UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

TearLab Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials. | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

TEARLAB CORPORATION

9980 Huennekens St., Suite 100

San Diego, California 92121

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON OCTOBER 3,12, 2017

To the Stockholders of TearLab Corporation:

Notice is hereby given that a Special Meeting of the Stockholders (with any amendments, postponements or adjournments thereof, the “Special Meeting”) of TearLab Corporation, a Delaware corporation (“TearLab” or the “Company”) will be held on October 3,12, 2017 at 8:00 a.m., Central Time, for the following purposes:

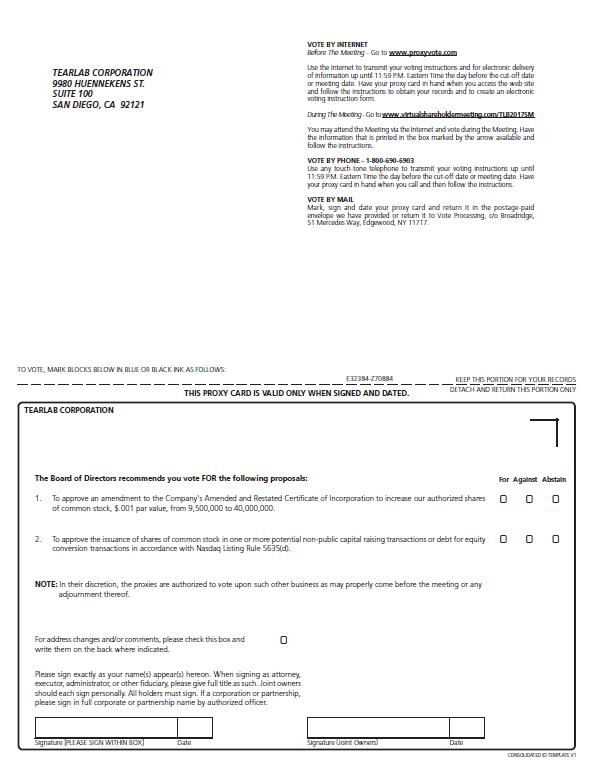

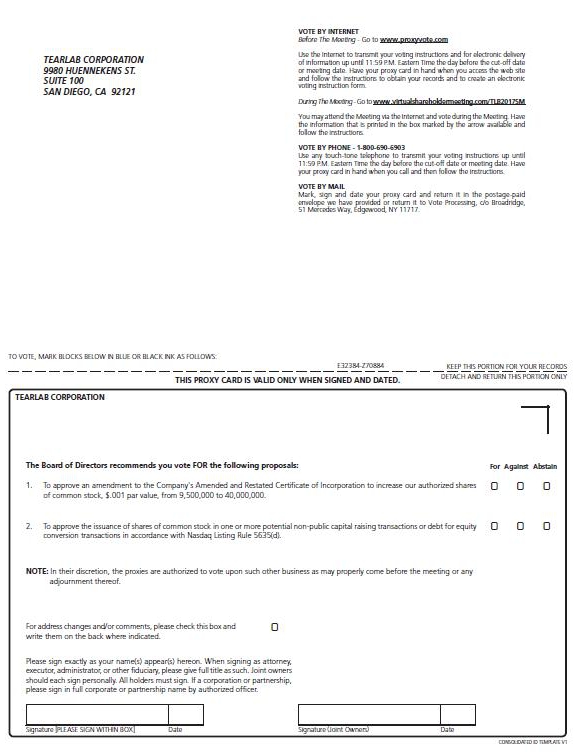

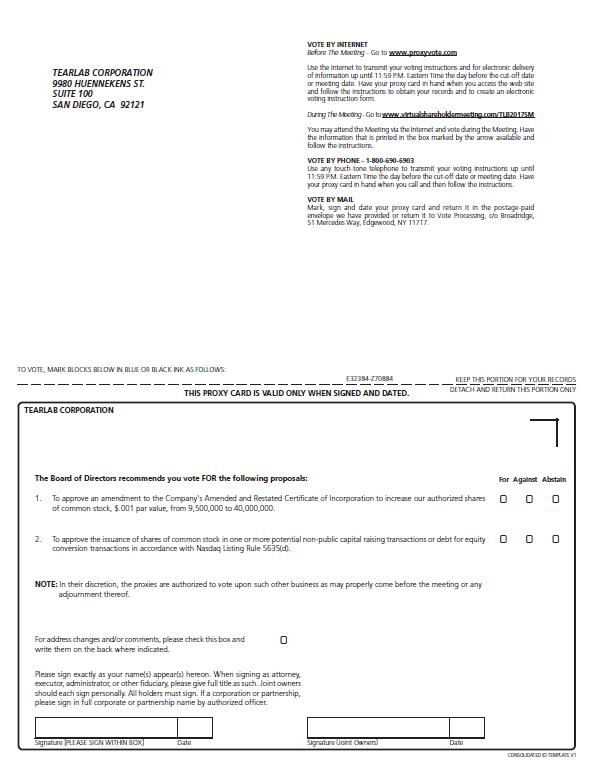

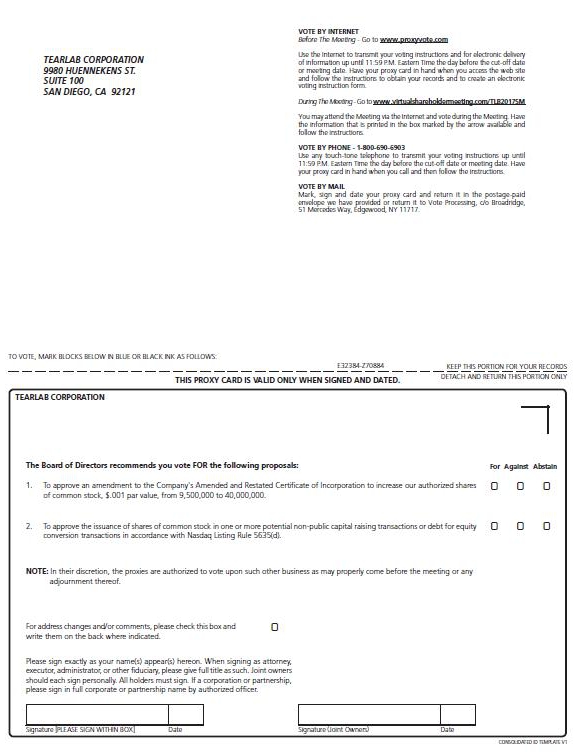

| 1. | To approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to increase our authorized shares of common stock, $.001 par value, from 9,500,000 to 40,000,000; | |

| 2. | To approve the issuance of shares of common stock in one or more potential non-public capital raising transactions or debt for equity conversion transactions in accordance with Nasdaq Listing Rule 5635(d); and | |

| 3. | To transact such other business as may be properly brought before the Special Meeting or any adjournment thereof. |

The Special Meeting will be a completely virtual meeting of stockholders, which will be conducted solely via live webcast. To participate, vote, or submit questions during the Special Meeting via live webcast, please visit www.virtualshareholdermeeting.com/TLB2017.You will not be able to attend the Special Meeting in person.

Details regarding how to attend the Special Meeting online and the business to be conducted at the Special Meeting are more fully described in the accompanying proxy statement.

Our Board of Directors has fixed the close of business on August 14,September 6, 2017, as the record date for the determination of stockholders entitled to notice of and to vote at our Special Meeting and at any adjournment or postponement thereof. Our proxy materials will be sent or given on ,or around September 13, 2017, to all stockholders as of the record date.

Whether or not you expect to attend our Special Meeting via live webcast, please complete, sign and date the Proxy you received in the mail and return it promptly. You may vote over the Internet, by telephone or by mailing a proxy or voting instruction card. You may also vote your shares during the Special Meeting. Please review the instructions on each of your voting options described in this proxy statement, as well as in the proxy card you received by mail.

All stockholders are cordially invited to attend the virtual meeting.

| By Order of the Board of Directors, | |

| San Diego, California | |

| | /s/ELIAS VAMVAKAS |

| Elias Vamvakas | |

| Executive Chairman of the Board |

YOUR VOTE IS VERY IMPORTANT, REGARDLESS OF THE NUMBER OF SHARES YOU OWN. PLEASE READ THE ATTACHED PROXY STATEMENT CAREFULLY, AND VOTE YOUR SHARES BY INTERNET, BY TELEPHONE, OR BY COMPLETING, SIGNING AND DATING THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE AND RETURNING IT IN THE ENCLOSED ENVELOPE.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting: The notice of special meeting and accompanying proxy statement is available to view at www.proxyvote.com

The date of this proxy statement is ,September 11, 2017 and it is being delivered to stockholders on or about ,September 13, 2017.

TEARLAB CORPORATION

9980 Huennekens St., Suite 100

San Diego, California 92121

PROXY STATEMENT

FOR THE SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON OCTOBER 3,12, 2017

The Board of Directors of TearLab Corporation (the “Board of Directors” or the “Board”) is soliciting proxies for the Special Meeting of Stockholders to be held on October 3,12, 2017. This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the meeting. Please read it carefully.

Our Board of Directors has set August 14,September 6, 2017 as the record date for the meeting. Stockholders who owned our common stock at the close of business on August 14,September 6, 2017 are entitled to vote at and attend the meeting, with each share entitled to one vote. On the record date, there were 5,742,453 shares of our common stock outstanding and no shares held by the Company in treasury stock. On the record date, the closing sale price of our common stock on The Nasdaq Capital Market was $2.17$1.317 per share.

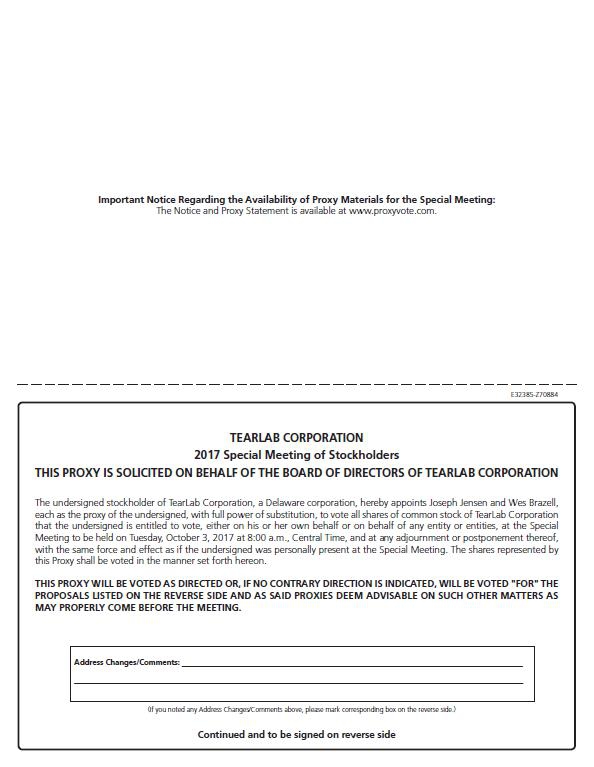

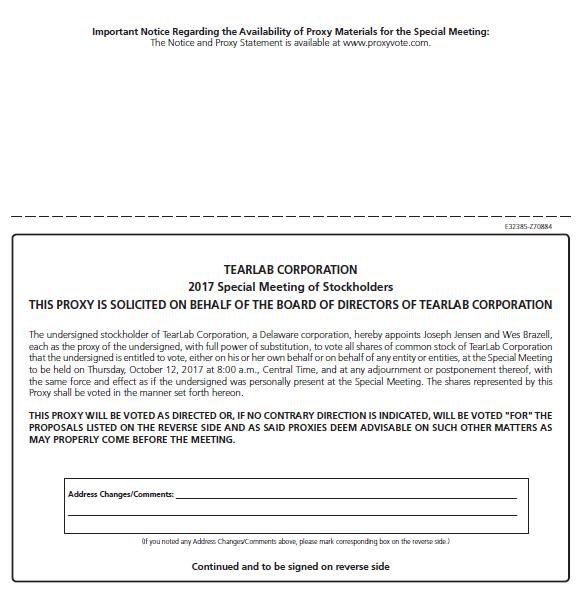

General

The enclosed proxy is solicited on behalf of the Board of Directors of TearLab Corporation, a Delaware corporation (“TearLab” or the “Company”), for use at the Special Meeting of Stockholders to be held on October 3,12, 2017 (the “Special Meeting”). These proxy solicitation materials are first being sent or made available on or about ,September 13, 2017, to all stockholders entitled to vote at the Special Meeting.

Voting

The specific proposals to be considered and acted upon at the Special Meeting are (i) to approve an amendment to the Company’s Amended and Restated Certificate of Incorporation (the “Amended and Restated Certificate”) to effect an increase in the number of authorized shares of the Company’s common stock from 9,500,000 to 40,000,000 with the effectiveness or abandonment of such amendment to be determined by the Board of Directors as permitted under Section 242(c) of the Delaware General Corporation Law (“Proposal One”) and (ii) to approve the issuance of securities in one or more potential non-public capital raising transactions or debt for equity conversion transactions where the maximum discount at which securities will be offered will be equivalent to a discount of 30% below the market price of our common stock, as required by and in accordance with Nasdaq Marketplace Rule 5635(d) (“Proposal Two”). On August 14,September 6, 2017, the record date for determination of stockholders entitled to notice of, and to vote at, the Special Meeting (the “Record Date”), there were 5,742,453 shares of our common stock outstanding, no shares held by the Company in treasury stock, and no shares of our preferred stock outstanding.

Each stockholder is entitled to one vote for each share of common stock held by such stockholder on the Record Date. The presence, in person or by proxy, of holders of a majority of our shares entitled to vote is necessary to constitute a quorum at the Special Meeting. The affirmative vote of a majority of the shares outstanding and entitled to vote as of the Record Date is required to approve Proposal One. As a result, abstentions, broker non-votes and the failure to submit a proxy or vote in person at the Special Meeting will have the same effect as a vote against Proposal One. Nasdaq Marketplace Rule 5635(e) requires the affirmative vote of a majority of the votes cast in person or by proxy to approve Proposal Two. Abstentions will be counted toward the vote total for Proposal Two and will have the same effect as a vote against Proposal Two. Because Proposal Two is a non-routine matter, broker non-votes will not be counted as votes cast on Proposal Two and therefore will not affect the outcome of Proposal Two.

All votes will be tabulated by the inspector of election appointed for the Special Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum for the transaction of business.

Proxies

If the form of proxy card is properly signed and returned or if you properly follow the instructions for telephone or Internet voting, the shares represented thereby will be voted at the Special Meeting in accordance with the instructions specified thereon. If you sign and return your proxy without specifying how the shares represented thereby are to be voted, the proxy will be voted as recommended by the Board of Directors. You may revoke or change your proxy at any time before the Special Meeting by filing with our Corporate Secretary at our principal executive offices at 9980 Huennekens St., Suite 100, San Diego, California 92121, a notice of revocation or another signed proxy with a later date. You may also revoke your proxy by attending the Special Meeting and voting in person.

| -1- |

Costs of Proxy Solicitation

We will pay the costs and expenses of soliciting proxies from stockholders. Certain of our officers, employees, and representatives may solicit proxies from the Company’s stockholders in person or by telephone, email, or other means of communication. Our directors, officers, employees, and representatives will not be additionally compensated for any such solicitation, but may be reimbursed for reasonable out-of-pocket expenses they incur. Arrangements will be made with brokerage houses, custodians, and other nominees for forwarding of proxy materials to beneficial owners of shares of our common stock held of record by such nominees and for reimbursement of reasonable expenses they incur.

Deadline for Receipt of Stockholder Proposals for 2018 Annual Meeting

Pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, as amended, proposals of our stockholders that are intended to be presented by such stockholders at this Special Meeting and that such stockholders desire to have included in our proxy materials relating to such meeting must be received by us at our offices at 9980 Huennekens St., Suite 100, San Diego, California 92121, Attn: Corporate Secretary, no later than January 5, 2018, which is 120 calendar days prior to the anniversary of the mailing date of the proxy materials relating to our 2017 annual meeting. Such proposals must be in compliance with applicable laws and regulations in order to be considered for possible inclusion in the proxy statement and form of proxy for that meeting.

Pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, as amended, proposals of our stockholders that are intended to be presented by such stockholders at our 2018 annual meeting and that such stockholders desire to have included in our proxy materials relating to such meeting must be received by us at our offices at 9980 Huennekens St., Suite 100, San Diego, California 92121, Attn: Corporate Secretary, no later January 5, 2018, which is 120 calendar days prior to the anniversary of the mailing date of the proxy materials relating to our 2017 annual meeting. Such proposals must be in compliance with applicable laws and regulations in order to be considered for possible inclusion in the proxy statement and form of proxy for that meeting.

A stockholder who wishes to make a proposal at our 2018 Annual Meeting of Stockholders without including the proposal in our proxy statement and form of proxy relating to that meeting must notify us no later than March 23, 2018, unless the date of the 2018 annual meeting is more than 30 days before or after the one-year anniversary of the 2017 annual meeting. If the stockholder fails to give notice by this date, then the persons named as proxies in the proxies solicited by the Board of Directors for the 2018 annual meeting may exercise discretionary voting power regarding any such proposal.

| -2- |

QUESTIONS AND ANSWERS

Although we encourage you to read the enclosed proxy statement in its entirety, we include this Question and Answer section to provide some background information and brief answers to several questions you might have about the Special Meeting.

Q: Why am I receiving this proxy statement?

A: This proxy statement describes the proposals on which we would like you, as a stockholder, to vote. It also gives you information on the issues so that you can make an informed decision.

Q: How do I get electronic access to the proxy materials?

A: The notice of special meeting and proxy statement are available at www.proxyvote.com

Q: What proposals am I being asked to consider at the upcoming Special Meeting of Stockholders?

A. We are seeking approval of two proposals:

| (1) | Proposal One: the approval of an amendment to our Amended and Restated Certificate of Incorporation to increase the number of authorized shares of the Company’s common stock, $.001 par value, from 9,500,000 to 40,000,000. Approval of the proposal would give the Board of Directors authority to amend the Amended and Restated Certificate of Incorporation to increase the number of authorized shares of common stock to 40,000,000 shares, an increase of 30,500,000 shares, as well as provide the Board authority to issue additional shares without requiring future stockholder approval of such issuances, except as may be required by applicable law or rules of any stock exchange on which our securities may be listed; and | |

| (2) | Proposal Two: the Board is seeking advance stockholder approval as required by NASDAQ Rule 5636(d) (the “Nasdaq Rule,” as described in Proposal Two) to enable the Company to issue shares of common stock in one or more capital raising transactions or debt for equity conversion transactions and to provide the Board with the flexibility to enter into and close such transactions on a timely basis. Specifically the Board is seeking approval of an issuance or issuances not to exceed 20,000,000 shares of common stock (including pursuant to preferred stock, options, warrants, convertible debt or other securities exercisable for or convertible into common stock), at a maximum discount of 30% below the market price of our common stock at the time of issuance, within the three month period commencing on the date of approval by the stockholders in accordance with the Nasdaq Rule and upon such terms as the Board shall deem to be in the Company’s best interest. |

We will also transact any other business that properly comes before the meeting.

Q. Why is TearLab seeking to increase the number of authorized shares of common stock?

A. The increase in the number of authorized shares of common stock is being proposed to allow the Company to raise additional capital to fund its operations, including the expected launch of its next generation TearLab Discovery™ System as well as to improve our flexibility in responding to future business opportunities. The additional shares are also needed for the Company to continue progress on its revised compliance plan submitted to the Nasdaq Panel (the Panel) whereby the Company is attempting to regain compliance with Nasdaq listing rules requiring a minimum stockholder equity of $2.5 million. The additional authorized shares will be available for issuance from time to time to enable us to respond to future business opportunities requiring the issuance of shares, the consummation of common stock-based financings, acquisition or strategic joint venture transactions involving the issuance of common stock, or for other general purposes that the Board may deem advisable. We are seeking approval for the amendment at this time because opportunities requiring prompt action may arise in the future, and the Board believes the delay and expense in seeking approval for additional authorized common stock at a special meeting of shareholders could deprive us of the ability to take advantage of potential opportunities.

Without an increase in the number of authorized shares of common stock, the Company may be constrained in its ability to raise capital, may not comply with its debt covenants and may lose important business opportunities, which could adversely affect our financial performance and growth.

In addition, on August 21, 2017, the Company filed a registration statement on Form S-1 related to a potential underwritten public offering of equity securities of the Company. Unless we increase the number of authorized shares of common stock, at our current market price we would not have sufficient unissued and unreserved shares of common stock available to issue in order to raise the amount of capital listed in the registration statement.

Q. If the stockholders approve this proposal, when would the Company implement the increase in the number of authorized shares?

A. We currently expect that the increase in the number of authorized shares will be implemented as soon as practicable after the receipt of the requisite stockholder approval. However, our Board of Directors will have the discretion to abandon the increase in authorized shares if the Board does not believe it to be in the best interests of TearLab and our stockholders.

| -3- |

Q. Why is TearLab seeking advanced stockholder approval for the issuance of additional shares of common stock?

A. The Board is seeking advance stockholder approval as required by NASDAQ Rule 5636(d) (the “Nasdaq Rule,” as described below) to enable the Company to issue shares of Common Stock in one or more capital raising transactions or debt conversion transactions and to provide the Board with the flexibility to enter into and close such capital raising transactions on a timely basis. The Nasdaq Rule requires stockholder approval prior to an issuance of securities in connection with a transaction other than a public offering involving the sale, issuance or potential issuance by a company of common stock equal to 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance for less than the greater of book and market value of our common stock as of the time of execution of the definitive agreement with respect to such transaction. The per share price of our common stock for which we obtain future commitments, if any, in connection with a potential private placement is likely to be less than the greater of book or market value currently. As a result, the Company is seeking advance stockholder approval for the sale and issuance of such shares in connection with potential capital raising transactions or debt conversion transactions pursuant to the Nasdaq Rule. We may seek to raise additional capital to implement our business strategy and enhance our overall capitalization. In addition, we will seek to raise additional capital and/or convert a portion of our outstanding debt to equity to evidence compliance with the Nasdaq listing standards as part of our compliance plan submitted to the Panel. We have not determined the particular terms for such prospective offerings. Because we may seek additional capital that triggers the requirements of the Nasdaq Rule, we are seeking stockholder approval now, so that we will be able to move quickly to take full advantage of any opportunities that may develop in the equity markets.

Q. Who can vote at the Special Meeting?

A. Our Board of Directors has set August 14,September 6, 2017 as the record date for the Special Meeting. All stockholders who owned TearLab common stock at the close of business on August 14,September 6, 2017 may attend and vote at the Special Meeting. Each stockholder is entitled to one vote for each share of common stock held as of the record date on all matters to be voted on. Stockholders do not have the right to cumulate votes. On August 14,September 6, 2017, there were 5,742,453 shares of our common stock outstanding. Shares held as of the record date include shares that are held directly in your name as the stockholder of record and those shares held for you as a beneficial owner through a broker, bank or other nominee.

Q. What is the difference between holding shares as a stockholder of record and as a beneficial owner?

A: Most stockholders of TearLab hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholders of record — If your shares are registered directly in your name with TearLab’s transfer agent, Computershare, you are considered the stockholder of record with respect to those shares and the proxy materials have been sent directly to you. As the stockholder of record, you have the right to grant your voting proxy directly to TearLab or to vote in person at the Special Meeting.

Beneficial owners — If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and the proxy materials have been forwarded to you by your broker, bank or other nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote and are also invited to attend the Special Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Special Meeting unless you request a “legal proxy” from the broker, bank or other nominee who holds your shares, giving you the right to vote the shares at the Special Meeting.

Q: Who counts the votes?

A: Voting results are tabulated and certified by Broadridge Financial Solutions, Inc.

Q. How can I vote my shares in person at the Special Meeting?

A. Shares held directly in your name as the stockholder of record may be voted in person at the Special Meeting. If you wish to vote at the Special Meeting, please review the instructions regarding how to connect and participate live via the Internet webcast, including how to demonstrate proof of stock ownership at www.virtualshareholdermeeting.com/TLB2017. Even if you plan to attend the Special Meeting, TearLab recommends that you vote your shares in advance as described below so that your vote will be counted if you later decide not to attend the Special Meeting. If you hold your shares in street name, you must request a legal proxy from your broker, bank or other nominee in order to vote in person at the Special Meeting.

| -4- |

Q: How can I vote my shares without attending the Special Meeting?

A: Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the Special Meeting. If you are a stockholder of record, you may vote by submitting a proxy; please refer to the voting instructions in the enclosed proxy card or below. If you hold shares beneficially in street name, you may vote by submitting voting instructions to your broker, bank or other nominee; please refer to the voting instructions provided to you by your broker, bank or other nominee.

| ● | Internet—Stockholders of record with Internet access may submit proxies by following the “Vote by Internet” instructions on the Notice until 11:59 p.m., Eastern Time, on, October | |

| ● | Telephone— You may submit your vote by telephone by following the instructions on the enclosed proxy card. | |

| ● | Mail— You may indicate your vote by completing, signing and dating the proxy card or voting instruction form where indicated and by returning it in the provided prepaid envelope. |

| -5- |

Q. What happens if I do not cast a vote?

A.Stockholders of record — If you are a stockholder of record and you do not cast your vote, no votes will be cast on your behalf on any of the items of business at the Special Meeting. However, if you submit a signed proxy card with no further instructions, the shares represented by that proxy card will be voted as recommended by our Board of Directors.

Beneficial owners — If you are a beneficial owner and you do not provide your broker, bank or other nominee that holds your shares with voting instructions, then your broker, bank or other nominee will determine if it has discretion to vote on each matter. Brokers do not have discretion to vote on non-routine matters. Proposal One and Proposal Two are each non-routine matters. As a result, if you do not provide voting instructions to your broker, bank or other nominee, then your broker, bank or other nominee may not vote your shares with respect to Proposal One or Proposal Two, which would result in a “broker non-vote” on each proposal..

Q. How can I change or revoke my vote?

A. Subject to any rules your broker, bank or other nominee may have, you may change your proxy instructions at any time before your proxy is voted at the Special Meeting.

Stockholders of record — If you are a stockholder of record, you may change your vote by (1) filing with our Corporate Secretary, prior to your shares being voted at the Special Meeting, a written notice of revocation or a duly executed proxy card, in either case dated later than the prior proxy relating to the same shares, or (2) attending the Special Meeting and voting in person (although attendance at the Special Meeting will not, by itself, revoke a proxy). Any written notice of revocation or subsequent proxy card must be received by our Corporate Secretary prior to the taking of the vote at the Special Meeting. Such written notice of revocation or subsequent proxy card should be hand delivered to our Corporate Secretary or should be sent so as to be delivered to our principal executive offices, Attention: Corporate Secretary.

Beneficial owners — If you are a beneficial owner of shares held in street name, you may change your vote by (1) submitting new voting instructions to your broker, bank or other nominee, or (2) attending the Special Meeting and voting in person if you have obtained a legal proxy giving you the right to vote the shares from the broker, bank or other nominee who holds your shares.

In addition, a stockholder of record or a beneficial owner who has voted via the Internet or by telephone may also change his, her or its vote by making a timely and valid later Internet or telephone vote no later than 11:59 p.m., Eastern Time, on October 2,11, 2017.

Q: What is a proxy card?

A: The proxy card enables you to appoint Joseph Jensen and Wes Brazell, with full power of substitution, who we refer to as the proxyholders, as your representatives at the Special Meeting. By completing and returning the proxy card, you are authorizing the proxyholders to vote your shares at the meeting, as you have instructed them on the proxy card. Even if you plan to attend the meeting, it is a good idea to complete, sign and return your proxy card or vote by proxy via the Internet or telephone in advance of the meeting just in case your plans change. You can vote in person at the meeting even if you have already sent in your proxy card.

If a proposal comes up for vote at the meeting that is not on the proxy card, the proxyholders will vote your shares, under your proxy, according to their best judgment.

Q. What if I return my proxy card but do not provide voting instructions?

A. Proxies that are signed and returned but do not contain instructions will be voted “FOR” Proposal One and “FOR” Proposal Two.

Q. If I hold shares through a broker, how do I vote them?

A. Your broker should have forwarded instructions to you regarding the manner in which you can direct your broker as to how you would like your shares to be voted. If you have not received these instructions or have questions about them, you should contact your broker directly.

Q. What does it mean if I receive more than one proxy card?

A. It means that you have multiple accounts with brokers and/or our transfer agent, Computershare. Please vote all of these shares. We recommend that you contact your broker and/or our transfer agent to consolidate as many accounts as possible under the same name and address.

| -6- |

Q. How may I obtain a separate set of proxy materials?

A: If you share an address with another stockholder, each stockholder may not receive a separate copy of the proxy materials. Stockholders who do not receive a separate copy of the proxy materials may request to receive a separate copy of the proxy materials by contacting our Investor Relations department (i) by mail at 9980 Huennekens St., Suite 100, San Diego, California 92121, (ii) by calling us at (858) 455-6006, or (iii) by sending an email to lroth@theruthgroup.com. Alternatively, stockholders who share an address and receive multiple copies of our proxy materials may request to receive a single copy by following the instructions above.

Q: What is a “broker non-vote”?

A: A broker non-vote occurs when a broker holding shares in street name does not vote on a particular proposal because the broker does not have discretionary voting power with respect to that proposal and has not received instructions from the beneficial owner. In order to effect the increase of authorized shares of common stock contemplated by Proposal One, Delaware law requires the approval of the holders of a majority of TearLab’s outstanding shares of common stock, and not merely the approval of a majority of the shares represented in person and by proxy at the Special Meeting. Therefore, a broker non-vote will count as a vote against Proposal One. Nasdaq Marketplace Rule 5635(e) requires the affirmative vote of a majority of the votes cast in person or by proxy to approve the issuance of securities in one or more non-public offerings contemplated by Proposal Two. Because Proposal Two is a non-routine matter, broker non-votes will not be counted as votes cast on Proposal Two and, therefore, will not affect the outcome of Proposal Two.

Q. How many votes must be present to hold the meeting?

A. Your shares are counted as present at the meeting if you attend the meeting and vote in person or if you properly return a proxy by Internet, telephone or mail. In order for us to conduct the meeting, a majority of our outstanding shares of common stock as of August 14,September 6, 2017 must be present in person or by proxy at the meeting. This is referred to as a quorum.

Q. How are different votes treated for purposes of establishing a quorum and determining whether the proposal has passed?

A. Shares that are voted “FOR,” “AGAINST” or “ABSTAIN” are treated as being present at the meeting for purposes of establishing a quorum and are also treated as shares entitled to vote at the meeting with respect to the proposal. Abstentions will have the same effect as a vote against both Proposal One and Proposal Two. Broker non-votes are counted for the purpose of determining the presence or absence of a quorum. Broker non-votes will have the same effect as a vote against Proposal One and will have no effect on the outcome of Proposal Two.

Q. Why is my vote important?

A. Your vote is important because Proposal One must receive the affirmative vote of a majority of shares outstanding in order to pass and Proposal Two must receive the affirmative vote of a majority of the votes cast in order to pass. Also, unless a majority of the shares outstanding as of the record date are voted or present at the meeting, we will not have a quorum, and we will be unable to transact any business at the Special Meeting. In that event, we would need to adjourn the meeting until such time as a quorum can be obtained.

Q: Who is soliciting my vote?

A: We will pay the costs and expenses of soliciting proxies from stockholders. Broadridge Financial Solutions, Inc. will tabulate the votes and act as inspector of the election. Certain of our officers, employees, and representatives may solicit proxies from the Company’s stockholders in person or by telephone, email, or other means of communication. Our directors, officers, employees, and representatives will not be additionally compensated for any such solicitation, but may be reimbursed for reasonable out-of-pocket expenses they incur. Arrangements will be made with brokerage houses, custodians, and other nominees for forwarding of proxy materials to beneficial owners of shares of our common stock held of record by such nominees and for reimbursement of reasonable expenses they incur.

| -7- |

PROPOSAL ONE

APPROVAL OF A PROPOSED AMENDMENT TO THE

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

TO INCREASE OUR AUTHORIZED SHARES OF COMMON STOCK

OVERVIEW

Our Certificate of Incorporation (the “Certificate”) currently authorizes us to issue a total of 9,500,000 shares of common stock, $0.001 par value, and 10,000,000 shares of preferred stock, $0.01 par value. Our Board of Directors has approved, and is seeking stockholder approval of, an amendment to our Certificate of Incorporation (the “Amendment”) to implement an increase in the number of shares of authorized common stock, $0.001 par value, from 9,500,000 shares to 40,000,000.

The Board is proposing the Amendment, in substantially the form attached hereto as Appendix A, to increase the number of authorized shares of our common stock from 9,500,000 shares to 40,000,000 shares. Of the 9,500,000 shares of common stock currently authorized by the Certificate, as of August 14,September 6, 2017, 5,742,453 shares are issued and outstanding, 1,324,000 shares are reserved for issuance upon exercise of existing stock purchase warrants, 567,941 shares are reserved for future issuance under existing equity incentive awards and 28,601 are reserved for purchases under the Company’s Employee Stock Purchase Plan. Therefore, we currently have limited authorized shares of common stock available for future issuance.

The Board has unanimously determined that the Amendment is advisable and in the best interests of the Company and our stockholders, and recommends that our stockholders approve the Amendment. In accordance with the General Corporation Law of the State of Delaware, we are hereby seeking approval of the Amendment by our stockholders.

No changes to the Certificate are being proposed with respect to the number of authorized shares of preferred stock. Other than the proposed increase in the number of authorized shares of common stock, the Amendment is not intended to modify the rights of existing stockholders in any material respect. The additional shares of common stock to be authorized pursuant to the proposed amendment will be of the same class of common stock as is currently authorized under our Certificate of Incorporation.

Under the Delaware General Corporation Law, our stockholders are not entitled to appraisal rights with respect to the proposed amendment to our Certificate of Incorporation to increase the number of authorized shares of common stock, and we will not independently provide stockholders with any such rights.

REASONS FOR THE AMENDMENT

The Company recently conducted an extensive and thorough strategic review of the alternatives available to it that included a broad marketing effort to solicit interest in a sale or other transaction to maximize value for all shareholders. During the process, TearLab received expressions of interest relating to a variety of potential transactions including interest to both acquire and invest in the Company. After careful consideration, the Company’s board of directors determined that the interests of the Company’s stockholders are best served by focusing on execution of the Company’s strategic business plan. The Company may from time-to-time receive indications of interest and have discussions regarding possible strategic alternatives, and intends to consider proposals it receives in the future that it believes could result in the creation of stockholder value. However, the Company is now focused on executing its strategic business plan which will require additional capital to fund its operations, provide the appropriate resources to launch its next generation platform and comply with its debt covenants.

The Board of Directors believes that the proposed increase in the number of authorized shares of common stock will benefit the Company by providing the shares needed to raise additional capital to execute its business plan as well as improving our flexibility in responding to future business opportunities. The additional authorized shares will be available for issuance from time to time to enable us to respond to future business opportunities requiring the issuance of shares, the consummation of common stock-based financings, acquisition or strategic joint venture transactions involving the issuance of common stock, or for other general purposes that the Board may deem advisable. We are seeking approval for the amendment at this time because opportunities requiring prompt action may arise in the future, and the Board believes the delay and expense in seeking approval for additional authorized common stock at a special meeting of shareholders could deprive us of the ability to take advantage of potential opportunities.

| -8- |

Without an increase in the number of authorized shares of common stock, the Company may be constrained in its ability to raise capital, may not be able to fund its operations, may not comply with its debt covenants and may lose important business opportunities, which could adversely affect our financial performance and growth. In addition, the Company would not be able to execute the compliance plan submitted to the Nasdaq Panel to regain compliance with minimum Nasdaq listing requirements.

In addition, on August 21, 2017, the Company filed a registration statement on Form S-1 related to a potential underwritten public offering of equity securities of the Company. Unless our stockholders approve this proposal and the Amendment to increase the number of authorized shares of common stock, at our current market price we would not have sufficient unissued and unreserved shares of common stock available to issue in order to raise the amount of capital listed in the registration statement.

In determining the size of the proposed authorized share increase, the Board considered a number of factors, including the amount of capital needed to fund its operations and launch its next generation platform, the potential terms needed to raise additional capital including the potential issuance of warrants to purchase common stock associated with equity financings and that over a number of years the Company may potentially need additional shares in connection with future equity transactions, acquisitions or other strategic transactions. If the stockholders do not approve the Proposal, then the Company will not have the needed additional shares available to raise the capital to execute its business plan and it may default on its debt covenants in the future.

While this Proposal One is intended to facilitate the Company regaining compliance with Nasdaq listing standards, even if the Company is successful in increasing the number of authorized shares available and can pursepursue the capital raising transaction(s) contemplated in Proposal Two, or via the Form S-1 registration statement, there can be no assurance that the Company will regain compliance with the Nasdaq minimum listing standards or that the Company’s common stock will continue to be listed on The Nasdaq Capital Market.

The Board of Directors does not intend to issue any common stock except on terms which the Board deems to be in the best interests of the Company and its then existing stockholders.

POTENTIAL EFFECTS OF THE AMENDMENT

The proposed increase in the number of authorized shares of common stock will not have any immediate effect on the rights of our existing stockholders. The Board will have the authority to issue the additional shares of common stock without requiring future stockholder approval of such issuances, except as may be required by applicable law or rules of any stock exchange on which our securities may be listed. The issuance of additional shares of common stock will decrease the relative percentage of equity ownership of our existing stockholders, thereby diluting the voting power of their common stock, and, depending on the price at which additional shares may be issued, could also be dilutive to the earnings per share of our common stock.

It is possible that a subsequent issuance of these shares could have the effect of delaying or preventing a change in control of the Company. Shares of authorized and unissued common stock could, within the limits imposed by applicable law, be issued in one or more transactions that would make a change in control of the Company more difficult, and therefore, less likely. Issuances of additional shares of our stock could dilute the earnings per share and book value per share of our outstanding common stock and dilute the stock ownership or voting rights of a person seeking to obtain control of the Company. While it may be deemed to have potential anti-takeover effects, the proposal to increase the authorized common stock is not prompted by any specific effort of which we are aware to accumulate shares of our common stock or obtain control of the Company.

The additional authorized shares of common stock, if and when issued, would be part of the existing class of common stock and would have the same rights and privileges as the shares of common stock currently outstanding. Stockholders do not have preemptive rights with respect to our common stock. Therefore, should the Board determine to issue additional shares of common stock, existing stockholders would not have any preferential rights to purchase such shares in order to maintain their proportionate ownership thereof.

EFFECTIVENESS OF AMENDMENT

If the Amendment is approved by our stockholders, it will become effective upon the filing of an amendment to our Certificate of Incorporation, which filing is expected to occur promptly after stockholder approval of this proposal. The text of Appendix A remains subject to modification to include such changes as may be required by the Secretary of State of the State of Delaware and as the Board deems necessary or advisable to implement the increase in our authorized shares.

| -9- |

APPROVAL REQUIRED

The affirmative vote of the holders of a majority of the shares of the Company’s common stock outstanding as of the record date is required to approve the proposed amendment to the Company’s Amended and Restated Certificate to increase our authorized shares of common stock, $.001 par value, from 9,500,000 to 40,000,000. Abstentions and “broker non-votes” will not be counted as having been voted on the proposal and, therefore, will have the same effect as negative votes.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors recommends that the stockholders vote “FOR” the proposed amendment to the Company’s Amended and Restated Certificate to increase our authorized shares of common stock, $.001 par value, from 9,500,000 to 40,000,000.

| -10- |

PROPOSAL TWO

APPROVAL OF THE ISSUANCE OF SHARES OF COMMON STOCK IN ONE

OR MORE POTENTIAL NON-PUBLIC CAPITAL RAISING TRANSACTIONS OR DEBT TO EQUITY

CONVERSION TRANSACTIONS IN ACCORDANCEWITH NASDAQ LISTING RULE 5635(d)

OVERVIEW AND REASON FOR THE AMENDMENTPROPOSAL

The Board is seeking advance stockholder approval as required by NASDAQ Rule 5635(d) (the “Nasdaq Rule,” as described below) to enable the Company to issue shares of common stock in one or more non-public capital raising transactions or debt to equity conversion transactions and to provide the Board with the flexibility to enter into and close such non-public capital raising transactions or debt to equity conversion transactions on a timely basis.

The Nasdaq Rule requires stockholder approval prior to an issuance of securities in connection with a transaction other than a public offering involving the sale, issuance or potential issuance by a company of common stock (or securities convertible into or exercisable for common stock) equal to 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance at a price less than the greater of book and market value of our common stock as of the time of execution of the definitive agreement with respect to such transaction. The per share price of our common stock for which we obtain future commitments, if any, in connection with a potential private placement is likely to be less than the greater of book or market value.

As a result, the Company is seeking advance stockholder approval for the sale and issuance of such shares in connection with potential non-public capital raising transactions or debt to equity conversion transactions pursuant to the Nasdaq Rule. We may seek to raise additional capital to implement our business strategy and enhance our overall capitalization. In addition, we will seek to raise additional capital and/or convert a portion of our outstanding debt to equity to evidence compliance with the Nasdaq listing standards as part of our compliance plan submitted to the Panel. Moreover, the Company’s audited financial statements for the fiscal year ended December 31, 2016 were prepared on the basis that the Company will continue as a going concern and, given the Company’s financial position, the Company will need additional financing to continue in operation.

We have not determined the particular terms for such prospective offerings. Because we may seek additional capital that triggers the requirements of the Nasdaq Rule, we are seeking stockholder approval now, so that we will be able to move quickly to take full advantage of any opportunities that may develop in the equity markets.

Specifically, we are seeking stockholder approval, for the purpose of compliance with the Nasdaq Rule, for the potential issuance of shares subject to the following limitations approved by our Board:

●

| potential issuance not to exceed 20,000,000 shares of our common stock (including pursuant to preferred stock, options, warrants, convertible debt or other securities exercisable for or convertible into common stock); | |

| ● | at a maximum discount of 30% below the market price of our common stock at the time of issuance; | |

| ● | the total aggregate consideration will not exceed $20 million; | |

| ● | such issuances must occur, if at all, within the three month period commencing on the date of the approval by the stockholders; and | |

| ● | upon such terms as the Board shall deem to be in the Company’s best interests. |

| -11- |

The Company has engaged an investment bank to assist the Company in identifying potential investors and opportunities, but has not arrived at any specific terms. The final terms of any such transaction will be determined by the Board. If this Proposal Number Two is approved, the Company will not solicit further authorization from its stockholders prior to any such capital raising transaction.

In addition, on August 21, 2017, the Company filed a registration statement on Form S-1 related to a potential publicly marketed offering of equity securities of the Company. While the issuances contemplated by this Proposal Two are separate from the issuances contemplated by the registration statement, the issuances contemplated by this Proposal Two could be used by the Board in addition to the issuance of additional common stock via the S-1 registration statement in order to regain compliance with Nasdaq listing standards.

While this Proposal Two is intended to facilitate the Company regaining compliance with Nasdaq listing standards, even if the Company consummates the capital raising transaction(s) contemplated by this Proposal Two, or via the Form S-1 registration statement, there can be no assurance that the Company will regain compliance with the Nasdaq minimum listing standards or that the Company’s common stock will continue to be listed on The Nasdaq Capital Market.

POTENTIAL EFFECTS OF THE PROPOSAL

The issuance of additional shares of common stock will decrease the relative percentage of equity ownership of our existing stockholders, thereby diluting the voting power of their common stock, and, depending on the price at which additional shares may be issued, could also be dilutive to the earnings per share of our common stock. It is possible that a subsequent issuance of these shares could have the effect of delaying or preventing a change in control of the Company. Shares of authorized and unissued common stock could, within the limits imposed by applicable law, be issued in one or more transactions that would make a change in control of the Company more difficult, and therefore, less likely. Issuances of additional shares of our stock could dilute the earnings per share and book value per share of our outstanding common stock and dilute the stock ownership or voting rights of a person seeking to obtain control of the Company. While it may be deemed to have potential anti-takeover effects, the proposal to authorize the Board to issue additional shares of common stock is not prompted by any specific effort of which we are aware to accumulate shares of our common stock or obtain control of the Company.

The additional authorized shares of common stock, if and when issued, would be part of the existing class of common stock and would have the same rights and privileges as the shares of common stock currently outstanding. Stockholders do not have preemptive rights with respect to our common stock. Therefore, should the Board determine to issue additional shares of common stock, existing stockholders would not have any preferential rights to purchase such shares in order to maintain their proportionate ownership thereof.

The Board of Directors has not yet determined the terms and conditions of any offerings. As a result, the level of potential dilution cannot be determined at this time, but as discussed above, we may not issue more than 20,000,000 shares of common stock in the aggregate pursuant to the authority requested from stockholders under this Proposal Two. It is possible that if we conduct a non-public capital raising transaction or debt to equity conversion transaction, some of the shares we sell could be purchased by one or more investors who could acquire a large block of our common stock. This may concentrate voting power in the hands of a few stockholders who may then be able to exercise greater influence on our operations or the outcome of matters put to a vote of stockholders in the future.

We cannot determine what the actual net proceeds of any transactions contemplated by this Proposal Two would be at this time, but as discussed above, the aggregate dollar amount of the non-public offerings will be no more than $20 million. If such a proposed transaction is completed, the net proceeds will be used for general corporate purposes. We currently have no arrangements or understandings regarding any specific transaction to be effected pursuant to the approval of this Proposal Two, so we cannot predict whether we will be successful should we seek to raise capital through any such offerings.

EFFECTIVENESS OF PROPOSAL

If the proposal is approved by our stockholders, it will become effective immediately and will remain in force for three months or until such time that the board may issue the maximum amount of authorized shares approved in this proposal.

APPROVAL REQUIRED

The affirmative vote of a majority of the votes cast in person or by proxy is required to approve the proposal to authorize the board to issue up to 20,000,000 shares of stock at a maximum discount of 30% below the market price of our common stock at the time of issuance with total aggregate consideration no to exceed $20 million and up to three months subsequent to the approval by stockholders. Abstentions will be counted toward the vote total for Proposal Two and will have the same effect as a vote against Proposal Two. Because Proposal Two is a non-routine matter, broker non-votes will not be counted as votes cast on Proposal Two and therefore will not affect the outcome of Proposal Two.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors recommends a vote “FOR” the approval of the issuance of shares of common stock in one or more potential capital raising or debt to equity conversion transactions in accordance with Nasdaq rule 5636(d).

| -12- |

ADDITIONAL INFORMATION

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of the Company’s common stock as of August 14,September 6, 2017 (unless otherwise indicated), by:

| ● | each person known by the Company to be a beneficial owner of five percent (5%) or more of the Company’s common stock; | |

| ● | each of the Company’s directors; | |

| ● | each of the Company’s named executive officers; and | |

| ● | all of the Company’s current directors and executive officers as a group |

Percentage of beneficial ownership is calculated based on 5,742,453 shares of common stock outstanding as of August 14September 6, 2017. Beneficial ownership is determined in accordance with the rules of the SEC which generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with respect to those securities and includes shares of Company common stock issuable pursuant to the exercise of stock options, warrants or other securities that are immediately exercisable or convertible or exercisable or convertible within 60 days of August 14,September 6, 2017. Unless otherwise indicated, the persons or entities identified in this table have sole voting and investment power with respect to all shares shown as beneficially owned by them. Unless otherwise noted, the address for each person set forth on the table below is c/o TearLab Corporation, 9980 Huennekens St., Suite 100, San Diego, California 92121.

| Beneficial Owner | Shares Beneficially Owned | Percentage of Shares Beneficially Owned | ||||||

| Other 5% stockholders: | ||||||||

| First Light Asset Management, LLC(1) | 420,066 | 7.3 | % | |||||

| Altrinsic Global Advisors, LLC(2) | 303,510 | 5.3 | % | |||||

| Executive Officers and Directors: | ||||||||

| Elias Vamvakas(3) | 306,224 | 5.3 | % | |||||

| Wes Brazell(4) | 26,332 | * | ||||||

| Paul Karpecki(5) | 15,073 | * | ||||||

| Richard Lindstrom(6) | 36,658 | * | ||||||

| Adrienne Graves(7) | 15,611 | * | ||||||

| Donald Rindell(8) | 16,706 | * | ||||||

| Anthony Altig(9) | 27,204 | * | ||||||

| Brock Wright(10) | 134,147 | 2.3 | % | |||||

| Thomas N. Davidson, Jr.(11) | 37,713 | * | ||||||

| Joseph Jensen(12) | 71,705 | 1.2 | % | |||||

| All directors and executive officers as a group (10 persons)(13) | 687,373 | 12.0 | % | |||||

* Represents beneficial ownership of less than 1%.

| -13- |

| (1) | Based solely on the most recently available Schedule 13F-HR filed with the SEC on August 14, 2017, First Light Asset Management, LLC has shared voting power as to 420,066 Shares and shared dispositive power as to 420,066 Shares. First Light Management, LLC is a Delaware limited liability company and the address of First Light Asset Management, LLC is 3300 Edinborough Way, Suite 201, Edina, MN 55435. | |

| (2) | Based solely on the most recently available Schedule 13G filed with the SEC on February 13, 2017, Altrinisic Global Advisors, LLC has shared voting power as to 303,510 Shares and shared dispositive power as to 303,510 Shares. Altrinsic Global | |

| (3) | Includes (a) 123,271 shares subject to options exercisable within 60 days of | |

| (4) | Includes (a) 16,333 shares subject to options exercisable within 60 days of | |

| (5) | Includes 12,873 shares subject to options exercisable within 60 days of

| |

| (6) | Includes (a) 15,214 shares subject to options exercisable within 60 days of |

| (7) | Includes 15,611 shares subject to options exercisable within 60 days of | |

| (8) | Includes 16,706 shares subject to options exercisable within 60 days of | |

| (9) | Includes (a) 16,705 shares subject to options exercisable within 60 days of | |

| (10) | Includes 12,195 shares subject to options exercisable within 60 days of | |

| (11) | Includes 11,677 shares subject to options exercisable within 60 days of | |

| (12) | Includes (a) 42,499 shares subject to options exercisable within 60 days of | |

| (13) | Includes (a) 283,084 shares subject to options exercisable within 60 days of |

| -14- |

HOUSEHOLDING OF PROXY MATERIALS

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy materials with respect to two or more stockholders sharing the same address by delivering a single copy of the applicable proxy materials addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

This year, a number of brokers with account holders who are TearLab Corp. stockholders will be “householding” our proxy materials. A single notice of special meeting and Proxy will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and would prefer to receive separate proxy materials, please notify your broker, direct your written request to TearLab Corp., Investor Relations; 9980 Huennekens St., Suite 100, San Diego, California 92121 or contact TearLab Corp. at (858) 455-6006. Stockholders who currently receive multiple copies of the proxy materials at their address and would like to request “householding” of their communications should contact their brokers.

OTHER BUSINESS

Our Board of Directors does not know of any matter to be presented at our Special Meeting which is not listed on the Notice of Special Meeting and discussed above. If other matters should properly come before the meeting, however, the persons named in the accompanying Proxy will vote all Proxies in accordance with their best judgment.

All stockholders are urged to complete, sign, date and return the accompanying Proxy Card.

| By Order of the Board of Directors, | |

| /s/ Elias Vamvakas | |

| Elias Vamvakas | |

| Executive Chairman of the Board |

| -15- |

APPENDIX A

CERTIFICATE OF AMENDMENT TO THE

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF

TEARLAB CORPORATION

TearLab Corporation, a corporation organized and existing under the laws of the State of Delaware (the “Corporation”), hereby certifies that:

1. The name of the Corporation is TearLab Corporation. The date of filing of the Corporation’s original Certificate of Incorporation with the Secretary of State of the State of Delaware was June 5, 2002, under the name Vascular Sciences Corporation.

2. This Certificate of Amendment to the Certificate of Incorporation was duly authorized and adopted by the Corporation’s Board of Directors and stockholders in accordance with Section 242 of the General Corporation Law of the State of Delaware and amends the provisions of the Company’s Certificate of Incorporation.

3. The amendment to the existing Amended and Restated Certificate of Incorporation being effected hereby is to delete the first paragraph of Article IV in its entirety and to substitute in its place the following:

“The Corporation is authorized to issue two classes of stock to be designated, respectively, “Common Stock” and “Preferred Stock.” The total number of shares of all classes of capital stock which the Corporation shall have authority to issue is fifty million (50,000,000) shares, of which forty million (40,000,000) shares, par value $0.001 per share, shall be common stock (the “Common Stock”) and ten million (10,000,000) shares, par value $0.001 per share, shall be preferred stock (the “Preferred Stock”).”

4. This Certificate of Amendment to the Amended and Restated Certificate of Incorporation was approved by written consent of the board of directors and by the stockholders of this Corporation at a meeting thereof duly called and held on October 3,12, 2017.

5. This Certificate of Amendment to the Amended and Restated Certificate of Incorporation shall be effective immediately upon filing by the Delaware Secretary of State.

****

IN WITNESS WHEREOF, TearLab Corporation has caused this Certificate of Amendment to the Amended and Restated Certificate of Incorporation to be signed by [_______], its [_______], this [●] day of [●], 2017.

| TEARLAB CORPORATION | ||

| A Delaware corporation | ||

| By: | ||

| Name: | ||

| Title: | ||