UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

(Amendment No. 1)2)

| Filed by the Registrantþ | |||

| Filed by a Party other than the Registrant¨ | |||

| Check the appropriate box: | |

| þ | Preliminary Proxy Statement |

| ¨ | Confidential, for |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material |

Acreage Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

| ACREAGE HOLDINGS, INC. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||

| ¨ | No fee required. | |

| þ | ||

| Fee paid previously with preliminary materials. | ||

| ¨ | ||

No securities regulatory authority or stock exchange in Canada, the United States or any other jurisdiction has expressed an opinion about, or passed upon the fairness or merits of, the transactions described in this document, the securities offered pursuant to such transactions or the adequacy of the information contained in this document and it is an offense to claim otherwise.

NOTICE OF SPECIAL MEETING OF FLOATING SHAREHOLDERS

to be held September 16, 2020March 15, 2023

and

PROXY STATEMENT AND MANAGEMENT INFORMATION CIRCULAR

with respect to a proposed

AMENDED PLAN OF ARRANGEMENT

involving

ACREAGE HOLDINGS, INC.,

SECURITYHOLDERSHOLDERS OF CLASS D SUBORDINATE VOTING SHARES OF ACREAGE HOLDINGS, INC.

and,

CANOPY GROWTH CORPORATION and

CANOPY USA, LLC

RECOMMENDATION TO FLOATING SHAREHOLDERS:

THE BOARD OF DIRECTORS OF ACREAGE HOLDINGS, INC. RECOMMENDS THAT FLOATING SHAREHOLDERS VOTE IN FAVORFAVOUR OF THE AMENDMENTARRANGEMENT RESOLUTION

These materials are important and require your immediate attention. They require shareholders of Acreage Holdings, Inc. (“Acreage”) to make important decisions. If you are in doubt as to how to make such decisions, please contact your financial, legal or other professional advisor.

The accompanying proxy statement and management information circular is dated AugustFebruary [¨], 2020 and is first being mailed to shareholders of Acreage on or about August 21, 2020.2023

These materials are important and require your immediate attention. They require holders (the “Floating Shareholders”) of Class D subordinate voting shares of Acreage Holdings, Inc. (“Acreage”) to make important decisions. If you are in doubt as to how to make such decisions, please contact your financial, legal or other professional advisor. The accompanying proxy statement and management information circular is dated February [¨], 2023 and is first being mailed to Floating Shareholders on or about February [¨], 2023. If you have any questions or require assistance, please contact Morrow Sodali, the strategic shareholder advisor and proxy solicitation agent for Acreage, by telephone at 1.888.444.0623 toll-free in North America (+1.289.695.3075 collect) or by e-mail at assistance@morrowsodali.com, or your professional advisor. |

If you have any questions or require assistance, please contact Kingsdale Advisors, the strategic shareholder advisor and proxy solicitation agent for Acreage, by telephoneMorrow Sodali at 1-877-657-58561.888.444.0623 toll-free in North America (+1-416-867-2272 collect)or 1.289.695.3075 outside of North America or by e-mailemail at contactus@kingsdaleadvisors.com, or your professional advisor.

August [¨], 2020assistance@morrowsodali.com.

Please visit http://investors.acreageholdings.com/ for additional information.

August [¨], 20202023

Dear Floating Shareholder:

The Board of Directors (the “Acreage Board”) of Acreage Holdings, Inc. (“Acreage”) cordially invites you to attend the special meeting (the “Meeting”) of holders (the “Floating Shareholders”) of Acreage’s issued and outstanding Class D subordinate voting shares (the “Floating Shares”) to be held at 11:12:00 a.m.p.m. (New York time) on September 16, 2020. In light of the recent coronavirus (COVID-19) outbreak and in order to address potential issues arising from the unprecedented public health impact of the novel coronavirus (COVID-19), comply with applicable public health directives that may be in force at the time of the Meeting, and to limit and mitigate risks to the health and safety of our communities, Shareholders, employees, directors and other stakeholders, theMarch 15, 2023. The Meeting will be held in a virtual format which will be conducted via live webcast online at web.lumiagm.com/221798142244671399 (password: Acreage2020acreage2023). Floating Shareholders will not need, to, or be able to, physically attend the Meeting. Floating Shareholders will have an equal opportunity to attend, ask questions and vote at the Meeting online regardless of their geographic location. Inside this document, you will find important information and instructions about how to participate in the Meeting.location or equity ownership.

On JuneOctober 24, 2020,2022, Acreage entered into a proposalan arrangement agreement (the “Floating Share Arrangement Agreement”) with Canopy Growth Corporation (“Canopy Growth”) (TSX: WEED, NASDAQ: CGC) and Canopy USA, LLC (“Canopy USA”), pursuant to which, sets out, among other things,subject to approval of the Floating Shareholders and the terms and conditions upon whichof the parties are proposing to enter into an amending agreement (the “Amending Agreement”) to amend the existing arrangement agreement between Acreage and Canopy Growth dated April 18, 2019, as amended on May 15, 2019 (the “ExistingFloating Share Arrangement Agreement,”), amend Canopy USA will acquire all of the issued and restate the existingoutstanding Floating Shares by way of a court-approved plan of arrangement (the “Amended Plan ofFloating Share Arrangement”) and implement the Amended Plan of Arrangement pursuant. Pursuant to the Business Corporations Act (British Columbia)Floating Share Arrangement, Canopy USA will acquire all of the issued and outstanding Floating Shares on the basis of 0.45 of a common share of Canopy (each whole share, a “Canopy Share”) for each Floating Share held at the time of the acquisition of the Floating Shares (the “Amended ArrangementConsideration Shares”).

At the Meeting, you will be asked to consider and approve a special resolution authorizing and approving (i) the Amended Arrangement, (ii) the Amending Agreement, (iii) the Amended Plan of Arrangement, and (iv) the second amended and restated equity incentive plan (the “Amended and Restated Omnibus Equity Incentive Plan”).Floating Share Arrangement.

Please complete the enclosed form of proxy and submit it to our transfer agent and registrar, Odyssey Trust Company, as soon as possible but not later than 48 hours (excluding Saturdays, Sundays and holidays) prior to the time of the Meeting or any adjournment or postponement thereof.

Pursuant to the Amended Plan of Arrangement, among other things, Canopy Growth will make an aggregate cash payment of US$37,500,024 to the Shareholders and certain holders of securities exchangeable for Existing Shares and Acreage will complete a capital reorganization (the “Capital Reorganization”) whereby: (i) each Class A subordinate voting share (each, an “Existing SVS”) will be exchanged for 0.7 of a Class E subordinate voting share (each whole share, a “Fixed Share”) and 0.3 of a Class D subordinate voting share (each whole share, a “Floating Share”); (ii) each Class B proportionate voting share (each, an “Existing PVS”) will be exchanged for 28 Fixed Shares and 12 Floating Shares; and (iii) each Class C multiple voting share (each, an “Existing MVS”, and together with the Existing SVS and Existing MVS, the “Existing Shares”) will be exchanged for 0.7 of a new multiple voting share (each whole share, a “Fixed Multiple Share”) and 0.3 of a Floating Share. Each Fixed Existing MVS will be entitled to 4,300 votes at all meetings of Shareholders with each Fixed Share and each Floating Share entitled to one vote per share at such meetings.

As a condition to implementation of the Amended Arrangement, an affiliate of Canopy Growth (the “Lender”) will advance the first tranche of US$50,000,000 of a loan of up to US$100,000,000 (the “Loan”) to an affiliate of the Company that operates solely in the hemp industry in full compliance with all applicable laws (“Hempco”) pursuant to a secured debenture (the “Debenture”).

Pursuant to the Amended Plan of Arrangement, upon the occurrence of a change in federal laws in the United States to permit the general cultivation, distribution and possession of marijuana (as defined in the relevant legislation) or to remove the regulation of such activities from the federal laws of the United States or waiver thereof (at the discretion of Canopy Growth), Canopy Growth will, subject to the satisfaction or waiver of certain closing conditions set out in the Amended Arrangement Agreement: (i) acquire all of the issued and outstanding Fixed Shares (following the mandatory conversion of the Fixed Multiple Shares into Fixed Shares) on the basis of 0.3048 of a common share in the capital of Canopy Growth (a “Canopy Growth Share”) for each Fixed Share held at the time of the acquisition of the Fixed Shares (the “Acquisition Time”), subject to adjustment inIn accordance with the terms of the Amended Plan ofFloating Share Arrangement (the “Agreement, Canopy Call Option”); and (ii) have the right (but not the obligation) (the “Floating Call Option”), exercisable for a period of 30 days following the Floating Rate Dateirrevocably waived its option to acquire all of the issued and outstanding Floating Shares. Upon exercise of the Floating Call Option, Canopy Growth may acquire the Floating Shares for cash or forunder the plan of arrangement implemented on September 23, 2020 involving Canopy Growth Shares or a combination thereof, in Canopy Growth’s sole discretion. If paid in cash, the price per Floating Share shall be equaland Acreage (the “Existing Arrangement”) pursuant to the volume-weighted average trading pricearrangement agreement between Canopy and Acreage dated April 18, 2019, as amended (the “Existing Arrangement Agreement”).

In accordance with the terms of the Floating Shares onShare Arrangement Agreement, Canopy will, subject to the Canadian Securities Exchangeterms and conditions therein, exercise its option pursuant to the Existing Arrangement Agreement (the “CSEFixed Call Option”) (or other recognized stock exchange on which the Floatingto acquire Acreage’s outstanding Class E subordinate voting shares (the “Fixed Shares are primarily traded as determined by volume) for the 30 trading day period prior to the exercise (or deemed exercise)”), representing approximately 70% of the Canopy Call Option, subject to a minimum amounttotal shares of US$6.41. If paid in Canopy Growth Shares, each Floating Share will be exchanged for a number of Canopy Growth Shares equal to (i) the volume-weighted average trading price of the Floating Shares on the CSE (or other recognized stock exchange on which the Floating Shares are primarily traded as determined by volume) for the 30 trading day period prior to the exercise (or deemed exercise) of the Canopy Call Option, subject to a minimum amount of US$6.41, divided by (ii) the volume-weighted average trading price (expressed in US$) of the Canopy Growth Shares on the New York Stock ExchangeAcreage (the “NYSEAcreage Shares”) (oras at the date hereof, at a fixed exchange ratio of 0.3048 of a Canopy Share for each Fixed Share held, such other recognized stock exchange on whichexercise to occur no later than five business days following the satisfaction of all required conditions. Canopy Growth Shares are primarily traded if not then traded onhas announced that it expects Canopy USA to complete the NYSE) for the 30 trading day period immediately prior to the exercise (or deemed exercise) of the Canopy Call Option (the “Floating Ratio”). The Floating Ratio is subject to adjustment in accordance with the Amended Plan of Arrangement if Acreage issues greater than the permitted number of Floating Shares prior to the Acquisition Date. No fractional Canopy Growth Shares will be issued pursuant to the Amended Plan of Arrangement. The Floating Call Option cannot be exercised unless the Canopy Call Option is exercised (or deemed to be exercised). The acquisition of the Floating Shares pursuant tounder the Floating Call Option, if exercised, will take place concurrently with the closingShare Arrangement immediately prior to completion of the acquisition of the Fixed Shares pursuant to the CanopyFixed Call Option. It is proposed thatCompletion of the Canopyacquisition of the Fixed Shares following exercise of the Fixed Call Option andis subject to the satisfaction or waiver of certain conditions set forth in the Existing Arrangement Agreement.

Upon completion of: (i) the acquisition of the Floating Call Option will expire 10 years from the Amendment Time. There can be no guarantee asShares pursuant to the valueFloating Share Arrangement; and (ii) the acquisition of athe Fixed Shares pursuant to the Existing Arrangement, Canopy Growth Share atUSA will own 100% of the Acquisition Time.issued and outstanding Acreage Shares.

The Special CommitteeAcreage Board and a special committee comprised of three independent members of the Acreage Board (the “Special Committee”) considered alternatives and a number of factors with respect to the Floating Share Arrangement including, among others, the following:

| (a) |

2

| (b) |

| (c) |

| (d) | Participate at the Onset of Canopy |

| (e) |

| (f) | |

If you have any questions please contact Morrow Sodali at 1.888.444.0623 toll-free in North America or 1.289.695.3075 outside of North America or by email at assistance@morrowsodali.com.

Please visit http://investors.acreageholdings.com/ for additional information.

3

| (g) | Support of Floating Shareholders. Certain directors and current and former officers of Acreage entered into voting support agreements pursuant to |

| (h) | Superior Proposal. Pursuant to the Floating Share Arrangement Agreement, the Acreage Board remains able to respond to an unsolicited written Acquisition Proposal (as defined in the Circular) on |

For additional information with respect to these and other anticipated benefits of the AmendedFloating Share Arrangement, see the section in the proxy statement and management information circular accompanying this letter (the “Circular”) entitled “The AmendedFloating Share Arrangement – Reasons for the AmendedFloating Share Arrangement”.

TheTo be adopted, the special resolution approving the AmendedFloating Share Arrangement the Amending Agreement, the Amended Plan of Arrangement and the Amended and Restated Omnibus Equity Incentive Plan (the “AmendmentArrangement Resolution”) must be approved by by: (i) at least 66⅔% of thethe votes cast by Floating Shareholders, present virtually or represented by proxy and entitled to vote at the Meeting by the holdersMeeting; and (ii) in accordance with Multilateral Instrument 61-101 – Protection of Existing Shares, voting together as a single class. In addition, the Amendment Resolution is subject to approval byMinority Security Holders in Special Transactions (“MI 61-101”), a simple majority of votes cast by the holders of Existing SVS and Existing PVS,Floating Shareholders, present virtually or represented by proxy and entitled to vote at the Meeting, voting together as a single class, excluding the votes in respect of ExistingFloating Shares which are owned, held, controlled or directed by Mr. Kevin Murphy. The Amendment Resolution is also subject to the approval of a simple majority of the votes cast by the holdersany “interested party”, any “related party” of outstanding Existing SVS, Existing PVS and Existing MVS, voting together as a single class, excluding the votesan “interested party” or any “joint actor” (as such terms are defined in respect of Existing Shares which are owned, held, controlled or directed by Mr. Murphy.MI 61-101) (together, the “Interested Parties”). Abstentions and broker non-votes will not have any effect on the approval of the AmendmentArrangement Resolution. The votes attaching to the Floating Shares held by the Interested Parties will be excluded for the purposes of determining whether “minority approval” has been obtained for the purposes of MI 61-101.

Eight Capital has delivereddelivered an opinion dated October 24, 2022 to the special committeeSpecial Committee which states that, as of the date thereof, and based upon and subject to the assumptions, qualifications and limitations contained therein, the number of Canopy Shares per Floating Share to be received by the Floating Shareholders (other than Canopy USA, Canopy and/or their respective affiliates) pursuant to the Floating Share Arrangement is fair, from a financial point of view, to the Floating Shareholders (other than Canopy USA, Canopy and/or their respective affiliates) (the “Eight Capital Fairness Opinion”).

In addition, the Acreage Board (the “received an opinion from Canaccord Genuity Corp. (“Special CommitteeCanaccord Genuity”), which states that, as of the date thereof, and based upon and subject to the assumptions, qualificationsqualifications, explanations and limitations set out therein,forth therein, and such other matters as Canaccord Genuity considered relevant, the considerationnumber of Consideration Shares to be receivedreceived by theFloating Shareholders (other than Canopy USA, Canopy and/or their respective affiliates) pursuant to the AmendedFloating Share Arrangement is fair, from a financial point of view, to the Floating Shareholders (the(other than Canopy USA, Canopy and/or their respective affiliates) (the “NewCanaccord Genuity Fairness Opinion” and, together with the Eight Capital Fairness Opinion, the “Fairness Opinions”).

After consulting with Acreage management and receiving advice and assistance offrom its financial and legal advisors, and after careful consideration of alternatives and a number of alternatives and factors, including, among others, receipt of the unanimous recommendation from the Special Committee, the New Fairness OpinionOpinions and the factors set out in the Circular under the heading “Reasons for the AmendedFloating Share Arrangement”, the members of the Acreage Board unanimously (with the exception of Mr.Kevin Murphy, whoJohn Boehner, Brian Mulroney and Peter Caldini, each having declared histheir interest in the transactions contemplated by the ProposalFloating Share Arrangement Agreement and the Amending Agreementconnected transactions and abstainedabstained from voting in respect thereof) determined that the AmendedFloating Share Arrangement and entry into the ProposalFloating Share Arrangement Agreement are in the best interests of Acreage and are fair to Floating Shareholders and recommend that Floating Shareholders vote FOR the AmendmentArrangement Resolution. The accompanying Circular describes the background to the Acreage Board’s determinations and recommendations.

The accompanying Circular contains a detailed description of the AmendedFloating Share Arrangement and includes other information to assist you in considering the matters to be voted upon which we encourage you to carefully consider. If you require assistance, you should consult your financial, tax, legal and other professional advisors.

If you have any questions please contact Morrow Sodali at 1.888.444.0623 toll-free in North America or 1.289.695.3075 outside of North America or by email at assistance@morrowsodali.com.

Please visit http://investors.acreageholdings.com/ for additional information.

4

Your vote is important regardless of the number of ExistingFloating Shares you own. All Floating Shareholders are encouraged to take the time to complete, sign, date and return the applicable form of proxy in accordance with the instructions set out therein and in the accompanying Circular so that your ExistingFloating Shares are voted at the Meeting in accordance with your instructions. If you are a non-registered Floating Shareholder and hold your ExistingFloating Shares through a broker, custodian, nominee or other intermediary, please follow their instructions.

Please vote as soon as possible.

While certain matters, such as the timing of the receipt of court approval and the satisfaction of certain other conditions, are beyond Acreage’s control, if the requisite approvals are obtained from Floating Shareholders, it is anticipated that the AmendedFloating Share Arrangement will be completed in Septemberthe second half of 2020.2023.

Enclosed is a letter of transmittal for registered Shareholders explaining how you can deposit your Existing Shares and obtain the Fixed Shares and Floating Shares in exchange therefor in connection with the Capital Reorganization. The letter of transmittal will also be available on the Company’s website at [] as well as on SEDAR at www.sedar.com, on EDGAR at www.sec.gov/edgar or by contacting Odyssey Trust Company (using the information set out on the back of the accompanying Circular).

If you have any questions regarding the submission of your proxy, please contact Odyssey Trust Company, at its NorthNorth American toll-free number: 1-888-290-1175 or Kingsdale Advisors,Morrow Sodali, the strategic advisor and the proxy solicitationsolicitation agent for Acreage, by telephone at 1-877-657-58561.888.444.0623 toll-free in North America (+1-416-867-2272(1.289.695.3075 collect) oror by e-mail at contactus@kingsdaleadvisors.comassistance@morrowsodali.com.

On behalf of Acreage, I would like to thank all ShareholdersAcreage shareholders for your ongoing support.

Sincerely,

“William C. Van Faasen”Peter Caldini

William C. Van Faasen

Interim Chief Executive Officer

Acreage Holdings, Inc.

If you have any questions please contact Morrow Sodali at 1.888.444.0623 toll-free in North America or 1.289.695.3075 outside of North America or by email at assistance@morrowsodali.com.

Please visit http://investors.acreageholdings.com/ for additional information.

TO BE COUNTED VOTES MUST BE RECEIVED BY ODYSSEY TRUST COMPANY NO LATER THAN 12:00 P.M. (EASTERN STANDARD TIME) ON MARCH 13, 2023

The time limit for the deposit of proxies/voting instruction forms may be waived or extended by the Chair of the Meeting at his discretion without notice.

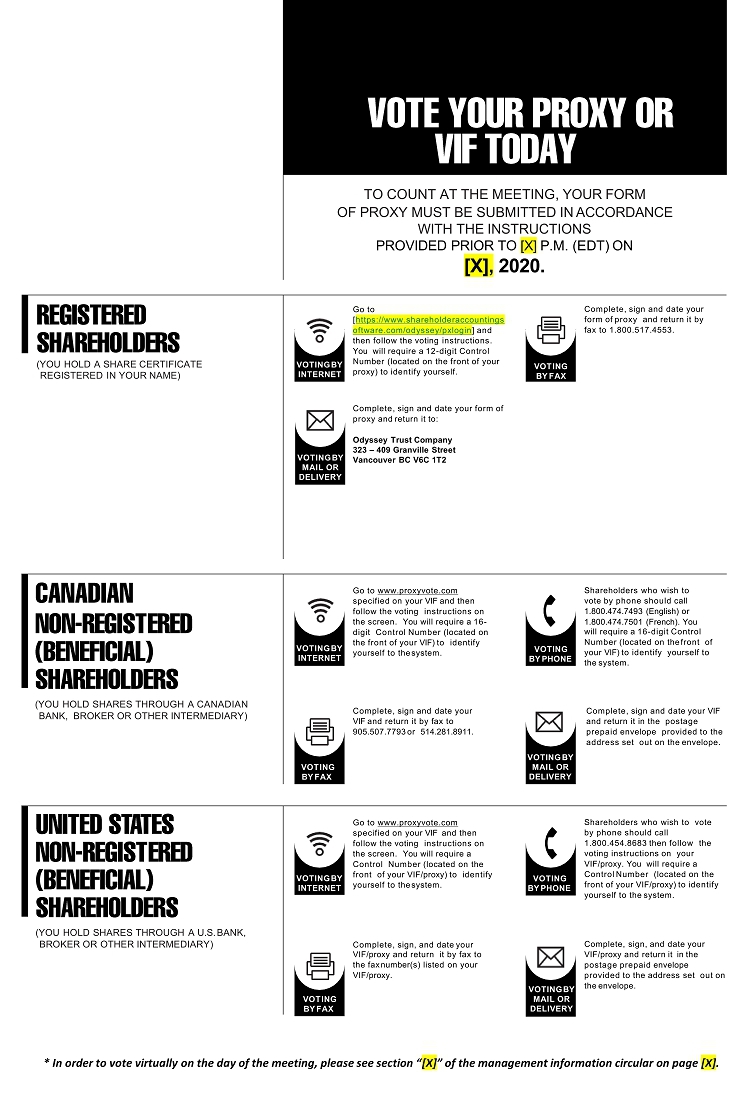

In order to ensure that your proxy/voting instruction form is received in time for Acreage Holdings, Inc.’s Special Shareholder Meeting to be held on March 15, 2023, we recommend that you vote in any of the following ways:

VOTING | BENEFICIAL (NON-REGISTERED) If your shares are held with a broker, bank | REGISTERED |

| BY INTERNET Go to www.proxyvote.com and follow the instructions. You will need your 16-digit control number found on your voting instruction form. | Go to https://login.odysseytrust.com/pxlogin and follow the instructions. You will need your 12-digit control number, which is on your proxy form. |

| BY PHONE: Canada: In English: 1-800-474-7493 In French: 1-800-474-7501 U.S.A.:1-800-454-8683 | N/A |

| BY FACSIMILE: Canada: Fax your voting instruction form to 1-905-507-7793 or toll-free to 1-866-623-5305 in order to ensure that your vote is received before the deadline. | N/A |

| BY MAIL Complete and return the voting instruction form and return it in the envelope provided. | Complete, sign and date your proxy form and return it in the envelope provided or mail to: Odyssey Trust Company Attention: Proxy Department 323 – 409 Granville Street, Vancouver, BC V6C 1T2 |

If you have any questions please contact Morrow Sodali at 1.888.444.0623 toll-free in North America or 1.289.695.3075 outside of North America or by email at assistance@morrowsodali.com.

Please visit http://investors.acreageholdings.com/ for additional information.

NOTICE OF MEETING

NOTICE IS HEREBY GIVEN that a special meeting (the “Meeting”) of the holders (the “Existing SVSFloating Shareholders”) of Class AD subordinate voting shares (the “Existing SVS”), the holders (the “Existing PVS Shareholders”) of Class B proportionate voting shares (the “Existing PVS”) and the holders (the “Existing MVS Shareholders” and, together with the Existing SVS Shareholders and the Proportionate Shareholders, (the “Shareholders”) of Class C multiple voting shares (the “Existing MVS”, and together with the Existing SVS and the Existing PVS, the “ExistingFloating Shares”) of Acreage Holdings, Inc. (“Acreage” or the “Company”) will be held on September 16, 2020March 15, 2023 at 11:12:00 a.m.p.m. (New York time) for the following purposes:

| 1. | to consider pursuant to an interim order of the Supreme Court of British Columbia (the “Court”) dated January 18, 2023, as varied on [ |

| 2. | to transact such other business as may properly be brought before the Meeting or any adjournment or postponement thereof. |

The Circular provides additional information relating to the matters to be addressed at the Meeting, including the AmendedFloating Share Arrangement.

The full text of the Amendedplan of arrangement (the “Floating Share Plan of Arrangement”) effecting the Amending AgreementFloating Share Arrangement and the Amendment Interim Order are attached to the Circular as Appendix “C”, Appendix “B” and Appendix “E”“F”, respectively. A copy of the Floating Share Arrangement Agreement has been filed under Acreage’s profile on SEDAR at www.sedar.com and with the SEC and available on EDGAR at www.sec.gov/edgar.

Additional information relating to the matters to be brought before the Meeting is set forth in the Circular which accompanies this Notice.

The Company’s board of directors (the “Acreage Board”) unanimously (with the exception of Mr.Kevin Murphy, whoJohn Boehner, Brian Mulroney and Peter Caldini, each of whom declared histheir interest in the transactions contemplated by the ProposalFloating Share Arrangement Agreement and the Amending Agreementconnected transactions and abstained from voting in respect thereof) recommends that Floating Shareholders vote FOR the AmendmentArrangement Resolution. It is a condition to the completion of the execution of the Amended Arrangement Agreement and the implementation of the AmendedFloating Share Arrangement that the AmendmentArrangement Resolution is adopted at the Meeting.

The Acreage Board fixed August 13, 2020,February 10, 2023 as the record date for the Meeting (the “Record Date”). Floating Shareholders of record at the close of business on the Record Date are entitled to notice of the Meeting and to vote thereat or at any adjournment or postponement thereof on the basis of: (i)of one vote for each Existing SVS held; (ii) 40 votes for each Existing PVS held; and (iii) 3,000 votes for each Existing MVSFloating Share held. To be adopted, the AmendmentArrangement Resolution must be approved by: (i) at least 66⅔% of the votes cast by Floating Shareholders, present virtually or represented by proxy and entitled to vote at the Meeting, voting together as a single class;Meeting; and (ii) in accordance with Multilateral Instrument 61-101 – Protection of Minority SecurityholdersSecurity Holders in Special Transactions (“MI 61-101”), a simple majority of votes cast by the holders of Existing SVS and Existing PVS,Floating Shares, present virtually or represented by proxy and entitled to vote at the Meeting, voting together as a single class, excluding the votes cast by any “interested party”, any “related party” of an “interested party” or any “joint actor” (as such terms are defined in MI 61-101) (the(together, the “Interested Parties”); and (iii) in accordance with Ontario Securities Commission Rule 56-501 (“OSC Rule 56-501”) and National Instrument 41-101 – General Prospectus Requirements (“NI 41-101”), a simple majority of the votes cast by the holders of Existing SVS, Existing PVS and Existing MVS, present virtually or represented by proxy and entitled to vote at the Meeting, voting together as a single class, excluding the votes cast by any affiliates of the Company and securities held directly or indirectly by control persons of the Company (the “Related Parties”). Abstentions and broker non-votes will not have any effect on the approval of the AmendmentArrangement Resolution. Since all of the holders of Existing MVS are Interested Parties, the votes with respect to all of the Existing MVS will not be considered for purposes of determining whether “minority approval” has been obtained pursuant to MI 61-101. The votes attaching to the Existing SVS and Existing PVSFloating Shares held by the Interested Parties will also be excluded for the purposes of determining whether “minority approval” has been obtained for the purposes of MI 61-101. In addition, since Mr. Murphy, the sole holder of Existing MVS, is a Related Party, the votes with respect to all of the Existing MVS will not be considered for purposes of determining whether “minority approval” has been obtained pursuant to OSC Rule 56-501 and NI 41-101. The votes attaching to the Existing SVS and Existing PVS held by the Related Parties will also be excluded for the purposes of determining whether “minority approval” has been obtained for the purposes of OSC Rule 56-501 and NI 41-101.

Meeting Format

The Company is holding the Meeting as a virtual meeting, which will be conducted via live webcast. Floating Shareholders will not need, or be able, to attend the Meeting in person.

To address potential issues arising from the unprecedented public health impact of the novel coronavirus (COVID-19), comply with applicable public health directives that may be in force at the time of the Meeting, and to limit and mitigate risks to the health and safety of our communities, Shareholders, employees, directors and other stakeholders, weAcreage will be holding the Meeting in a virtual only format. Floating Shareholders will not need, to, or be able, to physically attend the Meeting.Meeting in person. Registered Floating Shareholders (“Registered Shareholders”) and duly appointed proxyholders are entitled to vote at the Meeting either by attending virtually or by submitting a form of proxy, as described in the Circular under the headings, “General Proxy Information” and “How to Vote Your Shares”.

In order to attend, participate in or vote at the Meeting (including for voting and asking questions at the Meeting) or vote at the Meeting, Registered Shareholders and duly appointed proxyholders must have a valid username. Guests are welcome to attend and view the webcast, but will be unable to participate in or vote at the Meeting. To join as a guest please visit the Meeting online at web.lumiagm.com/221798142244671399 and select “Join as a Guest” when prompted.

Non-Registered

2

Non-registered Floating Shareholders (being(being beneficial Floating Shareholders who hold their ExistingFloating Shares through a broker, investment dealer, bank, trust company, custodian, nominee or other intermediary) who have not duly appointed themselves as proxyholder will be able to attend the Meeting as a guest and view the webcast but will not be able to participate in or vote at the Meeting. Registered Shareholders may attend, participate in and vote at the Meeting or may be represented by proxy. Registered Shareholders and duly appointed proxyholders will be able to access the Meeting at web.lumiagm.com/221798142.244671399. Registered Shareholders may enter the Meeting by clicking “I have a login” and entering a username and password before the start of the Meeting.

Registered Shareholders: The control number located on the form of proxy is the username. The password for the MeetingMeeting is “Acreage2020”“acreage2023” (case sensitive). If as a Registered Shareholder you use your control number to access the MeetingMeeting and you accepthave previously voted, you do not need to vote again when the terms and conditions,polls open. By voting at the meeting, you will be revoking any and all previously submitted proxies for the Meeting and will be provided with the opportunityopportunity to vote by online ballot on the matters put forth at the Meeting. If you do not wish to revoke a previouslypreviously submitted proxy, you will not be able to participate at the Meeting online and can only attend the meetingMeeting as a guest.guest.

Duly appointed proxyholders: Floating Shareholders who wish to appoint a third -partythird-party proxyholder to represent them at the Meeting (including Non-Registered Shareholders who have appointed themselveswish to appoint themselves as proxyholder to attend, participate in or vote at the Meeting) MUST submit their duly completed proxy or voting instruction form, as applicable, AND register the proxyholder in advance of the proxy cut-off at 11:12:00 a.m.p.m. (New York time) on September 14, 2020.March 13, 2023. Following registration of a proxyholder, Odyssey Trust Company will provide duly appointed proxyholders with a username by e-mail after the voting deadline has passed. The password for the Meeting is “Acreage2020”“acreage2023” (case sensitive). Non-RegisteredNon-registered Floating Shareholders who have not duly appointed themselves as proxyholder will be able to attend the Meeting as a guest but will not be able to participate in or vote at the Meeting.

If you are a Registered Shareholder and are unable to attend the Meeting virtually, please exercise your right to vote by completing, signing, dating and returning the applicable accompanying form of proxy to Odyssey Trust Company, the transfer agent of the Company as soon as possible, so that as large a representation as possible may be had at the Meeting. To be valid, completed proxy forms must be signed, dated and deposited with Odyssey Trust Company using one of the following methods:

| By Mail or Hand Delivery: | Odyssey Trust Company Attention: Proxy Department 323 – 409 Granville Street, Vancouver, BC V6C 1T2 |

| By Internet: | https:// |

Proxies must be deposited with Odyssey Trust Company not later than 11:12:00 a.m.p.m. (New York time) on September 14, 2020,March 13, 2023, or, if the Meeting is adjourned or postponed, not later than 48 hours, excluding Saturdays, Sundays and holidays, preceding the time of such reconvened Meeting or any adjournment or postponement thereof. The Chair of the Meeting shall have the discretion to waive or extend the proxy deadlines without notice.

If you are unable to attend the Meeting, we encourage you to complete and return the enclosed form of proxy as soon as possible so that as large a representation as possible may be had at the Meeting. If a Floating Shareholder receives more than one form of proxy because such holder owns ExistingFloating Shares of different classes and/or registered in different names or addresses, each form of proxy must be completed and returned in order to ensure all ExistingFloating Shares are voted.

Registered Shareholders have the right to dissent with respect to the AmendmentArrangement Resolution and, if the AmendmentArrangement Resolution is adopted, to be paid the fair value of their ExistingFloating Shares in accordance with the provisions of the BCBCA as modified by the AmendedFloating Share Plan of Arrangement, the Amendment Interim Order and the final order of the Court approving the AmendedFloating Share Plan of Arrangement (the “Amendment Final Order”), as described in the accompanying Circular under the heading “Dissent Rights”. Failure to strictly comply with the requirements with respect to the dissent rights set forth in the BCBCA, as modified by the AmendedFloating Share Plan of Arrangement, the Amendment Interim Order and the Amendment Final Order may result in the loss of any right to dissent. Persons who are beneficial owners of ExistingFloating Shares registered in the name of a broker, custodian, nominee or other intermediary and who wish to dissent must make arrangements for the ExistingFloating Shares beneficially owned by them to be registered in their name prior to the time thetheir written objection to the AmendmentArrangement Resolution is required to be received by the Company or, alternatively, make arrangements for the registered holder of such ExistingFloating Shares to dissent on their behalf.

If you have any questions please contact Morrow Sodali at 1.888.444.0623 toll-free in North America or 1.289.695.3075 outside of North America or by email at assistance@morrowsodali.com.

Please visit http://investors.acreageholdings.com/ for additional information.

3

If you are a Registered Shareholder and receive these materials through your broker or through another intermediary, please complete and return the form of proxy in accordance with the instructions provided to you by your broker or other intermediary, as applicable.

Enclosed is a letter of transmittal for registered Shareholders explaining how you can deposit your Existing Shares and obtain the Fixed Shares and Floating Shares in exchange therefor in connection with the Capital Reorganization. The letter of transmittal will also be available on the Company’s website at [¨] as well as on SEDAR at www.sedar.com, on EDGAR at www.sec.gov/edgar or by contacting Odyssey Trust Company (using the information set out on the back of the accompanying Circular).

If you have any questions or require assistance, please contact Kingsdale Advisors,Morrow Sodali, our strategic shareholder advisor andand proxy solicitation agent, by telephone at 1-877-657-58561.888.444.0623 toll-free in North America (+1-416-867-2272(1.289.695.3075 collect callscalls outside of North America) or by e-mail at contactus@kingsdaleadvisors.com,assistance@morrowsodali.com, or your professional advisor.advisor.

DATED at New York, New York this [¨] day of August, 2020.February, 2023.

BY ORDER OF THE BOARD OF DIRECTORS

Acreage Holdings, Inc. |

Please visit http://investors.acreageholdings.com/ for additional information.

i

QUESTIONS AND ANSWERS ABOUT THE AMENDEDFLOATING SHARE ARRANGEMENT THE POTENTIAL ACQUISITION AND THE MEETING

The information contained below is of a summary nature and therefore is not complete. This summary information is qualified in its entirety by the more detailed information contained elsewhere in or incorporated by reference into this Circular, including the Appendices hereto and the form of proxy, and the Capital Reorganization Letter of Transmittal, each of which are important and should be reviewed carefully. Capitalized terms used in these questions and answers but not otherwise defined herein have the meanings set forth in the “GlossaryAppendix “A” – Glossary of Terms”Terms in this Circular. See “Cautionary Note Regarding Forward-Looking Information” and “Risk Factors”.

Q&A ON THE AMENDEDFLOATING SHARE ARRANGEMENT

General

Q: What are the Floating Shareholders being asked to vote on?

A: Floating Shareholders are being asked to vote on a special resolution, the full text of which is set forth in Appendix “B” to this Circular, authorizing and approving, among other things, approve: (i) the Amended Arrangement; (ii) the Amending Agreement; (iii) the Amended Plan of Arrangement to terminate the Existing Canopy Option and provide for the Canopy Call Option and the Floating Call Option;Share Arrangement involving Acreage, Canopy and (iv)Canopy USA. If the AmendedFloating Share Arrangement is approved by the Floating Shareholders, Canopy USA will acquire all of the issued and Restated Omnibus Equity Incentive Plan.outstanding Floating Shares for consideration equal to 0.45 of a Canopy Share in exchange for each Floating Share held.

See “The AmendedFloating Share Arrangement – Required Shareholder Approvals”.

Q: What changes are being proposed to the Existing Canopy Option?

A: Under the Existing Arrangement, upon the occurrence or waiver (at the discretion of Canopy Growth) of the Triggering Event, Canopy Growth will, subject to the satisfaction or waiver of the Acquisition Closing Conditions, acquire all of the issued and outstanding Existing SVS (after each Existing MVS and Existing PVS is converted into an Existing SVS) in exchange for 0.5818 of a Canopy Growth Share for each Existing SVS, subject to adjustment in certain circumstances as set out in the Arrangement Agreement.

As described in greater detail below, the Amended Plan of Arrangement will include, the Capital Reorganization pursuant to which, among other things (i) each outstanding Existing SVS will be exchanged for 0.7 of a Fixed Share and 0.3 of a Floating Share; (ii) each outstanding Existing PVS will be exchanged for 28 Fixed Shares and 12 Floating Shares; and (iii) each outstanding Existing MVS will be exchanged for 0.7 of a Fixed Multiple Share and 0.3 of a Floating Share. Under the Amended Arrangement, upon the occurrence or waiver (at the discretion of Canopy Growth) of the Triggering Event, Canopy Growth will exercise (or be deemed to exercise) the Canopy Call Option and subject to the satisfaction or waiver of the Acquisition Closing Conditions, Canopy Growth will (i) acquire all of the issued and outstanding Fixed Shares (following the mandatory conversion of the Fixed Multiple Shares into Fixed Shares) on the basis of the Exchange Ratio for each Fixed Share held at the Acquisition Time; and (ii) have the right (but not the obligation) exercisable for a period of 30 days following the Floating Rate Date, to exercise the Floating Call Option to acquire all of the issued and outstanding Floating Shares. The Existing Canopy Option expires on December 27, 2026. Under the Amended Arrangement, the Canopy Call Option will expire 10 years from the Amendment Time.

If Canopy Growth exercises the Floating Call Option, it may acquire the Floating Shares for cash or Canopy Growth Shares or a combination thereof, in Canopy Growth’s sole discretion. If paid in cash, the price per Floating Share shall be equal to the volume-weighted average trading price of the Floating Shares on the CSE (or other recognized stock exchange on which the Floating Shares are primarily traded as determined by volume) for the 30 trading day period prior to the exercise (or deemed exercise) of the Canopy Call Option, subject to a minimum amount of US$6.41. If paid in Canopy Growth Shares, each Fixed Share will be exchanged for a number of Canopy Growth Shares equal to (i) the volume-weighted average trading price of the Floating Shares on the CSE (or other recognized stock exchange on which the Floating Shares are primarily traded as determined by volume) for the 30 trading day period prior to the exercise (or deemed exercise) of the Canopy Call Option, subject to a minimum amount of US$6.41, divided by (ii) the volume-weighted average trading price (expressed in US$) of the Canopy Growth Shares on the NYSE (or such other recognized stock exchange on which the Canopy Growth Shares are primarily traded if not then traded on the NYSE) for the 30 trading day period immediately prior to the exercise (or deemed exercise) of the Canopy Call Option.

See “The Amended Arrangement – Principal Steps of the Amended Arrangement”.

Q: What will I receive for my Shares upon implementation of the Amended Plan of Arrangement?

A: If implemented, at the Amendment Time, Canopy Growth will pay the Aggregate Amendment Option Payment of US$37,500,024 on a pro rata basis to each Shareholder, High Street Holder and USCo2 Holder and each of the holders thereof will be entitled to receive approximately $[¨] per Existing SVS (assuming the conversion or exchange of such Eligible Securities for Existing SVS) based on the number of outstanding Existing Shares as of the date hereof. In addition, among other things, the Company will complete the Capital Reorganization whereby, (i) each outstanding Existing SVS will be exchanged for 0.7 of a Fixed Share and 0.3 of a Floating Share; (ii) each outstanding Existing PVS will be exchanged for 28 Fixed Shares and 12 Floating Shares; and (iii) each outstanding Existing MVS will be exchanged for 0.7 of a Fixed Multiple Share and 0.3 of a Floating Share. No fractional Fixed Shares, Fixed Multiple Shares or Floating Shares will be issued pursuant to the Capital Reorganization. Each Fixed Multiple Share will be entitled to 4,300 votes at all meetings of Shareholders and each Fixed Share and each Floating Share will be entitled to one vote per share at such meetings.

See “The Amended Arrangement – Principal Steps of the Amended Arrangement”, “Transaction Agreements – Amending Agreement – Amended Plan of Arrangement” and “Procedures For Payment Of Aggregate Amendment Option Payment And Canopy Growth Consideration – Treatment of Fractional Consideration”.

Q: What will I receive for my Fixed Shares upon exercise (or deemed exercise) of the Canopy Call Option?

A: Under the Amended Arrangement, upon the occurrence or waiver (at the discretion of Canopy Growth) of the Triggering Event, Canopy Growth will exercise (or be deemed to exercise) the Canopy Call Option and subject to the satisfaction or waiver of the Acquisition Closing Conditions, Canopy Growth will acquire all of the issued and outstanding Fixed Shares (following the mandatory conversion of the Fixed Multiple Shares into Fixed Shares) in exchange for 0.3048 of a Canopy Growth Share for each Fixed Share held at the Acquisition Time, subject to adjustment in accordance with the terms of the Amended Arrangement, for each Fixed Share held at the Acquisition Time.

See “The Amended Arrangement – Principal Steps of the Amended Arrangement”, “The Amended Arrangement – Description of the AmendedFloating Share Arrangement” “Transaction Agreements – Amending Agreement – Amended Plan of Arrangement”, and “Procedures For Payment Of Aggregate Amendment Option Payment And Canopy Growth Consideration – Treatment of Fractional Consideration”.

Q: What will I receive for my Floating Shares if Canopy Growth exercisesupon completion of the Floating Call Option?Share Arrangement?

A: Upon the occurrence or waiver (at the discretion of Canopy Growth) of the Triggering Event, Canopy Growth will exercise (or be deemed to exercise) the Canopy Call Option and subjectPursuant to the satisfaction or waiverFloating Share Plan of the Acquisition Closing Conditions,Arrangement, among other things, Canopy GrowthUSA will have the right (but not the obligation) exercisable for a period of 30 days following the Floating Rate Date, to exercise the Floating Call Option to acquire all of the issued and outstanding Floating Shares.

Canopy Growth may acquire the Floating Shares for cash orconsideration equal to 0.45 of a Canopy Growth Shares or a combination thereof,Share in Canopy Growth’s sole discretion. If paid in cash, the price perexchange for each Floating Share shall be equal to the volume-weighted average trading priceheld. Upon completion of the Floating Shares on the CSE (or other recognized stock exchange on which theShare Arrangement, each Floating Shareholder will no longer hold any Floating Shares, are primarily traded as determined by volume) for the 30 trading day period prior to the exercise (or deemed exercise) of the Canopy Call Option, subject to a minimum amount of US$6.41. If paid in Canopy Growth Shares, each Fixed Sharebut instead, will be exchanged for ahold such number of Canopy Growth Shares as is equal to (i) the volume-weighted average trading price of the Floating Shares on the CSE (or other recognized stock exchange on which the Floating Shares are primarily traded as determined by volume) for the 30 trading day period prior to the exercise (or deemed exercise) of the Canopy Call Option, subject to a minimum amount of US$6.41, divided by (ii) the volume-weighted average trading price (expressed in US$) of the Canopy Growth Shares on the NYSE (or such other recognized stock exchange on which the Canopy Growth Shares are primarily traded if not then traded on the NYSE) for the 30 trading day period immediately prior to the exercise (or deemed exercise) of the Canopy Call Option. The foregoing Floating Ratio is subject to adjustment in accordance with the Amended Plan of Arrangement if Acreage issues greater than the permitted number of Floating Shares prior topreviously held by the Acquisition Date.Floating Shareholder, multiplied by the Exchange Ratio. For example, if you currently hold 1,000 Floating Shares, you will hold 450 Canopy Shares upon completion of the Floating Share Arrangement. No fractional Canopy Growth Shares will be issued to a Floating Shareholder pursuant to the terms of the Amended PlanFloating Share Arrangement.

As of Arrangement. Thethe Record Date, the maximum number of Canopy Shares that may be received by the Floating Call Option cannot be exercised unlessShareholders pursuant to the Canopy Call Option is exercised (or deemed to be exercised). The acquisitionterms of the Floating Share Arrangement, and assuming all securities convertible, exchangeable or exercisable for Floating Shares pursuantare so converted, exchanged or exercised prior to the Floating Call Option, if exercised, will take place concurrently with the closing of the acquisition of the Fixed Shares pursuant to theFloating Share Arrangement, is approximately [¨] Canopy Call Option.

At the time of the Meeting, Shareholders will not know whether or not the Floating Call Option will be exercised by Canopy Growth and, if exercised, whether Shareholders will receive cash, Canopy Growth Shares or a combination thereof in consideration for their Floating Shares. In addition, at the time of the Meeting, Shareholders will not know the value to be received in exchange for their Floating Shares, assuming that the Floating Call Option is exercised, as the Floating Ratio is based upon the future value of the Floating Shares, determined as of the date of the occurrence or waiver (at the discretion of Canopy Growth) of the Triggering Event. Within 30 days of the exercise (or deemed exercise) of the Canopy Call Option, Canopy Growth must decide whether or not to exercise the Floating Call Option and publicly announce whether the consideration for the Floating Shares will be comprised of cash, Canopy Growth Shares or a combination thereof.

See “The Amended Arrangement – Description of the Amended Arrangement”, “The AmendedFloating Share Arrangement – Principal Steps of the AmendedFloating Share Arrangement” and “Transaction Agreements – AmendingFloating Share Arrangement Agreement - Amended Plan of– Floating Share Arrangement”.

Q: What will happen to my AcreageFloating Options, Acreage Compensation OptionsFloating Warrants and Acreage RSUs pursuantFloating Share Units pursuant to the Amended Plan of Arrangement?Floating Share Arrangement?

A: At the Amendment Time, on the terms and subjectPursuant to the conditions ofFloating Share Arrangement, commencing at the Amended Plan of Arrangement,Effective Time, each AcreageFloating Option, Acreage RSUFloating Warrant and Acreage Compensation OptionFloating Share Unit that is outstanding immediately prior to the AmendmentEffective Time will be exchanged for a Fixed Share Replacement Security to acquire 0.7 of a Fixed Share and a Floating Share Replacement Security to acquire 0.3 of a Floating Share in order to account for the Capital Reorganization. The exercise price payable in respect of the Fixed Share Replacement Securities and Floating Share Replacement Securities will be multiplied by 0.7 or 0.3, as applicable, to reflect the Capital Reorganization.

At the Acquisition Time, on the terms and subject to the conditions of the Amended Plan of Arrangement, each Fixed Share Replacement Security will be exchanged for aa Replacement Option,Option, Replacement RSUs orWarrant and Replacement Compensation Options, as applicable,Share Unit, respectively, to acquire from Canopy GrowthCanopy such number of Canopy Growth Shares asas is equal to: (i) the number of FixedFloating Shares that were issuable upon exercise of such Fixed Share Replacement Security immediately prior to the Acquisition Time, multiplied by (ii) the Exchange Ratio in effect immediately prior to the Acquisition Time (provided that if the foregoing would result in the issuance of a fraction of a Canopy Growth Share, then the number of Canopy Growth Shares to be issued will be rounded down to the nearest whole number).

If the Floating Call Option is exercised and Canopy Growth acquires the Floating Shares at the Acquisition Time, on the terms and subject to the conditions of the Amended Plan of Arrangement, each Floating Share Replacement Security will be exchanged for a Replacement Option, Replacement RSUs or Replacement Compensation Options, as applicable, to acquire from Canopy Growth such number of Canopy Growth Shares as is equal to: (i) the number of Floating Shares that were issuable upon exercise of such Floating Share Replacement SecuritySecurity immediately prior to the AcquisitionEffective Time, multiplied by (ii) the Floating RatioExchange Ratio (provided that if any holder of Replacement Options, Replacement Warrants or Replacement Share Units, following the foregoingexchange pursuant to the terms of the Floating Share Plan of Arrangement, is holding, in aggregate, Replacement Options, Replacement Warrants or Replacement Share Units that would result in the issuance of a fraction of a Canopy Growth Share, then the number of Canopy Growth Shares to be issued pursuant to such Replacement Options, Replacement Warrants or Replacement Share Units will be roundedbe rounded down to the nearest whole number). The Replacement Options and Replacement Warrants will provide for an exercise price per Replacement Option or Replacement Warrant (rounded up to the nearest whole cent), as applicable, equal to the quotient obtained when: (i) the exercise price per Floating Share that would otherwise be payable pursuant to the Replacement Option or Replacement Warrant, as applicable, it replaces is divided by (ii) the Exchange Ratio, and any document evidencing a Floating Option or Floating Warrant, as applicable, will thereafter evidence and be deemed to evidence such Replacement Option or Replacement Warrant, respectively.

See “The AmendedFloating Share Arrangement – Principal Steps of the AmendedFloating Share Arrangement”.

If you have any questions please contact Morrow Sodali at 1.888.444.0623 toll-free in North America or 1.289.695.3075 outside

of North America or by email at assistance@morrowsodali.com.

Please visit http://investors.acreageholdings.com/ for additional information.

ii

Q:What happened to the Floating Call Option?

A: Pursuant to the floating share arrangement agreement, canopy irrevocably waived its floating call option. Subject to the provisions of the Floating Share Arrangement Agreement, the Fixed Call Option pursuant to the Existing Arrangement to acquire all of the issued and outstanding Fixed Shares (following the automatic conversion of the Fixed Multiple Shares), representing approximately 70% of the total issued and outstanding Acreage Shares as of the date hereof, at a fixed exchange ratio of 0.3048 of a Canopy Share for each Fixed Share, is required to be exercised no later than five Business Days following the exchange of all Canopy Shares held by CBG and Greenstar into Exchangeable Canopy Shares.

See “The Floating Share Arrangement – Description of the Floating Share Arrangement”.

Q: What will happen to my High Street Units and USCo2 Shares that are currently convertible or exchangeable into Existing SVS pursuant tofollowing the Amended Plan ofFloating Share Arrangement?

A: InConcurrently with the execution of the Floating Share Arrangement Agreement, Acreage amended the High Street Operating Agreement to: (i) allow Canopy USA to have a call right on the High Street Units effective immediately following the earlier of the closing of the Floating Share Arrangement or the closing of the Existing Arrangement (rather than the three year anniversary of the closing of the Existing Arrangement) thereby requiring each holder of High Street Units to exchange their High Street Units for Canopy Shares as described in further detail in such amendment; and (ii) make other non-substantive changes agreed upon by Acreage and Canopy which were advisable or necessary in order to reflectcarry out the Capital Reorganization,purpose and intention of the transactions contemplated in the Floating Share Arrangement.

The USCo2 Constating Documents will be amended prior to the closing of the Floating Share Arrangement to: (i) allow Canopy USA to have a call right on the USCo2 floating shares effective immediately following the Amendmentearlier of the closing of the Floating Share Arrangement or the closing of the Existing Arrangement (rather than the three year anniversary of the closing of the Existing Arrangement) thereby requiring each shareholder to exchange their floating shares for Canopy Shares; and (ii) make other non-substantive changes agreed upon by Acreage and Canopy which were advisable or necessary in order to carry out the purpose and intention of the transactions contemplated in the Floating Share Arrangement.

Immediately following the Effective Time, all High Street Units and USCo2 Shares may be exchanged for Floating Shares and Fixed Shares, which will then be exercisable, convertible or exchangeable on the basis of 0.7 of a Fixed Share and 0.3 of a Floating Share in respect of each Existing SVS that otherwise would have been issuable upon such exercise, conversion or exchange.

If the Canopy Call Option and the Floating Call Option are exercised, following the Acquisition Time, all High Street Units and USCo2 Shares will be exercisable, convertible or exchangeableexchanged for Canopy Growth Shares on the basis of the Exchange Ratio and the Fixed Exchange Ratio, as applicable. Upon the closing of the Floating Ratio.Share Arrangement, or if the Floating Share Arrangement does not close but the Existing Arrangement closes, all High Street Units and USCo2 Shares will be exercisable, convertible or exchangeable for Canopy Shares and Floating Shares in accordance with the provisions of such amendments.

See “The “AmendedThe Floating Share Arrangement – Treatment of High Street Holders and USCo2 Holders” Holders” and “Securities “Securities Law Matters – U.S. Securities Laws – Exemption from U.S. Registration”.

Q: What areWhen will the consequences of the Amending Agreement becoming effective at the Amendment Time?Floating Share Arrangement be completed?

A: IfSubject to receipt of Shareholder Approval, the Amendment Resolution is adoptedInterim Order and the AmendingFinal Order, and all other required approvals from the stock exchanges on which the Canopy Shares are listed, and the satisfaction or waiver of all other conditions specified in the Floating Share Arrangement Agreement, the Floating Share Arrangement is executed, the Amending Agreement will provide for, among other things: (i) the implementation of the Amended Plan of Arrangement; and (ii) amendments to the definition of Canopy Growth Approved Share Threshold (being the maximum number of Shares that may be issued without the consent of Canopy Growth and without reducing the Exchange Ratio) to reduce the number of shares of the Company available to be issued by the Company such that, following the Amendment Time, the Company may issue a maximum of 32,700,000 shares (or convertible securities in proportion to the foregoing), which will include (a) 3,700,000 Option Shares; (b) 8,700,000 Floating Shares other than the Option Shares; and (c) 20,300,000 Fixed Shares. Notwithstanding the foregoing, the Amending Agreement provides that the Company may not issue any equity securities, without Canopy Growth’s prior consent, other than: (i) upon the exercise or conversion of convertible securities outstanding as of the Amendment Date; (ii) contractual commitments existing as of the Amendment Date; (iii) the Option Shares; (iv) the issuance of up to US$3,000,000 worth of Fixed Shares pursuant to an at-the-market offeringexpected to be completed no more than four times during any one-year period; (v) the issuance of up to 500,000 Fixed Shares in connection with debt financing transactions that are otherwise in compliance with the terms of the Arrangement Agreement, as amended by the Amending Agreement; or (vi) pursuant to one private placement or public offering of securities during any one-year period for aggregate gross proceeds of up to US$20,000,000, subject to specific limitations as set out in the Amending Agreement.second half of 2023.

In addition, the Amending Agreement will provide for, among other things: (i) various Canopy Growth rights that extend beyond the Acquisition Date and continue until the End Date, including, among others, rights to nominate a majority of the Acreage Board following the Acquisition Time, rights to designate all replacement officers, following the resignation or termination, as applicable, of the officers following the Acquisition Time, restrictions on the Company’s ability to incur certain indebtedness without Canopy Growth’s consent; (ii) restrictive covenants in respect of the business conduct in favor of Canopy Growth; (iii) termination of non-competition and exclusivity rights granted to the Company by Canopy Growth in the Arrangement Agreement in the event that the Company does not meet certain specified financial targets on an annual basis during the term of the Canopy Call Option as further described below; (iv) implementation of further restrictions on the Company’s ability to operate its business, including its ability to hire certain employees or make certain payments or incur any non-trade-payable debt without Canopy Growth’s consent in the event that the Company does not meet certain specified financial targets on a quarterly basis during the term of the Canopy Call Option as further described below; (v) a specified set of criteria that each new director and officer, as applicable, is required to meet, unless the consent of Canopy Growth is obtained; and (vi) termination of the Arrangement Agreement and Canopy Growth’s obligation to complete the acquisition of the Fixed Shares pursuant to the Canopy Call Option in the event that the Company does not meet certain specified financial targets in the trailing 12 month period as further described below.

See“Regulatory Matters”, “Transaction Agreements – Amending Agreement”.

Q: What happens if Acreage does not meet or exceed the targets related to the Initial Business Plan?

A: In the event that Acreage has not satisfied: (i) 90%The Floating Share Arrangement Agreement – Conditions for Completion of the Pro-Forma Net Revenue Target or the Consolidated Adj. EBITDA Target set forth in the Initial Business Plan, measured on a quarterly basis, an Interim Failure to Perform will occurFloating Share Arrangement” and the Austerity Measures shall become applicable and provide significant restrictions on Acreage’s ability to take certain actions otherwise permitted by the Amended Arrangement Agreement; (ii) 80% of the Pro-Forma Net Revenue Target or the Consolidated Adj. EBITDA Target set forth in the Initial Business Plan, as determined on an annual basis (commencing in respect of the fiscal year ending December 31, 2021), a Material Failure to Perform will occur and (a) certain restrictive covenants applicable to Canopy Growth under the Amended Arrangement Agreement will cease to apply in order to permit Canopy Growth to acquire, or conditionally acquire, a competitor of the Company in the United States should it wish to do so, and (b) an event of default under the Debenture will likely occur resulting in the Loan becoming immediately due and payable; and (iii) 60% of the Pro-Forma Net Revenue Target or the Consolidated Adj. EBITDA Target set forth in the Initial Business Plan for the trailing 12 month period ending on the date that is 30 days prior to the proposed Acquisition Time, a Failure to Perform shall occur and a material adverse impact will be deemed to have occurred for purposes of Section 6.2(2)(h) of the Arrangement Agreement and Canopy Growth will not be required to complete the Acquisition of the Fixed Shares pursuant to the Canopy Call Option.

See “Transaction Agreements - Amending– Floating Share Arrangement Agreement - Covenants Regarding Acreage’s Business Plans”, “Business Plan Requirements” and “Risk Factors”.

If you have any questions please contact Morrow Sodali at 1.888.444.0623 toll-free in North America or 1.289.695.3075 outside of North America or by email at assistance@morrowsodali.com.

Please visit http://investors.acreageholdings.com/ for additional information.

iii

Q: What assumptions used to formulate the Initial Business Plan are most likely to cause a Failure to Perform, a Material Failure to Perform and/or an Interim Failure to Perform to occur?

A: The Initial Business Plan was prepared based on the current expectations of management and the Acreage Board with respect to the anticipated results of Acreage’s business for each of the fiscal years ending December 31, 2020 through December 31, 2029, which management and the Acreage Board believe are based on reasonable assumptions as of the date hereof. There can be no certainty that the assumptions underlying the Consolidated Adj. EBITDA Targets or the Pro-Forma Net Revenue Targets set out in the Initial Business Plan will prove to be accurate and the results of Acreage may deviate from the expectations of management and the Acreage Board described under the heading “Business Plan Requirements” in this Circular. These risks to achieving the targets set out in the Initial Business Plan include, among others, adverse regulatory changes in the Identified States, the failure to adequately raise the capital necessary to operate Acreage’s business, the inability to attract and retain appropriate employees and those other items identified under the heading “Risk Factors”. If Acreage does not meet the targets in the Initial Business Plan, there may be an Interim Failure to Perform, a Material Failure to Perform and, depending on when the Canopy Call Option is exercised, a Failure to Perform may occur.

See “Risk Factors”.

Q: If the Austerity Measures are implemented at any point in time, what implications would the Austerity Measures have for Acreage’s business and Acreage’s ability to avoid a Material Failure to Perform or a Failure to Perform?

A: In the event of an Interim Failure to Perform and the imposition of the Austerity Measures, the likelihood that, absent Canopy Growth’s consent to facilitate Acreage taking actions necessary to alleviate such Interim Failure to Perform, there will be a Material Failure to Perform and, if the Canopy Call Option is exercised, a Failure to Perform would be increased. Accordingly, the requirement of Canopy Growth to complete the Acquisition pursuant to the Canopy Call Option may be jeopardized; however, Canopy Growth would have the option, in its sole discretion, to waive such rights and complete the Acquisition notwithstanding any such Failure to Perform.

Q: When will the Amendment Time occur?

A: Subject to obtaining the Amendment Final Order as well as the satisfaction of all other conditions precedent set out in the Proposal Agreement, it is anticipated that the Amendment Time will occur in September, 2020. The Acquisition forming part of the Amended Arrangement will be completed upon occurrence or waiver (at the discretion of Canopy Growth) of the Triggering Event (at the discretion of Canopy Growth), subject to the satisfaction or waiver of the Acquisition Closing Conditions as described in the Circular.

See “Transaction Agreements - The Proposal Agreement - Conditions for Implementation of the Amended Arrangement” and “Transaction Agreements - Amending Agreement”.

Q: What will happen if the AmendmentArrangement Resolution is not adoptedapproved or the AmendedFloating Share Arrangement is not implemented for any reason?

A: If the Amendment Resolution is not approved, the Proposal Agreement will terminate and ceasePursuant to be effective and the Existing Arrangement, including the terms of the Existing Canopy Option, will remain in place,Floating Share Arrangement Agreement, the Capital Reorganization will notFloating Share Arrangement Agreement may be completed, the proposed amendmentsterminated prior to the Effective Time by either Acreage or Canopy if, among other things, the Shareholder Approval is not obtained at the Meeting in accordance with the Interim Order. Upon termination of the Floating Share Arrangement Agreement, Canopy will not be effective,no longer have the Debentureright to exercise its Floating Call Option pursuant to the Floating Share Arrangement; however, Canopy will not be entered intoretain its Fixed Call Option pursuant to the Existing Arrangement, and the Initial Advance will not be made to Hempco. Canopy Growthas such will continue to be required to acquire the Existing SVS in accordance with the Existing Canopy OptionFixed Shares upon the occurrence or waiver (at the discretion of Canopy Growth)Canopy’s discretion) of the Triggering Event and the satisfaction or waiver of the Acquisition Closing Conditions. In addition, the A&R License will continue to govern the relationship between the parties thereto. If the Acreage Board makes a Change in Recommendation, the Amendment Resolution is not approved and the Proposal Agreement is subsequently terminated, Acreage will be required to pay the Termination Expense Reimbursement to Canopy Growth in the amount of US$3,000,000; provided, however, that Acreage will not be required to make such payment if the Change in Recommendation was the result of a Purchaser Material Adverse Effect (as defined in the Arrangement Agreement).

See “Risk Factors -– Risks Relating to the Floating Share Arrangement – The Floating Share Arrangement may not be completed”, “Risk Factors – Risks Relating to the Completion of the Floating Share Arrangement – Acreage could fail to receive the necessary approvals required to complete the Floating Share Arrangement”, “Risk Factors – Risks Relating to the Completion of the Floating Share Arrangement – Canopy may not complete the Floating Share Arrangement if the Canopy Amendment Proposal is not adopted or CBG and Greenstar do not exchange their Canopy Shares”, “Risk Factors – Risks Relating to the Completion of the Floating Share Arrangement – Risks if the AmendedFloating Share Arrangement is not completed and Canopy acquires the Fixed Shares”, and “Transaction Agreements – The Floating Share Arrangement is Not Approved and the Existing Arrangement Remains in Effect”, “Transaction Agreements - The Proposal AgreementAgreement – Termination of Proposal AgreementFloating Share Arrangement Agreement” and “Transaction Agreements - The Proposal“The Floating Share Arrangement Agreement – Termination of Proposal Agreement – Expenses of the Amended Arrangement - Termination Expense ReimbursementThe Fixed Call Option”..”

Q: When is Canopy Growth expected to exercisewill the CanopyFixed Call Option?Option be exercised?

A: IfPursuant to the Amendment Resolution is adopted andterms of the AmendingFloating Share Arrangement Agreement, is executed, the Existing Canopy Option expires on December 27, 2026. Under the Amended Arrangement, the CanopyFixed Call Option expires 10 years from the Amendment Time. Canopy Growth is contractually obligatedrequired to exercise the Canopy Call Option upon the occurrence or waiver (at the discretion of Canopy Growth) of the Triggering Event; provided that the acquisitionbe exercised within five Business Days of the Fixed Shares is subject to the satisfaction or waiver of the Acquisition Closing Conditions. Canopy Growth may, in its sole discretion, elect to exercise the Floating Call Option within 30 days ofConditions being satisfied, being: (i) the exercise (or deemed exercise)approval of the Canopy Amendment Proposal at the Canopy Meeting; and (ii) CBG and Greenstar each electing (in their sole discretion) to exchange the Canopy Shares they currently hold for Exchangeable Canopy Shares.

If the Fixed Call Option.Option Conditions are not satisfied by the Exercise Outside Date, Acreage may terminate the Floating Share Arrangement Agreement, and Canopy will be obligated to pay the Canopy Expense Reimbursement to Acreage.

See “The AmendedFloating Share Arrangement – Description of the AmendedFloating Share Arrangement”, “The AmendedFloating Share Arrangement – Timing for ImplementationCompletion of the AmendedFloating Share Arrangement”, “The AmendedFloating Share Arrangement – Principal Steps of the AmendedFloating Share Arrangement” or the Amended Plan ofFloating Share Arrangement, a copy of which is attached as Appendix “C” to this Circular.

Q: Will the Existing SVSFloating Shares or Fixed Shares continue to trade following the AmendmentEffective Date?

A: No,No. It is expected that Canopy USA will apply to: (i) have the Existing SVS will cease to trade onFloating Shares delisted from the CSE, the OTCQX and the Frankfurt Stock ExchangeFSE as promptly as possible following the AmendmentEffective Date; and (ii) have the Fixed Shares delisted from the CSE, the OTCQX and the FSE as promptly as possible following the Acquisition Date. Following the Capital Reorganization,In addition, following completion of each of the Fixed SharesFloating Share Arrangement and the Floating SharesAcquisition, as applicable, it is expected that Canopy USA will apply to have Acreage cease to be listed on the CSE. Any Person who acquires Fixed Shares or Floating Shares following the Amendment Date (whether from a new issuance from treasury orreporting issuer in all jurisdictions in which it is a transfer)reporting issuer and thus will acquire such Fixed Shares and Floating Shares subject to the terms and conditions of the Amended Plan of Arrangement, including the Canopy Call Optionterminate Acreage’s reporting obligations in Canada and the Floating Call Option.United States.

See “Regulatory Matters -– Stock Exchange Matters”.

Q: WhoWhat will behappen to the directors and officers of Acreage following implementationcompletion of the Amended Plan of Arrangement and the Acquisition?Floating Share Arrangement?

A: Following the Amendment Time, it is not currently expected that there will be any changePursuant to the directors and officers of Acreage. During the Amendment Interim Period, other than the existing directors and officers of the Company, Acreage cannot nominate or appoint, as applicable, any individual to serve as a director or officerterms of the CompanyFloating Share Arrangement Agreement, Acreage has agreed that does not meet the Required Director Criteria or the Required Officer Criteria, as applicable. At the Acquisition Time, eachAcreage and its Subsidiaries will use their best efforts to cause all of the directors and officers are expectedof Acreage and its Subsidiaries to resignprovide resignations and Canopy Growthmutual releases prior to the Effective Time, failing which, Acreage and its Subsidiaries will be entitled to designate all replacementterminate such directors and officers effective as at the Effective Time. In addition, Acreage has agreed to filluse commercially reasonable efforts to cause any directors and officers receiving severance payments to execute full and final mutual releases releasing each of such vacancies In the event that the Floating Call Option is not exercised, Canopy Growth will have the right, until the End Date,director or officer, Acreage and its Subsidiaries from all liability and obligations owed to nominate a majorityone another, including in respect of the directors on the Acreage Board.any change of control entitlements in favour of Acreage.

See “Transaction Agreements – Amending Agreement – Covenants Regarding Acreage’s Directors and OfficersIf you have any questions please contact Morrow Sodali at 1.888.444.0623 toll-free in North America or 1.289.695.3075 outside of North America or by email at assistance@morrowsodali.com.

Please visit http://investors.acreageholdings.com/ for additional information.”.

Q. Will the Exchange Ratio and/or the Floating Ratio be reduced prior to the Triggering Event Date?

A: The Exchange Ratio and the Floating Ratio will only be reduced in the event that Acreage breaches certain covenants set out in the Amended Arrangement Agreement with respect to the maximum number of Fixed Shares and Floating Shares it may issue during the Amendment Interim Period, or, in the case of the Exchange Ratio, if Acreage is required to make a Payout.iv

Q: Are there any risks I should consider in connection with the AmendedFloating Share Arrangement?

A: Yes. Floating Shareholders should carefully consider the risk factors set out in this Circular before deciding to vote or instructing their vote to be cast to approve the Arrangement Resolution. In addition to the risk factors set out in this Circular, Floating Shareholders should also carefully consider the risk factors applicable to Acreage set out in the Acreage Annual Report under the heading “Risk Factors”, a copy of which is available under Acreage’s profile on SEDAR at www.sedar.com and on EDGAR at www.sec.gov/edgar, and the risk factors applicable to Canopy referred to in Appendix “G” to this Circular.

See “Risk Factors” and Appendix “G” – “Information Concerning Canopy”.

Q: Are there any risks I should consider in connection with holding Canopy Shares following the consummation of the Floating Share Arrangement?

A: Yes. There are a number ofFloating Shareholders should carefully consider the risk factors relatingapplicable to Canopy referred to in Appendix “G” to this Circular. These include the risk that if Canopy USA acquires Wana, Jetty or the Fixed Shares of Acreage, without structural amendments to Canopy’s interest in Canopy USA, the listing of the Canopy Shares on the Nasdaq Stock Market may be jeopardized.