UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section

14(a) of the Securities Exchange Act of 1934

☒ | Filed by the Registrant | ☐ Filed by a Party other than the Registrant |

Check the appropriate box:

| Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

WINDTREE THERAPEUTICS, INC.

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy Statement, if other than the

Registrant)

Payment of Filing Fee (Check all boxes that apply):

| |

☒ | No fee |

☐ | Fee paid previously with preliminary |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules14a-6(i)(1)and |

PRELIMINARY PROXY STATEMENT, SUBJECT TO COMPLETION, DATED DECEMBER 23, 2022

2600 Kelly Road, Suite 100

Warrington, Pennsylvania 18976

2023SPECIAL MEETING OF STOCKHOLDERS

To be Held onA LETTER FROM WINDTREE’, 2023S CHIEF EXECUTIVE OFFICER

, 2023

Dear Stockholder:Fellow Stockholders:

The year of 2022 and the start of 2023 has been marked by the delivery of positive milestones and meaningful advancements. We aremade significant progress across multiple fronts and have set up the next several quarters to be quite an eventful year ahead. As we turn the page from one year to the next, I wanted to take a moment to review our achievements and progress to date, and provide you with some insight for the upcoming year.

I am very pleased to invite youreport on our management team’s achievements with respect to attendour priority objectives for 2022, including:

1)Successfully Executed and Delivered a Special MeetingPositive SEISMiC Study with Istaroxime in Early Cardiogenic Shock

Patients in cardiogenic shock due to heart failure have significantly decreased heart function with extremely low blood pressure resulting in a critical reduction of Stockholders (the “Special Meeting”)blood flow to the body, including vital organs. Reversing the condition is urgent as it is often fatal with up to 30-40% mortality. Currently, physicians do not have adequate treatments and tend to reserve the available drug options because they are often accompanied by side effects that can be very problematic and even worsen outcomes. In our market research 99 out of 100 U.S.-based clinical cardiologists surveyed who treat shock said a new innovative drug therapy is highly needed and they would be highly receptive to using a new therapy fitting istaroxime’s unique profile. Based on U.S. hospital claims data and epidemiology data outside the U.S., we valued the global market at $1.25 billion and we saw that the U.S. average length of hospital stay is approximately 19 days with patient care costs in excess of $200,000 – yet we are not aware of any other agents in development for cardiogenic shock other than istaroxime. Based on this unmet need and the clinical profile that we observed in our two previous, positive studies in acute heart failure with istaroxime, Windtree Therapeutics, Inc. (“Windtree”conducted the SEISMiC study in early cardiogenic shock patients – and the results were positive and encouraging. The primary measure of systolic blood pressure significantly increased within the first six hours of initiating the infusion and the increase was maintained throughout the 24-hour infusion. In fact, this improvement was rapid within the first hour and sustained through the 96-hour post-infusion measure. Importantly, the underlying cause of the early cardiogenic shock - poor cardiac pump function - was positively impacted with key measures significantly or substantially improved. Kidney function was maintained which is important since these critical patients are typically experiencing fluid overload and require functioning kidneys to alleviate this. The SEISMiC study provided valuable information for optimizing our dose moving forward. The positive data substantiates and advances the rationale for istaroxime as a potential treatment for cardiogenic shock (and substantiates the previous acute heart failure data). Most of all, it paves the way for what we believe is a relatively faster and less expensive developmental and regulatory pathway than typical cardiac indications such as acute heart failure. This creates options for Windtree to capitalize upon possible global licensing and/or partnering opportunities or for Windtree to continue to execute the program to obtain regulatory approval and launch in the U.S. (and partner ex-US) in the future.

2)Created a more capital efficient organization with reduced cash burn and extended cash runway

By prioritizing our portfolio, focusing and aligning on the activities most associated with value-creation potential and then making the necessary self-critical calls on what is really needed for resources, we were able to significantly reduce our cash burn and extend our runway. Between the first quarter of 2022 and 2023, total company cash burn was reduced 58%, while non-program burn (i.e., the “Company”, “we”, or “us”), which will be held virtually at 9:00 A.M., Eastern Time, on , 2023ongoing, more constant spend outside of clinical studies) was reduced by 53% and headcount reduced by 46%. These actions are intended to direct more of our capital towards potential value-generating activity of research and drug development, and to extend our cash runway.

3)Successfully financed the company and operations for the following purposes:next steps in development

With positive data from SEISMiC, Windtree turned its attention to the next set of clinical activities to advance the program. Only after making the tough calls on organizational structure and prioritizing activities, significantly reducing our cash burn to extend our runway and, importantly, exploring multiple non-dilutive business development options, Windtree conducted a public financing in late April of this year. It had been nearly two years since our previous raise, and we went to the market for the minimum amount we believed necessary to properly progress our program to potentially meaningful milestone(s). Despite the very difficult market, we were successful in completing the round that, based on demand, was slightly upsized and avoided the negative elements that are common in predicate deals today. With the raise behind us, the company is in full execution mode!

4)Secured a global out-license of the KL4 platform including AEROSURF®

Given the attractive opportunity of istaroxime in cardiogenic shock shaping portfolio prioritization, in August 2022 Windtree announced that it had entered into a global licensing agreement with Lee’s Pharmaceuticals (Lee’s) and its affiliate Zhaoke Pharmaceutical (Zhaoke) for the development and commercialization of Windtree’s acute pulmonary pipeline treatments KL4 surfactant and drug/device combination, AEROSURF®, for the treatment of preterm infants with respiratory distress syndrome (RDS) and other potential applications. As part of the global license, Lee’s and Zhaoke are responsible for funding all development, intellectual property, manufacturing, and commercialization activities and provide developmental, regulatory and eventual commercial sales milestones for Windtree of up to $78.9 million plus potential tiered royalties. This transaction helped focus Windtree’s resources on its core programs and delivered potential value to stockholders on assets we were no longer progressing ourselves.

Looking Forward

The remainder of 2023 and first half of 2024 are focused on executing activities intended to transition istaroxime from Phase 2 to Phase 3 for cardiogenic shock while also exploring potential partnership and strategic opportunities. Our top priorities are:

| Execute the SEISMiC Extensionstudy: This study is designed to |

| Study SCAI Stage C patients: While a smaller group than SCAI stage B that was studied in our SEISMiC trial, we want and will need to |

● | Execute Business Development activities to gain stockholder value and support non-dilutive funding objectives: Given the significant opportunity of istaroxime in cardiogenic shock and acute heart failure along with the next generation, oral SERCA2a activators in pre-clinical development, we are active in exploring partnership and licensing opportunities. We are also open to and do explore potential strategic transactions (such as mergers and acquisitions), and will do so with our priority focus on creating value for our stockholders. |

● | Retain and strengthen the team: In all the talk of science and innovation in our industry, perhaps the most overlooked critical ingredient for success is the people. Windtree has an exceptionally experienced and talented team that has a strong track record of execution (such as successfully executing the early cardiogenic shock study in hospital intensive care units in the middle of the |

The Special Meeting can be accessed viaOver the Internet at: https://www.cstproxy.com/windtreetx/sm2022. This Proxy Statement (as defined below)next several months and enclosed proxy card are first being mailedcoming year, we expect to stockholders on or about , 2023. The opening of the polls will occur at approximately A.M. on , 2023.

Details regarding admission to the Special Meetingsee clinical execution and the business to be conducted are more fully described in the accompanying Notice of 2023 Special Meeting of Stockholders (the “Notice”), and the 2023 Special Meeting Proxy Statement (the “Proxy Statement”). You are entitled to vote at our Special Meeting and any adjournments thereof only if you were a stockholder as of December 2, 2022. As a result of the dividend of the shares of Series A Preferred Stock, par value $0.001 per share (“Series A Preferred Stock”), distributed on December 2, 2022, each holder of shares of our Common Stock also holds a number of one one-thousandthsimportant milestones that have the potential to be catalysts for growth and value generation, and the potential to create important new therapies for critically ill patients. I look forward to keeping you updated on our progress!

Best Regards,

Craig E. Fraser

President, Chief Executive Officer and

Chairman of the Board of Directors

Windtree Therapeutics, Inc.

We encourage you to read our 2022 Annual Report on Form 10-K, as amended by our Annual Report on Form 10-K/A, which includes our audited consolidated financial statements as of and for the year ended December 31, 2022, and the sections captioned "Risk Factors" and "Forward Looking Statements" for a sharedescription of our Series A Preferred Stock equalthe substantial risks and uncertainties related to the whole number of shares of Common Stock held by such holder. Because any one one-thousandths of a share of Series A Preferred Stock that are not present in person or by proxy at the Special Meeting as of immediately prior to the opening of the polls at the Special Meeting will be automatically redeemed, if you fail to submit a proxy to vote your shares or attend the Special Meeting in order to do so, your shares of Series A Preferred Stock will be redeemed immediately prior to the opening of the polls at the Special Meeting and will not be entitled to vote at the Special Meeting.forward-looking statements included herein.

Your vote is important. Whether or not you plan to virtually attend the Special Meeting, we hope you will vote as soon as possible. Information about voting methods is set forth in the accompanying Notice and Proxy Statement. If you have any questions regarding the attached proxy statement or need assistance in voting your shares of Common Stock or Series A Preferred Stock, please contact our Senior Vice President, Chief Financial Officer and Corporate Secretary, John P. Hamill, at (215) 488-9300.

| ||

|

| |

|

|

PRELIMINARY PROXY STATEMENT, SUBJECT TO COMPLETION, DATED DECEMBER 23, 2022

THIS PROXY STATEMENT AND ENCLOSED PROXY CARD ARE

FIRST BEING MAILED TO STOCKHOLDERS ON OR ABOUT , 2023.

NOTICE OF SPECIALANNUAL MEETING OF STOCKHOLDERS

Dear Stockholders:

You are invited to attend Windtree’s Special2023 Annual Meeting, which will be held at 9:00 a.m., Eastern time, on Tuesday, August 15, 2023, or the Annual Meeting. We have decided to hold the Annual Meeting virtually this year. The Annual Meeting can be accessed via the Internet at: https://www.cstproxy.com/windtreetx/2023. We believe that hosting the Annual Meeting virtually will enable greater stockholder participation and improves our ability to communicate more effectively with our stockholders. At the SpecialAnnual Meeting, stockholders will vote:vote to:

| elect the five director nominees that are set forth in the attached Proxy Statement to |

|

|

● | ratify the |

● | approve the amendment and restatement of our Amended and Restated Windtree Therapeutics 2020 Equity Incentive Plan, or the 2020 Plan, including an increase to the |

Stockholders will also will transact any other business that may properly come before the SpecialAnnual Meeting or any adjournment or postponement of the SpecialAnnual Meeting.

MEETING INFORMATIONINFORMATION:

Date: |

| |

Time: |

| |

Location: | Via the Internet: https://www.cstproxy.com/windtreetx/ | |

Record Date: | You can vote if you were a stockholder of record on | |

|

|

The Board has fixed the close of business on December 2, 2022 as the record date for the Special Meeting (the “Record Date”). Only stockholders of record on the Record Date are entitled to receive notice of the Special Meeting and to vote at the Special Meeting or at any adjournment(s) of the Special Meeting. Notwithstanding the foregoing, holders of our outstanding shares of Series A Preferred Stock will only be entitled to vote such shares on the Reverse Stock Split Proposal and the Adjournment Proposal to the extent that such shares have not been automatically redeemed in the Initial Redemption (as defined and described in the accompanying Proxy Statement).

On November 18, 2022, we announced an issuance of Series A Preferred Stock with multiple votes per share, to be paid to Company stockholders on December 2, 2022, with the intent of increasing the likelihood of receiving sufficient votes at the Special Meeting to approve the Reverse Stock Split Proposal. Please note that the holders of this SeriesA Preferred Stock may only vote on the Reverse Stock Split Proposal and Adjournment Proposal, and their votes may only be cast in direct proportion to the final votes cast by the holders of the Common Stock. As described in the accompanying proxy statement, the Series A Preferred Stock only serves to amplify the Common Stock voted on the Reverse Stock Split Proposal.

Your vote matters. Whether or not you plan to virtually attend the SpecialAnnual Meeting, please ensure that your shares are represented by voting, signing, dating and returning your proxy in the enclosed envelope, which requires no postage if mailed in the United States.

By Order of the Board of Directors | |

/s/ Diane Carman | |

| |

Senior Vice President, | |

|

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS. NOTICE OF THIS PROXY STATEMENT AND THE PROXY CARD IS BEING MAILED TO OUR STOCKHOLDERS ON OR ABOUT JUNE 29, 2023. In accordance with the rules of the Securities and Exchange Commission, or the SEC, we are advising our stockholders of the availability on the internet of our proxy materials related to our forthcoming Annual Meeting. Because we have elected to utilize the “notice and access” option, we are delivering to all stockholders a Notice of Internet Availability providing details on how to access to those proxy materials on a publicly accessible website or to request paper copies to be delivered. This Notice of Annual Meeting and Proxy Statement and the proxy card are being mailed to our stockholders on or about, 2023. This Proxy Statement is available to stockholdersholders of our common stock athttps://www.cstproxy.com/windtreetx/sm2022.2023 and on our corporate website at www.windtreetx.com.

SUMMARY INFORMATION |

To assist you in reviewing this meeting’syear’s proposals, we call your attention to the following proxy summary. This is only a summary; please review this 2023 Special Meeting Proxy Statement (the “Proxy Statement”)and our 2022 Annual Report in full.

PROXY SUMMARY |

Summary of Stockholder Voting Matters

|

|

| ||

Item 1: | Page | ✓FOR EACH NOMINEE | ||

Item | Page 41 | ✓ FOR | ||

Item 3: Ratification of Appointment of EisnerAmper LLP as our Independent Registered Public Accounting Firm for 2023 | Page 42 | ✓ FOR | ||

Item 4: Approval of | Page 43 | ✓ FOR |

Our Director Nominees

You are being asked to vote on the election of five director nominees, each to serve until our 2024 Annual Meeting of Stockholders. The number of members of our Board of Directors, or the Board, is currently set at five members.

The term of office of our directors expires at the Annual Meeting. We are nominating Craig E. Fraser, Daniel Geffken, Robert Scott, M.D., Mark Strobeck, Ph.D., and Leslie J. Williams for election at the Annual Meeting to serve until the 2024 Annual Meeting of Stockholders and until their successors, if any, are elected or appointed, or their earlier death, resignation, retirement, disqualification or removal. Directors are elected by a plurality of the votes properly cast by our stockholders at the Annual Meeting. The five director nominees receiving the most FOR votes (among votes properly cast in person or by proxy) will be elected. If no contrary indication is made, shares represented by executed proxies will be voted FOR the election of Messrs. Fraser and Geffken, Drs. Scott and Strobeck, and Ms. Williams. Each nominee has agreed to serve as a director if elected, and we have no reason to believe that any nominee will be unable to serve.

SUMMARY INFORMATION (continued) |

Director | Committee Memberships | Other Current Public Company | ||||||

Name | Age | Since | Occupation | Independent | AC | CC | NCGC | Boards |

Craig E. Fraser | 58 | 2016 | Our President, Chief Executive Officer and Chairman | No | ⸺ | ⸺ | ⸺ | None |

Daniel Geffken | 66 | 2019 | Managing Partner of Danforth Advisors | Yes | C | M | ⸺ | None |

Robert Scott, M.D. | 69 | 2021 | Former Chief Medical Officer and Head of Development for AbbVie | Yes | ⸺ | C | M | None |

Mark Strobeck, Ph.D. | 52 | 2023 | Director, President and CEO of Rockwell Medical, Inc. | Yes | M | M | ⸺ | Rockwell Medical, Inc. |

Leslie J. Williams | 63 | 2021 | Director, President and CEO of hC Bioscience, Inc. | Yes | M | ⸺ | C | Ocular Therapeutix, Inc. |

AC = Audit Committee | C = Chair |

CC = Compensation Committee | M = Member |

NCGC = Nominating and Corporate Governance Committee |

CORPORATE GOVERNANCE SUMMARY FACTS

The following table summarizes our current Board structure and key elements of our corporate governance framework:

| |

Size of Board (set by the Board) | 5 |

Number of Independent Directors | 4 |

Board Self-Evaluation | Annual |

Review of Independence of Board | Annual |

Independent Directors Meet Without Management Present | Yes |

Voting Standard for Election of Directors | Plurality |

Diversity of Board Background, Experience and Skills | Yes |

Lead Independent Director | Yes |

| 30 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

PROXY STATEMENT

This Proxy Statement, with the enclosed proxy card, is being mailedfurnished to stockholders of Windtree Therapeutics, Inc. (“Windtree”, the “Company”, “we” or “us”) in connection with the solicitation by our Board of Directors (the “Board”) of proxies to be voted at our SpecialAnnual Meeting of Stockholders (the “Special Meeting”) and at any postponements or adjournments thereof. The SpecialAnnual Meeting will be held virtually on ,Tuesday, August 15, 2023, at 9 A.M.9:00 a.m., Eastern Time,time via the Internet at live webcast by visiting https://www.cstproxy.com/windtreetx/sm2022.2023.

This Proxy Statement and the enclosed proxy card are first being mailed to our stockholders on or about ,June 29, 2023.

1 NTD: ToC to be updated once proxy is finalized.

PROXY SOLICITATION

The CompanyWindtree is soliciting your vote on matters that will be presented at the SpecialAnnual Meeting and at any adjournment or postponement thereof. This Proxy Statement contains information on these matters to assist you in voting your shares.

This Proxy Statement and the proxy card are first being mailedfurnished to our stockholders on or about ,June 29, 2023. This Proxy Statement isand our 2022 Annual Report are available to stockholdersholders of our common stock at https://www.cstproxy.com/windtreetx/sm2022.2023 and on our corporate website at www.windtreetx.com.

STOCKHOLDERS ENTITLED TO VOTE

StockholdersAll stockholders of record including holders of our common stock par value $0.001 per share (“Common Stock”), and holders of our Series A Preferred Stock, par value $0.001 per share (“Series A Preferred Stock”), at the close of business on December 2, 2022 (the “Record Date”) mayJune 26, 2023, or the Record Date, are entitled to receive the Notice and to vote their shares at the SpecialAnnual Meeting. Notwithstanding the foregoing, holdersAs of outstandingthat date, 5,148,219 shares of Series A Preferred Stock will only be entitled to vote such shares to the extent that such shares have not been automatically redeemed in the Initial Redemption (as defined below). Thereour common stock were 38,610,119 shares of Common Stock and 38,610.119 shares of Series A Preferred Stock outstanding on the Record Date.

Pursuant to the rights of our stockholders contained in our governing documents, eachoutstanding. Each share of our Common Stock is entitled to one vote on all matters listed in this proxy statement. As previously announced on November 18, 2022, the Board declared a dividend of one one-thousandth (1/1,000th) of a share of Series A Preferred Stock for each outstanding share of Common Stock to stockholders of record of Common Stock as of 5:00 p.m. Eastern Time on November 28, 2022. The holders of Series A Preferred Stock have 1,000,000 votes per whole share of Series A Preferred Stock (i.e., 1,000 votes per one one-thousandth of a share of Series A Preferred Stock) and are entitled to vote with the Common Stock, together as a single class, on the Reverse Stock Split Proposal and Adjournment Proposal, but are not otherwise entitled to vote on the other proposals, if any, to be presented at the Special Meeting. Notwithstanding the foregoing, each share of Series A Preferred Stock redeemed pursuantmatter properly brought to the Initial Redemption will have no voting power with respect to the Reverse Stock Split Proposal, the Adjournment Proposal or any other matter. Unless otherwise provided on any applicable proxy or ballot with respect to the voting on the Reverse Stock Split Proposal or the Adjournment Proposal, when a holder of Common Stock submits a vote on the Reverse Stock Split Proposal and the Adjournment Proposal, the corresponding number of shares of Series A Preferred Stock (or fraction thereof) held by such holder will be automatically cast in the same manner as the vote of the share of Common Stock (or fraction thereof) in respect of which such share of Series A Preferred Stock (or fraction thereof) was issued as a dividend is cast on the Reverse Stock Split Proposal and the Adjournment Proposal, and the proxy or ballot with respect to shares of Common Stock held by any holder on whose behalf such proxy or ballot is submitted will be deemed to include all shares of Series A Preferred Stock (or fraction thereof) held by such holder. Holders of Series A Preferred Stock will not receive a separate ballot or proxy to cast votes with respect to the Series A Preferred Stock on the Reverse Stock Split Proposal, the Adjournment Proposal or any other matter brought before the Special Meeting. For example, if a stockholder holds 10 shares of Common Stock (entitled to one vote per share) and votes in favor of the Reverse Stock Split Proposal, then 10,010 votes will be recorded in favor of the Reverse Stock Split Proposal, because the stockholder’s shares of Series A Preferred Stock will automatically be voted in favor of the Reverse Stock Split Proposal alongside such stockholder’s shares of Common Stock.meeting.

All shares of Series A Preferred Stock that are not present in person or by proxy at the Special Meeting as of immediately prior to the opening of the polls at the Special Meeting will be automatically redeemed (the “Initial Redemption”). Any outstanding shares of Series A Preferred Stock that have not been redeemed pursuant to the Initial Redemption will be redeemed in whole, but not in part, (i) if and when ordered by our Board or (ii) automatically upon the approval by the Company’s stockholders of the Reverse Stock Split Proposal at any meeting of the stockholders held for the purpose of voting on such proposal.

Any holder of shares of Common Stock that held such shares as of the Series A Preferred Stock Record Date on November 28, 2022 received a dividend of one one-thousandth (1/1,000th) of a share of Series A Preferred Stock for each share of Common Stock held by such holder, and is deemed to have the voting power attributable to both its shares of Common Stock and Series A Preferred Stock for purposes of the Special Meeting. Any holder that purchased any shares of Common Stock in the open market after the Series A Preferred Stock Record Date on November 28, 2022 and prior to the December 2, 2022 Special Meeting record date also received one one-thousandth (1/1,000th) of a share of Series A Preferred Stock for each share of Common Stock purchased by such holder and is deemed to have the voting power attributable to both its shares of Common Stock and Series A Preferred Stock for purposes of the Special Meeting. Conversely, the voting power held by any holder that sold any shares of Common Stock and Series A Preferred Stock after the Series A Preferred Stock Record Date on November 28, 2022 and prior to the December 2, 2022 Special Meeting record date is reduced in proportion to the number of shares of Common Stock and Series A Preferred Stock sold by such holder.

The Initial Redemption will occur after the quorum call and before opening of the polls at the Special Meeting. A holder’s shares of Series A Preferred Stock will be redeemed in the Initial Redemption if (1) such holder does not submit a proxy to vote its shares of Common Stock and Series A Preferred Stock at the Special Meeting (or revokes a submitted proxy prior to the Special Meeting); and (2) such holder is not present at the Special Meeting virtually in person or by proxy before opening of the polls at the Special Meeting. If a holder is present at the Special Meeting virtually in person or by proxy prior to the opening of the polls at the Special Meeting, such holder’s Series A Preferred Stock shall not be redeemed in the Initial Redemption and shall be deemed outstanding for purposes of the Special Meeting.

Additionally, if a holder of the Company’s Common Stock submits a proxy to vote its shares of Common Stock and Series A Preferred Stock, and subsequently revokes such proxy prior to the opening of the polls at the Special Meeting, any shares of Series A Preferred Stock held by such holder shall be redeemed in the Initial Redemption, unless such holder is present at the Special Meeting virtually in person prior to the opening of the polls at the Special Meeting, in which case such holder’s Series A Preferred Stock shall not be redeemed in the Initial Redemption and shall be deemed outstanding for purposes of the Special Meeting

Even if a holder of the Company’s Common Stock chooses to not cast a vote on the matters to be voted upon at the Special Meeting, the Company believes that the existence of the Series A Preferred Stock increases the likelihood that the Reverse Stock Split Proposal will be approved due to its amplified voting power, which may be further amplified as a result of the Initial Redemption. However, since holders of the Series A Preferred Stock have the opportunity to vote against the Reverse Stock Split Proposal, the Company may be unable to obtain the vote of the requisite voting power required to approve the Reverse Stock Split Proposal. In addition, if a holder of Series A Preferred Stock attends the Special Meeting virtually in person or by proxy and abstains from voting on the Reverse Stock Split Proposal, such holder’s Series A Preferred Stock shall not be redeemed in the Initial Redemption, and such abstention will be treated as a vote against the Reverse Stock Split Proposal.

The Series A Preferred Stock was issued to solely affect the passage of a charter amendment to effect a reverse stock split. The Board determined that the issuance of the Series A Preferred Stock was desirable as the Company recently had difficulty obtaining the vote of at least 50% of its total voting power on matters submitted to stockholders, which is required to approve the Reverse Stock Split Proposal. The Board determined that the issuance of the Series A Preferred Stock would assist the Company in obtaining the legally required approval for the Reverse Stock Split Proposal under Delaware law and the Company’s organizational documents without disenfranchising voters. Voters would not be disenfranchised since all of the Company’s stockholders on the Series A Preferred Stock dividend record date received shares of Series A Preferred Stock, and all such holders, as well as any holders who purchased shares of Common Stock (and therefore Series A Preferred Stock) prior the Record Date, have the opportunity to vote for or against the Reverse Stock Split Proposal.

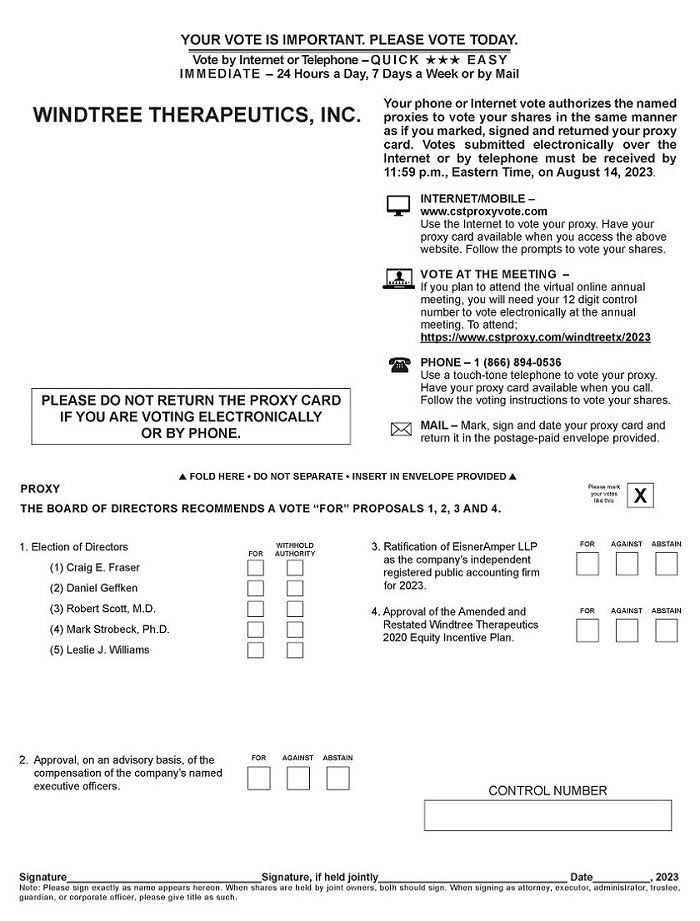

VOTING METHODS

You may vote at the SpecialAnnual Meeting by delivering a proxy card in personvia the Internet or you may cast your vote in any of the following ways:

|

|

| |

|

|

| |

Mailing your signed proxy card or voter instruction | Using the

|

https://www.cstproxy.com/windtreetx/ | Calling toll-free from the United States, U.S. territories and Canada to +1 (866) 894-0536 |

HOW YOUR SHARES WILL BE VOTED

In each case, your shares will be voted as you instruct. Unless otherwise provided on any applicable proxy or ballot with respect to the voting on the Reverse Stock Split Proposal or the Adjournment Proposal, when a holder of Common Stock submits a vote on the Reverse Stock Split Proposal and the Adjournment Proposal, the corresponding number of shares of Series A Preferred Stock (or fraction thereof) held by such holder will be automatically cast in the same manner as the vote of the share of Common Stock (or fraction thereof) in respect of which such share of Series A Preferred Stock (or fraction thereof) was issued as a dividend is cast on the Reverse Stock Split Proposal, or the Adjournment Proposal, and the proxy or ballot with respect to shares of Common Stock held by any holder on whose behalf such proxy or ballot is submitted will be deemed to include all shares of Series A Preferred Stock (or fraction thereof) held by such holder. If you return a signed card, but do not provide voting instructions, your shares will be voted FOR each of the proposals.proposals in Items 1, 2, 3 and 4. If you are the record holder of your shares, you may revoke or change your vote any time before the proxy is exercised. To do so, you must do one of the following:

Vote over the Internet as instructed above. Only your latest Internet vote is counted. You may not revoke or change your vote over the Internet after 11:59 p.m., Eastern Time, on , 2023.

Sign a new proxy card and submit it by mail, which must be received no later than , 2023. Only your latest dated proxy card will be counted.

Virtually attend the Special Meeting at https://www.cstproxy.com/windtreetx/sm2022. Virtually attending the Special Meeting will not by itself revoke a previously granted proxy

Give our Corporate Secretary written notice before or at the meeting that you want to revoke your proxy.

● | Vote over the internet or by telephone as instructed above. Only your latest internet or telephone vote is counted. You may not revoke or change your vote over the internet or by telephone after 11:59 p.m., Eastern time, on August 14, 2023; | |

● | Sign a new proxy card and submit it by mail, which must be received no later than August 14, 2023. Only your latest dated proxy card will be counted; | |

● | Virtually attend the Annual Meeting via live webcast by visiting https://www.cstproxy.com/windtreetx/2023. Virtually attending the Annual Meeting will not by itself revoke a previously granted proxy; or | |

● | Give our Corporate Secretary written notice before or at the meeting that you want to revoke your proxy. |

If your shares are held by your broker, bank or other holder of record as a nominee or agent (i.e.(i.e., the shares are held in “street name”), you should follow the instructions provided by your broker, bank or other holder of record.

Deadline for Voting. The deadline for voting by Internet,telephone or internet, other than by virtually attending the SpecialAnnual Meeting, is 11:59 p.m., Eastern Timetime on ,August 14, 2023. If you are a registered stockholder and virtually attend the SpecialAnnual Meeting, you may vote online duringat the SpecialAnnual Meeting.

|

BROKER VOTING AND VOTES REQUIRED FOR EACH PROPOSAL

If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of shares held in street name. The Notice of 2023 Special Meeting of Stockholders, (the “Notice”), has been forwarded to you by your broker, bank or other holder of record who is considered the stockholder of record of those shares. As the beneficial owner, you may direct your broker, bank or other holder of record on how to vote your shares by using the proxy card included in the materials made available or by following their instructions for voting on the Internet.internet.

GENERAL INFORMATION ABOUT THE MEETING (continued) |

A broker non-vote occurs when a broker or other nominee that holds shares for another does not vote on a particular item because the nominee does not have discretionary voting authority for that item and has not received instructions from the beneficial owner of the shares. The following table summarizes how broker non-votes, votes withheld, and abstentions are treated with respect to our proposals:

| Votes Required |

Abstentions, and Broker Non-Votes |

|

Voting | ||

|

|

|

| |||

|

|

| No | |||

Item 2: Approval, on an advisory basis, of the compensation of our named executive officers | Majority of the votes properly cast | Abstentions and broker non-votes have no effect on the outcome of the proposal | No | |||

Item 3: Ratification of appointment of EisnerAmper LLP as our Independent Registered Public Accounting Firm for 2023 | Majority of the votes properly cast | Abstentions and broker non-votes have no effect on the outcome of the proposal | Yes |

Proposal One:Approval of an amendment to the Charter to effect a reverse stock split of our outstanding shares of Common Stock by a ratio of any whole number between 1-for-20 and 1-for-50, the implementation and timing of which shall be subject to the discretion of the Board. The approval of the amendment to the Charter to effect a reverse stock split requires the affirmative votes of a majority of the combined voting power of the outstanding shares of Common Stock and Series A Preferred Stock, voting together as a single class, present in person or represented by proxy and entitled to vote on the proposal. The holders of Common Stock have the right to cast one (1) vote per share of Common Stock on this proposal. The holders of Series A Preferred Stock have the right to cast 1,000,000 votes per whole share of Series A Preferred Stock on this proposal.

ProposalTwo: Adjournment. The approval of the adjournment requires the affirmative vote of a majority of the votes cast by all stockholders present in person or represented by proxy at the Special Meeting and entitled to vote on the proposal.

| Majority of the votes properly cast | Abstentions and broker non-votes have no effect on the outcome of the proposal | No |

QUORUM AND APPROVAL

We must have a quorum to conduct business at the SpecialAnnual Meeting. A quorum consists of the presence at the Special Meetingmeeting either attending the meetingin person, virtually or represented by proxy of the holders of one-third (1/3) of the votes stockholders are entitled to cast at the Special Meeting, and such quorum must include at least one-third (1/3) of the votes represented by our Common Stock. Sharesshares of Series A Preferred Stock that are automatically redeemed in the Initial Redemption will not be counted towards the presence of a quorum or as part of thestock issued and outstanding shares of capital stock of the Companyand entitled to vote at our Special Meeting for purposes of determining the presence of a quorum.vote. For the purpose of establishing a quorum, broker non-votes andvotes withheld, abstentions, including brokers holding customers’ shares of record who cause abstentions to be recorded at the meeting, are considered stockholders who are presentAnnual Meeting, and entitled to vote, andbroker non-votes count toward the quorum. If there is no quorum, the holders of a majority of voting power virtuallyshares attending the SpecialAnnual Meeting virtually or represented by proxy or if no stockholder entitled to vote is present, then the chairman of the meeting, as determined by our Amended and Restated By-laws (the “Bylaws”),Annual Meeting may adjourn the Special Meetingmeeting to another date.

Each holder of one share of Common Stock that holds one one-thousandth (1/1,000th) of a share Series A Preferred Stock that is not redeemed in the Initial Redemption will have 1,001 votes with respect to the establishment of a quorum and the matters to be voted upon at the Special Meeting. Each holder of one share of Common Stock that holds one one-thousandth (1/1,000th) of a share Series A Preferred Stock that is redeemed in the Initial Redemption will have one vote with respect to the establishment of a quorum and the matters to be voted upon at the Special Meeting.

Shares of Series A Preferred Stock that are automatically redeemed in the Initial Redemption will not be counted towards the presence of a quorum or as part of the issued and outstanding shares of capital stock of the Company entitled to vote at the Company’s Special Meeting for purposes of determining the presence of a quorum or approval of the Reverse Stock Split Proposal. For illustrative purposes only, if the Company had 1,000,000 shares of Common Stock outstanding as of the Special Meeting record date, each with one vote per share, and 1,000 shares of Series A Preferred Stock, each with 1,000,000 votes per share, the total number of votes attributable to the Company’s capital stock would be 1,001,000,000. In this scenario, 333,666,667 votes (including one-third (1/3) of the voting power represented by our Common Stock) would be required to establish a quorum at the Special Meeting, and 500,500,001 votes would be required to approve the Reverse Stock Split Proposal. Further, if 500 shares of Series A Preferred Stock are redeemed in the Initial Redemption, the total number of votes attributable to the Company’s capital stock for purposes of the Special Meeting would be 501,000,000. In such scenario, 167,000,000 votes (including one-third (1/3) of the voting power represented by our Common Stock) would be required to establish a quorum at the Special Meeting, and 250,500,001 votes would be required to approve the Reverse Stock Split Proposal.

There were 38,610,119 shares of Common Stock and 38,610.119 shares of Series A Preferred Stock outstanding on the Record Date. If no shares of Series A Preferred Stock are redeemed in the Initial Redemption, (a) a quorum shall consist of the presence, virtually in person or by proxy, of at least (i) shares of Common Stock and Series A Preferred Stock representing 12,882,909,707 total votes, and (ii) 12,870,040 shares of Common Stock, (b) the Reverse Stock Split Proposal shall require the affirmative vote of at least 19,324,364,560 total votes, and (c) the Adjournment Proposal shall require a majority of the total votes cast. The thresholds required to approve the proposals at this Special Meeting shall be reduced proportionally as a result of any shares of Series A Preferred Stock redeemed in the Initial Redemption, however, in no event shall such Initial Redemption impact the requirement under Nasdaq Listing Rule 5620(c) that at least 33 1/3% of the Company’s Common Stock must be present, virtually in person or by proxy, to obtain a quorum.

PROXY SOLICITATION COSTS

We pay the cost of soliciting proxies. Proxies will be solicited on behalf of the Board by mail, telephone, and other electronic means or in person. Directors and employees will not be paid any additional compensation for soliciting proxies. We have engaged Morrow Sodali LLC to assist with the solicitation of proxies for an estimated fee of $10,500. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

Our Board has nominated Craig E. Fraser, Daniel Geffken, Robert Scott, M.D., Mark Strobeck, Ph.D. and Leslie J. Williams to be elected as directors at our Annual Meeting to hold office until our 2024 Annual Meeting of Stockholders. Our Board currently consists of five directors.

Our Board is the Company’s ultimate decision-making body, except with respect to those matters reserved to the stockholders. Our Board selects the members of our senior management team, who in turn are responsible for the day-to-day operations of the Company. Our Board acts as an advisor and counselor to senior management and oversees its performance.

Each of our current directors has been nominated by our Board for re-election at the Annual Meeting for one-year terms that will expire at the 2024 Annual Meeting of Stockholders and until their successors, if any, are elected or appointed, or their earlier death, resignation, retirement, disqualification or removal. Each of the nominees has agreed to be named and to serve, and we expect each nominee to be able to serve if elected. If any nominee is unable to serve, the Nominating and Corporate Governance Committee, or the Governance Committee, of our Board will recommend to our Board a replacement nominee. The Board may then designate the other nominee to stand for election. If you voted for the unavailable nominee, your vote will be cast for his or her replacement.

BOARD STRUCTURE AND COMPOSITION

The Governance Committee of our Board is responsible for recommending the composition and structure of our Board and for developing criteria for Board membership. The Governance Committee regularly reviews director competencies, qualities and experiences, with the goal of ensuring that our Board is comprised of an effective team of directors who function collegially and who are able to apply their experience toward meaningful contributions to our business strategy and oversight of our performance, risk management, organizational development and succession planning. The Governance Committee is also responsible for identifying individuals that it believes are qualified to become Board members.

Our Bylaws provide that the number of members of our Board shall be fixed by the Board from time to time. Our Board is currently fixed at five members.

SELECTION OF CANDIDATES

Our Board identifies director nominees by first evaluating the current members of our Board who are willing to continue in service. Current members with qualifications and skills that are consistent with our Board’s criteria for Board service are re-nominated. As to new candidates, our Board generally polls its members and members of our management for their recommendations. Our Board may also review the composition and qualification of the boards of our competitors and may seek input from industry experts or analysts. Our Board reviews the qualifications, experience and background of the candidates and, as discussed below, considers diversity in these areas among all the Board members. In making its determinations, our Board evaluates each individual in the context of the Board as a whole, with the objective of assembling a group that can best perpetuate our success and represent stockholder interests through the exercise of sound judgment. Any recommendations properly submitted by stockholders will be processed and are subject to the same criteria as any other candidates.

Each of the nominees included in this Proxy Statement and the enclosed proxy card(s) was recommended for inclusion by all of the members of our Board.

|

CRITERIA FOR BOARD MEMBERSHIP

The Governance Committee has identified certain criteria that it will consider in identifying director nominees. Important general criteria and considerations for Board membership include:

General Criteria | |||

Ability to contribute to the Board’s range of talent, skill and experience to provide sound and prudent guidance with respect to the Company’s strategy and operations, including, but not limited to: | |||

► | Experience in leadership roles in the life sciences, healthcare or public health fields, including experience in the areas of development and commercialization of drug products; | ||

► | Personal integrity and ethical character, commitment and independence of thought and judgment; | ||

► | Capability to fairly and equally represent our stockholders; | ||

► | Confidence and willingness to express ideas and engage in constructive discussion with other Board members and management, to actively participate in the Board’s decision-making process and make difficult decisions in the best interest of the Company and its stockholders; | ||

► | Diversity with respect to gender, age, race, ethnicity, background, professional experience and perspectives; | ||

► | Willingness and ability to devote sufficient time, energy and attention to the affairs of the Company and the Board; and | ||

► | Lack of actual and potential conflicts of interest. | ||

The Governance Committee also considers, on an ongoing basis, the background, experience and skills of the incumbent directors that are important to our current and future business needs, including, among others, the combined mix of experience in the following areas: technical, operational and/or economic knowledge of our business and industries; experience in operational, financial and/or administrative management; financial and risk management acumen; and experience in or familiarity with international business, markets and cultures, technological trends and developments, and corporate securities and tax laws. While a candidate may not possess every one of these qualifications, his or her background should reflect many of these qualifications.

BOARD COMMITMENT TO DIVERSITY

We do not have a formal policy regarding consideration of diversity in selecting the nominees for our Board; however, we seek to nominate Board members with a variety of complementary skills so that as a group, the Board will possess the appropriate talent, skills and expertise to oversee our business. As set forth above, the qualifications we look for in nominees for Board members (both new candidates and current Board members) include technical and operational knowledge of our business and industries; experience in operational, financial and/or risk management; familiarity with international business, markets and cultures; and expertise in the pharmaceutical industry, including research and development. Because not every nominee will possess all of these qualifications, our Board considers diversity in these factors when evaluating each nominee in the context of the Board as a whole.

The recently adopted listing rules of the Nasdaq Stock Market LLC, or Nasdaq, require each listed company to have, or explain why it does not have, two diverse directors on the board, including at least one diverse director who self-identifies as female and at least one diverse director who self-identifies as an underrepresented minority or LGBTQ+. Companies listed on the Nasdaq Capital Market must have at least one diverse director by December 31, 2023 and two diverse directors by December 31, 2026. Nasdaq provides flexibility for smaller reporting companies, which can meet the diversity objective by including two female directors, and for all companies with five or fewer directors, which can meet the diversity objective by including one diverse director.

As presently constituted, the Board represents a deliberate mix of members who have a deep understanding of our business as well as members who have different skill sets and points of view. The matrix below provides certain highlights of the composition of our Board members based on self-identification. Each of the categories listed in the matrix below has the meaning as it is used in Nasdaq Listing Rule 5605(f).

BOARD OF DIRECTORS |

Board Diversity Matrix | ||||

Total Number of Directors | 5 | |||

Female | Male | Non-Binary |

Did Not Disclose Gender

| |

Part I: Gender Identity | ||||

Directors | 1 | 4 | ||

Part II: Demographic Background | ||||

African American or Black | ||||

Alaskan Native or Native American | ||||

Asian | ||||

Asian American | ||||

Hispanic or Latinx | ||||

Native Hawaiian or Pacific Islander | ||||

White | 1 | 4 | ||

Two or More Races or Ethnicities | ||||

LGBTQ+ | ||||

Did Not Disclose Demographic Background | ||||

|

DIRECTOR CANDIDATES

On an ongoing basis, the Governance Committee considers potential director candidates identified on its own initiative as well as candidates referred or recommended to it by other directors, members of management, search firms, stockholders and others (including individuals seeking to join the Board). Stockholders who wish to recommend candidates may contact the Governance Committee in the manner described under the heading “Stockholder Communications to the Board” in this Proxy Statement. Stockholder nominations must be made according to the procedures required under our Bylaws and described in this Proxy Statement under the heading “Requirements for Submission of Stockholder Proposals for Next Year’s Annual Meeting.” Stockholder-recommended candidates and stockholder nominees whose nominations comply with these procedures and who meet the criteria referred to above will be evaluated by the Governance Committee in the same manner as the Governance Committee’s nominees.

Director | Committee Memberships | Other Current Public Company | ||||||

Name | Age | Since | Occupation | Independent | AC | CC | NCGC | Boards |

Craig E. Fraser | 58 | 2016 | Our President, Chief Executive Officer and Chairman | No | ⸺ | ⸺ | ⸺ | None |

Daniel Geffken | 66 | 2019 | Managing Partner of Danforth Advisors | Yes | C | M | ⸺ | None |

Robert Scott, M.D. | 69 | 2021 | Former Chief Medical Officer and Head of Development for AbbVie | Yes | ⸺ | C | M | None |

Mark Strobeck, Ph.D. | 52 | 2023 | Director, President and CEO of Rockwell Medical, Inc. | Yes | M | M | ⸺ | Rockwell Medical, Inc. |

Leslie J. Williams | 63 | 2021 | Director, President and CEO of hC Bioscience, Inc. | Yes | M | ⸺ | C | Ocular Therapeutix, Inc. |

AC = Audit Committee | C = Chair | |

CC = Compensation Committee | M = Member | |

NCGC = Nominating and Corporate Governance Committee |

In each of the director nominee biographies that follow, we highlight the specific experience, qualifications, attributes and skills that led the Board to conclude that the director nominee or continuing director should serve on our Board at this time.

BOARD OF DIRECTORS (continued) |

DIRECTOR NOMINEES

Craig E. Fraser (Chair) | ||

Age: 58 Director Since: 2016 | Committee Memberships: None. | Other Public Directorships: None. |

Mr. Fraser has served as President and Chief Executive Officer, or CEO, and a member of the Board since February 2016. He has also served as our Chairman since June 2023. He brings over 30 years of experience as a leader in drug development, fundraising, business development and commercial operations in building biopharmaceutical and device businesses for startups as well as larger companies. Prior to joining us, Mr. Fraser held executive positions at several biopharmaceutical companies, including Novelion as President and Chief Operating Officer from 2014 to 2015 and, prior to that, positions of increasing responsibility; as Vice President of Global Disease Areas at Pfizer from 2009 to 2011 and Vice President and Global Business Manager at Wyeth Pharmaceuticals from 2007 to 2009. Previously, Mr. Fraser served as Vice President, Sales & Marketing and Commercial Operations and as Vice President, Oncology Global Strategic Marketing at Johnson & Johnson; and as Gastroenterology Franchise Lead, National Sales Director - Immunology and Acute Cardiovasculars, and Marketing Director - Cardiovasculars and Diagnostics at Centocor and various sales and sales management positions prior to marketing roles. Mr. Fraser is a veteran of both the U.S. Marine Corps and the U.S. Army. Mr. Fraser does not serve on any other public company boards. Mr. Fraser received his B.S. degree in Public Administration from Slippery Rock University of Pennsylvania. | ||

Skills & Qualifications: | ||

Mr. Fraser’s knowledge of our business, as well as his extensive leadership and biopharmaceutical industry experience provide him with the qualifications and skills to serve on our Board. | ||

Daniel Geffken | ||

Age: 66 Director Since: 2019 | Committee Memberships: Audit (Chair) and Compensation | Other Public Directorships: None. |

Mr. Geffken has served as a member of our Board since April 2019 and also serves as Chair of the Audit Committee and as a member of the Compensation Committee. Since 2011, Mr. Geffken has been serving as the Founding Managing Partner of Danforth Advisors, a leading financial and strategy consulting firm to the life sciences industry. He has served as chief financial officer and strategic consultant to numerous companies, including Apellis Pharmaceuticals, Cidara Therapeutics, Cabaletta Bio, Homology Medicines, Stealth BioTherapeutics and Transkaryotic Therapies. Mr. Geffken has served on the Board of Elicio Bio, Alcobra Ltd. and Arcturus Inc., after its merger with Alcobra. Mr. Geffken earned his MBA from Harvard Business School, and his B.S. in Economics from the Wharton School. | ||

Skills & Qualifications: | ||

Mr. Geffken’s deep understanding of the industry in which we operate, in corporate financial management and his overall business acumen and insights provide him with the qualifications and skills to serve on our Board. | ||

BOARD OF DIRECTORS (continued) |

Robert Scott, M.D. | ||

Age: 69 Director Since: 2021 | Committee Memberships: Compensation (Chair) and Governance | Other Public Directorships: None. |

Dr. Scott has served as a member of our Board since February 2021 and also serves as Chair of the Compensation Committee and as a member of the Governance Committee. He has held leadership positions for over 30 years in the world’s leading biopharma companies, including J&J, Pfizer, Amgen and AbbVie. During that time, Dr. Scott has led development teams responsible for highly successful brands such as Norvasc®, Lipitor®, Repatha®, Humira®, Skyrizi® and Rinvoq™. Prior to his recent retirement as Chief Medical Officer and Head of Development for AbbVie, a research-based global biopharmaceutical company, in April 2020, Dr. Scott was responsible for a team of over 4,000 individuals across 52 countries, a budget of nearly US$3 billion and programs involving more than 40 new molecular entities since joining in April 2016. Prior to joining AbbVie, Dr. Scott served as Vice President of Global Development for Amgen from October 2010 to February 2016, where he conducted, among other programs, heart failure development. From 2002 until 2007, he was the Chief Medical Officer and Executive Vice President of Research and Development at AtheroGenics. While there he designed and implemented the first large cardiovascular outcomes study to be wholly performed by a small biotech. Dr. Scott also worked for Pfizer, one of the world’s premier biopharmaceutical companies, from 1992 to 2002. While there, he was intimately involved in many cardiovascular clinical trials. He also was integral in developing the cholesterol drug Lipitor® and Norvasc®, a drug used to treat high blood pressure. Dr. Scott has served on many committees and boards, including as a member of the FDA Cardiac and Renal Drug Advisory Committee from 2012 until 2016, the board of Transcelerate, and as a member of the PhRMA Research and Development Leadership Forum. Dr. Scott currently serves as a director for Redx Pharma, ArisGlobal, Confo Therapeutics, Oncospherix Inc. and Draupnir Bio, where he also sits on the remuneration committee. Dr. Scott received his BSc in Microbiology and Biochemistry and MbChB in Medicine from the University of Cape Town. | ||

Skills & Qualifications: | ||

Dr. Scott’s extensive experience leading large biopharmaceutical companies through several successful product developments provides him with the qualifications and skills to serve on our Board. | ||

BOARD OF DIRECTORS (continued) |

Mark Strobeck, Ph.D. | ||

Age: 52 Director Since: 2023 | Committee Memberships: Audit and Compensation | Other Public Directorships: Rockwell Medical, Inc. (RMTI) |

Mark Strobeck, Ph.D. has served as a member of our Board since June 2023 and also serves as a member of the Audit and Compensation Committees. Dr. Strobeck has also served as the President and CEO, and as a member of the board of directors, of Rockwell Medical, Inc., a biopharmaceutical company, since July 2022. Dr, Strobeck previously served as Managing Director of Aquilo Partners, LP, a life sciences investment bank, from May 2021 to June 2022. He previously served as Executive Vice President and Chief Operating Officer of Assertio Holdings, Inc., a pharmaceutical company, from May 2020 to December 2020. Prior to that, Dr. Strobeck was Executive Vice President and Chief Operating Officer of Zyla Life Sciences, a pharmaceutical company, from September 2015 through its merger with Assertio Holdings, Inc. in May 2020, and previously served as Zyla’s Chief Business Officer from January 2014 to September 2015. Before his employment at Zyla, he served as Zyla’s advisor from June 2012 to December 2013. From January 2012 to December 2013, he served as President and Chief Executive Officer and a director of Corridor Pharmaceuticals, Inc., a pharmaceuticals company, which was acquired by AstraZeneca plc in 2014. From December 2010 to October 2011, Dr. Strobeck served as Chief Business Officer of Topaz Pharmaceuticals Inc., a specialty pharmaceutical company acquired by Sanofi Pasteur in the fourth quarter of 2011. From June 2010 to November 2010 and October 2011 to January 2012, Dr. Strobeck worked as a consultant. From January 2008 to May 2010, Dr. Strobeck served as Chief Business Officer of Trevena, Inc., a pharmaceutical company. Prior to joining Trevena, Dr. Strobeck held management roles at GlaxoSmithKline plc, a pharmaceuticals company, and venture capital firms SR One Limited and EuclidSR Partners, L.P. Dr. Strobeck currently serves on the board of directors of Horse Power For Life, a nonprofit organization dedicated to improving the quality of life for individuals diagnosed with cancer, a position he has held since 2012. Dr. Strobeck received his B.S. in Biology from St. Lawrence University in 1993 and his Ph.D. in Pharmacology and Biophysics from the University of Cincinnati in 1999 and completed his post-doctoral fellowship in Cardiovascular Gene Regulation at the University of Pennsylvania School of Medicine in 2001. | ||

Skills & Qualifications: | ||

Dr. Strobeck’s extensive experience in the life sciences industry, scientific expertise and familiarity with public company boards provides him with the qualifications and skills to serve on our Board. | ||

BOARD OF DIRECTORS (continued) |

Leslie J. Williams (Lead Independent Director) | ||

Age: 63 Director Since: 2021 | Committee Memberships: Audit and Governance (Chair) | Other Public Directorships: Ocular Therapeutix, Inc. (OCUL) |

Ms. Williams has served as a member of our Board since February 2021 and also serves as our Lead Independent Director, and as Chair of the Governance Committee and as a member of the Audit Committee. She is a 25-year biopharmaceutical veteran and is an experienced biotech chief executive officer and board of directors’ member. She has experience in healthcare, management, commercial product development and marketing. In 2021, she founded hC Bioscience, Inc., a discovery stage biotech company, and serves as Director, President and Chief Executive Officer. Prior to this, she spent 10 years at ImmusanT, Inc., a clinical stage biotechnology company, and she served as Director, President & Chief Executive Officer of ImmusanT until 2019. Prior to that, she was President and Chief Executive Officer of Ventaira Pharmaceuticals since 2004 and under her leadership the company became a significant player in the pulmonary drug-delivery market until it was sold at the end of 2007. Prior to Ventaira, Ms. Williams was director of marketing for INO Therapeutics, Inc. and additional experience includes commercial positions at Merck and GSK, and drug-delivery and -monitoring experience at Datex-Ohmeda (formerly Ohmeda, Inc.). She was a venture partner at Battelle Ventures where she sourced and evaluated deals and assisted early-stage technology companies with strategy, management, business development and M&A. She has served on several private, public and non-profit boards. In addition to serving as Chief Executive Officer at hC Bioscience, she serves on the Board of Ocular Therapeutix, Inc. since 2019, Life Science Leader since 2011, CSCRI since 2018, and Life Science Cares since 2017. Ms. Williams holds an MBA from Washington University, John Olin School of Business, and a B.S. degree with honors in nursing from the University of Iowa. Before entering industry, she was a critical-care nurse at Duke University, Medical College of Virginia and at the University of Iowa. | ||

Skills & Qualifications: | ||

Ms. Williams’ insight into the biotechnology industry experience and familiarity with public life science company boards provides her with the qualifications and skills to serve on our Board. | ||

We are committed to good corporate governance and integrity in our business dealings. Our governance practices are documented in our Amended and Restated Certificate of Incorporation, or Charter, our Bylaws, our Code of Business Conduct and Ethics, or the Code of Conduct, and the charters of the committees of the Board, or collectively, the Committees. Aspects of our governance documents are summarized below. You can find our charters for each Committee and our Code of Conduct on our website www.windtreetx.com under “Investors-Corporate Governance.”

BOARD INDEPENDENCE

Our Board has undertaken a review of its composition, the composition of its committees and the independence of each director. Based upon information provided by each director, our Board has determined that each of our directors, and directors whom have served on our Board since the beginning of the 2022 fiscal year, with the exception of Mr. Fraser, does or did not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and is independent under the listing rules of Nasdaq. In making these determinations, our Board considered the current and prior relationships that each non-employee director has or had with our company and all other facts and circumstances our Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director, and the transactions involving them described in the section below titled “Certain Relationships and Related Party Transactions.”

BOARD LEADERSHIP STRUCTURE

Our Board is currently composed of five members. In accordance with our Bylaws, each director is elected at our Annual Meeting of Stockholders. Each director holds office until our next Annual Meeting of Stockholders and until his or her successors have been duly elected and qualified, or until such director’s death, or until such director shall have resigned, or have been removed.

We believe that the Board should remain free to configure the leadership of the Board and the Company in a way that best serves the interests of the Company and its stockholders at the time and, accordingly, has no fixed policy with respect to combining or separating the offices of the Chairman of the Board and the CEO. Effective as of June 22, 2023, our President and CEO, Craig E. Fraser, was appointed to serve as Chairman of our Board. Additionally, the Board appointed Leslie J. Williams to serve as lead independent director of the Board, effective as of June 22, 2023. The Board has chosen this structure because it believes Mr. Fraser serves as a bridge between management and the Board, ensuring that both groups act with a common purpose, while maintaining proper governance oversight through the appointment of a lead independent director. The Board considers the combined role to be appropriate as it promotes unified leadership, fosters strategic development and execution, and optimizes information flow between management and the Board. Accordingly, the Board believes, at this time, that the combined role of Chairman and CEO, together with a lead independent director and other independent directors, is in the best interest of stockholders, because it provides the appropriate balance between strategy development and independent oversight of management. Our Board will continue to evaluate its leadership structure in light of changing circumstances and will make changes at such times as it deems appropriate.

Lead Independent Director Responsibilities

In addition to the functions as discussed below, the Lead Independent Director’s responsibilities, include, among other things:

● | serving as liaison between the CEO and the non-employee directors; |

● | presiding at all meetings of the Board at which the Chair is not present; |

● | moderating executive sessions of the Board’s non-employee directors; and |

● | having the authority to call meetings of the non-employee directors. |

BOARD COMMITTEES

Our Board has established various Committees to assist in discharging its duties: the Audit Committee, the Compensation Committee and the Governance Committee. Each member of our Committees is an independent director as that term is defined by the U.S. Securities and Exchange Commission and Nasdaq. The primary responsibilities of each of the Committees and the Committee memberships are provided below under the section entitled “Board Attendance, Committee Meetings and Committee Membership.”

Each of the Committees has the authority, as its members deem appropriate, to engage legal counsel or other experts or consultants in order to assist the Committee in carrying out its responsibilities.

ROLE OF BOARD IN RISK OVERSIGHT

One of the key functions of our Board is to oversee our risk management process. Our Board does not have a standing risk management committee, but rather administers this oversight function directly through our Board as a whole, as well as through various standing committees of our Board that address the risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure and our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. While our Board maintains the ultimate oversight responsibility for the risk management process, its committees oversee risk in certain specified areas. For example:

● | Our Audit Committee oversees management of financial reporting, compliance and litigation risks, including risks related to our insurance, information technology and cybersecurity, human resources and regulatory matters, as well as the steps management has taken to monitor and control such exposures. |

● | Our Compensation Committee is responsible for overseeing the management of risks relating to our executive compensation policies, plans and arrangements and the extent to which those policies or practices increase or decrease risks for our company. |

● | Our Governance Committee manages risks associated with the independence of our Board, potential conflicts of interest and the effectiveness of our Board. |

EVALUATING BOARD EFFECTIVENESS

The Board is committed to continuous improvement and conducting annual self-evaluations as an important tool for evaluating effectiveness. The Board and each Committee conduct an annual self-evaluation of their performance and effectiveness.

CODE OF BUSINESS CONDUCT AND ETHICS

We have adopted a Code of Business Conduct and Ethics that applies to our officers, including our principal executive, financial and accounting officers, and our directors and employees. We have posted the Code of Business Conduct and Ethics on our Internet website at www.windtreetx.com under the “Investors—Corporate Governance” tab. We intend to make all required disclosures on our website concerning any amendments to, or waivers from, our Code of Business Conduct and Ethics with respect to our executive officers and directors.

DIRECTOR ORIENTATION AND CONTINUING EDUCATION

Our director orientation programs familiarize new directors with the Company’s businesses, strategies, and policies, and assist new directors in developing the skills and knowledge required for their service on the Board. All other directors are also invited to attend the orientation programs. From time to time, management advises, or invites outside experts to attend Board meetings to advise, the Board on its responsibilities, management’s responsibilities, developments relevant to corporate governance and best corporate practices. Additionally, Board members may attend, and are encouraged to attend, accredited director education programs at the Company’s expense.

RESTRICTIONS ON THE HEDGING AND PLEDGING OF WINDTREE SHARES

Pursuant to our Insider Trading Policy, which applies to all officers, all directors and all of our employees and any of our subsidiaries, or the Covered Individuals, the Covered Individuals are prohibited from purchasing securities or otherwise engaging in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of any equity security of Windtree or any such subsidiary. Covered Individuals are also prohibited from selling “short” any securities of those companies.

Covered Individuals are further prohibited from holding any equity securities of Windtree or any such subsidiary in a margin account or otherwise pledging such securities as collateral for a loan.

These prohibitions also apply to family members living in the same household as Covered Individuals, as well as entities influenced or controlled by the Covered Individuals.

CORPORATE GOVERNANCE AND RISK MANAGEMENT (continued) |

BOARD ATTENDANCE, COMMITTEE MEETINGS AND COMMITTEE MEMBERSHIP

Director | Independence | Board | AC | CC | NCGC |

Craig E. Fraser | No | M | ⸺ | ⸺ | ⸺ |

Daniel Geffken | Yes | M | C | M | ⸺ |

Robert Scott, M.D. | Yes | M | M | C | M |

Mark Strobeck, Ph.D.* | ⸺ | ⸺ | ⸺ | ⸺ | ⸺ |

Leslie J. Williams | Yes | M | M | ⸺ | C |

2022 Meetings | ⸺ | 7 | 4 | 1 | 0 |

AC = Audit Committee | C = Chair | |

CC = Compensation Committee | M = Member | |

NCGC = Nominating and Corporate Governance Committee | ||

* Dr. Strobeck did not serve as a member of the Board in 2022.

During 2022, each director attended at least 75% of the meetings of the Board and meetings of each Committee on which he or she served. Although we do not have a formal policy regarding attendance by members of our Board at our Annual Meeting, we encourage all of our directors to attend. Our Governance Committee did not meet separately in 2022, and the duties of the Governance Committee were carried out with the full Board.

Audit Committee

Our Audit Committee consists of Mr. Geffken, Dr. Strobeck and Ms. Williams, with Mr. Geffken serving as chair of our Audit Committee. Each member of our Audit Committee is an “independent director” as defined in Rule 5605(a)(2) of the Nasdaq Listing Rules and the financial sophistication requirements of the SEC rules. The Board has determined that each of Mr. Geffken and Dr. Strobeck is an “audit committee financial expert” as defined under SEC rules.

The primary purpose of the Audit Committee is to assist the Board in fulfilling its oversight responsibilities relating to our accounting, reporting and financial practices, and our compliance with all related legal and regulatory requirements, including, but not limited to, oversight of the:

● | appointment, retention and compensation of the Company’s independent auditor; |

● | maintenance by management of the reliability and integrity of the Company’s accounting policies, financial reporting and disclosure practices, and tax compliance; |

● | establishment and maintenance by management of processes to ensure that an adequate system of internal control is functioning within the Company; and |

● | establishment and maintenance by management of processes to ensure compliance by the Company with all applicable laws, regulations and Company policy. |

In addition, the Audit Committee is responsible for, among other things, the appointment, compensation and oversight of the work of our independent auditor or any registered public accounting firm engaged (including resolution of disagreements between management and the auditor regarding financial reporting), reviewing the range and cost of audit and non-audit services performed by our independent auditor, reviewing the adequacy of our systems of internal control, and reviewing all related party transactions. In discharging its role, the Audit Committee is empowered to investigate any matter brought to its attention and has full access to all our books, records, facilities and personnel. The Audit Committee also has the power to retain such legal, accounting and other advisors as it deems necessary to carry out its duties.

The Board has adopted a written Audit Committee Charter. The composition and responsibilities of the Audit Committee and the attributes of its members, as reflected in its Charter, are intended to be in accordance with certain listing requirements of Nasdaq and the rules of the SEC for corporate audit committees. The Audit Committee Charter may be found on our website at www.windtreetx.com under the “Investors-Corporate Governance” tab.

CORPORATE GOVERNANCE AND RISK MANAGEMENT (continued) |

Compensation Committee

Our Compensation Committee consists of Mr. Geffken, Dr. Scott and Dr. Strobeck, with Dr. Scott serving as chair of our Compensation Committee. Each member of this committee (i) meets the requirements for independence under the current Nasdaq Listing Rules, and (ii) is a non-employee director, as defined by Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended, or the Exchange Act.

The Compensation Committee is responsible for, among other things:

● | reviewing management of the Company’s policies regarding compensation policies relating to executive and general compensation; |

● | reviewing and approving corporate goals and objectives relating to the compensation of our CEO, executive officers and other senior officers, evaluate performance of executive officers and other senior officers and determine the CEO’s and other executive officers’ compensation level based on the Compensation Committee’s evaluation; |

● | reviewing and recommending the compensation of non-employee directors of the Board; and |

● | overseeing the key employee benefits programs, policies and plans relating to the compensation, benefits and equity incentives of the Company’s executives and, where deemed appropriate by the Compensation Committee, those programs, policies and plans relating to the Company’s other employees. |

The Board has adopted a written Compensation Committee Charter. The composition and responsibilities of the Compensation Committee, as reflected in its Charter, satisfy the applicable rules of the SEC and the listing requirements of Nasdaq. The Compensation Committee Charter may be found on our website at www.windtreetx.com under the “Investors-Corporate Governance” tab.

Our Compensation Committee has historically delegated authority to our CEO to grant options or other stock awards, in accordance with guidelines established by the Compensation Committee in consultation with our compensation consultant, to certain non-executive officers. Our Compensation Committee also has the authority to form and delegate authority to one or more subcommittees as it deems appropriate from time to time under the circumstances.