Advanced Materials and Bio-Based Industrials. At the Annual Meeting, we also will review our progress during the past year and answer your questions.

Thank you for your continued support.For more information and up-to-date postings, please go to www.dupont.com. If you have any questions, please contact Innisfree M&A Incorporated, our proxy solicitor assisting us in connection with the Annual Meeting. Stockholders may call toll free at (877) 750-9501. Banks and brokers may call collect at (212) 750-5833.

Thank you for your continued support, interest and investment in DuPont.

Sincerely,

![]()

Ellen J. KullmanChair & Chief Executive Officer

DuPont 974 Centre Road Chestnut Run Plaza Building 730 Wilmington, DE |

| Meeting Date: | ||

| Time: | ||

| Location: | 974 Centre Road, Chestnut Run Plaza, Building 730, Wilmington, DE 19805 |

| 1. | The election of ten (10) directors |

| 2. | The ratification of our independent registered public accounting firm |

| 3. | An advisory vote to approve executive compensation |

| 4. | An advisory vote on frequency of advisory votes on executive compensation |

| 5. | Two (2) stockholder proposals described in the Proxy Statement if properly presented at the Annual Meeting |

| 6. | Such other business as may properly come before the meeting |

All stockholders are cordially invited to attend, although only holders of record of DuPont Common Stock at the close of business on [DATE], 2015,March 28, 2017, are entitled to vote at the meeting.

This year, we are using the Securities and Exchange Commission’s Notice and Access model, allowing us to deliver proxy materials via the Internet. Notice and Access gives the Company a lower-cost way to furnish stockholders with their proxy materials. On April 14, 2017, we mailed to certain stockholders of record a “Notice Regarding the Availability of Proxy Materials,” with instructions on how to access the proxy materials via the Internet (or request a paper copy) and how to vote online.

If you are a registered stockholder and requested a full set of proxy materials, or if you hold DuPont Common Stock through a company savings plan, your admission ticket for the Annual Meeting is included on your Proxy Card. Registered stockholders may also use the Notice Regarding the Availability of Proxy Materials, received in the mail, as their admission ticket. If you hold shares in a brokerage account, please refer to page 4 of the Proxy Statement for information on attending the meeting. If you need special assistance, please call Innisfree M&A Incorporated,contact the firm assisting us in the solicitation. Stockholders may call toll freeDuPont Stockholder Relations Office at (877) 750-9501. Banks and brokers may call collect at (212) 750-5833.

Please note that Trian Partners, L.P. and certain of their affiliates (together, "Trian") have stated their intention to propose four alternative director nominees for election at the Annual Meeting. You may receive solicitation materials from Trian seeking your proxy to vote for Trian's nominees.THE BOARD UNANIMOUSLY RECOMMENDS A VOTE "FOR" THE ELECTION OF EACH OF THE BOARD'S NOMINEES ON THE ENCLOSED WHITE PROXY CARD AND URGES YOU NOT TO SIGN OR RETURN OR VOTE ANY PROXY CARD SENT TO YOU BY TRIAN. If you have already voted using a Gold proxy card sent to you by Trian, you canREVOKE it by signing and dating the enclosedWHITE proxy card and returning it in the postage-paid envelope provided or by voting via the Internet or by telephone by following the instructions provided on the enclosedWHITE proxy card. Only your last-dated proxy will count, and any proxy may be revoked at any time prior to its exercise at the Annual Meeting as described in the accompanying Proxy Statement.

YOUR VOTE IS VERY IMPORTANT. EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING, WE REQUEST THAT YOU READ THE PROXY STATEMENT AND VOTE YOUR SHARES BY SIGNING AND DATING THE ENCLOSED WHITE PROXY CARD AND RETURNING IT IN THE POSTAGE-PAID ENVELOPE PROVIDED OR BY VOTING VIA THE INTERNET OR BY TELEPHONE BY FOLLOWING THE INSTRUCTIONS PROVIDED ON THE ENCLOSED WHITE PROXY CARD.302-774-3034.

This notice and the accompanying proxy materials have been sent to you by order of the Board of Directors.

Erik T. Hoover

Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON MAY 24, 2017

The Notice and Proxy Statement and Annual Report

are available atwww.proxyvote.com

Stockholders may request their proxy materials be delivered to them electronically in 2018 by visiting

http://enroll.icsdelivery.com/dd.

2017 ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

Proxy Summary | 1 | |||

General Information |

PRELIMINARY PROXY — SUBJECT TO COMPLETION

2015 ANNUAL MEETING OF STOCKHOLDERS

| 2 | ||||

Governance of the Company | ||||

| 9 | |||

| 9 | |||

| 9 | |||

Board’s Role in the Oversight of Risk Management | 10 | |||

Committees of the Board | 11 | |||

Committee Membership | 12 | |||

Other Practices and Policies | 13 | |||

| ||||

Sustainability and Corporate Citizenship | 15 | |||

Directors’ Compensation | 16 | |||

Management Proposal 1 Election of Directors | 19 | |||

Director Skills and Qualifications | 19 | |||

Our Director Nominees | 20 | |||

Audit Committee Report | 25 | |||

Management Proposal 2 Ratification of Independent Registered Public Accounting Firm | 26 | |||

Ownership of Company Stock | 28 | |||

Security Ownership by Directors and Executive Officers | 29 | |||

Compensation Committee Interlocks and Insider Participation | 30 | |||

Compensation Committee Report | 30 | |||

Compensation Discussion and Analysis | ||||

| 31 | |||

| 31 | |||

| ||||

| ||||

| ||||

How We Determine Executive Compensation | 36 | |||

Components of Our Executive Compensation Program | 38 | |||

How We Manage Compensation Risk | 41 | |||

| 42 | |||

| 46 | |||

Compensation of Executive Officers | ||||

| 48 | |||

| 48 | |||

2016 Grants of Plan-Based Awards | 51 | |||

Outstanding Equity Awards | 53 | |||

| 55 | |||

Pension Benefits | 55 | |||

Nonqualified Deferred Compensation | 57 | |||

Potential Payments Upon Termination or Change in Control | 59 | |||

Management Proposal 3 Approve, by Advisory Vote, Executive Compensation | ||||

| 62 | |||

Management Proposal | 64 | |||

| 65 | |||

Proposal | 65 | |||

Proposal 6 Accident Risk Reduction Report | 67 | |||

Forward Looking Statements | 69 | |||

Director Nomination Process | A-1 | |||

Reconciliation of Non-GAAP Financial Measures | B-1 |

|

Proxy Statement for | i |

This proxy summary is an overview of information that you will find throughout this proxy statement. As this is only a summary, we encourage you to read the entire proxy statement, which was first distributed beginning on or about [DATE], 2015,April 14, 2017, for more information about these topics prior to voting.

ANNUAL MEETING OF STOCKHOLDERS

• • • Time and Date: | 10:30 a.m., May 24, 2017 | |

• • • Place: | 974 Centre Road, Chestnut Run Plaza, Building 730, Wilmington, DE 19805 | |

• • • Record Date: | Stockholders as of the close of business on March 28, 2017 | |

• • • Admission: | Please follow the instructions contained inHow to Attend the Annual Meeting on page 4. |

STOCKHOLDER VOTING MATTERS

| Proposal | Board’s Voting Recommendation | Page References (for more detail) | ||||

1. | Election of Directors | FOR EACH NOMINEE | 19 | |||

2. | Ratification of Independent Registered Public Accounting Firm | FOR | 26 | |||

3. | Advisory Vote on Executive Compensation | FOR | 62 | |||

4. | Advisory Vote on Frequency of Advisory Votes on Executive Compensation | ONE YEAR | 64 | |||

5. | Stockholder Proposal on Executive Compensation Report | AGAINST | 65 | |||

6. | Stockholder Proposal on Accident Risk Reduction Report | AGAINST | 67 | |||

|

| | | | | | | | | | | |

| Proposal | | Board's Voting Recommendation | | Page References (for more detail) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

| 1. | Election of Directors | FOR EACH NOMINEE RECOMMENDED BY YOUR BOARD | 27 | |||||||

| | | | | | | | | | | |

2. | Ratification of Independent Registered Public Accounting Firm | FOR | 34 | |||||||

| | | | | | | | | | | |

3. | Advisory Vote on Executive Compensation | FOR | 75 | |||||||

| | | | | | | | | | | |

4. | Stockholder Proposal on Lobbying | AGAINST | 76 | |||||||

| | | | | | | | | | | |

5. | Stockholder Proposal on Grower Compliance | AGAINST | 79 | |||||||

| | | | | | | | | | | |

6. | Stockholder Proposal on Plant Closures | AGAINST | 82 | |||||||

| | | | | | | | | | | |

7. | Stockholder Proposal to Repeal Certain Bylaws Adopted without Stockholder Approval | AGAINST | 84 | |||||||

| | | | | | | | | | | |

YOUR VOTE IS EXTREMELY IMPORTANT THIS YEAR IN LIGHT OF THE PROXY CONTEST BEING CONDUCTED BY TRIAN.

You may receive solicitation materials from a dissident stockholder, Trian Partners, L.P. and certain of their affiliates (together, "Trian"), seeking your proxy to vote for Nelson Peltz, John H. Myers, Arthur B. Winkleblack and Robert J. Zatta to become members of the Board of Directors and for a proposal to repeal any bylaws adopted without stockholder approval since August 12, 2013 (the "Trian Proposal").THE BOARD OF DIRECTORS DOES NOT ENDORSE THE TRIAN NOMINEES AND URGES YOU NOT TO SIGN OR RETURN

Proxy Statement for |

ANY PROXY CARD SENT TO YOU BY TRIAN. IF YOU HAVE PREVIOUSLY SIGNED A GOLD PROXY CARD SENT TO YOU BY TRIAN, YOU CAN REVOKE IT BY SIGNING, DATING AND MAILING THE ENCLOSED WHITE PROXY CARD IN THE ENVELOPE PROVIDED. ONLY YOUR LATEST DATED PROXY WILL BE COUNTED.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE ELECTION OF THE BOARD'S NOMINEES LISTED ON THE ENCLOSED WHITE PROXY CARD.

In addition, the Board recommends that you vote against Trian's proposal on the enclosedWHITE proxy card.

For more information and up-to-date postings, please go to www.dupont.com. If you have any questions or need assistance in voting your shares, please call Innisfree M&A Incorporated, the firm assisting us in the solicitation. Stockholders may call toll free at (877) 750-9501. Banks and brokers may call collect at (212) 750-5833.

PROXY STATEMENT

The enclosed proxy materials are being sent to stockholders at the request of the Board of Directors of E. I. du Pont de Nemours and Company to encourage you to vote your shares at the Annual Meeting of Stockholders to be held [DATE], 2015.May 24, 2017. This Proxy Statement contains information on matters that will be presented at the meeting and is provided to assist you in voting your shares.

DuPont's 2014DuPont’s 2016 Annual Report, on Form 10-K, containing management'smanagement’s discussion and analysis of financial condition and results of operations and the audited financial statements, and this Proxy Statement were distributed together beginning on or about [DATE], 2015.April 14, 2017.

Who Can Vote

Only holders of record of DuPont Common Stock at the close of business on [DATE],March 28, 2017, the record date for voting at the Annual Meeting, are entitled to vote at the Annual Meeting. On the record date, [ · ]866,755,737 shares of DuPont Common Stock were entitled to vote.

Determining the Number of Votes You Have

The enclosedWHITEproxy card indicates the number of shares of DuPont Common Stock that you own. Each share of DuPont Common Stock has one vote.

How to Vote

By Telephone — Stockholders can vote their shares byusing a toll-free telephone number by following the instructions provided on the enclosedWHITEproxy card. The telephone voting procedures are designed to authenticate a stockholder'sstockholder’s identity to allow stockholdersa stockholder to vote theirhis or her shares and confirm that theirhis or her instructions have been properly recorded. Voting by telephone authorizes the named proxies to vote your shares in the same manner as if you had submitted a validly executed proxy card.

By the Internet — Stockholders can simplify their voting by voting their shares via the Internet as instructed on the enclosedWHITEproxy card.card or Notice Regarding the Availability of Proxy Materials (“Proxy Notice”). The Internet procedures are designed to authenticate a stockholder'sstockholder’s identity to allow stockholdersa stockholder to vote theirhis or her shares and confirm that theirhis or her instructions have been properly recorded. Internet voting facilities for stockholders of record are available 24 hours a day. Voting via the Internet authorizes the named proxies to vote your shares in the same manner as if you had submitted a validly executed proxy card.

By Mail — Stockholders may vote their shares by signing and dating the enclosedWHITEproxy card and returning it in the postage-paid envelope provided with this Proxy Statement. Proxy cards submitted by mail must be received by the time of the Annual Meeting for your shares to be voted.

At the Annual Meeting — Only our stockholders and invited guests may attend the Annual Meeting.

You will need to bring picture identification to the meeting. If you own shares in street name (i.e., your

shares are held in street name through a broker, bank, trustee or other nominee), please bring your most recent brokerage statement, along with picture identification, to the meeting. We will use your brokerage statement to verify your ownership of DuPont Common Stock and admit you to the meeting. Shares held in your name as the stockholder of record may be voted by you in person at the Annual Meeting. Shares held beneficially in street name may be voted by you in person at the

Annual Meeting only if you obtain a legal proxy from the broker or other agent that holds your shares giving you the right to vote the shares and bring such proxy to the Annual Meeting. If you vote by proxy and also attend the Annual Meeting, you do not need to vote again at the Annual Meeting unless you wish to change your vote. If you are an employee of DuPont or one of our subsidiaries that participate in the DuPont Retirement Savings Plan (the “Plan”), please seeVoting by Employees Participating in DuPont Plans for information on how to vote your shares.

Even if you plan to attend the Annual Meeting, we strongly urge you to vote in advance by proxy by signing and dating the enclosed WHITE proxy card and returning it in the postage-paid envelope provided, or by voting via the Internet, or by telephone in each case by following the instructions provided on the enclosed WHITE proxy card. Directions to the Annual Meeting are available at:www.[ · ].card or Proxy Notice, as applicable.

If you vote by telephone, via the Internet or by signing, dating and returning a proxy card, weyour shares will vote your sharesbe voted as you direct. For the election of directors, you can specify whether your shares should be voted for all, some or none of the nominees for director listed. Your Board urges you to use the enclosedWHITEproxy card to vote based on its recommendations on page 1, includingFOR ALLof the nominees for director listed andAGAINSTthe four stockholder proposals.

If you submit a proxy to us without indicating instructions with respect to specific proposals, we will vote your shares consistent with the recommendations of our Board of Directors as stated in this Proxy Statement, specifically for all our nominees for director, in favor of the ratification of the appointment of PricewaterhouseCoopers LLP as our independent auditors, in favor of the advisory vote on the compensation of our named executive officers, in favor of annual frequency of our advisory vote on the compensation of our named executive officers, and against the stockholder proposals if

Proxy Statement ![]()

General Information

properly presented at the Annual Meeting. If any other matters arematter is properly presented at the Annual Meeting for consideration, then the persons named on your proxy will have discretion to vote for you on those matters.that matter. As of the date of the Notice of Annual Meeting of Stockholders, we knew of no other mattersmatter to be presented at the Annual Meeting.

An independent inspector of elections will tabulate the proxies and certify the results.

| ||||

2 | Proxy Statement for 2017 Annual Meeting of Stockholders |

Proxy Statement " General Information

SeeHow to Attend the Annual Meeting for additional information.

Voting of Shares of DuPont Common Stock Held in Street Name

If your brokerage firm, bank, broker-dealer or other similar organization is the holder of record of your shares (i.e., your shares are held in "street name"“street name”), you will receive voting instructions from the holder of record. You must follow these instructions in order forto vote your shares to be voted.shares. Your broker is required to vote those shares in accordance with your instructions.Because

Broker Non-votes

A broker non-vote occurs when a beneficial owner of shares held by a broker, bank or other nominee fails to provide the contested nature of the proposals, if you do not giverecord holder with specific instructions to your broker, your broker will not be ableconcerning how to vote your shares with respecton any“non-routine” matters brought to a vote at a stockholders meeting. Under the New York Stock Exchange (the “NYSE”) rules, “non-routine” matters include the election of directors (Proposal 1) or, the vote, on an advisory basis, of the compensation of the Company’s named executive officers (Proposal 3), the vote, on an advisory basis, of the frequency of the advisory vote on executive compensation (Proposal 4) and the vote on stockholder proposals (Proposals 4, 5, 65-6).

If you hold your shares in street name and 7). We urgewant your vote to be counted at the Annual Meeting, you to instructmust cast your vote by instructing your bank, broker or other nominee on how to vote your shares by following those instructions.vote.

Notification of Trian Proposal for Alternative Directors

Trian, a stockholder of the Company, has filed a preliminary proxy statement indicating that it intends to propose four alternative director nominees for election at the Annual Meeting in opposition to the nominees recommended by your Board. The Trian nominees have NOT been endorsed by your Board, and your Board unanimously recommends a vote FOR each of your Board's nominees for director on the enclosedWHITEproxy card accompanying this proxy statement.Your Board unanimously recommends that you disregard and do not return any Gold proxy card you receive from Trian. Voting to "withhold" with respect to any Trian nominee on a Gold proxy card sent to you by Trian is NOT the same as voting for your Board's nominees because a vote to "withhold" with respect to any Trian nominee on its Gold proxy card will revoke any proxy you previously submitted.If you have previously submitted a Gold proxy card sent to you by Trian, you can revoke that proxy and vote for your Board's nominees and on the other matters to be voted on at the Annual Meeting by using the enclosedWHITEproxy card.

Receipt of Multiple Proxy Cards

Many of our stockholders hold their shares in more than one account and may receive separate proxy cards or voting instructions forms for each of those accounts. To ensure that all of your shares are

represented at the Annual Meeting, we recommend that youvote every WHITE proxy card you receive.

Additionally, please note that Trian has stated its intention to nominate four alternative director nominees for election at the Annual Meeting and propose the Trian Proposal. If Trian proceeds with its alternative nominations and proposal, you may receive proxy solicitation materials from Trian, including an opposition proxy statement and a Gold proxy card.Your Board unanimously recommends that you disregard and do not return any Gold proxy card you receive from Trian. Voting to "withhold" with respect to any Trian nominee on a Gold proxy card sent to you by Trian is not the same as voting for your Board's nominees because a vote to "withhold" with respect to any Trian nominee on its Gold proxy card will revoke any proxy you previously submitted.

If you have already voted using Trian's Gold proxy card, you have every right to change your vote and revoke your prior proxy by signing and dating the enclosedWHITEproxy card and returning it in the postage-paid envelope provided or by voting via the Internet or by telephone by following the instructions provided on the enclosedWHITEproxy card.Only the latest dated proxy you submit will be counted. If you have any questions or need assistance voting, please call DuPont's proxy solicitor, Innisfree M&A Incorporated. Stockholders may call toll free at (877) 750-9501. Banks and brokers may call collect at (212) 750-5833.

Revocation of Proxies

You can change your vote or revoke your proxy at any time before it is exercised at the Annual Meeting by doing any of the following: (1) you can submit a valid proxy with a later date; (2) you can notify our Secretary in writing at Secretary, E. I. du Pont de Nemours and Company, 1007 Market Street,Chestnut Run Plaza, 974 Centre Road, Wilmington, Delaware 19898DE 19805 that you have revoked your proxy; or (3) you can vote in person by written ballot at the Annual Meeting.

If you have previously signed a Gold proxy card sentRequired Vote

Stockholders of record are entitled to you by Trian, you may change yourone vote and revoke your prior proxy by signing and dating the enclosed WHITE proxy card and returning it in the postage-paid envelope provided or by voting via the Internet or by telephone by following the instructions on the enclosed WHITE proxy card.Submitting a Trian Gold proxy card — even if you withhold your vote on the Trian nominees — will revoke any votes you previously made via ourWHITEproxy card. Accordingly, if you wish to vote pursuant to the recommendationper each share of our Board, you should disregard any proxy card that you receive that is not aWHITEproxy card and not return any Gold proxy card that you may receive from Trian, even as a protest.

Table of ContentsDuPont Common Stock.

Proxy Statement ![]()

General Information

Required Vote

Proposal 1: Election of Directors. Under our Bylaws, because we have received notice from Trian that it intends to nominate personssince this is an uncontested election (i.e., the number of nominees for election to the Board equals the provisionsnumber of our Bylaws relatingdirectors to be elected), majority voting for directors will notapply. Accordingly, a director nominee will be applicableelected to the Annual Meeting and, pursuant to our Bylaws, plurality voting will apply atBoard if the Annual Meeting.

The twelve nominees for director who receivenumber of shares voted “FOR” the most votesnominee exceeds the number of all votes cast for directors will be elected.“AGAINST” the nominee’s election. If you do not vote forany nominee

fails to receive a particularmajority of the votes cast “FOR” his or her election, then such nominee must promptly tender his or if you indicate on your proxy card, viaher resignation to the Internet or by telephone that you want to withhold authority to vote for a particular nominee, then your shares will not be voted for that nominee. In addition, if you hold sharesChair of DuPont Common Stock through a broker-dealer, bank nominee, custodian or other securities intermediary,the intermediary will not vote those shares for the election of any nominee for director unless you give the intermediary specific voting instructions on a timely basis directing the intermediary to vote for such nominee.Board. Abstentions and broker non-votes do not constitute a vote "for"“for” or "against"“against” a director.

Itdirector nominee and will NOT help elect your Board if you sign and return a proxy card sent by Trian, even if you withhold on their director nominees using Trian's proxy card. Doing so will cancel any previous vote you may have cast on our WHITE proxy card.be disregarded in the calculation of votes cast. The only way to support your Board's nominees is to vote FOR the Board's nominees on our WHITE proxy card and to disregard, and not return, any proxy card that you receive that is not a WHITE proxy card, including any proxy card that you receive from Trian.

Pursuant to our Bylaws, written notice by stockholdersCorporate Governance Committee (the “Governance Committee”) of qualifying nominations for election to our Board of Directors (or, under certain circumstances, another committee appointed by the Board) will promptly consider that resignation and recommend to the Board whether to accept the tendered resignation or reject it based on all relevant factors. The Board must have been received by our Secretary by January 23, 2015. We did not receive any such nominations otherthen act on that recommendation no later than 90 days following the nominations from Trian, and no other nominations for election to our Board may be made by stockholders at thedate of an Annual Meeting. Within four business days of the Board’s decision, we must disclose the decision in a Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”) that includes a full explanation of the process by which the decision was reached and, if applicable, the reasons for rejecting the resignation.

If for some reason any of the Board'sBoard’s director nominees are unable to serve, or for good cause will not serve if elected, the persons named as proxies may vote for a substitute nominee recommended by the Board and, unless you indicate otherwise on theWHITEproxy card, your shares will be voted in favor of the Board'sBoard’s remaining nominees. As of the date of the Notice of Annual Meeting of Stockholders, we knewknow of no reason why any of the Board'sBoard’s nominees would be unable or for good cause unwilling to serve as a director if elected.

In the event Trian were to withdraw its nominees, such that there would no longer be a contested election, the majority voting provisions of our Bylaws would apply. While we have no reason to expect this

will occur, if it did, then pursuant to the majority voting provisions of our Bylaws, any nominee for director who receives a greater number of votes "withheld" from his or her election than votes "for" such election must promptly tender his or her resignation to the Chairman of the Board. The Governance Committee of our Board of Directors (or, under certain circumstances, another committee appointed by the Board) will promptly consider that resignation and will recommend to the Board whether to accept the tendered resignation or reject it based on all relevant factors. The Board must then act on that recommendation no later than 90 days following the date of an Annual Meeting of Stockholders. Within four days of the Board's decision, we must disclose the decision in a Current Report on Form 8-K filed with the Securities and Exchange Commission ("SEC") that includes a full explanation of the process by which the decision was reached and, if applicable, the reasons for rejecting the resignation.

Proposal 2: Ratification of the appointment of PricewaterhouseCoopers LLP, an independent registered public accounting firm, as our independent auditors for the fiscal year ending December 31, 2015.2017.The votes cast "for"“for” this proposal must exceed the votes cast "against"“against” to approve the ratification of the appointment of PricewaterhouseCoopers LLP an independent registered public accounting firm, as our independent auditors for the fiscal year ending December 31, 2015.2017. Abstentions and broker non-votes do not constitute a vote "for"“for” or "against"“against” the proposal and will be disregarded in the calculation of "votesvotes cast."

Proposal 3: Advisory vote on executive compensation. The votes cast "for"“for” this proposal must exceed the votes cast "against"“against” to approve the advisory vote on the compensation of our named executive officers as disclosed in the Compensation Discussion and Analysis section and accompanying compensation tables contained in this Proxy Statement. Abstentions and broker non-votes do not

| ||||

Proxy Statement for 2017 Annual Meeting of Stockholders | 3 |

Proxy Statement " General Information

constitute a vote "for"“for” or "against"“against” the proposal and will be disregarded in the calculation of "votesvotes cast."Although the outcome of this advisory vote on the compensation of our named executive officers is non-binding, theour Human Resources and Compensation Committee and our Board will review and consider the outcome of this vote when making future compensation decisions for our named executive officers.

Proposal 4: Advisory vote on frequency of advisory votes on executive compensation. The number of votes for “ONE YEAR”, “TWO YEARS” or “THREE YEARS” will be counted, and the frequency with the highest number votes will be the frequency that our stockholders approve. Abstentions and broker non-votes do not constitute a vote “for” or “against” the proposal and will be disregarded in the calculation of votes cast. Although the outcome of this advisory vote on the frequency of advisory votes on executive compensation is non-binding, our Human Resources and Compensation Committee and Board will review and consider the outcome of this vote when determining the frequency of future advisory votes on executive compensation.

Proposals 4, 5 and 6 and 7:— Stockholder Proposals. Proposals:The votes cast "for"“for” a proposal must exceed the votes cast "against"“against” such proposal for a stockholder proposal to pass. Abstentions and broker non-votes do not constitute a vote "for"“for” or "against"“against” the proposal and will be disregarded in the calculation of "votesvotes cast." Each proposal must be properly presented at the Annual Meeting for such proposal to be voted upon.

Proxy Statement ![]()

General Information

Broker non-votes

A broker non-vote occurs when a beneficial owner of shares held by a broker, bank or other nominee fails to provide the record holder with specific instructions concerning how to vote on any "non-routine" matters brought to a vote at a stockholders meeting. Under the New York Stock Exchange (the "NYSE") rules, "non-routine" matters include the election of directors (Proposal 1) and the vote, on an advisory basis, of the compensation of the Company's named executive officers (Proposal 3).Given the contested nature of the meeting, for any accounts to which brokers deliver competing sets of proxy materials, the NYSE rules governing brokers' discretionary authority will not permit such brokers to exercise discretionary authority regarding any of the proposals to be voted on at the Annual Meeting.

If you hold your shares in street name, it is critical that you cast your vote by instructing your bank, broker or other nominee on how to vote if you want your vote to be counted at the Annual Meeting.

Voting by Employees Participating in DuPont Plans

If you are an employee of DuPont or one of our subsidiaries andthat participate in one of our employee plans, i.e., the DuPont 401(k) and Profit Sharing Plan, the DuPont Retirement Savings Plan the Thrift Plan for Employees of Sentinel Transportation, LLC and the Solae Savings Investment Plan (the "Plans"“Plan”), the enclosedWHITEvoting instruction form indicates the aggregate number of shares of DuPont Common Stock credited to your account as of [DATE], the record date for voting at the Annual Meeting. If you timely submit your voting instructions to the Plan Trustee by following the instructions on the enclosedWHITEvoting instruction form, your shares will be voted as you have directed. If you do not provide the Trustee with voting instructions, the Trustee may vote as directed by the plan fiduciary or by an independent fiduciary selected by the plan fiduciary all shares held in the plansPlan for which no voting instructions are received. The Trustee must receive your voting instructions no later than [DATE].May 19, 2017 or, if you are voting via the Internet or by phone, by 11:59 p.m., Eastern Daylight Time, on May 21, 2017. Please note

that Plan participants may vote their shares through the Trustee only and accordingly may not vote their Plan shares in person at the Annual Meeting.

How to Attend the Annual Meeting

Only our stockholders and invited guests may attend the Annual Meeting.

Registered stockholders may be admitted to the meeting upon providing picture identification. If you own shares in street name, (i.e., your shares are held in street name through a broker, bank, trustee or other nominee), please bring your most recent brokerage statement, along with picture

identification, to the meeting. We will use your brokerage statement to verify your ownership of DuPont Common Stock and admit you to the meeting.

Please note that cameras, sound or video recording equipment, or other similar equipment, electronic devices, large bags or packages will not be permitted in the Annual Meeting.

Proxy Committee

The Proxy Committee is composed of DuPont directors of the Company who vote as instructed the shares of DuPont Common Stock for which they receive proxies. Proxies also confer upon the Proxy Committee discretionary authority to vote the shares on any matter which was not known to the Board a reasonable time before solicitation of proxies, but which is properly presented for action at the meeting.

Quorum

A quorum of stockholders is necessary to transact business at the 20152017 Annual Meeting. A quorum exists if the holders of at least a majority of the shares of DuPont Common Stock entitled to vote are present either in person or by proxy at the meeting. Abstentions and broker non-votes will be counted in determining whether a quorum exists.

20162018 Stockholder Proposals

AtTypically, at each annual meeting, stockholders are asked to elect directors to serve on the Board, to ratify the appointment of DuPont'sDuPont’s independent registered public accounting firm for the year and to approve, by advisory vote, executive compensation. The Board or stockholders may submit other proposals to be included in the proxy statement. To be considered for inclusion in the 20162018 DuPont Annual Meeting Proxy Statement, stockholder proposals must meet the requirements of SEC Rule 14a-8 and must be received no later than [DATE], 2015.December 15, 2017. Our Bylaws provide that a stockholder may otherwise propose business for consideration or nominate persons for election to the Board, in compliance with federal proxy rules, applicable state law and other legal requirements and

| ||||

4 | Proxy Statement for 2017 Annual Meeting of Stockholders |

Proxy Statement " General Information

without seeking to have the proposal included in our proxy statement pursuant to Rule 14a-8. Our Bylaws currently require that notice of such proposals or nominations for DuPont's 2016DuPont’s 2018 Annual Meeting be received by us between [DATE]January 24, 2018 and [DATE].February 23, 2018. Any such notice must satisfy the other requirements in our Bylaws applicable to such proposals and nominations.

Stockholder Nominations for Election of Directors

For stockholder director nominations, the notification to our Corporate Secretary must contain or be accompanied by the information required by our

Proxy Statement ![]()

General Information

Bylaws. The information requirements include, among other things:

•••

the name, age, business address and residence address of each nominee;

•••

the principal occupation or employment of each such nominee;

•••

the number of shares of DuPont's capital stock which are owned of record and beneficially by each such nominee and any affiliates or associates of such nominee;

•••

a detailed description of any compensatory, payment or other financial agreement, arrangement or understanding between the nominee and any person or entity other than the Company, or whether the nominee has received any compensation or other payment from any person or entity other than the Company, in each case in connection with the candidacy or service as a director of DuPont;

•••

other information concerning each such nominee as would be required to be disclosed in a proxy statement soliciting proxies for the election of such nominee as a director in an election contest (even if an election contest is not involved) or that is otherwise required to be disclosed, under Section 14(a) of the Securities Exchange Act and the rules and regulations thereunder;

•••

the consent of the nominee to being named in the proxy statement as a nominee and to serving as a director if elected and a representation by the nominee to the effect that, if elected, the nominee will agree to and abide by all policies of the Board as may be in place at any time and from time to time; and

•••

certain information about the proposing stockholder.

| • • • | the name, age, business address and residence address of each nominee; |

| • • • | the principal occupation or employment of each such nominee; |

| • • • | the number of shares of DuPont’s capital stock which are owned of record and beneficially by each such nominee and any affiliates or associates of such nominee; |

| • • • | a detailed description of any compensatory, payment or other financial agreement, arrangement or understanding between the nominee and any person or entity other than the Company, or whether the nominee has received any compensation or other payment from any person or entity other than the Company, in each case in connection with the candidacy or service as a director of DuPont; |

| • • • | other information concerning each such nominee as would be required to be disclosed in a proxy statement soliciting proxies for the election of such nominee as a director in an election contest (even if an election contest is not involved) or that is otherwise required to be disclosed, under Section 14(a) of the Securities Exchange Act and the rules and regulations thereunder; |

| • • • | the consent of the nominee to being named in the proxy statement as a nominee and to serving as a director if elected and a representation by the nominee to the effect that, if elected, the nominee will agree to and abide by all policies of the Board as may be in place at any time and from time to time; and |

| • • • | certain information about the proposing stockholder. |

A copy of the full text of the relevant Bylaw provisions, which includes the complete list of the information that must be submitted to nominate a

director, may be obtained upon written request directed to our Corporate Secretary at our principal office.

A copy of our Bylaws is available on the "Investors"“Investors” caption of our website (www.dupont.com) under "Corporate“Corporate Governance."”

In addition to a stockholder'sstockholder’s ability to nominate candidates to serve on the Board as described above, stockholders also may recommend candidates to the Corporate Governance Committee (the "Governance Committee"“Governance Committee”) for its consideration. The Governance Committee will consider and evaluate candidates recommended by stockholders in the same manner that it considers and evaluates all other director candidates. To recommend a candidate, stockholders should follow the procedures set in the Director Nomination Process attached as Appendix A.

Cost of Solicitation

For information regardingWe will pay all costs relating to the costssolicitation of this solicitation, please see the section titled "Costproxies. Innisfree M&A Incorporated has been retained to assist in soliciting proxies at a cost of Solicitation" on page 85.approximately $15,000 plus reasonable expenses. Our officers, directors and employees may solicit proxies personally, by mail, by telephone or other electronic means. We will also reimburse brokers, custodians, nominees and fiduciaries for reasonable expenses in forwarding proxy materials to beneficial owners of DuPont Common Stock.

Householding Rules

The SEC's "householding"SEC’s “householding” rules permit the Companyus to deliver only one set of proxy materials to stockholders who share an address unless otherwise requested. This procedure reduces printing and mailing costs. If you are a registered stockholder and share an address with another stockholder and have received only one set of proxy materials, you may request a separate copy of these materials, and future materials, at no cost to you by writing to the DuPont Stockholder Relations Office at 1007 Market StreetChestnut Run Plaza, 974 Centre Road, Wilmington, DE 19805 or calling(302) 774-3034. Alternatively, if you are currently receiving multiple copies of the proxy materials at the same address and wish to receive a single copy in the future, you may contact the Companyus by calling the telephone number given above.

If you are a beneficial owner (i.e., yourown shares are held in thestreet name, of a bank, broker or other holder of record), the bank, broker or other holder of record may deliver only one copy of the Notice of Annual Meeting and Proxy Statement to stockholders who have the same address unless the bank, broker or other holder of record has received contrary instructions from one or more of the stockholders. If you wish to receive a separate copy of

| ||||

Proxy Statement for 2017 Annual Meeting of Stockholders | 5 |

Proxy Statement " General Information

the Notice of Annual Meeting and Proxy Statement, now or in the future, you may contact the Companyus at the telephone number above and you will promptly be sent a separate copy. Beneficial owners sharing an address who are currently receiving multiple copies of the Notice of Annual Meeting and Proxy Statement and wish to receive a single copy in the future, should contact their bank, broker or other holder of record to request that only a single copy be delivered to all stockholders at the shared address in the future.

Confidential Voting

As a matter of policy, proxies, ballots and voting tabulations that identify individual stockholders are held confidential. Such documents are available for examination only by the independent tabulation agents, the independent inspectors of election and certain employees associated with tabulation of the vote. The identity of the vote of any individual stockholder is not disclosed except as may be necessary to meet legal requirements.

| ||||

6 | Proxy Statement for |

BACKGROUND OF THE SOLICITATION

As part of their continuing review of the Company's performance, the Company's management and Board from time to time consider, among other things, potential changes to the Company's portfolio of businesses. Numerous changes in the Company's business mix have resulted from this review, including, among others, the acquisition of Danisco, a leading participant in the enzyme and specialty food ingredients industries, in 2011 and the disposition of the Company's Performance Coatings business in 2013. In late 2012, as a result of this continuing review process, the Company's management and, beginning in early 2013, the Board began to focus on the separation of the Company's Performance Chemicals segment.

On June 26, 2013, Mr. Edward Garden, Founding Partner and Chief Investment Officer of Trian, contacted the Company. The Company's director of investor relations returned Mr. Garden's call, and Mr. Garden then informed the Company that Trian had made an investment in the Company. At Mr. Garden's request, Ms. Kullman and Mr. Nicholas C. Fanandakis, Chief Financial Officer of the Company, agreed to a meeting on July 24, 2013 with Mr. Garden and other representatives of Trian to discuss Trian's investment.

On July 23, 2013, the Company publicly announced that it was exploring the spin-off or sale of its Performance Chemicals segment.

On July 24, 2013, Ms. Kullman and Mr. Fanandakis met with Mr. Garden and other representatives of Trian. At this meeting, Trian distributed and presented to Ms. Kullman and Mr. Fanandakis an initial "White Paper" presentation (the "First White Paper"), which centered on, among other things, a proposed four way break-up of the Company into an agriculture focused company, an industrial biosciences and nutrition and health based company, a TiO2 focused company and the remaining DuPont businesses, as a fourth company. Ms. Kullman and Mr. Fanandakis proceeded to analyze the First White Paper with the other members of management and the Company's financial and legal advisors and, shortly thereafter, provided a preliminary review of the presentation to the Board of Directors of the Company.

On August 4, 2013, pursuant to applicable U.S. antitrust laws, Trian provided a letter to the Company stating its intention to file notifications under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the "HSR Act"), to enable certain Trian funds to acquire voting securities of the Company. On September 5, 2013, the Federal Trade Commission granted early termination of the waiting periods applicable under the HSR Act with respect to those notifications. As a result of those filings and clearances, as well as subsequent HSR filings and clearances with regard to certain additional Trian funds, Trian entities may acquire shares with a total aggregate value of approximately $2,745 million, including those shares that those entities collectively hold.

On August 14, 2013, Trian filed a Schedule 13F with the SEC disclosing beneficial ownership of 5,778,403 shares of the Company's outstanding common stock by certain Trian funds, representing beneficial ownership of approximately 0.65% of the Company's common stock. As of its most recent 13F filing on January 8, 2015, Trian disclosed beneficial ownership of 24,313,084 shares of the Company's outstanding common stock. As of Trian's preliminary proxy filing on February 12, 2015, Trian disclosed beneficial ownership of 24,563,084 shares of the Company's outstanding common stock representing beneficial ownership of approximately 2.7% of the Company's common stock.

On September 3, 2013, after a thorough search process, which included the engagement of a third-party search firm, and considered deliberation by the Governance Committee and the Board, including with regard to the Company's corporate governance guidelines and skills-based approach, the Company announced the appointment of Patrick J. Ward, Chief Financial Officer and Vice President of Cummins, Inc., to the Board, effective as of October 23, 2013.

During September 2013, representatives of the Company's financial advisors met with Trian to further discuss its proposed break-up plan for the Company.

Including the specific engagements described herein, at various times throughout 2013, 2014 and early 2015, members of the Company's senior management team and the Company's Lead Director, Alexander M. Cutler, had, collectively, more than 20 conference calls and/or in-person meetings with representatives of Trian, which included Mr. Garden and/or Mr. Nelson Peltz, Founding Partner and Chief Executive Officer of Trian. These meetings focused on a wide range of topics, which included the Company's business and results of operations, our earnings performance, and our long-term strategies, including our capital allocation strategy and the composition of our Board, as well as discussions of Trian's plan to break up the Company.

Proxy Summary Statement "![]()

Background of the Solicitation

On October 15, 2013, less than five months after Trian notified the Company of its initial investment and on the day before a scheduled follow up meeting between Trian and the Company's financial advisors, Mr. Garden contacted Ms. Kullman by telephone and informed her that the Company had three choices: (1) accept and implement Trian's proposal to break-up the Company, (2) add Mr. Garden and an unidentified industry executive to be chosen by Trian to the Board of Directors of the Company or (3) face a public proxy campaign by Trian. In light of this ultimatum, the Company did not believe having its previously scheduled meeting with Trian the following day would be productive and cancelled it.

On October 24, 2013, the Company announced that the Board had unanimously determined to proceed with the separation of its Performance Chemicals segment.

On October 25, 2013, Mr. Kullman and Mr. Fanandakis informed Mr. Garden that the Board of Directors had carefully considered and unanimously rejected the analysis and conclusions set forth in Trian's First White Paper, including Trian's plan to break-up the Company. Ms. Kullman and Mr. Fanandakis also informed Mr. Garden that the Board of Directors, after considered deliberation, including with regard to the Company's corporate governance guidelines, had determined not to nominate him for service on the Board of Directors.

On December 5, 2013, Ms. Kullman and Mr. Cutler met with Mr. Garden, other representatives of Trian and representatives of the California State Teachers' Retirement System ("CalSTRS"), which Trian has publicly disclosed as employing Trian to manage certain of its funds, at the request of Mr. Garden, who informed Ms. Kullman that Trian wanted to meet in advance of "deadlines for stockholder proposals and director nominations," to discuss the Company's performance. At this meeting, Mr. Garden delivered and presented to Ms. Kullman and Mr. Cutler a revised "White Paper" presentation (the "Second White Paper"), which applauded the Company's decision to separate its Performance Chemicals business and, in addition proposed, among other things, a new, second break-up plan, this time focused on a two way break-up of the remaining businesses of DuPont into a "GrowthCo," consisting of the Company's agriculture, industrial biosciences and nutrition and health based businesses, and a "CyclicalCo," consisting of the Company's performance materials, electronics and safety and protection businesses. At the end of the meeting, Mr. Garden reiterated Trian's ultimatum: (1) accept and implement Trian's proposal to break-up the Company, (2) add Mr. Garden and an unidentified industry executive to be chosen by Trian to the Board of Directors of the Company or (3) face a public proxy campaign by Trian. Notwithstanding this ultimatum, Trian did not provide the Company with the notice required under the Company's Bylaws that it intended to nominate any Trian representatives to the Board.

During February 2014, the Company's Board carefully evaluated the Second White Paper and, after receiving input from the Company's financial advisors, determined that it was in the best interest of the Company's stockholders to continue to pursue the Company's strategic plan and not to implement the proposals in the Second White Paper.

During the next few months, the Company and Trian continued their dialogue regarding the Company's earnings performance and strategic plan. During this period, Trian issued no new ultimatums with regard to participation on the Company's Board.

In fact, reflective of the open engagement between the Company and Trian, on May 9, 2014, Mr. Garden, in a speech at the Council of Institutional Investors conference, stated that Ms. Kullman "has basically been an activist within DuPont to get that business to best-in-class operating metrics, separate the Coatings business, separated the Performance Chemicals business, she's buying back $5B in shares."(1)

On June 27, 2014, Mr. Garden called Ms. Kullman and Mr. Fanandakis to discuss the Company's earnings performance and earnings guidance. At the end of the call, in an abrupt return to earlier ultimatums, Mr. Garden once again informed Ms. Kullman and Mr. Fanandakis that the Company had three options: (1) accept and implement Trian's proposal to break-up the Company, (2) add Mr. Garden to the Board of Directors of the Company or (3) face a public proxy campaign by Trian.

On August 4, 2014, in anticipation of the upcoming retirement under the Company's age 72 mandatory retirement policy of Bertrand P. Collomb following the 2015 Annual Meeting and after a thorough search process, which included the engagement of a third-party search firm, and considered deliberation by the Governance Committee and the Board, including with regard to the Company's corporate governance

Proxy Summary ![]()

Background of the Solicitation

guidelines and skills-based approach, the Company announced the appointment of Ulf M. "Mark" Schneider, President and CEO of Fresenius SE & Co. KGaA to the Board, effective as of October 22, 2014.

On August 6, 2014, Mr. Cutler discussed Trian's Second White Paper with Mr. Garden, informing Mr. Garden that the Board, after fully reviewing the proposal, had carefully considered and unanimously rejected the analysis and conclusions in Trian's Second White Paper, including Trian's second plan to break-up the Company, and determined that its current course of action, which included cost cutting and the Performance Chemicals separation, was the appropriate course of action for the Company at such time. Mr. Garden then informed Mr. Cutler that Trian viewed itself and the Company as having only two options: DuPont would either appoint Mr. Garden to the Board or Trian would take the matter to DuPont's stockholders. Mr. Cutler replied that there was, in his view, a third option — continued constructive dialogue of the type in which the Company and Trian were already engaging — but, in response, Mr. Garden reiterated his position.

On August 12, 2014, Mr. Cutler called Mr. Garden to inform him that the Board of Directors had again determined not to nominate him for service on the Board of Directors.

On September 16, 2014, Trian sent a letter and a summary of its Second White Paper to the Board and publicly filed both documents.

On October 16, 2014, Mr. Cutler contacted Mr. Peltz by telephone, at the request of Mr. Peltz, to discuss, among other things, the performance of the Company and the progress regarding the separation of its Performance Chemicals segment. At the end of the call, Mr. Peltz stated that unless the Company agreed to appoint two Trian executives and one unidentified industry executive to be chosen by Trian to its Board, Trian would initiate a proxy fight with the goal of electing a majority of Trian-nominated directors to the Board.

On October 29, 2014, Ms. Kullman met with Mr. Peltz. The discussion at the meeting focused on, among other things, the performance of the Company. At the conclusion of the meeting, Mr. Peltz not only reiterated the ultimatum presented at the October 16th meeting, but also indicated that if Trian were to go public with its nominees, it would not thereafter agree to any settlement with the Company. Ms. Kullman expressed a willingness to continue discussions with Mr. Peltz and Trian as a stockholder, but reiterated that the Board had determined that the Company's current course of action was in the best interest of the Company's stockholders.

On November 5, 2014, the Board, after careful deliberation, including with regard to the Company's corporate governance guidelines, unanimously determined not to appoint Mr. Peltz or Mr. Garden to the Board and such determination was communicated to Trian by Ms. Kullman.

During the fall of 2014, the Company's management and the Board began the search for two new, highly-qualified directors to fill the vacancies to be created by the departures of Messrs. Richard H. Brown and Curtis J. Crawford, who were expected to leave the Board to join the board of directors of The Chemours Company ("Chemours") upon its separation from the Company. In connection with the process, the Board hired a third-party search firm to help assist them in identifying candidates that had the requisite skills and experience to meet the Board's and Governance Committee's criteria.

After the consideration and review of numerous candidates by the Governance Committee, including with regard to the Company's corporate governance guidelines, the Company's Board search process culminated with the identification of Messrs. Edward D. Breen and James L. Gallogly as the candidates who possessed, to the highest degree, the skills and experience sought by the Governance Committee and typified by the Company's existing Board members. For additional information on the criteria utilized by the Board, see "Proposal 1: Election of Directors — Director Skills and Qualifications."

On December 10, 2014, representatives from the Company's financial advisors met with representatives from Trian, including Messrs. Peltz and Garden. At the meeting, Messrs. Peltz and Garden reiterated that if Trian were to go public with its nominees, it would not thereafter agree to any settlement with the Company.

On January 8, 2015, Trian delivered a notice to the Company nominating four individuals (with Mr. Garden as an alternative nominee), including Mr. Peltz, to stand for election to the Board of Directors of the Company at the Annual Meeting, and stating that Trian would solicit proxies in support of such election. The notice also included a proposal to repeal any provisions or amendments to the Company's Bylaws adopted without stockholder approval after August 12, 2013 and prior to the Company's 2015 Annual Meeting.

Proxy Summary ![]()

Background of the Solicitation

On January 9, 2015, the Company publicly issued a statement confirming that it had received Trian's nomination notice and indicating that the Governance Committee would review Trian's proposed director nominees and make a recommendation regarding such nominees that it believed was in the best interest of all stockholders.

At the end of January 2015, in response to the notice received on January 8, 2015 and in connection with a process established by the Governance Committee for the consideration of new directors, members of the Governance Committee, including Mr. Cutler and Marillyn A. Hewson, interviewed each of the Trian nominees, including Mr. Peltz. Ms. Kullman participated in the interviews with respect to all Trian nominees other than Mr. Peltz, whom she had previously spoken with on numerous occasions.

On February 4, 2015, Ms. Kullman and Mr. Cutler met with Mr. Peltz to discuss the results of the Governance Committee's process with regard to the Trian nominees and the topic of Board composition. After explaining to Mr. Peltz that the Governance Committee, in considering how to fill the expected vacancies on the Board of Directors left by the planned departures of two members of the Board to join the Chemours Board, had determined that the Company's two previously identified candidates were superior candidates to each of Trian's candidates, Ms. Kullman and Mr. Cutler attempted to present Mr. Peltz with a proposal for resolving Trian's proxy contest.

The Company's proposed resolution centered around the possibility of appointing one of Trian's nominees, who had been selected by the Governance Committee as a viable candidate and was not Mr. Peltz, to the Board of Directors of the Company under circumstances in which Trian would withdraw its slate and support the Company's nominees at the Annual Meeting, thus avoiding a time consuming and costly proxy contest.

The Board had determined that adding Mr. Peltz to the Board would not serve the long-term interests of the Company's stockholders. This decision was based on insight gathered from direct interactions, including a formal interview, that members of the Board had with Mr. Peltz and feedback from Company representatives based on their direct interactions with Mr. Peltz and other Trian representatives. Based on these direct experiences, interview and reports, the Board became concerned that Mr. Peltz's decision-making would be guided by a predetermined agenda regarding Trian's break-up plan (particularly given that Trian's ultimatums were to break up the Company or appoint a Trian representative to the Board, suggesting that if the Company were to be broken up, then Trian would have no need for a Board seat), rather than the attitude of being open to all alternatives, with no preconceived notions, that all Board members must exhibit in order to be effective stewards of the Company and the stockholders whom they represent. Further, the Board has a skills-based approach for identifying director candidates that is largely focused on the business and Company's strategic direction and goals. After careful consideration, the Board concluded that Mr. Peltz's skills and experience would not be additive to the Board's current mix of skills and experience.

Mr. Peltz both refused to hear the details of the Company's proposal, specifically declining to be informed of either the names of the Company's two candidates or the potential viable Trian nominee candidate, and insisted that any settlement would require appointing Mr. Peltz personally to the Company's Board.

On February 5, 2015, in connection with the separation of Chemours, the Company announced that Messrs. Crawford and Brown would transition off of the Board immediately — to initially serve as consultants to Chemours, and then as directors upon completion of the separation — and that Messrs. Breen and Gallogly had been appointed as independent directors to its Board. Later that day, Trian released a statement that, among other things, applauded the appointment of Messrs. Breen and Gallogly, but continued to insist that Mr. Peltz personally be added to the Board.

On February 11, 2015, Trian publicly filed its preliminary proxy statement with regard to its nominees and proposal.

Subsequent to February 11, 2015, Trian and the Company each issued numerous press releases and sent various letters and presentations to the Company's stockholders.

Around noon on March 11, 2015, Mr. Peltz called Ms. Kullman and requested an immediate in-person meeting in New York to discuss Trian's proposed resolution to the proxy contest. Ms. Kullman and Mr. Cutler scheduled a call with Mr. Peltz for later that day. On that call, Mr. Peltz proposed that DuPont (i) appoint Mr. Peltz and one additional Trian nominee to the Board, (ii) appoint the two remaining Trian nominees to the Chemours

Proxy Summary ![]()

Background of the Solicitation

Board and (iii) change certain corporate governance provisions at Chemours. Ms. Kullman and Mr. Cutler responded by indicating that they would convey Mr. Peltz's proposal to the Board for review.

After thorough consideration, the Board determined that Mr. Peltz's proposal was not a meaningful step toward a constructive resolution that served the best interests of the Company and its stockholders and again determined, based on the persistence of the factors discussed in the Board's February 4th determination, that adding Mr. Peltz to the Board would not serve the long-term interests of the Company's stockholders. The Board then authorized Ms. Kullman and Mr. Cutler to deliver a settlement offer to Mr. Peltz that would expand the Board's size and appoint one of Trian's nominees, Mr. Myers, to the Board. On March 13, 2015, Ms. Kullman and Mr. Cutler sent a letter to Mr. Peltz explaining the Board's conclusions and making the aforementioned settlement offer.

On March 13, 2015, Trian filed an amended preliminary proxy statement with regard to its nominees and proposal.

As of the date hereof, the Company and Trian have had no other material contacts.

We are not responsible for the accuracy of any information provided by or relating to Trian contained in any proxy solicitation materials filed or disseminated by, or on behalf of, Trian or any other statements that Trian may otherwise make. Trian chooses which of our stockholders will receive Trian's proxy solicitation materials.

Proxy Summary ![]()

OUR DIRECTOR NOMINEES

You are being asked to vote on the election of 1210 directors. All directors are elected annually. Detailed information about each Director'sDirector’s background, skills and expertise can be found inProposal 1 — Election of Directors.Directors.

Name Years of Service Age Current Position | Committee Memberships | Other Public | |||||||||||||||||||||||||||||||||||

| Independent | Audit | Human Resources and Compensation | Corporate Governance | Policy and Safety | Science & Technology | ||||||||||||||||||||||||||||||||

Lamberto Andreotti Director since 2012; Age Retired Chair, Bristol-Myers Squibb Company | YES | X | X | X | |||||||||||||||||||||||||||||||||

Edward D. Breen Director since 2015; Age Chair and CEO, DuPont | NO | 1 | |||||||||||||||||||||||||||||||||||

Robert A. Brown Director since 2007; Age 65 President, Boston University | YES | X | X | Chair | |||||||||||||||||||||||||||||||||

Alexander M. Cutler Director since 2008; Age 65 Retired Chair and CEO, Eaton | YES | X | Chair | 1 | |||||||||||||||||||||||||||||||||

Eleuthère I. du Pont Director since 2006; Age 51 President, Longwood Foundation | YES | X | X | 1 | |||||||||||||||||||||||||||||||||

James L. Gallogly Director since 2015; Age 64 Former Chairman of Management Board and CEO, LyondellBasell Industries NV | YES | X | X | ||||||||||||||||||||||||||||||||||

Marillyn A. Hewson Director since 2007; Age 63 | |||||||||||||||||||||||||||||||||||||

Chairman, President and CEO, Lockheed Martin Corporation | YES | X | X | 1 | |||||||||||||||||||||||||||||||||

Lois D. Juliber Director since 1995; Age Retired Vice Chairman, Colgate-Palmolive Corporation | YES | Chair | X | X | 1 | ||||||||||||||||||||||||||||||||

Lee M. Thomas Director since 2011; Age Retired Chairman and CEO, Rayonier Inc. | YES | X | Chair | X | 1 | ||||||||||||||||||||||||||||||||

Patrick J. Ward Director since 2013; Age CFO, Cummins, Inc. | |||||||||||||||||||||||||||||||||||||

YES

Proxy Summary ![]()

Our Progress in 2014

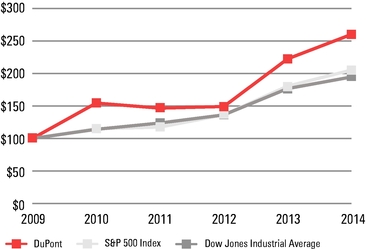

In 2014, DuPont continued to deliver value to shareholders through volume, margin, and earnings growth in a majority of our segments, despite macroeconomic headwinds. We continued to successfully transform DuPont to focus on commercial opportunities in Agriculture and Nutrition, Bio-Based Industrials and Advanced Materials, where we expect our science, engineering and innovation capabilities can deliver the greatest value. We continued to reduce costs and improve efficiency and effectiveness, which translates into better operating margins. And importantly, we continued our commitment to return capital to shareholders.

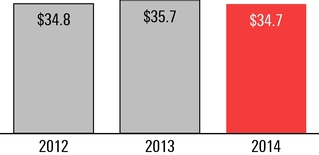

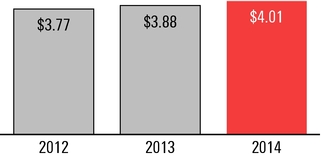

Through volume, margin, and earnings growth across the majority of our operating segments, we grew 2014 operating earnings per share ("EPS")(1) by 3.0% from 2013 despite significant market and macroeconomic challenges, including an overall weaker economy in the agriculture sector and a stronger dollar. These results include our Performance Chemicals segment, which is in the process of being separated from the Company, where full year operating earnings(1) were down 8% primarily due to lower pricing and the negative impacts of portfolio and currency. We continued to achieve significant margin improvement, with segment adjusted operating margin expansion of 740 basis points between 2008 and 2014(1).

DuPont is in the midst of a multi-year transformation of our portfolio to focus on the highest potential commercial opportunities where we expect our science and engineering capabilities can deliver the greatest value. As part of this process, the spin-off of The Chemours Company, our Performance Chemicals segment, remains on track for completion in mid-2015. In connection with the separation of Chemours, we undertook a comprehensive review of our business and cost structure, with the assistance of a leading management consulting firm, to ensure that the post-spin DuPont would be as efficient as possible. We exceeded our cost savings targets for the initial phase of implementation and have accelerated our originally announced schedule. We expect annual run-rate savings of approximately $1 billion and $1.3 billion by the end of 2015 and 2017, respectively, and continue to look for additional savings. These figures assume annual run-rate savings from the separation of Chemours of approximately $375 million, and other annual run rate savings of approximately $625 million and $925 million by the end of 2015 and 2017, respectively, in each case the majority of which is salary-and-benefits-related savings attributable to headcount reduction at the Company, with the remainder derived largely from increased manufacturing, warehouse and logistics efficiency. The Company is not aware of any factors that would result in the anticipated level of cost savings being reduced or delayed in any material respect. In 2014, savings from these redesign initiatives contributed $0.07 per share to operating earnings.

Our goal for the next generation DuPont is to connect the laboratory and the marketplace more closely than ever before, resulting in faster delivery of creative, science-based solutions for customers around the world. We are enabling safer, more nutritious food; creating high performance, cost effective, energy efficient materials; and increasingly delivering renewably sourced, bio-based materials and fuels. DuPont launched nearly 1,600 new products and filed more than 1,650 US patents in 2014 alone, including innovations like Dermacor® seed treatment for soybeans, Kapton® polyimide films for handheld electronic devices, and Tyvek® 800J for chemical protective garments. Excluding Performance Chemicals, new products introduced in the past four years delivered 32% of sales in 2014.

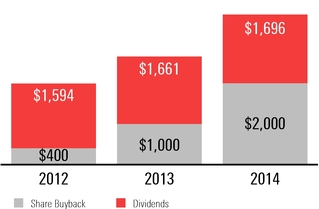

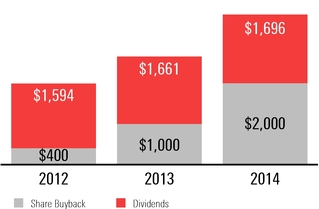

In 2014, we also continued the tradition of returning capital to shareholders. We executed $2 billion in share repurchases against our $5 billion share repurchase program and delivered a 4% increase in our common stock dividend for a total of $3.7 billion returned to shareholders in 2014. Going back the past six years, we have returned approximately $14 billion to shareholders through dividend growth (12% growth since 2009) and share repurchases.

We also expect to return all or substantially all of the one-time dividend proceeds from Chemours, currently estimated at $4 billion (based on a target BB credit rating for Chemours and pending the final credit ratings and underlying business conditions for Chemours), to DuPont shareholders via share repurchases over the 12 to 18 months following the separation, with a portion expected to be returned in 2015.

Chair

Proxy Summary ![]()

Our Progress in 2014

CAPITAL RETURNED TO STOCKHOLDERS(DOLLARS IN MILLIONS)

EXECUTIVE COMPENSATION — ALIGNING PAY WITH PERFORMANCE

We design our executive compensation programs to attract, motivate, reward and retain the high quality executives necessary to lead the Company and to accomplish our strategies. The following key principles guide the design and administration of those compensation programs:

•••

There should be a strong link between pay and performance.

•••

Executives' interests should be aligned with stockholders' interests.

•••

Programs should reinforce business strategies and drive long-term sustained stockholder value.

Summary of Our 2014 Compensation Actions

Linking Pay with Performance

Pay actions for our named executive officers in 2014 reflected our Company's performance.

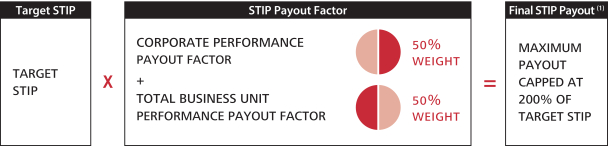

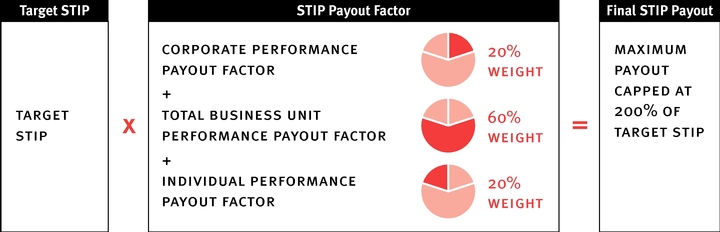

2014 SHORT-TERM PERFORMANCE AND INCENTIVE COMPENSATION

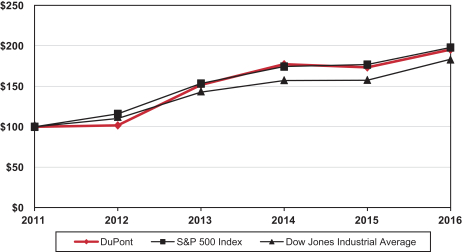

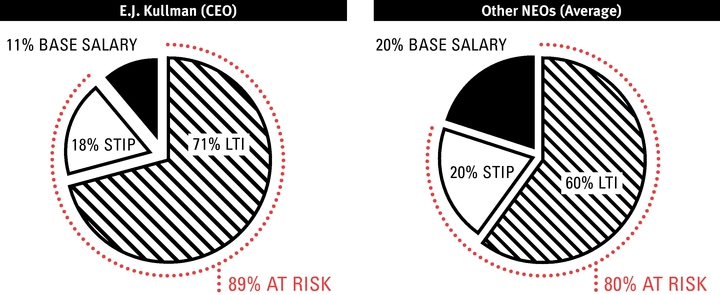

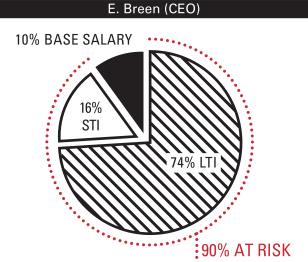

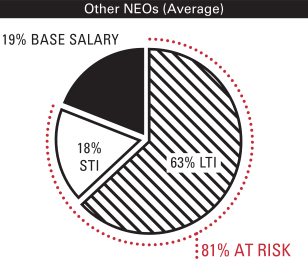

The NEO average payout factor under our short-term incentive program ("STIP") was 54% of target in 2014, down from 87% in 2013, which is based on a combination of (i) the Company's performance (the Company's Operating EPS), (ii) the applicable business units' performance (based upon after-tax operating income, revenue, cash flow from operations and certain other relevant metrics), and (iii) individual performance. For further discussion, please see the section entitled "Compensation Discussion and Analysis — 2014 Compensation Decisions — Our Annual Compensation Program" beginning on page 52 of this proxy statement.