PRELIMINARY PROXY STATEMENT — SUBJECT TO COMPLETION, — DATED MARCH 7, 2022APRIL 3, 2023

PROXY STATEMENT FOR

20222023 ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 26, 2022, 2023

at am MDT

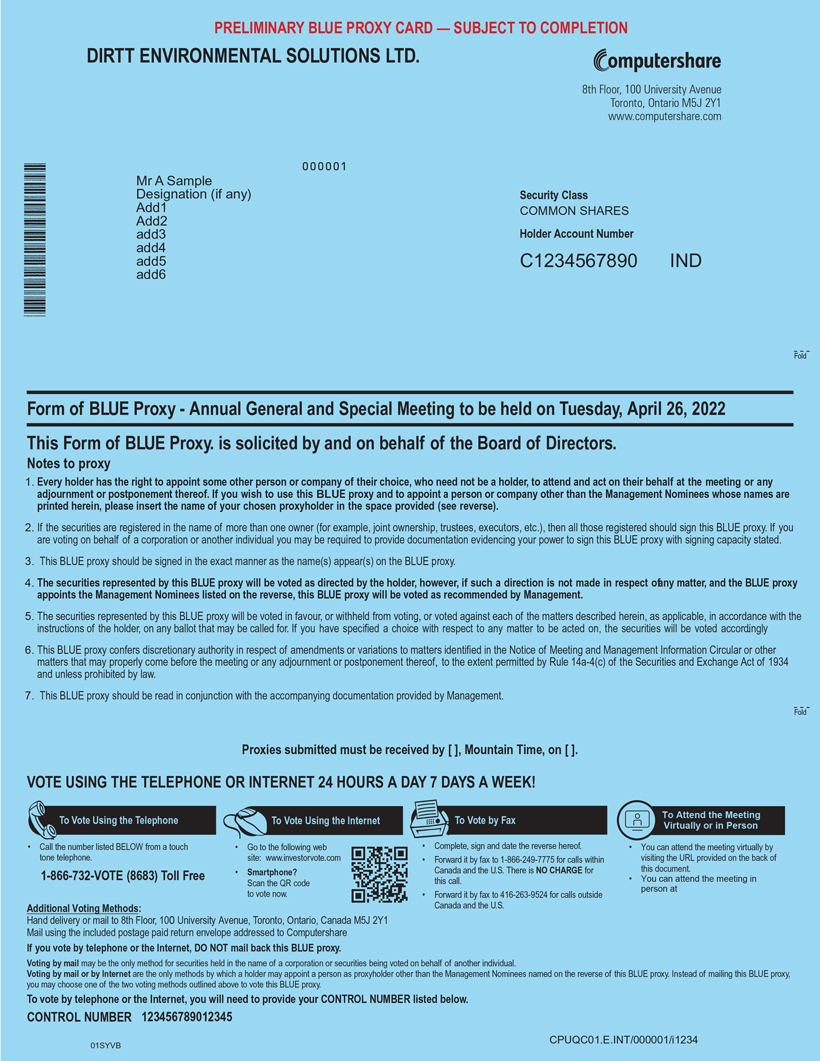

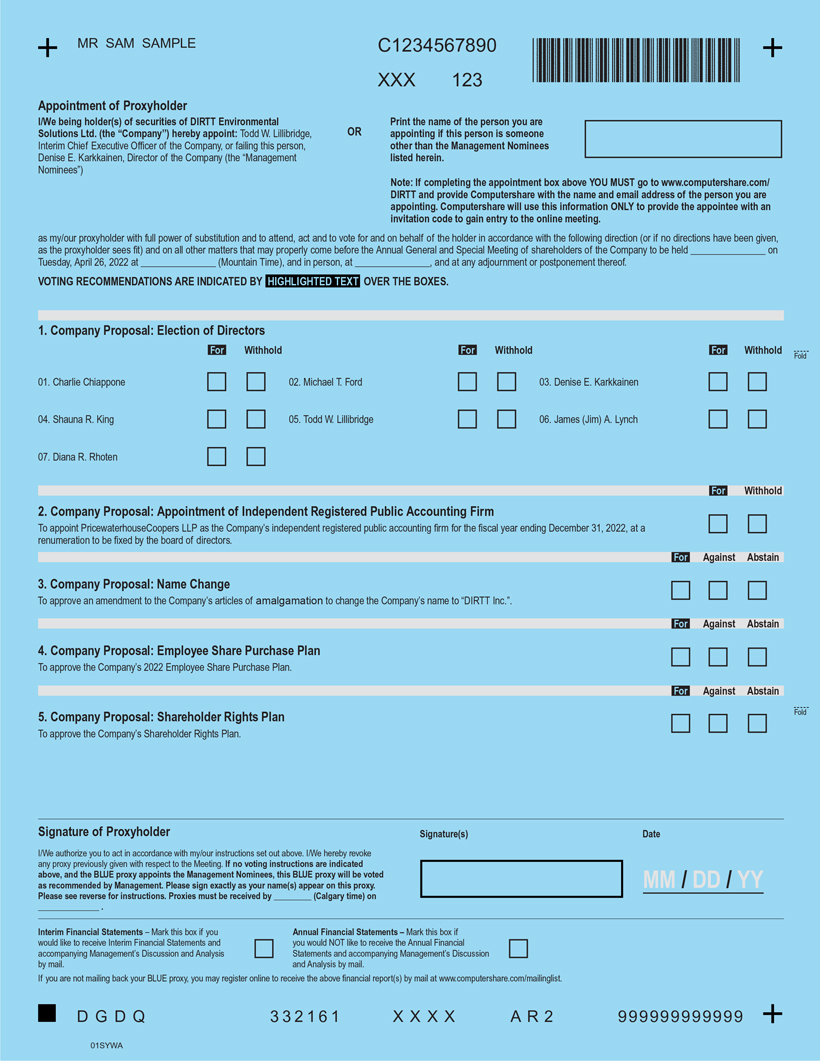

This management information circular and proxy statement (this(the “Proxy Statement”), dated March 7, 2022, and accompanying BLUE proxy card are, is provided in connection with the solicitation of proxies by or on behalf of managementthe Board of Directors (the “Board”) of DIRTT Environmental Solutions Ltd. for use at the annual and special meeting of shareholders (the “Meeting”). In this Proxy Statement, “DIRTT,” the “Company,” “we,” “us” or “our” refer to DIRTT Environmental Solutions Ltd., and “you,” “your” and “shareholder” refer to the holders of common shares of the Company (“Common Shares”). The Meeting is scheduled towill be held on Tuesday, April 26, 2022, , , 2023, ata.m. MDT for the purposes set forth in the Notice of Annual and Special Meeting. The approximate date on which this Proxy Statement and BLUE proxy card will be sent or given to shareholders is on or about , 2022.

The Meeting will be held in-person and virtually, with the in-person format to be held at and the virtual format to be conducted via live audio webcast online at . We are conducting a hybrid meeting this year due to the ongoing coronavirus (COVID-19) global pandemic. Our hybrid meeting format will enable our shareholders to participate in the Meeting regardless of their geographic location.

Registered shareholders and duly appointed and registered proxyholders (including non-registered shareholders who have duly appointed themselves as proxyholder) may participate in the Meeting, submit questions and vote, either in person or virtually. vote. Non-registered (beneficial) shareholders who have not duly appointed and registered themselves as proxyholders may still attend the Meeting virtually as guests,and ask questions, but will not be able to vote or ask questions at the Meeting.

A shareholder who wishes See also “How to (i) appoint a person other than the management nominees identified on their BLUEproxy card or voting instruction form (including a non-registered shareholder who wishes to appoint themselves to attend) and (ii) vote on the BLUE proxy card or voting instruction form must carefully follow the instructions in this Proxy Statement and on the BLUE proxy card or voting instruction form. These instructions include the additional step of registering such proxyholder with our transfer agent, Computershare Trust Company of Canada (“Computershare”), after submitting their proxy card or voting instruction form, in order to be able to attend the Meeting virtually. Failure to register the proxyholder with our transfer agent will result in the proxyholder not receiving an invitation code to participate in the Meeting virtually and only being able to attend as a guest.Guests will be able only to listen to the virtual Meeting but will not be able to vote or ask questions.Vote” below.

This Proxy Statement includes information that we are required to provide to you under the rules of the U.S. Securities and Exchange Commission (the “SEC”) and applicable corporate and securities laws in Canada, and that is designed to assist you in voting your Common Shares.

This Proxy Statement contains detailed information on the matters to be considered at the Meeting, or any adjournment or postponement thereof. Please read this Proxy Statement carefully and remember to vote your Common Shares, either by proxy or online at the Meeting, or any adjournment or postponement thereof. Your vote is important.

The Company uses the notice-and-access process as its method of communication with shareholders for voting and proxy-related materials. Access to this Proxy Statement, Notice of Annual Meeting, the related proxy card and the 2022 Annual Report to Shareholders (collectively, the “Proxy Materials”) will be provided to our shareholders via the Internet, with paper copies free of charge upon request. Accordingly, on or about , we began mailing a Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”) to shareholders entitled to vote at the Meeting containing instructions on how to access the Proxy Materials and how to vote online. Please follow the instructions on the Notice of Internet Availability for requesting paper or e-mail copies of our Proxy Materials. In addition, shareholders of record may request to receive Proxy Materials in printed form by mail or electronically by e-mail on an ongoing basis for future shareholders meetings. We believe electronic delivery will expedite the receipt of the materials and will help lower the costs of our Proxy Materials. Please note that, while our Proxy Materials are available at the website referenced in the Notice of Internet Availability and on our website, no other information contained on either website is incorporated by reference into or considered to be a part of this document.

We are permitted under applicable securities laws to deliver a single Notice of Internet Availability to one address shared by two or more shareholders. This delivery method is referred to as “householding” and helps reduce our printing costs and postage fees. See “Other Matters – Householding” on page 67 of this Proxy Statement.

Unless otherwise indicated, references herein to “$” or “dollars” are expressed in U.S. dollars (US$), and references to Canadian dollars are noted as “C$” or “CAD $.” Unless otherwise stated, all figures presented in Canadian dollars and translated into U.S. dollars were calculated using the daily average exchange rate as reported by the H.10 statistical release of the Board of Governors of the Federal Reserve System on December 31, 202130, 2022 of C$1.27771.3532 = US$1.00.

References in thisthe Proxy Statement, Notice of Annual and Special Meeting, the related BLUE proxy card and the 2021 Annual Report to ShareholdersMaterials to the “Meeting” also refer to any adjournments, postponements or changes in location or format of the Meeting, to the extent applicable.

i