UNITED STATES

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant | |||

| Filed by a Party other than the Registrant |

Check the appropriate box:

Preliminary Proxy Statement |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

Definitive Proxy Statement |

Definitive Additional Materials |

Soliciting Material under §240.14a-12 |

ORCHESTRA BIOMED HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

No fee required. | |||

Fee paid previously with preliminary materials. |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

ORCHESTRA BIOMED HOLDINGS, INC.

NOTICE OF EXTRAORDINARY GENERALANNUAL MEETING OF STOCKHOLDERS

Dear Stockholders of Orchestra BioMed Holdings, Inc.:

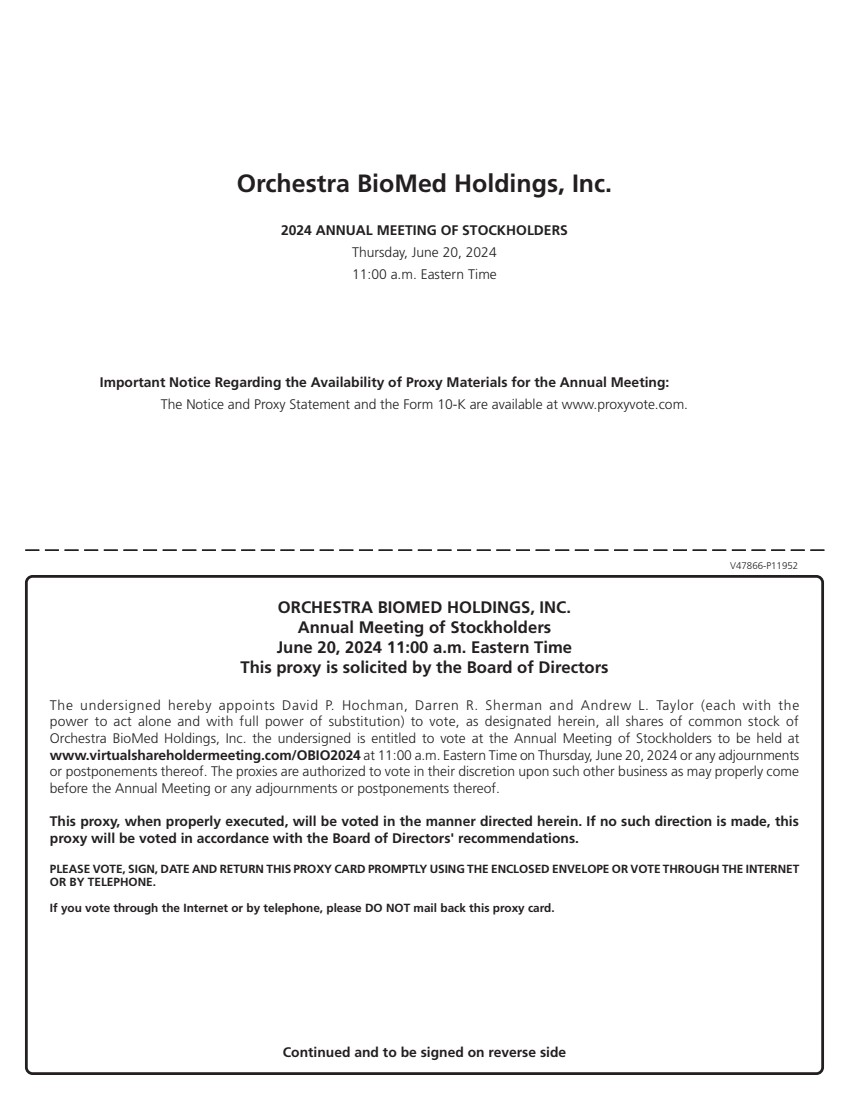

We cordially invitedinvite you to attend the Extraordinary General2024 Annual Meeting of Stockholders (the “General Meeting”“Annual Meeting”) of HEALTH SCIENCES ACQUISITIONS CORPORATION 2,Orchestra BioMed Holdings, Inc., a Delaware corporation (the “Company,” “HSAC2,” “we,” “us”“Company” or “our”“Orchestra”) to, which will be held virtually on Thursday, June 20, 2024 at [•] a.m. ET11:00a.m. Eastern Time via live audio webcast on [•]the Internet at www.virtualshareholdermeeting.com/OBIO2024, 2022. Forfor the following purposes, as more fully described in the accompanying proxy statement:

| 1. | To elect two Class I directors to serve until the 2027 annual meeting of stockholders and until their successors are duly elected and qualified; |

| 2. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024; and |

| 3. | To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

In order to provide expanded access to our stockholders, our board of directors has determined to hold a live audio webcast in lieu of an in-person meeting. You will be able to vote and submit your questions during the articles of association of HSAC2, themeeting at www.virtualshareholdermeeting.com/OBIO2024. Although no physical place of thein-person meeting will be [•]. Dueheld, we designed the format of this year’s Annual Meeting to ensure that our stockholders who attend the COVID-19 pandemic, the Company will be holding the General Meeting virtually via tele-conference using the following dial-in information:

IPO”) $160.0 million was placed in a trust account (“Trust Account”) located in the United States with Continental Stock Transfer & Trust Company acting as trustee, and held as cash or invested only in U.S. “government securities,” within the meaning set forth in Section 2(a)(16) of the Investment Company Act of 1940 (the “Investment Company Act”), with a maturity of 185 days or less, or in money market funds meeting certain conditions under the Investment Company Act, which invest only in direct U.S. government treasury obligations, as determined by us, until the earlier of: (i) the completion of a business combination and (ii) the distribution of the Trust Account. As of the date hereof, substantially all of the assets held in the Trust Account are held in money market funds, which primarily invest in U.S. Treasury Bills. There is uncertainty under the Investment Company Act whether certain special purpose acquisition companies, or “SPACs,” with trust account assets held in securities, that do not consummate an initial business combination within 24 months after the effective date the SPAC’s IPO registration statement, would fall under the definition of “investment company” under Section 3(a)(1)(A) of the Investment Company Act. HSAC2’s IPO registration statement became effective on August 3, 2020. Due to this uncertainty, HSAC2 intends to convert all of the assets held in the Trust Account into cash prior to the General Meeting.

We are providing our proxy materials to our stockholders over the Internet. This reduces our environmental impact and our costs while ensuring our stockholders have timely access to votethis important information. Accordingly, stockholders at the General Meeting and any adjournment thereof (the “Record Date”). On the Record Date, there were 20,450,000 outstanding Company ordinary shares (the “Ordinary Shares”), including 16,000,000 outstanding Public Shares. The Company’s warrants do not have voting rights. Only holdersclose of recordbusiness on April 26, 2024 will receive a Notice of the Company’s Ordinary SharesInternet Availability of Proxy Materials (“Notice of Internet Availability”) with details on the Record Date are entitled to have their votes counted at the General Meeting or any adjournment thereof.

Target”) for an initial business combination (the “Proposed Business Combination”). The Company believes the Target is a compelling opportunity for the Company’s initial business combination and is currently in advanced negotiations for an initial business combination involving the Target.

Orchestra BioMed Holdings, Inc.

150 Union Square Drive

New Hope, Pennsylvania 18938

Attention: Secretary

(215) 862-5797

info@orchestrabiomed.com

We appreciate your continued support of Orchestra.

By order of the Board of Directors,

David P. Hochman

Chief Executive Officer and Chairman of the Board of Directors

Important notice regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on June 20, 2024. This Notice of the Annual Meeting, the accompanying Proxy Statement and our 2023 Annual Report on Form 10-K are available free of charge at the General Meeting unless you request and obtain a valid proxy from your broker or other agent.proxyvote.com.

Table of Contents

PAGE

i |

ORCHESTRA BIOMED HOLDINGS, INC.

PROXY STATEMENT

2024 ANNUAL MEETING OF STOCKHOLDERS

This proxy statement (this “Proxy Statement”) is furnished in connection with the solicitation of proxies by our board of directors (our “Board”) for use at the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Orchestra BioMed Holdings, Inc., a redemption of these shares if you continue to hold them until the effective date of the Extension Amendment.

The Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) containing instructions on how to access this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “Annual Report”) is first being mailed on or about May 1, 2024 to all stockholders entitled to vote at the Annual Meeting.

January 2023 Business Combination

On January 26, 2023, Orchestra consummated the business combination contemplated by the Agreement and Plan of Merger, dated as of July 4, 2022 (as amended by Amendment No. 1 to Agreement and Plan of Merger, dated July 21, 2022, and Amendment No. 2 to Agreement and Plan of Merger, dated November 21, 2022, the “Merger Agreement”), by and among HSAC2, a special purpose acquisition company incorporated as a Cayman Islands exempted company in 2020 (“HSAC2”), HSAC Olympus Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of HSAC2 (“Merger Sub”), and Orchestra BioMed, Inc. (“Legacy Orchestra”). Pursuant to the Merger Agreement, (i) HSAC2 deregistered in the Cayman Islands in accordance with the Companies Act (2022 Revision) (As Revised) of the Cayman Islands and domesticated as a Delaware corporation in accordance with Section 388 of the Delaware General Corporation Law (the “Domestication”) and (ii) Merger Sub merged with and into Legacy Orchestra, with Legacy Orchestra as the surviving company in the merger and, after giving effect to such merger, continuing as a wholly owned subsidiary of Orchestra (the “Merger” and, together with the Domestication and the other transactions contemplated by the Merger Agreement, the “Business Combination”). As part of the Domestication, the Company’s name was changed from “Health Sciences Acquisitions Corporation 2” to “Orchestra BioMed Holdings, Inc.”

Unless the context indicates otherwise, references in this Proxy Statement to the “Company,” “Orchestra,” “we,” “us,” “our” and similar terms refer to Orchestra BioMed Holdings, Inc., a Delaware corporation formerly known as Health Sciences Acquisitions Corporation 2, and its consolidated subsidiaries. “Legacy Orchestra” refers to Orchestra BioMed, Inc., the private Delaware corporation that is now our wholly owned subsidiary. References to “HSAC2” refer to Health Sciences Acquisitions Corporation 2, our predecessor company prior to the consummation of the Business Combination.

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why did I receive a Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials?

In accordance with the rules of the Securities and Exchange Commission (the “SEC”), we have elected to furnish our proxy materials, including this Proxy Statement and our Annual Report, primarily via the Internet. The Notice of Internet Availability containing instructions on how to access our proxy materials is first being mailed on or about May 1, 2024 to all stockholders entitled to vote at the Annual Meeting. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by e-mail by following the instructions contained in the Notice of Internet Availability. We encourage stockholders to take advantage of the availability of our proxy materials on the Internet to help reduce the environmental impact and cost of our annual meetings of stockholders.

| 2 |

Will I receive any other proxy materials by mail?

No, you will not receive any other proxy materials by mail unless you request a paper copy of proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice of Internet Availability. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. Orchestra encourages you to take advantage of the availability of the proxy materials on the Internet.

What matters am I voting on?

You will be voting on:

| · | the election of two Class I directors to serve until the 2027 annual meeting of stockholders and until their successors are duly elected and qualified; |

| · | the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024; and |

| · | any other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

How does the Board recommend I vote on these proposals?

Our Board recommends a vote:

| · | “FOR” the election of Eric A. Rose, M.D. and Jason Aryeh as Class I directors; and |

| · | “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024. |

What if another matter is properly brought before the meeting?

Our Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

Who is entitled to vote?

Holders of our common stock as of the close of business on April 26, 2024, the record date for the Annual Meeting (the “Record Date”), may vote at the Annual Meeting. As of the Record Date, there were 35,786,497 shares of our common stock outstanding, all of which are shares of voting common stock. Each share of common stock is entitled to one vote on each proposal.

Registered Stockholders. If shares of our common stock are registered directly in your name with our transfer agent, you are considered the stockholder of record with respect to those shares, and the Notice of Internet Availability was provided to you directly by us. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card, vote live at the Annual Meeting, or vote by proxy through the Internet. Throughout this Proxy Statement, we refer to these registered stockholders as “stockholders of record.”

Street Name Stockholders. If shares of our common stock are held on your behalf in a brokerage account or by a bank or other nominee, you are considered to be the beneficial owner of shares that are held in “street name,” and the Notice of Internet Availability was forwarded to you by your broker, bank or other nominee, who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or other nominee as to how to vote your shares. Beneficial owners are also invited to attend the Annual Meeting and will generally be permitted to vote at Annual Meeting. See “—How do I attend the Annual Meeting?” If you request a printed copy of our proxy materials by mail, your broker, bank or other nominee will provide a voting instruction form for you to use instead of a proxy card. Throughout this Proxy Statement, we refer to stockholders who hold their shares through a broker, bank or other nominee as “street name stockholders.”

| 3 |

What is a broker non-vote?

Under rules that govern banks, brokers and others that have record ownership of company stock held in brokerage accounts for their clients that beneficially own the shares, these banks, brokers and other such holders who do not receive voting instructions from their clients have the discretion to vote uninstructed shares on “routine” matters (“routine matters”), but cannot vote uninstructed shares on “non-routine” matters (“non-routine matters”). Only the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm is considered a routine matter at the Annual Meeting under these rules. A broker may return a proxy card on behalf of a beneficial owner from whom the broker has not received voting instructions that casts a vote with regard to routine matters but must expressly state that the broker is not voting as to non-routine matters. The broker’s inability to vote with respect to the non-routine matters for which the broker has not received voting instructions from the beneficial owner is referred to as a “broker non-vote”.

How many votes are needed for approval of each proposal?

| · | Proposal No. 1: The election of directors requires a plurality of the vote of the shares of our common stock present in person, by remote communication, or represented by proxy at the Annual Meeting and entitled to vote thereon to be approved. “Plurality” means that the nominees who receive the largest number of votes cast “For” such nominees are elected as directors. As a result, only “For” votes will affect the outcome, and any shares not voted “For” a particular nominee (whether as a result of a withhold vote or a broker non-vote) will not be counted in such nominee’s favor and will have no effect on the outcome of the election. You may vote “For” or “Withhold” on each of the nominees for election as a director. |

| · | Proposal No. 2: The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024 requires the affirmative vote of the holders of a majority of the shares of our common stock present in person, by remote communication, or represented by proxy at the Annual Meeting and entitled to vote thereon to be approved. Stockholder abstentions are considered shares present and entitled to vote on this proposal, and thus, will have the same effect as a vote “Against” this proposal. Proposal 2 is considered a routine matter. Because a bank, broker, trustee, or other nominee may generally vote in their discretion on routine matters, no broker non-votes are expected in connection with this proposal. |

What is a quorum?

A quorum is the minimum number of shares required to be present at the Annual Meeting to properly hold an annual meeting of stockholders and conduct business under our bylaws (our “Bylaws”) and Delaware law. The presence, in person, by remote communication, or by proxy, duly authorized, of the holders of a majority of the voting power of the outstanding shares of our common stock entitled to vote at the Annual Meeting will constitute a quorum at the Annual Meeting. On the Record Date, there were 35,786,497 shares outstanding and entitled to vote. Thus, the holders of at least 17,893,249 shares must be present in person or by remote communication, if applicable, or represented by proxy at the meeting to have a quorum. Abstentions, withheld votes and broker non-votes are counted as shares present and entitled to vote for purposes of determining a quorum.

How do I vote?

If you are a stockholder of record, there are three ways to vote:

| · | by Internet at www.proxyvote.com, 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time on Wednesday, June 19, 2024 (have your Notice of Internet Availability or proxy card in hand when you visit the website); |

| · | by phone at 1-800-690-6903 until 11:59 p.m. Eastern Time on Wednesday, June 19, 2024 (have your Notice of Internet Availability or proxy card in hand when you call); |

| 4 |

| · | by completing and mailing your proxy card (if you received printed proxy materials); or |

| · | by Internet during the Annual Meeting. Instructions on how to attend and vote at the Annual Meeting are described above under the heading “—How do I attend the Annual Meeting?” and are also posted at www.virtualshareholdermeeting.com/OBIO2024. |

If you are a street name stockholder, your broker, bank or other nominee will send you printed copies of the proxy materials or provide instructions on how to access proxy materials electronically. You are entitled to direct your broker, bank or other nominee how to vote your shares by following the voting instructions that your broker, bank or other nominee provides to you.

If you plan to attend the Annual Meeting, we recommend that you also vote by proxy so that your vote will be counted if you later decide not to attend the Annual Meeting.

Can I change my vote or revoke my proxy?

Yes, if you are a stockholder of record, you can change your vote or revoke your proxy any time before the Annual Meeting by:

| · | entering a new vote by Internet; |

| · | completing and returning a later-dated proxy card; |

| · | notifying our Secretary, in writing, at Orchestra BioMed Holdings, Inc., 150 Union Square Drive, New Hope, PA 18938; or |

| · | attending and voting electronically at the Annual Meeting (although attendance at the Annual Meeting will not, by itself, revoke a proxy). |

If you are a street name stockholder, your broker, bank or other nominee can provide you with instructions on how to change your vote.

Will my vote be kept confidential?

Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Orchestra will not disclose the proxy instructions or ballots of individual stockholders, except:

| · | To allow for the tabulation and certification of votes; |

| · | To facilitate a successful proxy solicitation; |

| · | To assert claims for Orchestra; |

| · | To defend claims against Orchestra; and |

| · | As necessary to meet applicable legal requirements. |

| 5 |

If you write comments on your proxy card or ballot, the proxy card or ballot may be forwarded to Orchestra’s management and our Board to review your comments.

Why won’t there be an in-person meeting this year?

We are excited to embrace virtual meeting technology, which we believe provides expanded access, improved communications and cost and time savings for our stockholders and the Company. A virtual meeting enables increased stockholder attendance and participation from locations around the world. We believe the cost and time savings afforded by a virtual meeting encourages more stockholders to attend the Annual Meeting. Although no physical in-person meeting will be held, we designed the format of this year’s Annual Meeting to ensure that our stockholders who attend the Annual Meeting will be afforded similar rights and opportunities to participate as they would at an in-person meeting. You will be able to submit questions during the meeting through the virtual Annual Meeting web portal at www.virtualshareholdermeeting.com/OBIO2024.

How do I attend the Annual Meeting?

You will need to use your 16-digit control number on your Notice of Internet Availability or proxy card to log into www.virtualshareholdermeeting.com/OBIO2024. You are entitled to attend and participate in the virtual Annual Meeting if you were an Orchestra stockholder as of the close of business on the Record Date. If you do not comply with the procedures for attending the Annual Meeting described in this Proxy Statement or were not an Orchestra stockholder as of the Record Date, you may not attend the Annual Meeting. Instructions on how to participate in the Annual Meeting are also posted online at www.virtualshareholdermeeting.com/OBIO2024. Use of cameras and recording devices are prohibited while virtually attending the live audio webcast.

When does online check-in for the Annual Meeting begin?

The Annual Meeting audio webcast will begin promptly at 11:00 a.m. Eastern Time on Thursday, June 20, 2024. We encourage you to access the Annual Meeting portal prior to the start time. Online check-in will begin approximately 15 minutes prior to the start of the Annual Meeting.

Even if you plan on attending the Annual Meeting, we encourage you to vote your shares in advance using one of the methods described in this Proxy Statement or the Notice of Internet Availability to ensure that your vote will be represented at the Annual Meeting.

How can I get help if I have trouble checking in or listening to the meeting online?

If you encounter any difficulties accessing the virtual meeting during the check-in or meeting, please call the technical support number that will be posted on the Virtual Shareholder Meeting log-in page.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our Board. David P. Hochman, Darren R. Sherman and Andrew L. Taylor have been designated as proxy holders by our Board. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our Board as described above. If any matters not described in this Proxy Statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote the shares. If the Annual Meeting is adjourned, the proxy holders can vote the shares on the new Annual Meeting date as well, unless you have properly revoked your proxy instructions, as described above.

How are proxies solicited for the Annual Meeting?

Proxies may be solicited on our behalf by our directors, officers or employees in person or by telephone, mail, electronic transmission and/or facsimile transmission. Our directors and employees will not be paid any additional compensation for soliciting proxies.

| 6 |

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice of Internet Availability?

If you receive more than one Notice of Internet Availability, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each Notice of Internet Availability you receive to ensure that all of your shares are voted.

Where can I find the voting results of the Annual Meeting?

We expect to announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four business days after the Annual Meeting, we will file a Current Report on Form 8-K to publish preliminary results and will provide the final results in an amendment to the Current Report on Form 8-K as soon as they become available.

I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

Stockholders who share a single address will receive only one copy of the Notice of Internet Availability or other Annual Meeting materials, as the case may be, unless we or their broker, bank, trustee, or nominee has received contrary instructions from any stockholder at that address. This practice, known as “householding,” is designed to reduce printing and mailing costs. If any stockholders(s) sharing a single address wish to discontinue householding and receive a separate copy of the Notice of Internet Availability or other Annual Meeting materials, as the case may be, we will have a separate copy promptly delivered to you upon your written or oral request. To make the request, you may contact Broadridge, either by calling +1 (866) 540-7095, or by writing to Broadridge, Householding Department, 51 Mercedes Way, Edgewood, NY 11717, and including their name, the name of their broker or other nominee (if any), and their account number(s). You may also contact Broadridge if you have received multiple copies of the Notice of Internet Availability or other Annual Meeting materials and prefer to receive a single copy in the future.

What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?

Stockholder Proposals under Rule 14a-8. Stockholders who, in accordance with the SEC’s Rule 14a-8, wish to present proposals for inclusion in the proxy materials to be distributed by us in connection with our 2025 annual meeting of stockholders must have submitted their proposals to the Secretary of the Company on or before January 1, 2025 (which is 120 calendar days before the anniversary of the date the Notice of Internet Availability relating to this Annual Meeting was first sent to stockholders), and must otherwise comply with the requirements of Rule 14a-8. In the event that we hold our 2025 annual meeting of stockholders more than 30 days before or after the one-year anniversary date of the Annual Meeting, we will disclose the new deadline by which stockholders’ proposals must be received by any means reasonably calculated to inform stockholders. A proposal submitted to the Secretary of the Company should be submitted in writing to.

Orchestra BioMed Holdings, Inc.

150 Union Square Drive

New Hope, Pennsylvania 18938

Attention: Secretary

| 7 |

Stockholder Proposals under Our Bylaws. Our Bylaws also establish an advance notice procedure for stockholders who wish to present a proposal before an annual meeting of stockholders but do not intend for the proposal to be included in our proxy statement. Our Bylaws provide that the only business that may be conducted at an annual meeting of stockholders is business that is (i) specified in our notice of such annual meeting (with respect to business other than director nominations), (ii) otherwise properly brought before such annual meeting by or at the direction of our Board or (iii) properly brought before such meeting by a stockholder of record at the time of such stockholder’s timely delivery of written notice to our Secretary, which notice must contain the information specified in our Bylaws, who is entitled to vote at such annual meeting. To be timely for the 2025 annual meeting of stockholders, our Secretary must receive the written notice at our principal executive offices:

| · | not earlier than the close of business on February 20, 2025; and |

| · | not later than the close of business on March 22, 2025. |

In the event that we hold the 2025 annual meeting of stockholders more than 30 days before or more than 60 days after the one-year anniversary of the Annual Meeting, then, for notice by the stockholder to be timely, it must be received by the Secretary not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the 90th day prior to such annual meeting or, if later than the 90th day prior to such annual meeting, the tenth day following the day on which public announcement of the date of such meeting is first made.

Nomination of Director Candidates

Nominees Proposed Pursuant to our Bylaws. Our Bylaws also permit stockholders to nominate directors for election at an annual meeting of stockholders. To nominate a director, the stockholder must provide the information required by our Bylaws. In addition, the stockholder must give timely notice to our Secretary in accordance with our Bylaws, which, in general, require that the notice be received by our Secretary within the time periods described above under the section titled “—Stockholder Proposals Under our Bylaws.”

Universal Proxy Rules. In addition to satisfying the foregoing requirements under our By-laws, including advance notice of director nominations, to comply with the SEC’s universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than Orchestra’s nominees must provide notice that sets forth any additional information required by Rule 14a-19 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) no later than May 21, 2025. Such notice may be mailed to the Secretary at the address above.

Stockholder Recommendations Regarding Director Candidates. Holders of our common stock may propose director candidates for consideration by our Nominating and Corporate Governance Committee. Any such recommendations should include the nominee’s name and qualifications for membership on our Board. For additional information regarding stockholder recommendations for director candidates, see the section titled “Board of Directors and Corporate Governance—Stockholder Recommendations and Nominations to the Board of Directors.”

| 8 |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our business and affairs are managed under the direction of our Board. Our Board consists of seven directors, all of whom, other than David P. Hochman and Darren R. Sherman, qualify as “independent” under the listing standards of the Nasdaq Stock Market LLC (“Nasdaq”), including Nasdaq Listing Rule 5605(a)(2). Our Board is divided into three staggered classes of directors. At each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the class whose term is then expiring.

The following table sets forth the name, age and certain other information for each of the members of our Board with terms expiring at the Annual Meeting (who are also nominees for election as a director at the Annual Meeting) and for each of the continuing members of our Board:

| Directors with Terms Expiring at the Annual Meeting/Nominees | Class | Age(1) | Position | Director Since | Current Term Expires | Expiration of Term for Which Nominated | ||||||

| Eric A. Rose, M.D.(2)(4) | I | 73 | Director* | 2023 | 2024 | 2027 | ||||||

| Jason Aryeh(2)(3) | I | 55 | Director* | 2023 | 2024 | 2027 | ||||||

| Continuing Directors | ||||||||||||

| Pamela A. Connealy(3) | II | 62 | Director* | 2023 | 2025 | — | ||||||

| David Pacitti(3)(4) | II | 58 | Director* | 2024 | 2025 | — | ||||||

| David P. Hochman | III | 48 | Chief Executive Officer, Chairman of the Board and Director | 2023 | 2026 | — | ||||||

| Darren R. Sherman | III | 52 | President, Chief Operating Officer and Director | 2023 | 2026 | — | ||||||

| Eric S. Fain, M.D.(2)(4) | III | 63 | Lead Independent Director* | 2023 | 2026 | — |

| (1) | As of the Record Date. | |

| (2) | Member of the Nominating and Corporate Governance Committee | |

| (3) | Member of the Audit Committee | |

| (4) | Member of the Compensation Committee | |

| * | Independent Director. |

Nominees for Director

Jason Aryeh

Mr. Aryeh has served as a member of our Board and chairperson of the Nominating and Corporate Governance Committee since January 2023. Prior to that, he served as a director of Legacy Orchestra since November 2018. He previously served as a strategic advisor to Legacy Orchestra from July 2018 to November 2018. Mr. Aryeh is the founder and managing general partner of JALAA Equities, LP, a private investment fund focused on the biotechnology and medical device sectors, and has served in such capacity since 1997. Since September 2006, he has also served on the board of directors of Ligand Pharmaceuticals, Inc. (Nasdaq: LGND), a Nasdaq-listed biopharmaceutical company focused on developing or acquiring technologies that help pharmaceutical companies discover and develop medicines. He currently serves as chairman of its nominating and governance committee and has previously served as a member on its compensation committee. Since March 2021, Mr. Aryeh has also served on the board of directors of Anebulo Pharmaceuticals (Nasdaq: ANEB), a Nasdaq-listed biotechnology company, where he currently serves on the audit committee. Mr. Aryeh has also served as Executive Chair of Rio Grande Renewables, LLC, a renewable energy company he co-founded, since March 2009. He has served on the board of directors of multiple public and private life sciences companies since 2006, including Novelion Therapeutics Inc., which was a Nasdaq-listed biopharmaceutical company that focused on investing in science and clinical development of therapies for rare diseases, from November 2016 to August 2018, and its predecessor, QLT Inc., from June 2013 to November 2016. He also served on the Cystic Fibrosis Foundation’s Therapeutics board of directors from 2012 to February 2019. Mr. Aryeh earned a B.A. in economics, with honors, from Colgate University.

| 9 |

We believe that Mr. Aryeh’s finance background and extensive experience as a board member and an investor in life science companies, including his service as managing general partner of an investment fund focused on the life sciences sector and over 13 years as a board member of Ligand Pharmaceuticals, Inc., a leader in shared risk and reward partnering to drive innovation in the field of biopharmaceuticals, provide him with the qualifications and skills to serve on our Board.

Eric A. Rose, M.D.

Dr. Rose has served as a member of our Board since January 2023. Prior to that, he served as a director of Legacy Orchestra since December 2018. He previously served as a strategic advisor to Legacy Orchestra from July 2018 to December 2018. Since February 2022, Dr. Rose has served as Chief Medical Officer of Mesoblast Limited (Nasdaq: MESO), a Nasdaq-listed leader in cellular medicines for inflammatory diseases, where he has served as a director since April 2013. From October 2018 until June 2021, Dr. Rose served as Chairman of the board of directors of SIGA Technologies, Inc. (Nasdaq: SIGA), a Nasdaq-listed developer of antiviral drugs directed at potential agents of bioterror. Previously, he served as SIGA Technologies, Inc.’s Executive Chairman from October 2016 to December 2018, as its Chairman from January 2007 to October 2016 and as its Chief Executive Officer from January 2007 to October 2016. SIGA Technologies, Inc. filed voluntary proceedings under Chapter 11 of the United States Bankruptcy Code in September 2014 and exited from bankruptcy protection in April 2016. In addition to his roles at SIGA Technologies, Inc., Dr. Rose held a position as Executive Vice President for Life Sciences at MacAndrews & Forbes Incorporated, the diversified holding company wholly owned by investor Ronald O. Perelman and a related party to SIGA, from 2007 until December 2016. Dr. Rose chaired the Department of Health Evidence & Policy at the Icahn School of Medicine at Mount Sinai from 2008 to 2013 and has served as a professor in the Department of Population Health Science & Policy since 2008. From 1994 through 2007, he served as Chairman of the Department of Surgery and Surgeon-in-Chief of the Columbia Presbyterian Center of New York Presbyterian Hospital. In 2014, Dr. Rose became a director of ABIOMED, Inc. (Nasdaq: ABMD), a Nasdaq-listed leading provider of medical devices that provide circulatory support, and currently serves on its audit committee. He has been a member of the American Association for Thoracic Surgery since 1986 and a member and former president of the International Society of Heart and Lung Transplantation since 1982. Dr. Rose earned a B.A. from Columbia College and an M.D. from Columbia University College of Physicians and Surgeons.

We believe that Dr. Rose’s extensive medical background, including his role in leading a cardiology program at a leading hospital, and his senior management experience in the life sciences sector and medical research and financial experience provide him with the qualifications and skills to serve on our Board.

Continuing Directors

David P. Hochman — Chief Executive Officer, Chairman of the Board and Director

Mr. Hochman has served as the Chairman of our Board and as our Chief Executive Officer since the closing of the Business Combination in January 2023. From May 2018 to the closing of the Business Combination, he served as Legacy Orchestra’s Chief Executive Officer and Chairman of the Legacy Orchestra board of directors (“Legacy Orchestra Board”). He also co-founded Legacy Orchestra and its predecessors, which predecessors are now our wholly-owned subsidiaries, Caliber Therapeutics, LLC (“Caliber”), BackBeat Medical, LLC (“BackBeat”) and FreeHold Surgical, LLC (“FreeHold”). Mr. Hochman served as a member of the boards of directors of Caliber, FreeHold and BackBeat from December 2008, December 2010 and June 2010, respectively, until November 2018. He also served as BackBeat’s President from its inception in June 2010 until May 2018. Mr. Hochman has served as a board observer of Vivasure since 2019. Mr. Hochman has over 25 years of healthcare entrepreneurial, venture capital and investment banking experience. From 2006 until December 2019, he co-founded and was Managing Partner of Orchestra Medical Ventures, LLC (“OMV”), a medical technology venture capital firm. Funds managed by OMV were stockholders of Orchestra prior to their dissolution. From December 2009 to until its purchase by Legacy Orchestra in December 2019, Mr. Hochman served as President and a board member of Accelerated Technologies, Inc., a medical device accelerator company managed by OMV that helped create the concepts for BackBeat Cardiac Neuromodulation Therapy (“BackBeat CNT”), Virtue Sirolimus AngioInfusion Balloon (“Virtue SAB”), FreeHold devices, the Pure-Vu system and PerQSeal. From December 2016 to September 2023, Mr. Hochman served as a member of the board of directors of Motus GI (Nasdaq: MOTS), a Nasdaq-listed medical technology company in which Orchestra has a strategic investment, from December 2016 to September 2023 and as its Chairman of the Board from December 2016 to April 2023. From December 2013 until September 2020, Mr. Hochman was a co-founder and board member of Corbus Pharmaceuticals Holdings, Inc. (Nasdaq: CRBP), a Nasdaq-listed clinical stage biopharmaceutical company. Prior to co-founding OMV, Mr. Hochman was Chief Executive Officer of Spencer Trask Edison Partners, LLC, an investment partnership focused on early stage healthcare companies, from 2002 to 2006. He was also Managing Director of private equity firm Spencer Trask Ventures, Inc. from 2000 to 2006, during which time he led financing transactions for over twenty early-stage companies raising over $420.0 million. From 1999 to 2006, Mr. Hochman was a board advisor of Health Dialog Services Corporation, a leader in collaborative healthcare management that was acquired in 2008 by the British United Provident Association for $750.0 million. From 2005 to 2007, he was a co-founder and board member of PROLOR Biotech, Inc., a formerly NYSE-listed biopharmaceutical company developing longer lasting versions of approved therapeutic proteins, which was purchased by Opko Health, Inc. in 2013 for over $600.0 million. He currently serves as President and a board member of the Mollie Parnis Livingston Foundation. He earned a B.A. with honors from the University of Michigan.

| 10 |

We believe that Mr. Hochman’s role as a co-founder of Legacy Orchestra’s predecessors and founder of Legacy Orchestra, his experience in healthcare innovation and venture capital, his leadership at other companies, including publicly-traded medical technology and biotechnology companies, his financial experience, and his extensive knowledge of our business based on his years as Chief Executive Officer provide him with the qualifications and skills to serve on our Board.

Darren R. Sherman — President, Chief Operating Officer, Director and Founder

Mr. Sherman has served as President and Chief Operating Officer and a member of our Board since the closing of the Business Combination in January 2023. From May 2018 to the closing of the Business Combination, he served as Legacy Orchestra’s President and Chief Operating Officer and a member of the Legacy Orchestra Board. He also co-founded Legacy Orchestra and its predecessors, which predecessors are now our wholly-owned subsidiaries, Caliber, BackBeat and FreeHold. Mr. Sherman served as Chief Executive Officer of Caliber from 2009 to May 2018 and as Chief Executive Officer and President of FreeHold from 2012 to May 2018. He also served as a board member of Caliber, FreeHold and BackBeat from 2009, 2012 and 2010, respectively, until November 2018. From 2009 until December 2019, Mr. Sherman was Managing Partner of OMV, a medical technology venture capital firm. Funds managed by OMV were stockholders of Legacy Orchestra prior to their dissolution. From 2009 to December 2019, Mr. Sherman also served as Chief Technical Officer of Accelerated Technologies, Inc., a medical device accelerator company managed by OMV that Orchestra acquired in December 2019. Mr. Sherman has over 25 years of management and entrepreneurial experience in the medical technology industry spanning interventional cardiology, cardiac electrophysiology, sudden cardiac death, stroke, surgery, GI, and neurovascular therapies. From 2009 until August 2016, he served on the board of directors of Vivasure, in which Orchestra holds a strategic investment. He served as a director of Motus GI (Nasdaq: MOTS), a Nasdaq-listed medical technology company that Orchestra also has a strategic holding in, from December 2016 to September 2023. Prior to joining OMV, from February 2002 until March 2008, Mr. Sherman held various positions in executive management for Cordis Neurovascular, a Johnson & Johnson company that focused on leveraging technology into applications for the brain, including Executive Director of Research & Development and Director of Strategic Marketing. From January 1997 until February 2002, Mr. Sherman played an integral role in the formation and development of Revivant Corp., a company that designed, manufactured, and marketed AutoPulse and medical devices that automate cardiopulmonary resuscitation, prior to its acquisition by Zoll Medical Corporation, while working with Thomas J. Fogarty, M.D. at Fogarty Engineering Inc. From January 1995 until January 1997, Mr. Sherman held positions in research and development for Cardiac Pathways Corp., which manufactured minimally-invasive systems used to diagnose and treat cardiac tachyarrhythmias prior to its acquisition by Boston Scientific. Prior to Cardiac Pathways Corp., he worked at Baxter Healthcare, a healthcare company specializing in medical devices, pharmaceuticals and biotechnology. Mr. Sherman has authored more than 85 U.S. patents with an additional 100+ published applications. He earned a B.S. in Bioengineering from the University of California, San Diego.

| 11 |

We believe that Mr. Sherman’s role as a co-founder of Legacy Orchestra’s predecessors and founder of Legacy Orchestra, his experience in medical device innovation, his leadership at other companies, including medical technology companies, his product development experience, and his extensive knowledge of our business provide him with the qualifications and skills to serve on our Board.

Pamela Ann Connealy

Ms. Connealy has served as a member of our Board and chairperson of the Audit Committee since January 2023. Prior to that, she served as a director of Legacy Orchestra since February 2020. She has a wealth of leadership experience in biotech finance, business operations, strategic planning and management. She is currently the Chief Financial Officer and Chief Operating Officer of Pyxis Oncology, Inc. (Nasdaq: PYXS), a clinical stage oncology company, where she has served in such capacity since July 2021. Prior to Pyxis Oncology, Ms. Connealy served as Chief Financial Officer and Chief Human Resources Officer of Immunovant, Inc. (Nasdaq: IMVT), a biotech company focused on transformative therapies for patients with autoimmune diseases, from November 2019 to September 2021. At Immunovant, Inc., Ms. Connealy led finance, investor relations and human resources. She also has served as an advisor to Perfuse Therapeutics, an early-stage company focused on ophthalmic diseases, since October 2019. Prior to Immunovant, Inc., from August 2018 to November 2019, Ms. Connealy served as Chief Financial Officer, Chief Operating Officer and Chief Human Resources Officer of Kiva Microfunds, a San Francisco-based nonprofit organization focused on expanding financial access for underserved communities. From April 2015 to June 2018, she served as Global Head of Talent at the Bill & Melinda Gates Foundation, a private foundation, where she focused on talent management, compensation, benefits and global mobility. From March 2012 to November 2013, she served as Vice President of Business Operations at Salesforce.com Inc., an enterprise software company, and from March 2002 to April 2010, she served as Vice President and Corporate Officer at Genentech, Inc., a biotechnology company focused on developing, manufacturing and commercializing medicines to treat patients with serious and life-threatening medical conditions, with roles including Chief Financial Officer of Research & Development, Head of Global Procurement and other key global operational roles. Ms. Connealy earned an M.B.A. in finance from the University of St. Thomas and a B.S. in chemistry from Gannon University and has been a member of the Healthcare Business Women Association since 2002.

We believe that Ms. Connealy’s current and prior experience at leading life science companies, including as a chief financial officer, and her financial experience and expertise provide her with the qualifications and skills to serve on our Board.

Eric S. Fain, M.D.

Dr. Fain has served as a member of our Board and chairperson of the Compensation Committee since January 2023. Prior to that, he served as a director of Legacy Orchestra since November 2018. He previously served as a strategic advisor and a consultant to BackBeat, one of Legacy Orchestra’s predecessors and now our wholly-owned subsidiary, from October 2017 to November 2018. Since July 2018, he has served as the President and Chief Executive Officer of Procyrion, Inc., a development stage medical device company developing catheter-based circulatory support technologies for congestive heart failure patients. Previously, he was the Group President of Cardiovascular and Neuromodulation at Abbott Laboratories from January 2017 until July 2017, a multinational medical devices and healthcare company, following its acquisition of medical device company St. Jude Medical, Inc. Dr. Fain became Group President of St. Jude Medical, Inc. in January 2015, where he was responsible for global sales, marketing and clinical affairs across the entire St. Jude Medical portfolio worldwide. Dr. Fain joined St. Jude Medical in 1997 as Vice President of Systems Development as part of the company’s acquisition of Ventritex, Inc., where he had worked since 1987. He went on to become Senior Vice President of Clinical/ Regulatory Affairs for the St. Jude Medical Cardiac Rhythm Management Division (“CRMD”) in 1998. He was later promoted to Executive Vice President, Development and Clinical/Regulatory Affairs for CRMD in 2005 and then President of CRMD in 2007. Prior to his role as Group President, Dr. Fain was President of the company’s Implantable Electronic Systems Division beginning in 2012 when its CRMD and Neuromodulation Divisions merged. Dr. Fain earned an M.D. from Stanford University School of Medicine and a Sc.B. degree in applied math/biology from Brown University.

| 12 |

We believe that Dr. Fain’s extensive senior management experience in the life sciences sector, including his service as a top executive at one of the market leading global commercial companies in the medical device sector, as well as his medical background and financial and transaction structuring experience provide him with the qualifications and skills to serve on our Board.

David Pacitti

Mr. Pacitti has served as a member our Board since March 2024. Since February 2018, Mr. Pacitti has served as President of Siemens Medical Solutions USA, Inc. and Head of the Americas, Siemens Healthineers. Mr. Pacitti is responsible for leading the marketing, sales, service, and support functions in North America and Latin America, across the entire Siemens Healthineers portfolio, including medical imaging, laboratory diagnostics, therapy solutions, and services. From October 2015 to February 2018, he served as President and Head of Healthcare, North America, Siemens Healthineers. From April 2013 to October 2015, Mr. Pacitti served as Division Vice President of U.S. Commercial Operations, Sales, and Marketing at Abbott Vascular, overseeing the company’s business in North America. As a member of the Senior Executive Staff, he worked with the CEO, CFO, and Research & Development team on business development initiatives and played pivotal roles in key launches, including Abbott Vascular’s first drug-eluting stent franchise and structural heart franchise. Prior to this position, Mr. Pacitti was Vice President of Abbott Vascular’s Commercial Operations from 2009 to 2013, and Vice President of Global Marketing from 2006 to 2009. He joined Abbott Vascular with its acquisition of Guidant Corp, where he served in positions of increasing responsibility from 1995 to 2006. Early in Mr. Pacitti’s career, he was a sales representative in Siemens’ Molecular Imaging business. Mr. Pacitti served as Board Chair for Gynesonics, from June 2021 to September 2023 and served as Board Member for Apollo Endo-Surgery from November 2017 to April 2023. He currently serves on the Boards of Advanced Medical Technology Association (AdvaMed), and the Siemens Foundation. Mr. Pacitti is also a member of the CEO Council for Growth at the Chamber of Commerce for Greater Philadelphia, the Children’s Hospital of Philadelphia Corporate Council, the Medical University of South Carolina (MUSC) President’s Advisory Group, and the NextGen Advisory Board for the University of Missouri. Mr. Pacitti earned a B.A. from Villanova University and an MBA from the University of Maryland Global Campus.

We believe that Mr. Pacitti’s current and prior senior management experience, including his experience as a president at one of the leading global commercial companies in the medical device sector, as well as his expertise in medical device marketing, sales, service and support, provide him with the qualifications and skills to serve on our Board.

Board Diversity Matrix

In compliance with Nasdaq’s Board Diversity Rule, the table below provides enhanced disclosure regarding the diversity of our Board members and nominees. The information presented below is based on voluntary self-identification responses we received from each Board member and nominee. Each of the categories listed in the below table has the meaning as it is used in Nasdaq Rule 5605(f).

| 13 |

| Board Diversity Matrix | ||

| (as of April 26, 2024) | ||

| Total Number of Directors | 7 | |

| Part I: Gender Identity | Female | Male |

| Directors | 1 | 6 |

| Part II: Demographic Background | ||

| African American or Black | – | – |

| Alaskan Native or Native American | – | – |

| Asian | – | 1 |

| Hispanic or Latinx | – | – |

| Native Hawaiian or Pacific Islander | – | – |

| White | 1 | 5 |

| Two or More Races or Ethnicities | – | – |

| LGBTQ+ | – | |

| Did Not Disclose Demographic Background | – | |

Composition of Our Board of Directors

The primary responsibilities of our Board are to provide oversight, strategic guidance, counseling and direction to our management. Our Board meets on a regular basis and on an ad hoc basis as required. Our Board currently consists of seven directors. Our certificate of incorporation (“Charter”) and Bylaws provide that the authorized number of directors may be changed only by resolution approved by a majority of our Board. In accordance with our Charter, our Board is divided into three classes with staggered three-year terms. At each annual meeting of stockholders, the successors to directors whose terms are expiring will be elected to serve from the time of election and qualification until the third annual meeting following election. Our directors are divided among the three classes as follows:

| · | the Class I directors are Dr. Rose and Mr. Aryeh, and their terms will expire at the Annual Meeting; |

| · | the Class II directors are Ms. Connealy and Mr. Pacitti, and their terms will expire at our annual meeting of stockholders to be held in 2025; and |

| · | the Class III directors are Mr. Hochman, Mr. Sherman and Dr. Fain, and their terms will expire at our annual meeting of stockholders to be held in 2026. |

Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our Board into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control.

Director Independence

Nasdaq rules generally require that independent directors must comprise a majority of a listed company’s board of directors. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, we have determined that each of Dr. Rose, Mr. Aryeh, Mr. Pacitti, Dr. Fain and Ms. Connealy, representing a majority of the directors of our Board, are “independent” as that term is defined under the applicable rules and regulations of the SEC and the listing requirements and rules of Nasdaq. Our Board also determined that Geoffrey Smith, who resigned from the Board on November 9, 2023, was independent under the Nasdaq listing rules. Dr. Fain serves as the lead independent director. In making these determinations, the Board considered the current and prior relationships that each non-employee director has with us and all other facts and circumstances the Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director, and the transactions involving them described in the section titled “Certain Relationships and Related Party Transactions.”

| 14 |

Board Leadership Structure

Our Board is currently chaired by David P. Hochman, our founder and Chief Executive Officer. Our corporate governance guidelines provide our Board with the discretion to combine or separate the positions of Chief Executive Officer and Chairperson of the Board. Currently, the Board believes that the interests of the Company and its shareholders are best served through a leadership model with a combined Chairperson of the Board and Chief Executive Officer. Based on our corporate governance guidelines, the Board may determine that it is appropriate to separate the roles of Chairperson of the Board and Chief Executive Officer in the future.

Each of the committees of our Board is comprised solely of independent directors that provide strong independent leadership for each of these committees. Our independent directors generally meet in executive session after each regular meeting of our Board. At each such meeting, the presiding director for each executive session of our Board is an independent or non-employee director. Our Board will continue to evaluate this leadership structure on an ongoing basis based on factors such as the experience of the applicable individuals and the current business environment.

Board Meetings and Committees

Our Board may establish the authorized number of directors from time to time by resolutions adopted by a majority of our Board. Our Board currently consists of seven members.

During our fiscal year ended December 31, 2023, the Legacy Orchestra Board or, after the Business Combination, our Board held nine meetings (including regularly scheduled and special meetings) and acted by written consent five times. Each director attended at least 75% of the aggregate of (i) the total number of meetings of our Board held during the period for which the director had been a director and (ii) the total number of meetings held by all committees of our Board on which the director served during the periods that the director served.

In accordance with our corporate governance guidelines, members of our Board are encouraged, but not required to attend our annual meetings of stockholders.

Our Board has established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The composition and responsibilities of each of the committees of our Board are described below. Each committee of our Board has a written charter approved by our Board. Copies of each charter are posted in the “Investor Relations-Corporate Governance” portion of our website under investors.orchestrabiomed.com/corporate-governance/documents-charters (the “Corporate Governance Section”). The reference to our website address does not constitute incorporation by reference of the information contained at or available or accessible through our website, and you should not consider it to be a part of this Proxy Statement. Members serve on these committees until their resignation or until otherwise determined by our Board. Our Board may establish other committees as it deems necessary or appropriate from time to time.

Audit Committee

Our Audit Committee consists of Ms. Connealy, Mr. Aryeh and Mr. Pacitti. Our Board has determined that each member of our Audit Committee satisfies the independence requirements under Nasdaq listing standards, including those set forth under Rule 10A-3(b)(1) of the Exchange Act. The chairperson of our Audit Committee is Ms. Connealy. Our Board has determined that Ms. Connealy is an “audit committee financial expert” within the meaning of SEC regulations. This designation does not impose on either any duties, obligations or liabilities that are greater than are generally imposed on members of our audit committee and the Board. Each member of our Audit Committee can read and understand fundamental financial statements in accordance with applicable requirements. In arriving at these determinations, our Board has examined each Audit Committee member’s scope of experience and the nature of their employment.

| 15 |

The primary purpose of our Audit Committee is to assist the board in fulfilling its oversight responsibility with respect to, among other things, the Company’s accounting and financial reporting processes, the systems of internal control over financial reporting of the Company and the audits, quality and integrity of the Company’s financial statements and reports. Specific responsibilities of our Audit Committee include, among other things:

| · | selecting a firm to serve as the independent registered public accounting firm to audit our financial statements; |

| · | ensuring the independence of the independent registered public accounting firm; |

| · | discussing the scope and results of the audit with the independent registered public accounting firm and reviewing, with management and that firm, our interim and year-end operating results; |

| · | establishing procedures for employees to anonymously submit concerns about questionable accounting or audit matters; considering the adequacy of our internal controls and internal audit function; |

| · | reviewing proposed waivers of the code of conduct for directors and executive officers; |

| · | reviewing material related party transactions or those that require disclosure; and |

| · | approving all audit and non-audit services to be performed by our independent registered public accounting firm. |

Our Audit Committee reviews, discusses and assesses its own performance and composition annually. Our Audit Committee also periodically reviews and assesses the adequacy of its charter, including its role and responsibilities as outlined in its charter, and recommends any proposed changes to our Board for its consideration and approval.

During our fiscal year ended December 31, 2023, the Legacy Orchestra Audit Committee or, after the Business Combination, our Audit Committee held four meetings and acted by written consent one time.

Compensation Committee

Our Compensation Committee consists of Dr. Fain, Dr. Rose and Mr. Pacitti. The chairperson of our Compensation Committee is Dr. Fain. Our Board has determined that each member of our Compensation Committee is independent under the listing standards of Nasdaq relating to compensation committees, is a “non-employee director” as defined in Rule 16b-3 promulgated under the Exchange Act and is an outside director, as defined pursuant to Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”).

The primary purpose of our Compensation Committee is to act on behalf of the Board in fulfilling the Board’s oversight responsibilities with respect to the Company’s compensation policies, plans and programs with a goal to attract, incentivize, retain and reward top quality executive management and employees. Specific responsibilities of our Compensation Committee include, among other things:

| · | reviewing and approving, or recommending that our Board approve, the compensation of our executive officers; |

| · | reviewing and approving, or recommending that our Board approve, the compensation of our non-employee directors; |

| · | administering our stock and equity incentive plans; |

| · | reviewing and approving, or making recommendations to our Board with respect to, incentive compensation and equity plans; and |

| 16 |

| · | reviewing, modifying (as needed) and approving (or if it deems appropriate, making recommendations to our Board regarding) our overall compensation strategy and policies. |

Once we cease to be an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”), the responsibilities of our Compensation Committee will also include reviewing and recommending to our Board for approval the frequency with which we conduct a vote on executive compensation, taking into account the results of the most recent stockholder advisory vote on the frequency of the vote on executive compensation, and reviewing and approving the proposals regarding the frequency of the vote on executive compensation to be included in our annual meeting proxy statements.

In addition, once we are neither an “emerging growth company” as defined in the JOBS Act nor a “smaller reporting company” as defined in Rule 12b-2 under the Exchange Act, the responsibilities of our Compensation Committee will also include reviewing and discussing with management our Compensation Discussion and Analysis, and recommending to our Board that the Compensation Discussion and Analysis be approved for inclusion in our Annual Reports on Form 10-K, registration statements and our annual meeting proxy statements.

Under its charter, our Compensation Committee may form, and delegate authority to, subcommittees as appropriate. Our Compensation Committee reviews, discusses and assesses its own performance and composition annually. Our Compensation Committee also periodically reviews and assesses the adequacy of its charter, including its role and responsibilities as outlined in its charter, and recommends any proposed changes to our Board for its consideration and approval.

During our fiscal year ended December 31, 2023, the Legacy Orchestra Compensation Committee or, after the Business Combination, our Compensation Committee held two meetings and acted by written consent one time.

Compensation Committee Processes and Procedures

Typically, our Compensation Committee meets at least twice a year and with greater frequency if necessary. The agenda for each meeting is usually developed by the chairperson of our Compensation Committee, in consultation with the Chief Financial Officer. Our Compensation Committee meets regularly in executive session. However, from time to time, various members of management and other employees as well as outside advisors or consultants may be invited by our Compensation Committee to make presentations, to provide financial or other background information or advice or to otherwise participate in Compensation Committee meetings. No executive officer may be present during the voting or deliberations of our Compensation Committee regarding his or her compensation. The charter of our Compensation Committee grants our Compensation Committee full access to all of our books, records, facilities and personnel. In addition, under its charter, our Compensation Committee has the authority, in its sole discretion, to obtain, at our expense, advice and assistance from compensation consultants and internal and external legal counsel or other advisors our Compensation Committee considers necessary or appropriate in the performance of its duties. Our Compensation Committee has direct responsibility for the appointment, compensation and oversight of the work of any compensation consultant, legal counsel and other adviser it retains. Under its charter, our Compensation Committee may select, or receive advice from, a compensation consultant, legal counsel or other adviser , other than in-house legal counsel and certain other types of advisers, only after taking into consideration six factors, prescribed by the SEC and Nasdaq, that bear upon the adviser’s independence; however, there is no requirement that any adviser be independent.

On November 6, 2023, our Compensation Committee retained Frederic W. Cook & Co., Inc. (“FW Cook”) to serve as an objective, third-party consultant on the reasonableness of management compensation levels in comparison with those of other similarly situated companies, and on the appropriateness of the compensation program structure in supporting our business strategy and human resources objectives. The Compensation Committee assessed whether the work of FW Cook as a compensation consultant has raised any conflict of interest, taking into consideration the following factors: (i) the provision of other services, if any, to us by FW Cook; (ii) the amount of fees we paid to FW Cook as a percentage of FW Cook’s total revenue; (iii) FW Cook’s policies and procedures that are designed to prevent conflicts of interest; (iv) any business or personal relationship of the individual compensation advisors employed by FW Cook with an executive officer of the Company; (v) any shares of our common stock owned by FW Cook or the individual compensation advisors employed by FW Cook; and (vi) any business or personal relationship of the individual compensation advisors with any member of our Compensation Committee. After considering such factors, the Compensation Committee determined that the engagement of FW Cook did not raise any conflicts of interest.

| 17 |

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Mr. Aryeh, Dr. Fain and Dr. Rose. The chairperson of our Nominating and Corporate Governance Committee is Mr. Aryeh. Our Board has determined that each member of the Nominating and Corporate Governance Committee is independent under the listing standards of Nasdaq.

Specific responsibilities of our Nominating and Corporate Governance Committee include, among other things:

| · | identifying, reviewing and evaluating qualified candidates for membership on our Board and recommending candidates for nomination to our Board; |

| · | periodically reviewing and assessing our corporate governance guidelines and their application; |

| · | overseeing the process of evaluating the performance of our Board and its committees; and |

| · | assisting our Board on corporate governance matters. |

Potential director candidates meeting the criteria established by the Board are identified either by reputation, existing Board members or stockholders. In addition, beginning in 2023, the Company on behalf of the Nominating and Corporate Governance Committee retained a third party search firm to assist the Nominating and Corporate Governance Committee in identifying potential candidates with appropriate skill sets for membership on our Board. The Nominating and Corporate Governance Committee may delegate responsibility for day-to-day management and oversight of a search firm engagement to the Chief Executive Officer.

Our Nominating and Corporate Governance Committee periodically reviews, discusses and assesses the performance of our Board and the committees of our Board. In fulfilling this responsibility, our Nominating and Corporate Governance Committee seeks input from senior management, our Board and others, which may include external advisors. In assessing our Board, our Nominating and Corporate Governance Committee evaluates the overall composition of our Board, our Board’s contribution as a whole and its effectiveness in serving our best interests and the best interests of our stockholders and, following the assessment process, our Nominating and Corporate Governance Committee may recommend changes in the composition of our Board, changes in the size of our Board, or other recommended future additions or changes to our Board structure based on our clinical programs and business focus. Our Nominating and Corporate Governance Committee reviews, discusses and assesses its own performance and composition annually. Our Nominating and Corporate Governance Committee also periodically reviews and assesses the adequacy of its charter, including its role and responsibilities as outlined in its charter, and recommends any proposed changes to our Board for its consideration and approval.

During our fiscal year ended December 31, 2023, the Legacy Orchestra Nominating and Corporate Governance Committee or, after the Business Combination, our Nominating and Corporate Governance Committee did not meet and did not act by written consent.

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee is currently or has been at any time one of our officers or employees. None of our executive officers currently serves, or has served during the last completed fiscal year, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our Board or Compensation Committee.

Identifying and Evaluating Director Nominees

Our Nominating and Corporate Governance Committee is responsible for identifying, reviewing, evaluating and recommending candidates for nomination to our Board, including candidates to fill any vacancies that may occur. Our Nominating and Corporate Governance Committee assesses the qualifications of candidates in light of the policies and principles in our corporate governance guidelines and may also engage third-party search firms to identify director candidates. Our Nominating and Corporate Governance Committee may conduct interviews, detailed questionnaires and comprehensive background checks or use any other means that it deems appropriate to gather information to evaluate potential candidates. Based on the results of the evaluation process, our Nominating and Corporate Governance Committee recommends candidates to our Board for approval as director nominees for election to our Board. In assessing our Board, our Nominating and Corporate Governance Committee will evaluate the overall composition of our Board, our Board’s contribution as a whole and its effectiveness in serving our best interests and the best interests of our stockholders.

| 18 |

Minimum General Criteria

Our Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including being able to read and understand basic financial statements and having the highest personal integrity and ethics. In considering candidates for recommendation to the Board, our Nominating and Corporate Governance Committee will consider, among things, the factors set forth in our corporate governance guidelines, which include, without limitation: (i) possessing relevant expertise upon which to be able to offer advice and guidance to management; (ii) having sufficient time to devote to the affairs of the Company; (iii) demonstrating excellence in his or her field; (iv) having the ability to exercise sound business judgment; (v) experience as a board member or executive officer of another publicly held company; (vi) having a diverse personal background, perspective and experience; (vii) requirements of applicable law; and (viii) having the commitment to rigorously represent the long-term interests of the Company’s stockholders. Our Nominating and Corporate Governance Committee also reviews director candidates in the context of the current size and composition of our Board, our operating requirements and our stockholders’ long-term interests. While the Board does not have a specific diversity policy, in conducting this assessment, the Board considers diversity (including diversity of gender, race, ethnicity, age, sexual orientation and gender identity), age, skills, and such other factors as it deems appropriate given the current needs of the Board and the Company to maintain a balance of knowledge, experience and capability. In the case of incumbent directors whose terms of office are set to expire, our Nominating and Corporate Governance Committee reviews such directors’ overall service to us during their term, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair such directors’ independence. In the case of new director candidates, our Nominating and Corporate Governance Committee also determines whether the nominee is independent for purposes of Nasdaq listing rules.

Stockholder Recommendations and Nominations to the Board of Directors

Stockholders may submit recommendations for director candidates by delivering a written recommendation to the Nominating and Corporate Governance Committee, c/o Orchestra BioMed Holdings, Inc., 150 Union Square Drive, New Hope, PA 18938, Attn: Chief Financial Officer. The written recommendation must be received:

| · | in the case of an annual meeting, not later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the first anniversary of the preceding year's annual meeting; provided, however, that, in the event that the date of the annual meeting is advanced more than 30 days prior to or delayed by more than 30 days after the anniversary of the preceding year's annual meeting, notice by the stockholder to be timely must be so received (A) not earlier than the close of business on the 120th day prior to such annual meeting and (B) not later than the close of business on the later of the 90th day prior to such annual meeting or, if later than the 90th day prior to such annual meeting, the 10th day following the day on which public announcement of the date of such meeting was first made by the Company; and |

| · | in the case of a special meeting of stockholders at which directors are proposed for election, not later than the close of business on the later of the 90th day prior to such special meeting or the 10th day following the day on which public announcement is first made by the Company of the date of the special meeting at which directors are to be elected. |

Our Nominating and Corporate Governance Committee will evaluate any candidates recommended by stockholders against the same criteria and pursuant to the same policies and procedures applicable to the evaluation of candidates proposed by directors or management.

| 19 |

Stockholder and Other Interested Party Communications

Our Board provides to every stockholder the ability to communicate with our Board as a whole, and with individual directors on our Board, through an established process for stockholder communication. For such communications, stockholders may send a written communication to the Board or individual directors c/o Orchestra BioMed Holdings, Inc., 150 Union Square Drive, New Hope, PA 18938, Attn: Chief Financial Officer. Each communication must set forth the name and address of the stockholder(s) on whose behalf the communication is sent and the class, series and number of shares of capital stock that are owned beneficially and of record by such stockholder(s) as of the date of the communication.